UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21624

Allianz Variable Insurance Products Fund of Funds Trust

(Exact name of registrant as specified in charter)

| 5701 Golden Hills Drive, Minneapolis, MN | 55416-1297 | |

| (Address of principal executive offices) | (Zip code) |

Citi Fund Services Ohio, Inc., 3435 Stelzer Road, Columbus, OH 43219-8000

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-624-0197

Date of fiscal year end: December 31

Date of reporting period: December 31, 2014

Item 1. Reports to Stockholders.

AZL® Balanced Index Strategy Fund

Annual Report

December 31, 2014

Table of Contents

Management Discussion and Analysis

Page 1

Expense Examples and Portfolio Composition

Page 3

Schedule of Portfolio Investments

Page 4

Statement of Assets and Liabilities

Page 5

Statement of Operations

Page 5

Statements of Changes in Net Assets

Page 6

Financial Highlights

Page 7

Notes to the Financial Statements

Page 8

Report of Independent Registered Public Accounting Firm

Page 12

Other Federal Income Tax Information

Page 13

Other Information

Page 14

Approval of Investment Advisory Agreement

Page 15

Information about the Board of Trustees and Officers

Page 17

This report is submitted for the general information of the shareholder of the Fund. The report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus, which contains details concerning the sales charges and other pertinent information.

AZL® Balanced Index Strategy Fund Review (unaudited)

Allianz Investment Management LLC serves as the Manager for the AZL® Balanced Index Strategy Fund.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

What factors affected the Fund’s performance during the year ended December 31, 2014?

For the year ended December 31, 2014, the AZL® Balanced Index Strategy Fund had a total return of 6.11%. That compared to a 9.79% total return for its benchmark, the Balanced Composite Index, which is comprised of an equal weighting in the S&P 500 Index1 and the Barclays U.S. Aggregate Bond Index2.

The AZL Balanced Index Strategy Fund is a fund of funds that pursues broad diversification across four equity sub-portfolios and one fixed-income sub-portfolio. The four equity sub-portfolios pursue passive strategies that aim to achieve, before fees, returns similar to the S&P 500 Index, the S&P 400 Index, the S&P 600 Index, and the MSCI EAFE Index, which represents shares of large companies in developed foreign markets. The fixed income sub-portfolio is an enhanced bond index strategy that seeks to achieve a return that exceeds the Barclays Capital U.S. Aggregate Bond Index. Generally, the Fund allocates 40% to 60% of its assets to the underlying equity index funds and between 40% and 60% to the underlying bond index fund.

The U.S. equity market produced positive returns during the period, with the S&P 500 Index gaining 13.69%. Economic activity recovered after facing a contraction at the start of the year as extreme weather conditions across much of the U.S. created a challenging economic environment. Several economic indicators showed positive direction for most of the year. The U.S. employment situation improved, consumer confidence rose higher, the manufacturing sector rebounded, inflation remained below its long-term trend and the housing sector steadily improved. Consumers also benefited from the significant drop in oil prices that occurred toward the end of the year. The U.S. Federal Reserve (the Fed) exited its quantitative easing program by slowly reducing its bond purchases throughout the year, and concluded the program by making the final $15 billion purchase in October. Despite the continued economic gains, the Fed remained committed to keeping short-term interest rates anchored near zero until the economy could show further improvement.

Developed international equity markets lagged, with the MSCI EAFE Index declining 4.90% during the period. A continued weakness in Europe in addition to the contraction in Japan’s gross domestic product3 signaled further divergence between the U.S. and other major developed

economies in 2014. Attempts to stimulate growth in Europe and Japan were met with varying degrees of success. One outcome from these stimulative efforts has been continued strength in the U.S. dollar. This currency impact has created an additional headwind for international returns.*

Fixed income markets benefited from a decline in long-term interest rates during the last 12 months with the 10-year U.S. Treasury yield dropping 87 basis points (0.87%) during this period. Bond prices increase when interest rates decrease. Against this backdrop, the Barclays Capital U.S. Aggregate Bond Index gained 5.97%.

The Fund underperformed its composite benchmark in 2014 due in large part to its exposure to international equity and small- and mid-cap stocks. The Fund’s relative results were also hurt by the underlying fixed income fund’s modest underperformance compared to its stated benchmark during the period.*

Past performance does not guarantee future results.

| * | The Fund’s portfolio composition is subject to change. There is no guarantee that any sectors mentioned will continue to perform well or that securities in such sectors will be held by the Fund in the future. The information contained in this commentary is for informational purposes only and should not be construed as a recommendation to purchase or sell securities in the sector mentioned. The Fund’s holdings and weightings are as of December 31, 2014. |

| 1 | The Standard & Poor’s 500 Index (“S&P 500”) is representative of 500 selected common stocks, most of which are listed on the New York Stock Exchange, and is a measure of the U.S. Stock market as a whole. |

| 2 | The Barclays U.S. Aggregate Bond Index is a market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities, with maturities of at least one year. |

| 3 | Gross Domestic Product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all of private and public consumption, government outlays, investments and exports less imports that occur within a defined territory. |

Investors cannot invest directly in an index.

1

AZL® Balanced Index Strategy Fund Review (unaudited)

Fund Objective

The Fund’s investment objective is to seek long-term capital appreciation with preservation of capital as an important consideration. This objective may be changed by the Trustees of the Fund without shareholder approval. The Fund seeks to achieve its objective by investing in a combination of Permitted Underlying Funds that represent different classes in the Fund’s asset allocation.

Investment Concerns

The Fund invests in underlying funds, so its investment performance is directly related to the performance of those underlying funds. Before investing, investors should assess the risks associated with and types of investments made by each of the underlying funds in which the Fund invests.

Stocks are more volatile and carry more risk and return potential than other forms of investments.

Small- to mid-capitalization companies typically have a higher risk of failure and historically have experienced a greater degree of volatility.

International investing may involve risk of capital loss from unfavorable fluctuations in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations.

Bonds offer a relatively stable level of income, although bond prices will fluctuate, providing the potential for principal gain or loss.

The performance of the Fund is expected to be lower than that of the Indices because of Fund fees and expenses. Securities in which the Fund will invest may involve substantial risk and may be subject to sudden severe price declines.

For a complete description of these and other risks associated with investing in a mutual Fund, please refer to the Fund’s prospectus.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

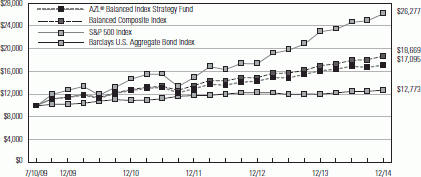

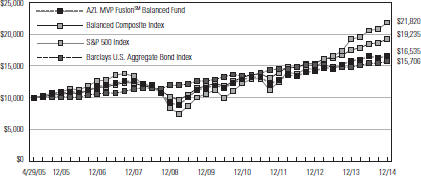

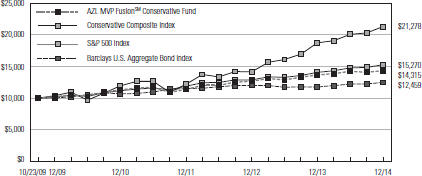

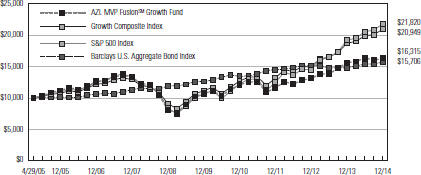

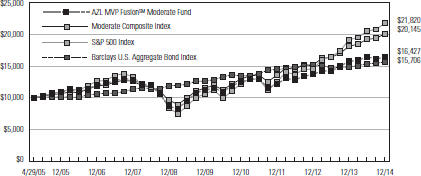

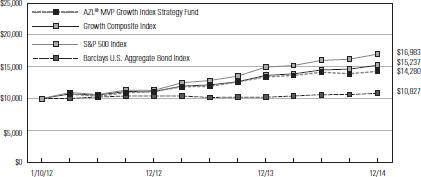

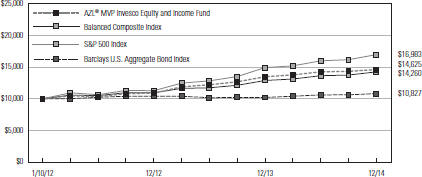

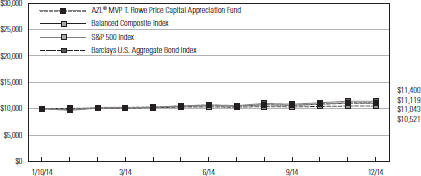

Growth of $10,000 Investment

The chart above represents a comparison of a hypothetical investment in the Fund versus a similar investment in the Fund’s benchmark as well as the two component indices of the Fund’s benchmark, and represents the reinvestment of dividends and capital gains in the Fund.

Average Annual Total Returns as of December 31, 2014

| 1 Year | 3 Year | 5 Year | Since Inception (7/10/09) | |||||||||||||

AZL® Balanced Index Strategy Fund | 6.11 | % | 9.74 | % | 8.38 | % | 10.28 | % | ||||||||

Balanced Composite Index | 9.79 | % | 11.39 | % | 10.20 | % | 12.08 | % | ||||||||

S&P 500 Index | 13.69 | % | 20.41 | % | 15.45 | % | 19.30 | % | ||||||||

Barclays U.S. Aggregate Bond Index | 5.97 | % | 2.66 | % | 4.45 | % | 4.57 | % | ||||||||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.Allianzlife.com.

Expense Ratio1 | Gross | |||

AZL® Balanced Index Strategy Fund | 0.70 | % | ||

The above expense ratio is based on the current Fund prospectus dated April 28, 2014. The Manager and the Fund have entered into a written contract limiting operating expenses, excluding certain expenses (such as interest expense and Acquired Fund fees and expenses), to 0.20% through April 30, 2016. Additional information pertaining to the December 31, 2014 expense ratios can be found in the financial highlights.

| 1 | Acquired Fund Fees and Expenses are incurred indirectly by the Fund through the valuation of the Fund’s investments in the Permitted Underlying Funds. Accordingly, Acquired Fund Fees and Expenses affect the Fund’s total returns. Because these fees and expenses are not included in the Fund’s financial highlights, the Fund’s total annual fund operating expenses do not correlate to the ratios of expenses to average net assets shown in the financial highlights table. Without Acquired Fund Fees and Expenses the Fund’s gross ratio would be 0.08%. |

| The total return of the Fund does not reflect the effect of any insurance charges, the annual maintenance fee or the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Such charges, fees and tax payments would reduce the performance quoted. |

| The Fund’s performance is measured against a composite index (the “Balanced Composite Index”), which is comprised of 50% of the Standard & Poor’s 500 Index (“S&P 500”) and 50% of the Barclays U.S. Aggregate Bond Index. The S&P 500 is representative of 500 selected common stocks, most of which are listed on the New York Stock Exchange, and is a measure of the U.S. Stock market as a whole. The Barclays U.S. Aggregate Bond Index is a market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities, with maturities of at least one year. These indices are unmanaged and do not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for services provided to the Fund. Investors cannot invest directly in an index. |

2

AZL Balanced Index Strategy Fund

Expense Examples

(Unaudited)

As a shareholder of the AZL Balanced Index Strategy Fund (the “Fund”), you incur ongoing costs, including management fees, distribution fees, and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. Please note that the expenses shown in each table do not reflect expenses that apply to the subaccount or the insurance contract. If the expenses that apply to the subaccount of the insurance contract were included, your costs would have been higher.

These examples are based on an investment of $1,000 invested at the beginning of the period and held for the periods presented below.

The Actual Expense table below provides information about actual account values and actual expenses. You may use the information below, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

| Beginning Account Value 7/1/14 | Ending Account Value 12/31/14 | Expenses Paid During Period 7/1/14 - 12/31/14* | Annualized Expense Ratio During Period 7/1/14 - 12/31/14 | |||||||||||||||||

AZL Balanced Index Strategy Fund | $ | 1,000.00 | $ | 1,011.90 | $ | 0.41 | 0.08 | % | ||||||||||||

The Hypothetical Expense table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

| Beginning Account Value 7/1/14 | Ending Account Value 12/31/14 | Expenses Paid During Period 7/1/14 - 12/31/14* | Annualized Expense Ratio During Period 7/1/14 - 12/31/14 | |||||||||||||||||

AZL Balanced Index Strategy Fund | $ | 1,000.00 | $ | 1,024.80 | $ | 0.41 | 0.08 | % | ||||||||||||

| * | Expenses are equal to the average account value over the period, multiplied by the Fund’s annualized expense ratio, multiplied by 184/365 (to reflect the one half year period). |

Portfolio Composition

(Unaudited)

| Investments | Percent of Net Assets | ||||

Fixed Income | 50.3 | % | |||

Domestic Equities | 37.4 | ||||

International Equities | 12.2 | ||||

|

| ||||

Total Investment Securities | 99.9 | ||||

Net other assets (liabilities) | 0.1 | ||||

|

| ||||

Net Assets | 100.0 | % | |||

|

| ||||

3

AZL Balanced Index Strategy Fund

Schedule of Portfolio Investments

December 31, 2014

| Shares | Fair Value | |||||||

| Affiliated Investment Companies (99.9%): | |||||||

| 19,804,160 | AZL Enhanced Bond Index Fund | $ | 220,420,305 | |||||

| 3,512,525 | AZL International Index Fund | 53,671,377 | ||||||

| 1,406,573 | AZL Mid Cap Index Fund | 33,040,394 | ||||||

| 7,852,357 | AZL S&P 500 Index Fund, Class 2 | 113,073,935 | ||||||

| 1,158,162 | AZL Small Cap Stock Index Fund | 17,870,443 | ||||||

|

| |||||||

| Total Affiliated Investment Companies (Cost $344,748,234) | 438,076,454 | ||||||

|

| |||||||

| Total Investment Securities (Cost $344,748,234)(a) — 99.9% | 438,076,454 | ||||||

| Net other assets (liabilities) — 0.1% | 574,120 | ||||||

|

| |||||||

| Net Assets — 100.0% | $ | 438,650,574 | |||||

|

| |||||||

Percentages indicated are based on net assets as of December 31, 2014.

| (a) | See Federal Tax Information listed in the Notes to the Financial Statements. |

See accompanying notes to the financial statements.

4

AZL Balanced Index Strategy Fund

Statement of Assets and Liabilities

December 31, 2014

Assets: | |||||

Investments in affiliates, at cost | $ | 344,748,234 | |||

|

| ||||

Investments in affiliates, at value | $ | 438,076,454 | |||

Receivable for capital shares issued | 611,466 | ||||

Receivable for affiliated investments sold | 432,179 | ||||

Prepaid expenses | 3,647 | ||||

|

| ||||

Total Assets | 439,123,746 | ||||

|

| ||||

Liabilities: | |||||

Cash overdraft | 432,179 | ||||

Payable for capital shares redeemed | 3,422 | ||||

Manager fees payable | 18,547 | ||||

Administration fees payable | 3,771 | ||||

Custodian fees payable | 356 | ||||

Administrative and compliance services fees payable | 1,237 | ||||

Trustee fees payable | 25 | ||||

Other accrued liabilities | 13,635 | ||||

|

| ||||

Total Liabilities | 473,172 | ||||

|

| ||||

Net Assets | $ | 438,650,574 | |||

|

| ||||

Net Assets Consist of: | |||||

Capital | $ | 333,286,680 | |||

Accumulated net investment income/(loss) | 4,617,148 | ||||

Accumulated net realized gains/(losses) from investment transactions | 7,418,526 | ||||

Net unrealized appreciation/(depreciation) on investments | 93,328,220 | ||||

|

| ||||

Net Assets | $ | 438,650,574 | |||

|

| ||||

Shares of beneficial interest (unlimited number of shares authorized, no par value) | 27,563,236 | ||||

Net Asset Value (offering and redemption price per share) | $ | 15.91 | |||

|

|

Statement of Operations

For the Year Ended December 31, 2014

Investment Income: | |||||

Dividends from affiliates | $ | 4,662,417 | |||

Foreign tax reclaims received | 1,396 | ||||

|

| ||||

Total Investment Income | 4,663,813 | ||||

|

| ||||

Expenses: | |||||

Manager fees | 212,276 | ||||

Administration fees | 53,381 | ||||

Custodian fees | 1,581 | ||||

Administrative and compliance services fees | 5,802 | ||||

Trustee fees | 22,402 | ||||

Professional fees | 18,720 | ||||

Shareholder reports | 13,630 | ||||

Other expenses | 8,084 | ||||

|

| ||||

Total expenses | 335,876 | ||||

|

| ||||

Net Investment Income/(Loss) | 4,327,937 | ||||

|

| ||||

Realized and Unrealized Gains/(Losses) on Investments: | |||||

Net realized gains/(losses) on securities transactions from affiliates | 6,280,152 | ||||

Net realized gains distributions from affiliated underlying funds | 2,091,460 | ||||

Net realized gains distributions | 1,598 | ||||

Change in net unrealized appreciation/depreciation on investments | 12,413,607 | ||||

|

| ||||

Net Realized/Unrealized Gains/(Losses) on Investments | 20,786,817 | ||||

|

| ||||

Change in Net Assets Resulting From Operations | $ | 25,114,754 | |||

|

|

See accompanying notes to the financial statements.

5

Statements of Changes in Net Assets

| AZL Balanced Index Strategy Fund | ||||||||||

| For the Year Ended December 31, 2014 | For the Year Ended December 31, 2013 | |||||||||

Change in Net Assets: | ||||||||||

Operations: | ||||||||||

Net investment income/(loss) | $ | 4,327,937 | $ | 4,213,776 | ||||||

Net realized gains/(losses) on investment transactions | 8,373,210 | 6,894,634 | ||||||||

Change in unrealized appreciation/depreciation on investments | 12,413,607 | 35,462,711 | ||||||||

|

|

|

| |||||||

Change in net assets resulting from operations | 25,114,754 | 46,571,121 | ||||||||

|

|

|

| |||||||

Dividends to Shareholders: | ||||||||||

From net investment income | (6,008,353 | ) | (6,512,409 | ) | ||||||

From net realized gains | (5,277,414 | ) | (1,087,438 | ) | ||||||

|

|

|

| |||||||

Change in net assets resulting from dividends to shareholders | (11,285,767 | ) | (7,599,847 | ) | ||||||

|

|

|

| |||||||

Capital Transactions: | ||||||||||

Proceeds from shares issued | 41,123,732 | 47,430,337 | ||||||||

Proceeds from dividends reinvested | 11,285,767 | 7,599,846 | ||||||||

Value of shares redeemed | (41,570,033 | ) | (34,130,779 | ) | ||||||

|

|

|

| |||||||

Change in net assets resulting from capital transactions | 10,839,466 | 20,899,404 | ||||||||

|

|

|

| |||||||

Change in net assets | 24,668,453 | 59,870,678 | ||||||||

Net Assets: | ||||||||||

Beginning of period | 413,982,121 | 354,111,443 | ||||||||

|

|

|

| |||||||

End of period | $ | 438,650,574 | $ | 413,982,121 | ||||||

|

|

|

| |||||||

Accumulated net investment income/(loss) | $ | 4,617,148 | $ | 6,008,337 | ||||||

|

|

|

| |||||||

Share Transactions: | ||||||||||

Shares issued | 2,613,550 | 3,212,441 | ||||||||

Dividends reinvested | 720,215 | 519,825 | ||||||||

Shares redeemed | (2,646,644 | ) | (2,322,343 | ) | ||||||

|

|

|

| |||||||

Change in shares | 687,121 | 1,409,923 | ||||||||

|

|

|

| |||||||

See accompanying notes to the financial statements.

6

AZL Balanced Index Strategy Fund

Financial Highlights

(Selected data for a share of beneficial interest outstanding throughout the periods indicated)

| Year Ended December 31, | |||||||||||||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | |||||||||||||||||||||

Net Asset Value, Beginning of Period | $ | 15.40 | $ | 13.91 | $ | 12.84 | $ | 12.63 | $ | 11.43 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Investment Activities: | |||||||||||||||||||||||||

Net Investment Income/(Loss) | 0.16 | 0.15 | 0.13 | 0.10 | 0.06 | ||||||||||||||||||||

Net Realized and Unrealized Gains/(Losses) on Investments | 0.78 | 1.63 | 1.19 | 0.20 | 1.14 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Total from Investment Activities | 0.94 | 1.78 | 1.32 | 0.30 | 1.20 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Dividends to Shareholders From: | |||||||||||||||||||||||||

Net Investment Income | (0.23 | ) | (0.25 | ) | (0.19 | ) | (0.09 | ) | — | ||||||||||||||||

Net Realized Gains | (0.20 | ) | (0.04 | ) | (0.06 | ) | — | — | |||||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Total Dividends | (0.43 | ) | (0.29 | ) | (0.25 | ) | (0.09 | ) | — | ||||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Net Asset Value, End of Period | $ | 15.91 | $ | 15.40 | $ | 13.91 | $ | 12.84 | $ | 12.63 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

Total Return(a) | 6.11 | % | 12.93 | % | 10.29 | % | 2.41 | % | 10.50 | % | |||||||||||||||

Ratios to Average Net Assets/Supplemental Data: | |||||||||||||||||||||||||

Net Assets, End of Period (000’s) | $ | 438,651 | $ | 413,982 | $ | 354,111 | $ | 298,174 | $ | 219,392 | |||||||||||||||

Net Investment Income/(Loss) | 1.02 | % | 1.10 | % | 1.08 | % | 1.10 | % | 0.58 | % | |||||||||||||||

Expenses Before Reductions*(b) | 0.08 | % | 0.08 | % | 0.09 | % | 0.09 | % | 0.10 | % | |||||||||||||||

Expenses Net of Reductions* | 0.08 | % | 0.08 | % | 0.09 | % | 0.09 | % | 0.10 | % | |||||||||||||||

Portfolio Turnover Rate | 9 | % | 8 | % | 7 | % | 6 | % | 4 | % | |||||||||||||||

| * | The expense ratios exclude the impact of fees/expenses paid by each underlying fund. |

| (a) | The returns include reinvested dividends and fund level expenses, but exclude insurance contract charges. If these charges were included, the returns would have been lower. |

| (b) | Excludes fee reductions, if any. If such fee reductions had not occurred, the ratios would have been as indicated. |

See accompanying notes to the financial statements.

7

AZL Balanced Index Strategy Fund

Notes to the Financial Statements

December 31, 2014

1. Organization

The Allianz Variable Insurance Products Fund of Funds Trust (the “Trust”) was organized as a Delaware statutory trust on June 16, 2004. The Trust is a diversified open-end management investment company registered under the Investment Company Act of 1940, as amended, (the “1940 Act”) and thus is determined to be an investment company for accounting purposes. The Trust consists of 12 separate investment portfolios (collectively, the “Funds”), of which one is included in this report, the AZL Balanced Index Strategy Fund (the “Fund”), and 11 are presented in separate reports.

The Fund is a “fund of funds,” which means that the Fund invests in other mutual funds. Underlying Funds invest in stock, bonds, and other securities and reflect varying amounts of potential investment risk and reward. The Underlying Funds record their investments at fair value. Periodically, the Fund will adjust its asset allocation as it seeks to achieve its investment objective.

The Trust is authorized to issue an unlimited number of shares of the Fund without par value. Shares of the Fund are available through the variable annuity contracts offered through the separate accounts of participating insurance companies.

Under the Trust’s organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund may enter into contracts with its vendors and others that provide for general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund. However, based on experience, the Fund expects that risk of loss to be remote.

2. Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The policies conform with U.S. generally accepted accounting principles (“U.S. GAAP”). The preparation of financial statements requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Security Valuation

The Fund records its investments at fair value. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between willing market participants at the measurement date. The valuation techniques used to determine fair value are further described in Note 4 below.

Investment Transactions and Investment Income

Investment transactions are recorded not later than on the business day following trade date. However, for financial reporting purposes, investment transactions are accounted for on trade date. Net realized gains and losses on investments sold are recorded on the basis of identified cost. Interest income is recorded on the accrual basis and includes, where applicable, the amortization of premiums or accretion of discounts. Dividend income is recorded on the ex-dividend date.

Dividends to Shareholders

Dividends to shareholders are recorded on the ex-dividend date. The Fund distributes its dividends from net investment income and net realized capital gains, if any, on an annual basis. The amount of dividends from net investment income and from net realized gains is determined in accordance with federal income tax regulations, which may differ from U.S. GAAP. These “book/tax” differences are either temporary or permanent in nature. To the extent these differences are permanent in nature (e.g., return of capital, net operating loss, and reclassification of certain distributions), such amounts are reclassified within the composition of net assets based on their federal tax-basis treatment; temporary differences (e.g., wash sales and post October losses) do not require reclassification. Dividends to shareholders that exceed net investment income and net realized gains for tax purposes are reported as distributions of capital.

Expense Allocation

Expenses directly attributable to the Fund are charged directly to the Fund, while expenses attributable to more than one Fund are allocated among the respective Funds based upon relative net assets or some other reasonable method. Expenses which are attributable to more than one Trust are allocated across the Allianz Variable Insurance Products and Allianz Variable Insurance Products Fund of Funds Trusts based upon relative net assets or another reasonable basis. Allianz Investment Management LLC (the “Manager”), serves as the investment manager for the Trust and the Allianz Variable Insurance Products Trust.

3. Related Party Transactions

The Manager provides investment advisory and management services for the Fund. The Manager has contractually agreed to waive fees and reimburse the Fund to limit the annual expenses, excluding interest expense (e.g., cash overdraft fees), taxes, brokerage commissions, other expenditures that are capitalized in accordance with U.S. GAAP and other extraordinary expenses not incurred in the ordinary course of the Fund’s business, based on the daily net assets of the Fund, through April 30, 2016. Expenses incurred for investment advisory and management services are reflected on the Statement of Operations as “Manager fees.”

8

AZL Balanced Index Strategy Fund

Notes to the Financial Statements

December 31, 2014

For the year ended December 31, 2014, the annual rate due to the Manager and the annual expense limit were as follows:

| Annual Rate | Annual Expense Limit | |||||||||

AZL Balanced Index Strategy Fund | 0.05 | % | 0.20 | % | ||||||

Any amounts contractually waived or reimbursed by the Manager in a particular fiscal year will be subject to repayment by the Fund to the Manager to the extent that from time to time through the next three fiscal years the repayment will not cause the Fund’s expenses to exceed the lesser of the stated limit at the time of the waiver or the current stated limit. Any amounts recouped by the Manager during the year are reflected on the Statement of Operations as “Recoupment of prior expenses reimbursed by the Manager.” At December 31, 2014, there were no remaining contractual reimbursements that are subject to repayment by the Fund in subsequent years.

In addition, the Manager may voluntarily waive or reimburse additional fees in order to maintain more competitive expense ratios. Any voluntary waivers or reimbursements are not subject to repayment in subsequent years. Information on the total amount waived/reimbursed by the Manager or repaid to the Manager by the Fund during the period can be found on the Statement of Operations. During the year ended December 31, 2014, there were no voluntary waivers.

The Manager or an affiliate of the Manager serves as the investment adviser of certain underlying funds in which the Fund invests. At December 31, 2014, these underlying funds are noted as Affiliated Investment Companies in the Fund’s Schedule of Portfolio Investments. The Manager or an affiliate of the Manager is paid a separate fee from the underlying funds for such services. A summary of the Fund’s investments in affiliated investment companies for the year ended December 31, 2014 is as follows:

| Fair Value 12/31/13 | Purchases at Cost | Proceeds from Sales | Net Realized Gain(Loss) | Change in Unrealized Appreciation/ Depreciation | Fair Value 12/31/14 | Dividend Income | |||||||||||||||||||||||||||||

AZL Enhanced Bond Index Fund | $ | 203,106,444 | $ | 23,645,726 | $ | (15,256,606 | ) | $ | (188,741 | ) | $ | 9,113,482 | $ | 220,420,305 | $ | 2,118,681 | |||||||||||||||||||

AZL International Index Fund | 52,704,199 | 9,365,286 | (4,106,722 | ) | 771,804 | (5,063,190 | ) | 53,671,377 | 935,211 | ||||||||||||||||||||||||||

AZL Mid Cap Index Fund | 31,706,819 | 3,112,230 | (3,368,412 | ) | 876,943 | 712,814 | 33,040,394 | 209,576 | |||||||||||||||||||||||||||

AZL S&P 500 Index Fund, Class 2 | 108,740,465 | 6,836,132 | (15,120,240 | ) | 4,483,332 | 8,134,246 | 113,073,935 | 1,295,359 | |||||||||||||||||||||||||||

AZL Small Cap Stock Index Fund | 17,122,526 | 2,163,781 | (1,268,933 | ) | 336,814 | (483,745 | ) | 17,870,443 | 103,590 | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||

| $ | 413,380,453 | $ | 45,123,155 | $ | (39,120,913 | ) | $ | 6,280,152 | $ | 12,413,607 | $ | 438,076,454 | $ | 4,662,417 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||

Pursuant to separate agreements between the Funds and the Manager, the Manager provides a Chief Compliance Officer (“CCO”) and certain compliance oversight and regulatory filing services to the Trust. Under these agreements the Manager is entitled to an amount equal to a portion of the compensation and certain other expenses related to the individuals performing the CCO and compliance oversight services, as well as $100 per hour for time incurred in connection with the preparation and filing of certain documents with the Securities and Exchange Commission. The fees are paid to the Manager on a quarterly basis. The total expenses incurred by the Fund for these services are reflected on the Statement of Operations as “Administrative and compliance services fees.”

Citi Fund Services Ohio, Inc. (“Citi” or the “Administrator”), a wholly owned subsidiary of Citigroup, Inc., with which an officer of the Trust is affiliated, serves as the Trust’s administrator, transfer agent, and fund accountant, and assists the Trust in all aspects of its administration and operation. The Administrator is entitled to a fee, accrued daily and paid monthly. In addition, the Administrator is entitled to annual account fees related to the transfer agency system, and a Trust-wide annual fee for providing infrastructure and support in implementing the written policies and procedures comprising the Fund’s compliance program. Fees payable to the Administrator are subject to certain reductions associated with services provided to new funds. Beginning January 1, 2015, these reductions are no longer applicable to new funds. The Administrator is also reimbursed for certain expenses incurred. The total expenses incurred by the Fund for these services are reflected on the Statement of Operations as “Administration fees.”

Allianz Life Financial Services, LLC (“ALFS”), an affiliate of the Manager, serves as distributor of the Fund and receives a Trust-wide annual fee of $7,500, paid by the Manager from its profits and not by the Trust, for recordkeeping and reporting services.

In addition, certain legal fees and expenses are paid to a law firm, Dorsey & Whitney LLP, of which the Secretary of the Fund is a partner. During the year ended December 31, 2014, $5,063 was paid from the Fund relating to these fees and expenses.

Certain Officers and Trustees of the Trust are affiliated with the Manager or the Administrator. Such Officers (except for the Trust’s CCO as noted above) and Trustees receive no compensation from the Trust for serving in their respective roles. For their service to the Trust and to the Allianz Variable Insurance Products Trust, each non-interested Trustee receives a $163,000 annual Board retainer and the Lead Director receives an additional $24,450 annually. In addition, the Trustees are reimbursed for certain expenses associated with attending Board meetings. Compensation to the Trustees is allocated between the Trust and the Allianz Variable Insurance Products Trust in proportion to the assets under management of each trust. During the year ended December 31, 2014, actual Trustee compensation was $1,155,670 in total for both trusts.

4. Investment Valuation Summary

The valuation techniques employed by the Fund, as described below, maximize the use of observable inputs and minimize the use of unobservable inputs in determining fair value. The inputs used for valuing the Fund’s investments are summarized in the three broad levels listed below:

| — | Level 1 — quoted prices in active markets for identical assets |

| — | Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayments speeds, credit risk, etc.) |

| — | Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The Fund determines transfers between fair value hierarchy levels at the reporting period end. The inputs or methodology used for valuing investments is not necessarily an indication of the risk associated with investing in those investments.

9

AZL Balanced Index Strategy Fund

Notes to the Financial Statements

December 31, 2014

Investments in other investment companies are valued at their published net asset value (“NAV”). Security prices are generally provided by an independent third party pricing service approved by the Trust’s Board of Trustees (“Trustees”) as of the close of the New York Stock Exchange (“NYSE”) (generally 4:00 pm Eastern Time). The investments utilizing Level 1 valuations represent investments in open-end investment companies.

For the year ended December 31, 2014, there were no Level 3 investments for which significant unobservable inputs were used to determine fair value.

The following is a summary of the valuation inputs used as of December 31, 2014 in valuing the Fund’s investments based upon the three levels defined above:

| Investment Securities: | Level 1 | Level 2 | Total | ||||||||||||

Affiliated Investment Companies | $ | 438,076,454 | $ | — | $ | 438,076,454 | |||||||||

|

|

|

|

|

| ||||||||||

Total Investment Securities | $ | 438,076,454 | $ | — | $ | 438,076,454 | |||||||||

|

|

|

|

|

| ||||||||||

5. Security Purchases and Sales

For the year ended December 31, 2014, cost of purchases and proceeds from sales of securities (excluding securities maturing less than one year from acquisition) were as follows:

| Purchases | Sales | |||||||||

AZL Balanced Index Strategy Fund | $ | 45,123,155 | $ | 39,120,913 | ||||||

6. Investment Risks

Derivatives Risk: The Fund may invest directly or through affiliated or unaffiliated mutual funds or unregistered investment pools in derivative instruments such as futures, options, and options on futures. A derivative is a financial contract whose value depends on, or is derived from, the value of an underlying asset, reference rate, or risk. Use of derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments. Derivatives are subject to a number of other risks, such as liquidity risk, interest rate risk, market risk, credit risk, and selection risk. Derivatives also involve the risk of mispricing or improper valuation and the risk that changes in the value may not correlate perfectly with the underlying asset, rate, or index. Using derivatives may result in losses, possibly in excess of the principal amount invested. Also, suitable derivative transactions may not be available in all circumstances. The other party to a derivatives contract could default. During the year ended December 31, 2014, the Fund did not directly invest in derivatives.

7. Federal Tax Information

It is the Fund’s policy to continue to comply with the requirements of the Internal Revenue Code under Subchapter M, applicable to regulated investment companies, and to distribute all of its taxable income, including any net realized gains on investments, to its shareholders. Therefore, no provision is made for federal income taxes.

Management of the Fund has reviewed tax positions taken in tax years that remain subject to examination by all major tax jurisdictions, including federal (i.e., the last four tax year ends and the interim tax period since then, as applicable). Management believes that there is no tax liability resulting from unrecognized tax benefits related to uncertain tax positions taken.

Cost for federal income tax purposes at December 31, 2014 is $345,514,555. The gross unrealized appreciation/ (depreciation) on a tax basis is as follows:

Unrealized appreciation | $ | 93,328,220 | ||

Unrealized depreciation | (766,321 | ) | ||

|

| |||

Net unrealized appreciation/(depreciation) | $ | 92,561,899 | ||

|

|

The tax character of dividends paid to shareholders during the year ended December 31, 2014 were as follows:

| Ordinary Income | Net Long-Term Capital Gains | Total Distributions(a) | |||||||||||||

AZL Balanced Index Strategy Fund | $ | 6,008,353 | $ | 5,277,414 | $ | 11,285,767 | |||||||||

| (a) | Total distributions paid may differ from the Statements of Changes in Net Assets because dividends are recognized when actually paid for tax purposes. |

The tax character of dividends paid to shareholders during the year ended December 31, 2013 were as follows:

| Ordinary Income | Net Long-Term Capital Gains | Total Distributions(a) | |||||||||||||

AZL Balanced Index Strategy Fund | $ | 6,512,409 | $ | 1,087,438 | $ | 7,599,847 | |||||||||

| (a) | Total distributions paid may differ from the Statements of Changes in Net Assets because dividends are recognized when actually paid for tax purposes. |

10

AZL Balanced Index Strategy Fund

Notes to the Financial Statements

December 31, 2014

As of December 31, 2014, the components of accumulated earnings on a tax basis were as follows:

| Undistributed Ordinary Income | Undistributed Long-Term Capital Gains | Accumulated Capital and Other Losses | Unrealized Appreciation/ (Depreciation)(a) | Total Accumulated Earnings/(Deficit) | |||||||||||||||||||||

AZL Balanced Index Strategy Fund | $ | 4,617,147 | $ | 8,184,848 | $ | — | $ | 92,561,899 | $ | 105,363,894 | |||||||||||||||

| (a) | The difference between book-basis and tax-basis unrealized appreciation/(depreciation) is attributable primarily to tax deferral of losses on wash sales. |

8. Subsequent Events

Management has evaluated events and transactions subsequent to period end through the date the financial statements were issued, for purposes of recognition or disclosure in these financial statements and there are no subsequent events to report.

11

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Shareholders and Board of Trustees of

Allianz Variable Insurance Products Fund of Funds Trust:

We have audited the accompanying statement of assets and liabilities of AZL Balanced Index Strategy Fund (the “Fund”) of the Allianz Variable Insurance Products Fund of Funds Trust, including the schedule of portfolio investments, as of December 31, 2014, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2014, by correspondence with the transfer agents of the underlying funds. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Fund as of December 31, 2014, the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended and the financial highlights for each of the years in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

/s/ KPMG LLP

Columbus, Ohio

February 25, 2015

12

Other Federal Income Tax Information (Unaudited)

For the year ended December 31, 2014, 25.66% of the total ordinary income dividends paid by the Fund qualify for the corporate dividends received deduction available to corporate shareholders.

During the year ended December 31, 2014, the Fund declared net long-term capital gain distributions of $5,277,414.

13

Other Information (Unaudited)

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available, without charge, upon request, by visiting the Securities and Exchange Commission’s (“Commission”) website at www.sec.gov, or by calling 800-624-0197.

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30th is available (i) without charge, upon request, by calling 800-624-0197; (ii) on the Allianz Variable Insurance Products Fund of Funds Trust’s website at https://www.allianzlife.com; and (iii) on the Commission’s website at http://www.sec.gov.

The Fund files complete Schedules of Portfolio Holdings with the Commission for the first and third quarters of each fiscal year on Form N-Q. Schedules of Portfolio Holdings for the Fund in this report are available without charge on the Commission’s website at http://www.sec.gov, or may be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330.

14

Approval of Investment Advisory Agreement (Unaudited)

Subject to the general supervision of the Board of Trustees and in accordance with each Fund’s investment objectives and restrictions, investment advisory services are provided to the Funds by Allianz Investment Management LLC (the “Manager”). The Manager manages each Fund pursuant to an investment management agreement (the “Management Agreement”) with the Trust in respect of each such Fund. The Management Agreement provides that the Manager, subject to the supervision and approval of the Board of Trustees, is responsible for the management of each Fund. For management services, each Fund pays the Manager an investment advisory fee based upon each Fund’s average daily net assets. The Manager has contractually agreed to limit the expenses of each Fund by reimbursing each Fund if and when total Fund operating expenses exceed certain amounts until at least May 1, 2016.

Wilshire Funds Management (“Wilshire”) serves as a consultant to the Manager in preparing statistical and other factual information for use in the creation and maintenance of the asset allocation models for the Fusion Funds (the AZL MVP Fusion Conservative, Balanced, Moderate and Growth Funds), pursuant to an agreement between the Manager and Wilshire. Wilshire serves as a consultant to the Manager with respect to selecting the Fusion Permitted Underlying Investments and the Fund’s asset allocations among the Permitted Underlying Investments. The Manager, not any Fund, pays a consultant fee to Wilshire. Wilshire began serving in its capacity as a consultant beginning January 1, 2010.

In reviewing the services provided by the Manager and the terms of the Management Agreement, the Board receives and reviews information related to the Manager’s experience and expertise in the variable insurance marketplace. Currently, the Funds are offered only through variable annuities and variable life insurance policies, and not in the retail fund market. In addition, the Board receives information regarding the Manager’s expertise with regard to portfolio diversification and asset allocation requirements within variable insurance products issued by Allianz Life Insurance Company of North America and its subsidiary, Allianz Life Insurance Company of New York. Currently, the Funds are offered only through Allianz Life and Allianz of New York variable products.

As required by the Investment Company Act of 1940 (the “1940 Act”), the Trust’s Board has reviewed and approved the Management Agreement with the Manager. The Board’s decision to approve this contract reflects the exercise of its business judgment on whether to approve new arrangements and continue the existing arrangements. During its review of the contract, the Board considered many factors, among the most material of which are: the Funds’ investment objectives, the Manager’s management philosophy, personnel, processes and investment performance, including its compliance history and the adequacy of its compliance processes; the preferences and expectations of Fund shareholders (and underlying contract owners) and their relative sophistication; the continuing state of competition in the mutual fund industry; and comparable fees in the mutual fund industry.

The Board also considered the compensation and benefits received by the Manager. This includes fees received for services provided to a Fund by employees of the Manager or of affiliates of the Manager and research services received by the Manager from brokers that execute Fund trades, as well as advisory fees. The Board considered the fact that: (1) the Manager and the Trust are parties to an Administrative Service Agreement and Compliance Services Agreement, under which the Manager is compensated by the Trust for performing certain administrative and compliance services including providing an employee of the Manager or one of its affiliates to act as the Trust’s Chief Compliance Officer; and (2) Allianz Life Financial Services LLC, an affiliated person of the Manager, is a registered securities broker-dealer and receives (along with its affiliated persons) payments made by the Underlying Funds pursuant to Rule 12b-1.

The Board is aware that various courts have interpreted provisions of the 1940 Act and have indicated in their decisions that the following factors may be relevant to the Manager’s compensation: the nature and quality of the services provided by the Manager, including the performance of the funds; the Manager’s cost of providing the services; the extent to which the Manager may realize “economies of scale” as the funds grow larger; any indirect benefits that may accrue to the Manager and its affiliates as a result of the Manager’s relationship with the funds; performance and expenses of comparable funds; the profitability to the Manager from acting as adviser to the funds; and the extent which the independent Board members are fully informed about all facts bearing on the Manager’s services and fees. The Trust’s Board is aware of these factors and took them into account in its review of the Management Agreement for the Funds.

The Board considered and weighed these circumstances in light of its experience in governing the Trust, and is assisted in its deliberations by the advice of legal counsel to the Independent Trustees. In this regard, the Board requests and receives a significant amount of information about the Funds and the Manager. Some of this information is provided at each regular meeting of the Board; additional information is provided in connection with the particular meeting or meetings at which the Board’s formal review of an advisory contract occurs. In between regularly scheduled meetings, the Board may receive information on particular matters as the need arises. Thus, the Board’s evaluation of the Management Agreement is informed by reports covering such matters as: the Manager’s investment philosophy, personnel and processes, and the Fund’s investment performance (in absolute terms as well as in relationship to its benchmark). In connection with comparing the performance of each Fund versus its benchmark, the Board receives reports on the extent to which the Fund’s performance may be attributed to various applicable factors, such as asset class allocation decisions and volatility management strategies, the performance of the Underlying Funds, rebalancing decisions, and the impact of cash positions and Fund fees and expenses. The Board also receives reports on the Funds’ expenses (including the advisory fee itself and the overall expense structure of the Funds, both in absolute terms and relative to similar and/or competing funds, with due regard for contractual or voluntary expense limitations); the nature and extent of the advisory and other services provided to the Fund by the Manager and its affiliates; compliance and audit reports concerning the Funds and the companies that service them; and relevant developments in the mutual fund industry and how the Funds and/or the Manager are responding to them.

The Board also receives financial information about the Manager, including reports on the compensation and benefits the Manager derives from its relationships with the Funds. These reports cover not only the fees under the Management Agreement, but also fees, if any, received for providing other services to the Funds. The reports also discuss any indirect or “fall out” benefits the Manager or its affiliates may derive from its relationship with the Funds.

The Management Agreement was most recently considered at Board of Trustees meetings held in the fall of 2014. Information relevant to the approval of such Agreement was considered at a telephonic Board of Trustees meeting on October 14, 2014, and at an “in person” Board of Trustees meeting held October 21, 2014. The Agreement was approved at the Board meeting of October 21, 2014. At such meeting the Board also approved an Expense Limitation Agreement between the Manager and the Trust for the period ending April 30, 2016. In connection with such meetings, the Trustees requested and evaluated extensive materials from the Manager, including performance and expense information for other investment companies with similar investment objectives derived from data compiled by an independent third party provider and other sources believed to be reliable by the Manager. Prior to voting, the Trustees reviewed the proposed approval/continuance of the Agreement with management and with experienced counsel who are independent of the Manager and received a memorandum from such counsel discussing the legal standards for their consideration of the proposed approvals/ continuances. The independent (“disinterested”) Trustees also discussed the proposed approvals/continuances in a private session with such counsel at which no representatives of the Manager were present. In reaching their determinations relating to the approval and/or continuance of the Agreement, in respect of each Fund, the Trustees considered all factors they believed relevant. The Board based its decision to approve the Management Agreement on the totality of the circumstances and relevant factors, and with a view to past and future long-term considerations. Not all of the factors and considerations discussed above and below are necessarily relevant to each Fund, and the Board did not assign relative weights to factors discussed herein or deem any one or group of them to be controlling in and of themselves.

15

An SEC rule requires that shareholder reports include a discussion of certain factors relating to the selection of the investment adviser and the approval of the advisory fee. The “factors” enumerated by the SEC are set forth below in italics, as well as the Board’s conclusions regarding such factors:

(1) The nature, extent and quality of services provided by the Manager. The Trustees noted that the Manager, subject to the control of the Board of Trustees, administers each Fund’s business and other affairs. The Trustees noted that the Manager also provides the Trust and each Fund with such administrative and other services (exclusive of, and in addition to, any such services provided by any others retained by the Trust on behalf of the Funds) and executive and other personnel as are necessary for the operation of the Trust and the Funds. Except for the Trust’s Chief Compliance Officer, the Manager pays all of the compensation of Trustees and officers of the Trust who are employees of the Manager or its affiliates.

The Trustees considered the scope and quality of services provided by the Manager and noted that the scope of such services provided had expanded as a result of recent regulatory and other developments. The Trustees noted that, for example, the Manager is responsible for maintaining and monitoring its own compliance program, and this compliance program has been continuously refined and enhanced in light of new regulatory requirements. The Trustees considered the capabilities and resources which the Manager has dedicated to performing services on behalf of the Trust and its Funds. The quality of administrative and other services, including the Manager’s role in coordinating the activities of the Trust’s other service providers, also was considered. The Trustees concluded that, overall, they were satisfied with the nature, extent and quality of services provided (and expected to be provided) to the Trust and to each of the Funds under the Management Agreement.

(2) The investment performance of the Fund and the Manager. In connection with the fall 2014 contract review process, Trustees received extensive information on the performance results of the Funds. (Of the 12 Funds, one Fund, the AZL MVP T. Rowe Price Capital Appreciation Fund, did not have at least 12 months of performance history.) Historical performance information of at least three years was available for each of the AZL MVP Fusion Conservative, AZL MVP Fusion Balanced, AZL MVP Fusion Moderate and AZL MVP Fusion Growth Funds and the AZL Balanced and Growth Index Strategy Funds. Performance information includes information on absolute total return, performance versus the appropriate benchmark(s), the contribution to performance of the Manager’s asset class allocation decisions and volatility management strategies (the volatility management strategy was modified to incorporate a volatility cap in the second quarter of 2013), the performance of the Underlying Funds, and the impact on performance of rebalancing decisions, cash and Fund fees. For example, in connection with the Board of Trustees meeting held October 21, 2014, the Manager reported that for the three year period ended June 30, 2014, the AZL MVP Fusion Conservative, Balanced, Growth and Moderate Funds ranked in the 43rd, 73rd, 74th, and 86th percentiles respectively, in their [Lipper] peer groups, and for the one year period ended June 30, 2014 they ranked in the 49th, 74th, 32nd, and 82nd percentiles, respectively. For the three year period ended June 30, 2014, the AZL Balanced Index Strategy and AZL Growth Index Strategy Funds ranked in the 47th and 27th percentiles of their peer groups, respectively, and for the one year ended June 30, 2014 they ranked in the 69th and 27th percentiles respectively.

At the Board of Trustees meeting held October 21, 2014 the Manager reported upon the performance of the MVP Funds compared to custom managed volatility peer groups. For the two year period ended June 30, 2014, the AZL Fusion Conservative, Balanced, Growth and Moderate Funds ranked in the 20th, 50th, 12th, and 24th percentiles respectively; the AZL MVP Balanced Index Strategy and AZL MVP Growth Index Strategy Funds ranked in the 30th and 1st percentiles respectively; and the AZL MVP BlackRock Global Allocation, AZL MVP Invesco Equity & Income and the AZL MVP Franklin Templeton Founding Strategy Plus Funds ranked in the 47th, 1st, and 8th percentiles respectively.

At the Board of Trustees meeting held October 21, 2014, the Trustees determined that the investment performance of the Funds was acceptable.

(3) The costs of services to be provided and profits to be realized by the Manager and its affiliates from the relationship with the Funds. The Board considered that the Manager receives an advisory fee from each of the Funds. The Manager reported that for the MVP Fusion Funds the advisory fee paid put these Funds in the 38th percentile of the customized peer group. The Manager reported that for the Index Strategy Funds the advisory fee paid put them in the 32nd percentile (or lower) of the customized peer group. The Manager reported that for the AZL MVP BlackRock Global Allocation, AZL MVP Franklin Templeton Founding Strategy Plus, AZL MVP Invesco Equity & Income, and AZL MVP T. Rowe Price Capital Appreciation Funds, the advisory fee paid put them in the 7th percentile of the customized peer group. Trustees were provided with information on the total expense ratios of the Funds and other funds in the customized peer groups, and the Manager reported upon the challenges in making peer group comparisons for the Funds.

The Manager provided information concerning the profitability of the Manager’s investment advisory activities for the period from 2011 through June 30, 2014. The Trustees recognized that it is difficult to make comparisons of profitability from investment company advisory agreements because comparative information is not generally publicly available and is affected by numerous factors, including the structure of the particular adviser, the types of funds it manages, its business mix, numerous assumptions regarding allocation of expenses and the adviser’s capital structure and cost of capital. In considering profitability information, the Trustees considered the possible effect of certain fall-out benefits to the Manager and its affiliates. The Trustees focused on profitability of the Manager’s relationships with the Funds before taxes and distribution expenses. The Trustees recognized that the Manager should, in the abstract, be entitled to earn a reasonable level of profits for the services it provides to each Fund.

Based upon the information provided, the Board concluded that the Funds’ advisory fees and expense ratios are not unreasonable, and determined that there was no evidence that the Manager’s level of profitability from its relationship with the Funds was excessive.

(4) and (5) The extent to which economies of scale would be realized as the Funds grow, and whether fee levels reflect these economies of scale. The Trustees noted that the advisory fee schedules for the Funds do not contain breakpoints that reduce the fee rate on assets above specified levels. The Trustees recognized that breakpoints may be an appropriate way for the Manager to share its economies of scale, if any, with Funds that have substantial assets. However, they also recognized that there may not be a direct relationship between any economies of scale realized by Funds and those realized by the Manager as assets increase. The Trustees do not believe there is a uniform methodology for establishing breakpoints that give effect to Fund-specific services provided by the Manager. The Trustees noted that in the fund industry as a whole, as well as among funds similar to the Funds, there is no uniformity or pattern in the fees and asset levels at which breakpoints (if any) apply. Depending on the age, size, and other characteristics of a particular fund and its manager’s cost structure, different conclusions can be drawn as to whether there are economies of scale to be realized at any particular level of assets, notwithstanding the intuitive conclusion that such economies exist, or will be realized at some level of total assets. Moreover, because different managers have different cost structures and service models, it is difficult to draw meaningful conclusions from the breakpoints that may have been adopted by other funds. The Trustees also noted that the advisory agreements for many funds do not have breakpoints at all, or if breakpoints exist, they may be at asset levels significantly greater than those of the individual Funds. The Trustees also noted that the total assets in all of the Funds as of June 30, 2014 were approximately $9.9 billion and that the largest Fund, the AZL MVP Fusion Moderate Fund, had assets of approximately $2.8 billion.

Having taken these factors into account, the Trustees concluded that the absence of breakpoints in the Funds’ advisory fee rate schedules was acceptable under each Fund’s circumstances.

The Trustees noted that the Manager has agreed to temporarily “cap” Fund expenses at certain levels, which has the effect of reducing expenses as would the implementation of advisory fee breakpoints. The Manager has committed to continue to consider the continuation of fee “caps” and/or advisory fee breakpoints as the Funds grow larger. The Board receives quarterly reports on the level of Fund assets. It expects to consider whether or not to approve the Management Agreement at a meeting to be held prior to December 31, 2015, and will at that time, or prior thereto, consider: (a) the extent to which economies of scale can be realized, and (b) whether the advisory fee should be modified to reflect such economies of scale, if any.

16

Information about the Board of Trustees and Officers (Unaudited)

The Trust is managed by the Trustees in accordance with the laws of the state of Delaware governing business trusts. There are currently nine Trustees, two of whom are “interested persons” of the Trust within the meaning of that term under the 1940 Act. The Trustees and Officers of the Trust, their addresses, ages, their positions held with the Trust, their terms of office with the Trust and length of time served, their principal occupation(s) during the past five years, the number of portfolios in the Trust they oversee, and their other directorships held during the past five years are as follows:

Non-Interested Trustees(1)

| Name, Address, and Age | Positions Held with VIP Trust and FOF Trust | Term of Office(2)/Length of Time Served | Principal Occupation(s) During Past 5 Years | Number of Portfolios Overseen for VIP Trust and FOF Trust | Other Directorships Held Outside the AZL Fund Complex | |||||

Peter R. Burnim, Age 67 5701 Golden Hills Drive Minneapolis, MN 55416 | Trustee | Since 2/07 | Chairman, Argus Investment Strategies Fund Ltd., February 2013 to present; Managing Director, iQ Venture Advisors, LLC. 2005 to 2012; Chairman, Northstar Group Holdings Ltd. Bermuda, 2011 to present; Expert Witness, Massachusetts Department of Revenue, 2011 to 2012; Executive Vice President, Northstar Companies, 2002 to 2005; Senior Officer, Citibank and Citicorp for over 25 years | 43 | Argus Group Holdings; Northstar Group Holdings, NRIL, Sterling Centrecorp Inc.; Highland Financial Holdings; and Bank of Bermuda NY | |||||

Peggy L. Ettestad, Age 57 5701 Golden Hills Drive Minneapolis, MN 55416 | Lead Independent Trustee | Since 10/14 (Trustee since 2/07) | Managing Director, Red Canoe Management Consulting LLC, 2008 to present; Senior Managing Director, Residential Capital LLC, 2003 to 2008; Chief Operations Officer, Transamerica Reinsurance 2002 to 2003 | 43 | Luther College | |||||

Roger Gelfenbien, Age 71 5701 Golden Hills Drive Minneapolis, MN 55416 | Trustee | Since 10/99 | Retired; Partner of Accenture 1983 to 1999 | 43 | Virtus Funds (8 Funds) | |||||

Claire R. Leonardi, Age 59 5701 Golden Hills Drive Minneapolis, MN 55416 | Trustee | Since 2/04 | Chief Executive Officer, Connecticut Innovations, Inc., 2012 to present; General Partner, Fairview Capital, L.P., 1994 to 2012 | 43 | Connecticut Technology Council and Connecticut Bioscience Innovation Fund | |||||

Dickson W. Lewis, Age 66 5701 Golden Hills Drive Minneapolis, MN 55416 | Trustee | Since 2/04 | Retired; Consultant to Lifetouch National School Studios; Vice President/General Manager, Yearbooks & Canada-Lifetouch National School Studios, 2006 to 2013; Vice President/General Manager of Jostens, Inc., 2002 to 2006; Senior Vice President of Fortis Group, 1997 to 2002 | 43 | None | |||||

Peter W. McClean, Age 70 5701 Golden Hills Drive Minneapolis, MN 55416 | Trustee | Since 2/04 | Retired; President and CEO of Measurisk, LLC, 2001 to 2003; Chief Risk Management Officer at Bank Of Bermuda Ltd., 1996 to 2001 | 43 | PNMAC Opportunity Fund; Northeast Bank; and FHI | |||||

Arthur C. Reeds III, Age 70 5701 Golden Hills Drive Minneapolis, MN 55416 | Trustee | Since 10/99 | Retired; Senior Investment Officer, Hartford Foundation for Public Giving, 2000 to 2003; Chairman, Chief Executive and President of Conning Corp., 1999 to 2000; Investment Consultant 1997 to 1999 | 43 | Connecticut Water Service, Inc. |

Interested Trustees(3)

| Name, Address, and Age | Positions Held with VIP Trust and FOF Trust | Term of Office(2)/Length of Time Served | Principal Occupation(s) During Past 5 Years | Number of Portfolios Overseen for VIP Trust and FOF Trust | Other Directorships Held Outside the AZL Fund Complex | |||||

Robert DeChellis, Age 47 5701 Golden Hills Drive Minneapolis, MN 55416 | Trustee | Since 3/08 | President and CEO, Allianz Life Financial Services, LLC, 2007 to present | 43 | None | |||||

Brian Muench, Age 44 5701 Golden Hills Drive Minneapolis, MN 55416 | Trustee | Since 6/11 | President, Allianz Investment Management LLC, November 2010 to present; Vice President, Allianz Life, April 2011 to present; Vice President, Advisory Management, Allianz Investment Management LLC from December 2005 to November 2010 | 43 | None |

17

Officers

| Name, Address, and Age | Positions Held with VIP and VIP FOF Trust | Term of Office(2)/Length of Time Served | Principal Occupation(s) During Past 5 Years | |||

Brian Muench, Age 44 5701 Golden Hills Drive Minneapolis, MN 55416 | President | Since 11/10 | President, Allianz Investment Management LLC, November 2010 to present; Vice President, Allianz Life, April 2011 to present; Vice President, Allianz Investment Management LLC from December 2005 to November 2010. | |||

Michael Radmer, Age 69 Dorsey & Whitney LLP, Suite 1500 50 South Sixth Street Minneapolis, MN 55402-1498 | Secretary | Since 2/02 | Partner, Dorsey and Whitney LLP since 1976. | |||

Steve Rudden, Age 45 Citi Fund Services Ohio, Inc. 3435 Stelzer Road Columbus, OH 43219 | Treasurer, Principal Accounting Officer and Principal Financial Officer | Since 6/14 | Senior Vice President, Financial Administration, Citi Fund Services Ohio, Inc., April 2011 to present; Vice President, JPMorgan, April 2006 to April 2010. | |||

Chris R. Pheiffer, Age 46 5701 Golden Hills Drive Minneapolis, MN 55416 | Chief Compliance Officer(4) and Anti-Money Laundering Compliance Officer | Since 2/14 | Chief Compliance Officer of the VIP Trust and the FOF Trust, February 2014 to present; Deputy Chief Compliance Officer of the VIP Trust and the FOF Trust and Compliance Director, Allianz Life, February 2007 to February 2014 |

| (1) | Member of the Audit Committee. |

| (2) | Indefinite. |

| (3) | Is an “interested person”, as defined by the 1940 Act, due to employment by Allianz. |

| (4) | The Manager and the Trust are parties to a Chief Compliance Officer Agreement under which the Manager is compensated by the Trust for providing an employee of the Manager or one of its affiliates to act as the Trust’s Chief Compliance Officer. The Chief Compliance Officer and Anti-Money Laundering Compliance Officer is not considered a corporate officer or executive employee of the Trust. |

18

The Allianz VIP Fund of Funds are distributed by Allianz Life Financial Services, LLC. These Funds are not FDIC Insured. | ANNRPT1214 2/15 |

AZL® Growth Index Strategy Fund

Annual Report

December 31, 2014

Table of Contents

Management Discussion and Analysis

Page 1

Expense Examples and Portfolio Composition

Page 3

Schedule of Portfolio Investments

Page 4

Statement of Assets and Liabilities

Page 5

Statement of Operations

Page 5

Statements of Changes in Net Assets

Page 6

Financial Highlights

Page 7

Notes to the Financial Statements

Page 8

Report of Independent Registered Public Accounting Firm

Page 12

Other Federal Income Tax Information

Page 13

Other Information

Page 14

Approval of Investment Advisory Agreement

Page 15

Information about the Board of Trustees and Officers

Page 17

This report is submitted for the general information of the shareholder of the Fund. The report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus, which contains details concerning the sales charges and other pertinent information.

AZL® Growth Index Strategy Fund Review (unaudited)

Allianz Investment Management LLC serves as the Manager for the AZL® Growth Index Strategy Fund.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

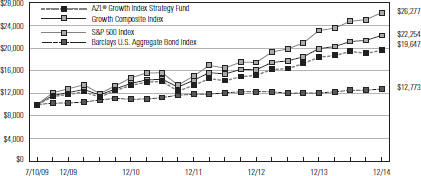

What factors affected the Fund’s performance during the year ended December 31, 2014?

For the year ended December 31, 2014, the AZL® Growth Index Strategy Fund returned 6.53%1. That compared to a 11.73% total return for its benchmark, the Growth Composite Index, which is comprised of a 75% weighting in the S&P 500 Index1 and a 25% weighting in the Barclays U.S. Aggregate Bond Index2.

The AZL Growth Index Strategy Fund is a fund of funds that pursues broad diversification across four equity sub-portfolios and one fixed-income sub-portfolio. The four equity sub-portfolios pursue passive strategies that aim to achieve, before fees, returns similar to the S&P 500 Index, the S&P 400 Index3, the S&P 600 Index4, and the MSCI EAFE Index5, which represents shares of large companies in developed foreign markets. The fixed income sub-portfolio is an enhanced bond index strategy that seeks to achieve a return that exceeds the Barclays Capital U.S. Aggregate Bond Index. Generally, the Fund allocates 65% to 85% of its assets to the underlying equity index funds and between 15% and 35% to the underlying bond index fund.