ANNUAL REPORT FOR THE FISCAL YEAR ENDING DECEMBER 31, 2007

As filed with the Securities and Exchange Commission on June 30, 2008

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

o | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

OR | |

|

|

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2007 |

|

|

OR | |

|

|

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

OR | |

|

|

o | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report . . . . . . . . . . . . . . . . . .. .

For the transition period from to

Commission file number 001-32305

CORPBANCA |

(Exact name of Registrant as specified in its charter) |

|

|

(Translation of Registrant’s name into English) |

|

Republic of Chile |

(Jurisdiction of incorporation or organization) |

|

Rosario Norte 660 |

(Address of principal executive offices) |

Securities registered or to be registered pursuant to Section 12(b) of the Act.

Title of each class |

| Name of each exchange on which registered |

American Depositary Shares |

| New York Stock Exchange |

* Not for trading purposes, but only in connection with the registration of American Depositary Shares pursuant to the requirements of the Securities and Exchange Commission.

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None. |

(Title of Class) |

|

|

(Title of Class) |

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None. |

(Title of Class) |

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

| 226,909,290,577 |

|

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

o Yes x No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

o Yes x No

Note — Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o |

| Accelerated filer x |

| Non-accelerated filer o |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in the filing:

o U.S. GAAP |

| o IFRS |

| x Other |

Indicate by check mark which financial statement item the registrant has elected to follow.

o Item 17 x Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

o Yes x No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

o Yes o No

CAUTIONARY LANGUAGE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 20-F contains statements that constitute forward-looking statements. These statements appear throughout this Annual Report, including, without limitation, under “Item 3. Key Information—Risk Factors,” “Item 4. Information on the Company” and “Item 5. Operating and Financial Review and Prospects” and include statements regarding our current intent, belief or expectations with respect to (1) our asset growth and financing plans, (2) trends affecting our financial condition or results of operations, (3) the impact of competition and regulations, (4) projected capital expenditures and (5) liquidity. Such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and actual results may differ materially from those described in such forward-looking statements included in this Annual Report as a result of various factors (including, without limitation, the actions of competitors, future global economic conditions, market conditions, currency exchange rates and operating and financial risks), many of which are beyond our control. The occurrence of any such factors, not currently expected by us, would significantly alter the results set forth in these statements.

Factors that could cause actual results to differ materially and adversely include, but are not limited to:

· changes in general economic, business or political or other conditions in Chile or changes in general economic or business conditions in Latin America,

· changes in capital markets in general that may affect policies or attitudes towards lending to Chile or Chilean companies or securities issued by Chilean companies,

· the monetary and interest rate policies of the Banco Central de Chile (the Central Bank of Chile), or the Central Bank,

· inflation,

· deflation,

· unemployment,

· unanticipated increases in financing and other costs or the inability to obtain additional debt or equity financing on attractive terms,

· unanticipated turbulence in interest rates,

· movements in currency exchange rates,

· movements in equity prices or other rates or prices,

· changes in Chilean and foreign laws and regulations,

· changes in taxes,

· competition, changes in competition and pricing environments,

· our inability to hedge certain risks economically,

· the adequacy of loss allowances or provisions,

· technological changes,

· changes in consumer spending and saving habits,

· successful implementation of new technologies,

· loss of market share,

· changes in, or failure to comply with banking regulations, and

· the factors discussed under “Item 3. Key Information—Risk Factors” in this Annual Report.

You should not place undue reliance on such statements, which speak only as of the date that they were made. These cautionary statements should be considered in connection with any written or oral forward-looking statements that we may make in the future. We do not undertake any obligation to release publicly any revisions to such forward-looking statements after the date of this Annual Report to reflect later events or circumstances or to reflect the occurrence of unanticipated events.

2

ENFORCEABILITY OF CIVIL LIABILITIES

We are a sociedad anónima (corporation) organized under the laws of the Republic of Chile. Nearly all of our directors or executive officers are not residents of the United States and a substantial portion of our assets are located outside the United States. As a result, it may be difficult for you to effect service of process within the United States upon such persons or to enforce against them or us in the United States courts, judgment obtained in the United States predicated upon the civil liability provisions of the federal securities laws of the United States.

No treaty exists between the United States and Chile for the reciprocal enforcement of judgments. Chilean courts, however, have enforced final judgments rendered in the United States by virtue of the legal principles of reciprocity and comity, subject to the review in Chile of the United States judgment in order to ascertain whether certain basic principles of due process and public policy have been respected without reviewing the merits of the subject matter of the case. If a U.S. court grants a final judgment in an action based on the civil liability provisions of the federal securities laws of the United States, enforceability of this judgment in Chile will be subject to the obtaining of the relevant “exequatur” (i.e., recognition and enforcement of the foreign judgment) according to Chilean civil procedure law in force at that time, and consequently, subject to the satisfaction of certain factors. Currently, the most important of these factors are the existence of reciprocity, the absence of a conflicting judgment by a Chilean court relating to the same parties and arising from the same facts and circumstances, the Chilean courts’ determination that the U.S. courts had jurisdiction, that service of process was appropriately made on the defendant and that the defendant was afforded a real opportunity to appear before the court and defend its case and that enforcement would not violate Chilean public policy.

If an action is started before Chilean courts, there is doubt as to the enforceability of liabilities based on the U.S. federal securities laws and as to the enforceability in Chilean courts of judgments of United States courts obtained in actions based upon civil liability provisions of the federal securities laws of the United States.

3

TABLE OF CONTENTS

|

| |

|

|

|

5 | ||

5 | ||

5 | ||

19 | ||

83 | ||

112 | ||

120 | ||

123 | ||

124 | ||

126 | ||

141 | ||

156 | ||

|

|

|

| 156 | |

|

|

|

156 | ||

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | 156 | |

156 | ||

158 | ||

|

|

|

| 160 | |

|

|

|

160 | ||

160 | ||

160 |

4

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

We prepare our consolidated financial statements in accordance with generally accepted accounting principles in Chile and regulations of the Chilean Superintendencia de Bancos e Instituciones Financieras, or the Chilean Superintendency of Banks, collectively referred to as Chilean GAAP, which differ in certain respects from generally accepted accounting principles in the United States, or U.S. GAAP. Our consolidated financial statements have been translated into English, certain reclassifications have been made and certain subtotals and clarifying account descriptions have been added in order to present them in accordance with requirements of U.S. Securities Act of 1933, as amended, or the Securities Act, and the U.S. Securities Exchange Act of 1934, as amended, or the Exchange Act. References to Chilean GAAP in this Annual Report are to Chilean GAAP as supplemented by the applicable rules of the Chilean Superintendency of Banks. See note 27 to our audited consolidated financial statements included herein for a description of the principal differences between Chilean GAAP and U.S. GAAP as they relate to us and our consolidated subsidiaries and a reconciliation to U.S. GAAP of net income for the years ended December 31, 2005, 2006 and 2007 and shareholders’ equity as of and for each of the years ended December 31, 2006 and 2007.

Our audited consolidated financial statements as of December 31, 2006 and 2007 and for each of the three years in the period ended December 31, 2007 are referred to herein as our financial statements. Pursuant to Chilean GAAP, unless otherwise indicated, financial data for all full-year periods through December 31, 2007 included in our audited consolidated financial statements and in the other financial information contained elsewhere in this Annual Report have been expressed in constant Chilean pesos as of December 31, 2007.

In this Annual Report, references to “$,” “US$,” “U.S. dollars” and “dollars” are to United States dollars, references to “pesos” or “Ch$” are to pesos, and references to “UF” are to Unidades de Fomento. The UF is an inflation-indexed, peso-denominated unit that is linked to and adjusted daily to reflect changes in the previous month’s Chilean consumer price index. As of December 31, 2007 one UF equaled US$39.41 and Ch$19,622.66 and as of June 3, 2008, one UF equaled US$41.20 and Ch$20,068.78. See “Item 5. Operating and Financial Review and Prospects.”

This Annual Report contains translations of certain peso amounts into U.S. dollars at specified rates solely for the convenience of the reader. These translations should not be construed as representations that the peso amounts actually represent such U.S. dollar amounts, were converted from U.S. dollars at the rate indicated in preparing our financial statements or could be converted into U.S. dollars at the rate indicated. Unless otherwise indicated, such U.S. dollar amounts have been translated from pesos based on our exchange rate of Ch$497.87 as of December 31, 2007. See “—Exchange Rate Information” below.

5

Unless otherwise specified, all references in this Annual Report (except in our financial statements) to loans are to loans and financial leases before deduction for allowances for loan losses, and, except as otherwise specified, all market share data presented herein are based on information published periodically by the Chilean Superintendency of Banks. Non-performing loans include loans which either principal or interest is overdue, and which do not accrue interest. Past due loans include, with respect to any loan, the amount of principal and interest that is 90 days or more overdue, and do not include the installments of such loans that are not overdue or that are less than 90 days overdue, unless legal proceedings have been commenced for the entire outstanding balance according to the terms of the loan. This practice differs from that normally followed in the United States where the amount classified as past due would include the total principal and interest on all loans which have any portion overdue. See “Item 4. Information on the Company—Business Overview—Selected Statistical Information—Classification of Loan Portfolio Based on Borrower’s Payment Performance.”

Certain figures included in this Annual Report and in our financial statements have been rounded for ease of presentation. Percentage figures included in this Annual Report have not in all cases been calculated on the basis of such rounded figures but on the basis of such amounts prior to rounding. For this reason, percentage amounts in this Annual Report may vary from those obtained by performing the same calculations using the figures in our financial statements. Certain other amounts that appear in this Annual Report may not sum due to rounding.

In this Annual Report, all macro-economic data related to the Chilean economy is based on information published by the Central Bank. All market share and other data related to the Chilean financial system is based on information published by the Chilean Superintendency of Banks as well as other publicly available information. Information regarding the consolidated risk index of the Chilean financial system as a whole is not available. The Chilean Superintendency of Banks publishes the unconsolidated risk index of the Chilean financial system on a monthly basis.

EXCHANGE RATE INFORMATION

Chile has two currency markets, the Mercado Cambiario Formal, or the Formal Exchange Market, and the Mercado Cambiario Informal, or the Informal Exchange Market. The Central Bank is empowered to determine that certain purchases and sales of foreign currencies must be carried out in the Formal Exchange Market. Pursuant to Central Bank regulations which are currently in effect, all payments, remittances or transfers of foreign currency abroad which are required to be effected through the Formal Exchange Market may be effected with foreign currency obtained outside the Formal Exchange Market. The Formal Exchange Market is comprised of the banks and other entities so authorized by the Central Bank. Current regulations require that the Central Bank be informed of certain transactions and that these transactions be effected through the Formal Exchange Market.

The reference exchange rate for the Formal Exchange Market is reset daily by the Central Bank, taking into account internal and external inflation, and is adjusted daily to reflect variations in parities between the peso and each of the U.S. dollar, the Euro and the Japanese yen. The observed exchange rate for a given date is the average exchange rate of the transactions conducted in the Formal Exchange Market on the immediately preceding banking day, as certified by the Central Bank.

Purchases and sales of foreign currencies which may be effected outside the Formal Exchange Market can be carried out in the Informal Exchange Market. The Informal Exchange Market reflects transactions carried out at informal exchange rates by entities not expressly authorized to operate in the Formal Exchange Market, such as certain foreign exchange houses and travel agencies. There are no limits imposed on the extent to which the rate of exchange in the Informal Exchange Market can fluctuate above or below the observed exchange rate. On December 31, 2007, the average exchange rate in the Informal Exchange Market was approximately the same as the published observed exchange rate for such date of Ch$495.82 per US$1.00. The average exchange rate in the Informal Exchange Market is widely used by the public in Chile. Prior to 2006, Chilean banks used the observed exchange rate as published by the Central Bank for conversion and valuation purposes as specified by the Chilean Superintendency of Banks. In accordance with Circular No. 3,345, during 2006, we began using foreign exchange rates obtained from market information. The method used to estimate the daily exchange rate is as follows:

a. Daily spot rates are obtained from the Datatec system, which contains all daily market foreign currency trading activities.

6

b. We only consider those transactions which occurred during the time frame of 12:45pm and 1:00pm.

c. The exchange rate is calculated using the simple average of transactions selected.

d. Alternatively, we can substitute the Datatec system with market information obtained from the Santiago Stock Exchange’s OTC trade system.

As of December 31, 2007 the U.S. dollar exchange rate used by us was Ch$497.87 per US$1.00.

The following table sets forth the annual low, high, average and period-end observed exchange rate for U.S. dollars for the periods set forth below, as reported by the Central Bank.

|

| Daily Observed Exchange Rate Ch$ per US$(1) |

| ||||||||||

|

| Low(2) |

| High(2) |

| Average(3) |

| Period End |

| ||||

|

|

|

|

|

|

|

|

|

| ||||

2003 |

| Ch$ | 593.10 |

| Ch$ | 758.21 |

| Ch$ | 691.40 |

| Ch$ | 599.42 |

|

2004 |

| 559.21 |

| 649.45 |

| 609.53 |

| 559.83 |

| ||||

2005 |

| 509.70 |

| 592.75 |

| 559.77 |

| 514.21 |

| ||||

2006 |

| 511.44 |

| 549.63 |

| 530.26 |

| 534.43 |

| ||||

2007 |

| 493.14 |

| 548.67 |

| 522.69 |

| 495.82 |

| ||||

December 2007 |

| 495.49 |

| 506.79 |

| 499.28 |

| 495.82 |

| ||||

January 2008 |

| 463.58 |

| 498.05 |

| 480.90 |

| 465.30 |

| ||||

February 2008 |

| 458.02 |

| 476.44 |

| 467.22 |

| 458.02 |

| ||||

March 2008 |

| 431.22 |

| 454.94 |

| 442.94 |

| 439.09 |

| ||||

April 2008 |

| 433.98 |

| 459.16 |

| 446.43 |

| 459.16 |

| ||||

May 2008 |

| 461.49 |

| 479.66 |

| 470.10 |

| 479.66 |

| ||||

June 2008(4) |

| 479.54 |

| 483.17 |

| 481.36 |

| 483.17 |

| ||||

(1) Nominal figures.

(2) Exchange rates are the actual low and high, on a day-by-day basis for each period.

(3) The average of the exchange rates on the last day of each month during the period.

(4) Through June 3, 2008.

The following table sets forth the annual low, high, average and period-end exchange rate for U.S. dollars for the periods under our new policy to calculate our own exchange rate:

|

| Bank’s Exchange Rate Ch$ per US$1 |

| ||||||||||

|

| Low(2) |

| High(2) |

| Average(3) |

| Period End |

| ||||

|

|

|

|

|

|

|

|

|

| ||||

2006 |

| Ch$ | 514.21 |

| Ch$ | 547.31 |

| Ch$ | 529.10 |

| Ch$ | 532.07 |

|

2007 |

| 493.07 |

| 548.09 |

| 522.57 |

| 497.87 |

| ||||

December 2007 |

| 495.24 |

| 507.04 |

| 498.73 |

| 497.87 |

| ||||

January 2008 |

| 465.23 |

| 497.93 |

| 478.92 |

| 465.47 |

| ||||

February 2008 |

| 454.78 |

| 476.44 |

| 466.74 |

| 454.78 |

| ||||

March 2008 |

| 431.40 |

| 454.45 |

| 442.03 |

| 435.81 |

| ||||

April 2008 |

| 434.06 |

| 462.82 |

| 447.46 |

| 462.82 |

| ||||

May 2008 |

| 465.62 |

| 481.57 |

| 471.46 |

| 479.83 |

| ||||

June 2008(4) |

| 484.73 |

| 487.07 |

| 485.90 |

| 487.07 |

| ||||

(1) Nominal figures.

(2) Exchange rates are the actual low and high, on a day-by-day basis for each period.

(3) The average of the exchange rates on the last day of each month during the period.

(4) Through June 3, 2008.

7

A. SELECTED FINANCIAL DATA

The following tables present our selected financial data as of the dates and for the periods indicated. You should read the following information together with our audited consolidated financial statements, including the notes thereto, included in this Annual Report and the information set forth in “Item 5. Operating and Financial Review and Prospects.”

The selected consolidated balance sheet data as of December 31, 2006 and 2007 and the selected consolidated income statement data for each of the three years in the period ended December 31, 2007 appearing herein have been derived from the audited consolidated financial statements for the year ended December 31, 2007 appearing elsewhere in this Annual Report, which have been audited by Deloitte & Touche Sociedad de Auditores y Consultores Ltda., or Deloitte.

Our selected consolidated balance sheet data for each of the three years in the period ended December 31, 2005 and the selected consolidated income statement data for each of the two years in the period ended December 31, 2004 have been derived from the audited consolidated financial statements for the years ended December 31, 2004 and 2005 and have been expressed in constant Chilean pesos as of December 31, 2007. These consolidated financial statements do not appear elsewhere in this Annual Report.

Our financial statements have been prepared in accordance with Chilean GAAP (including the regulations of the Chilean Superintendency of Banks), which differs in certain significant respects from U.S. GAAP. See notes 26 and 27 to our financial statements for a description of the principal differences between Chilean GAAP and U.S. GAAP as they relate to us, including the impact of such differences on our net income and shareholders’ equity. Net income and shareholders’ equity in U.S. GAAP are also included in the selected financial data as a reference.

8

|

| As of and for the Year Ended December 31, |

| ||||||||||||||||

|

| 2003 |

| 2004 |

| 2005 |

| 2006 |

| 2007 |

| 2007 |

| ||||||

|

| (in millions of constant Ch$ as of December 31, 2007)(1) |

| (in thousands of |

| ||||||||||||||

CONSOLIDATED INCOME STATEMENT DATA |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Chilean GAAP |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Interest revenue |

| Ch$ | 180,989 |

| Ch$ | 219,592 |

| Ch$ | 272,669 |

| Ch$ | 265,858 |

| Ch$ | 379,096 |

| US$ | 761,436 |

|

Interest expense |

| (69,659 | ) | (89,819 | ) | (142,481 | ) | (148,874 | ) | (214,328 | ) | (430,490 | ) | ||||||

Net interest revenue |

| 111,330 |

| 129,773 |

| 130,188 |

| 116,984 |

| 164,768 |

| 330,946 |

| ||||||

Provisions for loan losses |

| (29,744 | ) | (20,583 | ) | (15,167 | ) | (15,751 | ) | (25,991 | ) | (52,204 | ) | ||||||

Fees and income from services (net) |

| 25,603 |

| 21,420 |

| 25,411 |

| 30,297 |

| 36,865 |

| 74,045 |

| ||||||

Other operating income (net) |

| 21,756 |

| 4,958 |

| 6,705 |

| (4,205 | ) | (5,144 | ) | (10,331 | ) | ||||||

Other income and expenses (net) |

| (1,902 | ) | (2,004 | ) | (1,179 | ) | 251 |

| (2,103 | ) | (4,224 | ) | ||||||

Operating expenses |

| (63,650 | ) | (61,162 | ) | (64,902 | ) | (69,848 | ) | (82,069 | ) | (164,841 | ) | ||||||

Net loss from price-level restatement |

| (2,606 | ) | (7,330 | ) | (11,576 | ) | (7,527 | ) | (25,946 | ) | (52,114 | ) | ||||||

Income before income taxes |

| 60,787 |

| 65,072 |

| 69,480 |

| 50,201 |

| 60,380 |

| 121,277 |

| ||||||

Income tax expense |

| (2,417 | ) | (7,398 | ) | (11,766 | ) | (8,203 | ) | (9,331 | ) | (18,742 | ) | ||||||

Net income |

| Ch$ | 58,370 |

| Ch$ | 57,674 |

| Ch$ | 57,714 |

| Ch$ | 41,998 |

| Ch$ | 51,049 |

| US$ | 102,535 |

|

Net income per share of common stock(6) |

| 0.26 |

| 0.25 |

| 0.25 |

| 0.19 |

| 0.22 |

| 0.00045 |

| ||||||

Dividends per share of common stock (3) |

| 0.08 |

| 0.12 |

| 0.13 |

| 0.13 |

| 0.10 |

| 0.00020 |

| ||||||

Dividends per ADS (4) |

| 400.00 |

| 600.00 |

| 650.00 |

| 650.00 |

| 500.00 |

| 1.00 |

| ||||||

Shares of common stock outstanding (in thousands) |

| 226,909,290.6 |

| 226,909,290.6 |

| 226,909,290.6 |

| 226,909,290.6 |

| 226,909,290.6 |

| 226,909,290.6 |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

U.S. GAAP |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Net interest income (5) |

| Ch$ | 108,725 |

| Ch$ | 117,145 |

| Ch$ | 118,612 |

| Ch$ | 109,457 |

| Ch$ | 138,822 |

| US$ | 278,832 |

|

Provisions for loan losses |

| (23,839 | ) | (16,536 | ) | (12,181 | ) | (14,416 | ) | (25,955 | ) | (52,132 | ) | ||||||

Long-term borrowings |

| 497,895 |

| 618,832 |

| 772,766 |

| 849,957 |

| 994,094 |

| 1,996,694 |

| ||||||

Net income |

| 64,090 |

| 66,614 |

| 48,805 |

| 44,814 |

| 54,511 |

| 109,488 |

| ||||||

Net income per share of common stock (6) |

| 0.28 |

| 0.29 |

| 0.22 |

| 0.20 |

| 0.24 |

| 0.00048 |

| ||||||

Net income per ADS (6) |

| 1,400 |

| 1,450 |

| 1,100 |

| 1,000 |

| 1,200 |

| 2.41 |

| ||||||

Weighted average ADS outstanding (in millions) |

| 45 |

| 45 |

| 45 |

| 45 |

| 45 |

| — |

| ||||||

9

|

| As of and for the Year Ended December 31, |

| ||||||||||||||||

|

| 2003 |

| 2004 |

| 2005 |

| 2006 |

| 2007 |

| 2007 |

| ||||||

|

| (in millions of constant Ch$ as of December 31, 2007)(1) |

| (in thousands of |

| ||||||||||||||

CONSOLIDATED BALANCE SHEET DATA |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Chilean GAAP |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Cash and due from banks |

| Ch$ | 134,244 |

| Ch$ | 180,177 |

| Ch$ | 80,724 |

| Ch$ | 88,258 |

| Ch$ | 100,083 |

| US$ | 201,022 |

|

Investments |

| 536,043 |

| 601,425 |

| 461,672 |

| 170,276 |

| 239,927 |

| 481,907 |

| ||||||

Total loans |

| 2,436,931 |

| 2,776,059 |

| 3,123,269 |

| 3,578,380 |

| 4,345,436 |

| 8,728,053 |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Allowances for loan losses |

| (51,477 | ) | (47,271 | ) | (48,617 | ) | (49,967 | ) | (55,067 | ) | (110,605 | ) | ||||||

Derivatives |

| — |

| — |

| 8,663 |

| 4,781 |

| 34,055 |

| 68,401 |

| ||||||

Other assets (7) |

| 189,439 |

| 126,707 |

| 164,676 |

| 177,584 |

| 168,054 |

| 337,547 |

| ||||||

Total assets |

| 3,245,179 |

| 3,637,096 |

| 3,790,387 |

| 3,969,312 |

| 4,832,488 |

| 9,706,325 |

| ||||||

Deposits |

| 1,884,435 |

| 2,127,131 |

| 2,117,051 |

| 2,123,576 |

| 2,756,910 |

| 5,537,410 |

| ||||||

Other interest-bearing liabilities |

| 728,612 |

| 825,118 |

| 920,989 |

| 987,967 |

| 1,190,628 |

| 2,391,443 |

| ||||||

Derivatives |

| — |

| — |

| 584 |

| 5,306 |

| 34,238 |

| 68,769 |

| ||||||

Shareholders’ equity |

| 394,803 |

| 427,597 |

| 446,874 |

| 465,310 |

| 484,674 |

| 973,495 |

| ||||||

U.S. GAAP |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Total loans |

| 2,206,824 |

| 2,552,524 |

| 2,874,858 |

| 3,276,220 |

| 4,022,854 |

| 8,080,129 |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Allowances for loan losses |

| (51,477 | ) | (47,271 | ) | (48,617 | ) | (49,967 | ) | (55,067 | ) | (110,605 | ) | ||||||

Total assets |

| 3,004,702 |

| 3,401,808 |

| 3,530,048 |

| 3,658,849 |

| 4,504,210 |

| 9,046,960 |

| ||||||

Shareholders’ equity |

| 358,040 |

| 391,478 |

| 412,214 |

| 430,605 |

| 460,304 |

| 924,947 |

| ||||||

SELECTED CONSOLIDATED RATIOS |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Profitability and Performance |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Net interest margin (8) |

| 4.1 | % | 4.1 | % | 3.7 | % | 3.4 | % | 4.2 | % | — |

| ||||||

Return on average total assets (9) |

| 1.6 | % | 1.5 | % | 1.2 | % | 1.1 | % | 1.2 | % | — |

| ||||||

Return on average shareholders’ equity (10) |

| 15.8 | % | 14.6 | % | 13.7 | % | 9.4 | % | 11.6 | % | — |

| ||||||

Efficiency ratio (consolidated) (11) |

| 40.1 | % | 39.2 | % | 40.0 | % | 48.8 | % | 41.8 | % | — |

| ||||||

Dividend payout ratio (12) |

| 50.0 | % | 50.0 | % | 50.0 | % | 75.0 | % | 50.0 | % |

|

| ||||||

Capital |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Average shareholders’ equity as a percentage of average total assets |

| 10.2 | % | 10.1 | % | 9.1 | % | 11.2 | % | 10.5 | % | — |

| ||||||

Total liabilities as a multiple of shareholders’ equity |

| 7.2 |

| 7.5 |

| 7.5 |

| 7.5 |

| 9.0 |

| — |

| ||||||

Asset Quality |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Allowances for loan losses as a percentage of overdue loans(13) |

| 105.8 | % | 122.9 | % | 108.4 | % | 97.2 | % | 164.1 | % | — |

| ||||||

Overdue loans as a percentage of total loans(13) |

| 2.0 | % | 1.4 | % | 1.4 | % | 1.4 | % | 0.8 | % | — |

| ||||||

Allowances for loan losses as a percentage of total loans |

| 2.1 | % | 1.7 | % | 1.6 | % | 1.4 | % | 1.3 | % | — |

| ||||||

Past due loans as a percentage of total loans(14) |

| 1.2 | % | 0.8 | % | 0.9 | % | 0.6 | % | 0.5 | % | — |

| ||||||

U.S. GAAP |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Profitability and Performance |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Net interest margin(15) |

| 4.0 | % | 3.7 | % | 3.3 | % | 3.2 | % | 3.6 | % | — |

| ||||||

Return on average total assets(16) |

| 2.4 | % | 2.1 | % | 1.4 | % | 1.2 | % | 1.3 | % | — |

| ||||||

Return on average shareholders’ equity(17) |

| 18.7 | % | 17.8 | % | 12.1 | % | 10.6 | % | 12.2 | % | — |

| ||||||

Asset Quality |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Past due loans as a percentage of total loans(14) |

| 1.2 | % | 0.8 | % | 0.9 | % | 0.6 | % | 0.5 | % | — |

| ||||||

OTHER DATA |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Inflation rate |

| 1.1 | % | 2.4 | % | 3.7 | % | 2.6 | % | 7.8 | % | — |

| ||||||

Revaluation (Devaluation) rate (Ch$/US$) |

| 15.9 | % | 6.6 | % | 8.1 | % | (3.5 | )% | 6.4 | % | — |

| ||||||

Number of employees |

| 1,860 |

| 1,952 |

| 2,159 |

| 2,378 |

| 3,105 |

| — |

| ||||||

Number of branches and offices |

| 66 |

| 63 |

| 68 |

| 71 |

| 84 |

| — |

| ||||||

(1) Except per share data, percentages and ratios, share amounts, employee numbers and numbers of branch offices.

(2) Amounts stated in U.S. dollars as of and for the year ended December 31, 2007 have been translated from pesos at our exchange rate of Ch$497.87 per US$1.00 as of December 31, 2007; for figures in US$ see Note 1 t. to our financial statements.

(3) Represents dividends paid in respect of net income earned in the prior fiscal year.

(4) Each ADS represents 5,000 shares of common stock.

10

(5) Net interest income and total assets on a U.S. GAAP basis have been determined by applying the relevant US GAAP adjustments to net interest income presented in accordance with Article 9 of Regulation S-X; for figures in US$ see notes 26 and 27 to our financial statements.

(6) Net income per share of common stock has been calculated on the basis of the weighted average number of shares outstanding for the period. One ADS equals 5,000 shares of common stock. We do not have outstanding convertible securities and therefore our diluted and undiluted earnings per share are the same.

(7) This line item is comprised primarily of bank premises and equipment, assets received in lieu of payment (repossessed assets), assets to be leased, amounts received under spot foreign exchange transactions, transactions in process, prepaid and deferred expenses, deferred income taxes and goodwill.

(8) Net interest margin is defined as net interest revenue divided by average interest-earning assets.

(9) Return on average total assets is defined as net income divided by average total assets.

(10) Return on average shareholders’ equity is defined as net income divided by average shareholders’ equity.

(11) Operating expenses as a percentage of operating revenue. Operating revenue is the aggregate of net interest revenue, fees and income from service (net) and other operating income (net).

(12) Represents dividends divided by net income.

(13) Overdue loans consist of all non-current loans.

(14) Past due loans include, with respect to any loan, the amount of principal or interest that is 90 days or more overdue, and do not include the installments of such loan that are not overdue or that are less than 90 days overdue, unless legal proceedings have been commenced for the entire outstanding balance according to the terms of the loan. Under U.S. GAAP, non-performing loans would include the total outstanding amount of the loan if any principal or interest payment was 90 days or more past due.

(15) Net interest margin on a U.S. GAAP basis has been determined by applying the relevant U.S. GAAP adjustments to net interest income presented in accordance with Article 9 of Regulation S-X. See Notes 26 and 27 to our financial statements.

(16) Net income divided by average total assets. Average total assets were calculated as an average of the beginning and ending balance for each year, and total assets on a U.S. GAAP basis have been determined by applying the relevant U.S. GAAP adjustments to shareholders’ equity. See notes 26 and 27 to our financial statements.

(17) Average shareholders’ equity was calculated as an average of the beginning and ending balance for each year. Shareholders’ equity on a U.S. GAAP basis has been determined by applying the relevant U.S. GAAP adjustments to shareholders’ equity. See notes 26 and 27 to our financial statements.

B. CAPITALIZATION AND INDEBTEDNESS

Not applicable.

C. REASONS FOR THE OFFER AND USE OF PROCEEDS

Not applicable.

D. RISK FACTORS

RISKS ASSOCIATED WITH OUR BUSINESS

The growth of our loan portfolio may expose us to increased loan losses.

From December 31, 2003 to December 31, 2007, the compounded annual growth rate of our gross loan portfolio was 19.9% in nominal terms to Ch$4,317,422 million (excluding interbank loans). Our business strategy seeks to grow profitably while increasing the size of our loan portfolio. The growth of our loan portfolio (particularly in the lower-middle to middle income consumer and small and medium-sized corporate business segments) may expose us, in an economic downturn, to a higher level of loan losses and require us to establish proportionately higher levels of provisions for loan losses, which offset the increased income that we can expect to receive as the loan portfolio grows.

Our loan portfolio may not continue to grow at the same rate.

There can be no assurance that in the future our loan portfolio will continue to grow at the same or similar rates as the growth rate that we historically experienced. Average loan growth has, however, remained significant in the last five years. According to the Chilean Superintendency of Banks, from December 31, 2003 to December 31, 2007, the compounded annual growth rate of aggregate amount of loans in the Chilean banking system (on an unconsolidated basis) was 17.9% in nominal terms to Ch$63,331,008 million as of December 31, 2007. A reversal

11

of the rate of growth of the Chilean economy could adversely affect the rate of growth of our loan portfolio and our risk index and, accordingly, increase our required allowance for loan losses.

Increased competition and industry consolidation may adversely affect the results of our operations.

The Chilean market for financial services is highly competitive. We compete with other Chilean private sector domestic and foreign banks, with BancoEstado (a public-sector bank) and with large department stores that make consumer loans to a large portion of the Chilean population. The lower-middle to middle income segments of the Chilean population and the small and medium-sized corporate segments have become the target markets of several banks, and competition in these segments is likely to increase. As a result, net interest margins in these segments have declined. Although we believe that demand for financial products and services from the lower-middle to middle income consumer market segments and for small and medium-sized companies will continue to grow during the remainder of the decade, our net interest margins may not be maintained at their current levels. We believe that our principal competitors are Banco de Crédito e Inversiones, or BCI, Banco Bilbao Vizcaya Argentaria, Chile S.A., or BBVA, and Scotiabank Sudamericano, but we also face competition from larger banks such as Banco de Chile and Banco Santander Santiago, among others.

We also face competition from non-bank and non-finance competitors with respect to some of our credit products, such as credit cards and consumer loans. Non-bank competition from large department stores has become increasingly significant in the consumer lending sector. Since 2001, three new private sector banks affiliated with Chile’s largest department stores have initiated operations mainly as consumer and medium-sized corporate niche banks. In addition, we face competition from non-bank finance competitors, such as leasing, factoring and automobile finance companies, with respect to loans and credit products, and from mutual funds, pension funds and insurance companies, with respect to savings products and mortgage loans. Banks continue to be the main suppliers of leasing, factoring and mutual funds in Chile, and the insurance sales business has seen rapid growth. Nevertheless, non-banking competition, especially department stores, may be able to engage in some types of advertising and promotion in which, by virtue of Chilean banking rules and regulations, we are prohibited from engaging.

The increase in competition within the Chilean banking industry in recent years has led to, among other things, consolidation in the industry. In 2002 Banco Santiago and Banco Santander-Chile, the then second and third largest private banks in Chile, respectively, merged to become Chile’s largest bank. In 2002, Banco de Chile and Banco de A. Edwards, then the third and fifth largest private banks in Chile respectively, merged to become the second largest Chilean bank. In 2004, BCI purchased 99.9% of the shares of Banco Conosur, becoming the third largest private bank in Chile. In 2007, Scotiabank Sudamericano acquired 100% of Banco Desarrollo and in January 2008, Banco de Chile and Citibank Chile were authorized to merge operations. Consolidation, which can result in the creation of larger and stronger competitors, may adversely affect our financial condition and results of operations by decreasing the net interest margins we are able to generate and increasing our costs of operation.

Our exposure to individuals and small and medium-sized businesses could lead to higher levels of past due loans and subsequent loan losses.

A substantial number of our customers consists of individuals and small and medium-sized companies (those with annual sales between Ch$600 million and Ch$5,999 million). As part of our business strategy, we seek to increase lending and other services to small and medium-sized companies and individuals. Our business results relating to our individual and small and medium-sized company customers are, however, more likely to be adversely affected by downturns in the Chilean economy, including increases in unemployment, than our business from large corporations and high-income individuals. For example, unemployment directly affects the capacity of individuals to obtain and repay consumer loans. Consequently, in the future we may experience higher levels of past due loans, which could result in higher provisions for loan losses. In 1997, the Chilean Superintendency of Banks increased the level of provisions required for consumer loans (including loans to high income individuals) due to concerns regarding the levels of consumer indebtedness and vulnerability of the banking sector in an economic downturn and in 2004 the Chilean Superintendency of Banks issued new regulations concerning how loans are categorized for purposes of assigning provisions. There can be no assurance that the levels of past due loans and subsequent loan losses will not be materially higher in the future.

12

Our results of operations are affected by interest rate volatility.

Our results of operations depend to a great extent on our net interest revenue. In 2005, 2006 and 2007, our ratio of net interest revenue to total operating revenues was 80.2%, 81.8% and 83.9%, respectively. Changes in market interest rates could affect the interest rates earned on our interest-earning assets differently from the interest rates paid on our interest-bearing liabilities leading to a reduction in our net interest revenue. Interest rates are highly sensitive to many factors beyond our control, including the reserve policies of the Central Bank, deregulation of the financial sector in Chile, domestic and international economic and political conditions and other factors. Over the period from December 31, 1998 to December 31, 2007, yields on the Chilean government’s 90-day note as reported on those dates moved from 13.49% to 6.15%, with a high of 13.59% in April 1999 and a low of 1.31% in 2004. This benchmark rate began to rise in the latter part of 2005 and through 2006 and 2007, reaching a high of 5.21% and a low of 4.39% in 2006 and a high of 6.15% and a low of 4.61% in 2007. Between January 1, 2008 and May 31, 2008, this rate reached a high of 6.68% and a low of 6.50%. In the latter part of 2005 and the first half of 2006, we liquidated a significant portion of our investment portfolio in order to avoid substantial mark-to-market losses relating to our investments in Chilean government and Central Bank bonds, the value of which decreased as interest rates increased. Any volatility in interest rates could adversely affect our business, our future financial performance and the price of our securities.

We may experience operational problems or errors.

We, like all large financial institutions, are exposed to many types of operational risks, including the risk of fraud by employees and outsiders, failure to obtain proper authorizations, failure to properly document transactions, equipment failures and errors by employees. Although we maintain a system of operational controls, there can be no assurances that operational problems or errors will not occur and that their occurrence will not have a material adverse impact on our business, financial condition and results of operations.

RISKS RELATING TO CHILE

Our growth and profitability depend on the level of economic activity in Chile and other emerging markets.

A substantial amount of our loans are to borrowers doing business in Chile. Accordingly, the recoverability of these loans in particular, our ability to increase the amount of loans outstanding and our results of operations and financial condition in general, are dependent to a significant extent on the level of economic activity in Chile. The Chilean economy has been influenced, to varying degrees, by economic conditions in other emerging market countries. Changes in Chilean economic growth in the future or future developments in or affecting the Chilean economy, including further consequences of economic difficulties in Brazil, Argentina and other emerging markets or a deceleration in the economic growth of Asian or other developed nations to which Chile exports a majority of its goods, could materially and adversely affect our business, financial condition or results of operations.

According to data published by the Central Bank, the Chilean economy grew at a rate of 5.7%, 4.0% and 5.1% in 2005, 2006, and 2007, respectively. Historically, lower economic growth has adversely affected the overall asset quality of the Chilean banking system and that of our loan portfolio. Below is a detail of the deteriorations and improvements of the unconsolidated risk index of the banks comprising the Chilean financial system according to information published by the Chilean Superintendency of Banks:

Year |

| Risk Index |

|

December 31, 2003 |

| 1.82 | % |

December 31, 2004 |

| 1.99 | % |

December 31, 2005 |

| 1.61 | % |

December 31, 2006 |

| 1.48 | % |

December 31, 2007 |

| 1.58 | % |

13

See “Item 4. Information of the Company—Business Overview—Selected Statistical Information—Analysis of Our Loan Classification—Risk Index” for a definition of “risk index.” Our results of operations and financial condition could also be affected by changes in economic or other policies of the Chilean government, which has exercised and continues to exercise a substantial influence over many aspects of the private sector, or other political or economic developments in Chile.

Although economic conditions are different in each country, investors’ reactions to developments in one country may affect the securities of issuers in other countries, including Chile. For instance, the devaluation of the Mexican peso in December 1994 set off an economic crisis in Mexico that negatively affected the market value of securities in many countries throughout Latin America. The crisis in the Asian markets, beginning in July 1997, resulted in sharp devaluations of other Asian currencies and negatively affected markets throughout Asia, as well as many markets in Latin America, including Chile. Similar adverse consequences resulted from the 1998 crisis in Russia and the devaluation of the Brazilian real in 1999. In part due to the Asian and Russian crises, the Chilean stock market declined significantly in 1998 to levels equivalent to 1994.

Economic problems in Argentina and Brazil may have an adverse effect on the Chilean economy and on our results of operations and the share price of our ADSs and shares.

We are directly exposed to risks related to the weakness and volatility of the economic and political situation in Latin America, especially in Argentina and Brazil. If Argentina’s economic environment significantly deteriorates or does not improve, the economy in Chile, as both a neighboring country and a trading partner, could also be affected and could experience slower growth than in recent years. The recent cuts in gas exports from Argentina to Chile could also adversely affect economic growth in Chile. Our business could be affected by an economic downturn in Brazil. This could result in the need for us to increase our allowances for loan losses, thus affecting our financial results, our results of operations and the price of our securities. The crises and political uncertainties in other Latin American countries could also have an adverse effect on Chile, the price of our securities or our business.

Deceleration of economic growth in Asia and other developed nations may have an adverse effect on the Chilean economy and on our results of operations and the share price of our ADSs and shares.

We are directly exposed to risks related to the weakness and volatility of the economic and political situation in Asia and other developed nations, including the 2007 credit crunch and economic world crisis. If these nations’ economic environments deteriorate, the economy in Chile could also be affected and could experience slower growth than in recent years. This could result in the need for us to increase our allowances for loan losses, thus affecting our financial results, our results of operations and the price of our securities. The crises and political uncertainties in Asian nations or other developed countries could also have an adverse effect on Chile, the price of our securities or our business.

Currency fluctuations could adversely affect our financial condition and results of operations and the value of our shares and ADSs.

The Chilean government’s economic policies and any future changes in the value of the peso against the U.S. dollar could affect the dollar value of our securities. The peso has been subject to significant devaluations in the past and could be subject to similar fluctuations in the future. At December 31, 2003, 2004, and 2005 the value of the peso in relation to the U.S. dollar appreciated in value when compared to the prior year by approximately 15.9%, 6.6% and 8.1%, respectively. In 2006 the peso depreciated against the U.S. dollar by 3.5% as compared to 2005 and in 2007 appreciated in value by 6.4% as compared to 2006.

Our results of operations may be affected by fluctuations in exchange rates between the peso and the dollar despite our policy and Chilean regulations relating to the general avoidance of material exchange rate gaps. Entering into forward exchange transactions enables us to reduce the negative impact of material gaps between the balances of our foreign currency-denominated assets and liabilities. As of December 31, 2006 and 2007, the gap between foreign currency denominated assets and foreign currency denominated liabilities, including forward contracts, was Ch$423 million, and Ch$(432) million, respectively.

14

We may decide to change our policy regarding exchange rate gaps. Regulations that limit such gaps may also be amended or eliminated. Greater exchange rate gaps will increase our exposure to the devaluation of the peso, and any such devaluation may impair our capacity to service our foreign-currency obligations and may, therefore, materially and adversely affect our financial condition and results of operations. Notwithstanding the existence of general policies and regulations that limit material exchange rate gaps, the economic policies of the Chilean government and any future fluctuations of the peso against the dollar could affect our financial condition and results of operations.

Trading transactions in Chile of the shares of common stock underlying our ADSs are denominated in pesos. Cash distributions with respect to our shares of common stock are received in pesos by the depositary, which then converts such amounts to U.S. dollars at the then-prevailing exchange rate for the purpose of making payments in respect of our ADSs. If the value of the peso falls relative to the U.S. dollar, the dollar value of our ADSs and any distributions to be received from the depositary will be reduced. In addition, the depositary will incur customary currency conversion costs (to be borne by the holders of our ADSs) in connection with the conversion and subsequent distribution of dividends or other payments.

Inflation could adversely affect our financial condition and results of operations.

Although Chilean inflation has moderated in recent years, Chile has experienced high levels of inflation in the past. High levels of inflation in Chile could adversely affect the Chilean economy and have an adverse effect on our results of operations and, indirectly, the value of our securities. The following table shows the annual rate of inflation (as measured by changes in the Chilean Consumer Price Index, or CPI, and as reported by the Chilean Instituto Nacional de Estadísticas, or the Chilean National Institute of Statistics, during the last five years ended December 31, 2007 and through May 31, 2008.

Year |

| Inflation (CPI) (in percentages) |

|

2003 |

| 1.1 | % |

2004 |

| 2.4 |

|

2005 |

| 3.7 |

|

2006 |

| 2.6 |

|

2007 |

| 7.8 |

|

2008 (through May 31, 2008) |

| 2.8 |

|

Source: Chilean National Institute of Statistics.

There can be no assurance that our operating results will not be adversely affected by changing levels of inflation, or that Chilean inflation will not change significantly from the current level.

Banking regulations may adversely affect our financial condition and results of operations.

We are subject to regulation by the Chilean Superintendency of Banks. In addition, we are subject to regulation by the Central Bank with regard to certain matters, including interest rates and foreign exchange.

Pursuant to the Chilean Ley General de Bancos, Decreto con Fuerza de Ley No. 3 de 1997, or the General Banking Law, all Chilean banks, subject to the approval of the Chilean Superintendency of Banks, may engage in certain businesses other than commercial banking depending on the risk associated with such business and the financial strength of the bank. Such additional businesses include securities brokerage, asset management, securitization, insurance brokerage, leasing, factoring, financial advisory, custody and transportation of securities, loan collection and financial services. The General Banking Law also applies to the Chilean banking system a modified version of the capital adequacy guidelines issued by the Basle Committee on Banking Regulation and Supervisory Practices and limits the discretion of the Chilean Superintendency of Banks to deny new banking licenses. There can be no assurance that regulators will not in the future impose more restrictive limitations on the activities of banks, including us, than those currently in effect. Any change in applicable banking regulations could have a material adverse effect on our financial condition or results of operations.

15

Historically, Chilean banks have not paid interest on amounts deposited in checking accounts. However, effective June 1, 2002, the Central Bank allowed banks to pay interest on checking accounts. Currently, there are no applicable restrictions on the interest that may be paid on checking accounts. If competition or other factors lead us to pay interest on checking accounts, to relax the conditions under which we pay interest or to increase the number of checking accounts on which we pay interest, there may be a material adverse effect on our financial condition or results of operations.

Chile has different corporate disclosure and accounting standards than those you may be familiar with in the United States.

The accounting, financial reporting and securities disclosure requirements in Chile differ from those in the United States. Accordingly, the information about us available to you will not be the same as the information available to shareholders of a U.S. company.

Chilean financial statements and reported earnings generally differ from those reported based on U.S. accounting and reporting standards. See “Item 5. Operating and Financial Review and Prospects—Operating Results—Chilean and U.S. GAAP Reconciliation” and note 27 to our financial statements for a description of the principal differences between Chilean GAAP and U.S. GAAP as such differences relate to us, and a reconciliation to U.S. GAAP of our shareholders’ equity and net income as of and for each of the years ended December 31, 2006 and 2007.

As a regulated financial institution, we are required to submit to the Chilean Superintendency of Banks unaudited unconsolidated balance sheets and income statements, excluding any related footnote disclosure, prepared in accordance with Chilean GAAP and the rules of the Chilean Superintendency of Banks on a monthly basis. Beginning in 2008, we are required to submit both unaudited unconsolidated and consolidated balance sheets and income statements, excluding any related footnote disclosure, prepared in accordance with Chilean GAAP and the rules of the Chilean Superintendency of Banks on a monthly basis. The Chilean Superintendency of Banks also makes summary financial information available within three weeks of receipt. Such disclosure differs in a number of significant respects from information generally available in the United States with respect to U.S. financial institutions.

The securities laws of Chile, which govern open, or publicly listed, companies such as ours, have as a principal objective promoting disclosure of all material corporate information to the public. Chilean disclosure requirements, however, differ from those in the United States in some important respects. In addition, although Chilean law imposes restrictions on insider trading and price manipulation, applicable Chilean laws are different from those in the United States and in certain respects the Chilean securities markets are not as highly regulated and supervised as the U.S. securities markets.

Our status as a foreign private issuer allows us to follow alternate standards to the corporate governance standards of the New York Stock Exchange, limiting the protections afforded to investors.

We are a “foreign private issuer” within the meaning of the New York Stock Exchange corporate governance standards. Under the New York Stock Exchange rules, a foreign private issuer may elect to comply with the practice of its home country and not to comply with certain New York Stock Exchange corporate governance requirements applicable to U.S. companies with securities listed on the exchange. We currently follow Chilean practice concerning corporate governance and intend to continue to do so. Accordingly, you will not have the same protections afforded to shareholders of companies that are subject to all New York Stock Exchange corporate governance requirements. See “Item 6. Directors, Senior Management and Employees—Board Practices—Comparative Summary of Differences in Corporate Governance Standards” for a comparison of the corporate governance standards of the New York Stock Exchange and Chilean practice.

Chile imposes controls on foreign investment and repatriation of investments that may affect your investment in, and earnings from, our ADSs.

Equity investments in Chile by persons who are not Chilean residents have generally been subject to various exchange control regulations which restrict the repatriation of the investments and earnings therefrom. In April 2001, the Central Bank eliminated the regulations that affected foreign investors except that investors are still

16

required to provide the Central Bank with information related to equity investments and conduct such operations within the Formal Exchange Market. See “Item 10. Additional Information—Exchange Controls” for a discussion of the types of information required to be provided.

Owners of ADSs are entitled to receive dividends on the underlying shares to the same extent as the holders of shares. Dividends received by holders of ADSs will be converted into U.S. dollars and distributed net of foreign currency exchange fees and fees of the depositary and will be subject to Chilean withholding tax, currently imposed at a rate of 35.0% (subject to credits in certain cases). If for any reason, including changes in Chilean laws or regulations, the depositary were unable to convert pesos to U.S. dollars, investors may receive dividends and other distributions, if any, in pesos.

Additional Chilean restrictions applicable to holders of our ADSs, the disposition of the shares underlying them or the repatriation of the proceeds from such disposition or the payment of dividends could be imposed in the future and we cannot advise you as to the duration or impact of such restrictions if imposed.

RISKS RELATING TO OUR ADSs

There may be a lack of liquidity and market for our shares and ADSs.

A lack of liquidity in the markets may develop for our ADSs, which would negatively affect the ability of the holders to sell our ADSs or the price at which holders of our ADSs will be able to sell them. Future trading prices of our ADSs will depend on many factors including, among other things, prevailing interest rates, our operating results and the market for similar securities.

Our common stock underlying the ADSs is listed and traded on the Santiago Stock Exchange and the Chilean Electronic Exchange, although the trading market for the common stock is small by international standards. As of June 6, 2008, we had 221,236,558,313 shares of common stock outstanding and 5,672,732,264 shares in our custody. The Chilean securities markets are substantially smaller, less liquid and more volatile than major securities markets in the United States. In addition, according to Article 14 of the Ley de Mercado de Valores, Ley No. 18,045, or the Chilean Securities Market Law, the Superintendencia de Valores y Seguros, or the Chilean Superintendency of Securities and Insurance, may suspend the offer, quotation or trading of shares of any company listed on the Chilean stock exchanges for up to 30 days if, in its opinion, such suspension is necessary to protect investors or is justified for reasons of public interest. Such suspension may be extended for up to 120 days. If, at the expiration of the extension, the circumstances giving rise to the original suspension have not changed, the Chilean Superintendency of Securities and Insurance will then cancel the relevant listing in the registry of securities. Furthermore, the Santiago Stock Exchange may inquire as to any movement in the price of any securities in excess of 10% and suspend trading in such securities for a day if it is deemed necessary. These and other factors may substantially limit your ability to sell the common stock underlying your ADSs at a price and time at which you wish to do so.

There can be no assurance that any liquid trading market for our common stock in Chile will continue. Approximately 36.5% of our outstanding common stock was held by the public as of June 6, 2008. A limited trading market in general and our concentrated ownership in particular may impair the ability of an ADS holder to sell in the Chilean market shares of common stock obtained upon withdrawal of such shares from the ADR facility in the amount and at the price and time such holder desires, and could increase the volatility of the price of the ADSs.

Certain actions by our principal shareholder may have an adverse effect on the future market price of our ADSs and shares.

The individual controller of Corp Group Banking S.A. is Mr. Alvaro Saieh Bendeck. As of June 6, 2008, together with his family, Mr. Saieh Bendeck maintains in an indirect ownership of 59.11% of this company. In addition, Mr. Alvaro Saieh Bendeck with his spouse are indirect holders of 100% of the ownership rights of Compañía Inmobiliaria y de Inversiones Saga S.A. The sale or disposition by Mr. Saieh Bendeck of our shares or ADSs that he indirectly owns, or the perception in the marketplace that such a sale or disposition may occur, may adversely affect the trading price of our shares on the Santiago Stock Exchange and, consequently, the market price of the ADSs.

17

You may be unable to exercise preemptive rights.

The Ley Sobre Sociedades Anónimas, Ley No. 18,046 and the Reglamento de Sociedades Anónimas, which we refer to collectively as the Chilean Corporations Law, and applicable regulations require that whenever we issue new common stock for cash, we grant preemptive rights to all of our shareholders (including holders of ADSs), giving them the right to purchase a sufficient number of shares to maintain their existing ownership percentage. Such an offering would not be possible unless a registration statement under the Securities Act were effective with respect to such rights and common stock or an exemption from the registration requirements thereunder were available.

Since we are not obligated to file a registration statement with respect to such rights and the common stock, you may not be able to exercise your preemptive rights. If a registration statement is not filed and an applicable exemption is not available, the depositary will attempt to sell such holders’ preemptive rights and distribute the proceeds thereof, after deducting its expenses and fees, if a premium can be recognized over the cost of any such sale.

You may have fewer and less well defined shareholders’ rights than with shares of a company in the United States.

Our corporate affairs are governed by our estatutos, or by-laws, and the laws of Chile. Under such laws, our shareholders may have fewer or less well-defined rights than they might have as shareholders of a corporation incorporated in a U.S. jurisdiction. For example, under legislation applicable to Chilean banks, our shareholders would not be entitled to appraisal rights in the event of a merger or other business combination undertaken by us.

Holders of ADSs are not entitled to attend shareholders’ meetings, and they may only vote through the depositary.

Under Chilean law, a shareholder is required to be registered in our shareholders’ registry at least five business days before a shareholders’ meeting in order to vote at such meeting. A holder of ADSs will not be able to meet this requirement and accordingly is not entitled to vote at shareholders’ meetings because the shares underlying the ADSs will be registered in the name of the depositary. While a holder of ADSs is entitled to instruct the depositary as to how to vote the shares represented by ADSs in accordance with the procedures provided for in the deposit agreement, a holder of ADSs will not be able to vote its shares directly at a shareholders’ meeting or to appoint a proxy to do so. In certain instances, a discretionary proxy may vote our shares underlying the ADSs if a holder of ADSs does not instruct the depositary with respect to voting.

It may be difficult to enforce civil liabilities against us or our directors, officers and controlling persons.

We are organized under the laws of Chile, and nearly all of our directors, officers and controlling persons reside outside the United States. In addition, all or a substantial portion of our assets are located in Chile. As a result, it may be difficult for investors to effect service of process within the United States on such persons or to enforce judgments against them, including in any action based on civil liabilities under the U.S. federal securities laws. There is doubt as to the enforceability against such persons in Chile, whether in original actions or in actions to enforce judgments of U.S. courts, of liabilities based solely on the U.S. federal securities laws.

In order for ADS holders to enforce, in Chilean courts, judgments obtained in the U.S. courts against us or our directors and executive officers based on civil liability provisions of the U.S. federal securities laws, an exequatur (i.e., recognition and enforcement of the foreign judgment) must be obtained; provided, however, that a U.S. court granted a final judgment in the action based on the civil liability provisions of U.S. federal securities laws. Such exequatur shall be obtained in accordance with Chilean civil procedure law currently in force, and consequently, subject to the satisfaction of certain factors. The most important of these factors are the existence of reciprocity treaties between the countries, the absence of a conflicting judgment by a Chilean court relating to the same parties and arising from the same facts and circumstances and the Chilean courts’ determination that the U.S. courts had jurisdiction, that process was appropriately served on the defendant, that the enforcement is in full force in the foreign country and that enforcement would not violate Chilean public policy. Failure to satisfy any of such requirements may result in non-enforcement of your rights.

18

ITEM 4. INFORMATION ON THE COMPANY

A. HISTORY AND DEVELOPMENT OF THE COMPANY

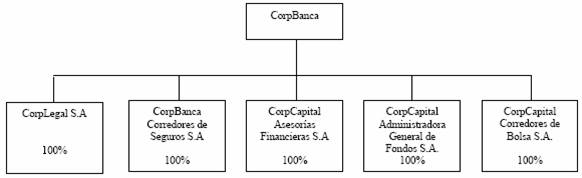

We are a sociedad anónima (corporation) organized under the laws of the Republic of Chile and licensed by the Chilean Superintendency of Banks to operate as a commercial bank. Our principal executive offices are located at Rosario Norte 660, Las Condes, Santiago, Chile. Our telephone number is 56-2-687-8000 and our website is www.bancocorpbanca.cl. Our agent in the United States is Josef Menajem Rebalski Hasson, located at 845 Third Avenue, 5th Floor, New York, NY 10022-6601. Information set forth on our website does not constitute a part of this Annual Report. CorpBanca and all our subsidiaries are organized under the laws of Chile. The terms “CorpBanca,” “we,” “us” and “our” in this Annual Report refer to CorpBanca together with its subsidiaries unless otherwise specified.

History

CorpBanca is Chile’s oldest currently operating bank. We were founded as Banco de Concepción in 1871 by a group of residents of the City of Concepción, Chile, led by Aníbal Pinto, who would later become President of Chile. In 1971, Banco de Concepción was transferred to a government agency, Corporación de Fomento de la Producción (the Chilean Corporation for the Development of Production, or CORFO). Also in 1971, Banco de Concepción acquired Banco Francés e Italiano in Chile, which provided for the expansion of Banco de Concepción into Santiago. In 1972 and 1975, the bank acquired Banco de Chillán and Banco de Valdivia, respectively. In November 1975, CORFO sold its shares of the bank to private business persons, who took control of the bank in 1976. In 1980 the name of the bank was changed to Banco Concepción. In 1983, control of Banco Concepción was assumed by the Chilean Superintendency of Banks. The bank remained under the control of the Chilean Superintendency of Banks through 1986, when it was acquired by Sociedad Nacional de Minería (the Chilean National Mining Society, or SONAMI). Under SONAMI’s control, Banco Concepción focused on providing financing to small- and medium-sized mining interests, increased its capital and sold a portion of its high-risk portfolio to the Central Bank. Investors led by Mr. Alvaro Saieh Bendeck purchased a majority interest of Banco Concepción from SONAMI in 1996. For over 19 years, Mr. Saieh Bendeck has directed the acquisition, creation and operation of a number of commercial banks, mutual fund companies, insurance companies and other financial entities in Chile and other parts of Latin America.

Following our acquisition in 1996, we began to take significant steps to improve our credit risk policies, increase operating efficiency and expand our operations. These steps included applying stricter provisioning and charge-off standards to our loan portfolio, cost cutting measures and technological improvements. We also changed our name to CorpBanca and hired a management team with substantial experience in the Chilean financial services industry. Several of our senior officers, prior to joining CorpBanca, were employed by Banco Osorno prior to its merger with Banco Santander-Chile in 1996. In addition, we significantly expanded our operations in 1998 through the acquisition of the Consumer Loan Division of Corfinsa (which was formerly a consumer loan division of Banco Sudamericano, currently Scotiabank Sudamericano) and the finance company Financiera Condell S.A. In November 2002, we completed the largest equity capital-raising transaction in Chile in that year, providing us with Ch$111,732 million (approximately US$153 million using the exchange rate that was in effect as of December 31, 2002) in capital to help implement our growth strategies. During this time, we consolidated our information technology systems into a single, integrated platform, Integrated Banking System, or IBS, a central information system that replaced a number of systems, providing us with a single, central electronic database that gives us up-to-date customer information in each of our business lines and calculates net earnings and profitability of each product and client segment.

As a result of the steps we have taken since the 1996 acquisition, we have developed a number of significant competitive strengths that we believe will continue to contribute to our growth potential. These include operating efficiencies, improved asset quality, an experienced management team, and a strong technological infrastructure. From 1996 to 2007, we were one of the fastest-growing banks in Chile in terms of loan portfolio size. In addition, our asset quality, as reflected by our risk index and our risk classification by the Chilean Superintendency of Banks, is comparable to that of our principal competitors, and our adequate capitalization places us in a strong position among Chilean banks in terms of ability to fund growth, especially with the placement of

19

subordinated bonds. In recent years, our cost of funding has decreased as a result of improvements in our ratings. We believe that these strengths position us well for continued growth in the Chilean financial services industry.

As of December 31, 2007, our gross loan portfolio amounted to Ch$4,317,422 million (excluding interbank loans), as compared to Ch$2,088,620 million as of December 31, 2003, representing a compounded annual growth rate of 19.9% in nominal terms (15.4% in real terms). During the past years, our consolidated efficiency ratio (operating expenses as a percentage of operating revenue which is the aggregate of net interest revenue, net fees and income from services and net other operating income) was 40.0%, 48.8%, and 41.8% in 2005, 2006, and 2007, respectively. These ratios are a significant improvement over our unconsolidated efficiency ratio of 81.3% for 1995 (when we were not required to present consolidated financial statements). In addition, during the period from 1995 through 2007, our return on average total assets increased from 0.5% to 1.2% as of December 31, 2007.