| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| MANAGEMENT INVESTMENT COMPANIES |

| |

| Investment Company Act file number 811-21503 |

| |

| The FBR Funds |

|

| (Exact name of registrant as specified in charter) |

| |

| 1001 Nineteenth Street North |

| Suite 1100 |

| Arlington, VA 22209 |

|

| (Address of principal executive offices) (Zip code) |

| |

| Registrant’s telephone number, including area code: 703.312.9568 |

| |

| |

| Gavin Beske |

| General Counsel |

| FBR & Co. |

| 1001 Nineteenth Street North |

| Suite 1100 |

| Arlington, VA 22209 |

|

| (Name and address of agent for service) |

Date of fiscal year end: October 31, 2012

Date of reporting period: April 30, 2012

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

ITEM 1. REPORT TO SHAREHOLDERS.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17CRF 270.30e-1).

| THE FBR FUNDS |

| |

| |

| FBR Large Cap Fund |

| FBR Mid Cap Fund |

| FBR Small Cap Fund |

| FBR Focus Fund |

| FBR Large Cap Financial Fund |

| FBR Small Cap Financial Fund |

| FBR Technology Fund |

| FBR Gas Utility Index Fund |

| FBR Balanced Fund |

| FBR Core Bond Fund |

| |

| |

| Semi-Annual Report |

| April 30, 2012 |

[THIS PAGE INTENTIONALLY LEFT BLANK]

Semi-Annual Letter to Shareholders

Dear Shareholder:

We are pleased to present The FBR Funds’ semi-annual report covering the six month period ending April 30, 2012. During the reporting period the Dow Jones Industrial Average rose 12.02%, the S&P 500 Index gained 12.77% and the smaller capitalization Russell 2000 Index rose 11.02%. The top three performing groups during the reporting period were Consumer Cyclical, Technology, and Communication Services. The three worst performing groups during the reporting period were Utilities, Energy and Basic Materials.

We continue to see the investment environment as challenging. Overall, the U.S. economy is looking better. Unemployment is falling, auto sales are strong, tech startup and IPO activity is improved, housing is perking up and banks are looking to lend money again. On the less positive side, we see federal and state governments with tight budgets, growing national debt levels, fragile consumer confidence and renewed fear of European economic austerity impacting the world economy. How things play out in Europe over the next couple years may have significant implications for the U.S. economy and the stock market. We are, like most everyone in the business, following developments there closely.

While the outlook may be challenging, we believe our investment process is well suited to weather the storm(s). Our investment process looks for companies with strong balance sheets and favorable earnings trends. Companies with these characteristics allow them to continue investing in the businesses they have and take share from their weaker or weakened competitors. We believe that companies that invest their profits the best are the best investments. Finally, we look to buy these companies cheap to give us some valuation protection.

We remain buyers of companies, not traders or renters of stocks. We remain mindful of the downside risks inherent in equity investing and look to protect against this downside with our process.

As in prior years, what follows is a commentary from each portfolio manager regarding fund performance and their outlook. This commentary is an important part of our communication to you from the portfolio managers. It is intended to give you a better understanding of their current thinking about the markets and/or individual companies.

All of us at The FBR Funds want to thank you for your continued support, and we look forward to serving your investment needs in the years ahead. As always, we welcome your questions and comments. You can reach us via e-mail at fbrfundsinfo@fbr.com or toll free at 888.200.4710. If you would like more timely updates, www.fbrfunds.com provides quarterly performance data as well as other important information.

Sincerely,

David H. Ellison

President, Chief Investment Officer and Trustee

The FBR Funds

2

Past performance is no guarantee of future results. The performance data quoted represents past performance and the current performance may be lower or higher than the performance data quoted. The investment return and principal will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The performance data does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption fees. If reflected, the redemption fees would reduce the performance quoted. To obtain performance data current to the most recent month-end please call 888.200.4710.

Investors should consider the investment objectives, risks, charges and expenses carefully before investing. This and other important information can be found in the Fund’s prospectus. To obtain a free prospectus, please call 888.200.4710 or visit www.fbrfunds.com. Please read the prospectus carefully before investing.

The FBR Funds are distributed by FBR Investment Services, Inc., member FINRA/SIPC.

3

FBR Large Cap Fund

Management Overview

Portfolio Managers: Robert Barringer, CFA® and Ryan Kelley, CFA®

Over the previous six months, how did the Fund perform and what factors contributed to this performance?

For the six-month period ended April 30, 2012, the Investor Class Shares of the FBR Large Cap Fund returned 9.01%. This compares to the S&P 500 Index and the Morningstar Large Blend Category Average which over the same time period returned 12.77% and 11.28%, respectively.

During this six month period, the domestic equity markets rose steadily throughout most of the period until leveling off in April. Stocks that typically do well in an improving economy led the way, including consumer cyclical and technology stocks. Financials, which were some of the worst performing stocks in 2011, surged in the beginning of this year only to retreat more recently as continued worries about capital losses and growth prevailed. Conversely, two sectors that performed relatively well in 2011 retrenched, namely materials and energy.

On a relative basis, the Fund lagged its benchmark in this rapidly rising stock market environment. We generally do not have a large exposure to cyclical stocks, but prefer to own steadily growing companies that are less sensitive to economic cycles. During this period, our underexposure to highly cyclical consumer stocks caused the majority of our relative underperformance, while materials and industrials also lagged.

On a positive note, we maintained an overweight position in financials, and in the aggregate the financial stocks we owned outperformed the benchmark. Technology also contributed strongly on a relative basis, primarily due to our overexposure compared to our benchmark.

Portfolio managers’ comments on the Fund and the related investment outlook.

We invest in companies trading at attractive valuations that exhibit high and consistent returns on equity, low financial leverage and debt levels, strong management teams, and compelling prospects of future profitability. We are currently fully invested, and, of the major sectors, we are slightly overweight technology and financials while underweight energy and materials.

Our outlook on the domestic equity market can be characterized as cautiously optimistic heading into the second half of the year. While the market surged from October of last year through most of April, recently it has given up most of its gains. While many headwinds persist including high unemployment and housing worries, domestic equities continue to benefit from low interest rates, political and economic unrest abroad, and generally

4

FBR Large Cap Fund

Management Overview (continued)

improving company earnings. We continue to look for investment opportunities to take advantage of what we believe to be an improving outlook for domestic markets.

The opinions expressed in this commentary reflect those of the Portfolio Managers as of the date written. Any such opinions are subject to change based on market or other conditions. These opinions may not be relied upon as investment advice. Investment decisions for The FBR Funds are based on several factors, and may not be relied upon as an indication of trading intent on behalf of any FBR Fund. Security positions can and do change.

5

FBR Large Cap Fund

Comparison of Changes in Value of $10,000 Investment in

Investor Class Shares(1)(2) vs. S&P 500 Index(1)(3)

(unaudited)

Total Returns—For the Periods Ended April 30, 2012(4) |

| | | | | | | | | | Annualized | |

| | | | | One Year | | Annualized

Five Year | | Since

Inception(5) | |

| | | | |

| |

| |

| |

| | FBR Large Cap Fund Investor Class(1)(2) | | | (0.61) | % | | 2.35 | % | | 5.95 | % | |

| | FBR Large Cap Fund Institutional Class(2)(6) | | | (0.37) | % | | 2.51 | % | | 6.08 | % | |

| | S&P 500 Index(1)(3) | | | 4.76 | % | | 1.01 | % | | 4.18 | % | |

| |

| PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS. |

| The performance data quoted represents past performance and the current performance may be lower or higher than the performance data quoted. The investment return and principal will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption fees. The Fund charges a redemption fee of 1.00% on shares redeemed or exchanged within 90 days; if reflected, the redemption fee would reduce the performance data quoted. To obtain performance data current to the most recent month-end, please call 888.200.4710. |

|

| (1) | | The graph assumes a hypothetical $10,000 initial investment in the Fund and reflects the reinvestment of dividends and all Fund expenses. Investors should note that the Fund is a professionally managed mutual fund while the index is unmanaged, does not incur expenses and is not available for investment. The performance of the index includes reinvested dividends, and does not reflect sales charges or expenses. |

| (2) | | FBR Fund Advisers, Inc. waived a portion of its advisory fees and agreed to contractually reimburse a portion of the Fund’s operating expenses, as necessary, to maintain existing expense limitations, as set forth in the notes to the financial statements. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waiver of fees and/or reimbursement of expenses in excess of expense limitations. |

| (3) | | The S&P 500 Index is a capitalization-weighted index of 500 stocks. The index is designed to represent the broad domestic economy through changes in aggregate market value of 500 stocks representing all major industries. |

| (4) | | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| (5) | | For the period November 15, 2005 (commencement of operations) through April 30, 2012. |

| (6) | | Represents the performance of the Institutional Class shares after May 30, 2008 (inception of the share class) and Investor Class for periods prior to that date. |

6

FBR Large Cap Fund

Portfolio Summary

April 30, 2012

(unaudited)

The following provides a breakdown of the Fund by industry sectors. The underlying securities represent a percentage of the portfolio investments.

Industry Sector | | % of Total Investments |

| |

|

| Technology | | | 19.9 | % |

| Consumer, Non-Cyclical | | | 19.8 | % |

| Financial | | | 17.9 | % |

| Industrial | | | 10.8 | % |

| Consumer, Cyclical | | | 9.6 | % |

| Communications | | | 8.0 | % |

| Energy | | | 7.4 | % |

| Utilities | | | 3.4 | % |

| Basic Materials | | | 2.4 | % |

| | | | | |

| Cash | | | 0.8 | % |

| | | | | |

7

FBR Large Cap Fund

Portfolio of Investments

April 30, 2012

(unaudited)

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | COMMON STOCKS — 99.2% | | | | |

| | | | Basic Materials — 2.4% | | | | |

| | 6,000 | | E.I. du Pont de Nemours and Co. | | $ | 320,760 | |

| | 10,000 | | Freeport-McMoRan Copper & Gold, Inc. | | | 383,000 | |

| | 3,000 | | Monsanto Co. | | | 228,540 | |

| | | | | |

| |

| | | | | | | 932,300 | |

| | | | | |

| |

| | | | Communications — 8.0% | | | | |

| | 1,000 | | Amazon.com, Inc.* | | | 231,900 | |

| | 15,000 | | AT&T, Inc. | | | 493,650 | |

| | 30,000 | | Cisco Systems, Inc. | | | 604,500 | |

| | 1,300 | | Google, Inc., Class A* | | | 786,799 | |

| | 900 | | LinkedIn Corp., Class A* | | | 97,605 | |

| | 6,000 | | Rackspace Hosting, Inc.* | | | 348,540 | |

| | 9,000 | | Verizon Communications, Inc. | | | 363,420 | |

| | 12,300 | | Yahoo, Inc.* | | | 191,142 | |

| | | | | |

| |

| | | | | | | 3,117,556 | |

| | | | | |

| |

| | | | Consumer, Cyclical — 9.6% | | | | |

| | 7,000 | | Bed Bath & Beyond, Inc.* | | | 492,730 | |

| | 8,000 | | Coach, Inc. | | | 585,280 | |

| | 3,500 | | Deckers Outdoor Corp.* | | | 178,535 | |

| | 11,700 | | Genuine Parts Co. | | | 757,926 | |

| | 9,400 | | Guess?, Inc. | | | 275,232 | |

| | 11,700 | | Kohl’s Corp. | | | 586,521 | |

| | 7,500 | | Tiffany & Co. | | | 513,450 | |

| | 10,000 | | Walgreen Co. | | | 350,600 | |

| | | | | |

| |

| | | | | | | 3,740,274 | |

| | | | | |

| |

| | | | Consumer, Non-cyclical — 19.8% | | | | |

| | 8,640 | | Abbott Laboratories | | | 536,198 | |

| | 7,000 | | Automatic Data Processing, Inc. | | | 389,340 | |

| | 8,475 | | Baxter International, Inc. | | | 469,600 | |

| | 2,970 | | C.R. Bard, Inc. | | | 293,911 | |

| | 13,500 | | Eli Lilly and Co. | | | 558,765 | |

| | 6,700 | | Gilead Sciences, Inc.* | | | 348,467 | |

| | 14,900 | | Hormel Foods Corp. | | | 432,994 | |

| | 14,400 | | Merck & Company, Inc. | | | 565,056 | |

8

FBR Large Cap Fund

Portfolio of Investments (continued)

April 30, 2012

(unaudited)

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | Consumer, Non-cyclical — 19.8% (continued) | | | | |

| | 10,700 | | Novartis AG | | $ | 590,319 | |

| | 12,000 | | Paychex, Inc. | | | 371,760 | |

| | 5,800 | | PepsiCo, Inc. | | | 382,800 | |

| | 10,700 | | Stryker Corp. | | | 583,899 | |

| | 7,000 | | The Coca-Cola Co. | | | 534,240 | |

| | 9,600 | | The Estee Lauder Companies, Inc., Class A | | | 627,360 | |

| | 7,800 | | The Procter & Gamble Co. | | | 496,392 | |

| | 15,000 | | Unilever PLC ADR | | | 514,800 | |

| | | | | |

| |

| | | | | | | 7,695,901 | |

| | | | | |

| |

| | | | Energy — 7.4% | | | | |

| | 4,202 | | Apache Corp. | | | 403,140 | |

| | 8,800 | | Devon Energy Corp. | | | 614,680 | |

| | 11,000 | | Halliburton Co. | | | 376,420 | |

| | 9,000 | | Hess Corp. | | | 469,260 | |

| | 8,200 | | Murphy Oil Corp. | | | 450,754 | |

| | 8,900 | | Patterson-UTI Energy, Inc. | | | 143,913 | |

| | 6,000 | | Range Resources Corp. | | | 399,960 | |

| | | | | |

| |

| | | | | | | 2,858,127 | |

| | | | | |

| |

| | | | Financial — 17.9% | | | | |

| | 60,000 | | Bank of America Corp. | | | 486,600 | |

| | 10,000 | | Capital One Financial Corp. | | | 554,800 | |

| | 12,000 | | Citigroup, Inc. | | | 396,480 | |

| | 18,000 | | Discover Financial Services | | | 610,200 | |

| | 3,575 | | Franklin Resources, Inc. | | | 448,698 | |

| | 16,725 | | JPMorgan Chase & Co. | | | 718,841 | |

| | 13,000 | | Morgan Stanley | | | 224,640 | |

| | 6,200 | | Prudential Financial, Inc. | | | 375,348 | |

| | 9,000 | | T. Rowe Price Group, Inc. | | | 568,035 | |

| | 7,800 | | The Chubb Corp. | | | 569,946 | |

| | 6,000 | | The PNC Financial Services Group, Inc. | | | 397,920 | |

| | 4,400 | | Torchmark Corp. | | | 214,324 | |

| | 18,500 | | U.S. Bancorp | | | 595,145 | |

| | 24,000 | | Wells Fargo & Co. | | | 802,320 | |

| | | | | |

| |

| | | | | | | 6,963,297 | |

| | | | | |

| |

9

FBR Large Cap Fund

Portfolio of Investments (continued)

April 30, 2012

(unaudited)

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | Industrial — 10.8% | | | | |

| | 11,500 | | 3M Co. | | $ | 1,027,640 | |

| | 6,000 | | Cummins, Inc. | | | 694,980 | |

| | 6,100 | | FedEx Corp. | | | 538,264 | |

| | 43,600 | | General Electric Co. | | | 853,688 | |

| | 8,600 | | Norfolk Southern Corp. | | | 627,198 | |

| | 4,000 | | Union Pacific Corp. | | | 449,760 | |

| | | | | |

| |

| | | | | | | 4,191,530 | |

| | | | | |

| |

| | | | Technology — 19.9% | | | | |

| | 3,550 | | Apple, Inc.* | | | 2,074,052 | |

| | 29,400 | | Applied Materials, Inc. | | | 352,506 | |

| | 9,200 | | Cerner Corp.* | | | 746,028 | |

| | 7,000 | | Check Point Software Technologies Ltd.* | | | 406,910 | |

| | 3,600 | | Citrix Systems, Inc.* | | | 308,196 | |

| | 27,000 | | Intel Corp. | | | 766,800 | |

| | 3,000 | | International Business Machines Corp. | | | 621,240 | |

| | 8,000 | | MICROS Systems, Inc.* | | | 454,640 | |

| | 18,350 | | Microsoft Corp. | | | 587,567 | |

| | 9,900 | | NetApp, Inc.* | | | 384,417 | |

| | 20,000 | | Oracle Corp. | | | 587,800 | |

| | 1,800 | | salesforce.com, Inc.* | | | 280,314 | |

| | 3,800 | | SanDisk Corp.* | | | 140,638 | |

| | | | | |

| |

| | | | | | | 7,711,108 | |

| | | | | |

| |

| | | | Utilities — 3.4% | | | | |

| | 4,800 | | Edison International | | | 211,248 | |

| | 14,000 | | Exelon Corp. | | | 546,140 | |

| | 8,500 | | PG&E Corp. | | | 375,530 | |

| | 6,100 | | Public Service Enterprise Group, Inc. | | | 190,015 | |

| | | | | |

| |

| | | | | | | 1,322,933 | |

| | | | | |

| |

| | | | | | | | |

| | | | Total Common Stocks (Cost $32,943,831) | | | 38,533,026 | |

| | | | | |

| |

10

FBR Large Cap Fund

Portfolio of Investments (continued)

April 30, 2012

(unaudited)

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | SHORT-TERM INVESTMENT — 1.0% | | | | |

| | 397,333 | | Fidelity Institutional Money Market Government Portfolio, Class I , 0.01%^ (Cost $397,333) | | $ | 397,333 | |

| | | | | |

| |

| | | | | | | | |

| | | | Total Investments — 100.2% (Cost $33,341,164) | | | 38,930,359 | |

| | | | | | | | |

| | | | Liabilities Less Other Assets — (0.2)% | | | (75,450 | ) |

| | | | | |

| |

| | | | | | | | |

| | | | Net Assets — 100.0% | | $ | 38,854,909 | |

| | | | | |

| |

|

| * | | Non-income producing security | |

| ADR | | American Depositary Receipts | |

| PLC | | Public Liability Company | |

| ^ | | 7-day yield as of April 30, 2012 | |

| | | | |

| Note: | | For presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with Section 8(b)(1) of the Investment Company Act of 1940, the Fund uses more specific industry classifications. | |

The accompanying notes are an integral part of the financial statements.

11

FBR Mid Cap Fund

Management Overview

Portfolio Manager: Ryan Kelley, CFA®

Over the previous six months, how did the Fund perform and what factors contributed to this performance?

For the six-month period ended April 30, 2012, the Investor Class of the FBR Mid Cap Fund returned 8.58%. This compares to the Russell Midcap Index and the Morningstar Mid Cap Blend Category Average which over the same time period returned 11.87% and 10.92%, respectively.

During this six month period, the domestic equity markets rose steadily throughout most of the period until leveling off in April with large cap stocks leading the way. In the mid cap space, consumer cyclical stocks performed exceptionally well, while healthcare also contributed strongly. Financials, which were some of the worst performing stocks in 2011, surged in the beginning of this year only to retreat more recently as continued worries about capital losses and growth prevailed. Conversely, two sectors that performed fairly well in 2011 lagged the market this year, namely energy and technology.

On a relative basis, the Fund underperformed its benchmark in this rapidly rising stock market environment. While we were in-line with our consumer cyclical exposure, the stocks we owned did not perform as well in the aggregate. Similarly, the healthcare companies that we owned caused a good portion of our underperformance.

On a positive note, we maintained an overweight position in financials, and in the aggregate the financial stocks we owned outperformed the benchmark. Technology and consumer defensive equities also contributed strongly on a relative basis, primarily due to our stock selection.

Portfolio manager comments on the Fund and the related investment outlook.

We are cautiously optimistic about the domestic equity market heading into the second half of the year. While the market surged from October of last year through most of April, recently it has retrenched. While many headwinds persist including high unemployment and housing worries, domestic equities continue to benefit from low interest rates, generally improving company earnings, and political and economic unrest abroad.

We invest in companies trading at attractive valuations that exhibit high and consistent returns on equity, low financial leverage and debt levels, strong management teams, and compelling prospects of future profitability. We are currently fully invested, and, of the major sectors, we are slightly overweight technology while underweight telecommunication

12

FBR Mid Cap Fund

Management Overview (continued)

stocks, utilities and materials. We continue to look for investment opportunities to take advantage of what we believe to be a relatively good outlook for domestic markets.

The opinions expressed in this commentary reflect those of the Portfolio Manager as of the date written. Any such opinions are subject to change based on market or other conditions. These opinions may not be relied upon as investment advice. Investment decisions for The FBR Funds are based on several factors, and may not be relied upon as an indication of trading intent on behalf of any FBR Fund. Security positions can and do change.

13

FBR Mid Cap Fund

Comparison of Changes in Value of $10,000 Investment in

Investor Class Shares(1)(2) vs. Russell Midcap Index(1)(3)

(unaudited)

Total Returns—For the Periods Ended April 30, 2012(4) |

| | | | | | | | | | | Annualized | |

| | | | | | | Annualized | | Since | |

| | | One Year | | Five Year | | Inception(5) | |

| | |

| |

| |

| |

FBR Mid Cap Fund Investor Class(1)(2) | | | (0.89) | % | | | 5.34 | % | | | 6.24 | % | |

FBR Mid Cap Fund Institutional Class(2)(6) | | | (0.70) | % | | | 5.46 | % | | | 6.35 | % | |

Russell Midcap Index(1)(3) | | | (0.03) | % | | | 2.19 | % | | | 3.02 | % | |

| |

| PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS. |

| The performance data quoted represents past performance and the current performance may be lower or higher than the performance data quoted. The investment return and principal will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption fees. The Fund charges a redemption fee of 1.00% on shares redeemed or exchanged within 90 days; if reflected, the redemption fee would reduce the performance data quoted. To obtain performance data current to the most recent month-end, please call 888.200.4710. |

|

| (1) | | The graph assumes a hypothetical $10,000 initial investment in the Fund and reflects the reinvestment of dividends and all Fund expenses. Investors should note that the Fund is a professionally managed mutual fund while the index is unmanaged, does not incur expenses and is not available for investment. The performance of the index includes reinvested dividends, and does not reflect sales charges or expenses. |

| (2) | | FBR Fund Advisers, Inc. waived a portion of its advisory fees and agreed to contractually reimburse a portion of the Fund’s operating expenses, as necessary, to maintain existing expense limitations, as set forth in the notes to the financial statements. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waiver of fees and/or reimbursement of expenses in excess of expense limitations. |

| (3) | | The Russell Midcap Index measures the performance of the 800 smallest companies in the Russell 1000 Index, which represents approximately 31% of the total market capitalization of the Russell 1000 Index. |

| (4) | | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| (5) | | For the period February 28, 2007 (commencement of operations) through April 30, 2012. |

| (6) | | Represents the performance of the Institutional Class shares after May 30, 2008 (inception of the share class) and Investor Class for periods prior to that date. |

14

FBR Mid Cap Fund

Portfolio Summary

April 30, 2012

(unaudited)

The following provides a breakdown of the Fund by industry sectors. The underlying securities represent a percentage of the portfolio investments.

| Industry Sector | | % of Total Investments |

| |

|

| Consumer, Cyclical | | | 20.4 | % |

| Consumer, Non-Cyclical | | | 19.5 | % |

| Financial | | | 16.5 | % |

| Industrial | | | 13.3 | % |

| Technology | | | 11.1 | % |

| Energy | | | 7.9 | % |

| Utilities | | | 4.7 | % |

| Communications | | | 3.1 | % |

| Basic Materials | | | 1.5 | % |

| | | | | |

| Cash | | | 2.0 | % |

15

FBR Mid Cap Fund

Portfolio of Investments

April 30, 2012

(unaudited)

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | COMMON STOCKS — 98.0% | | | | |

| | | | Basic Materials — 1.5% | | | | |

| | 3,984 | | Sigma-Aldrich Corp. | | $ | 282,466 | |

| | | | | |

| |

| | | | Communications — 3.1% | | | | |

| | 3,797 | | FactSet Research Systems, Inc. | | | 398,154 | |

| | 7,880 | | Telephone & Data Systems, Inc. | | | 191,405 | |

| | | | | |

| |

| | | | | | | 589,559 | |

| | | | | |

| |

| | | | Consumer, Cyclical — 20.4% | | | | |

| | 6,615 | | Abercrombie & Fitch Co., Class A | | | 331,875 | |

| | 3,900 | | Bed Bath & Beyond, Inc.* | | | 274,521 | |

| | 9,080 | | Big Lots, Inc.* | | | 332,691 | |

| | 14,970 | | Copart, Inc.* | | | 395,358 | |

| | 2,250 | | Deckers Outdoor Corp.* | | | 114,773 | |

| | 3,400 | | Genuine Parts Co. | | | 220,252 | |

| | 2,700 | | Guess?, Inc. | | | 79,056 | |

| | 10,930 | | Magna International, Inc. | | | 479,062 | |

| | 12,824 | | Mattel, Inc. | | | 430,886 | |

| | 2,800 | | MSC Industrial Direct Company, Inc., Class A | | | 206,388 | |

| | 7,735 | | Tiffany & Co. | | | 529,538 | |

| | 2,229 | | V.F. Corp. | | | 338,919 | |

| | 3,700 | | Williams-Sonoma, Inc. | | | 143,153 | |

| | | | | |

| |

| | | | | | | 3,876,472 | |

| | | | | |

| |

| | | | Consumer, Non-cyclical — 19.5% | | | | |

| | 3,022 | | Bunge Ltd. | | | 194,919 | |

| | 2,446 | | C.R. Bard, Inc. | | | 242,056 | |

| | 2,600 | | Covance, Inc.* | | | 121,576 | |

| | 9,050 | | Endo Pharmaceuticals Holdings, Inc.* | | | 318,017 | |

| | 6,438 | | Forest Laboratories, Inc.* | | | 224,236 | |

| | 1,400 | | Humana, Inc. | | | 112,952 | |

| | 6,995 | | Lincare Holdings, Inc. | | | 170,678 | |

| | 11,500 | | Monster Beverage Corp.* | | | 747,040 | |

| | 9,575 | | Paychex, Inc. | | | 296,634 | |

| | 20,450 | | SEI Investments Co. | | | 412,885 | |

| | 3,385 | | Techne Corp. | | | 226,592 | |

16

FBR Mid Cap Fund

Portfolio of Investments (continued)

April 30, 2012

(unaudited)

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | Consumer, Non-cyclical — 19.5% (continued) | | | | |

| | 1,650 | | Tupperware Brands Corp. | | $ | 102,778 | |

| | 13,275 | | Tyson Foods, Inc., Class A | | | 242,269 | |

| | 4,444 | | Varian Medical Systems, Inc.* | | | 281,838 | |

| | | | | |

| |

| | | | | | | 3,694,470 | |

| | | | | |

| |

| | | | Energy — 7.9% | | | | |

| | 4,677 | | Energen Corp. | | | 244,981 | |

| | 3,285 | | Ensco PLC ADR | | | 179,525 | |

| | 2,640 | | Helmerich & Payne, Inc. | | | 135,670 | |

| | 7,800 | | Nabors Industries Ltd.* | | | 129,870 | |

| | 2,925 | | Newfield Exploration Co.* | | | 105,008 | |

| | 2,975 | | Pioneer Natural Resources Co. | | | 344,564 | |

| | 3,900 | | Plains Exploration & Production Co.* | | | 159,315 | |

| | 5,550 | | Rowan Companies, Inc.* | | | 191,642 | |

| | | | | |

| |

| | | | | | | 1,490,575 | |

| | | | | |

| |

| | | | Financial — 16.5% | | | | |

| | 6,375 | | Comerica, Inc. | | | 204,128 | |

| | 17,900 | | Fifth Third Bancorp | | | 254,717 | |

| | 20,000 | | First Niagara Financial Group, Inc. | | | 178,800 | |

| | 26,950 | | KeyCorp | | | 216,678 | |

| | 2,546 | | M&T Bank Corp. | | | 219,643 | |

| | 11,785 | | New York Community Bancorp, Inc. | | | 158,980 | |

| | 10,250 | | People’s United Financial, Inc. | | | 126,485 | |

| | 8,700 | | Raymond James Financial, Inc. | | | 318,594 | |

| | 47,200 | | Regions Financial Corp. | | | 318,128 | |

| | 4,500 | | Reinsurance Group of America, Inc. | | | 261,630 | |

| | 6,821 | | T. Rowe Price Group, Inc. | | | 430,507 | |

| | 6,800 | | W. R. Berkley Corp. | | | 256,088 | |

| | 9,600 | | Zions Bancorp | | | 195,744 | |

| | | | | |

| |

| | | | | | | 3,140,122 | |

| | | | | |

| |

| | | | Industrial — 13.3% | | | | |

| | 6,625 | | Dolby Laboratories, Inc., Class A* | | | 259,899 | |

| | 9,075 | | FLIR Systems, Inc. | | | 203,824 | |

| | 5,950 | | Kansas City Southern | | | 458,269 | |

17

FBR Mid Cap Fund

Portfolio of Investments (continued)

April 30, 2012

(unaudited)

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | Industrial — 13.3% (continued) | | | | |

| | 3,700 | | Kirby Corp.* | | $ | 245,569 | |

| | 7,195 | | Pall Corp. | | | 428,894 | |

| | 4,592 | | Roper Industries, Inc. | | | 467,925 | |

| | 10,300 | | Spirit AeroSystems Holdings, Inc., Class A* | | | 257,500 | |

| | 3,500 | | Tidewater, Inc. | | | 192,605 | |

| | | | | |

| |

| | | | | | | 2,514,485 | |

| | | | | |

| |

| | | | Technology — 11.1% | | | | |

| | 32,168 | | Activision Blizzard, Inc. | | | 414,002 | |

| | 8,403 | | Check Point Software Technologies Ltd.* | | | 488,466 | |

| | 4,900 | | Microchip Technology, Inc. | | | 173,166 | |

| | 3,400 | | SanDisk Corp.* | | | 125,834 | |

| | 9,700 | | Seagate Technology PLC | | | 298,372 | |

| | 30,900 | | Siliconware Precision Industries Co. Ltd. ADR | | | 180,147 | |

| | 4,900 | | Western Digital Corp.* | | | 190,169 | |

| | 6,200 | | Xilinx, Inc. | | | 225,556 | |

| | | | | |

| |

| | | | | | | 2,095,712 | |

| | | | | |

| |

| | | | Utilities — 4.7% | | | | |

| | 8,800 | | Ameren Corp. | | | 288,552 | |

| | 17,700 | | NRG Energy, Inc.* | | | 300,900 | |

| | 10,650 | | Westar Energy, Inc. | | | 305,548 | |

| | | | | |

| |

| | | | | | | 895,000 | |

| | | | | |

| |

| | | | | | | | |

| | | | Total Common Stocks (Cost $15,276,026) | | | 18,578,861 | |

| | | | | |

| |

18

FBR Mid Cap Fund

Portfolio of Investments (continued)

April 30, 2012

(unaudited)

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | SHORT-TERM INVESTMENT — 2.0% | | | | |

| | 374,927 | | Fidelity Institutional Money Market Government Portfolio, Class I , 0.01%^ (Cost $374,927) | | $ | 374,927 | |

| | | | | |

| |

| | | | | | | | |

| | | | Total Investments — 100.0% (Cost $15,650,953) | | | 18,953,788 | |

| | | | | | | | |

| | | | Liabilities Less Other Assets — 0.0% | | | (2,176 | ) |

| | | | | |

| |

| | | | | | | | |

| | | | Net Assets — 100.0% | | $ | 18,951,612 | |

| | | | | |

| |

|

| * | | Non-income producing security |

| ADR | | American Depositary Receipts |

| PLC | | Public Liability Company |

| ^ | | 7-day yield as of April 30, 2012 |

| | | |

| Note: | | For presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with Section 8(b)(1) of the Investment Company Act of 1940, the Fund uses more specific industry classifications. |

The accompanying notes are an integral part of these financial statements.

19

FBR Small Cap Fund

Management Overview

Portfolio Manager: Robert Barringer, CFA®

Over the previous six months, how did the Fund perform and what factors contributed to this performance?

For the six-month period ended April 30, 2012, the Investor Class of the FBR Small Cap Fund returned 14.60%. This compares to the Russell 2000 Index and the Morningstar Small Growth Category, which returned 11.02% and 11.58% for the same period, respectively.

The Fund’s outperformance relative to its benchmark is due to particular stock selection in a few sectors that outperformed their peers over the past six months. Much of the outperformance came from selections within the technology, financial services and industrial sectors. In particular, some of the top holdings of the Fund performed particularly well, such as White Mountains Insurance Group Ltd. and Horace Mann Educators Corp., two insurance company stocks. Two sectors whose performance hurt the Fund’s performance were healthcare and consumer cyclicals, although not by a significant amount. One stock that hurt performance was Allscripts Healthcare Solutions, Inc., which declined approximately 43% for the period after management changes were announced and the firm lowered its outlook.

Portfolio manager comments on the Fund and the related investment outlook.

The Fund did well due to the selections as identified by the investment process, which emphasizes profitable, well-run companies selling at reasonable prices. The outlook at this time is uncertain as Europe attempts to deal with deteriorating conditions in a number of countries’ fiscal situations and financial systems, generally. However, small caps are usually more focused on the U.S. markets and, as such, should be able to weather the economics storm clouds relatively well, unless the U.S. starts to feel more of an impact.

The opinions expressed in this commentary reflect those of the Portfolio Manager as of the date written. Any such opinions are subject to change based on market or other conditions. These opinions may not be relied upon as investment advice. Investment decisions for The FBR Funds are based on several factors, and may not be relied upon as an indication of trading intent on behalf of any FBR Fund. Security positions can and do change.

20

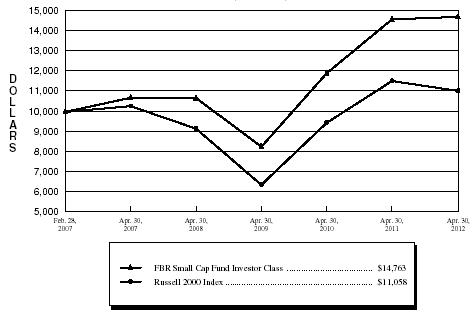

FBR Small Cap Fund

Comparison of Changes in Value of $10,000 Investment in

Investor Class Shares(1)(2) vs. Russell 2000 Index(1)(3)

(unaudited)

Total Returns—For the Periods Ended April 30, 2012(4) |

| | | | | | | | | | | Annualized | |

| | | | | | | Annualized | | Since | |

| | | One Year | | Five Year | | Inception(5) | |

| | |

| |

| |

| |

FBR Small Cap Fund Investor Class(1)(2) | | | 0.85 | % | | | 6.63 | % | | | 7.83 | % | |

FBR Small Cap Fund Institutional Class(2)(6) | | | 1.10 | % | | | 6.80 | % | | | 7.99 | % | |

Russell 2000 Index(1)(3) | | | (4.25) | % | | | 1.45 | % | | | 1.96 | % | |

| |

| PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS. |

| The performance data quoted represents past performance and the current performance may be lower or higher than the performance data quoted. The investment return and principal will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption fees. The Fund charges a redemption fee of 1.00% on shares redeemed or exchanged within 90 days; if reflected, the redemption fee would reduce the performance data quoted. To obtain performance data current to the most recent month-end, please call 888.200.4710. |

| | | |

|

| (1) | | The graph assumes a hypothetical $10,000 initial investment in the Fund and reflects the reinvestment of dividends and all Fund expenses. Investors should note that the Fund is a professionally managed mutual fund while the index is unmanaged, does not incur expenses and is not available for investment. The performance of the index includes reinvested dividends, and does not reflect sales charges or expenses. |

| (2) | | FBR Fund Advisers, Inc. waived a portion of its advisory fees and agreed to contractually reimburse a portion of the Fund’s operating expenses, as necessary, to maintain existing expense limitations, as set forth in the notes to the financial statements. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waiver of fees and/or reimbursement of expenses in excess of expense limitations. |

| (3) | | The Russell 2000 Index is comprised of the smallest of the 2000 companies of the Russell 3000 Index, representing approximately 8% of the Russell 3000’s total market capitalization. |

| (4) | | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| (5) | | For the period February 28, 2007 (commencement of operations) through April 30, 2012. |

| (6) | | Represents the performance of the Institutional Class shares after May 30, 2008 (inception of the share class) and Investor Class for periods prior to that date. |

21

FBR Small Cap Fund

Portfolio Summary

April 30, 2012

(unaudited)

The following provides a breakdown of the Fund by industry sectors. The underlying securities represent a percentage of the portfolio investments.

| Industry Sector | | % of Total Investments |

| |

|

| Financial | | | 19.7 | % |

| Technology | | | 18.1 | % |

| Consumer, Cyclical | | | 14.7 | % |

| Consumer, Non-Cyclical | | | 14.5 | % |

| Industrial | | | 11.0 | % |

| Energy | | | 8.3 | % |

| Basic Materials | | | 4.9 | % |

| Utilities | | | 2.1 | % |

| Communications | | | 1.9 | % |

| Real Estate Investment Trust | | | 0.9 | % |

| | | | | |

| Cash | | | 3.9 | % |

22

FBR Small Cap Fund

Portfolio of Investments

April 30, 2012

(unaudited)

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | COMMON STOCKS — 96.1% | | | | |

| | | | Basic Materials — 4.9% | | | | |

| | 12,000 | | Huntsman Corp. | | $ | 169,920 | |

| | 10,000 | | Innospec, Inc.* | | | 302,300 | |

| | 8,000 | | Kraton Performance Polymers, Inc.* | | | 208,000 | |

| | 6,000 | | Kronos Worldwide, Inc. | | | 142,440 | |

| | 1,500 | | NewMarket Corp. | | | 334,830 | |

| | 20,000 | | PolyOne Corp. | | | 277,200 | |

| | 5,000 | | Schnitzer Steel Industries, Inc., Class A | | | 199,350 | |

| | 4,000 | | W.R. Grace & Co.* | | | 238,440 | |

| | | | | |

| |

| | | | | | | 1,872,480 | |

| | | | | |

| |

| | | | Communications — 1.9% | | | | |

| | 2,000 | | Acme Packet, Inc.* | | | 56,140 | |

| | 3,500 | | ADTRAN, Inc. | | | 106,820 | |

| | 6,500 | | Aruba Networks, Inc.* | | | 137,280 | |

| | 1,000 | | Bazaarvoice, Inc.* | | | 19,810 | |

| | 7,000 | | Sourcefire, Inc.* | | | 356,930 | |

| | 3,000 | | Yelp, Inc.* | | | 68,580 | |

| | | | | |

| |

| | | | | | | 745,560 | |

| | | | | |

| |

| | | | Consumer, Cyclical — 14.7% | | | | |

| | 6,000 | | Alaska Air Group, Inc.* | | | 202,800 | |

| | 34,000 | | American Axle & Manufacturing Holdings, Inc.* | | | 329,460 | |

| | 18,000 | | Ascena Retail Group, Inc.* | | | 368,640 | |

| | 7,000 | | Bally Technologies, Inc.* | | | 339,850 | |

| | 10,000 | | Big Lots, Inc.* | | | 366,400 | |

| | 13,000 | | Chico’s FAS, Inc. | | | 199,680 | |

| | 4,000 | | Columbia Sportswear Co. | | | 188,400 | |

| | 9,000 | | Crocs, Inc.* | | | 181,800 | |

| | 3,000 | | Deckers Outdoor Corp.* | | | 153,030 | |

| | 70,000 | | JetBlue Airways Corp.* | | | 332,500 | |

| | 10,000 | | Meritor, Inc.* | | | 65,100 | |

| | 15,300 | | Modine Manufacturing Co.* | | | 120,870 | |

| | 16,000 | | Penn National Gaming, Inc.* | | | 719,680 | |

| | 22,000 | | Pier 1 Imports, Inc. | | | 377,960 | |

| | 1,000 | | Red Robin Gourmet Burgers, Inc.* | | | 35,660 | |

23

FBR Small Cap Fund

Portfolio of Investments (continued)

April 30, 2012

(unaudited)

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | Consumer, Cyclical — 14.7% (continued) | | | | |

| | 4,000 | | Select Comfort Corp.* | | $ | 115,520 | |

| | 6,000 | | Steven Madden Ltd.* | | | 259,260 | |

| | 5,600 | | The Buckle, Inc. | | | 258,608 | |

| | 4,000 | | The Children’s Place Retail Stores, Inc.* | | | 183,920 | |

| | 20,000 | | US Airways Group, Inc.* | | | 205,200 | |

| | 7,000 | | Westport Innovations, Inc.* | | | 219,100 | |

| | 10,000 | | Wolverine World Wide, Inc. | | | 419,500 | |

| | | | | |

| |

| | | | | | | 5,642,938 | |

| | | | | |

| |

| | | | Consumer, Non-cyclical — 14.5% | | | | |

| | 4,000 | | Abiomed, Inc.* | | | 97,320 | |

| | 14,000 | | Dollar Thrifty Automotive Group, Inc.* | | | 1,132,040 | |

| | 2,000 | | Idenix Pharmaceuticals, Inc.* | | | 17,540 | |

| | 6,000 | | ImmunoGen, Inc.* | | | 76,500 | |

| | 3,000 | | Jazz Pharmaceuticals, Inc.* | | | 153,090 | |

| | 1,000 | | MAKO Surgical Corp.* | | | 41,310 | |

| | 500 | | Medivation, Inc.* | | | 40,440 | |

| | 8,000 | | Optimer Pharmaceuticals, Inc.* | | | 118,400 | |

| | 10,000 | | Par Pharmaceutical Companies, Inc.* | | | 423,400 | |

| | 1,000 | | Pharmacyclics, Inc.* | | | 27,560 | |

| | 12,000 | | RSC Holdings, Inc.* | | | 284,640 | |

| | 4,500 | | Seattle Genetics, Inc.* | | | 88,965 | |

| | 36,000 | | SEI Investments Co. | | | 726,840 | |

| | 15,150 | | Sirona Dental Systems, Inc.* | | | 765,227 | |

| | 4,800 | | Sotheby’s | | | 188,736 | |

| | 6,000 | | The Cooper Companies, Inc. | | | 529,020 | |

| | 7,000 | | ViroPharma, Inc.* | | | 152,250 | |

| | 3,000 | | VIVUS, Inc.* | | | 72,660 | |

| | 10,000 | | Wright Express Corp.* | | | 638,200 | |

| | | | | |

| |

| | | | | | | 5,574,138 | |

| | | | | |

| |

| | | | Energy — 8.3% | | | | |

| | 14,012 | | Atwood Oceanics, Inc.* | | | 621,152 | |

| | 13,000 | | C&J Energy Services, Inc.* | | | 245,050 | |

| | 6,000 | | Cheniere Energy, Inc.* | | | 109,860 | |

| | 4,000 | | Clean Energy Fuels Corp.* | | | 76,960 | |

24

FBR Small Cap Fund

Portfolio of Investments (continued)

April 30, 2012

(unaudited)

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | Energy — 8.3% (continued) | | | | |

| | 9,000 | | Energy XXI (Bermuda) Ltd.* | | $ | 339,120 | |

| | 19,000 | | Key Energy Services, Inc.* | | | 240,540 | |

| | 70,000 | | Kodiak Oil & Gas Corp.* | | | 619,500 | |

| | 10,000 | | Oasis Petroleum, Inc.* | | | 330,700 | |

| | 4,000 | | Rosetta Resources, Inc.* | | | 201,080 | |

| | 15,592 | | Superior Energy Services, Inc.* | | | 419,737 | |

| | | | | |

| |

| | | | | | | 3,203,699 | |

| | | | | |

| |

| | | | Financial — 19.7% | | | | |

| | 30,000 | | Associated Banc-Corp | | | 399,900 | |

| | 12,000 | | BankUnited, Inc. | | | 295,200 | |

| | 10,000 | | Berkshire Hills Bancorp, Inc. | | | 226,900 | |

| | 59,729 | | Brookline Bancorp, Inc. | | | 536,366 | |

| | 15,000 | | Brown & Brown, Inc. | | | 404,550 | |

| | 29,454 | | Capitol Federal Financial | | | 347,852 | |

| | 19,139 | | Chicopee Bancorp, Inc.* | | | 275,602 | |

| | 28,500 | | CNO Financial Group, Inc.* | | | 207,195 | |

| | 6,000 | | Encore Capital Group, Inc.* | | | 142,200 | |

| | 32,253 | | First Horizon National Corp. | | | 296,082 | |

| | 32,200 | | Fulton Financial Corp. | | | 337,778 | |

| | 1,771 | | Hingham Institution for Savings | | | 102,098 | |

| | 38,700 | | Horace Mann Educators Corp. | | | 679,185 | |

| | 14,000 | | Independent Bank Corp. | | | 392,980 | |

| | 3,407 | | Investors Title Co. | | | 173,655 | |

| | 6,000 | | Newport Bancorp, Inc.* | | | 82,500 | |

| | 9,000 | | Peoples Federal Bancshares, Inc.* | | | 148,320 | |

| | 7,300 | | SI Financial Group, Inc. | | | 83,950 | |

| | 34,000 | | Susquehanna Bancshares, Inc. | | | 352,580 | |

| | 18,000 | | Tower Group, Inc. | | | 388,440 | |

| | 44,877 | | United Financial Bancorp, Inc. | | | 719,827 | |

| | 23,000 | | Waddell & Reed Financial, Inc. | | | 735,540 | |

| | 15,400 | | Washington Federal, Inc. | | | 270,116 | |

| | | | | |

| |

| | | | | | | 7,598,816 | |

| | | | | |

| |

25

FBR Small Cap Fund

Portfolio of Investments (continued)

April 30, 2012

(unaudited)

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | Industrial — 11.0% | | | | |

| | 15,000 | | A.O. Smith Corp. | | $ | 714,000 | |

| | 8,000 | | Atlas Air Worldwide Holdings, Inc.* | | | 368,400 | |

| | 4,000 | | Cymer, Inc.* | | | 207,360 | |

| | 8,000 | | Genesee & Wyoming, Inc., Class A* | | | 431,280 | |

| | 12,100 | | Heartland Express, Inc. | | | 167,343 | |

| | 8,000 | | Lennox International, Inc. | | | 347,200 | |

| | 16,000 | | Roadrunner Transportation Systems, Inc.* | | | 277,600 | |

| | 8,000 | | Sauer-Danfoss, Inc.* | | | 346,480 | |

| | 8,000 | | Simpson Manufacturing Company, Inc. | | | 248,240 | |

| | 5,200 | | Snap-on, Inc. | | | 325,208 | |

| | 12,000 | | Sun Hydraulics Corp. | | | 300,360 | |

| | 8,000 | | Terex Corp.* | | | 181,120 | |

| | 13,250 | | Werner Enterprises, Inc. | | | 312,965 | |

| | | | | |

| |

| | | | | | | 4,227,556 | |

| | | | | |

| |

| | | | Real Estate Investment Trust — 0.9% | | | | |

| | 34,800 | | Sunstone Hotel Investors, Inc.* | | | 354,960 | |

| | | | | |

| |

| | | | | | | | |

| | | | Technology — 18.1% | | | | |

| | 16,000 | | Allscripts Healthcare Solutions, Inc.* | | | 177,280 | |

| | 40,100 | | Brocade Communications Systems, Inc.* | | | 222,154 | |

| | 11,000 | | Cirrus Logic, Inc.* | | | 301,180 | |

| | 5,000 | | Comm Vault Systems, Inc.* | | | 260,350 | |

| | 22,000 | | Compuware Corp.* | | | 191,840 | |

| | 3,000 | | Concur Technologies, Inc.* | | | 169,680 | |

| | 2,000 | | Demandware, Inc.* | | | 54,500 | |

| | 20,000 | | Emulex Corp.* | | | 173,600 | |

| | 1,000 | | Fusion-io, Inc.* | | | 25,650 | |

| | 8,000 | | Greenway Medical Technologies, Inc.* | | | 123,200 | |

| | 2,000 | | Guidewire Software, Inc.* | | | 54,440 | |

| | 22,000 | | Jack Henry & Associates, Inc. | | | 747,120 | |

| | 16,000 | | Jive Software, Inc.* | | | 380,960 | |

| | 1,000 | | LivePerson, Inc.* | | | 15,880 | |

| | 18,000 | | MedAssets, Inc.* | | | 226,980 | |

26

FBR Small Cap Fund

Portfolio of Investments (continued)

April 30, 2012

(unaudited)

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | Technology — 18.1% (continued) | | | | |

| | 14,000 | | Medidata Solutions, Inc.* | | $ | 362,740 | |

| | 4,000 | | Mellanox Technologies Ltd.* | | | 234,360 | |

| | 2,000 | | MicroStrategy, Inc., Class A* | | | 279,560 | |

| | 12,000 | | MKS Instruments, Inc. | | | 331,800 | |

| | 4,000 | | Nanometrics, Inc.* | | | 62,040 | |

| | 6,000 | | NetSuite, Inc.* | | | 266,280 | |

| | 2,000 | | OmniVision Technologies, Inc.* | | | 36,840 | |

| | 7,175 | | Open Text Corp.* | | | 401,728 | |

| | 4,600 | | Qlik Technologies, Inc.* | | | 132,526 | |

| | 10,000 | | QLogic Corp.* | | | 172,500 | |

| | 16,000 | | Quality Systems, Inc. | | | 598,400 | |

| | 12,000 | | Radware Ltd.* | | | 461,760 | |

| | 8,000 | | Synchronoss Technologies, Inc.* | | | 250,400 | |

| | 1,000 | | Tangoe, Inc.* | | | 20,480 | |

| | 1,800 | | The Ultimate Software Group, Inc.* | | | 138,888 | |

| | 20,000 | | TriQuint Semiconductor, Inc.* | | | 97,600 | |

| | | | | |

| |

| | | | | | | 6,972,716 | |

| | | | | |

| |

| | | | Utilities — 2.1% | | | | |

| | 10,400 | | ALLETE, Inc. | | | 428,584 | |

| | 15,400 | | Portland General Electric Co. | | | 397,782 | |

| | | | | |

| |

| | | | | | | 826,366 | |

| | | | | |

| |

| | | | | | | | |

| | | | Total Common Stocks (Cost $34,185,960) | | | 37,019,229 | |

| | | | | |

| |

|

| | NO. OF | | | | | | |

| | RIGHTS | | | | | | |

|

| | | | RIGHTS — 0.0% | | | | |

| | 5,500 | | Forest Laboratories, Inc., Contingent Value Rights* | | | 5,225 | |

| | | | | |

| |

27

FBR Small Cap Fund

Portfolio of Investments (continued)

April 30, 2012

(unaudited)

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | SHORT-TERM INVESTMENT — 3.5% | | | | |

| | 1,323,204 | | Fidelity Institutional Money Market Government Portfolio, Class I, 0.01%^ (Cost $1,323,204) | | $ | 1,323,204 | |

| | | | | |

| |

| | | | | | | | |

| | | | Total Investments — 99.6% (Cost $35,509,164) | | | 38,347,658 | |

| | | | | | | | |

| | | | Other Assets Less Liabilities — 0.4% | | | 168,471 | |

| | | | | |

| |

| | | | | | | | |

| | | | Net Assets — 100.0% | | $ | 38,516,129 | |

| | | | | |

| |

|

| * | | Non-income producing security |

| ^ | | 7-day yield as of April 30, 2012 |

| | | |

| Note: | | For presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with Section 8(b)(1) of the Investment Company Act of 1940, the Fund uses more specific industry classifications. |

The accompanying notes are an integral part of the financial statements.

28

FBR Focus Fund

Management Overview

Portfolio Managers: David Rainey, CFA®, Brian Macauley, CFA® and Ira Rothberg, CFA®

Over the previous six months, how did the Fund perform and what factors contributed to this performance?

For the six-month period ended April 30, 2012, the Investor Class of the FBR Focus Fund returned 14.26% compared to 11.02% for the Russell 2000 Index, 12.77% for the S&P 500 Index, and 11.10% for the Morningstar Mid Cap Growth Category.

The Fund’s return during the period was the result of improved business prospects for its key holdings, owed to a better overall economic outlook and company specific developments. Leading contributors to the Fund’s performance were O’Reilly Automotive, Inc. (Nasdaq Symbol: ORLY), Bally Technologies, Inc. (Nasdaq Symbol: BYI), American Tower Corp. (NYSE Symbol: AMT), Penn National Gaming, Inc. (Nasdaq Symbol: PENN), and CarMax, Inc. (NYSE Symbol: KMX). The leading detractor from the Fund’s performance was Encore Capital Group, Inc. (Nasdaq Symbol: ECPG).

We invest with a long-term time horizon and encourage shareholders to do the same. Despite the discussion of six-month results referenced above, we encourage investors to evaluate the Fund’s performance over three-, five-, and ten-year periods since shorter time frames can be influenced by many transitory issues unrelated to the intrinsic worth of the Fund’s holdings. Long-term performance metrics for the Fund can be found in the table below.

Portfolio managers’ comments on the Fund and the related investment outlook.

We are pleased to report that during the six month period ended April 30, 2012, the Fund exited its position in 99 Cents Only Stores at a substantial profit. This sale eliminated a large and long-term holding from the portfolio. The Fund held the position for approximately seven years, and at various points during that time the position exceeded 10% of Fund assets. Please see the section below titled “99 Cents Only Stores - Shareholder Activism” for some details on our recent efforts to maximize value in this investment.

As we reflect upon this investment, it is interesting to note the stock’s price volatility during our holding period. The stock suffered eleven separate occasions of 20% or greater price declines, including gut wrenching declines of 41%, 62%, 51%, and 46%. And yet, despite these price declines, the company has gradually grown its intrinsic value, and the Fund has had a good overall investment experience! The Fund’s compound annual returns in 99 Cents Only Stores approximated 10% over the holding period which compares favorably to the low single digit returns from the major market indices.

We think that a key factor in making this a successful investment was the ability to hold onto the stock during these big price swoons, even adding to the position on several such occasions. This is not so easily done. When an investment declines significantly in market

29

FBR Focus Fund

Management Overview (continued)

price, it is human nature to have self doubts about your investment decision. A common response from some investors is to sell a stock that is down to avoid further price declines. Some firms even implement “stop loss” rules that mandate sale of a position that moves too far below initial purchase price. While this may provide some short-term psychological relief from an unpleasant situation, it is frequently the wrong long-term investment decision.

In our experience, the best way to manage the dramatic price swings in a stock is to take a long-term view, and to have a firm opinion of the stocks’ intrinsic value. It is only by knowing what a stock is worth (through diligent research and analysis), that you can determine if the current market price accurately reflects the company’s value. While intrinsic value cannot be calculated with precision, it is often possible to establish a reliable range. With this intrinsic value range in mind, an investor is equipped to make the proper response when confronted with significant stock price swings.

While the price moves in 99 Cents Only Stores stock might seem unusual, they are actually quite common for an individual security. Consider that Fund holding CarMax has had nine separate 20% or greater declines since initial purchase in 2002, including declines of 51%, 80%, and 38%. Fund holding Bally Technologies has had sixteen separate 20% or greater price declines since initial purchase in 2001, including declines of 74%, 43%, 44%, 67%, 52%, and 41%. Despite this stock price volatility, like 99 Cents Only Stores, these companies have gradually grown their intrinsic value driving their stock price higher and producing nice returns for the Fund.

Our experience with 99 Cents Only Stores and other portfolio companies has long convinced us that volatility is the friend of the value investor with staying power. It is our observation that stock prices are much more volatile than a company’s intrinsic value, and therein lies opportunity for the prepared investor. While the market swoons of the last several years are not enjoyable, they do create the environment in which great investment bargains can exist. We attempt to use the market volatility to the Fund’s advantage by purchasing shares in companies that we admire at discount prices.

During the six month period, we used the market’s volatility to add two new holdings (UTi Worldwide, Inc. and Dick’s Sporting Goods, Inc.) and increase the size of six existing positions at compelling purchase prices. While recent market conditions remain particularly volatile due to the continuing European sovereign debt crisis, European recession, and fear of slowing growth in Asia, we believe many of the Fund’s largest holdings are well positioned to continue to grow cash earnings per share at a double digit clip over the next several years even in a slow growth environment. Along the way, we plan to remain steadfast through the ebb and flow of fear and greed, allowing market volatility to serve us, not instruct us.

30

FBR Focus Fund

Management Overview (continued)

99 Cents Only Stores - Shareholder Activism

In March 2011, 99 Cents Only Stores received a buyout proposal from its founding family (“Schiffer/Gold Family”) and the private equity firm Leonard Green Partners. We thought that the $19.09 per share proposal significantly undervalued the company, and, because of the Schiffer/Gold Family’s involvement, we had serious concerns about the rigor that the company’s board would apply in evaluating their offer against other opportunities.

As a long time investor in the company, and one of the largest shareholders, we believed that we had the credibility to favorably influence the sales process, and thereby improve results for Fund shareholders. Soon after the announced receipt of the buyout proposal, we changed our regulatory filing status with the SEC to “13D”, enabling significantly more latitude to engage with, and potentially challenge, the company and board leadership.

We hired specialized legal counsel, and undertook a campaign to impress upon the board and other shareholders why the company was worth significantly more than $19.09 per share, and the importance of conducting a robust sales process to secure the best offer available. This campaign included a public letter to the board in April 2011, a public letter to the board’s special committee in May 2011 (both available on file at the SEC’s web site), numerous private communications with the special committee and its financial advisors, press releases, press interviews, and conversations with other large 99 Cents Only shareholders.

On October 11, 2011, the company announced that it had signed a binding agreement to be purchased by Ares Management, Canada Pension Plan Investment Board, and the Schiffer/Gold Family for $22.00 per share, which was a 15.2% premium to the initial proposal of $19.09 per share. While the precise impact of our 13D involvement cannot be known with certainty, we believe that these efforts were a significant influence in the process.

We thank you for entrusting your capital to us. We take this responsibility very seriously, and we will do our best to protect and grow your investment.

The opinions expressed in this commentary reflect those of the Portfolio Managers as of the date written. Any such opinions are subject to change based on market or other conditions. These opinions may not be relied upon as investment advice. Investment decisions for The FBR Funds are based on several factors, and may not be relied upon as an indication of trading intent on behalf of any FBR Fund. Security positions can and do change.

31

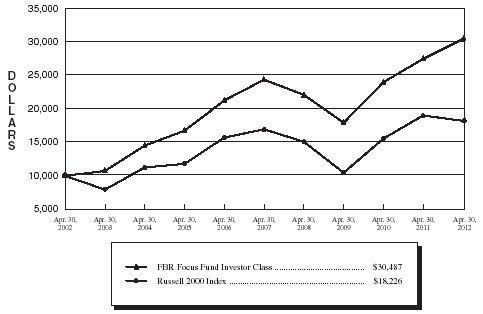

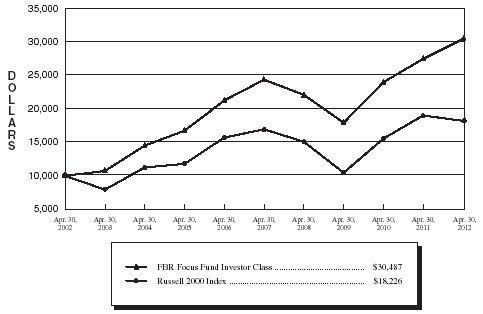

FBR Focus Fund

Comparison of Changes in Value of $10,000 Investment in

Investor Class Shares(1)(2) vs. Russell 2000 Index(1)(3)

(unaudited)

Total Returns—For the Periods Ended April 30, 2012(4) |

| | | | | One Year | | Annualized

Five Year | | Annualized

Ten Year | |

| | | | |

| |

| |

| |

| | FBR Focus Fund Investor Class(1)(2) | | | 10.79 | % | | 4.56 | % | | 11.79 | % | |

| | FBR Focus Fund Institutional Class(2)(5) | | | 11.08 | % | | 4.83 | % | | 11.94 | % | |

| | Russell 2000 Index(1)(3) | | | (4.25) | % | | 1.45 | % | | 6.19 | % | |

| |

| PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS. |

| The performance data quoted represents past performance and the current performance may be lower or higher than the performance data quoted. The investment return and principal will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption fees. The Fund charges a redemption fee of 1.00% on shares redeemed or exchanged within 90 days; if reflected, the redemption fee would reduce the performance data quoted. To obtain performance data current to the most recent month-end, please call 888.200.4710. |

|

| (1) | | The graph assumes a hypothetical $10,000 initial investment in the Fund and reflects the reinvestment of dividends and all Fund expenses. Investors should note that the Fund is a professionally managed mutual fund while the index is unmanaged, does not incur expenses and is not available for investment. The performance of the index includes reinvested dividends, and does not reflect sales charges or expenses. |

| (2) | | FBR Fund Advisers, Inc. waived a portion of its advisory fees and agreed to contractually reimburse a portion of the Fund’s operating expenses, as necessary, to maintain existing expense limitations, as set forth in the notes to the financial statements. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waiver of fees and/or reimbursement of expenses in excess of expense limitations. |

| (3) | | The Russell 2000 Index is comprised of the smallest of the 2000 companies of the Russell 3000 Index, representing approximately 8% of the Russell 3000’s total market capitalization. |

| (4) | | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| (5) | | Represents the performance of the Institutional Class shares after May 30, 2008 (inception of share class) and Investor Class for periods prior to that date. |

32

FBR Focus Fund

Portfolio Summary

April 30, 2012

(unaudited)

The following provides a breakdown of the Fund by industry sectors. The underlying securities represent a percentage of the portfolio investments.

| Industry Sector | | % of Total Investments |

| |

|

| Retail | | | 22.9 | % |

| Entertainment | | | 15.8 | % |

| Insurance | | | 13.1 | % |

| Telecommunications | | | 8.9 | % |

| Diversified Financial Services | | | 8.8 | % |

| Media | | | 4.9 | % |

| Internet | | | 4.6 | % |

| Building Materials | | | 3.4 | % |

| Advertising | | | 2.6 | % |

| Transportation | | | 2.4 | % |

| Healthcare Products | | | 1.8 | % |

| Home Furnishings | | | 1.6 | % |

| | | | | |

| Cash | | | 9.2 | % |

33

FBR Focus Fund

Portfolio of Investments

April 30, 2012

(unaudited)

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | COMMON STOCKS — 90.8% | | | | |

| | | | Advertising — 2.6% | | | | |

| | 630,000 | | Lamar Advertising Co., Class A* | | $ | 20,046,600 | |

| | | | | |

| |

| | | | Building Materials — 3.4% | | | | |

| | 825,000 | | Simpson Manufacturing Company, Inc. | | | 25,599,750 | |

| | | | | |

| |

| | | | Diversified Financial Services — 8.8% | | | | |

| | 94,910 | | Diamond Hill Investment Group, Inc. | | | 7,202,720 | |

| | 503,756 | | Encore Capital Group, Inc.* | | | 11,939,017 | |

| | 454,839 | | Marlin Business Services Corp. | | | 6,677,037 | |

| | 125,000 | | T. Rowe Price Group, Inc. | | | 7,889,375 | |

| | 2,017,000 | | The Charles Schwab Corp. | | | 28,843,100 | |

| | 173,137 | | White River Capital, Inc. | | | 3,912,896 | |

| | | | | |

| |

| | | | | | | 66,464,145 | |

| | | | | |

| |

| | | | Entertainment — 15.8% | | | | |

| | 1,169,000 | | Bally Technologies, Inc.* | | | 56,754,950 | |

| | 1,393,670 | | Penn National Gaming, Inc.* | | | 62,687,277 | |

| | | | | |

| |

| | | | | | | 119,442,227 | |

| | | | | |

| |

| | | | Healthcare Products — 1.8% | | | | |

| | 180,000 | | Henry Schein, Inc.* | | | 13,813,200 | |

| | | | | |

| |

| | | | Home Furnishings — 1.6% | | | | |

| | 680,160 | | American Woodmark Corp. | | | 12,208,872 | |

| | | | | |

| |

| | | | Insurance — 13.1% | | | | |

| | 755,000 | | Aon PLC | | | 39,109,000 | |

| | 136,640 | | Markel Corp.* | | | 60,159,859 | |

| | | | | |

| |

| | | | | | | 99,268,859 | |

| | | | | |

| |

| | | | Internet — 4.6% | | | | |

| | 57,500 | | Google, Inc., Class A* | | | 34,800,725 | |

| | | | | |

| |

| | | | Media — 4.9% | | | | |

| | 1,886,000 | | News Corp., Class A | | | 36,965,600 | |

| | | | | |

| |

34

FBR Focus Fund

Portfolio of Investments (continued)

April 30, 2012

(unaudited)

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | Retail — 22.9% | | | | |

| | 1,840,088 | | CarMax, Inc.* | | $ | 56,803,516 | |

| | 30,000 | | Dick’s Sporting Goods, Inc. | | | 1,518,000 | |

| | 730,000 | | O’Reilly Automotive, Inc.* | | | 76,985,800 | |

| | 859,150 | | World Fuel Services Corp. | | | 37,854,149 | |

| | | | | |

| |

| | | | | | | 173,161,465 | |

| | | | | |

| |

| | | | Telecommunications — 8.9% | | | | |

| | 1,034,000 | | American Tower Corp., Class A | | | 67,809,720 | |

| | | | | |

| |

| | | | Transportation — 2.4% | | | | |

| | 754,200 | | Roadrunner Transportation Systems, Inc.* | | | 13,085,370 | |

| | 328,277 | | UTi Worldwide, Inc. | | | 5,472,378 | |

| | | | | |

| |

| | | | | | | 18,557,748 | |

| | | | | |

| |

| | | | | | | | |

| | | | Total Common Stocks (Cost $363,114,295) | | | 688,138,911 | |

| | | | | |

| |

| | | | SHORT-TERM INVESTMENT — 9.5% | | | | |

| | 72,317,775 | | Fidelity Institutional Money Market Government Portfolio, Class I, 0.01%^ (Cost $72,317,775) | | | 72,317,775 | |

| | | | | |

| |

| | | | Total Investments — 100.3% (Cost $435,432,070) | | | 760,456,686 | |

| | | | | | | | |

| | | | Liabilities Less Other Assets — (0.3)% | | | (2,450,437 | ) |

| | | | | |

| |

| | | | | | | | |

| | | | Net Assets — 100.0% | | $ | 758,006,249 | |

| | | | | |

| |

|

| * | | Non-income producing security |

| PLC | | Public Liability Company |

| ^ | | 7-day yield as of April 30, 2012 |

| | | |

| Note: | | For presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with Section 8(b)(1) of the Investment Company Act of 1940, the Fund uses more specific industry classifications. |

The accompanying notes are an integral part of the financial statements.

35

| FBR Large Cap Financial Fund |

| Management Overview |

Portfolio Manager: David Ellison

Over the previous six months, how did the Fund perform and what factors contributed to this performance?

For the six-month period ended April 30, 2012, the Investor Class of the FBR Large Cap Financial Fund returned 16.88%. This compares to the KBW Bank Sector Index, the S&P 500 Index and the Morningstar Financial Category Average, which returned 21.67%, 12.77% and 13.03% for the same period, respectively.

The favorable performance was primarily driven by positions in the large domestic commercial banks. Insurance and brokerage companies were primary detractors from performance during the period. Improvements in credit, somewhat better housing activity and better loan demand helped the commercial banks during the period. Continued weakness in the capital markets, lower trading volumes and commissions, and lower investment returns hurt the brokerage and insurance stocks during the period.

The Fund continues to be concentrated in the mid to large domestic commercial banks. I believe these companies are best positioned for a better economy and have downside protection as they are not directly exposed to European economies. These companies have also built strong balance sheets as indicated by much improved capital, loss reserves and liquidity levels.

Portfolio manager comments on the Fund and the related investment outlook.

The U.S. financial services industry continues to recover from a deep recession. However, headwinds persist and the developing concerns out of Europe which began about a year ago are weighing on everyone. Macro concern about the global financial system is overwhelming improvements at the individual company level. I also believe the macro concerns are real and need to be taken into account when investing in this sector. I believe that a healthy banking system is a precondition to a better economy. I believe the strongest banking system is in the U.S., and should offer a basis for the U.S. being one of the better economies relative to the world going forward.

While the large capitalization financial stocks are cheap relative to history, I remain cautious and will look to protect the downside if macro risks inflate further.

|

The opinions expressed in this commentary reflect those of the Portfolio Manager as of the date written. Any such opinions are subject to change based on market or other conditions. These opinions may not be relied upon as investment advice. Investment decisions for The FBR Funds are based on several factors, and may not be relied upon as an indication of trading intent on behalf of any FBR Fund. Security positions can and do change. |

36

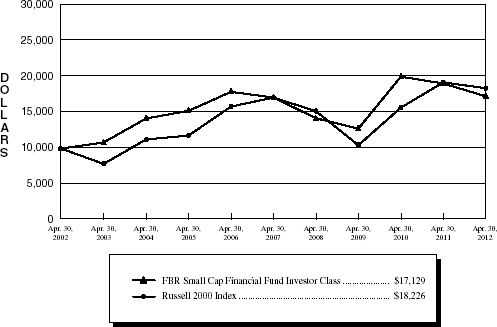

| FBR Large Cap Financial Fund |

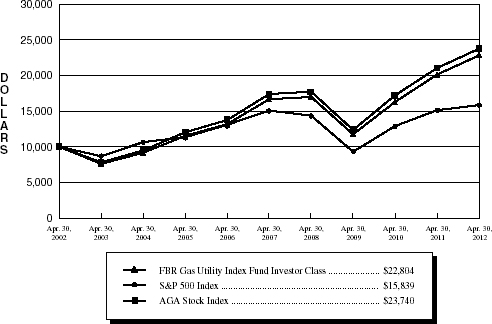

Comparison of Changes in Value of $10,000 Investment in

Investor Class Shares(1)(2) vs. Various Indices(1)(3)

(unaudited)

Total Returns—For the Periods Ended April 30, 2011(4) |

| | | | | One Year | | Annualized

Five Year | | Annualized

Ten Year | |

| | | | |

| |

| |

| |

| | FBR Large Cap Financial Fund Investor Class(1)(2) | | | (1.21) | % | | (2.82) | % | | 2.88 | % | |

| | S&P 500 Index(1)(3) | | | 4.76 | % | | 1.01 | % | | 4.71 | % | |

| | KBW Bank Sector Index(1)(3) | | | (4.39) | % | | (13.91) | % | | (3.02) | % | |

| |

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

The performance data quoted represents past performance and the current performance may be lower or higher than the performance data quoted. The investment return and principal will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption fees. The Fund charges a redemption fee of 1.00% on shares redeemed or exchanged within 90 days; if reflected, the redemption fee would reduce the performance data quoted. To obtain performance data current to the most recent month-end, please call 888.200.4710.

|

| (1) | | The graph assumes a hypothetical $10,000 initial investment in the Fund and reflects the reinvestment of dividends and all Fund expenses. Investors should note that the Fund is a professionally managed mutual fund while the index is unmanaged, does not incur expenses and is not available for investment. The performance of the index includes reinvested dividends, and does not reflect sales charges or expenses. |

| (2) | | FBR Fund Advisers, Inc. waived a portion of its advisory fees and agreed to contractually reimburse a portion of the Fund’s operating expenses, as necessary, to maintain existing expense limitations, as set forth in the notes to the financial statements. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waiver of fees and/or reimbursement of expenses in excess of expense limitations. |

| (3) | | The S&P 500 Index is a capitalization-weighted index of 500 stocks. The index is designed to represent the broad domestic ecomony through changes in aggregate market value of 500 stocks representing all major industries. The KBW Bank Sector Index is a capitalization-weighted index composed of 24 geographically diverse stocks representing national money center banks and leading regional institutions. |

| (4) | | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

37

FBR Large Cap Financial Fund

Portfolio Summary

April 30, 2012

(unaudited)

The following provides a breakdown of the Fund by industry sectors. The underlying securities represent a percentage of the portfolio investments.

| Industry Sector | | % of Total Investments |

| |

|

| Banks | | | 68.5 | % |

| Insurance | | | 8.6 | % |

| Diversified Financial Services | | | 7.9 | % |

| Commercial Services | | | 7.1 | % |

| Home Builders | | | 3.4 | % |

| Savings & Loans | | | 0.9 | % |

| Financial | | | 0.7 | % |

| | | | | |

| Cash | | | 2.9 | % |

38

FBR Large Cap Financial Fund

Portfolio of Investments

April 30, 2012

(unaudited)

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | | | | | |

| | | | COMMON STOCKS — 97.1% | | | | |

| | | | Banks — 68.5% | | | | |

| | 380,000 | | Bank of America Corp. | | $ | 3,081,800 | |

| | 50,000 | | BB&T Corp. | | | 1,602,000 | |

| | 62,000 | | Capital One Financial Corp. | | | 3,439,760 | |

| | 30,000 | | CIT Group, Inc.* | | | 1,135,500 | |

| | 100,000 | | Citigroup, Inc. | | | 3,304,000 | |

| | 100,000 | | Comerica, Inc. | | | 3,202,000 | |

| | 225,000 | | Fifth Third Bancorp | | | 3,201,750 | |

| | 340,000 | | Huntington Bancshares, Inc. | | | 2,274,600 | |

| | 80,000 | | JPMorgan Chase & Co. | | | 3,438,400 | |

| | 390,000 | | KeyCorp | | | 3,135,600 | |

| | 25,000 | | M&T Bank Corp. | | | 2,156,750 | |

| | 130,000 | | Morgan Stanley | | | 2,246,400 | |

| | 65,000 | | The Bank of New York Mellon Corp. | | | 1,537,250 | |

| | 11,000 | | The Goldman Sachs Group, Inc. | | | 1,266,650 | |

| | 50,000 | | The PNC Financial Services Group, Inc. | | | 3,316,000 | |

| | 105,000 | | U.S. Bancorp | | | 3,377,850 | |

| | 100,000 | | Wells Fargo & Co. | | | 3,343,000 | |

| | 35,808 | | Zions Bancorp | | | 730,125 | |

| | | | | |

| |