MicroCap Opportunities Fund

Ultra MicroCap Fund

Low Priced Stock Fund

Annual Report

October 31, 2016

The PERRITT MICROCAP OPPORTUNITIES FUND will, under normal circumstances, invest at least 80% of its net assets in a diversified portfolio of common stocks of United States companies that at the time of initial purchase have a market capitalization (equity market value) that is below $500 million (referred to as “micro-cap” companies). The Fund seeks to invest in micro-cap companies that have demonstrated above-average growth in revenues and/or earnings, possess relatively low levels of long-term debt, have a high percentage of their shares owned by company management, and possess modest price-to-sales ratios and price-to-earnings ratios that are below their long-term annual growth rate. At times, the Fund may also invest in “special situations” such as companies that possess valuable patents, companies undergoing restructuring, and companies involved in large share repurchase programs. Investors should expect the Fund to contain a mix of both value-priced and growth stocks.

The PERRITT ULTRA MICROCAP FUND will, under normal circumstances, invest at least 80% of its net assets in a diversified portfolio of common stocks of United States companies that at the time of initial purchase have a market capitalization (equity market value) that is below $300 million (referred to as “micro-cap” companies). The Fund seeks to invest in micro-cap companies that have a high percentage of their shares owned by company management, possess relatively low levels of long-term debt, have a potential for above average growth in revenues and/or earnings, and possess reasonable valuations based on the ratios of price-to-sales, price-to-earnings, and price-to-book values. The micro-cap companies in which the Fund may invest include “early stage” companies, which are companies that are in a relatively early stage of development with market capitalizations that are below $50 million. At times, the Fund may also invest in unseasoned companies, companies that are undergoing corporate restructuring, initial public offerings, and companies believed to possess undervalued assets.

The PERRITT LOW PRICED STOCK FUND will, under normal circumstances, invest at least 80% of its net assets in a diversified portfolio of low priced common stocks of United States companies that at the time of initial purchase have a market capitalization (equity market value) that is below $3 billion. Low priced stocks are those that are trading at or below $15 per share at the time of initial purchase. Subsequent to the initial purchase, the Fund may purchase such securities at a price above $15 per share. The Fund’s strategy is based on the premise that low priced stocks offer growth potential because these stocks have limited broker research coverage, the companies’ prospects are misunderstood by most investors, and some investors mistakenly believe stocks trading below $15 per share are more “speculative” than those trading at higher levels and therefore avoid low priced stocks. The Fund will invest in “growth” stocks, “value” stocks, or a combination of both. Given the market capitalization restrictions, the Fund will normally invest in securities issued by small-cap companies, including some micro-cap companies. However, micro-cap companies will only make up a small portion of the Fund’s portfolio. Micro-cap companies represent the smallest sector of public companies based on market capitalization. At times, the Fund’s portfolio may contain the shares of unseasoned companies, companies that are undergoing corporate restructuring, initial public offerings, and companies believed to possess undervalued assets.

Annual Report

October 31, 2016

| From the Desk of Michael Corbett, President and CIO | 2 |

| | |

| Perritt MicroCap Opportunities Fund | |

| From the Portfolio Managers | 4 |

| Performance | 8 |

| Ten Largest Common Stock Holdings | 10 |

| Allocation of Portfolio Investments | 11 |

| | |

| Perritt Ultra MicroCap Fund | |

| From the Portfolio Managers | 12 |

| Performance | 16 |

| Ten Largest Common Stock Holdings | 18 |

| Allocation of Portfolio Investments | 19 |

| | |

| Perritt Low Priced Stock Fund | |

| From the Portfolio Managers | 20 |

| Performance | 24 |

| Ten Largest Common Stock Holdings | 26 |

| Allocation of Portfolio Investments | 27 |

| | |

| Perritt Funds | |

| Schedules of Investments | 28 |

| Statements of Assets and Liabilities | 37 |

| Statements of Operations | 38 |

| Statements of Changes in Net Assets | 39 |

| Financial Highlights | 42 |

| Notes to Financial Statements | 45 |

| Report of the Independent Registered Public Accounting Firm | 54 |

| Expense Example | 55 |

| Directors and Officers | 57 |

| Information | 60 |

Perritt Funds, Inc.

| From the Desk of Michael Corbett, President and CIO |

Michael Corbett,

President and CIO

The past year marked a big change for small/micro-cap stocks. As we have discussed several times in the past few years, small/micro-cap stocks have been in a stealth bear market. A stealth bear market occurs when the average stock price is down more than 20%, but the indexes, such as the Russell 2000 Index and the Russell Microcap Index are not down 20% from peak levels. The Russell 2000 Index and the Russell Microcap Index both joined the bear market. As of February 11, 2016, the Russell 2000 Index declined nearly 26% from its peak in June 2015, and the Russell Microcap Index lost nearly 29% from its peak in June 2015.

Now that it appears small/micro-cap stocks have entered a new bull market, maybe we can finally put the bear market discussions behind us. From the February 11, 2016 through October 31, 2016, the Russell 2000 Index climbed 24.92%, and the Russell Microcap Index rose by 24.18% in that same period. These impressive gains did not come without increased volatility. These indexes experienced several daily moves of more than one percent, as well as several weekly and monthly moves of more than 5%. The thing that impressed us the most was the resilience the market showed during the past seven months. The markets shook off several poor economic reports, such as the poor jobs report in May. Additionally, when the United Kingdom voted on June 23, 2016 to exit the European Union,(now known as Brexit), the market initially sold off but once again, the markets showed resilience and rallied nicely in the next few months.

Perhaps the most interesting news of the year happened eight days after our fiscal year ended; Donald Trump’s surprise victory on November 8, 2016. Donald Trump’s election as president of the United States and the Republicans’ sweep of control in the legislation caught the financial world off guard. So, what does a Trump presidency mean for the markets and the economy? The implications of how a Trump win plays out in the markets are not entirely obvious. Trump has not been overly detailed on his economic policies and there is always a transition from campaign rhetoric to actual policy. However, it does seem clear that there will be a push for fewer regulations and lower taxes. In our opinion, these two potential changes in policy were the major reasons the markets reversed in under 24 hours. If you were watching closely, you probably noticed the Dow Jones Industrial Average futures were down nearly 800 points once it appeared Trump could win. However, the Dow quickly reversed, and in less than two weeks the index rallied by more than 10% from that low on election day. While the political situation is certainly one of the factors we use to evaluate investments, it is not the only factor, nor is it the most important. We also evaluate such factors as corporate profits, monetary and fiscal policy, currencies, and a host of various economic indicators. One of our favorite indicators is the Leading Economic Index (LEI). The LEI was developed by the Conference Board, and the index is published monthly. The index is made up of 10 economic components, whose changes tend to precede changes in the overall economy. Some of the components include consumer sentiment, new building permits, average hours worked and new orders for capital goods. This index has done a great job of predicting recessions. For example, this index last peaked in late 2006 and early 2007, and turned down throughout 2007. While the index did not predict the degree of the great recession of 2008/2009, it certainly gave us an indication that a recession was coming. Today, the index just returned to the 2007 peak, but history shows us that the index has always moved higher

Perritt Funds, Inc.

before another downturn in the economy. In fact, economic expansion has typically lasted another 4 to 8 years after this index tops its previous peak. If we believe in the LEI’s previous predicting power, it appears that the next economic downturn is not in the near term and may be at least another four years out. Therefore, we may finally get a great economic recovery after the great recession we all lived through in 2008/09.

Please refer to the Schedule of Investments in the report for more complete information regarding Funds’ holdings. Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security.

Mutual fund investing involves risk. Principal loss is possible. The Funds invest in smaller companies, which involve additional risks such as limited liquidity and greater volatility. The Funds invest in micro cap companies which tend to perform poorly during times of economic stress. The Ultra MicroCap Fund and Low Priced Stock Fund may invest in early stage companies which tend to be more volatile and somewhat more speculative than investments in more established companies. Low Priced stocks are generally more volatile than higher priced securities.

The Perritt Funds are distributed by Quasar Distributors, LLC.

Dow Jones Industrial Average Index is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. It is not possible to invest directly in an index.

Perritt MicroCap Opportunities Fund

| Portfolio Managers’ Message |

| | | | |

| |  | |

| | | | |

| Michael Corbett, | | George Metrou, | |

| Portfolio Manager | | Portfolio Manager | |

The Perritt Microcap Opportunities Fund posted a gain of 6.85% during the fiscal year ended October 31, 2016, which exceeded the 1.53% gain for the Russell Microcap Index and 4.11% gain for the Russell 2000 Index. The Fund’s longer-term performance results, as well as the benchmark’s performance, can be found later in this report.

Our due diligence process leads us to focus on businesses with high returns on capital, robust free cash flow generation, and solid balance sheets. Businesses that meet our quality standards have intrinsic value, often well above the prevailing market price. The understanding that we own and invest in high quality businesses is a crucial factor in our ability to have conviction in our positions. This conviction provides us an invaluable advantage during periods of volatility.

During the period, we continued to strategically reduce the number of names in the portfolio. We began the period with 101 positions in the Fund and ended the period with 86 positions. The majority of this reduction took place during the first half of the fiscal year as we concentrated the portfolio in the highest conviction names during the market stress. Though a reduction of a net 14 positions, we were still adding new securities as well as increasing our positions in existing holdings. At present, we believe the number of positions in the portfolio is appropriate.

Ten new positions were added during the period. They were Birner Dental Management Services Inc. (BDMS), First Internet Bancorp (INBK), Graham Corp. (GHM), Huttig Building Products Inc. (HBP), Innerworkings Inc. (INWK), Kadant Inc. (KAI), Libby Inc. (LBY), Radiant Logistics, Inc. (RLGT), Tactile Systems Technology, Inc. (TCMD), and Team Inc. (TISI). Each of these companies generates free cash flow, has a solid balance sheet, and earns an above average return on capital. Furthermore, the average market capitalization of the names added was $245 million with an average of only 2 Wall Street analysts covering the companies. Two positions have no coverage at all. These points on size and coverage speak to our dedication to remain true to our micro-cap space, investing in undiscovered and under researched securities.

During the period, we liquidated 24 positions. Four positions were sold after receiving a valid buyout offer: Epiq Systems, Inc. (EPIQ), Liberator Medical Holdings, Inc. (LBMH), Integrated Silicon Solutions Inc. (ISSI), and SL Industries Inc. (SLI). A fifth buyout occurred during the period when Team Inc. (TISI) offered to acquire the shares of Furmanite Corp. (FRM) in an all-stock transaction, however we have retained the shares of TISI acquired through this buyout.

Five companies were sold after reaching our price targets or becoming too large in terms of market capitalization: AEP Industries Group (AEPI), Baldwin & Lyons (BWINB), Ennis Inc. (EBF), Monmouth Realty (MNR), Physicians Realty Trust (DOC), and Universal Electronics Inc. (UEIC). The

Perritt MicroCap Opportunities Fund

remaining nineteen positions removed from the portfolio were sold after a downgrade in our view of the price appreciation potential of the security or to rotate capital to higher conviction ideas.

As of October 31, 2016, the Fund’s portfolio was comprised of 86 common stocks. The Fund’s 10 largest holdings and detailed descriptions can be found later in this report. Based on our earnings estimates, the Fund’s portfolio is trading at approximately 18.6 times 2016 earnings. Stocks in the portfolio are priced at a median 1.0 times revenue and the median price to book value is 1.9x. Lastly, the median market capitalization is approximately $295 million.

On November 18th, the Fund paid a capital gain distribution of $3.29 per share. This is the fourth distribution made by the Fund in the previous nine years. We believe this reflects our commitment to managing the portfolio in a tax-conscious manner. The capital gain distribution is not reflected in the financials of this annual report because it was completed in fiscal 2017, but distributed in calendar year 2016. Please review your statement for the full details of the capital gain distribution.

We are encouraged by the current composition of the portfolio. The Fund’s companies have a median revenue growth rate of 7%, return on invested capital of 11%, free cash flow margin of 6%, and trade at 1.0x revenue. This compares to a median revenue growth of 3%, return on invested capital of 4%, free cash flow margins of 2%, and a valuation of 1.4x revenue for the broader micro-cap market as measured by the Russell Microcap Index. The bottom line is that our portfolio has grown faster, has offered more profitability, has generated more cash, and has been cheaper than the broader micro-cap market. This may serve the Fund’s shareholders well in the future.

I want to thank my fellow shareholders for their continued support and confidence in the Perritt Capital Management team. We remain dedicated to investing in high quality micro-cap companies at attractive valuations. If you have any questions or comments about this report or your investment in the Perritt MicroCap Opportunities Fund, please call us toll-free at (800) 331-8936 or visit our website at www.perrittcap.com. Please refer to the prospectus for information about the Fund’s investment objectives and strategies.

|

| |

| George Metrou |

| Portfolio Manager |

Perritt MicroCap Opportunities Fund

Past performance does not guarantee future results.

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Russell Microcap Index is a capitalization weighted index of 2,000 small cap and micro cap stocks that captures the smallest 1,000 companies in the Russell 2000, plus 1,000 smaller U.S.-based listed stocks.

Russell 2000 Index is an index measuring the performance approximately 2,000 small-cap companies in the Russell 3000 Index, which is made up of 3,000 of the biggest U.S. stocks. The Russell 2000 serves as a benchmark for small-cap stocks in the United States.

Return on Invested Capital is a fundamental method of determining a company’s financial performance. It is used to measure how well a company is investing its capital.

Free Cash Flow is a measure of financial performance calculated as operating cash flow minus capital expenditures. Free cash flow (FCF) represents the cash that a company is able to generate after laying out the money required to maintain or expand its asset base.

Any tax or legal information provided is a summary of our understanding and interpretation of some of the current income tax regulations. Investors must consult their tax advisor or legal counsel for advice and information concerning their particular situation. Neither the Fund nor any of its representatives may give legal or tax advice.

(This Page Intentionally Left Blank.)

Perritt MicroCap Opportunities Fund

| Performance* (Unaudited) | October 31, 2016 |

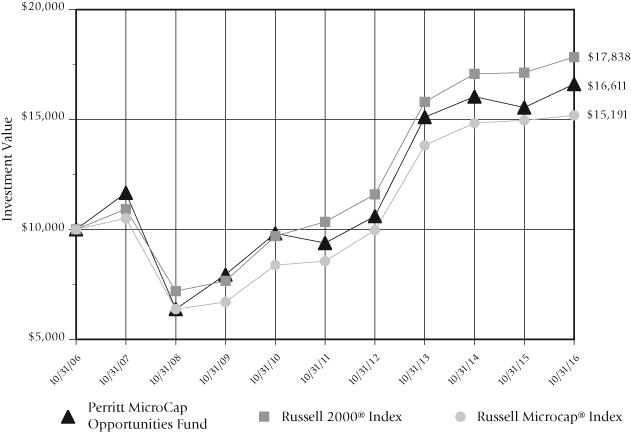

Perritt MicroCap Opportunities Fund versus

Russell 2000® Index and Russell Microcap® Index

There are several ways to evaluate a fund’s historical performance. You can look at the total percentage change in value, the average annual percentage change, or the growth of a hypothetical $10,000 investment. Each performance figure includes changes in a fund’s share price, plus reinvestment of any dividends (or income) and capital gains (the profits the fund earns when it sells stocks that have grown in value).

Cumulative total returns reflect the Fund’s actual performance over a set period. For example, if you invested $1,000 in a fund that had a 5% return over one year, you would end up with $1,050. You can compare the Fund’s returns to the Russell 2000® Index, which reflects a popular measure of the stock performance of small companies, and the Russell Microcap® Index, which measures the performance of the micro-cap segment of the U.S. equity market.

Average annual total returns take the Fund’s actual (or cumulative) return and show you what would have happened if the Fund had performed at a constant rate each year.

| * | The graph illustrates the performance of a hypothetical $10,000 investment made in the period presented. Assumes reinvestment of dividends and capital gains, but does not reflect the effect of any applicable sales charge or redemption fees or the deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of the Fund shares. The graph does not imply any future performance. |

Perritt MicroCap Opportunities Fund

| Performance* (Unaudited)(Continued) | October 31, 2016 |

| Cumulative Total Returns* |

| Periods ended October 31, 2016 (Unaudited) |

| | Past | Past | Past | Past | Past | Past |

| | 1 Year | 3 Years | 5 Years | 10 Years | 15 Years | 25 Years |

| | | | | | | |

| Perritt MicroCap | | | | | | |

| Opportunities Fund | 6.85% | 9.96% | 77.05% | 66.11% | 340.37% | 970.84% |

| | | | | | | |

| Russell 2000¨ Index | 4.11% | 12.89% | 72.43% | 78.38% | 239.77% | 809.33% |

| (reflects no deduction | | | | | | |

| for fees and expenses) | | | | | | |

| | | | | | | |

| Russell Microcap¨ Index | 1.53% | 9.89% | 77.58% | 51.91% | 218.93% | N/A |

| (reflects no deduction | | | | | | |

| for fees and expenses) | | | | | | |

| Average Annual Total Returns* |

| Periods ended October 31, 2016 (Unaudited) |

| | Past | Past | Past | Past | Past | Past |

| | 1 Year | 3 Years | 5 Years | 10 Years | 15 Years | 25 Years |

| | | | | | | |

| Perritt MicroCap | | | | | | |

| Opportunities Fund | 6.85% | 3.21% | 12.10% | 5.21% | 10.39% | 9.95% |

| | | | | | | |

| Russell 2000¨ Index | 4.11% | 4.12% | 11.51% | 5.96% | 8.50% | 9.23% |

| (reflects no deduction | | | | | | |

| for fees and expenses) | | | | | | |

| | | | | | | |

| Russell Microcap¨ Index | 1.53% | 3.19% | 12.17% | 4.27% | 8.04% | N/A |

| (reflects no deduction | | | | | | |

| for fees and expenses) | | | | | | |

The Perritt MicroCap Opportunities Fund’s annualized expense ratio for the year ended October 31, 2015, as stated in the statutory prospectus, was 1.22%. The Fund imposes a 2% redemption fee on shares held for 90 days or less. Performance data does not reflect the redemption fee. If reflected, total returns would be reduced.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end is available by calling 800-331-8936.

| * | The tables do not reflect the deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of Fund shares. |

Perritt MicroCap Opportunities Fund

| Ten Largest Common Stock Holdings (Unaudited) |

Hudson Technologies Inc. (HDSN) provides innovative services to the recurring problems within the refrigeration industry. Its products and services include refrigerant sales, refrigerant management services, reclamation of refrigerants and system decontamination to remove moisture, oils, and other pollutants.

AXT Inc. (AXTI) is a developer and producer of compound and single element semiconductor substrates known as wafers, which are made from gallium and arsenic (GaAs). AXT manufactures its semiconductor substrates using its proprietary vertical gradient freeze technology.

Tristate Capital Holdings, Inc. (TSC) is a bank holding company headquartered in Pittsburgh, providing commercial banking, private banking and investment management services to middle-market companies, institutional clients, and high-net-worth individuals.

Atlas Financial Holdings, Inc. (AFH) engages in the underwriting of commercial automobile insurance policies, focusing on the ‘light’ commercial automobile sector. This sector includes taxi cabs, non-emergency para-transit, limousine, livery, and business autos.

Farmer Brothers Co. (FARM) engages in the manufacture, wholesale, and distribution of coffee, tea, and culinary products in the United States. The company is a direct distributor of coffee to restaurants, hotels, casinos, offices, convenience stores, healthcare facilities, and other foodservice providers.

Addus Homecare Corporation (ADUS) is a provider of home and community-based personal care services, which are provided primarily in the home, and is focused on the dual eligible (Medicare/Medicaid) population. Addus provides these services on a long-term, continuous basis, with an average duration of over 20 months per consumer.

Triumph Bancorp Inc. (TBK) is a financial holding company. Triumph through its bank subsidiary, TBK Bank, offers banking services, as well as commercial finance products to businesses that require specialized financial solutions. The company operates through four segments: Banking, Factoring, Asset Management and Corporate.

KMG Chemicals Ins. (KMG) manufactures, formulates and globally distributes specialty chemicals. The company operates businesses selling electronic chemicals, industrial wood treating chemicals, and industrial valve lubricants and sealants.

American Software Inc. (AMSW.A) develops, markets and supports a portfolio of software and services that delivers enterprise management, supply chain and retail planning solutions to the marketplace. The company operates in three segments: Supply Chain Management (SCM), Enterprise Resource Planning (ERP), and Information Technology (IT) Consulting.

Perritt MicroCap Opportunities Fund

| Ten Largest Common Stock Holdings (Unaudited) (Continued) |

Miller Industries Inc. (MLR) engages in the manufacture and sale of towing and recovery equipment. It offers wreckers, such as conventional tow trucks and recovery vehicles. The company also provides transport trailers for moving multiple vehicles, auto auctions, car dealerships, leasing companies, and other similar applications.

Fund holdings and/or sector allocations are subject to change at any time and

are not recommendations to buy or sell any security.

Please refer to the Schedule of Investments in this report for a complete list of Fund holdings.

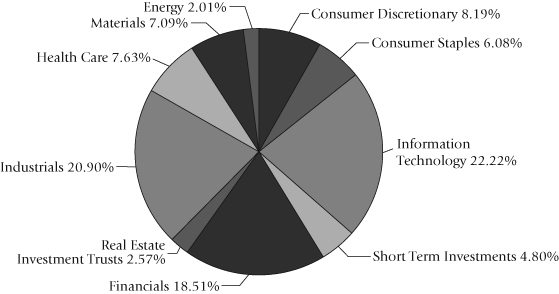

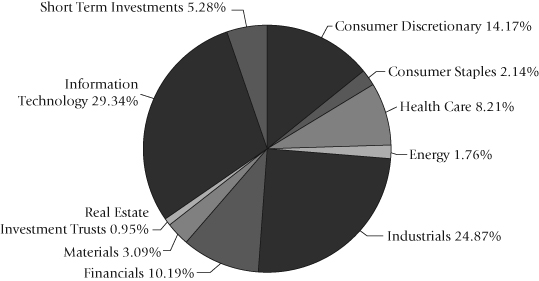

| Allocation of Portfolio Investments (Unaudited) | October 31, 2016 |

The sector classifications represented in the graph above and industry classifications represented in the Schedule of Investments are in accordance with Global Industry Classification Standard (GICS®), which was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC. Percentages are based on total investments, at value.

| Note: | For presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with section 8(b)(1) of the Investment Company Act of 1940, the Fund uses more specific industry classifications. |

Perritt Ultra MicroCap Fund

| Portfolio Managers’ Message |

| |  | |

| | | | |

| Michael Corbett, | | Matthew Brackmann, | |

| Portfolio Manager | | Portfolio Manager | |

The Perritt Ultra MicroCap Fund had a positive return of 9.11% for fiscal year 2016. This performance compares favorably to the positive 4.11% return for the Russell 2000 and the positive 1.53% return for the Russell Microcap Index. The complete performance for the fund and its benchmarks can be found on page 17.

During the fiscal year, the Fund has seen its strongest performance from its investments in the industrial and Information Technology sectors. Some of the top performers from the industrial sector include Gencore Industries (GENC), a heavy machinery manufacturer that was up 87.5% and DLH Holdings (DLHC), a provider of healthcare, logistical & technical services to various government entities that returned 81.3%. We also saw strong performance from our holding in Hudson Technologies (HDSN) which returned 77.84% during the past year. Hudson is a high conviction name due to their position as a provider of reclaimed refrigerants to industrial users. Recent EPA and Global mandates have required the cessation of manufacturing certain refrigerants, such as R-22. Hudson may stand to benefit as end users will be forced to purchase recycled materials. We remain positive on this name going forward and it remains as one of our top holdings. In the Information Technology sector, we saw the best performance in this sector from PCM, Inc. (PCMI), which was up 128% during the past year. PCM is a technology solutions provider & distributor of electronic equipment to small, medium and enterprise level businesses.

Since the period ending April 30th, the Fund has liquidated 12 investments from the portfolio. Two of these, Dawson Geophysical (DWSN) and LGI Homes (LGIH), were sold because each investment reached our valuation and price targets. Four companies, MeetMe (MEET), Air Gains (AIRG), Digital Turbine (APPS) & Stanley Furniture (STLY) were sold for tax efficiency reasons. The remaining six companies were eliminated due to weak results or material downgrades in the outlook for the company. The proceeds of these investments were replaced with 13 new companies that we believe will help contribute to the future performance of the Fund. Some of these investments include Global Self Storage (SELF), a newly debuted REIT in the self-storage market, IntriCon Inc. (IIN), which is a manufacturer of components for medical devices and is in the process of moving into the discounted hearing aid space, and Kewaunee Scientific Corp. (KEQU) which manufactures and distributes various furniture and related items for laboratory and healthcare environments.

As of October 31, 2016, the Fund holds the common stock of 91 companies which remains in line with the 90 names we held six months ago. We intend to keep the number of names in the portfolio around 90 names, and continue with our strategy of concentrating on higher quality and higher conviction names. Based on our earnings estimates, the Fund’s portfolio is trading at 13.5 times forward earnings. The median price to sales ratio is 0.9, the

Perritt Ultra MicroCap Fund

median price to book ratio is 1.7, the trailing 12-month price-earnings ratio is 19.5, and the median market cap is approximately $77 million. The Fund’s largest holdings and detailed descriptions can be found on page 18.

The Fund continues to actively underweight the Healthcare sector with an exposure of 7.34% versus 19.57% for the Russell Microcap Index. The Healthcare sector has companies within Pharmaceuticals, Life Sciences & Biotech businesses. Many of the companies in these sub-sectors have very little in the way of tangible assets, cash flow generation, profitability and many times revenue. These companies are exposed to a high degree of regulatory uncertainty due to the Food and Drug Administration (FDA) approval process as well as congressional scrutiny due to drug pricing. While the recent election results have lessened the risk of some regulatory risk in this space in regards to pricing, it does not remove the risks inherent in the FDA approval process. These factors eliminate them from eligibility for investment due to our criteria and screening process. The portfolio will remain underweight in this segment going forward due to our continued reliance on the valuation and stock picking criteria. The portfolio is also underweight in the Financial sector and are overweight in both Industrial and Information Technology names.

The Ultra MicroCap Fund tends to have investments that fly under the radar screen of most investors. The micro-cap universe, particularly those stocks with sub-$100 million market capitalizations, are often ignored by investors for an extended period. Therefore, the potential rewards can take longer to achieve, but can be swift. As fellow shareholders, we exit this fiscal year pleased with our performance relative to our index and remain focused on the long-term picture both for the individual companies within the portfolio as well as the portfolio as a whole. We remain confident that looking out at the long-term potential for our holdings based on sound fundamentals rather than focusing on short-term fluctuations in the market is in the best interest of our shareholders.

We want to thank our fellow shareholders for their continued support and confidence in the Perritt Capital Management team. Each member of our investment committee as well as many other employees have made continued investment in this Fund for the past 10 years and remain shareholders alongside all of you. If you have any questions or comments about this report or your investment in the Perritt Ultra MicroCap Fund, please call us toll-free at (800) 331-8936 or visit our web site at www.perrittcap.com. Please refer to the prospectus for information about the Fund’s investment objectives and strategies.

Matthew Brackmann

Portfolio Manager

Perritt Ultra MicroCap Fund

Past performance does not guarantee future results.

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Russell Microcap Index is a capitalization weighted index of 2,000 small cap and micro cap stocks that captures the smallest 1,000 companies in the Russell 2000, plus 1,000 smaller U.S.-based listed stocks.

Russell 2000 Index is an index measuring the performance approximately 2,000 small-cap companies in the Russell 3000 Index, which is made up of 3,000 of the biggest U.S. stocks. The Russell 2000 serves as a benchmark for small-cap stocks in the United States.

Cash flow is the net amount of cash and cash-equivalents moving into and out of a business. Positive cash flow indicates that a company’s liquid assets are increasing, enabling it to settle debts, reinvest in its business, return money to shareholders, pay expenses and provide a buffer against future financial challenges. Negative cash flow indicates that a company’s liquid assets are decreasing.

P/E (Price-to-Earnings) is a ratio for valuing a company that measures its current share price relative to its per-share earnings.

Price-to-Book (P/B) is a ratio used to compare a stock’s market value to its book value. It is calculated by dividing the current closing price of the stock by the latest quarter’s book value per share.

Price-to-Sales (P/S) is a valuation ratio that compares a company’s stock price to its revenues. The price-to-sales ratio is an indicator of the value placed on each dollar of a company’s sales or revenues.

(This Page Intentionally Left Blank.)

Perritt Ultra MicroCap Fund

| Performance* (Unaudited) | October 31, 2016 |

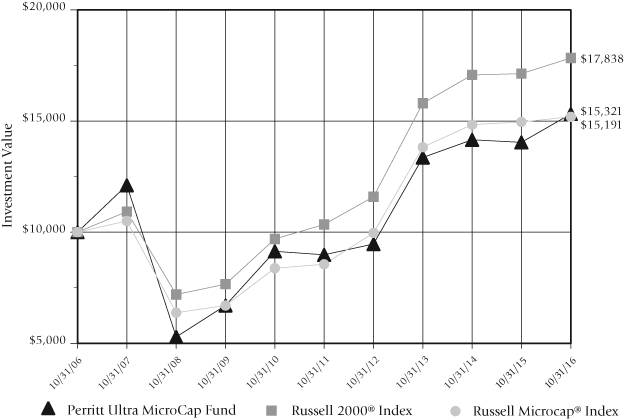

Perritt Ultra MicroCap Fund versus

Russell 2000® Index and Russell Microcap® Index

There are several ways to evaluate a fund’s historical performance. You can look at the total percentage change in value, the average annual percentage change, or the growth of a hypothetical $10,000 investment. Each performance figure includes changes in a fund’s share price, plus reinvestment of any dividends (or income) and capital gains (the profits the fund earns when it sells stocks that have grown in value).

Cumulative total returns reflect the Fund’s actual performance over a set period. For example, if you invested $1,000 in a fund that had a 5% return over one year, you would end up with $1,050. You can compare the Fund’s returns to the Russell 2000® Index, which reflects a popular measure of the stock performance of small companies, and the Russell Microcap® Index, which measures the performance of the micro-cap segment of the U.S. equity market.

Average annual total returns take the Fund’s actual (or cumulative) return and show you what would have happened if the Fund had performed at a constant rate each year.

| * | The graph illustrates the performance of a hypothetical $10,000 investment made in the period presented. Assumes reinvestment of dividends and capital gains, but does not reflect the effect of any applicable sales charge or redemption fees or the deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of Fund shares. The graph does not imply any future performance. |

Perritt Ultra MicroCap Fund

| Performance* (Unaudited) (Continued) | October 31, 2016 |

| Cumulative Total Returns** |

| Periods ended October 31, 2016 (Unaudited) |

| | Past | Past | Past | Past | Since |

| | 1 Year | 3 Years | 5 Years | 10 Years | Inception* |

| | | | | | |

| Perritt Ultra | | | | | |

| MicroCap Fund | 9.11% | 14.66% | 70.58% | 53.21% | 124.31% |

| | | | | | |

| Russell 2000¨ Index | 4.11% | 12.89% | 72.43% | 78.38% | 157.66% |

| (reflects no deduction | | | | | |

| for fees and expenses) | | | | | |

| | | | | | |

| Russell Microcap¨ Index | 1.53% | 9.89% | 77.58% | 51.91% | 111.51% |

| (reflects no deduction | | | | | |

| for fees and expenses) | | | | | |

| Average Annual Total Returns** |

| Periods ended October 31, 2016 (Unaudited) |

| | Past | Past | Past | Past | Since |

| | 1 Year | 3 Years | 5 Years | 10 Years | Inception* |

| | | | | | |

| Perritt Ultra | | | | | |

| MicroCap Fund | 9.11% | 4.67% | 11.27% | 4.36% | 6.86% |

| | | | | | |

| Russell 2000¨ Index | 4.11% | 4.12% | 11.51% | 5.96% | 8.09% |

| (reflects no deduction | | | | | |

| for fees and expenses) | | | | | |

| | | | | | |

| Russell Microcap¨ Index | 1.53% | 3.19% | 12.17% | 4.27% | 6.35% |

| (reflects no deduction | | | | | |

| for fees and expenses) | | | | | |

The Perritt Ultra MicroCap Fund’s annualized expense ratio for the year ended October 31, 2015, as stated in the statutory prospectus, was 1.76%. The Fund imposes a 2% redemption fee on shares held for 90 days or less. Performance data does not reflect the redemption fee. If reflected, total returns would be reduced.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end is available by calling 800-331-8936.

| * | | The since inception date is August 30, 2004. |

| | | |

| ** | | The tables do not reflect the deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of Fund shares. |

Perritt Ultra MicroCap Fund

| Ten Largest Common Stock Holdings (Unaudited) |

AXT Inc. (AXTI) is a developer and producer of compound and single element semiconductor substrates known as wafers, which are made from gallium and arsenic (GaAs). AXT manufactures its semiconductor substrates using its proprietary vertical gradient freeze technology.

DLH Holdings Coro. (DLHC) provides healthcare, logistics, and technical services, and solutions to the Federal Government agencies including the Department of Veteran Affairs, the Department of Defense, and other government clients.

Hudson Technologies Inc. (HDSN) provides innovative services to the recurring problems within the refrigeration industry. Its products and services include refrigerant sales, refrigerant management services, reclamation of refrigerants, and system decontamination to remove moisture, oils and other pollutants.

PCM, Inc. (PCMI) operates as a multi-vendor provider of technology products and solutions, and consumer products primarily in the United States and Canada. The company also provides value-added services, such as custom configured systems, software licensing, image management, asset tagging, and asset disposal services, IT management, and related services.

Gencor Industries Inc. (GENC) designs, manufactures, and sells machinery and related equipment used for the production of asphalt and highway construction materials. The company’s products include asphalt plants, combustion systems and fluid heat transfer systems. The company’s products are manufactured in two facilities in the United States.

Ballantyne Strong, Inc. (BTN) is a holding company. The company operates through two segments: Cinema and Digital Media. Its Cinema operations include the sale of digital projection equipment, screens, and sound systems. Its Digital Media operations include the delivery of end-to-end digital signage solutions, and management and service of digital signage and digital cinema equipment.

DSP Group Inc. (DSPG) provides wireless chipset solutions for converged communications, delivering system solutions that combine semiconductors, and software with reference designs. Its products enable converged voice, audio and data connectivity across diverse consumer products, ranging from cordless and VOIP phones to home gateways and connected multimedia screens.

Willdan Group, Inc. (WLDN) is a holding company. Willdan provides professional technical and consulting services to utilities, private and public agencies at all levels of government, primarily in California and New York. It operates through four segments: Energy Efficiency Services, Engineering Services, Public Finance Services, and Homeland Security Services.

Galaxy Gaming, Inc. (GLXZ) is engaged in designing, developing, manufacturing and acquiring casino table games and associated technology, platforms and systems for the global gaming industry. The company markets its products to land-based, riverboat and cruise ship gaming establishments and Internet gaming companies.

Perritt Ultra MicroCap Fund

| Ten Largest Common Stock Holdings (Unaudited) (Continued) |

iPass Inc. (IPAS) is a provider of global mobile connectivity, offering simple, secure, always-on Wi-Fi access on mobile devices. Built on a software-as-a-service (SaaS) platform, the iPass cloud-based service keeps its customers connected by providing unlimited Wi-Fi connectivity on unlimited devices.

Fund holdings and/or sector allocations are subject to change at any time and

are not recommendations to buy or sell any security.

Please refer to the Schedule of Investments in this report for a complete list of Fund holdings.

| Allocation of Portfolio Investments (Unaudited) | October 31, 2016 |

The sector classifications represented in the graph above and industry classifications represented in the Schedule of Investments are in accordance with Global Industry Classification Standard (GICS®), which was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC. Percentages are based on total investments, at value.

| Note: | For presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with section 8(b)(1) of the Investment Company Act of 1940, the Fund uses more specific industry classifications. |

Perritt Low Priced Stock Fund

| Portfolio Managers’ Message |

| |  | |

| | | | |

| Michael Corbett, | | Brian Gillespie, | |

| Portfolio Manager | | Portfolio Manager | |

The Perritt Low Priced Stock Fund produced a positive performance year, but the return lagged that of the Index. The Fund gained 1.04% for the one-year period ended October 31, 2016 versus the 4.11% gain for the Russell 2000 Index. More detailed performance results for the Fund, as well as the results for the Russell 2000 Index can be viewed on page 25. We continue to focus on the long-term prospects of the stocks in our portfolio.

Before discussing the portfolio, we would like to point out that the turnover ratio for the Fund was once again elevated above our desired level. The ratio for the most recent year was above 62%, which was below last year’s ratio of above 76%, but still above our stated goal of below 50%. Like last year, the ratio was elevated because of our attempts to limit our capital gains payout for the year. We were successful once again in our endeavor. Thus, we did not pay out any distribution of any kind for the year. This strategy has been used each of the last two years to help the Fund be more tax-conscious in future years.

As of October 31, 2016, the Fund’s portfolio was comprised of 62 common stocks. The Fund’s 10 largest holdings and detailed descriptions can be found on page 26. Based on our earnings estimate, the Fund’s portfolio is trading at just above 14 times next year’s earnings. The median price/revenues for the portfolio is roughly 1.5 times and the median market capitalization is approximately $685 million.

As far as sectors go within the Perritt Low Priced Fund, Information Technology was a big contributor to performance, up nearly 15% in the past year. Our names in the Consumer Discretionary sector were up 7.0% and contributed to performance as well. Energy and Materials were the biggest detractors from the Fund’s performance during the past twelve months.

As we have mentioned before, sector weightings are a function of where we see the best valuations and growth prospects. Information Technology and Industrials continue to represent two of our largest weightings. Information Technology represented 23.5% of our Fund compared to a 17.9% weighting in the Russell 2000 Index. Our overweight to this sector relative to the benchmark, as well as the performance of our names within the sector was a driver of performance in the fiscal year. Industrials was also an overweight compared to the Index. Industrials accounted for 20.0% of our Fund in the period compared to 13.1% in the Russell 2000 index. Unfortunately, our overweight did not help our performance as our Industrial investments declined 1.7% compared to a gain of 7.2%. Within Information Technology, we found attractive opportunities in the semiconductor space as well as in the electronic equipment area. In the Industrials sector, our allocation to Commercial Services and Supplies was a detractor to our performance. We did benefit from an underweight in Healthcare. We had an allocation of 10.6% to Healthcare compared to the Index weight of

Perritt Low Priced Stock Fund

14.4%. The Healthcare companies within the Russell 2000 declined 7.5% over the past twelve months. Our Healthcare investments gained 1.3% in the period due in part to our underweight of Biotechnology companies. We continue to avoid this area for the most part due to valuations and uncertainties surrounding receiving FDA approval.

Turning to a couple of individual names, one of our best performers was Orbotech Ltd. (ORBK). This company is a leading supplier of inspection and test/repair equipment to the Printed Circuit Board (PCB) and Flat Panel Display (FPD) industries. Shares of ORBK have gained 65% in the past twelve months as the company continues to benefit from the increasing complexity and functionality of electronics. Increased capacity in organic light-emitting diode (OLED) as a result of the growth in wearable devices and flexible displays should benefit the company in the future. Another solid performer for us was Gencor Industries Inc. (GENC), which is a leading manufacturer of asphalt plants, soil remediation plants, combustion systems and heat transfer systems to the road and highway construction industry. Shares in the company have surged 87% in the past year. The company’s stock benefited from the 5-year $305 billion highway bill signed into law in late 2015.

We had a few of our holdings contribute negatively to our performance. Holdings during the period, such as Ardmore Shipping Corporation (ASC), a provider of seaborne transportation of petroleum products and chemicals through product and chemical tankers worldwide, and TRC Companies (TRR), a provider of engineering, consulting, and construction management services in the United States, did not perform up to our expectations. Therefore, both positions were subsequently sold. We will continue to seek out companies that possess strong financials, such as strong cash flows and solid balance sheets. We were pleased with our results over the fiscal year and we will continue to examine our current positions and new opportunities to ensure the Low Priced Stock Fund continues to be successful.

If you have any questions or comments about this report or your investment in the Perritt Low Priced Stock Fund, please call us toll-free at (800) 331-8936 or visit our website at www.perrittcap.com. Please refer to the prospectus for information about the Fund’s investment objectives and strategies.

|

| |

| Brian Gillespie |

| Portfolio Manager |

Perritt Low Priced Stock Fund

Past performance does not guarantee future results.

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Turnover ratio is the percentage of investment’s holdings that have been replaced in a given year.

Russell Microcap Index is a capitalization weighted index of 2,000 small cap and micro cap stocks that captures the smallest 1,000 companies in the Russell 2000, plus 1,000 smaller U.S.-based listed stocks.

Russell 2000 Index is an index measuring the performance approximately 2,000 small-cap companies in the Russell 3000 Index, which is made up of 3,000 of the biggest U.S. stocks. The Russell 2000 serves as a benchmark for small-cap stocks in the United States.

(This Page Intentionally Left Blank.)

Perritt Low Priced Stock Fund

| Performance* (Unaudited) | October 31, 2016 |

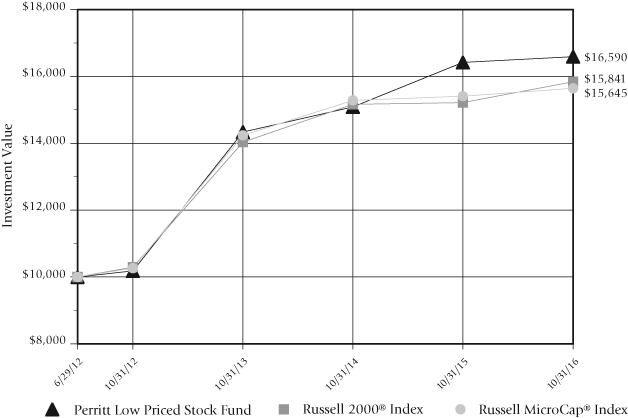

Perritt Low Priced Stock Fund** versus

Russell 2000® Index and Russell Microcap® Index

There are several ways to evaluate a fund’s historical performance. You can look at the total percentage change in value, the average annual percentage change, or the growth of a hypothetical $10,000 investment. Each performance figure includes changes in a fund’s share price, plus reinvestment of any dividends (or income) and capital gains (the profits the fund earns when it sells stocks that have grown in value).

Cumulative total returns reflect the Fund’s actual performance over a set period. For example, if you invested $1,000 in a fund that had a 5% return over one year, you would end up with $1,050. You can compare the Fund’s returns to the Russell 2000® Index, which reflects a popular measure of the stock performance of small companies, and the Russell Microcap® Index, which measures the performance of the micro-cap segment of the U.S. equity market.

Average annual total returns take the Fund’s actual (or cumulative) return and show you what would have happened if the Fund had performed at a constant rate each year.

| * | | The graph illustrates the performance of a hypothetical $10,000 investment made in the Fund at inception (June 29, 2012) of the Fund’s predecessor account through October 31, 2016. Assumes reinvestment of dividends and capital gains, but does not reflect the effect of any applicable sales charge or redemption fees or the deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of Fund shares. The graph does not imply any future performance. |

| | | |

| ** | | June 29, 2012 is the inception date of the Fund’s predecessor account. The Fund commenced operations on February 28, 2014. The investment policies, objectives, guidelines and restrictions of the Fund are in all material respects equivalent to those of the predecessor account. |

Perritt Low Priced Stock Fund

| Performance* (Unaudited) (Continued) | October 31, 2016 |

| Cumulative Total Returns** |

| Periods ended October 31, 2016 (Unaudited) |

| | Past | Past | Since |

| | 1 Year | 3 Years* | Inception* |

| | | | |

| Perritt Low Priced Stock Fund | 1.04% | 15.72% | 65.90% |

| | | | |

| Russell 2000® Index | 4.11% | 12.89% | 58.41% |

| (reflects no deduction for fees and expenses) | | | |

| | | | |

| Russell Microcap® Index | 1.53% | 9.89% | 56.45% |

| (reflects no deduction for fees and expenses) | | | |

| Average Annual Total Returns** |

| Periods ended October 31, 2016 (Unaudited) |

| | Past | Past | Since |

| | 1 Year | 3 Years* | Inception* |

| | | | |

| Perritt Low Priced Stock Fund | 1.04% | 4.99% | 12.38% |

| | | | |

| Russell 2000® Index | 4.11% | 4.12% | 11.19% |

| (reflects no deduction for fees and expenses) | | | |

| | | | |

| Russell Microcap® Index | 1.53% | 3.19% | 10.87% |

| (reflects no deduction for fees and expenses) | | | |

The Perritt Low Priced Stock Fund’s annualized net expense ratio, as stated in the statutory prospectus, dated October 31, 2015, was 1.41%. The Fund imposes a 2% redemption fee on shares held for 90 days or less. Performance data does not reflect the redemption fee. If reflected, total returns would be reduced.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end is available by calling 800-331-8936.

| * | | The Fund is the successor to a separately managed account. Immediately prior to the Fund commencing operations on February 28, 2014, the predecessor account transferred its assets to the Fund in exchange for the Fund’s shares. The investment policies, objectives, guidelines and restrictions of the Fund are in all material respects equivalent to those of the predecessor. In addition, the predecessor’s portfolio managers are the current portfolio managers of the Fund. As a mutual fund registered under the Investment Company Act of 1940 (the “1940 Act”), the Fund is subject to certain restrictions under the 1940 Act and the Internal Revenue Code to which the predecessor was not subject. Had the predecessor been registered under the 1940 Act and been subject to the provisions of the 1940 Act and the Internal Revenue Code, its investment performance may have been adversely affected. The performance was achieved by the predecessor when Fund assets were relatively small; the same strategies may not be available, and similar performance may not be achieved, when the Fund’s assets are larger. The performance shown includes an annual management fee of 1.00% and does not include any expenses paid by the predecessor’s investment advisor. |

| | | |

| | | The since inception date is June 29, 2012, the date of inception of the Fund’s predecessor account. The past performance of the Fund and its predecessor account (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. |

| | | |

| ** | | The tables do not reflect the deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of Fund shares. |

Perritt Low Priced Stock Fund

| Ten Largest Common Stock Holdings (Unaudited) |

Orbotech LTD (ORBK) provides yield-enhancing and process-enabling solutions for printed circuit boards (PCBs), liquid crystal displays (LCDs), and semiconductor devices in North America and internationally. It operates through three segments: Production Solutions for the Electronics Industry, Recognition Software, and Solar Energy.

Investors Bancorp Inc. (ISBC) operates as a holding company that provides various banking products and services for businesses and individuals in the United States. It offers deposit products, such as savings, checking, and money market accounts, as well as certificates of deposit.

Globus Medical, Inc. (GMED) is focused on developing products for patients with musculoskeletal disorders. Globus operates in two categories; The Innovative Fusion category products include fusion products to treat spinal disorders for the entire spine. The Disruptive Technologies category provides material improvements to fusion procedures, such as minimally invasive surgical techniques and motion preservation technologies.

Nautilus Inc. (NLS) is a consumer fitness products company that operates through two segments: The Direct segment offers products directly to consumers through television advertising, catalogs, and the Internet. The Retail segment offers its products through a network of independent retail companies with stores and Websites located in the United States and internationally.

Fox Factory Holding Corp (FOXF) designs and manufactures high-performance ride dynamics products primarily for bicycles, side-by-side vehicles, on-road and off-road vehicles and trucks, all-terrain vehicles, snowmobiles, specialty vehicles and applications, and motorcycles.

F.N.B. Corporation (FNB) is a financial holding company that provides various financial services to consumers, corporations, governments, and small to medium-sized businesses primarily in Pennsylvania, eastern Ohio, and northern West Virginia. F.N.B operates through four segments: Community Banking, Wealth Management, Insurance, and Consumer Finance.

Photronics Inc. (PLAB) offers services across the full spectrum of integrated chip (IC) production and flat panel display (FPD) technologies by manufacturing photomasks using electron beam or optical (laser-based) systems. The company primarily sells its products to leading semiconductor and FPD manufacturers.

Atlas Financial Holdings, Inc. (AFH) engages in the underwriting of commercial automobile insurance policies, focusing on the ‘light’ commercial automobile sector. This sector includes taxi cabs, non-emergency para-transit, limousine, livery and business autos.

Gencor Industries Inc. (GENC) designs, manufactures, and sells machinery and related equipment used for the production of asphalt and highway construction materials. The company’s products include asphalt plants, combustion systems and fluid heat transfer systems. The company’s products are manufactured in two facilities in the United States.

Perritt Low Priced Stock Fund

| Ten Largest Common Stock Holdings (Unaudited) (Continued) |

CryoLife Inc. (CRY) is a medical device manufacturing and distribution company that processes and distributes implantable human tissues for use in cardiac and vascular surgeries. It offers surgical sealants and hemostats, including BioGlue Surgical Adhesive, an agent for cross-linking proteins for cardiac, vascular, pulmonary, and general surgical applications.

Fund holdings and/or sector allocations are subject to change at any time and

are not recommendations to buy or sell any security.

Please refer to the Schedule of Investments in this report for a complete list of Fund holdings.

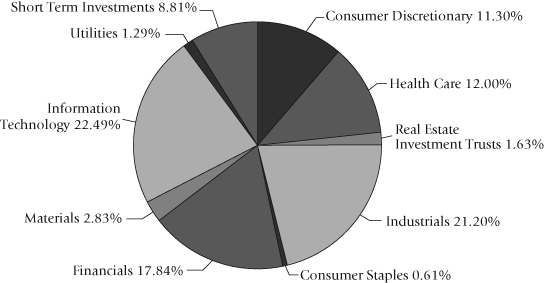

| Allocation of Portfolio Investments (Unaudited) | October 31, 2016 |

The sector classifications represented in the graph above and industry classifications represented in the Schedule of Investments are in accordance with Global Industry Classification Standard (GICS®), which was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC. Percentages are based on total investments, at value.

| Note: | For presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with section 8(b)(1) of the Investment Company Act of 1940, the Fund uses more specific industry classifications. |

Perritt MicroCap Opportunities Fund

| Schedule of Investments | October 31, 2016 |

| Shares | | COMMON STOCKS – 95.33% | | Value | |

| | |

| Aerospace & Defense – 0.92% | |

| | 358,787 | | CPI Aerostructures, | | | |

| | | | Inc.(a) | | $ | 2,421,812 | |

| | | | | | | 2,421,812 | |

| | |

| Auto Parts & Equipment – 3.85% | |

| | 220,570 | | Miller Industries, Inc. | | | 4,841,512 | |

| | 125,000 | | Motorcar Parts | | | | |

| | | | of America, Inc. | | | | |

| | | | (Acquired 9/10/2012 | | | | |

| | | | through 8/27/2014, | | | | |

| | | | Cost $1,052,127)(a)(b) | | | 3,280,000 | |

| | 10,000 | | Motorcar Parts | | | | |

| | | | of America, Inc. | | | 262,400 | |

| | 115,000 | | Stoneridge, Inc.(a) | | | 1,704,300 | |

| | | | | | | 10,088,212 | |

| | |

| Building Materials – 3.35% | |

| | 150,000 | | Global Brass & Copper | | | | |

| | | | Holdings, Inc. | | | 4,305,000 | |

| | 316,934 | | Huttig Building | | | | |

| | | | Products, Inc.(a) | | | 1,530,791 | |

| | 300,000 | | PGT, Inc.(a) | | | 2,940,000 | |

| | | | | | | 8,775,791 | |

| | |

| Business Services – 5.62% | |

| | 270,217 | | Datalink Corp.(a) | | | 2,561,657 | |

| | 134,567 | | GP Strategies Corp.(a) | | | 3,478,557 | |

| | 661,000 | | Innodata Isogen, Inc.(a) | | | 1,619,450 | |

| | 221,100 | | PCM, Inc.(a) | | | 4,687,320 | |

| | 305,200 | | Systemax, Inc. | | | 2,395,820 | |

| | | | | | | 14,742,804 | |

| | |

| Chemical & Related Products – 5.81% | |

| | 104,644 | | Aceto Corp. | | | 1,918,124 | |

| | 183,722 | | KMG Chemicals, Inc. | | | 4,986,215 | |

| | 202,000 | | Northern Technologies | | | | |

| | | | International Corp.(a) | | | 2,807,800 | |

| | 417,238 | | OMNOVA | | | | |

| | | | Solutions, Inc.(a) | | | 3,171,009 | |

| | 229,054 | | Trecora Resources(a) | | | 2,347,804 | |

| | | | | | | 15,230,952 | |

| | |

| Commercial Banks – 8.97% | |

| | 125,900 | | Bankwell Financial | | | | |

| | | | Group, Inc. | | | 3,104,694 | |

| | 112,000 | | Berkshire Hills | | | | |

| | | | Bancorp, Inc. | | | 3,309,600 | |

| | 135,000 | | First Internet Bancorp | | | 3,543,750 | |

| | 413,526 | | TriState Capital | | | | |

| | | | Holdings, Inc.(a) | | | 7,298,734 | |

| | 272,980 | | Triumph | | | | |

| | | | Bancorp, Inc.(a) | | | 5,077,428 | |

| | 67,800 | | Veritex Holdings, Inc.(a) | | | 1,195,314 | |

| | | | | | | 23,529,520 | |

| | |

| Commercial Services & Supplies – 0.67% | |

| | 200,000 | | InnerWorkings, Inc.(a) | | | 1,762,000 | |

| | | | | | | 1,762,000 | |

| | |

| Construction & Engineering – 3.53% | |

| | 58,000 | | Comfort Systems | | | | |

| | | | USA, Inc. | | | 1,673,300 | |

| | 965,232 | | Hill International, | | | | |

| | | | Inc.(a) | | | 3,716,143 | |

| | 125,532 | | Team, Inc.(a) | | | 3,860,109 | |

| | | | | | | 9,249,552 | |

| | |

| Consumer Products – Manufacturing – 3.70% | |

| | 125,000 | | Cherokee, Inc.(a) | | | 1,175,000 | |

| | 114,000 | | Delta Apparel, Inc.(a) | | | 1,881,000 | |

| | 16,609 | | Flexsteel | | | | |

| | | | Industries, Inc. | | | 695,917 | |

| | 56,818 | | Libbey, Inc. | | | 909,656 | |

| | 96,326 | | Orchids Paper | | | | |

| | | | Products Co. | | | 2,471,725 | |

| | 144,764 | | Superior Uniform | | | | |

| | | | Group, Inc. | | | 2,575,352 | |

| | | | | | | 9,708,650 | |

| | |

| Consumer Services – 0.57% | |

| | 260,000 | | DHI Group, Inc.(a) | | | 1,482,000 | |

| | | | | | | 1,482,000 | |

| | |

| Electronic Equipment & Instruments – 0.84% | |

| | 92,415 | | Bel Fuse, Inc. – Class B | | | 2,204,098 | |

| | | | | | | 2,204,098 | |

| | |

| Energy & Related Services – 2.01% | |

| | 180,643 | | Matrix Service Co.(a) | | | 3,197,381 | |

| | 133,744 | | PHI, Inc.(a) | | | 2,083,732 | |

| | | | | | | 5,281,113 | |

| | |

| Financial Services – 4.39% | |

| | 444,000 | | Cowen Group, | | | | |

| | | | Inc. – Class A(a) | | | 1,443,000 | |

| | 182,600 | | FBR & Co. | | | 2,538,140 | |

| | 96,728 | | Hennessy | | | | |

| | | | Advisors, Inc. | | | 2,793,505 | |

| | | | | | | | |

The accompanying notes to financial statements are an integral part of this schedule.

Perritt MicroCap Opportunities Fund

| Schedule of Investments (Continued) | October 31, 2016 |

| Shares | | | | Value | |

| | |

| Financial Services (Continued) | |

| | 115,821 | | Oppenheimer Holdings, | | | |

| | | | Inc. – Class A | | $ | 1,621,494 | |

| | 270,606 | | Silvercrest Asset | | | | |

| | | | Management Group, | | | | |

| | | | Inc. – Class A | | | 3,125,499 | |

| | | | | | | 11,521,638 | |

| | |

| Food – 5.14% | |

| | 321,872 | | Crimson Wine | | | | |

| | | | Group Ltd.(a) | | | 2,996,628 | |

| | 170,162 | | Farmer Brothers Co.(a) | | | 5,564,297 | |

| | 33,300 | | John B. Sanfilippo | | | | |

| | | | & Son, Inc. | | | 1,687,644 | |

| | 245,000 | | Landec Corp.(a) | | | 3,246,250 | |

| | | | | | | 13,494,819 | |

| | |

| Health Care Providers & Services – 0.99% | |

| | 140,000 | | The Ensign | | | | |

| | | | Group, Inc. | | | 2,585,800 | |

| | | | | | | 2,585,800 | |

| | |

| Industrial Goods – 4.18% | |

| | 1,400,000 | | Hudson | | | | |

| | | | Technologies, Inc.(a) | | | 8,540,000 | |

| | 100,000 | | Schnitzer Steel Industries, | | | | |

| | | | Inc. – Class A | | | 2,415,000 | |

| | | | | | | 10,955,000 | |

| | |

| Insurance – 5.17% | |

| | 418,397 | | Atlas Financial | | | | |

| | | | Holdings, Inc.(a) | | | 7,175,508 | |

| | 90,000 | | EMC Insurance | | | | |

| | | | Group, Inc. | | | 2,191,500 | |

| | 289,648 | | United Insurance | | | | |

| | | | Holdings Corp. | | | 4,199,896 | |

| | | | | | | 13,566,904 | |

| | |

| Leisure – 1.76% | |

| | 728,641 | | Century Casinos, | | | | |

| | | | Inc.(a) | | | 4,619,584 | |

| | | | | | | 4,619,584 | |

| | |

| Machinery Manufacturing – 1.31% | |

| | 100,000 | | Graham Corp. | | | 1,785,000 | |

| | 32,110 | | Kadant, Inc. | | | 1,658,482 | |

| | | | | | | 3,443,482 | |

| | |

| Medical Supplies & Services – 5.92% | |

| | 219,037 | | Addus HomeCare | | | | |

| | | | Corp.(a) | | | 5,541,636 | |

| | 35,820 | | Birner Dental | | | | |

| | | | Management | | | | |

| | | | Services, Inc. | | | 656,581 | |

| | 140,712 | | CryoLife, Inc. | | | 2,392,104 | |

| | 100,000 | | Exactech, Inc.(a) | | | 2,415,000 | |

| | 374,000 | | Syneron Medical Ltd.(a) | | | 2,805,000 | |

| | 96,771 | | Tactile Systems | | | | |

| | | | Technology, Inc.(a) | | | 1,719,137 | |

| | | | | | | 15,529,458 | |

| | |

| Real Estate Investment Trusts – 2.57% | |

| | 201,185 | | City Office Real | | | | |

| | | | Estate Investment | | | | |

| | | | Trust, Inc. | | | 2,526,884 | |

| | 115,000 | | Community Healthcare | | | | |

| | | | Trust, Inc. | | | 2,573,700 | |

| | 80,000 | | UMH Properties, Inc. | | | 969,600 | |

| | 50,000 | | Whitestone Real Estate | | | | |

| | | | Investment Trust | | | 665,000 | |

| | | | | | | 6,735,184 | |

| | |

| Retail – 1.68% | |

| | 175,000 | | Kirkland’s, Inc.(a) | | | 2,136,750 | |

| | 89,360 | | Weyco Group, Inc. | | | 2,261,702 | |

| | | | | | | 4,398,452 | |

| | |

| Semiconductor Related Products – 8.38% | |

| | 1,441,731 | | AXT, Inc.(a) | | | 7,424,915 | |

| | 351,000 | | DSP Group, Inc.(a) | | | 3,825,900 | |

| | 161,111 | | PDF Solutions, Inc.(a) | | | 3,181,942 | |

| | 415,000 | | Photronics, Inc.(a) | | | 4,025,500 | |

| | 195,000 | | Rudolph | | | | |

| | | | Technologies, Inc.(a) | | | 3,529,500 | |

| | | | | | | 21,987,757 | |

| | |

| Software – 5.20% | |

| | 472,000 | | American Software, | | | | |

| | | | Inc. – Class A | | | 4,922,960 | |

| | 1,967,092 | | iPass, Inc.(a) | | | 3,501,424 | |

| | 100,000 | | VASCO Data Security | | | | |

| | | | International, Inc.(a) | | | 1,375,000 | |

| | 942,493 | | Zix Corp.(a) | | | 3,835,946 | |

| | | | | | | 13,635,330 | |

| | |

| Specialty Manufacturing – 5.67% | |

| | 224,947 | | CECO | | | | |

| | | | Environmental Corp. | | | 2,226,975 | |

| | 166,339 | | Core Molding | | | | |

| | | | Technologies, Inc.(a) | | | 2,897,625 | |

The accompanying notes to financial statements are an integral part of this schedule.

Perritt MicroCap Opportunities Fund

| Schedule of Investments (Continued) | October 31, 2016 |

| Shares | | | | Value | |

| | |

| Specialty Manufacturing (Continued) | |

| | 99,500 | | Federal Signal Corp. | | $ | 1,221,860 | |

| | 295,482 | | KVH Industries, Inc.(a) | | | 2,349,082 | |

| | 297,969 | | LSI Industries, Inc. | | | 2,562,533 | |

| | 217,830 | | Manitex | | | | |

| | | | International, Inc.(a) | | | 1,208,957 | |

| | 100,000 | | Sparton Corp.(a) | | | 2,393,000 | |

| | | | | | | 14,860,032 | |

| | |

| Telecommunications – 2.08% | |

| | 1,039,548 | | Ceragon | | | | |

| | | | Networks Ltd.(a) | | | 2,671,638 | |

| | 550,000 | | PC-Tel, Inc. | | | 2,794,000 | |

| | | | | | | 5,465,638 | |

| | |

| Transportation – 1.05% | |

| | 1,103,769 | | Radiant Logistics, Inc.(a) | | | 2,759,422 | |

| | | | | | | 2,759,422 | |

| | | | TOTAL COMMON | | | | |

| | | | STOCKS | | | | |

| | | | (Cost $182,958,114) | | $ | 250,035,004 | |

| | | | | | | | |

| Contracts | | WARRANTS – 0.00% | | | |

| | |

| Insurance – 0.00% | |

| | | | Emergent Capital, | | | | |

| | | | Inc. Warrant; | | | | |

| | 38,106 | | Expiration: 10/06/2019, | | | | |

| | | | Exercise Price | | | | |

| | | | $10.75(a)(c) | | $ | — | |

| | | | TOTAL WARRANTS | | | | |

| | | | (Cost $0) | | $ | — | |

| | | | | | | | |

| | | | SHORT-TERM | | | | |

| | | | INVESTMENTS – 4.81% | | | | |

| | 12,606,512 | | Invesco Short Term | | | | |

| | | | Investments Government | | | | |

| | | | & Agency Portfolio – | | | | |

| | | | Class I, 0.29%(d) | | $ | 12,606,512 | |

| | | | TOTAL SHORT-TERM | | | | |

| | | | INVESTMENTS | | | | |

| | | | (Cost $12,606,512) | | $ | 12,606,512 | |

| | | | Total Investments | | | | |

| | | | (Cost $195,564,626) – | | | | |

| | | | 100.14% | | $ | 262,641,516 | |

| | | | Liabilities in | | | | |

| | | | Excess of Other | | | | |

| | | | Assets – (0.14)% | | | (373,905 | ) |

| | | | TOTAL NET ASSETS – | | | | |

| | | | 100.00% | | $ | 262,267,611 | |

Percentages are stated as a percent of net assets.

(a) | Non-income producing security. |

| | |

(b) | Security was purchased in a transaction exempt from registration in the U.S. under the Securities Act of 1933 (the “Act”) and, unless registered under the Act, may only be sold pursuant to exemption from registration and, in the case of a Rule 144A offering under the Act, may only be sold to “qualified institutional buyers.” The value of this security is $3,280,000 or 1.25% of the Fund’s net assets. This security is deemed to be liquid. |

| | |

(c) | The price for this security was derived from an estimate of fair value using methods approved by the Fund’s Board of Directors. This security represents $0 or 0.00% of the Fund’s net assets. This security is classified as Level 2 and is deemed to be illiquid. |

| | |

(d) | Variable rate security; the rate shown is the effective rate as of October 31, 2016. |

The industry classifications listed above are in accordance with Global Industry Classification Standard (GICS®), which was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”).

The accompanying notes to financial statements are an integral part of this schedule.

Perritt Ultra MicroCap Fund

| Schedule of Investments | October 31, 2016 |

| Shares | | COMMON STOCKS – 94.30% | | Value | |

| | |

| Aerospace & Defense – 1.31% | |

| | 48,294 | | Air Industries | | | |

| | | | Group, Inc. | | $ | 168,546 | |

| | 80,000 | | CPI Aerostructures, | | | | |

| | | | Inc.(a) | | | 540,000 | |

| | | | | | | 708,546 | |

| | |

| Air Transport – 0.56% | |

| | 34,047 | | AeroCentury Corp.(a) | | | 304,720 | |

| | | | | | | 304,720 | |

| | |

| Auto Parts & Equipment – 2.50% | |

| | 50,000 | | Supreme Industries, | | | | |

| | | | Inc. – Class A | | | 609,500 | |

| | 60,000 | | Unique | | | | |

| | | | Fabricating, Inc. | | | 749,400 | |

| | | | | | | 1,358,900 | |

| | |

| Building Materials – 1.03% | |

| | 119,778 | | Empire Resources, Inc. | | | 559,363 | |

| | | | | | | 559,363 | |

| | |

| Business Services – 13.66% | |

| | 625,547 | | Auxilio, Inc.(a) | | | 506,693 | |

| | 50,000 | | BG Staffing, Inc. | | | 713,000 | |

| | 288,291 | | DLH Holdings Corp.(a) | | | 1,470,284 | |

| | 150,000 | | Information Services | | | | |

| | | | Group, Inc.(a) | | | 592,500 | |

| | 205,500 | | Innodata Isogen, Inc.(a) | | | 503,475 | |

| | 236,199 | | Intrusion, Inc.(a)(c) | | | 118,100 | |

| | 57,000 | | PCM, Inc.(a) | | | 1,208,400 | |

| | 1,837,300 | | Quadrant 4 | | | | |

| | | | System Corp.(a) | | | 385,833 | |

| | 125,000 | | SITO Mobile Ltd.(a) | | | 600,000 | |

| | 52,147 | | Transcat, Inc.(a) | | | 547,543 | |

| | 125,000 | | USA Technologies, | | | | |

| | | | Inc.(a) | | | 562,500 | |

| | 508,900 | | WidePoint Corp.(a) | | | 213,738 | |

| | | | | | | 7,422,066 | |

| | |

| Chemical & Related Products – 1.98% | |

| | 320,000 | | Flexible Solutions | | | | |

| | | | International, Inc.(a) | | | 576,000 | |

| | 36,000 | | Northern Technologies | | | | |

| | | | International Corp.(a) | | | 500,400 | |

| | | | | | | 1,076,400 | |

| | |

| Computer and Electronic | |

| Product Manufacturing – 0.47% | |

| | 68,356 | | Dynatronics Corp.(a) | | | 177,726 | |

| | 194,000 | | Singing Machine Co., | | | | |

| | | | Inc.(a) | | | 77,600 | |

| | | | | | | 255,326 | |

| | |

| Computers & Electronics – 1.65% | |

| | 81,000 | | Concurrent | | | | |

| | | | Computer Corp. | | | 500,580 | |

| | 56,500 | | Napco Security | | | | |

| | | | Technologies, Inc.(a) | | | 395,500 | |

| | | | | | | 896,080 | |

| | |

| Construction & Engineering – 6.32% | |

| | 97,500 | | Gencor Industries, | | | | |

| | | | Inc.(a) | | | 1,179,750 | |

| | 150,000 | | Hill International, | | | | |

| | | | Inc.(a) | | | 577,500 | |

| | 25,000 | | NV5 Global, Inc.(a) | | | 715,000 | |

| | 60,000 | | Willdan Group, Inc.(a) | | | 963,600 | |

| | | | | | | 3,435,850 | |

| | |

| Consumer Goods – 1.03% | |

| | 50,000 | | MCBC Holdings, Inc. | | | 557,000 | |

| | | | | | | 557,000 | |

| | |

| Consumer Products – Distributing – 2.50% | |

| | 310,000 | | FitLife Brands, Inc.(a) | | | 558,000 | |

| | 260,000 | | US Auto Parts | | | | |

| | | | Network, Inc.(a) | | | 798,200 | |

| | | | | | | 1,356,200 | |

| | |

| Consumer Products – Manufacturing – 2.42% | |

| | 42,070 | | Cherokee, Inc.(a) | | | 395,458 | |

| | 50,000 | | Crown Crafts, Inc. | | | 482,500 | |

| | 45,000 | | Hardinge, Inc. | | | 436,500 | |

| | | | | | | 1,314,458 | |

| | |

| Consumer Services – 1.74% | |

| | 85,000 | | Xcel Brands, Inc.(a) | | | 425,000 | |

| | 80,000 | | ZAGG, Inc.(a) | | | 520,000 | |

| | | | | | | 945,000 | |

| | |

| Electronic Equipment & Instruments – 1.63% | |

| | 200,000 | | Iteris, Inc.(a) | | | 682,000 | |

| | 50,000 | | Ultralife Corp.(a) | | | 205,000 | |

| | | | | | | 887,000 | |

| | |

| Energy & Related Services – 1.36% | |

| | 95,000 | | DHT Holdings, Inc. | | | 386,650 | |

The accompanying notes to financial statements are an integral part of this schedule.

Perritt Ultra MicroCap Fund

| Schedule of Investments (Continued) | October 31, 2016 |

| Shares | | | | Value | |

| | |

| Energy & Related Services – 1.36% (Continued) | |

| | 119,206 | | Mitcham | | | |

| | | | Industries, Inc.(a) | | $ | 352,850 | |

| | | | | | | 739,500 | |

| | |

| Environmental Services – 0.59% | |

| | 250,000 | | Fuel Tech, Inc.(a) | | | 321,250 | |

| | | | | | | 321,250 | |

| | |

| Financial Services – 7.49% | |

| | 90,000 | | AMREP Corp.(a) | | | 664,200 | |

| | 25,000 | | First Internet Bancorp | | | 656,250 | |

| | 24,000 | | Hennessy Advisors, Inc. | | | 693,120 | |

| | 50,000 | | HopFed Bancorp, Inc. | | | 569,000 | |

| | 20,000 | | Pacific Premier | | | | |

| | | | Bancorp, Inc.(a) | | | 517,000 | |

| | 52,000 | | Silvercrest Asset | | | | |

| | | | Management Group, | | | | |

| | | | Inc. – Class A | | | 600,600 | |

| | 350,347 | | TheStreet, Inc. | | | 367,864 | |

| | | | | | | 4,068,034 | |

| | |

| Food – 1.11% | |

| | 5,000 | | John B. Sanfilippo | | | | |

| | | | & Son, Inc. | | | 253,400 | |

| | 42,691 | | Willamette Valley | | | | |

| | | | Vineyards, Inc.(a) | | | 347,932 | |

| | | | | | | 601,332 | |

| | |

| Health Care Providers & Services – 0.19% | |

| | 100,000 | | Celsion Corp.(a) | | | 105,000 | |

| | | | | | | 105,000 | |

| | |

| Industrial Goods – 2.47% | |

| | 219,900 | | Hudson | | | | |

| | | | Technologies, Inc.(a) | | | 1,341,390 | |

| | | | | | | 1,341,390 | |

| | |

| Insurance – 3.89% | |

| | 50,000 | | Atlas Financial | | | | |

| | | | Holdings, Inc.(a) | | | 857,500 | |

| | 72,900 | | Kingstone | | | | |

| | | | Companies, Inc. | | | 750,870 | |

| | 35,000 | | United Insurance | | | | |

| | | | Holdings Corp. | | | 507,500 | |

| | | | | | | 2,115,870 | |

| | |

| Leisure – 3.30% | |

| | 97,322 | | Century Casinos, Inc.(a) | | | 617,022 | |

| | 1,771,000 | | Galaxy Gaming, Inc.(a) | | | 920,920 | |

| | 150,000 | | Nevada Gold | | | | |

| | | | & Casinos, Inc.(a) | | | 255,000 | |

| | | | | | | 1,792,942 | |

| | |

| Medical Supplies & Services – 6.46% | |

| | 27,000 | | Addus | | | | |

| | | | HomeCare Corp.(a) | | | 683,100 | |

| | 3,500 | | Birner Dental Management | | | | |

| | | | Services, Inc. | | | 64,155 | |

| | 50,000 | | Cutera, Inc.(a) | | | 655,000 | |

| | 180,440 | | First Choice Healthcare | | | | |

| | | | Solutions, Inc.(a) | | | 196,679 | |

| | 213,334 | | Hooper Holmes, Inc.(a) | | | 192,001 | |

| | 115,000 | | IntriCon Corp.(a) | | | 695,750 | |

| | 70,000 | | MGC Diagnostics | | | | |

| | | | Corp.(a) | | | 528,500 | |

| | 80,000 | | Sensus Healthcare, Inc.(a) | | | 495,600 | |

| | | | | | | 3,510,785 | |

| | |

| Motion Pictures – 1.97% | |

| | 157,677 | | Ballantyne | | | | |

| | | | Strong, Inc.(a) | | | 1,072,203 | |

| | | | | | | 1,072,203 | |

| | |

| Pharmaceuticals – 0.85% | |

| | 82,629 | | ImmuCell Corp.(a) | | | 461,896 | |

| | | | | | | 461,896 | |

| | |

| Real Estate Investment Trusts – 0.94% | |

| | 100,000 | | Global Self | | | | |