UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21606

Centaur Mutual Funds Trust

(Exact name of registrant as specified in charter)

470 Park Avenue South, 9th Floor

New York, NY 10016

(Address of principal executive offices) (Zip code)

Ultimus Fund Solutions, LLC

Attn: Zachary P. Richmond

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-513-587-3400

Date of fiscal year end: October 31

Date of reporting period: April 30, 2021

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| |

| |

| |

| |

| |

| |

| |

|

| |

| |

| |

| |

| |

| |

| DCM/INNOVA HIGH EQUITY INCOME INNOVATION FUND |

| |

| |

| |

| |

| |

| |

| LEBENTHAL ULTRA SHORT TAX-FREE INCOME FUND |

| |

| |

| |

| |

| |

| |

| |

| |

| SEMI-ANNUAL REPORT |

| April 30, 2021 |

| Centaur Mutual Funds Trust |

| Message from the Chief Executive Officer |

| April 30, 2021 (Unaudited) |

We have to do more.

That is the message I give to the talented team of portfolio managers and analysts at DCM Advisors.

We have to do more for investors in terms of income generation. We have to do more in terms of tax-savvy facets within our portfolios. And to their credit, the team has responded and risen to the call to action.

Just yesterday I glanced at the 7-day yield of our Lebenthal Ultra Short Tax-Free Income Fund and noticed it was well in excess of my expectations. (As many of you may know, I keep my family’s cash in the Fund.)

Similarly, at a Board of Trustees meeting earlier this year, we looked at a list of Morningstar’s funds in the Large Cap Blend universe ranked by Trailing Twelve Month (TTM) Yield. S&P 500 funds and ETFs fall into this category and our solution in this space (the DCM/INNOVA High Equity Income Innovation Fund) specifically endeavors to have a low tracking error with the S&P 500 (“hugs” the S&P 500, if you will.) The average fund in this category produced a TTM yield of less than 1.5% which is no surprise—the S&P 500 as of the end of this Semi-Annual reporting period (April 30, 2021) produced a TTM yield of 1.4%. Once again, our solution in this space generates a TTM yield well in excess of the funds on that list. And when I say well in excess, I am referring to an amount that is greater than 4 times in size, 6.70%.

So, our investment team has risen to the occasion of doing more for shareholders in terms of producing income. And they are not resting on their laurels. The spirit of this team is one of constantly searching for ways to manage risk and deliver more for shareholders. Each morning I watch Gregory Serbe, the Portfolio manager of the Lebenthal Ultra Short Tax-Free Income Fund, scour the current offerings for solid, investment-grade municipal securities that offer excess yield versus recent market transactions. He is patient but more so, he is persistent and relentless in his quest for undervalued jewels for the Lebenthal Ultra Short Tax-Free Income Fund. No easy feat in an environment many have described as anemic as far as yield: somehow roughly 50 years of experience in municipals has been a friend to patience and sharpened his abilities to know where to “hunt”, what to avoid and what to scoop up for our Lebenthal Ultra Short Tax-Free Income Fund shareholders. Hence, this is not a case of “the early bird gets the worm” but more “the eagle patiently stalks and knows precisely when to strike.”

And the investment team working with Dr. Vijay Chopra, the Portfolio manager of the DCM/INNOVA High Equity Income Innovation Fund, did not rest on their laurels having produced a TTM Yield of 6.70%2 for shareholders of the DCM/INNOVA High Equity Income Innovation Fund. In the spirit of “doing more for shareholders”, they

| Semi-Annual Report | April 30, 2021 | 1 |

| Centaur Mutual Funds Trust |

| Message from the Chief Executive Officer |

| April 30, 2021 (Unaudited) |

produced something nobody saw but shareholders (like myself) appreciated greatly: they produced zero capital gains distributions in December at calendar year-end. Zero. This despite having produced very attractive double-digit total returns for the calendar year 2020 (+12.78%). Shareholders of equity income funds and S&P 500 ETFs generally find capital gains distributions a detracting element, especially when a shareholder is “inheriting” existing capital gains. I am in this camp and I worked with the team to develop a program that actively harvests losses throughout the year to offset gains. I felt we could do more for shareholders in the area of tax efficiency. And the team has done just that.

And we’re far from done seeking ways to do more for our shareholders, of which I am one.

Our portfolio managers took the weekend, away from the markets, to step back and write about what transpired during the November 1 to April 30 reporting period. You will read about many factors affecting the markets—inflation, tax proposals, vaccines, growth rates and interest rates—and you will hopefully get a sense of what I have come to know and love about them: steady, experienced hands, clear thinking, and consistent execution of a successful process.

Thank you for your trust and the opportunity to apply our talents to produce attractive investment returns for you. We’d like to do more.

Marc Rappaport

Chief Executive Officer

DCM Advisors

| 1 | Source: Charles Schwab Asset Management Money Fund Yields https://www.schwabassetmanagement.com/products/money-fund-yields |

| DCM/INNOVA High Equity Income Innovation Fund |

| Letter from the Portfolio Manager |

| April 30, 2021 (Unaudited) |

The DCM/INNOVA High Equity Income Innovation Fund’s (the “Fund’s”) first fiscal half year which ended on April 30, 2021 reaped the benefits of the resolution of two main sources of uncertainty that were hanging over the economy and financial markets in 2020. The first was the outcome of the US Presidential elections and the second was the outlook for the containment of the COVID-19 pandemic.

The US Presidential elections were too close to call heading into the polls on November 3rd, 2020. The market also feared that election results might not be known for weeks after the election and this would be an overhang on the economy and financial markets. One prevailing narrative was that if President Trump lost the election, the stock market would tank. A Democratic “sweep” would lead to less investor-friendly policies such as increased regulation and corporate taxation. The opposing narrative was that a Vice President Joe Biden victory would lead to additional fiscal stimulus through more generous unemployment benefits and perhaps a large infrastructure package. That would lead to a stronger economy in the short run.

The election uncertainty was resolved within a few days of the election with Joe Biden becoming the next President. More importantly, the outcome did not result in the strong Democratic dominance in the House and Senate with which the market had been concerned. (Democrats lost seats in the House and did not improve their position in the Senate to the extent legislation could “sail through”.) With the clouds of political uncertainty lifted, the focus shifted to earnings and vaccine advancements helping to “reopen” an economy in which analysts were revising growth expectations higher. Both earnings and vaccine news were strong, and the market rallied over the fiscal half year with the Fund returning 26.99% for the six months ended April 30, 2021.

The release of strongly positive test results for the Pfizer-BioNTech vaccine (showing an over 90% efficacy) on November 9, 2020 lit a fire under equity returns. There was a huge rotation in equities from high-valuation, mega-cap technology stocks into beaten-down energy, financials, and travel-related stocks and the Fund kept up with many of these sector and factor shifts. The FDA approved the Pfizer-BioNTech vaccine on December 11 and the Moderna vaccine on December 18, 2020. Earnings estimates for the fourth quarter of 2020 and the first quarter of 2021 were revised upwards strongly. Sales were recovering and forward guidance for the fourth quarter and 2021 was revised upward by many companies. The Fund kept up with the S&P index in its second fiscal quarter ending on April 30, 2021 with total returns of 12.92% compared with the S&P index returns of 12.98%.

After Growth outperformed Value for over 13 years (since 2007), Value came back into favor starting in late August 2020. Value outperformed Growth over the Fund’s fiscal half year, with the Russell 1000 Value index returning 36.3% compared with the 24.3%

| Semi-Annual Report | April 30, 2021 | 3 |

| DCM/INNOVA High Equity Income Innovation Fund |

| Letter from the Portfolio Manager |

| April 30, 2021 (Unaudited) |

returns of the Russell Growth index. This 12% outperformance of Value over Growth followed an underperformance of 36.8% over the Fund’s previous fiscal year ending on October 31, 2020.

The best performing sectors over the fiscal half year were Energy, Financials, Industrials and Materials which were up 75.9%, 53.4%, 35.4% and 32.6%. Defensive sectors such as Utilities, Consumer Staples and Health Care lagged the market with returns of 8.8%, 13.1% and 20.3%. Many of the mega-cap Technology, Media and Telecom stocks that had powered the market since the end of 2019 took a breather over the Fund’s first fiscal half year.

While equities rallied strongly, bonds suffered as 10-year Government bond yields rose from 88 basis points to 163 basis points over the course of the Fund’s fiscal first half year. Inflation expectations also picked up with the 10-year breakeven inflation rates going from 1.7% to 2.4%. The Fed continued with its relaxed stance towards inflation under the belief that the pickup in inflation is transitory.

Anticipating the growth in the economy as the election and vaccine-related uncertainty diminished, we positioned the portfolio away from expensive growth stocks towards beaten down value stocks in cyclical sectors. In mid-October, we trimmed our position in Alphabet, Electronic Arts and Amazon and added Caterpillar, Discover Financial Services and General Motors. In mid-November, we added Financials such as Regions Financial Corp, Truist Financial Corp, and Jefferies Financial Group. We also added Disney which we expected to do well as the economy reopened and pent-up demand for travel resumed. In late February 2021 we trimmed Amazon and Facebook and added Honeywell, HCA Healthcare and Methode Electronics.

The Fund’s overweights in Industrials, Materials, Energy and Financials contributed positively to performance. However, the Fund’s stock selection within Health Care, Information Technology and Energy detracted from performance.

We continue to be encouraged by the results of our innovative dividend income process for the quarter. The Fund pays dividends on a monthly basis and the payout over the fiscal first half year corresponds to an annual net dividend yield of 5.5%. The Fund has a trailing 12-month net yield of 6.7% as of the end of April 2021.

| DCM/INNOVA High Equity Income Innovation Fund |

| Letter from the Portfolio Manager |

| April 30, 2021 (Unaudited) |

Current positioning

The Fund held 86 equity securities diversified across sectors as of April 30, 2021, and the top five equity holdings as of the end of this period were Alphabet, Apple, Microsoft, Dow and Qorvo. The Fund has overweight positions relative to the S&P 500 index in Industrials, Materials, Financials and Energy, and underweight positions in Health Care, Consumer Discretionary, Information Technology and Consumer Staples sectors.

The forecast PE ratio of the Fund of 15.4x is well below that of the S&P index at 21.4x. The Price-to-Book ratio of companies in the Fund is 2.5x; much lower than the 4.5x value for the S&P index reflecting its weighting in value-oriented stocks.

We believe that the Fund is appropriately positioned to perform in-line with the S&P 500, while the income it generates (yield) is expected to exceed the benchmark. We are very positive on the outlook for dividend income generation heading into the fiscal second quarter.

Vijay Chopra, PhD, CFA

Senior Portfolio Manager

| Semi-Annual Report | April 30, 2021 | 5 |

| Lebenthal Ultra Short Tax-Free Income Fund |

| Letter from the Portfolio Manager |

| April 30, 2021 (Unaudited) |

In our last report, we described the impact that COVID-19 had not only on the municipal bond market, but on all of us. Now, three months later, while we cannot say that everything has returned to a pre-pandemic state, with the growing availability of various vaccines, there are many positive signs of hope going forward. With that as a backdrop, what were the other themes that dominated these six months? While the tumultuous political environment captured headlines on both sides of the political spectrum, the fiscal impact of COVID-19 had influence on the attitudes, concerns, and expectations of the direction of the economy.

| 1.) | The Background. In March of 2020, with the explosive growth of the virus, the Fed dropped short term taxable rates to a range from 0.00% to 0.25% in an effort to stimulate the economy. Businesses shut, the expression “work from home” became the generally understood initials WFH, and the main goal of most people was to stay healthy and safe. As the economy slowed, municipal budgets were stressed by declining revenues and increasing expenses. The Fed even had an optional emergency loan program for state and local governments. However, the fiscal stimulus provided by the Federal Government started to ease the risks of cash deficits experienced by state and local governments. As we close this reporting period, with the general impression that things are slowly starting to mend, inflation and future tax rates have begun to enter the dialogue. |

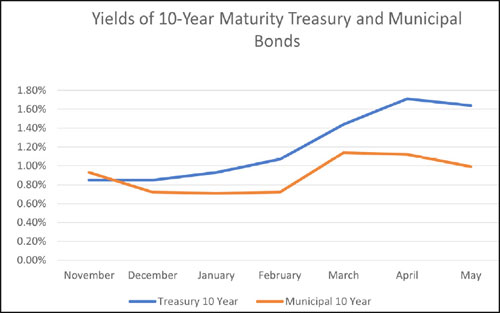

| 2.) | Inflation and Tax Rates. The US Government has borrowed trillions of dollars to stimulate the economy, help municipalities, provide support for beleaguered unemployed workers, and generate job creation. Even prior to the pandemic, the Federal Government was running a substantial deficit. The flip side to the positives provided by the stimulus expenditures is the fear of inflation and what it could do on a long-term basis to the economy. While the memory of the Weimar Republic is a distant event, the inflation of the late 1970’s and early 1980’s, and what it took to combat it, is a clear memory. Given that the tax rates had been lowered, the market is viewing a possible tax rate increase as a potential solution to offset the large borrowings. These diverse elements helped the municipal bond market go from stressed to favored. Using month end numbers from the start of November to the end of April, the following chart shows the change in investment attitudes for the tax-free market. Ten-year maturity municipal rates went from higher than the comparable ten-year Treasury Notes to substantially lower yields. The Treasury rates come from the morning postings on Bloomberg Analytics and the municipal rates for premier rate municipal issuers are calculated by MMD (Municipal Market Data), in our opinion, the municipal bond industry standard analytical service. |

| Lebenthal Ultra Short Tax-Free Income Fund |

| Letter from the Portfolio Manager |

| April 30, 2021 (Unaudited) |

Source: Bloomberg

When it became clear that there were not going to be widespread municipalities facing potential defaults, and that the Treasury was going to be an active issuer of debt securities, investors began to reinvest in municipal bonds. Not only was the credit fear eased, but the probability of tax rate increases surfaced. There are many proposals in Congress, so the final outcome is not set yet. However, if income and capital gains tax rates are increased, as is being debated, the fundamental value of a tax-exempt bond increases dramatically. Thus, the widening gap in the above chart shows investors favoring the tax-free alternative in their investment options.

| 3.) | Short Maturity Tax-Free Securities. The fund invests in short maturity securities, to keep liquidity for our shareholders. Part of the portfolio holds variable rate demand notes. The balance is invested in short term, fixed rate, fixed maturity bonds. As was mentioned above, the Fed has kept short rates in a range of 0% to .25%. Short maturity tax exempt rates were in a similar pattern. The index for variable rate municipal securities is a weekly publication from SIFMA (the Securities Industry and Financial Markets Association). During the Fund’s semiannual reporting period ended, it fluctuated in a range from .11% down to .06%. As a result, the Fund has used more fixed rate, fixed maturity investment grade bonds to be able to capture higher rates while still having a good quality portfolio. They have tended to be in the .30% to .50% range, providing investors with attractive relative yields. |

| Semi-Annual Report | April 30, 2021 | 7 |

| Lebenthal Ultra Short Tax-Free Income Fund |

| Letter from the Portfolio Manager |

| April 30, 2021 (Unaudited) |

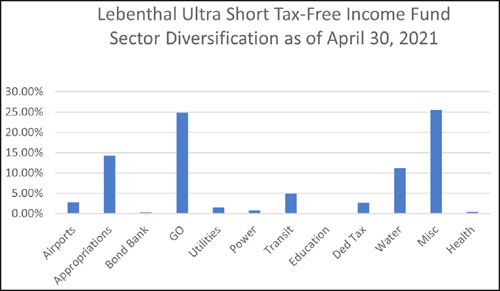

| 4.) | Fund Activity. We have continued to invest conservatively. To try to spread any potential risk, the portfolio is diversified across the various municipal bond general obligation bond and specific revenue bond industries. This is the fundamental infrastructure that helps us in our daily activities. |

Source: Bloomberg

| 5.) | Our Outlook. We have seen the market cope with stagflation, inflation, New York City’s credit crisis, oil shocks, war, terrorism, and now the pandemic. Through it all, it has maintained a fundamental value that municipal bondholders must be paid. We see improving conditions and yet remain ever watchful and conservative. |

Gregory Serbe

Senior Portfolio Manager

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month end are available by calling 1-888-484-5766.

| Lebenthal Ultra Short Tax-Free Income Fund |

| Letter from the Portfolio Manager |

| April 30, 2021 (Unaudited) |

An investor should consider the investment objectives, risks, charges and expenses of the Funds carefully before investing. The Funds’ prospectus contains this and other important information. To obtain a copy of the Funds’ prospectus please visit the Funds’ website at http://www.dcmmutualfunds.com or call 1-888-484-5766 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Funds are distributed by Ultimus Fund Distributors, LLC.

The Letter to Shareholders seeks to describe some of the investment advisor’s current opinions and views of the financial markets. Although the investment advisor believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. The securities held by the Funds that are discussed in the Letter to Shareholders were held during the period covered by this Report. They do not comprise the entire investment portfolio of the Funds, may be sold at any time and may no longer be held by the Funds. For a complete list of securities held by the Funds as of April 30, 2021, please see the Schedules of Investments sections of the semi-annual report. The opinions of DCM Advisors, LLC with respect to those securities may change at any time.

Statements in the Letter to Shareholders that reflect projections or expectations for future financial or economic performance of the Funds and the market in general and statements of the Funds’ plans and objectives for future operations are forward-looking statements. No assurance can be given that actual results or events will not differ materially from those projected, estimated, assumed, or anticipated in any such forward-looking statements. Important factors that could result in such differences, in addition to factors noted with such forward-looking statements, include, without limitation, general economic conditions, such as inflation, recession, and interest rates. Past performance is not a guarantee of future results.

| Semi-Annual Report | April 30, 2021 | 9 |

| DCM/INNOVA High Equity Income Innovation Fund |

| Performance Update |

| April 30, 2021 (Unaudited) |

Average Annual Total Returns for the period ended April 30, 2021*

| | One | Five | Ten | Since |

| | Year | Year | Year | Inception(a) |

| DCM/INNOVA High Equity Income Innovation Fund | 44.39% | 11.01% | 8.42% | 9.34% |

| S&P 500® Total Return Index(b) | 45.98% | 17.42% | 14.17% | 10.36% |

| Dow Jones U.S. Select Dividend Total Return Index(c) | 53.35% | 11.93% | 12.50% | 8.66% |

| | | | | |

| | | | | Expense |

| | | | | Ratios(d) |

| Gross | | | | 3.43% |

| With Applicable Waivers | | | | 1.57% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on the DCM/INNOVA High Equity Income Innovation Fund (the “DCM/INNOVA Fund”) distributions or the redemption of shares. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling (888) 484-5766.

| * | Return figures reflect any change in price per share and assume the reinvestment of all distributions. The DCM/INNOVA Fund’s returns reflect any fee reductions during the applicable period. If such fee reductions had not occurred, the quoted performances would have been lower. |

| (a) | The DCM/INNOVA Fund’s inception date – March 16, 2005 (Date of Initial Public Investment). |

| (b) | S&P 500 Total Return Index is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the DCM/ INNOVA Fund’s portfolio. |

| (c) | The Dow Jones U.S. Select Dividend Total Return Index consists of 100 of the highest dividend-yielding securities (excluding Real Estate Investment Trusts (REITs)) in the Dow Jones U.S. Index, a broad-based index representative of the total market for the United States equity securities. Individuals cannot invest directly in an index; however, an individual can invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

| (d) | The expense ratios shown are from the DCM/INNOVA Fund’s prospectus dated April 26, 2021. Additional information pertaining to the expense ratios as of April 30, 2021 can be found in the financial highlights. |

An investor should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The DCM/INNOVA Fund’s prospectus contains this and other important information. To obtain a copy of the Fund’s prospectus please visit our website at http://www.dcmmutualfunds.com or call (888) 484-5766 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest.

The DCM/INNOVA Fund is distributed by Ultimus Fund Distributors, LLC., Member FINRA/SIPC.

| Lebenthal Ultra Short Tax-Free Income Fund |

| Performance Update |

| April 30, 2021 (Unaudited) |

Average Annual Total Returns for the period ended April 30, 2021*

| | | Since |

| | One Year | Inception(a) |

| Lebenthal Ultra Short Tax-Free Income Fund - Class I Shares | 0.22% | 0.40% |

| Lebenthal Ultra Short Tax-Free Income Fund - Class A Shares (Without Load) | 0.00% | 0.18% |

| Lebenthal Ultra Short Tax-Free Income Fund - Class A Shares (With Load) | -0.50% | -0.19% |

| Bloomberg Barclays 1 Year Municipal Bond Index(b) | 1.75% | 1.51% |

| SIFMA Municipal Swap Index(c) | -72.73% | -91.50% |

| | | |

| | Expense Ratios(d) |

| | Class A Shares | Class I Shares |

| Gross | 3.13% | 2.88% |

| With Applicable Waivers | 0.75% | 0.50% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on the Lebenthal Ultra Short Tax-Free Income Fund (the “Lebenthal Fund”) distributions or the redemption of shares. Current performance may be lower or higher than the performance quoted. In the case of investments at or above $250,000, a contingent deferred sales charge (CDSC) of up to 0.25% may be charged on Class A shares redeemed within 12 months of purchase if you paid no sales charge on the original purchase and a finder’s fee was paid. Performance data current to the most recent month end may be obtained by calling (888) 484-5766.

| * | Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Lebenthal Fund’s returns reflect any fee reductions during the applicable period. If such fee reductions had not occurred, the quoted performances would have been lower. |

| (a) | The Lebenthal Fund’s inception date – December 30, 2019 (Date of Initial Public Investment). |

| (b) | Bloomberg Barclays 1 Year Municipal Bond Index is an unmanaged index of municipal bonds with a remaining maturity of one to two years. Individuals cannot invest directly in an index; however, an individual can invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

| (c) | The Securities Industry and Financial Markets Association Municipal Swap Index (“SIFMA Municipal Swap Index”) is a 7-day high-grade market index comprised of tax-exempt Variable Rate Demand Obligations (“VRDOs”) with certain characteristics. It is a short-term index which reflects activity in the VRDO market. |

| (d) | The expense ratios shown are from the Lebenthal Fund’s prospectus dated April 26, 2021. Additional information pertaining to the expense ratios as of April 30, 2021 can be found in the financial highlights. |

| Semi-Annual Report | April 30, 2021 | 11 |

| Lebenthal Ultra Short Tax-Free Income Fund |

| Performance Update |

| April 30, 2021 (Unaudited) |

An investor should consider the investment objectives, risks, charges and expenses of the Lebenthal Fund carefully before investing. The Lebenthal Fund’s prospectus contains this and other important information. To obtain a copy of the Lebenthal Fund’s prospectus please visit our website at http://www.dcmmutualfunds.com or call (888) 484-5766 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest.

The Lebenthal Fund is distributed by Ultimus Fund Distributors, LLC., Member FINRA/SIPC.

| DCM/INNOVA High Equity Income Innovation Fund |

| Schedule of Investments |

| April 30, 2021 (Unaudited) |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — 97.35% | | | | | | | | |

| | | | | | | | | |

| Communications — 11.21% | | | | | | | | |

| Alphabet, Inc., Class A(a) | | | 200 | | | $ | 470,700 | |

| Comcast Corp., Class A | | | 1,100 | | | | 61,765 | |

| Interpublic Group of Cos., Inc. | | | 4,000 | | | | 127,000 | |

| Liberty Media Corp.-Liberty Sirius XM, Class C(a) | | | 2,500 | | | | 113,075 | |

| Lumen Technologies, Inc. | | | 8,600 | | | | 110,338 | |

| News Corp., Class A | | | 2,500 | | | | 65,488 | |

| TEGNA, Inc. | | | 2,600 | | | | 52,156 | |

| Walt Disney Co. (The)(a) | | | 800 | | | | 148,816 | |

| | | | | | | | 1,149,338 | |

| | | | | | | | | |

| Consumer Discretionary — 8.74% | | | | | | | | |

| Amazon.com, Inc.(a) | | | 30 | | | | 104,023 | |

| Chipotle Mexican Grill, Inc.(a) | | | 70 | | | | 104,442 | |

| Dana, Inc. | | | 2,400 | | | | 60,720 | |

| General Motors Co. | | | 2,500 | | | | 143,049 | |

| Lear Corp. | | | 600 | | | | 110,304 | |

| Lithia Motors, Inc., Class A | | | 150 | | | | 57,657 | |

| Methode Electronics, Inc. | | | 1,200 | | | | 53,916 | |

| Patrick Industries, Inc. | | | 600 | | | | 53,760 | |

| Schaeffler AG, Preferred Shares | | | 11,000 | | | | 99,093 | |

| Starbucks Corp. | | | 950 | | | | 108,766 | |

| | | | | | | | 895,730 | |

| | | | | | | | | |

| Consumer Staples — 3.83% | | | | | | | | |

| Andersons, Inc. (The) | | | 1,600 | | | | 45,952 | |

| Bunge Ltd. | | | 900 | | | | 75,978 | |

| Lamb Weston Holdings, Inc. | | | 850 | | | | 68,425 | |

| Philip Morris International, Inc. | | | 800 | | | | 76,000 | |

| PriceSmart, Inc. | | | 700 | | | | 58,828 | |

| Sysco Corp. | | | 800 | | | | 67,784 | |

| | | | | | | | 392,967 | |

| | | | | | | | | |

| Energy — 6.47% | | | | | | | | |

| Archrock, Inc. | | | 4,500 | | | | 42,030 | |

| Chevron Corp. | | | 450 | | | | 46,382 | |

| Exxon Mobil Corp. | | | 900 | | | | 51,516 | |

| Marathon Petroleum Corp. | | | 2,520 | | | | 140,237 | |

| ONEOK, Inc. | | | 1,900 | | | | 99,446 | |

| Phillips 66 | | | 1,560 | | | | 126,220 | |

| ProPetro Holding Corp.(a) | | | 5,000 | | | | 48,150 | |

| Williams Cos., Inc. (The) | | | 4,500 | | | | 109,620 | |

| | | | | | | | 663,601 | |

| See Notes to Financial Statements |

| |

| Semi-Annual Report | April 30, 2021 | 13 |

| DCM/INNOVA High Equity Income Innovation Fund |

| Schedule of Investments |

| April 30, 2021 (Unaudited) |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — 97.35% (CONTINUED) | | | | | | | | |

| | | | | | | | | |

| Financials — 16.64% | | | | | | | | |

| BlackRock, Inc. | | | 130 | | | $ | 106,509 | |

| CNA Financial Corp.(a) | | | 2,880 | | | | 135,158 | |

| Comerica, Inc. | | | 1,000 | | | | 75,160 | |

| Discover Financial Services | | | 1,400 | | | | 159,600 | |

| Financial Institutions, Inc. | | | 3,000 | | | | 95,790 | |

| First Republic Bank | | | 500 | | | | 91,620 | |

| Jefferies Financial Group, Inc. | | | 4,500 | | | | 146,295 | |

| JPMorgan Chase & Co. | | | 700 | | | | 107,667 | |

| KeyCorp | | | 6,000 | | | | 130,560 | |

| Principal Financial Group, Inc. | | | 1,600 | | | | 102,192 | |

| Prudential Financial, Inc. | | | 1,500 | | | | 150,540 | |

| Regions Financial Corp. | | | 7,000 | | | | 152,600 | |

| Swiss Life Holding AG | | | 250 | | | | 121,786 | |

| Truist Financial Corp. | | | 2,200 | | | | 130,482 | |

| | | | | | | | 1,705,959 | |

| | | | | | | | | |

| Health Care — 2.84% | | | | | | | | |

| Ensign Group, Inc. (The) | | | 750 | | | | 64,388 | |

| HCA Healthcare, Inc. | | | 400 | | | | 80,424 | |

| Hill-Rom Holdings, Inc. | | | 500 | | | | 55,110 | |

| Hologic, Inc.(a) | | | 1,400 | | | | 91,770 | |

| | | | | | | | 291,692 | |

| | | | | | | | | |

| Industrials — 14.07% | | | | | | | | |

| Advanced Energy Industries, Inc. | | | 650 | | | | 71,702 | |

| Caterpillar, Inc. | | | 550 | | | | 125,461 | |

| CSX Corp. | | | 700 | | | | 70,525 | |

| Cummins, Inc. | | | 200 | | | | 50,408 | |

| Deere & Co. | | | 520 | | | | 192,841 | |

| Honeywell International, Inc. | | | 260 | | | | 57,990 | |

| Pentair PLC | | | 2,500 | | | | 161,275 | |

| Quanta Services, Inc. | | | 2,200 | | | | 212,608 | |

| SITC International Holdings Co., Ltd. | | | 30,000 | | | | 114,511 | |

| Sweco AB | | | 5,000 | | | | 89,183 | |

| Trane Technologies PLC | | | 600 | | | | 104,298 | |

| United Rentals, Inc.(a) | | | 600 | | | | 191,970 | |

| | | | | | | | 1,442,772 | |

| See Notes to Financial Statements |

| |

| 14 | www.dcmmutualfunds.com |

| DCM/INNOVA High Equity Income Innovation Fund |

| Schedule of Investments |

| April 30, 2021 (Unaudited) |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — 97.35% (CONTINUED) | | | | | | | | |

| | | | | | | | | |

| Materials — 10.79% | | | | | | | | |

| Albemarle Corp. | | | 800 | | | $ | 134,536 | |

| BASF SE | | | 1,500 | | | | 120,938 | |

| Boliden AB | | | 2,600 | | | | 101,288 | |

| Dow, Inc. | | | 3,900 | | | | 243,750 | |

| Eagle Materials, Inc. | | | 900 | | | | 124,326 | |

| Freeport-McMoRan, Inc. | | | 3,000 | | | | 113,130 | |

| LyondellBasell Industries N.V., Class A | | | 1,000 | | | | 103,740 | |

| Owens Corning | | | 1,700 | | | | 164,577 | |

| | | | | | | | 1,106,285 | |

| | | | | | | | | |

| Real Estate — 1.26% | | | | | | | | |

| Covivio | | | 1,450 | | | | 129,315 | |

| | | | | | | | | |

| Technology — 19.00% | | | | | | | | |

| Advanced Micro Devices, Inc.(a) | | | 1,900 | | | | 155,078 | |

| Apple, Inc. | | | 3,200 | | | | 420,672 | |

| Axcelis Technologies, Inc.(a) | | | 2,000 | | | | 83,060 | |

| Benchmark Electronics, Inc. | | | 1,800 | | | | 54,036 | |

| Broadcom, Inc. | | | 230 | | | | 104,926 | |

| Cadence Design Systems, Inc.(a) | | | 900 | | | | 118,593 | |

| Cisco Systems, Inc. | | | 1,500 | | | | 76,365 | |

| Cognyte Software Ltd.(a) | | | 900 | | | | 23,517 | |

| Corning, Inc. | | | 2,000 | | | | 88,420 | |

| Intel Corp. | | | 900 | | | | 51,777 | |

| Microsoft Corp. | | | 1,600 | | | | 403,488 | |

| Qorvo, Inc.(a) | | | 1,200 | | | | 225,803 | |

| QUALCOMM, Inc. | | | 700 | | | | 97,160 | |

| Verint Systems, Inc.(a) | | | 900 | | | | 43,713 | |

| | | | | | | | 1,946,608 | |

| | | | | | | | | |

| Utilities — 2.50% | | | | | | | | |

| AES Corp. | | | 4,500 | | | | 125,190 | |

| Fortum Oyj | | | 5,000 | | | | 131,310 | |

| | | | | | | | 256,500 | |

| | | | | | | | | |

| Total Common Stocks (Cost $7,550,034) | | | | | | | 9,980,767 | |

| See Notes to Financial Statements |

| |

| Semi-Annual Report | April 30, 2021 | 15 |

| DCM/INNOVA High Equity Income Innovation Fund |

| Schedule of Investments |

| April 30, 2021 (Unaudited) |

| | | Shares | | | Fair Value | |

| BUSINESS DEVELOPMENT COMPANIES — 0.05% | | | | | | | | |

| | | | | | | | | |

| Financials — 0.05% | | | | | | | | |

| Ares Capital Corp. | | | 271 | | | $ | 5,217 | |

| | | | | | | | | |

| Total Business Development Companies (Cost $5,159) | | | | | | | 5,217 | |

| | | | | | | | | |

| MONEY MARKET FUNDS — 1.71% | | | | | | | | |

| Fidelity Investments Money Market Government Portfolio, Class I, 0.01% (b) | | | 175,587 | | | | 175,587 | |

| | | | | | | | | |

| Total Money Market Funds (Cost $175,587) | | | | | | | 175,587 | |

| | | | | | | | | |

| Total Investments — 99.11% (Cost $7,730,780) | | | | | | | 10,161,571 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 0.89% | | | | | | | 91,727 | |

| | | | | | | | | |

| NET ASSETS — 100.00% | | | | | | $ | 10,253,298 | |

| (a) | Non-income producing security. |

| (b) | Rate disclosed is the seven day effective yield as of April 30, 2021. |

| See Notes to Financial Statements |

| |

| 16 | www.dcmmutualfunds.com |

| DCM/INNOVA High Equity Income Innovation Fund |

| Schedule of Investments |

| April 30, 2021 (Unaudited) |

| Summary of Investments (Unaudited) | | % of Net Assets | | | Value | |

| Common Stocks | | | | | | | | |

| Communications | | | 11.21 | % | | $ | 1,149,338 | |

| Consumer Discretionary | | | 8.74 | % | | | 895,730 | |

| Consumer Staples | | | 3.83 | % | | | 392,967 | |

| Energy | | | 6.47 | % | | | 663,601 | |

| Financials | | | 16.64 | % | | | 1,705,959 | |

| Health Care | | | 2.84 | % | | | 291,692 | |

| Industrials | | | 14.07 | % | | | 1,442,772 | |

| Materials | | | 10.79 | % | | | 1,106,285 | |

| Real Estate | | | 1.26 | % | | | 129,315 | |

| Technology | | | 19.00 | % | | | 1,946,608 | |

| Utilities | | | 2.50 | % | | | 256,500 | |

| Business Development Companies | | | 0.05 | % | | | 5,217 | |

| Money Market Funds | | | 1.71 | % | | | 175,587 | |

| Other Assets in Excess of Liabilities | | | 0.89 | % | | | 91,727 | |

| Total | | | 100.00 | % | | $ | 10,253,298 | |

| See Notes to Financial Statements |

| |

| Semi-Annual Report | April 30, 2021 | 17 |

| Lebenthal Ultra Short Tax-Free Income Fund |

| Schedule of Investments |

| April 30, 2021 (Unaudited) |

| | | Principal | | | | |

| | | Amount | | | Fair Value | |

| MUNICIPAL BONDS — 99.14% | | | | | | | | |

| | | | | | | | | |

| Alaska — 3.19% | | | | | | | | |

| Alaska Housing Finance Corp. Home Mortgage Revenue Bonds, Series 2007 A, 0.06%, 12/1/2041(a) | | $ | 300,000 | | | $ | 300,000 | |

| | | | | | | | | |

| Arizona — 0.38% | | | | | | | | |

| Pima County AZ Certificates of Participation, Series 2020 A, 5.00%, 12/1/2021 | | | 35,000 | | | | 35,981 | |

| | | | | | | | | |

| California — 1.57% | | | | | | | | |

| Los Angeles CA Unified School District General Obligation Refunding Bonds, Series 2011 A-1, 5.00%, 7/1/2021 | | | 30,000 | | | | 30,234 | |

| Oakland Joint Powers Financing Authority Lease Revenue Refunding Bonds, Series 2018, 5.00%, 11/1/2021 | | | 65,000 | | | | 66,572 | |

| Redding Elementary School District Refunding Certificates of Participation, Series 2018, 4.00%, 9/1/2021 | | | 50,000 | | | | 50,612 | |

| | | | | | | | 147,418 | |

| | | | | | | | | |

| Colorado — 1.89% | | | | | | | | |

| Pueblo County CO Certificates of Participation, Series 2012, 5.00%, 9/15/2021 | | | 175,000 | | | | 178,099 | |

| | | | | | | | | |

| Connecticut — 4.28% | | | | | | | | |

| Connecticut State General Obligation Bonds, Series 2013 A, 5.00%, 10/15/2021 | | | 70,000 | | | | 71,527 | |

| Connecticut State General Obligation Bonds, Series 2014 F, 5.00%, 11/15/2021 | | | 35,000 | | | | 35,906 | |

| Connecticut State General Obligation Refunding Bonds, Series 2012 C, 5.00%, 6/1/2021 | | | 40,000 | | | | 40,146 | |

| Connecticut State Health & Educational Facilities Authority Revenue Refunding Bonds, Series 2014 O, 4.00%, 11/1/2021 | | | 250,000 | | | | 254,628 | |

| | | | | | | | 402,207 | |

| See Notes to Financial Statements |

| |

| 18 | www.dcmmutualfunds.com |

| Lebenthal Ultra Short Tax-Free Income Fund |

| Schedule of Investments |

| April 30, 2021 (Unaudited) |

| | | Principal | | | | |

| | | Amount | | | Fair Value | |

| MUNICIPAL BONDS — 99.14% (CONTINUED) | | | | | | | | |

| | | | | | | | | |

| District of Columbia — 5.85% | | | | | | | | |

| District of Columbia Carnegie Endowment for International Peace Revenue Bonds, Series 2006, 0.05%, 11/1/2045(a) | | $ | 300,000 | | | $ | 300,000 | |

| District of Columbia Water & Sewer Authority Revenue Bonds, Series 2014 B-2, 0.06%, 10/1/2050(a) | | | 250,000 | | | | 250,000 | |

| | | | | | | | 550,000 | |

| | | | | | | | | |

| Florida — 8.24% | | | | | | | | |

| City of Port St Lucie FL Utility System Revenue Refunding Bonds, 4.00%, 9/1/2021 | | | 65,000 | | | | 65,791 | |

| County of Osceola FL Sales Tax Revenue Refunding Bonds, Series 2016 A, 4.00%, 10/1/2021 | | | 40,000 | | | | 40,615 | |

| County of Osceola FL Tourist Development Tax Revenue and Refunding Improvement Bonds, Series 2012, 5.00%, 10/1/2021 | | | 40,000 | | | | 40,778 | |

| Jacksonville FL Capital Improvement Refunding Revenue Bonds, Series 2012, 5.00%, 10/1/2022 | | | 110,000 | | | | 117,389 | |

| JEA Electric System Revenue Bonds, Series 2013 A, 5.00%, 10/1/2021 | | | 25,000 | | | | 25,495 | |

| JEA Electric System Revenue Bonds, Series 2013 3-A, 5.00%, 10/1/2022 | | | 35,000 | | | | 37,382 | |

| JEA Florida Water & Sewer System Revenue Bonds, Series 2008 B, 0.08%, 10/1/2041(a) | | | 300,000 | | | | 300,000 | |

| Key West FL Utility Board Electric Revenue System Revenue Refunding Bonds, Series 2014, 5.00%, 10/1/2021 | | | 60,000 | | | | 61,199 | |

| Miami-Dade County Expressway Authority Toll System Revenue and Refunding Bonds, Series 2014 B, 5.00%, 7/1/2021 | | | 25,000 | | | | 25,189 | |

| Miami-Dade County Expressway Authority Toll System Revenue Bonds, Series 2014 A, 5.00%, 7/1/2021 | | | 60,000 | | | | 60,455 | |

| | | | | | | | 774,293 | |

| | | | | | | | | |

| Georgia — 0.54% | | | | | | | | |

| Atlanta GA Airport Revenue General Refunding Bonds, Series 2019 E, 5.00%, 7/1/2021 | | | 50,000 | | | | 50,388 | |

| See Notes to Financial Statements |

| |

| Semi-Annual Report | April 30, 2021 | 19 |

| Lebenthal Ultra Short Tax-Free Income Fund |

| Schedule of Investments |

| April 30, 2021 (Unaudited) |

| | | Principal | | | | |

| | | Amount | | | Fair Value | |

| MUNICIPAL BONDS — 99.14% (CONTINUED) | | | | | | | | |

| | | | | | | | | |

| Illinois — 7.10% | | | | | | | | |

| Cook County IL Sales Tax Revenue Bonds, Series 2012, 5.00%, 11/15/2021 | | $ | 120,000 | | | $ | 123,138 | |

| Illinois Finance Authority Revenue Bonds, Series 2014 A, 5.00%, 10/1/2021 | | | 85,000 | | | | 86,679 | |

| Illinois Finance Authority Revenue Bonds, Series 2013 B, 4.00%, 1/1/2022 | | | 30,000 | | | | 30,776 | |

| Illinois Finance Authority Revenue Bonds, Series 2003 B, 0.03%, 7/1/2033(a) | | | 200,000 | | | | 200,000 | |

| Illinois State General Obligation Bonds, Series 2014, 5.00%, 5/1/2021 | | | 35,000 | | | | 35,000 | |

| Illinois State General Obligation Bonds, Series 2013, 5.00%, 7/1/2021 | | | 60,000 | | | | 60,443 | |

| Illinois State General Obligation Bonds, Series 2017 D, 5.00%, 11/1/2021 | | | 25,000 | | | | 25,561 | |

| Illinois State General Obligation Refunding Bonds, Series 2012, 5.00%, 8/1/2021 | | | 50,000 | | | | 50,563 | |

| Lake County IL Community School District General Obligation Bonds, 4.00%, 11/1/2021 | | | 25,000 | | | | 25,463 | |

| Regional Transportation Authority Illinois Revenue Refunding Bonds, Series 2001 B, 5.50%, 6/1/2021 | | | 30,000 | | | | 30,120 | |

| | | | | | | | 667,743 | |

| | | | | | | | | |

| Iowa — 1.07% | | | | | | | | |

| Des Moines Area Community College Plant Fund Capital Loan Notes, 4.00%, 6/1/2021 | | | 25,000 | | | | 25,073 | |

| Des Moines General Obligation Annual Appropriation Bonds, Series 2017 C, 4.00%, 6/1/2021 | | | 75,000 | | | | 75,215 | |

| | | | | | | | 100,288 | |

| | | | | | | | | |

| Kansas — 0.91% | | | | | | | | |

| Leavenworth County KS Unified School District 464 General Obligation Refunding and Improvement Bonds, Series 2019 A, 4.00%, 9/1/2021 | | | 85,000 | | | | 86,040 | |

| | | | | | | | | |

| Kentucky — 5.22% | | | | | | | | |

| Kentucky State Asset/Liability Commission Agency Fund Revenue Bonds, Series 2013 A, 5.00%, 9/1/2021 | | | 130,000 | | | | 132,039 | |

| Kentucky State Property & Building Commission Revenue and Revenue Refunding Bonds, Series 2002, 5.50%, 8/1/2021 | | | 50,000 | | | | 50,647 | |

| See Notes to Financial Statements |

| |

| 20 | www.dcmmutualfunds.com |

| Lebenthal Ultra Short Tax-Free Income Fund |

| Schedule of Investments |

| April 30, 2021 (Unaudited) |

| | | Principal | | | | |

| | | Amount | | | Fair Value | |

| MUNICIPAL BONDS — 99.14% (CONTINUED) | | | | | | | | |

| | | | | | | | | |

| Kentucky — 5.22% (Continued) | | | | | | | | |

| Kentucky State Property & Buildings Commission Agency Fund Revenue Bonds, Series 2017, 3.00%, 10/1/2021 | | $ | 45,000 | | | $ | 45,508 | |

| Kentucky State Property & Buildings Commission Revenue and Revenue Refunding Bonds, Series 2011 A, 5.00%, 8/1/2021 | | | 50,000 | | | | 50,587 | |

| Kentucky State Property & Buildings Commission Revenue Bonds, Series 2018, 5.00%, 5/1/2021 | | | 40,000 | | | | 40,000 | |

| Kentucky State Property & Buildings Commission Revenue Bonds, Series 2018, 5.00%, 5/1/2022 | | | 35,000 | | | | 36,685 | |

| Kentucky Turnpike Authority Revenue Bonds, Series 2015 B, 5.00%, 7/1/2021 | | | 100,000 | | | | 100,748 | |

| Louisville & Jefferson County Metropolitan Sewer District Revenue Bonds, Series 2016 C, 5.00%, 5/15/2021 | | | 35,000 | | | | 35,053 | |

| | | | | | | | 491,267 | |

| | | | | | | | | |

| Louisiana — 0.96% | | | | | | | | |

| Louisiana Stadium & Exposition District Senior Revenue Refunding Bonds, Series 2013 A, 5.00%, 7/1/2021 | | | 90,000 | | | | 90,661 | |

| | | | | | | | | |

| Maine — 0.27% | | | | | | | | |

| City of Portland ME General Airport Revenue Refunding Bonds, Series 2013, 5.00%, 7/1/2021 | | | 25,000 | | | | 25,172 | |

| | | | | | | | | |

| Maryland — 3.19% | | | | | | | | |

| Washington Suburban Sanitary District General Obligation Bonds, Series 2016 B-4, 0.05%, 6/1/2023 (a) | | | 200,000 | | | | 200,000 | |

| Washington Suburban Sanitary District General Obligation Bonds, Series 2015 B-3, 0.07%, 6/1/2023 (a) | | | 100,000 | | | | 100,000 | |

| | | | | | | | 300,000 | |

| | | | | | | | | |

| Michigan — 0.32% | | | | | | | | |

| Detroit MI Sewage Disposal System Revenue Refunding Second Lien Bonds, Series 2005 B, 5.50%, 7/1/2021 | | | 30,000 | | | | 30,243 | |

| See Notes to Financial Statements |

| |

| Semi-Annual Report | April 30, 2021 | 21 |

| Lebenthal Ultra Short Tax-Free Income Fund |

| Schedule of Investments |

| April 30, 2021 (Unaudited) |

| | | Principal | | | | |

| | | Amount | | | Fair Value | |

| MUNICIPAL BONDS — 99.14% (CONTINUED) | | | | | | | | |

| | | | | | | | | |

| Minnesota — 0.33% | | | | | | | | |

| St Paul Port Authority Revenue Tax-Exempt Limited Tax Supported Refunding Bonds, Series 2017 1, 5.00%, 3/1/2022 | | $ | 30,000 | | | $ | 31,217 | |

| | | | | | | | | |

| Nevada — 2.24% | | | | | | | | |

| Clark County NV Passenger Facility Charge Revenue Refunding Bonds, Series 2019 E, 5.00%, 7/1/2021 | | | 125,000 | | | | 125,957 | |

| Clark County NV School District General Obligation Limited Tax Refunding Bonds, Series 2012 A, 5.00%, 6/15/2021 | | | 35,000 | | | | 35,190 | |

| Clark County NV School District General Obligation Limited Tax Refunding Bonds, Series 2015 B, 5.00%, 6/15/2021 | | | 50,000 | | | | 50,271 | |

| | | | | | | | 211,418 | |

| | | | | | | | | |

| New Jersey — 10.88% | | | | | | | | |

| Jersey City NJ General Obligation Improvement Bonds, Series 2018, 5.00%, 12/1/2021 | | | 35,000 | | | | 35,959 | |

| Maplewood Township NJ General Improvement Bonds, Series 2018, 5.00%, 2/15/2022 | | | 50,000 | | | | 51,919 | |

| New Jersey Economic Development Authority Revenue Refunding Bonds, Series 2015 XX, 5.00%, 6/15/2021 | | | 165,000 | | | | 165,892 | |

| New Jersey Economic Development Authority Revenue Refunding Bonds, Series 2017 B, 5.00%, 11/1/2021 | | | 35,000 | | | | 35,818 | |

| New Jersey Economic Development Authority Revenue Refunding Bonds, Series 2005 K, 5.25%, 12/15/2021 | | | 15,000 | | | | 15,461 | |

| New Jersey State Educational Facilities Authority Revenue Bonds, Series 2014, 5.00%, 6/15/2021 | | | 50,000 | | | | 50,271 | |

| New Jersey State Educational Facilities Authority Revenue Bonds, Series 2014 A, 5.00%, 7/1/2021 | | | 40,000 | | | | 40,292 | |

| New Jersey State General Obligation Bonds, Series 2016, 5.00%, 6/1/2022 | | | 35,000 | | | | 36,815 | |

| New Jersey State General Obligation Bonds, Refunding Bonds, Series 2016 T, 5.00%, 6/1/2021 | | | 300,000 | | | | 301,087 | |

| New Jersey State Transportation Trust Fund Transportation Program Revenue Bonds, Series 2012 AA, 5.00%, 6/15/2021 | | | 50,000 | | | | 50,271 | |

| See Notes to Financial Statements |

| |

| 22 | www.dcmmutualfunds.com |

| Lebenthal Ultra Short Tax-Free Income Fund |

| Schedule of Investments |

| April 30, 2021 (Unaudited) |

| | | Principal | | | | |

| | | Amount | | | Fair Value | |

| MUNICIPAL BONDS — 99.14% (CONTINUED) | | | | | | | | |

| | | | | | | | | |

| New Jersey — 10.88% (Continued) | | | | | | | | |

| New Jersey State Transportation Trust Fund Authority Revenue Bonds, Series 2006 A, 5.50%, 12/15/2021 | | $ | 200,000 | | | $ | 206,448 | |

| The Passaic County NJ Improvement Authority Government Loan Revenue Bonds, 4.00%, 6/15/2021 | | | 35,000 | | | | 35,155 | |

| | | | | | | | 1,025,388 | |

| | | | | | | | | |

| New Mexico — 1.07% | | | | | | | | |

| New Mexico Institute of Mining & Technology Revenue Bonds, 5.00%, 7/1/2021 | | | 100,000 | | | | 100,759 | |

| | | | | | | | | |

| New York — 18.95% | | | | | | | | |

| Battery Park City Authority Junior Revenue Bonds, Series 2019 D-1, 0.03%, 11/1/2038(a) | | | 300,000 | | | | 300,000 | |

| Dutchess County Local Development Corp. Revenue Bonds, Series 2015 A, 5.00%, 7/1/2021 | | | 130,000 | | | | 130,949 | |

| Hempstead Town NY Local Development Corp. Revenue Refunding Bonds, 4.00%, 10/1/2021 | | | 25,000 | | | | 25,375 | |

| Long Island Power Authority Electric System General Revenue Bonds, Series 2016 B, 5.00%, 9/1/2021 | | | 50,000 | | | | 50,801 | |

| Metropolitan Transportation Authority Revenue Bonds, Series 2018 C-2, 5.00%, 9/1/2021 | | | 30,000 | | | | 30,462 | |

| Nassau County NY General Obligation Improvement Bonds, Series 2016 A, 5.00%, 1/1/2022 | | | 50,000 | | | | 51,585 | |

| New York City Trust for Cultural Resources Revenue Bonds, Series 2009 A, 0.03%, 7/1/2032(a) | | | 250,000 | | | | 250,000 | |

| New York City Trust for Cultural Resources Revenue Bonds, Series 2006 A-2, 0.03%, 10/1/2036(a) | | | 200,000 | | | | 200,000 | |

| New York NY General Obligation Bonds, Series 2012 A-1, 4.00%, 10/1/2021 | | | 35,000 | | | | 35,559 | |

| New York State Dormitory Authority Revenue Bonds, Series 2015 A, 5.00%, 5/1/2021 | | | 40,000 | | | | 40,000 | |

| New York State Dormitory Authority Revenue Bonds, Series 2012 A, 5.00%, 5/15/2021 | | | 25,000 | | | | 25,038 | |

| New York State Dormitory Authority Revenue Bonds, Series 2007 C, 5.25%, 7/1/2021 | | | 55,000 | | | | 55,428 | |

| New York State Dormitory Authority Revenue Bonds, Series 2012 H, 5.00%, 10/1/2021 | | | 55,000 | | | | 56,063 | |

| New York State Dormitory Authority Revenue Bonds, Series 2018 A, 5.00%, 10/1/2021 | | | 25,000 | | | | 25,483 | |

| See Notes to Financial Statements |

| |

| Semi-Annual Report | April 30, 2021 | 23 |

| Lebenthal Ultra Short Tax-Free Income Fund |

| Schedule of Investments |

| April 30, 2021 (Unaudited) |

| | | Principal | | | | |

| | | Amount | | | Fair Value | |

| MUNICIPAL BONDS — 99.14% (CONTINUED) | | | | | | | | |

| | | | | | | | | |

| New York — 18.95% (Continued) | | | | | | | | |

| New York State Dormitory Authority Revenue Bonds, Series 2012 A, 5.00%, 7/1/2022 | | $ | 35,000 | | | $ | 37,002 | |

| New York State Dormitory Authority Revenue Bonds, Series 2011 A, 5.00%, 7/1/2021 | | | 40,000 | | | | 40,309 | |

| New York State Dormitory Authority Revenue Bonds, Series 2015 B, 5.00%, 7/1/2021 | | | 35,000 | | | | 35,270 | |

| New York State Energy Research & Development Authority Facilities Revenue Bonds, Series 2005 A-3, 0.05%, 5/1/2039(a) | | | 300,000 | | | | 300,000 | |

| Schenectady County Capital Resources Corp. Tax-Exempt Revenue Bonds, Series 2012 A, 5.00%, 7/1/2021 | | | 60,000 | | | | 60,448 | |

| Triborough Bridge & Tunnel Authority Revenue Bonds, Series 2012 B, 4.00%, 11/15/2021 | | | 30,000 | | | | 30,625 | |

| | | | | | | | 1,780,397 | |

| | | | | | | | | |

| North Dakota — 0.53% | | | | | | | | |

| West Fargo ND Refunding Improvement Bonds, Series 2020 A, 2.00%, 5/1/2021 | | | 50,000 | | | | 50,000 | |

| | | | | | | | | |

| Ohio — 5.32% | | | | | | | | |

| Ohio State General Obligation Infrastructure Improvement Bonds, Series 2004 A, 0.04%, 2/1/2023(a) | | | 200,000 | | | | 200,000 | |

| Ohio Water Development Authority Water Pollution Control Loan Fund Revenue Bonds, Series 2016 A, 0.04%, 12/1/2036(a) | | | 300,000 | | | | 300,000 | |

| | | | | | | | 500,000 | |

| | | | | | | | | |

| Pennsylvania — 6.39% | | | | | | | | |

| Allegheny County PA Sanitary Authority Sewer Revenue Bonds, Series 2015, 5.00%, 12/1/2021 | | | 30,000 | | | | 30,827 | |

| Commonwealth of Pennsylvania General Obligation Bonds, Series 2015 D, 5.00%, 8/15/2021 | | | 40,000 | | | | 40,551 | |

| Delaware River Joint Toll Bridge Commission Bridge Revenue Refunding Bonds, Series 2019 B, 5.00%, 7/1/2021 | | | 30,000 | | | | 30,232 | |

| Pennsylvania Turnpike Commission Turnpike Revenue Bonds, Series 2013 C, 5.00%, 12/1/2021 | | | 50,000 | | | | 51,414 | |

| See Notes to Financial Statements |

| |

| 24 | www.dcmmutualfunds.com |

| Lebenthal Ultra Short Tax-Free Income Fund |

| Schedule of Investments |

| April 30, 2021 (Unaudited) |

| | | Principal | | | | |

| | | Amount | | | Fair Value | |

| MUNICIPAL BONDS — 99.14% (CONTINUED) | | | | | | | | |

| | | | | | | | | |

| Pennsylvania — 6.39% (Continued) | | | | | | | | |

| Pennsylvania Turnpike Commission Turnpike Revenue Refunding Bonds, Series 2019, 5.00%, 12/1/2021 | | $ | 55,000 | | | $ | 56,555 | |

| Pennsylvania Turnpike Commission Turnpike Subordinate Revenue Refunding Bonds, Series 2016, 5.00%, 6/1/2021 | | | 170,000 | | | | 170,622 | |

| Philadelphia Authority for Industrial Development City Service Agreement Revenue Bonds, Series 2017, 5.00%, 12/1/2021 | | | 25,000 | | | | 25,669 | |

| State Public School Building Authority PA School Lease Revenue Refunding Bonds, Series 2016 A, 5.00%, 6/1/2021 | | | 195,000 | | | | 195,697 | |

| | | | | | | | 601,567 | |

| | | | | | | | | |

| Puerto Rico — 0.75% | | | | | | | | |

| Commonwealth of Puerto Rico General Obligation Bonds, Series 2002 A, 5.50%, 7/1/2021 | | | 70,000 | | | | 70,306 | |

| | | | | | | | | |

| Rhode Island — 0.27% | | | | | | | | |

| Rhode Island Health and Educational Building Corp. Higher Educational Facilities Revenue Refunding Bonds, Series 2013 D, 5.00%, 9/15/2021 | | | 25,000 | | | | 25,433 | |

| | | | | | | | | |

| Virginia — 3.19% | | | | | | | | |

| Fairfax County VA Economic Development Revenue Bonds, Series 2003 A, 0.02%, 12/1/2033(a) | | | 300,000 | | | | 300,000 | |

| | | | | | | | | |

| Washington — 0.92% | | | | | | | | |

| Energy Northwest Columbia Generating Station Electric Revenue and Refunding Bonds, Series 2014 A, 5.00%, 7/1/2021 | | | 35,000 | | | | 35,274 | |

| Port of Seattle WA Revenue Intermediate Lien Revenue Refunding Bonds, Series 2012 A, 5.00%, 8/1/2021 | | | 50,000 | | | | 50,557 | |

| | | | | | | | 85,831 | |

| See Notes to Financial Statements |

| | |

| Semi-Annual Report | April 30, 2021 | 25 |

| Lebenthal Ultra Short Tax-Free Income Fund |

| Schedule of Investments |

| April 30, 2021 (Unaudited) |

| | | Principal | | | | |

| | | Amount/ | | | | |

| | | Shares | | | Fair Value | |

| MUNICIPAL BONDS — 99.14% (CONTINUED) | | | | | | | | |

| | | | | | | | | |

| Wisconsin — 3.32% | | | | | | | | |

| Brookfield Community Development & Redevelopment Community Development Revenue Bonds, Series 2015 A, 1.85%, 6/1/2021 | | $ | 50,000 | | | $ | 50,059 | |

| City of Madison WI General Obligation Promissory Notes, Series 2018 A, 4.00%, 10/1/2021 | | | 35,000 | | | | 35,560 | |

| Milwaukee WI General Obligation Promissory Notes, Series 2012 N-2, 5.00%, 5/1/2021 | | | 100,000 | | | | 99,999 | |

| Milwaukee WI General Obligation Promissory Notes, Series 2011 N-3, 5.00%, 5/15/2021 | | | 30,000 | | | | 30,044 | |

| Milwaukee WI Redevelopment Authority Lease Revenue Bonds, Series 2016 A, 3.00%, 11/15/2021 | | | 25,000 | | | | 25,374 | |

| Milwaukee WI Sewerage System Revenue Bonds, Series 2013 S-5, 5.00%, 6/1/2021 | | | 35,000 | | | | 35,127 | |

| Wisconsin State Master Lease Certificates of Participation, Series 2018 A, 5.00%, 9/1/2021 | | | 35,000 | | | | 35,552 | |

| | | | | | | | 311,715 | |

| Total Municipal Bonds (Cost $9,314,455) | | | | | | | 9,323,831 | |

| | | | | | | | | |

| MONEY MARKET FUNDS — 0.28% | | | | | | | | |

| Blackrock Liquidity Funds T-Fund, Institutional Shares, 0.02% (b) | | | 26,316 | | | | 26,316 | |

| | | | | | | | | |

| Total Money Market Funds (Cost $26,316) | | | | | | | 26,316 | |

| | | | | | | | | |

| Total Investments — 99.42% (Cost $9,340,771) | | | | | | | 9,350,147 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 0.58% | | | | | | | 54,266 | |

| | | | | | | | | |

| NET ASSETS — 100.00% | | | | | | $ | 9,404,413 | |

| (a) | Variable rate security. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities, therefore, do not indicate a reference rate and spread. |

| (b) | Rate disclosed is the seven day effective yield as of April 30, 2021. |

| See Notes to Financial Statements |

| |

| 26 | www.dcmmutualfunds.com |

| Lebenthal Ultra Short Tax-Free Income Fund |

| Schedule of Investments |

| April 30, 2021 (Unaudited) |

| Summary of Investments (Unaudited) | | % of Net Assets | | | Value | |

| Municipal Bonds | | | | | | | | |

| Alaska | | | 3.19 | % | | $ | 300,000 | |

| Arizona | | | 0.38 | % | | | 35,981 | |

| California | | | 1.57 | % | | | 147,418 | |

| Colorado | | | 1.89 | % | | | 178,099 | |

| Connecticut | | | 4.28 | % | | | 402,207 | |

| District of Columbia | | | 5.85 | % | | | 550,000 | |

| Florida | | | 8.24 | % | | | 774,293 | |

| Georgia | | | 0.54 | % | | | 50,388 | |

| Illinois | | | 7.10 | % | | | 667,743 | |

| Iowa | | | 1.07 | % | | | 100,288 | |

| Kansas | | | 0.91 | % | | | 86,040 | |

| Kentucky | | | 5.22 | % | | | 491,267 | |

| Louisiana | | | 0.96 | % | | | 90,661 | |

| Maine | | | 0.27 | % | | | 25,172 | |

| Maryland | | | 3.19 | % | | | 300,000 | |

| Michigan | | | 0.32 | % | | | 30,243 | |

| Minnesota | | | 0.33 | % | | | 31,217 | |

| Nevada | | | 2.24 | % | | | 211,418 | |

| New Jersey | | | 10.88 | % | | | 1,025,388 | |

| New Mexico | | | 1.07 | % | | | 100,759 | |

| New York | | | 18.95 | % | | | 1,780,397 | |

| North Dakota | | | 0.53 | % | | | 50,000 | |

| Ohio | | | 5.32 | % | | | 500,000 | |

| Pennsylvania | | | 6.39 | % | | | 601,567 | |

| Puerto Rico | | | 0.75 | % | | | 70,306 | |

| Rhode Island | | | 0.27 | % | | | 25,433 | |

| Virginia | | | 3.19 | % | | | 300,000 | |

| Washington | | | 0.92 | % | | | 85,831 | |

| Wisconsin | | | 3.32 | % | | | 311,715 | |

| Money Market | | | 0.28 | % | | | 26,316 | |

| Other Assets in Excess of Liabilities | | | 0.58 | % | | | 54,266 | |

| Total | | | 100.00 | % | | $ | 9,404,413 | |

| See Notes to Financial Statements |

| |

| Semi-Annual Report | April 30, 2021 | 27 |

| Centaur Mutual Funds Trust |

| Statements of Assets and Liabilities |

| April 30, 2021 (Unaudited) |

| | | DCM/INNOVA | | | Lebenthal | |

| | | High Equity | | | Ultra Short | |

| | | Income Innovation | | | Tax-Free Income | |

| | | Fund | | | Fund | |

| Assets | | | | | | | | |

| Investments in securities, at fair value (cost $7,730,780 and $9,340,771) | | $ | 10,161,571 | | | $ | 9,350,147 | |

| Foreign currencies, at value (cost $3,757 and $–) | | | 3,736 | | | | — | |

| Receivable for fund shares sold | | | 200 | | | | 861 | |

| Dividends and interest receivable | | | 52,314 | | | | 89,607 | |

| Tax reclaims receivable | | | 29,961 | | | | — | |

| Receivable from Adviser | | | 7,140 | | | | 19,709 | |

| Prepaid expenses | | | 27,532 | | | | 39,699 | |

| Total Assets | | | 10,282,454 | | | | 9,500,023 | |

| | | | | | | | | |

| Liabilities | | | | | | | | |

| Payable for investments purchased | | | — | | | | 60,510 | |

| Payable for distributions to shareholders | | | — | | | | 870 | |

| Accrued 12b-1 fees - Class A | | | — | | | | 30 | |

| Payable to Administrator | | | 15,297 | | | | 14,254 | |

| Other accrued expenses | | | 13,859 | | | | 19,946 | |

| Total Liabilities | | | 29,156 | | | | 95,610 | |

| Net Assets | | $ | 10,253,298 | | | $ | 9,404,413 | |

| | | | | | | | | |

| Net Assets consist of: | | | | | | | | |

| Paid-in capital | | | 8,397,257 | | | | 9,395,047 | |

| Accumulated earnings | | | 1,856,041 | | | | 9,366 | |

| Net Assets | | $ | 10,253,298 | | | $ | 9,404,413 | |

| See Notes to Financial Statements |

| |

| 28 | www.dcmmutualfunds.com |

| Centaur Mutual Funds Trust |

| Statements of Assets and Liabilities |

| April 30, 2021 (Unaudited) |

| | | DCM/INNOVA | | | Lebenthal | |

| | | High Equity | | | Ultra Short | |

| | | Income Innovation | | | Tax-Free Income | |

| | | Fund | | | Fund | |

| Class I Shares: | | | | | | | | |

| Net Assets | | | | | | $ | 9,374,380 | |

| Shares outstanding (unlimited number of shares authorized, no par value) | | | | | | | 936,491 | |

| Net asset value, offering and redemption price per share | | | | | | $ | 10.01 | |

| Class A Shares: | | | | | | | | |

| Net Assets | | | | | | $ | 30,033 | |

| Shares outstanding (unlimited number of shares authorized, no par value) | | | | | | | 3,004 | |

| Net asset value, offering and redemption price per share (a) | | | | | | $ | 10.00 | |

| Offering price per share (100%/(100%-0.50% (maximum sales charge)) of net asset value adjusted to the nearest cent) | | | | | | $ | 10.05 | |

| | | | | | | | | |

| Net Assets | | $ | 10,253,298 | | | | | |

| Shares outstanding (unlimited number of shares authorized, no par value) | | | 728,210 | | | | | |

| Net asset value, offering and redemption price per share | | $ | 14.08 | | | | | |

| (a) | In the case of investments at or above $250,000, a contingent deferred sales charge (“CDSC”) of up to 0.25% may be charged on shares redeemed within 12 months of purchase if no sales charge on the original purchase and a finder’s fee was paid. |

| See Notes to Financial Statements |

| |

| Semi-Annual Report | April 30, 2021 | 29 |

| Centaur Mutual Funds Trust |

| Statements of Operations |

| For the six months ended April 30, 2021 (Unaudited) |

| | | DCM/INNOVA | | | Lebenthal | |

| | | High Equity | | | Ultra Short | |

| | | Income Innovation | | | Tax-Free Income | |

| | | Fund | | | Fund | |

| Investment Income | | | | | | | | |

| Dividend income (net of foreign taxes withheld of $35,455 and $–) | | $ | 391,684 | | | $ | 15 | |

| Interest income | | | — | | | | 23,050 | |

| Total investment income | | | 391,684 | | | | 23,065 | |

| | | | | | | | | |

| Expenses | | | | | | | | |

| Advisor | | | 35,038 | | | | 19,591 | |

| Administration | | | 20,329 | | | | 19,088 | |

| Registration | | | 15,229 | | | | 24,814 | |

| Fund accounting | | | 14,817 | | | | 16,624 | |

| Legal | | | 12,411 | | | | 14,068 | |

| Custodian | | | 10,371 | | | | 2,480 | |

| Insurance | | | 7,759 | | | | 3,214 | |

| Audit and tax | | | 7,686 | | | | 9,422 | |

| Transfer agent | | | 7,439 | | | | 5,942 | |

| Report printing | | | 2,972 | | | | 3,325 | |

| Trustee | | | 1,398 | | | | 1,396 | |

| Pricing | | | 1,206 | | | | 5,800 | |

| 12b-1 fees- Investor class | | | — | | | | 52 | |

| Miscellaneous | | | 14,262 | | | | 11,524 | |

| Interest | | | 74 | | | | — | |

| Total expenses | | | 150,991 | | | | 137,340 | |

| Fees waived by Advisor | | | (80,696 | ) | | | (114,412 | ) |

| Fees voluntarily waived by Advisor | | | — | | | | (4,664 | ) |

| Net operating expenses | | | 70,295 | | | | 18,264 | |

| Net investment income | | | 321,389 | | | | 4,801 | |

| | | | | | | | | |

| Net Realized and Change in Unrealized Gain (Loss) on Investments | | | | | | | | |

| Net realized gain (loss) on: | | | | | | | | |

| Investment securities | | | 734,061 | | | | — | |

| Foreign currency translations | | | (23,505 | ) | | | — | |

| Change in unrealized appreciation (depreciation) on: | | | | | | | | |

| Investment securities | | | 1,152,736 | | | | (2,648 | ) |

| Foreign currency translations | | | 249 | | | | — | |

| Net realized and unrealized gain (loss) on investment securities and foreign currency translations | | | 1,863,541 | | | | (2,648 | ) |

| Net increase in net assets resulting from operations | | $ | 2,184,930 | | | $ | 2,153 | |

| See Notes to Financial Statements |

| |

| 30 | www.dcmmutualfunds.com |

| DCM/INNOVA High Equity Income Innovation Fund |

| Statements of Changes in Net Assets |

| | | For the | | | | |

| | | Six Months Ended | | | For the | |

| | | April 30, 2021 | | | Year Ended | |

| | | (Unaudited) | | | October 31, 2020 | |

| Increase (Decrease) in Net Assets due to: | | | | | | | | |

| Operations | | | | | | | | |

| Net investment income | | $ | 321,389 | | | $ | 602,348 | |

| Net realized gain (loss) on investment securities and foreign currency translations | | | 710,556 | | | | (1,262,038 | ) |

| Change in unrealized appreciation (depreciation) on investment securities and foreign currency translations | | | 1,152,985 | | | | 884,870 | |

| Net increase in net assets resulting from operations | | | 2,184,930 | | | | 225,180 | |

| | | | | | | | | |

| Distributions From | | | | | | | | |

| Earnings | | | (273,916 | ) | | | (639,617 | ) |

| Return of capital | | | — | | | | (23,084 | ) |

| Total Distributions | | | (273,916 | ) | | | (662,701 | ) |

| | | | | | | | | |

| Capital Transactions | | | | | | | | |

| Proceeds from shares sold | | | 563,226 | | | | 569,464 | |

| Reinvestment of distributions | | | 262,883 | | | | 633,576 | |

| Amount paid for shares redeemed | | | (697,923 | ) | | | (2,613,653 | ) |

| Net increase (decrease) in net assets resulting from capital transactions | | | 128,186 | | | | (1,410,613 | ) |

| Total Increase (Decrease) in Net Assets | | | 2,039,200 | | | | (1,848,134 | ) |

| | | | | | | | | |

| Net Assets | | | | | | | | |

| Beginning of period | | | 8,214,098 | | | | 10,062,232 | |

| End of period | | $ | 10,253,298 | | | $ | 8,214,098 | |

| | | | | | | | | |

| Share Transactions | | | | | | | | |

| Shares sold | | | 42,194 | | | | 49,884 | |

| Shares issued in reinvestment of distributions | | | 19,630 | | | | 55,113 | |

| Shares redeemed | | | (53,440 | ) | | | (246,215 | ) |

| Net increase (decrease) in shares outstanding | | | 8,384 | | | | (141,218 | ) |

| See Notes to Financial Statements |

| |

| Semi-Annual Report | April 30, 2021 | 31 |

| Lebenthal Ultra Short Tax-Free Income Fund |

| Statements of Changes in Net Assets |

| | | For the | | | | |

| | | Six Months Ended | | | For the | |

| | | April 30, 2021 | | | Period Ended | |

| | | (Unaudited) | | | October 31, 2020(a) | |

| Increase (Decrease) in Net Assets due to: | | | | | | | | |

| Operations | | | | | | | | |

| Net investment income | | $ | 4,801 | | | $ | 25,841 | |

| Net realized loss on investment securities transactions | | | — | | | | (5 | ) |

| Change in unrealized appreciation on investment securities | | | (2,648 | ) | | | 12,024 | |

| Net increase in net assets resulting from operations | | | 2,153 | | | | 37,860 | |

| | | | | | | | | |

| Distributions From | | | | | | | | |

| Earnings | | | | | | | | |

| Class I Shares | | | (4,806 | ) | | | (25,838 | ) |

| Class A Shares | | | — | | | | (46 | ) |

| Total Distributions | | | (4,806 | ) | | | (25,884 | ) |

| | | | | | | | | |

| Capital Transactions — Class I Shares | | | | | | | | |

| Proceeds from shares sold | | | 2,511 | | | | 9,332,000 | |

| Reinvestment of distributions | | | 4,754 | | | | 25,769 | |

| Amount paid for shares redeemed | | | (10 | ) | | | — | |

| Total Class I Shares | | | 7,255 | | | | 9,357,769 | |

| | | | | | | | | |

| Capital Transactions — Class A Shares | | | | | | | | |

| Proceeds from shares sold | | | 5,200 | | | | 45,000 | |

| Reinvestment of distributions | | | (20,180 | ) | | | 46 | |

| Total Class A | | | (14,980 | ) | | | 45,046 | |

| | | | | | | | | |

| Net increase (decrease) in net assets resulting from capital transactions | | | (7,725 | ) | | | 9,402,815 | |

| Total Increase (Decrease) in Net Assets | | | (10,378 | ) | | | 9,414,791 | |

| | | | | | | | | |

| Net Assets | | | | | | | | |

| Beginning of period | | | 9,414,791 | | | | — | |

| End of period | | $ | 9,404,413 | | | $ | 9,414,791 | |

| See Notes to Financial Statements |

| |

| 32 | www.dcmmutualfunds.com |

| Lebenthal Ultra Short Tax-Free Income Fund |

| Statements of Changes in Net Assets |

| | | For the | | | | |

| | | Six Months Ended | | | For the | |

| | | April 30, 2021 | | | Period Ended | |

| | | (Unaudited) | | | October 31, 2020(a) | |

| Share Transactions — Class I Shares | | | | | | |

| Shares sold | | | 251 | | | | 933,190 | |

| Shares issued in reinvestment of distributions | | | 475 | | | | 2,576 | |

| Shares redeemed | | | (1 | ) | | | — | |

| Total Class I | | | 725 | | | | 935,766 | |

| | | | | | | | | |

| Share Transactions — Class A Shares | | | | | | | | |

| Shares sold | | | 520 | | | | 4,498 | |

| Shares issued in reinvestment of distributions | | | (2,018 | ) | | | 4 | |

| Total Class A | | | (1,498 | ) | | | 4,502 | |

| | | | | | | | | |

| Net increase (decrease) in shares outstanding | | | (773 | ) | | | 940,268 | |

| (a) | For the period December 30, 2019 (commencement of operations) to October 31, 2020. |

| See Notes to Financial Statements |

| |

| Semi-Annual Report | April 30, 2021 | 33 |

| DCM/INNOVA High Equity Income Innovation Fund |

| Financial Highlights |

For a share outstanding during each period.

| | | For the | | | | | | | | | | | | | | | | |

| | | Six Months | | | | | | | | | | | | | | | | |

| | | Ended | | | For the | | | For the | | | For the | | | For the | | | For the | |

| | | April 30, | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | 2021 | | | October 31, | | | October 31, | | | October 31, | | | October 31, | | | October 31, | |

| | | (Unaudited) | | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| Selected Per Share Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 11.41 | | | $ | 11.69 | | | $ | 13.01 | | | $ | 14.25 | | | $ | 12.81 | | | $ | 12.83 | |

| Investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.45 | | | | 0.82 | | | | 0.17 | | | | (0.11 | ) | | | (0.17 | ) | | | (0.12 | ) |

| Net realized and unrealized gain (loss) on investments | | | 2.60 | | | | (0.23 | ) | | | 0.16 | | | | 0.35 | | | | 2.24 | | | | 0.75 | |

| Total from investment operations | | | 3.05 | | | | 0.59 | | | | 0.33 | | | | 0.24 | | | | 2.07 | | | | 0.63 | |

| Less distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.38 | ) | | | (0.84 | ) | | | — | | | | — | | | | — | | | | — | |

| Net realized gains | | | — | | | | — | | | | (1.65 | ) | | | (1.48 | ) | | | (0.63 | ) | | | (0.65 | ) |

| Return of capital | | | — | | | | (0.03 | ) | | | — | | | | — | | | | — | | | | — | |

| Total distributions | | | (0.38 | ) | | | (0.87 | ) | | | (1.65 | ) | | | (1.48 | ) | | | (0.63 | ) | | | (0.65 | ) |

| Paid in capital from redemption fees | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | (a) |

| Net asset value, end of period | | $ | 14.08 | | | $ | 11.41 | | | $ | 11.69 | | | $ | 13.01 | | | $ | 14.25 | | | $ | 12.81 | |

| Total Return(b) | | | 26.99 | % (c) | | | 5.29 | % | | | 3.21 | % | | | 1.80 | % | | | 16.73 | % | | | 5.25 | % |

| Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | | $ | 10,253 | | | $ | 8,214 | | | $ | 10,062 | | | $ | 25,251 | | | $ | 25,692 | | | $ | 25,923 | |

| Ratio of gross expenses to average net assets | | | 3.23 | % (d) | | | 3.36 | % | | | 3.15 | % | | | 2.56 | % | | | 2.55 | % | | | 2.81 | % |

| Ratio of net expenses to average net assets | | | 1.50 | % (d) | | | 1.50 | % | | | 1.70 | % | | | 1.95 | % | | | 1.95 | % | | | 1.95 | % |

| Ratio of net investment income (loss) to average net assets | | | 6.87 | % (d) | | | 6.81 | % | | | 1.13 | % | | | (0.84 | )% | | | (1.19 | )% | | | (0.89 | )% |

| Portfolio turnover rate | | | 213 | % (c) | | | 435 | % | | | 338 | % | | | 142 | % | | | 126 | % | | | 127 | % |

| (a) | Rounds to less than $0.005 per share. |

| (b) | Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

See Notes to Financial Statements

| Lebenthal Ultra Short Tax-Free Income Fund - Class I Shares |

| Financial Highlights |

For a share outstanding during each period.

| | | For the | | | | |

| | | Six Months | | | For the | |

| | | Ended | | | Period | |

| | | April 30, | | | Ended | |

| | | 2021 | | | October 31, | |

| | | (Unaudited) | | | 2020(a) | |

| Selected Per Share Data: | | | | | | | | |

| Net asset value, beginning of period | | $ | 10.01 | | | $ | 10.00 | |

| Investment operations: | | | | | | | | |

| Net investment income | | | 0.01 | | | | 0.04 | |

| Net realized and unrealized gain on investments | | | — | (b) | | | 0.01 | |

| Total from investment operations | | | 0.01 | | | | 0.05 | |

| Less distributions to shareholders from: | | | | | | | | |

| Net investment income | | | (0.01 | ) | | | (0.04 | ) |

| Total distributions | | | (0.01 | ) | | | (0.04 | ) |

| Net asset value, end of period | | $ | 10.01 | | | $ | 10.01 | |

| Total Return(c) | | | 0.05 | % (d) | | | 0.48 | % (d) |

| Ratios and Supplemental Data: | | | | | | | | |

| Net assets, end of period (000 omitted) | | $ | 9,374 | | | $ | 9,370 | |

| Ratio of gross expenses to average net assets | | | 2.94 | % (e) | | | 2.87 | % (e) |

| Ratio of net expenses to average net assets | | | 0.39 | % (e) | | | 0.43 | % (e) |

| Ratio of net investment income to average net assets | | | 0.10 | % (e) | | | 0.41 | % (e) |

| Portfolio turnover rate | | | 3 | % (d) | | | 88 | % (d) |

| (a) | For the period December 30, 2019 (commencement of operations) to October 31, 2020. |

| (b) | Rounds to less than $0.005 per share. |

| (c) | Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

See Notes to Financial Statements

| Semi-Annual Report | April 30, 2021 | 35 |

| Lebenthal Ultra Short Tax-Free Income Fund - Class A Shares |

| Financial Highlights |

For a share outstanding during each period.