UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-21497

AB CORPORATE SHARES

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, New York, New York 10105

(Address of principal executive offices) (Zip code)

Joseph J. Mantineo

AllianceBernstein L.P.

1345 Avenue of the Americas

New York, New York 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800)221-5672

Date of fiscal year end: April 30, 2020

Date of reporting period: October 31, 2019

ITEM 1. REPORTS TO STOCKHOLDERS.

OCT 10.31.19

SEMI-ANNUAL REPORT

AB CORPORATE INCOME SHARES

Beginning January 1, 2021, as permitted by new regulations adopted by the Securities and Exchange Commission, the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website address to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically at any time by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling the Fund at (800) 221 5672.

You may elect to receive all future reports in paper form free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports; if you invest directly with the Fund, you can call the Fund at (800) 221 5672. Your election to receive reports in paper form will apply to all funds held in your account with your financial intermediary or, if you invest directly, to all AB Mutual Funds you hold.

| | |

| |

| Investment Products Offered | | • Are Not FDIC Insured• May Lose Value• Are Not Bank Guaranteed |

Investors should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit us online at www.abfunds.com or contact your AB representative. Please read the prospectus and/or summary prospectus carefully before investing.

This shareholder report must be preceded or accompanied by the Fund’s prospectus for individuals who are not current shareholders of the Fund.

You may obtain a description of the Fund’s proxy voting policies and procedures, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent12-month period ended June 30, without charge. Simply visit AB’s website at www.abfunds.com, or go to the Securities and Exchange Commission’s (the “Commission”) website at www.sec.gov, or call AB at (800) 227 4618.

The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the Commission’s website at www.sec.gov. The Fund’s Forms N-PORT may also be reviewed and copied at the Commission’s Public Reference Room in Washington, DC; information on the operation of the Public Reference Room may be obtained by calling (800) SEC 0330. AB publishes full portfolio holdings for the Fund monthly at www.abfunds.com.

AllianceBernstein Investments, Inc. (ABI) is the distributor of the AB family of mutual funds. ABI is a member of FINRA and is an affiliate of AllianceBernstein L.P., the Adviser of the funds.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

| | |

| FROM THE PRESIDENT | |  |

Dear Shareholder,

We are pleased to provide this report for AB Corporate Income Shares (the “Fund”). Please review the discussion of Fund performance, the market conditions during the reporting period and the Fund’s investment strategy.

As always, AB strives to keep clients ahead of what’s next by:

| + | | Transforming uncommon insights into uncommon knowledge with a global research scope |

| + | | Navigating markets with seasoned investment experience and sophisticated solutions |

| + | | Providing thoughtful investment insights and actionable ideas |

Whether you’re an individual investor or a multi-billion-dollar institution, we put knowledge and experience to work for you.

AB’s global research organization connects and collaborates across platforms and teams to deliver impactful insights and innovative products. Better insights lead to better opportunities—anywhere in the world.

For additional information about AB’s range of products and shareholder resources, please log on to www.abfunds.com.

Thank you for your investment in the AB Mutual Funds.

Sincerely,

Robert M. Keith

President and Chief Executive Officer, AB Mutual Funds

| | |

| |

| abfunds.com | | AB CORPORATE INCOME SHARES | 1 |

SEMI-ANNUAL REPORT

December 11, 2019

This report provides management’s discussion of fund performance for AB Corporate Income Shares for the semi-annual reporting period ended October 31, 2019. Please note, shares of this Fund are available only to separately managed accounts or participants in “wrap fee” programs or other investment programs approved by the Adviser.

The Fund’s investment objective is to earn high current income.

NAV RETURNS AS OF OCTOBER 31, 2019(unaudited)

| | | | | | | | |

| | |

| | | 6 Months | | | 12 Months | |

| | |

| AB CORPORATE INCOME SHARES | | | 8.24% | | | | 16.46% | |

| | |

| Bloomberg Barclays US Credit Bond Index | | | 7.46% | | | | 14.88% | |

Please keep in mind that high, double-digit returns are highly unusual and cannot be sustained. Investors should also be aware that these returns were primarily achieved during favorable market conditions.

INVESTMENT RESULTS

The table above shows the Fund’s performance compared to its benchmark, the Bloomberg Barclays US Credit Bond Index, for thesix- and12-month periods ended October 31, 2019.

During thesix-month period, the Fund outperformed the benchmark. Yield-curve positioning was the primary contributor, relative to the benchmark, particularly an overweight in four- tosix-year maturities. Underweights along thetwo- to three-year and seven- to10-year and longer parts of the yield curve offset some of these gains. The Fund’s longer-than-benchmark duration was also positive, as rates rallied in the period. From an industry perspective, gains in finance and real estate investment trusts exceeded losses from energy. Security selection contributed to returns, as gains from selection within banking, real estate investment trusts and consumer non- cyclicals more than offset losses in energy.

During the12-month period, the Fund outperformed the benchmark. Yield-curve positioning was the primary contributor, particularly an overweight in three- tosix-year maturities. Underweights along theone- to three-year and seven- to10-year and longer parts of the yield curve offset some of these gains. The Fund’s longer-than-benchmark duration was also positive, as rates rallied in the period. From an industry perspective, gains in finance and supranational bonds exceeded losses from energy and treasuries. Security selection contributed, as gains from selection within banking, consumer non-cyclicals and technology more than offset losses in energy.

| | |

| |

| 2 | AB CORPORATE INCOME SHARES | | abfunds.com |

The Fund utilized derivatives in the form of futures and interest rate swaps for hedging purposes, and credit default swaps for investment purposes, which added to absolute returns for both periods.

MARKET REVIEW AND INVESTMENT STRATEGY

Fixed-income markets performed strongly over thesix-month period ended October 31, 2019. The US Federal Reserve lowered interest rates three times in reaction to slowing global growth, declining manufacturing output and faltering business confidence from the ongoingUS-China trade conflict. The European Central Bank followed suit in September by cutting rates to a record low and announcing the resumption of quantitative easing. The Reserve Bank of Australia cut interest rates three times to a new low while the Bank of Japan issued guidance for low interest rates well into 2020. The Bank of Canada maintained interest rates, as the country’s overall economy remained in balance. Central bankers in numerous other developed and emerging markets also lowered interest rates and signaled further monetary easing and potential fiscal stimulus measures to boost faltering demand. Inflation remains below target in most developed countries and is falling in emerging markets.

Long-dated developed-market treasury securities and emerging-market sovereign debt were strong performers given their interest-rate sensitivity. Investment-grade corporate bond returns were also robust, and spreads remained near historical lows, outperforming high-yield bonds. At the end of the period, positive signs emerged of a partialUS-China trade agreement and an increased likelihood of the UK leaving the European Union at the end of January 2020 with a negotiated deal. The US dollar remained strong as a safe haven during a period of increased global growth uncertainty, but weakened in October against most developed- and emerging-market currencies.

The Fund’s Senior Investment Management Team (the “Team”) continues to seek attractively priced securities throughtop-down andbottom-up research, while mitigating overall risk. The Team invests primarily in single-sector, investment-grade issues of global corporates, but has leeway to invest in below investment-grade bonds as well.

INVESTMENT POLICIES

The Fund invests, under normal circumstances, at least 80% of its net assets in US corporate bonds. The Fund may also invest in US government securities (other than US government securities that are mortgage-backed or asset-backed securities), repurchase agreements and forward contracts relating to US government securities. The Fund normally invests all of its assets in securities that are rated, at the time of purchase, at leastBBB- or the equivalent. The Fund will

(continued on next page)

| | |

| |

| abfunds.com | | AB CORPORATE INCOME SHARES | 3 |

not invest in unrated corporate debt securities. The Fund has the flexibility to invest in long- and short-term fixed-income securities. In making decisions about whether to buy or sell securities, the Adviser will consider, among other things, the strength of certain sectors of the fixed-income market relative to others, interest rates and other general market conditions and the credit quality of individual issuers.

The Fund also may: invest in convertible debt securities; invest up to 10% of its assets in inflation-indexed securities; invest up to 5% of its net assets in preferred stock; purchase and sell interest rate futures contracts and options; enter into swap transactions; invest inzero-coupon securities and“payment-in-kind” debentures; make secured loans of portfolio securities; and invest in US dollar-denominated fixed-income securities issued bynon-US companies.

| | |

| |

| 4 | AB CORPORATE INCOME SHARES | | abfunds.com |

DISCLOSURES AND RISKS

Benchmark Disclosure

The Bloomberg Barclays US Credit Bond Index is unmanaged and does not reflect fees and expenses associated with the active management of a fund. The Bloomberg Barclays US Credit Bond Index represents the performance of the US credit securities within the US fixed-income market. An investor cannot invest directly in an index, and its results are not indicative of the performance for any specific investment, including the Fund.

A Word About Risk

Market Risk: The value of the Fund’s assets will fluctuate as the stock or bond market fluctuates. The value of the Fund’s investments may decline, sometimes rapidly and unpredictably, simply because of economic changes or other events that affect large portions of the market.

Credit Risk: An issuer or guarantor of a fixed-income security, or the counterparty to a derivatives or other contract, may be unable or unwilling to make timely payments of interest or principal, or to otherwise honor its obligations. The issuer or guarantor may default, causing a loss of the full principal amount of a security and any accrued interest. The degree of risk for a particular security may be reflected in its credit rating. There is the possibility that the credit rating of a fixed-income security may be downgraded after purchase, which may adversely affect the value of the security. Investments in fixed-income securities with lower ratings tend to have a higher probability that an issuer will default or fail to meet its payment obligations.

Interest-Rate Risk: Changes in interest rates will affect the value of investments in fixed-income securities. When interest rates rise, the value of existing investments in fixed-income securities tends to fall and this decrease in value may not be offset by higher income from new investments. Interest-rate risk is generally greater for fixed-income securities with longer maturities or durations.

Inflation Risk: This is the risk that the value of assets or income from investments will be less in the future as inflation decreases the value of money. As inflation increases, the value of the Fund’s assets can decline as can the value of the Fund’s distributions. This risk is significantly greater for fixed-income securities with longer maturities.

Foreign(Non-US) Risk: Investments in securities ofnon-US issuers may involve more risk than those of US issuers. These securities may fluctuate more widely in price and may be more difficult to trade due to adverse market, economic, political, regulatory or other factors.

| | |

| |

| abfunds.com | | AB CORPORATE INCOME SHARES | 5 |

DISCLOSURES AND RISKS(continued)

Derivatives Risk: Derivatives may be difficult to price or unwind and leveraged so that small changes may produce disproportionate losses for the Fund. Derivatives, especiallyover-the-counter derivatives, are also subject to counterparty risk.

Management Risk: The Fund is subject to management risk because it is an actively managed investment fund. The Adviser will apply its investment techniques and risk analyses in making investment decisions, but there is no guarantee that its techniques will produce the intended results.

These risks are fully discussed in the Fund’s prospectus. As with all investments, you may lose money by investing in the Fund.

An Important Note About Historical Performance

The performance shown in this report represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recentmonth-end by calling (800) 227 4618. The investment return and principal value of an investment in the Fund will fluctuate, so that your shares, when redeemed, may be worth more or less than their original cost. Performance assumes reinvestment of distributions and does not account for taxes.

Investors should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. For copies of our prospectus and/or summary prospectus, which contain this and other information, visit us online at www.abfunds.com or contact your AllianceBernstein Investments representative. Please read the prospectus and/or summary prospectus carefully before investing.

| | |

| |

| 6 | AB CORPORATE INCOME SHARES | | abfunds.com |

HISTORICAL PERFORMANCE

AVERAGE ANNUAL RETURNS AS OF OCTOBER 31, 2019(unaudited)

| | | | |

| |

| | | NAV Returns | |

| |

| 1 Year | | | 16.46% | |

| |

| 5 Years | | | 4.74% | |

| |

| 10 Years | | | 6.01% | |

AVERAGE ANNUAL RETURNS

AS OF THE MOST RECENT CALENDARQUARTER-END

SEPTEMBER 30, 2019(unaudited)

| | | | |

| |

| | | NAV Returns | |

| |

| 1 Year | | | 13.94% | |

| |

| 5 Years | | | 4.81% | |

| |

| 10 Years | | | 6.07% | |

The prospectus fee table shows the fees and the total operating expenses of the Fund as 0.00% because the Adviser does not charge any fees or expenses and reimburses Fund operating expenses, except certain extraordinary expenses, taxes, brokerage costs and the interest on borrowings or certain leveraged transactions. Participants in a wrap fee program or other investment program eligible to invest in the Fund pay fees to the program sponsor and should review the program brochure or other literature provided by the sponsor for a discussion of fees and expenses charged.

| | |

| |

| abfunds.com | | AB CORPORATE INCOME SHARES | 7 |

EXPENSE EXAMPLE

(unaudited)

As a shareholder of the Fund, you may incur various ongoing non-operating and extraordinary costs. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or contingent deferred sales charges on redemptions. Therefore, the hypothetical example is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

May 1, 2019 | | | Ending

Account Value

October 31, 2019 | | | Expenses Paid

During Period* | | | Annualized

Expense Ratio* | |

Actual | | $ | 1,000 | | | $ | 1,082.40 | | | $ | – 0 – | | | | 0.00 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,025.14 | | | $ | – 0 – | | | | 0.00 | % |

| * | Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/366 (to reflect theone-half year period). The Fund’s operating expenses are borne by the Adviser or its affiliates. |

| ** | Assumes 5% annual return before expenses. |

| | |

| |

| 8 | AB CORPORATE INCOME SHARES | | abfunds.com |

PORTFOLIO SUMMARY

October 31, 2019(unaudited)

PORTFOLIO STATISTICS

Net Assets ($mil): $138.2

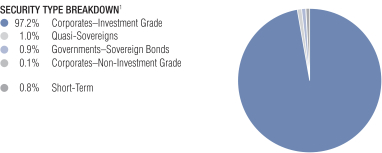

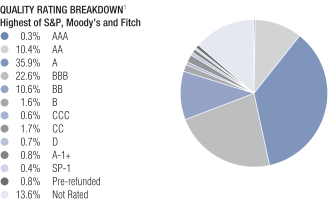

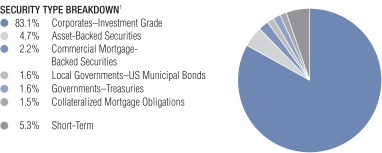

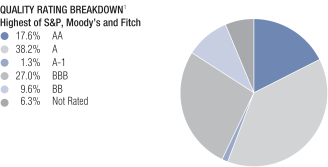

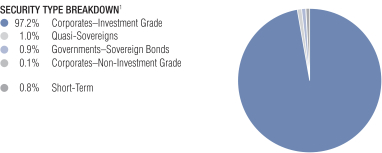

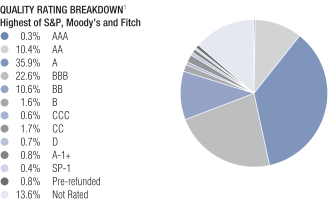

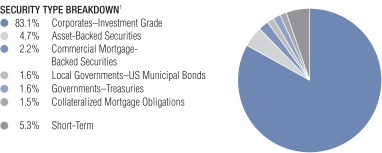

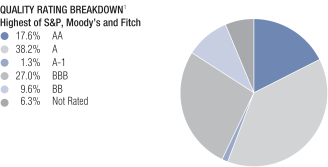

| 1 | All data are as of October 31, 2019. The Fund’s security type breakdown is expressed as a percentage of total investments and may vary over time. The Fund also enters into derivative transactions, which may be used for hedging or investment purposes (see “Portfolio of Investments” section of the report for additional details). |

| | |

| |

| abfunds.com | | AB CORPORATE INCOME SHARES | 9 |

PORTFOLIO OF INVESTMENTS

October 31, 2019(unaudited)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

CORPORATES – INVESTMENT GRADE – 95.6% | | | | | | | | |

Industrial – 48.8% | | | | | | | | |

Basic – 2.3% | | | | | | | | |

Celulosa Arauco y Constitucion SA

4.25%, 4/30/29(a) | | $ | 246 | | | $ | 250,182 | |

4.50%, 8/01/24 | | | 200 | | | | 208,312 | |

DuPont de Nemours, Inc.

5.419%, 11/15/48 | | | 121 | | | | 150,931 | |

Glencore Finance Canada Ltd.

4.95%, 11/15/21(a) | | | 80 | | | | 83,862 | |

Glencore Funding LLC

4.125%, 5/30/23(a) | | | 125 | | | | 130,733 | |

4.625%, 4/29/24(a) | | | 175 | | | | 187,614 | |

LYB International Finance BV

4.00%, 7/15/23 | | | 228 | | | | 241,933 | |

LyondellBasell Industries NV

4.625%, 2/26/55 | | | 102 | | | | 105,602 | |

Mosaic Co. (The)

4.25%, 11/15/23 | | | 221 | | | | 235,513 | |

Reliance Steel & Aluminum Co.

4.50%, 4/15/23 | | | 848 | | | | 899,516 | |

Sherwin-Williams Co. (The)

3.125%, 6/01/24 | | | 62 | | | | 64,326 | |

Suzano Austria GmbH

6.00%, 1/15/29 | | | 224 | | | | 247,072 | |

Westlake Chemical Corp.

4.375%, 11/15/47 | | | 360 | | | | 356,198 | |

| | | | | | | | |

| | | | | | | 3,161,794 | |

| | | | | | | | |

Capital Goods – 2.5% | | | | | | | | |

3M Co.

3.25%, 8/26/49 | | | 110 | | | | 109,875 | |

General Electric Co.

5.875%, 1/14/38 | | | 274 | | | | 328,857 | |

Series G

3.10%, 1/09/23 | | | 374 | | | | 380,635 | |

John Deere Capital Corp.

2.30%, 6/07/21 | | | 302 | | | | 304,283 | |

Masco Corp.

4.375%, 4/01/26 | | | 447 | | | | 485,062 | |

4.45%, 4/01/25 | | | 698 | | | | 759,745 | |

Molex Electronic Technologies LLC

2.878%, 4/15/20(a) | | | 130 | | | | 130,247 | |

United Technologies Corp.

2.80%, 5/04/24 | | | 198 | | | | 204,005 | |

5.70%, 4/15/40 | | | 222 | | | | 298,468 | |

| | |

| |

| 10 | AB CORPORATE INCOME SHARES | | abfunds.com |

PORTFOLIO OF INVESTMENTS(continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Vulcan Materials Co.

4.50%, 6/15/47 | | $ | 169 | | | $ | 183,933 | |

Wabtec Corp.

4.40%, 3/15/24 | | | 233 | | | | 248,560 | |

| | | | | | | | |

| | | | | | | 3,433,670 | |

| | | | | | | | |

Communications - Media – 4.2% | | | | | | | | |

CBS Corp.

4.20%, 6/01/29 | | | 393 | | | | 426,735 | |

Charter Communications Operating LLC/Charter Communications Operating Capital

5.125%, 7/01/49 | | | 249 | | | | 265,168 | |

5.375%, 5/01/47 | | | 374 | | | | 409,302 | |

Comcast Corp.

3.25%, 11/01/39 | | | 410 | | | | 417,474 | |

3.90%, 3/01/38 | | | 215 | | | | 236,883 | |

4.60%, 10/15/38 | | | 85 | | | | 101,300 | |

4.65%, 7/15/42 | | | 375 | | | | 448,132 | |

4.75%, 3/01/44 | | | 140 | | | | 170,201 | |

6.45%, 3/15/37 | | | 329 | | | | 463,929 | |

Discovery Communications LLC

5.20%, 9/20/47 | | | 358 | | | | 395,021 | |

Omnicom Group, Inc./Omnicom Capital, Inc.

4.45%, 8/15/20 | | | 101 | | | | 102,856 | |

Time Warner Entertainment Co. LP

8.375%, 3/15/23 | | | 987 | | | | 1,173,316 | |

Walt Disney Co. (The)

4.00%, 10/01/23(a) | | | 40 | | | | 42,693 | |

5.40%, 10/01/43(a) | | | 180 | | | | 247,723 | |

6.15%, 2/15/41(a) | | | 110 | | | | 161,399 | |

6.40%, 12/15/35(a) | | | 161 | | | | 230,765 | |

8.875%, 4/26/23(a) | | | 125 | | | | 152,549 | |

Weibo Corp.

3.50%, 7/05/24 | | | 373 | | | | 380,693 | |

| | | | | | | | |

| | | | | | | 5,826,139 | |

| | | | | | | | |

Communications - Telecommunications – 2.9% | | | | | | | | |

AT&T, Inc.

4.30%, 2/15/30 | | | 234 | | | | 257,711 | |

4.75%, 5/15/46 | | | 89 | | | | 98,776 | |

4.85%,3/01/39-7/15/45 | | | 194 | | | | 218,421 | |

5.15%, 2/15/50 | | | 75 | | | | 87,191 | |

5.35%, 9/01/40 | | | 415 | | | | 491,982 | |

5.45%, 3/01/47 | | | 168 | | | | 203,067 | |

6.55%,1/15/28-2/15/39 | | | 350 | | | | 442,703 | |

Rogers Communications, Inc.

4.50%, 3/15/43 | | | 4 | | | | 4,555 | |

| | |

| |

| abfunds.com | | AB CORPORATE INCOME SHARES | 11 |

PORTFOLIO OF INVESTMENTS(continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Telefonica Emisiones SA

4.665%, 3/06/38 | | $ | 196 | | | $ | 215,765 | |

Verizon Communications, Inc.

4.272%, 1/15/36 | | | 586 | | | | 665,596 | |

4.862%, 8/21/46 | | | 731 | | | | 907,076 | |

Vodafone Group PLC

4.25%, 9/17/50 | | | 132 | | | | 135,309 | |

4.875%, 6/19/49 | | | 78 | | | | 87,727 | |

5.25%, 5/30/48 | | | 184 | | | | 215,641 | |

| | | | | | | | |

| | | | | | | 4,031,520 | |

| | | | | | | | |

Consumer Cyclical - Automotive – 2.6% | | | | | | | | |

Ford Motor Credit Co. LLC

3.096%, 5/04/23 | | | 483 | | | | 476,557 | |

3.81%, 1/09/24 | | | 395 | | | | 394,794 | |

4.14%, 2/15/23 | | | 200 | | | | 203,886 | |

General Motors Co.

5.95%, 4/01/49 | | | 95 | | | | 103,130 | |

General Motors Financial Co., Inc.

3.25%, 1/05/23 | | | 921 | | | | 933,498 | |

3.50%, 11/07/24 | | | 599 | | | | 609,782 | |

4.15%, 6/19/23 | | | 116 | | | | 120,942 | |

4.30%, 7/13/25 | | | 314 | | | | 329,226 | |

Hyundai Capital America

2.55%, 4/03/20(a) | | | 102 | | | | 102,048 | |

PACCAR Financial Corp.

2.65%, 5/10/22 | | | 248 | | | | 252,749 | |

| | | | | | | | |

| | | | | | | 3,526,612 | |

| | | | | | | | |

Consumer Cyclical - Other – 0.6% | | | | | | | | |

Las Vegas Sands Corp.

3.20%, 8/08/24 | | | 573 | | | | 586,408 | |

3.50%, 8/18/26 | | | 200 | | | | 204,040 | |

| | | | | | | | |

| | | | | | | 790,448 | |

| | | | | | | | |

Consumer Cyclical - Restaurants – 0.9% | | | | | | | | |

McDonald’s Corp.

4.70%, 12/09/35 | | | 585 | | | | 695,904 | |

Starbucks Corp.

3.55%, 8/15/29 | | | 238 | | | | 257,823 | |

4.50%, 11/15/48 | | | 225 | | | | 260,636 | |

| | | | | | | | |

| | | | | | | 1,214,363 | |

| | | | | | | | |

Consumer Cyclical - Retailers – 0.8% | | | | | | | | |

Dollar General Corp.

3.25%, 4/15/23 | | | 61 | | | | 63,274 | |

Home Depot, Inc. (The)

5.875%, 12/16/36 | | | 40 | | | | 55,610 | |

| | |

| |

| 12 | AB CORPORATE INCOME SHARES | | abfunds.com |

PORTFOLIO OF INVESTMENTS(continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Lowe’s Cos., Inc.

4.375%, 9/15/45 | | $ | 305 | | | $ | 336,122 | |

Target Corp.

3.90%, 11/15/47 | | | 230 | | | | 263,148 | |

4.00%, 7/01/42 | | | 335 | | | | 383,997 | |

| | | | | | | | |

| | | | | | | 1,102,151 | |

| | | | | | | | |

ConsumerNon-Cyclical – 10.2% | | | | | | | | |

AbbVie, Inc.

4.40%, 11/06/42 | | | 185 | | | | 191,873 | |

4.875%, 11/14/48 | | | 375 | | | | 414,308 | |

Altria Group, Inc.

4.40%, 2/14/26 | | | 389 | | | | 419,396 | |

4.80%, 2/14/29 | | | 102 | | | | 111,839 | |

AmerisourceBergen Corp.

4.30%, 12/15/47 | | | 207 | | | | 213,156 | |

Anheuser-Busch Cos. LLC/Anheuser-Busch InBev Worldwide, Inc.

4.90%, 2/01/46 | | | 385 | | | | 460,964 | |

Anheuser-Busch InBev Finance, Inc.

4.70%, 2/01/36 | | | 320 | | | | 368,848 | |

Anheuser-Busch InBev Worldwide, Inc.

4.95%, 1/15/42 | | | 490 | | | | 581,630 | |

BAT Capital Corp.

2.789%, 9/06/24 | | | 330 | | | | 328,970 | |

4.39%, 8/15/37 | | | 795 | | | | 784,331 | |

Biogen, Inc.

5.20%, 9/15/45 | | | 214 | | | | 261,641 | |

Bunge Ltd. Finance Corp.

3.25%, 8/15/26 | | | 458 | | | | 459,511 | |

Cardinal Health, Inc.

3.20%, 3/15/23 | | | 529 | | | | 542,685 | |

Celgene Corp.

4.55%, 2/20/48 | | | 75 | | | | 91,004 | |

Cigna Corp.

3.00%, 7/15/23(a) | | | 71 | | | | 72,490 | |

4.80%, 8/15/38 | | | 37 | | | | 42,229 | |

4.80%, 7/15/46(a) | | | 263 | | | | 294,991 | |

7.875%, 5/15/27(a) | | | 53 | | | | 69,142 | |

CommonSpirit Health

4.35%, 11/01/42 | | | 44 | | | | 45,809 | |

Constellation Brands, Inc.

5.25%, 11/15/48 | | | 184 | | | | 227,575 | |

CVS Health Corp.

3.25%, 8/15/29 | | | 44 | | | | 44,442 | |

3.875%, 7/20/25 | | | 308 | | | | 327,669 | |

4.78%, 3/25/38 | | | 592 | | | | 659,583 | |

5.125%, 7/20/45 | | | 120 | | | | 138,316 | |

| | |

| |

| abfunds.com | | AB CORPORATE INCOME SHARES | 13 |

PORTFOLIO OF INVESTMENTS(continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Danaher Corp.

4.375%, 9/15/45 | | $ | 260 | | | $ | 304,213 | |

Eli Lilly & Co.

5.55%, 3/15/37 | | | 83 | | | | 111,451 | |

Gilead Sciences, Inc.

4.15%, 3/01/47 | | | 75 | | | | 83,206 | |

4.50%, 2/01/45 | | | 170 | | | | 196,557 | |

HCA, Inc.

4.75%, 5/01/23 | | | 155 | | | | 165,945 | |

Johnson & Johnson

3.55%, 3/01/36 | | | 851 | | | | 936,687 | |

Keurig Dr Pepper, Inc.

2.55%, 9/15/26 | | | 260 | | | | 258,856 | |

5.085%, 5/25/48 | | | 191 | | | | 229,618 | |

Kraft Heinz Foods Co.

5.20%, 7/15/45 | | | 124 | | | | 131,998 | |

6.875%, 1/26/39 | | | 242 | | | | 302,231 | |

Leggett & Platt, Inc.

4.40%, 3/15/29 | | | 773 | | | | 841,642 | |

Mylan, Inc.

4.20%, 11/29/23 | | | 307 | | | | 322,832 | |

4.55%, 4/15/28 | | | 380 | | | | 406,923 | |

Newell Brands, Inc.

3.85%, 4/01/23 | | | 548 | | | | 567,569 | |

Perrigo Finance Unlimited Co.

3.90%, 12/15/24 | | | 303 | | | | 311,472 | |

4.375%, 3/15/26 | | | 420 | | | | 434,948 | |

Philip Morris International, Inc.

4.50%, 3/26/20 | | | 475 | | | | 479,318 | |

Smithfield Foods, Inc.

3.35%, 2/01/22(a) | | | 65 | | | | 65,204 | |

Tyson Foods, Inc.

4.55%, 6/02/47 | | | 178 | | | | 202,368 | |

5.10%, 9/28/48 | | | 239 | | | | 294,051 | |

Wyeth LLC

5.95%, 4/01/37 | | | 188 | | | | 258,256 | |

| | | | | | | | |

| | | | | | | 14,057,747 | |

| | | | | | | | |

Energy – 10.5% | | | | | | | | |

Baker Hughes a GE Co. LLC

5.125%, 9/15/40 | | | 390 | | | | 445,942 | |

Boardwalk Pipelines LP

4.80%, 5/03/29 | | | 304 | | | | 323,626 | |

Buckeye Partners LP

3.95%, 12/01/26 | | | 474 | | | | 438,706 | |

Cenovus Energy, Inc.

3.00%, 8/15/22 | | | 90 | | | | 90,947 | |

| | |

| |

| 14 | AB CORPORATE INCOME SHARES | | abfunds.com |

PORTFOLIO OF INVESTMENTS(continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Columbia Pipeline Group, Inc.

4.50%, 6/01/25 | | $ | 867 | | | $ | 941,891 | |

Ecopetrol SA

5.875%,9/18/23-5/28/45 | | | 89 | | | | 99,983 | |

Enable Midstream Partners LP

3.90%, 5/15/24 | | | 921 | | | | 936,602 | |

5.00%, 5/15/44 | | | 41 | | | | 36,156 | |

Enbridge, Inc.

4.00%, 10/01/23 | | | 422 | | | | 447,691 | |

Energy Transfer Operating LP

5.875%, 1/15/24 | | | 539 | | | | 598,786 | |

Eni SpA

4.25%, 5/09/29(a) | | | 247 | | | | 271,048 | |

Enterprise Products Operating LLC

3.75%, 2/15/25 | | | 140 | | | | 149,787 | |

3.90%, 2/15/24 | | | 59 | | | | 62,847 | |

4.80%, 2/01/49 | | | 85 | | | | 98,189 | |

4.90%, 5/15/46 | | | 45 | | | | 52,179 | |

EQM Midstream Partners LP

4.75%, 7/15/23 | | | 1,135 | | | | 1,127,316 | |

EQT Corp.

3.00%, 10/01/22 | | | 867 | | | | 827,456 | |

3.90%, 10/01/27 | | | 274 | | | | 243,907 | |

Exxon Mobil Corp.

4.114%, 3/01/46 | | | 524 | | | | 624,278 | |

Husky Energy, Inc.

4.40%, 4/15/29 | | | 240 | | | | 253,589 | |

MPLX LP

3.50%, 12/01/22(a) | | | 175 | | | | 180,063 | |

Newfield Exploration Co.

5.375%, 1/01/26 | | | 610 | | | | 659,245 | |

5.625%, 7/01/24 | | | 475 | | | | 520,557 | |

Noble Energy, Inc.

3.25%, 10/15/29 | | | 135 | | | | 134,595 | |

6.00%, 3/01/41 | | | 113 | | | | 131,068 | |

Occidental Petroleum Corp.

2.90%, 8/15/24 | | | 319 | | | | 322,445 | |

3.20%, 8/15/26 | | | 52 | | | | 52,595 | |

4.30%, 8/15/39 | | | 128 | | | | 130,173 | |

ONEOK, Inc.

5.20%, 7/15/48 | | | 295 | | | | 324,612 | |

Plains All American Pipeline LP/PAA Finance Corp.

3.60%, 11/01/24 | | | 917 | | | | 938,742 | |

Sabine Pass Liquefaction LLC

5.625%,2/01/21-4/15/23 | | | 1,156 | | | | 1,240,149 | |

| | |

| |

| abfunds.com | | AB CORPORATE INCOME SHARES | 15 |

PORTFOLIO OF INVESTMENTS(continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Suncor Energy, Inc.

6.80%, 5/15/38 | | $ | 223 | | | $ | 314,392 | |

Sunoco Logistics Partners Operations LP

3.90%, 7/15/26 | | | 170 | | | | 177,242 | |

5.35%, 5/15/45 | | | 145 | | | | 152,837 | |

TransCanada PipeLines Ltd.

4.75%, 5/15/38 | | | 50 | | | | 56,834 | |

7.625%, 1/15/39 | | | 153 | | | | 226,376 | |

Transcontinental Gas Pipe Line Co. LLC

7.85%, 2/01/26 | | | 325 | | | | 411,911 | |

Valero Energy Corp.

6.625%, 6/15/37 | | | 160 | | | | 208,573 | |

Western Midstream Operating LP

4.65%, 7/01/26 | | | 81 | | | | 80,775 | |

5.30%, 3/01/48 | | | 130 | | | | 110,683 | |

5.45%, 4/01/44 | | | 149 | | | | 129,208 | |

| | | | | | | | |

| | | | | | | 14,574,001 | |

| | | | | | | | |

Other Industrial – 0.2% | | | | | | | | |

Alfa SAB de CV

5.25%, 3/25/24(a) | | | 200 | | | | 215,750 | |

| | | | | | | | |

| | |

Services – 0.7% | | | | | | | | |

eBay, Inc.

2.75%, 1/30/23 | | | 62 | | | | 62,942 | |

Global Payments, Inc.

2.65%, 2/15/25 | | | 320 | | | | 324,477 | |

IHS Markit Ltd.

4.00%, 3/01/26(a) | | | 76 | | | | 80,815 | |

4.125%, 8/01/23 | | | 208 | | | | 219,560 | |

Moody’s Corp.

5.25%, 7/15/44 | | | 255 | | | | 324,781 | |

| | | | | | | | |

| | | | | | | 1,012,575 | |

| | | | | | | | |

Technology – 8.7% | | | | | | | | |

Apple, Inc.

4.45%, 5/06/44 | | | 620 | | | | 753,015 | |

4.65%, 2/23/46 | | | 250 | | | | 313,892 | |

Avnet, Inc.

4.625%, 4/15/26 | | | 612 | | | | 655,085 | |

Broadcom Corp./Broadcom Cayman Finance Ltd.

2.65%, 1/15/23 | | | 857 | | | | 858,757 | |

3.625%, 1/15/24 | | | 251 | | | | 258,339 | |

Broadcom, Inc.

3.625%, 10/15/24(a) | | | 265 | | | | 272,553 | |

4.25%, 4/15/26(a) | | | 549 | | | | 572,942 | |

CA, Inc.

3.60%, 8/15/22 | | | 837 | | | | 852,342 | |

| | |

| |

| 16 | AB CORPORATE INCOME SHARES | | abfunds.com |

PORTFOLIO OF INVESTMENTS(continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Dell International LLC/EMC Corp.

4.90%, 10/01/26(a) | | $ | 411 | | | $ | 445,840 | |

6.02%, 6/15/26(a) | | | 386 | | | | 440,835 | |

DXC Technology Co.

4.25%, 4/15/24 | | | 160 | | | | 167,278 | |

Fidelity National Information Services, Inc.

5.00%, 10/15/25 | | | 2 | | | | 2,285 | |

Intel Corp.

4.90%, 7/29/45 | | | 195 | | | | 251,963 | |

International Business Machines Corp.

1.625%, 5/15/20 | | | 489 | | | | 488,394 | |

4.00%, 6/20/42 | | | 530 | | | | 583,594 | |

Lam Research Corp.

3.75%, 3/15/26 | | | 142 | | | | 153,082 | |

4.875%, 3/15/49 | | | 235 | | | | 289,431 | |

Microchip Technology, Inc.

3.922%, 6/01/21 | | | 175 | | | | 179,055 | |

Micron Technology, Inc.

4.64%, 2/06/24 | | | 276 | | | | 295,403 | |

4.975%, 2/06/26 | | | 703 | | | | 761,616 | |

Microsoft Corp.

4.50%, 10/01/40 | | | 429 | | | | 537,301 | |

NXP BV/NXP Funding LLC

4.875%, 3/01/24(a) | | | 495 | | | | 537,342 | |

Oracle Corp.

6.125%, 7/08/39 | | | 254 | | | | 358,386 | |

QUALCOMM, Inc.

4.30%, 5/20/47 | | | 3 | | | | 3,374 | |

Seagate HDD Cayman

4.75%, 1/01/25 | | | 19 | | | | 19,965 | |

4.875%, 3/01/24 | | | 485 | | | | 513,431 | |

Tech Data Corp.

3.70%, 2/15/22 | | | 867 | | | | 888,718 | |

Texas Instruments, Inc.

3.875%, 3/15/39 | | | 150 | | | | 171,330 | |

VMware, Inc.

3.90%, 8/21/27 | | | 422 | | | | 436,618 | |

| | | | | | | | |

| | | | | | | 12,062,166 | |

| | | | | | | | |

Transportation - Railroads – 0.3% | |

Burlington Northern Santa Fe LLC

4.55%, 9/01/44 | | | 85 | | | | 102,088 | |

CSX Corp.

3.80%, 11/01/46 | | | 175 | | | | 184,286 | |

Union Pacific Corp.

4.00%, 4/15/47 | | | 110 | | | | 121,716 | |

| | | | | | | | |

| | | | | | | 408,090 | |

| | | | | | | | |

| | |

| |

| abfunds.com | | AB CORPORATE INCOME SHARES | 17 |

PORTFOLIO OF INVESTMENTS(continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Transportation - Services – 1.4% | | | | | | | | |

Aviation Capital Group LLC

3.875%, 5/01/23(a) | | $ | 215 | | | $ | 222,347 | |

4.375%, 1/30/24(a) | | | 230 | | | | 242,707 | |

ERAC USA Finance LLC

3.85%, 11/15/24(a) | | | 145 | | | | 154,770 | |

FedEx Corp.

4.05%, 2/15/48 | | | 386 | | | | 380,569 | |

Penske Truck Leasing Co. Lp/PTL Finance Corp.

3.90%, 2/01/24(a) | | | 300 | | | | 316,824 | |

Ryder System, Inc.

2.50%, 9/01/22 | | | 150 | | | | 151,178 | |

United Parcel Service, Inc.

3.40%, 9/01/49 | | | 451 | | | | 460,340 | |

| | | | | | | | |

| | | | | | | 1,928,735 | |

| | | | | | | | |

| | | | | | | 67,345,761 | |

| | | | | | | | |

Financial Institutions – 41.1% | | | | | | | | |

Banking – 23.4% | | | | | | | | |

Banco Santander SA

5.179%, 11/19/25 | | | 400 | | | | 443,676 | |

Bank of America Corp.

3.366%, 1/23/26 | | | 603 | | | | 630,690 | |

3.458%, 3/15/25 | | | 230 | | | | 240,739 | |

Series L

3.95%, 4/21/25 | | | 1,134 | | | | 1,207,166 | |

Series X

6.25%, 9/05/24(b) | | | 175 | | | | 193,788 | |

Series Z

6.50%, 10/23/24(b) | | | 53 | | | | 59,832 | |

Bank of Montreal

4.338%, 10/05/28 | | | 480 | | | | 506,256 | |

Bank of Nova Scotia (The)

4.50%, 12/16/25 | | | 410 | | | | 448,630 | |

Barclays PLC

3.932%, 5/07/25 | | | 447 | | | | 466,444 | |

4.338%, 5/16/24 | | | 867 | | | | 912,344 | |

BBVA Bancomer SA/Texas

5.875%, 9/13/34(a) | | | 330 | | | | 334,455 | |

BBVA USA

3.875%, 4/10/25 | | | 481 | | | | 506,483 | |

Capital One Bank USA NA

3.375%, 2/15/23 | | | 525 | | | | 540,850 | |

Capital One Financial Corp.

3.30%, 10/30/24 | | | 916 | | | | 955,141 | |

3.75%, 7/28/26 | | | 240 | | | | 252,526 | |

| | |

| |

| 18 | AB CORPORATE INCOME SHARES | | abfunds.com |

PORTFOLIO OF INVESTMENTS(continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Citigroup, Inc.

2.876%, 7/24/23 | | $ | 740 | | | $ | 752,920 | |

3.875%, 3/26/25 | | | 461 | | | | 487,738 | |

5.50%, 9/13/25 | | | 595 | | | | 681,025 | |

Citizens Financial Group, Inc.

4.30%, 12/03/25 | | | 895 | | | | 964,434 | |

Cooperatieve Rabobank UA

3.75%, 7/21/26 | | | 525 | | | | 548,940 | |

4.375%, 8/04/25 | | | 500 | | | | 543,155 | |

Credit Suisse Group Funding Guernsey Ltd.

4.55%, 4/17/26 | | | 405 | | | | 448,088 | |

Deutsche Bank AG/New York NY

3.30%, 11/16/22 | | | 334 | | | | 335,065 | |

3.95%, 2/27/23 | | | 635 | | | | 649,065 | |

Discover Bank

4.682%, 8/09/28 | | | 385 | | | | 403,430 | |

Discover Financial Services

3.75%, 3/04/25 | | | 795 | | | | 843,638 | |

Goldman Sachs Group, Inc. (The)

2.625%, 4/25/21 | | | 323 | | | | 325,923 | |

2.876%, 10/31/22 | | | 247 | | | | 250,470 | |

2.905%, 7/24/23 | | | 466 | | | | 473,484 | |

2.908%, 6/05/23 | | | 235 | | | | 238,715 | |

3.75%, 5/22/25 | | | 95 | | | | 100,720 | |

4.25%, 10/21/25 | | | 325 | | | | 350,191 | |

4.411%, 4/23/39 | | | 148 | | | | 167,495 | |

5.95%, 1/15/27 | | | 40 | | | | 47,740 | |

HSBC Holdings PLC

4.25%,3/14/24-8/18/25 | | | 1,382 | | | | 1,473,395 | |

ING Bank NV

5.80%, 9/25/23(a) | | | 440 | | | | 490,314 | |

Intesa Sanpaolo SpA

3.125%, 7/14/22(a) | | | 245 | | | | 246,615 | |

Series XR

3.25%, 9/23/24(a) | | | 650 | | | | 652,392 | |

JPMorgan Chase & Co.

3.882%, 7/24/38 | | | 1,057 | | | | 1,163,990 | |

8.00%, 4/29/27 | | | 530 | | | | 707,979 | |

Series FF

5.00%, 8/01/24(b) | | | 175 | | | | 180,896 | |

Lloyds Banking Group PLC

4.45%, 5/08/25 | | | 233 | | | | 255,126 | |

4.50%, 11/04/24 | | | 1,187 | | | | 1,268,274 | |

M&T Bank Corp.

Series G

5.00%, 8/01/24(b) | | | 51 | | | | 53,263 | |

| | |

| |

| abfunds.com | | AB CORPORATE INCOME SHARES | 19 |

PORTFOLIO OF INVESTMENTS(continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Morgan Stanley

5.75%, 1/25/21 | | $ | 1,260 | | | $ | 1,316,826 | |

Series F

3.875%, 4/29/24 | | | 55 | | | | 58,650 | |

Royal Bank of Scotland Group PLC

5.125%, 5/28/24 | | | 591 | | | | 638,292 | |

6.10%, 6/10/23 | | | 724 | | | | 796,885 | |

6.125%, 12/15/22 | | | 247 | | | | 269,321 | |

Santander Holdings USA, Inc.

3.40%, 1/18/23 | | | 859 | | | | 879,521 | |

3.50%, 6/07/24 | | | 195 | | | | 200,448 | |

4.40%, 7/13/27 | | | 280 | | | | 300,628 | |

4.50%, 7/17/25 | | | 577 | | | | 621,596 | |

Santander UK Group Holdings PLC

3.373%, 1/05/24 | | | 867 | | | | 884,713 | |

3.571%, 1/10/23 | | | 348 | | | | 355,266 | |

Societe Generale SA

4.25%, 4/14/25(a) | | | 243 | | | | 255,196 | |

SunTrust Bank/Atlanta GA

3.20%, 4/01/24 | | | 230 | | | | 240,010 | |

3.30%, 5/15/26 | | | 934 | | | | 977,169 | |

Synchrony Bank

3.00%, 6/15/22 | | | 463 | | | | 469,964 | |

Wells Fargo & Co.

5.606%, 1/15/44 | | | 400 | | | | 519,604 | |

Series M

3.45%, 2/13/23 | | | 160 | | | | 165,646 | |

Westpac Banking Corp.

4.421%, 7/24/39 | | | 250 | | | | 275,492 | |

Series G

4.322%, 11/23/31 | | | 243 | | | | 258,659 | |

| | | | | | | | |

| | | | | | | 32,287,386 | |

| | | | | | | | |

Brokerage – 2.3% | | | | | | | | |

Brookfield Finance, Inc.

4.00%, 4/01/24 | | | 122 | | | | 129,879 | |

Invesco Finance PLC

3.125%, 11/30/22 | | | 867 | | | | 887,192 | |

Jefferies Financial Group, Inc.

5.50%, 10/18/23 | | | 904 | | | | 987,376 | |

Jefferies Group LLC/Jefferies Group Capital Finance, Inc.

4.85%, 1/15/27 | | | 518 | | | | 554,659 | |

Stifel Financial Corp.

4.25%, 7/18/24 | | | 548 | | | | 579,587 | |

| | | | | | | | |

| | | | | | | 3,138,693 | |

| | | | | | | | |

| | |

| |

| 20 | AB CORPORATE INCOME SHARES | | abfunds.com |

PORTFOLIO OF INVESTMENTS(continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Finance – 3.3% | | | | | | | | |

Aircastle Ltd.

4.125%, 5/01/24 | | $ | 107 | | | $ | 112,082 | |

4.40%, 9/25/23 | | | 867 | | | | 912,596 | |

Ares Capital Corp.

3.50%, 2/10/23 | | | 1,054 | | | | 1,070,137 | |

4.20%, 6/10/24 | | | 241 | | | | 250,307 | |

GE Capital International Funding Co. Unlimited Co.

4.418%, 11/15/35 | | | 275 | | | | 290,928 | |

International Lease Finance Corp.

5.875%, 8/15/22 | | | 867 | | | | 949,122 | |

Synchrony Financial

4.25%, 8/15/24 | | | 58 | | | | 61,361 | |

4.50%, 7/23/25 | | | 806 | | | | 868,610 | |

| | | | | | | | |

| | | | | | | 4,515,143 | |

| | | | | | | | |

Insurance – 1.5% | | | | | | | | |

Aetna, Inc.

3.875%, 8/15/47 | | | 175 | | | | 169,914 | |

American International Group, Inc.

3.75%, 7/10/25 | | | 280 | | | | 299,379 | |

Brighthouse Financial, Inc.

3.70%, 6/22/27 | | | 450 | | | | 441,895 | |

MetLife Capital Trust IV

7.875%, 12/15/37(a) | | | 150 | | | | 199,134 | |

MetLife, Inc.

Series C

5.25%, 6/15/20(b) | | | 205 | | | | 208,061 | |

Series D

5.875%, 3/15/28(b) | | | 170 | | | | 187,153 | |

Peachtree Corners Funding Trust

3.976%, 2/15/25(a) | | | 110 | | | | 116,182 | |

Prudential Financial, Inc.

5.20%, 3/15/44 | | | 112 | | | | 119,181 | |

5.625%, 6/15/43 | | | 149 | | | | 161,610 | |

5.875%, 9/15/42 | | | 235 | | | | 254,557 | |

| | | | | | | | |

| | | | | | | 2,157,066 | |

| | | | | | | | |

REITS – 10.6% | | | | | | | | |

Alexandria Real Estate Equities, Inc.

3.45%, 4/30/25 | | | 87 | | | | 91,637 | |

American Homes 4 Rent LP

4.25%, 2/15/28 | | | 5 | | | | 5,406 | |

American Tower Corp.

5.00%, 2/15/24 | | | 375 | | | | 414,982 | |

Brixmor Operating Partnership LP

3.85%, 2/01/25 | | | 176 | | | | 185,168 | |

| | |

| |

| abfunds.com | | AB CORPORATE INCOME SHARES | 21 |

PORTFOLIO OF INVESTMENTS(continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

EPR Properties

4.50%, 4/01/25 | | $ | 20 | | | $ | 21,252 | |

4.95%, 4/15/28 | | | 5 | | | | 5,489 | |

5.25%, 7/15/23 | | | 175 | | | | 188,032 | |

Equinix, Inc.

5.875%, 1/15/26 | | | 425 | | | | 452,153 | |

Essex Portfolio LP

3.25%, 5/01/23 | | | 231 | | | | 237,496 | |

3.375%, 1/15/23 | | | 125 | | | | 128,894 | |

3.875%, 5/01/24 | | | 84 | | | | 89,190 | |

GLP Capital LP/GLP Financing II, Inc.

5.25%, 6/01/25 | | | 323 | | | | 354,819 | |

5.375%,11/01/23-4/15/26 | | | 971 | | | | 1,061,062 | |

HCP, Inc.

3.25%, 7/15/26 | | | 51 | | | | 53,229 | |

3.875%, 8/15/24 | | | 150 | | | | 160,590 | |

4.00%, 6/01/25 | | | 630 | | | | 682,756 | |

4.25%, 11/15/23 | | | 315 | | | | 338,209 | |

Host Hotels & Resorts LP

3.875%, 4/01/24 | | | 171 | | | | 180,111 | |

Series E

4.00%, 6/15/25 | | | 728 | | | | 774,679 | |

Kilroy Realty LP

3.45%, 12/15/24 | | | 40 | | | | 41,690 | |

Kimco Realty Corp.

2.80%, 10/01/26 | | | 95 | | | | 95,881 | |

LifeStorage LP/CA

3.50%, 7/01/26 | | | 1,090 | | | | 1,125,730 | |

Mid-America Apartments LP

3.75%, 6/15/24 | | | 115 | | | | 121,080 | |

National Retail Properties, Inc.

3.90%, 6/15/24 | | | 170 | | | | 180,627 | |

Omega Healthcare Investors, Inc.

4.50%, 1/15/25 | | | 108 | | | | 114,883 | |

5.25%, 1/15/26 | | | 1,208 | | | | 1,338,887 | |

Regency Centers LP

3.75%, 6/15/24 | | | 33 | | | | 34,778 | |

Sabra Health Care LP

5.125%, 8/15/26 | | | 565 | | | | 612,048 | |

Sabra Health Care LP/Sabra Capital Corp.

4.80%, 6/01/24 | | | 710 | | | | 747,758 | |

Senior Housing Properties Trust

4.75%, 2/15/28 | | | 407 | | | | 416,389 | |

Service Properties Trust

4.65%, 3/15/24 | | | 1,135 | | | | 1,174,611 | |

Simon Property Group LP

3.25%, 9/13/49 | | | 265 | | | | 262,581 | |

| | |

| |

| 22 | AB CORPORATE INCOME SHARES | | abfunds.com |

PORTFOLIO OF INVESTMENTS(continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Spirit Realty LP

4.00%, 7/15/29 | | $ | 132 | | | $ | 139,847 | |

4.45%, 9/15/26 | | | 238 | | | | 255,714 | |

VEREIT Operating Partnership LP

4.60%, 2/06/24 | | | 1,036 | | | | 1,114,436 | |

Vornado Realty LP

3.50%, 1/15/25 | | | 435 | | | | 453,139 | |

Washington Real Estate Investment Trust

4.95%, 10/01/20 | | | 140 | | | | 141,394 | |

Welltower, Inc.

4.00%, 6/01/25 | | | 519 | | | | 561,049 | |

Weyerhaeuser Co.

7.375%, 3/15/32 | | | 225 | | | | 314,712 | |

WP Carey, Inc.

4.60%, 4/01/24 | | | 44 | | | | 47,092 | |

| | | | | | | | |

| | | | | | | 14,719,480 | |

| | | | | | | | |

| | | | | | | 56,817,768 | |

| | | | | | | | |

Utility – 5.7% | |

Electric – 5.0% | |

Abu Dhabi National Energy Co. PJSC

4.375%, 4/23/25(a) | | | 215 | | | | 230,789 | |

Dominion Energy, Inc.

3.90%, 10/01/25 | | | 110 | | | | 118,477 | |

DTE Energy Co.

Series C

3.40%, 6/15/29 | | | 304 | | | | 317,677 | |

Duke Energy Carolinas LLC

3.20%, 8/15/49 | | | 192 | | | | 193,638 | |

Duke Energy Corp.

3.75%, 9/01/46 | | | 220 | | | | 228,666 | |

4.20%, 6/15/49 | | | 302 | | | | 337,712 | |

4.875%, 9/16/24(b) | | | 112 | | | | 118,385 | |

Empresas Publicas de Medellin ESP

4.25%, 7/18/29(a) | | | 200 | | | | 208,735 | |

Enel Americas SA

4.00%, 10/25/26 | | | 53 | | | | 54,772 | |

Enel Chile SA

4.875%, 6/12/28 | | | 62 | | | | 68,588 | |

Entergy Corp.

4.00%, 7/15/22 | | | 153 | | | | 160,001 | |

Exelon Corp.

3.497%, 6/01/22 | | | 94 | | | | 96,676 | |

Florida Power & Light Co.

3.95%, 3/01/48 | | | 460 | | | | 534,989 | |

Georgia Power Co.

Series B

2.65%, 9/15/29 | | | 530 | | | | 526,889 | |

| | |

| |

| abfunds.com | | AB CORPORATE INCOME SHARES | 23 |

PORTFOLIO OF INVESTMENTS(continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Series C

2.00%, 9/08/20 | | $ | 575 | | | $ | 575,109 | |

NextEra Energy Capital Holdings, Inc.

5.65%, 5/01/79 | | | 194 | | | | 213,868 | |

PSEG Power LLC

3.00%, 6/15/21 | | | 160 | | | | 162,046 | |

8.625%, 4/15/31 | | | 388 | | | | 547,332 | |

Public Service Co. of New Hampshire

3.60%, 7/01/49 | | | 247 | | | | 269,867 | |

Sempra Energy

3.80%, 2/01/38 | | | 215 | | | | 218,750 | |

Southern Co. (The)

2.35%, 7/01/21 | | | 175 | | | | 176,027 | |

2.95%, 7/01/23 | | | 145 | | | | 148,576 | |

Southern Power Co.

Series F

4.95%, 12/15/46 | | | 77 | | | | 86,775 | |

Southwestern Public Service Co.

3.75%, 6/15/49 | | | 305 | | | | 335,942 | |

Virginia Electric & Power Co.

8.875%, 11/15/38 | | | 558 | | | | 940,548 | |

| | | | | | | | |

| | | | | | | 6,870,834 | |

| | | | | | | | |

Natural Gas – 0.2% | | | | | | | | |

CenterPoint Energy Resources Corp.

4.10%, 9/01/47 | | | 75 | | | | 81,233 | |

GNL Quintero SA

4.634%, 7/31/29(a) | | | 200 | | | | 211,300 | |

NiSource, Inc.

5.65%, 2/01/45 | | | 60 | | | | 77,995 | |

| | | | | | | | |

| | | | | | | 370,528 | |

| | | | | | | | |

Other Utility – 0.5% | | | | | | | | |

American Water Capital Corp.

3.75%, 9/01/47 | | | 80 | | | | 86,332 | |

4.15%, 6/01/49 | | | 496 | | | | 572,890 | |

| | | | | | | | |

| | | | | | | 659,222 | |

| | | | | | | | |

| | | | | | | 7,900,584 | |

| | | | | | | | |

Total Corporates – Investment Grade

(cost $125,108,853) | | | | | | | 132,064,113 | |

| | | | | | | | |

| | | | | | | | |

QUASI-SOVEREIGNS – 1.0% | | | | | | | | |

Quasi-Sovereign Bonds – 1.0% | | | | | | | | |

Chile – 0.3% | | | | | | | | |

Corp. Nacional del Cobre de Chile

3.625%, 8/01/27(a) | | | 200 | | | | 210,062 | |

Empresa Nacional del Petroleo

3.75%, 8/05/26(a) | | | 200 | | | | 204,742 | |

| | | | | | | | |

| | | | | | | 414,804 | |

| | | | | | | | |

| | |

| |

| 24 | AB CORPORATE INCOME SHARES | | abfunds.com |

PORTFOLIO OF INVESTMENTS(continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

Mexico – 0.3% | | | | | | | | |

Petroleos Mexicanos

6.50%, 1/23/29 | | $ | 240 | | | $ | 250,320 | |

6.75%, 9/21/47 | | | 140 | | | | 139,348 | |

7.69%, 1/23/50(a) | | | 80 | | | | 86,784 | |

| | | | | | | | |

| | | | | | | 476,452 | |

| | | | | | | | |

Panama – 0.4% | | | | | | | | |

Aeropuerto Internacional de Tocumen SA

5.625%, 5/18/36(a) | | | 200 | | | | 231,500 | |

Empresa de Transmision Electrica SA

5.125%, 5/02/49(a) | | | 246 | | | | 281,132 | |

| | | | | | | | |

| | | | | | | 512,632 | |

| | | | | | | | |

Total Quasi-Sovereigns

(cost $1,288,659) | | | | | | | 1,403,888 | |

| | | | | | | | |

| | | | | | | | |

GOVERNMENTS – SOVEREIGN BONDS – 0.9% | | | | | | | | |

Colombia – 0.2% | | | | | | | | |

Colombia Government International Bond

5.20%, 5/15/49 | | | 200 | | | | 240,875 | |

| | | | | | | | |

| | |

Mexico – 0.3% | | | | | | | | |

Mexico Government International Bond

4.60%, 1/23/46 | | | 200 | | | | 214,250 | |

4.75%, 3/08/44 | | | 150 | | | | 163,969 | |

| | | | | | | | |

| | | | | | | 378,219 | |

| | | | | | | | |

Qatar – 0.2% | | | | | | | | |

Qatar Government International Bond

4.817%, 3/14/49(a) | | | 228 | | | | 280,440 | |

| | | | | | | | |

| | |

Saudi Arabia – 0.2% | | | | | | | | |

Saudi Government International Bond

3.25%, 10/26/26(a) | | | 330 | | | | 340,890 | |

| | | | | | | | |

| | |

Total Governments – Sovereign Bonds

(cost $1,091,667) | | | | | | | 1,240,424 | |

| | | | | | | | |

| | | | | | | | |

CORPORATES –NON-INVESTMENT GRADE – 0.1% | | | | | | | | |

Industrial – 0.1% | | | | | | | | |

Technology – 0.1% | | | | | | | | |

Xerox Corp.

2.80%, 5/15/20

(cost $94,913) | | | 95 | | | | 94,914 | |

| | | | | | | | |

| | |

| |

| abfunds.com | | AB CORPORATE INCOME SHARES | 25 |

PORTFOLIO OF INVESTMENTS(continued)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

SHORT-TERM INVESTMENTS – 0.7% | | | | | | | | |

U.S. Treasury Bills – 0.7% | | | | | | | | |

U.S. Treasury Bill

Zero Coupon, 1/30/20

(cost $1,031,075) | | $ | 1,035 | | | $ | 1,031,067 | |

| | | | | | | | |

| | |

Total Investments – 98.3%

(cost $128,615,167) | | | | | | | 135,834,406 | |

Other assets less liabilities – 1.7% | | | | | | | 2,331,378 | |

| | | | | | | | |

| | |

Net Assets – 100.0% | | | | | | $ | 138,165,784 | |

| | | | | | | | |

FUTURES (see Note C)

| | | | | | | | | | | | | | | | |

| Description | | Number of

Contracts | | | Expiration

Month | | | Current

Notional | | | Value and

Unrealized

Appreciation/

(Depreciation) | |

Purchased Contracts | |

U.S. 10 Yr Ultra Futures | | | 68 | | | | December 2019 | | | $ | 9,663,438 | | | $ | (86,860 | ) |

U.S. Long Bond (CBT) Futures | | | 3 | | | | December 2019 | | | | 484,125 | | | | (10,434 | ) |

U.S.T-Note 2 Yr (CBT) Futures | | | 4 | | | | December 2019 | | | | 862,406 | | | | (1,567 | ) |

U.S.T-Note 10 Yr (CBT) Futures | | | 6 | | | | December 2019 | | | | 781,781 | | | | (8,727 | ) |

U.S. Ultra Bond (CBT) Futures | | | 14 | | | | December 2019 | | | | 2,656,500 | | | | (79,537 | ) |

|

Sold Contracts | |

U.S.T-Note 5 Yr (CBT) Futures | | | 31 | | | | December 2019 | | | | 3,695,297 | | | | 29,530 | |

| | | | | | | | | | | | | | | | |

| | | $ | (157,595 | ) |

| | | | | | | | | | | | | | | | |

CENTRALLY CLEARED CREDIT DEFAULT SWAPS (see Note C)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Description | | Fixed

Rate

(Pay)

Receive | | | Payment

Frequency | | | Implied

Credit

Spread at

October 31,

2019 | | Notional

Amount

(000) | | | Market

Value | | | Upfront

Premiums

Paid

(Received) | | | Unrealized

Appreciation/

(Depreciation) | |

Sale Contracts | |

CDX-NAIG Series 33, 5 Year Index, 12/20/24* | | | 1.00 | % | | | Quarterly | | | 0.55% | | | USD 5,380 | | | $ | 123,482 | | | $ | 99,036 | | | $ | 24,446 | |

| | |

| |

| 26 | AB CORPORATE INCOME SHARES | | abfunds.com |

PORTFOLIO OF INVESTMENTS(continued)

CENTRALLY CLEARED INTEREST RATE SWAPS (see Note C)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Rate Type | | | | |

Notional

Amount (000) | | | Termination

Date | | | Payments

made

by the

Fund | | | Payments

received

by the

Fund | | | Payment

Frequency

Paid/

Received | | | Market

Value | | | Upfront

Premiums

Paid

(Received) | | | Unrealized

Appreciation/

(Depreciation) | |

USD | | | 1,170 | | | | 9/09/21 | | | | 1.132% | | |

| 3 Month

LIBOR |

| |

| Semi-Annual/

Quarterly |

| | $ | 11,410 | | | $ | — | | | $ | 11,410 | |

USD | | | 1,070 | | | | 3/27/22 | | | | 2.058% | | |

| 3 Month

LIBOR |

| |

| Semi-Annual/

Quarterly |

| | | (12,855 | ) | | | — | | | | (12,855 | ) |

USD | | | 60 | | | | 11/04/44 | | |

| 3 Month

LIBOR |

| | | 3.049% | | |

| Quarterly/

Semi-Annual |

| | | 16,324 | | | | — | | | | 16,324 | |

USD | | | 60 | | | | 5/05/45 | | |

| 3 Month

LIBOR |

| | | 2.562% | | |

| Quarterly/

Semi-Annual |

| | | 10,230 | | | | — | | | | 10,230 | |

USD | | | 60 | | | | 6/02/46 | | |

| 3 Month

LIBOR |

| | | 2.186% | | |

| Quarterly/

Semi-Annual |

| | | 5,475 | | | | — | | | | 5,475 | |

USD | | | 690 | | | | 7/15/46 | | |

| 3 Month

LIBOR |

| | | 1.783% | | |

| Quarterly/

Semi-Annual |

| | | 1,263 | | | | — | | | | 1,263 | |

USD | | | 270 | | | | 9/02/46 | | |

| 3 Month

LIBOR |

| | | 1.736% | | |

| Quarterly/

Semi-Annual |

| | | (3,670 | ) | | | — | | | | (3,670 | ) |

USD | | | 50 | | | | 11/02/46 | | |

| 3 Month

LIBOR |

| | | 2.086% | | |

| Quarterly/

Semi-Annual |

| | | 3,475 | | | | — | | | | 3,475 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | $ | 31,652 | | | $ | — | | | $ | 31,652 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (a) | Security is exempt from registration under Rule 144A of the Securities Act of 1933. These securities are considered restricted, but liquid and may be resold in transactions exempt from registration, normally to qualified institutional buyers. At October 31, 2019, the aggregate market value of these securities amounted to $10,756,140 or 7.8% of net assets. |

| (b) | Securities are perpetual and, thus, do not have a predetermined maturity date. The date shown, if applicable, reflects the next call date. |

Glossary:

CBT – Chicago Board of Trade

CDX-NAIG – North American Investment Grade Credit Default Swap Index

LIBOR – London Interbank Offered Rates

PJSC – Public Joint Stock Company

REIT – Real Estate Investment Trust

See notes to financial statements.

| | |

| |

| abfunds.com | | AB CORPORATE INCOME SHARES | 27 |

STATEMENT OF ASSETS & LIABILITIES

October 31, 2019(unaudited)

| | | | |

| Assets | |

Investments in securities, at value (cost $128,615,167) | | $ | 135,834,406 | |

Cash | | | 2,012,256 | |

Cash collateral due from broker | | | 413,507 | |

Interest receivable | | | 1,402,595 | |

Receivable for shares of beneficial interest sold | | | 464,532 | |

Receivable for variation margin on futures | | | 99,000 | |

Receivable for variation margin on centrally cleared swaps | | | 22,110 | |

| | | | |

Total assets | | | 140,248,406 | |

| | | | |

| Liabilities | |

Payable for investment securities purchased | | | 1,440,296 | |

Dividends payable | | | 441,265 | |

Payable for shares of beneficial interest redeemed | | | 198,865 | |

Other liabilities | | | 2,196 | |

| | | | |

Total liabilities | | | 2,082,622 | |

| | | | |

Net Assets | | $ | 138,165,784 | |

| | | | |

| Composition of Net Assets | | | | |

Shares of beneficial interest, at par | | $ | 117 | |

Additionalpaid-in capital | | | 130,205,509 | |

Distributable earnings | | | 7,960,158 | |

| | | | |

| | $ | 138,165,784 | |

| | | | |

Net Asset Value Per Share—unlimited shares of beneficial interest authorized, $.00001 par value(based on 11,715,194 common shares outstanding) | | $ | 11.79 | |

| | | | |

See notes to financial statements.

| | |

| |

| 28 | AB CORPORATE INCOME SHARES | | abfunds.com |

STATEMENT OF OPERATIONS

Six Months Ended October 31, 2019(unaudited)

| | | | | | | | |

| Investment Income | | | | | | | | |

Interest | | $ | 2,481,879 | | | | | |

| | | | | | | | |

Total investment income | | | | | | $ | 2,481,879 | |

| | | | | | | | |

| Realized and Unrealized Gain (Loss) on Investment Transactions | | | | | | | | |

Net realized gain (loss) on: | | | | | | | | |

Investment transactions | | | | | | | 1,504,967 | |

Futures | | | | | | | 897,415 | |

Swaps | | | | | | | 34,132 | |

Net change in unrealized appreciation/depreciation of: | | | | | | | | |

Investments(a) | | | | | | | 5,002,584 | |

Futures | | | | | | | (195,325 | ) |

Swaps | | | | | | | 203,675 | |

| | | | | | | | |

Net gain on investment transactions | | | | | | | 7,447,448 | |

| | | | | | | | |

Net Increase in Net Assets from Operations | | | | | | $ | 9,929,327 | |

| | | | | | | | |

| (a) | Net of increase in accrued foreign capital gains taxes of $780. |

See notes to financial statements.

| | |

| |

| abfunds.com | | AB CORPORATE INCOME SHARES | 29 |

STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | Six Months Ended

October 31, 2019

(unaudited) | | | Year Ended

April 30,

2019 | |

Increase (Decrease) in Net Assets

from Operations | | | | | | | | |

Net investment income | | $ | 2,481,879 | | | $ | 3,598,990 | |

Net realized gain (loss) on investment transactions | | | 2,436,514 | | | | (1,603,725 | ) |

Net change in unrealized appreciation/depreciation of investments | | | 5,010,934 | | | | 4,265,898 | |

| | | | | | | | |

Net increase in net assets from operations | | | 9,929,327 | | | | 6,261,163 | |

Distribution to Shareholders | | | (2,504,924 | ) | | | (3,601,284 | ) |

| Transactions in Shares of Beneficial Interest | | | | | | | | |

Net increase | | | 32,060,907 | | | | 11,280,835 | |

| | | | | | | | |

Total increase | | | 39,485,310 | | | | 13,940,714 | |

| Net Assets | |

Beginning of period | | | 98,680,474 | | | | 84,739,760 | |

| | | | | | | | |

End of period | | $ | 138,165,784 | | | $ | 98,680,474 | |

| | | | | | | | |

See notes to financial statements.

| | |

| |

| 30 | AB CORPORATE INCOME SHARES | | abfunds.com |

NOTES TO FINANCIAL STATEMENTS

October 31, 2019(unaudited)

NOTE A

Significant Accounting Policies

AB Corporate Shares (the “Trust”) was organized as a Massachusetts business trust under the laws of The Commonwealth of Massachusetts by an Agreement and Declaration of Trust dated January 26, 2004. The Trust is registered under the Investment Company Act of 1940, as anopen-end, diversified management investment company. The Trust operates as a “series” company currently offering four separate portfolios: AB Corporate Income Shares, AB Municipal Income Shares, AB Taxable Multi-Sector Income Shares and AB Impact Municipal Income Shares. Each portfolio is considered to be a separate entity for financial reporting and tax purposes. This report relates only to AB Corporate Income Shares (the “Fund”).

Shares of the Fund are offered exclusively to holders of accounts established underwrap-fee programs sponsored and maintained by certain registered investment advisers approved by AllianceBernstein L.P. (the “Adviser”). The Fund’s shares may be purchased at the relevant net asset value without a sales charge or other fee. The financial statements have been prepared in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”) which require management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements and amounts of income and expenses during the reporting period. Actual results could differ from those estimates. The Fund is an investment company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies. The following is a summary of significant accounting policies followed by the Fund.

1. Security Valuation

Portfolio securities are valued at their current market value determined on the basis of market quotations or, if market quotations are not readily available or are deemed unreliable, at “fair value” as determined in accordance with procedures established by and under the general supervision of the Trust’s Board of Trustees (the “Board”).

In general, the market values of securities which are readily available and deemed reliable are determined as follows: securities listed on a national securities exchange (other than securities listed on the NASDAQ Stock Market, Inc. (“NASDAQ”)) or on a foreign securities exchange are valued at the last sale price at the close of the exchange or foreign securities exchange. If there has been no sale on such day, the securities are valued at the last traded price from the previous day. Securities listed on more than one exchange are valued by reference to the principal exchange on which the securities are traded; securities listed only on NASDAQ are valued in

| | |

| |

| abfunds.com | | AB CORPORATE INCOME SHARES | 31 |

NOTES TO FINANCIAL STATEMENTS(continued)

accordance with the NASDAQ Official Closing Price; listed or over the counter (“OTC”) market put or call options are valued at the mid level between the current bid and ask prices. If either a current bid or current ask price is unavailable, the Adviser will have discretion to determine the best valuation (e.g., last trade price in the case of listed options); open futures are valued using the closing settlement price or, in the absence of such a price, the most recent quoted bid price. If there are no quotations available for the day of valuation, the last available closing settlement price is used; U.S. Government securities and any other debt instruments having 60 days or less remaining until maturity are generally valued at market by an independent pricing vendor, if a market price is available. If a market price is not available, the securities are valued at amortized cost. This methodology is commonly used for short term securities that have an original maturity of 60 days or less, as well as short term securities that had an original term to maturity that exceeded 60 days. In instances when amortized cost is utilized, the Valuation Committee (the “Committee”) must reasonably conclude that the utilization of amortized cost is approximately the same as the fair value of the security. Such factors the Committee will consider include, but are not limited to, an impairment of the creditworthiness of the issuer or material changes in interest rates. Fixed-income securities, including mortgage-backed and asset-backed securities, may be valued on the basis of prices provided by a pricing service or at a price obtained from one or more of the major broker-dealers. In cases where broker-dealer quotes are obtained, the Adviser may establish procedures whereby changes in market yields or spreads are used to adjust, on a daily basis, a recently obtained quoted price on a security. Swaps and other derivatives are valued daily, primarily using independent pricing services, independent pricing models using market inputs, as well as third party broker-dealers or counterparties. Open end mutual funds are valued at the closing net asset value per share, while exchange traded funds are valued at the closing market price per share.

Securities for which market quotations are not readily available (including restricted securities) or are deemed unreliable are valued at fair value as deemed appropriate by the Adviser. Factors considered in making this determination may include, but are not limited to, information obtained by contacting the issuer, analysts, analysis of the issuer’s financial statements or other available documents. In addition, the Fund may use fair value pricing for securities primarily traded innon-U.S. markets because most foreign markets close well before the Fund values its securities at 4:00 p.m., Eastern Time. The earlier close of these foreign markets gives rise to the possibility that significant events, including broad market moves, may have occurred in the interim and may materially affect the value of those securities. To account for this, the Fund generally values many of its foreign equity securities using fair value prices based on third party vendor modeling tools to the extent available.

| | |

| |

| 32 | AB CORPORATE INCOME SHARES | | abfunds.com |

NOTES TO FINANCIAL STATEMENTS(continued)

2. Fair Value Measurements

In accordance with U.S. GAAP regarding fair value measurements, fair value is defined as the price that the Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. U.S. GAAP establishes a framework for measuring fair value, and a three-level hierarchy for fair value measurements based upon the transparency of inputs to the valuation of an asset or liability (including those valued based on their market values as described in Note A.1 above). Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Fund. Unobservable inputs reflect the Fund’s own assumptions about the assumptions that market participants would use in pricing the asset or liability based on the best information available in the circumstances. Each investment is assigned a level based upon the observability of the inputs which are significant to the overall valuation. The three-tier hierarchy of inputs is summarized below.

| | • | | Level 1—quoted prices in active markets for identical investments |

| | • | | Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| | • | | Level 3—significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The fair value of debt instruments, such as bonds, andover-the-counter derivatives is generally based on market price quotations, recently executed market transactions (where observable) or industry recognized modeling techniques and are generally classified as Level 2. Pricing vendor inputs to Level 2 valuations may include quoted prices for similar investments in active markets, interest rate curves, coupon rates, currency rates, yield curves, option adjusted spreads, default rates, credit spreads and other unique security features in order to estimate the relevant cash flows which are then discounted to calculate fair values. If these inputs are unobservable and significant to the fair value, these investments will be classified as Level 3.

Other fixed income investments, includingnon-U.S. government and corporate debt, are generally valued using quoted market prices, if available, which are typically impacted by current interest rates, maturity dates and any perceived credit risk of the issuer. Additionally, in the absence of quoted market prices, these inputs are used by pricing vendors to derive a valuation based upon industry or proprietary models which incorporate

| | |

| |

| abfunds.com | | AB CORPORATE INCOME SHARES | 33 |

NOTES TO FINANCIAL STATEMENTS(continued)

issuer specific data with relevant yield/spread comparisons with more widely quoted bonds with similar key characteristics. Those investments for which there are observable inputs are classified as Level 2. Where the inputs are not observable, the investments are classified as Level 3.

The following table summarizes the valuation of the Fund’s investments by the above fair value hierarchy levels as of October 31, 2019:

| | | | | | | | | | | | | | | | |

Investments in

Securities: | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Assets: | |

Corporates – Investment Grade | | $ | – 0 | – | | $ | 132,064,113 | | | $ | – 0 | – | | $ | 132,064,113 | |

Quasi-Sovereigns | | | – 0 | – | | | 1,403,888 | | | | – 0 | – | | | 1,403,888 | |

Governments – Sovereign Bonds | | | – 0 | – | | | 1,240,424 | | | | – 0 | – | | | 1,240,424 | |

Corporates –Non-Investment Grade | | | – 0 | – | | | 94,914 | | | | – 0 | – | | | 94,914 | |

Short-Term Investments | | | – 0 | – | | | 1,031,067 | | | | – 0 | – | | | 1,031,067 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities | | | – 0 | – | | | 135,834,406 | | | | – 0 | – | | | 135,834,406 | |

Other Financial Instruments(a): | | | | | | | | | | | | | | | | |

Assets: | |

Futures | | | 29,530 | | | | – 0 | – | | | – 0 | – | | | 29,530 | (b) |

Centrally Cleared Credit Default Swaps | | | – 0 | – | | | 123,482 | | | | – 0 | – | | | 123,482 | (b) |

Centrally Cleared Interest Rate Swaps | | | – 0 | – | | | 48,177 | | | | – 0 | – | | | 48,177 | (b) |

Liabilities: | |

Futures | | | (187,125 | ) | | | – 0 | – | | | – 0 | – | | | (187,125 | )(b) |

Centrally Cleared Interest Rate Swaps | | | – 0 | – | | | (16,525 | ) | | | – 0 | – | | | (16,525 | )(b) |

| | | | | | | | | | | | | | �� | | |

Total | | $ | (157,595 | ) | | $ | 135,989,540 | | | $ | – 0 | – | | $ | 135,831,945 | |

| | | | | | | | | | | | | | | | |

| (a) | Other financial instruments are derivative instruments, such as futures, forwards and swaps, which are valued at the unrealized appreciation/(depreciation) on the instrument. Other financial instruments may also include swaps with upfront premiums, options written and swaptions written which are valued at market value. |

| (b) | Only variation margin receivable/(payable) at period end is reported within the statement of assets and liabilities. This amount reflects cumulative unrealized appreciation/(depreciation) on futures and centrally cleared swaps as reported in the portfolio of investments. Where applicable, centrally cleared swaps with upfront premiums are presented here at market value. |

3. Taxes

It is the Fund’s policy to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its investment company taxable income and net realized gains, if any, to shareholders. Therefore, no provisions for federal income or excise taxes are required.

In accordance with U.S. GAAP requirements regarding accounting for uncertainties in income taxes, management has analyzed the Fund’s tax positions taken or expected to be taken on federal and state income tax returns for all open tax years (the current and the prior three tax years) and has concluded that no provision for income tax is required in the Fund’s financial statements.

| | |

| |

| 34 | AB CORPORATE INCOME SHARES | | abfunds.com |

NOTES TO FINANCIAL STATEMENTS(continued)

4. Investment Income and Investment Transactions