UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-21488 |

|

Cohen & Steers Global Infrastructure Fund, Inc. |

(Exact name of registrant as specified in charter) |

|

280 Park Avenue, New York, NY | | 10017 |

(Address of principal executive offices) | | (Zip code) |

|

Tina M. Payne Cohen & Steers Capital Management, Inc. 280 Park Avenue New York, New York 10017 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (212) 832-3232 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | December 31, 2012 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

To Our Shareholders:

We would like to share with you our report for the year ended December 31, 2012. The net asset values (NAV) per share at that date were $14.49, $14.53, $14.46 and $14.52 for Class A, Class B, Class C and Class I shares, respectively.

The total returns, including income and change in NAV, for the Fund and its comparative benchmarks were:

| | | Six Months Ended

December 31, 2012 | | Year Ended

December 31, 2012 | |

Cohen & Steers Global Infrastructure

Fund—Class A | | | 8.48 | % | | | 14.04 | % | |

Cohen & Steers Global Infrastructure

Fund—Class B | | | 8.08 | % | | | 13.28 | % | |

Cohen & Steers Global Infrastructure

Fund—Class C | | | 8.13 | % | | | 13.30 | % | |

Cohen & Steers Global Infrastructure

Fund—Class I | | | 8.70 | % | | | 14.44 | % | |

UBS Global 50/50 Infrastructure & Utilities

Index—neta | | | 6.98 | % | | | 11.71 | % | |

S&P 500 Indexa | | | 5.95 | % | | | 16.00 | % | |

The performance data quoted represent past performance. Past performance is no guarantee of future results. The investment return and the principal value of an investment will fluctuate and shares, if redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Current total returns of the Fund can be obtained by visiting our website at cohenandsteers.com. All share class returns assume the reinvestment of all dividends and distributions at NAV. Fund performance reflects fee waivers and/or expense reimbursements, without which the performance would have been lower. Performance quoted does not reflect the deduction of the maximum 4.5% initial sales charge on Class A shares or the 5% and 1% maximum contingent deferred sales charge on Class B and Class C shares, respectively. If such charges were included, returns would have been lower. Index performance does not reflect the deduction of any fees, taxes or expenses. An investor cannot invest directly in an index. Performance figures for periods shorter than one year are not annualized.

The Fund implements fair value pricing when the daily change in a specific U.S. market index exceeds a predetermined percentage. Fair value pricing adjusts the valuation of certain non-U.S. holdings to account for such index change following the close of foreign markets. This standard practice has been adopted by a majority of the fund industry. In the event fair value pricing is implemented on the first and/or last day of a performance measurement period, the Fund's return may diverge from the relative performance of its benchmark index, which does not use fair value pricing.

a The UBS Global 50/50 Infrastructure & Utilities Index tracks the performance of global infrastructure related securities, split evenly between utilities and infrastructure and is net of dividend withholding taxes. The S&P 500 Index is an unmanaged index of common stocks that is frequently used as a general measure of stock market performance.

1

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

Please note that distributions paid by the Fund to shareholders are subject to recharacterization for tax purposes and are taxable up to the amount of the Fund's investment company taxable income and net realized gains. Distributions in excess of the Fund's investment company taxable income and realized gains are a return of capital distributed from the Fund's assets.

Investment Review

Global equity markets ended 2012 with solid gains amid progress on Europe's sovereign debt crises, economic stabilization in China and encouraging U.S. economic data. The year began on an optimistic note, but skittish markets slumped midyear when Greece's exit from the Eurozone became a real (if temporary) threat and Spain's banks revealed capital shortfalls that were larger than previously thought. Exports from China to its European trading partners slowed, weakening its role as a global economic engine.

Central bank activity and policy statements in the third quarter helped reverse the downturn: the Federal Reserve announced an open-ended commitment to buy mortgage-backed securities at a monthly rate of $40 billion and resolved that, in the absence of inflation, it would keep interest rates low until unemployment reached 6.5% from its then-current 7.8%. European Central Bank President Mario Draghi vowed to do "whatever it takes" to preserve the euro. The Bank of England and People's Bank of China also injected more liquidity into their markets.

Global infrastructure stocks advanced but underperformed the broader markets in 2012. The UBS Global 50/50 Infrastructure & Utilities Index (the "benchmark") had a total return of 11.7%, compared with 16.5% for the MSCI World Index.

Communications companies (38.4%) were the top performers. U.S.-based tower companies led the advance as wireless carriers increased spending to build out their networks—a trend that showed no signs of abating. Merger and acquisition activity supplemented this organic growth. Airports (29.2%) benefited from resilient passenger volumes, as well as investors' search for yield. Toll roads (17.1%) had a big fourth-quarter rally, advancing on signs of economic improvement in Europe.

Electric utilities (0.2%) were out of favor all year. Regulated utilities in the United States were richly valued, while U.S. and European integrated utilities (which have a mix of regulated and unregulated operations) faced regulatory and political risks, as well as an oversupply of power relative to demand. Prospects for companies in the railways subsector (11.3%), most of which are in Japan, looked up in the fourth quarter: passenger traffic increased and Prime Minister Shinzo Abe's new government said it would enact measures to stimulate the country's moribund economy. Pipeline companies (14.6%) outperformed for most of the year, but pulled back in the fourth quarter on retail selling due to the expected increase in U.S. capital gains tax rates.

2

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

Fund Performance

The Fund advanced in 2012 and outperformed its benchmark. The biggest contributors to relative return were our underweight and stock selection in electric utilities, particularly our underweight in integrated utilities. Stock selection in the pipelines subsector was beneficial based on the performance of several smaller companies involved in liquids storage and transportation. Our overweight and stock selection in water companies (16.2%) were also favorable, particularly our out-of-index investment in Cia De Saneamento Basico do Estado de Sao Paulo, a Brazilian water company.

Our stock selection in communications detracted from relative return, although the negative impact was partly offset by our favorable overweight in the subsector. On a stock-specific basis, we were overweight Eutelsat Communications, a French satellite company partly owned by Spain-based Abertis Infraestructuras SA. Abertis sold most of its ownership interest in the first half of the year, which was an overhang for Eutelsat's shares. Our allocation in toll roads was unfavorable as well.

Investment Outlook

The global economic environment is likely to remain challenging in 2013, but we remain optimistic about the outlook for global infrastructure. The world's central bankers have taken extraordinary measures to stabilize their economies, which have met with some degree of success. In Europe, for example, recent industrial economic data have shown modest improvement—but consumer optimism is weak, and in our view is likely to remain so until employment recovers. A near-term crisis appears to have been averted, but significant medium-term growth risks remain. We believe the trend is moving in the right direction, however, and we have narrowed our underweight in the region. There is also encouraging progress in Asia. China's economy appears to be stabilizing, and Japan's recent elections were well received by the markets.

U.S. dividend tax rates in 2013 will be higher, but not as high as some had feared, which helps higher-income strategies such as infrastructure. Given that, U.S.-based regulated utilities may be poised for stronger performance in 2013, particularly in the context of their recent underperformance and subsequently more attractive valuations.We still find opportunities in North American pipelines, although we have limited the Fund's allocation to companies with exposure to natural gas liquids (NGL) prices; the abundant supply produced by shale drilling in the United States and Canada means NGL prices are likely to remain low for the foreseeable future.

We continue to see elevated political risk, specifically the possibility of government intervention in the form of rate freezes and higher taxes, and therefore favor companies that we believe can successfully navigate in this environment. Against this mixed backdrop, we believe the predictable income, modest volatility and, in our view, long-term growth potential of global listed infrastructure will appeal to investors in 2013.

3

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

Sincerely,

| | | | |

| |

| |

| | | MARTIN COHEN | | ROBERT H. STEERS | |

| | | Co-chairman | | Co-chairman | |

| | | | |

| |

| |

| | | ROBERT S. BECKER | | BEN MORTON | |

| | | Portfolio Manager | | Portfolio Manager | |

The views and opinions in the preceding commentary are subject to change and are as of the date of publication. There is no guarantee that any market forecast set forth in the commentary will be realized. This material represents an assessment of the market environment at a specific point in time, should not be relied upon as investment advice and is not intended to predict or depict performance of any investment.

Visit Cohen & Steers online at cohenandsteers.com

For more information about any of our funds, visit cohenandsteers.com, where you will find daily net asset values, fund fact sheets and portfolio highlights. You can also access newsletters, education tools and market updates covering the global real estate, commodities, global natural resource equities, listed infrastructure, utilities, large cap value and preferred securities sectors.

In addition, our website contains comprehensive information about our firm, including our most recent press releases, profiles of our senior investment professionals and an overview of our investment approach.

4

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

Performance Review (Unaudited)

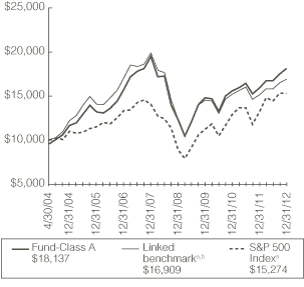

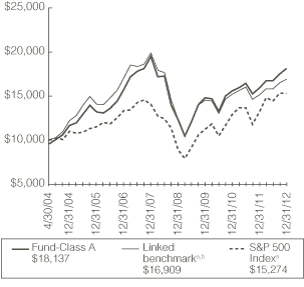

Class A—Growth of a $10,000 Investment

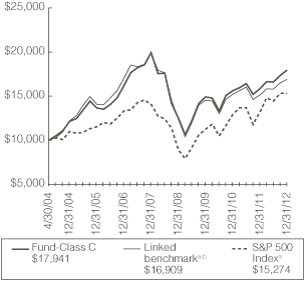

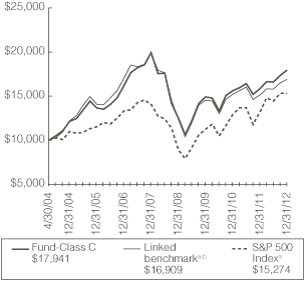

Class C—Growth of a $10,000 Investment

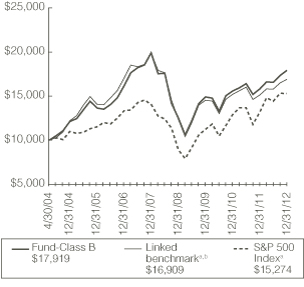

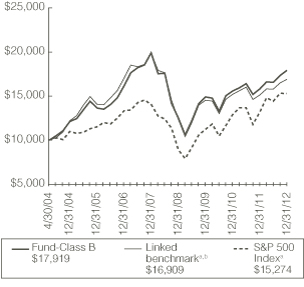

Class B—Growth of a $10,000 Investment

Class I—Growth of a $100,000 Investment

5

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

Performance Review (Unaudited)—(Continued)

Average Annual Total Returns—For Periods Ended December 31, 2012

| | | Class A Shares | | Class B Shares | | Class C Shares | | Class I Shares | |

1 Year (with sales charge) | | | 8.90 | %c | | | 8.28 | %d | | | 12.30 | %f | | | — | | |

1 Year (without sales charge) | | | 14.04 | % | | | 13.28 | % | | | 13.30 | % | | | 14.44 | % | |

5 Years (with sales charge) | | | –2.34 | %c | | | –2.49 | %e | | | –2.07 | % | | | — | | |

5 Years (without sales charge) | | | –1.44 | % | | | –2.09 | % | | | –2.07 | % | | | –1.10 | % | |

Since Inceptiong (with sales charge) | | | 7.09 | %c | | | 6.94 | % | | | 7.05 | % | | | — | | |

Since Inceptiong (without sales charge) | | | 7.66 | % | | | 6.94 | % | | | 7.05 | % | | | 8.03 | % | |

The performance data quoted represent past performance. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate and shares, if redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance information current to the most recent month end can be obtained by visiting our website at cohenandsteers.com. All share class returns assume the reinvestment of all dividends and distributions at NAV. The performance graphs and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During the periods presented above, the advisor waived fees and/or reimbursed expenses. Without this arrangement, performance would have been lower.

The annualized gross and net expense ratios, respectively, for each class of shares as disclosed in the May 1, 2012 prospectuses were as follows: Class A—1.61% and 1.50%; Class B—2.26% and 2.15%; Class C—2.26% and 2.15%; and Class I—1.29% and 1.15%. Through June 30, 2014, the advisor has contractually agreed to waive its fee and/or reimburse the Fund for expenses incurred (excluding applicable distribution and shareholder servicing fees for Class A and Class C, acquired fund fees and expenses and extraordinary expenses) to the extent necessary to maintain the Fund's total annual operating expenses as a percentage of average net assets at 1.50% for Class A shares, 2.15% for Class B shares, 2.15% for Class C shares and 1.15% for Class I shares.This contractual agreement can be amended at any time by agreement of the Fund and the advisor and will terminate automatically in the event of termination of the investment advisory agreement between the advisor and the Fund.

a The comparative indexes are not adjusted to reflect expenses or other fees that the SEC requires to be reflected in the Fund's performance. An investor cannot invest directly in an index. The Fund's performance assumes the reinvestment of all dividends and distributions at NAV. For more information, including charges and expenses, please read the prospectus carefully before you invest.

b The linked benchmark is represented by the performance of the S&P 1500 Utilities Index from April 30, 2004 through March 31, 2008, the Macquarie Global Infrastructure Index from April 1, 2008 through May 31, 2008 and the UBS Global 50/50 Infrastructure & Utilities Index from June 1, 2008 through December 31, 2012. The S&P 1500 Utilities Index is an unmanaged market-capitalization-weighted index of 64 companies whose primary business involves the generation, transmission and/or distribution of electricity and/or natural gas. The Macquarie Global Infrastructure Index is a capitalization-weighted, global infrastructure index containing all publicly quoted infrastructure related stocks that are members of the FTSE Global Equity Index Series with market capitalization exceeding $250 million and is net of dividend withholding taxes.

c Reflects a 4.50% front-end sales charge.

d Reflects a contingent deferred sales charge of 5%.

e Reflects a contingent deferred sales charge of 2%.

f Reflects a contingent deferred sales charge of 1%.

g Inception date of May 3, 2004.

6

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

Expense Example

(Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments; and (2) ongoing costs including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period July 1, 2012—December 31, 2012.

Actual Expenses

The first line of the following table provides information about actual account values and expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing cost of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges (loads). Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

7

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

Expense Example (Unaudited)—(Continued)

| | | Beginning

Account Value

July 1, 2012 | | Ending

Account Value

December 31, 2012 | | Expenses Paid

During Perioda

July 1, 2012–

December 31, 2012 | |

Class A | |

Actual (8.48% return) | | $ | 1,000.00 | | | $ | 1,084.80 | | | $ | 7.86 | | |

Hypothetical (5% annual return before

expenses) | | $ | 1,000.00 | | | $ | 1,017.60 | | | $ | 7.61 | | |

Class B | |

Actual (8.08% return) | | $ | 1,000.00 | | | $ | 1,080.80 | | | $ | 11.25 | | |

Hypothetical (5% annual return before

expenses) | | $ | 1,000.00 | | | $ | 1,014.33 | | | $ | 10.89 | | |

Class C | |

Actual (8.13% return) | | $ | 1,000.00 | | | $ | 1,081.30 | | | $ | 11.25 | | |

Hypothetical (5% annual return before

expenses) | | $ | 1,000.00 | | | $ | 1,014.33 | | | $ | 10.89 | | |

Class I | |

Actual (8.70% return) | | $ | 1,000.00 | | | $ | 1,087.00 | | | $ | 6.03 | | |

Hypothetical (5% annual return before

expenses) | | $ | 1,000.00 | | | $ | 1,019.36 | | | $ | 5.84 | | |

a Expenses are equal to the Fund's Class A, Class B, Class C and Class I annualized expense ratios of 1.50%, 2.15%, 2.15% and 1.15%, respectively, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). If the Fund had borne all of its expenses that were assumed by the advisor, the annualized expense ratios would have been 1.59%, 2.24%, 2.24% and 1.24%, respectively.

8

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

December 31, 2012

Top Ten Holdings

(Unaudited)

Security | | Value | | % of

Net

Assets | |

American Tower Corp. | | $ | 6,147,910 | | | | 5.7 | | |

Crown Castle International Corp. | | | 5,585,184 | | | | 5.1 | | |

East Japan Railway Co. | | | 5,496,449 | | | | 5.1 | | |

Vinci SA | | | 4,620,102 | | | | 4.3 | | |

Duke Energy Corp. | | | 3,700,400 | | | | 3.4 | | |

SBA Communications Corp. | | | 3,139,084 | | | | 2.9 | | |

Transurban Group | | | 3,073,483 | | | | 2.8 | | |

Central Japan Railway Co. | | | 2,767,537 | | | | 2.5 | | |

SES SA | | | 2,521,995 | | | | 2.3 | | |

NextEra Energy | | | 2,408,850 | | | | 2.2 | | |

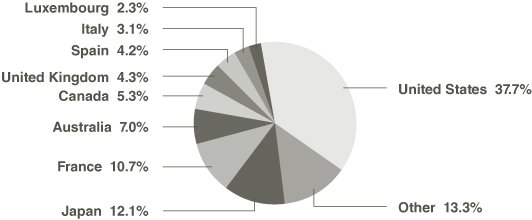

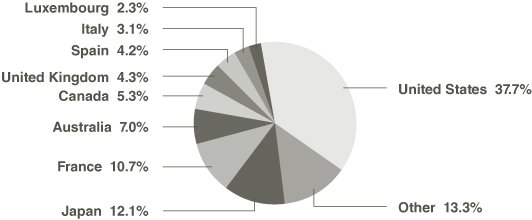

Country Breakdown

(Based on Net Assets)

(Unaudited)

9

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS

December 31, 2012

| | | | | Number

of Shares | | Value | |

COMMON STOCK | | 98.4% | | | | | | | | | |

AUSTRALIA | | 7.0% | | | | | | | | | |

AIRPORTS | | 1.0% | | | | | | | | | |

Sydney Airporta | | | | | 295,550 | | | $ | 1,041,089 | | |

ELECTRIC | | 0.9% | | | | | | | | | |

INTEGRATED ELECTRIC | | 0.3% | | | | | | | | | |

Origin Energy Ltd.a | | | | | 31,600 | | | | 388,449 | | |

REGULATED ELECTRIC | | 0.6% | | | | | | | | | |

Spark Infrastructure Group, 144Aa,b | | | | | 348,751 | | | | 609,713 | | |

TOTAL ELECTRIC | | | | | | | 998,162 | | |

MARINE PORTS | | 1.5% | | | | | | | | | |

Asciano Ltd.a | | | | | 325,200 | | | | 1,590,875 | | |

PIPELINES—C-CORP | | 0.8% | | | | | | | | | |

APA Groupa | | | | | 156,600 | | | | 904,055 | | |

TOLL ROADS | | 2.8% | | | | | | | | | |

Transurban Groupa | | | | | 483,511 | | | | 3,073,483 | | |

TOTAL AUSTRALIA | | | | | | | 7,607,664 | | |

BRAZIL | | 2.1% | | | | | | | | | |

ELECTRIC | | 0.8% | | | | | | | | | |

INTEGRATED ELECTRIC | | 0.2% | | | | | | | | | |

Cia Energetica de Minas Gerais | | | | | 21,600 | | | | 238,418 | | |

REGULATED ELECTRIC | | 0.6% | | | | | | | | | |

Transmissora Alianca de Energia Eletrica SA | | | | | 61,098 | | | | 650,518 | | |

TOTAL ELECTRIC | | | | | | | 888,936 | | |

TOLL ROADS | | 0.8% | | | | | | | | | |

CCR SA | | | | | 86,284 | | | | 819,645 | | |

WATER | | 0.5% | | | | | | | | | |

Cia de Saneamento Basico do Estado

de Sao Paulo, ADR | | | | | 7,150 | | | | 597,526 | | |

TOTAL BRAZIL | | | | | | | 2,306,107 | | |

CANADA | | 5.3% | | | | | | | | | |

MARINE PORTS | | 0.7% | | | | | | | | | |

Westshore Terminals Investment Corp. | | | | | 27,428 | | | | 759,668 | | |

See accompanying notes to financial statements.

10

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

December 31, 2012

| | | | | Number

of Shares | | Value | |

PIPELINES—C-CORP | | 4.6% | | | | | | | | | |

AltaGas Ltd. | | | | | 7,014 | | | $ | 236,714 | | |

Enbridge | | | | | 54,842 | | | | 2,371,874 | | |

TransCanada Corp. | | | | | 50,105 | | | | 2,368,490 | | |

| | | | | | | | 4,977,078 | | |

TOTAL CANADA | | | | | | | 5,736,746 | | |

CHINA | | 1.2% | | | | | | | | | |

ELECTRIC—INTEGRATED ELECTRIC | | 0.9% | | | | | | | | | |

Huaneng Power International, Class H (HKD)a | | | | | 1,092,005 | | | | 1,015,859 | | |

TOLL ROADS | | 0.3% | | | | | | | | | |

Jiangsu Expressway Co., Ltd., Class H (HKD)a | | | | | 18,000 | | | | 18,647 | | |

Zhejiang Expressway Co., Ltd. (HKD)a | | | | | 307,700 | | | | 245,390 | | |

| | | | | | | | 264,037 | | |

TOTAL CHINA | | | | | | | 1,279,896 | | |

FRANCE | | 10.7% | | | | | | | | | |

AIRPORTS | | 0.9% | | | | | | | | | |

Aeroports de Parisa | | | | | 12,500 | | | | 967,785 | | |

COMMUNICATIONS—SATELLITES | | 1.8% | | | | | | | | | |

Eutelsat Communicationsa | | | | | 59,210 | | | | 1,969,337 | | |

ELECTRIC—INTEGRATED ELECTRIC | | 1.2% | | | | | | | | | |

GDF Sueza | | | | | 63,339 | | | | 1,304,534 | | |

TOLL ROADS | | 6.2% | | | | | | | | | |

Groupe Eurotunnel SAa | | | | | 268,750 | | | | 2,088,383 | | |

Vinci SAa | | | | | 95,958 | | | | 4,620,102 | | |

| | | | | | | | 6,708,485 | | |

WATER | | 0.6% | | | | | | | | | |

Veolia Environnementa | | | | | 49,070 | | | | 594,878 | | |

TOTAL FRANCE | | | | | | | 11,545,019 | | |

GERMANY | | 2.1% | | | | | | | | | |

AIRPORTS | | 0.5% | | | | | | | | | |

Fraport AGa | | | | | 10,261 | | | | 598,587 | | |

ELECTRIC—INTEGRATED ELECTRIC | | 1.6% | | | | | | | | | |

E.ON AGa | | | | | 90,000 | | | | 1,688,042 | | |

TOTAL GERMANY | | | | | | | 2,286,629 | | |

See accompanying notes to financial statements.

11

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

December 31, 2012

| | | | | Number

of Shares | | Value | |

HONG KONG | | 1.4% | | | | | | | | | |

ELECTRIC—REGULATED ELECTRIC | |

Cheung Kong Infrastructure Holdings Ltd.

(Bermuda)a | | | | | 149,000 | | | $ | 920,373 | | |

CLP Holdings Ltd.a | | | | | 71,800 | | | | 604,647 | | |

| | | | | | | | 1,525,020 | | |

ITALY | | 3.1% | | | | | | | | | |

ELECTRIC | | 1.2% | | | | | | | | | |

INTEGRATED ELECTRIC | | 0.7% | | | | | | | | | |

Enel S.p.A.a | | | | | 176,865 | | | | 735,666 | | |

REGULATED ELECTRIC | | 0.5% | | | | | | | | | |

Terna Rete Elettrica Nazionale S.p.A.a | | | | | 141,600 | | | | 566,648 | | |

TOTAL ELECTRIC | | | | | | | 1,302,314 | | |

GAS DISTRIBUTION | | 0.7% | | | | | | | | | |

Snam Rete Gas S.p.A.a | | | | | 159,613 | | | | 745,003 | | |

TOLL ROADS | | 1.2% | | | | | | | | | |

Atlantia S.p.A.a | | | | | 74,461 | | | | 1,352,106 | | |

TOTAL ITALY | | | | | | | 3,399,423 | | |

JAPAN | | 12.1% | | | | | | | | | |

ELECTRIC—INTEGRATED ELECTRIC | | 2.0% | | | | | | | | | |

Chubu Electric Power Co.a | | | | | 79,400 | | | | 1,059,574 | | |

Kansai Electric Power Co.a | | | | | 102,600 | | | | 1,077,519 | | |

| | | | | | | | 2,137,093 | | |

GAS DISTRIBUTION | | 0.5% | | | | | | | | | |

Tokyo Gas Co., Ltd.a | | | | | 114,000 | | | | 520,872 | | |

RAILWAYS | | 9.6% | | | | | | | | | |

Central Japan Railway Co.a | | | | | 34,100 | | | | 2,767,537 | | |

East Japan Railway Co.a | | | | | 85,000 | | | | 5,496,449 | | |

West Japan Railway Co.a | | | | | 54,700 | | | | 2,154,996 | | |

| | | | | | | | 10,418,982 | | |

TOTAL JAPAN | | | | | | | 13,076,947 | | |

LUXEMBOURG | | 2.3% | | | | | | | | | |

COMMUNICATIONS—SATELLITES | |

SES SAa | | | | | 87,567 | | | | 2,521,995 | | |

See accompanying notes to financial statements.

12

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

December 31, 2012

| | | | | Number

of Shares | | Value | |

MEXICO | | 1.3% | | | | | | | | | |

AIRPORTS | | 0.8% | | | | | | | | | |

Grupo Aeroportuario del Pacifico SAB de CV, ADR | | | | | 14,842 | | | $ | 848,517 | | |

TOLL ROADS | | 0.5% | | | | | | | | | |

OHL Mexico SAB de CVc | | | | | 108,282 | | | | 237,652 | | |

Promotora y Operadora de Infraestructura

SAB de CVc | | | | | 49,200 | | | | 327,333 | | |

| | | | | | | | 564,985 | | |

TOTAL MEXICO | | | | | | | 1,413,502 | | |

NETHERLANDS | | 1.9% | | | | | | | | | |

MARINE PORTS | |

Koninklijke Vopak NVa | | | | | 28,853 | | | | 2,039,549 | | |

NEW ZEALAND | | 0.2% | | | | | | | | | |

AIRPORTS | |

Auckland International Airport Ltd.a | | | | | 124,305 | | | | 275,143 | | |

PORTUGAL | | 0.6% | | | | | | | | | |

ELECTRIC—INTEGRATED ELECTRIC | |

Energias de Portugal SAa | | | | | 222,770 | | | | 677,618 | | |

SOUTH KOREA | | 0.4% | | | | | | | | | |

ELECTRIC—REGULATED ELECTRIC | |

Korea Electric Power Corp.a,c | | | | | 13,800 | | | | 391,853 | | |

SPAIN | | 4.2% | | | | | | | | | |

ELECTRIC—REGULATED ELECTRIC | | 0.3% | | | | | | | | | |

Red Electrica Corp. SAa | | | | | 5,400 | | | | 266,738 | | |

TOLL ROADS | | 3.9% | | | | | | | | | |

Abertis Infraestructuras SAa | | | | | 141,479 | | | | 2,336,719 | | |

Ferrovial SAa | | | | | 129,050 | | | | 1,921,082 | | |

| | | | | | | | 4,257,801 | | |

TOTAL SPAIN | | | | | | | 4,524,539 | | |

SWITZERLAND | | 0.5% | | | | | | | | | |

AIRPORTS | |

Flughafen Zuerich AGa | | | | | 1,117 | | | | 517,212 | | |

See accompanying notes to financial statements.

13

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

December 31, 2012

| | | | | Number

of Shares | | Value | |

UNITED KINGDOM | | 4.3% | | | | | | | | | |

COMMUNICATIONS—SATELLITES | | 1.1% | | | | | | | | | |

Inmarsat PLCa | | | | | 119,050 | | | $ | 1,147,523 | | |

ELECTRIC | | 2.9% | | | | | | | | | |

INTEGRATED ELECTRIC | | 1.0% | | | | | | | | | |

SSE PLCa | | | | | 48,050 | | | | 1,117,840 | | |

REGULATED ELECTRIC | | 1.9% | | | | | | | | | |

National Grid PLCa | | | | | 179,051 | | | | 2,053,609 | | |

TOTAL ELECTRIC | | | | | | | 3,171,449 | | |

WATER | | 0.3% | | | | | | | | | |

Severn Trent PLCa | | | | | 12,100 | | | | 311,356 | | |

TOTAL UNITED KINGDOM | | | | | | | 4,630,328 | | |

UNITED STATES | | 37.7% | | | | | | | | | |

COMMUNICATIONS—TOWERS | | 13.7% | | | | | | | | | |

American Tower Corp. | | | | | 79,564 | | | | 6,147,910 | | |

Crown Castle International Corp.c | | | | | 77,400 | | | | 5,585,184 | | |

SBA Communications Corp.c | | | | | 44,200 | | | | 3,139,084 | | |

| | | | | | | | 14,872,178 | | |

ELECTRIC | | 13.9% | | | | | | | | | |

INTEGRATED ELECTRIC | | 5.2% | | | | | | | | | |

Exelon Corp. | | | | | 37,500 | | | | 1,115,250 | | |

FirstEnergy Corp. | | | | | 15,600 | | | | 651,456 | | |

NextEra Energy | | | | | 34,815 | | | | 2,408,850 | | |

PPL Corp. | | | | | 49,747 | | | | 1,424,256 | | |

| | | | | | | | 5,599,812 | | |

REGULATED ELECTRIC | | 8.7% | | | | | | | | | |

CenterPoint Energy | | | | | 45,850 | | | | 882,613 | | |

Duke Energy Corp. | | | | | 58,000 | | | | 3,700,400 | | |

PG&E Corp. | | | | | 45,530 | | | | 1,829,395 | | |

Southern Co. | | | | | 37,814 | | | | 1,618,817 | | |

Wisconsin Energy Corp. | | | | | 36,641 | | | | 1,350,221 | | |

| | | | | | | | 9,381,446 | | |

TOTAL ELECTRIC | | | | | | | 14,981,258 | | |

See accompanying notes to financial statements.

14

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

December 31, 2012

| | | | | Number

of Shares | | Value | |

GAS DISTRIBUTION | | 2.7% | | | | | | | | | |

Atmos Energy Corp. | | | | | 16,513 | | | $ | 579,937 | | |

Questar Corp. | | | | | 19,154 | | | | 378,483 | | |

Sempra Energy | | | | | 28,250 | | | | 2,004,055 | | |

| | | | | | | | 2,962,475 | | |

PIPELINES | | 6.1% | | | | | | | | | |

PIPELINES—C-CORP | | 2.7% | | | | | | | | | |

SemGroup Corp., Class Ac | | | | | 6,300 | | | | 246,204 | | |

Targa Resources Corp. | | | | | 10,600 | | | | 560,104 | | |

Williams Cos. (The) | | | | | 64,705 | | | | 2,118,442 | | |

| | | | | | | | 2,924,750 | | |

PIPELINES—MLP | | 3.4% | | | | | | | | | |

Access Midstream Partners LP | | | | | 18,300 | | | | 613,782 | | |

Enterprise Products Partners LP | | | | | 4,700 | | | | 235,376 | | |

EQT Midstream Partners LP | | | | | 13,999 | | | | 436,069 | | |

Golar LNG Partners LP (Marshall Islands) | | | | | 11,700 | | | | 349,245 | | |

MarkWest Energy Partners LP | | | | | 5,100 | | | | 260,151 | | |

| MPLX LPc | | | | | 13,800 | | | | 430,422 | | |

Oiltanking Partners LP | | | | | 15,456 | | | | 585,164 | | |

Rose Rock Midstream LP | | | | | 9,508 | | | | 299,217 | | |

Tesoro Logistics LP | | | | | 10,563 | | | | 462,659 | | |

| | | | | | | | 3,672,085 | | |

TOTAL PIPELINES | | | | | | | 6,596,835 | | |

SHIPPING | | 0.5% | | | | | | | | | |

GasLog Ltd. (Bermuda) | | | | | 41,030 | | | | 510,003 | | |

WATER | | 0.8% | | | | | | | | | |

American Water Works Co. | | | | | 22,702 | | | | 842,925 | | |

TOTAL UNITED STATES | | | | | | | 40,765,674 | | |

TOTAL COMMON STOCK

(Identified cost—$87,097,533) | | | | | | | 106,520,864 | | |

See accompanying notes to financial statements.

15

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

December 31, 2012

| | | | | Number

of Shares | | Value | |

SHORT-TERM INVESTMENTS | | | 2.0% | | | | | | | | | | |

MONEY MARKET FUNDS | |

BlackRock Liquidity Funds: FedFund, 0.01%d | | | | | 1,050,000 | | | $ | 1,050,000 | | |

Federated Government Obligations Fund, 0.01%d | | | | | 1,050,000 | | | | 1,050,000 | | |

TOTAL SHORT-TERM INVESTMENTS

(Identified cost—$2,100,000) | | | | | | | 2,100,000 | | |

TOTAL INVESTMENTS (Identified cost—$89,197,533) | | | 100.4 | % | | | | | | | 108,620,864 | | |

LIABILITIES IN EXCESS OF OTHER ASSETS | | | (0.4 | ) | | | | | | | (404,662 | ) | |

NET ASSETS | | | 100.0 | % | | | | | | $ | 108,216,202 | | |

Glossary of Portfolio Abbreviations

ADR American Depositary Receipt

HKD Hong Kong Dollar

MLP Master Limited Partnership

Note: Percentages indicated are based on the net assets of the Fund.

a Fair valued security. This security has been valued at its fair value as determined in good faith under procedures established by and under the general supervision of the Fund's Board of Directors. Aggregate fair valued securities represent 52.0% of the net assets of the Fund, all of which have been fair valued pursuant to foreign equity fair value pricing procedures approved by the Board of Directors.

b Resale is restricted to qualified institutional investors. Aggregate holdings equal 0.6% of the net assets of the Fund, of which 0.0% are illiquid.

c Non-income producing security.

d Rate quoted represents the seven-day yield of the fund.

See accompanying notes to financial statements.

16

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

December 31, 2012

Sector Summary | | % of

Net Assets | |

Electric | | | 28.0 | | |

Communications | | | 19.0 | | |

Toll Roads | | | 15.7 | | |

Pipelines | | | 11.5 | | |

Railways | | | 9.6 | | |

Marine Ports | | | 4.1 | | |

Airports | | | 3.9 | | |

Gas Distribution | | | 3.9 | | |

Water | | | 2.2 | | |

Other | | | 1.6 | | |

Shipping | | | 0.5 | | |

| | | | 100.0 | | |

See accompanying notes to financial statements.

17

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2012

ASSETS: | |

Investments in securities, at value (Identified cost—$89,197,533) | | $ | 108,620,864 | | |

Cash | | | 69,049 | | |

Foreign currency, at value (Identified cost—$13,840) | | | 13,859 | | |

Receivable for: | |

Dividends | | | 293,875 | | |

Investment securities sold | | | 157,861 | | |

Fund shares sold | | | 152,899 | | |

Other assets | | | 2,763 | | |

Total Assets | | | 109,311,170 | | |

LIABILITIES: | |

Payable for: | |

Investment securities purchased | | | 806,301 | | |

Investment advisory fees | | | 92,840 | | |

Fund shares redeemed | | | 34,667 | | |

Shareholder servicing fees | | | 6,094 | | |

Distribution fees | | | 2,380 | | |

Administration fees | | | 1,728 | | |

Directors' fees | | | 1,508 | | |

Other liabilities | | | 149,450 | | |

Total Liabilities | | | 1,094,968 | | |

NET ASSETS | | $ | 108,216,202 | | |

NET ASSETS consist of: | |

Paid-in capital | | $ | 102,711,246 | | |

| Dividends in excess of net investment income | | | (38,176 | ) | |

| Accumulated net realized loss | | | (13,880,244 | ) | |

| Net unrealized appreciation | | | 19,423,376 | | |

| | | $ | 108,216,202 | | |

See accompanying notes to financial statements.

18

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

STATEMENT OF ASSETS AND LIABILITIES—(Continued)

December 31, 2012

CLASS A SHARES: | |

NET ASSETS | | $ | 38,325,462 | | |

Shares issued and outstanding ($0.001 par value common stock outstanding) | | | 2,645,070 | | |

Net asset value and redemption price per share | | $ | 14.49 | | |

Maximum offering price per share ($14.49 ÷ 0.955)a | | $ | 15.17 | | |

CLASS B SHARES: | |

NET ASSETS | | $ | 352,744 | | |

Shares issued and outstanding ($0.001 par value common stock outstanding) | | | 24,269 | | |

Net asset value and offering price per shareb | | $ | 14.53 | | |

CLASS C SHARES: | |

NET ASSETS | | $ | 16,018,555 | | |

Shares issued and outstanding ($0.001 par value common stock outstanding) | | | 1,107,839 | | |

Net asset value and offering price per shareb | | $ | 14.46 | | |

CLASS I SHARES: | |

NET ASSETS | | $ | 53,519,441 | | |

Shares issued and outstanding ($0.001 par value common stock outstanding) | | | 3,684,757 | | |

Net asset value, offering and redemption price per share | | $ | 14.52 | | |

a On investments of $100,000 or more, the offering price is reduced.

b Redemption price per share is equal to the net asset value per share less any applicable contingent deferred sales charge which varies with the length of time shares are held.

See accompanying notes to financial statements.

19

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

STATEMENT OF OPERATIONS

For the Year Ended December 31, 2012

Investment Income: | |

Dividend income (net of $256,772 of foreign withholding tax) | | $ | 3,059,210 | | |

Expenses: | |

Investment advisory fees | | | 689,769 | | |

Distribution fees—Class A | | | 89,743 | | |

Distribution fees—Class B | | | 6,922 | | |

Distribution fees—Class C | | | 123,214 | | |

Professional fees | | | 146,274 | | |

Administration fees | | | 109,894 | | |

Shareholder servicing fees—Class A | | | 35,897 | | |

Shareholder servicing fees—Class B | | | 2,307 | | |

Shareholder servicing fees—Class C | | | 41,071 | | |

Shareholder servicing fees—Class I | | | 14,603 | | |

Custodian fees and expenses | | | 71,314 | | |

Registration and filing fees | | | 60,154 | | |

Transfer agent fees and expenses | | | 55,578 | | |

Shareholder reporting expenses | | | 28,318 | | |

Directors' fees and expenses | | | 8,890 | | |

Line of credit fees | | | 1,045 | | |

Miscellaneous | | | 18,677 | | |

Total Expenses | | | 1,503,670 | | |

Reduction of Expenses (See Note 2) | | | (146,869 | ) | |

Net Expenses | | | 1,356,801 | | |

| Net Investment Income | | | 1,702,409 | | |

Net Realized and Unrealized Gain (Loss): | |

Net realized gain (loss) on: | |

Investments | | | 1,445,021 | | |

Foreign currency transactions | | | (2,696 | ) | |

Net realized gain | | | 1,442,325 | | |

Net change in unrealized appreciation on: | |

| Investments | | | 8,855,686 | | |

Foreign currency translations | | | 2,700 | | |

| Net change in unrealized appreciation | | | 8,858,386 | | |

| Net realized and unrealized gain | | | 10,300,711 | | |

Net Increase in Net Assets Resulting from Operations | | $ | 12,003,120 | | |

See accompanying notes to financial statements.

20

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

STATEMENT OF CHANGES IN NET ASSETS

| | | For the

Year Ended

December 31, 2012 | | For the

Year Ended

December 31, 2011 | |

Change in Net Assets: | |

From Operations: | |

Net investment income | | $ | 1,702,409 | | | $ | 1,864,258 | | |

Net realized gain (loss) | | | 1,442,325 | | | | (1,174,465 | ) | |

| Net change in unrealized appreciation | | | 8,858,386 | | | | 1,240,325 | | |

Net increase in net assets resulting

from operations | | | 12,003,120 | | | | 1,930,118 | | |

Dividends and Distributions to Shareholders from: | | | | | | | | | |

Net investment income: | |

Class A | | | (681,133 | ) | | | (763,747 | ) | |

Class B | | | (7,374 | ) | | | (21,383 | ) | |

Class C | | | (197,569 | ) | | | (247,812 | ) | |

Class I | | | (862,262 | ) | | | (859,521 | ) | |

Tax return of capital: | |

Class A | | | — | | | | (6,984 | ) | |

Class B | | | — | | | | (396 | ) | |

Class C | | | — | | | | (3,472 | ) | |

Class I | | | — | | | | (5,899 | ) | |

Total dividends and distributions

to shareholders | | | (1,748,338 | ) | | | (1,909,214 | ) | |

Capital Stock Transactions: | |

Increase (decrease) in net assets from Fund share

transactions | | | 7,236,546 | | | | (4,380,170 | ) | |

Total increase (decrease) in net assets | | | 17,491,328 | | | | (4,359,266 | ) | |

Net Assets: | |

Beginning of year | | | 90,724,874 | | | | 95,084,140 | | |

End of yeara | | $ | 108,216,202 | | | $ | 90,724,874 | | |

a Includes dividends in excess of net investment income and accumulated undistributed net investment income of $38,176 and $3,254, respectively.

See accompanying notes to financial statements.

21

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

FINANCIAL HIGHLIGHTS

The following table includes selected data for a share outstanding throughout each year and other performance information derived from the financial statements. It should be read in conjunction with the financial statements and notes thereto.

| | | Class A | |

| | | For the Year Ended December 31, | |

Per Share Operating Performance: | | 2012 | | 2011 | | 2010 | | 2009 | | 2008 | |

Net asset value, beginning of year | | $ | 12.95 | | | $ | 12.93 | | | $ | 12.59 | | | $ | 10.68 | | | $ | 17.47 | | |

Income from investment operations: | |

| Net investment incomea | | | 0.25 | | | | 0.26 | | | | 0.22 | | | | 0.22 | | | | 0.38 | | |

| Net realized and unrealized gain (loss) | | | 1.55 | | | | 0.03 | | | | 0.42 | | | | 1.91 | | | | (6.77 | ) | |

Total from investment operations | | | 1.80 | | | | 0.29 | | | | 0.64 | | | | 2.13 | | | | (6.39 | ) | |

Less dividends and distributions to shareholders

from: | |

Net investment income | | | (0.26 | ) | | | (0.27 | ) | | | (0.29 | ) | | | (0.22 | ) | | | (0.40 | ) | |

Tax return of capital | | | — | | | | (0.00 | )b | | | (0.01 | ) | | | (0.00 | )b | | | (0.00 | )b | |

Total dividends and distributions to

shareholders | | | (0.26 | ) | | | (0.27 | ) | | | (0.30 | ) | | | (0.22 | ) | | | (0.40 | ) | |

Redemption fees retained by the Fund | | | — | | | | 0.00 | b | | | 0.00 | b | | | 0.00 | b | | | 0.00 | b | |

Net increase (decrease) in net asset value | | | 1.54 | | | | 0.02 | | | | 0.34 | | | | 1.91 | | | | (6.79 | ) | |

Net asset value, end of year | | $ | 14.49 | | | $ | 12.95 | | | $ | 12.93 | | | $ | 12.59 | | | $ | 10.68 | | |

Total investment returnc,d | | | 14.04 | % | | | 2.22 | % | | | 5.25 | % | | | 20.24 | % | | | –36.94 | % | |

Ratios/Supplemental Data: | |

Net assets, end of year (in millions) | | $ | 38.3 | | | $ | 35.2 | | | $ | 41.7 | | | $ | 54.7 | | | $ | 32.0 | | |

Ratio of expenses to average daily net assets

(before expense reduction) | | | 1.66 | %e | | | 1.61 | %e | | | 1.74 | %e | | | 1.90 | %e | | | 1.84 | % | |

Ratio of expenses to average daily net assets

(net of expense reduction) | | | 1.50 | %e | | | 1.50 | %e | | | 1.50 | %e | | | 1.50 | %e | | | 1.50 | % | |

Ratio of net investment income to average daily

net assets (before expense reduction) | | | 1.66 | %e | | | 1.86 | %e | | | 1.58 | %e | | | 1.61 | % | | | 2.40 | % | |

Ratio of net investment income to average daily

net assets (net of expense reduction) | | | 1.82 | %e | | | 1.97 | %e | | | 1.82 | %e | | | 2.00 | % | | | 2.74 | % | |

Portfolio turnover rate | | | 69 | % | | | 73 | % | | | 79 | % | | | 98 | % | | | 211 | % | |

a Calculation based on average shares outstanding.

b Amount is less than $0.005.

c Return assumes the reinvestment of all dividends and distributions at NAV.

d Does not reflect sales charges, which would reduce return.

e Non-class specific expenses are calculated at the Fund level and class specific expenses are calculated at the class level.

See accompanying notes to financial statements.

22

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

FINANCIAL HIGHLIGHTS—(Continued)

| | | Class B | |

| | | For the Year Ended December 31, | |

Per Share Operating Performance: | | 2012 | | 2011 | | 2010 | | 2009 | | 2008 | |

Net asset value, beginning of year | | $ | 12.94 | | | $ | 12.90 | | | $ | 12.55 | | | $ | 10.64 | | | $ | 17.39 | | |

Income from investment operations: | |

| Net investment incomea | | | 0.14 | | | | 0.16 | | | | 0.14 | | | | 0.15 | | | | 0.29 | | |

| Net realized and unrealized gain (loss) | | | 1.57 | | | | 0.04 | | | | 0.42 | | | | 1.89 | | | | (6.73 | ) | |

Total from investment operations | | | 1.71 | | | | 0.20 | | | | 0.56 | | | | 2.04 | | | | (6.44 | ) | |

Less dividends and distributions to shareholders

from: | |

Net investment income | | | (0.12 | ) | | | (0.16 | ) | | | (0.20 | ) | | | (0.13 | ) | | | (0.31 | ) | |

Tax return of capital | | | — | | | | (0.00 | )b | | | (0.01 | ) | | | (0.00 | )b | | | (0.00 | )b | |

Total dividends and distributions to

shareholders | | | (0.12 | ) | | | (0.16 | ) | | | (0.21 | ) | | | (0.13 | ) | | | (0.31 | ) | |

Redemption fees retained by the Fund | | | — | | | | 0.00 | b | | | 0.00 | b | | | 0.00 | b | | | 0.00 | b | |

Net increase (decrease) in net asset value | | | 1.59 | | | | 0.04 | | | | 0.35 | | | | 1.91 | | | | (6.75 | ) | |

Net asset value, end of year | | $ | 14.53 | | | $ | 12.94 | | | $ | 12.90 | | | $ | 12.55 | | | $ | 10.64 | | |

Total investment returnc,d | | | 13.28 | % | | | 1.51 | % | | | 4.57 | % | | | 19.41 | % | | | –37.35 | % | |

Ratios/Supplemental Data: | |

Net assets, end of year (in millions) | | $ | 0.4 | | | $ | 1.4 | | | $ | 3.1 | | | $ | 4.5 | | | $ | 6.2 | | |

Ratio of expenses to average daily net assets

(before expense reduction) | | | 2.31 | %e | | | 2.26 | %e | | | 2.39 | %e | | | 2.55 | %e | | | 2.46 | % | |

Ratio of expenses to average daily net assets

(net of expense reduction) | | | 2.15 | %e | | | 2.15 | %e | | | 2.15 | %e | | | 2.15 | %e | | | 2.15 | % | |

Ratio of net investment income to average daily

net assets (before expense reduction) | | | 0.88 | %e | | | 1.08 | %e | | | 0.89 | %e | | | 1.02 | % | | | 1.74 | % | |

Ratio of net investment income to average daily

net assets (net of expense reduction) | | | 1.04 | %e | | | 1.19 | %e | | | 1.13 | %e | | | 1.44 | % | | | 2.05 | % | |

Portfolio turnover rate | | | 69 | % | | | 73 | % | | | 79 | % | | | 98 | % | | | 211 | % | |

a Calculation based on average shares outstanding.

b Amount is less than $0.005.

c Does not reflect sales charges, which would reduce return.

d Return assumes the reinvestment of all dividends and distributions at NAV.

e Non-class specific expenses are calculated at the Fund level and class specific expenses are calculated at the class level.

See accompanying notes to financial statements.

23

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

FINANCIAL HIGHLIGHTS—(Continued)

| | | Class C | |

| | | For the Year Ended December 31, | |

Per Share Operating Performance: | | 2012 | | 2011 | | 2010 | | 2009 | | 2008 | |

Net asset value, beginning of year | | $ | 12.92 | | | $ | 12.90 | | | $ | 12.55 | | | $ | 10.65 | | | $ | 17.40 | | |

Income from investment operations: | |

| Net investment incomea | | | 0.16 | | | | 0.17 | | | | 0.14 | | | | 0.15 | | | | 0.29 | | |

| Net realized and unrealized gain (loss) | | | 1.55 | | | | 0.03 | | | | 0.43 | | | | 1.89 | | | | (6.74 | ) | |

Total from investment operations | | | 1.71 | | | | 0.20 | | | | 0.57 | | | | 2.04 | | | | (6.45 | ) | |

Less dividends and distributions to shareholders

from: | |

Net investment income | | | (0.17 | ) | | | (0.18 | ) | | | (0.21 | ) | | | (0.14 | ) | | | (0.30 | ) | |

Tax return of capital | | | — | | | | (0.00 | )b | | | (0.01 | ) | | | (0.00 | )b | | | (0.00 | )b | |

Total dividends and distributions to

shareholders | | | (0.17 | ) | | | (0.18 | ) | | | (0.22 | ) | | | (0.14 | ) | | | (0.30 | ) | |

Redemption fees retained by the Fund | | | — | | | | 0.00 | b | | | 0.00 | b | | | 0.00 | b | | | 0.00 | b | |

Net increase (decrease) in net asset value | | | 1.54 | | | | 0.02 | | | | 0.35 | | | | 1.90 | | | | (6.75 | ) | |

Net asset value, end of year | | $ | 14.46 | | | $ | 12.92 | | | $ | 12.90 | | | $ | 12.55 | | | $ | 10.65 | | |

Total investment returnc,d | | | 13.30 | % | | | 1.52 | % | | | 4.63 | % | | | 19.43 | % | | | –37.35 | % | |

Ratios/Supplemental Data: | |

Net assets, end of year (in millions) | | $ | 16.0 | | | $ | 17.2 | | | $ | 21.6 | | | $ | 25.8 | | | $ | 22.1 | | |

Ratio of expenses to average daily net assets

(before expense reduction) | | | 2.31 | %e | | | 2.26 | %e | | | 2.39 | %e | | | 2.55 | %e | | | 2.47 | % | |

Ratio of expenses to average daily net assets

(net of expense reduction) | | | 2.15 | %e | | | 2.15 | %e | | | 2.15 | %e | | | 2.15 | %e | | | 2.15 | % | |

Ratio of net investment income to average daily

net assets (before expense reduction) | | | 0.99 | %e | | | 1.20 | %e | | | 0.93 | %e | | | 1.00 | % | | | 1.72 | % | |

Ratio of net investment income to average daily

net assets (net of expense reduction) | | | 1.15 | %e | | | 1.31 | %e | | | 1.17 | %e | | | 1.40 | % | | | 2.04 | % | |

Portfolio turnover rate | | | 69 | % | | | 73 | % | | | 79 | % | | | 98 | % | | | 211 | % | |

a Calculation based on average shares outstanding.

b Amount is less than $0.005.

c Does not reflect sales charges, which would reduce return.

d Return assumes the reinvestment of all dividends and distributions at NAV.

e Non-class specific expenses are calculated at the Fund level and class specific expenses are calculated at the class level.

See accompanying notes to financial statements.

24

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

FINANCIAL HIGHLIGHTS—(Continued)

| | | Class I | |

| | | For the Year Ended December 31, | |

Per Share Operating Performance: | | 2012 | | 2011 | | 2010 | | 2009 | | 2008 | |

Net asset value, beginning of year | | $ | 12.97 | | | $ | 12.96 | | | $ | 12.62 | | | $ | 10.70 | | | $ | 17.51 | | |

Income from investment operations: | |

| Net investment incomea | | | 0.30 | | | | 0.32 | | | | 0.30 | | | | 0.26 | | | | 0.36 | | |

| Net realized and unrealized gain (loss) | | | 1.56 | | | | 0.01 | | | | 0.38 | | | | 1.91 | | | | (6.72 | ) | |

Total from investment operations | | | 1.86 | | | | 0.33 | | | | 0.68 | | | | 2.17 | | | | (6.36 | ) | |

Less dividends and distributions to shareholders

from: | |

Net investment income | | | (0.31 | ) | | | (0.32 | ) | | | (0.33 | ) | | | (0.25 | ) | | | (0.45 | ) | |

Tax return of capital | | | — | | | | (0.00 | )b | | | (0.01 | ) | | | (0.00 | )b | | | (0.00 | )b | |

Total dividends and distributions to

shareholders | | | (0.31 | ) | | | (0.32 | ) | | | (0.34 | ) | | | (0.25 | ) | | | (0.45 | ) | |

Redemption fees retained by the Fund | | | — | | | | 0.00 | b | | | 0.00 | b | | | 0.00 | b | | | 0.00 | b | |

Net increase (decrease) in net asset value | | | 1.55 | | | | 0.01 | | | | 0.34 | | | | 1.92 | | | | (6.81 | ) | |

Net asset value, end of year | | $ | 14.52 | | | $ | 12.97 | | | $ | 12.96 | | | $ | 12.62 | | | $ | 10.70 | | |

Total investment returnc | | | 14.44 | % | | | 2.51 | % | | | 5.65 | % | | | 20.64 | % | | | –36.73 | % | |

Ratios/Supplemental Data: | |

Net assets, end of year (in millions) | | $ | 53.5 | | | $ | 36.9 | | | $ | 28.7 | | | $ | 9.4 | | | $ | 5.8 | | |

Ratio of expenses to average daily net assets

(before expense reduction) | | | 1.31 | %d | | | 1.26 | %d | | | 1.39 | %d | | | 1.55 | %d | | | 1.69 | % | |

Ratio of expenses to average daily net assets

(net of expense reduction) | | | 1.15 | %d | | | 1.15 | %d | | | 1.15 | %d | | | 1.15 | %d | | | 1.15 | % | |

Ratio of net investment income to average daily

net assets (before expense reduction) | | | 2.04 | %d | | | 2.33 | %d | | | 2.16 | %d | | | 2.02 | % | | | 2.24 | % | |

Ratio of net investment income to average daily

net assets (net of expense reduction) | | | 2.20 | %d | | | 2.44 | %d | | | 2.40 | %d | | | 2.42 | % | | | 2.77 | % | |

Portfolio turnover rate | | | 69 | % | | | 73 | % | | | 79 | % | | | 98 | % | | | 211 | % | |

a Calculation based on average shares outstanding.

b Amount is less than $0.005.

c Return assumes the reinvestment of all dividends and distributions at NAV.

d Non-class specific expenses are calculated at the Fund level and class specific expenses are calculated at the class level.

See accompanying notes to financial statements.

25

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS

Note 1. Significant Accounting Policies

Cohen & Steers Global Infrastructure Fund, Inc. (the Fund), was incorporated under the laws of the State of Maryland on January 13, 2004 and is registered under the Investment Company Act of 1940, as amended, as a diversified, open-end management investment company. The Fund's investment objective is total return. The authorized shares of the Fund are divided into four classes designated Class A, B, C and I shares. Class B shares are no longer offered except through dividend reinvestment and permitted exchanges by existing Class B shareholders. Each of the Fund's shares has equal dividend, liquidation and voting rights (except for matters relating to distributions and shareholder servicing of such shares). Class B shares automatically convert to Class A shares at the end of the month which precedes the eighth anniversary of the purchase date.

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The policies are in conformity with accounting principles generally accepted in the United States of America (GAAP). The preparation of the financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Portfolio Valuation: Investments in securities that are listed on the New York Stock Exchange are valued, except as indicated below, at the last sale price reflected at the close of the New York Stock Exchange on the business day as of which such value is being determined. If there has been no sale on such day, the securities are valued at the mean of the closing bid and ask prices on such day or, if no ask price is available, at the bid price.

Securities not listed on the New York Stock Exchange but listed on other domestic or foreign securities exchanges are valued in a similar manner. Securities traded on more than one securities exchange are valued at the last sale price reflected at the close of the exchange representing the principal market for such securities on the business day as of which such value is being determined. If after the close of a foreign market, but prior to the close of business on the day the securities are being valued, market conditions change significantly, certain foreign securities may be fair valued pursuant to procedures established by the Board of Directors.

Readily marketable securities traded in the over-the-counter market, including listed securities whose primary market is believed by Cohen & Steers Capital Management, Inc. (the advisor) to be over-the-counter, are valued at the last sale price on the valuation date as reported by sources deemed appropriate by the Board of Directors to reflect their fair market value. If there has been no sale on such day, the securities are valued at the mean of the closing bid and ask prices on such day or, if no ask price is available, at the bid price.

Short-term debt securities with a maturity date of 60 days or less are valued at amortized cost, which approximates value. Investments in open-end mutual funds are valued at their closing net asset value.

26

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

The policies and procedures approved by the Fund's Board of Directors delegate authority to make fair value determinations to the advisor, subject to the oversight of the Board of Directors. The advisor has established a valuation committee (Valuation Committee) to administer, implement and oversee the fair valuation process according to the policies and procedures approved annually by the Board of Directors. Among other things, these procedures allow the Fund to utilize independent pricing services, quotations from securities and financial instrument dealers and other market sources to determine fair value.

Securities for which market prices are unavailable will be valued at fair value, as determined in good faith by the Valuation Committee, pursuant to procedures approved by the Fund's Board of Directors. Circumstances in which market prices may be unavailable include, but are not limited to, when trading in a security is suspended, the exchange on which the security is traded is subject to an unscheduled close or disruption or material events occur after the close of the exchange on which the security is principally traded. In these circumstances, the Fund determines fair value in a manner that fairly reflects the market value of the security on the valuation date based on consideration of any information or factors it deems appropriate. These may include, but are not limited to, recent transactions in comparable securities, information relating to the specific security and developments in the markets.

Foreign equity fair value pricing procedures utilized by the Fund may cause certain foreign securities to be fair valued on the basis of fair value factors provided by a pricing service to reflect any significant market movements between the time the Fund values such securities and the earlier closing of foreign markets.

The Fund's use of fair value pricing may cause the net asset value of Fund shares to differ from the net asset value that would be calculated using market quotations. Fair value pricing involves subjective judgments and it is possible that the fair value determined for a security may be materially different than the value that could be realized upon the sale of that security.

Fair value is defined as the price that the Fund would expect to receive upon the sale of an investment or expect to pay to transfer a liability in an orderly transaction with an independent buyer in the principal market or, in the absence of a principal market, the most advantageous market for the investment or liability. The hierarchy of inputs that are used in determining the fair value of the Fund's investments is summarized below.

• Level 1—quoted prices in active markets for identical investments

• Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, credit risk, etc.)

• Level 3—significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

For movements between the levels within the fair value hierarchy, the Fund has adopted a policy of recognizing the transfer at the end of the period in which the underlying event causing the movement occurred. Changes in valuation techniques may result in transfers into or out of an assigned level within

27

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

the disclosure hierarchy. As of December 31, 2012, there were $47,067,204 of securities transferred between Level 1 and Level 2, which resulted from foreign equity fair value pricing procedures utilized by the Fund as of December 31, 2012.

The following is a summary of the inputs used as of December 31, 2012 in valuing the Fund's investments carried at value:

| | | Total | | Quoted Prices

In Active

Markets for

Identical

Investments

(Level 1) | | Other

Significant

Observable

Inputs

(Level 2) | | Significant

Unobservable

Inputs

(Level 3) | |

Common Stock—Brazil | | $ | 2,306,107 | | | $ | 2,306,107 | | | $ | — | | | $ | — | | |

Common Stock—Canada | | | 5,736,746 | | | | 5,736,746 | | | | — | | | | — | | |

Common Stock—Mexico | | | 1,413,502 | | | | 1,413,502 | | | | — | | | | — | | |

Common Stock—United States | | | 40,765,674 | | | | 40,765,674 | | | | — | | | | — | | |

Common Stock—Other

Countries | | | 56,298,835 | | | | — | | | | 56,298,835 | | | | — | | |

Money Market Funds | | | 2,100,000 | | | | — | | | | 2,100,000 | | | | — | | |

Total Investmentsa | | $ | 108,620,864 | | | $ | 50,222,029 | | | $ | 58,398,835 | | | $ | — | | |

a Portfolio holdings are disclosed individually on the Schedule of Investments.

Security Transactions, Investment Income and Expense Allocations: Security transactions are recorded on trade date. Realized gains and losses on investments sold are recorded on the basis of identified cost. Interest income is recorded on the accrual basis. Discounts are accreted and premiums are amortized over the life of the respective securities. Dividend income is recorded on the ex-dividend date, except for certain dividends on foreign securities, which are recorded as soon as the Fund is informed after the ex-dividend date. Distributions from Master Limited Partnerships ("MLPs") are recorded as income and return of capital based on information reported by the MLPs and management's estimates of such amounts based on historical information. These estimates are adjusted when the actual source of distributions is disclosed by the MLPs and actual amounts may differ from the estimated amounts. Income, expenses (other than expenses attributable to a specific class) and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

Foreign Currency Translation: The books and records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based upon prevailing exchange rates on the date of valuation. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollars based upon prevailing exchange rates on the respective dates of such transactions. The Fund does not isolate that portion of the results of operations resulting from fluctuations in foreign

28

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales of foreign currencies, including gains and losses on forward foreign currency exchange contracts, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund's books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the values of assets and liabilities, other than investments in securities, on the date of valuation, resulting from changes in exchange rates. Pursuant to U.S. federal income tax regulations, certain foreign currency gains/losses included in realized and unrealized gain/loss are included in or are a reduction of ordinary income for federal income tax purposes.

Foreign Securities: The Fund may directly purchase securities of foreign issuers. Investing in securities of foreign issuers involves special risks not typically associated with investing in securities of U.S. issuers. The risks include possible revaluation of currencies, the ability to repatriate funds, less complete financial information about companies and possible future adverse political and economic developments. Moreover, securities of many foreign issuers and their markets may be less liquid and their prices more volatile than securities of comparable U.S. issuers.

Dividends and Distributions to Shareholders: Dividends from net investment income and capital gain distributions are determined in accordance with U.S. federal income tax regulations, which may differ from GAAP. Dividends from net investment income, if any, are declared and paid semi-annually. Net realized capital gains, unless offset by any available capital loss carryforward, are typically distributed to shareholders at least annually. Dividends and distributions to shareholders are recorded on the ex-dividend date and are automatically reinvested in full and fractional shares of the Fund based on the net asset value per share at the close of business on the payable date unless the shareholder has elected to have them paid in cash. Distributions paid by the Fund are subject to recharacterization for tax purposes.

Income Taxes: It is the policy of the Fund to continue to qualify as a regulated investment company, if such qualification is in the best interest of the shareholders, by complying with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies, and by distributing substantially all of its taxable earnings to its shareholders. Accordingly, no provision for federal income or excise tax is necessary. Dividend and interest income from holdings in non-U.S. securities is recorded net of non-U.S. taxes paid. Security and foreign currency transactions and any gains realized by the Fund on the sale of securities in certain non-U.S. markets are subject to non-U.S. taxes. The Fund records a liability based on any unrealized gains on securities held in these markets in order to estimate the potential non-U.S. taxes due upon the sale of these securities. Management has analyzed the Fund's tax positions taken on federal income tax returns as well as its tax positions in non-U.S. jurisdictions in which it trades for all open tax years and has concluded that as of December 31, 2012, no additional provisions for income tax are required in the Fund's financial statements. The Fund's tax positions for the tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service, state departments of revenue and by foreign tax authorities.

29

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

Note 2. Investment Advisory and Administration Fees and Other Transactions with Affiliates

Investment Advisory Fees: The advisor serves as the Fund's investment advisor pursuant to an investment advisory agreement (the investment advisory agreement). Under the terms of the investment advisory agreement, the advisor provides the Fund with day-to-day investment decisions and generally manages the Fund's investments in accordance with the stated policies of the Fund, subject to the supervision of the Board of Directors.

For the services provided to the Fund, the advisor receives a fee, accrued daily and paid monthly, at the annual rate of 0.75% of the average daily net assets of the Fund up to and including $1.5 billion and 0.65% of the average daily net assets above $1.5 billion.

For the year ended December 31, 2012, and through June 30, 2014, the advisor has contractually agreed to waive its fee and/or reimburse the Fund for expenses incurred (excluding distribution and shareholder servicing fees applicable to Class A, Class B and Class C shares, acquired fund fees and expenses and extraordinary expenses) to the extent necessary to maintain the Fund's total annual operating expenses as a percentage of average net assets at 1.50% for Class A shares, 2.15% for Class B shares and Class C shares and 1.15% for Class I shares. This contractual agreement can be amended at any time by agreement of the Fund and the advisor. For the year ended December 31, 2012, fees waived and/or expenses reimbursed totaled $146,869.

Under subadvisory agreements between the advisor and each of Cohen & Steers Asia Limited, Cohen & Steers UK Limited and Cohen & Steers Europe S.A. (collectively, the subadvisors), affiliates of the advisor, the subadvisors are responsible for managing the Fund's investments in certain non-U.S. securities. For their services provided under the subadvisory agreements, the advisor (not the Fund) pays the subadvisors. The advisor allocates 50% of the advisory fee received from the Fund among itself and each subadvisor based on the portion of the Fund's average daily net assets managed by the advisor and each subadvisor. On December 11, 2012, the Board of Directors of the Fund approved the termination of the subadvisory agreement with Cohen & Steers Europe S.A. effective December 31, 2012.

Administration Fees: The Fund has entered into an administration agreement with the advisor under which the advisor performs certain administrative functions for the Fund and receives a fee, accrued daily and paid monthly, at the annual rate of 0.02% of the average daily net assets of the Fund. For the year ended December 31, 2012, the Fund paid the advisor $18,394 in fees under this administration agreement. Additionally, the Fund pays State Street Bank and Trust Company as co-administrator under a fund accounting and administration agreement.

Distribution Fees: Shares of the Fund are distributed by Cohen & Steers Securities, LLC (the distributor), an affiliated entity of the advisor. The Fund has adopted a distribution plan (the plan) pursuant to Rule 12b-1 under the Investment Company Act of 1940. The plan provides that the Fund will pay the distributor a fee, accrued daily and paid monthly, at an annual rate of up to 0.25% of the average daily net assets attributable to Class A shares and up to 0.75% of the average daily net assets attributable to Class B and Class C shares.

There is a maximum initial sales charge of 4.50% for Class A shares. There is a contingent deferred sales charge ("CDSC") on Class B shares. There is a CDSC of 1.00% on Class C shares, which applies if

30

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

redemption occurs within one year from purchase. For the year ended December 31, 2012, the Fund has been advised that the distributor received $4,930 in sales commissions from the sale of Class A shares and $565 and $845 of CDSC relating to redemptions of Class B and Class C shares, respectively. The distributor has advised the Fund that proceeds from the CDSC on Class B and Class C shares are used by the distributor to defray its expenses related to providing distribution-related services to the Fund in connection with the sale of these classes, including payments to dealers and other financial intermediaries for selling these classes.

Shareholder Servicing Fees: For shareholder services, the Fund pays the distributor a fee, accrued daily and paid monthly, at an annual rate of up to 0.10% of the average daily net assets of the Fund's Class A and Class I shares and up to 0.25% of the average daily net assets of the Fund's Class B and Class C shares. The distributor is responsible for paying qualified financial institutions for shareholder services.

Directors' and Officers' Fees: Certain directors and officers of the Fund are also directors, officers and/or employees of the advisor. The Fund does not pay compensation to directors and officers affiliated with the advisor except for the Chief Compliance Officer, who received compensation from the advisor, which was reimbursed by the Fund, in the amount of $1,269 for the year ended December 31, 2012.

Note 3. Purchases and Sales of Securities

Purchases and sales of securities, excluding short-term investments, for the year ended December 31, 2012, totaled $69,909,711 and $63,290,143, respectively.

Note 4. Income Tax Information

The tax character of dividends and distributions paid was as follows:

| | | For the Year Ended

December 31, | |

| | | 2012 | | 2011 | |

Ordinary income | | $ | 1,748,338 | | | $ | 1,892,463 | | |

| Tax return of capital | | | — | | | | 16,751 | | |

Total dividends and distributions | | $ | 1,748,338 | | | $ | 1,909,214 | | |

As of December 31, 2012, the tax-basis components of accumulated earnings and the federal tax cost were as follows:

Cost for federal income tax purposes | | $ | 91,427,695 | | |

Gross unrealized appreciation | | $ | 19,406,947 | | |

| Gross unrealized depreciation | | | (2,213,778 | ) | |

Net unrealized appreciation | | $ | 17,193,169 | | |

Undistributed ordinary income | | $ | 30,299 | | |

31

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

As of December 31, 2012, the Fund had a net capital loss carryforward of $11,723,347 which may be used to offset future capital gains. These losses are comprised of a long-term capital loss carryover of $142,646 recognized during the year ended December 31, 2011, which under current federal income tax rules may offset capital gains recognized in any future period but must be utilized prior to using the its short-term capital loss carryover, of which $4,893,130 will expire on December 31, 2016, $4,314,050 will expire on December 31, 2017 and $2,373,521 will expire on December 31, 2018.

During the year ended December 31, 2012, the Fund utilized net capital loss carryforwards of $973,642.

As of December 31, 2012, the Fund had temporary book/tax differences primarily attributable to wash sales on portfolio securities and permanent book/tax differences primarily attributable to foreign currency transactions and prior year income redesignations. To reflect reclassifications arising from the permanent differences, paid-in capital was charged $13,053, accumulated net realized loss was credited $8,554 and dividends in excess of net investment income was credited $4,499. Net assets were not affected by this reclassification.

Note 5. Capital Stock

The Fund is authorized to issue 200 million shares of capital stock, at a par value of $0.001 per share. The Board of Directors of the Fund may increase or decrease the aggregate number of shares of common stock that the Fund has authority to issue. Transactions in Fund shares were as follows:

| | | For the

Year Ended

December 31, 2012 | | For the

Year Ended

December 31, 2011 | |

| | | Shares | | Amount | | Shares | | Amount | |

CLASS A: | |

Sold | | | 615,526 | | | $ | 8,492,957 | | | | 575,059 | | | $ | 7,618,283 | | |

Issued as reinvestment

of dividends and

distributions | | | 37,216 | | | | 513,337 | | | | 39,611 | | | | 514,393 | | |

Redeemed | | | (731,539 | ) | | | (9,982,253 | ) | | | (1,116,937 | ) | | | (14,551,239 | ) | |

Redemption fees retained

by the Funda | | | — | | | | — | | | | — | | | | 607 | | |

Net decrease | | | (78,797 | ) | | $ | (975,959 | ) | | | (502,267 | ) | | $ | (6,417,956 | ) | |

32

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

| | | For the

Year Ended

December 31, 2012 | | For the

Year Ended

December 31, 2011 | |

| | | Shares | | Amount | | Shares | | Amount | |

CLASS B: | |

Sold | | | 181 | | | $ | 2,429 | | | | 340 | | | $ | 4,451 | | |

Issued as reinvestment

of dividends and

distributions | | | 308 | | | | 4,195 | | | | 847 | | | | 11,118 | | |

Redeemed | | | (81,891 | ) | | | (1,124,633 | ) | | | (134,565 | ) | | | (1,767,965 | ) | |

Redemption fees retained

by the Funda | | | — | | | | — | | | | — | | | | 43 | | |

Net decrease | | | (81,402 | ) | | $ | (1,118,009 | ) | | | (133,378 | ) | | $ | (1,752,353 | ) | |

CLASS C: | |

Sold | | | 67,051 | | | $ | 916,578 | | | | 124,752 | | | $ | 1,621,924 | | |

Issued as reinvestment

of dividends and

distributions | | | 9,019 | | | | 123,541 | | | | 10,382 | | | | 134,908 | | |

Redeemed | | | (300,026 | ) | | | (4,064,877 | ) | | | (475,379 | ) | | | (6,181,624 | ) | |

Redemption fees retained

by the Funda | | | — | | | | — | | | | — | | | | 302 | | |

Net decrease | | | (223,956 | ) | | $ | (3,024,758 | ) | | | (340,245 | ) | | $ | (4,424,490 | ) | |

CLASS I: | |

Sold | | | 1,699,294 | | | $ | 24,018,969 | | | | 1,718,287 | | | $ | 22,598,883 | | |

Issued as reinvestment

of dividends and

distributions | | | 47,234 | | | | 654,591 | | | | 43,457 | | | | 563,921 | | |

Redeemed | | | (906,026 | ) | | | (12,318,288 | ) | | | (1,134,714 | ) | | | (14,948,576 | ) | |

Redemption fees retained

by the Funda | | | — | | | | — | | | | — | | | | 401 | | |