As filed with the Securities and Exchange Commission on March 8, 2019.

Registration No. 333-________

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 [X]

[ ] Pre-Effective Amendment No. ___

[ ] Post-Effective Amendment No. ___

PRINCIPAL VARIABLE CONTRACTS FUNDS, INC.

(Exact Name of Registrant as Specified in Charter)

711 High Street, Des Moines, Iowa 50392

(Address of Registrant's Principal Executive Offices)

515-247-5419

(Registrant's Telephone Number, Including Area Code)

Laura B. Latham

Assistant Counsel and Assistant Secretary, Principal Variable Contracts Funds, Inc.

The Principal Financial Group

Des Moines, Iowa 50392

(Name and Address of Agent for Service)

Approximate date of proposed public offering: As soon as practicable after this Registration Statement becomes effective.

Title of Securities Being Registered: Class 1 and Class 2 Shares, par value $.01 per share.

No filing fee is due because an indefinite number of shares have been registered in reliance on Section 24(f) under the Investment Company Act of 1940, as amended.

It is proposed that this filing will become effective on April 8, 2019, pursuant to Rule 488.

PRINCIPAL VARIABLE CONTRACTS FUNDS, INC.

711 High Street

Des Moines, Iowa 50392

1 (800) 222-5852

April __, 2019

Dear Contract Owner:

A Special Meeting of Shareholders (the "Meeting") of each of the Income Account ("Income"), the LargeCap Growth Account ("LargeCap Growth"), and the Multi-Asset Income Account ("Multi-Asset Income"), all series of Principal Variable Contracts Funds, Inc. (“PVC”), will be held at 655 9th Street, Des Moines, Iowa 50392, on May 31, 2019 at (i) 10:30 a.m., Central Time, for Income, (ii) 10:45 a.m., Central Time, for LargeCap Growth, and (iii) 11:00 a.m., Central Time, for Multi-Asset Income.

At the Meeting, the shareholders of each of Income, LargeCap Growth, and Multi-Asset Income (each, an "Acquired Fund" and, together, the "Acquired Funds") will be asked to consider and approve a Plan of Acquisition (a "Plan") providing for its reorganization into the corresponding PVC series listed in the second column below (each, an "Acquiring Fund").

|

| |

| ACQUIRED FUND | ACQUIRING FUND |

Income Account (Class 1 and Class 2) | Core Plus Bond Account (Class 1) |

| | |

LargeCap Growth Account (Class 1 and Class 2) | LargeCap Growth Account I (Class 1) |

| | |

Multi-Asset Income Account (Class 1 and Class 2) | SAM (Strategic Asset Management) Flexible Income Account (Class 1 and Class 2) |

The Acquired Funds' shareholders of record are insurance company separate accounts that offer variable life and variable annuity contracts. You are receiving these materials because you own a variable annuity contract or variable life insurance policy issued by an insurance company that is a shareholder of record, and you have allocated contract value of such contract or policy to one or more Acquired Funds. As a result, you have the right to instruct your insurance company how to vote the shares of the Acquired Funds that represent your contract value. Your insurance company will vote, in accordance with your instructions, the number of Acquired Fund shares that represents that portion of your contract value invested in each of the Acquired Funds as of March 29, 2019, the record date for the Meeting.

Under each Plan: (i) the applicable Acquiring Fund will acquire all the assets, subject to all the liabilities, of the corresponding Acquired Fund in exchange for shares of the Acquiring Fund; and (ii) the Acquiring Fund shares will be distributed to the shareholders of the Acquired Fund in complete liquidation and termination of the Acquired Fund (each, a “Reorganization”). As a result of each Reorganization, each shareholder of the applicable Acquired Fund will become a shareholder of the corresponding Acquiring Fund. The total value of all shares of each Acquiring Fund issued in each Reorganization will equal the total value of the net assets of the corresponding Acquired Fund. The number of full and fractional shares of the Acquiring Fund received by a shareholder of the Acquired Fund will be equal in value to the value of that shareholder’s shares of the Acquired Fund as of the close of regularly scheduled trading on the New York Stock Exchange (“NYSE”) on the closing date of the Reorganization.

For Income and LargeCap Growth, holders of Class 1 and Class 2 shares of each Acquired Fund will receive Class 1 shares of the corresponding Acquiring Fund. For Multi-Asset Income, holders of Class 1 and Class 2 shares of the Acquired Fund will receive, respectively, Class 1 and Class 2 shares of the Acquiring Fund. Each Reorganization is expected to occur on or about the close of regularly scheduled trading on the NYSE on June 7, 2019. All share classes of each Acquired Fund will vote in the aggregate and not by class with respect to that Fund's Reorganization. Effective following the close of business on June 14, 2019, the Class 2

shares of the Core Plus Bond Account will automatically convert to Class 1 shares of the Core Plus Bond Account, and the Class 2 shares of LargeCap Growth Account I will automatically convert to Class 1 shares of the LargeCap Growth Account I.

*****

Enclosed you will find a Notice of Special Meeting of Shareholders, a Proxy Statement/Prospectus, and a voting instruction card for the shares of the Acquired Fund to which you had allocated contract value as of March 29, 2019, the record date for the Meeting. The Proxy Statement/Prospectus provides background information and describes in detail the proposals to be voted on at the Meeting.

The PVC Board of Directors has voted in favor of each proposed Reorganization and recommends that you vote FOR each Proposal.

In order for the shares of the Acquired Fund to which you had allocated contract value as of the record date to be voted at the Meeting, we urge you to read the Proxy Statement/Prospectus and then give your voting instructions in one of the following three ways:

By Internet: Follow the instructions located on your voting instruction card.

By Phone: The phone number is located on your voting instruction card. Be sure you have your control number, as printed on your voting instruction card, available when you call.

By Mail: Complete and sign your voting instruction card and enclose it in the postage-paid envelope provided in this proxy package, allowing sufficient time for receipt by us by May 30, 2019.

We appreciate you taking the time to respond to this important matter. Your vote is important. If you have any questions regarding your Fund's Reorganization, please call our Shareholder Services Department toll-free at 1 (800) 222-5852.

Sincerely,

Michael J. Beer

President and Chief Executive Officer

PRINCIPAL VARIABLE CONTRACTS FUNDS, INC.

711 High Street

Des Moines, Iowa 50392

1 (800) 222-5852

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To the Contract Owners of the Income Account, the LargeCap Growth Account, and the Multi-Asset Income Account:

Notice is hereby given that a Special Meeting of Shareholders (the “Meeting”) of the Income Account ("Income"), the LargeCap Growth Account ("LargeCap Growth"), and the Multi-Asset Income Account ("Multi-Asset Income") (each, an "Acquired Fund" and, collectively, the “Acquired Funds”), each a series of Principal Variable Contracts Funds, Inc. (“PVC”), will be held at 655 9th Street, Des Moines, Iowa 50392, on May 31, 2019 at (i) 10:30 a.m., Central Time, for Income, (ii) 10:45 a.m., Central Time, for LargeCap Growth, and (iii) 11:00 a.m., Central Time, for Multi-Asset Income. A Proxy Statement/Prospectus providing information about the following proposals to be voted on at the Meeting is included with this notice. The Meeting is being held to consider and vote on such proposals as well as any other business that may properly come before the Meeting or any adjournment or postponement thereof.

| |

| Proposal 1: | Approval of a Plan of Acquisition providing for the reorganization of the Income Account (Class 1 and Class 2) into the Core Plus Bond Account (Class 1). |

(Only shareholders of the Income Account will vote on this proposal.)

| |

| Proposal 2: | Approval of a Plan of Acquisition providing for the reorganization of the LargeCap Growth Account (Class 1 and Class 2) into the LargeCap Growth Account I (Class 1). |

(Only shareholders of the LargeCap Growth Account will vote on this proposal.)

| |

| Proposal 3: | Approval of a Plan of Acquisition providing for the reorganization of the Multi-Asset Income Account (Class 1 and Class 2) into the SAM (Strategic Asset Management) Flexible Income Account (Class 1 and Class 2). |

(Only shareholders of the Multi-Asset Income Account will vote on this proposal.)

The PVC Board of Directors recommends that shareholders of each Acquired Fund vote FOR the Proposals.

Approval of each Proposal will require the affirmative vote of the holders of at least a “Majority of the Outstanding Voting Securities” (as defined in the accompanying Proxy Statement/Prospectus under "Voting Information - Voting rights") of the applicable Acquired Fund.

Each shareholder of record of each Acquired Fund at the close of business on March 29, 2019, the record date for the Meeting (the "Record Date"), is entitled to receive notice of and to vote at the Meeting and any adjournments or postponements thereof. The Acquired Funds' shareholders of record are insurance company separate accounts that offer variable life and variable annuity contracts. You are receiving these materials because you own a variable annuity contract or variable life insurance policy issued by an insurance company that is a shareholder of record, and you have allocated contract value of such contract or policy to one or more Acquired Funds. As a result, you have the right to instruct your insurance company how to vote the shares of the Acquired Funds that represent your contract value. Your insurance company will vote, in accordance with your instructions, the number of Acquired Fund shares that represents that portion of your contract value invested in each of the Acquired Funds as of the Record Date.

Please read the attached Proxy Statement/Prospectus.

By order of the Board of Directors

Michael J. Beer

President and Chief Executive Officer

April __, 2019

Des Moines, Iowa

PRINCIPAL VARIABLE CONTRACTS FUNDS, INC.

711 High Street

Des Moines, Iowa 50392

1 (800) 222-5852

---------------------------------

PROXY STATEMENT/PROSPECTUS

SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 31, 2019

RELATING TO THE REORGANIZATION OF:

| |

| 1) | THE INCOME ACCOUNT (Class 1 and Class 2) INTO THE CORE PLUS BOND ACCOUNT (Class 1) |

| |

| 2) | THE LARGECAP GROWTH ACCOUNT (Class 1 and Class 2) INTO THE LARGECAP GROWTH ACCOUNT I (Class 1) |

| |

| 3) | THE MULTI-ASSET INCOME ACCOUNT (Class 1 and Class 2) INTO THE SAM (Strategic Asset Management) FLEXIBLE INCOME ACCOUNT (Class 1 and Class 2) |

This Proxy Statement/Prospectus is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board” or “Directors”) of Principal Variable Contracts Funds, Inc. (“PVC”) to be used at a Special Meeting of Shareholders (the "Meeting") of the Income Account ("Income"), the LargeCap Growth Account ("LargeCap Growth"), and the Multi-Asset Income Account ("Multi-Asset Income"), all series of PVC, to be held at 655 9th Street, Des Moines, Iowa 50392, on May 31, 2019 at (i) 10:30 a.m., Central Time, for Income, (ii) 10:45 a.m., Central Time, for LargeCap Growth, and (iii) 11:00 a.m., Central Time, for Multi‑Asset Income.

At the Meeting, the shareholders of each of Income, LargeCap Growth, and Multi-Asset Income (each, an "Acquired Fund" and, together, the "Acquired Funds") will be asked to consider and approve a Plan of Acquisition (each, a "Plan") providing for its reorganization into the corresponding PVC series listed in the second column below (each, an "Acquiring Fund" and, together, the "Acquiring Funds") (the Acquired Funds and Acquiring Funds, together, the "Funds"). Each of these Funds is a separate series of PVC. PVC is a Maryland corporation and an open-end management investment company registered with the Securities and Exchange Commission (the "SEC") under the Investment Company Act of 1940, as amended (the "1940 Act").

|

| |

| ACQUIRED FUND | ACQUIRING FUND |

Income Account (Class 1 and Class 2) | Core Plus Bond Account (Class 1) |

| | |

LargeCap Growth Account (Class 1 and Class 2) | LargeCap Growth Account I (Class 1) |

| | |

Multi-Asset Income Account (Class 1 and Class 2) | SAM (Strategic Asset Management) Flexible Income Account (Class 1 and Class 2) |

All shares of the Acquired Funds are owned of record by insurance company separate accounts ("Separate Accounts") established to fund benefits under variable annuity contracts and variable life insurance policies (each, a "Contract") issued by such insurance companies (each, an "Insurance Company"). Persons holding Contracts are referred to herein as "Contract Owners."

Under each Plan: (i) the applicable Acquiring Fund will acquire all the assets, subject to all the liabilities, of the corresponding Acquired Fund in exchange for shares of the Acquiring Fund; and (ii) the Acquiring Fund shares will be distributed to the shareholders of the Acquired Fund in complete liquidation and termination of the Acquired Fund (each, a “Reorganization”). As a result of each Reorganization, each shareholder of the applicable Acquired Fund will become a shareholder of the corresponding Acquiring Fund. The total value of all shares of each Acquiring Fund issued in each Reorganization will equal the total value of the net assets of

the corresponding Acquired Fund. The number of full and fractional shares of the Acquiring Fund received by a shareholder of the Acquired Fund will be equal in value to the value of that shareholder’s shares of the Acquired Fund as of the close of regularly scheduled trading on the New York Stock Exchange (“NYSE”) on the closing date of the Reorganization.

| |

| 1) | Holders of Class 1 and Class 2 shares of the Income Account (Acquired Fund) will receive Class 1 shares of the Core Plus Bond Account (Acquiring Fund). |

| |

| 2) | Holders of Class 1 and Class 2 shares of the LargeCap Growth Account (Acquired Fund) will receive Class 1 shares of the LargeCap Growth Account I (Acquiring Fund). |

| |

| 3) | Holders of Class 1 and Class 2 shares of the Multi-Asset Income Account (Acquired Fund) will receive, respectively, Class 1 and Class 2 shares of the SAM (Strategic Asset Management) Flexible Income Account (Acquiring Fund). |

Each Reorganization is expected to occur on or about the close of regularly scheduled trading on the NYSE on June 7, 2019. Effective following the close of business on June 14, 2019, the Class 2 shares of the Core Plus Bond Account will automatically convert to Class 1 shares of the Core Plus Bond Account, and the Class 2 shares of LargeCap Growth Account I will automatically convert to Class 1 shares of the LargeCap Growth Account I.

Approval of each Reorganization will require the affirmative vote of the holders of at least a “Majority of the Outstanding Voting Securities” (as defined below in this Proxy Statement/Prospectus under "Voting Information - Voting rights") of the applicable Acquired Fund. All share classes of each Acquired Fund will vote in the aggregate and not by class with respect to that Fund's Reorganization. The terms and conditions of each Reorganization are more fully described below in this Proxy Statement/Prospectus and in the Forms of Plans of Acquisition, which are attached hereto as Appendix A.

This Proxy Statement/Prospectus contains information shareholders should know before voting on any Reorganization. Please read it carefully and retain it for future reference. The Annual and Semi-Annual Reports to Shareholders of PVC contain additional information about the investments of each Acquired Fund and Acquiring Fund. The Annual Report contains discussions of the market conditions and investment strategies that significantly affected these Funds during the fiscal year ended December 31, 2018. Copies of these reports may be obtained at no charge by calling our Shareholder Services Department toll-free at 1 (800) 222-5852 or online at www.principalfunds.com/prospectuses-pvc.

The Statement of Additional Information dated April ____, 2019 (the "Statement of Additional Information") relating to this Proxy Statement/Prospectus has been filed with the SEC (File No. 333-______) and is incorporated by reference into this Proxy Statement/Prospectus. PVC’s Prospectus dated May 1, 2018 and as supplemented, and the Statement of Additional Information for PVC dated May 1, 2018 and as supplemented, have been filed with the SEC (File No. 002-35570). Copies of these documents may be obtained without charge by writing to Principal Variable Contracts Funds, Inc., P.O. Box 219971, Kansas City, MO 64121-9971 or by calling our Shareholder Services Department toll-free at 1 (800) 222-5852. You may also call our Shareholder Services Department toll free at 1 (800) 222-5852 if you have any questions regarding your Fund's Reorganization.

PVC is subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and the 1940 Act, and files reports, proxy materials, and other information with the SEC. Such reports, proxy materials, and other information are available on the SEC’s EDGAR Database on its Internet site at www.sec.gov.

Important Notice Regarding Availability of Proxy Statement/Prospectus for the Shareholders’ Meeting to be Held on May 31, 2019.

This Proxy Statement/Prospectus is available on the Internet at:

https://www.

The SEC has not approved or disapproved these securities or passed upon the

accuracy or adequacy of this Proxy Statement/Prospectus. Any representation to the

contrary is a criminal offense.

The date of this Proxy Statement/Prospectus is April __, 2019.

|

| | |

| TABLE OF CONTENTS | | |

| | Page |

| | | |

| INTRODUCTION | | |

| THE REORGANIZATIONS | | |

PROPOSAL 1: Approval of a Plan of Acquisition Providing for the Reorganization of the Income Account into the Core Plus Bond Account | | |

| Comparison of Acquired and Acquiring Funds | | |

| Comparison of Investment Objectives and Strategies | | |

| Comparison of Principal Investment Risks | | |

| Fees and Expenses of the Funds | | |

| Performance | | |

| Board Consideration of the Reorganization | | |

PROPOSAL 2: Approval of a Plan of Acquisition Providing for the Reorganization of the LargeCap Growth Account into the LargeCap Growth Account I | | |

| Comparison of Acquired and Acquiring Funds | | |

| Comparison of Investment Objectives and Strategies | | |

| Comparison of Principal Investment Risks | | |

| Fees and Expenses of the Funds | | |

| Performance | | |

| Board Consideration of the Reorganization | | |

PROPOSAL 3: Approval of a Plan of Acquisition Providing for the Reorganization of the Multi-Asset Income Account into the SAM (Strategic Asset Management) Flexible Income Account | | |

| Comparison of Acquired and Acquiring Funds | | |

| Comparison of Investment Objectives and Strategies | | |

| Comparison of Principal Investment Risks | | |

| Fees and Expenses of the Funds | | |

| Performance | | |

| Board Consideration of the Reorganization | | |

| INFORMATION ABOUT THE REORGANIZATION | | |

| Plans of Acquisition | | |

| Description of the Securities to Be Issued | | |

| Federal Income Tax Consequences | | |

| CAPITALIZATION | | |

| ADDITIONAL INFORMATION ABOUT INVESTMENT STRATEGIES AND RISKS | | |

| ADDITIONAL INFORMATION ABOUT THE FUNDS | | |

| Multiple Classes of Shares | | |

| Intermediary Compensation | | |

| Dividends and Distributions | | |

| Pricing of Fund Shares | | |

| TAX INFORMATION | | |

|

| | |

| TABLE OF CONTENTS | | |

| (continued) | Page |

| | | |

| DISTRIBUTION PLAN AND ADDITIONAL INFORMATION REGARDING INTERMEDIARY COMPENSATION | | |

| ONGOING FEES | | |

| Frequent Trading and Market Timing (Abusive Trading Practices) | | |

| Eligible Purchasers | | |

| Shareholder Rights | | |

| Purchase of Fund Shares | | |

| Sale of Fund Shares | | |

| Restricted Transfers | | |

| Financial Statements | | |

| Portfolio Holdings Information | | |

| VOTING INFORMATION | | |

| OUTSTANDING SHARES AND SHARE OWNERSHIP | | |

| FINANCIAL HIGHLIGHTS | | |

| FINANCIAL STATEMENTS | | |

| LEGAL MATTERS | | |

| OTHER INFORMATION | | |

| APPENDIX A - Forms of Plans of Acquisitions | | |

| APPENDIX B - Description of Bond Ratings | | |

INTRODUCTION

This Proxy Statement/Prospectus is being furnished to shareholders of the Acquired Funds to provide information regarding the Plan and the Reorganization.

Principal Variable Contracts Funds, Inc. PVC is a Maryland corporation and an open-end management investment company registered with the SEC under the 1940 Act. PVC currently offers 36 separate series (the “PVC Accounts”), including the Acquired and Acquiring Funds. The sponsor of PVC is Principal Life Insurance Company (“Principal Life”), and the investment advisor to the PVC Accounts is Principal Global Investors, LLC (“PGI”). Principal Funds Distributor, Inc. (the “Distributor” or “PFD”) is the distributor for all share classes. Principal Life is an insurance company organized in 1879 under the laws of Iowa. Principal Life, PGI, and PFD are indirect, wholly-owned subsidiaries of Principal Financial Group, Inc. (“PFG”). Principal Life’s and PGI’s address is the Principal Financial Group, 711 High Street, Des Moines, Iowa 50392, and PFD’s address is 620 Coolidge Drive, Suite 300, Folsom, CA 95630.

Investment Management. Pursuant to an investment advisory agreement with PVC, PGI provides investment advisory services and is also responsible for, among other things, administering the business and affairs of each PVC Account. PGI is also responsible for selecting, contracting with, compensating, and monitoring the performance of any sub‑advisors that manage the investment of the assets of the PVC Accounts pursuant to sub-advisory agreements.

PGI is located at 801 Grand Avenue, Des Moines, IA 50392. PGI is an indirect, wholly-owned subsidiary of PFG.

THE REORGANIZATIONS

At its meeting held on December 11, 2018, the PVC Board of Directors (the “Board”), including all the Directors who are not “interested persons” (as defined in the 1940 Act) of PVC (the “Independent Directors”), approved each Reorganization pursuant to the corresponding Plan providing for the combination of each Acquired Fund into the corresponding Acquiring Fund. The Board concluded that each Reorganization is in the best interests of the applicable Acquired Fund and the corresponding Acquiring Fund and that the interests of existing shareholders of each Fund will not be diluted as a result of the Reorganization. The factors that the Board considered in deciding to approve each Reorganization as to each Acquired Fund are discussed in each Proposal under “Board Consideration of the Reorganization.”

Each Reorganization contemplates: (i) the transfer of all the assets, subject to all of the liabilities, of the applicable Acquired Fund to the corresponding Acquiring Fund in exchange for shares of the Acquiring Fund; and (ii) the distribution to Acquired Fund shareholders of the Acquiring Fund shares in complete liquidation and termination of the Acquired Fund. As a result of each Reorganization, each shareholder of the applicable Acquired Fund will become a shareholder of the corresponding Acquiring Fund. In each Reorganization, the applicable Acquiring Fund will issue to the corresponding Acquired Fund a number of shares with a total value equal to the total value of the net assets of the Acquired Fund, and each shareholder of the Acquired Fund will receive a number of full and fractional shares of the Acquiring Fund with a value equal to the value of that shareholder’s shares of the Acquired Fund, as of the close of regularly scheduled trading on the NYSE on the closing date of the Reorganization (the “Effective Time”). The closing date of each Reorganization is expected to be on or about June 7, 2019.

Holders of Class 1 and Class 2 shares of the Income Account will receive Class 1 shares of the Core Plus Bond Account.

Holders of Class 1 and Class 2 shares of the LargeCap Growth Account will receive Class 1 shares of the LargeCap Growth Account I.

Holders of Class 1 and Class 2 shares of the Multi-Asset Income Account will receive, respectively, Class 1 and Class 2 shares of the SAM (Strategic Asset Management) Flexible Income Account.

Effective following the close of business on June 14, 2019, the Class 2 shares of the Core Plus Bond Account will automatically convert to Class 1 shares of the Core Plus Bond Account, and the Class 2 shares of LargeCap Growth Account I will automatically convert to Class 1 shares of the LargeCap Growth Account I.

All share classes of each Acquired Fund will vote in the aggregate and not by class with respect to the Reorganization. The terms and conditions of each Reorganization are more fully described below in this Proxy Statement/Prospectus and in the Forms of Plans of Acquisition, which are attached hereto as Appendix A.

Proposal 1: Reorganization of the Income Account into the Core Plus Bond Account

In the opinion of legal counsel, the Reorganization is expected to be considered a taxable transaction for federal income tax purposes, and the Acquired Fund will recognize capital gains or losses on the Effective Date; however, since the taxable impact of the transaction does not flow through to the Contract Owners of the insurance company separate accounts that own the Acquired Fund shares, the Reorganization is not expected to be a taxable event for federal income tax purposes for Contract Owners. The taxable impact of capital gains realized in connection with repositioning the Acquired Fund's portfolio in connection with the Reorganization is not expected to flow through to the Contract Owners of the insurance company separate accounts that own the Acquired Fund shares. Please see “Information About the Reorganization - Federal Income Tax Consequences" for additional information about the federal income tax consequences of the Reorganization.

The Reorganization will not result in any material change in the purchase and redemption procedures followed with respect to the distribution of shares. See “Ongoing Fees - Purchase of Fund Shares" and "Ongoing Fees - Sale of Fund Shares.”

The direct expenses and out-of-pocket fees incurred in connection with the Reorganization, including printing, mailing, and solicitation costs and audit fees, will be paid by the Acquired Fund shareholders because the benefits of the Reorganization to Acquired Fund shareholders (as described under "Proposal 1 - Board Consideration of the Reorganization") are expected to outweigh these expenses and fees within twelve months. The costs are estimated to be $5,350. If the Reorganization is approved, the PVC SAM Portfolios, which are other series of PVC that own shares of the Acquired Fund, are expected to redeem their entire investment prior to the Effective Time, leaving approximately $14 million in assets under management in the Acquired Fund. The Acquired Fund will reposition its remaining portfolio prior to the Effective Time for the purpose of transferring only those assets that are consistent with the Acquiring Fund's investment strategy. The estimated trading costs are $28,000 (or 0.01% of the Acquiring Fund's net assets). It is expected that, for the entire repositioning, approximately $1.1 million (or 8.6%) of the portfolio securities of the Acquired Fund will be disposed of and new securities purchased. Each of the Acquired Fund and Acquiring Fund qualifies, and following the Reorganization it is expected that the Acquiring Fund will continue to qualify, as a Regulated Investment Company (“RIC”) for tax purposes.

Proposal 2: Reorganization of the LargeCap Growth Account into the LargeCap Growth Account I

In the opinion of legal counsel, the Reorganization is expected to qualify as a tax-free reorganization for federal income tax purposes, and no gain or loss will be recognized as a result of the Reorganization by the Acquired Fund or Acquiring Fund shareholders. The taxable impact of capital gains realized in connection with repositioning the Acquired Fund's portfolio in connection with the Reorganization is not expected to flow through to the Contract Owners of the insurance company separate accounts that own the Acquired Fund shares. Please see “Information About the Reorganization - Federal Income Tax Consequences" for additional information about the federal income tax consequences of the Reorganization.

The Reorganization will not result in any material change in the purchase and redemption procedures followed with respect to the distribution of shares. See “Ongoing Fees - Purchase of Fund Shares" and "Ongoing Fees - Sale of Fund Shares."

The direct expenses and out-of-pocket fees incurred in connection with the Reorganization, including printing, mailing, and solicitation costs and audit fees, will be paid by the Acquired Fund shareholders because the benefits of the Reorganization to Acquired Fund shareholders (as described under "Proposal 2 - Board Consideration of the Reorganization") are expected to outweigh these expenses and fees within twelve months. The costs are estimated to be $16,850. The Acquired Fund will reposition its portfolio prior to the Reorganization for the purpose of transferring only those assets that are consistent with the Acquiring Fund's investment strategy. Based on commission rates typically paid by the Acquired Fund, it is estimated that in connection with the repositioning of the assets of the Acquired Fund, the Acquired Fund will incur brokerage commissions of $16,500 (or 1.3 basis points). It is expected that for the entire repositioning, approximately 69% of the portfolio securities of the Acquired Fund will be disposed of and new securities purchased. Each of the Acquired Fund and Acquiring Fund qualifies, and following the Reorganization it is expected that the Acquiring Fund will continue to qualify, as a RIC for tax purposes.

Proposal 3: Reorganization of the Multi-Asset Income Account into the SAM (Strategic Asset Management) Flexible Income Account

In the opinion of legal counsel, the Reorganization is expected to qualify as a tax-free reorganization for federal income tax purposes, and no gain or loss will be recognized as a result of the Reorganization by the Acquired Fund or Acquiring Fund shareholders. The taxable impact of capital gains realized in connection with repositioning the Acquired Fund's portfolio in connection with the Reorganization is not expected to flow through to the Contract Owners of the insurance company separate accounts that own the Acquired Fund shares. Please see “Information About the Reorganization - Federal Income Tax Consequences" for additional information about the federal income tax consequences of the Reorganization.

The Reorganization will not result in any material change in the purchase and redemption procedures followed with respect to the distribution of shares. See “Ongoing Fees - Purchase of Fund Shares" and "Ongoing Fees - Sale of Fund Shares."

The direct expenses and out-of-pocket fees incurred in connection with the Reorganization, including printing, mailing, and solicitation costs and audit fees, will be paid by the Acquired Fund shareholders because the benefits of the Reorganization to Acquired Fund shareholders (as described under "Proposal 3 - Board Consideration of the Reorganization") are expected to outweigh these expenses and fees within twelve months; however, due to expense caps currently in place for the Acquired Fund and low assets under management, PGI will end up bearing these expenses and fees. The costs are estimated to be $4,850. The Acquired Fund will reposition its portfolio prior to the Reorganization for the purpose of transferring only those assets that are consistent with the Acquiring Fund's investment strategy. Since the transition is occurring between two fund-of-fund accounts that hold internal funds, the Acquired Fund will redeem its underlying funds and transfer cash on the designated day to complete the Reorganization. There are no brokerage commissions associated with these trades. Each of the Acquired Fund and Acquiring Fund qualifies, and following the Reorganization it is expected that the Acquiring Fund will continue to qualify, as a RIC for tax purposes.

PROPOSAL 1:

APPROVAL OF A PLAN OF ACQUISITION

PROVIDING FOR THE REORGANIZATION OF THE

INCOME ACCOUNT INTO THE CORE PLUS BOND ACCOUNT

Shareholders of the Income Account (the “Acquired Fund”) are being asked to approve the Plan, which provides for the reorganization of the Acquired Fund into the Core Plus Bond Account (the “Acquiring Fund”).

Comparison of Acquired and Acquiring Funds

The following tables provide comparative information with respect to the Acquired and Acquiring Funds. As indicated in the tables, the Funds have similar objectives in that the Acquired Fund seeks to provide a high level of current income consistent with preservation of capital while the Acquiring Fund seeks to provide current income and, as a secondary objective, capital appreciation. The Funds also have similar investment strategies and risks in that both Funds employ a strategy that focuses on a diversified pool of fixed-income securities, typically corporate bonds (both investment grade and below investment grade), asset-backed securities, and U.S. Treasury and agency bonds. The principal differences are that the maximum allowance for below investment grade corporate bonds and bank loans is higher within the Acquired Fund, and the Acquiring Fund utilizes derivatives as a principal strategy. |

| | |

Income Account (Acquired Fund) | | Core Plus Bond Account (Acquiring Fund) |

| Approximate Net Assets as of December 31, 2018: |

| $181,771,064 | | $281,520,295 |

| INVESTMENT ADVISOR |

| PGI | | PGI |

| | | |

| PGI PORTFOLIO MANAGERS |

John R. Friedl has been with Principal® since 2017. Prior thereto, he was with Edge Asset Management, Inc. (which merged with and into PGI in 2017) since 1998. He earned a B.A. in Communications and History from the University of Washington and a master's degree in Finance from Seattle University. Mr. Friedl has earned the right to use the Chartered Financial Analyst designation. Ryan P. McCann has been with Principal® since 2010. He earned a B.A. in Business Administration from Washington State University. Mr. McCann has earned the right to use the Chartered Financial Analyst designation. Scott J. Peterson has been with Principal® since 2002. He earned a bachelor’s degree in Mathematics from Brigham Young University and an M.B.A. from New York University’s Stern School of Business. Mr. Peterson has earned the right to use the Chartered Financial Analyst designation. | | William C. Armstrong has been with Principal® since 1992. He earned a bachelor’s degree from Kearney State College and an M.B.A. from the University of Iowa. Mr. Armstrong has earned the right to use the Chartered Financial Analyst designation. Tina Paris has been with Principal® since 2001. She earned a bachelor's degree in Finance and Economics from the University of Northern Iowa and an M.B.A with an emphasis in Finance from the University of Iowa. Ms. Paris has earned the right to use the Chartered Financial Analyst designation. Timothy R. Warrick has been with Principal® since 1990. He earned a bachelor’s degree in Accounting and Economics from Simpson College and an M.B.A. in Finance from Drake University. Mr. Warrick has earned the right to use the Chartered Financial Analyst designation. |

Comparison of Investment Objectives and Strategies

|

| | |

Income Account (Acquired Fund) | | Core Plus Bond Account (Acquiring Fund) |

| | | |

| INVESTMENT OBJECTIVES |

| The Acquired Fund seeks to provide a high level of current income consistent with preservation of capital. | | The Acquiring Fund seeks to provide current income and, as a secondary objective, capital appreciation. |

| | | |

| PRINCIPAL INVESTMENT STRATEGIES |

| | | |

Under normal circumstances, the Acquired Fund invests primarily in a diversified pool of fixed-income securities including corporate securities, U.S. government securities, and mortgage-backed securities (securitized products) (including collateralized mortgage obligations). The Acquired Fund may invest up to 35% of its assets in below investment grade bonds (sometimes called “high yield bonds” or "junk bonds") which are rated, at the time of purchase, Ba1 or lower by Moody's Investors Service, Inc. ("Moody's") and BB+ or lower by S&P Global Ratings ("S&P Global") (if the bond has been rated by only one of those agencies, that rating will determine whether the bond is below investment grade; if the bond has not been rated by either of those agencies, those selecting such investments will determine whether the bond is of a quality comparable to those rated below investment grade; if securities are rated differently by the rating agencies, the highest rating is used). The Acquired Fund also invests in foreign securities. Under normal circumstances, the Acquired Fund maintains an average portfolio duration that is within ±25% of the duration of the Bloomberg Barclays U.S. Aggregate Bond Index, which as of December 31, 2018 was 5.87 years. The Acquired Fund is not managed to a particular maturity. | | Under normal circumstances, the Acquiring Fund invests at least 80% of its net assets, plus any borrowings for investment purposes, in bonds or other debt securities at the time of purchase. Such investments include securities issued or guaranteed by the U.S. government or its agencies or instrumentalities (including collateralized mortgage obligations); asset-backed securities or mortgage-backed securities (securitized products); corporate bonds; and securities issued or guaranteed by foreign governments payable in U.S. dollars. The Acquiring Fund invests in investment-grade securities, and with respect to up to 20% of its assets, in below investment grade securities (sometimes called “high yield” or "junk") which are rated at the time of purchase Ba1 or lower by Moody's Investors Service, Inc. ("Moody's") and BB+ or lower by S&P Global Ratings ("S&P Global") (if the security has been rated by only one of those agencies, that rating will determine whether the security is below investment grade; if the security has not been rated by either of those agencies, those selecting such investments will determine whether the security is of a quality comparable to those rated below investment grade. If securities are rated differently by the rating agencies, the highest rating is used). The Acquiring Fund invests in foreign securities. The Acquiring Fund is not managed to a particular maturity. Under normal circumstances, the Acquiring Fund maintains an average portfolio duration that is within ±25% of the duration of the Bloomberg Barclays U.S. Aggregate Bond Index, which as of December 31, 2018 was 5.87 years. The Acquiring Fund actively trades portfolio securities. The Acquiring Fund enters into dollar roll transactions which may involve leverage. The Acquiring Fund invests in derivatives, included Treasury futures and interest rate swaps to manage the fixed-income exposure (including for hedging purposes) and credit default swaps to increase or decrease, in an efficient manner, exposures to certain sectors or individual issuers. A derivative is a financial arrangement, the value of which is derived from, or based on, a traditional security, asset, or market index. |

Temporary Defensive Investing

For temporary defensive purposes in times of unusual or adverse market, economic, or political conditions, each Fund may invest up to 100% of its assets in cash and cash equivalents. In taking such defensive measures, either Fund may fail to achieve its investment objective.

Fundamental Investment Restrictions

The Funds are subject to identical fundamental investment restrictions, which may not be changed without a shareholder vote. These fundamental restrictions deal with such matters as the issuance of senior securities, purchasing or selling real estate or commodities, borrowing money, making loans, underwriting securities of other issuers, diversification or concentration of investments, and short sales of securities. The fundamental investment restrictions of the Funds are described in the Statement of Additional Information under "Description of the Funds' Investments and Risks - Fundamental Restrictions."

Additional Information

The investment objective of each Fund may be changed by the Board without shareholder approval.

Additional information about the investment strategies and the types of securities in which the Funds may invest is discussed below under “Additional Information About Investment Strategies and Risks” as well as in the Statement of Additional Information.

The Statement of Additional Information provides further information about the portfolio manager(s) for each Fund, including information about compensation, other accounts managed, and ownership of Fund shares.

Comparison of Principal Investment Risks

In deciding whether to approve the Reorganization, shareholders should consider the amount and character of investment risk involved in the respective investment objectives and strategies of the Acquired and Acquiring Funds.

Principal Risks Applicable to Both Funds:

The following principal risks are applicable to the Acquired Fund and the Acquiring Fund:

Fixed-Income Securities Risk. Fixed-income securities are subject to interest rate, credit quality, and liquidity risks. The market value of fixed-income securities generally declines when interest rates rise and generally increases when interest rates fall. Higher interest rates may adversely affect the liquidity of certain fixed-income securities. Moreover, an issuer of fixed-income securities could default on its payment obligations due to increased interest rates or for other reasons.

Foreign Currency Risk. Risks of investing in securities denominated in, or that trade in, foreign (non-U.S.) currencies include changes in foreign exchange rates and foreign exchange restrictions.

Foreign Securities Risk. The risks of foreign securities include loss of value as a result of: political or economic instability; nationalization, expropriation or confiscatory taxation; settlement delays; and limited government regulation (including less stringent reporting, accounting, and disclosure standards than are required of U.S. companies).

High Yield Securities Risk. High yield fixed-income securities (commonly referred to as "junk bonds") are subject to greater credit quality risk than higher rated fixed-income securities and should be considered speculative.

Portfolio Duration Risk. Portfolio duration is a measure of the expected life of a fixed-income security and its sensitivity to changes in interest rates. The longer a fund's average portfolio duration, the more sensitive the fund will be to changes in interest rates, which means funds with longer average portfolio durations may be more volatile than those with shorter durations.

Real Estate Securities Risk. Investing in real estate securities subjects the fund to the risks associated with the real estate market (which are similar to the risks associated with direct ownership in real estate), including declines in real estate values, loss due to casualty or condemnation, property taxes, interest rate changes, increased expenses, cash flow of underlying real estate assets, regulatory changes (including zoning, land use and rents), and environmental problems, as well as to the risks related to the management skill and creditworthiness of the issuer.

Redemption and Large Transaction Risk. Ownership of the fund's shares may be concentrated in one or a few large investors (such as funds of funds, institutional investors, and asset allocation programs) that may redeem or purchase shares in large quantities. These transactions may cause the fund to sell securities to meet redemptions or to invest additional cash at times it would not otherwise do so, which may result in increased transaction costs, increased expenses, changes to expense ratios, and adverse effects to fund performance. Such transactions may also accelerate the realization of taxable income if sales of portfolio securities result in gains. Moreover, reallocations by large shareholders among share classes of a fund may result in changes to the expense ratios of affected classes, which may increase the expenses paid by shareholders of the class that experienced the redemption.

Securitized Products Risk. Investments in securitized products are subject to risks similar to traditional fixed income securities, such as credit, interest rate, liquidity, prepayment, extension, and default risk, as well as additional risks associated with the nature of the assets and the servicing of those assets. Unscheduled prepayments on securitized products may have to be reinvested at lower rates. A reduction in prepayments may increase the effective maturities of these securities, exposing them to the risk of decline in market value over time (extension risk).

U.S. Government Securities Risk. Yields available from U.S. government securities are generally lower than yields from many other fixed-income securities.

U.S. Government-Sponsored Securities Risk. Securities issued by U.S. government-sponsored enterprises such as the Federal Home Loan Mortgage Corporation, the Federal National Mortgage Association, and the Federal Home Loan Banks are not issued or guaranteed by the U.S. government.

Additional Principal Risks of Investing in the Acquiring Fund:

The following are additional principal risks of investing in the Acquiring Fund that are not principal risks of investing in the Acquired Fund:

Counterparty Risk. Counterparty risk is the risk that the counterparty to a contract or other obligation will be unable or unwilling to honor its obligations.

Derivatives Risk. Derivatives may not move in the direction anticipated by the portfolio manager. Transactions in derivatives may increase volatility, cause the liquidation of portfolio positions when not advantageous to do so and result in disproportionate losses that may be substantially greater than a fund's initial investment.

| |

| • | Credit Default Swaps. Credit default swaps involve special risks in addition to those associated with swaps generally because they are difficult to value, are highly susceptible to liquidity and credit risk, and generally pay a return to the party that has paid the premium only in the event of an actual default by the issuer of the underlying obligation (as opposed to a credit downgrade or other indication of financial difficulty). The protection “buyer” in a credit default contract may be obligated to pay the protection “seller” an up-front payment or a periodic stream of payments over the term of the contract provided generally that no credit event on a reference obligation has occurred. If a credit event occurs, the seller generally must pay the buyer the “par value” (i.e., full notional value) of the swap in exchange for an equal face amount of deliverable obligations of the reference entity described in the swap, or the seller may be required to deliver the related net cash amount, if the swap is cash settled. The Fund may be either the buyer or seller in the transaction. |

| |

| • | Currency Contracts. Derivatives related to currency contracts involve the specific risk of government action through exchange controls that would restrict the ability of the fund to deliver or receive currency. |

| |

| • | Futures and Swaps. These derivative instruments involve specific risks, including: the imperfect correlation between the change in market value of the instruments held by the fund and the price of the instruments; possible lack of a liquid secondary market for an instrument and the resulting inability to close it when desired; counterparty risk; and if the fund has insufficient cash, it may have to sell securities from its portfolio to meet any applicable daily variation margin requirements. |

Hedging Risk. A fund that implements a hedging strategy using derivatives and/or securities could expose the fund to the risk that can arise when a change in the value of a hedge does not match a change in the value of the asset it hedges. In other words, the change in value of the hedge could move in a direction that does not match the change in value of the underlying asset, resulting in a risk of loss to the fund.

Leverage Risk. Leverage created by borrowing or certain types of transactions or investments may impair the fund’s liquidity, cause it to liquidate positions at an unfavorable time, increase volatility of the fund’s net asset value, or diminish the fund’s performance.

Portfolio Turnover (Active Trading) Risk. High portfolio turnover (more than 100%) caused by actively trading portfolio securities may result in accelerating the realization of taxable gains and losses, lower fund performance and increased brokerage costs.

Additional Principal Risks of Investing in the Acquired Fund:

There are no additional principal risks of investing in the Acquired Fund that are not included above in "Principal Risks Applicable to Both Funds."

Fees and Expenses of the Funds

Fees and Expenses as a % of average daily net assets

The following table shows: (a) the ratios of expenses to average net assets of the Acquired Fund for the fiscal year ended December 31, 2018; (b) the ratios of expenses to average net assets of the Acquiring Fund for the fiscal year ended December 31, 2018; and (c) the pro forma expense ratios of the Acquiring Fund for the fiscal year ended December 31, 2018, assuming that the Reorganization had taken place at the commencement of the fiscal year ended December 31, 2018.

These fees and expenses do not include the effect of any sales charge, separate account expenses or other contract level expenses which may be applied at the variable life insurance or variable annuity product level. If such charges or fees were included, overall expenses would be higher and would lower the Acquired and Acquiring Funds’ performance.

Holders of Class 1 and Class 2 shares of the Income Account will receive Class 1 shares of the Core Plus Bond Account.

Annual Fund Operating Expenses

(Expenses that you pay each year as a percentage of the value of your investment)

|

| | |

Income Account (Acquired Fund) | | |

| | Class 1 | Class 2 |

| Management Fees | 0.50% | 0.50% |

| Distribution and/or Service (12b-1) Fees | N/A | 0.25% |

| Other Expenses | 0.01% | 0.01% |

| Total Annual Account Operating Expenses | 0.51% | 0.76% |

|

| | |

Core Plus Bond Account (Acquiring Fund) | | |

| | Class 1 | Class 2 |

| Management Fees | 0.45% | 0.45% |

| Distribution and/or Service (12b-1) Fees | N/A | 0.25% |

| Other Expenses | 0.02% | 0.02% |

| Acquired Funds Fees and Expenses | 0.01% | 0.01% |

| Total Annual Account Operating Expenses | 0.48% | 0.73% |

|

| | | |

Core Plus Bond Account (Acquiring Fund) (Pro forma assuming Reorganization) |

| | Class 1 | Class 2 | |

| Management Fees | 0.40% | 0.40% | |

| Distribution and/or Service (12b-1) Fees | N/A | 0.25% | |

| Other Expenses | 0.01% | 0.01% | |

| Acquired Funds Fees and Expenses | 0.01% | 0.01% | |

| Total Annual Account Operating Expenses | 0.42% | 0.67% | (1) (2) |

(1) Effective following the close of business on June 14, 2019, the Class 2 shares will automatically convert to Class 1 shares.

(2) If the Reorganization is approved, the PVC SAM Portfolios, which are other series of PVC that own shares of the Acquired Fund, are expected to redeem their entire investment prior to the Effective Time. If such redemption occurs, the pro forma annual account operating expenses are expected to be 0.47% for Class 1 and 0.72% for Class 2.

Examples: The following examples are intended to help you compare the costs of investing in shares of the Acquired and Acquiring Funds. The examples assume that fund expenses continue at the rates shown in the table above, that you invest $10,000 in the particular fund for the time periods indicated and that all dividends and distributions are reinvested. The examples also assume that your investment has a 5% return each year. If separate account expenses and contract level expenses were included, expenses would be higher. The examples should not be considered a representation of future expense of the Acquired or Acquiring Fund. Actual expense may be greater or less than those shown. |

| | | | | |

| ACCOUNT | | 1 Year | 3 Years | 5 Years | 10 Years |

| | | | | | |

Income (Acquired Fund) | Class 1 | $52 | $164 | $285 | $640 |

Income (Acquired Fund) | Class 2 | 78 | 243 | 422 | 942 |

| | | | | | |

Core Plus Bond (Acquiring Fund) | Class 1 | $49 | $154 | $269 | $604 |

Core Plus Bond (Acquiring Fund) | Class 2 | 75 | 233 | 406 | 906 |

| | | | | | |

Core Plus Bond (Acquiring Fund) (Pro forma assuming Reorganization) | Class 1 | $43 | $135 | $235 | $530 |

Core Plus Bond (Acquiring Fund) (Pro forma assuming Reorganization) | Class 2 | 68 | 214 | 373 | 835 |

Portfolio Turnover

Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction fees. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the portfolio turnover rate for the Acquired Fund was 9.4% of the average value of its portfolio while the portfolio turnover rate for the Acquiring Fund was 127.5%

Investment Management Fees

The Funds each pay their investment advisor, PGI, an advisory fee which for each Fund is calculated as a percentage of the Fund’s average daily net assets pursuant to the following fee schedule:

|

| | | |

Income Account

(Acquired Fund) | Core Plus Bond Account

(Acquiring Fund) |

| First $2 Billion | 0.50% | First $100 Million | 0.50% |

| Over $2 Billion | 0.45% | Next $100 Million | 0.45% |

| | | Next $100 Million | 0.40% |

| | | Next $100 Million | 0.35% |

| | | Thereafter | 0.30% |

The fee each Fund paid (as a percentage of the Fund's average daily net assets) for the fiscal year ended December 31, 2018 was:

|

| | | |

Income Account

(Acquired Fund) | Core Plus Bond Account

(Acquiring Fund) |

| 0.50% | 0.45% |

Availability of the discussions regarding the basis for the Board of Directors' approval of the management agreement and any sub-advisory agreements is as follows:

|

| |

| | Annual Report to Shareholders for the period ending December 31, 2018 |

| Account | Management Agreement |

Income (Acquired Fund) | X |

Core Plus Bond (Acquiring Fund) | X |

Performance

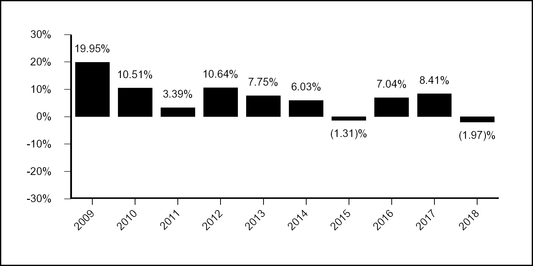

The following information provides some indication of the risks of investing in the Acquiring and Acquired Funds by showing their performance from year to year and by showing how the Acquiring and Acquired Fund’s average annual returns for 1, 5, and 10 years compare with those of one or more broad measures of market performance.

Past performance is not necessarily an indication of how the Funds will perform in the future. Performance figures for the Funds do not include any separate account expenses, cost of insurance, or other contract-level expenses; total returns for the Funds would be lower if such expenses were included.

Calendar Year Total Return (%) as of 12/31 Each Year

Income Account (Acquired Fund)

|

| | | |

| Highest return for a quarter during the period of the bar chart above: | Q2 '09 | 7.98 | % |

| Lowest return for a quarter during the period of the bar chart above: | Q2 '13 | (2.39 | )% |

|

| | | |

| Average Annual Total Returns |

| For the periods ended December 31, 2018 | 1 Year | 5 Years | 10 Years |

| Income Account - Class 1 | 0.78% | 3.26% | 5.84% |

| Income Account - Class 2 | 0.47% | 3.01% | 5.58% |

| Bloomberg Barclays U.S. Aggregate Bond Index (reflects no deduction for fees, expenses, or taxes) | 0.01% | 2.52% | 3.48% |

Calendar Year Total Return (%) as of 12/31 Each Year

Core Plus Bond Account (Acquiring Fund)

For periods prior to the inception date of Class 2 shares (May 1, 2015), the performance shown in the table for Class 2 shares is that of the Acquiring Fund's Class 1 shares, adjusted to reflect the fees and expenses of the Class 2 shares. These adjustments result in performance for such periods that is no higher than the historical performance of the Class 1 shares.

|

| | | |

| Highest return for a quarter during the period of the bar chart above: | Q3 '09 | 9.32 | % |

| Lowest return for a quarter during the period of the bar chart above: | Q4 '16 | (2.53 | )% |

|

| | | |

| Average Annual Total Returns |

| For the periods ended December 31, 2018 | 1 Year | 5 Years | 10 Years |

| Core Plus Bond Account - Class 1 | (1.41)% | 2.41% | 5.67% |

| Core Plus Bond Account - Class 2 | (1.63)% | 2.15% | 5.40% |

| Bloomberg Barclays U.S. Aggregate Bond Index (reflects no deduction for fees, expenses, or taxes) | 0.01% | 2.52% | 3.48% |

Board Consideration of the Reorganization

At its December 11, 2018 meeting, the PVC Board of Directors considered information presented by PGI. The Board requested and evaluated such information as it deemed necessary to consider the proposed Reorganization of the Acquired Fund into the Acquiring Fund. At the meeting, the Board approved the Reorganization after concluding that participation in the Reorganization is in the best interests of the Acquired Fund and the Acquiring Fund and that the interests of existing shareholders of each Fund will not be diluted as a result of the Reorganization.

In determining whether to approve the Reorganization, the Board made inquiry into a number of matters and considered, among other things, the following factors, in no order of priority:

| |

| • | the prospects for growth of and for achieving economies of scale by the Acquired Fund as compared to those of the Acquiring Fund, including the anticipated redemption by affiliated fund-of-fund products of assets invested in the Acquiring Fund; |

| |

| • | the Funds’ similar investment objectives and principal investment strategies and risks, and identical fundamental investment restrictions; |

| |

| • | the Funds’ current management fee rates and expense ratios and the expected management fee rate and expense ratio of the Acquired Fund following the Reorganization; |

| |

| • | the expected automatic conversion of Class 2 shares of the Acquiring Fund into Class 1 shares and that Class 2 shareholders of the Acquired Fund would become Class 1 shareholders of the Acquiring Fund in the Reorganization; |

| |

| • | the estimated costs of the Reorganization, including audit and proxy-related costs, and that such costs will be borne by the Acquired Fund; |

| |

| • | the estimated trading costs associated with disposing of any portfolio securities of the Acquired Fund and reinvesting the proceeds in connection with the Reorganization; |

| |

| • | information regarding the Funds’ investment performance and risk-return profiles; |

| |

| • | the direct or indirect federal income tax consequences of the Reorganization and their expected impact on Contract Owners of the insurance separate accounts that own the Acquired Fund shares; |

| |

| • | any direct or indirect benefits, including potential economic benefits, expected to be derived by PGI and its affiliates from the Reorganization; |

| |

| • | the absence of any material differences in the rights of shareholders of the Funds; |

| |

| • | the Reorganization will not result in the dilution of the interests of shareholders of the Acquired Fund or the Acquiring Fund; |

| |

| • | the terms and conditions of the Plan; and |

| |

| • | possible alternatives to the Reorganization, including liquidation of the Acquired Fund. |

The Board recommends that Acquired Fund shareholders vote to approve the Reorganization for the following reasons:

| |

| • | based on information provided by PGI, the Board expects a significant withdrawal of assets from the Acquired Fund as a result of the anticipated redemption by affiliated fund-of-funds products of assets invested in the Acquired Fund and believes there is otherwise a lack of foreseeable demand or prospects for scalable growth for the Acquired Fund; |

| |

| • | based on information provided by PGI, the Board believes the prospects for growth and for achieving economies of scale are better for the Acquiring Fund than the Acquired Fund; |

| |

| • | the Reorganization is expected to result in a decrease in the expense ratio for all shareholders of the Acquired Fund; |

| |

| • | the Acquired Fund and the Acquiring Fund have similar investment objectives and principal investment strategies and risks; and |

| |

| • | based on information provided by PGI, the Board believes all Acquired Fund shareholders will receive comparable investment performance post-Reorganization. |

PROPOSAL 2:

APPROVAL OF A PLAN OF ACQUISITION

PROVIDING FOR THE REORGANIZATION OF THE

LARGECAP GROWTH ACCOUNT INTO THE

LARGECAP GROWTH ACCOUNT I

Shareholders of the LargeCap Growth Account (the “Acquired Fund”) are being asked to approve the Plan, which provides for the reorganization of the Acquired Fund into the LargeCap Growth Account I (the “Acquiring Fund”).

Comparison of Acquired and Acquiring Funds

The following tables provide comparative information with respect to the Acquired and Acquiring Funds. As indicated in the tables, the Funds have the same objective in that both Funds seek long-term growth of capital. The Funds also have similar investment strategies and risks in that both in that both Funds employ a strategy that focuses on large capitalization growth securities. The principal differences are that the Acquiring Fund is multi-managed, and the Acquired Fund employs a more passive ehanced index strategy on up to 30% of the Fund's assets.

|

| | |

LargeCap Growth Account (Acquired Fund) | | LargeCap Growth Account I (Acquiring Fund) |

| Approximate Net Assets as of December 31, 2018: |

| $100,289,522 | | $299,298,482 |

| INVESTMENT ADVISOR |

| PGI | | PGI |

| | | |

| SUB-ADVISORS |

| Columbus Circle Investors ("CCI") | | Brown Advisory, LLC |

| | | T. Rowe Price Associates, Inc. |

| | | |

| CCI PORTFOLIO MANAGERS | | PGI PORTFOLIO MANAGERS |

Thomas J. Bisighini has been with CCI since 2004. He earned a B.S. from Bentley College and an M.B.A. in Finance from Fordham University. Mr. Bisighini has earned the right to use the Chartered Financial Analyst designation. Anthony Rizza has been with CCI since 1991. He earned a B.S. in Business from the University of Connecticut. Mr. Rizza has earned the right to use the Chartered Financial Analyst designation. | | The Acquiring Fund has two sub-advisors. For the Acquiring Fund, a team at PGI consisting of James Fennessey and Randy Welch, determines the portion of the Acquiring Fund's assets each sub-advisor will manage and may, from time to time, reallocate Fund assets between PGI acting in a discretionary advisory capacity and the sub-advisors. The decision to do so may be based on a variety of factors, including but not limited to: the investment capacity of PGI and each sub-advisor, portfolio diversification, volume of net cash flows, fund liquidity, investment performance, investment strategies, changes in PGI or each sub-advisor's firm or investment professionals or changes in the number of sub-advisors. Ordinarily, reallocations of Fund assets among sub-advisors occur as a sub-advisor liquidates assets in the normal course of portfolio management or with net new cash flows; however, at times existing Fund assets may be reallocated among sub-advisors. This team shares equally in the day-to-day portfolio management responsibility and agrees on allocation decisions. James W. Fennessey has been with Principal® since 2000. He is the Head of the Manager Research Team that is responsible for analyzing, interpreting, and coordinating investment performance data and evaluation of the investment managers under the due diligence process that monitors investment managers used by the Principal Funds. Mr. Fennessey earned a B.S. in Business Administration, with an emphasis in Finance, and a minor in Economics from Truman State University. He has earned the right to use the Chartered Financial Analyst designation. Randy L. Welch has been with Principal® since 1989 and oversees the functions of the Manager Selection & Investment Support Team, which includes investment manager research, investment consulting, performance analysis, and attribution. He is also responsible for the due diligence process that monitors investment managers on Principal's platform. Mr. Welch is an affiliate member of the Chartered Financial Analysts (CFA) Institute. Mr. Welch earned a B.A. in Business/Finance from Grand View College and an M.B.A. from Drake University. |

Comparison of Investment Objectives and Strategies

|

| | |

LargeCap Growth Account (Acquired Fund) | | LargeCap Growth Account I (Acquiring Fund) |

| | | |

| INVESTMENT OBJECTIVES |

| The Acquired Fund seeks long-term growth of capital. | | The Acquiring Fund seeks long-term growth of capital. |

| | | |

| PRINCIPAL INVESTMENT STRATEGIES |

| | | |

Under normal circumstances, the Acquired Fund invests at least 80% of its net assets, plus any borrowings for investment purposes, in equity securities of companies with large market capitalizations at the time of purchase. For the Acquired Fund, companies with large market capitalizations are those with market capitalizations within the range of companies comprising the Russell 1000® Growth Index (as of December 31, 2018, this range was between approximately $921.7 million and $780.4 billion). The Acquired Fund invests in growth equity securities; growth orientation emphasizes buying equity securities of companies whose potential for growth of capital and earnings is expected to be above average. | | Under normal circumstances, the Acquiring Fund invests at least 80% of its net assets, plus any borrowings for investment purposes, in equity securities of companies with large market capitalizations at the time of purchase. For the Acquiring Fund, companies with large market capitalizations are those with market capitalizations within the range of companies comprising the Russell 1000® Growth Index (as of December 31, 2018, this range was between approximately $921.7 million and $780.4 billion). The Acquired Fund invests in growth equity securities; growth orientation emphasizes buying equity securities of companies whose potential for growth of capital and earnings is expected to be above average. Principal Global Investors, LLC invests up to 30% of the Acquiring Fund's assets in equity securities in an attempt to match or exceed the performance of the Russell 1000® Growth Index by purchasing securities in the index while slightly overweighting and underweighting certain individual equity securities relative to their weight in the index. The Acquiring Fund's remaining assets are managed by the sub-advisors. |

Temporary Defensive Investing

For temporary defensive purposes in times of unusual or adverse market, economic, or political conditions, each Fund may invest up to 100% of its assets in cash and cash equivalents. In taking such defensive measures, either Fund may fail to achieve its investment objective.

Fundamental Investment Restrictions

The Funds are subject to identical fundamental investment restrictions, which may not be changed without a shareholder vote. These fundamental restrictions deal with such matters as the issuance of senior securities, purchasing or selling real estate or commodities, borrowing money, making loans, underwriting securities of other issuers, diversification or concentration of investments, and short sales of securities. The fundamental investment restrictions of the Funds are described in the Statement of Additional Information under "Description of the Funds' Investments and Risks - Fundamental Restrictions."

Additional Information

The investment objective of each Fund may be changed by the Board without shareholder approval.

Additional information about the investment strategies and the types of securities in which the Funds may invest is discussed below under “Additional Information About Investment Strategies and Risks” as well as in the Statement of Additional Information.

The Statement of Additional Information provides further information about the portfolio manager(s) for each Fund, including information about compensation, other accounts managed, and ownership of Fund shares.

Comparison of Principal Investment Risks

In deciding whether to approve the Reorganization, shareholders should consider the amount and character of investment risk involved in the respective investment objectives and strategies of the Acquired and Acquiring Funds.

Principal Risks Applicable to Both Funds:

The following principal risks are applicable to the Acquired Fund and the Acquiring Fund. There are no additional principal risks of investing in either the Acquired Fund or the Acquiring Fund that are not included below.

Equity Securities Risk. The value of equity securities could decline if the issuer’s financial condition declines or in response to overall market and economic conditions. A fund's principal market segment(s) (such as market capitalization or style) may underperform other market segments or the equity markets as a whole.

Growth Stock Risk. If growth companies do not increase their earnings at a rate expected by investors, the market price of the stock may decline significantly, even if earnings show an absolute increase. Growth company stocks also typically lack the dividend yield that can lessen price declines in market downturns.

Fees and Expenses of the Funds

Fees and Expenses as a % of average daily net assets

The following table shows: (a) the ratios of expenses to average net assets of the Acquired Fund for the fiscal year ended December 31, 2018; (b) the ratios of expenses to average net assets of the Acquiring Fund for the fiscal year ended December 31, 2018; and (c) the pro forma expense ratios of the Acquiring Fund for the fiscal year ended December 31, 2018, assuming that the Reorganization had taken place at the commencement of the fiscal year ended December 31, 2018.

These fees and expenses do not include the effect of any sales charge, separate account expenses or other contract level expenses which may be applied at the variable life insurance or variable annuity product level. If such charges or fees were included, overall expenses would be higher and would lower the Acquired and Acquiring Funds’ performance.

Holders of Class 1 and Class 2 shares of the LargeCap Growth Account will receive Class 1 shares of the LargeCap Growth Account I.

Annual Fund Operating Expenses

(Expenses that you pay each year as a percentage of the value of your investment)

|

| | |

LargeCap Growth Account (Acquired Fund) | | |

| | Class 1 | Class 2 |

| Management Fees | 0.68% | 0.68% |

| Distribution and/or Service (12b-1) Fees | N/A | 0.25% |

Other Expenses (1) | 0.01% | 0.01% |

| Total Annual Account Operating Expenses | 0.69% | 0.94% |

|

| | |

LargeCap Growth Account I (Acquiring Fund) | | |

| | Class 1 | Class 2 |

| Management Fees | 0.75% | 0.75% |

| Distribution and/or Service (12b-1) Fees | N/A | 0.25% |

Other Expenses (1) | 0.01% | 0.01% |

| Total Annual Account Operating Expenses | 0.76% | 1.01% |

Fee Waiver (2) | (0.02)% | (0.02)% |

| Total Annual Account Operating Expenses after Fee Waiver | 0.74% | 0.99% |

|

| | | |

LargeCap Growth Account I (Acquiring Fund) (Pro forma assuming Reorganization) |

| | Class 1 | Class 2 | |

| Management Fees | 0.71% | 0.71% | |

| Distribution and/or Service (12b-1) Fees | N/A | 0.25% | |

Other Expenses (1) | 0.01% | 0.01% | |

| Total Annual Account Operating Expenses | 0.72% | 0.97% | |

Expense Reimbursement and Fee Waiver (2)(3) | (0.03)% | (0.03)% | |

| Total Annual Account Operating Expenses after Expense Reimbursement and Fee Waiver | 0.69% | 0.94% | (4) |

(1) There were no acquired fund fees and expenses during the period.

(2) Principal Global Investors, LLC ("PGI"), the investment advisor, has contractually agreed to limit the Fund's management fees through the period ending April 30, 2020. The fee waiver will reduce the Fund's management fees by 0.016% (expressed as a percent of average net assets on an annualized basis). It is expected that the fee waiver will continue through the period disclosed; however, Principal Variable Contracts Funds, Inc. and PGI the parties to the agreement, may mutually agree to terminate the fee waiver prior to the end of the period.

(3) Effective with the Reorganization, Principal Global Investors, LLC ("PGI"), the investment advisor, has contractually agreed to limit the Fund's expenses by paying, if necessary, expenses normally payable by the Fund (excluding interest expense, expenses related to fund investments, acquired fund fees and expenses, and other extraordinary expenses) to maintain a total level of operating expenses (expressed as a percent of average net assets on an annualized basis) not to exceed 0.69% for Class 1 and 0.94% for Class 2 shares. It is expected that the expense limits will continue through the period ending April 30, 2021; however, Principal Variable Contracts Funds, Inc. and PGI, the parties to the agreement, may mutually agree to terminate the expense limits prior to the end of the period.

(4) Effective following the close of business on June 14, 2019, the Class 2 shares will automatically convert to Class 1 shares.

Examples: The following examples are intended to help you compare the costs of investing in shares of the Acquired and Acquiring Funds. The examples assume that fund expenses continue at the rates shown in the table above, that you invest $10,000 in the particular fund for the time periods indicated and that all dividends and distributions are reinvested. The examples also assume that your investment has a 5% return each year. If separate account expenses and contract level expenses were included, expenses would be higher. The examples should not be considered a representation of future expense of the Acquired or Acquiring Fund. Actual expense may be greater or less than those shown. |

| | | | | |

| ACCOUNT | | 1 Year | 3 Years | 5 Years | 10 Years |

| | | | | | |

LargeCap Growth (Acquired Fund) | Class 1 | $70 | $221 | $384 | $859 |

LargeCap Growth (Acquired Fund) | Class 2 | 96 | 300 | 520 | 1,155 |

| | | | | | |

LargeCap Growth I (Acquiring Fund) | Class 1 | $76 | $241 | $420 | $940 |

LargeCap Growth I (Acquiring Fund) | Class 2 | 101 | 320 | 556 | 1,234 |

| | | | | | |

LargeCap Growth I (Acquiring Fund) (Pro forma assuming Reorganization) | Class 1 | $70 | $227 | $398 | $892 |

LargeCap Growth I (Acquiring Fund) (Pro forma assuming Reorganization) | Class 2 | 96 | 306 | 533 | 1,187 |

Portfolio Turnover

Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction fees. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the portfolio turnover rate for the Acquired Fund was 77.8% of the average value of its portfolio while the portfolio turnover rate for the Acquiring Fund was 36.9%.

Investment Management Fees

The Funds each pay their investment advisor, PGI, an advisory fee which for each Fund is calculated as a percentage of the Fund’s average daily net assets pursuant to the following fee schedule:

|

| | | |

LargeCap Growth Account (Acquired Fund) | LargeCap Growth Account I (Acquiring Fund) |

| First $500 Million | 0.68% | First $100 Million | 0.80% |

| Next $500 Million | 0.63% | Next $100 Million | 0.75% |

| Next $1 Billion | 0.61% | Next $100 Million | 0.70% |

| Next $1 Billion | 0.56% | Next $100 Million | 0.65% |

| Over $3 Billion | 0.51% | Thereafter | 0.60% |

The fee each Fund paid (as a percentage of the Fund's average daily net assets) for the fiscal year ended December 31, 2018 was:

|

| | | |

LargeCap Growth Account (Acquired Fund) | LargeCap Growth Account I (Acquiring Fund) |

| 0.68% | 0.75% |