|

Management’s Discussion & Analysis of Financial Results

For the three and nine months ended September 30, 2019 |

Excellon Resources Inc. (the “Company” or “Excellon”) has prepared this Management’s Discussion and Analysis of Financial Results (“MD&A”) for the three and nine months ended September 30, 2019 in accordance with the requirements of National Instrument 51-102 (“NI 51-102”).

This MD&A contains information as at November 5, 2019 and provides information on the operations of the Company for the three and nine months ended September 30, 2019 and 2018 and subsequent to the period end, and should be read in conjunction with the unaudited condensed consolidated financial statements for the three and nine months ended September 30, 2019 and the audited consolidated financial statements and the related notes for the year end December 31, 2018 which have been filed on SEDAR. The audited consolidated financial statements for the year ended December 31, 2018 have been prepared in accordance with International Financial Reporting Standards (“IFRS”). All figures in this MD&A are in thousands of United States dollars unless otherwise noted.

This MD&A also refers to Production Cost per Tonne, Cash Cost per Silver Ounce Payable, and All-in Sustaining Cost (“AISC”) per Silver Ounce Payable, all of which are Non-IFRS Measures. Please refer to the sections of this MD&A entitled “Production Cost per Tonne”, “Total Cash Cost per Silver Ounce Payable” and “All-in Sustaining Cost per Silver Ounce Payable” for an explanation of these measures and reconciliation to the Company’s reported financial results.

COMPANY PROFILE

Excellon’s 100%-owned Platosa Mine has been Mexico’s highest-grade silver mine since production commenced in 2005. The Company is focused on optimizing Platosa’s cost and production profile, discovering further high-grade silver and carbonate replacement deposit mineralization on the 21,000-hectare Platosa Project and epithermal silver mineralization on the 100%-owned 45,000-hectare Evolución Property, and capitalizing on current market conditions by acquiring undervalued projects. The Company also holds an option on the 164 km2 Silver City Project in Saxony, Germany, a high-grade epithermal silver district with 750 years of mining history and no modern exploration.

Ore from Platosa is processed at the Company’s mill in Miguel Auza (within the Evolución Property) in Zacatecas. The Company produces a lead-silver concentrate and a zinc-silver concentrate. The concentrates are shipped to the port of Manzanillo where they are purchased by Trafigura Mexico, S.A. de C.V., a subsidiary within the Trafigura group of companies, and MK Metal Trading Mexico, S.A. de C.V., a subsidiary within the Ocean Partners group of companies.

HIGHLIGHTS

| ● | Revenues of $5.9 million (Q3 2018 – $2.6 million) |

| ● | Silver equivalent (“AgEq”) production of 427,131 ounces (Q3 2018 – 300,766 AgEq ounces) |

| ● | AgEq ounces payable sold of 370,376 (Q3 2018 – 258,920 AgEq ounces payable) |

| ● | Mined tonnage 39% higher in 9-mos 2019 relative to 9-mos 2018 |

| ● | Gross loss of $0.9 million (Q3 2018 – loss of $3.5 million) |

| ● | Total cash cost per Ag oz payable of $18.18 (Q3 2018 – $29.94) |

| ● | All-in sustaining cost net of byproducts per Ag oz payable (“AISC”) of $28.46 (Q3 2018 – $44.02) |

| ● | Net loss of $2.9 million or $0.03/share (Q3 2018 – net loss of $3.6 million or $0.04/share) |

| ● | Net working capital totaled $9.0 million at September 30, 2019 (June 30, 2019 – $3.8 million) |

| ● | Closed bought deal public offering of 10,925,000 units (collectively, the “Units”), including 1,425,000 Units issued upon full exercise of the over-allotment option, at a price of $1.06 per Unit for aggregate gross proceeds of approximately $11.5 million. Each Unit consisted of one common share in the capital of the Company (each a “Common Share”) and one-half of one common share purchase warrant (each whole warrant, a “Warrant”). Each Warrant entitles the holder to acquire an additional Common Share at a price of $1.40 at any time on or before August 27, 2021. The Warrants are listed on the Toronto Stock Exchange under the symbol EXN.WT |

| ● | On September 24, the Company entered into an agreement (the “Agreement”) with Globex Mining Enterprises Inc. (TSX:GMX, OTCQX:GLBXF and FRA:G1MN) for the option to acquire a 100% interest in the Silver City Project, a 164 km2 silver district in Saxony, Germany |

|

Management’s Discussion & Analysis of Financial Results

For the three and nine months ended September 30, 2019 |

THIRD QUARTER FINANCIAL AND OPERATIONAL SUMMARY

| (in thousands of U.S dollars except amounts per share, cost per tonne, ounces and per ounce) | | Q3 2019 | | | Q3 2018 | | | Nine months ended September 30, 2019 | | | Nine months ended September 30, 2018 | |

| | | | | | | | | | | | | |

| Revenues (1) | | $ | 5,943 | | | $ | 2,570 | | | $ | 19,795 | | | $ | 18,358 | |

| Gross profit (loss) | | $ | (987 | ) | | $ | (3,527 | ) | | $ | (862 | ) | | $ | 993 | |

| Net Income (Loss) | | $ | (2,902 | ) | | $ | (3,582 | ) | | $ | (8,894 | ) | | $ | (3,550 | ) |

| Income (loss) per share – basic | | $ | (0.03 | ) | | $ | (0.04 | ) | | $ | (0.09 | ) | | $ | (0.04 | ) |

| Silver ounces produced | | | 257,497 | | | | 171,227 | | | | 794,746 | | | | 643,390 | |

| Silver ounces payable | | | 227,350 | | | | 147,308 | | | | 730,322 | | | | 562,693 | |

| Silver equivalent ounces produced (2) | | | 427,131 | | | | 300,766 | | | | 1,532,330 | | | | 1,420,050 | |

| Silver equivalent ounces payable (2) (3) | | | 370,376 | | | | 258,920 | | | | 1,414,106 | | | | 1,234,284 | |

| Production cost per tonne (4) | | $ | 339 | | | $ | 292 | | | $ | 304 | | | $ | 241 | |

| Total cash cost per silver ounce payable | | $ | 18.18 | | | $ | 29.94 | | | $ | 12.58 | | | $ | 8.50 | |

| AISC per silver ounce payable | | $ | 28.46 | | | $ | 44.02 | | | $ | 22.51 | | | $ | 20.54 | |

| Average realized silver price per ounce sold (5) | | $ | 17.65 | | | $ | 14.51 | | | $ | 15.78 | | | $ | 15.74 | |

| (1) | Revenues are net of treatment and refining charges. A reconciliation of revenues can be found in the section “Summary of Financial Quarterly Results” of this MD&A. |

| (2) | AgEq ounces established using average realized metal prices during the period indicated applied to the recovered metal content of the concentrates to reflect the revenue contribution of base metal sales during the period. |

| (3) | Payable metal reflects current metals delivered, net of payable deductions under the Company’s offtake arrangements |

| (4) | Production cost per tonne includes mining and milling costs, excluding depletion and amortization and inventory adjustments. |

| (5) | Average realized silver price is calculated on current period sale deliveries and does not include prior period provisional adjustments recorded in the period. |

|

Management’s Discussion & Analysis of Financial Results

For the three and nine months ended September 30, 2019 |

OPERATIONAL REVIEW

Production

Platosa Mine production statistics for the periods indicated were as follows:

| | | Q3 | | | Q3 | | | 9-Mos | | | 9-Mos | |

| | | 2019(1) | | | 2018(1) | | | 2019(1) | | | 2018(1) | |

| Tonnes of ore produced: | | | 18,167 | | | | 10,974 | | | | 56,967 | | | | 40,905 | |

| Tonnes of ore processed: | | | 17,235 | | | | 11,141 | | | | 53,968 | | | | 40,743 | |

| Tonnes of historical stockpile processed: | | | - | | | | 6,765 | | | | 1,450 | | | | 18,921 | |

| Total tonnes processed: | | | 17,235 | | | | 17,906 | | | | 55,418 | | | | 59,664 | |

| Ore grades: | | | | | | | | | | | | | | | | |

| Silver (g/t) | | | 512 | | | | 416 | | | | 520 | | | | 461 | |

| Lead (%) | | | 4.44 | | | | 3.74 | | | | 4.81 | | | | 4.85 | |

| Zinc (%) | | | 5.97 | | | | 4.33 | | | | 7.13 | | | | 7.23 | |

| Historical stockpile grades: | | | | | | | | | | | | | | | | |

| Silver (g/t) | | | - | | | | 151 | | | | 123 | | | | 166 | |

| Lead (%) | | | - | | | | 1.36 | | | | 1.22 | | | | 1.57 | |

| Zinc (%) | | | - | | | | 1.45 | | | | 1.44 | | | | 2.05 | |

| Blended head grade: | | | | | | | | | | | | | | | | |

| Silver (g/t) | | | 512 | | | | 316 | | | | 509 | | | | 367 | |

| Lead (%) | | | 4.44 | | | | 2.84 | | | | 4.72 | | | | 3.81 | |

| Zinc (%) | | | 5.97 | | | | 3.24 | | | | 6.98 | | | | 5.59 | |

| Recoveries: | | | | | | | | | | | | | | | | |

| Silver (%) | | | 87.2 | | | | 89.9 | | | | 89.2 | | | | 89.2 | |

| Lead (%) | | | 77.7 | | | | 74.2 | | | | 78.9 | | | | 78.8 | |

| Zinc (%) | | | 76.5 | | | | 78.2 | | | | 78.1 | | | | 81.3 | |

| Production: | | | | | | | | | | | | | | | | |

| Silver – (oz) | | | 257,497 | | | | 171,227 | | | | 794,746 | | | | 643,390 | |

| Silver equivalent (oz) (2) | | | 427,131 | | | | 300,766 | | | | 1,532,330 | | | | 1,420,050 | |

| Lead – (lb) | | | 1,304,538 | | | | 823,982 | | | | 4,444,278 | | | | 3,947,367 | |

| Zinc – (lb) | | | 1,654,175 | | | | 1,005,767 | | | | 6,363,203 | | | | 6,069,780 | |

| Payable: (3) | | | | | | | | | | | | | | | | |

| Silver – (oz) | | | 227,350 | | | | 147,308 | | | | 730,322 | | | | 562,693 | |

| Silver equivalent (oz) (2) | | | 370,376 | | | | 258,920 | | | | 1,414,106 | | | | 1,234,284 | |

| Lead – (lb) | | | 1,182,211 | | | | 758,761 | | | | 4,203,295 | | | | 3,671,523 | |

| Zinc – (lb) | | | 1,322,133 | | | | 826,310 | | | | 5,796,157 | | | | 5,053,256 | |

| Average realized prices: (4) | | | | | | | | | | | | | | | | |

| Silver – ($US/oz) | | | 17.65 | | | | 14.51 | | | | 15.78 | | | | 15.74 | |

| Lead – ($US/lb) | | | 0.94 | | | | 0.92 | | | | 0.88 | | | | 1.02 | |

| Zinc – ($US/lb) | | | 1.07 | | | | 1.11 | | | | 1.15 | | | | 1.30 | |

| (1) | Period deliveries remain subject to assay and price adjustments on final settlement with concentrate purchaser(s). Data has been adjusted to reflect final assay and price adjustments for prior period deliveries settled during the period. |

| (2) | AgEq ounces established using average realized metal prices during the period indicated applied to the recovered metal content of the concentrates to reflect the revenue contribution of base metal sales during the period. |

| (3) | Payable metal is based on the metals delivered and sold during the period, net of payable deductions under the Company’s offtake arrangements, and will therefore differ produced ounces. |

| (4) | Average realized price is calculated on current period sale deliveries and does not include the impact of prior period provisional adjustments in the period. |

|

Management’s Discussion & Analysis of Financial Results

For the three and nine months ended September 30, 2019 |

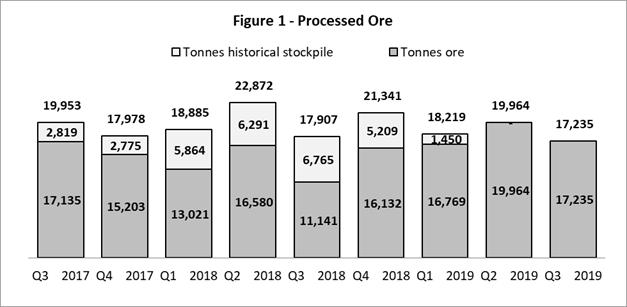

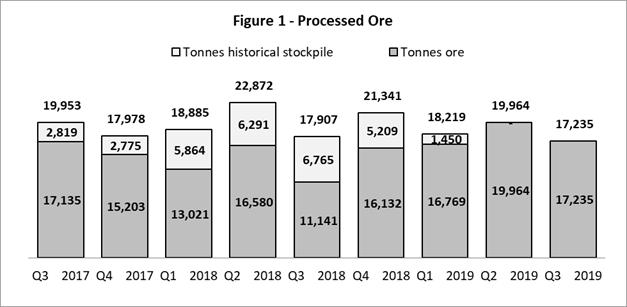

During Q3 2019, production grades from Platosa improved significantly compared to the same quarter last year. The mine accessed the 910 elevation in the Pierna Manto, which is expected to further improve base metal grades in the fourth quarter. Mined tonnage remained stable throughout the quarter at ~200 tonnes per day.

At the Miguel Auza processing facility, metal recoveries were lower than planned and delayed processing of ore stockpiles and delivery of concentrate inventory at quarter-end ultimately resulted in lower than expected metal production and sales relative to Q2 2019. This is expected to correct itself into the fourth quarter as new management is now in place at the facility and the newly optimized flow sheet upgrades continue to progress.

Total tonnage processed of 17,235 tonnes in Q3 2019 was 4% and 14% lower relative to Q3 2018 and Q2 2019 respectively. All of the tonnage processed was from freshly mined ore. Prior periods included processing of low-grade historical stockpiles, which have recently not been processed due to the availability of higher-grade ore.

Overall metal production of silver, lead and zinc was lower in Q3 2019 due to lower recoveries versus the previous quarter. In addition, lower overall tonnes were processed through the mill versus Q3 2019.

The previous eight quarters of production at Platosa are summarized below:

|

Management’s Discussion & Analysis of Financial Results

For the three and nine months ended September 30, 2019 |

Outlook

During Q3 2019, the operation accessed multiple ore faces with significantly improved grades relative to Q3 2018. Development has accessed the 910 elevation in the Pierna Manto, which is expected to further improve base metal grades in the fourth quarter. The Company will continue to implement efficiencies underground to improve dilution and grades to achieve steady production rates. In addition, the Company recently entered into an energy contract with a private provider to reduce electricity costs at Platosa. The benefits of this agreement are expected to be realized in H1 2020.

In Q4, the Company expects to achieve increased recoveries and throughput at the processing facility as flow sheet upgrades are implemented and approximately 1,000 tonnes of fresh ore that remained in stockpile at quarter-end in Q3 are processed.

As noted above, minor adjustments at the Miguel Auza processing facility are ongoing and the mill is processing a bulk sample from Hecla Mining Company’s (“Hecla”) San Sebastian Mine. The 25,000 tonne bulk sample program is expected to continue into Q1 2020 with a formal commercial milling arrangement to be determined in due course.

The Company is currently preparing to mobilize a drill rig to the PDN target, located two kilometers north of the Platosa mine. PDN is a skarn-style target believed to be related to mineralization encountered by the Company nearby in 2012. Additionally, underground access for a new exploration drift is currently being established to in-fill and define mineralization along the eastern extent of the Pierna and Rodilla mantos. The Company is also drilling the Lechuzas structure on the Evolución Property with drill results pending. Furthermore, preparation of drill permitting for the Silver City Project in Saxony, Germany is underway.

|

Management’s Discussion & Analysis of Financial Results

For the three and nine months ended September 30, 2019 |

Mine Optimization

The Platosa deposit comprises several high-grade massive sulphide mantos hosted in permeable limestone that have been mined by Excellon since 2005. In 2007, as mine workings extended below the local water table, the Company began an intensive program of reactive grouting and pumping to control and prevent water inflows. This program was effective in managing inflows, but was time-, labour- and cost-intensive, which historically limited production to less than 200 tpd. In April 2015, the Company released the results of a hydrogeological study prepared by Hydro-Ressources Inc. and Technosub Inc. (the “Optimization Plan”), which confirmed that dry mining conditions are achievable at Platosa and proposed to replace the grouting and pumping process with a more efficient and permanent dewatering system.

The Company commenced the second phase (“Phase 2”) of the Optimization Plan (“Dewatering Sustaining Capital”) during H2 2017, which is the ordinary course maintenance and expansion of the dewatering system going forward for the life of mine. Phase 2 comprises the periodic development of new well bays and the drilling of new wells, with submersible pumps being moved to the new wells as wells at higher elevation begin to lose pumping efficiency. Capital expenditures on Phase 2 are considered sustaining. In Q3 2019, the Company incurred capital expenditures of $2.0 million towards Dewatering Sustaining Capital.

Toll Milling Arrangements

The Company entered a toll milling arrangement in Q1 2018 with Hecla to process ore from the San Sebastian Mine, 42 kilometres northwest of the Miguel Auza mill. The initial bulk sample was increased during Q1 2019 to 25,000 tonnes. During Q3 2019, approximately 6,635 tonnes were processed with a total of 12,000 tonnes processed year-to-date.

Corporate Responsibility

In Q3 2019, the Company focused on continuing to implement the 25 corporate responsibility (“CR”) standards introduced over the past two years at both Platosa and Miguel Auza, the efforts of which were accelerated with the recruitment of a new General Manager.

CR Performance at Platosa and Miguel Auza

Management continues to evaluate and monitor compliance with legal requirements and manage CR risk and the Company’s operations continue to report on the key trailing CR performance indicators and elements of the Visible Felt Leadership process. Trailing safety performance early in Q3 2019, as measured by recordable injury frequency (RIF) and lost time injury frequency (LTIF), declined unexpectedly primarily as a result of challenging ground conditions. Management responded by changing ground support requirements. Our full-year 2019 RIF and LTIF are 12 percent higher than the full-year 2018 performance. Injury severity is 79 percent lower than the 2018 results.

During Q3 2019, the Company continued its engagement with a range of stakeholders surrounding the Platosa and Miguel Auza business units.

Tailings Management at Miguel Auza

There are two tailings management facilities (TMF) at Miguel Auza. TMF #1 is located immediately northwest of the concentrator and was decommissioned in October 2017 after having reached its final crest height of 6.52 m and design capacity of approximately 313,000 m3 (~520,000 tonnes) of tailings. Covering of the decommissioned TMF #1 with soil was completed in Q4 2018; re-vegetation was completed in Q2 2019. TMF #2 is located on land owned by Excellon approximately 1 km north of the Miguel Auza concentrator. Approval for the construction and operation of the facility was received on January 31, 2017.

|

Management’s Discussion & Analysis of Financial Results

For the three and nine months ended September 30, 2019 |

Work continued during the quarter to implement the actions resulting from the visual inspection and review of our tailings management practices. Work also continued on the process to design and construct the Phase II raise at TMF #2 with the Canadian-based third-party engineering firm. We began work to develop an Operations, Maintenance and Surveillance (OMS) Manual aligned with the Mining Association of Canada Guidelines.

We received our renewed mine waste management permit from SEMARNAT in late September.

There was one regulatory inspection by PROFEPA of the tailings management facilities (TMF) at Miguel Auza. Five non-material issues were identified, and we are working to resolve the identified issues.

EXPLORATION AND DEVELOPMENT

At the end of the quarter, the Company was drilling with one rig in the Jaboncillo target area on the Platosa Property, 11 kilometres northwest of Platosa. This area hosts multiple targets which resulted from an induced polarization (“IP”) survey completed in December 2018. The Company is also drilling on the Evolućion Project following up on mineralization intersected earlier in 2019. Current drill targets at Platosa include the extension of the NE-1S Manto, near-mine manto-style targets and PDN, a skarn-type target identified by a large geophysical anomaly, two kilometres north of Platosa and associated with the 2012 Rincon del Caido discovery.

Please also refer to the Company’s Annual Information Form (“AIF”) for summary and background on the Company’s exploration projects and Mineral Resource Statement.

Platosa Property

Ongoing Exploration

In Q3 2019, the Company continued to explore the Platosa property, with one diamond drill rig operating from surface, completing approximately 2,900 metres in seven drill holes at the Jaboncillo target. Drilling focused on following up on targets generated from geophysics, mapping and prospecting.

This initial drilling has confirmed the presence of a large hydrothermal, intrusion-related system altering the host limestone sequence. Drilling to date has intersected multiple gossanous horizons with pyritic breccias and arsenopyrite. These observations confirm the presence of the system on multiple structures over an approximately one-kilometre area. Drilling will continue in this area with the aim of discovering an economically significant component to this system.

Additional highlights from Q3 2019 include:

| | ● | Continuation of drilling from surface at Jaboncillo; |

| | ● | Field checking and surface validation of targets identified through IP and mapping; |

| | ● | Building and rehabilitation of road networks to facilitate access for drilling on Jaboncillo targets; |

| | ● | Ongoing fieldwork, including mapping and sampling at key outcrops and surface regional targets; and |

| | ● | Community relations. |

The Company expects to continue drilling programs from surface during 2019 following on from the work completed since late 2016. The program will continue to test for new manto-style mineralization near the Platosa Mine and elsewhere on the Platosa Property, as well as pursuing skarn targets on the property.

|

Management’s Discussion & Analysis of Financial Results

For the three and nine months ended September 30, 2019 |

Evolución Property (formerly the Miguel Auza Project)

The Company commenced a proof-of-concept 3,000 metre program on Evolución during Q2 2018 with one surface drill rig, targeting four priority targets believed to be indicative of the distal part of a larger epithermal system. The Company extended the program into Q4, increasing it to 6,000 metres based on initial success on the Lechuzas structure. Drilling in Q4 and into Q1 2019 tested strike and dip extensions of the mineralization encountered at Lechuzas with the purpose of tracking higher grades and more robust widths. During Q1 2019, the Company announced results from the Lechuzas structure where drilling has defined a mineralized envelope of 600 metres along strike and 500 metres down dip.

In the third quarter, the Company completed the initial drill program on the Laika target with two holes being completed for a total of 1,000 metres. A sequence of this overburden was intersected in these holes before transitioning into a rhyolite sequence with variable alteration. The target of this program, the origin of chalcedonic and opaline pyrite bearing quartz in the overburden, was not intersected.

Subsequent to the Laika program, the Company recommenced drilling in the Lechusas area following up on results highlighted below. By the end of the quarter, three holes had been completed totaling 1,800 metres intersecting the target in all holes. Assays are pending on this drilling.

2018/2019 Highlights:

| | ● | 101 g/t AgEq (22 g/t Ag, 0.4% Pb, 1.0% Zn and 0.1 g/t Au) over 154 metres in EX18MAZ-251, including 532 g/t AgEq (188 g/t Ag, 4.4% Pb, 2.9% Zn and 0.1 g/t Au) over 2.4 metres and 238 g/t AgEq (48 g/t Ag, 0.7% Pb, 2.8% Zn and 0.1 g/t Au) over 17.7 metres; |

| | ● | 70 g/t AgEq (14 g/t Ag, 0.3% Pb, 0.7% Zn and 0.1 g/t Au) over 219 metres in EX18MAZ-253, including 274 g/t AgEq (70 g/t Ag, 1.3% Pb, 2.2% Zn and 0.4 g/t Au) over 12.6 metres; |

| | ● | 663 g/t AgEq (175 g/t Ag, 4.3% Pb, 5.4% Zn and 0.4 g/t Au) over 3.4 metres in EX18MAZ-257; and |

| | ● | 259 g/t AgEq (64 g/t Ag, 1.4% Pb, 2.2% Zn and 0.3 g/t Au) over 24.9 metres in EX18MAZ-258. |

During Q3 2019, exploration activities continued, including:

| | ● | Completion of initial drilling at Laika; and |

| | ● | Recommencing drilling at Lechuzas. |

Silver City Project

In Q3 2019, the Company entered into an agreement with Globex Mining Enterprises Inc. for the option to acquire 100% interest over three years in the Silver City Project (the Bräunsdorf exploration license), a 164 km2 silver district in Saxony, Germany.

The Silver City Project encompasses a 36 km long epithermal vein system situated west of the city of Freiberg (30 km southwest of Dresden). The immediate exploration license and surrounding area have a long and rich history of silver mining dating back to the 12th century with numerous historic mining camps, small mines and prospects, many of which have only been explored and/or mined to shallow depths seldom exceeding 200 metres below surface. Historically reported veins ranged from 0.5 to 10 metres width, with grades of over 3,500 g/t Ag and little to no assaying for gold or zinc available at the time.

|

Management’s Discussion & Analysis of Financial Results

For the three and nine months ended September 30, 2019 |

The terms of the option agreement include:

| | (i) | Pay C$100,000 and issue 226,837 common shares of the Company to Globex (completed September 23, 2019); |

| | (ii) | Pay C$100,000 and issue Common Shares to Globex equivalent to C$325,000 based on the 5-day volume weighted average price (“VWAP”) on or before September 23, 2020; |

| | (iii) | Pay C$100,000 and issue Common Shares to Globex equivalent to C$425,000 based on the 5-day VWAP on or before September 23, 2021; |

| | (iv) | Pay C$200,000 and issue Common Shares to Globex equivalent to C$625,000 based on the 5-day VWAP on or before September 23, 2022; and |

| | (v) | Upon completion of the payments and issuances set out above, grant Globex a gross metals royalty on the exploration or production license on the Silver City Project of 3.0% for precious metals and 2.5% for other metals, which may be reduced to 2% and 1.5%, respectively, upon a payment of US$1,500,000. |

The total value of cash and share over the three-year term is C$500,000 and C$1.6 million, respectively. The Company may accelerate any of the payments, issuances or the royalty grant at any time during the term of the option. Additionally, the Company may terminate the option at any time provided that the payments and issuances described in (i) and (ii), above, have been completed and the work commitments under the exploration license in respect of the first year of the option have been satisfied.

In addition, the Company has agreed to make: (i) a one-time payment of C$300,000 following the announcement of a maiden resource on the Silver City Project and (ii) a one-time payment of C$700,000 upon the achievement of commercial production from the Silver City Project.

Future work program:

Based on compilations of historical data including, mapping, geochemistry surveys and geophysical surveys, the Company has identified several targets for drilling. An initial 1,500 metre drill program is planned for H1 2020 with permitting currently underway.

QUALIFIED PERSONS

Mr. Ben Pullinger, BSc., PGeo., Excellon’s Senior Vice President Geology has acted as the Qualified Person, as defined in NI 43-101, with respect to the disclosure of the scientific and technical information relating to geological interpretation and results contained in this MD&A.

Marcello Locatelli, P. Eng., Vice President Special Projects, has acted as the Qualified Person, as defined in NI 43-101, with respect to the disclosure of the scientific and technical information relating to production results contained in this press release.

COMMODITY PRICES AND MARKET CONDITIONS

| Average Commodity Prices | | Q3

2019 | | | Q3

2018 | | | Change | | | 9-Mos

2019 | | | 9-Mos

2018 | | | Change | |

| Silver ($/oz) (1) | | | 17.02 | | | | 14.99 | | | | +14 | % | | | 15.83 | | | | 16.10 | | | | -2 | % |

| Lead ($/lb) (2) | | | 0.92 | | | | 0.95 | | | | -3 | % | | | 0.90 | | | | 1.06 | | | | -15 | % |

| Zinc ($/lbs) (2) | | | 1.06 | | | | 1.15 | | | | -8 | % | | | 1.18 | | | | 1.37 | | | | -14 | % |

| | (1) | Source: Kitco |

| | (2) | Source: LME |

|

Management’s Discussion & Analysis of Financial Results

For the three and nine months ended September 30, 2019 |

Silver prices were higher in the current quarter compared to Q3 2018, with both silver and gold rallying on the back of unrest in Hong Kong, a debt crisis in Argentina and an ongoing decline in US rates, reflecting fears of recession. Much of the rally in silver was driven by rotational fund flows away from gold as silver was perceived to be cheap on a relative basis. ETF buying increased, with the largest inflow since May 2006. While semiconductor sales continued to decline signaling sluggish industrial demand, the silver: gold ratio dropped to 85:1 and prices exceeded $17.

Lead prices were slightly lower during Q3 2019, though demonstrated improvement late in the quarter. US/Chinese trade talks and continued smelter outages may have supported prices in the quarter. On the demand side, slowdown in global automotive sales continued to impact prices, with auto production and sales down materially year-over-year in the US, China and India. The market remained in a deficit during the first half of the year.

Zinc prices continued to slip hitting a three-year low during the quarter. Multiple factors continue to impact prices including softness in Chinese steel prices, ongoing U.S. and China trade concerns and the deceleration in the Chinese economy. The Shanghai physical inventory recovered, and supply is expected to continue to grow for the balance of the year as the market remains in deficit.

Refer to “Financial Instruments”, below, for a discussion of the Company’s exposure to foreign currencies.

SUMMARY OF FINANCIAL QUARTERLY RESULTS

Financial statement highlights for the quarter ended September 30, 2019 and 2018 and last eight quarters are as follows:

| | | Q3

2019(1) | | | Q2

2019(1) | | | Q1

2019(1) | | | Q4

2018(1) | | | Q3

2018(1) | | | Q2

2018(1) | | | Q1

2018(1) | | | Q4

2017(1) | |

| (in $000’s) | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | |

| Revenues | | | 5,943 | | | | 8,674 | | | | 5,179 | | | | 5,955 | | | | 2,570 | | | | 9,877 | | | | 5,911 | | | | 7,123 | |

| Production costs | | | (5,790 | ) | | | (6,797 | ) | | | (4,612 | ) | | | (5,213 | ) | | | (5,221 | ) | | | (5,173 | ) | | | (3,959 | ) | | | (4,796 | ) |

| Depletion and amortization | | | (1,140 | ) | | | (1,149 | ) | | | (1,169 | ) | | | (1,004 | ) | | | (876 | ) | | | (854 | ) | | | (1,282 | ) | | | (1,277 | ) |

| Cost of sales | | | (6,930 | ) | | | (7,946 | ) | | | (5,781 | ) | | | (6,217 | ) | | | (6,097 | ) | | | (6,027 | ) | | | (5,241 | ) | | | (6,073 | ) |

| Gross profit (loss) | | | (987 | ) | | | 728 | | | | (602 | ) | | | (262 | ) | | | (3,527 | ) | | | 3,850 | | | | 670 | | | | 1,050 | |

| Expenses: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| General and administrative | | | (1,151 | ) | | | (1,028 | ) | | | (1,361 | ) | | | (595 | ) | | | (1,021 | ) | | | (1,482 | ) | | | (1,423 | ) | | | (1,159 | ) |

| Exploration | | | (858 | ) | | | (967 | ) | | | (1,005 | ) | | | (1,115 | ) | | | (1,021 | ) | | | (1,053 | ) | | | (708 | ) | | | (345 | ) |

| Other income (expense) | | | (200 | ) | | | 34 | | | | (274 | ) | | | 51 | | | | 368 | | | | (497 | ) | | | 82 | | | | (415 | ) |

| Write-down of inventories (2) | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (568 | ) |

| Net Finance income (cost) | | | (71 | ) | | | (335 | ) | | | (52 | ) | | | 203 | | | | 1,081 | | | | (409 | ) | | | 1,024 | | | | 820 | |

| Income tax (expense) recovery | | | 365 | | | | (640 | ) | | | (491 | ) | | | (2,432 | ) | | | 538 | | | | 845 | | | | (867 | ) | | | 2,170 | |

| Net income (loss) for the period | | | (2,902 | ) | | | (2,208 | ) | | | (3,785 | ) | | | (4,150 | ) | | | (3,582 | ) | | | 1,254 | | | | (1,222 | ) | | | 1,553 | |

| Earnings (loss) per share – basic | | | (0.03 | ) | | | (0.02 | ) | | | (0.04 | ) | | | (0.04 | ) | | | (0.04 | ) | | | 0.01 | | | | (0.01 | ) | | | 0.02 | |

| – diluted | | | (0.03 | ) | | | (0.02 | ) | | | (0.03 | ) | | | (0.04 | ) | | | (0.04 | ) | | | 0.01 | | | | (0.01 | ) | | | 0.02 | |

| Cash flow from (used in) operations before changes in working capital | | | (1,658 | ) | | | 208 | | | | (977 | ) | | | (1,507 | ) | | | (4,125 | ) | | | 2,253 | | | | 471 | | | | 571 | |

|

Management’s Discussion & Analysis of Financial Results

For the three and nine months ended September 30, 2019 |

| | (1) | Includes fair value adjustment gain (loss) to net income (loss) for embedded derivative liability and warrants related to convertible debentures (the “Debentures”) issued in November 2015 and converted in December 2017 as follows: |

| Q3 2019 | | Q2 2019 | | Q1 2019 | | Q4 2018 | | Q3 2018 | | Q2 2018 | | Q1 2018 | | Q4 2017 |

| 0.1 million | | ($0.2 million) | | ($0.2 million) | | $0.3 million | | $0.6 million | | $0.1 million | | $0.5 million | | $1.3 million |

| | (2) | Write-down of production spares to its net realizable value by $0.57 million for slow moving and obsolescent inventory items identified at the end of the year. |

Quarterly revenue variances are a function of silver, lead and zinc prices, and production results. Production plans can fluctuate, and the driving factors of metal produced are mined tonnages, grades and mill recoveries. The Company currently expenses exploration costs not associated with mine resource expansion, which can also create volatility in earnings from period to period. The following is a discussion of the material variances between Q3-2019 versus Q3-2018 and 9 months ending 2019 versus 9 months ending 2018.

| | | Q3 2019 | | | Q3 2018 | | | 9-Mos 2019 | | | 9-Mos 2018 | |

| Revenue | | | 5,943 | | | | 2,570 | | | | 19,795 | | | | 18,358 | |

| Net Loss | | | (2,902 | ) | | | (3,582 | ) | | | (8,894 | ) | | | (3,550 | ) |

Net revenues increased by 131% during Q3 2019 compared to Q3 2018, due to increased AgEq ounces payable of 370,376 (258,920 AgEq ounces payable in Q3 2018) and higher realized silver prices, partially offset by lower zinc prices. For additional discussion, see “Provisionally Priced Sales”, below.

The main components contributing to the net loss variance of $0.7 million between Q3 2019 and Q3 2018, are increased revenues offset by the following factors:

| | (i) | 14% increase in cost of sales of $0.8 million as discussed below; |

| | (ii) | $0.5 million fair value adjustment difference in finance cost resulting from a fair value gain of $0.1 million on $0.50 warrants related to the Debentures in Q3 2019 compared to a $0.6 million fair value adjustment gain on warrants in Q3 2018; and |

| | (iii) | $0.6 million difference in unrealized gains from currency hedges |

The 9-Mos period net loss variance of $5.3 million was also driven by increased cost of sales, as a result of increased production ($3.3 million), considerably lower metal prices, finance income ($2.2 million), and a difference in deferred income tax ($1.3 million).

|

Management’s Discussion & Analysis of Financial Results

For the three and nine months ended September 30, 2019 |

| | | Q3 2019 | | | Q3 2018 | | | 9-Mos 2019 | | | 9-Mos 2018 | |

| Cost of Sales | | | (6,930 | ) | | | (6,097 | ) | | | (20,657 | ) | | | (17,365 | ) |

The variance in the cost of sales, including depletion and amortization of $0.8 million (14%) between Q3 2019 and Q3 2018 was mainly driven by higher labour cost of $0.4 million due to increased staff, higher depreciation and amortization cost of $0.3 million and increased administration cost of $0.3 million related to the replacement of the security contractor and recruiting fees for key positions at both Platosa and Miguel Auza. These increases were partially offset by improved efficiencies at the mine of $0.2 million, leading to lower consumable items, in particular, reduced use of explosives due to optimized drilling, loading practices and load design. The Company also anticipates lower electricity costs in 2020 as it recently signed a contract with a private energy provider.

The 9-Mos period variance was affected by similar cost components including, higher electricity cost of $0.7 million, labour cost of $0.9 million, depreciation and amortization cost of $0.4 million, increased administration cost of $0.5 million, higher transportation cost due to higher concentrate and ore production of $0.3 million and higher year-to-date consumables due to higher production of $0.4 million.

| | | Q3 2019 | | | Q3 2018 | | | 9-Mos 2019 | | | 9-Mos 2018 | |

| Exploration | | | (858 | ) | | | (1,021 | ) | | | (2,829 | ) | | | (2,782 | ) |

Surface exploration drilling continued at the Platosa property with 2,940 metres drilled in Q3 2019 (1,809 metres in Q3 2018). Exploration drilling at Evolución totaled 2,775 metres (2,933 metres in Q3 2018). The main difference in cost for the two periods is attributed to geophysics programs completed at Platosa in 2018.

For the 9-Mos period, the Company completed a total of 16,308 metres from surface representing an 18% increase when compared to the 13,348 metres drilled during the same period in 2018.

| | | Q3 2019 | | | Q3 2018 | | | 9-Mos 2019 | | | 9-Mos 2018 | |

| Other income (expenses) | | | (200 | ) | | | 368 | | | | (439 | ) | | | (47 | ) |

Other income includes unrealized and realized foreign exchange gains and losses, realized and unrealized gains and losses on marketable securities, provisional adjustments, and other non-routine income or expenses, if any.

The material variance from Q3 2019 ($200) versus Q3 2018 of $368 include $0.4 million in foreign exchange gains and $0.1 million in unrealized gain on marketable securities.

The variance from 9-Mos 2019 and 9-Mos 2018 is driven by a contingent liability provision related to a claim filed against the Company.

|

Management’s Discussion & Analysis of Financial Results

For the three and nine months ended September 30, 2019 |

| | | Q3 2019 | | | Q3 2018 | | | 9-Mos 2019 | | | 9-Mos 2018 | |

| Finance Income (cost) | | | (71 | ) | | | 1,081 | | | | (459 | ) | | | 1,696 | |

Net finance income (cost) consists primarily of fair value adjustments on warrants related to Debentures, and accretion of the rehabilitation provision for the mine and mill. The fair value adjustment derives primarily from the performance of the Company’s stock during the applicable period. As the Debentures were settled, fair value adjustments of the associated warrants remain required.

During Q3 2019, a decrease in the stock price from CAD$0.99 to CAD$0.93 resulted in a $0.1 million fair value adjustment gain on warrants related to the Debentures while during Q3 2018, a decrease from CAD$1.39 to CAD$0.96 resulted in a $0.6 million fair value adjustment gain from warrants outstanding at the time. Finance cost in Q3 2019 also included a $0.08 million unrealized loss on forward foreign exchange contracts that were marked to market at the end of the quarter (Q3 2018 – $0.5 million unrealized gain).

For the 9-Mos 2019, a $0.2 million fair value adjustment loss was registered on warrants related to the Debentures as a result of an increase in the stock price from CAD$0.69 to CAD$0.93 ($1.3 million gain during 9-Mos 2018 due to the share price decreasing from CAD$1.84 to CAD$0.96). Finance cost during the 9-Mos 2019 also included a $0.03 million loss on forward foreign exchange contracts mark-to-market at the end of the period ($0.6 million unrealized gain during 9-Mos 2018).

Provisionally Priced Sales

Sales are recorded using the metal price received for sales that settle during the reporting period. For sales that have not been settled, an estimate is used, based on the expected month of settlement and the forward price of the metal at the end of the reporting period. The difference between the estimate and the final price received is recognized by adjusting sales in the period in which the sale is settled (i.e. finalization adjustment). The finalization adjustment recorded for these sales depends on the actual price when the sale settles, which occurs either one or two months after shipment under the terms of the current concentrate purchase agreements.

In Q3 2019, the Company recognized negative adjustment to revenues, specifically zinc, of $31 primarily related to the reversal of the mark-to-market taken at the end of June 30, 2019 as receivables were ultimately settled at lower values in Q3 2019 (three months ended September 30, 2018 – negative adjustment of $1,040).

As at September 30, 2019, provisionally priced sales totaled $5,077 which are expected to settle at final prices during Q4 2019.

|

Management’s Discussion & Analysis of Financial Results

For the three and nine months ended September 30, 2019 |

Revenues recognized in the comparable periods are reconciled below (in thousands of US dollars):

| | | | | | Q3 2019 | | | | |

| | | Silver | | | Lead | | | Zinc | | | Total | |

| | | | $ | | | | $ | | | | $ | | | | $ | |

| Current period sales (1) | | | 3,920 | | | | 1,140 | | | | 1,463 | | | | 6,523 | |

| Prior period provisional adjustments (2) | | | 218 | | | | 34 | | | | (283 | ) | | | (31 | ) |

| Sales before treatment and refining charges (TC/RC) | | | 4,138 | | | | 1,174 | | | | 1,180 | | | | 6,492 | |

| Less: TC/RC | | | | | | | | | | | | | | | (719 | ) |

| Revenues from sales | | | | | | | | | | | | | | | 5,773 | |

| Revenues from tolling services | | | | | | | | | | | | | | | 170 | |

| Total revenues | | | | | | | | | | | | | | | 5,943 | |

| | | | | | | | 9-Mos 2019 | | | | |

| | | | Silver | | | | Lead | | | | Zinc | | | | Total | |

| | | | $ | | | | $ | | | | $ | | | | $ | |

| Current period sales (1) | | | 11,602 | | | | 3,779 | | | | 6,709 | | | | 22,090 | |

| Prior period provisional adjustments (2) | | | 5 | | | | (60 | ) | | | (30 | ) | | | (85 | ) |

| Sales before treatment and refining charges (TC/RC) | | | 11,607 | | | | 3,719 | | | | 6,679 | | | | 22,005 | |

| Less: TC/RC | | | | | | | | | | | | | | | (2,458 | ) |

| Total Sales | | | | | | | | | | | | | | | 19,547 | |

| Revenues from tolling services | | | | | | | | | | | | | | | 248 | |

| Total revenues | | | | | | | | | | | | | | | 19,795 | |

| | | | | | | | Q3 2018 | | | | | |

| | | | Silver | | | | Lead | | | | Zinc | | | | Total | |

| | | | $ | | | | $ | | | | $ | | | | $ | |

| Current period sales (1) | | | 2,027 | | | | 789 | | | | 907 | | | | 3,723 | |

| Prior period provisional adjustments (2) | | | (244 | ) | | | (298 | ) | | | (498 | ) | | | (1,040 | ) |

| Sales before treatment and refining charges (TC/RC) | | | 1,783 | | | | 491 | | | | 409 | | | | 2,683 | |

| Less: TC/RC | | | | | | | | | | | | | | | (113 | ) |

| Total revenues | | | | | | | | | | | | | | | 2,570 | |

| | | | | | | | 9-Mos 2018 | | | | | |

| | | | Silver | | | | Lead | | | | Zinc | | | | Total | |

| | | | $ | | | | $ | | | | $ | | | | $ | |

| Current period sales (1) | | | 8,845 | | | | 3,772 | | | | 6,700 | | | | 19,317 | |

| Prior period provisional adjustments (2) | | | 11 | | | | (32 | ) | | | 24 | | | | 3 | |

| Sales before treatment and refining charges (TC/RC) | | | 8,856 | | | | 3,740 | | | | 6,724 | | | | 19,320 | |

| Less: TC/RC | | | | | | | | | | | | | | | (962 | ) |

| Total Sales | | | | | | | | | | | | | | | 18,358 | |

| (1) | Includes provisional price adjustments on current period sales. |

| (2) | Prior period sales that settled at amounts different from prior period’s estimate. |

|

Management’s Discussion & Analysis of Financial Results

For the three and nine months ended September 30, 2019 |

Non-IFRS Measures

Production Cost Per Tonne, Total Cash Cost Net of By-Product Credits Per Silver Ounce Payable and All-In Sustaining Cost (AISC) Per Silver Ounce Payable are non-IFRS measures that do not have a standardized meaning. The calculation of these measures may differ from that used by other companies in the industry. The Company uses these measures internally to evaluate the underlying operating performance of the Company for the reporting periods presented. These measures should not be considered in isolation or as a substitute for measures of performance prepared in accordance with generally accepted accounting principles and are not necessarily indicative of operating expenses as determined under generally accepted accounting principles. Management believes that these measures are key performance indicators of the Company’s operational efficiency and are increasingly used across the global mining industry and are intended to provide investors with information about the cash generating capabilities of the Company’s operations.

| | | Q3 2019 | | Q3 2018 | | 9-Mos 2019 | | 9-Mos 2018 |

| Production Cost per Tonne | | $339/t | | $292/t | | $304/t | | $241/t |

The Company excludes inventory adjustments from the calculation of Production Cost per Tonne to improve period-over-period comparisons. A reconciliation between production cost per tonne (excluding depletion and amortization and inventory adjustments) and the Company’s cost of sales as reported in the Company’s financial statements is provided below.

The increase in cost per tonne processed is a function of higher labour costs, increased administration cost related to the replacement of the security contractor and recruiting fees for key positions at both Platosa and Miguel Auza, as well as lower tonnes through the mill, compared to prior periods.

| | | Q3

2019 | | | Q3

2018 | | | 9-Mos

2019 | | | 9-Mos

2018 | |

| | | $ 000’s | | | $ 000’s | | | $ 000’s | | | $ 000’s | |

| Cost of Sales | | | 6,930 | | | | 6,097 | | | | 20,657 | | | | 17,365 | |

| Depletion and amortization | | | (1,140 | ) | | | (876 | ) | | | (3,458 | ) | | | (3,012 | ) |

| Inventory adjustments | | | 53 | | | | (7 | ) | | | (355 | ) | | | 352 | |

| Production Costs (excluding inventory adjustments) | | | 5,843 | | | | 5,214 | | | | 16,864 | | | | 14,705 | |

| Tonnes milled | | | 17,235 | | | | 17,906 | | | | 55,418 | | | | 59,664 | |

| Production cost per tonne milled ($/tonne) | | | 339 | | | | 292 | | | | 304 | | | | 241 | |

| | | Q3 2019 | | | Q3 2018 | | | 9-Mos 2019 | | | 9-Mos 2018 | |

| Total Cash Cost Per Silver Ounce Payable | | $ | 18.18 | | | $ | 29.94 | | | $ | 12.58 | | | $ | 8.50 | |

Total cash costs per silver ounce payable of $18.18 in Q3 2019 improved as a result of increased production relative to Q3 2018.

For the 9-mos 2019, total cash costs of $12.58 was higher as a result of increased cost of sales and treatment and refining charges.

The calculation of total cash cost per silver ounce payable reflects the cost of production adjusted for by-product and various non-cash costs included in cost of sales. Changes in inventory have not been adjusted from cost of sales, as these costs are associated with the payable silver ounces sold in the period. The Company expects total cash costs net of by-product revenues to vary from period to period as planned production and development access different areas of the mine with different ore grades and characteristics.

|

Management’s Discussion & Analysis of Financial Results

For the three and nine months ended September 30, 2019 |

Reconciliation of total cash cost per silver ounce payable, net of by-product credits:

| | | Q3 2019 | | | Q3 2018 | | | 9-Mos 2019 | | | 9-Mos 2018 | |

| | | $ 000’s | | | $ 000’s | | | $ 000’s | | | $ 000’s | |

| Cost of sales | | | 6,930 | | | | 6,097 | | | | 20,657 | | | | 17,365 | |

| Adjustments - increase/(decrease): | | | | | | | | | | | | | | | | |

| Depletion and amortization | | | (1,140 | ) | | | (876 | ) | | | (3,458 | ) | | | (3,012 | ) |

| Third party smelting and refining charges (1) | | | 719 | | | | 113 | | | | 2,458 | | | | 962 | |

| Royalties (2) | | | (23 | ) | | | (23 | ) | | | (68 | ) | | | (68 | ) |

| By-product credits (3) | | | (2,353 | ) | | | (900 | ) | | | (10,398 | ) | | | (10,464 | ) |

| Total cash cost net of by-product credits | | | 4,133 | | | | 4,411 | | | | 9,191 | | | | 4,783 | |

| Silver ounces payable | | | 227,350 | | | | 147,308 | | | | 730,322 | | | | 562,693 | |

| Total cash cost per silver ounce payable ($/oz) | | | 18.18 | | | | 29.94 | | | | 12.58 | | | | 8.50 | |

| (1) | Treatment and refining charges recorded in net revenues. |

| (2) | Advance royalty payments on the Miguel Auza property unrelated to production from Platosa. |

| (3) | By-product credits comprise revenues from sales of lead and zinc. |

| | | Q3 2019 | | | Q3 2018 | | | 9-Mos 2019 | | | 9-Mos 2018 | |

| AISC Per Silver Ounce Payable (including non-cash items) | | $ | 28.46 | | | $ | 44.02 | | | $ | 22.51 | | | $ | 20.54 | |

AISC in Q3 2019 resulted from higher cash costs as described above. AISC excluding non-cash items was $27.38 in the quarter.

For the 9-mos 2019 AISC of $22.51 was higher as a result of higher cash costs and increased capital expenditures primarily related to the dewatering sustaining capital . AISC excluding non-cash items was $21.01 for the 9-mos 2019.

|

Management’s Discussion & Analysis of Financial Results

For the three and nine months ended September 30, 2019 |

AISC per silver ounce payable over the preceding eight quarters are summarized below:

Excellon adopted the AISC measure to provide further transparency on the costs associated with producing silver and to assist stakeholders of the Company in assessing operating performance, ability to generate free cash flow from current operations and overall value. The AISC measure is a non-GAAP measure based on guidance announced by the World Gold Council in June 2013.

Excellon defines AISC per silver ounce payable as the sum of total cash costs (including treatment charges and net of by-product credits), capital expenditures that are sustaining in nature, corporate general and administrative costs (including non-cash share-based compensation), capitalized and expensed exploration that is sustaining in nature, and environmental reclamation costs (non-cash), all divided by the total payable silver ounces sold during the period to arrive at a per ounce figure.

Capital expenditures to develop new operations or capital expenditures related to major projects at existing operations where these projects will materially increase production are classified as non-sustaining and are excluded. The definition of sustaining versus non-sustaining is similarly applied to capitalized and expensed exploration costs. Exploration costs to develop new operations or that relate to major projects at existing operations where these projects are expected to materially increase production are classified as non-sustaining and are excluded.

Costs excluded from AISC are non-sustaining capital expenditures and exploration costs (as described above), finance costs, tax expense, and any items that are deducted for the purposes of adjusted earnings.

The table below presents details of the AISC per silver ounce payable calculation.

|

Management’s Discussion & Analysis of Financial Results

For the three and nine months ended September 30, 2019 |

| | | Q3 2019 | | | Q3 2018 | | | 9-Mos 2019 | | | 9-Mos 2018 | |

| | | $ 000’s | | | $ 000’s | | | $ 000’s | | | $ 000’s | |

| | | | | | | | | | | | | |

| Total cash costs net of by-product credits | | | 4,133 | | | | 4,411 | | | | 9,191 | | | | 4,783 | |

| General and administrative costs (cash) | | | 881 | | | | 678 | | | | 2,434 | | | | 2,265 | |

| Share based payments (non-cash) | | | 191 | | | | 349 | | | | 918 | | | | 1,564 | |

| Accretion and amortization of reclamation costs (non-cash) | | | 55 | | | | 31 | | | | 171 | | | | 153 | |

| Sustaining exploration (manto resource exploration/drilling) | | | 32 | | | | 72 | | | | 176 | | | | 249 | |

| Sustaining capital expenditures (1) | | | 1,178 | | | | 944 | | | | 3,548 | | | | 2,541 | |

| Total sustaining costs | | | 2,337 | | | | 2,074 | | | | 7,247 | | | | 6,772 | |

| | | | | | | | | | | | | | | | | |

| All-in sustaining costs | | | 6,470 | | | | 6,485 | | | | 16,438 | | | | 11,555 | |

| | | | | | | | | | | | | | | | | |

| Silver ounces payable | | | 227,350 | | | | 147,308 | | | | 730,322 | | | | 562,693 | |

| | | | | | | | | | | | | | | | | |

| AISC per silver ounce payable ($/oz) | | | 28.46 | | | | 44.02 | | | | 22.51 | | | | 20.54 | |

| | | | | | | | | | | | | | | | | |

| AISC excluding non-cash items, per silver ounce payable ($/oz) | | | 27.38 | | | | 41.44 | | | | 21.01 | | | | 17.49 | |

| | | | | | | | | | | | | | | | | |

| Realized silver price per ounce sold (2) | | | 17.65 | | | | 14.51 | | | | 15.78 | | | | 15.74 | |

| (1) | Sustaining capital expenditure includes sustaining property plant and equipment acquisitions and capitalized development costs. |

| (2) | Average realized silver price is calculated on current period sale deliveries and does not include the impact of prior period provisional adjustments in the period. |

LIQUIDITY AND CAPITAL RESOURCES

In today’s commodity price environment, being able to produce at reduced cost and generate positive cash flows is essential to improving the Company’s working capital. The primary source of funds available to the Company is cash flow generated by the Platosa Mine. A continuous review of the Company’s capital expenditure programs ensures the Company’s capital resources are utilized in a responsible and sustainable manner to conserve cash during ongoing periods of low silver prices.

| | | September 30, 2019 | | | December 31, 2018 | |

| Cash and Cash Equivalents | | | 8,435 | | | | 6,417 | |

The Company’s cash increased by $2.0 million for the 9-Mos 2019. The year to date movements are as follows:

| | (i) | $2.4 million was used in operations with a minor movement in working capital of $0.1 million, for a net of $2.5 million used in operating activities, which included $3.2 million spent on exploration; |

| | | |

| | (ii) | $3.6 million was invested in capital expenditures, split between the dewatering sustaining capital , mine development and mining equipment; and |

| | | |

| | (iii) | Net $7.7 million sourced from financing activities associated with the $8.0 million bought deal financing of which $0.3 million was used to ease liability payments for leased mining equipment and office. |

|

Management’s Discussion & Analysis of Financial Results

For the three and nine months ended September 30, 2019 |

| | | September 30, 2019 | | | December 31, 2018 | |

| Working Capital | | | 9,055 | | | | 7,917 | |

Working capital increased by $5.3 million in Q3 2019 from Q2 2019, mainly driven by the cash inflows from the public equity financing completed during the reporting period. Working capital increased by $1.1 million at the end of Q3 2019 versus December 31, 2018. The main contributors to the working capital improvement was an increase in the cash balance of $2.0 million partially offset by a $1.4 million increase in trade and other payables.

| | | Q3 2019 | | | Q3 2018 | | | 9-Mos 2019 | | | 9-Mos 2018 | |

| Cash from (used in) operations before changes in working capital ($000’s) | | | (1,555 | ) | | | (4,125 | ) | | | (2,324 | ) | | | (1,401 | ) |

The variance between Q3 2019 and Q3 2018 of $2.5 million in cash flows before changes in working capital was primarily made up of non-cash items including $0.3 million of higher depreciation cost, $0.6 million in unrealized loss on currency hedges and $0.5 million in unrealized loss on fair value of the purchase warrants.

The variance between the 9-Mos 2019 and 9-Mos 2018 of ($1.0 million) was primarily driven by the offsetting movements of $1.5 million in deferred taxes, $1.5 million in purchase warrants valuation, $ 0.7 million of provisions, $0.6 million on currency hedges valuation and ($5.3 million) net loss variance.

| | | Q3 2019 | | | Q3 2018 | | | 9-Mos 2019 | | | 9-Mos 2018 | |

| Investing Activities ($000’s) | | | (1,069 | ) | | | (939 | ) | | | (3,626 | ) | | | (2,366 | ) |

For Q3 2019, the Company’s capital expenditures of $0.9 million primarily relates to $1.0 million of Dewatering Sustaining Capital, mine development and associated mining equipment.

For the 9-Mos 2019, the Company’s capital expenditures of $3.5 million related to $3.6 million on dewatering sustaining capital, mine development and mining equipment.

| | | Q3 2019 | | | Q3 2018 | | | 9-Mos 2019 | | | 9-Mos 2018 | |

| Financing Activities ($000’s) | | | 7,914 | | | | (67 | ) | | | 7,704 | | | | 1,397 | |

During Q3 2019, the Company completed a public equity financing (“2019 Bought Deal”) for net proceeds of $8.0 million.

During the 9-Mos 2018, the Company generated $7.7 million in financing activity primarily driven by the completion of the public equity financing (“2019 Bought Deal”) for net proceeds of $8.0 million partially offset by $0.3 million in repayment of lease obligations.

In recent quarters, the Company’s operations were not cash flow positive and the Company has drawn down on working capital. Although the Company’s production continues to increase, the Company’s ability to generate positive cash flows is impacted by financial market conditions, most notably metal prices as the Company derives its revenues from the sale of silver, lead and zinc and associated TC/RCs, as discussed above in “Commodity Prices and Market Conditions”. The Company is also exposed to currency exchange risk and accordingly manages this exposure with currency hedges as described below in “Financial Instruments”. The Company is also affected by increases in electricity prices due to dewatering requirements at the Platosa Mine, which have recently increased materially. In the absence of improvements in the operation, metal prices and input costs, the Company expects to use portions of available cash flow and cash reserves to fund exploration on each of the Company’s properties and capital expenditures at the Platosa and Miguel Auza operations.

|

Management’s Discussion & Analysis of Financial Results

For the three and nine months ended September 30, 2019 |

The Company has in-the-money warrants with a current exercise value of CAD$0.9 million and a market value of CAD$1.7 million based on the closing price of the Company’s Common Shares on September 30, 2019. These warrants expire November 27, 2019.

Financial Instruments

All financial assets and financial liabilities, other than derivatives, are initially recognized at the fair value of consideration paid or received, net of transaction costs as appropriate, and subsequently carried at fair value or amortized cost. The carrying values of cash and cash equivalents, trade receivables and other liabilities approximate their fair value, unless otherwise noted.

The Company’s financial performance is sensitive to changes in commodity prices, foreign exchange and interest rates, and the Company may periodically consider hedging such exposure. The Company’s board of directors has overall responsibility for the establishment and oversight of the Company’s risk management framework. The Company addresses its price-related exposure to foreign exchange through the use of options, futures, forwards and derivative contracts.

The Mexican peso (“MXN”) and the Canadian dollar (“CAD”) are the functional currencies of the Company, with currency exposures arising from transactions and balance in currencies other than the functional currencies.

A significant portion of the Company’s capital expenditures, operating costs, exploration, and administrative expenditures are incurred in MXN, while revenues from the sale of concentrates are denominated in US dollars (“USD”). The fluctuation of the USD in relation to the MXN, consequently, impacts the reported financial performance of the Company. To manage the Company’s exposure to changes in the USD/MXN exchange rate, the Company entered into forward contracts to purchase MXN in exchange for USD at various rates and maturity dates. As at September 30, 2019, forward contracts for the purchase of MXN175 million in exchange for $8.6 million at an average rate of 20.34 MXN/USD, at various maturity dates until August 2020, were outstanding. The fair value of these outstanding foreign currency forward contracts resulted in an unrealized loss position of $0.03 million at September 30, 2019 ($0.6 million unrealized loss as at September 30, 2018).

During Q3 2019, the Company realized beneficial exchange rates of $106,071 from contracts maturing during the quarter relative to spot rates (Q3 2018 – unfavorable $106,000). For the 9-Mos 2019 the Company realized beneficial exchange rates of $346,000 (9-Mos 2018 – beneficial $109,000).

|

Management’s Discussion & Analysis of Financial Results

For the three and nine months ended September 30, 2019 |

Commitments

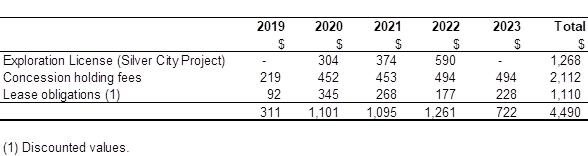

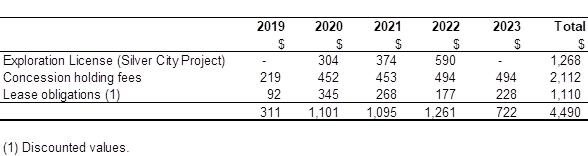

The following table summarizes the Company’s significant commitments as at September 30, 2019 (in thousands of US dollars):

Mine restoration provisions and employee future benefits committed in 2023 assume the closure of the Platosa Mine and Miguel Auza mill in that year, which may or may not be the case depending upon the Company’s ability to find new mineralization at Platosa or near Miguel Auza. Not included above is an NSR royalty payable semi-annually on the Platosa Property of (a) 1.25% in respect of manto mineralization other than skarn mineralization or (b) 0.5% in respect of skarn or “Source” mineralization. Such payments vary period to period based on production results and commodity prices.

Contingencies

A subsidiary of the Company is party to an action by a claimant in respect of damages under an option agreement concerning a mineral concession within the Miguel Auza property, which the concession is not considered material to the Company’s operating business or exploration plans. The court of first instance awarded the claimant the amount of approximately $0.7 million. The Company is appealing the decision and believes that the court made an incorrect finding of law in respect of approximately $0.6 million of the damage award. Until then, the Company has increased its previous provision of $0.1 million to $0.7 million in respect of such potential damage award.

Contingencies can be either possible assets or possible liabilities arising from past events which, by their nature, will only be resolved when one or more future events not within our control occur or fail to occur. The assessment of such contingencies inherently involves the exercise of significant judgment and estimates of the outcome of future events. In assessing loss contingencies related to legal proceedings that are pending against the Company or unasserted claims that may result in such proceedings or regulatory or government actions that may negatively impact our business or operations, the Company with assistance from its legal counsel evaluates the perceived merits of any legal proceedings or unasserted claims or actions.

Off-Balance Sheet Arrangements

The Company does not have any off-balance sheet arrangements.

|

Management’s Discussion & Analysis of Financial Results

For the three and nine months ended September 30, 2019 |

RISK AND UNCERTAINITIES

The Company’s business entails exposure to certain risks, including but not limited to: metal price risk since the Company derives its revenues from the sale of silver, lead and zinc; foreign exchange risk since the Company reports in United States dollars but operates in jurisdictions that use other currencies; the inherent risk of uncertainties in estimating Mineral Resources; political risk associated with operating in foreign jurisdictions; environmental risks; surface rights and access; enforcement of legal rights; and risks associated with labour relations issues. The current or future operations of Excellon including ongoing commercial production are or will be governed by and subject to federal, state and municipal laws and regulations regarding mineral taxation, mineral royalties and other governmental charges. Any change to the mineral taxation and royalty regimes in the jurisdictions in which Excellon operates or plans to operate could have an adverse financial impact on the Company’s current and planned operations and the overall financial results of the Company, the extent of which cannot be predicted. Further factors affecting the Company are described in the AIF.

COMMON SHARE DATA as at November 5, 2019

| Common shares issued and outstanding | | | 110,597,036 | |

| Stock options | | | 2,374,999 | |

| DSUs | | | 2,288,576 | |

| RSUs | | | 3,192,892 | |

| Warrants ($0.50) | | | 1,808,563 | |

| Warrants ($1.40) | | | 5,462,500 | |

| Fully diluted common shares | | | 125,724,566 | |

SUBSEQUENT EVENTS

The Company announced the resignation of Denis Flood, VP Technical Services on October 25, 2019. Additionally, Marcello Locatelli, VP Special Projects, stepped down on October 31, 2019 but will continue to provide consulting services to the Company.

INTERNAL CONTROL OVER FINANCIAL REPORTING AND DISCLOSURE CONTROLS AND PROCEDURES

CONTROLS AND PROCEDURES

Disclosure Controls and Procedures

In the disclosure set out below, references to management include the President and Chief Executive Officer and Chief Financial Officer. Management has designed disclosure controls and procedures (“DC&P”) to provide a reasonable assurance that (i) material information relating to the Company is made known to them by others, particularly during the period in which the annual filings are being prepared and (ii) information required to be disclosed by the Company in its annual filings, interim filings or other reports filed or submitted by it under securities legislation is recorded, processed, summarized and reported within the time periods specified in securities legislation.

In connection with the preparation and filing of the Company’s audited consolidated financial statements for the year ended December 31, 2018 (the “2018 Financial Statements”), the Company’s management assessed the effectiveness of the Company’s disclosure controls and procedures. In making this assessment, management used the criteria set forth in Internal Control - Integrated Framework (2013) (“COSO 2013”) issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on this assessment, management concluded that, as of December 31, 2018, the Company’s DC&P were not effective due to the material weakness described in the MD&A for the year ended December 31, 2018 (the “2018 MD&A”). Although the Company has taken steps to remediate the material weaknesses, management has concluded that material weaknesses in the design of DC&P continued to exist as of September 30, 2019.

|

Management’s Discussion & Analysis of Financial Results

For the three and nine months ended September 30, 2019 |

Internal Control Over Financial Reporting

Management is responsible for establishing, maintaining and assessing the effectiveness of adequate internal control over financial reporting (“ICFR”). The Company’s ICFR is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with IFRS.

In connection with the preparation and filing of the 2018 Financial Statements, management assessed the effectiveness of the Company’s ICFR. In making this assessment, management used the criteria set forth in COSO 2013. Based on this assessment, management concluded that, as of December 31, 2018, as a result of the material weaknesses identified as part of the ongoing investigation into concentrate theft, as disclosed in the 2018 MD&A, the Company’s ICFR was not effective. Although the Company has taken steps to remediate the material weaknesses, management has concluded that material weaknesses in the design of ICFR continued to exist as of September 30, 2019.

Remediation of Material Weaknesses

Management has taken an active approach remediating and enhancing controls in the revenues cycle for concentrate deliveries. This approach was set out in the 2018 MD&A, updated as follows:

| | ● | new procedures and processes for metal accounting are now in place; |

| | ● | increased surveillance of concentrate stockpiles on the loading pad is complete; |

| | ● | real time tracking of delivery trucks is in place; |

| | ● | reconciliation of truck security seals is incorporated into the new process; |

| | ● | installation of truck scales and internal weight reconciliation on site at both Platosa and Miguel Auza is complete; |

| | ● | independent interim testing by E&Y has been ongoing for the month of October 2019, with final year-end testing scheduled for December 2019 and early January 2020; management continues to actively monitor and improve the program; |

| | ● | management continues to review and streamline internal control reports. |

Although there have been significant improvements made to the Company’s ICFR in relation to the material weaknesses disclosed in the 2018 MD&A, the material weaknesses cannot be considered remediated until the applicable remedial controls operate for a sufficient period of time and management has concluded, through testing, that these controls are operating effectively. No assurance can be provided at this time that the actions and remediation efforts the Company has taken or will implement will effectively remediate the material weaknesses described above or prevent the incidence of other significant deficiencies or material weaknesses in the Company’s ICFR in the future. The Company does not expect that disclosure controls or ICFR will prevent all errors, even as the remediation measures are implemented and further improved to address the material weaknesses. The design of any system of controls is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving our stated goals under all potential future conditions.

Other than the changes described above that were implemented in 2018, 2019 to date and ongoing, there have been no changes in the Company’s ICFR during the third quarter of 2019 that have materially affected, or are reasonably likely to materially affect, the Company’s ICFR.

|

Management’s Discussion & Analysis of Financial Results

For the three and nine months ended September 30, 2019 |

ACCOUNTING STANDARDS ISSUED BUT NOT YET EFFECTIVE

In March 2018 the International Accounting Standards Board (IASB) issued a revised Conceptual Framework for Financial Reporting which is currently being used by the Board and Interpretations Committee of the IASB in developing new pronouncements. Preparers of the financial statements, however, will only begin referring to the new framework from January 1, 2020.

SIGNIFICANT ACCOUNTING ESTIMATES AND JUDGEMENTS

The Company’s significant accounting policies are described in Note 3 to the consolidated financial statements for the year ended December 31, 2018. The preparation of the consolidated financial statements require management to make estimates and assumptions that affect the reported amounts of assets and liabilities in the consolidated financial statements and reported amounts of expenses during the reporting period. Such estimates and assumptions affect the carrying value of assets and are based on historical experience and other factors considered relevant. The estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognized in the period in which the estimates are revised. For details of these estimates, assumptions and judgements, please refer to the Company’s consolidated financial statements for the year ended December 31, 2018, which are available on the Company’s website and on SEDAR.

ADDITIONAL SOURCES OF INFORMATION

Additional disclosures pertaining to the Company, including its most recent AIF, audited and unaudited interim financial statements, management information circular, material change reports, press releases and other information, are available on the SEDAR website at www.sedar.com or on the Company’s website at www.excellonresources.com.

This MD&A contains “forward-looking statements” within the meaning of applicable Canadian securities legislation and applicable U.S. securities laws. Except for statements of historical fact relating to the Company, such forward-looking statements include, without limitation, statements regarding the future results of operations, performance and achievements of the Company, including potential property acquisitions, the timing, content, cost and results of proposed work programs, the discovery and delineation of mineral deposits/resources/reserves, geological interpretations, the potential of the Company’s properties, proposed production rates, potential mineral recovery processes and rates, business plans and future operating revenues. Forward-looking statements are made based on management’s beliefs, estimates, assumptions and opinions on the date the statements are made. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct and the Company undertakes no obligation to update forward-looking statements. Forward-looking statements are typically identified by words such as: believes, expects, anticipates, intends, estimates, targets, plans, postulates, and similar expressions, or are those which, by their nature, refer to future events. The Company cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance, and that actual results may differ materially from those in forward-looking statements as a result of various risk factors, including, but not limited to, variations in the nature, quality and quantity of any mineral deposits that may be located, significant downward variations in the market price of any minerals produced (particularly silver), the Company’s inability to obtain any necessary permits, consents or authorizations required for its activities, to produce minerals from its properties successfully or profitably, to continue its projected growth, to raise the necessary capital or to be fully able to implement its business strategies. A description of the risk factors applicable to the Company can be found in the AIF under “Description of the Business – Risk Factors.” All of the Company’s public disclosure filings may be accessed via www.sedar.com and readers are urged to review these materials, including the technical reports filed with respect to the Company’s mineral properties. This document is not, and is not to be construed in any way as, an offer to buy or sell securities in the United States.

|

Management’s Discussion & Analysis of Financial Results

For the three and nine months ended September 30, 2019 |

Cautionary Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Resources

The terms “Measured,” “Indicated” and “Inferred” Mineral Resources used or referenced in this MD&A are defined in accordance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) under the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) Standards on Mineral Resources and Mineral Reserves. The CIM standards differ significantly from standards in the United States. United States investors are advised that while such terms are recognized and required by Canadian regulations, the United States Securities and Exchange Commission does not recognize them. “Inferred Mineral Resources” have a great amount of uncertainty as to their existence, and as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category or that Mineral Resources will ever be upgraded to Mineral Reserves. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or other economic studies other than a Preliminary Economic Assessment (“PEA”). United States investors are cautioned not to assume that all or any part of Measured or Indicated Mineral Resources will ever be converted into Mineral Reserves. United States investors are also cautioned not to assume that all or any part of an Inferred Mineral Resource exists or is economically or legally mineable, or that a Measured or Indicated Mineral Resource is economically or legally mineable.

Cautionary Note to United States Investors regarding Adjacent or Similar Properties

This MD&A may also contain information with respect to adjacent or similar mineral properties in respect of which the Company has no interest or rights to explore or mine. The Company advises United States investors that the United States Securities and Exchange Commission’s mining guidelines strictly prohibit information of this type in documents filed with the SEC. Readers are cautioned that the Company has no interest in or right to acquire any interest in any such properties, and that mineral deposits on adjacent or similar properties are not indicative of mineral deposits on the company’s properties.