Washington, D.C. 20549

Wade R. Bridge, Esq.

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

SEMI-ANNUAL REPORT

April 30, 2016

(Unaudited)

For more information or assistance in opening an account,

please call toll-free 1-888-534-2001.

LETTER TO SHAREHOLDERS

June 15, 2016

Dear Shareholder,

Enclosed is the Semi-Annual Report to shareholders of the TFS Market Neutral Fund (ticker: TFSMX), the TFS Small Cap Fund (ticker: TFSSX) and the TFS Hedged Futures Fund (ticker: TFSHX) for the six months ended April 30, 2016. On behalf of the investment manager, TFS Capital LLC (“TFS Capital”), I would like to thank you for your continued investment.

Below you will find performance updates on each of the mutual funds.

TFS Market Neutral Fund (ticker: TFSMX)

| | 1-year

return | 3-year

return | 5-year

return | 10-year

return | Since Inception (9/7/2004) |

TFS Market Neutral Fund | -8.56% | -1.03% | -0.04% | 4.31% | 5.36% |

S&P 500® Index | 1.21% | 11.26% | 11.02% | 6.91% | 7.61% |

Average annual total returns for periods ended April 30, 2016. Past performance is not a guarantee of future results.

TFSMX produced significantly negative alpha (i.e., the return that cannot be explained by a fund’s market exposure) overall during the first half of the fiscal year, and returned negative alpha for 4 out of the 6 months of the period. The loss of alpha was broadly spread across most strategies and most sectors in our small cap models. Strategies outside of small cap stocks generally performed well, but the Fund’s focus on small cap stocks limited their impact on performance.

Since inception, TFSMX has produced positive alpha, with lower volatility and market exposure than the S&P 500® Index. From inception through April 30, 2016, TFSMX has had an average annual return of 5.36%, as compared to S&P 500® Index performance during the same period of 7.61%. During this period, the Fund’s beta was 23%. This means that the Fund performed as if 23% of it was allocated to the market. In addition, during this time period, the Fund’s average annual volatility measure was 7.51%, compared to S&P 500® Index volatility of 19.65%.

Since inception, the strategies used in managing TFSMX have resulted in its returns having a low correlation to other asset classes. According to Modern Portfolio Theory, portfolios may benefit by combining non-correlated investments. For your reference, below are the TFS Market Neutral Fund’s correlations to several other asset classes since inception. It is notable that correlation to the equity indices in recent years has risen, as compared to historical averages.

Index | Correlation Since Inception |

S&P 500® Index | 0.60 |

Russell 2000® Index | 0.58 |

MSCI EAFE Index | 0.46 |

Barclays U.S. Aggregate Bond Index | (0.16) |

Dow Jones Equity REIT Total Index | 0.42 |

Bloomberg Commodity Index | 0.39 |

1

TFS Small Cap Fund (ticker: TFSSX)

| | 1-year

return | 3-year

return | 5-year

return | 10-year

return | Since Inception (3/7/2006) |

TFS Small Cap Fund | -8.04% | 8.78% | 8.12% | 9.36% | 9.98% |

Russell 2000® Index | -5.94% | 7.53% | 6.98% | 5.42% | 5.97% |

Average annual total returns for periods ended April 30, 2016. Past performance is not a guarantee of future results.

During the six month period ended April 30, 2016, TFSSX underperformed its benchmark, the Russell 2000® Index. TFSSX’s returns were heavily impacted by the movement of the U.S. “small-cap” equity sector as evidenced by comparing the return of TFSSX and its benchmark return (i.e., -2.28% versus -1.90%. respectively) during this period. Given its “long-only” mandate, TFSSX is expected to have a high correlation to U.S. small-cap equity market movements with any performance deviation generally attributable to TFS Capital’s equity selection.

However, TFSSX achieved its objective of outperforming the Russell 2000® Index over longer periods of time. In fact, it now has over a 10-year track record and has achieved an average annual return since inception that is four percentage points higher than that of the Russell 2000® Index.

TFS Hedged Futures Fund (ticker: TFSHX)

| | 1-year

return | 3-year

return | Since Inception (12/29/2011) |

TFS Hedged Futures Fund | 6.34% | 0.67% | 1.85% |

Diversified Trends Indicator® | -1.42% | 2.23% | -1.96% |

S&P 500® Index | 1.21% | 11.02% | 14.42% |

Average annual returns for periods ended April 30, 2016. Past performance is not a guarantee of future results.

During the 6-month period ended April 30, 2016, TFSHX appreciated by 6.34%. Performance during the six month period exceeded the Diversified Trends Indicator® (the “DTI®”), a commonly-used benchmark for managed-futures funds. Returns in the Fund’s volatility carry strategies were positive, helping performance; these strategies are not employed by the DTI®. Since inception, TFSHX has produced a positive return, while the DTI® has produced a negative return over the same period. Though the S&P 500® Index is not generally considered an appropriate benchmark for managed-futures funds, it is provided above for your reference.

2

Like the TFS Market Neutral Fund, the TFS Hedged Futures Fund has demonstrated a low correlation to many market indices. This low correlation suggests the addition of the TFS Hedged Futures Fund may improve the risk-adjusted performance of many investment portfolios. The TFS Hedged Futures Fund has had a slightly negative correlation to the Diversified Trends Indicator®, which suggests that it may also have a low correlation to other managed-futures funds that employ trend-following strategies. For your reference, below are the TFS Hedged Futures Fund’s correlations to several other asset classes.

Index | Correlation Since Inception |

Diversified Trends Indicator® | (0.02) |

S&P 500® Index | 0.12 |

Russell 2000® Index | 0.15 |

S&P GSCI Index | (0.02) |

Barclays U.S. Aggregate Bond Index | (0.04) |

Bloomberg Commodity Index | 0.02 |

As always, we do not recommend allocating a high percentage of one’s assets to any one investment fund managed by TFS Capital given the risks inherent in each product. Rather, we believe that they are best used as a component of a diversified portfolio of investments. If you have any questions regarding this material, please contact us.

Best regards,

Eric Newman

Chief Investment Officer & Co-Portfolio Manager

TFS Capital LLC

The performance data quoted represents past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment in the mutual funds discussed in this report (the “Funds”) will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Fee reductions and/or expense reimbursements by the Adviser have positively impacted the Funds’ performance. Without such reductions and/or reimbursements, performance would have been lower. An investor should consider the investment objectives, risks, charges and expenses of the Funds carefully before investing. To obtain a summary prospectus and/or prospectus, which each contain this and other important information, go to www.TFSCapital.com or call (888) 534-2001. Please read the summary prospectus and/or prospectus carefully before investing. The Funds may not be suitable for all investors. Futures investing is speculative. Each Fund’s current NAV per share is available at www.TFSCapital.com.

3

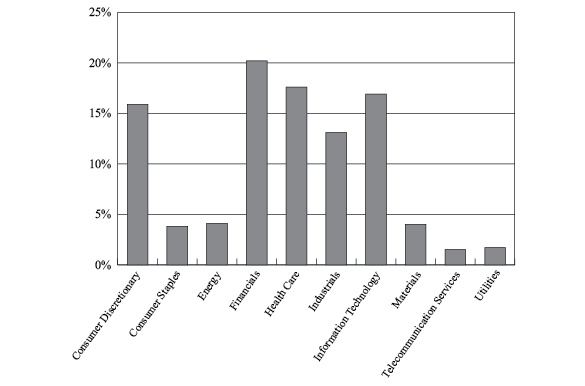

TFS MARKET NEUTRAL FUND

PORTFOLIO INFORMATION

April 30, 2016 (Unaudited)

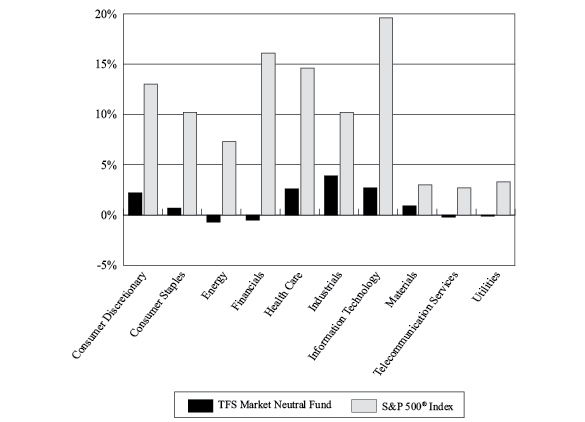

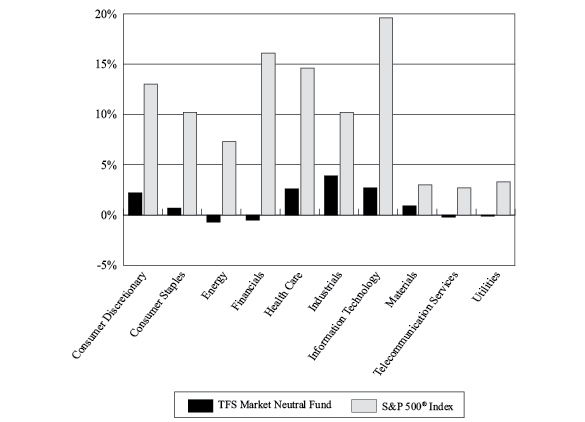

Common Stocks vs.

the S&P 500® Index Net Sector Exposure*

* | The net percentages for TFS Market Neutral Fund are computed by taking the net dollar exposure, including short positions, and dividing by the net assets of the Fund. Consequently, the percentages will not total to 100%. |

Top 10 Long Common Stocks | | Top 10 Short Common Stocks |

Security Description | % of

Net Assets | | Security Description | % of

Net Assets |

Archrock, Inc. | 0.53% | | Cliffs Natural Resources, Inc. | 0.53% |

Avon Products, Inc. | 0.40% | | Basic Energy Services, Inc. | 0.46% |

PDL BioPharma, Inc. | 0.39% | | OPOWER, Inc. | 0.43% |

Magellan Health, Inc. | 0.38% | | Lindsay Corporation | 0.43% |

Triple-S Management Corporation - Class B | 0.38% | | Solazyme, Inc. | 0.42% |

Tribune Publishing Company | 0.38% | | Rockwell Medical, Inc. | 0.42% |

QEP Resources, Inc. | 0.38% | | Conn's, Inc. | 0.42% |

HMS Holdings Corporation | 0.38% | | Straight Path Communications, Inc. - Class B | 0.41% |

Heska Corporation | 0.37% | | AAC Holdings, Inc. | 0.41% |

Ply Gem Holdings, Inc. | 0.37% | | Ebix, Inc. | 0.41% |

4

TFS SMALL CAP FUND

PORTFOLIO INFORMATION

April 30, 2016 (Unaudited)

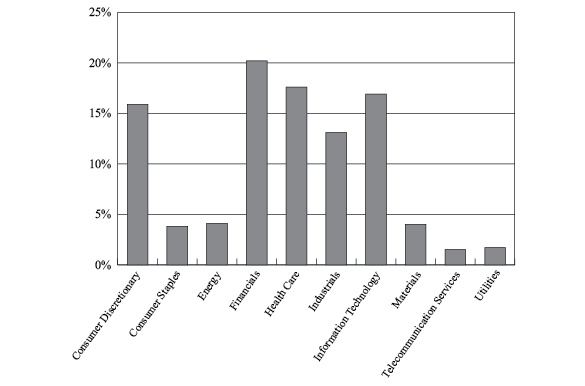

Sector Allocation (% of Net Assets)

Top 10 Equity Positions |

Security Description | % of

Net Assets |

Archrock, Inc. | 0.68% |

INC Research Holdings, Inc. - Class A | 0.61% |

Magellan Health, Inc. | 0.61% |

AMC Entertainment Holdings, Inc. - Class A | 0.53% |

Parkway Properties, Inc. | 0.51% |

Masimo Corporation | 0.51% |

Comtech Telecommunications Corporation | 0.50% |

Isle of Capri Casinos, Inc. | 0.50% |

Cynosure, Inc. - Class A | 0.49% |

La-Z-Boy, Inc. | 0.49% |

5

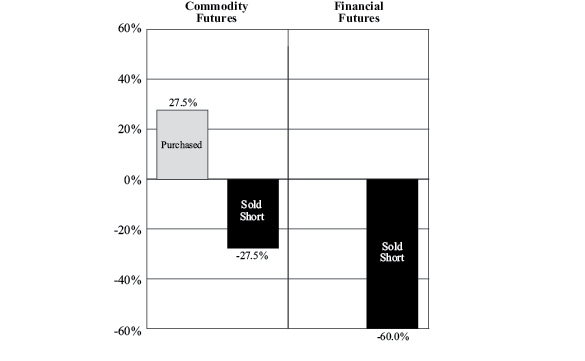

TFS HEDGED FUTURES FUND

PORTFOLIO INFORMATION

April 30, 2016 (Unaudited)

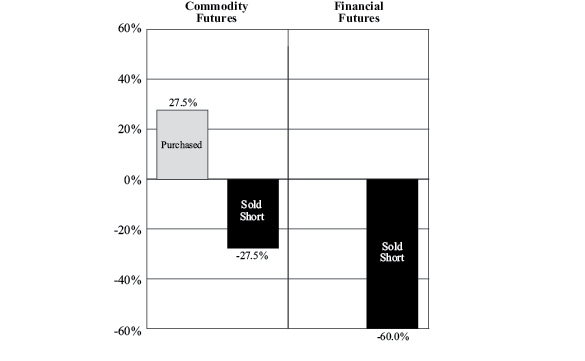

Exposure by Type of Futures Contract

(Notional Value as a % of Net Assets)

Net Exposure by Type of Futures Contract

(Net as a % of Net Assets) |

Net Commodity Futures Exposure | 0.0% |

Net Financial Futures Exposure | -60.0% |

6

TFS MARKET NEUTRAL FUND

SUMMARY SCHEDULE OF INVESTMENTS*

April 30, 2016 (Unaudited) | |

COMMON STOCKS — 92.3% | | Shares | | | Value | |

Consumer Discretionary — 15.1% | | | | | | |

Barnes & Noble, Inc. (a) | | | 140,865 | | | $ | 1,655,164 | |

Carrols Restaurant Group, Inc. (b) | | | 117,585 | | | | 1,635,607 | |

Genesco, Inc. (b) | | | 24,549 | | | | 1,698,300 | |

Isle of Capri Casinos, Inc. (a)(b) | | | 111,088 | | | | 1,655,211 | |

K12, Inc. (a)(b) | | | 145,081 | | | | 1,783,046 | |

Overstock.com, Inc. (a)(b) | | | 123,126 | | | | 1,796,408 | |

Tribune Publishing Company (a) | | | 180,687 | | | | 2,047,184 | |

Other Consumer Discretionary (c) | | | | | | | 69,431,105 | |

| | | | | | | | 81,702,025 | |

Consumer Staples — 3.4% | | | | | | | | |

Avon Products, Inc. (a) | | | 454,895 | | | | 2,142,555 | |

Seneca Foods Corporation - Class A (a)(b) | | | 57,044 | | | | 1,859,064 | |

Other Consumer Staples (c) | | | | | | | 14,446,653 | |

| | | | | | | | 18,448,272 | |

Energy — 6.8% | | | | | | | | |

Archrock, Inc. | | | 289,861 | | | | 2,855,131 | |

Delek US Holdings, Inc. (a) | | | 102,265 | | | | 1,624,991 | |

PDC Energy, Inc. (b) | | | 30,679 | | | | 1,926,334 | |

QEP Resources, Inc. (a) | | | 114,028 | | | | 2,044,522 | |

TETRA Technologies, Inc. (a)(b) | | | 266,146 | | | | 1,916,251 | |

Other Energy (c) | | | | | | | 26,340,495 | |

| | | | | | | | 36,707,724 | |

Financials — 9.4% | | | | | | | | |

Enova International, Inc. (b) | | | 195,428 | | | | 1,721,721 | |

Other Financials (c) | | | | | | | 49,369,906 | |

| | | | | | | | 51,091,627 | |

Health Care — 22.1% | | | | | | | | |

Acceleron Pharma, Inc. (a)(b) | | | 58,722 | | | | 1,758,724 | |

BioSpecifics Technologies Corporation (a)(b) | | | 45,167 | | | | 1,606,138 | |

Cantel Medical Corporation (a) | | | 24,999 | | | | 1,674,683 | |

Collegium Pharmaceutical, Inc. (a)(b) | | | 96,176 | | | | 1,833,115 | |

Cynosure, Inc. - Class A (a)(b) | | | 37,601 | | | | 1,840,193 | |

Five Prime Therapeutics, Inc. (a)(b) | | | 37,198 | | | | 1,770,253 | |

Genomic Health, Inc. (a)(b) | | | 62,293 | | | | 1,637,060 | |

Heska Corporation (a)(b) | | | 66,027 | | | | 2,020,426 | |

HMS Holdings Corporation (a)(b) | | | 120,226 | | | | 2,030,617 | |

Infinity Pharmaceuticals, Inc. (a)(b) | | | 311,962 | | | | 1,809,380 | |

Invacare Corporation (a) | | | 147,273 | | | | 1,655,349 | |

Magellan Health, Inc. (a)(b) | | | 29,121 | | | | 2,051,866 | |

Masimo Corporation (a)(b) | | | 41,507 | | | | 1,799,328 | |

Orthofix International N.V. (a)(b) | | | 45,465 | | | | 1,989,548 | |

PDL BioPharma, Inc. (a) | | | 562,578 | | | | 2,120,919 | |

Prestige Brands Holdings, Inc. (a)(b) | | | 28,205 | | | | 1,601,480 | |

7

TFS MARKET NEUTRAL FUND

SUMMARY SCHEDULE OF INVESTMENTS* (Continued) | |

COMMON STOCKS — 92.3% (Continued) | | Shares | | | Value | |

Health Care — 22.1% (Continued) | | | | | | |

Rigel Pharmaceuticals, Inc. (a)(b) | | | 616,178 | | | $ | 1,743,784 | |

Sagent Pharmaceuticals, Inc. (a)(b) | | | 149,261 | | | | 1,737,398 | |

Triple-S Management Corporation - Class B (a)(b) | | | 78,690 | | | | 2,049,088 | |

Other Health Care (c) | | | | | | | 84,571,375 | |

| | | | | | | | 119,300,724 | |

Industrials — 13.4% | | | | | | | | |

Babcock & Wilcox Enterprises, Inc. (a)(b) | | | 82,205 | | | | 1,878,384 | |

Harsco Corporation (a) | | | 249,661 | | | | 1,770,096 | |

Ply Gem Holdings, Inc. (a)(b) | | | 136,292 | | | | 1,996,678 | |

SkyWest, Inc. (a) | | | 77,764 | | | | 1,827,454 | |

SPX Corporation (a) | | | 113,892 | | | | 1,833,661 | |

YRC Worldwide, Inc. (a)(b) | | | 184,098 | | | | 1,693,702 | |

Other Industrials (c) | | | | | | | 61,704,689 | |

| | | | | | | | 72,704,664 | |

Information Technology — 15.8% | | | | | | | | |

Autobytel, Inc. (a)(b) | | | 100,551 | | | | 1,669,147 | |

Black Box Corporation (a) | | | 116,823 | | | | 1,707,952 | |

EarthLink Holdings Corporation (a) | | | 324,470 | | | | 1,885,171 | |

Hutchinson Technology, Inc. (a)(b) | | | 454,061 | | | | 1,657,323 | |

Insight Enterprises, Inc. (a)(b) | | | 78,942 | | | | 1,950,657 | |

Mentor Graphics Corporation (a) | | | 80,816 | | | | 1,613,087 | |

Rackspace Hosting, Inc. (a)(b) | | | 69,894 | | | | 1,598,476 | |

Rubicon Project, Inc. (The) (b) | | | 94,029 | | | | 1,821,342 | |

Unisys Corporation (a)(b) | | | 228,748 | | | | 1,763,647 | |

Other Information Technology (c) | | | | | | | 69,984,267 | |

| | | | | | | | 85,651,069 | |

Materials — 4.3% | | | | | | | | |

SunCoke Energy, Inc. (a) | | | 246,985 | | | | 1,835,099 | |

Other Materials (c) | | | | | | | 21,587,252 | |

| | | | | | | | 23,422,351 | |

Telecommunication Services — 1.5% | | | | | | | | |

IDT Corporation - Class B (a) | | | 104,399 | | | | 1,601,481 | |

Other Telecommunication Services (c) | | | | | | | 6,173,048 | |

| | | | | | | | 7,774,529 | |

Utilities — 0.5% | | | | | | | | |

Other Utilities (c) | | | | | | | 2,724,398 | |

| | | | | | | | | |

Total Common Stocks (Cost $460,601,321) | | | | | | $ | 499,527,383 | |

8

TFS MARKET NEUTRAL FUND

SUMMARY SCHEDULE OF INVESTMENTS* (Continued) | |

INVESTMENT COMPANIES — 3.9% | | Shares | | Value | |

Other Investment Companies (Cost $19,221,251) (c) | | | | | | $ | 21,018,835 | |

| | |

WARRANTS — 0.0% | | Shares | | | Value | |

Imperial Holdings, Inc. (b) (d) (Cost $0) | | | 1,663 | | | $ | 0 | |

| | |

MONEY MARKET FUNDS — 0.1% | | Shares | | | Value | |

Federated Government Obligations Fund - Institutional Class, 0.21% (a) (e) | | | 104,582 | | | $ | 104,582 | |

UMB Money Market Fiduciary, 0.01% (a) (e) | | | 445,836 | | | | 445,836 | |

Total Money Market Funds (Cost $550,418) | | | | | | $ | 550,418 | |

| | | | | | | | | |

Total Investments at Value — 96.3% (Cost $480,372,990) | | | | | | $ | 521,096,636 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 3.7% (f) | | | | | | | 20,004,486 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 541,101,122 | |

* | A complete Schedule of Investments is available without charge upon request by calling toll-free 1-888-534-2001 or on the SEC’s website at http://www.sec.gov. |

| | |

(a) | All or a portion of the shares have been committed as collateral for open short positions. |

| | |

(b) | Non-income producing security. |

| | |

(c) | Represents issuers not identified as either a top 50 holding in terms of value and issues or issuers not exceeding 1% of net assets individually or in the aggregate, respectively, or not a fair-valued security as of April 30, 2016. |

| | |

(d) | Security has been valued at fair value pursuant to procedures adopted by and under the supervision of the Board of Trustees. The total value of such securities is $0 at April 30, 2016 representing 0.0% of net assets (Note 2). |

| | |

(e) | The rate shown is the 7-day effective yield as of April 30, 2016. |

| | |

(f) | Includes cash held as margin deposits for open short positions and futures contracts. |

| | |

See accompanying notes to financial statements. |

9

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT

April 30, 2016 (Unaudited) | |

COMMON STOCKS — 80.8% | | Shares | | | Value | |

Consumer Discretionary — 12.9% | | | | | | |

Auto Components — 0.8% | | | | | | |

Ballard Power Systems, Inc. | | | 42,988 | | | $ | 68,781 | |

Dorman Products, Inc. | | | 8,974 | | | | 482,711 | |

Drew Industries, Inc. | | | 1,237 | | | | 80,195 | |

Federal Mogul Holdings Corporation | | | 74,018 | | | | 683,926 | |

Fox Factory Holding Corporation | | | 43,719 | | | | 756,776 | |

Gentex Corporation | | | 5,777 | | | | 92,663 | |

Motorcar Parts of America, Inc. | | | 19,368 | | | | 621,132 | |

Spartan Motors, Inc. | | | 56 | | | | 272 | |

Standard Motor Products, Inc. | | | 8,098 | | | | 287,560 | |

Strattec Security Corporation | | | 17,651 | | | | 933,738 | |

Visteon Corporation | | | 2,927 | | | | 233,194 | |

| | | | | | | | 4,240,948 | |

Automobiles — 0.1% | | | | | | | | |

Harley-Davidson, Inc. | | | 59 | | | | 2,822 | |

Kandi Technologies Group, Inc. | | | 37,723 | | | | 271,228 | |

Tesla Motors, Inc. | | | 338 | | | | 81,377 | |

Winnebago Industries, Inc. | | | 5,393 | | | | 116,705 | |

Workhorse Group, Inc. | | | 27,010 | | | | 208,787 | |

| | | | | | | | 680,919 | |

Distributors — 0.0% (a) | | | | | | | | |

Fenix Parts, Inc. | | | 18,261 | | | | 92,035 | |

LKQ Corporation | | | 170 | | | | 5,448 | |

Weyco Group, Inc. | | | 1,016 | | | | 28,489 | |

| | | | | | | | 125,972 | |

Diversified Consumer Services — 1.3% | | | | | | | | |

2U, Inc. | | | 51,259 | | | | 1,436,790 | |

Carriage Services, Inc. | | | 5,315 | | | | 129,845 | |

Collectors Universe, Inc. | | | 2,121 | | | | 36,884 | |

DeVry Education Group, Inc. | | | 15,023 | | | | 260,649 | |

Grand Canyon Education, Inc. | | | 20,681 | | | | 904,380 | |

H&R Block, Inc. | | | 4,271 | | | | 86,445 | |

ITT Educational Services, Inc. | | | 119,625 | | | | 257,194 | |

Liberty Tax, Inc. | | | 5,592 | | | | 66,824 | |

LifeLock, Inc. | | | 46,442 | | | | 540,585 | |

Matthews International Corporation - Class A | | | 3,145 | | | | 165,553 | |

Outerwall, Inc. | | | 37,751 | | | | 1,559,494 | |

Weight Watchers International, Inc. | | | 139,566 | | | | 1,807,380 | |

| | | | | | | | 7,252,023 | |

Hotels, Restaurants & Leisure — 2.8% | | | | | | | | |

Amaya, Inc. | | | 10,161 | | | | 139,511 | |

Belmond Ltd. - Class A | | | 6,653 | | | | 60,941 | |

Bob Evans Farms, Inc. | | | 593 | | | | 27,005 | |

10

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

COMMON STOCKS — 80.8% (Continued) | | Shares | | | Value | |

Consumer Discretionary — 12.9% (Continued) | | | | | | |

Hotels, Restaurants & Leisure — 2.8% (Continued) | | | | | | |

Caesars Entertainment Corporation | | | 63,986 | | | $ | 437,024 | |

Chipotle Mexican Grill, Inc. | | | 216 | | | | 90,930 | |

Chuy's Holdings, Inc. | | | 1,523 | | | | 46,512 | |

ClubCorp Holdings, Inc. | | | 17,021 | | | | 227,230 | |

Del Frisco's Restaurant Group, Inc. | | | 12,167 | | | | 193,820 | |

Del Taco Restaurants, Inc. | | | 4,451 | | | | 40,282 | |

Diamond Resorts International, Inc. | | | 58,162 | | | | 1,233,616 | |

Dunkin' Brands Group, Inc. | | | 1,855 | | | | 86,257 | |

Empire Resorts, Inc. | | | 35,239 | | | | 586,025 | |

Good Times Restaurants, Inc. | | | 1,376 | | | | 4,252 | |

Habit Restaurants, Inc. (The) - Class A | | | 55,883 | | | | 936,040 | |

Interval Leisure Group, Inc. | | | 63,615 | | | | 898,244 | |

Intrawest Resorts Holdings, Inc. | | | 293 | | | | 2,532 | |

Jamba, Inc. | | | 104,047 | | | | 1,351,571 | |

Kona Grill, Inc. | | | 23,235 | | | | 309,490 | |

Las Vegas Sands Corporation | | | 152 | | | | 6,863 | |

Marriott Vacations Worldwide Corporation | | | 2,365 | | | | 148,144 | |

McDonald's Corporation | | | 133 | | | | 16,823 | |

Noodles & Company | | | 109,717 | | | | 1,223,345 | |

Papa Murphy's Holdings, Inc. | | | 143,041 | | | | 1,796,595 | |

Planet Fitness, Inc. - Class A | | | 63,035 | | | | 968,218 | |

Rave Restaurant Group, Inc. | | | 62 | | | | 309 | |

RCI Hospitality Holdings, Inc. | | | 4,730 | | | | 48,482 | |

Red Robin Gourmet Burgers, Inc. | | | 226 | | | | 14,658 | |

SeaWorld Entertainment, Inc. | | | 44,924 | | | | 895,335 | |

Shake Shack, Inc. - Class A | | | 35,161 | | | | 1,284,080 | |

Starwood Hotels & Resorts Worldwide, Inc. | | | 154 | | | | 12,609 | |

Town Sports International Holdings, Inc. | | | 9,491 | | | | 31,605 | |

Wingstop, Inc. | | | 7,551 | | | | 188,322 | |

Wynn Resorts Ltd. | | | 607 | | | | 53,598 | |

Zoe's Kitchen, Inc. | | | 48,446 | | | | 1,816,241 | |

| | | | | | | | 15,176,509 | |

Household Durables — 1.5% | | | | | | | | |

Beazer Homes USA, Inc. | | | 2,323 | | | | 19,095 | |

Century Communities, Inc. | | | 13,184 | | | | 227,292 | |

Ethan Allen Interiors, Inc. | | | 25,635 | | | | 872,615 | |

GoPro, Inc. - Class A | | | 108,964 | | | | 1,377,305 | |

Green Brick Partners, Inc. | | | 131,519 | | | | 969,295 | |

Hooker Furniture Corporation | | | 930 | | | | 23,064 | |

Installed Building Products, Inc. | | | 3,554 | | | | 94,465 | |

iRobot Corporation | | | 15,549 | | | | 581,222 | |

KB Home | | | 100,190 | | | | 1,359,578 | |

LGI Homes, Inc. | | | 55,151 | | | | 1,544,780 | |

11

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

COMMON STOCKS — 80.8% (Continued) | | Shares | | | Value | |

Consumer Discretionary — 12.9% (Continued) | | | | | | |

Household Durables — 1.5% (Continued) | | | | | | |

Newell Brands, Inc. | | | 591 | | | $ | 26,914 | |

PulteGroup, Inc. | | | 4,787 | | | | 88,033 | |

SodaStream International Ltd. | | | 4,933 | | | | 67,681 | |

Taylor Morrison Home Corporation - Class A | | | 7,591 | | | | 109,311 | |

Tupperware Brands Corporation | | | 5,856 | | | | 340,058 | |

Turtle Beach Corporation | | | 2,630 | | | | 2,919 | |

Vuzix Corporation | | | 38,724 | | | | 182,390 | |

ZAGG, Inc. | | | 10,028 | | | | 80,324 | |

| | | | | | | | 7,966,341 | |

Internet & Catalog Retail — 0.7% | | | | | | | | |

Etsy, Inc. | | | 37,869 | | | | 332,490 | |

Expedia, Inc. | | | 107 | | | | 12,387 | |

Gaiam, Inc. - Class A | | | 9,759 | | | | 64,702 | |

Groupon, Inc. | | | 9,779 | | | | 35,400 | |

Lands' End, Inc. | | | 37,221 | | | | 905,587 | |

MakeMyTrip Ltd. | | | 2,602 | | | | 47,773 | |

Netflix, Inc. | | | 930 | | | | 83,728 | |

PetMed Express, Inc. | | | 31,792 | | | | 581,794 | |

TripAdvisor, Inc. | | | 449 | | | | 29,001 | |

Wayfair, Inc. - Class A | | | 38,070 | | | | 1,437,142 | |

| | | | | | | | 3,530,004 | |

Leisure Equipment & Products — 0.0% (a) | | | | | | | | |

Escalade, Inc. | | | 1,103 | | | | 13,159 | |

| | | | | | | | | |

Leisure Products — 0.3% | | | | | | | | |

JAKKS Pacific, Inc. | | | 23,160 | | | | 173,700 | |

Smith & Wesson Holding Corporation | | | 37,399 | | | | 816,420 | |

Sturm Ruger & Company, Inc. | | | 6,653 | | | | 425,992 | |

| | | | | | | | 1,416,112 | |

Media — 1.6% | | | | | | | | |

AMC Networks, Inc. - Class A | | | 393 | | | | 25,635 | |

Central European Media Enterprises Ltd. - Class A | | | 16,337 | | | | 43,456 | |

Charter Communications, Inc. - Class A | | | 196 | | | | 41,599 | |

Cinemark Holdings, Inc. | | | 97 | | | | 3,361 | |

Clear Channel Outdoor Holdings, Inc. - Class A | | | 22,029 | | | | 112,568 | |

Daily Journal Corporation | | | 1,198 | | | | 235,287 | |

Entercom Communications Corporation - Class A | | | 3,559 | | | | 40,359 | |

Eros International plc | | | 71,823 | | | | 960,992 | |

Hemisphere Media Group, Inc. | | | 3,856 | | | | 46,118 | |

IDI, Inc. | | | 57,590 | | | | 301,196 | |

IMAX Corporation | | | 18,506 | | | | 592,192 | |

Liberty Broadband - Series C | | | 74 | | | | 4,237 | |

Media General, Inc. | | | 67,377 | | | | 1,167,643 | |

12

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

COMMON STOCKS — 80.8% (Continued) | | Shares | | | Value | |

Consumer Discretionary — 12.9% (Continued) | | | | | | |

Media — 1.6% (Continued) | | | | | | |

Meredith Corporation | | | 2,808 | | | $ | 144,079 | |

New Media Investment Group, Inc. | | | 35,327 | | | | 566,998 | |

Nexstar Broadcasting Group, Inc. - Class A | | | 1,028 | | | | 52,767 | |

Omnicom Group, Inc. | | | 1,062 | | | | 88,114 | |

Pandora Media, Inc. | | | 140,125 | | | | 1,391,441 | |

Regal Entertainment Group - Class A | | | 42,049 | | | | 876,722 | |

Saga Communications, Inc. - Class A | | | 491 | | | | 20,647 | |

Scholastic Corporation | | | 555 | | | | 20,191 | |

Scripps Networks Interactive, Inc. - Class A | | | 1,347 | | | | 83,986 | |

Thomson Reuters Corporation | | | 49 | | | | 2,015 | |

Walt Disney Company (The) | | | 294 | | | | 30,359 | |

World Wrestling Entertainment, Inc. - Class A | | | 108,063 | | | | 1,798,168 | |

| | | | | | | | 8,650,130 | |

Multiline Retail — 0.4% | | | | | | | | |

Bon-Ton Stores, Inc. (The) | | | 508 | | | | 1,184 | |

Fred's, Inc. - Class A | | | 22,898 | | | | 335,914 | |

Sears Holdings Corporation | | | 122,012 | | | | 1,997,946 | |

Target Corporation | | | 171 | | | | 13,594 | |

| | | | | | | | 2,348,638 | |

Specialty Retail — 2.8% | | | | | | | | |

Aaron's, Inc. | | | 6,614 | | | | 173,353 | |

Abercrombie & Fitch Company - Class A | | | 663 | | | | 17,722 | |

America's Car-Mart, Inc. | | | 13,814 | | | | 367,038 | |

Boot Barn Holdings, Inc. | | | 72,917 | | | | 597,919 | |

Buckle, Inc. (The) | | | 46,838 | | | | 1,355,492 | |

CarMax, Inc. | | | 1,691 | | | | 89,538 | |

Chico's FAS, Inc. | | | 44,404 | | | | 559,934 | |

Children's Place, Inc. (The) | | | 415 | | | | 32,333 | |

Christopher & Banks Corporation | | | 432 | | | | 1,123 | |

Conn's, Inc. | | | 163,499 | | | | 2,246,476 | |

CST Brands, Inc. | | | 992 | | | | 37,468 | |

DavidsTea, Inc. | | | 7,137 | | | | 80,006 | |

Destination Maternity Corporation | | | 3,848 | | | | 26,821 | |

Destination XL Group, Inc. | | | 22,715 | | | | 121,980 | |

Dick's Sporting Goods, Inc. | | | 37 | | | | 1,715 | |

Group 1 Automotive, Inc. | | | 2,393 | | | | 157,555 | |

Guess?, Inc. | | | 17,729 | | | | 325,327 | |

hhgregg, Inc. | | | 4,383 | | | | 8,547 | |

Hibbett Sports, Inc. | | | 39,369 | | | | 1,421,221 | |

Lowe's Companies, Inc. | | | 132 | | | | 10,035 | |

Lumber Liquidators Holdings, Inc. | | | 136,254 | | | | 2,031,547 | |

Mattress Firm Holding Corporation | | | 31,894 | | | | 1,244,504 | |

Monro Muffler Brake, Inc. | | | 3,877 | | | | 268,366 | |

13

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

COMMON STOCKS — 80.8% (Continued) | | Shares | | | Value | |

Consumer Discretionary — 12.9% (Continued) | | | | | | |

Specialty Retail — 2.8% (Continued) | | | | | | |

New York & Company, Inc. | | | 1,183 | | | $ | 4,401 | |

Penske Automotive Group, Inc. | | | 5,854 | | | | 229,067 | |

Rent-A-Center, Inc. | | | 11,289 | | | | 165,948 | |

Restoration Hardware Holdings, Inc. | | | 12,150 | | | | 525,731 | |

Sears Hometown and Outlet Stores, Inc. | | | 1,033 | | | | 6,993 | |

Select Comfort Corporation | | | 54,065 | | | | 1,334,324 | |

Stein Mart, Inc. | | | 655 | | | | 4,742 | |

Ulta Salon Cosmetics & Fragrance, Inc. | | | 434 | | | | 90,394 | |

Vitamin Shoppe, Inc. | | | 51,412 | | | | 1,407,146 | |

Zumiez, Inc. | | | 7,185 | | | | 120,564 | |

| | | | | | | | 15,065,330 | |

Textiles, Apparel & Luxury Goods — 0.6% | | | | | | | | |

Cherokee, Inc. | | | 33,761 | | | | 528,022 | |

Crocs, Inc. | | | 14,311 | | | | 119,497 | |

Deckers Outdoor Corporation | | | 494 | | | | 28,558 | |

G-III Apparel Group Ltd. | | | 610 | | | | 27,603 | |

Iconix Brand Group, Inc. | | | 84,130 | | | | 713,422 | |

Lakeland Industries, Inc. | | | 5,180 | | | | 45,014 | |

lululemon athletica, Inc. | | | 1,191 | | | | 78,070 | |

Sequential Brands Group, Inc. | | | 259,995 | | | | 1,442,972 | |

Skechers U.S.A., Inc. - Class A | | | 367 | | | | 12,129 | |

Superior Uniform Group, Inc. | | | 2,271 | | | | 43,194 | |

Under Armour, Inc. - Class A | | | 2,089 | | | | 91,791 | |

Vera Bradley, Inc. | | | 4,438 | | | | 77,843 | |

| | | | | | | | 3,208,115 | |

Consumer Staples — 2.7% | | | | | | | | |

Beverages — 0.1% | | | | | | | | |

Boston Beer Company, Inc. - Class A | | | 3,614 | | | | 564,073 | |

Coca-Cola Company (The) | | | 364 | | | | 16,307 | |

MGP Ingredients, Inc. | | | 825 | | | | 21,797 | |

| | | | | | | | 602,177 | |

Food & Staples Retailing — 0.4% | | | | | | | | |

Chefs' Warehouse, Inc. (The) | | | 21,867 | | | | 421,377 | |

Diplomat Pharmacy, Inc. | | | 12,063 | | | | 365,388 | |

Natural Grocers by Vitamin Cottage, Inc. | | | 110,669 | | | | 1,478,538 | |

Sprouts Farmers Market, Inc. | | | 1,143 | | | | 32,084 | |

Whole Foods Market, Inc. | | | 1,067 | | | | 31,028 | |

| | | | | | | | 2,328,415 | |

Food Products — 1.4% | | | | | | | | |

Alico, Inc. | | | 25,301 | | | | 731,452 | |

Amira Nature Foods Ltd. | | | 42,440 | | | | 307,690 | |

Blue Buffalo Pet Products, Inc | | | 3,766 | | | | 93,246 | |

Calavo Growers, Inc. | | | 320 | | | | 18,294 | |

14

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

COMMON STOCKS — 80.8% (Continued) | | Shares | | | Value | |

Consumer Staples — 2.7% (Continued) | | | | | | |

Food Products — 1.4% (Continued) | | | | | | |

Cal-Maine Foods, Inc. | | | 36,547 | | | $ | 1,855,126 | |

Campbell Soup Company | | | 43 | | | | 2,653 | |

Flowers Foods, Inc. | | | 4,737 | | | | 90,761 | |

Freshpet, Inc. | | | 145,306 | | | | 1,203,134 | |

Hormel Foods Corporation | | | 551 | | | | 21,241 | |

Inventure Foods, Inc. | | | 195,217 | | | | 1,397,754 | |

Kraft Heinz Company (The) | | | 381 | | | | 29,745 | |

Limoneira Company | | | 10,993 | | | | 196,665 | |

Pilgrim's Pride Corporation | | | 3,758 | | | | 101,128 | |

S&W Seed Company | | | 2,978 | | | | 13,639 | |

Sanderson Farms, Inc. | | | 12,377 | | | | 1,135,466 | |

Tootsie Roll Industries, Inc. | | | 2,182 | | | | 77,766 | |

| | | | | | | | 7,275,760 | |

Household Products — 0.2% | | | | | | | | |

HRG Group, Inc. | | | 47,367 | | | | 682,085 | |

Orchids Paper Products Company | | | 5,661 | | | | 173,623 | |

Spectrum Brands Holdings, Inc. | | | 804 | | | | 91,334 | |

WD-40 Company | | | 1,957 | | | | 200,201 | |

| | | | | | | | 1,147,243 | |

Personal Products — 0.6% | | | | | | | | |

China-Biotics, Inc. (b) | | | 535,616 | | | | 0 | |

Coty, Inc. - Class A | | | 2,583 | | | | 78,523 | |

Elizabeth Arden, Inc. | | | 64,058 | | | | 655,313 | |

Herbalife Ltd. | | | 1,010 | | | | 58,530 | |

Natural Health Trends Corporation | | | 55,562 | | | | 2,010,789 | |

Neptune Technologies & Bioresources, Inc. | | | 1,118 | | | | 1,297 | |

Nu Skin Enterprises, Inc. - Class A | | | 4,226 | | | | 172,294 | |

United-Guardian, Inc. | | | 2,161 | | | | 38,898 | |

USANA Health Sciences, Inc. | | | 93 | | | | 11,015 | |

| | | | | | | | 3,026,659 | |

Tobacco — 0.0% (a) | | | | | | | | |

Universal Corporation | | | 2,774 | | | | 151,322 | |

Vector Group Ltd. | | | 927 | | | | 20,023 | |

| | | | | | | | 171,345 | |

Energy — 7.5% | | | | | | | | |

Energy Equipment & Services — 2.8% | | | | | | | | |

Atwood Oceanics, Inc. | | | 40,598 | | | | 392,177 | |

Basic Energy Services, Inc. | | | 782,288 | | | | 2,503,322 | |

Bristow Group, Inc. | | | 4,125 | | | | 94,545 | |

C&J Energy Services Ltd. | | | 530,878 | | | | 769,773 | |

CARBO Ceramics, Inc. | | | 78,391 | | | | 1,164,106 | |

Ensco plc - Class A | | | 5,218 | | | | 62,407 | |

Era Group, Inc. | | | 988 | | | | 9,416 | |

15

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

COMMON STOCKS — 80.8% (Continued) | | Shares | | | Value | |

Energy — 7.5% (Continued) | | | | | | |

Energy Equipment & Services — 2.8% (Continued) | | | | | | |

Forum Energy Technologies, Inc. | | | 12,742 | | | $ | 213,301 | |

Geospace Technologies Corporation | | | 58,704 | | | | 960,397 | |

Gulfmark Offshore, Inc. - Class A | | | 254,961 | | | | 1,728,636 | |

Helmerich & Payne, Inc. | | | 1,425 | | | | 94,221 | |

Hercules Offshore, Inc. | | | 1,577 | | | | 3,280 | |

Hornbeck Offshore Services, Inc. | | | 123,843 | | | | 1,453,917 | |

Independence Contract Drilling, Inc. | | | 8,361 | | | | 33,277 | |

McDermott International, Inc. | | | 21,116 | | | | 95,867 | |

Natural Gas Services Group, Inc. | | | 26,855 | | | | 617,396 | |

Newpark Resources, Inc. | | | 8,344 | | | | 38,966 | |

Noble Corporation plc | | | 75,574 | | | | 848,696 | |

Ocean Rig UDW, Inc. | | | 113,140 | | | | 237,594 | |

Oceaneering International, Inc. | | | 5,421 | | | | 198,680 | |

Oil States International, Inc. | | | 5,137 | | | | 177,946 | |

Precision Drilling Corporation | | | 12,235 | | | | 63,622 | |

RPC, Inc. | | | 6,388 | | | | 96,586 | |

Schlumberger Ltd. | | | 1 | | | | 29 | |

SEACOR Holdings, Inc. | | | 17,141 | | | | 1,007,377 | |

Seadrill Ltd. | | | 336,700 | | | | 1,609,426 | |

Synthesis Energy Systems, Inc. | | | 71,186 | | | | 85,423 | |

Tesco Corporation | | | 22,592 | | | | 213,720 | |

Tidewater, Inc. | | | 35,247 | | | | 308,764 | |

US Silica Holdings, Inc. | | | 168 | | | | 4,292 | |

| | | | | | | | 15,087,159 | |

Oil, Gas & Consumable Fuels — 4.7% | | | | | | | | |

Amyris, Inc. | | | 235,381 | | | | 240,089 | |

Antero Resources Corporation | | | 1,446 | | | | 40,922 | |

Apache Corporation | | | 366 | | | | 19,910 | |

Approach Resources, Inc. | | | 35,804 | | | | 104,906 | |

Ardmore Shipping Corporation | | | 1,534 | | | | 14,343 | |

Bill Barrett Corporation | | | 2,128 | | | | 16,939 | |

Bonanza Creek Energy, Inc. | | | 121,310 | | | | 470,683 | |

California Resources Corporation | | | 319,165 | | | | 702,164 | |

Centrus Energy Corporation - Class A | | | 12,369 | | | | 39,457 | |

Chesapeake Energy Corporation | | | 256,412 | | | | 1,761,550 | |

Clayton Williams Energy, Inc. | | | 85,805 | | | | 1,555,645 | |

Clean Energy Fuels Corporation | | | 38,924 | | | | 111,323 | |

Cloud Peak Energy, Inc. | | | 251,111 | | | | 554,955 | |

Cobalt International Energy, Inc. | | | 54,657 | | | | 176,542 | |

CONSOL Energy, Inc. | | | 6,095 | | | | 91,730 | |

Continental Resources, Inc. | | | 626 | | | | 23,325 | |

Denbury Resources, Inc. | | | 370,531 | | | | 1,430,250 | |

Dorian LPG Ltd. | | | 28,763 | | | | 292,232 | |

16

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

COMMON STOCKS — 80.8% (Continued) | | Shares | | | Value | |

Energy — 7.5% (Continued) | | | | | | |

Oil, Gas & Consumable Fuels — 4.7% (Continued) | | | | | | |

Eclipse Resources Corporation | | | 65,968 | | | $ | 160,302 | |

Enbridge Energy Management, LLC | | | 1 | | | | 26 | |

EnLink Midstream, LLC | | | 164 | | | | 2,350 | |

EP Energy Corporation - Class A | | | 88,502 | | | | 434,545 | |

Erin Energy Corporation | | | 5,090 | | | | 10,180 | |

Evolution Petroleum Corporation | | | 1,478 | | | | 8,188 | |

EXCO Resources, Inc. | | | 207,756 | | | | 315,789 | |

Exxon Mobil Corporation | | | 312 | | | | 27,581 | |

Gastar Exploration, Inc. | | | 93,840 | | | | 186,742 | |

Gener8 Maritime, Inc. | | | 8,639 | | | | 62,460 | |

Halcon Resources Corporation | | | 233,671 | | | | 285,079 | |

Hallador Energy Company | | | 6,702 | | | | 31,298 | |

Jones Energy, Inc. - Class A | | | 213,776 | | | | 1,026,125 | |

Laredo Petroleum, Inc. | | | 122,678 | | | | 1,494,218 | |

Lucas Energy, Inc. | | | 1,727 | | | | 7,288 | |

Navios Maritime Acquisition Corporation | | | 698 | | | | 1,347 | |

Nordic American Offshore Ltd. | | | 178,010 | | | | 1,012,877 | |

Nordic American Tankers Ltd. | | | 135,669 | | | | 2,090,659 | |

Northern Oil & Gas, Inc. | | | 29,563 | | | | 161,414 | |

Oasis Petroleum, Inc. | | | 91,274 | | | | 884,445 | |

Pacific Ethanol, Inc. | | | 47,392 | | | | 224,164 | |

Parsley Energy, Inc. - Class A | | | 8,773 | | | | 205,464 | |

Peabody Energy Corporation | | | 1 | | | | 1 | |

Pengrowth Energy Corporation | | | 29,824 | | | | 48,911 | |

Range Resources Corporation | | | 2,434 | | | | 107,364 | |

Renewable Energy Group, Inc. | | | 24,120 | | | | 234,446 | |

REX American Resources Corporation | | | 2,808 | | | | 152,671 | |

Rex Energy Corporation | | | 156,176 | | | | 157,738 | |

Sanchez Energy Corporation | | | 112,093 | | | | 1,007,716 | |

Ship Finance International Ltd. | | | 5,126 | | | | 77,761 | |

SM Energy Company | | | 34,404 | | | | 1,072,029 | |

Solazyme, Inc. | | | 980,359 | | | | 2,294,040 | |

Southwestern Energy Company | | | 29,657 | | | | 398,293 | |

Stone Energy Corporation | | | 83,286 | | | | 81,629 | |

Synergy Resources Corporation | | | 18,607 | | | | 134,342 | |

W&T Offshore, Inc. | | | 849,883 | | | | 2,048,218 | |

Westmoreland Coal Company | | | 33 | | | | 235 | |

Whiting Petroleum Corporation | | | 124,872 | | | | 1,498,464 | |

WPX Energy, Inc. | | | 5,126 | | | | 49,518 | |

| | | | | | | | 25,642,882 | |

Financials — 10.0% | | | | | | | | |

Banks — 3.8% | | | | | | | | |

1st Century Bancshares, Inc. | | | 1,675 | | | | 18,442 | |

17

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

COMMON STOCKS — 80.8% (Continued) | | Shares | | | Value | |

Financials — 10.0% (Continued) | | | | | | |

Banks — 3.8% (Continued) | | | | | | |

Access National Corporation | | | 6,222 | | | $ | 122,324 | |

American National Bankshares, Inc. | | | 1,051 | | | | 28,093 | |

American River Bankshares | | | 68 | | | | 688 | |

Ameris Bancorp | | | 6,277 | | | | 197,098 | |

Ames National Corporation | | | 102 | | | | 2,631 | |

Arrow Financial Corporation | | | 1,562 | | | | 43,986 | |

Associated Banc-Corp | | | 266 | | | | 4,852 | |

Banco Latinoamericano de Comericio Exterior S.A. | | | 262 | | | | 6,775 | |

Bancorp, Inc. (The) | | | 128,717 | | | | 729,825 | |

Bank of Hawaii Corporation | | | 4,962 | | | | 339,450 | |

Bank of Marin Bancorp | | | 53 | | | | 2,598 | |

Banner Corporation | | | 2,983 | | | | 127,613 | |

Bar Harbor Bankshares | | | 1,111 | | | | 38,552 | |

BBCN Bancorp, Inc. | | | 805 | | | | 12,574 | |

BCB Bancorp, Inc. | | | 1,283 | | | | 12,984 | |

Blue Hills Bancorp, Inc. | | | 2,115 | | | | 30,837 | |

BOK Financial Corporation | | | 1,073 | | | | 64,573 | |

Boston Private Financial Holdings, Inc. | | | 9,994 | | | | 122,127 | |

Bridge Bancorp, Inc. | | | 15,678 | | | | 477,238 | |

Bryn Mawr Bank Corporation | | | 44,546 | | | | 1,265,997 | |

C1 Financial, Inc. | | | 4,886 | | | | 119,854 | |

Camden National Corporation | | | 954 | | | | 41,509 | |

Capital City Bank Group, Inc. | | | 6,374 | | | | 94,463 | |

Carolina Bank Holdings, Inc. | | | 68 | | | | 1,022 | |

Chemical Financial Corporation | | | 2,233 | | | | 85,881 | |

Chemung Financial Corporation | | | 159 | | | | 4,231 | |

Citizens & Northern Corporation | | | 223 | | | | 4,502 | |

City Holding Company | | | 30,459 | | | | 1,496,146 | |

Civista Bancshares, Inc. | | | 41 | | | | 472 | |

CoBiz Financial, Inc. | | | 10,726 | | | | 129,892 | |

Columbia Banking System, Inc. | | | 361 | | | | 10,646 | |

Community Bank System, Inc. | | | 19,938 | | | | 788,947 | |

Community Trust Bancorp, Inc. | | | 351 | | | | 12,590 | |

ConnectOne Bancorp, Inc. | | | 7,591 | | | | 130,641 | |

Cullen/Frost Bankers, Inc. | | | 893 | | | | 57,143 | |

CVB Financial Corporation | | | 23,167 | | | | 398,009 | |

Enterprise Bancorp, Inc. | | | 18 | | | | 434 | |

Enterprise Financial Services Corporation | | | 189 | | | | 5,173 | |

Farmers Capital Bank Corporation | | | 3,099 | | | | 87,113 | |

First Bancorp (North Carolina) | | | 1,579 | | | | 32,212 | |

First Busey Corporation | | | 1,193 | | | | 24,385 | |

First Business Financial Services, Inc. | | | 5,429 | | | | 137,408 | |

First Commonwealth Financial Corporation | | | 21,561 | | | | 197,930 | |

18

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

COMMON STOCKS — 80.8% (Continued) | | Shares | | | Value | |

Financials — 10.0% (Continued) | | | | | | |

Banks — 3.8% (Continued) | | | | | | |

First Financial Bankshares, Inc. | | | 65,654 | | | $ | 2,125,876 | |

First Financial Corporation | | | 706 | | | | 25,014 | |

First Interstate BancSystem, Inc. - Class A | | | 6,815 | | | | 184,686 | |

First Merchants Corporation | | | 968 | | | | 24,829 | |

First NBC Bank Holding Company | | | 12,545 | | | | 272,728 | |

First Niagara Financial Group, Inc. | | | 3,081 | | | | 32,535 | |

FirstMerit Corporation | | | 306 | | | | 6,781 | |

German American Bancorp, Inc. | | | 2,891 | | | | 93,177 | |

Hampton Roads Bankshares, Inc. | | | 14,352 | | | | 25,259 | |

Hancock Holding Company | | | 1,849 | | | | 48,019 | |

Heritage Financial Corporation | | | 16,602 | | | | 306,307 | |

Heritage Oaks Bancorp | | | 2,522 | | | | 21,059 | |

Independent Bank Corporation (Michigan) | | | 347 | | | | 5,257 | |

Lakeland Bancorp, Inc. | | | 46,463 | | | | 515,275 | |

LegacyTexas Financial Group, Inc. | | | 24 | | | | 592 | |

Mackinac Financial Corporation | | | 754 | | | | 8,007 | |

MB Financial, Inc. | | | 477 | | | | 16,580 | |

MidSouth Bancorp, Inc. | | | 9,886 | | | | 89,468 | |

MidWestOne Financial Group, Inc. | | | 2,524 | | | | 71,581 | |

Monarch Financial Holdings, Inc. | | | 181 | | | | 3,329 | |

National Bank Holdings Corporation - Class A | | | 4,281 | | | | 85,577 | |

National Bankshares, Inc. | | | 38 | | | | 1,368 | |

NBT Bancorp, Inc. | | | 765 | | | | 21,680 | |

Northrim BanCorp, Inc. | | | 69 | | | | 1,780 | |

OFG Bancorp | | | 64,637 | | | | 570,745 | |

Old National Bancorp | | | 2,991 | | | | 40,079 | |

Pacific Mercantile Bancorp | | | 3,075 | | | | 23,093 | |

Park National Corporation | | | 2,947 | | | | 270,535 | |

Park Sterling Corporation | | | 32,175 | | | | 234,877 | |

Penns Woods Bancorp, Inc. | | | 5,240 | | | | 218,089 | |

Peoples Bancorp, Inc. | | | 28,789 | | | | 618,676 | |

Peoples Financial Services Corporation | | | 1,997 | | | | 78,722 | |

Prosperity Bancshares, Inc. | | | 3,589 | | | | 189,392 | |

QCR Holdings, Inc. | | | 604 | | | | 15,565 | |

Republic First Bancorp, Inc. | | | 224 | | | | 1,042 | |

S&T Bancorp, Inc. | | | 10,201 | | | | 261,860 | |

Sandy Spring Bancorp, Inc. | | | 88 | | | �� | 2,516 | |

Seacoast Banking Corporation of Florida | | | 17,297 | | | | 280,557 | |

Simmons First National Corporation - Class A | | | 111 | | | | 5,184 | |

Southside Bancshares, Inc. | | | 38,166 | | | | 1,114,829 | |

Southwest Bancorp, Inc. | | | 29,622 | | | | 475,433 | |

State Bank Financial Corporation | | | 5,591 | | | | 116,740 | |

Stock Yards Bancorp, Inc. | | | 1,379 | | | | 55,767 | |

19

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

COMMON STOCKS — 80.8% (Continued) | | Shares | | | Value | |

Financials — 10.0% (Continued) | | | | | | |

Banks — 3.8% (Continued) | | | | | | |

Sun Bancorp, Inc./NJ | | | 728 | | | $ | 15,645 | |

TowneBank | | | 611 | | | | 12,831 | |

Trustmark Corporation | | | 1,385 | | | | 33,946 | |

UMB Financial Corporation | | | 9,629 | | | | 536,817 | |

Union Bankshares Corporation | | | 134 | | | | 3,539 | |

United Bankshares, Inc. | | | 33,167 | | | | 1,283,231 | |

Univest Corporation of Pennsylvania | | | 7,083 | | | | 139,818 | |

Veritex Holdings, Inc. | | | 3,171 | | | | 49,119 | |

Washington Trust Bancorp, Inc. | | | 5,505 | | | | 201,648 | |

WesBanco, Inc. | | | 12,209 | | | | 392,275 | |

West Bancorporation, Inc. | | | 76 | | | | 1,417 | |

Westamerica Bancorporation | | | 34,519 | | | | 1,681,766 | |

Wilshire Bancorp, Inc. | | | 3,095 | | | | 33,333 | |

Wintrust Financial Corporation | | | 2,221 | | | | 115,536 | |

Yadkin Financial Corporation | | | 1 | | | | 25 | |

| | | | | | | | 20,571,271 | |

Capital Markets — 0.8% | | | | | | | | |

Artisan Partners Asset Management, Inc. - Class A | | | 326 | | | | 10,533 | |

Capitala Finance Corporation | | | 3,383 | | | | 45,772 | |

Cowen Group, Inc. - Class A | | | 160,071 | | | | 557,847 | |

Diamond Hill Investment Group, Inc. | | | 294 | | | | 51,526 | |

FBR & Company | | | 2,351 | | | | 43,493 | |

Federated Investors, Inc. - Class B | | | 2,403 | | | | 75,935 | |

Fidus Investment Corporation | | | 2,081 | | | | 33,171 | |

Financial Engines, Inc. | | | 9,431 | | | | 303,773 | |

FS Investment Corporation | | | 154 | | | | 1,434 | |

FXCM, Inc. - Class A | | | 18,308 | | | | 213,471 | |

Gladstone Capital Corporation | | | 4,930 | | | | 37,665 | |

Greenhill & Company, Inc. | | | 7,083 | | | | 155,968 | |

GSV Capital Corporation | | | 12,952 | | | | 74,215 | |

Harvest Capital Credit Corporation | | | 70 | | | | 905 | |

INTL FCStone, Inc. | | | 216 | | | | 5,897 | |

Ladenburg Thalmann Financial Services, Inc. | | | 10,748 | | | | 28,805 | |

LPL Financial Holdings, Inc. | | | 42,074 | | | | 1,110,754 | |

Main Street Capital Corporation | | | 3,887 | | | | 121,352 | |

Manning & Napier, Inc. | | | 38,739 | | | | 331,218 | |

OFS Capital Corporation | | | 110 | | | | 1,452 | |

OHA Investment Corporation | | | 3,090 | | | | 8,745 | |

PJT Partners, Inc. - Class A | | | 3,275 | | | | 73,098 | |

Prospect Capital Corporation | | | 20,591 | | | | 154,021 | |

Pzena Investment Management, Inc. - Class A | | | 7,380 | | | | 66,863 | |

Safeguard Scientifics, Inc. | | | 15,753 | | | | 217,391 | |

Solar Senior Capital Ltd. | | | 294 | | | | 4,410 | |

20

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

COMMON STOCKS — 80.8% (Continued) | | Shares | | | Value | |

Financials — 10.0% (Continued) | | | | | | |

Capital Markets — 0.8% (Continued) | | | | | | |

Stifel Financial Corporation | | | 5,013 | | | $ | 164,978 | |

T Rowe Price Group, Inc. | | | 348 | | | | 26,201 | |

Triangle Capital Corporation | | | 45 | | | | 956 | |

Virtu Financial, Inc. - Class A | | | 2,113 | | | | 44,056 | |

Virtus Investment Partners, Inc. | | | 1,469 | | | | 114,905 | |

Westwood Holdings Group, Inc. | | | 171 | | | | 9,841 | |

| | | | | | | | 4,090,651 | |

Consumer Finance — 0.6% | | | | | | | | |

Atlanticus Holdings Corporation | | | 31,353 | | | | 94,686 | |

Cash America International, Inc. | | | 234 | | | | 8,649 | |

Credit Acceptance Corporation | | | 506 | | | | 99,312 | |

Emergent Capital, Inc. | | | 3,228 | | | | 14,139 | |

Encore Capital Group, Inc. | | | 5,438 | | | | 153,080 | |

EZCORP, Inc. - Class A | | | 173,549 | | | | 859,067 | |

First Cash Financial Services, Inc. | | | 4,099 | | | | 187,447 | |

First Data Corporation - Class A | | | 25,177 | | | | 286,766 | |

PRA Group, Inc. | | | 2,243 | | | | 74,423 | |

Regional Management Corporation | | | 7,661 | | | | 126,560 | |

World Acceptance Corporation | | | 33,638 | | | | 1,459,553 | |

| | | | | | | | 3,363,682 | |

Diversified Financial Services — 0.3% | | | | | | | | |

CBOE Holdings, Inc. | | | 46 | | | | 2,850 | |

CME Group, Inc. | | | 417 | | | | 38,326 | |

Consumer Portfolio Services, Inc. | | | 4,681 | | | | 18,490 | |

FNFV Group | | | 848 | | | | 9,133 | |

Medallion Financial Corporation | | | 34,597 | | | | 266,397 | |

On Deck Capital, Inc. | | | 29,346 | | | | 253,256 | |

PHH Corporation | | | 63,720 | | | | 817,528 | |

Resource America, Inc. - Class A | | | 5,200 | | | | 32,864 | |

| | | | | | | | 1,438,844 | |

Insurance — 1.1% | | | | | | | | |

Ambac Financial Group, Inc. | | | 1,929 | | | | 31,308 | |

American Equity Investment Life Holding Company | | | 8,124 | | | | 113,736 | |

AmTrust Financial Services, Inc. | | | 648 | | | | 16,103 | |

Arthur J. Gallagher & Company | | | 440 | | | | 20,257 | |

Assurant, Inc. | | | 42 | | | | 3,552 | |

Baldwin & Lyons, Inc. - Class B | | | 40 | | | | 977 | |

Citizens, Inc. | | | 141,658 | | | | 1,154,513 | |

Conifer Holdings, Inc. | | | 1,718 | | | | 11,648 | |

Donegal Group, Inc. - Class A | | | 6,773 | | | | 103,695 | |

Federated National Holding Company | | | 4,490 | | | | 85,534 | |

Greenlight Capital Re Ltd. - Class A | | | 19,545 | | | | 420,804 | |

HCI Group, Inc. | | | 3,130 | | | | 93,775 | |

21

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

COMMON STOCKS — 80.8% (Continued) | | Shares | | | Value | |

Financials — 10.0% (Continued) | | | | | | |

Insurance — 1.1% (Continued) | | | | | | |

Maiden Holdings Ltd. | | | 12,620 | | | $ | 154,343 | |

MBIA, Inc. | | | 105,822 | | | | 825,412 | |

Mercury General Corporation | | | 815 | | | | 43,113 | |

National Western Life Group, Inc. - Class A | | | 10 | | | | 2,167 | |

OneBeacon Insurance Group Ltd. - Class A | | | 2,243 | | | | 27,813 | |

Patriot National, Inc. | | | 165,028 | | | | 1,373,033 | |

Primerica, Inc. | | | 13,494 | | | | 668,763 | |

State Auto Financial Corporation | | | 1,006 | | | | 20,633 | |

Stewart Information Services Corporation | | | 1,540 | | | | 53,623 | |

Third Point Reinsurance Ltd. | | | 3,666 | | | | 41,719 | |

Torchmark Corporation | | | 1,213 | | | | 70,220 | |

Universal Insurance Holdings, Inc. | | | 44,295 | | | | 780,035 | |

W.R. Berkley Corporation | | | 1,604 | | | | 89,824 | |

| | | | | | | | 6,206,600 | |

Real Estate Investment Trusts (REIT) — 1.9% | | | | | | | | |

Acadia Realty Trust | | | 4,998 | | | | 168,433 | |

Agree Realty Corporation | | | 60 | | | | 2,327 | |

Alexandria Real Estate Equities, Inc. | | | 1,262 | | | | 117,303 | |

American Homes 4 Rent - Class A | | | 1 | | | | 16 | |

CareTrust REIT, Inc. | | | 25,060 | | | | 318,763 | |

CorEnergy Infrastructure Trust, Inc. | | | 2 | | | | 43 | |

CoreSite Realty Corporation | | | 319 | | | | 23,903 | |

Crown Castle International Corporation | | | 218 | | | | 18,940 | |

CyrusOne, Inc. | | | 3,725 | | | | 164,384 | |

Douglas Emmett, Inc. | | | 790 | | | | 25,636 | |

Duke Realty Corporation | | | 20,496 | | | | 448,248 | |

DuPont Fabros Technology, Inc. | | | 4,077 | | | | 162,346 | |

Easterly Government Properties, Inc. | | | 13,041 | | | | 240,606 | |

Education Realty Trust, Inc. | | | 2,279 | | | | 90,636 | |

Extra Space Storage, Inc. | | | 8,226 | | | | 698,799 | |

Federal Realty Investment Trust | | | 4,618 | | | | 702,305 | |

Gaming and Leisure Properties, Inc. | | | 1,391 | | | | 45,611 | |

Gladstone Commercial Corporation | | | 249 | | | | 4,191 | |

Government Properties Income Trust | | | 24,734 | | | | 467,967 | |

Gramercy Property Trust | | | 30,771 | | | | 260,630 | |

HCP, Inc. | | | 939 | | | | 31,766 | |

Healthcare Realty Trust, Inc. | | | 4,626 | | | | 140,075 | |

Healthcare Trust of America, Inc. - Class A | | | 7,011 | | | | 202,548 | |

Iron Mountain, Inc. | | | 499 | | | | 18,229 | |

Liberty Property Trust | | | 5,009 | | | | 174,814 | |

LTC Properties, Inc. | | | 15,481 | | | | 718,164 | |

Monogram Residential Trust, Inc. | | | 6,428 | | | | 65,116 | |

National Storage Affiliates Trust | | | 5,368 | | | | 104,783 | |

22

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

COMMON STOCKS — 80.8% (Continued) | | Shares | | | Value | |

Financials — 10.0% (Continued) | | | | | | |

Real Estate Investment Trusts (REIT) — 1.9% (Continued) | | | | | | |

New Senior Investment Group, Inc. | | | 13,149 | | | $ | 142,009 | |

Northstar Realty Europe Corporation | | | 15,614 | | | | 186,275 | |

Physicians Realty Trust | | | 1,608 | | | | 29,153 | |

Prologis, Inc. | | | 3,467 | | | | 157,437 | |

Public Storage | | | 488 | | | | 119,467 | |

QTS Realty Trust, Inc. - Class A | | | 2,946 | | | | 142,645 | |

Realty Income Corporation | | | 5,616 | | | | 332,467 | |

Regency Centers Corporation | | | 3,157 | | | | 232,671 | |

Retail Properties of America, Inc. - Class A | | | 93 | | | | 1,487 | |

Seritage Growth Properties - Class A | | | 2,131 | | | | 113,731 | |

STAG Industrial, Inc. | | | 35,869 | | | | 715,945 | |

Universal Health Realty Income Trust | | | 220 | | | | 12,012 | |

Urstadt Biddle Properties, Inc. - Class A | | | 5,849 | | | | 120,255 | |

Ventas, Inc. | | | 3,927 | | | | 243,945 | |

Walter Investment Management Corporation | | | 225,404 | | | | 1,634,179 | |

Welltower, Inc. | | | 10,432 | | | | 724,189 | |

Whitestone REIT | | | 11,097 | | | | 149,033 | |

| | | | | | | | 10,473,482 | |

Real Estate Management & Development — 0.3% | | | | | | | | |

Alexander & Baldwin, Inc. | | | 257 | | | | 9,828 | |

Altisource Portfolio Solutions S.A. | | | 11,993 | | | | 375,261 | |

AV Homes, Inc. | | | 6,195 | | | | 71,242 | |

Consolidated-Tomoka Land Company | | | 2,101 | | | | 103,579 | |

Forestar Group, Inc. | | | 35,800 | | | | 483,300 | |

Realogy Holdings Corporation | | | 81 | | | | 2,895 | |

St. Joe Company (The) | | | 21,072 | | | | 355,063 | |

Tejon Ranch Company | | | 4,340 | | | | 97,737 | |

| | | | | | | | 1,498,905 | |

Thrifts & Mortgage Finance — 1.2% | | | | | | | | |

Atlantic Coast Financial Corporation | | | 388 | | | | 2,491 | |

Banc of California, Inc. | | | 10,950 | | | | 222,833 | |

Bank Mutual Corporation | | | 356 | | | | 2,877 | |

BankFinancial Corporation | | | 11,495 | | | | 142,078 | |

BBX Capital Corporation - Class A | | | 1,591 | | | | 24,533 | |

BofI Holding, Inc. | | | 84,300 | | | | 1,717,191 | |

BSB Bancorp, Inc. | | | 104 | | | | 2,472 | |

Cheviot Financial Corporation | | | 657 | | | | 9,829 | |

Clifton Bancorp, Inc. | | | 19,319 | | | | 287,467 | |

Hingham Institution for Savings | | | 35 | | | | 4,480 | |

HomeStreet, Inc. | | | 12,214 | | | | 263,212 | |

Impac Mortgage Holdings, Inc. | | | 91,380 | | | | 1,297,596 | |

Kearny Financial Corporation | | | 2,444 | | | | 30,843 | |

Lake Sunapee Bank Group | | | 537 | | | | 7,647 | |

23

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

COMMON STOCKS — 80.8% (Continued) | | Shares | | | Value | |

Financials — 10.0% (Continued) | | | | | | |

Thrifts & Mortgage Finance — 1.2% (Continued) | | | | | | |

LendingTree, Inc. | | | 14,892 | | | $ | 1,332,387 | |

Meridian Bancorp, Inc. | | | 1,029 | | | | 15,044 | |

MMA Capital Management, LLC | | | 26 | | | | 417 | |

Northfield Bancorp, Inc. | | | 10,419 | | | | 165,245 | |

Northwest Bancshares, Inc. | | | 30,909 | | | | 433,344 | |

OceanFirst Financial Corporation | | | 7,328 | | | | 142,749 | |

Ocwen Financial Corporation | | | 6,887 | | | | 15,565 | |

People's United Financial, Inc. | | | 2,402 | | | | 37,231 | |

Stonegate Mortgage Corporation | | | 8,977 | | | | 51,797 | |

Timberland Bancorp, Inc. | | | 3 | | | | 42 | |

TrustCo Bank Corporation | | | 30,679 | | | | 196,652 | |

United Financial Bancorp, Inc. | | | 16,222 | | | | 210,562 | |

Waterstone Financial, Inc. | | | 1,255 | | | | 17,595 | |

WSFS Financial Corporation | | | 315 | | | | 10,754 | |

| | | | | | | | 6,644,933 | |

Health Care — 19.5% | | | | | | | | |

Biotechnology — 9.1% | | | | | | | | |

Abeona Therapeutics, Inc. | | | 30,661 | | | | 83,398 | |

ACADIA Pharmaceuticals, Inc. | | | 6,765 | | | | 218,509 | |

Actinium Pharmaceuticals, Inc. | | | 848 | | | | 1,594 | |

Adamas Pharmaceuticals, Inc. | | | 7,765 | | | | 131,073 | |

Advaxis, Inc. | | | 7,950 | | | | 61,533 | |

Aegerion Pharmaceuticals, Inc. | | | 58,622 | | | | 167,073 | |

Aeterna Zentaris, Inc. | | | 26,055 | | | | 105,523 | |

Agios Pharmaceuticals, Inc. | | | 609 | | | | 29,811 | |

Akebia Therapeutics, Inc. | | | 10,563 | | | | 99,187 | |

Alder Biopharmaceuticals, Inc. | | | 58,809 | | | | 1,561,379 | |

Amicus Therapeutics, Inc. | | | 106,678 | | | | 796,885 | |

Anacor Pharmaceuticals, Inc. | | | 346 | | | | 21,708 | |

Anavex Life Sciences Corporation | | | 69,373 | | | | 378,777 | |

Aquinox Pharmaceuticals, Inc. | | | 13,190 | | | | 107,367 | |

Argos Therapeutics, Inc. | | | 49,696 | | | | 310,103 | |

ARIAD Pharmaceuticals, Inc. | | | 116,178 | | | | 834,158 | |

Array BioPharma, Inc. | | | 204,686 | | | | 652,948 | |

Arrowhead Pharmaceuticals, Inc. | | | 231,569 | | | | 1,340,785 | |

Asterias Biotherapeutics, Inc. | | | 2,498 | | | | 10,716 | |

Athersys, Inc. | | | 70,693 | | | | 163,301 | |

aTyr Pharma, Inc. | | | 56,466 | | | | 201,019 | |

Aurinia Pharmaceuticals, Inc. | | | 1,507 | | | | 4,400 | |

Axovant Sciences Ltd. | | | 1,619 | | | | 21,047 | |

Bio Blast Pharma Ltd. | | | 11,451 | | | | 26,108 | |

BioTime, Inc. | | | 105,448 | | | | 307,908 | |

bluebird bio, Inc. | | | 1,575 | | | | 69,851 | |

24

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

COMMON STOCKS — 80.8% (Continued) | | Shares | | | Value | |

Health Care — 19.5% (Continued) | | | | | | |

Biotechnology — 9.1% (Continued) | | | | | | |

Catabasis Pharmaceuticals, Inc. | | | 349 | | | $ | 1,539 | |

Catalyst Pharmaceutical, Inc. | | | 15,108 | | | | 10,273 | |

Celator Pharmaceuticals, Inc. | | | 41,659 | | | | 627,801 | |

Celldex Therapeutics, Inc. | | | 76,154 | | | | 304,616 | |

Cellular Biomedicine Group, Inc. | | | 4,608 | | | | 79,580 | |

Cerulean Pharma, Inc. | | | 99 | | | | 325 | |

Chiasma, Inc. | | | 273,263 | | | | 920,896 | |

Chimerix, Inc. | | | 127,417 | | | | 761,954 | |

Clovis Oncology, Inc. | | | 122,532 | | | | 1,704,420 | |

Codexis, Inc. | | | 5,525 | | | | 17,404 | |

Conatus Pharmaceuticals, Inc. | | | 10,346 | | | | 29,693 | |

CorMedix, Inc. | | | 32,837 | | | | 137,259 | |

CytRx Corporation | | | 239,738 | | | | 781,546 | |

Dynavax Technologies Corporation | | | 10,269 | | | | 168,514 | |

Eagle Pharmaceuticals, Inc. | | | 34,739 | | | | 1,315,219 | |

Editas Medicine, Inc. | | | 2,441 | | | | 80,675 | |

Exact Sciences Corporation | | | 11,201 | | | | 78,631 | |

Exelixis, Inc. | | | 9,421 | | | | 43,431 | |

Fibrocell Science, Inc. | | | 2,056 | | | | 5,675 | |

Flexion Therapeutics, Inc. | | | 1,952 | | | | 20,301 | |

Galena Biopharma, Inc. | | | 1,189,559 | | | | 1,641,591 | |

Genocea Biosciences, Inc. | | | 215,101 | | | | 946,444 | |

Geron Corporation | | | 16,538 | | | | 48,787 | |

GlycoMimetics, Inc. | | | 705 | | | | 4,441 | |

Heron Therapeutics, Inc. | | | 78,791 | | | | 1,689,279 | |

Idera Pharmaceuticals, Inc. | | | 474,078 | | | | 786,969 | |

Ignyta, Inc. | | | 577 | | | | 3,993 | |

Immunomedics, Inc. | | | 127,911 | | | | 454,084 | |

Inotek Pharmaceuticals Corporation | | | 26,631 | | | | 260,984 | |

Inovio Pharmaceuticals, Inc. | | | 72,313 | | | | 757,840 | |

Insys Therapeutics, Inc. | | | 123,846 | | | | 1,794,529 | |

Intercept Pharmaceuticals, Inc. | | | 1,925 | | | | 290,174 | |

Invitae Corporation | | | 34,997 | | | | 333,871 | |

Ionis Pharmaceuticals, Inc. | | | 2,063 | | | | 84,521 | |

Ironwood Pharmaceuticals, Inc. | | | 921 | | | | 9,624 | |

IsoRay, Inc. | | | 22,521 | | | | 25,899 | |

Juno Therapeutics, Inc. | | | 2,145 | | | | 90,283 | |

Karyopharm Therapeutics, Inc. | | | 11,280 | | | | 104,904 | |

Keryx Biopharmaceuticals, Inc. | | | 288,011 | | | | 1,566,780 | |

Kite Pharma, Inc. | | | 323 | | | | 14,948 | |

La Jolla Pharmaceutical Company | | | 22,460 | | | | 415,735 | |

Lion Biotechnologies, Inc. | | | 43,767 | | | | 248,159 | |

Loxo Oncology, Inc. | | | 28,765 | | | | 663,033 | |

25

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

COMMON STOCKS — 80.8% (Continued) | | Shares | | | Value | |

Health Care — 19.5% (Continued) | | | | | | |

Biotechnology — 9.1% (Continued) | | | | | | |

MacroCure Ltd. | | | 66,442 | | | $ | 68,435 | |

MannKind Corporation | | | 1,238,315 | | | | 1,671,725 | |

MediciNova, Inc. | | | 44,944 | | | | 309,215 | |

Merrimack Pharmaceuticals, Inc. | | | 11,508 | | | | 81,477 | |

MiMedx Group, Inc. | | | 21,471 | | | | 161,677 | |

Mirati Therapeutics, Inc. | | | 4,236 | | | | 87,770 | |

Myriad Genetics, Inc. | | | 1,713 | | | | 61,668 | |

NantKwest, Inc. | | | 98,401 | | | | 815,744 | |

Nivalis Therapeutics, Inc. | | | 11,379 | | | | 48,133 | |

Northwest Biotherapeutics, Inc. | | | 677,113 | | | | 947,958 | |

Novavax, Inc. | | | 181,287 | | | | 949,944 | |

Nymox Pharmaceutical Corporation | | | 16,588 | | | | 37,489 | |

Ohr Pharmaceutical, Inc. | | | 12,877 | | | | 42,108 | |

Omeros Corporation | | | 98,474 | | | | 1,304,780 | |

Oncothyreon, Inc. | | | 156,420 | | | | 203,346 | |

OPKO Health, Inc. | | | 7,051 | | | | 75,798 | |

Organovo Holdings, Inc. | | | 351,181 | | | | 955,212 | |

Osiris Therapeutics, Inc. | | | 20,232 | | | | 113,502 | |

OvaScience, Inc. | | | 108,179 | | | | 906,540 | |

Portola Pharmaceuticals, Inc. | | | 22,539 | | | | 535,527 | |

Proteon Therapeutics, Inc. | | | 36 | | | | 351 | |

PTC Therapeutics, Inc. | | | 143,787 | | | | 1,066,900 | |

Puma Biotechnology, Inc. | | | 22,839 | | | | 700,929 | |

Radius Health, Inc. | | | 19,748 | | | | 703,029 | |

Regulus Therapeutics, Inc. | | | 95,383 | | | | 557,037 | |

Sage Therapeutics, Inc. | | | 36 | | | | 1,357 | |

Sarepta Therapeutics, Inc. | | | 123,619 | | | | 1,754,154 | |

Seattle Genetics, Inc. | | | 2,404 | | | | 85,294 | |

Seres Therapeutics, Inc. | | | 570 | | | | 16,826 | |

Synergy Pharmaceuticals, Inc. | | | 245,732 | | | | 771,598 | |

Synthetic Biologics, Inc. | | | 809,577 | | | | 1,805,357 | |

TESARO, Inc. | | | 4,302 | | | | 178,275 | |

Tobira Therapeutics, Inc. | | | 16,279 | | | | 128,116 | |

Tonix Pharmaceuticals Holding Corporation | | | 21,600 | | | | 54,432 | |

Tracon Pharmaceuticals, Inc. | | | 1,803 | | | | 13,054 | |

Trovagene, Inc. | | | 363,159 | | | | 1,459,899 | |

Ultragenyx Pharmaceutical, Inc. | | | 2,540 | | | | 171,755 | |

Versartis, Inc. | | | 13,170 | | | | 119,320 | |

Viking Therapeutics, Inc. | | | 22,836 | | | | 33,112 | |

Vital Therapies, Inc. | | | 31,618 | | | | 270,966 | |

vTv Therapeutics, Inc. - Class A | | | 693 | | | | 4,366 | |

XBiotech, Inc. | | | 67,517 | | | | 860,842 | |

Zafgen, Inc. | | | 105,273 | | | | 670,589 | |

26

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

COMMON STOCKS — 80.8% (Continued) | | Shares | | | Value | |

Health Care — 19.5% (Continued) | | | | | | |

Biotechnology — 9.1% (Continued) | | | | | | |

ZIOPHARM Oncology, Inc. | | | 182,780 | | | $ | 1,436,651 | |

| | | | | | | | 49,275,042 | |

Health Care Equipment & Supplies — 3.5% | | | | | | | | |

Abaxis, Inc. | | | 80 | | | | 3,626 | |

Accuray, Inc. | | | 17,143 | | | | 91,887 | |

Amedica Corporation | | | 63,253 | | | | 98,675 | |

Anika Therapeutics, Inc. | | | 140 | | | | 6,392 | |

Antares Pharma, Inc. | | | 31,563 | | | | 34,719 | |

Avinger, Inc. | | | 105,011 | | | | 1,216,027 | |

AxoGen, Inc. | | | 53,252 | | | | 309,927 | |

Biolase, Inc. | | | 21,145 | | | | 30,026 | |

Cardiovascular Systems, Inc. | | | 61,709 | | | | 862,692 | |

Cerus Corporation | | | 4,193 | | | | 26,248 | |

ConforMIS, Inc. | | | 125,533 | | | | 1,555,354 | |

CONMED Corporation | | | 1,622 | | | | 67,183 | |

Corindus Vascular Robotics, Inc. | | | 35,242 | | | | 37,004 | |

CytoSorbents Corporation | | | 32,207 | | | | 139,134 | |

Derma Sciences, Inc. | | | 14,563 | | | | 50,679 | |

DexCom, Inc. | | | 1,322 | | | | 85,110 | |

Digirad Corporation | | | 11,210 | | | | 65,354 | |

EndoChoice Holdings, Inc. | | | 180,642 | | | | 997,144 | |

Entellus Medical, Inc. | | | 227 | | | | 3,301 | |

GenMark Diagnostics, Inc. | | | 201,903 | | | | 1,193,247 | |

Great Basin Scientific, Inc. | | | 32,308 | | | | 99,509 | |

Greatbatch, Inc. | | | 4,483 | | | | 156,008 | |

Hansen Medical, Inc. | | | 27,081 | | | | 109,678 | |

Insulet Corporation | | | 4,879 | | | | 162,471 | |

Invuity, Inc. | | | 4,792 | | | | 32,586 | |

iRadimed Corporation | | | 72,875 | | | | 1,192,964 | |

IRIDEX Corporation | | | 101 | | | | 1,156 | |

LDR Holding Corporation | | | 5,954 | | | | 160,460 | |

Meridian Bioscience, Inc. | | | 5,660 | | | | 108,163 | |

Navidea Biopharmaceuticals, Inc. | | | 198,692 | | | | 274,195 | |

Nevro Corporation | | | 13,381 | | | | 899,872 | |

Novadaq Technologies, Inc. | | | 1,957 | | | | 21,918 | |

Novocure Ltd. | | | 14,862 | | | | 191,720 | |

Quidel Corporation | | | 3,248 | | | | 56,190 | |

Quotient Ltd. | | | 6,514 | | | | 69,439 | |

ReWalk Robotics Ltd. | | | 6,651 | | | | 60,258 | |

Rockwell Medical, Inc. | | | 244,213 | | | | 2,258,970 | |

Second Sight Medical Products, Inc. | | | 292,267 | | | | 1,382,423 | |

Sientra, Inc. | | | 96,695 | | | | 785,163 | |

Spectranetics Corporation (The) | | | 11,443 | | | | 194,531 | |

27

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

COMMON STOCKS — 80.8% (Continued) | | Shares | | | Value | |

Health Care — 19.5% (Continued) | | | | | | |

Health Care Equipment & Supplies — 3.5% (Continued) | | | | | | |

STAAR Surgical Company | | | 9,987 | | | $ | 77,000 | |

SurModics, Inc. | | | 626 | | | | 12,595 | |

Tandem Diabetes Care, Inc. | | | 80,989 | | | | 901,408 | |

TransEnterix, Inc. | | | 623,311 | | | | 934,967 | |

Vascular Solutions, Inc. | | | 286 | | | | 9,996 | |

Wright Medical Group N.V. | | | 67,453 | | | | 1,266,767 | |

ZELTIQ Aesthetics, Inc. | | | 16,750 | | | | 500,825 | |

Zimmer Biomet Holdings, Inc. | | | 736 | | | | 85,207 | |

| | | | | | | | 18,880,168 | |

Health Care Providers & Services — 2.7% | | | | | | | | |

AAC Holdings, Inc. | | | 106,637 | | | | 2,195,656 | |

Aceto Corporation | | | 307 | | | | 6,886 | |

Addus HomeCare Corporation | | | 27,973 | | | | 517,500 | |

Adeptus Health, Inc. - Class A | | | 30,165 | | | | 2,054,840 | |

Air Methods Corporation | | | 13,713 | | | | 507,107 | |

AMN Healthcare Services, Inc. | | | 25,075 | | | | 890,413 | |

Anthem, Inc. | | | 20 | | | | 2,815 | |

BioScrip, Inc. | | | 646,504 | | | | 1,706,770 | |

Centene Corporation | | | 1 | | | | 11 | |

Ensign Group, Inc. (The) | | | 1,403 | | | | 31,652 | |

ExamWorks Group, Inc. | | | 18,520 | | | | 667,646 | |

Express Scripts Holding Company | | | 37 | | | | 2,728 | |

Hanger, Inc. | | | 4,970 | | | | 34,243 | |

InfuSystem Holdings, Inc. | | | 14,421 | | | | 51,916 | |

Landauer, Inc. | | | 26,855 | | | | 932,943 | |

MEDNAX, Inc. | | | 1,234 | | | | 87,972 | |

Nobilis Health Corporation | | | 195,789 | | | | 826,230 | |

Patterson Companies, Inc. | | | 1,945 | | | | 84,316 | |

Psychemedics Corporation | | | 1,760 | | | | 25,344 | |

Select Medical Holdings Corporation | | | 46,263 | | | | 618,999 | |

Sharps Compliance Corporation | | | 11,019 | | | | 50,026 | |

Teladoc, Inc. | | | 169,399 | | | | 2,058,198 | |

Trupanion, Inc. | | | 82,227 | | | | 1,025,371 | |

| | | | | | | | 14,379,582 | |

Health Care Technology — 0.8% | | | | | | | | |

Castlight Health, Inc. - Class B | | | 264,100 | | | | 950,760 | |

Computer Programs & Systems, Inc. | | | 20,576 | | | | 1,056,166 | |

Connecture, Inc. | | | 1,356 | | | | 3,133 | |

Evolent Health, Inc. - Class A | | | 43,493 | | | | 522,351 | |

Imprivata, Inc. | | | 2,925 | | | | 35,451 | |

Inovalon Holdings, Inc. - Class A | | | 55,453 | | | | 948,246 | |

Medidata Solutions, Inc. | | | 2,666 | | | | 116,318 | |

Veeva Systems, Inc. - Class A | | | 26,685 | | | | 734,104 | |

| | | | | | | | 4,366,529 | |

28

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

COMMON STOCKS — 80.8% (Continued) | | Shares | | | Value | |

Health Care — 19.5% (Continued) | | | | | | |

Life Sciences Tools & Services — 0.7% | | | | | | |

Accelerate Diagnostics, Inc. | | | 149,463 | | | $ | 1,875,761 | |

Albany Molecular Research, Inc. | | | 9,395 | | | | 141,395 | |

Fluidigm Corporation | | | 7,987 | | | | 76,515 | |

Illumina, Inc. | | | 658 | | | | 88,823 | |

Luminex Corporation | | | 2,710 | | | | 54,471 | |

Pacific Biosciences of California, Inc. | | | 138,907 | | | | 1,340,452 | |

pSivida Corporation | | | 16,413 | | | | 47,105 | |

Sequenom, Inc. | | | 185,324 | | | | 237,215 | |

Waters Corporation | | | 667 | | | | 86,817 | |

| | | | | | | | 3,948,554 | |

Pharmaceuticals — 2.7% | | | | | | | | |

AcelRx Pharmaceuticals, Inc. | | | 3,418 | | | | 11,553 | |

Aclaris Therapeutics, Inc. | | | 2,616 | | | | 48,344 | |

Aerie Pharmaceuticals, Inc. | | | 15,139 | | | | 240,105 | |

Akorn, Inc. | | | 14,381 | | | | 365,996 | |

Alcobra Ltd. | | | 1,536 | | | | 6,159 | |

Alimera Sciences, Inc. | | | 16,411 | | | | 36,432 | |

Allergan plc | | | 29 | | | | 6,280 | |

Ampio Pharmaceuticals, Inc. | | | 262,606 | | | | 1,105,571 | |

Aralez Pharmaceuticals, Inc. | | | 55,821 | | | | 218,260 | |

Aratana Therapeutics, Inc. | | | 152,023 | | | | 913,658 | |

Catalent, Inc. | | | 301 | | | | 8,889 | |

Cempra, Inc. | | | 3,264 | | | | 55,260 | |

Concordia Healthcare Corporation | | | 3,092 | | | | 90,101 | |

ContraVir Pharmaceuticals, Inc. | | | 4,050 | | | | 4,050 | |

Cynapsus Therapeutics, Inc. | | | 3,618 | | | | 43,561 | |

Dipexium Pharmaceuticals, Inc. | | | 531 | | | | 6,892 | |

Egalet Corporation | | | 74,633 | | | | 508,997 | |

Endocyte, Inc. | | | 33,017 | | | | 128,766 | |

EyeGate Pharmaceuticals, Inc. | | | 59 | | | | 202 | |

Flex Pharma, Inc. | | | 13,556 | | | | 148,574 | |

Foamix Pharmaceuticals Ltd. | | | 7,681 | | | | 48,467 | |

Horizon Pharma plc | | | 15,280 | | | | 234,854 | |

Innoviva, Inc. | | | 48,042 | | | | 592,838 | |

Intellipharmaceutics International, Inc. | | | 982 | | | | 1,994 | |

KemPharm, Inc. | | | 15,336 | | | | 253,964 | |

Lannett Company, Inc. | | | 599 | | | | 11,489 | |

Lipocine, Inc. | | | 46,455 | | | | 452,936 | |

Marinus Pharmaceuticals, Inc. | | | 35,637 | | | | 195,647 | |

Medicines Company (The) | | | 6,071 | | | | 216,067 | |

MyoKardia, Inc. | | | 309 | | | | 3,535 | |

Ocular Therapeutix, Inc. | | | 48,585 | | | | 596,624 | |

Oculus Innovative Sciences, Inc. | | | 100,962 | | | | 99,952 | |

29

TFS MARKET NEUTRAL FUND

SCHEDULE OF SECURITIES SOLD SHORT (Continued) | |

COMMON STOCKS — 80.8% (Continued) | | Shares | | | Value | |

Health Care — 19.5% (Continued) | | | | | | |

Pharmaceuticals — 2.7% (Continued) | | | | | | |

Pain Therapeutics, Inc. | | | 63,362 | | | $ | 155,871 | |

Pernix Therapeutics Holdings, Inc. | | | 32,907 | | | | 24,684 | |

Perrigo Company plc | | | 258 | | | | 24,941 | |

Relypsa, Inc. | | | 110,579 | | | | 2,001,480 | |

Revance Therapeutics, Inc. | | | 359 | | | | 6,598 | |

Teligent, Inc. | | | 302,986 | | | | 1,672,483 | |

Tetraphase Pharmaceuticals, Inc. | | | 76,180 | | | | 426,608 | |

TherapeuticsMD, Inc. | | | 83,152 | | | | 686,004 | |

Titan Pharmaceuticals, Inc. | | | 1,443 | | | | 8,586 | |

Tokai Pharmaceuticals, Inc. | | | 170,498 | | | | 1,249,750 | |

VIVUS, Inc. | | | 836,895 | | | | 1,380,877 | |

XenoPort, Inc. | | | 990 | | | | 4,356 | |

Zogenix, Inc. | | | 15,104 | | | | 154,816 | |

Zynerba Pharmaceuticals, Inc. | | | 3,443 | | | | 28,060 | |

| | | | | | | | 14,481,131 | |

Industrials — 9.5% | | | | | | | | |

Aerospace & Defense — 1.1% | | | | | | | | |

Aerojet Rocketdyne Holdings, Inc. | | | 103,720 | | | | 1,879,406 | |

AeroVironment, Inc. | | | 310 | | | | 8,953 | |

American Science & Engineering, Inc. | | | 637 | | | | 18,250 | |

Astrotech Corporation | | | 596 | | | | 1,180 | |

CPI Aerostructures, Inc. | | | 3,469 | | | | 23,936 | |

Cubic Corporation | | | 20,989 | | | | 872,513 | |

Engility Holdings, Inc. | | | 7,832 | | | | 154,056 | |

Hexcel Corporation | | | 532 | | | | 24,084 | |

KEYW Holding Corporation (The) | | | 261,235 | | | | 1,799,909 | |

KLX, Inc. | | | 974 | | | | 32,843 | |

National Presto Industries, Inc. | | | 2,964 | | | | 258,431 | |

Rockwell Collins, Inc. | | | 983 | | | | 86,691 | |

Sparton Corporation | | | 3,579 | | | | 76,805 | |

TASER International, Inc. | | | 43,784 | | | | 799,496 | |

TransDigm Group, Inc. | | | 402 | | | | 91,604 | |

| | | | | | | | 6,128,157 | |

Air Freight & Logistics — 0.1% | | | | | | | | |

Echo Global Logistics, Inc. | | | 625 | | | | 14,606 | |

Forward Air Corporation | | | 3,203 | | | | 145,993 | |