| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| SCHEDULE 14A |

| |

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 |

| |

| Filed by the Registrant |

| |

| Filed by a Party other than the Registrant |

| |

| Check the appropriate box: |

| x | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material under §240.14a-12 |

| |

ROOT9B TECHNOLOGIES, INC. |

| (Name of Registrant as Specified In Its Charter) |

| |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| x | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

| | | |

ROOT9B TECHNOLOGIES, INC.

4521 Sharon Road, Suite 300

Charlotte, North Carolina 28211

Tel. (704) 521-8077

Dear Fellow Stockholder:

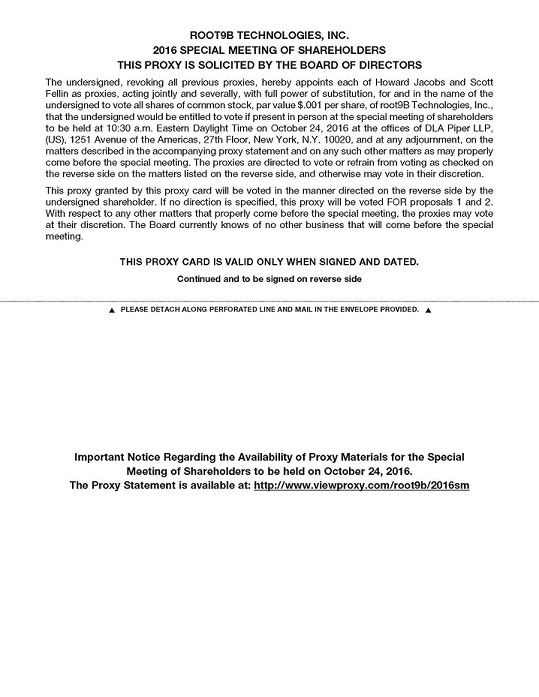

You are cordially invited to attend the 2016 Special Meeting of Stockholders of root9B Technologies, Inc., to be held at 10:30 a.m. Eastern Daylight Time on October 24, 2016 at the offices of DLA Piper LLP (US), 1251 Avenue of the Americas, 27th Floor, New York, New York, 10020.

At this meeting, you will be asked to consider and vote, in person or by proxy, on the following two matters:

| 1. | The approval of an amendment to our certificate of incorporation to effect a reverse stock split at a ratio to be determined by our Board within the range of 1:9 to 1:18; and |

| 2. | The approval of an amendment to our certificate of incorporation to decrease our authorized shares of common stock. |

The official notice of meeting, proxy statement, and proxy card are included with this letter. The matters listed in the notice of meeting are described in detail in the accompanying proxy statement.

After carefully review the proxy statement, please complete and forward the enclosed proxy card as soon as possible to ensure that your vote is recorded even if you plan to attend the special meeting.

Very truly yours,

____________________________

Joseph J. Grano, Jr.

CEO and Chairman of the Board of Directors

Dated: September __, 2016

ROOT9B TECHNOLOGIES, INC.

4521 Sharon Road, Suite 300

Charlotte, North Carolina 28211

Tel. (704) 521-8077

NOTICE OF 2016 SPECIAL MEETING OF STOCKHOLDERS

To the Stockholders of root9B Technologies, Inc.:

We hereby notify you that a special meeting of stockholders of root9B Technologies, Inc. will be held on October 24, 2016 at 10:30 a.m. Eastern Daylight Time, at the offices of DLA Piper LLP (US), 1251 Avenue of the Americas, 27th Floor, New York, New York, 10020. This meeting is being held for the following purposes:

| 1. | The approval of an amendment to our certificate of incorporation to effect a reverse stock at a ratio determined by our Board within the range of 1:9 to 1:18; and |

| 2. | The approval of an amendment to our certificate of incorporation to decrease our authorized shares of common stock. |

The matters listed in this notice of meeting are described in detail in the accompanying proxy statement. We have not received notice of other matters that may be properly presented at the special meeting.

Only stockholders of record at the close of business on September 9, 2016 will be entitled to vote at the meeting and any adjournment. As of that day, we had _______ shares of our common stock and _______ shares of our Series C preferred stock outstanding. You may examine a list of stockholders of record as of the close of business on September 9, 2016, for any purpose germane to the meeting during the ten-day period preceding the date of the meeting at our offices located at 4521 Sharon Road, Suite 300, Charlotte, North Carolina 28211.

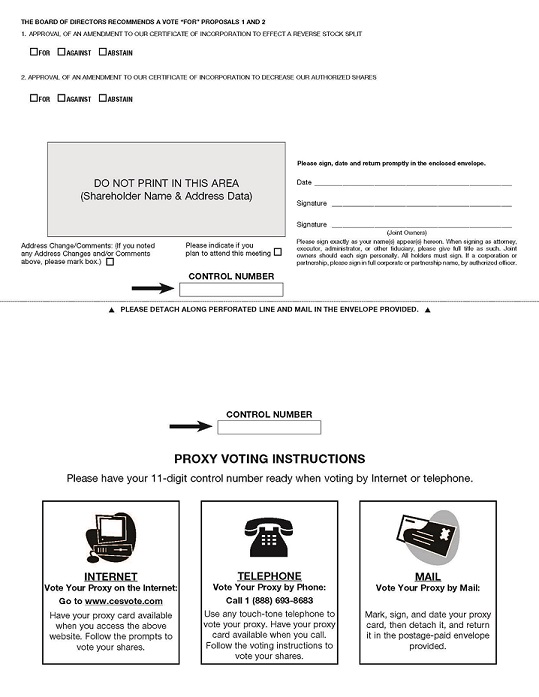

Please vote as soon as possible as instructed in the proxy materials to ensure that your vote is recorded, even if you plan to attend the 2016 Special Meeting in person. Please vote by following the instructions contained in the proxy statement and on the proxy card. If you hold your shares in your name as a registered holder and not through a bank or brokerage firm, you may submit your vote in person. The vote you cast in person will supersede any previous votes that you submitted, whether by Internet, phone, or mail. You may also request a paper proxy card to submit your vote by mail, if you prefer. If your shares are held in street name through a brokerage account, bank or other nominee, you must provide your voting instructions in accordance with the voting instruction form provided by your broker, bank or other nominee. Please note that if you are a beneficial owner and wish to vote in person at the Meeting, you must provide a “legal proxy” from the bank, brokerage firm or other nominee that is the stockholder of record for your shares of our common stock giving you the right to vote the shares at the Meeting.

By order of the Board of Directors:

____________________________

Joseph J. Grano, Jr.

CEO and Chairman of the Board of Directors

Dated: September ___, 2016

| | TABLE OF CONTENTS | | |

| | | Page | |

| | | | |

| | GENERAL INFORMATION | 5 | |

| | PROPOSAL 1: APPROVAL OF AN AMENDMENT TO OUR CERTIFICATE OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT | 9 | |

| | PROPOSAL 2: APPROVAL OF AN AMENDMENT TO OUR CERTIFICATE OF INCORPORATION TO DECREASE OUR AUTHORIZED SHARES OF COMMON STOCK | 17 | |

| | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 20 | |

| | INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON | 22 | |

| | HOUSEHOLDING OF PROXY MATERIALS | 22 | |

| | STOCKHOLDER PROPOSALS | 22 | |

| | OTHER MATTERS | 23 | |

ROOT9B TECHNOLOGIES, INC.

4521 Sharon Road, Suite 300

Charlotte, North Carolina 28211

Tel. (704) 521-8077

SPECIAL MEETING PROXY STATEMENT

Our Board of Directors solicits your proxy for the 2016 Special Meeting of Stockholders of root9B Technologies, Inc., which we refer to as the “Special Meeting”, to be held at 10:30 a.m. Eastern Daylight Time on October 24, 2016, at the offices of DLA Piper LLP (US), 1251 Avenue of the Americas, 27th Floor, New York, New York, 10020, and at any postponements and adjournments thereof, for the purposes set forth in the “Notice of 2016 Special Meeting of Stockholders.”

It is anticipated that the proxy materials, which includes this proxy statement, the annex to this proxy statement, and the form of proxy relating to our special meeting of stockholders, will be first mailed to stockholders on or about September ___, 2016. We will bear the cost of the solicitation of proxies. The original solicitation of proxies by mail may be supplemented by information provided via personal interviews, telephone, the Internet, and facsimile by our directors, officers, and employees. Arrangements will also be made with brokerage houses and other custodians, nominees, and fiduciaries to forward our solicitation materials to the beneficial owners of our common stock, and we may reimburse those custodians, nominees and fiduciaries for reasonable out-of-pocket expenses incurred by them in doing so.

Proposals Requiring Your Vote. Our Board is proposing the following two matters to be considered at the Special Meeting:

| · | The approval of an amendment to our certificate of incorporation to effect a reverse stock at a ratio determined by our Board within the range of 1:9 to 1:18, as set forth in Proposal 1; and |

| · | The approval of an amendment to our certificate of incorporation to our certificate of incorporation to decrease our authorized shares of common stock from 125,000,000 to 22,250,000, as set forth in Proposal 2. |

Recommendations and Rationale. Our Board recommends that you vote your shares:

| · | FOR “Proposal 1: Approval of an Amendment to Our Certificate of Incorporation to Effect a Reverse Stock Split”; and |

| · | FOR “Proposal 2: Approval of an Amendment to Our Certificate of Incorporation to Decrease Our Authorized Shares of Common Stock”. |

Our Board is submitting Proposal 1 with a view of increasing the per share trading price of our common stock so that the we may be able to satisfy the minimum bid price listing requirements of the Nasdaq Capital Market stock exchange, which we refer to as the “Nasdaq CM”. Proposal 2 will reduce the authorized shares of common stock we may issue to 22,250,000. The net effect of Proposals 1 and 2, if both are approved and implemented, is that we will have relatively 60-220% more authorized shares available to be issued than we do currently.

Our Board believes that providing flexibility in managing our capital structure is important for our ability to attract additional investors and grow. Nearly all of our currently authorized shares are either issued to stockholders or reserved for future issuance in connection with outstanding warrants and pursuant to our equity incentive benefit plans. If our stockholders do not approve Proposal 1 and Proposal 2, we will not have access to the additional authorized shares of common stock that would become available upon implementation of those proposals, which could limit our ability to raise additional capital.

Submitting and Revoking Your Proxy. If you complete and submit your proxy, the persons named as proxies will follow your instructions. If you submit your proxy card but do not fill out the voting instructions on the proxy card, the persons named as proxies will vote your shares “FOR” each of the proposals in this proxy statement.

In addition, if other matters are properly presented at the Special Meeting, the persons named as proxies will vote on such matters in accordance with their best judgment. We have not received notice of other matters that may be properly presented for voting at the special meeting.

Your vote is important. Please vote as soon as possible to ensure that your vote is recorded, even if you plan to attend the Special Meeting in person. If you hold your shares in your name as a registered holder and not through a bank or brokerage firm, you may submit your vote in person. If voting in person at the meeting, please bring proof of identification. The vote you cast in person will supersede any previous votes that you submitted, whether by Internet, phone, or mail.

If you are a registered holder, you may revoke your proxy at any time before the Special Meeting by submitting a later-dated proxy, voting in person at the Special Meeting, or by delivering instructions to our Corporate Secretary before the Special Meeting. If you hold shares through a bank or brokerage firm, you must contact that firm to revoke any prior voting instructions.

If your shares are held in street name through a brokerage account, bank or other nominee, you must provide your voting instructions in accordance with the voting instruction form provided by your broker, bank or other nominee. Please note that if you are a beneficial owner and wish to vote in person at the Meeting, you must provide a “legal proxy” from the bank, brokerage firm or other nominee that is the stockholder of record for your shares of our common stock giving you the right to vote the shares at the Meeting.

Quorum Requirement. The holders of at least one-third of the outstanding shares of stock entitled to vote constitute a quorum at the Special Meeting.

Votes Required to Adopt Proposals. Each share of our common stock and each share of Series C preferred stock (on an as-converted to common stock basis) outstanding on September 9, 2016, the record date, is entitled to one vote on each of the proposals. As of that day, we had ________ shares of our common stock and _________ shares of our Series C preferred stock outstanding. All shares of our common stock and Series C preferred stock will vote as one group. The approval of both Proposal 1 and Proposal 2 requires the affirmative vote of the majority of our outstanding shares of our common stock and preferred stock (on an as-converted to common stock basis), voting as a single class. Abstentions will have the same effect as votes against these proposals. Because brokers have discretionary authority to vote on both Proposal 1 and Proposal 2, we do not expect any broker non-votes in connection with these proposals.

Appraisal Rights. Under the Delaware General Corporation Law, our stockholders are not entitled to dissenter’s rights or appraisal rights with respect to any of the proposals.

Important Notice Regarding the Availability of Proxy Materials for the 2016 Special Meeting of Stockholders: These proxy materials, our 2015 Annual Report, and other filings we make with the Securities and Exchange Commission, or the SEC, are available on the investor relations page of our website (www.root9btechnologies.com), and through the SEC’s website (www.sec.gov).

Your Vote is Important

Please vote as promptly as possible

by signing, dating and returning the enclosed Proxy Card.

By order of the Board of Directors:

____________________________

Joseph J. Grano, Jr.

CEO and Chairman of the Board of Directors

Dated: September __, 2016

PROPOSALS TO BE VOTED ON

Stockholders are being asked to consider, and if deemed appropriate, to approve, (i) the reverse stock split of the shares of our common stock at a ratio to be determined by our Board within the range of 1:9 to 1:18, which we refer to as the “reverse split”, and (ii) a reduction in the amount of our authorized shares of common stock from 125,000,000 shares to 22,250,000 shares, which we refer to as the “share reduction”. We refer to the reverse split and the share reduction together as the “amendment”.

The primary purpose of the amendment is to increase the per-share market price of our common stock in order to become eligible for listing on the Nasdaq CM and to provide us with increased flexibility in raising addition capital. The amendment will also provide us with flexibility in raising additional capital and managing our capital structure. Our Board, in its sole discretion, will have discretion to implement the amendment by filing an amendment to our Certificate of Incorporation with the Secretary of State of Delaware at any time prior to the next annual meeting of the our stockholders.

We believe that stockholder approval of a discretionary ability to implement the amendment provides our Board with the maximum flexibility possible to achieve the primary purpose of the amendment (becoming eligible for listing on the Nasdaq CM) and is, therefore, in the best interest of our company and our stockholders. The reasons for each of the reverse split and the share reduction, and associate certain risks and related information, are discussed below.

PROPOSAL 1: APPROVAL OF AN AMENDMENT TO OUR CERTIFICATE OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT

Our Board is proposing a reverse stock split for our common stock to prepare for its eligibility for listing on the Nasdaq CM. Stockholders are being asked to consider, and if deemed appropriate, to approve, the reverse stock split of the shares of our common stock at a ratio to be determined by our Board within the range of 1:9 to 1:18.

Reasons for the Reverse Split

Our Board authorized the reverse split with the primary intent of increasing the trading price of our common stock in order to meet the bid price criteria for initial listing on the Nasdaq CM. To be eligible to be listed on the Nasdaq CM, among other things, the bid price for a share of our common stock must be at least $4.00. Our common stock is currently traded and listed on the OTCQB exchange under the symbol “RTNB.” On September ____, 2016, the closing price of a share of our common stock was $_____. In addition to increasing the price of our common stock to meet one part of the Nasdaq CM’s initial listing standards, our Board believes that the reverse split would make our common stock more attractive to a broader range of institutional and other investors. Accordingly, as discussed in more detail below, we believe that effecting the reverse stock split is in our company’s and our stockholders’ best interests.

We believe that the reverse split will allow us to meet the minimum bid price requirements to be listed on the Nasdaq CM. Following the implementation of the reverse split and the share reduction, which is described below in Proposal 2, we intend to submit an application to Nasdaq to list our common stock on the Nasdaq CM. We believe that by listing our common stock on the Nasdaq CM, our common stock will be more attractive to a broader range of institutional and other investors. We have been advised that the current market price of our common stock may affect its acceptability to certain institutional investors, professional investors, and other members of the investing public. Many brokerage houses and institutional investors have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers or providing analyst coverage to research the stock. Some of those policies and practices may function to make the processing of trades in low-priced stocks economically unattractive to brokers. Moreover, because brokers’ commissions on low-priced stocks generally represent a higher percentage of the stock price than commissions on higher-priced stocks, the current average price per share of common stock can result in individual stockholders paying transaction costs representing a higher percentage of their total share value than would be the case if the share price were substantially higher. We also believe that listing our common stock on the Nasdaq CM will increase the trading volume of our common stock, which will provide better liquidity to our stockholders.

Reducing the number of outstanding shares of our common stock through the reverse split is intended, absent other factors, to increase the per share market price of our common stock. Other factors, such as our financial results, market conditions, and the market perception of our business may adversely affect the per share market price of our common stock. As a result, there can be no assurance that the reverse stock split, if completed, will result in the intended benefits described above, that the market price of our common stock will increase following the reverse stock split, or that the market price of our common stock will not decrease in the future.

If the stockholders do not approve this Proposal 1 and Proposal 2, which is discussed below, we believe that we will remain ineligible for listing on the Nasdaq CM and will not file an application for initial listing with the Nasdaq CM. Moreover, nearly all of our currently authorized shares are either issued or reserved for future issuance in connection with outstanding warrants, conversion rights, and pursuant to our equity incentive benefit plans. If our stockholders do not approve Proposal 1 and Proposal 2 by the required vote, we will not have access to the additional authorized shares of common stock that would become available upon implementation of the reverse split, which could limit our ability to raise additional capital.

Relation to Proposal 2

In connection with this Proposal 1, our Board has also announced a proposed reduction in the total amount of our authorized common stock available for issuance. Details of this proposal are outlined below in Proposal 2. Although our Board considers both this Proposal 1 and Proposal 2 to be part of the same plan, federal regulations require us to present these proposals separately.

The implementation of Proposal 1 will be dependent on approval of Proposal 2. If Proposal 1 is approved by the stockholders, but Proposal 2 is not approved, our Board will not implement either proposal. Similarly, if the Proposal 1 is not approved by the stockholder, but Proposal 2 is approved, our Board will not implement either proposal.

Board Discretion to Implement

If approved, the amendment, which includes the reverse split and the share reduction discussed in Proposal 2, will be implemented, if at all, at a time that our Board believes that it is in the best interests of our company and our stockholder to do so. In connection with any determination to implement the amendment, our Board will set the timing for the amendment to become effective, which our Board currently anticipates will be within six months following the Special Meeting. No further action on the part of the stockholders would be required in order for our Board to implement the amendment. If our Board does not implement the amendment prior to the next annual meeting of our stockholders, the authority granted by our stockholders to implement the amendment on these terms will lapse and be of no further force or effect. Our Board may elect not to proceed with, and abandon, the amendment at any time if it determines, in its sole discretion, to do so.

Determination of the Ratio

The Board believes that stockholder approval of a range of potential exchange ratios (rather than a single exchange ratio) is in the best interests of our company and stockholders because it provides the Board with the flexibility to achieve the desired results of the reverse split and because it is not possible to predict market conditions at the time the reverse split would be implemented. The ratio to be selected by the Board in its sole discretion will be a whole number ratio not less than 1:9 and not more than 1:18. In selecting the ratio, the Board will consider, among other factors:

| · | the historical and projected performance of our common stock; |

| · | prevailing market conditions; |

| · | general economic and other related conditions in our industry and in the marketplace; |

| · | the projected impact of the selected reverse split ratio on trading liquidity in our common stock; |

| · | the desire to satisfy the minimum closing price of $4.00 for listing on the Nasdaq CM; |

| · | our capitalization (including the number of shares of our common stock issued and outstanding); |

| · | the prevailing trading price for our common stock and the volume level thereof; and |

| · | potential devaluation of our market capitalization as a result of a reverse stock split. |

The purpose of asking for authorization to implement the reverse split at a ratio to be determined by our Board, as opposed to a ratio fixed in advance, is to give the Board the flexibility to take into account then-current market conditions and changes in price of our common stock and to respond to other developments that may be deemed relevant when considering the appropriate ratio.

Effects of the Reverse Split on the Shares of Common Stock

If approved and implemented, the reverse split will occur simultaneously for all of the shares of our common stock. Except for any variances attributable to fractional shares, the change in the number of issued and outstanding shares of common stock that will result from the reverse split will cause no change in the aggregate capital attributable to the shares of common stock and will not materially affect any stockholder’s percentage ownership in our company, even though such ownership will be represented by a smaller number of shares.

Effect on Voting Rights

The reverse split will not materially affect any stockholder’s proportionate voting rights. Each share of common stock outstanding after the reverse split will be entitled to one vote and will be fully paid and non-assessable.

Effects on Number of Outstanding and Authorized Shares of Common Stock

Upon the implementation of the reverse split, the number of shares of our common stock available for issuance will increase significantly because the reverse split, by itself, will not result in a reduction of the number of shares of authorized but unissued common stock. Proposal 2 seeks to address this issue by reducing the number of shares of our common stock available for issuance. The net effect of Proposals 1 and 2, if both are adopted and implemented, we will have relatively 60-220% more authorized shares available to be issued than we do currently.

The following table shows the number of shares that would be (a) issued and outstanding, (b) authorized and reserved for issuance upon the exercise of outstanding stock options, convertible securities, and warrants and (c) authorized but unreserved for issuance, as well as (d) the total amount authorized upon the implementation of the reverse split and the share reduction discussed in Proposal 2 based on the our company’s capitalization as of August 23, 2016.

| | Shares of Common Stock |

| Issued & Outstanding | Total Authorized |

| As of August 23, 2016 | 84,370,314 | 125,000,000 |

| Ratio of 1:9 | 9,374,479 | 22,250,000* |

| Ratio of 1:12 | 7,030,859 | 22,250,000* |

| Ratio of 1:15 | 5,624,687 | 22,250,000* |

| Ratio of 1:18 | 4,687,239 | 22,250,000* |

* Assumes implementation of Proposal 2.

Effects on Options, Warrants, and Convertible Securities

Proportionate adjustments are generally required to be made to the per share exercise price and the number of shares of common stock issuable upon the exercise or conversion of all outstanding options, warrants, or other convertible securities entitling the holders to purchase, exchange for, or convert into, shares of common stock. This would result in approximately the same aggregate price being required to be paid under such options, warrants, or other convertible securities upon exercise, and approximately the same value of shares of common stock being delivered upon such exercise, exchange or conversion, immediately following the reverse split as was the case immediately preceding the reverse split. The number of shares reserved for issuance in connection with these securities will be reduced proportionately to the reverse split, as will the number of any shares remaining available for grant under our stock option plans at the time of the reverse split.

Effect on Preferred Stock

Our preferred stock votes on an as-if-converted basis. If the reverse split is implemented, the conversion price at which our preferred stock is convertible into common stock will be proportionately adjusted. As a result, the proportionate voting rights and other rights of the holders of our preferred stock will not be affected by the reverse split. The reverse split will not affect the amount of authorized shares of preferred stock.

Effect on Par Value

The proposed amendments to our Certificate of Incorporation to implement the reverse split will not affect the par value of our common stock, which will remain at $0.001 per share, or the par value of our preferred stock, which will remain at $0.001 per share.

Reduction in Stated Capital

As a result of implementing the reverse split, the stated capital on our balance sheet attributable to our common stock, which consists of the par value per share of our common stock multiplied by the aggregate number of shares of our common stock issued and outstanding, will be reduced in proportion to the size of the reverse split. Correspondingly, our additional paid-in capital account, which consists of the difference between our stated capital and the aggregate amount paid to us upon issuance of all currently outstanding shares of our common stock, will be increased by the amount by which the stated capital is reduced. Our stockholders’ equity, in the aggregate, will remain unchanged.

Amended Text of the Certificate of Incorporation

The following sets forth the form of text that will be added to Article IV of our Certificate of Incorporation in connection with the reverse split. A form of the full text of the certificate of amendment we intend to file with the Secretary of State of the State of Delaware that reflect the approval of both this Proposal 1 and Proposal 2 can be found in Annex A.

“Upon filing and effectiveness (the “Effective Time”) of this Certificate of Incorporation, as amended, of the Corporation pursuant to the General Corporation Law of the State of Delaware, each ____ shares of Common Stock issued and outstanding or held in treasury immediately prior to the Effective Time shall automatically be combined into one validly issued, fully paid and non-assessable share of Common Stock without any further action by the Corporation or the holder thereof, subject to the treatment of fractional share interests as described below (such combination, the “Reverse Stock Split”). No fractional shares of Common Stock shall be issued in connection with the Reverse Stock Split. Stockholders who otherwise would be entitled to receive fractional shares of Common Stock shall be entitled to receive cash (without interest) from the Corporation’s transfer agent in lieu of such fractional shares in an amount equal to the proceeds attributable to the sale of such fractional shares following the aggregation and sale by the Corporation’s transfer agent of all fractional shares otherwise issuable. Stockholders who hold certificates that immediately prior to the Effective Time represented shares of Common Stock (“Old Certificates”) shall be entitled to receive such cash payment in lieu of fractional shares upon receipt by the Corporation’s transfer agent of the stockholder’s properly completed and duly executed transmittal letter and the surrender of the stockholder’s Old Certificates. After the Effective Time, each Old Certificate that has not been surrendered shall represent that number of shares of Common Stock into which the shares of Common Stock represented by the Old Certificate shall have been combined, subject to the elimination of fractional share interests as described above. Notwithstanding anything to the contrary in the Corporation’s bylaws, at all times that the Corporation’s shares are listed on a national stock exchange, the shares of capital stock of the Corporation shall comply with all direct registration system eligibility requirements established by such exchange, including any requirement that shares of the Corporation’s capital stock be eligible for issue in book-entry form. All issuances and transfers of shares of the Corporation’s capital stock shall be entered on the books of the Corporation with all information necessary to comply with such direct registration.”

Holders of Certified Shares of Common Stock

No delivery of a certificate evidencing a post-reverse split share will be made to a stockholder until the stockholder has surrendered the issued certificates representing its pre-reverse split shares. Until surrendered, each certificate formerly representing pre-reverse split shares shall be deemed for all purposes to represent the number of post-reverse split shares to which the holder is entitled as a result of the reverse split. No shareholder will be required to pay a transfer or other fee to exchange his, her or its pre-reverse split share certificate.

YOU SHOULD NOT SEND YOUR OLD CERTIFICATES NOW. YOU SHOULD SEND THEM ONLY AFTER YOU RECEIVE THE LETTER OF TRANSMITTAL FROM OUR TRANSFER AGENT.

Beneficial Holders of Common Stock (i.e. stockholders who hold in street name)

Non-registered stockholders, holding their shares of common stock through a bank, broker or other nominee should note that such banks, brokers or other nominees may have various procedures for processing the reverse split. If a stockholder holds shares of common stock with such a bank, broker or other nominee and has any questions in this regard, the stockholder is encouraged to contact its nominee.

Certain Risks Associated with the Reverse Split

There are numerous factors and contingencies that could affect the price per share of our common stock prior to or following the reverse split, including the status of our reported financial results in future periods, and general economic, geopolitical, stock market and industry conditions. Accordingly, the market price of our shares of common stock may not be sustainable at the direct arithmetic result of the reverse split, and may decline following the implementation of the reverse split. If the market price of a share of our common stock is lower than it was before the reverse split on an arithmetic equivalent basis, our total market capitalization (which is the aggregate value of all shares at the then-current market price) after the reverse split may be lower than before the reverse split.

A decline in the market price of a share of our common stock after the reverse split may result in a greater percentage decline than would occur in the absence of the reverse split, and the liquidity of the shares could be adversely affected following the reverse split.

If the reverse split is implemented and the market price of a share of our common stock declines, the percentage decline may be greater in total value than would occur in the absence of the reverse split. The market price of a share of our common stock will nevertheless be based on our performance and other factors, which are unrelated to the number of shares of common stock outstanding.

Some investors may view the reverse split negatively because it reduces the number of shares of common stock available in the public market. With fewer shares our commons stock being traded, the liquidity of the shares could be adversely affected by the reduced number of shares of common stock that would be outstanding after the reverse split.

The reverse split may result in some stockholders owning “odd lots” of less than 100 shares on a post-split basis. “Odd lots” may be more difficult to sell, or require greater transaction costs per share to sell, than shares held in “board lots” of even multiples of 100 shares.

Even if the reverse split is implemented, the Company may still be ineligible for listing on the Nasdaq CM. Although the Company believes that it may meet the minimum requirements for listing on the Nasdaq CM, there is no assurance that it will meet the minimum listing requirements and the listing application will be accepted or become effective. There is no assurance that the Company’s stock price will achieve the minimum amount and that the stock price will continue to meet the minimum requirement for continued listing on the Nasdaq CM.

Material U.S. Federal Income Tax Consequences of the Reverse Stock Split

The following discussion is a summary of the material U.S. federal income tax consequences of the reverse split to “U.S. Holders” (as defined below) of our common stock. This discussion is based on the Internal Revenue Code of 1986, as amended (which we refer to as the “Code”), final, temporary or proposed U.S. Treasury regulations promulgated thereunder, administrative pronouncements and judicial decisions, all as in effect on the date hereof, and all of which are subject to change (possibly with retroactive effect) and to differing interpretations. Any such change could affect the accuracy of the statements and conclusions set forth in this discussion. WE ENCOURAGE EACH HOLDER OF COMMON STOCK TO CONSULT SUCH STOCKHOLDER’S TAX ADVISOR WITH RESPECT TO THE PARTICULAR TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT TO SUCH HOLDER.

For purposes of this discussion, a U.S. Holder means a beneficial owner of our common stock that is, for U.S. federal income tax purposes: (i) an individual who is a citizen or resident of the United States, (ii) a corporation, or other entity taxable as a corporation for U.S. federal income tax purposes, created or organized under the laws of the United States, any state thereof, or the District of Columbia, (iii) an estate, the income of which is subject to U.S. federal income tax regardless of its source, or (iv) a trust if (A) a court within the United States is able to exercise primary supervision over the administration of the trust and one or more U.S. persons have the authority to control all substantial decisions of the trust or (B) it has a valid election in effect under applicable U.S. Treasury regulations to be treated as a U.S. person.

If an entity or arrangement that is treated as a partnership for U.S. federal income tax purposes holds our common stock, the tax treatment of a partner in such partnership generally will depend on the status of the partners and the activities of the partnership. Partners in partnerships holding our common stock should consult their tax advisors.

This discussion applies only to U.S. Holders that hold their shares of our common stock as capital assets within the meaning of Section 1221 of the Code (generally, property held for investment). This discussion does not address all aspects of U.S. federal income taxation that may be relevant to holders in light of their particular circumstances or to holders who may be subject to special tax treatment under U.S. federal income tax laws (including, for example, holders who are dealers in securities or foreign currency, foreign persons, insurance companies, tax-exempt organizations, banks, financial institutions, broker-dealers, holders who hold our common stock as part of a hedge, straddle, conversion or other risk reduction transaction, partnerships or other flow-through entities and their partners or members, U.S. expatriates, holders liable for the alternative minimum tax, holders whose functional currency is not the U.S. dollar, or holders who acquired our common stock pursuant to the exercise of compensatory stock options, the vesting of previously restricted shares of stock or otherwise as compensation). This summary does not address tax considerations under state, local, foreign, and other laws, nor does it address any U.S. federal tax considerations other than those pertaining to the U.S. income tax.

We have not sought, and will not seek, an opinion of counsel or a ruling from the Internal Revenue Service regarding the federal income tax consequences of the Reverse Stock Split. EACH HOLDER OF OUR COMMON STOCK SHOULD CONSULT ITS TAX ADVISOR WITH RESPECT TO THE PARTICULAR TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT TO SUCH HOLDER.

The Reverse Stock Split is intended to be treated as a recapitalization for U.S. federal income tax purposes. Assuming the Reverse Stock Split qualifies as a recapitalization,

| · | a U.S. Holder generally will not recognize gain or loss on the reverse split; |

| · | the aggregate tax basis of the shares of our common stock received in the reverse split will be equal to the aggregate tax basis of the shares exchanged therefor (excluding any portion of such basis allocated to a fractional share); and |

| · | the holding period of the shares of our common stock received in the reverse split will include the holding period of the shares exchanged therefore. |

No Fractional Shares to be Issued

The Company does not expect to issue certificates representing fractional shares. Stockholders of record who would otherwise hold fractional shares because the number of shares of common stock they hold before the reverse split is not evenly divisible by the split ratio will be entitled to will be entitled to receive cash (without interest or deduction) in lieu of such fractional shares from our transfer agent, upon receipt by our transfer agent of a properly completed and duly executed transmittal letter and, where shares are held in certificated form, the surrender of all old stock certificates, in an amount equal to the proceeds attributable to the sale of such fractional shares following the aggregation and sale by our transfer agent of all fractional shares otherwise issuable. The ownership of a fractional share interest will not give the holder any voting, dividend or other rights, except to receive the above- described cash payment. We will be responsible for any brokerage fees or commissions related to the transfer agent’s selling in the open market shares that would otherwise be fractional shares.

Stockholders should be aware that, under the escheatment laws of various jurisdictions, sums due for fractional interests that are not timely claimed after the implementation of the reverse split may be required to be paid to the designated agent for each such jurisdiction, unless correspondence has been received by us or our transfer agent concerning ownership of such funds within the time permitted in such jurisdiction. Thereafter, if applicable, stockholders otherwise entitled to receive such funds, but who do not receive them due to, for example, their failure to timely comply with our transfer agent’s instructions, will have to seek to obtain such funds directly from the state to which they were paid.

Procedure for Implementing the Reverse Split

If the stockholders approve this Proposal 1 and Proposal 2, the Board will have the authority to file, when it deems it in the best interest of our company and stockholders, documentation with the Delaware Secretary of State and certain regulatory bodies to effect the amendment. After the amendment becomes effective, the shares of our common stock will have a new Committee on Uniform Securities Identification Procedures (CUSIP) number, which is a number used to identify the Company’s equity securities. The proposed form of the amendment is attached to this proxy statement as Annex A.

Dissenter’s Rights

Under the Delaware General Corporation Law, our stockholders are not entitled to dissenter’s rights in connection with this Proposal 1.

Required Vote

Under the Delaware General Corporation Law and our Certificate of Incorporation, the reverse split will be approved upon the affirmative vote of the majority of our outstanding shares of our common stock and preferred stock (on an as-converted to common stock basis), voting as a single class. Abstentions will have the same effect as votes against these proposals. For additional information on how votes are counted, see the discussion under the caption “Votes Required to Adopt Proposals” in the “General Information” section of this proxy statement.

Our Board recommends that you vote your shares FOR an amendment to our Certificate of

Incorporation and to authorize the Board to effect a reverse stock split of our common stock,

$0.001 par value per share, at a ratio of 1:9 to 1:18.

PROPOSAL 2: APPROVAL OF AN AMENDMENT TO OUR CERTIFICATE OF INCORPORATION TO DECREASE OUR AUTHORIZED SHARES

Our Board is proposing a reverse stock split of our shares of common stock in connection with a proposed listing on the Nasdaq CM, which is described in detail above in Proposal 1. In addition to the reverse split, our Board is proposing an amendment to our Certificate of Incorporation to decrease our authorized shares of common stock from 125,000,000 shares to 22,250,000 shares, which we refer to as the “share reduction”. The share reduction will not affect the number of authorized shares of preferred stock.

Although the share reduction will reduce the total amount of authorized shares of common stock, the net effect of Proposals 1 and 2 will be that we will have relatively 60-220% more authorized shares available to be issued than we do currently.

Implementation of Proposal 2 is conditioned upon the approval and implementation of Proposal 1: if Proposal 1 is not approved and implemented, then Proposal 2 will not be implemented.

Reasons for the Reverse Split

Our Board believes that providing flexibility as to our capital structure is important for our ability to attract additional investors and grow our company. Nearly all of our currently authorized shares of common stock are either issued or reserved for future issuance in connection with outstanding warrants, conversion rights, and pursuant to our equity incentive benefit plans. If our stockholders do not approve Proposal 1 and Proposal 2 by the required vote, we will not have access to the additional authorized shares of common stock that would become available upon implementation of those proposals, which could limit our ability to raise additional capital.

Relation to Proposal 1

In connection with this Proposal 2, our Board also proposed a reverse stock split of the shares of our common stock at a ratio of 1:9 to 1:18. Details of this proposal are outlined above in Proposal 1. Although our Board considers both Proposal 1 and this Proposal 2 to be part of the same plan, federal regulations require us to present these proposals separately.

The implementation of Proposal 2 will be dependent on approval of Proposal 1. If Proposal 1 is approved by the stockholders, but Proposal 2 is not approved, our Board will not implement either proposal. Similarly, if the Proposal 1 is not approved by the stockholder, but Proposal 2 is approved, the Board will not implement either proposal.

Board Discretion to Implement

If approved, the amendment, which includes the reverse split and the reverse split discussed in Proposal 1, will be implemented, if at all, at a time that our Board believes that it is in the best interests of our company and our stockholder to do so. In connection with any determination to implement the amendment, our Board will set the timing for the amendment to become effective, which our Board currently anticipates will be within six months following the Special Meeting. No further action on the part of the stockholders would be required in order for our Board to implement the amendment. If our Board does not implement the amendment prior to the next annual meeting of our stockholders, the authority granted by the ordinary resolution to implement the amendment on these terms will lapse and be of no further force or effect. Our Board may elect not to proceed with, and abandon, the amendment at any time if it determines, in its sole discretion, to do so.

Effect of the Share Reduction

If approved, implementation of Proposal 2 will reduce our authorized shares of common stock from 125,000,000 shares to 22,250,000 shares. The decrease in authorized shares of common stock will not affect the rights of existing stockholders. Should our Board determine in the future that it is advisable to issue shares of common stock in excess of the authorized shares available for issuance after the share reduction, our Board would need to obtain stockholder approval to increase the number of authorized shares of common stock prior to any such issuances.

Amended Text of the Certificate of Incorporation

The following sets forth the form of text that will amend Article IV of our Certificate of Incorporation in connection with the share reduction. A form of the certificate of amendment we intend to submit to the Secretary of State of the State of Delaware that reflect the approval of both this Proposal 1 and this Proposal 2 can be found in Annex A.

“FOURTH: The Corporation shall be authorized to issue two classes of stock to be designated, respectively, “Common Stock” and “Preferred Stock.” The total number of shares of both classes of stock which the Corporation has authority to issue is thirty two million, two hundred fifty thousand (32,250,000) shares, consisting of: twenty two million, two hundred fifty thousand (22,250,000) shares of Common Stock, $0.001 par value per share, and ten million (10,000,000) shares of Preferred Stock, $0.001 par value per share.

The Board of Directors of the Corporation (the “Board of Directors”) is authorized, subject to limitations prescribed by applicable law and the provisions of this Article FOURTH, to provide for the issuance of the shares of Preferred Stock from time to time in one or more series, each of which series shall have such distinctive designation or title as shall be fixed by the Board of Directors prior to the issuance of any shares thereof. Each such series of Preferred Stock shall have such voting powers, shall consist of such number of shares, shall be issued for such consideration and shall otherwise have such powers, designations, preferences and relative, participating, optional or other rights, if any, and such qualifications, limitations or restrictions, if any, as shall be stated in such resolution or resolutions providing for the issue of such series of Preferred Stock as may be adopted from time to time by the Board of Directors prior to the issuance of any shares thereof pursuant to the authority hereby expressly vested in it, all in accordance with applicable law.”

Certain Risks Associated with the Share Reduction and the Amendment

Although implementation of Proposal 2 will reduce the total amount of authorized shares of common stock, the net effect of the reverse split and the share reduction, which we refer to as the “amendment”, will cause us to have relatively 60-220% more authorized shares available to be issued than we do currently. The additional authorized shares of common stock would have rights identical to those of our currently outstanding shares of our common stock. Approval of the amendment and issuance of the additional authorized shares of common stock would not affect the rights of the holders of currently outstanding shares of our common stock, except for effects incidental to increasing the number of shares of our common stock outstanding, such as dilution of any earnings per share and voting rights of current holders of common stock. The additional authorized shares of common stock could be issued by our Board without further vote of our stockholders except as may be required in particular cases by our Certificate of Incorporation, applicable law, or regulatory agencies. Under our Certificate of Incorporation, holders of our common stock do not have preemptive rights to subscribe to additional securities that we issue, which means that current common stockholders do not have a right to purchase any new issue of common stock in order to maintain their proportionate ownership interest in our company prior to any new issuance of common stock.

The amendment could, under certain circumstances, have an anti-takeover effect. The additional authorized shares of common stock that would become available for issuance if the amendment is approved could also be used by us to oppose a hostile takeover attempt or to delay or prevent changes in control or our management. For example, without further stockholder approval, the Board could adopt a “poison pill” which would, under certain circumstances related to an acquisition of our securities not approved by our Board, give certain holders the right to acquire additional shares of common stock at a low price, or our Board could strategically sell shares of common stock in a private transaction to purchasers who would oppose a takeover or favor the current Board. Although the amendment has been prompted by business and financial considerations and not by the threat of any hostile takeover attempt (nor is the Board currently aware of any such attempts directed at us), stockholders should be aware that approval of the amendment could facilitate future efforts by us to deter or prevent changes in control, including transactions in which the stockholders might otherwise receive a premium for their shares over then current market prices.

Procedure for Implementing the Share Reduction

If the stockholders approve Proposal 1 and this Proposal 2, the Board will have the authority to file, when it deems it in the best interest of our company and stockholders, documentation with the Delaware Secretary of State and certain regulatory bodies to effect the amendment. After the amendment becomes effective, the shares of our common stock will have a new Committee on Uniform Securities Identification Procedures (CUSIP) number, which is a number used to identify the Company’s equity securities. The proposed form of the amendment is attached to this proxy statement as Annex A.

Dissenter’s Rights

Under the Delaware General Corporation Law, our stockholders are not entitled to dissenter’s rights in connection with this Proposal 2.

Required Vote

Under the Delaware General Corporation Law and our Certificate of Incorporation, as amended, the share reduction will be approved upon the affirmative vote of the majority of our outstanding shares of our common stock and preferred stock (on an as-converted to common stock basis), voting as a single class. Abstentions will have the same effect as votes against these proposals. For additional information on how votes are counted, see the discussion under the caption “Votes Required to Adopt Proposals” in the “General Information” section of this proxy statement.

Our Board recommends that you vote your shares FOR an amendment to our Certificate of

Incorporation to authorize the Board to reduce the amount of authorized shares of common stock

from 125,000,000 shares to 22,250,000 shares.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information, as of August 23, 2016 with respect to the beneficial ownership of our outstanding common and preferred stock by (i) each person known to own beneficially more than 5% of our each class of securities; (ii) each of our named executive officers and our directors; and (iii) all of our directors and executive officers as a group.

Unless otherwise indicated in the footnotes below, we believe the persons and entities named in the table have sole voting or investment power with respect to all shares owned. Additionally, unless otherwise indicated, the address of each person is care of root9B Technologies, Inc., 4521 Sharon Road, Suite 300, Charlotte, North Carolina 28211.

| Name | | Number of Shares of Common Stock Beneficially Owned | | | % of Class (1) | | | Number of Shares of Series C Preferred Stock Beneficially Owned | | | % of Class | |

| Joseph J. Grano Jr. (2) | | | 7,580,833 | | | | 8.71 | % | | | | | | |

| Brian King (3) | | | 1,020,466 | | | | 1.20 | % | | | | | | |

| Michael Effinger (4) | | | 100,000 | | | | 0.12 | % | | | | | | |

| Dan Wachtler (5) | | | 6,459,566 | | | | 7.64 | % | | | | | | |

| Eric Hipkins (6) | | | 2,092,282 | | | | 2.46 | % | | | | | | |

| Gregory C Morris (7) | | | 337,000 | | | | 0.40 | % | | | | | | |

| Seymour Siegel (8) | | | 340,518 | | | | 0.40 | % | | | | | | |

| Cary Sucoff (9) | | | 838,137 | | | | 0.99 | % | | | | | | |

| Kevin Carnahan (10) | | | 556,093 | | | | 0.66 | % | | | | | | |

| Anthony Sartor (11) | | | 391,000 | | | | 0.46 | % | | | | | | |

| Isaac Blech (12) | | | 1,509,231 | | | | 1.77 | % | | | | | | |

| Miriam Blech (13) | | | 972,891 | | | | 1.15 | % | | | 1,428,571 | | | | 60.0 | % |

| River Charitable Remainder Unitrust f/b/o Isaac Blech (14) | | | 648,594 | | | | 0.77 | % | | | 952,381 | | | | 40.0 | % |

| Wellington Management Group, LLP (15) | | | 11,822,634 | | | | 14.01 | % | | | | | | | | |

| Quad Capital Management Advisors, LLC (16) | | | 5,555,617 | | | | 6.55 | % | | | | | | | | |

| All directors and executive officers as a group (2) thru (12) and (14) | | | 21,912,988 | | | | 24.14 | % | | | | | | | | |

| (1) | For purposes of this table, a person or group of persons is deemed to have “beneficial ownership” of any shares of common stock they have the right to acquire within 60 days of August 23, 2016. The number and percentage of shares beneficially owned are based on 84,370,314 shares of common stock issued and outstanding as of August 23, 2016. When computing beneficial ownership percentages, shares of common stock that may be acquired within 60 days are considered outstanding for that holder only, not for any other holder. |

| (2) | Includes 500,000 shares received in the acquisition of Ecological, LLC by the Company and 457,220 received in the acquisition of IPSA International by the Company. The shares are registered in the name of Centurion Holdings, LLC, of which Mr. Grano is a controlling member. Also includes 918,896 shares as a result of exercised options. Also includes 317,000 shares purchased in the open market. Also includes 1,036,842 shares of common stock issuable upon exercise of stock options issued to Joseph Grano, Jr, Chairman of the Board of Directors of the Company. The 1,036,842 options are held in the name of Centurion Holdings LLC, of which Mr. Grano is a controlling member. Also includes 1,669,262 shares of common stock issuable upon exercise of stock options that are currently exercisable or exercisable within 60 days of August 23, 2016. Also includes 2,681,613 shares received in the acquisition of Ecological, LLC by the Company which are registered in the name of “Joseph C. Grano and Robert H. Silver, Trustees of The Grano Children’s Trust dated December 13, 2012, and beneficially owned per a swap agreement in the Trust. |

| (3) | Includes 400,000 shares of common stock issuable upon exercise of stock options that are currently exercisable or exercisable within 60 days of August 23, 2016. |

| (4) | Includes 100,000 shares of common stock issuable upon exercise of stock options that are currently exercisable or exercisable within 60 days of August 23, 2016. |

| (5) | Includes 230,273 shares of common stock and 230,273 warrants purchased by DWW Family Trust, of which Dan Wachtler is the Trustee. |

| (6) | Includes 383,334 shares of common stock issuable upon exercise of stock options that are currently exercisable or exercisable within 60 days of August 23, 2016. |

| (7) | Includes 325,000 shares of common stock issuable upon exercise of stock options and stock warrants that are currently exercisable or exercisable within 60 days of August 23, 2016. |

| (8) | Includes 300,000 shares of common stock issuable upon exercise of stock options that are currently exercisable or exercisable within 60 days of August 23, 2016. |

| (9) | Includes 460,000 shares of common stock issuable upon exercise of stock options and stock warrants that are currently exercisable or exercisable within 60 days of August 23, 2016. |

| (10) | Includes 107,759 shares of common stock and 23,334 shares of common stock issuable upon exercise of warrants owned by The Carnahan Trust, of which Kevin and Laurie Carnahan are trustees. Also includes 225,000 shares of common stock issuable upon exercise of stock options that are currently exercisable or exercisable within 60 days of August 23, 2016. |

| (11) | Includes 325,000 shares of common stock issuable upon exercise of stock options that are currently exercisable or exercisable within 60 days of August 23, 2016. |

| (12) | Includes 725,000 shares of common stock issuable upon exercise of stock options that are currently exercisable or exercisable within 60 days of August 23, 2016. |

| (13) | Does not include 4,285,713 shares of common stock issuable upon conversion of the Series C preferred stock or 4,285,713 shares of common stock issuable upon exercise of warrants beneficially owned by River Charitable Remainder Unitrust f/b/o Isaac Blech (the “Trust”), of which Isaac Blech is the sole trustee. Pursuant to a previously disclosed letter agreement, the Trust has agreed not to convert or exercise these instruments prior to the Special Meeting. Miriam Blech is Isaac Blech’s wife and a beneficiary under the Trust. Mrs. Blech disclaims beneficial ownership of the shares held by the Trust, except to the extent of any pecuniary interest therein. Mr. Blech disclaims beneficial interest in the shares held by Mrs. Blech. |

| (14) | Does not include 2,857,143 shares of common stock issuable upon conversion of the Series C preferred stock or 2,857,143 shares of common stock issuable upon exercise of warrants beneficially owned by Miriam Blech. Pursuant to a previously disclosed letter agreement, Mrs. Blech has agreed not to convert or exercise these instruments prior to the Special Meeting. The sole trustee of the Trust is Isaac Blech, who has sole voting and dispositive power of the Trust. The beneficiaries of the Trust are Miriam and Isaac Blech. Mr. Blech disclaims beneficial ownership of the shares held by Mrs. Blech, except to the extent of the any pecuniary interest therein. |

| (15) | Pursuant to the Schedule 13-G filed with the SEC on April 11, 2016, Wellington Management Company LLP (“Wellington”) has shared voting power and dispositive power with respect to 11,822,634 shares of common stock. Wellington’s address is 280 Congress Street, Boston MA 02210. Additionally, Wellington, an investment advisor, lists Ithan Creek as a client and has included Ithan Creek’s holding in its beneficial ownership claim. Wellington’s mailing address is listed as 280 Congress Street, Boston, Massachusetts 02210. |

| (16) | Pursuant to the Schedule 13-G filed with the SEC on February 3, 2016, Quad Capital may be deemed to beneficially own 4,378,206 shares. This amount includes 3,923,661 shares and 454,545 shares obtainable upon exercise of warrants. Quad Capital Management may be deemed to beneficially own the 4,378,206 shares beneficially owned by Quad Capital. John Vincent Guarino may be deemed to beneficially own 4,707,749 shares, which amount includes the 4,378,206 shares beneficially owned by Quad Capital as well as 271,362 shares, and 68,181 shares obtainable upon exercise of warrants, directly held by Mr. Guarino. Guerino Ciampi may be deemed to beneficially own 5,555,617 shares, which amount includes the 4,378,206 shares beneficially owned by Quad Capital as well as 1,018,320 shares, and 159,091 shares obtainable upon exercise of warrants, directly held by Mr. Ciampi. Quad Capital Management Advisors, LLC, Mr. Guarino, and Mr. Ciampi share voting and dispositive power. |

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

Miriam Blech and River Charitable Remainder Unitrust f/b/o Isaac Blech, who we refer to as the Series C Holders, together control all of the our Series C Preferred Stock. The Certificate of Designation of our Series C Preferred Stock provides that shares of the Series C Preferred Stock may be converted into an aggregate amount of approximately 7,142,856 shares of our common stock. As previously disclosed, we have entered into various letters agreements with the Series C Holders whereby the Series C Holders have agreed to temporarily waive their conversion rights until the earlier of (a) five business days following this special meeting and (b) December 31, 2016. The Series C Holders have indicated that they intend to convert all shares of Series C Preferred Stock they hold following the Special Meeting, assuming Proposal 1 and Proposal 2 are approved. Unless our stockholders approve of the reverse split, we will not have sufficient authorized shares of our common stock to issue to the Series C Holders upon the conversion of the Series C Preferred Stock. Miriam Blech is Isaac Blech’s wife, and Isaac Blech servers as the sole trustee for the River Charitable Remainder Unitrust f/b/o Isaac Blech. Isaac Blech is a director and serves as our Board’ Vice Chairman,

HOUSEHOLDING OF PROXY MATERIALS

The Securities and Exchange Commission permits companies and intermediaries such as brokers to satisfy the delivery requirements for proxy materials with respect to two or more stockholders sharing the same address by delivering a single set of proxy materials addressed to those stockholders. This process, which is commonly referred to as “householding”, potentially provides extra conveniences for stockholders and cost savings for companies.

Although we do not intend to household for our stockholders of record, some brokers household our proxy materials, delivering a single set of proxy materials to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker that they will be householding materials to your address, householding will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in householding and would prefer to receive a separate set of proxy materials, or if you are receiving multiple sets of proxy materials and wish to receive only one, please notify your broker. Stockholders who currently receive multiple sets of the proxy materials at their address and would like to request “householding” of their communications should contact their broker.

Stockholder business may be brought before the Special Meeting so long as we receive notice of the proposal at a reasonable time before we begin printing our proxy materials for this special meeting. We anticipate to begin printing our proxy materials on September ____, 2016. Proposals received after such time will be considered untimely.

Stockholder proposals may be included in our proxy materials for an annual meeting so long as they are provided to us on a timely basis and satisfy the other conditions set forth in the applicable rules of the Securities and Exchange Commission. For a stockholder proposal to be included in our proxy materials for the 2017 annual meeting, the proposal must be received at our principal executive offices, addressed to the Secretary, not later than December 31, 2016.

The Board does not intend to present any other items of business other than those stated in the Notice of 2016 Special Meeting of Stockholders. If other matters are properly brought before the meeting, the persons named as your proxies will vote the shares represented by it in accordance with their best judgment. Discretionary authority to vote on other matters is included in the proxy.

A copy of the Company’s Annual Report on Form 10-K for the year ended December 31, 2015 is available without charge upon written request to:

root9B Technologies, Inc.

4521 Sharon Road, Suite 300

Charlotte, North Carolina 28211

Telephone: (704) 521-8077

If you would like to request documents, please do so as promptly as possible to receive them before the Special Meeting. If you request any documents, we will strive to mail them to you by first-class mail, or another equally prompt means, within one business day of receipt of your request. You may also access all of these documents at www.sec.gov, or through the investor relations page of our website (www.root9btechnologies.com)

You should rely only on the information contained in this proxy statement, including the annexes attached hereto or the information incorporated by reference herein, to vote your shares at the Special Meeting. We have not authorized anyone to provide you with information that differs from that contained in this proxy statement. This proxy statement is dated September ____, 2016. You should not assume that the information contained in this proxy statement is accurate as of any date other than that date, and the mailing of this proxy statement to stockholders will not create any implication to the contrary.

Annex A

CERTIFICATE OF AMENDMENT TO

CERTIFICATE OF INCORPORATION

OF

ROOT9B TECHNOLOGIES, INC.

root9B Technologies, Inc., a corporation duly organized and existing under the General Corporation Law of the State of Delaware (the “Corporation”), does hereby certify that:

FIRST: Article FOURTH of the Certificate of Incorporation, as amended, is hereby amended and restated in its entirety as follows:

FOURTH: The Corporation shall be authorized to issue two classes of stock to be designated, respectively, “Common Stock” and “Preferred Stock.” The total number of shares of both classes of stock which the Corporation has authority to issue is thirty two million, two hundred fifty thousand (32,250,000) shares, consisting of: twenty two million, two hundred fifty thousand (22,250,000) shares of Common Stock, $0.001 par value per share, and ten million (10,000,000) shares of Preferred Stock, $0.001 par value per share.

The Board of Directors of the Corporation (the “Board of Directors”) is authorized, subject to limitations prescribed by applicable law and the provisions of this Article FOURTH, to provide for the issuance of the shares of Preferred Stock from time to time in one or more series, each of which series shall have such distinctive designation or title as shall be fixed by the Board of Directors prior to the issuance of any shares thereof. Each such series of Preferred Stock shall have such voting powers, shall consist of such number of shares, shall be issued for such consideration and shall otherwise have such powers, designations, preferences and relative, participating, optional or other rights, if any, and such qualifications, limitations or restrictions, if any, as shall be stated in such resolution or resolutions providing for the issue of such series of Preferred Stock as may be adopted from time to time by the Board of Directors prior to the issuance of any shares thereof pursuant to the authority hereby expressly vested in it, all in accordance with applicable law.

Upon filing and effectiveness (the “Effective Time”) of this Certificate of Incorporation, as amended, of the Corporation pursuant to the General Corporation Law of the State of Delaware, each [____] shares of Common Stock issued and outstanding or held in treasury immediately prior to the Effective Time shall automatically be combined into one validly issued, fully paid and non-assessable share of Common Stock without any further action by the Corporation or the holder thereof, subject to the treatment of fractional share interests as described below (such combination, the “Reverse Stock Split”). No fractional shares of Common Stock shall be issued in connection with the Reverse Stock Split. Stockholders who otherwise would be entitled to receive fractional shares of Common Stock shall be entitled to receive cash (without interest) from the Corporation’s transfer agent in lieu of such fractional shares in an amount equal to the proceeds attributable to the sale of such fractional shares following the aggregation and sale by the Corporation’s transfer agent of all fractional shares otherwise issuable. Stockholders who hold certificates that immediately prior to the Effective Time represented shares of Common Stock (“Old Certificates”) shall be entitled to receive such cash payment in lieu of fractional shares upon receipt by the Corporation’s transfer agent of the stockholder’s properly completed and duly executed transmittal letter and the surrender of the stockholder’s Old Certificates. After the Effective Time, each Old Certificate that has not been surrendered shall represent that number of shares of Common Stock into which the shares of Common Stock represented by the Old Certificate shall have been combined, subject to the elimination of fractional share interests as described above. Notwithstanding anything to the contrary in the Corporation’s bylaws, at all times that the Corporation’s shares are listed on a national stock exchange, the shares of capital stock of the Corporation shall comply with all direct registration system eligibility requirements established by such exchange, including any requirement that shares of the Corporation’s capital stock be eligible for issue in book-entry form. All issuances and transfers of shares of the Corporation’s capital stock shall be entered on the books of the Corporation with all information necessary to comply with such direct registration.

SECOND: The foregoing amendment to the Certificate of Incorporation, as amended, has been duly adopted by the Corporation’s Board of Directors and Stockholders in accordance with the provisions of Sections 242 and 228 of the General Corporation Law of the State of Delaware.

THIRD: This amendment to the Corporation’s Certificate of Incorporation shall be effective on and as of the date of filing of this Certificate of amendment with the Delaware Secretary of State.