UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FormN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number:811-21574

Eaton Vance Floating-Rate Income Trust

(Exact Name of Registrant as Specified in Charter)

Two International Place, Boston, Massachusetts 02110

(Address of Principal Executive Offices)

Maureen A. Gemma

Two International Place, Boston, Massachusetts 02110

(Name and Address of Agent for Services)

(617)482-8260

(Registrant’s Telephone Number)

May 31

Date of Fiscal Year End

November 30, 2018

Date of Reporting Period

Item 1. Reports to Stockholders

Eaton Vance

Floating-Rate Income Trust (EFT)

Semiannual Report

November 30, 2018

Important Note. Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website(funds.eatonvance.com/closed-end-fund-and-term-trust-documents.php), and you will be notified by mail each time a report is posted and provided with a website address to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. If you hold shares at the Fund’s transfer agent, American Stock Transfer & Trust Company, LLC (“AST”), you may elect to receive shareholder reports and other communications from the Fund electronically by contacting AST. If you own your shares through a financial intermediary (such as a broker-dealer or bank), you must contact your financial intermediary to sign up.

You may elect to receive all future Fund shareholder reports in paper free of charge. If you hold shares at AST, you can inform AST that you wish to continue receiving paper copies of your shareholder reports by calling1-866-439-6787. If you own these shares through a financial intermediary, you must contact your financial intermediary or follow instructions included with this disclosure, if applicable, to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held with AST or to all funds held through your financial intermediary, as applicable.

Commodity Futures Trading Commission Registration. Effective December 31, 2012, the Commodity Futures Trading Commission (“CFTC”) adopted certain regulatory changes that subject registered investment companies and advisers to regulation by the CFTC if a fund invests more than a prescribed level of its assets in certain CFTC-regulated instruments (including futures, certain options and swap agreements) or markets itself as providing investment exposure to such instruments. The Fund has claimed an exclusion from the definition of the term “commodity pool operator” under the Commodity Exchange Act. Accordingly, neither the Fund nor the adviser with respect to the operation of the Fund is subject to CFTC regulation. Because of its management of other strategies, the Fund’s adviser is registered with the CFTC as a commodity pool operator and a commodity trading advisor.

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

Semiannual ReportNovember 30, 2018

Eaton Vance

Floating-Rate Income Trust

Table of Contents

| | | | |

Performance | | | 2 | |

| |

Fund Profile | | | 3 | |

| |

Endnotes and Additional Disclosures | | | 4 | |

| |

Financial Statements | | | 5 | |

| |

Officers and Trustees | | | 44 | |

| |

Important Notices | | | 45 | |

Eaton Vance

Floating-Rate Income Trust

November 30, 2018

Performance1,2

Portfolio ManagersScott H. Page, CFA and Ralph Hinckley, CFA

| | | | | | | | | | | | | | | | | | | | |

| % Average Annual Total Returns | | Inception Date | | | Six Months | | | One Year | | | Five Years | | | Ten Years | |

Fund at NAV | | | 06/29/2004 | | | | 1.04 | % | | | 4.58 | % | | | 5.12 | % | | | 12.84 | % |

Fund at Market Price | | | — | | | | –7.09 | | | | –0.50 | | | | 3.48 | | | | 12.46 | |

S&P/LSTA Leveraged Loan Index | | | — | | | | 1.00 | % | | | 3.47 | % | | | 3.68 | % | | | 8.52 | % |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| % Premium/Discount to NAV3 | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | –12.52 | % |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Distributions4 | | | | | | | | | | | | | | | |

Total Distributions per share for the period | | | | | | | | | | | | | | | | | | $ | 0.408 | |

Distribution Rate at NAV | | | | | | | | | | | | | | | | | | | 5.40 | % |

Distribution Rate at Market Price | | | | | | | | | | | | | | | | | | | 6.17 | % |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| % Total Leverage5 | | | | | | | | | | | | | | | |

Borrowings | | | | | | | | | | | | | | | | | | | 26.17 | % |

Variable Rate Term Preferred Shares (VRTP Shares) | | | | | | | | | | | | | | | | | | | 8.54 | |

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or market price (as applicable) with all distributions reinvested and include management fees and other expenses. Fund performance at market price will differ from its results at NAV due to factors such as changing perceptions about the Fund, market conditions, fluctuations in supply and demand for Fund shares, or changes in Fund distributions. Investment return and principal value will fluctuate so that shares, when sold, may be worth more or less than their original cost. Performance less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, current Fund performance may be lower or higher than the quoted return. For performance as of the most recent month-end, please refer to eatonvance.com.

Eaton Vance

Floating-Rate Income Trust

November 30, 2018

Fund Profile

Top 10 Issuers (% of total investments)6

| | | | |

Reynolds Group Holdings, Inc. | | | 1.2 | % |

| |

Bausch Health Companies, Inc. | | | 1.1 | |

| |

Asurion, LLC | | | 1.1 | |

| |

TransDigm, Inc. | | | 1.0 | |

| |

Univision Communications, Inc. | | | 1.0 | |

| |

Virgin Media Investment Holdings Limited | | | 0.8 | |

| |

JBS USA, LLC | | | 0.8 | |

| |

Infor (US), Inc. | | | 0.7 | |

| |

Jaguar Holding Company II | | | 0.7 | |

| |

MA FinanceCo., LLC | | | 0.7 | |

| |

Total | | | 9.1 | % |

Top 10 Sectors (% of total investments)6

| | | | |

Electronics/Electrical | | | 11.7 | % |

| |

Health Care | | | 9.8 | |

| |

Business Equipment and Services | | | 8.7 | |

| |

Chemicals and Plastics | | | 4.9 | |

| |

Telecommunications | | | 4.5 | |

| |

Drugs | | | 4.4 | |

| |

Industrial Equipment | | | 4.1 | |

| |

Cable and Satellite Television | | | 3.9 | |

| |

Lodging and Casinos | | | 3.8 | |

| |

Leisure Goods/Activities/Movies | | | 3.6 | |

| |

Total | | | 59.4 | % |

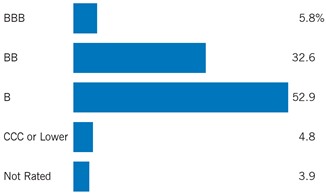

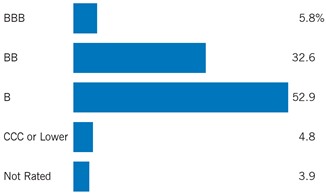

Credit Quality (% of bonds, loans and asset-backed securities)7

See Endnotes and Additional Disclosures in this report.

Eaton Vance

Floating-Rate Income Trust

November 30, 2018

Endnotes and Additional Disclosures

| 1 | S&P/LSTA Leveraged Loan Index is an unmanaged index of the institutional leveraged loan market. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. |

| 2 | Performance results reflect the effects of leverage. The Fund’s performance for certain periods reflects the effects of expense reductions. Absent these reductions, performance would have been lower. Performance since inception for an index, if presented, is the performance since the Fund’s or oldest share class’ inception, as applicable. |

| 3 | The shares of the Fund often trade at a discount or premium from their net asset value. The discount or premium of the Fund may vary over time and may be higher or lower than what is quoted in this report. Forup-to-date premium/discount information, please refer to http://eatonvance.com/closedend. |

| 4 | The Distribution Rate is based on the Fund’s last regular distribution per share in the period (annualized) divided by the Fund’s NAV or market price at the end of the period. The Fund’s distributions may be comprised of amounts characterized for federal income tax purposes as qualified andnon-qualified ordinary dividends, capital gains and nondividend distributions, also known as return of capital. For additional information about nondividend distributions, please refer to Eaton Vance Closed- End Fund Distribution Notices (19a) posted on our website, eatonvance.com. The Fund will determine the federal income tax character of distributions paid to a shareholder after the end of the calendar year. This is reported on the IRS form 1099- DIV and provided to the shareholder shortly after each year- end. For information about the tax character of distributions made in prior calendar years, please refer toPerformance-Tax Character of Distributions on the Fund’s webpage available at eatonvance.com. The Fund’s distributions are determined by the investment adviser based on its current assessment of the Fund’s long-term return potential. Fund distributions may be affected by numerous factors including changes in Fund performance, the cost of financing for leverage, portfolio holdings, realized and projected returns, and other factors. As portfolio and market conditions change, the rate of distributions paid by the Fund could change. |

| 5 | Leverage represents the liquidation value of the Fund’s VRTP Shares and borrowings outstanding as a percentage of Fund net assets applicable to common shares plus VRTP Shares and borrowings outstanding. Use of leverage creates an opportunity for income, but creates risks including greater price volatility. The cost of leverage rises and falls with changes in short-term interest rates. The Fund may be required to maintain prescribed asset coverage for its leverage and may be required to reduce its leverage at an inopportune time. |

| 6 | Excludes cash and cash equivalents. |

| 7 | Credit ratings are categorized using S&P Global Ratings (“S&P”). Ratings, which are subject to change, apply to the creditworthiness of the issuers of the underlying securities and not to the Fund or its shares. Credit ratings measure the quality of a bond based on the issuer’s creditworthiness, with ratings ranging from AAA, being the highest, to D, being the lowest based on S&P’s measures. Ratings of BBB or higher by S&P are considered to be investment- grade quality. Credit ratings are based largely on the ratings agency’s analysis at the time of rating. The rating assigned to any particular security is not necessarily a reflection of the issuer’s current financial condition and does not necessarily reflect its assessment of the volatility of a security’s market value or of the liquidity of an investment in the security. Holdings designated as “Not Rated” (if any) are not rated by S&P. |

| | Fund profile subject to change due to active management. |

Eaton Vance

Floating-Rate Income Trust

November 30, 2018

Portfolio of Investments (Unaudited)

| | | | | | | | | | | | |

| Senior Floating-Rate Loans — 141.4%(1) | |

| Borrower/Tranche Description | | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Aerospace and Defense — 2.2% | |

| Accudyne Industries, LLC | | | | | | | | | |

Term Loan, 5.34%, (1 mo. USD LIBOR + 3.00%), Maturing August 18, 2024 | | | | | | | 693 | | | $ | 684,491 | |

| IAP Worldwide Services, Inc. | | | | | | | | | |

Revolving Loan, 1.46%, (3 mo. USD LIBOR + 5.50%), Maturing July 18, 2019(2) | | | | | | | 325 | | | | 324,920 | |

Term Loan - Second Lien, 8.89%, (3 mo. USD LIBOR + 6.50%), Maturing July 18, 2019(3) | | | | | | | 431 | | | | 346,539 | |

| TransDigm, Inc. | | | | | | | | | |

Term Loan, 4.84%, (1 mo. USD LIBOR + 2.50%), Maturing June 9, 2023 | | | | | | | 6,610 | | | | 6,478,887 | |

Term Loan, 4.84%, (1 mo. USD LIBOR + 2.50%), Maturing August 22, 2024 | | | | | | | 2,863 | | | | 2,794,400 | |

| Wesco Aircraft Hardware Corp. | | | | | | | | | |

Term Loan, 5.35%, (1 mo. USD LIBOR + 3.00%), Maturing November 30, 2020 | | | | | | | 968 | | | | 965,081 | |

| WP CPP Holdings, LLC | | | | | | | | | |

Term Loan, 6.28%, (USD LIBOR + 3.75%), Maturing April 30,

2025(4) | | | | | | | 1,700 | | | | 1,691,500 | |

| | | | | | | | | | | $ | 13,285,818 | |

|

| Automotive — 2.8% | |

| American Axle and Manufacturing, Inc. | | | | | | | | | |

Term Loan, 4.64%, (USD LIBOR + 2.25%), Maturing April 6, 2024(4) | | | | | | | 3,291 | | | $ | 3,177,098 | |

| Apro, LLC | | | | | | | | | |

Term Loan, 6.34%, (1 mo. USD LIBOR + 4.00%), Maturing August 8, 2024 | | | | | | | 292 | | | | 291,864 | |

| Belron Finance US, LLC | | | | | | | | | |

Term Loan, 4.84%, (3 mo. USD LIBOR + 2.25%), Maturing November 7, 2024 | | | | | | | 596 | | | | 589,545 | |

| Chassix, Inc. | | | | | | | | | |

Term Loan, 8.29%, (USD LIBOR + 5.50%), Maturing November 15, 2023(4) | | | | | | | 1,489 | | | | 1,490,611 | |

| Dayco Products, LLC | | | | | | | | | |

Term Loan, 6.96%, (3 mo. USD LIBOR + 4.25%), Maturing May 19, 2023 | | | | | | | 1,102 | | | | 1,110,172 | |

| Garrett LX III S.a.r.l. | | | | | | | | | |

Term Loan, 2.75%, (3 mo. EURIBOR + 2.75%), Maturing September 27, 2025 | | | EUR | | | | 475 | | | | 533,267 | |

Term Loan, 4.89%, (3 mo. USD LIBOR + 2.50%), Maturing September 27, 2025 | | | | | | | 275 | | | | 270,875 | |

| Horizon Global Corporation | | | | | | | | | |

Term Loan, 8.34%, (1 mo. USD LIBOR + 6.00%), Maturing June 30, 2021 | | | | | | | 388 | | | | 360,659 | |

| | | | | | | | | | | | |

| Borrower/Tranche Description | | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Automotive (continued) | |

| L&W, Inc. | | | | | | | | | |

Term Loan, 6.32%, (1 mo. USD LIBOR + 4.00%), Maturing May 22, 2025 | | | | | | | 873 | | | $ | 874,994 | |

| Tenneco, Inc. | | | | | | | | | |

Term Loan, 5.09%, (1 mo. USD LIBOR + 2.75%), Maturing October 1, 2025 | | | | | | | 3,825 | | | | 3,750,891 | |

| Thor Industries, Inc. | | | | | | | | | |

Term Loan, Maturing October 30, 2025(5) | | | | | | | 1,750 | | | | 1,731,406 | |

| TI Group Automotive Systems, LLC | | | | | | | | | |

Term Loan, 3.50%, (3 mo. EURIBOR + 2.75%, Floor 0.75%), Maturing June 30, 2022 | | | EUR | | | | 873 | | | | 988,736 | |

Term Loan, 4.84%, (1 mo. USD LIBOR + 2.50%), Maturing June 30, 2022 | | | | | | | 1,057 | | | | 1,040,401 | |

| Tower Automotive Holdings USA, LLC | | | | | | | | | |

Term Loan, 5.13%, (1 mo. USD LIBOR + 2.75%), Maturing March 7, 2024 | | | | | | | 1,202 | | | | 1,188,771 | |

| | | | | | | | | | | $ | 17,399,290 | |

|

| Beverage and Tobacco — 0.8% | |

| Arterra Wines Canada, Inc. | | | | | | | | | |

Term Loan, 5.09%, (3 mo. USD LIBOR + 2.75%), Maturing December 15, 2023 | | | | | | | 2,731 | | | $ | 2,710,618 | |

| Flavors Holdings, Inc. | | | | | | | | | |

Term Loan, 8.14%, (3 mo. USD LIBOR + 5.75%), Maturing April 3, 2020 | | | | | | | 1,219 | | | | 1,148,924 | |

Term Loan - Second Lien, 12.39%, (3 mo. USD LIBOR + 10.00%), Maturing October 3, 2021 | | | | | | | 1,000 | | | | 875,000 | |

| | | | | | | | | | | $ | 4,734,542 | |

|

| Brokerage / Securities Dealers / Investment Houses — 0.7% | |

| Advisor Group, Inc. | | | | | | | | | |

Term Loan, 6.05%, (1 mo. USD LIBOR + 3.75%), Maturing August 15, 2025 | | | | | | | 625 | | | $ | 625,391 | |

| Aretec Group, Inc. | | | | | | | | | |

Term Loan, 6.59%, (1 mo. USD LIBOR + 4.25%), Maturing October 1, 2025 | | | | | | | 2,225 | | | | 2,215,265 | |

| OZ Management L.P. | | | | | | | | | |

Term Loan, 7.25%, (2 mo. USD LIBOR + 4.75%), Maturing April 10, 2023 | | | | | | | 560 | | | | 554,400 | |

| Resolute Investment Managers, Inc. | | | | | | | | | |

Term Loan - Second Lien, 10.03%, (3 mo. USD LIBOR + 7.50%), Maturing April 30, 2023 | | | | | | | 600 | | | | 607,500 | |

| | | | | | | | | | | $ | 4,002,556 | |

| | | | |

| | 5 | | See Notes to Financial Statements. |

Eaton Vance

Floating-Rate Income Trust

November 30, 2018

Portfolio of Investments (Unaudited) — continued

| | | | | | | | | | | | |

| Borrower/Tranche Description | | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Building and Development — 3.9% | |

| American Builders & Contractors Supply Co., Inc. | | | | | | | | | |

Term Loan, 4.34%, (1 mo. USD LIBOR + 2.00%), Maturing October 31, 2023 | | | | | | | 2,807 | | | $ | 2,737,319 | |

| Beacon Roofing Supply, Inc. | | | | | | | | | |

Term Loan, 4.57%, (1 mo. USD LIBOR + 2.25%), Maturing January 2, 2025 | | | | | | | 622 | | | | 606,328 | |

| Brookfield Property REIT, Inc. | | | | | | | | | |

Term Loan, 4.85%, (1 mo. USD LIBOR + 2.50%), Maturing August 27, 2025 | | | | | | | 1,025 | | | | 994,250 | |

| Core & Main L.P. | | | | | | | | | |

Term Loan, 5.53%, (3 mo. USD LIBOR + 3.00%), Maturing August 1, 2024 | | | | | | | 817 | | | | 810,114 | |

| CPG International, Inc. | | | | | | | | | |

Term Loan, 6.25%, (6 mo. USD LIBOR + 3.75%), Maturing May 5, 2024 | | | | | | | 2,014 | | | | 2,004,056 | |

| DTZ U.S. Borrower, LLC | | | | | | | | | |

Term Loan, 5.59%, (1 mo. USD LIBOR + 3.25%), Maturing August 21, 2025 | | | | | | | 5,950 | | | | 5,870,020 | |

| Henry Company, LLC | | | | | | | | | |

Term Loan, 6.34%, (1 mo. USD LIBOR + 4.00%), Maturing October 5, 2023 | | | | | | | 443 | | | | 442,564 | |

| Ply Gem Midco, Inc. | | | | | | | | | |

Term Loan, 6.18%, (3 mo. USD LIBOR + 3.75%), Maturing April 12, 2025 | | | | | | | 825 | | | | 808,844 | |

| Quikrete Holdings, Inc. | | | | | | | | | |

Term Loan, 5.09%, (1 mo. USD LIBOR + 2.75%), Maturing November 15, 2023 | | | | | | | 2,788 | | | | 2,738,668 | |

| RE/MAX International, Inc. | | | | | | | | | |

Term Loan, 5.09%, (1 mo. USD LIBOR + 2.75%), Maturing December 15, 2023 | | | | | | | 2,080 | | | | 2,072,182 | |

| Realogy Group, LLC | | | | | | | | | |

Term Loan, 4.56%, (1 mo. USD LIBOR + 2.25%), Maturing February 8, 2025 | | | | | | | 907 | | | | 889,998 | |

| Summit Materials Companies I, LLC | | | | | | | | | |

Term Loan, 4.34%, (1 mo. USD LIBOR + 2.00%), Maturing November 21, 2024 | | | | | | | 670 | | | | 657,795 | |

| Werner FinCo L.P. | | | | | | | | | |

Term Loan, 6.30%, (1 mo. USD LIBOR + 4.00%), Maturing July 24, 2024 | | | | | | | 1,139 | | | | 1,105,067 | |

| WireCo WorldGroup, Inc. | | | | | | | | | |

Term Loan, 7.34%, (1 mo. USD LIBOR + 5.00%), Maturing September 30, 2023 | | | | | | | 637 | | | | 639,123 | |

Term Loan - Second Lien, 11.34%, (1 mo. USD LIBOR + 9.00%), Maturing September 30, 2024 | | | | | | | 1,500 | | | | 1,507,500 | |

| | | | | | | | | | | $ | 23,883,828 | |

| | | | | | | | | | |

| Borrower/Tranche Description | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Business Equipment and Services — 13.2% | |

| Acosta Holdco, Inc. | | | | | | | | |

Term Loan, 5.59%, (1 mo. USD LIBOR + 3.25%), Maturing September 26, 2021 | | | | | 3,284 | | | $ | 2,290,749 | |

| Adtalem Global Education, Inc. | | | | | | | | |

Term Loan, 5.34%, (1 mo. USD LIBOR + 3.00%), Maturing April 11, 2025 | | | | | 424 | | | | 423,408 | |

| AlixPartners, LLP | | | | | | | | |

Term Loan, 5.09%, (1 mo. USD LIBOR + 2.75%), Maturing April 4, 2024 | | | | | 2,417 | | | | 2,398,104 | |

| Altran Technologies S.A. | | | | | | | | |

Term Loan, 2.75%, (3 mo. EURIBOR + 2.75%), Maturing March 20, 2025 | | EUR | | | 1,541 | | | | 1,745,665 | |

| AppLovin Corporation | | | | | | | | |

Term Loan, 6.19%, (3 mo. USD LIBOR + 3.75%), Maturing August 15, 2025 | | | | | 1,625 | | | | 1,620,937 | |

| ASGN Incorporated | | | | | | | | |

Term Loan, 4.34%, (1 mo. USD LIBOR + 2.00%), Maturing April 2, 2025 | | | | | 503 | | | | 499,190 | |

| BlitzF18-675 GmbH | | | | | | | | |

Term Loan, 3.75%, (3 mo. EURIBOR + 3.75%), Maturing July 31, 2025 | | EUR | | | 1,625 | | | | 1,844,262 | |

| Bracket Intermediate Holding Corp. | | | | | | | | |

Term Loan, 6.57%, (3 mo. USD LIBOR + 4.25%), Maturing September 5, 2025 | | | | | 950 | | | | 953,563 | |

| Brand Energy & Infrastructure Services, Inc. | | | | | | | | |

Term Loan, 6.73%, (3 mo. USD LIBOR + 4.25%), Maturing June 21, 2024 | | | | | 568 | | | | 560,912 | |

| Camelot UK Holdco Limited | | | | | | | | |

Term Loan, 5.59%, (1 mo. USD LIBOR + 3.25%), Maturing October 3, 2023 | | | | | 2,001 | | | | 1,982,189 | |

| Cast and Crew Payroll, LLC | | | | | | | | |

Term Loan, 5.10%, (1 mo. USD LIBOR + 2.75%), Maturing September 27, 2024 | | | | | 419 | | | | 412,367 | |

| Ceridian HCM Holding, Inc. | | | | | | | | |

Term Loan, 5.59%, (1 mo. USD LIBOR + 3.25%), Maturing April 30, 2025 | | | | | 1,575 | | | | 1,567,125 | |

| Change Healthcare Holdings, LLC | | | | | | | | |

Term Loan, 5.09%, (1 mo. USD LIBOR + 2.75%), Maturing March 1, 2024 | | | | | 6,924 | | | | 6,848,453 | |

| Crossmark Holdings, Inc. | | | | | | | | |

Term Loan, 5.89%, (3 mo. USD LIBOR + 3.50%), Maturing December 20, 2019 | | | | | 1,500 | | | | 592,449 | |

| Cypress Intermediate Holdings III, Inc. | | | | | | | | |

Term Loan, 5.35%, (1 mo. USD LIBOR + 3.00%), Maturing April 26, 2024 | | | | | 2,583 | | | | 2,557,481 | |

| EAB Global, Inc. | | | | | | | | |

Term Loan, 6.41%, (USD LIBOR + 3.75%), Maturing November 15,

2024(4) | | | | | 1,393 | | | | 1,375,588 | |

| | | | |

| | 6 | | See Notes to Financial Statements. |

Eaton Vance

Floating-Rate Income Trust

November 30, 2018

Portfolio of Investments (Unaudited) — continued

| | | | | | | | | | |

| Borrower/Tranche Description | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Business Equipment and Services (continued) | |

| Education Management, LLC | | | | | | | | |

Term Loan, 0.00%, Maturing July 2, 2020(3)(6) | | | | | 566 | | | $ | 0 | |

Term Loan, 0.00%, Maturing July 2,

2020(3)(6) | | | | | 252 | | | | 47,468 | |

| EIG Investors Corp. | | | | | | | | |

Term Loan, 6.43%, (USD LIBOR + 3.75%), Maturing February 9,

2023(4) | | | | | 3,448 | | | | 3,443,234 | |

Element Materials Technology Group US Holdings,

Inc. | | | | | | | | |

Term Loan, 5.84%, (1 mo. USD LIBOR + 3.50%), Maturing June 28, 2024 | | | | | 422 | | | | 421,813 | |

| Extreme Reach, Inc. | | | | | | | | |

Term Loan, 8.60%, (1 mo. USD LIBOR + 6.25%), Maturing February 7, 2020 | | | | | 2,183 | | | | 2,180,163 | |

| First Data Corporation | | | | | | | | |

Term Loan, 4.32%, (1 mo. USD LIBOR + 2.00%), Maturing July 8, 2022 | | | | | 2,296 | | | | 2,262,360 | |

| Garda World Security Corporation | | | | | | | | |

Term Loan, 5.82%, (3 mo. USD LIBOR + 3.50%), Maturing May 24, 2024 | | | | | 2,088 | | | | 2,082,730 | |

Term Loan, 6.33%, (1 mo. USD LIBOR + 4.25%), Maturing May 24, 2024 | | CAD | | | 960 | | | | 724,627 | |

| Global Payments, Inc. | | | | | | | | |

Term Loan, 4.09%, (1 mo. USD LIBOR + 1.75%), Maturing April 21, 2023 | | | | | 984 | | | | 978,426 | |

| IG Investment Holdings, LLC | | | | | | | | |

Term Loan, 5.86%, (USD LIBOR + 3.50%), Maturing May 23, 2025(4) | | | | | 2,648 | | | | 2,644,917 | |

| Information Resources, Inc. | | | | | | | | |

Term Loan, Maturing December 1, 2025(5) | | | | | 1,650 | | | | 1,633,500 | |

| Iron Mountain, Inc. | | | | | | | | |

Term Loan, 4.09%, (1 mo. USD LIBOR + 1.75%), Maturing January 2, 2026 | | | | | 920 | | | | 905,028 | |

| J.D. Power and Associates | | | | | | | | |

Term Loan, 6.09%, (1 mo. USD LIBOR + 3.75%), Maturing September 7, 2023 | | | | | 3,440 | | | | 3,439,812 | |

| KAR Auction Services, Inc. | | | | | | | | |

Term Loan, 4.69%, (3 mo. USD LIBOR + 2.25%), Maturing March 11, 2021 | | | | | 1,963 | | | | 1,952,547 | |

| Kronos Incorporated | | | | | | | | |

Term Loan, 5.54%, (USD LIBOR + 3.00%), Maturing November 1, 2023(4) | | | | | 6,378 | | | | 6,310,186 | |

| Monitronics International, Inc. | | | | | | | | |

Term Loan, 7.89%, (3 mo. USD LIBOR + 5.50%), Maturing September 30, 2022 | | | | | 1,910 | | | | 1,806,438 | |

| PGX Holdings, Inc. | | | | | | | | |

Term Loan, 7.60%, (1 mo. USD LIBOR + 5.25%), Maturing September 29, 2020 | | | | | 1,360 | | | | 1,326,250 | |

| | | | | | | | | | |

| Borrower/Tranche Description | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Business Equipment and Services (continued) | |

| Ping Identity Corporation | | | | | | | | |

Term Loan, 6.09%, (1 mo. USD LIBOR + 3.75%), Maturing January 24, 2025 | | | | | 374 | | | $ | 371,257 | |

| Pre-Paid Legal Services, Inc. | | | | | | | | |

Term Loan, 5.34%, (1 mo. USD LIBOR + 3.00%), Maturing May 1, 2025 | | | | | 482 | | | | 479,279 | |

| Prime Security Services Borrower, LLC | | | | | | | | |

Term Loan, 5.09%, (1 mo. USD LIBOR + 2.75%), Maturing May 2, 2022 | | | | | 2,777 | | | | 2,752,436 | |

| Red Ventures, LLC | | | | | | | | |

Term Loan, 5.32%, (3 mo. USD LIBOR + 3.00%), Maturing November 8, 2024 | | | | | 1,063 | | | | 1,058,006 | |

| SMG Holdings, Inc. | | | | | | | | |

Term Loan, 5.34%, (1 mo. USD LIBOR + 3.00%), Maturing January 23, 2025 | | | | | 249 | | | | 246,263 | |

| Solera, LLC | | | | | | | | |

Term Loan, 5.09%, (1 mo. USD LIBOR + 2.75%), Maturing March 3, 2023 | | | | | 2,389 | | | | 2,361,293 | |

| Spin Holdco, Inc. | | | | | | | | |

Term Loan, 5.69%, (3 mo. USD LIBOR + 3.25%), Maturing November 14, 2022 | | | | | 3,826 | | | | 3,764,259 | |

| Tempo Acquisition, LLC | | | | | | | | |

Term Loan, 5.34%, (1 mo. USD LIBOR + 3.00%), Maturing May 1, 2024 | | | | | 1,931 | | | | 1,917,013 | |

| Trans Union, LLC | | | | | | | | |

Term Loan, 4.34%, (1 mo. USD LIBOR + 2.00%), Maturing June 19, 2025 | | | | | 449 | | | | 444,586 | |

| Travelport Finance (Luxembourg) S.a.r.l. | | | | | | | | |

Term Loan, 5.12%, (3 mo. USD LIBOR + 2.50%), Maturing March 17, 2025 | | | | | 2,127 | | | | 2,105,197 | |

| Vestcom Parent Holdings, Inc. | | | | | | | | |

Term Loan, 6.34%, (1 mo. USD LIBOR + 4.00%), Maturing December 19, 2023 | | | | | 565 | | | | 559,309 | |

| WASH Multifamily Laundry Systems, LLC | | | | | | | | |

Term Loan, 5.59%, (1 mo. USD LIBOR + 3.25%), Maturing May 14, 2022 | | | | | 268 | | | | 263,897 | |

| West Corporation | | | | | | | | |

Term Loan, 6.03%, (USD LIBOR + 3.50%), Maturing October 10, 2024(4) | | | | | 349 | | | | 341,083 | |

Term Loan, 6.53%, (USD LIBOR + 4.00%), Maturing October 10, 2024(4) | | | | | 1,166 | | | | 1,152,612 | |

| Worldpay, LLC | | | | | | | | |

Term Loan, 4.06%, (1 mo. USD LIBOR + 1.75%), Maturing October 14, 2023 | | | | | 307 | | | | 304,736 | |

Term Loan, 4.06%, (1 mo. USD LIBOR + 1.75%), Maturing August 9, 2024 | | | | | 1,915 | | | | 1,904,069 | |

| | | | |

| | 7 | | See Notes to Financial Statements. |

Eaton Vance

Floating-Rate Income Trust

November 30, 2018

Portfolio of Investments (Unaudited) — continued

| | | | | | | | | | | | |

| Borrower/Tranche Description | | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Business Equipment and Services (continued) | |

| ZPG PLC | | | | | | | | | |

Term Loan, 5.49%, (1 mo. GBP LIBOR + 4.75%), Maturing June 30, 2025 | | | GBP | | | | 775 | | | $ | 985,383 | |

| | | | | | | | | | | $ | 80,842,619 | |

| | | |

| Cable and Satellite Television — 5.9% | | | | | | | | | |

| Charter Communications Operating, LLC | | | | | | | | | |

Term Loan, 4.35%, (1 mo. USD LIBOR + 2.00%), Maturing April 30, 2025 | | | | | | | 3,821 | | | $ | 3,787,213 | |

| CSC Holdings, LLC | | | | | | | | | |

Term Loan, 4.56%, (1 mo. USD LIBOR + 2.25%), Maturing July 17, 2025 | | | | | | | 3,762 | | | | 3,704,242 | |

Term Loan, Maturing January 15, 2026(5) | | | | | | | 1,100 | | | | 1,075,250 | |

Term Loan, 4.81%, (1 mo. USD LIBOR + 2.50%), Maturing January 25, 2026 | | | | | | | 1,368 | | | | 1,350,168 | |

| Numericable Group S.A. | | | | | | | | | |

Term Loan, 3.00%, (3 mo. EURIBOR + 3.00%), Maturing July 31, 2025 | | | EUR | | | | 493 | | | | 541,414 | |

Term Loan, 5.09%, (1 mo. USD LIBOR + 2.75%), Maturing July 31, 2025 | | | | | | | 1,995 | | | | 1,868,714 | |

Term Loan, 5.99%, (1 mo. USD LIBOR + 3.69%), Maturing January 31, 2026 | | | | | | | 798 | | | | 753,098 | |

| Radiate Holdco, LLC | | | | | | | | | |

Term Loan, 5.34%, (1 mo. USD LIBOR + 3.00%), Maturing February 1, 2024 | | | | | | | 2,054 | | | | 2,017,614 | |

| Telenet Financing USD, LLC | | | | | | | | | |

Term Loan, 4.56%, (1 mo. USD LIBOR + 2.25%), Maturing August 15, 2026 | | | | | | | 2,750 | | | | 2,709,322 | |

| Unitymedia Finance, LLC | | | | | | | | | |

Term Loan, 4.56%, (1 mo. USD LIBOR + 2.25%), Maturing January 15, 2026 | | | | | | | 1,050 | | | | 1,041,562 | |

| Unitymedia Hessen GmbH & Co. KG | | | | | | | | | |

Term Loan, 2.75%, (6 mo. EURIBOR + 2.75%), Maturing January 15, 2027 | | | EUR | | | | 1,000 | | | | 1,132,525 | |

| UPC Financing Partnership | | | | | | | | | |

Term Loan, 4.81%, (1 mo. USD LIBOR + 2.50%), Maturing January 15, 2026 | | | | | | | 2,166 | | | | 2,142,561 | |

| Virgin Media Bristol, LLC | | | | | | | | | |

Term Loan, 4.81%, (1 mo. USD LIBOR + 2.50%), Maturing January 15, 2026 | | | | | | | 7,400 | | | | 7,319,643 | |

| Ziggo Secured Finance B.V. | | | | | | | | | |

Term Loan, 3.00%, (6 mo. EURIBOR + 3.00%), Maturing April 15, 2025 | | | EUR | | | | 2,425 | | | | 2,730,071 | |

| Ziggo Secured Finance Partnership | | | | | | | | | |

Term Loan, 4.81%, (1 mo. USD LIBOR + 2.50%), Maturing April 15, 2025 | | | | | | | 3,825 | | | | 3,741,328 | |

| | | | | | | | | | | $ | 35,914,725 | |

| | | | | | | | | | |

| Borrower/Tranche Description | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Chemicals and Plastics — 7.4% | |

| Alpha 3 B.V. | | | | | | | | |

Term Loan, 5.39%, (3 mo. USD LIBOR + 3.00%), Maturing January 31, 2024 | | | | | 683 | | | $ | 678,820 | |

| Aruba Investments, Inc. | | | | | | | | |

Term Loan, 5.59%, (1 mo. USD LIBOR + 3.25%), Maturing February 2, 2022 | | | | | 994 | | | | 988,793 | |

| Ashland, Inc. | | | | | | | | |

Term Loan, 4.07%, (1 mo. USD LIBOR + 1.75%), Maturing May 17, 2024 | | | | | 617 | | | | 615,799 | |

| Axalta Coating Systems US Holdings, Inc. | | | | | | | | |

Term Loan, 4.14%, (3 mo. USD LIBOR + 1.75%), Maturing June 1, 2024 | | | | | 2,699 | | | | 2,666,739 | |

| Cabot Microelectronics Corporation | | | | | | | | |

Term Loan, 4.63%, (1 mo. USD LIBOR + 2.25%), Maturing November 14, 2025 | | | | | 875 | | | | 872,802 | |

| Chemours Company (The) | | | | | | | | |

Term Loan, 2.50%, (3 mo. EURIBOR + 2.00%, Floor 0.50%), Maturing March 21, 2025 | | EUR | | | 644 | | | | 730,548 | |

Term Loan, 4.10%, (1 mo. USD LIBOR + 1.75%), Maturing April 3, 2025 | | | | | 341 | | | | 335,869 | |

| Emerald Performance Materials, LLC | | | | | | | | |

Term Loan, 5.84%, (1 mo. USD LIBOR + 3.50%), Maturing August 1, 2021 | | | | | 549 | | | | 546,242 | |

Term Loan - Second Lien, 10.09%, (1 mo. USD LIBOR + 7.75%), Maturing August 1, 2022 | | | | | 625 | | | | 625,391 | |

| Ferro Corporation | | | | | | | | |

Term Loan, 4.64%, (3 mo. USD LIBOR + 2.25%), Maturing February 14, 2024 | | | | | 357 | | | | 354,746 | |

Term Loan, 4.64%, (3 mo. USD LIBOR + 2.25%), Maturing February 14, 2024 | | | | | 365 | | | | 362,458 | |

Term Loan, 4.64%, (3 mo. USD LIBOR + 2.25%), Maturing February 14, 2024 | | | | | 443 | | | | 440,710 | |

| Flint Group GmbH | | | | | | | | |

Term Loan, 5.49%, (3 mo. USD LIBOR + 3.00%), Maturing September 7, 2021 | | | | | 160 | | | | 154,018 | |

| Flint Group US, LLC | | | | | | | | |

Term Loan, 5.49%, (3 mo. USD LIBOR + 3.00%), Maturing September 7, 2021 | | | | | 968 | | | | 931,682 | |

| Gemini HDPE, LLC | | | | | | | | |

Term Loan, 5.03%, (3 mo. USD LIBOR + 2.50%), Maturing August 7, 2024 | | | | | 2,342 | | | | 2,330,680 | |

| H.B. Fuller Company | | | | | | | | |

Term Loan, 4.30%, (1 mo. USD LIBOR + 2.00%), Maturing October 20, 2024 | | | | | 1,987 | | | | 1,959,458 | |

| Ineos US Finance, LLC | | | | | | | | |

Term Loan, 2.50%, (1 mo. EURIBOR + 2.00%, Floor 0.50%), Maturing March 31, 2024 | | EUR | | | 3,250 | | | | 3,639,700 | |

| | | | |

| | 8 | | See Notes to Financial Statements. |

Eaton Vance

Floating-Rate Income Trust

November 30, 2018

Portfolio of Investments (Unaudited) — continued

| | | | | | | | | | |

| Borrower/Tranche Description | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Chemicals and Plastics (continued) | |

| Ineos US Finance, LLC (continued) | | | | | | | | |

Term Loan, 4.34%, (1 mo. USD LIBOR + 2.00%), Maturing March 31, 2024 | | | | | 99 | | | $ | 97,992 | |

| Invictus US, LLC | | | | | | | | |

Term Loan, 5.50%, (2 mo. USD LIBOR + 3.00%), Maturing March 28, 2025 | | | | | 522 | | | | 520,198 | |

| Kraton Polymers, LLC | | | | | | | | |

Term Loan, 4.84%, (1 mo. USD LIBOR + 2.50%), Maturing March 5, 2025 | | | | | 1,015 | | | | 1,010,593 | |

| MacDermid, Inc. | | | | | | | | |

Term Loan, 4.84%, (1 mo. USD LIBOR + 2.50%), Maturing June 7, 2020 | | | | | 1,077 | | | | 1,077,628 | |

Term Loan, 5.34%, (1 mo. USD LIBOR + 3.00%), Maturing June 7, 2023 | | | | | 2,773 | | | | 2,779,229 | |

| Messer Industries GmbH | | | | | | | | |

Term Loan, Maturing October 1, 2025(5) | | | | | 1,550 | | | | 1,532,175 | |

| Minerals Technologies, Inc. | | | | | | | | |

Term Loan, 4.58%, (USD LIBOR + 2.25%), Maturing February 14,

2024(4) | | | | | 928 | | | | 922,138 | |

| Orion Engineered Carbons GmbH | | | | | | | | |

Term Loan, 4.39%, (3 mo. USD LIBOR + 2.00%), Maturing July 25, 2024 | | | | | 1,157 | | | | 1,154,592 | |

Term Loan, 2.25%, (3 mo. EURIBOR + 2.25%), Maturing July 31, 2024 | | EUR | | | 828 | | | | 939,075 | |

| Platform Specialty Products Corporation | | | | | | | | |

Term Loan, Maturing November 15, 2025(5) | | | | | 700 | | | | 694,313 | |

| PMHC II, Inc. | | | | | | | | |

Term Loan, 6.15%, (USD LIBOR + 3.50%), Maturing March 31, 2025(4) | | | | | 398 | | | | 384,070 | |

| PQ Corporation | | | | | | | | |

Term Loan, 5.03%, (3 mo. USD LIBOR + 2.50%), Maturing February 8, 2025 | | | | | 3,005 | | | | 2,970,911 | |

| Schenectady International Group, Inc. | | | | | | | | |

Term Loan, 7.19%, (3 mo. USD LIBOR + 4.75%), Maturing October 15, 2025 | | | | | 1,000 | | | | 990,000 | |

| Sonneborn Refined Products B.V. | | | | | | | | |

Term Loan, 6.09%, (1 mo. USD LIBOR + 3.75%), Maturing December 10, 2020 | | | | | 69 | | | | 69,251 | |

| Sonneborn, LLC | | | | | | | | |

Term Loan, 6.09%, (1 mo. USD LIBOR + 3.75%), Maturing December 10, 2020 | | | | | 392 | | | | 392,422 | |

| Spectrum Holdings III Corp. | | | | | | | | |

Term Loan, 5.59%, (1 mo. USD LIBOR + 3.25%), Maturing January 31, 2025 | | | | | 362 | | | | 354,031 | |

| Starfruit Finco B.V. | | | | | | | | |

Term Loan, 3.75%, (6 mo. EURIBOR + 3.75%), Maturing October 1, 2025 | | EUR | | | 475 | | | | 538,294 | |

| | | | | | | | | | | | |

| Borrower/Tranche Description | | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Chemicals and Plastics (continued) | |

| Starfruit Finco B.V. (continued) | | | | | | | | | |

Term Loan, 5.55%, (1 mo. USD LIBOR + 3.25%), Maturing October 1, 2025 | | | | | | | 3,050 | | | $ | 3,012,333 | |

| Tronox Blocked Borrower, LLC | | | | | | | | | |

Term Loan, 5.34%, (1 mo. USD LIBOR + 3.00%), Maturing September 23, 2024 | | | | | | | 1,110 | | | | 1,100,847 | |

| Tronox Finance, LLC | | | | | | | | | |

Term Loan, 5.34%, (1 mo. USD LIBOR + 3.00%), Maturing September 23, 2024 | | | | | | | 2,562 | | | | 2,540,416 | |

| Unifrax I, LLC | | | | | | | | | |

Term Loan, 5.89%, (3 mo. USD LIBOR + 3.50%), Maturing April 4, 2024 | | | | | | | 593 | | | | 585,849 | |

| Univar, Inc. | | | | | | | | | |

Term Loan, 4.59%, (1 mo. USD LIBOR + 2.25%), Maturing July 1, 2024 | | | | | | | 2,701 | | | | 2,656,705 | |

| Venator Materials Corporation | | | | | | | | | |

Term Loan, 5.34%, (1 mo. USD LIBOR + 3.00%), Maturing August 8, 2024 | | | | | | | 421 | | | | 414,954 | |

| | | | | | | | | | | $ | 44,972,471 | |

|

| Conglomerates — 0.0%(7) | |

| Penn Engineering & Manufacturing Corp. | | | | | | | | | |

Term Loan, 5.09%, (1 mo. USD LIBOR + 2.75%), Maturing June 27, 2024 | | | | | | | 272 | | | $ | 269,526 | |

| | | | | | | | | | | $ | 269,526 | |

|

| Containers and Glass Products — 3.9% | |

| Berlin Packaging, LLC | | | | | | | | | |

Term Loan, 5.32%, (USD LIBOR + 3.00%), Maturing November 7, 2025(4) | | | | | | | 274 | | | $ | 270,655 | |

| Berry Global, Inc. | | | | | | | | | |

Term Loan, 4.32%, (1 mo. USD LIBOR + 2.00%), Maturing October 1, 2022 | | | | | | | 873 | | | | 867,303 | |

| BWAY Holding Company | | | | | | | | | |

Term Loan, 5.66%, (3 mo. USD LIBOR + 3.25%), Maturing April 3, 2024 | | | | | | | 2,554 | | | | 2,491,221 | |

| Consolidated Container Company, LLC | | | | | | | | | |

Term Loan, 5.09%, (1 mo. USD LIBOR + 2.75%), Maturing May 22, 2024 | | | | | | | 421 | | | | 416,813 | |

| Crown Americas, LLC | | | | | | | | | |

Term Loan, 2.38%, (1 mo. EURIBOR + 2.38%), Maturing April 3, 2025 | | | EUR | | | | 623 | | | | 709,028 | |

| Flex Acquisition Company, Inc. | | | | | | | | | |

Term Loan, 5.30%, (1 mo. USD LIBOR + 3.00%), Maturing December 29, 2023 | | | | | | | 3,472 | | | | 3,404,419 | |

Term Loan, 5.55%, (1 mo. USD LIBOR + 3.25%), Maturing June 29, 2025 | | | | | | | 1,546 | | | | 1,525,639 | |

| | | | |

| | 9 | | See Notes to Financial Statements. |

Eaton Vance

Floating-Rate Income Trust

November 30, 2018

Portfolio of Investments (Unaudited) — continued

| | | | | | | | | | | | |

| Borrower/Tranche Description | | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Containers and Glass Products (continued) | |

| Libbey Glass, Inc. | | | | | | | | | |

Term Loan, 5.32%, (1 mo. USD LIBOR + 3.00%), Maturing April 9, 2021 | | | | | | | 1,111 | | | $ | 1,089,844 | |

| Pelican Products, Inc. | | | | | | | | | |

Term Loan, 5.81%, (1 mo. USD LIBOR + 3.50%), Maturing May 1, 2025 | | | | | | | 648 | | | | 643,917 | |

| Reynolds Group Holdings, Inc. | | | | | | | | | |

Term Loan, 5.09%, (1 mo. USD LIBOR + 2.75%), Maturing February 5, 2023 | | | | | | | 5,771 | | | | 5,727,030 | |

| Ring Container Technologies Group, LLC | | | | | | | | | |

Term Loan, 5.09%, (1 mo. USD LIBOR + 2.75%), Maturing October 31, 2024 | | | | | | | 919 | | | | 909,624 | |

| Trident TPI Holdings, Inc. | | | | | | | | | |

Term Loan, 3.50%, (3 mo. EURIBOR + 3.50%), Maturing October 17, 2024 | | | EUR | | | | 1,365 | | | | 1,523,720 | |

Term Loan, 5.59%, (1 mo. USD LIBOR + 3.25%), Maturing October 17, 2024 | | | | | | | 770 | | | | 760,678 | |

| Verallia Packaging S.A.S | | | | | | | | | |

Term Loan, 2.75%, (1 mo. EURIBOR + 2.75%), Maturing October 29, 2022 | | | EUR | | | | 1,692 | | | | 1,898,888 | |

Term Loan, 3.25%, (1 mo. EURIBOR + 3.25%), Maturing August 29, 2025 | | | EUR | | | | 1,525 | | | | 1,719,331 | |

| | | | | | | | | | | $ | 23,958,110 | |

|

| Cosmetics / Toiletries — 0.3% | |

| KIK Custom Products, Inc. | | | | | | | | | |

Term Loan, 6.34%, (1 mo. USD LIBOR + 4.00%), Maturing May 15, 2023 | | | | | | | 2,019 | | | $ | 1,932,851 | |

| | | | | | | | | | | $ | 1,932,851 | |

|

| Drugs — 6.1% | |

| Albany Molecular Research, Inc. | | | | | | | | | |

Term Loan, 5.59%, (1 mo. USD LIBOR + 3.25%), Maturing August 30, 2024 | | | | | | | 842 | | | $ | 834,558 | |

Term Loan - Second Lien, 9.34%, (1 mo. USD LIBOR + 7.00%), Maturing August 30, 2025 | | | | | | | 500 | | | | 501,875 | |

| Alkermes, Inc. | | | | | | | | | |

Term Loan, 4.57%, (1 mo. USD LIBOR + 2.25%), Maturing March 23, 2023 | | | | | | | 402 | | | | 402,431 | |

| Amneal Pharmaceuticals, LLC | | | | | | | | | |

Term Loan, 5.88%, (1 mo. USD LIBOR + 3.50%), Maturing May 4, 2025 | | | | | | | 3,790 | | | | 3,787,234 | |

| Arbor Pharmaceuticals, Inc. | | | | | | | | | |

Term Loan, 7.35%, (1 mo. USD LIBOR + 5.00%), Maturing July 5, 2023 | | | | | | | 2,905 | | | | 2,730,670 | |

| | | | | | | | | | | | |

| Borrower/Tranche Description | | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Drugs (continued) | |

| Endo Luxembourg Finance Company I S.a.r.l. | | | | | | | | | |

Term Loan, 6.63%, (1 mo. USD LIBOR + 4.25%), Maturing April 29, 2024 | | | | | | | 6,436 | | | $ | 6,430,766 | |

| Horizon Pharma, Inc. | | | | | | | | | |

Term Loan, 5.38%, (1 mo. USD LIBOR + 3.00%), Maturing March 29, 2024 | | | | | | | 4,297 | | | | 4,273,822 | |

| Jaguar Holding Company II | | | | | | | | | |

Term Loan, 4.84%, (1 mo. USD LIBOR + 2.50%), Maturing August 18, 2022 | | | | | | | 7,037 | | | | 6,940,101 | |

| Mallinckrodt International Finance S.A. | | | | | | | | | |

Term Loan, 5.14%, (3 mo. USD LIBOR + 2.75%), Maturing September 24, 2024 | | | | | | | 2,750 | | | | 2,658,707 | |

Term Loan, 5.62%, (3 mo. USD LIBOR + 3.00%), Maturing February 24, 2025 | | | | | | | 920 | | | | 895,558 | |

| PharMerica Corporation | | | | | | | | | |

Term Loan, 5.81%, (1 mo. USD LIBOR + 3.50%), Maturing December 6, 2024 | | | | | | | 846 | | | | 841,521 | |

Term Loan - Second Lien, 10.06%, (1 mo. USD LIBOR + 7.75%), Maturing December 5, 2025 | | | | | | | 450 | | | | 446,625 | |

| Valeant Pharmaceuticals International, Inc. | | | | | | | | | |

Term Loan, 5.31%, (1 mo. USD LIBOR + 3.00%), Maturing June 2, 2025 | | | | | | | 6,677 | | | | 6,618,734 | |

| | | | | | | | | | | $ | 37,362,602 | |

|

| Ecological Services and Equipment — 1.0% | |

| Advanced Disposal Services, Inc. | | | | | | | | | |

Term Loan, 4.47%, (1 week USD LIBOR + 2.25%), Maturing November 10, 2023 | | | | | | | 2,180 | | | $ | 2,158,509 | |

| EnergySolutions, LLC | | | | | | | | | |

Term Loan, 6.14%, (3 mo. USD LIBOR + 3.75%), Maturing May 9, 2025 | | | | | | | 1,297 | | | | 1,270,815 | |

| GFL Environmental, Inc. | | | | | | | | | |

Term Loan, 5.39%, (3 mo. USD LIBOR + 3.00%), Maturing May 30, 2025 | | | | | | | 2,307 | | | | 2,253,578 | |

Term Loan, 7.00%, (3 mo. USD Prime + 1.75%), Maturing May 30, 2025 | | | | | | | 287 | | | | 280,649 | |

| Wastequip, LLC | | | | | | | | | |

Term Loan, 5.82%, (1 mo. USD LIBOR + 3.50%), Maturing March 20, 2025 | | | | | | | 149 | | | | 149,623 | |

| | | | | | | | | | | $ | 6,113,174 | |

|

| Electronics / Electrical — 18.1% | |

| Almonde, Inc. | | | | | | | | | |

Term Loan, 5.89%, (3 mo. USD LIBOR + 3.50%), Maturing June 13, 2024 | | | | | | | 3,795 | | | $ | 3,688,653 | |

| | | | |

| | 10 | | See Notes to Financial Statements. |

Eaton Vance

Floating-Rate Income Trust

November 30, 2018

Portfolio of Investments (Unaudited) — continued

| | | | | | | | | | |

| Borrower/Tranche Description | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Electronics / Electrical (continued) | |

| Answers Finance, LLC | | | | | | | | |

Term Loan - Second Lien, 9.00%, (3 mo. USD Prime + 7.90%, Cap 1.10%), Maturing September 15, 2021(3) | | | | | 497 | | | $ | 397,728 | |

| Applied Systems, Inc. | | | | | | | | |

Term Loan, 5.39%, (3 mo. USD LIBOR + 3.00%), Maturing September 19, 2024 | | | | | 3,076 | | | | 3,071,656 | |

Term Loan - Second Lien, Maturing September 19, 2025(5) | | | | | 2,200 | | | | 2,224,200 | |

| Aptean, Inc. | | | | | | | | |

Term Loan, 6.64%, (3 mo. USD LIBOR + 4.25%), Maturing December 20, 2022 | | | | | 1,277 | | | | 1,276,220 | |

| Avast Software B.V. | | | | | | | | |

Term Loan, 4.89%, (3 mo. USD LIBOR + 2.50%), Maturing September 30, 2023 | | | | | 1,510 | | | | 1,506,065 | |

| Barracuda Networks, Inc. | | | | | | | | |

Term Loan, 5.55%, (1 mo. USD LIBOR + 3.25%), Maturing February 12, 2025 | | | | | 1,942 | | | | 1,926,341 | |

| Blackhawk Network Holdings, Inc. | | | | | | | | |

Term Loan, 5.39%, (3 mo. USD LIBOR + 3.00%), Maturing June 15, 2025 | | | | | 848 | | | | 839,820 | |

| BMC Software Finance, Inc. | | | | | | | | |

Term Loan, 4.75%, (3 mo. EURIBOR + 4.75%), Maturing October 2, 2025 | | EUR | | | 300 | | | | 340,409 | |

Term Loan, 6.65%, (3 mo. USD LIBOR + 4.25%), Maturing October 2, 2025 | | | | | 3,450 | | | | 3,414,520 | |

| Campaign Monitor Finance Pty. Limited | | | | | | | | |

Term Loan, 7.64%, (3 mo. USD LIBOR + 5.25%), Maturing March 18, 2021 | | | | | 1,024 | | | | 927,744 | |

| Celestica, Inc. | | | | | | | | |

Term Loan, 4.81%, (2 mo. USD LIBOR + 2.50%), Maturing June 27, 2025 | | | | | 375 | | | | 370,781 | |

| Cohu, Inc. | | | | | | | | |

Term Loan, 5.40%, (3 mo. USD LIBOR + 3.00%), Maturing September 20, 2025 | | | | | 825 | | | | 812,625 | |

| CommScope, Inc. | | | | | | | | |

Term Loan, 4.35%, (1 mo. USD LIBOR + 2.00%), Maturing December 29, 2022 | | | | | 399 | | | | 393,239 | |

| CPI International, Inc. | | | | | | | | |

Term Loan, 5.84%, (1 mo. USD LIBOR + 3.50%), Maturing July 26, 2024 | | | | | 718 | | | | 713,264 | |

| Cypress Semiconductor Corporation | | | | | | | | |

Term Loan, 4.35%, (1 mo. USD LIBOR + 2.00%), Maturing July 5, 2021 | | | | | 1,102 | | | | 1,093,957 | |

| DigiCert, Inc. | | | | | | | | |

Term Loan, 6.34%, (1 mo. USD LIBOR + 4.00%), Maturing October 31, 2024 | | | | | 4,520 | | | | 4,498,278 | |

| | | | | | | | | | |

| Borrower/Tranche Description | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Electronics / Electrical (continued) | |

| Electro Rent Corporation | | | | | | | | |

Term Loan, 7.49%, (3 mo. USD LIBOR + 5.00%), Maturing January 31, 2024 | | | | | 1,351 | | | $ | 1,356,848 | |

| Energizer Holdings, Inc. | | | | | | | | |

Term Loan, Maturing June 20, 2025(5) | | | | | 575 | | | | 562,781 | |

| Epicor Software Corporation | | | | | | | | |

Term Loan, 5.60%, (1 mo. USD LIBOR + 3.25%), Maturing June 1, 2022 | | | | | 2,907 | | | | 2,874,739 | |

| Exact Merger Sub, LLC | | | | | | | | |

Term Loan, 6.64%, (3 mo. USD LIBOR + 4.25%), Maturing September 27, 2024 | | | | | 668 | | | | 668,668 | |

| EXC Holdings III Corp. | | | | | | | | |

Term Loan, 5.89%, (3 mo. USD LIBOR + 3.50%), Maturing December 2, 2024 | | | | | 521 | | | | 519,760 | |

| Financial & Risk US Holdings, Inc. | | | | | | | | |

Term Loan, 6.09%, (1 mo. USD LIBOR + 3.75%), Maturing October 1, 2025 | | | | | 1,225 | | | | 1,195,779 | |

| Flexera Software, LLC | | | | | | | | |

Term Loan, 5.60%, (1 mo. USD LIBOR + 3.25%), Maturing February 26, 2025 | | | | | 274 | | | | 272,832 | |

| GlobalLogic Holdings, Inc. | | | | | | | | |

Term Loan, 1.63%, Maturing August 1, 2025(2) | | | | | 66 | | | | 65,377 | |

Term Loan, 5.59%, (1 mo. USD LIBOR + 3.25%), Maturing August 1, 2025 | | | | | 459 | | | | 457,641 | |

| Go Daddy Operating Company, LLC | | | | | | | | |

Term Loan, 4.59%, (1 mo. USD LIBOR + 2.25%), Maturing February 15, 2024 | | | | | 5,771 | | | | 5,718,301 | |

| GTCR Valor Companies, Inc. | | | | | | | | |

Term Loan, 5.14%, (3 mo. USD LIBOR + 2.75%), Maturing June 16, 2023 | | | | | 1,603 | | | | 1,592,311 | |

Term Loan, 3.00%, (3 mo. EURIBOR + 3.00%), Maturing June 20, 2023 | | EUR | | | 495 | | | | 562,053 | |

| Hyland Software, Inc. | | | | | | | | |

Term Loan, 5.84%, (1 mo. USD LIBOR + 3.50%), Maturing July 1, 2024 | | | | | 4,025 | | | | 4,006,279 | |

| Infoblox, Inc. | | | | | | | | |

Term Loan, 6.84%, (1 mo. USD LIBOR + 4.50%), Maturing November 7, 2023 | | | | | 2,072 | | | | 2,083,202 | |

| Infor (US), Inc. | | | | | | | | |

Term Loan, 5.14%, (3 mo. USD LIBOR + 2.75%), Maturing February 1, 2022 | | | | | 7,120 | | | | 7,041,263 | |

| Informatica, LLC | | | | | | | | |

Term Loan, 3.50%, (3 mo. EURIBOR + 3.50%), Maturing August 5, 2022 | | EUR | | | 347 | | | | 395,608 | |

Term Loan, 5.59%, (1 mo. USD LIBOR + 3.25%), Maturing August 5, 2022 | | | | | 3,965 | | | | 3,959,633 | |

| | | | |

| | 11 | | See Notes to Financial Statements. |

Eaton Vance

Floating-Rate Income Trust

November 30, 2018

Portfolio of Investments (Unaudited) — continued

| | | | | | | | | | |

| Borrower/Tranche Description | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Electronics / Electrical (continued) | |

| Lattice Semiconductor Corporation | | | | | | | | |

Term Loan, 6.57%, (1 mo. USD LIBOR + 4.25%), Maturing March 10, 2021 | | | | | 498 | | | $ | 499,918 | |

| MA FinanceCo., LLC | | | | | | | | |

Term Loan, 4.59%, (1 mo. USD LIBOR + 2.25%), Maturing November 19, 2021 | | | | | 3,027 | | | | 2,979,110 | |

Term Loan, 4.84%, (1 mo. USD LIBOR + 2.50%), Maturing June 21, 2024 | | | | | 525 | | | | 515,660 | |

| MACOM Technology Solutions Holdings, Inc. | | | | | | | | |

Term Loan, 4.59%, (1 mo. USD LIBOR + 2.25%), Maturing May 17, 2024 | | | | | 1,290 | | | | 1,245,742 | |

| Microchip Technology Incorporated | | | | | | | | |

Term Loan, 4.35%, (1 mo. USD LIBOR + 2.00%), Maturing May 29, 2025 | | | | | 2,510 | | | | 2,498,546 | |

| MTS Systems Corporation | | | | | | | | |

Term Loan, 5.56%, (1 mo. USD LIBOR + 3.25%), Maturing July 5, 2023 | | | | | 1,213 | | | | 1,207,992 | |

| Prometric Holdings, Inc. | | | | | | | | |

Term Loan, 5.35%, (1 mo. USD LIBOR + 3.00%), Maturing January 29, 2025 | | | | | 323 | | | | 321,354 | |

| Renaissance Holding Corp. | | | | | | | | |

Term Loan, 5.59%, (1 mo. USD LIBOR + 3.25%), Maturing May 30, 2025 | | | | | 1,297 | | | | 1,280,541 | |

Term Loan - Second Lien, 9.34%, (1 mo. USD LIBOR + 7.00%), Maturing May 29, 2026 | | | | | 200 | | | | 195,500 | |

| Seattle Spinco, Inc. | | | | | | | | |

Term Loan, 4.84%, (1 mo. USD LIBOR + 2.50%), Maturing June 21, 2024 | | | | | 3,544 | | | | 3,483,484 | |

| SGS Cayman L.P. | | | | | | | | |

Term Loan, 7.76%, (3 mo. USD LIBOR + 5.38%), Maturing April 23, 2021 | | | | | 401 | | | | 382,299 | |

| SkillSoft Corporation | | | | | | | | |

Term Loan, 7.09%, (1 mo. USD LIBOR + 4.75%), Maturing April 28, 2021 | | | | | 5,047 | | | | 4,624,004 | |

| SolarWinds Holdings, Inc. | | | | | | | | |

Term Loan, 5.09%, (1 mo. USD LIBOR + 2.75%), Maturing February 5, 2024 | | | | | 3,481 | | | | 3,472,093 | |

| Southwire Company | | | | | | | | |

Term Loan, 4.31%, (1 mo. USD LIBOR + 2.00%), Maturing May 19, 2025 | | | | | 623 | | | | 619,541 | |

| SS&C Technologies Holdings Europe S.a.r.l. | | | | | | | | |

Term Loan, 4.59%, (1 mo. USD LIBOR + 2.25%), Maturing April 16, 2025 | | | | | 1,421 | | | | 1,391,167 | |

| SS&C Technologies, Inc. | | | | | | | | |

Term Loan, 4.59%, (1 mo. USD LIBOR + 2.25%), Maturing April 16, 2025 | | | | | 3,732 | | | | 3,652,535 | |

| | | | | | | | | | | | |

| Borrower/Tranche Description | | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Electronics / Electrical (continued) | |

| SurveyMonkey, Inc. | | | | | | | | | |

Term Loan, 6.10%, (1 mo. USD LIBOR + 3.75%), Maturing October 10, 2025 | | | | | | | 1,063 | | | $ | 1,060,675 | |

| Sutherland Global Services, Inc. | | | | | | | | | |

Term Loan, 7.76%, (3 mo. USD LIBOR + 5.38%), Maturing April 23, 2021 | | | | | | | 1,722 | | | | 1,642,339 | |

| Switch, Ltd. | | | | | | | | | |

Term Loan, 4.59%, (1 mo. USD LIBOR + 2.25%), Maturing June 27, 2024 | | | | | | | 272 | | | | 269,977 | |

| Tibco Software, Inc. | | | | | | | | | |

Term Loan, 5.85%, (1 mo. USD LIBOR + 3.50%), Maturing December 4, 2020 | | | | | | | 542 | | | | 541,591 | |

| TriTech Software Systems | | | | | | | | | |

Term Loan, 6.09%, (1 mo. USD LIBOR + 3.75%), Maturing August 29, 2025 | | | | | | | 925 | | | | 918,930 | |

| TTM Technologies, Inc. | | | | | | | | | |

Term Loan, 4.80%, (1 mo. USD LIBOR + 2.50%), Maturing September 28, 2024 | | | | | | | 320 | | | | 311,607 | |

| Uber Technologies | | | | | | | | | |

Term Loan, 5.81%, (1 mo. USD LIBOR + 3.50%), Maturing July 13, 2023 | | | | | | | 4,316 | | | | 4,257,690 | |

Term Loan, 6.32%, (1 mo. USD LIBOR + 4.00%), Maturing April 4, 2025 | | | | | | | 2,621 | | | | 2,596,366 | |

| Ultra Clean Holdings, Inc. | | | | | | | | | |

Term Loan, 6.84%, (1 mo. USD LIBOR + 4.50%), Maturing August 27, 2025 | | | | | | | 950 | | | | 928,625 | |

| VeriFone Systems, Inc. | | | | | | | | | |

Term Loan, 6.64%, (3 mo. USD LIBOR + 4.00%), Maturing August 20, 2025 | | | | | | | 1,000 | | | | 993,125 | |

| Veritas Bermuda Ltd. | | | | | | | | | |

Term Loan, 6.85%, (USD LIBOR + 4.50%), Maturing January 27, 2023(4) | | | | | | | 2,421 | | | | 2,184,860 | |

| Vero Parent, Inc. | | | | | | | | | |

Term Loan, 6.84%, (1 mo. USD LIBOR + 4.50%), Maturing August 16, 2024 | | | | | | | 2,599 | | | | 2,608,495 | |

| Wall Street Systems Delaware, Inc. | | | | | | | | | |

Term Loan, 4.00%, (3 mo. EURIBOR + 3.00%, Floor 1.00%), Maturing November 21, 2024 | | | EUR | | | | 620 | | | | 705,182 | |

Term Loan, 5.39%, (3 mo. USD LIBOR + 3.00%), Maturing November 21, 2024 | | | | | | | 794 | | | | 781,097 | |

| Western Digital Corporation | | | | | | | | | |

Term Loan, 4.06%, (1 mo. USD LIBOR + 1.75%), Maturing April 29, 2023 | | | | | | | 1,694 | | | | 1,650,362 | |

| | | | | | | | | | | $ | 110,648,982 | |

| | | | |

| | 12 | | See Notes to Financial Statements. |

Eaton Vance

Floating-Rate Income Trust

November 30, 2018

Portfolio of Investments (Unaudited) — continued

| | | | | | | | | | | | |

| Borrower/Tranche Description | | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Equipment Leasing — 0.8% | |

| Avolon TLB Borrower 1 (US), LLC | | | | | | | | | |

Term Loan, 4.30%, (1 mo. USD LIBOR + 2.00%), Maturing January 15, 2025 | | | | | | | 4,480 | | | $ | 4,441,801 | |

| IBC Capital Limited | | | | | | | | | |

Term Loan, 6.09%, (3 mo. USD LIBOR + 3.75%), Maturing September 11, 2023 | | | | | | | 622 | | | | 617,988 | |

| | | | | | | | | | | $ | 5,059,789 | |

|

| Financial Intermediaries — 4.1% | |

| Citco Funding, LLC | | | | | | | | | |

Term Loan, 4.84%, (1 mo. USD LIBOR + 2.50%), Maturing September 28, 2023 | | | | | | | 2,835 | | | $ | 2,816,904 | |

| Clipper Acquisitions Corp. | | | | | | | | | |

Term Loan, 4.06%, (1 mo. USD LIBOR + 1.75%), Maturing December 27, 2024 | | | | | | | 1,265 | | | | 1,262,011 | |

| Ditech Holding Corporation | | | | | | | | | |

Term Loan, 8.34%, (1 mo. USD LIBOR + 6.00%), Maturing June 30, 2022 | | | | | | | 3,315 | | | | 2,975,094 | |

| Donnelley Financial Solutions, Inc. | | | | | | | | | |

Term Loan, 5.22%, (1 week USD LIBOR + 3.00%), Maturing October 2, 2023 | | | | | | | 184 | | | | 183,595 | |

| EIG Management Company, LLC | | | | | | | | | |

Term Loan, 6.06%, (1 mo. USD LIBOR + 3.75%), Maturing February 22, 2025 | | | | | | | 274 | | | | 274,480 | |

| Evergood 4 ApS | | | | | | | | | |

Term Loan, Maturing February 6, 2025(5) | | | EUR | | | | 118 | | | | 134,772 | |

Term Loan, Maturing February 6, 2025(5) | | | EUR | | | | 632 | | | | 718,785 | |

| Focus Financial Partners, LLC | | | | | | | | | |

Term Loan, 4.84%, (1 mo. USD LIBOR + 2.50%), Maturing July 3, 2024 | | | | | | | 1,995 | | | | 1,981,284 | |

| Fortress Investment Group, LLC | | | | | | | | | |

Term Loan, 4.34%, (1 mo. USD LIBOR + 2.00%), Maturing December 27, 2022 | | | | | | | 1,081 | | | | 1,072,164 | |

| Franklin Square Holdings L.P. | | | | | | | | | |

Term Loan, 4.81%, (1 mo. USD LIBOR + 2.50%), Maturing August 1, 2025 | | | | | | | 575 | | | | 572,484 | |

| Freedom Mortgage Corporation | | | | | | | | | |

Term Loan, 7.09%, (1 mo. USD LIBOR + 4.75%), Maturing February 23, 2022 | | | | | | | 1,977 | | | | 1,971,183 | |

| Greenhill & Co., Inc. | | | | | | | | | |

Term Loan, 6.21%, (USD LIBOR + 3.75%), Maturing October 12, 2022(4) | | | | | | | 1,059 | | | | 1,061,397 | |

| GreenSky Holdings, LLC | | | | | | | | | |

Term Loan, 5.63%, (1 mo. USD LIBOR + 3.25%), Maturing March 31, 2025 | | | | | | | 1,493 | | | | 1,486,903 | |

| | | | | | | | | | | | |

| Borrower/Tranche Description | | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Financial Intermediaries (continued) | |

| Guggenheim Partners, LLC | | | | | | | | | |

Term Loan, 5.09%, (1 mo. USD LIBOR + 2.75%), Maturing July 21, 2023 | | | | | | | 1,133 | | | $ | 1,133,534 | |

| Harbourvest Partners, LLC | | | | | | | | | |

Term Loan, 4.56%, (1 mo. USD LIBOR + 2.25%), Maturing March 1, 2025 | | | | | | | 1,134 | | | | 1,127,284 | |

| LPL Holdings, Inc. | | | | | | | | | |

Term Loan, 4.55%, (1 mo. USD LIBOR + 2.25%), Maturing September 23, 2024 | | | | | | | 1,481 | | | | 1,471,400 | |

| MIP Delaware, LLC | | | | | | | | | |

Term Loan, 5.39%, (3 mo. USD LIBOR + 3.00%), Maturing March 9, 2020 | | | | | | | 109 | | | | 108,987 | |

| Ocwen Financial Corporation | | | | | | | | | |

Term Loan, 7.32%, (1 mo. USD LIBOR + 5.00%), Maturing December 5, 2020 | | | | | | | 317 | | | | 316,892 | |

| Sesac Holdco II, LLC | | | | | | | | | |

Term Loan, 5.34%, (1 mo. USD LIBOR + 3.00%), Maturing February 23, 2024 | | | | | | | 591 | | | | 582,135 | |

| StepStone Group L.P. | | | | | | | | | |

Term Loan, 6.35%, (1 mo. USD LIBOR + 4.00%), Maturing March 14, 2025 | | | | | | | 647 | | | | 645,942 | |

| Victory Capital Holdings, Inc. | | | | | | | | | |

Term Loan, 5.14%, (3 mo. USD LIBOR + 2.75%), Maturing February 12, 2025 | | | | | | | 292 | | | | 291,849 | |

| Virtus Investment Partners, Inc. | | | | | | | | | |

Term Loan, 4.91%, (3 mo. USD LIBOR + 2.50%), Maturing June 1, 2024 | | | | | | | 702 | | | | 702,414 | |

| Walker & Dunlop, Inc. | | | | | | | | | |

Term Loan, 4.59%, (1 mo. USD LIBOR + 2.25%), Maturing October 31, 2025 | | | | | | | 2,300 | | | | 2,297,125 | |

| | | | | | | | | | | $ | 25,188,618 | |

|

| Food Products — 4.2% | |

| Alphabet Holding Company, Inc. | | | | | | | | | |

Term Loan, 5.84%, (1 mo. USD LIBOR + 3.50%), Maturing September 26, 2024 | | | | | | | 2,574 | | | $ | 2,428,410 | |

| Badger Buyer Corp. | | | | | | | | | |

Term Loan, 5.84%, (1 mo. USD LIBOR + 3.50%), Maturing September 30, 2024 | | | | | | | 371 | | | | 363,361 | |

| CHG PPC Parent, LLC | | | | | | | | | |

Term Loan, 5.09%, (1 mo. USD LIBOR + 2.75%), Maturing March 31, 2025 | | | | | | | 524 | | | | 517,783 | |

| Del Monte Foods, Inc. | | | | | | | | | |

Term Loan, 5.91%, (3 mo. USD LIBOR + 3.25%), Maturing February 18, 2021 | | | | | | | 2,312 | | | | 1,985,107 | |

| | | | |

| | 13 | | See Notes to Financial Statements. |

Eaton Vance

Floating-Rate Income Trust

November 30, 2018

Portfolio of Investments (Unaudited) — continued

| | | | | | | | | | | | |

| Borrower/Tranche Description | | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Food Products (continued) | |

| Dole Food Company, Inc. | | | | | | | | | |

Term Loan, 5.09%, (USD LIBOR + 2.75%), Maturing April 6, 2024(4) | | | | | | | 1,841 | | | $ | 1,816,467 | |

| Froneri International PLC | | | | | | | | | |

Term Loan, 2.63%, (3 mo. EURIBOR + 2.63%), Maturing January 22, 2025 | | | EUR | | | | 2,825 | | | | 3,196,184 | |

| Hearthside Food Solutions, LLC | | | | | | | | | |

Term Loan, 6.03%, (1 mo. USD LIBOR + 3.69%), Maturing May 23, 2025 | | | | | | | 773 | | | | 754,702 | |

Term Loan, 6.32%, (1 mo. USD LIBOR + 4.00%), Maturing May 31, 2025 | | | | | | | 500 | | | | 495,625 | |

| High Liner Foods Incorporated | | | | | | | | | |

Term Loan, 5.65%, (3 mo. USD LIBOR + 3.25%), Maturing April 24, 2021 | | | | | | | 848 | | | | 795,405 | |

| HLF Financing S.a.r.l. | | | | | | | | | |

Term Loan, 5.59%, (1 mo. USD LIBOR + 3.25%), Maturing August 18, 2025 | | | | | | | 1,125 | | | | 1,123,125 | |

| Jacobs Douwe Egberts International B.V. | | | | | | | | | |

Term Loan, 2.50%, (3 mo. EURIBOR + 2.00%, Floor 0.50%), Maturing November 1, 2025 | | | EUR | | | | 285 | | | | 324,333 | |

Term Loan, 4.56%, (3 mo. USD LIBOR + 2.00%), Maturing November 1, 2025 | | | | | | | 1,737 | | | | 1,733,826 | |

| JBS USA Lux S.A. | | | | | | | | | |

Term Loan, 4.84%, (3 mo. USD LIBOR + 2.50%), Maturing October 30, 2022 | | | | | | | 7,542 | | | | 7,468,557 | |

| Nomad Foods Europe Midco Limited | | | | | | | | | |

Term Loan, 4.56%, (1 mo. USD LIBOR + 2.25%), Maturing May 15, 2024 | | | | | | | 1,294 | | | | 1,271,672 | |

| Post Holdings, Inc. | | | | | | | | | |

Term Loan, 4.32%, (1 mo. USD LIBOR + 2.00%), Maturing May 24, 2024 | | | | | | | 1,071 | | | | 1,068,061 | |

| Restaurant Technologies, Inc. | | | | | | | | | |

Term Loan, 5.65%, (3 mo. USD LIBOR + 3.25%), Maturing October 1, 2025 | | | | | | | 225 | | | | 224,859 | |

| | | | | | | | | | | $ | 25,567,477 | |

|

| Food Service — 2.5% | |

| 1011778 B.C. Unlimited Liability Company | | | | | | | | | |

Term Loan, 4.59%, (1 mo. USD LIBOR + 2.25%), Maturing February 16, 2024 | | | | | | | 6,329 | | | $ | 6,199,735 | |

| Aramark Services, Inc. | | | | | | | | | |

Term Loan, 4.09%, (1 mo. USD LIBOR + 1.75%), Maturing March 11, 2025 | | | | | | | 909 | | | | 904,516 | |

| Del Frisco’s Restaurant Group, Inc. | | | | | | | | | |

Term Loan, 8.38%, (1 mo. USD LIBOR + 6.00%), Maturing June 27, 2025 | | | | | | | 648 | | | | 619,198 | |

| | | | | | | | | | | | |

| Borrower/Tranche Description | | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Food Service (continued) | |

| Dhanani Group, Inc. | | | | | | | | | |

Term Loan, 6.09%, (1 mo. USD LIBOR + 3.75%), Maturing July 20, 2025 | | | | | | | 648 | | | $ | 641,891 | |

| IRB Holding Corp. | | | | | | | | | |

Term Loan, 5.57%, (1 mo. USD LIBOR + 3.25%), Maturing February 5, 2025 | | | | | | | 2,301 | | | | 2,280,610 | |

| KFC Holding Co. | | | | | | | | | |

Term Loan, 4.05%, (1 mo. USD LIBOR + 1.75%), Maturing April 3, 2025 | | | | | | | 1,054 | | | | 1,047,786 | |

| NPC International, Inc. | | | | | | | | | |

Term Loan, 5.84%, (1 mo. USD LIBOR + 3.50%), Maturing April 19, 2024 | | | | | | | 938 | | | | 900,600 | |

| Seminole Hard Rock Entertainment, Inc. | | | | | | | | | |

Term Loan, 5.15%, (3 mo. USD LIBOR + 2.75%), Maturing May 14, 2020 | | | | | | | 284 | | | | 283,954 | |

| US Foods, Inc. | | | | | | | | | |

Term Loan, 4.34%, (1 mo. USD LIBOR + 2.00%), Maturing June 27, 2023 | | | | | | | 895 | | | | 886,186 | |

| Welbilt, Inc. | | | | | | | | | |

Term Loan, 4.84%, (1 mo. USD LIBOR + 2.50%), Maturing October 23, 2025 | | | | | | | 1,753 | | | | 1,732,953 | |

| | | | | | | | | | | $ | 15,497,429 | |

|

| Food / Drug Retailers — 1.3% | |

| Albertsons, LLC | | | | | | | | | |

Term Loan, 5.38%, (3 mo. USD LIBOR + 3.00%), Maturing December 21, 2022 | | | | | | | 1,474 | | | $ | 1,453,281 | |

Term Loan, 5.69%, (3 mo. USD LIBOR + 3.00%), Maturing June 22, 2023 | | | | | | | 3,983 | | | | 3,918,377 | |

Term Loan, 5.45%, (3 mo. USD LIBOR + 3.00%), Maturing November 17, 2025 | | | | | | | 1,125 | | | | 1,101,832 | |

| Diplomat Pharmacy, Inc. | | | | | | | | | |

Term Loan, 6.85%, (1 mo. USD LIBOR + 4.50%), Maturing December 20, 2024 | | | | | | | 505 | | | | 506,896 | |

| Holland & Barrett International | | | | | | | | | |

Term Loan, 4.25%, (3 mo. EURIBOR + 4.25%), Maturing August 9, 2024 | | | EUR | | | | 450 | | | | 497,346 | |

Term Loan, 6.05%, (3 mo. GBP LIBOR + 5.25%), Maturing September 2, 2024 | | | GBP | | | | 450 | | | | 547,430 | |

| | | | | | | | | | | $ | 8,025,162 | |

|

| Health Care — 14.0% | |

| Acadia Healthcare Company, Inc. | | | | | | | | | |

Term Loan, 4.84%, (1 mo. USD LIBOR + 2.50%), Maturing February 11, 2022 | | | | | | | 258 | | | $ | 256,460 | |

| | | | |

| | 14 | | See Notes to Financial Statements. |

Eaton Vance

Floating-Rate Income Trust

November 30, 2018

Portfolio of Investments (Unaudited) — continued

| | | | | | | | | | |

| Borrower/Tranche Description | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Health Care (continued) | |

| ADMI Corp. | | | | | | | | |

Term Loan, 5.34%, (1 mo. USD LIBOR + 3.00%), Maturing April 30, 2025 | | | | | 1,845 | | | $ | 1,837,685 | |

| Akorn, Inc. | | | | | | | | |

Term Loan, 7.88%, (1 mo. USD LIBOR + 5.50%), Maturing April 16, 2021 | | | | | 1,935 | | | | 1,641,891 | |

| Alliance Healthcare Services, Inc. | | | | | | | | |

Term Loan, 6.84%, (1 mo. USD LIBOR + 4.50%), Maturing October 24, 2023 | | | | | 1,084 | | | | 1,083,594 | |

Term Loan - Second Lien, 12.34%, (1 mo. USD LIBOR + 10.00%), Maturing April 24, 2024 | | | | | 525 | | | | 525,000 | |

| Argon Medical Devices, Inc. | | | | | | | | |

Term Loan, 6.09%, (1 mo. USD LIBOR + 3.75%), Maturing January 23, 2025 | | | | | 821 | | | | 821,388 | |

| Athletico Management, LLC | | | | | | | | |

Term Loan, 5.80%, (1 mo. USD LIBOR + 3.50%), Maturing October 31, 2025 | | | | | 575 | | | | 577,875 | |

| Auris Luxembourg III S.a.r.l. | | | | | | | | |

Term Loan, 5.39%, (3 mo. USD LIBOR + 3.00%), Maturing January 17, 2022 | | | | | 820 | | | | 818,268 | |

| Avantor, Inc. | | | | | | | | |

Term Loan, 6.07%, (1 mo. USD LIBOR + 3.75%), Maturing November 21, 2024 | | | | | 1,315 | | | | 1,315,679 | |

| Beaver-Visitec International, Inc. | | | | | | | | |

Term Loan, 6.39%, (3 mo. USD LIBOR + 4.00%), Maturing August 21, 2023 | | | | | 858 | | | | 857,538 | |

| BioClinica, Inc. | | | | | | | | |

Term Loan, 6.75%, (3 mo. USD LIBOR + 4.25%), Maturing October 20, 2023 | | | | | 1,525 | | | | 1,440,979 | |

| BW NHHC Holdco, Inc. | | | | | | | | |

Term Loan, 7.30%, (1 mo. USD LIBOR + 5.00%), Maturing May 15, 2025 | | | | | 1,072 | | | | 1,053,547 | |

| Carestream Dental Equipment, Inc. | | | | | | | | |

Term Loan, 5.64%, (3 mo. USD LIBOR + 3.25%), Maturing September 1, 2024 | | | | | 1,386 | | | | 1,365,210 | |

| Certara L.P. | | | | | | | | |

Term Loan, 5.89%, (1 mo. USD LIBOR + 3.50%), Maturing August 15, 2024 | | | | | 990 | | | | 978,863 | |

| CHG Healthcare Services, Inc. | | | | | | | | |

Term Loan, 5.46%, (USD LIBOR + 3.00%), Maturing June 7, 2023(4) | | | | | 3,526 | | | | 3,514,262 | |

| Community Health Systems, Inc. | | | | | | | | |

Term Loan, 5.96%, (3 mo. USD LIBOR + 3.25%), Maturing January 27, 2021 | | | | | 1,793 | | | | 1,756,759 | |

| Concentra, Inc. | | | | | | | | |

Term Loan, 5.07%, (1 mo. USD LIBOR + 2.75%), Maturing June 1, 2022 | | | | | 611 | | | | 606,114 | |

| | | | | | | | | | |

| Borrower/Tranche Description | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Health Care (continued) | |

| Convatec, Inc. | | | | | | | | |

Term Loan, 4.64%, (3 mo. USD LIBOR + 2.25%), Maturing October 31, 2023 | | | | | 640 | | | $ | 635,848 | |

| CPI Holdco, LLC | | | | | | | | |

Term Loan, 5.89%, (1 mo. USD LIBOR + 3.50%), Maturing March 21, 2024 | | | | | 839 | | | | 834,617 | |

| CryoLife, Inc. | | | | | | | | |

Term Loan, 5.64%, (3 mo. USD LIBOR + 3.25%), Maturing November 14, 2024 | | | | | 521 | | | | 520,411 | |

| CTC AcquiCo GmbH | | | | | | | | |

Term Loan, 3.00%, (3 mo. EURIBOR + 3.00%), Maturing March 7, 2025 | | EUR | | | 903 | | | | 1,018,094 | |

| DaVita, Inc. | | | | | | | | |

Term Loan, 5.09%, (1 mo. USD LIBOR + 2.75%), Maturing June 24, 2021 | | | | | 1,935 | | | | 1,933,850 | |

| DJO Finance, LLC | | | | | | | | |

Term Loan, 5.62%, (USD LIBOR + 3.25%), Maturing June 8, 2020(4) | | | | | 2,346 | | | | 2,344,721 | |

| Envision Healthcare Corporation | | | | | | | | |

Term Loan, 6.09%, (1 mo. USD LIBOR + 3.75%), Maturing October 10, 2025 | | | | | 4,925 | | | | 4,739,081 | |

| Equian, LLC | | | | | | | | |

Term Loan, 5.57%, (1 mo. USD LIBOR + 3.25%), Maturing May 20, 2024 | | | | | 668 | | | | 663,923 | |

| Gentiva Health Services, Inc. | | | | | | | | |

Term Loan, 6.13%, (1 mo. USD LIBOR + 3.75%), Maturing July 2, 2025 | | | | | 2,175 | | | | 2,170,583 | |

| GHX Ultimate Parent Corporation | | | | | | | | |

Term Loan, 5.64%, (3 mo. USD LIBOR + 3.25%), Maturing June 28, 2024 | | | | | 990 | | | | 974,152 | |

| Greatbatch Ltd. | | | | | | | | |

Term Loan, 5.32%, (1 mo. USD LIBOR + 3.00%), Maturing October 27, 2022 | | | | | 1,702 | | | | 1,700,583 | |

| Grifols Worldwide Operations USA, Inc. | | | | | | | | |

Term Loan, 4.47%, (1 week USD LIBOR + 2.25%), Maturing January 31, 2025 | | | | | 3,669 | | | | 3,644,127 | |

| Hanger, Inc. | | | | | | | | |

Term Loan, 5.84%, (1 mo. USD LIBOR + 3.50%), Maturing March 6, 2025 | | | | | 1,144 | | | | 1,142,820 | |

| Indivior Finance S.a.r.l. | | | | | | | | |

Term Loan, 7.03%, (3 mo. USD LIBOR + 4.50%), Maturing December 18, 2022 | | | | | 2,017 | | | | 1,986,364 | |

| Inovalon Holdings, Inc. | | | | | | | | |

Term Loan, 5.88%, (1 mo. USD LIBOR + 3.50%), Maturing April 2, 2025 | | | | | 1,347 | | | | 1,339,330 | |

| | | | |

| | 15 | | See Notes to Financial Statements. |

Eaton Vance

Floating-Rate Income Trust

November 30, 2018

Portfolio of Investments (Unaudited) — continued

| | | | | | | | | | |

| Borrower/Tranche Description | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Health Care (continued) | |

| IQVIA, Inc. | | | | | | | | |

Term Loan, 4.39%, (3 mo. USD LIBOR + 2.00%), Maturing March 7, 2024 | | | | | 551 | | | $ | 549,510 | |

Term Loan, 4.39%, (3 mo. USD LIBOR + 2.00%), Maturing January 17, 2025 | | | | | 990 | | | | 982,884 | |

| Kinetic Concepts, Inc. | | | | | | | | |

Term Loan, 5.64%, (3 mo. USD LIBOR + 3.25%), Maturing February 2, 2024 | | | | | 2,913 | | | | 2,905,842 | |

| KUEHG Corp. | | | | | | | | |

Term Loan, 6.14%, (3 mo. USD LIBOR + 3.75%), Maturing February 21, 2025 | | | | | 3,278 | | | | 3,267,633 | |

Term Loan - Second Lien, 10.64%, (3 mo. USD LIBOR + 8.25%), Maturing August 18, 2025 | | | | | 425 | | | | 427,125 | |

| Medical Solutions, LLC | | | | | | | | |

Term Loan, 6.09%, (1 mo. USD LIBOR + 3.75%), Maturing June 9, 2024 | | | | | 769 | | | | 768,281 | |

| MedPlast Holdings, Inc. | | | | | | | | |

Term Loan, 6.15%, (3 mo. USD LIBOR + 3.75%), Maturing July 2, 2025 | | | | | 500 | | | | 500,313 | |

| MPH Acquisition Holdings, LLC | | | | | | | | |

Term Loan, 5.14%, (3 mo. USD LIBOR + 2.75%), Maturing June 7, 2023 | | | | | 3,436 | | | | 3,378,078 | |

| National Mentor Holdings, Inc. | | | | | | | | |

Term Loan, 5.39%, (3 mo. USD LIBOR + 3.00%), Maturing January 31, 2021 | | | | | 1,061 | | | | 1,060,495 | |

| Navicure, Inc. | | | | | | | | |

Term Loan, 6.09%, (1 mo. USD LIBOR + 3.75%), Maturing November 1, 2024 | | | | | 844 | | | | 838,164 | |

| New Millennium Holdco, Inc. | | | | | | | | |

Term Loan, 8.84%, (1 mo. USD LIBOR + 6.50%), Maturing December 21, 2020 | | | | | 554 | | | | 313,666 | |

| One Call Corporation | | | | | | | | |

Term Loan, 7.56%, (1 mo. USD LIBOR + 5.25%), Maturing November 25, 2022 | | | | | 2,512 | | | | 2,302,756 | |

| Ortho-Clinical Diagnostics S.A. | | | | | | | | |

Term Loan, 5.58%, (3 mo. USD LIBOR + 3.25%), Maturing June 30, 2025 | | | | | 3,619 | | | | 3,534,859 | |

| Parexel International Corporation | | | | | | | | |

Term Loan, 5.09%, (1 mo. USD LIBOR + 2.75%), Maturing September 27, 2024 | | | | | 2,822 | | | | 2,748,141 | |

| Press Ganey Holdings, Inc. | | | | | | | | |

Term Loan, 5.09%, (1 mo. USD LIBOR + 2.75%), Maturing October 23, 2023 | | | | | 811 | | | | 802,710 | |

| Prospect Medical Holdings, Inc. | | | | | | | | |

Term Loan, 7.88%, (1 mo. USD LIBOR + 5.50%), Maturing February 22, 2024 | | | | | 1,269 | | | | 1,273,382 | |

| | | | | | | | | | | | |

| Borrower/Tranche Description | | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Health Care (continued) | |

| R1 RCM, Inc. | | | | | | | | | |

Term Loan, 7.65%, (3 mo. USD LIBOR + 5.25%), Maturing May 8, 2025 | | | | | | | 623 | | | $ | 621,100 | |

| RadNet, Inc. | | | | | | | | | |

Term Loan, 6.22%, (3 mo. USD LIBOR + 3.75%), Maturing June 30, 2023 | | | | | | | 1,628 | | | | 1,628,568 | |

| Select Medical Corporation | | | | | | | | | |

Term Loan, 4.81%, (1 mo. USD LIBOR + 2.50%), Maturing March 6, 2025 | | | | | | | 1,773 | | | | 1,765,243 | |

| Sotera Health Holdings, LLC | | | | | | | | | |

Term Loan, 5.34%, (1 mo. USD LIBOR + 3.00%), Maturing May 15, 2022 | | | | | | | 900 | | | | 891,975 | |

| Sound Inpatient Physicians | | | | | | | | | |

Term Loan, 5.34%, (1 mo. USD LIBOR + 3.00%), Maturing June 27, 2025 | | | | | | | 499 | | | | 497,815 | |

| Surgery Center Holdings, Inc. | | | | | | | | | |

Term Loan, 5.60%, (1 mo. USD LIBOR + 3.25%), Maturing September 2, 2024 | | | | | | | 1,064 | | | | 1,051,279 | |

| Syneos Health, Inc. | | | | | | | | | |

Term Loan, 4.34%, (1 mo. USD LIBOR + 2.00%), Maturing August 1, 2024 | | | | | | | 391 | | | | 388,169 | |

| Team Health Holdings, Inc. | | | | | | | | | |

Term Loan, 5.09%, (1 mo. USD LIBOR + 2.75%), Maturing February 6, 2024 | | | | | | | 2,216 | | | | 2,072,194 | |

| Tecomet, Inc. | | | | | | | | | |

Term Loan, 5.82%, (1 mo. USD LIBOR + 3.50%), Maturing May 1, 2024 | | | | | | | 839 | | | | 832,030 | |

| U.S. Anesthesia Partners, Inc. | | | | | | | | | |

Term Loan, 5.34%, (1 mo. USD LIBOR + 3.00%), Maturing June 23, 2024 | | | | | | | 1,710 | | | | 1,706,805 | |

| Universal Hospital Services, Inc. | | | | | | | | | |

Term Loan, Maturing October 18, 2025(5) | | | | | | | 475 | | | | 473,813 | |

| Verscend Holding Corp. | | | | | | | | | |

Term Loan, 6.84%, (1 mo. USD LIBOR + 4.50%), Maturing August 27, 2025 | | | | | | | 1,625 | | | | 1,619,413 | |

| Wink Holdco, Inc. | | | | | | | | | |

Term Loan, 5.34%, (1 mo. USD LIBOR + 3.00%), Maturing December 2, 2024 | | | | | | | 496 | | | | 490,047 | |

| | | | | | | | | | | $ | 85,791,906 | |

|

| Home Furnishings — 1.0% | |

| Bright Bidco B.V. | | | | | | | | | |

Term Loan, 5.87%, (USD LIBOR + 3.50%), Maturing June 30, 2024(4) | | | | | | | 1,680 | | | $ | 1,545,882 | |

| | | | |

| | 16 | | See Notes to Financial Statements. |

Eaton Vance

Floating-Rate Income Trust

November 30, 2018

Portfolio of Investments (Unaudited) — continued

| | | | | | | | | | | | |

| Borrower/Tranche Description | | | | | Principal

Amount*

(000’s omitted) | | | Value | |

|

| Home Furnishings (continued) | |

| Serta Simmons Bedding, LLC | | | | | | | | | |

Term Loan, 5.81%, (1 mo. USD LIBOR + 3.50%), Maturing November 8, 2023 | | | | | | | 4,839 | | | $ | 4,320,658 | |

| | | | | | | | | | | $ | 5,866,540 | |

|