As filed with the Securities and Exchange Commission on December 28, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21597

PRIMECAP Odyssey Funds

(Exact name of registrant as specified in charter)

177 East Colorado Boulevard, 11th Floor

Pasadena, CA 91105

(Address of principal executive offices) (Zip code)

Julietta Martikyan

PRIMECAP Management Company

177 East Colorado Boulevard, 11th Floor

Pasadena, CA 91105

(Name and address of agent for service)

(626) 304-9222

Registrant’s telephone number, including area code

Date of fiscal year end: October 31

Date of reporting period: October 31, 2023

Item 1. Reports to Stockholders.

Item 1. Reports to Stockholders.

ANNUAL REPORT

For the Year Ended October 31, 2023

PRIMECAP ODYSSEY STOCK (POSKX)

PRIMECAP ODYSSEY GROWTH (POGRX)

PRIMECAP ODYSSEY AGGRESSIVE GROWTH (POAGX)

| | |

| | Table of Contents PRIMECAP Odyssey Funds |

1

| | |

| | Letter to Shareholders PRIMECAP Odyssey Funds |

Dear Fellow Shareholders,

For the fiscal year ended October 31, 2023, the PRIMECAP Odyssey Stock Fund, PRIMECAP Odyssey Growth Fund, and PRIMECAP Odyssey Aggressive Growth Fund produced total returns of +8.13%, +9.30%, and +9.01%, respectively. The unmanaged S&P 500® Index produced a total return of +10.14% during the period. Relative to the S&P 500®, favorable stock selection was unable to offset unfavorable sector allocation in the Stock and Growth Funds, while the Aggressive Growth Fund lagged on modestly unfavorable selection results.

The fiscal year featured a resurgent equity market, peaking mid-summer before faltering somewhat thereafter. Prior to its late-period weakness, the S&P 500®’s rebound had fully retraced last fiscal year’s 15% decline. Market optimism in a “soft landing,” coupled with particular enthusiasm for the promise of artificial intelligence, pushed equities higher. But market strength was narrowly tailored to select large-capitalization growth stocks, with the Russell 1000 Growth Index surging 19%; many other market gauges instead declined during the period, including the relevant Russell indices for value stocks, small-cap stocks, and mid-cap stocks.

The underlying economy proved resilient during the year, supported by a still-tight labor market. The unemployment rate remained below 4%, and job growth sustained at a solid pace. Consumers thus continued to spend reliably, and this consistent strength in personal consumption expenditures translated to healthy real GDP growth. Inflation moderated to roughly 4%; September’s CPI reading was less than half year-ago levels, while Core CPI remained above target but was trending lower.

The Federal Reserve, meanwhile, persisted in its aggressive tightening campaign, executing 11 rate hikes totaling 525 basis points dating back to last year. The relentless rise in rates sparked a short-lived regional banking crisis in March, underscored by Silicon Valley Bank’s overnight collapse. The Fed eventually paused its campaign, but interest rates continued to drift higher. Rising yields applied increasing pressure to a variety of rate-sensitive industries, and ultimately tipped market sentiment negative into year-end.

Communication services (+36%) and information technology (+33%) were the undisputed winning sectors in a comeback year for Big Tech. Indeed, of the newly minted “Magnificent Seven,” only Tesla (-12%) failed to ignite. The other constituents – Meta (+223%), NVIDIA (+202%), Microsoft (+47%), Alphabet (+32%), Amazon (+30%), and Apple (+12%) – fueled the S&P 500® return. All remaining sectors lagged the index, and most outright declined. Defensive sectors (utilities -8%, real estate -7%, health care -5%, consumer staples -3%) were weakest, but energy (-2%) and financials (-1%) also finished in the red.

All three Funds underperformed the S&P 500® this year. The Funds’ single-digit exposure to the Magnificent Seven – stocks that now comprise nearly 30% of the S&P 500® – created a relative headwind of more than 500 basis points per Fund. Even more, suitable substitutes were scarce; the S&P 500®’s average stock return was negative, and smaller stocks generally fared even

2

Letter to Shareholders

PRIMECAP Odyssey Funds

continued

worse. Within this unforgiving context, all three Funds nearly kept pace with the benchmark’s gain, and the Stock and Growth Funds even managed to deliver favorable stock selection. But such moral victories provide limited solace when the Funds fall short.

The Funds’ sector positioning shifted only slightly. The Funds continue to hold overweight positions in the health care and industrials sectors and underweight position in the energy, real estate, consumer staples, communication services, materials, and utilities sectors. Financials flipped to an underweight position in the Stock Fund, a function of both Fund performance and portfolio management; the other Funds were already underweight the sector. And information technology reverted to an overweight position in the Aggressive Growth Fund, while the Stock and Growth Funds maintained their underweight exposures. The Aggressive Growth Fund also features an overweight position in the consumer discretionary sector, whereas the Stock and Growth Funds continue to express a modest underweight view.

A more detailed discussion of the results of each PRIMECAP Odyssey Fund follows.

PRIMECAP Odyssey Stock Fund

For the fiscal year ended October 31, 2023, the Stock Fund’s total return of +8.13% trailed the S&P 500®’s total return of +10.14%. Relative to the S&P 500®, unfavorable sector allocation more than offset favorable stock selection.

The Stock Fund’s sector allocation created a sizable headwind relative to the index. The Fund’s only two overweight sectors, health care (27% of average Stock Fund assets versus 14% for the index) and industrials (20% versus 9%), both lagged the S&P 500®. Meanwhile, underweight positions in the two best-performing sectors, information technology (20% versus 26%) and communication services (3% versus 8%), compounded the problem. Providing a partial offset were underweight positions in three defensive sector laggards (consumer staples, real estate, and utilities).

Strong stock selection helped narrow the performance gap to the index. Eli Lilly (+55%), the Fund’s largest position, was the standout performer within health care, charting another robust return on increasing enthusiasm in Mounjaro/Zepbound, its diabetes/obesity drug. This more than compensated for weakness in Bristol-Myers (-31%) and Biogen (-16%). Industrials was also a bright spot, as FedEx (+53%) rebounded after a difficult stretch and satellite imaging company Maxar Technologies (+137%) was acquired by private equity firm Advent International. Southwest (-38%) was a partial offset as persistent operational challenges exacerbated what was a challenging environment for the airlines.

Stock selection elsewhere was less favorable. Lithium producer Albemarle (-54%) slumped within materials, and financial services firm Raymond James (-18%) faltered within financials. But selection results were mostly hampered by underweight positions in the mega-capitalization technology companies. NVIDIA (+202%) and Microsoft (+47%) soared on AI-centric optimism, more than offsetting strong performances by KLA (+50%), Intel (+33%), and Flex (+31%) within

3

Letter to Shareholders

PRIMECAP Odyssey Funds

continued

information technology. Likewise, Meta (+223%) tripled following last year’s steep decline, while Alphabet (+32%) also bounced; the Fund’s underweight position in both companies weighed on results in communication services. And within consumer discretionary, no exposure to Amazon (+30%) also detracted from results, adding to weakness from the Fund’s sizable ownership of Whirlpool (-20%).

The top 10 holdings, which collectively represented 37.3% of the portfolio at the period end, are listed below:

| | | | |

| | |

PRIMECAP Odyssey Stock Fund

Top 10 Holdings as of 10/31/23 | | Ending % of

Total Portfolio* | |

Eli Lilly & Co. | | | 10.1 | |

Astrazeneca PLC – ADR | | | 4.3 | |

AECOM | | | 3.4 | |

FedEx Corp. | | | 3.0 | |

Microsoft Corp. | | | 3.0 | |

Intel Corp. | | | 2.9 | |

Amgen, Inc. | | | 2.9 | |

KLA Corp. | | | 2.7 | |

Biogen, Inc. | | | 2.6 | |

Flex Ltd. | | | 2.4 | |

Total % of Portfolio | | | 37.3 | |

| | * | The percentage is calculated by using the ending market value of the security divided by the ending market value of the total investments of the Fund. |

PRIMECAP Odyssey Growth Fund

For the fiscal year ended October 31, 2023, the Growth Fund returned +9.30%, trailing the S&P 500®’s +10.14% total return and the Russell 1000 Growth Index’s total return of +18.95%. Unfavorable sector allocation more than offset favorable stock selection relative to the S&P 500®.

Sector allocation was less punitive than that of the Stock Fund given more exposure to communication services (5%) and information technology (23%) and less exposure to industrials (14%) and financials (8%), all of which benefited relative results. This was partially offset by the Growth Fund’s larger health care overweight position (33%).

Stock selection was favorable overall and nearly offset the allocation headwind. Health care was particularly strong – Eli Lilly again led the way, but Seagen (+67%) and ABIOMED (+51%), acquisition targets of Pfizer and Johnson & Johnson, respectively, also contributed.

4

Letter to Shareholders

PRIMECAP Odyssey Funds

continued

Smaller-capitalization health care stocks generally struggled, however, punctuated by significant weakness in FibroGen (-97%) and Insulet (-49%). Within information technology, Cisco (+18%) announced its purchase of enterprise software company Splunk (+77%), the Fund’s second-largest position, while greater exposure to electronics manufacturer Jabil (+92%) complemented the Fund’s significant stake in competitor Flex.

Selection in other sectors was generally unfavorable. Industrial parts marketplace Xometry (-76%) and a larger position in Raymond James (-18%) beset industrials and financials, respectively. And within consumer discretionary, Royal Caribbean (+59%) surged as cruise demand recovered but was unable to offset iRobot (-42%), whose delayed acquisition by Amazon faced ongoing hurdles.

The top 10 holdings, which collectively represented 33.6% of the portfolio at the period end, are listed below:

| | | | |

| | |

PRIMECAP Odyssey Growth Fund

Top 10 Holdings as of 10/31/23 | | Ending % of

Total Portfolio* | |

Eli Lilly & Co. | | | 8.6 | |

Splunk, Inc. | | | 3.8 | |

Alphabet, Inc. – Class A & C | | | 3.2 | |

Seagen, Inc. | | | 3.2 | |

Biogen Inc. | | | 3.0 | |

AECOM | | | 2.7 | |

Microsoft Corp. | | | 2.3 | |

Amgen, Inc. | | | 2.3 | |

Raymond James Financial, Inc. | | | 2.3 | |

BioMarin Pharmaceutical, Inc. | | | 2.2 | |

Total % of Portfolio | | | 33.6 | |

| | * | The percentage is calculated by using the ending market value of the security divided by the ending market value of the total investments of the Fund. |

PRIMECAP Odyssey Aggressive Growth Fund

For the fiscal year ended October 31, 2023, the Aggressive Growth Fund’s total return of +9.01% trailed the S&P 500®’s total return of +10.14% but exceeded the Russell Midcap Growth Index’s total return of +3.35%. Modestly unfavorable stock selection was the primary driver of underperformance relative to the S&P 500®.

The Aggressive Growth Fund’s sector allocation was roughly neutral. Similar to the Growth Fund, greater exposure to communication services (6%) and information technology (26%) and less exposure to industrials (12%) and financials (5%) were the key differentiators.

5

Letter to Shareholders

PRIMECAP Odyssey Funds

continued

Stock selection was unfavorable, due in part to the Aggressive Growth Fund’s heightened exposure to smaller stocks, particularly within the health care sector. Eli Lilly, Seagen, and ABIOMED were again hugely beneficial, but their collective impact was nearly offset by several key underperformers, including Xencor (-38%), BioNTech (-32%), and larger positions in Biogen, FibroGen, and Insulet.

Beyond health care, selection delivered a mixed impact. Within information technology, semiconductor technology company Axcelis (+120%) and OLED developer Universal Display (+48%) were key contributors, adding to strength from Splunk, Jabil, KLA, and Flex; however, small-cap semiconductor holdings Wolfspeed (-57%) and MaxLinear (-51%) joined the Fund’s underweight positions in Microsoft and NVIDIA as prominent detractors. Within financials, selection results were notably improved, owing both to less bank exposure and a position in electronic trading platform Tradeweb (+64%). And within consumer discretionary, Xpeng (+119%), Sony (+23%), and more exposure to Royal Caribbean countered the Fund’s modest overweight position in Tesla (-12%).

The top 10 holdings, which collectively represented 33.6% of the portfolio at the period end, are listed below:

| | | | |

| | |

PRIMECAP Odyssey Aggressive Growth Fund

Top 10 Holdings as of 10/31/23 | | Ending % of

Total Portfolio* | |

Eli Lilly & Co. | | | 5.6 | |

Seagen, Inc. | | | 5.0 | |

Splunk Inc. | | | 4.0 | |

Biogen, Inc. | | | 3.2 | |

Micron Technology, Inc. | | | 3.1 | |

Sony Group Corp. – ADR | | | 2.9 | |

Alphabet, Inc. – Class A & C | | | 2.6 | |

BioMarin Pharmaceutical, Inc. | | | 2.5 | |

Flex Ltd. | | | 2.4 | |

Tesla, Inc. | | | 2.3 | |

Total % of Portfolio | | | 33.6 | |

| | * | The percentage is calculated by using the ending market value of the security divided by the ending market value of the total investments of the Fund. |

Outlook

The equity market finished the year on a downward slide, approaching “correction” territory. The abrupt decline reflects a certain fragility in the current moment, as escalating yields threaten to

6

Letter to Shareholders

PRIMECAP Odyssey Funds

continued

upend the Fed’s precarious balancing act. Even with its recent weakness, however, the S&P 500® Index’s valuation (17.3x forward P/E) sits above historical norms (15.6x 20-year average).

And this lofty valuation is artificially depressed by rosy estimates. Forward earnings incorporate most of 2024’s consensus 12% earnings growth, an expectation that defies widespread concerns about a slowing macroeconomic environment. Meanwhile, interest rates continue to climb; the 10-year Treasury yield finished the period just shy of 5%, a level not seen since 2007. Higher interest rates do not necessarily compel multiples lower, but a higher-for-longer rate regime undermines support for above-average equity valuations. These metrics warrant ongoing caution.

That said, this big picture assessment obscures important nuance. Market leadership this year belonged primarily to Big Tech, resulting in unprecedented index concentration for the so-called Magnificent Seven. Apple and Microsoft are each currently larger than five entire sectors, and the two titans combined exceed the size of every sector but their own (information technology). Market-level analysis is thus increasingly skewed by a handful of non-representative stocks.

For instance, trading at roughly 28x forward P/E in aggregate, the Seven exert upward pressure on index valuation. Absent these hefty, higher-multiple outliers, the rest of the index – the Mundane Four Hundred Ninety-Three perhaps – trades closer to 14x forward P/E, below the S&P 500® Equal Weighted Index’s longer-term average. Put differently, even if the capitalization-weighted index feels pricey, the average stock is not overly expensive – a few big-ticket items bias the basket.

To be clear, the Seven have earned their Magnificent moniker; they sport high-growth, wide-moat businesses with dominant positions in massive industries. The Funds meaningfully participated in some of these success stories and overlooked others; we maintain consequential positions in several (Microsoft, Alphabet, Tesla). But today, as reflected in our stark collective underweight position, we are skeptical. Skeptical of their sheer size and corresponding multiples, which may imply unsustainable expectations. Skeptical of their regulatory runway, with global regulators in heavy pursuit. And, perhaps most importantly, skeptical of their market supremacy; creative destruction is undefeated, no matter how entrenched the incumbent.

Fortunately, there are no shortage of companies that we would rather own. And while we recently highlighted one such company – Eli Lilly – in last year’s letter, the stock’s centrality to each Fund’s performance merits a refresh. Lilly logged yet another big gain this year, with incremental upside driven by the company’s almost open-ended obesity opportunity.

Not long ago, glucagon-like peptide-1 receptor agonists, or GLP-1s, were a relatively obscure drug class primarily used to treat diabetes. Novo Nordisk’s Victoza launched in 2010, followed by Lilly’s superior Trulicity product in 2014. These GLP-1 therapies and their next-generation derivatives lower blood sugar levels and thus help resolve a diabetic deficiency. But they also induce weight loss, at least in part by signaling satiety to the hypothalamus. First Novo and then Lilly thus pivoted to an obesity indication, with Novo’s Wegovy (a version of its Ozempic

7

Letter to Shareholders

PRIMECAP Odyssey Funds

continued

product) achieving FDA approval for obesity in 2021 and, as something of a Trulicity echo, Lilly’s superior tirzepatide drug (brand name Mounjaro for diabetes and Zepbound for obesity) recently achieving the same milestone.

Today, GLP-1s are no longer just another drug class. Most drugs aim to transform a patient’s life; GLP-1s may transform the entire economy. Obesity is an intractable public health problem, a crisis with expansive ramifications. There are roughly 100 million obese adults in the United States alone; rationalizing their collective appetite should drive better health outcomes, which would have first-order consequences for adjacent medical fields. But such massive behavioral change would also bend the country’s food spend lower. And if, as some project, GLP-1-induced satiety softens impulses more broadly, this drug class could disrupt overall consumption in countless ways.

The Funds were invested in Lilly well before these developments unfolded. Our Lilly thesis had many elements, including stellar management, disproportionately high R&D spend supporting best-in-class research, and a uniquely potent pipeline. We were especially eager to underwrite two mammoth pipeline opportunities, donanemab in Alzheimer’s and this next-generation GLP-1 in diabetes/obesity. Both drugs have now cleared their respective clinical hurdles; donanemab awaits full FDA approval, while tirzepatide won approval for both diabetes (Mounjaro) and obesity (Zepbound). As a combination GLP-1/GIP agonist, tirzepatide is a novel formulation in the GLP-1 class; it delivers better efficacy and will be advantaged commercially. The stage is set for tirzepatide to become one of the most successful drugs in pharmaceutical history. Lilly’s earnings could quadruple or more by decade-end.

Lilly’s story continues to be a staggering success. Of note, the Funds hold dozens of other mundane, not-yet-magnificent stocks with enormous upside potential, whose fundamental trajectories today may resemble Lilly’s a decade ago. Of course, many will not fully realize this potential – such outcomes are exceedingly rare. But our portfolio is biased towards such differentiated opportunities.

The market is awash in powerful crosscurrents. This year’s once-inevitable recession never arrived, as the Fed has managed to trim inflation without stalling the economic engine. Worrisome indicators – for instance, an inverted yield curve and declining money supply – have thus far not been predictive, even if our qualitative assessment of the economy skews negative, and our outlook leans cautious. But we still own attractively-priced companies whose fundamentals, like those of Eli Lilly, can evolve much better than the market anticipates. And we still prefer such stocks to the Magnificent Seven.

Sincerely,

PRIMECAP Management Company

November 10, 2023

8

Letter to Shareholders

PRIMECAP Odyssey Funds

continued

Past performance is not a guarantee of future results.

The funds invest in smaller companies, which involve additional risks such as limited liquidity and greater volatility. All funds may invest in foreign securities, which involves greater volatility and political, economic and currency risks and differences in accounting methods. Mutual fund investing involves risk, and loss of principal is possible. Growth stocks typically are more volatile than value stocks; however, value stocks have a lower expected growth rate in earnings and sales.

Please refer to the Schedule of Investments for details of fund holdings. Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security.

The S&P 500® is a market capitalization-weighted index of 500 large-capitalization stocks commonly used to represent the U.S. equity market. The Russell 1000 Growth Index is an index that measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values (the Russell 1000 Index measures the performance of the large-cap segment of the U.S. equity universe). The Russell Midcap Growth Index measures the performance of those Russell Midcap companies with higher price-to-book ratios and higher forecasted growth values. You cannot invest directly in an index.

Earnings per share (EPS) is calculated by taking the total earnings divided by the number of shares outstanding.

Price-to-earnings ratio is calculated by dividing the current share price of a stock by its earnings per share.

Earnings growth is not a prediction of a fund’s future performance.

The information provided herein represents the opinions of PRIMECAP Management Company and is not intended to be a forecast of future events, a guarantee of future results, or investment advice.

9

| | |

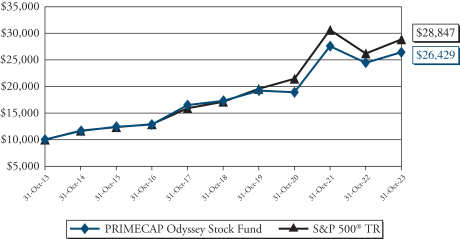

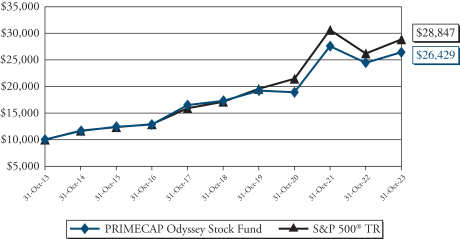

| | Performance Graphs PRIMECAP Odyssey Stock Fund |

The chart below illustrates the performance of a hypothetical $10,000 investment made on October 31, 2013 and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of dividends and capital gains for the fund and dividends for the index.

| | | | | | | | | | | | | | | | |

| | | Total Return

Period Ended October 31, 2023 | |

| | | 1 Year | | | Annualized

5 Year | | | Annualized

10 Year | | | Annualized

Since Inception^ | |

Stock Fund | | | 8.13% | | | | 8.85% | | | | 10.21% | | | | 9.74% | |

S&P 500®* | | | 10.14% | | | | 11.01% | | | | 11.18% | | | | 9.29% | |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-729-2307.

| | * | The S&P 500® is a market capitalization-weighted index of 500 large-capitalization stocks commonly used to represent the U.S. equity market. |

10

| | |

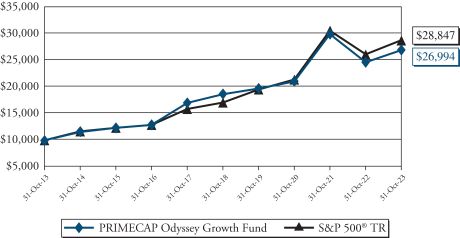

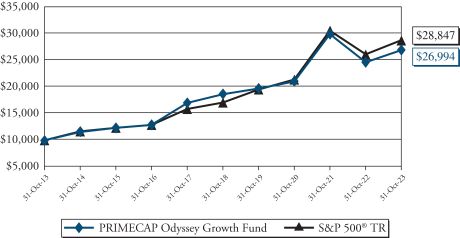

| | Performance Graphs PRIMECAP Odyssey Growth Fund |

The chart below illustrates the performance of a hypothetical $10,000 investment made on October 31, 2013 and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of dividends and capital gains for the fund and dividends for the index.

| | | | | | | | | | | | | | | | |

| | | Total Return

Period Ended October 31, 2023 | |

| | | 1 Year | | | Annualized

5 Year | | | Annualized

10 Year | | | Annualized

Since Inception^ | |

Growth Fund | | | 9.30% | | | | 7.63% | | | | 10.44% | | | | 10.33% | |

S&P 500®* | | | 10.14% | | | | 11.01% | | | | 11.18% | | | | 9.29% | |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-729-2307.

| | * | The S&P 500® is a market capitalization-weighted index of 500 large-capitalization stocks commonly used to represent the U.S. equity market. |

11

| | |

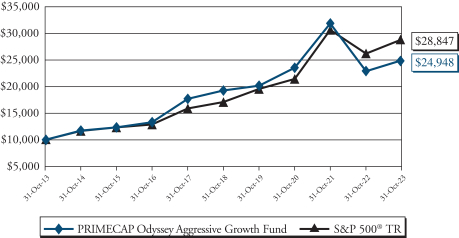

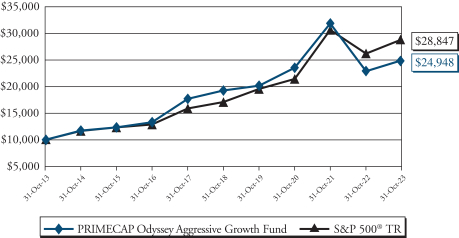

| | Performance Graphs PRIMECAP Odyssey Aggressive Growth Fund |

The chart below illustrates the performance of a hypothetical $10,000 investment made on October 31, 2013 and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of dividends and capital gains for the fund and dividends for the index.

| | | | | | | | | | | | | | | | |

| | | Total Return

Period Ended October 31, 2023 | |

| | | 1 Year | | | Annualized

5 Year | | | Annualized

10 Year | | | Annualized

Since Inception^ | |

Aggressive Growth Fund | | | 9.01% | | | | 5.29% | | | | 9.57% | | | | 11.34% | |

S&P 500®* | | | 10.14% | | | | 11.01% | | | | 11.18% | | | | 9.29% | |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-729-2307.

| | * | The S&P 500® is a market capitalization-weighted index of 500 large-capitalization stocks commonly used to represent the U.S. equity market. |

12

| | |

| | Sector Breakdown PRIMECAP Odyssey Funds |

PRIMECAP Odyssey Stock Fund

| | | | |

Communication Services | | | 2.8% | |

Consumer Discretionary | | | 8.8% | |

Consumer Staples | | | 1.5% | |

Energy | | | 3.1% | |

Financials | | | 9.4% | |

Health Care | | | 28.4% | |

Industrials | | | 18.7% | |

Information Technology | | | 22.0% | |

Materials | | | 2.0% | |

Short-Term Investments, net of Liabilities in Excess of Other Assets | | | 3.3% | |

Total | | | 100.0% | |

PRIMECAP Odyssey Growth Fund

| | | | |

Communication Services | | | 5.7% | |

Consumer Discretionary | | | 9.1% | |

Consumer Staples | | | 0.5% | |

Energy | | | 3.5% | |

Financials | | | 7.3% | |

Health Care | | | 33.1% | |

Industrials | | | 13.6% | |

Information Technology | | | 25.3% | |

Materials | | | 0.6% | |

Rights (Health Care) | | | 0.0% | |

Short-Term Investments and Other Assets | | | 1.3% | |

Total | | | 100.0% | |

The tables above list sector allocations as a percentage of each fund’s total net assets as of October 31, 2023. The management report may make reference to average allocations during the period. As a result, the sector allocations above may differ from those discussed in the management report.

13

Sector Breakdown

PRIMECAP Odyssey Funds

continued

PRIMECAP Odyssey Aggressive Growth Fund

| | | | |

Communication Services | | | 6.5% | |

Consumer Discretionary | | | 12.3% | |

Consumer Staples | | | 0.0% | |

Energy | | | 1.8% | |

Financials | | | 4.8% | |

Health Care | | | 31.7% | |

Industrials | | | 10.6% | |

Information Technology | | | 29.2% | |

Materials | | | 0.7% | |

Real Estate | | | 0.1% | |

Rights (Health Care) | | | 0.0% | |

Warrants (Materials) | | | 0.0% | |

Short-Term Investments, net of Liabilities in Excess of Other Assets | | | 2.3% | |

Total | | | 100.0% | |

The table above lists sector allocations as a percentage of the fund’s total net assets as of October 31, 2023. The management report may make reference to average allocations during the period. As a result, the sector allocations above may differ from those discussed in the management report.

14

| | |

| | Schedule of Investments PRIMECAP Odyssey Stock Fund October 31, 2023 |

| | | | | | | | |

| Shares | | | | | Value | |

| | COMMON STOCKS – 96.7% | | | | |

| |

| Communication Services – 2.8% | | | |

| | 352,700 | | | Alphabet, Inc. – Class A (a) | | $ | 43,763,016 | |

| | 367,050 | | | Alphabet, Inc. – Class C (a) | | | 45,991,365 | |

| | 138,600 | | | Comcast Corp. – Class A | | | 5,722,794 | |

| | 55,200 | | | Meta Platforms, Inc. – Class A (a) | | | 16,630,104 | |

| | 300,000 | | | Nintendo Co. Ltd. – JPY | | | 12,312,716 | |

| | 296,200 | | | Walt Disney Co. (The) (a) | | | 24,166,958 | |

| | | | | | | | |

| | | | | | | 148,586,953 | |

| | | | | | | | |

| Consumer Discretionary – 8.8% | | | |

| | 423,200 | | | Bath & Body Works, Inc. | | | 12,547,880 | |

| | 150,800 | | | Brinker International, Inc. (a) | | | 5,115,136 | |

| | 25,700 | | | Burlington Stores, Inc. (a) | | | 3,110,471 | |

| | 129,400 | | | Capri Holdings Ltd. (a) | | | 6,622,692 | |

| | 502,700 | | | CarMax, Inc. (a) | | | 30,709,943 | |

| | 958,800 | | | Carnival Corp. (a) | | | 10,987,848 | |

| | 207,780 | | | eBay, Inc. | | | 8,151,209 | |

| | 217,800 | | | Leslie’s, Inc. (a) | | | 1,075,932 | |

| | 3,870,660 | | | Mattel, Inc. (a) | | | 73,852,193 | |

| | 78,400 | | | MGM Resorts International | | | 2,737,728 | |

| | 1,280,000 | | | Newell Brands, Inc. | | | 8,601,600 | |

| | 842,600 | | | Ross Stores, Inc. | | | 97,716,322 | |

| | 184,550 | | | Royal Caribbean Cruises Ltd. (a) | | | 15,636,922 | |

| | 1,270,989 | | | Sony Group Corp. – ADR | | | 105,555,636 | |

| | 213,600 | | | TJX Cos., Inc. (The) | | | 18,811,752 | |

| | 227,533 | | | Victoria’s Secret & Co. (a) | | | 4,068,290 | |

| | 508,339 | | | Whirlpool Corp. | | | 53,151,926 | |

| | | | | | | | |

| | | | | | | 458,453,480 | |

| | | | | | | | |

| Consumer Staples – 1.5% | | | |

| | 169,100 | | | Altria Group, Inc. | | | 6,792,747 | |

| | 298,600 | | | BJ’s Wholesale Club Holdings, Inc. (a) | | | 20,340,632 | |

| | 189,800 | | | Dollar Tree, Inc. (a) | | | 21,084,882 | |

| | 85,600 | | | Philip Morris International, Inc. | | | 7,632,096 | |

| | 239,500 | | | Sysco Corp. | | | 15,924,355 | |

| | 149,000 | | | Tyson Foods, Inc. – Class A | | | 6,906,150 | |

| | | | | | | | |

| | | | | | | 78,680,862 | |

| | | | | | | | |

| Energy – 3.1% | | | |

| | 166,500 | | | Cameco Corp. | | | 6,811,515 | |

| | 207,300 | | | EOG Resources, Inc. | | | 26,171,625 | |

| | 339,140 | | | Hess Corp. | | | 48,971,816 | |

The accompanying notes are an integral part of these financial statements.

15

Schedule of Investments

PRIMECAP Odyssey Stock Fund

October 31, 2023 – continued

| | | | | | | | |

| Shares | | | | | Value | |

| Energy (continued) | | | |

| | 171,000 | | | Pioneer Natural Resources Co. | | $ | 40,869,000 | |

| | 1,310,000 | | | Southwestern Energy Co. (a) | | | 9,340,300 | |

| | 233,600 | | | TechnipFMC PLC | | | 5,027,072 | |

| | 1,119,600 | | | Transocean Ltd. (a) | | | 7,411,752 | |

| | 152,600 | | | Valero Energy Corp. | | | 19,380,200 | |

| | | | | | | | |

| | | | | | | 163,983,280 | |

| | | | | | | | |

| Financials – 9.4% | | | |

| | 771,200 | | | Bank of America Corp. | | | 20,313,408 | |

| | 90,000 | | | Bank of New York Mellon Corp. (The) | | | 3,825,000 | |

| | 1,105,850 | | | Citigroup, Inc. | | | 43,670,017 | |

| | 228,200 | | | CME Group, Inc. – Class A | | | 48,711,572 | |

| | 387,600 | | | Discover Financial Services | | | 31,814,208 | |

| | 9,790 | | | Evercore, Inc. – Class A | | | 1,274,462 | |

| | 70,900 | | | Fidelity National Information Services, Inc. | | | 3,481,899 | |

| | 385,400 | | | JPMorgan Chase & Co. | | | 53,593,724 | |

| | 240,000 | | | KeyCorp | | | 2,452,800 | |

| | 590,700 | | | Northern Trust Corp. | | | 38,933,037 | |

| | 97,050 | | | PayPal Holdings, Inc. (a) | | | 5,027,190 | |

| | 71,640 | | | Progressive Corp. (The) | | | 11,325,568 | |

| | 848,575 | | | Raymond James Financial, Inc. | | | 80,987,998 | |

| | 125,100 | | | Visa, Inc. – Class A | | | 29,411,010 | |

| | 2,887,808 | | | Wells Fargo & Co. | | | 114,848,124 | |

| | 21,440 | | | WEX, Inc. (a) | | | 3,569,331 | |

| | | | | | | | |

| | | | | | | 493,239,348 | |

| | | | | | | | |

| Health Care – 28.4% | | | |

| | 68,000 | | | Abbott Laboratories | | | 6,429,400 | |

| | 379,300 | | | Agilent Technologies, Inc. | | | 39,208,241 | |

| | 46,400 | | | Alcon, Inc. | | | 3,309,248 | |

| | 586,900 | | | Amgen, Inc. | | | 150,070,330 | |

| | 3,562,100 | | | AstraZeneca PLC – ADR | | | 225,231,583 | |

| | 582,280 | | | Biogen, Inc. (a) | | | 138,314,791 | |

| | 349,600 | | | Boston Scientific Corp. (a) | | | 17,896,024 | |

| | 1,506,300 | | | Bristol-Myers Squibb Co. | | | 77,619,639 | |

| | 197,030 | | | CVS Health Corp. | | | 13,597,040 | |

| | 6,700 | | | Danaher Corp. | | | 1,286,534 | |

| | 3,369,341 | | | Elanco Animal Health, Inc. (a) | | | 29,683,894 | |

| | 953,023 | | | Eli Lilly & Co. | | | 527,908,030 | |

| | 719,880 | | | GSK PLC – ADR | | | 25,699,716 | |

| | 391,890 | | | LivaNova PLC (a) | | | 19,222,205 | |

The accompanying notes are an integral part of these financial statements.

16

Schedule of Investments

PRIMECAP Odyssey Stock Fund

October 31, 2023 – continued

| | | | | | | | |

| Shares | | | | | Value | |

| Health Care (continued) | | | |

| | 31,700 | | | Medtronic PLC | | $ | 2,236,752 | |

| | 69,100 | | | Merck & Co., Inc. | | | 7,096,570 | |

| | 528,550 | | | Novartis AG – ADR | | | 49,461,709 | |

| | 183,000 | | | Revvity, Inc. | | | 15,161,550 | |

| | 76,411 | | | Roche Holding AG – CHF | | | 19,643,503 | |

| | 29,650 | | | Sandoz Group AG – CHF (a) | | | 770,871 | |

| | 86,450 | | | Sanofi – ADR | | | 3,911,863 | |

| | 127,000 | | | Siemens Healthineers AG – EUR | | | 6,224,423 | |

| | 20,800 | | | Stryker Corp. | | | 5,620,576 | |

| | 135,400 | | | Thermo Fisher Scientific, Inc. | | | 60,221,858 | |

| | 15,480 | | | Waters Corp. (a) | | | 3,692,444 | |

| | 327,000 | | | Zimmer Biomet Holdings, Inc. | | | 34,142,070 | |

| | 3,500 | | | ZimVie, Inc. (a) | | | 24,710 | |

| | | | | | | | |

| | | | | | | 1,483,685,574 | |

| | | | | | | | |

| Industrials – 18.7% | | | |

| | 2,309,600 | | | AECOM | | | 176,799,880 | |

| | 298,869 | | | Airbus SE – EUR | | | 39,933,951 | |

| | 54,050 | | | Alaska Air Group, Inc. (a) | | | 1,709,601 | |

| | 2,269,750 | | | American Airlines Group, Inc. (a) | | | 25,307,712 | |

| | 34,900 | | | AMETEK, Inc. | | | 4,912,873 | |

| | 332,062 | | | Carrier Global Corp. | | | 15,826,075 | |

| | 108,023 | | | Caterpillar, Inc. | | | 24,418,599 | |

| | 280,700 | | | CSX Corp. | | | 8,378,895 | |

| | 229,720 | | | Curtiss-Wright Corp. | | | 45,670,633 | |

| | 5,200 | | | Deere & Co. | | | 1,899,872 | |

| | 938,450 | | | Delta Air Lines, Inc. | | | 29,326,562 | |

| | 654,585 | | | FedEx Corp. | | | 157,165,859 | |

| | 72,200 | | | General Dynamics Corp. | | | 17,422,582 | |

| | 68,200 | | | GXO Logistics, Inc. (a) | | | 3,444,782 | |

| | 481,030 | | | Jacobs Solutions, Inc. | | | 64,121,299 | |

| | 276,000 | | | JELD-WEN Holding, Inc. (a) | | | 3,127,080 | |

| | 326,400 | | | Kirby Corp. (a) | | | 24,382,080 | |

| | 36,000 | | | Knight-Swift Transportation Holdings, Inc. | | | 1,760,040 | |

| | 23,300 | | | L3Harris Technologies, Inc. | | | 4,180,253 | |

| | 164,200 | | | Matson, Inc. | | | 14,293,610 | |

| | 84,400 | | | Moog, Inc. – Class A | | | 9,794,620 | |

| | 75,800 | | | Norfolk Southern Corp. | | | 14,461,882 | |

| | 31,581 | | | Otis Worldwide Corp. | | | 2,438,369 | |

| | 17,390 | | | Rockwell Automation, Inc. | | | 4,570,266 | |

The accompanying notes are an integral part of these financial statements.

17

Schedule of Investments

PRIMECAP Odyssey Stock Fund

October 31, 2023 – continued

| | | | | | | | |

| Shares | | | | | Value | |

| Industrials (continued) | | | |

| | 11,262 | | | RTX Corp. | | $ | 916,614 | |

| | 314,100 | | | RXO, Inc. (a) | | | 5,499,891 | |

| | 14,700 | | | Saia, Inc. (a) | | | 5,269,803 | |

| | 911,112 | | | Siemens AG – EUR | | | 120,467,422 | |

| | 2,377,950 | | | Southwest Airlines Co. | | | 52,861,829 | |

| | 30,400 | | | Union Pacific Corp. | | | 6,311,344 | |

| | 1,318,040 | | | United Airlines Holdings, Inc. (a) | | | 46,144,580 | |

| | 198,600 | | | United Parcel Service, Inc. – Class B | | | 28,052,250 | |

| | 241,000 | | | XPO, Inc. (a) | | | 18,270,210 | |

| | | | | | | | |

| | | | | | | 979,141,318 | |

| | | | | | | | |

| Information Technology – 22.0% | | | |

| | 108,650 | | | Adobe, Inc. (a) | | | 57,808,319 | |

| | 183,710 | | | Analog Devices, Inc. | | | 28,903,094 | |

| | 509,450 | | | Applied Materials, Inc. | | | 67,425,708 | |

| | 416,500 | | | Cisco Systems, Inc. | | | 21,712,145 | |

| | 263,698 | | | Corning, Inc. | | | 7,056,558 | |

| | 4,994,549 | | | Flex Ltd. (a) | | | 128,459,800 | |

| | 3,771,600 | | | Hewlett Packard Enterprise Co. | | | 58,007,208 | |

| | 1,172,000 | | | HP, Inc. | | | 30,858,760 | |

| | 4,124,010 | | | Intel Corp. | | | 150,526,365 | |

| | 45,000 | | | Jabil, Inc. | | | 5,526,000 | |

| | 129,450 | | | Keysight Technologies, Inc. (a) | | | 15,799,373 | |

| | 307,230 | | | KLA Corp. | | | 144,305,931 | |

| | 4,843,930 | | | L.M. Ericsson Telephone Co. – ADR | | | 21,603,928 | |

| | 462,670 | | | Microsoft Corp. | | | 156,433,354 | |

| | 819,630 | | | NetApp, Inc. | | | 59,652,671 | |

| | 12,800 | | | NVIDIA Corp. | | | 5,219,840 | |

| | 809,700 | | | Oracle Corp. | | | 83,722,980 | |

| | 313,247 | | | QUALCOMM, Inc. | | | 34,140,791 | |

| | 57,800 | | | Seagate Technology Holdings PLC | | | 3,944,850 | |

| | 141,300 | | | Teradyne, Inc. | | | 11,766,051 | |

| | 419,020 | | | Texas Instruments, Inc. | | | 59,505,030 | |

| | | | | | | | |

| | | | | | | 1,152,378,756 | |

| | | | | | | | |

| Materials – 2.0% | | | |

| | 218,400 | | | Albemarle Corp. | | | 27,688,752 | |

| | 149,200 | | | Corteva, Inc. | | | 7,182,488 | |

| | 137,600 | | | Dow, Inc. | | | 6,651,584 | |

| | 206,884 | | | DuPont de Nemours, Inc. | | | 15,077,706 | |

| | 508,900 | | | Freeport-McMoRan, Inc. | | | 17,190,642 | |

The accompanying notes are an integral part of these financial statements.

18

Schedule of Investments

PRIMECAP Odyssey Stock Fund

October 31, 2023 – continued

| | | | | | | | |

| Shares | | | | | Value | |

| Materials (continued) | | | |

| | 4,609,278 | | | Glencore PLC – GBP | | $ | 24,378,629 | |

| | 375,200 | | | Tronox Holdings PLC | | | 4,010,888 | |

| | | | | | | | |

| | | | | | | 102,180,689 | |

| | | | | | | | |

| TOTAL COMMON STOCKS

(Cost $2,704,042,761) | | $ | 5,060,330,260 | |

| | | | | |

| | SHORT-TERM INVESTMENTS – 3.4% | | | | |

| | 177,435,746 | | | Dreyfus Treasury Securities Cash Management Fund – Institutional Shares – 5.27% (b) | | $ | 177,435,746 | |

| | | | | | | | |

| TOTAL SHORT-TERM INVESTMENTS

(Cost $177,435,746) | | | 177,435,746 | |

| | | | | | | | |

| TOTAL INVESTMENTS IN SECURITIES

(Cost $2,881,478,507) – 100.1% | | | 5,237,766,006 | |

| | Liabilities in Excess of Other Assets – (0.1)% | | | (6,435,263 | ) |

| | | | | |

| | TOTAL NET ASSETS – 100.0% | | $ | 5,231,330,743 | |

| | | | | | | | |

| ADR | American Depository Receipt |

| GBP | British Pound Sterling |

| (b) | Rate quoted is seven-day yield at period end. |

The Global Industry Classification Standard (GICS ®) was developed by and is the exclusive property of MSCI Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by the fund’s administrator.

The accompanying notes are an integral part of these financial statements.

19

| | |

| | Schedule of Investments PRIMECAP Odyssey Growth Fund October 31, 2023 |

| | | | | | | | |

| Shares | | | | | Value | |

| | COMMON STOCKS – 98.7% | | | | |

| |

| Communication Services – 5.7% | | | |

| | 894,420 | | | Alphabet, Inc. – Class A (a) | | $ | 110,979,634 | |

| | 709,620 | | | Alphabet, Inc. – Class C (a) | | | 88,915,386 | |

| | 585,800 | | | Baidu, Inc. – ADR (a) | | | 61,509,000 | |

| | 89,000 | | | Electronic Arts, Inc. | | | 11,017,310 | |

| | 326,600 | | | IMAX Corp. (a) | | | 5,947,386 | |

| | 60,660 | | | Live Nation Entertainment, Inc. (a) | | | 4,854,013 | |

| | 31,400 | | | Meta Platforms, Inc. – Class A (a) | | | 9,459,878 | |

| | 14,500 | | | Netflix, Inc. (a) | | | 5,969,505 | |

| | 550,000 | | | Nintendo Co. Ltd. – JPY | | | 22,573,313 | |

| | 85,900 | | | Shutterstock, Inc. | | | 3,494,412 | |

| | 142,000 | | | Trade Desk, Inc. (The) – Class A (a) | | | 10,076,320 | |

| | 301,200 | | | Walt Disney Co. (The) (a) | | | 24,574,908 | |

| | | | | | | | |

| | | | | | | 359,371,065 | |

| | | | | | | | |

| Consumer Discretionary – 9.1% | | | |

| | 1,157,900 | | | Alibaba Group Holding Ltd. – ADR (a) | | | 95,573,066 | |

| | 499,498 | | | Bath & Body Works, Inc. | | | 14,810,116 | |

| | 282,100 | | | Bowlero Corp. – Class A (a) | | | 2,846,389 | |

| | 80,600 | | | Burlington Stores, Inc. (a) | | | 9,755,018 | |

| | 442,800 | | | Capri Holdings Ltd. (a) | | | 22,662,504 | |

| | 677,350 | | | CarMax, Inc. (a) | | | 41,379,311 | |

| | 193,400 | | | Carnival Corp. (a) | | | 2,216,364 | |

| | 15,400 | | | DoorDash, Inc. �� Class A (a) | | | 1,154,230 | |

| | 120,820 | | | eBay, Inc. | | | 4,739,769 | |

| | 2,063,624 | | | Entain PLC – GBP | | | 23,336,604 | |

| | 38,000 | | | Etsy, Inc. (a) | | | 2,367,400 | |

| | 76,143 | | | Flutter Entertainment PLC – GBP (a) | | | 11,943,328 | |

| | 1,019,260 | | | iRobot Corp. (a) | | | 33,564,232 | |

| | 247,900 | | | Leslie’s, Inc. (a) | | | 1,224,626 | |

| | 32,000 | | | Marriott International, Inc. – Class A | | | 6,033,920 | |

| | 2,654,600 | | | Mattel, Inc. (a) | | | 50,649,768 | |

| | 9,300 | | | McDonald’s Corp. | | | 2,438,181 | |

| | 85,900 | | | MGM Resorts International | | | 2,999,628 | |

| | 529,900 | | | Norwegian Cruise Line Holdings Ltd. (a) | | | 7,206,640 | |

| | 75,700 | | | Ollie’s Bargain Outlet Holdings, Inc. (a) | | | 5,847,068 | |

| | 11,000 | | | Restaurant Brands International, Inc. | | | 739,200 | |

| | 112,500 | | | Ross Stores, Inc. | | | 13,046,625 | |

| | 523,971 | | | Royal Caribbean Cruises Ltd. (a) | | | 44,396,063 | |

| | 795,837 | | | Sony Group Corp. – ADR | | | 66,094,263 | |

The accompanying notes are an integral part of these financial statements.

20

Schedule of Investments

PRIMECAP Odyssey Growth Fund

October 31, 2023 – continued

| | | | | | | | |

| Shares | | | | | Value | |

| Consumer Discretionary (continued) | | | |

| | 423,930 | | | Tesla, Inc. (a) | | $ | 85,142,101 | |

| | 180,200 | | | TJX Cos., Inc. (The) | | | 15,870,214 | |

| | 265,099 | | | Victoria’s Secret & Co. (a) | | | 4,739,970 | |

| | | | | | | | |

| | | | | | | 572,776,598 | |

| | | | | | | | |

| Consumer Staples – 0.5% | | | |

| | 129,100 | | | Altria Group, Inc. | | | 5,185,947 | |

| | 134,000 | | | BJ’s Wholesale Club Holdings, Inc. (a) | | | 9,128,080 | |

| | 131,500 | | | Dollar Tree, Inc. (a) | | | 14,608,335 | |

| | | | | | | | |

| | | | | | | 28,922,362 | |

| | | | | | | | |

| Energy – 3.5% | | | |

| | 550,000 | | | Coterra Energy, Inc. | | | 15,125,000 | |

| | 99,200 | | | EOG Resources, Inc. | | | 12,524,000 | |

| | 404,021 | | | Hess Corp. | | | 58,340,632 | |

| | 348,860 | | | Pioneer Natural Resources Co. | | | 83,377,540 | |

| | 48,500 | | | Schlumberger Ltd. | | | 2,699,510 | |

| | 1,570,000 | | | Southwestern Energy Co. (a) | | | 11,194,100 | |

| | 27,500 | | | TechnipFMC PLC | | | 591,800 | |

| | 5,378,304 | | | Transocean Ltd. (a) | | | 35,604,373 | |

| | | | | | | | |

| | | | | | | 219,456,955 | |

| | | | | | | | |

| Financials – 7.3% | | | |

| | 230,900 | | | Bank of America Corp. | | | 6,081,906 | |

| | 320,500 | | | Citigroup, Inc. | | | 12,656,545 | |

| | 119,100 | | | CME Group, Inc. – Class A | | | 25,423,086 | |

| | 98,010 | | | Discover Financial Services | | | 8,044,661 | |

| | 60,960 | | | Evercore, Inc. – Class A | | | 7,935,773 | |

| | 132,700 | | | JPMorgan Chase & Co. | | | 18,453,262 | |

| | 140,100 | | | MarketAxess Holdings, Inc. | | | 29,946,375 | |

| | 5,400 | | | Mastercard, Inc. – Class A | | | 2,032,290 | |

| | 384,100 | | | Morgan Stanley | | | 27,201,962 | |

| | 551,710 | | | Northern Trust Corp. | | | 36,363,206 | |

| | 25,600 | | | PayPal Holdings, Inc. (a) | | | 1,326,080 | |

| | 1,480,655 | | | Raymond James Financial, Inc. | | | 141,313,713 | |

| | 164,700 | | | Tradeweb Markets, Inc. – Class A | | | 14,824,647 | |

| | 206,200 | | | Visa, Inc. – Class A | | | 48,477,620 | |

| | 1,964,400 | | | Wells Fargo & Co. | | | 78,124,188 | |

| | 8,150 | | | WEX, Inc. (a) | | | 1,356,812 | |

| | | | | | | | |

| | | | | | | 459,562,126 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

21

Schedule of Investments

PRIMECAP Odyssey Growth Fund

October 31, 2023 – continued

| | | | | | | | |

| Shares | | | | | Value | |

| Health Care – 33.1% | | | |

| | 108,200 | | | Agilent Technologies, Inc. | | $ | 11,184,634 | |

| | 62,800 | | | Alcon, Inc. | | | 4,478,896 | |

| | 351,500 | | | Alkermes PLC (a) | | | 8,502,785 | |

| | 569,400 | | | Amgen, Inc. | | | 145,595,580 | |

| | 1,991,480 | | | AstraZeneca PLC – ADR | | | 125,921,280 | |

| | 679,827 | | | BeiGene Ltd. – ADR (a) | | | 126,638,174 | |

| | 796,150 | | | Biogen, Inc. (a) | | | 189,117,471 | |

| | 1,707,521 | | | BioMarin Pharmaceutical, Inc. (a) | | | 139,077,585 | |

| | 418,700 | | | BioNTech SE – ADR (a) | | | 39,165,198 | |

| | 1,071,800 | | | Boston Scientific Corp. (a) | | | 54,865,442 | |

| | 216,670 | | | Bridgebio Pharma, Inc. (a) | | | 5,642,087 | |

| | 1,021,550 | | | Bristol-Myers Squibb Co. | | | 52,640,471 | |

| | 196,000 | | | CVS Health Corp. | | | 13,525,960 | |

| | 35,000 | | | Edwards Lifesciences Corp. (a) | | | 2,230,200 | |

| | 3,711,941 | | | Elanco Animal Health, Inc. (a) | | | 32,702,200 | |

| | 968,978 | | | Eli Lilly & Co. | | | 536,745,984 | |

| | 97,766 | | | Enovis Corp. (a) | | | 4,487,459 | |

| | 2,446,110 | | | FibroGen, Inc. (a) | | | 1,323,346 | |

| | 234,480 | | | GSK PLC – ADR | | | 8,370,936 | |

| | 53,800 | | | Guardant Health, Inc. (a) | | | 1,392,344 | |

| | 2,000 | | | Humana, Inc. | | | 1,047,380 | |

| | 26,500 | | | Illumina, Inc. (a) | | | 2,899,630 | |

| | 289,677 | | | Insulet Corp. (a) | | | 38,402,480 | |

| | 21,560 | | | IQVIA Holdings, Inc. (a) | | | 3,898,695 | |

| | 972,470 | | | LivaNova PLC (a) | | | 47,699,654 | |

| | 22,100 | | | Merck & Co., Inc. | | | 2,269,670 | |

| | 2,122,556 | | | Nektar Therapeutics (a) | | | 995,479 | |

| | 72,700 | | | Neurocrine Biosciences, Inc. (a) | | | 8,065,338 | |

| | 486,096 | | | Novartis AG – ADR | | | 45,488,864 | |

| | 26,540 | | | Omnicell, Inc. (a) | | | 943,232 | |

| | 117,700 | | | OraSure Technologies, Inc. (a) | | | 607,332 | |

| | 149,250 | | | QIAGEN N.V. – EUR (a) | | | 5,546,202 | |

| | 58,100 | | | Revvity, Inc. | | | 4,813,585 | |

| | 2,554,602 | | | Rhythm Pharmaceuticals, Inc. (a) | | | 59,036,852 | |

| | 107,777 | | | Roche Holding AG – CHF | | | 27,706,977 | |

| | 20,728 | | | Sandoz Group AG – CHF (a) | | | 538,913 | |

| | 935,250 | | | Seagen, Inc. (a) | | | 199,030,552 | |

| | 78,300 | | | Siemens Healthineers AG – EUR | | | 3,837,577 | |

| | 10,800 | | | Stryker Corp. | | | 2,918,376 | |

The accompanying notes are an integral part of these financial statements.

22

Schedule of Investments

PRIMECAP Odyssey Growth Fund

October 31, 2023 – continued

| | | | | | | | |

| Shares | | | | | Value | |

| Health Care (continued) | | | |

| | 96,800 | | | Thermo Fisher Scientific, Inc. | | $ | 43,053,736 | |

| | 4,000 | | | Waters Corp. (a) | | | 954,120 | |

| | 2,218,170 | | | Xencor, Inc. (a) | | | 38,485,249 | |

| | 309,420 | | | Zimmer Biomet Holdings, Inc. | | | 32,306,542 | |

| | | | | | | | |

| | | | | | | 2,074,154,467 | |

| | | | | | | | |

| Industrials – 13.6% | | | |

| | 2,254,952 | | | AECOM | | | 172,616,576 | |

| | 223,095 | | | Airbus SE – EUR | | | 29,809,263 | |

| | 2,267,401 | | | American Airlines Group, Inc. (a) | | | 25,281,521 | |

| | 60,000 | | | AMETEK, Inc. | | | 8,446,200 | |

| | 85,000 | | | Carrier Global Corp. | | | 4,051,100 | |

| | 35,000 | | | CSX Corp. | | | 1,044,750 | |

| | 183,200 | | | Curtiss-Wright Corp. | | | 36,421,992 | |

| | 1,300,700 | | | Delta Air Lines, Inc. | | | 40,646,875 | |

| | 87,265 | | | ESAB Corp. | | | 5,523,874 | |

| | 196,700 | | | FedEx Corp. | | | 47,227,670 | |

| | 71,100 | | | General Dynamics Corp. | | | 17,157,141 | |

| | 46,800 | | | IDEX Corp. | | | 8,957,988 | |

| | 54,700 | | | J.B. Hunt Transport Services, Inc. | | | 9,401,289 | |

| | 878,184 | | | Jacobs Solutions, Inc. | | | 117,061,927 | |

| | 539,500 | | | JetBlue Airways Corp. (a) | | | 2,028,520 | |

| | 341,300 | | | Lyft, Inc. – Class A (a) | | | 3,129,721 | |

| | 132,000 | | | Nextracker, Inc. – Class A (a) | | | 4,588,320 | |

| | 8,300 | | | Old Dominion Freight Line, Inc. | | | 3,126,278 | |

| | 18,300 | | | Saia, Inc. (a) | | | 6,560,367 | |

| | 780,601 | | | Siemens AG – EUR | | | 103,211,230 | |

| | 2,244,600 | | | Southwest Airlines Co. | | | 49,897,458 | |

| | 294,570 | | | Textron, Inc. | | | 22,387,320 | |

| | 14,100 | | | TransDigm Group, Inc. | | | 11,676,069 | |

| | 107,900 | | | Uber Technologies, Inc. (a) | | | 4,669,912 | |

| | 48,000 | | | Union Pacific Corp. | | | 9,965,280 | |

| | 1,667,800 | | | United Airlines Holdings, Inc. (a) | | | 58,389,678 | |

| | 3,651,178 | | | Xometry, Inc. – Class A (a) (b) | | | 53,124,640 | |

| | | | | | | | |

| | | | | | | 856,402,959 | |

| | | | | | | | |

| Information Technology – 25.3% | | | |

| | 152,800 | | | Adobe, Inc. (a) | | | 81,298,768 | |

| | 271,363 | | | Altair Engineering, Inc. – Class A (a) | | | 16,857,070 | |

| | 176,740 | | | Analog Devices, Inc. | | | 27,806,504 | |

| | 252,700 | | | Applied Materials, Inc. | | | 33,444,845 | |

The accompanying notes are an integral part of these financial statements.

23

Schedule of Investments

PRIMECAP Odyssey Growth Fund

October 31, 2023 – continued

| | | | | | | | |

| Shares | | | | | Value | |

| Information Technology (continued) | | | |

| | 115,900 | | | Arm Holdings PLC – ADR (a) | | $ | 5,712,711 | |

| | 42,400 | | | ASML Holding N.V. – ADR | | | 25,389,544 | |

| | 3,000 | | | Autodesk, Inc. (a) | | | 592,890 | |

| | 4,926,243 | | | BlackBerry Ltd. (a) | | | 17,635,950 | |

| | 423,900 | | | Cisco Systems, Inc. | | | 22,097,907 | |

| | 45,810 | | | Dell Technologies, Inc. – Class C | | | 3,065,147 | |

| | 287,913 | | | Descartes Systems Group, Inc. (The) (a) | | | 20,790,198 | |

| | 4,951,399 | | | Flex Ltd. (a) | | | 127,349,982 | |

| | 577,618 | | | FormFactor, Inc. (a) | | | 19,569,698 | |

| | 1,000 | | | Fortinet, Inc. (a) | | | 57,170 | |

| | 1,625,500 | | | Hewlett Packard Enterprise Co. | | | 25,000,190 | |

| | 408,936 | | | HP, Inc. | | | 10,767,285 | |

| | 2,742,500 | | | Intel Corp. | | | 100,101,250 | |

| | 11,800 | | | Intuit, Inc. | | | 5,840,410 | |

| | 506,700 | | | Jabil, Inc. | | | 62,222,760 | |

| | 17,530 | | | Keysight Technologies, Inc. (a) | | | 2,139,536 | |

| | 239,224 | | | KLA Corp. | | | 112,363,513 | |

| | 1,469,600 | | | L.M. Ericsson Telephone Co. – ADR | | | 6,554,416 | |

| | 134,000 | | | Marvell Technology, Inc. | | | 6,327,480 | |

| | 398,670 | | | MaxLinear, Inc. (a) | | | 6,059,784 | |

| | 1,916,000 | | | Micron Technology, Inc. | | | 128,122,920 | |

| | 431,700 | | | Microsoft Corp. | | | 145,962,087 | |

| | 646,611 | | | NetApp, Inc. | | | 47,060,349 | |

| | 503,100 | | | Nutanix, Inc. – Class A (a) | | | 18,207,189 | |

| | 70,000 | | | NVIDIA Corp. | | | 28,546,000 | |

| | 10,000 | | | Okta, Inc. – Class A (a) | | | 674,100 | |

| | 391,100 | | | Oracle Corp. | | | 40,439,740 | |

| | 50,000 | | | OSI Systems, Inc. (a) | | | 5,213,500 | |

| | 33,060 | | | Palo Alto Networks, Inc. (a) | | | 8,034,241 | |

| | 264,950 | | | QUALCOMM, Inc. | | | 28,876,900 | |

| | 46,600 | | | Salesforce, Inc. (a) | | | 9,358,678 | |

| | 1,600,855 | | | Splunk, Inc. (a) | | | 235,581,822 | |

| | 1,911,799 | | | Stratasys Ltd. (a) | | | 19,442,996 | |

| | 136,600 | | | Teradyne, Inc. | | | 11,374,682 | |

| | 383,095 | | | Texas Instruments, Inc. | | | 54,403,321 | |

| | 351,950 | | | Trimble, Inc. (a) | | | 16,587,403 | |

| | 246,166 | | | Universal Display Corp. | | | 34,261,384 | |

| | 21,760 | | | VMware, Inc. – Class A (a) | | | 3,169,344 | |

| | 26,000 | | | Western Digital Corp. (a) | | | 1,043,900 | |

| | 334,500 | | | Wolfspeed, Inc. (a) | | | 11,319,480 | |

| | | | | | | | |

| | | | | | | 1,586,725,044 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

24

Schedule of Investments

PRIMECAP Odyssey Growth Fund

October 31, 2023 – continued

| | | | | | | | |

| Shares | | | | | Value | |

| Materials – 0.6% | | | |

| | 205,050 | | | Albemarle Corp. | | $ | 25,996,239 | |

| | 600,000 | | | Ivanhoe Mines Ltd. – Class A – CAD (a) | | | 4,421,850 | |

| | 10,900 | | | Linde PLC | | | 4,165,544 | |

| | | | | | | | |

| | | | | | | 34,583,633 | |

| | | | | | | | |

| TOTAL COMMON STOCKS

(Cost $3,432,206,690) | | $ | 6,191,955,209 | |

| | | | | |

| | RIGHTS – 0.0% | | | | |

| |

| Health Care – 0.0% | | | |

| | 387,250 | | | ABIOMED, Inc. – CVR (Issue Date 12/23/22) (a) (c) (d) | | | 394,995 | |

| | 4,207,543 | | | Epizyme, Inc. – CVR (Issue Date 8/15/22) (a) (c) (d) | | | 84,151 | |

| | | | | | | | |

| | | | | | | 479,146 | |

| | | | | | | | |

| TOTAL RIGHTS

(Cost $0) | | | 479,146 | |

| | | | | | | | |

| | SHORT-TERM INVESTMENTS – 1.2% | | | | |

| | 75,774,345 | | | Dreyfus Treasury Securities Cash Management Fund – Institutional Shares – 5.27% (e) | | $ | 75,774,345 | |

| | | | | | | | |

| TOTAL SHORT-TERM INVESTMENTS

(Cost $75,774,345) | | | 75,774,345 | |

| | | | | | | | |

| TOTAL INVESTMENTS IN SECURITIES

(Cost $3,507,981,035) – 99.9% | | | 6,268,208,700 | |

| | Other Assets in Excess of Liabilities – 0.1% | | | 6,704,919 | |

| | | | | |

| | TOTAL NET ASSETS – 100.0% | | $ | 6,274,913,619 | |

| | | | | | | | |

| ADR | American Depository Receipt |

| CVR | Contingent Value Rights |

| GBP | British Pound Sterling |

| (b) | Considered an affiliated company of the fund as the fund owns 5% or more of the outstanding voting securities of such company. (Note 7) |

| (d) | Fair-valued security (Note 4) |

| (e) | Rate quoted is seven-day yield at period end. |

The Global Industry Classification Standard (GICS ®) was developed by and is the exclusive property of MSCI Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by the fund’s administrator.

The accompanying notes are an integral part of these financial statements.

25

| | |

| | Schedule of Investments PRIMECAP Odyssey Aggressive Growth Fund October 31, 2023 |

| | | | | | | | |

| Shares | | | | | Value | |

| | COMMON STOCKS – 97.7% | | | | |

| |

| Communication Services – 6.5% | | | |

| | 720,050 | | | Alphabet, Inc. – Class A (a) | | $ | 89,343,804 | |

| | 601,340 | | | Alphabet, Inc. – Class C (a) | | | 75,347,902 | |

| | 924,900 | | | Baidu, Inc. – ADR (a) | | | 97,114,500 | |

| | 96,000 | | | Electronic Arts, Inc. | | | 11,883,840 | |

| | 631,000 | | | IMAX Corp. (a) | | | 11,490,510 | |

| | 70,920 | | | Live Nation Entertainment, Inc. (a) | | | 5,675,018 | |

| | 520,528 | | | Madison Square Garden Entertainment Corp. – Class A (a) | | | 15,865,694 | |

| | 30,300 | | | Meta Platforms, Inc. – Class A (a) | | | 9,128,481 | |

| | 16,900 | | | Netflix, Inc. (a) | | | 6,957,561 | |

| | 1,613,100 | | | Pinterest, Inc. – Class A (a) | | | 48,199,428 | |

| | 102,000 | | | Snap, Inc. – Class A (a) | | | 1,021,020 | |

| | 570,528 | | | Sphere Entertainment Corp. – Class A (a) | | | 18,776,077 | |

| | 93,650 | | | T-Mobile US, Inc. (a) | | | 13,472,489 | |

| | 5,478,000 | | | WildBrain Ltd. – CAD (a) | | | 5,372,331 | |

| | 192,469 | | | ZoomInfo Technologies, Inc. (a) | | | 2,494,398 | |

| | | | | | | | |

| | | | | | | 412,143,053 | |

| | | | | | | | |

| Consumer Discretionary – 12.3% | | | |

| | 1,159,700 | | | Alibaba Group Holding Ltd. – ADR (a) | | | 95,721,638 | |

| | 161,500 | | | Amazon.com, Inc. (a) | | | 21,494,035 | |

| | 65,830 | | | Boot Barn Holdings, Inc. (a) | | | 4,575,185 | |

| | 91,400 | | | Burlington Stores, Inc. (a) | | | 11,062,142 | |

| | 216,837 | | | Capri Holdings Ltd. (a) | | | 11,097,718 | |

| | 766,300 | | | CarMax, Inc. (a) | | | 46,813,267 | |

| | 8,000 | | | Darden Restaurants, Inc. | | | 1,164,240 | |

| | 1,100 | | | Deckers Outdoor Corp. (a) | | | 656,766 | |

| | 1,750 | | | Duolingo, Inc. (a) | | | 255,587 | |

| | 235,120 | | | eBay, Inc. | | | 9,223,758 | |

| | 3,966,609 | | | Entain PLC – GBP | | | 44,856,613 | |

| | 54,200 | | | Etsy, Inc. (a) | | | 3,376,660 | |

| | 3,000 | | | Five Below, Inc. (a) | | | 521,940 | |

| | 22,700 | | | Flutter Entertainment PLC – GBP (a) | | | 3,560,584 | |

| | 99,000 | | | Gildan Activewear, Inc. | | | 2,812,590 | |

| | 846,100 | | | GrowGeneration Corp. (a) | | | 1,726,044 | |

| | 741,995 | | | iRobot Corp. (a) | | | 24,433,895 | |

| | 329,700 | | | Mobileye Global, Inc. – Class A (a) | | | 11,760,399 | |

| | 1,039,565 | | | Norwegian Cruise Line Holdings Ltd. (a) | | | 14,138,084 | |

| | 146,480 | | | Ollie’s Bargain Outlet Holdings, Inc. (a) | | | 11,314,115 | |

The accompanying notes are an integral part of these financial statements.

26

Schedule of Investments

PRIMECAP Odyssey Aggressive Growth Fund

October 31, 2023 – continued

| | | | | | | | |

| Shares | | | | | Value | |

| Consumer Discretionary (continued) | | | |

| | 81,200 | | | Restaurant Brands International, Inc. | | $ | 5,456,640 | |

| | 58,660 | | | Rivian Automotive, Inc. – Class A (a) | | | 951,465 | |

| | 781,876 | | | Royal Caribbean Cruises Ltd. (a) | | | 66,248,353 | |

| | 2,262,350 | | | Sony Group Corp. – ADR | | | 187,888,168 | |

| | 721,790 | | | Tesla, Inc. (a) | | | 144,964,304 | |

| | 24,160 | | | Ulta Beauty, Inc. (a) | | | 9,212,450 | |

| | 108,400 | | | Victoria’s Secret & Co. (a) | | | 1,938,192 | |

| | 2,913,350 | | | XPeng, Inc. – ADR (a) | | | 42,185,308 | |

| | | | | | | | |

| | | | | | | 779,410,140 | |

| | | | | | | | |

| Consumer Staples – 0.0% | | | |

| | 7,000 | | | Dollar General Corp. | | | 833,280 | |

| | | | | | | | |

| |

| Energy – 1.8% | | | |

| | 544,350 | | | Coterra Energy, Inc. | | | 14,969,625 | |

| | 131,700 | | | EOG Resources, Inc. | | | 16,627,125 | |

| | 960,300 | | | New Fortress Energy, Inc. | | | 29,097,090 | |

| | 8,197,982 | | | Transocean Ltd. (a) | | | 54,270,641 | |

| | | | | | | | |

| | | | | | | 114,964,481 | |

| | | | | | | | |

| Financials – 4.8% | | | |

| | 192,700 | | | AssetMark Financial Holdings, Inc. (a) | | | 4,607,457 | |

| | 164,771 | | | CME Group, Inc. – Class A | | | 35,172,017 | |

| | 233,803 | | | Discover Financial Services | | | 19,190,550 | |

| | 17,000 | | | Flywire Corp. (a) | | | 457,130 | |

| | 116,700 | | | Galaxy Digital Holdings Ltd. – CAD (a) | | | 530,168 | |

| | 31,500 | | | LPL Financial Holdings, Inc. | | | 7,072,380 | |

| | 519,720 | | | MarketAxess Holdings, Inc. | | | 111,090,150 | |

| | 355,000 | | | Marqeta, Inc. – Class A (a) | | | 1,835,350 | |

| | 583,112 | | | Morgan Stanley | | | 41,295,992 | |

| | 476,600 | | | NMI Holdings, Inc. – Class A (a) | | | 13,035,010 | |

| | 108,110 | | | Progressive Corp. (The) | | | 17,091,110 | |

| | 504,000 | | | Tradeweb Markets, Inc. – Class A | | | 45,365,040 | |

| | 52,250 | | | WEX, Inc. (a) | | | 8,698,580 | |

| | | | | | | | |

| | | | | | | 305,440,934 | |

| | | | | | | | |

| Health Care – 31.7% | | | |

| | 31,400 | | | 10x Genomics, Inc. – Class A (a) | | | 1,107,792 | |

| | 140,000 | | | Accuray, Inc. (a) | | | 369,600 | |

| | 104,230 | | | Adaptive Biotechnologies Corp. (a) | | | 462,781 | |

| | 1,057,200 | | | Alkermes PLC (a) | | | 25,573,668 | |

| | 1,814,271 | | | Allogene Therapeutics, Inc. (a) | | | 5,116,244 | |

The accompanying notes are an integral part of these financial statements.

27

Schedule of Investments

PRIMECAP Odyssey Aggressive Growth Fund

October 31, 2023 – continued

| | | | | | | | |

| Shares | | | | | Value | |

| Health Care (continued) | | | |

| | 1,094,200 | | | Amicus Therapeutics, Inc. (a) | | $ | 12,003,374 | |

| | 271,500 | | | Amylyx Pharmaceuticals, Inc. (a) | | | 4,428,165 | |

| | 706,387 | | | BeiGene Ltd. – ADR (a) | | | 131,585,770 | |

| | 871,539 | | | Biogen, Inc. (a) | | | 207,025,374 | |

| | 1,941,745 | | | BioMarin Pharmaceutical, Inc. (a) | | | 158,155,130 | |

| | 1,362,522 | | | BioNTech SE – ADR (a) | | | 127,450,308 | |

| | 493,800 | | | Boston Scientific Corp. (a) | | | 25,277,622 | |

| | 436,630 | | | Bridgebio Pharma, Inc. (a) | | | 11,369,845 | |

| | 8,613,000 | | | Cerus Corp. (a) | | | 12,058,200 | |

| | 13,950 | | | Charles River Laboratories International, Inc. (a) | | | 2,348,622 | |

| | 630,892 | | | Elanco Animal Health, Inc. (a) | | | 5,558,159 | |

| | 645,294 | | | Eli Lilly & Co. | | | 357,447,705 | |

| | 437,600 | | | Exact Sciences Corp. (a) | | | 26,951,784 | |

| | 4,240,951 | | | FibroGen, Inc. (a) | | | 2,294,355 | |

| | 571,830 | | | Galapagos NV – ADR (a) | | | 19,121,995 | |

| | 549,320 | | | Glaukos Corp. (a) | | | 37,463,624 | |

| | 45,450 | | | Globus Medical, Inc. – Class A (a) | | | 2,077,520 | |

| | 22,490 | | | Guardant Health, Inc. (a) | | | 582,041 | |

| | 1,113,806 | | | Health Catalyst, Inc. (a) | | | 8,342,407 | |

| | 11,310 | | | Illumina, Inc. (a) | | | 1,237,540 | |

| | 183,200 | | | ImmunoGen, Inc. (a) | | | 2,722,352 | |

| | 358,816 | | | Insulet Corp. (a) | | | 47,568,237 | |

| | 1,049,700 | | | LivaNova PLC (a) | | | 51,487,785 | |

| | 10,000 | | | Mereo Biopharma Group PLC – ADR (a) | | | 20,050 | |

| | 4,233,380 | | | Nektar Therapeutics (a) | | | 1,985,455 | |

| | 594,920 | | | OraSure Technologies, Inc. (a) | | | 3,069,787 | |

| | 19,220 | | | Penumbra, Inc. (a) | | | 3,673,903 | |

| | 1,196,216 | | | PolyPeptide Group AG – CHF (a) | | | 22,381,791 | |

| | 3,746,971 | | | Pulmonx Corp. (a) (b) | | | 32,935,875 | |

| | 191,800 | | | QIAGEN N.V. – EUR (a) | | | 7,127,381 | |

| | 22,386 | | | Repligen Corp. (a) | | | 3,012,260 | |

| | 5,364,910 | | | Rhythm Pharmaceuticals, Inc. (a) (b) | | | 123,983,070 | |

| | 118,800 | | | Roche Holding AG – CHF | | | 30,540,736 | |

| | 75,700 | | | Sage Therapeutics, Inc. (a) | | | 1,417,861 | |

| | 1,488,013 | | | Seagen, Inc. (a) | | | 316,664,047 | |

| | 220,100 | | | Shockwave Medical, Inc. (a) | | | 45,397,826 | |

| | 2,195,369 | | | Standard BioTools, Inc. (a) | | | 4,368,784 | |

| | 3,295,770 | | | Wave Life Sciences Ltd. (a) | | | 17,731,243 | |

| | 5,671,887 | | | Xencor, Inc. (a) (b) | | | 98,407,239 | |

| | 736,880 | | | Zentalis Pharmaceuticals, Inc. (a) | | | 12,055,357 | |

| | | | | | | | |

| | | | | | | 2,011,960,664 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

28

Schedule of Investments

PRIMECAP Odyssey Aggressive Growth Fund

October 31, 2023 – continued

| | | | | | | | |

| Shares | | | | | Value | |

| Industrials – 10.6% | | | |

| | 1,750,600 | | | AECOM | | $ | 134,008,430 | |

| | 390,800 | | | Alaska Air Group, Inc. (a) | | | 12,361,004 | |

| | 25,100 | | | Allegiant Travel Co. | | | 1,672,162 | |

| | 4,129,000 | | | American Airlines Group, Inc. (a) | | | 46,038,350 | |

| | 701,600 | | | Array Technologies, Inc. (a) | | | 12,158,728 | |

| | 112,500 | | | Axon Enterprise, Inc. (a) | | | 23,005,125 | |

| | 49,600 | | | Bloom Energy Corp. – Class A (a) | | | 515,840 | |

| | 41,000 | | | Controladora Vuela Compania de Aviacion, S.A.B. de C.V. – ADR (a) | | | 234,110 | |

| | 197,580 | | | Curtiss-Wright Corp. | | | 39,280,880 | |

| | 2,179,697 | | | Delta Air Lines, Inc. | | | 68,115,531 | |

| | 31,400 | | | FedEx Corp. | | | 7,539,140 | |

| | 70,600 | | | Frontier Group Holdings, Inc. (a) | | | 239,334 | |

| | 324,500 | | | GFL Environmental, Inc. | | | 9,352,090 | |

| | 95,600 | | | Gibraltar Industries, Inc. (a) | | | 5,818,216 | |

| | 176,400 | | | Griffon Corp. | | | 7,045,416 | |

| | 144,900 | | | Hawaiian Holdings, Inc. (a) | | | 610,029 | |

| | 296,200 | | | Hertz Global Holdings, Inc. (a) | | | 2,496,966 | |

| | 863,680 | | | Jacobs Solutions, Inc. | | | 115,128,544 | |

| | 2,484,900 | | | JetBlue Airways Corp. (a) | | | 9,343,224 | |

| | 3,130,400 | | | Li-Cycle Holdings Corp. (a) | | | 4,194,736 | |

| | 560,000 | | | Lyft, Inc. – Class A (a) | | | 5,135,200 | |

| | 156,200 | | | Masonite International Corp. (a) | | | 12,361,668 | |

| | 377,400 | | | NN, Inc. (a) | | | 679,320 | |

| | 2,600 | | | Old Dominion Freight Line, Inc. | | | 979,316 | |

| | 55,000 | | | RXO, Inc. (a) | | | 963,050 | |

| | 15,800 | | | Ryanair Holdings PLC – ADR (a) | | | 1,385,660 | |

| | 1,704,500 | | | Southwest Airlines Co. | | | 37,891,035 | |

| | 189,300 | | | Spirit Airlines, Inc. | | | 2,173,164 | |

| | 46,815 | | | Sun Country Airlines Holdings, Inc. (a) | | | 609,531 | |

| | 34,800 | | | TransDigm Group, Inc. | | | 28,817,532 | |

| | 318,200 | | | Uber Technologies, Inc. (a) | | | 13,771,696 | |

| | 1,897,440 | | | United Airlines Holdings, Inc. (a) | | | 66,429,375 | |

| | 26,800 | | | WillScot Mobile Mini Holdings Corp. (a) | | | 1,056,188 | |

| | 40,000 | | | XPO, Inc. (a) | | | 3,032,400 | |

| | | | | | | | |

| | | | | | | 674,442,990 | |

| | | | | | | | |

| Information Technology – 29.2% | | | |

| | 144,300 | | | Adobe, Inc. (a) | | | 76,776,258 | |

| | 31,300 | | | Ambarella, Inc. (a) | | | 1,408,187 | |

The accompanying notes are an integral part of these financial statements.

29

Schedule of Investments

PRIMECAP Odyssey Aggressive Growth Fund

October 31, 2023 – continued

| | | | | | | | |

| Shares | | | | | Value | |

| Information Technology (continued) | | | |

| | 87,400 | | | Applied Materials, Inc. | | $ | 11,567,390 | |

| | 2,735,300 | | | Arlo Technologies, Inc. (a) | | | 23,222,697 | |

| | 35,100 | | | ASML Holding N.V. – ADR | | | 21,018,231 | |

| | 3,182,700 | | | Aurora Innovation, Inc. – Class A (a) | | | 5,569,725 | |

| | 37,700 | | | Autodesk, Inc. (a) | | | 7,450,651 | |

| | 976,976 | | | Axcelis Technologies, Inc. (a) | | | 124,564,440 | |

| | 8,995,866 | | | BlackBerry Ltd. (a) | | | 32,205,200 | |

| | 649,200 | | | Credo Technology Group Holding Ltd. (a) | | | 9,231,624 | |

| | 123,099 | | | CrowdStrike Holdings, Inc. – Class A (a) | | | 21,760,210 | |

| | 59,250 | | | CyberArk Software Ltd. (a) | | | 9,695,670 | |

| | 85,000 | | | Dell Technologies, Inc. – Class C | | | 5,687,350 | |

| | 302,741 | | | Descartes Systems Group, Inc. (The) (a) | | | 21,860,928 | |

| | 200 | | | DocuSign, Inc. (a) | | | 7,776 | |

| | 5,961,940 | | | Flex Ltd. (a) | | | 153,341,097 | |

| | 838,115 | | | FormFactor, Inc. (a) | | | 28,395,336 | |

| | 108,500 | | | Freshworks, Inc. – Class A (a) | | | 1,946,490 | |

| | 20,350 | | | GitLab, Inc. – Class A (a) | | | 880,748 | |

| | 567,150 | | | Hewlett Packard Enterprise Co. | | | 8,722,767 | |

| | 184,000 | | | HP, Inc. | | | 4,844,720 | |

| | 92,550 | | | HubSpot, Inc. (a) | | | 39,219,913 | |

| | 4,091,700 | | | indie Semiconductor, Inc. – Class A (a) | | | 20,008,413 | |

| | 92,200 | | | Intuit, Inc. | | | 45,634,390 | |

| | 597,500 | | | Jabil, Inc. | | | 73,373,000 | |

| | 82,400 | | | Jamf Holding Corp. (a) | | | 1,323,344 | |

| | 35,500 | | | Keysight Technologies, Inc. (a) | | | 4,332,775 | |

| | 191,850 | | | KLA Corp. | | | 90,111,945 | |

| | 141,400 | | | Marvell Technology, Inc. | | | 6,676,908 | |

| | 1,607,500 | | | MaxLinear, Inc. (a) | | | 24,434,000 | |

| | 2,959,065 | | | Micron Technology, Inc. | | | 197,872,677 | |

| | 16,500 | | | MongoDB, Inc. (a) | | | 5,685,735 | |

| | 866,367 | | | NetApp, Inc. | | | 63,054,190 | |

| | 182,643 | | | nLIGHT, Inc. (a) | | | 1,521,416 | |

| | 1,939,525 | �� | | Nutanix, Inc. – Class A (a) | | | 70,191,410 | |

| | 170,280 | | | NVIDIA Corp. | | | 69,440,184 | |

| | 262,500 | | | Okta, Inc. – Class A (a) | | | 17,695,125 | |

| | 185,790 | | | OSI Systems, Inc. (a) | | | 19,372,323 | |

| | 63,500 | | | Palo Alto Networks, Inc. (a) | | | 15,431,770 | |

| | 286,260 | | | PROS Holdings, Inc. (a) | | | 8,916,999 | |

| | 332,023 | | | QUALCOMM, Inc. | | | 36,187,187 | |

The accompanying notes are an integral part of these financial statements.

30

Schedule of Investments

PRIMECAP Odyssey Aggressive Growth Fund

October 31, 2023 – continued

| | | | | | | | |

| Shares | | | | | Value | |

| Information Technology (continued) | | | |

| | 183,400 | | | Rapid7, Inc. (a) | | $ | 8,526,266 | |

| | 5,000 | | | RingCentral, Inc. – Class A (a) | | | 132,900 | |

| | 1,712,510 | | | Splunk, Inc. (a) | | | 252,012,972 | |

| | 1,032,800 | | | Stratasys Ltd. (a) | | | 10,503,576 | |

| | 107,100 | | | Tenable Holdings, Inc. (a) | | | 4,509,981 | |

| | 502,790 | | | Trimble, Inc. (a) | | | 23,696,493 | |

| | 230,933 | | | Unity Software, Inc. (a) | | | 5,858,770 | |

| | 767,299 | | | Universal Display Corp. | | | 106,792,675 | |

| | 116,000 | | | VMware, Inc. – Class A (a) | | | 16,895,400 | |

| | 322,800 | | | Western Digital Corp. (a) | | | 12,960,420 | |

| | 514,100 | | | Wolfspeed, Inc. (a) | | | 17,397,144 | |

| | 262,000 | | | Zoom Video Communications, Inc. – Class A (a) | | | 15,714,760 | |

| | | | | | | | |

| | | | | | | 1,855,642,556 | |

| | | | | | | | |

| Materials – 0.7% | | | |

| | 93,630 | | | Albemarle Corp. | | | 11,870,412 | |

| | 31,000 | | | Bioceres Crop Solutions Corp. (a) | | | 342,240 | |

| | 37,500 | | | Ingevity Corp. (a) | | | 1,510,500 | |

| | 332,100 | | | Ivanhoe Electric, Inc. (a) | | | 3,400,704 | |

| | 2,880,600 | | | Ivanhoe Mines Ltd. – Class A – CAD (a) | | | 21,229,300 | |

| | 1,234,152 | | | Perimeter Solutions SA (a) | | | 3,949,286 | |

| | | | | | | | |

| | | | | | | 42,302,442 | |

| | | | | | | | |

| Real Estate – 0.1% | | | |

| | 136,720 | | | EPR Properties | | | 5,837,944 | |

| | 53,600 | | | Safehold, Inc. | | | 872,072 | |

| | | | | | | | |

| | | | | | | 6,710,016 | |

| | | | | | | | |

| TOTAL COMMON STOCKS

(Cost $3,788,993,696) | | $ | 6,203,850,556 | |

| | | | | | | | |

| | RIGHTS – 0.0% | | | | |

| |

| Health Care – 0.0% | | | |

| | 349,922 | | | ABIOMED, Inc. – CVR

(Issue Date 12/23/22) (a) (c) (d) | | | 356,921 | |

| | 10,344,756 | | | Epizyme, Inc. – CVR (Issue Date 8/15/22) (a) (c) (d) | | | 206,895 | |

| | 3,786,300 | | | Mereo BioPharma Group PLC – CVR

(Issue Date 4/23/19) (a) (c) (d) | | | 0 | |

| | | | | | | | |

| | | | | | | 563,816 | |

| | | | | | | | |

| TOTAL RIGHTS

(Cost $0) | | | 563,816 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

31

Schedule of Investments

PRIMECAP Odyssey Aggressive Growth Fund

October 31, 2023 – continued

| | | | | | | | |

| Shares | | | | | Value | |

| | WARRANTS – 0.0% | | | | |

| |

| Materials – 0.0% | | | |

| | 364,100 | | | Perimeter Solutions SA (Expiration Date 11/8/24) (a) | | $ | 14,564 | |

| | | | | | | | |

| TOTAL WARRANTS

(Cost $3,641) | | | 14,564 | |

| | | | | | | | |

| | SHORT-TERM INVESTMENTS – 2.6% | | | | |

| | 167,960,350 | | | Dreyfus Treasury Securities Cash Management Fund – Institutional Shares – 5.27% (e) | | $ | 167,960,350 | |

| | | | | | | | |

| TOTAL SHORT-TERM INVESTMENTS

(Cost $167,960,350) | | | 167,960,350 | |

| | | | | | | | |

| TOTAL INVESTMENTS IN SECURITIES

(Cost $3,956,957,687) – 100.3% | | | 6,372,389,286 | |

| | Liabilities in Excess of Other Assets – (0.3)% | | | (18,981,453 | ) |

| | | | | | | | |

| | TOTAL NET ASSETS – 100.0% | | $ | 6,353,407,833 | |

| | | | | | | | |

| ADR | American Depository Receipt |

| CVR | Contingent Value Rights |

| GBP | British Pound Sterling |

| (b) | Considered an affiliated company of the fund as the fund owns 5% or more of the outstanding voting securities of such company. (Note 7) |

| (d) | Fair-valued security (Note 4) |

| (e) | Rate quoted is seven-day yield at period end. |

The Global Industry Classification Standard (GICS ®) was developed by and is the exclusive property of MSCI Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by the fund’s administrator.

The accompanying notes are an integral part of these financial statements.

32

| | |

| | Statements of Assets and Liabilities PRIMECAP Odyssey Funds October 31, 2023 |

| | | | | | | | | | | | |

| | | PRIMECAP

Odyssey

Stock Fund | | | PRIMECAP

Odyssey

Growth Fund | | | PRIMECAP

Odyssey Aggressive

Growth Fund | |

ASSETS | | | | | | | | | | | | |

Investments, at cost (unaffiliated) | | $ | 2,881,478,507 | | | $ | 3,426,737,041 | | | $ | 3,606,043,322 | |

| | | | | | | | | | | | |