October 31, 2013

For more information or assistance in opening an account,

please call toll-free 1-888-534-2001.

December 16, 2013

Dear Shareholder,

Enclosed is the Annual Report to shareholders of the TFS Market Neutral Fund (ticker: TFSMX), the TFS Small Cap Fund (ticker: TFSSX) and the TFS Hedged Futures Fund (ticker: TFSHX) for the year ended October 31, 2013. On behalf of the investment manager, TFS Capital LLC (“TFS Capital”), I would like to thank you for your continued investment.

In October, TFS Capital announced that there will be a reduction in the advisory fee paid to TFS Capital for all three funds effective January 1, 2014. In addition, the maximum expense ratio of each fund will be reduced. TFS Capital believes these reductions (which are detailed in Note 9 to the financial statements) are in the best interests of the funds’ shareholders and consistent with industry demand for lower fees. TFS Capital believes the fee reductions strengthen the firm’s long-term value proposition.

TFS Market Neutral Fund (ticker: TFSMX)

| | | | | Since Inception (9/7/2004) |

| TFS Market Neutral Fund | 6.30% | 4.69% | 7.04% | 7.57% |

S&P 500® Index | 27.18% | 16.56% | 15.17% | 7.24% |

Average annual total returns for periods ended October 31, 2013

TFSMX did not produce positive alpha (i.e., the return that cannot be explained by market exposure) in the current fiscal year. While the fund, with a beta in the 0.2-0.3 range, should not be expected to outperform the equity markets when they rise significantly, its return of 6.30% for the fiscal year is below expectations. The shortfall occurred primarily during the months of April and May; excluding those months, TFSMX produced small, but positive, alpha during the remainder of the period. During April and May, TFSMX lost more than 4% of its value, while the S&P 500® Index appreciated by more than 4%. Many of the fund’s short positions rose significantly more than the market, leading to the substantial loss. TFS Capital believes this period of underperformance in TFSMX may have been driven by a “short-squeeze” affecting the portfolio (i.e., a price dislocation that occurs when short positions in thinly traded securities are exited quickly resulting in a rise in price). While TFS Capital believes the impact from this market action may be temporary and could represent a buying opportunity, it is impossible to determine whether prices on certain short positions will improve (i.e., return to pre-short-squeeze levels). Since the end of May, TFSMX has recovered a small portion of the loss in alpha.

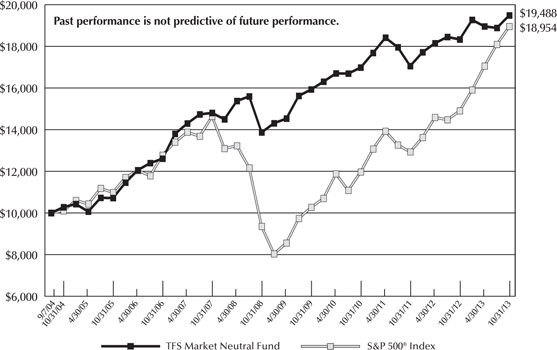

TFSMX’s performance over longer periods of time compares more favorably to the overall U.S. equity market as measured by the S&P 500® Index. From inception through October 31, 2013, TFSMX generated a 7.57% average annual return and had an annualized standard deviation of 7.98%, whereas the S&P 500® Index generated a 7.24% average annual return and had an annualized standard deviation of 21.07%. Therefore, during this time period, TFSMX produced an average annual return that was slightly ahead of the S&P 500® Index while subjecting investors to only 35.9% of the S&P 500® Index’s volatility. Based on its trailing 5-year return through October 31, 2013, TFSMX was ranked #5 among 41 funds in the Lipper “Equity Market Neutral” category.1

The strategies used in managing TFSMX have resulted in its returns having a low correlation to other asset classes. According to Modern Portfolio Theory, portfolios may benefit by combining non-correlated investments. For your reference, below are the TFS Market Neutral Fund’s correlations to several other asset classes since inception. It is notable that TFSMX’s correlation to the equity indices has increased in recent years.

| Correlation Since Inception |

S&P 500® Index | 0.61 |

Russell 2000® Index | 0.60 |

| MSCI EAFE Index | 0.50 |

| Barclays U.S. Aggregate Bond Index | -0.17 |

| Dow Jones REIT ETF Index | 0.43 |

| Dow Jones Commodity Futures | 0.44 |

The TFS Market Neutral Fund continues to operate under a subscription policy that limits additional shareholder investments. Given its investment strategies’ capacity limitations, this policy allows the TFS Market Neutral Fund to seek stability in its net assets and maintain control of its growth.

TFS Small Cap Fund (ticker: TFSSX)

| | | | | Since Inception (3/7/2006) |

| TFS Small Cap Fund | 44.15% | 20.09% | 25.03% | 12.37% |

Russell 2000® Index | 36.28% | 17.69% | 17.04% | 7.13% |

Average annual total returns for periods ended October 31, 2013

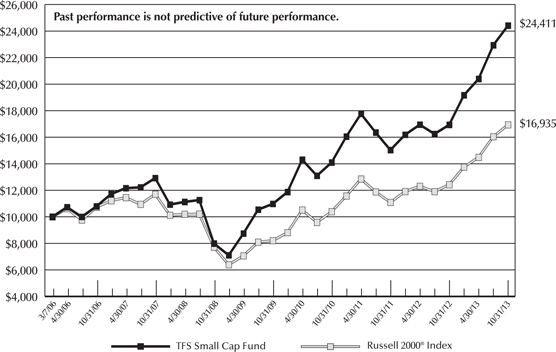

During the fiscal year, TFSSX outperformed its benchmark, the Russell 2000® Index. Given its “long-only” mandate, TFSSX is expected to have a high correlation to U.S. small-cap equity market movements with most of the performance deviation attributable to TFS Capital’s equity selection. All strategies contributed to the outperformance, and we are pleased that the fund added such significant alpha.

TFSSX also achieved its objective of outperforming the Russell 2000® Index over longer periods of time. In fact, it now has over a 7-year track record and has achieved an average annual return since inception that is 524 basis points higher than that of the Russell 2000® Index. Based on its trailing 5-year return through October 31, 2013, TFSSX was ranked #9 among 578 funds in the Lipper Small Cap Core category.2

TFS Hedged Futures Fund (ticker: TFSHX)

| | | Since Inception (12/29/2011) |

| TFS Hedged Futures Fund | -8.14% | 0.76% |

| S&P Diversified Trends Indicator | 4.53% | -4.95% |

S&P 500® Index | 27.18% | 22.24% |

Average annual total return for the periods ended October 31, 2013

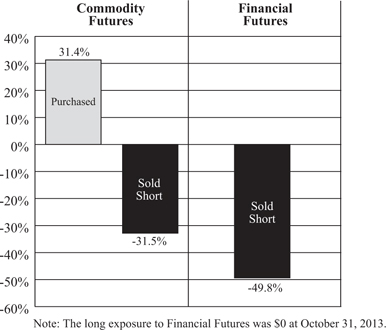

TFSHX, a hedged futures fund, was down 8.14% during the fiscal year. This loss was due primarily to losses in its commodities investments, as well as a smaller loss from financial futures. We are disappointed in this performance. We made some changes to the investment models in the fund in an effort to capture more of the opportunities we see in the market and realize greater risk-adjusted returns.

Like the TFS Market Neutral Fund, the TFS Hedged Futures Fund has demonstrated a low correlation to many market indices. This low correlation suggests the addition of the TFS Hedged Futures Fund may improve the risk-adjusted performance of many investment portfolios. The TFS Hedged Futures Fund has had a slightly negative correlation to the S&P Diversified Trends Indicator, which suggests that it may also have a low correlation to other managed-futures mutual funds that track this index. The TFS Hedged Futures Fund also has a low correlation to the TFS Market Neutral Fund which suggests that these two investments may complement each other in an investment portfolio. For your reference, below are the TFS Hedged Futures Fund’s correlations since inception to several other asset classes including the TFS Market Neutral Fund.

| Correlation Since Inception |

| TFS Market Neutral Fund (ticker: TFSMX) | 0.29 |

| S&P Diversified Trends Indicator | -0.09 |

S&P 500® Index | 0.24 |

Russell 2000® Index | 0.27 |

| S&P GSCI Index | 0.17 |

| Barclays U.S. Aggregate Bond Index | -0.10 |

As always, we do not recommend allocating a high percentage of one’s assets to any one investment fund managed by TFS Capital given the risks inherent in each product. Rather, we believe that they are best used as a component of a diversified portfolio of investments. If you have any questions regarding this material, please contact us.

Best regards,

Larry S. Eiben

Chief Operating Officer & Co-Portfolio Manager

TFS Capital LLC

The performance data quoted represents past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment in the mutual funds discussed in this report (the “Funds”) will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. During the reporting period, the Funds charged a 2% redemption penalty on shares invested for less than 90 days. If shares were redeemed within the 90 day period, investment returns would have been reduced from those shown above. Fee reductions and/or expense reimbursements by the Adviser have positively impacted the Funds’ performance. Without such reductions and/or reimbursements, performance would have been lower. An investor should consider the investment objectives, risks, charges and expenses of the Funds carefully before investing. To obtain a summary prospectus and/or prospectus, which each contain this and other important information, go to www.TFSCapital.com or call (888) 534-2001. Please read the summary prospectus and/or prospectus carefully before investing. The Funds may not be suitable for all investors. Futures investing is speculative. Each Fund’s current NAV per share is available at www.TFSCapital.com.

| 1 | In the Lipper “Equity Market Neutral” category, TFSMX was ranked #5 out of 41 using its 5-year return and #6 out of 60 using its 3-year return. At 10/31/2013, Lipper did not make 1-year rankings available to the public. |

| 2 | In the Lipper “Small Cap Core” category, TFSSX was ranked #9 out of 578 using its 5-year return and #73 out of 637 using its 3-year return. At 10/31/2013, Lipper did not make 1-year rankings available to the public. |

Ranking information provided by Lipper for the periods ended October 31, 2013. TFSSX was assigned by Lipper to the Small-Cap Core category. TFSMX was assigned by Lipper to the Equity Market Neutral category. The Funds are ranked based on total return and are ranked within a universe of funds with similar investment objectives. Rankings include the reinvestment of dividends and capital gains but exclude the effect of a fund’s sales load, if applicable. Fund rankings are calculated monthly by Lipper Analytical Services of New York. Lipper Inc. is a nationally recognized organization that ranks the performance of mutual funds.

TFS MARKET NEUTRAL FUND

PERFORMANCE INFORMATION (Unaudited)

Comparison of the Change in Value of a $10,000 Investment in

TFS Market Neutral Fund versus the S&P 500® Index

Average Annual Total Returns(a) For the periods ended October 31, 2013 |

| | 1 Year | 5 Years | Since Inception(b) |

| TFS Market Neutral Fund | 6.30% | 7.04% | 7.57% |

S&P 500® Index | 27.18% | 15.17% | 7.24% |

| (a) | The total returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (b) | Initial public offering of shares was September 7, 2004. |

TFS SMALL CAP FUND

PERFORMANCE INFORMATION (Unaudited)

Comparison of the Change in Value of a $10,000 Investment in

TFS Small Cap Fund versus the Russell 2000® Index

Average Annual Total Returns(a) For the periods ended October 31, 2013 |

| | 1 Year | 5 Years | Since Inception(b) |

| TFS Small Cap Fund | 44.15% | 25.03% | 12.37% |

Russell 2000® Index | 36.28% | 17.04% | 7.13% |

| (a) | The total returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (b) | Initial public offering of shares was March 7, 2006. |

TFS HEDGED FUTURES FUND

PERFORMANCE INFORMATION (Unaudited)

Comparison of the Change in Value of a $10,000 Investment in

TFS Hedged Futures Fund versus the

S&P Diversified Trends Indicator and the S&P 500® Index

Average Annual Total Returns(a) For the periods ended October 31, 2013 |

| | 1 Year | Since Inception(b) |

| TFS Hedged Futures Fund | -8.14% | 0.76% |

| S&P Diversified Trends Indicator | 4.53% | -4.95% |

S&P 500® Index | 27.18% | 22.24% |

| (a) | The total returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (b) | Initial public offering of shares was December 29, 2011. |

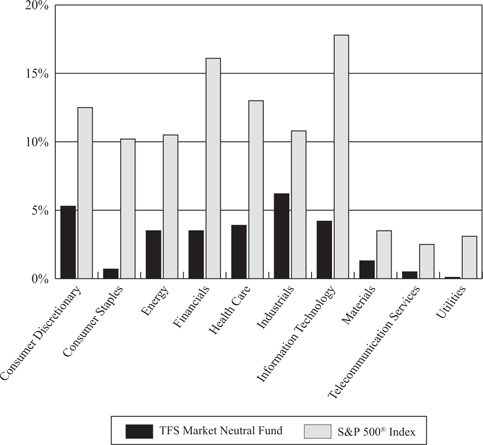

TFS MARKET NEUTRAL FUND

PORTFOLIO INFORMATION

October 31, 2013 (Unaudited)

Common Stocks vs.

the Standard & Poor's 500® Index Net Sector Exposure*

| * | The net percentages for TFS Market Neutral Fund are computed by taking the net dollar exposure, including short positions, and dividing by the net assets of the Fund. Consequently, the percentages will not total to 100%. |

Top 10 Long Common Stocks | | Top 10 Short Common Stocks |

| | | | |

| Penn Virginia Corporation | 0.70% | | Geospace Technologies Corporation | 0.57% |

| MAKO Surgical Corporation | 0.68% | | Walter Energy, Inc. | 0.48% |

| Carrizo Oil & Gas, Inc. | 0.57% | | Fusion-io, Inc. | 0.48% |

| Triangle Petroleum Corporation | 0.49% | | Dendreon Corporation | 0.45% |

| Stone Energy Corporation | 0.48% | | VirnetX Holding Corporation | 0.45% |

| Sanmina Corporation | 0.42% | | Ebix, Inc. | 0.43% |

| iGATE Corporation | 0.42% | | SunEdison, Inc. | 0.42% |

| Rosetta Resources, Inc. | 0.38% | | VeriFone Systems, Inc. | 0.40% |

| Mueller Water Products, Inc. - Class A | 0.37% | | Aéropostale, Inc. | 0.40% |

| Federal-Mogul Corporation | 0.35% | | Encore Capital Group, Inc. | 0.40% |

Please note that the Fund may hold securities other than common stocks.

TFS SMALL CAP FUND

PORTFOLIO INFORMATION

October 31, 2013 (Unaudited)

Sector Allocation (% of Net Assets)

|

| |

| ShoreTel, Inc. | 0.56% |

| iGATE Corporation | 0.56% |

| Triangle Petroleum Corporation | 0.52% |

| Federal-Mogul Corporation | 0.49% |

| Mueller Water Products, Inc. - Class A | 0.47% |

| Intersil Corporation - Class A | 0.47% |

| LifePoint Hospitals, Inc. | 0.47% |

| Lender Processing Services, Inc. | 0.47% |

| Winnebago Industries, Inc. | 0.46% |

| H.B. Fuller Company | 0.45% |

TFS HEDGED FUTURES FUND

PORTFOLIO INFORMATION

October 31, 2013 (Unaudited)

Exposure by Type of Futures Contract

(Value as a % of Net Assets)

Net Exposure by Type of Futures Contract (Net as a % of Net Assets) |

| Net Commodity Futures Exposure | -0.1% |

| Net Financial Futures Exposure | -49.8% |

TFS MARKET NEUTRAL FUND

SUMMARY SCHEDULE OF INVESTMENTS*

October 31, 2013

| | | | | | |

| Consumer Discretionary — 14.4% | | | | | | |

ANN, INC. (a) (b) | | | 123,988 | | | $ | 4,384,216 | |

Belo Corporation - Class A (b) | | | 382,485 | | | | 5,251,519 | |

Children's Place Retail Stores, Inc. (The) (a) (b) | | | 81,636 | | | | 4,456,509 | |

Digital Generation, Inc. (a) (b) | | | 364,961 | | | | 4,616,757 | |

Federal-Mogul Corporation (a) | | | 270,871 | | | | 5,550,147 | |

Guess?, Inc. (b) | | | 133,868 | | | | 4,183,375 | |

| Lithia Motors, Inc. | | | 73,683 | | | | 4,630,977 | |

Modine Manufacturing Company (a) (b) | | | 314,467 | | | | 4,188,700 | |

Sotheby's (b) | | | 87,125 | | | | 4,521,787 | |

Winnebago Industries, Inc. (a) | | | 174,005 | | | | 5,160,988 | |

Zale Corporation (a) (b) | | | 328,892 | | | | 5,140,582 | |

Other Consumer Discretionary (c) | | | | | | | 175,370,265 | |

| | | | | | | | 227,455,822 | |

| Consumer Staples — 2.8% | | | | | | | | |

Other Consumer Staples (c) | | | | | | | 43,863,818 | |

| | | | | | | | | |

| Energy — 9.8% | | | | | | | | |

Callon Petroleum Company (a) (b) | | | 727,013 | | | | 4,965,499 | |

Carrizo Oil & Gas, Inc. (a) (b) | | | 206,092 | | | | 9,035,073 | |

Hercules Offshore, Inc. (a) | | | 609,902 | | | | 4,147,334 | |

Matrix Service Company (a) | | | 199,172 | | | | 4,140,786 | |

Penn Virginia Corporation (a) (b) | | | 1,307,555 | | | | 11,127,293 | |

Rosetta Resources, Inc. (a) (b) | | | 99,538 | | | | 5,966,308 | |

Stone Energy Corporation (a) (b) | | | 216,291 | | | | 7,539,904 | |

Triangle Petroleum Corporation (a) (b) | | | 739,977 | | | | 7,821,557 | |

Other Energy (c) | | | | | | | 99,882,121 | |

| | | | | | | | 154,625,875 | |

| Financials — 12.6% | | | | | | | | |

CapLease, Inc. (b) | | | 640,320 | | | | 5,442,720 | |

Resource Capital Corporation (b) | | | 701,087 | | | | 4,311,685 | |

Symetra Financial Corporation (b) | | | 220,738 | | | | 4,134,423 | |

Other Financials (c) | | | | | | | 185,847,902 | |

| | | | | | | | 199,736,730 | |

| Health Care — 15.1% | | | | | | | | |

Affymetrix, Inc. (a) (b) | | | 648,446 | | | | 4,584,513 | |

AmSurg Corporation (a) (b) | | | 112,718 | | | | 4,834,475 | |

BioCryst Pharmaceuticals, Inc. (a) (b) | | | 830,816 | | | | 4,781,346 | |

Cambrex Corporation (a) | | | 249,236 | | | | 4,192,149 | |

Impax Laboratories, Inc. (a) (b) | | | 214,390 | | | | 4,343,541 | |

LifePoint Hospitals, Inc. (a) (b) | | | 86,016 | | | | 4,441,866 | |

Magellan Health Services, Inc. (a) (b) | | | 94,407 | | | | 5,541,691 | |

MAKO Surgical Corporation (a) (b) | | | 361,776 | | | | 10,784,543 | |

Medicines Company (The) (a) (b) | | | 131,823 | | | | 4,471,436 | |

TFS MARKET NEUTRAL FUND

SUMMARY SCHEDULE OF INVESTMENTS* (Continued)

COMMON STOCKS — 92.6% (Continued) | | | | | | |

| Health Care — 15.1% (Continued) | | | | | | |

VCA Antech, Inc. (a) (b) | | | 190,292 | | | $ | 5,413,807 | |

Other Health Care (c) | | | | | | | 185,977,437 | |

| | | | | | | | 239,366,804 | |

| Industrials — 13.5% | | | | | | | | |

Avis Budget Group, Inc. (a) (b) | | | 156,794 | | | | 4,912,356 | |

| EMCOR Group, Inc. | | | 129,739 | | | | 4,808,127 | |

| Manitowoc Company, Inc. (The) | | | 229,475 | | | | 4,465,584 | |

Mueller Water Products, Inc. - Class A (b) | | | 690,640 | | | | 5,918,785 | |

Orbital Sciences Corporation (a) | | | 181,553 | | | | 4,188,428 | |

Republic Airways Holdings, Inc. (a) (b) | | | 464,438 | | | | 5,471,079 | |

Ryder System, Inc. (b) | | | 71,157 | | | | 4,684,265 | |

Other Industrials (c) | | | | | | | 179,107,726 | |

| | | | | | | | 213,556,350 | |

| Information Technology — 16.3% | | | | | | | | |

Active Network, Inc. (The) (a) | | | 341,803 | | | | 4,935,635 | |

DST Systems, Inc. (b) | | | 49,972 | | | | 4,236,126 | |

Ellie Mae, Inc. (a) (b) | | | 187,365 | | | | 5,414,849 | |

iGATE Corporation (a) (b) | | | 207,124 | | | | 6,594,828 | |

Kulicke & Soffa Industries, Inc. (a) (b) | | | 402,587 | | | | 5,193,372 | |

Sanmina Corporation (a) (b) | | | 453,658 | | | | 6,605,260 | |

ShoreTel, Inc. (a) (b) | | | 655,742 | | | | 5,213,149 | |

TiVo, Inc. (a) (b) | | | 315,017 | | | | 4,186,576 | |

Other Information Technology (c) | | | | | | | 215,915,469 | |

| | | | | | | | 258,295,264 | |

| Materials — 5.4% | | | | | | | | |

Carpenter Technology Corporation (b) | | | 77,865 | | | | 4,619,730 | |

H.B. Fuller Company (b) | | | 115,663 | | | | 5,536,788 | |

Other Materials (c) | | | | | | | 76,325,882 | |

| | | | | | | | 86,482,400 | |

| Telecommunication Services — 1.4% | | | | | | | | |

Other Telecommunication Services (c) | | | | | | | 21,846,489 | |

| | | | | | | | | |

| Utilities — 1.3% | | | | | | | | |

Other Utilities (c) | | | | | | | 20,346,054 | |

| | | | | | | | | |

Total Common Stocks (Cost $1,284,089,511) | | | | | | $ | 1,465,575,606 | |

| | | | |

Other Preferred Stocks (Cost $2,593,825) (c) | | | $ | 2,679,032 | |

TFS MARKET NEUTRAL FUND

SUMMARY SCHEDULE OF INVESTMENTS* (Continued)

| | | | | | |

VelocityShares Daily Inverse VIX Short-Term ETN (a) | | | 258,300 | | | $ | 7,490,700 | |

Other Investments (c) | | | | | | | 66,125,486 | |

Total Other Investments (Cost $72,682,589) | | | | | | $ | 73,616,186 | |

CORPORATE BONDS — 0.0% (d) | | | | |

Financials — 0.0% (d) | | | | |

Other Financials (Cost $0) (c) | | | $ | 2,918 | |

MONEY MARKET FUNDS — 1.1% | | | | | | |

Federated Government Obligations Fund - Institutional Class, 0.01% (e) | | | 15,218,554 | | | $ | 15,218,554 | |

UMB Money Market Fiduciary, 0.01% (e) | | | 2,419,354 | | | | 2,419,354 | |

Total Money Market Funds (Cost $17,637,908) | | | | | | $ | 17,637,908 | |

| | | | | | | | | |

Total Investments at Value — 98.5% (Cost $1,377,003,833) | | | | | | $ | 1,559,511,650 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 1.5% | | | | | | | 23,285,065 | (f) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 1,582,796,715 | |

| * | A complete Schedule of Investments is available without charge upon request by calling toll-free 1-888-534-2001 or on the SEC’s website at http://www.sec.gov. |

| (a) | Non-income producing security. |

| (b) | All or a portion of the shares have been committed as collateral for open short positions. |

| (c) | Represents issuers not identified as either a top 50 holding in terms of value and issues or issuers not exceeding 1% of net assets individually or in the aggregate, respectively, as of October 31, 2013. |

| (d) | Percentage rounds to less than 0.1%. |

| (e) | The rate shown is the 7-day effective yield as of October 31, 2013. |

| (f) | Includes cash held as margin deposits for open short positions. |

See accompanying notes to financial statements.

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT

October 31, 2013

| | | | | | |

| Consumer Discretionary — 9.1% | | | | | | |

| Auto Components — 0.2% | | | | | | |

| American Axle & Manufacturing Holdings, Inc. | | | 6,286 | | | $ | 116,982 | |

| Ballard Power Systems, Inc. | | | 235,176 | | | | 322,191 | |

| China XD Plastics Company Ltd. | | | 103,237 | | | | 498,635 | |

| Dana Holding Corporation | | | 817 | | | | 16,013 | |

| Motorcar Parts of America, Inc. | | | 4,115 | | | | 56,293 | |

| Quantum Fuel Systems Technologies Worldwide, Inc. | | | 278,301 | | | | 1,327,496 | |

| SORL Auto Parts, Inc. | | | 44,089 | | | | 212,068 | |

| Standard Motor Products, Inc. | | | 1,593 | | | | 57,603 | |

| Tenneco Automotive, Inc. | | | 3,839 | | | | 203,736 | |

| | | | | | | | 2,811,017 | |

| Automobiles — 0.3% | | | | | | | | |

| Kandi Technologies Group, Inc. | | | 753,627 | | | | 4,936,257 | |

| Tesla Motors, Inc. | | | 1,716 | | | | 274,457 | |

| | | | | | | | 5,210,714 | |

Distributors — 0.0% (a) | | | | | | | | |

| China Metro-Rural Holdings Ltd. | | | 100 | | | | 110 | |

| | | | | | | | | |

| Diversified Consumer Services — 0.9% | | | | | | | | |

| Ascent Capital Group, Inc. | | | 660 | | | | 55,717 | |

| Bridgepoint Education, Inc. | | | 7,237 | | | | 141,845 | |

| Career Education Corporation | | | 5,302 | | | | 29,055 | |

| Collectors Universe, Inc. | | | 2,887 | | | | 48,069 | |

| Corinthian Colleges, Inc. | | | 725,419 | | | | 1,552,397 | |

| DeVry, Inc. | | | 2,987 | | | | 107,233 | |

| Education Management Corporation | | | 56,873 | | | | 870,157 | |

| ITT Educational Services, Inc. | | | 44,619 | | | | 1,790,114 | |

| K12, Inc. | | | 21,999 | | | | 402,142 | |

| LifeLock, Inc. | | | 10,300 | | | | 165,727 | |

| Matthews International Corporation - Class A | | | 16,358 | | | | 664,135 | |

| Outerwall, Inc. | | | 46,889 | | | | 3,046,847 | |

| Regis Corporation | | | 43,903 | | | | 636,594 | |

| Service Corporation International | | | 48,297 | | | | 869,829 | |

| StoneMor Partners, L.P. | | | 91,637 | | | | 2,405,471 | |

| Strayer Education, Inc. | | | 45,217 | | | | 1,787,428 | |

| | | | | | | | 14,572,760 | |

| Hotels, Restaurants & Leisure — 0.5% | | | | | | | | |

| Bally Technologies, Inc. | | | 13,078 | | | | 956,525 | |

| Buffalo Wild Wings, Inc. | | | 487 | | | | 69,436 | |

| Churchill Downs, Inc. | | | 7,111 | | | | 610,906 | |

| Empire Resorts, Inc. | | | 400 | | | | 2,456 | |

| Iao Kun Group Holding Company Ltd. | | | 41,287 | | | | 137,899 | |

| Interval Leisure Group, Inc. | | | 915 | | | | 22,207 | |

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued)

COMMON STOCKS — 63.5% (Continued) | | | | | | |

| Consumer Discretionary — 9.1% (Continued) | | | | | | |

| Hotels, Restaurants & Leisure — 0.5% (Continued) | | | | | | |

| Life Time Fitness, Inc. | | | 16,704 | | | $ | 758,696 | |

| Morgans Hotel Group Company | | | 25,086 | | | | 179,616 | |

| Noodles & Company | | | 39,246 | | | | 1,718,582 | |

| PokerTek, Inc. | | | 1,884 | | | | 2,223 | |

| Red Lion Hotels Corporation | | | 12,215 | | | | 73,534 | |

| Red Robin Gourmet Burgers, Inc. | | | 299 | | | | 22,778 | |

| Ryman Hospitality Properties, Inc. | | | 24,056 | | | | 887,907 | |

| Six Flags Entertainment Corporation | | | 1,157 | | | | 43,515 | |

| Vail Resorts, Inc. | | | 34,165 | | | | 2,406,924 | |

| | | | | | | | 7,893,204 | |

| Household Durables — 1.9% | | | | | | | | |

| Beazer Homes USA, Inc. | | | 162,640 | | | | 2,955,169 | |

| Blyth, Inc. | | | 385,032 | | | | 5,317,292 | |

| Cavco Industries, Inc. | | | 3,530 | | | | 206,752 | |

| Comstock Homebuilding Companies, Inc. - Class A | | | 72,445 | | | | 148,512 | |

| Desarrolladora Homex S.A.B de C.V. - ADR | | | 36,260 | | | | 47,863 | |

| Dixie Group, Inc. (The) | | | 10,021 | | | | 126,265 | |

| Ethan Allen Interiors, Inc. | | | 34,651 | | | | 923,103 | |

| Hovnanian Enterprises, Inc. - Class A | | | 754,666 | | | | 3,818,610 | |

| KB Home | | | 263,066 | | | | 4,464,230 | |

| Location Based Technologies, Inc. | | | 95,655 | | | | 9,566 | |

| M/I Homes, Inc. | | | 70,313 | | | | 1,439,307 | |

| Mad Catz Interactive, Inc. | | | 483,035 | | | | 324,358 | |

| MDC Holdings, Inc. | | | 114,621 | | | | 3,345,787 | |

| Ryland Group, Inc. (The) | | | 108,067 | | | | 4,344,293 | |

| SodaStream International Ltd. | | | 38,692 | | | | 2,068,861 | |

| Tempur Sealy International, Inc. | | | 8,083 | | | | 309,983 | |

| William Lyon Homes - Class A | | | 16,367 | | | | 379,223 | |

| | | | | | | | 30,229,174 | |

| Internet & Catalog Retail — 0.3% | | | | | | | | |

| Blue Nile, Inc. | | | 37,491 | | | | 1,539,755 | |

| E-Commerce China Dangdang, Inc. - ADR | | | 68,164 | | | | 603,252 | |

| HomeAway, Inc. | | | 16,522 | | | | 489,877 | |

| Overstock.com, Inc. | | | 6,486 | | | | 151,967 | |

| PetMed Express, Inc. | | | 117,075 | | | | 1,737,393 | |

| ValueVision Media, Inc. | | | 36,848 | | | | 196,768 | |

| | | | | | | | 4,719,012 | |

| Leisure Equipment & Products — 0.5% | | | | | | | | |

| Black Diamond, Inc. | | | 27,986 | | | | 417,271 | |

| JAKKS Pacific, Inc. | | | 492,851 | | | | 3,173,961 | |

| LeapFrog Enterprises, Inc. | | | 116,200 | | | | 994,672 | |

| Smith & Wesson Holding Corporation | | | 122,489 | | | | 1,320,431 | |

| Sturm Ruger & Company, Inc. | | | 20,954 | | | | 1,370,601 | |

| | | | | | | | 7,276,936 | |

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued)

COMMON STOCKS — 63.5% (Continued) | | | | | | |

| Consumer Discretionary — 9.1% (Continued) | | | | | | |

| Media — 1.1% | | | | | | |

| AirMedia Group, Inc. - ADR | | | 16,842 | | | $ | 28,463 | |

| Bona Film Group Ltd. - ADR | | | 9,458 | | | | 54,478 | |

| Central European Media Enterprises Ltd. | | | 72,460 | | | | 222,452 | |

| China Yida Holding Company | | | 1,551 | | | | 6,638 | |

| Clear Channel Outdoor Holdings, Inc. | | | 24,149 | | | | 205,267 | |

| Cumulus Media, Inc. - Class A | | | 313,271 | | | | 1,873,361 | |

| DreamWorks Animation SKG, Inc. - Class A | | | 68,523 | | | | 2,346,228 | |

| Gray Television, Inc. | | | 15,218 | | | | 128,592 | |

| Manchester United plc - Class A | | | 5,356 | | | | 87,303 | |

| McClatchy Company (The) - Class A | | | 300,014 | | | | 846,039 | |

| Media General, Inc. - Class A | | | 48,509 | | | | 707,261 | |

| Meredith Corporation | | | 58,988 | | | | 3,026,084 | |

| Nexstar Broadcasting Group, Inc. | | | 109,859 | | | | 4,876,641 | |

| ReachLocal, Inc. | | | 24,961 | | | | 306,771 | |

| Scholastic Corporation | | | 63,304 | | | | 1,816,192 | |

| Sinclair Broadcast Group, Inc. | | | 8,229 | | | | 263,822 | |

| SPAR Group, Inc. | | | 195 | | | | 380 | |

| Tiger Media, Inc. | | | 1,132 | | | | 1,528 | |

| Valassis Communications, Inc. | | | 41,892 | | | | 1,146,165 | |

| VisionChina Media, Inc. - ADR | | | 10,700 | | | | 75,328 | |

| | | | | | | | 18,018,993 | |

| Multiline Retail — 0.9% | | | | | | | | |

| Bon-Ton Stores, Inc. (The) | | | 92,588 | | | | 1,060,133 | |

| Dillard's, Inc. - Class A | | | 50,132 | | | | 4,109,821 | |

| Fred's, Inc. - Class A | | | 87,598 | | | | 1,419,088 | |

| J. C. Penney Company, Inc. | | | 632,253 | | | | 4,741,898 | |

| Sears Canada, Inc. | | | 7,343 | | | | 102,116 | |

| Sears Holdings Corporation | | | 43,954 | | | | 2,552,848 | |

| | | | | | | | 13,985,904 | |

| Specialty Retail — 2.1% | | | | | | | | |

| Abercrombie & Fitch Company - Class A | | | 106,029 | | | | 3,973,967 | |

| Aéropostale, Inc. | | | 673,907 | | | | 6,260,596 | |

| America's Car-Mart, Inc. | | | 11,273 | | | | 515,627 | |

AutoChina International Ltd. (b) | | | 143 | | | | 1,973 | |

| Barnes & Noble, Inc. | | | 139,325 | | | | 1,968,662 | |

| bebe stores, inc. | | | 12,624 | | | | 76,123 | |

| Books-A-Million, Inc. | | | 13,918 | | | | 34,934 | |

| Buckle, Inc. (The) | | | 16,907 | | | | 827,429 | |

| China Auto Logistics, Inc. | | | 1,926 | | | | 5,123 | |

| Coldwater Creek, Inc. | | | 31,901 | | | | 31,901 | |

| Conn's, Inc. | | | 53,651 | | | | 3,242,666 | |

| Destination XL Group, Inc. | | | 5,570 | | | | 38,712 | |

| Francesca's Holdings Corporation | | | 77,453 | | | | 1,393,379 | |

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued)

COMMON STOCKS — 63.5% (Continued) | | | | | | |

| Consumer Discretionary — 9.1% (Continued) | | | | | | |

| Specialty Retail — 2.1% (Continued) | | | | | | |

| hhgregg, Inc. | | | 102,495 | | | $ | 1,589,697 | |

| Hibbett Sports, Inc. | | | 29,396 | | | | 1,714,669 | |

| Lentuo International, Inc. - ADR | | | 2,110 | | | | 6,794 | |

| Office Depot, Inc. | | | 317,491 | | | | 1,774,775 | |

| OfficeMax, Inc. | | | 60,785 | | | | 910,559 | |

| OSH 1 Liquidating Corporation | | | 11,183 | | | | 3,914 | |

| Pep Boys - Manny Moe & Jack (The) | | | 6,936 | | | | 89,752 | |

| Pier 1 Imports, Inc. | | | 206,942 | | | | 4,320,949 | |

| Rent-A-Center, Inc. | | | 23,906 | | | | 818,541 | |

| Restoration Hardware Holdings, Inc. | | | 1,171 | | | | 81,666 | |

| Select Comfort Corporation | | | 35,018 | | | | 641,530 | |

| Stage Stores, Inc. | | | 76,034 | | | | 1,570,102 | |

| Systemax, Inc. | | | 1,915 | | | | 18,193 | |

| Zumiez, Inc. | | | 50,991 | | | | 1,511,373 | |

| | | | | | | | 33,423,606 | |

| Textiles, Apparel & Luxury Goods — 0.4% | | | | | | | | |

| American Apparel, Inc. | | | 12,083 | | | | 16,191 | |

| Deckers Outdoor Corporation | | | 3,168 | | | | 218,054 | |

| DGSE Companies, Inc. | | | 2,185 | | | | 5,463 | |

| G-III Apparel Group Ltd. | | | 12,988 | | | | 736,679 | |

| Iconix Brand Group, Inc. | | | 13,675 | | | | 493,531 | |

| Kingold Jewelry, Inc. | | | 195,743 | | | | 395,401 | |

| Oxford Industries, Inc. | | | 1,160 | | | | 83,253 | |

| Vera Bradley, Inc. | | | 156,208 | | | | 3,460,007 | |

| | | | | | | | 5,408,579 | |

| Consumer Staples — 2.1% | | | | | | | | |

| Beverages — 0.1% | | | | | | | | |

| Primo Water Corporation | | | 177,933 | | | | 443,053 | |

| Reed's, Inc. | | | 89,069 | | | | 573,605 | |

| | | | | | | | 1,016,658 | |

| Food & Staples Retailing — 0.6% | | | | | | | | |

| China Jo-Jo Drugstores, Inc. | | | 395 | | | | 399 | |

| Crumbs Bake Shop, Inc. | | | 137 | | | | 178 | |

| Fairway Group Holdings Corporation | | | 11,332 | | | | 276,841 | |

| Nash Finch Company | | | 17,239 | | | | 483,726 | |

| Natural Grocers by Vitamin Cottage, Inc. | | | 22,531 | | | | 898,987 | |

| Pizza Inn Holdings, Inc. | | | 57,838 | | | | 473,693 | |

| Spartan Stores, Inc. | | | 24,975 | | | | 587,662 | |

| SUPERVALU, Inc. | | | 708,032 | | | | 4,977,465 | |

| Susser Holdings Corporation | | | 24,801 | | | | 1,360,087 | |

| | | | | | | | 9,059,038 | |

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued)

COMMON STOCKS — 63.5% (Continued) | | | | | | |

| Consumer Staples — 2.1% (Continued) | | | | | | |

| Food Products — 0.7% | | | | | | |

| AgFeed Industries, Inc. | | | 146,948 | | | $ | 39,676 | |

| Annie's, Inc. | | | 48,548 | | | | 2,293,893 | |

| Boulder Brands, Inc. | | | 94,438 | | | | 1,547,839 | |

| Calavo Growers, Inc. | | | 27,166 | | | | 806,558 | |

| China Marine Food Group Ltd. | | | 95,426 | | | | 19,849 | |

| Coffee Holding Company, Inc. | | | 87,149 | | | | 465,376 | |

| Dean Foods Company | | | 155,808 | | | | 3,038,256 | |

| Diamond Foods, Inc. | | | 91,772 | | | | 2,240,154 | |

| Green Mountain Coffee Roasters, Inc. | | | 2,982 | | | | 187,299 | |

| Le Gaga Holdings Ltd. - ADR | | | 6,179 | | | | 22,183 | |

| S&W Seed Company | | | 4,952 | | | | 35,605 | |

| SkyPeople Fruit Juice, Inc. | | | 34,162 | | | | 65,591 | |

| | | | | | | | 10,762,279 | |

Household Products — 0.0% (a) | | | | | | | | |

| Central Garden & Pet Company - Class A | | | 13,376 | | | | 98,447 | |

| | | | | | | | | |

| Personal Products — 0.4% | | | | | | | | |

| China Sky One Medical, Inc. | | | 36,447 | | | | 8,747 | |

| China-Biotics, Inc. | | | 535,616 | | | | 1,365,821 | |

| Herbalife Ltd. | | | 25,182 | | | | 1,632,297 | |

| LifeVantage Corporation | | | 236,686 | | | | 518,342 | |

| Mannatech, Inc. | | | 2,247 | | | | 53,007 | |

| Medifast, Inc. | | | 43,853 | | | | 1,022,214 | |

| Synutra International, Inc. | | | 80,486 | | | | 549,719 | |

| USANA Health Sciences, Inc. | | | 19,585 | | | | 1,336,285 | |

| | | | | | | | 6,486,432 | |

| Tobacco — 0.3% | | | | | | | | |

| Star Scientific, Inc. | | | 1,026,502 | | | | 1,857,968 | |

| Universal Corporation | | | 53,321 | | | | 2,827,613 | |

| Vector Group Ltd. | | | 51,046 | | | | 825,414 | |

| | | | | | | | 5,510,995 | |

| Energy — 6.3% | | | | | | | | |

| Energy Equipment & Services — 1.3% | | | | | | | | |

| Cal Dive International, Inc. | | | 1,166,144 | | | | 2,297,304 | |

| CARBO Ceramics, Inc. | | | 35,110 | | | | 4,400,687 | |

| Exterran Holdings, Inc. | | | 1,387 | | | | 39,599 | |

| Forum Energy Technologies, Inc. | | | 7,815 | | | | 228,667 | |

| Geospace Technologies Corporation | | | 93,288 | | | | 9,088,117 | |

| McDermott International, Inc. | | | 27,123 | | | | 191,760 | |

| Patterson-UTI Energy, Inc. | | | 13,028 | | | | 316,059 | |

| Recon Technology Ltd. | | | 41,638 | | | | 186,538 | |

| RPC, Inc. | | | 5,980 | | | | 109,673 | |

| Tidewater, Inc. | | | 56,647 | | | | 3,411,282 | |

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued)

COMMON STOCKS — 63.5% (Continued) | | | | | | |

| Energy — 6.3% (Continued) | | | | | | |

| Energy Equipment & Services — 1.3% (Continued) | | | | | | |

| Vantage Drilling Company | | | 170,920 | | | $ | 304,238 | |

| | | | | | | | 20,573,924 | |

| Oil, Gas & Consumable Fuels — 5.0% | | | | | | | | |

| Alliance Resource Partners, L.P. | | | 1,973 | | | | 149,770 | |

| Alon USA Energy, Inc. | | | 178,489 | | | | 2,156,147 | |

| Alpha Natural Resources, Inc. | | | 246,559 | | | | 1,725,913 | |

| Amyris, Inc. | | | 200,087 | | | | 504,219 | |

| Apco Oil and Gas International, Inc. | | | 1,828 | | | | 27,822 | |

| Arch Coal, Inc. | | | 86,527 | | | | 366,875 | |

| Berry Petroleum Company - Class A | | | 2,900 | | | | 138,475 | |

| Bill Barrett Corporation | | | 40,132 | | | | 1,110,452 | |

| BioFuel Energy Corporation | | | 109,169 | | | | 375,541 | |

| Blue Dolphin Energy Company | | | 38,398 | | | | 209,653 | |

| BPZ Resources, Inc. | | | 842,525 | | | | 1,693,475 | |

| BreitBurn Energy Partners, L.P. | | | 22,000 | | | | 422,840 | |

| CAMAC Energy, Inc. | | | 245,365 | | | | 244,138 | |

| Chesapeake Granite Wash Trust | | | 36,651 | | | | 449,341 | |

| China Integrated Energy, Inc. | | | 405,472 | | | | 223,010 | |

| Clean Energy Fuels Corporation | | | 175,509 | | | | 1,999,048 | |

| Comstock Resources, Inc. | | | 54,837 | | | | 938,261 | |

| Contango Oil & Gas Company | | | 26,295 | | | | 1,126,741 | |

| Crosstex Energy, L.P. | | | 5,533 | | | | 140,704 | |

| Cubic Energy, Inc. | | | 4,183 | | | | 1,590 | |

| Delek US Holdings, Inc. | | | 208,244 | | | | 5,320,634 | |

| Dominion Resources Black Warrior Trust | | | 1,278 | | | | 7,387 | |

| ECA Marcellus Trust I | | | 48,071 | | | | 481,671 | |

| Enbridge Energy Management, LLC | | | 58,549 | | | | 1,669,818 | |

| Endeavour International Corporation | | | 164,262 | | | | 975,716 | |

| Evolution Petroleum Corporation | | | 4,638 | | | | 55,934 | |

| EXCO Resources, Inc. | | | 246,281 | | | | 1,332,380 | |

| Frontline Ltd. | | | 1,470,440 | | | | 3,117,333 | |

| Gevo, Inc. | | | 234,631 | | | | 398,873 | |

| Global Partners, L.P. | | | 8,113 | | | | 289,634 | |

| GMX Resources, Inc. | | | 72,181 | | | | 9,384 | |

| Golar LNG Ltd. | | | 16,762 | | | | 622,373 | |

| GreenHunter Resources, Inc. | | | 78,321 | | | | 104,167 | |

| Halcon Resources Corporation | | | 235,527 | | | | 1,220,030 | |

| Harvest Natural Resources, Inc. | | | 317,596 | | | | 1,587,980 | |

| Houston American Energy Corporation | | | 39,340 | | | | 10,228 | |

| Hyperdynamics Corporation | | | 119,465 | | | | 431,269 | |

| InterOil Corporation | | | 19,078 | | | | 1,324,967 | |

| Isramco, Inc. | | | 2,362 | | | | 311,713 | |

| Ivanhoe Energy, Inc. | | | 4,600 | | | | 3,151 | |

| James River Coal Company | | | 2,228,219 | | | | 4,278,180 | |

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued)

COMMON STOCKS — 63.5% (Continued) | | | | | | |

| Energy — 6.3% (Continued) | | | | | | |

| Oil, Gas & Consumable Fuels — 5.0% (Continued) | | | | | | |

| Kinder Morgan Management, LLC | | | 19,330 | | | $ | 1,455,902 | |

| KiOR, Inc. - Class A | | | 1,055,979 | | | | 2,460,431 | |

| L & L Energy, Inc. | | | 497,168 | | | | 705,979 | |

| LinnCo, LLC | | | 52,510 | | | | 1,548,520 | |

| Lucas Energy, Inc. | | | 373,047 | | | | 414,082 | |

| Midstates Petroleum Company, Inc. | | | 33,372 | | | | 188,218 | |

| Miller Energy Resources, Inc. | | | 490,141 | | | | 3,313,353 | |

| New Concept Energy, Inc. | | | 13,597 | | | | 22,027 | |

| Newfield Exploration Company | | | 19,684 | | | | 599,378 | |

| NGL Energy Partners, L.P. | | | 10,617 | | | | 334,011 | |

| Niska Gas Storage Partners, LLC | | | 18,126 | | | | 286,391 | |

| Nordic American Tankers Ltd. | | | 375,836 | | | | 3,066,822 | |

| North European Oil Royalty Trust | | | 10,200 | | | | 234,600 | |

| Northern Oil & Gas, Inc. | | | 20,056 | | | | 329,520 | |

| Nuverra Environmental Solutions, Inc. | | | 884,415 | | | | 2,157,973 | |

| Overseas Shipholding Group, Inc. | | | 526,119 | | | | 1,815,111 | |

| Oxford Resource Partners, L.P. | | | 189,133 | | | | 295,047 | |

| Pacific Coast Oil Trust | | | 8,046 | | | | 120,690 | |

| Pacific Ethanol, Inc. | | | 482,026 | | | | 1,764,215 | |

| Patriot Coal Corporation | | | 288,164 | | | | 36,597 | |

| PDC Energy, Inc. | | | 14,412 | | | | 977,278 | |

| PetroQuest Energy, Inc. | | | 49,065 | | | | 231,587 | |

| Pyramid Oil Company | | | 33,335 | | | | 176,676 | |

| Quicksilver Resources, Inc. | | | 65,629 | | | | 140,446 | |

| Rhino Resource Partners, L.P. | | | 13,818 | | | | 175,627 | |

| Royale Energy, Inc. | | | 196,705 | | | | 529,136 | |

| San Juan Basin Royalty Trust | | | 171,178 | | | | 2,694,342 | |

| SandRidge Energy, Inc. | | | 26,065 | | | | 165,252 | |

| SandRidge Mississippian Trust I | | | 45,880 | | | | 565,242 | |

| Sino Clean Energy, Inc. | | | 213,222 | | | | 36,248 | |

| Solazyme, Inc. | | | 499,382 | | | | 5,223,536 | |

| Spectra Energy Partners, L.P. | | | 4,852 | | | | 212,129 | |

| Summit Midstream Partners, L.P. | | | 777 | | | | 25,835 | |

| TC PipeLines, L.P. | | | 1,875 | | | | 95,644 | |

| Teekay Offshore Partners, L.P. | | | 7,530 | | | | 253,083 | |

| Teekay Tankers Ltd. - Class A | | | 277,461 | | | | 724,173 | |

| Ultra Petroleum Corporation | | | 26,276 | | | | 482,427 | |

| Uranerz Energy Corporation | | | 533,293 | | | | 490,630 | |

| Uranium Energy Corporation | | | 484,371 | | | | 852,493 | |

| Uranium Resources, Inc. | | | 157,024 | | | | 370,577 | |

| Ur-Energy, Inc. | | | 117,560 | | | | 123,438 | |

| USEC, Inc. | | | 58,548 | | | | 471,897 | |

| Verenium Corporation | | | 115,638 | | | | 461,396 | |

| Western Refining, Inc. | | | 26,263 | | | | 847,507 | |

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued)

COMMON STOCKS — 63.5% (Continued) | | | | | | |

| Energy — 6.3% (Continued) | | | | | | |

| Oil, Gas & Consumable Fuels — 5.0% (Continued) | | | | | | |

| Whiting USA Trust I | | | 553,369 | | | $ | 2,905,187 | |

| World Fuel Services Corporation | | | 12,342 | | | | 470,847 | |

| Zion Oil & Gas, Inc. | | | 262,571 | | | | 430,616 | |

| | | | | | | | 78,838,953 | |

| Financials — 9.1% | | | | | | | | |

| Capital Markets — 1.5% | | | | | | | | |

| Apollo Investment Corporation | | | 312,856 | | | | 2,668,662 | |

| Calamos Asset Management, Inc. | | | 12,695 | | | | 124,665 | |

| Cohen & Steers, Inc. | | | 39,354 | | | | 1,509,619 | |

| Federated Investors, Inc. - Class B | | | 71,043 | | | | 1,926,686 | |

| Fidus Investment Corporation | | | 121,917 | | | | 2,476,134 | |

| Financial Engines, Inc. | | | 12,949 | | | | 723,461 | |

| Garrison Capital, Inc. | | | 21,311 | | | | 313,911 | |

| Gladstone Investment Corporation | | | 219,825 | | | | 1,554,163 | |

| Golub Capital BDC, Inc. | | | 106,911 | | | | 1,881,634 | |

| Hannon Armstrong Sustainable Infrastructure Capital, Inc. | | | 26,588 | | | | 325,703 | |

| Hercules Technology Growth Capital, Inc. | | | 71,951 | | | | 1,110,923 | |

| Horizon Technology Finance Corporation | | | 13,673 | | | | 184,312 | |

| INTL FCStone, Inc. | | | 51,236 | | | | 1,048,289 | |

| KCAP Financial, Inc. | | | 156,005 | | | | 1,315,122 | |

| Keating Capital, Inc. | | | 2,082 | | | | 14,491 | |

| Medley Capital Corporation | | | 19,493 | | | | 271,732 | |

| MVC Capital, Inc. | | | 10,675 | | | | 147,635 | |

| Noah Holdings Ltd. - ADR | | | 24,090 | | | | 464,696 | |

| Och-Ziff Capital Management Group, LLC | | | 50,083 | | | | 625,537 | |

| PennantPark Floating Rate Capital Ltd. | | | 28,718 | | | | 381,662 | |

| Prospect Capital Corporation | | | 107,917 | | | | 1,223,779 | |

| Rand Capital Corporation | | | 751 | | | | 2,140 | |

| Safeguard Scientifics, Inc. | | | 56,344 | | | | 983,203 | |

| Stifel Financial Corporation | | | 8,555 | | | | 350,327 | |

| TCP Capital Corporation | | | 13,928 | | | | 232,180 | |

| THL Credit, Inc. | | | 15,904 | | | | 258,440 | |

| TICC Capital Corporation | | | 157,401 | | | | 1,574,010 | |

| Triangle Capital Corporation | | | 12,112 | | | | 360,453 | |

| | | | | | | | 24,053,569 | |

| Commercial Banks — 3.3% | | | | | | | | |

| Ameris Bancorp | | | 30,895 | | | | 565,378 | |

| Arrow Financial Corporation | | | 26,523 | | | | 684,559 | |

| Athens Bancshares Corporation | | | 289 | | | | 5,216 | |

| Auburn National Bancorporation, Inc. | | | 25 | | | | 640 | |

| BancorpSouth, Inc. | | | 13,544 | | | | 299,322 | |

| Bank of Hawaii Corporation | | | 14,761 | | | | 855,843 | |

| Bank of the Ozarks, Inc. | | | 56,767 | | | | 2,808,831 | |

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued)

COMMON STOCKS — 63.5% (Continued) | | | | | | |

| Financials — 9.1% (Continued) | | | | | | |

| Commercial Banks — 3.3% (Continued) | | | | | | |

| Banner Corporation | | | 21,726 | | | $ | 831,237 | |

| Capital City Bank Group, Inc. | | | 17,627 | | | | 216,812 | |

| Cardinal Financial Corporation | | | 13,234 | | | | 218,361 | |

| Cascade Bancorp | | | 25,281 | | | | 130,703 | |

| Cathay General Bancorp | | | 24,871 | | | | 612,573 | |

| Citizens Holding Company | | | 589 | | | | 11,262 | |

| City Bank | | | 12,333 | | | | 1,418 | |

| City Holding Company | | | 66,177 | | | | 3,011,053 | |

| Columbia Banking System, Inc. | | | 49,591 | | | | 1,273,993 | |

| Commerce Bancshares, Inc. | | | 4,685 | | | | 215,557 | |

| Community Bank System, Inc. | | | 48,794 | | | | 1,771,710 | |

| CommunityOne Bancorp | | | 15,963 | | | | 171,762 | |

| Customers Bancorp, Inc. | | | 16,587 | | | | 277,832 | |

| CVB Financial Corporation | | | 13,586 | | | | 197,540 | |

| DNB Financial Corporation | | | 10 | | | | 208 | |

| Farmers Capital Bank Corporation | | | 316 | | | | 6,491 | |

| Fauquier Bankshares, Inc. | | | 323 | | | | 4,425 | |

| Fidelity Southern Corporation | | | 10,603 | | | | 161,901 | |

| First Busey Corporation | | | 156,204 | | | | 807,575 | |

| First Community Corporation | | | 75 | | | | 786 | |

| First Financial Bancorporation | | | 54,750 | | | | 849,720 | |

| First Financial Bankshares, Inc. | | | 59,163 | | | | 3,639,116 | |

| First Merchants Corporation | | | 7,096 | | | | 133,405 | |

| FNB Corporation | | | 2,134 | | | | 26,696 | |

| Frontier Financial Corporation | | | 10,318 | | | | 1,032 | |

| Fulton Financial Corporation | | | 9,994 | | | | 122,027 | |

| Glacier Bancorp, Inc. | | | 50,735 | | | | 1,401,808 | |

| Glen Burnie Bancorp | | | 49 | | | | 584 | |

| Hampton Roads Bankshares, Inc. | | | 178,524 | | | | 251,719 | |

| Hancock Holding Company | | | 30,619 | | | | 1,003,691 | |

| Heartland Financial USA, Inc. | | | 2,048 | | | | 54,252 | |

| Independent Bank Corporation (Massachusetts) | | | 55,084 | | | | 1,976,414 | |

| Independent Bank Corporation (Michigan) | | | 43,320 | | | | 421,070 | |

| Intervest Bancshares Corporation - Class A | | | 11,918 | | | | 86,882 | |

| Lakeland Bancorp, Inc. | | | 33,657 | | | | 383,690 | |

| Macatawa Bank Corporation | | | 35,844 | | | | 175,994 | |

| National Bank Holdings Corporation | | | 6,169 | | | | 129,549 | |

| National Penn Bancshares, Inc. | | | 63,385 | | | | 657,302 | |

| Oak Valley Bancorp | | | 270 | | | | 2,201 | |

| OFG Bancorp | | | 66,426 | | | | 983,769 | |

| Old National Bancorp | | | 25,366 | | | | 368,822 | |

| Old Second Bancorp, Inc. | | | 68,547 | | | | 326,969 | |

| OptimumBank Holdings, Inc. | | | 1,136 | | | | 1,681 | |

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued)

COMMON STOCKS — 63.5% (Continued) | | | | | | |

| Financials — 9.1% (Continued) | | | | | | |

| Commercial Banks — 3.3% (Continued) | | | | | | |

| Pacific Premier Bancorp, Inc. | | | 5,833 | | | $ | 81,137 | |

| PacWest Bancorp | | | 41,085 | | | | 1,563,284 | |

| Park National Corporation | | | 30,196 | | | | 2,392,127 | |

| Park Sterling Corporation | | | 26,509 | | | | 172,574 | |

| Patriot National Bancorp | | | 418 | | | | 506 | |

| Pinnacle Financial Partners, Inc. | | | 74,679 | | | | 2,315,049 | |

| Plumas Bancorp | | | 45 | | | | 288 | |

| Porter Bancorp, Inc. | | | 177 | | | | 198 | |

| Renasant Corporation | | | 67,423 | | | | 1,933,692 | |

| Republic Bancorp, Inc. - Class A | | | 25,920 | | | | 596,678 | |

| S&T Bancorp, Inc. | | | 7,105 | | | | 174,215 | |

| Southside Bancshares, Inc. | | | 83,168 | | | | 2,270,486 | |

| Southwest Bancorp, Inc. | | | 14,331 | | | | 229,439 | |

| State Bank Financial Corporation | | | 6,514 | | | | 111,129 | |

| Taylor Capital Group, Inc. | | | 59,033 | | | | 1,357,759 | |

| Texas Capital Bancshares, Inc. | | | 11,581 | | | | 602,791 | |

| TowneBank | | | 54,502 | | | | 793,549 | |

| Tristate Capital Holdings, Inc. | | | 1,519 | | | | 19,003 | |

| Two River Bancorp | | | 20 | | | | 150 | |

| Umpqua Holdings Corporation | | | 29,265 | | | | 479,068 | |

| Union First Market Bankshares Corporation | | | 23,923 | | | | 577,023 | |

| United Bancorp, Inc. | | | 539 | | | | 3,676 | |

| United Bankshares, Inc. | | | 108,538 | | | | 3,210,554 | |

| United Security Bancshares | | | 1,542 | | | | 7,923 | |

| Westamerica Bancorporation | | | 45,355 | | | | 2,334,875 | |

| Wintrust Financial Corporation | | | 47,364 | | | | 2,060,808 | |

| Yadkin Financial Corporation | | | 1,075 | | | | 17,652 | |

| | | | | | | | 51,447,014 | |

| Consumer Finance — 0.4% | | | | | | | | |

| Atlanticus Holdings Corporation | | | 106,479 | | | | 371,612 | |

| Encore Capital Group, Inc. | | | 127,994 | | | | 6,252,507 | |

| Green Dot Corporation - Class A | | | 12,087 | | | | 259,387 | |

| | | | | | | | 6,883,506 | |

| Diversified Financial Services — 0.1% | | | | | | | | |

| DJSP Enterprises, Inc. | | | 15,126 | | | | 2,118 | |

| Global Eagle Entertainment, Inc. | | | 19,502 | | | | 198,530 | |

| Life Partners Holdings, Inc. | | | 156,457 | | | | 316,043 | |

| Manhattan Bridge Capital, Inc. | | | 829 | | | | 1,865 | |

| MarketAxess Holdings, Inc. | | | 3,947 | | | | 257,463 | |

| | | | | | | | 776,019 | |

| Insurance — 0.9% | | | | | | | | |

| Arthur J. Gallagher & Company | | | 14,422 | | | | 684,324 | |

| Citizens, Inc. | | | 21,539 | | | | 180,928 | |

| CNA Financial Corporation | | | 2,682 | | | | 108,862 | |

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued)

COMMON STOCKS — 63.5% (Continued) | | | | | | |

| Financials — 9.1% (Continued) | | | | | | |

| Insurance — 0.9% (Continued) | | | | | | |

| eHealth, Inc. | | | 8,789 | | | $ | 374,587 | |

| First American Financial Corporation | | | 56,860 | | | | 1,470,400 | |

| Greenlight Capital Re Ltd. - Class A | | | 36,451 | | | | 1,122,326 | |

| HCI Group, Inc. | | | 9,413 | | | | 413,607 | |

| Hilltop Holdings, Inc. | | | 44,803 | | | | 776,884 | |

| Kingsway Financial Services, Inc. | | | 2,403 | | | | 7,666 | |

| Meadowbrook Insurance Group, Inc. | | | 387,812 | | | | 2,575,072 | |

| Montpelier Re Holdings Ltd. | | | 45,005 | | | | 1,242,588 | |

| Phoenix Companies, Inc. (The) | | | 17,713 | | | | 683,190 | |

| Primerica, Inc. | | | 24,215 | | | | 1,040,034 | |

| StanCorp Financial Group, Inc. | | | 3,862 | | | | 227,472 | |

| Stewart Information Services Corporation | | | 73,767 | | | | 2,310,382 | |

| Tower Group International Ltd. | | | 103,279 | | | | 374,903 | |

| | | | | | | | 13,593,225 | |

| Real Estate Investment Trusts (REIT) — 1.7% | | | | | | | | |

| Agree Realty Corporation | | | 13,108 | | | | 413,820 | |

| American Residential Properties, Inc. | | | 34,892 | | | | 601,189 | |

| AmREIT, Inc. | | | 10,164 | | | | 178,886 | |

| Armada Hoffler Properties, Inc. | | | 26,801 | | | | 257,826 | |

| Associated Estates Realty Corporation | | | 55,680 | | | | 854,131 | |

| Campus Crest Communities, Inc. | | | 48,580 | | | | 486,286 | |

| Chambers Street Properties | | | 101,178 | | | | 943,991 | |

| Colony Financial, Inc. | | | 32,610 | | | | 659,700 | |

| CommonWealth REIT | | | 6,305 | | | | 153,653 | |

| CYS Investments, Inc. | | | 212,899 | | | | 1,807,513 | |

| DCT Industrial Trust, Inc. | | | 54,858 | | | | 425,149 | |

| DuPont Fabros Technology, Inc. | | | 34,038 | | | | 845,844 | |

| Education Realty Trust, Inc. | | | 15,065 | | | | 137,694 | |

| Equity Lifestyle Properties, Inc. | | | 9,765 | | | | 370,972 | |

| Equity One, Inc. | | | 6,464 | | | | 155,847 | |

| First Potomac Realty Trust | | | 43,351 | | | | 532,784 | |

| Geo Group, Inc. (The) | | | 6,548 | | | | 230,948 | |

| Getty Realty Corporation | | | 70,928 | | | | 1,360,399 | |

| Gladstone Commercial Corporation | | | 1,602 | | | | 30,278 | |

| Invesco Mortgage Capital, Inc. | | | 8,589 | | | | 132,700 | |

| iStar Financial, Inc. | | | 151,413 | | | | 1,912,346 | |

| JAVELIN Mortgage Investment Corporation | | | 32,659 | | | | 387,662 | |

| Liberty Property Trust | | | 1,602 | | | | 59,578 | |

| Monmouth Real Estate Investment Corporation - Class A | | | 24,618 | | | | 226,978 | |

| New Residential Investment Corporation | | | 11,665 | | | | 77,106 | |

| New York Mortgage Trust, Inc. | | | 14,868 | | | | 95,453 | |

| NorthStar Realty Finance Corporation | | | 52,383 | | | | 488,733 | |

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued)

COMMON STOCKS — 63.5% (Continued) | | | | | | |

| Financials — 9.1% (Continued) | | | | | | |

| Real Estate Investment Trusts (REIT) — 1.7% (Continued) | | | | | | |

| Omega Healthcare Investors, Inc. | | | 53,446 | | | $ | 1,776,545 | |

| Parkway Properties, Inc. | | | 3,911 | | | | 70,828 | |

| PennyMac Mortgage Investment Trust | | | 8,243 | | | | 190,166 | |

| Preferred Apartment Communities, Inc. - Class A | | | 2,900 | | | | 24,012 | |

| Ramco-Gershenson Properties Trust | | | 19,890 | | | | 323,411 | |

| Redwood Trust, Inc. | | | 109,686 | | | | 1,921,699 | |

| Rouse Properties, Inc. | | | 118,326 | | | | 2,392,552 | |

| Sabra Health Care REIT, Inc. | | | 23,218 | | | | 624,564 | |

| Silver Bay Realty Trust Corporation | | | 17,962 | | | | 277,693 | |

| Spirit Realty Capital, Inc. | | | 60,877 | | | | 636,773 | |

| Walter Investment Management Corporation | | | 98,902 | | | | 3,735,529 | |

| Western Asset Mortgage Capital Corporation | | | 63,303 | | | | 1,019,811 | |

| Wheeler Real Estate Investment Trust, Inc. | | | 2,809 | | | | 11,798 | |

| | | | | | | | 26,832,847 | |

| Real Estate Management & Development — 0.3% | | | | | | | | |

| Alexander & Baldwin, Inc. | | | 3,013 | | | | 111,481 | |

| AV Homes, Inc. | | | 832 | | | | 15,891 | |

| Brookfield Property Partners, L.P. | | | 1,000 | | | | 19,260 | |

| China HGS Real Estate, Inc. | | | 4,201 | | | | 24,576 | |

| China Housing & Land Development, Inc. | | | 213,770 | | | | 575,041 | |

| Forest City Enterprises, Inc. | | | 139,761 | | | | 2,831,558 | |

| Gazit-Globe Ltd. | | | 1,213 | | | | 16,473 | |

| Kennedy-Wilson Holdings, Inc. | | | 44,876 | | | | 899,315 | |

| Mays (J.W.), Inc. | | | 125 | | | | 3,500 | |

| St. Joe Company (The) | | | 52,397 | | | | 978,252 | |

| | | | | | | | 5,475,347 | |

| Thrifts & Mortgage Finance — 0.9% | | | | | | | | |

| America First Tax Exempt Investors, L.P. | | | 10,633 | | | | 76,345 | |

| Astoria Financial Corporation | | | 37,732 | | | | 498,440 | |

| Banc of California, Inc. | | | 38,507 | | | | 543,334 | |

| BBX Capital Corporation - Class A | | | 24,803 | | | | 327,151 | |

| Beneficial Mutual Bancorp, Inc. | | | 48,826 | | | | 476,053 | |

| BofI Holding, Inc. | | | 2,698 | | | | 163,013 | |

| Brookline Bancorp, Inc. | | | 123,841 | | | | 1,098,470 | |

| Capitol Federal Financial, Inc. | | | 16,126 | | | | 204,316 | |

| CMS Bancorp, Inc. | | | 46 | | | | 371 | |

| First Federal Bancshares of Arkansas, Inc. | | | 5,667 | | | | 50,890 | |

| Five Oaks Investment Corporation | | | 14,164 | | | | 168,268 | |

| Freddie Mac | | | 50,442 | | | | 112,990 | |

| Greene County Bancorp, Inc. | | | 89 | | | | 2,174 | |

| Impac Mortgage Holdings, Inc. | | | 46,184 | | | | 314,051 | |

| NASB Financial, Inc. | | | 3,300 | | | | 84,975 | |

| Northfield Bancorp, Inc. | | | 13,151 | | | | 170,042 | |

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued)

COMMON STOCKS — 63.5% (Continued) | | | | | | |

| Financials — 9.1% (Continued) | | | | | | |

| Thrifts & Mortgage Finance — 0.9% (Continued) | | | | | | |

| Oconee Federal Financial Corporation | | | 100 | | | $ | 1,650 | |

| PennyMac Financial Services, Inc. - Class A | | | 3,726 | | | | 59,989 | |

| Provident Financial Holdings, Inc. | | | 17,485 | | | | 265,073 | |

| Provident New York Bancorp | | | 207,909 | | | | 2,436,693 | |

| Radian Group, Inc. | | | 333,301 | | | | 4,856,196 | |

| Security National Financial Corporation - Class A | | | 88,662 | | | | 520,446 | |

| Tree.com, Inc. | | | 3,782 | | | | 111,607 | |

| TrustCo Bank Corporation | | | 269,187 | | | | 1,808,937 | |

| ViewPoint Financial Group, Inc. | | | 1,459 | | | | 31,821 | |

| | | | | | | | 14,383,295 | |

| Health Care — 11.2% | | | | | | | | |

| Biotechnology — 6.5% | | | | | | | | |

| Aastrom Biosciences, Inc. | | | 35,395 | | | | 141,580 | |

| ACADIA Pharmaceuticals, Inc. | | | 65,057 | | | | 1,478,746 | |

| Achillion Pharmaceuticals, Inc. | | | 150,691 | | | | 378,234 | |

| Aegerion Pharmaceuticals, Inc. | | | 6,548 | | | | 542,305 | |

| AEterna Zentaris, Inc. | | | 325,185 | | | | 439,000 | |

| Alnylam Pharmaceuticals, Inc. | | | 3,334 | | | | 192,072 | |

| Amarin Corporation plc - ADR | | | 919,383 | | | | 1,516,982 | |

| Anthera Pharmaceuticals, Inc. | | | 18,201 | | | | 57,515 | |

| ARCA Biopharma, Inc. | | | 341,488 | | | | 464,424 | |

| Arena Pharmaceuticals, Inc. | | | 80,919 | | | | 355,234 | |

| Ariad Pharmaceuticals, Inc. | | | 31,019 | | | | 68,242 | |

| Arrowhead Research Corporation | | | 52,664 | | | | 368,648 | |

| BioTime, Inc. | | | 259,137 | | | | 940,667 | |

| bluebird bio, Inc. | | | 10,566 | | | | 224,528 | |

| Cardium Therapeutics, Inc. | | | 15,545 | | | | 11,970 | |

| Catalyst Pharmaceutical Partners, Inc. | | | 281,358 | | | | 455,800 | |

| Cell Therapeutics, Inc. | | | 25,920 | | | | 45,619 | |

| Celldex Therapeutics, Inc. | | | 227,223 | | | | 5,205,679 | |

| Celsion Corporation | | | 563,445 | | | | 2,265,049 | |

| Cepheid | | | 25,602 | | | | 1,042,513 | |

| Chelsea Therapeutics International Ltd. | | | 386,078 | | | | 1,092,601 | |

| Cleveland BioLabs, Inc. | | | 282,604 | | | | 389,994 | |

| Coronado Biosciences, Inc. | | | 142,197 | | | | 237,469 | |

| Cubist Pharmaceuticals, Inc | | | 273,707 | | | | 528,255 | |

| Cyclacel Pharmaceuticals, Inc. | | | 34,204 | | | | 120,056 | |

| Cytori Therapeutics, Inc. | | | 110,201 | | | | 227,014 | |

| DARA BioSciences, Inc. | | | 594,711 | | | | 291,408 | |

| Dendreon Corporation | | | 2,776,373 | | | | 7,135,279 | |

| Discovery Laboratories, Inc. | | | 58,720 | | | | 120,963 | |

| Durata Therapeutics, Inc. | | | 71,202 | | | | 689,235 | |

| Dynavax Technologies Corporation | | | 119,493 | | | | 146,976 | |

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued)

COMMON STOCKS — 63.5% (Continued) | | | | | | |

| Health Care — 11.2% (Continued) | | | | | | |

| Biotechnology — 6.5% (Continued) | | | | | | |

| Exelixis, Inc. | | | 634,567 | | | $ | 3,128,415 | |

| Fibrocell Science, Inc. | | | 64,609 | | | | 239,053 | |

| Galectin Therapeutics, Inc. | | | 213,775 | | | | 2,233,949 | |

| Galena Biopharma, Inc. | | | 2,271,732 | | | | 5,065,962 | |

| Genomic Health, Inc. | | | 4,978 | | | | 148,942 | |

| Geron Corporation | | | 91,827 | | | | 362,717 | |

| Horizon Pharma, Inc. | | | 190,320 | | | | 797,441 | |

| Hyperion Therapeutics, Inc. | | | 20,516 | | | | 410,936 | |

| iBio, Inc. | | | 205,076 | | | | 72,289 | |

| Idenix Pharmaceuticals, Inc. | | | 367,944 | | | | 1,210,536 | |

| Idera Pharmaceuticals, Inc. | | | 393,243 | | | | 723,567 | |

| ImmunoGen, Inc. | | | 11,751 | | | | 193,422 | |

| Immunomedics, Inc. | | | 218,791 | | | | 829,218 | |

| Infinity Pharmaceuticals, Inc. | | | 177,473 | | | | 2,404,759 | |

| Inovio Pharmaceuticals, Inc. | | | 814,597 | | | | 1,409,253 | |

| Insmed, Inc. | | | 101,709 | | | | 1,448,336 | |

| Insys Therapeutics, Inc. | | | 25,238 | | | | 1,006,744 | |

| InterMune, Inc. | | | 394,812 | | | | 5,562,901 | |

| Intrexon Corporation | | | 12,347 | | | | 261,756 | |

| Ironwood Pharmaceuticals, Inc. | | | 464,950 | | | | 4,468,170 | |

| IsoRay, Inc. | | | 299,790 | | | | 154,392 | |

| Keryx Biopharmaceuticals, Inc. | | | 103,055 | | | | 1,066,619 | |

| Kythera Biopharmaceuticals, Inc. | | | 7,287 | | | | 325,802 | |

| MannKind Corporation | | | 466,608 | | | | 2,281,713 | |

| Marina Biotech, Inc. | | | 244,030 | | | | 58,567 | |

| Mast Therapeutics, Inc. | | | 1,138,317 | | | | 557,775 | |

| Medgenics, Inc. | | | 125,667 | | | | 923,652 | |

| MediciNova, Inc. | | | 120,557 | | | | 297,776 | |

| MEI Pharma, Inc. | | | 103,114 | | | | 826,974 | |

| Metabolix, Inc. | | | 296,223 | | | | 325,845 | |

| MiMedx Group, Inc. | | | 451,087 | | | | 2,390,761 | |

| NanoViricides, Inc. | | | 105,221 | | | | 570,298 | |

| NeoStem, Inc. | | | 153,113 | | | | 973,799 | |

| Neuralstem, Inc. | | | 352,800 | | | | 786,744 | |

| Neurocrine Biosciences, Inc. | | | 9,210 | | | | 86,942 | |

| NewLink Genetics Corporation | | | 97,745 | | | | 1,637,229 | |

| Nymox Pharmaceutical Corporation | | | 86,485 | | | | 608,854 | |

| Omeros Corporation | | | 77,198 | | | | 771,980 | |

| Oncolytics Biotech, Inc. | | | 369,376 | | | | 982,540 | |

| Opexa Therapeutics, Inc. | | | 276,243 | | | | 511,050 | |

| OPKO Health, Inc. | | | 228,858 | | | | 2,293,161 | |

| Oragenics, Inc. | | | 2,139 | | | | 5,604 | |

| Orexigen Therapeutics, Inc. | | | 43,309 | | | | 211,348 | |

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued)

COMMON STOCKS — 63.5% (Continued) | | | | | | |

| Health Care — 11.2% (Continued) | | | | | | |

| Biotechnology — 6.5% (Continued) | | | | | | |

| Organovo Holdings, Inc. | | | 170,603 | | | $ | 1,240,284 | |

| Osiris Therapeutics, Inc. | | | 50,844 | | | | 676,734 | |

| OXiGENE, Inc. | | | 30,225 | | | | 76,469 | |

| Oxygen Biotherapeutics, Inc. | | | 20,826 | | | | 63,103 | |

| Palatin Technologies, Inc. | | | 3,448 | | | | 2,000 | |

| Peregrine Pharmaceuticals, Inc. | | | 605,183 | | | | 780,686 | |

| PharmAthene, Inc. | | | 262,583 | | | | 538,295 | |

| Pluristem Therapeutics, Inc. | | | 169,230 | | | | 555,074 | |

| Prana Biotechnology Ltd. - ADR | | | 98,989 | | | | 446,440 | |

| Raptor Pharmaceutical Corporation | | | 76,674 | | | | 1,102,572 | |

| Repligen Corporation | | | 25,645 | | | | 280,556 | |

| Rexahn Pharmaceuticals, Inc. | | | 1,103,625 | | | | 455,797 | |

| Rosetta Genomics Ltd. | | | 159,480 | | | | 425,812 | |

| Sangamo BioSciences, Inc. | | | 51,299 | | | | 480,672 | |

| Sarepta Therapeutics, Inc. | | | 22,273 | | | | 867,311 | |

| Savient Pharmaceuticals, Inc. | | | 1,070,379 | | | | 46,562 | |

| SIGA Technologies, Inc. | | | 40,862 | | | | 140,157 | |

| Spectrum Pharmaceuticals, Inc. | | | 344,693 | | | | 2,960,913 | |

| StemCells, Inc. | | | 173,413 | | | | 230,639 | |

| Stemline Therapeutics, Inc. | | | 1,131 | | | | 31,476 | |

| Sunesis Pharmaceuticals, Inc. | | | 288,449 | | | | 1,445,130 | |

| Synageva BioPharma Corporation | | | 4,367 | | | | 221,844 | |

| Synergy Pharmaceuticals, Inc. | | | 135,330 | | | | 546,733 | |

| Synta Pharmaceuticals Corporation | | | 835,008 | | | | 3,790,936 | |

| Synthetic Biologics, Inc. | | | 80,610 | | | | 120,915 | |

| Tekmira Pharmaceuticals Corporation | | | 2,838 | | | | 25,400 | |

| TESARO, Inc. | | | 22,370 | | | | 861,245 | |

| TG Therapeutics, Inc. | | | 91,258 | | | | 329,441 | |

| Vanda Pharmaceuticals, Inc. | | | 239,415 | | | | 1,714,211 | |

| Venaxis, Inc. | | | 273,845 | | | | 503,875 | |

| Zalicus, Inc. | | | 1 | | | | 4 | |

| ZIOPHARM Oncology, Inc. | | | 1,312,395 | | | | 4,645,878 | |

| | | | | | | | 103,409,012 | |

| Health Care Equipment & Supplies — 2.3% | | | | | | | | |

| Abaxis, Inc. | | | 5,225 | | | | 186,689 | |

| Abiomed, Inc. | | | 92,012 | | | | 2,206,448 | |

| Accuray, Inc. | | | 225,333 | | | | 1,520,998 | |

| Antares Pharma, Inc. | | | 72,746 | | | | 290,984 | |

| Atossa Genetics, Inc. | | | 133,976 | | | | 235,798 | |

| Bacterin International Holdings, Inc. | | | 340,137 | | | | 201,735 | |

| BIOLASE, Inc. | | | 159,283 | | | | 297,859 | |

| BSD Medical Corporation | | | 828,821 | | | | 1,309,537 | |

| Cerus Corporation | | | 17,903 | | | | 112,968 | |

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued)

COMMON STOCKS — 63.5% (Continued) | | | | | | |

| Health Care — 11.2% (Continued) | | | | | | |

| Health Care Equipment & Supplies — 2.3% (Continued) | | | | | | |

| Cyberonics, Inc. | | | 2,534 | | | $ | 146,364 | |

| Cynosure, Inc. | | | 43,798 | | | | 946,475 | |

| Delcath Systems, Inc. | | | 1,522,006 | | | | 499,218 | |

| Echo Therapeutics, Inc. | | | 91,640 | | | | 232,765 | |

| Fonar Corporation | | | 27,673 | | | | 301,359 | |

| GenMark Diagnostics, Inc. | | | 229,356 | | | | 2,775,208 | |

| Hansen Medical, Inc. | | | 62,107 | | | | 112,414 | |

| InspireMD, Inc. | | | 132,728 | | | | 374,293 | |

| Insulet Corporation | | | 7,870 | | | | 307,087 | |

| Integra LifeSciences Holdings Corporation | | | 6,176 | | | | 282,737 | |

| Masimo Corporation | | | 3,117 | | | | 79,857 | |

| MELA Sciences, Inc. | | | 631,264 | | | | 452,932 | |

| Meridian Bioscience, Inc. | | | 134,311 | | | | 3,320,168 | |

| Navidea Biopharmaceuticals, Inc. | | | 682,839 | | | | 1,365,678 | |

| NxStage Medical, Inc. | | | 9,117 | | | | 120,982 | |

| OraSure Technologies, Inc. | | | 87,527 | | | | 570,676 | |

| Quidel Corporation | | | 79,885 | | | | 1,973,159 | |

| ResMed, Inc. | | | 3,040 | | | | 157,290 | |

| Rockwell Medical, Inc. | | | 469,367 | | | | 5,407,108 | |

| Solta Medical, Inc. | | | 92,279 | | | | 170,716 | |

| Spectranetics Corporation (The) | | | 20,964 | | | | 437,938 | |

| Stereotaxis, Inc. | | | 362,797 | | | | 1,585,423 | |

| Synergetics USA, Inc. | | | 13,748 | | | | 57,192 | |

| TearLab Corporation | | | 346,400 | | | | 3,612,952 | |

| Unilife Corporation | | | 1,141,530 | | | | 3,458,836 | |

| Uroplasty, Inc. | | | 15,325 | | | | 46,435 | |

| Vermillion, Inc. | | | 12,777 | | | | 31,176 | |

| Volcano Corporation | | | 38,542 | | | | 738,850 | |

| Wright Medical Group, Inc. | | | 5,959 | | | | 161,906 | |

| | | | | | | | 36,090,210 | |

| Health Care Providers & Services — 0.9% | | | | | | | | |

| Acadia Healthcare Company, Inc. | | | 19,528 | | | | 846,734 | |

| Accretive Health, Inc. | | | 57,474 | | | | 474,735 | |

| Air Methods Corporation | | | 32,816 | | | | 1,434,715 | |

| Bio-Reference Laboratories, Inc. | | | 79,614 | | | �� | 2,580,290 | |

| Chemed Corporation | | | 23,602 | | | | 1,600,688 | |

| FAB Universal Corporation | | | 674,707 | | | | 4,230,413 | |

| Healthways, Inc. | | | 30,591 | | | | 294,591 | |

| IPC The Hospitalist Company, Inc. | | | 18,816 | | | | 1,030,929 | |

| Owens & Minor, Inc. | | | 26,127 | | | | 977,672 | |

| Patterson Companies, Inc. | | | 586 | | | | 24,911 | |

| Team Health Holdings, Inc. | | | 1,896 | | | | 82,362 | |

| Universal American Corporation | | | 49,721 | | | | 368,930 | |

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued)

COMMON STOCKS — 63.5% (Continued) | | | | | | |

| Health Care — 11.2% (Continued) | | | | | | |

| Health Care Providers & Services — 0.9% (Continued) | | | | | | |

| USMD Holdings, Inc. | | | 435 | | | $ | 12,106 | |

| | | | | | | | 13,959,076 | |

| Health Care Technology — 0.2% | | | | | | | | |

| Allscripts Healthcare Solutions, Inc. | | | 206,086 | | | | 2,850,169 | |

| Computer Programs and Systems, Inc. | | | 361 | | | | 20,592 | |

| MGT Capital Investment, Inc. | | | 8,381 | | | | 24,305 | |

| Streamline Health Solutions, Inc. | | | 3,595 | | | | 29,299 | |

| | | | | | | | 2,924,365 | |

| Life Sciences Tools & Services — 0.3% | | | | | | | | |

| Accelerate Diagnostics, Inc. | | | 78,116 | | | | 1,001,447 | |

| Apricus Biosciences, Inc. | | | 279,454 | | | | 539,346 | |

| Bioanalytical Systems, Inc. | | | 6,029 | | | | 11,093 | |

| BioDelivery Sciences International, Inc. | | | 152,145 | | | | 798,761 | |

| CombiMatrix Corporation | | | 166,061 | | | | 459,989 | |

| Genetic Technologies Ltd. - ADR | | | 70,962 | | | | 134,828 | |

| Life Technologies Corporation | | | 2,587 | | | | 194,827 | |

| PURE Bioscience, Inc. | | | 59,879 | | | | 80,238 | |

| Sequenom, Inc. | | | 711,218 | | | | 1,365,539 | |

| | | | | | | | 4,586,068 | |

| Pharmaceuticals — 1.0% | | | | | | | | |

| AcelRx Pharmaceuticals, Inc. | | | 155,781 | | | | 1,046,848 | |

| Acura Pharmaceuticals, Inc. | | | 156,634 | | | | 266,278 | |

| Alexza Pharmaceuticals, Inc. | | | 298,969 | | | | 1,491,855 | |

| Ampio Pharmaceuticals, Inc. | | | 238,220 | | | | 2,105,865 | |

| ANI Pharmaceuticals, Inc. | | | 46,691 | | | | 478,583 | |

| Aoxing Pharmaceutical Company, Inc. | | | 11,481 | | | | 2,711 | |

| Aratana Therapeutics, Inc. | | | 6,249 | | | | 124,730 | |

| Auxilium Pharmaceuticals, Inc. | | | 16,490 | | | | 283,793 | |

| AVANIR Pharmaceuticals, Inc. - Class A | | | 72,663 | | | | 294,285 | |

| Cadence Pharmaceuticals, Inc. | | | 30,796 | | | | 151,824 | |

| Columbia Laboratories, Inc. | | | 38,680 | | | | 278,496 | |

| DURECT Corporation | | | 20,263 | | | | 30,394 | |

| Emisphere Technologies, Inc. | | | 4,999 | | | | 950 | |

| Endocyte, Inc. | | | 56,884 | | | | 593,300 | |

| GW Pharmaceuticals plc - ADR | | | 16,072 | | | | 487,946 | |

| IntelliPharmaCeutics International, Inc. | | | 61,706 | | | | 113,539 | |

| Jazz Pharmaceuticals plc | | | 2,194 | | | | 199,084 | |

| Novabay Pharmaceuticals, Inc. | | | 80,822 | | | | 134,164 | |

| NuPathe, Inc. | | | 210,804 | | | | 354,151 | |

| Oculus Innovative Sciences, Inc. | | | 1,767 | | | | 4,559 | |

| Pacira Pharmaceuticals, Inc. | | | 6,207 | | | | 313,516 | |

| Repros Therapeutics, Inc. | | | 132,176 | | | | 2,384,455 | |

| VIVUS, Inc. | | | 362,479 | | | | 3,403,678 | |

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued)

COMMON STOCKS — 63.5% (Continued) | | | | | | |

| Health Care — 11.2% (Continued) | | | | | | |

| Pharmaceuticals — 1.0% (Continued) | | | | | | |

| XenoPort, Inc. | | | 144,854 | | | $ | 757,586 | |

| Zogenix, Inc. | | | 326,617 | | | | 956,988 | |

| | | | | | | | 16,259,578 | |

| Industrials — 7.4% | | | | | | | | |

| Aerospace & Defense — 0.9% | | | | | | | | |

| Ascent Solar Technologies, Inc. | | | 505,545 | | | | 475,212 | |

| Elbit Systems Ltd. | | | 24 | | | | 1,286 | |

| GenCorp, Inc. | | | 299,282 | | | | 5,027,937 | |

| Huntington Ingalls Industries, Inc. | | | 41,143 | | | | 2,943,782 | |

| KEYW Holding Corporation (The) | | | 227,686 | | | | 2,618,389 | |

| LMI Aerospace, Inc. | | | 69,326 | | | | 1,088,418 | |

| National Presto Industries, Inc. | | | 32,552 | | | | 2,296,544 | |

| Taser International, Inc. | | | 10,530 | | | | 187,118 | |

| | | | | | | | 14,638,686 | |

| Air Freight & Logistics — 0.2% | | | | | | | | |

| XPO Logistics, Inc. | | | 155,770 | | | | 3,143,439 | |

| | | | | | | | | |

Airlines — 0.0% (a) | | | | | | | | |

| AMR Corporation | | | 10,761 | | | | 79,094 | |

| Spirit Airlines, Inc. | | | 49 | | | | 2,114 | |

| US Airways Group, Inc. | | | 13,431 | | | | 295,079 | |

| | | | | | | | 376,287 | |

| Building Products — 0.1% | | | | | | | | |

| Builders FirstSource, Inc. | | | 25,197 | | | | 186,710 | |

| NCI Building Systems, Inc. | | | 126,630 | | | | 1,827,271 | |

| Nortek, Inc. | | | 1,393 | | | | 97,747 | |

| Ply Gem Holdings, Inc. | | | 2,066 | | | | 30,783 | |

| USG Corporation | | | 5,823 | | | | 159,026 | |

| | | | | | | | 2,301,537 | |

| Commercial Services & Supplies — 0.9% | | | | | | | | |

| ACCO Brands Corporation | | | 318,858 | | | | 1,865,319 | |

| Cenveo, Inc. | | | 468,533 | | | | 1,471,194 | |

| China Recycling Energy Corporation | | | 23,454 | | | | 70,128 | |

| Consolidated Graphics, Inc. | | | 1,034 | | | | 66,269 | |

| EnerNOC, Inc. | | | 4,852 | | | | 80,689 | |

| Healthcare Services Group, Inc. | | | 134,474 | | | | 3,683,243 | |

| Heritage-Crystal Clean, Inc. | | | 1,466 | | | | 25,904 | |

| Industrial Services of America, Inc. | | | 21,860 | | | | 50,278 | |

| InnerWorkings, Inc. | | | 175,536 | | | | 1,679,880 | |

| Intersections, Inc. | | | 60,248 | | | | 516,325 | |

| McGrath RentCorp | | | 5,306 | | | | 189,265 | |

| Mobile Mini, Inc. | | | 143 | | | | 5,165 | |

| Quad/Graphics, Inc. - Class A | | | 32,667 | | | | 1,140,732 | |

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued)

COMMON STOCKS — 63.5% (Continued) | | | | | | |

| Industrials — 7.4% (Continued) | | | | | | |

| Commercial Services & Supplies — 0.9% (Continued) | | | | | | |

| RINO International Corporation | | | 67,543 | | | $ | 2,026 | |

| Standard Register Company (The) | | | 3,708 | | | | 31,518 | |

| Team, Inc. | | | 13,994 | | | | 521,836 | |

| United Stationers, Inc. | | | 44,696 | | | | 1,986,290 | |

| | | | | | | | 13,386,061 | |

| Construction & Engineering — 0.2% | | | | | | | | |

| Aegion Corporation | | | 28,799 | | | | 590,379 | |

| Ameresco, Inc. - Class A | | | 8,416 | | | | 88,031 | |

| Great Lakes Dredge & Dock Company | | | 65,341 | | | | 530,569 | |

| Layne Christensen Company | | | 31,127 | | | | 601,996 | |

| MasTec, Inc. | | | 32,849 | | | | 1,050,183 | |

| | | | | | | | 2,861,158 | |

| Electrical Equipment — 1.5% | | | | | | | | |

| Advanced Battery Technologies, Inc. | | | 596,378 | | | | 122,258 | |

| Altair Nanotechnologies, Inc. | | | 72,700 | | | | 338,055 | |

| Capstone Turbine Corporation | | | 685,947 | | | | 871,153 | |

| China BAK Battery, Inc. | | | 147,694 | | | | 305,727 | |

| China Ming Yang Wind Power Group Ltd. - ADR | | | 243,703 | | | | 604,383 | |

| Coleman Cable, Inc. | | | 14,420 | | | | 354,732 | |

| Digital Power Corporation | | | 712 | | | | 491 | |

| ECOtality, Inc. | | | 270,888 | | | | 14,086 | |

| Encore Wire Corporation | | | 21,055 | | | | 1,042,854 | |

| FuelCell Energy, Inc. | | | 167,557 | | | | 224,526 | |

| Generac Holdings, Inc. | | | 3,246 | | | | 160,190 | |

| General Cable Corporation | | | 14,694 | | | | 483,873 | |

| GrafTech International Ltd. | | | 273,599 | | | | 2,435,031 | |

| Highpower International, Inc. | | | 4,308 | | | | 12,235 | |

| Hydrogenics Corporation | | | 35,048 | | | | 427,936 | |

| Jinpan International Ltd. | | | 8,432 | | | | 51,604 | |

| New Energy Systems Group | | | 9,385 | | | | 1,314 | |

| Ocean Power Technologies, Inc. | | | 134,107 | | | | 315,151 | |

| Plug Power, Inc. | | | 855,346 | | | | 496,101 | |

| Power Solutions International, Inc. | | | 15,230 | | | | 887,300 | |

| PowerSecure International, Inc. | | | 91,162 | | | | 1,648,209 | |

| Real Goods Solar, Inc. - Class A | | | 1,582,086 | | | | 5,299,988 | |

| Regal-Beloit Corporation | | | 11,033 | | | | 809,050 | |

| Revolution Lighting Technologies, Inc. | | | 1,689,397 | | | | 5,051,297 | |

| SolarCity Corporation | | | 18,438 | | | | 982,377 | |

| Trina Solar Ltd. - ADR | | | 19,120 | | | | 280,490 | |

| Ultralife Corporation | | | 3,008 | | | | 11,731 | |

| Yingli Green Energy Holding Company Ltd. - ADR | | | 51,078 | | | | 306,468 | |

| | | | | | | | 23,538,610 | |

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued)

COMMON STOCKS — 63.5% (Continued) | | | | | | |

| Industrials — 7.4% (Continued) | | | | | | |