| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| SCHEDULE 14A |

| |

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. 1) |

| |

Filed by the Registrant x |

| |

Filed by a Party other than the Registrant o |

| |

| Check the appropriate box: |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material under §240.14a-12 |

| |

PREMIER ALLIANCE GROUP, INC. |

| (Name of Registrant as Specified In Its Charter) |

| |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| x | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| �� | | |

| | (5) | Total fee paid: |

| | | |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

| | | |

On April 24, 2014, Premier Alliance Group, Inc. (the “Company”) filed its Definitive Proxy Statement on Form 14-A announcing the date of its 2014 Annual Meeting of Shareholders (the “Annual Meeting”), then scheduled for June 12, 2014. On May 23, 2014, the Company announced that it would be postponing its scheduled Annual Meeting to a date to be determined by the Company’s Board of Directors (the “Board of Directors”). On May 20, 2014, the Company announced the reorganization of its executive team, including the appointment of Joseph J. Grano, Jr., the Company’s Chairman of the Board of Directors, as Chief Executive Officer of the Company. The Board of Directors elected to postpone the Company’s Annual Meeting in order to permit the Company’s shareholders to consider the impact of the changes to the Company’s management team and to provide additional items that the shareholders will be asked to consider and vote upon at the Annual Meeting.

The Board of Directors has set a new Annual Meeting date of August 13, 2014 and a new record date of June 19, 2014. Only shareholders of record at the close of business on June 19, 2014 will be entitled to vote at the Annual Meeting.

The Company has amended its proxy statement to include disclosures: (i) relating to the reorganization of the Company’s management team; (ii) to remove Kent Anson, the Company’s prior Chief Executive Officer and Director, as a nominee for the Board of Directors; and (iii) to include additional proposals which shareholders will be asked to consider and vote on, including an increase in the Company’s authorized capital stock and an increase in the number of shares of common stock available for issuance under the terms of the Company’s 2008 Stock Incentive Plan.

PREMIER ALLIANCE GROUP, INC.

4521 Sharon Road, Suite 300

Charlotte, North Carolina 28211

Tel. (704) 521-8077

Dear Fellow Shareholder:

You are cordially invited to attend the 2014 Annual Meeting of Shareholders of Premier Alliance Group, Inc., to be held at 1:00 pm Eastern Daylight Time on August 13, 2014 at our corporate offices located at 4521 Sharon Road, Suite 300, Charlotte, North Carolina 28211.

At this meeting, you will be asked to consider and vote, in person or by proxy, on the following matters:

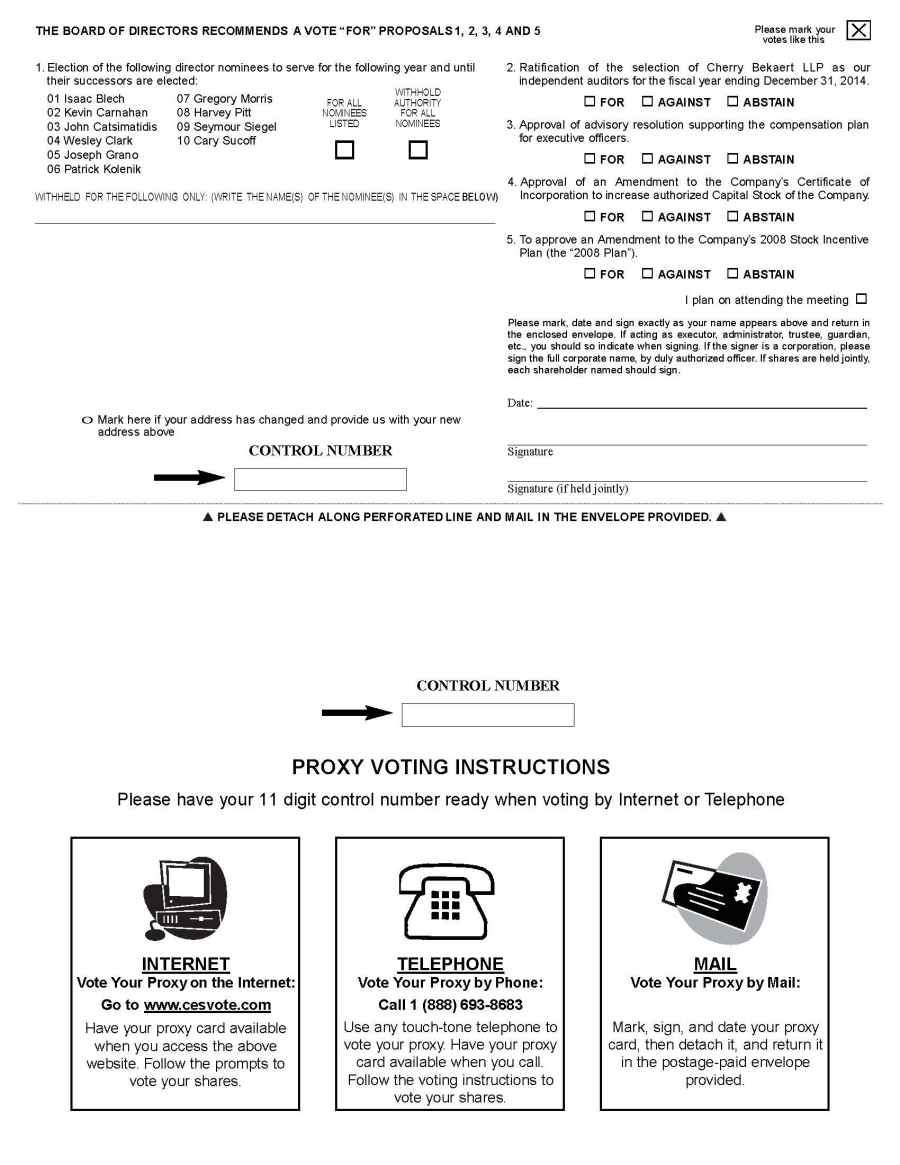

| 1. | Election of ten directors to the Board of Directors; |

| 2. | Ratification of the appointment of Cherry Bekaert LLP as our independent auditors; |

| 3. | Approval of a non-binding advisory resolution supporting the compensation of our named executive officers; |

| 4. | Approval of an amendment to the Company’s Certificate of Incorporation to be filed with the Delaware Secretary of State to increase the Company’s authorized common stock, par value $0.001 (the “Common Stock”) from 90,000,000 shares to 125,000,000 shares; |

| | |

| 5. | To approve an Amendment to the Company’s 2008 Stock Incentive Plan (the “2008 Plan”) increasing the number of shares of Common Stock available for issuance under the Plan from 10,000,000 to 20,000,000; and |

| 6. | Transaction of such other business as may properly come before the meeting or any adjournment. |

The official notice of meeting, proxy statement, and proxy card are included with this letter. The matters listed in the notice of meeting are described in detail in the accompanying proxy statement. We are also providing you with a copy of our annual report on Form 10-K for our fiscal year ended December 31, 2013.

Please vote as soon as possible to ensure that your vote is recorded promptly even if you plan to attend the Annual Meeting.

Very truly yours,

| /s/ Joseph J. Grano, Jr. |

Joseph J. Grano, Jr. Chairman of the Board of Directors |

PREMIER ALLIANCE GROUP, INC.

4521 Sharon Road, Suite 300

Charlotte, North Carolina 28211

Tel. (704) 521-8077

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To the Shareholders of Premier Alliance Group, Inc.:

We hereby notify you that the 2014 Annual Meeting of Shareholders of Premier Alliance Group, Inc., a Delaware corporation (“Premier” or the “Company”), will be held on August 13, 2014 at 1:00 pm Eastern Daylight Time, at our corporate offices, which are located at 4521 Sharon Road, Suite 300, Charlotte, North Carolina 28211. This meeting is being held for the following purposes:

| 1. | Election of ten directors to the Board of Directors; |

| 2. | Ratification of the appointment of Cherry Bekaert LLP as our independent auditors; |

| 3. | Approval of a non-binding advisory resolution supporting the compensation of our named executive officers; |

| 4. | Approval of an amendment to the Company’s Certificate of Incorporation to be filed with the Delaware Secretary of State to increase the Company’s authorized common stock, par value $0.001 (the “Common Stock”) from 90,000,000 shares to 125,000,000 shares; |

| | |

| 5. | To approve an Amendment to the Company’s 2008 Stock Incentive Plan (the “2008 Plan”) increasing the number of shares of Common Stock available for issuance under the Plan from 10,000,000 to 20,000,000; and |

| 6. | To Transaction of such other business as may properly come before the meeting or any adjournment. |

The matters listed in this notice of meeting are described in detail in the accompanying proxy statement. We have not received notice of other matters that may be properly presented at the Annual Meeting.

Only shareholders of record at the close of business on June 19, 2014 will be entitled to vote at the meeting and any adjournment (the “Record Date”). You may examine a list of the shareholders of record as of the close of business on June 20, 2014, for any purpose germane to the meeting during the ten-day period preceding the date of the meeting at our corporate offices, which are located at 4521 Sharon Road, Suite 300, Charlotte, North Carolina 28211.

Please vote as soon as possible as instructed in the Notice of Internet Availability of Proxy Materials, to ensure that your vote is recorded promptly, even if you plan to attend the Annual Meeting in person. If you hold your shares in your name as a registered holder and not through a bank or brokerage firm, you may submit your vote in person. The vote you cast in person will supersede any previous votes that you submitted, whether by Internet, phone, or mail. You may also request a paper proxy card to submit your vote by mail, if you prefer.

| By order of the Board of Directors | | |

| | | |

| /s/ Joseph J. Grano, Jr. | | | |

Joseph J. Grano, Jr. Chairman of the Board of Directors | | | |

Dated: June 23, 2014

Charlotte, North Carolina

| | TABLE OF CONTENTS | | |

| | | Page | |

| | | | |

| | GENERAL INFORMATION ABOUT PROXY SOLICITATION | 1 | |

| | PROPOSAL I: ELECTION OF DIRECTORS | 3 | |

| | INFORMATION ABOUT THE NOMINEES | 3 | |

| | INFORMATION REGARDING THE BOARD OF DIRECTORS | 6 | |

| | COMMUNICATIONS WITH THE BOARD OF DIRECTORS | 7 | |

| | DIRECTOR COMPENSATION | 8 | |

| | EXECUTIVE COMPENSATION | 9 | |

| | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 13 | |

| | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 17 | |

| | PROPOSAL 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS | 18 | |

| | REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS | 18 | |

| | PROPOSAL 3: ADVISORY RESOLUTION SUPPORTING THE COMPENSATION OF EXECUTIVE OFFICERS | 20 | |

| | PROPOSAL 4: INCREASE AUTHORIZED CAPITAL STOCK OF THE COMPANY | 21 | |

| | PROPOSAL 5: AMENDMENT TO PREMIER ALLIANCE GROUP INC.’S 2008 STOCK INCENTIVE PLAN | 23 | |

| | OTHER MATTERS | 26 | |

| | APPENDIX AND EXHIBITS | | |

PREMIER ALLIANCE GROUP, INC.

4521 Sharon Road, Suite 300

Charlotte, North Carolina 28211

Tel. (704) 521-8077

Our Board of Directors solicits your proxy for the 2014 Annual Meeting of Shareholders of Premier Alliance Group, Inc., to be held at 1:00 Eastern Daylight Time on August 13, 2014, at our corporate offices, 4521 Sharon Road, Suite 300, Charlotte, North Carolina 28211, and at any postponements and adjournments thereof, for the purposes sets forth in the “Notice of Annual Meeting of Shareholders.”

It is anticipated that the Notice of Internet Availability of Proxy Materials is first being sent to shareholders, and this proxy statement and the form of proxy relating to our 2014 Annual Meeting are first being made available to shareholders, on or about July 1, 2014. We will bear the cost of the solicitation of proxies. The original solicitation of proxies by mail may be supplemented by personal interview, telephone, and facsimile by our directors, officers, and employees. Arrangements will also be made with brokerage houses and other custodians, nominees, and fiduciaries for the forwarding of solicitation material to the beneficial owners of stock held by any such persons, and we may reimburse those custodians, nominees and fiduciaries for reasonable out-of-pocket expenses incurred by them in doing so.

Record Date and Stock Ownership. Only shareholders of record at the close of business on June 19, 2014 will be entitled to vote at the Annual Meeting. The majority of the shares of common stock outstanding on the record date and shares of preferred stock must be present in person or by proxy to have a quorum. We had 29,140,366 outstanding shares of common stock and 3,554,328 outstanding shares of preferred stock (convertible into an aggregate of 26,304,248 shares of common stock) as of the record date.

Submitting and Revoking Your Proxy. If you complete and submit your proxy, the persons named as proxies will follow your instructions. If you submit your proxy card but do not fill out the voting instructions on the proxy card, the persons named as proxies will vote your shares as follows:

| · | FOR the election of the director nominees as set forth in “Proposal 1: Election of Directors.” |

| · | FOR the ratification of the appointment of Cherry Bekaert LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014 as set forth in “Proposal 2: Ratification of Independent Registered Public Accounting Firm.” |

| · | FOR the non-binding resolution approving the compensation of our named executive officers as set forth in “Proposal 3: Advisory Resolution Supporting the Compensation of our Named Executive Officers.” |

| · | FOR an amendment to the Company’s Certificate of Incorporation filed with the Delaware Secretary of State to increase the Company’s authorized common stock, par value $0.001 (the “Common Stock”) from 90,000,000 shares to 125,000,000 shares, set forth in “Proposal 4: Increase in Authorized Capital Stock.” |

| | |

| · | FOR an amendment to the Company’s 2008 Stock Incentive Plan increasing the number of shares of Common Stock available for issuance under the Plan from 10,000,000 to 20,000,000, set forth in “Proposal 5: Amendment to Premier Alliance Group, Inc.’s 2008 Stock Incentive Plan.” |

In addition, if other matters are properly presented for voting at the annual meeting, the persons named as proxies will vote on such matters in accordance with their best judgment. We have not received notice of other matters that may be properly presented for voting at the annual meeting.

Your shareholder vote is important. Please vote as soon as possible to ensure that your vote is recorded promptly, even if you plan to attend the annual meeting in person. If you hold your shares in your name as a registered holder and not through a bank or brokerage firm, you may submit your vote in person. If voting in person at the meeting, please bring proof of identification. The vote you cast in person will supersede any previous votes that you submitted, whether by Internet, phone, or mail. For directions to the Corporate Office call 800-521-8077.

If you are a registered holder, you may revoke your proxy at any time before the Annual Meeting by submitting a later-dated proxy, voting in person at the Annual Meeting, or by delivering instructions to our Corporate Secretary before the Annual Meeting. If you hold shares through a bank or brokerage firm, you must contact that firm to revoke any prior voting instructions.

Quorum Requirement. The holders of at least one-third of the outstanding shares of stock entitled to vote shall constitute a quorum at the Annual Meeting of shareholders for the transaction of any business.

Votes Required to Adopt Proposals. Each share of our common stock and each share of preferred stock (on an as-converted to common stock basis) outstanding on the Record Date is entitled to one vote on each of the ten director nominees and one vote on each other matter. Directors receiving the plurality of votes cast will be elected (the number of shares voted “for” a director nominee must exceed the number of votes cast “against” that nominee). The approval of (A) the ratification of the appointment of Cherry Bekaert LLP, as our independent registered public accounting firm for the fiscal year ending December 31, 2014, (B) the approval of the non-binding advisory resolution supporting the compensation of our named executive officers, (C) the amendment to the Company’s Certificate of Incorporation filed with the Delaware Secretary of State to increase the Company’s authorized common stock, par value $0.001 (the “Common Stock”) from 90,000,000 shares to 125,000,000, and (d) the amendment to the Company’s 2008 Stock Incentive Plan increasing the number of shares of Common Stock available for issuance under the Plan from 10,000,000 to 20,000,000, requires the affirmative vote of the majority of the shares of our common stock and preferred stock (on an as-converted to common stock basis) present or represented by proxy with respect to each such proposal.

Shares of common stock and preferred stock not present at the Annual Meeting and shares voting “abstain” have no effect on the election of directors, the approval of the non-binding advisory resolution supporting the compensation of our named executive officers, the amendment to the Company’s Certificate of Incorporation increasing the authorized capital stock of the Company and the proposal amending the Company’s 2008 Plan. For the proposal approving ratifying the independent registered public accounting firm, abstentions are treated as shares present or represented and voting, so abstaining has the same effect as a negative vote. Broker non-votes on a proposal (shares held by brokers that do not have discretionary authority to vote on the matter and have not received voting instructions from their clients) are not counted or deemed present or represented for determining whether shareholders have approved that proposal. Please note, under changes to NYSE rule 452 effective January 1, 2010, that banks and brokers that have not received voting instructions from their clients CANNOT vote on their clients’ behalf on the proposal for election of the director nominees and approval of advisory resolution supporting the compensation of named executive officers.

Under rules adopted by the Securities and Exchange Commission, the Company is making this Proxy Statement and the Company’s Annual Report to Shareholders available on the Internet instead of mailing a printed copy of these materials to each shareholder. Shareholders who received a Notice of Internet Availability of Proxy Materials (the “Notice”) by mail will not receive a printed copy of these materials other than as described below. Instead, the Notice contains instructions as to how shareholders may access and review all of the important information contained in the materials on the Internet, including how shareholders may submit proxies by telephone or over the Internet.

If you received the Notice by mail and would prefer to receive a printed copy of the Company’s proxy materials, please follow the instructions for requesting printed copies included in the Notice.

Your Vote is Important

Please vote as promptly as possible

by signing, dating and returning the enclosed Proxy Card

PROPOSAL 1: ELECTION OF DIRECTORS Our nominees for the election of directors at the Annual Meeting include our Chairman, CEO and nine independent directors, as defined by the Nasdaq Marketplace Rules. Shareholders elect all directors annually. At the recommendation of the Nominating Committee, the Board of Directors (the “Board”) has selected the nominees to serve as directors for the one-year term beginning at the Annual Meeting on August 13, 2014, or until their successors, if any, are elected or appointed.

On May 20, 2014, Kent Anson, the Company’s former Chief Executive Officer and Director, resigned from his position as Chief Executive Officer and director of the Company and was appointed to serve as President of the Energy and Controls division of the Company. As such, Mr. Anson is not included as a nominee for election to the Board.

Unless proxy cards are otherwise marked, the persons named as proxies will vote all proxies received FOR the election of each nominee named in this section. If any director nominee is unable or unwilling to serve as a nominee at the time of the Annual Meeting, the persons named as proxies may vote for a substitute nominee chosen by the present Board to fill the vacancy or for the balance of the nominees, leaving a vacancy. Alternatively, the Board may reduce the size of the Board. We have no reason to believe that any of the nominees will be unwilling or unable to serve if elected as a director.

The Board recommends that you vote your shares “FOR” each of these nominees.

THE NOMINEES

| Name | Age | Position | Director Since |

| Joseph J. Grano, Jr | 66 | CEO, Director, Chairman | 2012 |

| Isaac Blech | 64 | Director, Vice Chairman | 2011 |

| Kevin Carnahan | 56 | Director | 2011 |

| John Catsimatidis | 65 | Director | 2012 |

| Wesley Clark | 70 | Director | 2012 |

| Patrick M. Kolenik | 62 | Director | 2011 |

| Gregory C. Morris | 53 | Director | 2008 |

| Harvey Pitt | 69 | Director | 2012 |

| Seymour Siegel | 71 | Director | 2012 |

| Cary W. Sucoff | 62 | Director | 2011 |

INFORMATION ABOUT THE NOMINEES

None of our directors or executive officers is related to any other director or executive officer. Our directors who holds any directorships in any other public company are identified under each individual below. All directors, except Mr. Grano, are independent directors as defined by the Nasdaq Marketplace Rules.

Stated below is the principal occupation of each nominee, the business experience of each nominee for at least the past five years, and certain other information relating to the nominees.

Joseph J. Grano, Jr., Chairman and Chief Executive Officer. Mr. Grano was appointed the Company’s Chief Executive Officer on May 20, 2014. Mr. Grano, Chairman and Chief Executive Officer of Centurion Holdings since 2004, was previously the Chairman and Chief Executive Officer of UBS Financial Services (formerly UBS PaineWebber). Mr. Grano is a former Chairman of the NASD Board of Governors; member of the NASD’s Executive Committee; and was appointed in 2002 by President George W. Bush to serve as Chairman of the Homeland Security Advisory Council. He began his Wall Street career with Merrill Lynch after serving in Vietnam as a member of the U. S. Special Forces (Green Berets). Mr. Grano holds Honorary Doctor of Law degrees from Pepperdine University and Babson College as well as Honorary Doctor of Humane Letters degrees from Queens College, City University of New York, and Central Connecticut State University. In addition he holds an Honorary Doctor of Business Administration degree from the University of New Haven. Mr. Grano is on the board of directors for Medgenics Inc where he is chair of the nominating and governance committee and a member of the compensation committee. Mr. Grano is the current CEO and Chairman of the Board for Premier Alliance Group.

Isaac Blech, Director, Vice Chairman. Mr. Blech, over the past three decades, has established some of the leading biotechnology companies in the world. These include Celgene Corporation, ICOS Corporation, Nova Pharmaceutical Corporation, Pathogenesis Corporation, and Genetics Systems Corporation. Collectively, these companies have produced major advances in a broad array of diseases including the diagnosis and treatment of cancer, chlamydia, sexual dysfunction, cystic fibrosis, and AIDS. Celgene Corporation is one of the world’s leading cancer and hematology companies and has a current value in excess of $55 billion. ICOS Corporation discovered the drug Cialis, and was acquired by Eli Lilly and Company for over $2 billion. Nova Pharmaceutical Corporation developed a new treatment for brain cancer, and after merging with Scios Corporation, was purchased for $2 billion by Johnson and Johnson. Pathogeneses Corporation created TOBI for cystic fibrosis, the first inhaled antibiotic approved by the Food and Drug Administration, and was acquired by Chiron Corp for $660 million. Genetics Systems Corporation developed the first inexpensive and accurate test to diagnosis chlamydia, allowing tens of thousands of babies to be born to women who otherwise would have become sterile from pelvic inflammatory disease. Genetics Systems was acquired for approximately 3% of Bristol Myers’s stock. Mr. Blech is currently a major shareholder and board member of ContraFect Corporation, Cerecor, Inc., Edge Therapeutics and Centrexion Corporation, all private companies. Mr. Blech is on the board of directors for The SpendSmart Payments Company (“SpendSmart”), Medgenics Inc., RestorGenex Corporation and Premier Alliance Group, all public companies. Mr. Blech serves as the chair of the nominating committee for SpendSmart and RestorGenex, is on the compensation committee for SpendSmart and Medgenics, and is on the nominating committee for Medgenics.

Kevin Carnahan, Director. Mr. Carnahan is a past senior managing partner at Accenture LLP where he led the systems integration business up until 2009. During his time at Accenture LLP, Mr. Carnahan also led Client Service Delivery and Quality for Financial Services, including Management Consulting, Technology (Systems Integration and IT Outsourcing) and BPO. Prior to that, he led several financial services teams in Europe. Mr. Carnahan serves on the Board of Premier Alliance Group and is on the compensation committee as well as serves as a director on three non-profit organizations.

John Catsimatidis, Director. Mr. Catsimatidis has been the Chairman and CEO of the Red Apple Group since 1986 and United Refining Company since 1987. Mr. Catsimatidis started out from the ground floor in the supermarket business. Since acquiring the Gristedes supermarkets in 1986, he has built Red Apple Group into an organization with diversified business holdings including oil refining and distribution, corporate jet leasing, convenience stores, the Hellenic Times newspaper and various real estate holdings. Mr. Catsimatidis founded and co-chairs the Brooklyn Tech Endowment Foundation, oversees the John Catsimatidis Scholarship Fund of the New York University Stern School of Business and sits on the Board of Trustees of the New School’s Milano School for Management and Urban Policy and the Executive Committee of the Columbia University Medical Center Board of Visitors. Mr. Catsimatidis has also served with several public companies in the past: as Chairman and CEO for United Refining Energy Corp, as a director for U.S. Corrugated, Inc and currently is on the Board of Directors and is a member of the Nominating Commitee of Premier Alliance Group.

Wesley Clark, Director. General Clark serves as Chairman and CEO of Wesley K. Clark & Associates, a strategic consulting firm he founded in 2004, Co-Chairman of Growth Energy, senior fellow at UCLA's Burkle Center for International Relations, Chairman of Clean Terra, Inc., and Director of International Crisis Group. General Clark serves as a member of the Clinton Global Initiative's Energy & Climate Change Advisory Board, and ACORE's Advisory Board. General Clark retired a four star general after serving 38 years in the United States Army. He served in a number of significant staff positions, including service as the Director of Strategic Plans and Policy (J-5) and in his last assignment as Supreme Allied Commander Europe. His awards include the Presidential Medal of Freedom, Defense Distinguished Service Medal (five awards), Silver Star, Bronze Star, Purple Heart, honorary knighthoods from the British and Dutch governments, and numerous other awards from other governments, including the award of Commander of the Legion of Honor (France). He graduated first in his class at West Point and completed degrees in Philosophy, Politics and Economics at Oxford University (B.A. and M.A.) as a Rhodes Scholar. He currently serves on the boards of the following public companies and their respective committees: Amaya Gaming out of Canada AMG Advanced Metallurgical Group a Dutch based company (Selection Committee), Bankers Petroleum Ltd out of Canada (Compensation & Governance Committee), BNK Petroleum Inc. (Environmental Committee), Juhl Energy (Audit Committee), Petromanas Energy, Prysmian (Internal Control), Rentech, Inc, and Premier Alliance Group.

Patrick M. Kolenik, Director. Mr. Kolenik has a forty year history working in positions involving all areas of securities trading and management with retail brokerage firms, equities and management of trading desk personnel and investment banking. Mr. Kolenik is currently the President of Cyndel and Company, an advisory consulting company, and is a General Partner in Huntington Laurel Partners, a hedge fund, and over the past 5 years provides management consulting services independently. Prior to this he held a variety of roles at Sherwood Securities where he progressed to Chairman and CEO. Mr. Kolenik was also the President of WinCapital Corporation, a full service brokerage firm. He has served as a board member for Sherwood Securities, Paradigm Medical, and WinCapital Corporation in the past and currently serves on the board for SpendSmart and Premier Alliance Group. Mr. Kolenik is a member of the compensation committee for SpendSmart and Premier Alliance Group.

Gregory C. Morris, Director. Mr. Morris has worked in positions involving finance, investments, benefits, risk management and human resources for more than 30 years. Since 2013 he has been the Vice President of Administration at Swisher Hygiene (a NASDAQ and Toronto Stock Exchange, company). From 2011 to 2012 he was a Vice President of Sales Human Resources for Snyder’s-Lance, Inc. (a NASDAQ listed company with revenues over $1.7 billion). Prior to this he held the positions of Vice President-Human Resource Operations and Senior Director-Benefits and Risk Management for Lance, Inc for 15 years prior to a merger with Snyders. At Lance, Mr. Morris has served as the Chairman of the Risk Management Committee, chaired the Business Continuity Plan Steering Committee, and was a member of the Corporate Mergers & Acquisitions team. Prior to joining Lance, Greg held various positions with Belk Stores, Collins & Aikman and Laporte plc. Greg also serves as a board member for the Second Harvest Food Bank of Metrolina. Mr. Morris currently serves on the audit committee for Premier Alliance Group as well as is the chair of the compensation committee.

Harvey Pitt, Director. Mr. Pitt served as the 26th Chairman of the Securities and Exchange Commission (the “SEC”) from 2001 – 2003. From 1975 – 1978 he was the SEC’s General Counsel. For nearly a quarter of a century before rejoining the SEC, Mr. Pitt was in the private practice of law. Mr. Pitt received a J.D. degree from St. John’s University School of Law (1968), and his B.A. from the City University of New York (Brooklyn College) (1965). He was awarded an honorary doctorate in law by St. John’s University School of Law in June 2002. Mr. Pitt served as an Adjunct Professor of Law at Georgetown University Law Center (1975-84), George Washington University Law School (1974-82) and the University of Pennsylvania School of Law (1983-84). Mr. Pitt has been the CEO and Managing Director of Kalorama Partners since 2003. Mr. Pitt currently services on the audit committee for Premier Alliance Group and is a director for the Paulson International Hedge Funds serving on their audit committee.

Seymour Siegel, Director. Mr. Siegel is a Certified Public Accountant, inactive, and since 2000 is a principal emeritus at Rothstein Kass, a national firm of accountants and consultants. Mr. Siegel was a founder of Siegel Rich & Co. CPA’s, which eventually merged into what is now known as WeiserMazars LLP, a large regional firm. He was a senior partner there until selling his interest and co-founding a business advisory firm, which later became a part of Rothstein Kass. He received his Bachelor of Business Administration from the Bernard M. Baruch School of the City College of New York. He has been a director and officer of numerous businesses, philanthropic and civic organizations. As a professional director, he has served on the boards of about a dozen public companies over the last 25 years, generally as audit committee chairman. He is currently a director and chairman of the audit committees of Air Industries Group, Inc., and Premier Alliance Group, Inc. He was formerly a director of Hauppauge Digital Inc., Oak Hall Capital Fund, Prime Motor Inns Limited Partnership, Noise Cancellation Technologies and Emerging Vision, Inc., among others.

Cary W. Sucoff, Director. Mr. Sucoff has over 30 years of securities industry experience encompassing supervisory, banking and sales responsibilities. Since January 2012 Mr. Sucoff has owned and operated Equity Source Partners, LLC an advisory and consulting firm. From February 2006 until December 2011, Mr. Sucoff owned and operated Equity Source Partners, LLC, a FINRA member firm which operated as a boutique investment bank. Mr. Sucoff currently serves on the following Boards of Directors: Contrafect Corp., Cerecor, Inc., SpendSmart and Premier Alliance Group. In addition, Mr. Sucoff serves as a consultant to Medgenics, Inc. (MDGN) and RestorGenex. Mr. Sucoff is the President of New England Law/Boston, has been a member of the Board of Trustees for over 25 years and is the current Chairman of the Endowment Committee. Mr. Sucoff received a B.A. from SUNY Binghamton (1974) and a J.D. from New England School of Law (1977) where he was the Managing Editor of the Law Review and graduated Magna Cum Laude. Mr. Sucoff has been a member of the Bar of the State of New York since 1978. Mr. Sucoff serves on the compensation committee for Premier Alliance Group and on the audit committee for SpendSmart.

INFORMATION REGARDING THE BOARD OF DIRECTORS

COMMITTEES OF THE BOARD OF DIRECTORS

Audit Committee

The Audit Committee assists the Board in its general oversight of our financial reporting, internal controls, and audit functions, and is responsible for the appointment, retention, compensation, and oversight of the work of our independent registered public accounting firm. The Audit Committee’s job is one of oversight. Management is responsible for the Company’s financial reporting process including its system of internal control, and for the preparation of consolidated financial statements in accordance with U.S. generally accepted accounting principles. The Company’s independent registered public accounting firm is responsible for auditing our financial statements. It is the Audit Committee’s responsibility to monitor and review these processes. It is not the Audit Committee’s duty or responsibility to conduct auditing or accounting reviews. Therefore, the Audit Committee has relied on management’s representation that the financial statements have been prepared with integrity and objectivity and in conformity with U.S. generally accepted accounting principles and on the representations of the independent registered public accounting firm included in their report on the Company’s financial statements.

The Audit Committee is currently comprised of Messrs Siegel, Pitt, and Morris. Mr. Siegel is the acting Chair of the Audit Committee. All members are independent. The Board has determined that Mr. Siegel meets the SEC’s qualifications to be an “audit committee financial expert,” including meeting the relevant definition of an “independent director.” Under the rules promulgated by the SEC, the designation or identification of a person as an audit committee financial expert does not impose on such person any duties, obligations or liabilities that are greater than the duties, obligations and liabilities imposed on such person as a member of the Audit Committee and Board in the absence of such designation or identification. The Board has determined that all members of the Audit Committee are financially literate and experienced in business matters and are capable of (1) understanding generally accepted accounting principles (“GAAP”) and financial statements, (2) assessing the general application of GAAP principles in connection with our accounting for estimates, accruals and reserves, (3) analyzing and evaluating our financial statements, (4) understanding our internal controls and procedures for financial reporting, and (5) understanding audit committee functions.

The report of the Audit Committee for fiscal year 2013 can be found below under the heading “Proposal Two: Ratification of Appointment of Independent Auditors.” The Audit Committee operates under a written charter adopted by the Board. A copy of the charter is available on our website, www.premieralliance.com, under the “Investor Relations” tab.

The Compensation Committee has authority for reviewing and determining salaries, performance-based incentives, and other matters related to the compensation of our executive officers, and administering our stock option plans, including reviewing, amending, and granting stock options to our executive officers and key employees.

The Compensation Committee is currently comprised of Messrs Carnahan, Kolenik, Morris, and Sucoff. Mr. Morris is the chair of the Compensation Committee. All members are independent.

The Compensation Committee operates under a formal charter that governs its duties and standards of performance. A copy of the charter is available on our website, www.premieralliance.com, under the “Investor Relations” tab.

Nominating Committee

The Nominating Committee establishes procedures for the nomination process, makes recommendations to the Board regarding the size and composition of the Board, and nominates officers for election by the Board. The Nominating Committee in 2013 was comprised of Messrs Blech, Catsimatidis, and Elliott. Mr. Elliott resigned from the board on April 1, 2014. Mr. Blech is the acting Chair of the Nominating Committee.

The Nominating Committee is responsible for reviewing with the Board, from time to time, the appropriate skills and characteristics required of Board members in the context of the current makeup of the Board. This assessment includes understanding of and experience in business, consulting and solution companies and finance experience. The Nominating Committee reviews these factors, and others considered useful by the Nominating Committee, in the context of an assessment of the perceived needs of the Board at a particular point in time. As a result, the priorities and emphasis of the Nominating Committee and of the Board may change from time to time to take into account changes in business and other trends, and the portfolio of skills and experience of current and prospective Board members.

Consideration of new Board candidates typically involves a series of internal discussions, review of information concerning candidates, and interviews with selected candidates. Board members or executive officers typically suggest candidates for nomination to the Board. The Nominating Committee considers candidates proposed by shareholders and evaluates them using the same criteria as for other candidates. A shareholder seeking to recommend a prospective nominee for the Nominating Committee’s consideration must do so by giving notice in writing to Chairman of the Nominating Committee, Premier Alliance Group, Inc., 4521 Sharon Road, Suite 300, Charlotte, North Carolina 28211. Any such notice must, for any given annual meeting, be delivered to the Chairman not less than 120 days prior to the anniversary of the preceding year's annual meeting. The notice must state (1) the name and address of the shareholder making the recommendations, (2) the name, age, business address, and residential address of each person recommended, (3) the principal occupation or employment of each person recommended, (4) the class and number of shares of Premier Alliance Group shares that are beneficially owned by each person recommended and by the recommending shareholder, (5) any other information concerning the persons recommended that must be disclosed in nominee and proxy solicitations in accordance with Regulation 14A of the Securities Exchange Act of 1934, and (6) a signed consent of each person recommended stating that he or she consents to serve as a director of our company if elected.

The Nominating Committee operates under a written charter, a copy of which is available on our website, www.premieralliance.com, under the “Investor Relations” tab.

In 2013, the board employed a search firm in connection with seeking and evaluating CEO candidates.

Attendance at Board, Committee and Annual Shareholders’ Meetings. The Board held four formal meetings/calls and acted by unanimous written consent one time in 2013. Committee meetings are held as needed and can be conducted via telephone. The Audit Committee met six times, the Compensation Committee met two times and the Nominating Committee did not meet during 2013. We expect each director to attend every meeting of the Board and the committees on which he serves. The majority of the directors attended at least 90% of the meetings of the Board and the committees on which they served in 2013 during the time in which they were appointed to the Board and the respective committees. We encourage each of the directors to attend the Annual Meeting of shareholders. Mr. Pitt attended 2 of the 4 board meetings during 2013 and attended 5 of the 6 audit committee meetings.

Director Independence. In accordance with the disclosure requirements of the SEC, and since the OTC Bulletin Board does not have its own rules for director independence, we have adopted the NASDAQ listing standards for independence. Nine of our current directors Isaac Blech, Kevin Carnahan, John Catsimatidis, Wesley Clark, Patrick Kolenik, Gregory Morris, Harvey Pitt, Seymour Siegel, and Cary Sucoff are non-employee directors and qualify as “independent” in accordance with the published listing requirements of NASDAQ. During his tenure as a director of the Company, Mark Elliott did not qualify as independent because he was an employee of Premier. Joseph J. Grano, Jr. does not qualify as independent due to the fact that Mr. Grano is our current Chief Executive Officer. Additionally, Mr. Grano was the Chairman of Ecological, LLC and participated in a transaction with Premier, relating to the acquisition of Ecological, LLC, which exceeded permissible amounts to retain such independence as set forth in NASDAQ Rule 5605(a)(2)(D). The NASDAQ rules have both objective tests and a subjective test for determining who is an “independent director.” The objective tests state, for example, that a director is not considered independent if he or she is an employee of the Company or is a partner in or executive officer of an entity to which the Company made, or from which the Company received, payments in the current or any of the past three fiscal years that exceed 5% of the recipient’s consolidated gross revenue for that year, or $200,000, whichever is greater. The subjective test states that an independent director must be a person who lacks a relationship that, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Corporate Code of Ethics. The Board is committed to legal and ethical conduct in fulfilling its responsibilities. The Board expects all directors, as well as officers and employees, to act ethically at all times. Additionally, the Board expects the Chief Executive Officer, the Chief Financial Officer, and all senior financial and accounting officials to adhere to the Company’s Code of Ethics. The Code of Ethics is posted on our Internet website at www.premieralliance.com, under the “Investor Relations” tab.

Communications with the Board of Directors. The Board recommends that shareholders initiate any communication with the Board in writing and send it to the attention of our Corporate Secretary by mail to: Board of Directors, Premier Alliance Group, Inc., 4521 Sharon Road, Suite 300, Charlotte, North Carolina 28211 or by e-mail to investor@premieralliance.com. This process will assist the Board in reviewing and responding to shareholder communications in an appropriate manner. The Board has instructed our Corporate Secretary to review such correspondence and, in his discretion, not to forward items if he deems them to be of a commercial or frivolous nature or otherwise inappropriate for the Board’s consideration.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Under Section 16 of the Exchange Act, our directors and executive officers and beneficial owners of more than 10% of any class of our equity securities are required to file certain reports, within specified time periods, indicating their holdings of and transactions in any class of equity securities and derivative securities. Officers, directors and greater than ten percent shareholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file. Based solely on a review of any such reports provided to us and written representations from such persons regarding the necessity to file any such reports, all filings were current as of our fiscal year ended December 31, 2013.

DIRECTOR COMPENSATION

The following table sets forth certain information regarding the compensation earned by or awarded to each independent director who served on our Board in 2013.

Director | Fees Earned Or Paid In Cash (1) ($) | Stock Awards ($) | Option Awards (2) ($) | Non-Equity Incentive Plan Compensation ($) | Non-qualified Deferred Compensation Earnings ($) | All Other Compensation (3) ($) | Total ($) |

| | | | | | | | |

| Isaac Blech | 27,000 | - | 13,785 | - | - | - | 40,785 |

| Kevin Carnahan | 23,000 | - | 13,785 | - | - | - | 36,785 |

| Pat Kolenik | 23,000 | - | 13,785 | - | - | - | 36,785 |

| Greg Morris | 37,000 | - | 13,785 | - | - | - | 50,785 |

| Cary Sucoff | 23,000 | - | 13,785 | - | - | - | 36,785 |

| Wesley Clark | 60,000 | - | | - | - | - | 60,000 |

| Seymour Siegel | 42,000 | - | 13,785 | - | - | - | 55,785 |

| Harvey Pitt | 25,500 | - | | - | - | - | 25,500 |

| Joseph J. Grano Jr. | 23,000 | - | 13,785 | - | - | - | 36,785 |

| John Catsimatidis | 13,500 | - | | - | - | - | 13,500 |

| (1) | Our standard compensation as established in mid-2013, each independent director receives a baseline of $3,500 for attendance at each regular and special meeting of the Board, and receives $1,500 for each committee meeting they attend. In addition each director receives a retainer of $10,000 for the year and committee chairs receive an additional retainer as follows: audit - $10,000, compensation - $7,500, and nominating - $5,000. Mr. Clark is compensated $5,000 per month of service for all meetings and committee service. |

| (2) | Our standard compensation established in mid-2013, consists of each independent director being granted options for 75,000 shares upon acceptance of a Board position each year. Mr. Clark was granted options for 300,000 shares upon acceptance of a Board position of which 150,000 vested immediately with 50,000 vesting annually for each year of service after the first year. Mr. Catsimatidis was granted options for 300,000 shares upon acceptance of a Board position of which 150,000 vested immediately with 50,000 vesting annually for each year of service after the first year. Mr. Pitt was granted options for 250,000 shares upon acceptance of a Board position of which 100,000 vested immediately with 50,000 vesting annually for each year of service after the first year. The amount set forth in this column represents the aggregate fair value of the awards as of the grant date, computed in accordance with FASB ASC Topic 718, "Compensation-Stock Compensation." Using the Black –Scholes valuation method. The assumptions used in calculating these amounts are based on a vesting period of five years and current risk free interest rates and volatility at grant date. |

Each director is also entitled to reimbursement for his or her reasonable out-of-pocket expenses incurred in connection with travel to and from, and attendance at, meetings of our Board or its committees and related activities, including director education courses and materials.

EXECUTIVE TEAM REORGANIZATION

On May 20, 2014, the Company appointed Joseph J. Grano, Jr. to serve as Chief Executive Officer of the Company. Mr. Grano also currently serves as the Chairman of the Company’s Board of Directors. Kent Anson, the Company’s former Chief Executive Officer, was appointed to serve as President of the Energy and Controls division of the Company.

On May 20, 2014, the Company appointed Brian King to serve as Chief Operating Officer of the Company. Mark Elliott, the Company’s former Chief Operating Officer, was appointed to serve as the Chief Administrative Officer of the Company.

Premier has entered into the following employment agreements:

On June 1, 2011, Premier entered into a three year employment agreement with Mark Elliott, past Chief Executive Officer and current Chief Administrative Officer. On August 9, 2013, Premier entered into a subsequent employment agreement with Mr. Elliott which amends the employment term through December 2015. The terms of the employment agreement provide for a minimum $210,000 annual base salary unless adjusted by the Board. Additional options and stock awards may be issued upon certain milestones and as determined by Premier’s board of directors.

On November 22 2013, Premier entered into a two year employment agreement with Eric Hipkins, head of the Cyber Security unit (Root9B). The terms of the employment agreement provide for a $200,000 annual base salary. Additional options and stock awards may be issued upon certain milestones and as determined by Premier’s board of directors.

On January 1, 2014 Premier entered into a one year employment agreement with Ken Smith, our Chief Financial Officer. The terms of the employment agreement provide for a $180,000 annual base salary. Mr. Smith also received an option to purchase an aggregate of 350,000 shares of common stock which will vest over a four year period.

On January 20, 2014, Premier entered into a one year employment agreement with Kent Anson, our then Chief Executive Officer. The terms of the employment agreement provide for a $275,000 annual base salary. Mr. Anson received a $100,000 signing bonus and will be eligible for a minimum guaranteed bonus of $100,000 payable at the end of 2014. Mr. Anson also received an option to purchase an aggregate of 800,000 shares of common stock which will vest over a three year period. Additional options and stock awards may be issued upon certain milestones and as determined by Premier’s board of directors. On May 20, 2014, Mr. Anson resigned from his position as Chief Executive Officer and director of the Company and was appointed to serve as President of the Energy and Controls division of the Company.

On May 20, 2014, Premier entered into an employment agreement with Joseph J. Grano, Jr., our Chief Executive Officer (the “Grano Employment Agreement”), which provides for a term of three years. Pursuant to the terms of the Grano Employment Agreement, the Company has agreed to pay Mr. Grano a base salary of $500,000 annually. Mr. Grano shall also be eligible for a minimum guaranteed annual bonus of $500,000 and was issued an option to purchase an aggregate of 2,000,000 shares of the Company’s common stock, which will vest one third immediately, one-third after one year and one-third after two years.

Compensation Discussion and Analysis

The Compensation Committee of our Board is charged with administering our executive compensation programs. The Compensation Committee evaluates the performance and, based on such evaluation, sets the compensation of our Board, Chief Executive Officer, President and other executive officers and administers our equity compensation plans.

Executive Compensation Policy

The objectives of our executive compensation programs are to:

| · | Attract, retain and motivate key executive personnel who possess the skills and qualities to perform successfully in the business and technology consulting industries and achieve our objective of maximizing shareholder value; |

| · | Closely align the interests of our executives with those of our shareholders; |

| · | Provide a total compensation opportunity that is competitive with our market for executive talent; and |

| · | Align our executives’ compensation to our Company’s operating performance with performance-based compensation that will provide actual compensation above the market median when the Company delivers strong financial performance and below the market median when performance is not strong. |

While we compete for talent with companies across all industries and sectors, we primarily focus on professional services companies in the energy and business consulting industries. While we often compete for talent outside this market, these companies define our market for compensation purposes. The Compensation Committee reviews data from these companies, along with other data as it deems appropriate, to determine market compensation levels from time to time and also can seek advice from outside compensation consultants.

Compensation Components

The Compensation Committee primarily uses a combination of base salary, discretionary bonuses and long-term incentive programs to compensate our executive officers. Each element aligns the interests of our executive officers with the interests of our shareholders by focusing on both our short-term and long-term performance.

Base Salaries. We are committed to retaining talented executives capable of diverse responsibilities and, as a result, believe base salaries for executives should be maintained at rates at or slightly ahead of market rates. The Compensation Committee assesses base salaries for each position, based on the value of the individual’s experience, performance and/or specific skill set, in the ordinary course of business, but generally not less than once each year as part of our budget determination process. Other than market adjustments that may be required from time to time, the Compensation Committee believes annual merit percentage increases for executives, if any, should generally not exceed, in any year, the average merit increase percentage earned by our non-executives.

Discretionary Annual Bonuses. The Compensation Committee has the authority to award discretionary annual cash or share bonuses to our executive officers based on individual and Company performance. We believe these bonuses are an important tool in motivating and rewarding the performance of our executive officers. Performance-based cash incentive compensation is expected to be paid to our executive officers based on individual and/or overall performance standards. The Board issued a discretionary bonus of $50,000 to the CEO in March 2012, however the CEO deferred receipt until 2013.

Long-Term Incentives. The Compensation Committee also believes that a portion of each executive’s annual total compensation should be a long-term incentive, both to align each executive with the interests of our shareholders and also to provide a retention incentive. The Compensation Committee approved our 2008 Stock Incentive Plan in May 2008 and received shareholder approval in 2009 (the “Plan”). As of December 31, 2013 2,175,000 stock options have been granted to senior management and executives under the Plan. The Outstanding Equity Awards at Fiscal Year End Table below details the stock options granted to executives under the Plan since 2008. In 2014, options were issued to a new CEO, CFO, and COO, as of June 1, 2014 a total of 5,525,000 stock options have been granted and are outstanding to senior management and executives under the Plan.

The following table sets forth the information as to compensation paid to or earned by our Chief Executive Officer and our two other most highly compensated executive officers during the fiscal years ended December 31, 2013 and 2012.

Joseph J. Grano, Jr., Ken Smith, Mark Elliott, Larry Brumfield and Graeme Booth are referred to in this proxy statement as our “Named Executive Officers”. Joseph J. Grano, Jr., our Chief Executive Officer as of May 20, 2014, Kent Anson, our Chief Executive Officer from January 20, 2014 through May 20, 2014, and Ken Smith, our Chief Financial Officer as of January 1, 2014, had no compensation in 2013. As none of our Named Executive Officers received any stock awards, non-equity incentive plan compensation, or nonqualified deferred compensation earnings during the fiscal years ended December 31, 2013 and 2012, we have omitted those columns from the table.

SUMMARY COMPENSATION TABLE

| Name and Principal Position | Year | Salary (3) | Bonus($) | Option Awards (1) | Other Compensation (2) | Total Compensation |

Mark S. Elliott(7) Chief Executive Officer | 2013 | 215,750 | 48,000(5) | | 3,582 | 267,332 |

| | 2012 | $218,009 | 0 | 44,400 | $4,425 | $266,834 |

| | | | | | | |

Larry W. Brumfield (4)(6) Chief Financial Officer | 2013 | 184,182 | | | | 184,182 |

| | 2012 | $150,000 | 0 | 14,800 | 0 | $164,800 |

| | | | | | | |

Graeme Booth President of Services | 2013 | 225,038 | 3,000 | | | 228,038 |

| | 2012 | $220,146 | 0 | 14,800 | 0 | $234,946 |

| | | | | | | |

| 1) | Represents stock options granted to these executives. |

| 2) | The amount under “Other Compensation” represents a car allowance or allocations. |

| 3) | Variances from base salary include compensation per company policy for payouts of Paid Time Off not used in prior years that is ineligible to rollover year to year. |

| 4) | On November 22, 2013, the Company and Larry Brumfield jointly determined to end their relationship. |

| 5) | Bonus was awarded in 2012 and paid during 2013. |

| 6) | On January 1, 2014, the Company hired Ken Smith as the Chief Financial Officer. |

| 7) | On January 20, 2015, the Company hired Kent Anson as Chief Executive Officer and Mark Elliott assumed the role of Chief Operating Officer. On May 20, 2014, the Company appointed Joseph J. Grano, Jr. as Chief Executive Officer and Kent Anson assumed the role of President of the Energy and Controls division of the Company. |

DESCRIPTION OF BENEFIT PLANS

2008 Stock Incentive Plan

The following table provides information about the number of outstanding equity awards held by our senior management team including our named executive officers at December 31, 2013. As of December 31, 2013, options to purchase 2,175,000 shares of our common stock by our executives were outstanding. For issuances to executive officers in 2014 refer to Executive Compensation above.

Outstanding Equity Awards at Fiscal Year-End

| | Option awards | Stock awards |

Name | Number of securities underlying unexercised options (#) exercisable | Number of securities underlying unexercised options (#) unexercisable | Equity incentive plan awards: Number of securities underlying unexercised unearned options (#) | Option exercise price ($) | Option expiration date | Number of shares or units of stock that have not vested (#) | Market value of shares or units of stock that have not vested ($) | Equity incentive plan awards: Number of unearned shares, units or other rights that have not vested (#) | Equity incentive plan awards: Market or payout value of unearned shares, units or other rights that have not vested ($) |

| Mark Elliott | 300,000 75,000 200,000 | | | 1.00 1.00 0.75 | 3/31/17 12/2020 5/2018 | | | | |

| Larry Brumfield (1) | 100,000 200,000 | | | 1.00 1.00 | 3/31/17 10/2021 | | | | |

| Kevin Hasenfus | 75,000 200,000 | | | 1.00 0.75 | 12/2020 5/2018 | | | | |

| Robert Yearwood(2) | 75,000 200,000 | | | 1.00 0.75 | 12/2020 5/2018 | | | | |

| Graeme Booth | 100,000 150,000 100,000 200,000 | | | 1.00 1.10 1.00 1.00 | 3/31/17 06/2021 12/2020 6/2020 | 50,000 | 32,500 | | |

| John Galt | 200,000 | | | 0.78 | 12/31/17 | | | | |

| (1) | On November 22, 2013, the Company and Larry Brumfield jointly determined to end their relationship. All of these options expired and are cancelled effective March 1, 2014 |

| On March 31, 2014, the Company and Robert Yearwood jointly determined to end their relationship. All of these options will expire and be cancelled effective July 1, 2014 if not exercised. |

LIMITS ON LIABILITY AND INDEMNIFICATION

We provide Directors and Officers insurance for our current directors and officers.

Our certificate of incorporation eliminates the personal liability of our directors to the fullest extent permitted by law. The certificate of incorporation further provides that the Company will indemnify its officers and directors to the fullest extent permitted by law. We believe that this indemnification covers at least negligence and gross negligence on the part of the indemnified parties. Insofar as indemnification for liabilities under the Securities Act may be permitted to our directors, officers, and controlling persons under the foregoing provisions or otherwise, we have been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act of 1933 and is therefore unenforceable.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information, as of June 1, 2014, with respect to the beneficial ownership of our outstanding common and preferred stock by (i) each person known to own beneficially more than 5% of our each class of securities; (ii) each of our named executive officers and our directors; and (iii) all of our directors and executive officers as a group.

Unless otherwise indicated in the footnotes below, we believe the persons and entities named in the table have sole voting or investment power with respect to all shares owned. Additionally, unless otherwise indicated, the address of each person is care of Premier Alliance Group, Inc., 4521 Sharon Road, Suite 300, Charlotte, North Carolina 28211.

| Name | Number of Shares of Common Stock Beneficially Owned | % of Class (1) | Number of Shares of Series C Preferred Stock Beneficially Owned | % of Class | Number of Shares of Series B Preferred Stock Beneficially Owned | % of Class | Number of Shares of Series D Preferred Stock Beneficially Owned | % of Class |

| Kent Anson (24) | 995,000 | 3.3% | | | | | | |

| Ken Smith (25) | 350,000 | 1.2% | | | | | | |

| Mark S. Elliott (2) | 1,226,016 | 4.1% | | | | | | |

| Robert N. Yearwood (3) | 1,877,119 | 6.4% | | | | | | |

| Kevin J. Hasenfus (3) | 1,567,031 | 5.3% | | | | | | |

| Gregory C. Morris (4) | 150,000 | 0.5% | | | | | | |

| Graeme Booth (6) | 550,000 | 1.9% | | | | | | |

| John Galt (7) | 465,033 | 1.4% | | | | | | |

| John Catsimatidis (8) | 656,836 | 2.2% | | | | | | |

| Seymour Siegel (9) | 165,518 | 0.6% | | | | | | |

| Wesley Clark (10) | 300,000 | 1.0% | | | | | | |

| Harvey Pitt (11) | 250,000 | 0.9% | | | | | | |

| Patrick Kolenik (12) | 839,117 | 2.8% | | | | | | |

| Cary Sucoff (13) | 859,385 | 2.9% | | | | | | |

| Richard Siskey (14) | 1,051,944 | 3.6% | | | | | | |

| Kevin Carnahan (15) | 318,334 | 1.1% | | | | | | |

| Joseph J. Grano, Jr. (16) | 4,125,000 | 12.6% | | | | | | |

| Isaac Blech (17) | 1,384,231 | 4.7% | | | | | | |

| Brian King (18) | 870,466 | 3.0% | | | | | | |

| Miriam Blech (19) | 9,408,835 | 24.9% | 1,428,571 | 60% | | | | |

| River Charitable Remainder Unitrust f/b/o Isaac Blech (20) | 6,272,555 | 18.0% | 952,381 | 40% | | | | |

| Joseph C Grano & Robert Silver Trustees of The Granos Childrens Trust (26) | 2,681,613 | 9.2% | | | | | | |

| Eric Hipkins (27) | 1,698,215 | 5.8% | | | | | | |

| Maxim Group, LLC (21) | 2,725,170 | 9.4% | | | | | | |

| Philip Kolenik (22) | 311,832 | 1.1% | | | 160,000 | 13.8% | | |

| Louis Eckley (22) | 194,303 | 0.7% | | | 100,000 | 8.6% | | |

| Equitable Trust Company, dba Sterling Trust Custodian FBO David J. Mahoney, IRA (22) | 194,484 | 0.7% | | | 100,000 | 8.6% | | |

| Rozsak Capital, LLLP (22) | 155,443 | 0.5% | | | 80,000 | 6.9% | | |

| K&A Trust (22) | 155,443 | 0.5% | | | 80,000 | 6.9% | | |

| Matthew McFee (22) | 155,777 | 0.5% | | | 80,000 | 6.9% | | |

| Michael Burkhard&Teresa Hawkins (22) | 116,582 | 0.4% | | | 60,000 | 5.2% | | |

| Jenco Business Advisors (22) | 156,799 | 0.5% | | | 80,000 | 6.9% | | |

| Jerold Novack (22) | 117,599 | 0.4% | | | 60,000 | 5.2% | | |

| Equitable Trust Company, dba Sterling Trust Custodian FBO Thomas W. Brake, IRA (22) | 116,691 | 0.4% | | | 60,000 | 5.2% | | |

| Robert Kargman & Marjie Kargman JT TEN (23) | 2,655,939 | 8.4% | | | | | 1,500 | 10.8% |

| Sol J. Barer (23) | 1,770,626 | 5.7% | | | | | 1,000 | 7.2% |

| ACNYC, LLC (23) | 1,770,626 | 5.7% | | | | | 1,000 | 7.2% |

| Transpac Investments Limited (23) | 1,750,063 | 5.7% | | | | | 1,000 | 7.2% |

| The Peierls Foundation (23) | 1,239,439 | 4.1% | | | | | 700 | 5.0% |

All directors and named officers as a group (2)(3)(4)(5)(6)(7)(8)(10) (11)(12)(13)(14)(15)(16)(17)(18) | 19,724,484 | 35.6% | 952,381 | 40% | | | | |

| (1) | For purposes of this table, a person or group of persons is deemed to have “beneficial ownership” of any shares of common stock they have the right to acquire within 60 days of December 31, 2013. When computing beneficial ownership percentages, shares of common stock that may be acquired within 60 days are considered outstanding for that holder only, not for any other holder. The number and percentage of shares beneficially owned are based on 28,433,813 shares of common stock issued and outstanding as of April, 1, 2014. |

| (2) | Includes 575,000 shares issuable upon exercise of stock options held by Mark Elliott. The options were granted in May 2008, December 2010 and March 2012. |

| (3) | Includes 275,000 shares issuable upon exercise of stock options held each by Kevin Hasenfus and Robert Yearwood. The options were granted in May 2008 and December 2010. |

| (4) | Includes 50,000 shares issuable upon exercise of warrants held by Greg Morris, granted in June 2011. Also includes 100,000 shares issuable upon exercise of stock options granted in July 2012 and July 2013. |

| (5) | Includes 300,000 shares issuable upon exercise of stock options held by Larry Brumfield. |

| (6) | Includes 550,000 shares issuable upon exercise of stock options by Graeme Booth. |

| (7) | All of the shares held (212,026) have been placed in escrow under the terms of the acquisition of GreenHouse Holdings, Inc. by the Company. This also includes 200,000 shares of common stock issuable upon exercise of stock options. |

| (8) | Represents 300,000 shares of common stock issuable upon exercise of stock options issued July 18, 2012 upon his becoming a new member of the Board of Directors. Includes 250 shares of Series D Preferred Stock convertible into 333,334 shares of common stock and dividends issued on the Series D Preferred Stock in 2013, which are owned by United Acquisition Corp of which Mr. Catsimatidis indirectly controls and owns. |

| (9) | Represents 150,000 shares of common stock issuable upon exercise of stock options. 25,000 shares were granted on March 14, 2012 for past board service with GreenHouse and an additional 50,000 were granted on July 1, 2012 upon his being named to the Board of Directors for Premier. 75,000 were granted in July 2013. |

| (10) | Represents 300,000 shares of common stock issuable upon exercise of stock options issued August 14, 2012 upon his becoming a new member of the Board of Directors. |

| (11) | Represents 250,000 shares of common stock issuable upon exercise of warrants issued March 21, 2012 upon his becoming a new member of the Board of Directors. |

| (12) | Includes 540,000 shares issuable upon exercise of warrants. The warrants were granted in April 2010, March 2011, June 2011 and March 2012 and expire in 5 years from issue. Also includes 155,044 shares of common stock held by Huntington Laurel Partners LP of which Mr. Kolenik is a General Partner. Mr. Kolenik shares investment and voting power of the Huntington Laurel Partners shares, and disclaims beneficial ownership to 77,522 of those shares. Also includes 100,000 shares of common stock issuable upon exercise of stock options granted in July 2012 and July 2013. |

| (13) | Includes 706,440 shares issuable upon exercise of warrants. The warrants were granted in April, June, and December of 2010 and March 2011 and June 2011, and March 2012 and expire in 5 years from issue. Also includes 100,000 shares of common stock issuable upon exercise of stock options granted in July 2012 and July 2013. |

| (14) | Includes 70,000 shares issuable upon exercise of warrants granted in December 2010, which expire in December 2015. |

| (15) | Includes 100,000 shares issuable upon exercise of warrants held by Kevin Carnahan granted in September 2011 and 125,000 shares of common stock issuable upon exercise of stock options granted in July 2012 and July 2013. Also represents 70 shares of Series D Preferred Stock convertible into 93,334 shares of common stock. |

| (16) | Includes 500,000 shares received in the acquisition of Ecological, LLC by the Company. The shares are registered in the name of Centurion Holdings, LLC, of which Mr. Grano is a controlling member. Includes 1,300,000 shares of common stock issuable upon exercise of stock options issued to Joseph Grano, Jr, named as the Chairman of the Board of Directors of the Company. The 1,300,000 options are held in the name of Centurion Holdings LLC, of which Mr. Grano is a controlling member. Includes 75,000 options issued for annual board service in July 2013 and 250,000 options issued for board service in March 2014 and 2,000,000 options issued when named the CEO in May 2014. |

| (17) | Represents 834,231 shares of common stock, 100,000 shares of common stock issuable upon exercise of stock options granted in July 2012 and July 2013, and 50,000 shares of stock issuable upon exercise of warrants granted June 2011 and 400,000 shares of stock issuable upon exercise of warrants granted May 2012 upon Mr. Blech accepting the position of Vice Chairman of the Board of Directors, both held directly in the name of Isaac Blech. |

| (18) | Includes 620,466 of common stock owned pursuant to the Company’s acquisition of Ecological, LLC on December 31, 2012 by the CEO of Ecological Partners, LLC, the Company’s wholly owned subsidiary. Also includes 250,000 shares issuable upon exercise of options granted in January 2014. |

| (19) | Represents (a) 1,428,571 shares of Series C Preferred Stock convertible into 4,285,714 shares of common stock, (b) 4,285,714 shares of common stock issuable upon the exercise of warrants and (c) 837,407 shares of Common Stock. Does not include 952,381 shares of Series C Preferred Stock convertible into 2,857,143 shares of common stock and 2,857,142 shares of common issuable upon the exercise of warrants beneficially owned by River Charitable Remainder Unitrust f/b/o Isaac Blech (the “Trust”), of which Isaac Blech is the sole trustee. Miriam Blech is Isaac Blech’s wife and a beneficiary under the Trust. Mrs. Blech disclaims beneficial ownership of the shares held by the Trust, except to the extent of any pecuniary interest therein. Mr. Blech disclaims beneficial interest in the shares held by Mrs. Blech. |

| (20) | Represents (a) 952,381 shares of Series C Preferred Stock convertible into 2,857,142 shares of common stock, (b) 2,857,142 shares of common stock issuable upon the exercise of warrants and (c) 558,271 shares of common stock. Does not include 1,428,571 shares of Series C Preferred Stock convertible into 4,285,713 shares of common stock and 4,285,714 shares of common issuable upon the exercise of warrants beneficially owned by Miriam Blech. The sole trustee of the Trust is Isaac Blech, who has sole voting and dispositive power of the Trust. The beneficiaries of the Trust are Miriam and Isaac Blech. Mr. Blech disclaims beneficial ownership of the shares held by Mrs. Blech, except to the extent of the any pecuniary interest therein. |

| (21) | Includes 260,750 shares of common stock owned. Also includes 2,464,420 shares of common stock issuable upon exercise of warrants. The warrants were granted in March 2011 (714,285), December 2012 (939,467), January 25, 2013 (527,334), and February 26, 2013 (283,334) and expire in 5 years from issue. |

| (22) | Represents shares of common stock underlying Series B Preferred Stock convertible on a one-to-one basis, common shares issued as dividends on the Preferred Stock and 870,000 shares of common stock issuable upon exercise of warrants collectively. |

| (23) | Represents shares of common stock underlying Convertible Redeemable Series D Preferred Stock. Each share represents $1,000 and is convertible at $0.75. Also includes warrants at 25% total coverage on the converted common shares. Also includes common stock dividends issued on Series D Preferred Stock in 2013. |

| (24) | Includes 800,000 shares of common stock issuable upon exercise of stock options issued January 2013 upon his becoming the Chief Executive Officer of the company. |

| (25) | Represents 350,000 shares of common stock issuable upon exercise of stock options issued January 2013 upon his becoming the Chief Financial Officer of the company. |

| (26) | Includes 2,681,613 shares received in the acquisition of Ecological, LLC. The shares are registered in the name of “Joseph C. Grano and Robert H. Silver, Trustees of The Grano Children’s Trust dtd. December 13, 2012” . |

| (27) | Includes 1,698,215 shares received in the acquisition of Root9B, LLC by the Company of which Mr. Hipkins was the CEO. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Our Audit Committee reviews any related party transaction, as that term is defined in Item 404 of Regulation S-K, in which we or any of our directors, nominees for director, executive officers or holders of more than 5% of our common stock or any of their immediate family members, is, was or is proposed to be a participant. Our management is responsible for determining whether a transaction contains the characteristics described above requiring review by our board of directors.

Except for the transaction described below, or otherwise set forth in this proxy statement, none of our directors or executive officers and no holder of more than 5% of the outstanding shares of our common stock, and no member of the immediate family of any such director, officer or security holder, to our knowledge, had any material interest in any transaction during the fiscal year ended December 31, 2013, or in any currently proposed transaction, which would qualify as a related party transaction, as that term is defined in Item 404 of Regulation S-K

On December 31, 2012 we purchased substantially all of the assets of Ecological LLC. Mr. Grano, our current Chief Executive Officer and Chairman of the Board, served as Chairman of Ecological, LLC at the time of the acquisition, and as such is deemed a related party for purpose of Item 404 of Regulation S-K. In consideration for the purchase of the Ecological, LLC assets, we paid approximately $7 million in cash and shares of our common stock. Mr. Grano individually received approximately $1,972,600 in consideration for the sale of the assets of Ecological, LLC.

PROPOSAL 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

Cherry Bekaert LLP (CB) was selected by the audit committee as our independent accountant in January 2012, responsible for auditing our financial statements. CB is the second largest public accounting firm in the south and is in the top 30 nationally. CB has a significant presence in Charlotte, our headquarters, and has strong practice experience not only as it relates to financial audit and reporting but with M&A and strategic planning. By selecting CB as our auditors we are positioned with a firm that has the expertise and capability to support us through our growth.

During the two most recent fiscal years and through the date of dismissal, we had no disagreements, whether or not resolved, with Cherry Bekaert on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which, if not resolved to Cherry Bekaert’s satisfaction, would have caused Cherry Bekaert to make reference to the subject matter of the disagreement in connection with its report. There were no events otherwise reportable under Item 304(a)(1)(iv) of Regulation S-K.

During our two most recent fiscal years, we did not consult CB regarding the application of accounting principles to a specific completed or contemplated transaction, or the type of audit opinion that might be rendered on our financial statements.

Our Board of Directors recommends that you vote your shares FOR ratification of selection of Cherry Bekaert LLPas our independent auditors for the 2014 fiscal year.

We do not anticipate that representatives of Cherry Bekaert LLP will attend the Annual Meeting.

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The Audit Committee oversees our financial reporting process on behalf of the board of directors. Management has the primary responsibility for the financial statements and the reporting process, including the system of internal control. In fulfilling its oversight responsibilities, the Audit Committee reviewed the audited financial statements in the Annual Report on Form 10-K with management, including a discussion of the quality, not just the acceptability, of the accounting principles; the reasonableness of significant judgments; and the clarity of disclosures in the financial statements.

The Audit Committee reviewed with the independent auditors, who are responsible for expressing an opinion on the conformity of those audited financial statements with accounting principles generally accepted in the U.S., their judgments as to the quality, not just the acceptability, of our accounting principles, and such other matters as are required to be discussed with the Audit Committee under auditing standards of the Public Company Accounting Oversight Board (United States). In addition, the Audit Committee has discussed with the independent auditors the auditors’ independence from management and our company, including the matters in the written disclosures provided to us by the independent auditors, as required by the Public Company Accounting Oversight Board (United States), and considered the compatibility of non-audit services with the auditors’ independence.

The Audit Committee discussed with our independent auditors the overall scope and plans for their audit. The Audit Committee meets with the independent auditors to discuss the results of their examinations, their evaluations of our internal controls, and the overall quality of our financial reporting.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the board of directors (and the board of directors has approved) that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2013, for filing with the Securities and Exchange Commission.