UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21503

The FBR Funds

(Exact name of registrant as specified in charter)

1001 Nineteenth Street North

Arlington, VA 22209

(Address of principal executive offices) (Zip code)

Registrant’s telephone number, including area code: 703.469.1040

William Ginivan

General Counsel

FBR Capital Markets, Inc.

Potomac Tower

1001 Nineteenth Street North

Arlington, VA 22209

(Name and address of agent for service)Date of fiscal year end: October 31, 2009

Date of reporting period: April 30, 2009

ITEM 1. REPORT TO SHAREHOLDERS.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17CRF 270.30e-1).

THE FBR FUNDS

FBR Pegasus FundTM

FBR Pegasus Mid Cap FundTM

FBR Pegasus Small Cap FundTM

FBR Pegasus Small Cap Growth FundTM

FBR Focus Fund

FBR Large Cap Financial Fund

FBR Small Cap Financial Fund

FBR Technology Fund

FBR Gas Utility Index Fund

FBR Fund for Government Investors

Semi-Annual Report

April 30, 2009

[THIS PAGE INTENTIONALLY LEFT BLANK]

The FBR Funds

Semi-Annual Letter to Shareholders

Dear Shareholder,

We are pleased to present the The FBR Funds’ Semi-Annual Report for the six-month period ended April 30, 2009.

These past six months were among the most turbulent in recent history for equity investors. Never before in my investing career has the importance of disciplined fundamental security analysis been so overlooked by investors in favor of fear, pessimism and emotion. Without question there has been no shortage of macroeconomic releases which, when filtered through the popular media, left even the most rational minds wondering about the permanence of the current recession and future trajectory of the economy. The past six months have truly tested every measure of confidence, trust, belief, hope and courage to a degree which has not been experienced in many generations.

Recent data show signs of reprieve, indicating a possible economic bottoming which has lifted investors’ spirits and risk appetite. In April, consumer confidence jumped, capital-goods orders rose and the Government revised upwards its previous estimate of GDP. LIBOR (a measure of short-term bank lending costs) has decreased from 4.8% in October of last year to below 1% today. Credit spreads have narrowed and financial institutions have recently been successful at raising capital to improve reserve positions and rebuild their balance sheets. The Federal Reserve and U.S. Treasury’s stabilization policies have begun to take hold and we have seen activity return to some of the nation’s most battered housing markets. In April, existing home sales rose as we witnessed a large increase in first-time home buyers who accounted for 53% of transactions1.

Over the course of the reporting period, the value of money market funds exceeded stock funds for the first time in sixteen years. To put the severity of investors’ anxiety in context, in the summer of 2007 the value of stock funds were three times greater than those in money market funds. According to mutual fund consulting firm, Strategic Insight, during April of this year, stock and bond mutual fund flows experienced a dramatic rebound as investors began to move cash off the sidelines and back into equities. Total long-term fund net inflows surpassed $52 billion, a level of activity not seen since February of last year2. Despite the magnitude of money in motion, the total equity fund assets under management for our complex essentially remained flat over the reporting period. In fact, the month of April was particularly strong as our equity funds garnered net inflows. The strength continued into May nearly doubling our total year-to-date net inflows.

The effects of last fall’s damage continue to haunt long-term investors. The ten-year returns through the end of April for the S&P 500 Index remained in negative territory down 2.48% and the average domestic equity fund returned just 0.49%3. I am extremely proud to share with you that according to Morningstar, the Investor Class of both the FBR Focus Fund and FBR Small Cap Financial Fund ranked in the top 1% of all domestic equity funds for the same ten-year period returning 10.00% and 8.69%, respectively.

Morningstar fund rankings are based solely on total returns generated by each fund across the various time periods in each Morningstar category. For the trailing one-, five- and ten-year periods ended April 30, 2009, the Investor Class of the FBR Focus Fund ranked in the top 6% (906 out of 14,511 funds),

|

| 1 | | Standard and Poor’s Global Economic Policy Committee Notes; April 29, 2009. |

| 2 | | Strategic Insight Mutual Fund Research and Consulting® LLC; Highlights of April 2009 Mutual Fund Industry Results. |

| 3 | | Morningstar Direct; April 30, 2009. |

2

top 3% (336 out of 10,545 funds), and top 1% (81 out of 6,820 funds) of all domestic equity funds, respectively and the Investor Class of the FBR Small Cap Financial Fund ranked in the top 1% (197 out of 14,511 funds), top 9% (979 out of 10,545 funds) and top 1% (157 out of 6,820) of all domestic equity funds, respectively.

| | | | For the Period Ended April 30, 2009 | |

| | | |

| |

| | | 1-yr | | 5-yrs | | 10-yrs |

| | |

| |

| |

|

| FBR Focus Fund Investor Class | | (18.84 | )% | | 4.32 | % | | | 10.00 | % |

| FBR Small Cap Financial Fund Investor Class | | (10.11 | )% | | (2.05 | )% | | | 8.69 | % |

For the 2009 semi-annual reporting period, all eight of our actively managed equity funds, both traditional asset class and specialty, delivered on our objective of providing investors with downside protection by outperforming each of their respective Morningstar category averages. In general, this relative outperformance is attributable to the investing philosophy that serves as a guideline for all of our portfolio managers which emphasizes balance sheet strength, durable revenues and attractive valuations. We firmly believe that on a relative and absolute basis, outperformance in difficult markets is a key factor in creating long-term wealth for our clients.

We are fully aware that the prospect for timing the lows in the stock market is virtually impossible. As long-term investors, shareholders should take comfort in knowing that each of our portfolio managers has a well thought out plan of action and is diligently executing against their objectives on a daily basis to give your money the best chance to participate in the eventual stabilization and recovery of the economy. In our experience, the careful selection of individual securities paired with a heavy emphasis on buying at the right price can dramatically reduce a portfolio’s risk profile and enhance the opportunity for outperformance over a full market cycle.

As in prior years, what follows in this report is a discussion with each portfolio manager with respect to the performance of their fund over the first half of fiscal year 2009 and their outlook going forward.

All of us at The FBR Funds want to thank you for your continued support, and we look forward to serving your investment needs in the years ahead. If you would like more timely updates, fbrfunds.com provides monthly performance data, and other important fund information. As always, we welcome your questions and comments. You can reach us via e-mail at fbrfundsinfo@fbr.com or toll free at 888.200.4710.

Sincerely,

| David Ellison |

| President, Chief Investment Officer and Trustee |

| The FBR Funds |

| |

|

Past performance is no guarantee of future results. The performance data quoted represents past performance and the current performance may be lower or higher than the data quoted. Investment return and principal will fluctuate so that investors’ shares, when redeemed may be worth more or less than their original value. The performance data does not reflect the deduction of redemption fees and if reflected, the redemption fee would reduce the performance quoted. To obtain performance data current to the most recent month-end call 888.888.0025. |

3

The FBR Funds

FBR Pegasus FundTM

Management Overview

Portfolio Manager(s): Robert Barringer, CFA® and Ryan Kelley, CFA®

Over the last six months, how did the Fund perform?

For the six-month period ended April 30, 2009, the Investor Class of the FBR Pegasus FundTM returned -0.89%. This compares to the S&P 500 Index and the Morningstar Large Blend Category average which returned -8.53% and -6.71%, for the same period, respectively.

What factors contributed to the Fund’s performance?

The Investor Class of the Fund outperformed its benchmark, the S&P 500 Index, by 7.64% and its peers, represented by the Morningstar Large Blend Category average, by 5.82%. Given the dramatic moves in stock prices over the past six months, we are encouraged by our relative performance during a difficult market. The FBR Funds are driven by a philosophy of outperforming over a complete market cycle, and we feel that the past six months’ performance has provided solid proof that downside protection is beneficial over the long-term.

Our performance was driven primarily by stock selection. The vast majority of the Fund’s outperformance relative to its benchmark during the past six months was attributable to our ability to choose and weight individual securities within each sector, regardless of the sector’s overall performance.

Relative to the S&P 500 Index, the Fund benefited from its underexposure to the health care and industrial sectors. During this time period, financials were the worst performing group of stocks in the S&P 500 Index. While we were overweight this sector, the financial stocks we owned were only down on average 12% versus financial stocks in the S&P 500 Index which were down on average 29%.

Individual stock selection in and underexposure to the information technology sector were the largest detractors from the Fund’s performance relative to the benchmark. The Fund’s underweight to the telecommunications sector also negatively contributed to relative performance.

What is the outlook for the Fund?

We believe superior long-term investment performance is generated through individual stock selection. We invest in industry leading companies with robust business models that exhibit defensive characteristics such as; low levels of debt, high profit margins and skilled management teams. During this tumultuous market, we believe we are seeing opportunities to

4

The FBR Funds

FBR Pegasus FundTM

Management Overview (continued)

commit new capital in solid, long-term winners at distressed valuations. Overall, we are confident in our investment process as we head into the second half of 2009, despite uncertainties that exist in the market.

|

The opinions expressed in this commentary reflect those of the Portfolio Manager(s) as of the date written. Any such opinions are subject to change based on market or other conditions. These opinions may not be relied upon as investment advice. Investment decisions for The FBR Funds are based on several factors, and may not be relied upon as an indication of trading intent on behalf of any FBR Fund. Security positions can and do change. |

5

The FBR Funds

FBR Pegasus FundTM

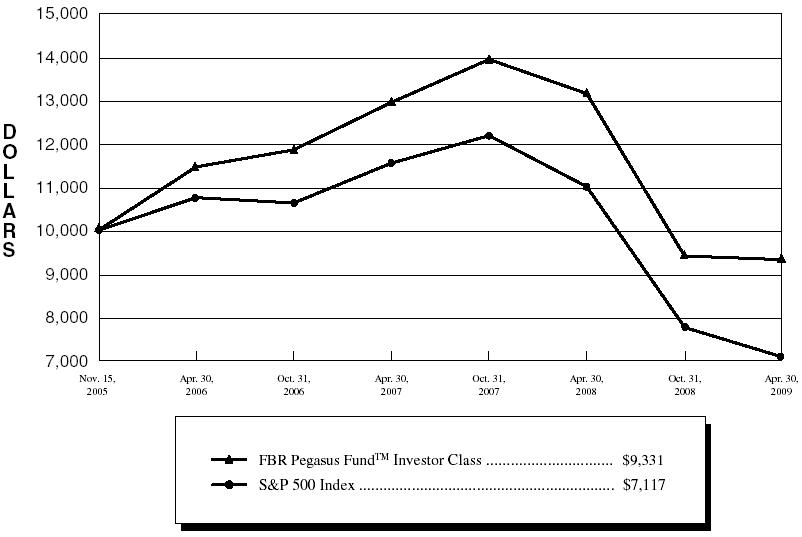

Comparison of Changes in Value of $10,000 Investment in

Investor Class Shares(1)(2) vs. S&P 500 Index(1)(3)

(unaudited)

| Total Returns—For the Periods Ended April 30, 2009(4) | |

| | | | | | | Annualized | | Cumulative | |

| | | | | | | Since | | Since | |

| | | | One Year | | Inception(5) | | Inception(6) | |

| | | |

| |

| |

| |

FBR Pegasus FundTM Investor Class(1)(2) | | | (28.98 | )% | | (1.98 | )% | | N/A | | |

FBR Pegasus FundTM I Class(2)(6) | | | N/A | | | N/A | | | (29.95 | )% | |

S&P 500 Index(1)(3) | | | (35.31 | )% | | (9.36 | )% | | (36.14 | )% | |

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

The performance data quoted represents past performance and the current performance may be lower or higher than the performance data quoted. The investment return and principal will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption fees. If reflected, the redemption fee would reduce the performance data quoted. To obtain performance data current to the most recent month-end, please call 888.200.4710 or visit www.fbrfunds.com.

|

| (1) | | The graph assumes a hypothetical $10,000 initial investment in the Fund and reflects the reinvestment of dividends and all Fund expenses. Investors should note that the Fund is a professionally managed mutual fund while the index is unmanaged, does not incur expenses and is not available for investment. The performance of the index includes reinvested dividends, and does not reflect sales charges or expenses. |

| (2) | | FBR Fund Advisers, Inc. waived a portion of its advisory fees and agreed to contractually reimburse a portion of the Fund’s operating expenses, as necessary, to maintain existing expense limitations, as set forth in the notes to the financial statements. Total returns shown include fee waivers and expense reimbursements; total returns would have been lower had there been no waiver of fees and/or reimbursement of expenses in excess of expense limitations. |

| (3) | | The S&P 500 Index is a capitalization-weighted index of 500 stocks. The index is designed to represent the broad domestic economy through changes in aggregate market value of 500 stocks representing all major industries. |

| (4) | | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| (5) | | For the period November 15, 2005 (commencement of investment operations) through April 30, 2009. |

| (6) | | For the period May 30, 2008 (inception of share class) through April 30, 2009. |

6

| The FBR Funds |

|

| FBR Pegasus FundTM |

| Portfolio Summary |

April 30, 2009

(unaudited) |

The following provides a breakdown of the Fund by industry sectors. The underlying securities represent a percentage of the portfolio investments.

| Industry Sector | | % of Total Investments |

| |

|

| Financials | | 18.6 | % |

| Information Technology | 18.5 | % |

| Energy | | 11.3 | % |

| Consumer Staples | 10.1 | % |

| Industrials | | 10.1 | % |

| Consumer Discretionary | 10.1 | % |

| Health Care | | 9.4 | % |

| Materials | | 5.7 | % |

| Utilities | | 1.6 | % |

| Telecommunication Services | 0.5 | % |

| | | | |

| Cash | | 4.1 | % |

7

| The FBR Funds |

|

| FBR Pegasus FundTM |

| Portfolio of Investments |

April 30, 2009

(unaudited) |

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | COMMON STOCKS — 97.6% | | | | |

| | | | Consumer Discretionary — 10.3% | | | | |

| | 10,600 | | American Eagle Outfitters, Inc. | | $ | 157,092 | |

| | 1,650 | | Apollo Group, Inc., Class A* | | | 103,868 | |

| | 6,550 | | Carnival Corp. | | | 176,064 | |

| | 3,000 | | Kohl’s Corp.* | | | 136,050 | |

| | 11,900 | | Lowe’s Companies, Inc. | | | 255,849 | |

| | 4,000 | | Target Corp. | | | 165,040 | |

| | 3,825 | | The Gap, Inc. | | | 59,441 | |

| | 3,000 | | Tiffany & Co. | | | 86,820 | |

| | | | | |

| |

| | | | | | | 1,140,224 | |

| | | | | |

| |

| | | | Consumer Staples — 10.3% | | | | |

| | 950 | | Brown-Forman Corp., Class B | | | 44,175 | |

| | 800 | | Bunge Ltd. | | | 38,408 | |

| | 3,250 | | Campbell Soup Co. | | | 83,590 | |

| | 1,475 | | Colgate-Palmolive Co. | | | 87,025 | |

| | 1,400 | | Kellogg Co. | | | 58,954 | |

| | 1,550 | | Ralcorp Holdings, Inc.* | | | 88,598 | |

| | 2,950 | | The Coca-Cola Co. | | | 126,998 | |

| | 1,200 | | The Hershey Co. | | | 43,368 | |

| | 2,002 | | The J.M. Smucker Co. | | | 78,879 | |

| | 1,512 | | The Procter & Gamble Co. | | | 74,753 | |

| | 7,500 | | Unilever PLC ADR | | | 145,950 | |

| | 4,900 | | Walgreen Co. | | | 154,007 | |

| | 2,350 | | Wal-Mart Stores, Inc. | | | 118,440 | |

| | | | | |

| |

| | | | | | | 1,143,145 | |

| | | | | |

| |

| | | | Energy — 11.5% | | | | |

| | 2,677 | | Apache Corp. | | | 195,045 | |

| | 4,075 | | Cimarex Energy Co. | | | 109,618 | |

| | 4,000 | | ConocoPhillips | | | 164,000 | |

| | 800 | | Exxon Mobil Corp. | | | 53,336 | |

| | 1,600 | | Newfield Exploration Co.* | | | 49,888 | |

| | 1,885 | | Occidental Petroleum Corp. | | | 106,107 | |

| | 3,600 | | Petro-Canada | | | 113,508 | |

| | 1,830 | | PetroChina Company Ltd. ADR | | | 159,045 | |

| | 5,000 | | Pioneer Natural Resources Co. | | | 115,600 | |

8

| The FBR Funds |

|

| FBR Pegasus FundTM |

| Portfolio of Investments (continued) |

April 30, 2009

(unaudited) |

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | Energy — 11.5% (continued) | | | | |

| | 1,800 | | Pride International, Inc.* | | $ | 40,860 | |

| | 1,498 | | Royal Dutch Shell PLC, Class A ADR | | | 68,429 | |

| | 4,900 | | Valero Energy Corp. | | | 97,216 | |

| | | | | |

| |

| | | | | | | 1,272,652 | |

| | | | | |

| |

| | | | Financials — 18.9% | | | | |

| | 1,350 | | ACE Ltd. | | | 62,532 | |

| | 21,300 | | Bank of America Corp. | | | 190,209 | |

| | 3,125 | | Franklin Resources, Inc. | | | 189,000 | |

| | 2,700 | | HCC Insurance Holdings, Inc. | | | 64,584 | |

| | 12,500 | | Hudson City Bancorp, Inc. | | | 157,000 | |

| | 700 | | IntercontinentalExchange, Inc.* | | | 61,320 | |

| | 8,200 | | JPMorgan Chase & Co. | | | 270,600 | |

| | 11,400 | | Manulife Financial Corp. | | | 194,940 | |

| | 3,100 | | People’s United Financial, Inc. | | | 48,422 | |

| | 1,000 | | Prudential Financial, Inc. | | | 28,880 | |

| | 7,900 | | SEI Investments Co. | | | 110,837 | |

| | 8,650 | | T. Rowe Price Group, Inc. | | | 333,197 | |

| | 1,725 | | The Goldman Sachs Group, Inc. | | | 221,663 | |

| | 8,400 | | Wells Fargo & Co. | | | 168,084 | |

| | | | | |

| |

| | | | | | | 2,101,268 | |

| | | | | |

| |

| | | | Health Care — 9.5% | | | | |

| | 2,240 | | Abbott Laboratories | | | 93,744 | |

| | 375 | | Baxter International, Inc. | | | 18,188 | |

| | 1,325 | | Becton, Dickinson and Co. | | | 80,136 | |

| | 820 | | C.R. Bard, Inc. | | | 58,737 | |

| | 3,000 | | Eli Lilly and Co. | | | 98,760 | |

| | 1,900 | | Forest Laboratories, Inc.* | | | 41,211 | |

| | 3,700 | | Johnson & Johnson | | | 193,731 | |

| | 1,483 | | Life Technologies Corp.* | | | 55,316 | |

| | 4,300 | | Merck & Company, Inc. | | | 104,232 | |

| | 1,800 | | Novartis AG ADR | | | 68,238 | |

| | 1,720 | | Novo Nordisk A/S ADR | | | 81,717 | |

| | 900 | | St. Jude Medical, Inc.* | | | 30,168 | |

| | 3,100 | | Wyeth | | | 131,440 | |

| | | | | |

| |

| | | | | | | 1,055,618 | |

| | | | | |

| |

9

| The FBR Funds |

|

| FBR Pegasus FundTM |

| Portfolio of Investments (continued) |

April 30, 2009

(unaudited) |

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | Industrials — 10.3% | | | | |

| | 6,815 | | 3M Co. | | $ | 392,544 | |

| | 3,800 | | ABB Ltd. ADR | | | 54,036 | |

| | 1,900 | | Burlington Northern Santa Fe Corp. | | | 128,212 | |

| | 1,200 | | Copart, Inc.* | | | 37,668 | |

| | 1,250 | | Cummins, Inc. | | | 42,500 | |

| | 1,000 | | Fastenal Co. | | | 38,360 | |

| | 13,200 | | General Electric Co. | | | 166,980 | |

| | 2,600 | | Rockwell Automation, Inc. | | | 82,134 | |

| | 4,050 | | Union Pacific Corp. | | | 199,017 | |

| | | | | |

| |

| | | | | | | 1,141,451 | |

| | | | | |

| |

| | | | Information Technology — 18.8% | | | | |

| | 2,450 | | Accenture Ltd., Class A | | | 72,104 | |

| | 3,600 | | Adobe Systems, Inc.* | | | 98,460 | |

| | 1,525 | | Apple, Inc.* | | | 191,891 | |

| | 1,700 | | Automatic Data Processing, Inc. | | | 59,840 | |

| | 4,000 | | Canon, Inc. ADR | | | 120,840 | |

| | 9,200 | | Cisco Systems, Inc.* | | | 177,744 | |

| | 1,000 | | Global Payments, Inc. | | | 32,060 | |

| | 425 | | Google, Inc., Class A* | | | 168,287 | |

| | 12,900 | | Intel Corp. | | | 203,562 | |

| | 2,200 | | International Business Machines Corp. | | | 227,061 | |

| | 1,060 | | Kyocera Corp. ADR | | | 82,235 | |

| | 3,000 | | Maxim Integrated Products, Inc. | | | 40,650 | |

| | 2,000 | | MEMC Electronic Materials, Inc.* | | | 32,400 | |

| | 4,850 | | Microsoft Corp. | | | 98,261 | |

| | 10,450 | | Oracle Corp. | | | 202,103 | |

| | 4,000 | | SAP AG ADR | | | 152,360 | |

| | 10,400 | | Total System Services, Inc. | | | 129,688 | |

| | | | | |

| |

| | | | | | | 2,089,546 | |

| | | | | |

| |

| | | | Materials — 5.8% | | | | |

| | 3,500 | | BHP Billiton Ltd. ADR | | | 168,490 | |

| | 2,450 | | Freeport-McMoRan Copper & Gold, Inc. | | | 104,493 | |

| | 1,550 | | Sigma-Aldrich Corp. | | | 67,952 | |

10

| The FBR Funds |

|

| FBR Pegasus FundTM |

| Portfolio of Investments (continued) |

April 30, 2009

(unaudited) |

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | Materials — 5.8% (continued) | | | | |

| | 12,300 | | Teck Resources Ltd., Class B | | $ | 129,642 | |

| | 6,400 | | United States Steel Corp. | | | 169,920 | |

| | | | | |

| |

| | | | | | | 640,497 | |

| | | | | |

| |

| | | | Telecommunication Services — 0.5% | | | | |

| | 1,850 | | America Movil S.A.B. de C.V., Series L ADR | | | 60,773 | |

| | | | | |

| |

| | | | | | | | |

| | | | Utilities — 1.7% | | | | |

| | 1,826 | | Edison International | | | 52,059 | |

| | 1,675 | | PG&E Corp. | | | 62,176 | |

| | 1,517 | | Sempra Energy | | | 69,813 | |

| | | | | |

| |

| | | | | | | 184,048 | |

| | | | | |

| |

| | | | Total Common Stocks (Cost $11,178,537) | | | 10,829,222 | |

| | | | | |

| |

| | | | | | | | |

| | | | MONEY MARKET FUND — 4.0% | | | | |

| | 443,426 | | JPMorgan 100% U.S. Treasury Securities Money Market Fund (Cost $443,426) | | | 443,426 | |

| | | | | |

| |

| | | | | | | | |

| | | | Total Investments — 101.6% (Cost $11,621,963) | | | 11,272,648 | |

| | | | | | | | |

| | | | Liabilities Less Other Assets — (1.6%) | | | (182,422 | ) |

| | | | | |

| |

| | | | | | | | |

| | | | Net Assets — 100.0% | | $ | 11,090,226 | |

| | | | | |

| |

|

| * | | Non-income producing security |

| ADR | | American Depositary Receipts |

| PLC | | Public Liability Company |

| Note: | | For presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with Section 8(b)(1) of the Investment Company Act of 1940, the Fund uses more specific industry classifications. |

The accompanying notes are an integral part of the financial statements.

11

The FBR Funds

FBR Pegasus Mid Cap FundTM

Management Overview

Portfolio Manager: Ryan Kelley, CFA®

Over the last six months, how did the Fund perform?

For the six-month period ended April 30, 2009, the Investor Class of the FBR Pegasus Mid Cap FundTM returned 0.85%. This compares to the Russell Midcap Index and the Morningstar Mid Blend Category average which returned -1.64% and -1.43%, for the same period, respectively.

What factors contributed to the Fund’s performance?

The Investor Class of the Fund outperformed its benchmark, the Russell Midcap Index, by 2.49% and its peers, represented by the Morningstar Mid Blend Category average, by 2.28%. Given the dramatic moves in stock prices over the past six months, we are encouraged by our relative performance during a difficult market. The FBR Funds are driven by a philosophy of outperforming over a complete market cycle, and we feel that the past six months’ performance has provided solid proof that downside protection is beneficial over the long-term.

Sector selection, a description of a fund’s relative exposure to different industries, is a major determinant of fund performance. Relative to the Russell Midcap Index, the Fund benefited from its underexposure to the financials and utilities sectors, which were the two worst performing sectors in the Russell Midcap Index. Consumer discretionary and telecommunications stocks performed best, yet we were underweight those sectors during this time period. Individual stock selection in the healthcare sector was the single largest detractor from the Fund’s performance relative to the benchmark.

Overall, our outperformance was driven primarily by stock selection, as the majority of our excess return above our benchmark was attributable to our ability to choose and weight individual securities within each sector, regardless of a sector’s overall performance. Simply put, we tend to own the right stocks, regardless of their sector’s performance.

What is the outlook for the Fund?

We strive to provide solid long-term returns for our shareholders while protecting against the downside and exhibiting a lower level of volatility. Since its inception in February 2007, the Fund has managed to achieve this objective through the implementation of its disciplined investment process. Over its 26 months of existence, the Fund has consistently outperformed its benchmark and delivered top decile performance relative to its mid blend peers. It has done so with 25% less volatility than its benchmark, as measured by standard deviation, and a 75% downside capture ratio. In other words, when the benchmark is down 1%, the Fund typically is down only 0.75%. We continue to aim for these types of metrics.

12

The FBR Funds

FBR Pegasus Mid Cap FundTM

Management Overview (continued)

The Fund’s average cash levels remain between 5% and 15%, well within our comfort range. We note that in the tables below, cash on April 30, 2009 exceeded 20%, due to a large inflow of new cash in the week preceding the close of the reporting period. We believe we are seeing opportunities in the capital markets to commit new capital in solid, long-term winners at distressed valuations. As demonstrated above, our disciplined and consistent investment process and ability to under- or over-weight specific sectors of the market allow us to maintain our long-term orientation and construct a well-rounded and balanced portfolio. Our focus remains on uncovering stocks with sound business models, improving fundamentals selling at attractive valuations. Companies that exhibit a combination of these characteristics provide us the confidence necessary to make investments in companies within out of favor sectors, while enhancing the opportunity to preserve capital in declining markets reducing the overall risk profile of the portfolio.

|

The opinions expressed in this commentary reflect those of the Portfolio Manager as of the date written. Any such opinions are subject to change based on market or other conditions. These opinions may not be relied upon as investment advice. Investment decisions for The FBR Funds are based on several factors, and may not be relied upon as an indication of trading intent on behalf of any FBR Fund. Security positions can and do change. |

13

The FBR Funds

FBR Pegasus Mid Cap FundTM

Comparison of Changes in Value of $10,000 Investment in

Investor Class Shares(1)(2) vs. Russell Midcap Index(1)(3)

(unaudited)

| Total Returns—For the Periods Ended April 30, 2009(4) | |

| | | | | | Annualized | | Cumulative | |

| | | | | | Since | | Since | |

| | | One Year | | Inception(5) | | Inception(6) | |

| | |

| |

| |

| |

FBR Pegasus Mid Cap FundTM Investor Class(1)(2) | | (24.25 | )% | | (7.97 | )% | | N/A | | |

FBR Pegasus Mid Cap FundTM I Class(2)(6) | | N/A | | | N/A | | | (28.23 | )% | |

Russell Midcap Index(1)(3) | | (36.03 | )% | | (19.33 | )% | | (38.42 | )% | |

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

The performance data quoted represents past performance and the current performance may be lower or higher than the performance data quoted. The investment return and principal will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption fees. If reflected, the redemption fee would reduce the performance data quoted. To obtain performance data current to the most recent month-end, please call 888.200.4710 or visit www.fbrfunds.com.

|

| (1) | | The graph assumes a hypothetical $10,000 initial investment in the Fund and reflects the reinvestment of dividends and all Fund expenses. Investors should note that the Fund is a professionally managed mutual fund while the index is unmanaged, does not incur expenses and is not available for investment. The performance of the index includes reinvested dividends, and does not reflect sales charges or expenses. |

| (2) | | FBR Fund Advisers, Inc. waived a portion of its advisory fees and agreed to contractually reimburse a portion of the Fund’s operating expenses, as necessary, to maintain existing expense limitations, as set forth in the notes to the financial statements. Total returns shown include fee waivers and expense reimbursements; total returns would have been lower had there been no waiver of fees and/or reimbursement of expenses in excess of expense limitations. |

| (3) | | The Russell Midcap Index measures the performance of the 800 smallest companies in the Russell 1000 Index, which represents approximately 31% of the total market capitalization of the Russell 1000 Index. |

| (4) | | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| (5) | | For the period February 28, 2007 (commencement of investment operations) through April 30, 2009. |

| (6) | | For the period May 30, 2008 (inception of share class) through April 30, 2009. |

14

| The FBR Funds |

|

| FBR Pegasus Mid Cap FundTM |

| Portfolio Summary |

April 30, 2009

(unaudited) |

The following provides a breakdown of the Fund by industry sectors. The underlying securities represent a percentage of the portfolio investments.

| Industry Sector | | % of Total Investments |

| |

|

| Financials | | 15.1 | % |

| Consumer Discretionary | 13.7 | % |

| Information Technology | 10.7 | % |

| Industrials | | 7.5 | % |

| Health Care | | 7.5 | % |

| Energy | | 6.1 | % |

| Consumer Staples | 6.0 | % |

| Utilities | | 5.5 | % |

| Materials | | 5.2 | % |

| Telecommunication Services | 1.0 | % |

| | | | |

| Cash | | 21.7 | % |

15

| The FBR Funds |

|

| FBR Pegasus Mid Cap FundTM |

| Portfolio of Investments |

April 30, 2009

(unaudited) |

|

| | | | | | | VALUE | |

| | SHARES | | | | | (NOTE 2) | |

|

| | | | COMMON STOCKS — 85.5% | | | | |

| | | | Consumer Discretionary — 15.0% | | | | |

| | 7,965 | | Abercrombie & Fitch Co., Class A | | $ | 215,532 | |

| | 13,225 | | American Eagle Outfitters, Inc. | | | 195,995 | |

| | 600 | | Apollo Group, Inc., Class A* | | | 37,770 | |

| | 535 | | ITT Educational Services, Inc.* | | | 53,912 | |

| | 2,545 | | Magna International, Inc., Class A | | | 86,428 | |

| | 11,925 | | Mattel, Inc. | | | 178,398 | |

| | 5,200 | | Tiffany & Co. | | | 150,488 | |

| | 2,750 | | VF Corp. | | | 162,993 | |

| | | | | |

| |

| | | | | | | 1,081,516 | |

| | | | | |

| |

| | | | Consumer Staples — 6.5% | | | | |

| | 3,350 | | Alberto-Culver Co. | | | 74,672 | |

| | 2,525 | | BJ’s Wholesale Club, Inc.* | | | 84,184 | |

| | 2,310 | | Bunge Ltd. | | | 110,903 | |

| | 3,075 | | Hansen Natural Corp.* | | | 125,336 | |

| | 7,075 | | Tyson Foods, Inc., Class A | | | 74,571 | |

| | | | | |

| |

| | | | | | | 469,666 | |

| | | | | |

| |

| | | | Energy — 6.7% | | | | |

| | 5,048 | | ENSCO International, Inc. | | | 142,757 | |

| | 4,970 | | Helmerich & Payne, Inc. | | | 153,175 | |

| | 8,000 | | Pioneer Natural Resources Co. | | | 184,961 | |

| | | | | |

| |

| | | | | | | 480,893 | |

| | | | | |

| |

| | | | Financials — 16.4% | | | | |

| | 3,850 | | Annaly Capital Management, Inc. | | | 54,170 | |

| | 3,150 | | BB&T Corp. | | | 73,521 | |

| | 2,040 | | Capitol Federal Financial | | | 79,478 | |

| | 2,325 | | Comerica, Inc. | | | 48,779 | |

| | 2,175 | | Commerce Bancshares, Inc. | | | 71,993 | |

| | 11,425 | | Hudson City Bancorp, Inc. | | | 143,497 | |

| | 10,550 | | KeyCorp | | | 64,883 | |

| | 1,090 | | M&T Bank Corp. | | | 57,171 | |

| | 6,200 | | New York Community Bancorp, Inc. | | | 70,122 | |

| | 9,075 | | People’s United Financial, Inc. | | | 141,751 | |

| | 16,100 | | Regions Financial Corp. | | | 72,289 | |

| | 5,350 | | SEI Investments Co. | | | 75,061 | |

16

| The FBR Funds |

|

| FBR Pegasus Mid Cap FundTM |

| Portfolio of Investments (continued) |

April 30, 2009

(unaudited) |

|

| | | | | | | VALUE | |

| | SHARES | | | | | (NOTE 2) | |

|

| | | | Financials — 16.4% (continued) | | | | |

| | 4,690 | | T. Rowe Price Group, Inc. | | $ | 180,658 | |

| | 2,000 | | The Hanover Insurance Group, Inc. | | | 59,960 | |

| | | | | |

| |

| | | | | | | 1,193,333 | |

| | | | | |

| |

| | | | Health Care — 8.2% | | | | |

| | 355 | | Bio-Rad Laboratories, Inc., Class A* | | | 24,740 | |

| | 2,396 | | C.R. Bard, Inc. | | | 171,625 | |

| | 4,088 | | Forest Laboratories, Inc.* | | | 88,669 | |

| | 1,030 | | Lincare Holdings, Inc.* | | | 24,854 | |

| | 1,810 | | Techne Corp. | | | 103,568 | |

| | 5,250 | | Varian Medical Systems, Inc.* | | | 175,193 | |

| | | | | |

| |

| | | | | | | 588,649 | |

| | | | | |

| |

| | | | Industrials — 8.2% | | | | |

| | 4,375 | | Copart, Inc.* | | | 137,331 | |

| | 2,818 | | Cummins, Inc. | | | 95,812 | |

| | 1,350 | | Equifax, Inc. | | | 39,366 | |

| | 950 | | Fastenal Co. | | | 36,442 | |

| | 1,625 | | Kubota Corp. ADR | | | 48,734 | |

| | 2,425 | | Pall Corp. | | | 64,044 | |

| | 2,800 | | Ritchie Bros. Auctioneers, Inc. | | | 62,720 | |

| | 2,412 | | Roper Industries, Inc. | | | 109,963 | |

| | | | | |

| |

| | | | | | | 594,412 | |

| | | | | |

| |

| | | | Information Technology — 11.7% | | | | |

| | 22,900 | | Activision Blizzard, Inc.* | | | 246,633 | |

| | 7,525 | | Check Point Software Technologies Ltd.* | | | 174,354 | |

| | 2,720 | | FactSet Research Systems, Inc. | | | 145,765 | |

| | 4,000 | | Global Payments, Inc. | | | 128,240 | |

| | 1,775 | | Ingram Micro, Inc., Class A* | | | 25,773 | |

| | 4,625 | | Paychex, Inc. | | | 124,921 | |

| | | | | |

| |

| | | | | | | 845,686 | |

| | | | | |

| |

| | | | Materials — 5.7% | | | | |

| | 5,150 | | Compania de Minas Buenaventura S.A.A. ADR | | | 108,974 | |

| | 2,100 | | Ecolab, Inc. | | | 80,955 | |

| | 2,580 | | Sigma-Aldrich Corp. | | | 113,107 | |

| | 3,950 | | United States Steel Corp. | | | 104,873 | |

| | | | | |

| |

| | | | | | | 407,909 | |

| | | | | |

| |

17

| The FBR Funds |

|

| FBR Pegasus Mid Cap FundTM |

| Portfolio of Investments (continued) |

April 30, 2009

(unaudited) |

|

| | | | | | | VALUE | |

| | SHARES | | | | | (NOTE 2) | |

|

| | | | Telecommunication Services — 1.1% | | | | |

| | 2,700 | | Telephone and Data Systems, Inc. | | $ | 77,409 | |

| | | | | |

| |

| | | | Utilities — 6.0% | | | | |

| | 2,290 | | Energen Corp. | | | 82,715 | |

| | 2,175 | | Pinnacle West Capital Corp. | | | 59,552 | |

| | 2,938 | | Questar Corp. | | | 87,316 | |

| | 1,900 | | SCANA Corp. | | | 57,418 | |

| | 1,350 | | Sempra Energy | | | 62,127 | |

| | 2,850 | | Westar Energy, Inc. | | | 49,961 | |

| | 1,900 | | Xcel Energy, Inc. | | | 35,036 | |

| | | | | |

| |

| | | | | | | 434,125 | |

| | | | | |

| |

| | | | Total Common Stocks (Cost $6,209,237) | | | 6,173,598 | |

| | | | | |

| |

| | | | | | | | |

| | | | MONEY MARKET FUND — 23.7% | | | | |

| | 1,711,276 | | JPMorgan 100% U.S. Treasury Securities Money Market Fund (Cost $1,711,276) | | | 1,711,276 | |

| | | | | |

| |

| | | | | | | | |

| | | | Total Investments — 109.2% (Cost $7,920,513) | | | 7,884,874 | |

| | | | | | | | |

| | | | Liabilities Less Other Assets — (9.2%) | | | (665,761 | ) |

| | | | | |

| |

| | | | | | | | |

| | | | Net Assets — 100.0% | | $ | 7,219,113 | |

| | | | | |

| |

|

| * | | Non-income producing security |

| ADR | | American Depositary Receipts |

| Note: | | For presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with Section 8(b)(1) of the Investment Company Act of 1940, the Fund uses more specific industry classifications. |

The accompanying notes are an integral part of the financial statements.

18

The FBR Funds

FBR Pegasus Small Cap FundTM

Management Overview

Portfolio Manager: Robert Barringer, CFA®

Over the last six months, how did the Fund perform?

For the six-month period ended April 30, 2009, the Investor Class of the FBR Pegasus Small Cap FundTM returned -2.61%. This compares to the Russell 2000 Index and the Morningstar Small Blend Category average, which returned -8.40% and -3.27%, for the same period, respectively.

What factors contributed to the Fund’s performance?

I believe the Investor Class of the Fund outperformed the Russell 2000 Index over the course of the reporting period due to a number of factors. The majority of the Fund’s return and relative outperformance was attributable to selection effect; our ability to choose and emphasize different securities than the benchmark, rather than industry allocation. An important and beneficial portfolio move was to underweight the financial sector during this unprecedented and tumultuous period, while remaining focused on companies with differentiated strategies and solid balance sheets. The market was concerned with the overall strength and viability of the entire financial system, especially those financial institutions deemed to have weak capital structures. By emphasizing the stronger, better managed and capitalized financial companies, the Fund was able to enhance its relative performance.

During this period, stock selection was also a key driver in both the industrial and consumer discretionary sectors as well. The market favored companies with adequate financing and solid balance sheets that managed to weather the financial storm and are positioned to gain share in their respective markets as the economy recovers. In particular, our investments in several consumer apparel companies and in the depressed building products companies with low to no debt worked well.

Our overweight and security selection in the consumer staples sector detracted slightly from performance. Certain companies represented in the Russell 2000 Index, which we consider to be fundamentally lower-quality, performed very well over the reporting period as investor’s appetite for risk seemed to return along with increased optimism.

What is the outlook for the Fund?

We continue to believe that the long-term outlook for small-caps and the Fund is very attractive, even after the market’s recent rebound off the March lows and positive performance year-to-date. Companies categorized as “value” investments were hit particularly hard, with the financials and cyclicals impacted the most in the aftermath of market downturn from its peak in 2007. What had previously been an extremely painful and unnerving experience for all investors, has evolved into a very attractive opportunity to purchase many high quality, industry leading companies and tilt the portfolio towards these more “value” oriented areas. Some of the more interesting opportunities available in

19

The FBR Funds

FBR Pegasus Small Cap FundTM

Management Overview (continued)

the small-cap investment universe center on companies that were previously classified as mid-caps or in some cases even large-caps, which have fallen into the small-cap arena. While their market caps today are considered small, these companies may provide substantial leverage to the stabilization and ultimate recovery of the economy. In my view, we are in the very early stages of a global recovery period and I am excited about the opportunity to continue to execute our investment process at a time where an abundance of attractive investments can be uncovered for patient, long-term investors.

|

The opinions expressed in this commentary reflect those of the Portfolio Manager as of the date written. Any such opinions are subject to change based on market or other conditions. These opinions may not be relied upon as investment advice. Investment decisions for The FBR Funds are based on several factors, and may not be relied upon as an indication of trading intent on behalf of any FBR Fund. Security positions can and do change. |

20

The FBR Funds

FBR Pegasus Small Cap FundTM

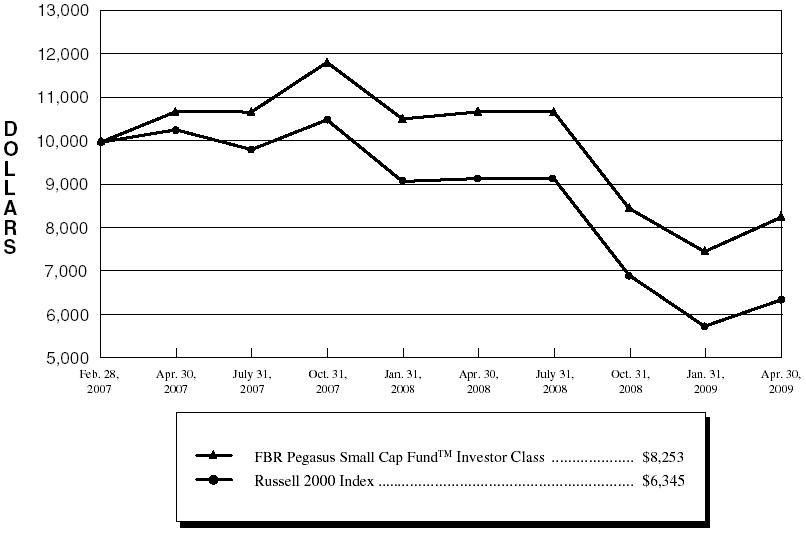

Comparison of Changes in Value of $10,000 Investment in

Investor Class Shares(1)(2) vs. Russell 2000 Index(1)(3)

(unaudited)

| Total Returns—For the Periods Ended April 30, 2009(4) | |

| | | | | | Annualized | | Cumulative | |

| | | | | | Since | | Since | |

| | | One Year | | Inception(5) | | Inception(6) | |

| | |

| |

| |

| |

FBR Pegasus Small Cap FundTM Investor Class(1)(2) | | (22.89 | )% | | (8.48 | )% | | N/A | | |

FBR Pegasus Small Cap FundTM I Class(2)(6) | | N/A | | | N/A | | | (25.80 | )% | |

Russell 2000 Index(1)(3) | | (30.74 | )% | | (18.89 | )% | | (33.54 | )% | |

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

The performance data quoted represents past performance and the current performance may be lower or higher than the performance data quoted. The investment return and principal will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption fees. If reflected, the redemption fee would reduce the performance data quoted. To obtain performance data current to the most recent month-end, please call 888.200.4710 or visit www.fbrfunds.com.

|

| (1) | | The graph assumes a hypothetical $10,000 initial investment in the Fund and reflects the reinvestment of dividends and all Fund expenses. Investors should note that the Fund is a professionally managed mutual fund while the index is unmanaged, does not incur expenses and is not available for investment. The performance of the index includes reinvested dividends, and does not reflect sales charges or expenses. |

| (2) | | FBR Fund Advisers, Inc. waived a portion of its advisory fees and agreed to contractually reimburse a portion of the Fund’s operating expenses, as necessary, to maintain existing expense limitations, as set forth in the notes to the financial statements. Total returns shown include fee waivers and expense reimbursements; total returns would have been lower had there been no waiver of fees and/or reimbursement of expenses in excess of expense limitations. |

| (3) | | The Russell 2000 Index is comprised of the smallest of the 2000 companies of the Russell 3000 Index, representing approximately 8% of the Russell 3000’s total market capitalization. |

| (4) | | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| (5) | | For the period February 28, 2007 (commencement of investment operations) through April 30, 2009. |

| (6) | | For the period May 30, 2008 (inception of share class) through April 30, 2009. |

21

| The FBR Funds |

|

| FBR Pegasus Small Cap FundTM |

| Portfolio Summary |

April 30, 2009

(unaudited) |

The following provides a breakdown of the Fund by industry sectors. The underlying securities represent a percentage of the portfolio investments.

| Industry Sector | | % of Total Investments |

| |

|

| Financials | | 26.2 | % |

| Industrials | | 18.0 | % |

| Information Technology | 15.6 | % |

| Consumer Discretionary | 14.2 | % |

| Health Care | | 10.6 | % |

| Materials | | 6.2 | % |

| Consumer Staples | 2.7 | % |

| Energy | | 2.0 | % |

| Utilities | | 0.8 | % |

| | | | |

| Cash | | 3.7 | % |

22

| The FBR Funds |

|

| FBR Pegasus Small Cap FundTM |

| Portfolio of Investments |

April 30, 2009

(unaudited) |

|

| | | | | | | VALUE | |

| | SHARES | | | | | (NOTE 2) | |

|

| | | | COMMON STOCKS — 101.3% | | | | |

| | | | Consumer Discretionary — 15.0% | | | | |

| | 4,100 | | Abercrombie & Fitch Co., Class A | | $ | 110,946 | |

| | 6,800 | | American Eagle Outfitters, Inc. | | | 100,776 | |

| | 2,200 | | CarMax, Inc.* | | | 28,072 | |

| | 7,700 | | Chico’s FAS, Inc.* | | | 58,828 | |

| | 3,000 | | Interactive Data Corp. | | | 67,440 | |

| | 90 | | NVR, Inc.* | | | 45,483 | |

| | 4,500 | | Pool Corp. | | | 80,370 | |

| | 3,050 | | Snap-On, Inc. | | | 103,456 | |

| | 3,250 | | The Black & Decker Corp. | | | 130,974 | |

| | 750 | | The Buckle, Inc. | | | 28,028 | |

| | 1,325 | | The Gymboree Corp.* | | | 45,580 | |

| | 1,400 | | The Men’s Wearhouse, Inc. | | | 26,096 | |

| | 1,450 | | The Timberland Co., Class A* | | | 23,548 | |

| | 2,875 | | Tiffany & Co. | | | 83,203 | |

| | 3,850 | | Williams-Sonoma, Inc. | | | 53,900 | |

| | 5,225 | | Wolverine World Wide, Inc. | | | 108,837 | |

| | | | | |

| |

| | | | | | | 1,095,537 | |

| | | | | |

| |

| | | | Consumer Staples — 2.9% | | | | |

| | 2,950 | | Alberto-Culver Co. | | | 65,756 | |

| | 2,000 | | BJ’s Wholesale Club, Inc.* | | | 66,680 | |

| | 3,375 | | Flowers Foods, Inc. | | | 77,962 | |

| | | | | |

| |

| | | | | | | 210,398 | |

| | | | | |

| |

| | | | Energy — 2.1% | | | | |

| | 1,700 | | Concho Resources, Inc.* | | | 46,614 | |

| | 1,990 | | Denbury Resources, Inc.* | | | 32,397 | |

| | 2,150 | | Goodrich Petroleum Corp.* | | | 49,300 | |

| | 400 | | SEACOR Holdings, Inc.* | | | 26,288 | |

| | | | | |

| |

| | | | | | | 154,599 | |

| | | | | |

| |

| | | | Financials — 27.6% | | | | |

| | 3,235 | | American Financial Group, Inc. | | | 56,871 | |

| | 5,950 | | Arthur J. Gallagher & Co. | | | 133,756 | |

| | 667 | | Bank of Marin Bancorp | | | 17,085 | |

| | 2,700 | | Capitol Federal Financial | | | 105,192 | |

| | 9,635 | | Cohen & Steers, Inc. | | | 141,827 | |

23

| The FBR Funds |

|

| FBR Pegasus Small Cap FundTM |

| Portfolio of Investments (continued) |

April 30, 2009

(unaudited) |

|

| | | | | | | VALUE | |

| | SHARES | | | | | (NOTE 2) | |

|

| | | | Financials — 27.6% (continued) | | | | |

| | 4,300 | | Commerce Bancshares, Inc. | | $ | 142,330 | |

| | 5,100 | | ESSA Bancorp, Inc. | | | 69,564 | |

| | 13,900 | | First Niagara Financial Group, Inc. | | | 188,205 | |

| | 3,600 | | Fox Chase Bancorp, Inc.* | | | 34,128 | |

| | 1,465 | | HCC Insurance Holdings, Inc. | | | 35,043 | |

| | 3,450 | | Home Federal Bancorp, Inc. | | | 34,811 | |

| | 7,050 | | Knight Capital Group, Inc., Class A* | | | 109,205 | |

| | 415 | | Markel Corp.* | | | 119,105 | |

| | 2,050 | | National Health Investors, Inc. | | | 54,981 | |

| | 2,950 | | Odyssey Re Holdings Corp. | | | 112,956 | |

| | 3,325 | | optionsXpress Holdings, Inc. | | | 54,730 | |

| | 15,560 | | SEI Investments Co. | | | 218,306 | |

| | 2,950 | | The Hanover Insurance Group, Inc. | | | 88,441 | |

| | 5,440 | | Torchmark Corp. | | | 159,555 | |

| | 1,200 | | Validus Holdings Ltd. | | | 26,880 | |

| | 4,985 | | Waddell & Reed Financial, Inc., Class A | | | 111,714 | |

| | | | | |

| |

| | | | | | | 2,014,685 | |

| | | | | |

| |

| | | | Health Care — 11.1% | | | | |

| | 500 | | Bio-Rad Laboratories, Inc., Class A* | | | 34,845 | |

| | 600 | | Dionex Corp.* | | | 37,800 | |

| | 1,870 | | IDEXX Laboratories, Inc.* | | | 73,491 | |

| | 2,300 | | Lincare Holdings, Inc.* | | | 55,499 | |

| | 1,900 | | MEDNAX, Inc.* | | | 68,210 | |

| | 750 | | National HealthCare Corp. | | | 29,775 | |

| | 8,680 | | Patterson Companies, Inc.* | | | 177,592 | |

| | 6,150 | | STERIS Corp. | | | 148,215 | |

| | 2,575 | | Techne Corp. | | | 147,342 | |

| | 1,700 | | VCA Antech, Inc.* | | | 42,534 | |

| | | | | |

| |

| | | | | | | 815,303 | |

| | | | | |

| |

| | | | Industrials — 18.9% | | | | |

| | 2,325 | | A.O. Smith Corp. | | | 72,284 | |

| | 2,350 | | American Woodmark Corp. | | | 48,645 | |

| | 1,475 | | Arkansas Best Corp. | | | 34,043 | |

| | 2,210 | | Carlisle Companies, Inc. | | | 50,278 | |

| | 8,400 | | Continental Airlines, Inc., Class B* | | | 88,368 | |

| | 1,565 | | Donaldson Company, Inc. | | | 51,629 | |

24

| The FBR Funds |

|

| FBR Pegasus Small Cap FundTM |

| Portfolio of Investments (continued) |

April 30, 2009

(unaudited) |

|

| | | | | | | VALUE | |

| | SHARES | | | | | (NOTE 2) | |

|

| | | | Industrials — 18.9% (continued) | | | | |

| | 3,550 | | Equifax, Inc. | | $ | 103,518 | |

| | 2,950 | | Genesee & Wyoming, Inc., Class A* | | | 88,500 | |

| | 2,180 | | Graco, Inc. | | | 51,426 | |

| | 1,180 | | Granite Construction, Inc. | | | 46,551 | |

| | 4,150 | | Insteel Industries, Inc. | | | 30,918 | |

| | 4,200 | | KBR, Inc. | | | 65,604 | |

| | 3,350 | | Lennox International, Inc. | | | 106,832 | |

| | 1,200 | | Lincoln Electric Holdings, Inc. | | | 53,436 | |

| | 1,775 | | Mueller Industries, Inc. | | | 38,997 | |

| | 4,200 | | Pall Corp. | | | 110,921 | |

| | 2,770 | | Rollins, Inc. | | | 49,860 | |

| | 2,015 | | Simpson Manufacturing Company, Inc. | | | 44,854 | |

| | 3,575 | | The Toro Co. | | | 108,608 | |

| | 875 | | Valmont Industries, Inc. | | | 55,808 | |

| | 2,800 | | Werner Enterprises, Inc. | | | 45,780 | |

| | 1,850 | | Woodward Governor Co. | | | 36,926 | |

| | | | | |

| |

| | | | | | | 1,383,786 | |

| | | | | |

| |

| | | | Information Technology — 16.4% | | | | |

| | 5,300 | | ADTRAN, Inc. | | | 112,095 | |

| | 1,325 | | Cymer, Inc.* | | | 37,643 | |

| | 1,950 | | Intersil Corp., Class A | | | 22,620 | |

| | 1,500 | | j2 Global Communications, Inc.* | | | 35,985 | |

| | 2,250 | | Jack Henry & Associates, Inc. | | | 40,545 | |

| | 6,200 | | MICROS Systems, Inc.* | | | 130,076 | |

| | 9,200 | | NCR Corp.* | | | 93,380 | |

| | 2,600 | | Parametric Technology Corp.* | | | 28,990 | |

| | 11,150 | | QLogic Corp.* | | | 158,107 | |

| | 1,500 | | SPSS, Inc.* | | | 46,350 | |

| | 2,350 | | Sybase, Inc.* | | | 79,806 | |

| | 11,100 | | Teradata Corp.* | | | 185,592 | |

| | 18,150 | | Total System Services, Inc. | | | 226,331 | |

| | | | | |

| |

| | | | | | | 1,197,520 | |

| | | | | |

| |

| | | | Materials — 6.5% | | | | |

| | 200 | | CF Industries Holdings, Inc. | | | 14,410 | |

| | 1,500 | | H.B. Fuller Co. | | | 26,490 | |

| | 1,925 | | Pactiv Corp.* | | | 42,081 | |

25

| The FBR Funds |

|

| FBR Pegasus Small Cap FundTM |

| Portfolio of Investments (continued) |

April 30, 2009

(unaudited) |

|

| | | | | | | VALUE | |

| | SHARES | | | | | (NOTE 2) | |

|

| | | | Materials — 6.5% (continued) | | | | |

| | 1,350 | | Schnitzer Steel Industries, Inc., Class A | | $ | 66,906 | |

| | 2,250 | | Sensient Technologies Corp. | | | 52,605 | |

| | 1,375 | | Terra Industries, Inc. | | | 36,438 | |

| | 5,800 | | The Valspar Corp. | | | 139,199 | |

| | 3,800 | | United States Steel Corp. | | | 100,890 | |

| | | | | |

| |

| | | | | | | 479,019 | |

| | | | | |

| |

| | | | Utilities — 0.8% | | | | |

| | 880 | | Energen Corp. | | | 31,785 | |

| | 1,850 | | The Empire District Electric Co. | | | 27,695 | |

| | | | | |

| |

| | | | | | | 59,480 | |

| | | | | |

| |

| | | | Total Common Stocks (Cost $7,051,424) | | | 7,410,327 | |

| | | | | |

| |

| | | | | | | | |

| | | | MONEY MARKET FUND — 3.8% | | | | |

| | 278,480 | | JPMorgan 100% U.S. Treasury Securities Money Market Fund (Cost $278,480) | | | 278,480 | |

| | | | | |

| |

| | | | | | | | |

| | | | Total Investments — 105.1% (Cost $7,329,904) | | | 7,688,807 | |

| | | | | | | | |

| | | | Liabilities Less Other Assets — (5.1%) | | | (371,374 | ) |

| | | | | |

| |

| | | | | | | | |

| | | | Net Assets — 100.0% | | $ | 7,317,433 | |

| | | | | |

| |

|

| * | | Non-income producing security |

| Note: | | For presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with Section 8(b)(1) of the Investment Company Act of 1940, the Fund uses more specific industry classifications. |

The accompanying notes are an integral part of the financial statements.

26

The FBR Funds

FBR Pegasus Small Cap Growth FundTM

Management Overview

Portfolio Manager: Robert Barringer, CFA®

Over the last six months, how did the Fund perform?

For the six-month period ended April 30, 2009, the Investor Class of the FBR Pegasus Small Cap Growth FundTM returned 2.40%. This compares to the Morningstar Small Cap Growth Fund Index and the Russell 2000 Growth Index, which returned -3.22% and -3.77%, for the same period, respectively.

What factors contributed to the Fund’s performance?

The Investor Class of the Fund outperformed the Russell 2000 Growth Index over the course of the reporting period due to a number of factors, including a combination of sector selection and individual stock selection. One of the more fruitful portfolio moves was to underweight the industrials for the reporting period while limiting investments in the sector to a few select companies with differentiated strategies and solid balance sheets. The Fund benefited from its lack of exposure to the aerospace and defense industries, both which performed poorly. Stock selection in the healthcare sector was also an important positive contributor to the Fund’s outperformance. In particular the Fund’s position in Cerner Corp., a company that is a major player in the electronic medical records space, was a key driver. The market came to appreciate Cerner’s current profitability, and the potential for sustainable growth of its business for the foreseeable future under an administration that is making electronic medical records a priority. Despite being penalized for an underweight allocation to the consumer discretionary sector, the top-performing sector of the Russell 2000 Growth Index during the reporting period, the Fund outperformed due to superior stock selection, most notably its positions in ITT Educational Services, Inc. and Priceline.com, Inc.

On the negative side, the Fund’s overweight to the energy sector was the largest detractor of relative performance. During the reporting period, the decline of oil prices negatively impacted the smaller companies in the sector, as the market favored larger and more diversified companies with lower breakeven oil price business models.

What is the outlook for the Fund?

I am optimistic about the outlook for the Fund at this time, and, as I write this piece, the market is solidly in positive territory year-to-date. While the economy faces definite challenges ahead, business and consumers have proven remarkably resilient, and I am seeing signs of stabilization; the first step before growth. For example, the capital markets are now open again for many companies, and fears are declining around whether some companies in the financial area in particular, will survive.

Current valuations for small-cap growth companies are reasonable, particularly in the more cyclical areas that were inordinately impacted by fears of an extended global slowdown. As healing across the financial segment continues, investor’s fears will

27

The FBR Funds

FBR Pegasus Small Cap Growth FundTM

Management Overview (continued)

continue to abate, and rational thinking will certainly return. I remain confident in the investment process employed by the Fund which is designed to identify industry leading small growth companies, with strong balance sheets, adequate financing and higher than average returns on owner’s capital. Our relentless attention to valuations and ultimately the purchase price of the Fund’s holdings has the potential to provide upside participation while decreasing the overall risk-profile of the Fund.

|

The opinions expressed in this commentary reflect those of the Portfolio Manager as of the date written. Any such opinions are subject to change based on market or other conditions. These opinions may not be relied upon as investment advice. Investment decisions for The FBR Funds are based on several factors, and may not be relied upon as an indication of trading intent on behalf of any FBR Fund. Security positions can and do change. |

28

The FBR Funds

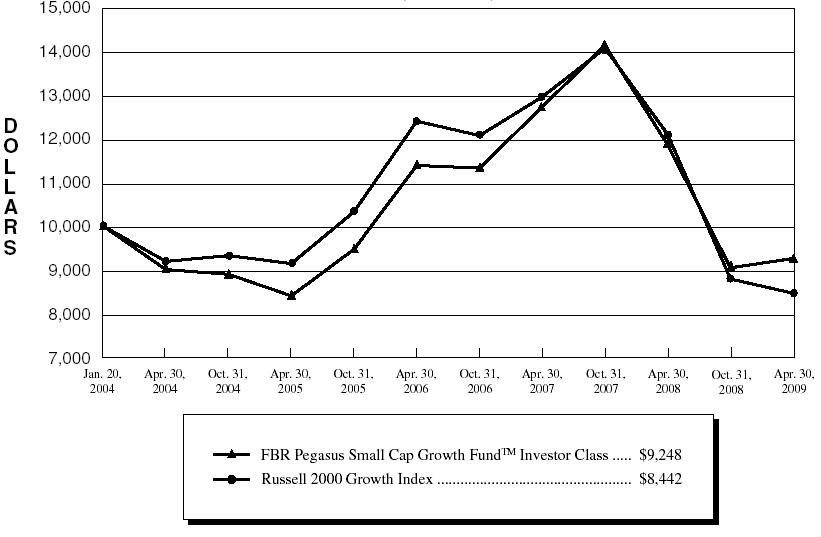

FBR Pegasus Small Cap Growth FundTM

Comparison of Changes in Value of $10,000 Investment in

Investor Class Shares(1)(2) vs. Russell 2000 Growth Index(1)(3)

(unaudited)

| Total Returns—For the Periods Ended April 30, 2009(4) | |

| | | | | | | | | Annualized | | Cumulative | |

| | | | | | Annualized | | Since | | Since | |

| | | One Year | | Five Year | | Inception(5) | | Inception(6) | |

| | |

| |

| |

| |

| |

FBR Pegasus Small Cap Growth FundTM | | | | | | | | | | | | | |

| Investor Class(1)(2) | | (22.12 | )% | | 0.57 | % | | (1.47 | )% | | N/A | | |

FBR Pegasus Small Cap Growth FundTM I Class(2)(6) | | N/A | | | N/A | | | N/A | | | (26.40 | )% | |

FBR Pegasus Small Cap Growth FundTM | | | | | | | | | | | | | |

| R Class (2)(6) | | N/A | | | N/A | | | N/A | | | (26.70 | )% | |

Russell 2000 Growth Index(1)(3) | | (30.36 | )% | | (1.67 | )% | | (3.16 | )% | | (33.74 | )% | |

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

The performance data quoted represents past performance and the current performance may be lower or higher than the performance data quoted. The investment return and principal will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption fees. If reflected, the redemption fee would reduce the performance data quoted. To obtain performance data current to the most recent month-end, please call 888.200.4710 or visit www.fbrfunds.com.

|

| (1) | | The graph assumes a hypothetical $10,000 initial investment in the Fund and reflects the reinvestment of dividends and all Fund expenses. Investors should note that the Fund is a professionally managed mutual fund while the index is unmanaged, does not incur expenses and is not available for investment. The performance of the index includes reinvested dividends, and does not reflect sales charges or expenses. |

| (2) | | FBR Fund Advisers, Inc. waived a portion of its advisory fees and agreed to contractually reimburse a portion of the Fund’s operating expenses, as necessary, to maintain existing expense limitations, as set forth in the notes to the financial statements. Total returns shown includes fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waiver of fees and/or reimbursement of expenses in excess of expense limitations. |

| (3) | | The Russell 2000 Growth Index measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000 companies with higher price-to-value ratios and higher forecasted growth values. |

| (4) | | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| (5) | | For the period January 20, 2004 (commencement of investment operations) through April 30, 2009. |

| (6) | | For the period May 30, 2008 (inception of share class) through April 30, 2009. |

29

| The FBR Funds |

|

| FBR Pegasus Small Cap Growth FundTM |

| Portfolio Summary |

April 30, 2009

(unaudited) |

The following provides a breakdown of the Fund by industry sectors. The underlying securities represent a percentage of the portfolio investments.

| Industry Sector | | % of Total Investments |

| |

|

| Information Technology | 23.6 | % |

| Health Care | | 20.6 | % |

| Industrials | | 18.2 | % |

| Consumer Discretionary | 16.3 | % |

| Financials | | 12.3 | % |

| Energy | | 2.9 | % |

| Consumer Staples | 1.9 | % |

| Materials | | 1.7 | % |

| Telecommunication Services | 0.6 | % |

| Utilities | | 0.4 | % |

| | | | |

| Cash | | 1.5 | % |

30

| The FBR Funds |

|

| FBR Pegasus Small Cap Growth FundTM |

| Portfolio of Investments |

April 30, 2009

(unaudited) |

|

| | | | | | | VALUE | |

| | SHARES | | | | | (NOTE 2) | |

|

| | | | COMMON STOCKS — 100.3% | | | | |

| | | | Consumer Discretionary — 16.6% | | | | |

| | 1,800 | | Aéropostale, Inc.* | | $ | 61,145 | |

| | 940 | | Capella Education Co.* | | | 48,297 | |

| | 500 | | Chipotle Mexican Grill, Inc., Class A* | | | 40,545 | |

| | 650 | | DreamWorks Animation SKG, Inc., Class A* | | | 15,607 | |

| | 1,300 | | Gentex Corp. | | | 17,381 | |

| | 1,900 | | Guess?, Inc. | | | 49,476 | |

| | 445 | | ITT Educational Services, Inc.* | | | 44,843 | |

| | 1,460 | | J. Crew Group, Inc.* | | | 25,127 | |

| | 690 | | Morningstar, Inc.* | | | 27,372 | |

| | 1,725 | | Penn National Gaming, Inc.* | | | 58,685 | |

| | 1,500 | | Polaris Industries, Inc. | | | 50,175 | |

| | 475 | | Priceline.com, Inc.* | | | 46,118 | |

| | 1,400 | | Under Armour, Inc., Class A* | | | 32,956 | |

| | 1,800 | | Urban Outfitters, Inc.* | | | 35,082 | |

| | | | | |

| |

| | | | | | | 552,809 | |

| | | | | |

| |

| | | | Consumer Staples — 1.9% | | | | |

| | 275 | | Energizer Holdings, Inc.* | | | 15,758 | |

| | 1,200 | | Hansen Natural Corp.* | | | 48,912 | |

| | | | | |

| |

| | | | | | | 64,670 | |

| | | | | |

| |

| | | | Energy — 2.9% | | | | |

| | 1,050 | | Basic Energy Services, Inc.* | | | 10,710 | |

| | 1,900 | | Cal Dive International, Inc.* | | | 15,048 | |

| | 640 | | Comstock Resources, Inc.* | | | 22,054 | |

| | 300 | | Core Laboratories N.V. | | | 24,969 | |

| | 1,300 | | Superior Energy Services, Inc.* | | | 24,973 | |

| | | | | |

| |

| | | | | | | 97,754 | |

| | | | | |

| |

| | | | Financials — 12.5% | | | | |

| | 1,200 | | Comerica, Inc. | | | 25,176 | |

| | 1,300 | | Commerce Bancshares, Inc. | | | 43,030 | |

| | 1,500 | | Flagstone Reinsurance Holdings Ltd. | | | 13,890 | |

| | 2,350 | | Fox Chase Bancorp, Inc.* | | | 22,278 | |

| | 1,245 | | Investment Technology Group, Inc.* | | | 28,361 | |

| | 100 | | Markel Corp.* | | | 28,700 | |

31

| The FBR Funds |

|

| FBR Pegasus Small Cap Growth FundTM |

| Portfolio of Investments (continued) |

April 30, 2009

(unaudited) |

|

| | | | | | | VALUE | |

| | SHARES | | | | | (NOTE 2) | |

|

| | | | Financials — 12.5% (continued) | | | | |

| | 1,725 | | optionsXpress Holdings, Inc. | | $ | 28,394 | |

| | 3,500 | | Regions Financial Corp. | | | 15,715 | |

| | 3,500 | | SEI Investments Co. | | | 49,105 | |

| | 1,275 | | Stifel Financial Corp.* | | | 62,768 | |

| | 2,000 | | thinkorswim Group, Inc.* | | | 19,000 | |

| | 3,700 | | TradeStation Group, Inc.* | | | 30,007 | |

| | 1,625 | | Waddell & Reed Financial, Inc., Class A | | | 36,416 | |

| | 600 | | Zenith National Insurance Corp. | | | 13,674 | |

| | | | | |

| |

| | | | | | | 416,514 | |

| | | | | |

| |

| | | | Health Care — 21.0% | | | | |

| | 375 | | Alexion Pharmaceuticals, Inc.* | | | 12,533 | |

| | 500 | | AMERIGROUP Corp.* | | | 14,935 | |

| | 325 | | Bio-Rad Laboratories, Inc., Class A* | | | 22,649 | |

| | 1,730 | | Cerner Corp.* | | | 93,073 | |

| | 1,000 | | Crucell N.V. ADR* | | | 20,990 | |

| | 1,500 | | Cypress Bioscience, Inc.* | | | 10,800 | |

| | 2,025 | | Dendreon Corp.* | | | 42,930 | |

| | 725 | | Gen-Probe, Inc.* | | | 34,916 | |

| | 1,165 | | IDEXX Laboratories, Inc.* | | | 45,785 | |

| | 1,000 | | Kinetic Concepts, Inc.* | | | 24,760 | |

| | 1,640 | | Lincare Holdings, Inc.* | | | 39,573 | |

| | 650 | | MEDNAX, Inc.* | | | 23,335 | |

| | 825 | | Mettler-Toledo International, Inc.* | | | 50,845 | |

| | 350 | | OSI Pharmaceuticals, Inc.* | | | 11,750 | |

| | 3,050 | | Patterson Companies, Inc.* | | | 62,403 | |

| | 1,200 | | Perrigo Co. | | | 31,104 | |

| | 600 | | Pharmaceutical Product Development, Inc. | | | 11,766 | |

| | 600 | | ResMed, Inc.* | | | 23,070 | |

| | 1,130 | | Techne Corp. | | | 64,658 | |

| | 175 | | United Therapeutics Corp.* | | | 10,992 | |

| | 1,900 | | VCA Antech, Inc.* | | | 47,538 | |

| | | | | |

| |

| | | | | | | 700,405 | |

| | | | | |

| |

| | | | Industrials — 18.5% | | | | |

| | 750 | | Badger Meter, Inc. | | | 29,220 | |

| | 2,275 | | Copart, Inc.* | | | 71,411 | |

32

| The FBR Funds |

|

| FBR Pegasus Small Cap Growth FundTM |

| Portfolio of Investments (continued) |

April 30, 2009

(unaudited) |

|

| | | | | | | VALUE | |

| | SHARES | | | | | (NOTE 2) | |

|

| | | | Industrials — 18.5% (continued) | | | | |

| | 1,150 | | Crane Co. | | $ | 26,554 | |

| | 1,875 | | Genessee & Wyoming, Inc., Class A* | | | 56,250 | |

| | 3,000 | | Heartland Express, Inc. | | | 44,850 | |

| | 800 | | Kaydon Corp. | | | 25,568 | |

| | 3,075 | | KBR, Inc. | | | 48,032 | |

| | 2,750 | | Knight Transportation, Inc. | | | 48,620 | |

| | 600 | | L.B. Foster Co.* | | | 19,650 | |

| | 1,200 | | Layne Christensen Co.* | | | 25,992 | |

| | 750 | | Lennox International, Inc. | | | 23,918 | |

| | 300 | | Lincoln Electric Holdings, Inc. | | | 13,359 | |

| | 925 | | Pall Corp. | | | 24,429 | |

| | 1,200 | | Ritchie Bros. Auctioneers, Inc. | | | 26,880 | |

| | 400 | | Valmont Industries, Inc. | | | 25,512 | |

| | 1,500 | | Westinghouse Air Brake Technologies | | | 57,210 | |

| | 410 | | Watson Wyatt Worldwide, Inc., Class A | | | 21,751 | |

| | 1,425 | | Woodward Governor Co. | | | 28,443 | |

| | | | | |

| |

| | | | | | | 617,649 | |

| | | | | |

| |

| | | | Information Technology — 24.1% | | | | |

| | 525 | | ANSYS, Inc.* | | | 14,501 | |

| | 3,175 | | Compuware Corp.* | | | 23,749 | |

| | 675 | | Concur Technologies, Inc.* | | | 18,272 | |

| | 1,300 | | FactSet Research Systems, Inc. | | | 69,666 | |

| | 1,400 | | Fidelity National Information Services, Inc. | | | 24,990 | |

| | 1,900 | | Global Payments, Inc. | | | 60,914 | |

| | 950 | | Hittite Microwave Corp.* | | | 35,302 | |

| | 3,050 | | Informatica Corp.* | | | 48,495 | |

| | 2,677 | | Jack Henry & Associates, Inc. | | | 48,240 | |

| | 1,500 | | JDA Software Group, Inc.* | | | 21,165 | |

| | 2,700 | | Metavante Technologies, Inc.* | | | 63,693 | |

| | 3,095 | | MICROS Systems, Inc.* | | | 64,932 | |

| | 2,100 | | Parametric Technology Corp.* | | | 23,415 | |

| | 1,125 | | Polycom, Inc.* | | | 20,970 | |

| | 3,025 | | QLogic Corp.* | | | 42,895 | |

| | 950 | | Quality Systems, Inc. | | | 50,939 | |

33

| The FBR Funds |

|

| FBR Pegasus Small Cap Growth FundTM |

| Portfolio of Investments (continued) |

April 30, 2009

(unaudited) |

|

| | | | | | | VALUE | |

| | SHARES | | | | | (NOTE 2) | |

|

| | | | Information Technology — 24.1% (continued) | | | | |

| | 2,525 | | Quest Software, Inc.* | | $ | 36,688 | |

| | 1,200 | | SPSS, Inc.* | | | 37,080 | |

| | 900 | | Supertex, Inc.* | | | 23,148 | |

| | 1,400 | | Sybase, Inc.* | | | 47,544 | |

| | 885 | | Syntel, Inc. | | | 24,532 | |

| | | | | |

| |

| | | | | | | 801,130 | |

| | | | | |

| |

| | | | Materials — 1.7% | | | | |

| | 900 | | Allegheny Technologies, Inc. | | | 29,457 | |

| | 1,125 | | Balchem Corp. | | | 28,001 | |

| | | | | |

| |

| | | | | | | 57,458 | |

| | | | | |

| |

| | | | Telecommunication Services — 0.6% | | | | |

| | 750 | | SBA Communications Corp., Class A* | | | 18,900 | |

| | | | | |

| |

| | | | | | | | |

| | | | Utilities — 0.5% | | | | |

| | 350 | | ITC Holdings Corp. | | | 15,236 | |

| | | | | |

| |

| | | | | | | | |

| | | | Total Common Stocks (Cost $3,450,277) | | | 3,342,525 | |

| | | | | |

| |

| | | | | | | | |

| | | | MONEY MARKET FUND — 1.6% | | | | |

| | 52,640 | | JPMorgan 100% U.S. Treasury Securities Money Market Fund (Cost $52,640) | | | 52,640 | |

| | | | | |

| |

| | | | | | | | |

| | | | Total Investments — 101.9% (Cost $3,502,917) | | | 3,395,165 | |

| | | | | | | | |

| | | | Liabilities Less Other Assets — (1.9%) | | | (64,127 | ) |

| | | | | |

| |

| | | | | | | | |

| | | | Net Assets — 100.0% | | $ | 3,331,038 | |

| | | | | |

| |

|

| * | | Non-income producing security |

| ADR | | American Depositary Receipts |

The accompanying notes are an integral part of the financial statements.

34

The FBR Funds

FBR Focus Fund

Management Overview

Investment Sub Adviser: Akre Capital Management, LLC

Portfolio Manager: Charles T. Akre, Jr.

Fellow shareholders know all too well that calendar year 2008 was a terrible experience for holders of common stocks, and in the Investor Class of the FBR Focus Fund (FBRVX), we were down 34%. Our experience was modestly better (300 basis points) than the S&P 500 Index, and approximately even with the Russell 2000 Index. Even though this was a difficult experience for many of us, our longer term ten year record (through 4/30/09) is 10.00%, which compares very favorably with the S&P 500 Index at -2.48% and the Russell 2000 Index at 2.53% for the same period.

Over the course of the 2009 semi-annual reporting period (six months ended 4/30/09), the Investor Class of the FBR Focus Fund returned 8.72% while the S&P 500 Index, Russell 2000 Index and Morningstar Mid Cap Growth Category average returned -8.53%, -8.40% and -0.85%, respectively.

The last week of February and the first week of March represented a true “blood running in the streets”, a phrase often associated with the French Revolution. This phenomenon, while accurately reflecting the carnage taking place with individual share prices, also created unique opportunities to make purchases at unheard of prices. In hindsight we bought way too little, but managed to position the Fund such that during the balance of March and all of April the Investor Class of the Fund experienced an important reversal, and ended April with a year to date return of 12.89%.

It will not surprise you to know that the portfolio today looks very much like it did a year ago; heavy concentration in a select group of businesses we believe are better than average in all important aspects. There are also a few new positions, and a few businesses no longer in the portfolio. This is to be expected.

As I recently reread the October 2007 letter to you, I was surprised by my thoughts about the deteriorating housing and credit markets, simply because it has taken an additional eighteen months for the bubble’s bursting to run its course in the stock market. In the economy in general, we are likely to have more downside as it relates to this classic debt deleveraging taking place. Worth paying close attention to will be the effect on consumer discretionary spending, absent the massive amounts of money available from home refinancing and home equity loans. I believe our portfolio of unique businesses is today well positioned to succeed in the economic environment we face!

But beyond this massive deleveraging coupled with the schizophrenic fears of both deflation and inflation, we have our eye on something additional. Our friend in Dallas, Texas, Shad Rowe, reminded us of the concept of “American Exceptionalism” which simply stated is “When the going gets tough, the tough get going”. I have written in the past about the nearly universal desire of outsiders to want admission to the U.S. The simple

35

The FBR Funds

FBR Focus Fund

Management Overview (continued)

reason for this desire is the enormous opportunity which exists here in greater abundance than anywhere else in the world. The American spirit is a factor which no quantitative model can properly account for, yet it has been such an important factor throughout our history. I remember well the explosion in the stock market on January 17, 1991, when U.S. Troops went into Kuwait City. The rally extended for a decade with very little interruption, despite many negatives in the economy, including the disruptive effect of the work of the RTC (Resolution Trust Corporation) absorbing 1,000 financial institutions and spewing out those assets. My closing comments today are that in the midst of all our problems; do not underestimate the American people!

|

The opinions expressed in this commentary reflect those of the Portfolio Manager as of the date written. Any such opinions are subject to change based on market or other conditions. These opinions may not be relied upon as investment advice. Investment decisions for The FBR Funds are based on several factors, and may not be relied upon as an indication of trading intent on behalf of any FBR Fund. Security positions can and do change. |

36

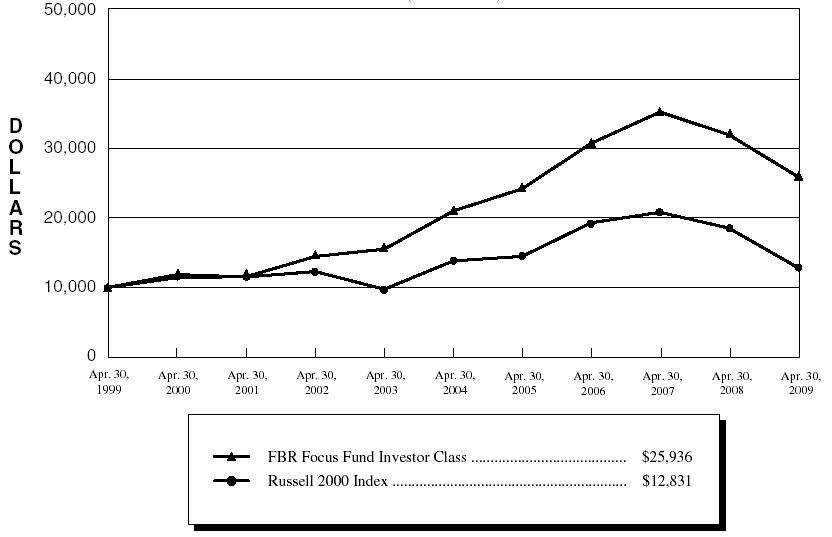

The FBR Funds

FBR Focus Fund

Comparison of Changes in Value of $10,000 Investment in

Investor Class Shares(1)(2) vs. Russell 2000 Index(1)(3)

(unaudited)

| Total Returns—For the Periods Ended April 30, 2009(4) | |

| | | | | | | | | | | | | Cumulative | |

| | | | | Annualized | | Annualized | | | Since | |

| | | One Year | | Five Year | | Ten Year | | | Inception(5) | |

| | |

| |

| |

| | |

| |

FBR Focus Fund Investor Class(1)(2) | | (18.84 | )% | | 4.32 | % | | 10.00 | % | | | N/A | | |

FBR Focus Fund I Class(2)(5) | | N/A | | | N/A | | | N/A | | | | (20.65 | )% | |

FBR Focus Fund R Class(2)(5) | | N/A | | | N/A | | | N/A | | | | (21.68 | )% | |

Russell 2000 Index(1)(3) | | (30.74 | )% | | (1.45 | )% | | 2.53 | % | | | (33.54 | )% | |

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.