As filed with the Securities and Exchange Commission on March 10, 2010

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file Number: 811-21680

DCA Total Return Fund

(Exact Name of the Registrant as Specified in Charter)

518 17th Street, Suite 1200, Denver, CO 80202

(Address of Principal Executive Offices - Zip Code)

Registrant’s Telephone Number, including area code: 303-228-2200

Jeffrey W. Taylor

President

518 17th Street, Suite 1200

Denver, CO 80202

(Names and Addresses of agents for service)

Date of fiscal year end: December 31

Date of reporting period: December 31, 2009

| Item 1. | Reports to Shareholders |

The following is a copy of the report to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “Act”).

Dividend Capital Investments

DCA Total Return Fund

DCW Total Return Fund

Annual Report

December 31, 2009

Dividend Capital Investments

Table of Contents

Shareholder Letter 2

DCA Total Return Fund (DCA)

Total Returns and Trading History 6

Portfolio Profile 7

DCW Total Return Fund (DCW)

Total Returns and Trading History 8

Portfolio Profile 9

Statement of Investments

DCA Total Return Fund 10

DCW Total Return Fund 18

Statements of Assets & Liabilities 26

Statements of Operations 27

Statements of Changes in Net Assets

DCA Total Return Fund 28

DCW Total Return Fund 29

Financial Highlights

DCA Total Return Fund 30

DCW Total Return Fund 32

Notes to Financial Statements 33

Report of Independent Registered Public Accounting Firm

DCA Total Return Fund 54

DCW Total Return Fund 55

Shareholder Tax Information 56

Dividend Reinvestment Plan 57

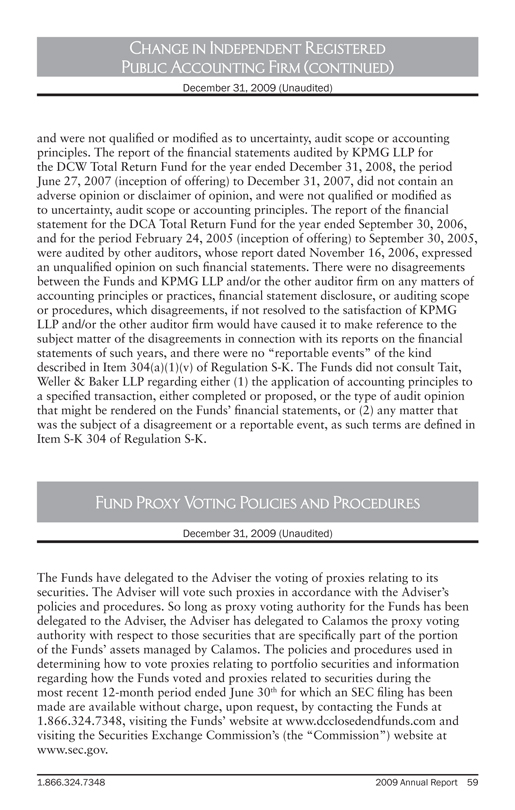

Change in Independent Registered Public Accounting Firm 58

Fund Proxy Voting Policies and Procedures 59

Portfolio Holdings 60

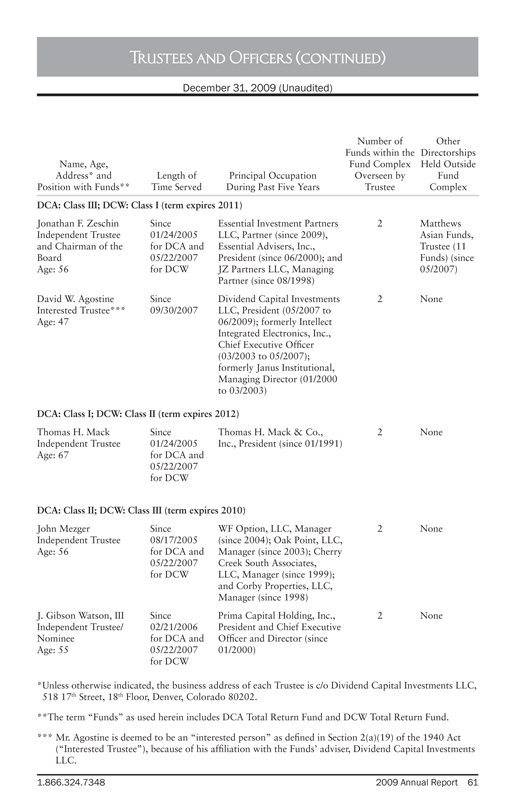

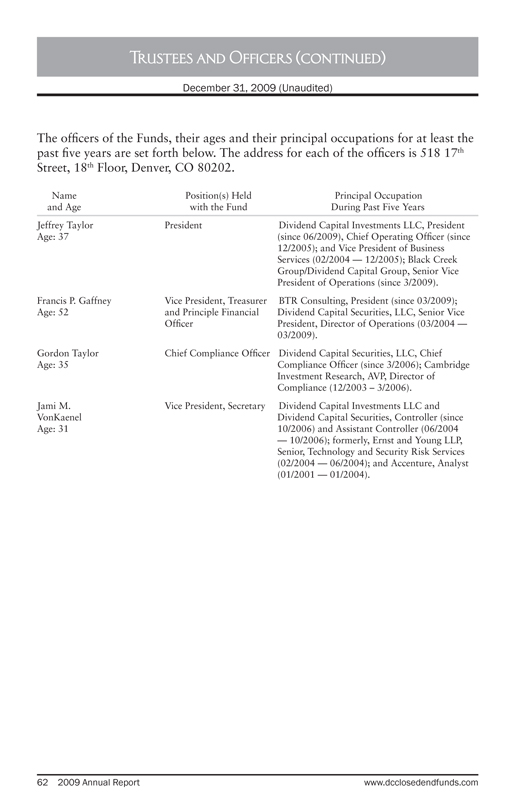

Trustees and Officers 60

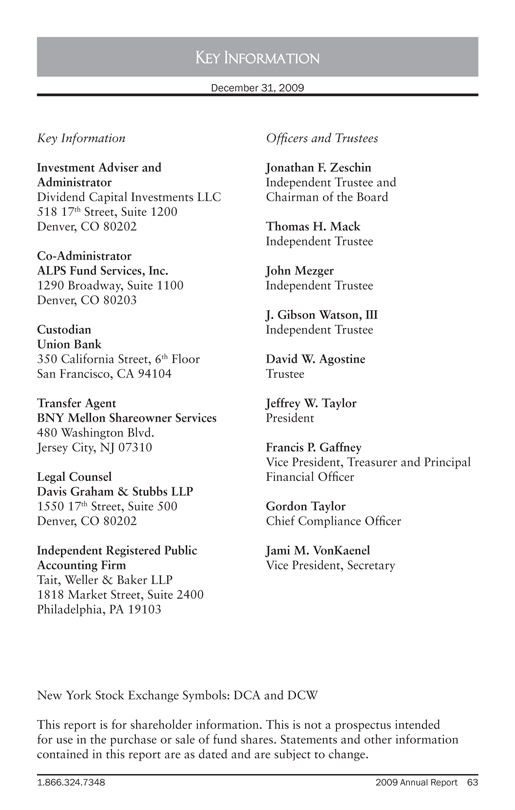

Key Information 63

The Investment Commentary included in this shareholder report contains certain forward-looking statements about the factors that may affect the performance of the Funds in the future. These statements are based on Fund management’s predictions and expectations concerning certain future events and their expected impact on the Funds, such as performance of the economy as a whole and of the global capital markets, changes in the level of interest rates, the impact of developing world events, and other factors that may influence the future performance of the Funds. Management believes these forward looking statements to be reasonable, although they are inherently uncertain and difficult to predict and there is no guarantee of their accuracy. Actual events may cause adjustments in portfolio management strategies from those currently expected to be employed.

1.866.324.7348 2009 Annual Report 1

Shareholder Letter

February 23, 2010

Fellow Shareholders,

2009 can be categorized as a year of pronounced change. In many ways the capital markets reflected a mirror image of 2008, as indices rebounded sharply from new cyclical lows reached in March, followed by a significant 48.26% rally through December 31, 2009 (as represented by the MSCI World Index March 31, 2009 through December 31, 2009). In part, we believe the rally was fueled by sentiment that the worst of the financial crisis had passed, diminishing the near-term likelihood of the “worst-case” scenario. This sentiment was reflected in the significant appreciation realized by lower quality, higher levered and higher risk securities during the rally — the same types of securities that exhibited significant declines in 2008. We also feel a belief emerged that the so-called “great recession” may have bottomed in the second half of the year. In our view, while the employment picture currently remains poor, this turning point was somewhat supported by the fourth quarter’s estimated 5.7% GDP growth.

2009 also brought significant, and we believe positive, changes to both DCA Total Return Fund and DCW Total Return Fund. While we encourage you to review the proxy statement that outlines the proposals adopted at our March 16, 2009 shareholder meeting, the key changes implemented this year include:

Changing the Funds’ prior objectives of high current income with a secondary focus on capital appreciation to an objective of total return

Eliminating the investment policies requiring at least 80% of managed assets to be invested in securities of real estate companies

Removing any specific limitation regarding the Funds’ investment in foreign securities

Modifying the dividend policies from a monthly level-rate payment to quarterly distributions

In addition, while we did not seek shareholder approval to modify the Funds’ policies that permitted both direct and indirect leverage, the Funds were run with very little or no leverage over the balance of 2009.

As part of this new focus, Dividend Capital Realty Income Allocation Fund changed its name to DCA Total Return Fund, and Dividend Capital Global Realty Exposure Fund changed its name to DCW Total Return Fund. Both Funds retained their respective NYSE symbols – DCA and DCW. In addition, we transitioned the Funds’ primary benchmarks to the MSCI World Index, which is more representative of the Funds’ revised strategies.

2 2009 Annual Report www.dcclosedendfunds.com

Shareholder Letter (continued)

To assist in the execution of the Funds’ new strategies, Calamos Advisors LLC was approved to serve as the Funds’ investment sub-adviser. In the revised advisory arrangement, Dividend Capital Investments provides overall investment advisory services to the Funds, including management of the Funds’ long-term real estate and debt securities portfolio, while Calamos manages the Funds’ common equity allocations. Calamos is a diversified investment firm offering equity, fixed-income, convertible and alternative investment strategies. With roots dating back to 1977, the firm, which had $31.3 billion in assets under management as of January 31, 2010, serves institutions and individuals via separately managed accounts and a family of open-end and closed-end funds, providing a risk-managed approach to capital appreciation and income-producing strategies.

Following shareholder approval of the changes, for the rest of 2009 we generally targeted 50%-75% of each Fund’s net assets to be allocated to a NAV appreciation strategy and the remaining 25%-50% allocated toward more income-oriented securities. The NAV appreciation allocations have been sub-advised by Calamos and currently consist of a global common equity mandate. The income-oriented allocations have been overseen directly by Dividend Capital Investments and currently consist primarily of commercial real estate debt and preferred equity securities. Dividend Capital Investments, as adviser to the Funds, also maintained responsibility for overall management of the Funds, including but not limited to establishing each Fund’s overall investment strategy, implementation of the strategies — including the portfolio profiles and asset allocation decisions — as well as analyzing and recommending the Funds’ distribution levels to the Board.

We were pleased with the results of these strategic changes. As displayed in the performance tables that follow this letter, during the twelve months ended December 31, 2009, DCA’s NAV total return was 29.07% while the market price total return was 32.67%, and DCW’s NAV total return was 42.55% while the market price total return was 63.95%. It is also worth noting that for the period March 31, 2009 through December 31, 2009, during which the markets experienced significant appreciation and substantial progress was made in the execution of the strategic portfolio changes, DCA’s NAV total return was 72.29% while the market price total return was 108.11%, and DCW’s NAV total return was 69.44% while the market price total return was 99.38%.

During 2009, both Funds’ performance was influenced by overall market conditions and by the timing of the overall allocation shifts we began to implement soon after receiving shareholder approval. The Funds benefited not only from outperformance (relative to the MSCI World Index) experienced in their Calamos-managed global common equity strategies, but also realized positive total return from both Funds’ preferred equity portfolios. Real estate debt securities continued to be a negative influence on both Funds’ performance as commercial real estate fundamentals weakened, continuing to call into question the overall long-term value and income generation capability of these securities.

1.866.324.7348 2009 Annual Report 3

Shareholder Letter (continued)

An additional result of the shift to a total return strategy for both Funds was a lower distribution level than was historically realized by the Funds. Following shareholder approval, we factored in the desire to base quarterly distributions on projected net investment income as well as the Funds’ previously discussed targeted allocations. The distribution amounts were also influenced by the lack of leverage, which we believe reduced the Funds’ overall risk profile, but resulted in lower return potential and contributed to lower distributions. Secondarily, the distribution amounts were influenced by floating rate securities — which given the low level of short-term interest rates, produced relatively lower coupons — as well as by securities for which current payments were deferred. In closing, we believe the strategic changes discussed above have helped to better position the Funds to realize shareholder value by creating investment vehicles that are focused on total return through investment in common equity, preferred equity and debt securities across a broad range of industries and geographic regions. We believe this broader mandate has the potential to capitalize on investment opportunities that may emerge as capital markets continue to recover from the financial crisis. We also believe it has the potential to reduce the Funds’ risk profile via permitting investment in an expanded universe of securities and industries than has been historically utilized in the Funds. Consistent with steps taken in 2009, we will continue to assess ongoing opportunities to enhance both Funds’ return potential through a combination of potential expense reductions and a broader utilization of the global total return investment mandate. While more recent market performance has been positive following signs of stabilization in the capital markets and a potential bottoming in the U.S. and global economies, we continue to believe that there is a premium on investment vigilance. However, we also believe this environment will create compelling, long-term investment opportunities and that the Funds have the potential to create long-term value for shareholders. We thank you for your continued support.

Sincerely,

Jeffrey Taylor

President Jeffrey Randall

Portfolio Manager

4 2009 Annual Report www.dcclosedendfunds.com

This Page Intentionally Left Blank

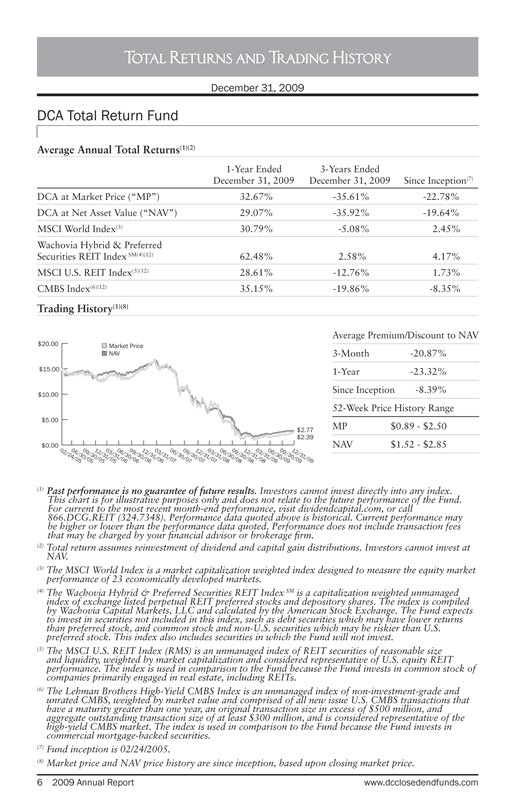

Total Returns and Trading History

December 31, 2009

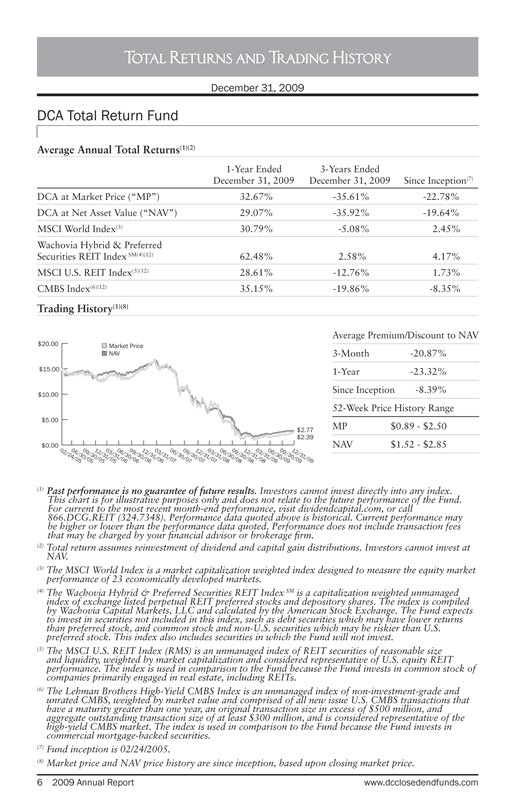

DCA Total Return Fund

Average Annual Total Returns(1)(2)

1-Year Ended December 31, 2009 3-Years Ended December 31, 2009 Since Inception(7)

DCA at Market Price (“MP”) 32.67% -35.61% -22.78%

DCA at Net Asset Value (“NAV”) 29.07% -35.92% -19.64%

MSCI World Index(3) 30.79% -5.08% 2.45%

Wachovia Hybrid & Preferred Securities REIT Index SM(4)(12) 62.48% 2.58% 4.17%

MSCI U.S. REIT Index(5)(12) 28.61% -12.76% 1.73%

CMBS Index(6)(12) 35.15% -19.86% -8.35%

Trading History(1)(8)

$20.00

$15.00

$10.00

$5.00

$0.00

$2.77

$2.39

02/24/05

06/30/05

09/30/05

12/31/05

03/31/06

06/30/06

09/30/06

12/31/06

03/31/07

06/30/07

09/30/07

12/31/07

03/31/08

06/30/08

09/30/08

12/31/08

03/31/09

06/30/09

09/30/09

12/31/09

Market Price

NAV

Average Premium/Discount to NAV

3-Month -20.87%

1-Year -23.32%

Since Inception -8.39%

52-Week Price History Range

MP $0.89—$2.50

NAV $1.52—$2.85

(1) Past performance is no guarantee of future results. Investors cannot invest directly into any index.

This chart is for illustrative purposes only and does not relate to the future performance of the Fund.

For current to the most recent month-end performance, visit dividendcapital.com, or call

866.DCG.REIT (324.7348). Performance data quoted above is historical. Current performance may

be higher or lower than the performance data quoted. Performance does not include transaction fees

that may be charged by your financial advisor or brokerage firm.

(2) Total return assumes reinvestment of dividend and capital gain distributions. Investors cannot invest at

NAV.

(3) The MSCI World Index is a market capitalization weighted index designed to measure the equity market

performance of 23 economically developed markets.

(4) The Wachovia Hybrid & Preferred Securities REIT Index SM is a capitalization weighted unmanaged

index of exchange listed perpetual REIT preferred stocks and depository shares. The index is compiled

by Wachovia Capital Markets, LLC and calculated by the American Stock Exchange. The Fund expects

to invest in securities not included in this index, such as debt securities which may have lower returns

than preferred stock, and common stock and non-U.S. securities which may be riskier than U.S.

preferred stock. This index also includes securities in which the Fund will not invest.

(5) The MSCI U.S. REIT Index (RMS) is an unmanaged index of REIT securities of reasonable size

and liquidity, weighted by market capitalization and considered representative of U.S. equity REIT

performance. The index is used in comparison to the Fund because the Fund invests in common stock of

companies primarily engaged in real estate, including REITs.

(6) The Lehman Brothers High-Yield CMBS Index is an unmanaged index of non-investment-grade and

unrated CMBS, weighted by market value and comprised of all new issue U.S. CMBS transactions that

have a maturity greater than one year, an original transaction size in excess of $500 million, and

aggregate outstanding transaction size of at least $300 million, and is considered representative of the

high-yield CMBS market. The index is used in comparison to the Fund because the Fund invests in

commercial mortgage-backed securities.

(7) Fund inception is 02/24/2005.

(8) Market price and NAV price history are since inception, based upon closing market price.

6 2009 Annual Report www.dcclosedendfunds.com

Portfolio Profile

December 31, 2009

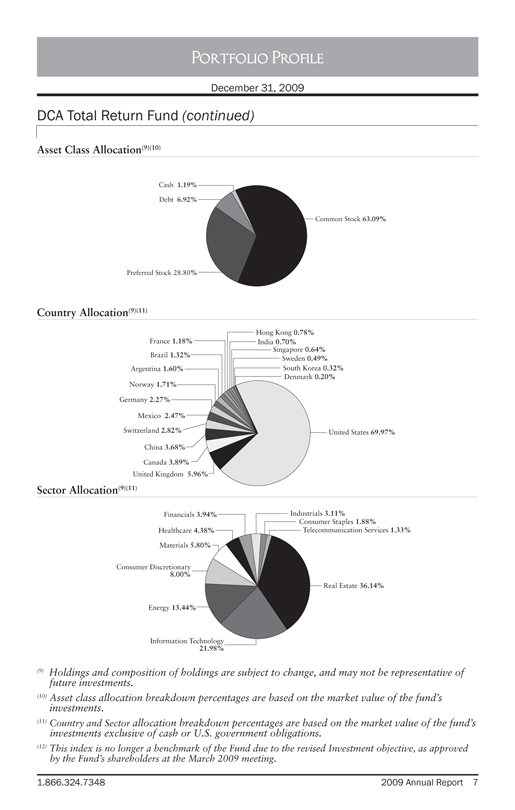

DCA Total Return Fund (continued)

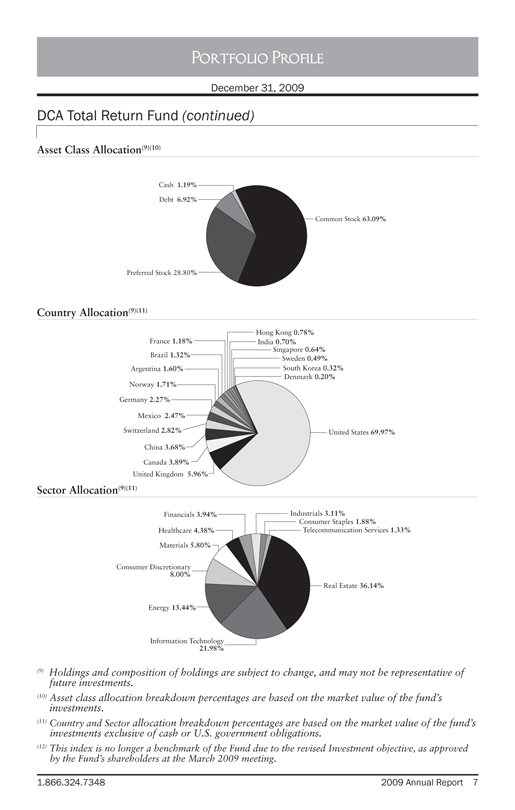

Asset Class Allocation(9)(10)

Cash 1.19%

Debt 6.92%

Common Stock 63.09%

Preferred Stock 28.80%

Country Allocation(9)(11)

France 1.18%

Brazil 1.32%

Argentina 1.60%

Norway 1.71%

Germany 2.27%

Mexico 2.47%

Switzerland 2.82%

China 3.68%

Canada 3.89%

United Kingdom 5.96%

Hong Kong 0.78%

India 0.70%

Singapore 0.64%

Sweden 0.49%

South Korea 0.32%

Denmark 0.20%

United States 69.97%

Sector Allocation(9)(11)

Financials 3.94%

Healthcare 4.38%

Materials 5.80%

Consumer Discretionary 8.00%

Energy 13.44%

Information Technology 21.98%

Industrials 3.11%

Consumer Staples 1.88%

Telecommunication Services 1.33%

Real Estate 36.14%

(9) Holdings and composition of holdings are subject to change, and may not be representative of future investments.

(10) Asset class allocation breakdown percentages are based on the market value of the fund’s investments.

(11) Country and Sector allocation breakdown percentages are based on the market value of the fund’s investments exclusive of cash or U.S. government obligations.

(12) This index is no longer a benchmark of the Fund due to the revised Investment objective, as approved by the Fund’s shareholders at the March 2009 meeting.

1.866.324.7348 2009 Annual Report 7

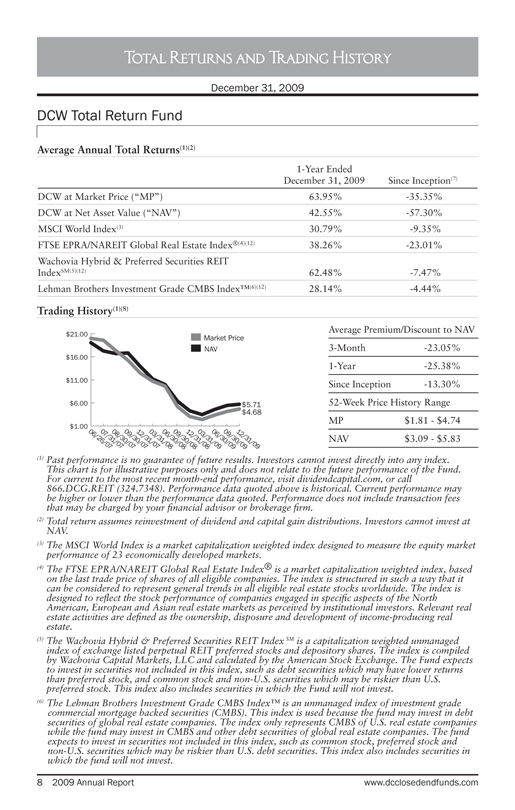

Total Returns and Trading History

December 31, 2009

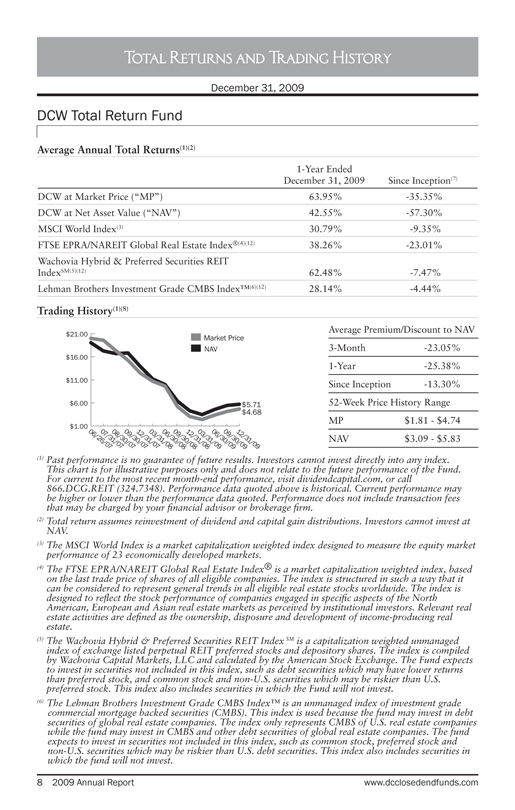

DCW Total Return Fund

Average Annual Total Returns(1)(2)

1-Year Ended December 31, 2009 Since Inception(7)

DCW at Market Price (“MP”) 63.95% -35.35%

DCW at Net Asset Value (“NAV”) 42.55% -57.30%

MSCI World Index(3) 30.79% -9.35%

FTSE EPRA/NAREIT Global Real Estate Index®(4)(12) 38.26% -23.01%

Wachovia Hybrid & Preferred Securities REIT IndexSM(5)(12) 62.48% -7.47%

Lehman Brothers Investment Grade CMBS Index™(6)(12) 28.14% -4.44%

Trading History(1)(8)

$21.00 $16.00 $11.00 $6.00 $1.00

Market Price

NAV

$5.71 $4.68

06/26/07 07/31/07 08/30/07 09/30/07 12/31/07 03/31/08 06/30/08 09/30/08 12/31/08 03/31/09 06/30/09 09/30/09 12/31/09

Average Premium/Discount to NAV

3-Month -23.05%

1-Year -25.38%

Since Inception -13.30%

52-Week Price History Range

MP $1.81—$4.74

NAV $3.09—$5.83

(1) Past performance is no guarantee of future results. Investors cannot invest directly into any index. This chart is for illustrative purposes only and does not relate to the future performance of the Fund. For current to the most recent month-end performance, visit dividendcapital.com, or call 866.DCG.REIT (324.7348). Performance data quoted above is historical. Current performance may be higher or lower than the performance data quoted. Performance does not include transaction fees that may be charged by your financial advisor or brokerage firm.

(2) Total return assumes reinvestment of dividend and capital gain distributions. Investors cannot invest at NAV.

(3) The MSCI World Index is a market capitalization weighted index designed to measure the equity market performance of 23 economically developed markets.

(4) The FTSE EPRA/NAREIT Global Real Estate Index® is a market capitalization weighted index, based on the last trade price of shares of all eligible companies. The index is structured in such a way that it can be considered to represent general trends in all eligible real estate stocks worldwide. The index is designed to reflect the stock performance of companies engaged in specific aspects of the North American, European and Asian real estate markets as perceived by institutional investors. Relevant real estate activities are defined as the ownership, disposure and development of income-producing real estate.

(5) The Wachovia Hybrid & Preferred Securities REIT Index SM is a capitalization weighted unmanaged index of exchange listed perpetual REIT preferred stocks and depository shares. The index is compiled by Wachovia Capital Markets, LLC and calculated by the American Stock Exchange. The Fund expects to invest in securities not included in this index, such as debt securities which may have lower returns than preferred stock, and common stock and non-U.S. securities which may be riskier than U.S. preferred stock. This index also includes securities in which the Fund will not invest.

(6) The Lehman Brothers Investment Grade CMBS Index™ is an unmanaged index of investment grade commercial mortgage backed securities (CMBS). This index is used because the fund may invest in debt securities of global real estate companies. The index only represents CMBS of U.S. real estate companies while the fund may invest in CMBS and other debt securities of global real estate companies. The fund expects to invest in securities not included in this index, such as common stock, preferred stock and non-U.S. securities which may be riskier than U.S. debt securities. This index also includes securities in which the fund will not invest.

8 2009 Annual Report www.dcclosedendfunds.com

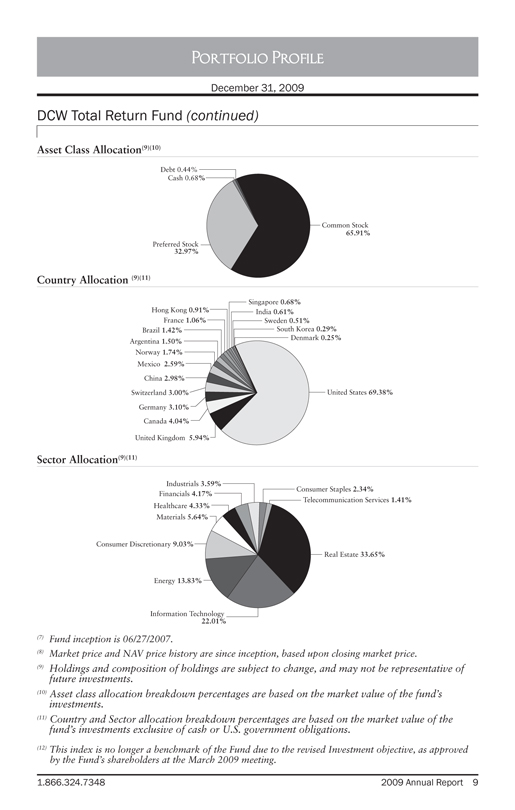

Portfolio Profile

December 31, 2009

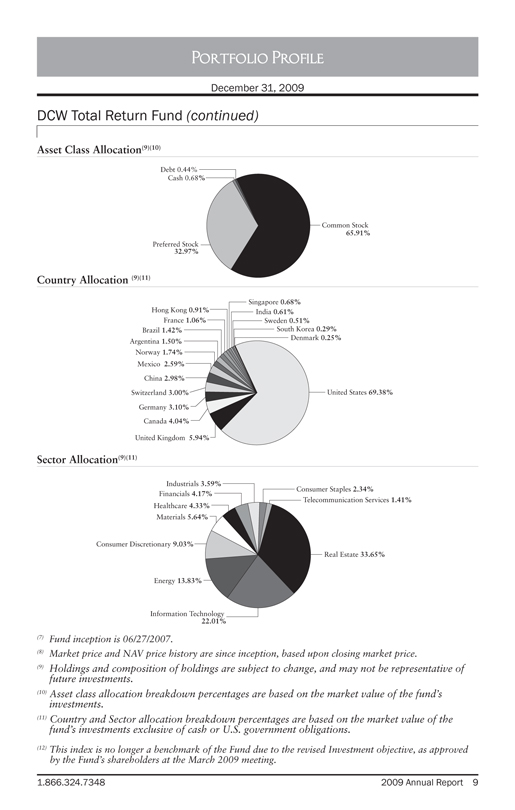

DCW Total Return Fund (continued)

Asset Class Allocation(9)(10)

Debt 0.44%

Cash 0.68%

Preferred Stock 32.97%

Common Stock 65.91%

Country Allocation (9)(11)

Hong Kong 0.91%

France 1.06%

Brazil 1.42%

Argentina 1.50%

Norway 1.74%

Mexico 2.59%

China 2.98%

Switzerland 3.00%

Germany 3.10%

Canada 4.04%

United Kingdom 5.94%

Singapore 0.68%

India 0.61%

Sweden 0.51%

South Korea 0.29%

Denmark 0.25%

United States 69.38%

Sector Allocation(9)(11)

Industrials 3.59%

Financials 4.17% Healthcare 4.33%

Materials 5.64%

Consumer Discretionary 9.03%

Energy 13.83%

Information Technology 22.01%

Consumer Staples 2.34%

Telecommunication Services 1.41%

Real Estate 33.65%

(7) Fund inception is 06/27/2007.

(8) Market price and NAV price history are since inception, based upon closing market price.

(9) Holdings and composition of holdings are subject to change, and may not be representative of future investments.

(10) Asset class allocation breakdown percentages are based on the market value of the fund’s investments.

(11) Country and Sector allocation breakdown percentages are based on the market value of the fund’s investments exclusive of cash or U.S. government obligations.

(12) This index is no longer a benchmark of the Fund due to the revised Investment objective, as approved by the Fund’s shareholders at the March 2009 meeting.

1.866.324.7348 2009 Annual Report 9

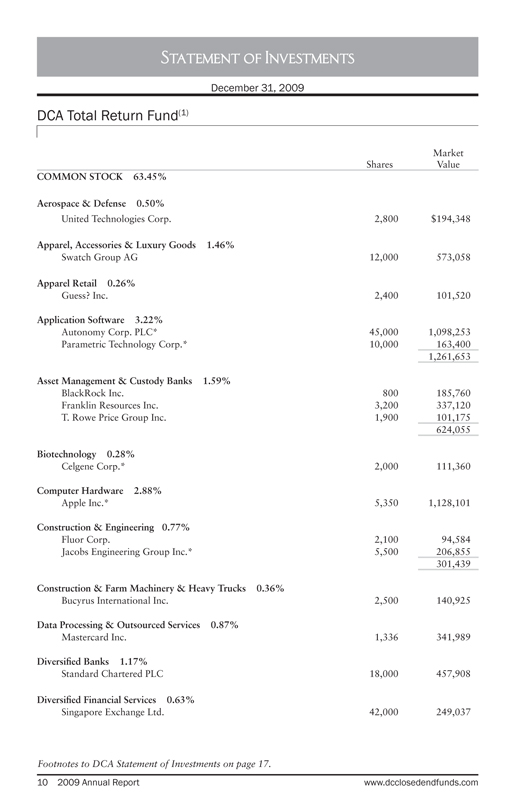

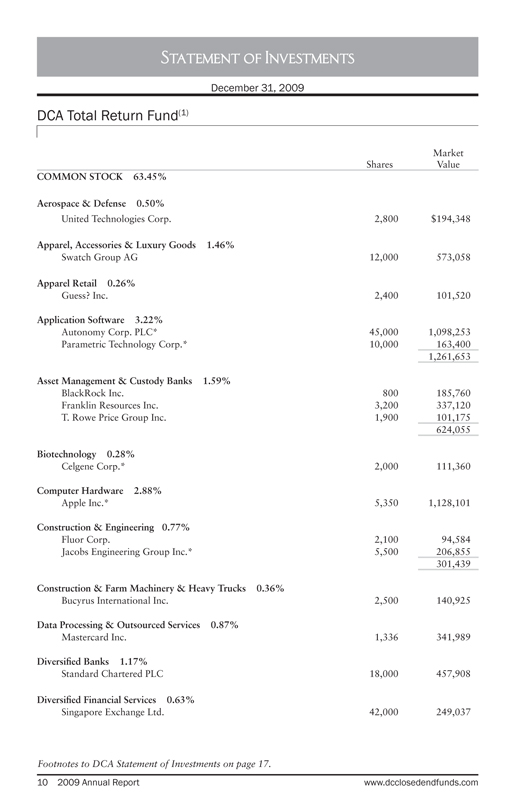

Statement of Investments

December 31, 2009

DCA Total Return Fund(1)

Shares Market Value

COMMON STOCK 63.45%

Aerospace & Defense 0.50%

United Technologies Corp. 2,800 $194,348

Apparel, Accessories & Luxury Goods 1.46%

Swatch Group AG 12,000 573,058

Apparel Retail 0.26%

Guess? Inc. 2,400 101,520

Application Software 3.22%

Autonomy Corp. PLC* 45,000 1,098,253

Parametric Technology Corp.* 10,000 163,400 1,261,653

Asset Management & Custody Banks 1.59%

BlackRock Inc. 800 185,760

Franklin Resources Inc. 3,200 337,120

T. Rowe Price Group Inc. 1,900 101,175 624,055

Biotechnology 0.28%

Celgene Corp.* 2,000 111,360

Computer Hardware 2.88%

Apple Inc.* 5,350 1,128,101

Construction & Engineering 0.77%

Fluor Corp. 2,100 94,584

Jacobs Engineering Group Inc.* 5,500 206,855 301,439

Construction & Farm Machinery & Heavy Trucks 0.36%

Bucyrus International Inc. 2,500 140,925

Data Processing & Outsourced Services 0.87%

Mastercard Inc. 1,336 341,989

Diversified Banks 1.17%

Standard Chartered PLC 18,000 457,908

Diversified Financial Services 0.63%

Singapore Exchange Ltd. 42,000 249,037

Footnotes to DCA Statement of Investments on page 17.

10 2009 Annual Report www.dcclosedendfunds.com

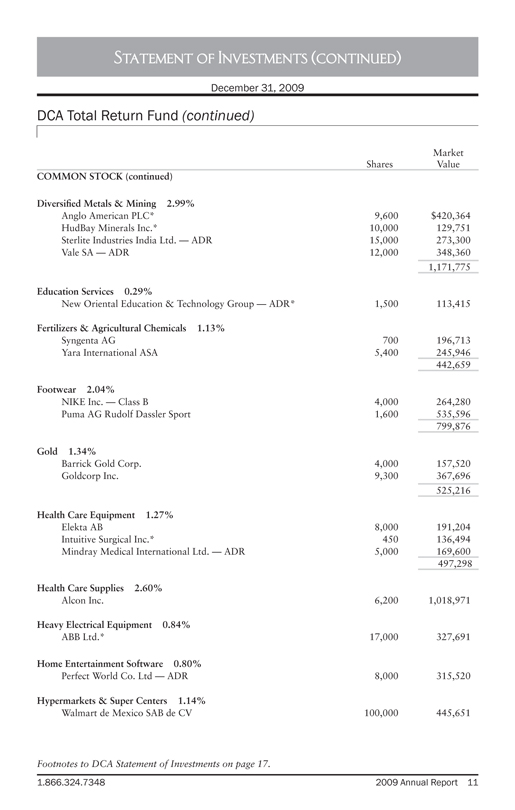

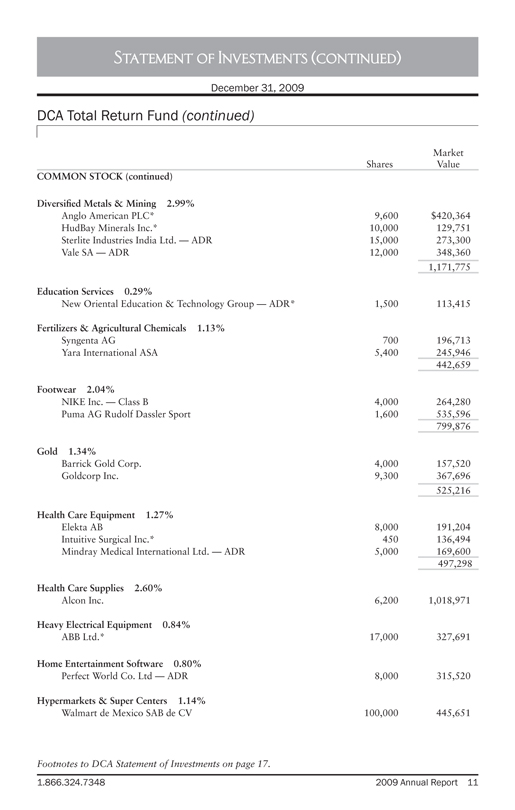

Statement of Investments (continued)

December 31, 2009

DCA Total Return Fund (continued)

Shares Market Value

COMMON STOCK (continued)

Diversified Metals & Mining 2.99%

Anglo American PLC* 9,600 $420,364

HudBay Minerals Inc.* 10,000 129,751

Sterlite Industries India Ltd. — ADR 15,000 273,300

Vale SA — ADR 12,000 348,360 1,171,775

Education Services 0.29%

New Oriental Education & Technology Group — ADR* 1,500 113,415

Fertilizers & Agricultural Chemicals 1.13%

Syngenta AG 700 196,713

Yara International ASA 5,400 245,946 442,659

Footwear 2.04%

NIKE Inc. — Class B 4,000 264,280

Puma AG Rudolf Dassler Sport 1,600 535,596 799,876

Gold 1.34%

Barrick Gold Corp. 4,000 157,520

Goldcorp Inc. 9,300 367,696 525,216

Health Care Equipment 1.27%

Elekta AB 8,000 191,204

Intuitive Surgical Inc.* 450 136,494

Mindray Medical International Ltd. — ADR 5,000 169,600 497,298

Health Care Supplies 2.60%

Alcon Inc. 6,200 1,018,971

Heavy Electrical Equipment 0.84%

ABB Ltd.* 17,000 327,691

Home Entertainment Software 0.80%

Perfect World Co. Ltd — ADR 8,000 315,520

Hypermarkets & Super Centers 1.14%

Walmart de Mexico SAB de CV 100,000 445,651

Footnotes to DCA Statement of Investments on page 17.

1.866.324.7348 2009 Annual Report 11

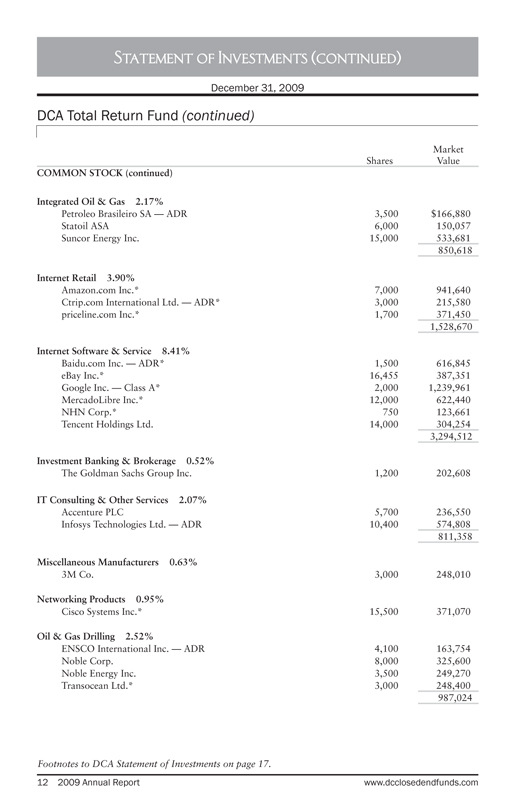

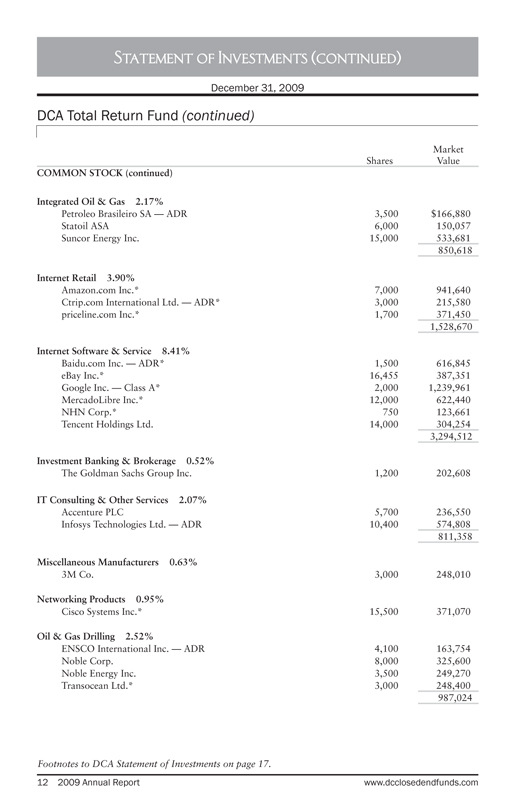

Statement of Investments (continued)

December 31, 2009

DCA Total Return Fund (continued)

Shares Market Value

COMMON STOCK (continued)

Integrated Oil & Gas 2.17%

Petroleo Brasileiro SA — ADR 3,500 $166,880

Statoil ASA 6,000 150,057

Suncor Energy Inc. 15,000 533,681 850,618

Internet Retail 3.90%

Amazon.com Inc.* 7,000 941,640

Ctrip.com International Ltd. — ADR* 3,000 215,580

priceline.com Inc.* 1,700 371,450 1,528,670

Internet Software & Service 8.41%

Baidu.com Inc. — ADR* 1,500 616,845

eBay Inc.* 16,455 387,351

Google Inc. — Class A* 2,000 1,239,961

MercadoLibre Inc.* 12,000 622,440

NHN Corp.* 750 123,661

Tencent Holdings Ltd. 14,000 304,254 3,294,512

Investment Banking & Brokerage 0.52%

The Goldman Sachs Group Inc. 1,200 202,608

IT Consulting & Other Services 2.07%

Accenture PLC 5,700 236,550

Infosys Technologies Ltd. — ADR 10,400 574,808 811,358

Miscellaneous Manufacturers 0.63%

3M Co. 3,000 248,010

Networking Products 0.95%

Cisco Systems Inc.* 15,500 371,070

Oil & Gas Drilling 2.52%

ENSCO International Inc. — ADR 4,100 163,754

Noble Corp. 8,000 325,600

Noble Energy Inc. 3,500 249,270

Transocean Ltd.* 3,000 248,400 987,024

Footnotes to DCA Statement of Investments on page 17.

12 2009 Annual Report www.dcclosedendfunds.com

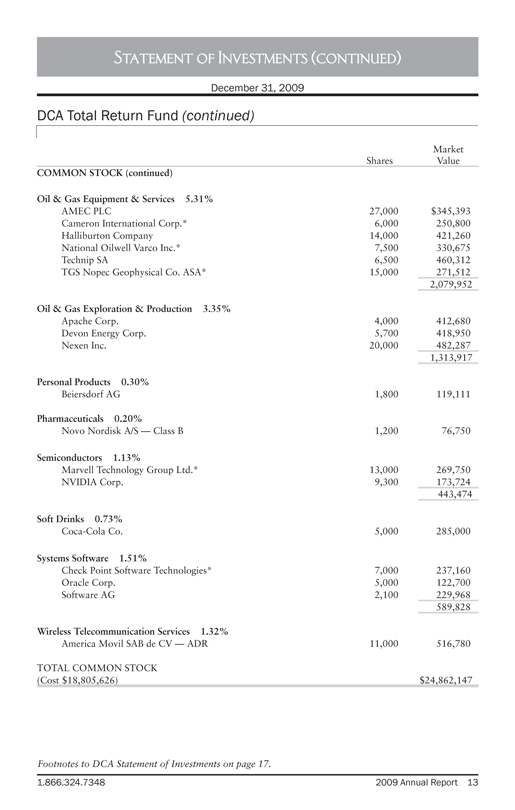

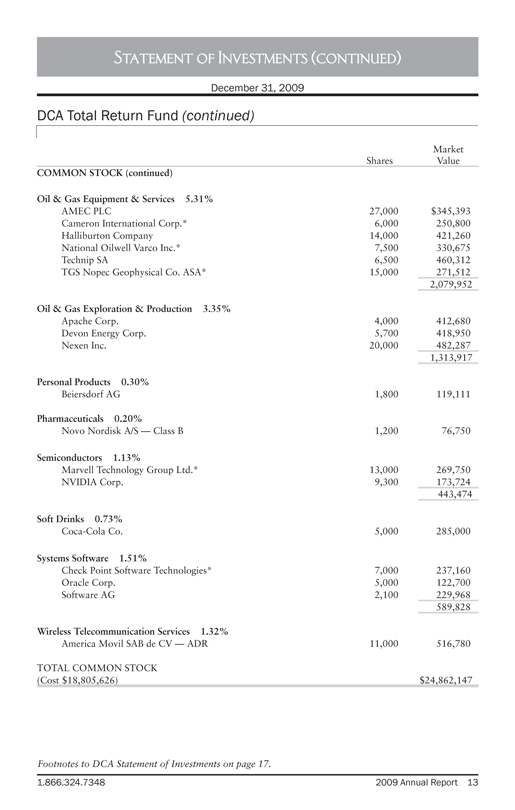

Statement of Investments (continued)

December 31, 2009

DCA Total Return Fund (continued)

Shares Market Value

COMMON STOCK (continued)

Oil & Gas Equipment & Services 5.31%

AMEC PLC 27,000 $345,393

Cameron International Corp.* 6,000 250,800

Halliburton Company 14,000 421,260

National Oilwell Varco Inc.* 7,500 330,675

Technip SA 6,500 460,312

TGS Nopec Geophysical Co. ASA* 15,000 271,512 2,079,952

Oil & Gas Exploration & Production 3.35%

Apache Corp. 4,000 412,680

Devon Energy Corp. 5,700 418,950

Nexen Inc. 20,000 482,287 1,313,917

Personal Products 0.30%

Beiersdorf AG 1,800 119,111

Pharmaceuticals 0.20%

Novo Nordisk A/S — Class B 1,200 76,750

Semiconductors 1.13%

Marvell Technology Group Ltd.* 13,000 269,750

NVIDIA Corp. 9,300 173,724 443,474

Soft Drinks 0.73%

Coca-Cola Co. 5,000 285,000

Systems Software 1.51%

Check Point Software Technologies* 7,000 237,160

Oracle Corp. 5,000 122,700

Software AG 2,100 229,968 589,828

Wireless Telecommunication Services 1.32%

America Movil SAB de CV — ADR 11,000 516,780

TOTAL COMMON STOCK

(Cost $18,805,626) $24,862,147

Footnotes to DCA Statement of Investments on page 17.

1.866.324.7348 2009 Annual Report 13

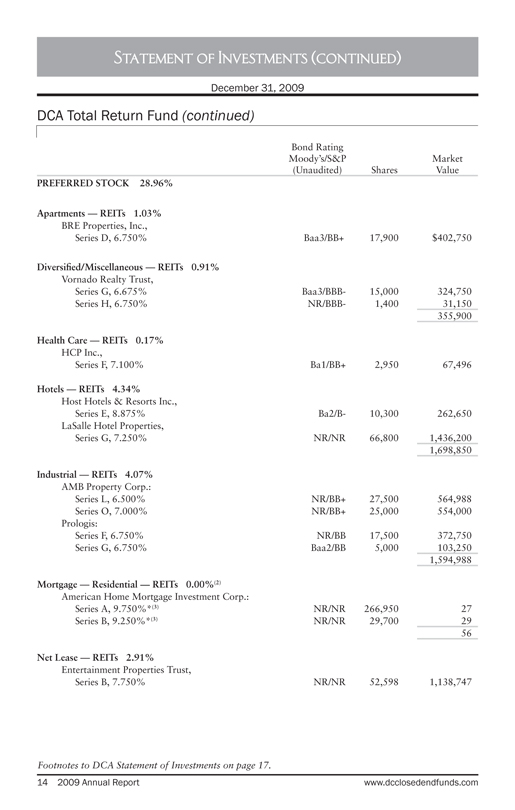

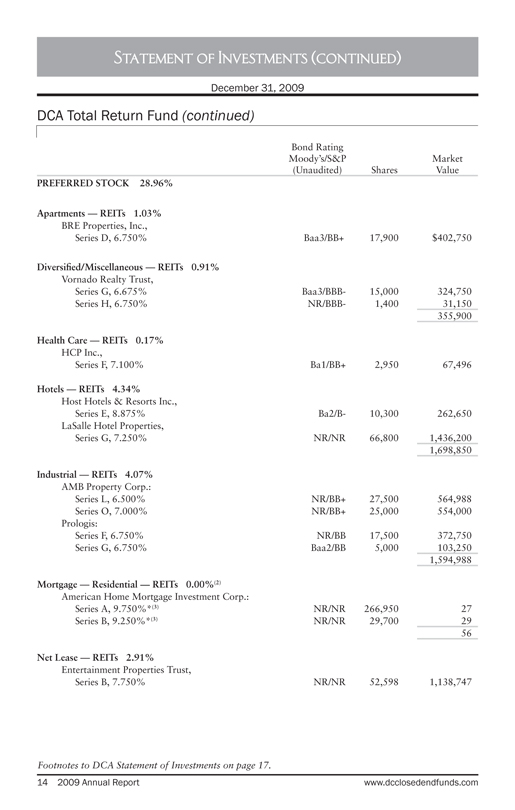

Statement of Investments (continued)

December 31, 2009

DCA Total Return Fund (continued)

Bond Rating Moody’s/S&P (Unaudited) Shares Market Value

PREFERRED STOCK 28.96%

Apartments — REITs 1.03%

BRE Properties, Inc.,

Series D, 6.750% Baa3/BB+ 17,900 $402,750

Diversified/Miscellaneous — REITs 0.91%

Vornado Realty Trust,

Series G, 6.675% Baa3/BBB- 15,000 324,750

Series H, 6.750% NR/BBB- 1,400 31,150 355,900

Health Care — REITs 0.17%

HCP Inc.,

Series F, 7.100% Ba1/BB+ 2,950 67,496

Hotels — REITs 4.34%

Host Hotels & Resorts Inc.,

Series E, 8.875% Ba2/B- 10,300 262,650

LaSalle Hotel Properties,

Series G, 7.250% NR/NR 66,800 1,436,200 1,698,850

Industrial — REITs 4.07%

AMB Property Corp.:

Series L, 6.500% NR/BB+ 27,500 564,988

Series O, 7.000% NR/BB+ 25,000 554,000

Prologis:

Series F, 6.750% NR/BB 17,500 372,750

Series G, 6.750% Baa2/BB 5,000 103,250 1,594,988

Mortgage — Residential — REITs 0.00%(2)

American Home Mortgage Investment Corp.:

Series A, 9.750%*(3) NR/NR 266,950 27

Series B, 9.250%*(3) NR/NR 29,700 29 56

Net Lease — REITs 2.91%

Entertainment Properties Trust,

Series B, 7.750% NR/NR 52,598 1,138,747

Footnotes to DCA Statement of Investments on page 17.

14 2009 Annual Report www.dcclosedendfunds.com

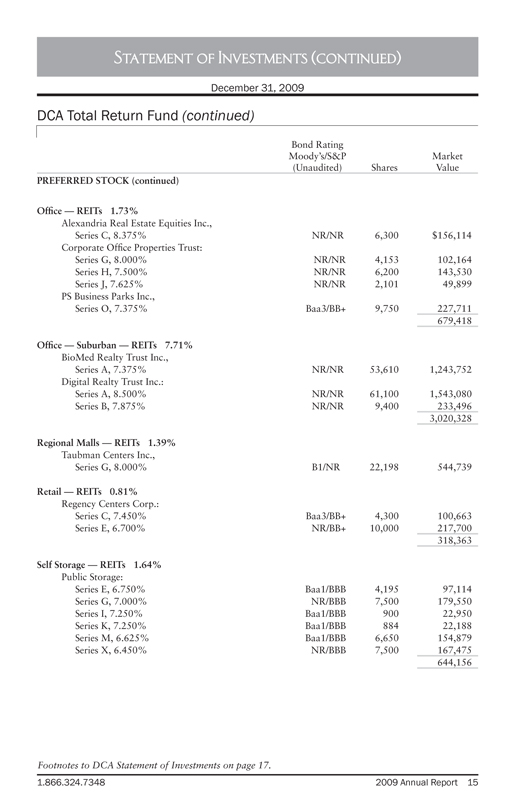

Statement of Investments (continued)

December 31, 2009

DCA Total Return Fund (continued)

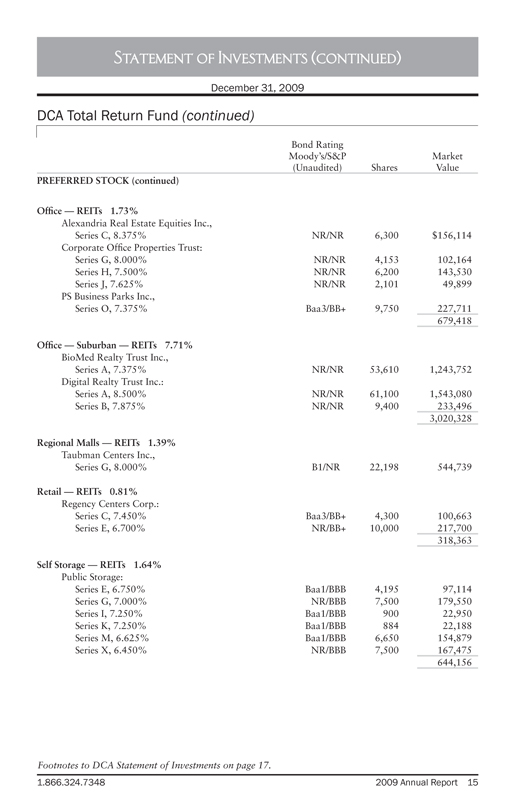

Bond Rating Moody’s/S&P (Unaudited) Shares Market Value

PREFERRED STOCK (continued)

Office — REITs 1.73%

Alexandria Real Estate Equities Inc.,

Series C, 8.375% NR/NR 6,300 $156,114

Corporate Office Properties Trust:

Series G, 8.000% NR/NR 4,153 102,164

Series H, 7.500% NR/NR 6,200 143,530

Series J, 7.625% NR/NR 2,101 49,899

PS Business Parks Inc.,

Series O, 7.375% Baa3/BB+ 9,750 227,711 679,418

Office — Suburban — REITs 7.71%

BioMed Realty Trust Inc.,

Series A, 7.375% NR/NR 53,610 1,243,752

Digital Realty Trust Inc.:

Series A, 8.500% NR/NR 61,100 1,543,080

Series B, 7.875% NR/NR 9,400 233,496 3,020,328

Regional Malls — REITs 1.39%

Taubman Centers Inc.,

Series G, 8.000% B1/NR 22,198 544,739

Retail — REITs 0.81%

Regency Centers Corp.:

Series C, 7.450% Baa3/BB+ 4,300 100,663

Series E, 6.700% NR/BB+ 10,000 217,700 318,363

Self Storage — REITs 1.64%

Public Storage:

Series E, 6.750% Baa1/BBB 4,195 97,114

Series G, 7.000% NR/BBB 7,500 179,550

Series I, 7.250% Baa1/BBB 900 22,950

Series K, 7.250% Baa1/BBB 884 22,188

Series M, 6.625% Baa1/BBB 6,650 154,879

Series X, 6.450% NR/BBB 7,500 167,475 644,156

Footnotes to DCA Statement of Investments on page 17.

1.866.324.7348 2009 Annual Report 15

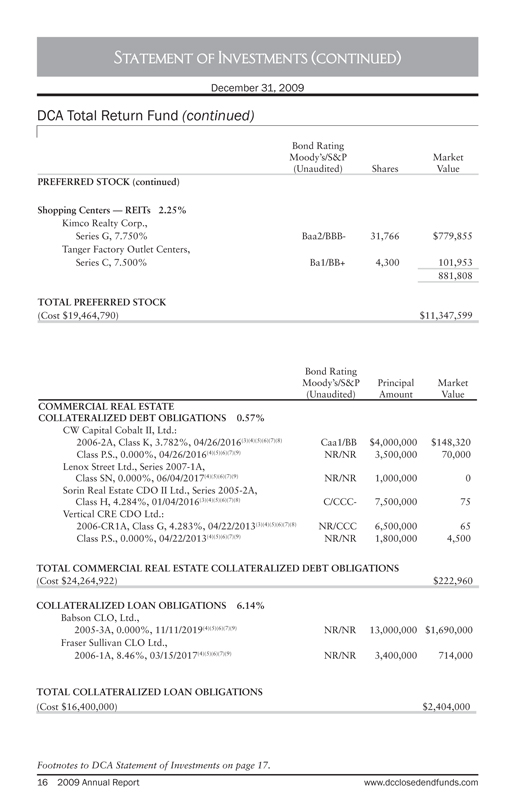

Statement of Investments (continued)

December 31, 2009

DCA Total Return Fund (continued)

Bond Rating Moody’s/S&P (Unaudited) Shares Market Value

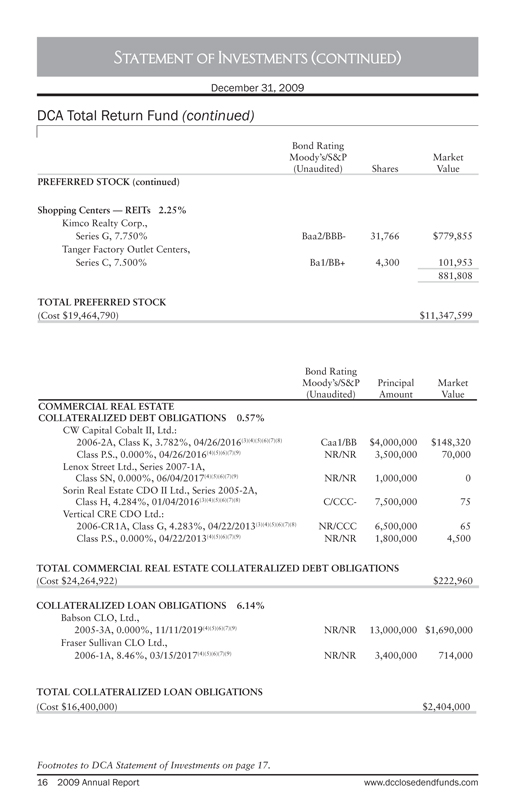

PREFERRED STOCK (continued)

Shopping Centers — REITs 2.25%

Kimco Realty Corp.,

Series G, 7.750% Baa2/BBB- 31,766 $779,855

Tanger Factory Outlet Centers,

Series C, 7.500% Ba1/BB+ 4,300 101,953 881,808

TOTAL PREFERRED STOCK

(Cost $19,464,790) $11,347,599

Bond Rating Moody’s/S&P (Unaudited) Principal Amount Market Value

COMMERCIAL REAL ESTATE

COLLATERALIZED DEBT OBLIGATIONS 0.57%

CW Capital Cobalt II, Ltd.:

2006-2A, Class K, 3.782%, 04/26/2016(3)(4)(5)(6)(7)(8) Caa1/BB $4,000,000 $148,320

Class P.S., 0.000%, 04/26/2016(4)(5)(6)(7)(9) NR/NR 3,500,000 70,000

Lenox Street Ltd., Series 2007-1A,

Class SN, 0.000%, 06/04/2017(4)(5)(6)(7)(9) NR/NR 1,000,000 0

Sorin Real Estate CDO II Ltd., Series 2005-2A,

Class H, 4.284%, 01/04/2016(3)(4)(5)(6)(7)(8) C/CCC- 7,500,000 75

Vertical CRE CDO Ltd.:

2006-CR1A, Class G, 4.283%, 04/22/2013(3)(4)(5)(6)(7)(8) NR/CCC 6,500,000 65

Class P.S., 0.000%, 04/22/2013(4)(5)(6)(7)(9) NR/NR 1,800,000 4,500

TOTAL COMMERCIAL REAL ESTATE COLLATERALIZED DEBT OBLIGATIONS

(Cost $24,264,922) $222,960

COLLATERALIZED LOAN OBLIGATIONS 6.14%

Babson CLO, Ltd.,

2005-3A, 0.000%, 11/11/2019(4)(5)(6)(7)(9) NR/NR 13,000,000 $1,690,000

Fraser Sullivan CLO Ltd.,

2006-1A, 8.46%, 03/15/2017(4)(5)(6)(7)(9) NR/NR 3,400,000 714,000

TOTAL COLLATERALIZED LOAN OBLIGATIONS (Cost $16,400,000) $2,404,000

Footnotes to DCA Statement of Investments on page 17.

16 2009 Annual Report www.dcclosedendfunds.com

Statement of Investments (continued)

December 31, 2009

DCA Total Return Fund (continued)

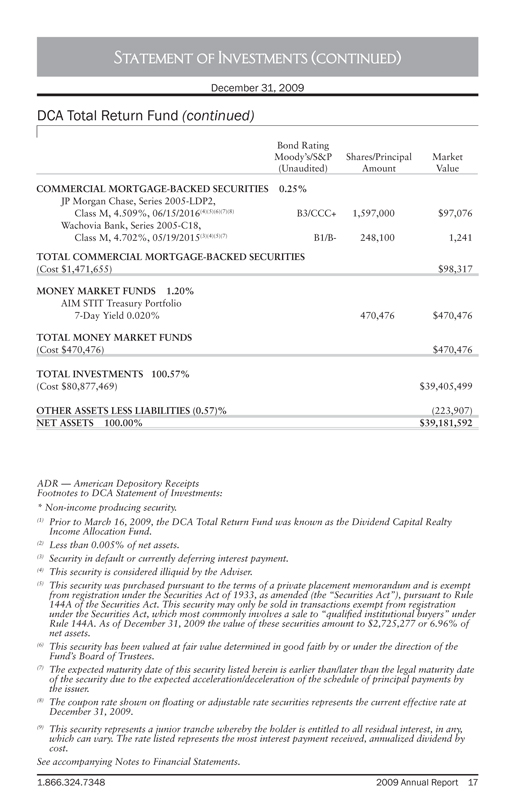

Bond Rating Moody’s/S&P (Unaudited) Shares/Principal Amount Market Value

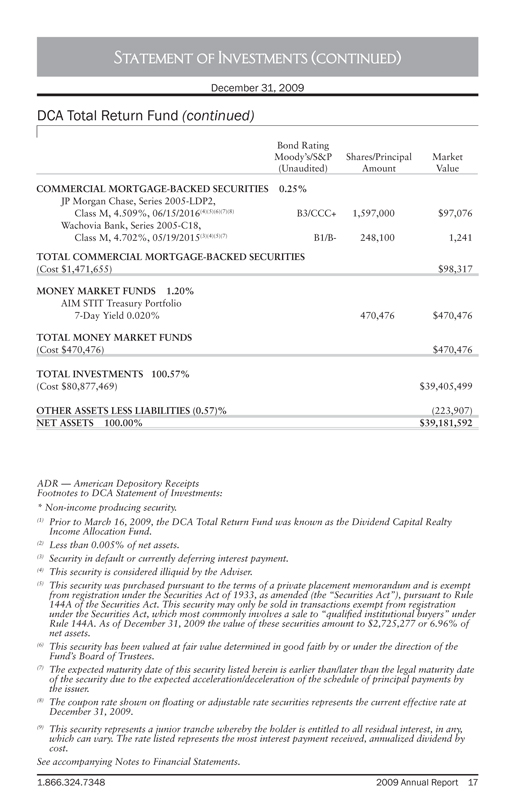

COMMERCIAL MORTGAGE-BACKED SECURITIES 0.25%

JP Morgan Chase, Series 2005-LDP2,

Class M, 4.509%, 06/15/2016(4)(5)(6)(7)(8) B3/CCC+ 1,597,000 $97,076

Wachovia Bank, Series 2005-C18,

Class M, 4.702%, 05/19/2015(3)(4)(5)(7) B1/B- 248,100 1,241

TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES (Cost $1,471,655) $98,317

MONEY MARKET FUNDS 1.20%

AIM STIT Treasury Portfolio

7-Day Yield 0.020% 470,476 $470,476

TOTAL MONEY MARKET FUNDS (Cost $470,476) $470,476

TOTAL INVESTMENTS 100.57% (Cost $80,877,469) $39,405,499

OTHER ASSETS LESS LIABILITIES (0.57)%(223,907)

NET ASSETS 100.00% $39,181,592

ADR — American Depository Receipts Footnotes to DCA Statement of Investments:

* Non-income producing security.

(1) Prior to March 16, 2009, the DCA Total Return Fund was known as the Dividend Capital Realty Income Allocation Fund.

(2) Less than 0.005% of net assets.

(3) Security in default or currently deferring interest payment.

(4) This security is considered illiquid by the Adviser.

(5) This security was purchased pursuant to the terms of a private placement memorandum and is exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”), pursuant to Rule 144A of the Securities Act. This security may only be sold in transactions exempt from registration under the Securities Act, which most commonly involves a sale to “qualified institutional buyers” under Rule 144A. As of December 31, 2009 the value of these securities amount to $2,725,277 or 6.96% of net assets.

(6) This security has been valued at fair value determined in good faith by or under the direction of the Fund’s Board of Trustees.

(7) The expected maturity date of this security listed herein is earlier than/later than the legal maturity date of the security due to the expected acceleration/deceleration of the schedule of principal payments by the issuer.

(8) The coupon rate shown on floating or adjustable rate securities represents the current effective rate at December 31, 2009.

(9) This security represents a junior tranche whereby the holder is entitled to all residual interest, in any, which can vary. The rate listed represents the most interest payment received, annualized dividend by cost.

See accompanying Notes to Financial Statements.

1.866.324.7348 2009 Annual Report 17

Statement of Investments

December 31, 2009

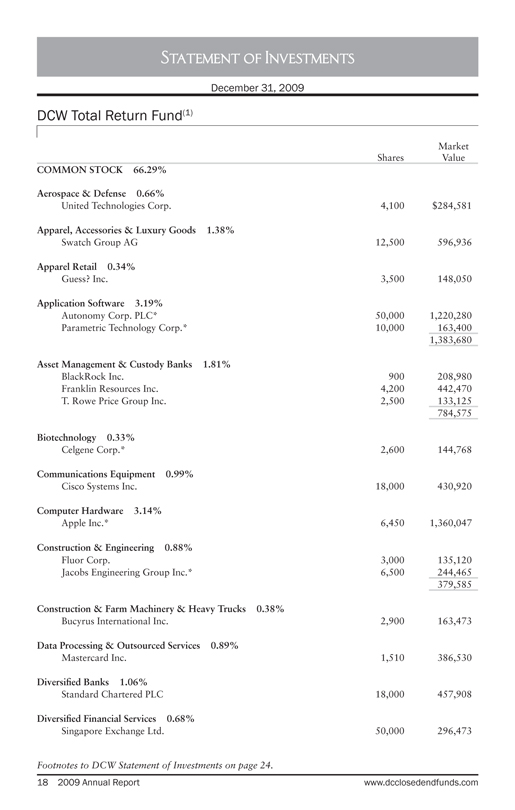

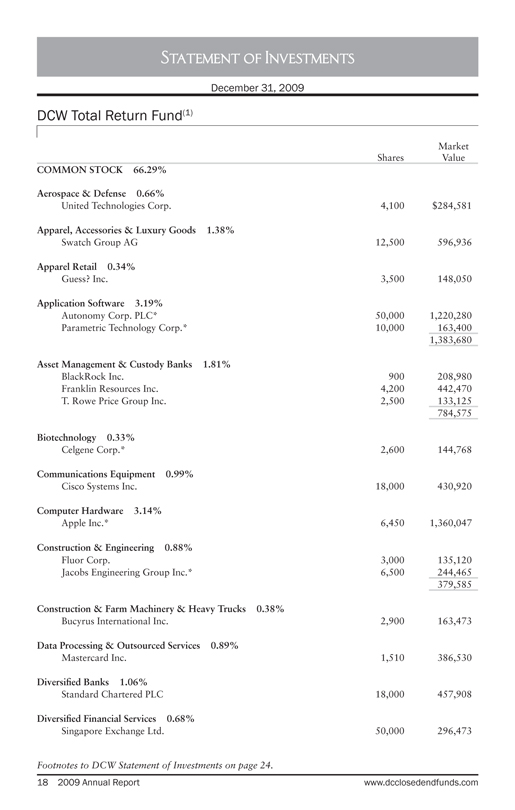

DCW Total Return Fund(1)

Shares Market Value

COMMON STOCK 66.29%

Aerospace & Defense 0.66%

United Technologies Corp. 4,100 $284,581

Apparel, Accessories & Luxury Goods 1.38%

Swatch Group AG 12,500 596,936

Apparel Retail 0.34%

Guess? Inc. 3,500 148,050

Application Software 3.19%

Autonomy Corp. PLC* 50,000 1,220,280

Parametric Technology Corp.* 10,000 163,400 1,383,680

Asset Management & Custody Banks 1.81%

BlackRock Inc. 900 208,980

Franklin Resources Inc. 4,200 442,470

T. Rowe Price Group Inc. 2,500 133,125 784,575

Biotechnology 0.33%

Celgene Corp.* 2,600 144,768

Communications Equipment 0.99%

Cisco Systems Inc. 18,000 430,920

Computer Hardware 3.14%

Apple Inc.* 6,450 1,360,047

Construction & Engineering 0.88%

Fluor Corp. 3,000 135,120

Jacobs Engineering Group Inc.* 6,500 244,465 379,585

Construction & Farm Machinery & Heavy Trucks 0.38%

Bucyrus International Inc. 2,900 163,473

Data Processing & Outsourced Services 0.89%

Mastercard Inc. 1,510 386,530

Diversified Banks 1.06%

Standard Chartered PLC 18,000 457,908

Diversified Financial Services 0.68%

Singapore Exchange Ltd. 50,000 296,473

Footnotes to DCW Statement of Investments on page 24.

18 2009 Annual Report www.dcclosedendfunds.com

Statement of Investments (continued)

December 31, 2009

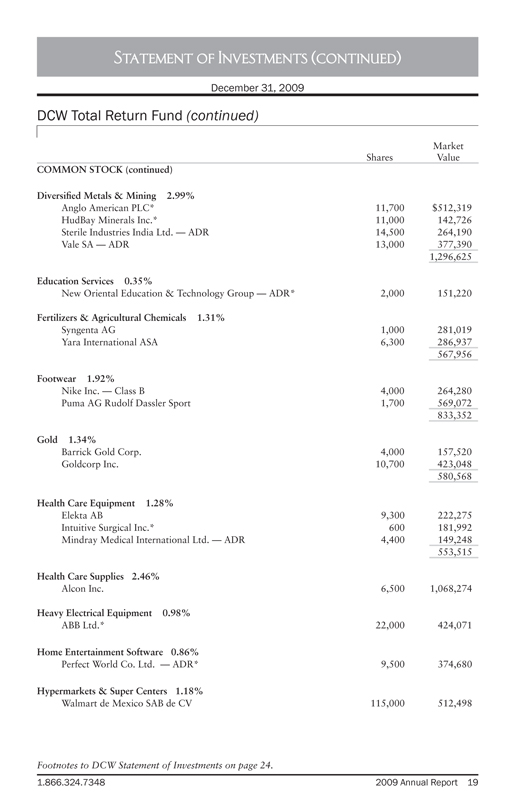

DCW Total Return Fund (continued)

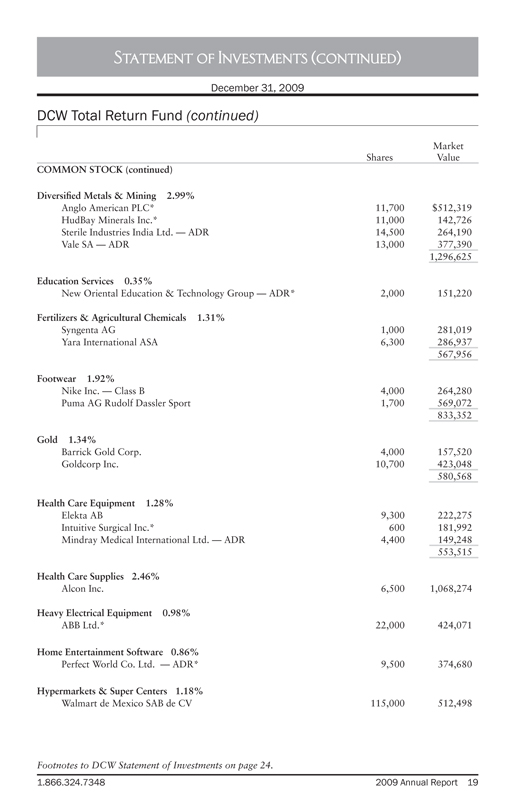

Shares Market Value

COMMON STOCK (continued)

Diversified Metals & Mining 2.99%

Anglo American PLC* 11,700 $512,319

HudBay Minerals Inc.* 11,000 142,726

Sterile Industries India Ltd. — ADR 14,500 264,190

Vale SA — ADR 13,000 377,390 1,296,625

Education Services 0.35%

New Oriental Education & Technology Group — ADR* 2,000 151,220

Fertilizers & Agricultural Chemicals 1.31%

Syngenta AG 1,000 281,019

Yara International ASA 6,300 286,937 567,956

Footwear 1.92%

Nike Inc. — Class B 4,000 264,280

Puma AG Rudolf Dassler Sport 1,700 569,072 833,352

Gold 1.34%

Barrick Gold Corp. 4,000 157,520

Goldcorp Inc. 10,700 423,048 580,568

Health Care Equipment 1.28%

Elekta AB 9,300 222,275

Intuitive Surgical Inc.* 600 181,992

Mindray Medical International Ltd. — ADR 4,400 149,248 553,515

Health Care Supplies 2.46%

Alcon Inc. 6,500 1,068,274

Heavy Electrical Equipment 0.98%

ABB Ltd.* 22,000 424,071

Home Entertainment Software 0.86%

Perfect World Co. Ltd. — ADR* 9,500 374,680

Hypermarkets & Super Centers 1.18%

Walmart de Mexico SAB de CV 115,000 512,498

Footnotes to DCW Statement of Investments on page 24.

1.866.324.7348 2009 Annual Report 19

Statement of Investments (continued)

December 31, 2009

DCW Total Return Fund (continued)

Shares Market Value

COMMON STOCK (continued)

Integrated Oil & Gas 2.37%

Petroleo Brasileiro SA — ADR 5,000 $238,400

StatoilHydro ASA 6,000 150,057

Suncor Energy Inc. 18,000 640,417 1,028,874

Internet Retail 4.18%

Amazon.com Inc.* 8,500 1,143,420

Ctrip.com International Ltd. — ADR* 3,500 251,510

priceline.com Inc.* 1,900 415,150 1,810,080

Internet Software & Services 8.66%

Baidu.com Inc. — ADR* 1,800 740,214

eBay Inc.* 18,882 444,482

Google Inc. — Class A* 2,300 1,425,954

MercadoLibre Inc.* 12,500 648,375

NHN Corp.* 750 123,661

Tencent Holdings Ltd. 17,000 369,451 3,752,137

Investment Banking & Brokerage 0.62%

The Goldman Sachs Group Inc. 1,600 270,144

IT Consulting & Other Services 2.24%

Accenture PLC 6,600 273,900

Infosys Technologies Ltd. — ADR 12,600 696,402 970,302

Miscellaneous Manufacturers 0.71%

3M Co. 3,700 305,879

Oil & Gas Drilling 2.64%

ENSCO International Inc. — ADR 4,600 183,724

Noble Corp. 8,500 345,950

Noble Energy Inc. 4,000 284,880

Transocean Ltd.* 4,000 331,200 1,145,754

Footnotes to DCW Statement of Investments on page 24.

20 2009 Annual Report www.dcclosedendfunds.com

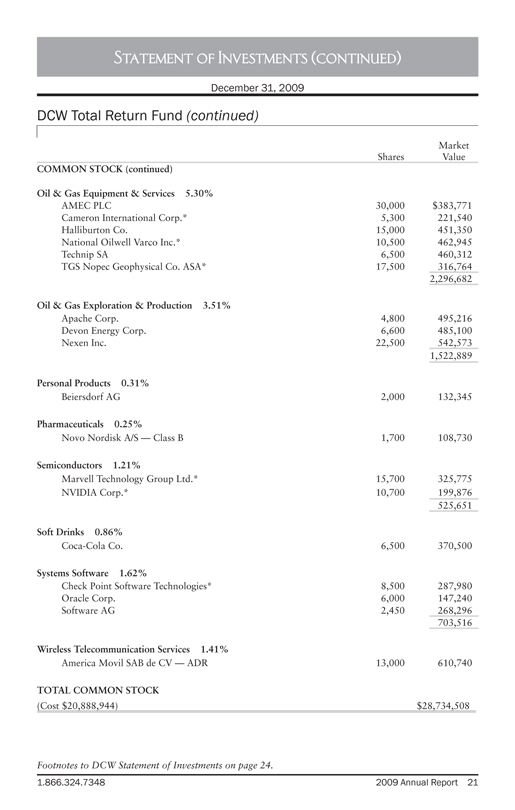

Statement of Investments (continued)

December 31, 2009

DCW Total Return Fund (continued)

Shares Market Value

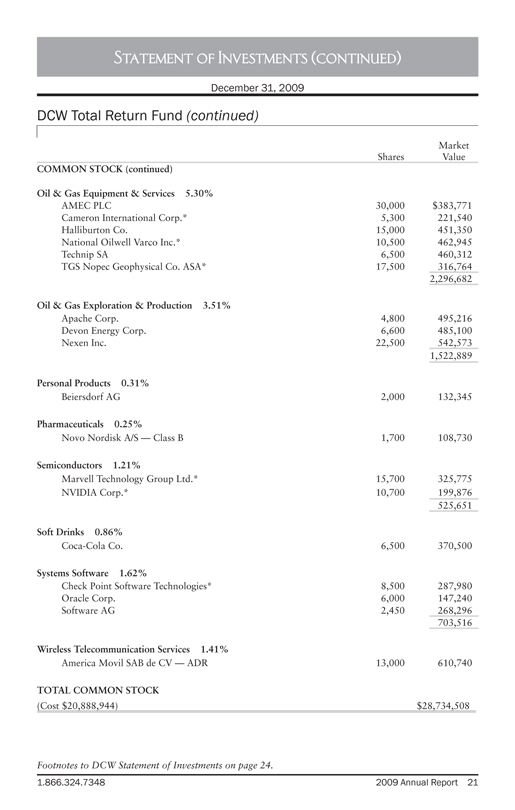

COMMON STOCK (continued)

Oil & Gas Equipment & Services 5.30%

AMEC PLC 30,000 $383,771

Cameron International Corp.* 5,300 221,540

Halliburton Co. 15,000 451,350

National Oilwell Varco Inc.* 10,500 462,945

Technip SA 6,500 460,312

TGS Nopec Geophysical Co. ASA* 17,500 316,764 2,296,682

Oil & Gas Exploration & Production 3.51%

Apache Corp. 4,800 495,216

Devon Energy Corp. 6,600 485,100

Nexen Inc. 22,500 542,573 1,522,889

Personal Products 0.31%

Beiersdorf AG 2,000 132,345

Pharmaceuticals 0.25%

Novo Nordisk A/S — Class B 1,700 108,730

Semiconductors 1.21%

Marvell Technology Group Ltd.* 15,700 325,775

NVIDIA Corp.* 10,700 199,876 525,651

Soft Drinks 0.86%

Coca-Cola Co. 6,500 370,500

Systems Software 1.62%

Check Point Software Technologies* 8,500 287,980

Oracle Corp. 6,000 147,240

Software AG 2,450 268,296 703,516

Wireless Telecommunication Services 1.41%

America Movil SAB de CV — ADR 13,000 610,740

TOTAL COMMON STOCK

(Cost $20,888,944) $28,734,508

Footnotes to DCW Statement of Investments on page 24.

1.866.324.7348 2009 Annual Report 21

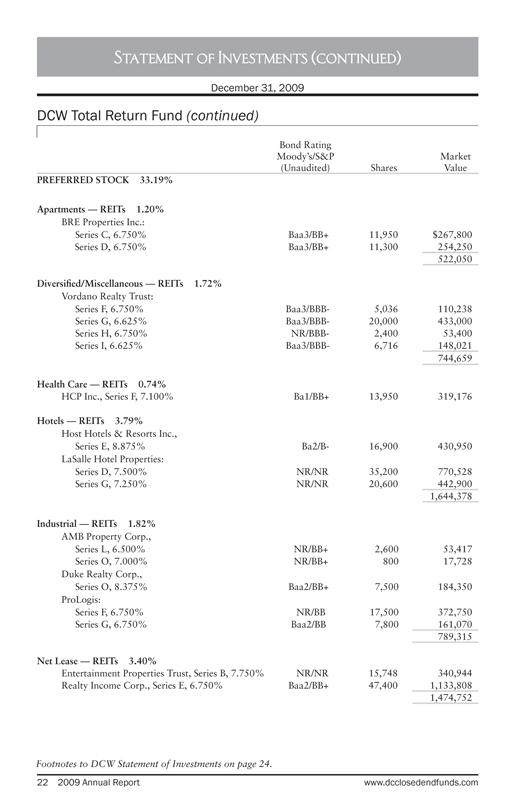

Statement of Investments (continued)

December 31, 2009

DCW Total Return Fund (continued)

Bond Rating Moody’s/S&P (Unaudited) Shares Market Value

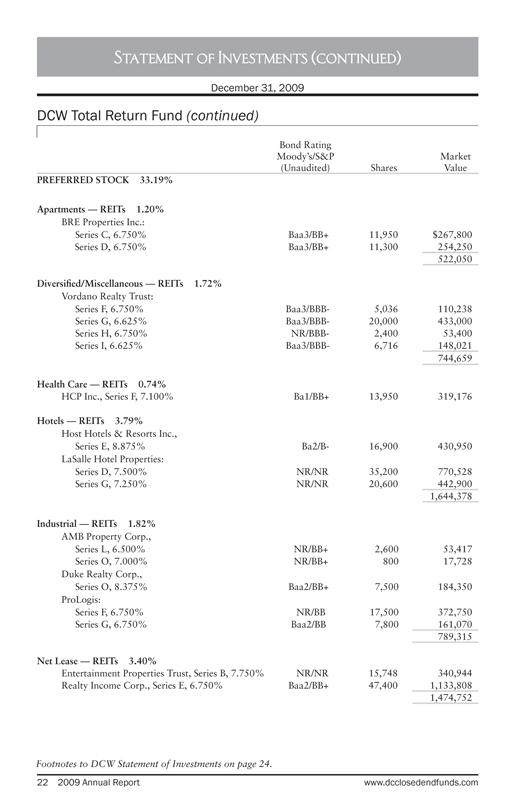

PREFERRED STOCK 33.19%

Apartments — REITs 1.20%

BRE Properties Inc.:

Series C, 6.750% Baa3/BB+ 11,950 $267,800

Series D, 6.750% Baa3/BB+ 11,300 254,250 522,050

Diversified/Miscellaneous — REITs 1.72%

Vordano Realty Trust:

Series F, 6.750% Baa3/BBB- 5,036 110,238

Series G, 6.625% Baa3/BBB- 20,000 433,000

Series H, 6.750% NR/BBB- 2,400 53,400

Series I, 6.625% Baa3/BBB- 6,716 148,021 744,659

Health Care — REITs 0.74%

HCP Inc., Series F, 7.100% Ba1/BB+ 13,950 319,176

Hotels — REITs 3.79%

Host Hotels & Resorts Inc.,

Series E, 8.875% Ba2/B- 16,900 430,950

LaSalle Hotel Properties:

Series D, 7.500% NR/NR 35,200 770,528

Series G, 7.250% NR/NR 20,600 442,900 1,644,378

Industrial — REITs 1.82%

AMB Property Corp.,

Series L, 6.500% NR/BB+ 2,600 53,417

Series O, 7.000% NR/BB+ 800 17,728

Duke Realty Corp.,

Series O, 8.375% Baa2/BB+ 7,500 184,350

ProLogis:

Series F, 6.750% NR/BB 17,500 372,750

Series G, 6.750% Baa2/BB 7,800 161,070 789,315

Net Lease — REITs 3.40%

Entertainment Properties Trust, Series B, 7.750% NR/NR 15,748 340,944

Realty Income Corp., Series E, 6.750% Baa2/BB+ 47,400 1,133,808 1,474,752

Footnotes to DCW Statement of Investments on page 24.

22 2009 Annual Report www.dcclosedendfunds.com

Statement of Investments (continued)

December 31, 2009

DCW Total Return Fund (continued)

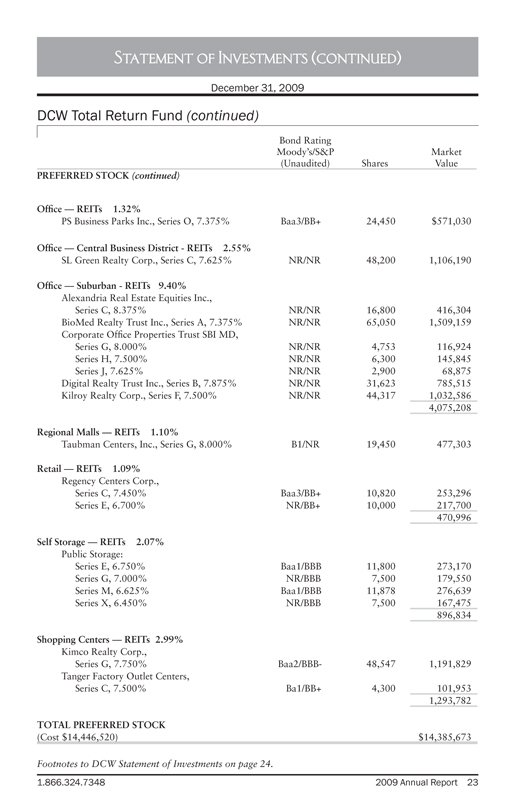

Bond Rating Moody’s/S&P (Unaudited) Shares Market Value

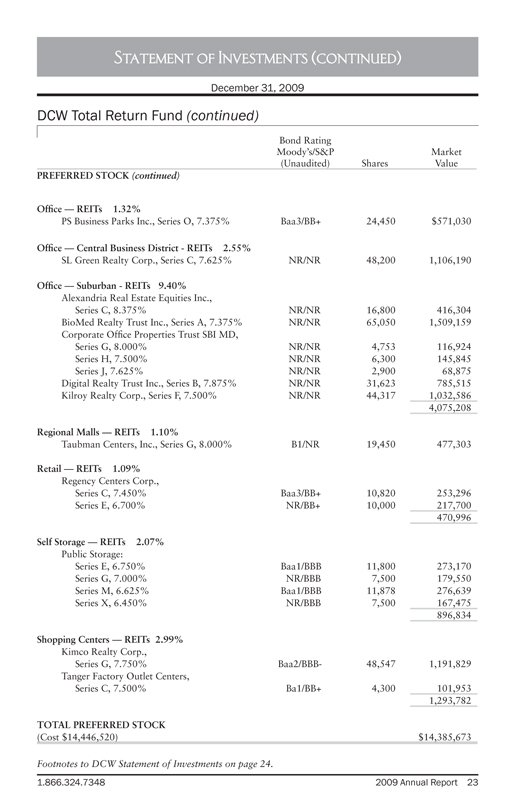

PREFERRED STOCK (continued)

Office — REITs 1.32%

PS Business Parks Inc., Series O, 7.375% Baa3/BB+ 24,450 $571,030

Office — Central Business District—REITs 2.55%

SL Green Realty Corp., Series C, 7.625% NR/NR 48,200 1,106,190

Office — Suburban—REITs 9.40%

Alexandria Real Estate Equities Inc., Series C, 8.375% NR/NR 16,800 416,304

BioMed Realty Trust Inc., Series A, 7.375% NR/NR 65,050 1,509,159

Corporate Office Properties Trust SBI MD, Series G, 8.000% NR/NR 4,753 116,924

Series H, 7.500% NR/NR 6,300 145,845

Series J, 7.625% NR/NR 2,900 68,875

Digital Realty Trust Inc., Series B, 7.875% NR/NR 31,623 785,515

Kilroy Realty Corp., Series F, 7.500% NR/NR 44,317 1,032,586 4,075,208

Regional Malls — REITs 1.10%

Taubman Centers, Inc., Series G, 8.000% B1/NR 19,450 477,303

Retail — REITs 1.09%

Regency Centers Corp.,

Series C, 7.450% Baa3/BB+ 10,820 253,296

Series E, 6.700% NR/BB+ 10,000 217,700 470,996

Self Storage — REITs 2.07%

Public Storage:

Series E, 6.750% Baa1/BBB 11,800 273,170

Series G, 7.000% NR/BBB 7,500 179,550

Series M, 6.625% Baa1/BBB 11,878 276,639

Series X, 6.450% NR/BBB 7,500 167,475 896,834

Shopping Centers — REITs 2.99%

Kimco Realty Corp.,

Series G, 7.750% Baa2/BBB- 48,547 1,191,829

Tanger Factory Outlet Centers,

Series C, 7.500% Ba1/BB+ 4,300 101,953 1,293,782

TOTAL PREFERRED STOCK (Cost $14,446,520) $14,385,673

Footnotes to DCW Statement of Investments on page 24.

1.866.324.7348 2009 Annual Report 23

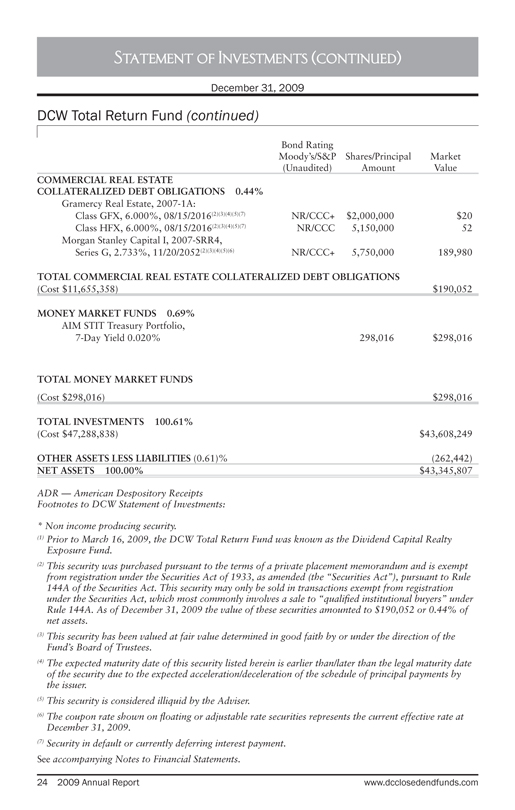

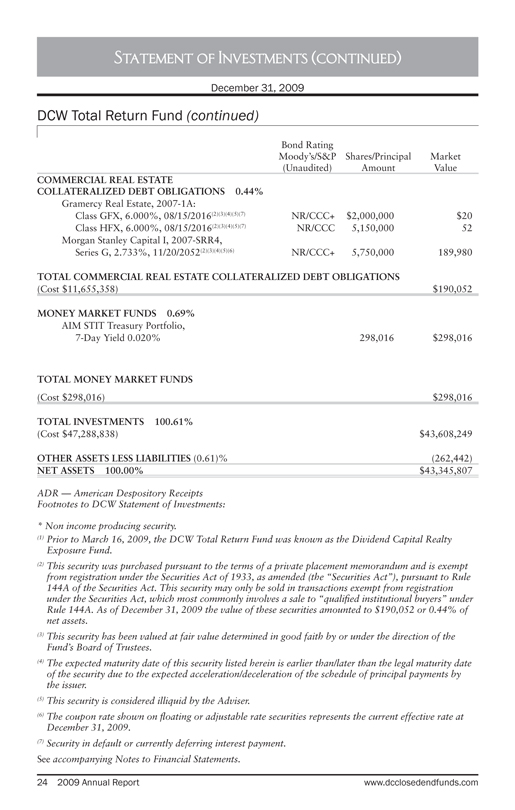

Statement of Investments (continued)

December 31, 2009

DCW Total Return Fund (continued)

Bond Rating Moody’s/S&P Shares/Principal Market (Unaudited) Amount Value

COMMERCIAL REAL ESTATE

COLLATERALIZED DEBT OBLIGATIONS 0.44%

Gramercy Real Estate, 2007-1A:

Class GFX, 6.000%, 08/15/2016(2)(3)(4)(5)(7) NR/CCC+ $2,000,000 $20

Class HFX, 6.000%, 08/15/2016(2)(3)(4)(5)(7) NR/CCC 5,150,000 52

Morgan Stanley Capital I, 2007-SRR4,

Series G, 2.733%, 11/20/2052(2)(3)(4)(5)(6) NR/CCC+ 5,750,000 189,980

TOTAL COMMERCIAL REAL ESTATE COLLATERALIZED DEBT OBLIGATIONS (Cost $11,655,358) $190,052

MONEY MARKET FUNDS 0.69%

AIM STIT Treasury Portfolio,

7-Day Yield 0.020% 298,016 $298,016

TOTAL MONEY MARKET FUNDS (Cost $298,016) $298,016

TOTAL INVESTMENTS 100.61% (Cost $47,288,838) $43,608,249

OTHER ASSETS LESS LIABILITIES (0.61)%(262,442)

NET ASSETS 100.00% $43,345,807

ADR — American Despository Receipts Footnotes to DCW Statement of Investments:

* Non income producing security.

(1) Prior to March 16, 2009, the DCW Total Return Fund was known as the Dividend Capital Realty Exposure Fund.

(2) This security was purchased pursuant to the terms of a private placement memorandum and is exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”), pursuant to Rule 144A of the Securities Act. This security may only be sold in transactions exempt from registration under the Securities Act, which most commonly involves a sale to “qualified institutional buyers” under Rule 144A. As of December 31, 2009 the value of these securities amounted to $190,052 or 0.44% of net assets.

(3) This security has been valued at fair value determined in good faith by or under the direction of the Fund’s Board of Trustees.

(4) The expected maturity date of this security listed herein is earlier than/later than the legal maturity date of the security due to the expected acceleration/deceleration of the schedule of principal payments by the issuer.

(5) This security is considered illiquid by the Adviser.

(6) The coupon rate shown on floating or adjustable rate securities represents the current effective rate at December 31, 2009.

(7) Security in default or currently deferring interest payment. See accompanying Notes to Financial Statements.

24 2009 Annual Report www.dcclosedendfunds.com

This Page Intentionally Left Blank

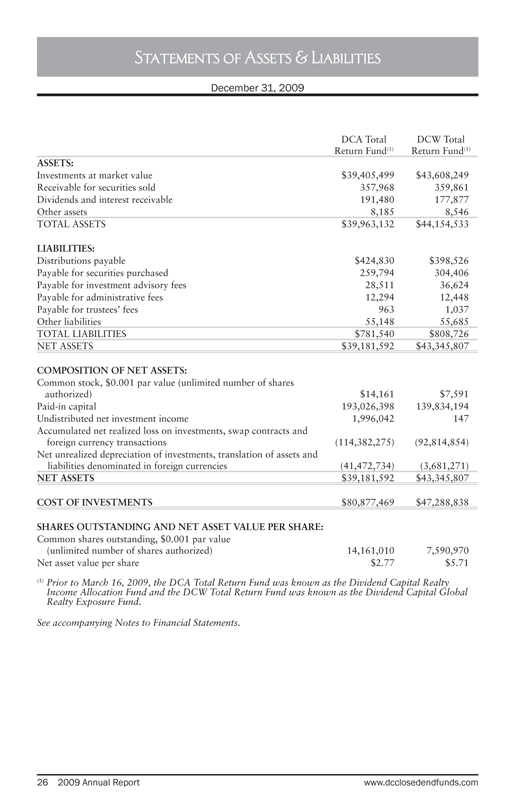

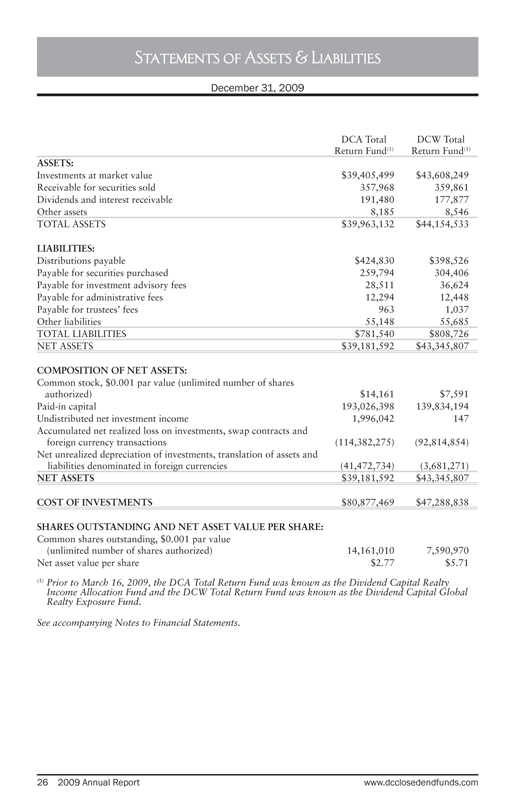

Statements of Assets & Liabilities

December 31, 2009

DCA Total Return Fund(1) DCW Total Return Fund(1)

ASSETS:

Investments at market value $39,405,499 $43,608,249

Receivable for securities sold 357,968 359,861

Dividends and interest receivable 191,480 177,877

Other assets 8,185 8,546

TOTAL ASSETS $39,963,132 $44,154,533

LIABILITIES:

Distributions payable $424,830 $398,526

Payable for securities purchased 259,794 304,406

Payable for investment advisory fees 28,511 36,624

Payable for administrative fees 12,294 12,448

Payable for trustees’ fees 963 1,037

Other liabilities 55,148 55,685

TOTAL LIABILITIES $781,540 $808,726

NET ASSETS $39,181,592 $43,345,807

COMPOSITION OF NET ASSETS:

Common stock, $0.001 par value (unlimited number of shares authorized) $14,161 $7,591

Paid-in capital 193,026,398 139,834,194

Undistributed net investment income 1,996,042 147

Accumulated net realized loss on investments, swap contracts and foreign currency transactions (114,382,275) (92,814,854)

Net unrealized depreciation of investments, translation of assets and liabilities denominated in foreign currencies (41,472,734) (3,681,271)

NET ASSETS $39,181,592 $43,345,807

COST OF INVESTMENTS $80,877,469 $47,288,838

SHARES OUTSTANDING AND NET ASSET VALUE PER SHARE:

Common shares outstanding, $0.001 par value (unlimited number of shares authorized) 14,161,010 7,590,970

Net asset value per share $2.77 $5.71

(1) Prior to March 16, 2009, the DCA Total Return Fund was known as the Dividend Capital Realty Income Allocation Fund and the DCW Total Return Fund was known as the Dividend Capital Global Realty Exposure Fund.

See accompanying Notes to Financial Statements.

26 2009 Annual Report www.dcclosedendfunds.com

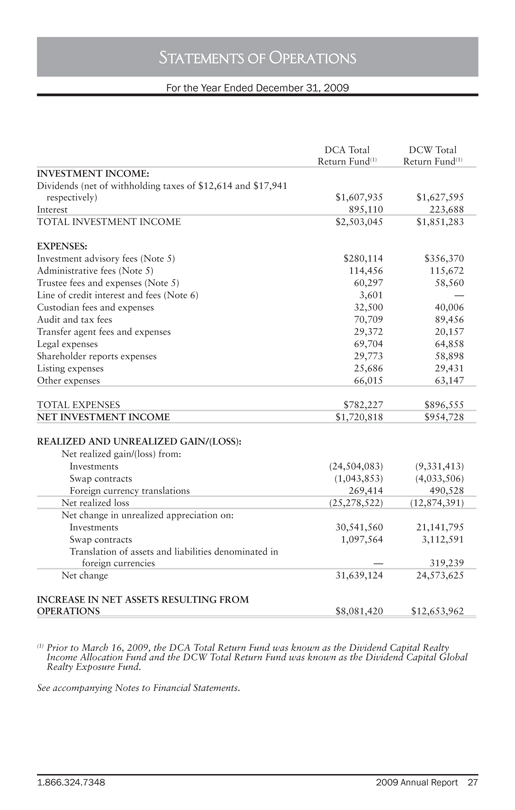

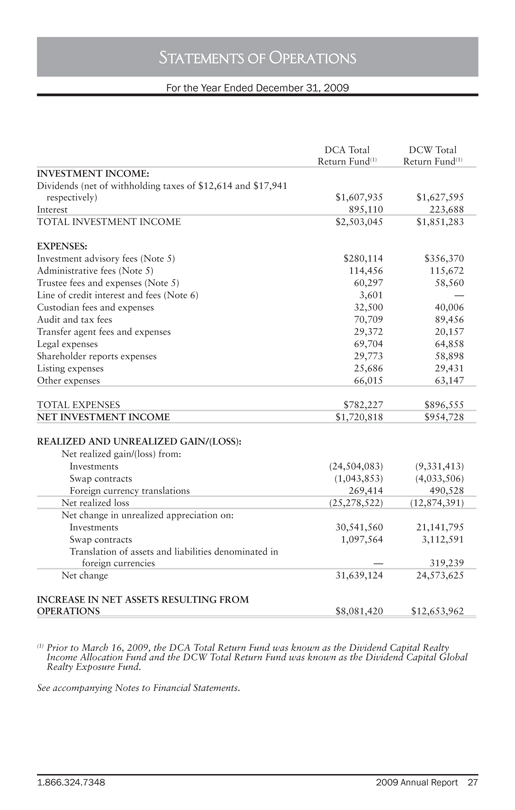

Statements of Operations

For the Year Ended December 31, 2009

DCA Total Return Fund(1) DCW Total Return Fund(1)

INVESTMENT INCOME:

Dividends (net of withholding taxes of $12,614 and $17,941 respectively) $1,607,935 $1,627,595

Interest 895,110 223,688

TOTAL INVESTMENT INCOME $2,503,045 $1,851,283

EXPENSES:

Investment advisory fees (Note 5) $280,114 $356,370

Administrative fees (Note 5) 114,456 115,672

Trustee fees and expenses (Note 5) 60,297 58,560

Line of credit interest and fees (Note 6) 3,601 —

Custodian fees and expenses 32,500 40,006

Audit and tax fees 70,709 89,456

Transfer agent fees and expenses 29,372 20,157

Legal expenses 69,704 64,858

Shareholder reports expenses 29,773 58,898

Listing expenses 25,686 29,431

Other expenses 66,015 63,147

TOTAL EXPENSES $782,227 $896,555

NET INVESTMENT INCOME $1,720,818 $954,728

REALIZED AND UNREALIZED GAIN/(LOSS):

Net realized gain/(loss) from:

Investments (24,504,083) (9,331,413)

Swap contracts (1,043,853) (4,033,506)

Foreign currency translations 269,414 490,528

Net realized loss (25,278,522) (12,874,391)

Net change in unrealized appreciation on:

Investments 30,541,560 21,141,795

Swap contracts 1,097,564 3,112,591

Translation of assets and liabilities denominated in foreign currencies — 319,239

Net change 31,639,124 24,573,625

INCREASE IN NET ASSETS RESULTING FROM

OPERATIONS $8,081,420 $12,653,962

(1) Prior to March 16, 2009, the DCA Total Return Fund was known as the Dividend Capital Realty Income Allocation Fund and the DCW Total Return Fund was known as the Dividend Capital Global Realty Exposure Fund.

See accompanying Notes to Financial Statements.

1.866.324.7348 2009 Annual Report 27

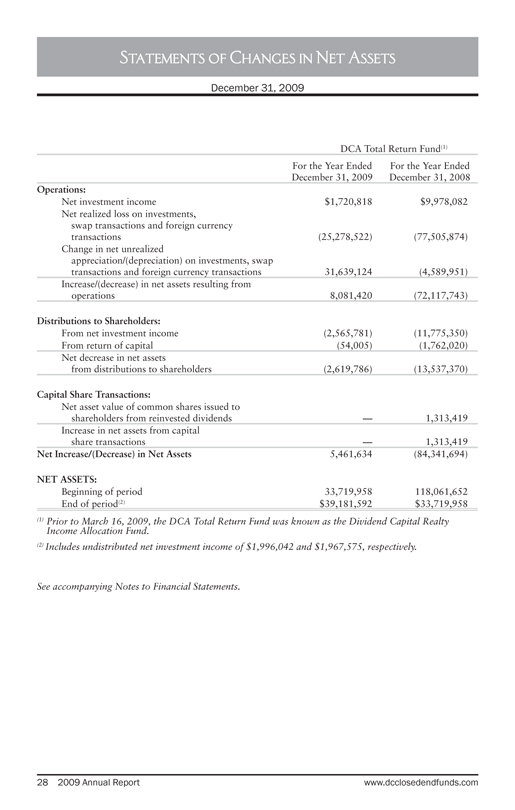

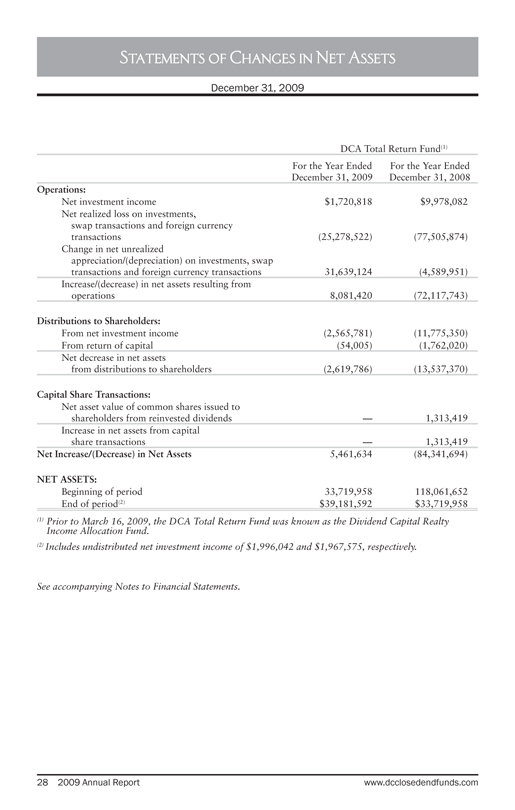

Statements of Changes in Net Assets

December 31, 2009

DCA Total Return Fund(1)

For the Year Ended December 31, 2009 For the Year Ended December 31, 2008

Operations:

Net investment income $1,720,818 $9,978,082

Net realized loss on investments, swap transactions and foreign currency transactions (25,278,522) (77,505,874)

Change in net unrealized appreciation/(depreciation) on investments, swap transactions and foreign currency transactions 31,639,124 (4,589,951)

Increase/(decrease) in net assets resulting from operations 8,081,420 (72,117,743)

Distributions to Shareholders:

From net investment income (2,565,781) (11,775,350)

From return of capital (54,005) (1,762,020)

Net decrease in net assets from distributions to shareholders (2,619,786) (13,537,370)

Capital Share Transactions:

Net asset value of common shares issued to shareholders from reinvested dividends — 1,313,419

Increase in net assets from capital share transactions — 1,313,419

Net Increase/(Decrease) in Net Assets 5,461,634 (84,341,694)

NET ASSETS:

Beginning of period 33,719,958 118,061,652

End of period(2) $39,181,592 $33,719,958

(1) Prior to March 16, 2009, the DCA Total Return Fund was known as the Dividend Capital Realty Income Allocation Fund.

(2) Includes undistributed net investment income of $1,996,042 and $1,967,575, respectively.

See accompanying Notes to Financial Statements.

28 2009 Annual Report www.dcclosedendfunds.com

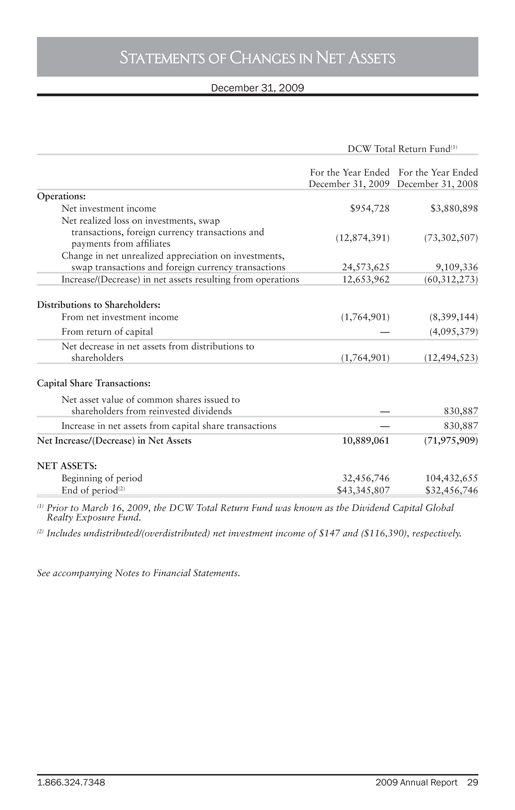

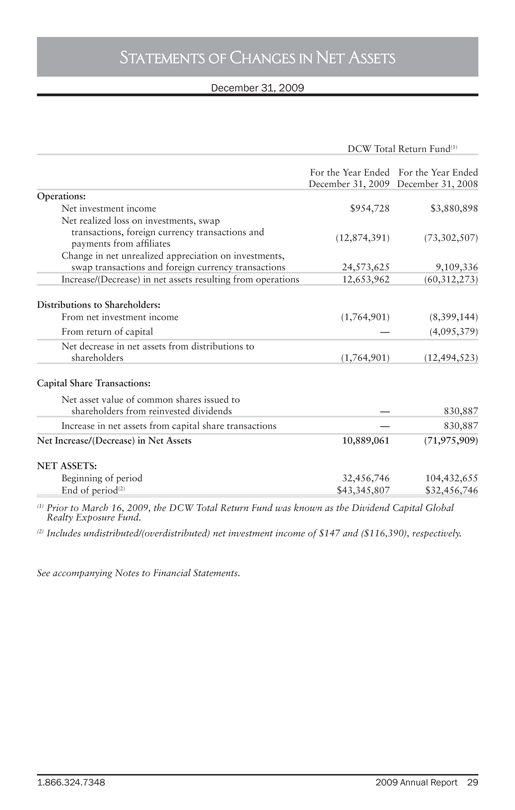

Statements of Changes in Net Assets

December 31, 2009

DCW Total Return Fund(1)

For the Year Ended December 31, 2009 For the Year Ended December 31, 2008

Operations:

Net investment income $954,728 $3,880,898

Net realized loss on investments, swap transactions, foreign currency transactions and payments from affiliates (12,874,391)(73,302,507)

Change in net unrealized appreciation on investments, swap transactions and foreign currency transactions 24,573,625 9,109,336

Increase/(Decrease) in net assets resulting from operations 12,653,962(60,312,273)

Distributions to Shareholders:

From net investment income (1,764,901)(8,399,144)

From return of capital —(4,095,379)

Net decrease in net assets from distributions to shareholders (1,764,901)(12,494,523)

Capital Share Transactions:

Net asset value of common shares issued to shareholders from reinvested dividends — 830,887

Increase in net assets from capital share transactions — 830,887

Net Increase/(Decrease) in Net Assets 10,889,061(71,975,909)

NET ASSETS:

Beginning of period 32,456,746 104,432,655

End of period(2) $43,345,807 $32,456,746

(1) Prior to March 16, 2009, the DCW Total Return Fund was known as the Dividend Capital Global Realty Exposure Fund.

(2) Includes undistributed/(overdistributed) net investment income of $147 and ($116,390), respectively.

See accompanying Notes to Financial Statements.

1.866.324.7348 2009 Annual Report 29

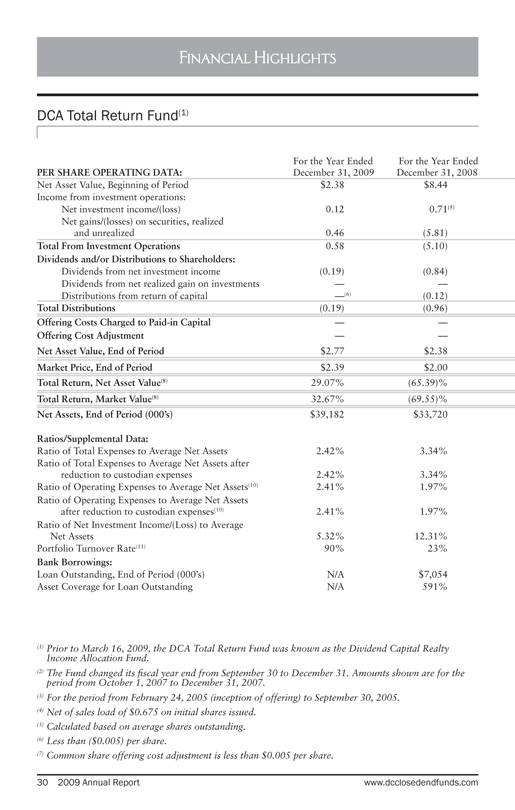

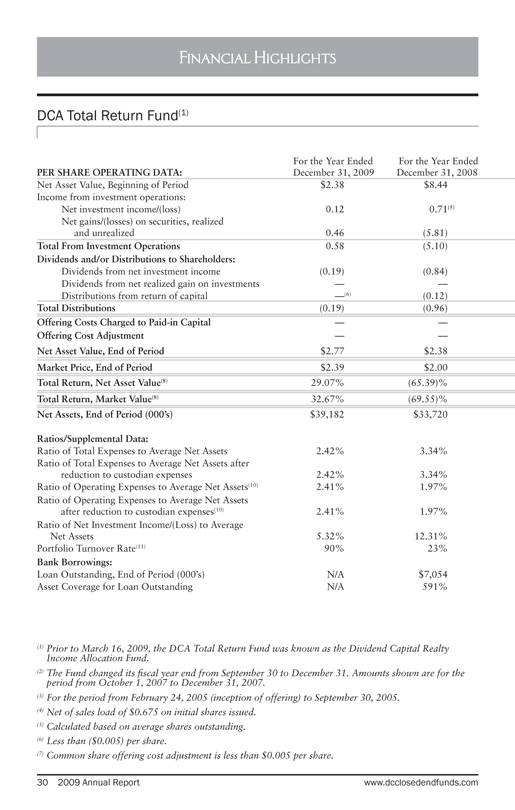

Financial Highlights

DCA Total Return Fund(1)

For the Year Ended For the Year Ended

PER SHARE OPERATING DATA: December 31, 2009 December 31, 2008

Net Asset Value, Beginning of Period $2.38 $8.44

Income from investment operations:

Net investment income/(loss) 0.12 0.71(5)

Net gains/(losses) on securities, realized and unrealized 0.46 (5.81)

Total From Investment Operations 0.58 (5.10)

Dividends and/or Distributions to Shareholders:

Dividends from net investment income (0.19) (0.84)

Dividends from net realized gain on investments — —

Distributions from return of capital —(6)(0.12)

Total Distributions (0.19) (0.96)

Offering Costs Charged to Paid-in Capital — —

Offering Cost Adjustment — —

Net Asset Value, End of Period $2.77 $2.38

Market Price, End of Period $2.39 $2.00

Total Return, Net Asset Value(8) 29.07%(65.39)%

Total Return, Market Value(8) 32.67%(69.55)%

Net Assets, End of Period (000’s) $39,182 $33,720

Ratios/Supplemental Data:

Ratio of Total Expenses to Average Net Assets 2.42% 3.34%

Ratio of Total Expenses to Average Net Assets after reduction to custodian expenses 2.42% 3.34%

Ratio of Operating Expenses to Average Net Assets(10) 2.41% 1.97%

Ratio of Operating Expenses to Average Net Assets after reduction to custodian expenses(10) 2.41% 1.97%

Ratio of Net Investment Income/(Loss) to Average

Net Assets 5.32% 12.31%

Portfolio Turnover Rate(11) 90% 23%

Bank Borrowings:

Loan Outstanding, End of Period (000’s) N/A $7,054

Asset Coverage for Loan Outstanding N/A 591%

(1) Prior to March 16, 2009, the DCA Total Return Fund was known as the Dividend Capital Realty Income Allocation Fund.

(2) The Fund changed its fiscal year end from September 30 to December 31. Amounts shown are for the period from October 1, 2007 to December 31, 2007.

(3) For the period from February 24, 2005 (inception of offering) to September 30, 2005. (4) Net of sales load of $0.675 on initial shares issued.

(5) Calculated based on average shares outstanding. (6) Less than ($0.005) per share.

(7) Common share offering cost adjustment is less than $0.005 per share.

30 2009 Annual Report www.dcclosedendfunds.com

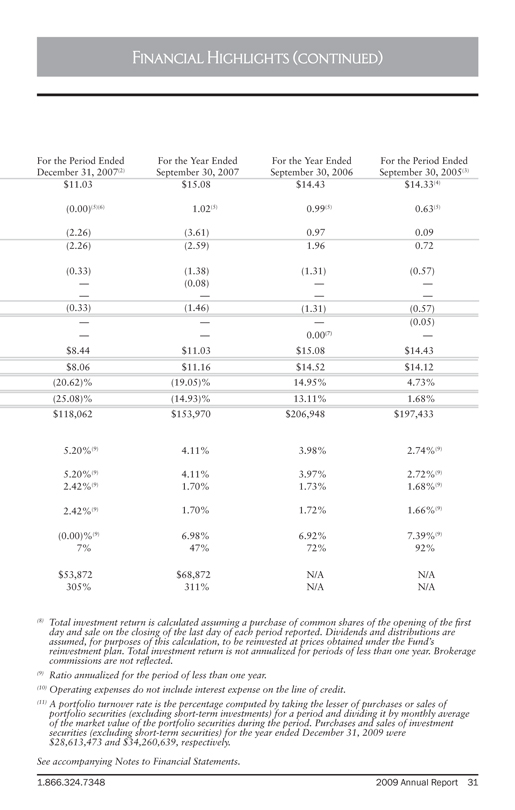

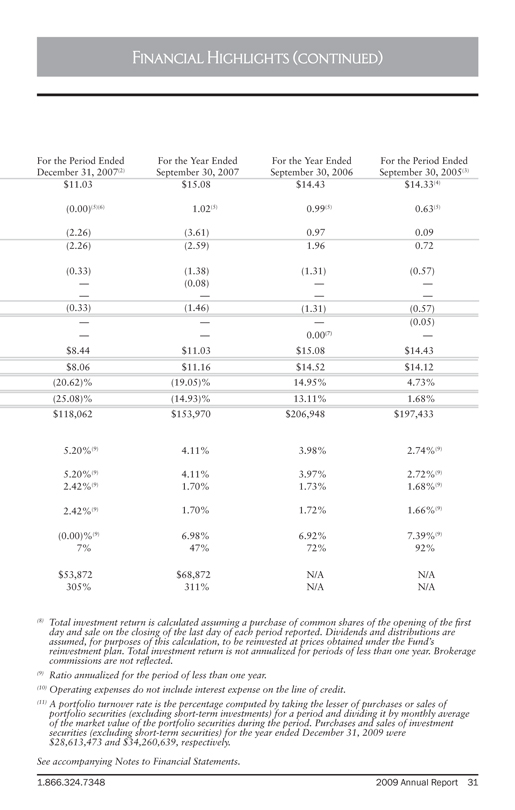

Financial Highlights (continued)

For the Period Ended December 31, 2007(2)

For the Year Ended September 30, 2007

For the Year Ended September 30, 2006

For the Period Ended September 30, 2005(3)

$11.03 $15.08 $14.43 $14.33(4)

(0.00)(5)(6) 1.02(5) 0.99(5) 0.63(5)

(2.26) (3.61) 0.97 0.09

(2.26) (2.59) 1.96 0.72

(0.33) (1.38) (1.31) (0.57)

— (0.08) — —

— — — —

(0.33) (1.46) (1.31) (0.57)

— — — (0.05)

— — 0.00(7) —

$8.44 $11.03 $15.08 $14.43

$8.06 $11.16 $14.52 $14.12

(20.62)% (19.05)% 14.95% 4.73%

(25.08)% (14.93)% 13.11% 1.68%

$118,062 $153,970 $206,948 $197,433

5.20%(9) 4.11% 3.98% 2.74%(9)

5.20%(9) 4.11% 3.97% 2.72%(9)

2.42%(9) 1.70% 1.73% 1.68%(9)

2.42%(9) 1.70% 1.72% 1.66%(9)

(0.00)%(9) 6.98% 6.92% 7.39%(9)

7% 47% 72% 92%

$53,872 $68,872 N/A N/A

305% 311% N/A N/A

(8) Total investment return is calculated assuming a purchase of common shares of the opening of the first day and sale on the closing of the last day of each period reported. Dividends and distributions are assumed, for purposes of this calculation, to be reinvested at prices obtained under the Fund’s reinvestment plan. Total investment return is not annualized for periods of less than one year. Brokerage commissions are not reflected.

(9) Ratio annualized for the period of less than one year.

(10) Operating expenses do not include interest expense on the line of credit.

(11) A portfolio turnover rate is the percentage computed by taking the lesser of purchases or sales of portfolio securities (excluding short-term investments) for a period and dividing it by monthly average of the market value of the portfolio securities during the period. Purchases and sales of investment securities (excluding short-term securities) for the year ended December 31, 2009 were $28,613,473 and $34,260,639, respectively.

See accompanying Notes to Financial Statements.

1.866.324.7348 2009 Annual Report 31

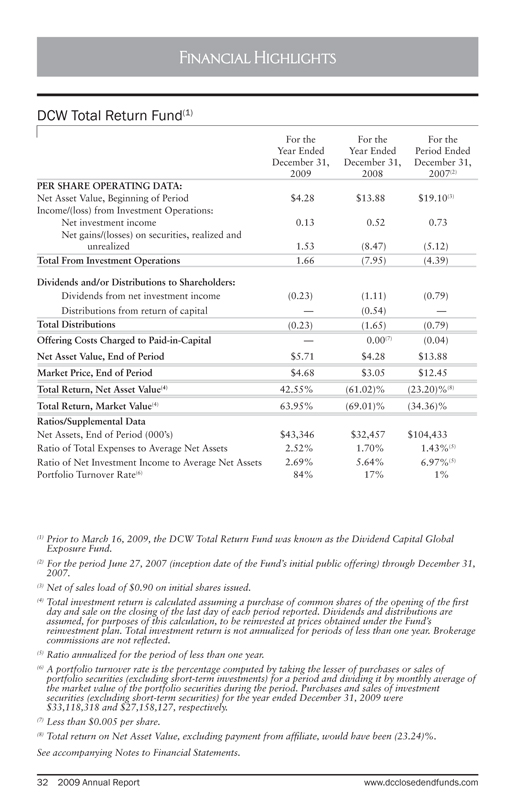

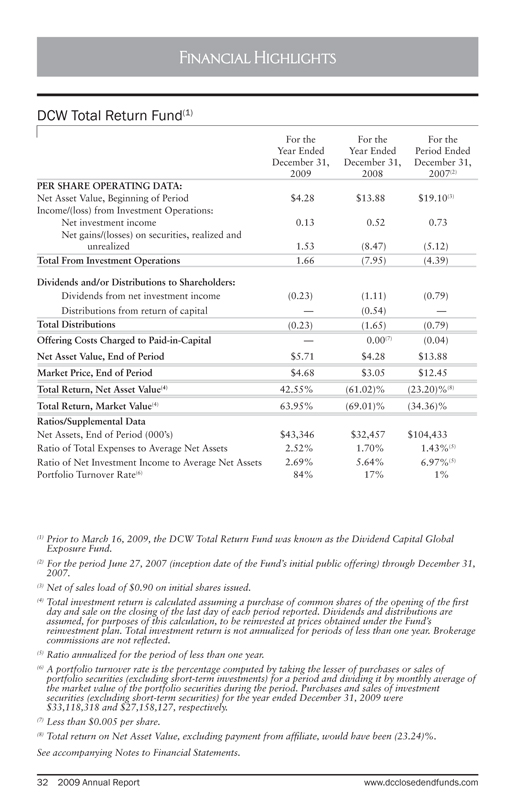

Financial Highlights

DCW Total Return Fund(1)

For the Year Ended December 31, 2009 For the Year Ended December 31, 2008 For the Period Ended December 31, 2007(2)

PER SHARE OPERATING DATA:

Net Asset Value, Beginning of Period $4.28 $13.88 $19.10(3)

Income/(loss) from Investment Operations:

Net investment income 0.13 0.52 0.73

Net gains/(losses) on securities, realized and unrealized 1.53(8.47)(5.12)

Total From Investment Operations 1.66(7.95)(4.39)

Dividends and/or Distributions to Shareholders:

Dividends from net investment income (0.23)(1.11)(0.79)

Distributions from return of capital —(0.54) —

Total Distributions (0.23)(1.65)(0.79)

Offering Costs Charged to Paid-in-Capital — 0.00(7)(0.04)

Net Asset Value, End of Period $5.71 $4.28 $13.88

Market Price, End of Period $4.68 $3.05 $12.45

Total Return, Net Asset Value(4) 42.55%(61.02)%(23.20)%(8)

Total Return, Market Value(4) 63.95%(69.01)%(34.36)%

Ratios/Supplemental Data

Net Assets, End of Period (000’s) $43,346 $32,457 $104,433

Ratio of Total Expenses to Average Net Assets 2.52% 1.70% 1.43%(5)

Ratio of Net Investment Income to Average Net Assets 2.69% 5.64% 6.97%(5)

Portfolio Turnover Rate(6) 84% 17% 1%

(1) Prior to March 16, 2009, the DCW Total Return Fund was known as the Dividend Capital Global Exposure Fund.

(2) For the period June 27, 2007 (inception date of the Fund’s initial public offering) through December 31, 2007.

(3) Net of sales load of $0.90 on initial shares issued.

(4) Total investment return is calculated assuming a purchase of common shares of the opening of the first day and sale on the closing of the last day of each period reported. Dividends and distributions are assumed, for purposes of this calculation, to be reinvested at prices obtained under the Fund’s reinvestment plan. Total investment return is not annualized for periods of less than one year. Brokerage commissions are not reflected.

(5) Ratio annualized for the period of less than one year.

(6) A portfolio turnover rate is the percentage computed by taking the lesser of purchases or sales of portfolio securities (excluding short-term investments) for a period and dividing it by monthly average of the market value of the portfolio securities during the period. Purchases and sales of investment securities (excluding short-term securities) for the year ended December 31, 2009 were $33,118,318 and $27,158,127, respectively.

(7) Less than $0.005 per share.

(8) Total return on Net Asset Value, excluding payment from affiliate, would have been (23.24)%.

See accompanying Notes to Financial Statements.

32 2009 Annual Report www.dcclosedendfunds.com

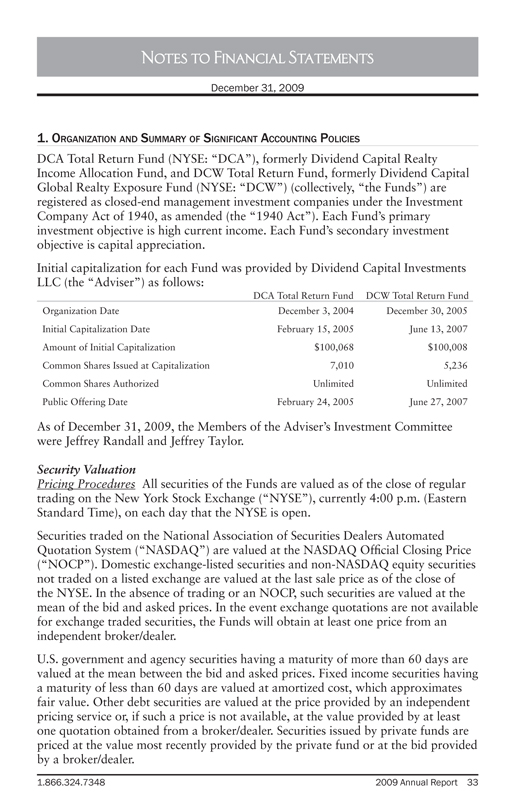

Notes to Financial Statements

December 31, 2009

1. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

DCA Total Return Fund (NYSE: “DCA”), formerly Dividend Capital Realty Income Allocation Fund, and DCW Total Return Fund, formerly Dividend Capital Global Realty Exposure Fund (NYSE: “DCW”) (collectively, “the Funds”) are registered as closed-end management investment companies under the Investment Company Act of 1940, as amended (the “1940 Act”). Each Fund’s primary investment objective is high current income. Each Fund’s secondary investment objective is capital appreciation.

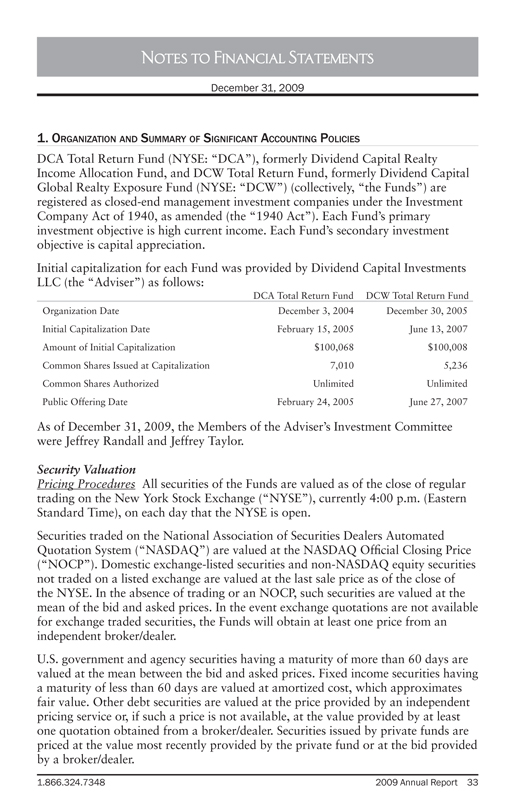

Initial capitalization for each Fund was provided by Dividend Capital Investments LLC (the “Adviser”) as follows:

DCA Total Return Fund DCW Total Return Fund

Organization Date December 3, 2004 December 30, 2005

Initial Capitalization Date February 15, 2005 June 13, 2007

Amount of Initial Capitalization $100,068 $100,008

Common Shares Issued at Capitalization 7,010 5,236

Common Shares Authorized Unlimited Unlimited

Public Offering Date February 24, 2005 June 27, 2007

As of December 31, 2009, the Members of the Adviser’s Investment Committee were Jeffrey Randall and Jeffrey Taylor.

Security Valuation

Pricing Procedures All securities of the Funds are valued as of the close of regular trading on the New York Stock Exchange (“NYSE”), currently 4:00 p.m. (Eastern Standard Time), on each day that the NYSE is open.

Securities traded on the National Association of Securities Dealers Automated Quotation System (“NASDAQ”) are valued at the NASDAQ Official Closing Price (“NOCP”). Domestic exchange-listed securities and non-NASDAQ equity securities not traded on a listed exchange are valued at the last sale price as of the close of the NYSE. In the absence of trading or an NOCP, such securities are valued at the mean of the bid and asked prices. In the event exchange quotations are not available for exchange traded securities, the Funds will obtain at least one price from an independent broker/dealer.

U.S. government and agency securities having a maturity of more than 60 days are valued at the mean between the bid and asked prices. Fixed income securities having a maturity of less than 60 days are valued at amortized cost, which approximates fair value. Other debt securities are valued at the price provided by an independent pricing service or, if such a price is not available, at the value provided by at least one quotation obtained from a broker/dealer. Securities issued by private funds are priced at the value most recently provided by the private fund or at the bid provided by a broker/dealer.

1.866.324.7348 2009 Annual Report 33

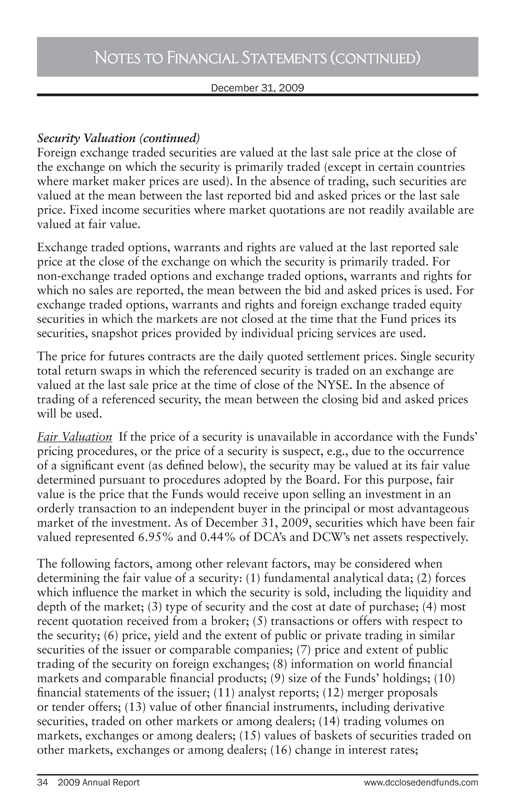

Notes to Financial Statements (continued)

December 31, 2009

Security Valuation (continued)

Foreign exchange traded securities are valued at the last sale price at the close of the exchange on which the security is primarily traded (except in certain countries where market maker prices are used). In the absence of trading, such securities are valued at the mean between the last reported bid and asked prices or the last sale price. Fixed income securities where market quotations are not readily available are valued at fair value.

Exchange traded options, warrants and rights are valued at the last reported sale price at the close of the exchange on which the security is primarily traded. For non-exchange traded options and exchange traded options, warrants and rights for which no sales are reported, the mean between the bid and asked prices is used. For exchange traded options, warrants and rights and foreign exchange traded equity securities in which the markets are not closed at the time that the Fund prices its securities, snapshot prices provided by individual pricing services are used.

The price for futures contracts are the daily quoted settlement prices. Single security total return swaps in which the referenced security is traded on an exchange are valued at the last sale price at the time of close of the NYSE. In the absence of trading of a referenced security, the mean between the closing bid and asked prices will be used.

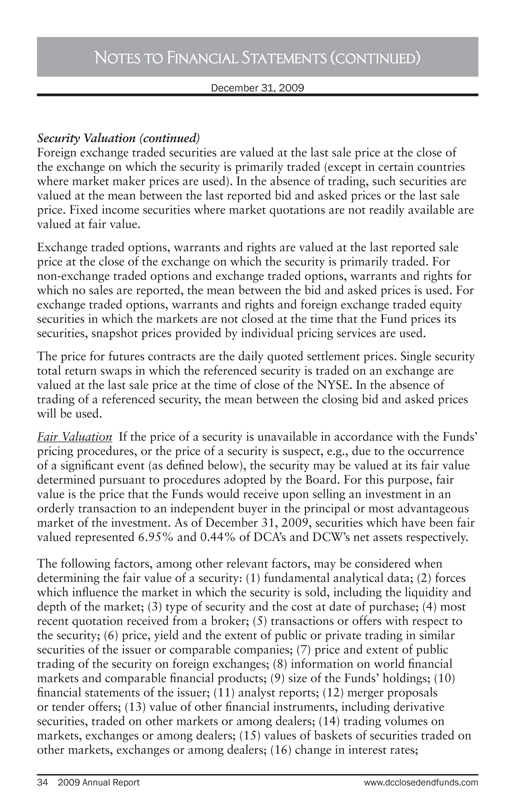

Fair Valuation If the price of a security is unavailable in accordance with the Funds’ pricing procedures, or the price of a security is suspect, e.g., due to the occurrence of a significant event (as defined below), the security may be valued at its fair value determined pursuant to procedures adopted by the Board. For this purpose, fair value is the price that the Funds would receive upon selling an investment in an orderly transaction to an independent buyer in the principal or most advantageous market of the investment. As of December 31, 2009, securities which have been fair valued represented 6.95% and 0.44% of DCA’s and DCW’s net assets respectively.

The following factors, among other relevant factors, may be considered when determining the fair value of a security: (1) fundamental analytical data; (2) forces which influence the market in which the security is sold, including the liquidity and depth of the market; (3) type of security and the cost at date of purchase; (4) most recent quotation received from a broker; (5) transactions or offers with respect to the security; (6) price, yield and the extent of public or private trading in similar securities of the issuer or comparable companies; (7) price and extent of public trading of the security on foreign exchanges; (8) information on world financial markets and comparable financial products; (9) size of the Funds’ holdings; (10) financial statements of the issuer; (11) analyst reports; (12) merger proposals or tender offers; (13) value of other financial instruments, including derivative securities, traded on other markets or among dealers; (14) trading volumes on markets, exchanges or among dealers; (15) values of baskets of securities traded on other markets, exchanges or among dealers; (16) change in interest rates;

34 2009 Annual Report www.dcclosedendfunds.com

Notes to Financial Statements (continued)

December 31, 2009

Security Valuation (continued)

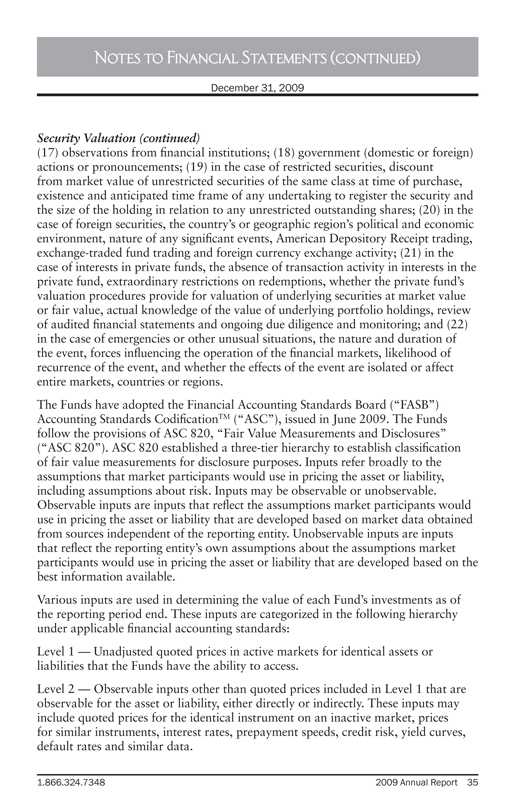

(17) observations from financial institutions; (18) government (domestic or foreign) actions or pronouncements; (19) in the case of restricted securities, discount from market value of unrestricted securities of the same class at time of purchase, existence and anticipated time frame of any undertaking to register the security and the size of the holding in relation to any unrestricted outstanding shares; (20) in the case of foreign securities, the country’s or geographic region’s political and economic environment, nature of any significant events, American Depository Receipt trading, exchange-traded fund trading and foreign currency exchange activity; (21) in the case of interests in private funds, the absence of transaction activity in interests in the private fund, extraordinary restrictions on redemptions, whether the private fund’s valuation procedures provide for valuation of underlying securities at market value or fair value, actual knowledge of the value of underlying portfolio holdings, review of audited financial statements and ongoing due diligence and monitoring; and (22) in the case of emergencies or other unusual situations, the nature and duration of the event, forces influencing the operation of the financial markets, likelihood of recurrence of the event, and whether the effects of the event are isolated or affect entire markets, countries or regions.

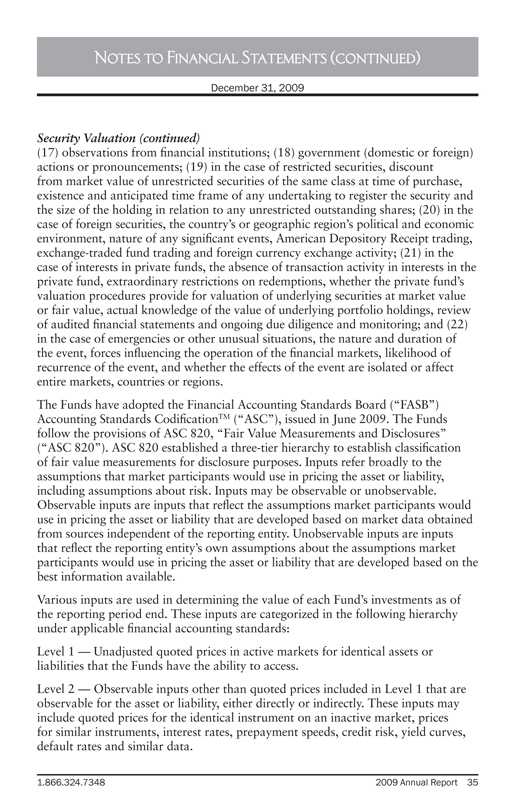

The Funds have adopted the Financial Accounting Standards Board (“FASB”) Accounting Standards CodificationTM (“ASC”), issued in June 2009. The Funds follow the provisions of ASC 820, “Fair Value Measurements and Disclosures” (“ASC 820”). ASC 820 established a three-tier hierarchy to establish classification of fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

Various inputs are used in determining the value of each Fund’s investments as of the reporting period end. These inputs are categorized in the following hierarchy under applicable financial accounting standards: Level 1 — Unadjusted quoted prices in active markets for identical assets or liabilities that the Funds have the ability to access.

Level 2 — Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

1.866.324.7348 2009 Annual Report 35

Notes to Financial Statements (continued)

December 31, 2009

Security Valuation (continued)

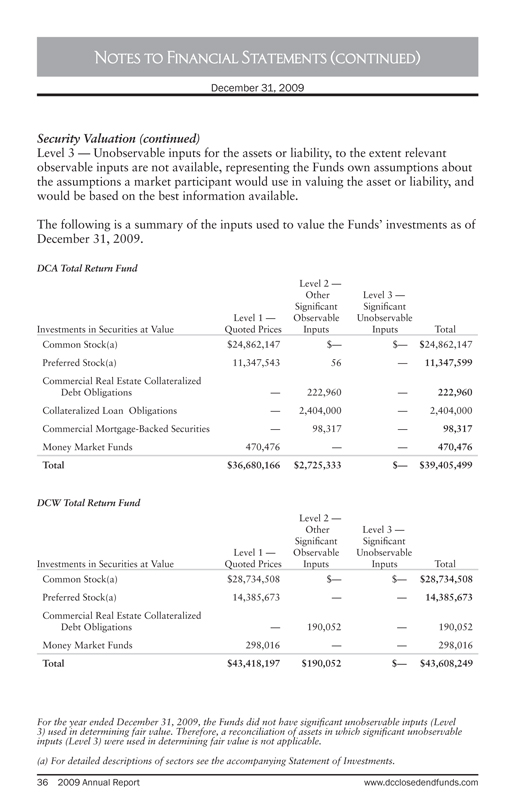

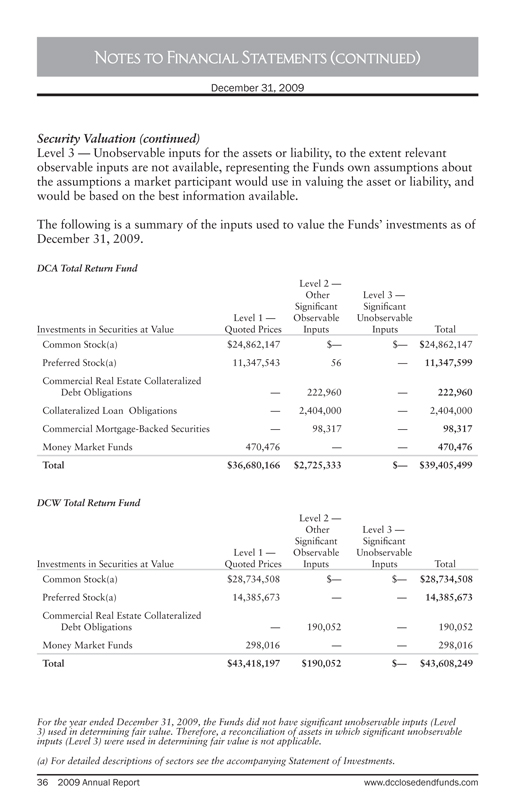

Level 3 — Unobservable inputs for the assets or liability, to the extent relevant observable inputs are not available, representing the Funds own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The following is a summary of the inputs used to value the Funds’ investments as of December 31, 2009.

DCA Total Return Fund

Level 1 — Level 2 — Other Significant Observable Level 3 — Significant Unobservable

Investments in Securities at Value Quoted Prices Inputs Inputs Total

Common Stock(a) $24,862,147 $— $— $24,862,147

Preferred Stock(a) 11,347,543 56 — 11,347,599

Commercial Real Estate Collateralized

Debt Obligations — 222,960 — 222,960

Collateralized Loan Obligations — 2,404,000 — 2,404,000

Commercial Mortgage-Backed Securities — 98,317 — 98,317

Money Market Funds 470,476 — — 470,476

Total $36,680,166 $2,725,333 $ — $39,405,499

DCW Total Return Fund

Level 1 — Level 2 — Other Significant Observable Level 3 — Significant Unobservable

Investments in Securities at Value Quoted Prices Inputs Inputs Total

Common Stock(a) $28,734,508 $— $— $28,734,508

Preferred Stock(a) 14,385,673 — — 14,385,673

Commercial Real Estate Collateralized

Debt Obligations — 190,052 — 190,052

Money Market Funds 298,016 — — 298,016

Total $43,418,197 $190,052 $— $43,608,249

For the year ended December 31, 2009, the Funds did not have significant unobservable inputs (Level 3) used in determining fair value. Therefore, a reconciliation of assets in which significant unobservable inputs (Level 3) were used in determining fair value is not applicable.

(a) For detailed descriptions of sectors see the accompanying Statement of Investments.

36 2009 Annual Report www.dcclosedendfunds.com

Notes to Financial Statements (continued)

December 31, 2009

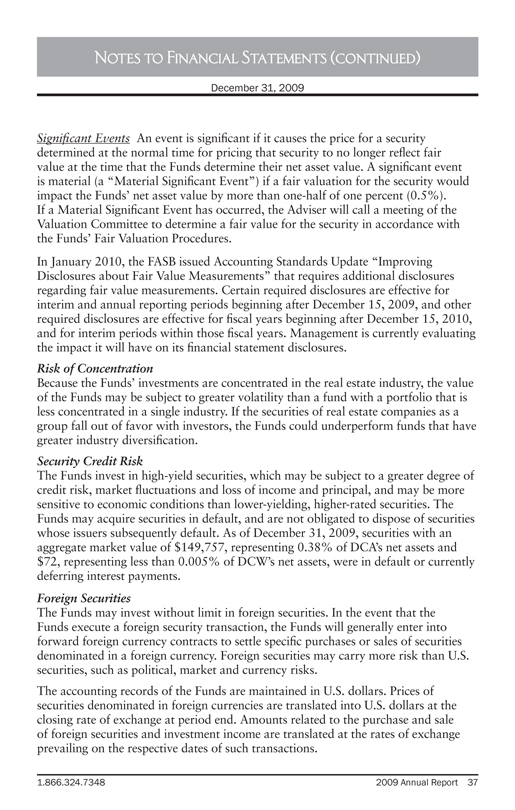

Significant Events An event is significant if it causes the price for a security determined at the normal time for pricing that security to no longer reflect fair value at the time that the Funds determine their net asset value. A significant event is material (a “Material Significant Event”) if a fair valuation for the security would impact the Funds’ net asset value by more than one-half of one percent (0.5%). If a Material Significant Event has occurred, the Adviser will call a meeting of the Valuation Committee to determine a fair value for the security in accordance with the Funds’ Fair Valuation Procedures.

In January 2010, the FASB issued Accounting Standards Update “Improving Disclosures about Fair Value Measurements” that requires additional disclosures regarding fair value measurements. Certain required disclosures are effective for interim and annual reporting periods beginning after December 15, 2009, and other required disclosures are effective for fiscal years beginning after December 15, 2010, and for interim periods within those fiscal years. Management is currently evaluating the impact it will have on its financial statement disclosures.

Risk of Concentration

Because the Funds’ investments are concentrated in the real estate industry, the value of the Funds may be subject to greater volatility than a fund with a portfolio that is less concentrated in a single industry. If the securities of real estate companies as a group fall out of favor with investors, the Funds could underperform funds that have greater industry diversification.

Security Credit Risk

The Funds invest in high-yield securities, which may be subject to a greater degree of credit risk, market fluctuations and loss of income and principal, and may be more sensitive to economic conditions than lower-yielding, higher-rated securities. The Funds may acquire securities in default, and are not obligated to dispose of securities whose issuers subsequently default. As of December 31, 2009, securities with an aggregate market value of $149,757, representing 0.38% of DCA’s net assets and $72, representing less than 0.005% of DCW’s net assets, were in default or currently deferring interest payments.

Foreign Securities

The Funds may invest without limit in foreign securities. In the event that the Funds execute a foreign security transaction, the Funds will generally enter into forward foreign currency contracts to settle specific purchases or sales of securities denominated in a foreign currency. Foreign securities may carry more risk than U.S. securities, such as political, market and currency risks.

The accounting records of the Funds are maintained in U.S. dollars. Prices of securities denominated in foreign currencies are translated into U.S. dollars at the closing rate of exchange at period end. Amounts related to the purchase and sale of foreign securities and investment income are translated at the rates of exchange prevailing on the respective dates of such transactions.

1.866.324.7348 2009 Annual Report 37

Notes to Financial Statements (continued)

December 31, 2009

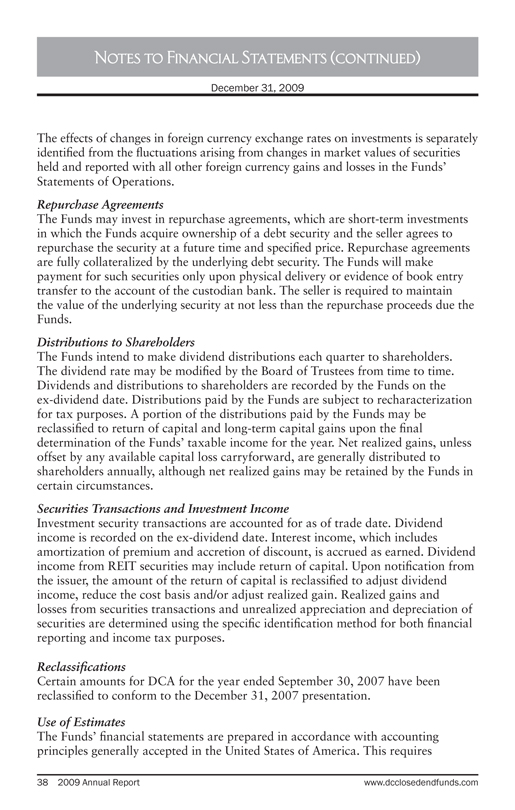

The effects of changes in foreign currency exchange rates on investments is separately identified from the fluctuations arising from changes in market values of securities held and reported with all other foreign currency gains and losses in the Funds’ Statements of Operations.

Repurchase Agreements

The Funds may invest in repurchase agreements, which are short-term investments in which the Funds acquire ownership of a debt security and the seller agrees to repurchase the security at a future time and specified price. Repurchase agreements are fully collateralized by the underlying debt security. The Funds will make payment for such securities only upon physical delivery or evidence of book entry transfer to the account of the custodian bank. The seller is required to maintain the value of the underlying security at not less than the repurchase proceeds due the Funds.

Distributions to Shareholders

The Funds intend to make dividend distributions each quarter to shareholders. The dividend rate may be modified by the Board of Trustees from time to time. Dividends and distributions to shareholders are recorded by the Funds on the ex-dividend date. Distributions paid by the Funds are subject to recharacterization for tax purposes. A portion of the distributions paid by the Funds may be reclassified to return of capital and long-term capital gains upon the final determination of the Funds’ taxable income for the year. Net realized gains, unless offset by any available capital loss carryforward, are generally distributed to shareholders annually, although net realized gains may be retained by the Funds in certain circumstances.

Securities Transactions and Investment Income

Investment security transactions are accounted for as of trade date. Dividend income is recorded on the ex-dividend date. Interest income, which includes amortization of premium and accretion of discount, is accrued as earned. Dividend income from REIT securities may include return of capital. Upon notification from the issuer, the amount of the return of capital is reclassified to adjust dividend income, reduce the cost basis and/or adjust realized gain. Realized gains and losses from securities transactions and unrealized appreciation and depreciation of securities are determined using the specific identification method for both financial reporting and income tax purposes.

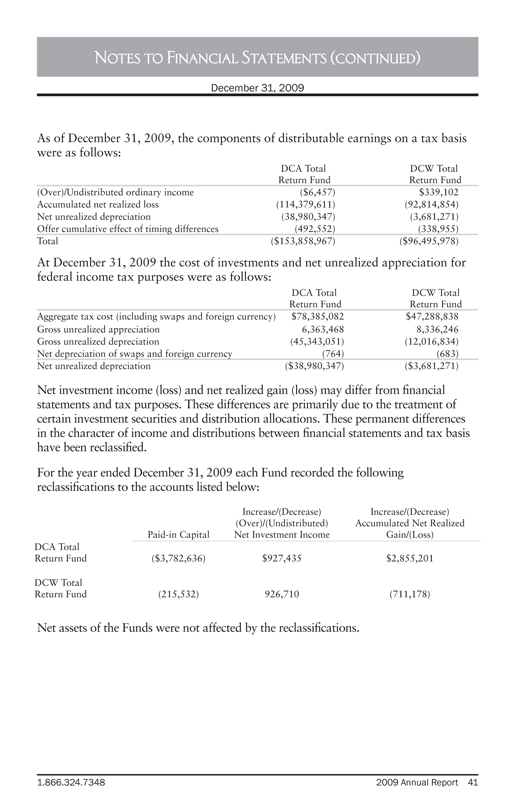

Reclassifications

Certain amounts for DCA for the year ended September 30, 2007 have been reclassified to conform to the December 31, 2007 presentation.

Use of Estimates

The Funds’ financial statements are prepared in accordance with accounting principles generally accepted in the United States of America. This requires

38 2009 Annual Report www.dcclosedendfunds.com

Notes to Financial Statements (continued)

December 31, 2009

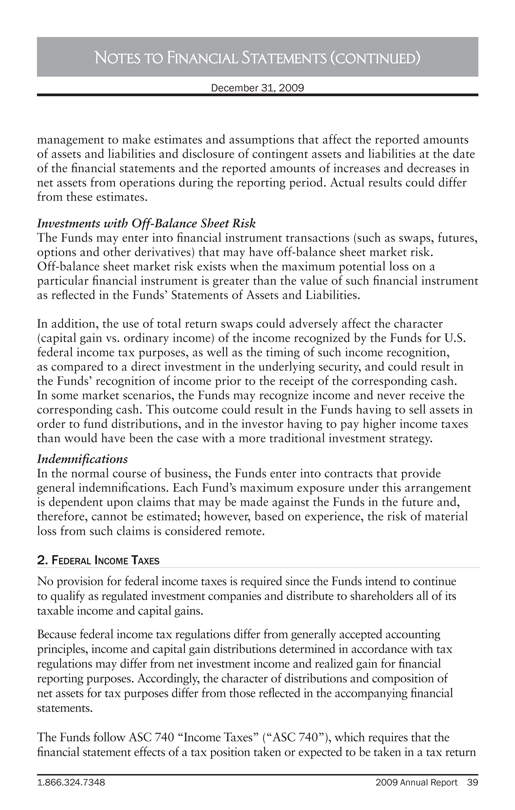

management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from these estimates.

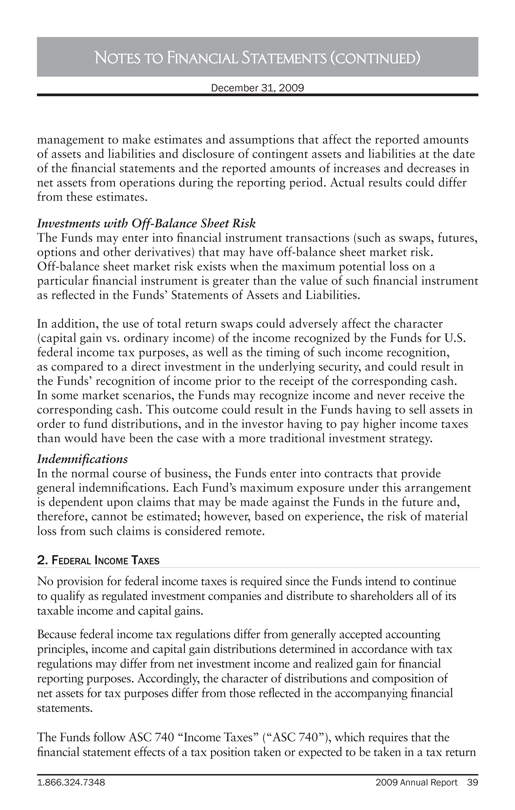

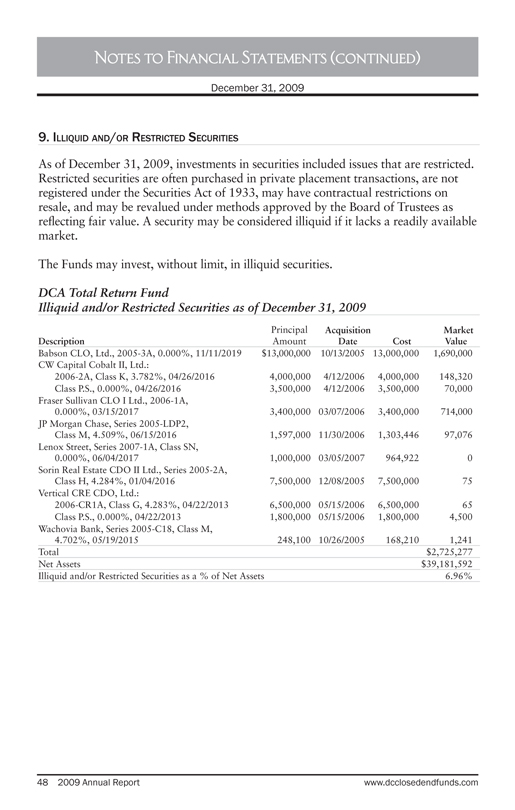

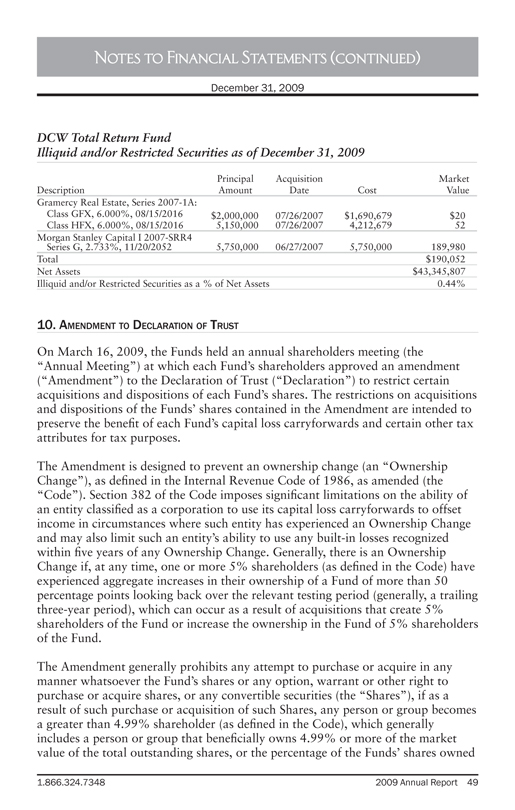

Investments with Off-Balance Sheet Risk

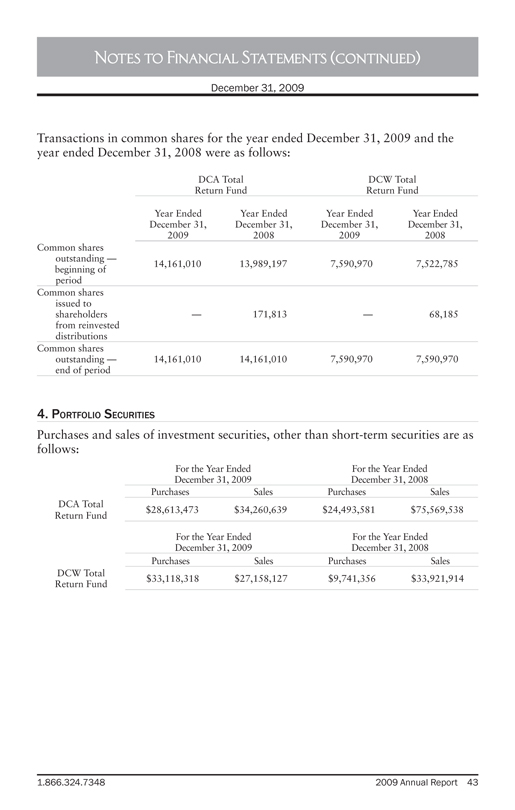

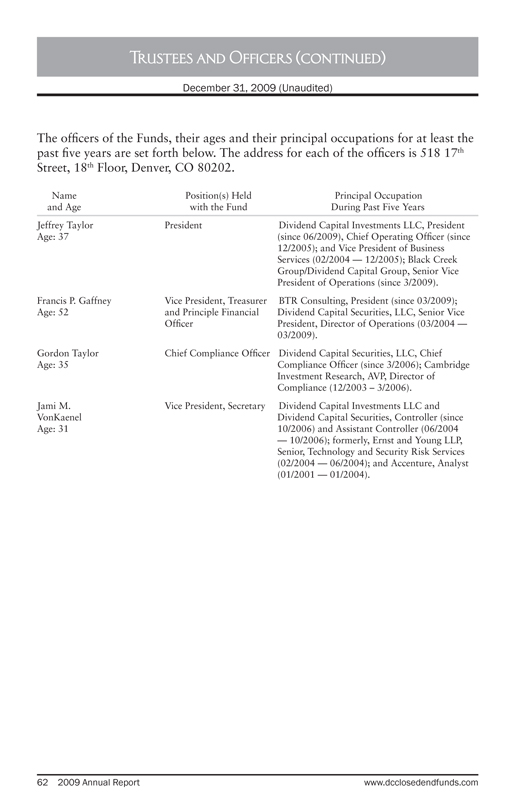

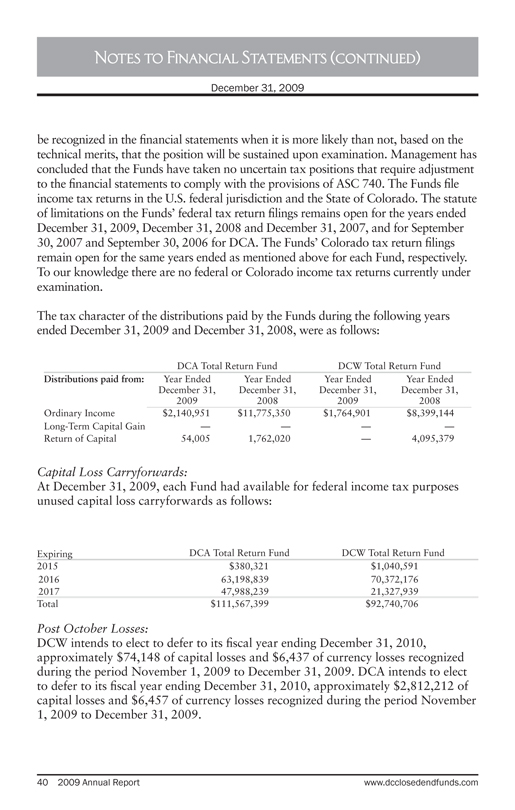

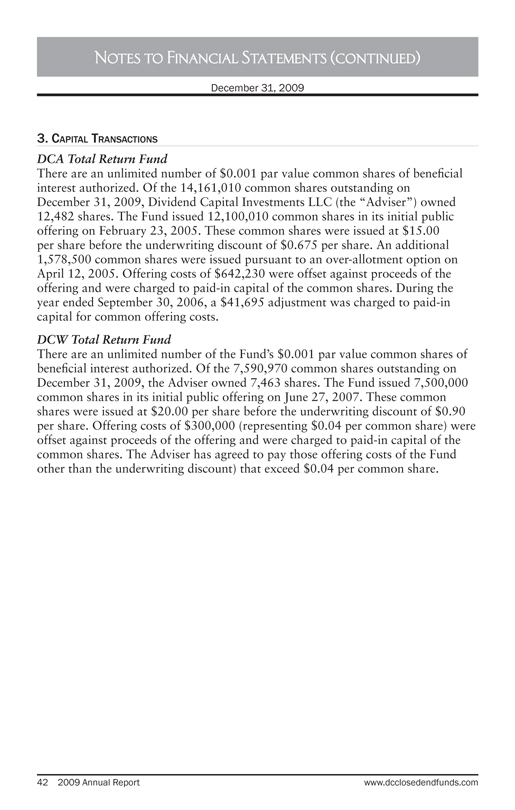

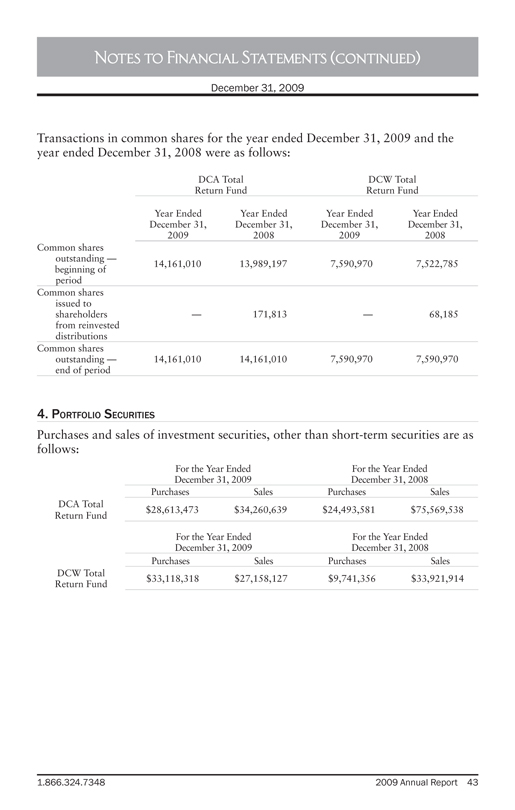

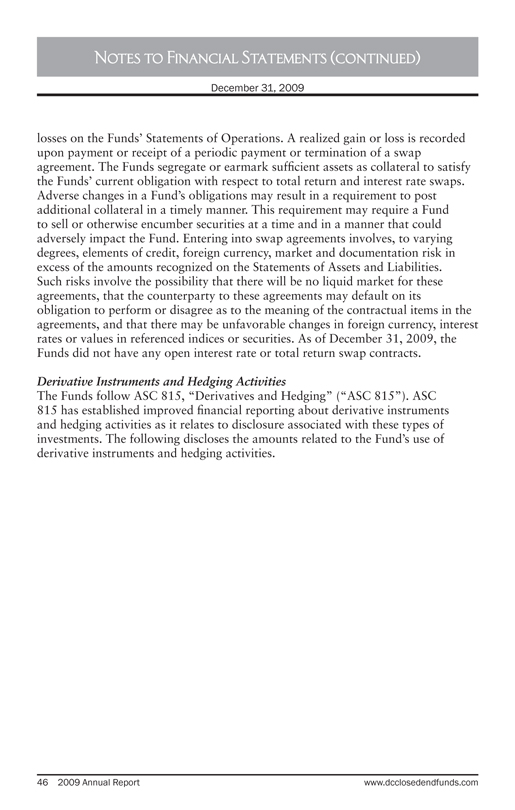

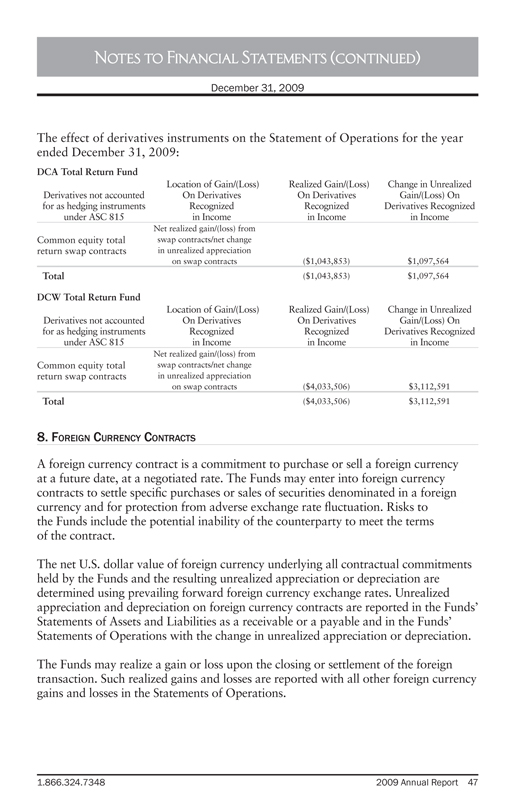

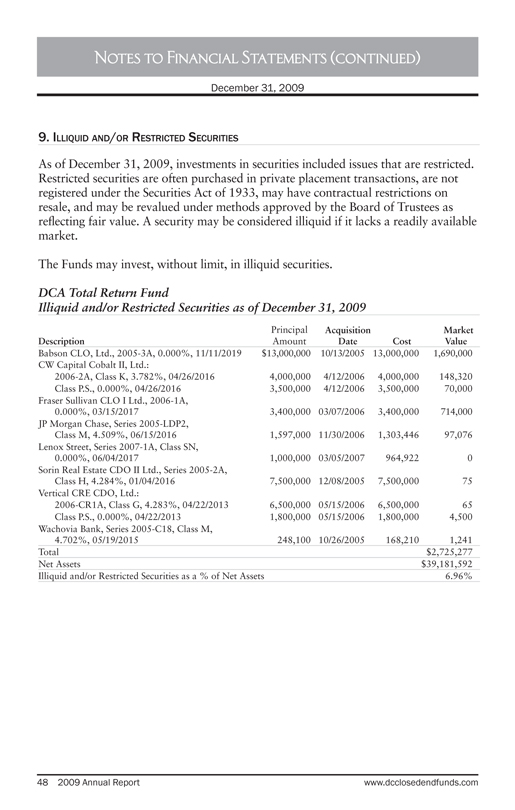

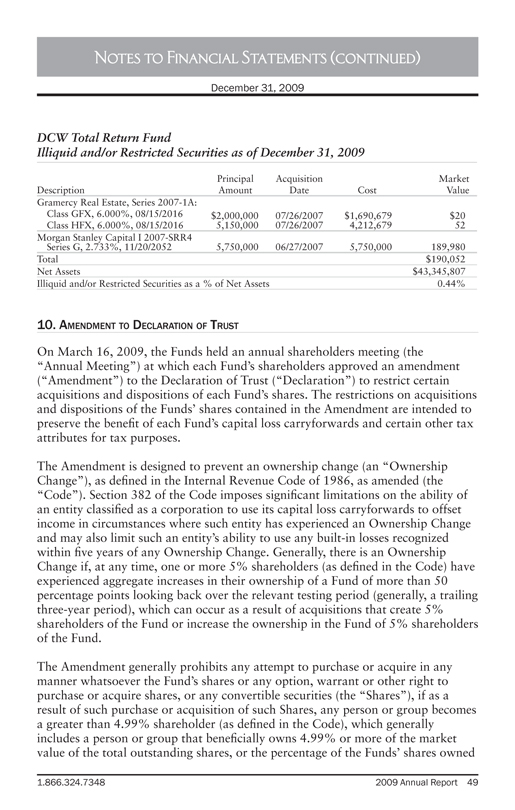

The Funds may enter into financial instrument transactions (such as swaps, futures, options and other derivatives) that may have off-balance sheet market risk. Off-balance sheet market risk exists when the maximum potential loss on a particular financial instrument is greater than the value of such financial instrument as reflected in the Funds’ Statements of Assets and Liabilities.