UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

ý | | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2006

OR

o | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from To

Commission file number 333-109064

WORLDSPAN, L.P.

(Exact name of registrant as specified in its charter)

Delaware | | 75-3125716 |

(State or other jurisdiction of | | (I.R.S. Employer Identification No.) |

incorporation or organization) | | |

| | |

300 Galleria Parkway, N.W. | | |

Atlanta, Georgia | | 30339 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code (770) 563-7400

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

ý Yes o No

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer (as defined in Rule 12b-2 of the Exchange Act).

Large accelerated filer | o | Accelerated Filer | o | Non-accelerated filer | ý | |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

As of May 12, 2006, Registrant’s parent had outstanding 83,257,698 shares of Class A Common Stock and 11,000,000 shares of Class B Common Stock.

WORLDSPAN, L.P.

REPORT ON FORM 10-Q

FOR THE PERIOD ENDED MARCH 31, 2006

INDEX

2

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

Worldspan, L.P.

Condensed Consolidated Balance Sheets

(Unaudited) (dollars in thousands)

| | March 31, 2006 | | December 31, 2005 | |

Assets | | | | | |

Current assets | | | | | |

Cash and cash equivalents | | $ | 70,211 | | $ | 58,093 | |

Trade accounts receivable, net | | 118,490 | | 97,984 | |

Prepaid expenses and other current assets | | 15,479 | | 16,992 | |

Total current assets | | 204,180 | | 173,069 | |

Property and equipment, net | | 83,893 | | 91,283 | |

Deferred charges | | 27,180 | | 24,392 | |

Debt issuance costs, net | | 13,596 | | 14,626 | |

Supplier and agency relationships, net | | 226,780 | | 236,981 | |

Developed technology, net | | 177,834 | | 183,254 | |

Trade name | | 72,142 | | 72,142 | |

Goodwill | | 111,803 | | 111,803 | |

Other intangible assets, net | | 28,404 | | 29,106 | |

Other long-term assets | | 54,230 | | 52,194 | |

Total assets | | $ | 1,000,042 | | $ | 988,850 | |

| | | | | |

Liabilities and Partners’ Capital | | | | | |

Current liabilities | | | | | |

Accounts payable | | $ | 19,482 | | $ | 16,847 | |

Accrued expenses | | 158,942 | | 144,738 | |

Current portion of capital lease obligations | | 16,389 | | 17,863 | |

Current portion of long-term debt | | 4,000 | | 4,000 | |

Total current liabilities | | 198,813 | | 183,448 | |

Long-term portion of capital lease obligations | | 33,757 | | 36,555 | |

Long-term debt | | 627,500 | | 667,500 | |

Pension and postretirement benefits | | 58,883 | | 60,238 | |

Other long-term liabilities | | 10,030 | | 9,510 | |

Total liabilities | | 928,983 | | 957,341 | |

Commitments and contingencies | | | | | |

Partners’ capital | | 71,059 | | 31,509 | |

Total liabilities and Partners’ capital | | $ | 1,000,042 | | $ | 988,850 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

3

Worldspan, L.P.

Condensed Consolidated Statements of Operations

(Unaudited) (dollars in thousands)

| | Three months ended | |

| | March 31, 2006 | | March 31, 2005 | |

| | | | | |

Revenues | | | | | |

Electronic travel distribution | | $ | 242,728 | | $ | 241,958 | |

Information technology services | | 19,371 | | 18,624 | |

Total revenues | | 262,099 | | 260,582 | |

Operating Expenses | | | | | |

Cost of revenues | | | | | |

Cost of revenues excluding developed technology amortization | | 163,822 | | 178,141 | |

Developed technology amortization | | 5,420 | | 5,698 | |

Total cost of revenues | | 169,242 | | 183,839 | |

Selling, general and administrative | | 27,644 | | 32,616 | |

Amortization of intangible assets | | 10,903 | | 9,135 | |

Total operating expenses | | 207,789 | | 225,590 | |

Operating income | | 54,310 | | 34,992 | |

Other Income (Expense) | | | | | |

Interest expense, net | | (16,264 | ) | (12,329 | ) |

Loss on extinguishment of debt | | — | | (55,597 | ) |

Other, net | | (946 | ) | (210 | ) |

Total other expense, net | | (17,210 | ) | (68,136 | ) |

Income (loss) before provision for income taxes | | 37,100 | | (33,144 | ) |

Income tax expense | | 643 | | 918 | |

Net income (loss) | | $ | 36,457 | | $ | (34,062 | ) |

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

Worldspan, L.P.

Condensed Consolidated Statements of Changes in Partners’ Capital

(Unaudited) (dollars in thousands)

| | Partners’

Capital | | Accumulated

Other

Comprehensive

Income | | Total | |

| | | | | | | |

Balance at December 31, 2005 | | $ | 30,892 | | $ | 617 | | $ | 31,509 | |

Comprehensive income: | | | | | | | |

Net income | | 36,457 | | — | | 36,457 | |

Change in fair value of derivative accounted for as a hedge | | — | | 2,431 | | 2,431 | |

Comprehensive income | | | | | | 38,888 | |

Stock-based compensation | | 662 | | — | | 662 | |

Balance at March 31, 2006 | | $ | 68,011 | | $ | 3,048 | | $ | 71,059 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

5

Worldspan, L.P.

Condensed Consolidated Statements of Cash Flows

(Unaudited) (dollars in thousands)

| | Three months ended | |

| | March 31, 2006 | | March 31, 2005 | |

Cash flows from operating activities: | | | | | |

Net income (loss) | | $ | 36,457 | | $ | (34,062 | ) |

Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | | | |

Depreciation and amortization | | 25,820 | | 24,880 | |

Amortization of debt issuance costs | | 1,030 | | 760 | |

Loss on extinguishment of debt | | — | | 55,597 | |

Stock-based compensation | | 662 | | 644 | |

Loss on disposal of property and equipment, net | | 77 | | 250 | |

Changes in operating assets and liabilities: | | | | | |

Trade accounts receivable, net | | (20,506 | ) | (38,019 | ) |

Prepaid expenses and other current assets | | 1,513 | | 970 | |

Deferred charges | | (2,788 | ) | 1,684 | |

Other long-term assets | | 397 | | 486 | |

Accounts payable | | 2,635 | | 1,093 | |

Accrued expenses | | 14,204 | | 12,664 | |

Pension and postretirement benefits | | (1,445 | ) | (1,251 | ) |

Other long-term liabilities | | 519 | | (643 | ) |

Net cash provided by operating activities | | 58,575 | | 25,053 | |

Cash flows from investing activities: | | | | | |

Purchase of property and equipment | | (2,080 | ) | (1,574 | ) |

Proceeds from sale of property and equipment | | 66 | | 54 | |

Net cash used in investing activities | | (2,014 | ) | (1,520 | ) |

Cash flows from financing activities: | | | | | |

Proceeds from issuance of debt, net of debt issuance costs | | — | | 734,864 | |

Principal payments on capital leases | | (4,443 | ) | (4,737 | ) |

Principal payments on debt | | (40,000 | ) | (58,488 | ) |

Repurchase 9 5/8% senior notes | | — | | (327,481 | ) |

Distributions to WTI, net | | — | | (425,678 | ) |

Net cash used in financing activities | | (44,443 | ) | (81,520 | ) |

Net increase (decrease) in cash and cash equivalents | | 12,118 | | (57,987 | ) |

Cash and cash equivalents at beginning of period | | 58,093 | | 100,474 | |

Cash and cash equivalents at end of period | | $ | 70,211 | | $ | 42,487 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

6

Worldspan, L.P.

Notes to Condensed Consolidated Financial Statements

(Unaudited) (dollars in thousands)

1. Accounting Policies

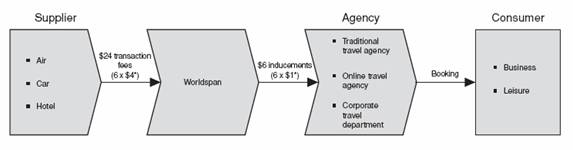

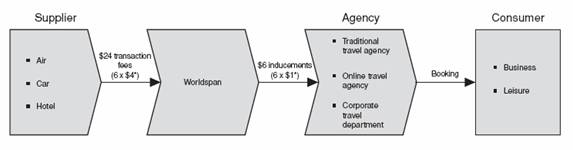

Nature of Business. Worldspan, L.P. (the “Partnership”) is a Delaware limited partnership formed in 1990. On June 30, 2003, Worldspan Technologies Inc. (“WTI”), formerly named Travel Transaction Processing Corporation, formed by Citigroup Venture Capital Equity Partners, L.P. (“CVC”) and Ontario Teachers’ Pension Plan Board (“OTPP”), indirectly acquired 100% of the outstanding partnership interests of the Partnership from affiliates of Delta Air Lines, Inc. (“Delta”), Northwest Airlines, Inc. (“Northwest”) and American Airlines, Inc. (“American”) (the “Acquisition”). WTI owns all of the general partnership interests in the Partnership. WS Holdings LLC (“WS Holdings”), which is owned by WTI, is the sole limited partner of the Partnership, owning all of the limited partnership interests.

The Partnership provides information, reservations, transaction processing and related services for airlines, travel agencies and other travel-related entities. The Partnership owns and operates a global distribution system (“GDS”) and provides subscribers with access to and use of this GDS. The Partnership also charges airlines, hotels, car rental companies and others for the use of the GDS.

Basis of Presentation. The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by accounting principles generally accepted in the United States for complete financial statements. In the opinion of management these financial statements contain all adjustments, consisting of normal recurring accruals, necessary to present fairly the financial position, results of operations and cash flows for the periods indicated. The preparation of financial statements in accordance with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the amounts reported in the financial statements and the accompanying notes. Operating results for the three months ended March 31, 2006 and March 31, 2005 are not necessarily indicative of results that may be expected for any other interim period or for the year ending December 31, 2006. The Partnership’s quarterly financial data should be read in conjunction with its consolidated financial statements for the year ended December 31, 2005 (including the notes thereto), set forth in its annual report on Form 10-K filed with the Securities and Exchange Commission on March 3, 2006.

Derivative Instruments. All derivatives are measured at fair value and recognized as either assets or liabilities on our consolidated balance sheets. Changes in the fair values of derivative instruments that do not qualify as hedges and/or any ineffective portion of hedges are recognized as a gain or loss in our condensed consolidated statement of operations in the current period. Changes in the fair values of derivative instruments used effectively as fair value hedges are recognized in earnings, along with the change in the value of the hedged item. Changes in the fair value of the effective portions of cash flow hedges are reported in other comprehensive income and recognized in earnings when the hedged item is recognized in earnings.

Risks and Uncertainties. The Partnership derives substantially all of its revenues from the travel industry. Accordingly, events, circumstances and changes affecting the travel industry, particularly changes in airline travel and the financial well-being of the participating airlines, can significantly affect the Partnership’s business, financial condition and results of operations. The Partnership’s customers are primarily located in the United States and Europe.

Travel agencies are the primary channel of distribution for the services offered by travel vendors. If the Partnership were to lose all or part of the transactions generated by any significant travel agency and not replace such transactions, its business, financial condition and results of operations could be adversely affected. One online agency subscriber, Expedia, generated transactions in the Partnership’s electronic travel distribution segment which resulted in revenues of approximately $75,586 and $73,362 for the three months ended March 31, 2006 and March 31, 2005, respectively. These amounts represented 29% and 28% of total revenues for the three months ended March 31, 2006 and March 31, 2005, respectively.

On May 5, 2004, the Partnership announced that it had been informed by Expedia of its intention to move a portion of its transactions to another GDS provider in order to diversify its GDS relationships beyond using a single provider to process substantially all of its GDS transactions. Expedia has not specified the volumes or percentages of volumes it intends to process through this other GDS. Through March 31, 2006, the announced movement of Expedia’s transactions has not yet occurred; however, based on recent announcements by Expedia, the Partnership believes some movement of Expedia’s transactions may occur in the second half of 2006. Currently, the Partnership cannot forecast the magnitude of any such movement of transactions and therefore is unable to estimate the impact on its financial position, results of operations and cash flows. Also, in October 2005, Expedia notified the Partnership of its intention to move some portion but not all of its European transactions to another GDS provider in 2006. Expedia announced in May 2006 that it has commenced booking at select points of sale certain European segments through another GDS as previously announced. Currently, the Partnership cannot forecast the magnitude of any such movement of transactions and therefore is unable to estimate the impact on its financial position, results of operations and cash flows. Additionally, Priceline, one of the Partnership’s largest online travel agency customers, has signed an agreement with

7

another GDS; however, we have not received any notification from Priceline as to the timing and volume of transactions that it intends to move. Furthermore, if we are unable to satisfactorily resolve the claims asserted against us by Orbitz, our second largest online travel agency, (see Note 5) and its lawsuit against us is successful, there would be few or no restrictions to prevent Orbitz from moving a significant portion of its business from our GDS. If Expedia, Priceline or Orbitz were to move a material portion of their respective transactions to other GDS providers, the Partnership’s business would be negatively and materially impacted.

A development within the GDS industry over the past several years involves the competitive need for GDSs to maintain full content, including web fare content, for distribution to traditional and online agency subscribers. We have recently entered into long-term content agreements with American, Continental and United. Subject to termination rights, these new agreements continue until 2011. Should we fail to maintain competitive content, our traditional and online agency subscribers could move transactions to competitors with access to this content, thus negatively affecting the Partnership’s business, financial condition and results of operations. See Note 11 for a discussion of our content agreements.

Furthermore, the Partnership charges airline carriers, rental car companies, hotels and other providers of travel products and services (collectively referred to as “suppliers”) for electronic travel distribution services and information technology services.

Effective September 14, 2005, Delta and Northwest, both significant suppliers of the Partnership, entered bankruptcy protection. Revenues generated by Delta and Northwest were $62,389 and $75,849 for the three months ended March 31, 2006 and 2005, respectively. These amounts represented approximately 24% and 29% of total revenues for the three months ended March 31, 2006 and 2005, respectively. Delta and Northwest accounted for 14% and 10%, respectively, of total revenue for the three months ended March 31, 2006.

Pre-bankruptcy petition accounts receivable at March 31, 2006 under the Partnership’s two primary agreements with Delta and Northwest are $16,402, collectively. Post-bankruptcy petition accounts receivable at March 31, 2006 under the Partnership’s two primary agreements with Delta and Northwest are $31,199, collectively. The Partnership believes that its pre-bankruptcy petition accounts receivable will likely be realized over an extended period of time. The Partnership believes it will continue to provide the services to the airlines and, absent further significant deterioration in the financial condition of the airlines, post-bankruptcy petition accounts receivable are expected to be collected in accordance with the terms of the Partnership’s current commercial agreements.

While under bankruptcy protection, Delta and Northwest could petition the court to reject certain or all of the existing agreements with the Partnership, subject to Northwest’s restrictions in the new content agreement referred to in Note 11 below. The Partnership is not aware of an action by either Delta or Northwest to reject any agreements with it and, accordingly continues to operate with the two airlines under its existing commercial agreements. See Note 11 for a discussion of the new five-year content agreement signed with Northwest. Additional facts could become known or actions taken by either airline in bankruptcy that could impact the Partnership’s assessment of the collectibility and thus result in a charge to earnings in future periods. Furthermore, the Partnership is not yet in a position to ultimately determine whether payments previously made to it will be challenged or unwound in the bankruptcy proceedings.

The Partnership maintained an allowance for doubtful accounts of approximately $8,283 and $8,110 at March 31, 2006 and December 31, 2005, respectively.

Accounting Pronouncements. In December 2004, the Financial Accounting Standards Board (“FASB”) issued SFAS No. 123R, Share-Based Payment. The Statement requires an entity to measure the cost of employee services received in exchange for an award of equity instruments based on the grant-date fair value of the award. That cost will be recognized over the period during which an employee is required to provide service in exchange for the award, known as the requisite service period. SFAS No. 123(R) became applicable to the Partnership beginning January 1, 2006. See Note 10 for a discussion of the impact of adopting SFAS No. 123(R).

In May 2005, the FASB issued SFAS No. 154, “Accounting Changes and Error Corrections” (“SFAS No. 154”) which supersedes APB Opinion No. 20, “Accounting Changes” and SFAS No. 3 “Reporting Accounting Changes in Interim Financial Statements”. SFAS No. 154 changes the requirements for accounting for and reporting of changes in accounting principles. The statement requires the retroactive application to prior periods’ financial statements of changes in accounting principles, unless it is impracticable to determine either the period specific effects or the cumulative effect of the change. SFAS No. 154 does not change the guidance for reporting the correction of an error in previously issued financial statements or the change in an accounting estimate. SFAS No. 154 became effective for accounting changes and corrections of errors

8

made in fiscal years beginning after December 15, 2005. As of and for the three months ended March 31, 2006, SFAS No. 154 did not impact the Partnership’s consolidated financial position or results of operations.

In February 2006, the Financial Accounting Standards Board (“FASB”) issued statement No. 155, “Accounting for Certain Hybrid Financial Instruments” (“SFAS No. 155”). Under current generally accepted accounting principles an entity that holds a financial instrument with an embedded derivative must bifurcate the financial instrument, resulting in the host and the embedded derivative being accounted for separately. SFAS No. 155 permits, but does not require, entities to account for financial instruments with an embedded derivative at fair value thus negating the need to bifurcate the instrument between its host and the embedded derivative. SFAS No. 155 is effective as of the beginning of the first annual reporting period that begins after September 15, 2006. We expect that SFAS No. 155 will not have a material effect on our consolidated financial condition or results of operations.

In March 2006, the FASB issued statement No. 156, “Accounting for Servicing of Financial Assets” (“SFAS No. 156”). SFAS No. 156 amends FASB Statement No. 140, “Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities,” to require that all separately recognized servicing assets and servicing liabilities be initially measured at fair value, if practicable. SFAS No. 156 permits, but does not require, the subsequent measurement of separately recognized servicing assets and servicing liabilities at fair value. An entity that uses derivative instruments to mitigate the risks inherent in servicing assets and servicing liabilities is required to account for those derivative instruments at fair value. SFAS No. 156 is effective as of the beginning of the first annual reporting period that begins after September 15, 2006. We expect that SFAS No. 156 will not have a material effect on our financial condition or results of operations.

2. Debt

On February 11, 2005, the Partnership, WS Financing Corp. (“WS Financing”), the wholly-owned domestic subsidiaries of the Partnership, as guarantors (the “Guarantor Subsidiaries”) and The Bank of New York Trust Company, N.A., as trustee, entered into an Indenture (the “Indenture”). Pursuant to the Indenture, the Guarantor Subsidiaries issued $300,000 of Senior Second Lien Secured Floating Rate Notes due 2011 (the “Floating Rate Notes”), secured on a second priority basis by substantially all of the assets of the Partnership, WS Financing and the Guarantor Subsidiaries. In addition, the Partnership, as borrower, WTI, and WS Holdings entered into a new credit agreement (the “Credit Agreement”) with a syndicate of financial institutions as lenders. In connection with the closing under the Credit Agreement, a new senior credit facility (the “2005 Senior Credit Facility”), consisting of a five-year revolving credit facility in the amount of $40,000 and a new term loan facility due 2010 (the “Term Loan under 2005 Senior Credit Facility”) in the amount of $450,000, was made available to the Partnership. Obligations under the 2005 Senior Credit Facility and the guarantees are secured by a perfected first priority security interest in all of the Partnership’s tangible and intangible assets and all of the tangible and intangible assets of WTI and each of the Guarantor Subsidiaries, subject to customary exceptions, and a pledge of (i) all of the membership interests of WS Holdings LLC owned by WTI, (ii) all of the partnership interests owned by WTI and WS Holdings LLC, and (iii) all of the capital stock of the Partnership’s Guarantor Subsidiaries and significant portions of the Partnership’s holdings in foreign subsidiaries.

At the Partnership’s option, the interest rate applied to borrowings under the 2005 Senior Credit Facility is based on the LIBOR rate (as defined in the Credit Agreement) plus the initial applicable margin of 2.75%. The alternative rate is a base rate (generally defined as the sum of (i) the higher of (x) the prime rate and (y) the federal funds effective rate, plus one half percent (0.50%) per annum and (ii) an initial applicable margin of 1.75%).The interest rate applicable to borrowings under the Floating Rate Notes is based on the three-month LIBOR rate plus 6.25%. At March 31, 2006, the three-month LIBOR rate was 5.0%. Borrowings under the 2005 Senior Credit Facility are subject to quarterly interest payments with respect to loans bearing interest at the base rate described above or at the end of each one, two, three or six month interest period for loans bearing interest at the LIBOR rate described above.

The net proceeds from the sale of the Floating Rate Notes and the closing of the Term Loan under 2005 Senior Credit Facility, along with available cash of the Partnership, were used to (collectively referred to as the “Refinancing Transactions”):

• repay approximately $57,488 of the outstanding balance of the then-existing senior term loan due 2007 including any accrued and unpaid interest then outstanding under the then existing senior credit facility,

• purchase pursuant to a cash tender offer of $279,500 of the Partnership’s outstanding 9 5/8% Senior Notes due 2011,

• distribute funds to WTI to redeem WTI’s outstanding Preferred Stock at a redemption price equal to the face amount of WTI’s Preferred Stock plus accrued and unpaid dividends to the redemption date for a total redemption price of approximately $375,729,

• distribute funds to WTI to pay a consent fee of $8,638 (the “Consent Fee”) to certain related parties of CVC in connection with the Holdco Notes described below, and

9

• pay fees and expenses related to the Refinancing Transactions.

In connection with the Refinancing Transactions, on February 16, 2005, WTI issued $43,630 in new 11% Subordinated Notes due 2013 (the “Holdco Notes”) to certain related parties of CVC and paid $365 in accrued and unpaid interest in exchange for the surrender and cancellation of all of the obligations owing by WTI related to the then outstanding subordinated notes due 2012.

As a result of the Refinancing Transactions described above, the Partnership recorded a loss on extinguishment of debt of $55,597 during the three months ended March 31, 2005.

On March 4, 2005, the Partnership entered into an interest rate swap with a notional amount that began at $508,370 on November 15, 2005 and is amortized on a quarterly basis to $102,250 at November 15, 2008. The reset dates on the swap are February 15, May 15, August 15 and November 15 of each year until maturity on November 15, 2008. The notional amount as of March 31, 2006 is $480,530. This agreement, which has been designated as a cash flow hedge, is being used to convert the variable component of the interest rates on certain indebtedness to a fixed rate of 4.3%, effective November 15, 2005. Because the critical terms of the swap match those of the debt it is hedging, the swap is considered a perfect hedge against changes in the fair value of the debt and the hedge has resulted in no ineffectiveness being recognized in operations. Changes in the fair value of the swap are recognized as a component of accumulated other comprehensive income in each reporting period. As of March 31, 2006, the fair value of this swap was an asset of $5,812, which is included in other long-term assets in the condensed consolidated balance sheet.

The 2005 Senior Credit Facility requires the Partnership to meet financial tests, including without limitation, a minimum interest coverage ratio and a maximum total leverage ratio. Also, the Indenture requires the Guarantor Subsidiaries to maintain a minimum fixed charge coverage ratio. In addition, certain non-financial covenants restrict the activities of the Guarantor Subsidiaries.

Long-term debt consisted of the following:

| | March 31,

2006 | | December 31,

2005 | |

| | | | | |

Term loan under 2005 Senior Credit Facility (1) | | $ | 331,000 | | $ | 371,000 | |

Floating Rate Notes (2) | | 300,000 | | 300,000 | |

95/8% Senior Notes (1) | | 500 | | 500 | |

| | 631,500 | | 671,500 | |

Less current portion of long-term debt | | 4,000 | | 4,000 | |

Long-term debt, excluding current portion | | $ | 627,500 | | $ | 667,500 | |

(1) Based on borrowing rates currently available to the Partnership, the carrying value of the debt obligation approximates fair value.

(2) $290,000 of the Floating Rate Notes are publicly traded and at May 11, 2006 had a market value of approximately $284,925 based on the quoted market price for such notes. The remaining $10,000 of Floating Rate Notes have not yet been registered.with the Securities and Exchange Commission.

During the three months ended March 31, 2006, the Partnership paid $40,000 in principal on the term loan, of which $1,000 was a scheduled principal payment.

3. Employee Benefit Plans

The components of net pension and postretirement costs were as follows:

10

| | Pension Benefits | | Postretirement Benefits | |

| | Three months

ended

March 31,

2006 | | Three months

ended

March 31,

2005 | | Three months

ended

March 31,

2006 | | Three months

ended

March 31,

2005 | |

Service cost | | $ | — | | $ | — | | $ | 59 | | $ | 66 | |

Interest cost | | 2,923 | | 2,892 | | 380 | | 407 | |

Expected return on plan assets | | (3,948 | ) | (3,656 | ) | — | | — | |

Amortization of transition obligation | | — | | — | | — | | — | |

Amortization of prior service cost | | — | | — | | — | | — | |

Recognized net actuarial loss | | 32 | | 27 | | — | | — | |

Net periodic pension benefit (income) expense | | $ | (993 | ) | $ | (737 | ) | $ | 439 | | $ | 473 | |

Effective January 1, 2002, the defined benefit pension plan was amended to exclude employees hired on or after January 1, 2002. Effective December 31, 2003, the Partnership froze all further benefit accruals under the defined benefit pension plan.

4. Related Party Transactions

In February 2005, the Partnership entered into the Refinancing Transactions. Certain of the parties to these transactions were related parties, including WTI, CVC and OTPP. See Note 2 for a full description of these matters.

In connection with the Refinancing Transactions, on February 16, 2005, the Partnership entered into an amendment to its Advisory Agreement with WTI to terminate all advisory and other fees payable under that agreement as of January 1, 2005 in return for a prepayment of $7,700 payable on or before December 15, 2005. The prepaid advisory fees are included in “Prepaid expenses and other current assets” and “Other long-term assets” in the accompanying consolidated balance sheets. The prepaid advisory fees are being amortized on a straight line basis over the remaining term that the services are provided. The agreement expires in June 2013. During the three months ended March 31, 2006, the Partnership recognized $227 of expense in connection with this agreement. During the three months ended March 31, 2005 the Partnership recognized a total of $601 of expense related to advisory fees.

On January 10, 2005, WTI entered into a Note Redemption Agreement (the “Note Redemption Agreement”) with Delta. Pursuant to the Note Redemption Agreement, WTI redeemed the 10% Subordinated Note due 2012 in an original principal amount of $45,000 issued by WTI to Delta on June 30, 2003, the additional notes issued in lieu of cash interest and all accrued and unpaid interest up to January 10, 2005 for $36,137. The Partnership distributed $36,137 to WTI to finance this transaction.

During the quarter ended March 31, 2005, the Partnership distributed $4,700 to WTI to enable WTI to cover income taxes that it owed on the income generated by the Partnership in the United States. There were no distributions to WTI for any purpose in the quarter ended March 31, 2006.

Under the WTI stock incentive plan, WTI offers restricted shares of its Common Stock and grants options to purchase shares of its Common Stock to certain employees of the Partnership. As the options and restricted shares are being granted to employees of the Partnership, the Partnership recognizes this value as an expense over the period in which the options and restricted shares vest.

In 2005 the Partnership entered into a master services agreement for technology services with Calleo Distribution Technologies Pvt. Ltd (“Calleo”). Additionally in 2005, the Partnership’s United Kingdom domiciled subsidiary, Worldspan Services Limited, entered into a distributor agreement with Calleo for the distribution of our services in the India sub-continent and other countries. In 2006, the master services agreement for technology services with Calleo was terminated and the Partnership entered into a similar master services agreement for technology services with InterGlobe Technologies, Pvt. Ltd. (“IGT”). Mr. Rakesh Gangwal, Chairman, President and Chief Executive Officer of the Partnership, has a greater than 10% equity ownership interest in both Calleo and IGT. The master services agreement has an initial term of ten years, subject to termination rights, and is expected to generate payments of approximately $7 million annually for the technology services. The distributor agreement also has an initial ten year term, subject to termination rights. Payments under the agreements are contingent upon bookings generated by Calleo. The Partnership has paid $250 and $487 to Calleo and IGT, respectively, during the three months ended March 31, 2006, and has approximately $155 and $203 of accrued expenses owed to Calleo and IGT, respectively, as of March 31, 2006.

11

5. Commitments and Contingencies

On September 19, 2005, the Partnership filed a lawsuit against Orbitz in the United States District Court, Northern District of Illinois, Eastern Division (“Federal Suit”). Orbitz is one of the Partnership’s largest online travel agency customers and represented approximately 9% of its transaction volume for the three month period ended March 31, 2006. The Federal Suit alleged that Orbitz accessed and used the Partnership’s seat map data in violation of the Federal Computer Fraud and Abuse Act (“FCFAA”) and in breach of the Partnership’s agreement with Orbitz. The Federal Suit contained several additional state-law claims. On April 19, 2006, the court considering the Federal Suit dismissed the Partnership’s claim under the FCFAA and relinquished jurisdiction over the Partnership’s state-law claims against Orbitz without prejudice to Worldspan refiling its state-law claims in state court.

On April 24, 2006, Worldspan filed its state-law claims in the Circuit Court of Cook County, Illinois, County Department, Law Division. The complaint alleges that Orbitz’s improper accessing and use of the Partnership’s seat map data violates the agreements with Orbitz, and that Orbitz’s use of Galileo and ITA, competing computer reservation systems, constitutes breaches of the Partnership’s agreement with Orbitz. The Partnership is seeking injunctive relief to prevent the unauthorized accessing and use of its seat map data as well as to prevent Orbitz’s use of the services or data of Galileo and ITA. The Partnership also seeks monetary damages from Orbitz in excess of $50,000 and reimbursement for its attorneys’ fees and costs.

After filing its Federal Suit, the Partnership learned that Orbitz filed suit against it on September 16, 2005, in the Circuit Court of Cook County, Illinois, County Department, Law Division, purporting to assert two causes of action against the Partnership for violation of the Illinois Consumer Fraud Act and equitable estoppel. Orbitz has claimed that certain exclusivity, minimum segment fee and 100% booking requirement provisions in the Partnership’s agreement were illegal and in violation of public policy. In its suit, Orbitz seeks a court order precluding Worldspan from pursuing its breach of contract claims against Orbitz, an order terminating and rescinding the first and second amendments of its contract with Orbitz (which include, among other things, provisions containing commitments from Orbitz with respect to its usage of the Partnerhsip’s GDS through 2011), monetary damages in excess of $50, punitive damages and reimbursement for attorneys’ fees and costs. The Partnership believes that the allegations in the Orbitz complaint are without merit and it intends to defend against this action vigorously. In addition, the Partnership believes that Orbitz’s filing of its lawsuit against it constitutes another violation of the contract between the parties, and the Partnership has instituted the dispute resolution process to resolve this issue as required by the contract. If the Partnership is unable to satisfactorily resolve the claims asserted by Orbitz and its lawsuit against the Partnership is successful, there would be few or no restrictions to prevent Orbitz from moving a significant portion of its business from the Partnership’s GDS, which would have a material adverse effect on the Partnerhsip’s business, financial condition and results of operations.

In September 2003, the Partnership received multiple assessments totaling €39,503 from the tax authorities of Greece relating to tax years 1993-2002. The Partnership filed appeals of these assessments. Pursuant to a formal tax amnesty program with the Greek authorities, the Partnership reached a settlement of the outstanding assessments in an amount of approximately €7,775. The Partnership Interest Purchase Agreement, dated March 3, 2003, provides that each of Delta, Northwest and American (collectively, our “founding airlines”) shall severally indemnify WTI and hold WTI harmless on a net after-tax basis from and against any and all taxes of the Partnership and its subsidiaries related to periods prior to the Acquisition. The Partnership informed the founding airlines of the receipt of these assessments and the indemnity obligation of the founding airlines under the Partnership Interest Purchase Agreement. As of March 31, 2006, the balance of the amounts due from the founding airlines was $2,384 based on the March 31, 2006 exchange rate. Because of the indemnity provision and other remedies available under the applicable agreements, the Partnership believes that amounts paid to settle the Greek assessment will be recovered from the founding airlines and will not have an effect on the Partnership’s financial position or results of operations.

Additionally, in connection with the Acquisition of the Partnership in 2003, Delta, Northwest and American agreed to retain the rights and obligations of all tax matters relating to tax periods prior to June 30, 2003. However, the exercise of these rights could be successfully challenged in bankruptcy court.

In addition, the Partnership is currently involved in various claims related to matters arising from the ordinary course of business. Management believes the ultimate disposition of these actions will not materially affect the financial position or results of operations of the Partnership.

12

6. Other Events

In the first quarter of 2006, the Partnership collected outstanding disputed amounts regarding minimum booking fees with certain former online travel agencies. The settlement resulted in the receipt of approximately $11,290 in minimum booking fees. The receipts were classified in the accompanying statement of operations as a reduction in cost of revenues in accordance with EITF 01-9. No revenue was recognized related to these amounts in prior periods as the revenue was not fixed and determinable and collectibility was not assured. The contracts with these agencies have been terminated.

7. Business Segment Information

The Partnership’s operations are classified into two reportable business segments: electronic travel distribution and information technology services. The Partnership’s two reportable business segments are managed separately based on fundamental differences in their operations. In addition, each business segment offers different products and services. The electronic travel distribution segment distributes travel services of its suppliers to subscribers of the Worldspan GDS. By having access to the Worldspan GDS, subscribers are able to book reservations with the suppliers. The information technology services segment provides technology services to Delta and Northwest and other companies in the travel industry.

The Partnership evaluates segment performance and allocates resources based on operating income plus depreciation and amortization. The accounting policies of the reportable segments are the same as those described in the summary of significant accounting policies. There are no intersegment sales.

| | Three months ended | |

| | March 31,

2006 | | March 31,

2005 | |

| | | | | |

Revenues | | | | | |

Electronic travel distribution | | $ | 242,728 | | $ | 241,958 | |

Information technology services | | 19,371 | | 18,624 | |

Total revenues | | $ | 262,099 | | $ | 260,582 | |

Operating income | | | | | |

Electronic travel distribution | | $ | 60,052 | | $ | 41,783 | |

Information technology services | | (5,742 | ) | (6,791 | ) |

Total operating income | | $ | 54,310 | | $ | 34,992 | |

Depreciation and amortization | | | | | |

Electronic travel distribution | | $ | 20,648 | | $ | 19,656 | |

Information technology services | | 5,172 | | 5,224 | |

Total depreciation and amortization | | $ | 25,820 | | $ | 24,880 | |

The Partnership’s principal administrative, marketing, product development and technical operations are located in the United States. Areas of operation outside of North America include EMEA, Asia and Latin America which are primarily composed of selling and marketing functions.

The following table includes selected interim financial information for the three months ended March 31, 2006 and March 31, 2005, respectively, related to our geographic areas.

| | Three months ended | |

| | March 31,

2006 | | March 31,

2005 | |

| | | | | |

Geographic areas | | | | | |

Total revenues | | | | | |

United States | | $ | 241,767 | | $ | 223,166 | |

Foreign | | 20,332 | | 37,416 | |

Total | | $ | 262,099 | | $ | 260,582 | |

Long-lived assets | | | | | |

United States | | $ | 768,814 | | $ | 836,892 | |

Foreign | | 27,048 | | 33,615 | |

Total | | $ | 795,862 | | $ | 870,507 | |

13

8. Supplemental Guarantor/Non-Guarantor Financial Information

In conjunction with the closing of the Refinancing Transactions discussed in Note 2, the Term Loan under 2005 Senior Credit Facility became fully and unconditionally guaranteed on a senior secured basis by the domestic operations and assets of the Partnership (referred to as “Worldspan, L.P.—Guarantor” in the accompanying financial information). Included in Worldspan, L.P.—Guarantor are Worldspan, L.P. and all of its wholly-owned domestic subsidiaries including WS Financing. These domestic subsidiaries also fully and unconditionally guarantee on a second priority basis the Floating Rate Notes. These domestic subsidiaries collectively represent less than one percent of the Partnership’s total assets, Partners’ capital, total revenues, net income, and cash flows from operating activities. The guarantees of each of the legal entities comprised by Worldspan, L.P.—Guarantor are joint and several. The foreign subsidiaries (referred to as “Non-Guarantor Subsidiaries” in the accompanying financial information) represent the foreign operations of the Partnership. WS Financing does not have any substantial operations, assets or revenues. The following financial information presents condensed consolidating balance sheets, statements of operations and statements of cash flows for Worldspan, L.P.—Guarantor and Non-Guarantor Subsidiaries. The information has been presented as if Worldspan, L.P.—Guarantor accounted for its ownership of the Non-Guarantor Subsidiaries using the equity method of accounting.

14

Condensed Consolidating Balance Sheets

as of March 31, 2006

| | Worldspan, L.P.—

Guarantor | | Non-Guarantor

Subsidiaries | | Eliminating

Entries | | Worldspan

Consolidated | |

| | | | | | | | | |

Assets | | | | | | | | | |

Current assets | | | | | | | | | |

Cash and cash equivalents | | $ | 65,084 | | $ | 5,127 | | $ | — | | $ | 70,211 | |

Trade accounts receivable, net | | 113,453 | | 5,037 | | — | | 118,490 | |

Prepaid expenses and other current assets | | 14,749 | | 730 | | — | | 15,479 | |

Total current assets | | 193,286 | | 10,894 | | — | | 204,180 | |

Property and equipment, net | | 78,584 | | 5,309 | | — | | 83,893 | |

Deferred charges | | 15,968 | | 11,212 | | — | | 27,180 | |

Debt issuance costs, net | | 13,596 | | — | | — | | 13,596 | |

Goodwill | | 111,803 | | — | | — | | 111,803 | |

Other intangible assets, net | | 505,160 | | — | | — | | 505,160 | |

Investments in subsidiaries | | 29,067 | | — | | (29,067 | ) | — | |

Other long-term assets | | 43,703 | | 10,527 | | — | | 54,230 | |

Total assets | | $ | 991,167 | | $ | 37,942 | | $ | (29,067 | ) | $ | 1,000,042 | |

| | | | | | | | | |

Liabilities and Partners’ Capital | | | | | | | | | |

Current liabilities | | | | | | | | | |

Accounts payable | | $ | 17,102 | | $ | 2,380 | | $ | — | | $ | 19,482 | |

Intercompany accounts payable (receivable) | | 22,797 | | (22,797 | ) | — | | — | |

Accrued expenses | | 129,554 | | 29,388 | | — | | 158,942 | |

Current portion of capital lease obligations | | 16,389 | | — | | — | | 16,389 | |

Current portion of senior debt | | 4,000 | | — | | — | | 4,000 | |

Total current liabilities | | 189,842 | | 8,971 | | — | | 198,813 | |

Long-term portion of capital lease obligations | | 33,757 | | — | | — | | 33,757 | |

Long-term debt | | 627,500 | | — | | — | | 627,500 | |

Pension and postretirement benefits | | 58,925 | | (42 | ) | — | | 58,883 | |

Other long-term liabilities | | 10,084 | | (54 | ) | — | | 10,030 | |

Total liabilities | | 920,108 | | 8,875 | | — | | 928,983 | |

Commitments and contingencies | | | | | | | | | |

Partners’ capital | | 71,059 | | 29,067 | | (29,067 | ) | 71,059 | |

Total liabilities and Partners’ capital | | $ | 991,167 | | $ | 37,942 | | $ | (29,067 | ) | $ | 1,000,042 | |

15

Condensed Consolidating Balance Sheets

as of December 31, 2005

| | Worldspan, L.P.— Guarantor | | Non-Guarantor

Subsidiaries | | Eliminating

Entries | | Worldspan

Consolidated | |

| | | | | | | | | |

Assets | | | | | | | | | |

Current assets | | | | | | | | | |

Cash and cash equivalents | | $ | 55,238 | | $ | 2,855 | | $ | — | | $ | 58,093 | |

Trade accounts receivable, net | | 95,475 | | 2,509 | | — | | 97,984 | |

Prepaid expenses and other current assets | | 16,196 | | 796 | | — | | 16,992 | |

Total current assets | | 166,909 | | 6,160 | | — | | 173,069 | |

Property and equipment, net | | 85,311 | | 5,972 | | — | | 91,283 | |

Deferred charges | | 12,984 | | 11,408 | | — | | 24,392 | |

Debt issuance costs, net | | 14,626 | | — | | — | | 14,626 | |

Goodwill | | 111,803 | | — | | — | | 111,803 | |

Other intangible assets, net | | 521,483 | | — | | — | | 521,483 | |

Investments in subsidiaries | | 27,811 | | — | | (27,811 | ) | — | |

Other long-term assets | | 41,444 | | 10,750 | | — | | 52,194 | |

Total assets | | $ | 982,371 | | $ | 34,290 | | $ | (27,811 | ) | $ | 988,850 | |

| | | | | | | | | |

Liabilities and Partners’ Capital | | | | | | | | | |

Current liabilities | | | | | | | | | |

Accounts payable | | $ | 12,477 | | $ | 4,370 | | $ | — | | $ | 16,847 | |

Intercompany accounts payable (receivable) | | 31,461 | | (31,461 | ) | — | | — | |

Accrued expenses | | 111,089 | | 33,649 | | — | | 144,738 | |

Current portion of capital lease obligations | | 17,863 | | — | | — | | 17,863 | |

Current portion of long-term debt | | 4,000 | | — | | — | | 4,000 | |

Total current liabilities | | 176,890 | | 6,558 | | — | | 183,448 | |

Long-term portion of capital lease obligations | | 36,555 | | — | | — | | 36,555 | |

Long-term debt | | 667,500 | | — | | — | | 667,500 | |

Pension and postretirement benefits | | 60,370 | | (42 | ) | — | | 60,328 | |

Other long-term liabilities | | 9,547 | | (37 | ) | — | | 9,510 | |

Total liabilities | | 950,862 | | 6,479 | | — | | 957,341 | |

Commitments and contingencies | | | | | | | | | |

Partners’ capital | | 31,509 | | 27,811 | | (27,811 | ) | 31,509 | |

Total liabilities and Partners’ capital | | $ | 982,371 | | $ | 34,290 | | $ | (27,811 | ) | $ | 988,850 | |

16

Condensed Consolidating Statements of Operations

for the Three Months Ended March 31, 2006

| | Worldspan, L.P.—

Guarantor | | Non-Guarantor

Subsidiaries | | Eliminating

Entries | | Worldspan

Consolidated | |

| | | | | | | | | |

Revenues | | $ | 241,767 | | $ | 20,332 | | $ | — | | $ | 262,099 | |

Operating expenses | | 190,337 | | 17,452 | | — | | 207,789 | |

Operating income | | 51,430 | | 2,880 | | — | | 54,310 | |

Other income (expense) | | | | | | | | | |

Interest (expense) income, net | | (16,281 | ) | 17 | | — | | (16,264 | ) |

Income from subsidiaries | | 1,256 | | — | | (1,256 | ) | — | |

Other, net | | 52 | | (998 | ) | — | | (946 | ) |

Total other expense, net | | (14,973 | ) | (981 | ) | (1,256 | ) | (17,210 | ) |

Income before income taxes | | 36,457 | | 1,899 | | (1,256 | ) | 37,100 | |

Provision for income taxes | | — | | 643 | | — | | 643 | |

Net income | | $ | 36,457 | | 1,256 | | (1,256 | ) | 36,457 | |

| | | | | | | | | | | | | |

Condensed Consolidating Statements of Operations

for the Three Months Ended March 31, 2005

| | Worldspan, L.P.—

Guarantor | | Non-Guarantor

Subsidiaries | | Eliminating

Entries | | Worldspan

Consolidated | |

| | | | | | | | | |

Revenues | | $ | 223,166 | | $ | 37,416 | | $ | — | | $ | 260,582 | |

Operating expenses | | 190,101 | | 35,489 | | — | | 225,590 | |

Operating income | | 33,065 | | 1,927 | | — | | 34,992 | |

Other income (expense) | | | | | | | | | |

Interest (expense) income, net | | (12,389 | ) | 60 | | — | | (12,329 | ) |

Loss on extinguishment of debt | | (55,597 | ) | — | | — | | (55,597 | ) |

Income from subsidiaries | | 533 | | — | | (533 | ) | — | |

Other, net | | 326 | | (536 | ) | — | | (210 | ) |

Total other expense, net | | (67,127 | ) | (476 | ) | (533 | ) | (68,136 | ) |

(Loss) income before income taxes | | (34,062 | ) | 1,451 | | (533 | ) | (33,144 | ) |

Income tax expense | | — | | 918 | | — | | 918 | |

Net (loss) income | | $ | (34,062 | ) | 533 | | (533 | ) | (34,062 | ) |

| | | | | | | | | | | | | |

17

Condensed Consolidating Statements of Cash Flows

for the Three Months Ended March 31, 2006

| | Worldspan, L.P.—

Guarantor | | Non-Guarantor

Subsidiaries | | Eliminating

Entries | | Worldspan

Consolidated | |

| | | | | | | | | |

Net cash provided by operating activities | | $ | 57,471 | | $ | 1,104 | | $ | — | | $ | 58,575 | |

Cash flows from investing activities: | | | | | | | | | |

Purchase of property and equipment | | (1,948 | ) | (132 | ) | — | | (2,080 | ) |

Proceeds from sale of property and equipment | | 22 | | 44 | | — | | 66 | |

Investment in subsidiaries | | (1,256 | ) | — | | 1,256 | | — | |

Net cash used in investing activities | | (3,182 | ) | (88 | ) | 1,256 | | (2,014 | ) |

Cash flows from financing activities: | | | | | | | | | |

Proceeds from issuance of debt, net of debt issuance costs | | — | | — | | — | | — | |

Principal payments on capital leases | | (4,443 | ) | — | | — | | (4,443 | ) |

Principal payments on debt | | (40,000 | ) | — | | — | | (40,000 | ) |

Repurchase old notes | | — | | — | | — | | — | |

Distribution to WTI, net | | — | | — | | — | | — | |

Contributions to subsidiaries | | — | | 1,256 | | (1,256 | ) | — | |

Net cash (used in) provided by financing activities | | (44,443 | ) | 1,256 | | (1,256 | ) | (44,443 | ) |

Net increase in cash and cash equivalents | | 9,846 | | 2,272 | | — | | 12,118 | |

Cash and cash equivalents at beginning of period | | 55,238 | | 2,855 | | — | | 58,093 | |

Cash and cash equivalents at end of period | | $ | 65,084 | | $ | 5,127 | | $ | — | | $ | 70,211 | |

18

Condensed Consolidating Statements of Cash Flows

for the Three Months Ended March 31, 2005

| | Worldspan,

L.P.—

Guarantor | | Non-

Guarantor

Subsidiaries | | Eliminating

Entries | | Worldspan

Consolidated | |

| | | | | | | | | |

Net cash provided by (used in) operating activities | | $ | 28,244 | | $ | (3,191 | ) | $ | — | | $ | 25,053 | |

Cash flows from investing activities: | | | | | | | | | |

Purchase of property and equipment | | (1,267 | ) | (307 | ) | — | | (1,574 | ) |

Proceeds from sale of property and equipment | | 54 | | — | | — | | 54 | |

Investments in subsidiaries | | (3,329 | ) | — | | 3,329 | | — | |

Net cash used in investing activities | | (4,542 | ) | (307 | ) | 3,329 | | (1,520 | ) |

Cash flows from financing activities: | | | | | | | | | |

Proceeds from issuance of debt, net of debt issuance costs | | 734,864 | | — | | — | | 734,864 | |

Principal payments on capital leases | | (4,737 | ) | — | | — | | (4,737 | ) |

Principal payments on debt | | (58,488 | ) | — | | — | | (58,488 | ) |

Repurchase old notes | | (327,481 | ) | — | | — | | (327,481 | ) |

Distribution to WTI, net | | (425,678 | ) | — | | — | | (425,678 | ) |

Contributions to subsidiaries | | — | | 3,329 | | (3,329 | ) | — | |

Net cash (used in) provided by financing activities | | (81,520 | ) | 3,329 | | (3,329 | ) | (81,520 | ) |

Net decrease in cash and cash equivalents | | (57,818 | ) | (169 | ) | — | | (57,987 | ) |

Cash and cash equivalents at beginning of period | | 96,504 | | 3,970 | | — | | 100,474 | |

Cash and cash equivalents at end of period | | $ | 38,686 | | $ | 3,801 | | $ | — | | $ | 42,487 | |

19

9. Goodwill and Other Intangible Assets

Goodwill and other intangible assets consisted of the following:

| | | | March 31, 2006 | | December 31, 2005 | |

| | Estimated

Useful Life | | Cost | | Accumulated

Amortization | | Cost | | Accumulated

Amortization | |

Supplier and agency relationships | | 8-11 years | | $ | 318,467 | | $ | 91,687 | | $ | 321,618 | | $ | 84,637 | |

Information technology services contracts | | 5-15 years | | 36,126 | | 7,722 | | 36,126 | | 7,020 | |

Developed technology | | 5-11 years | | 238,979 | | 61,145 | | 238,979 | | 55,725 | |

Goodwill | | Indefinite | | 111,803 | | — | | 111,803 | | — | |

Trade name | | Indefinite | | 72,142 | | — | | 72,142 | | — | |

| | | | $ | 777,517 | | $ | 160,554 | | $ | 780,668 | | $ | 147,382 | |

During the three months ended March 31, 2006, the Partnership recorded $1,615 acceleration of amortization of agency relationship intangibles related to two online agencies. The contracts with the Partnership were terminated by the agencies. The write-off was recorded as additional amortization in the statement of operations.

As discussed in Note 1, Delta and Northwest, both significant suppliers of the Partnership, entered bankruptcy protection in September 2005. In connection with the Acquisition, the Partnership recorded an intangible asset in the amount of $33,152 related to its founding airline services agreements (“FASAs”) with Delta and Northwest. As of March 31, 2006, the unamortized portion of the intangible asset related to the Delta and Northwest FASAs was $27,080. This amount is included in “Other intangible assets, net” in the accompanying consolidated balance sheets. The services provided to Delta and Northwest under the terms of their respective FASAs include internal reservation services, development services and other support services. The Partnership continues to provide services to the airlines in accordance with the terms of the respective FASA. The Partnership believes that these services are essential to the continued operation of the airlines. In addition, the Partnership believes that the cost of the services provided to Delta and Northwest are competitive to current market rates for these services given the cost formula and the monthly credit the airlines receive as a part of the FASA. The Partnership does not believe that the long term value of the FASA has changed based solely on the bankruptcy filings and any additional facts currently available to it. Additional facts could become known or actions taken by the airlines in bankruptcy that could impact the long term value of the FASA and possibly result in an impairment of the intangible asset in the future.

In connection with the Acquisition, the Partnership also recorded additional intangible assets of approximately $318,467 related to the value of its exisiting relationships with online travel agencies, traditional travel agencies and travel suppliers. The Partnership believes to date that the Delta and Northwest bankruptcy filings are not expected to have a materially adverse impact on cash flows because the travel customer would be able to select another supplier if Delta and Northwest were to selectively reduce their flight capacity. Alternatively, in connection with their bankruptcy related restructuring, Delta and Northwest could pursue a GDS alternative allowing them to bypass the Worldspan GDS. If either Delta or Nothwest were successful in bypassing the Worldspan GDS or significantly reducing their flight capacity, the Partnership’s cash flow and financial condition could be materially, adversely affected and possibly result in an impairment of the intangible asset in the future.

Of the $318,467 recorded for the Parnership’s existing relationships with travel agencies and travel suppliers, the Partnership estimates that $35,234, $76,174 and $14,223 were related to the Expedia, Orbitz and Priceline contracts, respectively. Based on these estimates, the portions of these intangible assets that were unamortized as of March 31, 2006 were $23,122, $49,989 and $9,334. Upon determination of the specific volumes, percentage of volumes or timing relating to Expedia’s or Priceline’s announced agreements with another GDS provider and the outcome of the Orbitz claims against us, the Partnership will further assess the impact, if any, on the overall financial condition as prescribed by Statement of Financial Accounting Standards (“SFAS”) No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets , and SFAS No. 142, Goodwill and Other Intangible Assets. See Note 1 for a discussion of the potential movement of Expedia, Priceline and Orbitz transactions to another GDS.

20

The Partnership recorded amortization expense for its intangible assets of $16,323 and $14,679 for the three months ended March 31, 2006 and 2005, respectively. Estimated amortization expense for the Partnership’s intangible assets, excluding the $16,323 amortization recorded for the three months ended March 31, 2006, is as follows:

Year Ended December 31, | | | |

Remaining in 2006 | | $ | 43,328 | |

2007 | | 57,771 | |

2008 | | 56,871 | |

2009 | | 57,171 | |

2010 | | 57,171 | |

Thereafter | | 160,722 | |

| | $ | 433,034 | |

10. Stock-Based Compensation

Under the WTI stock incentive plan, WTI offers restricted shares of its Class A Common Stock and grants options to purchase shares of its Class A Common Stock to selected management employees of the Partnership. WTI has reserved 12,580,000 shares of its Class A Common Stock for issuance under the stock incentive plan. Up to 6,580,000 shares may be offered as restricted stock, and up to 6,000,000 shares may be subject to options. The securities underlying the options are not traded on an established exchange. The exercise price of any options granted or the purchase price for restricted stock offered under the stock incentive plan is determined by the Board of Directors. Restricted stock awards and options vest over a five-year period which is deemed to be the service period over which the stock-based compensation expense is recognized. Options expire ten years from date of grant. Option grants consist of “Series 1” and “Series 2” options.

In the event of an employee termination, WTI has the right to repurchase all or any of the shares of Common Stock acquired by an employee under the WTI stock incentive plan for a cash payment equal to the fair market value (as determined by the Board of Directors) of the shares of Common Stock on the day of repurchase. If, however, the employee is terminated for cause, then the cash payment will be the lower of the fair market value and the employee’s original purchase price.

Prior to January 1, 2006, WTI accounted for employee stock options and restricted stock awards in accordance with SFAS No. 123, Accounting for Stock- Based Compensation (“SFAS No. 123”). Under SFAS No. 123, WTI valued the stock options based upon a binomial option-pricing model. As the options to purchase Class A Common Stock were being granted to employees of the Partnership, the Partnership recognized the grant-date fair value as an expense ratably over the period in which the options vest, with a corresponding increase in Partners’ capital.

In December 2004, the FASB issued SFAS No. 123(R), Share-Based Payment (“SFAS No. 123(R)”), which is a revision of SFAS No. 123. The Partnership adopted the provisions of SFAS No. 123(R) effective at the beginning of 2006. The Partnership elected to use the modified-prospective transition method which had no significant impact on income before income taxes, net income, cash flow from operations or cash flow from financing activities.

21

Stock option activity under the WTI stock incentive plan for the three-month period ended March 31, 2006 is summarized as follows:

| | Series 1 | | Series 2 | |

| | Number of Shares | | Weighted-Average

Exercise Price | | Number of Shares | | Weighted-

Average

Exercise Price | |

Outstanding at December 31, 2005 | | 2,102,500 | | $ | 1.48 | | 2,102,500 | | $ | 6.49 | |

Granted (1) | | 7,500 | | 3.79 | | 7,500 | | 7.79 | |

Exercised (2) | | (280,000 | ) | 1.20 | | — | | — | |

Forfeited | | (8,500 | ) | 1.40 | | (8,500 | ) | 6.26 | |

Unexercised | | (3,000 | ) | 1.20 | | (3,000 | ) | 6.42 | |

| | | | | | | | | |

Outstanding at March 31, 2006 (3) | | 1,818,500 | | 1.33 | | 2,098,500 | | 6.34 | |

| | | | | | | | | |

Exercisable at March 31, 2006 (4) | | 596,500 | | 1.22 | | 876,500 | | 6.41 | |

| | | | | | | | | | | |

(1) As allowed under SFAS No. 123(R), WTI has continued to apply the binomial option-pricing model in valuing the options granted in the first quarter of 2006 with the resulting fair value being amortized straight-line over the service period. The weighted-average exercise price and weighted-average grant-date fair value of the Series 1 options reflected above as being granted during the quarter were $3.79 and $2.05, respectively, per share. These options were granted with an exercise price lower than the market value of the underlying Class A Common Stock. The weighted-average exercise price and weighted-average grant-date fair value of the Series 2 options reflected above as being granted during the quarter were $7.79 and $0, respectively, per share. These options were granted with an exercise price higher than the market value of the underlying Class A Common Stock. During the quarter ended March 31, 2005, there were 77,500 Series 1 options granted with a weighted-average exercise price of $1.83 and a weighted-average grant-date fair value of $0.31; additionally, there were 77,500 Series 2 options granted with a weighted-average exercise price of $6.06 and a weighted-average grant-date fair value of $0.

(2) WTI received $336 in cash upon exercise of these options. The intrinsic value of the 280,000 Series 1 options exercised during the quarter ended March 31, 2006 was approximately $865, which represents the amount by which the market value of the underlying stock exceeds the exercise price of the option. The market value of the underlying stock was approximately $4.29 on the date of exercise. There were no options exercised during the quarter ended March 31, 2005.

(3) The aggregate intrinsic value of the Series 1 and Series 2 options expected to vest at March 31, 2006 was approximately $3,387 and $0, respectively. See item (2) above regarding the definition of “intrinsic value.” The weighted-average exercise prices of the Series 1 and Series 2 options expected to vest were $1.39 and $6.30, respectively. The weighted-average remaining contractual term of the Series 1 and Series 2 options expected to vest at March 31, 2006 was 8.0 years for both Series. The total compensation cost to be recognized under SFAS 123(R) related to Series 1 and Series 2 options at March 31, 2006 expected to vest is approximately $547 and $114, respectively, which will be expensed over the remaining weighted-average vesting period of 3.0 years for both Series.

(4) The total fair value of Series 1 and Series 2 options vested at March 31, 2006 was approximately $356 and approximately $106, respectively. At March 31, 2005, there were 516,000 Series 1 options vested with a total fair value of approximately $151 and 516,000 Series 2 options vested with a total fair value of approximately $44. The aggregate intrinsic value of the Series 1 and Series 2 options vested at March 31, 2006 was approximately $1,834 and $0, respectively. See item (2) above regarding the definition of “intrinsic value.” The weighted-average remaining contractual term of the Series 1 and Series 2 options exercisable at March 31, 2006 was 7.5 years for both Series.

For grants of options awarded during the quarters ended March 31, 2006 and 2005, the weighted-average assumptions used in the binomial option-pricing model were as follows:

| | Risk-Free

Interest Rate

(1) | | Expected

Life (2) | | Expected

Volatility (3) | | Expected

Dividend Yield | |

2006 | | 4.61 | % | 6.5 years | | 35.22 | % | 0 | % |

2005 | | 4.00 | % | 5 years | | 0 | % | 0 | % |

(1) Represents the rate of a U.S. Treasury security maturing from the grant date over a period of time approximating the expected life of the option.

(2) Prior to January 1, 2006, the Partnership estimated the expected life to approximate the vesting period. However, due to a lack of substantial history regarding the timing of exercises (the Partnership was formed only recently – June 30, 2003), the Partnership has elected to use the simplified method allowed by Staff Accounting Bulletin (SAB) No. 107, Share-Based Payment, for estimating the expected term equal to the midpoint between the vesting period and the contractual term. This change of estimate was effective January 1, 2006.

(3) Prior to January 1, 2006, the Partnership estimated expected volatility to approach zero as the underlying stock is not publicly traded. Effective January 1, 2006, as required under SFAS No. 123 (R), the Partnership has estimated the volatility of the underlying stock. The Partnership has determined that the historical volatility experienced by one of its major competitor’s publicly-traded stock reflects a more accurate forecast of volatility.

22

Non-vested restricted share activity under the WTI stock incentive plan for the three-month period ended March 31, 2006 is summarized as follows:

| | Number of Shares | | Weighted-

Average

Grant-Date Fair

Value (1) | |

Non-vested restricted shares of Class A Common Stock at December 31, 2005 | | 3,139,046 | | $ | 2.54 | |

Granted | | — | | — | |

Vested (2) | | (40,000 | ) | 0.88 | |

Forfeited | | — | | — | |

| | | | | |

Non-vested restricted shares of Class A Common Stock at March 31, 2006 (3) | | 3,099,046 | | $ | 2.56 | |

(1) Under both SFAS No. 123(R) and SFAS No. 123, the fair value of restricted stock awards is measured as being the intrinsic value of the shares on the day of grant – i.e. the amount by which the market value of the shares on the day of grant exceeds the exercise/purchase price of the shares.

(2) The fair value of restricted stock awards vested during the three months ended March 31, 2006 was approximately $35. No restricted stock awards vested during the three months ended March 31, 2005.

(3) Of the non-vested shares at March 31, 2006, 3,099,046 are expected to vest. The total compensation cost to be recognized under SFAS 123(R) related to the shares at March 31, 2006 expected to vest is approximately $7,492, which will be expensed over the remaining weighted-average service period of 2.8 years.

During the three months ended March 31, 2006 and March 31, 2005, the Partnership recorded $662 and $644, respectively, in total stock-based employee compensation expense, of which $219 and $116, respectively, was attributable to stock options. The Partnership recognized stock-based compensation expense of $43 and $64 during the three month periods ended March 31, 2006 and 2005 attributable to restricted stock grants. The Partnership recognized stock-based compensation expense of $400 and $464 during the three month periods ended March 31, 2006 and 2005, respectively, attributable to restricted stock subscription agreements.

WTI did not issue any restricted stock awards during the quarter ended March 31, 2006. On February 28, 2005, WTI entered into a stock subscription agreement in connection with the exercise by a member of management of his option to purchase 16,000 shares of Class A Common Stock for an aggregate purchase price of $25. This sale was exempt from registration under the Securities Act in reliance on Rule 506 promulgated thereunder. On March 21, 2005, WTI entered into a restricted stock subscription agreement under which one of our executive officers purchased an aggregate of 200,000 restricted shares of WTI Class A Common Stock at a price of $1.00 per share, for an aggregate purchase price of $200. These restricted shares vest over approximately five years, which is deemed to be the service period over which the stock-based compensation expense is recognized. This sale was exempt from registration under the Securities Act in reliance on Rule 506 promulgated thereunder and was made without registration pursuant to the exemption provided by Rule 701 of the Securities Act.

11. Airline Content Agreements

In March and April 2006, the Partnership signed five-year content agreements with American, Continental and United. In May 2006, the Partnership signed a five-year content agreement with Northwest. The terms of these agreements will become effective in the third quarter of 2006 with the exception of the Northwest agreement which must also receive Bankruptcy Court approval. In conjunction with the agreements, Worldspan has developed two new optional products to introduce into the marketplace. Through these new agreements, travel agencies will have the opportunity to access the airlines' comprehensive published fares and inventory. The Partnership expects that our new content agreements will result in reduced transaction fees from participating airlines which could have a material adverse effect on revenue, however, the Partnership cannot predict at this time the ultimate impact of these agreements on earnings.

12. Subsequent Events

On April 10, 2006 the Partnership made a $10 million discretionary payment on the Term Loan.

In May 2006, the Partnership received approximately $10,450 in previously disputed excess messaging fees from a certain former online travel agency. The receipt of these fees will be included in the Partnership’s second quarter 2006 results of operations as the amount of the fees was not fixed and determinable and collectibility was not reasonably assured at March 31, 2006.

23

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

References to “WTI” refer to Worldspan Technologies Inc. References to the “company” or “partnership” refer to Worldspan, L.P. The terms “we”, “us”, “our” and other similar terms refer to the consolidated businesses of the company and all of its subsidiaries. References to the “Acquisition” refer to the acquisition by WTI, of our general partnership interests and, through its wholly-owned subsidiaries, limited partnership interests. The following discussion and analysis of the financial condition and results of operations should be read in conjunction with the consolidated financial statements and related notes included in our annual report on Form 10-K filed with the Securities and Exchange Commission on March 3, 2006.

Overview

We are a provider of mission-critical transaction processing and information technology services to the global travel industry. We provide subscribers (including traditional travel agencies, online travel agencies and corporate travel departments) with real-time access to schedule, price, availability and other travel information and the ability to process bookings and issue tickets for the products and services of over 700 travel suppliers (such as airlines, hotels, car rental companies, tour companies and cruise lines) throughout the world. Globally, we are the largest transaction processor for online travel agencies, having processed approximately 59% of all global distribution system, or GDS, online air transactions during the twelve months ended March 31, 2006. In the United States (the world’s largest travel market), we are the second largest transaction processor for travel agencies, accounting for approximately 32% of GDS air transactions and approximately 63% of online GDS air transactions processed during the twelve months ended March 31, 2006. During the twelve months ended March 31, 2006, we processed approximately 202 million transactions. We also provide information technology services to the travel industry, primarily airline internal reservation systems, flight operations technology and software development.

We depend upon a relatively small number of airlines and online travel agencies for a significant portion of our revenues. Our five largest airline relationships represented an aggregate of approximately 51% and 52% of our total revenues for the twelve months ended March 31, 2006 and December 31, 2005, respectively, while our top ten largest airline relationships represented an aggregate of approximately 63% and 64% of our total revenues for the twelve months ended March 31, 2006 and December 31, 2005, respectively. Our relationships with four online travel agencies, Expedia, Orbitz, Hotwire and Priceline, represented 50% of our total transactions during the twelve months ended March 31, 2006. We expect to continue to depend upon a relatively small number of airlines and online travel agencies for a significant portion of our revenues.

In September 2005, we and Orbitz LLC (“Orbitz”) each filed separate complaints against the other with respect to certain disputes arising under our online agreement with Orbitz. See “Item 1. Legal Proceedings” in Part II. In addition, both Expedia and Priceline have signed agreements with other GDS providers. While we are unable to estimate the volume of Expedia transactions that could move to the other GDS, based on recent statements made by Expedia, we believe some portion of Expedia volume could move in the second half of 2006. In fact, Expedia announced in May 2006 that it has commenced booking at select points of sale certain European segments through another GDS as previously announced. Currently, we cannot forecast the magnitude of any such movement of transactions and therefore are unable to estimate the impact on our financial position, results of operations and cash flows. We have not received any notification from Priceline as to the timing and volume of transactions that it intends to move.

Effective September 14, 2005, Delta and Northwest, both significant suppliers of ours, entered bankruptcy protection. For a more complete discussion of the bankruptcies, see the section captioned “Liquidity and Capital Resources.”

Supplier Content and Transaction Fees

A development within the GDS industry over the past several years involves the competitive need for GDSs to maintain full content for distribution to traditional and online agency subscribers. Historically, we have increased the transaction fees we collect from our airline suppliers. As our business evolves and we continue to explore new ways to offer effective distribution options to our travel suppliers and travel agencies, we are entering into new content arrangements that depart from our traditional business model. As a result, we do not anticipate that the historic trend

24