Washington, D.C. 20549

Bo J. Howell, Esq.

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

SEMI-ANNUAL REPORT

April 30, 2017

(Unaudited)

For more information or assistance in opening an account,

please call toll-free 1-888-534-2001.

LETTER TO SHAREHOLDERS

June 15, 2017

Dear Shareholder,

Enclosed is the Semi-Annual Report to shareholders of the TFS Market Neutral Fund (ticker: TFSMX), the TFS Small Cap Fund (ticker: TFSSX) and the TFS Hedged Futures Fund (ticker: TFSHX) for the six months ended April 30, 2017. On behalf of the investment manager, TFS Capital LLC (“TFS Capital”), I would like to thank you for your continued investment.

Below you will find performance updates on each of the mutual funds.

TFS Market Neutral Fund (ticker: TFSMX)

| 1-year

return | 3-year

return | 5-year

return | 10-year

return | Since Inception (9/7/2004) |

| TFS Market Neutral Fund | 7.55% | 1.60% | 1.72% | 3.29% | 5.54% |

S&P 500® Index | 17.92% | 10.47% | 13.68% | 7.15% | 8.39% |

Average annual total returns for periods ended April 30, 2017. Past performance is not a guarantee of future results.

TFSMX produced significantly positive alpha (i.e., the return that cannot be explained by a fund’s market exposure) overall during the first half of the fiscal year, increasing 5.29% compared to its benchmark, the S&P 500® Index, which increased 13.32%. This was driven by a recovery in the performance of our quantitative investment strategies in small cap stocks during November and December. The Fund’s market exposure, or beta, for the period was very low at 0.06. Only a small portion of the Fund’s performance was driven by the market gains.

Since inception, TFSMX has produced positive alpha, with lower volatility and market exposure than the S&P 500® Index. From inception through April 30, 2017, TFSMX has had an average annual return of 5.54%, as compared to S&P 500® Index performance during the same period of 8.39%.

Since inception, the strategies used in managing TFSMX have resulted in its returns having a low correlation to other asset classes. According to Modern Portfolio Theory, portfolios may benefit by combining non-correlated investments. For your reference, below are the TFS Market Neutral Fund’s correlations to several other asset classes since inception. It is notable that correlation to the equity indices in recent years has risen, as compared to historical averages.

| Index | Correlation Since Inception |

S&P 500® Index | 0.59 |

Russell 2000® Index | 0.57 |

| MSCI EAFE Index | 0.45 |

| Barclays U.S. Aggregate Bond Index | (0.16) |

| Dow Jones Equity REIT Total Index | 0.41 |

| Bloomberg Commodity Index | 0.38 |

1

TFS Small Cap Fund (ticker: TFSSX)

| 1-year

return | 3-year

return | 5-year

return | 10-year

return | Since Inception (3/7/2006) |

| TFS Small Cap Fund | 24.19% | 8.05% | 13.98% | 10.36% | 11.18% |

Russell 2000® Index | 25.63% | 9.03% | 12.95% | 7.05% | 7.60% |

Average annual total returns for periods ended April 30, 2017. Past performance is not a guarantee of future results.

During the six-month period ended April 30, 2017, TFSSX roughly matched its benchmark, the Russell 2000® Index. The Fund was up 18.43% compared to a return of 18.37% for the Benchmark. Given its “long-only” mandate, TFSSX is expected to have a high correlation to U.S. small-cap equity market movements with any performance deviation generally attributable to TFS Capital’s equity selection.

TFSSX achieved its objective of outperforming the Russell 2000® Index over longer periods. Both the 10-year track record and performance since inception are more than three percentage points higher than the performance of the Russell 2000® Index.

TFS Hedged Futures Fund (ticker: TFSHX)

| 1-year

return | 3-year

return | 5-year

return | Since Inception (12/29/2011) |

| TFS Hedged Futures Fund | 0.28% | 2.10% | 0.40% | 1.55% |

Diversified Trends Indicator® | -2.74% | 0.91% | 0.11% | -1.21% |

S&P 500® Index | 17.92% | 10.47% | 13.68% | 15.06% |

Average annual returns for periods ended April 30, 2017. Past performance is not a guarantee of future results.

During the six-month period ended April 30, 2017, TFSHX was up 0.19%. Performance during the six-month period was below that of the Diversified Trends Indicator® (the “DTI®”), a commonly-used benchmark for managed-futures funds. Positive performance in the Fund’s volatility carry strategies were offset by negative performance in the commodity strategies. Though the S&P 500® Index is not generally considered an appropriate benchmark for managed-futures funds, it is provided above for your reference.

2

Like the TFS Market Neutral Fund, the TFS Hedged Futures Fund has demonstrated a low correlation to many market indices. This low correlation suggests the addition of the TFS Hedged Futures Fund may improve the risk-adjusted performance of many investment portfolios. The TFS Hedged Futures Fund has had a slightly negative correlation to the DTI®, which suggests that it may also have a low correlation to other managed futures funds that employ trend-following strategies. For your reference, below are the TFS Hedged Futures Fund’s correlations to several other asset classes.

| Index | Correlation Since Inception |

Diversified Trends Indicator® | (0.05) |

S&P 500® Index | 0.10 |

Russell 2000® Index | 0.13 |

| S&P GSCI Index | (0.06) |

| Barclays U.S. Aggregate Bond Index | (0.02) |

| Bloomberg Commodity Index | (0.03) |

As always, we do not recommend allocating a high percentage of one’s assets to any one investment fund managed by TFS Capital given the risks inherent in each product. Rather, we believe that they are best used as a component of a diversified portfolio of investments. If you have any questions regarding this material, please contact us.

Best regards,

Eric Newman

Chief Investment Officer & Co-Portfolio Manager

TFS Capital LLC

The performance data quoted represents past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment in the mutual funds discussed in this report (the “Funds”) will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Fee reductions and/or expense reimbursements by the Adviser have positively impacted the Funds’ performance. Without such reductions and/or reimbursements, performance would have been lower. An investor should consider the investment objectives, risks, charges and expenses of the Funds carefully before investing. To obtain a summary prospectus and/or prospectus, which each contain this and other important information, go to www.TFSCapital.com or call (888) 534-2001. Please read the summary prospectus and/or prospectus carefully before investing. The Funds may not be suitable for all investors. Futures investing is speculative. Each Fund’s current net asset value per share is available at www.TFSCapital.com.

3

TFS MARKET NEUTRAL FUND

PORTFOLIO INFORMATION

April 30, 2017 (Unaudited)

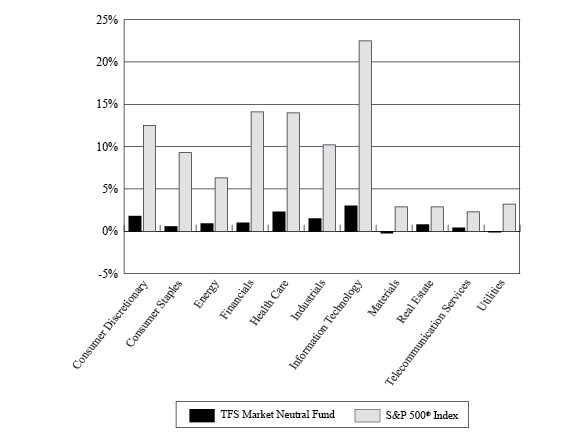

Common Stocks vs.

the S&P 500® Index Net Sector Exposure*

| * | The net percentages for TFS Market Neutral Fund are computed by taking the net dollar exposure, including short positions, and dividing by the net assets of the Fund. Consequently, the percentages will not total to 100%. |

| Top 10 Long Common Stocks | | Top 10 Short Common Stocks |

| Security Description | % of

Net Assets | | Security Description | % of

Net Assets |

| Telephone and Data Systems, Inc. | 0.52% | | Tempur Sealy International, Inc. | (0.50%) |

| Terex Corporation | 0.51% | | Ebix, Inc. | (0.49%) |

| Magellan Health, Inc. | 0.51% | | Sprouts Farmers Market, Inc. | (0.47%) |

| Zynga, Inc. - Class A | 0.51% | | Covanta Holding Corporation | (0.45%) |

| John Wiley & Sons, Inc. - Class A | 0.50% | | Community Bank System, Inc. | (0.45%) |

| R.R. Donnelley & Sons Company | 0.48% | | Tenet Healthcare Corporation | (0.45%) |

| Groupon, Inc. | 0.48% | | Kate Spade & Company | (0.44%) |

| First Potomac Realty Trust | 0.47% | | Credit Acceptance Corporation | (0.42%) |

| Phibro Animal Health Corporation - Class A | 0.43% | | Fitbit, Inc. - Class A | (0.42%) |

| CorEnergy Infrastructure Trust, Inc. | 0.43% | | Dun & Bradstreet Corporation (The) | (0.41%) |

4

TFS SMALL CAP FUND

PORTFOLIO INFORMATION

April 30, 2017 (Unaudited)

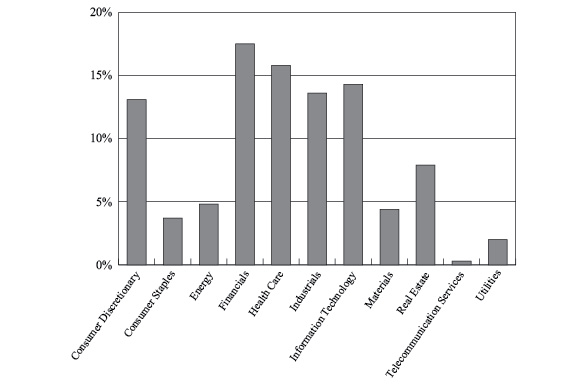

Sector Allocation (% of Net Assets)

| Top 10 Equity Positions |

| Security Description | % of

Net Assets |

| InfraREIT, Inc. | 0.74% |

| Independence Realty Trust, Inc. | 0.64% |

| Monogram Residential Trust, Inc. | 0.63% |

| CBL & Associates Properties, Inc. | 0.62% |

| Kite Realty Group Trust | 0.62% |

| Silver Bay Realty Trust Corporation | 0.61% |

| Hudson Pacific Properties, Inc. | 0.61% |

| Mack-Cali Realty Corporation | 0.60% |

| TIER REIT, Inc. | 0.60% |

| Parkway, Inc. | 0.59% |

5

TFS HEDGED FUTURES FUND

PORTFOLIO INFORMATION

April 30, 2017 (Unaudited)

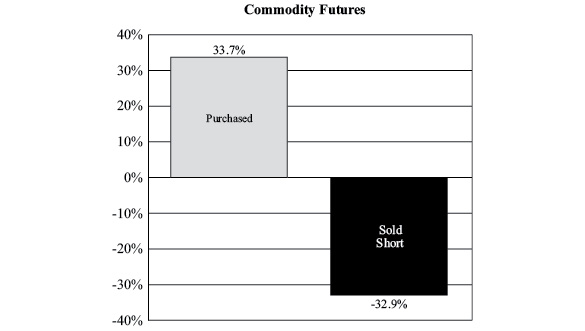

Exposure by Type of Futures Contract

(Notional Value as a % of Net Assets)

Net Exposure by Type of Futures Contract

(Net as a % of Net Assets) |

| Net Commodity Futures Exposure | 0.8% |

| | |

6

TFS MARKET NEUTRAL FUND

SUMMARY SCHEDULE OF INVESTMENTS*

April 30, 2017 (Unaudited) | |

| COMMON STOCKS — 91.9% | | Shares | | | Value | |

| Consumer Discretionary — 15.4% | | | | | | |

Groupon, Inc. (a) | | | 274,054 | | | $ | 1,074,292 | |

| John Wiley & Sons, Inc. - Class A | | | 21,283 | | | | 1,121,614 | |

| Red Rock Resorts, Inc. - Class A | | | 36,269 | | | | 847,969 | |

Taylor Morrison Home Corporation - Class A (a) (b) | | | 38,516 | | | | 889,720 | |

| Tower International, Inc. | | | 32,694 | | | | 886,007 | |

Other Consumer Discretionary (c) | | | | | | | 29,963,823 | |

| | | | | | | | 34,783,425 | |

| Consumer Staples — 5.3% | | | | | | | | |

Avon Products, Inc. (a) | | | 179,348 | | | | 869,838 | |

HRG Group, Inc. (a) | | | 43,405 | | | | 868,534 | |

| Inter Parfums, Inc. | | | 24,019 | | | | 911,521 | |

Other Consumer Staples (c) | | | | | | | 9,266,956 | |

| | | | | | | | 11,916,849 | |

| Energy — 5.8% | | | | | | | | |

Delek US Holdings, Inc. (b) | | | 35,545 | | | | 855,568 | |

Other Energy (c) | | | | | | | 12,208,433 | |

| | | | | | | | 13,064,001 | |

| Financials — 6.0% | | | | | | | | |

| BankUnited, Inc. | | | 24,031 | | | | 848,054 | |

Houlihan Lokey, Inc. (b) | | | 26,394 | | | | 885,255 | |

National General Holdings Corporation (b) | | | 37,846 | | | | 860,618 | |

Other Financials (c) | | | | | | | 10,987,607 | |

| | | | | | | | 13,581,534 | |

| Health Care — 22.2% | | | | | | | | |

Catalent, Inc. (a) (b) | | | 29,282 | | | | 857,377 | |

Exactech, Inc. (a) (b) | | | 29,462 | | | | 873,548 | |

FibroGen, Inc. (a) (b) | | | 31,599 | | | | 884,772 | |

Genomic Health, Inc. (a) (b) | | | 25,993 | | | | 854,130 | |

Haemonetics Corporation (a) (b) | | | 20,291 | | | | 849,787 | |

Halyard Health, Inc. (a) (b) | | | 21,876 | | | | 864,102 | |

Horizon Pharma plc (a) (b) | | | 55,817 | | | | 858,466 | |

Magellan Health, Inc. (a) | | | 16,669 | | | | 1,146,827 | |

Merit Medical Systems, Inc. (a) | | | 28,398 | | | | 957,013 | |

Momenta Pharmaceuticals, Inc. (a) | | | 59,899 | | | | 859,551 | |

Phibro Animal Health Corporation - Class A (b) | | | 32,554 | | | | 968,482 | |

PRA Health Sciences, Inc. (a) (b) | | | 13,242 | | | | 846,958 | |

Providence Service Corporation (The) (a) | | | 19,271 | | | | 847,924 | |

Other Health Care (c) | | | | | | | 38,427,407 | |

| | | | | | | | 50,096,344 | |

| Industrials — 11.6% | | | | | | | | |

Builders FirstSource, Inc. (a) (b) | | | 52,871 | | | | 846,465 | |

| R.R. Donnelley & Sons Company | | | 85,791 | | | | 1,078,393 | |

7

TFS MARKET NEUTRAL FUND

SUMMARY SCHEDULE OF INVESTMENTS* (Continued) | |

| COMMON STOCKS — 91.9% (Continued) | | Shares | | | Value | |

| Industrials — 11.6% (Continued) | | | | | | |

Steelcase, Inc. - Class A (b) | | | 50,769 | | | $ | 865,611 | |

| Terex Corporation | | | 33,222 | | | | 1,162,106 | |

TrueBlue, Inc. (a) (b) | | | 32,420 | | | | 886,687 | |

Other Industrials (c) | | | | | | | 21,394,736 | |

| | | | | | | | 26,233,998 | |

| Information Technology — 13.8% | | | | | | | | |

CommVault Systems, Inc. (a) (b) | | | 16,805 | | | | 847,812 | |

Insight Enterprises, Inc. (a) (b) | | | 20,736 | | | | 872,986 | |

IXYS Corporation (b) | | | 62,457 | | | | 871,275 | |

Jive Software, Inc. (a) (b) | | | 172,252 | | | | 869,873 | |

Progress Software Corporation (b) | | | 29,162 | | | | 866,695 | |

Tech Data Corporation (a) (b) | | | 8,885 | | | | 849,850 | |

Zynga, Inc. - Class A (a) | | | 396,254 | | | | 1,145,174 | |

Other Information Technology (c) | | | | | | | 24,826,697 | |

| | | | | | | | 31,150,362 | |

| Materials — 4.0% | | | | | | | | |

| Innophos Holdings, Inc. | | | 17,752 | | | | 851,031 | |

| Materion Corporation | | | 23,346 | | | | 888,315 | |

Other Materials (c) | | | | | | | 7,252,200 | |

| | | | | | | | 8,991,546 | |

| Real Estate — 4.8% | | | | | | | | |

| CBL & Associates Properties, Inc. | | | 100,304 | | | | 927,812 | |

| CorEnergy Infrastructure Trust, Inc. | | | 26,544 | | | | 968,325 | |

| First Potomac Realty Trust | | | 96,667 | | | | 1,063,337 | |

| Hudson Pacific Properties, Inc. | | | 28,061 | | | | 964,176 | |

| InfraREIT, Inc. | | | 50,000 | | | | 955,000 | |

| Kilroy Realty Corporation | | | 13,255 | | | | 934,875 | |

| Life Storage, Inc. | | | 11,298 | | | | 885,650 | |

| TIER REIT, Inc. | | | 55,092 | | | | 953,642 | |

| Vornado Realty Trust | | | 9,643 | | | | 928,042 | |

| Washington Prime Group, Inc. | | | 105,056 | | | | 924,493 | |

Other Real Estate (c) | | | | | | | 1,307,770 | |

| | | | | | | | 10,813,122 | |

| Telecommunication Services — 1.8% | | | | | | | | |

Telephone and Data Systems, Inc. (b) | | | 42,909 | | | | 1,178,281 | |

Other Telecommunication Services (c) | | | | | | | 2,831,358 | |

| | | | | | | | 4,009,639 | |

| Utilities — 1.2% | | | | | | | | |

Other Utilities (c) | | | | | | | 2,817,293 | |

| | | | | | | | | |

Total Common Stocks (Cost $197,378,918) | | | | | | $ | 207,458,113 | |

8

TFS MARKET NEUTRAL FUND

SUMMARY SCHEDULE OF INVESTMENTS* (Continued) | |

| INVESTMENT COMPANIES — 3.4% | Shares | | Value | |

Other Investment Companies (Cost $7,284,573) (c) | | | $ | 7,686,422 | |

| |

| RIGHTS — 0.0% | | Shares | | | Value | |

Interoil Corporation (d) (Cost $0) | | | 901 | | | $ | 0 | |

| |

| WARRANTS — 0.0% | | Shares | | | Value | |

Imperial Holdings, Inc. (d) (Cost $0) | | | 1,663 | | | $ | 0 | |

| |

CORPORATE BONDS — 0.0% (d) | Par Value | | Value | |

Other Corporate Bonds (Cost $21,000) (c) | | | $ | 21,000 | |

| | | | | | |

Total Investments at Value — 95.3% (Cost $204,684,491) | | | $ | 215,165,535 | |

| | | | | | |

Other Assets in Excess of Liabilities — 4.7% (f) | | | | 10,577,601 | |

| | | | | | |

| Net Assets — 100.0% | | | $ | 225,743,136 | |

| * | A complete Schedule of Investments is available without charge upon request by calling toll-free 1-888-534-2001 or on the SEC’s website at http://www.sec.gov. |

(a) | Non-income producing security. |

(b) | All or a portion of the shares have been committed as collateral for open short positions. |

(c) | Represents issuers not identified as either a top 50 holding in terms of value and issues or issuers not exceeding 1% of net assets individually or in the aggregate, respectively, or not a fair-valued security as of April 30, 2017. |

(d) | Security has been valued at fair value pursuant to procedures adopted by and under the supervision of the Board of Trustees. The total value of such securities is $0 at April 30, 2017, representing 0.0% of net assets (Note 2). |

(e) | Percentage rounds to less than 0.1%. |

(f) | Includes cash held as margin deposits for open short positions. |

| See accompanying notes to financial statements. |

9

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT

April 30, 2017 (Unaudited) | |

| COMMON STOCKS — 79.9% | | Shares | | | Value | |

| Consumer Discretionary — 13.6% | | | | | | |

| Auto Components — 0.8% | | | | | | |

| Ballard Power Systems, Inc. | | | 24,597 | | | $ | 80,432 | |

| China Automotive Systems, Inc. | | | 5,998 | | | | 28,611 | |

| China XD Plastics Company Ltd. | | | 13 | | | | 63 | |

| Cooper Tire & Rubber Company | | | 120 | | | | 4,596 | |

| Gentex Corporation | | | 18,232 | | | | 376,491 | |

| Horizon Global Corporation | | | 43,618 | | | | 614,578 | |

| Motorcar Parts of America, Inc. | | | 23,245 | | | | 704,788 | |

| SORL Auto Parts, Inc. | | | 140 | | | | 588 | |

| | | | | | | | 1,810,147 | |

| Automobiles — 0.5% | | | | | | | | |

| Kandi Technologies Group, Inc. | | | 158,519 | | | | 649,928 | |

| Tesla Motors, Inc. | | | 1,244 | | | | 390,703 | |

| Workhorse Group, Inc. | | | 63,346 | | | | 129,226 | |

| | | | | | | | 1,169,857 | |

| Distributors — 0.1% | | | | | | | | |

| Fenix Parts, Inc. | | | 12,697 | | | | 14,221 | |

| KBS Fashion Group Ltd. | | | 99 | | | | 530 | |

| Weyco Group, Inc. | | | 2,539 | | | | 70,990 | |

| | | | | | | | 85,741 | |

| Diversified Consumer Services — 0.6% | | | | | | | | |

| 2U, Inc. | | | 3,705 | | | | 168,207 | |

| Carriage Services, Inc. | | | 2,341 | | | | 64,026 | |

| Collectors Universe, Inc. | | | 170 | | | | 4,643 | |

| DeVry Education Group, Inc. | | | 18,810 | | | | 711,958 | |

| H&R Block, Inc. | | | 15,249 | | | | 378,023 | |

| Liberty Tax, Inc. | | | 42 | | | | 590 | |

| Sotheby's | | | 365 | | | | 17,286 | |

| Weight Watchers International, Inc. | | | 3,253 | | | | 67,923 | |

| | | | | | | | 1,412,656 | |

| Hotels, Restaurants & Leisure — 1.9% | | | | | | | | |

| Amaya, Inc. | | | 2,077 | | | | 36,971 | |

| Bravo Brio Restaurant Group, Inc. | | | 605 | | | | 2,934 | |

| Caesars Entertainment Corporation | | | 3,479 | | | | 38,617 | |

| Cheesecake Factory, Inc. (The) | | | 95 | | | | 6,095 | |

| Chipotle Mexican Grill, Inc. | | | 833 | | | | 395,233 | |

| Fogo de Chao, Inc. | | | 8,418 | | | | 142,685 | |

| Gaming Partners International Corporation | | | 1,202 | | | | 11,972 | |

| J. Alexander's Holdings, Inc. | | | 413 | | | | 4,543 | |

| Jamba, Inc. | | | 60,257 | | | | 513,390 | |

| Kona Grill, Inc. | | | 2,408 | | | | 13,726 | |

| Lindblad Expeditions Holdings, Inc. | | | 354 | | | | 3,363 | |

| McDonald's Corporation | | | 99 | | | | 13,853 | |

10

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

| COMMON STOCKS — 79.9% (Continued) | | Shares | | | Value | |

| Consumer Discretionary — 13.6% (Continued) | | | | | | |

| Hotels, Restaurants & Leisure — 1.9% (Continued) | | | | | | |

| Noodles & Company | | | 6,197 | | | $ | 36,252 | |

| ONE Group Hospitality, Inc. | | | 21,778 | | | | 48,347 | |

| Panera Bread Company - Class A | | | 1,131 | | | | 353,641 | |

| Papa Murphy's Holdings, Inc. | | | 24,571 | | | | 119,906 | |

| Red Robin Gourmet Burgers, Inc. | | | 11,881 | | | | 698,009 | |

| Ruby Tuesday, Inc. | | | 131,231 | | | | 334,639 | |

| Shake Shack, Inc. - Class A | | | 20,221 | | | | 686,301 | |

| Sonic Corporation | | | 4,482 | | | | 120,476 | |

| Town Sports International Holdings, Inc. | | | 1,121 | | | | 4,372 | |

| Wingstop, Inc. | | | 241 | | | | 7,093 | |

| Zoe's Kitchen, Inc. | | | 39,055 | | | | 704,943 | |

| | | | | | | | 4,297,361 | |

| Household Durables — 1.6% | | | | | | | | |

| Garmin Ltd. | | | 7,643 | | | | 388,570 | |

| GoPro, Inc. - Class A | | | 13,171 | | | | 108,661 | |

| Green Brick Partners, Inc. | | | 70 | | | | 721 | |

| iRobot Corporation | | | 8,023 | | | | 639,754 | |

| LGI Homes, Inc. | | | 22,443 | | | | 714,361 | |

| New Home Company, Inc. (The) | | | 79 | | | | 921 | |

| Skyline Corporation | | | 20,219 | | | | 124,549 | |

| Tempur Sealy International, Inc. | | | 24,073 | | | | 1,130,227 | |

| UCP, Inc. - Class A | | | 427 | | | | 4,889 | |

| Vuzix Corporation | | | 57,675 | | | | 340,283 | |

| William Lyon Homes - Class A | | | 258 | | | | 5,676 | |

| ZAGG, Inc. | | | 25,328 | | | | 179,829 | |

| | | | | | | | 3,638,441 | |

| Internet & Direct Marketing Retail — 1.4% | | | | | | | | |

| CafePress, Inc. | | | 238 | | | | 678 | |

| Duluth Holdings, Inc. - Class B | | | 36,115 | | | | 799,947 | |

| EVINE Live, Inc. | | | 8,699 | | | | 12,179 | |

| Gaia, Inc. | | | 6,162 | | | | 67,474 | |

| Lands' End, Inc. | | | 2,420 | | | | 57,112 | |

| Netflix, Inc. | | | 2,566 | | | | 390,545 | |

| PetMed Express, Inc. | | | 9,438 | | | | 218,018 | |

| RetailMeNot, Inc. | | | 53,087 | | | | 615,809 | |

| TripAdvisor, Inc. | | | 9,043 | | | | 407,026 | |

| Wayfair, Inc. - Class A | | | 14,765 | | | | 674,908 | |

| | | | | | | | 3,243,696 | |

| Leisure Products — 0.9% | | | | | | | | |

| American Outdoor Brands Corporation | | | 34,011 | | | | 753,344 | |

| Escalade, Inc. | | | 264 | | | | 3,524 | |

| Marine Products Corporation | | | 1,363 | | | | 16,301 | |

| Polaris Industries, Inc. | | | 404 | | | | 34,445 | |

11

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

| COMMON STOCKS — 79.9% (Continued) | | Shares | | | Value | |

| Consumer Discretionary — 13.6% (Continued) | | | | | | |

| Leisure Products — 0.9% (Continued) | | | | | | |

| Sturm Ruger & Company, Inc. | | | 13,651 | | | $ | 825,203 | |

| Vista Outdoor, Inc. | | | 19,146 | | | | 374,496 | |

| | | | | | | | 2,007,313 | |

| Media — 1.7% | | | | | | | | |

| Ballantyne Strong, Inc. | | | 100 | | | | 630 | |

| Beasley Broadcasting Group, Inc. | | | 8,654 | | | | 113,800 | |

| Central European Media Enterprises Ltd. - Class A | | | 28,124 | | | | 115,308 | |

| Charter Communications, Inc. - Class A | | | 871 | | | | 300,634 | |

| Cinemark Holdings, Inc. | | | 97 | | | | 4,190 | |

| Clear Channel Outdoor Holdings, Inc. - Class A | | | 15,980 | | | | 82,297 | |

| Daily Journal Corporation | | | 22 | | | | 4,599 | |

| E.W. Scripps Company (The) - Class A | | | 230 | | | | 5,124 | |

| Entercom Communications Corporation - Class A | | | 2,265 | | | | 28,652 | |

| Entravision Communications Corporation - Class A | | | 23 | | | | 143 | |

| Eros International plc | | | 74,826 | | | | 744,519 | |

| Global Eagle Entertainment, Inc. | | | 211,881 | | | | 656,831 | |

| Hemisphere Media Group, Inc. | | | 70 | | | | 816 | |

| Lee Enterprises, Inc. | | | 272 | | | | 707 | |

| Liberty Broadband - Series C | | | 4,296 | | | | 391,623 | |

| Liberty Global plc LiLAC - Class A | | | 9,267 | | | | 198,963 | |

| Lions Gate Entertainment Corporation - Class B | | | 75 | | | | 1,789 | |

| Meredith Corporation | | | 4,858 | | | | 284,436 | |

| Pandora Media, Inc. | | | 33,579 | | | | 364,332 | |

| Radio One, Inc. - Class D | | | 41,332 | | | | 123,996 | |

| Saga Communications, Inc. - Class A | | | 85 | | | | 4,356 | |

| Sirius XM Holdings, Inc. | | | 69,336 | | | | 343,213 | |

| Walt Disney Company (The) | | | 268 | | | | 30,981 | |

| Xcel Brands, Inc. | | | 906 | | | | 2,129 | |

| | | | | | | | 3,804,068 | |

| Multi-Line Retail — 0.3% | | | | | | | | |

| Big Lots, Inc. | | | 449 | | | | 22,670 | |

| Fred's, Inc. - Class A | | | 3,946 | | | | 58,085 | |

| J. C. Penney Company, Inc. | | | 70,287 | | | | 378,144 | |

| Sears Holdings Corporation | | | 9,438 | | | | 96,457 | |

| | | | | | | | 555,356 | |

| Specialty Retail — 2.5% | | | | | | | | |

| Abercrombie & Fitch Company - Class A | | | 2,138 | | | | 25,635 | |

| Ascena Retail Group, Inc. | | | 8,110 | | | | 31,710 | |

| Big 5 Sporting Goods Corporation | | | 568 | | | | 8,747 | |

| Boot Barn Holdings, Inc. | | | 823 | | | | 8,732 | |

| Buckle, Inc. (The) | | | 46,867 | | | | 876,413 | |

| Cabela's, Inc. | | | 193 | | | | 10,538 | |

| CarMax, Inc. | | | 6,044 | | | | 353,574 | |

12

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

| COMMON STOCKS — 79.9% (Continued) | | Shares | | | Value | |

| Consumer Discretionary — 13.6% (Continued) | | | | | | |

| Specialty Retail — 2.5% (Continued) | | | | | | |

| Conn's, Inc. | | | 2,704 | | | $ | 47,590 | |

| DAVIDsTEA, Inc. | | | 38,358 | | | | 239,738 | |

| Destination Maternity Corporation | | | 704 | | | | 2,408 | |

| Destination XL Group, Inc. | | | 48,679 | | | | 124,131 | |

| Express, Inc. | | | 2,630 | | | | 22,697 | |

| GNC Holdings, Inc. - Class A | | | 94,674 | | | | 736,564 | |

| Lumber Liquidators Holdings, Inc. | | | 27,949 | | | | 686,148 | |

| Murphy USA, Inc. | | | 225 | | | | 15,653 | |

| Pier 1 Imports, Inc. | | | 3,810 | | | | 25,679 | |

| Rent-A-Center, Inc. | | | 29,467 | | | | 315,002 | |

| RH | | | 15,882 | | | | 761,860 | |

| Sally Beauty Holdings, Inc. | | | 33 | | | | 628 | |

| Sears Hometown and Outlet Stores, Inc. | | | 1,098 | | | | 3,678 | |

| ServiceMaster Global Holdings, Inc. | | | 8,947 | | | | 340,881 | |

| Sportman's Warehouse Holdings, Inc. | | | 153,802 | | | | 629,050 | |

| Tailored Brands, Inc. | | | 212 | | | | 2,614 | |

| Vitamin Shoppe, Inc. | | | 271 | | | | 5,230 | |

| Williams-Sonoma, Inc. | | | 7,025 | | | | 379,701 | |

| Winmark Corporation | | | 34 | | | | 4,389 | |

| | | | | | | | 5,658,990 | |

| Textiles, Apparel & Luxury Goods — 1.3% | | | | | | | | |

| Cherokee, Inc. | | | 16,073 | | | | 138,228 | |

| Deckers Outdoor Corporation | | | 495 | | | | 29,497 | |

| Delta Apparel, Inc. | | | 1,469 | | | | 25,751 | |

| Differential Brands Group, Inc. | | | 1,174 | | | | 2,172 | |

| Fossil Group, Inc. | | | 308 | | | | 5,313 | |

| G-III Apparel Group Ltd. | | | 7,368 | | | | 174,622 | |

| Iconix Brand Group, Inc. | | | 705 | | | | 4,935 | |

| Kate Spade & Company | | | 57,699 | | | | 1,003,962 | |

| Lululemon Athletica, Inc. | | | 7,134 | | | | 370,968 | |

| NIKE, Inc. - Class B | | | 6,623 | | | | 366,980 | |

| Sequential Brands Group, Inc. | | | 109,491 | | | | 368,985 | |

| Under Armour, Inc. - Class A | | | 19,438 | | | | 417,723 | |

| Vera Bradley, Inc. | | | 593 | | | | 5,426 | |

| Vince Holding Corporation | | | 105,111 | | | | 105,111 | |

| | | | | | | | 3,019,673 | |

| Consumer Staples — 4.7% | | | | | | | | |

| Beverages — 0.5% | | | | | | | | |

| Brown-Forman Corporation - Class B | | | 790 | | | | 37,383 | |

| Castle Brands, Inc. | | | 402,557 | | | | 708,500 | |

| Coca-Cola Company (The) | | | 8,165 | | | | 352,320 | |

| MGP Ingredients, Inc. | | | 166 | | | | 8,692 | |

| National Beverage Corporation | | | 514 | | | | 45,535 | |

| | | | | | | | 1,152,430 | |

13

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

| COMMON STOCKS — 79.9% (Continued) | | Shares | | | Value | |

| Consumer Staples — 4.7% (Continued) | | | | | | |

| Food & Staples Retailing — 1.2% | | | | | | |

| Casey's General Stores, Inc. | | | 3,198 | | | $ | 358,400 | |

| Chefs' Warehouse, Inc. (The) | | | 641 | | | | 8,750 | |

| Natural Grocers by Vitamin Cottage, Inc. | | | 16,388 | | | | 179,285 | |

| Smart & Final Stores, Inc. | | | 57,182 | | | | 674,747 | |

| Sprouts Farmers Market, Inc. | | | 47,131 | | | | 1,051,493 | |

| Whole Foods Market, Inc. | | | 9,373 | | | | 340,896 | |

| | | | | | | | 2,613,571 | |

| Food Products — 1.9% | | | | | | | | |

| Alico, Inc. | | | 121 | | | | 3,624 | |

| Amira Nature Foods Ltd. | | | 7,977 | | | | 41,401 | |

| Amplify Snack Brands, Inc. | | | 92,008 | | | | 828,072 | |

| Blue Buffalo Pet Products, Inc. | | | 180 | | | | 4,437 | |

| Calavo Growers, Inc. | | | 10,749 | | | | 705,134 | |

| Cal-Maine Foods, Inc. | | | 22,055 | | | | 832,576 | |

| Dean Foods Company | | | 449 | | | | 8,863 | |

| Freshpet, Inc. | | | 11,235 | | | | 132,011 | |

| Hormel Foods Corporation | | | 10,743 | | | | 376,865 | |

| Mead Johnson Nutrition Company | | | 4,028 | | | | 357,364 | |

| Pilgrim's Pride Corporation | | | 15,177 | | | | 393,995 | |

| Post Holdings, Inc. | | | 3,894 | | | | 327,836 | |

| S&W Seed Company | | | 29,428 | | | | 141,254 | |

| Sanderson Farms, Inc. | | | 66 | | | | 7,642 | |

| Tootsie Roll Industries, Inc. | | | 690 | | | | 25,775 | |

| | | | | | | | 4,186,849 | |

| Household Products — 0.6% | | | | | | | | |

| Church & Dwight Company, Inc. | | | 610 | | | | 30,213 | |

| Clorox Company (The) | | | 49 | | | | 6,551 | |

| HRG Group, Inc. | | | 305 | | | | 6,103 | |

| Orchids Paper Products Company | | | 31,995 | | | | 779,078 | |

| WD-40 Company | | | 6,120 | | | | 641,682 | |

| | | | | | | | 1,463,627 | |

| Personal Products — 0.5% | | | | | | | | |

China-Biotics, Inc. (b) | | | 535,616 | | | | 0 | |

| e.l.f. Beauty, Inc. | | | 24,912 | | | | 678,852 | |

| Herbalife Ltd. | | | 6,235 | | | | 394,426 | |

| LifeVantage Corporation | | | 3,445 | | | | 17,087 | |

| Natural Health Trends Corporation | | | 2,038 | | | | 58,450 | |

| Neptune Technologies & Bioressources, Inc. | | | 10,092 | | | | 10,294 | |

| Shineco, Inc. | | | 9,515 | | | | 42,818 | |

| Synutra International, Inc. | | | 495 | | | | 2,982 | |

| United-Guardian, Inc. | | | 3,272 | | | | 46,135 | |

| | | | | | | | 1,251,044 | |

14

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

| COMMON STOCKS — 79.9% (Continued) | | Shares | | | Value | |

| Consumer Staples — 4.7% (Continued) | | | | | | |

Tobacco — 0.0% (a) | | | | | | |

| Alliance One International, Inc. | | | 135 | | | $ | 1,856 | |

| | | | | | | | | |

| Energy — 4.9% | | | | | | | | |

| Energy Equipment & Services — 1.9% | | | | | | | | |

| Aspen Aerogels, Inc. | | | 85 | | | | 345 | |

| Atwood Oceanics, Inc. | | | 2,032 | | | | 15,911 | |

| Bristow Group, Inc. | | | 46,864 | | | | 626,572 | |

| CARBO Ceramics, Inc. | | | 91,571 | | | | 629,093 | |

| Diamond Offshore Drilling, Inc. | | | 340 | | | | 4,903 | |

| Dril-Quip, Inc. | | | 134 | | | | 6,908 | |

| Frank's International N.V. | | | 72,732 | | | | 661,861 | |

| Geospace Technologies Corporation | | | 1,488 | | | | 24,611 | |

| Helmerich & Payne, Inc. | | | 5,650 | | | | 342,616 | |

| Hornbeck Offshore Services, Inc. | | | 198,275 | | | | 676,118 | |

| ION Geophysical Corporation | | | 30,000 | | | | 129,000 | |

| Noble Corporation plc | | | 3,550 | | | | 17,040 | |

| North American Energy Partners, Inc. | | | 9,481 | | | | 45,035 | |

| Oil States International, Inc. | | | 20 | | | | 595 | |

| PHI, Inc. | | | 198 | | | | 2,322 | |

| RPC, Inc. | | | 14,426 | | | | 262,120 | |

| Seadrill Ltd. | | | 65,868 | | | | 45,436 | |

| Superior Energy Services, Inc. | | | 24,150 | | | | 291,732 | |

| US Silica Holdings, Inc. | | | 9,790 | | | | 406,285 | |

| | | | | | | | 4,188,503 | |

| Oil, Gas & Consumable Fuels — 3.0% | | | | | | | | |

| Aegean Marine Petroleum Network, Inc. | | | 796 | | | | 8,875 | |

| Approach Resources, Inc. | | | 30,557 | | | | 63,253 | |

| Ardmore Shipping Corporation | | | 23,350 | | | | 180,963 | |

| Baytex Energy Corporation | | | 11,018 | | | | 33,274 | |

| Bill Barrett Corporation | | | 161,307 | | | | 619,419 | |

| California Resources Corporation | | | 54,375 | | | | 636,187 | |

| Centrus Energy Corporation - Class A | | | 161 | | | | 836 | |

| Cheniere Energy, Inc. | | | 8,145 | | | | 369,376 | |

| Chesapeake Energy Corporation | | | 64,428 | | | | 338,891 | |

| Comstock Resources, Inc. | | | 11,625 | | | | 101,603 | |

| CVR Energy, Inc. | | | 639 | | | | 13,988 | |

| Denbury Resources, Inc. | | | 299,977 | | | | 665,949 | |

| DHT Holdings, Inc. | | | 61,938 | | | | 296,683 | |

| Earthstone Energy, Inc. | | | 3,288 | | | | 44,289 | |

| EP Energy Corporation - Class A | | | 22,088 | | | | 99,838 | |

| Evolution Petroleum Corporation | | | 426 | | | | 3,408 | |

| Extraction Oil & Gas, Inc. | | | 9,450 | | | | 147,893 | |

| Frontline Ltd. | | | 15,497 | | | | 103,055 | |

15

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

| COMMON STOCKS — 79.9% (Continued) | | Shares | | | Value | |

| Energy — 4.9% (Continued) | | | | | | |

| Oil, Gas & Consumable Fuels — 3.0% (Continued) | | | | | | |

| Gastar Exploration, Inc. | | | 493,846 | | | $ | 646,938 | |

| Golar LNG Ltd. | | | 194 | | | | 4,949 | |

| Halcon Resources Corporation | | | 2,585 | | | | 17,320 | |

| Harvest Natural Resources, Inc. | | | 20,393 | | | | 140,916 | |

| Jones Energy, Inc. - Class A | | | 19,911 | | | | 39,822 | |

| Laredo Petroleum, Inc. | | | 24,946 | | | | 320,806 | |

| Lonestar Resources US, Inc. - Class A | | | 721 | | | | 3,482 | |

| Navigator Holdings Ltd. | | | 2,018 | | | | 24,317 | |

| Noble Energy, Inc. | | | 463 | | | | 14,959 | |

| Nordic American Tankers Ltd. | | | 14,721 | | | | 122,184 | |

| Northern Oil & Gas, Inc. | | | 287,752 | | | | 647,442 | |

| ONEOK, Inc. | | | 2,600 | | | | 136,786 | |

| Pengrowth Energy Corporation | | | 17,791 | | | | 17,524 | |

| Penn West Petroleum Ltd. | | | 23,117 | | | | 34,444 | |

| Renewable Energy Group, Inc. | | | 2,640 | | | | 27,588 | |

| Resolute Energy Corporation | | | 684 | | | | 25,616 | |

| Rice Energy, Inc. | | | 3,966 | | | | 84,436 | |

| Sanchez Energy Corporation | | | 146 | | | | 1,130 | |

| Scorpio Tankers, Inc. | | | 154,530 | | | | 679,932 | |

| Ship Finance International Ltd. | | | 734 | | | | 10,313 | |

| SRC Energy, Inc. | | | 708 | | | | 5,338 | |

| StealthGas, Inc. | | | 9,363 | | | | 32,021 | |

| Stone Energy Corporation | | | 2 | | | | 39 | |

| Torchlight Energy Resources, Inc. | | | 44,587 | | | | 63,759 | |

| Uranium Energy Corporation | | | 19,198 | | | | 23,806 | |

| W&T Offshore, Inc. | | | 14,551 | | | | 29,684 | |

| | | | | | | | 6,883,331 | |

| Financials — 5.0% | | | | | | | | |

| Banks — 1.0% | | | | | | | | |

| Bancorp, Inc. (The) | | | 1,057 | | | | 6,818 | |

| Bank of America Corporation | | | 2,083 | | | | 48,617 | |

| BCB Bancorp, Inc. | | | 39 | | | | 616 | |

| City Holding Company | | | 130 | | | | 9,242 | |

| Civista Bancshares, Inc. | | | 2,424 | | | | 52,674 | |

| Codorus Valley Bancorp, Inc. | | | 20 | | | | 580 | |

| Community Bank System, Inc. | | | 18,197 | | | | 1,018,122 | |

| County Bancorp, Inc. | | | 959 | | | | 26,325 | |

| Customers Bancorp, Inc. | | | 176 | | | | 5,444 | |

| CVB Financial Corporation | | | 2,592 | | | | 55,832 | |

| Enterprise Financial Services Corporation | | | 43 | | | | 1,817 | |

| Farmers Capital Bank Corporation | | | 221 | | | | 9,171 | |

| First Bancorp (North Carolina) | | | 223 | | | | 6,699 | |

| First Financial Bankshares, Inc. | | | 140 | | | | 5,593 | |

16

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

| COMMON STOCKS — 79.9% (Continued) | | Shares | | | Value | |

| Financials — 5.0% (Continued) | | | | | | |

| Banks — 1.0% (Continued) | | | | | | |

| First Interstate BancSystem, Inc. - Class A | | | 169 | | | $ | 6,380 | |

| First Merchants Corporation | | | 109 | | | | 4,510 | |

| First NBC Bank Holding Company | | | 45,093 | | | | 119,496 | |

| German American Bancorp, Inc. | | | 168 | | | | 5,524 | |

| Glacier Bancorp, Inc. | | | 162 | | | | 5,472 | |

| Lakeland Financial Corporation | | | 202 | | | | 9,223 | |

| LegacyTexas Financial Group, Inc. | | | 24 | | | | 907 | |

| Live Oak Bancshares, Inc. | | | 243 | | | | 5,868 | |

| Mackinac Financial Corporation | | | 290 | | | | 4,321 | |

| Merchants Bancshares, Inc. | | | 145 | | | | 7,221 | |

| National Bankshares, Inc. | | | 811 | | | | 34,103 | |

| Northrim BanCorp, Inc. | | | 1,403 | | | | 44,896 | |

| OFG Bancorp | | | 2,351 | | | | 27,507 | |

| Opus Bank | | | 977 | | | | 22,031 | |

| Pacific Mercantile Bancorp | | | 8,596 | | | | 66,619 | |

| Pacific Premier Bancorp, Inc. | | | 11 | | | | 393 | |

| Porter Bancorp, Inc. | | | 3,903 | | | | 39,850 | |

| Republic First Bancorp, Inc. | | | 500 | | | | 4,300 | |

| S&T Bancorp, Inc. | | | 118 | | | | 4,243 | |

| ServisFirst Bancshares, Inc. | | | 156 | | | | 5,897 | |

| Simmons First National Corporation - Class A | | | 99 | | | | 5,410 | |

| Southern First Bancshares, Inc. | | | 18 | | | | 607 | |

| Southside Bancshares, Inc. | | | 162 | | | | 5,625 | |

| Stock Yards Bancorp, Inc. | | | 172 | | | | 7,052 | |

| Summit Financial Group, Inc. | | | 77 | | | | 1,684 | |

| Tompkins Financial Corporation | | | 672 | | | | 55,554 | |

| Trustmark Corporation | | | 770 | | | | 25,579 | |

| Union Bankshares, Inc. | | | 2,034 | | | | 85,530 | |

| United Bankshares, Inc. | | | 40 | | | | 1,596 | |

| West Bancorporation, Inc. | | | 101 | | | | 2,353 | |

| Westamerica Bancorporation | | | 7,043 | | | | 387,506 | |

| | | | | | | | 2,244,807 | |

| Capital Markets — 1.1% | | | | | | | | |

| American Capital Senior Floating Ltd. | | | 149 | | | | 1,997 | |

| Arlington Asset Investment Corporation - Class A | | | 810 | | | | 11,794 | |

| Artisan Partners Asset Management, Inc. - Class A | | | 12,978 | | | | 380,255 | |

| CM Finance, Inc. | | | 195 | | | | 1,969 | |

| Cowen Group, Inc - Class A | | | 5,833 | | | | 92,745 | |

| FBR & Company | | | 7,152 | | | | 129,451 | |

| Federated Investors, Inc. - Class B | | | 318 | | | | 8,529 | |

| Fidus Investment Corporation | | | 179 | | | | 3,209 | |

| Fifth Street Asset Management, Inc. | | | 9,405 | | | | 44,203 | |

| Fifth Street Senior Floating Rate Corporation | | | 107 | | | | 872 | |

17

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

| COMMON STOCKS — 79.9% (Continued) | | Shares | | | Value | |

| Financials — 5.0% (Continued) | | | | | | |

| Capital Markets — 1.1% (Continued) | | | | | | |

| Financial Engines, Inc. | | | 3,457 | | | $ | 146,922 | |

| Garrison Capital, Inc. | | | 2,310 | | | | 22,592 | |

| Goldman Sachs BDC, Inc. | | | 754 | | | | 18,850 | |

| Greenhill & Company, Inc. | | | 295 | | | | 7,463 | |

| GSV Capital Corporation | | | 29,596 | | | | 130,814 | |

| Manning & Napier, Inc. | | | 23,036 | | | | 133,609 | |

| MFC Bancorp Ltd. | | | 3,654 | | | | 6,066 | |

| OFS Capital Corporation | | | 121 | | | | 1,750 | |

| OHA Investment Corporation | | | 921 | | | | 1,363 | |

| Prospect Capital Corporation | | | 2,142 | | | | 19,921 | |

| Stellus Capital Investment Corporation | | | 138 | | | | 1,982 | |

| TICC Capital Corporation | | | 24 | | | | 176 | |

| Virtu Financial, Inc. - Class A | | | 40,892 | | | | 629,737 | |

| Virtus Investment Partners, Inc. | | | 80 | | | | 8,512 | |

| Waddell & Reed Financial, Inc. - Class A | | | 288 | | | | 5,181 | |

| WisdomTree Investments, Inc. | | | 80,762 | | | | 674,363 | |

| | | | | | | | 2,484,325 | |

| Consumer Finance — 0.7% | | | | | | | | |

| Credit Acceptance Corporation | | | 4,647 | | | | 944,503 | |

| Encore Capital Group, Inc. | | | 9,255 | | | | 308,654 | |

| Enova International, Inc. | | | 648 | | | | 9,202 | |

| FirstCash, Inc. | | | 73 | | | | 3,792 | |

| PRA Group, Inc. | | | 2,243 | | | | 72,225 | |

| Regional Management Corporation | | | 444 | | | | 8,804 | |

| World Acceptance Corporation | | | 2,306 | | | | 121,987 | |

| | | | | | | | 1,469,167 | |

Diversified Financial Services — 0.0% (a) | | | | | | | | |

| A-Mark Precious Metals, Inc. | | | 129 | | | | 2,272 | |

| Medallion Financial Corporation | | | 22,548 | | | | 45,998 | |

| On Deck Capital, Inc. | | | 1,096 | | | | 5,206 | |

| | | | | | | | 53,476 | |

| Insurance — 1.7% | | | | | | | | |

| Argo Group International Holdings Ltd. | | | 15 | | | | 989 | |

| Assurant, Inc. | | | 42 | | | | 4,042 | |

| Assured Guaranty Ltd. | | | 4,811 | | | | 183,443 | |

| Baldwin & Lyons, Inc. - Class B | | | 40 | | | | 980 | |

| Citizens, Inc. | | | 85,855 | | | | 605,278 | |

| Conifer Holdings, Inc. | | | 2,465 | | | | 19,104 | |

| eHealth, Inc. | | | 56,696 | | | | 803,949 | |

| Fidelity & Guaranty Life | | | 1,087 | | | | 30,925 | |

| HCI Group, Inc. | | | 230 | | | | 10,969 | |

| Health Insurance Innovations, Inc. - Class A | | | 49,229 | | | | 824,586 | |

| MBIA, Inc. | | | 1,026 | | | | 8,618 | |

18

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

| COMMON STOCKS — 79.9% (Continued) | | Shares | | | Value | |

| Financials — 5.0% (Continued) | | | | | | |

| Insurance — 1.7% (Continued) | | | | | | |

| Mercury General Corporation | | | 1,146 | | | $ | 70,468 | |

| OneBeacon Insurance Group Ltd. - Class A | | | 222 | | | | 3,541 | |

| Patriot National, Inc. | | | 53,986 | | | | 156,020 | |

| RLI Corporation | | | 11,623 | | | | 665,068 | |

| United Insurance Holdings Corporation | | | 207 | | | | 3,159 | |

| Universal Insurance Holdings, Inc. | | | 1,785 | | | | 46,499 | |

| WMIH Corporation | | | 270,699 | | | | 406,048 | |

| | | | | | | | 3,843,686 | |

| Mortgage Real Estate Investment Trusts (REITs) — 0.1% | | | | | | | | |

| New York Mortgage Trust, Inc. | | | 877 | | | | 5,622 | |

| Orchid Island Capital, Inc. | | | 9,024 | | | | 95,654 | |

| | | | | | | | 101,276 | |

| Thrifts & Mortgage Finance — 0.4% | | | | | | | | |

| Banc of California, Inc. | | | 6,525 | | | | 141,592 | |

| BofI Holding, Inc. | | | 6,240 | | | | 149,074 | |

| Capitol Federal Financial, Inc. | | | 608 | | | | 8,895 | |

| Charter Financial Corporation | | | 161 | | | | 2,954 | |

| Clifton Bancorp, Inc. | | | 326 | | | | 5,444 | |

| Five Oaks Investment Corporation | | | 25,845 | | | | 138,788 | |

| Impac Mortgage Holdings, Inc. | | | 20,332 | | | | 290,747 | |

| LendingTree, Inc. | | | 373 | | | | 52,556 | |

| Nationstar Mortgage Holdings, Inc. | | | 7,188 | | | | 115,799 | |

| Northwest Bancshares, Inc. | | | 1,641 | | | | 26,486 | |

| Oritani Financial Corporation | | | 525 | | | | 8,899 | |

| People's United Financial, Inc. | | | 183 | | | | 3,197 | |

| Walker & Dunlop, Inc. | | | 206 | | | | 9,239 | |

| WSFS Financial Corporation | | | 10 | | | | 472 | |

| | | | | | | | 954,142 | |

| Health Care — 19.9% | | | | | | | | |

| Biotechnology — 8.2% | | | | | | | | |

| AC Immune S.A. | | | 401 | | | | 3,830 | |

| ACADIA Pharmaceuticals, Inc. | | | 10,943 | | | | 375,673 | |

| Adamas Pharmaceuticals, Inc. | | | 534 | | | | 8,747 | |

| Aduro Biotech, Inc. | | | 41,978 | | | | 405,088 | |

| Advaxis, Inc. | | | 12,620 | | | | 108,027 | |

| Agios Pharmaceuticals, Inc. | | | 6,832 | | | | 339,619 | |

| Alder Biopharmaceuticals, Inc. | | | 26,769 | | | | 536,718 | |

| Aldeyra Therapeutics, Inc. | | | 20,363 | | | | 88,579 | |

| Alnylam Pharmaceuticals, Inc. | | | 7,609 | | | | 407,842 | |

| Amicus Therapeutics, Inc. | | | 726 | | | | 5,576 | |

| Anavex Life Sciences Corporation | | | 11,077 | | | | 62,364 | |

| Arbutus Biopharma Corporation | | | 1,453 | | | | 4,868 | |

| ArQule, Inc. | | | 16,863 | | | | 16,694 | |

19

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

| COMMON STOCKS — 79.9% (Continued) | | Shares | | | Value | |

| Health Care — 19.9% (Continued) | | | | | | |

| Biotechnology — 8.2% (Continued) | | | | | | |

| Array BioPharma, Inc. | | | 3,695 | | | $ | 32,036 | |

| Atara Biotherapeutics, Inc. | | | 39,563 | | | | 676,527 | |

| Athersys, Inc. | | | 25,792 | | | | 38,172 | |

| aTyr Pharma, Inc. | | | 39,023 | | | | 128,776 | |

| Aurinia Pharmaceuticals, Inc. | | | 110,897 | | | | 777,388 | |

| Avexis, Inc. | | | 3,932 | | | | 316,526 | |

| Brainstorm Cell Therapeutics, Inc. | | | 14,433 | | | | 59,608 | |

| Calithera Biosciences, Inc. | | | 3,521 | | | | 38,203 | |

| Cara Therapeutics, Inc. | | | 44,861 | | | | 712,841 | |

| Cascadian Therapeutics, Inc. | | | 921 | | | | 3,914 | |

| Clovis Oncology, Inc. | | | 722 | | | | 41,797 | |

| Corbus Pharmaceuticals Holdings, Inc. | | | 115,773 | | | | 833,566 | |

| Dynavax Technologies Corporation | | | 8,972 | | | | 49,795 | |

| Eagle Pharmaceuticals, Inc. | | | 59 | | | | 5,345 | |

| Editas Medicine, Inc. | | | 2,603 | | | | 49,067 | |

| Eiger BioPharmaceuticals, Inc. | | | 4,936 | | | | 38,994 | |

| Esperion Therapeutics, Inc. | | | 224 | | | | 8,008 | |

| Flexion Therapeutics, Inc. | | | 23,411 | | | | 477,818 | |

| Fortress Biotech, Inc. | | | 37,540 | | | | 136,646 | |

| Galectin Therapeutics, Inc. | | | 8,790 | | | | 26,897 | |

| Geron Corporation | | | 296,819 | | | | 759,857 | |

| GlycoMimetics, Inc. | | | 952 | | | | 4,094 | |

| GTx, Inc. | | | 4,770 | | | | 20,511 | |

| Halozyme Therapeutics, Inc. | | | 404 | | | | 5,632 | |

| Heron Therapeutics, Inc. | | | 46,496 | | | | 713,714 | |

| Ignyta, Inc. | | | 577 | | | | 5,106 | |

| ImmunoGen, Inc. | | | 172,873 | | | | 750,269 | |

| Immunomedics, Inc. | | | 133,068 | | | | 762,480 | |

| Incyte Corporation | | | 2,820 | | | | 350,470 | |

| Infinity Pharmaceuticals, Inc. | | | 8,777 | | | | 18,871 | |

| Inotek Pharmaceuticals Corporation | | | 66,154 | | | | 132,308 | |

| Inovio Pharmaceuticals, Inc. | | | 5,777 | | | | 36,337 | |

| Insys Therapeutics, Inc. | | | 9,928 | | | | 111,690 | |

| Intellia Therapeutics, Inc. | | | 1,927 | | | | 28,076 | |

| Intercept Pharmaceuticals, Inc. | | | 3,348 | | | | 376,148 | |

| Intrexon Corporation | | | 21,763 | | | | 453,541 | |

| Juno Therapeutics, Inc. | | | 16,399 | | | | 408,991 | |

| Kadmon Holdings, Inc. | | | 76,256 | | | | 209,704 | |

| Keryx Biopharmaceuticals, Inc. | | | 16,571 | | | | 98,100 | |

| Kindred Biosciences, Inc. | | | 354 | | | | 2,460 | |

| La Jolla Pharmaceutical Company | | | 23,778 | | | | 689,562 | |

| Lexicon Pharmaceuticals, Inc. | | | 2,879 | | | | 44,941 | |

| Ligand Pharmaceuticals, Inc. - Class B | | | 55 | | | | 6,114 | |

20

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

| COMMON STOCKS — 79.9% (Continued) | | Shares | | | Value | |

| Health Care — 19.9% (Continued) | | | | | | |

| Biotechnology — 8.2% (Continued) | | | | | | |

| Loxo Oncology, Inc. | | | 14,458 | | | $ | 665,935 | |

| MacroGenics, Inc. | | | 80 | | | | 1,729 | |

| MannKind Corporation | | | 157,916 | | | | 137,955 | |

| MediciNova, Inc. | | | 20,099 | | | | 115,569 | |

| Merrimack Pharmaceuticals, Inc. | | | 35,865 | | | | 119,430 | |

| MiMedx Group, Inc. | | | 8,751 | | | | 111,050 | |

| Mirati Therapeutics, Inc. | | | 398 | | | | 1,811 | |

| Myriad Genetics, Inc. | | | 392 | | | | 7,209 | |

| Novavax, Inc. | | | 27,780 | | | | 22,671 | |

| Nymox Pharmaceutical Corporation | | | 6,182 | | | | 29,117 | |

| Omeros Corporation | | | 4,858 | | | | 79,283 | |

| Oncobiologics, Inc. | | | 1,427 | | | | 3,196 | |

| OncoMed Pharmaceuticals, Inc. | | | 160,500 | | | | 632,370 | |

| OPKO Health, Inc. | | | 45 | | | | 350 | |

| Organovo Holdings, Inc. | | | 18,851 | | | | 54,668 | |

| OvaScience, Inc. | | | 84,039 | | | | 126,899 | |

| Pluristem Therapeutics, Inc. | | | 2,107 | | | | 3,034 | |

| ProQR Therapeutics N.V. | | | 966 | | | | 4,733 | |

| Protalix BioTherapeutics, Inc. | | | 68,886 | | | | 64,064 | |

| Proteostasis Therapeutics, Inc. | | | 59,241 | | | | 358,112 | |

| Puma Biotechnology, Inc. | | | 18 | | | | 731 | |

| Radius Health, Inc. | | | 142 | | | | 5,548 | |

| Regulus Therapeutics, Inc. | | | 89,492 | | | | 138,713 | |

| Retrophin, Inc. | | | 285 | | | | 5,583 | |

| Rigel Pharmaceuticals, Inc. | | | 885 | | | | 2,646 | |

| Sangamo Therapeutics, Inc. | | | 141,240 | | | | 677,952 | |

| Sarepta Therapeutics, Inc. | | | 784 | | | | 28,428 | |

| Seattle Genetics, Inc. | | | 5,859 | | | | 400,170 | |

| Seres Therapeutics, Inc. | | | 15,621 | | | | 153,554 | |

| Sorrento Therapeutics, Inc. | | | 11,906 | | | | 23,217 | |

| Spark Therapeutics, Inc. | | | 99 | | | | 5,739 | |

| Spring Bank Pharmaceuticals, Inc. | | | 2,086 | | | | 20,005 | |

| Stonebridge Biopharma plc | | | 32,195 | | | | 144,877 | |

| Syros Pharmaceuticals, Inc. | | | 223 | | | | 3,387 | |

| T2 Biosystems, Inc. | | | 199 | | | | 957 | |

| TG Therapeutics, Inc. | | | 55,446 | | | | 612,678 | |

| Tracon Pharmaceuticals, Inc. | | | 201 | | | | 714 | |

| Trevena, Inc. | | | 170,614 | | | | 557,908 | |

| vTv Therapeutics, Inc. - Class A | | | 3,718 | | | | 20,486 | |

| XBiotech, Inc. | | | 8,135 | | | | 88,509 | |

| Xenon Pharmaceuticals, Inc. | | | 27,224 | | | | 106,854 | |

| ZIOPHARM Oncology, Inc. | | | 24,375 | | | | 171,600 | |

| | | | | | | | 18,513,966 | |

21

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

| COMMON STOCKS — 79.9% (Continued) | | Shares | | | Value | |

| Health Care — 19.9% (Continued) | | | | | | |

| Health Care Equipment & Supplies — 4.9% | | | | | | |

| ABIOMED, Inc. | | | 3,013 | | | $ | 392,654 | |

| Accuray, Inc. | | | 68 | | | | 309 | |

| Alere, Inc. | | | 67 | | | | 3,294 | |

| Align Technology, Inc. | | | 3,088 | | | | 415,707 | |

| Antares Pharma, Inc. | | | 2,334 | | | | 7,282 | |

| Avinger, Inc. | | | 162 | | | | 91 | |

| Baxter International, Inc. | | | 7 | | | | 390 | |

| Biolase, Inc. | | | 4,853 | | | | 6,212 | |

| Bovie Medical Corporation | | | 25,394 | | | | 68,564 | |

| Cerus Corporation | | | 149,223 | | | | 649,120 | |

| Check-Cap Ltd. | | | 1,096 | | | | 2,378 | |

| Cogentix Medical, Inc. | | | 21 | | | | 39 | |

| ConforMIS, Inc. | | | 63,405 | | | | 356,336 | |

| Corindus Vascular Robotics, Inc. | | | 497,706 | | | | 627,110 | |

| CRH Medical Corporation | | | 2,490 | | | | 14,691 | |

| CryoPort, Inc. | | | 21,754 | | | | 52,427 | |

| CytoSorbents Corporation | | | 4,917 | | | | 25,568 | |

| DexCom, Inc. | | | 4,813 | | | | 375,222 | |

| Digirad Corporation | | | 19,502 | | | | 91,659 | |

| Endologix, Inc. | | | 95,183 | | | | 712,921 | |

| Entellus Medical, Inc. | | | 50,633 | | | | 720,001 | |

| GenMark Diagnostics, Inc. | | | 53,884 | | | | 690,793 | |

| Glaukos Corporation | | | 14,499 | | | | 689,137 | |

| IDEXX Laboratories, Inc. | | | 2,404 | | | | 403,223 | |

| Integra LifeSciences Holdings Corporation | | | 44 | | | | 2,023 | |

| Intuitive Surgical, Inc. | | | 101 | | | | 84,423 | |

| Invacare Corporation | | | 39,765 | | | | 584,546 | |

| InVivo Therapeutics Holdings Corporation | | | 49,164 | | | | 186,823 | |

| iRadimed Corporation | | | 12,989 | | | | 111,705 | |

| IRIDEX Corporation | | | 1,872 | | | | 21,341 | |

| Lantheus Holdings, Inc. | | | 187 | | | | 2,431 | |

| Neovasc, Inc. | | | 27,603 | | | | 42,785 | |

| Nevro Corporation | | | 59 | | | | 5,559 | |

| Novadaq Technologies, Inc. | | | 1,869 | | | | 13,008 | |

| NovoCure Ltd. | | | 65,973 | | | | 745,495 | |

| Nuvectra Corporation | | | 11,644 | | | | 95,248 | |

| Oxford Immunotec Global plc | | | 7 | | | | 108 | |

| Pulse Biosciences, Inc. | | | 4,219 | | | | 101,762 | |

| Quotient Ltd. | | | 36,560 | | | | 248,974 | |

| ResMed, Inc. | | | 3,599 | | | | 244,696 | |

| Rockwell Medical, Inc. | | | 77,859 | | | | 669,587 | |

| Second Sight Medical Products, Inc. | | | 244 | | | | 283 | |

| Senseonics Holdings, Inc. | | | 27,987 | | | | 47,298 | |

22

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

| COMMON STOCKS — 79.9% (Continued) | | Shares | | | Value | |

| Health Care — 19.9% (Continued) | | | | | | |

| Health Care Equipment & Supplies — 4.9% (Continued) | | | | | | |

| Tandem Diabetes Care, Inc. | | | 66,818 | | | $ | 63,658 | |

| TransEnterix, Inc. | | | 288 | | | | 187 | |

| ViewRay, Inc. | | | 108,960 | | | | 751,824 | |

| Viveve Medical, Inc. | | | 93,713 | | | | 758,138 | |

| | | | | | | | 11,087,030 | |

| Health Care Providers & Services — 1.8% | | | | | | | | |

| AAC Holdings, Inc. | | | 91,622 | | | | 656,013 | |

| Acadia Healthcare Company, Inc. | | | 8,107 | | | | 353,303 | |

| Aceto Corporation | | | 15,117 | | | | 239,604 | |

| American Renal Associates Holdings, Inc. | | | 231 | | | | 3,975 | |

| Anthem, Inc. | | | 20 | | | | 3,558 | |

| BioScrip, Inc. | | | 65,373 | | | | 99,367 | |

| Community Health Systems, Inc. | | | 4,837 | | | | 41,647 | |

| Express Scripts Holding Company | | | 37 | | | | 2,270 | |

| Fulgent Genetics, Inc. | | | 4,094 | | | | 41,718 | |

| InfuSystems Holdings, Inc. | | | 6,051 | | | | 12,404 | |

| MEDNAX, Inc. | | | 5,212 | | | | 314,596 | |

| Nobilis Health Corporation | | | 310,732 | | | | 388,415 | |

| Owens & Minor, Inc. | | | 154 | | | | 5,336 | |

| Quorum Health Corporation | | | 58 | | | | 248 | |

| Sharps Compliance Corporation | | | 26,954 | | | | 115,902 | |

| Surgery Partners, Inc. | | | 188 | | | | 3,234 | |

| Teladoc, Inc. | | | 27,037 | | | | 670,518 | |

| Tenet Healthcare Corporation | | | 64,309 | | | | 1,007,722 | |

| Triple-S Management Corporation - Class B | | | 68 | | | | 1,231 | |

| Trupanion, Inc. | | | 6,275 | | | | 99,710 | |

| Veracyte, Inc. | | | 500 | | | | 4,235 | |

| | | | | | | | 4,065,006 | |

| Health Care Services — 0.2% | | | | | | | | |

| Envision Healthcare Corporation | | | 5,869 | | | | 328,840 | |

| | | | | | | | | |

| Health Care Technology — 0.8% | | | | | | | | |

| athenahealth, Inc. | | | 3,264 | | | | 319,905 | |

| Computer Programs & Systems, Inc. | | | 4,123 | | | | 113,176 | |

| Connecture, Inc. | | | 1,929 | | | | 1,647 | |

| Evolent Health, Inc. - Class A | | | 30,592 | | | | 711,264 | |

| HTG Molecular Diagnostics, Inc. | | | 607 | | | | 3,047 | |

| iCAD, Inc. | | | 674 | | | | 3,768 | |

| Inovalon Holdings, Inc. - Class A | | | 4,148 | | | | 50,813 | |

| NantHealth, Inc. | | | 193,373 | | | | 601,390 | |

| Omnicell, Inc. | | | 131 | | | | 5,423 | |

| Simulations Plus, Inc. | | | 3,373 | | | | 39,464 | |

| | | | | | | | 1,849,897 | |

23

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

| COMMON STOCKS — 79.9% (Continued) | | Shares | | | Value | |

| Health Care — 19.9% (Continued) | | | | | | |

| Life Sciences Tools & Services — 1.1% | | | | | | |

| Accelerate Diagnostics, Inc. | | | 31,887 | | | $ | 870,515 | |

| Bio-Techne Corporation | | | 3,489 | | | | 373,602 | |

| ChromaDex Corporation | | | 7,997 | | | | 24,871 | |

| Compugen Ltd. | | | 1,810 | | | | 7,330 | |

| Fluidigm Corporation | | | 135,443 | | | | 669,088 | |

| Pacific Biosciences of California, Inc. | | | 158,323 | | | | 623,793 | |

| | | | | | | | 2,569,199 | |

| Pharmaceuticals — 2.9% | | | | | | | | |

| Achaogen, Inc. | | | 29,648 | | | | 713,924 | |

| Adamis Pharmaceuticals Corporation | | | 11,658 | | | | 43,135 | |

| Akorn, Inc. | | | 11,920 | | | | 398,724 | |

| Aralez Pharmaceuticals, Inc. | | | 367,731 | | | | 592,047 | |

| Aratana Therapeutics, Inc. | | | 33,267 | | | | 206,256 | |

| Assembly Biosciences, Inc. | | | 87 | | | | 2,056 | |

| Axsome Therapeutics, Inc. | | | 18,368 | | | | 75,309 | |

| BioDelivery Sciences International, Inc. | | | 58,981 | | | | 107,640 | |

| Cempra, Inc. | | | 11,810 | | | | 50,783 | |

| Clearside Biomedical, Inc. | | | 4,498 | | | | 35,804 | |

| Collegium Pharmaceutical, Inc. | | | 723 | | | | 7,093 | |

| Concordia International Corporation | | | 32,951 | | | | 41,518 | |

| Depomed, Inc. | | | 56,464 | | | | 677,003 | |

| Egalet Corporation | | | 4,220 | | | | 16,120 | |

| Flex Pharma, Inc. | | | 3,304 | | | | 11,366 | |

| Foamix Pharmaceuticals Ltd. | | | 155,011 | | | | 652,596 | |

| Impax Laboratories, Inc. | | | 5,583 | | | | 78,441 | |

| Intra-Cellular Therapies, Inc. | | | 1,970 | | | | 27,225 | |

| KemPharm, Inc. | | | 14,499 | | | | 66,695 | |

| Lannett Company, Inc. | | | 7,343 | | | | 190,918 | |

| Lipocine, Inc. | | | 335 | | | | 1,420 | |

| Neos Therapeutics, Inc. | | | 99,998 | | | | 709,986 | |

| Neuroderm Ltd. | | | 1,622 | | | | 46,835 | |

| Ocular Therapeutix, Inc. | | | 12,151 | | | | 121,024 | |

| Reata Pharmaceuticals, Inc. - Class A | | | 2,239 | | | | 46,437 | |

| Revance Therapeutics, Inc. | | | 2,084 | | | | 45,327 | |

| SteadyMed Ltd. | | | 5,709 | | | | 41,105 | |

| Teligent, Inc. | | | 9,635 | | | | 76,020 | |

| TherapeuticsMD, Inc. | | | 152,539 | | | | 777,949 | |

| Titan Pharmaceuticals, Inc. | | | 504 | | | | 1,487 | |

| WAVE Life Sciences Ltd. | | | 24,544 | | | | 517,879 | |

| Zogenix, Inc. | | | 503 | | | | 5,533 | |

| Zynerba Pharmaceuticals, Inc. | | | 3,444 | | | | 72,255 | |

| | | | | | | | 6,457,910 | |

24

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

| COMMON STOCKS — 79.9% (Continued) | | Shares | | | Value | |

| Industrials — 10.1% | | | | | | |

| Aerospace & Defense — 0.9% | | | | | | |

| AeroVironment, Inc. | | | 24,210 | | | $ | 691,680 | |

| Axon Enterprise, Inc. | | | 28,975 | | | | 712,206 | |

| Cubic Corporation | | | 106 | | | | 5,501 | |

| DigitalGlobe, Inc. | | | 271 | | | | 8,726 | |

| HEICO Corporation | | | 18 | | | | 1,244 | |

| KEYW Holding Corporation (The) | | | 20,649 | | | | 195,959 | |

| KLX, Inc. | | | 116 | | | | 5,487 | |

| Kratos Defense & Security Solutions, Inc. | | | 1,182 | | | | 9,007 | |

| TransDigm Group, Inc. | | | 1,574 | | | | 388,353 | |

| Triumph Group, Inc. | | | 207 | | | | 5,423 | |

| | | | | | | | 2,023,586 | |

| Air Freight & Logistics — 0.3% | | | | | | | | |

| Echo Global Logistics, Inc. | | | 34,254 | | | | 642,262 | |

| | | | | | | | | |

| Airlines — 0.1% | | | | | | | | |

| Copa Holdings S.A. - Class A | | | 397 | | | | 46,219 | |

| Spirit Airlines, Inc. | | | 4,312 | | | | 246,948 | |

| | | | | | | | 293,167 | |

| Building Products — 0.7% | | | | | | | | |

| AAON, Inc. | | | 153 | | | | 5,607 | |

| Advanced Drainage Systems, Inc. | | | 31,510 | | | | 726,306 | |

| Apogee Enterprises, Inc. | | | 13,657 | | | | 744,307 | |

| Armstrong Flooring, Inc. | | | 162 | | | | 3,109 | |

| Quanex Building Products Corporation | | | 273 | | | | 5,569 | |

| USG Corporation | | | 1,054 | | | | 31,936 | |

| | | | | | | | 1,516,834 | |

| Commercial Services & Supplies — 1.5% | | | | | | | | |

| Acme United Corporation | | | 3 | | | | 87 | |

| Aqua Metals, Inc. | | | 47,529 | | | | 784,229 | |

| ARC Document Solutions, Inc. | | | 161 | | | | 592 | |

| Asta Funding, Inc. | | | 1,030 | | | | 8,652 | |

| Atento, S.A. | | | 16 | | | | 143 | |

| Avery Dennison Corporation | | | 43 | | | | 3,578 | |

| CompX International, Inc. | | | 258 | | | | 3,844 | |

| Covanta Holding Corporation | | | 70,195 | | | | 1,021,337 | |

| Healthcare Services Group, Inc. | | | 15,240 | | | | 699,668 | |

| Hudson Technologies, Inc. | | | 795 | | | | 5,645 | |

| Interface, Inc. | | | 35 | | | | 697 | |

| Intersections, Inc. | | | 21,559 | | | | 105,639 | |

| Johnson Controls International plc | | | 403 | | | | 16,753 | |

| Mobile Mini, Inc. | | | 23,122 | | | | 663,601 | |

| Multi-Color Corporation | | | 73 | | | | 5,606 | |

| Performant Financial Corporation | | | 45,865 | | | | 104,572 | |

25

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

| COMMON STOCKS — 79.9% (Continued) | | Shares | | | Value | |

| Industrials — 10.1% (Continued) | | | | | | |

| Commercial Services & Supplies — 1.5% (Continued) | | | | | | |

| R.R. Donnelley & Sons Company | | | 42 | | | $ | 528 | |

| Team, Inc. | | | 996 | | | | 26,792 | |

| Tetra Tech, Inc. | | | 9 | | | | 396 | |

| Virco Manufacturing Corporation | | | 3,634 | | | | 16,535 | |

| | | | | | | | 3,468,894 | |

| Construction & Engineering — 1.2% | | | | | | | | |

| Goldfield Corporation (The) | | | 121,759 | | | | 663,587 | |

| HC2 Holdings, Inc. | | | 179 | | | | 1,045 | |

| IES Holdings, Inc. | | | 14,964 | | | | 299,280 | |

| Layne Christensen Company | | | 1,657 | | | | 13,206 | |

| Northwest Pipe Company | | | 3,336 | | | | 46,738 | |

| NV5 Global, Inc. | | | 17,074 | | | | 660,764 | |

| Orion Group Holdings, Inc. | | | 75 | | | | 566 | |

| Quanta Services, Inc. | | | 9,564 | | | | 338,948 | |

| Willdan Group, Inc. | | | 22,578 | | | | 640,538 | |

| | | | | | | | 2,664,672 | |

| Electrical Equipment — 1.0% | | | | | | | | |

| Acuity Brands, Inc. | | | 2,041 | | | | 359,420 | |

| American Superconductor Corporation | | | 15,676 | | | | 81,672 | |

| Energous Corporation | | | 61,383 | | | | 774,653 | |

| Energy Focus, Inc. | | | 31 | | | | 96 | |

| Enphase Energy, Inc. | | | 754 | | | | 897 | |

| FuelCell Energy, Inc. | | | 84,590 | | | | 97,278 | |

| Hydrogenics Corporation | | | 15,395 | | | | 115,463 | |

| Plug Power, Inc. | | | 41,509 | | | | 92,980 | |

| Sunrun, Inc. | | | 145,173 | | | | 767,965 | |

| Ultralife Corporation | | | 683 | | | | 3,757 | |

| | | | | | | | 2,294,181 | |

| Industrial Conglomerates — 0.1% | | | | | | | | |

| General Electric Company | | | 11,818 | | | | 342,604 | |

| | | | | | | | | |

| Machinery — 1.5% | | | | | | | | |

| Actuant Corporation - Class A | | | 207 | | | | 5,651 | |

| American Railcar Industries, Inc. | | | 2,129 | | | | 89,312 | |

| ARC Group Worldwide, Inc. | | | 18,856 | | | | 66,939 | |

| Chart Industries, Inc. | | | 155 | | | | 5,659 | |

| CIRCOR International, Inc. | | | 143 | | | | 9,540 | |

| Deere & Company | | | 3,273 | | | | 365,300 | |

| DMC Global, Inc. | | | 2,155 | | | | 32,971 | |

| Energy Recovery, Inc. | | | 54,155 | | | | 457,068 | |

| ExOne Company (The) | | | 3,605 | | | | 36,374 | |

| Graco, Inc. | | | 747 | | | | 80,564 | |

| Greenbrier Companies, Inc. (The) | | | 2,671 | | | | 116,055 | |

26

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

| COMMON STOCKS — 79.9% (Continued) | | Shares | | | Value | |

| Industrials — 10.1% (Continued) | | | | | | |

| Machinery — 1.5% (Continued) | | | | | | |

| Hardinge, Inc. | | | 283 | | | $ | 2,971 | |

| Hyster-Yale Materials Handling, Inc. | | | 9,272 | | | | 557,340 | |

| Key Technology, Inc. | | | 2,995 | | | | 39,055 | |

| Kornit Digital Ltd. | | | 4,954 | | | | 99,575 | |

| Lincoln Electric Holdings, Inc. | | | 50 | | | | 4,451 | |

| Lindsay Corporation | | | 2,087 | | | | 181,277 | |

| Manitowoc Company, Inc. (The) | | | 1,601 | | | | 9,558 | |

| Navistar International Corporation | | | 226 | | | | 6,082 | |

| Omega Flex, Inc. | | | 268 | | | | 15,054 | |

| Perma-Pipe International Holdings, Inc. | | | 831 | | | | 6,690 | |

| Proto Labs, Inc. | | | 13,295 | | | | 771,110 | |

| Sun Hydraulics Corporation | | | 150 | | | | 5,826 | |

| Supreme Industries, Inc. - Class A | | | 2,337 | | | | 46,833 | |

| Wabash National Corporation | | | 1,041 | | | | 23,714 | |

| Wabtec Corporation | | | 1,831 | | | | 153,603 | |

| Welbilt, Inc. | | | 453 | | | | 9,286 | |

| Westport Fuel Systems, Inc. | | | 165,306 | | | | 224,816 | |

| | | | | | | | 3,422,674 | |

| Marine — 0.2% | | | | | | | | |

| Danaos Corporation | | | 3,100 | | | | 5,270 | |

| Diana Shipping, Inc. | | | 19,131 | | | | 76,333 | |

| Eagle Bulk Shipping, Inc. | | | 7,626 | | | | 37,596 | |

| Genco Shipping & Trading Ltd. | | | 3,759 | | | | 43,304 | |

| Golden Ocean Group Ltd. | | | 3,023 | | | | 23,035 | |

| Navios Maritime Holdings, Inc. | | | 25,498 | | | | 43,346 | |

| Seaspan Corporation | | | 15,344 | | | | 108,022 | |

| Star Bulk Carriers Corporation | | | 3,032 | | | | 28,683 | |

| | | | | | | | 365,589 | |

| Professional Services — 1.1% | | | | | | | | |

| Acacia Research Corporation | | | 787 | | | | 4,289 | |

| BG Staffing, Inc. | | | 8,227 | | | | 128,341 | |

| CDI Corporation | | | 437 | | | | 3,561 | |

| Cogint, Inc. | | | 131,612 | | | | 697,544 | |

| Dun & Bradstreet Corporation (The) | | | 8,483 | | | | 929,822 | |

| FTI Consulting, Inc. | | | 10,980 | | | | 379,798 | |

| Hill International, Inc. | | | 318 | | | | 1,288 | |

| Paylocity Holding Corporation | | | 9,528 | | | | 375,784 | |

| | | | | | | | 2,520,427 | |

| Road & Rail — 0.5% | | | | | | | | |

| Avis Budget Group, Inc. | | | 187 | | | | 5,704 | |

| CSX Corporation | | | 6,969 | | | | 354,304 | |

| Heartland Express, Inc. | | | 1,314 | | | | 26,438 | |

| Hertz Global Holdings, Inc. | | | 565 | | | | 9,317 | |

27

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

| COMMON STOCKS — 79.9% (Continued) | | Shares | | | Value | |

| Industrials — 10.1% (Continued) | | | | | | |

| Road & Rail — 0.5% (Continued) | | | | | | |

| P.A.M. Transportation Services, Inc. | | | 46 | | | $ | 863 | |

| Student Transportation, Inc. | | | 875 | | | | 5,206 | |

| Swift Transportation Company | | | 28,192 | | | | 692,959 | |

| Universal Logistics Holdings, Inc. | | | 1,408 | | | | 19,642 | |

| USA Truck, Inc. | | | 589 | | | | 3,952 | |

| | | | | | | | 1,118,385 | |

| Trading Companies & Distributors — 0.9% | | | | | | | | |

| EnviroStar, Inc. | | | 6,224 | | | | 147,198 | |

| Fastenal Company | | | 547 | | | | 24,440 | |

| GATX Corporation | | | 12,711 | | | | 761,389 | |

| Houston Wire & Cable Company | | | 62 | | | | 388 | |

| Kaman Corporation | | | 1,180 | | | | 56,652 | |

| MSC Industrial Direct Company, Inc. - Class A | | | 2,325 | | | | 208,157 | |

| Neff Corporation - Class A | | | 114 | | | | 2,006 | |

| Nexeo Solutions, Inc. | | | 7,511 | | | | 68,425 | |

| Titan Machinery, Inc. | | | 351 | | | | 5,563 | |

| United Rentals, Inc. | | | 2,819 | | | | 309,132 | |

| W.W. Grainger, Inc. | | | 1,836 | | | | 353,797 | |

| | | | | | | | 1,937,147 | |

| Transportation Infrastructure — 0.1% | | | | | | | | |

| Pingtan Marine Enterprise Ltd. | | | 9,753 | | | | 46,522 | |

| Wesco Aircraft Holdings, Inc. | | | 17,372 | | | | 211,070 | |

| | | | | | | | 257,592 | |

| Information Technology — 10.8% | | | | | | | | |

| Communications Equipment — 2.0% | | | | | | | | |

| Applied Optoelectronics, Inc. | | | 14,371 | | | | 709,784 | |

| Arista Networks, Inc. | | | 2,801 | | | | 391,132 | |

| Bel Fuse, Inc. - Class B | | | 17 | | | | 411 | |

| CalAmp Corporation | | | 39,730 | | | | 712,756 | |

| Ceragon Networks Ltd. | | | 233 | | | | 776 | |

| ClearOne, Inc. | | | 188 | | | | 1,918 | |

| Extreme Networks, Inc. | | | 376 | | | | 2,938 | |

| F5 Networks, Inc. | | | 1,094 | | | | 141,268 | |

| Harmonic, Inc. | | | 20,223 | | | | 117,293 | |

| Infinera Corporation | | | 65,171 | | | | 646,496 | |

| Inseego, Corporation | | | 60,682 | | | | 129,859 | |

| Lantronix, Inc. | | | 21,234 | | | | 59,455 | |

| MRV Communications, Inc. | | | 1,235 | | | | 11,732 | |

| Network-1 Technologies, Inc. | | | 83,902 | | | | 402,730 | |

| Numerex Corporation - Class A | | | 12,039 | | | | 54,175 | |

| Oclaro, Inc. | | | 2,099 | | | | 16,813 | |

| Palo Alto Networks, Inc. | | | 3,375 | | | | 365,884 | |

| PC-TEL, Inc. | | | 231 | | | | 1,788 | |

28

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

| COMMON STOCKS — 79.9% (Continued) | | Shares | | | Value | |

| Information Technology — 10.8% (Continued) | | | | | | |

| Communications Equipment — 2.0% (Continued) | | | | | | |

| Resonant, Inc. | | | 26,707 | | | $ | 128,461 | |

| Sierra Wireless, Inc. | | | 605 | | | | 15,307 | |

| Ubiquiti Networks, Inc. | | | 13,380 | | | | 689,338 | |

| Wi-LAN, Inc. | | | 1,476 | | | | 2,967 | |

| | | | | | | | 4,603,281 | |

| Electronic Equipment, Instruments & Components — 1.5% | | | | | | | | |

| Airgain, Inc. | | | 2,996 | | | | 44,670 | |

| Anixter International, Inc. | | | 24 | | | | 1,957 | |

| Applied DNA Science, Inc. | | | 26,459 | | | | 46,303 | |

| ClearSign Combustion Corporation | | | 36,164 | | | | 128,382 | |

| Cognex Corporation | | | 4,566 | | | | 389,662 | |

| CUI Global, Inc. | | | 10,607 | | | | 46,777 | |

| Electro Scientific Industries, Inc. | | | 16,270 | | | | 113,565 | |

| eMagin Corporation | | | 18,989 | | | | 43,675 | |

| Fitbit, Inc. - Class A | | | 163,995 | | | | 938,051 | |

| Identiv, Inc. | | | 749 | | | | 4,299 | |

| Knowles Corporation | | | 5,582 | | | | 98,969 | |

| LightPath Technologies, Inc. - Class A | | | 46,071 | | | | 124,392 | |

| Magal Security Systems Ltd. | | | 4,644 | | | | 31,022 | |

| Maxwell Technologies, Inc. | | | 21,634 | | | | 131,967 | |

| MicroVision, Inc. | | | 296,300 | | | | 666,675 | |

| Neonode, Inc. | | | 77,188 | | | | 130,448 | |

| Netlist, Inc. | | | 105,738 | | | | 135,345 | |

| PAR Technology Corporation | | | 93 | | | | 795 | |

| Radisys Corporation | | | 14 | | | | 56 | |

| SuperCom Ltd. | | | 19,669 | | | | 52,910 | |

| TTM Technologies, Inc. | | | 509 | | | | 8,516 | |

| Universal Display Corporation | | | 2,395 | | | | 213,993 | |

| Vishay Intertechnology, Inc. | | | 6,330 | | | | 103,496 | |

| | | | | | | | 3,455,925 | |

| Internet Software & Services — 1.5% | | | | | | | | |

| Aerohive Networks, Inc. | | | 24,137 | | | | 93,410 | |

| Appfolio, Inc. - Class A | | | 17 | | | | 451 | |

| Benefitfocus, Inc. | | | 198 | | | | 6,237 | |

| Care.com, Inc. | | | 55 | | | | 652 | |

| Chegg, Inc. | | | 11,550 | | | | 104,065 | |

| Cimpress N.V. | | | 103 | | | | 8,454 | |

| Coupa Software, Inc. | | | 26,929 | | | | 747,280 | |

| Five9, Inc. | | | 215 | | | | 3,923 | |

| Gogo, Inc. | | | 11,064 | | | | 139,517 | |

| iPass, Inc. | | | 108,178 | | | | 134,141 | |

| LendingClub Corporation | | | 5,690 | | | | 33,286 | |

| Marin Software, Inc. | | | 29,926 | | | | 50,874 | |

29

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

| COMMON STOCKS — 79.9% (Continued) | | Shares | | | Value | |

| Information Technology — 10.8% (Continued) | | | | | | |

| Internet Software & Services — 1.5% (Continued) | | | | | | |

| MINDBODY, Inc. - Class A | | | 65 | | | $ | 1,843 | |

| New Relic, Inc. | | | 118 | | | | 4,718 | |

| Nutanix, Inc. - Class A | | | 4,747 | | | | 72,107 | |

Piksel, Inc. - Series A-2 (b) | | | 346,880 | | | | 0 | |

| Quotient Technology, Inc. | | | 762 | | | | 8,306 | |

| Reis, Inc. | | | 6,657 | | | | 125,152 | |

| Remark Holdings, Inc | | | 44,314 | | | | 134,271 | |

| Rocket Fuel, Inc. | | | 6,656 | | | | 33,446 | |

| Shutterstock, Inc. | | | 211 | | | | 9,122 | |

| Stamps.com, Inc. | | | 299 | | | | 31,739 | |

| StarTek, Inc. | | | 316 | | | | 2,869 | |

| Trade Desk, Inc. (The) - Class A | | | 461 | | | | 17,218 | |

| Tremor Video, Inc. | | | 806 | | | | 1,805 | |

| TrueCar, Inc. | | | 43,133 | | | | 755,690 | |

| Twilio, Inc. - Class A | | | 3,170 | | | | 104,769 | |

| VeriSign, Inc. | | | 4,338 | | | | 385,735 | |

| WebMD Health Corporation | | | 169 | | | | 9,165 | |

| Xactly Corporation | | | 1,648 | | | | 19,117 | |

| Zillow Group, Inc. - Class A | | | 10,506 | | | | 404,376 | |

| | | | | | | | 3,443,738 | |

| IT Services — 1.3% | | | | | | | | |

| ALJ Regional Holdings, Inc. | | | 4,483 | | | | 15,018 | |

| Black Knight Financial Services, Inc. - Class A | | | 189 | | | | 7,825 | |

| CardConnect Corporation | | | 3,299 | | | | 45,196 | |

| China Customer Relations Centers, Inc. | | | 293 | | | | 4,377 | |

| Edgewater Technology, Inc. | | | 28 | | | | 204 | |

| FleetCor Technologies, Inc. | | | 83 | | | | 11,715 | |

| Forrester Research, Inc. | | | 42 | | | | 1,703 | |

| Information Services Group, Inc. | | | 38,244 | | | | 120,469 | |

| Mattersight Corporation | | | 39,781 | | | | 135,255 | |

| ModusLink Global Solutions, Inc. | | | 1,196 | | | | 2,021 | |

| Rightside Group Ltd. | | | 168 | | | | 1,687 | |

| ServiceSource International, Inc. | | | 120,354 | | | | 452,531 | |

| Square, Inc. - Class A | | | 2,465 | | | | 44,962 | |

| Unisys Corporation | | | 25,701 | | | | 290,421 | |

| VeriFone Systems, Inc. | | | 20,237 | | | | 375,194 | |

| Virtusa Corporation | | | 22,951 | | | | 711,022 | |

| Western Union Company (The) | | | 18,011 | | | | 357,698 | |

| WEX, Inc. | | | 3,481 | | | | 353,182 | |

| | | | | | | | 2,930,480 | |

| Semiconductors & Semiconductor Equipment — 1.4% | | | | | | | | |

| Acacia Communications, Inc. | | | 16,214 | | | | 743,250 | |

| Aehr Test Systems | | | 16,145 | | | | 73,783 | |

30

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

| COMMON STOCKS — 79.9% (Continued) | | Shares | | | Value | |

| Information Technology — 10.8% (Continued) | | | | | | |

| Semiconductors & Semiconductor Equipment — 1.4% (Continued) | | | | | | |

| Ambarella, Inc. | | | 396 | | | $ | 22,263 | |

| Amtech Systems, Inc. | | | 501 | | | | 3,527 | |

| Canadian Solar, Inc. | | | 2,750 | | | | 36,575 | |

| Cree, Inc. | | | 3,657 | | | | 80,015 | |

| CyberOptics Corporation | | | 75 | | | | 1,624 | |

| Everspin Technologies, Inc. | | | 1,373 | | | | 13,730 | |

| Impinj, Inc. | | | 1,227 | | | | 45,988 | |