MicroCap Opportunities Fund

Ultra MicroCap Fund

Low Priced Stock Fund

Annual Report

October 31, 2017

The PERRITT MICROCAP OPPORTUNITIES FUND will, under normal circumstances, invest at least 80% of its net assets in a diversified portfolio of common stocks of United States companies that at the time of initial purchase have a market capitalization (equity market value) that is below $500 million (referred to as “micro-cap” companies). The Fund seeks to invest in micro-cap companies that have demonstrated above-average growth in revenues and/or earnings, possess relatively low levels of long-term debt, have a high percentage of their shares owned by company management, and possess modest price-to-sales ratios and price-to-earnings ratios that are below their long-term annual growth rate. At times, the Fund may also invest in “special situations” such as companies that possess valuable patents, companies undergoing restructuring, and companies involved in large share repurchase programs. Investors should expect the Fund to contain a mix of both value-priced and growth stocks.

The PERRITT ULTRA MICROCAP FUND will, under normal circumstances, invest at least 80% of its net assets in a diversified portfolio of common stocks of United States companies that at the time of initial purchase have a market capitalization (equity market value) that is below $300 million (referred to as “micro-cap” companies). The Fund seeks to invest in micro-cap companies that have a high percentage of their shares owned by company management, possess relatively low levels of long-term debt, have a potential for above average growth in revenues and/or earnings, and possess reasonable valuations based on the ratios of price-to-sales, price-to-earnings, and price-to-book values. The micro-cap companies in which the Fund may invest include “early stage” companies, which are companies that are in a relatively early stage of development with market capitalizations that are below $50 million. At times, the Fund may also invest in unseasoned companies, companies that are undergoing corporate restructuring, initial public offerings, and companies believed to possess undervalued assets.

The PERRITT LOW PRICED STOCK FUND will, under normal circumstances, invest at least 80% of its net assets in a diversified portfolio of low priced common stocks of United States companies that at the time of initial purchase have a market capitalization (equity market value) that is below $3 billion. Low priced stocks are those that are trading at or below $15 per share at the time of initial purchase. Subsequent to the initial purchase, the Fund may purchase such securities at a price above $15 per share. The Fund’s strategy is based on the premise that low priced stocks offer growth potential because these stocks have limited broker research coverage, the companies’ prospects are misunderstood by most investors, and some investors mistakenly believe stocks trading below $15 per share are more “speculative” than those trading at higher levels and therefore avoid low priced stocks. The Fund will invest in “growth” stocks, “value” stocks, or a combination of both. Given the market capitalization restrictions, the Fund will normally invest in securities issued by small-cap companies, including some micro-cap companies. However, micro-cap companies will only make up a small portion of the Fund’s portfolio. Micro-cap companies represent the smallest sector of public companies based on market capitalization. At times, the Fund’s portfolio may contain the shares of unseasoned companies, companies that are undergoing corporate restructuring, initial public offerings, and companies believed to possess undervalued assets.

Annual Report

October 31, 2017

| From the Desk of Michael Corbett, President and CIO | 2 |

| | |

| Perritt MicroCap Opportunities Fund | |

| From the Portfolio Managers | 5 |

| Performance | 8 |

| Ten Largest Common Stock Holdings | 10 |

| Allocation of Portfolio Investments | 11 |

| | |

| Perritt Ultra MicroCap Fund | |

| From the Portfolio Managers | 12 |

| Performance | 16 |

| Ten Largest Common Stock Holdings | 18 |

| Allocation of Portfolio Investments | 19 |

| | |

| Perritt Low Priced Stock Fund | |

| From the Portfolio Manager | 20 |

| Performance | 22 |

| Ten Largest Common Stock Holdings | 24 |

| Allocation of Portfolio Investments | 25 |

| | |

| Perritt Funds | |

| Schedules of Investments | 26 |

| Statements of Assets and Liabilities | 35 |

| Statements of Operations | 36 |

| Statements of Changes in Net Assets | 37 |

| Financial Highlights | 40 |

| Notes to Financial Statements | 43 |

| Report of the Independent Registered Public Accounting Firm | 52 |

| Expense Example | 53 |

| Directors and Officers | 55 |

| Information | 58 |

Perritt Funds, Inc.

| From the Desk of Michael Corbett, President and CIO |

Michael Corbett,

President and CIO

All equity markets produced solid gains during the past 12 months ending October 31, 2017. As measured by the S&P 500 Index, large-cap stocks rose 23.63%. Smaller stocks outperformed large stocks during that same period. The Russell 2000 index rose 27.85% and the Russell Microcap Index was up 29.53%. We are not surprised by these gains. In fact, we have remained positive since small stocks hit a bear market bottom a little more than 20 months ago. Since the bear market low on February 11, 2016, the Russell 2000 Index and Russell Microcap Index have each gained more than 31%. Due to several macro factors, we remain confident about the future for stocks, which we will outline later in this message. The big surprise to us, though, is that the recent gains in the markets have been without volatility or even a modest correction.

Each of the major stock market averages have not experienced a modest 5% correction in the past year. The worst decline this year for S&P 500 Index was 2.8% from March 1, 2017 through April 13, 2017. Since 1929, the S&P 500 Index on average has dropped 5% three times a year, and declined 10% or more about once a year. We are now nearly a year without a 5% correction, which is the longest such streak in 26 years. Given this historical perspective, the stock market does seem overdue for a correction.

While a correction may well be in our future, a true bear market (20% decline) is unlikely to occur without a recession. None of the typical recession indicators seem imminent, and global economic fundamentals are strong. We are in the middle of a global economic growth recovery which has provided strong support for market gains. For the first time since 2007, all 45 economies tracked by the OECD (Organization for Economic Co-operation and Development) Composite Leading Indicators Index have positive GDP growth for the year. Furthermore, despite minor interest rate increases in the U.S., global central bank policies remain very accommodating with low interest rates around the world.

In addition to the positives in the global markets, the Trump Administration’s pro-growth agenda is still a possibility. The pro-growth agenda includes slashing onerous regulations that have stifled business, a proposed $1 trillion infrastructure spending scheduled for 2018, a significant increase in military budget, as well as individual and corporate tax cuts. The current plan calls for reducing corporate taxes from 35% to as low as 20%. While it seems unlikely that congress will agree to that degree of tax cut, any cut would be welcomed by the equity markets.

What would concern us in the near term? There are several indicators we review regularly to give us hope or concern about the near term for equity markets. One of those indicators is our conversation with management teams. Most of conversations and observations with management teams have been more upbeat than negative. Another indicator is the Leading Economic Indicators (LEI). The LEI rose 1.2% in November, the largest increase since November 2013. So, we see no concern from the LEI. And yet another indicator we watch closely is sentiment. Consumer sentiment has been climbing lately and remains at near term highs. However, investor sentiment remains subdued. On a sentiment basis, we would be more concerned about the markets if investor sentiment was at new highs.

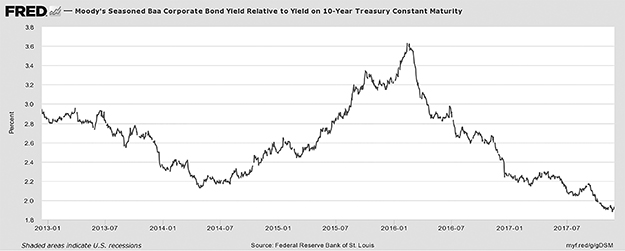

The one indicator that is of some concern is corporate debt. American corporations have been borrowing money at a rapid clip over the last several years, bringing total corporate

Perritt Funds, Inc.

debt to $8.7 trillion, its highest level relative to U.S. GDP (45%) since the financial crisis. In just two years, corporations have added $1 trillion of new debt, which is the equivalent of a borrowing stampede. The demand for corporate bonds has also been like a stampede. The chart below shows the spread between corporate bond yields and U.S. Treasuries. This risk premium for owning corporate bonds over U.S. Treasuries is at historic lows, which does concern us.

The Spread Between Corporate Bond Yields and the 10-Year U.S. Treasury is < 2%

As of 11/27/17

There will always be some indicators that concern us, but we have not seen enough evidence to put caution in our forecast. Until we see a deterioration in the LEI or excessive investor optimism, we remain optimistic about the near-term future for stock prices.

Past performance does not guarantee future results.

S&P 500 Index is an American stock market index based on the market capitalizations of 500 large companies having common stock listed on the NYSE or NASDAQ.

Russell Microcap Index is a capitalization weighted index of 2,000 small cap and micro cap stocks that captures the smallest 1,000 companies in the Russell 2000, plus 1,000 smaller U.S.-based listed stocks.

Russell 2000 Index is an index measuring the performance approximately 2,000 small-cap companies in the Russell 3000 Index, which is made up of 3,000 of the biggest U.S. stocks. The Russell 2000 serves as a benchmark for small-cap stocks in the United States.

One cannot invest directly in an index.

The Organization for Economic Co-operation and Development (OECD) is an intergovernmental economic organization with 35 member countries, founded in 1960 to stimulate economic progress and world trade.

Leading Economic Indicators (LEI) are measurable economic factors that change before the economy starts to follow a particular pattern or trend. Leading indicators are used to predict changes in the economy, but they are not always accurate.

Gross Domestic Product (GDP) is the broadest quantitative measure of a nation’s total economic activity. GDP represents the monetary value of all goods and services produced within a nation’s geographic borders over a specified period of time.

Perritt Funds, Inc.

Moody’s Seasoned Baa Corporate Bond Yield is a corporate yield of a Moody’s Graded Bond. A Seasoned Baa Corporate Bond of 30 years is the yield return of bonds graded Baa by Moody’s with a maturity of 30 years.

Yield on 10 year Treasury Constant Maturity is an index published by the Federal Reserve Board based on the average yield of a range of Treasury securities, all adjusted to the equivalent of a 10-year maturity. Yields on Treasury securities at constant maturity are determined by the U.S. Treasury from the daily yield curve.

Perritt MicroCap Opportunities Fund

| Portfolio Managers’ Message |

| |  |

| Michael Corbett, | | George Metrou, |

| Portfolio Manager | | Portfolio Manager |

The Perritt MicroCap Opportunities Fund posted a gain of +24.2% during the fiscal year ended October 31, 2017, compared to a +29.5% gain for the Russell Microcap Index and +27.9% gain for the Russell 2000 Index. The Fund’s longer-term performance results, as well as the benchmarks’ performance, can be found later in this report.

We focus on managing a portfolio of microcap equities. In this pursuit, we perform bottom up due-diligence on companies, attempt to value the securities of these companies, and actively engage in security selection to build a portfolio. Our due diligence process leads us to focus on businesses with high returns on capital, robust free cash flow generation, solid balance sheets, and a competitive advantage.

We are confident that businesses with these attributes generate value over time. When valued appropriately, and purchased at a price below intrinsic value, we believe an investor can capture an above market rate of return. We also believe that in the long run, an active and diligent based approach is the best path for consistent return generation. Unfortunately, the path to the “long run” is not always linear.

While pleased with the absolute return of the portfolio this year at +24.2%, we also find ourselves feeling a bit of Déjà vu at the markets willingness to again reward low quality, money losing businesses with aggressive valuations. Many of the hottest areas of the market, with above average returns were found in sectors our process leads us to avoid. These areas include: 1) biotech and pharmaceuticals where binary outcomes with low success rates often prevail, 2) software and technology companies with some unproven business models and suspect profit capability, and 3) medical device companies, where some valuations are not driven not by cash flows, but by forward revenue growth projections.

We have experienced markets like this as recently as 2014 and 2015, and believe today, as we did then, that these trends are not durable. Price meets value in the long run. So, we focus on value, and where value can be found, not on the hot price action.

During the year, we made significant strides in upgrading the quality of the portfolio. We began the period with 86 positions and ended the period with 83 positions. While the net reduction represents only three positions, it belies the substantial amount of rotation that took place during the year. In gross terms, we added sixteen new positions to the portfolio, and eliminated nineteen. We view this balance as a signal we have found the appropriate size portfolio, in terms of number of positions.

Within the sixteen names added to the portfolio, we were able to find new opportunities in various sectors. We added five positions in Industrials, three in each the Consumer and Financials sectors, two in Technology, and single positions in the Energy, Real Estate, and Healthcare sectors. Each of the companies added adhere to our disciplined focus on companies who can generate free cash flow, have a solid balance sheet, and have earned a strong return on capital.

Perritt MicroCap Opportunities Fund

The average market capitalization of the positions added was $273 million. The average number of Wall Street analysts covering the companies was two. Two of the companies have no analyst coverage at all. These data points on size and coverage speak to our dedication to remain true to our microcap space, investing in undiscovered and under researched securities. Sticking to our process has yielded promising initial results from the new additions to the portfolio.

Historically, our decision to exit a position is driven by three primary causes: 1) companies receive an offer to be bought out (M&A), 2) securities achieve our price targets, or 3) disappointing results or a change in our thesis. This year was no exception, and we had roughly equal amounts of each type of liquidation. Five positions were sold after receiving a valid buyout offer: Datalink Corp. (DTLK), Exactech Inc. (EXAC), FBR & Co. (FBRC), Sparton Corp. (SPA), and Syneron Medical Ltd. (ELOS).

Six securities were sold after reaching our price target: CryoLife Inc. (CRY), Flexsteel Industries Inc. (FLXS), John B Sanfilippo & Sons Inc. (JBSS), Tactile Systems Technology Inc. (TCMD), UMH Properties Inc. (UMH), and VASCO Data Security Int’l Inc. (VDSI). The remaining eight positions removed from the portfolio were sold after a downgrade in our view of the price appreciation potential of the security or to rotate capital to higher conviction ideas.

As of October 31, 2017, the Fund’s portfolio was comprised of 83 common stocks. The Fund’s 10 largest holdings and detailed descriptions can be found later in this report. Based on our earnings estimates, the Fund’s portfolio is trading at approximately 22.2 times 2017 earnings. Stocks in the portfolio are priced at a median 1.0 times revenue and the median price to book value is 1.8x. Lastly, the median market capitalization is approximately $317 million.

On November 17th, the Fund paid a capital gain distribution of $8.07 per share. The capital gain distribution is not reflected in the financials of this annual report because it was completed in fiscal 2018, but distributed in calendar year 2017. Please review your statement for the full details of the capital gain distribution.

I want to thank my fellow shareholders for their continued support and confidence in the Perritt Capital Management team. If you have any questions or comments about this report or your investment in the Perritt MicroCap Opportunities Fund, please call us toll-free at (800)331-8936 or visit our web site at www.perrittcap.com. Please refer to the prospectus for information about the Fund’s investment objectives and strategies.

George Metrou

Portfolio Manager

Perritt MicroCap Opportunities Fund

Mutual fund investing involves risk. Principal loss is possible. The Funds invest in smaller companies, which involve additional risks, such as limited liquidity and greater volatility. The Funds invest in micro-cap companies which tend to perform poorly during times of economic stress.

Past performance does not guarantee future results.

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Russell Microcap Index is a capitalization weighted index of 2,000 small cap and micro cap stocks that captures the smallest 1,000 companies in the Russell 2000, plus 1,000 smaller U.S.-based listed stocks.

Russell 2000 Index is an index measuring the performance approximately 2,000 small-cap companies in the Russell 3000 Index, which is made up of 3,000 of the biggest U.S. stocks. The Russell 2000 serves as a benchmark for small-cap stocks in the United States.

Return on Equity is a measure of profitability that calculates how many dollars of profit a company generates with each dollar of shareholders’ equity.

Return on Invested Capital is a fundamental method of determining a company’s financial performance. It is used to measure how well a company is investing its capital.

Free Cash Flow is a measure of financial performance calculated as operating cash flow minus capital expenditures. Free cash flow (FCF) represents the cash that a company is able to generate after laying out the money required to maintain or expand its asset base.

Price to Book is a ratio used to compare a stock’s market value to its book value. It is calculated by dividing the current closing price of the stock by the latest quarter’s book value per share.

Tangible Book Value is the total net asset value of a company (book value) minus intangible assets and goodwill.

Perritt MicroCap Opportunities Fund

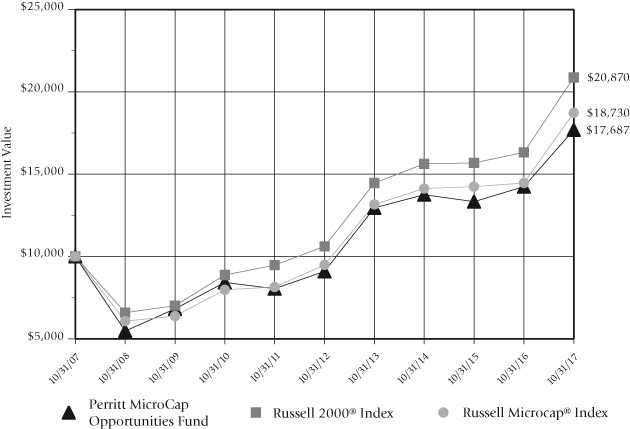

| Performance* (Unaudited) | October 31, 2017 |

Perritt MicroCap Opportunities Fund versus

Russell 2000® Index and Russell Microcap® Index

There are several ways to evaluate a fund’s historical performance. You can look at the total percentage change in value, the average annual percentage change, or the growth of a hypothetical $10,000 investment. Each performance figure includes changes in a fund’s share price, plus reinvestment of any dividends (or income) and capital gains (the profits the fund earns when it sells stocks that have grown in value).

Cumulative total returns reflect the Fund’s actual performance over a set period. For example, if you invested $1,000 in a fund that had a 5% return over one year, you would end up with $1,050. You can compare the Fund’s returns to the Russell 2000® Index, which reflects a popular measure of the stock performance of small companies, and the Russell Microcap® Index, which measures the performance of the micro-cap segment of the U.S. equity market.

Average annual total returns take the Fund’s actual (or cumulative) return and show you what would have happened if the Fund had performed at a constant rate each year.

| * | The graph illustrates the performance of a hypothetical $10,000 investment made in the period presented. Assumes reinvestment of dividends and capital gains, but does not reflect the effect of any applicable sales charge or redemption fees or the deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of the Fund shares. The graph does not imply any future performance. |

Perritt MicroCap Opportunities Fund

| Performance (Unaudited) (Continued) | October 31, 2017 |

| Cumulative Total Returns* | | | | | | |

| Periods ended October 31, 2017 (Unaudited) | | | | | | |

| | Past | Past | Past | Past | Past | Past |

| | 1 Year | 3 Years | 5 Years | 10 Years | 15 Years | 25 Years |

| Perritt MicroCap | | | | | | |

| Opportunities Fund | 24.20% | 28.63% | 94.55% | 76.87% | 436.53% | 1208.15% |

| | | | | | | |

| Russell 2000 index | 27.85% | 33.55% | 96.69% | 108.70% | 391.22% | 961.79% |

| (reflects no deduction | | | | | | |

| for fees and expenses) | | | | | | |

| | | | | | | |

| Russell Microcap Index | 29.53% | 32.60% | 97.43% | 87.30% | 351.92% | N/A |

| (reflects no deduction | | | | | | |

| for fees and expenses) | | | | | | |

| | | | | | | |

| Average Annual Total Returns* | | | | | | |

| Periods ended October 31, 2017 (Unaudited) | | | | | | |

| | Past | Past | Past | Past | Past | Past |

| | 1 Year | 3 Years | 5 Years | 10 Years | 15 Years | 25 Years |

| Perritt MicroCap | | | | | | |

| Opportunities Fund | 24.20% | 8.75% | 14.24% | 5.87% | 11.85% | 10.83% |

| | | | | | | |

| Russell 2000 index | 27.85% | 10.12% | 14.49% | 7.63% | 11.19% | 9.91% |

| (reflects no deduction | | | | | | |

| for fees and expenses) | | | | | | |

| | | | | | | |

| Russell Microcap Index | 29.53% | 9.86% | 14.57% | 6.48% | 10.58% | N/A |

| (reflects no deduction | | | | | | |

| for fees and expenses) | | | | | | |

The Perritt MicroCap Opportunities Fund’s annualized expense ratio for the year ended October 31, 2016, as stated in the statutory prospectus, was 1.23%. The Fund imposes a 2% redemption fee on shares held for 90 days or less. Performance data does not reflect the redemption fee. If reflected, total returns would be reduced.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end is available by calling 800-331-8936.

| * | The tables do not reflect the deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of Fund shares. |

Perritt MicroCap Opportunities Fund

| Ten Largest Common Stock Holdings (Unaudited) |

Atlas Financial Holdings, Inc. (AFH) engages in the underwriting of commercial automobile insurance policies, focusing on the ‘light’ commercial automobile sector. This sector includes taxi cabs, nonemergency para-transit, limousine, livery, and business autos.

Century Casinos, Inc. (CNTY) operates as a casino entertainment company worldwide. The company develops and operates gaming establishments, as well as related lodging, restaurant, horse racing, and entertainment facilities.

First Internet Bancorp (INBK) operates as a bank holding company for First Internet Bank of Indiana that provides commercial and retail banking products and services through its website, firstib.com.

Addus HomeCare Corporation (ADUS) is a provider of home and community-based personal care services, which are provided primarily in the home, and is focused on the dual eligible (Medicare/Medicaid) population. Addus provides these services on a long-term, continuous basis, with an average duration of over 20 months per consumer.

Miller Industries, Inc. (MLR) engages in the manufacture and sale of towing and recovery equipment. It offers wreckers, such as conventional tow trucks and recovery vehicles. The company also provides transport trailers for moving multiple vehicles, auto auctions, car dealerships, leasing companies, and other similar applications.

Hill International, Inc. (HIL) provides project and construction management, and other consulting services primarily for the buildings, transportation, environmental, energy, and industrial markets.

OMNOVA Solutions Inc. (OMN) provides emulsion polymers, specialty chemicals, and engineered surfaces for various commercial, industrial, and residential end uses in the United States, Europe, and Asia. Omnova operates in two segments, Performance Chemicals and Engineered Surfaces.

Bankwell Financial Group, Inc. (BWFG) operates as the bank holding company for Bankwell Bank, it provides a range of banking services to commercial and consumer customers in Connecticut.

Global Brass and Copper Holdings, Inc. (BRSS) converts, fabricates, processes, and distributes non-ferrous products in the United States, the Asia Pacific, and Mexico. Its products are used in the building and housing, automotive, electronics/electrical components, munitions, coinage, and industrial machinery and equipment markets.

Silvercrest Asset Management Group Inc. (SAMG) is a wealth management firm that provides financial advisory and related family office services in the United States. The company serves ultra-high net worth individuals and families, as well as their trusts; endowments; foundations; and other institutional investors. It also manages funds of funds and other investment funds.

Fund holdings and/or sector allocations are subject to change at any time and

are not recommendations to buy or sell any security.

Please refer to the Schedule of Investments in this report for a complete list of Fund holdings.

Perritt MicroCap Opportunities Fund

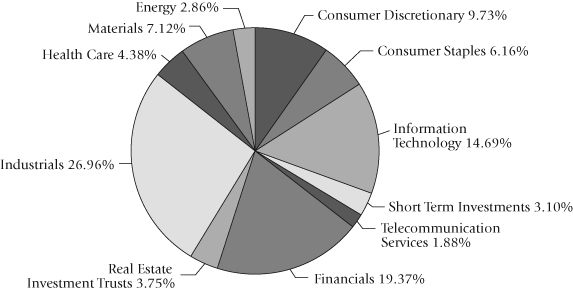

| Allocation of Portfolio Investments (Unaudited) | October 31, 2017 |

The sector classifications represented in the graph above and industry classifications represented in

the Schedule of Investments are in accordance with Global Industry Classification Standard

(GICS®), which was developed by and/or is the exclusive property of MSCI, Inc. and Standard &

Poor Financial Services LLC. Percentages are based on total investments, at value.

| Note: | For presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with section 8(b)(1) of the Investment Company Act of 1940, the Fund uses more specific industry classifications. |

Perritt Ultra MicroCap Fund

| Portfolio Managers’ Message |

| |  |

| Michael Corbett, | | Matthew Brackmann, |

| Portfolio Manager | | Portfolio Manager |

The Perritt Ultra MicroCap Fund had a positive return of 25.27% for the fiscal year ending October 31, 2017. This compares unfavorably to the Russell Microcap Index benchmark of 29.53%. The Fund performance for the second half of the fiscal year returned a positive 12.33%, which does compare favorably to the 9.44% return for the Russell Microcap Index. The complete performance for the Fund and its benchmarks can be found later in this report.

During the fiscal year, the Fund has seen its strongest performance from its investments in the information technology and industrial spaces. Some of the top performers in the information technology space were Ultra Clean Technologies (UCTT), a semi-conductor capital equipment manufacturer which returned 261.5% and Data I/O Corp (DAIO), a manufacturer of automatic programming devices which returned 207.7%. We also saw strong performance from industrial holdings, such as NV5 Global (NVEE), a construction & engineering contractor that returned 103.2%. We also had several successes in the machinery & equipment manufacturing space, including Hardinge Inc. (HDNG), Hurco Companies (HURC), Supreme Industries (STS) and Gencor Industries (GENC). These names cumulatively added 5.1% to the Fund’s performance. While we sold out of Supreme Industries over the course of the year, the others remain as holdings in the portfolio.

Since our semi-annual report for the period ending April 30, 2017, the Fund has liquidated 10 investments. One of these, ARI Network Services (ARIS) was sold because of the company receiving a valid buyout offer. Six companies, Supreme Industries, KVH Industries (KVHI), Orbit International (ORBT), Sito Mobile (SITO), Intricon (IIN) & Ultra Clean Technologies (UCTT) were sold due to the companies reaching our valuation targets. The remaining three companies were eliminated due to weak results or material downgrades in the outlook for the company, as well as for tax efficiency purposes. These were replaced with new additions that we believe will help contribute to the future performance of the Fund. These include Layne Christenson (LAYN), a contractor in the water management and drilling for the water, mineral & energy space, OurPet’s Company (OPCO), a designer, producer and distributor of pet products & Lakeland Industries (LAKE), a manufacturer of various safety garments and accessories.

As of October 31, 2017, the Fund holds the common stock of 87 companies which is greater than the 85 names we held at the time of our semi-annual report, April 30, 2017. We intend to keep the number of names in the portfolio around this number and continue with our strategy of concentrating on higher quality and higher conviction names. Based on our earnings estimates, the Fund’s portfolio is trading at 17.2 times forward earnings. The median price to sales ratio is 1.14x, the median price to book ratio is 2.03, the trailing twelve-month price earnings ratio is 21.9x and the median market cap is unchanged at

Perritt Ultra MicroCap Fund

$90 million. The Fund’s largest holdings and detailed descriptions can be found later in this report.

In terms of allocations to individual sectors, the Fund continues to maintain large underweights in both the financial and healthcare sectors. While we have closed the gaps on both over the course of the last year, we continue to avoid certain regional banks and biotech stocks in each respective sector due to valuations, risk exposure, and liquidity reasons and will continue to utilize the stock picking criteria we have relied on the past 29 years. Despite our aversion to those sub-sectors, we have found some opportunities for investments in specialty finance companies, healthcare services, and medical devices and continue to look for opportunities in those areas. We maintain over-weight allocations to consumer discretionary, industrial, and information technology names while the remaining sectors remain even-weight with the index.

The Ultra Microcap Fund tends to have investments that fly under the radar screen of most investors. The microcap universe, particularly those stocks with market capitalizations below $100 million, are often ignored by investors for an extended period. Therefore, the potential rewards can take longer to achieve, but can be swift. As fellow shareholders, we exit this fiscal year pleased with our performance relative to our index and remain focused on the long-term picture both for the individual companies within the portfolio, as well as the portfolio as a whole. We remain confident that looking out at the long-term potential for our holdings based on sound fundamentals rather than focusing on short- term fluctuations in the market is in the best interest of our shareholders. As always, we would like to remind investors that the rewards of microcap investing may not be consistent in the short run, but can have the potential to be rewarding in a full market cycle.

We want to thank our fellow shareholders for their continued support and confidence in the Perritt Capital Management team. Each member of our investment committee, as well as many other employees have made continued investment in this Fund for over 10 years and remain shareholders alongside all of you. If you have any questions or comments about this report or your investment in the Perritt Ultra MicroCap Fund, please call us toll- free at (800) 331-8936 or visit our web site at www.perrittcap.com. Please refer to the prospectus for information about the Fund’s investment objectives and strategies.

Matthew Brackmann

Portfolio Manager

Perritt Ultra MicroCap Fund

Past performance does not guarantee future results.

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Russell Microcap Index is a capitalization weighted index of 2,000 small cap and micro cap stocks that captures the smallest 1,000 companies in the Russell 2000, plus 1,000 smaller U.S.-based listed stocks.

Russell 2000 Index is an index measuring the performance approximately 2,000 small-cap companies in the Russell 3000 Index, which is made up of 3,000 of the biggest U.S. stocks. The Russell 2000 serves as a benchmark for small-cap stocks in the United States.

Cash flow is the net amount of cash and cash-equivalents moving into and out of a business. Positive cash flow indicates that a company’s liquid assets are increasing, enabling it to settle debts, reinvest in its business, return money to shareholders, pay expenses and provide a buffer against future financial challenges. Negative cash flow indicates that a company’s liquid assets are decreasing.

Price-to-Book (P/B) is a ratio used to compare a stock’s market value to its book value. It is calculated by dividing the current closing price of the stock by the latest quarter’s book value per share.

Price-to-Sales (P/S) is a valuation ratio that compares a company’s stock price to its revenues. The price-to-sales ratio is an indicator of the value placed on each dollar of a company’s sales or revenues.

Price-to-Earnings (P/E) is the ratio for valuing a company that measures its current share price relative to its per share earnings.

Trailing Price-to Earnings (P/E) is calculated by taking the current stock price and dividing it by the trailing earnings per share (EPS) for the past 12 months.

(This Page Intentionally Left Blank.)

Perritt Ultra MicroCap Fund

| Performance* (Unaudited) | October 31, 2017 |

Perritt Ultra MicroCap Fund versus

Russell 2000® Index and Russell Microcap® Index

There are several ways to evaluate a fund’s historical performance. You can look at the total percentage change in value, the average annual percentage change, or the growth of a hypothetical $10,000 investment. Each performance figure includes changes in a fund’s share price, plus reinvestment of any dividends (or income) and capital gains (the profits the fund earns when it sells stocks that have grown in value).

Cumulative total returns reflect the Fund’s actual performance over a set period. For example, if you invested $1,000 in a fund that had a 5% return over one year, you would end up with $1,050. You can compare the Fund’s returns to the Russell 2000® Index, which reflects a popular measure of the stock performance of small companies, and the Russell Microcap® Index, which measures the performance of the micro-cap segment of the U.S. equity market.

Average annual total returns take the Fund’s actual (or cumulative) return and show you what would have happened if the Fund had performed at a constant rate each year.

| * | The graph illustrates the performance of a hypothetical $10,000 investment made in the period presented. Assumes reinvestment of dividends and capital gains, but does not reflect the effect of any applicable sales charge or redemption fees or the deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of Fund shares. The graph does not imply any future performance. |

Perritt Ultra MicroCap Fund

| Performance (Unaudited) (Continued) | October 31, 2017 |

| Cumulative Total Returns** | | | | | |

| Periods ended October 31, 2017 (Unaudited) | | | | | |

| | Past | Past | Past | Past | Since |

| | 1 Year | 3 Years | 5 Years | 10 Years | Inception* |

| Perritt Ultra | | | | | |

| MicroCap Fund | 25.27% | 35.55% | 102.71% | 58.44% | 180.99% |

| | | | | | |

| Russell 2000 Index | 27.85% | 33.55% | 96.69% | 108.70% | 229.41% |

| (reflects no deduction | | | | | |

| for fees and expenses) | | | | | |

| | | | | | |

| Russell Microcap Index | 29.53% | 32.60% | 97.43% | 87.30% | 173.94% |

| (reflects no deduction | | | | | |

| for fees and expenses) | | | | | |

| | | | | | |

| Average Annual Total Returns** | | | | | |

| Periods ended October 31, 2017 (Unaudited) | | | | | |

| | Past | Past | Past | Past | Since |

| | 1 Year | 3 Years | 5 Years | 10 Years | Inception* |

| Perritt Ultra | | | | | |

| MicroCap Fund | 25.27% | 10.67% | 15.18% | 4.71% | 8.16% |

| | | | | | |

| Russell 2000 Index | 27.85% | 10.12% | 14.49% | 7.63% | 9.47% |

| (reflects no deduction | | | | | |

| for fees and expenses) | | | | | |

| | | | | | |

| Russell Microcap Index | 29.53% | 9.86% | 14.57% | 6.48% | 7.95% |

| (reflects no deduction | | | | | |

| for fees and expenses) | | | | | |

The Perritt Ultra MicroCap Fund’s annualized expense ratio for the year ended October 31, 2016, as stated in the statutory prospectus, was 1.78%. The Fund imposes a 2% redemption fee on shares held for 90 days or less. Performance data does not reflect the redemption fee. If reflected, total returns would be reduced.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end is available by calling 800-331-8936.

| * | | The since inception date is August 30, 2004. |

| ** | | The tables do not reflect the deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of Fund shares. |

Perritt Ultra MicroCap Fund

| Ten Largest Common Stock Holdings (Unaudited) |

Galaxy Gaming, Inc. (GLXZ) is a gaming company that designs, develops, manufactures, markets, acquires, and licenses proprietary casino table games and associated technology, platforms, and systems for the gaming industry.

Data I/O Corporation (DAIO) designs, manufactures, and sells programming systems for electronic device manufacturers worldwide. Its programming system products are used to program integrated circuits (ICs) with the specific data necessary for the ICs. The company also provides hardware support, system installation and repair, and device programming services.

ZAGG Inc. (ZAGG) together with its subsidiaries, designs, manufactures, and distributes mobile tech accessories for smartphones and tablets in the United States, Europe, and internationally.

Gencor Industries, Inc. (GENC) designs, manufactures, and sells machinery and related equipment used to produce asphalt and highway construction materials. The company’s products include asphalt plants, combustion systems, and fluid heat transfer systems, which are manufactured in two facilities in the United States.

DLH Holdings Corp. (DLHC) provides healthcare, logistics, and technical services and solutions to Federal Government agencies including the Department of Veteran Affairs, the Department of Defense, and other government clients.

First Internet Bancorp (INBK) operates as a bank holding company for First Internet Bank of Indiana that provides commercial and retail banking products and services through its website, firstib.com.

Safeguard Scientifics, Inc. (SFE) is a private equity and venture capital firm specializing in expansion financings, growth capital, management buyouts, recapitalizations, industry consolidations, corporate spinouts, growth stage, and early stage financings in Fintech sector.

Cutera, Inc. (CUTR) designs, develops, manufactures, markets, and services laser and other energy based aesthetics systems. It offers a laser system for tattoo removal, and treatment of benign pigmented lesions; hair removal solutions for various skin types; and a high-powered radio frequency platform for deep tissue heating.

Asure Software, Inc. (ASUR) provides cloud-based software-as-a-service (SaaS) time and labor management, and workspace management solutions worldwide. The company offers a suite of solutions to help clients optimize and manage their mobile workforces and their global workspaces.

Matrix Service Company (MTRX) provides engineering, fabrication, construction, and maintenance services primarily to the oil, gas, power, petrochemical, industrial, agricultural, and mining and minerals markets in the United States, Canada, and internationally.

Fund holdings and/or sector allocations are subject to change at any time and

are not recommendations to buy or sell any security.

Please refer to the Schedule of Investments in this report for a complete list of Fund holdings.

Perritt Ultra MicroCap Fund

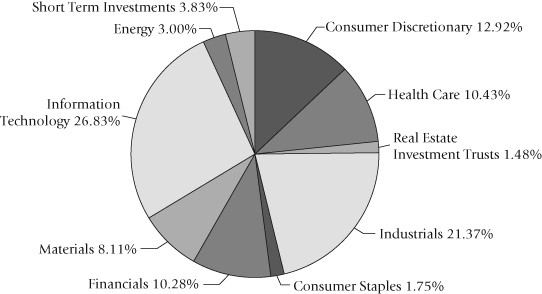

| Allocation of Portfolio Investments (Unaudited) | October 31, 2017 |

The sector classifications represented in the graph above and industry classifications represented in

the Schedule of Investments are in accordance with Global Industry Classification Standard

(GICS®), which was developed by and/or is the exclusive property of MSCI, Inc. and Standard &

Poor Financial Services LLC. Percentages are based on total investments, at value.

| Note: | For presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with section 8(b)(1) of the Investment Company Act of 1940, the Fund uses more specific industry classifications. |

Perritt Low Priced Stock Fund

| Portfolio Manager’s Message |

Michael Corbett,

Portfolio Manager

The Perritt Low Priced Stock Fund produced strong performance during the fiscal year ended October 31, 2017. The Fund gained 28.28% versus a 27.85% gain for the benchmark Russell 2000 Index. The Perritt Low Priced Stock Fund has now officially been around for more than three years. More detailed performance results for the Fund for the past year and three years, as well as the results for the Russell 2000 index can be found later in this report.

We attribute the Fund’s competitive performance mostly due to stock selection. As might be expected, most of the stocks in the portfolio rose during the past twelve months. However, there were a few stellar performers. Nova Measuring Instruments (NVMI) was the best performer, climbing more than 160% during the past 12 months. Nova Measuring, which sells process control systems used in semiconductor industry, consistently raised guidance in the past year, and management is forecasting another record year in 2018. We also had three other stocks that climbed near or more than 100% during the past 12 months: Entegris (ENTG), Fox Factory Holding (FOXF), and Wabash National (WNC). ENTG and FOXF both grew their businesses at impressive rates, and managements expect more of the same next year. WNC is more of a turnaround, and they made a very large acquisition this past year. We expect WNC to realize some gratifying synergies from their acquisition, and solid performance next year.

We did turn the portfolio over a great deal in the past year. Our objective was to increase the Fund’s investments in high quality companies with stronger earnings growth. During the past year, we sold 32 names from the portfolio, but added 49 new names. We sold several companies, such as Marine Products (MPX) and Merit Medical (MMSI), because their valuations were too rich, particularly relative to their growth rates. Most of the other companies liquidated were due to disappointing earnings growth prospects. The net result is that we believe the portfolio is packed with companies that have the potential to offer stronger earnings growth. On an industry basis, we significantly reduced our weight in financial services and increased our weight in information technology and materials. We also initiated a couple investments within the energy services. Another reason to turn the portfolio over was to increase the average company size in the portfolio. The net result is that the average market capitalization increased from $685 million a year ago to nearly $1 billion today (10/31/17).

As of October 31, 2017, the Fund’s portfolio was comprised of 79 common stocks. The Fund’s 10 largest holdings and detailed description can be found later in this report. Based on our earnings estimate, the Fund’s portfolio trades at 15.6 times 2018 earnings. The median price to revenue is slightly less than 1.4 times and the median market capitalization is approximately $955 million. Lastly, we estimate that earnings growth should be very robust for our companies in 2018. On a median basis, we estimate that earnings growth will

Perritt Low Priced Stock Fund

be about 19% in 2018. However, we have weighted the Fund’s portfolio toward stronger earnings growth investments, which means that on that basis we are looking for growth closer to 40%.

We are pleased with the results over the past year, which also came without much volatility. While predicting the future is very difficult, it seems likely to us that volatility may increase in the future. We remain confident with our investment approach and discipline, and believe our process will seek to offer solid results in the future.

Thank you for entrusting your investment with us. The Perritt Capital Management team continue to show their commitment to the Fund’s success with their own personal investment. As a fellow shareholder and the largest shareholder, I am committed to the success of this fund. If you have any questions or comments about this report or your investment in the Perritt Low Priced Stock Fund, please call us toll-free at (800) 331-8936 or visit our website at www.perrittcap.com. Please refer to the prospectus for information about the Fund’s investment objectives and strategies.

Michael Corbett

Portfolio Manager

Past performance does not guarantee future results.

Earnings Growth is not a measure of the Fund’s future performance.

Opinions expressed are subject to change at any time, are not guaranteed, and should not be considered investment advice.

The Russell 2000 Index consists of the smallest 2000 companies in a group of 3000 companies in the Russell 3000 as ranked by market cap.

Turnover represents the percentage of the portfolio that is sold in a particular time period.

Price to Revenue compares a company’s stock price to its revenues, which is an indicator of the value placed on each dollar of a company’s sales or revenues.

Please refer to the Schedule of Investments in the report for more complete information regarding Fund holdings. Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security.

Mutual fund investing involves risk. Principal loss is possible. The Funds invest in smaller companies, which involve additional risks, such as limited liquidity and greater volatility. The Funds invest in micro-cap companies which tend to perform poorly during times of economic stress. The Low Priced Stock Fund may invest in early stage companies which tend to be more volatile and somewhat more speculative than investments in more established companies. Low Priced stocks are generally more volatile than higher priced securities.

The annual report must be preceded or accompanied by a prospectus. One cannot invest directly in an index.

The Perritt Funds are distributed by Quasar Distributors, LLC.

Perritt Low Priced Stock Fund

| Performance* (Unaudited) | October 31, 2017 |

Perritt Low Priced Stock Fund** versus

Russell 2000® Index and Russell Microcap® Index

There are several ways to evaluate a fund’s historical performance. You can look at the total percentage change in value, the average annual percentage change, or the growth of a hypothetical $10,000 investment. Each performance figure includes changes in a fund’s share price, plus reinvestment of any dividends (or income) and capital gains (the profits the fund earns when it sells stocks that have grown in value).

Cumulative total returns reflect the Fund’s actual performance over a set period. For example, if you invested $1,000 in a fund that had a 5% return over one year, you would end up with $1,050. You can compare the Fund’s returns to the Russell 2000® Index, which reflects a popular measure of the stock performance of small companies, and the Russell Microcap® Index, which measures the performance of the micro-cap segment of the U.S. equity market.

Average annual total returns take the Fund’s actual (or cumulative) return and show you what would have happened if the Fund had performed at a constant rate each year.

| * | | The graph illustrates the performance of a hypothetical $10,000 investment made in the Fund at inception (June 29, 2012) of the Fund’s predecessor account through October 31, 2017. Assumes reinvestment of dividends and capital gains, but does not reflect the effect of any applicable sales charge or redemption fees or the deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of Fund shares. The graph does not imply any future performance. |

| ** | | June 29, 2012 is the inception date of the Fund’s predecessor account. The Fund commenced operations on February 28, 2014. The investment policies, objectives, guidelines and restrictions of the Fund are in all material respects equivalent to those of the predecessor account. |

Perritt Low Priced Stock Fund

| Performance (Unaudited) (Continued) | October 31, 2017 |

| Cumulative Total Returns** | | | |

| Periods ended October 31, 2017 (Unaudited) | | | |

| | Past | Past | Since |

| | 1 Year | 3 Years | Inception* |

| Perritt Low Priced Stock Fund | 28.28% | 41.06% | 33.07% |

| | | | |

| Russell 2000 index | 27.85% | 33.55% | 33.66% |

| (reflects no deduction for fees and expenses) | | | |

| | | | |

| Russell Microcap Index | 29.53% | 32.60% | 26.27% |

| (reflects no deduction for fees and expenses) | | | |

| | | | |

| Average Annual Total Returns** | | | |

| Periods ended October 31, 2017 (Unaudited) | | | |

| | Past | Past | Since |

| | 1 Year | 3 Years | Inception* |

| Perritt Low Priced Stock Fund | 28.28% | 12.15% | 15.20% |

| | | | |

| Russell 2000 index | 27.85% | 10.12% | 14.14% |

| (reflects no deduction for fees and expenses) | | | |

| | | | |

| Russell Microcap Index | 29.53% | 9.86% | 14.15% |

| (reflects no deduction for fees and expenses) | | | |

The Perritt Low Priced Stock Fund’s annualized net expense ratio, as stated in the statutory prospectus, dated October 31, 2016, was 1.40%. The Fund imposes a 2% redemption fee on shares held for 90 days or less. Performance data does not reflect the redemption fee. If reflected, total returns would be reduced.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end is available by calling 800-331-8936.

| * | | The Fund is the successor to a separately managed account. Immediately prior to the Fund commencing operations on February 28, 2014, the predecessor account transferred its assets to the Fund in exchange for the Fund’s shares. The investment policies, objectives, guidelines and restrictions of the Fund are in all material respects equivalent to those of the predecessor. In addition, the predecessor’s portfolio managers are the current portfolio managers of the Fund. As a mutual fund registered under the Investment Company Act of 1940 (the “1940 Act”), the Fund is subject to certain restrictions under the 1940 Act and the Internal Revenue Code to which the predecessor was not subject. Had the predecessor been registered under the 1940 Act and been subject to the provisions of the 1940 Act and the Internal Revenue Code, its investment performance may have been adversely affected. The performance was achieved by the predecessor when Fund assets were relatively small; the same strategies may not be available, and similar performance may not be achieved, when the Fund’s assets are larger. The performance shown includes an annual management fee of 1.00% and does not include any expenses paid by the predecessor’s investment advisor. |

| | | The since inception date is June 29, 2012, the date of inception of the Fund’s predecessor account. The past performance of the Fund and its predecessor account (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. |

| ** | | The tables do not reflect the deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of Fund shares. |

Perritt Low Priced Stock Fund

| Ten Largest Common Stock Holdings (Unaudited) |

Builders FirstSource, Inc. (BLDR) manufactures and supplies building materials, manufactured components, and construction services to professional contractors, sub-contractors, and consumers in the United States. Its products include lumber and lumber sheet goods; windows, interior and exterior door units, as well as interior trims and custom products.

Ferro Corporation (FOE) produces specialty materials in the United States and internationally. It offers frits, porcelain, and other glass enamels, glazes, stains, decorating colors, pigments, inks, polishing materials, dielectrics, electronic glasses, and other specialty coatings. Its products are used in appliances, automobiles, building and renovation, electronics, household furnishings, industrial products, and packaging.

Modine Manufacturing Company (MOD) develops, manufactures, and markets engineered heat transfer systems and heat transfer components for use in on- and off-highway original equipment manufacturer vehicular applications. The company operates through Americas, Europe, Asia, and Building HVAC segments.

Gencor Industries, Inc. (GENC) designs, manufactures, and sells machinery and related equipment used to produce asphalt and highway construction materials. The company’s products include asphalt plants, combustion systems, and fluid heat transfer systems, which are manufactured in two facilities in the United States.

New Media Investment Group Inc. (NEWM) invests in, owns, and operates local media assets in the United States. The company’s principal products include newspapers, yellow page directories and Propel digital marketing and business services.

AMN Healthcare Services, Inc. (AMN) provides healthcare workforce solutions and staffing services in the United States. The company operates through three segments: Nurse and Allied Solutions, Locum Tenens Solutions, and Other Workforce Solutions.

CNO Financial Group, Inc. (CNO), develops, markets and administers health insurance, annuity, individual life insurance and other insurance products. The Company's segments include Bankers Life, Washington National and Colonial Penn.

Kforce Inc. (KFRC) provides professional and technical specialty staffing services and solutions through three segments: Technology (Tech), Finance and Accounting (FA), and Government Solutions (GS). They serve clients in industries primarily in financial services, communications, insurance services, government sectors, and healthcare.

Kulicke and Soffa Industries, Inc. (KLIC) designs, manufactures, and sells capital equipment and expendable tools to assemble semiconductor devices. It operates in two segments, Equipment and Expendable Tools.

Orbotech Ltd. (ORBK) provides yield-enhancing and process-enabling solutions for printed circuit boards (PCBs), liquid crystal displays (LCDs), and semiconductor devices in North America and internationally. It operates through three segments: Product Solutions for the Electronics Industry, Recognition Software, and Solar Energy.

Fund holdings and/or sector allocations are subject to change at any time and

are not recommendations to buy or sell any security.

Please refer to the Schedule of Investments in this report for a complete list of Fund holdings.

Perritt Low Priced Stock Fund

| Allocation of Portfolio Investments (Unaudited) | October 31, 2017 |

The sector classifications represented in the graph above and industry classifications represented in

the Schedule of Investments are in accordance with Global Industry Classification Standard

(GICS®), which was developed by and/or is the exclusive property of MSCI, Inc. and Standard &

Poor Financial Services LLC. Percentages are based on total investments, at value.

| Note: | For presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with section 8(b)(1) of the Investment Company Act of 1940, the Fund uses more specific industry classifications. |

Perritt MicroCap Opportunities Fund

| Schedule of Investments | October 31, 2017 |

| Shares | | COMMON STOCKS – 96.31% | | Value | |

| Administrative and Support Services – 0.38% | | | |

| | 40,462 | | Kforce, Inc. | | $ | 847,679 | |

| | | | | | | 847,679 | |

| Aerospace & Defense – 1.65% | | | | |

| | 398,891 | | CPI Aerostructures, | | | | |

| | | | Inc.(a) | | | 3,729,631 | |

| | | | | | | 3,729,631 | |

| Auto Parts & Equipment – 4.75% | | | | |

| | 167,771 | | Miller Industries, Inc. | | | 4,739,531 | |

| | 125,000 | | Motorcar Parts | | | | |

| | | | of America, Inc.(a)(b) | | | 3,613,750 | |

| | 10,500 | | Motorcar Parts | | | | |

| | | | of America, Inc.(a) | | | 303,555 | |

| | 90,000 | | Stoneridge, Inc.(a) | | | 2,046,600 | |

| | | | | | | 10,703,436 | |

| Building Materials – 6.30% | | | | |

| | 425,000 | | BlueLinx | | | | |

| | | | Holdings, Inc.(a) | | | 3,706,000 | |

| | 130,000 | | Global Brass & Copper | | | | |

| | | | Holdings, Inc. | | | 4,550,000 | |

| | 471,677 | | Huttig Building | | | | |

| | | | Products, Inc.(a) | | | 3,169,669 | |

| | 47,454 | | Insteel Industries, Inc. | | | 1,212,450 | |

| | 110,800 | | PGT Innovations, Inc.(a) | | | 1,562,280 | |

| | | | | | | 14,200,399 | |

| Business Services – 4.48% | | | | |

| | 107,642 | | GP Strategies Corp.(a) | | | 3,127,000 | |

| | 163,263 | | Innodata Isogen, Inc.(a) | | | 212,242 | |

| | 171,383 | | PCM, Inc.(a) | | | 2,407,931 | |

| | 405,469 | | PFSweb, Inc.(a) | | | 3,365,393 | |

| | 35,000 | | Systemax, Inc. | | | 999,250 | |

| | | | | | | 10,111,816 | |

| Chemical & Related Products – 6.11% | | | | |

| | 104,644 | | Aceto Corp. | | | 1,053,765 | |

| | 22,506 | | KMG Chemicals, Inc. | | | 1,240,756 | |

| | 204,165 | | Northern Technologies | | | | |

| | | | International Corp.(a) | | | 3,378,931 | |

| | 417,238 | | OMNOVA | | | | |

| | | | Solutions, Inc.(a) | | | 4,610,480 | |

| | 287,266 | | Trecora Resources(a) | | | 3,490,282 | |

| | | | | | | 13,774,214 | |

| Commercial Banks – 6.91% | | | | |

| | 125,900 | | Bankwell Financial | | | | |

| | | | Group, Inc. | | | 4,607,940 | |

| | 112,000 | | Berkshire Hills | | | | |

| | | | Bancorp, Inc. | | | 4,289,600 | |

| | 75,000 | | Esquire Financial | | | | |

| | | | Holdings, Inc.(a) | | | 1,253,250 | |

| | 117,141 | | Triumph | | | | |

| | | | Bancorp, Inc.(a) | | | 3,631,371 | |

| | 68,590 | | Veritex Holdings, Inc.(a) | | | 1,808,032 | |

| | | | | | | 15,590,193 | |

| Commercial Services – 0.65% | | | | |

| | 65,000 | | TriState Capital | | | | |

| | | | Holdings, Inc.(a) | | | 1,472,250 | |

| | | | | | | 1,472,250 | |

| Commercial Services & Supplies – 1.19% | | | | |

| | 247,500 | | InnerWorkings, | | | | |

| | | | Inc.(a) | | | 2,692,800 | |

| | | | | | | 2,692,800 | |

| Construction & Engineering – 6.08% | | | | |

| | 58,000 | | Comfort Systems | | | | |

| | | | USA, Inc. | | | 2,569,400 | |

| | 889,832 | | Hill International, | | | | |

| | | | Inc.(a) | | | 4,716,110 | |

| | 132,776 | | IES Holdings, | | | | |

| | | | Inc.(a) | | | 2,482,911 | |

| | 281,700 | | Limbach | | | | |

| | | | Holdings, Inc.(a) | | | 3,943,800 | |

| | | | | | | 13,712,221 | |

| Consumer Products – | | | | |

| Manufacturing – 2.55% | | | | |

| | 114,000 | | Delta Apparel, Inc.(a) | | | 2,386,020 | |

| | 130,181 | | Orchids Paper | | | | |

| | | | Products Co. | | | 1,598,623 | |

| | 74,764 | | Superior Uniform | | | | |

| | | | Group, Inc. | | | 1,754,711 | |

| | | | | | | 5,739,354 | |

| Consumer Services – 0.85% | | | | |

| | 173,583 | | Primo Water Corp.(a) | | | 1,911,149 | |

| | | | | | | 1,911,149 | |

| Data Processing, Hosting | | | | |

| and Related Services – 1.86% | | | | |

| | 400,000 | | Ooma, Inc.(a) | | | 4,200,000 | |

| | | | | | | 4,200,000 | |

The accompanying notes to financial statements are an integral part of this schedule.

Perritt MicroCap Opportunities Fund

| Schedule of Investments (Continued) | October 31, 2017 |

| Shares | | | | Value | |

| Electronic Equipment & Instruments – 1.51% | | | |

| | 105,297 | | Bel Fuse, Inc. – Class B | | $ | 3,406,358 | |

| | | | | | | 3,406,358 | |

| Energy & Related Services – 2.31% | | | | |

| | 279,658 | | Matrix Service Co.(a) | | | 3,943,178 | |

| | 108,744 | | PHI, Inc.(a) | | | 1,271,217 | |

| | | | | | | 5,214,395 | |

| Financial Services – 6.83% | | | | |

| | 50,000 | | Cowen, Inc.(a) | | | 750,000 | |

| | 135,000 | | First Internet Bancorp | | | 5,089,500 | |

| | 145,092 | | Hennessy Advisors, Inc. | | | 2,396,920 | |

| | 53,124 | | Northeast Bancorp | | | 1,367,943 | |

| | 63,027 | | Oppenheimer Holdings, | | | | |

| | | | Inc. – Class A | | | 1,370,837 | |

| | 270,606 | | Silvercrest Asset | | | | |

| | | | Management Group, | | | | |

| | | | Inc. – Class A | | | 4,410,878 | |

| | | | | | | 15,386,078 | |

| Food – 4.57% | | | | |

| | 171,270 | | Crimson Wine | | | | |

| | | | Group Ltd.(a) | | | 1,738,390 | |

| | 116,981 | | Farmer Brothers Co.(a) | | | 3,971,505 | |

| | 198,500 | | Landec Corp.(a) | | | 2,630,125 | |

| | 89,726 | | Omega Protein Corp. | | | 1,964,999 | |

| | | | | | | 10,305,019 | |

| Health Care Providers & Services – 1.40% | | | | |

| | 136,400 | | The Ensign Group, Inc. | | | 3,148,112 | |

| | | | | | | 3,148,112 | |

| Industrial Goods – 2.25% | | | | |

| | 560,000 | | Hudson Technologies, | | | | |

| | | | Inc.(a) | | | 3,315,200 | |

| | 60,000 | | Schnitzer Steel Industries, | | | | |

| | | | Inc. – Class A | | | 1,767,000 | |

| | | | | | | 5,082,200 | |

| Insurance – 4.41% | | | | |

| | 298,826 | | Atlas Financial | | | | |

| | | | Holdings, Inc.(a)(e) | | | 5,901,814 | |

| | 64,565 | | EMC Insurance | | | | |

| | | | Group, Inc. | | | 1,902,085 | |

| | 134,767 | | United Insurance | | | | |

| | | | Holdings Corp. | | | 2,121,233 | |

| | | | | | | 9,925,132 | |

| Leisure – 2.57% | | | | |

| | 703,550 | | Century Casinos, Inc.(a) | | | 5,804,287 | |

| | | | | | | 5,804,287 | |

| Machinery Manufacturing – 1.29% | | | | |

| | 102,600 | | Graham Corp. | | | 1,977,102 | |

| | 8,150 | | Kadant, Inc. | | | 925,840 | |

| | | | | | | 2,902,942 | |

| Medical Supplies & Services – 2.49% | | | | |

| | 135,683 | | Addus HomeCare | | | | |

| | | | Corp.(a) | | | 4,884,588 | |

| | 40,000 | | OrthoPediatrics | | | | |

| | | | Corp.(a) | | | 730,400 | |

| | | | | | | 5,614,988 | |

| Real Estate Investment Trusts – 4.17% | | | | |

| | 250,000 | | City Office REIT, Inc. | | | 3,260,000 | |

| | 115,000 | | Community Healthcare | | | | |

| | | | Trust, Inc. | | | 3,154,450 | |

| | 232,515 | | Global Medical | | | | |

| | | | REIT, Inc. | | | 1,967,077 | |

| | 100,000 | | Resource Capital Corp. | | | 1,026,000 | |

| | | | | | | 9,407,527 | |

| Retail – 1.53% | | | | |

| | 175,000 | | Kirkland’s, Inc.(a) | | | 2,047,500 | |

| | 51,403 | | Weyco Group, Inc. | | | 1,397,648 | |

| | | | | | | 3,445,148 | |

| Security Manufacturing – 1.09% | | | | |

| | 150,602 | | Horizon | | | | |

| | | | Global Corp.(a) | | | 2,444,270 | |

| | | | | | | 2,444,270 | |

| Semiconductor Related Products – 5.69% | | | | |

| | 286,367 | | AXT, Inc.(a) | | | 2,663,213 | |

| | 128,327 | | DSP Group, Inc.(a) | | | 1,719,582 | |

| | 171,111 | | PDF Solutions, Inc.(a) | | | 2,506,776 | |

| | 415,000 | | Photronics, Inc.(a) | | | 4,025,500 | |

| | 69,000 | | Rudolph Technologies, | | | | |

| | | | Inc.(a) | | | 1,914,750 | |

| | | | | | | 12,829,821 | |

| Software – 2.03% | | | | |

| | 250,000 | | American Software, | | | | |

| | | | Inc. – Class A | | | 3,102,500 | |

| | 300,000 | | Zix Corp.(a) | | | 1,455,000 | |

| | | | | | | 4,557,500 | |

| Specialty Manufacturing – 4.89% | | | | |

| | 268,663 | | Aspen Aerogels, Inc.(a) | | | 1,203,610 | |

| | 226,797 | | CECO Environmental | | | | |

| | | | Corp. | | | 1,989,010 | |

| | 63,141 | | Core Molding | | | | |

| | | | Technologies, Inc. | | | 1,465,502 | |

The accompanying notes to financial statements are an integral part of this schedule.

Perritt MicroCap Opportunities Fund

| Schedule of Investments (Continued) | October 31, 2017 |

| Shares | | | | Value | |

| Specialty Manufacturing (Continued) | | | |

| | 99,500 | | Federal Signal Corp. | | $ | 2,124,325 | |

| | 327,696 | | LSI Industries, Inc. | | | 2,277,487 | |

| | 217,830 | | Manitex International, | | | | |

| | | | Inc.(a) | | | 1,977,896 | |

| | | | | | | 11,037,830 | |

| Telecommunications – 2.29% | | | | |

| | 700,000 | | Ceragon Networks | | | | |

| | | | Ltd.(a)(e) | | | 1,505,000 | |

| | 548,800 | | PC-Tel, Inc. | | | 3,649,520 | |

| | | | | | | 5,154,520 | |

| Transportation – 1.23% | | | | |

| | 568,891 | | Radiant | | | | |

| | | | Logistics, Inc.(a) | | | 2,776,188 | |

| | | | | | | 2,776,188 | |

| | | | TOTAL COMMON | | | | |

| | | | STOCKS | | | | |

| | | | (Cost $140,636,109) | | $ | 217,127,457 | |

| | | | | | | | |

| Contracts | | WARRANTS – 0.00% | | Value | |

| Insurance – 0.00% | | | | |

| | | | Emergent Capital, | | | | |

| | | | Inc. Warrant; | | | | |

| | 38,106 | | Expiration: 10/06/2019, | | | | |

| | | | Exercise Price | | | | |

| | | | $10.75(a)(c) | | $ | — | |

| | | | TOTAL WARRANTS | | | | |

| | | | (Cost $0) | | $ | — | |

| | | | | | | | |

| Shares | | SHORT-TERM | | Value | |

| | | | INVESTMENTS – 3.08% | | | | |

| | 6,942,638 | | Invesco Short Term | | | | |

| | | | Investments Government | | | | |

| | | | & Agency Portfolio – | | | | |

| | | | Class I 0.94%(d) | | $ | 6,942,638 | |

| | | | TOTAL SHORT-TERM | | | | |

| | | | INVESTMENTS | | | | |

| | | | (Cost $6,942,638) | | $ | 6,942,638 | |

| | | | Total Investments | | | | |

| | | | (Cost $147,578,747) – | | | | |

| | | | 99.39% | | $ | 224,070,095 | |

| | | | Other Assets in | | | | |

| | | | Excess of | | | | |

| | | | Liabilities – 0.61% | | | 1,374,592 | |

| | | | TOTAL NET ASSETS – | | | | |

| | | | 100.00% | | $ | 225,444,687 | |

Percentages are stated as a percent of net assets.

(a) | Non-income producing security. |

(b) | Security was purchased in a transaction exempt from registration in the U.S. under the Securities Act of 1933 (the “Act”) and, unless registered under the Act, may only be sold pursuant to exemption from registration and, in the case of a Rule 144A offering under the Act, may only be sold to “qualified institutional buyers.” The value of this security is $3,613,750 or 1.60% of the Fund’s net assets. This security is deemed to be liquid. |

(c) | The price for this security was derived from an estimate of fair value using methods approved by the Fund’s Board of Directors. This security represents $0 or 0.00% of the Fund’s net assets. This security is classified as Level 2 and is deemed to be illiquid. |

(d) | Variable rate security; the rate shown is the effective rate as of October 31, 2017. |

(e) | Foreign issued security. |

The industry classifications listed above are in accordance with Global Industry Classification Standard (GICS®), which was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”).

The accompanying notes to financial statements are an integral part of this schedule.

Perritt Ultra MicroCap Fund

| Schedule of Investments | October 31, 2017 |

| Shares | | COMMON STOCKS – 97.27% | | Value | |

| Aerospace & Defense – 0.81% | | | |

| | 60,000 | | CPI Aerostructures, | | | |

| | | | Inc.(a) | | $ | 561,000 | |

| | | | | | | 561,000 | |

| Air Transport – 1.07% | | | | |

| | 53,077 | | AeroCentury Corp.(a) | | | 745,732 | |

| | | | | | | 745,732 | |

| Auto Parts & Equipment – 0.74% | | | | |

| | 60,000 | | Unique | | | | |

| | | | Fabricating, Inc. | | | 514,800 | |

| | | | | | | 514,800 | |

| Business Services – 11.04% | | | | |

| | 50,000 | | BG Staffing, Inc. | | | 844,000 | |

| | 350,000 | | CynergisTek, Inc.(a) | | | 1,035,999 | |

| | 244,300 | | DLH Holdings Corp(a) | | | 1,492,673 | |

| | 275,000 | | Information Services | | | | |

| | | | Group, Inc.(a) | | | 1,122,000 | |

| | 205,500 | | Innodata Isogen, Inc.(a) | | | 267,150 | |

| | 80,000 | | PCM, Inc.(a) | | | 1,124,000 | |

| | 50,000 | | Transcat, Inc.(a) | | | 635,000 | |

| | 125,000 | | USA Technologies, | | | | |

| | | | Inc.(a) | | | 793,750 | |

| | 701,005 | | WidePoint Corp.(a) | | | 371,533 | |

| | | | | | | 7,686,105 | |

| Chemical & Related Products – 1.72% | | | | |

| | 320,000 | | Flexible Solutions | | | | |

| | | | International, Inc.(a) | | | 604,800 | |

| | 36,000 | | Northern Technologies | | | | |

| | | | International Corp.(a) | | | 595,800 | |

| | | | | | | 1,200,600 | |

| Chemical Manufacturing – 1.16% | | | | |

| | 200,000 | | Intrepid Potash, Inc.(a) | | | 804,000 | |

| | | | | | | 804,000 | |

| Computer & Electronic | | | | |

| Product Manufacturing – 3.60% | | | | |

| | 200,000 | | Dynatronics Corp.(a) | | | 490,000 | |

| | 940,000 | | Singing Machine | | | | |

| | | | Co., Inc.(a) | | | 394,800 | |

| | 450,000 | | Luna Innovations, Inc.(a) | | | 706,500 | |

| | 83,348 | | PAR Technology Corp.(a) | | | 911,827 | |

| | | | | | | 2,503,127 | |

| Computers & Electronics – 1.13% | | | | |

| | 70,000 | | Concurrent | | | | |

| | | | Computer Corp. | | | 429,800 | |

| | 35,000 | | Napco Security | | | | |

| | | | Technologies, Inc.(a) | | | 355,250 | |

| | | | | | | 785,050 | |

| Construction & Engineering – 6.11% | | | | |

| | 83,254 | | Gencor Industries, | | | | |

| | | | Inc.(a) | | | 1,506,897 | |

| | 150,000 | | Hill International, | | | | |

| | | | Inc.(a) | | | 795,000 | |

| | 82,000 | | Layne Christensen | | | | |

| | | | Co.(a) | | | 1,083,220 | |

| | 15,000 | | NV5 Global, Inc.(a) | | | 871,500 | |

| | | | | | | 4,256,617 | |

| Consumer Goods – 1.15% | | | | |

| | 35,000 | | MCBC Holdings, Inc.(a) | | | 800,450 | |

| | | | | | | 800,450 | |

| Consumer Products – Distributing – 1.10% | | | | |

| | 300,000 | | US Auto Parts | | | | |

| | | | Network, Inc.(a) | | | 768,000 | |

| | | | | | | 768,000 | |

| Consumer Products – Manufacturing – 1.36% | | | | |

| | 47,070 | | Cherokee, Inc.(a) | | | 105,907 | |

| | 51,095 | | Hardinge, Inc. | | | 845,111 | |

| | | | | | | 951,018 | |

| Consumer Services – 3.79% | | | | |

| | 175,000 | | Meet Group, Inc.(a) | | | 593,250 | |

| | 150,000 | | Xcel Brands, Inc.(a) | | | 480,000 | |

| | 100,000 | | ZAGG, Inc.(a) | | | 1,565,000 | |

| | | | | | | 2,638,250 | |

| Diversified Financials – 1.82% | | | | |

| | 90,000 | | Safeguard Scientifics, | | | | |

| | | | Inc.(a) | | | 1,269,000 | |

| | | | | | | 1,269,000 | |

| Electronic Equipment & Instruments – 0.89% | | | | |

| | 90,000 | | Iteris, Inc.(a) | | | 621,900 | |

| | | | | | | 621,900 | |

| Energy & Related Services – 3.01% | | | | |

| | 145,000 | | DHT Holdings, Inc.(e) | | | 571,300 | |

| | 80,000 | | Matrix Service Co.(a) | | | 1,128,000 | |

| | 121,000 | | Mitcham Industries, | | | | |

| | | | Inc.(a) | | | 394,460 | |

| | | | | | | 2,093,760 | |

The accompanying notes to financial statements are an integral part of this schedule.

Perritt Ultra MicroCap Fund

| Schedule of Investments (Continued) | October 31, 2017 |

| Shares | | | | Value | |

| Financial Services – 6.42% | | | |

| | 65,000 | | AMREP Corp.(a) | | $ | 462,150 | |

| | 35,000 | | First Internet Bancorp | | | 1,319,500 | |

| | 36,000 | | Hennessy Advisors, Inc. | | | 594,720 | |

| | 50,000 | | HopFed Bancorp, Inc. | | | 720,500 | |

| | 52,500 | | Silvercrest Asset Management | | | | |

| | | | Group, Inc. – Class A | | | 855,750 | |

| | 200,000 | | US Global Investors, Inc. | | | 522,000 | |

| | | | | | | 4,474,620 | |

| Food – 0.52% | | | | |

| | 42,400 | | Willamette Valley | | | | |

| | | | Vineyards, Inc.(a) | | | 362,944 | |

| | | | | | | 362,944 | |

| Health Care – 1.07% | | | | |

| | 122,917 | | Rockwell Medical | | | | |

| | | | Technologies, Inc.(a) | | | 744,877 | |

| | | | | | | 744,877 | |

| Industrial Goods – 1.19% | | | | |

| | 139,900 | | Hudson Technologies, | | | | |

| | | | Inc.(a) | | | 828,208 | |

| | | | | | | 828,208 | |

| Insurance – 2.91% | | | | |

| | 50,000 | | Atlas Financial | | | | |

| | | | Holdings, Inc.(a)(e) | | | 987,500 | |

| | 30,000 | | Kingstone | | | | |

| | | | Companies, Inc. | | | 486,000 | |

| | 35,000 | | United Insurance | | | | |

| | | | Holdings Corp. | | | 550,900 | |

| | | | | | | 2,024,400 | |

| Leisure – 3.73% | | | | |

| | 97,322 | | Century Casinos, Inc.(a) | | | 802,907 | |

| | 1,534,599 | | Galaxy Gaming, Inc.(a) | | | 1,795,481 | |

| | | | | | | 2,598,388 | |

| Medical Supplies & Services – 8.30% | | | | |

| | 24,500 | | Addus HomeCare | | | | |

| | | | Corp.(a) | | | 882,000 | |

| | 75,049 | | Birner Dental Management | | | | |

| | | | Services, Inc.(a) | | | 322,711 | |

| | 30,000 | | Cutera, Inc.(a) | | | 1,179,000 | |

| | 609,000 | | First Choice Healthcare | | | | |

| | | | Solutions, Inc.(a) | | | 621,058 | |

| | 498,001 | | Hooper Holmes, Inc.(a) | | | 239,040 | |

| | 50,000 | | Lakeland Industries, Inc.(a) | | | 792,500 | |

| | 70,000 | | MGC Diagnostics Corp. | | | 595,700 | |

| | 200,000 | | Sensus Healthcare, | | | | |

| | | | Inc.(a) | | | 1,150,000 | |

| | | | | | | 5,782,009 | |

| Motion Pictures – 0.91% | | | | |

| | 100,000 | | Ballantyne | | | | |

| | | | Strong, Inc.(a) | | | 636,660 | |

| | | | | | | 636,660 | |

| Oil & Gas Services – 1.32% | | | | |

| | 500,000 | | Profire Energy, Inc.(a) | | | 920,000 | |

| | | | | | | 920,000 | |

| Pharmaceuticals – 1.48% | | | | |

| | 134,300 | | ImmuCell Corp.(a) | | | 1,032,767 | |

| | | | | | | 1,032,767 | |

| Professional, Scientific, | | | | |

| and Technical Services – 4.47% | | | | |

| | 135,000 | | AutoWeb, Inc.(a) | | | 934,200 | |

| | 350,000 | | CUI Global, Inc.(a) | | | 1,088,500 | |

| | 550,000 | | FORM Holdings | | | | |

| | | | Corp.(a) | | | 671,000 | |

| | 249,640 | | Sigma Labs, Inc.(a)(d) | | | 414,402 | |

| | | | | | | 3,108,102 | |

| Real Estate Investment Trusts – 2.33% | | | | |

| | 164,199 | | Global Self Storage, Inc. | | | 766,809 | |

| | 200,000 | | Sachem Capital Corp. | | | 858,000 | |

| | | | | | | 1,624,809 | |

| Retail – 2.90% | | | | |

| | 125,000 | | Build-A-Bear | | | | |

| | | | Workshop, Inc.(a) | | | 975,000 | |

| | 500,000 | | Christopher & | | | | |

| | | | Banks Corp.(a) | | | 590,000 | |

| | 280,000 | | OurPet’s Co.(a) | | | 450,800 | |

| | | | | | | 2,015,800 | |

| Semiconductor Related Products – 1.87% | | | | |