Wrap Up Lori Ryerkerk

2 Keep in mind… 1 OUR 2023 OUTLOOK IS BASED ON CONTROLLABLE ACTIONS 2 THERE ARE SIGNIFICANT VALUE OPPORTUNITIES BEYOND WHATIS INCLUDED IN OUR 2023 OUTLOOK 3 WE ARE TAKING ACTIONS TODAY TO DELIVER INCREMENTALGROWTH BEYOND 2023

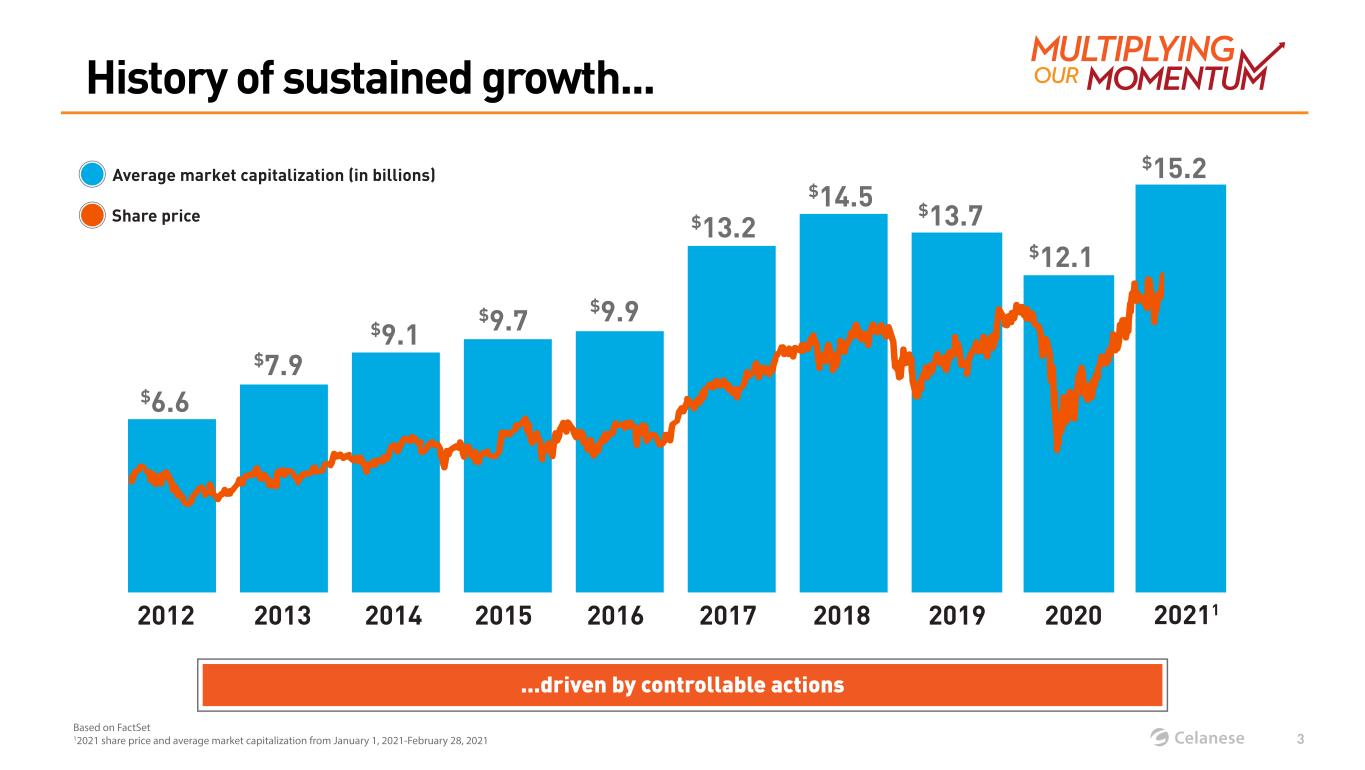

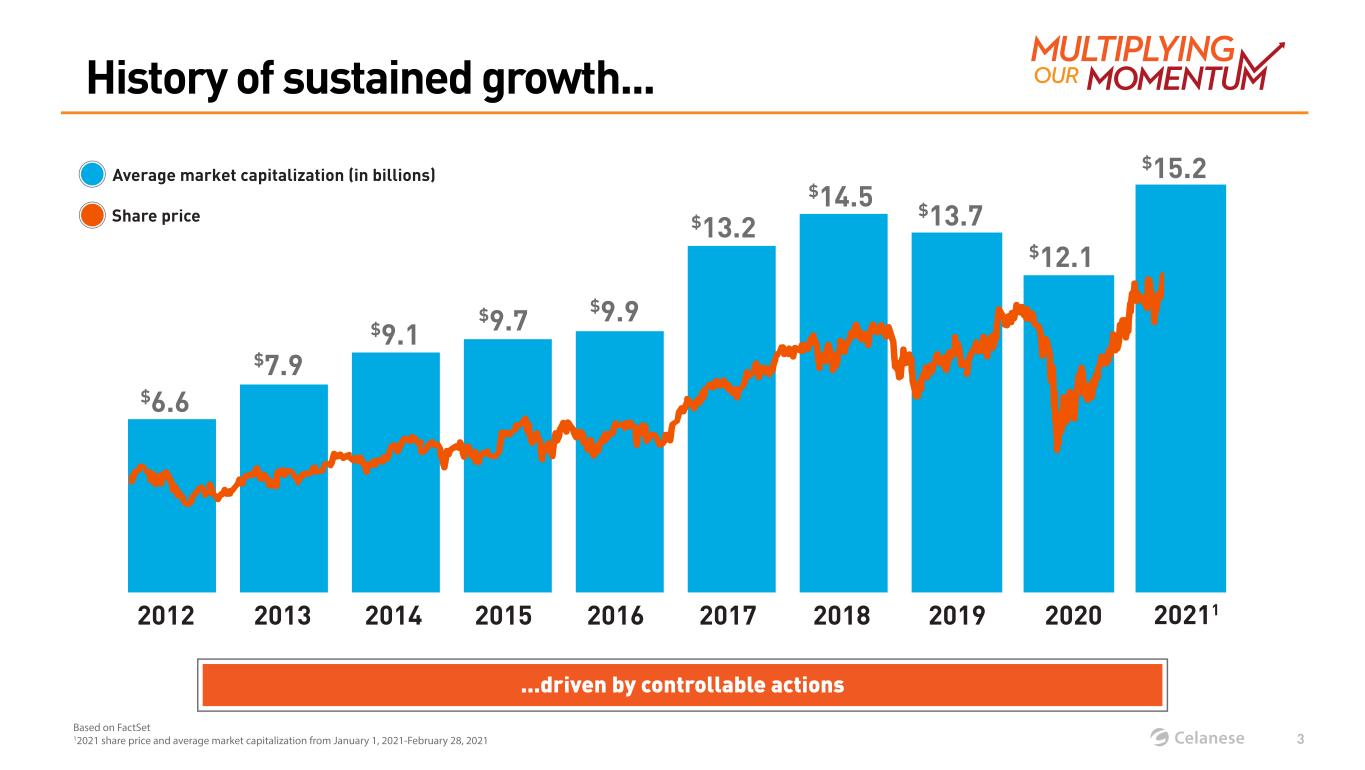

...driven by controllable actions 2012 2013 2014 2015 2016 2017 2018 2019 2020 Average market capitalization (in billions) Share price 20211 $6.6 $7.9 $9.1 $15.2 $12.1 $9.7 $9.9 $13.2 $14.5 $13.7 3 History of sustained growth... Based on FactSet 12021 share price and average market capitalization from January 1, 2021-February 28, 2021

Additional growth opportunities Broad replacement of single-use plastics with sustainable alternatives Acceleration of US, EU, or China infrastructure development Material acetyls curtailment or rationalization activity in China Tow industry rationalization or consolidation Actionability of industry M&A, particularly transformational Accelerated global transition to electric and hybrid vehicles Uniquely positioned to drive these opportunities for further earnings growth 4

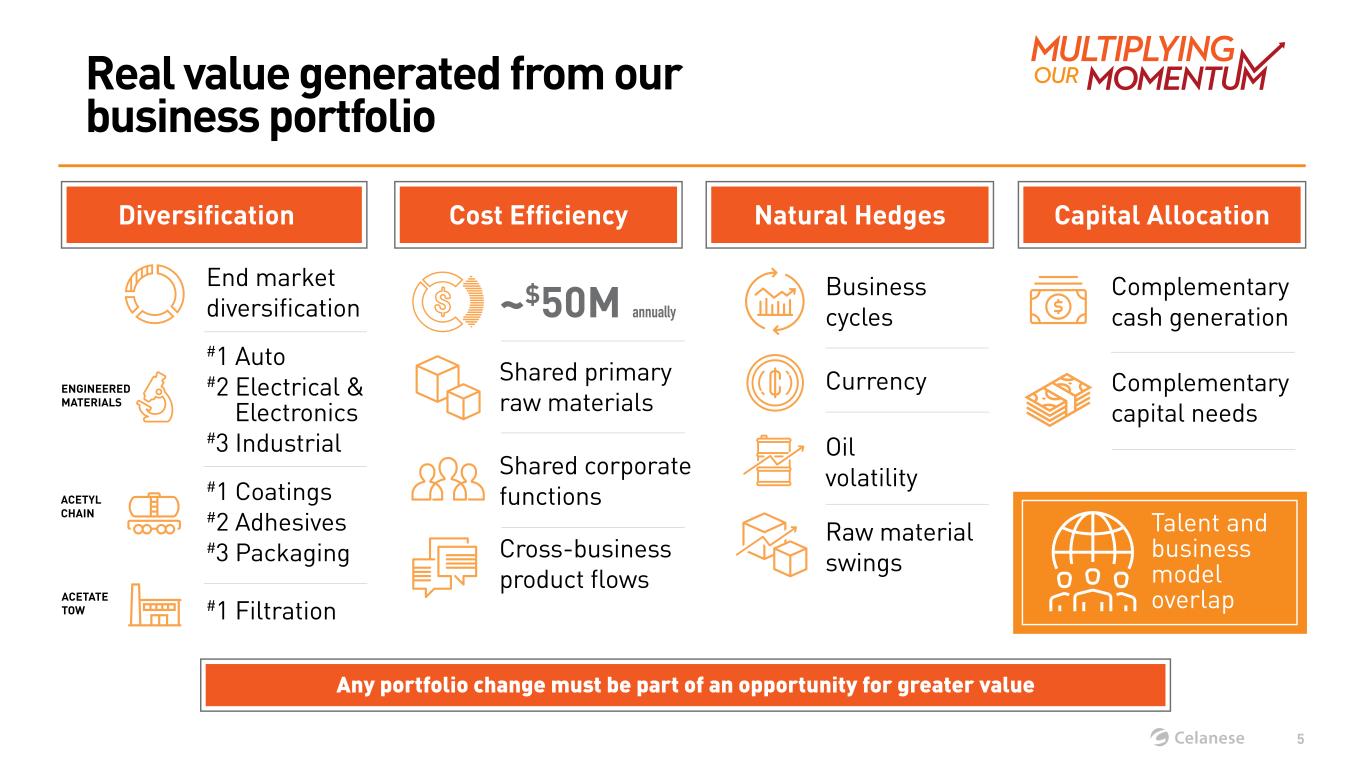

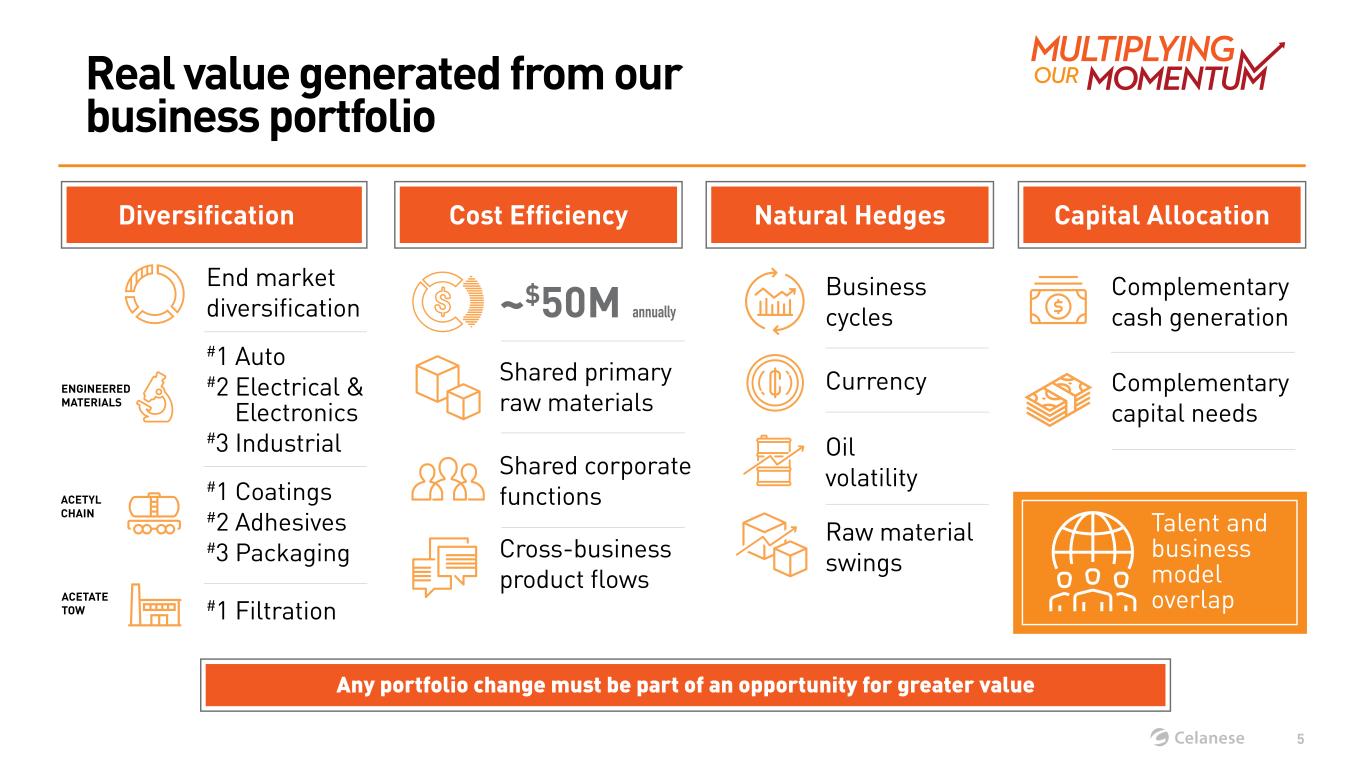

Real value generated from our business portfolio Any portfolio change must be part of an opportunity for greater value Diversification Cost Efficiency Natural Hedges Capital Allocation End market diversification Business cycles Oil volatility Complementary capital needs Raw material swings Currency Complementary cash generation Shared primary raw materials Shared corporate functions Cross-business product flows #1 Auto #2 Electrical & Electronics #3 Industrial #1 Coatings #2 Adhesives #3 Packaging #1 Filtration ~$50M annually ENGINEERED MATERIALS ACETYL CHAIN ACETATE TOW 5 Talent and business model overlap

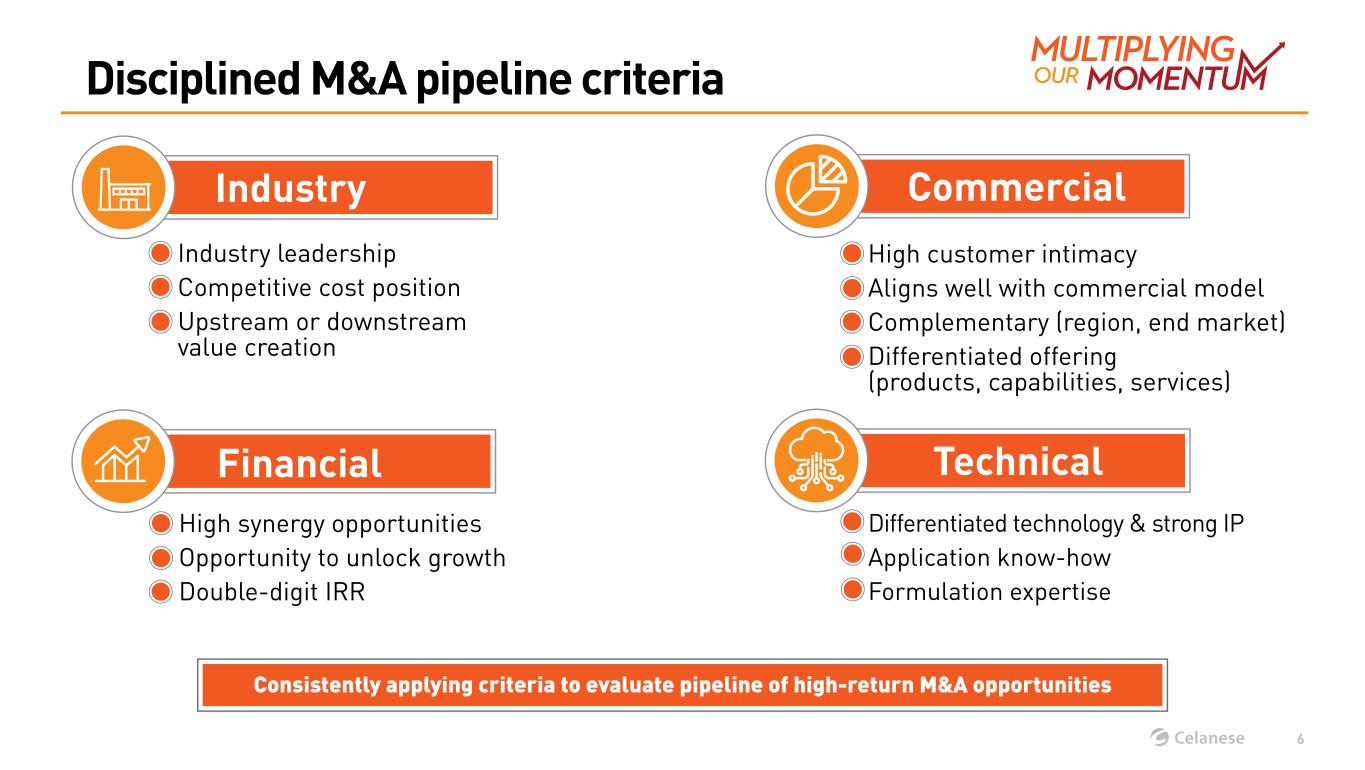

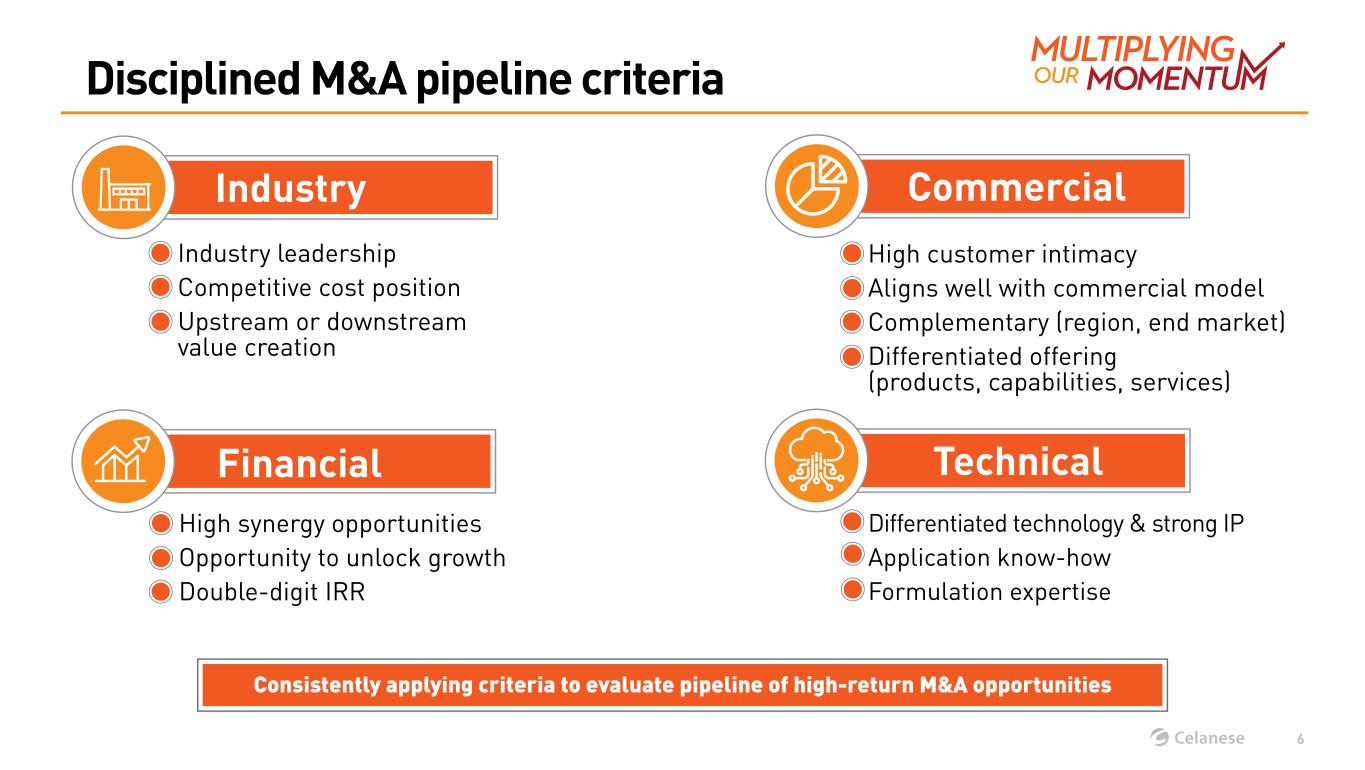

Disciplined M&A pipeline criteria Industry Consistently applying criteria to evaluate pipeline of high-return M&A opportunities Financial Industry leadership Competitive cost position Upstream or downstream value creation High synergy opportunities Opportunity to unlock growth Double-digit IRR Commercial Technical High customer intimacy Aligns well with commercial model Complementary (region, end market) Differentiated offering (products, capabilities, services) Differentiated technology & strong IP Application know-how Formulation expertise 6

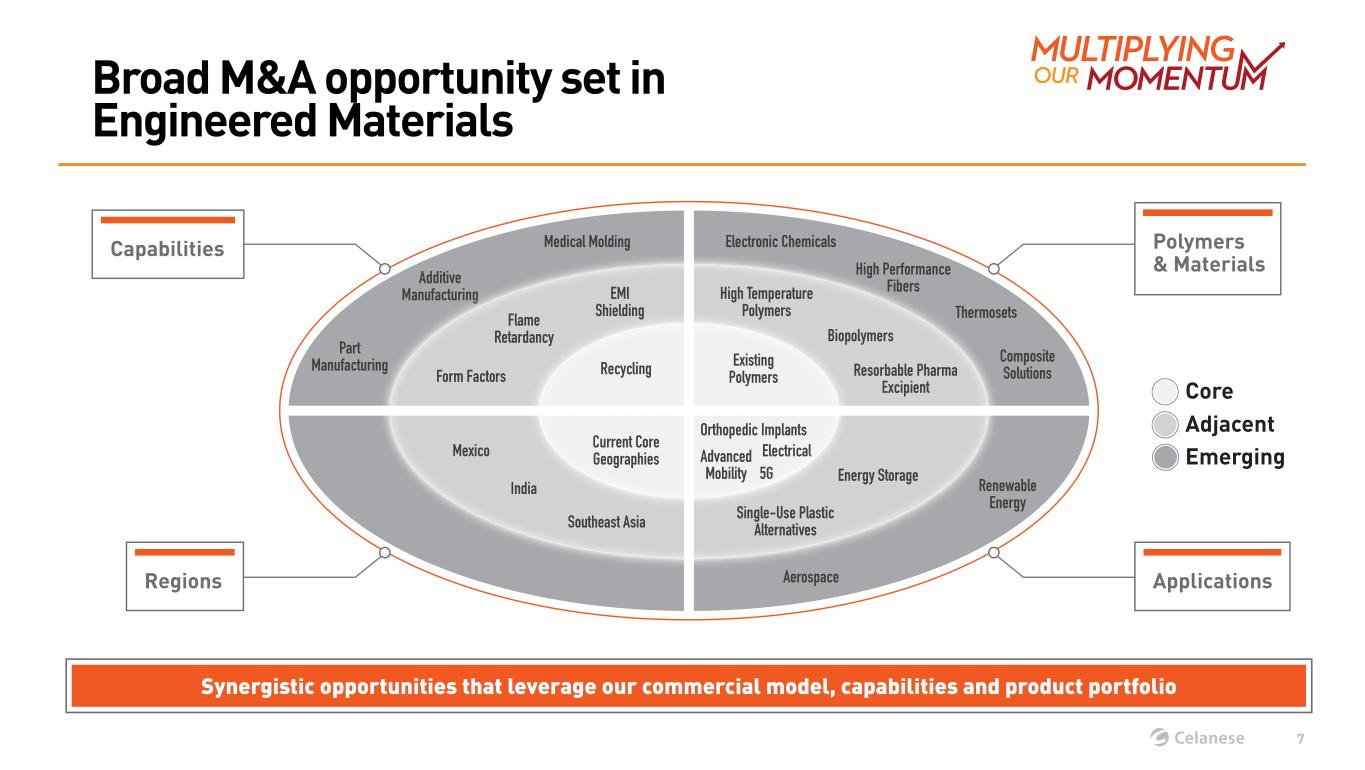

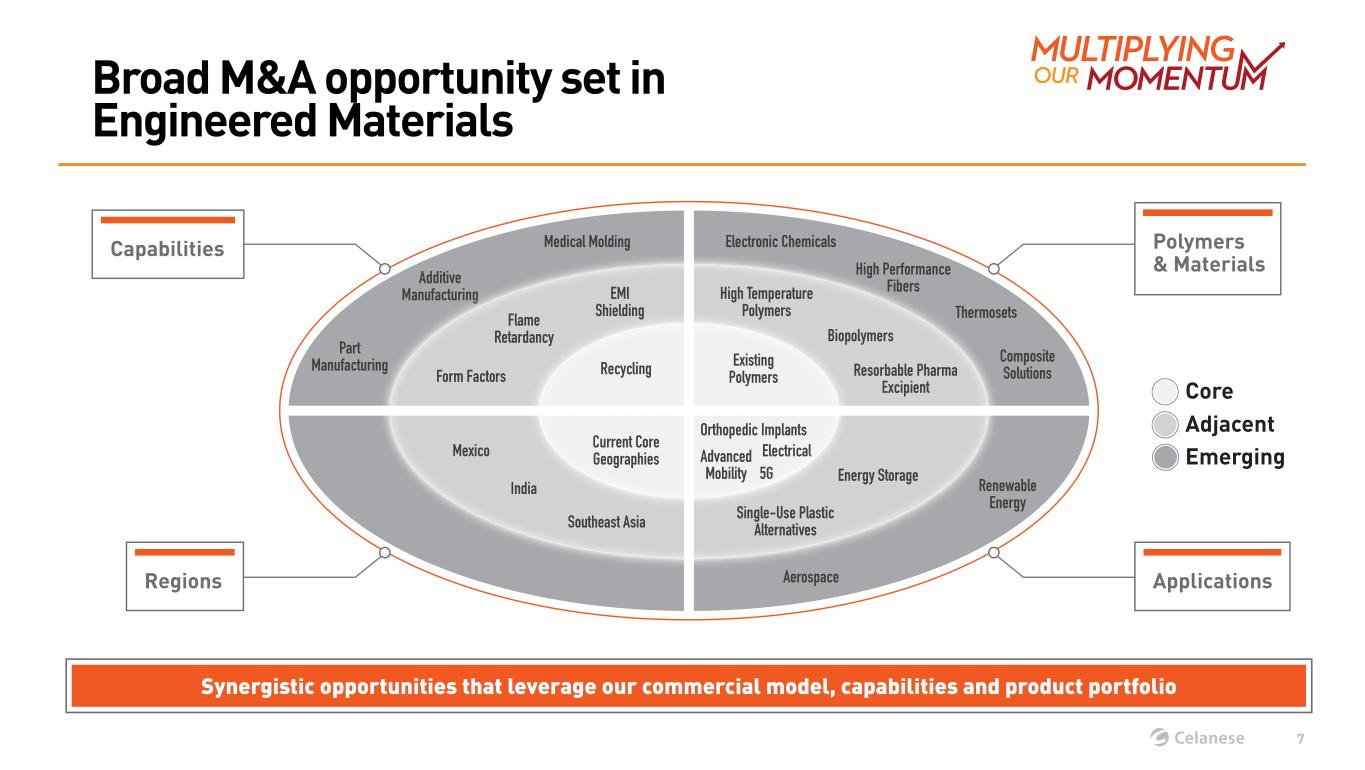

Synergistic opportunities that leverage our commercial model, capabilities and product portfolio Broad M&A opportunity set in Engineered Materials Polymers & Materials ApplicationsRegions Capabilities Orthopedic Implants Electrical Energy Storage Renewable Energy Resorbable Pharma Excipient Biopolymers High Temperature Polymers High Performance Fibers Composite Solutions EMI Shielding Flame Retardancy Part Manufacturing Additive Manufacturing Medical Molding Electronic Chemicals Thermosets Form Factors Mexico India Southeast Asia Existing PolymersRecycling Current Core Geographies Single-Use Plastic Alternatives Aerospace Advanced Mobility 5G Core Adjacent Emerging 7

Committed to delivering outsized value creation through strong execution and M&A Significant upside with M&A 1 Excess cash generation and cash reserves following dividends and capital expenditures Market Capitalization Growth Outlook (in billions)1 2 3 Outlook assumes 100% of excess cash generation1 goes to share repurchases and M&A !"#$%&'(") *+*+ *+*, *+** *+*- Potential for $2-3B value creation2 from M&A synergies Additional value opportunity through rerating from demonstrated track record and portfolio 2015 2020 20213 2023F-2025F $10 $12 $15 Earnings Expansion $5+ $20+ approaching M&A Opportunity Up To 8 2 Range dependent on various factors including deal structure, valuation, synergy profile, etc.Based on FactSet and internal estimates 3 Average market capitalization from January 1, 2021 - February 28, 2021

Extending our strategic investment horizon Controllable actions today to deliver value beyond 2023 Adjusted Earnings Per Share 2018 2019 2020 2021F 2022F 2023F 2024F 2025F $7.64 $9.53 $11.00 $8-10 $11-14 Contributors Beyond 2023 (startup within 2023 or after) Startup 2023 2023 2023 2023 2023 Acetyl Chain Clear Lake acetic acid expansion Methanol from CO2 Nanjing VAM expansion Frankfurt emulsions expansion Nanjing emulsions expansion Engineered Materials Nanjing compounding expansion LCP China capacity EU GUR expansion 2023 2024 2024 9

How we deliver shareholder value… 3 2 1 4 5 6 10 Multiplying Our Momentum Deliver shareholder value on what we can control Partner with our customers to deliver innovative solutions Expand and flex our commercial optionality Allocate our capital with a disciplined focus on returns Foster a culture of diversity, equity and inclusion Deliver a growing portfolio of sustainable products