| | |

| UNITED STATES

SECURITIES AND EXCHANGE COMMISSION |

| | |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| | |

| Investment Company Act file number: | (811-21598) |

| | |

| Exact name of registrant as specified in charter: | Putnam RetirementReady Funds |

| | |

| Address of principal executive offices: | One Post Office Square, Boston, Massachusetts 02109 |

| | |

| Name and address of agent for service: | Robert T. Burns, Vice President

One Post Office Square

Boston, Massachusetts 02109 |

| | |

| Copy to: | John W. Gerstmayr, Esq.

Ropes & Gray LLP

800 Boylston Street

Boston, Massachusetts 02199-3600 |

| | |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

| | |

| Date of fiscal year end: | July 31, 2013 |

| | |

| Date of reporting period: | August 1, 2012 — January 31, 2013 |

| | |

|

Item 1. Report to Stockholders: | |

| | |

| The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940: | |

Putnam

RetirementReady®

Funds

| |

| Putnam RetirementReady 2055 Fund | Putnam RetirementReady 2030 Fund |

| Putnam RetirementReady 2050 Fund | Putnam RetirementReady 2025 Fund |

| Putnam RetirementReady 2045 Fund | Putnam RetirementReady 2020 Fund |

| Putnam RetirementReady 2040 Fund | Putnam RetirementReady 2015 Fund |

| Putnam RetirementReady 2035 Fund | Putnam Retirement Income Fund Lifestyle 1 |

Semiannual report

1 | 31 | 13

| | | |

| Message from the Trustees | 1 | | |

| | |

| About the funds | 2 | | |

| | |

| Performance snapshot | 4 | | |

| | |

| Interview with your fund’s portfolio manager | 5 | | |

| | |

| Your fund’s performance | 12 | | |

| | |

| Your fund’s expenses | 21 | | |

| | |

| Terms and definitions | 26 | | |

| | |

| Other information for shareholders | 27 | | |

| | |

| Financial statements | 28 | | |

| | |

Consider these risks before investing: The allocation of assets among the underlying funds may hurt performance. The funds also bear the following risks associated with the underlying funds. International investing involves certain risks, such as currency fluctuations, economic instability, and political developments. Additional risks may be associated with emerging-market securities, including illiquidity and volatility. Investments in small and/or midsize companies increase the risk of greater price fluctuations. Lower-rated bonds may offer higher yields in return for more risk. Funds that invest in government securities are not guaranteed. Mortgage-backed securities are subject to prepayment risk. An underlying fund’s allocation of assets among permitted asset categories may hurt performance. Derivatives also involve the risk, in the case of many over-the-counter instruments, of the potential inability to terminate or sell derivatives positions and the potential failure of the other party to the instrument to meet its obligations. The efforts of some underlying funds to produce lower-volatility returns may not be successful and may make it more difficult at times for these funds to achieve their targeted returns. In addition, under certain market conditions, these funds may accept greater volatility than would typically be the case in order to seek their targeted returns. Growth stocks may be more susceptible to earnings disappointments, and value stocks may fail to rebound. Bond investments are subject to interest-rate risk, which means the prices of the underlying funds’ bond investments are likely to fall if interest rates rise. Bond investments also are subject to credit risk, which is the risk that the issuer of the bond may default on payment of interest or principal. Interest-rate risk is generally greater for longer-term bonds, and credit risk is generally greater for below-investment-grade bonds, which may be considered speculative. Unlike bonds, funds that invest in bonds have ongoing fees and expenses. An underlying fund’s active trading strategies may lose money or not earn a return sufficient to cover trading and other costs. An underlying fund’s use of leverage increases these risks by increasing investment exposure. The prices of stocks and bonds in the underlying funds’ portfolio may fall or fail to rise over extended periods of time for a variety of reasons, including both general financial market conditions and factors related to a specific issuer or industry. The funds may invest in a money market fund for cash management. Money market funds are not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other governmental agency. Although money market funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in these funds.

Message from the Trustees

Dear Fellow Shareholder:

Stock markets around the world have continued to show strength into 2013, with the S&P 500 Index delivering its best January return since 1997. Investors witnessed several positive developments, including the U.S. fiscal cliff bill that Congress passed on January 1, 2013; the improving employment and housing situations; a more stable Europe; and China’s “soft landing” and positive growth.

Today’s market environment is one of slow and steady improvement, but uncertainties linger. Questions remain about potential economic fallout from the upcoming debt ceiling and budget sequestration debates in the United States. And the sovereign debt situation in Europe, while stabilized, is far from resolved.

At Putnam, our investment team is focused on actively managing risk and pursuing returns in today’s volatile global market. As always, it is important to rely on the guidance of your financial advisor to help you manage your investment portfolio in accordance with your goals and risk tolerance.

We would also like to extend a welcome to new shareholders of the fund and to thank all of our investors for your continued confidence in Putnam.

Performance snapshot

Annualized total return (%) comparison as of 1/31/13

Fund returns for class A shares before sales charges

| | | | | |

| | 2055 Fund | 2050 Fund | 2045 Fund | 2040 Fund | 2035 Fund |

|

| | Before sales charge | Before sales charge | Before sales charge | Before sales charge | Before sales charge |

|

| Life of fund* | 9.48% | 4.53% | 4.82% | 4.88% | 4.77% |

|

| 5 years | — | 2.74 | 2.80 | 2.97 | 2.99 |

|

| 3 years | — | 11.11 | 10.92 | 10.68 | 10.15 |

|

| 1 year | 15.18 | 15.05 | 14.75 | 14.43 | 13.57 |

|

| 6 months† | 11.75 | 11.57 | 11.18 | 10.73 | 9.76 |

|

| | | | | |

| | | | | | Retirement |

| | | | | | Income Fund |

| | 2030 Fund | 2025 Fund | 2020 Fund | 2015 Fund | Lifestyle 1 |

|

| | Before sales charge | Before sales charge | Before sales charge | Before sales charge | Before sales charge |

|

| Life of fund* | 4.62% | 4.36% | 3.85% | 3.26% | 2.91% |

|

| 5 years | 2.89 | 2.59 | 2.27 | 1.73 | 2.39 |

|

| 3 years | 9.36 | 8.36 | 7.15 | 5.65 | 4.30 |

|

| 1 year | 12.35 | 10.79 | 9.07 | 7.43 | 6.39 |

|

| 6 months† | 8.32 | 6.60 | 4.96 | 3.66 | 2.95 |

|

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares. Performance of class A shares assumes reinvestment of distributions and does not account for taxes. Fund returns in the table above do not reflect a sales charge of 4.00% for Retirement Income Fund Lifestyle 1 and 5.75% for all other funds; had they, returns would have been lower. See pages 5 and 12–21 for additional performance information. For a portion of the periods, the funds had expense limitations, without which returns would have been lower. To obtain the most recent month-end performance, visit putnam.com.

* With the exception of Putnam RetirementReady 2050 Fund and 2055 Fund (inceptions: 5/2/05 and 11/30/10, respectively), the inception date of all share classes of RetirementReady Funds is 11/1/04.

† Returns for the six-month period are not annualized, but cumulative.

Interview with your fund’s portfolio manager

How did Putnam RetirementReady® Funds perform for the semiannual period ended January 31, 2013?

With broad improvement in macroeconomic conditions contributing to a more upbeat outlook for global growth, investors migrated into more economically sensitive, higher-risk assets — fueling a considerable rally for the six months ended January 31, 2013. It was a rewarding time to be invested in the markets, and we are happy to report that the funds posted positive results across the board. Given the “risk-on” rally and the renewed focus on fundamentals, the funds’ slightly pro-risk investment stance was prudent, as demand for credit-sensitive fixed-income investments and growth-oriented, cyclical equities outperformed more conservative or defensive investments.

Could you highlight some of the more notable performers for the reporting period?

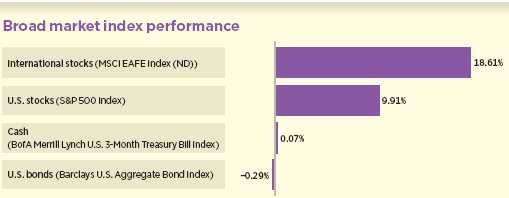

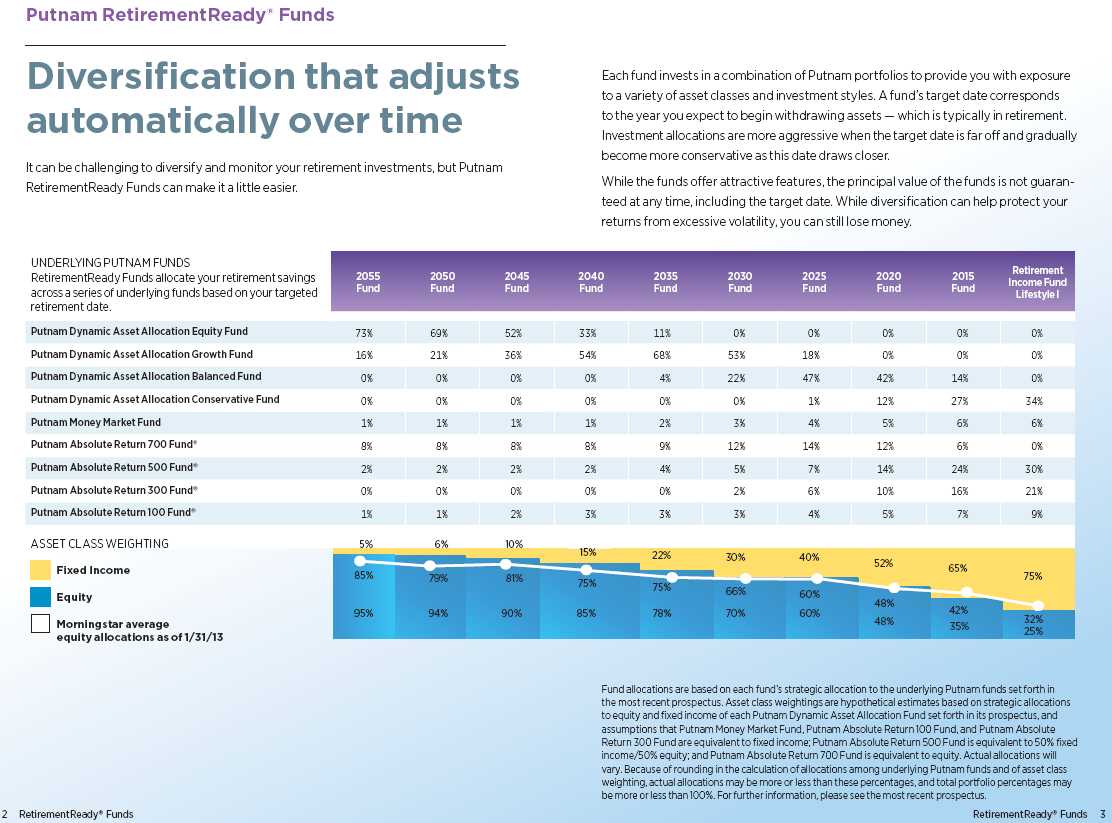

Interestingly, after months of strong performance, market leadership transitioned from U.S. stocks to international stocks during the period. While U.S. stocks delivered positive gains, international equity markets posted even stronger results, as fears waned over the prospects of the eurozone’s demise and economic data suggested that China’s economy was beginning to reaccelerate. Japan also experienced a jolt of new life this past December in the wake of national elections and the installation of new political

This chart shows performance of broad market indexes for the six months ended 1/31/13. See pages 4 and 12–21 for fund performance information. Index descriptions can be found on page 26.

leadership. Japanese exporters rallied as a result of improving prospects as well as from a sharply declining yen, offering hope for an area characterized by protracted economic and market weakness.

Emerging markets also rebounded nicely during the period. As an asset class, emerging markets are more heavily geared toward cyclical sectors, which were weak relative to defensive stocks before investors rediscovered their appetites for risk. Importantly, domestic capital markets are still evolving in these countries and are reliant upon the infusion of foreign investor capital. Given the general abatement of macro risks and a steadier growth outlook, we believe emerging markets could continue to show areas of strength well into 2013.

From an industry perspective, global financials was one of the strongest-performing sectors for the period. Despite the rally, however, fear continues to be priced into U.S., European, and Asian banking and insurance companies. As long as the macroeconomic outlook calls for low to moderate growth, we believe financial stocks around the globe could continue to display strong momentum, especially since valuations remain quite attractive, in our view, despite the positive movement to date.

Are U.S. interest rates likely to remain “range-bound”?

They appear likely to for the foreseeable future. The Federal Reserve launched “QE3” in September 2012, a bond-buying program authorized to purchase up to $40 billion of agency mortgage-backed securities per month. Not long after, in December, the Fed replaced the expiring “Operation Twist” with an additional unlimited round of easing, targeting up to $45 billion worth of intermediate- and longer-term Treasuries per month — with no intent of stopping so long as inflation remains below 2.5% and unemployment stays above 6.5%. These kinds of explicit targets are rare coming from the Fed, and, we believe, provide some welcome insight as to when the Fed is likely to begin shifting to a more neutral monetary stance.

Do you think U.S corporate debt will continue to outperform in the slow-growth environment?

Our outlook for corporate debt — including the investment-grade, high-yield, and floating-rate segments of the market — remains positive, although we believe it is unlikely that these markets will post the heady gains in 2013 that investors enjoyed in 2012. Given the rally, credit spreads [the difference in yield between higher- and lower-rated bonds] tightened significantly, particularly in the high-yield market, and are in line with their long-term average.

Our base case forecast for 2013 is for continued slow, but steady economic growth. As we have discussed before, that kind of an environment has often been supportive of corporate debt, especially relative to equities. Broadly speaking, equity investors are reliant on earnings growth and multiple expansions, which can prove elusive in a slow-growth environment. Corporate debt investors, on the other hand, are concerned primarily with repayment of interest and principal, which does not necessarily require a thriving economy. Corporations today, as has been the case for the past four years, are sitting on record amounts of cash and have been extremely conservative with their plans for expansion or investment in new equipment and personnel. This fact is reflected in part by the below-average default rate, which was around 1.5% as of the end of 2012. This figure continues to be well below the 4.5% long-term average, and may remain below average for at least the next several quarters.

Has the eurozone turned the corner?

During the period, the actions of policymakers and the European Central Bank [ECB] helped to mitigate the risk of a eurozone breakup. Thus, we believe the fiscal condition of the eurozone is unlikely to be as relevant to investors in 2013 as it was in the first half of 2012. The situation has stabilized, and the focus has turned to Europe’s medium-and long-term structural issues, including fostering competitive economies and reforming unsustainable entitlement states. While these are not small hurdles, we find it unlikely that sluggish progress in Europe will trigger renewed fears of an imminent liquidity event.

We are by no means bullish on the outlook for Europe, however. Growth figures in the fourth quarter were disappointingly low, and many countries are likely to still remain in recession. That said, while we believe there will be bumps along the way on Europe’s road to recovery, the stability of interest rates today and the gradual structural reforms that policymakers are introducing should be enough to entice some investors to reexamine and perhaps reenter European markets.

Given the strength of the rally in equities during the period, are we seeing the beginning of a shift of investor assets out of bonds into stocks?

There is still an extraordinary amount of money on the sidelines or in safe-haven Treasuries, and we believe these investors may be more attuned to the opportunity costs of inaction in 2013. Furthermore, even considering the strong run for equities in 2012, it could be argued that many sectors have seen only a small correction in the market anomalies of the past several years.

The strongest case for equities today may be their potential relative to other asset classes. In many instances, we are seeing equities delivering more attractive dividend yields than their fixed-income counterparts, while offering the added benefit of capital appreciation potential. Among dividend-paying stocks, a focus on dividend growers over dividend payers should be beneficial. While investor demand has driven the highest dividend payers to expensive levels, in areas such as financials, we are seeing historically low payout ratios, making dividend growth a possibility in 2013.

Does the changing correlation landscape have implications for the funds’ portfolio construction?

While investors naturally focus on expected returns, we also pay attention to the volatility of various investment choices, as well as the correlation structure of markets. As 2013 begins, we find that important changes are occurring in this structure that could shape investment strategies. We have begun to see a decline in the elevated correlations across all kinds of equities and risk assets, which has been a hallmark of recent years. The Fed has become the dominant buyer of Treasuries through its quantitative easing programs. When these programs are ultimately unwound, we expect pressure on Treasury bond prices. Second, it seems a goal of the aggressive monetary policy choices around the world is to foment inflation, which would ease the sting of outstanding debts. While inflation is unlikely to be a problem this year, we expect inflationary pressures ultimately to erode the real return of fixed-income investments beyond 2013.

Given the markets’ rally, are you upbeat about prospects for performance later this year?

Broadly speaking, investors had a defensive mindset in 2012, and often focused on what might next go wrong in the capital markets. We believe that mindset may be starting to shift, with investors more focused now on where the best investment opportunities lie. With the tax component of the fiscal cliff now resolved and the European sovereign debt situation more stable, it seems that there are relatively few storm clouds looming on the horizon for investors. The outlook for developed global economies is by no means rosy, but we believe that the current environment presents an opportunity for measured risk taking, and that investors will be more willing to move off the sidelines in the absence of another perceived crisis.

Thank you, Robert, for your time and insights today.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk.

The views expressed in this report are exclusively those of Putnam Management and are subject to change. They are not meant as investment advice.

Of special interest

On February 1, 2013, Putnam Investments announced a new leadership structure for its Global Asset Allocation (GAA) investment organization, which manages Putnam RetirementReady Funds. Working closely with Walter C. Donovan, Chief Investment Officer at Putnam, the team will be led by Co-Heads James A. Fetch; Robert J. Kea, CFA; Robert J. Schoen; and

A word about derivatives

Derivatives are an increasingly common type of investment instrument, the performance of which is derived from an underlying security, index, currency, or other area of the capital markets. Derivatives employed by the funds’ managers generally serve one of two main purposes: to implement a strategy that may be difficult or more expensive to invest in through traditional securities, or to hedge unwanted risk associated with a particular position.

For example, the funds’ managers might use forward currency contracts to capitalize on an anticipated change in exchange rates between two currencies. This approach would require a significantly smaller outlay of capital than purchasing traditional bonds denominated in the underlying currencies. In another example, the managers may identify a bond that they believe is undervalued relative to its risk of default, but may seek to reduce the interest-rate risk of that bond by using interest-rate swaps, a derivative through which two parties “swap” payments based on the movement of certain rates. In other examples, the managers may use options and futures contracts to hedge against a variety of risks by establishing a combination of long and short exposures to specific equity markets or sectors.

Like any other investment, derivatives may not appreciate in value and may lose money. Derivatives may amplify traditional investment risks through the creation of leverage and may be less liquid than traditional securities. And because derivatives typically represent contractual agreements between two financial institutions, derivatives entail “counterparty risk,” which is the risk that the other party is unable or unwilling to pay. Putnam monitors the counterparty risks we assume. For example, Putnam may enter into collateral agreements that require the counterparties to post collateral on a regular basis to cover their obligations to the funds.

Jason R. Vaillancourt, CFA. All four co-heads are long-time Putnam GAA veterans, who average 22 years of overall investment experience, including an average of 18 years at Putnam. Consistent with the current approach, Fetch continues to lead portfolio construction and risk, Kea drives top-down equity efforts, Schoen oversees equity process and risk, and Vaillancourt manages global macro efforts. Jeffrey L. Knight, who previously led the group, has left the firm to pursue other opportunities.

IN THE NEWS

Mixed signals are coming from the U.S. economy. On the positive side, the unemployment rate continues to tick down, the housing sector is recovering, and the stock market has reached multi-year highs. But uncertainty remains. The nation’s GDP was essentially flat in the fourth quarter of 2012, after several consecutive quarters of expansion. A precipitous drop in military spending contributed to the slowdown, and many questions remain about government spending and its impact on GDP going forward. Consumer confidence recently dropped following the tax increases resulting from the fiscal cliff resolution, as people anticipate the pinch of less take-home pay. The next few months should provide clearer direction for the markets on government spending and the resilience of the recovery.

Composition of the funds’ underlying investments

Historically, each Putnam RetirementReady® Fund invests, to varying degrees, in a variety of Putnam mutual funds. This section describes the goals and strategies of each of the underlying Putnam funds. For more information, please see the funds’ prospectus.

Putnam Absolute Return 100, 300, 500, and 700 Funds

Each fund pursues an “absolute return” strategy that seeks to earn a positive total return over a reasonable period of time (generally at least three years or more) regardless of market conditions or general market direction. The target return for each fund is the rate of inflation plus a number of basis points specified in the fund’s name. For example, the Absolute Return 500 Fund seeks to earn a total return of 500 basis points (or 5.00%) over the rate of inflation. The funds pursue their goals through portfolios that are structured to offer varying degrees of risk, expected volatility, and expected returns.

Putnam Dynamic Asset Allocation Equity Fund

The fund’s portfolio invests mainly in common stocks (growth or value stocks or both) of large and midsize companies worldwide and is designed for investors seeking long-term growth. The fund typically allocates approximately 75% of its assets to investments in U.S. companies and 25% of its assets to international companies, but allocations may vary. The Portfolio Managers can adjust allocations based on market conditions.

Putnam Dynamic Asset Allocation Growth Fund

The fund’s portfolio invests mainly in equity securities (growth or value stocks or both) of U.S. and international companies and is designed for investors seeking capital appreciation with moderate risk. The fund’s strategic equity weighting is 80% (the range is 65% to 95%), with the balance invested in a range of fixed-income investments. The Portfolio Managers can adjust allocations based on market conditions.

Putnam Dynamic Asset Allocation Balanced Fund

The fund’s portfolio is diversified across stocks and bonds in global markets and is designed for investors seeking total return. The fund’s strategic equity allocation is 60% (the range is 45% to 75%), with the balance invested in bonds and money market instruments. The Portfolio Managers can adjust the allocations based on market conditions.

Putnam Dynamic Asset Allocation Conservative Fund

The fund’s globally diversified portfolio emphasizes bonds over stocks and is designed for investors who want to protect the value of their investment while receiving regular income and protection against inflation. The strategic fixed-income allocation is 70% (with a range of 55% to 85%), with the balance invested in stocks and money market instruments. The Portfolio Managers can adjust allocations based on market conditions.

| |

| 10 | RetirementReady® Funds |

Putnam Money Market Fund

The fund seeks as high a rate of current income as Putnam Management believes is consistent with preservation of capital and maintenance of liquidity. The fund invests mainly in money market instruments that are high quality and have short-term maturities.

Money market funds are not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other governmental agency. Although the fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the fund.

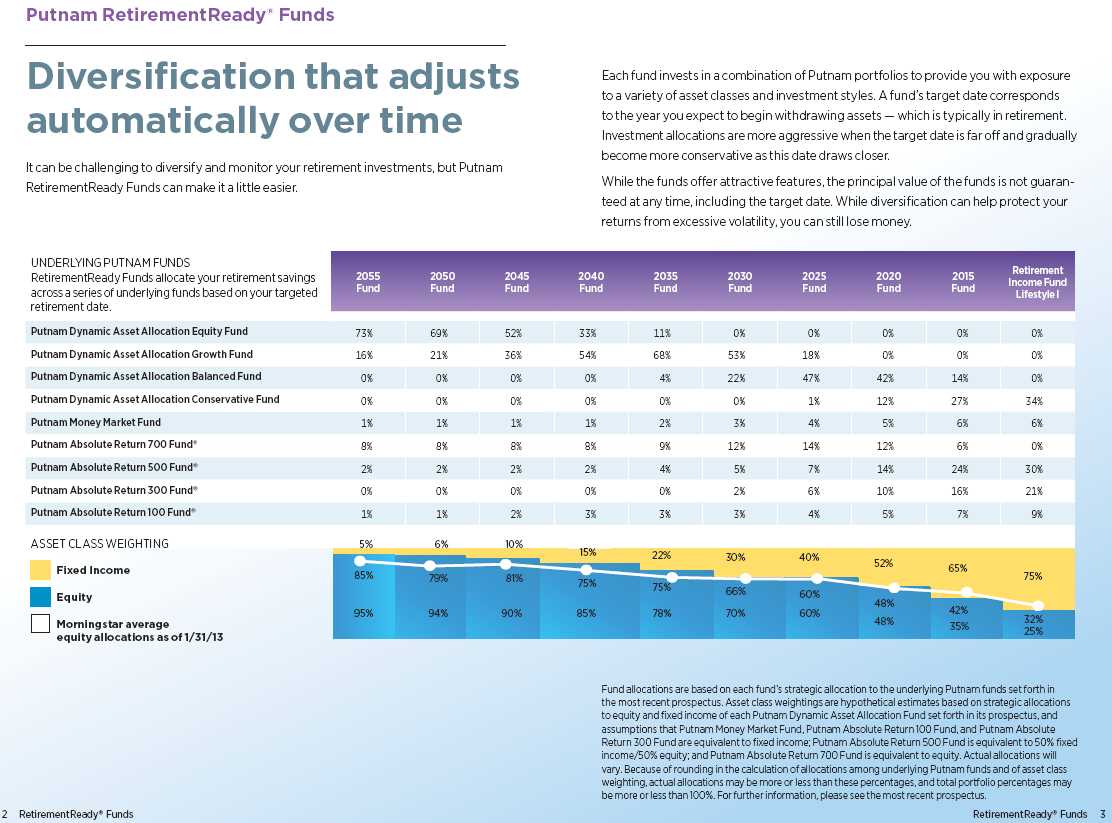

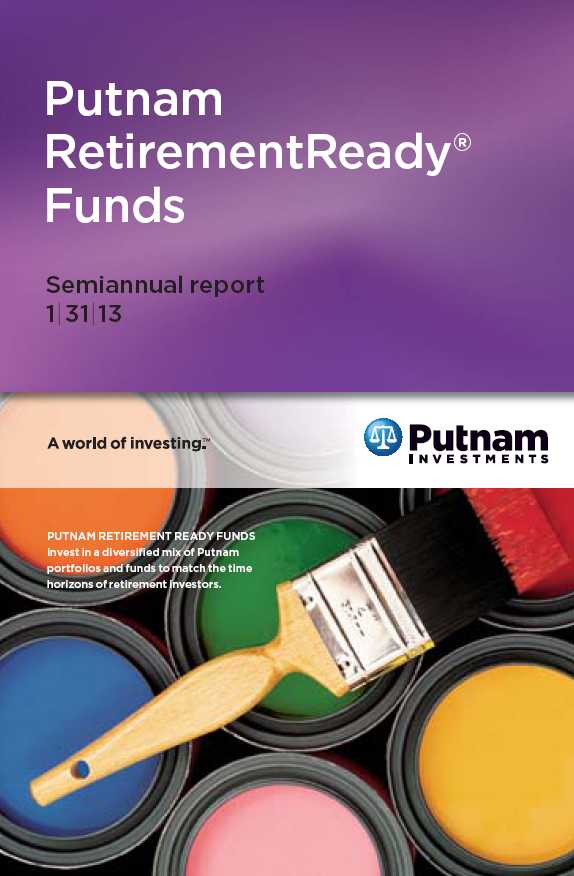

Allocations by fund as of 1/31/13

| | | | | | | | | | |

| | | | | | | | | | Putnam |

| Putnam | Putnam | Putnam | Putnam | Putnam | Putnam | Putnam | Putnam | Putnam | Retirement |

| | RetirementReady | RetirementReady | RetirementReady | RetirementReady | RetirementReady | RetirementReady | RetirementReady | RetirementReady | RetirementReady | Income Fund |

| Underlying Putnam Fund | 2055 Fund | 2050 Fund | 2045 Fund | 2040 Fund | 2035 Fund | 2030 Fund | 2025 Fund | 2020 Fund | 2015 Fund | Lifestyle 1 |

|

| Putnam Dynamic Asset | | | | | | | | | | |

| Allocation Equity Fund | 73.7% | 69.0% | 52.8% | 33.6% | 10.7% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% |

|

| Putnam Dynamic Asset | | | | | | | | | | |

| Allocation Growth Fund | 15.9% | 20.4% | 35.9% | 53.9% | 68.3% | 53.4% | 17.8% | 0.0% | 0.0% | 0.0% |

|

| Putnam Dynamic Asset | | | | | | | | | | |

| Allocation Balanced Fund | 0.0% | 0.0% | 0.0% | 0.0% | 3.8% | 21.7% | 47.1% | 42.2% | 14.5% | 0.0% |

|

| Putnam Dynamic Asset | | | | | | | | | | |

| Allocation Conservative Fund | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 1.0% | 12.1% | 27.4% | 34.1% |

|

| Putnam Absolute Return | | | | | | | | | | |

| 700 Fund | 7.3% | 7.3% | 7.3% | 7.3% | 8.8% | 11.6% | 13.4% | 12.3% | 5.9% | 0.0% |

|

| Putnam Absolute Return | | | | | | | | | | |

| 500 Fund | 2.1% | 2.1% | 2.1% | 2.3% | 3.9% | 5.2% | 7.3% | 13.4% | 23.5% | 30.0% |

|

| Putnam Absolute Return | | | | | | | | | | |

| 300 Fund | 0.0% | 0.0% | 0.0% | 0.0% | 0.4% | 2.3% | 5.6% | 9.9% | 15.6% | 21.1% |

|

| Putnam Absolute Return | | | | | | | | | | |

| 100 Fund | 0.6% | 0.8% | 1.4% | 2.4% | 2.4% | 2.9% | 3.9% | 5.1% | 7.1% | 9.0% |

|

| Putnam Money Market Fund | 0.4% | 0.4% | 0.4% | 0.4% | 1.7% | 2.9% | 3.9% | 5.1% | 5.9% | 5.9% |

|

Percentages are based on market value. Portfolio composition will vary over time. Due to rounding, percentages may not equal 100%.

| |

| RetirementReady® Funds | 11 |

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended January 31, 2013, the end of the first half of its current fiscal year. In accordance with regulatory requirements for mutual funds, we also include performance information as of the most recent calendar quarter-end and expense information taken from the fund’s current prospectus. Performance should always be considered in light of a fund’s investment strategy. Data represent past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. For the most recent month-end performance, please visit the Individual Investors section at putnam.com or call Putnam at 1-800-225-1581. Class R and class Y shares are not available to all investors. See the Terms and Definitions section in this report for definitions of the share classes offered by your fund.

Fund performance Total return for periods ended 1/31/13

| | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

| (inception dates) | (11/1/04) | (11/1/04) | (11/1/04) | (11/1/04) | (11/1/04) | (11/1/04) |

|

| | Before | After | | | | | Before | After | Net | Net |

| | sales | sales | Before | After | Before | After | sales | sales | asset | asset |

| | charge | charge | CDSC | CDSC | CDSC | CDSC | charge | charge | value | value |

|

| 2055 Fund* | | | | | | | | | | |

|

| Life of fund | 21.69% | 14.69% | 19.67% | 16.67% | 19.68% | 19.68% | 20.36% | 16.18% | 20.95% | 22.27% |

| Annual average | 9.48 | 6.53 | 8.64 | 7.38 | 8.65 | 8.65 | 8.93 | 7.17 | 9.18 | 9.72 |

|

| 1 year | 15.18 | 8.51 | 14.31 | 9.31 | 14.25 | 13.25 | 14.57 | 10.59 | 14.77 | 15.40 |

|

| 6 months | 11.75 | 5.36 | 11.26 | 6.26 | 11.18 | 10.18 | 11.39 | 7.52 | 11.46 | 11.73 |

|

| 2050 Fund† | | | | | | | | | | |

|

| Life of fund | 41.01% | 32.90% | 33.03% | 33.03% | 32.99% | 32.99% | 35.52% | 30.78% | 38.20% | 43.68% |

| Annual average | 4.53 | 3.74 | 3.75 | 3.75 | 3.74 | 3.74 | 4.00 | 3.52 | 4.26 | 4.78 |

|

| 5 years | 14.46 | 7.88 | 10.24 | 8.59 | 10.21 | 10.21 | 11.60 | 7.69 | 13.00 | 15.84 |

| Annual average | 2.74 | 1.53 | 1.97 | 1.66 | 1.96 | 1.96 | 2.22 | 1.49 | 2.47 | 2.98 |

|

| 3 years | 37.18 | 29.25 | 34.09 | 31.09 | 34.05 | 34.05 | 35.00 | 30.30 | 36.06 | 38.13 |

| Annual average | 11.11 | 8.93 | 10.27 | 9.44 | 10.26 | 10.26 | 10.52 | 9.22 | 10.81 | 11.37 |

|

| 1 year | 15.05 | 8.47 | 14.24 | 9.24 | 14.15 | 13.15 | 14.46 | 10.43 | 14.77 | 15.36 |

|

| 6 months | 11.57 | 5.14 | 11.12 | 6.12 | 11.11 | 10.11 | 11.21 | 7.33 | 11.44 | 11.71 |

|

| 2045 Fund‡ | | | | | | | | | | |

|

| Life of fund | 47.47% | 39.00% | 38.62% | 38.62% | 38.64% | 38.64% | 41.61% | 36.66% | 44.57% | 50.53% |

| Annual average | 4.82 | 4.07 | 4.04 | 4.04 | 4.04 | 4.04 | 4.30 | 3.86 | 4.57 | 5.08 |

|

| 5 years | 14.79 | 8.19 | 10.57 | 8.94 | 10.60 | 10.60 | 12.03 | 8.11 | 13.39 | 16.24 |

| Annual average | 2.80 | 1.59 | 2.03 | 1.73 | 2.04 | 2.04 | 2.30 | 1.57 | 2.55 | 3.06 |

|

| 3 years | 36.48 | 28.60 | 33.43 | 30.43 | 33.47 | 33.47 | 34.49 | 29.83 | 35.44 | 37.46 |

| Annual average | 10.92 | 8.75 | 10.09 | 9.26 | 10.10 | 10.10 | 10.38 | 9.09 | 10.64 | 11.19 |

|

| 1 year | 14.75 | 8.12 | 13.84 | 8.84 | 13.91 | 12.91 | 14.26 | 10.23 | 14.46 | 15.02 |

|

| 6 months | 11.18 | 4.81 | 10.79 | 5.79 | 10.80 | 9.80 | 10.95 | 7.07 | 11.05 | 11.34 |

|

| |

| 12 | RetirementReady® Funds |

Fund performance Total return for periods ended 1/31/13 cont.

| | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

| (inception dates) | (11/1/04) | (11/1/04) | (11/1/04) | (11/1/04) | (11/1/04) | (11/1/04) |

|

| | Before | After | | | | | Before | After | Net | Net |

| | sales | sales | Before | After | Before | After | sales | sales | asset | asset |

| | charge | charge | CDSC | CDSC | CDSC | CDSC | charge | charge | value | value |

|

| 2040 Fund‡ | | | | | | | | | | |

|

| Life of fund | 48.17% | 39.65% | 39.32% | 39.32% | 39.37% | 39.37% | 42.11% | 37.13% | 45.19% | 51.22% |

| Annual average | 4.88 | 4.13 | 4.10 | 4.10 | 4.10 | 4.10 | 4.35 | 3.90 | 4.62 | 5.14 |

|

| 5 years | 15.78 | 9.12 | 11.55 | 9.78 | 11.55 | 11.55 | 12.85 | 8.90 | 14.32 | 17.21 |

| Annual average | 2.97 | 1.76 | 2.21 | 1.88 | 2.21 | 2.21 | 2.45 | 1.72 | 2.71 | 3.23 |

|

| 3 years | 35.60 | 27.76 | 32.65 | 29.65 | 32.62 | 32.62 | 33.56 | 28.92 | 34.61 | 36.58 |

| Annual average | 10.68 | 8.51 | 9.88 | 9.04 | 9.87 | 9.87 | 10.13 | 8.84 | 10.41 | 10.95 |

|

| 1 year | 14.43 | 7.88 | 13.60 | 8.60 | 13.56 | 12.56 | 13.83 | 9.82 | 14.10 | 14.68 |

|

| 6 months | 10.73 | 4.39 | 10.37 | 5.37 | 10.32 | 9.32 | 10.42 | 6.58 | 10.57 | 10.88 |

|

| 2035 Fund | | | | | | | | | | |

|

| Life of fund | 46.87% | 38.42% | 38.05% | 38.05% | 38.13% | 38.13% | 40.93% | 36.00% | 43.77% | 49.96% |

| Annual average | 4.77 | 4.02 | 3.98 | 3.98 | 3.99 | 3.99 | 4.24 | 3.79 | 4.50 | 5.03 |

|

| 5 years | 15.86 | 9.19 | 11.57 | 9.70 | 11.59 | 11.59 | 12.97 | 9.02 | 14.45 | 17.34 |

| Annual average | 2.99 | 1.77 | 2.21 | 1.87 | 2.22 | 2.22 | 2.47 | 1.74 | 2.74 | 3.25 |

|

| 3 years | 33.64 | 25.97 | 30.63 | 27.63 | 30.68 | 30.68 | 31.71 | 27.11 | 32.68 | 34.66 |

| Annual average | 10.15 | 8.00 | 9.32 | 8.47 | 9.33 | 9.33 | 9.62 | 8.32 | 9.88 | 10.43 |

|

| 1 year | 13.57 | 7.06 | 12.76 | 7.76 | 12.81 | 11.81 | 13.06 | 9.09 | 13.31 | 13.94 |

|

| 6 months | 9.76 | 3.43 | 9.30 | 4.30 | 9.35 | 8.35 | 9.52 | 5.65 | 9.67 | 9.93 |

|

| 2030 Fund | | | | | | | | | | |

|

| Life of fund | 45.23% | 36.88% | 36.47% | 36.47% | 36.46% | 36.46% | 39.30% | 34.43% | 42.22% | 48.19% |

| Annual average | 4.62 | 3.88 | 3.84 | 3.84 | 3.84 | 3.84 | 4.10 | 3.65 | 4.36 | 4.88 |

|

| 5 years | 15.33 | 8.70 | 11.08 | 9.15 | 11.07 | 11.07 | 12.46 | 8.52 | 13.89 | 16.77 |

| Annual average | 2.89 | 1.68 | 2.12 | 1.77 | 2.12 | 2.12 | 2.38 | 1.65 | 2.64 | 3.15 |

|

| 3 years | 30.78 | 23.29 | 27.81 | 24.81 | 27.81 | 27.81 | 28.78 | 24.31 | 29.78 | 31.70 |

| Annual average | 9.36 | 7.23 | 8.52 | 7.67 | 8.52 | 8.52 | 8.80 | 7.52 | 9.08 | 9.61 |

|

| 1 year | 12.35 | 5.89 | 11.50 | 6.50 | 11.48 | 10.48 | 11.78 | 7.88 | 12.09 | 12.65 |

|

| 6 months | 8.32 | 2.07 | 7.94 | 2.94 | 7.93 | 6.93 | 8.08 | 4.31 | 8.21 | 8.46 |

|

| 2025 Fund | | | | | | | | | | |

|

| Life of fund | 42.25% | 34.07% | 33.68% | 33.68% | 33.70% | 33.70% | 36.51% | 31.73% | 39.37% | 45.23% |

| Annual average | 4.36 | 3.62 | 3.58 | 3.58 | 3.58 | 3.58 | 3.84 | 3.39 | 4.10 | 4.62 |

|

| 5 years | 13.66 | 7.12 | 9.43 | 7.52 | 9.46 | 9.46 | 10.83 | 6.95 | 12.24 | 15.09 |

| Annual average | 2.59 | 1.39 | 1.82 | 1.46 | 1.82 | 1.82 | 2.08 | 1.35 | 2.34 | 2.85 |

|

| 3 years | 27.23 | 19.92 | 24.39 | 21.39 | 24.44 | 24.44 | 25.32 | 20.90 | 26.31 | 28.25 |

| Annual average | 8.36 | 6.24 | 7.55 | 6.67 | 7.56 | 7.56 | 7.81 | 6.53 | 8.10 | 8.65 |

|

| 1 year | 10.79 | 4.42 | 9.89 | 4.89 | 9.91 | 8.91 | 10.22 | 6.38 | 10.51 | 11.07 |

|

| 6 months | 6.60 | 0.47 | 6.21 | 1.21 | 6.23 | 5.23 | 6.38 | 2.68 | 6.47 | 6.77 |

|

| |

| RetirementReady® Funds | 13 |

Fund performance Total return for periods ended 1/31/13 cont.

| | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

| (inception dates) | (11/1/04) | (11/1/04) | (11/1/04) | (11/1/04) | (11/1/04) | (11/1/04) |

|

| | Before | After | | | | | Before | After | Net | Net |

| | sales | sales | Before | After | Before | After | sales | sales | asset | asset |

| | charge | charge | CDSC | CDSC | CDSC | CDSC | charge | charge | value | value |

|

| 2020 Fund | | | | | | | | | | |

|

| Life of fund | 36.62% | 28.77% | 28.41% | 28.41% | 28.35% | 28.35% | 31.06% | 26.48% | 33.87% | 39.44% |

| Annual average | 3.85 | 3.11 | 3.08 | 3.08 | 3.07 | 3.07 | 3.33 | 2.89 | 3.60 | 4.11 |

|

| 5 years | 11.86 | 5.43 | 7.75 | 5.89 | 7.68 | 7.68 | 9.07 | 5.25 | 10.41 | 13.24 |

| Annual average | 2.27 | 1.06 | 1.50 | 1.15 | 1.49 | 1.49 | 1.75 | 1.03 | 2.00 | 2.52 |

|

| 3 years | 23.03 | 15.98 | 20.27 | 17.27 | 20.19 | 20.19 | 21.20 | 16.99 | 22.05 | 23.91 |

| Annual average | 7.15 | 5.07 | 6.35 | 5.45 | 6.32 | 6.32 | 6.62 | 5.37 | 6.87 | 7.41 |

|

| 1 year | 9.07 | 2.80 | 8.27 | 3.27 | 8.20 | 7.20 | 8.55 | 4.72 | 8.79 | 9.35 |

|

| 6 months | 4.96 | –1.09 | 4.59 | –0.41 | 4.54 | 3.54 | 4.72 | 1.03 | 4.81 | 5.09 |

|

| 2015 Fund | | | | | | | | | | |

|

| Life of fund | 30.35% | 22.86% | 22.54% | 22.54% | 22.52% | 22.52% | 25.19% | 20.81% | 27.80% | 33.14% |

| Annual average | 3.26 | 2.53 | 2.49 | 2.49 | 2.49 | 2.49 | 2.76 | 2.32 | 3.02 | 3.53 |

|

| 5 years | 8.95 | 2.68 | 4.93 | 3.16 | 4.91 | 4.91 | 6.33 | 2.61 | 7.59 | 10.38 |

| Annual average | 1.73 | 0.53 | 0.97 | 0.62 | 0.96 | 0.96 | 1.24 | 0.52 | 1.47 | 1.99 |

|

| 3 years | 17.91 | 11.16 | 15.31 | 12.31 | 15.28 | 15.28 | 16.21 | 12.11 | 17.09 | 18.90 |

| Annual average | 5.65 | 3.59 | 4.86 | 3.95 | 4.85 | 4.85 | 5.14 | 3.88 | 5.40 | 5.94 |

|

| 1 year | 7.43 | 1.27 | 6.63 | 1.63 | 6.66 | 5.66 | 6.98 | 3.25 | 7.23 | 7.75 |

|

| 6 months | 3.66 | –2.32 | 3.30 | –1.70 | 3.26 | 2.26 | 3.44 | –0.18 | 3.60 | 3.85 |

|

| Retirement Income Fund Lifestyle 1 | | | | | | | | |

|

| Life of fund | 26.72% | 21.65% | 19.05% | 19.05% | 19.21% | 19.21% | 22.06% | 18.10% | 24.11% | 29.31% |

| Annual average | 2.91 | 2.40 | 2.13 | 2.13 | 2.15 | 2.15 | 2.44 | 2.04 | 2.65 | 3.16 |

|

| 5 years | 12.54 | 8.05 | 8.34 | 6.45 | 8.42 | 8.42 | 10.18 | 6.61 | 11.09 | 13.92 |

| Annual average | 2.39 | 1.56 | 1.61 | 1.26 | 1.63 | 1.63 | 1.96 | 1.29 | 2.13 | 2.64 |

|

| 3 years | 13.45 | 8.93 | 10.90 | 7.90 | 10.91 | 10.91 | 12.17 | 8.51 | 12.59 | 14.31 |

| Annual average | 4.30 | 2.89 | 3.51 | 2.57 | 3.51 | 3.51 | 3.90 | 2.76 | 4.03 | 4.56 |

|

| 1 year | 6.39 | 2.16 | 5.54 | 0.54 | 5.59 | 4.59 | 6.12 | 2.64 | 6.14 | 6.64 |

|

| 6 months | 2.95 | –1.15 | 2.51 | –2.49 | 2.56 | 1.56 | 2.82 | –0.51 | 2.83 | 3.07 |

|

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. After-sales-charge returns for class A and M shares reflect the deduction of the maximum 5.75% and 3.50% sales charge, respectively, levied at the time of purchase. The maximum sales charges for Retirement Income Fund Lifestyle 1 class A and M shares are 4.00% and 3.25%, respectively. Class B share returns after the contingent deferred sales charge (CDSC) reflect the applicable CDSC, which is 5% in the first year, declining over time to 1% in the sixth year, and is eliminated thereafter. Class C share returns after CDSC reflect a 1% CDSC for the first year that is eliminated thereafter. Class R and Y shares have no initial sales charge or CDSC.

For a portion of the periods, these funds had expense limitations, without which returns would have been lower.

Class B share performance does not reflect conversion to class A shares.

* The inception date of Putnam RetirementReady 2055 Fund is 11/30/10, for all share classes.

† The inception date of Putnam RetirementReady 2050 Fund is 5/2/05, for all share classes.

‡ Because no class R shares of the fund were outstanding on 12/20/05 and 12/21/05, class R performance for the period from 12/19/05 to 12/21/05 is based on class A performance, adjusted for the applicable sales charge and the higher operating expenses for class R shares.

| |

| 14 | RetirementReady® Funds |

Comparative index returns For periods ended 1/31/13

| | |

| | | Barclays U.S. |

| | S&P 500 Index | Aggregate Bond Index |

|

| Life of fund* | 57.48% | 51.70% |

| Annual average | 5.66 | 5.18 |

|

| 5 years | 21.51 | 30.36 |

| Annual average | 3.97 | 5.45 |

|

| 3 years | 48.71 | 17.11 |

| Annual average | 14.14 | 5.41 |

|

| 1 year | 16.78 | 2.59 |

|

| 6 months | 9.91 | –0.29 |

|

Index results should be compared with fund performance before sales charge, before CDSC, or at net asset value.

* Life-of-fund period begins at 11/1/04, the inception date of all the Putnam RetirementReady Funds with the exception of the 2050 Fund and 2055 Fund (inceptions: 5/2/05 and 11/30/10, respectively).

Fund price and distribution information For the six-month period ended 1/31/13

| | | | | | | | |

| 2055 Fund | | | | | | | | |

|

| Distributions | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Number | 1 | 1 | 1 | 1 | 1 | 1 |

|

| Income | $0.195 | $0.149 | $0.134 | $0.142 | $0.168 | $0.216 |

|

| Long-term capital gains | 0.045 | 0.045 | 0.045 | 0.045 | 0.045 | 0.045 |

|

| Short-term capital gains | — | — | — | — | — | — |

|

| Total | $0.240 | $0.194 | $0.179 | $0.187 | $0.213 | $0.261 |

|

| | Before | After | Net | Net | Before | After | Net | Net |

| | sales | sales | asset | asset | sales | sales | asset | asset |

| Share value | charge | charge | value | value | charge | charge | value | value |

|

| 7/31/12 | $9.73 | $10.32 | $9.72 | $9.65 | $9.72 | $10.07 | $9.72 | $9.76 |

|

| 1/31/13 | 10.62 | 11.27 | 10.61 | 10.54 | 10.63 | 11.02 | 10.61 | 10.63 |

|

| 2050 Fund | | | | | | | | |

|

| Distributions | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Number | 1 | 1 | 1 | 1 | 1 | 1 |

|

| Income | $0.167 | $0.071 | $0.092 | $0.100 | $0.142 | $0.197 |

|

| Capital gains | — | — | — | — | — | — |

|

| Total | $0.167 | $0.071 | $0.092 | $0.100 | $0.142 | $0.197 |

|

| | Before | After | Net | Net | Before | After | Net | Net |

| | sales | sales | asset | asset | sales | sales | asset | asset |

| Share value | charge | charge | value | value | charge | charge | value | value |

|

| 7/31/12 | $12.58 | $13.35 | $12.45 | $12.39 | $12.71 | $13.17 | $12.41 | $12.62 |

|

| 1/31/13 | 13.86 | 14.71 | 13.76 | 13.67 | 14.03 | 14.54 | 13.68 | 13.89 |

|

| |

| RetirementReady® Funds | 15 |

Fund price and distribution information For the six-month period ended 1/31/13 cont.

| | | | | | | | |

| 2045 Fund | | | | | | | | |

|

| Distributions | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Number | 1 | 1 | 1 | 1 | 1 | 1 |

|

| Income | $0.382 | $0.304 | $0.344 | $0.335 | $0.348 | $0.418 |

|

| Capital gains | — | — | — | — | — | — |

|

| Total | $0.382 | $0.304 | $0.344 | $0.335 | $0.348 | $0.418 |

|

| | Before | After | Net | Net | Before | After | Net | Net |

| | sales | sales | asset | asset | sales | sales | asset | asset |

| Share value | charge | charge | value | value | charge | charge | value | value |

|

| 7/31/12 | $14.14 | $15.00 | $13.06 | $13.16 | $13.81 | $14.31 | $14.44 | $16.57 |

|

| 1/31/13 | 15.32 | 16.25 | 14.15 | 14.22 | 14.97 | 15.51 | 15.67 | 18.01 |

|

| 2040 Fund | | | | | | | | |

|

| Distributions | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Number | 1 | 1 | 1 | 1 | 1 | 1 |

|

| Income | $0.307 | $0.215 | $0.218 | $0.270 | $0.271 | $0.344 |

|

| Capital gains | — | — | — | — | — | — |

|

| Total | $0.307 | $0.215 | $0.218 | $0.270 | $0.271 | $0.344 |

|

| | Before | After | Net | Net | Before | After | Net | Net |

| | sales | sales | asset | asset | sales | sales | asset | asset |

| Share value | charge | charge | value | value | charge | charge | value | value |

|

| 7/31/12 | $15.48 | $16.42 | $14.42 | $14.33 | $14.71 | $15.24 | $15.84 | $17.83 |

|

| 1/31/13 | 16.82 | 17.85 | 15.69 | 15.58 | 15.96 | 16.54 | 17.23 | 19.41 |

|

| 2035 Fund | | | | | | | | |

|

| Distributions | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Number | 1 | 1 | 1 | 1 | 1 | 1 |

|

| Income | $0.207 | $0.101 | $0.120 | $0.142 | $0.176 | $0.247 |

|

| Capital gains | — | — | — | — | — | — |

|

| Total | $0.207 | $0.101 | $0.120 | $0.142 | $0.176 | $0.247 |

|

| | Before | After | Net | Net | Before | After | Net | Net |

| | sales | sales | asset | asset | sales | sales | asset | asset |

| Share value | charge | charge | value | value | charge | charge | value | value |

|

| 7/31/12 | $15.83 | $16.80 | $14.68 | $14.70 | $15.32 | $15.88 | $15.24 | $18.20 |

|

| 1/31/13 | 17.16 | 18.21 | 15.94 | 15.95 | 16.63 | 17.23 | 16.53 | 19.75 |

|

| 2030 Fund | | | | | | | | |

|

| Distributions | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Number | 1 | 1 | 1 | 1 | 1 | 1 |

|

| Income | $0.168 | $0.050 | $0.060 | $0.089 | $0.134 | $0.209 |

|

| Capital gains | — | — | — | — | — | — |

|

| Total | $0.168 | $0.050 | $0.060 | $0.089 | $0.134 | $0.209 |

|

| | Before | After | Net | Net | Before | After | Net | Net |

| | sales | sales | asset | asset | sales | sales | asset | asset |

| Share value | charge | charge | value | value | charge | charge | value | value |

|

| 7/31/12 | $16.16 | $17.15 | $15.38 | $15.41 | $15.74 | $16.31 | $15.33 | $18.28 |

|

| 1/31/13 | 17.33 | 18.39 | 16.55 | 16.57 | 16.92 | 17.53 | 16.45 | 19.61 |

|

| |

| 16 | RetirementReady® Funds |

Fund price and distribution information For the six-month period ended 1/31/13 cont.

| | | | | | | | |

| 2025 Fund | | | | | | | | |

|

| Distributions | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Number | 1 | 1 | 1 | 1 | 1 | 1 |

|

| Income | $0.268 | $0.147 | $0.142 | $0.218 | $0.227 | $0.310 |

|

| Capital gains | — | — | — | — | — | — |

|

| Total | $0.268 | $0.147 | $0.142 | $0.218 | $0.227 | $0.310 |

|

| | Before | After | Net | Net | Before | After | Net | Net |

| | sales | sales | asset | asset | sales | sales | asset | asset |

| Share value | charge | charge | value | value | charge | charge | value | value |

|

| 7/31/12 | $17.21 | $18.26 | $16.12 | $16.14 | $16.37 | $16.96 | $16.13 | $17.28 |

|

| 1/31/13 | 18.07 | 19.17 | 16.97 | 17.00 | 17.19 | 17.81 | 16.94 | 18.13 |

|

| 2020 Fund | | | | | | | | |

|

| Distributions | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Number | 1 | 1 | 1 | 1 | 1 | 1 |

|

| Income | $0.336 | $0.232 | $0.226 | $0.245 | $0.295 | $0.377 |

|

| Capital gains | — | — | — | — | — | — |

|

| Total | $0.336 | $0.232 | $0.226 | $0.245 | $0.295 | $0.377 |

|

| | Before | After | Net | Net | Before | After | Net | Net |

| | sales | sales | asset | asset | sales | sales | asset | asset |

| Share value | charge | charge | value | value | charge | charge | value | value |

|

| 7/31/12 | $16.19 | $17.18 | $15.60 | $15.65 | $15.88 | $16.46 | $15.60 | $17.97 |

|

| 1/31/13 | 16.65 | 17.67 | 16.08 | 16.13 | 16.38 | 16.97 | 16.05 | 18.50 |

|

| 2015 Fund | | | | | | | | |

|

| Distributions | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Number | 1 | 1 | 1 | 1 | 1 | 1 |

|

| Income | $0.329 | $0.195 | $0.178 | $0.246 | $0.289 | $0.371 |

|

| Capital gains | — | — | — | — | — | — |

|

| Total | $0.329 | $0.195 | $0.178 | $0.246 | $0.289 | $0.371 |

|

| | Before | After | Net | Net | Before | After | Net | Net |

| | sales | sales | asset | asset | sales | sales | asset | asset |

| Share value | charge | charge | value | value | charge | charge | value | value |

|

| 7/31/12 | $16.51 | $17.52 | $16.00 | $15.99 | $16.29 | $16.88 | $15.95 | $16.55 |

|

| 1/31/13 | 16.78 | 17.80 | 16.33 | 16.33 | 16.60 | 17.20 | 16.23 | 16.81 |

|

| |

| RetirementReady® Funds | 17 |

Fund price and distribution information For the six-month period ended 1/31/13 cont.

| | | | | | | | |

| Retirement Income Fund Lifestyle 1 | | | | | | | |

|

| Distributions | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Number | 6 | 1 | 1 | 6 | 6 | 6 |

|

| Income | $0.152 | $0.118 | $0.118 | $0.131 | $0.131 | $0.173 |

|

| Capital gains | — | — | — | — | — | — |

|

| Total | $0.152 | $0.118 | $0.118 | $0.131 | $0.131 | $0.173 |

|

| | Before | After | Net | Net | Before | After | Net | Net |

| | sales | sales | asset | asset | sales | sales | asset | asset |

| Share value | charge | charge | value | value | charge | charge | value | value |

|

| 7/31/12 | $16.39 | $17.07 | $16.34 | $16.38 | $16.43 | $16.98 | $16.38 | $16.44 |

|

| 1/31/13 | 16.72 | 17.42 | 16.63 | 16.68 | 16.76 | 17.32 | 16.71 | 16.77 |

|

The classification of distributions, if any, is an estimate. Before-sales-charge share value and current dividend rate for class A and M shares, if applicable, do not take into account any sales charge levied at the time of purchase. After-sales-charge share value, current dividend rate, and current 30-day SEC yield, if applicable, are calculated assuming that the maximum sales charge (5.75% for class A shares and 3.50% for class M shares for all funds except Retirement Income Fund Lifestyle 1, for which the rates are 4.00% for class A shares and 3.25% for class M shares) was levied at the time of purchase. Final distribution information will appear on your year-end tax forms.

Fund performance as of most recent calendar quarter

Total return for periods ended 12/31/12

| | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

| (inception dates) | (11/1/04) | (11/1/04) | (11/1/04) | (11/1/04) | (11/1/04) | (11/1/04) |

|

| | Before | After | | | | | Before | After | Net | Net |

| | sales | sales | Before | After | Before | After | sales | sales | asset | asset |

| | charge | charge | CDSC | CDSC | CDSC | CDSC | charge | charge | value | value |

|

| 2055 Fund* | | | | | | | | | | |

|

| Life of fund | 16.30% | 9.62% | 14.48% | 11.48% | 14.57% | 14.57% | 15.15% | 11.15% | 15.70% | 16.98% |

| Annual average | 7.52 | 4.51 | 6.71 | 5.35 | 6.75 | 6.75 | 7.01 | 5.21 | 7.25 | 7.82 |

|

| 1 year | 16.11 | 9.39 | 15.21 | 10.20 | 15.27 | 14.27 | 15.48 | 11.38 | 15.80 | 16.44 |

|

| 6 months | 7.91 | 1.68 | 7.54 | 2.54 | 7.66 | 6.66 | 7.68 | 3.90 | 7.85 | 8.11 |

|

| 2050 Fund† | | | | | | | | | | |

|

| Life of fund | 34.91% | 27.15% | 27.32% | 27.32% | 27.35% | 27.35% | 29.72% | 25.18% | 32.24% | 37.47% |

| Annual average | 3.98 | 3.18 | 3.20 | 3.20 | 3.20 | 3.20 | 3.45 | 2.97 | 3.71 | 4.24 |

|

| 5 years | 1.36 | –4.46 | –2.40 | –3.86 | –2.38 | –2.38 | –1.18 | –4.63 | 0.05 | 2.60 |

| Annual average | 0.27 | –0.91 | –0.48 | –0.78 | –0.48 | –0.48 | –0.24 | –0.94 | 0.01 | 0.51 |

|

| 3 years | 26.69 | 19.42 | 23.87 | 20.87 | 23.88 | 23.88 | 24.84 | 20.44 | 25.75 | 27.70 |

| Annual average | 8.21 | 6.09 | 7.40 | 6.52 | 7.40 | 7.40 | 7.68 | 6.40 | 7.94 | 8.49 |

|

| 1 year | 16.06 | 9.35 | 15.14 | 10.14 | 15.23 | 14.23 | 15.45 | 11.36 | 15.78 | 16.38 |

|

| 6 months | 7.94 | 1.73 | 7.48 | 2.48 | 7.53 | 6.53 | 7.64 | 3.84 | 7.76 | 8.08 |

|

| |

| 18 | RetirementReady® Funds |

Fund performance as of most recent calendar quarter

Total return for periods ended 12/31/12 cont.

| | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

| (inception dates) | (11/1/04) | (11/1/04) | (11/1/04) | (11/1/04) | (11/1/04) | (11/1/04) |

|

| | Before | After | | | | | Before | After | Net | Net |

| | sales | sales | Before | After | Before | After | sales | sales | asset | asset |

| | charge | charge | CDSC | CDSC | CDSC | CDSC | charge | charge | value | value |

|

| 2045 Fund‡ | | | | | | | | | | |

|

| Life of fund | 41.41% | 33.28% | 33.04% | 33.04% | 33.09% | 33.09% | 35.75% | 31.00% | 38.66% | 44.34% |

| Annual average | 4.33 | 3.58 | 3.56 | 3.56 | 3.56 | 3.56 | 3.81 | 3.36 | 4.08 | 4.59 |

|

| 5 years | 1.99 | –3.87 | –1.74 | –3.19 | –1.70 | –1.70 | –0.53 | –4.02 | 0.75 | 3.29 |

| Annual average | 0.39 | –0.79 | –0.35 | –0.65 | –0.34 | –0.34 | –0.11 | –0.82 | 0.15 | 0.65 |

|

| 3 years | 26.59 | 19.33 | 23.79 | 20.79 | 23.89 | 23.89 | 24.64 | 20.28 | 25.57 | 27.48 |

| Annual average | 8.18 | 6.07 | 7.37 | 6.50 | 7.40 | 7.40 | 7.62 | 6.35 | 7.89 | 8.43 |

|

| 1 year | 15.96 | 9.32 | 15.05 | 10.05 | 15.10 | 14.10 | 15.29 | 11.27 | 15.64 | 16.24 |

|

| 6 months | 7.91 | 1.72 | 7.48 | 2.48 | 7.50 | 6.50 | 7.60 | 3.80 | 7.78 | 8.07 |

|

| 2040 Fund‡ | | | | | | | | | | |

|

| Life of fund | 42.44% | 34.25% | 34.00% | 34.00% | 34.00% | 34.00% | 36.68% | 31.89% | 39.63% | 45.38% |

| Annual average | 4.42 | 3.67 | 3.65 | 3.65 | 3.65 | 3.65 | 3.90 | 3.45 | 4.17 | 4.69 |

|

| 5 years | 3.44 | –2.51 | –0.36 | –1.94 | –0.40 | –0.40 | 0.84 | –2.69 | 2.15 | 4.76 |

| Annual average | 0.68 | –0.51 | –0.07 | –0.39 | –0.08 | –0.08 | 0.17 | –0.54 | 0.43 | 0.93 |

|

| 3 years | 26.39 | 19.13 | 23.56 | 20.56 | 23.57 | 23.57 | 24.45 | 20.09 | 25.43 | 27.31 |

| Annual average | 8.12 | 6.01 | 7.31 | 6.43 | 7.31 | 7.31 | 7.56 | 6.29 | 7.85 | 8.38 |

|

| 1 year | 15.72 | 9.06 | 14.92 | 9.92 | 14.80 | 13.80 | 15.12 | 11.11 | 15.44 | 16.04 |

|

| 6 months | 7.78 | 1.60 | 7.42 | 2.42 | 7.34 | 6.34 | 7.51 | 3.73 | 7.62 | 7.93 |

|

| 2035 Fund | | | | | | | | | | |

|

| Life of fund | 41.82% | 33.67% | 33.37% | 33.37% | 33.45% | 33.45% | 36.10% | 31.33% | 38.81% | 44.72% |

| Annual average | 4.37 | 3.61 | 3.59 | 3.59 | 3.59 | 3.59 | 3.84 | 3.39 | 4.09 | 4.63 |

|

| 5 years | 4.39 | –1.61 | 0.51 | –1.18 | 0.51 | 0.51 | 1.76 | –1.80 | 3.06 | 5.68 |

| Annual average | 0.86 | –0.32 | 0.10 | –0.24 | 0.10 | 0.10 | 0.35 | –0.36 | 0.60 | 1.11 |

|

| 3 years | 25.45 | 18.21 | 22.65 | 19.65 | 22.61 | 22.61 | 23.57 | 19.20 | 24.51 | 26.38 |

| Annual average | 7.85 | 5.73 | 7.04 | 6.16 | 7.03 | 7.03 | 7.31 | 6.03 | 7.58 | 8.12 |

|

| 1 year | 15.08 | 8.46 | 14.23 | 9.23 | 14.20 | 13.20 | 14.51 | 10.53 | 14.78 | 15.34 |

|

| 6 months | 7.35 | 1.20 | 6.98 | 1.98 | 6.96 | 5.96 | 7.09 | 3.33 | 7.22 | 7.51 |

|

| 2030 Fund | | | | | | | | | | |

|

| Life of fund | 40.95% | 32.85% | 32.60% | 32.60% | 32.59% | 32.59% | 35.27% | 30.53% | 38.15% | 43.80% |

| Annual average | 4.29 | 3.54 | 3.51 | 3.51 | 3.51 | 3.51 | 3.77 | 3.31 | 4.03 | 4.55 |

|

| 5 years | 4.95 | –1.08 | 1.10 | –0.66 | 1.09 | 1.09 | 2.32 | –1.26 | 3.69 | 6.24 |

| Annual average | 0.97 | –0.22 | 0.22 | –0.13 | 0.22 | 0.22 | 0.46 | –0.25 | 0.73 | 1.22 |

|

| 3 years | 23.95 | 16.86 | 21.24 | 18.24 | 21.25 | 21.25 | 22.09 | 17.78 | 23.08 | 24.90 |

| Annual average | 7.42 | 5.33 | 6.63 | 5.74 | 6.63 | 6.63 | 6.88 | 5.61 | 7.17 | 7.69 |

|

| 1 year | 13.79 | 7.25 | 12.96 | 7.96 | 13.01 | 12.01 | 13.22 | 9.25 | 13.57 | 14.05 |

|

| 6 months | 6.58 | 0.47 | 6.26 | 1.26 | 6.25 | 5.25 | 6.30 | 2.61 | 6.51 | 6.71 |

|

| |

| RetirementReady® Funds | 19 |

Fund performance as of most recent calendar quarter

Total return for periods ended 12/31/12 cont.

| | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

| (inception dates) | (11/1/04) | (11/1/04) | (11/1/04) | (11/1/04) | (11/1/04) | (11/1/04) |

|

| | Before | After | | | | | Before | After | Net | Net |

| | sales | sales | Before | After | Before | After | sales | sales | asset | asset |

| | charge | charge | CDSC | CDSC | CDSC | CDSC | charge | charge | value | value |

|

| 2025 Fund | | | | | | | | | | |

|

| Life of fund | 38.95% | 30.95% | 30.69% | 30.69% | 30.64% | 30.64% | 33.33% | 28.67% | 36.08% | 41.78% |

| Annual average | 4.11 | 3.35 | 3.33 | 3.33 | 3.32 | 3.32 | 3.58 | 3.13 | 3.84 | 4.36 |

|

| 5 years | 4.68 | –1.34 | 0.81 | –0.94 | 0.79 | 0.79 | 2.05 | –1.53 | 3.32 | 5.98 |

| Annual average | 0.92 | –0.27 | 0.16 | –0.19 | 0.16 | 0.16 | 0.41 | –0.31 | 0.66 | 1.17 |

|

| 3 years | 22.21 | 15.17 | 19.47 | 16.47 | 19.46 | 19.46 | 20.28 | 16.04 | 21.25 | 23.07 |

| Annual average | 6.91 | 4.82 | 6.11 | 5.21 | 6.11 | 6.11 | 6.35 | 5.08 | 6.63 | 7.16 |

|

| 1 year | 12.00 | 5.53 | 11.14 | 6.14 | 11.09 | 10.09 | 11.39 | 7.52 | 11.64 | 12.22 |

|

| 6 months | 5.59 | –0.50 | 5.20 | 0.20 | 5.16 | 4.16 | 5.25 | 1.55 | 5.39 | 5.70 |

|

| 2020 Fund | | | | | | | | | | |

|

| Life of fund | 34.16% | 26.45% | 26.17% | 26.17% | 26.20% | 26.20% | 28.82% | 24.32% | 31.53% | 36.95% |

| Annual average | 3.66 | 2.91 | 2.89 | 2.89 | 2.89 | 2.89 | 3.15 | 2.70 | 3.41 | 3.92 |

|

| 5 years | 4.44 | –1.57 | 0.59 | –1.14 | 0.60 | 0.60 | 1.88 | –1.68 | 3.13 | 5.77 |

| Annual average | 0.87 | –0.32 | 0.12 | –0.23 | 0.12 | 0.12 | 0.37 | –0.34 | 0.62 | 1.13 |

|

| 3 years | 19.62 | 12.75 | 16.89 | 13.89 | 16.97 | 16.97 | 17.85 | 13.72 | 18.70 | 20.53 |

| Annual average | 6.15 | 4.08 | 5.34 | 4.43 | 5.36 | 5.36 | 5.63 | 4.38 | 5.88 | 6.42 |

|

| 1 year | 10.07 | 3.78 | 9.21 | 4.21 | 9.21 | 8.21 | 9.56 | 5.73 | 9.82 | 10.34 |

|

| 6 months | 4.56 | –1.43 | 4.11 | –0.89 | 4.19 | 3.19 | 4.31 | 0.65 | 4.39 | 4.73 |

|

| 2015 Fund | | | | | | | | | | |

|

| Life of fund | 28.72% | 21.32% | 21.04% | 21.04% | 21.02% | 21.02% | 23.61% | 19.28% | 26.15% | 31.39% |

| Annual average | 3.14 | 2.39 | 2.36 | 2.36 | 2.36 | 2.36 | 2.63 | 2.18 | 2.88 | 3.40 |

|

| 5 years | 4.00 | –1.98 | 0.13 | –1.56 | 0.10 | 0.10 | 1.43 | –2.12 | 2.62 | 5.32 |

| Annual average | 0.79 | –0.40 | 0.03 | –0.31 | 0.02 | 0.02 | 0.28 | –0.43 | 0.52 | 1.04 |

|

| 3 years | 15.84 | 9.18 | 13.23 | 10.23 | 13.20 | 13.20 | 14.15 | 10.15 | 14.97 | 16.75 |

| Annual average | 5.02 | 2.97 | 4.23 | 3.30 | 4.22 | 4.22 | 4.51 | 3.27 | 4.76 | 5.30 |

|

| 1 year | 8.40 | 2.18 | 7.55 | 2.55 | 7.57 | 6.57 | 7.82 | 4.04 | 8.08 | 8.66 |

|

| 6 months | 3.74 | –2.20 | 3.33 | –1.67 | 3.35 | 2.35 | 3.46 | –0.14 | 3.62 | 3.87 |

|

| |

| 20 | RetirementReady® Funds |

Fund performance as of most recent calendar quarter

Total return for periods ended 12/31/12 cont.

| | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

| (inception dates) | (11/1/04) | (11/1/04) | (11/1/04) | (11/1/04) | (11/1/04) | (11/1/04) |

|

| | Before | After | | | | | Before | After | Net | Net |

| | sales | sales | Before | After | Before | After | sales | sales | asset | asset |

| | charge | charge | CDSC | CDSC | CDSC | CDSC | charge | charge | value | value |

|

| Retirement Income Fund Lifestyle 1 | | | | | | | | |

|

| Life of fund | 25.39% | 20.38% | 17.91% | 17.91% | 18.00% | 18.00% | 20.81% | 16.89% | 22.84% | 27.93% |

| Annual average | 2.81 | 2.30 | 2.04 | 2.04 | 2.05 | 2.05 | 2.34 | 1.93 | 2.55 | 3.06 |

|

| 5 years | 9.28 | 4.91 | 5.22 | 3.39 | 5.23 | 5.23 | 6.98 | 3.50 | 7.89 | 10.63 |

| Annual average | 1.79 | 0.96 | 1.02 | 0.67 | 1.02 | 1.02 | 1.36 | 0.69 | 1.53 | 2.04 |

|

| 3 years | 12.27 | 7.80 | 9.70 | 6.70 | 9.73 | 9.73 | 10.99 | 7.37 | 11.43 | 13.05 |

| Annual average | 3.93 | 2.54 | 3.13 | 2.19 | 3.14 | 3.14 | 3.54 | 2.40 | 3.67 | 4.17 |

|

| 1 year | 7.07 | 2.80 | 6.27 | 1.27 | 6.25 | 5.25 | 6.80 | 3.30 | 6.82 | 7.31 |

|

| 6 months | 3.17 | –0.93 | 2.78 | –2.22 | 2.77 | 1.77 | 3.03 | –0.34 | 3.04 | 3.28 |

|

* The inception date of Putnam RetirementReady 2055 Fund is 11/30/10, for all share classes.

† The inception date of Putnam RetirementReady 2050 Fund is 5/2/05, for all share classes.

‡ Because no class R shares of the fund were outstanding on 12/20/05 and 12/21/05, class R performance for the period from 12/19/05 to 12/21/05 is based on class A performance, adjusted for the applicable sales charge and the higher operating expenses for class R shares.

See the discussion following the Fund performance tables on pages 12–14 for more information about the calculation of fund performance.

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. In the most recent six-month period, your fund’s expenses were limited; had expenses not been limited, they would have been higher. Using the following information, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

Expense ratios

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Putnam RetirementReady 2055 Fund | | | | | | |

|

| Estimated net expenses for the fiscal year | | | | | | |

| ended 7/31/12* | 1.28% | 2.03% | 2.03% | 1.78% | 1.53% | 1.03% |

|

| Your fund’s estimated total annual operating | | | | | | |

| expenses for the fiscal year ended 7/31/12 | 1.76% | 2.51% | 2.51% | 2.26% | 2.01% | 1.51% |

|

| Your fund’s annualized expense ratio for the | | | | | | |

| six-month period ended 1/31/13† | 0.25% | 1.00% | 1.00% | 0.75% | 0.50% | 0.00% |

|

| |

| RetirementReady® Funds | 21 |

Expense ratios cont.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Putnam RetirementReady 2050 Fund | | | | | | |

|

| Net expenses for the fiscal year ended 7/31/12* | 1.27% | 2.02% | 2.02% | 1.77% | 1.52% | 1.02% |

|

| Your fund’s total annual operating expenses for | | | | | | |

| the fiscal year ended 7/31/12 | 1.42% | 2.17% | 2.17% | 1.92% | 1.67% | 1.17% |

|

| Your fund’s annualized expense ratio for the | | | | | | |

| six-month period ended 1/31/13† | 0.25% | 1.00% | 1.00% | 0.75% | 0.50% | 0.00% |

|

| Putnam RetirementReady 2045 Fund | | | | | | |

|

| Net expenses for the fiscal year ended 7/31/12* | 1.24% | 1.99% | 1.99% | 1.74% | 1.49% | 0.99% |

|

| Your fund’s total annual operating expenses for | | | | | | |

| the fiscal year ended 7/31/12 | 1.36% | 2.11% | 2.11% | 1.86% | 1.61% | 1.11% |

|

| Your fund’s annualized expense ratio for the | | | | | | |

| six-month period ended 1/31/13† | 0.25% | 1.00% | 1.00% | 0.75% | 0.50% | 0.00% |

|

| Putnam RetirementReady 2040 Fund | | | | | | |

|

| Net expenses for the fiscal year ended 7/31/12* | 1.20% | 1.95% | 1.95% | 1.70% | 1.45% | 0.95% |

|

| Your fund’s total annual operating expenses for | | | | | | |

| the fiscal year ended 7/31/12 | 1.32% | 2.07% | 2.07% | 1.82% | 1.57% | 1.07% |

|

| Your fund’s annualized expense ratio for the | | | | | | |

| six-month period ended 1/31/13† | 0.25% | 1.00% | 1.00% | 0.75% | 0.50% | 0.00% |

|

| Putnam RetirementReady 2035 Fund | | | | | | |

|

| Net expenses for the fiscal year ended 7/31/12* | 1.14% | 1.89% | 1.89% | 1.64% | 1.39% | 0.89% |

|

| Your fund’s total annual operating expenses for | | | | | | |

| the fiscal year ended 7/31/12 | 1.25% | 2.00% | 2.00% | 1.75% | 1.50% | 1.00% |

|

| Your fund’s annualized expense ratio for the | | | | | | |

| six-month period ended 1/31/13† | 0.25% | 1.00% | 1.00% | 0.75% | 0.50% | 0.00% |

|

| Putnam RetirementReady 2030 Fund | | | | | | |

|

| Net expenses for the fiscal year ended 7/31/12* | 1.10% | 1.85% | 1.85% | 1.60% | 1.35% | 0.85% |

|

| Your fund’s total annual operating expenses for | | | | | | |

| the fiscal year ended 7/31/12 | 1.21% | 1.96% | 1.96% | 1.71% | 1.46% | 0.96% |

|

| Your fund’s annualized expense ratio for the | | | | | | |

| six-month period ended 1/31/13† | 0.25% | 1.00% | 1.00% | 0.75% | 0.50% | 0.00% |

|

| Putnam RetirementReady 2025 Fund | | | | | | |

|

| Net expenses for the fiscal year ended 7/31/12* | 1.07% | 1.82% | 1.82% | 1.57% | 1.32% | 0.82% |

|

| Your fund’s total annual operating expenses for | | | | | | |

| the fiscal year ended 7/31/12 | 1.17% | 1.92% | 1.92% | 1.67% | 1.42% | 0.92% |

|

| Your fund’s annualized expense ratio for the | | | | | | |

| six-month period ended 1/31/13† | 0.25% | 1.00% | 1.00% | 0.75% | 0.50% | 0.00% |

|

| Putnam RetirementReady 2020 Fund | | | | | | |

|

| Net expenses for the fiscal year ended 7/31/12* | 1.04% | 1.79% | 1.79% | 1.54% | 1.29% | 0.79% |

|

| Your fund’s total annual operating expenses for | | | | | | |

| the fiscal year ended 7/31/12 | 1.14% | 1.89% | 1.89% | 1.64% | 1.39% | 0.89% |

|

| Your fund’s annualized expense ratio for the | | | | | | |

| six-month period ended 1/31/13† | 0.25% | 1.00% | 1.00% | 0.75% | 0.50% | 0.00% |

|

| Putnam RetirementReady 2015 Fund | | | | | | |

|

| Net expenses for the fiscal year ended 7/31/12* | 1.00% | 1.75% | 1.75% | 1.50% | 1.25% | 0.75% |

|

| Your fund’s total annual operating expenses for | | | | | | |

| the fiscal year ended 7/31/12 | 1.11% | 1.86% | 1.86% | 1.61% | 1.36% | 0.86% |

|

| Your fund’s annualized expense ratio for the | | | | | | |

| six-month period ended 1/31/13† | 0.25% | 1.00% | 1.00% | 0.75% | 0.50% | 0.00% |

|

| |

| 22 | RetirementReady® Funds |

Expense ratios cont.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Putnam Retirement Income Fund Lifestyle 1 | | | | | | |

|

| Net expenses for the fiscal year ended 7/31/12* | 0.97% | 1.72% | 1.72% | 1.22% | 1.22% | 0.72% |

|

| Your fund’s total annual operating expenses for | | | | | | |

| the fiscal year ended 7/31/12 | 1.09% | 1.84% | 1.84% | 1.34% | 1.34% | 0.84% |

|

| Your fund’s annualized expense ratio for the | | | | | | |

| six-month period ended 1/31/13† | 0.25% | 1.00% | 1.00% | 0.50% | 0.50% | 0.00% |

|

Fiscal year expense information in this table is taken from the most recent prospectus, is subject to change, and differs from that shown for the annualized expense ratio and in the financial highlights of this report because it includes fees and expenses of the underlying Putnam mutual funds in which the fund invests. Expenses are shown as a percentage of average net assets.

* Reflects Putnam Management’s decision to contractually limit expenses through 11/30/13.

† Excludes the expense ratios of the underlying Putnam mutual funds.

Expenses per $1,000

The following table shows the expenses you would have paid on a $1,000 investment in the fund from August 1, 2012, to January 31, 2013. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Putnam RetirementReady 2055 Fund | | | | | |

|

| Expenses paid per $1,000*† | $1.33 | $5.32 | $5.32 | $4.00 | $2.66 | $— |

|

| Ending value (after expenses) | $1,117.50 | $1,112.60 | $1,111.80 | $1,113.90 | $1,114.60 | $1,117.30 |

|

| Putnam RetirementReady 2050 Fund | | | | | |

|

| Expenses paid per $1,000*† | $1.33 | $5.32 | $5.32 | $3.99 | $2.66 | $— |

|

| Ending value (after expenses) | $1,115.70 | $1,111.20 | $1,111.10 | $1,112.10 | $1,114.40 | $1,117.10 |

|

| Putnam RetirementReady 2045 Fund | | | | | |

|

| Expenses paid per $1,000*† | $1.33 | $5.31 | $5.31 | $3.99 | $2.66 | $— |

|

| Ending value (after expenses) | $1,111.80 | $1,107.90 | $1,108.00 | $1,109.50 | $1,110.50 | $1,113.40 |

|

| Putnam RetirementReady 2040 Fund | | | | | |

|

| Expenses paid per $1,000*† | $1.33 | $5.30 | $5.30 | $3.98 | $2.65 | $— |

|

| Ending value (after expenses) | $1,107.30 | $1,103.70 | $1,103.20 | $1,104.20 | $1,105.70 | $1,108.80 |

|

| Putnam RetirementReady 2035 Fund | | | | | |

|

| Expenses paid per $1,000*† | $1.32 | $5.28 | $5.28 | $3.96 | $2.64 | $— |

|

| Ending value (after expenses) | $1,097.60 | $1,093.00 | $1,093.50 | $1,095.20 | $1,096.70 | $1,099.30 |

|

| Putnam RetirementReady 2030 Fund | | | | | |

|

| Expenses paid per $1,000*† | $1.31 | $5.24 | $5.24 | $3.93 | $2.62 | $— |

|

| Ending value (after expenses) | $1,083.20 | $1,079.40 | $1,079.30 | $1,080.80 | $1,082.10 | $1,084.60 |

|

| Putnam RetirementReady 2025 Fund | | | | | |

|

| Expenses paid per $1,000*† | $1.30 | $5.20 | $5.20 | $3.90 | $2.60 | $— |

|

| Ending value (after expenses) | $1,066.00 | $1,062.10 | $1,062.30 | $1,063.80 | $1,064.70 | $1,067.70 |

|

| Putnam RetirementReady 2020 Fund | | | | | |

|

| Expenses paid per $1,000*† | $1.29 | $5.16 | $5.16 | $3.87 | $2.58 | $— |

|

| Ending value (after expenses) | $1,049.60 | $1,045.90 | $1,045.40 | $1,047.20 | $1,048.10 | $1,050.90 |

|

| |

| RetirementReady® Funds | 23 |

Expenses per $1,000 cont.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Putnam RetirementReady 2015 Fund | | | | | |

|

| Expenses paid per $1,000*† | $1.28 | $5.12 | $5.12 | $3.85 | $2.57 | $— |

|

| Ending value (after expenses) | $1,036.60 | $1,033.00 | $1,032.60 | $1,034.40 | $1,036.00 | $1,038.50 |

|

| Putnam Retirement Income Fund Lifestyle 1 | | | | | |

|

| Expenses paid per $1,000*† | $1.28 | $5.10 | $5.11 | $2.56 | $2.56 | $— |

|

| Ending value (after expenses) | $1,029.50 | $1,025.10 | $1,025.60 | $1,028.20 | $1,028.30 | $1,030.70 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 1/31/13. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

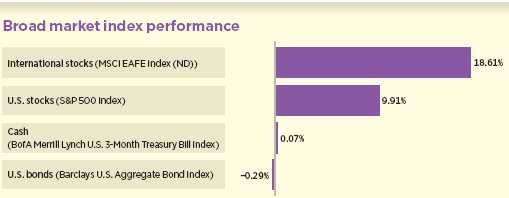

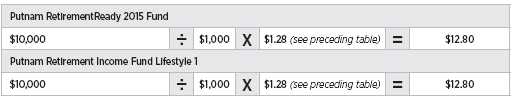

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended January 31, 2013, use the following calculation method. To find the value of your investment on August 1, 2012, call Putnam at 1-800-225-1581.

| |

| 24 | RetirementReady® Funds |

Estimate the expenses you paid cont.

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the following table shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in each of the RetirementReady funds with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Putnam RetirementReady | | | | | | |

| 2055 Fund, 2050 Fund, 2045 Fund | | | | | |

| 2040 Fund, 2035 Fund, 2030 Fund | | | | | |

| 2025 Fund, 2020 Fund, 2015 Fund | | | | | |

|

| Expenses paid per $1,000*† | $1.28 | $5.09 | $5.09 | $3.82 | $2.55 | $— |

|

| Ending value (after expenses) | $1,023.95 | $1,020.16 | $1,020.16 | $1,021.42 | $1,022.68 | $1,025.21 |

|

| Putnam Retirement Income Fund Lifestyle 1 | | | | | |

|

| Expenses paid per $1,000*† | $1.28 | $5.09 | $5.09 | $2.55 | $2.55 | $— |

|

| Ending value (after expenses) | $1,023.95 | $1,020.16 | $1,020.16 | $1,022.68 | $1,022.68 | $1,025.21 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 1/31/13. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

| |

| RetirementReady® Funds | 25 |

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Before sales charge, or net asset value, is the price, or value, of one share of a mutual fund, without a sales charge. Before-sales-charge figures fluctuate with market conditions, and are calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

After sales charge is the price of a mutual fund share plus the maximum sales charge levied at the time of purchase. After-sales-charge performance figures shown here assume the 5.75% maximum sales charge for class A shares and 3.50% for class M shares (4.00% for class A shares and 3.25% for class M shares of Retirement Income Fund Lifestyle 1).

Contingent deferred sales charge (CDSC) is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines over time from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Share classes

Class A shares are generally subject to an initial sales charge and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class B shares are not subject to an initial sales charge. They may be subject to a CDSC.

Class C shares are not subject to an initial sales charge and are subject to a CDSC only if the shares are redeemed during the first year.

Class M shares have a lower initial sales charge and a higher 12b-1 fee than class A shares and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class R shares are not subject to an initial sales charge or CDSC and are available only to certain defined contribution plans.

Class Y shares are not subject to an initial sales charge or CDSC, and carry no 12b-1 fee. They are generally only available to corporate and institutional clients and clients in other approved programs.

Comparative indexes

Barclays U.S. Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

BofA (Bank of America) Merrill Lynch U.S. 3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

MSCI EAFE Index (ND) is an unmanaged index of equity securities from developed countries in Western Europe, the Far East, and Australasia.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Lipper is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

| |

| 26 | RetirementReady® Funds |

Other information for shareholders

Important notice regarding delivery of shareholder documents

In accordance with Securities and Exchange Commission (SEC) regulations, Putnam sends a single copy of annual and semiannual shareholder reports, prospectuses, and proxy statements to Putnam shareholders who share the same address, unless a shareholder requests otherwise. If you prefer to receive your own copy of these documents, please call Putnam at 1-800-225-1581, and Putnam will begin sending individual copies within 30 days.

Proxy voting