TABLE OF CONTENTS

| Centaur Total Return Fund | |

| Shareholder Letter | 1 |

| Performance Update | 5 |

| Disclosure of Fund Expenses | 6 |

| Schedule of Investments | 7 |

| Statement of Assets and Liabilities | 10 |

| Statement of Operations | 11 |

| Statements of Changes in Net Assets | 12 |

| Financial Highlights | 13 |

| Notes to Financial Statements | 14 |

| Additional Information | 20 |

Statements in this Semi-Annual Report that reflect projections or expectations of future financial or economic performance of the Fund and of the market in general and statements of the Fund’s plans and objectives for future operations are forward-looking statements. No assurance can be given that actual results or events will not differ materially from those projected, estimated, assumed or anticipated in any such forward-looking statements. Important factors that could result in such differences, in addition to the other factors noted with such forward-looking statements, include, without limitation, general economic conditions such as inflation, recession and interest rates. Past performance is not a guarantee of future results.

Investment in the Fund is subject to investment risks, including the possible loss of some or all of the principal amount invested. There can be no assurance that the Fund will be successful in meeting its investment objective. Generally, the Fund will be subject to the following additional risks: market risk, management style risk, sector focus risk, foreign securities risk, non-diversified fund risk, credit risk, interest rate risk, maturity risk, investment grade securities risk, junk bonds or lower-rated securities risk, derivative instruments risk, valuation risk for non-exchange traded options, risk from writing call options, real estate securities risk, MLP risk, Royalty Trust risk, Risks Related to other equity securities, and portfolio turnover risk. More information about these risks and other risks can be found in the Fund’s prospectus and statement of additional information. When the Fund sells covered call options, the Fund gives up additional appreciation in the stock above the strike price since there is the obligation to sell the stock at the covered call option’s strike price.

The performance information quoted in this Semi-Annual Report represents past performance, which is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. An investor may obtain performance data current to the most recent month-end by visiting www.centaurmutualfunds.com.

An investor should consider the investment objectives, risks, and charges and expenses of the Fund carefully before investing. The prospectus contains this and other information about the Fund. A copy of the prospectus is available at www.centaurmutualfunds.com or by calling Shareholder Services at (1-888-484-5766). The prospectus should be read carefully before investing.

| Centaur Total Return Fund | Shareholder Letter |

April 30, 2016 (Unaudited)

Dear Centaur Total Return Fund Investors:

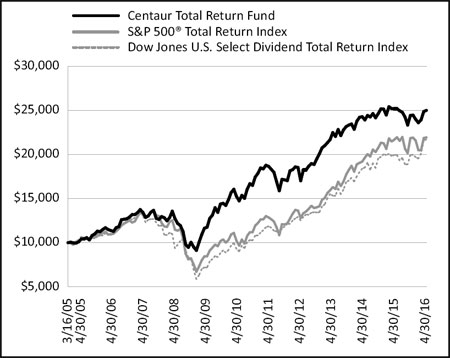

The Fund produced a return of -0.72% for the year ending April 30, 2016. This compares to the S&P 500® Total Return Index, which returned 1.21%, and the Dow Jones U.S. Select Dividend Total Return Index, which returned 8.85% for the same period.

For the five-year period ending April 30, 2016, the Fund returned 5.90% annualized, while the S&P 500® Total Return Index and the Dow Jones U.S. Select Dividend Total Return Index have returned 11.02% and 13.06% annualized, respectively.

For the ten-year period ending April 30, 2016, the Fund returned 7.89% annualized while the S&P 500® Total Return Index and the Dow Jones U.S. Select Dividend Total Return Index have returned 6.91% and 6.96% annualized, respectively.

The table below shows the Fund’s performance and that of the two comparison indices across various time periods:

(For the Fund’s most up-to-date performance information, please see our web site at www.centaurmutualfunds.com.)

Performance as of April 30, 2016 Average Annual Total Returns | Past 1 Year | Past 5 Years | Past 10 Years | Since Inception* |

| Centaur Total Return Fund | -0.72% | 5.90% | 7.89% | 8.59% |

S&P 500® Total Return Index | 1.21% | 11.02% | 6.91% | 7.32% |

| Dow Jones U.S. Select Dividend Total Return Index | 8.85% | 13.06% | 6.96% | 7.22% |

Performance shown is for the period ended April 30, 2016. The performance data quoted above represents past performance, which is not a guarantee of future results. Investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain more current performance data regarding the Fund, including performance data current to the Fund’s most recent month-end, please visit www.centaurmutualfunds.com. Prior to February 28, 2016, a 2% redemption fee was charged upon redemption of the Fund's shares occurring within one year of the issuance of such shares. As of February 28, 2016, the Fund no longer charges a redemption fee. The performance data quoted above does not reflect the deduction of the redemption fee and if reflected, the redemption fee would reduce the performance quoted.

The S&P 500® Total Return Index is the Standard & Poor’s composite index of 500 stocks a widely recognized index of common stock prices.

The Dow Jones U.S. Select Dividend Total Return Index is an index of 100 dividend-paying stocks selected according to a methodology developed and administered by Dow Jones & Co. It is not possible to invest in indices (like the S&P 500® Total Return Index and the U.S. Select Dividend Total Return Index) that are unmanaged and do not incur fees and charges.

| * | The Fund’s inception date is March 16, 2005. |

Total Annual Operating Expenses

| | Net Expense Ratio** | Gross Expense Ratio*** |

| Centaur Total Return Fund | 2.09% | 2.58% |

| ** | The net expense ratio reflects a contractual expense limitation that continues through February 28, 2017. Thereafter, the expense limitation may be changed or terminated at any time. Performance would have been lower without this expense limitation. The Net Expense Ratio above does not correlate to the ratio of total expenses provided in the Financial Highlights table of the Fund’s Annual Report for the year ended October 31, 2015, as the Financial Highlights table does not include Acquired Fund Fees and Expenses. |

| *** | Gross expense ratio is from the Fund's prospectus dated February 28, 2016. |

| Semi-Annual Report | April 30, 2016 | 1 |

| Centaur Total Return Fund | Notes to Financial Statements |

April 30, 2016 (Unaudited)

1. ORGANIZATION

The Centaur Total Return Fund (the “Fund”), is an active investment portfolio of The Centaur Mutual Funds Trust, (the “Trust”) which is organized as a Delaware statutory trust and is registered under the Investment Company Act of 1940 (the “1940 Act”), as amended, as an open-ended management investment company. The Fund is classified as non-diversified as defined in the 1940 Act.

The Fund commenced operations on March 16, 2005. The investment objective of the Fund is to seek maximum total return through a combination of capital appreciation and current income. The Fund invests in companies that Centaur Capital Partners, L.P. (the “Advisor”) believes to be undervalued in their respective markets, but which also offer high dividend yields relative to the average yields of the broad market.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund. The policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Fund is considered an investment company for financial reporting purposes under GAAP.

Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in the net assets from operations during the reported period. Actual results could differ from those estimates.

Investment Valuation

The Fund’s investments in securities are carried at fair value. Securities listed on an exchange or quoted on a national market system are valued at the last sales price as of 4:00 p.m. Eastern Time. Securities traded in the NASDAQ over-the-counter market are generally valued at the NASDAQ Official Closing Price. Other securities traded in the over-the-counter market and listed securities for which no sale was reported on that date are valued at the most recent bid price. Securities and assets for which representative market quotations are not readily available or which cannot be accurately valued using the Fund’s normal pricing procedures are valued at fair value as determined in good faith under policies approved by the Trustees. Fair value pricing may be used, for example, in situations where (i) a portfolio security is so thinly traded that there have been no transactions for that security over an extended period of time; (ii) the exchange on which the portfolio security is principally traded closes early; or (iii) trading of the portfolio security is halted during the day and does not resume prior to the Fund’s net asset value calculation. A portfolio security’s “fair value” price may differ from the price next available for that portfolio security using the Fund’s normal pricing procedures. Instruments with maturities of 60 days or less are valued at amortized cost, which approximates market value.

Option Valuation

Exchange-listed options are valued at their last quoted sales price as reported on their primary exchange as of 4:00 p.m. Eastern Time (the “Valuation Time”). For purposes of determining the primary exchange for each exchange-traded portfolio option the following shall apply: (i) if the option is traded on the Chicago Board Options Exchange (“CBOE”), the CBOE shall be considered the primary exchange for such option, unless the Advisor instructs the Administrator in writing to use a different exchange as the primary exchange for such option; and (ii) if the option does not trade on the CBOE, the Advisor shall instruct the Administrator in writing as to the primary exchange for such option. Unlisted options for which market quotations are readily available are valued at the last quoted sales price at the Valuation Time. If an option is not traded on the valuation date, the option shall be priced at the mean of the last quoted bid and ask prices as of the Valuation Time. An option may be valued using Fair Valuation when (i) the option does not trade on the valuation date; and (ii) reliable last quoted bid and ask prices as of the Valuation Time are not readily available.

Fair Value Measurement

GAAP establishes a framework for measuring fair value and expands disclosure about fair value measurements. Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

| Level 1 – | Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; |

| Level 2 – | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

| Level 3 – | Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

| 14 | www.centaurmutualfunds.com |

| Centaur Total Return Fund | Notes to Financial Statements |

April 30, 2016 (Unaudited)

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

An investment asset’s or liability’s level within the fair value hierarchy is based on the lowest level input, individually or in the aggregate, that is significant to fair value measurement.

The valuation techniques used by the Fund to measure fair value during the six months ended April 30, 2016 maximized the use of observable inputs and minimized the use of unobservable inputs.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following is a summary of the inputs used in valuing the Fund’s assets and liabilities as of April 30, 2016:

| Centaur Total Return Fund | | | | | | | | | | | | |

| Investments in Securities at Value | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Assets | | | | | | | | | | | | |

| Common Stocks | | $ | 12,398,776 | | | $ | – | | | $ | – | | | $ | 12,398,776 | |

| Closed End Funds | | | 549,100 | | | | – | | | | – | | | | 549,100 | |

| Exchange Traded Funds | | | 509,400 | | | | – | | | | – | | | | 509,400 | |

| Convertible Corporate Bonds | | | – | | | | 526,312 | | | | – | | | | 526,312 | |

| Warrants | | | 1,095,900 | | | | – | | | | – | | | | 1,095,900 | |

| Short Term Investment | | | 11,611,882 | | | | – | | | | – | | | | 11,611,882 | |

| Total | | $ | 26,165,058 | | | $ | 526,312 | | | $ | – | | | $ | 26,691,370 | |

| Other Financial Instruments | | | | | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | | | | | |

| Written Options | | $ | (131,820 | ) | | $ | – | | | $ | – | | | $ | (131,820 | ) |

| Total | | $ | (131,820 | ) | | $ | – | | | $ | – | | | $ | (131,820 | ) |

For the six months ended April 30, 2016, there have been no significant changes to the Fund’s fair value methodologies. The Fund recognizes transfers between levels as of the end of the annual period in which the transfer occurred. During the six months ended April 30, 2016, there were no transfers between Level 1, Level 2 and Level 3 for the Fund.

For the six months ended April 30, 2016, the Fund did not have investments with significant unobservable inputs (Level 3) used in determining fair value.

Underlying Investment In Other Investment Companies

The Fund currently seeks to achieve its investment objectives by investing a portion of its assets in Fidelity Institutional Money Market Fund. The Fund may redeem its investment from the Fidelity Institutional Money Market Fund at any time if the Advisor determines that it is in the best interest of the Fund and its shareholders to do so.

The performance of the Fund may be directly affected by the performance of the Fidelity Institutional Money Market Fund. The financial statements of the Fidelity Institutional Money Market Fund, a series of the Fidelity Funds, including the portfolio of investments, are included in the Fidelity Institutional Money Market Fund’s NCSR filing dated May 31, 2016, available at www.sec.gov or can be found at www.fidelity.com and should be read in conjunction with the Fund’s financial statements. As of April 30, 2016, the percentage of net assets invested in the Fidelity Institutional Money Market Fund was 42.97%.

Derivative Financial Instruments

The following discloses the Fund’s use of derivative instruments:

The Fund’s investment objective not only permits the Fund to purchase investment securities, it also allows the Fund to enter into various types of derivative contracts such as purchased and written options. In doing so, the Fund will employ strategies in differing combinations to permit it to increase, decrease, or change the level or types of exposure to market factors. Central to those strategies are features inherent to derivatives that make them more attractive for this purpose than equity or debt securities; they require little or no initial cash investment, they can focus exposure on only certain selected risk factors, and they may not require the ultimate receipt or delivery of the underlying security (or securities) to the contract. This may allow the Fund to pursue its objectives more quickly and efficiently than if it were to make direct purchases or sales of securities capable of affecting a similar response to market factors.

| Semi-Annual Report | April 30, 2016 | 15 |

| Centaur Total Return Fund | Notes to Financial Statements |

April 30, 2016 (Unaudited)

Market Risk Factors: In pursuit of the investment objectives, the Fund may seek to use derivatives to increase or decrease its exposure to the following market risk factors:

Equity Risk: Equity risk relates to the change in value of equity securities as they relate to increases or decreases in the general market.

Foreign Exchange Rate Risk: Foreign exchange rate risk relates to the change in the U.S. dollar value of a security held that is denominated in a foreign currency. The value of a foreign currency denominated security will decrease as the dollar appreciates against the currency, while the value of the foreign currency denominated security will increase as the dollar depreciates against the currency.

Risk of Investing in Derivatives

The Fund’s use of derivatives can result in losses due to unanticipated changes in the market risk factors and the overall market.

Derivatives may have little or no initial cash investment relative to their market value exposure and therefore can produce significant gains or losses in excess of their cost. This use of embedded leverage allows the Fund to increase its market value exposure relative to its net assets and can substantially increase the volatility of the Fund’s performance.

Additional associated risks from investing in derivatives also exist and potentially could have significant effects on the valuation of the derivatives and the Fund. Typically, the associated risks are not the risks that the Fund is attempting to increase or decrease exposure to, per the investment objectives, but are the additional risks from investing in derivatives.

One example of these associated risks is liquidity risk, which is the risk that the Fund will not be able to sell the derivative in the open market in a timely manner, and counterparty credit risk, which is the risk that the counterparty will not fulfill its obligation to the Fund.

Option Writing/Purchasing

The Fund may write or purchase option contracts to adjust risk and return of its overall investment positions. When the Fund writes or purchases an option, an amount equal to the premium received or paid by the Fund is recorded as a liability or an asset and is subsequently adjusted to the current market value of the option written or purchased. Premiums received or paid from writing or purchasing options that expire unexercised are treated by the Fund on the expiration date as realized gains or losses. The difference between the premium and the amount paid or received on affecting a closing purchase or sale transaction, including brokerage commissions, is also treated as a realized gain or loss. If an option is exercised, the premium paid or received is added to or subtracted from the cost of the purchase or proceeds from the sale in determining whether the Fund has realized a gain or loss on investment transactions. Risks from entering into option transactions arise from the potential inability of counterparties to meet the terms of the contracts, the potential inability to enter into closing transactions because of an illiquid secondary market and from unexpected movements in security values. Written option activity for the fiscal six months ended April 30, 2016 was as follows:

Centaur Total Return Fund

| Option Contracts Written for the six months ended April 30, 2016 | | Contracts | | | Premiums Received | |

| Options Outstanding, Beginning of Year | | | 286 | | | $ | 91,625 | |

| Options written | | | 885 | | | | 153,947 | |

| Options closed | | | (526 | ) | | | (148,507 | ) |

| Options Outstanding, End of the Year | | | 645 | | | $ | 97,065 | |

Statement of Assets and Liabilities – Fair Value of Derivative Instruments as of April 30, 2016:

| Risk Exposure | | Asset Derivatives Statement of Assets and Liabilities Location | | | Fair Value | | | Liability Derivatives Statement of Assets and Liabilities Location | | | Fair Value | |

| Equity Contracts (Warrants) | | Investments, at Value | | | $ | 1,095,900 | | | N/A | | | | N/A | |

| Equity Contracts (Written Options Contracts) | | N/A | | | | N/A | | | Call options written, at value | | | $ | 131,820 | |

| | | | | | $ | 1,095,900 | | | | | | $ | 131,820 | |

| 16 | www.centaurmutualfunds.com |

| Centaur Total Return Fund | Notes to Financial Statements |

April 30, 2016 (Unaudited)

The effect of derivative instruments on the Statement of Operations for the six months ended April 30, 2016:

| Risk Exposure | Statement of Operations Location | | Realized Gain on Derivatives Recognized in Income | | | Change in Unrealized Appreciation (Depreciation) on Derivatives Recognized in Income | |

Equity Contracts

(Warrants) | Net realized gain (loss) from: Investments/Change in unrealized appreciation (depreciation) on: Investments | | $ | 186,250 | | | $ | 26,978 | |

Equity Contracts

(Purchased Options Contracts) | Net realized gain (loss) from: Investments/Change in unrealized appreciation (depreciation) on: Investments | | | 18,443 | | | | – | |

Equity Contracts

(Written Options Contracts) | Net realized gain (loss) from: Written options/Change in unrealized appreciation (deprecation) on: Written options | | | (312 | ) | | | 13,600 | |

| Total | | | $ | 204,381 | | | $ | 40,578 | |

Volume of Derivative Instruments for the Fund during the six months ended April 30, 2016 was as follows:

| Derivative Type | Unit of Measurement | Monthly Average |

| Written Option Contracts | Contracts | (517) |

Foreign Currency Translation

Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based on the exchange rate of such currencies against U.S. dollars on the date of valuation. Purchases and sales of securities and income items denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date. The Fund does not separately report the effect of changes in foreign exchange rates from changes in market prices on securities held. Such changes are included in net realized and unrealized gain or loss from investments.

Realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions and the difference between the recorded amounts of dividends, interest, and foreign withholding taxes, and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in foreign exchange rates on foreign denominated assets and liabilities other than investments in securities held at the end of the reporting period.

Investment Transactions and Investment Income

Investment transactions are accounted for as of the date purchased or sold (trade date). Dividend income is recorded on the ex-dividend date. Certain dividends from foreign securities will be recorded as soon as the Fund is informed of the dividend if such information is obtained subsequent to the ex-dividend date. Interest income is recorded on the accrual basis and includes amortization of discounts and premiums. Gains and losses are determined on the identified cost basis, which is the same basis used for federal income tax purposes.

Expenses

The Fund bears expenses incurred specifically for the Fund and general Trust expenses.

Dividend Distributions

The Fund may declare and distribute dividends from net investment income (if any) at the end of each calendar quarter. Distributions from capital gains (if any) are generally declared and distributed annually. Dividends and distributions to shareholders are recorded on ex-date.

Fees on Redemptions

The Fund previously charged a redemption fee of 2.00% on redemptions of Fund’s shares occurring within one year following the issuance of such shares. The redemption fee was not a fee to finance sales or sales promotion expenses, but was paid to the Fund to defray the costs of liquidating an investor and discouraging short-term trading of the Fund’s shares. No redemption fee was imposed on the redemption of shares representing dividends or capital gains distributions, or on amounts representing capital appreciation of shares. The redemption fees charged for the six months ended April 30, 2016 were $2,212. As of February 28, 2016, the Fund no longer charges a redemption fee.

Warrants

The Fund may invest in warrants. The Fund may purchase warrants issued by domestic and foreign companies to purchase newly created equity securities consisting of common and/or preferred stock. Warrants are derivatives that give the holder the right, but not the obligation to purchase equity issues of the company issuing the warrants, or a related company, at a fixed price either on a date certain or during a set period. The equity security underlying a warrant is authorized at the time the warrant is issued or is issued together with the warrant.

| Semi-Annual Report | April 30, 2016 | 17 |

| Centaur Total Return Fund | Notes to Financial Statements |

April 30, 2016 (Unaudited)

Investing in warrants can provide a greater potential for profit or loss than an equivalent investment in the underlying security, and, thus, can be a speculative investment. At the time of issue, the cost of a warrant is substantially less than the cost of the underlying security itself, and price movements in the underlying security are generally magnified in the price movements of the warrant. This leveraging effect enables the investor to gain exposure to the underlying security with a relatively low capital investment.

This leveraging increases an investor’s risk; however, in the event of a decline in the value of the underlying security, a complete loss of the amount invested in the warrant may result. In addition, the price of a warrant tends to be more volatile than, and may not correlate exactly to, the price of the underlying security. If the market price of the underlying security is below the exercise price of the warrant on its expiration date, the warrant will generally expire without value. The value of a warrant may decline because of a decline in the value of the underlying security, the passage of time, changes in interest rates or in the dividend or other policies of the company whose equity underlies the warrant or a change in the perception as to the future price of the underlying security, or any combination thereof. Warrants generally pay no dividends and confer no voting or other rights other than to purchase the underlying security.

Federal Income Taxes

As of and during the year ended October 31, 2015, the Fund did not have a liability for any unrecognized tax benefits. The Fund files U.S. federal, state, and local tax returns as required. The Fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations which is generally three years after the filing of the tax return. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

The Fund’s policy is to continue to comply with the requirements of the Internal Revenue Code that are applicable to regulated investment companies and to distribute all its taxable income to its shareholders. The Fund also intends to distribute sufficient net investment income and net capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. Therefore, no federal income tax or excise tax provision is required.

3. TRANSACTIONS WITH AFFILIATES

Advisor

Centaur Capital Partners, L.P. is the Fund’s investment advisor (the “Advisor”). The Fund pays the Advisor a monthly fee based upon the average daily net assets of the Fund and calculated at an annual rate of 1.50%. For the six months ended April 30, 2016, the Advisor earned advisory fees of $208,129.

The Advisor entered into a contractual agreement (“Expense Limit Agreement”) with the Fund through February 28, 2017, to waive a portion of its advisory fee and to reimburse the Fund for other expenses to the extent necessary so that the total expenses incurred by the Fund (exclusive of interest, taxes, brokerage commissions, other expenditures which are capitalized in accordance with GAAP, other extraordinary expenses, dividend expense on securities sold short, “acquired fund fees and expenses” and 12b-1 fees) do not exceed 1.95% of the average daily net assets of the Fund. For the six months ended April 30, 2016, the Advisor waived/reimbursed expenses in the amount of $110,643.

Administrator

ALPS Fund Services, Inc. (“ALPS” or the “Administrator”) serves as the Trust’s administrator pursuant to an Administration, Bookkeeping and Pricing Services Agreement (“Administration Agreement”) with the Trust which became effective as of September 30, 2011. The Administrator is also reimbursed by the Trust for certain out-of-pocket expenses.

Compliance Services

ALPS provides services which assist the Trust’s Chief Compliance Officer in monitoring and testing the policies and procedures of the Trust in conjunction with requirements under Rule 38a-1 under the 1940 Act. ALPS is compensated under the Administration Agreement for these services.

Transfer Agent

ALPS serves as transfer, dividend paying, and shareholder servicing agent for the Fund. ALPS is compensated based upon an annual base fee. The Transfer Agent is also reimbursed by the Fund for certain out-of-pocket expenses.

Distributor

ALPS Distributors, Inc. (the “Distributor”) serves as the Fund’s distributor. The Distributor acts as an agent for the Fund and the distributor of its shares.

Certain officers of the Trust are also officers of the Advisor, the Distributor or the Administrator.

| 18 | www.centaurmutualfunds.com |

| Centaur Total Return Fund | Notes to Financial Statements |

April 30, 2016 (Unaudited)

4. PURCHASES AND SALES OF INVESTMENT SECURITIES

The aggregate cost of purchases and proceeds from sales of investment securities, excluding short-term securities, are $12,340,287 and $18,828,927, respectively, for the six months ended April 30, 2016.

5. FEDERAL INCOME TAXES

Distributions are determined in accordance with Federal income tax regulations, which differ from GAAP, and, therefore, may differ significantly in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences.

Management has reviewed the Fund’s tax positions to be taken on federal income tax returns for the open tax years of 2012, 2013 and 2014, and as of and during the fiscal year ended October 31, 2015, and has determined that the Fund does not have a liability for uncertain tax positions. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the year, the Fund did not incur any interest or penalties.

Permanent differences in book and tax accounting were reclassified. Those reclassifications relate primarily to differing book/tax treatment of net operating loss, gain on the sale of PFIC securities, foreign currency transactions, and other certain investments. For the fiscal year ended April 30, 2016, the following reclassifications, which had no impact on results of operations or net assets, were recorded to reflect tax character:

Distributions paid during the fiscal years ended October 31, were characterized for tax purposes as follows:

| | For the fiscal year ended | | Ordinary Income | | | Long-Term Capital Gain | |

| Centaur Total Return Fund | 10/31/2015 | | $ | 2,532,429 | | | $ | 728,643 | |

| Centaur Total Return Fund | 10/31/2014 | | | 8,833,048 | | | | 2,302,171 | |

As of April 30, 2016, the aggregate cost of investments, gross unrealized appreciation and net unrealized depreciation for Federal tax purposes was as follows:

| | | Cost of Investments for Income Tax Purposes | | | Gross Unrealized Appreciation | | | Gross Unrealized Depreciation | | | Net Unrealized Appreciation | |

| Centaur Total Return Fund | | $ | 25,420,507 | | | $ | 1,695,885 | | | $ | (425,022 | ) | | $ | 1,270,863 | |

The difference between book basis and tax basis net unrealized appreciation/(depreciation) is attributable to the deferral of losses from wash sales, and the mark to market of passive foreign investment companies.

6. COMMITMENTS AND CONTINGENCIES

Under the Trust’s organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Trust entered into contracts with its service providers, on behalf of the Fund, and others that provide for general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund. The Fund expects the risk of loss to be remote.

7. TRUSTEE COMPENSATION

As of April 30, 2016 there were two Trustees, both of whom are not “interested persons” (as defined in the 1940 Act) of the Trust (the “Independent Trustees”). Each of the Independent Trustees receives a fee of $2,000 each year plus $500 per series of the Trust per meeting attended in person and $200 per series of the Trust per meeting attended by telephone. The officers of the Trust will not receive compensation from the Trust for performing the duties of their offices. All Trustees and officers are reimbursed for any out-of-pocket expenses incurred in connection with attendance at meetings.

| Semi-Annual Report | April 30, 2016 | 19 |

| Centaur Total Return Fund | Additional Information |

April 30, 2016 (Unaudited)

1. PROXY VOTING POLICIES AND VOTING RECORD

A copy of the Trust’s Proxy Voting and Disclosure Policy and the Advisor’s Proxy Voting and Disclosure Policy are included as Appendix B to the Fund’s Statement of Additional Information and are available, (1) without charge, upon request, by calling (1-888-484-5766) and (2) on the SEC’s website at http://ww.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 will be available (1) without charge, upon request, by calling the Fund at the number above and (2) on the SEC’s website at http://www.sec.gov.

2. QUARTERLY PORTFOLIO HOLDINGS

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the SEC’s website at http://www.sec.gov. You may review and make copies at the SEC’s Public Reference Room in Washington, D.C. You may also obtain copies after paying a duplicating fee by writing the SEC’s Public Reference Section, Washington, D.C. 20549-0102 or by electronic request to publicinfo@sec.gov, or is available without charge, upon request, by calling the Fund at 1-888-484-5766. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330, (1-800-732-0330).

| 20 | www.centaurmutualfunds.com |