As filed with the Securities and Exchange Commission on January 23, 2015.

Registration No. 333-________

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 [X]

[ ] Pre-Effective Amendment No. ___

[ ] Post-Effective Amendment No. ____

PRINCIPAL VARIABLE CONTRACTS FUNDS, INC.

(Exact name of Registrant as specified in charter)

655 9th Street, Des Moines, Iowa 50309

(Address of Registrant's Principal Executive Offices)

515-235-9328

(Registrant's Telephone Number, Including Area Code)

Adam U. Shaikh

Assistant Counsel, Principal Variable Contracts Funds, Inc.

The Principal Financial Group

Des Moines, Iowa 50392

(Name and Address of Agent for Service)

|

| |

| Copies of all communications to: |

| | |

| | JOSHUA B. DERINGER |

| | Drinker Biddle & Reath, LLP |

| | One Logan Square, Ste 2000 |

| | Philadelphia, PA 19103-6996 |

| | 215-988-2959 |

Approximate date of proposed public offering: As soon as practicable after this Registration Statement becomes effective.

Title of Securities Being Registered: Class 1 and Class 2 Shares, par value $.01 per share.

No filing fee is due because an indefinite number of shares have been registered in reliance on Section 24(f) under the Investment Company Act of 1940, as amended.

PRINCIPAL VARIABLE CONTRACTS FUNDS, INC.

655 9th Street

Des Moines, Iowa 50392

1-800-222-5852

February ____, 2015

Dear Shareholder:

A Special Meeting of Shareholders of Principal Variable Contracts Funds, Inc. ("PVC") will be held at 655 9th Street, Des Moines, Iowa 50392, on April 10, 2015, 10:00 a.m. Central Time (the "Meeting").

At the Meeting, the shareholders of each of the series of PVC listed in the first column below (each an "Acquired Fund") will be asked to consider and approve a Plan of Acquisition (a "Plan") providing for its reorganization into the PVC series listed in the second column below (the "Acquiring Fund") (each a reorganization and, collectively, the "Reorganization"). As indicated, the Acquiring Fund is the same in each reorganization.

|

| | |

| ACQUIRED FUND | | ACQUIRING FUND |

| SmallCap Growth Account II | | SmallCap Blend Account |

| SmallCap Value Account I | | SmallCap Blend Account |

Under the Plans and with respect to each reorganization: (i) the Acquiring Fund will acquire all the assets, subject to all the liabilities, of an Acquired Fund in exchange for shares of the Acquiring Fund; (ii) the Acquiring Fund shares will be distributed to the shareholders of the Acquired Fund; and (iii) the Acquired Fund will liquidate and terminate. As a result of the Reorganization, each shareholder of an Acquired Fund will become a shareholder of the Acquiring Fund. The total value of all shares of the Acquiring Fund issued in the Reorganization to an Acquired Fund will equal the total value of the net assets of the Acquired Fund. The number of full and fractional shares of the Acquiring Fund received by a shareholder of an Acquired Fund will be equal in value to the value of that shareholder’s shares of the Acquired Fund as of the close of regularly scheduled trading on the New York Stock Exchange ("NYSE") on the closing date of the Reorganization. Holders of Class 1 and Class 2 of an Acquired Fund will receive, respectively, Class 1 and Class 2 shares of the Acquiring Fund. The Reorganization is expected to occur as of the close of regularly scheduled trading on the NYSE on April 24, 2015. All share classes of each Acquired Fund will vote in the aggregate and not by class with respect to the Reorganization. The implementation of the Reorganization as to one Acquired Fund is not contingent upon its implementation as to the other Acquired Fund.

The value of your investment will not be affected by the Reorganization. Furthermore, in the opinion of legal counsel, no gain or loss will be recognized by any shareholder for federal income tax purposes as a result of the Reorganization.

*****

Enclosed you will find a Notice of Special Meeting of Shareholders, a Proxy Statement/Prospectus, and a voting instruction card for the shares of each Acquired Fund attributable to your variable contract or policy as of February 6, 2015, the record date for the Meeting. The Proxy Statement/Prospectus provides background information and concisely describes in detail the matters to be voted on at the Meeting.

The Board of Directors has unanimously voted in favor of the proposed Reorganization and recommends that you vote FOR the Proposal.

In order for shares to be voted at the Meeting, we urge you to read the Proxy Statement/Prospectus and then complete and mail your voting instruction card(s) in the enclosed postage-paid envelope, allowing sufficient time for receipt by us by April 9, 2015. As a convenience, we offer three options by which to vote your shares:

By Internet: Follow the instructions located on your proxy card.

By Phone: The phone number is located on your proxy card. Be sure you have your control number, as printed on your proxy card, available at the time you call.

By Mail: Sign your proxy card and enclose it in the postage-paid envelope provided in this proxy package.

We appreciate your taking the time to respond to this important matter. Your vote is important. If you have any questions regarding the Reorganization, please call our shareholder services department toll free at 1-800-222-5852.

Sincerely,

Nora M. Everett

President and Chief Executive Officer

PRINCIPAL VARIABLE CONTRACTS FUNDS, INC.

655 9th Street

Des Moines, Iowa 50392

1-800-222-5852

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To the Shareholders of the SmallCap Growth Account II and SmallCap Value Account I:

Notice is hereby given that a Special Meeting of Shareholders (the "Meeting") of the SmallCap Growth Account II and SmallCap Value Account I (collectively, the "Acquired Funds"), each a separate series of Principal Variable Contracts Funds, Inc. ("PVC"), will be held at 655 9th Street, Des Moines, Iowa 50392, on April 10, 2015, at 10:00 a.m. Central Time. A Proxy Statement/Prospectus providing information about the following proposals to be voted on at the Meeting is included with this notice. The Meeting is being held to consider and vote on such proposals as well as any other business that may properly come before the Meeting or any adjournment thereof:

| |

| Proposal 1: | Approval of a Plan of Acquisition providing for the reorganization of the SmallCap Growth Account II into the SmallCap Blend Account. (Only shareholders of the SmallCap Growth Account II will vote on this proposal.) |

| |

| Proposal 2: | Approval of a Plan of Acquisition providing for the reorganization of the SmallCap Value Account I into the SmallCap Blend Account. (Only shareholders of the SmallCap Value Account I will vote on this proposal.) |

The Board of Directors of PVC recommends that shareholders of the Acquired Funds vote FOR the Proposals.

Approval of the Proposal will require the affirmative vote of the holders of at least a "Majority of the Outstanding Voting Securities" (as defined in the accompanying Proxy Statement/Prospectus) of the applicable Acquired Fund.

Each shareholder of record at the close of business on February 6, 2015 is entitled to receive notice of and to vote at the Meeting.

Please read the attached Proxy Statement/Prospectus.

By order of the Board of Directors

Nora M. Everett

President and Chief Executive Officer

February ____, 2015

Des Moines, Iowa

PRINCIPAL VARIABLE CONTRACTS FUNDS, INC.

655 9th Street, Des Moines, Iowa 50392

1-800-222-5852

—————————

PROXY STATEMENT/PROSPECTUS

SPECIAL MEETING OF SHAREHOLDERS TO BE HELD APRIL 10, 2015

RELATING TO THE REORGANIZATION OF:

1) THE SMALLCAP GROWTH ACCOUNT II INTO THE SMALLCAP BLEND ACCOUNT

2) THE SMALLCAP VALUE ACCOUNT I INTO THE SMALLCAP BLEND ACCOUNT

This Proxy Statement/Prospectus is furnished in connection with the solicitation by the Board of Directors (the "Board" or "Directors") of Principal Variable Contracts Funds, Inc. ("PVC") of proxies to be used at a Special Meeting of Shareholders of PVC to be held at 655 9th Street, Des Moines, Iowa 50392, on April 10, 2015, at 10:00 a.m. Central Time (the "Meeting").

At the Meeting, shareholders of each of the series of PVC listed in the first column below (each, an "Acquired Fund") will be asked to consider and approve a Plan of Acquisition (a "Plan") providing for its reorganization into the PVC series listed in the second column below (the "Acquiring Fund").

|

| | |

| ACQUIRED FUND | | ACQUIRING FUND |

| SmallCap Growth Account II | | SmallCap Blend Account |

| SmallCap Value Account I | | SmallCap Blend Account |

Under the Plans and with respect to each reorganization: (i) the Acquiring Fund will acquire all the assets, subject to all the liabilities, of an Acquired Fund in exchange for shares of the Acquiring Fund; (ii) the Acquiring Fund shares will be distributed to the shareholders of the Acquired Fund; and (iii) the Acquired Fund will liquidate and terminate. As a result of the Reorganization, each shareholder of an Acquired Fund will become a shareholder of the Acquiring Fund. The total value of all shares of the Acquiring Fund issued in the Reorganization to an Acquired Fund will equal the total value of the net assets of the Acquired Fund. The number of full and fractional shares of the Acquiring Fund received by a shareholder of an Acquired Fund will be equal in value to the value of that shareholder’s shares of the Acquired Fund as of the close of regularly scheduled trading on the New York Stock Exchange ("NYSE") on the closing date of the Reorganization. Holders of Class 1 and Class 2 of an Acquired Fund will receive, respectively, Class 1 and Class 2 shares of the Acquiring Fund. The Reorganization is expected to occur as of the close of regularly scheduled trading on the NYSE on April 17, 2015. All share classes of each Acquired Fund will vote in the aggregate and not by class with respect to the Reorganization. The implementation of the Reorganization as to one Acquired Fund is not contingent upon its implementation as to the other Acquired Fund.

This Proxy Statement/Prospectus contains information shareholders should know before voting on the Reorganization. Please read it carefully and retain it for future reference. The Annual and Semi-Annual Reports to Shareholders of PVC contain additional information about the investments of the Acquired and Acquiring Funds, and the Annual Report contains discussions of the market conditions and investment strategies that significantly affected the Acquired and Acquiring Funds during the fiscal year ended December 31, 2013. Copies of these reports may be obtained without charge by writing PVC at the address noted above or by calling our shareholder services department toll free at 1-800-247-4123. The Annual Report for the fiscal year ended December 31, 2014 is expected to be sent to shareholders on or about February ____, 2015.

A Statement of Additional Information dated February ____, 2015 (the "Statement of Additional Information") relating to this Proxy Statement/Prospectus has been filed with the Securities and Exchange Commission ("SEC") and is incorporated by reference into this Proxy Statement/Prospectus. PVC’s Prospectus, dated May 1, 2014 and as supplemented through the date of this registration statement (File No. 02-35570) and the Statement of Additional Information for PVC, dated May 1, 2014 and as supplemented through the date of this registration statement ("PVC SAI"), have been filed with the SEC and, insofar as they relate to the Acquired Funds, are incorporated by reference into this Proxy Statement/Prospectus. PVC’s prospectus sets forth concisely the information about the Funds that a prospective investor ought to know before investing. Copies of these documents may be obtained without charge by writing to PVC at the address noted above or by calling our shareholder services department toll free at 1-800-222-5852. You may also call our shareholder services department toll fee at 1-800-222-5852 if you have any questions regarding the Reorganization.

PVC is subject to the informational requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940 (the "1940 Act") and files reports, proxy materials and other information with the SEC. Such reports, proxy materials and other information may be inspected and copied at the Public Reference Room of the SEC at 100 F Street, N.E., Washington, D.C. 20549 (information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-202-551-5850). Such materials are also available on the SEC’s EDGAR Database on its Internet site at www.sec.gov, and copies may be obtained, after paying a duplicating fee, by email request addressed to publicinfo@sec.gov or by writing to the SEC’s Public Reference Room.

Important Notice Regarding Availability of Proxy Statement for the Shareholders’ Meeting to be Held on April 10, 2014. This Proxy Statement is available on the Internet at www.2voteproxy.com/PVCSC.

The SEC has not approved or disapproved these securities or passed upon the accuracy or adequacy of this Proxy Statement/Prospectus. Any representation to the contrary is a criminal offense.

The date of this Proxy Statement/Prospectus is February ____, 2015.

|

| | |

| TABLE OF CONTENTS |

| INTRODUCTION | |

| THE REORGANIZATION | |

| PROPOSAL 1: | Approval of a Plan of Acquisition Providing for the Reorganization of the SmallCap Growth Account II into the SmallCap Blend Account | |

| | Comparison of Acquired and Acquiring Funds | |

| | Comparison of Investment Objectives and Strategies | |

| | Comparison of Principal Investment Risks | |

| | Fees and Expenses of the Funds | |

| | Performance | |

| | Reasons for the Reorganization | |

| | Board Consideration of the Reorganization | |

| PROPOSAL 2: | Approval of a Plan of Acquisition Providing for the Reorganization of the SmallCap Value Account I into the SmallCap Blend Account | |

| | Comparison of Acquired and Acquiring Funds | |

| | Comparison of Investment Objectives and Strategies | |

| | Comparison of Principal Investment Risks | |

| | Fees and Expenses of the Funds | |

| | Performance | |

| | Reasons for the Reorganization | |

| | Board Consideration of the Reorganization | |

| INFORMATION ABOUT THE REORGANIZATION | |

| | Plans of Acquisition | |

| | Description of the Securities to Be Issued | |

| | Federal Income Tax Consequences | |

| CAPITALIZATION | |

| ADDITIONAL INFORMATION ABOUT THE FUNDS | |

| | Certain Investment Strategies and Related Risks of the Funds | |

| | Multiple Classes of Shares | |

| | Costs of Investing in the Funds | |

| | Distribution Plans and Intermediary Compensation | |

| | Pricing of Fund Shares | |

| | Purchase of Fund Shares | |

| | Sale of Fund Shares | |

| | Frequent Trading and Market Timing (Abusive Trading Practices) | |

| | Dividends and Distributions | |

| | Tax Considerations | |

| | Portfolio Holdings Information | |

| VOTING INFORMATION | |

| OUTSTANDING SHARES AND SHARE OWNERSHIP | |

| FINANCIAL HIGHLIGHTS | |

| FINANCIAL STATEMENTS | |

| LEGAL MATTERS | |

| OTHER INFORMATION | |

| APPENDIX A Forms of Plans of Acquisition | |

INTRODUCTION

This Proxy Statement/Prospectus is being furnished to shareholders of the Acquired Funds to provide information regarding the Plans and the Reorganization.

Principal Variable Contracts Funds, Inc. PVC is a Maryland corporation and an open-end management investment company registered with the SEC under the 1940 Act. PVC currently offers 39 separate series or funds (the "PVC Funds"), including the Acquired and Acquiring Funds. The sponsor of PVC is Principal Life Insurance Company ("Principal Life"), and the investment advisor to the PVC Funds is Principal Management Corporation ("PMC"). Principal Funds Distributor, Inc. (the "Distributor" or "PFD") is the distributor for all share classes of the Acquired and Acquiring Funds. Principal Life, an insurance company organized in 1879 under the laws of Iowa, PMC and PFD are indirect, wholly-owned subsidiaries of Principal Financial Group, Inc. ("PFG"). Their address is the Principal Financial Group, Des Moines, Iowa 50392.

Investment Management. Pursuant to an investment advisory agreement with PVC with respect to each of the Acquired and Acquiring Funds, PMC provides investment advisory services and certain corporate administrative services to the Funds. As permitted by the investment advisory agreement, PMC has entered into sub-advisory agreements with respect to each of the Acquired and Acquiring Funds as follows:

|

| |

| Acquired Fund | Sub-Advisor |

| SmallCap Growth Account II | Emerald Advisers, Inc. ("Emerald") |

| SmallCap Value Account I | J.P. Morgan Investment Management Inc. ("J.P. Morgan") |

| | |

| Acquiring Fund | Sub-Advisor |

| SmallCap Blend Account | Principal Global Investors ("PGI") |

PMC and each sub-advisor are registered with the SEC as investment advisors under the Investment Advisers Act of 1940.

Emerald is located at 3175 Oregon Pike, Leola, PA 17540.

J.P. Morgan is located at 270 Park Avenue, New York, NY 10017.

PGI is located at 801 Grand Avenue, Des Moines, IA 50392. PGI is an affiliate of PFG and PMC.

THE REORGANIZATION

At its meeting held on December 9, 2014, the Board of Directors of PVC (the "Board"), including all the Directors who are not "interested persons" (as defined in the 1940 Act) of PVC (the "Independent Directors"), approved the Reorganization pursuant to the Plans providing for the combination of each Acquired Fund into the Acquiring Fund. The Board concluded with respect to each combination that the Reorganization is in the best interests of the Acquired Fund and the Acquiring Fund and that the interests of existing shareholders of each Fund will not be diluted as a result of the Reorganization. The factors that the Board considered in deciding to approve the Reorganization as to each Acquired Fund is discussed under each proposal under "Information About the Reorganization – Board Consideration of the Reorganization."

The Reorganization contemplates: (i) the transfer of all the assets, subject to all of the liabilities, of each Acquired Fund to the Acquiring Fund in exchange for shares of the Acquiring Fund; (ii) the distribution to Acquired Fund shareholders of the Acquiring Fund shares; and (iii) the liquidation and termination of each Acquired Fund. As a result of the Reorganization, each shareholder of an Acquired Fund will become a shareholder of the Acquiring Fund. In the Reorganization, the Acquiring Fund will issue to each Acquired Fund a number of shares with a total value equal to the total value of the net assets of the Acquired Fund, and each shareholder of the Acquired Fund will receive a number of full and fractional shares of the Acquiring Fund with a value equal to the value of that shareholder’s shares of the Acquired Fund, as of the close of regularly scheduled trading on the NYSE on the closing date of the Reorganization (the "Effective Time"). The closing date of the Reorganization is expected to be April 17, 2015. Holders of Class 1 and Class 2 shares of an Acquired Fund will receive, respectively, Class 1 and Class 2 shares of the Acquiring Fund. The terms and conditions of the Reorganization are more fully described below in this Proxy Statement/Prospectus and in the Forms of the Plans attached hereto as Appendix A. The implementation of the Reorganization as to one Acquired Fund is not contingent upon its implementation as to the other Acquired Fund.

The Board believes that the Reorganization of the SmallCap Growth Account II into the SmallCap Blend Fund under Proposal 1 will serve the best interests of the shareholders of both Funds. The SmallCap Blend Fund has outperformed the SmallCap Growth Account II over the one-, three-, and five-year periods ended September 30, 2014. The Funds have the same investment objectives in that both seek to provide long-term growth of capital, and they also have similar principal policies and risks in that both invest principally in equity securities of companies with small market capitalizations. The SmallCap Blend Account also has a lower advisory fee than the SmallCap Growth Account II. The Board noted that, although the Annual Fund Operating Expenses table for this prospectus/proxy shows the SmallCap Blend Account having an expense ratio higher than that of the SmallCap Growth Account II post-reorganization, that the expense ratios includes an item entitled "Acquired Fund Fees and Expenses" ("AFFE"). The Board noted that a fund whose expense ratio includes AFFE does not actually pay the AFFE from its assets as an expense, as is the case with expenses other than AFFE that are included in the Annual Fund Operating Expenses table, but rather experiences the effect of AFFE on the performance of the fund. The Board believes that the SmallCap Blend Account is expected to have a lower expense ratio post-reorganization than the SmallCap Growth Account II when the expense ratios of the two funds are compared on a consistent basis. The Board believes combining the Funds will not result in any dilution of the interests of existing shareholders of the Funds.

The Board believes that the Reorganization of the SmallCap Value Account I into the SmallCap Blend Account under Proposal 2 will serve the best interests of the shareholders of both Funds. The SmallCap Blend Account has outperformed the SmallCap Value Account I over the one-, three- and five-year periods ended September 30, 2014. The Funds have the same investment objectives in that both seek to provide long-term growth of capital, and they also have similar principal policies and risks in that both invest principally in equity securities of companies with small market capitalizations. The SmallCap Blend Account has a lower advisory fee than the SmallCap Value Account I and the SmallCap Value Account I shareholders are expected to see lower overall net operating expense ratios with respect to all share classes. Combining the Funds will not result in any dilution of the interests of existing shareholders of the Funds.

In the opinion of legal counsel, each reorganization will qualify as a tax-free reorganization and, for federal income tax purposes, no gain or loss will be recognized as a result of the reorganization by the Acquired or Acquiring Fund shareholders. Please see "Information About the Reorganization – Federal Income Tax Consequences" for a discussion the tax consequences to each Acquired Fund and its shareholders of disposing of portfolio securities, as described below, and their relation to available pre-reorganization capital losses of that Acquired Fund.

The Reorganization will not result in any material change in the purchase, redemption, and exchange procedures followed with respect to the distribution of shares. See "Additional Information About the Funds – Purchases, Redemptions and Exchanges of Shares."

With respect to the reorganization of the SmallCap Growth Account II into the SmallCap Blend Fund under Proposal 1, the SmallCap Growth Account II is expected to achieve the greatest benefit from the reorganization.The expenses and out-of-pocket fees to be incurred by the SmallCap Growth Account II in connection with the Reorganization, including printing, mailing, and legal fees are expected to total $22,000.The SmallCap Growth Account II will pay any trading costs associated with disposing, prior to the Reorganization, of any portfolio securities of the SmallCap Growth Account II that would not be compatible with the investment objectives and strategies of the SmallCap Blend Account and reinvesting the proceeds in securities that would be compatible. The SmallCap Growth Account II is expected to dispose of approximately 91% of its portfolio securities. The explicit trading costs (brokerage costs) are estimated to be $65,000 with an approximate gain of $11,556,000 on a U.S. GAAP basis. The per share capital gain is estimated to be $3.27.

With respect to the reorganization of the SmallCap Value Account I into the SmallCap Blend Account under Proposal 2, the SmallCap Value Account I is expected to achieve the greatest benefit from the reorganization. The expenses and out-of-pocket fees incurred by the SmallCap Value Account I in connection with the Reorganization, including printing, mailing, and legal fees will are expected to total $37,000.The SmallCap Value Account I will pay any trading costs associated with disposing, prior to the Reorganization, of any portfolio securities of the SmallCap Value Account I that would not be compatible with the investment objectives and strategies of the SmallCap Blend Account I and reinvesting the proceeds in securities that would be compatible. The SmallCap Value Account I is expected to dispose of approximately 93% of its portfolio securities. The explicit trading costs (brokerage costs) are estimated to be $111,000 with an approximate gain of $19,008,000 on a U.S. GAAP basis. The per share capital gain is estimated to be $3.82.

PROPOSAL 1:

Approval of a Plan of Acquisition Providing for the Reorganization of the

SmallCap Growth Account II into the SmallCap Blend Account

Shareholders of the SmallCap Growth Account II (the "Acquired Fund") are being asked to approve the reorganization of the Acquired Fund into the SmallCap Blend Account (the "Acquiring Fund.) Under Proposal 2, the shareholders of a second Fund, the SmallCap Value Account I, are being asked to approve the reorganization of that Fund into the Acquiring Fund.

Comparison of Acquired and Acquiring Funds

The following table provides comparative information with respect to the Acquired and Acquiring Funds. As indicated in the table, the Funds have the same investment objectives in that both Funds seek to provide long-term growth of capital. In addition, both Funds invest primarily in equity securities of companies with small market capitalizations. The Funds differ principally in that the Acquired Fund invests in securities with a growth orientation while the Acquiring Fund invests in securities with a blend of growth and value orientations. Further, the Acquired Fund invests a portion of its assets pursuant to an enhanced index strategy as described below. |

| | | |

SmallCap Growth Account II (Acquired Fund) | SmallCap Blend Account (Acquiring Fund) |

| Approximate Net Assets as of June 30, 2014 (unaudited) | |

| $64,937,000 | $67,870,000 |

| Investment Advisor: | PMC (for both Funds) | |

| Sub-Advisors and Portfolio Managers: |

| Emerald | PGI |

Joseph W. Garner has been with Emerald since 1994. He earned a B.A. in Economics from Millersville University and an M.B.A. from the Katz Graduate School of Business, University of Pittsburgh. Kenneth G. Mertz II has been with Emerald since 1992. He earned a B.A. in Economics from Millersville University. Mr. Mertz has earned the right to use the Chartered Financial Analyst designation. Stacey L. Sears has been with Emerald since 1992. She earned a B.S. in Business Administration from Millersville University and an M.B.A. from Villanova University. | Phil Nordhus has been with PGI since 1990. He earned a bachelor’s degree in Economics from Kansas State University and an M.B.A. from Drake University. Mr. Nordhus has earned the right to use the Chartered Financial Analyst designation. Brian W. Pattinson has been with PGI since 1994. He earned a bachelor's degree and an M.B.A. in Finance from the University of Iowa. Mr. Pattinson has earned the right to use the Chartered Financial Analyst designation. |

| PMC | |

Mariateresa Monaco has worked as a Portfolio Manager for Principal since 2009. Previously, she worked as a Portfolio Manager for Principal Global Investors, LLC, where she worked as a Portfolio Manager since 2005. She earned a master’s degree in Electrical Engineering from Politecnico di Torino, Italy, a master’s degree in Electrical Engineering from Northeastern University, and an M.B.A. from the Sloan School of Management at the Massachusetts Institute of Technology. | |

|

| | | |

| Comparison of Investment Objectives and Strategies |

| Investment Objective: | Both Funds seek to provide long-term growth of capital. | |

| Principal Investment Strategies: | |

Under normal circumstances, the Fund invests at least 80% of its net assets, plus any borrowings for investment purposes, in equity securities of companies with small market capitalizations at the time of each purchase. For this Fund, companies with small market capitalizations are those with market capitalizations equal to or smaller than the greater of 1) $2.5 billion or 2) the highest market capitalization of the companies comprising the Russell 2000® Growth Index (as of December 31, 2014, this range was between approximately $31 million and $7.3 billion). The Fund invests in growth equity securities; growth orientation emphasizes buying equity securities of companies whose potential for growth of capital and earnings is expected to be above average. PMC invests between 10% and 35% of the Fund's assets in equity securities in an attempt to match or exceed the performance of the Fund's benchmark index (listed in the Average Annual Total Returns table) by purchasing securities in the index while slightly overweighting and underweighting certain individual equity securities relative to their weight in the index. | Under normal circumstances, the Fund invests at least 80% of its net assets, plus any borrowings for investment purposes, in equity securities of companies with small market capitalizations at the time of each purchase. For this Fund, companies with small market capitalizations are those with market capitalizations within the range of companies comprising the Russell 2000® Index (as of December 31, 2014, this range was between approximately $19 million and $7.3 billion). The Fund invests in equity securities with value and/or growth characteristics and constructs an investment portfolio that has a "blend" of equity securities with these characteristics. Investing in value equity securities is an investment strategy that emphasizes buying equity securities that appear to be undervalued. The growth orientation selection emphasizes buying equity securities of companies whose potential for growth of capital and earnings is expected to be above average. The Fund does not have a policy of preferring one of these categories over the other. |

The investment objective of each Fund may be changed by the Board without shareholder approval.

Additional information about the investment strategies and the types of securities in which the Funds may invest is discussed below under "Certain Investment Strategies and Related Risks of the Funds" as well as in the Statement of Additional Information.

The Statement of Additional Information provides further information about the portfolio manager(s) for each Fund, including information about compensation, other accounts managed and ownership of Fund shares.

Comparison of Principal Investment Risks

In deciding whether to approve the Reorganization, shareholders should consider the amount and character of investment risk involved in the respective investment objectives and strategies of the Acquired and Acquiring Funds. Because the Funds have identical investment objectives and substantially similar principal policies, the Funds’ risks are substantially similar. As described below, the Funds also have some different risks. Many factors affect the value of investments in the Funds, and it is possible to lose money by investing in either Fund.

Risks Applicable to both Funds:

Equity Securities Risk. The value of equity securities could decline if the issuer’s financial condition declines or in response to overall market and economic conditions. A fund's principal market segment(s), such as large cap, mid cap or small cap stocks, or growth or value stocks, may underperform other market segments or the equity markets as a whole. Investments in smaller companies and mid-size companies may involve greater risk and price volatility than investments in larger, more mature companies.

Growth Stock Risk. If growth companies do not increase their earnings at a rate expected by investors, the market price of the stock may decline significantly, even if earnings show an absolute increase. Growth company stocks also typically lack the dividend yield that can lessen price declines in market downturns.

Risk Applicable to the Acquiring Fund:

Value Stock Risk. The market may not recognize the intrinsic value of value stocks for a long time, or they may be appropriately priced at the time of purchase.

Fees and Expenses of the Funds

Fees and Expenses as a % of average daily net assets

The following table shows: (a) the ratios of expenses to average net assets of the Acquired Funds for the fiscal year ended December 31, 2013; (b) the ratios of expenses to average net assets of the Acquiring Fund for the fiscal year ended December 31, 2013; and (c) the pro forma expense ratios of the Acquiring Fund for the fiscal year ending December 31, 2013 assuming that the Reorganization had taken place at the commencement of that fiscal year, and (d) the pro forma expense ratios of the Acquiring Fund for the fiscal year ended December 31, 2013, assuming that the Reorganization under both Proposals 1 and 2 had taken place at the commencement of that fiscal year.

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

|

| | | | | | | | |

| | Class | Management Fees | 12b-1 Fees | Other Expenses | Acquired Fund Fees & Expenses | Total Operating Expense Ratio | Fee Waiver | Total Operating Expenses After Fee Waiver |

| (a) SmallCap Growth Account II (Acquired Fund) |

| | 1 | 1.00% | N/A | 0.05% | – | 1.05% | (0.10)%(1) | 0.95% |

| | 2 | 1.00% | 0.25% | 0.05% | – | 1.30% | (0.10)%(1) | 1.20% |

| (b) SmallCap Blend Account ( Acquiring Fund) |

| | 1 | 0.85% | N/A | 0.02% | 0.10% | 0.97% | – | 0.97% |

| | 2 | 0.85% | 0.25% | 0.02% | 0.10% | 1.22% | – | 1.22% |

(c) SmallCap Blend Fund (Acquiring Fund) (Pro forma assuming Reorganization) |

| | 1 | 0.85% | N/A | 0.01% | 0.10% | 0.96% | – | 0.96% |

| | 2 | 0.85% | 0.25% | 0.01% | 0.10% | 1.21% | – | 1.21% |

(d) SmallCap Blend Fund (Acquiring Fund) (Pro forma assuming Reorganization and second fund Reorganization under Proposal 2) |

| | 1 | 0.85% | N/A | 0.01% | 0.10% | 0.96% | – | 0.96% |

| | 2 | 0.85% | 0.25% | 0.01% | 0.10% | 1.21% | – | 1.21% |

| |

(1) | Principal Management Corporation ("Principal"), the investment advisor, has contractually agreed to limit the Fund's Management Fees through the period ending April 30, 2016. The fee waiver will reduce the Fund's Management Fees by 0.10% (expressed as a percent of average net assets on an annualized basis). It is expected that the fee waiver will continue through the period disclosed; however, Principal Variable Contracts Funds, Inc. and Principal, the parties to the agreement, may agree to terminate the fee waiver prior to the end of the period. |

Examples: The following examples are intended to help you compare the costs of investing in shares of the Acquired and Acquiring Funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. If separate account expenses and contract level expenses were included, expenses would be higher. The examples should not be considered a representation of future expense of the Acquired or Acquiring fund. Actual expense may be greater or less than those shown. |

| | | | | | | | | | | | | |

| If you sell your shares at the end of the period: | 1 Year | 3 Years | 5 Years | 10 Years |

| SmallCap Growth Account II (Acquired Fund) | Class 1 | $ | 97 |

| $ | 321 |

| $ | 566 |

| $ | 1,270 |

|

| | Class 2 | 122 |

| 399 |

| 700 |

| 1,556 |

|

| | | | | | |

| SmallCap Blend Account (Acquiring Fund) | Class 1 | 99 |

| 309 |

| 536 |

| 1,190 |

|

| | Class 2 | 124 |

| 387 |

| 670 |

| 1,477 |

|

| | | | | | |

| SmallCap Blend Account (Acquiring Fund) | Class 1 | 98 |

| 306 |

| 531 |

| 1,178 |

|

| (Pro forma assuming Reorganization) | Class 2 | 124 |

| 387 |

| 670 |

| 1,477 |

|

| | | | | | |

| SmallCap Blend Account (Acquiring Fund) | Class 1 | 98 |

| 306 |

| 531 |

| 1,178 |

|

| (Pro forma assuming Reorganization and second fund Reorganization under Proposal 2) | Class 2 | 124 |

| 387 |

| 670 |

| 1,477 |

|

Portfolio Turnover

Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes for shareholders who hold Fund shares in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect Fund performance. During the most recent fiscal year, the portfolio turnover rate for the Acquired Fund was 72.8% of the average value of its portfolio while the portfolio turnover rate for the Acquiring Fund was 78.1%.

Investment Management Fees/Sub-Advisory Arrangements

Each Fund pays its investment advisor, PMC, an advisory fee which for each Fund is calculated as a percentage of the Fund’s average daily net assets pursuant to the following fee schedule:

|

| |

SmallCap Growth Account II (Acquired Fund) | SmallCap Blend Account (Acquiring Fund) |

First $100 million 1.00% Next $100 million 0.95% Next $100 million 0.90% Next $100 million 0.85% Over $400 million 0.80% | First $100 million 0.85% Next $100 million 0.80% Next $100 million 0.75% Next $100 million 0.70% Over $400 million 0.65% |

The sub-advisor to each Fund receives sub-advisory fees paid by PMC and not by the Fund.

A discussion of the basis of the Board’s approval of the advisory and sub-advisory agreements with respect to the Acquired and Acquiring Funds is available in PVC’s Annual Report to Shareholders for the fiscal year ended December 31, 2013.

Performance

The following information provides an indicator of the risks of investing in the Funds. The bar chart below shows how the Acquired Fund’s total return has varied year-by-year, while the table below shows each Fund’s performance over time (along with the returns of a broad-based market index for reference). Annual returns do not reflect any applicable sales charges and would be lower if they did. A Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. You may get updated performance information online at www.principalfunds.com or by calling 1-800-222-5852.

Performance of the Class 2 shares of the SmallCap Growth Account II for periods prior to inception of the class (January 8, 2007) reflects performance of the Class 1 shares, which have the same investments as Class 2 shares, but has been adjusted downward to reflect the higher expenses of Class 2 shares.

For periods prior to the inception date of Class 2 Shares (February 17, 2015) of the SmallCap Blend Account, performance shown in the table for Class 2 shares is based on the performance of the Fund's Class 1 shares adjusted to reflect the fees and expenses of the Class 2 shares. The adjustments result in performance for such periods that is no higher than the historical performance of the Class 1 shares, which were first sold on May 1, 1998.

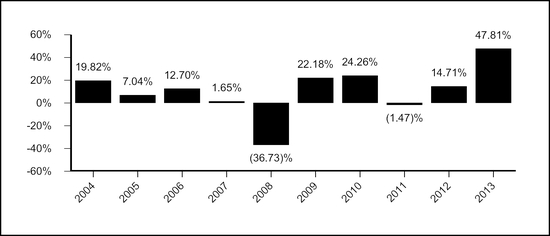

Calendar Year Total Returns (%) as of 12/31 each year (Class 1 Shares)

SmallCap Growth Account II (Acquired Fund)

|

| | | |

| Highest return for a quarter during the period of the bar chart above: | Q1 '12 | 18.63 | % |

| Lowest return for a quarter during the period of the bar chart above: | Q4 '08 | (28.78 | )% |

| | | |

| Year-to-date return for the quarter ending September 30, 2014: (4.75)% | | |

|

| | | |

| Average Annual Total Returns (%) |

| For the periods ended December 31, 2013 | 1 Year | 5 Years | 10 Years |

| SmallCap Growth Account II - Class 1 (inception 05/01/1998) | 47.42% | 22.34% | 8.16% |

| SmallCap Growth Account II - Class 2 (inception 01/08/2007) | 46.98% | 22.02% | 7.87% |

| Russell 2000 Growth Index (reflects no deduction for fees, expenses, or taxes) | 43.30% | 22.58% | 9.41% |

Calendar Year Total Returns (%) as of 12/31 each year (Class 1 Shares)

SmallCap Blend Fund (Acquiring Fund)

|

| | | |

| Highest return for a quarter during the period of the bar chart above: | Q4 '11 | 18.26 | % |

| Lowest return for a quarter during the period of the bar chart above: | Q4 '08 | (26.33 | )% |

| | | |

| Year-to-date return for the quarter ending September 30, 2014: (3.35)% | | |

|

| | | |

| Average Annual Total Returns (%) |

| For the periods ended December 31, 2013 | 1 Year | 5 Year | 10 Year |

| SmallCap Blend Account - Class 1 (inception 05/01/1998) | 47.81% | 20.46% | 8.96% |

| SmallCap Blend Account - Class 2 (inception 02/17/2015) | 47.46% | 20.17% | 8.70% |

| Russell 2000 Index (reflects no deduction for fees, expenses, or taxes) | 38.82% | 20.08% | 9.07% |

Reasons for the Reorganization

The Board believes that the reorganization will serve the best interests of the shareholders of both the Acquired and Acquiring Funds. The Board believes that the Reorganization of the Acquired Fund into the Acquiring Fund under Proposal 1 will serve the best interests of the shareholders of both Funds. The Acquiring Fund has outperformed the Acquired Fund over the one-, three-, and five-year periods ended September 30, 2014. The Funds have the same investment objectives in that both seek to provide long-term growth of capital, and they also have similar principal policies and risks in that both invest principally in equity securities of companies with small market capitalizations. The Acquiring Fund also has a lower advisory fee than the Acquired Fund. The Board noted that, although the Annual Fund Operating Expenses table for this prospectus/proxy shows the Acquiring Fund having an expense ratio higher than that of the Acquired Fund post-reorganization, that the expense ratios includes an item entitled "Acquired Fund Fees and Expenses" ("AFFE"). The Board noted that a fund whose expense ratio includes AFFE does not actually pay the AFFE from its assets as an expense, as is the case with expenses other than AFFE that are included in the Annual Fund Operating Expenses table, but rather experiences the effect of AFFE on the performance of the fund. The Board believes that the Acquiring Fund is expected to have a lower expense ratio post-reorganization than the Acquired Fund when the expense ratios of the two funds are compared on a consistent basis. The Board believes combining the Funds will not result in any dilution of the interests of existing shareholders of the Funds.

Board Consideration of the Reorganization

At its December 9, 2014 meeting, the Board considered information presented by PMC, and the Independent Directors were assisted by independent legal counsel. The Board requested and evaluated such information as it deemed necessary to consider the Reorganization. At the meeting, the Board unanimously approved the Reorganization after concluding that participation in the Reorganization is in the best interests of the Acquired Fund and the Acquiring Fund and that the interests of existing shareholders of the Funds will not be diluted as a result of the Reorganization.

In determining whether to approve the Reorganization, the Board made inquiry into a number of matters and considered, among others, the following factors, in no order of priority:

| |

| (1) | the investment objectives and principal investment strategies and risks of the Funds; |

| |

| (2) | identical fundamental investment restrictions; |

| |

| (3) | estimated trading costs associated with disposing of any portfolio securities of the Acquired Fund and reinvesting the proceeds in connection with the Reorganization; |

| |

| (4) | expense ratios and available information regarding the fees and expenses of the Funds; |

| |

| (5) | the estimated out-of-pocket expenses to be paid by the Acquired Fund related to the Reorganization; |

| |

| (6) | comparative investment performance of and other information pertaining to the Funds; |

| |

| (7) | the prospects for growth of and for achieving economies of scale by the Acquired Fund in combination with the Acquiring Fund; |

| |

| (8) | the absence of any material differences in the rights of shareholders of the Funds; |

| |

| (9) | the financial strength, investment experience and resources of PGI, which currently serves as sub-advisor to the Acquiring Fund; |

| |

| (10) | any direct or indirect benefits, including potential economic benefits, expected to be derived by PMC and its affiliates from the Reorganization; |

| |

| (11) | the direct or indirect federal income tax consequences of the Reorganization, including the expected tax-free nature of the Reorganization and the impact of any federal income tax loss carry forwards and the estimated capital gain or loss expected to be incurred in connection with disposing of any portfolio securities that would not be compatible with the investment objectives and strategies of the Acquiring Fund; |

| |

| (12) | the fact that the Reorganization will not result in any dilution of Acquired or Acquiring Fund shareholder values; |

| |

| (13) | the terms and conditions of the Plan; and |

| |

| (14) | possible alternatives to the Reorganization including liquidation of the Acquired Fund or continuing the Acquired Fund as currently operated. |

The Board’s decision to recommend approval of the Reorganization was based on a number of factors, including the following:

| |

| (1) | it should be reasonable for shareholders of the Acquired Fund to have similar investment expectations after the Reorganization because the Funds have the same investment objectives and substantially similar principal investment strategies and risks; |

| |

| (2) | PGI as sub-advisor responsible for managing the assets of the Acquiring Fund may be expected to provide high quality investment advisory services and personnel for the foreseeable future; |

| |

| (3) | the Acquiring Fund has a lower advisory fee than the Acquired Fund and the Board noted that, although the Annual Fund Operating Expenses table for this prospectus/proxy shows the Acquiring Fund having an expense ratio higher than that of the Acquired Fund post-reorganization, that the expense ratios includes an item entitled "Acquired Fund Fees and Expenses" ("AFFE"). The Board noted that a fund whose expense ratio includes AFFE does not actually pay the AFFE from its assets as an expense, as is the case with expenses other than AFFE that are included in the Annual Fund Operating Expenses table, but rather experiences the effect of AFFE on the performance of the fund. The Board believes that the Acquiring Fund is expected to have a lower expense ratio post-reorganization than the Acquired Fund when the expense ratios of the two funds are compared on a consistent basis; |

| |

| (4) | the Acquiring Fund has outperformed the Acquired Fund for the one-, three-, and five-year periods ended September 30, 2014. ; and |

| |

| (5) | the combination of the Acquired and Acquiring Funds may be expected to afford shareholders of the Acquired Fund on an ongoing basis greater prospects for growth and efficient management. |

PROPOSAL 2:

Approval of a Plan of Acquisition Providing for the Reorganization of the

SmallCap Value Account I into the SmallCap Blend Account

Shareholders of the SmallCap Value Account I (the "Acquired Fund") are being asked to approve the reorganization of the Acquired Fund into the SmallCap Blend Account (the "Acquiring Fund"). Under Proposal 1, the shareholders of a second Fund, the SmallCap Growth Account II, are being asked to approve the reorganization of that Fund into the Acquiring Fund.

Comparison of Acquired and Acquiring Funds

The following table provides comparative information with respect to the Acquired and Acquiring Funds. As indicated in the table, the Funds have the same investment objectives in that both Funds seek to provide long-term growth of capital. In addition, both Funds invest primarily in equity securities of companies with small market capitalizations. The Funds differ principally in that the Acquired Fund invests in securities with a value orientation while the Acquiring Fund invests in securities with a blend of value and growth orientations. Further, the Acquired Fund invests a portion of its assets pursuant to an enhanced index strategy as described below.

|

| | | |

SmallCap Value Account I (Acquired Fund) | SmallCap Blend Account (Acquiring Fund) |

| Approximate Net Assets as of June 30, 2014 (unaudited) | |

| $113,109,000 | $67,870,000 |

| Investment Advisor: | PMC (for both funds) | |

| Sub-Advisors and Portfolio Managers: | |

| J.P. Morgan | PGI |

Phillip D. Hart has been with J.P. Morgan since 2003. Mr. Hart earned a B.A. in Economics from Cornell University. He has earned the right to use the Chartered Financial Analyst designation. Dennis S. Ruhl has been with J.P. Morgan since 1999. He earned B.S. degrees in Mathematics and Computer Science and an M.Eng. in Computer Science from Massachusetts Institute of Technology. Mr. Ruhl has earned the right to use the Chartered Financial Analyst designation. | Phil Nordhus has been with PGI since 1990. He earned a bachelor’s degree in Economics from Kansas State University and an M.B.A. from Drake University. Mr. Nordhus has earned the right to use the Chartered Financial Analyst designation. Brian W. Pattinson has been with PGI since 1994. He earned a bachelor's degree and an M.B.A. in Finance from the University of Iowa. Mr. Pattinson has earned the right to use the Chartered Financial Analyst designation. |

| PMC | |

Mariateresa Monaco has worked as a Portfolio Manager for Principal since 2009. Previously, she worked as a Portfolio Manager for Principal Global Investors, LLC, where she worked as a Portfolio Manager since 2005. She earned a master’s degree in Electrical Engineering from Politecnico di Torino, Italy, a master’s degree in Electrical Engineering from Northeastern University, and an M.B.A. from the Sloan School of Management at the Massachusetts Institute of Technology. | |

|

| | | |

| Comparison of Investment Objectives and Strategies |

| Investment Objective: | Both Funds seek to provide long-term growth of capital. | |

| Principal Investment Strategies: | |

Under normal circumstances, the Fund invests at least 80% of its net assets, plus any borrowings for investment purposes, in a diversified group of equity securities of U.S. companies with small market capitalizations at the time of each purchase. For this Fund, companies with small market capitalizations are those with market capitalizations within the range of companies comprising the Russell 2000® Value Index (as of December 31, 2014, this range was between approximately $19 million and $5 billion). The Fund invests in value equity securities, an investment strategy that emphasizes buying equity securities that appear to be undervalued. The Fund invests in real estate investment trusts. PMC invests between 10% and 35% of the Fund's assets in equity securities in an attempt to match or exceed the performance of the Fund's benchmark index (listed in the Average Annual Total Returns table) by purchasing securities in the index while slightly overweighting and underweighting certain individual equity securities relative to their weight in the index. | Under normal circumstances, the Fund invests at least 80% of its net assets, plus any borrowings for investment purposes, in equity securities of companies with small market capitalizations at the time of each purchase. For this Fund, companies with small market capitalizations are those with market capitalizations within the range of companies comprising the Russell 2000® Index (as of December 31, 2014, this range was between approximately $19 million and $7.3 billion). The Fund invests in equity securities with value and/or growth characteristics and constructs an investment portfolio that has a "blend" of equity securities with these characteristics. Investing in value equity securities is an investment strategy that emphasizes buying equity securities that appear to be undervalued. The growth orientation selection emphasizes buying equity securities of companies whose potential for growth of capital and earnings is expected to be above average. The Fund does not have a policy of preferring one of these categories over the other. |

The investment objective of each Fund may be changed by the Board without shareholder approval.

Additional information about the investment strategies and the types of securities in which the Funds may invest is discussed below under "Certain Investment Strategies and Related Risks of the Funds" as well as in the Statement of Additional Information.

The Statement of Additional Information provides further information about the portfolio manager(s) for each Fund, including information about compensation, other accounts managed and ownership of Fund shares.

Comparison of Principal Investment Risks

In deciding whether to approve the Reorganization, shareholders should consider the amount and character of investment risk involved in the respective investment objectives and strategies of the Acquired and Acquiring Funds. Because the Funds have identical investment objectives and substantially similar principal policies, the Funds’ risks are substantially similar. As described below, the Funds also have some different risks. Many factors affect the value of investments in the Funds, and it is possible to lose money by investing in either Fund.

Risks Applicable to both Funds:

Equity Securities Risk. The value of equity securities could decline if the issuer’s financial condition declines or in response to overall market and economic conditions. A fund's principal market segment(s), such as large cap, mid cap or small cap stocks, or growth or value stocks, may underperform other market segments or the equity markets as a whole. Investments in smaller companies and mid-size companies may involve greater risk and price volatility than investments in larger, more mature companies.

Value Stock Risk. The market may not recognize the intrinsic value of value stocks for a long time, or they may be appropriately priced at the time of purchase.

Risks Applicable to the Acquired Fund:

Real Estate Investment Trusts ("REITs") Risk. A REIT could fail to qualify for tax-free pass-through of income under the Internal Revenue Code, and fund shareholders will indirectly bear their proportionate share of the expenses of REITs in which the fund invests.

Real Estate Securities Risk. Real estate securities are subject to the risks associated with direct ownership of real estate, including declines in value, adverse economic conditions, increases in expenses, regulatory changes and environmental problems. Investing in securities of companies in the real estate industry, subjects a fund to the special risks associated with the real estate market including factors such as loss to casualty or condemnation, changes in real estate values, property taxes, interest rates, cash flow of underlying real estate assets, occupancy rates, government regulations affecting zoning, land use and rents, and the management skill and creditworthiness of the issuer.

Risk Applicable to the Acquiring Fund:

Growth Stock Risk. If growth companies do not increase their earnings at a rate expected by investors, the market price of the stock may decline significantly, even if earnings show an absolute increase. Growth company stocks also typically lack the dividend yield that can lessen price declines in market downturns.

Fees and Expenses of the Funds

Fees and Expenses as a % of average daily net assets

The following table shows: (a) the ratios of expenses to average net assets of the Acquired Fund for the fiscal year ended December 31, 2013; (b) the ratios of expenses to average net assets of the Acquiring Fund for the fiscal year ended December 31, 2013; and (c) the pro forma expense ratios of the Acquiring Fund for the fiscal year ending December 31, 2013 assuming that the Reorganization had taken place at the commencement of that fiscal year, and (d) the pro forma expense ratios of the Acquiring Fund for the fiscal year ended December 31, 2013, assuming that the Reorganization under both Proposals 1 and 2 had taken place at the commencement of that fiscal year.

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

|

| | | | | | | | |

| | Class | Management Fees | 12b-1 Fees | Other Expenses | Acquired Fund Fees & Expenses | Total Operating Expense Ratio | Fee Waiver | Total Operating Expenses |

| (a) SmallCap Value Account I (Acquired Fund) |

| | 1 | 1.09% | N/A | 0.05% | 0.09% | 1.23% | (0.15)%(1)(2) | 1.08% |

| | 2 | 1.09% | 0.25% | 0.05% | 0.09% | 1.48% | (0.15)%(1)(2) | 1.33% |

| (b) SmallCap Blend Account ( Acquiring Fund) |

| | 1 | 0.85% | N/A | 0.02% | 0.10% | 0.97% | – | 0.97% |

| | 2 | 0.85% | 0.25% | 0.02% | 0.10% | 1.22% | – | 1.22% |

(c) SmallCap Blend Fund (Acquiring Fund) (Pro forma assuming Reorganization) |

| | 1 | 0.85% | N/A | 0.01% | 0.10% | 0.96% | – | 0.96% |

| | 2 | 0.85% | 0.25% | 0.01% | 0.10% | 1.21% | – | 1.21% |

(d) SmallCap Blend Fund (Acquiring Fund) (Pro forma assuming Reorganization and second fund Reorganization under Proposal 1) |

| | 1 | 0.85% | N/A | 0.01% | 0.10% | 0.96% | – | 0.96% |

| | 2 | 0.85% | 0.25% | 0.01% | 0.10% | 1.21% | – | 1.21% |

| |

(1) | Principal Management Corporation ("Principal"), the investment advisor, has contractually agreed to limit the Fund's Management Fees through the period ending April 30, 2016. The fee waiver will reduce the Fund's Management Fees by 0.02% (expressed as a percent of average net assets on an annualized basis). It is expected that the fee waiver will continue through the period disclosed; however, Principal Variable Contracts Funds, Inc. and Principal, the parties to the agreement, may agree to terminate the fee waiver prior to the end of the period. |

| |

(2) | Principal Management Corporation ("Principal"), the investment advisor, has contractually agreed to limit the Fund’s expenses by paying, if necessary, expenses normally payable by the Fund, (excluding interest expense, expenses related to fund investments, acquired fund fees and expenses, and other extraordinary expenses) to maintain a total level of operating expenses (expressed as a percent of average net assets on an annualized basis) not to exceed 0.99% for Class 1 and 1.24% for Class 2 shares. It is expected that the expense limit will continue through the period ending April 30, 2016; however, Principal Variable Contracts, Inc. and Principal, the parties to the agreement, may agree to terminate the expense limit prior to the end of the period. |

Examples: The following examples are intended to help you compare the costs of investing in shares of the Acquired and Acquiring Funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. If separate account expenses and contract level expenses were included, expenses would be higher. The examples should not be considered a representation of future expense of the Acquired or Acquiring fund. Actual expense may be greater or less than those shown.

|

| | | | | | | | | | | | | |

| If you sell your shares at the end of the period: | 1 Year | 3 Years | 5 Years | 10 Years |

| SmallCap Value Account I (Acquired Fund) | Class 1 | $ | 110 |

| $ | 370 |

| $ | 656 |

| $ | 1,471 |

|

| | Class 2 | 135 |

| 448 |

| 789 |

| 1,751 |

|

| | | | | | |

| SmallCap Blend Account (Acquiring Fund) | Class 1 | 99 |

| 309 |

| 536 |

| 1,190 |

|

| | Class 2 | 124 |

| 387 |

| 670 |

| 1,477 |

|

| | | | | | |

| SmallCap Value Account I (Acquiring Fund) | Class 1 | 98 |

| 306 |

| 531 |

| 1,178 |

|

| (Pro forma assuming Reorganization) | Class 2 | 124 |

| 387 |

| 670 |

| 1,477 |

|

| | | | | | |

| SmallCap Blend Account (Acquiring Fund) | Class 1 | 98 |

| 306 |

| 531 |

| 1,178 |

|

| (Pro forma assuming Reorganization and | Class 2 | 124 |

| 387 |

| 670 |

| 1,477 |

|

| second fund Reorganization under Proposal 1) | | | | | |

Portfolio Turnover

Each of the Funds pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes for shareholders who hold Fund shares in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the portfolio turnover rate for the Acquired Fund was 57.0% of the average value of its portfolio while the portfolio turnover rate for the Acquiring Fund was 78.1%.

Investment Management Fees/Sub-Advisory Arrangements

Each Fund pays its investment advisor, PMC, an advisory fee which for each Fund is calculated as a percentage of the Fund’s average daily net assets pursuant to the following fee schedule: |

| |

SmallCap Value Account I (Acquired Fund) | SmallCap Blend Account (Acquiring Fund) |

First $100 million 1.10% Next $100 million 1.05% Next $100 million 1.00% Next $100 million 0.95% Over $400 million 0.90% | First $100 million 0.85% Next $100 million 0.80% Next $100 million 0.75% Next $100 million 0.70% Over $400 million 0.65% |

The sub-advisor to each Fund receives sub-advisory fees paid by PMC and not by the Fund.

A discussion of the basis of the Board’s approval of the advisory and sub-advisory agreements with respect to the Acquired and Acquiring Funds is available in PVC’s Annual Report to Shareholders for the fiscal year ended December 31, 2013.

Performance

The following information provides an indicator of the risks of investing in the Funds. The bar chart below shows how each Fund’s total return has varied year-by-year, while the table below shows each Fund’s performance over time (along with the returns of a broad-based market index for reference). Annual returns do not reflect any applicable sales charges and would be lower if they did. A Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. You may get updated performance information online at www.principalfunds.com or by calling 1-800-222-5852.

For periods prior to the inception date of Class 2 Shares (February 17, 2015) of the SmallCap Blend Account, performance shown in the table for Class 2 shares is based on the performance of the Fund's Class 1 shares adjusted to reflect the fees and expenses of the Class 2 shares. The adjustments result in performance for such periods that is no higher than the historical performance of the Class 1 shares, which were first sold on May 1, 1998.

Calendar Year Total Returns (%) as of 12/31 each year (Class 1 Shares)

SmallCap Value Account I (Acquired Fund)

|

| | | |

| Highest return for a quarter during the period of the bar chart above: | Q3 ‘09 | 21.31 | % |

| Lowest return for a quarter during the period of the bar chart above: | Q4 '08 | (25.12 | )% |

| | | |

| Year-to-date return for the quarter ending September 30, 2014: (3.45)% | | |

|

| | | |

| Average Annual Total Returns |

| For the periods ended December 31, 2013 | 1 Year | 5 Years | 10 Years |

| SmallCap Value Account I - Class 1 (inception 05/01/1998) | 39.76% | 19.15% | 8.67% |

| SmallCap Value Account I - Class 2 (inception 01/08/2007) | 39.44% | 18.86% | 8.42% |

| Russell 2000 Value Index (reflects no deduction for fees, expenses, or taxes) | 34.52% | 17.64% | 8.61% |

Calendar Year Total Returns (%) as of 12/31 each year (Class 1 Shares)

SmallCap Blend Fund (Acquiring Fund)

|

| | | |

| Highest return for a quarter during the period of the bar chart above: | Q4 '11 | 18.26 | % |

| Lowest return for a quarter during the period of the bar chart above: | Q4 '08 | (26.33 | )% |

| | | |

| Year-to-date return for the quarter ending September 30, 2014: (3.35)% | | |

|

| | | |

| Average Annual Total Returns (%) |

| For the periods ended December 31, 2013 | 1 Year | 5 Year | 10 Year |

| SmallCap Blend Account - Class 1 (inception 05/01/1998) | 47.81% | 20.46% | 8.96% |

| SmallCap Blend Account - Class 2 (inception 02/17/2015) | 47.46% | 20.17% | 8.70% |

| Russell 2000 Index (reflects no deduction for fees, expenses, or taxes) | 38.82% | 20.08% | 9.07% |

Reasons for the Reorganization

The Board believes that the Reorganization will serve the best interests of the shareholders of both the Acquired and Acquiring Funds. The Acquiring Fund has outperformed the Acquired Fund over the one-, three- and five-year periods ended September 30, 2014. The Funds have the same investment objectives in that both seek to provide long-term growth of capital, and they also have similar principal policies and risks in that both invest principally in equity securities of companies with small market capitalizations. The Acquiring Fund has a lower advisory fee than the Acquired Fund and the Acquired Fund shareholders are expected to see lower overall net operating expense ratios with respect to all share classes. Combining the Funds will not result in any dilution of the interests of existing shareholders of the Funds.

Board Consideration of the Reorganization

At its December 9, 2014 meeting, the Board considered information presented by PMC, and the Independent Directors were assisted by independent legal counsel. The Board requested and evaluated such information as it deemed necessary to consider the Reorganization. At the meeting, the Board unanimously approved the Reorganization after concluding that participation in the Reorganization is in the best interests of the Acquired Fund and the Acquiring Fund and that the interests of existing shareholders of the Funds will not be diluted as a result of the Reorganization.

In determining whether to approve the Reorganization, the Board made inquiry into a number of matters and considered, among others, the following factors, in no order of priority:

| |

| (1) | the investment objectives and principal investment strategies and risks of the Funds; |

| |

| (2) | identical fundamental investment restrictions; |

| |

| (3) | estimated trading costs associated with disposing of any portfolio securities of the Acquired Fund and reinvesting the proceeds in connection with the Reorganization; |

| |

| (4) | expense ratios and available information regarding the fees and expenses of the Funds; |

| |

| (5) | the estimated out-of-pocket expenses to be paid by the Acquired Fund related to the Reorganization; |

| |

| (6) | comparative investment performance of and other information pertaining to the Funds; |

| |

| (7) | the prospects for growth of and for achieving economies of scale by the Acquired Fund in combination with the Acquiring Fund; |

| |

| (8) | the absence of any material differences in the rights of shareholders of the Funds; |

| |

| (9) | the financial strength, investment experience and resources of PGI, which currently serves as sub-advisor to the Acquiring Fund; |

| |

| (10) | any direct or indirect benefits, including potential economic benefits, expected to be derived by PMC and its affiliates from the Reorganization; |

| |

| (11) | the direct or indirect federal income tax consequences of the Reorganization, including the expected tax-free nature of the Reorganization and the impact of any federal income tax loss carry forwards and the estimated capital gain or loss expected to be incurred in connection with disposing of any portfolio securities that would not be compatible with the investment objectives and strategies of the Acquiring Fund; |

| |

| (12) | the fact that the Reorganization will not result in any dilution of Acquired or Acquiring Fund shareholder values; |

| |

| (13) | the terms and conditions of the Plan; and |

| |

| (14) | possible alternatives to the Reorganization including liquidation of the Acquired Fund or continuing the Acquired Fund as currently operated. |

The Board’s decision to recommend approval of the Reorganization was based on a number of factors, including the following:

| |

| (1) | it should be reasonable for shareholders of the Acquired Fund to have similar investment expectations after the Reorganization because the Funds have the same investment objectives and substantially similar principal investment strategies and risks; |

| |

| (2) | PGI as sub-advisor responsible for managing the assets of the Acquiring Fund may be expected to provide high quality investment advisory services and personnel for the foreseeable future; |

| |

| (3) | The Acquiring Fund has lower advisory fee rates and is expected to have lower expense ratios following the Reorganization; |

| |

| (4) | the Acquiring Fund has outperformed the Acquired Fund for the one-, three- and five-year periods ended September 30, 2014 ; and |

| |

| (5) | the combination of the Acquired and Acquiring Funds may be expected to afford shareholders of the Acquired Fund on an ongoing basis greater prospects for growth and efficient management. |

INFORMATION ABOUT THE REORGANIZATION

Plans of Acquisition

The terms of the Plans are summarized below. The summary is qualified in its entirety by reference to the Forms of the Plans attached as Appendix A to this Proxy Statement/Prospectus.

Under each Plan, the Acquiring Fund will acquire all the assets, subject to all the liabilities, of the Acquired Fund. We expect that the closing date will be April 17, 2015, or such earlier or later date as PMC may determine, and that the Effective Time of the Reorganization will be as of the close of regularly scheduled trading on the NYSE (normally 3:00 p.m., Central Time) on that date. Each Fund will determine its net asset values as of the close of trading on the NYSE using the procedures described in its then current prospectus (the procedures applicable to the Acquired Fund and the Acquiring Fund are identical). The Acquiring Fund will issue to the Acquired Fund a number of shares of each share class with a total value equal to the total value of the net assets of the corresponding share class of the Acquired Fund outstanding at the Effective Time.

Immediately after the Effective Time, each Acquired Fund will distribute to its shareholders Acquiring Fund shares of the same class as the Acquired Fund shares each shareholder owns in exchange for all Acquired Fund shares of that class. Acquired Fund shareholders will receive a number of full and fractional shares of the Acquiring Fund that are equal in value to the value of the shares of the Acquired Fund that are surrendered in the exchange. In connection with the exchange, the Acquiring Fund will credit on its books an appropriate number of its shares to the account of each Acquired Fund shareholder, and each Acquired Fund will cancel on its books all its shares registered to the account of that shareholder. After the Effective Time, each Acquired Fund will be dissolved in accordance with applicable law.

The Plans may be amended, but no amendment may be made which in the opinion of the Board would materially adversely affect the interests of the shareholders of the Acquired Funds. The Board may abandon and terminate either or both of the Plans at any time before the Effective Time if it believes that consummation of the transactions contemplated by the Plan(s) would not be in the best interests of the shareholders of any or all of the Funds.

Under the Plan related to the Reorganization of the SmallCap Growth Account II into the SmallCap Blend Account, the SmallCap Growth Account II will pay all expenses and out-of-pocket fees incurred and allocated to it in connection with the Reorganization. The SmallCap Growth Account II will pay these costs regardless of whether the Reorganization is consummated.

Under the Plan related to the Reorganization of the SmallCap Value Account I into the SmallCap Blend Account, the SmallCap Value Account I will pay all expenses and out-of-pocket costs incurred and allocated to it in connection with the transaction contemplated under this Plan. The SmallCap Value Account I will pay these costs regardless of whether the Reorganization is consummated.

If a Reorganization is not consummated for any reason, the Board will consider other possible courses of action, including the liquidation (and termination) of an Acquired Fund.

Description of the Securities to Be Issued

PVC is a Maryland corporation that is authorized to issue its shares of common stock in separate series and separate classes of series. Each of the Acquired and Acquiring Funds is a separate series of PVC, and the Class 1 and Class 2 shares of common stock of the Acquiring Funds to be issued in connection with the Reorganization represent interests in the assets belonging to that series and have identical dividend, liquidation and other rights, except that expenses allocated to a particular series or class are borne solely by that series or class and may cause differences in rights as described herein. Expenses related to the distribution of, and other identified expenses properly allocated to, the shares of a particular series or class are charged to, and borne solely by, that series or class, and the bearing of expenses by a particular series or class may be appropriately reflected in the net asset value attributable to, and the dividend and liquidation rights of, that series or class.

All shares of PVC have equal voting rights and are voted in the aggregate and not by separate series or class of shares except that shares are voted by series or class: (i) when expressly required by Maryland law or the 1940 Act and (ii) on any matter submitted to shareholders which the Board has determined affects the interests of only a particular series or class.

The share classes of the Acquired Funds have the same rights with respect to the Acquired Funds that the share classes of the Acquiring Fund have with respect to the Acquiring Fund.

Shares of all Funds, when issued, have no cumulative voting rights, are fully paid and non-assessable, have no preemptive or conversion rights and are freely transferable. Each fractional share has proportionately the same rights as are provided for a full share.

Federal Income Tax Consequences

To be considered a tax-free "reorganization" under Section 368 of the Internal Revenue Code of 1986, as amended (the "Code"), a reorganization must exhibit a continuity of business enterprise. Because, with respect to the reorganization under each of Proposal 1 and Proposal 2, the Acquiring Fund will use a portion of the Acquired Fund’s assets in its business and will continue the Acquired Fund’s historic business, the combination of the Acquired Fund into the Acquiring Fund will exhibit a continuity of business enterprise. Therefore each combination will be considered a tax-free "reorganization" under applicable provisions of the Code. In the opinion of tax counsel to PVC, no gain or loss will be recognized by either of the Acquired Funds or their shareholders in connection with each combination, the tax cost basis of the Acquiring Fund shares received by shareholders of the Acquired Fund will equal the tax cost basis of their shares in the Acquired Fund, and their holding periods for the Acquiring Fund shares will include their holding periods for the Acquired Fund shares.