(a) Include a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1).

Annual Report –

Baird Funds

December 31, 2020

Taxable Bond Funds

| Baird Ultra Short Bond Fund | Baird Aggregate Bond Fund |

| Baird Short-Term Bond Fund | Baird Core Plus Bond Fund |

Baird Intermediate Bond Fund

Municipal Bond Funds

Baird Short-Term Municipal Bond Fund

Baird Strategic Municipal Bond Fund

Baird Quality Intermediate Municipal Bond Fund

Baird Core Intermediate Municipal Bond Fund

Baird Municipal Bond Fund

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Funds’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Funds’ website (www.bairdassetmanagement.com/baird-funds/funds-and-performance#Literature) and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically anytime by contacting your financial intermediary or, if you are a direct investor, by calling 1-866-442-2473, or sending an e-mail request to prospectus@bairdfunds.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with a Fund, you can call 1-866-442-2473 or send an e-mail request to prospectus@bairdfunds.com to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds held in your account if you invest through your financial intermediary or all Funds held with the fund complex if you invest directly with the Funds.

| Go Green. |  | Go Paperless. |

Sign up to receive your Baird Funds’ prospectuses and reports online.

Table of Contents

| Letter to Shareholders | | 1 |

| 2020 Bond Market Overview | | 2 |

| Baird Ultra Short Bond Fund | | 7 |

| Baird Short-Term Bond Fund | | 33 |

| Baird Intermediate Bond Fund | | 62 |

| Baird Aggregate Bond Fund | | 89 |

| Baird Core Plus Bond Fund | | 144 |

| 2020 Municipal Bond Market Overview | | 206 |

| Baird Short-Term Municipal Bond Fund | | 210 |

| Baird Strategic Municipal Bond Fund | | 298 |

| Baird Quality Intermediate Municipal Bond Fund | | 329 |

| Baird Core Intermediate Municipal Bond Fund | | 371 |

| Baird Municipal Bond Fund | | 431 |

| Additional Information on Fund Expenses | | 450 |

| Statements of Assets and Liabilities | | 452 |

| Statements of Operations | | 456 |

| Statements of Changes in Net Assets | | 460 |

| Financial Highlights | | 470 |

| Notes to the Financial Statements | | 490 |

| Report of Independent Registered Public Accounting Firm | | 509 |

| Directors and Officers | | 510 |

| Disclosure Regarding the Board of Directors’ Approval | | |

| of the Investment Advisory Agreement for Baird Bond Funds | | 513 |

| Additional Information | | 517 |

| Privacy Notice | | A-1 |

This report has been prepared for shareholders and may be distributed to others only if preceded or accompanied by a current prospectus.

Cautionary Note on Analyses, Opinions and Outlooks: In this report we offer analyses and opinions on the performance of individual securities, companies, industries, sectors, markets, interest rates, asset classes, types of fixed income securities and governmental policies, including predictions, forecasts and outlooks regarding possible future events. These can generally be identified as such because the context of the statements may include such words as “believe,” “should,” “will,” “expects,” “anticipates,” “hopes” and words of similar effect. These statements reflect the portfolio managers’ good faith beliefs and judgments and involve risks and uncertainties, including the risk that the portfolio managers’ analyses, opinions and outlooks are or will prove to be inaccurate. It is inherently difficult to correctly assess and explain the performance of particular securities, sectors, markets, interest rate movements, governmental actions or general economic trends and conditions, and many unforeseen factors contribute to the performance of Baird Funds. Investors are, therefore, cautioned not to place undue reliance on subjective judgments contained in this report.

Baird Funds

1-866-442-2473

www.bairdfunds.com

February 26, 2021

Dear Shareholder,

After the challenges we have all endured over the past year, our Baird Advisors team hopes this letter finds you, your families and your loved ones healthy and safe. To say that 2020 was a challenging year for the financial markets and investors truly understates what we have all experienced. The impact of the coronavirus on our investors’ lives, families, businesses and communities felt at times overwhelming, but you all persevered and we are honored to have been your fixed income manager during this period. For our Baird Advisors team, this year has reminded us of the importance of looking out for each other and remaining laser focused on delivering on your financial needs. We have spent decades building and refining our all-weather strategies and I am extremely proud of our team for navigating the unprecedented weather in 2020. We delivered competitive returns but also peace of mind that your bond portfolio was doing what it was supposed to do. In addition, having a talented, well-respected municipal bond team embedded with our taxable team remains a significant competitive advantage. That expertise and talent was a contributor to the Baird Bond Funds’ strong performance in 2020 across our entire lineup.

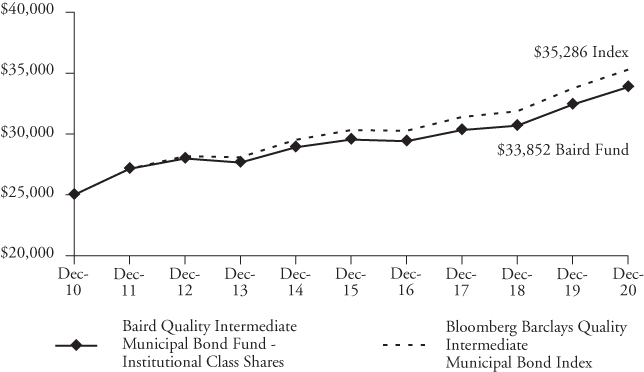

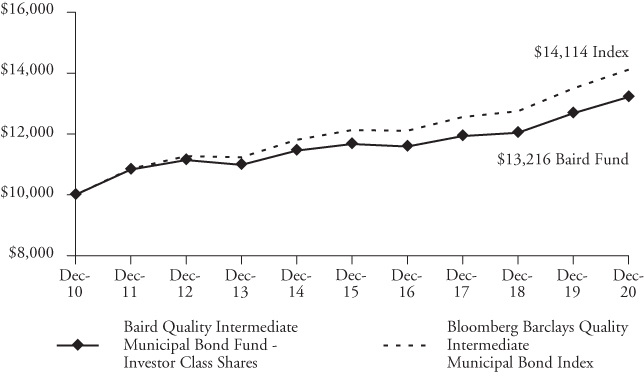

Amidst this extremely volatile and challenged environment, the Baird Bond Funds delivered very strong absolute performance and nearly all materially exceeded their benchmarks. While the Baird Quality Intermediate Municipal Bond Fund modestly lagged its benchmark, it continued to achieve its wealth preservation goal, remaining one of if not the highest quality bond fund available in the market. All of the Baird Bond Funds’ long-term track records remain very competitive and we believe the portfolios are positioned well as we enter 2021.

While much in the world has changed, our core commitment to our investors has not. We remain dedicated to generating competitive, risk-controlled returns over full market cycles, providing competitively-priced products, delivering outstanding service and continuing to invest in our long-tenured and seasoned investment team.

Through all of the challenges in 2020, we never lost sight of the fact that our long-term success rests on the trust you have placed in us to be effective stewards of your assets. We want to express our sincere appreciation for your confidence in our work and continued investment in the Baird Bond Funds. May 2021 bring you health, happiness and success.

Sincerely,

Mary Ellen Stanek, CFA

President

Baird Funds

2020 Bond Market Overview

(Unaudited)

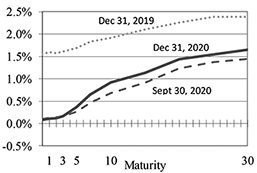

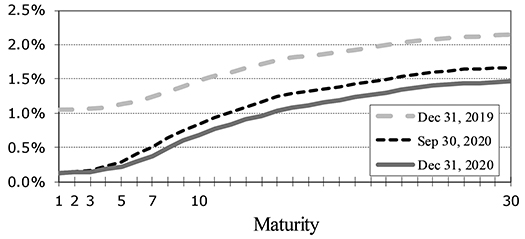

2020 – Global Pandemic Shock Followed by Massive Coordinated Fiscal and Monetary ResponseTreasury yields fell across the curve in 2020, with the benchmark 10yr Treasury down 100 bps to finish the year at 0.92%, after hitting an all-time [intra-day] record low of 0.31% on March 9. The curve steepened, with the spread between 2yr and 30yr Treasuries increasing from 82 bps to 153 bps during the year, as yields in shorter maturities saw the largest decline. Starting in late February, the coronavirus (COVID-19) affected every aspect of the economy, leading to the swiftest equity bear market in history, with an over 33% peak-to-trough drop in the S&P 500 in just over a month ending March 23, and fixed income markets hitting levels of distress not seen since the Global Financial Crisis (GFC) in 2008. However, unlike 2008, the massive, coordinated monetary and fiscal responses resulted in a much swifter recovery. Unemployment dropped to 6.7% by year end after peaking at 14.7% in April as businesses reopened, and the Pfizer and Moderna vaccines offered hope for a return to normal. The S&P 500 ended the year +16% at record highs and credit spreads tightened through year end, completely erasing the pandemic-related widening in many sectors. The COVID-19 pandemic and the policy response to it essentially created a full market cycle for spreads in the span of a calendar year.

Treasury Yields

Maturity | 12/31/19 | 9/30/20 | 12/31/20 | Q4 Change | 2020 Change |

| 3mo | 1.55% | 0.10% | 0.09% | -0.01% | -1.46% |

| 1 | 1.60% | 0.12% | 0.11% | -0.01% | -1.49% |

| 2 | 1.57% | 0.13% | 0.12% | -0.01% | -1.45% |

| 3 | 1.61% | 0.15% | 0.17% | 0.02% | -1.44% |

| 5 | 1.69% | 0.27% | 0.36% | 0.09% | -1.33% |

| 7 | 1.83% | 0.47% | 0.65% | 0.18% | -1.18% |

| 10 | 1.92% | 0.68% | 0.92% | 0.24% | -1.00% |

| 30 | 2.39% | 1.45% | 1.65% | 0.20% | -0.74% |

Fed’s Response and Congress’ CARES Act Eased the Pain; Politics and Geopolitical Uncertainty were High in 2020

The Fed cut rates in two emergency meetings in early March, slashing the fed funds rate 150 bps to the zero bound. Then as credit markets froze up, the Fed implemented “unlimited” purchases of U.S. Treasuries and Agency Mortgage-Backed Securities at a truly astounding pace, authorizing their fourth quantitative easing (“QE”) program with purchases of up to $75B Treasuries and $50B MBS per day, buying more in a day than during a full month during QE3. The Fed rebooted several 2008-era emergency lending programs, and created a few brand new lending facilities to keep primary and secondary bond trading in corporates and municipals from grinding to a halt. Late in March, Congress passed the $2.2T Coronavirus Aid, Relief, and Economic Security

2020 Bond Market Overview

(Unaudited)

(CARES) Act, the largest fiscal aid package ever at 10% of GDP. The act included support for small businesses, direct payments and enhanced unemployment benefit payments to consumers, and additional funding to hospitals and health care providers. In August, Fed Chair Powell released a “Statement on Longer-Run Goals and Monetary Policy Strategy” – as expected, the Fed moved to an inflation target that averages 2% over time, while forecasting the fed funds rate to remain at the zero bound through 2023. Housing was a bright spot in the economy, with the Freddie Mac 30-yr Mortgage Market Survey Rate hitting all-times lows 14 times during the year, ending at 2.7%. Political uncertainty was high throughout the year. Democratic challenger Joe Biden defeated incumbent President Trump in November, and despite claims of widespread voter fraud by President Trump, Biden was inaugurated on January 20. U.S./China trade tensions continued and Beijing further limited Hong Kong’s autonomy by enacting a national security law on June 30. The UK officially left the EU on January 31, 2020, reaching a final agreement on trade in late December and avoiding a worst-case scenario no-deal Brexit.

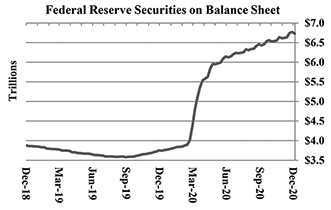

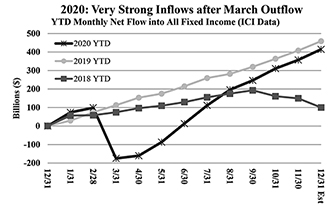

As the Fed Balance Sheet Expanded at a Furious Pace, Fixed Income Flows Rebounded

The Fed’s bond-buying program (QE4) added an astounding $3T to its investment portfolio, from $3.7 T to $6.7T. QE4 in combination with slashing short rates to zero helped stabilize the bond market. As investor confidence swiftly returned, the $175B in YTD net mutual fund and ETF outflows through March completely reversed, and fund inflows returned at record-setting pace. Net fixed income mutual fund and ETF inflows ended 2020 at $415B and, importantly, the ICI data doesn’t fully capture demand from all market participants – such as insurance companies, pensions, and foreign investors. Global investors have been drawn to the positive yields on U.S. debt, as nearly $18T in global bonds were trading at negative yields at year end, reaching all-time highs in 2020 according to Bloomberg data.

Option-Adjusted Spreads (in bps)

| | | | March | | | Q4 | YTD |

| | | 12/31/19 | Wides | 9/30/20 | 12/31/20 | Chg | Chg |

| U.S. Aggregate Index | | 39 | 127 (3/20) | 60 | 42 | -18 | 3 |

| U.S. Agency (non-mortgage) | | 10 | 53 (3/25) | 16 | 10 | -6 | 0 |

| Mortgage and ABS Sectors | | | | | | | |

| U.S. Agency Pass-throughs | | 39 | 132 (3/19) | 61 | 39 | -22 | 0 |

| U.S. Agency CMBS | | 53 | 144 (3/23) | 62 | 44 | -18 | -9 |

| U.S. Non-Agency CMBS | | 85 | 348 (3/25) | 139 | 109 | -30 | 24 |

| Asset-Backed Securities | | 44 | 325 (3/26) | 41 | 33 | -8 | -11 |

| Corporate Sectors | | | | | | | |

| U.S. Investment Grade | | 93 | 373 (3/23) | 136 | 96 | -40 | 3 |

| Industrial | | 99 | 383 (3/23) | 140 | 101 | -39 | 2 |

| Utility | | 97 | 298 (3/24) | 141 | 106 | -35 | 9 |

| Financial Institutions | | 80 | 378 (3/23) | 126 | 83 | -43 | 3 |

| Other Govt. Related | | 72 | 180 (3/23) | 84 | 66 | -18 | -6 |

| U.S. High Yield Corporates | | 336 | 1100 (3/23) | 517 | 360 | -157 | 24 |

| Emerging Market Debt | | 573 | 1370 (3/23) | 638 | 503 | -135 | -70 |

Source: Bloomberg Barclays Indices

2020 Bond Market Overview

(Unaudited)

2020 Spreads: Full Market Cycle for Spreads in One YearSpreads in most sectors ended the year relatively close to where they began, masking huge intra-year volatility in 2020. For the year, spreads in Agency Pass-throughs were flat, U.S. Investment Grade Corporates widened 3 bps and ABS tightened 11 bps. However, at their March wides, these three sectors were wider by 93 bps, 280 bps and 281 bps, respectively. These swings were due in large part to the uncertainty around COVID-19 and what impact the government’s containment efforts would have on the economy, the unprecedented fiscal and monetary support detailed above, and positive vaccine news later in the year providing investors with a light at the end of the tunnel. In particular, the tightening in Agency Pass-through spreads was primarily due to the Fed’s $600B in net purchases, which decreased available supply to investors. Furthermore, record-low mortgage rates provided strength to the housing sector and homeowners refinanced at faster-than-expected speeds. Outlier sectors include Non-Agency CMBS, which widened 24 bps (with the most severe widening focused in “A” and lower rated securities) on uncertainty around pandemic-hit sectors such as retail and hotel space, and U.S. High Yield Corporates which widened 24 bps. The outsized move tighter in Emerging Market Debt for the year (70 bps tighter) was largely driven by the removal of Venezuela from the index in May which reduced the OAS of the index by over 300bps. (The EM index underperformed similar-maturity Treasuries in 2020). Investment Grade Corporates had record gross ($2.1T) and net ($1.1T) supply, which was met by very strong demand.

Strong Market Returns, Credit Outperformed in 2020

The returns in the U.S. fixed income market were truly remarkable considering the strong total returns in 2019 and the fact the 10-year Treasury yield began the year at just 1.92%. Both credit risk and duration risk were rewarded in 2020. U.S. Investment Grade Corporates posted the strongest spread sector returns in 2020 (+9.89%), and returns on longer maturities (U.S. Gov’t/Credit + 8.93%) were substantially greater than those on shorter maturities (U.S. 1-3 Yr. Gov’t/Credit Index +3.33%). Agency Pass-throughs were the weakest-performing sector (+3.87%), largely due to record-low mortgage rates and historically fast residential mortgage refinancing activity, generating large prepayments in the premium-priced sector. TIPS were the top-performing sector (+10.99%) due to their longer duration and the Fed’s efforts to engineer negative real yields.

Total Returns of Selected Bloomberg Barclays Indices and Subsectors

| | | | | | Effective |

| | December | Q4 | 2020 | 2019 | Duration (yrs) |

| U.S. Aggregate Index | 0.14% | 0.67% | 7.51% | 8.72% | 6.22 |

| U.S. Gov’t/Credit Index | 0.09% | 0.82% | 8.93% | 9.71% | 7.74 |

| U.S. Intermediate Gov’t/Credit Index | 0.21% | 0.48% | 6.43% | 6.80% | 4.12 |

| U.S. 1-3 Yr. Gov’t/Credit Index | 0.09% | 0.21% | 3.33% | 4.03% | 1.91 |

| U.S. Treasury | -0.23% | -0.83% | 8.00% | 6.86% | 7.21 |

| U.S. Agency (Non-Mortgage) | 0.11% | 0.04% | 5.48% | 5.89% | 3.66 |

| U.S. Agency Pass-Throughs | 0.22% | 0.24% | 3.87% | 6.35% | 2.34 |

| CMBS (Commercial Mortgage | | | | | |

| Backed Securities) | 0.73% | 1.05% | 8.11% | 8.29% | 5.31 |

| ABS (Asset-Backed Securities) | 0.20% | 0.36% | 4.52% | 4.53% | 2.10 |

| U.S. Corporate Investment Grade | 0.44% | 3.05% | 9.89% | 14.54% | 8.84 |

| U.S. High Yield Corporates | 1.88% | 6.45% | 7.11% | 14.32% | 3.58 |

| Emerging Market Debt | 2.86% | 7.62% | 4.26% | 10.90% | 5.35 |

| Municipal Bond Index | 0.61% | 1.82% | 5.21% | 7.54% | 5.18 |

| TIPS (Treasury Inflation | | | | | |

| Protected Securities) | 1.15% | 1.62% | 10.99% | 8.43% | 7.81 |

2020 Bond Market Overview

(Unaudited)

2021 OutlookWe expect above-average economic growth in 2021 as the lagged stimulus benefits, reduced spread of COVID-19 as vaccinations increase, and pent-up consumer demand take effect. While the Fed will remain highly accommodative, anchoring short-term rates at zero and continuing QE, market consensus anticipates a steeper curve with higher inflation expectations and ever-rising Treasury supply pushing longer rates higher. However, we anticipate more modest upward pressure on yields as still-strong secular disinflationary forces temper near-term cyclical inflation pressure and strong demand from yield-starved investors limit the increase in yields. We expect spreads to remain relatively tight in 2021 on solid and improving fundamentals and favorable supply/demand technicals. Absolute returns will be more modest given the low starting yields, and every basis point will be especially important. Sector weightings, security selection and roll down will take on even greater importance in this new year.

Disclosures

Fixed income is generally considered to be a more conservative investment than stocks, but bonds and other fixed income investments still carry a variety of risks such as interest rate risk, credit risk, inflation risk, and liquidity risk. In a rising interest rate environment, the value of fixed-income securities generally decline and conversely, in a falling interest rate environment, the value of fixed-income securities generally increase. High yield securities may be subject to heightened market, interest rate or credit risk and should not be purchased solely because of the stated yield.

The Bloomberg Barclays Aggregate Bond Index is an index comprised of approximately 6000 publicly traded bonds including U.S. Government, mortgage-backed, corporate, and Yankee bonds with an average maturity of approximately 10 years.

The Bloomberg Barclays Government/Credit Index is a combination of the Government Index which measures government-bond general and Treasury funds, and the Credit Bond Index, which is a market value-weighted index which tracks the returns of all publicly issued, fixed-rate, nonconvertible, dollar-denominated, SEC registered, investment grade Corporate Debt.

The Bloomberg Barclays Intermediate Government/Credit Index is a combination of the Government Index which measures government-bond general and Treasury funds, and the Credit Bond Index, which is a market value-weighted index which tracks the returns of all publicly issued, fixed-rate, nonconvertible, dollar-denominated, SEC registered, investment grade Corporate Debt with maturities between one and ten years.

The Bloomberg Barclays Government/Credit Intermediate Index (1 – 3 yr.) is a combination of the Government Index which measures government-bond general and Treasury funds, and the Credit Bond Index, which is a market value-weighted index which tracks the returns of all publicly issued, fixed-rate, nonconvertible, dollar-denominated, SEC registered, investment grade Corporate Debt with maturities between zero and three years.

The Bloomberg Barclays U.S. Treasury Index includes public obligations of the U.S. Treasury. Treasury bills are excluded by the maturity constraint of at least one year but are part of a separate Short Treasury Index. In addition, certain special issues, such as state and local government series bonds (SLGs), as well as U.S. Treasury TIPS, are excluded. STRIPS are excluded from the index because their inclusion would result in double-counting. Securities in the Index roll up to the U.S. Aggregate, U.S. Universal, and Global Aggregate Indices. The U.S. Treasury Index was launched on January 1, 1973.

U.S. Agency: This index is the U.S. Agency component of the U.S. Government/Credit index. Publicly issued debt of U.S. Government agencies, quasi-federal corporations, and corporate or foreign debt guaranteed by the U.S. Government (such as USAID securities). The largest issues are Fannie Mae, Freddie Mac, and the Federal Home Loan Bank System (FHLB). The index includes both callable and non-callable agency securities.

2020 Bond Market Overview

(Unaudited)

U.S Corporate – Investment Grade: This index is the Corporate component of the U.S. Credit index. It includes publicly issued U.S. corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity, and quality requirements. To qualify, bonds must be SEC-registered.

CMBS (Commercial Mortgage-Backed Securities): This index is the CMBS component of the U.S. Aggregate index. The Bloomberg Barclays CMBS ERISA-Eligible Index is the ERISA-eligible component of the Bloomberg Barclays CMBS Index. This index, which includes investment grade securities that are ERISA eligible under the underwriter’s exemption, is the only CMBS sector that is included in the U.S. Aggregate Index.

MBS (Mortgage-Backed Securities): This index is the U.S. MBS component of the U.S. Aggregate index. The MBS Index covers the mortgage-backed pass-through securities of Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC). The MBS Index is formed by grouping the universe of over 600,000 individual fixed rate MBS pools into approximately 3,500 generic aggregates.

ABS (Asset-Backed Securities): This index is the ABS component of the U.S. Aggregate index. The ABS index has three subsectors: credit and charge cards, autos, and utility. The index includes pass-through, bullet, and controlled amortization structures. The ABS Index includes only the senior class of each ABS issue and the ERISA-eligible B and C tranche. The Manufactured Housing sector was removed as of January 1, 2008, and the Home Equity Loan sector was removed as of October 1, 2009.

Corporate High Yield: The Bloomberg Barclays U.S. High Yield Index covers the universe of fixed rate, non-investment grade debt. Eurobonds and debt issues from countries designated as emerging markets (sovereign rating of Baa1/BBB+/BBB+ and below using the middle of Moody’s, S&P, and Fitch) are excluded, but Canadian and global bonds (SEC registered) of issuers in non-EMG countries are included. Original issue zeroes, step-up coupon structures, 144-As and pay-in-kind bonds (PIKs, as of October 1, 2009) are also included.

Emerging Market: Bloomberg uses a fixed list of countries defined as emerging markets countries for index inclusion purposes that is based on World Bank Income group definitions (Low/Middle), IMF country classifications (Non-Advanced Economies), and other advanced economies that may be less accessible or investable for global debt investors.

The Bloomberg Barclays Municipal Bond Index is a broad-based, total-return index. The bonds are all investment-grade, tax-exempt, and fixed-rate securities with long-term maturities (greater than 2 years). They are selected from issues larger than $50 million.

The Bloomberg Barclays TIPS Index consists of Treasury Inflation Protected Securities (TIPS). TIPS are securities whose principal is tied to the Consumer Price Index. TIPS pay interest semi-annually, based on the fixed rate applied to the adjusted principal.

Ratings are measured on a scale that ranges from AAA or Aaa (highest) to D or C (lowest). Investment grade investments are those rated from highest down to BBB- or Baa3.

Robert W. Baird & Co. Incorporated. This is not a complete analysis of every material fact regarding any company, industry or security. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy. Indices are unmanaged, and are not available for direct investment. Past performance is not a guarantee of future results.

Baird Ultra Short Bond Fund

December 31, 2020 (Unaudited)

The Baird Ultra Short Bond Fund seeks current income consistent with preservation of capital. The Fund’s primary benchmark index against which it measures performance is the Bloomberg Barclays U.S. Short-Term Government/Corporate Index. The Bloomberg Barclays U.S. Short-Term Government/Corporate Index is an unmanaged, market value weighted index of investment grade fixed debt, including government and corporate securities, with maturities of less than one year.

Treasury yields fell across the curve in 2020, with the benchmark 10-year Treasury down 100 bps to finish the year at 0.92%, after hitting an all-time [intra-day] record low of 0.31% on March 9. The curve steepened, with the spread between 2-year and 30-year Treasuries increasing from 82 bps to 153 bps during the year, as yields in shorter maturities saw the largest decline. Starting in late February, the coronavirus (COVID-19) affected every aspect of the economy, leading to the swiftest equity bear market in history, with an over 33% peak-to-trough drop in the S&P 500 in just over a month ending March 23, and fixed income markets hitting levels of distress not seen since the Global Financial Crisis (GFC) in 2008. However, unlike 2008, the massive, coordinated monetary and fiscal policy response resulted in a much swifter recovery. U.S. unemployment dropped to 6.7% by year end after peaking at 14.7% in April as businesses reopened, and the Pfizer and Moderna vaccines offered hope for a return to normal sometime in 2021. The S&P 500 ended the year up 16% at record highs, and credit spreads tightened through year end, completely erasing the pandemic-related widening in many sectors. The COVID-19 pandemic and the massive government policy response to it essentially created a full market cycle for spreads in the span of a calendar year.

During 2020, the Fund’s Institutional Class Shares generated strong absolute and relative returns and outperformed its benchmark by 35 basis points net of fees. The primary factors contributing to the Fund’s absolute and relative performance in 2020 include:

| | • | Credit Positioning |

| | | • | Positive – Overweight to Investment Grade Credit (increased exposure post widening of the spread) |

| | | • | Positive – Opportunistically increasing exposure to municipal securities |

| | • | Mortgage-Backed Securities (MBS) & Asset-Backed Securities (ABS) Positioning – Positive overall |

| | | • | Positive – Exposure to ABS & Non-Agency RMBS (increased exposure post widening of the spread) |

We expect the economic impact of COVID-19 to linger well into 2021, particularly as it relates to the travel and hospitality service sectors. Yet, with the massive fiscal stimulus that is already in the pipeline, and likely more coming now that the Democratic Party has full, albeit narrow, control of Washington, above-average economic growth is very likely in 2021. Stronger growth may pressure inflation modestly higher, a goal of the Fed, translating into moderately higher intermediate and long-term rates. With short-term rates still anchored close to zero by the Fed, a steeper yield curve will enable investors to capture some added performance as bonds roll down the curve. We expect the roll-down return to be an important component of total return this year, as well as security selection, sector allocation, and the yield advantage the Fund enjoys above that of its benchmark. Strategic positioning across market sectors and along the yield curve (including the ability to thoughtfully reposition should spreads widen into volatility) will complement the always-important security selection process to help navigate through the current environment.

The Fund remains duration neutral with a modest overweight to Investment Grade corporate credit, particularly Financials. The Fund is also maintaining its allocation in the MBS/ABS sectors at the senior part of the capital structure given attractive relative valuations and the continued broad sector diversification benefit they provide to the overall portfolio. The Fund only purchases U.S. dollar denominated securities in the cash bond market (no derivatives) and we believe the Fund is well positioned to add value relative to its benchmark.

Baird Ultra Short Bond Fund

December 31, 2020 (Unaudited)

Portfolio Characteristics

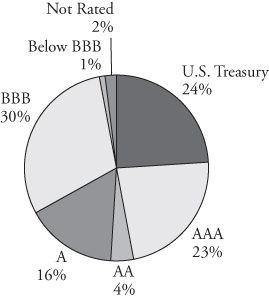

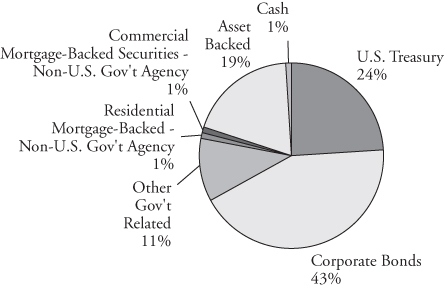

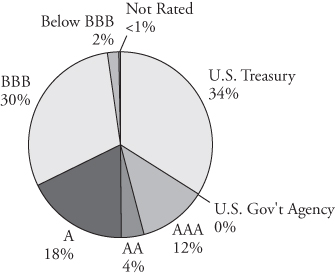

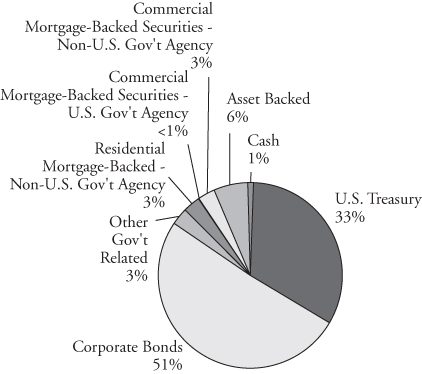

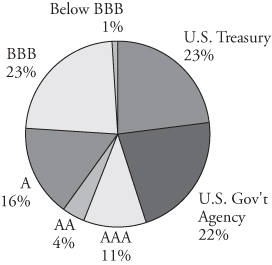

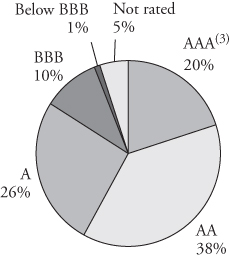

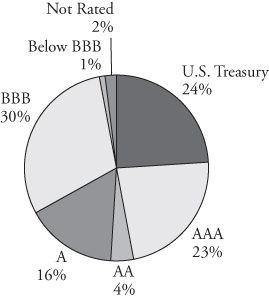

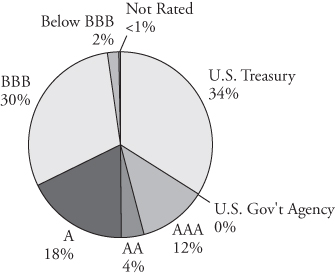

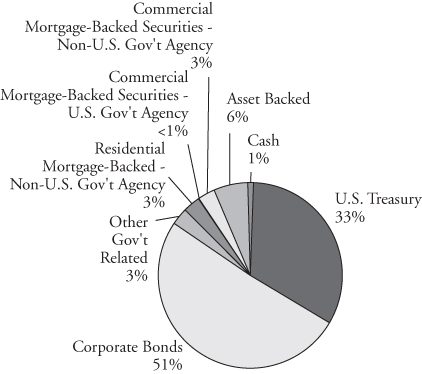

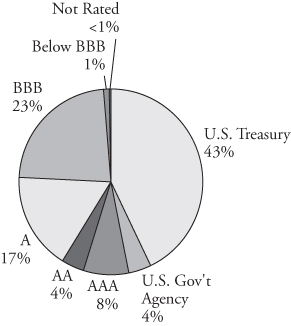

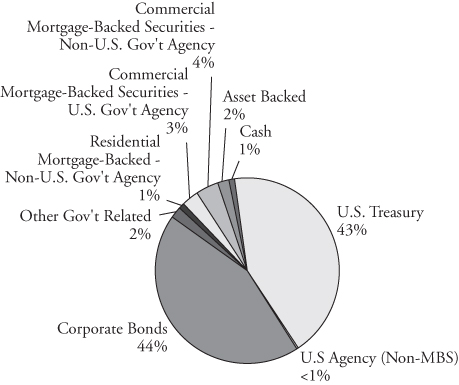

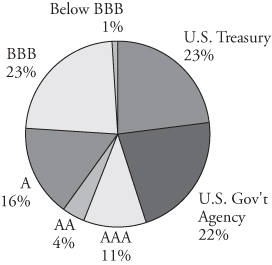

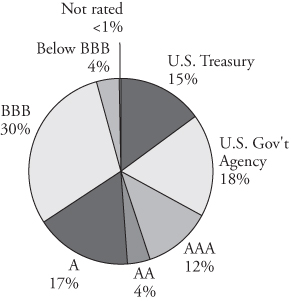

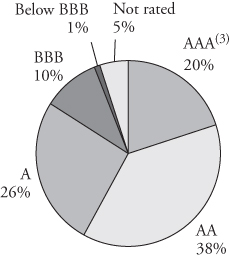

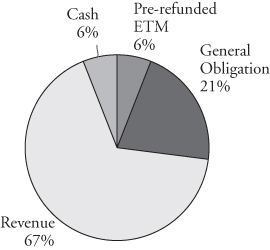

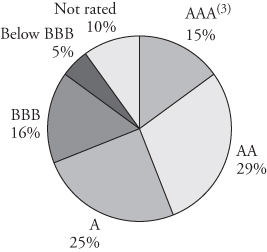

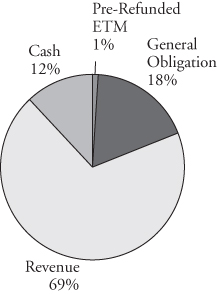

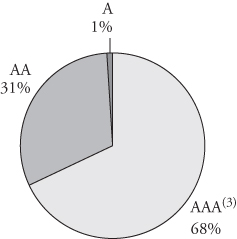

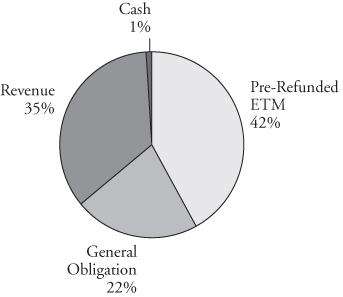

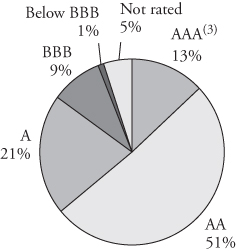

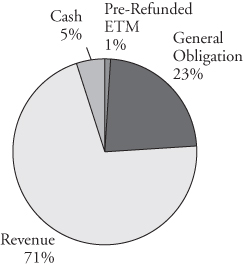

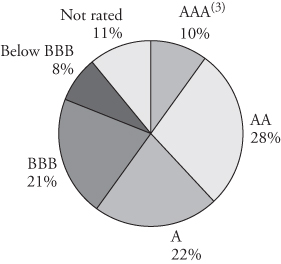

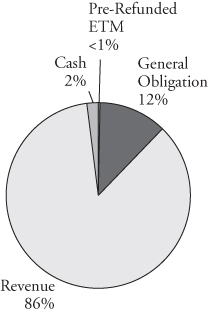

Quality Distribution(1)(2)

| | Net Assets | $4,579,120,228 | |

| | | | |

| | SEC 30-Day | | |

| | Yield(3) | | |

| | Institutional Class | | |

| | (Subsidized) | 0.68% | |

| | Institutional Class | | |

| | (Unsubsidized) | 0.53% | |

| | Investor Class | | |

| | (Subsidized) | 0.43% | |

| | Investor Class | | |

| | (Unsubsidized) | 0.29% | |

| | | | |

| | Average | | |

| | Effective | | |

| | Duration | 0.47 years | |

| | | | |

| | Average | | |

| | | Effective | | |

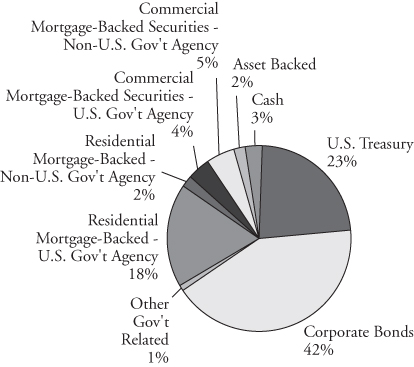

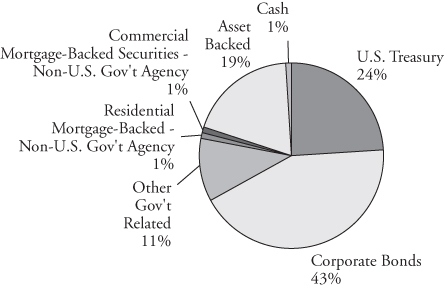

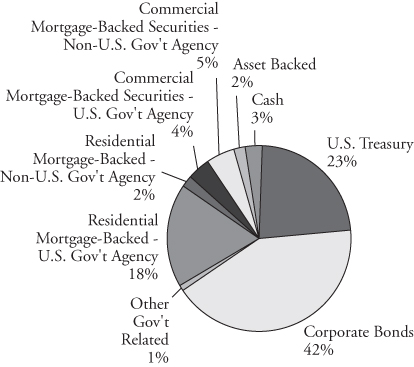

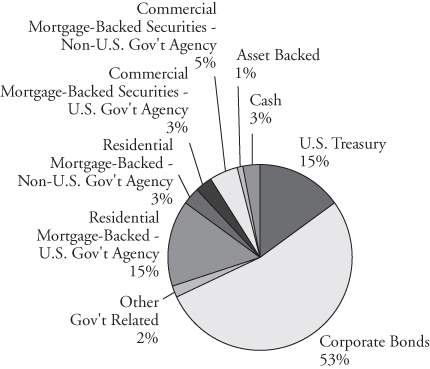

Sector Weightings(1) | | Maturity | 0.53 years | |

| | | | | |

| | Annualized | | |

| | Expense Ratio(4) | | |

| | Gross | | |

| | Institutional Class | 0.30% | |

| | Investor Class | 0.55% | (5) |

| | | | |

| | Net | | |

| | Institutional Class | 0.15% | |

| | Investor Class | 0.40% | (5) |

| | | | |

| | Portfolio | | |

| | Turnover Rate | 92% | |

| | | | |

| | Number of | | |

| | Holdings | 453 | |

| | | | |

| | | | |

| | | | | |

| (1) | Percentages shown are based on the Fund’s total investments. |

| (2) | The quality profile is calculated on a market value-weighted basis using the highest credit quality rating for each security held by the Fund given by S&P, Moody’s or Fitch, each of which is a Nationally Recognized Statistical Rating Organization (NRSRO). NRSROs rate the credit quality of securities using a scale that generally ranges from AAA (highest) to D (lowest). |

| (3) | SEC yields are based on SEC guidelines and are calculated for the 30 days ended December 31, 2020. |

| (4) | Reflects expense ratios as stated in the Fund’s current prospectus. The Advisor has contractually agreed to waive management fees in an amount equal to an annual rate of 0.15% of average daily net assets for the Fund, at least through April 30, 2022. The agreement may only be terminated prior to the end of this term by or with the consent of the Board of Directors of Baird Funds, Inc. |

| (5) | Includes 0.25% 12b-1 fee. |

Baird Ultra Short Bond Fund

December 31, 2020 (Unaudited)

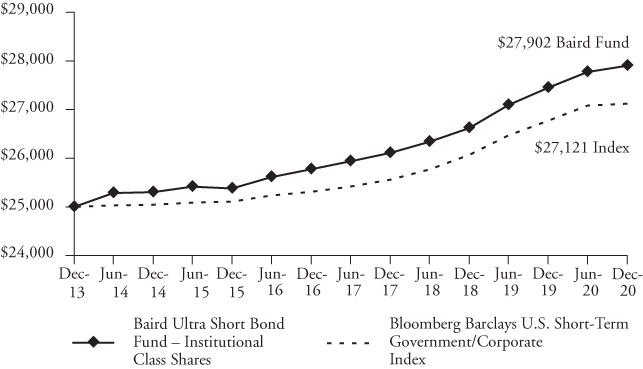

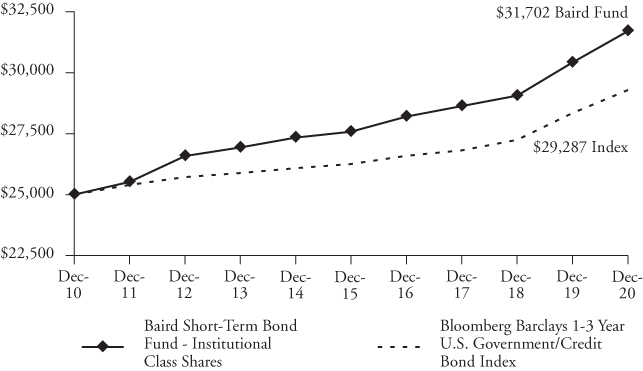

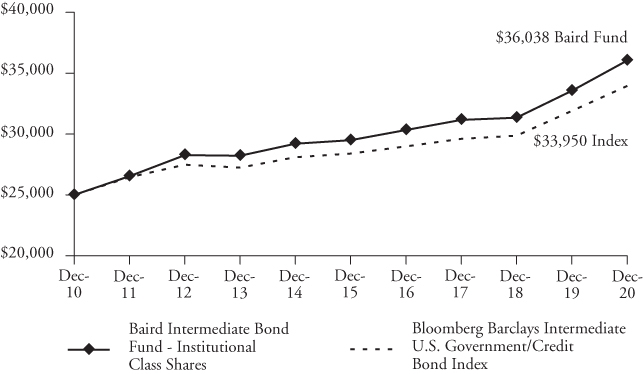

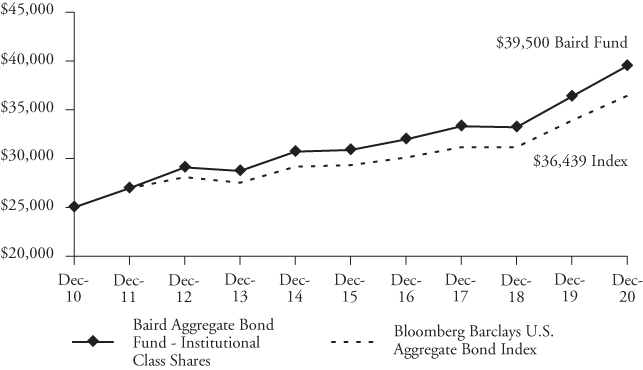

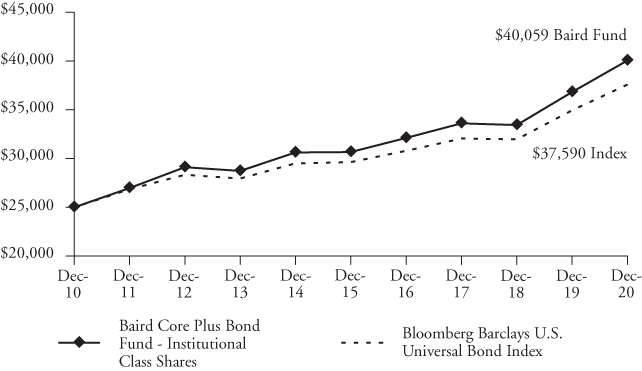

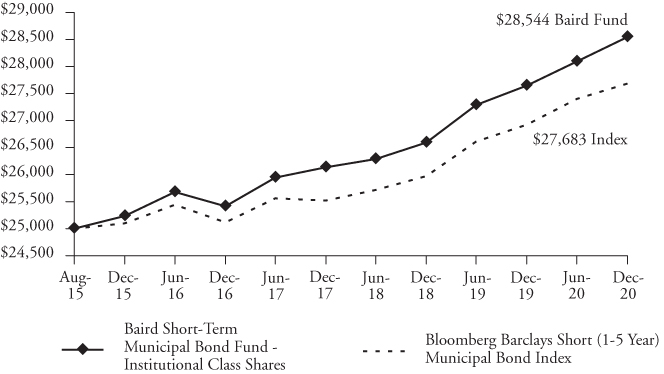

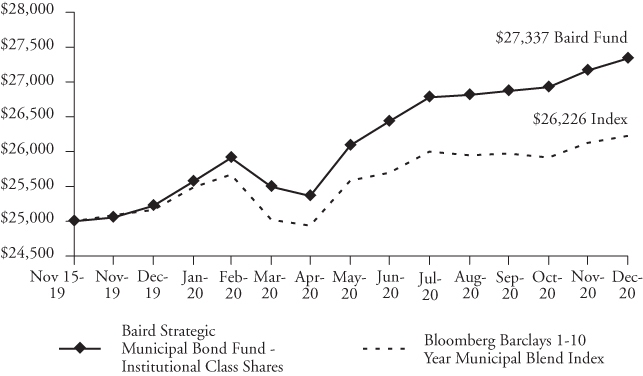

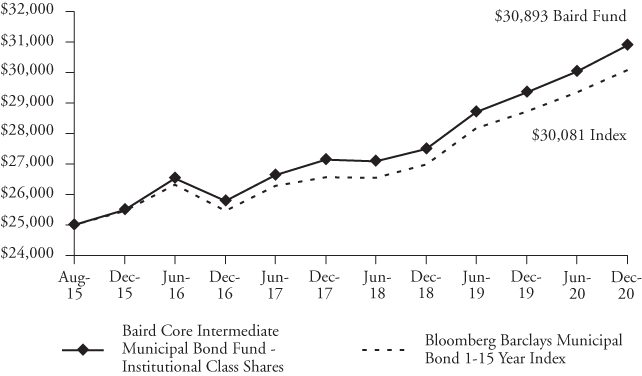

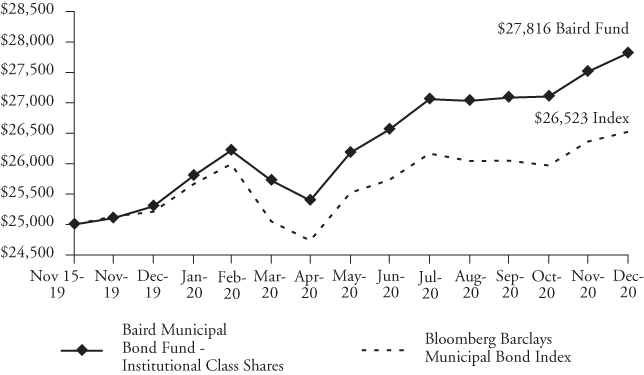

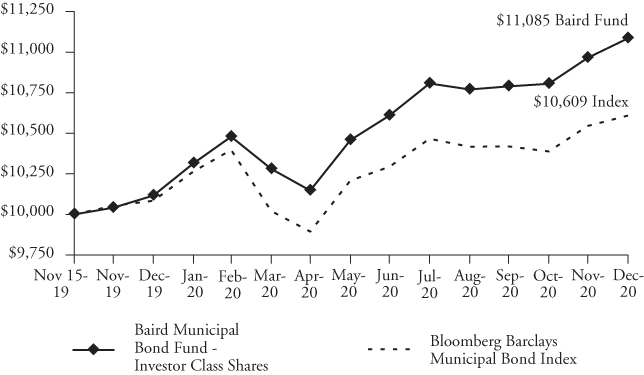

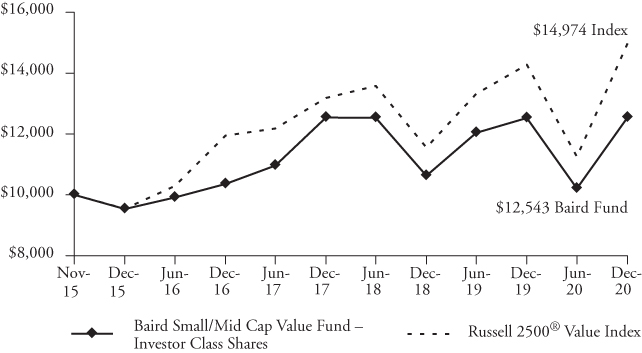

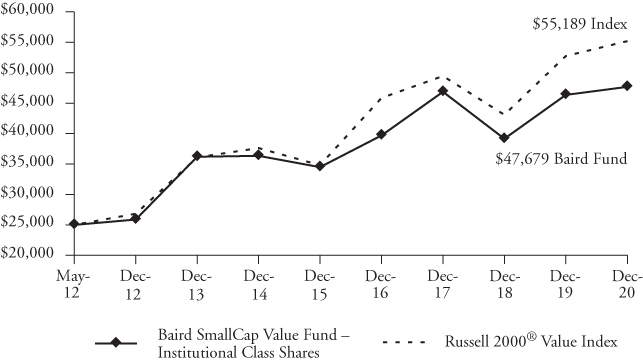

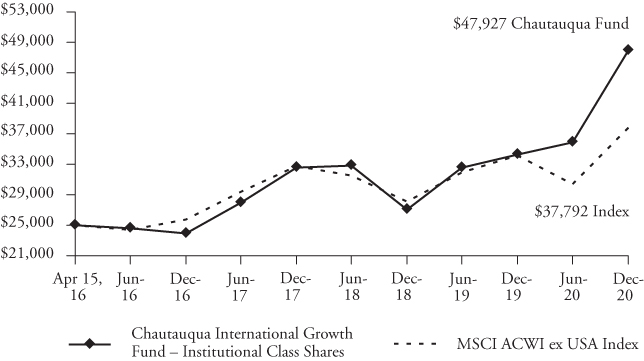

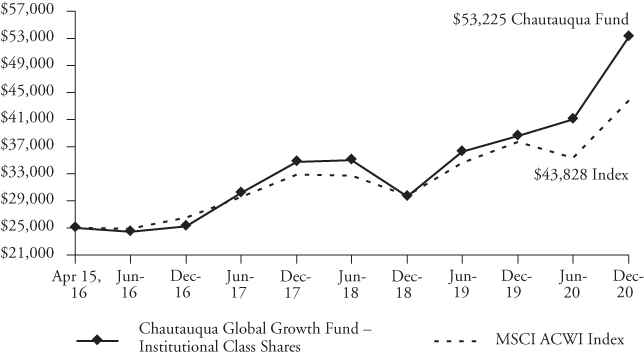

Institutional ClassValue of a $25,000 Investment

Growth of a hypothetical investment of $25,000 made on the Fund’s inception date (12/31/13), assuming reinvestment of all distributions.

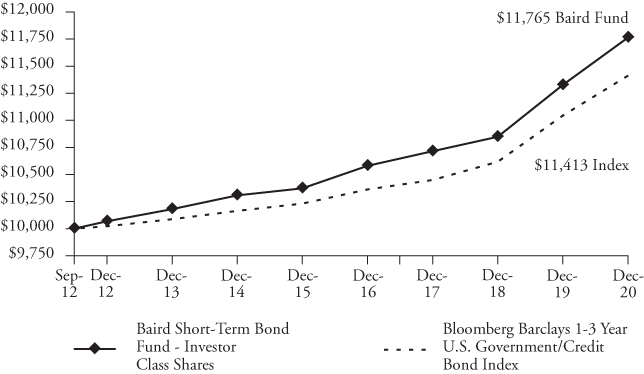

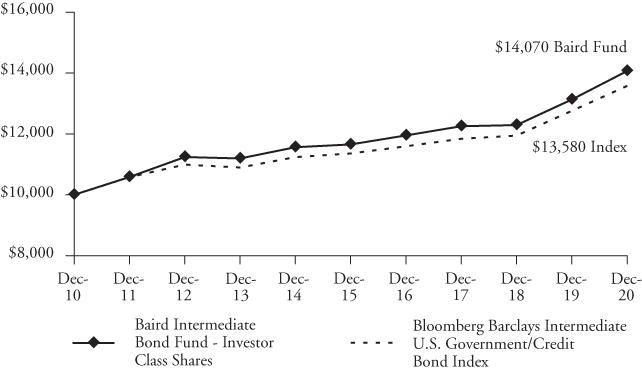

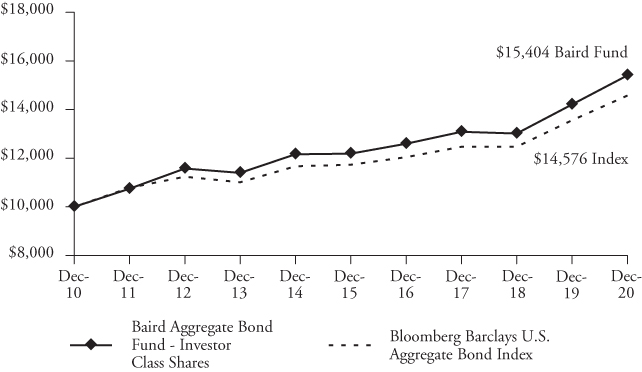

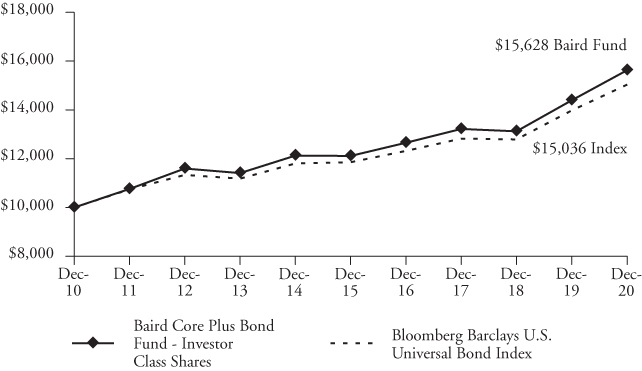

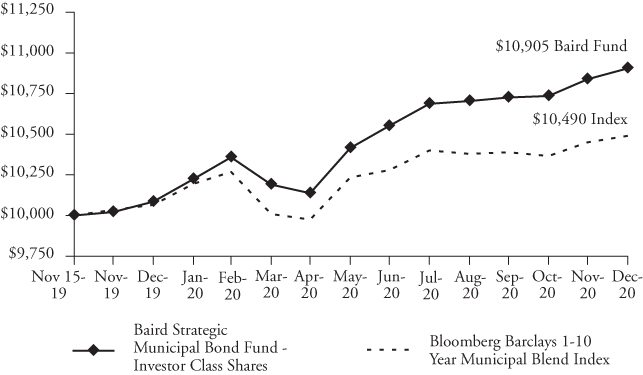

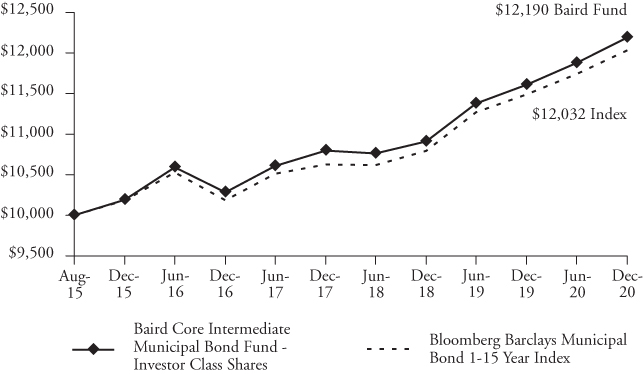

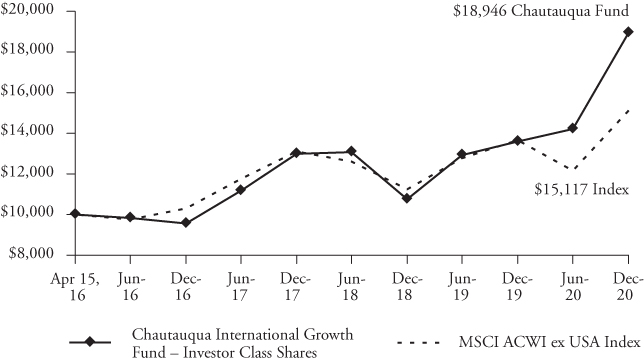

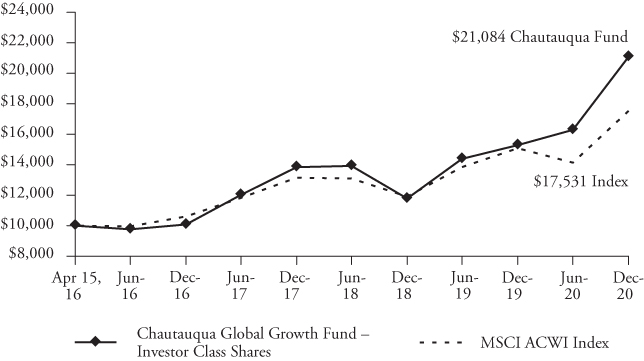

Investor Class

Value of a $10,000 Investment

Growth of a hypothetical investment of $10,000 made on the Fund’s inception date (12/31/13), assuming reinvestment of all distributions.

Baird Ultra Short Bond Fund

December 31, 2020 (Unaudited)

Total Returns

| | | Average Annual |

| | One | Three | Five | Since |

| For the Periods Ended December 31, 2020 | Year | Years | Years | Inception(1) |

| Institutional Class Shares | 1.66% | 2.24% | 1.91% | 1.58% |

| Investor Class Shares | 1.66% | 2.04% | 1.70% | 1.36% |

| Bloomberg Barclays U.S. Short-Term | | | | |

Government/Corporate Index(2) | 1.31% | 2.00% | 1.55% | 1.17% |

| (1) | For the period from December 31, 2013 (inception date) through December 31, 2020. |

| (2) | The Bloomberg Barclays U.S. Short-Term Government/Corporate Index is an unmanaged, market value weighted index of investment grade, fixed-rate debt issues, including government and corporate securities, with maturities less than one year. This Index does not reflect any deduction for fees, expenses or taxes. A direct investment in an index is not possible. |

The line graphs on the previous page and the returns shown in the table above reflect reinvestment of dividends and/or capital gains distributions in additional shares. The returns in the graphs and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The returns reflect the actual performance for each period and do not include the impact of trades executed on the last business day of the period that were recorded on the first business day of the next period.

The Fund’s gross expense ratio for each Class, as reflected in the Fund’s current prospectus, is set forth under “Portfolio Characteristics”.

The Fund may invest up to 10% of its net assets in non-investment grade debt securities (commonly referred to as “high yield” bonds). While these types of securities typically offer higher yields than investment grade securities, they also include greater risks including increased credit risk and the increased risk of default or bankruptcy. The Fund may also invest in U.S. dollar denominated foreign securities which involve additional risks such as political and economic instability, and different and sometimes less strict financial reporting standards and regulation. The Fund may also invest in mortgage- and asset-backed securities, which include interest rate and prepayment risks more pronounced than those of other fixed income securities. U.S. and international markets have experienced significant periods of volatility in recent years and months due to a number of economic, political and global macro factors including the impact of the coronavirus (COVID-19) as a global pandemic and related public health issues, growth concerns in the U.S. and overseas, uncertainties regarding interest rates, trade tensions and the threat of tariffs imposed by the U.S. and other countries. These and other geopolitical events may cause market disruptions and could have an adverse effect on the value of the Fund’s investments.

Past performance does not guarantee future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

For information about the performance of the Fund as of the most recent month-end, please call 1-866-44BAIRD or visit www.bairdfunds.com. Mutual fund performance changes over time and current performance may be lower or higher than that stated.

Baird Ultra Short Bond Fund

Schedule of Investments, December 31, 2020

Long-Term Investments

| | | Principal | | | | | | % of | |

| | | Amount | | | Value | | | Net Assets | |

| U.S. Treasury Securities | | | | | | | | | |

| U.S. Treasury Bonds: | | | | | | | | | |

| 2.000%, 01/15/2021 | | $ | 45,000,000 | | | $ | 45,025,000 | | | | |

| 2.250%, 02/15/2021 | | | 15,000,000 | | | | 15,035,923 | | | | |

| 2.375%, 03/15/2021 | | | 80,000,000 | | | | 80,347,059 | | | | |

| 2.625%, 05/15/2021 | | | 190,000,000 | | | | 191,736,718 | | | | |

| 2.125%, 08/15/2021 | | | 230,000,000 | | | | 232,857,032 | | | | |

| 2.000%, 11/15/2021 | | | 245,000,000 | | | | 249,000,389 | | | | |

| 2.500%, 01/15/2022 | | | 60,000,000 | | | | 61,475,820 | | | | |

| Total U.S. Treasury Securities | | | | | | | | | | | |

| (Cost $875,369,336) | | | | | | | 875,477,941 | | | | 19.1 | % |

| Other Government Related Securities | | | | | | | | | | | | |

| Industrial Bank of Korea, | | | | | | | | | | | | |

| 0.814%, 08/02/2021 | | | | | | | | | | | | |

(3 Month LIBOR USD + 0.600%)(1)(2)(3) | | | 4,000,000 | | | | 4,007,280 | | | | | |

| Total Other Government Related Securities | | | | | | | | | | | | |

| (Cost $4,000,000) | | | | | | | 4,007,280 | | | | 0.1 | % |

| Corporate Bonds | | | | | | | | | | | | |

| Industrials | | | | | | | | | | | | |

| AbbVie, Inc.: | | | | | | | | | | | | |

| 0.563%, 05/21/2021 | | | | | | | | | | | | |

(3 Month LIBOR USD + 0.350%)(3) | | | 6,525,000 | | | | 6,531,296 | | | | | |

| 2.150%, 11/19/2021 | | | 7,195,000 | | | | 7,310,885 | | | | | |

| 5.000%, 12/15/2021 | | | 18,628,000 | | | | 19,230,778 | | | | | |

| Analog Devices, Inc., | | | | | | | | | | | | |

| 2.500%, 12/05/2021 | | | 2,000,000 | | | | 2,036,045 | | | | | |

| Anglo American Capital PLC, | | | | | | | | | | | | |

4.125%, 04/15/2021(1)(2) | | | 5,304,000 | | | | 5,346,303 | | | | | |

| AT&T, Inc., | | | | | | | | | | | | |

| 1.187%, 07/15/2021 | | | | | | | | | | | | |

(3 Month LIBOR USD + 0.950%)(3) | | | 3,000,000 | | | | 3,013,429 | | | | | |

| AutoNation, Inc., | | | | | | | | | | | | |

| 3.350%, 01/15/2021 | | | 1,403,000 | | | | 1,403,794 | | | | | |

| BAE Systems PLC, | | | | | | | | | | | | |

4.750%, 10/11/2021(1)(2) | | | 4,395,000 | | | | 4,536,139 | | | | | |

| Bayer US Finance II LLC: | | | | | | | | | | | | |

| 0.881%, 06/25/2021 | | | | | | | | | | | | |

(3 Month LIBOR USD + 0.630%)(2)(3) | | | 10,000,000 | | | | 10,020,308 | | | | | |

3.500%, 06/25/2021(2) | | | 7,110,000 | | | | 7,196,439 | | | | | |

2.750%, 07/15/2021(2) | | | 1,184,000 | | | | 1,198,625 | | | | | |

| Bayer US Finance LLC, | | | | | | | | | | | | |

3.000%, 10/08/2021(2) | | | 2,800,000 | | | | 2,847,685 | | | | | |

| Becton Dickinson and Co., | | | | | | | | | | | | |

| 3.125%, 11/08/2021 | | | 31,610,000 | | | | 32,310,779 | | | | | |

The accompanying notes are an integral part of these financial statements.

Baird Ultra Short Bond Fund

Schedule of Investments, December 31, 2020

Long-Term Investments (cont.)

| | | Principal | | | | | | % of | |

| | | Amount | | | Value | | | Net Assets | |

| BG Energy Capital PLC, | | | | | | | | | |

4.000%, 10/15/2021(1)(2) | | $ | 2,940,000 | | | $ | 3,018,393 | | | |

|

|

| BMW US Capital LLC, | | | | | | | | | | | | |

3.100%, 04/12/2021(2) | | | 2,671,000 | | | | 2,690,124 | | | | | |

| Broadcom, Inc.: | | | | | | | | | | | | |

| 3.125%, 04/15/2021 | | | 16,222,000 | | | | 16,314,888 | | | | | |

| 3.000%, 01/15/2022 | | | 8,997,000 | | | | 9,203,978 | | | | | |

| Campbell Soup Co., | | | | | | | | | | | | |

| 0.847%, 03/15/2021 | | | | | | | | | | | | |

(3 Month LIBOR USD + 0.630%)(3) | | | 4,275,000 | | | | 4,278,824 | | | | | |

| Canadian Natural Resources Ltd., | | | | | | | | | | | | |

3.450%, 11/15/2021(1) | | | 12,696,000 | | | | 12,923,512 | | | | | |

| Celanese US Holdings LLC, | | | | | | | | | | | | |

| 5.875%, 06/15/2021 | | | 3,491,000 | | | | 3,567,853 | | | | | |

| CF Industries, Inc., | | | | | | | | | | | | |

3.400%, 12/01/2021(2) | | | 10,045,000 | | | | 10,280,584 | | | | | |

| Cigna Corp.: | | | | | | | | | | | | |

| 0.879%, 09/17/2021 | | | | | | | | | | | | |

(3 Month LIBOR USD + 0.650%)(3) | | | 2,000,000 | | | | 2,000,316 | | | | | |

| 3.900%, 02/15/2022 | | | 9,376,000 | | | | 9,740,612 | | | | | |

| CNH Industrial Capital LLC: | | | | | | | | | | | | |

| 4.875%, 04/01/2021 | | | 2,009,000 | | | | 2,028,658 | | | | | |

| 3.875%, 10/15/2021 | | | 9,528,000 | | | | 9,751,722 | | | | | |

| CRH America, Inc., | | | | | | | | | | | | |

| 5.750%, 01/15/2021 | | | 4,855,000 | | | | 4,861,878 | | | | | |

| CVS Health Corp., | | | | | | | | | | | | |

| 0.950%, 03/09/2021 | | | | | | | | | | | | |

(3 Month LIBOR USD + 0.720%)(3) | | | 7,485,000 | | | | 7,493,669 | | | | | |

| Daimler Finance North America LLC: | | | | | | | | | | | | |

| 0.663%, 02/22/2021 | | | | | | | | | | | | |

(3 Month LIBOR USD + 0.450%)(2)(3) | | | 3,500,000 | | | | 3,501,612 | | | | | |

3.000%, 02/22/2021(2) | | | 2,800,000 | | | | 2,809,236 | | | | | |

3.350%, 05/04/2021(2) | | | 4,605,000 | | | | 4,649,164 | | | | | |

2.000%, 07/06/2021(2) | | | 5,000,000 | | | | 5,039,614 | | | | | |

3.750%, 11/05/2021(2) | | | 6,629,000 | | | | 6,812,710 | | | | | |

2.850%, 01/06/2022(2) | | | 1,091,000 | | | | 1,117,046 | | | | | |

| 1.121%, 02/15/2022 | | | | | | | | | | | | |

(3 Month LIBOR USD + 0.900%)(2)(3) | | | 3,500,000 | | | | 3,526,332 | | | | | |

| 1.093%, 02/22/2022 | | | | | | | | | | | | |

(3 Month LIBOR USD + 0.880%)(2)(3) | | | 3,150,000 | | | | 3,172,925 | | | | | |

| Danone SA, | | | | | | | | | | | | |

2.077%, 11/02/2021(1)(2) | | | 4,184,000 | | | | 4,235,610 | | | | | |

| Dentsply Sirona, | | | | | | | | | | | | |

| 4.125%, 08/15/2021 | | | 2,000,000 | | | | 2,024,848 | | | | | |

The accompanying notes are an integral part of these financial statements.

Baird Ultra Short Bond Fund

Schedule of Investments, December 31, 2020

Long-Term Investments (cont.)

| | | Principal | | | | | | % of | |

| | | Amount | | | Value | | | Net Assets | |

| Eastman Chemical Co., | | | | | | | | | |

| 3.500%, 12/01/2021 | | $ | 10,820,000 | | | $ | 11,113,875 | | | | |

| Enbridge Energy Partners LP, | | | | | | | | | | |

|

|

| 4.200%, 09/15/2021 | | | 7,459,000 | | | | 7,584,338 | | | | | |

| Energy Transfer Operating LP, | | | | | | | | | | | | |

| 4.650%, 06/01/2021 | | | 9,491,000 | | | | 9,562,203 | | | | | |

| Energy Transfer Partners LP, | | | | | | | | | | | | |

| 5.200%, 02/01/2022 | | | 3,500,000 | | | | 3,630,277 | | | | | |

| Enterprise Products Operating LLC, | | | | | | | | | | | | |

| 2.850%, 04/15/2021 | | | 20,701,000 | | | | 20,802,070 | | | | | |

| Equifax, Inc.: | | | | | | | | | | | | |

| 1.091%, 08/15/2021 | | | | | | | | | | | | |

(3 Month LIBOR USD + 0.870%)(3) | | | 6,420,000 | | | | 6,439,738 | | | | | |

| 3.600%, 08/15/2021 | | | 2,859,000 | | | | 2,912,280 | | | | | |

| ERAC USA Finance LLC, | | | | | | | | | | | | |

2.600%, 12/01/2021(2) | | | 3,100,000 | | | | 3,153,606 | | | | | |

| Family Dollar Stores, Inc., | | | | | | | | | | | | |

| 5.000%, 02/01/2021 | | | 905,000 | | | | 907,719 | | | | | |

| FedEx Corp., | | | | | | | | | | | | |

| 3.400%, 01/14/2022 | | | 12,500,000 | | | | 12,894,854 | | | | | |

| Ford Motor Credit Co. LLC: | | | | | | | | | | | | |

| 5.085%, 01/07/2021 | | | 350,000 | | | | 350,000 | | | | | |

| 5.750%, 02/01/2021 | | | 5,200,000 | | | | 5,213,000 | | | | | |

| 3.336%, 03/18/2021 | | | 1,700,000 | | | | 1,704,250 | | | | | |

| Fresenius Medical Care US Finance, Inc., | | | | | | | | | | | | |

5.750%, 02/15/2021(2) | | | 8,027,000 | | | | 8,071,571 | | | | | |

| Fresenius US Finance II, Inc., | | | | | | | | | | | | |

4.250%, 02/01/2021(2) | | | 2,350,000 | | | | 2,355,997 | | | | | |

| General Mills, Inc., | | | | | | | | | | | | |

| 0.770%, 04/16/2021 | | | | | | | | | | | | |

(3 Month LIBOR USD + 0.540%)(3) | | | 3,500,000 | | | | 3,505,008 | | | | | |

| General Motors Co., | | | | | | | | | | | | |

| 1.130%, 09/10/2021 | | | | | | | | | | | | |

(3 Month LIBOR USD + 0.900%)(3) | | | 1,500,000 | | | | 1,501,725 | | | | | |

| General Motors Financial Co., Inc.: | | | | | | | | | | | | |

| 4.200%, 03/01/2021 | | | 1,815,000 | | | | 1,819,463 | | | | | |

| 3.550%, 04/09/2021 | | | 4,155,000 | | | | 4,187,169 | | | | | |

| 3.200%, 07/06/2021 | | | 11,356,000 | | | | 11,478,144 | | | | | |

| 4.375%, 09/25/2021 | | | 2,808,000 | | | | 2,883,823 | | | | | |

| 4.200%, 11/06/2021 | | | 7,996,000 | | | | 8,241,614 | | | | | |

| 3.450%, 01/14/2022 | | | 4,100,000 | | | | 4,209,693 | | | | | |

| Georgia-Pacific LLC, | | | | | | | | | | | | |

3.163%, 11/15/2021(2) | | | 3,670,000 | | | | 3,738,778 | | | | | |

| Glencore Finance (Canada) Ltd., | | | | | | | | | | | | |

4.950%, 11/15/2021(1)(2) | | | 14,364,000 | | | | 14,937,489 | | | | | |

The accompanying notes are an integral part of these financial statements.

Baird Ultra Short Bond Fund

Schedule of Investments, December 31, 2020

Long-Term Investments (cont.)

| | | Principal | | | | | | % of | |

| | | Amount | | | Value | | | Net Assets | |

| Global Payments, Inc., | | | | | | | | | |

| 3.800%, 04/01/2021 | | $ | 12,116,000 | | | $ | 12,182,684 | | | | |

| Grupo Bimbo SAB de CV, | | | | | | | | | | |

|

|

4.500%, 01/25/2022(1)(2) | | | 3,000,000 | | | | 3,117,570 | | | | | |

| Halliburton Co., | | | | | | | | | | | | |

| 3.250%, 11/15/2021 | | | 2,121,000 | | | | 2,157,364 | | | | | |

| Hewlett Packard Enterprise Co.: | | | | | | | | | | | | |

| 0.900%, 03/12/2021 | | | | | | | | | | | | |

(3 Month LIBOR USD + 0.680%)(3) | | | 5,000,000 | | | | 5,004,432 | | | | | |

| 3.500%, 10/05/2021 | | | 13,340,000 | | | | 13,621,736 | | | | | |

| Hyundai Capital America: | | | | | | | | | | | | |

3.450%, 03/12/2021(2) | | | 1,905,000 | | | | 1,914,430 | | | | | |

2.450%, 06/15/2021(2) | | | 3,150,000 | | | | 3,174,852 | | | | | |

3.750%, 07/08/2021(2) | | | 17,785,000 | | | | 18,044,821 | | | | | |

3.950%, 02/01/2022(2) | | | 1,595,000 | | | | 1,647,888 | | | | | |

| Hyundai Capital America, Inc., | | | | | | | | | | | | |

| 1.174%, 07/08/2021 | | | | | | | | | | | | |

(3 Month LIBOR USD + 0.940%)(2)(3) | | | 1,825,000 | | | | 1,827,422 | | | | | |

| IDEX Corp., | | | | | | | | | | | | |

| 4.200%, 12/15/2021 | | | 1,200,000 | | | | 1,230,837 | | | | | |

| Ingersoll-Rand Global Holding Co. Ltd., | | | | | | | | | | | | |

| 2.900%, 02/21/2021 | | | 3,000,000 | | | | 3,009,493 | | | | | |

| International Business Machines Corp., | | | | | | | | | | | | |

| 0.621%, 05/13/2021 | | | | | | | | | | | | |

(3 Month LIBOR USD + 0.400%)(3) | | | 6,400,000 | | | | 6,409,289 | | | | | |

| JD.com, Inc., | | | | | | | | | | | | |

3.125%, 04/29/2021(1) | | | 10,645,000 | | | | 10,718,195 | | | | | |

| Keurig Dr Pepper, Inc.: | | | | | | | | | | | | |

| 3.551%, 05/25/2021 | | | 3,624,000 | | | | 3,669,199 | | | | | |

| 2.530%, 11/15/2021 | | | 1,000,000 | | | | 1,018,444 | | | | | |

| Kinder Morgan Energy Partners LP: | | | | | | | | | | | | |

| 5.800%, 03/01/2021 | | | 9,581,000 | | | | 9,659,000 | | | | | |

| 5.000%, 10/01/2021 | | | 11,779,000 | | | | 12,033,506 | | | | | |

| Kinder Morgan, Inc., | | | | | | | | | | | | |

5.000%, 02/15/2021(2) | | | 9,105,000 | | | | 9,131,871 | | | | | |

| Kinross Gold Corp., | | | | | | | | | | | | |

5.125%, 09/01/2021(1) | | | 22,869,000 | | | | 23,281,768 | | | | | |

| Kroger Co., | | | | | | | | | | | | |

| 3.400%, 04/15/2022 | | | 4,800,000 | | | | 4,950,123 | | | | | |

| Lennar Corp., | | | | | | | | | | | | |

| 6.250%, 12/15/2021 | | | 18,621,000 | | | | 19,067,904 | | | | | |

| Marathon Petroleum Corp., | | | | | | | | | | | | |

| 5.125%, 03/01/2021 | | | 5,000,000 | | | | 5,035,364 | | | | | |

The accompanying notes are an integral part of these financial statements.

Baird Ultra Short Bond Fund

Schedule of Investments, December 31, 2020

Long-Term Investments (cont.)

| | | Principal | | | | | | % of | |

| | | Amount | | | Value | | | Net Assets | |

| Marriott International, Inc.: | | | | | | | | | |

| 0.876%, 03/08/2021 | | | | | | | | | |

(3 Month LIBOR USD + 0.650%)(3) | | $ | 3,300,000 | | | $ | 3,301,252 | | | |

|

|

| 2.300%, 01/15/2022 | | | 3,002,000 | | | | 3,041,508 | | | | | |

| Microchip Technology, Inc., | | | | | | | | | | | | |

| 3.922%, 06/01/2021 | | | 33,038,000 | | | | 33,507,114 | | | | | |

| Molson Coors Beverage Co., | | | | | | | | | | | | |

| 2.100%, 07/15/2021 | | | 18,135,000 | | | | 18,287,214 | | | | | |

| Mosaic Co., | | | | | | | | | | | | |

| 3.750%, 11/15/2021 | | | 2,105,000 | | | | 2,146,843 | | | | | |

| Mylan NV, | | | | | | | | | | | | |

3.150%, 06/15/2021(1) | | | 23,233,000 | | | | 23,457,585 | | | | | |

| Nissan Motor Acceptance Corp.: | | | | | | | | | | | | |

2.550%, 03/08/2021(2) | | | 4,630,000 | | | | 4,642,617 | | | | | |

1.900%, 09/14/2021(2) | | | 1,250,000 | | | | 1,258,648 | | | | | |

| 0.869%, 09/21/2021 | | | | | | | | | | | | |

(3 Month LIBOR USD + 0.630%)(2)(3) | | | 4,800,000 | | | | 4,788,178 | | | | | |

3.650%, 09/21/2021(2) | | | 3,773,000 | | | | 3,838,751 | | | | | |

2.800%, 01/13/2022(2) | | | 7,409,000 | | | | 7,534,477 | | | | | |

| Occidental Petroleum Corp.: | | | | | | | | | | | | |

| 4.850%, 03/15/2021 | | | 5,160,000 | | | | 5,160,000 | | | | | |

| 1.671%, 08/15/2022 | | | | | | | | | | | | |

(3 Month LIBOR USD + 1.450%)(3) | | | 8,000,000 | | | | 7,840,000 | | | | | |

| Orlando Health Obligated Group, | | | | | | | | | | | | |

| 3.205%, 10/01/2021 | | | 1,000,000 | | | | 1,017,797 | | | | | |

| Ovintiv Inc., | | | | | | | | | | | | |

| 3.900%, 11/15/2021 (Callable 8/15/2021) | | | 11,619,000 | | | | 11,765,061 | | | | | |

| Penske Truck Leasing Co.: | | | | | | | | | | | | |

3.300%, 04/01/2021(2) | | | 3,000,000 | | | | 3,013,789 | | | | | |

3.650%, 07/29/2021(2) | | | 6,560,000 | | | | 6,661,245 | | | | | |

3.375%, 02/01/2022(2) | | | 11,050,000 | | | | 11,342,921 | | | | | |

| Phillips 66: | | | | | | | | | | | | |

| 0.833%, 02/26/2021 | | | | | | | | | | | | |

(3 Month LIBOR USD + 0.600%)(3) | | | 2,710,000 | | | | 2,710,313 | | | | | |

| 4.300%, 04/01/2022 | | | 3,751,000 | | | | 3,928,290 | | | | | |

| POSCO, | | | | | | | | | | | | |

5.250%, 04/14/2021(1)(2) | | | 9,116,000 | | | | 9,223,933 | | | | | |

| Raytheon Technologies Corp., | | | | | | | | | | | | |

| 3.100%, 11/15/2021 | | | 6,329,000 | | | | 6,443,205 | | | | | |

| Regency Energy Partners LP / | | | | | | | | | | | | |

| Regency Energy Finance Corp., | | | | | | | | | | | | |

| 5.875%, 03/01/2022 | | | 4,001,000 | | | | 4,183,151 | | | | | |

| Reliance Industries Ltd., | | | | | | | | | | | | |

5.400%, 02/14/2022(1)(2) | | | 1,100,000 | | | | 1,151,707 | | | | | |

| Roper Technologies, Inc., | | | | | | | | | | | | |

| 2.800%, 12/15/2021 | | | 2,851,000 | | | | 2,911,539 | | | | | |

The accompanying notes are an integral part of these financial statements.

Baird Ultra Short Bond Fund

Schedule of Investments, December 31, 2020

Long-Term Investments (cont.)

| | | Principal | | | | | | % of | |

| | | Amount | | | Value | | | Net Assets | |

| Sabine Pass Liquefaction LLC, | | | | | | | | | |

| 6.250%, 03/15/2022 | | $ | 11,834,000 | | | $ | 12,454,625 | | | |

|

|

| Seven & i Holdings Co., Ltd., | | | | | | | | | | | | |

3.350%, 09/17/2021(1)(2) | | | 1,608,000 | | | | 1,639,374 | | | | | |

| Shell International Finance BV, | | | | | | | | | | | | |

1.875%, 05/10/2021(1) | | | 10,200,000 | | | | 10,258,170 | | | | | |

| Sonoco Products Co., | | | | | | | | | | | | |

| 4.375%, 11/01/2021 | | | 2,000,000 | | | | 2,040,873 | | | | | |

| Southern Natural Gas Co. LLC, | | | | | | | | | | | | |

| 4.400%, 06/15/2021 (Callable 03/15/2021) | | | 22,428,000 | | | | 22,595,106 | | | | | |

| Spirit AeroSystems, Inc., | | | | | | | | | | | | |

| 1.017%, 06/15/2021 | | | | | | | | | | | | |

(3 Month LIBOR USD + 0.800%)(3) | | | 4,000,000 | | | | 3,949,447 | | | | | |

| Sunoco Logistics Partners Operations LP, | | | | | | | | | | | | |

| 4.400%, 04/01/2021 | | | 15,000,000 | | | | 15,093,762 | | | | | |

| Takeda Pharmaceutical Co. Ltd., | | | | | | | | | | | | |

2.450%, 01/18/2022(1)(2) | | | 3,076,000 | | | | 3,136,042 | | | | | |

| Telefonica Emisiones SA, | | | | | | | | | | | | |

5.462%, 02/16/2021(1) | | | 8,643,000 | | | | 8,691,409 | | | | | |

| Time Warner Cable LLC, | | | | | | | | | | | | |

| 4.000%, 09/01/2021 | | | 24,622,000 | | | | 24,971,500 | | | | | |

| TTX Co., | | | | | | | | | | | | |

4.400%, 05/01/2021(2) | | | 524,000 | | | | 530,529 | | | | | |

| Verizon Communications, Inc., | | | | | | | | | | | | |

| 1.321%, 05/15/2025 | | | | | | | | | | | | |

(3 Month LIBOR USD + 1.100%(3) | | | 4,000,000 | | | | 4,107,403 | | | | | |

| Volkswagen Group of America Finance LLC: | | | | | | | | | | | | |

2.500%, 09/24/2021(2) | | | 7,300,000 | | | | 7,408,773 | | | | | |

| 1.154%, 11/12/2021 | | | | | | | | | | | | |

(3 Month LIBOR USD + 0.940%)(2)(3) | | | 6,000,000 | | | | 6,043,263 | | | | | |

4.000%, 11/12/2021(2) | | | 10,041,000 | | | | 10,347,526 | | | | | |

| Vulcan Materials Co., | | | | | | | | | | | | |

| 0.875%, 03/01/2021 | | | | | | | | | | | | |

(3 Month LIBOR USD + 0.650%)(3) | | | 9,236,000 | | | | 9,239,910 | | | | | |

| Williams Companies, Inc.: | | | | | | | | | | | | |

| 7.875%, 09/01/2021 | | | 11,619,000 | | | | 12,181,343 | | | | | |

| 4.000%, 11/15/2021 | | | 14,625,000 | | | | 14,939,700 | | | | | |

| 3.600%, 03/15/2022 | | | 4,610,000 | | | | 4,758,695 | | | | | |

| Xylem, Inc., | | | | | | | | | | | | |

| 4.875%, 10/01/2021 | | | 28,425,000 | | | | 29,343,279 | | | | | |

| Zimmer Holdings, Inc., | | | | | | | | | | | | |

| 3.150%, 04/01/2022 | | | 10,898,000 | | | | 11,207,762 | | | | | |

| Total Industrials | | | | | | | | | | | | |

| (Cost $959,650,997) | | | | | | | 961,229,118 | | | | 21.0 | % |

The accompanying notes are an integral part of these financial statements.

Baird Ultra Short Bond Fund

Schedule of Investments, December 31, 2020

Long-Term Investments (cont.)

| | | Principal | | | | | | % of | |

| | | Amount | | | Value | | | Net Assets | |

| Utilities | | | | | | | | | |

| American Electric Power Co., Inc., | | | | | | | | | |

| 3.650%, 12/01/2021 | | $ | 6,450,000 | | | $ | 6,649,187 | | | | |

| American Transmission Systems, Inc., | | | | | | | | | | | |

5.250%, 01/15/2022(2) | | | 9,300,000 | | | | 9,692,481 | | | | |

| EDP Finance BV, | | | | | | | | | | | |

5.250%, 01/14/2021(1)(2) | | | 29,227,000 | | | | 29,260,974 | | | | |

| Emera US Finance LP, | | | | | | | | | | | |

| 2.700%, 06/15/2021 | | | 17,903,000 | | | | 18,042,314 | | | | |

| Exelon Corp., | | | | | | | | | | | |

| 2.450%, 04/15/2021 | | | 6,615,000 | | | | 6,640,955 | | | | |

| LG&E and KU Energy LLC, | | | | | | | | | | | |

| 4.375%, 10/01/2021 | | | 1,900,000 | | | | 1,935,085 | | | | |

| NextEra Energy Capital Holdings, Inc., | | | | | | | | | | | |

| 0.774%, 08/28/2021 | | | | | | | | | | | |

(3 Month LIBOR USD + 0.550%)(3) | | | 2,619,000 | | | | 2,619,842 | | | | |

| PNM Resources, Inc., | | | | | | | | | | | |

| 3.250%, 03/09/2021 | | | 23,964,000 | | | | 24,058,013 | | | | |

| Southwestern Electric Power Co., | | | | | | | | | | | |

| 3.550%, 02/15/2022 | | | 10,750,000 | | | | 11,038,099 | | | | |

| Tampa Electric Co., | | | | | | | | | | | |

| 5.400%, 05/15/2021 | | | 2,930,000 | | | | 2,981,803 | | | | |

| Western Power Distribution, | | | | | | | | | | | |

5.375%, 05/01/2021(1)(2) | | | 16,221,000 | | | | 16,279,448 | | | | |

| Total Utilities | | | | | | | | | | | |

| (Cost $129,077,713) | | | | | | | 129,198,201 | | | | 2.8 | % |

| Financials | | | | | | | | | | | | |

| ABN AMRO Bank NV, | | | | | | | | | | | | |

| 0.803%, 08/27/2021 | | | | | | | | | | | | |

(3 Month LIBOR USD + 0.570%)(1)(2)(3) | | | 1,000,000 | | | | 1,003,228 | | | | | |

| Ally Financial, Inc.: | | | | | | | | | | | | |

| 4.250%, 04/15/2021 | | | 11,625,000 | | | | 11,744,648 | | | | | |

| 4.125%, 02/13/2022 | | | 13,631,000 | | | | 14,155,614 | | | | | |

| American International Group, Inc., | | | | | | | | | | | | |

| 3.300%, 03/01/2021 | | | 1,804,000 | | | | 1,807,798 | | | | | |

| Banco Santander SA, | | | | | | | | | | | | |

3.500%, 04/11/2022(1) | | | 6,505,000 | | | | 6,755,142 | | | | | |

| Bank of America Corp.: | | | | | | | | | | | | |

| 5.700%, 01/24/2022 | | | 11,399,000 | | | | 12,047,096 | | | | | |

| 0.901%, 06/25/2022 | | | | | | | | | | | | |

(3 Month LIBOR USD + 0.650%)(3) | | | 4,000,000 | | | | 4,010,140 | | | | | |

| Barclays Bank PLC, | | | | | | | | | | | | |

10.180%, 06/12/2021(1)(2) | | | 1,951,000 | | | | 2,029,135 | | | | | |

The accompanying notes are an integral part of these financial statements.

Baird Ultra Short Bond Fund

Schedule of Investments, December 31, 2020

Long-Term Investments (cont.)

| | | Principal | | | | | | % of | |

| | | Amount | | | Value | | | Net Assets | |

| Barclays PLC: | | | | | | | | | |

3.250%, 01/12/2021(1) | | $ | 3,720,000 | | | $ | 3,722,007 | | | |

|

|

3.200%, 08/10/2021(1) | | | 16,325,000 | | | | 16,594,192 | | | | | |

| BBVA USA: | | | | | | | | | | | | |

| 0.951%, 06/11/2021 | | | | | | | | | | | | |

(3 Month LIBOR USD + 0.730%)(3) | | | 4,750,000 | | | | 4,760,819 | | | | | |

| 3.500%, 06/11/2021 | | | 26,214,000 | | | | 26,510,168 | | | | | |

| BPCE SA, | | | | | | | | | | | | |

2.750%, 12/02/2021(1) | | | 5,870,000 | | | | 5,997,664 | | | | | |

| Capital One Financial Corp., | | | | | | | | | | | | |

| 3.450%, 04/30/2021 | | | 8,401,000 | | | | 8,463,401 | | | | | |

| Capital One NA, | | | | | | | | | | | | |

| 2.950%, 07/23/2021 | | | 14,214,000 | | | | 14,386,385 | | | | | |

| CIT Group, Inc., | | | | | | | | | | | | |

| 4.125%, 03/09/2021 | | | 16,265,000 | | | | 16,313,795 | | | | | |

| Citibank NA, | | | | | | | | | | | | |

| 0.824%, 05/20/2022 | | | | | | | | | | | | |

(3 Month LIBOR USD + 0.600%)(3) | | | 7,000,000 | | | | 7,012,254 | | | | | |

| Citigroup, Inc.: | | | | | | | | | | | | |

| 2.350%, 08/02/2021 | | | 1,269,000 | | | | 1,283,780 | | | | | |

| 2.900%, 12/08/2021 | | | 18,821,000 | | | | 19,227,751 | | | | | |

| 1.175%, 04/25/2022 | | | | | | | | | | | | |

(3 Month LIBOR USD + 0.960%)(3) | | | 4,875,000 | | | | 4,918,518 | | | | | |

| Citizens Bank NA, | | | | | | | | | | | | |

| 0.941%, 02/14/2022 | | | | | | | | | | | | |

(3 Month LIBOR USD + 0.720%)(3) | | | 1,500,000 | | | | 1,506,976 | | | | | |

| Citizens Financial Group, Inc., | | | | | | | | | | | | |

| 2.375%, 07/28/2021 | | | 4,000,000 | | | | 4,039,336 | | | | | |

| Credit Suisse, | | | | | | | | | | | | |

3.450%, 04/16/2021(1) | | | 11,509,000 | | | | 11,614,474 | | | | | |

| Danske Bank A/S, | | | | | | | | | | | | |

5.000%, 01/12/2022(1)(2) | | | 19,458,000 | | | | 20,313,341 | | | | | |

| Deutsche Bank AG: | | | | | | | | | | | | |

3.150%, 01/22/2021(1) | | | 11,708,000 | | | | 11,720,986 | | | | | |

4.250%, 10/14/2021(1) | | | 11,666,000 | | | | 11,962,630 | | | | | |

| Fifth Third Bank NA, | | | | | | | | | | | | |

| 0.854%, 02/01/2022 | | | | | | | | | | | | |

(3 Month LIBOR USD + 0.640%)(3) | | | 2,000,000 | | | | 2,011,945 | | | | | |

| Goldman Sachs Group, Inc.: | | | | | | | | | | | | |

| 1.977%, 02/25/2021 | | | | | | | | | | | | |

(3 Month LIBOR USD + 1.770%)(3) | | | 2,285,000 | | | | 2,290,520 | | | | | |

| 5.750%, 01/24/2022 | | | 27,450,000 | | | | 29,014,534 | | | | | |

| HSBC Finance Corp., | | | | | | | | | | | | |

| 6.676%, 01/15/2021 | | | 9,975,000 | | | | 9,988,377 | | | | | |

The accompanying notes are an integral part of these financial statements.

Baird Ultra Short Bond Fund

Schedule of Investments, December 31, 2020

Long-Term Investments (cont.)

| | | Principal | | | | | | % of | |

| | | Amount | | | Value | | | Net Assets | |

| Lloyds Bank PLC: | | | | | | | | | |

| 0.703%, 05/07/2021 | | | | | | | | | |

(3 Month LIBOR USD + 0.490%)(1)(3) | | $ | 3,665,000 | | | $ | 3,670,488 | | | |

|

|

3.000%, 01/11/2022(1) | | | 7,622,000 | | | | 7,817,734 | | | | | |

| Macquarie Bank Ltd., | | | | | | | | | | | | |

6.625%, 04/07/2021(1)(2) | | | 3,971,000 | | | | 4,032,979 | | | | | |

| Macquarie Group Ltd., | | | | | | | | | | | | |

6.250%, 01/14/2021(1)(2) | | | 10,344,000 | | | | 10,358,929 | | | | | |

| Mitsubishi UFJ Financial Group, Inc.: | | | | | | | | | | | | |

| 0.865%, 07/26/2021 | | | | | | | | | | | | |

(3 Month LIBOR USD + 0.650%)(1)(3) | | | 5,981,000 | | | | 5,999,073 | | | | | |

| 0.925%, 03/07/2022 | | | | | | | | | | | | |

(3 Month LIBOR USD + 0.700%)(1)(3) | | | 3,173,000 | | | | 3,190,859 | | | | | |

| Mizuho Financial Group, Inc.: | | | | | | | | | | | | |

| 1.704%, 04/12/2021 | | | | | | | | | | | | |

(3 Month LIBOR USD + 1.480%)(1)(2)(3) | | | 1,500,000 | | | | 1,505,692 | | | | | |

2.632%, 04/12/2021(1)(2) | | | 3,600,000 | | | | 3,622,727 | | | | | |

| 1.164%, 02/28/2022 | | | | | | | | | | | | |

(3 Month LIBOR USD + 0.940%)(1)(3) | | | 5,205,000 | | | | 5,250,465 | | | | | |

| Morgan Stanley, | | | | | | | | | | | | |

| 1.398%, 01/20/2022 | | | | | | | | | | | | |

(3 Month LIBOR USD + 1.180%)(3) | | | 17,400,000 | | | | 17,408,875 | | | | | |

| Nationwide Financial Services, Inc., | | | | | | | | | | | | |

5.375%, 03/25/2021(2) | | | 5,372,000 | | | | 5,430,363 | | | | | |

| Nordea Bank AB, | | | | | | | | | | | | |

4.875%, 05/13/2021(1)(2) | | | 23,525,000 | | | | 23,886,903 | | | | | |

| PNC Bank NA, | | | | | | | | | | | | |

| 0.660%, 12/09/2022 | | | | | | | | | | | | |

(3 Month LIBOR USD + 0.430%)(3) | | | 8,000,000 | | | | 8,021,985 | | | | | |

| Reliance Standard Life Global Funding II, | | | | | | | | | | | | |

3.050%, 01/20/2021(2) | | | 1,000,000 | | | | 1,001,146 | | | | | |

| Santander Holdings USA, Inc., | | | | | | | | | | | | |

| 4.450%, 12/03/2021 | | | 2,000,000 | | | | 2,065,229 | | | | | |

| Santander UK Group Holdings PLC: | | | | | | | | | | | | |

3.125%, 01/08/2021(1) | | | 4,588,000 | | | | 4,588,992 | | | | | |

2.875%, 08/05/2021(1) | | | 3,270,000 | | | | 3,315,798 | | | | | |

| Santander UK PLC: | | | | | | | | | | | | |

2.500%, 01/05/2021(1) | | | 2,000,000 | | | | 2,000,000 | | | | | |

3.400%, 06/01/2021(1) | | | 2,088,000 | | | | 2,114,387 | | | | | |

| 0.881%, 11/15/2021 | | | | | | | | | | | | |

(3 Month LIBOR USD + 0.660%)(1)(3) | | | 2,750,000 | | | | 2,763,183 | | | | | |

| Standard Chartered PLC: | | | | | | | | | | | | |

3.050%, 01/15/2021(1)(2) | | | 3,500,000 | | | | 3,502,627 | | | | | |

| 1.430%, 09/10/2022 | | | | | | | | | | | | |

(3 Month LIBOR USD + 1.200%)(1)(2)(3) | | | 5,000,000 | | | | 5,020,907 | | | | | |

The accompanying notes are an integral part of these financial statements.

Baird Ultra Short Bond Fund

Schedule of Investments, December 31, 2020

Long-Term Investments (cont.)

| | | Principal | | | | | | % of | |

| | | Amount | | | Value | | | Net Assets | |

| Standard Chartered PLC: (cont.) | | | | | | | | | |

| 1.368%, 01/20/2023 | | | | | | | | | |

(3 Month LIBOR USD + 1.150%)(1)(2)(3) | | $ | 3,000,000 | | | $ | 3,019,698 | | | |

|

|

| Sumitomo Mitsui Financial Group, Inc.: | | | | | | | | | | | | |

2.442%, 10/19/2021(1) | | | 15,000,000 | | | | 15,246,146 | | | | | |

2.846%, 01/11/2022(1) | | | 2,356,000 | | | | 2,415,068 | | | | | |

| SunTrust Banks, Inc., | | | | | | | | | | | | |

| 0.812%, 05/17/2022 | | | | | | | | | | | | |

(3 Month LIBOR USD + 0.590%)(3) | | | 8,400,000 | | | | 8,451,060 | | | | | |

| Svenska Handelsbanken AB, | | | | | | | | | | | | |

| 0.675%, 05/24/2021 | | | | | | | | | | | | |

(3 Month LIBOR USD + 0.470%)(1)(3) | | | 3,725,000 | | | | 3,731,626 | | | | | |

| Swedbank AB, | | | | | | | | | | | | |

2.650%, 03/10/2021(1)(2) | | | 1,750,000 | | | | 1,757,340 | | | | | |

| Synchrony Bank, | | | | | | | | | | | | |

| 3.650%, 05/24/2021 | | | 11,730,000 | | | | 11,846,307 | | | | | |

| Synchrony Financial, | | | | | | | | | | | | |

| 3.750%, 08/15/2021 | | | 13,877,000 | | | | 14,075,629 | | | | | |

| Toronto-Dominion Bank, | | | | | | | | | | | | |

3.250%, 06/11/2021(1) | | | 10,000,000 | | | | 10,131,686 | | | | | |

| Trinity Acquisition PLC, | | | | | | | | | | | | |

3.500%, 09/15/2021(1) | | | 4,815,000 | | | | 4,901,260 | | | | | |

| UBS Group Funding Switzerland AG: | | | | | | | | | | | | |

| 2.004%, 04/14/2021 | | | | | | | | | | | | |

(3 Month LIBOR USD + 1.780%)(1)(2)(3) | | | 8,500,000 | | | | 8,539,410 | | | | | |

| 1.744%, 02/01/2022 | | | | | | | | | | | | |

(3 Month LIBOR USD + 1.530%)(1)(2)(3) | | | 4,650,000 | | | | 4,719,547 | | | | | |

| Wells Fargo & Co.: | | | | | | | | | | | | |

| 1.240%, 07/26/2021 | | | | | | | | | | | | |

(3 Month LIBOR USD + 1.025%)(3) | | | 4,975,000 | | | | 5,001,787 | | | | | |

| 1.144%, 02/11/2022 | | | | | | | | | | | | |

(3 Month LIBOR USD + 0.930%)(3) | | | 19,300,000 | | | | 19,316,384 | | | | | |

| Wells Fargo Bank NA, | | | | | | | | | | | | |

| 0.890%, 09/09/2022 | | | | | | | | | | | | |

(3 Month LIBOR USD + 0.660%)(3) | | | 8,150,000 | | | | 8,182,321 | | | | | |

| Willis Towers Watson PLC, | | | | | | | | | | | | |

5.750%, 03/15/2021(1) | | | 17,847,000 | | | | 18,026,717 | | | | | |

| Total Financials | | | | | | | | | | | | |

| (Cost $551,945,322) | | | | | | | 553,137,981 | | | | 12.1 | % |

| Total Corporate Bonds | | | | | | | | | | | | |

| (Cost $1,640,674,032) | | | | | | | 1,643,565,300 | | | | 35.9 | % |

The accompanying notes are an integral part of these financial statements.

Baird Ultra Short Bond Fund

Schedule of Investments, December 31, 2020

Long-Term Investments (cont.)

| | | Principal | | | | | | % of | |

| | | Amount | | | Value | | | Net Assets | |

| Municipal Bonds | | | | | | | | | |

| Berks County Municipal Authority, | | | | | | | | | |

1.050%, 05/15/2022 (Callable 01/04/2021)(4) | | $ | 800,000 | | | $ | 800,000 | | | |

|

|

| Borough of Carlstadt NJ, | | | | | | | | | | | | |

| 2.000%, 07/23/2021 | | | 8,525,000 | | | | 8,595,928 | | | | | |

| Burke County Development Authority: | | | | | | | | | | | | |

1.650%, 11/01/2048(4) | | | 3,000,000 | | | | 3,016,950 | | | | | |

1.550%, 12/01/2049(4) | | | 13,000,000 | | | | 13,207,480 | | | | | |

| Central Texas Turnpike System, | | | | | | | | | | | | |

| 0.000%, 08/15/2021 | | | 1,115,000 | | | | 1,111,599 | | | | | |

| Chicago Midway International Airport, | | | | | | | | | | | | |

| 5.000%, 01/01/2021 | | | 2,000,000 | | | | 2,000,000 | | | | | |

| City of Baton Rouge and Parish of East Baton Rouge, | | | | | | | | | | | | |

| 5.000%, 08/01/2021 | | | 1,500,000 | | | | 1,539,300 | | | | | |

| City of Bridgeport CT, | | | | | | | | | | | | |

| 3.313%, 07/01/2021 | | | 2,150,000 | | | | 2,171,349 | | | | | |

| City of New York NY, | | | | | | | | | | | | |

0.310%, 10/01/2046 (Callable 01/04/2021)(4) | | | 1,700,000 | | | | 1,700,000 | | | | | |

| City of Newark NJ, | | | | | | | | | | | | |

| 2.000%, 10/05/2021 | | | 3,000,000 | | | | 3,021,420 | | | | | |

| City of Ontario CA, | | | | | | | | | | | | |

| 1.971%, 06/01/2021 | | | 470,000 | | | | 471,772 | | | | | |

| City of Philadelphia PA, | | | | | | | | | | | | |

| 5.000%, 08/01/2021 | | | 1,040,000 | | | | 1,066,770 | | | | | |

| City of Troy NY, | | | | | | | | | | | | |

| 1.250%, 07/30/2021 | | | 12,902,475 | | | | 12,982,083 | | | | | |

| City of Whiting IN, | | | | | | | | | | | | |

| 5.250%, 01/01/2021 | | | 10,000,000 | | | | 10,000,000 | | | | | |

| Clark County School District, | | | | | | | | | | | | |

| 5.000%, 06/15/2021 | | | 1,075,000 | | | | 1,097,027 | | | | | |

| Connecticut State Development Authority, | | | | | | | | | | | | |

| 5.500%, 04/01/2021 | | | 1,000,000 | | | | 1,011,690 | | | | | |

| County of Burleigh ND: | | | | | | | | | | | | |

| 0.650%, 11/01/2021 | | | 3,200,000 | | | | 3,200,640 | | | | | |

| 2.750%, 02/01/2022 (Callable 01/21/2021) | | | 20,000,000 | | | | 20,003,400 | | | | | |

| County of Carroll KY, | | | | | | | | | | | | |

1.200%, 02/01/2032(4) | | | 14,250,000 | | | | 14,278,785 | | | | | |

| County of Clark Department of Aviation, | | | | | | | | | | | | |

| 5.000%, 07/01/2021 | | | 9,500,000 | | | | 9,708,050 | | | | | |

| County of Hudson NJ, | | | | | | | | | | | | |

| 7.000%, 06/01/2021 | | | 5,070,000 | | | | 5,186,813 | | | | | |

| County of Lucas OH, | | | | | | | | | | | | |

| 0.450%, 10/15/2021 | | | 10,500,000 | | | | 10,502,205 | | | | | |

| County of Meade KY, | | | | | | | | | | | | |

0.120%, 07/01/2060 (Callable 01/04/2021)(4) | | | 8,000,000 | | | | 8,000,000 | | | | | |

The accompanying notes are an integral part of these financial statements.

Baird Ultra Short Bond Fund

Schedule of Investments, December 31, 2020

Long-Term Investments (cont.)

| | | Principal | | | | | | % of | |

| | | Amount | | | Value | | | Net Assets | |

| County of Riverside CA, | | | | | | | | | |

| 2.165%, 02/15/2021 | | $ | 3,500,000 | | | $ | 3,506,930 | | | |

|

|

| County of St. Lucie FL, | | | | | | | | | | | | |

0.030%, 09/01/2028 (Callable 01/04/2021)(4) | | | 15,000,000 | | | | 15,000,000 | | | | | |

| County of Suffolk NY: | | | | | | | | | | | | |

| 2.000%, 07/22/2021 | | | 4,800,000 | | | | 4,830,576 | | | | | |

| 2.000%, 08/19/2021 | | | 9,000,000 | | | | 9,065,430 | | | | | |

| Dallas/Fort Worth International Airport, | | | | | | | | | | | | |

| 5.000%, 11/01/2038 (Callable 11/01/2021) | | | 1,120,000 | | | | 1,163,568 | | | | | |

| Delaware River Port Authority, | | | | | | | | | | | | |

| 5.000%, 01/01/2021 | | | 5,500,000 | | | | 5,500,000 | | | | | |

| Florida Development Finance Corp., | | | | | | | | | | | | |

| 1.645%, 04/01/2021 | | | 505,000 | | | | 505,505 | | | | | |

| Garden State Preservation Trust, | | | | | | | | | | | | |

| 0.000%, 11/01/2021 | | | 1,000,000 | | | | 993,700 | | | | | |

| Glendale-River Hills School District: | | | | | | | | | | | | |

| 1.000%, 04/19/2021 | | | 2,050,000 | | | | 2,055,309 | | | | | |

| 1.000%, 08/23/2021 | | | 2,000,000 | | | | 2,010,420 | | | | | |

| Gulf Coast Authority: | | | | | | | | | | | | |

2.450%, 05/01/2028(4) | | | 2,500,000 | | | | 2,514,700 | | | | | |

0.040%, 06/01/2030 (Callable 01/04/2021)(4) | | | 10,950,000 | | | | 10,950,000 | | | | | |

| Howard University, | | | | | | | | | | | | |

| 2.638%, 10/01/2021 | | | 925,000 | | | | 933,047 | | | | | |

| Illinois Development Finance Authority, | | | | | | | | | | | | |

0.550%, 11/01/2044 (Callable 08/03/2021)(4) | | | 6,000,000 | | | | 6,004,440 | | | | | |

| Indiana Finance Authority, | | | | | | | | | | | | |

| 3.875%, 08/01/2021 | | | 8,500,000 | | | | 8,665,665 | | | | | |

| Indianapolis Local Public Improvement Bond Bank, | | | | | | | | | | | | |

| 1.450%, 06/01/2021 (Callable 02/01/2021) | | | 11,000,000 | | | | 11,000,440 | | | | | |

| Industrial Development Authority | | | | | | | | | | | | |

| of the County of Yavapai, | | | | | | | | | | | | |

2.800%, 06/01/2027(4) | | | 1,500,000 | | | | 1,513,965 | | | | | |

| Jersey City Redevelopment Agency, | | | | | | | | | | | | |

| 3.000%, 05/27/2021 | | | 2,000,000 | | | | 2,021,220 | | | | | |

| Joplin Industrial Development Authority, | | | | | | | | | | | | |

| 2.154%, 02/15/2022 | | | 1,400,000 | | | | 1,418,340 | | | | | |

| Kendall County Forest Preserve District, | | | | | | | | | | | | |

| 5.000%, 01/01/2021 | | | 2,000,000 | | | | 2,000,000 | | | | | |

| Louisiana Public Facilities Authority, | | | | | | | | | | | | |

| 6.750%, 05/01/2041 (Callable 05/01/2021) | | | 3,000,000 | | | | 3,060,870 | | | | | |

| Massachusetts Development Finance Agency, | | | | | | | | | | | | |

2.450%, 05/01/2027(2)(4) | | | 3,000,000 | | | | 3,017,640 | | | | | |

| Massachusetts Educational Financing Authority, | | | | | | | | | | | | |

| 5.000%, 01/01/2021 | | | 3,000,000 | | | | 3,000,000 | | | | | |

The accompanying notes are an integral part of these financial statements.

Baird Ultra Short Bond Fund

Schedule of Investments, December 31, 2020

Long-Term Investments (cont.)

| | | Principal | | | | | | % of | |

| | | Amount | | | Value | | | Net Assets | |

| Memphis-Shelby County Airport Authority, | | | | | | | | | |

| 5.000%, 07/01/2021 | | $ | 1,000,000 | | | $ | 1,021,800 | | | |

|

|

| Merrimack Valley Regional Transit Authority, | | | | | | | | | | | | |

| 1.500%, 06/25/2021 | | | 1,650,000 | | | | 1,656,881 | | | | | |

| Metropolitan Transportation Authority: | | | | | | | | | | | | |

| 5.000%, 05/15/2021 | | | 4,685,000 | | | | 4,734,146 | | | | | |

| 5.000%, 05/15/2021 | | | 1,365,000 | | | | 1,379,319 | | | | | |

| 5.000%, 09/01/2021 | | | 16,960,000 | | | | 17,281,392 | | | | | |

| Miami-Dade County Industrial | | | | | | | | | | | | |

| Development Authority, | | | | | | | | | | | | |

0.550%, 11/01/2041(4) | | | 2,750,000 | | | | 2,752,035 | | | | | |

| Minneapolis-Saint Paul | | | | | | | | | | | | |

| Metropolitan Airports Commission, | | | | | | | | | | | | |

| 5.000%, 01/01/2022 | | | 1,000,000 | | | | 1,044,230 | | | | | |

| Mississippi Business Finance Corp., | | | | | | | | | | | | |

| 2.500%, 04/01/2022 (Callable 04/01/2021) | | | 4,000,000 | | | | 4,016,280 | | | | | |

| Mizuho Floater/Residual Trust, | | | | | | | | | | | | |

0.470%, 11/15/2036(2)(4) | | | 15,200,000 | | | | 15,200,000 | | | | | |

| Monroe County Development Authority, | | | | | | | | | | | | |

0.060%, 09/01/2037 (Callable 01/04/2021)(4) | | | 10,000,000 | | | | 10,000,000 | | | | | |

| Montachusett Regional Transit Authority, | | | | | | | | | | | | |

| 1.500%, 07/30/2021 | | | 19,000,000 | | | | 19,113,810 | | | | | |

| New Jersey Economic Development Authority: | | | | | | | | | | | | |

| 0.000%, 02/15/2021 | | | 12,980,000 | | | | 12,974,159 | | | | | |

| 5.000%, 06/15/2021 | | | 5,000,000 | | | | 5,101,800 | | | | | |

| 0.000%, 02/15/2022 | | | 5,000,000 | | | | 4,969,800 | | | | | |

| New Jersey Educational Facilities Authority, | | | | | | | | | | | | |

| 5.000%, 09/01/2021 | | | 1,610,000 | | | | 1,658,220 | | | | | |

| New Jersey Housing & Mortgage Finance Agency, | | | | | | | | | | | | |

| 0.743%, 04/01/2021 | | | 1,080,000 | | | | 1,080,054 | | | | | |

| New Jersey Sports & Exposition Authority, | | | | | | | | | | | | |

| 5.000%, 09/01/2021 | | | 1,300,000 | | | | 1,335,087 | | | | | |

| New York State Dormitory Authority: | | | | | | | | | | | | |

| 4.200%, 01/01/2021 | | | 2,170,000 | | | | 2,170,000 | | | | | |

| 5.000%, 07/01/2021 | | | 1,545,000 | | | | 1,579,824 | | | | | |

| Penns Grove-Carneys Point Regional School District, | | | | | | | | | | | | |

| 2.000%, 07/09/2021 | | | 6,858,000 | | | | 6,909,298 | | | | | |

| Pennsylvania Economic | | | | | | | | | | | | |

| Development Financing Authority, | | | | | | | | | | | | |

0.700%, 08/01/2037(4) | | | 7,500,000 | | | | 7,502,175 | | | | | |

| Philadelphia Authority for Industrial Development, | | | | | | | | | | | | |

| 3.664%, 04/15/2022 | | | 6,750,000 | | | | 6,877,035 | | | | | |

| Philadelphia Parking Authority, | | | | | | | | | | | | |

| 5.000%, 09/01/2021 (Callable 02/01/2021) | | | 8,450,000 | | | | 8,477,463 | | | | | |

The accompanying notes are an integral part of these financial statements.

Baird Ultra Short Bond Fund

Schedule of Investments, December 31, 2020

Long-Term Investments (cont.)

| | | Principal | | | | | | % of | |

| | | Amount | | | Value | | | Net Assets | |

| Port of Port Arthur Navigation District: | | | | | | | | | |

0.090%, 04/01/2040 (Callable 01/04/2021)(4) | | $ | 8,505,000 | | | $ | 8,505,000 | | | |

|

|

0.220%, 11/01/2040 (Callable 01/04/2021)(4) | | | 10,000,000 | | | | 10,000,000 | | | | | |

| Public Finance Authority, | | | | | | | | | | | | |

| 5.000%, 07/01/2022 | | | 2,790,000 | | | | 2,895,853 | | | | | |

| Regional Transit Authority, | | | | | | | | | | | | |

| 0.000%, 12/01/2021 | | | 1,425,000 | | | | 1,421,010 | | | | | |

| Sacramento County Public Financing Authority, | | | | | | | | | | | | |

| 3.543%, 04/01/2021 | | | 1,300,000 | | | | 1,308,983 | | | | | |