Exhibit

Excellon Resources Inc.

Consolidated Financial Statements

For the years ended December 31, 2019 and 2018

in thousands of US dollars

Management’s Responsibility for Financial Reporting

The management of Excellon Resources Inc. is responsible for the integrity and fair presentation of the accompanying consolidated financial statements.

The consolidated financial statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) and reflect management’s best estimates and judgements.

Management is responsible for establishing and maintaining adequate internal control over financial reporting. Management has developed and maintains a system of internal controls to obtain reasonable assurance that the Company’s assets are safeguarded, transactions are authorized, and financial information is reliable. Any system of internal control over financial reporting has inherent limitations, including the possibility of circumvention and overriding of controls, and therefore, can provide only reasonable assurance with respect to financial statement preparation and presentation.

The Board of Directors oversees management’s responsibility for financial reporting and internal control systems through an Audit Committee, which is composed entirely of independent directors. The Audit Committee of the Board of Directors has met with the Company’s independent auditors to review the scope and results of the annual audit and to review the consolidated financial statements and related financial reporting and control matters prior to submitting the consolidated financial statements to the Board for approval. The Audit Committee also reviews the quarterly financial statements and recommends them for approval to the Board of Directors and continues to review with management on and ongoing basis, the Company’s systems of internal control, and approves the scope of the independent auditors audit and non-audit work.

The consolidated financial statements have been audited by PricewaterhouseCoopers LLP, Chartered Professional Accountants, Licensed Public Accountants. Their report outlines the scope of their examination and opinion on the consolidated financial statements.

| (Signed) “Brendan Cahill” | (Signed) “Anna M. Ladd-Kruger” |

| | |

| President & Chief Executive Officer | Chief Financial Officer & VP Corporate Development |

March 30, 2020

Independent auditor’s report

To the Shareholders of Excellon Resources Inc.

Our opinion

In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the financial position of Excellon Resources Inc. and its subsidiaries (together, the Company) as at December 31, 2019 and 2018, and its financial performance and its cash flows for the years then ended in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (IFRS).

What we have audited

The Company’s consolidated financial statements comprise:

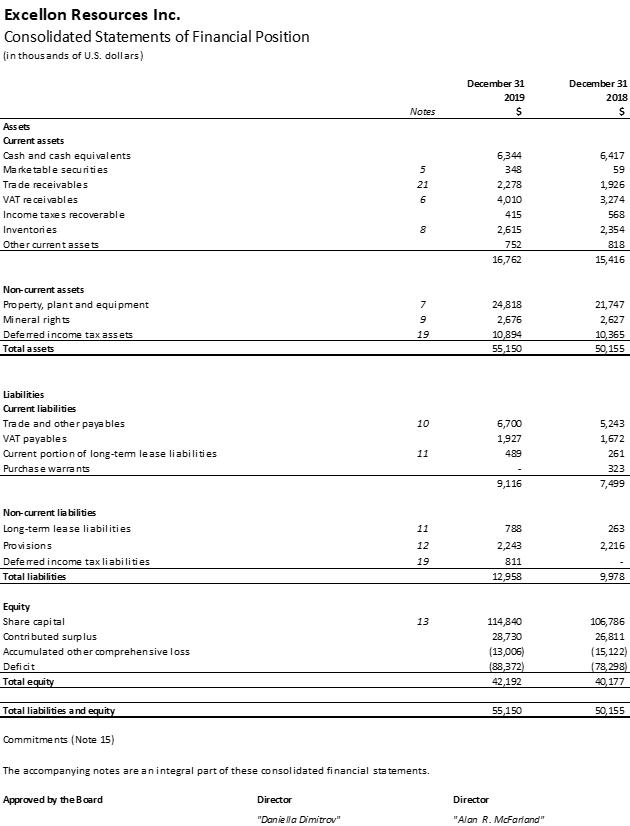

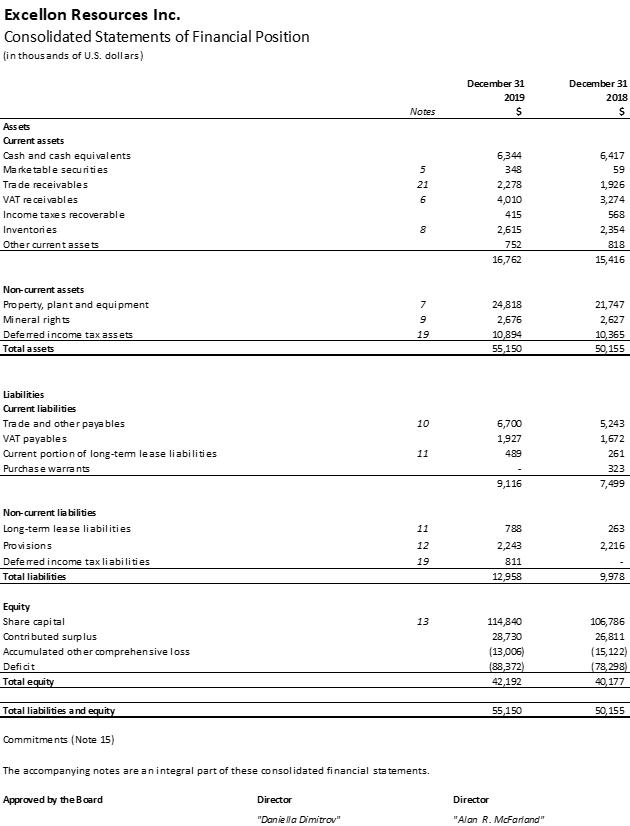

| ● | the consolidated statements of financial position as at December 31, 2019 and 2018; |

| ● | the consolidated statements of loss and comprehensive loss for the years then ended; |

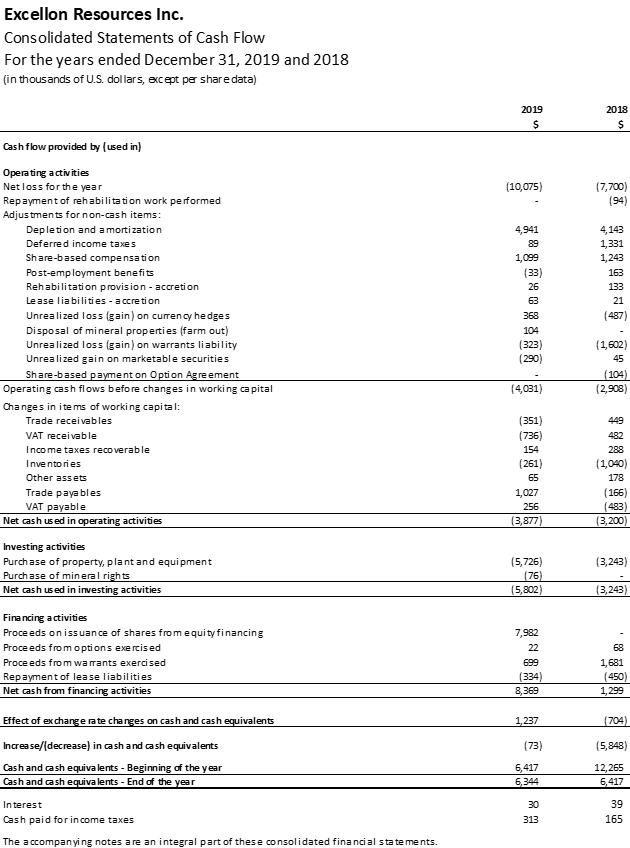

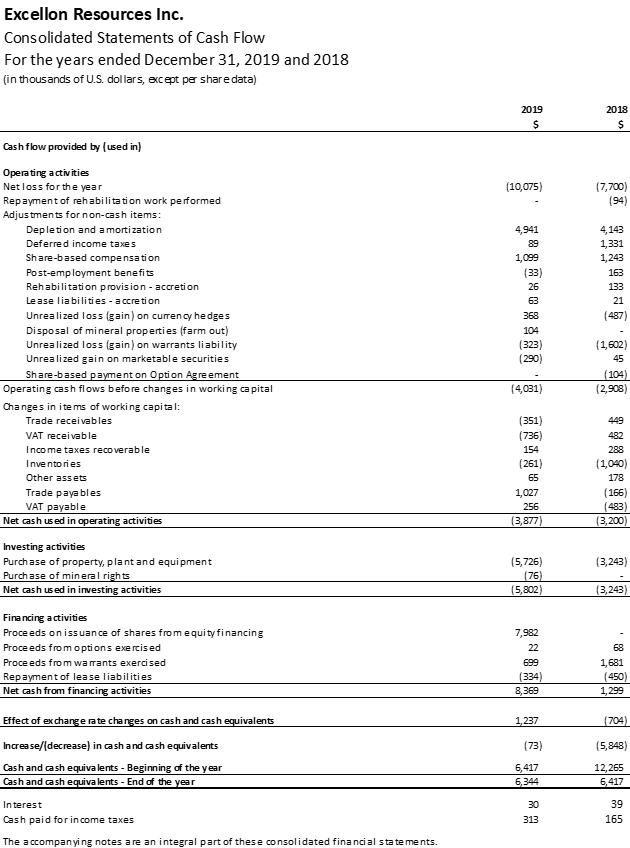

| ● | the consolidated statements of cash flows for the years then ended; |

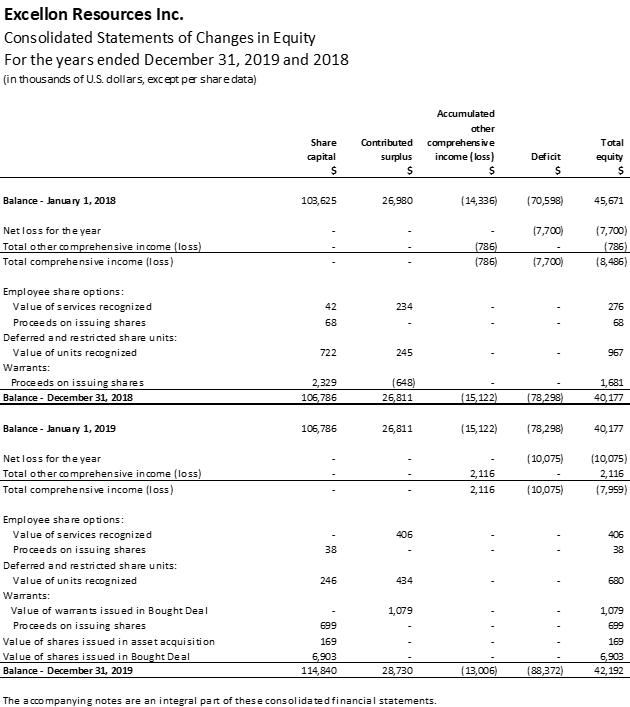

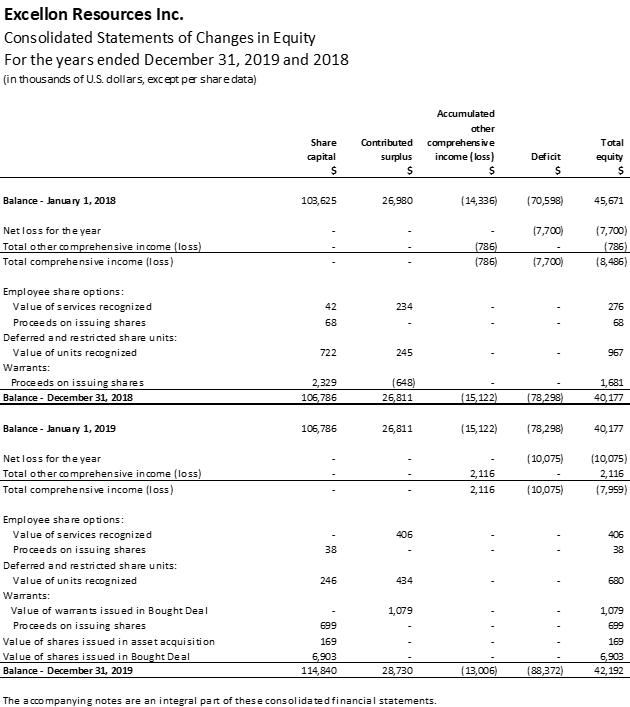

| ● | the consolidated statements of changes in equity for the years then ended; and |

| ● | the notes to the consolidated financial statements, which include a summary of significant accounting policies. |

Basis for opinion

We conducted our audit in accordance with Canadian generally accepted auditing standards. Our responsibilities under those standards are further described in the Auditor’s responsibilities for the audit of the consolidated financial statements section of our report.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Independence

We are independent of the Company in accordance with the ethical requirements that are relevant to our audit of the consolidated financial statements in Canada. We have fulfilled our other ethical responsibilities in accordance with these requirements.

Other information

Management is responsible for the other information. The other information comprises the Management’s Discussion and Analysis of Financial Results.

PricewaterhouseCoopers LLP

PwC Tower, 18 York Street, Suite 2600, Toronto, Ontario, Canada M5J 0B2

T: +1 416 863 1133, F: +1 416 365 8215

“PwC” refers to PricewaterhouseCoopers LLP, an Ontario limited liability partnership, which is a member firm of PricewaterhouseCoopers International Limited, each member firm of which is a separate legal entity.

Our opinion on the consolidated financial statements does not cover the other information and we do not express any form of assurance conclusion thereon.

In connection with our audit of the consolidated financial statements, our responsibility is to read the other information identified above and, in doing so, consider whether the other information is materially inconsistent with the consolidated financial statements or our knowledge obtained in the audit, or otherwise appears to be materially misstated.

If, based on the work we have performed, we conclude that there is a material misstatement of this other information, we are required to report that fact. We have nothing to report in this regard.

Responsibilities of management and those charged with governance for the consolidated financial statements

Management is responsible for the preparation and fair presentation of the consolidated financial statements in accordance with IFRS, and for such internal control as management determines is necessary to enable the preparation of consolidated financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the consolidated financial statements, management is responsible for assessing the Company’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Company or to cease operations, or has no realistic alternative but to do so.

Those charged with governance are responsible for overseeing the Company’s financial reporting process.

Auditor’s responsibilities for the audit of the consolidated financial statements

Our objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with Canadian generally accepted auditing standards will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these consolidated financial statements.

As part of an audit in accordance with Canadian generally accepted auditing standards, we exercise professional judgment and maintain professional skepticism throughout the audit. We also:

| ● | Identify and assess the risks of material misstatement of the consolidated financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. |

| ● | Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. |

| ● | Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management. |

| ● | Conclude on the appropriateness of management’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Company’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor’s report to the related disclosures in the consolidated financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditor’s report. However, future events or conditions may cause the Company to cease to continue as a going concern. |

| ● | Evaluate the overall presentation, structure and content of the consolidated financial statements, including the disclosures, and whether the consolidated financial statements represent the underlying transactions and events in a manner that achieves fair presentation. |

| ● | Obtain sufficient appropriate audit evidence regarding the financial information of the entities or business activities within the Company to express an opinion on the consolidated financial statements. We are responsible for the direction, supervision and performance of the group audit. We remain solely responsible for our audit opinion. |

We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit.

We also provide those charged with governance with a statement that we have complied with relevant ethical requirements regarding independence, and to communicate with them all relationships and other matters that may reasonably be thought to bear on our independence, and where applicable, related safeguards.

The engagement partner on the audit resulting in this independent auditor’s report is Marelize Barber.

Chartered Professional Accountants, Licensed Public Accountants

Toronto, Ontario, Canada

March 30, 2020

Excellon Resources Inc.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2019 and 2018

(in thousands of US dollars, except share and per share data)

Excellon Resources Inc. (the Company or Excellon) is a silver mining and exploration company listed on the Toronto Stock Exchange trading under the symbol EXN. The Company is focused on optimizing the Platosa Mine’s cost and production profile, discovering further high-grade silver and carbonate replacement deposit (“CRD”) mineralization on the 14,000 hectare Platosa Property located in northeastern Durango, Mexico and epithermal silver mineralization on the 45,000 hectare Evolución Property on the northern Fresnillo silver trend in Zacatecas, Mexico. The Company also holds an option on the 164 km2 Silver City Project in Saxony, Germany, a high-grade epithermal silver district with 750 years of mining history and no modern exploration. Also refer to the subsequent event in Note 25.

Excellon is domiciled in Canada and incorporated under the laws of the province of Ontario. The address of its registered office is 10 King Street East, Suite 200, Toronto, Ontario, M5C 1C3, Canada. The common shares of Excellon (“Common Shares”) trade on the Toronto Stock Exchange under the symbol “EXN”.

These consolidated financial statements were approved by the Board of Directors on March 30, 2020.

These consolidated financial statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”). The consolidated financial statements have been prepared under the historical cost method, except for certain financial instruments measured at fair value. The accounting policies set out below were consistently applied to all periods presented, except for the adoption of new accounting standards and accounting policies disclosed in Note 4.

| 3. | USE OF ESTIMATES AND JUDGMENTS |

The preparation of the consolidated financial statements requires management to select accounting policies and make estimates and judgments that may have a significant impact on the consolidated financial statements.

Critical judgments exercised in applying accounting policies that have the most significant effect on the amounts recognized in the consolidated financial statements are as follows:

| ● | Indicators of impairment - the Company assesses the carrying amount of property, plant and equipment and mineral rights at each reporting date to determine whether there are any indicators that the carrying amount of the assets may be impaired. The Company has determined that exploratory drilling, evaluation and related costs incurred, which were capitalized, have future economic benefits and are economically recoverable. In making this judgment, the Company has assessed various sources of information including, but not limited to, geological and metallurgical information, history of conversion of mineral deposits to proven and probable reserves, scoping and feasibility studies, proximity to existing ore bodies, existing permits, and life of mine plans. |

Estimates are continuously evaluated and are based on management’s experience and expectations of future events that are believed to be reasonable under the circumstances. However, actual outcomes can differ from these estimates. Key sources of estimation uncertainty that have the most significant effect on the carrying amounts of assets and liabilities are:

Excellon Resources Inc.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2019 and 2018

(in thousands of US dollars, except share and per share data)

| ● | Useful economic life of property, plant and equipment - the cost less residual value of each item of property, plant and equipment is amortized over its useful economic life. Amortization is charged to cost of production over the shorter of the estimated lives of the individual assets or the life of mine using the units-of-production method. Amortization commences when assets are available for use. Land is not amortized. The assets useful lives, expected units-of-production and methods of amortization are reviewed and adjusted if appropriate at each fiscal year end. |

| | |

| ● | Decommissioning and site rehabilitation provision - the Company records any decommissioning and site rehabilitation obligation as a liability in the period in which the related environmental disturbance occurs, based on the net present value of the estimated future costs. This obligation is adjusted at the end of each fiscal period to reflect the passage of time and changes in the estimated future costs underlying the obligation. In determining this obligation, management must make a number of assumptions about the amount and timing of future cash flows and discount rate to be used. |

| | |

| ● | Share-based compensation expense - the amount expensed for stock-based compensation is based on the application of a recognized option valuation formula, which is highly dependent on the expected volatility of the Company’s registered shares, the expected life of the options and forfeiture rate. The Company uses an expected volatility rate for its shares based on past stock trading data, adjusted for future expectations, and actual volatility may be significantly different. While the estimate of stock-based compensation can have a material impact on the operating results reported by the Company, it is a non-cash charge and as such has no impact on the Company’s cash position or future cash flows. |

| | |

| ● | Determination of reserves and resources - the Company uses the both internal and external technical experts to estimate the indicated and inferred resources of its mineral properties. These experts express an opinion based on certain technological and legal information as prepared by management as being current, complete and accurate as of the date of their calculations and in compliance with National Instrument 43-101 Standards of Disclosure for Mineral Projects. These estimated resources are used in the evaluation of potential impairment of asset carrying values, the useful lives of assets, amortization rates and the timing of cash flows. |

| | |

| ● | Income taxes and recovery of deferred tax assets - The Company has carry-forward losses and other tax attributes that have the potential to reduce tax payments in future years. Judgment is required in determining whether deferred tax assets are recognized in the consolidated financial statements. Deferred tax assets are recognized for all deductible temporary differences, carry-forward unused tax credits and tax losses to the extent it is probable that future taxable profits will be available against which they can be utilized. Estimates of future taxable income are based on forecasted cash flows from operations and the application of existing tax laws as well as the continuity of current contracts and agreements. Assumptions about the generation of future taxable profits depend on management’s estimates of future cash flows. To the extent that future cash flows and taxable income differ significantly from estimates, the ability of the Company to realize the net deferred tax assets recorded at the reporting date could be impacted. |

| | |

| | Uncertainties exist with respect to the interpretation of tax regulations. The Company establishes provisions for tax liabilities that are uncertain as to their amount and the probability of their occurrence. The amount of such provisions is based on various factors, such as experience with previous tax audits, differing legal interpretations by the taxable entity and the responsible tax authority. The final resolution of some of these items may give rise to a material change in the amount of the income tax expense recorded in consolidated statement of income and related tax payments. |

Excellon Resources Inc.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2019 and 2018

(in thousands of US dollars, except share and per share data)

| 4. | SIGNIFICANT ACCOUNTING POLICIES |

The accounting policies set out below have been applied consistently to all periods presented in these consolidated financial statements.

| | i. | Subsidiaries - are entities controlled by the Company where control is achieved when the Company has the power to govern the financial and operating policies of the entity. The Company owns directly and indirectly 100% of all the subsidiaries. The financial statements of subsidiaries are included in the consolidated financial statements from the date that control commences until the date that control ceases. The accounting policies of subsidiaries have been changed when necessary to align them with the policies adopted by the Company. |

| | | |

| | ii. | Transactions eliminated on consolidation - intercompany transactions, balances, income and expenses are eliminated in preparing the consolidated financial statements. |

The Company has two reportable segments based on a geographical basis. During the year, the Company operated in Mexico and Canada. The Mexican operation is principally engaged in the acquisition, exploration, evaluation, and development of mining properties. The Platosa property is in commercial production and is earning revenue through the sale of silver-lead concentrate and silver-zinc concentrate. The Canadian operations are principally engaged in the financing, acquisition, exploration and evaluation of mining properties. Non-current assets located at the corporate office in Canada are not material. Segments are reviewed by the CEO, who is considered to be the chief operating decision maker.

| (c) | Foreign currency transactions and translation |

| | i. | Transactions and balances - foreign currency transactions are translated into the functional currency using the exchange rates prevailing at the date of the transactions or valuation where items are remeasured. Foreign exchange gains and losses resulting from the settlement of such transactions and from the translation at period-end exchange rates of monetary assets and liabilities denominated in foreign currencies are recognized in the Company’s consolidated statements of loss. |

| | | |

| | | All foreign exchange gains and losses are presented in the statement of income within Other income/expense. |

| | | |

| | ii. | Translation - the results and financial position of all the Company entities that have a functional currency different from the presentation currency are translated into the presentation currency as follows: |

| | ● | Assets and liabilities for each balance sheet presented are translated at the closing rate at the date of that balance sheet; |

| | | |

| | ● | Income and expenses for each statement of loss and comprehensive loss are translated at average exchange rates (unless this average is not a reasonable approximation of the cumulative effect of the rates prevailing on the transaction dates, in which case income and expenses are translated at the rate on the dates of the transactions); and |

| | | |

| | ● | All resulting exchange differences have been recognized in other comprehensive income and accumulated as a separate component of equity in accumulated other comprehensive loss. |

Excellon Resources Inc.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2019 and 2018

(in thousands of US dollars, except share and per share data)

Financial assets

Routine purchases and sales of financial assets are recognized on trade date, the date on which the Company commits to purchase or sell the asset. At initial recognition, the Company measures a financial asset at its fair value plus, in the case of a financial asset not at fair value through profit or loss, transaction costs that are directly attributable to the acquisition of the financial asset. Transaction costs of financial assets carried at fair value through profit or loss are expensed in profit or loss.

Subsequent measurement of debt instruments depends on the classification of financial assets determined at initial recognition. Classification of financial assets depends on the entity’s business model for managing the financial assets and the contractual terms of the cash flows. The Company classifies and provides for financial assets as follows:

| | ● | Financial assets at fair value through profit or loss include principally the Company’s cash and cash equivalents, as well as foreign currency forward sales contracts. A financial asset is classified in this category if it does not meet the criteria for amortized cost of fair value through other comprehensive income, or is a derivative instrument not designated for hedging. Gains and losses arising from changes in fair value are presented in the consolidated statements of profit and comprehensive profit in the period in which they arise. |

| | | |

| | ● | Financial assets at fair value through other comprehensive income are financial assets that are held in a business model with an objective that is achieved by both collecting contractual cash flows and selling financial assets, and where the assets’ cash flows represent solely payments of principal and interest. Movements in the carrying amount are taken through other comprehensive income, except for the recognition of impairment gains or losses, and foreign exchange gains and losses which are recognized in profit or loss. When the financial asset is derecognized, the cumulative gain or loss previously recognized in other comprehensive income is reclassified from equity to profit or loss and recognized in other gains/(losses). Foreign exchange gains and losses are presented in other gains/(losses) and impairment expenses are presented as separate line item in the statement of profit or loss. |

| | | |

| | ● | Financial assets at amortized cost are financial assets with the objective to hold assets in order to collect contractual cash flows, and the contractual terms of the financial asset give rise on specified dates to cash flows that are solely payments of principal and interest on the principal amount outstanding. This includes the entities trade, and non-trade receivables. Interest income from these financial assets is included in finance income using the effective interest rate method. Any gain or loss arising on derecognition is recognized directly in profit or loss and presented in other gains/(losses), together with foreign exchange gains and losses. |

At each balance sheet date, the Company assesses the expected credit losses associated with its financial assets carried at amortized cost and fair value through other comprehensive income. The impairment methodology applied depends on whether there has been a significant increase in credit risk. When sold or impaired, any accumulated fair value adjustments previously recognized are included in profit or loss.

For trade receivables, the Company applies the simplified approach permitted by IFRS 9, which requires expected lifetime losses to be recognized from initial recognition of the receivables.

Excellon Resources Inc.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2019 and 2018

(in thousands of US dollars, except share and per share data)

Financial assets are derecognized when the rights to receive cash flows from the financial assets have expired or have been transferred and the Company has transferred substantially all the risks and rewards of ownership.

Derivative financial instruments

The Company may hold derivative financial instruments to hedge its risk exposure to fluctuations in commodity prices, including the Company’s final product, consumables and other currencies compared to the USD. Derivative financial instruments are measured at fair value at each reporting period.

Non-hedged derivative financial instruments

All derivative instruments not designated in a hedge relationship that qualifies for hedge accounting are classified as financial instruments at fair value through profit or loss. Changes in fair value of non-hedged derivative financial instruments are included in net income or loss as non-hedged derivative gains or losses.

Financial liabilities

Transaction costs associated with financial instruments, carried at fair value through profit or loss, are expensed as incurred, while transaction costs associated with all other financial instruments are included in the initial carrying amount of the asset or the liability. The amortization of debt issue costs is calculated using the effective interest method.

| (e) | Cash and Cash equivalents |

Cash and cash equivalents consist of cash on hand, bank deposits and highly liquid short-term investments with a maturity date of three months or less when acquired.

Silver-lead and silver-zinc in concentrate and ore stockpiles are physically measured or estimated and valued at the lower of cost or net realizable value. Net realizable value is the estimated selling price, less estimated costs of completion and costs of selling final product.

Cost is determined by the weighted average method and comprises direct purchase costs and an appropriate portion of fixed and variable overhead costs, including amortization, incurred in converting materials into finished goods. The cost of production is allocated to joint products using a ratio of weighted average volume by product at each month end. Separately identifiable costs of conversion of each metal concentrate are specifically allocated.

Materials and supplies are valued at the lower of cost or net realizable value. Any provision for obsolescence is determined by reference to specific items. A regular review is undertaken to determine the extent of any provision for obsolescence by comparing items to their replacement costs.

When inventories have been written down to net realizable value, the Company makes a new assessment of net realizable value in each subsequent period. If the circumstances that caused the write-down no longer exist, the remaining amount of the write-down is reversed.

| (g) | Property, plant and equipment |

Property, plant and equipment are carried at cost less accumulated amortization and any impairment charges.

When parts of an item of property, plant and equipment have different useful lives, they are accounted for as separate assets (major components) of property, plant and equipment.

Excellon Resources Inc.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2019 and 2018

(in thousands of US dollars, except share and per share data)

The cost of replacing a part of an item of property, plant and equipment is recognized in the carrying amount of the item if it is probable that the future economic benefits embodied within the part will flow to the Company, and its cost can be measured reliably. The carrying amount of the replaced part is derecognized. The costs of the day-to-day servicing of property, plant and equipment are recognized in profit or loss as incurred.

Amortization is recorded over the useful life of the asset, or over the remaining life of the mine, if shorter, as follows:

| | ● | Mining properties – on a units-of-production basis; |

| | ● | Associated mining equipment – 3-10 years on a straight-line basis; |

| | ● | Buildings – 20 years on a straight-line basis; and |

| | ● | Processing equipment – 4-8 years on a straight-line basis. |

Amortization charges on a unit-of-production basis are based on measured and indicated mineral resources.

The method of amortization, estimates of residual values and useful lives are reassessed at least at each financial year-end, and any change in estimate is taken into account in the determination of future amortization charges.

| (h) | Exploration and evaluation expenditures |

Acquisitions of mineral rights are capitalized. Subsequent exploration and evaluation costs related to an area of interest are expensed as incurred on a project-by-project basis pending determination of indicated resources. Upon determination of indicated resources, further development costs are capitalized. When a licence is relinquished or a project is abandoned, the related costs are immediately recognized in profit or loss.

Exploration properties that contain estimated Proven and Probable Mineral Reserves, but for which a development decision has not yet been made, are subject to periodic review for impairment when events or changes in circumstances indicate the project’s carrying value may not be recoverable.

Exploration and evaluation assets are reclassified to “Mine Properties - Mines under construction” when the technical feasibility and commercial viability of extracting the Mineral Resources or Mineral Reserves are demonstrable and construction has commenced or a decision to construct has been made. Exploration and evaluation assets are assessed for impairment before reclassification to “Mines under construction”, and the impairment loss, if any, is recognized in profit or loss.

| (i) | Development expenditure |

Development expenditures incurred by or on behalf of the Company are accumulated separately for each area of interest in which an indicated resource has been identified. Such expenditures comprise costs directly attributable to the construction of a mine and the related infrastructure.

General and administrative costs are allocated to a development asset only to the extent that those costs can be related directly to development activities in the relevant area of interest.

Once a development decision has been taken, the development expenditure is classified under property, plant and equipment as ‘‘development properties’’.

A development property is reclassified as a “mining property’’ at the end of the commissioning phase, when the mine is capable of operating in the manner intended by management.

Excellon Resources Inc.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2019 and 2018

(in thousands of US dollars, except share and per share data)

No amortization is recognized in respect of development properties until they are reclassified as “mining properties’’.

Each development property is tested for impairment in accordance with the Company’s impairment policy.

When further development expenditures are incurred in respect of a mining property after the commencement of production, such expenditures are carried forward as part of the mining property when it is probable that additional future economic benefits associated with the expenditure will flow to the consolidated entity. Otherwise such expenditures are classified as a cost of production.

Amortization is charged using the units-of-production method. The units-of-production basis results in an amortization charge proportional to the depletion of measured and indicated resources.

Mine properties are tested for impairment in accordance with the Company’s impairment policy.

| (k) | Decommissioning and site rehabilitation provision |

The Company records the present value of estimated costs of legal and constructive obligations required to restore operating locations in the period in which the obligation is incurred. The nature of these restoration activities includes dismantling and removing structures, rehabilitating mines and tailings dams, dismantling operating facilities, closure of plant and waste sites, and restoration, reclamation and re-vegetation of affected areas.

The obligation is attributable to development when the asset is installed, or the environment is disturbed at the production location. Provisions are measured at the present value of the expenditures expected to be required to settle the obligation using a discount rate that reflects the current market assessments of the time value of money. When the liability is initially recognized, the present value of the estimated cost is capitalised by increasing the carrying amount of the related mining asset.

The periodic unwinding of the discount applied in establishing the net present value of provisions due to the passage of time is recognized in the consolidated statement of income as a finance cost. Changes in the rehabilitation estimate attributable to development will be recognized as additions or charges to the corresponding assets and rehabilitation liability when they occur.

Mineral rights are carried at cost and amortized using a units-of-production method based on the resources that exist in the location that has access to such rights.

Methods of amortization and estimated useful lives are reassessed annually and any change in estimate is taken into account in the determination of future amortization charges.

| | i. | Financial assets - a financial asset not carried at fair value through profit or loss is assessed at each reporting date to determine whether there is objective evidence that it is impaired. A financial asset is impaired if objective evidence indicates that a loss event has occurred after the initial recognition of the asset, and that the loss event had a negative effect on the estimated future cash flows of that asset that can be estimated reliably. |

Excellon Resources Inc.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2019 and 2018

(in thousands of US dollars, except share and per share data)

| | ii. | Non-financial assets - the carrying amounts of the Company’s non-financial assets, primarily property, plant and equipment and mineral rights, are reviewed at each reporting date to determine whether there is any indication of impairment. If any such indication exists, then the asset or cash generating unit (CGU) recoverable amount is estimated. Recoverability of assets or CGU, the mine operation, to be held and used are measured by a comparison of the carrying value of the asset to the recoverable amount, which is the higher of value in use and fair value less costs to sell. |

| | | |

| | | For the purpose of impairment testing, assets that cannot be tested individually are grouped together into the smallest group of assets that generates cash inflows from continuing use that are largely independent of the cash inflows of other assets or groups of assets. |

| | | |

| | | An impairment loss is recognized if the carrying amount of an asset or the CGU exceeds its estimated recoverable amount. Impairment losses are recognized in profit or loss. Impairment losses recognized in respect of the CGU are allocated to reduce the carrying amount of long-lived assets in the unit on a pro rata basis. |

| | | |

| | | Non-financial assets that have been impaired in prior periods are tested for possible reversal of impairment whenever events or changes in circumstances indicate that the impairment has reversed. If the impairment has reversed, the carrying amount of the asset is increased to its recoverable amount but not beyond the carrying amount that would have been determined had no impairment loss been recognized for the asset in the prior periods. A reversal of an impairment loss is recognized into earnings immediately. |

| (n) | Future Termination Benefits |

Employees of the Company’s Mexican mines are entitled by local labor laws to employee departure indemnities, generally based on each employee’s length of service, employment category and remuneration.

The cost of these retirement benefits is determined using the projected unit credit method. Current service cost and any past service cost are recognized in the same line item in the statements of income as the related compensation cost. Changes in actuarial assumptions used to determine the accrued benefit obligation are recognized in full in the period in which they occur, in the statements of income.

The most significant assumptions used in accounting for post employment benefits are the discount rate, the mortality and the life of mine. The discount rate is used to determine the net present value of future liabilities. Each year, the unwinding of the discount on those liabilities is charged to the Company’s income statement as the interest cost. The life of mine and mortality assumptions are used to project the future stream of benefit payments, which is then discounted to arrive at a net present value of liabilities. The values attributed to the liabilities are assessed in accordance with the advice of independent qualified actuaries.

| (o) | Current and deferred income tax |

The tax expense for the period comprises of the current and deferred tax. Tax is recognized in the statement of income and comprehensive income, except to the extent that it relates to items recognized in other comprehensive income or directly in equity. In this case the tax is also recognized in other comprehensive income or directly in equity, respectively.

Excellon Resources Inc.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2019 and 2018

(in thousands of US dollars, except share and per share data)

The current income tax charge is calculated on the basis of the tax laws substantively enacted at the balance sheet date in the countries where the Company’s entities operate and generate taxable income. Management periodically evaluates positions taken in tax returns with respect to situations in which applicable tax regulation is subject to interpretation. Where appropriate, the Company establishes provisions expected to be paid to the tax authorities.

Deferred income tax is recognized, using the liability method, on temporary differences arising between the tax bases of assets and liabilities and their carrying amounts in the consolidated financial statements. However, the deferred income tax is not accounted for if it arises from initial recognition of an asset or liability in a transaction other than a business combination that at the time of the transaction affects neither accounting nor taxable profit nor loss. Deferred income tax is provided on temporary differences arising on investments in subsidiaries except in the case of a subsidiary where timing of the reversal of the temporary difference is controlled by the Company and it is probable that the temporary difference will not reverse in the foreseeable future. Deferred income tax is determined on a non discount basis using tax rates (and laws) that have been substantively enacted by the balance sheet date and are expected to apply when the related deferred income tax asset is realised or the deferred income tax liability is settled.

Deferred income tax assets are recognized only to the extent that it is probable that future taxable profit will be available against which the temporary differences can be utilized. In assessing the need to recognize a deferred tax asset, management considers all available evidence including past operating results, estimates of future taxable income and the feasibility of ongoing tax planning strategies.

The Company recognizes neither the deferred tax asset regarding the temporary difference on the rehabilitation liability, nor the corresponding deferred tax liability regarding the temporary difference on the rehabilitation asset.

Deferred income tax assets and liabilities are offset when there is a legally enforceable right to offset current tax assets against current tax liabilities and when the deferred income taxes assets and liabilities relate to income taxes levied by the same taxation authority on either the taxable entity or different taxable entities where there is an intention to settle the balances on a net basis.

| | i. | Royalties - royalties, resource rent taxes and revenue-based taxes are accounted for under taxes when they have the characteristics of an income tax. This is considered to be the case when they are imposed under Government authority and the amount payable is based on taxable income – rather than based on quantity produced or as a percentage of revenue – after adjustment for temporary differences. For such arrangements, current and deferred tax is provided on the same basis as described above for other forms of taxation. Obligations arising from royalty arrangements that do not satisfy these criteria are recognized as current provisions and included in cost of sales. The 7.5% Mexican mining royalty is based on earnings before interest tax, depreciation and amortization (EBITDA), is treated as an income tax in accordance with IFRS, as it is based on a measure of revenue less certain specified costs. The extraordinary mining royalty of 0.5% on precious metals revenues is not considered to be an income tax in accordance with IFRS as it is based on a percentage of revenue and not taxable income. |

| | i. | Share option plan - employees (including directors and senior executives) of the Company receive a portion of their remuneration in the form of share-based payment transactions, whereby employees render services as consideration for equity instruments (“equity-settled transactions”). |

Excellon Resources Inc.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2019 and 2018

(in thousands of US dollars, except share and per share data)

In situations where equity instruments are issued to non-employees and some or all of the goods or services received by the Company, as consideration cannot be specifically identified, they are measured at fair value of the share-based payment. Otherwise, share-based payments are measured at the fair value of goods or services received.

| | ii. | Equity-settled transactions - the costs of equity-settled transactions with employees are measured by reference to the fair value at the date on which they are granted using the Black-Scholes option-pricing model. |

The costs of equity-settled transactions are recognized, together with a corresponding increase in equity, over the period in which the performance and/or service conditions are fulfilled, ending on the date on which the relevant employees become fully entitled to the award (“the vesting date”). The cumulative expense is recognized for equity-settled transactions at each reporting date until the vesting date reflects the Company’s best estimate of the number of equity instruments that will ultimately vest. The profit or loss charge or credit for a period represents the movement in cumulative expense recognized as at the beginning and end of that period and the corresponding amount is represented in contributed surplus. No expense is recognized for awards that do not ultimately vest.

Where the terms of an equity-settled award are modified, the minimum expense recognized is the expense as if the terms had not been modified. An additional expense is recognized for any modification, which increases the total fair value of the share-based payment arrangement or is otherwise beneficial to the employee as measured at the date of modification.

The dilutive effect of outstanding options is reflected as additional dilution in the computation of earnings per share.

| | iii. | Cash-settled transactions - a Deferred Share Unit (“DSU”) Plan was established for directors of the Company. The cost of the DSUs is measured initially at fair value based on the closing price of the Common Shares preceding the day the DSUs are granted. The Company has the option of settling the DSUs in cash or Common Shares either from treasury or from market purchases. Accordingly, the expense is recorded in the consolidated statement of loss and comprehensive loss as share-based payments and credited to equity under contributed surplus. |

A Restricted Share Unit (“RSU”) Plan was established for directors, certain employees and eligible contractors of the Company. The cost of the RSUs is measured initially at fair value on the authorization date based on the market price of the Common Shares preceding the day the RSUs are authorized by the Board of Directors. The Company has the option of settling the RSUs in cash or Common Shares either from treasury or from market purchases. Accordingly, the expense is recorded in the consolidated statement of loss and comprehensive loss in share-based payments and credited to equity under contributed surplus.

Company policy requires all production to be sold under contract. Revenue is only recognized on individual concentrate shipments when following conditions are satisfied:

| | ● | Contracts with customers have been identified |

| | ● | Performance obligations in the contract have been identified |

| | ● | Transaction price is determined |

| | ● | Transaction price is allocated to the performance obligations in the contract |

| | ● | Performance obligation in the contract is satisfied |

Excellon Resources Inc.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2019 and 2018

(in thousands of US dollars, except share and per share data)

Satisfaction of these conditions depends on the terms of trade with individual customers. Generally, control over goods are considered to have transferred to the customer upon delivery.

Concentrate products are sold on a ‘provisional pricing’ basis where the sale price received by the group is subject to a final adjustment at the end of a period that may be up to 90 days after delivery to the customer. The final sale price is based on the market price on the quotational date in the contract of sale. Sales are initially recognized when the revenue recognition criteria have been satisfied, using market prices at that date. At each reporting date the provisionally priced shipment is marked to market based on the forward selling price for the quotational point specified in the contract until that point is reached. Revenue is only recognized on this basis where the forward selling price can be reliably measured.

Many of the Company’s sales are subject to an adjustment based on confirmation of the technical specifications of each shipment by the customer. In such cases, revenue is recognized based on the group’s best estimate of the technical specifications at the time of shipment, and any subsequent adjustments are recorded against revenue when final specifications are confirmed and agreed to by both parties, as per the offtake agreement terms.

Basic earnings per share (“EPS”) is calculated by dividing the net income (loss) for the period attributable to equity owners of Excellon by the weighted average number of Common Shares outstanding during the period.

Diluted EPS is calculated by adjusting the weighted average number of Common Shares outstanding for dilutive instruments. The number of shares included with respect to options, warrants and similar instruments is computed using the treasury stock method. Excellon’s potentially dilutive Common Shares comprise stock options granted to employees and warrants.

| (s) | New accounting standards and policies adopted |

IFRS 16 Leases

Effective January 1, 2019, the Company adopted IFRS 16 Leases (“IFRS 16”) which replaces IAS 17 Leases (“IAS 17”) and requires the recognition of most leases on the balance sheet. IFRS 16 effectively removes the classification of leases as either finance or operating leases and treats all leases as finance leases for lessees with optional exemptions for short-term leases where the term is twelve months or less.

The Company selected the modified retrospective transition approach, with no restatement of comparative figures. As such, comparative information continues to be reported under IAS 17 and International Financial Reporting Interpretations Committee (“IFRIC”) 4. The details of accounting policies under IAS 17 and IFRIC 4 are disclosed separately if they are different from those under IFRS 16 and the impact of the change is disclosed below.

The Company’s accounting policy under IFRS 16 is as follows:

At inception of a contract, the Company assesses whether a contract is, or contains, a lease based on whether the contract conveys the right to control the use of an identified asset for a period of time in exchange for consideration. The Company recognizes a right-of-use asset and a lease liability at the lease commencement date. The right-of-use asset is initially measured based on the initial amount of the lease liability adjusted for any lease payments made at or before the commencement date, plus any initial direct costs incurred and an estimate of costs to dismantle and remove the underlying asset or to restore the underlying asset or the site on which it is located, less any lease incentives received. The assets are amortized to the earlier of the end of the useful life of the right-of-use asset or the lease term using the straight-line method as this most closely reflects the expected pattern of consumption of the future economic benefits. In addition, the right-of-use assets may be periodically reduced by impairment losses, if any, and adjusted for certain re-measurements of the lease liability.

Excellon Resources Inc.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2019 and 2018

(in thousands of US dollars, except share and per share data)

The lease liability is initially measured at the present value of the lease payments that are not paid at the commencement date, discounted using the interest rate implicit in the lease or, if that rate cannot be readily determined, the Company’s incremental borrowing rate. Lease payments include fixed payments, and variable payments that are based on an index or a rate.

Cash payments for the principal portion of the lease liability are presented within the financing activities and the interest portion of the lease liability is presented within the operating activities of the statement of cash flows. Short-term lease payments and variable lease payments not included in the measurement of the lease liability are presented within the operating activities of the statement of cash flows.

The lease liability is measured at amortized cost using the effective interest method. It is re-measured when there is a change in future lease payments arising from a change in an index or rate, if there is a change in the Company’s estimate of the amount expected to be payable under a residual value guarantee, or if the Company changes its assessment of whether it will exercise a purchase, extension or termination option.

When the lease liability is re-measured in this way, a corresponding adjustment is either made to the carrying amount of the right-of-use asset or is recorded in profit or loss if the carrying amount of the right-of-use asset has been reduced to zero.

Under IAS 17 In the comparative period, the Company classified leases that transfer substantially all of the risks and rewards of ownership as finance leases. When this was the case, the leased assets were measured initially at an amount equal to the lower of their fair value and the present value of minimum lease payments. Minimum lease payments were the payments over the lease term that the lessee was required to make, excluding any contingent rent.

Subsequently, the assets were accounted for in accordance with the accounting policy applicable to that asset.

Assets held under other leases were classified as operating leases and were not recognized in the Company’s statement of financial position. Payments made under operating leases were recognized in profit or loss on a straight-line basis over the term of the lease. Lease incentives received were recognized as an integral part of the total lease expense over the term of the lease.

As part of the initial application of IFRS 16, the Company also chose to apply the following transitional provisions:

Right-of-use assets are measured at:

| | ● | An amount equal to the lease liability on January 1, 2019, adjusted by the amount of any prepaid or accrued lease payments relating to that lease recognized in the statement of financial position immediately before the date of transition. |

The Company applied the following practical expedients when applying IFRS 16 to leases previously classified as operating leases under IAS 17:

| | ● | Adjusted the right-of-use assets by the amount of any provision for onerous leases recognized in the balance sheet immediately before the date of initial application, as an alternative to performing an impairment review. |

| | | |

| | ● | Not to recognize right-of-use assets and lease liabilities for short-term leases that have a lease term of twelve months or less and longer-term leases that have a short remaining term at the time of adoption. The lease payments associated with these leases are recognized as an expense on a straight-line basis over the lease term. |

Excellon Resources Inc.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2019 and 2018

(in thousands of US dollars, except share and per share data)

The Company has lease arrangements that include both lease and non-lease components. The Company accounts for each separate lease component and its associated non-lease components as a single lease component for all its asset classes. Additionally, for certain lease arrangements that involve leases of similar assets, the Company applies a portfolio approach to effectively account for the underlying right-of-use ROU assets and lease liabilities.

For leases that were classified as finance leases under IAS 17, the carrying amount of the right-of-use asset and the lease liability at January 1, 2019 were determined as the carrying amount of the lease asset and lease liability under IAS 17 immediately before that date.

Farm-out accounting policy (Note 9)

Mineral rights held by the Company which are subject to a farm-out arrangement, where a farmee incurs certain expenditures on a property to earn an interest in that property, are accounted as follows:

| | ● | the Company does not record exploration expenditures made by the farmee on the property; |

| | ● | any cash consideration and the initial fair value of any shares received is credited against the costs previously capitalized to the mineral rights; |

| | ● | the change in fair value of any shares received by Company as part of a farm-out arrangement are recorded through profit or loss; and |

| | ● | the Company uses the carrying value of the mineral rights before the farm-out arrangement as the carrying value for the portion of the interest retained (if any). |

| (t) | Accounting standards issued but not yet applied |

In March 2018 the International Accounting Standards Board (IASB) issued a revised Conceptual Framework for Financial Reporting which is currently being used by the Board and Interpretations Committee of the IASB in developing new pronouncements. However, preparers of the financial statements will only begin referring to the new framework from January 1, 2020.

In 2018, the Company entered into an option agreement (the “Wallbridge Agreement”) with Wallbridge Mining Company Ltd. (“Wallbridge”). Wallbridge agreed to incur an aggregate of CAD$4,500 in exploration expenditures on the Beschefer property (Note 9) and issue a total of 7,000,000 common shares of Wallbridge (“Wallbridge Shares”) over three years to earn a 100% interest in the property. On September 21, 2019 the parties amended the original option agreement to increase the total number of shares to 8,000,000 and extend the option period by one year.

The Company has received 500,000 Wallbridge Shares, and recorded an unrealized fair value gain of $289 in profit and loss for the year ended December 31, 2019 (2018: loss of $45). Also refer Notes 9 and 25.

VAT (value added tax) receivables consist of the total VAT credits recoverable by each of the Company’s Mexican subsidiaries. In Mexico, VAT credits can only be applied to VAT payable specific to each entity and are non-transferable. The Company’s VAT payable position is reflected separately on the consolidated statement of financial position.

Excellon Resources Inc.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2019 and 2018

(in thousands of US dollars, except share and per share data)

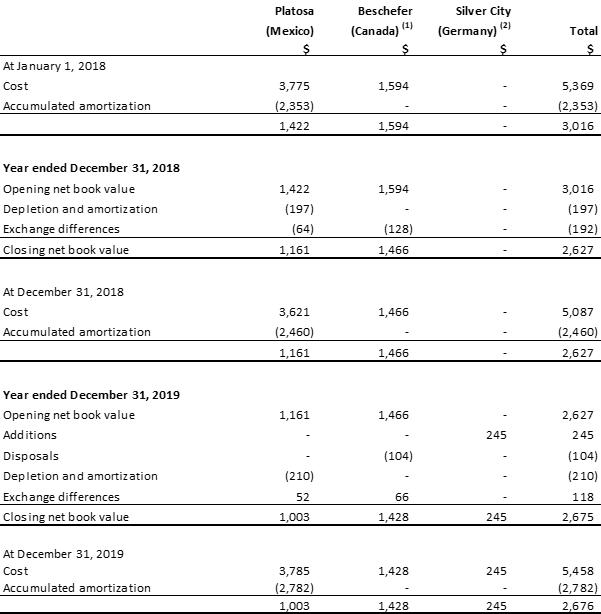

| 7. | PROPERTY, PLANT AND EQUIPMENT |

| (1) | During the year ended December 31, 2019, the Company incurred $2,911 related to sustaining capital expenditures recorded as assets under construction. Once these related assets are commissioned, they will be reclassified to their appropriate asset class. |

Excellon Resources Inc.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2019 and 2018

(in thousands of US dollars, except share and per share data)

Excellon Resources Inc.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2019 and 2018

(in thousands of US dollars, except share and per share data)

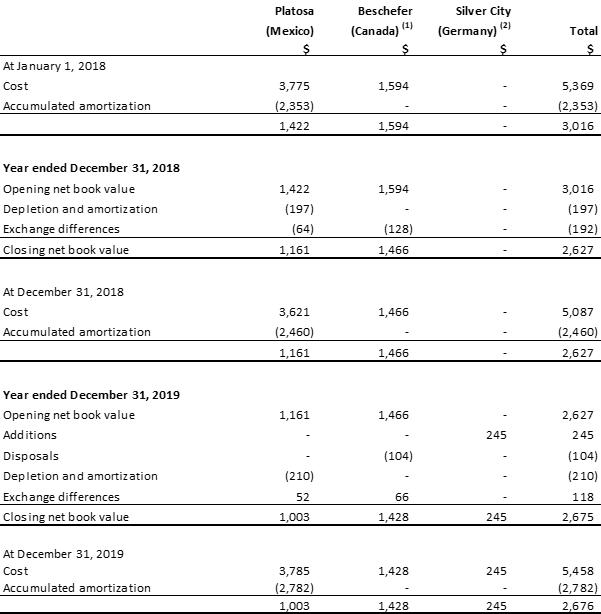

| | (1) | In Q3 2018, the Company entered into the Wallbridge Agreement (Note 5). In 2019, the Company accounted for this transaction as a farm-out arrangement and credited the related mineral rights by $104 the initial fair value of the Wallbridge Shares received. Prior to the adoption of the farm-out accounting policy (Note 4), the initial fair value of the shares received had been recorded in income. The Company has not restated the comparative period for the adoption of the farm-out accounting policy. On March 17, 2020, the Company entered into an updated agreement in respect of the Beschefer property to amend the Option payments, and deemed such Option payments fully satisfied through the issuance of a total of 3,500,000 Wallbridge Shares and 500,000 warrants to purchase Wallbridge Shares exercisable at $1.00 for a period of five years from the date of issuance (collectively, the “Wallbridge Consideration”). The Company relinquished all interest in the Beschefer Property upon execution of the updated agreement. |

| | | |

| | (2) | On September 24, 2019 the Company signed an option agreement (the “Globex Agreement”) with Globex Mining Enterprises Inc. (“Globex”) to acquire a 100% interest in the Braunsdörf exploration license for the Silver City Project in Saxony, Germany, pursuant to which the Company agreed to pay total aggregate consideration of CAD$500 in cash and issue Common Shares valued at CAD$1,600 over a period of three years. Upon completion of the payments and common share issuances the Company will grant Globex a gross metals royalty of 3% for precious metals and 2.5% for other metals, both of which may be reduced by 1% upon a payment of CAD$1,500. Additional one-time payments of CAD$300 and CAD$700 will be made by the Company following any future announcement of a maiden resource on the property and upon achievement of commercial production from the project, respectively. The first issuance of 226,837 Common Shares (valued at CAD$225) and the first cash payment (CAD$100) were made on the effective date of the Globex Agreement and recorded as an addition to the mineral rights ($245). |

| 10. | TRADE AND OTHER PAYABLES |

The Company’s trade payables comprise accounts payable and accruals as at December 31, 2019. Accounts payable accounted for $4,672 of the $6,700 balance (as at December 31, 2018 – $3,389 of the $5,243 balance), of which $793 related to electricity, $268 related to exploration and $331 related to dewatering sustaining capital expenditures (as at December 31, 2018 – $557 related to electricity, $257 related to exploration drilling and $400 related to dewatering sustaining capital expenditures). Accruals and other payables of $2,028 (as at December 31, 2018 – $1,854) relate to operating costs, accounting, legal, statutory payroll withholding taxes and forward foreign exchange contracts that are marked to market.

The mark to market on forward foreign exchange contracts resulted in an unrealized gain adjustment of $119 recorded in finance cost during the year ended December 31, 2019 and a corresponding decrease in accruals resulting in a net asset balance of $373 in accruals (as at December 31, 2018 – $313 asset balance in accruals).

Excellon Resources Inc.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2019 and 2018

(in thousands of US dollars, except share and per share data)

During the year, the Company entered into finance leases for mining equipment with various vendors. All leases entered are fixed interest rates leases and security is provided by the equipment being leased.

Future minimum lease payments are as follows:

The net carrying values of the leased mining equipment are as follows:

Total interest expense on finance lease obligations for the year ending December 31, 2019 was $30 (2018: $21).

Excellon Resources Inc.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2019 and 2018

(in thousands of US dollars, except share and per share data)

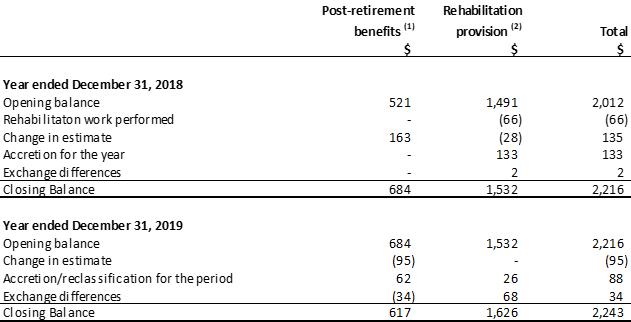

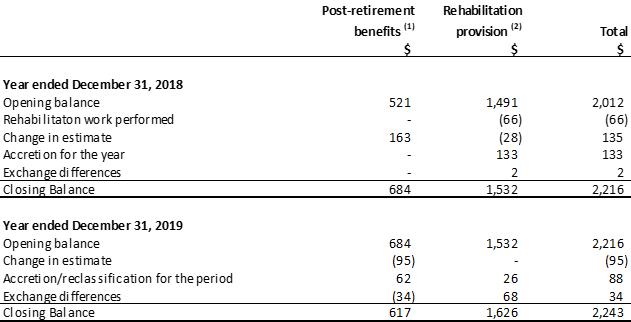

| (1) | Post-retirement benefits: The Company provides post-retirement benefits supplements as well as leaving indemnities to employees at the Mexican operations. Under Mexican labour law, the Company provides statutorily mandated severance benefits to its employees terminated under certain circumstances. Such benefits consist of a one-time payment of three months wages plus 20 days wages for each year of service payable upon involuntary termination without just cause. Key financial assumptions used in the above estimate include an annual discount rate of 6.8% (December 31, 2018– 8.5%) based on the yield curve from short and long term Mexican government bonds, annual salary rate increase of 3.75% (December 31, 2018 – 3.75%) and minimum wage increase rate of 5.31% (December 31, 2018 – 5.31%) and the life of mine of approximately four years. |

| | |

| (2) | Rehabilitation provision: Key financial assumptions used in the above estimate include an annual discount rate of 4.4% (December 31, 2018 – 6.9%) based on the current risk-free borrowing rate, Mexican inflation rate and the life of mine of four years. The total undiscounted amount of estimated cash flows required to settle the Company’s obligations is $1,727 of which $823 relates to the Platosa mine and $904 relates to the Miguel Auza mill. The present value of the total discounted obligation is $1,626 of which $775 relates to the Platosa mine and $851 relates to the Miguel Auza mill. |

Excellon Resources Inc.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2019 and 2018

(in thousands of US dollars, except share and per share data)

The Company’s authorized share capital consists of an unlimited number of Common Shares.

| (1) | On April 2, 2018, 3,333,333 CAD$0.65 Warrants were exercised for proceeds of CAD$2,167, and a reclassification from contributed surplus of CAD$836. |

| | |

| (2) | On November 27, 2019, 1,851,046 CAD$0.50 Warrants were exercised for proceeds of CAD$926. |

| | |

| (3) | On August 27, 2019 the Company completed a public equity financing (the “2019 Bought Deal”) of 10,925,000 units (“2019 Public Units”) at a price of CAD$1.06 per Public Unit for gross proceeds of CAD$11,581 (the “2019 Offering”). Each 2019 Public Unit comprised one Common Share and one half-warrant (“$1.40 Warrant”) with each whole warrant entitling the holder to acquire a Common Share at a price of CAD$1.40 for a period of two years ending August 27, 2021. The Company issued 5,462,500 CAD$1.40 warrants. |

| | |

| | Broker and underwriting fees of CAD$800 were paid in respect of the 2019 Bought Deal. |

| | |

| | The net proceeds of CAD$10,510 ($8,000) after transaction costs, were allocated proportionally between the fair values of the Common Shares and the $1.40 Warrants. |

| | |

| (4) | On September 24, 2019, the Company announced the Globex Agreement, pursuant to which the Company agreed to pay a total aggregate consideration value of CAD$500 in cash and issue Common Shares valued at CAD$1,600 over a period of three years. The first issuance of 226,837 Common Shares (valued at CAD$225) and the first cash payment (CAD$100) were made on the effective date of the option agreement and recorded as an addition to mineral rights (Note 9). |

Excellon Resources Inc.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2019 and 2018

(in thousands of US dollars, except share and per share data)

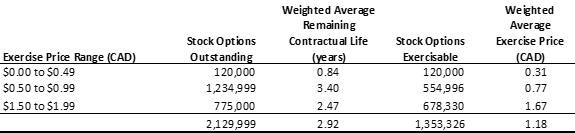

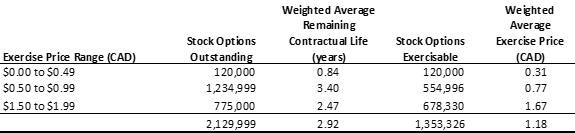

The outstanding number and weighted average exercise prices of Stock Options (equity-settled), Purchase Warrants, Deferred Share Units (DSUs”) and Restricted Share Units (RSUs”) are as follows:

Options outstanding and exercisable are as follows:

Inputs for measurement of grant date fair values of Options

The grant date fair values of the Options were measured based on the Black-Scholes formula. Expected volatility is estimated by considering historic average share price volatility. The inputs used in the measurement of the fair values at grant date of the Options were the following:

Excellon Resources Inc.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2019 and 2018

(in thousands of US dollars, except share and per share data)

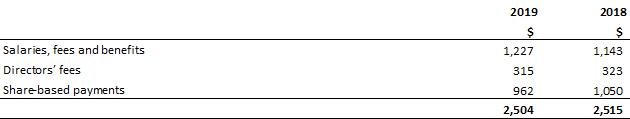

Compensation expense is recognized over the vesting period of the grant with the corresponding equity impact recorded in contributed surplus. Share-based compensation expense comprises the following:

The following table lists the equity securities excluded from the computation of diluted earnings per share. The securities were excluded as the inclusion of the equity securities has an anti-dilutive effect on net loss; or the exercise prices relating to the particular security exceed the weighted average market price of the Common Shares.

Excellon Resources Inc.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2019 and 2018

(in thousands of US dollars, except share and per share data)

| 15. | COMMITMENTS AND CONTINGENCIES |

The following table summarizes the Company’s significant commitments as of December 31, 2019:

Excluded above is the Platosa Project Net Smelter Return (NSR) royalty as such payments vary period to period based on production results and commodity prices. The NSR bears a rate of either (a) 1.25% in respect of manto or mineralization other than skarn mineralization or (b) 0.50% in respect of skarn or “Source” mineralization. Payments are made in cash semi-annually. NSR royalty expense for the year ended 2019 was $290 (2018: $285) and was recorded in cost of sales.

Legal contingencies

The Company is defending various legal claims including one against a subsidiary of the Company which is party to an action by a claimant in respect of damages under a property agreement regarding a non-material mineral concession within the Evolución Project. The concession is subject to an exploration and exploitation agreement with purchase option (the “Antigua Agreement”) dated December 3, 2006 between San Pedro Resources SA de CV (“San Pedro”, now a subsidiary of Excellon) and the owner (the “Plaintiff”) that provides, among other things, for a minimum payment of US$2,500 plus value added tax per month and the payment of a 3% NSR royalty. San Pedro has the right to purchase absolute title to La Antigua including the NSR royalty upon payment of US$500,000. San Pedro was under no contractual obligation to put the mine into production and has not done so. The Plaintiff was awarded damages in the court of first instance in Torreón, Coahuila. Both San Pedro and the Plaintiff appealed the decision to the Second District State Court in the Judicial District of Torreón. That Court confirmed the initial decision but, subsequently, pursuant to an order obtained by the Plaintiff, granted the Plaintiff an award of damages multiple times greater than any income the applicable NSR royalty could produce even in the event of commercial production. San Pedro is appealing this decision to the federal courts of Mexico and believes that the decision is without merit and not supported by the evidence, facts or law. The Company expects the decision in respect of damages is remote and will be reversed and rationalized in the federal court system. There is no impact to the ongoing operations of the business.

Under the terms of the Company’s concentrate sales contracts, lead–silver and zinc-silver concentrates are sold on a provisional pricing basis whereby sales are recognized at prevailing metal prices when the revenue recognition criteria have been met, namely when title, and risks and rewards of ownership, have transferred to the customer. Revenue is recorded net of treatment and refining charges. Final pricing of each delivery is not determined until one or two months post-delivery. The price recorded at the time of sale may differ from the actual final price received from the customer due to changes in market prices for metals. The price volatility is considered an embedded derivative in accounts receivable. The embedded derivative is recorded at fair value by mark-to-market adjustments at each reporting period until settlement occurs, with the changes in fair value recorded to revenues. An amount of $2,192 is included in the trade receivables as at December 31, 2019 (as at December 31, 2018: $835) reflecting revenues recorded based on provisional prices.

Excellon Resources Inc.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2019 and 2018

(in thousands of US dollars, except share and per share data)

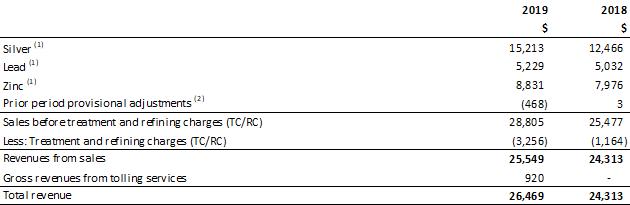

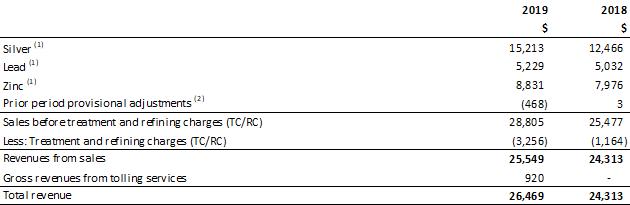

During the year ended December 31, 2019, the Company recognized a negative adjustment to revenues of ($468) primarily related to the reversal of the mark-to-market taken at the end of 2018 as receivables were ultimately settled at lower values during the first quarter of 2019 (2018: positive adjustment of $3).

As at December 31, 2019, provisionally priced sales totalled $7,492 which are expected to settle at final prices during the first quarter of 2020.

During the year ended December 31, 2019, the Company recorded $920 in revenues associated with the initial ore milling test under the current toll milling arrangement signed with Hecla Mining Company (2018: nil).

The disaggregation of revenue from contracts with customers is as follows:

| | (1) | Includes provisional price adjustments on current period sales. |

| | (2) | Prior period sales that settled at amounts different from prior period’s estimate. |

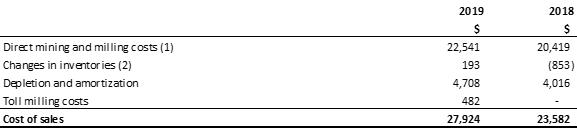

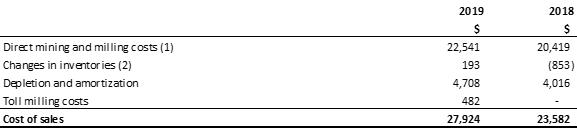

| | (a) | Cost of sales consist of the following: |

| | (1) | Direct mining and milling costs include personnel, general and administrative, fuel and electricity, maintenance and repair costs as well as operating supplies, external services and transport fees. |

| | | |

| | (2) | Changes in inventories reflect the net cost of ore and concentrate (i) sold during the current period but produced in a previous period (an addition to direct mining and milling costs) or (ii) produced but not sold in the current period (a deduction from direct mining and milling costs). |

Excellon Resources Inc.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2019 and 2018

(in thousands of US dollars, except share and per share data)

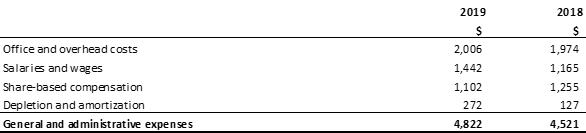

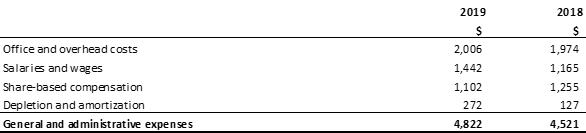

| | (b) | General and administrative expenses consist of the following: |

| | (c) | Other income (expense) consists of the following: |

| 18. | FINANCE (INCOME) EXPENSE |

Finance (income) expense comprises the following:

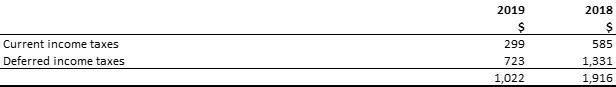

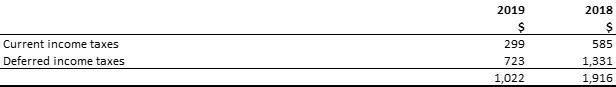

The Company’s provision for income taxes differs from the amount computed by applying the combined Canadian federal and provincial income tax rates to income (loss) before income tax as a result of the following:

Excellon Resources Inc.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2019 and 2018

(in thousands of US dollars, except share and per share data)

The enacted or substantively enacted tax rates in Canada (26.5% in 2019) and Mexico (30% in 2019) where the Company operates are applied in the tax provision calculation.

The 7.5% mining royalty in Mexico is treated as an income tax in accordance with IFRS for financial reporting purposes, as it is based on a measure of revenue less certain specified costs. On substantive enactment, a taxable temporary difference arises, as certain mining assets related to extractive activities have a book basis but no tax basis for purpose of the royalty. As at December 31, 2019, the Company has recognized a deferred tax liability of $152 (as at December 31, 2018 – $250) in respect of this special mining royalty. This deferred tax liability will be drawn down to $nil as a reduction to tax expense over the life of mine as the mine and its related assets are depleted or depreciated.

The following table reflects the Company’s deferred income tax assets (liabilities):

The Company recognized deferred tax liabilities of $811, and deferred tax assets of $10,894 in respect of tax losses as at December 31, 2019 (as at December 31, 2018 – net deferred tax asset of $10,365) as projections of various sources of income support the conclusion that the realization of these deferred tax assets is probable.

Excellon Resources Inc.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2019 and 2018

(in thousands of US dollars, except share and per share data)

The following temporary differences and non-capital losses have not been recognized in the consolidated financial statements.

As at December 31, 2019, the Company has non-capital losses to be carried forward and applied against taxable income of future years. The non-capital losses have expiry dates as follows:

As at December 31, 2019, the Company has Canadian capital losses of $8,252 (as at December 31, 2019 – $7,901) that may be carried forward indefinitely and applied against capital gains of future years.

At December 31, 2019, $nil (as at December 31, 2018 – $nil) was recognised as a deferred tax liability for taxes that would be payable on the unremitted earnings of certain of the Company’s subsidiaries as the Company has determined that undistributed profits of its subsidiaries will not be distributed in the foreseeable future; and the investments are not held for resale and are expected to be recouped by continued use of these operations by the subsidiaries. The amount of temporary differences not booked for these unremitted earnings at December 31, 2019 is $5,147 (as at December 31, 2018 – $6,599).

The corporate secretary of the Company is a partner in a firm that provides legal services to the Company. During 2019, the Company incurred legal services of $74 (2018 – $25). As at December 31, 2018, the Company had an outstanding payable balance of $nil (as at December 31, 2018 – $5).

Included in the Company’s royalty expense is an amount of $8 (2018 - $8) paid to certain key management and directors.

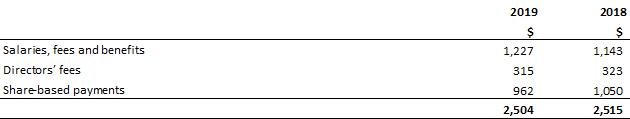

| 21. | KEY MANAGEMENT TRANSACTIONS |

Remuneration to directors and key management who have the authority and responsibility for planning, directing and continuing the activities of the Company:

Excellon Resources Inc.

Notes to the Consolidated Financial Statements

For the years ended December 31, 2019 and 2018

(in thousands of US dollars, except share and per share data)

Fair Values of non-derivative financial instruments