UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21597

PRIMECAP Odyssey Funds

(Exact name of registrant as specified in charter)

177 East Colorado Boulevard, 11th Floor

Pasadena, CA 91105

(Address of principal executive offices) (Zip code)

Julietta Martikyan

PRIMECAP Management Company

177 East Colorado Boulevard, 11th Floor

Pasadena, CA 91105

(Name and address of agent for service)

(626) 304-9222

Registrant’s telephone number, including area code

Date of fiscal year end: October 31

Date of reporting period: October 31, 2024

Item 1. Reports to Stockholders.

| | |

PRIMECAP Odyssey Stock Fund | |

| POSKX |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the PRIMECAP Odyssey Stock Fund for the period of November 1, 2023, to October 31, 2024. You can find additional information about the Fund at https://prospectus-express.broadridge.com/summary.asp?doctype=ann&cid=primecap&fid=74160Q301. You can also request this information by contacting us at 1-800-729-2307.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| PRIMECAP Odyssey Stock Fund | $77 | 0.67% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the fiscal year ended October 31, 2024, the PRIMECAP Odyssey Stock Fund’s total return of +29.83% trailed the S&P 500® Index’s total return of +38.02%.

• During the fiscal year, the U.S. economy proved resilient as a firm labor market and robust consumer spending delivered

healthy real GDP growth. Core inflation moderated somewhat but persisted at above-target levels, forcing the Federal

Reserve to keep its benchmark rate above 5% for most of the year. But as economic data softened towards period-end,

the Fed in September initiated its long-awaited dovish pivot with a 50 basis point cut.

• Increasing optimism in a so-called “soft landing” and the prospect of lower interest rates bolstered equities. The S&P

500® Index’s forward price-to-earnings multiple expanded over 20% during the period, from roughly 17x to 21x, driving

most of the market’s return. Forward earnings also showed healthy double-digit growth.

• The Fund logged a strong gain but was unable to keep pace with the S&P 500® Index’s torrid rise. Relative to the S&P

500® Index, sector allocation and stock selection were both unfavorable.

• The Fund’s sector allocation headwind stemmed from its significant overweight position in health care and its

substantial underweight positions in the two best performing sectors, information technology and communication

services.

• Stock selection was positive in the health care, industrials, and financials sectors. Stock selection was broadly

unfavorable otherwise, with the information technology sector serving as the primary detractor.

| PRIMECAP Odyssey Stock Fund | PAGE 1 | TSR-AR-74160Q301 |

HOW DID THE FUND PERFORM OVER THE PAST 10 YEARS?

The chart illustrates the performance of a hypothetical $10,000 investment in the Fund. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of dividends and capital gains for the fund and dividends for the index.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

PRIMECAP Odyssey Stock Fund | 29.83 | 12.27 | 11.41 |

S&P 500® Index | 38.02 | 15.27 | 13.00 |

Investment result data reflects deduction of fund operating expenses. Total return represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be different than quoted, and performance as of the most recent month-end can be obtained by calling 1-800-729-2307 or by visiting https://www.primecap.com/funds/primecap-odyssey-stock-fund/.

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $5,229,150,351 |

Number of Holdings | 144 |

Net Advisory Fee | $30,958,259 |

Portfolio Turnover | 3% |

WHAT DID THE FUND INVEST IN? (% of net assets as of October 31, 2024)

| |

Top 10 Issuers | (%) |

Eli Lilly & Co. | 9.5% |

AstraZeneca PLC | 4.0% |

AECOM | 3.7% |

Amgen, Inc. | 3.0% |

KLA Corp. | 2.9% |

Flex Ltd. | 2.9% |

FedEx Corp. | 2.9% |

Microsoft Corp. | 2.9% |

Siemens AG | 2.9% |

Raymond James Financial, Inc. | 2.1% |

| |

Top Sectors | (%) |

Health Care | 26.1% |

Information Technology | 22.6% |

Industrials | 21.8% |

Financials | 9.4% |

Consumer Discretionary | 8.5% |

Communication Services | 3.6% |

Energy | 2.3% |

Consumer Staples | 1.9% |

Materials | 1.8% |

Cash & Other | 2.0% |

The Fund is distributed by ALPS Distributors, Inc.

| PRIMECAP Odyssey Stock Fund | PAGE 2 | TSR-AR-74160Q301 |

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact the Fund at 1-800-729-2307, or contact your financial intermediary. Your request will be implemented within 30 days.

| |

| |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy voting information, scan the QR code or visit https://www.primecap.com/funds/primecap-odyssey-stock-fund/. |

| PRIMECAP Odyssey Stock Fund | PAGE 3 | TSR-AR-74160Q301 |

10000106641103914186148521651916274236692098822695294661000010520109941359314591166811830126155223342459933950

| | |

PRIMECAP Odyssey Growth Fund | |

| POGRX |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the PRIMECAP Odyssey Growth Fund for the period of November 1, 2023, to October 31, 2024. You can find additional information about the Fund at https://prospectus-express.broadridge.com/summary.asp?doctype=ann&cid=primecap&fid=74160Q103. You can also request this information by contacting us at 1-800-729-2307.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| PRIMECAP Odyssey Growth Fund | $75 | 0.66% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the fiscal year ended October 31, 2024, the PRIMECAP Odyssey Growth Fund returned +27.97%, trailing the S&P 500® Index’s +38.02% total return and the Russell 1000 Growth Index’s total return of +43.77%.

• During the fiscal year, the U.S. economy proved resilient as a firm labor market and robust consumer spending delivered

healthy real GDP growth. Core inflation moderated somewhat but persisted at above-target levels, forcing the Federal

Reserve to keep its benchmark rate above 5% for most of the year. But as economic data softened towards period-end,

the Fed in September initiated its long-awaited dovish pivot with a 50 basis point cut.

• Increasing optimism in a so-called “soft landing” and the prospect of lower interest rates bolstered equities. The S&P

500® Index’s forward price-to-earnings multiple expanded over 20% during the period, from roughly 17x to 21x, driving

most of the market’s return. Forward earnings also showed healthy double-digit growth.

• The Fund logged a strong gain but was unable to keep pace with the S&P 500® Index’s torrid rise. Relative to the S&P

500® Index, sector allocation and stock selection were both unfavorable.

• The Fund’s sector allocation headwind stemmed primarily from its significant overweight position in health care.

Otherwise, underweight positions in the two best performing sectors, information technology and communication

services, roughly offset the Fund’s underweight position in the consumer staples sector.

• Stock selection was most positive in the health care sector. Selection was weakest in the information technology sector,

while selection in the communication services and consumer discretionary sectors also detracted from relative

performance.

| PRIMECAP Odyssey Growth Fund | PAGE 1 | TSR-AR-74160Q103 |

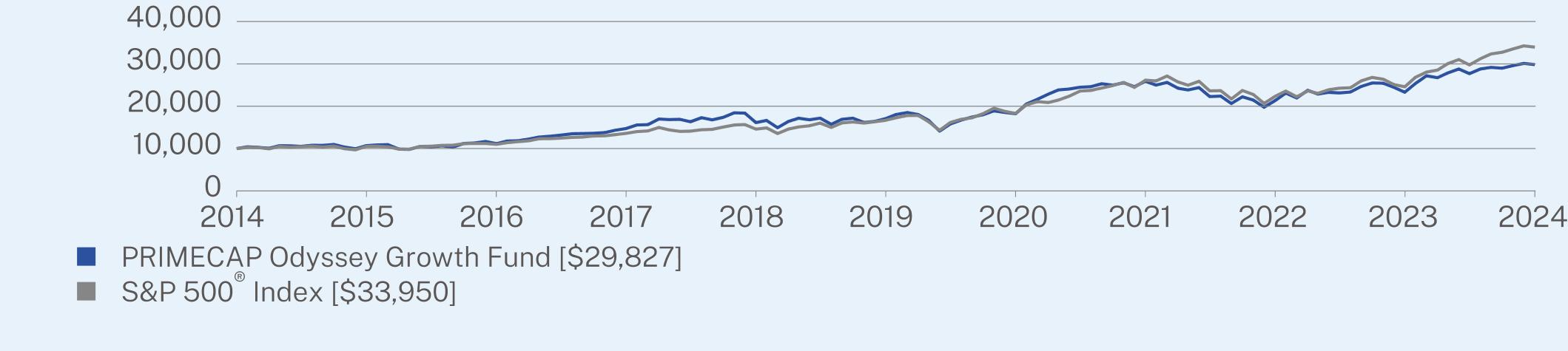

HOW DID THE FUND PERFORM OVER THE PAST 10 YEARS?

The chart illustrates the performance of a hypothetical $10,000 investment in the Fund. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of dividends and capital gains for the fund and dividends for the index.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

PRIMECAP Odyssey Growth Fund | 27.97 | 11.81 | 11.55 |

S&P 500® Index | 38.02 | 15.27 | 13.00 |

Investment result data reflects deduction of fund operating expenses. Total return represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be different than quoted, and performance as of the most recent month-end can be obtained by calling 1-800-729-2307 or by visiting https://www.primecap.com/funds/primecap-odyssey-growth-fund/.

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $5,845,196,577 |

Number of Holdings | 188 |

Net Advisory Fee | $35,365,762 |

Portfolio Turnover | 5% |

WHAT DID THE FUND INVEST IN? (% of net assets as of October 31, 2024)

| |

Top 10 Issuers | (%) |

Eli Lilly & Co. | 7.9% |

Alphabet, Inc. - Class A & C | 3.8% |

Raymond James Financial, Inc. | 3.2% |

Micron Technology, Inc. | 3.0% |

AECOM | 2.8% |

BeiGene Ltd. | 2.4% |

Microsoft Corp. | 2.3% |

Flex Ltd. | 2.3% |

Amgen, Inc. | 2.2% |

Biogen, Inc. | 2.2% |

| |

Top Sectors | (%) |

Health Care | 29.6% |

Information Technology | 23.1% |

Industrials | 17.6% |

Consumer Discretionary | 8.7% |

Financials | 8.5% |

Communication Services | 7.0% |

Energy | 2.1% |

Consumer Staples | 1.2% |

Materials | 0.6% |

Cash & Other | 1.6% |

The Fund is distributed by ALPS Distributors, Inc.

| PRIMECAP Odyssey Growth Fund | PAGE 2 | TSR-AR-74160Q103 |

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact the Fund at 1-800-729-2307, or contact your financial intermediary. Your request will be implemented within 30 days.

| |

| |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy voting information, scan the QR code or visit https://www.primecap.com/funds/primecap-odyssey-growth-fund/. |

| PRIMECAP Odyssey Growth Fund | PAGE 3 | TSR-AR-74160Q103 |

10000106961115714740161371706618232258832132423307298271000010520109941359314591166811830126155223342459933950

| | |

PRIMECAP Odyssey Aggressive Growth Fund | |

| POAGX |

| Annual Shareholder Report | October 31, 2024 |

This annual shareholder report contains important information about the PRIMECAP Odyssey Aggressive Growth Fund for the period of November 1, 2023, to October 31, 2024. You can find additional information about the Fund at https://prospectus-express.broadridge.com/summary.asp?doctype=ann&cid=primecap&fid=74160Q202. You can also request this information by contacting us at 1-800-729-2307.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| PRIMECAP Odyssey Aggressive Growth Fund | $74 | 0.65% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the fiscal year ended October 31, 2024, the Aggressive Growth Fund’s total return of +27.27% trailed both the S&P 500® Index’s total return of +38.02% and the Russell Midcap Growth Index’s total return of +38.67%.

• During the fiscal year, the U.S. economy proved resilient as a firm labor market and robust consumer spending delivered

healthy real GDP growth. Core inflation moderated somewhat but persisted at above-target levels, forcing the Federal

Reserve to keep its benchmark rate above 5% for most of the year. But as economic data softened towards period-end,

the Fed in September initiated its long-awaited dovish pivot with a 50 basis point cut.

• Increasing optimism in a so-called “soft landing” and the prospect of lower interest rates bolstered equities. The S&P

500® Index’s forward price-to-earnings multiple expanded over 20% during the period, from roughly 17x to 21x, driving

most of the market’s return. Forward earnings also showed healthy double-digit growth.

• The Fund logged a strong gain but was unable to keep pace with the S&P 500® Index’s torrid rise. Relative to the S&P

500® Index, sector allocation and stock selection were both unfavorable.

• The Fund’s sector allocation headwind stemmed primarily from its significant overweight position in health care.

Otherwise, underweight positions in communication services and financials partially offset the Fund’s underweight

positions in consumer staples and energy.

• Stock selection was most positive in the health care and industrials sectors. Selection was weakest in the information

technology sector, while selection in the communication services, energy, and consumer discretionary sectors also

detracted from relative performance.

| PRIMECAP Odyssey Aggressive Growth Fund | PAGE 1 | TSR-AR-74160Q202 |

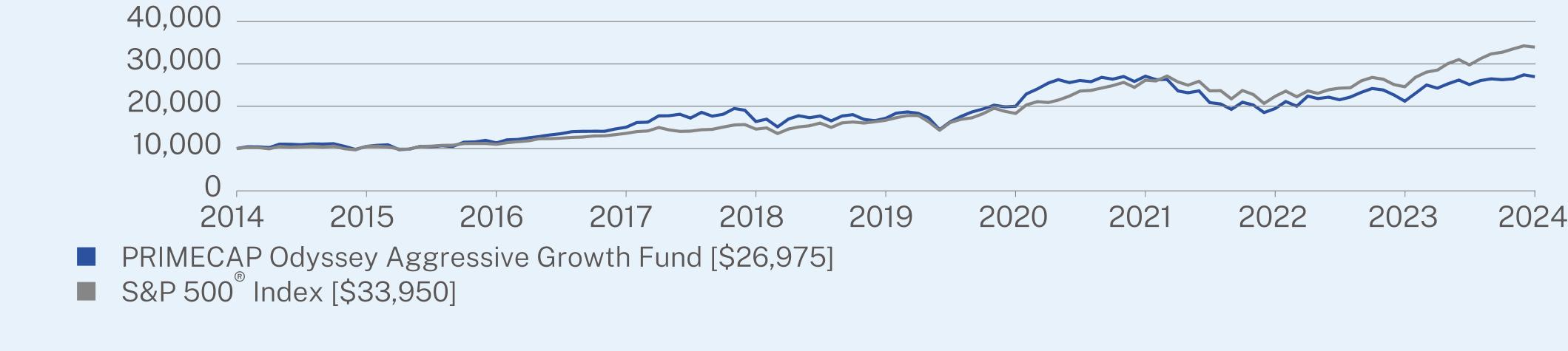

HOW DID THE FUND PERFORM OVER THE PAST 10 YEARS?

The chart illustrates the performance of a hypothetical $10,000 investment in the Fund. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of dividends and capital gains for the fund and dividends for the index.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

PRIMECAP Odyssey Aggressive Growth Fund | 27.27 | 9.48 | 10.43 |

S&P 500® Index | 38.02 | 15.27 | 13.00 |

Investment result data reflects deduction of fund operating expenses. Total return represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be different than quoted, and performance as of the most recent month-end can be obtained by calling 1-800-729-2307 or by visiting https://www.primecap.com/funds/primecap-odyssey-aggressive-growth-fund/.

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $6,882,857,448 |

Number of Holdings | 200 |

Net Advisory Fee | $38,429,054 |

Portfolio Turnover | 9% |

WHAT DID THE FUND INVEST IN? (% of net assets as of October 31, 2024)

| |

Top 10 Issuers | (%) |

Eli Lilly & Co. | 5.6% |

Micron Technology, Inc. | 4.1% |

Rhythm Pharmaceuticals, Inc. | 3.2% |

Alphabet, Inc. - Class A & C | 2.8% |

Flex Ltd. | 2.7% |

Sony Group Corp. | 2.5% |

MarketAxess Holdings, Inc. | 2.3% |

AECOM | 2.3% |

Tesla, Inc. | 2.3% |

Biogen, Inc. | 2.2% |

| |

Top Sectors | (%) |

Information Technology | 27.7% |

Health Care | 27.6% |

Industrials | 14.4% |

Consumer Discretionary | 12.6% |

Communication Services | 6.5% |

Financials | 5.9% |

Energy | 1.3% |

Materials | 1.0% |

Consumer Staples | 0.7% |

Cash & Other | 2.3% |

The Fund is distributed by ALPS Distributors, Inc.

| PRIMECAP Odyssey Aggressive Growth Fund | PAGE 2 | TSR-AR-74160Q202 |

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact the Fund at 1-800-729-2307, or contact your financial intermediary. Your request will be implemented within 30 days.

| |

| |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy voting information, scan the QR code or visit https://www.primecap.com/funds/primecap-odyssey-aggressive-growth-fund/. |

| PRIMECAP Odyssey Aggressive Growth Fund | PAGE 3 | TSR-AR-74160Q202 |

10000105131134415041163801715119985270851944321195269751000010520109941359314591166811830126155223342459933950

Item 2. Code of Ethics.

The Registrant has adopted a code of ethics that applies to the Registrant’s principal executive officers and principal financial officer. The Registrant has not made any amendments to its code of ethics during the period covered by this report. The Registrant has not granted any waivers, including any implicit waivers, from any provisions of the code of ethics during the period covered by this report.

The Registrant undertakes to provide to any person without charge, upon request, a copy of its code of ethics by mail when such person calls the Registrant at 1-800-729-2307.

Item 3. Audit Committee Financial Expert.

The Registrant’s Board of Trustees has determined that there is at least one audit committee financial expert serving on its audit committee. Wayne H. Smith and Steven Paul Cesinger are the Registrant’s “audit committee financial experts” and are considered to be “independent” as each term is defined in Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

(a) Audit Fees

The Registrant has engaged its principal accountant, PricewaterhouseCoopers LLP, to perform audit services, audit-related services, and tax services during the past two fiscal years. “Audit services” refer to performing an audit of the Registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years.

(b) Audit-Related Fees

“Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit.

(c) Tax Fees

“Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning and specifically relate to the accountant’s review of the Registrant’s federal and state tax returns.

(d) All Other Fees

There were no other services provided by the principal accountant to the Registrant during the past two fiscal years.

The following table details the aggregate fees billed or expected to be billed to the Registrant for each of the last two fiscal years for audit fees, audit-related fees, tax fees and all other fees by the principal accountant.

| | FYE 10/31/2024 | FYE 10/31/2023 |

| (a) Audit Fees | $163,697 | $186,946(1) |

| (b) Audit-Related Fees | $0 | $0 |

| (c) Tax Fees | $18,927 | $19,779 |

| (d) All Other Fees | $0 | $0 |

| (1) | The Audit Fees included $23,900 in scope change fees, which were paid by US Bancorp Fund Services, LLC, related to additional procedures performed due to US Bancorp Fund Accounting’s SOC-1 report not being completed prior to the issuance of the principal accountant’s audit report. |

(e)(1) The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre-approve all audit and non-audit services of the Registrant, including services provided to any entity affiliated with the Registrant. All services were pre-approved and no waivers to the pre-approval requirement were made.

(e)(2) The percentage of fees billed by PricewaterhouseCoopers applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows:

| | FYE 10/31/2024 | FYE 10/31/2023 |

| Audit-Related Fees | 0% | 0% |

| Tax Fees | 0% | 0% |

| All Other Fees | 0% | 0% |

(f) Not applicable.

(g) The following table indicates the non-audit fees billed or expected to be billed by the Registrant’s accountant for services rendered to the Registrant and to the Registrant’s investment adviser (and any entity controlling, controlled by, or under common control with the investment adviser) for the last two years.

| Non-Audit Fees | FYE 10/31/2024 | FYE 10/31/2023 |

| Registrant | $18,927 | $19,779 |

| Registrant’s Investment Adviser | $0 | $0 |

(h) The audit committee of the Board of Trustees has considered whether the provision of non-audit services that were rendered to the Registrant’s investment adviser is compatible with maintaining the principal accountant’s independence and has concluded that the provision of such non-audit services by the accountant has not compromised the accountant’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

| (a) | Schedules of Investments are included within the financial statements filed under Item 7 of this Form. |

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

PRIMECAP Odyssey Stock Fund

PRIMECAP Odyssey Growth Fund

PRIMECAP Odyssey Aggressive Growth Fund

Core Financial Statements

October 31, 2024

TABLE OF CONTENTS

PRIMECAP Odyssey Stock Fund

Schedule of Investments

October 31, 2024

| | | | | | | |

COMMON STOCKS - 98.0%

| | | | | | |

Communication Services - 3.6%

| | | | | | |

Alphabet, Inc. - Class A | | | 322,170 | | | $55,126,509 |

Alphabet, Inc. - Class C | | | 293,650 | | | 50,710,418 |

Comcast Corp. - Class A | | | 138,600 | | | 6,052,662 |

Meta Platforms, Inc. - Class A | | | 55,200 | | | 31,330,416 |

Nintendo Co. Ltd. - JPY | | | 300,000 | | | 15,846,895 |

Walt Disney Co. (The) | | | 296,200 | | | 28,494,440 |

| | | | | | 187,561,340 |

Consumer Discretionary - 8.5%

| | | | | | |

Bath & Body Works, Inc. | | | 419,200 | | | 11,896,896 |

Burlington Stores, Inc.(a) | | | 21,300 | | | 5,277,501 |

Capri Holdings Ltd.(a) | | | 238,000 | | | 4,698,120 |

CarMax, Inc.(a) | | | 455,100 | | | 32,940,138 |

Carnival Corp.(a) | | | 933,500 | | | 20,537,000 |

eBay, Inc. | | | 166,600 | | | 9,581,166 |

Leslie’s, Inc.(a) | | | 217,800 | | | 585,882 |

Mattel, Inc.(a) | | | 2,998,100 | | | 61,101,278 |

MGM Resorts International(a) | | | 71,330 | | | 2,629,937 |

Newell Brands, Inc. | | | 1,600,000 | | | 14,080,000 |

Ross Stores, Inc. | | | 663,580 | | | 92,715,398 |

Royal Caribbean Cruises Ltd. | | | 160,750 | | | 33,170,762 |

Sony Group Corp. - ADR | | | 5,318,915 | | | 93,612,904 |

TJX Cos., Inc. (The) | | | 130,100 | | | 14,705,203 |

Victoria’s Secret & Co.(a) | | | 123,033 | | | 3,722,979 |

Whirlpool Corp. | | | 429,059 | | | 44,411,897 |

| | | | | | 445,667,061 |

Consumer Staples - 1.9%

| | | | | | |

Altria Group, Inc. | | | 126,100 | | | 6,867,406 |

BJ’s Wholesale Club Holdings, Inc.(a) | | | 284,400 | | | 24,097,212 |

Dollar Tree, Inc.(a) | | | 395,300 | | | 25,552,192 |

Philip Morris International, Inc. | | | 63,800 | | | 8,466,260 |

Sysco Corp. | | | 352,446 | | | 26,415,828 |

Tyson Foods, Inc. - Class A | | | 137,600 | | | 8,061,984 |

| | | | | | 99,460,882 |

Energy - 2.3%

| | | | | | |

Cameco Corp. | | | 140,700 | | | 7,347,354 |

ConocoPhillips | | | 219,000 | | | 23,989,260 |

EOG Resources, Inc. | | | 157,500 | | | 19,208,700 |

Expand Energy Corp. | | | 85,000 | | | 7,201,200 |

Exxon Mobil Corp. | | | 25,552 | | | 2,983,963 |

Hess Corp. | | | 324,140 | | | 43,590,347 |

TechnipFMC PLC | | | 228,000 | | | 6,085,320 |

Transocean Ltd.(a) | | | 1,607,800 | | | 6,977,852 |

Valero Energy Corp. | | | 15,000 | | | 1,946,400 |

| | | | | | 119,330,396 |

Financials - 9.4%

| | | | | | |

Bank of America Corp. | | | 575,100 | | | 24,050,682 |

Bank of New York Mellon Corp.

(The) | | | 100,000 | | | 7,536,000 |

Citigroup, Inc. | | | 428,200 | | | 27,477,594 |

CME Group, Inc. - Class A | | | 216,500 | | | 48,790,440 |

| | | | | | | |

| | | | | | | |

Comerica, Inc. | | | 1,000 | | | $63,710 |

Discover Financial Services | | | 68,800 | | | 10,211,984 |

Evercore, Inc. - Class A | | | 9,290 | | | 2,454,139 |

Fidelity National Information Services, Inc. | | | 70,900 | | | 6,361,857 |

JPMorgan Chase & Co. | | | 305,100 | | | 67,707,792 |

Northern Trust Corp. | | | 568,480 | | | 57,143,610 |

PayPal Holdings, Inc.(a) | | | 265,100 | | | 21,022,430 |

Progressive Corp. (The) | | | 57,010 | | | 13,843,738 |

Raymond James Financial, Inc. | | | 725,315 | | | 107,506,189 |

Visa, Inc. - Class A | | | 123,400 | | | 35,767,490 |

Wells Fargo & Co. | | | 880,068 | | | 57,134,015 |

WEX, Inc.(a) | | | 15,200 | | | 2,623,520 |

| | | | | | 489,695,190 |

Health Care - 26.1%

| | | | | | |

Abbott Laboratories | | | 60,220 | | | 6,827,141 |

Agilent Technologies, Inc. | | | 315,120 | | | 41,063,287 |

Alcon, Inc. | | | 45,700 | | | 4,202,115 |

Amgen, Inc. | | | 490,500 | | | 157,038,480 |

AstraZeneca PLC - ADR | | | 2,927,170 | | | 208,268,146 |

Biogen, Inc.(a) | | | 546,570 | | | 95,103,180 |

Boston Scientific Corp.(a) | | | 322,500 | | | 27,096,450 |

Bristol-Myers Squibb Co. | | | 1,159,500 | | | 64,665,315 |

CVS Health Corp. | | | 152,550 | | | 8,612,973 |

Elanco Animal Health, Inc.(a) | | | 3,330,571 | | | 42,098,418 |

Eli Lilly & Co. | | | 597,323 | | | 495,622,786 |

GRAIL, Inc.(a) | | | 7,934 | | | 107,664 |

GSK PLC - ADR | | | 1,045,720 | | | 38,440,667 |

Illumina, Inc.(a) | | | 77,300 | | | 11,142,022 |

LivaNova PLC(a) | | | 199,460 | | | 10,296,125 |

Medtronic PLC | | | 28,600 | | | 2,552,550 |

Merck & Co., Inc. | | | 51,400 | | | 5,259,248 |

Novartis AG - ADR | | | 252,120 | | | 27,329,808 |

Revvity, Inc. | | | 151,940 | | | 18,018,565 |

Roche Holding AG - CHF | | | 14,720 | | | 4,561,780 |

Sanofi SA - ADR | | | 79,000 | | | 4,177,520 |

Siemens Healthineers AG - EUR | | | 110,740 | | | 5,781,120 |

Stryker Corp. | | | 16,200 | | | 5,771,736 |

Thermo Fisher Scientific, Inc. | | | 87,860 | | | 47,999,675 |

Waters Corp.(a) | | | 5,080 | | | 1,641,399 |

Zimmer Biomet Holdings, Inc. | | | 306,640 | | | 32,785,949 |

| | | | | | 1,366,464,119 |

Industrials - 21.8%

| | | | | | |

AECOM | | | 1,832,100 | | | 195,668,280 |

Airbus SE - EUR | | | 258,469 | | | 39,427,132 |

Alaska Air Group, Inc.(a) | | | 54,050 | | | 2,589,535 |

Amentum Holdings, Inc.(a) | | | 449,020 | | | 13,353,855 |

American Airlines Group, Inc.(a) | | | 2,187,350 | | | 29,310,490 |

AMETEK, Inc. | | | 15,700 | | | 2,878,438 |

Carrier Global Corp. | | | 125,032 | | | 9,092,327 |

Caterpillar, Inc. | | | 29,200 | | | 10,985,040 |

CSX Corp. | | | 70,400 | | | 2,368,256 |

Curtiss-Wright Corp. | | | 169,530 | | | 58,481,069 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

PRIMECAP Odyssey Stock Fund

Schedule of Investments

October 31, 2024(Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Industrials - (Continued)

|

Delta Air Lines, Inc. | | | 924,450 | | | $52,897,029 |

FedEx Corp. | | | 555,815 | | | 152,209,938 |

General Dynamics Corp. | | | 60,180 | | | 17,549,090 |

GXO Logistics, Inc.(a) | | | 76,700 | | | 4,587,427 |

Jacobs Solutions, Inc. | | | 356,460 | | | 50,111,147 |

JELD-WEN Holding, Inc.(a) | | | 250,000 | | | 3,540,000 |

Kirby Corp.(a) | | | 248,800 | | | 28,552,288 |

Knight-Swift Transportation Holdings, Inc. | | | 35,500 | | | 1,848,840 |

L3Harris Technologies, Inc. | | | 23,300 | | | 5,766,051 |

Matson, Inc. | | | 50,250 | | | 7,783,222 |

Moog, Inc. - Class A | | | 94,900 | | | 17,898,140 |

Nextracker, Inc. - Class A(a) | | | 667,508 | | | 26,580,169 |

Norfolk Southern Corp. | | | 79,500 | | | 19,909,185 |

Otis Worldwide Corp. | | | 28,881 | | | 2,836,114 |

Rockwell Automation, Inc. | | | 15,800 | | | 4,214,018 |

RTX Corp. | | | 9,062 | | | 1,096,411 |

RXO, Inc.(a) | | | 150,000 | | | 4,228,500 |

Saia, Inc.(a) | | | 15,900 | | | 7,768,899 |

Siemens AG - EUR | | | 769,663 | | | 149,737,652 |

Southwest Airlines Co. | | | 2,117,250 | | | 64,745,505 |

Union Pacific Corp. | | | 32,400 | | | 7,519,068 |

United Airlines Holdings, Inc.(a) | | | 1,303,960 | | | 102,047,910 |

United Parcel Service, Inc. -

Class B | | | 173,600 | | | 23,272,816 |

XPO, Inc.(a) | | | 164,400 | | | 21,459,132 |

| | | | | | 1,142,312,973 |

Information Technology - 22.6%

| | | | | | |

Adobe, Inc.(a) | | | 88,700 | | | 42,405,696 |

Analog Devices, Inc. | | | 165,330 | | | 36,886,776 |

Apple, Inc. | | | 10,000 | | | 2,259,100 |

Applied Materials, Inc. | | | 365,950 | | | 66,449,201 |

Ciena Corp.(a) | | | 3,700 | | | 234,987 |

Corning, Inc. | | | 243,398 | | | 11,583,311 |

Flex Ltd.(a) | | | 4,391,899 | | | 152,267,138 |

Hewlett Packard Enterprise Co. | | | 3,179,700 | | | 61,972,353 |

HP, Inc. | | | 1,169,960 | | | 41,556,979 |

Infineon Technologies AG - EUR | | | 260,000 | | | 8,222,396 |

Intel Corp. | | | 4,113,320 | | | 88,518,646 |

Jabil, Inc. | | | 52,000 | | | 6,400,680 |

Keysight Technologies, Inc.(a) | | | 108,660 | | | 16,191,427 |

KLA Corp. | | | 229,290 | | | 152,759,877 |

L.M. Ericsson Telephone Co. -

ADR | | | 4,572,830 | | | 38,320,315 |

Microsoft Corp. | | | 370,150 | | | 150,410,453 |

NetApp, Inc. | | | 500,750 | | | 57,741,482 |

NVIDIA Corp. | | | 118,620 | | | 15,747,991 |

Oracle Corp. | | | 604,700 | | | 101,492,848 |

QUALCOMM, Inc. | | | 197,547 | | | 32,154,725 |

Seagate Technology Holdings PLC | | | 149,500 | | | 15,005,315 |

| | | | | | | |

| | | | | | | |

Teradyne, Inc. | | | 97,300 | | | $10,334,233 |

Texas Instruments, Inc. | | | 351,610 | | | 71,433,088 |

| | | | | | 1,180,349,017 |

Materials - 1.8%

| | | | | | |

Albemarle Corp. | | | 252,910 | | | 23,958,164 |

Corteva, Inc. | | | 120,700 | | | 7,353,044 |

Dow, Inc. | | | 114,930 | | | 5,675,243 |

DuPont de Nemours, Inc. | | | 130,500 | | | 10,830,195 |

Freeport-McMoRan, Inc. | | | 408,900 | | | 18,408,678 |

Glencore PLC - GBP | | | 4,517,278 | | | 23,691,636 |

Tronox Holdings PLC | | | 312,700 | | | 3,789,924 |

| | | | | | 93,706,884 |

TOTAL COMMON STOCKS

(Cost $2,218,628,325) | | | | | | 5,124,547,862 |

SHORT-TERM INVESTMENTS - 2.1%

| | | | | | |

Money Market Funds - 2.1%

| | | | | | |

Dreyfus Treasury Securities Cash Management Fund - Institutional Shares - 4.66%(b) | | | 110,070,194 | | | 110,070,194 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $110,070,194) | | | | | | 110,070,194 |

TOTAL INVESTMENTS - 100.1%

(Cost $2,328,698,519) | | | | | | $5,234,618,056 |

Liabilities in Excess of Other

Assets - (0.1)% | | | | | | (5,467,705) |

TOTAL NET ASSETS - 100.0% | | | | | | $5,229,150,351 |

| | | | | | | |

Percentages are stated as a percent of net assets.

The Global Industry Classification Standard (“GICS®”) was developed by and is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by the fund’s administrator.

ADR - American Depositary Receipt

CHF - Swiss Francs

EUR -Euros

GBP - British Pound Sterling

JPY - Japanese Yen

(a)

| Non-income producing security. |

(b)

| The rate shown represents the 7-day annualized effective yield as of October 31, 2024. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

PRIMECAP Odyssey Growth Fund

Schedule of Investments

October 31, 2024

| | | | | | | |

COMMON STOCKS - 98.4%

| | | | | | |

Communication Services - 7.0%

| | | | | | |

Alphabet, Inc. - Class A | | | 714,070 | | | $122,184,518 |

Alphabet, Inc. - Class C | | | 593,670 | | | 102,520,872 |

Baidu, Inc. - ADR(a) | | | 679,600 | | | 61,999,908 |

Electronic Arts, Inc. | | | 50,000 | | | 7,542,500 |

IMAX Corp.(a) | | | 275,400 | | | 6,692,220 |

Live Nation Entertainment, Inc.(a) | | | 41,600 | | | 4,873,024 |

Meta Platforms, Inc. - Class A | | | 30,200 | | | 17,140,916 |

Netflix, Inc.(a) | | | 11,750 | | | 8,883,353 |

Nintendo Co. Ltd. - JPY | | | 550,000 | | | 29,052,641 |

Shutterstock, Inc. | | | 40,000 | | | 1,283,600 |

Spotify Technology SA(a) | | | 5,100 | | | 1,964,010 |

Trade Desk, Inc. (The) - Class A(a) | | | 66,200 | | | 7,957,902 |

Universal Music Group N.V. - EUR | | | 211,874 | | | 5,332,056 |

Walt Disney Co. (The) | | | 301,200 | | | 28,975,440 |

| | | | | | 406,402,960 |

Consumer Discretionary - 8.7%

| | | | | | |

Alibaba Group Holding Ltd. - ADR | | | 1,246,940 | | | 122,175,181 |

Amazon.com, Inc.(a) | | | 11,000 | | | 2,050,400 |

Bath & Body Works, Inc. | | | 418,898 | | | 11,888,325 |

Bowlero Corp. - Class A | | | 282,100 | | | 2,925,377 |

Burlington Stores, Inc.(a) | | | 5,000 | | | 1,238,850 |

Capri Holdings Ltd.(a) | | | 213,800 | | | 4,220,412 |

CarMax, Inc.(a) | | | 573,200 | | | 41,488,216 |

Carnival Corp.(a) | | | 97,900 | | | 2,153,800 |

Carvana Co.(a) | | | 25,600 | | | 6,331,136 |

DoorDash, Inc. - Class A(a) | | | 14,510 | | | 2,273,717 |

eBay, Inc. | | | 90,300 | | | 5,193,153 |

Entain PLC - GBP | | | 400,000 | | | 3,847,023 |

Flutter Entertainment PLC - GBP(a) | | | 24,477 | | | 5,725,997 |

iRobot Corp.(a) | | | 154,200 | | | 1,346,166 |

Leslie’s, Inc.(a) | | | 247,900 | | | 666,851 |

Marriott International, Inc. - Class A | | | 25,000 | | | 6,500,500 |

Mattel, Inc.(a) | | | 2,470,700 | | | 50,352,866 |

McDonald’s Corp. | | | 9,300 | | | 2,716,623 |

MGM Resorts International(a) | | | 67,000 | | | 2,470,290 |

Norwegian Cruise Line Holdings Ltd.(a) | | | 252,300 | | | 6,393,282 |

Ollie’s Bargain Outlet Holdings, Inc.(a) | | | 61,800 | | | 5,675,094 |

Restaurant Brands International, Inc. | | | 11,000 | | | 765,050 |

Ross Stores, Inc. | | | 85,400 | | | 11,932,088 |

Royal Caribbean Cruises Ltd. | | | 259,671 | | | 53,583,111 |

Sony Group Corp. - ADR | | | 3,026,385 | | | 53,264,376 |

Tapestry, Inc. | | | 15,000 | | | 711,750 |

Tesla, Inc.(a) | | | 360,000 | | | 89,946,000 |

TJX Cos., Inc. (The) | | | 61,000 | | | 6,894,830 |

Victoria’s Secret & Co.(a) | | | 166,699 | | | 5,044,312 |

| | | | | | 509,774,776 |

Consumer Staples - 1.2%

| | | | | | |

Altria Group, Inc. | | | 65,500 | | | 3,567,130 |

BellRing Brands, Inc.(a) | | | 54,900 | | | 3,614,067 |

BJ’s Wholesale Club Holdings, Inc.(a) | | | 125,200 | | | 10,608,196 |

Casey’s General Stores, Inc. | | | 12,200 | | | 4,807,044 |

| | | | | | | |

| | | | | | | |

Dollar Tree, Inc.(a) | | | 281,200 | | | $18,176,768 |

e.l.f. Beauty, Inc.(a) | | | 55,560 | | | 5,847,690 |

Performance Food Group Co.(a) | | | 311,700 | | | 25,325,625 |

US Foods Holding Corp.(a) | | | 18,608 | | | 1,147,183 |

| | | | | | 73,093,703 |

Energy - 2.1%

| | | | | | |

ConocoPhillips | | | 187,405 | | | 20,528,344 |

Coterra Energy, Inc. | | | 312,000 | | | 7,463,040 |

EOG Resources, Inc. | | | 75,900 | | | 9,256,764 |

Expand Energy Corp. | | | 61,601 | | | 5,218,837 |

Exxon Mobil Corp. | | | 159,470 | | | 18,622,906 |

Hess Corp. | | | 289,621 | | | 38,948,232 |

Schlumberger Ltd. | | | 48,500 | | | 1,943,395 |

TechnipFMC PLC | | | 10,000 | | | 266,900 |

Transocean Ltd.(a) | | | 5,298,304 | | | 22,994,639 |

| | | | | | 125,243,057 |

Financials - 8.5%

| | | | | | |

Bank of America Corp. | | | 151,200 | | | 6,323,184 |

Citigroup, Inc. | | | 259,200 | | | 16,632,864 |

CME Group, Inc. - Class A | | | 119,100 | | | 26,840,376 |

Discover Financial Services | | | 31,000 | | | 4,601,330 |

Evercore, Inc. - Class A | | | 40,100 | | | 10,593,217 |

JPMorgan Chase & Co. | | | 79,700 | | | 17,687,024 |

MarketAxess Holdings, Inc. | | | 143,672 | | | 41,581,550 |

Mastercard, Inc. - Class A | | | 3,900 | | | 1,948,401 |

Northern Trust Corp. | | | 451,010 | | | 45,335,525 |

PayPal Holdings, Inc.(a) | | | 207,900 | | | 16,486,470 |

Raymond James Financial, Inc. | | | 1,246,225 | | | 184,715,470 |

Tradeweb Markets, Inc. - Class A | | | 164,700 | | | 20,916,900 |

Visa, Inc. - Class A | | | 180,250 | | | 52,245,462 |

Wells Fargo & Co. | | | 773,040 | | | 50,185,757 |

| | | | | | 496,093,530 |

Health Care - 29.6%

| | | | | | |

Agilent Technologies, Inc. | | | 92,700 | | | 12,079,737 |

Alcon, Inc. | | | 57,050 | | | 5,245,748 |

Alkermes PLC(a) | | | 264,500 | | | 6,797,650 |

Amgen, Inc. | | | 407,100 | | | 130,337,136 |

AstraZeneca PLC - ADR | | | 1,594,280 | | | 113,433,022 |

BeiGene Ltd. - ADR(a) | | | 684,227 | | | 138,651,759 |

Biogen, Inc.(a) | | | 734,980 | | | 127,886,520 |

BioMarin Pharmaceutical, Inc.(a) | | | 1,458,536 | | | 96,102,937 |

BioNTech SE - ADR(a) | | | 405,900 | | | 45,907,290 |

Boston Scientific Corp.(a) | | | 1,004,700 | | | 84,414,894 |

Bridgebio Pharma, Inc.(a) | | | 177,450 | | | 4,154,104 |

Bristol-Myers Squibb Co. | | | 830,290 | | | 46,305,273 |

CVS Health Corp. | | | 143,600 | | | 8,107,656 |

Elanco Animal Health, Inc.(a) | | | 3,605,271 | | | 45,570,625 |

Eli Lilly & Co. | | | 555,478 | | | 460,902,316 |

Enovis Corp.(a) | | | 43,333 | | | 1,788,353 |

Glaukos Corp.(a) | | | 23,800 | | | 3,147,550 |

GRAIL, Inc.(a) | | | 16,116 | | | 218,694 |

GSK PLC - ADR | | | 868,150 | | | 31,913,194 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

PRIMECAP Odyssey Growth Fund

Schedule of Investments

October 31, 2024(Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Health Care - (Continued)

|

Humana, Inc. | | | 2,000 | | | $515,660 |

Illumina, Inc.(a) | | | 138,800 | | | 20,006,632 |

Insulet Corp.(a) | | | 202,237 | | | 46,823,933 |

IQVIA Holdings, Inc.(a) | | | 20,100 | | | 4,136,982 |

LivaNova PLC(a) | | | 798,500 | | | 41,218,570 |

Merck & Co., Inc. | | | 14,800 | | | 1,514,336 |

Nektar Therapeutics(a) | | | 1,509,856 | | | 1,796,729 |

Neurocrine Biosciences, Inc.(a) | | | 70,950 | | | 8,533,157 |

Novartis AG - ADR | | | 150,136 | | | 16,274,742 |

OraSure Technologies, Inc.(a) | | | 101,800 | | | 413,817 |

QIAGEN N.V. - EUR(a) | | | 117,000 | | | 4,958,279 |

Revvity, Inc. | | | 46,340 | | | 5,495,461 |

Rhythm Pharmaceuticals, Inc.(a) | | | 1,986,102 | | | 94,796,648 |

Roche Holding AG - CHF | | | 6,500 | | | 2,014,373 |

Siemens Healthineers AG - EUR | | | 60,700 | | | 3,168,810 |

Stryker Corp. | | | 10,800 | | | 3,847,824 |

Thermo Fisher Scientific, Inc. | | | 54,430 | | | 29,736,198 |

Waters Corp.(a) | | | 4,000 | | | 1,292,440 |

Xencor, Inc.(a) | | | 2,591,100 | | | 54,439,011 |

Zimmer Biomet Holdings, Inc. | | | 249,720 | | | 26,700,062 |

| | | | | | 1,730,648,122 |

Industrials - 17.6%

| | | | | | |

AECOM | | | 1,517,952 | | | 162,117,274 |

Airbus SE - EUR | | | 192,601 | | | 29,379,558 |

Amentum Holdings, Inc.(a) | | | 583,614 | | | 17,356,680 |

American Airlines Group, Inc.(a) | | | 2,917,201 | | | 39,090,493 |

AMETEK, Inc. | | | 40,000 | | | 7,333,600 |

Carrier Global Corp. | | | 33,600 | | | 2,443,392 |

Chart Industries, Inc.(a) | | | 22,000 | | | 2,655,840 |

Curtiss-Wright Corp. | | | 113,470 | | | 39,142,611 |

Delta Air Lines, Inc. | | | 1,260,100 | | | 72,102,922 |

FedEx Corp. | | | 180,000 | | | 49,293,000 |

General Dynamics Corp. | | | 53,900 | | | 15,717,779 |

IDEX Corp. | | | 35,760 | | | 7,675,526 |

J.B. Hunt Transport Services, Inc. | | | 54,700 | | | 9,879,914 |

Jacobs Solutions, Inc. | | | 581,084 | | | 81,688,789 |

JetBlue Airways Corp.(a) | | | 121,300 | | | 691,410 |

Lyft, Inc. - Class A(a) | | | 470,706 | | | 6,105,057 |

Nextracker, Inc. - Class A(a) | | | 787,014 | | | 31,338,898 |

Norfolk Southern Corp. | | | 22,500 | | | 5,634,675 |

Saia, Inc.(a) | | | 19,600 | | | 9,576,756 |

Siemens AG - EUR | | | 579,624 | | | 112,765,635 |

Southwest Airlines Co. | | | 2,152,500 | | | 65,823,450 |

Stratasys Ltd.(a) | | | 912,189 | | | 6,522,151 |

Textron, Inc. | | | 214,300 | | | 17,234,006 |

TransDigm Group, Inc. | | | 14,100 | | | 18,362,430 |

Uber Technologies, Inc.(a) | | | 114,900 | | | 8,278,545 |

Union Pacific Corp. | | | 24,500 | | | 5,685,715 |

United Airlines Holdings, Inc.(a) | | | 1,561,050 | | | 122,167,773 |

Xometry, Inc. - Class A(a)(b) | | | 4,058,058 | | | 79,862,582 |

| | | | | | 1,025,926,461 |

| | | | | | | |

| | | | | | | |

Information Technology - 23.1%

| | | | | | |

Adobe, Inc.(a) | | | 113,000 | | | $54,023,040 |

Altair Engineering, Inc. - Class A(a) | | | 227,763 | | | 23,685,074 |

Analog Devices, Inc. | | | 141,000 | | | 31,458,510 |

Applied Materials, Inc. | | | 138,900 | | | 25,221,462 |

AppLovin Corp. - Class A(a) | | | 61,400 | | | 10,400,546 |

Arm Holdings PLC - ADR(a) | | | 64,000 | | | 9,043,200 |

ASML Holding N.V. - ADR | | | 31,900 | | | 21,454,345 |

Autodesk, Inc.(a) | | | 3,000 | | | 851,400 |

Broadcom, Inc. | | | 25,550 | | | 4,337,624 |

Dell Technologies, Inc. - Class C | | | 36,400 | | | 4,500,132 |

Descartes Systems Group, Inc.

(The)(a) | | | 165,300 | | | 17,179,629 |

DocuSign, Inc.(a) | | | 14,200 | | | 985,196 |

Flex Ltd.(a) | | | 3,898,329 | | | 135,155,066 |

FormFactor, Inc.(a) | | | 481,518 | | | 18,288,054 |

Gartner, Inc.(a) | | | 1,300 | | | 653,250 |

Hewlett Packard Enterprise Co. | | | 1,525,600 | | | 29,733,944 |

HP, Inc. | | | 401,736 | | | 14,269,663 |

Intel Corp. | | | 2,653,200 | | | 57,096,864 |

Intuit, Inc. | | | 4,500 | | | 2,746,350 |

Jabil, Inc. | | | 427,700 | | | 52,645,593 |

Keysight Technologies, Inc.(a) | | | 14,570 | | | 2,171,076 |

KLA Corp. | | | 173,924 | | | 115,873,387 |

L.M. Ericsson Telephone Co. - ADR | | | 1,406,900 | | | 11,789,822 |

Marvell Technology, Inc. | | | 178,200 | | | 14,275,602 |

MaxLinear, Inc.(a) | | | 257,500 | | | 3,339,775 |

Micron Technology, Inc. | | | 1,764,100 | | | 175,792,565 |

Microsoft Corp. | | | 335,600 | | | 136,371,060 |

NetApp, Inc. | | | 257,111 | | | 29,647,469 |

Nutanix, Inc. - Class A(a) | | | 379,980 | | | 23,596,758 |

NVIDIA Corp. | | | 632,000 | | | 83,904,320 |

Okta, Inc. - Class A(a) | | | 18,500 | | | 1,329,965 |

Oracle Corp. | | | 265,600 | | | 44,578,304 |

OSI Systems, Inc.(a) | | | 72,600 | | | 9,598,446 |

Palo Alto Networks, Inc.(a) | | | 28,350 | | | 10,215,355 |

QUALCOMM, Inc. | | | 171,650 | | | 27,939,471 |

Salesforce, Inc. | | | 46,600 | | | 13,577,842 |

Teradyne, Inc. | | | 74,590 | | | 7,922,204 |

Texas Instruments, Inc. | | | 301,595 | | | 61,272,040 |

Trimble, Inc.(a) | | | 313,000 | | | 18,936,500 |

Universal Display Corp. | | | 188,019 | | | 33,903,586 |

Wolfspeed, Inc.(a) | | | 726,200 | | | 9,665,722 |

| | | | | | 1,349,430,211 |

Materials - 0.6%

| | | | | | |

Albemarle Corp. | | | 257,540 | | | 24,396,764 |

Ivanhoe Mines Ltd. - Class A -

CAD(a) | | | 600,000 | | | 7,933,350 |

Linde PLC | | | 10,900 | | | 4,972,035 |

| | | | | | 37,302,149 |

TOTAL COMMON STOCKS

(Cost $2,591,010,862) | | | | | | 5,753,914,969 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

PRIMECAP Odyssey Growth Fund

Schedule of Investments

October 31, 2024(Continued)

| | | | | | | |

RIGHTS - 0.0%

| | | | | | |

Health Care - 0.0%

| | | | | | |

ABIOMED, Inc. - CVR

(Issue Date 12/23/22)(a)(c)(d) | | | 387,250 | | | $394,995 |

Epizyme, Inc. - CVR

(Issue Date 8/15/22)(a)(c)(d) | | | 4,207,543 | | | 84,151 |

Total Health Care | | | | | | 479,146 |

TOTAL RIGHTS (Cost $0) | | | | | | 479,146 |

SHORT-TERM INVESTMENTS - 1.7%

| | | | | | |

Money Market Funds - 1.7%

| | | | | | |

Dreyfus Treasury Securities Cash Management Fund - Institutional Shares - 4.66%(e) | | | 97,202,468 | | | 97,202,468 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $97,202,468) | | | | | | 97,202,468 |

TOTAL INVESTMENTS - 100.1%

(Cost $2,688,213,330) | | | | | | $5,851,596,583 |

Liabilities in Excess of Other

Assets - (0.1)% | | | | | | (6,400,006) |

TOTAL NET ASSETS - 100.0% | | | | | | $5,845,196,577 |

| | | | | | | |

Percentages are stated as a percent of net assets.

The Global Industry Classification Standard (“GICS®”) was developed by and is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by the fund’s administrator.

ADR - American Depositary Receipt

CAD - Canadian Dollars

CHF - Swiss Francs

CVR - Contingent Value Rights

EUR - Euros

GBP - British Pound Sterling

JPY - Japanese Yen

(a)

| Non-income producing security.

|

(b)

| Considered an affiliated company of the fund as the fund owns 5% or more of the outstanding voting securities of such company. (Note 7) |

(d)

| Fair-valued security. (Note 4) |

(e)

| The rate shown represents the 7-day annualized effective yield as of October 31, 2024. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

PRIMECAP Odyssey Aggressive Growth Fund

Schedule of Investments

October 31, 2024

| | | | | | | |

COMMON STOCKS - 97.8%

| | | | | | |

Communication Services - 6.5%

| | | | | | |

Alphabet, Inc. - Class A | | | 621,800 | | | $ 106,396,198 |

Alphabet, Inc. - Class C | | | 481,840 | | | 83,208,949 |

Baidu, Inc. - ADR(a) | | | 1,048,590 | | | 95,662,866 |

Electronic Arts, Inc. | | | 75,500 | | | 11,389,175 |

Ibotta, Inc. - Class A(a) | | | 56,130 | | | 4,113,768 |

IMAX Corp.(a) | | | 562,000 | | | 13,656,600 |

Live Nation Entertainment, Inc.(a) | | | 63,795 | | | 7,472,946 |

Madison Square Garden Entertainment Corp.(a) | | | 76,100 | | | 3,174,131 |

Meta Platforms, Inc. - Class A | | | 34,300 | | | 19,467,994 |

Netflix, Inc.(a) | | | 16,500 | | | 12,474,495 |

Pinterest, Inc. - Class A(a) | | | 1,310,750 | | | 41,668,742 |

Sphere Entertainment Co.(a) | | | 392,223 | | | 16,398,844 |

T-Mobile US, Inc. | | | 84,830 | | | 18,930,663 |

WildBrain Ltd. - CAD(a) | | | 4,895,400 | | | 3,867,519 |

ZoomInfo Technologies, Inc.(a) | | | 760,537 | | | 8,403,934 |

| | | | | | 446,286,824 |

Consumer Discretionary - 12.6%

| | | | | | |

Alibaba Group Holding Ltd. - ADR | | | 1,281,600 | | | 125,571,168 |

Amazon.com, Inc.(a) | | | 173,000 | | | 32,247,200 |

Boot Barn Holdings, Inc.(a) | | | 62,370 | | | 7,768,183 |

Burlington Stores, Inc.(a) | | | 90,400 | | | 22,398,408 |

Capri Holdings Ltd.(a) | | | 340,937 | | | 6,730,096 |

CarMax, Inc.(a) | | | 725,400 | | | 52,504,452 |

Carvana Co.(a) | | | 36,400 | | | 9,002,084 |

Deckers Outdoor Corp.(a) | | | 15,600 | | | 2,509,884 |

Duolingo, Inc.(a) | | | 4,000 | | | 1,171,880 |

eBay, Inc. | | | 214,740 | | | 12,349,697 |

Entain PLC - GBP | | | 3,134,108 | | | 30,142,463 |

Etsy, Inc.(a) | | | 14,200 | | | 730,448 |

Flutter Entertainment PLC - GBP(a) | | | 22,700 | | | 5,310,297 |

Gildan Activewear, Inc. | | | 95,535 | | | 4,671,661 |

GrowGeneration Corp.(a) | | | 846,100 | | | 1,738,736 |

iRobot Corp.(a) | | | 172,000 | | | 1,501,560 |

Mobileye Global, Inc. - Class A(a) | | | 340,900 | | | 4,639,649 |

Norwegian Cruise Line Holdings

Ltd.(a) | | | 820,400 | | | 20,788,936 |

Ollie’s Bargain Outlet Holdings,

Inc.(a) | | | 128,900 | | | 11,836,887 |

Restaurant Brands International,

Inc. | | | 20,000 | | | 1,391,000 |

Rivian Automotive, Inc. -

Class A(a) | | | 15,300 | | | 154,530 |

Royal Caribbean Cruises Ltd. | | | 570,300 | | | 117,681,405 |

Savers Value Village, Inc.(a) | | | 398,600 | | | 4,077,678 |

Sony Group Corp. - ADR | | | 9,894,550 | | | 174,144,080 |

Tapestry, Inc. | | | 325,000 | | | 15,421,250 |

Tesla, Inc.(a) | | | 627,590 | | | 156,803,362 |

Ulta Beauty, Inc.(a) | | | 22,400 | | | 8,265,152 |

XPeng, Inc. - ADR(a) | | | 3,423,130 | | | 38,441,750 |

| | | | | | 869,993,896 |

| | | | | | | |

| | | | | | | |

Consumer Staples - 0.7%

| | | | | | |

BellRing Brands, Inc.(a) | | | 115,729 | | | $ 7,618,440 |

Dollar General Corp. | | | 7,000 | | | 560,280 |

e.l.f. Beauty, Inc.(a) | | | 79,515 | | | 8,368,954 |

Performance Food Group Co.(a) | | | 366,300 | | | 29,761,875 |

| | | | | | 46,309,549 |

Energy - 1.3%

| | | | | | |

Coterra Energy, Inc. | | | 499,350 | | | 11,944,452 |

EOG Resources, Inc. | | | 115,300 | | | 14,061,988 |

New Fortress Energy, Inc. | | | 3,044,500 | | | 25,604,245 |

Transocean Ltd.(a) | | | 8,214,982 | | | 35,653,022 |

| | | | | | 87,263,707 |

Financials - 5.9%

| | | | | | |

CME Group, Inc. - Class A | | | 195,671 | | | 44,096,416 |

Discover Financial Services | | | 166,713 | | | 24,745,211 |

Flywire Corp.(a) | | | 1,818,383 | | | 31,676,232 |

Galaxy Digital Holdings Ltd. -

CAD(a) | | | 116,700 | | | 1,516,216 |

LPL Financial Holdings, Inc. | | | 16,000 | | | 4,514,880 |

MarketAxess Holdings, Inc. | | | 558,040 | | | 161,507,937 |

Marqeta, Inc. - Class A(a) | | | 451,600 | | | 2,556,056 |

Morgan Stanley | | | 217,533 | | | 25,288,211 |

NMI Holdings, Inc. - Class A(a) | | | 436,300 | | | 16,876,084 |

Progressive Corp. (The) | | | 97,950 | | | 23,785,198 |

Tradeweb Markets, Inc. - Class A | | | 503,000 | | | 63,881,000 |

WEX, Inc.(a) | | | 15,500 | | | 2,675,300 |

| | | | | | 403,118,741 |

Health Care - 27.6%

| | | | | | |

10X Genomics, Inc. - Class A(a) | | | 132,600 | | | 2,125,578 |

Accuray, Inc.(a) | | | 137,800 | | | 238,394 |

Alkermes PLC(a) | | | 907,835 | | | 23,331,360 |

Allogene Therapeutics, Inc.(a) | | | 1,835,770 | | | 4,690,392 |

Amicus Therapeutics, Inc.(a) | | | 1,005,800 | | | 11,486,236 |

BeiGene Ltd. - ADR(a) | | | 705,057 | | | 142,872,750 |

Biogen, Inc.(a) | | | 869,794 | | | 151,344,156 |

BioMarin Pharmaceutical, Inc.(a) | | | 1,894,130 | | | 124,804,226 |

BioNTech SE - ADR(a) | | | 1,196,599 | | | 135,335,347 |

Boston Scientific Corp.(a) | | | 539,010 | | | 45,287,620 |

Bridgebio Pharma, Inc.(a) | | | 427,200 | | | 10,000,752 |

Cerus Corp.(a) | | | 3,226,361 | | | 5,065,387 |

Charles River Laboratories International, Inc.(a) | | | 13,750 | | | 2,455,475 |

Elanco Animal Health, Inc.(a) | | | 626,992 | | | 7,925,179 |

Eli Lilly & Co. | | | 464,094 | | | 385,077,356 |

Exact Sciences Corp.(a) | | | 437,600 | | | 30,163,768 |

FibroGen, Inc.(a) | | | 150,000 | | | 45,210 |

Galapagos N.V. - ADR(a) | | | 593,800 | | | 15,700,072 |

Glaukos Corp.(a) | | | 827,065 | | | 109,379,346 |

Globus Medical, Inc. - Class A(a) | | | 40,150 | | | 2,952,631 |

GRAIL, Inc.(a) | | | 1,490,519 | | | 20,226,343 |

Health Catalyst, Inc.(a) | | | 1,635,100 | | | 12,704,727 |

Illumina, Inc.(a) | | | 201,210 | | | 29,002,409 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

PRIMECAP Odyssey Aggressive Growth Fund

Schedule of Investments

October 31, 2024(Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Health Care - (Continued)

|

Immunocore Holdings PLC -

ADR(a) | | | 658,330 | | | $20,296,314 |

Immunome, Inc.(a) | | | 239,600 | | | 2,748,212 |

Insulet Corp.(a) | | | 317,696 | | | 73,556,155 |

LivaNova PLC(a) | | | 1,019,140 | | | 52,608,007 |

Mural Oncology PLC(a) | | | 45,260 | | | 159,315 |

Nektar Therapeutics(a) | | | 3,604,176 | | | 4,288,969 |

Nurix Therapeutics, Inc.(a) | | | 217,000 | | | 5,333,860 |

OraSure Technologies, Inc.(a) | | | 271,400 | | | 1,103,241 |

Penumbra, Inc.(a) | | | 19,220 | | | 4,398,881 |

PolyPeptide Group AG - CHF(a) | | | 891,304 | | | 29,735,883 |

Pulmonx Corp.(a)(b) | | | 3,791,931 | | | 23,699,569 |

QIAGEN N.V. - EUR(a) | | | 181,170 | | | 7,677,705 |

Repligen Corp.(a) | | | 12,800 | | | 1,718,656 |

Rhythm Pharmaceuticals, Inc.(a)(b) | | | 4,680,380 | | | 223,394,537 |

Roche Holding AG - CHF | | | 47,005 | | | 14,567,015 |

Standard BioTools, Inc.(a) | | | 379,900 | | | 744,604 |

Wave Life Sciences Ltd.(a) | | | 2,494,960 | | | 34,205,902 |

Xencor, Inc.(a)(b) | | | 5,850,857 | | | 122,926,506 |

Zentalis Pharmaceuticals, Inc.(a) | | | 1,129,510 | | | 3,083,562 |

| | | | | | 1,898,461,607 |

Industrials - 14.4%

| | | | | | |

AECOM | | | 1,502,620 | | | 160,479,816 |

Alaska Air Group, Inc.(a) | | | 381,100 | | | 18,258,501 |

Allegiant Travel Co. | | | 25,100 | | | 1,631,751 |

Amentum Holdings, Inc.(a) | | | 847,400 | | | 25,201,676 |

American Airlines Group, Inc.(a) | | | 5,368,200 | | | 71,933,880 |

Array Technologies, Inc.(a) | | | 837,900 | | | 5,471,487 |

Axon Enterprise, Inc.(a) | | | 65,400 | | | 27,696,900 |

Chart Industries, Inc.(a) | | | 39,300 | | | 4,744,296 |

Controladora Vuela Compania de Aviacion, S.A.B. de C.V. -

ADR(a) | | | 41,000 | | | 301,760 |

Curtiss-Wright Corp. | | | 178,290 | | | 61,502,918 |

Delta Air Lines, Inc. | | | 2,146,837 | | | 122,842,013 |

FedEx Corp. | | | 33,500 | | | 9,173,975 |

Frontier Group Holdings, Inc.(a) | | | 263,800 | | | 1,603,904 |

GFL Environmental, Inc. | | | 356,300 | | | 14,893,340 |

Gibraltar Industries, Inc.(a) | | | 95,600 | | | 6,452,044 |

Griffon Corp. | | | 191,100 | | | 12,016,368 |

Hertz Global Holdings, Inc.(a) | | | 296,200 | | | 823,436 |

Jacobs Solutions, Inc. | | | 729,140 | | | 102,502,501 |

JetBlue Airways Corp.(a) | | | 1,242,100 | | | 7,079,970 |

Li-Cycle Holdings Corp.(a) | | | 131,050 | | | 326,315 |

Lyft, Inc. - Class A(a) | | | 614,910 | | | 7,975,383 |

Nextracker, Inc. - Class A(a) | | | 945,714 | | | 37,658,331 |

NN, Inc.(a) | | | 330,000 | | | 1,039,500 |

Old Dominion Freight Line, Inc. | | | 5,200 | | | 1,046,864 |

Ryanair Holdings PLC - ADR | | | 39,500 | | | 1,748,270 |

Southwest Airlines Co. | | | 1,535,500 | | | 46,955,590 |

Stratasys Ltd.(a) | | | 708,970 | | | 5,069,136 |

| | | | | | | |

| | | | | | | |

Sun Country Airlines Holdings,

Inc.(a) | | | 51,815 | | | $ 728,001 |

TransDigm Group, Inc. | | | 36,700 | | | 47,794,410 |

Uber Technologies, Inc.(a) | | | 318,200 | | | 22,926,310 |

United Airlines Holdings, Inc.(a) | | | 1,873,740 | | | 146,638,892 |

VSE Corp. | | | 97,500 | | | 10,005,450 |

WillScot Holdings Corp.(a) | | | 120,000 | | | 3,976,800 |

XPO, Inc.(a) | | | 40,000 | | | 5,221,200 |

| | | | | | 993,720,988 |

Information Technology - 27.7%

| | | | | | |

Adobe, Inc.(a) | | | 124,650 | | | 59,592,672 |

Ambarella, Inc.(a) | | | 28,700 | | | 1,612,653 |

Applied Materials, Inc. | | | 77,500 | | | 14,072,450 |

AppLovin Corp. - Class A(a) | | | 69,400 | | | 11,755,666 |

Arlo Technologies, Inc.(a) | | | 2,988,100 | | | 30,359,096 |

ASML Holding N.V. - ADR | | | 34,200 | | | 23,001,210 |

Aurora Innovation, Inc. - Class A(a) | | | 3,295,500 | | | 17,120,122 |

Autodesk, Inc.(a) | | | 37,700 | | | 10,699,260 |

Axcelis Technologies, Inc.(a) | | | 896,976 | | | 76,521,023 |

Broadcom, Inc. | | | 146,900 | | | 24,939,213 |

Credo Technology Group Holding Ltd.(a) | | | 540,500 | | | 20,376,850 |

Crowdstrike Holdings, Inc. - Class A(a) | | | 112,210 | | | 33,311,783 |

CyberArk Software Ltd.(a) | | | 59,500 | | | 16,452,940 |

Dell Technologies, Inc. - Class C | | | 83,000 | | | 10,261,290 |

Descartes Systems Group, Inc. (The)(a) | | | 215,741 | | | 22,421,962 |

DocuSign, Inc.(a) | | | 221,200 | | | 15,346,856 |

Flex Ltd.(a) | | | 5,358,515 | | | 185,779,715 |

FormFactor, Inc.(a) | | | 790,855 | | | 30,036,673 |

Gitlab, Inc. - Class A(a) | | | 159,300 | | | 8,562,375 |

Hewlett Packard Enterprise Co. | | | 565,000 | | | 11,011,850 |

HP, Inc. | | | 184,000 | | | 6,535,680 |

HubSpot, Inc.(a) | | | 88,950 | | | 49,348,570 |

indie Semiconductor, Inc. - Class A(a)(b) | | | 16,250,460 | | | 53,789,023 |

Intuit, Inc. | | | 73,200 | | | 44,673,960 |

Jabil, Inc. | | | 563,000 | | | 69,299,670 |

Jamf Holding Corp.(a) | | | 39,000 | | | 648,960 |

Keysight Technologies, Inc.(a) | | | 35,000 | | | 5,215,350 |

KLA Corp. | | | 167,015 | | | 111,270,403 |

Marvell Technology, Inc. | | | 153,400 | | | 12,288,874 |

MaxLinear, Inc.(a) | | | 1,491,020 | | | 19,338,529 |

Micron Technology, Inc. | | | 2,818,050 | | | 280,818,683 |

MongoDB, Inc.(a) | | | 13,900 | | | 3,758,560 |

NetApp, Inc. | | | 563,692 | | | 64,999,325 |

nLIGHT, Inc.(a) | | | 184,343 | | | 2,300,601 |

Nutanix, Inc. - Class A(a) | | | 1,201,925 | | | 74,639,542 |

NVIDIA Corp. | | | 1,102,590 | | | 146,379,848 |

Okta, Inc. - Class A(a) | | | 318,600 | | | 22,904,154 |

OneStream, Inc.(a) | | | 30,200 | | | 891,504 |

OSI Systems, Inc.(a) | | | 190,800 | | | 25,225,668 |

Palo Alto Networks, Inc.(a) | | | 70,035 | | | 25,235,712 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

PRIMECAP Odyssey Aggressive Growth Fund

Schedule of Investments

October 31, 2024(Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Information Technology - (Continued)

|

PROS Holdings, Inc.(a) | | | 72,793 | | | $1,441,301 |

QUALCOMM, Inc. | | | 306,623 | | | 49,909,026 |

Rapid7, Inc.(a) | | | 94,900 | | | 3,835,858 |

RingCentral, Inc. - Class A(a) | | | 9,000 | | | 324,090 |

Trimble, Inc.(a) | | | 482,970 | | | 29,219,685 |

Unity Software, Inc.(a) | | | 52,300 | | | 1,050,184 |

Universal Display Corp. | | | 661,329 | | | 119,250,845 |

Western Digital Corp.(a) | | | 187,000 | | | 12,212,970 |

Wolfspeed, Inc.(a) | | | 1,401,300 | | | 18,651,303 |

Zoom Video Communications, Inc. - Class A(a) | | | 370,700 | | | 27,706,118 |

| | | | | | 1,906,399,655 |

Materials - 1.0%

| | | | | | |

Albemarle Corp. | | | 114,600 | | | 10,856,058 |

Bioceres Crop Solutions Corp.(a) | | | 2,000 | | | 13,440 |

Ingevity Corp.(a) | | | 54,500 | | | 2,277,555 |

Ivanhoe Electric, Inc.(a) | | | 331,100 | | | 3,360,665 |

Ivanhoe Mines Ltd. - Class A - CAD(a) | | | 2,855,600 | | | 37,757,457 |

Perimeter Solutions SA(a) | | | 1,187,852 | | | 15,774,675 |

| | | | | | 70,039,850 |

Real Estate - 0.1%

| | | | | | |

EPR Properties | | | 128,200 | | | 5,816,434 |

TOTAL COMMON STOCKS

(Cost $3,397,902,661) | | | | | | 6,727,411,251 |

RIGHTS - 0.0%

| | | | | | |

Health Care - 0.0%

| | | | | | |

ABIOMED, Inc. - CVR

(Issue Date 12/23/22)(a)(c)(d) | | | 349,922 | | | 356,921 |

Epizyme, Inc. - CVR

(Issue Date 8/15/22)(a)(c)(d) | | | 10,344,756 | | | 206,895 |

Total Health Care | | | | | | 563,816 |

TOTAL RIGHTS

(Cost $0) | | | | | | 563,816 |

WARRANTS - 0.0%

| | | | | | |

Materials - 0.0%

| | | | | | |

Perimeter Solutions SA (Expiration Date 11/8/24)(a) | | | 364,100 | | | 120,153 |

TOTAL WARRANTS

(Cost $3,641) | | | | | | 120,153 |

| | | | | | | |

| | | | | | | |

SHORT-TERM INVESTMENTS - 2.3%

| | | | | | |

Money Market Funds - 2.3%

| | | | | | |

Dreyfus Treasury Securities Cash Management Fund - Institutional Shares - 4.66%(e) | | | 158,983,867 | | | $158,983,867 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $158,983,867) | | | | | | 158,983,867 |

TOTAL INVESTMENTS - 100.1%

(Cost $3,556,890,169) | | | | | | $6,887,079,087 |

Liabilities in Excess of Other

Assets - (0.1)% | | | | | | (4,221,639) |

TOTAL NET ASSETS - 100.0% | | | | | | $6,882,857,448 |

| | | | | | | |

Percentages are stated as a percent of net assets.

The Global Industry Classification Standard (“GICS®”) was developed by and is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by the fund’s administrator.

ADR - American Depositary Receipt

CAD - Canadian Dollars

CHF - Swiss Francs

CVR - Contingent Value Rights

EUR - Euros

GBP - British Pound Sterling

(a)

| Non-income producing security. |

(b)

| Considered an affiliated company of the fund as the fund owns 5% or more of the outstanding voting securities of such company. (Note 7) |

(d)

| Fair-valued security. (Note 4) |

(e)

| The rate shown represents the 7-day annualized effective yield as of October 31, 2024. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

PRIMECAP Odyssey Funds

Statements of Assets and Liabilities

October 31, 2024

| | | | | | | | | | |

ASSETS

| | | | | | | | | |

Investments, at cost (unaffiliated) | | | $2,328,698,519 | | | $2,599,737,898 | | | $3,132,713,733 |

Investments, at cost (affiliated) | | | — | | | 88,475,432 | | | 424,176,436 |

Investments, at value (unaffiliated) | | | 5,234,618,056 | | | 5,771,734,001 | | | 6,463,269,452 |

Investments, at value (affiliated) | | | — | | | 79,862,582 | | | 423,809,635 |

Receivable for investments sold | | | 555,455 | | | 2,200,936 | | | 8,921,622 |

Receivable for dividends and interest | | | 6,922,731 | | | 6,531,968 | | | 2,673,673 |

Receivable for fund shares sold | | | 506,049 | | | 420,018 | | | 363,855 |

Prepaid expenses and other assets | | | 54,384 | | | 54,850 | | | 68,776 |

Total assets | | | 5,242,656,675 | | | 5,860,804,355 | | | 6,899,107,013 |

LIABILITIES

| | | | | | | | | |

Payable for investments purchased | | | 332,447 | | | 109,905 | | | 868,366 |

Payable for fund shares repurchased | | | 4,571,918 | | | 5,991,349 | | | 4,506,862 |

Payable to the advisor (Note 6) | | | 7,407,803 | | | 8,265,932 | | | 9,521,440 |

Payable for shareholder servicing | | | 837,046 | | | 888,907 | | | 988,423 |

Payable to custodian | | | 20,970 | | | 24,963 | | | 24,999 |

Other accrued expenses and liabilities | | | 336,140 | | | 326,722 | | | 339,475 |

Total liabilities | | | 13,506,324 | | | 15,607,778 | | | 16,249,565 |

NET ASSETS | | | $ 5,229,150,351 | | | $5,845,196,577 | | | $6,882,857,448 |

Number of shares issued and outstanding (unlimited shares authorized, $0.01 par value) | | | 132,384,372 | | | 145,052,285 | | | 148,747,622 |

Net asset value, offering and redemption price per

share | | | $39.50 | | | $40.30 | | | $46.27 |

Components of Net Assets

| | | | | | | | | |

Paid-in capital | | | $1,566,337,403 | | | $1,745,200,277 | | | $2,970,649,354 |

Total distributable earnings | | | 3,662,812,948 | | | 4,099,996,300 | | | 3,912,208,094 |

Net Assets | | | $5,229,150,351 | | | $5,845,196,577 | | | $6,882,857,448 |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements

TABLE OF CONTENTS

PRIMECAP Odyssey Funds

Statements of Operations

For the Year Ended October 31, 2024

| | | | | | | | | | |

INVESTMENT INCOME

| | | | | | | | | |

Dividends (unaffiliated)(1) | | | $81,429,051 | | | $61,378,121 | | | $34,219,370 |

Interest income | | | 7,675,161 | | | 7,857,393 | | | 12,419,548 |

Total investment income | | | 89,104,212 | | | 69,235,514 | | | 46,638,918 |

EXPENSES

| | | | | | | | | |

Advisory fees (Note 6) | | | 30,958,259 | | | 35,365,762 | | | 38,429,054 |

Shareholder servicing | | | 4,968,631 | | | 5,246,238 | | | 5,435,917 |

Trustee fees | | | 260,141 | | | 260,215 | | | 260,215 |

Custody | | | 119,656 | | | 142,308 | | | 138,409 |

Other | | | 1,160,934 | | | 1,173,521 | | | 1,215,353 |

Total expenses | | | 37,467,621 | | | 42,188,044 | | | 45,478,948 |

Net investment income | | | 51,636,591 | | | 27,047,470 | | | 1,159,970 |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY

| | | | | | | | | |

Net realized gain (loss) on:

| | | | | | | | | |

Investments (unaffiliated) | | | 858,471,255 | | | 1,187,319,680 | | | 735,070,785 |

Investments (affiliated) | | | — | | | (312,488) | | | 4,441,205 |

Foreign currency transactions | | | 7,658 | | | 145 | | | 40,229 |

Change in unrealized appreciation/depreciation on:

| | | | | | | | | |

Investments (unaffiliated) | | | 549,632,038 | | | 383,649,085 | | | 810,892,577 |

Investments (affiliated) | | | — | | | 19,506,503 | | | 103,864,742 |

Foreign currency translations | | | 111,715 | | | 117,894 | | | 50,547 |

Net realized and unrealized gain on investments and foreign currency | | | 1,408,222,666 | | | 1,590,280,819 | | | 1,654,360,085 |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | | $1,459,859,257 | | | $1,617,328,289 | | | $1,655,520,055 |

| | | | | | | | | | |

(1)

| Net of foreign taxes withheld of $1,328,805, $1,116,258, and $386,426, respectively.

|

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

PRIMECAP Odyssey Stock Fund

Statements of Changes in Net Assets

| | | | | | | |

INCREASE (DECREASE) IN NET ASSETS FROM:

| | | | | | |

OPERATIONS

| | | | | | |

Net investment income | | | $51,636,591 | | | $65,607,784 |

Net realized gain (loss) on:

| | | | | | |

Investments | | | 858,471,255 | | | 542,618,630 |

Foreign currency transactions | | | 7,658 | | | (22,646) |

Change in unrealized appreciation/depreciation on:

| | | | | | |

Investments | | | 549,632,038 | | | (144,459,268) |

Foreign currency translations | | | 111,715 | | | 239,197 |

Net increase in net assets resulting from operations | | | 1,459,859,257 | | | 463,983,697 |

Net distributions to shareholders | | | (543,292,220) | | | (623,026,904) |

CAPITAL SHARE TRANSACTIONS

| | | | | | |

Proceeds from shares sold | | | 365,296,780 | | | 424,348,515 |

Proceeds from reinvestment of distributions | | | 520,727,056 | | | 603,545,405 |

Cost of shares repurchased | | | (1,804,771,265) | | | (1,436,622,953) |

Net decrease from capital share transactions | | | (918,747,429) | | | (408,729,033) |

Total decrease in net assets | | | (2,180,392) | | | (567,772,240) |

NET ASSETS

| | | | | | |

Beginning of year | | | 5,231,330,743 | | | 5,799,102,983 |

End of year | | | $5,229,150,351 | | | $5,231,330,743 |

CHANGE IN CAPITAL SHARES

| | | | | | |

Shares outstanding, beginning of year | | | 155,863,842 | | | 166,752,590 |

Shares sold | | | 9,840,806 | | | 12,399,802 |

Shares issued on reinvestment of distributions | | | 15,097,914 | | | 18,807,897 |

Shares repurchased | | | (48,418,190) | | | (42,096,447) |

Decrease in capital shares | | | (23,479,470) | | | (10,888,748) |

Shares outstanding, end of year | | | 132,384,372 | | | 155,863,842 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

PRIMECAP Odyssey Growth Fund

Statements of Changes in Net Assets

| | | | | | | |

INCREASE (DECREASE) IN NET ASSETS FROM:

| | | | | | |

OPERATIONS

| | | | | | |

Net investment income | | | $27,047,470 | | | $33,113,325 |

Net realized gain on:

| | | | | | |

Investments | | | 1,187,007,192 | | | 900,110,645 |

Foreign currency transactions | | | 145 | | | 8,084 |

Change in unrealized appreciation/depreciation on:

| | | | | | |

Investments | | | 403,155,588 | | | (289,754,450) |

Foreign currency translations | | | 117,894 | | | 259,701 |

Net increase in net assets resulting from operations | | | 1,617,328,289 | | | 643,737,305 |

Net distributions to shareholders | | | (831,948,160) | | | (759,221,460) |

CAPITAL SHARE TRANSACTIONS

| | | | | | |

Proceeds from shares sold | | | 321,730,178 | | | 494,456,847 |

Proceeds from reinvestment of distributions | | | 797,037,283 | | | 727,799,102 |

Cost of shares repurchased | | | (2,333,864,632) | | | (1,789,442,494) |

Net decrease from capital share transactions | | | (1,215,097,171) | | | (567,186,545) |

Total decrease in net assets | | | (429,717,042) | | | (682,670,700) |

NET ASSETS

| | | | | | |

Beginning of year | | | 6,274,913,619 | | | 6,957,584,319 |

End of year | | | $5,845,196,577 | | | $6,274,913,619 |

CHANGE IN CAPITAL SHARES

| | | | | | |

Shares outstanding, beginning of year | | | 175,469,794 | | | 189,577,840 |

Shares sold | | | 8,480,375 | | | 13,632,185 |

Shares issued on reinvestment of distributions | | | 22,146,076 | | | 21,280,675 |

Shares repurchased | | | (61,043,960) | | | (49,020,906) |

Decrease in capital shares | | | (30,417,509) | | | (14,108,046) |

Shares outstanding, end of year | | | 145,052,285 | | | 175,469,794 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

PRIMECAP Odyssey Aggressive Growth Fund

Statements of Changes in Net Assets

| | | | | | | |

INCREASE (DECREASE) IN NET ASSETS FROM:

| | | | | | |

OPERATIONS

| | | | | | |

Net investment income (loss) | | | $1,159,970 | | | $(6,012,989) |

Net realized gain on:

| | | | | | |

Investments | | | 739,511,990 | | | 461,964,269 |

In-kind redemptions | | | — | | | 152,903,699 |

Foreign currency transactions | | | 40,229 | | | 15,937 |

Change in unrealized appreciation/depreciation on:

| | | | | | |

Investments | | | 914,757,319 | | | 20,728,661 |

Foreign currency translations | | | 50,547 | | | 60,395 |

Net increase in net assets resulting from operations | | | 1,655,520,055 | | | 629,659,972 |

NET DISTRIBUTIONS TO SHAREHOLDERS | | | (384,018,326) | | | (641,269,952) |

CAPITAL SHARE TRANSACTIONS

| | | | | | |

Proceeds from shares sold | | | 396,539,842 | | | 746,030,472 |

Proceeds from reinvestment of distributions | | | 367,519,346 | | | 610,014,476 |

Cost of shares repurchased | | | (1,506,111,302) | | | (1,922,098,498) |

Other capital contribution | | | — | | | 78(1) |

Net decrease from capital share transactions | | | (742,052,114) | | | (566,053,472) |

Total increase (decrease) in net assets | | | 529,449,615 | | | (577,663,452) |

NET ASSETS

| | | | | | |

Beginning of year | | | 6,353,407,833 | | | 6,931,071,285 |

End of year | | | $6,882,857,448 | | | $6,353,407,833 |

CHANGE IN CAPITAL SHARES

| | | | | | |

Shares outstanding, beginning of year | | | 165,450,352 | | | 178,104,760 |

Shares sold | | | 9,092,025 | | | 18,814,530 |

Shares issued on reinvestment of distributions | | | 8,686,347 | | | 16,371,832 |

Shares repurchased | | | (34,481,102) | | | (47,840,770) |

Decrease in capital shares | | | (16,702,730) | | | (12,654,408) |

Shares outstanding, end of year | | | 148,747,622 | | | 165,450,352 |

| | | | | | | |

(1)

| During the year ended October 31, 2023, the Transfer Agent reimbursed the Aggressive Growth Fund $78 for a net loss realized related to a shareholder redemption. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

PRIMECAP Odyssey Stock Fund

Financial Highlights

For a capital share outstanding throughout each year.

| | | | |

Net asset value, beginning of year | | | $33.56 | | | $34.78 | | | $42.97 | | | $31.89 | | | $34.33 |

INCOME (LOSS) FROM INVESTMENT OPERATIONS:

| | | | | | | | | | | | | | | |

Net investment income(1) | | | 0.35 | | | 0.40 | | | 0.35 | | | 0.27 | | | 0.40 |

Net realized and unrealized gain (loss) on investments and foreign currency | | | 9.15 | | | 2.25 | | | (4.78) | | | 13.57 | | | (0.76) |

Total from investment operations | | | 9.50 | | | 2.65 | | | (4.43) | | | 13.84 | | | (0.36) |

LESS:

| | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.43) | | | (0.41) | | | (0.28) | | | (0.48) | | | (0.47) |

Distributions from net realized gain | | | (3.13) | | | (3.46) | | | (3.48) | | | (2.28) | | | (1.61) |

Total distributions | | | (3.56) | | | (3.87) | | | (3.76) | | | (2.76) | | | (2.08) |

Net asset value, end of year | | | $39.50 | | | $33.56 | | | $34.78 | | | $42.97 | | | $31.89 |

Total return | | | 29.83% | | | 8.13% | | | (11.33)% | | | 45.44% | | | (1.48)% |

RATIOS/SUPPLEMENTAL DATA:

| | | | | | | | | | | | | | | |

Net assets, end of year (millions) | | | $5,229.2 | | | $5,231.3 | | | $5,799.1 | | | $7,733.6 | | | $6,244.6 |

Ratio of expenses to average net assets | | | 0.67% | | | 0.67% | | | 0.66% | | | 0.65% | | | 0.65% |

Ratio of net investment income to average net assets | | | 0.92% | | | 1.15% | | | 0.93% | | | 0.67% | | | 1.28% |

Portfolio turnover rate | | | 3% | | | 4% | | | 4% | | | 6% | | | 8% |

| | | | | | | | | | | | | | | | |

(1)

| Calculated using the average shares method. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

PRIMECAP Odyssey Growth Fund

Financial Highlights

For a capital share outstanding throughout each year.

| | | | |

Net asset value, beginning of year | | | $35.76 | | | $36.70 | | | $50.78 | | | $40.31 | | | $39.68 |

INCOME (LOSS) FROM INVESTMENT OPERATIONS:

| | | | | | | | | | | | | | | |

Net investment income(1) | | | 0.16 | | | 0.18 | | | 0.16 | | | 0.05 | | | 0.16 |

Net realized and unrealized gain (loss) on investments and foreign currency | | | 9.26 | | | 3.04 | | | (8.21) | | | 15.72 | | | 2.57 |

Total from investment operations | | | 9.42 | | | 3.22 | | | (8.05) | | | 15.77 | | | 2.73 |

LESS:

| | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.19) | | | (0.21) | | | (0.05) | | | (0.17) | | | (0.20) |

Distributions from net realized gain | | | (4.69) | | | (3.95) | | | (5.98) | | | (5.13) | | | (1.90) |

Total distributions | | | (4.88) | | | (4.16) | | | (6.03) | | | (5.30) | | | (2.10) |