INDEX OIL and GAS Inc

(the “Company”)

Forward Looking Statement Disclaimer

The statements in this document that relate to the company's expectations with regard to the future impact the company's results from acquisitions or actions in development are forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The statements in this document may also contain "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21 E of the Securities Exchange Act of 1934.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, such statements should not be regarded as a representation by the Company, or any other person, that such forward-looking statements will be achieved. Since the information may contain statements that involve risk and uncertainties and are subject to change at any time, the company's actual results may differ materially from expected results. Index Oil and Gas Inc. disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. In light of the foregoing, readers are cautioned not to place undue reliance on such forward-looking statements.

· Impressive Performance Track Record.

· Blue Chip Management Team

· Exciting Drilling Program with Opportunities for Follow-On Wells

· Politically Stable and Robust Market

· Sound Business Plan and Financial Basis

· | Daniel (“Dan”) Murphy – Chairman 39 yrs + experience in worldwide executive positions for Shell Oil, Occidental Petroleum, Santa Fe, Brown & Root, and Kvaerner. Participated in the development of the 500m+ bbl Buzzard field (UKCS). |

· | Lyndon West - Chief Executive Officer 25 yrs + experience in the Oil and Gas Industry - VC backed with IEDS limited, successful exit. He was appointed CEO of the IHSE International Division and subsequently New Venture Services Practice Director for the buyer, IHS Energy. |

· | Andrew (“Andy”) Boetius - Chief Financial Officer has extensive E&P experience including fourteen years with Amerada Hess where he was Divisional Finance Director (UK gas operations) and Fortum Group, where he divested the UK energy marketing business. |

· | David (Dave) Jenkins – Non Executive Director 31 years experience in global hydrocarbon exploration. He was instrumental in developing the integrated exploration process which resulted in Conoco being an industry leader in terms of commercial success rate and the number of significant discoveries of a size greater than 100 million boe. |

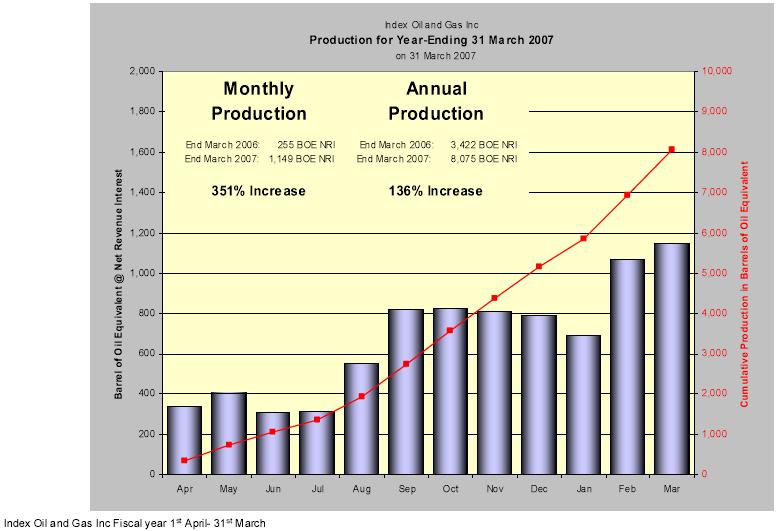

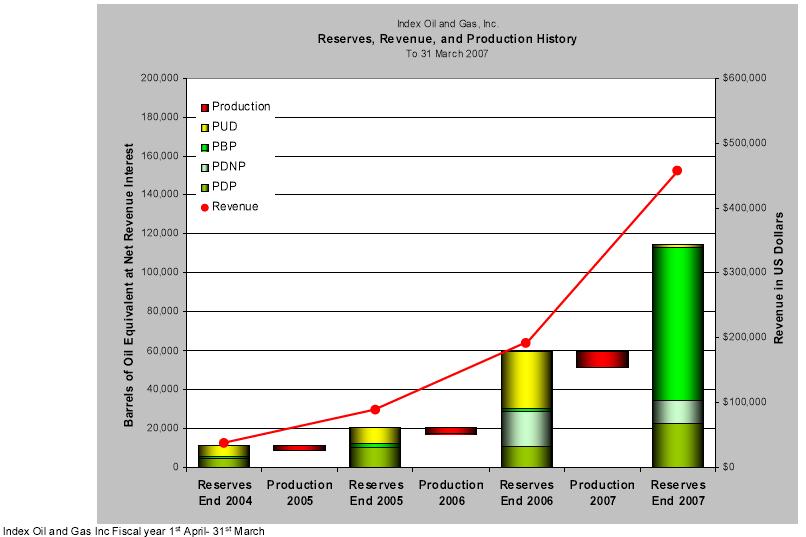

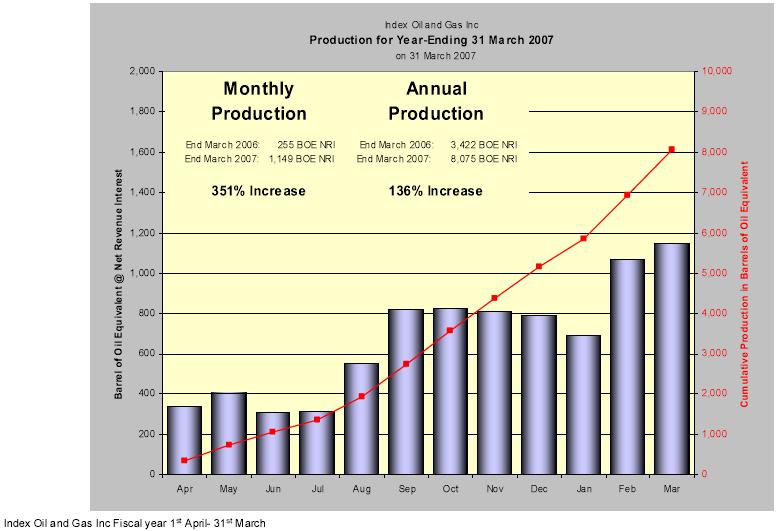

· 136% Annual Production increase between March ‘06 and ’07.

· 93% Year-End Reserves increase between March ’06 and ‘07

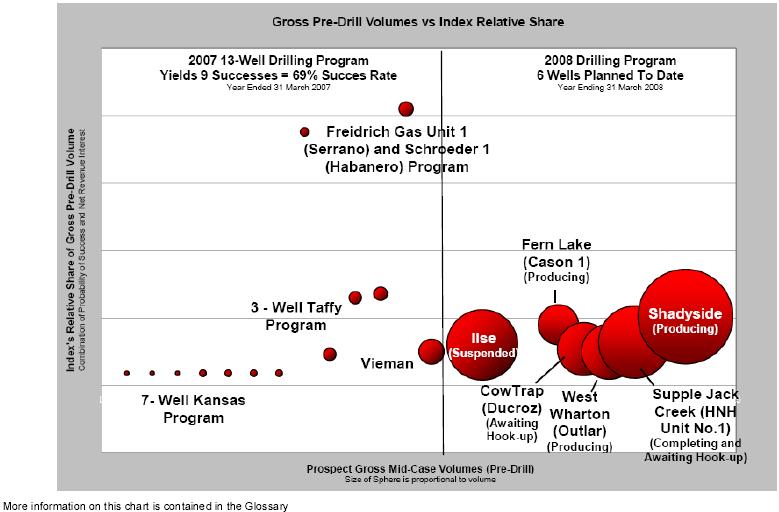

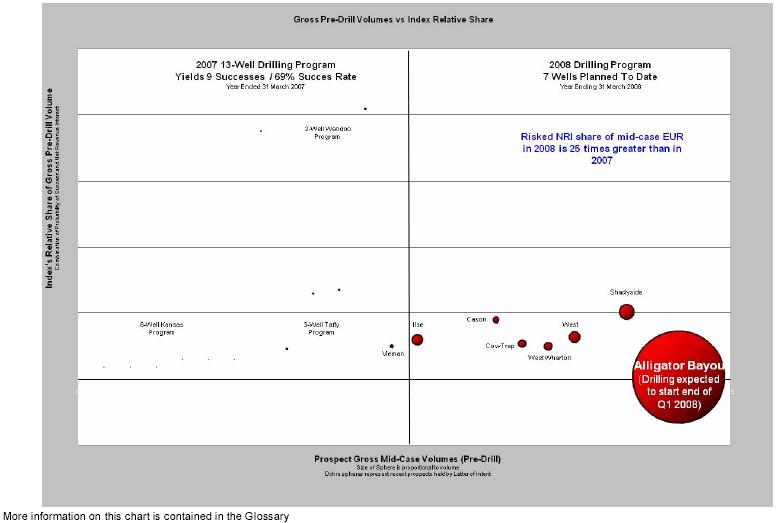

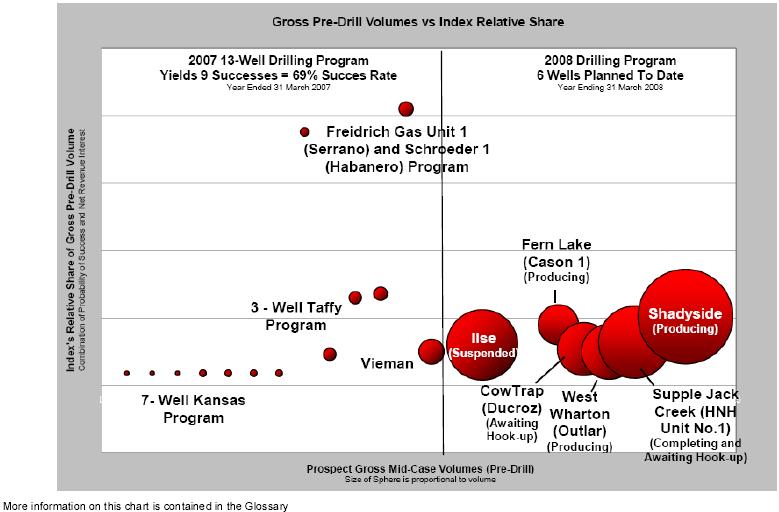

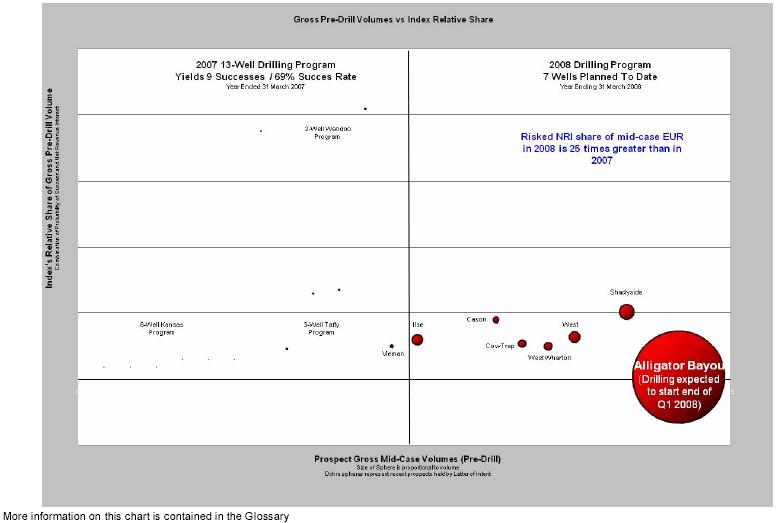

· 69% Success Rate in Index participated wells (13 drilled with 9 successes)

· Signed participation contracts in 7 high impact wells in FY 2008 plus 1 production well with Proven Undeveloped Reserves

· Q3 2006 - raised $11 million (gross) at $1/share private placement

· Operational focus Mid Continent and Onshore Gulf Coast regions of the USA

· Drilled 6 out of 7 high impact wells

· Currently 3 producing, 1 awaiting hook up, 1 testing and 1 suspended

· Follow-on drilling opportunities in:

· Cason – 1 additional well already drilled; drilling to shortly begin on a third well

· Shadyside – Evaluating deeper and shallower potential

· Outlar (West Wharton) – Potentially 4 additional wells

· HNH Gas Unit No. 1 (Supple Jack Creek) – Further activity subject to current testing program

Current Status and Results for higher impact Wells

Prospect | Status | NRI% (Approx)* | Test results | Recent Production (Approx) *** |

| (Cason 1) | Producing | 18.36 (13.77) % | 1.2 mmcfpd | 0.55 mmcfpd |

| Shadyside** | Producing | 21.15 (19.04) % | 3.0 mmcfpd & 200 bcpd | 1.6mmcfpd & 134 bcpd |

| West Wharton (Outlar) | Producing | 8.20 (7.03) % | 1.6 mmcfpd & 75 bcpd | 3.2mmcfpd & 190 bcpd |

| Cow Trap (Ducroz) | Awaiting hook up | 5.25 % | 4.0 mmcfpd **** | |

| Supple Jack Creek (HNH Gas Unit 1) | Completing and awaiting testing | 14.45 (14.02) % | Pending | |

| New Taiton (Ilse) | Suspended | 7.30 (6.00) % | Wilcox C non productive. | |

* NRI = net revenue interest – Figures shown in brackets are After Pay Out (APO). ** Shadyside equity was increased post drilling and pre completion

*** Recent production is indicative and does vary

**** Initial production anticipated to be lower

Current Status of Additional Wells

Prospect | Status | NRI (Approx) | Comments |

| Cason 2 | Completing and testing | 18.36 (13.77)% | Ongoing |

| Cason 3 | Awaiting spud | 18.36 (13.77)% | Expected mid Jan |

| Alligator Bayou | Awaiting Spud | 3.5% | Expected end Q1 08 |

Status Update on selected Wells Drilled in FY2007

Well | Status June 11 | NRI (Approx) | Current Status |

| Schroeder | Awaiting Hook up | 28.13% | Producing |

| Hawkins | Awaiting Hook up | 10.01% | Producing |

| Vieman | Re-Completing | 14.56% | Re-Completing |

· Drilling opportunities

» Target size 20+bcf mid case unrisked – with follow on wells and/or prospects to enhance economics

» Gulf Coast/Mid Continent – conventional oil and gas

· Acquisition opportunities

» Target up to 50% PDP to add immediate reserves and production

» Strong element of PUDs with near term drilling prospects to add to inventory

· Land play

» Acquire land position; develop and prove concept through seismic analysis or initial well exploration drilling

» Bring in partners with capital to (part) finance projects

· Ticker symbol OTCBB: IXOG

· 65.7 million common stock shares issued at July 31 2007

· Director’s & Executive’s share Ownership 9.6 million (14.6%)

· 52 week trading range ($1.40 to $0.46)

· Q1 calendar year 2006 raised $5 million gross at $0.60/share private placement

· Q3 calendar year 2006 raised $11 million gross at $1/share private placement

· Projecting cashflow positive on a go forward basis by end FY 08 (Q1 08)

· No debt

Sound FInancial Basis

· Apply capital to best available risk mitigated balanced portfolio of opportunities

· Quickly build reserves, production and create a cash positive business

· 7 firm FY 2008 wells committed (6 wells now drilled as of 12/31/07)

· 1 Production Well with Proven Developed Reserves

· 6 high impact wells with Alligator Bayou potentially very high impact

· Targeting operating cash positive during FY 2008

· Earnings positive for start of FY 2009

· Available capital fully committed and applied by end FY 2008

· Track record in a politically stable and robust market

· Experienced team with strong industry relationships

· Proven access to quality projects not available in the open market

· Risk mitigated balanced portfolio approach to building value

· High impact opportunities with considerable potential upside

· Fully-funded program targeted to be drilled during FY 2008

Appendix

Company Historical Review

· Raised approx $2 million between March ‘03 and Aug ‘05

· Entered first project in Kansas (Seward)

· Proved business concept (low risk/low equity project entry)

· Created early cashflow and management team

· Drilled successful Walker well in Louisiana (oil and gas producer)

· Committed to Taffy 1 & 2 (Hawkins/Dark) and Vieman wells in Texas

· Positioned for next funding round

· Merged with Public Company Jan ‘06

· Raised $5.12 million in Jan 06

· Increased working interests and number of Texas wells;

· Taffy #1 (7.5% Ö 12.5%), Taffy #2 (7.5% Ö 30%) & Taffy # 3 (30%)

· Moved toward higher equity positions and increased size of prospect

· Committed to West 1 & Ilse wells plus other forward projects

· More material projects with follow-on drilling in success case

· Signed 3D seismic reprocessing and exploration agreement with ADC (to provide prospect flow)

· Cason well is first well proposed (land acquired – awaiting contracts)

· Raised $11 million (gross) in Q3 ‘06

· Focused on larger prospects with follow on drilling opportunities

· More material equity, increase size of prospect, risk and reward

· Shadyside (Louisiana) West Wharton, West 1, Ilse, and Cason (all located in Texas)

· Cowtrap, a low risk production well

· Serrano and Habanero to balance portfolio and potential forward dealflow

· Committed $9 million of funds raised to date to drilling and entry costs

· Will focus remaining available capital on similar size and risk profile projects in Gulf Coast area

INDEX OIL AND GAS INC. Lyndon J. West CEO 10,000 Memorial Drive Houston, TX 77024 Tel: 1 713 683 0800 Fax: 1 713 956 8855 Email: lyndon.west@indexoil.com www.indexoil.com | INVESTOR RELATIONS Consulting for Strategic Growth 1 Stanley Wunderlich CEO Tel: 1 800 625 2236 Fax: 1 212 337-8089 Email: info@CFSG1.com www.cfsg1.com |

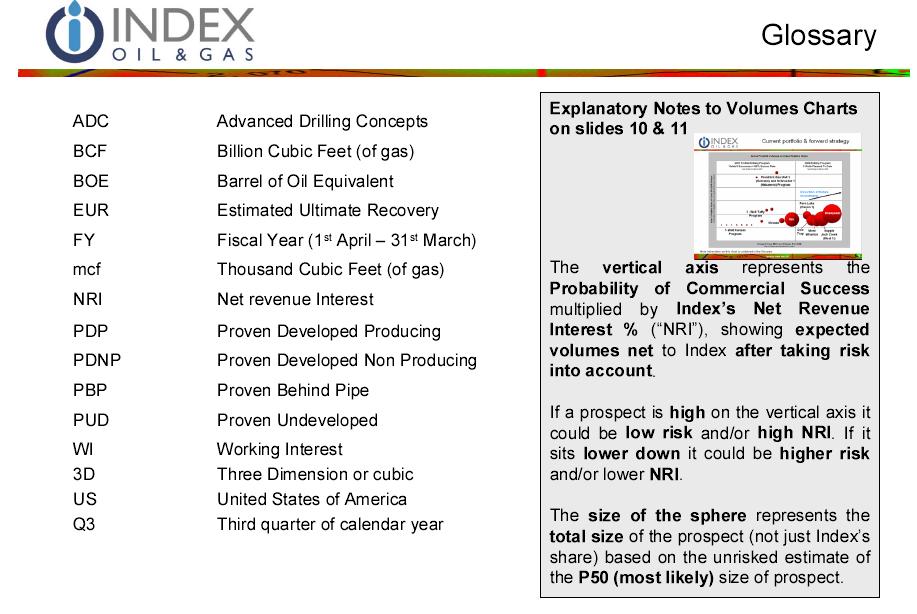

23