UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21497

AB CORPORATE SHARES

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, New York, New York 10105

(Address of principal executive offices) (Zip code)

Joseph J. Mantineo

AllianceBernstein L.P.

1345 Avenue of the Americas

New York, New York 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: April 30, 2019

Date of reporting period: October 31, 2018

ITEM 1. REPORTS TO STOCKHOLDERS.

OCT 10.31.18

SEMI-ANNUAL REPORT

AB CORPORATE INCOME SHARES

Beginning January 1, 2021, as permitted by new regulations adopted by the Securities and Exchange Commission, the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website address to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically at any time by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling the Fund at (800) 221 5672.

You may elect to receive all future reports in paper form free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports; if you invest directly with the Fund, you can call the Fund at (800) 221 5672. Your election to receive reports in paper form will apply to all funds held in your account with your financial intermediary or, if you invest directly, to all AB Mutual Funds you hold.

| | |

| |

| Investment Products Offered | | • Are Not FDIC Insured • May Lose Value • Are Not Bank Guaranteed |

Investors should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit us online at www.abfunds.com or contact your AB representative. Please read the prospectus and/or summary prospectus carefully before investing.

This shareholder report must be preceded or accompanied by the Fund’s prospectus for individuals who are not current shareholders of the Fund.

You may obtain a description of the Fund’s proxy voting policies and procedures, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, without charge. Simply visit AB’s website at www.abfunds.com, or go to the Securities and Exchange Commission’s (the “Commission”) website at www.sec.gov, or call AB at (800) 227 4618.

The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year. The Fund’s portfolio holdings reports are available on the Commission’s website at www.sec.gov. The Fund’s portfolio holdings reports may also be reviewed and copied at the Commission’s Public Reference Room in Washington, DC; information on the operation of the Public Reference Room may be obtained by calling (800) SEC 0330. AB publishes full portfolio holdings for the Fund monthly at www.abfunds.com.

AllianceBernstein Investments, Inc. (ABI) is the distributor of the AB family of mutual funds. ABI is a member of FINRA and is an affiliate of AllianceBernstein L.P., the Adviser of the funds.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

| | |

| FROM THE PRESIDENT | |  |

Dear Shareholder,

We are pleased to provide this report for AB Corporate Income Shares (the “Fund”). Please review the discussion of Fund performance, the market conditions during the reporting period and the Fund’s investment strategy.

As always, AB strives to keep clients ahead of what’s next by:

| + | | Transforming uncommon insights into uncommon knowledge with a global research scope |

| + | | Navigating markets with seasoned investment experience and sophisticated solutions |

| + | | Providing thoughtful investment insights and actionable ideas |

Whether you’re an individual investor or a multi-billion-dollar institution, we put knowledge and experience to work for you.

AB’s global research organization connects and collaborates across platforms and teams to deliver impactful insights and innovative products. Better insights lead to better opportunities—anywhere in the world.

For additional information about AB’s range of products and shareholder resources, please log on to www.abfunds.com.

Thank you for your investment in the AB Mutual Funds.

Sincerely,

Robert M. Keith

President and Chief Executive Officer, AB Mutual Funds

| | |

| abfunds.com | | AB CORPORATE INCOME SHARES | 1 |

SEMI-ANNUAL REPORT

December 11, 2018

This report provides management’s discussion of fund performance for AB Corporate Income Shares for the semi-annual reporting period ended October 31, 2018. Please note, shares of this Fund are available only to separately managed accounts or participants in “wrap fee” programs or other investment programs approved by the Adviser.

The Fund’s investment objective is to earn high current income.

NAV RETURNS AS OF OCTOBER 31, 2018 (unaudited)

| | | | | | | | |

| | | 6 Months | | | 12 Months | |

| AB CORPORATE INCOME SHARES | | | -0.53% | | | | -3.04% | |

| Bloomberg Barclays US Credit Bond Index | | | -0.49% | | | | -2.81% | |

INVESTMENT RESULTS

The table above shows the Fund’s performance compared to its benchmark, the Bloomberg Barclays US Credit Bond Index, for the six- and 12-month periods ended October 31, 2018.

During the six-month period, the Fund underperformed the benchmark. Industry allocation detracted from relative performance mainly because of an overweight in the energy sector, while a cash position and a lack of exposure to supranationals also detracted. Overweights in banking and real estate investment trusts contributed, offsetting some of these losses. Security selection also contributed, as gains from selection within energy, media and basic industries more than offset losses from selection within banking. The Fund’s yield-curve positioning did not significantly impact overall performance.

During the 12-month period, the Fund underperformed the benchmark. A lack of exposure to US municipal local-government bonds and supranationals had a negative impact on returns, as did a modest cash position. Yield-curve positioning also detracted, primarily because of an overweight in five- to 10-year maturities, which more than offset gains from the Fund’s underweight in three- to four-year maturities and overweight in four- to five-year maturities. Security decisions contributed, mainly within the energy sector, though selections in banking were negative.

The Fund utilized derivatives in the form of futures for hedging purposes, which detracted from absolute returns for both periods; interest rate swaps for hedging purposes contributed for the six-month period and detracted for the 12-month period; credit default swaps for investment purposes had no material impact for the six-month period and detracted for the 12-month period.

| | |

| 2 | AB CORPORATE INCOME SHARES | | abfunds.com |

MARKET REVIEW AND INVESTMENT STRATEGY

Fixed-income markets had mixed performance during the six-month period, as volatility spiked in the latter part of the period on tighter monetary policy and the onset of a global trade war. Developed-market treasuries rallied, outperforming the negative returns of investment-grade securities, emerging-market local-currency government bonds and global high yield. A stronger US dollar, slowing Chinese growth, the global trade war and a hawkish US Federal Reserve (the “Fed”) weighed on emerging markets. Developed-market yield curves moved in different directions (bond yields move inversely to price).

The Fed raised interest rates twice in the period, while the European Central Bank started to scale back asset purchases but updated forward guidance to say that it would not change its policy rate until summer 2019 at the earliest. The Bank of Japan tweaked its monetary policy, holding rates and yields steady, but widening the band around 10-year yields, potentially allowing them to move higher. US yields rose dramatically, with the 10- and 30-year Treasury yields soaring to multiyear highs, on the back of higher inflation forecasts, the Fed’s expected rate hike path and a robust US labor market. The US administration announced tariffs on imports from China, the European Union, Mexico and Canada, all of which reciprocated with tariffs on the US, triggering a global trade war. An upsurge in geopolitical uncertainty, including governmental turmoil in Italy, sparked a flight to quality.

The Fund’s Senior Investment Management Team (the “Team”) continues to seek attractively priced securities through top-down and bottom-up research, while mitigating overall risk. The Team invests primarily in single-sector, investment-grade issues of global corporates, but has leeway to invest in below investment-grade bonds as well.

INVESTMENT POLICIES

The Fund invests, under normal circumstances, at least 80% of its net assets in US corporate bonds. The Fund may also invest in US government securities (other than US government securities that are mortgage-backed or asset-backed securities), repurchase agreements and forward contracts relating to US government securities. The Fund normally invests all of its assets in securities that are rated, at the time of purchase, at least BBB- or the equivalent. The Fund will not invest in unrated corporate debt securities. The Fund has the flexibility to invest in long- and short-term fixed-income securities. In making decisions about whether to buy or sell securities, the Adviser will consider, among other things, the strength of certain sectors of the fixed-income market relative to others, interest rates and other general market conditions and the credit quality of individual issuers.

(continued on next page)

| | |

| abfunds.com | | AB CORPORATE INCOME SHARES | 3 |

The Fund also may: invest in convertible debt securities; invest up to 10% of its assets in inflation-indexed securities; invest up to 5% of its net assets in preferred stock; purchase and sell interest rate futures contracts and options; enter into swap transactions; invest in zero-coupon securities and “payment-in-kind” debentures; make secured loans of portfolio securities; and invest in US dollar-denominated fixed-income securities issued by non-US companies.

| | |

| 4 | AB CORPORATE INCOME SHARES | | abfunds.com |

DISCLOSURES AND RISKS

Benchmark Disclosure

The Bloomberg Barclays US Credit Bond Index is unmanaged and does not reflect fees and expenses associated with the active management of a fund. The Bloomberg Barclays US Credit Bond Index represents the performance of the US credit securities within the US fixed-income market. An investor cannot invest directly in an index, and its results are not indicative of the performance for any specific investment, including the Fund.

A Word About Risk

Market Risk: The value of the Fund’s assets will fluctuate as the stock or bond market fluctuates. The value of the Fund’s investments may decline, sometimes rapidly and unpredictably, simply because of economic changes or other events that affect large portions of the market.

Credit Risk: An issuer or guarantor of a fixed-income security, or the counterparty to a derivatives or other contract, may be unable or unwilling to make timely payments of interest or principal, or to otherwise honor its obligations. The issuer or guarantor may default, causing a loss of the full principal amount of a security and any accrued interest. The degree of risk for a particular security may be reflected in its credit rating. There is the possibility that the credit rating of a fixed-income security may be downgraded after purchase, which may adversely affect the value of the security. Investments in fixed-income securities with lower ratings tend to have a higher probability that an issuer will default or fail to meet its payment obligations.

Interest-Rate Risk: Changes in interest rates will affect the value of investments in fixed-income securities. When interest rates rise, the value of existing investments in fixed-income securities tends to fall and this decrease in value may not be offset by higher income from new investments. Interest-rate risk is generally greater for fixed-income securities with longer maturities or durations.

Inflation Risk: This is the risk that the value of assets or income from investments will be less in the future as inflation decreases the value of money. As inflation increases, the value of the Fund’s assets can decline as can the value of the Fund’s distributions. This risk is significantly greater for fixed-income securities with longer maturities.

Foreign (Non-US) Risk: Investments in securities of non-US issuers may involve more risk than those of US issuers. These securities may fluctuate more widely in price and may be less liquid due to adverse market, economic, political, regulatory or other factors.

| | |

| abfunds.com | | AB CORPORATE INCOME SHARES | 5 |

DISCLOSURES AND RISKS (continued)

Derivatives Risk: Derivatives may be illiquid, difficult to price, and leveraged so that small changes may produce disproportionate losses for the Fund, and may be subject to counterparty risk to a greater degree than more traditional investments.

Management Risk: The Fund is subject to management risk because it is an actively managed investment fund. The Adviser will apply its investment techniques and risk analyses in making investment decisions, but there is no guarantee that its techniques will produce the intended results.

These risks are fully discussed in the Fund’s prospectus. As with all investments, you may lose money by investing in the Fund.

An Important Note About Historical Performance

The performance shown in this report represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by calling (800) 227 4618. The investment return and principal value of an investment in the Fund will fluctuate, so that your shares, when redeemed, may be worth more or less than their original cost. Performance assumes reinvestment of distributions and does not account for taxes.

Investors should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. For copies of our prospectus and/or summary prospectus, which contain this and other information, visit us online at www.abfunds.com or contact your AllianceBernstein Investments representative. Please read the prospectus and/or summary prospectus carefully before investing.

| | |

| 6 | AB CORPORATE INCOME SHARES | | abfunds.com |

HISTORICAL PERFORMANCE

AVERAGE ANNUAL RETURNS AS OF OCTOBER 31, 2018 (unaudited)

| | | | |

| | | NAV Returns | |

| 1 Year | | | -3.04% | |

| 5 Years | | | 3.10% | |

| 10 Years | | | 7.64% | |

AVERAGE ANNUAL RETURNS

AS OF THE MOST RECENT CALENDAR QUARTER-END

SEPTEMBER 30, 2018 (unaudited)

| | | | |

| | | NAV Returns | |

| 1 Year | | | -1.18% | |

| 5 Years | | | 3.77% | |

| 10 Years | | | 6.93% | |

The prospectus fee table shows the fees and the total operating expenses of the Fund as 0.00% because the Adviser does not charge any fees or expenses and reimburses Fund operating expenses, except certain extraordinary expenses, taxes, brokerage costs and the interest on borrowings or certain leveraged transactions. Participants in a wrap fee program or other investment program eligible to invest in the Fund pay fees to the program sponsor and should review the program brochure or other literature provided by the sponsor for a discussion of fees and expenses charged.

| | |

| abfunds.com | | AB CORPORATE INCOME SHARES | 7 |

EXPENSE EXAMPLE

(unaudited)

As a shareholder of the Fund, you may incur various ongoing non-operating and extraordinary costs. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or contingent deferred sales charges on redemptions. Therefore, the hypothetical example is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

May 1, 2018 | | | Ending

Account Value

October 31, 2018 | | | Expenses Paid

During Period* | | | Annualized

Expense Ratio* | |

Actual | | $ | 1,000 | | | $ | 994.70 | | | $ | – 0 | – | | | 0.00 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,025.21 | | | $ | – 0 | – | | | 0.00 | % |

| * | Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The Fund’s operating expenses are borne by the Adviser or its affiliates. |

| ** | Assumes 5% annual return before expenses. |

| | |

| 8 | AB CORPORATE INCOME SHARES | | abfunds.com |

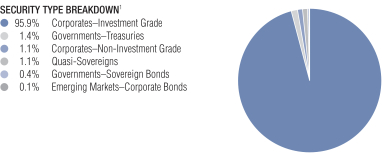

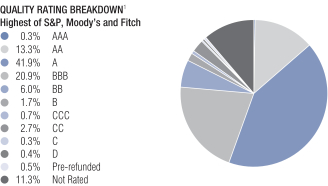

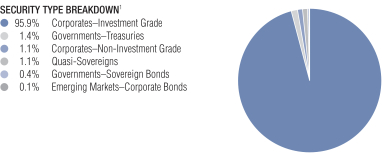

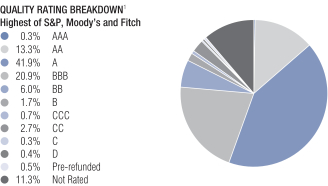

PORTFOLIO SUMMARY

October 31, 2018 (unaudited)

PORTFOLIO STATISTICS

Net Assets ($mil): $83.9

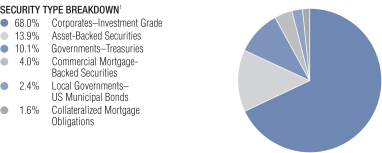

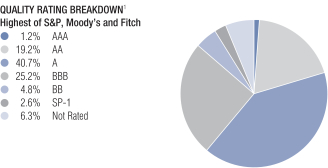

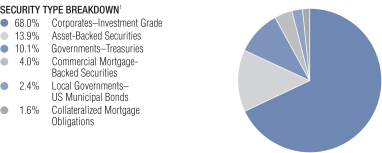

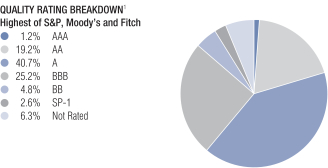

| 1 | All data are as of October 31, 2018. The Fund’s security type breakdown is expressed as a percentage of total investments and may vary over time. The Fund also enters into derivative transactions, which may be used for hedging or investment purposes (see “Portfolio of Investments” section of the report for additional details). |

| | |

| abfunds.com | | AB CORPORATE INCOME SHARES | 9 |

PORTFOLIO OF INVESTMENTS

October 31, 2018 (unaudited)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

CORPORATES – INVESTMENT GRADE – 94.8% | | | | | | | | |

Industrial – 54.6% | | | | | | | | |

Basic – 3.5% | | | | | | | | |

Alpek SAB de CV

4.50%, 11/20/22(a) | | $ | 200 | | | $ | 195,000 | |

Anglo American Capital PLC

4.875%, 5/14/25(a) | | | 200 | | | | 197,208 | |

Celulosa Arauco y Constitucion SA

4.50%, 8/01/24 | | | 200 | | | | 197,250 | |

Dow Chemical Co. (The)

4.375%, 11/15/42 | | | 140 | | | | 123,866 | |

Georgia-Pacific LLC

5.40%, 11/01/20(a) | | | 110 | | | | 113,977 | |

Glencore Finance Canada Ltd.

4.95%, 11/15/21(a) | | | 80 | | | | 82,178 | |

Glencore Funding LLC

4.125%, 5/30/23(a) | | | 125 | | | | 123,926 | |

4.625%, 4/29/24(a) | | | 175 | | | | 174,930 | |

International Paper Co.

3.00%, 2/15/27 | | | 100 | | | | 90,109 | |

LYB International Finance BV

4.00%, 7/15/23 | | | 228 | | | | 227,111 | |

LyondellBasell Industries NV

4.625%, 2/26/55 | | | 102 | | | | 85,614 | |

Mexichem SAB de CV

4.00%, 10/04/27(a) | | | 200 | | | | 177,500 | |

Mosaic Co. (The)

4.25%, 11/15/23 | | | 431 | | | | 432,573 | |

Newmont Mining Corp.

5.125%, 10/01/19 | | | 325 | | | | 330,372 | |

Vale Overseas Ltd.

6.25%, 8/10/26 | | | 90 | | | | 96,189 | |

Yamana Gold, Inc.

4.625%, 12/15/27 | | | 175 | | | | 161,788 | |

4.95%, 7/15/24 | | | 91 | | | | 88,874 | |

| | | | | | | | |

| | | | | | | 2,898,465 | |

| | | | | | | | |

Capital Goods – 1.7% | | | | | | | | |

Boeing Co. (The)

6.125%, 2/15/33 | | | 55 | | | | 66,849 | |

General Electric Co.

3.375%, 3/11/24 | | | 150 | | | | 142,878 | |

4.50%, 3/11/44 | | | 185 | | | | 159,831 | |

Series D

5.00%, 1/21/21(b) | | | 104 | | | | 96,473 | |

Johnson Controls International PLC

4.50%, 2/15/47 | | | 142 | | | | 130,207 | |

| | |

| 10 | AB CORPORATE INCOME SHARES | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Molex Electronic Technologies LLC

2.878%, 4/15/20(a) | | $ | 130 | | | $ | 128,389 | |

United Technologies Corp.

2.80%, 5/04/24 | | | 135 | | | | 126,994 | |

3.95%, 8/16/25 | | | 214 | | | | 211,851 | |

4.125%, 11/16/28 | | | 90 | | | | 88,373 | |

4.625%, 11/16/48 | | | 220 | | | | 211,229 | |

Wabtec Corp.

4.15%, 3/15/24 | | | 63 | | | | 61,441 | |

| | | | | | | | |

| | | | | | | 1,424,515 | |

| | | | | | | | |

Communications - Media – 5.2% | | | | | | | | |

21st Century Fox America, Inc.

4.00%, 10/01/23 | | | 40 | | | | 40,353 | |

5.40%, 10/01/43 | | | 180 | | | | 202,743 | |

8.875%, 4/26/23 | | | 125 | | | | 149,017 | |

CBS Corp.

3.375%, 2/15/28 | | | 60 | | | | 54,030 | |

3.50%, 1/15/25 | | | 110 | | | | 104,111 | |

3.70%, 6/01/28(a) | | | 90 | | | | 83,014 | |

4.00%, 1/15/26 | | | 175 | | | | 168,927 | |

5.50%, 5/15/33 | | | 65 | | | | 66,784 | |

Charter Communications Operating LLC/Charter Communications Operating Capital

4.908%, 7/23/25 | | | 400 | | | | 402,040 | |

5.75%, 4/01/48 | | | 217 | | | | 205,278 | |

Comcast Corp.

2.85%, 1/15/23 | | | 470 | | | | 455,049 | |

3.375%, 2/15/25 | | | 96 | | | | 92,875 | |

3.40%, 7/15/46 | | | 115 | | | | 91,169 | |

3.90%, 3/01/38 | | | 215 | | | | 191,776 | |

3.969%, 11/01/47 | | | 135 | | | | 117,076 | |

4.60%, 10/15/38 | | | 85 | | | | 83,007 | |

4.70%, 10/15/48 | | | 85 | | | | 82,550 | |

4.75%, 3/01/44 | | | 140 | | | | 136,585 | |

Grupo Televisa SAB

6.625%, 3/18/25 | | | 100 | | | | 110,625 | |

Interpublic Group of Cos., Inc. (The)

3.75%, 10/01/21 | | | 111 | | | | 111,002 | |

Omnicom Group, Inc./Omnicom Capital, Inc.

3.60%, 4/15/26 | | | 359 | | | | 337,126 | |

3.65%, 11/01/24 | | | 95 | | | | 91,448 | |

Time Warner Cable LLC

4.50%, 9/15/42 | | | 65 | | | | 52,341 | |

5.875%, 11/15/40 | | | 30 | | | | 28,762 | |

6.55%, 5/01/37 | | | 24 | | | | 24,949 | |

Viacom, Inc.

3.45%, 10/04/26 | | | 95 | | | | 87,646 | |

| | |

| abfunds.com | | AB CORPORATE INCOME SHARES | 11 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Walt Disney Co. (The)

Series G

4.125%, 6/01/44 | | $ | 90 | | | $ | 85,602 | |

Warner Media LLC

2.95%, 7/15/26 | | | 95 | | | | 84,453 | |

3.55%, 6/01/24 | | | 68 | | | | 65,796 | |

3.60%, 7/15/25 | | | 244 | | | | 231,144 | |

4.00%, 1/15/22 | | | 140 | | | | 140,899 | |

4.70%, 1/15/21 | | | 60 | | | | 61,386 | |

4.85%, 7/15/45 | | | 95 | | | | 84,232 | |

| | | | | | | | |

| | | | | | | 4,323,795 | |

| | | | | | | | |

Communications -Telecommunications – 4.0% | | | | | | | | |

AT&T, Inc.

3.40%, 5/15/25 | | | 407 | | | | 382,653 | |

4.125%, 2/17/26 | | | 372 | | | | 360,170 | |

4.45%, 4/01/24 | | | 106 | | | | 106,995 | |

4.75%, 5/15/46 | | | 89 | | | | 77,007 | |

5.15%, 2/15/50(a) | | | 75 | | | | 67,309 | |

5.45%, 3/01/47 | | | 95 | | | | 89,977 | |

6.55%, 1/15/28(a) | | | 130 | | | | 145,136 | |

SK Telecom Co., Ltd.

3.75%, 4/16/23(a) | | | 215 | | | | 212,512 | |

Sprint Spectrum Co. LLC/Sprint Spectrum Co. II LLC/Sprint Spectrum Co. III LLC

4.738%, 3/20/25(a) | | | 210 | | | | 209,870 | |

TELUS Corp.

4.60%, 11/16/48 | | | 175 | | | | 167,694 | |

Verizon Communications, Inc.

3.376%, 2/15/25 | | | 401 | | | | 386,777 | |

3.85%, 11/01/42 | | | 245 | | | | 205,097 | |

4.15%, 3/15/24 | | | 290 | | | | 293,764 | |

4.862%, 8/21/46 | | | 215 | | | | 205,753 | |

Vodafone Group PLC

4.125%, 5/30/25 | | | 243 | | | | 238,065 | |

4.375%, 5/30/28 | | | 175 | | | | 168,654 | |

| | | | | | | | |

| | | | | | | 3,317,433 | |

| | | | | | | | |

Consumer Cyclical - Automotive – 2.1% | | | | | | | | |

Ford Motor Credit Co. LLC

3.20%, 1/15/21 | | | 220 | | | | 214,652 | |

3.81%, 1/09/24 | | | 400 | | | | 371,716 | |

4.14%, 2/15/23 | | | 200 | | | | 193,896 | |

General Motors Co.

5.40%, 4/01/48 | | | 120 | | | | 105,819 | |

5.95%, 4/01/49 | | | 95 | | | | 88,269 | |

| | |

| 12 | AB CORPORATE INCOME SHARES | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

General Motors Financial Co., Inc.

3.50%, 11/07/24 | | $ | 599 | | | $ | 556,878 | |

4.35%, 4/09/25 | | | 120 | | | | 115,193 | |

Hyundai Capital America

2.55%, 4/03/20(a) | | | 102 | | | | 100,230 | |

| | | | | | | | |

| | | | | | | 1,746,653 | |

| | | | | | | | |

Consumer Cyclical - Entertainment – 0.1% | | | | | | | | |

Hasbro, Inc.

5.10%, 5/15/44 | | | 70 | | | | 63,078 | |

| | | | | | | | |

| | |

Consumer Cyclical - Other – 0.1% | | | | | | | | |

Owens Corning

4.40%, 1/30/48 | | | 85 | | | | 66,390 | |

7.00%, 12/01/36 | | | 35 | | | | 38,790 | |

| | | | | | | | |

| | | | | | | 105,180 | |

| | | | | | | | |

Consumer Cyclical - Restaurants – 0.1% | | | | | | | | |

Starbucks Corp.

4.50%, 11/15/48 | | | 90 | | | | 83,389 | |

| | | | | | | | |

| | |

Consumer Cyclical - Retailers – 1.1% | | | | | | | | |

Dollar General Corp.

4.125%, 5/01/28 | | | 170 | | | | 164,567 | |

Home Depot, Inc. (The)

4.40%, 3/15/45 | | | 105 | | | | 103,016 | |

5.40%, 9/15/40 | | | 130 | | | | 144,967 | |

5.875%, 12/16/36 | | | 100 | | | | 117,106 | |

Lowe’s Cos., Inc.

3.70%, 4/15/46 | | | 160 | | | | 137,728 | |

Walgreens Boots Alliance, Inc.

3.80%, 11/18/24 | | | 250 | | | | 244,017 | |

| | | | | | | | |

| | | | | | | 911,401 | |

| | | | | | | | |

Consumer Non - Cyclical – 15.2% | | | | | | | | |

AbbVie, Inc.

3.20%, 5/14/26 | | | 199 | | | | 182,525 | |

3.60%, 5/14/25 | | | 440 | | | | 420,050 | |

4.45%, 5/14/46 | | | 95 | | | | 82,542 | |

4.70%, 5/14/45 | | | 60 | | | | 54,193 | |

4.875%, 11/14/48 | | | 225 | | | | 207,601 | |

Altria Group, Inc.

3.875%, 9/16/46 | | | 80 | | | | 66,069 | |

4.25%, 8/09/42 | | | 95 | | | | 83,736 | |

AmerisourceBergen Corp.

3.45%, 12/15/27 | | | 99 | | | | 91,595 | |

4.30%, 12/15/47 | | | 132 | | | | 114,547 | |

Amgen, Inc.

2.70%, 5/01/22 | | | 120 | | | | 116,156 | |

3.125%, 5/01/25 | | | 230 | | | | 217,821 | |

| | |

| abfunds.com | | AB CORPORATE INCOME SHARES | 13 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

4.40%, 5/01/45 | | $ | 120 | | | $ | 109,192 | |

4.663%, 6/15/51 | | | 105 | | | | 96,752 | |

Anheuser-Busch InBev Finance, Inc.

4.90%, 2/01/46 | | | 335 | | | | 315,138 | |

Anheuser-Busch InBev Worldwide, Inc.

4.375%, 4/15/38 | | | 170 | | | | 154,504 | |

4.60%, 4/15/48 | | | 210 | | | | 189,130 | |

BAT Capital Corp.

3.222%, 8/15/24(a) | | | 390 | | | | 367,867 | |

4.54%, 8/15/47(a) | | | 90 | | | | 78,124 | |

Bayer US Finance II LLC

2.85%, 4/15/25(a) | | | 155 | | | | 139,080 | |

Becton Dickinson and Co.

2.675%, 12/15/19 | | | 37 | | | | 36,740 | |

3.25%, 11/12/20 | | | 79 | | | | 78,407 | |

3.363%, 6/06/24 | | | 84 | | | | 80,254 | |

3.734%, 12/15/24 | | | 354 | | | | 343,083 | |

Biogen, Inc.

5.20%, 9/15/45 | | | 100 | | | | 100,099 | |

Bunge Ltd. Finance Corp.

3.50%, 11/24/20 | | | 174 | | | | 173,480 | |

Cardinal Health, Inc.

3.079%, 6/15/24 | | | 335 | | | | 313,697 | |

3.41%, 6/15/27 | | | 95 | | | | 86,033 | |

Celgene Corp.

4.55%, 2/20/48 | | | 75 | | | | 64,789 | |

Conagra Brands, Inc.

3.20%, 1/25/23 | | | 32 | | | | 30,930 | |

Constellation Brands, Inc.

4.40%, 11/15/25 | | | 300 | | | | 300,495 | |

CVS Health Corp.

2.125%, 6/01/21 | | | 160 | | | | 154,373 | |

3.375%, 8/12/24 | | | 250 | | | | 239,895 | |

3.875%, 7/20/25 | | | 260 | | | | 252,873 | |

4.10%, 3/25/25 | | | 170 | | | | 167,866 | |

4.30%, 3/25/28 | | | 170 | | | | 165,662 | |

4.78%, 3/25/38 | | | 340 | | | | 327,073 | |

Express Scripts Holding Co.

3.00%, 7/15/23 | | | 71 | | | | 67,937 | |

3.40%, 3/01/27 | | | 95 | | | | 87,231 | |

3.50%, 6/15/24 | | | 109 | | | | 105,710 | |

4.80%, 7/15/46 | | | 90 | | | | 84,685 | |

Fresenius Medical Care US Finance, Inc.

5.75%, 2/15/21(a) | | | 70 | | | | 72,850 | |

General Mills, Inc.

3.459% (LIBOR 3 Month + 1.01%), 10/17/23(c) | | | 85 | | | | 85,314 | |

4.00%, 4/17/25 | | | 260 | | | | 255,141 | |

| | |

| 14 | AB CORPORATE INCOME SHARES | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Gilead Sciences, Inc.

3.50%, 2/01/25 | | $ | 40 | | | $ | 38,806 | |

3.65%, 3/01/26 | | | 371 | | | | 359,069 | |

4.15%, 3/01/47 | | | 75 | | | | 66,428 | |

4.50%, 2/01/45 | | | 170 | | | | 158,586 | |

4.60%, 9/01/35 | | | 140 | | | | 138,032 | |

Kellogg Co.

4.30%, 5/15/28 | | | 305 | | | | 296,975 | |

Keurig Dr. Pepper, Inc.

4.057%, 5/25/23(a) | | | 220 | | | | 218,858 | |

4.417%, 5/25/25(a) | | | 220 | | | | 218,156 | |

Kraft Heinz Foods Co.

3.95%, 7/15/25 | | | 230 | | | | 222,332 | |

4.375%, 6/01/46 | | | 105 | | | | 87,214 | |

5.20%, 7/15/45 | | | 124 | | | | 116,349 | |

Laboratory Corp. of America Holdings

3.20%, 2/01/22 | | | 42 | | | | 41,346 | |

3.60%, 2/01/25 | | | 76 | | | | 73,183 | |

McKesson Corp.

3.95%, 2/16/28 | | | 97 | | | | 92,876 | |

Medtronic, Inc.

3.15%, 3/15/22 | | | 380 | | | | 375,649 | |

4.375%, 3/15/35 | | | 155 | | | | 154,234 | |

4.625%, 3/15/45 | | | 265 | | | | 267,881 | |

Mondelez International Holdings Netherlands BV

2.00%, 10/28/21(a) | | | 200 | | | | 190,388 | |

Mylan NV

3.15%, 6/15/21 | | | 94 | | | | 91,871 | |

3.95%, 6/15/26 | | | 184 | | | | 169,171 | |

Mylan, Inc.

4.20%, 11/29/23 | | | 95 | | | | 92,703 | |

Pfizer, Inc.

4.10%, 9/15/38 | | | 135 | | | | 130,267 | |

4.125%, 12/15/46 | | | 160 | | | | 152,402 | |

7.20%, 3/15/39 | | | 65 | | | | 87,407 | |

Philip Morris International, Inc.

4.25%, 11/10/44 | | | 290 | | | | 260,698 | |

Reynolds American, Inc.

4.45%, 6/12/25 | | | 330 | | | | 327,941 | |

4.85%, 9/15/23 | | | 40 | | | | 41,204 | |

Smithfield Foods, Inc.

3.35%, 2/01/22(a) | | | 65 | | | | 63,019 | |

Stryker Corp.

3.65%, 3/07/28 | | | 215 | | | | 204,962 | |

4.10%, 4/01/43 | | | 75 | | | | 67,061 | |

Thermo Fisher Scientific, Inc.

3.00%, 4/15/23 | | | 140 | | | | 134,964 | |

3.60%, 8/15/21 | | | 120 | | | | 120,006 | |

| | |

| abfunds.com | | AB CORPORATE INCOME SHARES | 15 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Tyson Foods, Inc.

2.25%, 8/23/21 | | $ | 75 | | | $ | 72,180 | |

5.10%, 9/28/48 | | | 140 | | | | 136,898 | |

Whirlpool Corp.

3.70%, 3/01/23 | | | 120 | | | | 118,258 | |

Wyeth LLC

6.00%, 2/15/36 | | | 180 | | | | 212,294 | |

Zimmer Biomet Holdings, Inc.

2.70%, 4/01/20 | | | 430 | | | | 425,425 | |

| | | | | | | | |

| | | | | | | 12,786,332 | |

| | | | | | | | |

Energy – 11.5% | | | | | | | | |

Anadarko Finance Co.

Series B

7.50%, 5/01/31 | | | 45 | | | | 53,552 | |

Anadarko Petroleum Corp.

3.45%, 7/15/24 | | | 125 | | | | 118,842 | |

5.55%, 3/15/26 | | | 88 | | | | 91,629 | |

6.20%, 3/15/40 | | | 35 | | | | 36,814 | |

Andeavor Logistics LP/Tesoro Logistics Finance Corp.

3.50%, 12/01/22 | | | 175 | | | | 171,036 | |

Apache Corp.

7.75%, 12/15/29 | | | 35 | | | | 42,601 | |

Boardwalk Pipelines LP

4.95%, 12/15/24 | | | 65 | | | | 65,747 | |

Canadian Natural Resources Ltd.

3.80%, 4/15/24 | | | 90 | | | | 88,582 | |

6.50%, 2/15/37 | | | 20 | | | | 22,877 | |

Cenovus Energy, Inc.

3.00%, 8/15/22 | | | 90 | | | | 86,098 | |

3.80%, 9/15/23 | | | 355 | | | | 346,849 | |

4.25%, 4/15/27 | | | 90 | | | | 84,766 | |

ConocoPhillips

6.50%, 2/01/39 | | | 194 | | | | 242,533 | |

ConocoPhillips Co.

4.95%, 3/15/26 | | | 135 | | | | 143,197 | |

ConocoPhillips Holding Co.

6.95%, 4/15/29 | | | 101 | | | | 124,501 | |

Continental Resources, Inc./OK

3.80%, 6/01/24 | | | 270 | | | | 260,661 | |

4.50%, 4/15/23 | | | 213 | | | | 213,577 | |

Devon Energy Corp.

3.25%, 5/15/22 | | | 195 | | | | 189,604 | |

Ecopetrol SA

5.875%, 9/18/23-5/28/45 | | | 89 | | | | 90,712 | |

Enbridge Energy Partners LP

4.20%, 9/15/21 | | | 100 | | | | 101,193 | |

| | |

| 16 | AB CORPORATE INCOME SHARES | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

5.875%, 10/15/25 | | $ | 60 | | | $ | 64,944 | |

7.375%, 10/15/45 | | | 65 | | | | 80,990 | |

9.875%, 3/01/19 | | | 120 | | | | 122,596 | |

Energy Transfer Operating LP

3.60%, 2/01/23 | | | 142 | | | | 138,279 | |

Energy Transfer Operating LP

6.05%, 6/01/41 | | | 35 | | | | 34,348 | |

Energy Transfer Partners LP/Regency Energy Finance Corp.

4.50%, 11/01/23 | | | 215 | | | | 216,376 | |

5.00%, 10/01/22 | | | 55 | | | | 56,641 | |

Eni SpA

Series X-R

4.00%, 9/12/23(a) | | | 200 | | | | 196,528 | |

Enterprise Products Operating LLC

3.35%, 3/15/23 | | | 105 | | | | 102,731 | |

3.75%, 2/15/25 | | | 140 | | | | 137,224 | |

4.80%, 2/01/49 | | | 85 | | | | 81,590 | |

4.90%, 5/15/46 | | | 45 | | | | 43,780 | |

EOG Resources, Inc.

2.625%, 3/15/23 | | | 128 | | | | 122,584 | |

Hess Corp.

4.30%, 4/01/27 | | | 307 | | | | 289,231 | |

6.00%, 1/15/40 | | | 35 | | | | 34,510 | |

7.125%, 3/15/33 | | | 40 | | | | 44,753 | |

Husky Energy, Inc.

4.00%, 4/15/24 | | | 65 | | | | 64,231 | |

Kerr-McGee Corp.

6.95%, 7/01/24 | | | 50 | | | | 55,687 | |

Kinder Morgan Energy Partners LP

4.30%, 5/01/24 | | | 295 | | | | 295,552 | |

5.30%, 9/15/20 | | | 55 | | | | 56,636 | |

6.375%, 3/01/41 | | | 40 | | | | 43,206 | |

Kinder Morgan, Inc./DE

5.05%, 2/15/46 | | | 175 | | | | 164,223 | |

Marathon Oil Corp.

6.80%, 3/15/32 | | | 191 | | | | 221,298 | |

Marathon Petroleum Corp.

4.75%, 12/15/23(a) | | | 205 | | | | 210,984 | |

5.00%, 9/15/54 | | | 75 | | | | 69,283 | |

5.125%, 12/15/26(a) | | | 140 | | | | 143,458 | |

5.85%, 12/15/45 | | | 41 | | | | 42,177 | |

6.50%, 3/01/41 | | | 110 | | | | 123,710 | |

MPLX LP

4.875%, 12/01/24 | | | 60 | | | | 61,508 | |

Noble Energy, Inc.

3.85%, 1/15/28 | | | 350 | | | | 321,720 | |

| | |

| abfunds.com | | AB CORPORATE INCOME SHARES | 17 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

3.90%, 11/15/24 | | $ | 172 | | | $ | 167,222 | |

4.15%, 12/15/21 | | | 65 | | | | 65,516 | |

Occidental Petroleum Corp.

4.20%, 3/15/48 | | | 222 | | | | 206,764 | |

4.40%, 4/15/46 | | | 80 | | | | 77,344 | |

ONEOK Partners LP

3.375%, 10/01/22 | | | 55 | | | | 53,843 | |

3.80%, 3/15/20 | | | 125 | | | | 125,384 | |

4.90%, 3/15/25 | | | 30 | | | | 30,700 | |

ONEOK, Inc.

4.55%, 7/15/28 | | | 175 | | | | 171,419 | |

5.20%, 7/15/48 | | | 90 | | | | 87,088 | |

Phillips 66

4.875%, 11/15/44 | | | 75 | | | | 72,857 | |

Plains All American Pipeline LP/PAA Finance Corp. 3.60%, 11/01/24 | | | 90 | | | | 85,593 | |

3.85%, 10/15/23 | | | 170 | | | | 165,340 | |

4.65%, 10/15/25 | | | 90 | | | | 88,952 | |

Sabine Pass Liquefaction LLC

4.20%, 3/15/28 | | | 90 | | | | 85,689 | |

5.00%, 3/15/27 | | | 135 | | | | 136,230 | |

Spectra Energy Partners LP

3.50%, 3/15/25 | | | 110 | | | | 104,639 | |

4.50%, 3/15/45 | | | 50 | | | | 45,460 | |

4.60%, 6/15/21 | | | 75 | | | | 76,351 | |

4.75%, 3/15/24 | | | 130 | | | | 132,280 | |

Suncor Energy, Inc.

6.50%, 6/15/38 | | | 92 | | | | 108,209 | |

Sunoco Logistics Partners Operations LP

3.90%, 7/15/26 | | | 170 | | | | 157,831 | |

5.40%, 10/01/47 | | | 80 | | | | 72,765 | |

Valero Energy Corp.

3.65%, 3/15/25 | | | 96 | | | | 92,424 | |

6.625%, 6/15/37 | | | 95 | | | | 108,496 | |

Western Gas Partners LP

4.50%, 3/01/28 | | | 90 | | | | 85,078 | |

4.75%, 8/15/28 | | | 54 | | | | 51,709 | |

5.45%, 4/01/44 | | | 85 | | | | 76,190 | |

Williams Cos., Inc. (The)

3.60%, 3/15/22 | | | 415 | | | | 408,825 | |

3.90%, 1/15/25 | | | 109 | | | | 105,293 | |

4.50%, 11/15/23 | | | 215 | | | | 217,778 | |

| | | | | | | | |

| | | | | | | 9,679,418 | |

| | | | | | | | |

Other Industrial – 0.2% | | | | | | | | |

Alfa SAB de CV

5.25%, 3/25/24(a) | | | 200 | | | | 197,500 | |

| | | | | | | | |

| | |

| 18 | AB CORPORATE INCOME SHARES | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Services – 1.9% | | | | | | | | |

Amazon.com, Inc.

3.875%, 8/22/37 | | $ | 85 | | | $ | 79,943 | |

4.05%, 8/22/47 | | | 235 | | | | 219,208 | |

4.80%, 12/05/34 | | | 110 | | | | 115,663 | |

Equifax, Inc.

3.60%, 8/15/21 | | | 175 | | | | 173,526 | |

IHS Markit Ltd.

4.00%, 3/01/26(a) | | | 76 | | | | 71,458 | |

4.125%, 8/01/23 | | | 208 | | | | 205,167 | |

4.75%, 8/01/28 | | | 88 | | | | 86,090 | |

Moody’s Corp.

2.75%, 12/15/21 | | | 230 | | | | 224,241 | |

S&P Global, Inc.

4.00%, 6/15/25 | | | 140 | | | | 139,517 | |

4.50%, 5/15/48 | | | 125 | | | | 120,679 | |

Total System Services, Inc.

3.80%, 4/01/21 | | | 66 | | | | 66,104 | |

Verisk Analytics, Inc.

5.50%, 6/15/45 | | | 60 | | | | 60,502 | |

| | | | | | | | |

| | | | | | | 1,562,098 | |

| | | | | | | | |

Technology – 6.5% | | | | | | | | |

Activision Blizzard, Inc.

2.60%, 6/15/22 | | | 139 | | | | 134,235 | |

Analog Devices, Inc.

3.125%, 12/05/23 | | | 225 | | | | 216,655 | |

Apple, Inc.

3.45%, 2/09/45 | | | 360 | | | | 308,794 | |

3.85%, 8/04/46 | | | 75 | | | | 68,482 | |

4.65%, 2/23/46 | | | 250 | | | | 257,435 | |

Applied Materials, Inc.

4.35%, 4/01/47 | | | 70 | | | | 65,872 | |

Broadcom Corp./Broadcom Cayman Finance Ltd.

3.625%, 1/15/24 | | | 284 | | | | 272,140 | |

3.875%, 1/15/27 | | | 390 | | | | 357,926 | |

Cisco Systems, Inc.

5.50%, 1/15/40 | | | 60 | | | | 69,228 | |

5.90%, 2/15/39 | | | 45 | | | | 54,198 | |

Dell International LLC/EMC Corp.

5.45%, 6/15/23(a) | | | 62 | | | | 64,140 | |

6.02%, 6/15/26(a) | | | 300 | | | | 311,289 | |

DXC Technology Co.

2.875%, 3/27/20 | | | 104 | | | | 102,952 | |

Fidelity National Information Services, Inc.

3.875%, 6/05/24 | | | 19 | | | | 18,832 | |

5.00%, 10/15/25 | | | 2 | | | | 2,083 | |

| | |

| abfunds.com | | AB CORPORATE INCOME SHARES | 19 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Series 30Y

4.75%, 5/15/48 | | $ | 90 | | | $ | 85,640 | |

HP, Inc.

3.75%, 12/01/20 | | | 14 | | | | 14,086 | |

Intel Corp.

3.734%, 12/08/47 | | | 375 | | | | 333,589 | |

Juniper Networks, Inc.

4.35%, 6/15/25 | | | 50 | | | | 49,226 | |

4.50%, 3/15/24 | | | 120 | | | | 121,547 | |

KLA-Tencor Corp.

4.65%, 11/01/24 | | | 215 | | | | 219,152 | |

Lam Research Corp.

2.75%, 3/15/20 | | | 115 | | | | 113,959 | |

Maxim Integrated Products, Inc.

3.375%, 3/15/23 | | | 150 | | | | 145,875 | |

Microchip Technology, Inc.

3.922%, 6/01/21(a) | | | 175 | | | | 173,950 | |

Microsoft Corp.

3.45%, 8/08/36 | | | 420 | | | | 385,959 | |

3.70%, 8/08/46 | | | 270 | | | | 247,687 | |

Series 30Y

4.25%, 2/06/47 | | | 70 | | | | 70,388 | |

Oracle Corp.

3.90%, 5/15/35 | | | 255 | | | | 238,861 | |

4.00%, 11/15/47 | | | 130 | | | | 117,030 | |

4.50%, 7/08/44 | | | 140 | | | | 136,802 | |

QUALCOMM, Inc.

2.60%, 1/30/23 | | | 190 | | | | 181,820 | |

2.90%, 5/20/24 | | | 135 | | | | 128,095 | |

3.45%, 5/20/25 | | | 95 | | | | 91,144 | |

4.30%, 5/20/47 | | | 95 | | | | 85,225 | |

Seagate HDD Cayman

4.75%, 1/01/25 | | | 38 | | | | 34,764 | |

4.875%, 3/01/24 | | | 25 | | | | 23,651 | |

VMware, Inc.

2.95%, 8/21/22 | | | 60 | | | | 57,509 | |

Xerox Corp.

2.80%, 5/15/20 | | | 95 | | | | 93,065 | |

| | | | | | | | |

| | | | | | | 5,453,285 | |

| | | | | | | | |

Transportation - Railroads – 0.5% | | | | | | | | |

Burlington Northern Santa Fe LLC

4.55%, 9/01/44 | | | 85 | | | | 84,802 | |

CSX Corp.

3.80%, 11/01/46 | | | 175 | | | | 150,416 | |

Union Pacific Corp.

4.00%, 4/15/47 | | | 110 | | | | 99,030 | |

4.375%, 9/10/38 | | | 90 | | | | 87,399 | |

| | | | | | | | |

| | | | | | | 421,647 | |

| | | | | | | | |

| | |

| 20 | AB CORPORATE INCOME SHARES | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Transportation - Services – 0.9% | | | | | | | | |

Aviation Capital Group LLC

3.875%, 5/01/23(a) | | $ | 215 | | | $ | 211,663 | |

ERAC USA Finance LLC

3.85%, 11/15/24(a) | | | 145 | | | | 143,145 | |

Penske Truck Leasing Co. LP/PTL Finance Corp.

3.90%, 2/01/24(a) | | | 300 | | | | 294,987 | |

Ryder System, Inc.

2.50%, 9/01/22 | | | 150 | | | | 143,243 | |

| | | | | | | | |

| | | | | | | 793,038 | |

| | | | | | | | |

| | | | | | | 45,767,227 | |

| | | | | | | | |

Financial Institutions – 35.2% | | | | | | | | |

Banking – 22.9% | | | | | | | | |

AIB Group PLC

4.75%, 10/12/23(a) | | | 200 | | | | 199,370 | |

Banco Santander SA

3.50%, 4/11/22 | | | 200 | | | | 195,434 | |

4.25%, 4/11/27 | | | 200 | | | | 185,856 | |

Bank of America Corp.

2.881%, 4/24/23 | | | 110 | | | | 106,396 | |

3.419%, 12/20/28 | | | 131 | | | | 120,816 | |

3.97%, 3/05/29 | | | 85 | | | | 81,824 | |

4.00%, 1/22/25 | | | 615 | | | | 598,549 | |

4.20%, 8/26/24 | | | 125 | | | | 124,083 | |

4.45%, 3/03/26 | | | 93 | | | | 91,966 | |

Series G

3.593%, 7/21/28 | | | 580 | | | | 545,119 | |

Series V

5.125%, 6/17/19(b) | | | 80 | | | | 80,051 | |

Bank of Ireland Group PLC

4.50%, 11/25/23(a) | | | 225 | | | | 222,991 | |

Bank of New York Mellon Corp. (The)

2.661%, 5/16/23 | | | 85 | | | | 81,986 | |

Series E

4.95%, 6/20/20(b) | | | 197 | | | | 198,215 | |

Bank One Michigan

8.25%, 11/01/24 | | | 160 | | | | 192,026 | |

BNP Paribas SA

6.75%, 3/14/22(a)(b) | | | 265 | | | | 268,188 | |

BPCE SA

5.15%, 7/21/24(a) | | | 205 | | | | 206,952 | |

Capital One Bank USA NA

3.375%, 2/15/23 | | | 775 | | | | 750,293 | |

Citigroup, Inc.

3.40%, 5/01/26 | | | 305 | | | | 286,136 | |

3.668%, 7/24/28 | | | 283 | | | | 265,219 | |

| | |

| abfunds.com | | AB CORPORATE INCOME SHARES | 21 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

3.70%, 1/12/26 | | $ | 285 | | | $ | 273,432 | |

3.875%, 3/26/25 | | | 190 | | | | 183,173 | |

4.044%, 6/01/24 | | | 310 | | | | 309,306 | |

4.40%, 6/10/25 | | | 280 | | | | 277,248 | |

4.45%, 9/29/27 | | | 225 | | | | 218,797 | |

Citizens Financial Group, Inc.

4.15%, 9/28/22(a) | | | 225 | | | | 223,330 | |

Compass Bank

5.50%, 4/01/20 | | | 110 | | | | 112,407 | |

Cooperatieve Rabobank UA

4.375%, 8/04/25 | | | 500 | | | | 489,135 | |

Credit Suisse Group Funding Guernsey Ltd.

4.55%, 4/17/26 | | | 405 | | | | 400,820 | |

Danske Bank A/S

3.875%, 9/12/23(a) | | | 265 | | | | 257,620 | |

Discover Bank

4.682%, 8/09/28 | | | 265 | | | | 261,791 | |

Discover Financial Services

3.75%, 3/04/25 | | | 185 | | | | 175,343 | |

DNB Bank ASA

6.50%, 3/26/22(a)(b) | | | 200 | | | | 199,864 | |

Goldman Sachs Group, Inc. (The)

3.75%, 5/22/25-2/25/26 | | | 273 | | | | 262,849 | |

3.85%, 1/26/27 | | | 545 | | | | 522,541 | |

4.25%, 10/21/25 | | | 325 | | | | 316,062 | |

4.411%, 4/23/39 | | | 148 | | | | 139,034 | |

5.95%, 1/15/27 | | | 40 | | | | 43,226 | |

HSBC Holdings PLC

4.25%, 3/14/24 | | | 395 | | | | 389,995 | |

6.50%, 3/23/28(b) | | | 210 | | | | 197,190 | |

Intesa Sanpaolo SpA

3.125%, 7/14/22(a) | | | 286 | | | | 259,928 | |

JPMorgan Chase & Co.

2.776%, 4/25/23 | | | 300 | | | | 290,319 | |

3.125%, 1/23/25 | | | 425 | | | | 402,883 | |

3.22%, 3/01/25 | | | 300 | | | | 288,513 | |

3.509%, 1/23/29 | | | 90 | | | | 84,143 | |

3.54%, 5/01/28 | | | 225 | | | | 212,794 | |

3.875%, 9/10/24 | | | 295 | | | | 289,817 | |

3.882%, 7/24/38 | | | 95 | | | | 86,001 | |

3.964%, 11/15/48 | | | 215 | | | | 189,095 | |

Series Z

5.30%, 5/01/20(b) | | | 12 | | | | 12,155 | |

Lloyds Banking Group PLC

4.05%, 8/16/23 | | | 220 | | | | 217,826 | |

4.582%, 12/10/25 | | | 225 | | | | 216,756 | |

| | |

| 22 | AB CORPORATE INCOME SHARES | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Morgan Stanley

3.625%, 1/20/27 | | $ | 550 | | | $ | 519,013 | |

Series F

3.875%, 4/29/24 | | | 55 | | | | 54,324 | |

Series G

3.75%, 2/25/23 | | | 144 | | | | 142,917 | |

4.00%, 7/23/25 | | | 103 | | | | 101,209 | |

4.35%, 9/08/26 | | | 280 | | | | 273,426 | |

Nordea Bank Abp

3.75%, 8/30/23(a) | | | 230 | | | | 226,444 | |

5.50%, 9/23/19(a)(b) | | | 255 | | | | 252,549 | |

PNC Bank NA

2.95%, 1/30/23 | | | 250 | | | | 241,292 | |

PNC Financial Services Group, Inc. (The)

3.90%, 4/29/24 | | | 228 | | | | 225,987 | |

Royal Bank of Scotland Group PLC

5.125%, 5/28/24 | | | 391 | | | | 386,355 | |

Santander Holdings USA, Inc.

3.40%, 1/18/23 | | | 215 | | | | 205,123 | |

4.40%, 7/13/27 | | | 280 | | | | 261,464 | |

Societe Generale SA

5.00%, 1/17/24(a) | | | 215 | | | | 215,275 | |

Standard Chartered PLC

3.95%, 1/11/23(a) | | | 225 | | | | 219,298 | |

State Street Corp.

2.653%, 5/15/23 | | | 85 | | | | 82,106 | |

SunTrust Bank/Atlanta GA

2.92% (LIBOR 3 Month + 0.59%), 8/02/22(c) | | | 220 | | | | 219,560 | |

Svenska Handelsbanken AB

5.25%, 3/01/21(a)(b) | | | 255 | | | | 250,479 | |

Swedbank AB

5.50%, 3/17/20(a)(b) | | | 200 | | | | 197,810 | |

UBS Group Funding Switzerland AG

4.125%, 9/24/25(a) | | | 405 | | | | 398,763 | |

UniCredit SpA

4.625%, 4/12/27(a) | | | 200 | | | | 177,506 | |

US Bancorp

Series J

5.30%, 4/15/27(b) | | | 27 | | | | 26,433 | |

Wells Fargo & Co.

3.00%, 10/23/26 | | | 1,285 | | | | 1,175,942 | |

3.584%, 5/22/28 | | | 243 | | | | 230,993 | |

4.40%, 6/14/46 | | | 95 | | | | 85,890 | |

Series K

6.104% (LIBOR 3 Month + 3.77%), 12/15/18(b)(c) | | | 180 | | | | 181,640 | |

| | |

| abfunds.com | | AB CORPORATE INCOME SHARES | 23 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Zions Bancorp NA

3.50%, 8/27/21 | | $ | 275 | | | $ | 272,858 | |

4.50%, 6/13/23 | | | 13 | | | | 13,027 | |

| | | | | | | | |

| | | | | | | 19,242,546 | |

| | | | | | | | |

Brokerage – 0.2% | | | | | | | | |

Jefferies Group LLC/Jefferies Group Capital Finance, Inc.

4.15%, 1/23/30 | | | 215 | | | | 187,927 | |

| | | | | | | | |

| | |

Finance – 1.7% | | | | | | | | |

AIG Global Funding

2.15%, 7/02/20(a) | | | 175 | | | | 171,294 | |

Air Lease Corp.

3.25%, 3/01/25 | | | 230 | | | | 213,426 | |

Comerica, Inc.

3.70%, 7/31/23 | | | 175 | | | | 173,500 | |

GE Capital International Funding Co. Unlimited Co.

4.418%, 11/15/35 | | | 200 | | | | 175,616 | |

Peachtree Corners Funding Trust

3.976%, 2/15/25(a) | | | 110 | | | | 106,392 | |

Synchrony Financial

4.25%, 8/15/24 | | | 135 | | | | 128,210 | |

4.50%, 7/23/25 | | | 436 | | | | 413,066 | |

| | | | | | | | |

| | | | | | | 1,381,504 | |

| | | | | | | | |

Insurance – 5.4% | | | | | | | | |

ACE Capital Trust II

9.70%, 4/01/30 | | | 100 | | | | 139,097 | |

Aegon NV

5.50%, 4/11/48 | | | 210 | | | | 199,458 | |

Aetna, Inc.

3.875%, 8/15/47 | | | 175 | | | | 148,249 | |

Allstate Corp. (The)

2.816% (LIBOR 3 Month + 0.43%), 3/29/21(c) | | | 320 | | | | 321,373 | |

6.50%, 5/15/57 | | | 84 | | | | 91,544 | |

American International Group, Inc.

8.175%, 5/15/58 | | | 65 | | | | 79,996 | |

Series A-9

5.75%, 4/01/48 | | | 245 | | | | 232,539 | |

Anthem, Inc.

3.125%, 5/15/22 | | | 110 | | | | 107,525 | |

3.65%, 12/01/27 | | | 300 | | | | 280,626 | |

Aon Corp.

8.205%, 1/01/27 | | | 100 | | | | 119,454 | |

Aon PLC

4.60%, 6/14/44 | | | 70 | | | | 65,832 | |

Cigna Corp.

7.875%, 5/15/27 | | | 53 | | | | 64,586 | |

| | |

| 24 | AB CORPORATE INCOME SHARES | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Cloverie PLC for Swiss Re Corporate Solutions Ltd.

4.50%, 9/11/44(a) | | $ | 200 | | | $ | 188,932 | |

Guardian Life Insurance Co. of America (The)

4.85%, 1/24/77(a) | | | 86 | | | | 82,539 | |

Halfmoon Parent, Inc.

4.125%, 11/15/25(a) | | | 170 | | | | 167,970 | |

4.375%, 10/15/28(a) | | | 135 | | | | 131,871 | |

4.80%, 8/15/38(a) | | | 90 | | | | 86,681 | |

4.90%, 12/15/48(a) | | | 135 | | | | 127,958 | |

Hartford Financial Services Group, Inc. (The)

6.10%, 10/01/41 | | | 45 | | | | 51,479 | |

Jackson National Life Global Funding

2.50%, 6/27/22(a) | | | 190 | | | | 182,444 | |

MetLife Capital Trust IV

7.875%, 12/15/37(a) | | | 150 | | | | 181,453 | |

MetLife, Inc.

Series C

5.25%, 6/15/20(b) | | | 205 | | | | 206,626 | |

Series D

5.875%, 3/15/28(b) | | | 170 | | | | 169,570 | |

Nationwide Mutual Insurance Co.

9.375%, 8/15/39(a) | | | 55 | | | | 82,951 | |

Principal Financial Group, Inc.

4.70%, 5/15/55 | | | 227 | | | | 224,271 | |

Progressive Corp. (The)

4.125%, 4/15/47 | | | 150 | | | | 140,975 | |

Prudential Financial, Inc.

5.375%, 5/15/45 | | | 140 | | | | 136,574 | |

5.625%, 6/15/43 | | | 200 | | | | 203,442 | |

QBE Insurance Group Ltd.

6.75%, 12/02/44(a) | | | 240 | | | | 247,721 | |

Swiss Re America Holding Corp.

7.00%, 2/15/26 | | | 90 | | | | 103,819 | |

| | | | | | | | |

| | | | | | | 4,567,555 | |

| | | | | | | | |

REITS – 5.0% | | | | | | | | |

Alexandria Real Estate Equities, Inc.

3.45%, 4/30/25 | | | 87 | | | | 82,870 | |

American Homes 4 Rent LP

4.25%, 2/15/28 | | | 215 | | | | 204,727 | |

American Tower Corp.

3.125%, 1/15/27 | | | 95 | | | | 85,244 | |

3.375%, 10/15/26 | | | 100 | | | | 92,104 | |

Boston Properties LP

2.75%, 10/01/26 | | | 100 | | | | 89,743 | |

EPR Properties

4.50%, 4/01/25 | | | 20 | | | | 19,577 | |

| | |

| abfunds.com | | AB CORPORATE INCOME SHARES | 25 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

4.95%, 4/15/28 | | $ | 85 | | | $ | 82,236 | |

5.25%, 7/15/23 | | | 175 | | | | 179,501 | |

Essex Portfolio LP

3.25%, 5/01/23 | | | 56 | | | | 54,304 | |

3.375%, 1/15/23 | | | 125 | | | | 121,860 | |

3.875%, 5/01/24 | | | 84 | | | | 83,103 | |

HCP, Inc.

3.40%, 2/01/25 | | | 243 | | | | 228,286 | |

3.875%, 8/15/24 | | | 150 | | | | 146,050 | |

Hospitality Properties Trust

4.65%, 3/15/24 | | | 148 | | | | 146,777 | |

Kilroy Realty LP

6.625%, 6/01/20 | | | 200 | | | | 208,750 | |

Kimco Realty Corp.

2.80%, 10/01/26 | | | 95 | | | | 83,997 | |

Mid-America Apartments LP

3.75%, 6/15/24 | | | 115 | | | | 112,409 | |

Omega Healthcare Investors, Inc.

4.50%, 1/15/25 | | | 108 | | | | 105,457 | |

Realty Income Corp.

5.75%, 1/15/21 | | | 210 | | | | 218,948 | |

SITE Centers Corp

3.625%, 2/01/25 | | | 135 | | | | 127,863 | |

Spirit Realty LP

4.45%, 9/15/26 | | | 153 | | | | 145,353 | |

Ventas Realty LP

3.50%, 2/01/25 | | | 87 | | | | 82,758 | |

VEREIT Operating Partnership LP

3.00%, 2/06/19 | | | 60 | | | | 59,978 | |

4.60%, 2/06/24 | | | 169 | | | | 169,054 | |

Vornado Realty LP

3.50%, 1/15/25 | | | 435 | | | | 414,351 | |

Washington Real Estate Investment Trust

4.95%, 10/01/20 | | | 140 | | | | 141,970 | |

Welltower, Inc.

4.00%, 6/01/25 | | | 519 | | | | 507,079 | |

Weyerhaeuser Co.

4.625%, 9/15/23 | | | 120 | | | | 123,437 | |

WP Carey, Inc.

4.60%, 4/01/24 | | | 44 | | | | 44,347 | |

| | | | | | | | |

| | | | | | | 4,162,133 | |

| | | | | | | | |

| | | | | | | 29,541,665 | |

| | | | | | | | |

Utility – 5.0% | | | | | | | | |

Electric – 4.5% | | | | | | | | |

Abu Dhabi National Energy Co. PJSC

4.375%, 4/23/25(a) | | | 215 | | | | 211,775 | |

| | |

| 26 | AB CORPORATE INCOME SHARES | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

AEP Transmission Co. LLC

3.75%, 12/01/47 | | $ | 80 | | | $ | 70,501 | |

Berkshire Hathaway Energy Co.

4.50%, 2/01/45 | | | 70 | | | | 67,788 | |

6.125%, 4/01/36 | | | 147 | | | | 173,739 | |

Consolidated Edison Co. of New York, Inc.

Series 12-A

4.20%, 3/15/42 | | | 70 | | | | 66,902 | |

Dominion Energy, Inc.

2.579%, 7/01/20 | | | 185 | | | | 182,136 | |

3.90%, 10/01/25 | | | 110 | | | | 107,703 | |

Duke Energy Corp.

3.75%, 9/01/46 | | | 220 | | | | 187,277 | |

Enel Americas SA

4.00%, 10/25/26 | | | 53 | | | | 49,489 | |

Enel Chile SA

4.875%, 6/12/28 | | | 62 | | | | 60,915 | |

Enel Finance International NV

3.625%, 5/25/27(a) | | | 200 | | | | 174,096 | |

Enel Generacion Chile SA

4.25%, 4/15/24 | | | 33 | | | | 32,258 | |

Entergy Corp.

4.00%, 7/15/22 | | | 153 | | | | 153,946 | |

Exelon Corp.

3.497%, 6/01/22 | | | 94 | | | | 91,721 | |

5.10%, 6/15/45 | | | 250 | | | | 255,830 | |

Exelon Generation Co. LLC

2.95%, 1/15/20 | | | 157 | | | | 155,959 | |

Florida Power & Light Co.

4.05%, 6/01/42 | | | 70 | | | | 67,122 | |

Kallpa Generacion SA

4.125%, 8/16/27(a) | | | 200 | | | | 182,500 | |

Oklahoma Gas & Electric Co.

3.85%, 8/15/47 | | | 63 | | | | 55,848 | |

Pacific Gas & Electric Co.

3.25%, 9/15/21 | | | 217 | | | | 213,406 | |

PacifiCorp

6.00%, 1/15/39 | | | 70 | | | | 84,237 | |

PSEG Power LLC

3.00%, 6/15/21 | | | 160 | | | | 157,203 | |

Public Service Enterprise Group, Inc.

1.60%, 11/15/19 | | | 150 | | | | 147,556 | |

Sempra Energy

3.80%, 2/01/38 | | | 215 | | | | 188,682 | |

Southern Co. (The)

2.35%, 7/01/21 | | | 175 | | | | 169,183 | |

2.95%, 7/01/23 | | | 145 | | | | 138,613 | |

| | |

| abfunds.com | | AB CORPORATE INCOME SHARES | 27 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

3.25%, 7/01/26 | | $ | 100 | | | $ | 92,816 | |

Southern Power Co.

4.15%, 12/01/25 | | | 302 | | | | 295,743 | |

| | | | | | | | |

| | | | | | | 3,834,944 | |

| | | | | | | | |

Natural Gas – 0.4% | | | | | | | | |

CenterPoint Energy Resources Corp.

4.10%, 9/01/47 | | | 75 | | | | 66,504 | |

GNL Quintero SA

4.634%, 7/31/29(a) | | | 200 | | | | 193,250 | |

NiSource, Inc.

5.65%, 2/01/45 | | | 60 | | | | 65,383 | |

| | | | | | | | |

| | | | | | | 325,137 | |

| | | | | | | | |

Other Utility – 0.1% | | | | | | | | |

American Water Capital Corp.

3.75%, 9/01/47 | | | 80 | | | | 70,126 | |

| | | | | | | | |

| | | | | | | 4,230,207 | |

| | | | | | | | |

Total Corporates – Investment Grade

(cost $82,577,068) | | | | | | | 79,539,099 | |

| | | | | | | | |

| | | | | | | | |

GOVERNMENTS – TREASURIES – 1.4% | | | | | | | | |

United States – 1.4% | | | | | | | | |

U.S. Treasury Bonds Principal Strip

Zero Coupon, 5/15/38-5/15/48 | | | 1,697 | | | | 660,065 | |

U.S. Treasury Notes

2.875%, 5/15/28 | | | 515 | | | | 503,091 | |

| | | | | | | | |

| | |

Total Governments – Treasuries

(cost $1,200,588) | | | | | | | 1,163,156 | |

| | | | | | | | |

| | | | | | | | |

CORPORATES – NON-INVESTMENT GRADE – 1.1% | | | | | | | | |

Financial Institutions – 0.8% | | | | | | | | |

Banking – 0.6% | | | | | | | | |

Danske Bank A/S

6.125%, 3/28/24(a)(b) | | | 200 | | | | 178,932 | |

Skandinaviska Enskilda Banken AB

5.75%, 5/13/20(a)(b) | | | 255 | | | | 253,982 | |

Standard Chartered PLC

4.03% (LIBOR 3 Month + 1.51%),

1/30/27(a)(b)(c) | | | 100 | | | | 82,312 | |

| | | | | | | | |

| | | | | | | 515,226 | |

| | | | | | | | |

Finance – 0.1% | | | | | | | | |

Navient Corp.

4.875%, 6/17/19 | | | 46 | | | | 46,246 | |

| | | | | | | | |

| | |

| 28 | AB CORPORATE INCOME SHARES | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Insurance – 0.1% | | | | | | | | |

Voya Financial, Inc.

5.65%, 5/15/53 | | $ | 135 | | | $ | 133,056 | |

| | | | | | | | |

| | | | | | | 694,528 | |

| | | | | | | | |

Industrial – 0.3% | | | | | | | | |

Energy – 0.3% | | | | | | | | |

Diamond Offshore Drilling, Inc.

4.875%, 11/01/43 | | | 90 | | | | 62,300 | |

Nabors Industries, Inc.

5.50%, 1/15/23 | | | 153 | | | | 143,935 | |

| | | | | | | | |

| | | | | | | 206,235 | |

| | | | | | | | |

Total Corporates – Non-Investment Grade

(cost $975,522) | | | | | | | 900,763 | |

| | | | | | | | |

| | | | | | | | |

QUASI-SOVEREIGNS – 1.0% | | | | | | | | |

Quasi-Sovereign Bonds – 1.0% | | | | | | | | |

Chile – 0.4% | | | | | | | | |

Corp. Nacional del Cobre de Chile

3.625%, 8/01/27(a) | | | 200 | | | | 186,135 | |

Empresa Nacional del Petroleo

3.75%, 8/05/26(a) | | | 200 | | | | 184,200 | |

| | | | | | | | |

| | | | | | | 370,335 | |

| | | | | | | | |

Mexico – 0.1% | | | | | | | | |

Petroleos Mexicanos

5.625%, 1/23/46 | | | 125 | | | | 96,863 | |

6.75%, 9/21/47 | | | 14 | | | | 12,016 | |

| | | | | | | | |

| | | | | | | 108,879 | |

| | | | | | | | |

Panama – 0.3% | | | | | | | | |

Aeropuerto Internacional de Tocumen SA

5.625%, 5/18/36(a) | | | 200 | | | | 205,000 | |

| | | | | | | | |

| | |

United Arab Emirates – 0.2% | | | | | | | | |

Abu Dhabi Crude Oil Pipeline LLC

4.60%, 11/02/47(a) | | | 200 | | | | 189,000 | |

| | | | | | | | |

| | |

Total Quasi-Sovereigns

(cost $917,804) | | | | | | | 873,214 | |

| | | | | | | | |

| | | | | | | | |

GOVERNMENTS – SOVEREIGN BONDS – 0.4% | | | | | | | | |

Mexico – 0.4% | | | | | | | | |

Mexico Government International Bond

4.60%, 1/23/46 | | | 200 | | | | 174,000 | |

4.75%, 3/08/44 | | | 150 | | | | 132,750 | |

| | | | | | | | |

| | |

Total Governments – Sovereign Bonds

(cost $322,316) | | | | | | | 306,750 | |

| | | | | | | | |

| | |

| abfunds.com | | AB CORPORATE INCOME SHARES | 29 |

PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

EMERGING MARKETS – CORPORATE BONDS – 0.2% | | | | | | | | |

Industrial – 0.2% | | | | | | | | |

Consumer Non-Cyclical – 0.2% | | | | | | | | |

Teva Pharmaceutical Finance Netherlands III BV

3.15%, 10/01/26

(cost $144,808) | | $ | 156 | | | $ | 126,555 | |

| | | | | | | | |

| | |

Total Investments – 98.9%

(cost $86,138,106) | | | | | | | 82,909,537 | |

Other assets less liabilities – 1.1% | | | | | | | 952,120 | |

| | | | | | | | |

| | |

Net Assets – 100.0% | | | | | | $ | 83,861,657 | |

| | | | | | | | |

FUTURES (see Note C)

| | | | | | | | | | | | | | | | | | | | | | | | |

| Description | | Number of

Contracts | | | Expiration

Month | | | Notional

(000) | | | Original

Value | | | Value at

October 31,

2018 | | | Unrealized

Appreciation/

(Depreciation) | |

Purchased Contracts | |

U.S. Long Bond (CBT) Futures | | | 10 | | |

| December

2018 |

| | USD | 1,000 | | | $ | 1,449,233 | | | $ | 1,381,250 | | | $ | (67,983 | ) |

U.S. T-Note 2 Yr (CBT) Futures | | | 7 | | |

| December

2018 |

| | USD | 1,400 | | | | 1,478,743 | | | | 1,474,594 | | | | (4,149 | ) |

|

Sold Contracts | |

U.S. 10 Yr Ultra Futures | | | 25 | | |

| December

2018 |

| | USD | 2,500 | | | | 3,192,012 | | | | 3,127,734 | | | | 64,278 | |

U.S. T-Note 5 Yr (CBT) Futures | | | 12 | | |

| December

2018 |

| | USD | 1,200 | | | | 1,358,922 | | | | 1,348,594 | | | | 10,328 | |

U.S. T-Note 10 Yr (CBT) Futures | | | 16 | | |

| December

2018 |

| | USD | 1,600 | | | | 1,919,071 | | | | 1,895,000 | | | | 24,071 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | $ | 26,545 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| 30 | AB CORPORATE INCOME SHARES | | abfunds.com |

PORTFOLIO OF INVESTMENTS (continued)

CENTRALLY CLEARED INTEREST RATE SWAPS (see Note C)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Rate Type | | | | | | | | | | | | | |

Notional

Amount

(000) | | Termination

Date | | | Payments

made by the

Fund | | | Payments

received

by the

Fund | | | Payment

Frequency

Paid/

Received | | | Market

Value | | | Upfront

Premiums

Paid

(Received) | | | Unrealized

Appreciation/

(Depreciation) | |

USD 1,710 | | | 11/16/18 | | |

| 3 Month

LIBOR |

| | | 1.235% | | |

| Quarterly/

Semi-Annual |

| | $ | 332 | | | $ | — | | | $ | 332 | |

USD 1,170 | | | 9/09/21 | | | | 1.132% | | |

| 3 Month

LIBOR |

| |

| Semi-Annual/

Quarterly |

| | | 65,437 | | | | — | | | | 65,437 | |

USD 1,070 | | | 3/27/22 | | | | 2.058% | | |

| 3 Month

LIBOR |

| |

| Semi-Annual/

Quarterly |

| | | 37,066 | | | | — | | | | 37,066 | |

USD 60 | | | 11/04/44 | | |

| 3 Month

LIBOR |

| | | 3.049% | | |

| Quarterly/

Semi-Annual |

| | | (2,511 | ) | | | — | | | | (2,511 | ) |

USD 60 | | | 5/05/45 | | |

| 3 Month

LIBOR |

| | | 2.562% | | |

| Quarterly/

Semi-Annual |

| | | (8,036 | ) | | | — | | | | (8,036 | ) |

USD 60 | | | 6/02/46 | | |

| 3 Month

LIBOR |

| | | 2.186% | | |

| Quarterly/

Semi-Annual |

| | | (12,597 | ) | | | — | | | | (12,597 | ) |

USD 690 | | | 7/15/46 | | |

| 3 Month

LIBOR |

| | | 1.783% | | |

| Quarterly/

Semi-Annual |

| | | (198,412 | ) | | | — | | | | (198,412 | ) |

USD 270 | | | 9/02/46 | | |

| 3 Month

LIBOR |

| | | 1.736% | | |

| Quarterly/

Semi-Annual |

| | | (81,684 | ) | | | — | | | | (81,684 | ) |

USD 50 | | | 11/02/46 | | |

| 3 Month

LIBOR |

| | | 2.086% | | |

| Quarterly/

Semi-Annual |

| | | (11,582 | ) | | | — | | | | (11,582 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | $ | (211,987 | ) | | $ | — | | | $ | (211,987 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

CREDIT DEFAULT SWAPS (see Note C)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Swap

Counterparty &

Referenced

Obligation | | Fixed

Rate

(Pay)

Receive | | | Payment

Frequency | | | Implied

Credit

Spread at

October 31,

2018 | | | Notional

Amount

(000) | | | Market

Value | | | Upfront

Premiums

Paid

(Received) | | | Unrealized

Appreciation/

(Depreciation) | |

Sale Contracts | | | | | | | | | | | | | | | | | | | | | | | | | |

Credit Suisse International | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Kohl’s Corp., 4.000%, 11/01/21, 6/20/19* | | | 1.00 | % | | | Quarterly | | | | 0.11 | % | | | USD 34 | | | $ | 233 | | | $ | (58 | ) | | $ | 291 | |

INTEREST RATE SWAPS (see Note C)

| | | | | | | | | | | | | | | | | | |

| | | | | | | Rate Type | | | | | | |

Swap

Counterparty | | Notional

Amount

(000) | | Termination

Date | | Payments

made by the

Fund | | | Payments

received

by the

Fund | | | Payment

Frequency

Paid/Received | | Unrealized

Appreciation/

(Depreciation) | |

Deutsche Bank AG | | USD 600 | | 6/10/43 | | | 3 Month LIBOR | | | | 3.191 | % | | Quarterly/

Semi-Annual | | $ | (5,459 | ) |

| | |

| abfunds.com | | AB CORPORATE INCOME SHARES | 31 |

PORTFOLIO OF INVESTMENTS (continued)

| (a) | Security is exempt from registration under Rule 144A of the Securities Act of 1933. These securities are considered restricted, but liquid and may be resold in transactions exempt from registration, normally to qualified institutional buyers. At October 31, 2018, the aggregate market value of these securities amounted to $12,954,378 or 15.4% of net assets. |

| (b) | Securities are perpetual and, thus, do not have a predetermined maturity date. The date shown, if applicable, reflects the next call date. |

| (c) | Floating Rate Security. Stated interest/floor/ceiling rate was in effect at October 31, 2018. |

Glossary:

CBT – Chicago Board of Trade

LIBOR – London Interbank Offered Rates

PJSC – Public Joint Stock Company

REIT – Real Estate Investment Trust

See notes to financial statements.

| | |

| 32 | AB CORPORATE INCOME SHARES | | abfunds.com |

STATEMENT OF ASSETS & LIABILITIES

October 31, 2018 (unaudited)

| | | | |

| Assets | | | | |

Investments in securities, at value (cost $86,138,106) | | $ | 82,909,537 | |

Cash | | | 1,171,668 | |

Cash collateral due from broker | | | 93,148 | |

Interest and dividends receivable | | | 912,914 | |

Receivable for shares of beneficial interest sold | | | 56,566 | |

Receivable for variation margin on futures | | | 11,255 | |

Market value on credit default swaps (net premium paid $58) | | | 233 | |

Other assets | | | 371 | |

| | | | |

Total assets | | | 85,155,692 | |

| | | | |

| Liabilities | | | | |

Payable for investment securities purchased | | | 895,830 | |

Dividends payable | | | 298,936 | |

Payable for shares of beneficial interest redeemed | | | 88,523 | |

Unrealized depreciation on interest rate swaps | | | 5,459 | |

Payable for variation margin on centrally cleared swaps | | | 3,338 | |

Other liabilities | | | 1,949 | |

| | | | |

Total liabilities | | | 1,294,035 | |

| | | | |

Net Assets | | $ | 83,861,657 | |

| | | | |

| Composition of Net Assets | | | | |

Shares of beneficial interest, at par | | $ | 80 | |

Additional paid-in capital | | | 88,145,900 | |

Accumulated loss | | | (4,284,323 | ) |

| | | | |

| | $ | 83,861,657 | |

| | | | |

Net Asset Value Per Share—unlimited shares of beneficial interest authorized, $.00001 par value (based on 7,956,377 common shares outstanding) | | $ | 10.54 | |

| | | | |

See notes to financial statements.

| | |

| abfunds.com | | AB CORPORATE INCOME SHARES | 33 |

STATEMENT OF OPERATIONS

Six Months Ended October 31, 2018 (unaudited)

| | | | | | | | |

| Investment Income | | | | | | | | |

Interest | | $ | 1,760,057 | | | | | |

Other income | | | 378 | | | | | |

| | | | | | | | |

Total investment income | | | | | | $ | 1,760,435 | |

| | | | | | | | |

| Realized and Unrealized Gain (Loss) on Investment Transactions | | | | | | | | |

Net realized gain (loss) on: | | | | | | | | |

Investment transactions(a) | | | | | | | (904,951 | ) |

Futures | | | | | | | (2,572 | ) |

Swaps | | | | | | | 1,933 | |

Net change in unrealized appreciation/depreciation of: | | | | | | | | |

Investments(b) | | | | | | | (1,197,355 | ) |

Futures | | | | | | | 12,726 | |

Swaps | | | | | | | (71,010 | ) |

| | | | | | | | |

Net loss on investment transactions | | | | | | | (2,161,229 | ) |

| | | | | | | | |

Net Decrease in Net Assets from Operations | | | | | | $ | (400,794 | ) |

| | | | | | | | |

| (a) | Net of foreign capital gains taxes of $634. |

| (b) | Net of increase in accrued foreign capital gains taxes of $1,315. |

See notes to financial statements.

| | |

| 34 | AB CORPORATE INCOME SHARES | | abfunds.com |

STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | Six Months Ended

October 31, 2018

(unaudited) | | | Year Ended

April 30,

2018 | |

| Increase (Decrease) in Net Assets from Operations | | | | | | | | |

Net investment income | | $ | 1,760,435 | | | $ | 2,826,325 | |

Net realized gain (loss) on investment transactions | | | (905,590 | ) | | | 461,846 | |

Net change in unrealized appreciation/depreciation of investments | | | (1,255,639 | ) | | | (3,145,718 | ) |

| | | | | | | | |

Net increase (decrease) in net assets from operations | | | (400,794 | ) | | | 142,453 | |

Distributions to shareholders | | | (1,759,405 | ) | | | (2,860,509 | ) |

| Transactions in Shares of Beneficial Interest | | | | | | | | |

Net increase | | | 1,282,096 | | | | 13,267,098 | |

| | | | | | | | |

Total increase (decrease) | | | (878,103 | ) | | | 10,549,042 | |

| Net Assets | | | | | | | | |

Beginning of period | | | 84,739,760 | | | | 74,190,718 | |

| | | | | | | | |

End of period | | $ | 83,861,657 | | | $ | 84,739,760 | |

| | | | | | | | |

See notes to financial statements.

| | |

| abfunds.com | | AB CORPORATE INCOME SHARES | 35 |

NOTES TO FINANCIAL STATEMENTS

October 31, 2018 (unaudited)

NOTE A

Significant Accounting Policies

AB Corporate Shares (the “Trust”) was organized as a Massachusetts business trust under the laws of The Commonwealth of Massachusetts by an Agreement and Declaration of Trust dated January 26, 2004. The Trust is registered under the Investment Company Act of 1940, as an open-end, diversified management investment company. The Trust operates as a “series” company currently offering four separate portfolios: AB Corporate Income Shares, AB Municipal Income Shares, AB Taxable Multi-Sector Income Shares and AB Impact Municipal Income Shares. Each portfolio is considered to be a separate entity for financial reporting and tax purposes. This report relates only to AB Corporate Income Shares (the “Fund”).

Shares of the Fund are offered exclusively to holders of accounts established under wrap-fee programs sponsored and maintained by certain registered investment advisers approved by AllianceBernstein L.P. (the “Adviser”). The Fund’s shares may be purchased at the relevant net asset value without a sales charge or other fee. The financial statements have been prepared in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”) which require management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements and amounts of income and expenses during the reporting period. Actual results could differ from those estimates. The Fund is an investment company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies. The following is a summary of significant accounting policies followed by the Fund.

1. Security Valuation

Portfolio securities are valued at their current market value determined on the basis of market quotations or, if market quotations are not readily available or are deemed unreliable, at “fair value” as determined in accordance with procedures established by and under the general supervision of the Trust’s Board of Trustees (the “Board”).