UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-21488 |

|

Cohen & Steers Global Infrastructure Fund, Inc. |

(Exact name of registrant as specified in charter) |

|

280 Park Avenue, New York, NY | | 10017 |

(Address of principal executive offices) | | (Zip code) |

|

Tina M. Payne Cohen & Steers Capital Management, Inc. 280 Park Avenue New York, New York 10017 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (212) 832-3232 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | December 31, 2015 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

To Our Shareholders:

We would like to share with you our report for the year ended December 31, 2015. The net asset values (NAV) per share at that date were $16.09, $16.05, $16.14, $16.14 and $16.13 for Class A, Class C, Class I, Class R and Class Z shares, respectively.

The total returns, including income and change in NAV, for the Fund and its comparative benchmarks were:

| | Six Months Ended

December 31, 2015 | | Year Ended

December 31, 2015 | |

Cohen & Steers Global Infrastructure

Fund—Class A | | | –7.13 | % | | | –8.10 | % | |

Cohen & Steers Global Infrastructure

Fund—Class C | | | –7.48 | % | | | –8.70 | % | |

Cohen & Steers Global Infrastructure

Fund—Class I | | | –7.00 | % | | | –7.79 | % | |

Cohen & Steers Global Infrastructure

Fund—Class R | | | –7.23 | % | | | –8.22 | % | |

Cohen & Steers Global Infrastructure

Fund—Class Z | | | –6.98 | % | | | –7.79 | % | |

| Linked Global Infrastructure Index-Neta | | | –4.54 | % | | | –6.71 | % | |

| S&P 500 Indexa | | | 0.15 | % | | | 1.38 | % | |

The performance data quoted represent past performance. Past performance is no guarantee of future results. The investment return and the principal value of an investment will fluctuate and shares, if redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Current total returns of the Fund can be obtained by visiting our website at cohenandsteers.com. All share class returns assume the reinvestment of all dividends and distributions at NAV. Performance quoted does not reflect the deduction of the maximum 4.50%

a The Linked Global Infrastructure Index-Net (the Linked Benchmark) is represented by the performance of the S&P 1500 Utilities Index from December 31, 1994 through March 31, 2008, the Macquarie Global Infrastructure Index from April 1, 2008 through May 31, 2008, the UBS Global 50/50 Infrastructure & Utilities Index-net (UBS 50/50) from June 1, 2008 through March 31, 2015 and the FTSE Global Core Infrastructure 50/50 Net Tax Index (FTSE 50/50) thereafter. The benchmark was replaced on March 31, 2015 because UBS retired the UBS 50/50. The UBS 50/50 tracked a 50% exposure to global developed market utilities sector and a 50% exposure to global developed market infrastructure sector. The index is free-float market-capitalization weighted and reconstituted annually with quarterly rebalances and is net of dividend withholding taxes. The FTSE 50/50 is a market-capitalization-weighted index of the worldwide infrastructure and infrastructure-related securities. Constituent weights are adjusted semi-annually according to three broad industry sectors: 50% utilities, 30% transportation, and a 20% mix of other sectors, including pipelines, satellites and telecommunication towers. The S&P 500 Index is an unmanaged index of 500 large-capitalization stocks that is frequently used as a general measure of U.S. stock market performance.

1

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

initial sales charge on Class A shares or the 1.00% maximum contingent deferred sales charge on Class C shares. The 1.00% maximum contingent deferred sales charge on Class C shares applies if redemption occurs on or before the one year anniversary date of their purchase. If such charges were included, returns would have been lower. Index performance does not reflect the deduction of any fees, taxes or expenses. An investor cannot invest directly in an index. Performance figures for periods shorter than one year are not annualized.

The Fund implements fair value pricing when the daily change in a specific U.S. market index exceeds a predetermined percentage. Fair value pricing adjusts the valuation of certain non-U.S. equity holdings to account for such index change following the close of foreign markets. This standard practice has been adopted by a majority of the fund industry. In the event fair value pricing is implemented on the first and/or last day of a performance measurement period, the Fund's return may diverge from the relative performance of its benchmark, which does not use fair value pricing.

Please note that distributions paid by the Fund to shareholders are subject to recharacterization for tax purposes and are taxable up to the amount of the Fund's investment company taxable income and net realized gains. Distributions in excess of the Fund's investment company taxable income and net realized gains are a return of capital distributed from the Fund's assets.

Market Review

Global listed infrastructure had a negative overall return for the year, as significant declines within the pipelines subsector overwhelmed generally positive returns in other categories. Developed economies showed modest improvement, with Europe in particular gaining momentum amid aggressive monetary easing by the European Central Bank. However, concerns over the slowdown in China and other emerging markets—as well as uncertainty leading up to the Federal Reserve's first interest-rate hike in years—led to a generally challenging market environment.

Crude oil prices continued to fall precipitously in 2015, pressured by rising inventories, slowing demand from emerging markets and a strengthening U.S. dollar. The response from suppliers was relatively muted, particularly with OPEC (the Organization of Petroleum Exporting Countries) maintaining production levels in a fight for global market share at the expense of prices. Falling energy prices were detrimental to certain infrastructure subsectors, particularly pipeline companies, most of which had meaningful declines in their share prices. However, lower energy prices benefited transportation-related subsectors, which generally saw better passenger volumes.

Fund Performance

The Fund declined in 2015 and underperformed its Linked Benchmark. The largest detractor to relative performance was an out-of-index position in Teekay Corp. The liquefied natural gas and crude oil shipping company declined sharply late in the year upon taking steps to manage its capital needs in the context of the fundamental energy market downturn and its rising cost of capital. Investors were generally caught off guard by the size of its dividend cut and decision to forego near-term general partner cash flows from its limited partnerships.

2

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

Also hindering the portfolio's relative performance were our stock selection and underweight in electric utilities. The subsector, which is frequently considered to be defensive in nature, outperformed the broad infrastructure universe, as investors sought refuge from market volatility in assets with relatively predictable revenues.

Our stock selection and overweight allocation to railways also detracted from relative performance. Within the subsector, we had a beneficial overweight in Japanese passenger rail companies—a group that had good performance amid rising traffic. However, the advantage was more than countered by the effect of our overweights in freight operators Union Pacific and Canadian Pacific, which underperformed their peers.

The largest contributor to the Fund's relative performance during the year was our stock selection and overweight allocation to communications, namely tower companies. Wireless tower companies enjoyed healthy earnings growth in 2015, with revenues that were relatively insulated from economic uncertainty. We were substantially overweight Crown Castle International, which delivered results throughout the year that were above expectations. We also had an out-of-index position in Ei Towers and an overweight in Rai Way, two Italian companies involved in mergers.

Pipeline companies were the poorest performing subsector in the period. As energy producers slashed capital spending plans for 2016, markets anticipated slower pipeline volumes and reduced cash flow growth. Pipeline companies also faced difficulties in accessing capital and the challenge of balancing cash flows with refinancing needs and distribution expectations. In this environment, our close-to-neutral weighting in pipelines had a relatively negligible effect on relative performance, although our stock selection within the subsector was relatively favorable. We were underweight Kinder Morgan, which sold off sharply after cutting its dividend, and we did not own Spectra Energy or Oneok, which also had sizable declines.

Stock selection in airports was another favorable contributor to relative performance. Our out-of-index position in Grupo Aeroportuario Del Pacifico benefited from thriving tourism in Mexico. We also sidestepped several struggling airport companies in other emerging markets.

Impact of Foreign Currency on Fund Performance

The currency impact of the Fund's investments in foreign securities detracted significantly from absolute performance during the year. Although the Fund reports its NAV and pays dividends in U.S. dollars, the Fund's investments denominated in foreign currencies are subject to foreign currency risk. The U.S. dollar remained strong during the period, while most other currencies depreciated, particularly in resource-export economies such as Australia and Canada, as well as Europe. Consequently, changes in the exchange rates between foreign currencies and the U.S. dollar were a headwind for absolute returns.

3

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

Sincerely,

ROBERT H. STEERS

Chairman

| | | | |

| |

| |

| | | ROBERT S. BECKER | | BEN MORTON | |

| | | Portfolio Manager | | Portfolio Manager | |

The views and opinions in the preceding commentary are subject to change without notice and are as of the date of the report. There is no guarantee that any market forecast set forth in the commentary will be realized. This material represents an assessment of the market environment at a specific point in time, should not be relied upon as investment advice and is not intended to predict or depict performance of any investment.

Visit Cohen & Steers online at cohenandsteers.com

For more information about the Cohen & Steers family of mutual funds, visit cohenandsteers.com. Here you will find fund net asset values, fund fact sheets and portfolio highlights, as well as educational resources and timely market updates.

Our website also provides comprehensive information about Cohen & Steers, including our most recent press releases, profiles of our senior investment professionals and their investment approach to each asset class. The Cohen & Steers family of mutual funds invests in major real asset categories including real estate securities, listed infrastructure, commodities and natural resource equities, as well as preferred securities and other income solutions.

4

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

Performance Review (Unaudited)

Class A—Growth of a $10,000 Investment

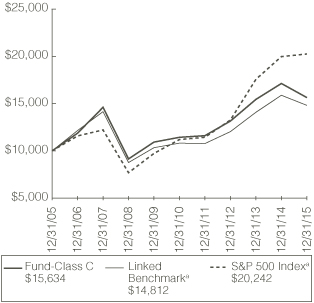

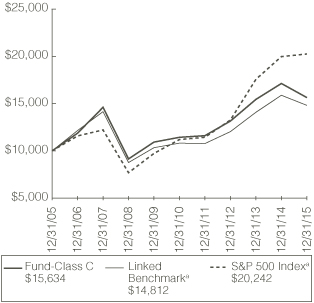

Class C—Growth of a $10,000 Investment

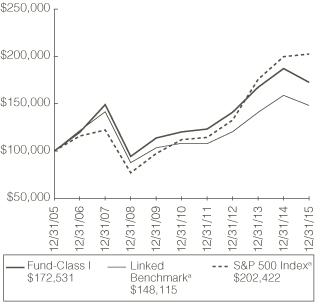

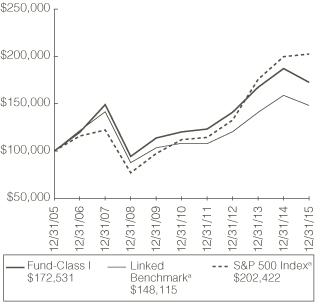

Class I—Growth of a $100,000 Investment

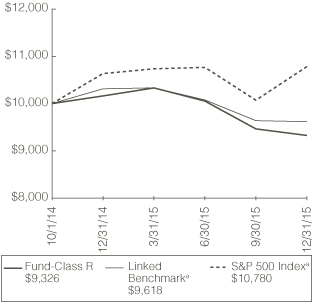

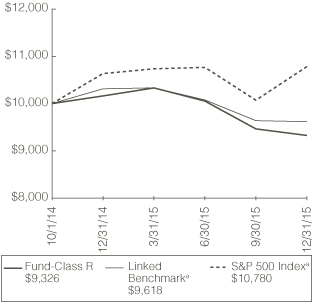

Class R—Growth of a $10,000 Investment

5

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

Performance Review (Unaudited)—(Continued)

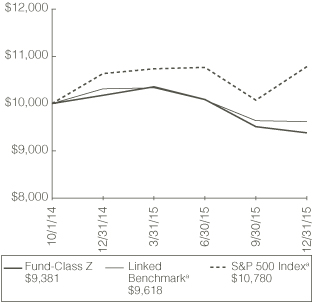

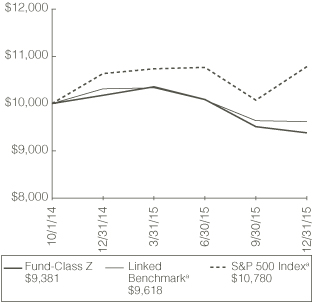

Class Z—Growth of a $10,000 Investment

Average Annual Total Returns—For Periods Ended December 31, 2015

| | | Class A

Shares | | Class C

Shares | | Class I

Shares | | Class R

Shares | | Class Z

Shares | |

1 Year (with sales charge) | | | –12.23 | %b | | | –9.61 | %c | | | — | | | | — | | | | — | | |

1 Year (without sales charge) | | | –8.10 | % | | | –8.70 | % | | | –7.79 | % | | | -8.22 | % | | | –7.79 | % | |

5 Years (with sales charge) | | | 6.17 | %b | | | 6.46 | % | | | — | | | | — | | | | — | | |

5 Years (without sales charge) | | | 7.16 | % | | | 6.46 | % | | | 7.50 | % | | | — | | | | — | | |

10 Years (with sales charge) | | | 4.76 | %b | | | 4.57 | % | | | — | | | | — | | | | — | | |

10 Years (without sales charge) | | | 5.25 | % | | | 4.57 | % | | | 5.61 | % | | | — | | | | — | | |

Since Inceptiond (with sales charge) | | | 6.97 | %b | | | 6.76 | % | | | — | | | | — | | | | — | | |

Since Inceptiond (without sales charge) | | | 7.39 | % | | | 6.76 | % | | | 7.76 | % | | | –5.44 | % | | | –4.99 | % | |

The performance data quoted represent past performance. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate and shares, if redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance information current to the most recent month end can be obtained by visiting our website at cohenandsteers.com. All share class returns assume the reinvestment of all dividends and distributions at NAV. The performance graphs and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During certain periods presented above, the investment advisor waived fees and/or reimbursed expenses. Without this arrangement, performance would have been lower.

6

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

The annualized net expense ratios for each class of shares as disclosed in the July 1, 2015 prospectus, as supplemented October 30, 2015 and November 6, 2015, were as follows: Class A—1.36%; Class C—2.01%; Class I—1.11%; Class R—1.51%; and Class Z—1.01%. For the seven months ended July 31, 2015, the investment advisor contractually agreed to waive its fee and/or reimburse expenses so that the Fund's total annual operating expenses (excluding acquired fund fees and expenses and extraordinary expenses) did not exceed 1.50% for Class A shares, 2.15% for Class C shares, 1.15% for Class I shares, 1.65% for Class R shares and 1.15% for Class Z shares. On June 16, 2015, the Board of Directors of the Fund approved the termination of the Fund's fee waiver/expense reimbursement agreement with the investment advisor, effective August 1, 2015. For the year ended December 31, 2015, there were no fees waived and/or expenses reimbursed to the Fund.

a The comparative indices are not adjusted to reflect expenses or other fees that the SEC requires to be reflected in the Fund's performance. Index performance does not reflect the deduction of any fees, taxes or expenses. An investor cannot invest directly in an index. The Fund's performance assumes the reinvestment of all dividends and distributions at NAV. For more information, including charges and expenses, please read the prospectus carefully before you invest.

b Reflects a 4.50% front-end sales charge.

c Reflects a contingent deferred sales charge of 1.00%.

d Inception dates: May 3, 2004 for Class A, C and I shares and October 1, 2014 for Class R and Z shares.

7

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

Expense Example (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments; and (2) ongoing costs including investment advisory fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period July 1, 2015—December 31, 2015.

Actual Expenses

The first line of the following table provides information about actual account values and expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing cost of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges (loads). Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

8

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

Expense Example (Unaudited)—(Continued)

| | Beginning

Account Value

July 1, 2015 | | Ending

Account Value

December 31, 2015 | | Expenses Paid

During Perioda

July 1, 2015–

December 31, 2015 | |

Class A | |

Actual (–7.13% return) | | $ | 1,000.00 | | | $ | 928.70 | | | $ | 6.56 | | |

Hypothetical (5% annual return before

expenses) | | $ | 1,000.00 | | | $ | 1,018.40 | | | $ | 6.87 | | |

Class C | |

Actual (–7.48% return) | | $ | 1,000.00 | | | $ | 925.20 | | | $ | 9.71 | | |

Hypothetical (5% annual return before

expenses) | | $ | 1,000.00 | | | $ | 1,015.12 | | | $ | 10.16 | | |

Class I | |

Actual (–7.00% return) | | $ | 1,000.00 | | | $ | 930.00 | | | $ | 5.11 | | |

Hypothetical (5% annual return before

expenses) | | $ | 1,000.00 | | | $ | 1,019.91 | | | $ | 5.35 | | |

Class R | |

Actual (–7.23% return) | | $ | 1,000.00 | | | $ | 927.70 | | | $ | 7.29 | | |

Hypothetical (5% annual return before

expenses) | | $ | 1,000.00 | | | $ | 1,017.64 | | | $ | 7.63 | | |

Class Z | |

Actual (–6.98% return) | | $ | 1,000.00 | | | $ | 930.20 | | | $ | 4.87 | | |

Hypothetical (5% annual return before

expenses) | | $ | 1,000.00 | | | $ | 1,020.21 | | | $ | 5.09 | | |

a Expenses are equal to the Fund's Class A, Class C, Class I, Class R and Class Z annualized net expense ratios of 1.35%, 2.00%, 1.05%, 1.50%, and 1.00% respectively, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

9

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

December 31, 2015

Top Ten Holdings

(Unaudited)

| Security | | Value | | % of

Net

Assets | |

Transurban Group | | $ | 9,295,256 | | | | 4.3 | | |

Crown Castle International Corp. | | | 8,851,442 | | | | 4.1 | | |

Sempra Energy | | | 7,836,016 | | | | 3.6 | | |

Dominion Resources | | | 7,258,854 | | | | 3.4 | | |

PG&E Corp. | | | 7,151,927 | | | | 3.3 | | |

National Grid PLC | | | 7,137,443 | | | | 3.3 | | |

TransCanada Corp. | | | 6,803,125 | | | | 3.1 | | |

Union Pacific Corp. | | | 6,645,514 | | | | 3.1 | | |

NextEra Energy | | | 6,170,443 | | | | 2.8 | | |

CMS Energy Corp. | | | 5,848,676 | | | | 2.7 | | |

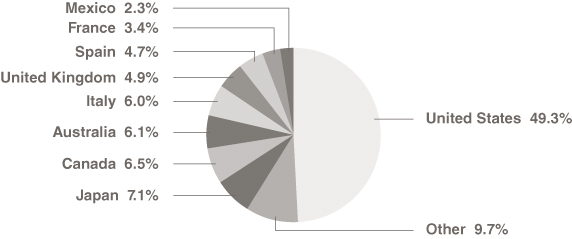

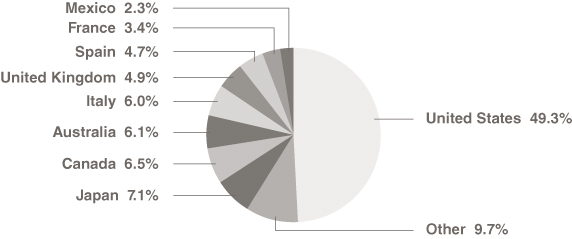

Country Breakdown

(Based on Net Assets)

(Unaudited)

10

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS

December 31, 2015

| | | | | Number

of Shares/Units | | Value | |

COMMON STOCK | | 98.5% | | | | | | | | | |

AUSTRALIA | | 6.1% | | | | | | | | | |

ELECTRIC—REGULATED ELECTRIC | | 0.5% | | | | | | | | | |

Spark Infrastructure Groupa | | | | | 828,685 | | | $ | 1,152,641 | | |

PIPELINES—C-CORP | | 1.0% | | | | | | | | | |

APA Groupa | | | | | 350,105 | | | | 2,202,988 | | |

TOLL ROADS | | 4.6% | | | | | | | | | |

Transurban Groupa,b | | | | | 72,735 | | | | 551,328 | | |

Transurban Groupa | | | | | 1,226,294 | | | | 9,295,256 | | |

| | | | | | | | 9,846,584 | | |

TOTAL AUSTRALIA | | | | | | | 13,202,213 | | |

BRAZIL | | 0.3% | | | | | | | | | |

TOLL ROADS | |

CCR SAa | | | | | 190,801 | | | | 602,858 | | |

CANADA | | 6.5% | | | | | | | | | |

MARINE PORTS | | 0.2% | | | | | | | | | |

Westshore Terminals Investment Corp. | | | | | 51,687 | | | | 435,177 | | |

PIPELINES—C-CORP | | 4.3% | | | | | | | | | |

Enbridge | | | | | 78,049 | | | | 2,594,676 | | |

TransCanada Corp. | | | | | 208,309 | | | | 6,803,125 | | |

| | | | | | | | 9,397,801 | | |

RAILWAYS | | 2.0% | | | | | | | | | |

Canadian National Railway Co. | | | | | 45,873 | | | | 2,564,340 | | |

Canadian Pacific Railway Ltd | | | | | 13,562 | | | | 1,732,176 | | |

| | | | | | | | 4,296,516 | | |

TOTAL CANADA | | | | | | | 14,129,494 | | |

CHILE | | 0.5% | | | | | | | | | |

WATER | |

Aguas Andinas SA, Class A | | | | | 1,994,696 | | | | 1,016,266 | | |

CHINA | | 1.8% | | | | | | | | | |

GAS DISTRIBUTION | | 0.4% | | | | | | | | | |

Enn Energy Holdings Ltd. (HKD)a | | | | | 178,000 | | | | 939,654 | | |

See accompanying notes to financial statements.

11

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

December 31, 2015

| | | | | Number

of Shares/Units | | Value | |

TOLL ROADS | | 1.4% | | | | | | | | | |

Jiangsu Expressway Co., Ltd., Class H (HKD)a | | | | | 1,418,000 | | | $ | 1,903,112 | | |

Zhejiang Expressway Co., Ltd., Class H (HKD)a | | | | | 878,000 | | | | 1,049,072 | | |

| | | | | | | | 2,952,184 | | |

TOTAL CHINA | | | | | | | 3,891,838 | | |

FRANCE | | 3.4% | | | | | | | | | |

AIRPORTS | | 0.5% | | | | | | | | | |

Aeroports de Parisa | | | | | 9,667 | | | | 1,124,934 | | |

COMMUNICATIONS—SATELLITES | | 1.9% | | | | | | | | | |

Eutelsat Communications SAa | | | | | 141,083 | | | | 4,224,085 | | |

RAILWAYS | | 1.0% | | | | | | | | | |

Groupe Eurotunnel SAa | | | | | 166,078 | | | | 2,066,189 | | |

TOTAL FRANCE | | | | | | | 7,415,208 | | |

HONG KONG | | 1.4% | | | | | | | | | |

ELECTRIC—REGULATED ELECTRIC | | 0.8% | | | | | | | | | |

Power Assets Holdings Ltd.a | | | | | 180,000 | | | | 1,654,787 | | |

GAS DISTRIBUTION | | 0.4% | | | | | | | | | |

China Gas Holdings Ltd. (Bermuda)a | | | | | 587,028 | | | | 844,997 | | |

MARINE PORTS | | 0.2% | | | | | | | | | |

Cosco Pacific Ltd. (Bermuda)a | | | | | 388,000 | | | | 426,502 | | |

TOTAL HONG KONG | | | | | | | 2,926,286 | | |

ITALY | | 6.0% | | | | | | | | | |

COMMUNICATIONS—TOWERS | | 2.2% | | | | | | | | | |

Ei Towers S.p.A.a | | | | | 51,475 | | | | 3,316,493 | | |

RAI Way S.p.A., 144Ac | | | | | 268,710 | | | | 1,377,753 | | |

| | | | | | | | 4,694,246 | | |

GAS DISTRIBUTION | | 2.2% | | | | | | | | | |

Snam S.p.A.a | | | | | 923,694 | | | | 4,820,698 | | |

TOLL ROADS | | 1.6% | | | | | | | | | |

Atlantia S.p.A.a | | | | | 127,674 | | | | 3,378,050 | | |

TOTAL ITALY | | | | | | | 12,892,994 | | |

See accompanying notes to financial statements.

12

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

December 31, 2015

| | | | | Number

of Shares/Units | | Value | |

JAPAN | | 7.1% | | | | | | | | | |

ELECTRIC—INTEGRATED ELECTRIC | | 4.3% | | | | | | | | | |

Chugoku Electric Power Co. (The)a | | | | | 178,200 | | | $ | 2,352,838 | | |

Electric Power Development Co., Ltd.a | | | | | 89,200 | | | | 3,177,004 | | |

Tohoku Electric Power Co.a | | | | | 301,600 | | | | 3,770,394 | | |

| | | | | | | | 9,300,236 | | |

GAS DISTRIBUTION | | 1.4% | | | | | | | | | |

Tokyo Gas Co., Ltd.a | | | | | 652,000 | | | | 3,063,612 | | |

RAILWAYS | | 1.4% | | | | | | | | | |

Central Japan Railway Co.a | | | | | 17,300 | | | | 3,071,336 | | |

TOTAL JAPAN | | | | | | | 15,435,184 | | |

MEXICO | | 2.3% | | | | | | | | | |

AIRPORTS | | 1.6% | | | | | | | | | |

Grupo Aeroportuario del Pacifico SAB de CV, ADR | | | | | 40,756 | | | | 3,597,940 | | |

TOLL ROADS | | 0.7% | | | | | | | | | |

OHL Mexico SAB de CVb | | | | | 1,402,918 | | | | 1,476,627 | | |

TOTAL MEXICO | | | | | | | 5,074,567 | | |

NEW ZEALAND | | 2.0% | | | | | | | | | |

AIRPORTS | |

Auckland International Airport Ltd.a | | | | | 1,082,852 | | | | 4,248,142 | | |

SPAIN | | 4.7% | | | | | | | | | |

COMMUNICATIONS—TOWERS | | 0.8% | | | | | | | | | |

Cellnex Telecom SAU, 144Aa,c | | | | | 89,250 | | | | 1,668,703 | | |

GAS DISTRIBUTION | | 0.6% | | | | | | | | | |

Enagas SAa | | | | | 47,080 | | | | 1,328,029 | | |

TOLL ROADS | | 3.3% | | | | | | | | | |

Abertis Infraestructuras SAa | | | | | 216,434 | | | | 3,384,893 | | |

Ferrovial SAa | | | | | 166,610 | | | | 3,767,588 | | |

| | | | | | | | 7,152,481 | | |

TOTAL SPAIN | | | | | | | 10,149,213 | | |

SWITZERLAND | | 2.2% | | | | | | | | | |

AIRPORTS | |

Flughafen Zuerich AGa | | | | | 6,384 | | | | 4,789,990 | | |

See accompanying notes to financial statements.

13

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

December 31, 2015

| | | | | Number

of Shares/Units | | Value | |

UNITED KINGDOM | | 4.9% | | | | | | | | | |

ELECTRIC—REGULATED ELECTRIC | | 3.3% | | | | | | | | | |

National Grid PLCa | | | | | 517,522 | | | $ | 7,137,443 | | |

WATER | | 1.6% | |

United Utilities Group PLCa | | | | | 256,827 | | | | 3,536,330 | | |

TOTAL UNITED KINGDOM | | | | | | | 10,673,773 | | |

UNITED STATES | | 49.3% | | | | | | | | | |

COMMUNICATIONS—TOWERS | | 6.5% | | | | | | | | | |

American Tower Corp. | | | | | 54,563 | | | | 5,289,883 | | |

Crown Castle International Corp. | | | | | 102,388 | | | | 8,851,442 | | |

| | | | | | | | 14,141,325 | | |

DIVERSIFIED | | 0.8% | | | | | | | | | |

Macquarie Infrastructure Co LLC | | | | | 24,138 | | | | 1,752,419 | | |

ELECTRIC | | 27.1% | | | | | | | | | |

INTEGRATED ELECTRIC | | 7.8% | | | | | | | | | |

Dominion Resources | | | | | 107,316 | | | | 7,258,854 | | |

NextEra Energy | | | | | 59,394 | | | | 6,170,443 | | |

NextEra Energy Partners LP | | | | | 43,001 | | | | 1,283,580 | | |

Pattern Energy Group | | | | | 105,754 | | | | 2,211,316 | | |

| | | | | | | | 16,924,193 | | |

REGULATED ELECTRIC | | 19.3% | | | | | | | | | |

Alliant Energy Corp. | | | | | 89,642 | | | | 5,598,143 | | |

CMS Energy Corp. | | | | | 162,103 | | | | 5,848,676 | | |

DTE Energy Co. | | | | | 59,251 | | | | 4,751,338 | | |

Duke Energy Corp. | | | | | 44,533 | | | | 3,179,211 | | |

Edison International | | | | | 85,973 | | | | 5,090,461 | | |

Eversource Energy | | | | | 52,957 | | | | 2,704,514 | | |

PG&E Corp. | | | | | 134,460 | | | | 7,151,927 | | |

WEC Energy Group | | | | | 43,063 | | | | 2,209,563 | | |

Xcel Energy | | | | | 145,801 | | | | 5,235,714 | | |

| | | | | | | | 41,769,547 | | |

TOTAL ELECTRIC | | | | | | | 58,693,740 | | |

See accompanying notes to financial statements.

14

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

December 31, 2015

| | | | | Number

of Shares/Units | | Value | |

GAS DISTRIBUTION | | 6.6% | | | | | | | | | |

Atmos Energy Corp. | | | | | 78,674 | | | $ | 4,959,609 | | |

NiSource | | | | | 72,742 | | | | 1,419,196 | | |

Sempra Energy | | | | | 83,353 | | | | 7,836,016 | | |

| | | | | | | | 14,214,821 | | |

PIPELINES | | 3.6% | | | | | | | | | |

PIPELINES—C-CORP | | 3.3% | | | | | | | | | |

Kinder Morgan | | | | | 216,965 | | | | 3,237,118 | | |

SemGroup Corp., Class A | | | | | 31,198 | | | | 900,374 | | |

Tallgrass Energy GP LP | | | | | 44,086 | | | | 704,054 | | |

Williams Cos. (The) | | | | | 90,109 | | | | 2,315,801 | | |

| | | | | | | | 7,157,347 | | |

PIPELINES—MLP | | 0.3% | | | | | | | | | |

Rice Midstream Partners LP | | | | | 47,500 | | | | 640,775 | | |

TOTAL PIPELINES | | | | | | | 7,798,122 | | |

RAILWAYS | | 3.1% | | | | | | | | | |

Union Pacific Corp. | | | | | 84,981 | | | | 6,645,514 | | |

SHIPPING | | 0.4% | | | | | | | | | |

Teekay Corp. (Marshall Islands) | | | | | 91,878 | | | | 906,836 | | |

WATER | | 1.2% | | | | | | | | | |

American Water Works Co. | | | | | 43,218 | | | | 2,582,275 | | |

TOTAL UNITED STATES | | | | | | | 106,735,052 | | |

TOTAL COMMON STOCK

(Identified cost—$205,255,872) | | | | | | | 213,183,078 | | |

See accompanying notes to financial statements.

15

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

December 31, 2015

| | | | | Number

of Shares/Units | | Value | |

SHORT-TERM INVESTMENTS | | | 0.5% | | | | | | | | | | |

MONEY MARKET FUNDS | |

State Street Institutional Treasury Money

Market Fund, 0.07%d | | | | | 1,100,000 | | | $ | 1,100,000 | | |

TOTAL SHORT-TERM INVESTMENTS

(Identified cost—$1,100,000) | | | | | | | | | 1,100,000 | | |

TOTAL INVESTMENTS (Identified cost—$206,355,872) | | | 99.0 | % | | | | | | | 214,283,078 | | |

OTHER ASSETS IN EXCESS OF LIABILITIES | | | 1.0 | | | | | | | | 2,229,930 | | |

NET ASSETS | | | 100.0 | % | | | | | | $ | 216,513,008 | | |

Glossary of Portfolio Abbreviations

ADR American Depositary Receipt

HKD Hong Kong Dollar

MLP Master Limited Partnership

Note: Percentages indicated are based on the net assets of the Fund.

a Fair valued security. This security has been valued at its fair value as determined in good faith under procedures established by and under the general supervision of the Fund's Board of Directors. Aggregate fair valued securities represent 39.2% of the net assets of the Fund, all of which have been fair valued pursuant to foreign equity fair value pricing procedures approved by the Board of Directors.

b Non-income producing security.

c Resale is restricted to qualified institutional investors. Aggregate holdings equal 1.4% of the net assets of the Fund, of which 0.0% are illiquid.

d Rate quoted represents the annualized seven-day yield of the Fund.

See accompanying notes to financial statements.

16

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

December 31, 2015

Sector Summary | | % of

Net Assets | |

Electric | | | 36.0 | | |

Toll Roads | | | 11.9 | | |

Gas Distribution | | | 11.6 | | |

Communications | | | 11.4 | | |

Pipelines | | | 8.9 | | |

Railways | | | 7.5 | | |

Airports | | | 6.3 | | |

Water | | | 3.3 | | |

Other | | | 1.5 | | |

Diversified | | | 0.8 | | |

Shipping | | | 0.4 | | |

Marine Ports | | | 0.4 | | |

| | | | 100.0 | | |

See accompanying notes to financial statements.

17

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2015

ASSETS: | |

Investments in securities, at value (Identified cost—$206,355,872) | | $ | 214,283,078 | | |

Cash | | | 1,198,586 | | |

Foreign currency, at value (Identified cost—$11,541) | | | 11,516 | | |

Receivable for: | |

Fund shares sold | | | 1,352,135 | | |

Dividends | | | 754,763 | | |

Other assets | | | 5,858 | | |

Total Assets | | | 217,605,936 | | |

LIABILITIES: | |

Payable for: | |

Fund shares redeemed | | | 736,574 | | |

Investment advisory fees | | | 140,706 | | |

Shareholder servicing fees | | | 41,847 | | |

Administration fees | | | 3,752 | | |

Distribution fees | | | 1,456 | | |

Directors' fees | | | 23 | | |

Other liabilities | | | 168,570 | | |

Total Liabilities | | | 1,092,928 | | |

NET ASSETS | | $ | 216,513,008 | | |

NET ASSETS consist of: | |

Paid-in capital | | $ | 214,917,484 | | |

| Accumulated undistributed net investment income | | | 313,827 | | |

Accumulated net realized loss | | | (6,636,545 | ) | |

| Net unrealized appreciation | | | 7,918,242 | | |

| | | $ | 216,513,008 | | |

See accompanying notes to financial statements.

18

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

STATEMENT OF ASSETS AND LIABILITIES—(Continued)

December 31, 2015

CLASS A SHARES: | |

NET ASSETS | | $ | 38,134,011 | | |

Shares issued and outstanding ($0.001 par value common stock outstanding) | | | 2,369,892 | | |

Net asset value and redemption price per share | | $ | 16.09 | | |

Maximum offering price per share ($16.09 ÷ 0.955)a | | $ | 16.85 | | |

CLASS C SHARES: | |

NET ASSETS | | $ | 22,418,791 | | |

Shares issued and outstanding ($0.001 par value common stock outstanding) | | | 1,396,682 | | |

Net asset value and offering price per shareb | | $ | 16.05 | | |

CLASS I SHARES: | |

NET ASSETS | | $ | 155,928,621 | | |

Shares issued and outstanding ($0.001 par value common stock outstanding) | | | 9,663,957 | | |

Net asset value, offering and redemption price per share | | $ | 16.14 | | |

CLASS R SHARES: | |

NET ASSETS | | $ | 8,750 | | |

Shares issued and outstanding ($0.001 par value common stock outstanding) | | | 542 | | |

Net asset value, offering and redemption price per share | | $ | 16.14 | | |

CLASS Z SHARES: | |

NET ASSETS | | $ | 22,835 | | |

Shares issued and outstanding ($0.001 par value common stock outstanding) | | | 1,416 | | |

Net asset value, offering and redemption price per share | | $ | 16.13 | | |

a On investments of $100,000 or more, the offering price is reduced.

b Redemption price per share is equal to the net asset value per share less any applicable contingent deferred sales charge of 1.00% on shares held for less than one year.

See accompanying notes to financial statements.

19

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

STATEMENT OF OPERATIONS

For the Year Ended December 31, 2015

Investment Income: | |

Dividend income (net of $362,942 of foreign withholding tax) | | $ | 7,290,548 | | |

Expenses: | |

Investment advisory fees | | | 1,925,140 | | |

Distribution fees—Class A | | | 127,075 | | |

Distribution fees—Class Ba | | | 145 | | |

Distribution fees—Class C | | | 195,898 | | |

Distribution fees—Class R | | | 50 | | |

Shareholder servicing fees—Class A | | | 50,183 | | |

Shareholder servicing fees—Class Ba | | | 48 | | |

Shareholder servicing fees—Class C | | | 65,299 | | |

Shareholder servicing fees—Class I | | | 109,053 | | |

Administration fees | | | 130,472 | | |

Professional fees | | | 127,022 | | |

Registration and filing fees | | | 88,300 | | |

Transfer agent fees and expenses | | | 85,736 | | |

Shareholder reporting expenses | | | 57,983 | | |

Custodian fees and expenses | | | 52,860 | | |

Proxy expenses | | | 23,280 | | |

Directors' fees and expenses | | | 14,916 | | |

Line of credit fees | | | 1,524 | | |

Miscellaneous | | | 19,146 | | |

Total Expenses | | | 3,074,130 | | |

| Net Investment Income | | | 4,216,418 | | |

Net Realized and Unrealized Gain (Loss): | |

Net realized gain (loss) on: | |

| Investments | | | 7,057,780 | | |

Foreign currency transactions | | | (115,265 | ) | |

| Net realized gain | | | 6,942,515 | | |

Net change in unrealized appreciation (depreciation) on: | |

Investments | | | (32,527,057 | ) | |

Foreign currency translations | | | (2,459 | ) | |

Net change in unrealized appreciation (depreciation) | | | (32,529,516 | ) | |

Net realized and unrealized loss | | | (25,587,001 | ) | |

Net Decrease in Net Assets Resulting from Operations | | $ | (21,370,583 | ) | |

a On June 19, 2015, all Class B shares converted to Class A shares.

See accompanying notes to financial statements.

20

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

STATEMENT OF CHANGES IN NET ASSETS

| | | For the

Year Ended

December 31, 2015 | | For the

Year Ended

December 31, 2014 | |

Change in Net Assets: | |

From Operations: | |

Net investment income | | $ | 4,216,418 | | | $ | 2,908,836 | | |

| Net realized gain | | | 6,942,515 | | | | 3,866,472 | | |

Net change in unrealized appreciation

(depreciation) | | | (32,529,516 | ) | | | 10,757,487 | | |

Net increase (decrease) in net assets

resulting from operations | | | (21,370,583 | ) | | | 17,532,795 | | |

Dividends and Distributions to Shareholders from: | | | | | | | | | |

Net investment income: | |

Class A | | | (777,822 | ) | | | (486,378 | ) | |

Class Ba | | | — | | | | (206 | ) | |

Class C | | | (233,351 | ) | | | (121,856 | ) | |

Class I | | | (3,304,337 | ) | | | (2,120,079 | ) | |

Class R | | | (140 | ) | | | (51 | ) | |

Class Z | | | (461 | ) | | | (64 | ) | |

Net realized gain: | |

Class A | | | (1,791,029 | ) | | | (74,522 | ) | |

Class Ba | | | — | | | | (173 | ) | |

Class C | | | (969,484 | ) | | | (40,380 | ) | |

Class I | | | (6,713,597 | ) | | | (258,191 | ) | |

Class R | | | (386 | ) | | | — | | |

Class Z | | | (972 | ) | | | — | | |

Total dividends and distributions to

shareholders | | | (13,791,579 | ) | | | (3,101,900 | ) | |

Capital Stock Transactions: | |

Increase in net assets from Fund share

transactions | | | 926,760 | | | | 91,509,661 | | |

Total increase (decrease) in net assets | | | (34,235,402 | ) | | | 105,940,556 | | |

Net Assets: | |

Beginning of year | | | 250,748,410 | | | | 144,807,854 | | |

End of yearb | | $ | 216,513,008 | | | $ | 250,748,410 | | |

a On June 19, 2015, all Class B shares converted to Class A shares.

b Includes accumulated undistributed net investment income of $313,827 and $264,261, respectively.

See accompanying notes to financial statements.

21

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

FINANCIAL HIGHLIGHTS

The following tables include selected data for a share outstanding throughout each period and other performance information derived from the financial statements. They should be read in conjunction with the financial statements and notes thereto.

| | | Class A | |

| | | For the Year Ended December 31, | |

Per Share Operating Performance: | | 2015 | | 2014 | | 2013 | | 2012 | | 2011 | |

Net asset value, beginning of year | | $ | 18.59 | | | $ | 16.88 | | | $ | 14.49 | | | $ | 12.95 | | | $ | 12.93 | | |

Income (loss) from investment operations: | |

| Net investment incomea | | | 0.28 | | | | 0.25 | | | | 0.20 | | | | 0.25 | | | | 0.26 | | |

Net realized and unrealized gain (loss) | | | (1.78 | ) | | | 1.71 | | | | 2.42 | | | | 1.55 | | | | 0.03 | | |

Total from investment operations | | | (1.50 | ) | | | 1.96 | | | | 2.62 | | | | 1.80 | | | | 0.29 | | |

Less dividends and distributions to shareholders

from: | |

Net investment income | | | (0.29 | ) | | | (0.21 | ) | | | (0.23 | ) | | | (0.26 | ) | | | (0.27 | ) | |

Net realized gain | | | (0.71 | ) | | | (0.04 | ) | | | — | | | | — | | | | — | | |

Return of capital | | | — | | | | — | | | | — | | | | — | | | | (0.00 | )b | |

Total dividends and distributions to

shareholders | | | (1.00 | ) | | | (0.25 | ) | | | (0.23 | ) | | | (0.26 | ) | | | (0.27 | ) | |

Redemption fees retained by the Fund | | | — | | | | — | | | | — | | | | — | | | | 0.00 | b | |

Net increase (decrease) in net asset value | | | (2.50 | ) | | | 1.71 | | | | 2.39 | | | | 1.54 | | | | 0.02 | | |

Net asset value, end of year | | $ | 16.09 | | | $ | 18.59 | | | $ | 16.88 | | | $ | 14.49 | | | $ | 12.95 | | |

Total investment returnc,d | | | –8.10 | % | | | 11.57 | % | | | 18.20 | % | | | 14.04 | % | | | 2.22 | % | |

Ratios/Supplemental Data: | |

Net assets, end of year (in millions) | | $ | 38.1 | | | $ | 48.6 | | | $ | 33.3 | | | $ | 38.3 | | | $ | 35.2 | | |

Ratio of expenses to average daily net assets

(before expense reduction) | | | 1.33 | %e | | | 1.36 | % | | | 1.50 | % | | | 1.66 | %f | | | 1.61 | %f | |

Ratio of expenses to average daily net assets

(net of expense reduction) | | | 1.33 | %e | | | 1.36 | % | | | 1.50 | % | | | 1.50 | %f | | | 1.50 | %f | |

Ratio of net investment income to average daily

net assets (before expense reduction) | | | 1.50 | %e | | | 1.36 | % | | | 1.24 | % | | | 1.66 | %f | | | 1.86 | %f | |

Ratio of net investment income to average daily

net assets (net of expense reduction) | | | 1.50 | %e | | | 1.36 | % | | | 1.24 | % | | | 1.82 | %f | | | 1.97 | %f | |

Portfolio turnover rate | | | 86 | % | | | 36 | % | | | 68 | % | | | 69 | % | | | 73 | % | |

a Calculation based on average shares outstanding.

b Amount is less than $0.005.

c Return assumes the reinvestment of all dividends and distributions at NAV.

d Does not reflect sales charges, which would reduce return.

e Includes extraordinary expenses related to shareholder proxy expenses. Without these expenses, the ratio of expenses to average daily net assets (before expense reduction and net of expense reduction) would have been 1.32% and the ratio of net investment income to average daily net assets (before expense reduction and net of expense reduction) would have been 1.51%.

f Non-class specific expenses are calculated at the Fund level and class specific expenses are calculated at the class level.

See accompanying notes to financial statements.

22

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

FINANCIAL HIGHLIGHTS—(Continued)

| | | Class C | |

| | | For the Year Ended December 31, | |

Per Share Operating Performance: | | 2015 | | 2014 | | 2013 | | 2012 | | 2011 | |

Net asset value, beginning of year | | $ | 18.54 | | | $ | 16.84 | | | $ | 14.46 | | | $ | 12.92 | | | $ | 12.90 | | |

Income (loss) from investment operations: | |

| Net investment incomea | | | 0.15 | | | | 0.13 | | | | 0.10 | | | | 0.16 | | | | 0.17 | | |

Net realized and unrealized gain (loss) | | | (1.76 | ) | | | 1.71 | | | | 2.41 | | | | 1.55 | | | | 0.03 | | |

Total from investment operations | | | (1.61 | ) | | | 1.84 | | | | 2.51 | | | | 1.71 | | | | 0.20 | | |

Less dividends and distributions to shareholders

from: | |

Net investment income | | | (0.17 | ) | | | (0.10 | ) | | | (0.13 | ) | | | (0.17 | ) | | | (0.18 | ) | |

Net realized gain | | | (0.71 | ) | | | (0.04 | ) | | | — | | | | — | | | | — | | |

Return of capital | | | — | | | | — | | | | — | | | | — | | | | (0.00 | )b | |

Total dividends and distributions to

shareholders | | | (0.88 | ) | | | (0.14 | ) | | | (0.13 | ) | | | (0.17 | ) | | | (0.18 | ) | |

Redemption fees retained by the Fund | | | — | | | | — | | | | — | | | | — | | | | 0.00 | b | |

Net increase (decrease) in net asset value | | | (2.49 | ) | | | 1.70 | | | | 2.38 | | | | 1.54 | | | | 0.02 | | |

Net asset value, end of year | | $ | 16.05 | | | $ | 18.54 | | | $ | 16.84 | | | $ | 14.46 | | | $ | 12.92 | | |

Total investment returnc,d | | | –8.70 | % | | | 10.88 | % | | | 17.41 | % | | | 13.30 | % | | | 1.52 | % | |

Ratios/Supplemental Data: | |

Net assets, end of year (in millions) | | $ | 22.4 | | | $ | 26.1 | | | $ | 18.4 | | | $ | 16.0 | | | $ | 17.2 | | |

Ratio of expenses to average daily net assets

(before expense reduction) | | | 1.98 | %e | | | 2.01 | % | | | 2.15 | % | | | 2.31 | %f | | | 2.26 | %f | |

Ratio of expenses to average daily net assets

(net of expense reduction) | | | 1.98 | %e | | | 2.01 | % | | | 2.15 | % | | | 2.15 | %f | | | 2.15 | %f | |

Ratio of net investment income to average daily

net assets (before expense reduction) | | | 0.85 | %e | | | 0.72 | % | | | 0.61 | % | | | 0.99 | %f | | | 1.20 | %f | |

Ratio of net investment income to average daily

net assets (net of expense reduction) | | | 0.85 | %e | | | 0.72 | % | | | 0.61 | % | | | 1.15 | %f | | | 1.31 | %f | |

Portfolio turnover rate | | | 86 | % | | | 36 | % | | | 68 | % | | | 69 | % | | | 73 | % | |

a Calculation based on average shares outstanding.

b Amount is less than $0.005.

c Return assumes the reinvestment of all dividends and distributions at NAV.

d Does not reflect sales charges, which would reduce return.

e Includes extraordinary expenses related to shareholder proxy expenses. Without these expenses, the ratio of expenses to average daily net assets (before expense reduction and net of expense reduction) would have been 1.97% and the ratio of net investment income to average daily net assets (before expense reduction and net of expense reduction) would have been 0.86%.

f Non-class specific expenses are calculated at the Fund level and class specific expenses are calculated at the class level.

See accompanying notes to financial statements.

23

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

FINANCIAL HIGHLIGHTS—(Continued)

| | | Class I | |

| | | For the Year Ended December 31, | |

Per Share Operating Performance: | | 2015 | | 2014 | | 2013 | | 2012 | | 2011 | |

Net asset value, beginning of year | | $ | 18.64 | | | $ | 16.93 | | | $ | 14.52 | | | $ | 12.97 | | | $ | 12.96 | | |

Income (loss) from investment operations: | |

| Net investment incomea | | | 0.33 | | | | 0.30 | | | | 0.26 | | | | 0.30 | | | | 0.32 | | |

Net realized and unrealized gain (loss) | | | (1.78 | ) | | | 1.71 | | | | 2.43 | | | | 1.56 | | | | 0.01 | | |

Total from investment operations | | | (1.45 | ) | | | 2.01 | | | | 2.69 | | | | 1.86 | | | | 0.33 | | |

Less dividends and distributions to shareholders

from: | |

Net investment income | | | (0.34 | ) | | | (0.26 | ) | | | (0.28 | ) | | | (0.31 | ) | | | (0.32 | ) | |

Net realized gain | | | (0.71 | ) | | | (0.04 | ) | | | — | | | | — | | | | — | | |

Return of capital | | | — | | | | — | | | | — | | | | — | | | | (0.00 | )b | |

Total dividends and distributions to

shareholders | | | (1.05 | ) | | | (0.30 | ) | | | (0.28 | ) | | | (0.31 | ) | | | (0.32 | ) | |

Redemption fees retained by the Fund | | | — | | | | — | | | | — | | | | — | | | | 0.00 | b | |

Net increase (decrease) in net asset value | | | (2.50 | ) | | | 1.71 | | | | 2.41 | | | | 1.55 | | | | 0.01 | | |

Net asset value, end of year | | $ | 16.14 | | | $ | 18.64 | | | $ | 16.93 | | | $ | 14.52 | | | $ | 12.97 | | |

Total investment returnc | | | –7.79 | % | | | 11.82 | % | | | 18.69 | % | | | 14.44 | % | | | 2.51 | % | |

Ratios/Supplemental Data: | |

Net assets, end of year (in millions) | | $ | 155.9 | | | $ | 175.9 | | | $ | 93.0 | | | $ | 53.5 | | | $ | 36.9 | | |

Ratio of expenses to average daily net assets

(before expense reduction) | | | 1.04 | %d | | | 1.10 | % | | | 1.16 | % | | | 1.31 | %e | | | 1.26 | %e | |

Ratio of expenses to average daily net assets

(net of expense reduction) | | | 1.04 | %d | | | 1.10 | % | | | 1.15 | % | | | 1.15 | %e | | | 1.15 | %e | |

Ratio of net investment income to average daily

net assets (before expense reduction) | | | 1.80 | %d | | | 1.63 | % | | | 1.62 | % | | | 2.04 | %e | | | 2.33 | %e | |

Ratio of net investment income to average daily

net assets (net of expense reduction) | | | 1.80 | %d | | | 1.63 | % | | | 1.63 | % | | | 2.20 | %e | | | 2.44 | %e | |

Portfolio turnover rate | | | 86 | % | | | 36 | % | | | 68 | % | | | 69 | % | | | 73 | % | |

a Calculation based on average shares outstanding.

b Amount is less than $0.005.

c Return assumes the reinvestment of all dividends and distributions at NAV.

d Includes extraordinary expenses related to shareholder proxy expenses. Without these expenses, the ratio of expenses to average daily net assets (before expense reduction and net of expense reduction) would have been 1.03% and the ratio of net investment income to average daily net assets (before expense reduction and net of expense reduction) would have been 1.81%.

e Non-class specific expenses are calculated at the Fund level and class specific expenses are calculated at the class level.

See accompanying notes to financial statements.

24

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

FINANCIAL HIGHLIGHTS—(Continued)

| | | Class R | |

Per Share Operating Performance: | | For the

Year Ended

December 31, 2015 | | For the Period

October 1, 2014a

through

December 31, 2014 | |

Net asset value, beginning of period | | $ | 18.64 | | | $ | 18.44 | | |

Income (loss) from investment operations: | |

| Net investment incomeb | | | 0.25 | | | | 0.04 | | |

Net realized and unrealized gain (loss) | | | (1.78 | ) | | | 0.26 | | |

Total from investment operations | | | (1.53 | ) | | | 0.30 | | |

Less dividends and distributions to shareholders from: | |

Net investment income | | | (0.26 | ) | | | (0.10 | ) | |

Net realized gain | | | (0.71 | ) | | | — | | |

Total dividends and distributions to shareholders | | | (0.97 | ) | | | (0.10 | ) | |

Net increase (decrease) in net asset value | | | (2.50 | ) | | | 0.20 | | |

Net asset value, end of period | | $ | 16.14 | | | $ | 18.64 | | |

Total investment returnc | | | –8.22 | % | | | 1.61 | %d | |

Ratios/Supplemental Data: | |

Net assets, end of period (in 000s) | | $ | 8.8 | | | $ | 10.1 | | |

Ratio of expenses to average daily net assets

(before expense reduction) | | | 1.48 | %e | | | 1.52 | %f | |

Ratio of expenses to average daily net assets

(net of expense reduction) | | | 1.48 | %e | | | 1.52 | %f | |

Ratio of net investment income to average daily net assets

(before expense reduction) | | | 1.34 | %e | | | 0.98 | %f | |

Ratio of net investment income to average daily net assets

(net of expense reduction) | | | 1.34 | %e | | | 0.98 | %f | |

Portfolio turnover rate | | | 86 | % | | | 36 | %d | |

a Commencement of operations.

b Calculation based on average shares outstanding.

c Return assumes the reinvestment of all dividends and distributions at NAV.

d Not annualized.

e Includes extraordinary expenses related to shareholder proxy expenses. Without these expenses, the ratio of expenses to average daily net assets (before expense reduction and net of expense reduction) would have been 1.47% and the ratio of net investment income to average daily net assets (before expense reduction and net of expense reduction) would have been 1.35%.

f Annualized.

See accompanying notes to financial statements.

25

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

FINANCIAL HIGHLIGHTS—(Continued)

| | | Class Z | |

Per Share Operating Performance: | | For the

Year Ended

December 31, 2015 | | For the Period

October 1, 2014a

through

December 31, 2014 | |

Net asset value, beginning of period | | $ | 18.64 | | | $ | 18.44 | | |

Income (loss) from investment operations: | |

| Net investment incomeb | | | 0.38 | | | | 0.07 | | |

Net realized and unrealized gain (loss) | | | (1.83 | ) | | | 0.25 | | |

Total from investment operations | | | (1.45 | ) | | | 0.32 | | |

Less dividends and distributions to shareholders from: | |

Net investment income | | | (0.35 | ) | | | (0.12 | ) | |

Net realized gain | | | (0.71 | ) | | | — | | |

Total dividends and distributions to shareholders | | | (1.06 | ) | | | (0.12 | ) | |

Net increase (decrease) in net asset value | | | (2.51 | ) | | | 0.20 | | |

Net asset value, end of period | | $ | 16.13 | | | $ | 18.64 | | |

Total investment returnc | | | –7.79 | % | | | 1.74 | %d | |

Ratios/Supplemental Data: | |

Net assets, end of period (in 000s) | | $ | 22.8 | | | $ | 10.1 | | |

Ratio of expenses to average daily net assets

(before expense reduction) | | | 0.98 | %e | | | 1.02 | %f | |

Ratio of expenses to average daily net assets

(net of expense reduction) | | | 0.98 | %e | | | 1.02 | %f | |

Ratio of net investment income to average daily net assets

(before expense reduction) | | | 2.06 | %e | | | 1.49 | %f | |

Ratio of net investment income to average daily net assets

(net of expense reduction) | | | 2.06 | %e | | | 1.49 | %f | |

Portfolio turnover rate | | | 86 | % | | | 36 | %d | |

a Commencement of operations.

b Calculation based on average shares outstanding.

c Return assumes the reinvestment of all dividends and distributions at NAV.

d Not annualized.

e Includes extraordinary expenses related to shareholder proxy expenses. Without these expenses, the ratio of expenses to average daily net assets (before expense reduction and net of expense reduction) would have been 0.97% and the ratio of net investment income to average daily net assets (before expense reduction and net of expense reduction) would have been 2.07%.

f Annualized.

See accompanying notes to financial statements.

26

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS

Note 1. Organization and Significant Accounting Policies

Cohen & Steers Global Infrastructure Fund, Inc. (the Fund), was incorporated under the laws of the State of Maryland on January 13, 2004 and is registered under the Investment Company Act of 1940 (the 1940 Act) as a diversified, open-end management investment company. The Fund's investment objective is total return. On July 22, 2014, the Board of Directors of the Fund approved the Fund's offering of Class R and Class Z shares. Class R and Class Z shares became available for investment on October 1, 2014, on which date the Fund sold 542 shares each of Class R and Class Z for $20,000 to Cohen & Steers Capital Management, Inc. (the investment advisor). The authorized shares of the Fund are divided into five classes designated Class A, C, I, R and Z shares. Class B shares were converted to Class A shares on June 19, 2015. Each of the Fund's shares has equal dividend, liquidation and voting rights (except for matters relating to distribution and shareholder servicing of such shares).

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The Fund is an investment company and, accordingly, follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standards Codification (ASC) Topic 946—Investment Companies. The accounting policies of the Fund are in conformity with accounting principles generally accepted in the United States of America (GAAP). The preparation of the financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Portfolio Valuation: Investments in securities that are listed on the New York Stock Exchange (NYSE) are valued, except as indicated below, at the last sale price reflected at the close of the NYSE on the business day as of which such value is being determined. If there has been no sale on such day, the securities are valued at the mean of the closing bid and ask prices on such day or, if no ask price is available, at the bid price.

Securities not listed on the NYSE but listed on other domestic or foreign securities exchanges are valued in a similar manner. Securities traded on more than one securities exchange are valued at the last sale price reflected at the close of the exchange representing the principal market for such securities on the business day as of which such value is being determined. If after the close of a foreign market, but prior to the close of business on the day the securities are being valued, market conditions change significantly, certain non-U.S. equity holdings may be fair valued pursuant to procedures established by the Board of Directors.

Readily marketable securities traded in the over-the-counter market, including listed securities whose primary market is believed by the investment advisor to be over-the-counter, are valued at the last sale price on the valuation date as reported by sources deemed appropriate by the Board of Directors to reflect their fair market value. If there has been no sale on such day, the securities are valued at the mean of the closing bid and ask prices on such day or, if no ask price is available, at the bid price.

27

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

Short-term debt securities with a maturity date of 60 days or less are valued at amortized cost, which approximates fair value. Investments in open-end mutual funds are valued at their closing net asset value.

The policies and procedures approved by the Fund's Board of Directors delegate authority to make fair value determinations to the investment advisor, subject to the oversight of the Board of Directors. The investment advisor has established a valuation committee (Valuation Committee) to administer, implement and oversee the fair valuation process according to the policies and procedures approved annually by the Board of Directors. Among other things, these procedures allow the Fund to utilize independent pricing services, quotations from securities and financial instrument dealers and other market sources to determine fair value.

Securities for which market prices are unavailable, or securities for which the investment advisor determines that the bid and/or ask price or a counterparty valuation does not reflect market value, will be valued at fair value, as determined in good faith by the Valuation Committee, pursuant to procedures approved by the Fund's Board of Directors. Circumstances in which market prices may be unavailable include, but are not limited to, when trading in a security is suspended, the exchange on which the security is traded is subject to an unscheduled close or disruption or material events occur after the close of the exchange on which the security is principally traded. In these circumstances, the Fund determines fair value in a manner that fairly reflects the market value of the security on the valuation date based on consideration of any information or factors it deems appropriate. These may include, but are not limited to, recent transactions in comparable securities, information relating to the specific security and developments in the markets.

Foreign equity fair value pricing procedures utilized by the Fund may cause certain non-U.S. equity holdings to be fair valued on the basis of fair value factors provided by a pricing service to reflect any significant market movements between the time the Fund values such securities and the earlier closing of foreign markets.

The Fund's use of fair value pricing may cause the net asset value of Fund shares to differ from the net asset value that would be calculated using market quotations. Fair value pricing involves subjective judgments and it is possible that the fair value determined for a security may be materially different than the value that could be realized upon the sale of that security.

Fair value is defined as the price that the Fund would expect to receive upon the sale of an investment or expect to pay to transfer a liability in an orderly transaction with an independent buyer in the principal market or, in the absence of a principal market, the most advantageous market for the investment or liability. The hierarchy of inputs that are used in determining the fair value of the Fund's investments is summarized below.

• Level 1—quoted prices in active markets for identical investments

• Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, credit risk, etc.)

• Level 3—significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments)

28

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

For movements between the levels within the fair value hierarchy, the Fund has adopted a policy of recognizing the transfer at the end of the period in which the underlying event causing the movement occurred. Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy. As of December 31, 2015, there were $3,316,493 of securities transferred from Level 1 to Level 2 and $1,016,266 of securities transferred from Level 2 to Level 1, which resulted from the Fund utilizing foreign equity fair value pricing procedures as of December 31, 2015.

The following is a summary of the inputs used as of December 31, 2015 in valuing the Fund's investments carried at value:

| | | Total | | Quoted Prices

in Active

Markets for

Identical

Investments

(Level 1) | | Other

Significant

Observable

Inputs

(Level 2) | | Significant

Unobservable

Inputs

(Level 3) | |

Common Stock: | |

Canada | | $ | 14,129,494 | | | $ | 14,129,494 | | | $ | — | | | $ | — | | |

Chile | | | 1,016,266 | | | | 1,016,266 | | | | — | | | | — | | |

Italy | | | 12,892,994 | | | | 1,377,753 | | | | 11,515,241 | | | | — | | |

Mexico | | | 5,074,567 | | | | 5,074,567 | | | | — | | | | — | | |

United States | | | 106,735,052 | | | | 106,735,052 | | | | — | | | | — | | |

Other Countries | | | 73,334,705 | | | | — | | | | 73,334,705 | | | | — | | |

Short-Term Investments | | | 1,100,000 | | | | — | | | | 1,100,000 | | | | — | | |

Total Investmentsa | | $ | 214,283,078 | | | $ | 128,333,132 | | | $ | 85,949,946 | | | $ | — | | |

a Portfolio holdings are disclosed individually on the Schedule of Investments.

Security Transactions, Investment Income and Expense Allocations: Security transactions are recorded on trade date. Realized gains and losses on investments sold are recorded on the basis of identified cost. Interest income is recorded on the accrual basis. Discounts are accreted and premiums are amortized over the life of the respective securities. Dividend income is recorded on the ex-dividend date, except for certain dividends on foreign securities, which are recorded as soon as the Fund is informed after the ex-dividend date. Distributions from Master Limited Partnerships (MLPs) are recorded as income and return of capital based on information reported by the MLPs and management's estimates of such amounts based on historical information. These estimates are adjusted when the actual source of distributions is disclosed by the MLPs and actual amounts may differ from the estimated amounts. Income, expenses (other than expenses attributable to a specific class) and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

29

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

Foreign Currency Translation: The books and records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based upon prevailing exchange rates on the date of valuation. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollars based upon prevailing exchange rates on the respective dates of such transactions. The Fund does not isolate that portion of the results of operations resulting from fluctuations in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales of foreign currencies, including gains and losses on forward foreign currency exchange contracts, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund's books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the values of assets and liabilities, other than investments in securities, on the date of valuation, resulting from changes in exchange rates. Pursuant to U.S. federal income tax regulations, certain foreign currency gains/losses included in realized and unrealized gains/losses are included in or are a reduction of ordinary income for federal income tax purposes.

Foreign Securities: The Fund directly purchases securities of foreign issuers. Investing in securities of foreign issuers involves special risks not typically associated with investing in securities of U.S. issuers. The risks include possible revaluation of currencies, the ability to repatriate funds, less complete financial information about companies and possible future adverse political and economic developments. Moreover, securities of many foreign issuers and their markets may be less liquid and their prices more volatile than securities of comparable U.S. issuers.

Dividends and Distributions to Shareholders: Dividends from net investment income and capital gain distributions are determined in accordance with U.S. federal income tax regulations, which may differ from GAAP. Dividends from net investment income, if any, are declared and paid semi-annually. Net realized capital gains, unless offset by any available capital loss carryforward, are typically distributed to shareholders at least annually. Dividends and distributions to shareholders are recorded on the ex-dividend date and are automatically reinvested in full and fractional shares of the Fund based on the net asset value per share at the close of business on the payable date, unless the shareholder has elected to have them paid in cash.

Dividends from net investment income are subject to recharacterization for tax purposes. Based upon the results of operations for the year ended December 31, 2015, a portion of the dividends have been reclassified to distributions from net realized gains.

Income Taxes: It is the policy of the Fund to continue to qualify as a regulated investment company, if such qualification is in the best interest of the shareholders, by complying with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies, and by distributing substantially all of its taxable earnings to its shareholders. Also, in order to avoid the payment of any federal excise taxes, the Fund will distribute substantially all of its net investment income and net realized gains on a calendar year basis. Accordingly, no provision for federal income or excise tax is

30

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

necessary. Dividend and interest income from holdings in non-U.S. securities is recorded net of non-U.S. taxes paid. Security and foreign currency transactions and any gains realized by the Fund on the sale of securities in certain non-U.S. markets are subject to non-U.S. taxes. The Fund records a liability based on any unrealized gains on securities held in these markets in order to estimate the potential non-U.S. taxes due upon the sale of these securities. Management has analyzed the Fund's tax positions taken on federal and applicable state income tax returns as well as its tax positions in non-U.S. jurisdictions in which it trades for all open tax years and has concluded that as of December 31, 2015, no additional provisions for income tax are required in the Fund's financial statements. The Fund's tax positions for the tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service, state departments of revenue and by foreign tax authorities.

Note 2. Investment Advisory, Administration Fees and Other Transactions with Affiliates

Investment Advisory Fees: The investment advisor serves as the Fund's investment advisor pursuant to an investment advisory agreement (the investment advisory agreement). Under the terms of the investment advisory agreement, the investment advisor provides the Fund with day-to-day investment decisions and generally manages the Fund's investments in accordance with the stated policies of the Fund, subject to the supervision of the Board of Directors.

For the services provided to the Fund, the investment advisor receives a fee, accrued daily and paid monthly, at the annual rate of 0.75% of the average daily net assets of the Fund up to and including $1.5 billion and 0.65% of the average daily net assets above $1.5 billion.

For the seven months ended July 31, 2015, the investment advisor contractually agreed to waive its fee and/or reimburse expenses so that the Fund's total annual operating expenses (excluding acquired fund fees and expenses and extraordinary expenses) did not exceed 1.50% for Class A shares, 2.15% for Class C shares, 1.15% for Class I shares, 1.65% for Class R shares and 1.15% for Class Z shares. On June 16, 2015, the Board of Directors of the Fund approved the termination of the Fund's fee waiver/expense reimbursement agreement with the investment advisor, effective August 1, 2015. For the year ended December 31, 2015, there were no fees waived and/or expenses reimbursed to the Fund.

Under subadvisory agreements between the investment advisor and each of Cohen & Steers Asia Limited and Cohen & Steers UK Limited (collectively, the subadvisors), affiliates of the investment advisor, the subadvisors are responsible for managing the Fund's investments in certain non-U.S. securities. For their services provided under the subadvisory agreements, the investment advisor (not the Fund) pays the subadvisors. The investment advisor allocates 50% of the investment advisory fee received from the Fund among itself and each subadvisor based on the portion of the Fund's average daily net assets managed by the investment advisor and each subadvisor.

Administration Fees: The Fund has entered into an administration agreement with the investment advisor under which the investment advisor performs certain administrative functions for the Fund and receives a fee, accrued daily and paid monthly, at the annual rate of 0.02% of the average daily net assets of the Fund. For the year ended December 31, 2015, the Fund incurred $51,337 in fees under

31

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

this administration agreement. Additionally, the Fund pays State Street Bank and Trust Company as co-administrator under a fund accounting and administration agreement.

Distribution Fees: Shares of the Fund are distributed by Cohen & Steers Securities, LLC (the distributor), an affiliated entity of the investment advisor. The Fund has adopted an amended distribution and service plan (the plan) pursuant to Rule 12b-1 under the 1940 Act. The plan provides that the Fund will pay the distributor a fee, accrued daily and paid monthly, at an annual rate of up to 0.25% of the average daily net assets attributable to Class A shares, up to 0.75% of the average daily net assets attributable to Class B and Class C shares, and up to 0.50% of the average daily net assets attributable to Class R shares. On May 1, 2015, the fee was discontinued for Class B shares and Class B shares were converted to Class A shares on June 19, 2015. In addition, with respect to Class R shares, such amounts may also be used to pay for services to fund shareholders or services related to the maintenance of shareholder accounts.

There is a maximum initial sales charge of 4.50% for Class A shares. There is a contingent deferred sales charge (CDSC) of 1.00% on purchases of $1 million or more of Class A shares, which applies if redemption occurs within one year from purchase. There was a CDSC on Class B shares from January 1, 2015 through April 30, 2015. There is a CDSC of 1.00% on Class C shares, which applies if redemption occurs within one year from purchase. For the year ended December 31, 2015, the Fund has been advised that the distributor or its affiliates received $7,216 in sales commissions from the sale of Class A shares and $5,130 of CDSC relating to redemptions of Class C shares. The distributor has advised the Fund that proceeds from the CDSC on these classes are used by the distributor to defray its expenses related to providing distribution-related services to the Fund in connection with the sale of these classes, including payments to dealers and other financial intermediaries for selling these classes.

Shareholder Servicing Fees: For shareholder services, the Fund pays the distributor or its affiliates a fee, accrued daily, at an annual rate of up to 0.10% of the average daily net assets of the Fund's Class A and Class I shares and up to 0.25% of the average daily net assets of the Fund's Class B and Class C shares. On May 1, 2015, the fee was discontinued for Class B shares and Class B shares were converted to Class A shares on June 19, 2015. The distributor is responsible for paying qualified financial institutions for shareholder services.

Directors' and Officers' Fees: Certain directors and officers of the Fund are also directors, officers and/or employees of the investment advisor. The Fund does not pay compensation to directors and officers affiliated with the investment advisor except for the Chief Compliance Officer, who received compensation from the investment advisor, which was reimbursed by the Fund, in the amount of $3,159 for the year ended December 31, 2015.

Note 3. Purchases and Sales of Securities

Purchases and sales of securities, excluding short-term investments, for the year ended December 31, 2015, totaled $214,268,908 and $216,244,242, respectively.

32

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

Note 4. Income Tax Information

The tax character of dividends and distributions paid was as follows:

| | For the Year Ended

December 31, | |

| | 2015 | | 2014 | |

Ordinary income | | $ | 4,316,111 | | | $ | 2,728,634 | | |

| Long-term capital gain | | | 9,475,468 | | | | 373,266 | | |

Total dividends and distributions | | $ | 13,791,579 | | | $ | 3,101,900 | | |

As of December 31, 2015, the tax-basis components of accumulated earnings and the federal tax cost were as follows:

Cost for federal income tax purposes | | $ | 208,538,049 | | |

Gross unrealized appreciation | | $ | 25,537,824 | | |

| Gross unrealized depreciation | | | (19,792,795 | ) | |

Net unrealized appreciation | | $ | 5,745,029 | | |

The Fund incurred short-term capital losses of $3,879,309 and long-term capital losses of $261,232 after October 31, 2015, that is has elected to treat as arising in the following fiscal year.

As of December 31, 2015, the Fund had temporary book/tax differences primarily attributable to wash sales on portfolio securities and partnership investments and permanent book/tax differences primarily attributable to Fund redemptions used as distributions, foreign currency transactions, prior year income redesignations and partnership investments. To reflect reclassifications arising from the permanent differences, paid-in capital was credited $1,156,498, accumulated net realized loss was charged $1,305,757 and accumulated undistributed net investment income was credited $149,259. Net assets were not affected by this reclassification.

33

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

Note 5. Capital Stock