| |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| MANAGEMENT INVESTMENT COMPANIES |

|

| Investment Company Act file number 811- 21416 |

| |

| John Hancock Tax-Advantaged Dividend Income Fund |

| (Exact name of registrant as specified in charter) |

| |

| 601 Congress Street, Boston, Massachusetts 02210 |

| (Address of principal executive offices) (Zip code) |

| |

| Salvatore Schiavone |

| Treasurer |

|

| 601 Congress Street |

| |

| Boston, Massachusetts 02210 |

| (Name and address of agent for service) |

| |

| Registrant's telephone number, including area code: 617-663-4497 |

| |

| |

| Date of fiscal year end: | October 31 |

| |

| |

| Date of reporting period: | April 30, 2010 |

Item 1. Schedule of Investments.

Portfolio summary

| | | | |

| Top 10 Holdings1 | | | | |

|

| OGE Energy Corp. | 3.5% | | ONEOK, Inc. | 2.9% |

| |

|

| DTE Energy Company | 3.2% | | Bank of America Corp., 8.625% | 2.8% |

| |

|

| Integrys Energy Group, Inc. | 3.2% | | NSTAR | 2.6% |

| |

|

| Spectra Energy Corp. | 3.0% | | Atmos Energy Corp. | 2.5% |

| |

|

| Progress Energy, Inc. | 3.0% | | Duquesne Light Company, 6.500% | 2.3% |

| |

|

|

| |

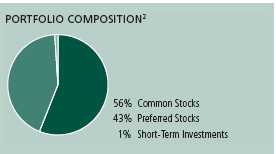

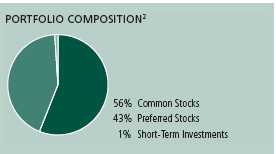

| Sector Composition2,3 | | | | |

|

| Utilities | 59% | | Industrials | 1% |

| |

|

| Financials | 24% | | Consumer Discretionary | 1% |

| |

|

| Energy | 9% | | Short-Term Investments & Other | 1% |

| |

|

| Telecommunication Services | 5% | | | |

| | |

1 As a percentage of the Fund’s total investments on April 30, 2010. Excludes cash and cash equivalents.

2 As a percentage of the Fund’s total investments on April 30, 2010.

3 Sector investing is subject to greater risks than the market as a whole. Because the Fund may focus on particular sectors of the economy, its performance may depend on the performance of those sectors.

| |

| 6 | Tax-Advantaged Dividend Income Fund | Semiannual report |

Fund’s investments

As of 4-30-10 (unaudited)

| | |

| | Shares | Value |

| Common Stocks 83.40% | | $495,121,439 |

|

| (Cost $493,611,787) | | |

| | | |

| Consumer Discretionary 0.00% | | 89 |

| | | |

| Publishing 0.00% | | |

|

| SuperMedia, Inc. (I) | 26,830 | 89 |

| | | |

| Energy 7.72% | | 45,839,926 |

| | | |

| Oil, Gas & Consumable Fuels 7.72% | | |

|

| BP PLC, SADR | 187,500 | 9,778,126 |

|

| Chevron Corp. (Z) | 35,000 | 2,850,400 |

|

| Spectra Energy Corp. (Z) | 1,155,000 | 26,957,700 |

|

| Total SA, SADR (Z) | 115,000 | 6,253,700 |

| | | |

| Industrials 1.46% | | 8,675,600 |

| | | |

| Industrial Conglomerates 1.46% | | |

|

| General Electric Company (Z) | 460,000 | 8,675,600 |

| | | |

| Telecommunication Services 3.47% | | 20,606,050 |

| | | |

| Diversified Telecommunication Services 1.99% | | |

|

| Alaska Communications Systems Group, Inc. (Z) | 55,000 | 470,800 |

|

| AT&T, Inc. (Z) | 202,500 | 5,277,150 |

|

| Verizon Communications, Inc. | 210,000 | 6,066,900 |

| | | |

| Wireless Telecommunication Services 1.48% | | |

|

| Vodafone Group PLC, SADR (Z) | 396,000 | 8,791,200 |

| | | |

| Utilities 70.75% | | 419,999,774 |

| | | |

| Electric Utilities 16.88% | | |

|

| American Electric Power Company, Inc. (Z) | 595,000 | 20,408,500 |

|

| Duke Energy Corp. (Z) | 765,000 | 12,836,700 |

|

| Entergy Corp. | 83,250 | 6,767,392 |

|

| FirstEnergy Corp. | 112,500 | 4,260,375 |

|

| Great Plains Energy, Inc. (Z) | 40,000 | 773,200 |

|

| Northeast Utilities | 155,000 | 4,307,450 |

|

| Pinnacle West Capital Corp. (Z) | 215,000 | 8,028,100 |

|

| PNM Resources, Inc. (Z) | 58,000 | 788,220 |

|

| Progress Energy, Inc. (Z) | 671,200 | 26,794,304 |

|

| Southern Company (Z) | 441,867 | 15,270,924 |

| | | |

| Gas Utilities 9.16% | | |

|

| Atmos Energy Corp. (Z) | 745,000 | 22,037,100 |

|

| Northwest Natural Gas Company (Z) | 132,500 | 6,279,175 |

|

| ONEOK, Inc. (Z) | 530,000 | 26,044,200 |

| | |

| See notes to financial statements | Semiannual report | Tax-Advantaged Dividend Income Fund | 7 |

| | |

| | Shares | Value |

| Multi-Utilities 44.71% | | |

|

| Ameren Corp. (Z) | 555,000 | $14,407,800 |

|

| Black Hills Corp. (Z) | 560,000 | 18,418,400 |

|

| CH Energy Group, Inc. (Z) | 451,500 | 18,701,130 |

|

| Consolidated Edison, Inc. (Z) | 317,500 | 14,351,000 |

|

| Dominion Resources, Inc. (Z) | 420,000 | 17,556,000 |

|

| DTE Energy Company (Z) | 600,000 | 28,902,000 |

|

| Integrys Energy Group, Inc. (Z) | 580,000 | 28,773,800 |

|

| NiSource, Inc. (Z) | 790,500 | 12,885,150 |

|

| NSTAR (Z) | 626,500 | 22,929,900 |

|

| OGE Energy Corp. (Z) | 760,000 | 31,448,800 |

|

| Public Service Enterprise Group, Inc. (Z) | 360,000 | 11,566,800 |

|

| TECO Energy, Inc. (Z) | 387,800 | 6,565,454 |

|

| Vectren Corp. (Z) | 790,000 | 19,757,900 |

|

| Xcel Energy, Inc. (Z) | 880,000 | 19,140,000 |

| |

| | Shares | Value |

| Preferred Stocks 64.73% | | $384,319,541 |

|

| (Cost $395,352,314) | | |

| | | |

| Consumer Discretionary 1.12% | | 6,683,470 |

| | | |

| Media 1.12% | | |

|

| CBS Corp., 7.250% (Z) | 145,000 | 3,572,800 |

|

| Comcast Corp., 7.000% (Z) | 123,000 | 3,110,670 |

| | | |

| Energy 6.11% | | 36,256,860 |

| | | |

| Oil, Gas & Consumable Fuels 6.11% | | |

|

| Southern Union Company, 7.550% (C)(Z) | 610,200 | 15,590,610 |

|

| Nexen, Inc., 7.350% (C)(Z) | 835,000 | 20,666,250 |

| | | |

| Financials 35.50% | | 210,775,615 |

| | | |

| Capital Markets 0.00% | | |

|

| Lehman Brothers Holdings, Inc., 6.500%, | | |

| Depositary Shares, Series F (I) | 219,300 | 8,772 |

|

| Lehman Brothers Holdings, Inc., 5.940%, | | |

| Depositary Shares, Series C (I) | 274,760 | 13,738 |

|

| Lehman Brothers Holdings, Inc., 5.670%, | | |

| Depositary Shares, Series D (I) | 65,000 | 5,265 |

| | | |

| Commercial Banks 7.16% | | |

|

| Barclays Bank PLC, 8.125%, Series 5 | 50,000 | 1,258,000 |

|

| HSBC Holdings PLC, 8.125% (Z) | 50,000 | 1,330,000 |

|

| Royal Bank of Scotland Group PLC, 5.750%, | | |

| Series L (Z) | 858,500 | 13,667,320 |

|

| Santander Finance Preferred SA Unipersonal, | | |

| 10.500%, Series 10 | 167,500 | 4,550,975 |

|

| Santander Holdings USA, Inc., 7.300% | 2,800 | 69,552 |

|

| USB Capital VIII, 6.350%, Series 1 | 55,000 | 1,285,350 |

|

| Wells Fargo & Company, 8.000% (Z) | 742,000 | 20,330,800 |

| | | |

| Consumer Finance 0.83% | | |

|

| HSBC Finance Corp., 6.360%, Depositary | | |

| Shares, Series B (Z) | 150,000 | 3,360,000 |

|

| SLM Corp., 6.970%, Series A (Z) | 40,600 | 1,591,520 |

| | |

| 8 | Tax-Advantaged Dividend Income Fund | Semiannual report | See notes to financial statements |

| | |

| | Shares | Value |

| Diversified Financial Services 24.29% | | |

|

| Bank of America Corp., 6.204%, Depositary | | |

| Shares, Series D (Z) | 240,000 | $4,850,400 |

|

| Bank of America Corp., 8.200% (Z) | 185,000 | 4,721,200 |

|

| Bank of America Corp., 6.625% (Z) | 355,000 | 7,870,350 |

|

| Bank of America Corp., 6.375% (Z) | 139,000 | 2,885,640 |

|

| Bank of America Corp., 6.700% (Z) | 500,000 | 10,945,000 |

|

| Bank of America Corp., 8.625% (C)(Z) | 957,800 | 25,218,874 |

|

| Citigroup Capital VIII, 6.950% | 540,000 | 11,950,200 |

|

| Deutsche Bank Capital Funding Trust VIII, | | |

| 6.375% (Z) | 282,000 | 6,373,200 |

|

| Deutsche Bank Contingent Capital Trust II, | | |

| 6.550% (Z) | 310,000 | 6,872,700 |

|

| Deutsche Bank Contingent Capital Trust III, | | |

| 7.600% (Z) | 797,893 | 19,811,683 |

|

| ING Groep NV, 7.050% (Z) | 140,000 | 2,786,000 |

|

| ING Groep NV, 6.200% (Z) | 109,100 | 1,931,070 |

|

| JPMorgan Chase & Company, 8.625% (Z) | 140,000 | 3,892,000 |

|

| JPMorgan Chase & Company, 5.490%, | | |

| Series G (Z) | 260,927 | 12,615,820 |

|

| JPMorgan Chase & Company, 5.720%, | | |

| Series F (Z) | 55,900 | 2,721,771 |

|

| JPMorgan Chase & Company, 6.150%, | | |

| Series E (Z) | 104,500 | 5,194,695 |

|

| RBS Capital Funding Trust VII, 6.080% (C)(Z) | 983,000 | 13,555,570 |

| | | |

| Insurance 3.20% | | |

|

| MetLife, Inc., 6.500%, Series B (Z) | 785,000 | 19,020,550 |

| | | |

| Thrifts & Mortgage Finance 0.02% | | |

|

| Federal National Mortgage Association | | |

| (8.250% to 12-13-10 then higher of 7.750% | | |

| or 3 month U.S. LIBOR + 4.230%) (I) | 60,000 | 87,600 |

| | | |

| Telecommunication Services 3.85% | | 22,861,311 |

| | | |

| Wireless Telecommunication Services 3.85% | | |

|

| Telephone & Data Systems, Inc., Series A, | | |

| 7.600% (Z) | 476,000 | 11,714,360 |

|

| United States Cellular Corp., 7.500% (Z) | 448,389 | 11,146,951 |

| | | |

| Utilities 18.15% | | 107,742,285 |

| | | |

| Electric Utilities 12.65% | | |

|

| Alabama Power Company, 5.300%, Class A (Z) | 176,500 | 4,333,075 |

|

| Carolina Power & Light Company, 5.440% (Z) | 111,493 | 10,738,170 |

|

| Duquesne Light Company, 6.500% (Z) | 427,000 | 20,762,875 |

|

| Entergy Arkansas, Inc., 4.560% (Z) | 9,388 | 749,574 |

|

| Entergy Arkansas, Inc., 6.450% (Z) | 110,000 | 2,609,068 |

|

| Entergy Mississippi, Inc., 4.920% (Z) | 8,190 | 685,145 |

|

| Entergy Mississippi, Inc., 6.250% (Z) | 197,500 | 4,943,682 |

|

| FPC Capital I, 7.100%, Series A (Z) | 65,000 | 1,651,650 |

|

| FPL Group Capital Trust I, 5.875% (Z) | 235,000 | 5,978,400 |

|

| PPL Electric Utilities Corp., 6.250%, Depositary | | |

| Shares (Z) | 300,000 | 7,453,140 |

| | |

| See notes to financial statements | Semiannual report | Tax-Advantaged Dividend Income Fund | 9 |

| | | | |

| | | | Shares | Value |

| Electric Utilities (continued) | | | | |

|

| PPL Energy Supply, LLC, 7.000% (Z) | | | 297,512 | $7,571,680 |

|

| Southern California Edison Company, | | | | |

| 6.125% (Z) | | | 50,000 | 4,775,000 |

|

| Southern California Edison Company, 6.000%, | | | | |

| Series C (Z) | | | 30,000 | 2,832,189 |

| | | | | |

| Independent Power Producers & Energy Traders 2.36% | | | |

|

| Constellation Energy Group, Inc., 8.625%, | | | | |

| Series A (Z) | | | 535,000 | 13,990,250 |

| | | | | |

| Multi-Utilities 3.14% | | | | |

|

| BGE Capital Trust II, 6.200% (Z) | | | 150,500 | 3,521,700 |

|

| Interstate Power & Light Company, 8.375%, | | | | |

| Series B (Z) | | | 230,000 | 6,722,900 |

|

| Interstate Power & Light Company, 7.100%, | | | | |

| Series C (Z) | | | 20,700 | 529,299 |

|

| Pacific Enterprises, 4.500% (Z) | | | 45,000 | 3,555,000 |

|

| Xcel Energy, Inc., 4.560%, Series G (Z) | | | 53,900 | 4,339,488 |

| |

| | | Maturity | | |

| | Yield* | date | Par value | Value |

| Short-Term Investments 1.98% | | | | $11,768,961 |

|

| (Cost $11,768,961) | | | | |

| | | | | |

| Short-Term Investments 1.95% | | | | 11,599,961 |

| Federal Home Loan Bank Discount Notes | 0.060% | 05-03-10 | $11,600,000 | 11,599,961 |

| | | | | |

| Repurchase Agreement 0.03% | | | | 169,000 |

| Repurchase Agreement with State Street Corp. dated 4-30-10 at 0.010% | | |

| to be repurchased at $169,000 on 5-03-10, collateralized by $165,000 | | |

| Federal National Mortgage Association, 4.125% due 4-15-14 (valued at | | |

| $176,963, including interest) | | | 169,000 | 169,000 |

| |

| Total investments (Cost $900,733,062)† 150.11% | | | $891,209,941 |

|

| |

| Other assets and liabilities, net (50.11%) | | ($297,522,981) |

|

| |

| Total net assets 100.00% | | | | $593,686,960 |

|

The percentage shown for each investment category is the total value of the category as a percentage of the net assets of the Fund.

SADR Sponsored American Depositary Receipts

(C) All or a portion of this security is segregated as collateral for options overlay (see Note 3). Total collateral value at April 30, 2010 was $72,537,929.

(I) Non-income producing security.

(Z) All or a portion of this security is segregated as collateral pursuant to the Committed Facility Agreement (see Note 8). Total collateral value at April 30, 2010 was $657,602,926.

* Yield represents either the annualized yield at the date of purchase, the stated coupon rate or, for floating rate securities, the rate at period end.

† At April 30, 2010, the aggregate cost of investment securities for federal income tax purposes was $915,081,236 Net unrealized depreciation aggregated $23,871,295, of which $80,947,153 related to appreciated investment securities and $104,818,448 related to depreciated investment securities.

| | |

| 10 | Tax-Advantaged Dividend Income Fund | Semiannual report | See notes to financial statements |

F I N A N C I A L S T A T E M E N T SFinancial statements

Statement of assets and liabilities 4-30-10 (unaudited)

This Statement of Assets and Liabilities is the Fund’s balance sheet. It shows the value of what the Fund owns, is due and owes. You’ll also find the net asset value for each common share.

| |

| Assets | |

|

| Investments, at value (Cost $900,733,062) | $891,209,941 |

| Cash | 48,890 |

| Receivable for investments sold | 3,446,523 |

| Dividends and interest receivable | 2,665,396 |

| Other assets | 46,608 |

| |

| Total assets | 897,417,358 |

| |

| Liabilities | |

|

| Committed facility agreement payable (Note 8) | 296,200,000 |

| Payable for investments purchased | 3,554,517 |

| Written options, at value (Premiums received $895,166) (Note 3) | 807,637 |

| Unrealized depreciation of swap contracts (Note 3) | 3,069,172 |

| Interest payable (Note 8) | 20,403 |

| Payable to affiliates | |

| Accounting and legal services fees | 7,719 |

| Trustees’ fees | 25,186 |

| Other liabilities and accrued expenses | 45,764 |

| | |

| Total liabilities | 303,730,398 |

| |

| Net assets | |

|

| Capital paid-in | $716,454,928 |

| Undistributed net investment income | 789,211 |

| Accumulated net realized loss on investments, written options | |

| and swap agreements | (111,052,415) |

| Net unrealized depreciation on investments, written options | |

| and swap agreements | (12,504,764) |

| | |

| Net assets | $593,686,960 |

|

| Net asset value per share | |

|

| Based on 38,248,017 shares of beneficial interest outstanding — unlimited | |

| number of shares authorized with no par value | $15.52 |

| | |

| See notes to financial statements | Semiannual report | Tax-Advantaged Dividend Income Fund | 11 |

F I N A N C I A L S T A T E M E N T SStatement of operations For the six-month period ended 4-30-10 (unaudited)

This Statement of Operations summarizes the Fund’s investment income earned and expenses incurred in operating the Fund. It also shows net gains (losses) for the period stated.

| |

| Investment income | |

|

| Dividends | $26,364,841 |

| Interest | 3,157 |

| Less foreign taxes withheld | (30,997) |

| | |

| Total investment income | 26,337,001 |

| |

| Expenses | |

|

| Investment management fees (Note 5) | 3,088,029 |

| Accounting and legal services fees (Note 5) | 16,615 |

| Transfer agent fees | 41,431 |

| Trustees’ fees (Note 5) | 29,499 |

| Printing and postage fees | 113,797 |

| Professional fees | 47,691 |

| Custodian fees | 59,861 |

| Interest expense (Note 8) | 1,740,835 |

| Stock exchange listing fees | 16,908 |

| Other | 24,330 |

| | |

| Total expenses | 5,178,996 |

| Less expense reductions (Note 5) | (545,626) |

| | |

| Net expenses | 4,633,370 |

| | |

| Net investment income | 21,703,631 |

|

| Realized and unrealized gain (loss) | |

|

| Net realized loss on | |

| Investments | (1,532,384) |

| Written options (Note 3) | (2,316,482) |

| Swap contracts (Note 3) | (1,600,547) |

| | (5,449,413) |

| Change in net unrealized appreciation (depreciation) of | |

| Investments | 106,138,778 |

| Written options (Note 3) | (1,271,331) |

| Swap contracts (Note 3) | 1,252,432 |

| | 106,119,879 |

| Net realized and unrealized gain | 100,670,466 |

| | |

| Increase in net assets from operations | $122,374,097 |

| | |

| 12 | Tax-Advantaged Dividend Income Fund | Semiannual report | See notes to financial statements |

F I N A N C I A L S T A T E M E N T SStatements of changes in net assets

These Statements of Changes in Net Assets show how the value of the Fund’s net assets has changed during the last three periods. The difference reflects earnings less expenses, any investment gains and losses, distributions, if any, paid to shareholders and the net of Fund share transactions.

| | | |

| | For the | | |

| | six-month | | |

| | period ended | Period | Year |

| | 4-30-10 | ended | ended |

| | (Unaudited) | 10-31-091 | 12-31-08 |

| Increase (decrease) in net assets | | | |

|

| From operations | | | |

| Net investment income | $21,703,631 | $33,697,608 | $45,341,667 |

| Net realized loss | (5,449,413) | (86,658,935) | (10,172,908) |

| Change in net unrealized | | | |

| appreciation (depreciation) | 106,119,879 | 108,119,036 | (273,056,724) |

| Distributions to Auction Preferred Shares (APS) | — | — | (6,127,843) |

| | | | |

| Increase (decrease) in net assets resulting | | | |

| from operations | 122,374,097 | 55,157,709 | (244,015,808) |

| | | | |

| Distributions to shareholders | | | |

| From net investment income | (20,894,255) | (31,693,150) | (39,254,688) |

| From net realized gain | — | — | (6,140,997) |

| From tax return of capital | — | (8,933,496) | (17,698,324) |

| | | | |

| Total distributions | (20,894,255) | (40,626,646) | (63,094,009) |

| | | | |

| From Fund share transactions (Note 6) | (806,667) | (1,786,938) | (53,556,991) |

| | | | |

| Total increase (decrease) | 100,673,175 | 12,744,125 | (360,666,808) |

| |

| Net assets | | | |

|

| Beginning of period | 493,013,785 | 480,269,660 | 840,936,468 |

| | | | |

| End of period | $593,686,960 | $493,013,785 | $480,269,660 |

| | | | |

| Undistributed/(Distributions in excess of) net | | | |

| investment income | $789,211 | ($20,165) | ($21,118) |

1 For the ten-month period ended October 31, 2009. The Fund changed its fiscal year end from December 31 to October 31.

| | |

| See notes to financial statements | Semiannual report | Tax-Advantaged Dividend Income Fund | 13 |

Statement of cash flows (unaudited)

This Statement of Cash Flows shows cash flow from operating and financing activities for the period stated.

| |

| | For the |

| | six-month |

| | period ended |

| | 4-30-10 |

| |

| Cash flows from operating activities | |

|

| Net increase in net assets from operations | $122,374,097 |

| Adjustments to reconcile net increase in net assets from operations | |

| to net cash used in operating activities: | |

| Long-term investments purchased | (102,477,714) |

| Long-term investments sold | 68,700,073 |

| Increase in short-term investments | (8,957,962) |

| Decrease in dividends and interest receivable | 5,146 |

| Decrease in receivable from affiliates | 8,660 |

| Increase in payable for investments purchased | 755,057 |

| Decrease in receivable for investments sold | 4,706,855 |

| Increase in other receivables and prepaid expenses | (12,313) |

| Net change in unrealized (appreciation) depreciation on swap contracts | (1,252,432) |

| Decrease in payable for written options | (189,688) |

| Decrease in payable to affiliates | (6,126) |

| Decrease in interest payable | (7,568) |

| Decrease in other liabilities and accrued expenses | (91,750) |

| Net change in unrealized (appreciation) depreciation on investments | (106,138,778) |

| Net realized loss on investments | 1,532,384 |

|

| |

| Net cash used in operating activities | ($21,052,059) |

|

| Cash flows from financing activities | |

| Borrowings from committed facility agreement payable | 42,800,000 |

| Repurchase of common shares | (806,667) |

| Distributions to common shareholders | (20,894,255) |

| | |

| Net cash provided by financing activities | $21,099,078 |

| | |

| Net increase in cash | $47,019 |

| | |

| Cash at beginning of period | $1,871 |

| | |

| Cash at end of period | $48,890 |

|

| |

| Supplemental disclosure of cash flow information | |

|

| |

| Cash paid for interest | $1,748,403 |

| | |

| 14 | Tax-Advantaged Dividend Income Fund | Semiannual report | See notes to financial statements |

Financial highlights

The Financial Highlights show how the Fund’s net asset value for a share has changed since the end of the previous period.

| | | | | | | |

| COMMON SHARES | | | | | | | |

| Period ended | 4-30-101 | 10-31-092 | 12-31-08 | 12-31-07 | 12-31-06 | 12-31-053 | 12-31-043,4 |

| Per share operating performance | | | | | | |

|

| Net asset value, | | | | | | | |

| beginning of period | $12.87 | $12.48 | $19.99 | $22.90 | $19.93 | $20.48 | $19.105 |

| Net investment income6 | 0.57 | 0.88 | 1.13 | 1.26 | 1.437 | 1.22 | 1.14 |

| Net realized and | | | | | | | |

| unrealized gain (loss) | | | | | | | |

| on investments | 2.63 | 0.56 | (7.07) | (1.98) | 3.62 | (0.23) | 1.54 |

| Distributions to APS* | — | — | (0.15) | (0.41) | (0.39) | (0.29) | (0.29) |

| Total from | | | | | | | |

| investment operations | 3.20 | 1.44 | (6.09) | (1.13) | 4.66 | 0.70 | 2.39 |

| Less distributions to | | | | | | | |

| common shareholders | | | | | | | |

| From net | | | | | | | |

| investment income | (0.55) | (0.83) | (0.99) | (1.19) | (1.16) | (1.16) | (0.87) |

| From net realized gain | — | — | (0.15) | (0.59) | (0.53) | (0.09) | — |

| From tax return of capital | — | (0.23) | (0.44) | — | — | — | — |

| Total distributions | (0.55) | (1.06) | (1.58) | (1.78) | (1.69) | (1.25) | (0.87) |

| Anti-dilutive impact of | | | | | | | |

| repurchase plan | —8 | 0.018 | 0.168 | — | — | — | — |

| Offering costs related to | | | | | | | |

| common shares | — | — | — | — | — | — | (0.02) |

| Offering costs and under- | | | | | | | |

| writing discounts related | | | | | | | |

| to APS* | — | — | — | — | — | — | (0.12) |

| Net asset value, end | | | | | | | |

| of period | $15.52 | $12.87 | $12.48 | $19.99 | $22.90 | $19.93 | $20.48 |

| Per share market value, | | | | | | | |

| end of period | $13.99 | $11.35 | $10.30 | $17.90 | $20.32 | $16.81 | $17.99 |

| Total return at net asset | | | | | | | |

| value (%)9,10 | 25.6611 | 15.3411 | (29.97) | (4.19) | (25.67)12 | 4.4412 | 12.8511,12 |

| Total return at market | | | | | | | |

| value (%)9 | 28.4411 | 23.2411 | (35.46) | (3.32) | (32.21) | 0.28 | (5.47)11,13 |

|

| Ratios and supplemental data | | | | | | |

|

| Net assets applicable to | | | | | | | |

| common shares, end of | | | | | | | |

| period (in millions) | $594 | $493 | $480 | $841 | $964 | $838 | $862 |

| Ratios (as a percentage of | | | | | | | |

| average net assets): | | | | | | | |

| Expenses before | | | | | | | |

| reductions (excluding | | | | | | | |

| interest expense) | 1.2614 | 1.3914 | 1.42 | 1.2715 | 1.2815 | 1.3215 | 1.2314,15 |

| Interest expense | | | | | | | |

| (Note 8) | 0.6314 | 0.8714 | 0.87 | — | — | — | — |

| Expenses before | | | | | | | |

| reductions (including | | | | | | | |

| interest expense) | 1.8914 | 2.2614 | 2.29 | 1.2715 | 1.2815 | 1.3215 | 1.2314,15 |

| Expenses (excluding | | | | | | | |

| interest expense) | 1.0614 | 1.1414 | 1.12 | 0.99 | 1.00 | 1.03 | 0.9514 |

| Expenses net of fee | | | | | | | |

| waivers and credits | 1.6914 | 2.0114 | 1.99 | 0.9916 | 1.0016 | 1.0316 | 0.9514,16 |

| Net investment income | 7.9014 | 9.4414 | 7.02 | 5.6517 | 6.767,17 | 5.9717 | 6.1114,17 |

| Portfolio turnover (%) | 8 | 21 | 29 | 26 | 41 | 24 | 42 |

| | |

| See notes to financial statements | Semiannual report | Tax-Advantaged Dividend Income Fund | 15 |

| | | | | | | |

| COMMON SHARES | | | | | | | |

| Period ended | 4-30-101 | 10-31-092 | 12-31-08 | 12-31-07 | 12-31-06 | 12-31-053 | 12-31-043,4 |

|

| Senior securities | | | | | | | |

|

| Total value of APS* | | | | | | | |

| outstanding (in millions) | — | — | — | $380 | $380 | $380 | $380 |

| Involuntary liquidation | | | | | | | |

| preference per unit | | | | | | | |

| (in thousands) | — | — | — | 25 | 25 | 25 | 25 |

| Average market value per | | | | | | | |

| unit (in thousands) | — | — | — | 25 | 25 | 25 | 25 |

| Asset coverage per unit18 | — | — | — | $81,737 | $88,352 | $79,901 | $79,542 |

| Total debt outstanding | | | | | | | |

| end of year (in millions) | | | | | | | |

| (Note 8) | $296 | $253 | $267 | — | — | — | — |

| Asset coverage per | | | | | | | |

| $1,000 of APS*,19 | — | — | — | $3,212 | $3,536 | $3,207 | $3,268 |

| Asset coverage per | | | | | | | |

| $1,000 of debt20 | $3,004 | $2,946 | $2,797 | — | — | — | — |

| |

* Auction Preferred Shares (APS)

1 Semiannual period from 11-1-09 to 4-30-10. Unaudited.

2 For the ten-month period ended October 31, 2009. The Fund changed its fiscal year end from December 31 to October 31.

3 Audited by previous independent registered public accounting firm.

4 Period from 2-27-04 (inception date) to 12-31-04.

5 Reflects the deduction of a $0.90 per share sales load.

6 Based on the average daily shares outstanding.

7 Net investment income per share and ratio of net investment income to average net assets reflects a special dividend received by the Fund, which amounted to $0.13 per share and 0.63% of average net assets.

8 The repurchase plan was completed at an average repurchase price of $12.17, $10.29 and $14.92, respectively, for 66,300 shares, 173,600 shares and 3,589,570 shares, respectively. The redemption for the periods ended April 30, 2010, October 31, 2009 and December 31, 2008 were $806,667, $1,786,938 and $53,556,991, respectively, and had a less than $0.005, $0.01 and $0.16 NAV impact, respectively.

9 Total return based on net asset value reflects changes in the Fund’s net asset value during each period. Total return based on market value reflects changes in market value. Each figure assumes that dividend and capital gain distributions, if any, were reinvested. These figures will differ depending upon the level of any discount from or premium to net asset value at which the Fund’s shares traded during the period.

10 Total returns would have been lower had certain expenses not been reduced during the periods shown.

11 Not annualized.

12 Unaudited.

13 Assumes dividend reinvestment and a purchase at $20.01 per share on the inception date and a sale at the current market price on the last day of the period.

14 Annualized.

15 Ratios calculated on the basis of gross expenses relative to the average net assets of common shares that does not take into consideration expense reductions during the periods shown. Without the exclusion of preferred shares, the annualized ratio of expenses would have been 0.90%, 0.90%, 0.91% and 0.89% for the periods ended 12-31-07, 12-31-06, 12-31-05 and 12-31-04, respectively.

16 Ratios calculated on the basis of net expenses relative to the average net assets of common shares. Without the exclusion of preferred shares, the annualized ratio of expenses would have been 0.70%, 0.70%, 0.71% and 0.69% for the periods ended 12-31-07, 12-31-06, 12-31-05 and 12-31-04, respectively.

17 Ratios calculated on the basis of net investment income relative to the average net assets of common shares. Without the exclusion of preferred shares, the annualized ratio of net investment income would have been 4.03%, 4.74%, 4.14% and 4.42% for the periods ended 12-31-07, 12-31-06, 12-31-05 and 12-31-04, respectively.

18 Calculated by subtracting the Fund’s total liabilities from the Fund’s total assets and dividing that amount by the number of APS outstanding, as of the applicable 1940 Act Evaluation Date, which may differ from the financial reporting date.

19 Asset coverage equals the total net assets plus APS divided by the APS of the Fund outstanding at period end.

20 Asset coverage equals the total net assets plus borrowings divided by the borrowing of the Fund outstanding at period end (Note 8).

| | |

| 16 | Tax-Advantaged Dividend Income Fund | Semiannual report | See notes to financial statements |

Notes to financial statements

(unaudited)

Note 1 — Organization

John Hancock Tax-Advantaged Dividend Income Fund (the Fund) is a closed-end diversified management investment company registered under the Investment Company Act of 1940, as amended (the 1940 Act). The Fund began operations February 27, 2004.

Note 2 — Significant accounting policies

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Events or transactions occurring after the end of the fiscal period through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Security valuation. Investments are stated at value as of the close of regular trading on the New York Stock Exchange (NYSE), normally at 4:00 p.m., Eastern Time. The Fund uses a three-tier hierarchy to prioritize the pricing assumptions, referred to as inputs, used in valuation techniques to measure fair value. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes significant observable inputs. Observable inputs may include quoted prices for similar securities, interest rates, prepayment speeds and credit risk. Prices for securities valued using these techniques are received from independent pricing vendors and brokers and are based on an evaluation of the inputs described. Level 3 includes significant unobservable inputs wh en market prices are not readily available or reliable, including the Fund’s own assumptions in determining the fair value of investments. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the values by input classification of the Fund’s investments as of April 30, 2010, by major security category or type:

| | | | |

| | | | LEVEL 2 | LEVEL 3 |

| | TOTAL MARKET | LEVEL 1 | SIGNIFICANT | SIGNIFICANT |

| | VALUE AT | QUOTED | OBSERVABLE | UNOBSERV- |

| | 4-30-10 | PRICE | INPUTS | ABLE INPUTS |

|

| Common Stocks | | | | |

|

| Consumer Discretionary | $89 | — | — | $89 |

|

| Energy | 45,839,926 | $45,839,926 | — | — |

|

| Industrials | 8,675,600 | 8,675,600 | — | — |

|

| Telecommunication Services | 20,606,050 | 20,606,050 | — | — |

|

| Utilities | 419,999,774 | 419,999,774 | — | — |

| | | | | |

| Preferred Stocks | | | | |

|

| Consumer Discretionary | 6,683,470 | 6,683,470 | — | — |

|

| Energy | 36,256,860 | 36,256,860 | — | — |

|

| Financials | 210,775,615 | 210,761,877 | $13,738 | — |

|

| Telecommunication Services | 22,861,311 | 22,861,311 | — | — |

|

| Utilities | 107,742,285 | 52,193,441 | 55,548,844 | — |

| | | | |

| Short-Term Investments | 11,768,961 | — | 11,768,961 | |

|

| Total Investments in Securities | $891,209,941 | $823,878,309 | $67,331,543 | $89 |

|

| Other Financial Instruments | ($3,876,809) | ($807,637) | ($3,069,172) | — |

|

| Totals | $887,333,132 | $823,070,672 | $64,262,371 | $89 |

|

| | |

| | Semiannual report | Tax-Advantaged Dividend Income Fund | 17 |

The following is a reconciliation of Level 3 assets for which significant unobservable inputs were used to determine fair value:

| |

| | Consumer Discretionary |

|

| Balance as of 10/31/09 | — |

| Accrued discounts/premiums | — |

| Realized gain (loss) | — |

| Change in unrealized appreciation (depreciation) | ($501) |

| Net purchases (sales) | — |

| Net transfers in and/out of Level 3 | 590 |

| Balance as of 4/30/10 | $89 |

During the six-month period ended April 30, 2010, there were no significant transfers in/out of Level 1 and Level 2 assets.

In order to value the securities, the Fund uses the following valuation techniques. Equity securities held by the Fund are valued at the last sale price or official closing price on the principal securities exchange on which they trade. In the event there were no sales during the day or closing prices are not available, then securities are valued using the last quoted bid or evaluated price. Foreign securities and currencies are valued in U.S. dollars, based on foreign currency exchange rates supplied by an independent pricing service. Certain securities traded only in the over-the-counter market are valued at the last bid price quoted by brokers making markets in the securities at the close of trading. Certain short-term securities are valued at amortized cost.

Other portfolio securities and assets, where market quotations are not readily available, are valued at fair value, as determined in good faith by the Fund’s Pricing Committee, following procedures established by the Board of Trustees. Generally, trading in non-U.S. securities is substantially completed each day at various times prior to the close of trading on the NYSE. The values of non-U.S. securities, used in computing the net asset value of the Fund’s shares, are generally determined at these times. Significant market events that affect the values of non-U.S. securities may occur after the time when the valuation of the securities is generally determined and the close of the NYSE. During significant market events, these securities will be valued at fair value, as determined in good faith, following procedures established by the Board of Trustees.

Repurchase agreements. The Fund may enter into repurchase agreements. When a Fund enters into a repurchase agreement it receives collateral which is held in a segregated account by the Fund’s custodian. The collateral amount is marked-to-market and monitored on a daily basis to ensure that the collateral held is in an amount not less than the principal amount of the repurchase agreement plus any accrued interest. In the event of a default by the counterparty, realization of the collateral proceeds could be delayed, during which time the collateral value may decline.

Security transactions and related investment income. Investment security transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is accrued as earned. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds from litigation. Dividend income is recorded on the ex-date except for certain foreign dividends where the ex-date may have passed, which are recorded when the Fund becomes aware of the dividends.

Overdrafts. Pursuant to the custodian agreement, the Fund’s custodian may, in its discretion, advance funds to the Fund to make properly authorized payments. When such payments result in an overdraft, the Fund is obligated to repay the custodian for any overdraft, including any costs or expenses associated with the overdraft. The custodian has a lien, security interest or security

| |

| 18 | Tax-Advantaged Dividend Income Fund | Semiannual report |

entitlement in any Fund property, that is not segregated, to the maximum extent permitted by law to the extent of any overdraft.

Expenses. The majority of expenses are directly attributable to an individual fund. Expenses that are not readily attributable to a specific fund are allocated among all funds in an equitable manner, taking into consideration, among other things, the nature and type of expense and the fund’s relative assets. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Federal income taxes. The Fund intends to qualify as a regulated investment company by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required.

For federal income tax purposes, the Fund has a capital loss carryforward of $89,895,968 available to offset future net realized capital gains as of October 31, 2009. The loss carryforward expires as follows: October 31, 2016 — $9,941,872 and October 31, 2017 — $79,954,096.

As of October 31, 2009, the Fund had no uncertain tax positions that would require financial statement recognition, de-recognition or disclosure. The Fund’s federal tax return is subject to examination by the Internal Revenue Service for a period of three years.

Distribution of income and gains. Distributions to shareholders from net investment income and net realized gains, if any, are recorded on the ex-date. The Fund generally declares and pays dividends monthly and capital gain distributions, if any, annually.

Such distributions, on a tax basis, are determined in conformity with income tax regulations, which may differ from accounting principles generally accepted in the United States of America. Material distributions in excess of tax basis earnings and profits, if any, are reported in the Fund’s financial statements as a return of capital.

Capital accounts within financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences will reverse in a subsequent period. Permanent book-tax differences are primarily attributable to derivative transactions.

Statement of cash flows. Information on financial transactions that have been settled through the receipt and disbursement of cash is presented in the Statement of Cash Flows. The cash amount shown in the Statement of Cash Flows is the amount included in the Fund’s Statement of Assets and Liabilities and represents the cash on hand at its custodian and does not include any short-term investments.

Note 3 — Derivative instruments

The Fund may invest in derivatives, including written options in order to meet its investment objectives. The Fund may use derivatives to manage against anticipated changes in securities markets, gain exposure to securities or indexes and enhance potential gains.

The use of derivatives may involve risks different from, or potentially greater than, the risks associated with investing directly in securities. Specifically, derivatives expose a Fund to the risk that the counterparty to an over-the-counter (OTC) derivatives contract will be unable or unwilling to make timely settlement payments or otherwise honor its obligations. OTC derivatives transactions typically can only be closed out with the other party to the transaction. If the counterparty defaults, the Fund will have contractual remedies, but there is no assurance that the counterparty will meet its contractual obligations or the Fund will succeed in enforcing them.

| | |

| | Semiannual report | Tax-Advantaged Dividend Income Fund | 19 |

Options. There are two types of options, a put option and a call option. Options are traded either over-the-counter or by means of an exchange. A call option gives the purchaser of the option the right to buy (and the seller the obligation to sell) the underlying instrument at the exercise price. A put option gives the purchaser of the option the right to sell (and the writer the obligation to buy) the underlying instrument at the exercise price. Writing puts and buying calls may increase the Fund’s exposure to changes in the value of the underlying instrument. Buying puts and writing calls may decrease the Fund’s exposure to such changes. Risks related to the use of options include the loss of the premium, possible illiquidity of the options markets, trading restrictions imposed by an exchange, movements in underlying security values, and for written options, potential losses in excess of the fund’s initial investment.

Options listed on an exchange are valued at their closing price. If no closing price is available, then they are valued at the mean between the last bid and ask prices from the exchange on which they are principally traded. For options not listed on an exchange, an independent pricing source is used to value the options at the mean between the last bid and ask prices. When the Fund purchases an option, the premium paid by the Fund is included in the Portfolio of Investments and subsequently “marked-to-market” to reflect current market value. If the purchased option expires, the Fund realizes a loss equal to the cost of the option. If the Fund enters into a closing sale transaction, the Fund realizes a gain or loss, depending on whether proceeds from the closing sale are greater or less than the original cost. If the Fund exercises a call option, the cost of the securities acquired by exercising the call is increased by the premium paid to buy the call. If the Fund exercises a put option, it realizes a gain or loss from the sale of the underlying security and the proceeds from such sale are decreased by the premium paid.

During the six-month period ended April 30, 2010, the Fund wrote option contracts to seek to enhance potential gain as well as reduce overall portfolio volatility. The following tables summarize the Fund’s written options activities during the six-month period ended April 30, 2010 and the contracts held at April 30, 2010.

| | |

| | NUMBER | |

| | OF CONTRACTS | PREMIUMS |

|

| Outstanding, beginning of period | 2,885 | $2,356,185 |

| Options written | 22,011 | 18,122,610 |

| Options closed | (17,146) | (17,167,217) |

| Options expired | (5,870) | (2,416,412) |

| Outstanding, end of period | 1,880 | $895,166 |

| |

| 20 | Tax-Advantaged Dividend Income Fund | Semiannual report |

| | | | | | |

| | | | | NUMBER OF | | |

| NAME OF ISSUER | EXERCISE PRICE | | EXPIRATION DATE | CONTRACTS | PREMIUM | VALUE |

|

| CALLS | | | | | | |

| Dow Jones Industrial | | | | | | |

| Average Index | $114 | | May 2010 | 545 | $12,551 | ($11,990) |

| Morgan Stanley | | | | | | |

| Technology Index | 640 | | May 2010 | 95 | 20,805 | (7,837) |

| NASDAQ 100 Stock | | | | | | |

| Index | 2,100 | | May 2010 | 30 | 17,970 | (12,720) |

| Philadelphia | | | | | | |

| Semiconductor Index | 405 | | May 2010 | 150 | 58,350 | (41,625) |

| Russell 2000 Index | 730 | | May 2010 | 85 | 56,015 | (87,890) |

| S&P 100 Index | 540 | | Jun 2010 | 100 | 169,700 | (143,200) |

| S&P 100 Index | 550 | | Jun 2010 | 100 | 110,700 | (89,000) |

| S&P 400 Midcap | | | | | | |

| Index | 840 | | May 2010 | 75 | 38,175 | (63,375) |

| S&P 500 Index | 1,225 | | May 2010 | 700 | 410,900 | (350,000) |

| Total | | | | 1,880 | $895,166 | ($807,637) |

Swaps. The Fund may enter into interest rate, credit default, and other forms of swap agreements. Swap agreements are privately negotiated agreements between a Fund and counterparty to exchange cash flows, assets, foreign currencies or market-linked returns at specified intervals. Swaps are marked to market daily based upon values from third party vendors or broker quotations, and the change in value is recorded as an unrealized appreciation/depreciation of swap contracts.

Upfront payments made/received by the Fund are amortized/accreted for financial reporting purposes, with the unamortized/unaccreted portion included in the Statement of Assets and Liabilities. A termination payment by the counterparty or the Fund is recorded as realized gain or loss, as well as, the net periodic payments received or paid by a Fund.

Entering into swap agreements involves, to varying degrees, elements of credit, market and documentation risk that may amount to values that are in excess of the amounts recognized on the Statement of Assets and Liabilities. Such risks involve the possibility that there will be no liquid market for the swap, that a counterparty may default on its obligation or delay payment under the swap terms. The counterparty may disagree or contest the terms of the swap. Market risks may also accompany the swap, including interest rate risk. The Fund may also suffer losses if it is unable to terminate or assign outstanding swaps or reduce its exposure through offsetting transactions.

Interest rate swaps. Interest rate swaps represent an agreement between a Fund and counterparty to exchange cash flows based on the difference between two interest rates applied to a notional amount. The payment flows are usually netted against each other, with the difference being paid by one party to the other. The Fund settles accrued net interest receivable or payable under the swap contracts on a periodic basis.

During the six-month period ended April 30, 2010, the Fund used interest rate swaps in anticipation of rising interest rates. The following table summarizes the interest rate swap contracts held as of April 30, 2010. During the six-month period ended April 30, 2010, the Fund invested in interest rate swaps with total notional values as represented below.

| | |

| | Semiannual report | Tax-Advantaged Dividend Income Fund | 21 |

| | | | | | | |

| | USD | PAYMENTS | PAYMENTS | | | UNREALIZED | |

| | NOTIONAL | MADE | RECEIVED | EFFECTIVE | TERMINATION | APPRECIATION | |

| COUNTERPARTY | AMOUNT | BY FUND | BY FUND | DATE | DATE | (DEPRECIATION) | MARKET VALUE |

|

| | | | 3-month | | | | |

| Bank of America | $95,000,000 | 3.6000% | LIBOR (a) | 1-9-08 | 1-9-11 | ($3,069,172) | ($3,069,172) |

|

| (a) At April 30, 2010, the 3-month LIBOR rate was 0.34656%. | | | | |

Fair value of derivative instruments by risk category

The table below summarizes the fair value of derivatives held by the Fund at April 30, 2010 by risk category:

| | | | |

| | STATEMENT OF ASSETS | FINANCIAL | ASSET | LIABILITY |

| | AND LIABILITIES | INSTRUMENTS | DERIVATIVES | DERIVATIVES |

| RISK | LOCATION | LOCATION | FAIR VALUE | FAIR VALUE |

|

| Equity contracts | Written options, | Written options | — | ($807,637) |

| | at value | | | |

| |

| |

| Interest rate contracts | Unrealized | Interest rate | — | (3,069,172) |

| | depreciation of | swaps | | |

| | swap contracts | | | |

| |

| Total | | | — | ($3,876,809) |

Effect of derivative instruments on the Statement of Operations

The table below summarizes the net realized gain (loss) included in the net increase (decrease) in net assets from operations, classified by derivative instrument and risk category, for the six-month period ended April 30, 2010:

| | | | |

| | STATEMENT OF | | | |

| | OPERATIONS | | | |

| RISK | LOCATION | WRITTEN OPTIONS | SWAP CONTRACTS | TOTAL |

|

| Equity Contracts | Net realized gain | ($2,316,482) | — | ($2,316,482) |

| | (loss) on | | | |

| Interest rate contracts | Net realized gain | — | ($1,600,547) | (1,600,547) |

| | (loss) on | | | |

|

| Total | | ($2,316,482) | ($1,600,547) | ($3,917,029) |

The table below summarizes the net change in unrealized appreciation (depreciation) included in the net increase (decrease) in net assets from operations, classified by derivative instrument and risk category, for the six-month period ended April 30, 2010:

| | | | |

| | STATEMENT OF OPERATIONS | | | |

| RISK | LOCATION | WRITTEN OPTIONS | SWAP CONTRACTS | TOTAL |

|

| Equity Contracts | Change in unrealized | ($1,271,331) | — | ($1,271,331) |

| | appreciation | | | |

| | (depreciation) of | | | |

| |

| Interest rate contracts | Change in | — | $1,252,432 | 1,252,432 |

| | unrealized appreciation | | | |

| | (depreciation) of | | | |

|

| Total | | ($1,271,331) | $1,252,432 | ($18,899) |

Note 4 — Guarantees and indemnifications

Under the Fund’s organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred.

| |

| 22 | Tax-Advantaged Dividend Income Fund | Semiannual report |

Note 5 — Fees and transactions with affiliates

John Hancock Advisers, LLC (the Adviser) serves as investment adviser for the Fund. The Adviser is an indirect wholly owned subsidiary of Manulife Financial Corporation (MFC).

Management fee. The Fund has an investment management contract with the Adviser under which the Fund pays a daily management fee to the Adviser equivalent, on an annual basis, of 0.75% of the Fund’s average daily net assets and the value attributed to the committed facility agreement (see Note 8) (collectively, managed assets). The Adviser has subadvisory agreements with MFC Global Investment Management (U.S.), LLC, an indirect owned subsidiary of MFC and an affiliate of the Adviser, and Analytic Investors, LLC. The Fund is not responsible for payment of the subadvisory fees.

The Adviser has contractually agreed to limit the Fund’s management fee to the following: 0.55% of the Fund’s average daily managed assets until the fifth anniversary of the commencement of the Fund’s operations, 0.60% of such assets in the sixth year, 0.65% of such assets in the seventh year and 0.70% of average daily managed assets in the eighth year. After the eighth year, the Adviser will no longer waive a portion of the management fee. Accordingly, the expense reductions related to the reduction in the management fee amounted to $545,626 for the six-month period ended April 30, 2010.

The investment management fees incurred for the six-month period ended April 30, 2010 were equivalent to an annual effective rate of 0.62% of the Fund’s average daily managed assets.

Accounting and legal services. Pursuant to the Service Agreement, the Fund reimburses the Adviser for all expenses associated with providing the administrative, financial, legal, accounting and recordkeeping services of the Fund, including the preparation of all tax returns, periodic reports to shareholders and regulatory reports amongst other services. The accounting and legal services fees incurred for the six-month period ended April 30, 2010, amounted to an effective rate of 0.004% of the Fund’s average daily managed assets.

Trustees expenses. The Trust compensates each Trustee who is not an employee of the Adviser or its affiliates. These Trustees may, for tax purposes, elect to defer receipt of this compensation under the John Hancock Group of Funds Deferred Compensation Plan (the Plan). Deferred amounts are invested in various John Hancock funds and remain in the funds until distributed in accordance with the Plan. The investment of deferred amounts and the offsetting liability are included in the accompanying Statement of Assets and Liabilities.

Note 6 — Fund share transactions

In December 2007, the Board of Trustees approved a share repurchase plan, which was renewed in December 2008. Under the share repurchase plan, the Fund may purchase in the open market up to 10% of its outstanding common shares. On December 8, 2009, the Board of Trustees approved the renewal of the Fund’s share repurchase plan. As renewed, the Fund may purchase, in the open market, up to an additional 10% of its outstanding common shares between January 1, 2010 and December 31, 2010 (based on common shares outstanding as of December 31, 2009).

The Fund is authorized to issue an unlimited number of common shares with no par value. During the six-month period ended April 30, 2010, the ten month period ended October 31, 2009 and the year ended October 31, 2008, the Fund repurchased 66,300, 173,600 and 3,589,570, respectively (0.17%, 0.45% and 8.53% of shares outstanding, respectively) of its common shares under the share repurchase program. The corresponding dollar amount of the share repurchase amounted to $806,667, $1,786,938 and $53,556,991 during the six-month period ended April 30, 2010, the ten-month period ended October 31, 2009 and the year ended October 31, 2008, respectively.

Note 7 — Leverage risk

The Fund utilizes a Committed Facility Agreement (CFA) to increase its assets available for investment. When the Fund leverages its assets, common shareholders bear the fees associated

| | |

| | Semiannual report | Tax-Advantaged Dividend Income Fund | 23 |

with the facility and have the potential to benefit or be disadvantaged from the use of leverage. The Adviser’s fee is also incurred from the use of leverage. Consequently, the Fund and the Adviser may have differing interests in determining whether to leverage the Fund’s assets. Leverage creates risks that may adversely affect the return for the holders of common shares, including:

• the likelihood of greater volatility of net asset value and market price of common shares

• fluctuations in the interest rate paid for the use of the credit facility

• increased operating costs, which may reduce the Fund’s total return

• the potential for a decline in the value of an investment acquired through leverage, while the Fund’s obligations under such leverage remains fixed

• the Fund is more likely to have to sell securities in a volatile market in order to meet asset coverage or other debt compliance requirements

To the extent the income or capital appreciation derived from securities purchased with funds received from leverage exceeds the cost of leverage, the Fund’s return will be greater than if leverage had not been used, conversely, returns would be lower if the cost of the leverage exceeds the income or capital appreciation derived.

Note 8 — Committed Facility Agreement

The Fund has entered into a CFA with a subsidiary of BNP Paribas (BNP) that allows it to borrow up to $351 million and to invest the borrowings in accordance with its investment practices. Borrowings under the CFA are secured by the assets of the Fund as disclosed in the Fund’s investments. Interest charged is at the rate of one month LIBOR (reset daily) plus 0.85%. The Fund also pays a commitment fee of 0.60% per annum on the unused portion of the facility. Commitment fee for the six-month period ended April 30, 2010 totaled $220,390 and is included in the interest expense in the Statement of Operations. As of April 30, 2010, the Fund had borrowings of $296,200,000 at an interest rate of 1.13% which are reflected in the committed facility agreement payable on the Statement of Asset and Liabilities. During the six-month period ended April 30, 2010, the average borrowing under the CFA and the effective average interest rate were $277,942,541 and 1.09%, respectively.

The Fund may terminate the agreement with 60 days’ notice, if the Board of Trustees determines that the elimination of all indebtedness leveraging the Fund’s investments is in the best interests of the Fund’s shareholders. In certain circumstances, the CFA may automatically terminate or it may be reduced to a 30-day facility. In addition, upon the occurrence of certain defaults, the lender may terminate the CFA, and it may modify or terminate the CFA upon 270 days’ notice.

On October 30, 2009, the Fund entered into an agreement with BNP that allows BNP to borrow a portion of the pledged collateral (Lent Securities) in an amount not to exceed the lesser of: (i) outstanding borrowings owed by the Fund to BNP and (ii) thirty three and one third percent of the Fund’s total assets. The Fund can designate any security within the pledged collateral as ineligible to be a Lent Security and can recall any of the Lent Securities. The Fund also has the right to apply and set-off an amount equal to one hundred percent (100%) of the then-current fair market value of such Lent Securities against the current borrowings under the CFA.

Note 9 — Purchase and sale of securities

Purchases and sales of securities, other than short-term securities, aggregated $102,477,714 and $68,700,073, respectively, for the six-month period ended April 30, 2010.

| |

| 24 | Tax-Advantaged Dividend Income Fund | Semiannual report |

Additional information

Unaudited

Investment objective and policy

The Fund’s investment objective is to provide a high level of after-tax total return from dividend income and gains and capital appreciation.

Under normal market conditions, the Fund will invest at least 80% of its assets (net assets plus borrowings for investment purposes) in dividend-paying common and preferred securities that the Adviser believes at the time of acquisition are eligible to pay dividends which, for individual shareholders, qualify for U.S. federal income taxation at rates applicable to long-term capital gains, which currently are taxed at a maximum rate of 15% (“tax-advantaged dividends”). Tax-advantaged dividends generally include dividends from domestic corporations and dividends from foreign corporations that meet certain specified criteria. The Fund generally can pass the tax treatment of tax-advantaged dividends it receives through to its common shareholders.

On December 17, 2007, the Fund’s Trustees approved a change to the fund’s investment policy regarding investments in foreign securities. The revised policy provides that the Fund may invest up to 40% of its net assets in securities of corporate and government issuers located outside the United States that are traded or denominated in U.S. dollars.

On March 31, 2008, the shareholders approved the following changes to the Fund’s fundamental investment policy: To eliminate the Fund’s “concentration” policy (i.e., investing at least 25% of its net assets) with respect to securities issued by financial services corporations; and to modify the Fund’s concentration policy with respect to investing in the utilities sector by permitting the Fund to invest in both U.S. and foreign utilities corporations, rather than only U.S. utilities corporations (as required under the prior policy).

On December 9, 2008, the Fund’s Trustees approved the following investment policy: The fund may write (sell) covered call index options on up to 30% of the value of the fund’s total assets.

Bylaws

Effective September 9, 2008, the Fund’s bylaws were amended with respect to notice requirements for Trustee nominations and other proposals by the Fund’s shareholders. These provisions require the disclosure of the nominating shareholder and the nominee’s investment interests as they relate to the Fund, as well as the name of any other shareholder supporting the nominee for election as a Trustee or the proposal of other business. In order for notice to be proper, such notice must disclose the economic interests of the nominating shareholder and nominee, including his or her holdings of shares in the Fund, the intent upon which those shares were acquired, and any hedging arrangements (including leveraged or short positions) made with respect to the shares of the Fund. Additionally, any material interest that the shareholder has in the business to be brought before the meeting must be disclosed.

| | |

| | Semiannual report | Tax-Advantaged Dividend Income Fund | 25 |

Dividends and distributions

During the six month period ended April 30, 2010, dividends from net investment income totaling $0.546 per share were paid to common shareholders. The dates of payments and the amounts per share are as follows:

| | | | |

| | INCOME | | | |

| PAYMENT DATE | DIVIDEND | | | |

| | | |

| November 30, 2009 | $0.091 | | | |

| December 31, 2009 | 0.091 | | | |

| January 29, 2010 | 0.091 | | | |

| February 26, 2010 | 0.091 | | | |

| March 31, 2010 | 0.091 | | | |

| April 30, 2010 | 0.091 | | | |

| Total | $0.546 | | | |

Dividend reinvestment plan

The Fund offers its shareholders a Dividend Reinvestment Plan (the Plan), which offers the opportunity to earn compounded yields. Each shareholder will automatically have all distributions of dividends and capital gains reinvested by Mellon Bank, N.A., as plan agent (the Plan Agent). Holders of common shares who elect not to participate in the Plan will receive all distributions in cash, paid by check mailed directly to the shareholder of record (or, if the common shares are held in street or other nominee name, then to the nominee) by the Plan Agent, as dividend disbursing agent.

Shareholders may join the Plan by filling out and mailing an authorization card, by notifying the Plan Agent by telephone or by visiting the Plan Agent’s Web site at www.melloninvestor.com. Shareholders must indicate an election to reinvest all or a portion of dividend payments. If received in proper form by the Plan Agent before the record date of a dividend, the election will be effective with respect to all dividends paid after such record date. Shareholders whose shares are held in the name of a broker or nominee should contact the broker or nominee to determine whether and how they may participate in the Plan.

If the Fund declares a dividend payable either in common shares or in cash, nonparticipants will receive cash, and participants in the Plan will receive the equivalent in common shares.

If the market price of the common shares on the payment date of the dividend is equal to or exceeds their net asset value as determined on the payment date, participants will be issued common shares (out of authorized but unissued shares) at a value equal to the higher of net asset value or 95% of the market price. If the net asset value exceeds the market price of the common shares at such time, or if the Board of Trustees declares a dividend payable only in cash, the Plan Agent will, as agent for Plan participants, buy shares in the open market, on the New York Stock Exchange or elsewhere, for the participants’ accounts. Such purchases will be made promptly after the payable date for such dividend and, in any event, prior to the next ex-dividend date after such date, except where necessary to comply with federal securities laws. If, before the Plan Agent has completed its purchases, the market price exceeds the net asset value of the common shares, t he average per share purchase price paid by the Plan Agent may exceed the net asset value of the common shares, resulting in the acquisition of fewer shares than if the dividend had been paid in shares issued by the Fund.

Each participant will pay a pro rata share of brokerage commissions incurred with respect to the Plan Agent’s open market purchases in connection with the reinvestment of dividends and distributions. In each case, the cost per share of the shares purchased for each participant’s account will be the average cost, including brokerage commissions, of any shares purchased on the open market plus the cost of any shares issued by the Fund. There will be no brokerage charges with respect to common shares issued directly by the Fund. There are no other charges to participants for reinvesting dividends or capital gain distributions.

| |

| 26 | Tax-Advantaged Dividend Income Fund | Semiannual report |

Participants in the Plan may withdraw from the Plan at any time by contacting the Plan Agent by telephone, in writing or by visiting the Plan Agent’s Web site at www.melloninvestor.com. Such withdrawal will be effective immediately if received prior to a dividend record date; otherwise, it will be effective for all subsequent dividend record dates. When a participant withdraws from the Plan or upon termination of the Plan, as provided below, certificates for whole common shares credited to his or her account under the Plan will be issued, and a cash payment will be made for any fraction of a share credited to such account.

The Plan Agent maintains each shareholder’s account in the Plan and furnishes monthly written confirmations of all transactions in the accounts, including information needed by the shareholders for personal and tax records. The Plan Agent will hold common shares in the account of each Plan participant in noncertificated form in the name of the participant. Proxy material relating to the shareholders’ meetings of the Fund will include those shares purchased as well as shares held pursuant to the Plan.

The reinvestment of dividends and distributions will not relieve participants of any federal income tax that may be payable or required to be withheld on such dividends or distributions. Participants under the Plan will receive tax information annually. The amount of dividend to be reported on 1099-DIV should be (1) in the case of shares issued by the Fund, the fair market value of such shares on the dividend payment date and (2) in the case of shares purchased by the Plan Agent in the open market, the amount of cash used by the Plan Agent to purchase shares in the open market, including the amount of cash allocated to brokerage commissions paid on such purchases.

Experience under the Plan may indicate that changes are desirable. Accordingly, the Fund reserves the right to amend or terminate the Plan as applied to any dividend or distribution paid subsequent to written notice of the change sent to all shareholders of the Fund at least 90 days before the record date for the dividend or distribution. The Plan may be amended or terminated by the Plan Agent after at least 90 days’ written notice to all shareholders of the Fund. All correspondence or additional information concerning the Plan should be directed to the Plan Agent, Mellon Bank, N.A., c/o Mellon Investor Services, P.O. Box 358015, Pittsburgh, PA 15252–8015 (Telephone: 1-800-852-0218).

Shareholder communication and assistance

If you have any questions concerning the Fund, we will be pleased to assist you. If you hold shares in your own name and not with a brokerage firm, please address all notices, correspondence, questions or other communications regarding the Fund to the transfer agent at:

Mellon Investor Services

Newport Office Center VII

480 Washington Boulevard

Jersey City, NJ 07310

Telephone: 1-800-852-0218

If your shares are held with a brokerage firm, you should contact that firm, bank or other nominee for assistance.

| | |

| | Semiannual report | Tax-Advantaged Dividend Income Fund | 27 |

Shareholder meeting (unaudited)

The Fund held its Annual Meeting of Shareholders on January 22, 2010. The following action was taken by the shareholders:

Proposal: Election of four (4) Trustees to serve for a three-year term ending at the Annual Meeting of Shareholders in 2013. The votes cast with respect to each Trustee are set forth below:

THE PROPOSAL PASSED FOR ALL TRUSTEES ON JANUARY 22, 2010.

| | |

| | TOTAL VOTES FOR | TOTAL VOTES WITHHELD |

| | THE NOMINEE | FROM THE NOMINEE |

|

| James R. Boyle | 31,141,494 | 974,039 |

| Deborah C. Jackson | 30,908,167 | 1,207,366 |

| Patti McGill Peterson | 31,094,325 | 1,021,208 |

| Steven R. Pruchansky | 31,101,931 | 1,013,602 |

The following seven Trustees of the Fund were not up for election and remain in office: James F. Carlin, William H. Cunningham, Charles L. Ladner, Stanley Martin, John A. Moore, Gregory A. Russo and John G Vrysen.

| |

| 28 | Tax-Advantaged Dividend Income Fund | Semiannual report |

More information

| | |

| Trustees | Officers | Investment adviser |

| Patti McGill Peterson, | Keith F. Hartstein | John Hancock Advisers, LLC |

| Chairperson | President and | |

| James R. Boyle† | Chief Executive Officer | Subadvisers |

| James F. Carlin | | MFC Global Investment |

| William H. Cunningham | Andrew G. Arnott | Management (U.S.), LLC |

| Deborah C. Jackson* | Chief Operating Officer | |

| Charles L. Ladner | | Analytic Investors, LLC |

| Stanley Martin* | Thomas M. Kinzler | |

| Dr. John A. Moore | Secretary and | Custodian |

| Steven R. Pruchansky* | Chief Legal Officer | State Street Bank and |

| Gregory A. Russo | | Trust Company |

| John G. Vrysen† | Francis V. Knox, Jr. | |

| *Member of the Audit Committee | Chief Compliance Officer | Transfer agent |

| †Non-Independent Trustee | | Mellon Investor Services |

| Charles A. Rizzo | |

| Chief Financial Officer | Legal counsel |

| | | K&L Gates LLP |

| Salvatore Schiavone | |

| | Treasurer | Stock symbol |

| | | Listed New York Stock |

| | | Exchange: HTD |

For shareholder assistance refer to page 27

| | |

| You can also contact us: | 1-800-852-0218 | Regular mail: |

| | jhfunds.com | Mellon Investor Services |

| | | Newport Office Center VII |

| | | 480 Washington Boulevard |

| | | Jersey City, NJ 07310 |

The Fund’s proxy voting policies and procedures, as well as the Fund’s proxy voting record for the most recent twelve-month period ended June 30, are available free of charge on the Securities and Exchange Commission (SEC) Web site at www.sec.gov or on our Web site.

The Fund’s complete list of portfolio holdings, for the first and third fiscal quarters, is filed with the SEC on FormN-Q. The Fund’s Form N-Q is available on our Web site and the SEC’s Web site, www.sec.gov, and can be reviewed and copied (for a fee) at the SEC’s Public Reference Room in Washington, DC. Call 1-800-SEC-0330 toreceive information on the operation of the SEC’s Public Reference Room.

We make this information on your fund, as well as monthly portfolio holdings, and other fund details available on our Web site www.jhfunds.com or by calling 1-800-852-0218.

The report is certified under the Sarbanes-Oxley Act, which requires mutual funds and other public companies to affirm that, to the best of their knowledge, the information in their financial reports is fairly and accurately stated in all material respects.

The Fund is listed for trading on the NYSE and has filed with the NYSE its chief executive officer certification regarding compliance with the NYSE’s listing standards. The Fund also files with the SEC the certification of its chief executive officer and chief financial officer required by Section 302 of the Sarbanes-Oxley Act.

| | |

| | Semiannual report | Tax-Advantaged Dividend Income Fund | 29 |

1-800-852-0218

1-800-231-5469 TDD

1-800-843-0090 EASI-Line

www.jhfunds.com

| |

| PRESORTED | |

| STANDARD | |

| U.S. POSTAGE | |

| PAID | |

| MIS | |

ITEM 2. CODE OF ETHICS.

Not applicable.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

Not applicable at this time.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

Not applicable at this time.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable at this time.

ITEM 6. SCHEDULE OF INVESTMENTS.

(a) Not applicable.

(b) Not applicable.

ITEM 7. DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 8. PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 9. PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS.

(a) Not applicable.

| | | | |

| (b) REGISTRANT PURCHASES OF EQUITY SECURITIES | |

| | | | |

| | | | | Maximum |

| | | | Total Number of | Number |

| | | | Shares | of Shares that |

| | Total Number | | Purchased | May |

| | of | Average | as Part of | Yet Be |

| | Shares | Price | Publicly | Purchased |

| Period | Purchased * | per Share | Announced Plan* | Under the Plan* |

|

| |

| | | | |

| November 1, 2009 to | | | | |

| November 30,2009 | 39,900 | $11.655 | 39,900 | 3,791,532 |

| |

| | | | |

| December 1, 2009 to | | | | |

| December 31, 2009 | 0 | 0 | 39,900 | 3,791,532 |

| | | | | |

| | | | |

| January 1, 2010 to | | | | |

| January 31, 2010 | 26,400 | 12.921 | 66,300 | 3,765,132 |

| |

| February 1, 2010 to | | | | |

| February 28, 2010 | 0 | 0 | 66,300 | 3,765,132 |

| |

| March 1, 2010 to | | | | |

| March 31, 2010 | 0 | 0 | 66,300 | 3,765,132 |

| |

| April 1, 2010 to | | | | |

| April 30, 2010 | 0 | 0 | 66,300 | 3,765,132 |

|

| |

| Total | 66,300 | $12.167 | | |

|

*In December 2007, the Board of Trustees approved a share repurchase plan, which was renewed in December 2008. Under the share repurchase plan, the Fund may purchase in the open market up to 10% of its outstanding common shares. On December 8, 2009, the Board of Trustees approved the renewal of the Fund’s share repurchase plan. As renewed, the Fund may repurchase in the open market, up to an additional 10% of its outstanding common shares between January 1, 2010 and December 31, 2010 (based on common shares outstanding as of December 31, 2009). During the period ended April 30, 2010, the Fund repurchased 66,300 common shares or 0.17% of the outstanding common shares.

ITEM 10. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

Not applicable.

ITEM 11. CONTROLS AND PROCEDURES.

(a) Based upon their evaluation of the registrant's disclosure controls and procedures as conducted within 90 days of the filing date of this Form N-CSR, the registrant's principal executive officer and principal financial officer have concluded that those disclosure controls and procedures provide reasonable assurance that the material information required to be disclosed by the registrant on this report is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission's rules and forms.

(b) There were no changes in the registrant's internal control over financial reporting that occurred during the registrant's most recent fiscal half-year (the registrant's second fiscal half-year in the case of an annual report) that have materially affected, or are reasonably likely to materially affect, the registrant's internal control over financial reporting.

ITEM 12. EXHIBITS.

(a) Separate certifications for the registrant's principal executive officer and principal financial officer, as required by Section 302 of the Sarbanes-Oxley Act of 2002 and Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(b) Separate certifications for the registrant's principal executive officer and principal financial officer, as required by 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, and Rule 30a-2(b) under the Investment Company Act of 1940, are attached. The certifications furnished pursuant to this paragraph are not deemed to be "filed" for

purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liability of that section. Such certifications are not deemed to be incorporated by reference into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that the Registrant specifically incorporates them by reference.

(c) Contact person at the registrant.