Acetate Tow Lori Ryerkerk Financial Excellence Scott Richardson

Disciplined focus to drive shareholder value 2 1 2 LEVERAGE OUR BUSINESSES TO DRIVE STRONG CASH GENERATION AND USE THAT CASH FOR SHAREHOLDER VALUE ACCRETION 3 INVEST TIME AND EFFORT TO EVOLVE OUR LEADING BUSINESS FRANCHISES FOCUS ON DELIVERING DOUBLE-DIGIT PER YEAR ADJUSTED EARNINGS PER SHARE GROWTH

Leading positions and business model evolution have driven performance uplift Sustained track record of earnings growth $962 $1,056 $1,268 $6.02 $1,236 $1,852 $11.00-11.50 $7.64$7.51 $11.00 $6.61 $5.67 $4.50 $4.07 $1,131 $1,476 $1,356 $1,278 $9.53 Adjusted EBIT (in millions) Adjusted Earnings Per Share 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021F 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021F 3

Consistent performance translates to shareholder value Compelling relative performance and valuation continue to drive superior returns Total Shareholder Return (February 28, 2018 – February 28, 2021) Free Cash Flow Yield (Avg. 2018 – 2020) Return on Invested Capital (Avg. 2018 – 2020) Shareholder Yield (Avg. 2018 – 2020) 47%CE 22%29%DJUSCHProxy Peers 20%CE 11%12%DJUSCHProxy Peers 8%CE 6%6%DJUSCHProxy Peers 8%CE 4%5%DJUSCHProxy Peers 4Based on FactSet and internal estimates

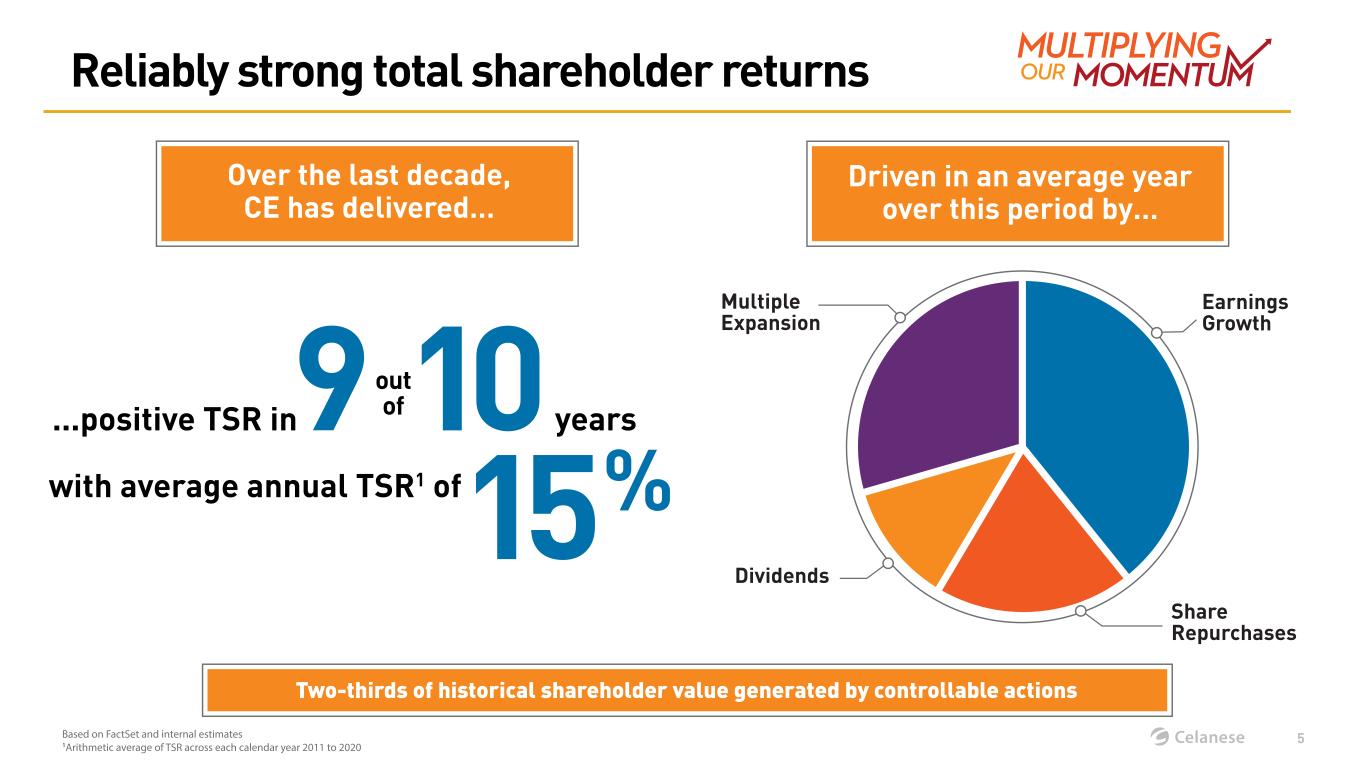

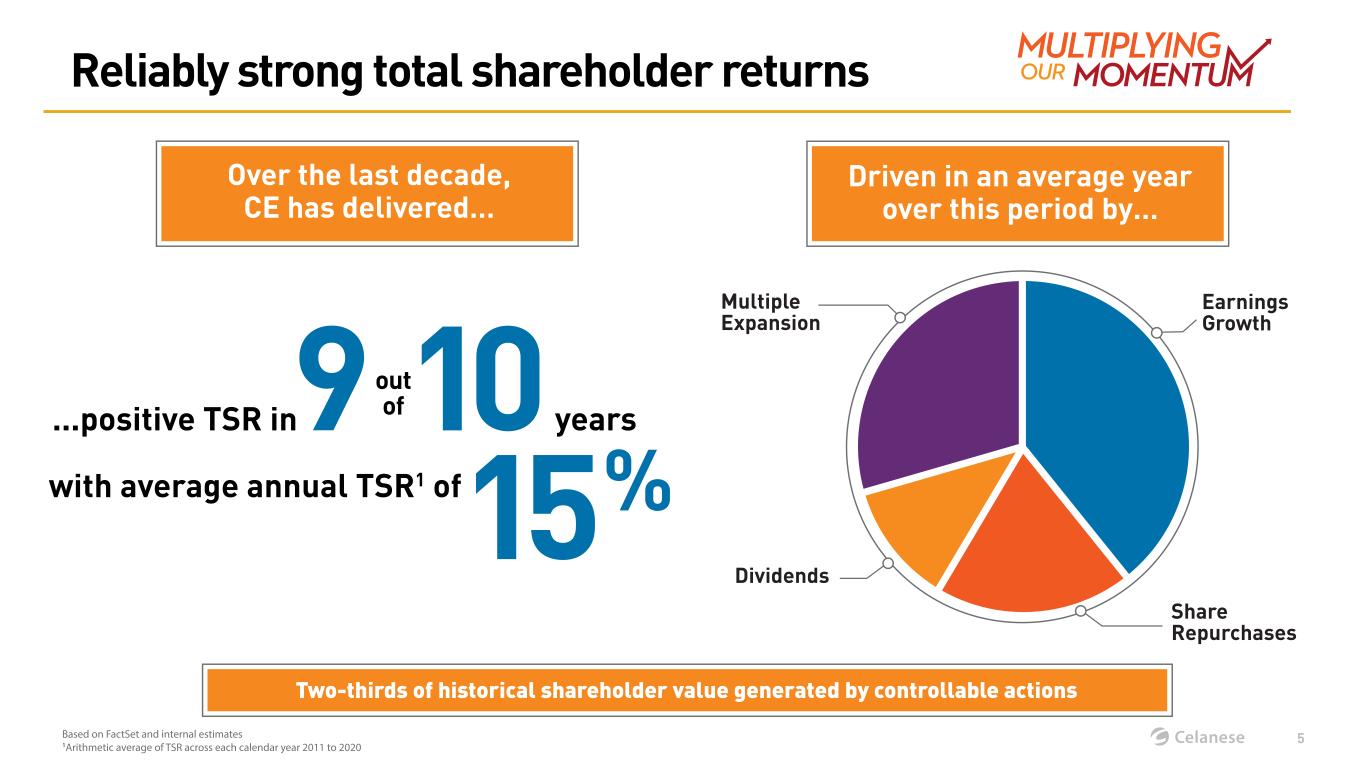

Two-thirds of historical shareholder value generated by controllable actions Reliably strong total shareholder returns Driven in an average year over this period by… ...positive TSR in years with average annual TSR1 of Over the last decade, CE has delivered… Multiple Expansion Earnings Growth Share Repurchases Dividends 9 15% 1Arithmetic average of TSR across each calendar year 2011 to 2020 10out of 5Based on FactSet and internal estimates

Foundational level of returns from dividends and share repurchases Dividends and Share Repurchases $65 $88 $247 $394 $594 $701 $741 $1,097 $1,300 $943 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 >$6 billion returned over the last decade and growing shareholder yield 0.6% 1.3% 3.2% 4.3% 6.2% 7.0% 5.6% 7.7% 9.5% 7.7% Repurchases Dividends Shareholder Yield 6Based on FactSet (in millions) 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

Complementary pillars focus the organization on controllable actions Key pillars in place to lift earnings profile Pipeline model evolution Scaling our models Expanded optionality Productivity-based investments Incremental, capital-efficient expansions Production & supply chain optimization Product & technology enhancement Supportive of business models Feeding productivity pipeline High-Return M&A Organic Investment 2012 2013 2014 2015 2016 2017 2018 2019 2020 Adjusted EBIT (in millions) Raw material & energy efficiency Scaling our production Process & system automation Productivity Business Model Enhancement 2011 7 $950-1,300 $1,100-1,400 $1,300-1,600 1

Earnings growth begins with productivity culture 2015 2016 2017 2018 2019 2020 Historical Productivity (in millions) $235 $165 $145 $125 $168 $214 ~$150 M Average 2020 Productivity Business Enterprise Manufacturing Procurement Elevated and highly sustainable productivity in 2020 8

Productivity remains core component of organic investment Clear Lake Acetic Acid Expansion European Compounding Center of Excellence End to End Supply Chain Transformation (Wave 1) Acetyl Chain • Low-cost natural gas feedstock • Raw material & catalyst usage gains • Fixed cost scale ROCE 25%+ Business Capital Cost & Completion Productivity Engineered Materials <$20M • Consolidate European footprint • Improve compounding utilization • Leverage existing infrastructure Simple Payback All • Supply chain optimization tools • Process optimization • Analytics platforms 2021 Savings Three examples of how productivity contributes to top tier capital returns 1 2 <$350M <$25M 3 2.5 years 2023 2022 2021 ~$20M 9Based on internal estimates

Annual productivity is comprised of hundreds of individual projects Example of end to end supply chain transformation Multiple Waves Three BenefitsHundreds of Drivers11 Project Workstreams (Wave 1) Wave 1 Wave 2 Advanced Statistical Forecasting Supply Network Planning Production Schedule Optimization End-to-End Cost-to-Serve Sampling Execution Distribution Network Optimization Customer Experience Solutions New supply chain technology tools10 Corporate functions optimized 10 Hours of work take out>20k RPA’s1 (“Bots”)20 Productivity Savings Customer Satisfaction Employee Satisfaction 1RPA - Robotic Process Automation 10

Revitalizing a deep organic investment pipeline to drive future returns Organic investments represent highest return opportunities 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021F 2022F 2023F 5% 6% 10% 9% 5%5% 5% 6%6% 2020 CAPEXHistorical CAPEX Cost Reduction Maintenance of Business EHS1 Revenue Generation % of Net Sales 11 Total 1EHS - Environmental, Health and Safety

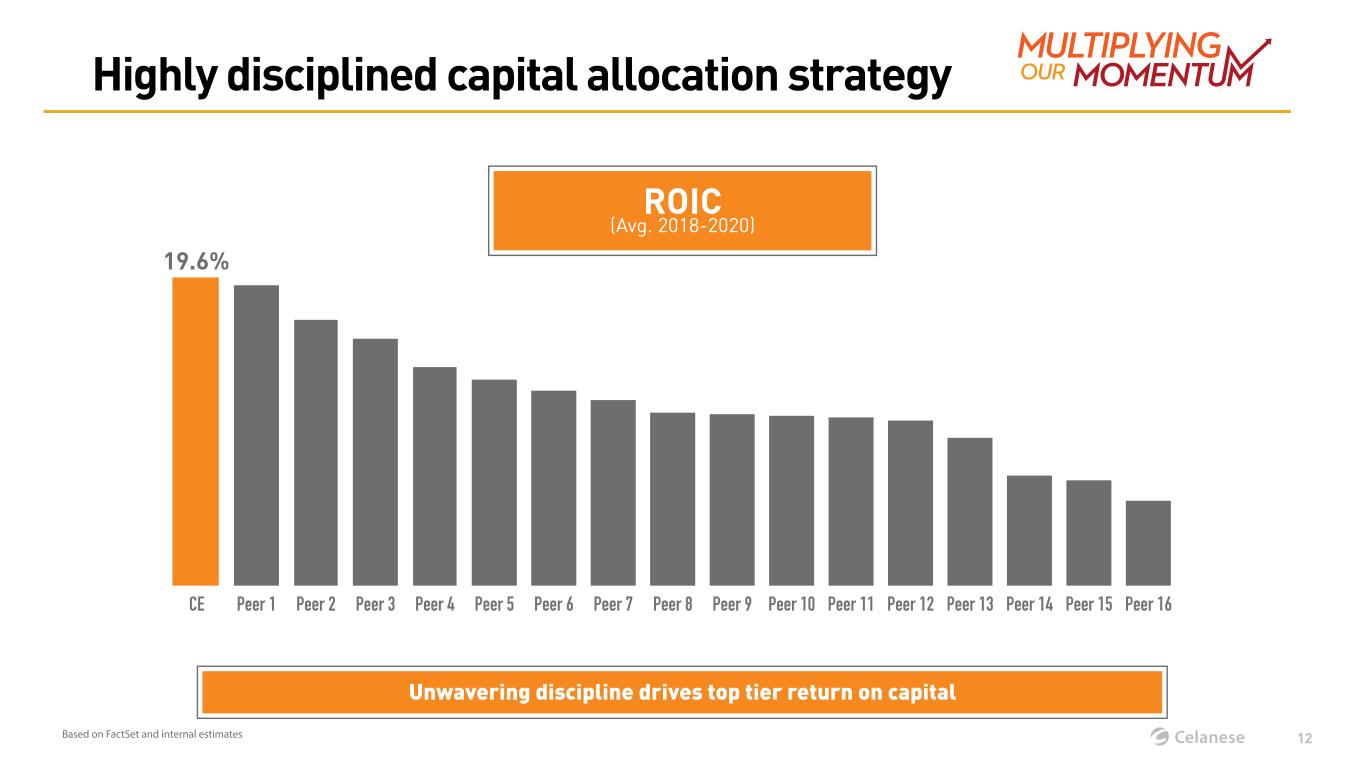

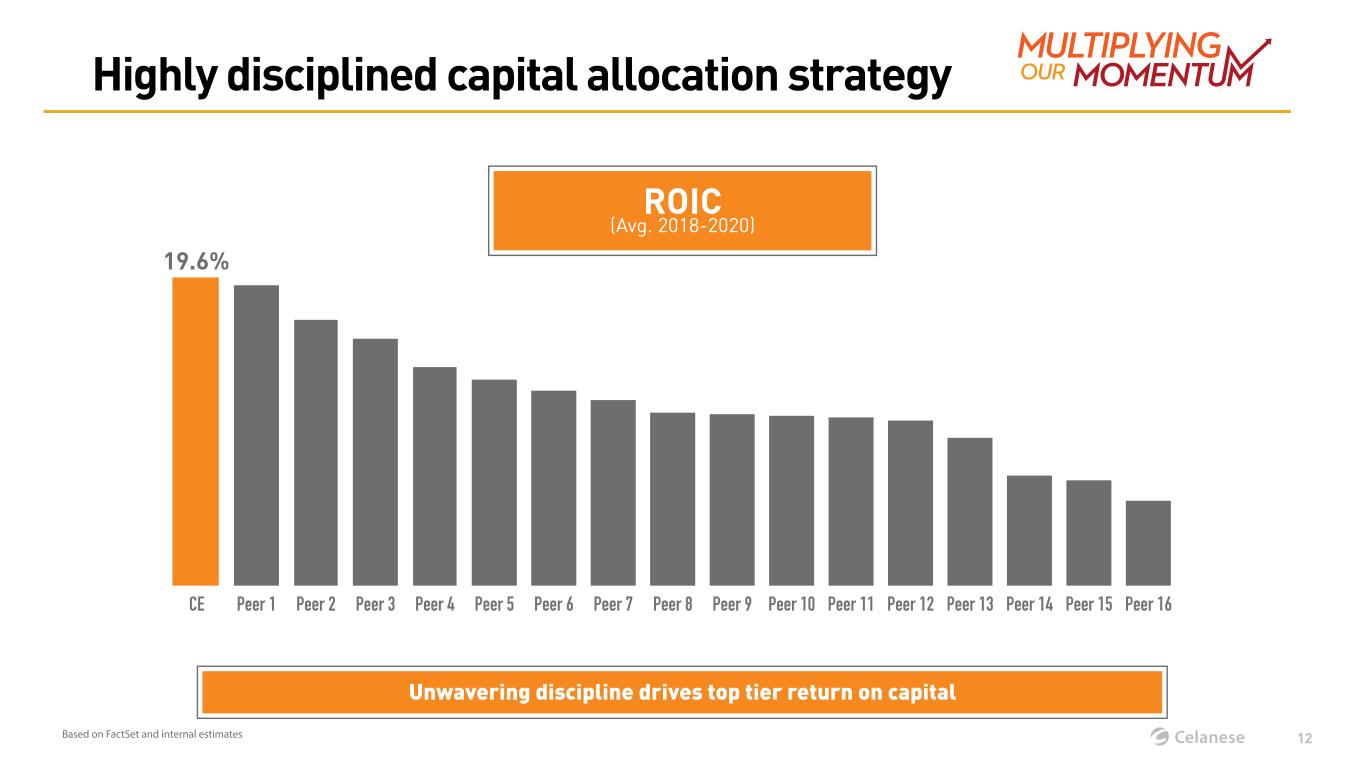

Highly disciplined capital allocation strategy ROIC (Avg. 2018-2020) CE Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 Peer 12 Peer 13 Peer 14 Peer 15 Peer 16 19.6% Unwavering discipline drives top tier return on capital 12Based on FactSet and internal estimates

Business plans to yield high-quality earnings ENGINEERED MATERIALS • Project pipeline and incremental investments • >85% adjusted EBIT from base business • Upside from M&A potential • Leading network optionality and incremental expansion • Earnings profile on normalized industry dynamics • Upside from M&A potential and industry dynamics • Stabilized industry dynamics • Secular demand declines offset by productivity • >50% from growing Chinese affiliate dividends ACETATE TOW ACETYL CHAIN $700- ~$245 Elevating the sustainable earnings profile of our businesses million $1.7-1.8 billion1 EBIT Adjusted 2023 13 1Includes Other Activities 750 $900-1,000 million million

Excess cash generation between 2021 and 2023 for further deployment Cumulative Operating Cash Flow (2021 - 2023) (in billions) Uses of Operating Cash Flow (2021 - 2023) (in billions) 2021F 2022F 2023F >$1.5-2.5 excess cash generation for share repurchases and M&A CAPEX ~$1.5 DIVIDENDS ~$1.0 Business plans yield powerful cash generation ~$4-5 14Based on internal estimates

Flexible, diversified balance sheet enables growth strategy Ability to access multiple debt markets quickly and efficiently $0 $1000 2021 2022 2023 20241 2025 2026 2027 € Bond $ Bond 1Prepayable $1.25 billion revolver matures in 2024. Zero balance as of December 31, 2020. Debt / EBITDA 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021F 1.6 2.2 2.5 2.3 1.7 2.0 1.9 2.2 1.6 2.2 2.5 1.9 15 Debt Maturity Profile (in millions)

Additional firepower on the balance sheet Central Nervous System DisordersOphthalmology Current Excess Cash Levels Cash Generation (2021-2023) Balance Sheet Capacity (through 2023) Excess Cash Balance1 Operating Cash Flow Dividends Capital Expenditures Additional Debt Capacity2 Firepower available to drive growth including M&A and share repurchases Up to $6B available through 2023 for oppor unistic deployment $1.2B $4.0-5.0B $1.0B $1.5B $2.0B $6.0B 1As of December 31, 2020 2Estimated minimum additional debt capacity by 2023 while maintaining Investment Grade credit rating 16 Up to

Sustaining double-digit growth in adjusted earnings per share… Winning in key end markets Transforming our productivity Driving greater sustainability Enhancing our capital deployment $7.64 $13.00-14.00 2020 2021F Engineered Materials Acetyl Chain Acetate Tow 2023F Double- digit CAGR Adjusted Earnings Per Share …on business earnings growth, cash conversion and capital deployment strategy 17 3 2 1 4 $11.00-11.50

Glossary 1Or operating profit if adjusted earnings metric not provided 2Or GAAP income taxes if adjusted income taxes not provided 20 For Celanese Non-GAAP measures, please refer to the Non-US GAAP Financial Measures and Supplemental Information documents under Financial Information/Non-GAAP Financial Measures on our investor relations website, investors.celanese.com • Average Market Cap is the average of quarterly beginning and ending market caps during each measurement period. For instance, 2020 average market cap is the average of market caps of the beginning of Q1, and the ending of Q1, Q2, Q3, and Q4 of 2020. • Dividend Yield is defined as Common Stock Cash Dividends Paid divided by Average Market Cap. (6) • Free Cash Flow for proxy peers and DJUSCH index is defined as Cash Flow from Operations less Capital Expenditures; Free Cash Flow for Celanese is per Celanese non-GAAP disclosure. • Free Cash Flow Yield is defined as Free Cash Flow divided by Average Market Cap. (4) • Debt to EBITDA Ratio is defined as Total Debt divided by Operating EBITDA. (15) • Proxy Peers include ALB, APD, ASH, AVNT, AXTA, CC, CF, ECL, EMN, FMC, HUN, IFF, LYB, PPG, RPM, SHW. (4, 12) • Repurchase Yield is defined as Share Repurchases divided by Average Market Cap. (6) • ROIC for proxy peers is defined as adjusted earnings1 tax effected, divided by the average Invested Capital at the beginning and ending of each measurement period. ROIC = adjusted EBIT less adjusted income taxes2) / (average Total Debt + average Stockholders’ Equity). (4, 12); ROIC for Celanese is per Celanese non-GAAP disclosure. • Shareholder Yield is defined as the sum of Dividend Yield and Repurchase Yield. (4, 6)