Washington, D.C. 20549

Wade R. Bridge, Esq.

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

October 31, 2010

For more information or assistance in opening an account,

please call toll-free 1-888-534-2001.

December 17, 2010

Dear Shareholder,

Enclosed is the Annual Report to shareholders of the TFS Market Neutral Fund (ticker: TFSMX) and the TFS Small Cap Fund (ticker: TFSSX) for the fiscal year ended October 31, 2010. On behalf of the investment manager, TFS Capital LLC (“TFS Capital”), I’d like to thank you for your investment.

At this time, TFS Capital would like to report that the TFS Market Neutral Fund will be returning to a “soft close” status effective January 10, 2011. A “soft close” means that TFSMX will be open for additional investment by all current investors and financial advisers that have previously allocated client assets to the Fund. The TFS Capital research team believes it has been successful in uncovering additional investment strategies that will permit the Fund to increase its current asset level.

As you may recall, the Fund implemented a “hard close” in January of 2010 in an effort to greatly limit Fund growth. The “hard close” was successful as the Fund maintained a narrow asset range since the close of between $1.0 to $1.2 billion. Please note that TFS Capital may recommend that the Fund revert back to a “hard close” in the future. Given the rising demand for “market-neutral-equity” strategies in mutual funds, a shift back to a hard close could occur quickly.

TFS Capital invested heavily in 2010 to strengthen its operations. Notably, the firm now has relationships with three separate brokerage firms to minimize its dependence on any one firm. Moreover, it has continued to automate trading, through enhancements in its proprietary trading software, which enables it to capitalize more quickly on perceived inefficiencies. TFS Capital’s infrastructure enhancements enabled it to trade more than 2 billion shares, representing greater than $22 billion in value, on behalf of the Funds during the fiscal year.

It is notable that the TFS Small Cap Fund remains open to existing and new investors. This Fund provides investors with another way to gain exposure to the management team at TFS Capital.

Below are performance highlights for the Funds.

TFS Market Neutral Fund (ticker: TFSMX)

| | | | Since Inception (9/7/2004) |

| TFS Market Neutral Fund | 6.60% | 4.68% | 9.64% | 9.00% |

| S&P 500 Index | 16.52% | -6.49% | 1.73% | 2.97% |

Average annual total returns for periods ended October 31, 2010

TFSMX’s performance over longer-term periods compares favorably to the overall U.S. equity market as measured by the S&P 500 Index. From inception through October 31, 2010, TFSMX generated a 9.00% average annual return and had an annualized standard deviation of 8.58%, whereas the S&P 500 Index generated a 2.97% average annual return and had an annualized standard deviation of 22.90%. Therefore, from inception through October 31, 2010, TFSMX produced an average annual return that was 6.03 percentage points above that of the S&P 500 Index while subjecting investors to only 37.5% of the volatility. At the end of October 2010, the trailing 5-year return placed TFSMX as the top performing fund in the Lipper “Market Neutral” category.1

During the period, TFSMX’s returns were largely driven by equity selection by the portfolio management team. In making these selections, the portfolio management team continued to follow TFS Capital’s proprietary stock selection models. These models are designed to predict the future performance of individual stocks relative to the overall U.S. equity market.

The broad U.S. equity market experienced a large gain during the fiscal period of 16.52% but this had little impact on TFSMX given its ongoing hedge and corresponding low “beta” (i.e., market exposure) during the period. The positive “alpha” production by the Fund during the period (i.e., return that cannot be explained by the Fund’s market exposure), provides evidence of good stock selection decisions by the portfolio management team.

The strategies used in managing TFSMX have resulted in the Fund having a low correlation to other asset classes. According to Modern Portfolio Theory, investors may benefit by combining non-correlated investments. For your reference, below are the Fund’s correlations to several other asset classes.

| Correlation Since Inception |

| S&P 500 Index | 0.55 |

Russell 2000® Index | 0.52 |

| MSCI EAFE Index | 0.48 |

| Barclays Capital U.S. Agg. Bond Index | -0.11 |

| Wilshire REIT ETF Index | 0.39 |

| Dow Jones Commodity Futures | 0.44 |

Earlier his year, Morningstar created a new fund category (“Market Neutral”) and added the TFS Market Neutral Fund to it. TFSMX had previously been placed in Morningstar’s “Long-Short” category. TFS Capital sees this new category as a positive shift for the Fund given that, with an average beta below 0.2 and a relatively “static” hedge, it is, in our opinion, more appropriately placed in this category for comparison purposes. This category is populated with other mutual funds like TFSMX (i.e., funds with a low beta that generate the vast majority of their return stream from alpha).

On December 12, 2010, TFSMX paid its annual capital gains distribution. The distribution of $1.486 per share was higher than in past years and higher than is expected on average. The distribution, on a percentage basis, actually exceeded the Fund’s gain for the year. This situation is not unexpected given the high portfolio turnover of the Fund and the lower-than-expected distributions from prior years. Generally speaking, TFSMX is not expected to be a tax efficient fund and one may expect that a large percentage of any appreciation of fund value will be distributed annually in the form of capital gains.

TFS Small Cap Fund (ticker: TFSSX)

| | | | Since Inception (3/7/2006) |

| TFS Small Cap Fund | 28.40% | 2.94% | 7.66% |

Russell 2000® Index | 26.58% | -3.91% | 0.83% |

Average annual total returns for periods ended October 31, 2010

As evidenced by the return figures above, TFSSX has continued to achieve its objective of outperforming the Russell 2000® Index. In fact, the Fund now has over a 4-year track record and has achieved an average annual return that is 6.83 percentage points higher than that of the Russell 2000® Index. On a cumulative basis since inception, TFSSX generated a 40.96% total return compared to 4.00% total return for the Russell 2000® Index. At the end of October 2010, the trailing 3-year return placed TFSSX in the top 2% of the Lipper “Small Cap Core” category.1

During the period, TFSSX’s returns were largely driven by the favorable market conditions overall. That is, the broad U.S. equity market and, more specifically, the “small cap” segment experienced large gains. Given its long-only mandate, the Fund will generally correlate to U.S. small-cap equity market movements with some deviation attributable to TFS Capital’s equity selection.

Despite the Funds’ excellent performance, we do not recommend allocating a high percentage of one’s assets to either Fund given the risks inherent in the Funds. Rather, we believe that they are best used as a component of a diversified portfolio of investments. If you have any questions about the Funds or TFS Capital, please contact us.

Best regards,

Larry S. Eiben

Chief Operating Officer & Co-Portfolio Manager

TFS Capital LLC

The performance data quoted represents past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment in the Funds will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Funds charge a 2% redemption penalty on shares invested for less than 90 days. If shares are redeemed within the 90 day period, investment returns would be reduced from those shown above. Fee waivers and/or expense reimbursements by the Adviser have positively impacted the Funds’ performance. Without such waivers and/or reimbursements, performance would have been lower. An investor should consider the investment objectives, risks, charges and expenses of the Funds carefully before investing. To obtain a summary prospectus and/or prospectus, which each contain this and other important information, go to www.TFSCapital.com or call (888) 534-2001. Please read the summary prospectus and/or prospectus carefully before investing. The Funds may not be suitable for all investors.

| 1 | TFSMX was ranked #1 out of 31 in the Lipper “Market Neutral” category using its 5-year return. TFSMX was ranked #1 out of 45 in the Lipper “Market Neutral” category using its 5-year return. TFSMX was ranked #9 out of 69 in the Lipper “Market Neutral” category using its 1-year return. TFSSX was ranked #7 out of 684 in the Lipper “Small Cap Core” category using its 3-year return. TFSSX was ranked #364 out of 778 in the Lipper “Small Cap Core” category using its 1-year return. |

Ranking information provided by Lipper for the periods ended October 31, 2010. TFSSX was assigned by Lipper to the Small-Cap Core category. TFSMX was assigned by Lipper to the Market Neutral category. The Funds are ranked based on total return and are ranked within a universe of funds with similar investment objectives. Rankings include the reinvestment of dividends and capital gains but exclude the effect of a fund’s sales load, if applicable. Fund rankings are calculated monthly by Lipper Analytical Services of New York. Lipper Inc. is a nationally recognized organization that ranks the performance of mutual funds.

TFS MARKET NEUTRAL FUND PERFORMANCE INFORMATION (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment in the

TFS Market Neutral Fund versus the S&P 500 Index

Average Annual Total Returns(a) For the periods ended October 31, 2010 |

| | 1 Year | 5 Years | Since Inception(b) |

| TFS Market Neutral Fund | 6.60% | 9.64% | 9.00% |

| S&P 500 Index | 16.52% | 1.73% | 2.97% |

| (a) | The total returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| | |

| (b) | Initial public offering of shares was September 7, 2004. |

TFS SMALL CAP FUND PERFORMANCE INFORMATION (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment in the

TFS Small Cap Fund versus the Russell 2000 Index

Average Annual Total Returns(a) For the periods ended October 31, 2010 |

| | 1 Year | Since Inception(b) |

| TFS Small Cap Fund | 28.40% | 7.66% |

| Russell 2000 Index | 26.58% | 0.83% |

| (a) | The total returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| | |

| (b) | Initial public offering of shares was March 7, 2006. |

TFS MARKET NEUTRAL FUND PORTFOLIO INFORMATION October 31, 2010 (Unaudited) |

TFS Market Neutral Fund vs S&P 500 Index

Net Sector Exposure*

| * | The net percentages for the TFS Market Neutral Fund are computed by taking the net dollar exposure, including short positions, and dividing by the net assets of the Fund. Consequently, the percentages are not likely to total to 100%. |

Top 10 Long Equity Positions | | Top 10 Short Equity Positions |

| | | | |

| King Pharmaceuticals, Inc. | 0.47% | | Great Atlantic & Pacific Tea Company, Inc. (The) | 0.46% |

| BE Aerospace, Inc. | 0.47% | | iStar Financial, Inc. | 0.45% |

| United Rentals, Inc. | 0.43% | | Texas Industries, Inc. | 0.41% |

| SUPERVALU, Inc. | 0.41% | | WESCO International, Inc. | 0.35% |

| Corn Products International, Inc. | 0.40% | | MELA Sciences, Inc. | 0.35% |

| Alliance Data Systems Corporation | 0.40% | | AMR Corporation | 0.34% |

| Sonus Networks, Inc. | 0.40% | | Allegiant Travel Company | 0.34% |

| Cinemark Holdings, Inc. | 0.39% | | Granite Construction, Inc. | 0.32% |

| Cardtronics, Inc. | 0.39% | | Global Payments, Inc. | 0.31% |

| Lattice Semiconductor Corporation | 0.39% | | PHH Corporation | 0.31% |

TFS SMALL CAP FUND PORTFOLIO INFORMATION October 31, 2010 (Unaudited) |

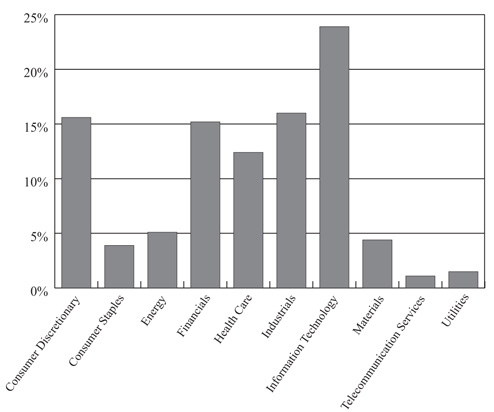

TFS Small Cap Fund

Sector Allocation (% of Net Assets)

|

| |

| Sotheby's | 0.53% |

| ON Semiconductor Corporation | 0.48% |

| Ariad Pharmaceuticals, Inc. | 0.47% |

| ITT Educational Services, Inc. | 0.47% |

| Veeco Instruments, Inc. | 0.47% |

| Cypress Semiconductor Corporation | 0.46% |

| Blue Coat Systems, Inc. | 0.46% |

| SUPERVALU, Inc. | 0.45% |

| Dorman Products, Inc. | 0.45% |

| Websense, Inc. | 0.45% |

TFS MARKET NEUTRAL FUND SUMMARY SCHEDULE OF INVESTMENTS* October 31, 2010 |

| | | | | | |

| Consumer Discretionary — 12.1% | | | | | | |

| Auto Components — 1.1% | | | | | | |

Other Auto Components (a) | | | | | $ | 12,331,483 | |

| | | | | | | | |

| Automobiles — 0.1% | | | | | | | |

Other Automobiles (a) | | | | | | 1,173,498 | |

| | | | | | | | |

| Distributors — 0.0% | | | | | | | |

Other Distributors (a) | | | | | | 14,358 | |

| | | | | | | | |

| Diversified Consumer Services — 0.6% | | | | | | | |

Other Diversified Consumer Services (a) | | | | | | 7,328,636 | |

| | | | | | | | |

| Hotels, Restaurants & Leisure — 2.7% | | | | | | | |

Penn National Gaming, Inc. (b) (c) | | | 123,200 | | | | 4,097,632 | |

Other Hotels, Restaurants & Leisure (a) | | | | | | | 26,535,016 | |

| | | | | | | | 30,632,648 | |

| Household Durables — 1.3% | | | | | | | | |

Harman International Industries, Inc. (b) (c) | | | 113,400 | | | | 3,804,570 | |

Other Household Durables (a) | | | | | | | 11,455,140 | |

| | | | | | | | 15,259,710 | |

| Internet & Catalog Retail — 0.2% | | | | | | | | |

Other Internet & Catalog Retail (a) | | | | | | | 1,958,118 | |

| | | | | | | | | |

| Leisure Equipment & Products — 0.2% | | | | | | | | |

Other Leisure Equipment & Products (a) | | | | | | | 2,562,319 | |

| | | | | | | | | |

| Media — 1.9% | | | | | | | | |

Cinemark Holdings, Inc. (c) | | | 256,183 | | | | 4,496,012 | |

Other Media (a) | | | | | | | 16,890,421 | |

| | | | | | | | 21,386,433 | |

| Multiline Retail — 0.6% | | | | | | | | |

Retail Ventures, Inc. (b) (c) | | | 312,943 | | | | 4,252,896 | |

Other Multiline Retail (a) | | | | | | | 2,023,666 | |

| | | | | | | | 6,276,562 | |

| Specialty Retail — 2.5% | | | | | | | | |

Other Specialty Retail (a) | | | | | | | 28,749,196 | |

| | | | | | | | | |

| Textiles, Apparel & Luxury Goods — 0.9% | | | | | | | | |

Other Textiles, Apparel & Luxury Goods (a) | | | | | | | 10,655,550 | |

| | | | | | | | | |

| Consumer Staples — 3.5% | | | | | | | | |

| Beverages — 0.5% | | | | | | | | |

Constellation Brands, Inc. - Class A (b) (c) | | | 191,300 | | | | 3,774,349 | |

Other Beverages (a) | | | | | | | 2,011,810 | |

| | | | | | | | 5,786,159 | |

TFS MARKET NEUTRAL FUND SUMMARY SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 89.1% (Continued) | | | | | | |

| Consumer Staples — 3.5% (Continued) | | | | | | |

| Food & Staples Retailing — 1.0% | | | | | | |

SUPERVALU, Inc. (c) | | | 435,140 | | | $ | 4,695,161 | |

Other Food & Staples Retailing (a) | | | | | | | 6,243,420 | |

| | | | | | | | 10,938,581 | |

| Food Products — 1.2% | | | | | | | | |

Corn Products International, Inc. (c) | | | 108,605 | | | | 4,621,143 | |

Other Food Products (a) | | | | | | | 9,376,627 | |

| | | | | | | | 13,997,770 | |

| Household Products — 0.2% | | | | | | | | |

Other Household Products (a) | | | | | | | 2,129,115 | |

| | | | | | | | | |

| Personal Products — 0.6% | | | | | | | | |

Other Personal Products (a) | | | | | | | 7,223,456 | |

| | | | | | | | | |

| Tobacco — 0.0% | | | | | | | | |

Other Tobacco (a) | | | | | | | 220,029 | |

| | | | | | | | | |

| Energy — 7.0% | | | | | | | | |

| Energy Equipment & Services — 2.2% | | | | | | | | |

Dresser-Rand Group, Inc. (b) (c) | | | 116,000 | | | | 3,969,520 | |

Superior Energy Services, Inc. (b) (c) | | | 150,312 | | | | 4,151,617 | |

Other Energy Equipment & Services (a) | | | | | | | 16,691,717 | |

| | | | | | | | 24,812,854 | |

| Oil, Gas & Consumable Fuels — 4.8% | | | | | | | | |

Other Oil, Gas & Consumable Fuels (a) | | | | | | | 54,702,811 | |

| | | | | | | | | |

| Financials — 14.8% | | | | | | | | |

| Capital Markets — 1.9% | | | | | | | | |

BlackRock Kelso Capital Corporation (c) | | | 305,970 | | | | 3,585,968 | |

E*TRADE Financial Corporation (b) (c) | | | 271,633 | | | | 3,884,352 | |

Other Capital Markets (a) | | | | | | | 14,437,291 | |

| | | | | | | | 21,907,611 | |

| Commercial Banks — 2.0% | | | | | | | | |

CapitalSource, Inc. (c) | | | 540,329 | | | | 3,301,410 | |

East West Bancorp, Inc. (c) | | | 210,869 | | | | 3,717,620 | |

Fulton Financial Corporation (c) | | | 361,520 | | | | 3,376,597 | |

Other Commercial Banks (a) | | | | | | | 12,680,958 | |

| | | | | | | | 23,076,585 | |

| Consumer Finance — 0.8% | | | | | | | | |

Cardtronics, Inc. (b) (c) | | | 262,872 | | | | 4,455,680 | |

Other Consumer Finance (a) | | | | | | | 4,824,225 | |

| | | | | | | | 9,279,905 | |

| Diversified Financial Services — 0.5% | | | | | | | | |

Other Diversified Financial Services (a) | | | | | | | 5,761,066 | |

| | | | | | | | | |

| Insurance — 4.1% | | | | | | | | |

American Financial Group, Inc. (c) | | | 112,795 | | | | 3,449,271 | |

TFS MARKET NEUTRAL FUND SUMMARY SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 89.1% (Continued) | | | | | | |

| Financials — 14.8% (Continued) | | | | | | |

| Insurance — 4.1% (Continued) | | | | | | |

Aspen Insurance Holdings Ltd. (c) | | | 136,866 | | | $ | 3,882,888 | |

Other Insurance (a) | | | | | | | 38,782,187 | |

| | | | | | | | 46,114,346 | |

| Real Estate Investment Trusts — 4.7% | | | | | | | | |

Hospitality Properties Trust (c) | | | 193,740 | | | | 4,419,209 | |

Mack-Cali Realty Corporation (c) | | | 106,100 | | | | 3,562,838 | |

Saul Centers, Inc. (c) | | | 77,753 | | | | 3,318,498 | |

Senior Housing Properties Trust (c) | | | 152,800 | | | | 3,650,392 | |

Other Real Estate Investment Trusts (a) | | | | | | | 38,736,518 | |

| | | | | | | | 53,687,455 | |

| Real Estate Management & Development — 0.2% | | | | | | | | |

Other Real Estate Management & Development (a) | | | | | | | 2,350,176 | |

| | | | | | | | | |

| Thrifts & Mortgage Finance — 0.6% | | | | | | | | |

Other Thrifts & Mortgage Finance (a) | | | | | | | 6,797,154 | |

| | | | | | | | | |

| Health Care — 9.9% | | | | | | | | |

| Biotechnology — 1.7% | | | | | | | | |

Other Biotechnology (a) | | | | | | | 19,054,598 | |

| | | | | | | | | |

| Health Care Equipment & Supplies — 1.8% | | | | | | | | |

Teleflex, Inc. (c) | | | 62,438 | | | | 3,480,918 | |

Other Health Care Equipment & Supplies (a) | | | | | | | 16,737,621 | |

| | | | | | | | 20,218,539 | |

| Health Care Providers & Services — 3.2% | | | | | | | | |

Coventry Health Care, Inc. (b) (c) | | | 161,900 | | | | 3,791,698 | |

Health Net, Inc. (b) (c) | | | 141,317 | | | | 3,800,014 | |

Other Health Care Providers & Services (a) | | | | | | | 28,907,653 | |

| | | | | | | | 36,499,365 | |

| Health Care Technology — 0.6% | | | | | | | | |

SXC Health Solutions Corporation (b) (c) | | | 92,700 | | | | 3,611,592 | |

Other Health Care Technology (a) | | | | | | | 3,279,109 | |

| | | | | | | | 6,890,701 | |

| Life Sciences Tools & Services — 0.9% | | | | | | | | |

PerkinElmer, Inc. (c) | | | 159,944 | | | | 3,750,687 | |

Other Life Sciences Tools & Services (a) | | | | | | | 6,845,995 | |

| | | | | | | | 10,596,682 | |

| Pharmaceuticals — 1.7% | | | | | | | | |

King Pharmaceuticals, Inc. (b) (c) | | | 380,090 | | | | 5,374,473 | |

Other Pharmaceuticals (a) | | | | | | | 13,994,774 | |

| | | | | | | | 19,369,247 | |

| Industrials — 15.4% | | | | | | | | |

| Aerospace & Defense — 1.7% | | | | | | | | |

BE Aerospace, Inc. (b) (c) | | | 145,700 | | | | 5,355,932 | |

TransDigm Group, Inc. (b) (c) | | | 63,560 | | | | 4,212,121 | |

Other Aerospace & Defense (a) | | | | | | | 10,476,468 | |

| | | | | | | | 20,044,521 | |

TFS MARKET NEUTRAL FUND SUMMARY SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 89.1% (Continued) | | | | | | |

| Industrials — 15.4% (Continued) | | | | | | |

| Air Freight & Logistics — 0.4% | | | | | | |

Other Air Freight & Logistics (a) | | | | | $ | 4,420,356 | |

| | | | | | | | |

| Airlines — 0.4% | | | | | | | |

Other Airlines (a) | | | | | | 4,585,425 | |

| | | | | | | | |

| Building Products — 0.2% | | | | | | | |

Other Building Products (a) | | | | | | 2,470,686 | |

| | | | | | | | |

| Commercial Services & Supplies — 1.3% | | | | | | | |

Other Commercial Services & Supplies (a) | | | | | | 14,618,932 | |

| | | | | | | | |

| Construction & Engineering — 1.8% | | | | | | | |

Great Lakes Dredge & Dock Corporation (c) | | | 609,407 | | | | 3,772,230 | |

Other Construction & Engineering (a) | | | | | | | 16,895,410 | |

| | | | | | | | 20,667,640 | |

| Electrical Equipment — 1.3% | | | | | | | | |

Hubbell, Inc. - Class B (c) | | | 70,322 | | | | 3,798,794 | |

Thomas & Betts Corporation (b) (c) | | | 83,000 | | | | 3,614,650 | |

Other Electrical Equipment (a) | | | | | | | 7,904,912 | |

| | | | | | | | 15,318,356 | |

| Industrial Conglomerates — 0.2% | | | | | | | | |

Other Industrial Conglomerates (a) | | | | | | | 1,874,149 | |

| | | | | | | | | |

| Machinery — 4.2% | | | | | | | | |

Navistar International Corporation (b) (c) | | | 86,300 | | | | 4,157,934 | |

Sauer-Danfoss, Inc. (b) (c) | | | 183,729 | | | | 4,062,248 | |

WABCO Holdings, Inc. (b) (c) | | | 88,696 | | | | 4,117,268 | |

Other Machinery (a) | | | | | | | 35,876,684 | |

| | | | | | | | 48,214,134 | |

| Marine — 0.9% | | | | | | | | |

Other Marine (a) | | | | | | | 9,848,096 | |

| | | | | | | | | |

| Professional Services — 0.7% | | | | | | | | |

Other Professional Services (a) | | | | | | | 7,838,580 | |

| | | | | | | | | |

| Road & Rail — 0.8% | | | | | | | | |

Ryder System, Inc. | | | 78,900 | | | | 3,451,875 | |

Other Road & Rail (a) | | | | | | | 6,348,128 | |

| | | | | | | | 9,800,003 | |

| Trading Companies & Distributors — 1.3% | | | | | | | | |

Aircastle Ltd. (c) | | | 461,880 | | | | 4,253,915 | |

United Rentals, Inc. (b) (c) | | | 260,700 | | | | 4,898,553 | |

Other Trading Companies & Distributors (a) | | | | | | | 5,768,366 | |

| | | | | | | | 14,920,834 | |

| Transportation Infrastructure — 0.2% | | | | | | | | |

Other Transportation Infrastructure (a) | | | | | | | 1,867,980 | |

TFS MARKET NEUTRAL FUND SUMMARY SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 89.1% (Continued) | | | | | | |

| Information Technology — 18.2% | | | | | | |

| Communications Equipment — 2.7% | | | | | | |

Sonus Networks, Inc. (b) (c) | | | 1,480,083 | | | $ | 4,603,058 | |

Other Communications Equipment (a) | | | | | | | 26,387,723 | |

| | | | | | | | 30,990,781 | |

| Computers & Peripherals — 1.2% | | | | | | | | |

Other Computers & Peripherals (a) | | | | | | | 12,961,515 | |

| | | | | | | | | |

| Electronic Equipment, Instruments & Components — 3.1% | | | | | | | | |

Arrow Electronics, Inc. (b) (c) | | | 111,700 | | | | 3,307,437 | |

Cogent, Inc. (b) | | | 317,520 | | | | 3,340,310 | |

Other Electronic Equipment, Instruments & Components (a) | | | | | | | 28,355,491 | |

| | | | | | | | 35,003,238 | |

| Internet Software & Services — 1.1% | | | | | | | | |

Other Internet Software & Services (a) | | | | | | | 12,892,187 | |

| | | | | | | | | |

| IT Services — 2.2% | | | | | | | | |

Alliance Data Systems Corporation (b) (c) | | | 76,006 | | | | 4,615,084 | |

iGATE Corporation (c) | | | 161,027 | | | | 3,291,392 | |

Other IT Services (a) | | | | | | | 17,597,156 | |

| | | | | | | | 25,503,632 | |

| Office Electronics — 0.0% | | | | | | | | |

Other Office Electronics (a) | | | | | | | 252,356 | |

| | | | | | | | | |

| Semiconductors & Semiconductor Equipment — 5.5% | | | | | | | | |

Fairchild Semiconductor International, Inc. (b) (c) | | | 322,100 | | | | 3,630,067 | |

Lattice Semiconductor Corporation (b) (c) | | | 914,817 | | | | 4,446,011 | |

Other Semiconductors & Semiconductor Equipment (a) | | | | | | | 54,506,777 | |

| | | | | | | | 62,582,855 | |

| Software — 2.4% | | | | | | | | |

Other Software (a) | | | | | | | 27,583,432 | |

| | | | | | | | | |

| Materials — 5.8% | | | | | | | | |

| Chemicals — 2.8% | | | | | | | | |

Cabot Corporation (c) | | | 110,200 | | | | 3,749,004 | |

Cytec Industries, Inc. (c) | | | 71,993 | | | | 3,565,093 | |

Other Chemicals (a) | | | | | | | 24,490,886 | |

| | | | | | | | 31,804,983 | |

| Construction Materials — 0.0% | | | | | | | | |

Other Construction Materials (a) | | | | | | | 64,384 | |

| | | | | | | | | |

| Containers & Packaging — 0.6% | | | | | | | | |

Packaging Corporation of America (c) | | | 137,866 | | | | 3,368,066 | |

Other Containers & Packaging (a) | | | | | | | 3,616,546 | |

| | | | | | | | 6,984,612 | |

| Metals & Mining — 2.3% | | | | | | | | |

Other Metals & Mining (a) | | | | | | | 26,231,641 | |

| | | | | | | | | |

| Paper & Forest Products — 0.1% | | | | | | | | |

Other Paper & Forest Products (a) | | | | | | | 1,280,694 | |

TFS MARKET NEUTRAL FUND SUMMARY SCHEDULE OF INVESTMENTS (Continued) |

COMMON STOCKS — 89.1% (Continued) | | | | | | |

| Telecommunication Services — 0.7% | | | | | | |

| Diversified Telecommunication Services — 0.5% | | | | | | |

Other Diversified Telecommunication Services (a) | | | | | $ | 5,416,147 | |

| | | | | | | | |

| Wireless Telecommunication Services — 0.2% | | | | | | | |

Other Wireless Telecommunication Services (a) | | | | | | 2,434,070 | |

| | | | | | | | |

| Utilities — 1.7% | | | | | | | |

| Electric Utilities — 0.6% | | | | | | | |

Other Electric Utilities (a) | | | | | | 7,116,820 | |

| | | | | | | | |

| Gas Utilities — 0.9% | | | | | | | |

AGL Resources, Inc. (c) | | | 93,752 | | | | 3,680,703 | |

UGI Corporation (c) | | | 123,913 | | | | 3,728,542 | |

Other Gas Utilities (a) | | | | | | | 2,232,914 | |

| | | | | | | | 9,642,159 | |

| Independent Power Producers & Energy Traders — 0.0% | | | | | | | | |

Other Independent Power Producers & Energy Traders (a) | | | | | | | 476,351 | |

| | | | | | | | | |

| Multi-Utilities — 0.1% | | | | | | | | |

Other Multi-Utilities (a) | | | | | | | 1,311,897 | |

| | | | | | | | | |

| Water Utilities — 0.1% | | | | | | | | |

Other Water Utilities (a) | | | | | | | 1,086,562 | |

| | | | | | | | | |

Total Common Stocks (Cost $947,935,809) | | | | | | $ | 1,017,852,724 | |

| | | | |

Other Closed-End Funds (Cost $40,736,777) (a) | | | $ | 41,055,193 | |

EXCHANGE-TRADED FUNDS — 0.1% | | | | |

Other Exchange-Traded Funds (Cost $739,151) (a) | | | $ | 725,199 | |

| | | | |

Other Rights (Cost $64,169) (a) (e) | | | $ | 541,256 | |

| | | | |

Other Warrants (Cost $0) (a) | | | $ | 2 | |

TFS MARKET NEUTRAL FUND SUMMARY SCHEDULE OF INVESTMENTS (Continued) |

MONEY MARKET FUNDS — 7.6% | | | | | | |

UMB Money Market Fiduciary, 0.02% (d) (Cost $86,302,892) | | | 86,302,892 | | | $ | 86,302,892 | |

| | | | | | | | | |

Total Investments at Value — 100.4% (Cost $1,075,778,798) | | | | | | $ | 1,146,477,266 | |

| | | | | | | | | |

Liabilities in Excess of Other Assets — (0.4%) | | | | | | | (4,257,836 | ) |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 1,142,219,430 | |

| * | A complete Schedule of Investments is available without charge upon request by calling toll-free 1-888-534-2001 or on the SEC’s website at http://www.sec.gov. |

| | |

| (a) | Represents issuers not identified as a top 50 holding in terms of market value and issues or issuers not exceeding 1% of net assets individually or in the aggregate, respectively, as of October 31, 2010. |

| | |

| (b) | Non-income producing security. |

| | |

| (c) | All or a portion of the shares have been committed as collateral for open short positions. |

| | |

| (d) | Variable rate security. The rate shown is the 7-day effective yield as of October 31, 2010. |

| | |

| (e) | Fair value priced (Note 2). Fair valued securities totaled $541,256 at October 31, 2010, representing 0.0% of net assets. |

| | |

| See accompanying notes to financial statements. |

TFS MARKET NEUTRAL FUND SCHEDULE OF SECURITIES SOLD SHORT October 31, 2010 |

| | | | | | |

| Consumer Discretionary — 10.1% | | | | | | |

| Auto Components — 0.0% | | | | | | |

Cooper Tire & Rubber Company | | | 6,801 | | | $ | 133,368 | |

Goodyear Tire & Rubber Company (The) (a) | | | 38,500 | | | | 393,470 | |

Icahn Enterprises, L.P. | | | 570 | | | | 19,722 | |

Johnson Controls, Inc. | | | 1,300 | | | | 45,656 | |

| | | | | | | | 592,216 | |

| Automobiles — 0.1% | | | | | | | | |

Ford Motor Company (a) | | | 6,100 | | | | 86,193 | |

Harley-Davidson, Inc. | | | 700 | | | | 21,476 | |

Kandi Technologies Corporation (a) | | | 6,300 | | | | 35,406 | |

Tesla Motors, Inc. (a) | | | 58,790 | | | | 1,283,974 | |

| | | | | | | | 1,427,049 | |

| Distributors — 0.1% | | | | | | | | |

Audiovox Corporation - Class A (a) | | | 12,514 | | | | 81,091 | |

Core-Mark Holding Company, Inc. (a) | | | 18,562 | | | | 612,546 | |

LKQ Corporation (a) | | | 620 | | | | 13,479 | |

| | | | | | | | 707,116 | |

| Diversified Consumer Services — 1.0% | | | | | | | | |

American Public Education, Inc. (a) | | | 6,209 | | | | 173,604 | |

Apollo Group, Inc. - Class A (a) | | | 2,700 | | | | 101,196 | |

Bridgepoint Education, Inc. (a) | | | 89,946 | | | | 1,280,831 | |

Capella Education Company (a) | | | 50,769 | | | | 2,783,664 | |

Career Education Corporation (a) | | | 4,300 | | | | 75,422 | |

Coinstar, Inc. (a) | | | 3,100 | | | | 178,498 | |

Corinthian Colleges, Inc. (a) | | | 93,500 | | | | 488,070 | |

DeVry, Inc. | | | 8,200 | | | | 392,452 | |

Education Management Corporation (a) | | | 120,578 | | | | 1,446,936 | |

Grand Canyon Education, Inc. (a) | | | 205 | | | | 3,856 | |

H&R Block, Inc. | | | 29,400 | | | | 346,626 | |

Learning Tree International, Inc. (a) | | | 5,878 | | | | 57,016 | |

Lincoln Educational Services Corporation (a) | | | 700 | | | | 8,722 | |

Sotheby's | | | 7,600 | | | | 333,184 | |

Stewart Enterprises, Inc. - Class A | | | 345,385 | | | | 1,920,341 | |

Strayer Education, Inc. | | | 17,000 | | | | 2,377,110 | |

| | | | | | | | 11,967,528 | |

| Hotels, Restaurants & Leisure — 0.9% | | | | | | | | |

Ambassadors Group, Inc. | | | 525 | | | | 5,822 | |

Bally Technologies, Inc. (a) | | | 2,400 | | | | 86,592 | |

Biglari Holdings, Inc. (a) | | | 481 | | | | 160,361 | |

Bluegreen Corporation (a) | | | 110 | | | | 355 | |

Buffalo Wild Wings, Inc. (a) | | | 2,700 | | | | 126,981 | |

Cheesecake Factory, Inc. (The) (a) | | | 600 | | | | 17,472 | |

Chipotle Mexican Grill, Inc. (a) | | | 200 | | | | 42,042 | |

Cracker Barrel Old Country Store, Inc. | | | 5,020 | | | | 270,528 | |

Darden Restaurants, Inc. | | | 400 | | | | 18,284 | |

DineEquity, Inc. (a) | | | 12,300 | | | | 546,735 | |

Gaylord Entertainment Company (a) | | | 35,170 | | | | 1,172,568 | |

TFS MARKET NEUTRAL FUND SCHEDULE OF SECURITIES SOLD SHORT (Continued) |

COMMON STOCKS — 60.2% (Continued) | | | | | | |

| Consumer Discretionary — 10.1% (Continued) | | | | | | |

| Hotels, Restaurants & Leisure — 0.9% (Continued) | | | | | | |

Hyatt Hotels Corporation - Class A (a) | | | 2,900 | | | $ | 116,870 | |

International Speedway Corporation - Class A | | | 34,963 | | | | 798,555 | |

Jack in the Box, Inc. (a) | | | 1,200 | | | | 27,792 | |

Las Vegas Sands Corporation (a) | | | 3,400 | | | | 155,992 | |

Marriott International, Inc. - Class A | | | 100 | | | | 3,705 | |

McDonald's Corporation | | | 300 | | | | 23,331 | |

MGM Resorts International (a) | | | 4,100 | | | | 44,813 | |

Morgans Hotel Group Company (a) | | | 159,525 | | | | 1,287,367 | |

Panera Bread Company - Class A (a) | | | 1,700 | | | | 152,167 | |

Peet's Coffee & Tea, Inc. (a) | | | 66,062 | | | | 2,526,871 | |

Red Robin Gourmet Burgers, Inc. (a) | | | 6,094 | | | | 123,708 | |

Six Flags Entertainment Corporation (a) | | | 3,513 | | | | 180,147 | |

Speedway Motorsports, Inc. | | | 7,700 | | | | 117,810 | |

Starwood Hotels & Resorts Worldwide, Inc. | | | 400 | | | | 21,656 | |

Texas Roadhouse, Inc. (a) | | | 58,192 | | | | 893,829 | |

Town Sports International Holdings, Inc. (a) | | | 400 | | | | 1,200 | |

Universal Travel Group (a) | | | 24,600 | | | | 137,760 | |

Vail Resorts, Inc. (a) | | | 8,600 | | | | 348,816 | |

WMS Industries, Inc. (a) | | | 9,900 | | | | 431,937 | |

Wyndham Worldwide Corporation | | | 560 | | | | 16,100 | |

| | | | | | | | 9,858,166 | |

| Household Durables — 1.3% | | | | | | | | |

American Greetings Corporation - Class A | | | 99,528 | | | | 1,927,857 | |

Beazer Homes USA, Inc. (a) | | | 45,300 | | | | 183,918 | |

Blyth, Inc. | | | 3,469 | | | | 139,176 | |

Brookfield Homes Corporation (a) | | | 14,430 | | | | 120,346 | |

Cavco Industries, Inc. (a) | | | 19,645 | | | | 622,550 | |

Comstock Homebuilding Companies, Inc. - Class A (a) | | | 2,103 | | | | 2,419 | |

CSS Industries, Inc. | | | 2 | | | | 34 | |

D.R. Horton, Inc. | | | 13,100 | | | | 136,764 | |

Deer Consumer Products, Inc. (a) | | | 38,300 | | | | 438,535 | |

Ethan Allen Interiors, Inc. | | | 55,882 | | | | 847,730 | |

Flexsteel Industries, Inc. | | | 1,700 | | | | 25,704 | |

Hooker Furniture Corporation | | | 4,004 | | | | 42,322 | |

Hovnanian Enterprises, Inc. - Class A (a) | | | 179,295 | | | | 638,290 | |

iRobot Corporation (a) | | | 26,953 | | | | 562,779 | |

KB Home | | | 267,700 | | | | 2,813,527 | |

La-Z-Boy, Inc. (a) | | | 95,700 | | | | 743,589 | |

Lennar Corporation - Class A | | | 228,100 | | | | 3,309,731 | |

Libbey, Inc. (a) | | | 13,846 | | | | 184,013 | |

Lifetime Brands, Inc. (a) | | | 701 | | | | 9,001 | |

Meritage Homes Corporation (a) | | | 8,000 | | | | 146,480 | |

Mohawk Industries, Inc. (a) | | | 6,766 | | | | 387,962 | |

National Presto Industries, Inc. | | | 600 | | | | 67,158 | |

Pulte Homes, Inc. (a) | | | 28,199 | | | | 221,362 | |

Ryland Group, Inc. (The) | | | 24,120 | | | | 361,318 | |

Sealy Corporation (a) | | | 286,073 | | | | 752,372 | |

Stanley Black & Decker, Inc. | | | 400 | | | | 24,788 | |

TFS MARKET NEUTRAL FUND SCHEDULE OF SECURITIES SOLD SHORT (Continued) |

COMMON STOCKS — 60.2% (Continued) | | | | | | |

| Consumer Discretionary — 10.1% (Continued) | | | | | | |

| Household Durables — 1.3% (Continued) | | | | | | |

Tempur-Pedic International, Inc. (a) | | | 1,640 | | | $ | 56,580 | |

Whirlpool Corporation | | | 600 | | | | 45,498 | |

| | | | | | | | 14,811,803 | |

| Internet & Catalog Retail — 1.0% | | | | | | | | |

1-800-FLOWERS.COM, Inc. (a) | | | 51,535 | | | | 92,763 | |

Amazon.com, Inc. (a) | | | 600 | | | | 99,084 | |

Blue Nile, Inc. (a) | | | 71,779 | | | | 3,057,786 | |

Gaiam, Inc. - Class A | | | 20 | | | | 141 | |

HSN, Inc. (a) | | | 237 | | | | 7,096 | |

Liberty Media Corporation - Interactive - Series A (a) | | | 13,700 | | | | 202,212 | |

NetFlix, Inc. (a) | | | 1,400 | | | | 242,900 | |

NutriSystem, Inc. | | | 116,046 | | | | 2,218,800 | |

Overstock.com, Inc. (a) | | | 108,927 | | | | 1,460,711 | |

PetMed Express, Inc. | | | 193,745 | | | | 2,993,360 | |

priceline.com, Inc. (a) | | | 200 | | | | 75,362 | |

Shutterfly, Inc. (a) | | | 35,443 | | | | 1,066,834 | |

SinoCoking Coal and Coke Chemical Industries, Inc. (a) | | | 14,566 | | | | 117,693 | |

ValueVision Media, Inc. (a) | | | 400 | | | | 948 | |

| | | | | | | | 11,635,690 | |

| Leisure Equipment & Products — 0.9% | | | | | | | | |

Arctic Cat, Inc. (a) | | | 20,317 | | | | 270,419 | |

Brunswick Corporation | | | 82,570 | | | | 1,306,257 | |

Callaway Golf Company | | | 169,420 | | | | 1,165,610 | |

JAKKS Pacific, Inc. (a) | | | 60,267 | | | | 1,136,033 | |

Polaris Industries, Inc. | | | 23,700 | | | | 1,684,833 | |

Pool Corporation | | | 116,625 | | | | 2,348,828 | |

Smith & Wesson Holding Corporation (a) | | | 107,075 | | | | 401,531 | |

Steinway Musical Instruments, Inc. (a) | | | 100 | | | | 1,701 | |

Sturm Ruger & Company, Inc. | | | 95,552 | | | | 1,496,344 | |

Summer Infant, Inc. (a) | | | 11,169 | | | | 89,352 | |

| | | | | | | | 9,900,908 | |

| Media — 1.1% | | | | | | | | |

A.H. Belo Corporation (a) | | | 21,764 | | | | 158,224 | |

Arbitron, Inc. | | | 39,300 | | | | 995,076 | |

Ascent Media Corporation (a) | | | 386 | | | | 10,515 | |

China MediaExpress Holdings, Inc. (a) | | | 125,079 | | | | 1,933,721 | |

China Yida Holding Company (a) | | | 100 | | | | 1,063 | |

Dex One Corporation (a) | | | 6,600 | | | | 46,266 | |

DIRECTV (a) | | | 400 | | | | 17,384 | |

DISH Network Corporation - Class A (a) | | | 2,600 | | | | 51,636 | |

E.W. Scripps Company - Class A (a) | | | 33,401 | | | | 291,925 | |

Emmis Communications Corporation - Class A (a) | | | 600 | | | | 515 | |

Entercom Communications Corporation - Class A (a) | | | 40,467 | | | | 337,899 | |

Gannett Company, Inc. | | | 24,836 | | | | 294,307 | |

Harte-Hanks, Inc. | | | 1,100 | | | | 13,288 | |

IMAX Corporation (a) | | | 600 | | | | 12,990 | |

Interpublic Group of Companies, Inc. (The) (a) | | | 13,960 | | | | 144,486 | |

Martha Stewart Living Omnimedia, Inc. - Class A (a) | | | 230,064 | | | | 1,003,079 | |

TFS MARKET NEUTRAL FUND SCHEDULE OF SECURITIES SOLD SHORT (Continued) |

COMMON STOCKS — 60.2% (Continued) | | | | | | |

| Consumer Discretionary — 10.1% (Continued) | | | | | | |

| Media — 1.1% (Continued) | | | | | | |

McClatchy Company (The) - Class A (a) | | | 365,575 | | | $ | 1,008,987 | |

McGraw-Hill Companies, Inc. (The) | | | 400 | | | | 15,060 | |

Media General, Inc. (a) | | | 111,386 | | | | 613,737 | |

Meredith Corporation | | | 1,800 | | | | 61,110 | |

Morningstar, Inc. (a) | | | 2,530 | | | | 123,515 | |

New York Times Company (The) (a) | | | 33,347 | | | | 255,771 | |

Radio One, Inc. - Class D (a) | | | 20,000 | | | | 23,200 | |

Rentrak Corporation (a) | | | 11 | | | | 299 | |

Scholastic Corporation | | | 113,121 | | | | 3,331,413 | |

Spanish Broadcasting System, Inc. (a) | | | 1,500 | | | | 1,110 | |

SuperMedia, Inc. (a) | | | 18,512 | | | | 121,809 | |

Time Warner Cable, Inc. | | | 100 | | | | 5,787 | |

Viacom, Inc. - Class A | | | 27,374 | | | | 1,170,786 | |

Viacom, Inc. - Class B | | | 100 | | | | 3,859 | |

Washington Post Company (The) - Class B | | | 100 | | | | 40,215 | |

World Wrestling Entertainment, Inc. - Class A | | | 2,400 | | | | 33,216 | |

| | | | | | | | 12,122,248 | |

| Multiline Retail — 0.3% | | | | | | | | |

Big Lots, Inc. (a) | | | 7,600 | | | | 238,412 | |

Dillard's, Inc. - Class A | | | 5,295 | | | | 135,076 | |

Dollar Tree, Inc. (a) | | | 400 | | | | 20,524 | |

Fred's, Inc. - Class A | | | 42,831 | | | | 513,115 | |

J.C. Penney Company, Inc. | | | 1,600 | | | | 49,888 | |

Kohl's Corporation (a) | | | 400 | | | | 20,480 | |

Nordstrom, Inc. | | | 2,300 | | | | 88,573 | |

Sears Holdings Corporation (a) | | | 31,000 | | | | 2,231,380 | |

| | | | | | | | 3,297,448 | |

| Specialty Retail — 2.1% | | | | | | | | |

A.C. Moore Arts & Crafts, Inc. (a) | | | 600 | | | | 1,350 | |

Aaron's, Inc. | | | 13,210 | | | | 249,141 | |

Abercrombie & Fitch Company - Class A | | | 3,300 | | | | 141,438 | |

Aéropostale, Inc. (a) | | | 5,700 | | | | 138,966 | |

American Eagle Outfitters, Inc. | | | 6,000 | | | | 96,060 | |

AnnTaylor Stores Corporation (a) | | | 11,100 | | | | 258,630 | |

AutoNation, Inc. (a) | | | 300 | | | | 6,966 | |

AutoZone, Inc. (a) | | | 200 | | | | 47,526 | |

Barnes & Noble, Inc. | | | 175,370 | | | | 2,627,043 | |

Bed Bath & Beyond, Inc. (a) | | | 100 | | | | 4,390 | |

Best Buy Company, Inc. | | | 3,100 | | | | 133,238 | |

Blockbuster, Inc. - Class A (a) | | | 100,400 | | | | 4,418 | |

Brown Shoe Company, Inc. | | | 14,739 | | | | 173,183 | |

Buckle, Inc. (The) | | | 99,986 | | | | 2,908,593 | |

Build-A-Bear Workshop, Inc. (a) | | | 1,839 | | | | 12,928 | |

Cabela's, Inc. - Class A (a) | | | 69,836 | | | | 1,294,759 | |

Cache, Inc. (a) | | | 167 | | | | 833 | |

Citi Trends, Inc. (a) | | | 44,502 | | | | 933,652 | |

Collective Brands, Inc. (a) | | | 39,100 | | | | 599,403 | |

Conn's, Inc. (a) | | | 250,888 | | | | 1,103,907 | |

TFS MARKET NEUTRAL FUND SCHEDULE OF SECURITIES SOLD SHORT (Continued) |

COMMON STOCKS — 60.2% (Continued) | | | | | | |

| Consumer Discretionary — 10.1% (Continued) | | | | | | |

| Specialty Retail — 2.1% (Continued) | | | | | | |

Dick's Sporting Goods, Inc. (a) | | | 4,700 | | | $ | 135,454 | |

DSW, Inc. - Class A (a) | | | 48,300 | | | | 1,606,941 | |

Foot Locker, Inc. | | | 44,500 | | | | 708,885 | |

GameStop Corporation - Class A (a) | | | 1,600 | | | | 31,456 | |

Genesco, Inc. (a) | | | 22,837 | | | | 748,140 | |

Group 1 Automotive, Inc. (a) | | | 1,631 | | | | 57,509 | |

Guess?, Inc. | | | 6,900 | | | | 268,548 | |

Hastings Entertainment, Inc. (a) | | | 100 | | | | 664 | |

Haverty Furniture Companies, Inc. (a) | | | 98,012 | | | | 1,047,748 | |

hhgregg, Inc. (a) | | | 70,578 | | | | 1,626,117 | |

Hibbett Sports, Inc. (a) | | | 18,300 | | | | 493,185 | |

J. Crew Group, Inc. (a) | | | 7,800 | | | | 249,522 | |

Limited Brands, Inc. | | | 300 | | | | 8,817 | |

Lowe's Companies, Inc. | | | 700 | | | | 14,931 | |

Lumber Liquidators Holdings, Inc. (a) | | | 83,918 | | | | 2,020,746 | |

MarineMax, Inc. (a) | | | 37,332 | | | | 279,243 | |

Midas, Inc. (a) | | | 1,159 | | | | 8,530 | |

Monro Muffler Brake, Inc. | | | 100 | | | | 4,774 | |

OfficeMax, Inc. (a) | | | 10,180 | | | | 180,186 | |

Penske Auto Group, Inc. (a) | | | 600 | | | | 8,070 | |

Pep Boys - Manny Moe & Jack (The) | | | 858 | | | | 10,030 | |

PetSmart, Inc. | | | 500 | | | | 18,715 | |

Rent-A-Center, Inc. | | | 2,500 | | | | 62,850 | |

Rue21, Inc. (a) | | | 3,900 | | | | 103,818 | |

Sonic Automotive, Inc. - Class A (a) | | | 105,999 | | | | 1,157,509 | |

Syms Corporation (a) | | | 1,300 | | | | 9,477 | |

Talbots, Inc. (The) (a) | | | 37,241 | | | | 364,217 | |

TJX Companies, Inc. | | | 100 | | | | 4,589 | |

Ulta Salon Cosmetics & Fragrance, Inc. (a) | | | 70,100 | | | | 2,151,369 | |

Urban Outfitters, Inc. (a) | | | 100 | | | | 3,077 | |

Vitamin Shoppe, Inc. (a) | | | 4,249 | | | | 118,165 | |

West Marine, Inc. (a) | | | 8 | | | | 79 | |

Williams-Sonoma, Inc. | | | 12,420 | | | | 402,035 | |

Winmark Corporation | | | 603 | | | | 19,851 | |

Zale Corporation (a) | | | 100 | | | | 256 | |

| | | | | | | | 24,661,927 | |

| Textiles, Apparel & Luxury Goods — 1.3% | | | | | | | | |

Columbia Sportswear Company | | | 46,415 | | | | 2,425,184 | |

Culp, Inc. (a) | | | 7,681 | | | | 77,885 | |

Deckers Outdoor Corporation (a) | | | 400 | | | | 23,240 | |

DGSE Companies, Inc. (a) | | | 400 | | | | 1,620 | |

Fuqi International, Inc. (a) | | | 128,213 | | | | 950,058 | |

G-III Apparel Group Ltd. (a) | | | 29,255 | | | | 772,332 | |

Hanesbrands, Inc. (a) | | | 3,100 | | | | 76,880 | |

Iconix Brand Group, Inc. (a) | | | 34,500 | | | | 603,750 | |

Joe's Jeans, Inc. (a) | | | 85,700 | | | | 132,835 | |

Jones Group, Inc. (The) | | | 149,900 | | | | 2,167,554 | |

K-Swiss, Inc. - Class A (a) | | | 17,957 | | | | 218,357 | |

TFS MARKET NEUTRAL FUND SCHEDULE OF SECURITIES SOLD SHORT (Continued) |

COMMON STOCKS — 60.2% (Continued) | | | | | | |

| Consumer Discretionary — 10.1% (Continued) | | | | | | |

| Textiles, Apparel & Luxury Goods — 1.3% (Continued) | | | | | | |

lululemon athletica, Inc. (a) | | | 8,000 | | | $ | 354,560 | |

Movado Group, Inc. (a) | | | 9,328 | | | | 104,847 | |

Phillips-Van Heusen Corporation | | | 1,400 | | | | 85,876 | |

R.G. Barry Corporation | | | 8,022 | | | | 82,948 | |

Rocky Brands, Inc. (a) | | | 100 | | | | 917 | |

Skechers U.S.A., Inc. - Class A (a) | | | 2,300 | | | | 44,712 | |

Steven Madden Ltd. (a) | | | 1,300 | | | | 54,990 | |

True Religion Apparel, Inc. (a) | | | 109,154 | | | | 2,232,199 | |

Under Armour, Inc. - Class A (a) | | | 47,883 | | | | 2,235,178 | |

Volcom, Inc. (a) | | | 114,751 | | | | 1,970,275 | |

| | | | | | | | 14,616,197 | |

| Consumer Staples — 2.8% | | | | | | | | |

| Beverages — 0.1% | | | | | | | | |

Boston Beer Company, Inc. - Class A (a) | | | 200 | | | | 14,318 | |

China New Borun Corporation (a) | | | 8,370 | | | | 122,453 | |

Coca-Cola Company (The) | | | 400 | | | | 24,528 | |

Coca-Cola Enterprises, Inc. | | | 24,800 | | | | 595,448 | |

Hansen Natural Corporation (a) | | | 500 | | | | 25,605 | |

Molson Coors Brewing Company - Class B | | | 200 | | | | 9,446 | |

| | | | | | | | 791,798 | |

| Food & Staples Retailing — 0.7% | | | | | | | | |

Costco Wholesale Corporation | | | 400 | | | | 25,108 | |

Great Atlantic & Pacific Tea Company, Inc. (The) (a) | | | 1,524,602 | | | | 5,244,631 | |

Kroger Company (The) | | | 400 | | | | 8,800 | |

Nash Finch Company | | | 29,266 | | | | 1,226,246 | |

QKL Stores, Inc. (a) | | | 200 | | | | 1,086 | |

Ruddick Corporation | | | 22,500 | | | | 785,250 | |

Spartan Stores, Inc. | | | 20,107 | | | | 300,600 | |

Sysco Corporation | | | 100 | | | | 2,946 | |

United Natural Foods, Inc. (a) | | | 9,200 | | | | 328,992 | |

Walgreen Company | | | 10,300 | | | | 348,964 | |

Wal-Mart Stores, Inc. | | | 400 | | | | 21,668 | |

Weis Markets, Inc. | | | 7,271 | | | | 283,278 | |

Winn-Dixie Stores, Inc. (a) | | | 1,692 | | | | 11,336 | |

| | | | | | | | 8,588,905 | |

| Food Products — 1.4% | | | | | | | | |

American Dairy, Inc. (a) | | | 74,227 | | | | 754,888 | |

American Lorain Corporation (a) | | | 300 | | | | 915 | |

Calavo Growers, Inc. | | | 21,672 | | | | 475,267 | |

Cal-Maine Foods, Inc. | | | 86,689 | | | | 2,511,380 | |

China Marine Food Group Ltd. (a) | | | 23,804 | | | | 138,539 | |

Chiquita Brands International, Inc. (a) | | | 120,610 | | | | 1,600,495 | |

ConAgra Foods, Inc. | | | 100 | | | | 2,249 | |

Dean Foods Company (a) | | | 1,500 | | | | 15,600 | |

Diamond Foods, Inc. | | | 41,746 | | | | 1,845,173 | |

Dole Food Company, Inc. (a) | | | 186,246 | | | | 1,717,188 | |

Flowers Foods, Inc. | | | 74,136 | | | | 1,888,985 | |

General Mills, Inc. | | | 600 | | | | 22,524 | |

TFS MARKET NEUTRAL FUND SCHEDULE OF SECURITIES SOLD SHORT (Continued) |

COMMON STOCKS — 60.2% (Continued) | | | | | | |

| Consumer Staples — 2.8% (Continued) | | | | | | |

| Food Products — 1.4% (Continued) | | | | | | |

Green Mountain Coffee Roasters, Inc. (a) | | | 1,200 | | | $ | 39,588 | |

Hain Celestial Group, Inc. (The) (a) | | | 1,000 | | | | 24,730 | |

Harbinger Group, Inc. (a) | | | 200 | | | | 1,032 | |

Hershey Company (The) | | | 400 | | | | 19,796 | |

Imperial Sugar Company | | | 8,123 | | | | 103,162 | |

Kellogg Company | | | 300 | | | | 15,078 | |

Kraft Foods, Inc. - Class A | | | 400 | | | | 12,908 | |

Lancaster Colony Corporation | | | 10,969 | | | | 547,134 | |

Reddy Ice Holdings, Inc. (a) | | | 600 | | | | 2,094 | |

Sara Lee Corporation | | | 100 | | | | 1,433 | |

Seneca Foods Corporation - Class A (a) | | | 3,300 | | | | 76,230 | |

Smart Balance, Inc. (a) | | | 39,523 | | | | 140,702 | |

Tootsie Roll Industries, Inc. | | | 58,299 | | | | 1,530,349 | |

TreeHouse Foods, Inc. (a) | | | 26,200 | | | | 1,223,540 | |

Tyson Foods, Inc. | | | 514 | | | | 7,993 | |

Yuhe International, Inc. (a) | | | 19,390 | | | | 155,508 | |

Zhongpin, Inc. (a) | | | 36,500 | | | | 738,030 | |

| | | | | | | | 15,612,510 | |

| Household Products — 0.0% | | | | | | | | |

Central Garden & Pet Company - Class A (a) | | | 6,500 | | | | 67,925 | |

Clorox Company | | | 100 | | | | 6,655 | |

Colgate-Palmolive Company | | | 400 | | | | 30,848 | |

Energizer Holdings, Inc. (a) | | | 500 | | | | 37,390 | |

Kimberly Clark Corporation | | | 200 | | | | 12,668 | |

| | | | | | | | 155,486 | |

| Personal Products — 0.3% | | | | | | | | |

Avon Products, Inc. | | | 400 | | | | 12,180 | |

China Sky One Medical, Inc. (a) | | | 130,291 | | | | 1,186,951 | |

China-Biotics, Inc. (a) | | | 165,373 | | | | 2,073,777 | |

Estée Lauder Companies, Inc. (The) - Class A | | | 400 | | | | 28,468 | |

Medifast, Inc. (a) | | | 7,110 | | | | 169,787 | |

Schiff Nutrition International, Inc. (a) | | | 24,158 | | | | 195,197 | |

USANA Health Sciences, Inc. (a) | | | 4,354 | | | | 191,228 | |

| | | | | | | | 3,857,588 | |

| Tobacco — 0.3% | | | | | | | | |

Alliance One International, Inc. (a) | | | 14,565 | | | | 64,377 | |

Altria Group, Inc. | | | 100 | | | | 2,542 | |

Philip Morris International, Inc. | | | 400 | | | | 23,400 | |

Star Scientific, Inc. (a) | | | 329,792 | | | | 659,584 | |

Universal Corporation | | | 64,500 | | | | 2,672,880 | |

| | | | | | | | 3,422,783 | |

| Energy — 4.4% | | | | | | | | |

| Energy Equipment & Services — 1.0% | | | | | | | | |

Baker Hughes, Inc. | | | 2,600 | | | | 120,458 | |

Bolt Technology Corporation (a) | | | 355 | | | | 3,944 | |

Bristow Group, Inc. (a) | | | 23,500 | | | | 911,330 | |

Bronco Drilling Company, Inc. (a) | | | 21,548 | | | | 90,933 | |

Cameron International Corporation (a) | | | 400 | | | | 17,500 | |

TFS MARKET NEUTRAL FUND SCHEDULE OF SECURITIES SOLD SHORT (Continued) |

COMMON STOCKS — 60.2% (Continued) | | | | | | |

| Energy — 4.4% (Continued) | | | | | | |

| Energy Equipment & Services — 1.0% (Continued) | | | | | | |

Dawson Geophysical Company (a) | | | 23,717 | | | $ | 589,130 | |

ENGlobal Corporation (a) | | | 400 | | | | 1,156 | |

Exterran Holdings, Inc. (a) | | | 41,420 | | | | 1,042,541 | |

FMC Technologies, Inc. (a) | | | 400 | | | | 28,840 | |

Geokinetics, Inc. (a) | | | 7,180 | | | | 48,968 | |

Gulfmark Offshore, Inc. - Class A (a) | | | 6,018 | | | | 178,193 | |

Halliburton Company | | | 841 | | | | 26,794 | |

Helmerich & Payne, Inc. | | | 1,082 | | | | 46,288 | |

Hercules Offshore, Inc. (a) | | | 108,098 | | | | 255,111 | |

Hornbeck Offshore Services, Inc. (a) | | | 44,780 | | | | 995,907 | |

Key Energy Services, Inc. (a) | | | 8,100 | | | | 79,785 | |

Matrix Service Company (a) | | | 6,344 | | | | 57,603 | |

Natural Gas Services Group, Inc. (a) | | | 2,645 | | | | 41,659 | |

Newpark Resources, Inc. (a) | | | 379,034 | | | | 2,228,720 | |

PHI, Inc. (a) | | | 3,165 | | | | 55,293 | |

Royale Energy, Inc. (a) | | | 1,600 | | | | 3,232 | |

Seahawk Drilling, Inc. (a) | | | 118,351 | | | | 1,192,978 | |

SulphCo, Inc. (a) | | | 255,735 | | | | 63,934 | |

Tesco Corporation (a) | | | 16,300 | | | | 206,358 | |

Tidewater, Inc. | | | 65,205 | | | | 3,007,907 | |

| | | | | | | | 11,294,562 | |

| Oil, Gas & Consumable Fuels — 3.4% | | | | | | | | |

Alliance Holdings GP, L.P. | | | 400 | | | | 16,604 | |

Alliance Resource Partners, L.P. | | | 2,569 | | | | 151,160 | |

Alpha Natural Resources, Inc. (a) | | | 900 | | | | 40,653 | |

American Oil & Gas, Inc. (a) | | | 107,978 | | | | 932,930 | |

Anadarko Petroleum Corporation | | | 1,200 | | | | 73,884 | |

Apache Corporation | | | 400 | | | | 40,408 | |

Arch Coal, Inc. | | | 500 | | | | 12,295 | |

ATP Oil & Gas Corporation (a) | | | 81,530 | | | | 1,170,771 | |

BP Prudhoe Bay Royalty Trust | | | 1,408 | | | | 144,757 | |

BPZ Resources, Inc. (a) | | | 418,182 | | | | 1,555,637 | |

Callon Petroleum Company (a) | | | 28,652 | | | | 141,254 | |

Carrizo Oil & Gas, Inc. (a) | | | 68,500 | | | | 1,617,970 | |

Cheniere Energy Partners, L.P. | | | 6,200 | | | | 118,916 | |

Cheniere Energy, Inc. (a) | | | 286,885 | | | | 940,983 | |

Chesapeake Energy Corporation | | | 300 | | | | 6,510 | |

Chevron Corporation | | | 100 | | | | 8,261 | |

China Integrated Energy, Inc. (a) | | | 55,912 | | | | 463,511 | |

Cimarex Energy Company | | | 100 | | | | 7,675 | |

Clean Energy Fuels Corporation (a) | | | 148,647 | | | | 2,158,354 | |

Cloud Peak Energy, Inc. (a) | | | 8,723 | | | | 151,519 | |

Comstock Resources, Inc. (a) | | | 25,438 | | | | 568,539 | |

CONSOL Energy, Inc. | | | 700 | | | | 25,732 | |

Copano Energy, LLC | | | 2,700 | | | | 75,492 | |

Crosstex Energy, Inc. | | | 4 | | | | 32 | |

Crosstex Energy, L.P. | | | 51,023 | | | | 713,812 | |

DCP Midstream Partners, L.P. | | | 12,041 | | | | 429,623 | |

TFS MARKET NEUTRAL FUND SCHEDULE OF SECURITIES SOLD SHORT (Continued) |

COMMON STOCKS — 60.2% (Continued) | | | | | | |

| Energy — 4.4% (Continued) | | | | | | |

| Oil, Gas & Consumable Fuels — 3.4% (Continued) | | | | | | |

Devon Energy Corporation | | | 100 | | | $ | 6,502 | |

DHT Holdings, Inc. | | | 99,610 | | | | 428,323 | |

El Paso Corporation | | | 50 | | | | 663 | |

Enbridge Energy Management, LLC (a) | | | 4,904 | | | | 292,671 | |

Endeavour International Corporation (a) | | | 54,211 | | | | 74,811 | |

Energy Partners Ltd. (a) | | | 28,500 | | | | 318,345 | |

Enterprise GP Holdings, L.P. | | | 700 | | | | 44,800 | |

EOG Resources, Inc. | | | 100 | | | | 9,572 | |

EQT Corporation | | | 1,100 | | | | 41,184 | |

Equal Energy Ltd. (a) | | | 200 | | | | 976 | |

Forest Oil Corporation (a) | | | 5,720 | | | | 175,776 | |

GeoGlobal Resources, Inc. (a) | | | 22,523 | | | | 18,014 | |

GMX Resources, Inc. (a) | | | 204,378 | | | | 915,613 | |

Golar LNG Ltd. | | | 13,445 | | | | 178,281 | |

Goodrich Petroleum Corporation (a) | | | 5,316 | | | | 72,510 | |

Green Plains Renewable Energy, Inc. (a) | | | 23,596 | | | | 262,388 | |

GreenHunter Energy, Inc. (a) | | | 1,400 | | | | 1,204 | |

Houston American Energy Corporation | | | 159,742 | | | | 2,244,375 | |

Hyperdynamics Corporation (a) | | | 41,749 | | | | 102,285 | |

Inergy Holdings, L.P. | | | 575 | | | | 17,365 | |

Inergy, L.P. | | | 5,100 | | | | 200,226 | |

Isramco, Inc. (a) | | | 100 | | | | 5,730 | |

James River Coal Company (a) | | | 34,414 | | | | 595,706 | |

Kinder Morgan Management, LLC (a) | | | 15,421 | | | | 951,029 | |

K-Sea Transportation Partners, L.P. | | | 2,142 | | | | 8,547 | |

L & L Energy, Inc. (a) | | | 84,096 | | | | 687,064 | |

Linn Energy, LLC | | | 500 | | | | 17,490 | |

Lucas Energy, Inc. (a) | | | 5,400 | | | | 10,962 | |

Magellan Petroleum Corporation (a) | | | 400 | | | | 812 | |

Magnum Hunter Resources Corporation (a) | | | 35,109 | | | | 167,821 | |

Mariner Energy, Inc. (a) | | | 200 | | | | 4,984 | |

MarkWest Energy Partners, L.P. | | | 10,000 | | | | 381,200 | |

Massey Energy Company | | | 8,305 | | | | 349,391 | |

Miller Petroleum, Inc. (a) | | | 200,106 | | | | 1,100,583 | |

Natural Resource Partners, L.P. | | | 1,200 | | | | 34,800 | |

Nordic American Tanker Shipping Ltd. | | | 44,000 | | | | 1,145,320 | |

NuStar Energy, L.P. | | | 795 | | | | 50,085 | |

Occidental Petroleum Corporation | | | 100 | | | | 7,863 | |

Overseas Shipholding Group, Inc. | | | 11,800 | | | | 394,474 | |

Panhandle Oil & Gas, Inc. | | | 17 | | | | 420 | |

Patriot Coal Corporation (a) | | | 49,800 | | | | 671,802 | |

Penn Virginia Corporation | | | 138,416 | | | | 2,051,325 | |

Penn Virginia Resource Partners, L.P. | | | 27,341 | | | | 736,840 | |

Petrohawk Energy Corporation (a) | | | 15,700 | | | | 267,057 | |

PetroQuest Energy, Inc. (a) | | | 58,137 | | | | 324,404 | |

Pioneer Natural Resources Company | | | 600 | | | | 41,880 | |

Provident Energy Trust | | | 2,000 | | | | 15,360 | |

Range Resources Corporation | | | 100 | | | | 3,739 | |

TFS MARKET NEUTRAL FUND SCHEDULE OF SECURITIES SOLD SHORT (Continued) |

COMMON STOCKS — 60.2% (Continued) | | | | | | |

| Energy — 4.4% (Continued) | | | | | | |

| Oil, Gas & Consumable Fuels — 3.4% (Continued) | | | | | | |

Rentech, Inc. (a) | | | 76,911 | | | $ | 91,524 | |

Resolute Energy Corporation (a) | | | 46,200 | | | | 554,862 | |

Rex Energy Corporation (a) | | | 152,002 | | | | 1,872,665 | |

SandRidge Energy, Inc. (a) | | | 186,245 | | | | 1,018,760 | |

Scorpio Tankers, Inc. (a) | | | 4,393 | | | | 51,310 | |

Ship Finance International Ltd. | | | 9,700 | | | | 195,067 | |

Southwestern Energy Company (a) | | | 200 | | | | 6,770 | |

Spectra Energy Corporation | | | 100 | | | | 2,377 | |

Swift Energy Company (a) | | | 55,900 | | | | 1,780,415 | |

TC PipeLines, L.P. | | | 2,432 | | | | 119,776 | |

Teekay LNG Partners, L.P. | | | 6,700 | | | | 230,078 | |

Tesoro Corporation | | | 3,500 | | | | 45,360 | |

TransAtlantic Petroleum Ltd. (a) | | | 15,428 | | | | 47,055 | |

TransCanada Corporation | | | 700 | | | | 25,865 | |

Tri-Valley Corporation (a) | | | 62,216 | | | | 45,356 | |

Uranerz Energy Corporation (a) | | | 1,000 | | | | 2,240 | |

Uranium Energy Corporation (a) | | | 69,898 | | | | 270,505 | |

USEC, Inc. (a) | | | 382,830 | | | | 2,055,797 | |

Venoco, Inc. (a) | | | 4,025 | | | | 62,307 | |

Verenium Corporation (a) | | | 28,634 | | | | 109,668 | |

W&T Offshore, Inc. | | | 92,630 | | | | 1,007,814 | |

Western Refining, Inc. (a) | | | 234,581 | | | | 1,559,964 | |

Whiting Petroleum Corporation (a) | | | 500 | | | | 50,220 | |

Whiting USA Trust I | | | 5,346 | | | | 123,279 | |

Williams Companies, Inc. | | | 900 | | | | 19,368 | |

Williams Partners, L.P. | | | 100 | | | | 4,410 | |

World Fuel Services Corporation | | | 2,640 | | | | 74,527 | |

Zion Oil & Gas, Inc. (a) | | | 29,020 | | | | 151,775 | |

| | | | | | | | 38,578,968 | |

| Financials — 10.3% | | | | | | | | |

| Capital Markets — 0.9% | | | | | | | | |

AllianceBernstein Holding, L.P. | | | 6,701 | | | | 163,504 | |

Apollo Investment Corporation | | | 617 | | | | 6,781 | |

Arlington Asset Investment Corporation | | | 11,874 | | | | 281,295 | |

BGC Partners, Inc. - Class A | | | 85,859 | | | | 595,861 | |

BlackRock, Inc. - Class A | | | 600 | | | | 102,594 | |

Blackstone Group, L.P. (The) | | | 10,500 | | | | 141,540 | |

Deutsche Bank AG | | | 3,794 | | | | 219,597 | |

Duff & Phelps Corporation | | | 1,376 | | | | 19,181 | |

Eaton Vance Corporation | | | 11,700 | | | | 336,609 | |

Evercore Partners, Inc. - Class A | | | 1,300 | | | | 39,468 | |

FBR Capital Markets Corporation (a) | | | 77,358 | | | | 273,847 | |

Federated Investors, Inc. - Class B | | | 6,075 | | | | 151,328 | |

Franklin Resources, Inc. | | | 400 | | | | 45,880 | |

Gladstone Capital Corporation | | | 22,267 | | | | 255,403 | |

Goldman Sachs Group, Inc. (The) | | | 600 | | | | 96,570 | |

Greenhill & Company, Inc. | | | 14,300 | | | | 1,110,681 | |

Janus Capital Group, Inc. | | | 299,380 | | | | 3,161,453 | |

TFS MARKET NEUTRAL FUND SCHEDULE OF SECURITIES SOLD SHORT (Continued) |

COMMON STOCKS — 60.2% (Continued) | | | | | | |

| Financials — 10.3% (Continued) | | | | | | |

| Capital Markets — 0.9% (Continued) | | | | | | |

JMP Group, Inc. | | | 411 | | | $ | 2,733 | |

KBW, Inc. | | | 2,719 | | | | 68,791 | |

Knight Capital Group, Inc. (a) | | | 103,659 | | | | 1,350,677 | |

Morgan Stanley | | | 400 | | | | 9,948 | |

Oppenheimer Holdings, Inc. | | | 1,184 | | | | 30,133 | |

Penson Worldwide, Inc. (a) | | | 153,550 | | | | 790,783 | |

Raymond James Financial, Inc. | | | 1,000 | | | | 28,220 | |

Rodman & Renshaw Capital Group, Inc. (a) | | | 300 | | | | 861 | |

Sanders Morris Harris Group, Inc. | | | 4,683 | | | | 27,161 | |

SEI Investments Company | | | 18,800 | | | | 416,420 | |

State Street Corporation | | | 500 | | | | 20,880 | |

Stifel Financial Corporation (a) | | | 1,400 | | | | 66,346 | |

SWS Group, Inc. | | | 20,635 | | | | 141,762 | |

U.S. Global Investors, Inc. | | | 19,672 | | | | 155,606 | |

| | | | | | | | 10,111,913 | |

| Commercial Banks — 4.9% | | | | | | | | |

1st Source Corporation | | | 3,700 | | | | 65,379 | |

Ameris Bancorp (a) | | | 1,314 | | | | 12,181 | |

Arrow Financial Corporation | | | 572 | | | | 13,951 | |

Associated Banc-Corp | | | 39,860 | | | | 505,026 | |

Auburn National Bancorporation, Inc. | | | 200 | | | | 4,112 | |

BancFirst Corporation | | | 3,349 | | | | 137,644 | |

Bancorp, Inc. (The) (a) | | | 2,100 | | | | 15,729 | |

BancorpSouth, Inc. | | | 136,163 | | | | 1,795,990 | |

BancTrust Financial Group, Inc. (a) | | | 800 | | | | 2,336 | |

Bank of the Ozarks, Inc. | | | 49,699 | | | | 1,889,059 | |

Bar Harbor Bankshares | | | 100 | | | | 2,719 | |

Bridge Bancorp, Inc. | | | 1,000 | | | | 23,280 | |

Capital City Bank Group, Inc. | | | 18,648 | | | | 222,844 | |

Capitol Bancorp Ltd. (a) | | | 12,354 | | | | 14,084 | |

Cascade Bancorp, Inc. (a) | | | 43,934 | | | | 23,285 | |

Cathay General Bancorp | | | 83,322 | | | | 1,133,179 | |

CenterState Banks, Inc. | | | 1,009 | | | | 7,467 | |

Central Pacific Financial Corporation (a) | | | 1,000 | | | | 1,520 | |

Chemical Financial Corporation | | | 4,880 | | | | 98,966 | |

Citizens Holding Company | | | 301 | | | | 5,620 | |

City Bank (a) | | | 13,068 | | | | 1,568 | |

City Holding Company | | | 85,739 | | | | 2,717,926 | |

City National Corporation | | | 4,403 | | | | 227,063 | |

CoBiz Financial, Inc. | | | 113,043 | | | | 547,128 | |

Colonial Bancgroup, Inc. (The) (a) | | | 108,955 | | | | 1,416 | |

Columbia Banking Systems, Inc. | | | 73,008 | | | | 1,329,476 | |

Community Bank System, Inc. | | | 100,362 | | | | 2,345,460 | |

Community Trust Bancorp, Inc. | | | 557 | | | | 15,212 | |

Cullen/Frost Bankers, Inc. | | | 1,400 | | | | 73,416 | |

CVB Financial Corporation | | | 364,789 | | | | 2,776,044 | |

Danvers Bancorp, Inc. | | | 1,280 | | | | 19,238 | |

Eagle Bancorp, Inc. (a) | | | 2,621 | | | | 32,396 | |

TFS MARKET NEUTRAL FUND SCHEDULE OF SECURITIES SOLD SHORT (Continued) |

COMMON STOCKS — 60.2% (Continued) | | | | | | |

| Financials — 10.3% (Continued) | | | | | | |

| Commercial Banks — 4.9% (Continued) | | | | | | |

First BanCorp (North Carolina) | | | 8,718 | | | $ | 116,734 | |

First BanCorp (Puerto Rico) (a) | | | 1,600 | | | | 488 | |

First Busey Corporation | | | 114,625 | | | | 531,860 | |

First Commonwealth Financial Corporation | | | 86,720 | | | | 504,710 | |

First Financial Bankshares, Inc. | | | 34,041 | | | | 1,608,778 | |

First Horizon National Corporation (a) | | | 84,501 | | | | 852,613 | |

First South Bancorp, Inc. | | | 4,887 | | | | 49,065 | |

FNB Corporation | | | 118,841 | | | | 1,010,148 | |

Frontier Financial Corporation (a) | | | 8,859 | | | | 1,081 | |

Glacier Bancorp, Inc. | | | 86,300 | | | | 1,121,900 | |

Great Southern Bancorp, Inc. | | | 15,525 | | | | 349,157 | |

Green Bankshares, Inc. (a) | | | 16,753 | | | | 64,667 | |

Hanmi Financial Corporation (a) | | | 229,587 | | | | 268,617 | |

Independent Bank Corporation | | | 73,218 | | | | 1,719,891 | |

International Bancshares Corporation | | | 121,694 | | | | 2,084,618 | |

Lakeland Bancorp, Inc. | | | 23,362 | | | | 216,566 | |

Lakeland Financial Corporation | | | 313 | | | | 5,944 | |

Macatawa Bank Corporation (a) | | | 707 | | | | 1,329 | |

Marshall & Ilsley Corporation | | | 5,800 | | | | 34,278 | |

National Penn Bancshares, Inc. | | | 220,520 | | | | 1,431,175 | |

Old Second Bancorp, Inc. | | | 44,084 | | | | 86,845 | |

Oriental Financial Group, Inc. | | | 5,800 | | | | 76,734 | |

Pacific Capital Bancorp (a) | | | 200 | | | | 128 | |

PacWest Bancorp | | | 82,141 | | | | 1,431,718 | |

Park National Corporation | | | 45,397 | | | | 2,966,694 | |

Penns Woods Bancorp, Inc. | | | 83 | | | | 2,735 | |

Pinnacle Financial Partners, Inc. (a) | | | 154,548 | | | | 1,763,393 | |

Popular, Inc. (a) | | | 51,600 | | | | 140,868 | |

Premierwest Bancorp, Inc. (a) | | | 68,742 | | | | 27,098 | |

Regions Financial Corporation | | | 800 | | | | 5,040 | |

Renasant Corporation | | | 58,860 | | | | 962,361 | |

Republic Bancorp, Inc. - Class A | | | 3,742 | | | | 76,486 | |

S&T Bancorp, Inc. | | | 109,109 | | | | 2,138,536 | |

S.Y. Bancorp, Inc. | | | 4,780 | | | | 117,110 | |

Sandy Spring Bancorp, Inc. | | | 13,279 | | | | 231,055 | |

SCBT Financial Corporation | | | 4,667 | | | | 142,483 | |

Seacoast Banking Corporation of Florida (a) | | | 790 | | | | 987 | |

Security Bank Corporation (a) | | | 32,973 | | | | — | |

Sierra Bancorp | | | 1,300 | | | | 13,533 | |

Simmons First National Coporation - Class A | | | 2,078 | | | | 56,501 | |

Southern Connecticut Bancorp, Inc. (a) | | | 200 | | | | 1,190 | |

Southside Bancshares, Inc. | | | 11,183 | | | | 210,352 | |

Sterling Bancorp | | | 3,200 | | | | 30,048 | |

Suffolk Bancorp | | | 25,908 | | | | 671,017 | |

SunTrust Banks, Inc. | | | 300 | | | | 7,506 | |

Synovus Financial Corporation | | | 49,600 | | | | 107,136 | |

Taylor Capital Group, Inc. (a) | | | 35,736 | | | | 430,976 | |

TCF Financial Corporation | | | 103,100 | | | | 1,356,796 | |

TFS MARKET NEUTRAL FUND SCHEDULE OF SECURITIES SOLD SHORT (Continued) |

COMMON STOCKS — 60.2% (Continued) | | | | | | |

| Financials — 10.3% (Continued) | | | | | | |

| Commercial Banks — 4.9% (Continued) | | | | | | |

Texas Capital Bancshares, Inc. (a) | | | 195,872 | | | $ | 3,555,077 | |

Tompkins Financial Corporation | | | 7,466 | | | | 288,188 | |

Tower Bancorp, Inc. | | | 4,200 | | | | 90,804 | |

Towne Bank | | | 76,804 | | | | 1,113,658 | |

Trico Bancshares | | | 6,839 | | | | 106,620 | |

Trustmark Corporation | | | 7,852 | | | | 173,451 | |

U.S. Bancorp | | | 1,700 | | | | 41,106 | |

UMB Financial Corporation | | | 700 | | | | 25,942 | |

Union First Market Bankshares Corporation | | | 500 | | | | 6,430 | |

United Bankshares, Inc. | | | 106,659 | | | | 2,849,928 | |

United Security Bancshares | | | 1,018 | | | | 9,366 | |

United Security Bancshares, Inc. (a) | | | 2,315 | | | | 11,343 | |

Univest Corporation of Pennsylvania | | | 2,337 | | | | 44,076 | |

Valley National Bancorp | | | 21,200 | | | | 282,808 | |

Washington Trust Bancorp, Inc. | | | 4,112 | | | | 82,610 | |

Webster Financial Corporation | | | 46,400 | | | | 794,368 | |

WesBanco, Inc. | | | 5,253 | | | | 87,252 | |

West Coast Bancorp (a) | | | 34,785 | | | | 91,484 | |

Westamerica Bancorporation | | | 41,751 | | | | 2,088,385 | |

Western Alliance Bancorporation (a) | | | 260,267 | | | | 1,572,013 | |

Whitney Holding Corporation | | | 54,796 | | | | 453,711 | |

Wilmington Trust Corporation | | | 9,900 | | | | 70,389 | |

Wilshire Bancorp, Inc. | | | 186,800 | | | | 1,253,428 | |

Zions Bancorporation | | | 12,600 | | | | 260,316 | |

| | | | | | | | 56,442,412 | |

| Consumer Finance — 0.3% | | | | | | | | |

Advance America, Cash Advance Centers, Inc. | | | 28,872 | | | | 144,071 | |

American Express Company | | | 200 | | | | 8,292 | |

Cash America International, Inc. | | | 8,089 | | | | 284,975 | |

CompuCredit Holdings Corporation (a) | | | 42,574 | | | | 239,692 | |

First Marblehead Corporation (The) (a) | | | 19,313 | | | | 43,068 | |

Green Dot Corporation - Class A (a) | | | 1,100 | | | | 55,880 | |

SLM Corporation (a) | | | 100 | | | | 1,190 | |

World Acceptance Corporation (a) | | | 57,337 | | | | 2,474,092 | |

| | | | | | | | 3,251,260 | |

| Diversified Financial Services — 0.7% | | | | | | | | |

CBOE Holdings, Inc. | | | 24,013 | | | | 576,552 | |

IntercontinentalExchange, Inc. (a) | | | 100 | | | | 11,487 | |

JPMorgan Chase & Company | | | 100 | | | | 3,763 | |

Life Partners Holdings, Inc. | | | 164,522 | | | | 3,053,528 | |

Moody's Corporation | | | 2,700 | | | | 73,062 | |

NASDAQ OMX Group, Inc. (The) (a) | | | 2,020 | | | | 42,461 | |

NewStar Financial, Inc. (a) | | | 10,574 | | | | 80,468 | |

PHH Corporation (a) | | | 184,500 | | | | 3,555,315 | |

Portfolio Recovery Associates, Inc. (a) | | | 7,525 | | | | 504,551 | |

Primus Guaranty Ltd. (a) | | | 1,700 | | | | 8,449 | |

| | | | | | | | 7,909,636 | |

TFS MARKET NEUTRAL FUND SCHEDULE OF SECURITIES SOLD SHORT (Continued) |

COMMON STOCKS — 60.2% (Continued) | | | | | | |

| Financials — 10.3% (Continued) | | | | | | |

| Insurance — 0.7% | | | | | | |

American Equity Investment Life Holding Company | | | 31,500 | | | $ | 341,775 | |

American International Group, Inc. (a) | | | 39,300 | | | | 1,650,993 | |

AMERISAFE, Inc. (a) | | | 2,490 | | | | 47,534 | |

AmTrust Financial Services, Inc. | | | 22,240 | | | | 332,933 | |

Assured Guaranty Ltd. | | | 1,100 | | | | 20,955 | |

Berkshire Hathaway, Inc. - Class B (a) | | | 100 | | | | 7,956 | |

Citizens, Inc. (a) | | | 50 | | | | 346 | |

Crawford & Company - Class B (a) | | | 2,482 | | | | 6,354 | |

Donegal Group, Inc. - Class A | | | 100 | | | | 1,385 | |

eHealth, Inc. (a) | | | 52,157 | | | | 704,641 | |

Fidelity National Financial, Inc. - Class A | | | 6,300 | | | | 84,357 | |

First American Financial Corporation | | | 75,112 | | | | 1,054,572 | |

FPIC Insurance Group, Inc. (a) | | | 1,342 | | | | 47,534 | |

Gerova Financial Group Ltd. (a) | | | 800 | | | | 4,560 | |

Lincoln National Corporation | | | 300 | | | | 7,344 | |

Marsh & McLennan Companies, Inc. | | | 100 | | | | 2,498 | |

Mercer Insurance Group, Inc. | | | 680 | | | | 12,478 | |

Montpelier Re Holdings Ltd. | | | 7,800 | | | | 142,896 | |

National Financial Partners Corporation (a) | | | 6,600 | | | | 91,080 | |

Old Republic International Corporation | | | 22,240 | | | | 293,568 | |

Primerica, Inc. | | | 7,593 | | | | 160,364 | |

RLI Corporation | | | 13,456 | | | | 772,644 | |

StanCorp Financial Group, Inc. | | | 6,400 | | | | 274,560 | |

Stewart Information Services Corporation | | | 154,477 | | | | 1,671,441 | |

Tower Group, Inc. | | | 16,708 | | | | 405,670 | |

W.R. Berkley Corporation | | | 800 | | | | 22,016 | |

Wesco Financial Corporation | | | 159 | | | | 57,781 | |

| | | | | | | | 8,220,235 | |

| Real Estate Investment Trusts — 2.2% | | | | | | | | |

Alexandria Real Estate Equities, Inc. | | | 3,280 | | | | 241,014 | |

AMB Property Corporation | | | 1,200 | | | | 33,828 | |

American Campus Communities, Inc. | | | 6,000 | | | | 189,780 | |

American Capital Agency Corporation | | | 3,400 | | | | 97,648 | |

Ashford Hospitality Trust (a) | | | 91,771 | | | | 931,476 | |

Capital Trust, Inc. - Class A (a) | | | 78,877 | | | | 115,160 | |

CapLease, Inc. | | | 245,573 | | | | 1,439,058 | |

Capstead Mortgage Corporation | | | 9,090 | | | | 103,626 | |

CBL & Associates Properties, Inc. | | | 102,500 | | | | 1,607,200 | |

Colony Financial, Inc. | | | 4,200 | | | | 79,632 | |

Corporate Office Properties Trust | | | 8,500 | | | | 301,665 | |

Cousins Properties, Inc. | | | 4,420 | | | | 32,752 | |

DCT Industrial Trust, Inc. | | | 127,400 | | | | 638,274 | |

Developers Diversified Realty Corporation | | | 32,037 | | | | 413,277 | |

Douglas Emmett, Inc. | | | 2,900 | | | | 52,026 | |

Dupont Fabros Technology, Inc. | | | 30,600 | | | | 768,060 | |

Education Realty Trust, Inc. | | | 142,942 | | | | 1,072,065 | |

Entertainment Properties Trust | | | 27,800 | | | | 1,285,194 | |

Equity Lifestyle Properties, Inc. | | | 1,900 | | | | 108,148 | |

TFS MARKET NEUTRAL FUND SCHEDULE OF SECURITIES SOLD SHORT (Continued) |

COMMON STOCKS — 60.2% (Continued) | | | | | | |

| Financials — 10.3% (Continued) | | | | | | |

| Real Estate Investment Trusts — 2.2% (Continued) | | | | | | |

Essex Property Trust, Inc. | | | 1,900 | | | $ | 214,624 | |

First Industrial Realty Trust, Inc. (a) | | | 63,329 | | | | 464,202 | |

Franklin Street Properties Corporation | | | 6,200 | | | | 82,770 | |

Hatteras Financial Corporation | | | 8,300 | | | | 243,024 | |

iStar Financial, Inc. (a) | | | 1,119,662 | | | | 5,116,855 | |

Lexington Realty Trust | | | 119,575 | | | | 930,294 | |

Liberty Property Trust | | | 1,000 | | | | 33,460 | |

Medical Properties Trust, Inc. | | | 8,338 | | | | 93,302 | |

National Retail Properties, Inc. | | | 35,000 | | | | 948,500 | |

Nationwide Health Properties, Inc. | | | 700 | | | | 28,581 | |

New York Mortgage Trust, Inc. | | | 100 | | | | 636 | |

Omega Healthcare Investors, Inc. | | | 6,700 | | | | 154,100 | |

Parkway Properties, Inc. | | | 65,653 | | | | 1,021,561 | |

Pennsylvania Real Estate Investment Trust | | | 45,363 | | | | 647,330 | |

PennyMac Mortgage Investment Trust | | | 12,769 | | | | 220,393 | |

Post Properties, Inc. | | | 20,655 | | | | 628,738 | |

Potlatch Corporation | | | 1,100 | | | | 37,455 | |

Redwood Trust, Inc. | | | 51,706 | | | | 733,191 | |

Strategic Hotels & Resorts, Inc. (a) | | | 1 | | | | 5 | |

Sun Communities, Inc. | | | 72,930 | | | | 2,378,247 | |

Sunstone Hotel Investors, Inc. (a) | | | 21,400 | | | | 232,190 | |

Tanger Factory Outlet Centers, Inc. | | | 2,000 | | | | 95,840 | |

Taubman Centers, Inc. | | | 1,400 | | | | 64,988 | |

Terreno Realty Corporation (a) | | | 1,400 | | | | 25,368 | |

UMH Properties, Inc. | | | 73 | | | | 773 | |

Walter Investment Management Corporation | | | 3,180 | | | | 58,258 | |

Washington Real Estate Investment Trust | | | 2,000 | | | | 64,060 | |

Weingarten Realty Investors | | | 44,788 | | | | 1,080,734 | |

| | | | | | | | 25,109,362 | |

| Real Estate Management & Development — 0.2% | | | | | | | | |

China Housing & Land Development, Inc. (a) | | | 34,400 | | | | 82,216 | |

Forest City Enterprises, Inc. (a) | | | 600 | | | | 8,754 | |