Exhibit

Excellon Resources Inc.

Condensed Interim Consolidated Financial Statements

March 31, 2019

in thousands of U.S. dollars

(unaudited)

Notice of No Auditor Review of Condensed Interim Consolidated Financial Statements Under National Instrument 51-102, Part 4, subsection 4.3(3) (a), if an auditor has not performed a review of the interim financial statements; they must be accompanied by a notice indicating that the financial statements have not been reviewed by an auditor. The accompanying unaudited condensed interim consolidated financial statements of the Company have been prepared by management and approved by the Board of Directors of the Company on the recommendation of the Audit Committee.

The Company’s independent auditor has not performed a review of these financial statements in accordance with the standards established by Chartered Professional Accountants of Canada for a review of interim financial statements by an entity’s auditor.

Excellon Resources Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2019 and 2018

(unaudited) (in thousands of U.S. dollars, except share data)

Excellon (the Company or Excellon) is a primary silver mining and exploration company listed on the Toronto Stock Exchange trading under the symbol EXN. The Company is focused on optimizing the Platosa Mine’s cost and production profile, discovering further high-grade silver and carbonate replacement deposit (“CRD”) mineralization on the 20,969-hectare Platosa Property located in northeastern Durango, Mexico and epithermal silver mineralization on the 45,000 hectare Evolución Property on the northern Fresnillo silver trend in Zacatecas and capitalizing on the opportunity in current market conditions to acquire undervalued projects in the Americas.

Excellon is domiciled in Canada and incorporated under the laws of the province of Ontario. The address of its registered office is 10 King Street East, Suite 200, Toronto, Ontario, M5C 1C3, Canada.

| a. | Statement of compliance |

The Company prepares its condensed interim consolidated financial statements in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) and Interpretations of the International Financial Reporting Interpretations Committee (“IFRIC”), which the Canadian Accounting Standards Board has approved for incorporation into Part 1 of the Chartered Professional Accountants of Canada. including IAS 34, Interim Financial Reporting. The condensed interim consolidated financial statements should be read in conjunction with the annual consolidated financial statements for the year ended December 31, 2018.

The accounting policies and the application adopted are consistent with those disclosed in Note 3 to the Company’s consolidated financial statements for the year ended December 31, 2018 except for the adoption of new and amended standards set out below.

Areas of critical accounting estimates and judgments that have the most significant effect on the amounts recognized in the condensed interim consolidated financial statements are disclosed in Note 4 of the Company’s consolidated financial statements as at and for the year ended December 31, 2018.

All financial information presented in United States dollars has been rounded to the nearest thousand unless otherwise stated.

These condensed interim consolidated financial statements were approved by the Board of Directors on May 9, 2019.

| b. | Accounting standards issued but not yet applied |

| | |

| | In March 2018 the International Accounting Standards Board (IASB) issued a revised Conceptual Framework for Financial Reporting which is currently being used by the Board and Interpretations Committee of the IASB in developing new pronouncements. However, preparers of the financial statements will only begin referring to the new framework from January 1, 2020. |

| | |

| c. | Impact of changes in accounting standards effective January 1, 2019: |

| | |

| | IFRS 16 Leases |

| | |

| | Effective January 1, 2019, the Company adopted IFRS 16 Leases (“IFRS 16”) which replaces IAS 17 Leases (“IAS 17”) and requires the recognition of most leases on the balance sheet. IFRS 16 effectively removes the classification of leases as either finance or operating leases and treats all leases as finance leases for lessees with optional exemptions for short-term leases where the term is twelve months or less. |

Excellon Resources Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2019 and 2018

(unaudited) (in thousands of U.S. dollars, except share data)

The Company has selected the modified retrospective transition approach, with no restatement of comparative figures. As such, comparative information continues to be reported under IAS 17 and International Financial Reporting Interpretations Committee (“IFRIC”) 4. The details of accounting policies under IAS 17 and IFRIC 4 are disclosed separately if they are different from those under IFRS 16 and the impact of the change is disclosed below.

The Company’s accounting policy under IFRS 16 is as follows:

At inception of a contract, the Company assesses whether a contract is, or contains, a lease based on whether the contract conveys the right to control the use of an identified asset for a period of time in exchange for consideration. The Company recognizes a right-of-use asset and a lease liability at the lease commencement date. The right-of-use asset is initially measured based on the initial amount of the lease liability adjusted for any lease payments made at or before the commencement date, plus any initial direct costs incurred and an estimate of costs to dismantle and remove the underlying asset or to restore the underlying asset or the site on which it is located, less any lease incentives received. The assets are amortized to the earlier of the end of the useful life of the right-of-use asset or the lease term using the straight-line method as this most closely reflects the expected pattern of consumption of the future economic benefits. In addition, the right-of-use assets may be periodically reduced by impairment losses, if any, and adjusted for certain re-measurements of the lease liability.

The lease liability is initially measured at the present value of the lease payments that are not paid at the commencement date, discounted using the interest rate implicit in the lease or, if that rate cannot be readily determined, the Company’s incremental borrowing rate. Lease payments include fixed payments, and variable payments that are based on an index or a rate.

Cash payments for the principal portion of the lease liability are presented within the financing activities and the interest portion of the lease liability is presented within the operating activities of the statement of cash flows. Short-term lease payments and variable lease payments not included in the measurement of the lease liability are presented within the operating activities of the statement of cash flows.

The lease liability is measured at amortized cost using the effective interest method. It is re-measured when there is a change in future lease payments arising from a change in an index or rate, if there is a change in the Company’s estimate of the amount expected to be payable under a residual value guarantee, or if the Company changes its assessment of whether it will exercise a purchase, extension or termination option.

When the lease liability is re-measured in this way, a corresponding adjustment is either made to the carrying amount of the right-of-use asset or is recorded in profit or loss if the carrying amount of the right-of-use asset has been reduced to zero.

Under IAS 17 In the comparative period, the Company classified leases that transfer substantially all of the risks and rewards of ownership as finance leases. When this was the case, the leased assets were measured initially at an amount equal to the lower of their fair value and the present value of minimum lease payments. Minimum lease payments were the payments over the lease term that the lessee was required to make, excluding any contingent rent.

Subsequently, the assets were accounted for in accordance with the accounting policy applicable to that asset.

Assets held under other leases were classified as operating leases and were not recognized in the Company’s statement of financial position. Payments made under operating leases were recognized in profit or loss on a straight-line basis over the term of the lease. Lease incentives received were recognized as an integral part of the total lease expense over the term of the lease.

Excellon Resources Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2019 and 2018

(unaudited) (in thousands of U.S. dollars, except share data)

As part of the initial application of IFRS 16, the Company also chose to apply the following transitional provisions:

Right-of-use assets are measured at:

| | ● | An amount equal to the lease liability on January 1, 2019, adjusted by the amount of any prepaid or accrued lease payments relating to that lease recognized in the statement of financial position immediately before the date of transition. |

The Company applied the following practical expedients when applying IFRS 16 to leases previously classified as operating leases under IAS 17:

| | ● | Adjusted the right-of-use assets by the amount of any provision for onerous leases recognized in the balance sheet immediately before the date of initial application, as an alternative to performing an impairment review. |

| | | |

| | ● | Not to recognize right-of-use assets and lease liabilities for short-term leases that have a lease term of twelve months or less and longer-term leases that have a short remaining term at the time of adoption. The lease payments associated with these leases are recognized as an expense on a straight-line basis over the lease term. |

The Company has determined that it does not have any contracts that fall under the scope of IFRS 16 that would require recognition in the current period. Therefore, there is no impact on the Condensed Interim Consolidated Financial Statements for the current or comparative periods. The adoption of IFRS 16 also has no impact basic and diluted loss per share or opening deficit.

For leases that were classified as finance leases under IAS 17, the carrying amount of the right-of-use asset and the lease liability at January 1, 2019 were determined as the carrying amount of the lease asset and lease liability under IAS 17 immediately before that date.

There were no lease liabilities recognized under IFRS 16 upon adoption.

On October 17, 2018 the Company announced that it had entered into an option agreement with Wallbridge Mining Company Limited (“Wallbridge”) to sell the Beschefer property (refer to Note 7 for a summary of terms). As part of the agreement, the Company received 500,000 common shares of Wallbridge and has recorded these as marketable securities. These securities have been classified as a financial asset recorded at fair value with an adjustment through profit or loss during the three months ended March 31, 2019. An unrealized gain of $68 was recorded in income for the three months ended March 31, 2019 in recognition of an increase in value as at March 31, 2019.

VAT (value added tax) receivables consist of the total VAT credits recoverable by each of the Company’s Mexican subsidiaries. In Mexico, VAT credits can only be applied to VAT payable specific to each entity and are non-transferable. The Company’s VAT payable position is reflected separately on the condensed consolidated statement of financial position.

Excellon Resources Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2019 and 2018

(unaudited) (in thousands of U.S. dollars, except share data)

Excellon Resources Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2019 and 2018

(unaudited) (in thousands of U.S. dollars, except share data)

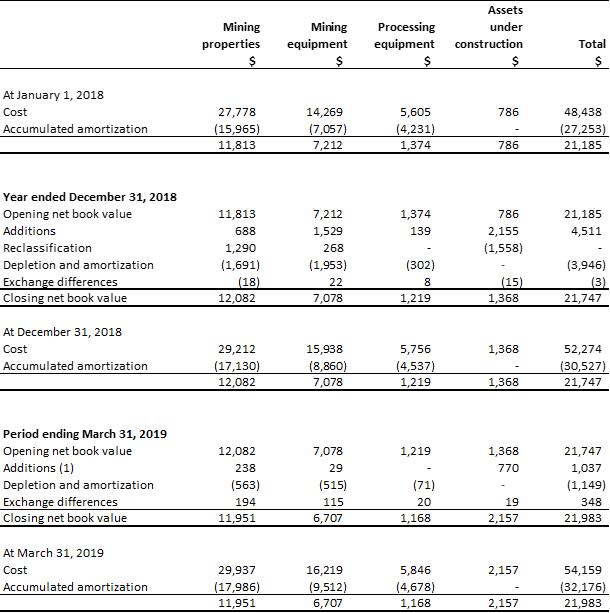

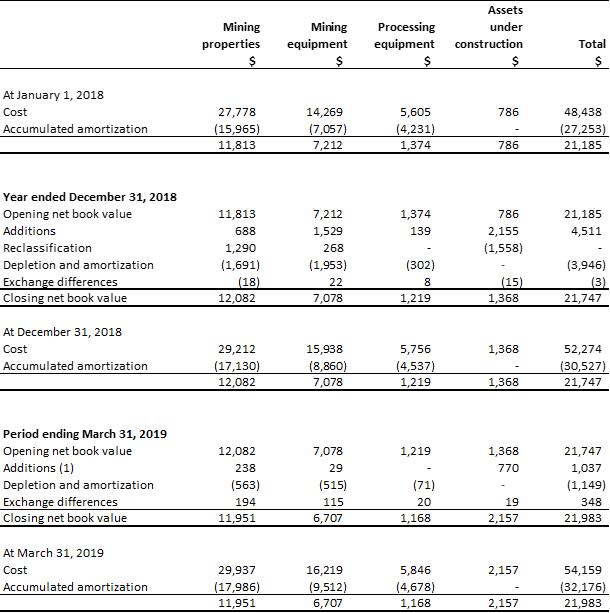

| 6. | PROPERTY, PLANT AND EQUIPMENT |

| | (1) | During the three months ended March 31, 2019, the Company incurred capital expenditures of $528 related to the Optimization Plan Phase 2 which were recorded in assets under construction. Once these related assets are commissioned, they will be reclassified to their appropriate asset class. |

Excellon Resources Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2019 and 2018

(unaudited) (in thousands of U.S. dollars, except share data)

| | (1) | On October 17, 2018 the Company announced an option agreement with Wallbridge on the Beschefer property, pursuant to which Wallbridge agreed to incur an aggregate of CAD$4,500 in exploration expenditures on the property and issue a total of 7,000,000 common shares over three years to earn a 100% interest in the property. The first issuance of 500,000 common shares was made on the effective date of the option agreement, which were recorded in other income at fair value of $104. The common shares are reflected as marketable securities in Note 3. |

The Company’s trade payables comprise accounts payable and accruals as at March 31, 2019. Accounts payable accounted for $3,206 of the $5,783 balance (as at December 31, 2018 – $3,389 of the $5,243 balance), of which $601 related to electricity, $197 related to exploration and $196 related to Optimization Plan Phase 2 (as at December 31, 2018 – $557 related to electricity, $257 related to exploration and $400 related to Optimization Plan Phase 2). Accruals of $1,850 (as at December 31, 2018 – $1,854) relate to operating costs, accounting, legal, statutory payroll withholding taxes and forward foreign exchange contracts that are marked to market.

Excellon Resources Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2019 and 2018

(unaudited) (in thousands of U.S. dollars, except share data)

The mark to market on forward foreign exchange contracts resulted in an unrealized gain adjustment of $174 recorded in finance cost during the three months ended March 31, 2019 and a corresponding decrease in accruals resulting in a net asset balance of $487 in accruals (as at December 31, 2018 – $313 net asset balance in accruals).

Included in trade payables is a provision of $727 (as at December 31, 2018 – $127) related to a claim made against the Company in respect of damages under an option agreement concerning a mineral concession within the Miguel Auza property, which concession is not considered material to the Company. As a result of this claim, the Company recorded an additional $600 provision in other expenses for the three months ended March 31, 2019.

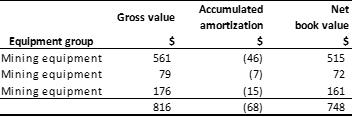

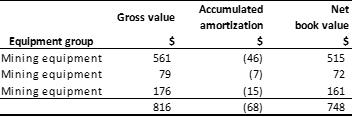

During 2018, the Company entered into finance leases for mining equipment with various vendors. All leases entered are fixed interest rates leases and security is provided by the piece of the equipment being leased. The lease interest rate from KFMX, S.A. de C.V. is 0% due to the amount and nature of the equipment being leased.

Future minimum lease payments are as follows:

Future minimum lease payments under finance leases, together with the present value of the net minimum lease payments, are as follows:

During the three months ended March 31, 2019, the Company repaid $97 of principal against the lease liabilities. Total interest expense on the lease liabilities for the three months ending March 31, 2019 was $10.

Excellon Resources Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2019 and 2018

(unaudited) (in thousands of U.S. dollars, except share data)

The net carrying values of the leased equipment as at March 31, 2019 is as follows:

A - Convertible Debentures and Purchase Warrants

During Q4 2015, the Company completed a $4,766 (CAD$6,600) financing through the private placement of secured convertible debentures of the Company (the “Debentures”) valued at $4,040 (CAD$5,610) and the sale of a net smelter return royalty (the “NSR”) on the Platosa Project valued at $726 (CAD$990), collectively the “Debenture Financing”. The Company exercised its conversion right and settled the Debentures in Q4 2017.

The Company also issued a total of 2,002,772 Common Share purchase warrants (“$0.50 Warrants”) to the purchasers of the Debentures in connection with the financing. Each $0.50 Warrant is exercisable at a price of CAD$0.50 for a period of four years from the date of issuance until November 27, 2019.

In accordance with IFRS 9, Financial Instruments, the $0.50 Warrants were detached from the Debentures host contract and recognized as a separate financial liability. The $0.50 Warrants were fair valued using the Black-Scholes Model upon initial recognition based on the $0.50 Warrants terms. The fair value adjustment loss of the $0.50 Warrants for the three months ended March 31, 2019 was $187 which was recorded in finance cost (three months ended March 31, 2018 – $524 fair value adjustment gain).

During the three months ended March 31, 2019, 12,138 $0.50 Warrants were exercised (three months ended March 31, 2018 – nil). As at March 31, 2019, 1,838,908 $0.50 Warrants were outstanding.

The fair value of the $0.50 Warrants is summarized as follows:

The above remaining components have been classified as current liabilities on the consolidated statement of financial position.

Excellon Resources Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2019 and 2018

(unaudited) (in thousands of U.S. dollars, except share data)

B - Net Smelter Return Royalty (“NSR”)

An NSR applies to the Platosa Project and bears a rate of either (a) 1.25% in respect of manto or mineralization other than skarn mineralization or (b) 0.50% in respect of skarn or “Source” mineralization. Payments are made in cash semi-annually. The NSR proceeds of $726 were amortized into income in 2015.

NSR royalty expensed for the three months ended March 31, 2019 was $56 (three months ended March 31, 2018 – $77) and was recorded in cost of sales.

| | (1) | Post-retirement benefits: The Company provides post-retirement benefits supplements as well as leaving indemnities to employees at the Mexican operations. Under Mexican Labour Law, the Company provides statutorily mandated severance benefits to its employees terminated under certain circumstances. Such benefits consist of a one-time payment of three months wages plus 20 days wages for each year of service payable upon involuntary termination without just cause. Key financial assumptions used in the above estimate include an annual discount rate of 8.5% (December 31, 2018– 8.5%) based on the yield curve from short and long term Mexican government bonds, annual salary rate increase of 3.75% (December 31, 2018 – 3.75%) and minimum wage increase rate of 5.31% (December 31, 2018 – 5.31%) and the life of mine of approximately five years. |

| | | |

| | (2) | Rehabilitation provision: Key financial assumptions used in the above estimate include an annual discount rate of 6.9% (December 31, 2018 – 6.9%) based on the current risk-free borrowing rate, Mexican inflation rate and the life of mine of four years. The total undiscounted amount of estimated cash flows required to settle the Company’s obligations is $2,028 of which $966 relates to the Platosa mine and $1,062 relates to the Miguel Auza mill. The present value of the total discounted obligation is $1,583 of which $754 relates to the Platosa mine and $829 relates to the Miguel Auza mill. |

Excellon Resources Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2019 and 2018

(unaudited) (in thousands of U.S. dollars, except share data)

The Company’s authorized share capital consists of an unlimited number of common shares.

| | (1) | On April 2, 2018, 3,333,333 CAD$0.65 Warrants were exercised for proceeds of CAD$2,167. |

Excellon Resources Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2019 and 2018

(unaudited) (in thousands of U.S. dollars, except share data)

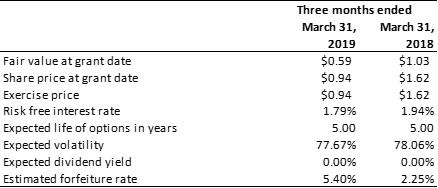

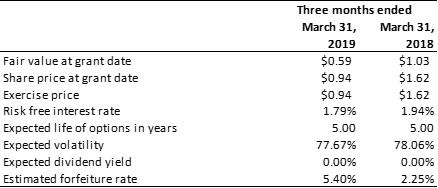

Stock option plan (equity-settled)

The Company has a stock option plan that entitles directors, officers, employees and consultants to purchase Common Shares. Under the program, the Company may grant options to purchase Common Shares (“Options”) for up to 10% of the Common Shares issued and outstanding. The exercise price of each Option may not be less than the market price of the Common Shares on the date of grant and each Option has a maximum term of five years. Options may be granted by the board of directors at any time with varying vesting conditions.

Disclosure of stock option program

The number and weighted average exercise prices of Options are as follows:

Options outstanding and exercisable are as follows:

Excellon Resources Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2019 and 2018

(unaudited) (in thousands of U.S. dollars, except share data)

Inputs for measurement of grant date fair values

The grant date fair values of the Options were measured based on the Black-Scholes formula. Expected volatility is estimated by considering historic average share price volatility. The inputs used in the measurement of the fair values at grant date of the Options were the following:

Share-based compensation expense

Compensation expense is recognized over the vesting period of the grant with the corresponding equity impact recorded in contributed surplus. Share-based compensation expense comprises the following costs:

Deferred SHARE UNITS (“DSU”)

The Company has implemented a DSU plan, primarily in respect of director compensation, whereby DSUs granted may be paid in cash or in awards of Common Shares either from treasury or from market purchases based on the five-day VWAP of the Common Shares on settlement dates elected by the holder between the retirement date and December 15th of the calendar year subsequent to the year of the holder’s retirement. All grants under the plan are fully vested upon credit to an eligible holder’s account. The value of the cash payout is determined by multiplying the number of DSUs vested at the payout date by the VWAP of the Common Shares. The expense is recorded in the condensed interim consolidated statement of loss and comprehensive income in share-based compensation and credited to equity under contributed surplus as the payment in cash or Common Shares is at the option of the Company.

Excellon Resources Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2019 and 2018

(unaudited) (in thousands of U.S. dollars, except share data)

Disclosure of DSU program

DSUs outstanding are as follows:

During the three months ended March 31, 2019, the Company granted 395,147 DSUs (three months ended March 31, 2018 – 313,885 DSUs) with market value of CAD$373 (three months ended March 31, 2018 – CAD$503) at the date of grant to non-executive directors as compensation in lieu of cash director fees and other compensation.

During the three months ended March 31, 2019, there were nil DSUs settled for Common Shares (three months ended March 31, 2018 – nil).

Total share based compensation expensed in the three months ended March 31, 2019 related to vested DSUs was CAD$373 (three months ended March 31, 2018 – CAD$503).

As at March 31, 2019, 2,257,642 DSUs were outstanding.

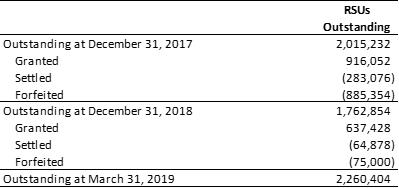

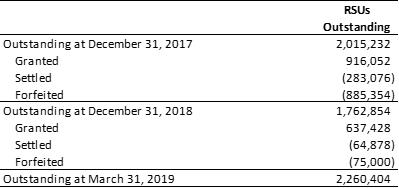

REstricted Share units (“RSU”)

The Company has implemented an RSU plan whereby officers, employees and consultants may be entitled to either a cash payment or an award of Common Shares from treasury or from market purchases at the end of a term or performance period of up to three years following the date of the grant of applicable RSUs. The value of the payout is determined by multiplying the number of RSUs vested at the payout date by the five-day VWAP of the Common Shares prior to a payout date with settlement in either cash or Common Shares. The expense is recorded in the condensed interim consolidated statement of loss and comprehensive income in share-based compensation and credited to equity under contributed surplus as the payment in cash or Common Shares is at the option of the Company.

Excellon Resources Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2019 and 2018

(unaudited) (in thousands of U.S. dollars, except share data)

Disclosure of RSU program

RSUs outstanding are as follows:

During the three months ended March 31, 2019, the Company granted 477,500 RSUs subject to performance vesting conditions (three months ended March 31, 2018 – 661,500 RSUs) with a market value of CAD$435 (three months ended March 31, 2018 – CAD$1,072) at the date of grant to officers, employees and consultants.

During the three months ended March 31, 2019, the Company granted 159,928 RSUs subject to time vesting conditions (three months ended March 31, 2018 – 132,087 RSUs) with a market value of CAD$110 (three months ended March 31, 2018 – CAD$227) at the date of grant to officers, employees and consultants.

During the three months ended March 31, 2019, the Company settled 10,000 RSUs subject to performance vesting conditions with Common Shares (three months ended March 31, 2018 – nil).

During the three months ended March 31, 2019, the Company settled 54,878 RSUs subject to time vesting conditions with Common Shares (three months ended March 31, 2018 – 100,000 RSUs subject to time vesting conditions with Common Shares).

Total share-based compensation expensed in the three months ended March 31, 2019 related to RSUs was CAD$82 (three months ended March 31, 2018 – CAD$146).

As at March 31, 2019, 2,260,404 RSUs were outstanding.

Excellon Resources Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2019 and 2018

(unaudited) (in thousands of U.S. dollars, except share data)

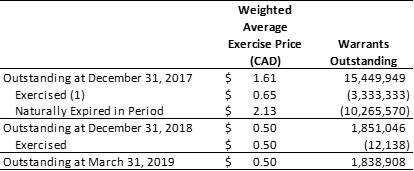

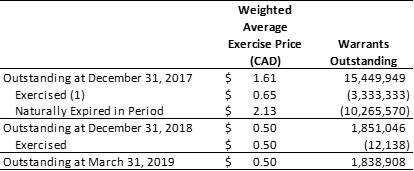

WARRANTS

Disclosure of Common Share Purchases Warrants outstanding

Common share purchase warrants outstanding are as follows:

| | (1) | On April 2, 2018, 3,333,333 CAD$0.65 Warrants were exercised for proceeds of CAD$2,167. |

During the three months ended March 31, 2019, the Company recognized a fair value adjustment loss of $187 on the $0.50 Warrants related to the Debentures, which was recorded in finance cost (three months ended March 31, 2018 – fair value adjustment gain of $524).

As at March 31, 2019, the following common share purchase warrants were outstanding:

Excellon Resources Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2019 and 2018

(unaudited) (in thousands of U.S. dollars, except share data)

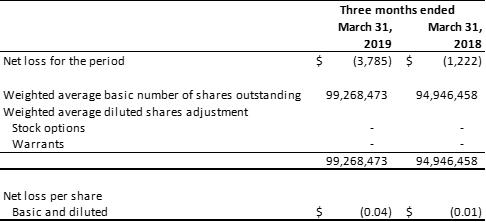

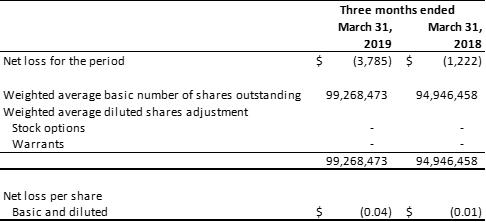

The following table lists the equity securities excluded from the computation of diluted earnings per share. The securities were excluded as the inclusion of the equity securities has an anti-dilutive effect on net loss; or the exercise prices relating to the particular security exceed the weighted average market price of the Company’s common shares.

The following table summarizes the Company’s significant commitments as of March 31, 2019:

| | (1) | Office lease above commences on April 1, 2019 and will be reflected as a lease liability in accordance with IFRS 16 in the second quarter of 2019. |

| | | |

| | (2) | Not included above is the NSR as such payments vary period to period based on production results and commodity prices. |

Under the terms of the Company’s concentrate sales contracts, lead–silver and zinc-silver concentrates are sold on a provisional pricing basis whereby sales are recognized at prevailing metal prices when the revenue recognition criteria have been met, namely when title, and risks and rewards of ownership have transferred to the customer. Revenue is recorded net of treatment and refining charges. Final pricing of each delivery is not determined until one or two months post-delivery. The price recorded at the time of sale may differ from the actual final price received from the customer due to changes in market prices for metals. The price volatility is considered an embedded derivative in accounts receivable. The embedded derivative is recorded at fair value by mark-to-market adjustments at each reporting period until settlement occurs, with the changes in fair value recorded to revenues. An amount of $1,147 is included in the trade receivables as at March 31, 2019 (as at March 31, 2018 – $2,361).

During the three months ended March 31, 2019, the Company recognized negative adjustment to revenues of $95 primarily related to the reversal of the mark-to-market taken at the end of 2018 as receivables were ultimately settled at lower values in 2019 (three months ended March 31, 2018 – positive adjustment of $3).

As at March 31, 2019, provisionally priced sales totalled $3,956 which are expected to settle at final prices during the second quarter of 2019. A 10% increase or decrease in the prices of silver, lead and zinc will result in a corresponding increase or decrease in revenues of $396 during the second quarter of 2019.

Excellon Resources Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2019 and 2018

(unaudited) (in thousands of U.S. dollars, except share data)

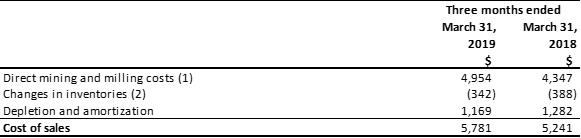

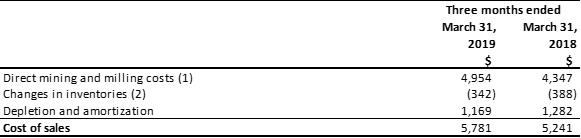

| | (a) | Cost of sales consist of the following: |

| | (1) | Direct mining and milling costs include personnel, general and administrative, fuel and electricity, maintenance and repair costs as well as operating supplies, external services, third party smelting, refining and transport fees. |

| | (2) | Changes in inventories reflect the net cost of ore and concentrate (i) sold during the current period but produced in a previous period (an addition to direct mining and milling costs) or (ii) produced but not sold in the current period (a deduction from direct mining and milling costs). |

| | (b) | General and administrative expenses consist of the following: |

| | (c) | Other income consists of the following: |

Excellon Resources Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2019 and 2018

(unaudited) (in thousands of U.S. dollars, except share data)

Finance cost (income) comprises the following:

Income tax expense is recognized based on management’s best estimate of the weighted average annual income tax rate expected for the full financial year.

The corporate secretary of the Company is a partner in a firm that provides legal services to the Company. During the three months ended March 31, 2019, the Company incurred legal services of $10 (three months ended March 31, 2018 – $10). As at March 31, 2019, the Company had an outstanding payable balance of $11 (as at March 31, 2018 – $7.

Fair Values of non-derivative financial instruments

All financial assets and financial liabilities, other than derivatives, are initially recognized at the fair value of consideration paid or received, net of transaction costs as appropriate, and are subsequently carried at fair value or amortized cost. The carrying values of cash and cash equivalents, trade receivables and other liabilities approximate their fair value. The methods and assumptions used in estimating the fair value of other financial assets and liabilities are as follows:

Embedded derivatives

Revenues from the sale of metals produced since the commencement of commercial production are based on provisional prices at the time of shipment. Variations between the price recorded at the time of sale and the actual final price received from the customer are caused by changes in market prices for metals sold and result in an embedded derivative in accounts receivable. The embedded derivative is recorded at fair value each reporting period until settlement occurs, with the changes in fair value recorded to revenues.

For the three months ended March 31, 2019, the Company recorded $3,956 (three months ended March 31, 2018 – $5,472) in revenues from provisionally priced sales on the statement of loss and comprehensive loss, which are subject to adjustment pending final settlement in the second quarter of 2019. As at March 31, 2019, the Company has recorded embedded derivatives in the amount of $1,147 in trade receivables (as at March 31, 2018 – $2,361).

Excellon Resources Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2019 and 2018

(unaudited) (in thousands of U.S. dollars, except share data)

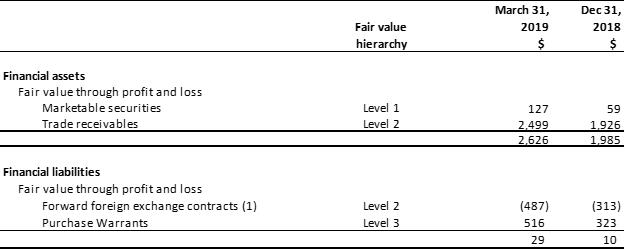

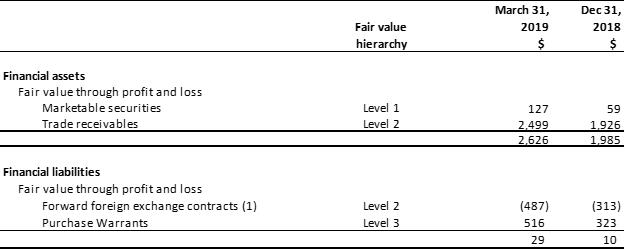

Fair Value Hierarchy

The Company values financial instruments carried at fair value using quoted market prices, where available. The three levels of the fair value hierarchy are as follows:

| | ● | Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities; |

| | ● | Level 2 – Inputs other than quoted prices that are observable for the asset or liability either directly or indirectly; and |

| | ● | Level 3 – Inputs that are not based on observable market data |

The financial liabilities are presented by class in the following table at their carrying values, which generally approximate to the fair values due to their short period to maturity:

| | (1) | Forward foreign exchange contracts are recorded in Trade Payables. |

There were no transfers between levels 1, 2 or 3 during the three months ended March 31, 2019.

Risk management policies and hedging activities

The Company is sensitive to changes in commodity prices, foreign exchange and interest rates. The Company’s board of directors has overall responsibility for the establishment and oversight of the Company’s risk management framework. The Company addresses its price-related exposures through the use of options, futures, forwards and derivative contracts described below under currency risk.

Economic dependence

The Company has offtake agreements with two customers, Trafigura Mexico, S.A. de C.V. (“Trafigura”), a subsidiary within the Trafigura group of companies and MK Metal Trading Mexico, S.A. de C.V. (“MK Metals”), a subsidiary within the Ocean Partners group of companies. The Company believes that because of the availability of alternative processing and commercialization options for its concentrate, it would suffer no material adverse effect if it lost the services of Trafigura or MK Metals.

Excellon Resources Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2019 and 2018

(unaudited) (in thousands of U.S. dollars, except share data)

Credit risk

Credit risk is the risk of unexpected loss if a customer or third party to a financial instrument fails to meet its contractual obligations. The Company’s credit risk is primarily attributable to cash and cash equivalents. Management believes the credit risk on cash and cash equivalents is low since the Company’s cash and cash equivalents balance are held at large international financial institutions with strong credit ratings.

The Company is exposed to credit risk from its customers, Trafigura and MK Metals. Accounts receivable are subject to normal industry credit risks and are considered low.

Liquidity risk

Liquidity risk is the risk that the Company will not be able to meet its financial obligations as they fall due. The Company’s approach to managing liquidity is to ensure that it will have sufficient liquidity to meet its liabilities when due. To the extent the Company does not believe it has sufficient liquidity to meet these obligations, management will consider securing additional funds through equity or debt transactions. Accounts payable excluding accrued liabilities are due within 90 days or less.

Currency risk

The Mexican peso (MXN) and the Canadian dollar (CAD) are the functional currencies of the Company and as a result, currency exposures arise from transactions and balance in currencies other than the functional currencies. The Company’s potential currency exposures comprise:

| | ● | translational exposure in respect of non-functional currency monetary items |

| | ● | transactional exposure in respect of non-functional currency expenditure and revenues; |

| | ● | commodity price risk; and |

| | ● | interest rate risk. |

A significant portion of the Company’s capital expenditures, operating costs, exploration, and administrative expenditures are incurred in Mexican pesos (“MXN”), while revenues from the sale of concentrates are denominated in US dollars (“USD”). The fluctuation of the USD in relation to the MXN, consequently, impacts the reported financial performance of the Company. To manage the Company’s exposure to changes in the USD/MXN exchange rate, the Company entered into forward contracts to purchase MXN in exchange for USD at various rates and maturity dates.

As at March 31, 2019, forward contracts for the purchase of MXN199,000 in exchange for USD$9,800 at an average rate of 20.34 MXN/USD, at various maturity dates until February 2020, were outstanding. The fair value of these outstanding foreign currency forward contracts resulted in an unrealized gain position of $487 as at March 31, 2019. Accordingly, for the three months ended March 31, 2019, the Company recorded an unrealized exchange gain of $174 (three months ended March 31, 2018 – $547 unrealized gain) in finance cost (income).

For the three months ended March 31, 2019, the Company realized beneficial exchange rates from contracts maturing during the quarter relative to spot rates resulting in $89 in additional cash on these contracts (three months ended March 31, 2018 – $25 additional cash from beneficial exchange rates).

Translational exposure in respect of non-functional currency monetary items

Monetary items, including financial assets and liabilities, denominated in currencies other than the functional currency of an operation are periodically revalued to the functional currency equivalents as at that date, and the associated unrealized gain or loss is taken to the income statement to reflect this risk.

Excellon Resources Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2019 and 2018

(unaudited) (in thousands of U.S. dollars, except share data)

The principal non-functional currency to which the Company is exposed is the United States dollar (USD). Based on the Company’s net financial assets and liabilities in USD as at March 31, 2019, a weakening of the USD against the MXN and CAD functional currencies by 1% with all other variables held constant, would increase/(decrease) net income and equity by approximately $17.

Transactional exposure in respect of non-functional currency expenditure and revenues

Certain operating and capital expenditures are incurred by some operations in currencies other than their functional currency. To a lesser extent, certain sales revenue is earned in currencies other than the functional currency of operations, and certain exchange control restrictions may require that funds be maintained in currencies other than the functional currency of the operation.

At March 31, 2019, the Company has entered into forward exchange contracts to manage short-term foreign currency cash flows relating to operating activities.

Commodity price risk

The nature of the Company’s operations results in exposure to fluctuations in commodity prices. Management continuously monitors commodity prices of silver, lead and zinc.

The Company is particularly exposed to the risk of movements in the price of silver. Declining market prices for silver could have a material effect on the Company’s profitability, and the Company may consider hedging its exposure to silver. The London Silver Spot price average, in USD per ounce, was $16 for the three months ended March 31, 2019 (three months ended March 31, 2018 – $17). The Company estimates that a 10% increase/decrease in commodity prices in 2019 with all other variables held constant would have resulted in an increase/decrease in net income of approximately $575.

Interest rate risk

Cash and cash equivalents earn interest at floating rates dependent upon market conditions.

The Company’s objectives of capital management are intended to safeguard the entity’s ability to continue as a going concern and to continue the exploration and extraction of ore from its mining properties.

The capital of the Company consists of the items included in shareholders’ equity. Risk and capital management are monitored by the board of directors. The Company manages the capital structure and makes adjustments depending on economic conditions. Funds have been primarily secured through issuances of equity capital. The Company invests all capital that is surplus to its immediate needs in short-term, liquid and highly rated financial instruments, such as cash and other short-term deposits, all held with major financial institutions. Significant risks are monitored and actions are taken, when necessary, according to the Company’s approved policies.

Excellon Resources Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months ended March 31, 2019 and 2018

(unaudited) (in thousands of U.S. dollars, except share data)