developing world, and taking advantage of the return premiums available in less-liquid strategies would pay large dividends over coming years. While we had a respectable year in the Fund, up 15.01%, we lagged most “market” benchmarks and any insurance, or hedging, was a drag on performance in 2009. Looking back on 2009, it appears that we, like my son’s lacrosse team, came out flat. If we were keeping score, our team would have been losing 2–0.

Heading into 2010, we preferred debt over equity with “distressed” being most attractive. We were convinced that long/short would win over long only and macro would have another day in the sun as volatility rose from very depressed levels. We favored healthcare and technology sectors within developed markets and the BRICs were still our favorite regions, despite some concerns about valuations in the short-term. We loved “real assets” for the long-term, but feared the impact of a surprise dollar rally on commodity prices (and Emerging Market valuations) would create better entry points later in the year. So what did all this get us in the first quarter of 2010? It got us behind 4–0. We heard murmurs from the stands, but we stuck to the game plan.

After what happened in 2009, the shouts from the “crowd” have been audible and our convictions were challenged. Should we change up the line-up? Should we find another strategy? Was the Endowment Model broken? Is long/short equity a relic of the past? Has FAS 157 destroyed the private equity model? We heard the feedback and our investment teams met on many occasions to stress test our model, challenge our inputs and revisit our investment themes and core strategies. We feel strongly that our strategy is sound, our outlook is appropriate, and we are committed to our disciplined process.

Our conservative posture looks pretty good right now, but no one knows what tomorrow will bring, so we are not doing any “victory dances.” Sometimes we get it right in the short-term; sometimes we get it wrong. What we really care about is getting it right in the long-run. To do that consistently, you have to follow a solid game plan, be disciplined in your execution, have courage of your convictions and don’t listen to the “noise.” Sometimes you can have the best game plan in the world, follow it to the letter, have great conviction and, unfortunately, still have a bad outcome in the short-term. The great news is that in investing you get many more chances because the season never ends. Our job is simple, deliver long-term returns equivalent to the real return of equities, do so with volatility closer to bonds and have low correlation to traditional assets. If we do these things, adding the Fund to a diversified portfolio will enhance returns and reduce risk.

Thank you for your support and partnership. Please don’t hesitate to call if you have questions or need additional information from the team.

DEFINITIONS

Barclays Capital Aggregate Bond Index: The Index represents securities that are SEC-registered, taxable, and dollar denominated. It covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. These major sectors are subdivided into more specific indices that are calculated and reported on a regular basis.

FTSE NAREIT All REITs Index: The Index is a comprehensive universe of publicly traded Real Estate Investment Trusts (REITs). To be included, firms must be traded on the NYSE, American Stock Exchange, or NASDAQ; have a minimum valuation of $100 million; and meet minimum share liquidity standards.

HFRX Absolute Return Index: The Index is designed to be representative of the overall composition of the hedge fund universe. It is comprised of all eligible hedge fund strategies, including but not limited to convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. As a component of the optimization process, the Index selects constituents which characteristically exhibit lower volatilities and lower correlations to standard directional benchmarks of equity market and hedge fund industry performance.

HFRX Global Hedge Fund Index: The Index is designed to be representative of the overall composition of the hedge fund universe. It is comprised of all eligible hedge fund strategies, including but not limited to convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry.

Merrill Lynch High Yield Master II Index: The Index is a commonly used benchmark for high yield corporate bonds. It measures the broad high yield market.

MSCI EAFE Index: The Morgan Stanley Capital International Europe, Australia, Far East Index is a benchmark of foreign stocks. Compiled by Morgan Stanley, the Index is an aggregate of 21 individual country indices that collectively represent many of the major markets of the world, including: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom. Most international mutual funds measure their performance against this index. It is a market-capitalization weighted index.

MSCI Emerging Markets Index: The Morgan Stanley Capital International Emerging Markets Index is designed to measure equity market performance in global emerging markets. The Index is a float-adjusted market capitalization index. As of May 2005, it consisted of indices in the following 26 emerging economies: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Israel, Jordan, Korea, Malaysia, Mexico, Morocco, Pakistan, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, Turkey, and Venezuela.

S&P/LSTA Leveraged Loan Index: A partnership between Standard & Poor’s and the Loan Syndications and Trading Association, the Index tracks returns in the leveraged loan market, capturing a broad cross-section of the U.S. leveraged loan market including dollar-denominated, U.S.-syndicated loans to overseas issuers.

Standard & Poor’s (S&P) 500 Total Return Index: The Index consists of 500 stocks chosen for market size, liquidity and industry group representation. It is a market value weighted index, with each stock’s weight in the index proportionate to its market value.

The Standard & Poor’s (S&P) GSCI Index: The Index provides investors with a reliable and publicly available benchmark for investment performance in the commodity markets. It is designed to be tradable, readily accessible to market participants, and cost-efficient to implement. The Index is widely recognized as the leading measure of general commodity price movements and inflation in the world economy.

SIX

RELATIONSHIPS • ALTERNATIVES • RESULTS

SAFE HARBOR ANDFORWARD-LOOKING STATEMENTS DISCLOSURE

The opinions expressed in this report are subject to change without notice. This material has been prepared or is distributed solely for informational purposes and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. The opinions discussed in the letter are solely those of Hatteras and may contain certain forward-looking statements about the factors that may affect the performance of the illustrative examples in the future. These statements are based on Hatteras’ predictions and expectations concerning certain future events and their expected impact, such as performance of the economy as a whole and of specific industry sectors, changes in the levels of interest rates, the impact of developing world events, and other factors that may influence the future performance of the illustrative examples. Hatteras believes these forward-looking statements to be reasonable, although they are inherently uncertain and difficult to predict. Actual events may cause adjustments in portfolio management strategies from those currently expected to be employed. It is intended solely for the use of the person to whom it is given and may not be reproduced or distributed to any other person. The information and statistics in this report are from sources believed to be reliable, but are not warranted by Hatteras to be accurate or complete. Past performance does not guarantee future results.

IMPORTANT DISCLOSURES AND RISK FACTORS

This is not an offering to subscribe for units in any fund and is intended for informational purposes only. An offering can only be made by delivery of the Prospectus to “qualified clients” within the meaning of U.S. securities laws. Please carefully consider the investment objectives, risks, and charges and expenses of the Funds (as defined below) before investing. Please read the Prospectus carefully before investing as it contains important information on the investment objectives, composition, fees, charges and expenses, risks, suitability, and tax obligations of investing in the Funds. Copies of the Prospectus and performance data current to the most recent month-end may be obtained online at www.hatterasfunds.com or by contacting Hatteras at 1-866-388-6292. Past performance does not guarantee future results.

The Hatteras Multi-Strategy Fund, L.P.; the Hatteras Multi-Strategy TEI Fund, L.P.; the Hatteras Multi-Strategy Institutional Fund, L.P.; and the Hatteras Multi-Strategy TEI Institutional Fund, L.P. (collectively referred to herein as the “Hatteras Multi-Strategy Funds” or the “Funds”) are Delaware limited partnerships that are registered under the Investment Company Act of 1940 (the “1940 Act”), as amended, as non-diversified, closed-end management investment companies whose units are registered under the Securities Act of 1933, as amended. The Hatteras Multi-Strategy Funds are funds of alternative investments. As such, the Funds invest in private hedge funds and private equity investments. Hedge funds are speculative investments and are not suitable for all investors, nor do they represent a complete investment program. A hedge fund can be described generally as a private and unregistered investment pool that accepts investors’ money and employs hedging and arbitrage techniques using long and short positions, leverage and derivatives, and investments in many markets.

Key Risk Factors: The Funds, through an investment in the Master Fund, will invest substantially all of their assets in underlying funds that are generally not registered as investment companies under the 1940 Act and, therefore, the Funds will not have the benefit of various protections provided under the 1940 Act with respect to an investment in those underlying funds. The Funds can be highly volatile, carry substantial fees, and involve complex tax structures. Investments in the Funds involve a high degree of risk, including loss of entire capital. The underlying funds may engage in speculative investment strategies and practices, such as the use of leverage, short sales, and derivatives transactions, which can increase the risk of investment loss. The Funds provide limited liquidity, and units in the Funds are not transferable. Liquidity will be provided only through repurchase offers made by the Funds from time to time, generally on a quarterly basis upon prior written notice.

The success of the Funds is highly dependent on the financial and managerial expertise of its principals and key personnel of the Funds’ investment managers. Although the investment managers for the Funds expect to receive detailed information from each underlying fund on a regular basis regarding its valuation, investment performance, and strategy, in most cases the investment managers have little or no means of independently verifying this information. The underlying funds are not required to provide transparency with respect to their respective investments. By investing in the underlying funds indirectly through the Funds, investors will be subject to a dual layer of fees, both at the Funds and underlying fund levels.

Please see the Prospectus for a detailed discussion of the specific risks disclosed here and other important risks and considerations.

Securities offered through Hatteras Capital Distributors, LLC, member FINRA/SIPC. Hatteras Capital Distributors, LLC is affiliated with Hatteras Investment Partners, LLC by virtue of common control/ownership. This document is not an offering to subscribe for units of any fund and is intended for informational purposes only.

SEVEN

PERFORMANCE SUMMARY1 (UNAUDITED)

HATTERAS MULTI-STRATEGY FUND, L.P. (inception date: April 1, 2005)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year | | Jan | | Feb | | Mar | | Apr | | May | | Jun | | Jul | | Aug | | Sep | | Oct | | Nov | | Dec | | Year2 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2010 | | –0.30 | % | 0.06 | % | 1.72 | % | | | | | | | | | | | | | | | | | | | 1.47 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2009 | | 0.17 | % | –0.42 | % | –0.50 | % | 0.49 | % | 3.69 | % | 0.79 | % | 2.20 | % | 1.20 | % | 2.39 | % | 0.11 | % | 0.85 | % | 0.95 | % | 12.51 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2008 | | –2.89 | % | 1.86 | % | –2.88 | % | 1.57 | % | 2.10 | % | –0.48 | % | –2.84 | % | –1.53 | % | –8.28 | % | –7.54 | % | –4.29 | % | –1.01 | % | –23.79 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2007 | | 0.97 | % | 0.67 | % | 1.60 | % | 1.86 | % | 2.01 | % | 0.78 | % | –0.05 | % | –1.85 | % | 1.93 | % | 2.71 | % | –1.72 | % | 0.92 | % | 10.16 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2006 | | 2.80 | % | –0.20 | % | 1.74 | % | 1.10 | % | –1.97 | % | –0.75 | % | 0.37 | % | 0.76 | % | 0.26 | % | 1.60 | % | 2.09 | % | 0.93 | % | 8.98 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2005 | | | | | | | | –1.54 | % | 0.26 | % | 1.46 | % | 2.16 | % | 0.48 | % | 1.39 | % | –1.46 | % | 1.35 | % | 1.85 | % | 6.04 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | |

Annualized Returns | | Fund | | S&P 5003 | | HFRXGL3 | | 60/404 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year-to-date | | | 1.47 | % | | 5.39 | % | | 1.63 | % | | 4.02 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1-Year | | | 15.01 | % | | 49.77 | % | | 14.46 | % | | 31.66 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3-Year | | | –2.46 | % | | –4.17 | % | | –3.18 | % | | 0.31 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5-Year | | | 2.06 | % | | 1.92 | % | | 0.89 | % | | 3.64 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Since Inception | | | 2.06 | % | | 1.92 | % | | 0.89 | % | | 3.64 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | |

Historical Data

(since inception) | | Fund | | S&P 5003 | | HFRXGL3 | | 60/404 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cumulative Return | | | 10.75 | % | | 9.97 | % | | 4.55 | % | | 19.57 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Standard Deviation5 | | | 7.63 | % | | 16.31 | % | | 7.47 | % | | 10.22 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Largest Drawdown6 | | | –24.98 | % | | –50.95 | % | | –25.21 | % | | –32.54 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Drawdown—# of months7 | | | 17 | | | 16 | | | 14 | | | 16 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Recovery—# of months8 | | | N.A. | | | N.A. | | | N.A. | | | N.A. | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HATTERAS MULTI-STRATEGY TEI FUND, L.P. (inception date: April 1, 2005)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year | | Jan | | Feb | | Mar | | Apr | | May | | Jun | | Jul | | Aug | | Sep | | Oct | | Nov | | Dec | | Year5 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2010 | | –0.34 | % | 0.06 | % | 1.72 | % | | | | | | | | | | | | | | | | | | | 1.44 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2009 | | 0.16 | % | –0.42 | % | –0.50 | % | 0.47 | % | 3.71 | % | 0.79 | % | 2.19 | % | 1.20 | % | 2.39 | % | 0.11 | % | 0.85 | % | 0.95 | % | 12.49 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2008 | | –2.95 | % | 1.82 | % | –2.92 | % | 1.53 | % | 2.08 | % | –0.52 | % | –2.88 | % | –1.57 | % | –8.33 | % | –7.56 | % | –4.31 | % | –0.86 | % | –23.98 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2007 | | 0.94 | % | 0.64 | % | 1.58 | % | 1.83 | % | 1.99 | % | 0.75 | % | –0.07 | % | –1.88 | % | 1.89 | % | 2.68 | % | –1.74 | % | 0.87 | % | 9.79 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2006 | | 2.77 | % | –0.20 | % | 1.72 | % | 1.09 | % | –1.98 | % | –0.75 | % | 0.37 | % | 0.72 | % | 0.23 | % | 1.57 | % | 2.05 | % | 0.90 | % | 8.73 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2005 | | | | | | | | –1.54 | % | 0.26 | % | 1.46 | % | 2.16 | % | 0.48 | % | 1.39 | % | –1.46 | % | 1.32 | % | 1.82 | % | 5.97 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | |

Annualized Returns | | Fund | | S&P 5003 | | HFRXGL3 | | 60/404 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year-to-date | | | 1.44 | % | | 5.39 | % | | 1.63 | % | | 4.02 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1-Year | | | 14.97 | % | | 49.77 | % | | 14.46 | % | | 31.66 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3-Year | | | –2.64 | % | | –4.17 | % | | –3.18 | % | | 0.31 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5-Year | | | 1.88 | % | | 1.92 | % | | 0.89 | % | | 3.64 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Since Inception | | | 1.88 | % | | 1.92 | % | | 0.89 | % | | 3.64 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | |

Historical Data

(since inception) | | Fund | | S&P 5003 | | HFRXGL3 | | 60/404 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cumulative Return | | | 9.74 | % | | 9.97 | % | | 4.55 | % | | 19.57 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Standard Deviation5 | | | 7.64 | % | | 16.31 | % | | 7.47 | % | | 10.22 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Largest Drawdown6 | | | –25.22 | % | | –50.95 | % | | –25.21 | % | | –32.54 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Drawdown—# of months7 | | | 17 | | | 16 | | | 14 | | | 16 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Recovery—# of months8 | | | N.A. | | | N.A. | | | N.A. | | | N.A. | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1. | Performance results and calculations after the Funds’ most recent fiscal year are unaudited. The principal value of the Funds will fluctuate so that an investor’s units, when redeemed, may be worth more or less than the original cost. Returns are net of all expenses of the Funds, including the management fee and incentive allocations, and reflect reinvestment of all distributions, if applicable. Returns do not reflect payment of the 5% redemption fee or up-front placement fees, which could be up to 2%, which would reduce returns shown above. Past performance does not guarantee future results and current performance may be lower or higher than the figures shown. The net expense ratio and total expense ratio for the Hatteras Multi-Strategy Fund, L.P. are 2.35% and 10.06%, respectively. The next expense ratio and total expense ratio for the Hatteras Multi-Strategy TEI Fund, L.P. are 2.39% and 10.10%, respectively. The total expense ratio for both funds includes Acquired Fund Fees and Expenses of 7.71%. The Investment Manager has contractually agreed to waive fees and/or reimburse certain expenses for one year from the date of the most recent Prospectus so that the total annual expenses will not exceed 2.35%. Please see the current Prospectus for detailed information regarding the expenses of the Funds. |

| |

2. | Cumulative Return. Returns are net of all expenses of the Funds, including the management fee and incentive allocations, and reflect reinvestment of all distributions, if applicable. Returns do not reflect payment of placement fees, if applicable, which would reduce returns noted above. |

| |

3. | S&P 500 Index and HFRX Global Hedge Fund Index (HFRXGL) data are sourced from Bloomberg. The indices are unmanaged portfolios of securities. Their performance results do not reflect the deduction of management fees, incentive compensation, commissions or other expenses. An investor cannot invest directly in an index. The S&P 500 Index consists of 500 stocks chosen for market size, liquidity and industry group representation. It is a market value weighted index, with each stock’s weight in the Index proportionate to its market value. HFRXGL is designed to be representative of the overall composition of the hedge fund universe. It is comprised of eight strategies: convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry. |

| |

4. | 60%S&P/40%Barclays Capital Aggregate Bond Index—The Barclays Capital Aggregate Bond Index represents securities that are SEC-registered, taxable and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities and asset-backed securities. These major sectors are subdivided into more specific indices that are calculated and reported on a regular basis. All blended index data is sourced from Bloomberg and represents a composite that is rebalanced between indices monthly. |

| |

5. | Measurement of the investment’s volatility. |

| |

6. | The peak to trough decline of an investment. |

| |

7. | Number of months of a peak to trough decline of an investment. |

| |

8. | Number of months to recover from a drawdown. |

EIGHT

RELATIONSHIPS • ALTERNATIVES • RESULTS

PERFORMANCE SUMMARY1 (UNAUDITED)

HATTERAS MULTI-STRATEGY INSTITUTIONAL FUND, L.P. (inception date: January 1, 2007)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year | | Jan | | Feb | | Mar | | Apr | | May | | Jun | | Jul | | Aug | | Sep | | Oct | | Nov | | Dec | | Year2 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2010 | | –0.24 | % | 0.12 | % | 1.78 | % | | | | | | | | | | | | | | | | | | | 1.67 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2009 | | 0.24 | % | –0.33 | % | –0.45 | % | 0.55 | % | 3.75 | % | 0.86 | % | 2.27 | % | 1.27 | % | 2.46 | % | 0.17 | % | 0.91 | % | 1.01 | % | 13.38 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2008 | | –2.85 | % | 1.91 | % | –2.81 | % | 1.63 | % | 2.14 | % | –0.42 | % | –2.78 | % | –1.47 | % | –8.22 | % | –7.50 | % | –4.23 | % | –0.94 | % | –23.27 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2007 | | 1.12 | % | 0.73 | % | 1.65 | % | 1.89 | % | 2.06 | % | 0.82 | % | 0.00 | % | –1.89 | % | 2.00 | % | 2.75 | % | –1.71 | % | 0.97 | % | 10.76 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | |

Annualized Returns | | Fund | | S&P 5003 | | HFRXGL3 | | 60/404 | |

|

|

|

|

|

|

|

|

|

|

Trailing 3 Months | | | 1.67 | % | | 5.39 | % | | 1.63 | % | | 4.02 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year-to-date | | | 1.67 | % | | 5.39 | % | | 1.63 | % | | 4.02 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1-Year | | | 15.90 | % | | 49.77 | % | | 14.46 | % | | 31.66 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3-Year | | | –1.83 | % | | –4.17 | % | | –3.18 | % | | 0.31 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Since Inception | | | –0.63 | % | | –3.66 | % | | –2.47 | % | | 0.60 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | |

Historical Data

(since inception) | | Fund | | S&P 5003 | | HFRXGL3 | | 60/404 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cumulative Return | | | –2.03 | % | | –11.42 | % | | –7.81 | % | | 1.95 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Standard Deviation5 | | | 8.79 | % | | 19.61 | % | | 8.64 | % | | 12.31 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Largest Drawdown6 | | | –24.26 | % | | –50.95 | % | | –25.21 | % | | –32.54 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Drawdown—# of months7 | | | 17 | | | 16 | | | 14 | | | 16 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Recovery—# of months8 | | | N.A. | | | N.A. | | | N.A. | | | N.A. | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HATTERAS MULTI-STRATEGY TEI INSTITUTIONAL FUND, L.P. (inception date: February 1, 2007)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year | | Jan | | Feb | | Mar | | Apr | | May | | Jun | | Jul | | Aug | | Sep | | Oct | | Nov | | Dec | | Year5 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2010 | | –0.23 | % | 0.13 | % | 1.79 | % | | | | | | | | | | | | | | | | | | | 1.69 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2009 | | 0.24 | % | –0.32 | % | –0.43 | % | 0.54 | % | 3.74 | % | 0.85 | % | 2.26 | % | 1.27 | % | 2.46 | % | 0.18 | % | 0.92 | % | 1.02 | % | 13.41 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2008 | | –2.87 | % | 1.87 | % | –2.83 | % | 1.59 | % | 2.09 | % | –0.44 | % | –2.82 | % | –1.50 | % | –8.26 | % | –7.51 | % | –4.24 | % | –0.91 | % | –23.48 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2007 | | | | 0.71 | % | 1.62 | % | 1.87 | % | 2.03 | % | 0.80 | % | –0.04 | % | –1.95 | % | 2.01 | % | 2.72 | % | –1.76 | % | 0.96 | % | 9.23 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | |

Annualized Returns | | Fund | | S&P 5006 | | HFRXGL6 | | 60/407 | |

|

|

|

|

|

|

|

|

|

|

Trailing 3 Months | | | 1.69 | % | | 5.39 | % | | 1.63 | % | | 4.02 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year-to-date | | | 1.69 | % | | 5.39 | % | | 1.63 | % | | 4.02 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1-Year | | | 15.91 | % | | 49.77 | % | | 14.46 | % | | 31.66 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3-Year | | | –1.98 | % | | –4.17 | % | | –3.18 | % | | 0.31 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Since Inception | | | –1.15 | % | | –4.21 | % | | –2.99 | % | | 0.33 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | |

Historical Data

(since inception) | | Fund | | S&P 5006 | | HFRXGL6 | | 60/407 | |

|

|

|

|

|

|

|

|

|

|

Cumulative Return | | | –3.61 | % | | –12.74 | % | | –9.18 | % | | 1.05 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Standard Deviation5 | | | 8.90 | % | | 19.85 | % | | 8.70 | % | | 12.47 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Largest Drawdown6 | | | –24.50 | % | | –50.95 | % | | –25.21 | % | | –32.54 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Drawdown—# of months7 | | | 17 | | | 16 | | | 14 | | | 16 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Recovery—# of months8 | | | N.A. | | | N.A. | | | N.A. | | | N.A. | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1. | Performance results and calculations after the Funds’ most recent fiscal year are unaudited. The principal value of the Funds will fluctuate so that an investor’s units, when redeemed, may be worth more or less than the original cost. Returns are net of all expenses of the Funds, including the management fee and incentive allocations, and reflect reinvestment of all distributions, if applicable. Returns do not reflect payment of the 5% redemption fee or up-front placement fees, which could be up to 2%, which would reduce returns shown above. Past performance does not guarantee future results and current performance may be lower or higher than the figures shown. The net expense ratio and total expense ratio for the Hatteras Multi-Strategy Institutional Fund, L.P. are 1.57% and 9.28%, respectively. The net expense ratio and total expense ratio for the Hatteras Multi-Strategy TEI Institutional Fund, L.P. are 1.55% and 9.26%, respectively. The total expense ratio for both funds includes Acquired Fund Fees and Expenses of 7.71%. The Investment Manager has contractually agreed to waive fees and/or reimburse certain expenses for one year from the date of the most recent Prospectus so that the total annual expenses will not exceed 1.75%. Please see the current Prospectus for detailed information regarding the expenses of the Funds. |

| |

2. | Cumulative Return. Returns are net of all expenses of the Funds, including the management fee and incentive allocations, and reflect reinvestment of all distributions, if applicable. Returns do not reflect payment of placement fees, if applicable, which would reduce returns noted above. |

| |

3. | S&P 500 Index and HFRX Global Hedge Fund Index (HFRXGL) data are sourced from Bloomberg. The indices are unmanaged portfolios of securities. Their performance results do not reflect the deduction of management fees, incentive compensation, commissions or other expenses. An investor cannot invest directly in an index. The S&P 500 Index consists of 500 stocks chosen for market size, liquidity and industry group representation. It is a market value weighted index, with each stock’s weight in the Index proportionate to its market value. HFRXGL is designed to be representative of the overall composition of the hedge fund universe. It is comprised of eight strategies: convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry. |

| |

4. | 60%S&P/40%Barclays Capital Aggregate Bond Index—The Barclays Capital Aggregate Bond Index represents securities that are SEC-registered, taxable and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities and asset-backed securities. These major sectors are subdivided into more specific indices that are calculated and reported on a regular basis. All blended index data is sourced from Bloomberg and represents a composite that is rebalanced between indices monthly. |

| |

5. | Measurement of the investment’s volatility. |

| |

6. | The peak to trough decline of an investment. |

| |

7. | Number of months of a peak to trough decline of an investment. |

| |

8. | Number of months to recover from a drawdown. |

NINE

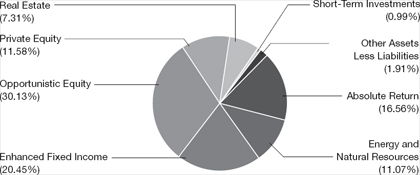

STRATEGY (UNAUDITED)

ALLOCATION

| | | | | | | | | | |

Strategies | | Target

Allocation | | Actual

Allocation1 | | # of Funds | |

|

|

|

|

|

|

|

|

Opportunistic Equity | | 25 | % | | 31 | % | | 31 | | |

|

|

|

|

|

|

|

|

|

|

|

Enhanced Fixed Income | | 25 | % | | 21 | % | | 21 | | |

|

|

|

|

|

|

|

|

|

|

|

Absolute Return | | 20 | % | | 17 | % | | 19 | | |

|

|

|

|

|

|

|

|

|

|

|

Real Estate | | 10 | % | | 8 | % | | 25 | | |

|

|

|

|

|

|

|

|

|

|

|

Private Equity | | 10 | % | | 12 | % | | 58 | | |

|

|

|

|

|

|

|

|

|

|

|

Energy & Natural Resources | | 10 | % | | 11 | % | | 28 | | |

|

|

|

|

|

|

|

|

|

|

|

Total | | | | | | | | 182 | | |

|

|

|

|

|

|

|

|

|

|

|

STRATEGY ALLOCATION1

CONTRIBUTION

HATTERAS MULTI-STRATEGY FUND, L.P. (inception date: April 1, 2005)

| | | | | | |

Strategy Performance2 | | Fiscal Year | | ITD %4 | |

|

|

|

|

|

|

|

Opportunistic Equity | | 15.86 | % | | 23.23 | % |

|

|

|

|

|

|

|

Enhanced Fixed Income | | 24.80 | % | | 0.96 | % |

|

|

|

|

|

|

|

Absolute Return | | 11.28 | % | | 8.52 | % |

|

|

|

|

|

|

|

Real Estate | | 3.04 | % | | –20.41 | % |

|

|

|

|

|

|

|

Private Equity | | 17.46 | % | | 14.51 | % |

|

|

|

|

|

|

|

Energy & Natural Resources | | 8.95 | % | | 17.03 | % |

|

|

|

|

|

|

|

| | | | | | |

Strategy Contribution3 | | Fiscal Year | | ITD %4 | |

|

|

|

|

|

|

|

Opportunistic Equity | | 4.35 | % | | 8.06 | % |

|

|

|

|

|

|

|

Enhanced Fixed Income | | 4.47 | % | | –0.28 | % |

|

|

|

|

|

|

|

Absolute Return | | 2.14 | % | | 1.95 | % |

|

|

|

|

|

|

|

Real Estate | | 0.29 | % | | –1.90 | % |

|

|

|

|

|

|

|

Private Equity | | 1.62 | % | | 0.82 | % |

|

|

|

|

|

|

|

Energy & Natural Resources | | 1.14 | % | | 2.11 | % |

|

|

|

|

|

|

|

| |

1. | Percentages are based on total portfolio investments exclusive of cash, cash equivalents, money market funds, and short-term investments. |

| |

2. | Strategy Performance: The above illustration offers historical performance for each individual strategy as a composite of the actual underlying advisory funds. The historical performance shown indicates how each strategy (composite) performed on a stand-alone basis, net of all fees. However, none of the (composite) strategies shown above are offered as stand-alone investments. This is not meant to predict or project results into the future, nor is it intended to portray performance of the Fund. |

| |

3. | Strategy Contribution: The above illustration attempts to break down the pro rata contribution of the six strategies of the Fund (in other words, their contribution to the Fund’s overall return) by strategy, and is intended to allocate the portion of the (past) performance that is attributable to the particular strategy. It is not meant to predict or project results into the future, nor is it intended to portray performance of the Fund. |

| |

4. | ITD = Inception to date. |

TEN

RELATIONSHIPS • ALTERNATIVES • RESULTS

STRATEGY (UNAUDITED)

HATTERAS MULTI-STRATEGY TEI FUND, L.P. (inception date: April 1, 2005)

| | | | | | | |

Strategy Performance2 | | Fiscal Year | | ITD %4 | |

|

|

|

|

|

|

|

|

Opportunistic Equity | | | 15.82 | % | | 22.10 | % |

|

|

|

|

|

|

|

|

Enhanced Fixed Income | | | 24.76 | % | | 0.04 | % |

|

|

|

|

|

|

|

|

Absolute Return | | | 11.24 | % | | 7.54 | % |

|

|

|

|

|

|

|

|

Real Estate | | | 3.00 | % | | –21.14 | % |

|

|

|

|

|

|

|

|

Private Equity | | | 17.42 | % | | 13.47 | % |

|

|

|

|

|

|

|

|

Energy & Natural Resources | | | 8.91 | % | | 15.96 | % |

|

|

|

|

|

|

|

|

| | | | | | | |

Strategy Contribution3 | | Fiscal Year | | ITD %4 | |

|

|

|

|

|

|

|

|

Opportunistic Equity | | | 4.34 | % | | 7.76 | % |

|

|

|

|

|

|

|

|

Enhanced Fixed Income | | | 4.46 | % | | –0.51 | % |

|

|

|

|

|

|

|

|

Absolute Return | | | 2.13 | % | | 1.77 | % |

|

|

|

|

|

|

|

|

Real Estate | | | 0.29 | % | | –1.98 | % |

|

|

|

|

|

|

|

|

Private Equity | | | 1.61 | % | | 0.71 | % |

|

|

|

|

|

|

|

|

Energy & Natural Resources | | | 1.14 | % | | 1.99 | % |

|

|

|

|

|

|

|

|

HATTERAS MULTI-STRATEGY INSTITUTIONAL FUND, L.P. (inception date: January 1, 2007)

| | | | | | | |

Strategy Performance2 | | Fiscal Year | | ITD %4 | |

|

|

|

|

|

|

|

|

Opportunistic Equity | | | 16.75 | % | | 1.58 | % |

|

|

|

|

|

|

|

|

Enhanced Fixed Income | | | 25.75 | % | | –8.60 | % |

|

|

|

|

|

|

|

|

Absolute Return | | | 12.13 | % | | 3.75 | % |

|

|

|

|

|

|

|

|

Real Estate | | | 3.84 | % | | –33.17 | % |

|

|

|

|

|

|

|

|

Private Equity | | | 18.36 | % | | 11.80 | % |

|

|

|

|

|

|

|

|

Energy & Natural Resources | | | 9.79 | % | | –4.92 | % |

|

|

|

|

|

|

|

|

| | | | | | | |

Strategy Contribution3 | | Fiscal Year | | ITD %4 | |

|

|

|

|

|

|

|

|

Opportunistic Equity | | | 4.92 | % | | 1.50 | % |

|

|

|

|

|

|

|

|

Enhanced Fixed Income | | | 4.90 | % | | –1.79 | % |

|

|

|

|

|

|

|

|

Absolute Return | | | 2.46 | % | | 1.25 | % |

|

|

|

|

|

|

|

|

Real Estate | | | 0.43 | % | | –3.45 | % |

|

|

|

|

|

|

|

|

Private Equity | | | 1.83 | % | | 0.69 | % |

|

|

|

|

|

|

|

|

Energy & Natural Resources | | | 1.35 | % | | –0.24 | % |

|

|

|

|

|

|

|

|

HATTERAS MULTI-STRATEGY TEI INSTITUTIONAL FUND, L.P. (inception date: February 1, 2007)

| | | | | |

Strategy Performance2 | | Fiscal Year | | ITD %4 | |

|

|

|

|

|

|

|

|

Opportunistic Equity | | | 16.78 | % | | 1.42 | % |

|

|

|

|

|

|

|

|

Enhanced Fixed Income | | | 25.78 | % | | –9.50 | % |

|

|

|

|

|

|

|

|

Absolute Return | | | 12.16 | % | | 1.88 | % |

|

|

|

|

|

|

|

|

Real Estate | | | 3.86 | % | | –33.97 | % |

|

|

|

|

|

|

|

|

Private Equity | | | 18.39 | % | | 10.56 | % |

|

|

|

|

|

|

|

|

Energy & Natural Resources | | | 9.82 | % | | –4.20 | % |

|

|

|

|

|

|

|

|

| | | | | | | |

Strategy Contribution3 | | Fiscal Year | | ITD %4 | |

|

|

|

|

|

|

|

|

Opportunistic Equity | | | 4.93 | % | | 1.09 | % |

|

|

|

|

|

|

|

|

Enhanced Fixed Income | | | 4.91 | % | | –2.11 | % |

|

|

|

|

|

|

|

|

Absolute Return | | | 2.46 | % | | 0.74 | % |

|

|

|

|

|

|

|

|

Real Estate | | | 0.43 | % | | –3.56 | % |

|

|

|

|

|

|

|

|

Private Equity | | | 1.83 | % | | 0.48 | % |

|

|

|

|

|

|

|

|

Energy & Natural Resources | | | 1.36 | % | | –0.26 | % |

|

|

|

|

|

|

|

|

| |

1. | Percentages are based on total portfolio investments exclusive of cash, cash equivalents, money market funds, and short-term investments. |

| |

2. | Strategy Performance: The above illustration offers historical performance for each individual strategy as a composite of the actual underlying advisory funds. The historical performance shown indicates how each strategy (composite) performed on a stand-alone basis, net of all fees. However, none of the (composite) strategies shown above are offered as stand-alone investments. This is not meant to predict or project results into the future, nor is it intended to portray performance of the Fund. |

| |

3. | Strategy Contribution: The above illustration attempts to break down the pro rata contribution of the six strategies of the Fund (in other words, their contribution to the Fund’s overall return) by strategy, and is intended to allocate the portion of the (past) performance that is attributable to the particular strategy. It is not meant to predict or project results into the future, nor is it intended to portray performance of the Fund. |

| |

4. | ITD = Inception to date. |

ELEVEN

TOP 10 HOLDINGS (UNAUDITED)

| | | | | | | |

| | Capital Balance,

March 31, 2010 | | Percent of

Partners’ Capital | |

|

|

|

|

|

|

Samlyn Onshore Fund, LP | | $ | 42,093,984 | | | 2.98 | % |

|

|

|

|

|

|

|

|

Silverback Opportunistic Convertible Fund, LLC | | | 31,741,248 | | | 2.25 | % |

|

|

|

|

|

|

|

|

Viking Global Equities, LP | | | 31,598,662 | | | 2.24 | % |

|

|

|

|

|

|

|

|

BDCM Partners I, L.P. | | | 27,840,585 | | | 1.97 | % |

|

|

|

|

|

|

|

|

Southport Energy Plus Partners, L.P. | | | 26,940,157 | | | 1.91 | % |

|

|

|

|

|

|

|

|

HealthCor, L.P. | | | 26,127,623 | | | 1.85 | % |

|

|

|

|

|

|

|

|

Citadel Wellington, LLC | | | 25,500,933 | | | 1.81 | % |

|

|

|

|

|

|

|

|

Miura Global Partners II, LP | | | 25,486,777 | | | 1.81 | % |

|

|

|

|

|

|

|

|

TT Mid-Cap Europe Long/Short Fund Limited | | | 25,286,353 | | | 1.79 | % |

|

|

|

|

|

|

|

|

Paulson Advantage, L.P. | | | 24,616,966 | | | 1.74 | % |

|

|

|

|

|

|

|

|

* Top 10 Holdings are exclusive of cash, cash equivalents, money market funds, and short-term investments.

TWELVE

| |

| FINANCIAL SECTION |

| For the Year Ended March 31, 2010 |

THIRTEEN

THIS PAGE INTENTIONALLY LEFT BLANK.

HATTERAS FUNDS

Hatteras Multi-Strategy Fund, L.P. (a Delaware Limited Partnership)

Hatteras Multi-Strategy TEI Fund, L.P. (a Delaware Limited Partnership)

Hatteras Multi-Strategy Institutional Fund, L.P. (a Delaware Limited Partnership)

Hatteras Multi-Strategy TEI Institutional Fund, L.P. (a Delaware Limited Partnership)

Financial Statements

As of and for the year ended March 31, 2010

with Report of Independent Registered Public Accounting Firm

HATTERAS FUNDS

As of and for the year ended March 31, 2010

Hatteras Multi-Strategy Fund, L.P. (a Delaware Limited Partnership)

Hatteras Multi-Strategy TEI Fund, L.P. (a Delaware Limited Partnership)

Hatteras Multi-Strategy Institutional Fund, L.P. (a Delaware Limited Partnership)

Hatteras Multi-Strategy TEI Institutional Fund, L.P. (a Delaware Limited Partnership)

| |

| Deloitte & Touche LLP

1700 Market Street

Philadelphia, PA 19103-3984

USA |

| |

| Tel: +1 215 246 2300 |

| Fax: +1 215 569 2441 |

| www.deloitte.com |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Partners of Hatteras Multi-Strategy Fund, L.P., Hatteras Multi-Strategy TEI Fund, L.P., Hatteras Multi-Strategy Institutional Fund, L.P., and Hatteras Multi-Strategy TEI Institutional Fund, L.P.:

We have audited the accompanying statements of assets, liabilities, and partners’ capital of Hatteras Multi-Strategy Fund, L.P., Hatteras Multi-Strategy TEI Fund, L.P, Hatteras Multi-Strategy Institutional Fund, L.P., and Hatteras Multi-Strategy TEI Institutional Fund, L.P. (all Delaware Limited Partnership) (collectively the “Feeder Funds”) as of March 31, 2010, and the related statements of operations and cash flows for the year then ended, and the statements of changes in partners’ capital for each of the two years in the period then ended. These financial statements are the responsibility of the Feeder Funds’ management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Feeder Funds are not required to have, nor were we engaged to perform, an audit of their internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Feeder Funds’ internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of each of the Feeder Funds as of March 31, 2010, the results of their operations and their cash flows for the year then ended, and the changes in their partners’ capital for each of the two years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

May 28, 2010

| |

| Member of |

| Deloitte Touche Tohmatsu |

HATTERAS FUNDS (EACH A DELAWARE LIMITED PARTNERSHIP)

STATEMENTS OF ASSETS, LIABILITIES AND PARTNERS’ CAPITAL

March 31, 2010

| | | | | | | | | | | | | |

| | Hatteras

Multi-Strategy

Fund, L.P. | | Hatteras

Multi-Strategy

TEI

Fund, L.P.* | | Hatteras

Multi-Strategy

Institutional

Fund, L.P. | | Hatteras

Multi-Strategy

TEI

Institutional

Fund, L.P.* | |

|

|

|

|

|

|

|

|

|

|

Assets | | | | | | | | | | | | | |

Investment in Hatteras Master Fund, L.P., at fair value (cost $240,275,697, $316,737,396,$269,680,531, $585,816,235, respectively) | | $ | 231,638,732 | | $ | 301,067,170 | | $ | 249,283,402 | | $ | 561,868,792 | |

Cash and cash equivalents | | | 250,000 | | | 302,500 | | | 150,000 | | | 155,000 | |

Receivable for withdrawal from Hatteras Master Fund, L.P. | | | 8,294,911 | | | 11,481,235 | | | 6,567,754 | | | 7,228,368 | |

Investment in Hatteras Master Fund, L.P. paid in advance | | | 3,234,931 | | | 6,002,126 | | | 8,252,349 | | | 8,393,301 | |

Prepaid assets | | | 30,565 | | | 29,059 | | | 17,211 | | | 9,560 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets | | $ | 243,449,139 | | $ | 318,882,090 | | $ | 264,270,716 | | $ | 577,655,021 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and partners’ capital | | | | | | | | | | | | | |

Withdrawals payable | | $ | 8,415,051 | | $ | 11,564,602 | | $ | 6,685,743 | | $ | 7,296,733 | |

Contributions received in advance | | | 3,450,500 | | | 6,277,075 | | | 8,295,077 | | | 8,424,760 | |

Servicing fee payable | | | 169,856 | | | 221,093 | | | 21,324 | | | 45,569 | |

Professional fees payable | | | 56,361 | | | 41,056 | | | 61,222 | | | 26,763 | |

Accounting and administration fees payable | | | 11,681 | | | 16,203 | | | 10,850 | | | 18,889 | |

Directors’ fees payable | | | 1,250 | | | 1,250 | | | 1,250 | | | 1,250 | |

Custodian fees payable | | | 729 | | | 2,359 | | | 294 | | | 4,939 | |

Withholding tax payable | | | — | | | 144,305 | | | — | | | 216,913 | |

Other accrued expenses | | | 29,909 | | | 37,677 | | | 41,711 | | | 37,860 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities | | | 12,135,337 | | | 18,305,620 | | | 15,117,471 | | | 16,073,676 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Partners’ capital | | | 231,313,802 | | | 300,576,470 | | | 249,153,245 | | | 561,581,345 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and partners’ capital | | $ | 243,449,139 | | $ | 318,882,090 | | $ | 264,270,716 | | $ | 577,655,021 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Components of partners’ capital | | | | | | | | | | | | | |

Capital contributions (net) | | $ | 248,037,212 | | $ | 327,485,564 | | $ | 271,164,886 | | $ | 588,887,302 | |

Accumulated net investment loss | | | (14,781,058 | ) | | (19,076,874 | ) | | (6,025,501 | ) | | (11,418,815 | ) |

Accumulated net realized loss | | | (17,268,409 | ) | | (20,765,987 | ) | | (17,613,957 | ) | | (31,735,018 | ) |

Accumulated net unrealized appreciation on investments | | | 15,326,057 | | | 12,933,767 | | | 1,627,817 | | | 15,847,876 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Partners’ capital | | $ | 231,313,802 | | $ | 300,576,470 | | $ | 249,153,245 | | $ | 561,581,345 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net asset value per unit | | $ | 87.74 | | $ | 87.69 | | $ | 88.91 | | $ | 88.86 | |

Maximum offering price per unit** | | $ | 89.49 | | $ | 89.44 | | $ | 88.91 | | $ | 88.86 | |

Number of authorized units | | | 7,500,000.00 | | | 7,500,000.00 | | | 7,500,000.00 | | | 7,500,000.00 | |

Number of outstanding units | | | 2,636,355.16 | | | 3,427,716.62 | | | 2,802,308.46 | | | 6,319,844.08 | |

| |

* | Consolidated Statement. See note 1. |

|

** | The maximum sales load for the Hatteras Multi-Strategy Fund, L.P. and the Hatteras Multi-Strategy TEI Fund, L.P. is 2.00%. The remaining funds are not subject to a sales load. |

See notes to financial statements.

TWO

HATTERAS FUNDS (EACH A DELAWARE LIMITED PARTNERSHIP)

STATEMENTSOFOPERATIONS

For the year ended March 31, 2010

| | | | | | | | | | | | | |

| | Hatteras

Multi-Strategy

Fund, L.P. | | Hatteras

Multi-Strategy

TEI Fund,

L.P.* | | Hatteras

Multi-Strategy

Institutional

Fund, L.P. | | Hatteras

Multi-Strategy

TEI

Institutional

Fund, L.P.* | |

|

|

|

|

|

|

|

|

|

|

Net investment loss allocated from Hatteras Master Fund, L.P. | | | | | | | | | | | | | |

Investment income | | $ | 1,039,114 | | $ | 1,288,438 | | $ | 1,050,522 | | $ | 2,188,275 | |

Expenses | | | (2,962,294 | ) | | (3,686,636 | ) | | (2,998,884 | ) | | (6,301,240 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net investment loss allocated from Hatteras Master Fund, L.P. | | | (1,923,180 | ) | | (2,398,198 | ) | | (1,948,362 | ) | | (4,112,965 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Feeder Fund investment income | | | | | | | | | | | | | |

Interest | | | 511 | | | 616 | | | 371 | | | 460 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total fund investment income | | | 511 | | | 616 | | | 371 | | | 460 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Feeder Fund expenses | | | | | | | | | | | | | |

Servicing fee | | | 1,986,878 | | | 2,469,355 | | | 236,404 | | | 493,901 | |

Accounting and administration fees | | | 164,457 | | | 212,622 | | | 136,313 | | | 251,350 | |

Professional fees | | | 89,294 | | | 49,771 | | | 59,327 | | | 34,274 | |

Registration fees | | | 43,000 | | | 43,000 | | | 43,000 | | | 57,900 | |

Insurance fees | | | 31,204 | | | 31,745 | | | 31,720 | | | 31,485 | |

Directors’ fees | | | 25,000 | | | 25,000 | | | 25,000 | | | 25,000 | |

Custodian fees | | | 7,836 | | | 11,925 | | | 7,000 | | | 6,240 | |

Printing fees | | | 70,000 | | | 75,000 | | | 60,000 | | | 60,147 | |

Withholding tax | | | — | | | 163,607 | | | — | | | 260,000 | |

Other expenses | | | 53,187 | | | 83,183 | | | 61,200 | | | 67,652 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Feeder Fund expenses | | | 2,470,856 | | | 3,165,208 | | | 659,964 | | | 1,287,949 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net investment loss | | | (4,393,525 | ) | | (5,562,790 | ) | | (2,607,955 | ) | | (5,400,454 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net realized gain and change in unrealized appreciation on investments allocated from Hatteras Master Fund, L.P. | | | | | | | | | | | | | |

Net realized gain from investments in Adviser Funds | | | 1,478,969 | | | 2,019,587 | | | 1,689,201 | | | 4,231,803 | |

Net change in unrealized appreciation on investments in Adviser Funds | | | 35,351,703 | | | 43,406,668 | | | 35,254,387 | | | 71,527,489 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net realized gain and change in unrealized appreciation on investments in Adviser Funds allocated from Hatteras Master Fund, L.P. | | | 36,830,672 | | | 45,426,255 | | | 36,943,588 | | | 75,759,292 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net increase in partners’ capital resulting from operations | | $ | 32,437,147 | | $ | 39,863,465 | | $ | 34,335,633 | | $ | 70,358,838 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Consolidated Statement. See note 1.

See notes to financial statements.

THREE

HATTERAS FUNDS (EACH A DELAWARE LIMITED PARTNERSHIP)

STATEMENTS OFCHANGES INPARTNERS’ CAPITAL

For the years ended March 31, 2009 and 2010

| | | | | | | | | | |

| | Hatteras Multi-Strategy

Fund, L.P. | |

| |

|

|

| | General

Partner | | Limited

Partners | | Total

Partners | |

|

|

|

|

|

|

|

|

Partners’ Capital, at March 31, 2008 | | $ | — | | $ | 237,029,405 | | $ | 237,029,405 | |

Capital contributions | | | — | | | 100,849,100 | | | 100,849,100 | |

Capital withdrawals | | | (41,336 | ) | | (59,019,097 | ) | | (59,060,433 | ) |

Withdrawal fees | | | — | | | 142,516 | | | 142,516 | |

Net investment loss | | | — | | | (4,793,939 | ) | | (4,793,939 | ) |

Net realized loss from investments in Adviser Funds | | | — | | | (21,617,812 | ) | | (21,617,812 | ) |

Net change in unrealized appreciation/(depreciation) on investments in Adviser Funds | | | — | | | (37,383,867 | ) | | (37,383,867 | ) |

Performance Allocation | | | 41,336 | | | (41,336 | ) | | — | |

|

|

|

|

|

|

|

|

|

|

|

Partners’ Capital, at March 31, 2009** | | $ | — | | $ | 215,164,970 | | $ | 215,164,970 | |

Capital contributions | | | — | | | 34,388,550 | | | 34,388,550 | |

Capital withdrawals | | | — | | | (50,685,488 | ) | | (50,685,488 | ) |

Withdrawal fees | | | — | | | 8,623 | | | 8,623 | |

Net investment loss | | | — | | | (4,393,525 | ) | | (4,393,525 | ) |

Net realized gain from investments in Adviser Funds | | | — | | | 1,478,969 | | | 1,478,969 | |

Net change in unrealized appreciation/(depreciation) on investments in Adviser Funds | | | — | | | 35,351,703 | | | 35,351,703 | |

|

|

|

|

|

|

|

|

|

|

|

Partners’ Capital, at March 31, 2010*** | | $ | — | | $ | 231,313,802 | | $ | 231,313,802 | |

|

|

|

|

|

|

|

|

|

|

|

* Consolidated Statement. See note 1.

** Including accumulated net investment loss of $10,387,533, $13,514,084, $3,417,546, and $6,018,361, respectively.

*** Including accumulated net investment loss of $14,781,058, $19,076,874, $6,025,501, and $11,418,815, respectively.

See notes to financial statements.

FOUR

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Hatteras Multi-Strategy

TEI Fund, L.P.* | | Hatteras Multi-Strategy

Institutional Fund, L.P. | | Hatteras Multi-Strategy

TEI Institutional Fund, L.P.* | |

| |

|

|

|

|

|

|

| | General

Partner | | Limited

Partners | | Total

Partners | | General

Partner | | Limited

Partners | | Total

Partners | | General

Partner | | Limited

Partners | | Total

Partners | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Partners’ Capital, at March 31, 2008 | | $ | — | | $ | 304,765,103 | | $ | 304,765,103 | | $ | — | | $ | 149,881,611 | | $ | 149,881,611 | | $ | — | | $ | 209,737,462 | | $ | 209,737,462 | |

Capital contributions | | | — | | | 111,736,175 | | | 111,736,175 | | | — | | | 132,797,628 | | | 132,797,628 | | | — | | | 289,128,901 | | | 289,128,901 | |

Capital withdrawals | | | (43,372 | ) | | (82,788,891 | ) | | (82,832,263 | ) | | (68,296 | ) | | (25,181,302 | ) | | (25,249,598 | ) | | (158,881 | ) | | (20,372,604 | ) | | (20,531,485 | ) |

Withdrawal fees | | | — | | | 87,248 | | | 87,248 | | | — | | | 103,650 | | | 103,650 | | | — | | | 45,896 | | | 45,896 | |

Net investment loss | | | — | | | (6,128,602 | ) | | (6,128,602 | ) | | — | | | (2,531,781 | ) | | (2,531,781 | ) | | — | | | (4,686,631 | ) | | (4,686,631 | ) |

Net realized loss from investments in Adviser Funds | | | — | | | (26,166,822 | ) | | (26,166,822 | ) | | — | | | (20,261,882 | ) | | (20,261,882 | ) | | — | | | (37,112,434 | ) | | (37,112,434 | ) |

Net change in unrealized appreciation/(depreciation) on investments in Adviser Funds | | | — | | | (43,956,668 | ) | | (43,956,668 | ) | | — | | | (31,841,141 | ) | | (31,841,141 | ) | | — | | | (51,680,470 | ) | | (51,680,470 | ) |

Performance Allocation | | | 43,372 | | | (43,372 | ) | | — | | | 68,296 | | | (68,296 | ) | | — | | | 158,881 | | | (158,881 | ) | | — | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Partners’ Capital, at March 31, 2009** | | $ | — | | $ | 257,504,171 | | $ | 257,504,171 | | $ | — | | $ | 202,898,487 | | $ | 202,898,487 | | $ | — | | $ | 384,901,239 | | $ | 384,901,239 | |

Capital contributions | | | — | | | 52,754,880 | | | 52,754,880 | | | — | | | 56,937,218 | | | 56,937,218 | | | — | | | 150,151,092 | | | 150,151,092 | |

Capital withdrawals | | | — | | | (49,546,046 | ) | | (49,546,046 | ) | | — | | | (45,028,789 | ) | | (45,028,789 | ) | | — | | | (43,858,364 | ) | | (43,858,364 | ) |

Withdrawal fees | | | — | | | — | | | — | | | — | | | 10,696 | | | 10,696 | | | — | | | 28,540 | | | 28,540 | |

Net investment loss | | | — | | | (5,562,790 | ) | | (5,562,790 | ) | | — | | | (2,607,955 | ) | | (2,607,955 | ) | | — | | | (5,400,454 | ) | | (5,400,454 | ) |

Net realized gain from investments in Adviser Funds | | | — | | | 2,019,587 | | | 2,019,587 | | | — | | | 1,689,201 | | | 1,689,201 | | | — | | | 4,231,803 | | | 4,231,803 | |

Net change in unrealized appreciation/(depreciation) on investments in Adviser Funds | | | — | | | 43,406,668 | | | 43,406,668 | | | — | | | 35,254,387 | | | 35,254,387 | | | — | | | 71,527,489 | | | 71,527,489 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Partners’ Capital, at March 31, 2010*** | | $ | — | | $ | 300,576,470 | | $ | 300,576,470 | | $ | — | | $ | 249,153,245 | | $ | 249,153,245 | | $ | — | | $ | 561,581,345 | | $ | 561,581,345 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FIVE

HATTERAS FUNDS (EACH A DELAWARE LIMITED PARTNERSHIP)

STATEMENTS OFCASH FLOWS

For the year ended March 31, 2010

| | | | | | | | | | | | | |

| | Hatteras

Multi-Strategy

Fund, L.P. | | Hatteras

Multi-Strategy

TEI Fund,

L.P.* | | Hatteras

Multi-Strategy

Institutional

Fund, L.P. | | Hatteras

Multi-Strategy

TEI

Institutional

Fund, L.P.* | |

|

|

|

|

|

|

|

|

|

|

Cash flows from operating activities: | | | | | | | | | | | | | |

Net increase in partners’ capital resulting from operations | | $ | 32,437,147 | | $ | 39,863,465 | | $ | 34,335,633 | | $ | 70,358,838 | |

Adjustments to reconcile net increase in partners’ capital resulting from operations to net cash provided by (used in) operating activities: | | | | | | | | | | | | | |

Purchases of interests in Hatteras Master Fund, L.P. | | | (32,070,157 | ) | | (49,781,392 | ) | | (56,570,190 | ) | | (149,324,850 | ) |

Proceeds from withdrawals from Hatteras Master Fund, L.P. | | | 50,658,814 | | | 49,661,308 | | | 44,983,513 | | | 44,020,097 | |

Net investment loss allocated from Hatteras Master Fund, L.P. | | | 1,923,180 | | | 2,398,198 | | | 1,948,362 | | | 4,112,965 | |

Net realized gain from investments in Adviser Funds allocated from Hatteras Master Fund, L.P. | | | (1,478,969 | ) | | (2,019,587 | ) | | (1,689,201 | ) | | (4,231,803 | ) |

Net change in unrealized appreciation on investments in Adviser Funds allocated from Hatteras Master Fund, L.P. | | | (35,351,703 | ) | | (43,406,668 | ) | | (35,254,387 | ) | | (71,527,489 | ) |

(Increase)/Decrease in receivable for withdrawals from Hatteras Master Fund, L.P. | | | 6,838,233 | | | 9,650,787 | | | 7,178,395 | | | 6,892,720 | |

(Increase)/Decrease in investment in Hatteras Master Fund, L.P. paid in advance | | | (368,692 | ) | | (2,924,191 | ) | | (3,068,269 | ) | | (752,166 | ) |

(Increase)/Decrease in receivable from affiliates | | | — | | | 124,098 | | | 100,000 | | | 200,000 | |

(Increase)/Decrease in interest receivable | | | 30,166 | | | 166 | | | 38 | | | 34 | |

(Increase)/Decrease in prepaid assets | | | 11,219 | | | 13,459 | | | 24,700 | | | 30,464 | |

Increase/(Decrease) in withholding tax payable | | | — | | | 19,305 | | | — | | | 91,913 | |

Increase/(Decrease) in servicing fee payable | | | 6,644 | | | 23,624 | | | 3,266 | | | 12,323 | |

Increase/(Decrease) in accounting and administration fees payable | | | (19,203 | ) | | (18,608 | ) | | (16,951 | ) | | (24,018 | ) |

Increase/(Decrease) in professional fees payable | | | 5,010 | | | 9,938 | | | 10,533 | | | 2,186 | |

Increase/(Decrease) in custodian fees payable | | | 379 | | | 3 | | | 200 | | | 2,958 | |

Increase/(Decrease) in directors fees payable | | | 1,250 | | | 1,250 | | | 1,250 | | | 1,250 | |

Increase/(Decrease) in due to affiliates payable | | | — | | | (200,000 | ) | | — | | | (100,000 | ) |

Increase/(Decrease) in other accrued expenses | | | 1,899 | | | 3,608 | | | 17,770 | | | 2,631 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) operating activities | | | 22,625,217 | | | 3,418,763 | | | (7,995,338 | ) | | (100,231,947 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities: | | | | | | | | | | | | | |

Capital contributions | | | 34,764,150 | | | 55,712,055 | | | 60,007,295 | | | 150,873,583 | |

Capital withdrawals, net of withdrawal fees | | | (57,389,367 | ) | | (59,133,318 | ) | | (52,011,957 | ) | | (50,641,636 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) financing activities | | | (22,625,217 | ) | | (3,421,263 | ) | | 7,995,338 | | | 100,231,947 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net change in cash and cash equivalents | | | — | | | (2,500 | ) | | — | | | — | |

Cash and cash equivalents at beginning of year | | | 250,000 | | | 305,000 | | | 150,000 | | | 155,000 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at end of year | | $ | 250,000 | | $ | 302,500 | | $ | 150,000 | | $ | 155,000 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Consolidated Statement. See note 1.

See notes to financial statements.

SIX

HATTERAS FUNDS (EACH A DELAWARE LIMITED PARTNERSHIP)

NOTES TOFINANCIAL STATEMENTS

As of and for the year ended March 31, 2010

1. ORGANIZATION

The Hatteras Funds, each a “Feeder Fund” and collectively the “Feeder Funds” are:

| |

| Hatteras Multi-Strategy Fund, L.P. |

| Hatteras Multi-Strategy TEI Fund, L.P. |

| Hatteras Multi-Strategy Institutional Fund, L.P. |

| Hatteras Multi-Strategy TEI Institutional Fund, L.P. |

The Hatteras Multi-Strategy TEI Fund, L.P. and the Hatteras Multi-Strategy TEI Institutional Fund, L.P. each invest substantially all of their assets in the Hatteras Multi-Strategy Offshore Fund, LDC, and Hatteras Multi-Strategy Offshore Institutional Fund, LDC, (collectively the “Blocker Funds”), respectively. The Blocker Funds are Cayman Islands limited duration companies with the same investment objective as the Feeder Funds. The Blocker Funds serve solely as intermediate entities through which the Multi-Strategy TEI Fund, L.P. and the Hatteras Multi-Strategy TEI Institutional Fund, L.P. invest in Hatteras Master Fund, L.P. (the “Master Fund” and together with the Feeder Funds, the “Funds”). The Blocker Funds enable tax-exempt Limited Partners (as defined below) to invest without receiving certain income in a form that would otherwise be taxable to such tax-exempt Limited Partners regardless of their tax-exempt status. The Hatteras Multi-Strategy TEI Fund, L.P. owns 100% of the participating beneficial interests of the Hatteras Multi-Strategy Offshore Fund, LDC and the Hatteras Multi-Strategy TEI Institutional Fund, L.P. owns 100% of the participating beneficial interests of the Hatteras Multi-Strategy Offshore Institutional Fund, LDC. Where these Notes to Financial Statements discuss the Feeder Funds’ investment in the Master Fund, for Hatteras Multi-Strategy TEI Fund, L.P. and Hatteras Multi-Strategy TEI Institutional Fund, L.P., it means their investment in the Master Fund through the applicable Blocker Fund.