Acetyl Chain John Fotheringham

Evolution of the Acetyl Chain business model... ...has doubled foundational earnings in the last decade Legacy Business Chain Implementation 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 0.3 Enhanced Flexibility Adjusted EBIT Adjusted EBIT margin 2008-2009 financial crisis 2 VAE footprint rationalizations VAM footprint rationalizations VAM footprint rationalizations Creation of “Acetyl Chain” business Start of Fairway Methanol JV 2018 market dislocation Clear Lake VAM expansion 2020 pandemic earnings exceed 2014-2017 avg. 14% 17% 25% 18% $450M - 600M $700M - 900M

Themes you will hear today 1 GLOBAL MANUFACTURING FOOTPRINT SERVICING A WIDE RANGE OFRESILIENT END USES 2 UNMATCHED VALUE CHAIN OPTIONALITY SUPPORTED BY LOWCOST TECHNOLOGY 3 HEALTHY INDUSTRY DYNAMICS WITH STRONG DEMAND GROWTH 4 TARGETED CAPITAL INVESTMENT SUPPORTING GROWING AND SUSTAINABLE END USES 3

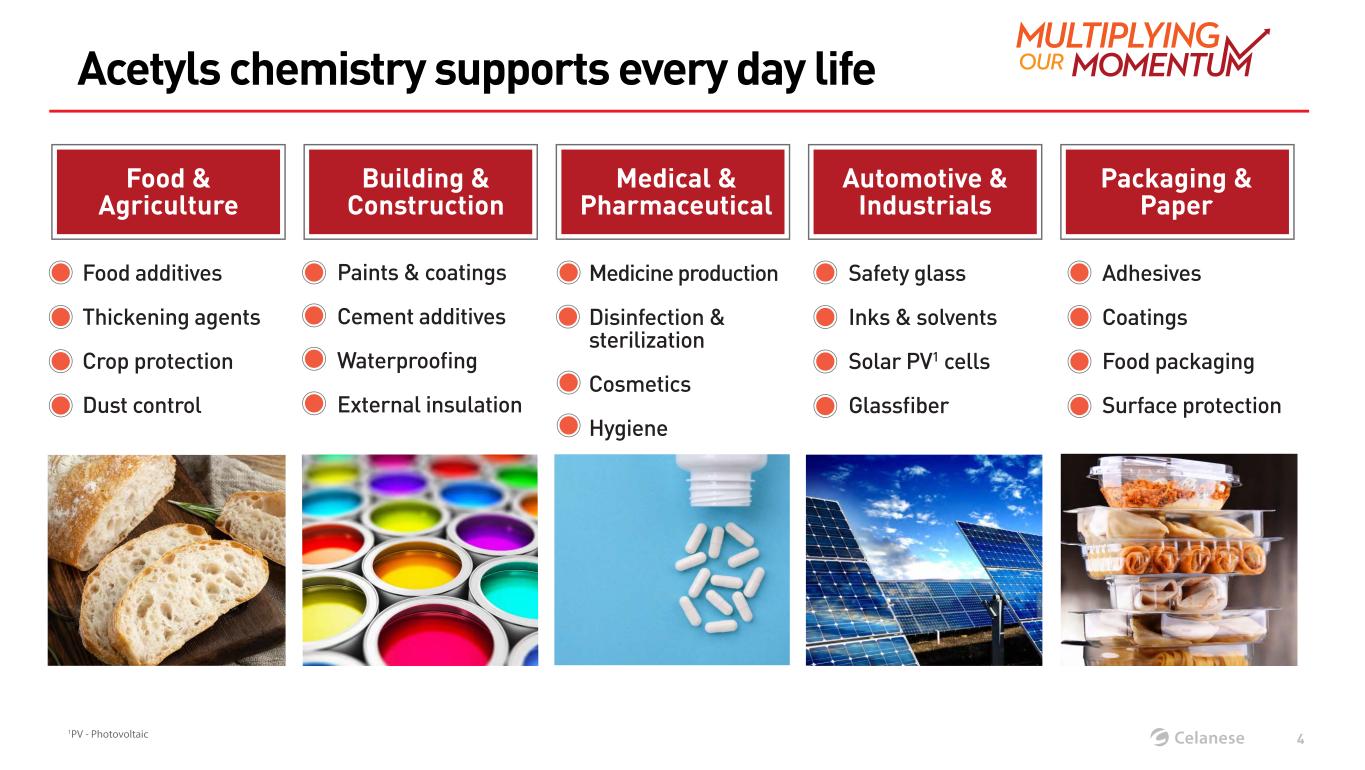

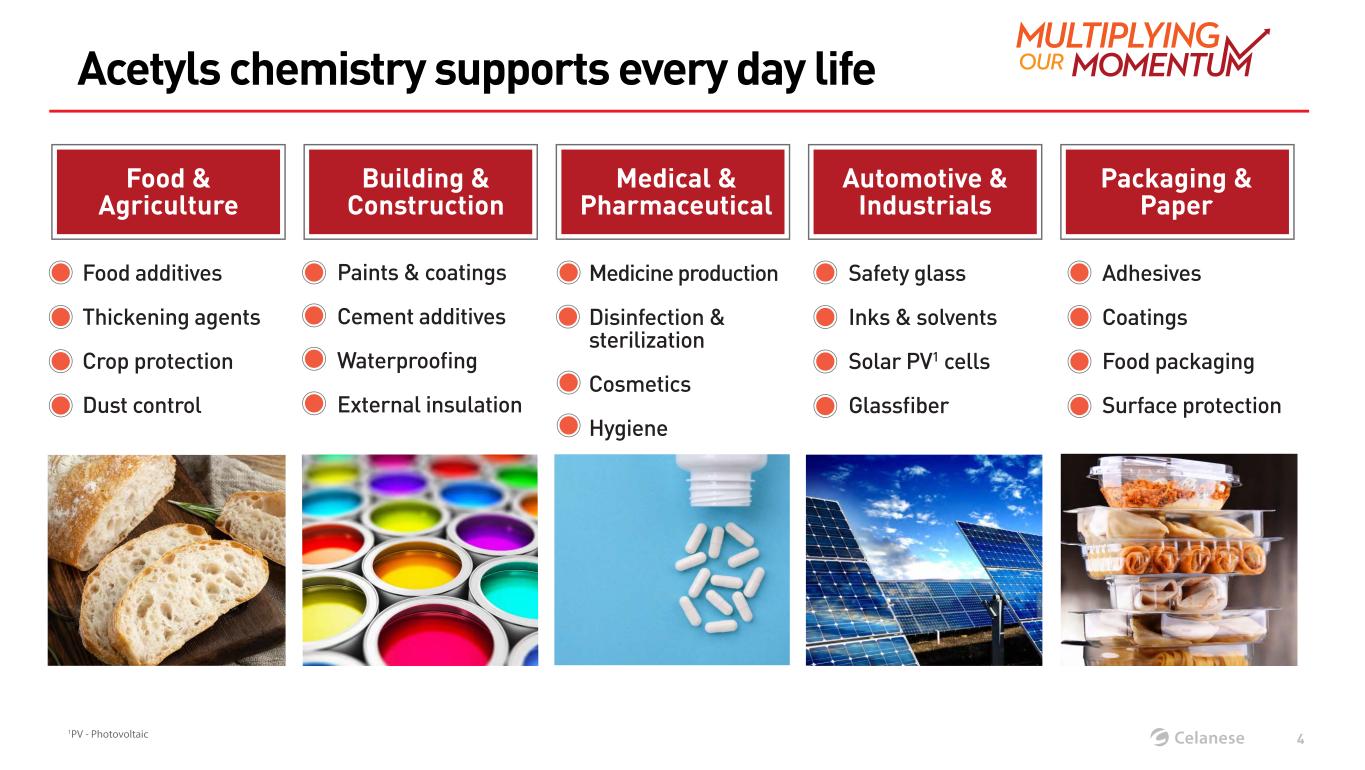

Acetyls chemistry supports every day life Food & Agriculture Building & Construction Medical & Pharmaceutical Automotive & Industrials Packaging & Paper Food additives Thickening agents Crop protection Dust control Paints & coatings Cement additives Waterproofing External insulation Medicine production Disinfection & sterilization Cosmetics Hygiene Safety glass Inks & solvents Solar PV1 cells Glassfiber Adhesives Coatings Food packaging Surface protection 4 1PV - Photovoltaic

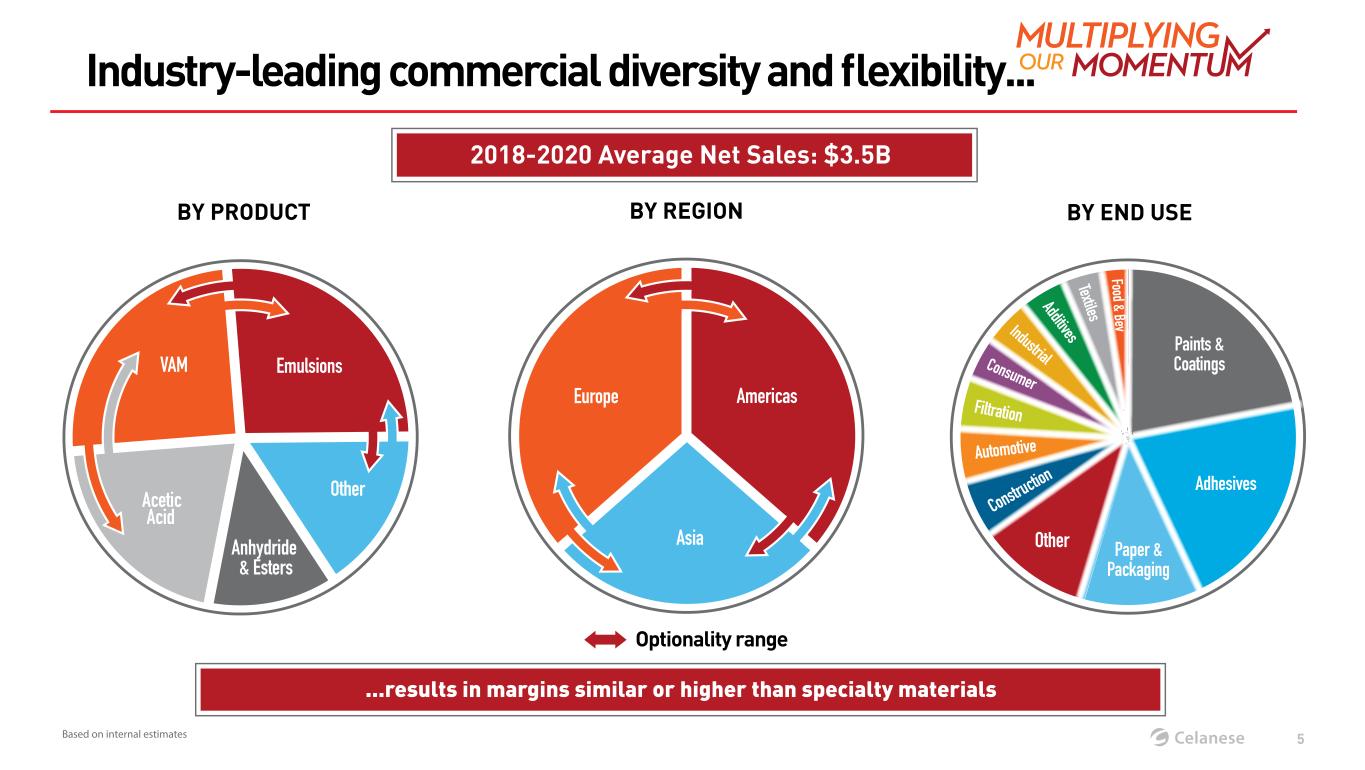

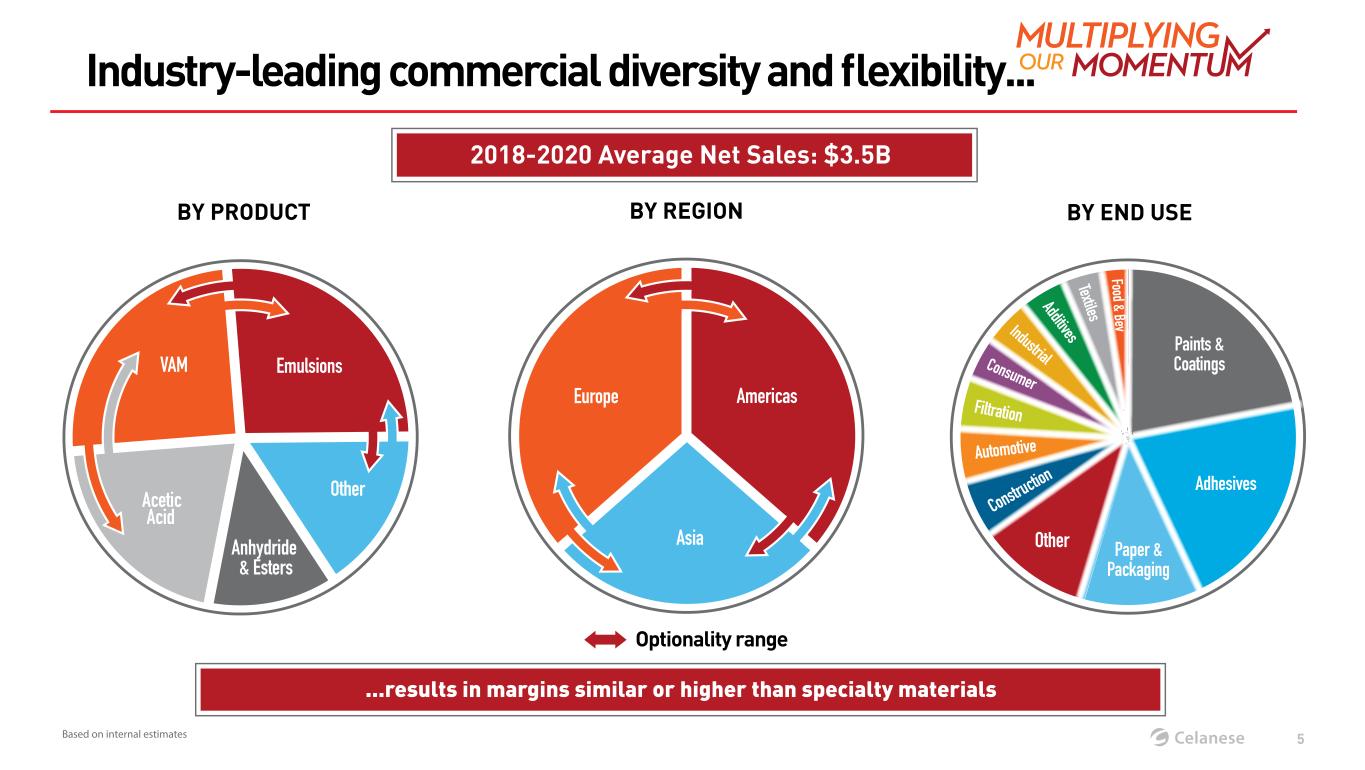

Industry-leading commercial diversity and flexibility... ...results in margins similar or higher than specialty materials Based on internal estimates 2018-2020 Average Net Sales: $3.5B BY PRODUCT BY REGION BY END USE Anhydride & Esters OtherAcetic Acid VAM 21 11 10 Paints & Coatings Adhesives Paper & Packaging Other Con stru ctio n Automotive Filtration Consumer Industrial Additives Textiles Food & Bev Americas Asia Europe Optionality range Emulsions 5

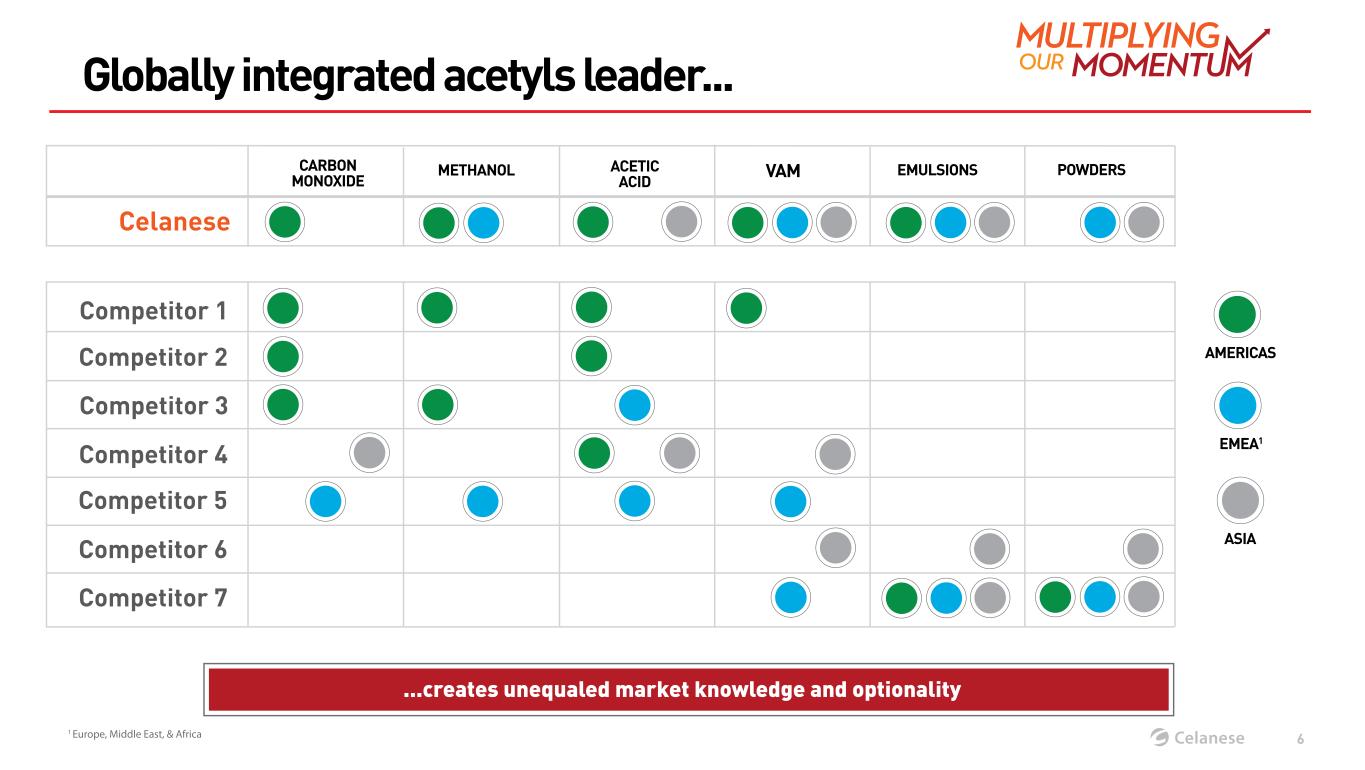

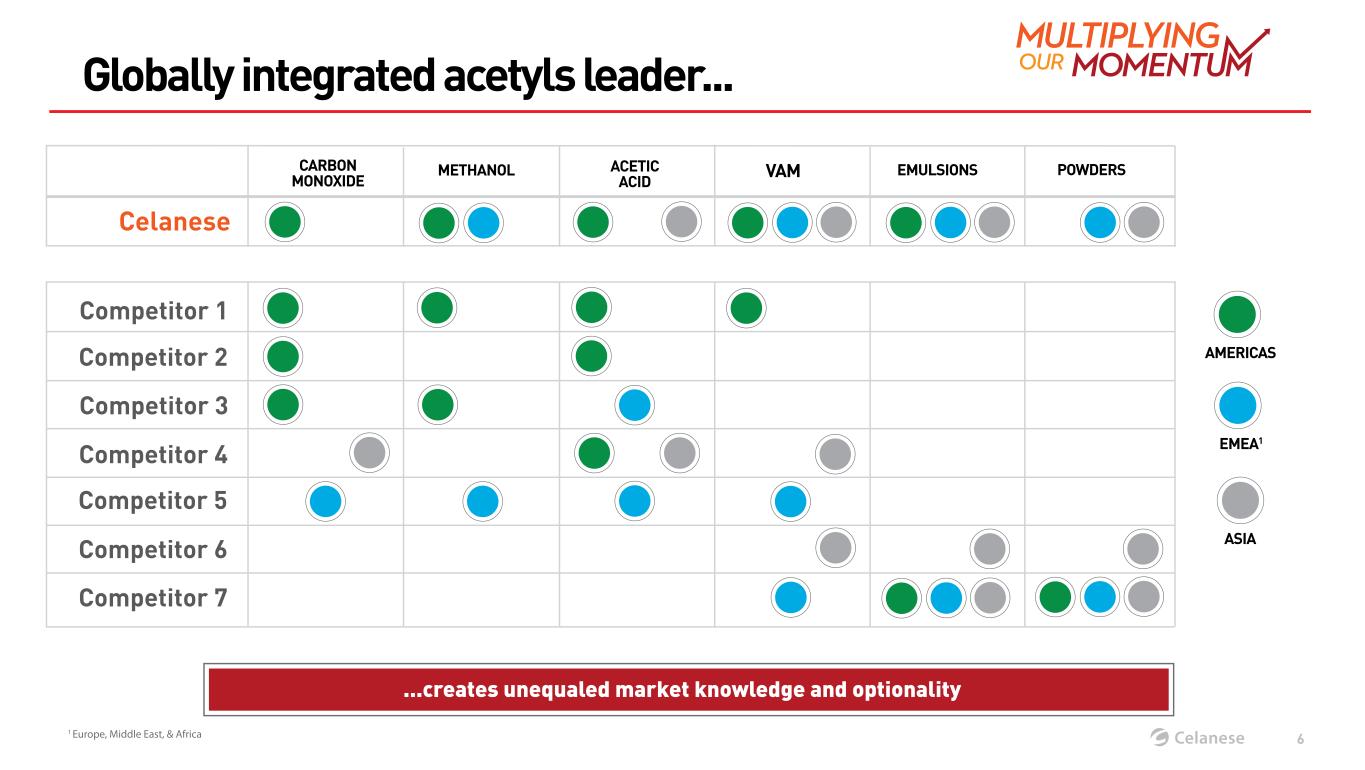

Globally integrated acetyls leader... ...creates unequaled market knowledge and optionality 1 Europe, Middle East, & Africa CARBON MONOXIDE METHANOL ACETIC ACID VAM EMULSIONS POWDERS AMERICAS EMEA1 ASIA 6 Competitor 1 Competitor 7 Competitor 5 Competitor 6 Competitor 3 Competitor 4 Competitor 2 Celanese

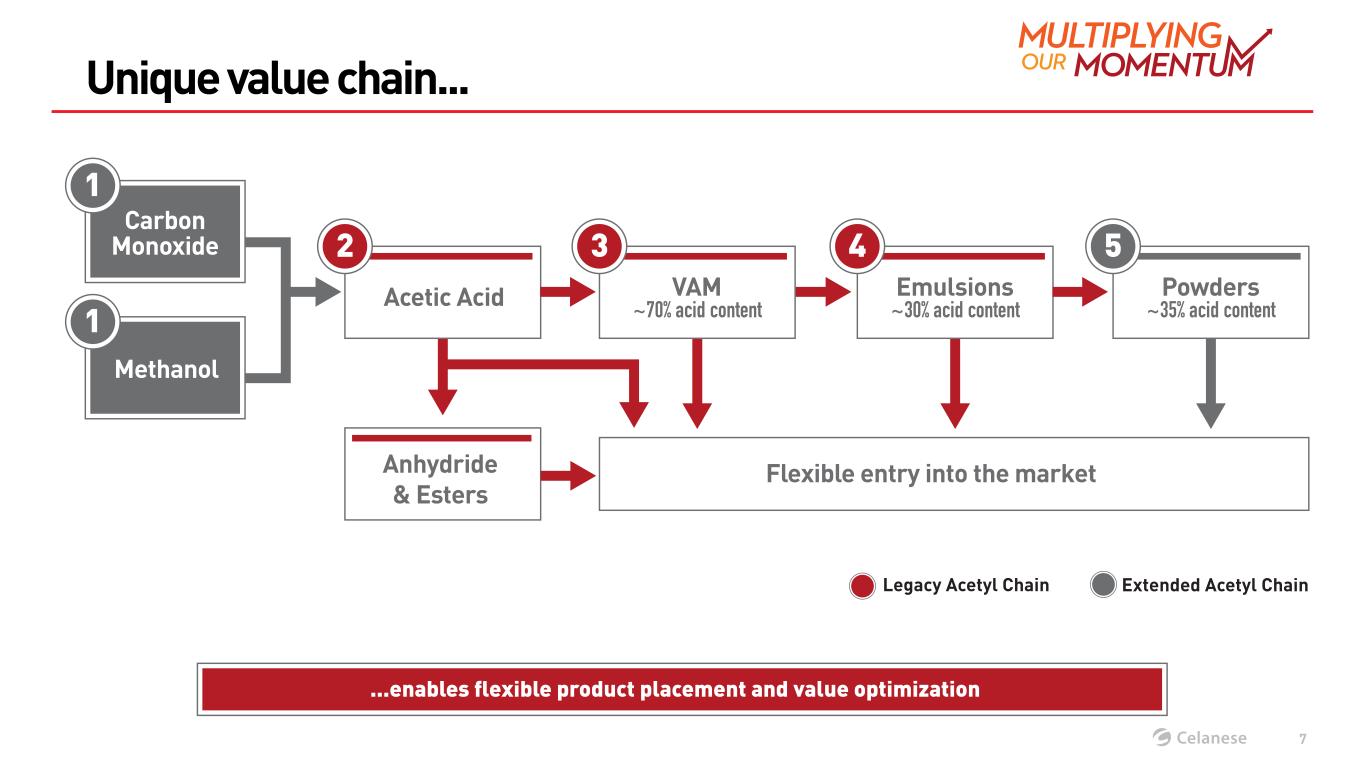

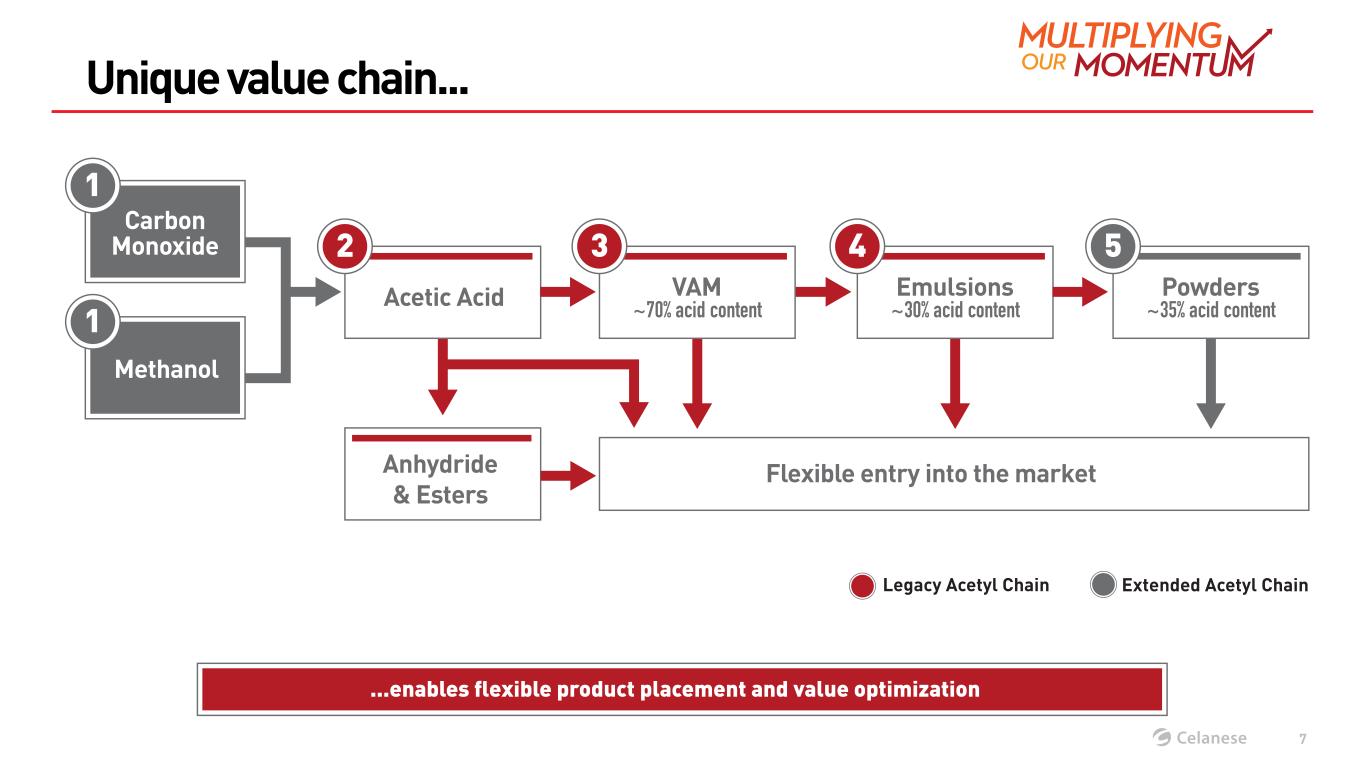

Unique value chain... Carbon Monoxide Methanol 1 1 Acetic Acid Anhydride & Esters Flexible entry into the market 2 VAM ~70% acid content 3 Emulsions ~30% acid content 4 Powders ~35% acid content 5 Legacy Acetyl Chain Extended Acetyl Chain ...enables flexible product placement and value optimization 7

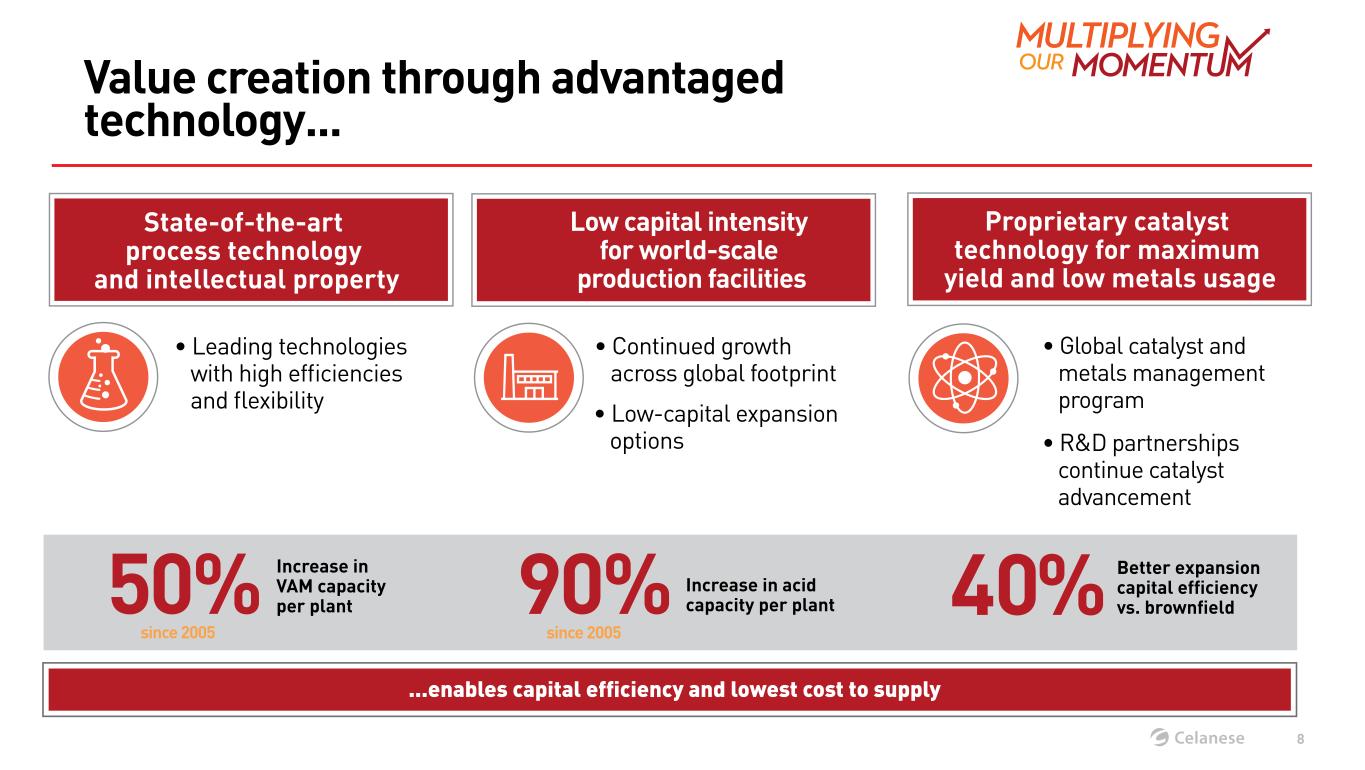

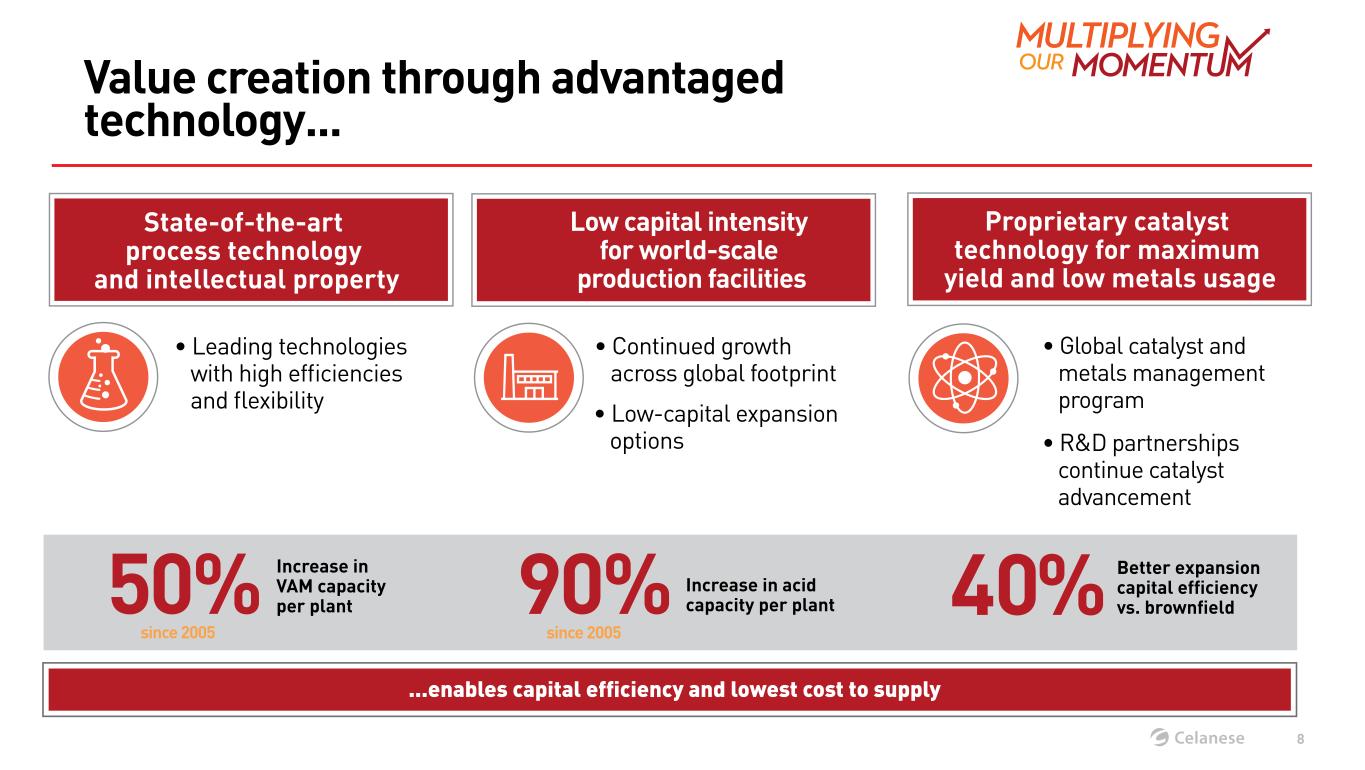

Value creation through advantaged technology... ...enables capital efficiency and lowest cost to supply State-of-the-art process technology and intellectual property • Leading technologies with high efficiencies and flexibility 8 Low capital intensity for world-scale production facilities Proprietary catalyst technology for maximum yield and low metals usage Increase in VAM capacity per plant Increase in acid capacity per plant Better expansion capital efficiency vs. brownfield50% 40%90% • Continued growth across global footprint • Low-capital expansion options • Global catalyst and metals management program • R&D partnerships continue catalyst advancement since 2005 since 2005

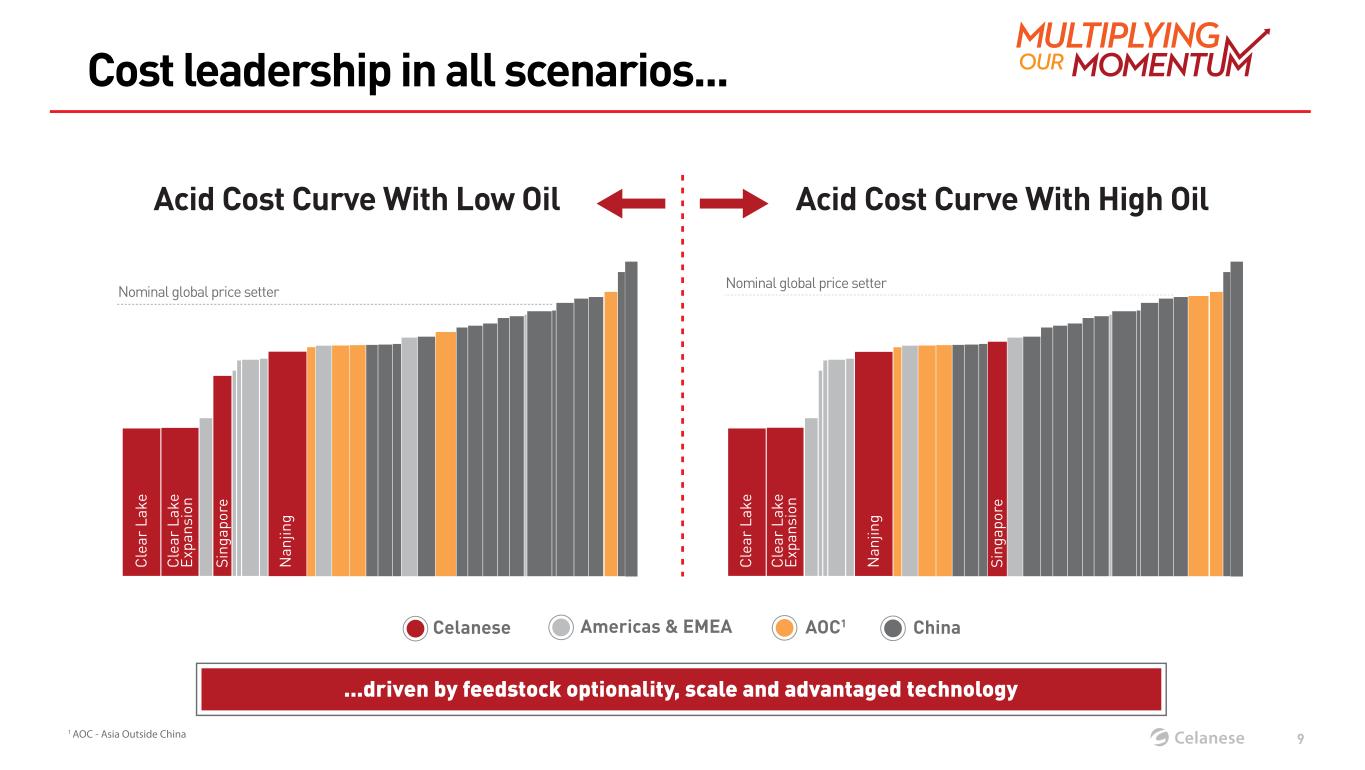

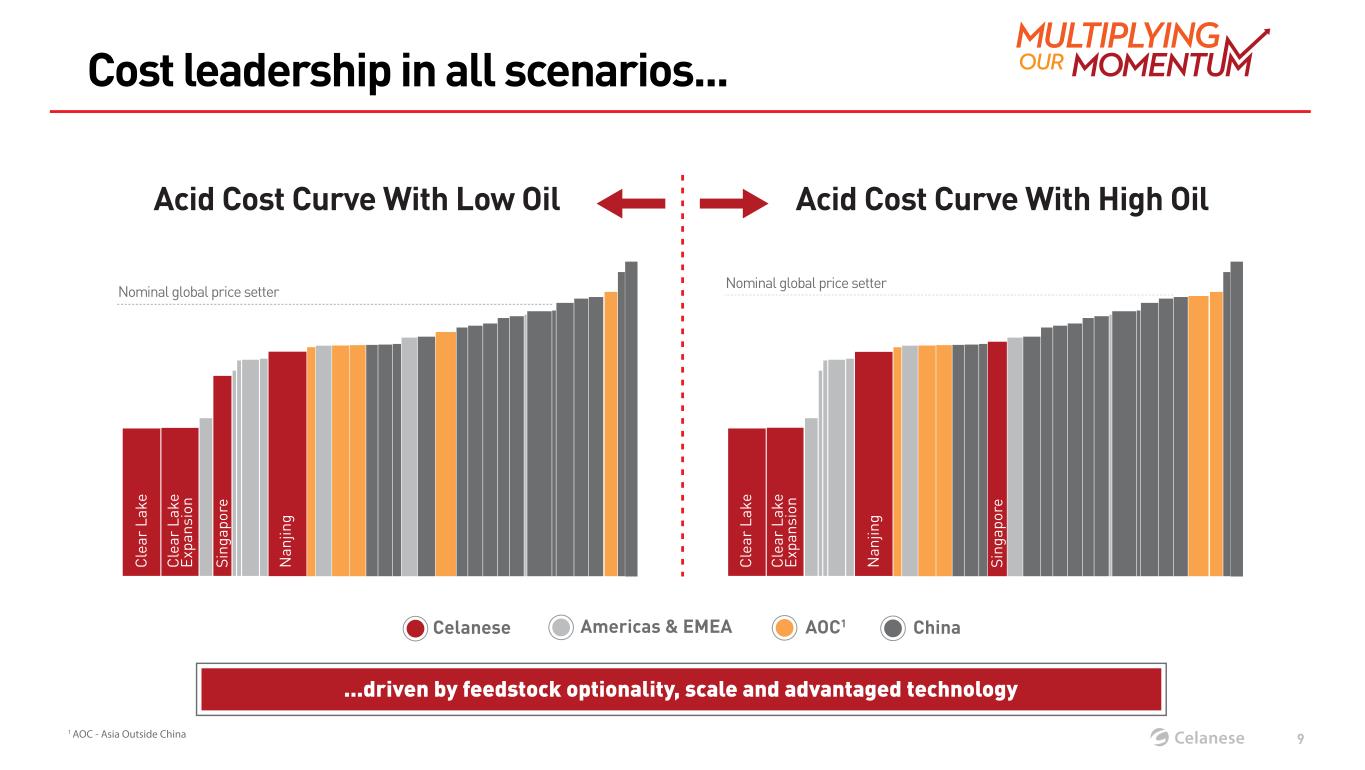

Cost leadership in all scenarios... ...driven by feedstock optionality, scale and advantaged technology Acid Cost Curve With Low Oil Acid Cost Curve With High Oil C le ar L ak e S in ga po re N an jin g C le ar L ak e E xp an si on C le ar L ak e S in ga po re N an jin g Americas & EMEA AOC1 China Nominal global price setter Nominal global price setter C le ar L ak e E xp an si on Celanese 9 1 AOC - Asia Outside China

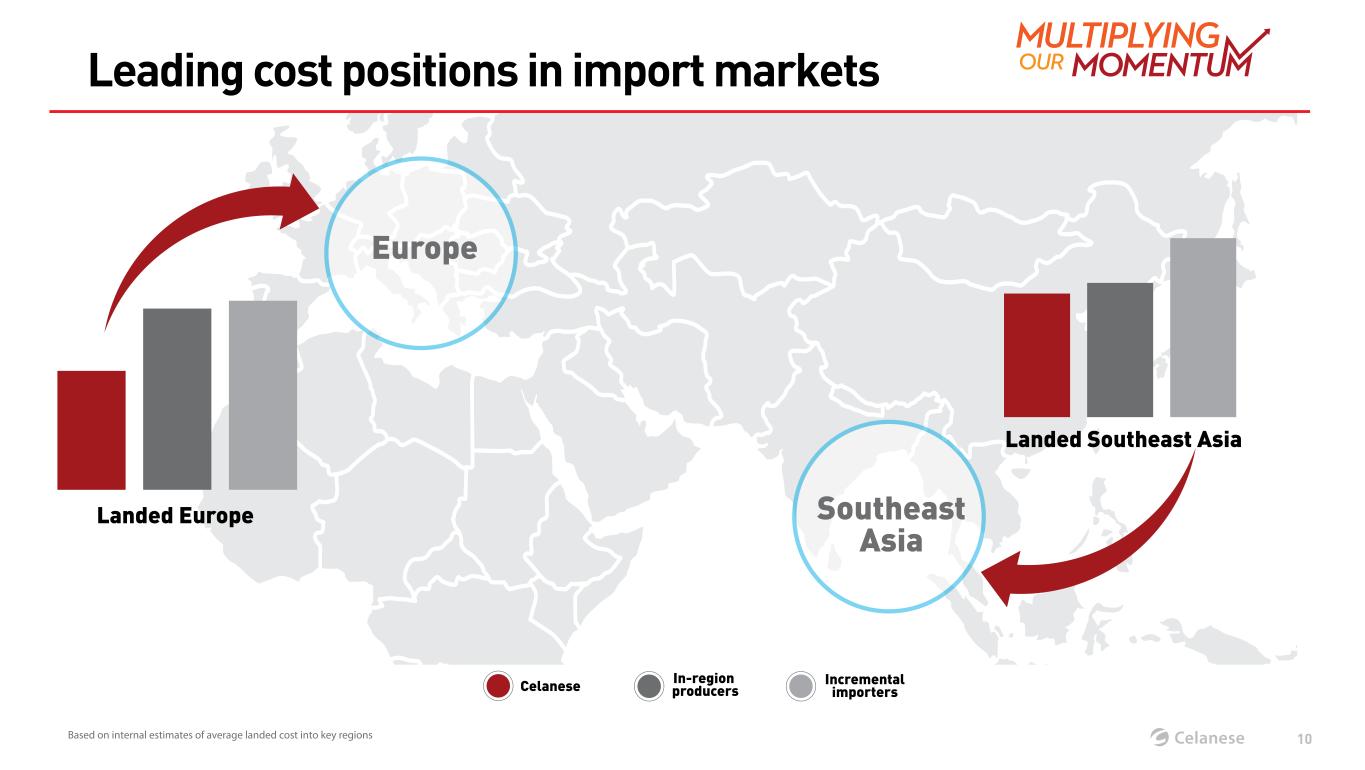

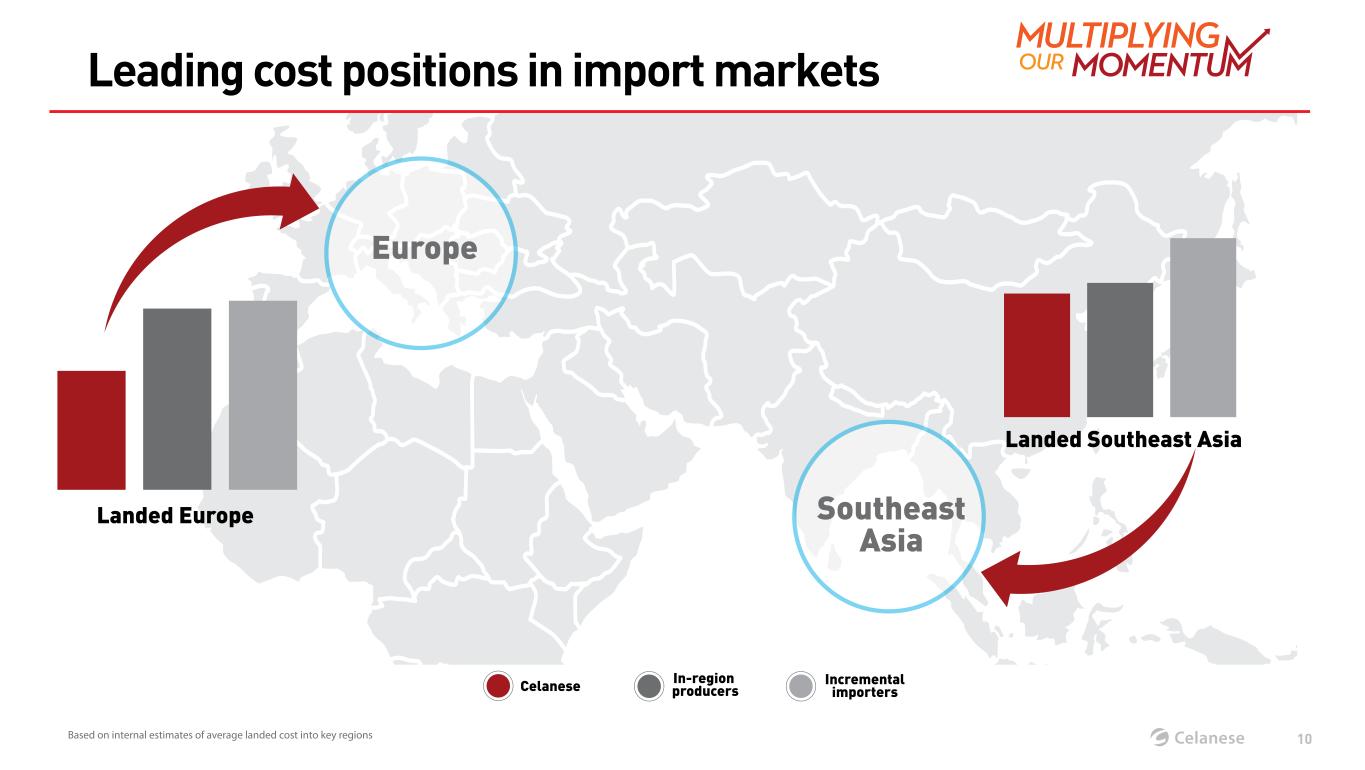

Leading cost positions in import markets Landed Europe Europe Based on internal estimates of average landed cost into key regions Celanese In-region producers Incremental importers Southeast Asia Landed Southeast Asia 10

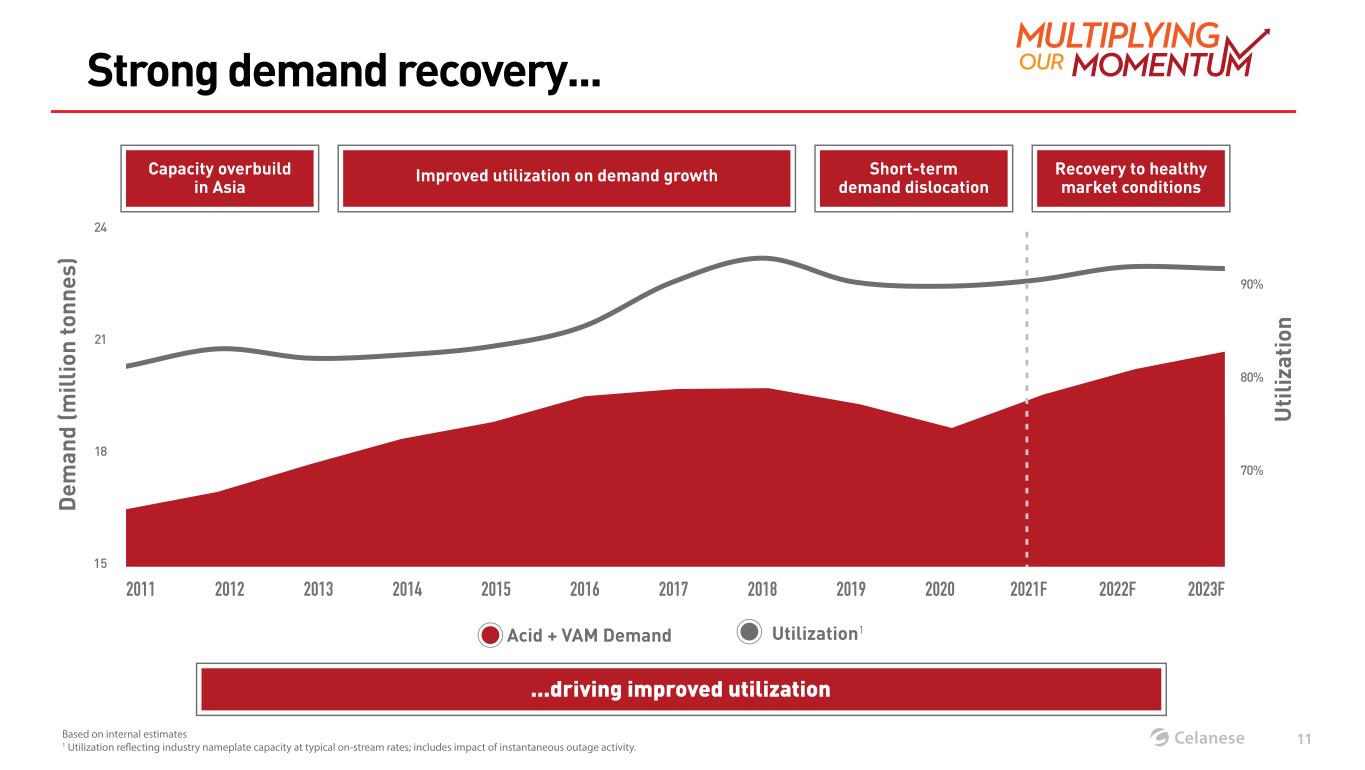

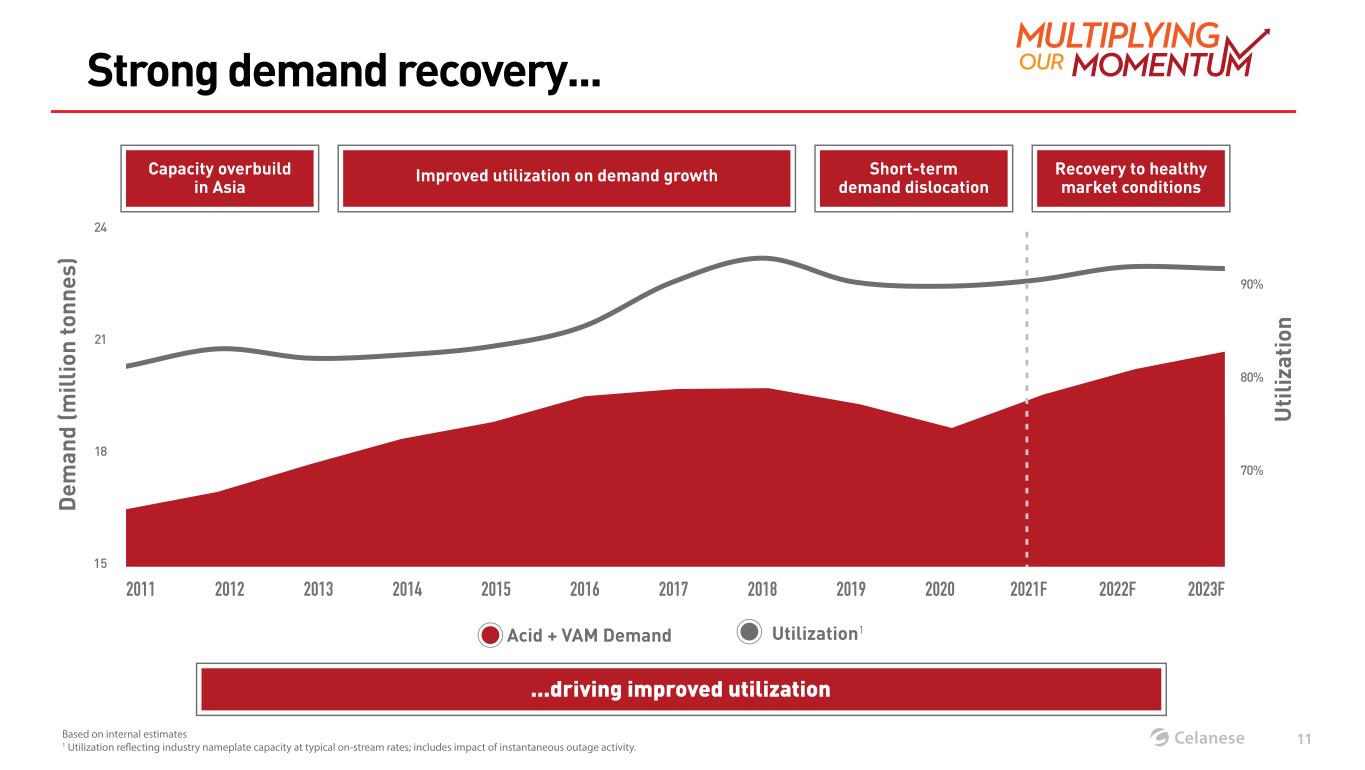

Strong demand recovery... ...driving improved utilization Based on internal estimates 1 Utilization reflecting industry nameplate capacity at typical on-stream rates; includes impact of instantaneous outage activity. Capacity overbuild in Asia Short-term demand dislocation Recovery to healthy market conditions Improved utilization on demand growth D em an d (m il li on t on ne s) U ti li za ti on 80% 90% 70% 15 21 24 18 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021F 2022F 2023F Utilization1Acid + VAM Demand 11

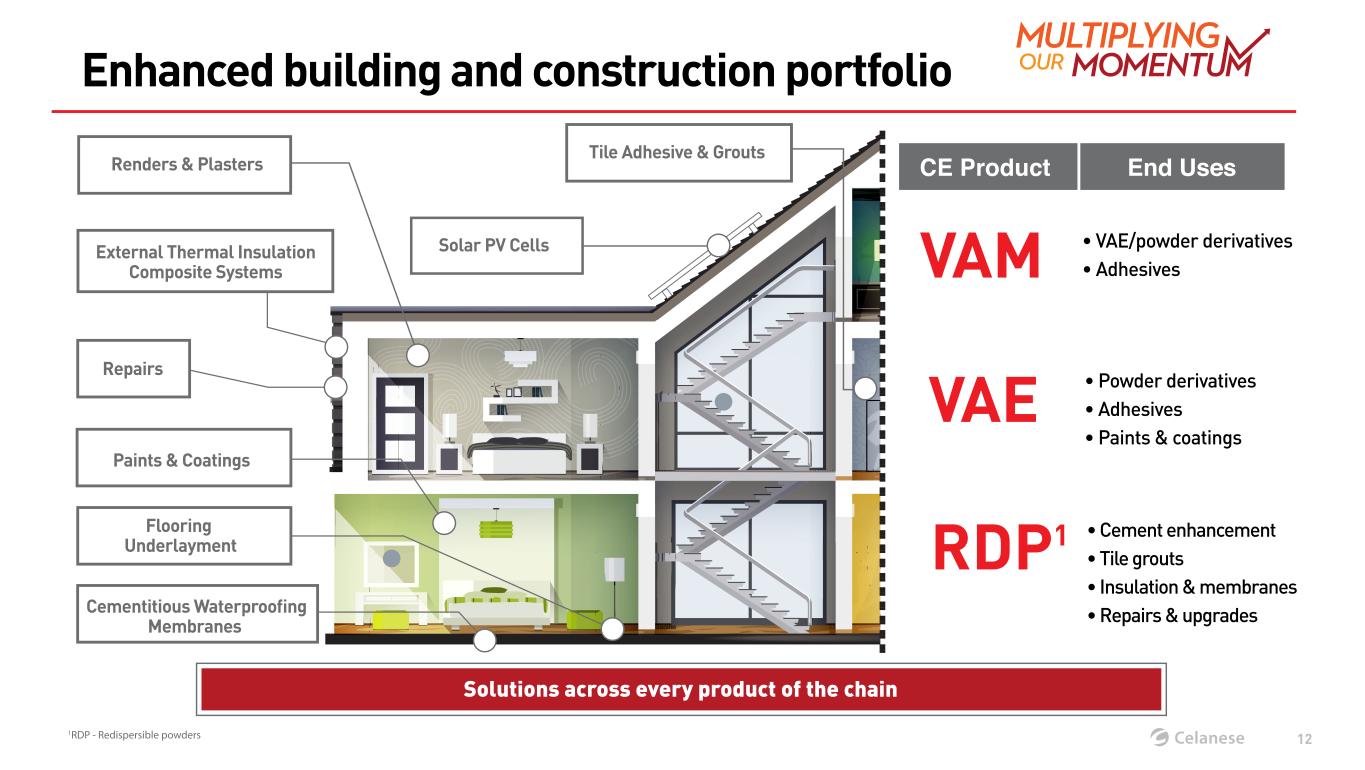

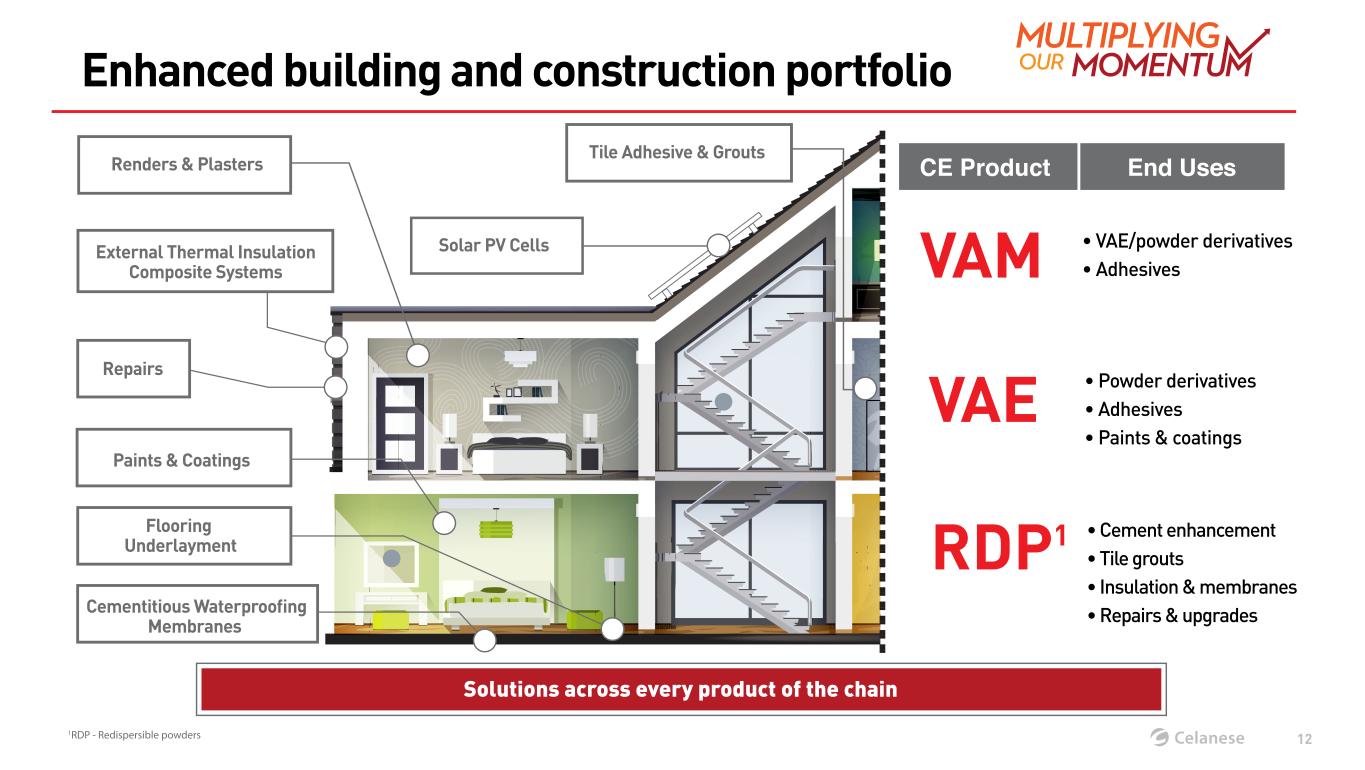

Enhanced building and construction portfolio Solutions across every product of the chain VAM VAE RDP1 CE Product End Uses • VAE/powder derivatives • Adhesives • Powder derivatives • Adhesives • Paints & coatings • Cement enhancement • Tile grouts • Insulation & membranes • Repairs & upgrades Renders & Plasters Flooring Underlayment Repairs Paints & Coatings Tile Adhesive & Grouts External Thermal Insulation Composite Systems Cementitious Waterproofing Membranes 12 1RDP - Redispersible powders Solar PV Cells

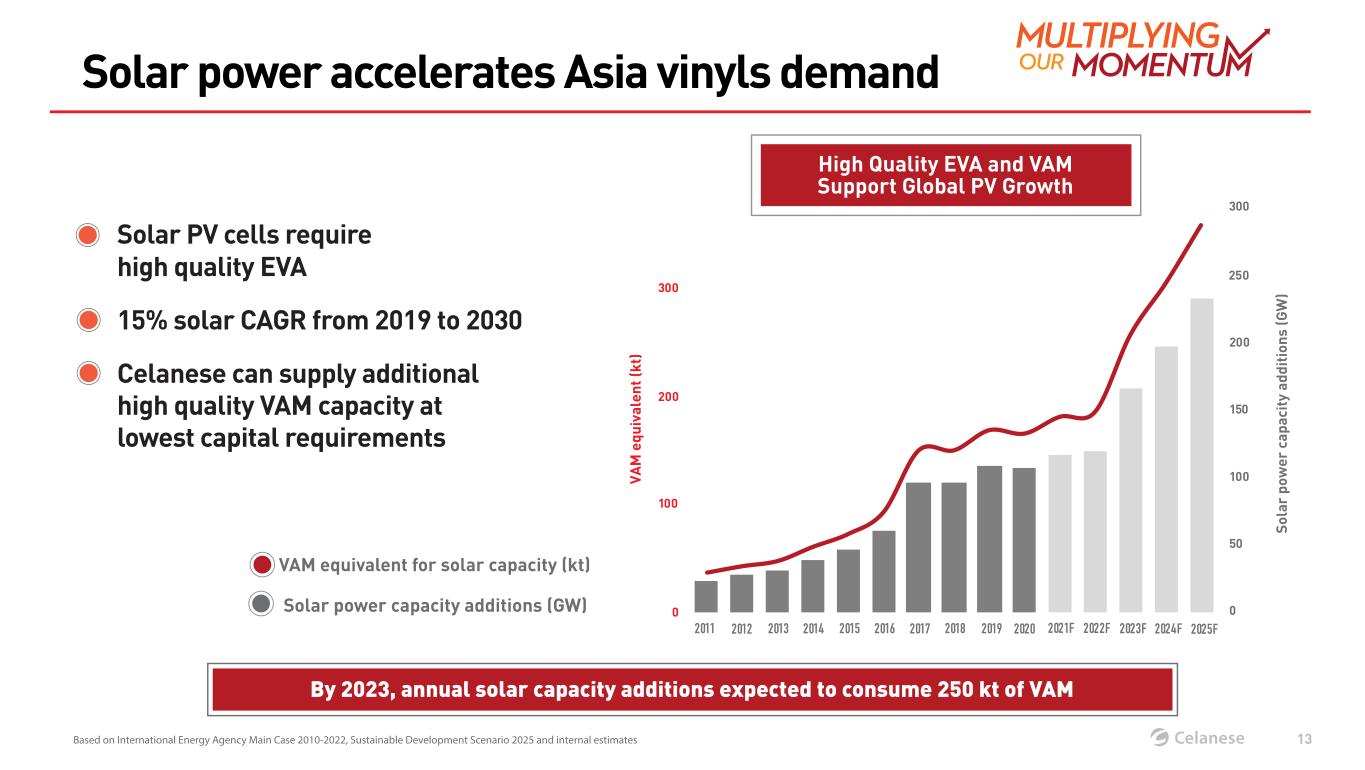

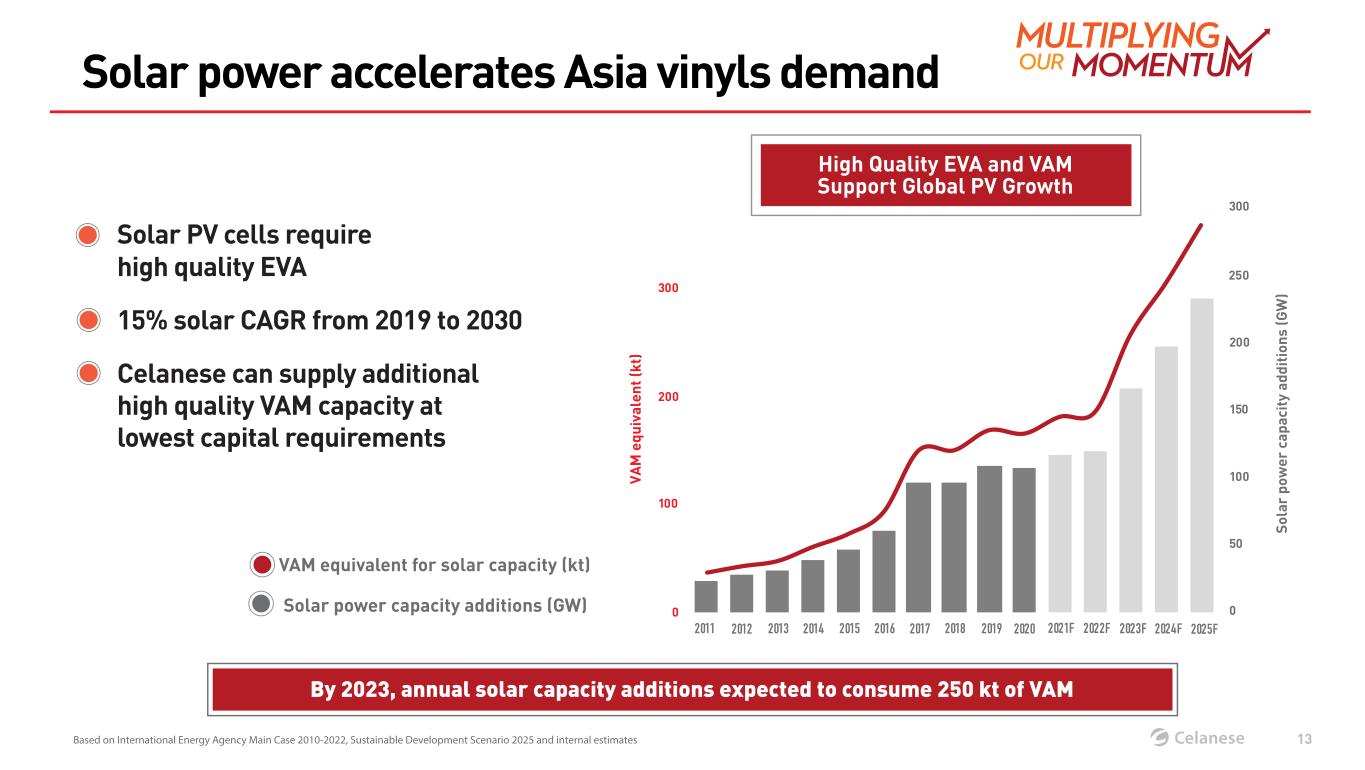

Solar power accelerates Asia vinyls demand Solar PV cells require high quality EVA 15% solar CAGR from 2019 to 2030 Celanese can supply additional high quality VAM capacity at lowest capital requirements Based on International Energy Agency Main Case 2010-2022, Sustainable Development Scenario 2025 and internal estimates High Quality EVA and VAM Support Global PV Growth By 2023, annual solar capacity additions expected to consume 250 kt of VAM 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021F 2022F 2023F 2024F 13 0 100 200 300 0 50 100 150 200 250 300 S ol ar p ow er c ap ac it y ad di ti on s (G W ) 2025F V A M e qu iv al en t (k t) Solar power capacity additions (GW) VAM equivalent for solar capacity (kt)

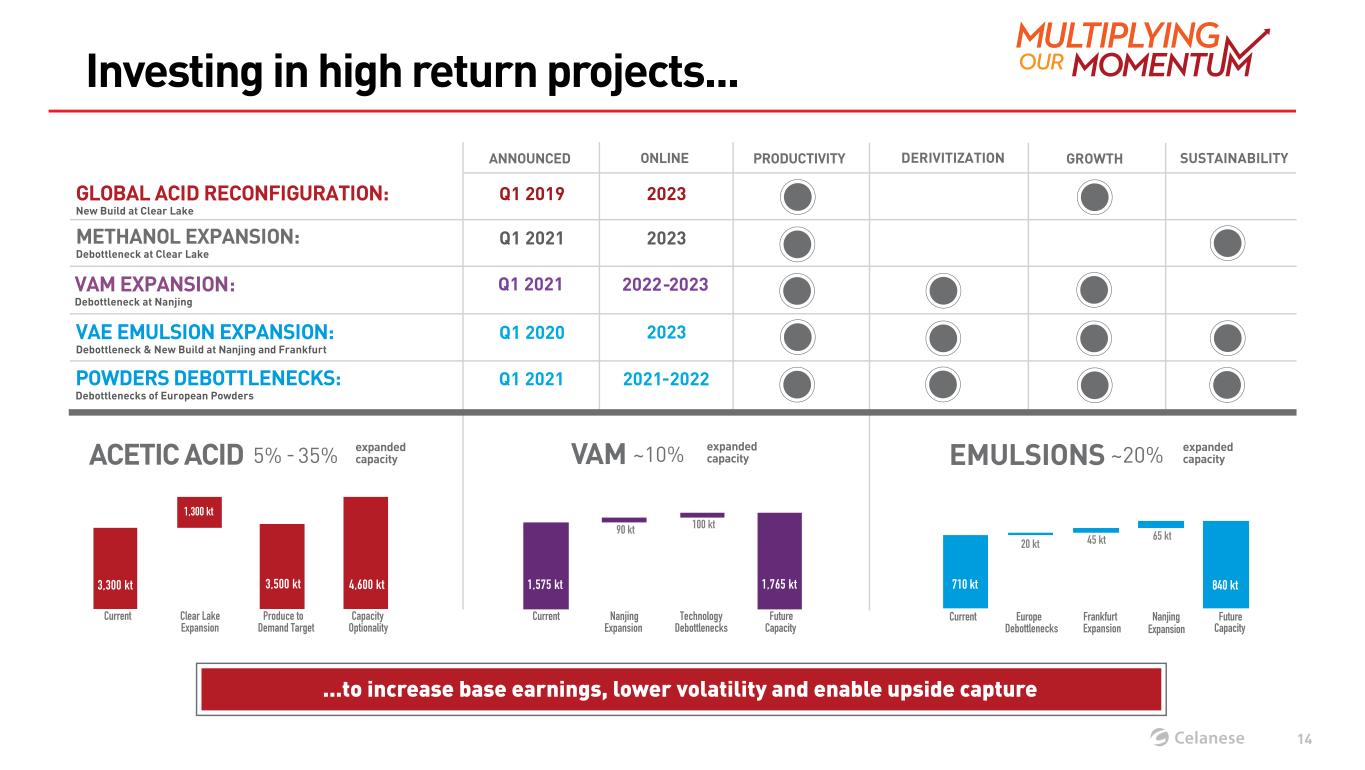

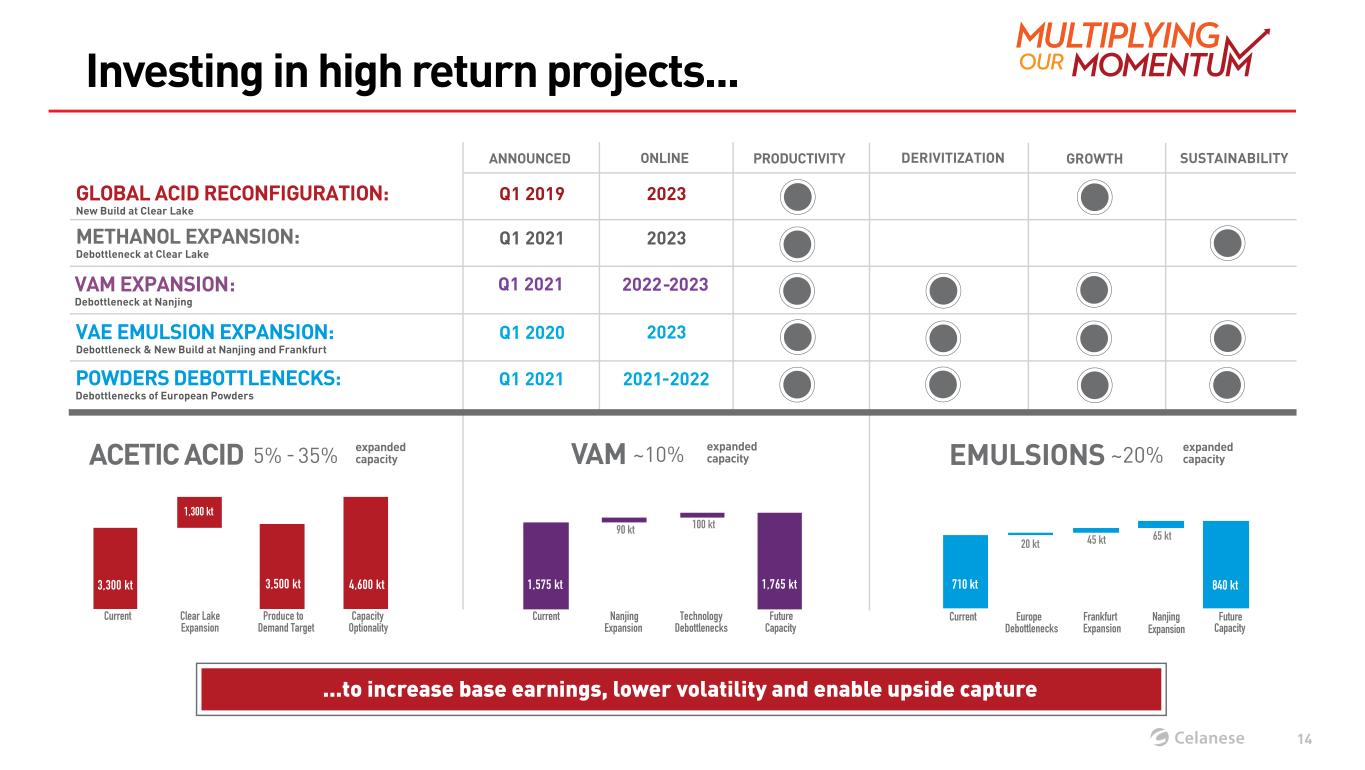

...to increase base earnings, lower volatility and enable upside capture Q1 2019 2023GLOBAL ACID RECONFIGURATION: New Build at Clear Lake Q1 2021 2023METHANOL EXPANSION: Debottleneck at Clear Lake Q1 2020 2023VAE EMULSION EXPANSION: Debottleneck & New Build at Nanjing and Frankfurt Q1 2021 2022-2023VAM EXPANSION: Debottleneck at Nanjing Q1 2021 2021-2022POWDERS DEBOTTLENECKS: Debottlenecks of European Powders ONLINE PRODUCTIVITY DERIVITIZATION GROWTHANNOUNCED SUSTAINABILITY 3,300 kt 1,300 kt 3,500 kt 4,600 kt Current Clear Lake Expansion Produce to Demand Target Capacity Optionality 5% - 35% expanded capacity 1,575 kt 90 kt 100 kt 1,765 kt Current Nanjing Expansion Technology Debottlenecks Future Capacity 710 kt 20 kt 45 kt 65 kt 840 kt Current Europe Debottlenecks Frankfurt Expansion Nanjing Expansion Future Capacity VAM ~10% EMULSIONS ~20%ACETIC ACID Investing in high return projects... 14 expanded capacity expanded capacity

Enhanced acetic acid project positions for growth... CAPITAL EXPENDITURE ~$350M 1,000kt MANUFACTURING FLEXIBILITYANNUALIZED AVERAGE VALUE ~$100M INCREMENTAL CAPACITY 1,300kt Enhanced Asia flexibility with new supply contracts Retention of project value and supply optionality Clear Lake capital efficiency and productivity Lowered cost position relative to coal and oil Enhanced offtake flexibility improves global optionality Unparalleled capacity and raw material optionality ~$100M average earnings lift per year across project cycle Project extension enabled capital savings World-scale capacity with operating cost productivity Wide operating range to match market demand 15

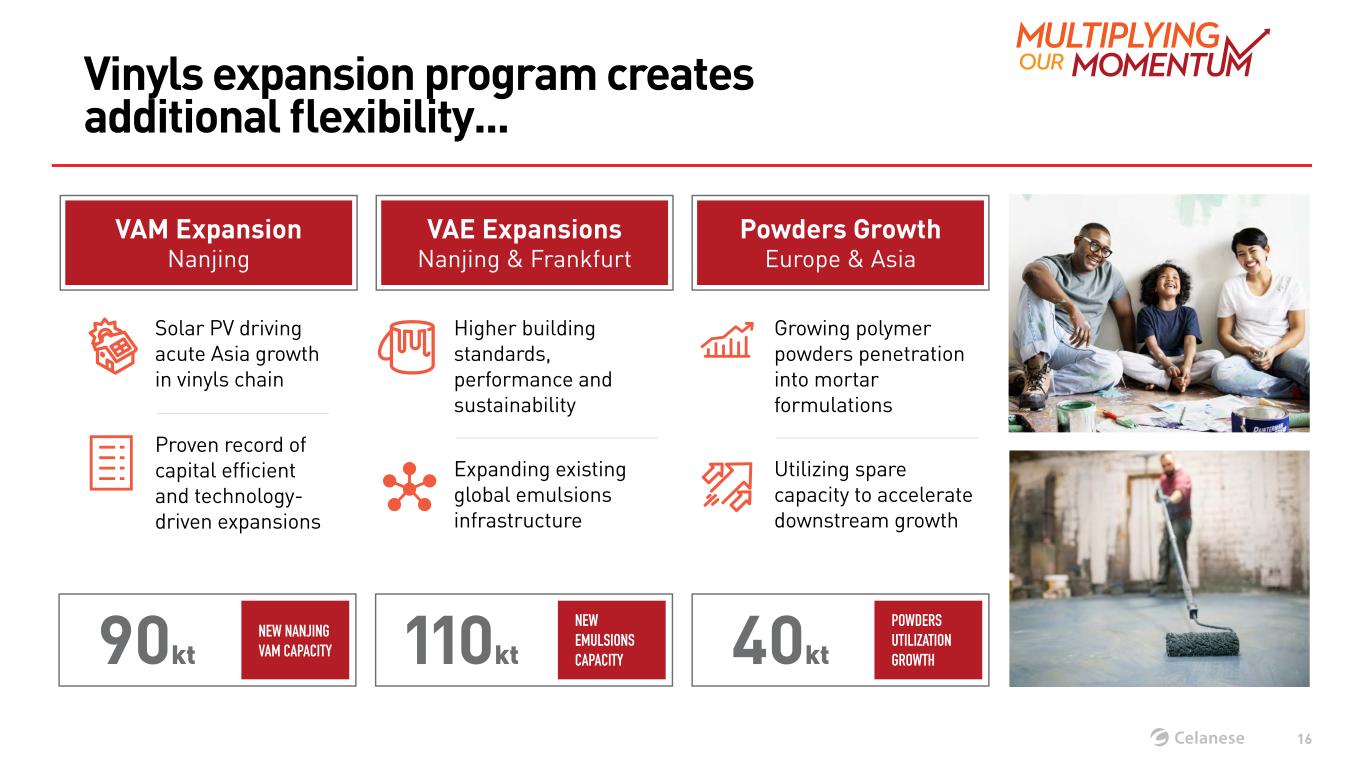

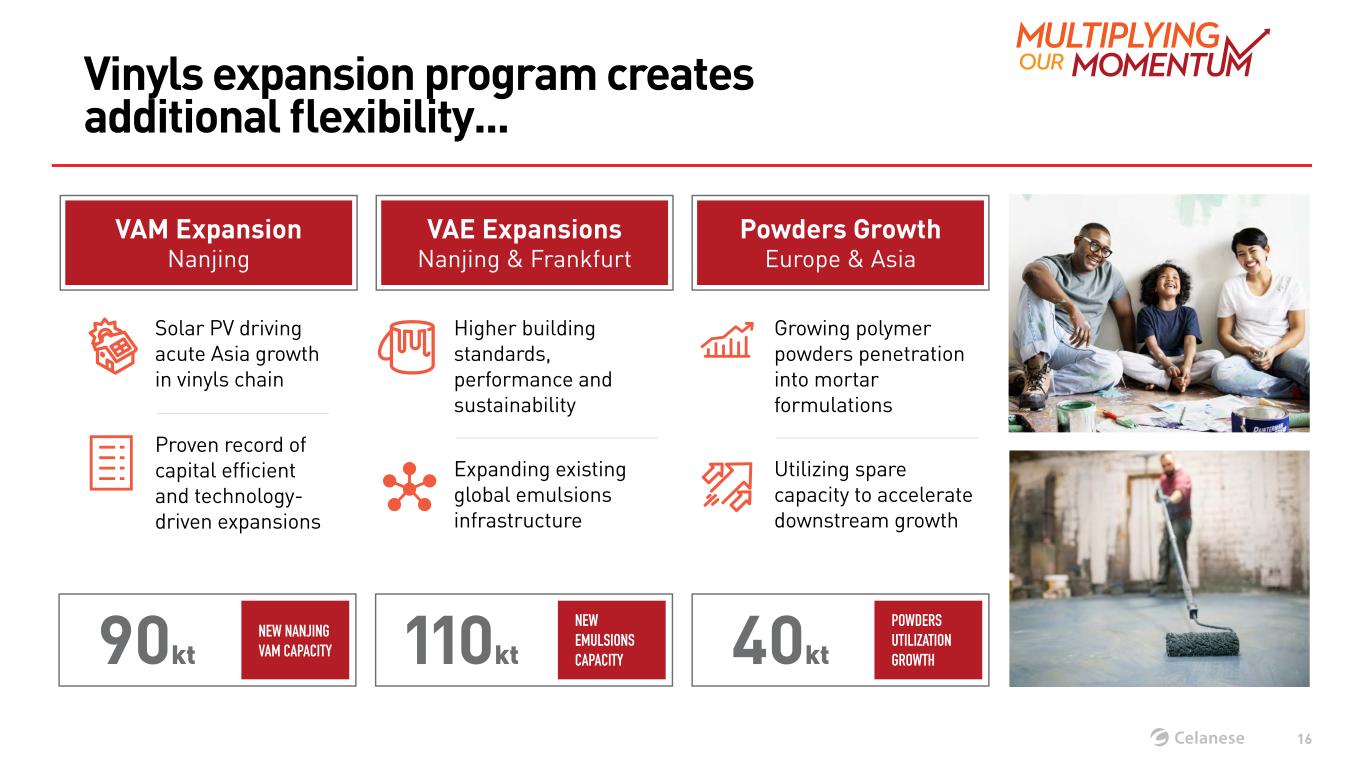

16 Vinyls expansion program creates additional flexibility... VAM Expansion Nanjing NEW NANJING VAM CAPACITY90kt NEWEMULSIONSCAPACITY110kt POWDERS UTILIZATION GROWTH40kt Powders Growth Europe & Asia VAE Expansions Nanjing & Frankfurt Solar PV driving acute Asia growth in vinyls chain Proven record of capital efficient and technology- driven expansions Growing polymer powders penetration into mortar formulations Utilizing spare capacity to accelerate downstream growth Higher building standards, performance and sustainability Expanding existing global emulsions infrastructure

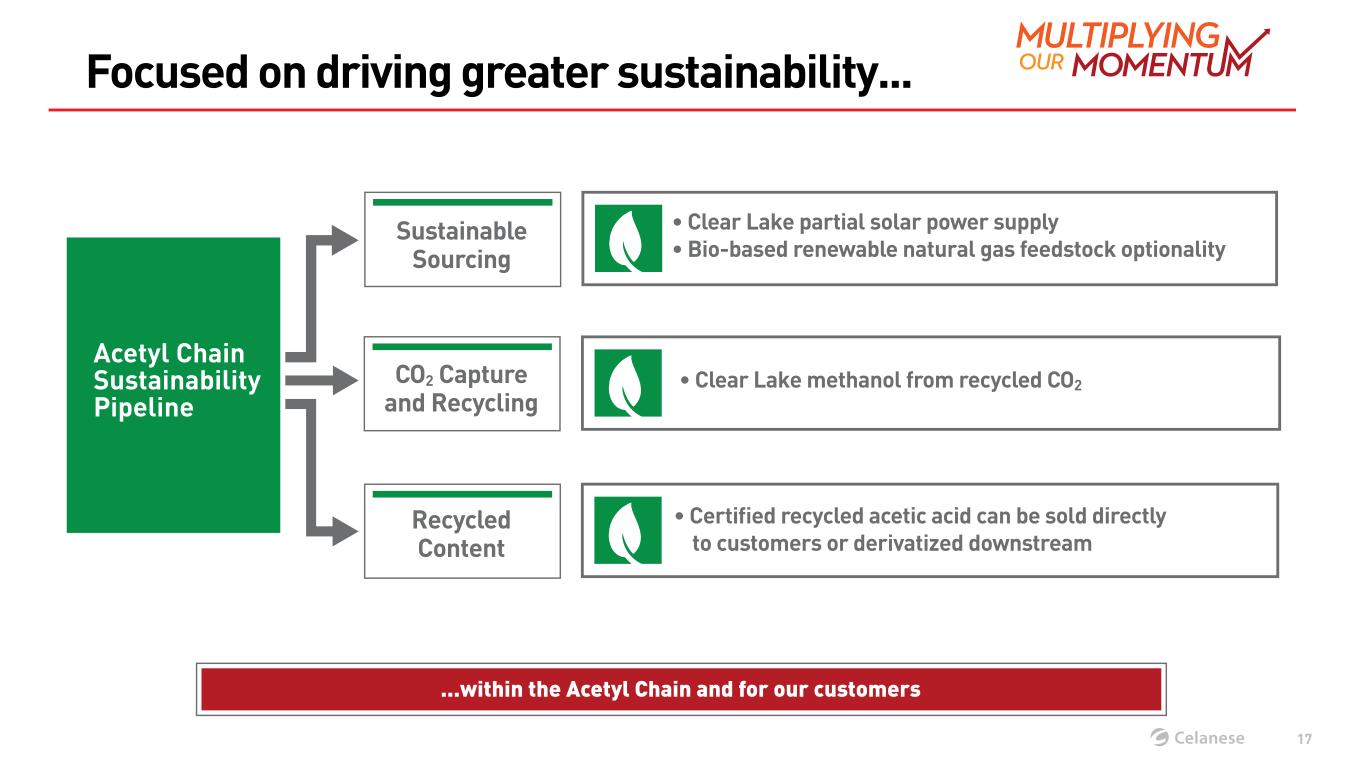

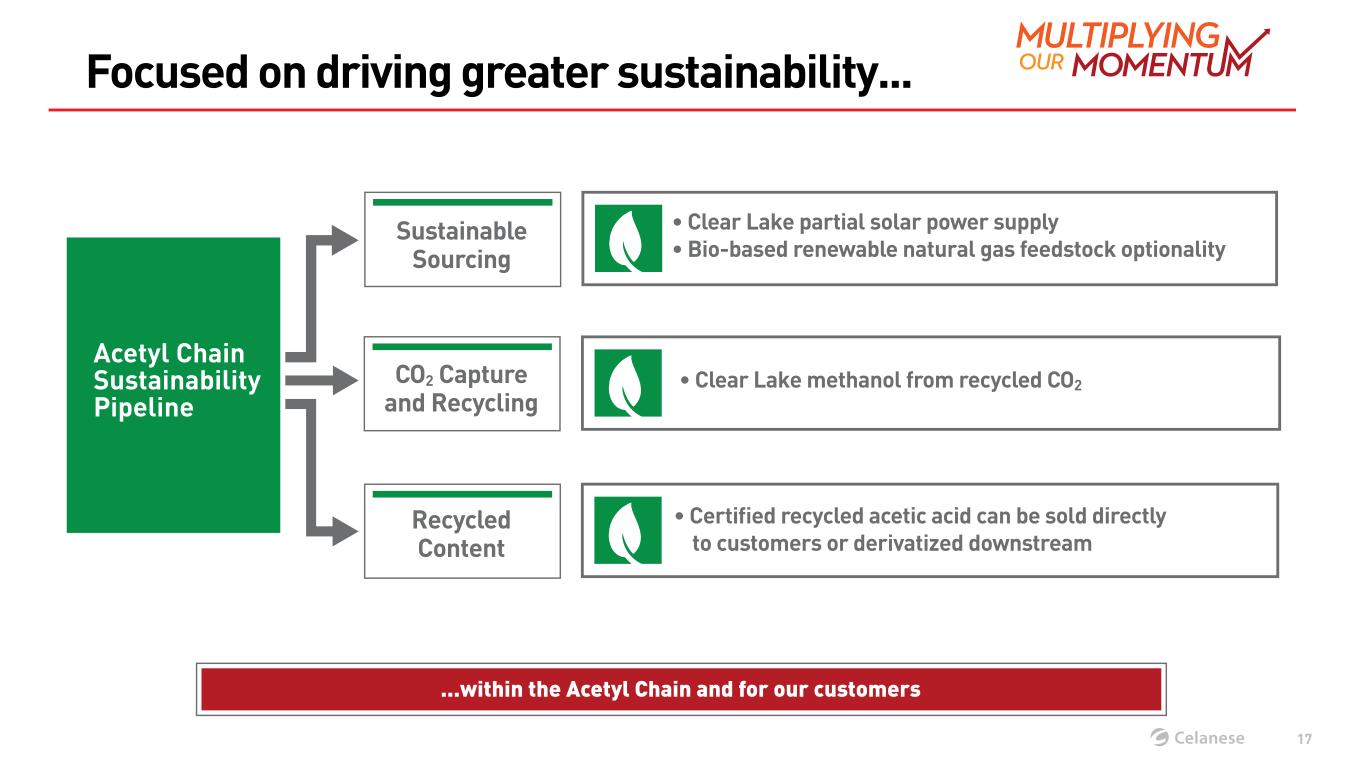

...within the Acetyl Chain and for our customers Focused on driving greater sustainability... Acetyl Chain Sustainability Pipeline Sustainable Sourcing CO2 Capture and Recycling Recycled Content • Clear Lake partial solar power supply • Bio-based renewable natural gas feedstock optionality • Clear Lake methanol from recycled CO2 • Certified recycled acetic acid can be sold directly to customers or derivatized downstream 17

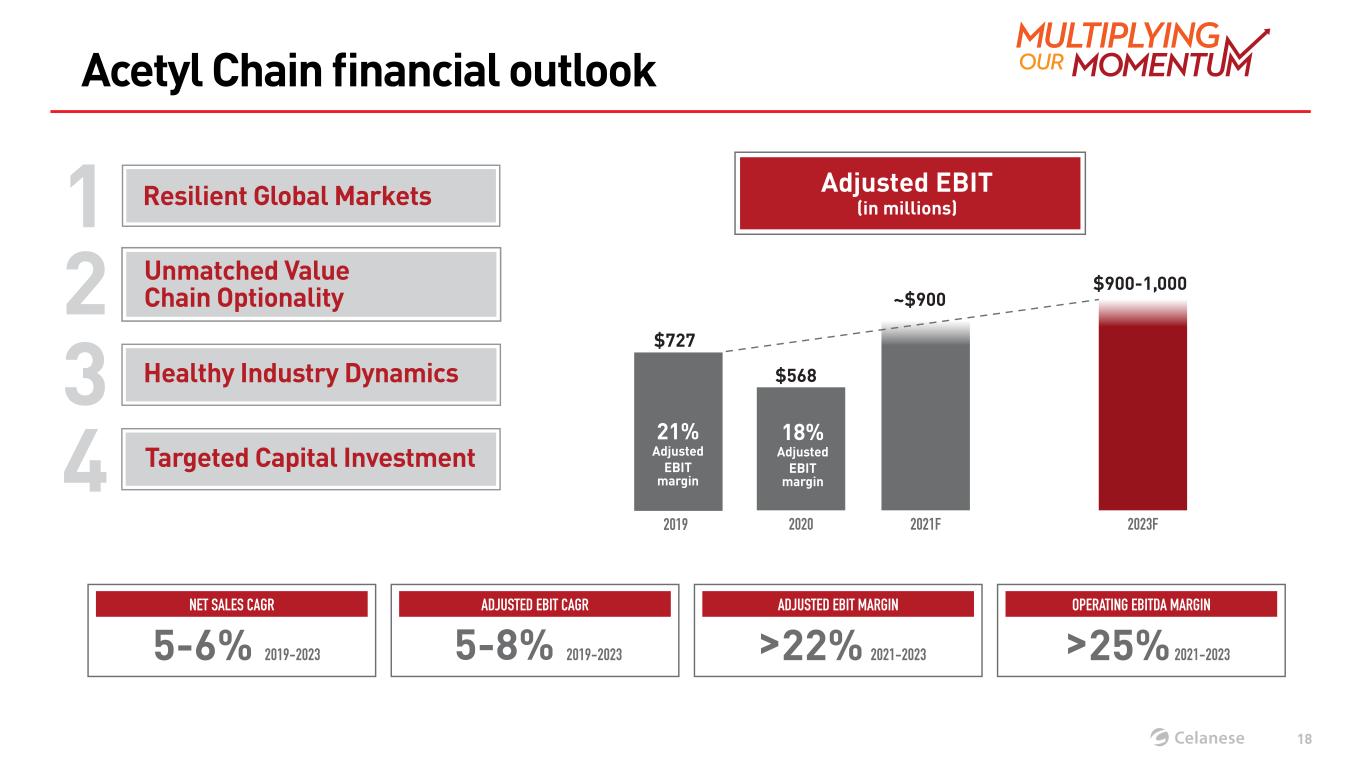

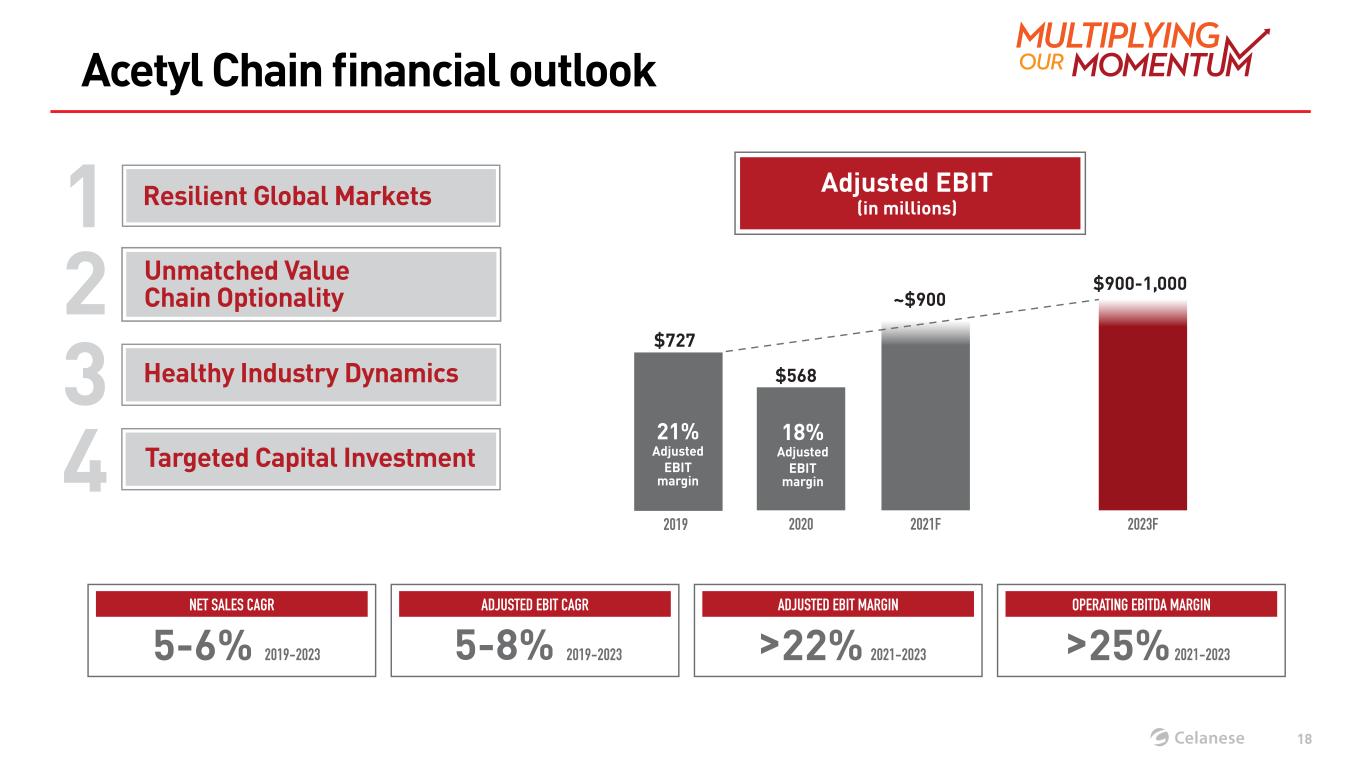

Acetyl Chain financial outlook Resilient Global Markets ADJUSTED EBIT MARGIN >22% 2021-2023 >25% 2021-2023 OPERATING EBITDA MARGIN $568 ~$900 $900-1,000 2020 2021F 2023F NET SALES CAGR 5-6% 2019-2023 ADJUSTED EBIT CAGR 2019-2023 18% Adjusted EBIT margin Adjusted EBIT (in millions) 18 1 2 3 4 Unmatched Value Chain Optionality Healthy Industry Dynamics Targeted Capital Investment 5-8% $727 21% Adjusted EBIT margin 2019