As filed with the Securities and Exchange Commission on September 3, 2010

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file Number: 811-21680

DCA Total Return Fund

(Exact Name of the Registrant as Specified in Charter)

518 17th Street, Suite 1200, Denver, CO 80202

(Address of Principal Executive Offices - Zip Code)

303-228-2200

Registrant’s Telephone Number, including area code:

Jeffrey W. Taylor

President

518 17th Street, Suite 1200

Denver, CO 80202

(Names and Addresses of agents for service)

Date of fiscal year end: December 31, 2010

Date of reporting period: June 30, 2010

Item 1. Reports to Shareholders

The following is a copy of the report to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “Act”).

Table of Contents

Shareholder Letter

2

DCA Total Return Fund (DCA)

Total Returns and Trading History

6

Portfolio Profile

7

DCW Total Return Fund (DCW)

Total Returns and Trading History

8

Portfolio Profile

9

Statement of Investments

DCA Total Return Fund

10

DCW Total Return Fund

18

Statements of Assets & Liabilities

26

Statements of Operations

27

Statements of Changes in Net Assets

DCA Total Return Fund

28

DCW Total Return Fund

29

Financial Highlights

DCA Total Return Fund

30

DCW Total Return Fund

32

Notes to Financial Statements

33

Dividend Reinvestment Plan

50

Fund Proxy Voting Policies and Procedures

51

Portfolio Holdings

52

Trustees and Officers

52

Approval of Investment Advisory Agreement

55

Key Information

58

The Shareholder Letter and other information included in this shareholder report may contain certain forward-looking statements about the factors that may affect the performance of the Funds in the future. These statements are based on Fund management’s predictions and expectations concerning certain future events and their expected impact on the Funds, such as performance of the economy as a whole and of the global capital markets, changes in the level of interest rates, the impact of developing world events, and other factors that may influence the future performance of the Funds. Management believes these forward looking statements to be reasonable, although they are inherently uncertain and difficult to predict and there is no guarantee of their accuracy. Actual events may cause adjustments in portfolio management strategies from those currently expected to be employed.

1.866.324.7348

2010 Semi-Annual Report (Unaudited) 1

Shareholder Letter

August 20, 2010

Fellow Shareholders,

Following a sharp rally in the capital markets in 2009, the U.S. economy has so far struggled in 2010 to extend the recovery from the worst recession since the Great Depression. Plagued by domestic challenges to growth at home, including persistently high unemployment and a prolonged housing slump, the U.S. economy faced added uncertainty as overseas markets sent mixed signals. While China, India and Brazil posted solid economic growth year-to-date, helping drive global demand, the euro-zone debt crisis overshadowed the recovery as concerns over sovereign debt levels spread, threatening growth prospects in the EU region and beyond. The end result has been a decline in global equity values as represented by the MSCI World Index return of -9.56% over the six-month period ending June 30, 2010.

Against this back-drop the Funds have performed relatively well. As displayed in the performance tables that follow this letter, during the six-months ended June 30, 2010, DCA’s NAV total return was 19.15% while the market price total return was 7.55% and DCW’s NAV total return was -1.98% while the market price total return was -5.23%.

During this period, both Funds’ performance was negatively influenced by overall market conditions, but positively influenced by their overall asset allocations. The Funds benefited not only from outperformance (relative to the MSCI World Index) experienced in their Calamos-managed global common equity strategy, but also experienced positive total returns from both Funds’ preferred equity portfolios. DCA also materially benefited from an increase in value and realization of substantial cash flows from its Collateralized Loan Obligation holdings. The performance of these securities accounts for the majority of the performance differential between the Funds. Real estate debt securities continued to be a negative influence on both Funds’ performance as the future income generation capability of certain positions was deemed to be unlikely.

During 2010, we continued our efforts to implement strategic changes for the Funds. Most notably, pursuant to a proxy statement dated July 30, 2010 each Fund’s Board of Trustees (the “Boards”), including the Independent Trustees, approved and are asking you to approve the following:

1. A proposal to elect two Trustees to serve three year terms, each to serve until his successor has been duly elected and qualified.

2. A proposal to approve the removal of the fundamental restriction requiring each Fund to invest greater than 25% of its total assets in securities of companies in the real estate industry.

2 2010 Semi-Annual Report (Unaudited)

www.dcclosedendfunds.com

SHAREHOLDER LETTER (CONTINUED)

| | 3. | | A proposal to approve an Agreement and Plan of Reorganization reorganizing DCW into DCA (the “Reorganization”), the termination of DCW’s registration under the Investment Company Act of 1940, and the dissolution of DCW under Delaware law. |

The proposals listed above include significant and we believe positive changes for the Funds.

First, the Boards believe the removal of the fundamental restrictions requiring each Fund to invest greater than 25% of its total assets in securities of real estate companies benefits shareholders by enabling the Funds greater asset class allocation flexibility, which will in turn facilitate investment opportunities to be sourced from a wider universe of securities. This increased flexibility potentially enhances each Fund’s ability to achieve its investment objective of total return.

Second, following shareholder meetings held March 16, 2009, the Funds changed their investment objectives and certain non-fundamental investment policies. This included changing their historic objectives of high current income with a secondary focus on capital appreciation to an objective of total return, eliminating the investment policies requiring at least 80% of managed assets to be invested in securities of real estate companies, removing any specific limitations regarding the Funds’ investment in foreign securities and modifying the dividend policies from a monthly level-rate payment to quarterly distributions. These changes result in global-oriented, total return Funds with investment strategies that may include investments in a wide range of securities that may include common equity, preferred equity, debt securities and derivative instruments.

As a result of these changes, the investment strategies and securities portfolios of the Funds have become substantially similar. Given their similarities and significant overlap in investment portfolios, the Boards believe shareholders of both Funds will benefit from the economies of scale to be realized by a merger. In addition, the total annual operating expense ratio of the combined fund after the Reorganization is expected to be lower than each Fund’s current total annual operating expense ratio, because the fixed expenses of the combined fund following the Reorganization will be spread over a larger asset base.

If you have not already done so, please take time to review the current proxy statement, which will discuss some of these changes in more detail and matters to be voted upon by shareholders at the September 16, 2010 Annual Meeting of Shareholders.

In closing, we believe the strategic changes discussed above will further help position the Funds to realize shareholder value by creating a single, combined fund that is focused on total return through investment in common equity, preferred equity, debt securities and derivative instruments across a broad range of industries and geographic regions. Consistent with the steps taken beginning in 2009, we will continue to assess ongoing opportunities to enhance the Funds’ return potential.

1.866.324.7348

2010 Semi-Annual Report (Unaudited) 3

SHAREHOLDER LETTER (CONTINUED)

As evidenced by the year-to-date market performance, we continue to believe that there is a premium on investment vigilance. However, we also believe this environment will create compelling, long-term investment opportunities and that the Funds have the potential to create long-term value for shareholders.

We thank you for your continued support.

Sincerely,

Jeffrey Taylor

Jeffrey Randall

President

Portfolio Manager

4 2010 Semi-Annual Report (Unaudited)

www.dcclosedendfunds.com

This Page Intentionally Left Blank

Total Returns and Trading History

June 30, 2010 (Unaudited)

DCA Total Return Fund

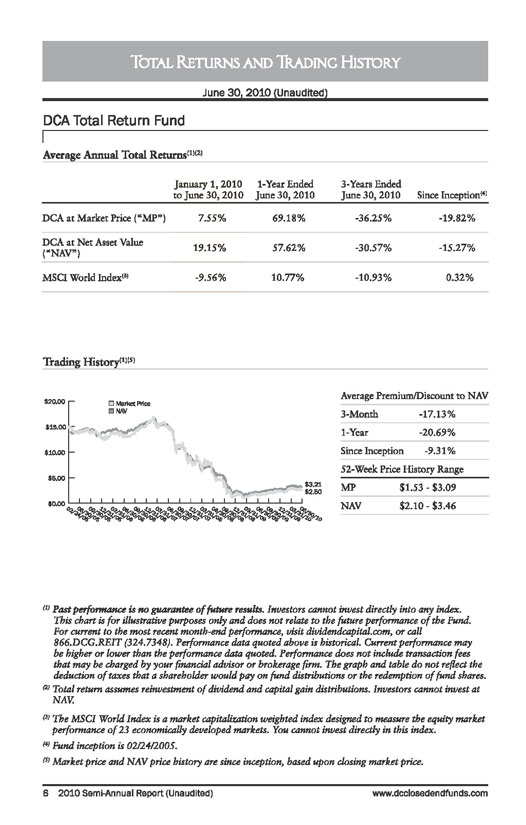

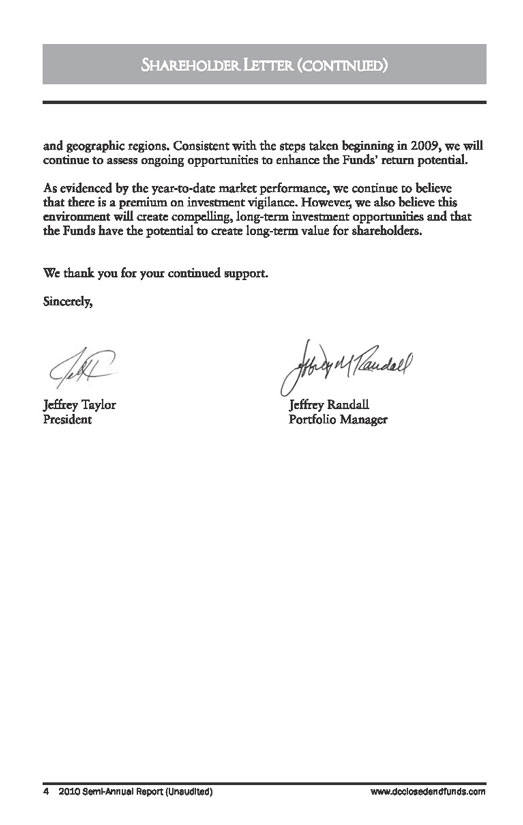

Average Annual Total Returns (1)(2)

January 1, 2010

to June 30, 2010

1-Year Ended

June 30, 2010

3-Years Ended

June 30, 2010

Since Inception (4)

DCA at Market Price (“MP”)

7.55%

69.18%

-36.25%

-19.82%

DCA at Net Asset Value (“NAV”)

19.15%

57.62%

-30.57%

-15.27%

MSCI World Index (3)

-9.56%

10.77%

-10.93%

0.32%

Trading History (1)(5)

Average Premium/Discount to NAV

3-Month

-17.13%

1-Year

-20.69%

Since Inception

-9.31%

52-Week Price History Range

MP

$1.53 - $3.09

NAV

$2.10 - $3.46

(1) Past performance is no guarantee of future results. Investors cannot invest directly into any index. This chart is for illustrative purposes only and does not relate to the future performance of the Fund. For current to the most recent month-end performance, visit dividendcapital.com, or call 866.DCG.REIT (324.7348). Performance data quoted above is historical. Current performance may be higher or lower than the performance data quoted. Performance does not include transaction fees that may be charged by your financial advisor or brokerage firm. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

(2) Total return assumes reinvestment of dividend and capital gain distributions. Investors cannot invest at NAV.

(3) The MSCI World Index is a market capitalization weighted index designed to measure the equity market performance of 23 economically developed markets. You cannot invest directly in this index.

(4) Fund inception is 02/24/2005.

(5) Market price and NAV price history are since inception, based upon closing market price.

6 2010 Semi-Annual Report (Unaudited)

www.dcclosedendfunds.com

Portfolio Profile

June 30, 2010 (Unaudited)

DCA Total Return Fund (continued)

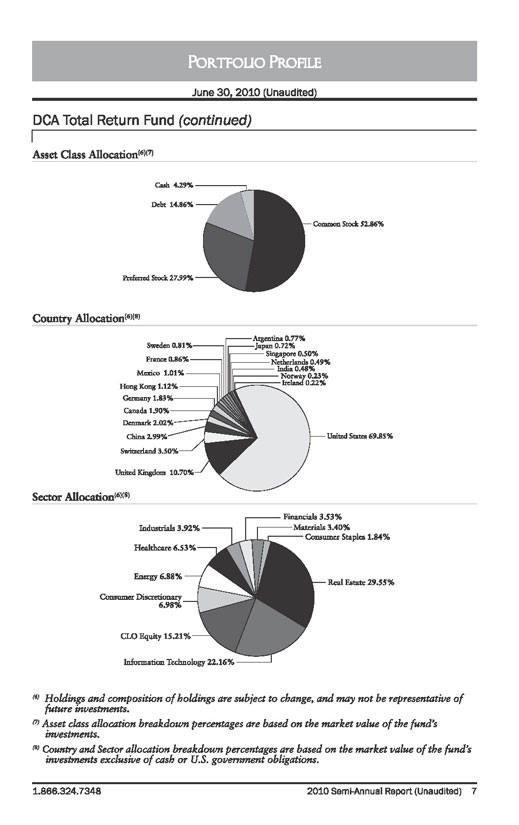

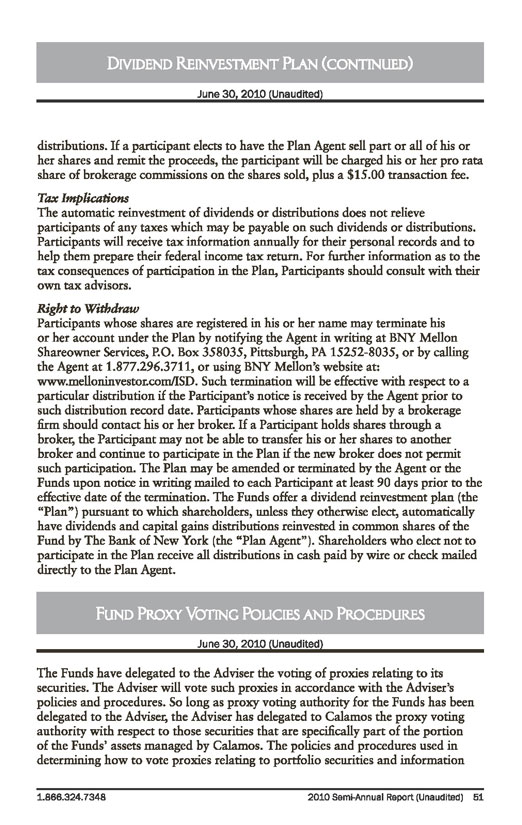

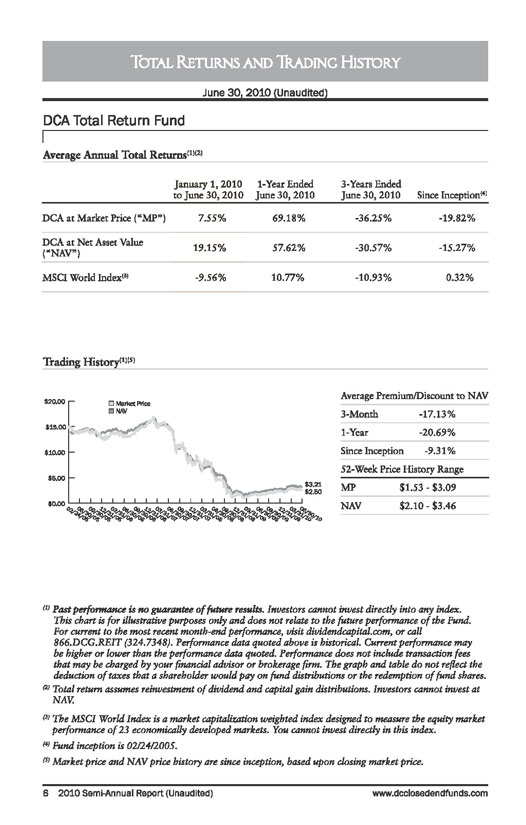

Asset Class Allocation (6)(7)

Country Allocation (6)(8)

Sector Allocation (6)(8)

(6) Holdings and composition of holdings are subject to change, and may not be representative of future investments.

(7) Asset class allocation breakdown percentages are based on the market value of the fund’s investments.

(8) Country and Sector allocation breakdown percentages are based on the market value of the fund’s investments exclusive of cash or U.S. government obligations.

1.866.324.7348

2010 Semi-Annual Report (Unaudited) 7

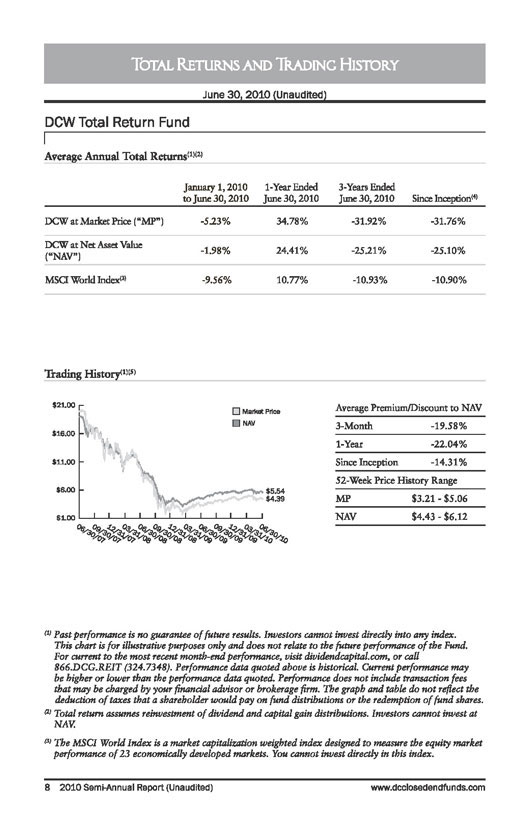

Total Returns and Trading History

June 30, 2010 (Unaudited)

DCW Total Return Fund

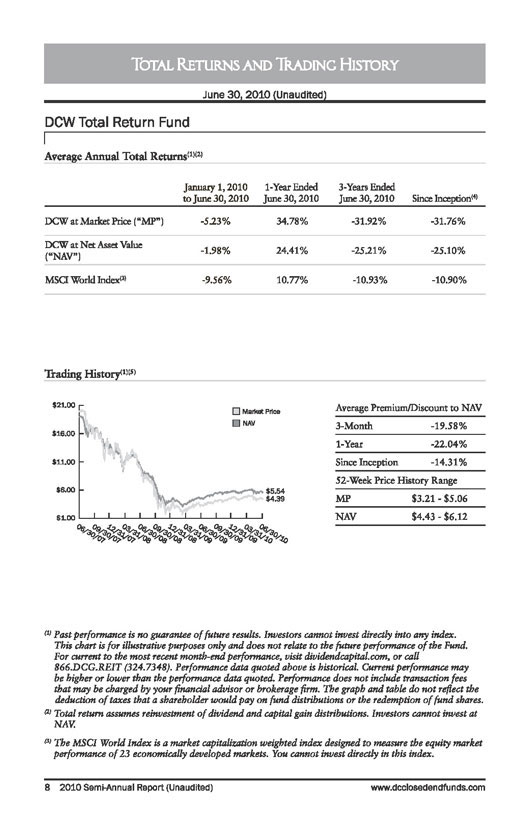

Average Annual Total Returns (1)(2)

January 1, 2010 to June 30, 2010

1-Year Ended June 30, 2010

3-Years Ended June 30, 2010

Since Inception (4)

DCW at Market Price (“MP”)

-5.23%

34.78%

-31.92%

-31.76%

DCW at Net Asset Value (“NAV”)

-1.98%

24.41%

-25.21%

-25.10%

MSCI World Index (3)

-9.56%

10.77%

-10.93%

-10.90%

Trading History (1)(5)

Average Premium/Discount to NAV

3-Month

-19.58%

1-Year

-22.04%

Since Inception

-14.31%

52-Week Price History Range

MP

$3.21 - $5.06

NAV

$4.43 - $6.12

(1) Past performance is no guarantee of future results. Investors cannot invest directly into any index. This chart is for illustrative purposes only and does not relate to the future performance of the Fund. For current to the most recent month-end performance, visit dividendcapital.com, or call 866.DCG.REIT (324.7348). Performance data quoted above is historical. Current performance may be higher or lower than the performance data quoted. Performance does not include transaction fees that may be charged by your financial advisor or brokerage firm. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

(2) Total return assumes reinvestment of dividend and capital gain distributions. Investors cannot invest at NAV.

(3) The MSCI World Index is a market capitalization weighted index designed to measure the equity market performance of 23 economically developed markets. You cannot invest directly in this index.

8 2010 Semi-Annual Report (Unaudited)

www.dcclosedendfunds.com

Portfolio Profile

June 30, 2010 (Unaudited)

DCW Total Return Fund (continued)

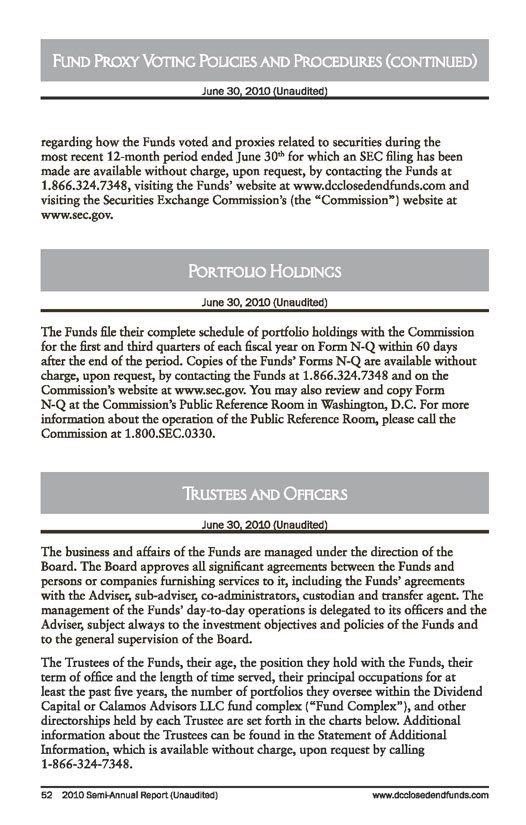

Asset Class Allocation (6)(7)

Country Allocation (6)(8)

Sector Allocation (6)(8)

(4) Fund inception is 06/27/2007.

(5) Market price and NAV price history are since inception, based upon closing market price.

(6) Holdings and composition of holdings are subject to change, and may not be representative of future investments.

(7) Asset class allocation breakdown percentages are based on the market value of the fund’s investments.

(8) Country and Sector allocation breakdown percentages are based on the market value of the fund’s investments exclusive of cash or U.S. government obligations.

1.866.324.7348

2010 Semi-Annual Report (Unaudited) 9

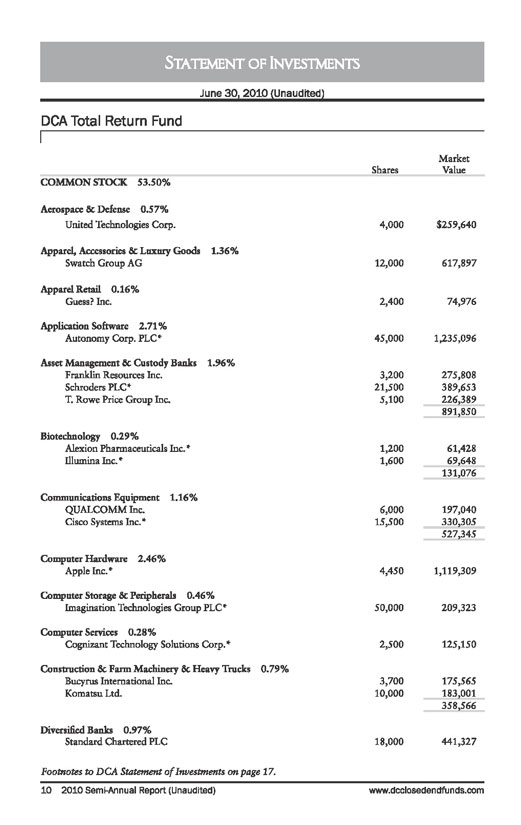

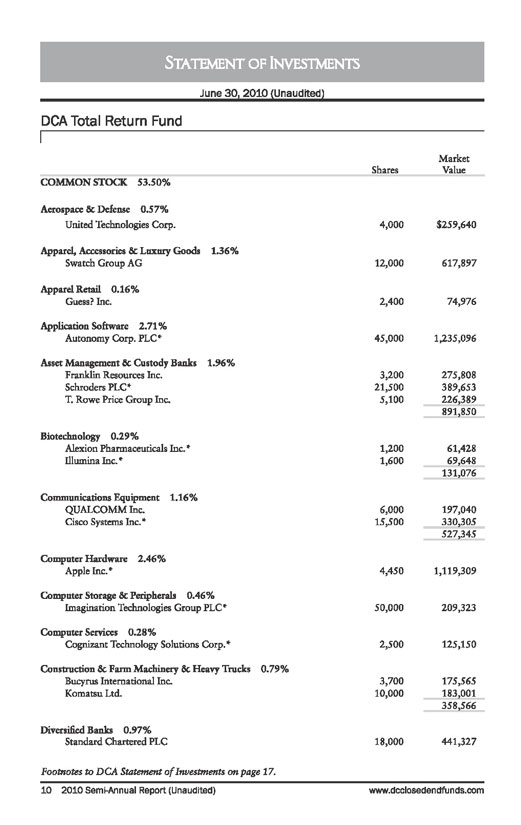

Statement of Investments

June 30, 2010 (Unaudited)

DCA Total Return Fund

Shares

Market Value

COMMON STOCK 53.50%

Aerospace & Defense 0.57%

United Technologies Corp.

4,000

$259,640

Apparel, Accessories & Luxury Goods 1.36%

Swatch Group AG

12,000

617,897

Apparel Retail 0.16%

Guess? Inc.

2,400

74,976

Application Software 2.71%

Autonomy Corp. PLC*

45,000

1,235,096

Asset Management & Custody Banks 1.96%

Franklin Resources Inc.

3,200

275,808

Schroders PLC*

21,500

389,653

T. Rowe Price Group Inc.

5,100

226,389

891,850

Biotechnology 0.29%

Alexion Pharmaceuticals Inc.*

1,200

61,428

Illumina Inc.*

1,600

69,648

131,076

Communications Equipment 1.16%

QUALCOMM Inc.

6,000

197,040

Cisco Systems Inc.*

15,500

330,305

527,345

Computer Hardware 2.46%

Apple Inc.*

4,450

1,119,309

Computer Storage & Peripherals 0.46%

Imagination Technologies Group PLC*

50,000

209,323

Computer Services 0.28%

Cognizant Technology Solutions Corp.*

2,500

125,150

Construction & Farm Machinery & Heavy Trucks 0.79%

Bucyrus International Inc.

3,700

175,565

Komatsu Ltd.

10,000

183,001

358,566

Diversified Banks 0.97%

Standard Chartered PLC

18,000

441,327

Footnotes to DCA Statement of Investments on page 17.

10 2010 Semi-Annual Report (Unaudited)

www.dcclosedendfunds.com

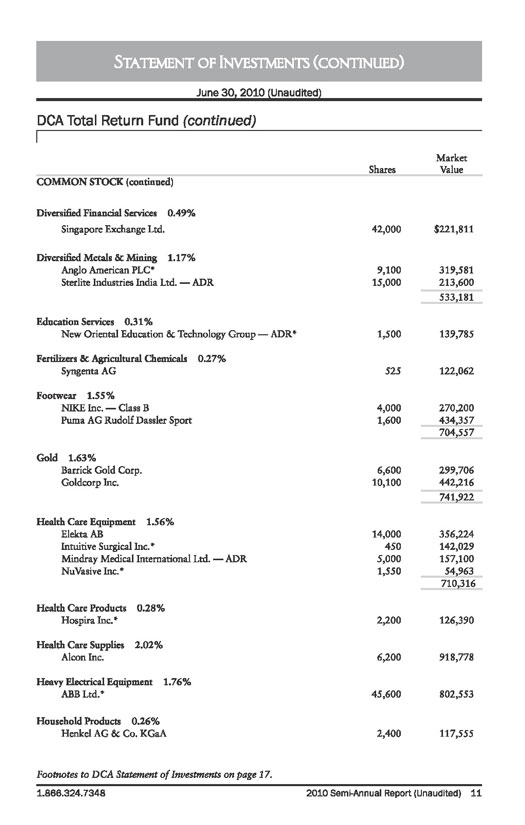

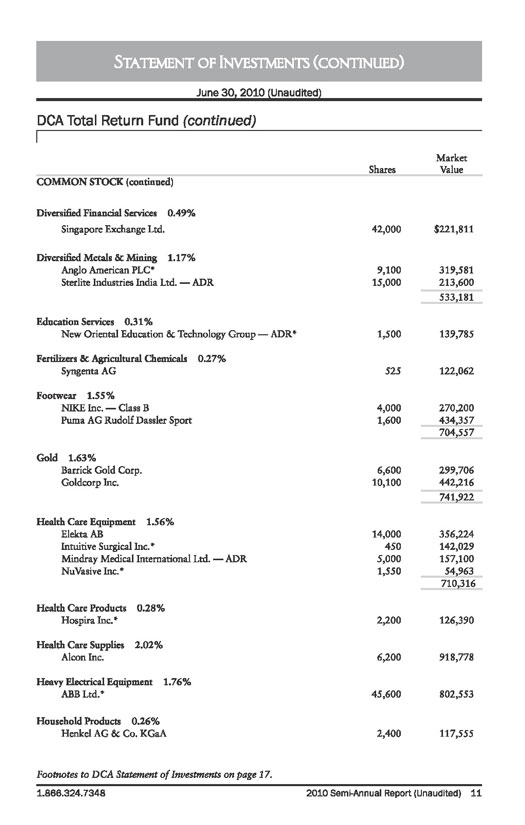

Statement of Investments (continued)

June 30, 2010 (Unaudited)

DCA Total Return Fund (continued)

Shares

Market Value

COMMON STOCK (continued)

Diversified Financial Services 0.49%

Singapore Exchange Ltd.

42,000

$221,811

Diversified Metals & Mining 1.17%

Anglo American PLC*

9,100

319,581

Sterlite Industries India Ltd. - ADR

15,000

213,600

533,181

Education Services 0.31%

New Oriental Education & Technology Group - ADR*

1,500

139,785

Fertilizers & Agricultural Chemicals 0.27%

Syngenta AG

525

122,062

Footwear 1.55%

NIKE Inc. - Class B

4,000

270,200

Puma AG Rudolf Dassler Sport

1,600

434,357

704,557

Gold 1.63%

Barrick Gold Corp.

6,600

299,706

Goldcorp Inc.

10,100

442,216

741,922

Health Care Equipment 1.56%

Elekta AB

14,000

356,224

Intuitive Surgical Inc.*

450

142,029

Mindray Medical International Ltd. - ADR

5,000

157,100

NuVasive Inc.*

1,550

54,963

710,316

Health Care Products 0.28%

Hospira Inc.*

2,200

126,390

Health Care Supplies 2.02%

Alcon Inc.

6,200

918,778

Heavy Electrical Equipment 1.76%

ABB Ltd.*

45,600

802,553

Household Products 0.26%

Henkel AG & Co. KGaA

2,400

117,555

Footnotes to DCA Statement of Investments on page 17.

1.866.324.7348

2010 Semi-Annual Report (Unaudited) 11

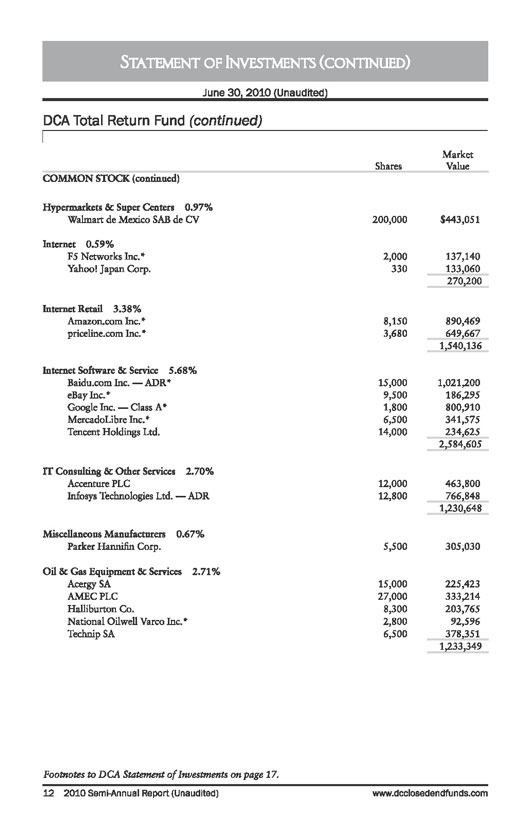

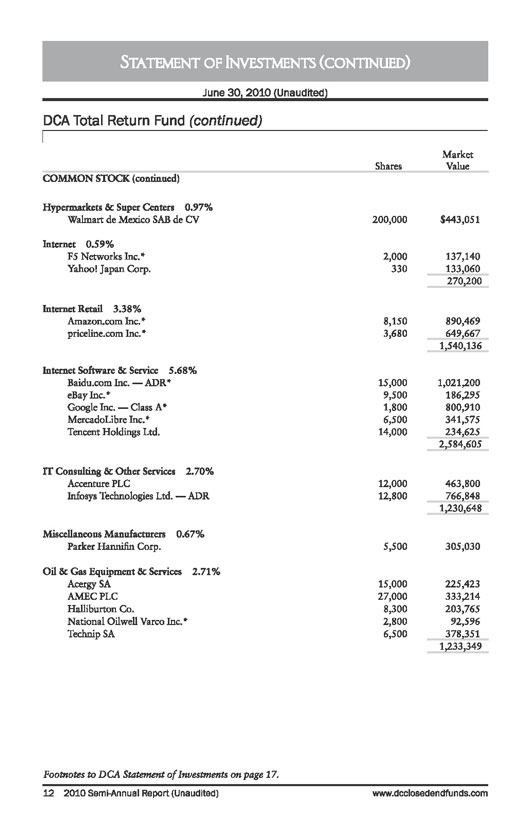

Statement of Investments (continued)

June 30, 2010 (Unaudited)

DCA Total Return Fund (continued)

Shares

Market Value

COMMON STOCK (continued)

Hypermarkets & Super Centers 0.97%

Walmart de Mexico SAB de CV

200,000

$443,051

Internet 0.59%

F5 Networks Inc.*

2,000

137,140

Yahoo! Japan Corp.

330

133,060

270,200

Internet Retail 3.38%

Amazon.com Inc.*

8,150

890,469

priceline.com Inc.*

3,680

649,667

1,540,136

Internet Software & Service 5.68%

Baidu.com Inc. - ADR*

15,000

1,021,200

eBay Inc.*

9,500

186,295

Google Inc. - Class A*

1,800

800,910

MercadoLibre Inc.*

6,500

341,575

Tencent Holdings Ltd.

14,000

234,625

2,584,605

IT Consulting & Other Services 2.70%

Accenture PLC

12,000

463,800

Infosys Technologies Ltd. - ADR

12,800

766,848

1,230,648

Miscellaneous Manufacturers 0.67%

Parker Hannifin Corp.

5,500

305,030

Oil & Gas Equipment & Services 2.71%

Acergy SA

15,000

225,423

AMEC PLC

27,000

333,214

Halliburton Co.

8,300

203,765

National Oilwell Varco Inc.*

2,800

92,596

Technip SA

6,500

378,351

1,233,349

Footnotes to DCA Statement of Investments on page 17.

12 2010 Semi-Annual Report (Unaudited)

www.dcclosedendfunds.com

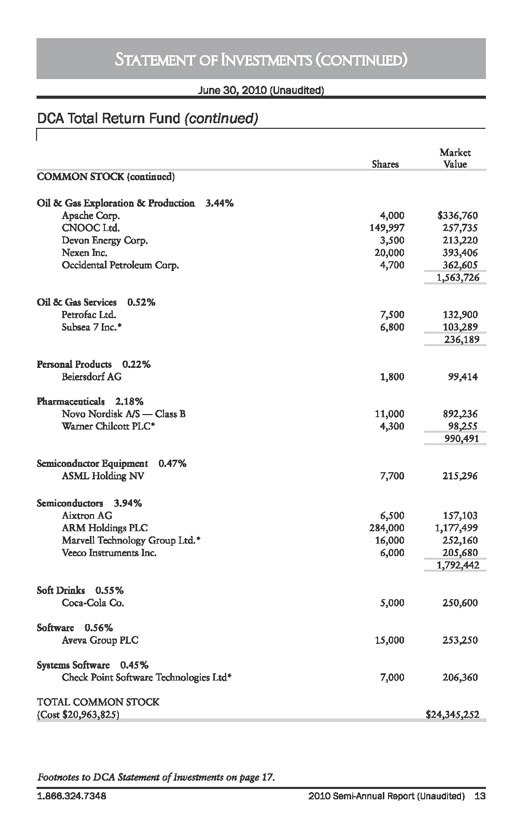

Statement of Investments (continued)

June 30, 2010 (Unaudited)

DCA Total Return Fund (continued)

Shares

Market

Value

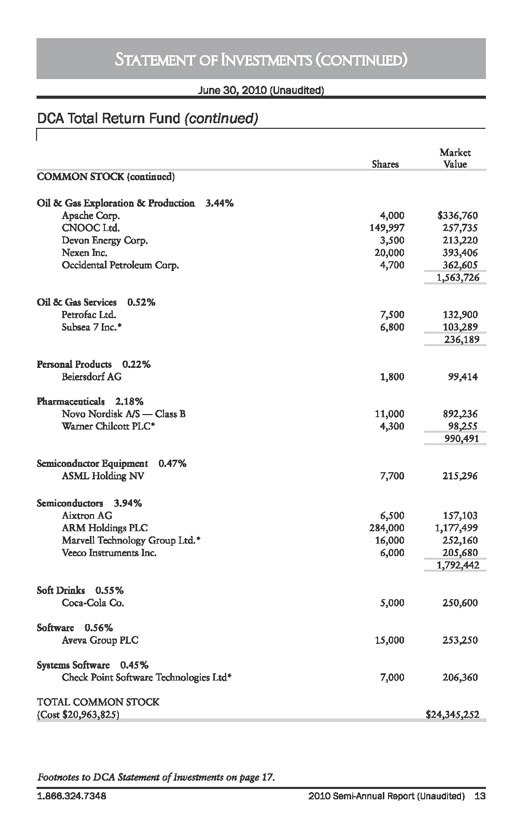

COMMON STOCK (continued)

Oil & Gas Exploration & Production 3.44%

Apache Corp.

4,000

$336,760

CNOOC Ltd.

149,997

257,735

Devon Energy Corp.

3,500

213,220

Nexen Inc.

20,000

393,406

Occidental Petroleum Corp.

4,700

362,605

1,563,726

Oil & Gas Services 0.52%

Petrofac Ltd.

7,500

132,900

Subsea 7 Inc.*

6,800

103,289

236,189

Personal Products 0.22%

Beiersdorf AG

1,800

99,414

Pharmaceuticals 2.18%

Novo Nordisk A/S - Class B

11,000

892,236

Warner Chilcott PLC*

4,300

98,255

990,491

Semiconductor Equipment 0.47%

ASML Holding NV

7,700

215,296

Semiconductors 3.94%

Aixtron AG

6,500

157,103

ARM Holdings PLC

284,000

1,177,499

Marvell Technology Group Ltd.*

16,000

252,160

Veeco Instruments Inc.

6,000

205,680

1,792,442

Soft Drinks 0.55%

Coca-Cola Co.

5,000

250,600

Software 0.56%

Aveva Group PLC

15,000

253,250

Systems Software 0.45%

Check Point Software Technologies Ltd*

7,000

206,360

TOTAL COMMON STOCK

(Cost $20,963,825)

$24,345,252

Footnotes to DCA Statement of Investments on page 17.

1.866.324.7348

2010 Semi-Annual Report (Unaudited) 13

Statement of Investments (continued)

June 30, 2010 (Unaudited)

DCA Total Return Fund (continued)

Bond Rating Moody’s/S&P (Unaudited)

Shares

Market Value

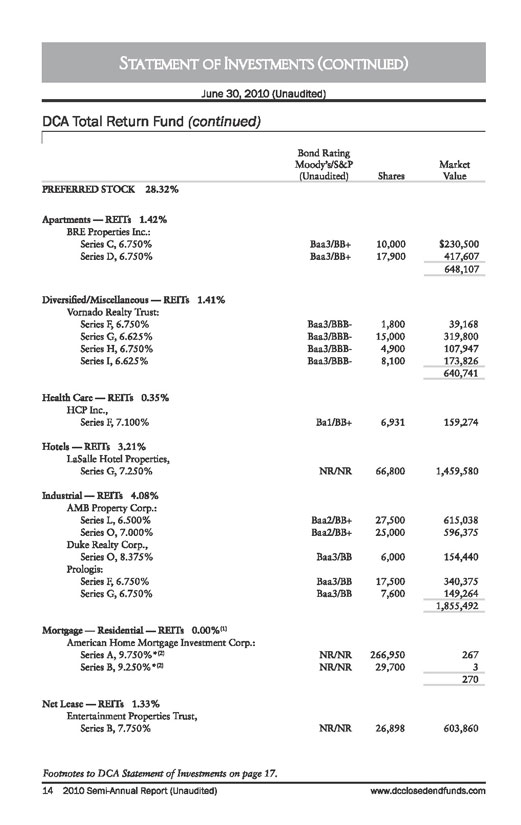

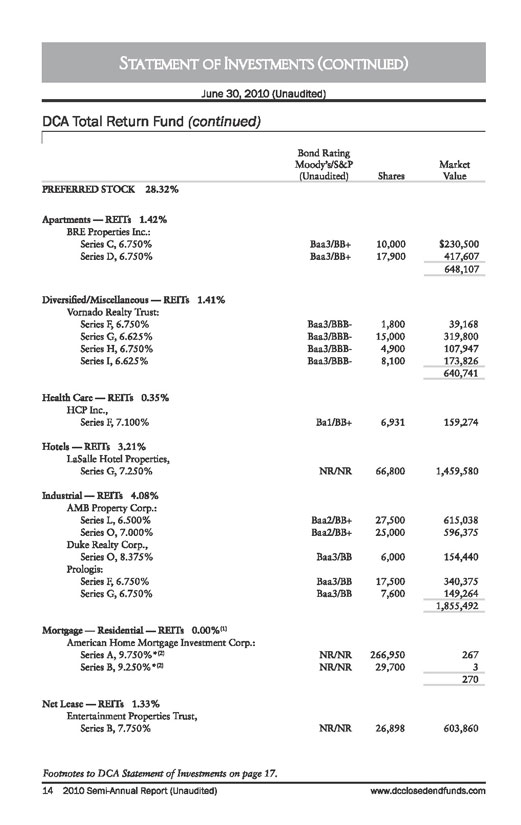

PREFERRED STOCK 28.32%

Apartments - REITs 1.42%

BRE Properties Inc.:

Series C, 6.750%

Baa3/BB+

10,000

$230,500

Series D, 6.750%

Baa3/BB+

17,900

417,607

648,107

Diversified/Miscellaneous - REITs 1.41%

Vornado Realty Trust:

Series F, 6.750%

Baa3/BBB-

1,800

39,168

Series G, 6.625%

Baa3/BBB-

15,000

319,800

Series H, 6.750%

Baa3/BBB-

4,900

107,947

Series I, 6.625%

Baa3/BBB-

8,100

173,826

640,741

Health Care - REITs 0.35%

HCP Inc.,

Series F, 7.100%

Bal/BB+

6,931

159,274

Hotels - REITs 3.21%

LaSalle Hotel Properties,

Series G, 7.250%

NR/NR

66,800

1,459,580

Industrial - REITs 4.08%

AMB Property Corp.:

Series L, 6.500%

Baa2/BB+

27,500

615,038

Series O, 7.000%

Baa2/BB+

25,000

596,375

Duke Realty Corp.,

Series O, 8.375%

Baa3/BB

6,000

154,440

Prologis:

Series F, 6.750%

Baa3/BB

17,500

340,375

Series G, 6.750%

Baa3/BB

7,600

149,264

1,855,492

Mortgage - Residential - REITs 0.00% (1)

American Home Mortgage Investment Corp.:

Series A, 9.750%* (2)

NR/NR

266,950

267

Series B, 9.250%* (2)

NR/NR

29,700

3

270

Net Lease - REITs 1.33%

Entertainment Properties Trust,

Series B, 7.750%

NR/NR

26,898

603,860

Footnotes to DCA Statement of Investments on page 17.

14 2010 Semi-Annual Report (Unaudited)

www.dcclosedendfunds.com

Statement of Investments (continued)

June 30, 2010 (Unaudited)

DCA Total Return Fund (continued)

Bond Rating Moody’s/S&P (Unaudited)

Shares

Market Value

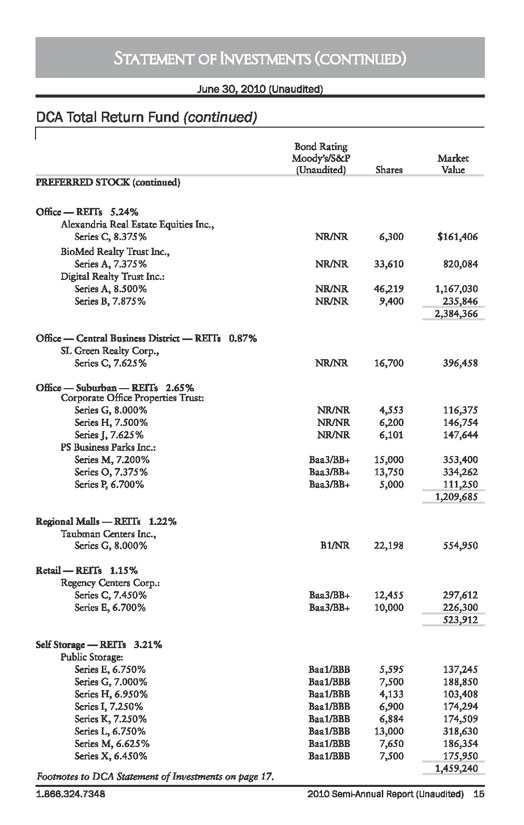

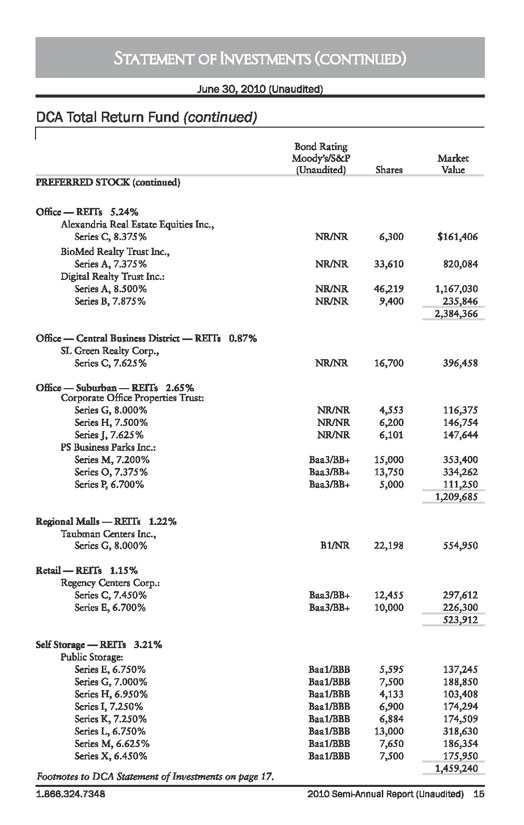

PREFERRED STOCK (continued)

Office - REITs 5.24%

Alexandria Real Estate Equities Inc.,

Series C, 8.375%

NR/NR

6,300

$161,406

BioMed Realty Trust Inc.,

Series A, 7.375%

NR/NR

33,610

820,084

Digital Realty Trust Inc.:

Series A, 8.500%

NR/NR

46,219

1,167,030

Series B, 7.875%

NR/NR

9,400

235,846

2,384,366

Office - Central Business District - REITs 0.87%

SL Green Realty Corp.,

Series C, 7.625%

NR/NR

16,700

396,458

Office - Suburban - REITs 2.65%

Corporate Office Properties Trust:

Series G, 8.000%

NR/NR

4,553

116,375

Series H, 7.500%

NR/NR

6,200

146,754

Series J, 7.625%

NR/NR

6,101

147,644

PS Business Parks Inc.:

Series M, 7.200%

Baa3/BB+

15,000

353,400

Series O, 7.375%

Baa3/BB+

13,750

334,262

Series P, 6.700%

Baa3/BB+

5,000

111,250

1,209,685

Regional Malls - REITs 1.22%

Taubman Centers Inc.,

Series G, 8.000%

Bl/NR

22,198

554,950

Retail - REITs 1.15%

Regency Centers Corp.:

Series C, 7.450%

Baa3/BB+

12,455

297,612

Series E, 6.700%

Baa3/BB+

10,000

226,300

523,912

Self Storage - REITs 3.21%

Public Storage:

Series E, 6.750%

Baal/BBB

5,595

137,245

Series G, 7.000%

Baal/BBB

7,500

188,850

Series H, 6.950%

Baal/BBB

4,133

103,408

Series I, 7.250%

Baal/BBB

6,900

174,294

Series K, 7.250%

Baal/BBB

6,884

174,509

Series L, 6.750%

Baal/BBB

13,000

318,630

Series M, 6.625%

Baal/BBB

7,650

186,354

Series X, 6.450%

Baal/BBB

7,500

175,950

1,459,240

Footnotes to DCA Statement of Investments on page 17.

1.866.324.7348

2010 Semi-Annual Report (Unaudited) 15

Statement of Investments (continued)

June 30, 2010 (Unaudited)

DCA Total Return Fund (continued)

Bond Rating Moody’s/S&P (Unaudited)

Shares

Market

Value

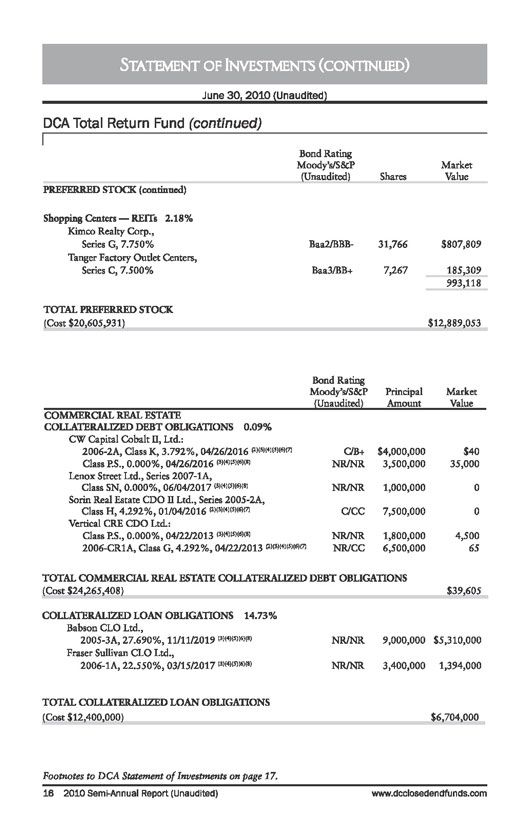

PREFERRED STOCK (continued)

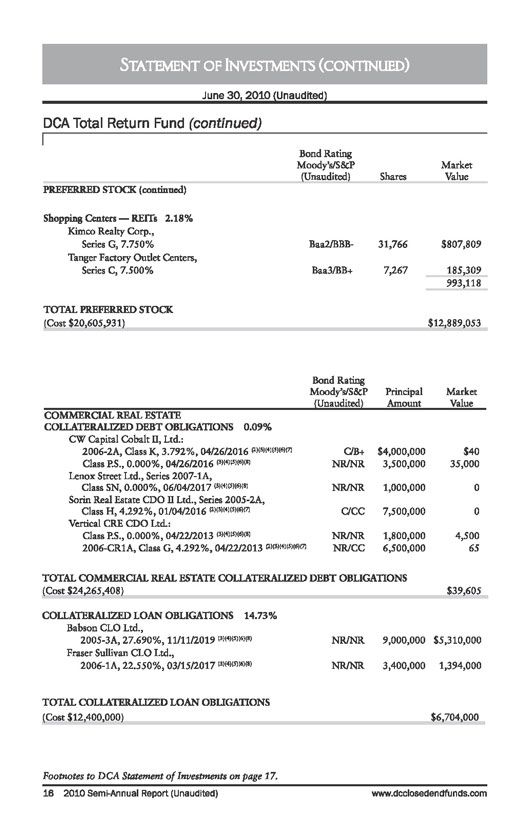

Shopping Centers - REITs 2.18%

Kimco Realty Corp.,

Series G, 7.750%

Baa2/BBB-

31,766

$807,809

Tanger Factory Outlet Centers,

Series C, 7.500%

Baa3/BB+

7,267

185,309

993,118

TOTAL PREFERRED STOCK

(Cost $20,605,931)

$12,889,053

Bond Rating Moody’s/S&P (Unaudited)

Principal Amount

Market

Value

COMMERCIAL REAL ESTATE

COLLATERALIZED DEBT OBLIGATIONS 0.09%

CW Capital Cobalt II, Ltd.:

2006-2A, Class K, 3.792%, 04/26/2016 (2)(3)(4)(5)(6)(7)

C/B+

$4,000,000

$40

Class P.S., 0.000%, 04/26/2016 (3)(4)(5)(6)(8)

NR/NR

3,500,000

35,000

Lenox Street Ltd., Series 2007-1A,

Class SN, 0.000%, 06/04/2017 (3)(4)(5)(6)(8)

NR/NR

1,000,000

0

Sorin Real Estate CDO II Ltd., Series 2005-2A,

Class H, 4.292%, 01/04/2016 (2)(3)(4)(5)(6)(7)

C/CC

7,500,000

0

Vertical CRE CDO Ltd.:

Class P.S., 0.000%, 04/22/2013 (3)(4)(5)(6)(8)

NR/NR

1,800,000

4,500

2006-CR1A, Class G, 4.292%, 04/22/2013 (2)(3)(4)(5)(6)(7)

NR/CC

6,500,000

65

TOTAL COMMERCIAL REAL ESTATE COLLATERALIZED DEBT OBLIGATIONS

(Cost $24,265,408)

$39,605

COLLATERALIZED LOAN OBLIGATIONS 14.73%

Babson CLO Ltd.,

2005-3A, 27.690%, 11/11/2019 (3)(4)(5)(6)(8)

NR/NR

9,000,000

$5,310,000

Fraser Sullivan CLO Ltd.,

2006-1A, 22.550%, 03/15/2017 (3)(4)(5)(6)(8)

NR/NR

3,400,000

1,394,000

TOTAL COLLATERALIZED LOAN OBLIGATIONS

(Cost $12,400,000)

$6,704,000

Footnotes to DCA Statement of Investments on page 17.

16 2010 Semi-Annual Report (Unaudited)

www.dcclosedendfunds.com

Statement of Investments (continued)

June 30, 2010 (Unaudited)

DCA Total Return Fund (continued)

Bond Rating Moody’s/S&P (Unaudited)

Shares/

Principal Amount

Market

Value

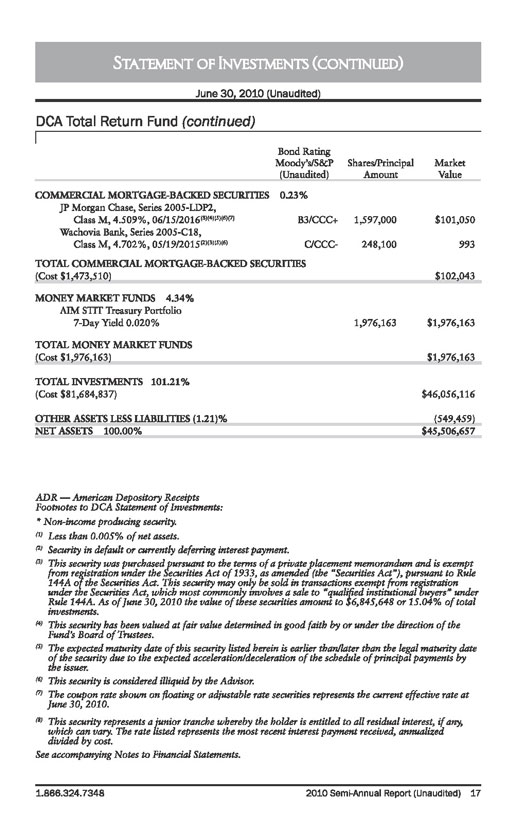

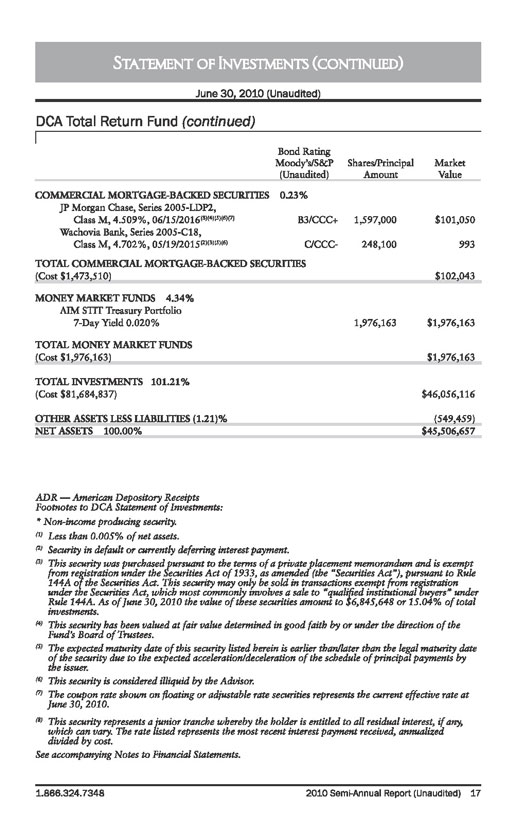

COMMERCIAL MORTGAGE-BACKED SECURITIES 0.23%

JP Morgan Chase, Series 2005-LDP2,

Class M, 4.509%, 06/15/2016 (3)(4)(5)(6)(7)

B3/CCC+

1,597,000

$101,050

Wachovia Bank, Series 2005-C18,

Class M, 4.702%, 05/19/2015 (2)(3)(5)(6)

C/CCC-

248,100

993

TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES

(Cost $1,473,510)

$102,043

MONEY MARKET FUNDS 4.34%

AIM STIT Treasury Portfolio

7-Day Yield 0.020%

1,976,163

$1,976,163

TOTAL MONEY MARKET FUNDS

(Cost $1,976,163)

$1,976,163

TOTAL INVESTMENTS 101.21%

(Cost $81,684,837)

$46,056,116

OTHER ASSETS LESS LIABILITIES (1.21)%

(549,459)

NET ASSETS 100.00%

$45,506,657

ADR – American Depository Receipts

Footnotes to DCA Statement of Investments:

* Non-income producing security.

(1) Less than 0.005% of net assets.

(2) Security in default or currently deferring interest payment.

(3) This security was purchased pursuant to the terms of a private placement memorandum and is exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”), pursuant to Rule 144A of the Securities Act. This security may only be sold in transactions exempt from registration under the Securities Act, which most commonly involves a sale to “qualified institutional buyers” under Rule 144A. As of June 30, 2010 the value of these securities amount to $6,845,648 or 15.04% of total investments.

(4) This security has been valued at fair value determined in good faith by or under the direction of the Fund’s Board of Trustees.

(5) The expected maturity date of this security listed herein is earlier than/later than the legal maturity date of the security due to the expected acceleration/deceleration of the schedule of principal payments by the issuer.

{6) This security is considered illiquid by the Advisor.

(7) The coupon rate shown on floating or adjustable rate securities represents the current effective rate at June 30, 2010.

(8) This security represents a junior tranche whereby the holder is entitled to all residual interest, if any, which can vary. The rate listed represents the most recent interest payment received, annualized divided by cost.

See accompanying Notes to Financial Statements.

1.866.324.7348

2010 Semi-Annual Report (Unaudited) 17

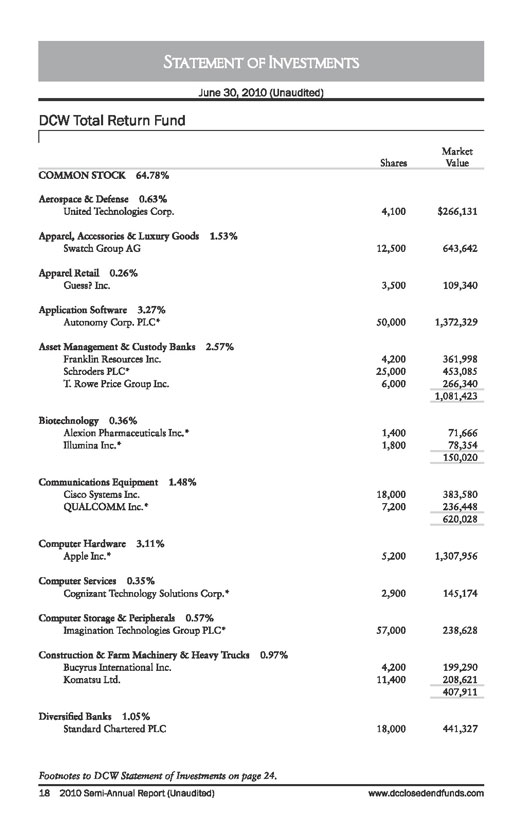

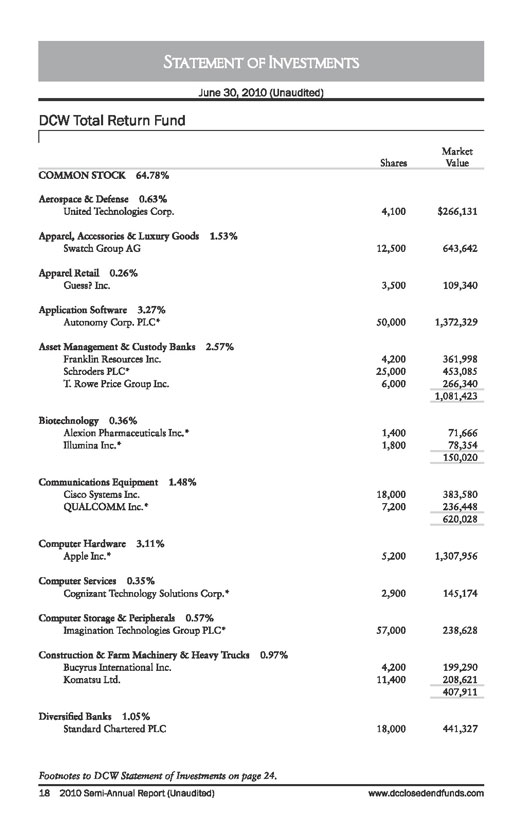

Statement of Investments

June 30, 2010 (Unaudited)

DCW Total Return Fund

Shares

Market Value

COMMON STOCK 64.78%

Aerospace & Defense 0.63%

United Technologies Corp.

4,100

$266,131

Apparel, Accessories & Luxury Goods 1.53%

Swatch Group AG

12,500

643,642

Apparel Retail 0.26%

Guess? Inc.

3,500

109,340

Application Software 3.27%

Autonomy Corp. PLC*

50,000

1,372,329

Asset Management & Custody Banks 2.57%

Franklin Resources Inc.

4,200

361,998

Schroders PLC*

25,000

453,085

T. Rowe Price Group Inc.

6,000

266,340

1,081,423

Biotechnology 0.36%

Alexion Pharmaceuticals Inc.*

1,400

71,666

Illumina Inc.*

1,800

78,354

150,020

Communications Equipment 1.48%

Cisco Systems Inc.

18,000

383,580

QUALCOMM Inc.*

7,200

236,448

620,028

Computer Hardware 3.11%

Apple Inc.*

5,200

1,307,956

Computer Services 0.35%

Cognizant Technology Solutions Corp.*

2,900

145,174

Computer Storage & Peripherals 0.57%

Imagination Technologies Group PLC*

57,000

238,628

Construction & Farm Machinery & Heavy Trucks 0.97%

Bucyrus International Inc.

4,200

199,290

Komatsu Ltd.

11,400

208,621

407,911

Diversified Banks 1.05%

Standard Chartered PLC

18,000

441,327

Footnotes to DCW Statement of Investments on page 24.

18 2010 Semi-Annual Report (Unaudited)

www.dcclosedendfunds.com

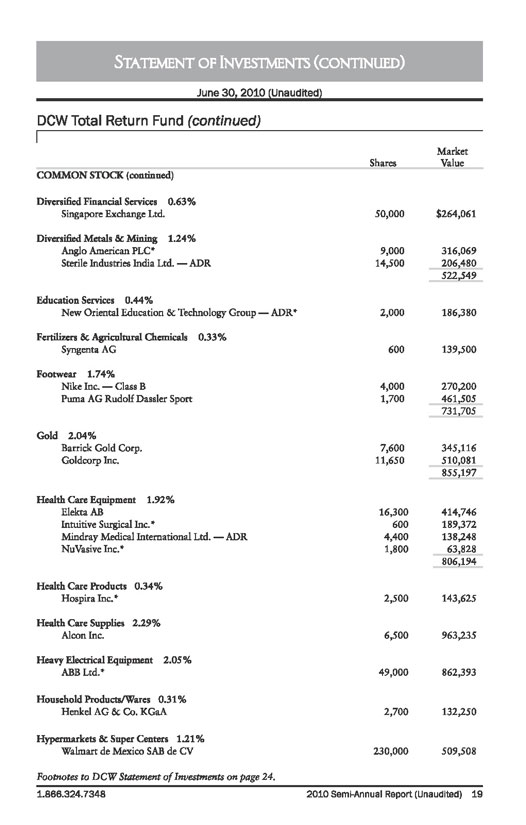

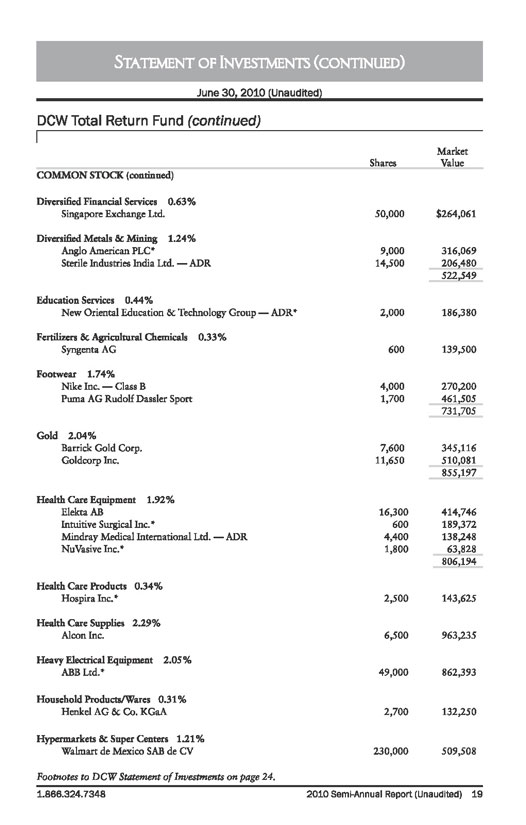

Statement of Investments (continued)

June 30, 2010 (Unaudited)

DCW Total Return Fund (continued)

Shares

Market Value

COMMON STOCK (continued)

Diversified Financial Services 0.63%

Singapore Exchange Ltd.

50,000

$264,061

Diversified Metals & Mining 1.24%

Anglo American PLC*

9,000

316,069

Sterile Industries India Ltd. - ADR

14,500

206,480

522,549

Education Services 0.44%

New Oriental Education & Technology Group - ADR*

2,000

186,380

Fertilizers & Agricultural Chemicals 0.33%

Syngenta AG

600

139,500

Footwear 1.74%

Nike Inc. - Class B

4,000

270,200

Puma AG Rudolf Dassler Sport

1,700

461,505

731,705

Gold 2.04%

Barrick Gold Corp.

7,600

345,116

Goldcorp Inc.

11,650

510,081

855,197

Health Care Equipment 1.92%

Elekta AB

16,300

414,746

Intuitive Surgical Inc.*

600

189,372

Mindray Medical International Ltd. - ADR

4,400

138,248

NuVasive Inc.*

1,800

63,828

806,194

Health Care Products 0.34%

Hospira Inc.*

2,500

143,625

Health Care Supplies 2.29%

Alcon Inc.

6,500

963,235

Heavy Electrical Equipment 2.05%

ABB Ltd.*

49,000

862,393

Household Products/Wares 0.31 %

Henkel AG & Co. KGaA

2,700

132,250

Hypermarkets & Super Centers 1.21%

Walmart de Mexico SAB de CV

230,000

509,508

Footnotes to DCW Statement of Investments on page 24.

1.866.324.7348

2010 Semi-Annual Report (Unaudited) 19

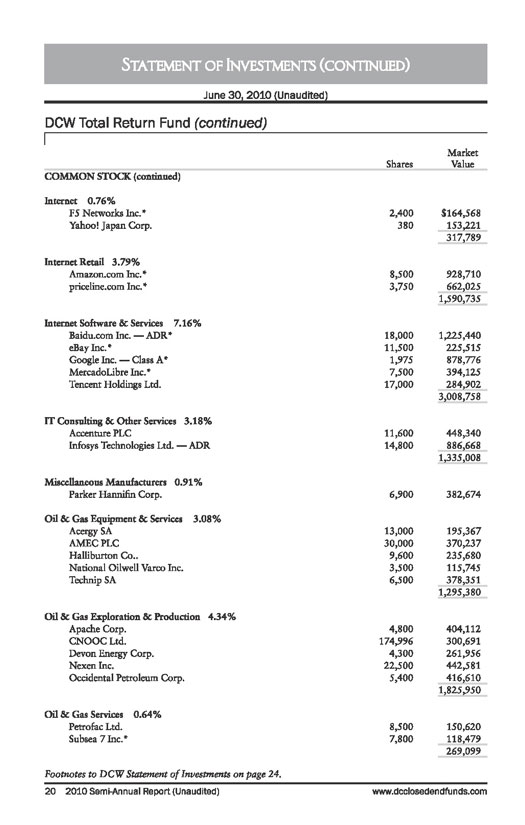

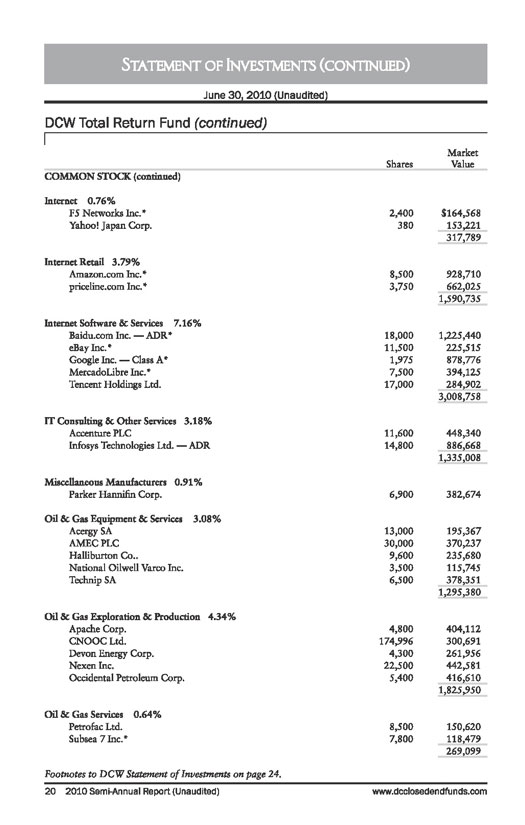

Statement of Investments (continued)

June 30, 2010 (Unaudited)

DCW Total Return Fund (continued)

Shares Market Value COMMON STOCK (continued) Internet 0.76%

F5 Networks Inc.* 2,400 $164,568

Yahoo! Japan Corp. 380 153,221 317,789

Internet Retail 3.79%

Amazon.com Inc.* 8,500 928,710 priceline.com Inc.* 3,750 662,025 1,590,735

Internet Software & Services 7.16%

Baidu.com Inc. - ADR*

18,000

1,225,440

eBay Inc.*

11,500

225,515

Google Inc. - Class A*

1,975

878,776

MercadoLibre Inc.*

7,500

394,125

Tencent Holdings Ltd.

17,000

284,902

3,008,758

IT Consulting & Other Services 3.18%

Accenture PLC

11,600

448,340

Infosys Technologies Ltd. - ADR

14,800

886,668

1,335,008

Miscellaneous Manufacturers 0.91%

Parker Hannifin Corp.

6,900

382,674

Oil & Gas Equipment & Services 3.08%

Acergy SA

13,000

195,367

AMEC PLC

30,000

370,237

Halliburton Co.

9,600

235,680

National Oilwell Varco Inc.

3,500

115,745

Technip SA

6,500

378,351

1,295,380

Oil & Gas Exploration & Production 4.34%

Apache Corp.

4,800

404,112

CNOOC Ltd.

174,996

300,691

Devon Energy Corp.

4,300

261,956

Nexen Inc.

22,500

442,581

Occidental Petroleum Corp.

5,400

416,610

1,825,950

Oil & Gas Services 0.64%

Petrofac Ltd.

8,500

150,620

Subsea 7 Inc.*

7,800

118,479

269,099

Footnotes to DCW Statement of Investments on page 24.

20 2010 Semi-Annual Report (Unaudited)

www.dcclosedendfunds.com

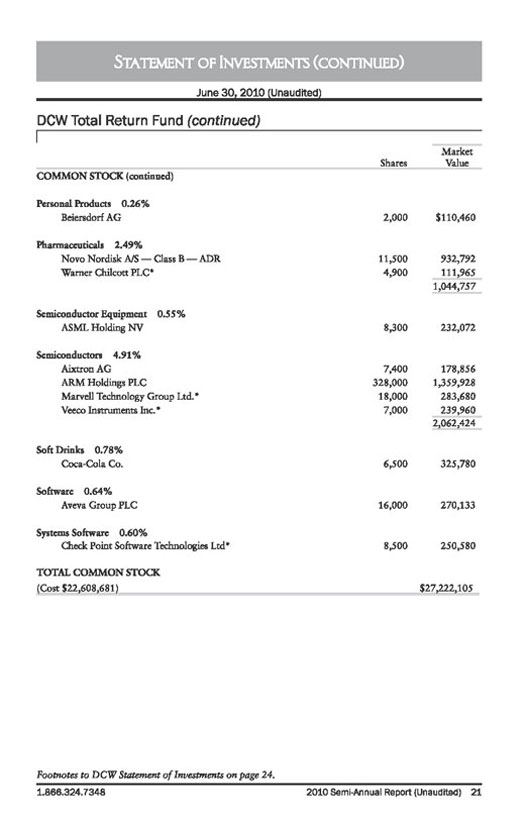

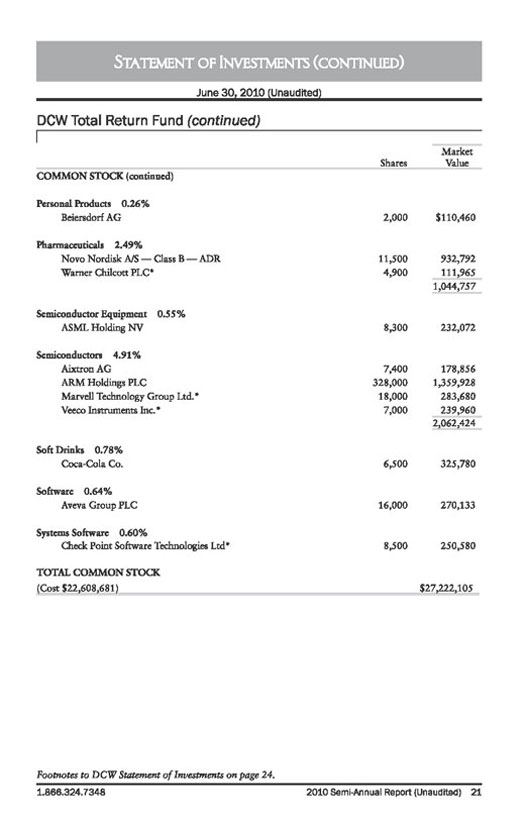

Statement of Investments (continued)

June 30, 2010 (Unaudited)

DCW Total Return Fund (continued)

Shares

Market Value

COMMON STOCK (continued)

Internet 0.76%

F5 Networks Inc.* 2,400 $164,568 Yahoo! Japan Corp. 380 153,221 317,789

Internet Retail 3.79%

Amazon.com Inc.* 8,500 928,710 priceline.com Inc.* 3,750 662,025 1,590,735

Internet Software & Services 7.16% Baidu.com Inc. - ADR* 18,000 1,225,440 eBay Inc.* 11,500 225,515

Google Inc. - Class A*

1,975

878,776

MercadoLibre Inc.*

7,500

394,125

Tencent Holdings Ltd.

17,000

284,902

3,008,758

IT Consulting & Other Services 3.18%

Accenture PLC

11,600

448,340

Infosys Technologies Ltd. - ADR

14,800

886,668

1,335,008

Miscellaneous Manufacturers 0.91%

Parker Hannifin Corp.

6,900

382,674

Oil & Gas Equipment & Services 3.08%

Acergy SA

13,000

195,367

AMEC PLC

30,000

370,237

Halliburton Co.

9,600

235,680

National Oilwell Varco Inc.

3,500

115,745

Technip SA

6,500

378,351

1,295,380

Oil & Gas Exploration & Production 4.34%

Apache Corp.

4,800

404,112

CNOOC Ltd.

174,996

300,691

Devon Energy Corp.

4,300

261,956

Nexen Inc.

22,500

442,581

Occidental Petroleum Corp.

5,400

416,610

1,825,950

Oil & Gas Services 0.64%

Petrofac Ltd.

8,500

150,620

Subsea 7 Inc.*

7,800

118,479

269,099

Footnotes to DCW Statement of Investments on page 24.

1.866.324.7348

2010 Semi-Annual Report (Unaudited) 21

Statement of Investments (continued)

June 30, 2010 (Unaudited)

DCW Total Return Fund (continued)

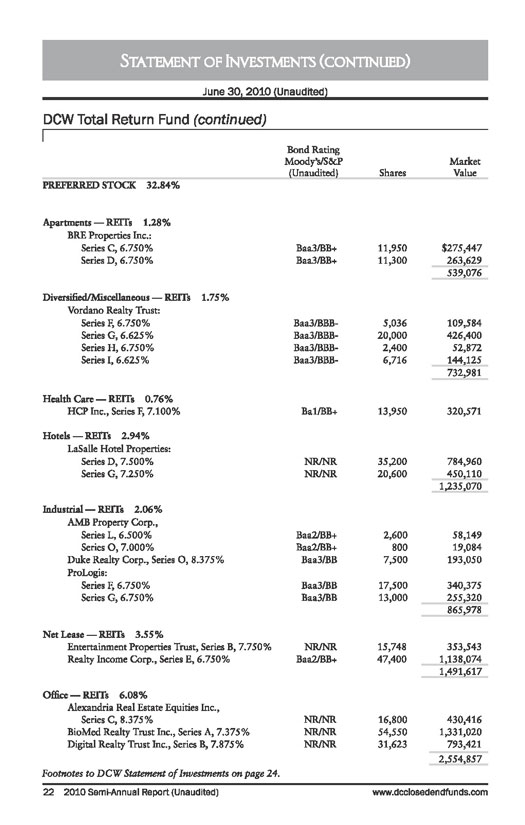

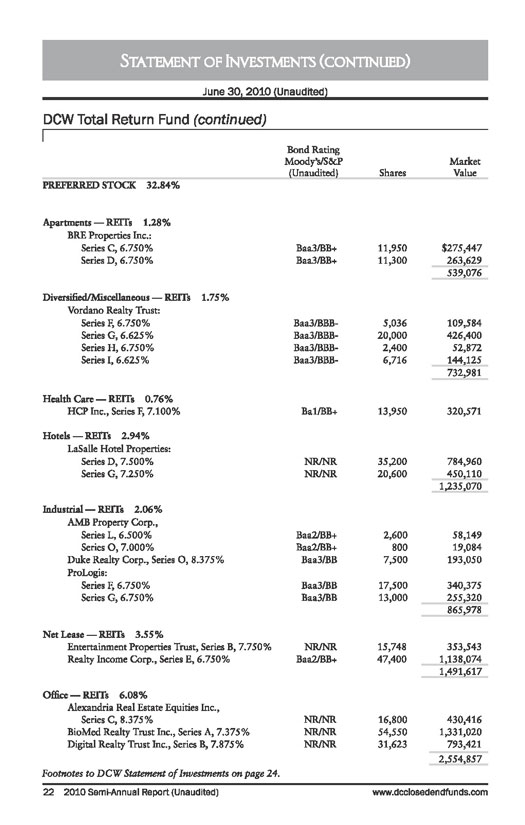

Bond Rating Moody’s/S&P (Unaudited) Shares Market Value PREFERRED STOCK 32.84%

Apartments - REITs 1.28%

BRE Properties Inc.: Series C, 6.750% Baa3/BB+ 11,950

$275,447

Series D, 6.750%

Baa3/BB+

11,300

263,629

539,076

Diversified/Miscellaneous - REITs 1.75%

Vordano Realty Trust:

Series F, 6.750%

Baa3/BBB-

5,036

109,584

Series G, 6.625%

Baa3/BBB-

20,000

426,400

Series H, 6.750%

Baa3/BBB-

2,400

52,872

Series I, 6.625%

Baa3/BBB-

6,716

144,125

732,981

Health Care - REITs 0.76%

HCP Inc., Series F, 7.100%

Bal/BB+

13,950

320,571

Hotels - REITs 2.94%

LaSalle Hotel Properties:

Series D, 7.500%

NR/NR

35,200

784,960

Series G, 7.250%

NR/NR

20,600

450,110

1,235,070

Industrial - REITs 2.06%

AMB Property Corp.,

Series L, 6.500%

Baa2/BB+ 2,600 58,149 Series O, 7.000% Baa2/BB+ 800 19,084 Duke Realty Corp., Series O, 8.375% Baa3/BB 7,500 193,050

ProLogis:

Series F, 6.750% Baa3/BB 17,500 340,375 Series G, 6.750% Baa3/BB 13,000 255,320

865,978 Net Lease - REITs 3.55%

Entertainment Properties Trust, Series B, 7.750%

NR/NR

15,748

353,543

Realty Income Corp., Series E, 6.750%

Baa2/BB+

47,400

1,138,074

1,491,617

Office - REITs 6.08%

Alexandria Real Estate Equities Inc., Series C, 8.375%

NR/NR

16,800

430,416

BioMed Realty Trust Inc., Series A, 7.375%

NR/NR

54,550

1,331,020

Digital Realty Trust Inc., Series B, 7.875%

NR/NR

31,623

793,421

2,554,857

Footnotes to DCW Statement of Investments on page 24.

22 2010 Semi-Annual Report (Unaudited)

www.dcclosedendfunds.com

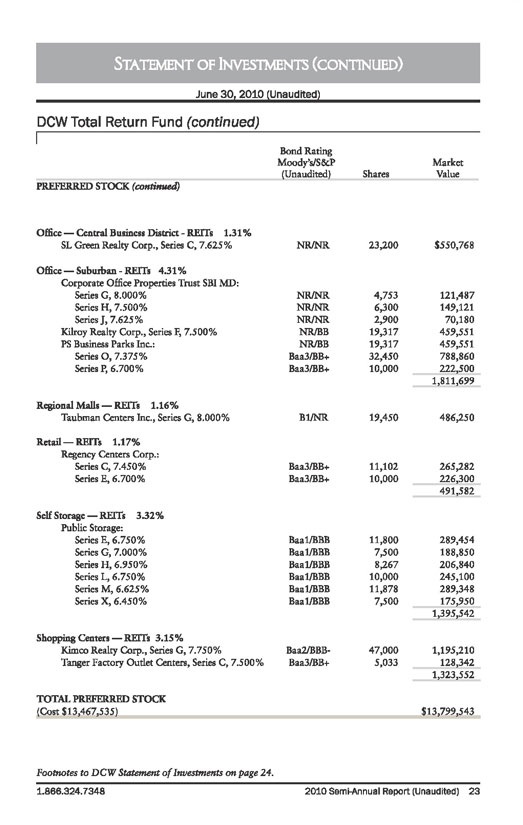

Statement of Investments (continued)

June 30, 2010 (Unaudited)

DCW Total Return Fund (continued)

Bond Rating Moody’s/S&P (Unaudited)

Shares

Market

Value

PREFERRED STOCK (continued)

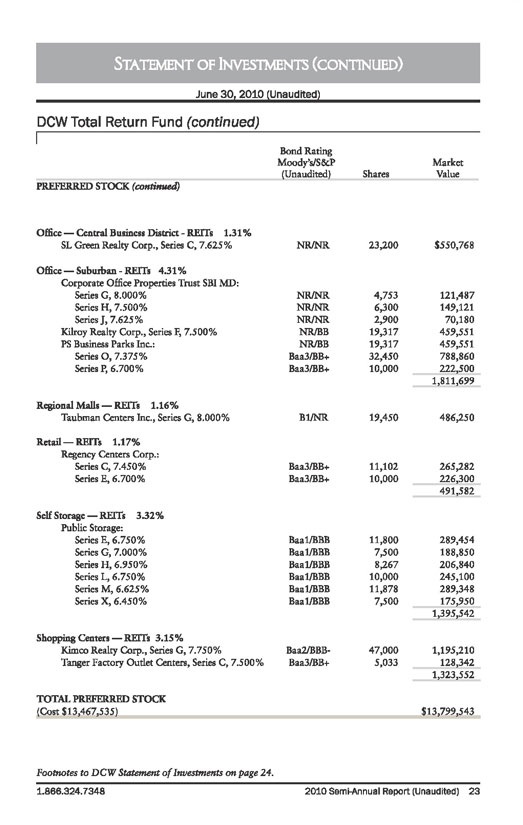

Office - Central Business District - REITs 1.31%

SL Green Realty Corp., Series C, 7.625%

NR/NR

23,200

$550,768

Office - Suburban - REITs 4.31%

Corporate Office Properties Trust SBI MD:

Series G, 8.000%

NR/NR

4,753

121,487

Series H, 7.500%

NR/NR

6,300

149,121

Series J, 7.625%

NR/NR

2,900

70,180

Kilroy Realty Corp., Series F, 7.500%

NR/BB

19,317

459,551

PS Business Parks Inc.:

NR/BB

19,317

459,551

Series O, 7.375%

Baa3/BB+

32,450

788,860

Series P, 6.700%

Baa3/BB+

10,000

222,500

1,811,699

Regional Malls - REITs 1.16%

Taubman Centers Inc., Series G, 8.000%

Bl/NR

19,450

486,250

Retail - REITs 1.17%

Regency Centers Corp.:

Series C, 7.450%

Baa3/BB+

11,102

265,282

Series E, 6.700%

Baa3/BB+

10,000

226,300

491,582

Self Storage - REITs 3.32%

Public Storage:

Series E, 6.750%

Baal/BBB

11,800

289,454

Series G, 7.000%

Baal/BBB

7,500

188,850

Series H, 6.950%

Baal/BBB

8,267

206,840

Series L, 6.750%

Baal/BBB

10,000

245,100

Series M, 6.625%

Baal/BBB

11,878

289,348

Series X, 6.450%

Baal/BBB

7,500

175,950

1,395,542

Shopping Centers - REITs 3.15%

Kimco Realty Corp., Series G, 7.750%

Baa2/BBB-

47,000

1,195,210

Tanger Factory Outlet Centers, Series C, 7.500%

Baa3/BB+

5,033

128,342

1,323,552

TOTAL PREFERRED STOCK

(Cost $13,467,535)

$13,799,543

Footnotes to DCW Statement of Investments on page 24.

1.866.324.7348

2010 Semi-Annual Report (Unaudited) 23

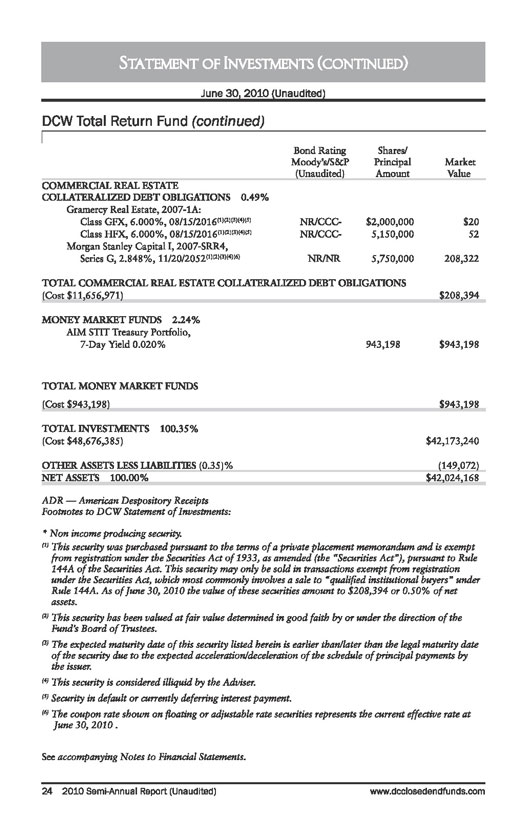

Statement of Investments (continued)

June 30, 2010 (Unaudited)

DCW Total Return Fund (continued)

Bond Rating Moody’s/S&P (Unaudited)

Shares/ Principal Amount

Market

Value

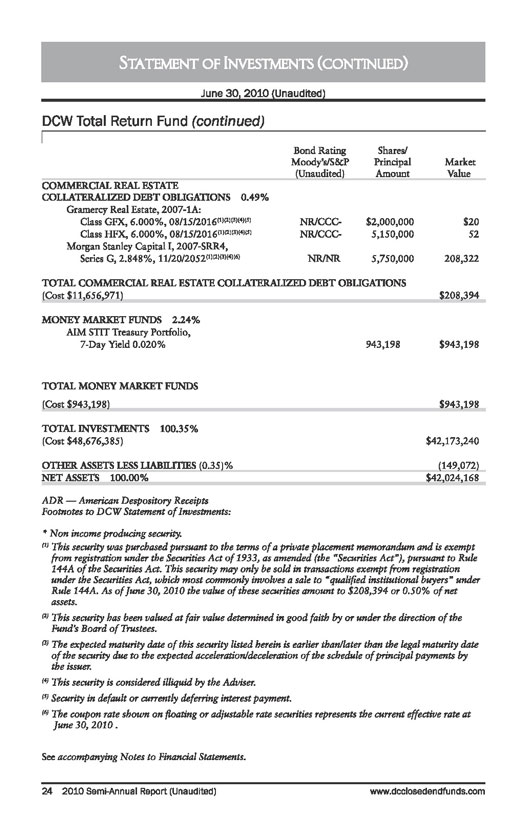

COMMERCIAL REAL ESTATE

COLLATERALIZED DEBT OBLIGATIONS 0.49%

Gramercy Real Estate, 2007-1A:

Class GFX, 6.000%, 08/15/2016 (1)(2)(3)(4)(5)

NR/CCC-

$2,000,000

$20

Class HFX, 6.000%, 08/15/2016 (1)(2)(3)(4)(5)

NR/CCC-

5,150,000

52

Morgan Stanley Capital I, 2007-SRR4,

Series G, 2.848%, 11/20/2052 (1)(2)(3)(4)(6)

NR/NR

5,750,000

208,322

TOTAL COMMERCIAL REAL ESTATE COLLATERALIZED DEBT OBLIGATIONS

(Cost $11,656,971)

$208,394

MONEY MARKET FUNDS 2.24 %

AIM STIT Treasury Portfolio,

7-Day Yield 0.020%

943,198

$943,198

TOTAL MONEY MARKET FUNDS

(Cost $943,198)

$943,198

TOTAL INVESTMENTS 100.35%

(Cost $48,676,385)

$42,173,240

OTHER ASSETS LESS LIABILITIES (0.35)%

(149,072)

NET ASSETS 100.00%

$42,024,168

ADR – American Despository Receipts

Footnotes to DCW Statement of Investments:

* Non income producing security.

(1) This security was purchased pursuant to the terms of a private placement memorandum and is exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”), pursuant to Rule 144A of the Securities Act. This security may only be sold in transactions exempt from registration under the Securities Act, which most commonly involves a sale to “qualified institutional buyers” under Rule 144A. As of June 30, 2010 the value of these securities amount to $208,394 or 0.50% of net assets.

(2) This security has been valued at fair value determined in good faith by or under the direction of the Fund’s Board of Trustees.

(3)} The expected maturity date of this security listed herein is earlier than/later than the legal maturity date of the security due to the expected acceleration/deceleration of the schedule of principal payments by the issuer.

(4) This security is considered illiquid by the Adviser.

(5) Security in default or currently deferring interest payment.

(6) The coupon rate shown on floating or adjustable rate securities represents the current effective rate at June 30, 2010.

See accompanying Notes to Financial Statements.

24 2010 Semi-Annual Report (Unaudited)

www.dcclosedendfunds.com

This Page Intentionally Left Blank

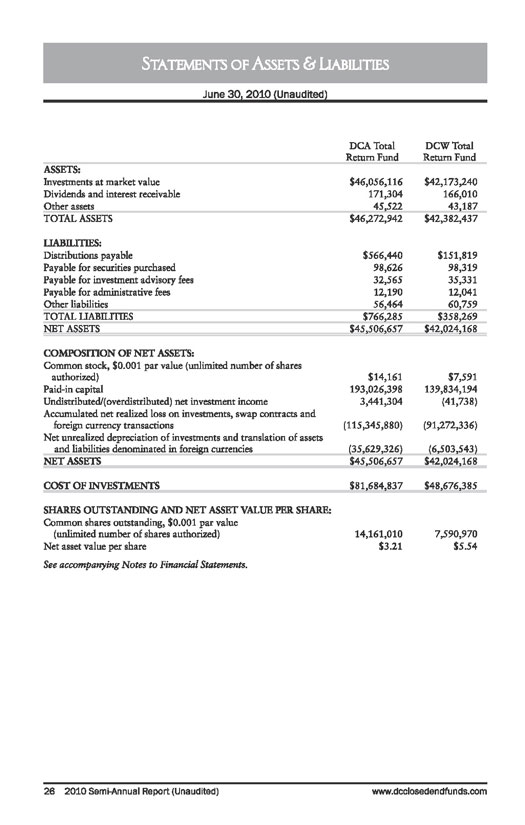

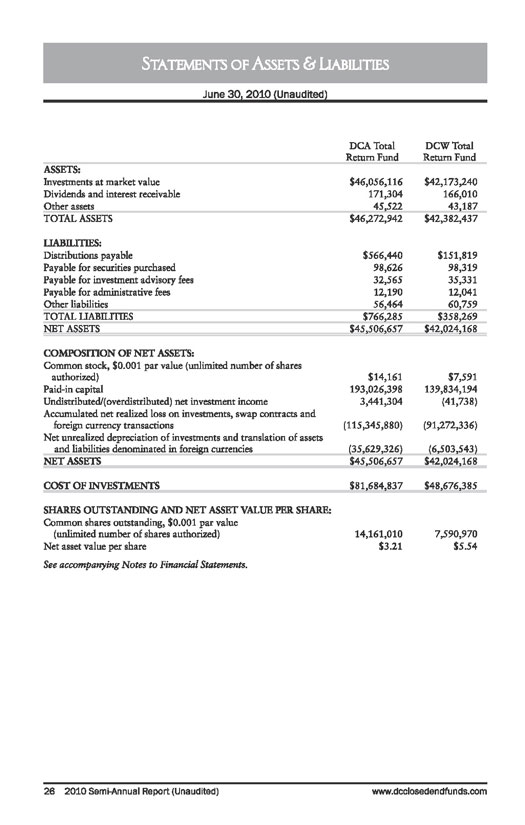

Statements of Assets & Liabilities

June 30, 2010 (Unaudited)

DCA Total Return Fund

DCW Total Return Fund

ASSETS:

Investments at market value

$46,056,116

$42,173,240

Dividends and interest receivable

171,304

166,010

Other assets

45,522

43,187

TOTAL ASSETS

$46,272,942

$42,382,437

LIABILITIES:

Distributions payable

$566,440

$151,819

Payable for securities purchased

98,626

98,319

Payable for investment advisory fees

32,565

35,331

Payable for administrative fees

12,190

12,041

Other liabilities

56,464

60,759

TOTAL LIABILITIES

$766,285

$358,269

NET ASSETS

$45,506,657

$42,024,168

COMPOSITION OF NET ASSETS:

Common stock, $0.001 par value (unlimited number of shares authorized)

$14,161

$7,591

Paid-in capital

193,026,398

139,834,194

Undistributed/(overdistributed) net investment income

3,441,304

(41,738)

Accumulated net realized loss on investments, swap contracts and foreign currency transactions

(115,345,880)

(91,272,336)

Net unrealized depreciation of investments and translation of assets and liabilities denominated in foreign currencies

(35,629,326)

(6,503,543)

NET ASSETS

$45,506,657

$42,024,168

COST OF INVESTMENTS

$81,684,837

$48,676,385

SHARES OUTSTANDING AND NET ASSET VALUE PER SHARE:

Common shares outstanding, $0.001 par value (unlimited number of shares authorized)

14,161,010

7,590,970

Net asset value per share

$3.21

$5.54

See accompanying Notes to Financial Statements.

26 2010 Semi-Annual Report (Unaudited)

www.dcclosedendfunds.com

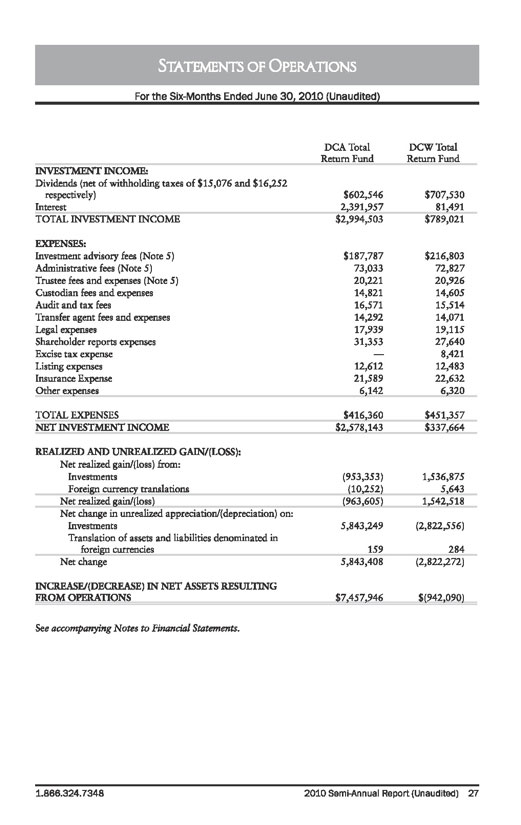

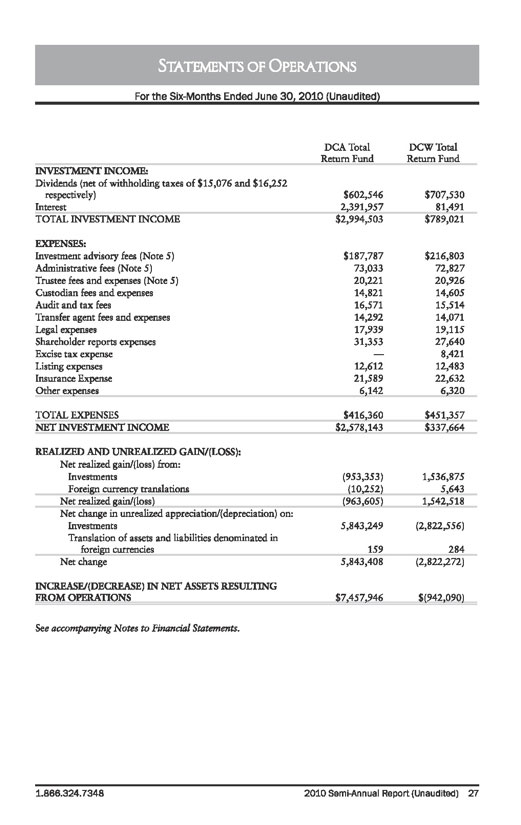

Statements of Operations

For the Six-Months Ended June 30, 2010 (Unaudited)

DCA Total

Return Fund

DCW Total Return Fund

INVESTMENT INCOME:

Dividends (net of withholding taxes of $15,076 and $16,252 respectively)

$602,546

$707,530

Interest

2,391,957

81,491

TOTAL INVESTMENT INCOME

$2,994,503

$789,021

EXPENSES:

Investment advisory fees (Note 5)

$187,787

$216,803

Administrative fees (Note 5)

73,033

72,827

Trustee fees and expenses (Note 5)

20,221

20,926

Custodian fees and expenses

14,821

14,605

Audit and tax fees

16,571

15,514

Transfer agent fees and expenses

14,292

14,071

Legal expenses

17,939

19,115

Shareholder reports expenses

31,353

27,640

Excise tax expense

—

8,421

Listing expenses

12,612

12,483

Insurance Expense

21,589

22,632

Other expenses

6,142

6,320

TOTAL EXPENSES

$416,360

$451,357

NET INVESTMENT INCOME

$2,578,143

$337,664

REALIZED AND UNREALIZED GAIN/(LOSS):

Net realized gain/(loss) from:

Investments

(953,353)

1,536,875

Foreign currency translations

(10,252)

5,643

Net realized gain/(loss)

(963,605)

1,542,518

Net change in unrealized appreciation/(depreciation) on:

Investments

5,843,249

(2,822,556)

Translation of assets and liabilities denominated in foreign currencies

159

284

Net change

5,843,408

(2,822,272)

INCREASE/(DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS

$7,457,946

$(942,090)

See accompanying Notes to Financial Statements.

1.866.324.7348

2010 Semi-Annual Report (Unaudited) 27

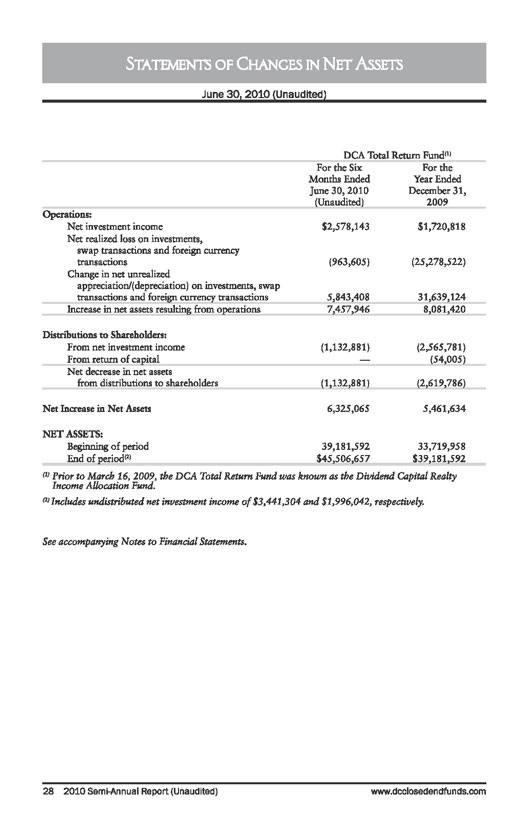

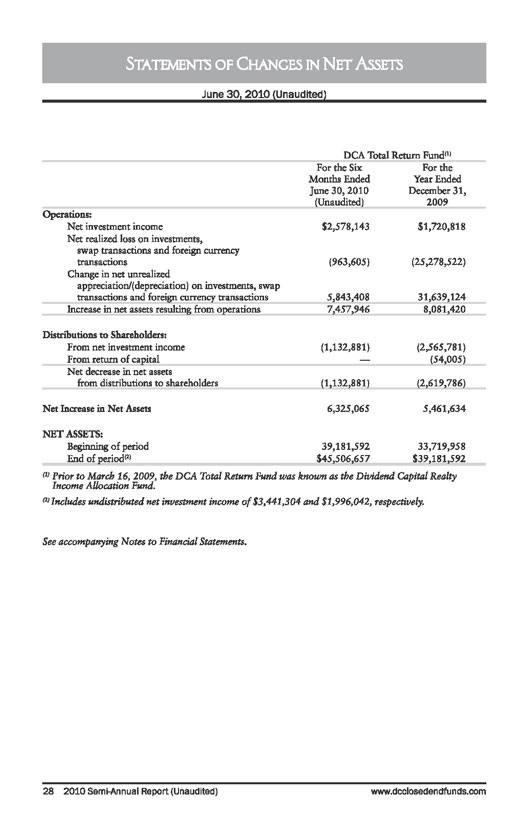

Statements of Changes in Net Assets

June 30, 2010 (Unaudited)

DCA Total Return Fund (1)

For the Six Months Ended June 30, 2010 (Unaudited)

For the

Year Ended December 31, 2009

Operations:

Net investment income

$2,578,143

$1,720,818

Net realized loss on investments, swap transactions and foreign currency transactions

(963,605)

(25,278,522)

Change in net unrealized appreciation/(depreciation) on investments, swap transactions and foreign currency transactions

5,843,408

31,639,124

Increase in net assets resulting from operations

7,457,946

8,081,420

Distributions to Shareholders:

From net investment income

(1,132,881)

(2,565,781)

From return of capital

—

(54,005)

Net decrease in net assets from distributions to shareholders

(1,132,881)

(2,619,786)

Net Increase in Net Assets

6,325,065

5,461,634

NET ASSETS:

Beginning of period

39,181,592

33,719,958

End of period (2)

$45,506,657

$39,181,592

(1) Prior to March 16, 2009, the DCA Total Return Fund was known as the Dividend Capital Realty Income Allocation Fund.

(2) Includes undistributed net investment income of $3,441,304 and $1,996,042, respectively.

See accompanying Notes to Financial Statements.

28 2010 Semi-Annual Report (Unaudited)

www.dcclosedendfunds.com

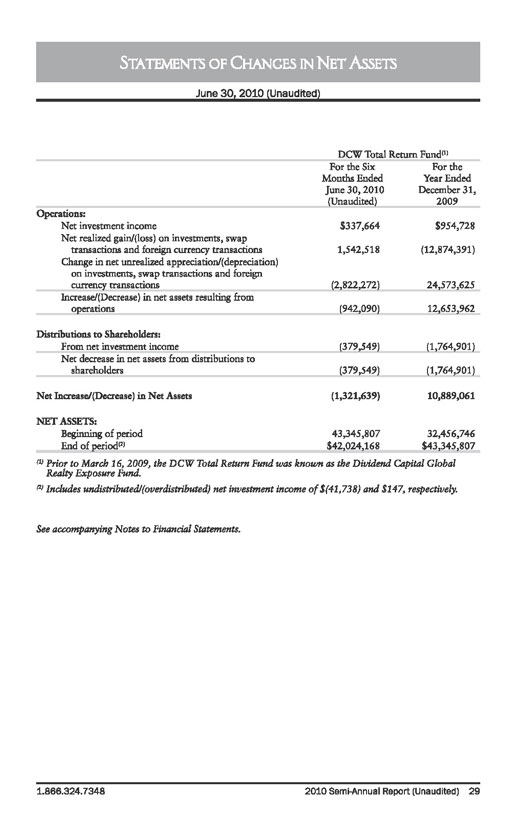

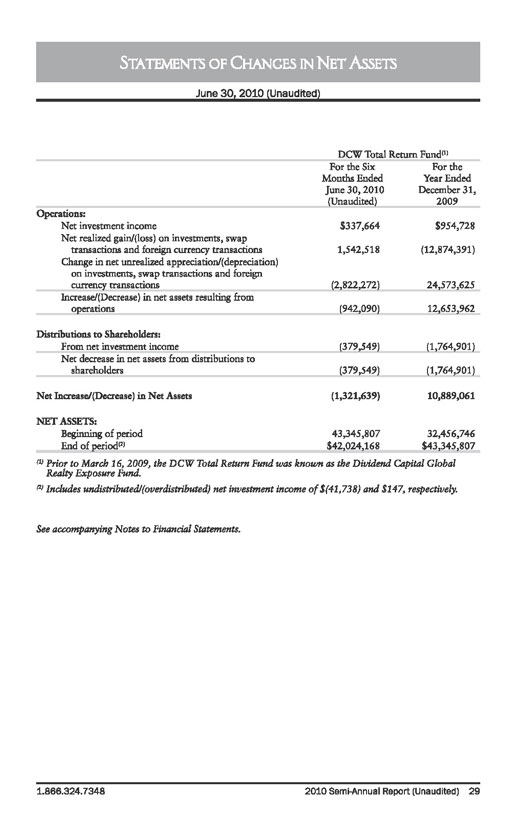

Statements of Changes in Net Assets

June 30, 2010 (Unaudited)

DCW Total Return Fund (1)

For the Six Months Ended June 30, 2010 (Unaudited)

For the

Year Ended December 31, 2009

Operations:

Net investment income

$337,664

$954,728

Net realized gain/(loss) on investments, swap transactions and foreign currency transactions

1,542,518

(12,874,391)

Change in net unrealized appreciation/(depreciation) on investments, swap transactions and foreign currency transactions

(2,822,272)

24,573,625

Increase/(Decrease) in net assets resulting from operations

(942,090)

12,653,962

Distributions to Shareholders:

From net investment income

(379,549)

(1,764,901)

Net decrease in net assets from distributions to shareholders

(379,549)

(1,764,901)

Net Increase/(Decrease) in Net Assets

(1,321,639)

10,889,061

NET ASSETS:

Beginning of period

43,345,807

32,456,746

End of period (2)

$42,024,168

$43,345,807

(1) Prior to March 16, 2009, the DCW Total Return Fund was known as the Dividend Capital Global Realty Exposure Fund.

(2) Includes undistributed/(overdistributed) net investment income of $(41,738) and $147, respectively.

See accompanying Notes to Financial Statements.

1.866.324.7348

2010 Semi-Annual Report (Unaudited) 29

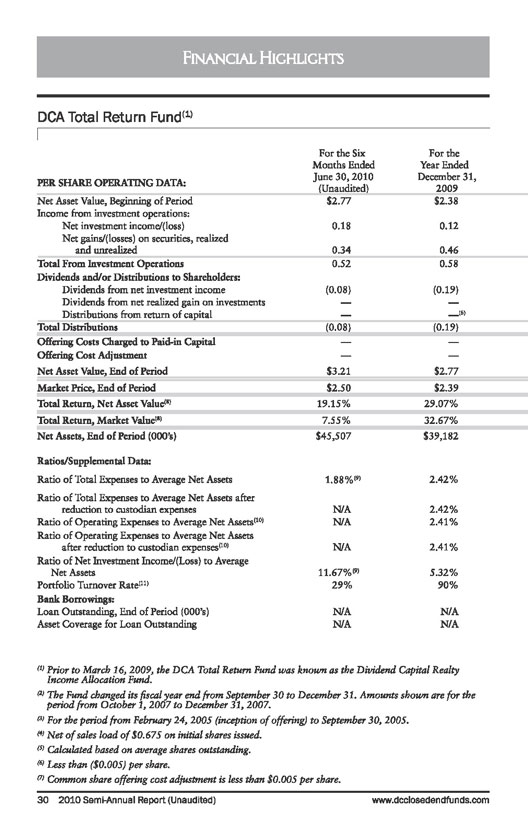

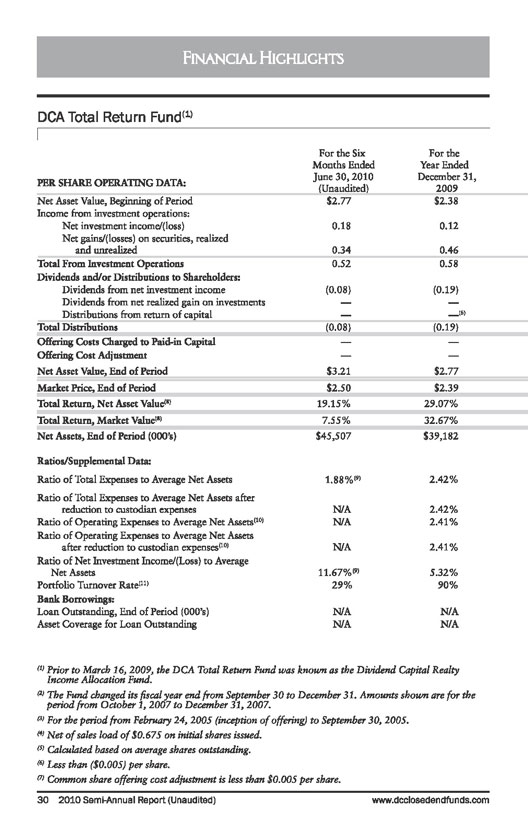

Financial Highlights

DCA Total Return Fund (1)

For the Six Months Ended June 30, 2010 (Unaudited)

For the Year Ended December 31, 2009

PER SHARE OPERATING DATA:

Net Asset Value, Beginning of Period

$2.77

$2.38

Income from investment operations:

Net investment income/(loss)

0.18

0.12

Net gains/(losses) on securities, realized and unrealized

0.34

0.46

Total From Investment Operations

0.52

0.58

Dividends and/or Distributions to Shareholders:

Dividends from net investment income

(0.08)

(0.19)

Dividends from net realized gain on investments

—

—

Distributions from return of capital

—

— (6)

Total Distributions

(0.08)

(0.19)

Offering Costs Charged to Paid-in Capital

—

—

Offering Cost Adjustment

—

—

Net Asset Value, End of Period

$3.21

$2.77

Market Price, End of Period

$2.50

$2.39

Total Return, Net Asset Value(8)

19.15%

29.07%

Total Return, Market Value(8)

7.55%

32.67%

Net Assets, End of Period (000’s)

$45,507

$39,182

Ratios/Supplemental Data:

Ratio of Total Expenses to Average Net Assets

1.88%(9)

2.42%

Ratio of Total Expenses to Average Net Assets after reduction to custodian expenses

N/A

2.42%

Ratio of Operating Expenses to Average Net Assets(10)

N/A

2.41%

Ratio of Operating Expenses to Average Net Assets after reduction to custodian expenses(10)

N/A

2.41%

Ratio of Net Investment Income/(Loss) to Average

Net Assets

11.67%(9)

5.32%

Portfolio Turnover Rate(11)

29%

90%

Bank Borrowings:

Loan Outstanding, End of Period (000’s)

N/A

N/A

Asset Coverage for Loan Outstanding

N/A

N/A

(1) Prior to March 16, 2009, the DCA Total Return Fund was known as the Dividend Capital Realty Income Allocation Fund.

(2) The Fund changed its fiscal year end from September 30 to December 31. Amounts shown are for the period from October 1, 2007 to December 31, 2007.

(3) For the period from February 24, 2005 (inception of offering) to September 30, 2005.

(4) Net of sales load of $0.675 on initial shares issued.

(5) Calculated based on average shares outstanding.

(6) Less than ($0.005) per share.

(7) Common share offering cost adjustment is less than $0.005 per share.

30 2010 Semi-Annual Report (Unaudited)

www.dcclosedendfunds.com

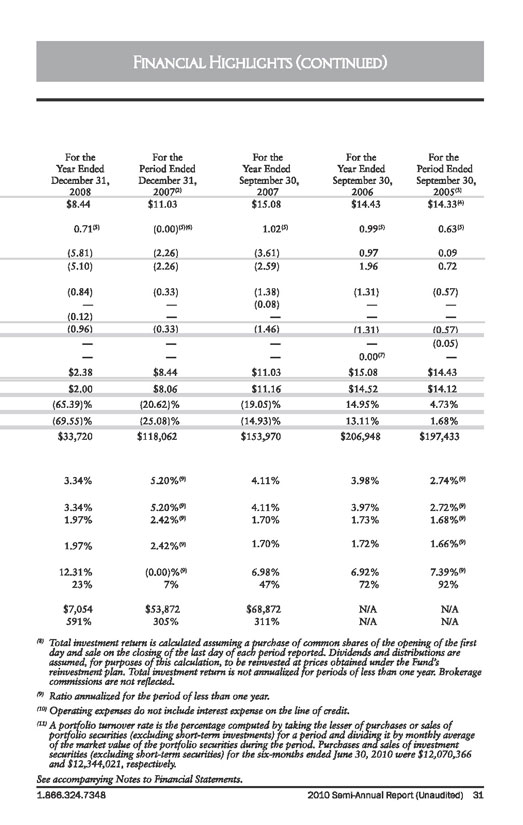

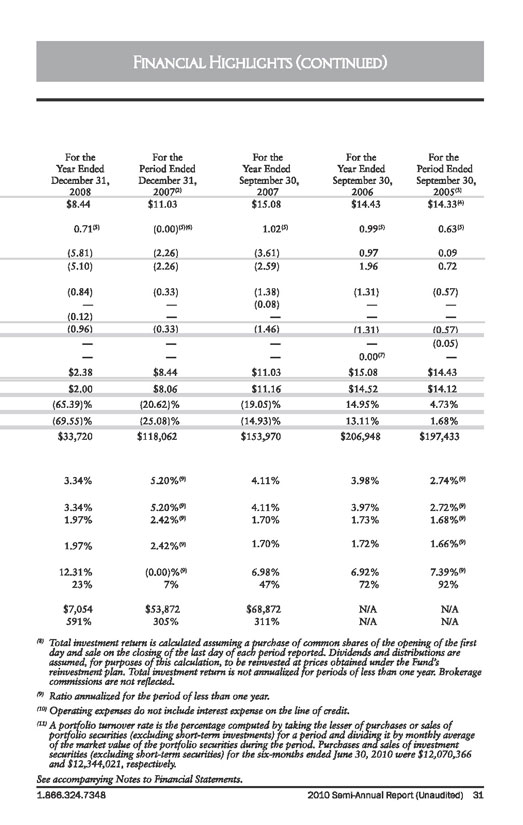

Financial Highlights (continued)

For the Year Ended December 31, 2008

For the Period Ended December 31, 2007(2)

For the Year Ended September 30, 2007

For the Year Ended September 30, 2006

For the Period

Ended September 30, 2005(3)

$8.44

$11.0.3

$15.08

$14.43

$14.33

0.71(5)

(0.00)(5)(6)

1.02(5)

0.99(5)

0.63(5)

(5.81)

(2.26)

(3.61)

0.97

0.09

(5.10)

(2.26)

(2.59)

1.96

0.72

(0.84)

(0.33)

(1.38)

(1.31)

(0.57)

—

—

(0.08)

—

—

(0.12)

—

—

—

—

(0.96)

(0.33)

(1.46)

(1.31)

(0.57)

—

—

—

—

(0.05)

—

—

—

0.00(7)

—

$2.38

$8.44

$11.03

$15.08

$14.43

$2.00

$8.06

$11.16

$14.52

$14.12

(65.39)%

(20.62)%

(19.05)%

14.95%

4.73%

(69.55)%

(25.08)%

(14.93)%

13.11%

1.68%

$33,720

$118,062

$153,970

$206,948

$197,433

3.34%

5.20%(9)

4.11%

3.98%

2.74%(9)

3.34%

5.20%(9)

4.11%

3.97%

2.72%(9)

1.97%

2.42%(9)

1.70%

1.73%

1.68%(9)

1.97%

2.42%(9)

1.70%

1.72%

1.66%(9)

12.31%

(0.00)%(9)

6.98%

6.92%

7.39%(9)

23%

7%

47%

72%

92%

$7,054

$53,872

$68,872

N/A

N/A

591%

305%

311%

N/A

N/A

(8) Total investment return is calculated assuming a purchase of common shares of the opening of the first day and sale on the closing of the last day of each period reported. Dividends and distributions are assumed, for purposes of this calculation, to be reinvested at prices obtained under the Fund’s reinvestment plan. Total investment return is not annualized for periods of less than one year. Brokerage commissions are not reflected.

(9) Ratio annualized for the period of less than one year.

(10) Operating expenses do not include interest expense on the line of credit.

(11) A portfolio turnover rate is the percentage computed by taking the lesser of purchases or sales of portfolio securities (excluding short-term investments) for a period and dividing it by monthly average of the market value of the portfolio securities during the period. Purchases and sales of investment securities (excluding short-term securities) for the six-months ended June 30, 2010 were $12,070,366 and $12,344,021, respectively.

See accompanying Notes to Financial Statements.

1.866.324.7348

2010 Semi-Annual Report (Unaudited) 31

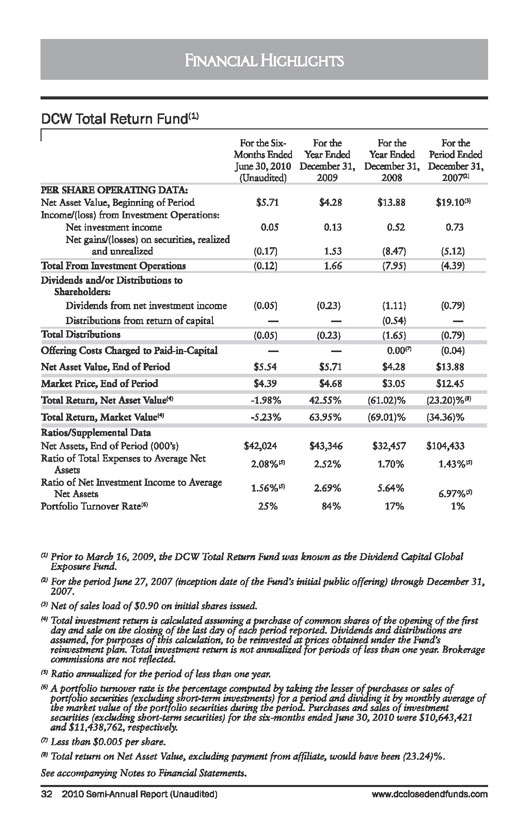

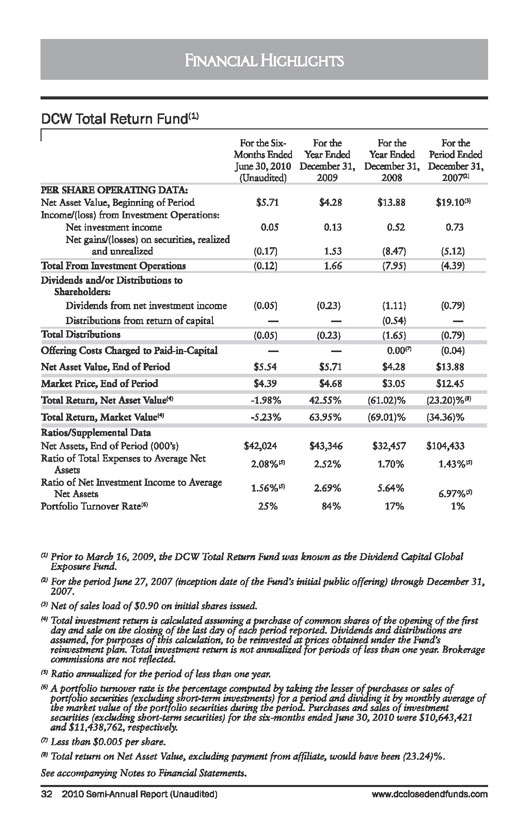

Financial Highlights

DCW Total Return Fund (1)

For the Six-Months Ended June 30,2010 (Unaudited)

For the

Year Ended December 31, 2009

For the

Year Ended December 31, 2008

For the Period Ended December 31, 2007(2)

PER SHARE OPERATING DATA:

Net Asset Value, Beginning of Period

$5.71

$4.28

$13.88

$19.10(3)

Income/floss) from Investment Operations:

Net investment income

0.05

0.13

0.52

0.73

Net gains/(losses) on securities, realized and unrealized

(0.17)

1.53

(8.47)

(5.12)

Total From Investment Operations

(0.12)

1.66

(7.95)

(4.39)

Dividends and/or Distributions to Shareholders:

Dividends from net investment income

(0.05)

(0.23)

(1.11)

(0.79)

Distributions from return of capital

—

—

(0.54)

—

Total Distributions

(0.05)

(0.23)

(1.65)

(0.79)

Offering Costs Charged to Paid-in-Capital

—

—

0.00(7)

(0.04)

Net Asset Value, End of Period

$5.54

$5.71

$4.28

$13.88

Market Price, End of Period

$4.39

$4.68

$3.05

$12.45

Total Return, Net Asset Value(4)

-1.98%

42.55%

(61.02)%

(23.20)%(8)

Total Return, Market Value(4)

-5.23 %

63.95%

(69.01)%

(34.36)%

Ratios/Supplemental Data

Net Assets, End of Period (000’s)

$42,024

$43,346

$32,457

$104,433

Ratio of Total Expenses to Average Net Assets

2.08%(5)

2.52%

1.70%

1.43%(5)

Ratio of Net Investment Income to Average Net Assets

1.56%(5)

2.69%

5.64%

6.97%(5)

Portfolio Turnover Rate(6)

25%

84%

17%

1%

(1) Prior to March 16, 2009, the DCW Total Return Fund was known as the Dividend Capital Global Exposure Fund.

(2) For the period June 27, 2007 (inception date of the Fund’s initial public offering) through December 31, 2007.

(3) Net of sales load of $0.90 on initial shares issued.

(4) Total investment return is calculated assuming a purchase of common shares of the opening of the first day and sale on the closing of the last day of each period reported. Dividends and distributions are assumed, for purposes of this calculation, to be reinvested at prices obtained under the Fund’s reinvestment plan. Total investment return is not annualized for periods of less than one year. Brokerage commissions are not reflected.

(5) Ratio annualized for the period of less than one year.

(6) A portfolio turnover rate is the percentage computed by taking the lesser of purchases or sales of portfolio securities (excluding short-term investments) for a period and dividing it by monthly average of the market value of the portfolio securities during the period. Purchases and sales of investment securities (excluding short-term securities) for the six-months ended June 30, 2010 were $10,643,421 and $11,438,762, respectively.

(7) Less than $0,005 per share.

(8) Total return on Net Asset Value, excluding payment from affiliate, would have been (23.24)%.

See accompanying Notes to Financial Statements.

32 2010 Semi-Annual Report (Unaudited)

www.dcclosedendfunds.com

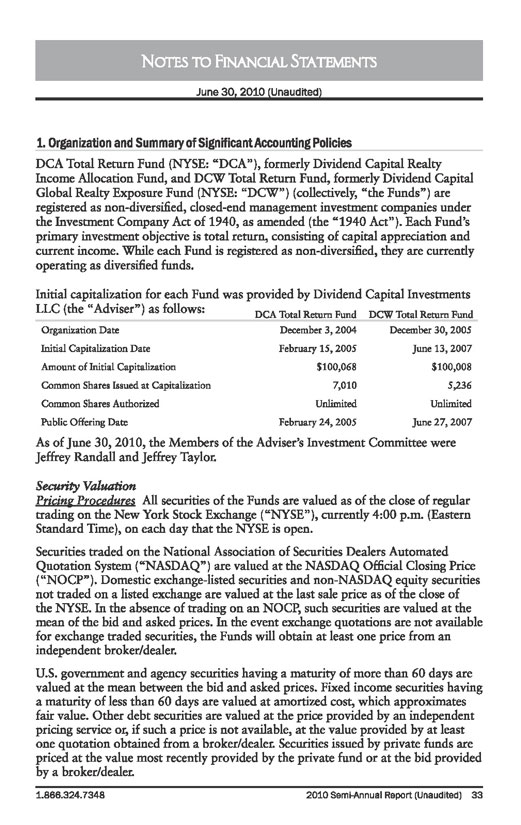

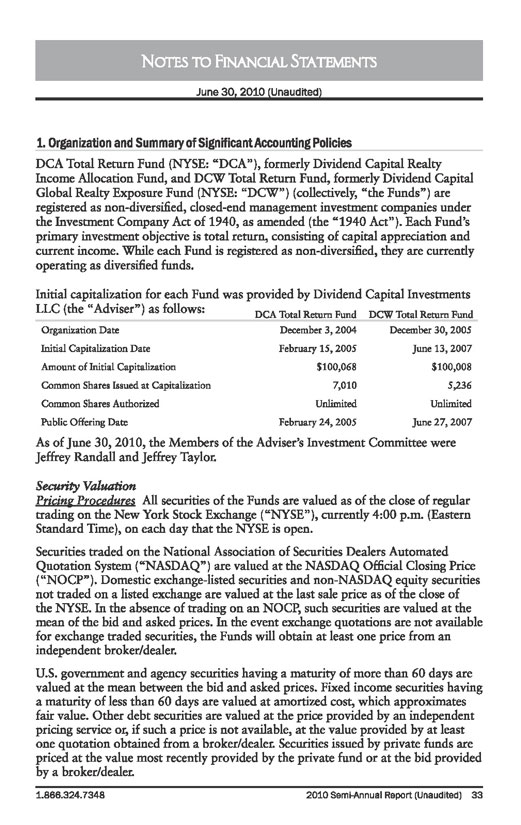

Notes To Financial Statements

June 30, 2010 (Unaudited)

1. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

DCA Total Return Fund (NYSE: “DCA”), formerly Dividend Capital Realty Income Allocation Fund, and DCW Total Return Fund, formerly Dividend Capital Global Realty Exposure Fund (NYSE: “DCW”) (collectively, “the Funds”) are registered as non-diversified, closed-end management investment companies under the Investment Company Act of 1940, as amended (the “1940 Act”). Each Fund’s primary investment objective is total return, consisting of capital appreciation and current income. While each Fund is registered as non-diversified, they are currently operating as diversified funds.

Initial capitalization for each Fund was provided by Dividend Capital Investments LLC (the “Adviser”) as follows:

DCA Total Return Fund

DCW Total Return Fund

Organization Date

December 3, 2004

December 30, 2005

Initial Capitalization Date

February 15, 2005

June 13, 2007

Amount of Initial Capitalization

$100,068

$100,008

Common Shares Issued at Capitalization

7,010

5,236

Common Shares Authorized

Unlimited

Unlimited

Public Offering Date

February 24, 2005

June 27, 2007

As of June 30, 2010, the Members of the Adviser’s Investment Committee were Jeffrey Randall and Jeffrey Taylor.

Security Valuation

Pricing Procedures All securities of the Funds are valued as of the close of regular trading on the New York Stock Exchange (“NYSE”), currently 4:00 p.m. (Eastern Standard Time), on each day that the NYSE is open.

Securities traded on the National Association of Securities Dealers Automated Quotation System (“NASDAQ”) are valued at the NASDAQ Official Closing Price (“NOCP”). Domestic exchange-listed securities and non-NASDAQ equity securities not traded on a listed exchange are valued at the last sale price as of the close of the NYSE. In the absence of trading on an NOCP, such securities are valued at the mean of the bid and asked prices. In the event exchange quotations are not available for exchange traded securities, the Funds will obtain at least one price from an independent broker/dealer.

U.S. government and agency securities having a maturity of more than 60 days are valued at the mean between the bid and asked prices. Fixed income securities having a maturity of less than 60 days are valued at amortized cost, which approximates fair value. Other debt securities are valued at the price provided by an independent pricing service or, if such a price is not available, at the value provided by at least one quotation obtained from a broker/dealer. Securities issued by private funds are priced at the value most recently provided by the private fund or at the bid provided by a broker/dealer.

1.866.324.7348

2010 Semi-Annual Report (Unaudited) 33

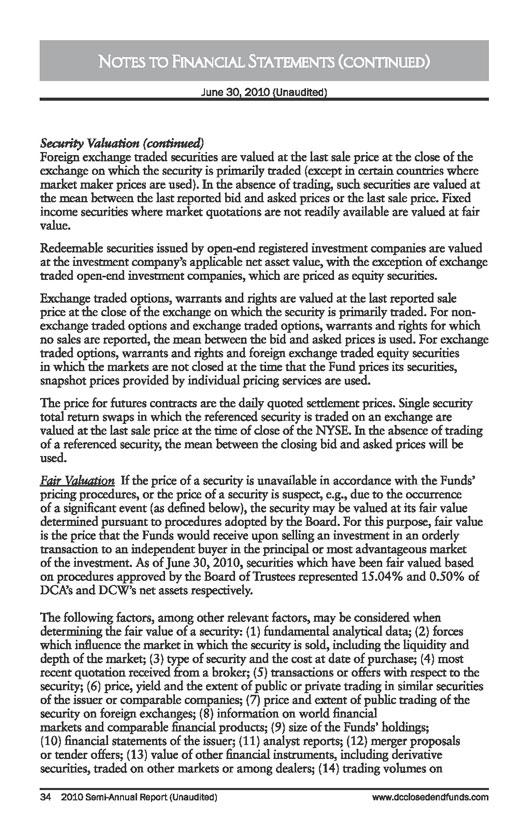

Notes to Financial Statements (continued)

June 30, 2010 (Unaudited)

Security Valuation (continued)

Foreign exchange traded securities are valued at the last sale price at the close of the exchange on which the security is primarily traded (except in certain countries where market maker prices are used). In the absence of trading, such securities are valued at the mean between the last reported bid and asked prices or the last sale price. Fixed income securities where market quotations are not readily available are valued at fair value.

Redeemable securities issued by open-end registered investment companies are valued at the investment company’s applicable net asset value, with the exception of exchange traded open-end investment companies, which are priced as equity securities.

Exchange traded options, warrants and rights are valued at the last reported sale price at the close of the exchange on which the security is primarily traded. For non-exchange traded options and exchange traded options, warrants and rights for which no sales are reported, the mean between the bid and asked prices is used. For exchange traded options, warrants and rights and foreign exchange traded equity securities in which the markets are not closed at the time that the Fund prices its securities, snapshot prices provided by individual pricing services are used.

The price for futures contracts are the daily quoted settlement prices. Single security total return swaps in which the referenced security is traded on an exchange are valued at the last sale price at the time of close of the NYSE. In the absence of trading of a referenced security, the mean between the closing bid and asked prices will be used.

Fair Valuation If the price of a security is unavailable in accordance with the Funds’ pricing procedures, or the price of a security is suspect, e.g., due to the occurrence of a significant event (as defined below), the security may be valued at its fair value determined pursuant to procedures adopted by the Board. For this purpose, fair value is the price that the Funds would receive upon selling an investment in an orderly transaction to an independent buyer in the principal or most advantageous market of the investment. As of June 30, 2010, securities which have been fair valued based on procedures approved by the Board of Trustees represented 15.04% and 0.50% of DCA’s and DCW’s net assets respectively.

The following factors, among other relevant factors, may be considered when determining the fair value of a security: (1) fundamental analytical data; (2) forces which influence the market in which the security is sold, including the liquidity and depth of the market; (3) type of security and the cost at date of purchase; (4) most recent quotation received from a broker; (5) transactions or offers with respect to the security; (6) price, yield and the extent of public or private trading in similar securities of the issuer or comparable companies; (7) price and extent of public trading of the security on foreign exchanges; (8) information on world financial markets and comparable financial products; (9) size of the Funds’ holdings; (10) financial statements of the issuer; (11) analyst reports; (12) merger proposals or tender offers; (13) value of other financial instruments, including derivative securities, traded on other markets or among dealers; (14) trading volumes on

34 2010 Semi-Annual Report (Unaudited)

www.dcclosedendfunds.com

Notes to Financial Statements (continued)

June 30, 2010 (Unaudited)

Security Valuation (continued)

markets, exchanges or among dealers; (15) values of baskets of securities traded on other markets, exchanges or among dealers; (16) change in interest rates; (17) observations from financial institutions; (18) government (domestic or foreign) actions or pronouncements; (19) in the case of restricted securities, discount from market value of unrestricted securities of the same class at time of purchase, existence and anticipated time frame of any undertaking to register the security and the size of the holding in relation to any unrestricted outstanding shares; (20) in the case of foreign securities, the country’s or geographic region’s political and economic environment, nature of any significant events, American Depository Receipt trading, exchange-traded fund trading and foreign currency exchange activity; (21) in the case of interests in private funds, the absence of transaction activity in interests in the private fund, extraordinary restrictions on redemptions, whether the private fund’s valuation procedures provide for valuation of underlying securities at market value or fair value, actual knowledge of the value of underlying portfolio holdings, review of audited financial statements and ongoing due diligence and monitoring; and (22) in the case of emergencies or other unusual situations, the nature and duration of the event, forces influencing the operation of the financial markets, likelihood of recurrence of the event, and whether the effects of the event are isolated or affect entire markets, countries or regions.

A three-tier hierarchy has been established to classify fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

Various inputs are used in determining the value of each Fund’s investments as of the reporting period end. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities that the Funds have the ability to access at the measurement date.

Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 – Unobservable inputs for the assets or liability, to the extent relevant observable inputs are not available, representing the Funds own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

1.866.324.7348

2010 Semi-Annual Report (Unaudited) 35

Notes to Financial Statements (continued)

June 30, 2010 (Unaudited)

Security Valuation (continued)

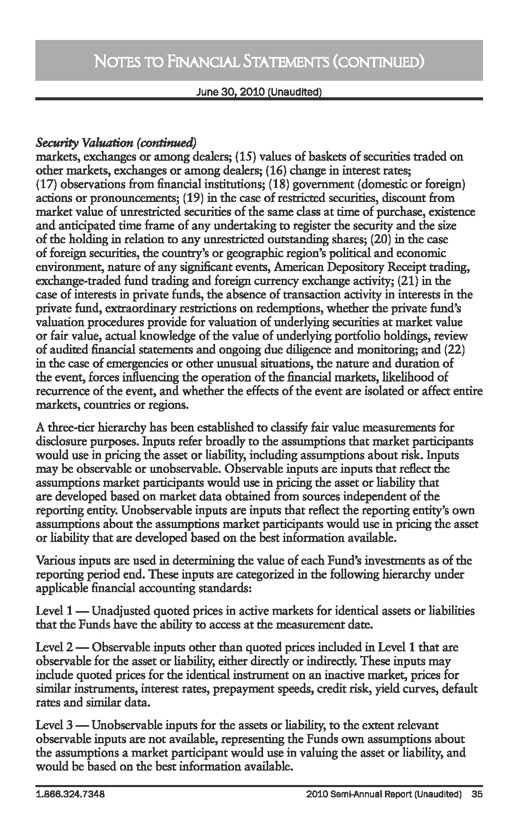

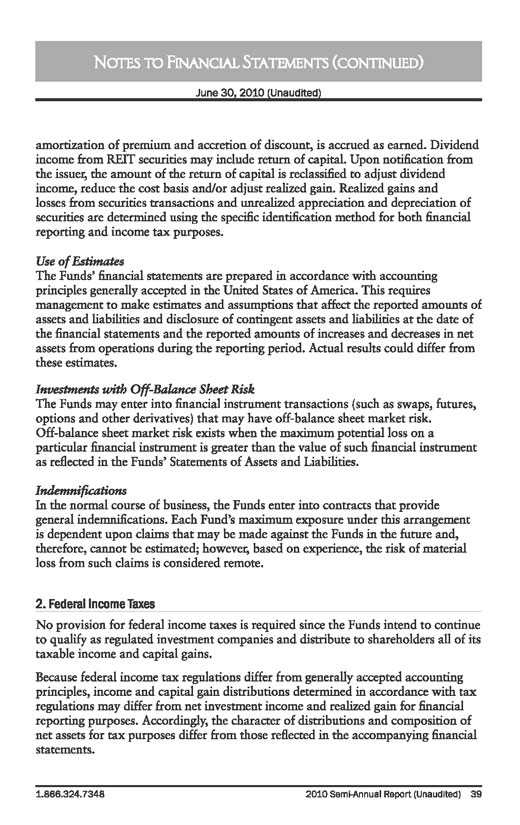

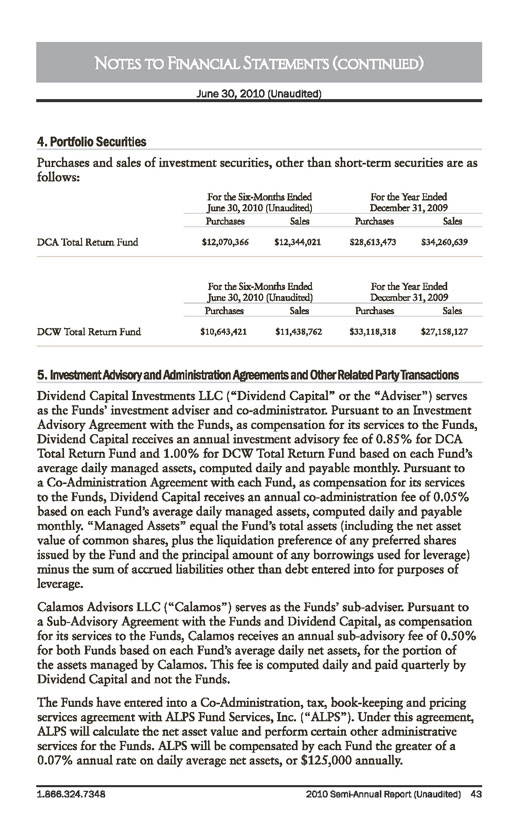

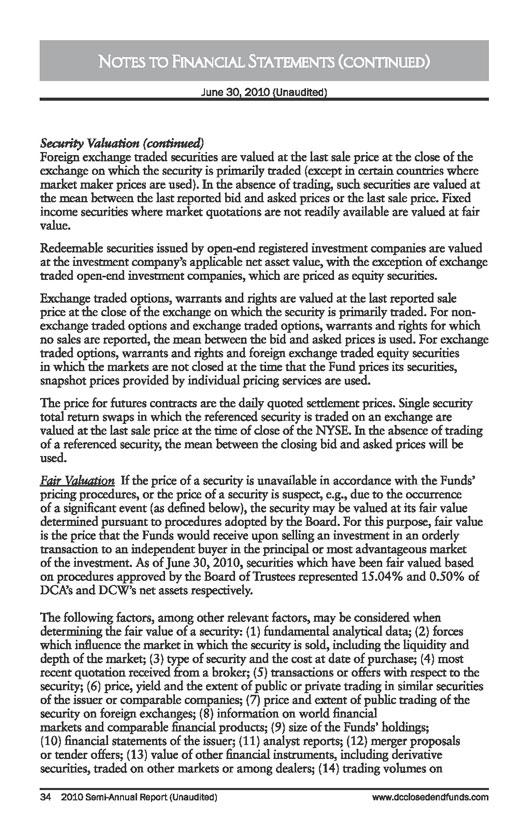

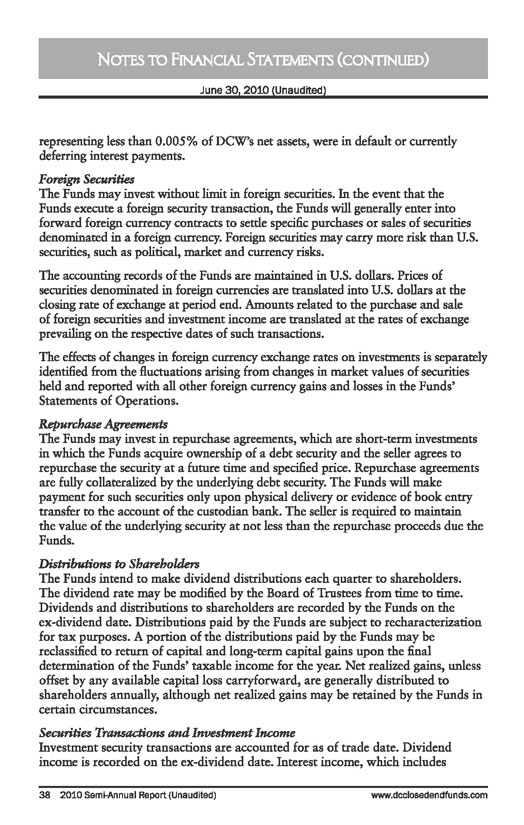

The following is a summary of the inputs used to value the Funds’ investments as of June 30, 2010.

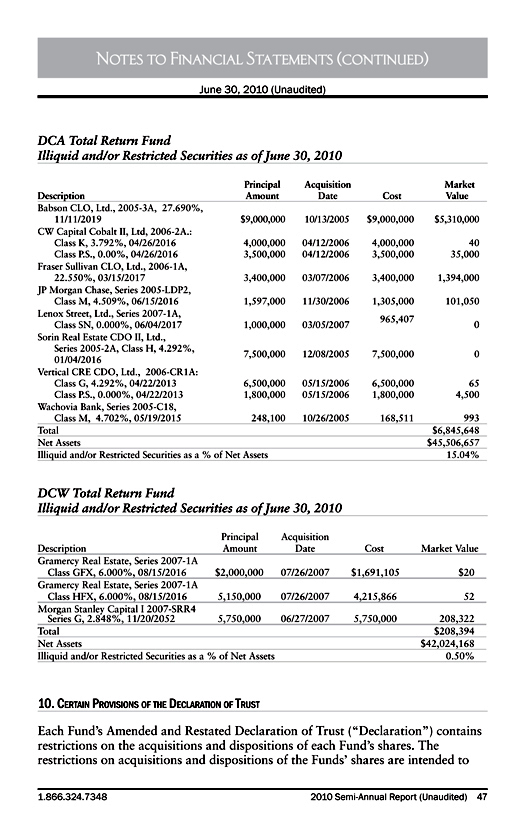

DCA Total Return Fund

Investments in Securities at Value

Level 1 – Quoted Prices

Level 2 –

Other Significant Observable Inputs

Level 3 – Significant Unobservable Inputs

Total

Common Stock(a)

$24,345,252

$—

$—

$24,345,252

Preferred Stock(a)

12,888,783

270

—

12,889,053

Commercial Real Estate Collateralized Debt Obligations

—

39,605

—

39,605

Collateralized Loan Obligations

—

6,704,000

—

6,704,000

Commercial Mortgage-Backed Securities

—

102,043

—

102,043

Money Market Funds

1,976,163

—

—

1,976,163

Total

$39,210,198

$6,845,918

$—

$46,056,116

The following is a reconciliation of assets in which significant unobservable inputs (Level 3) were such in determining fair value:

Investments in Securities at Value

Balance

as of

12/31/2009

Realized gain/ (loss)

Change in unrealized appreciation/ (depreciation)

Net purchases/ (sales)

Transfer in and/ or out of Level 3

Balance as of 06/30/2010

Commercial Real Estate Collateralized Debt Obligations

$—

$—

$(75)

$—

$75

$—

Total

$—

$—

$(75)

$—

$75

$—

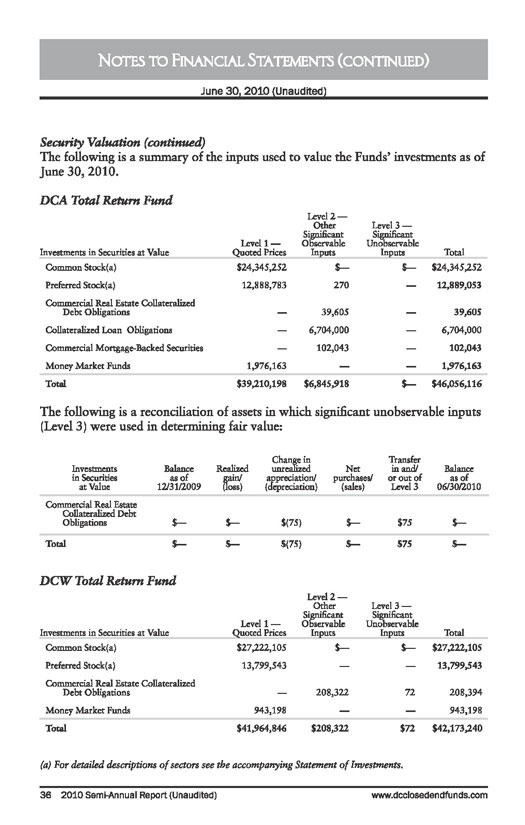

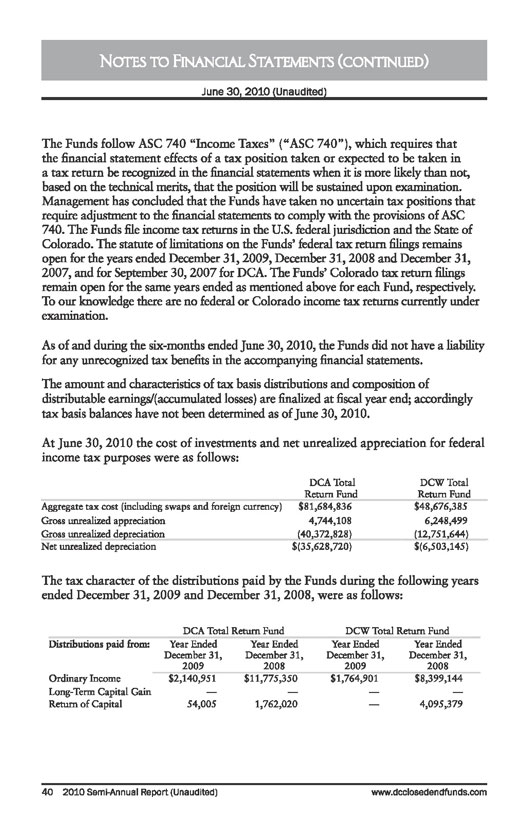

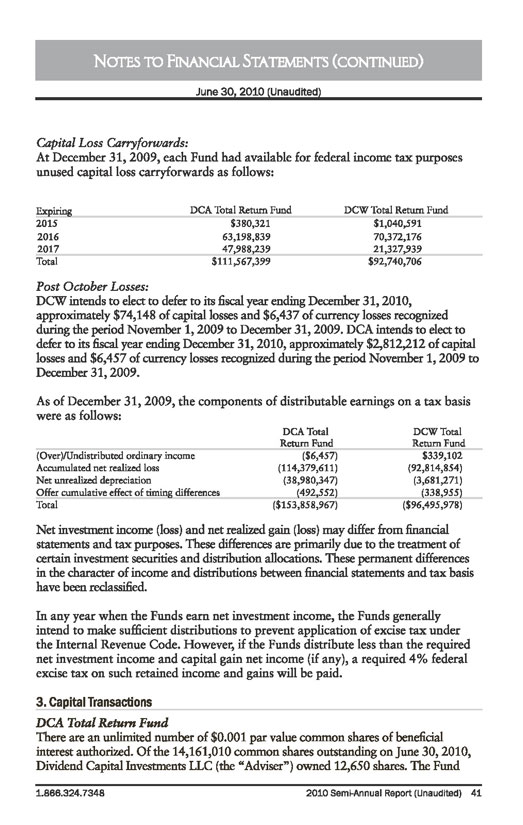

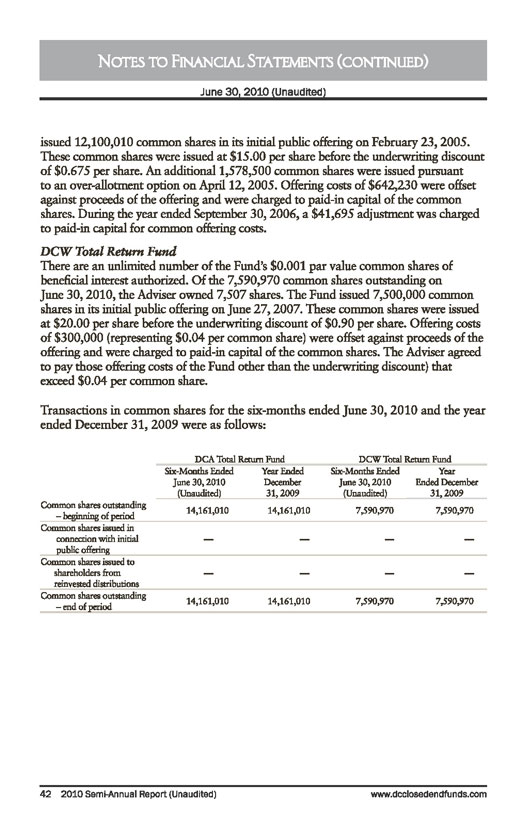

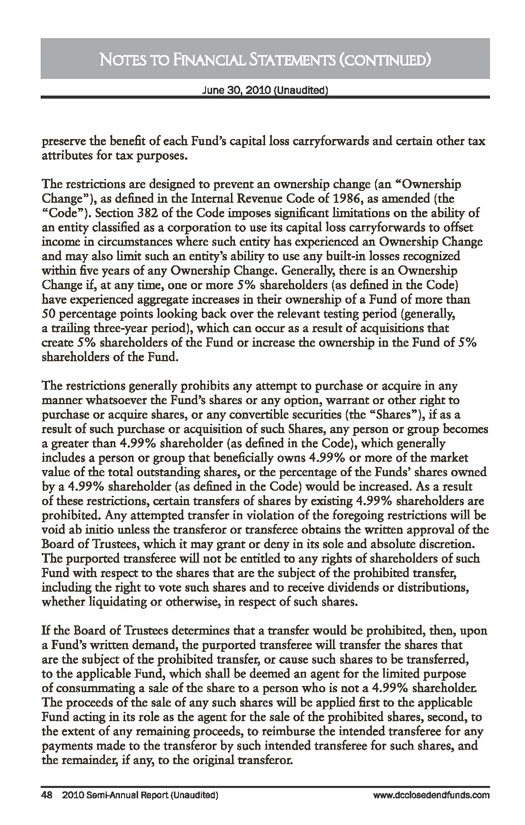

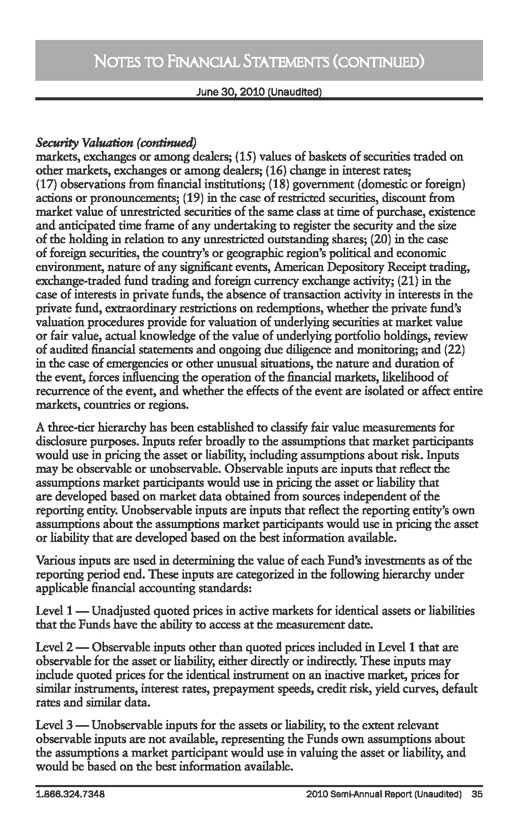

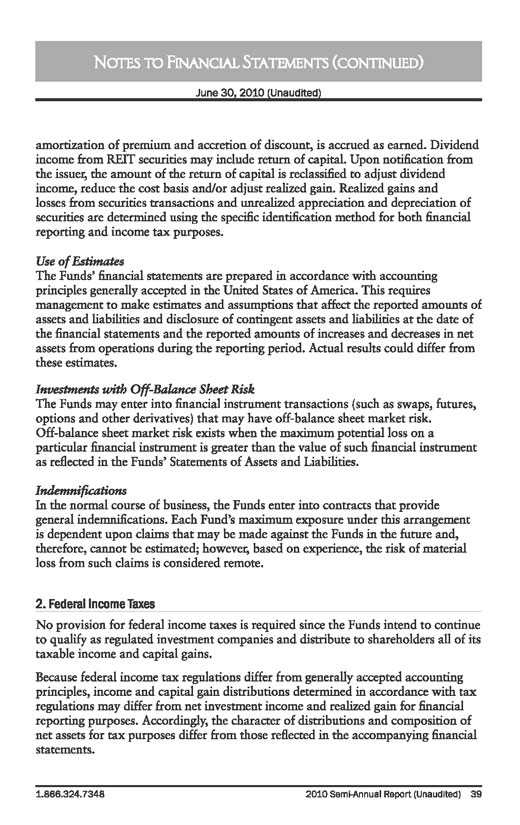

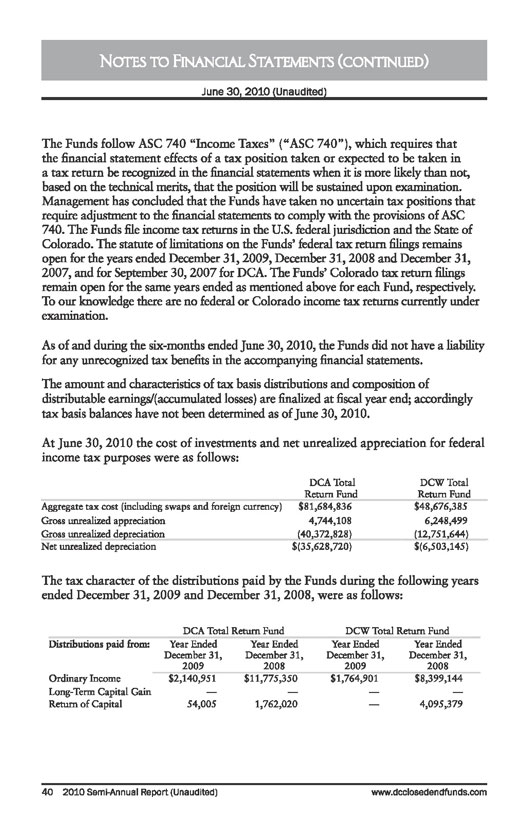

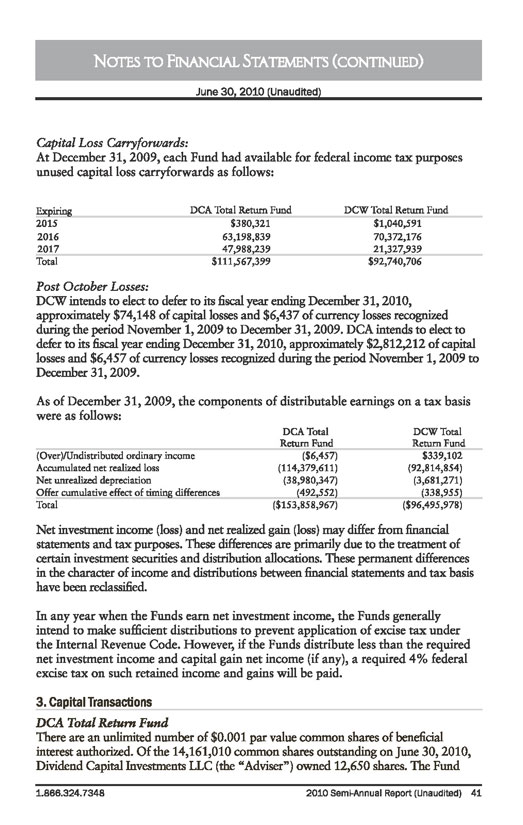

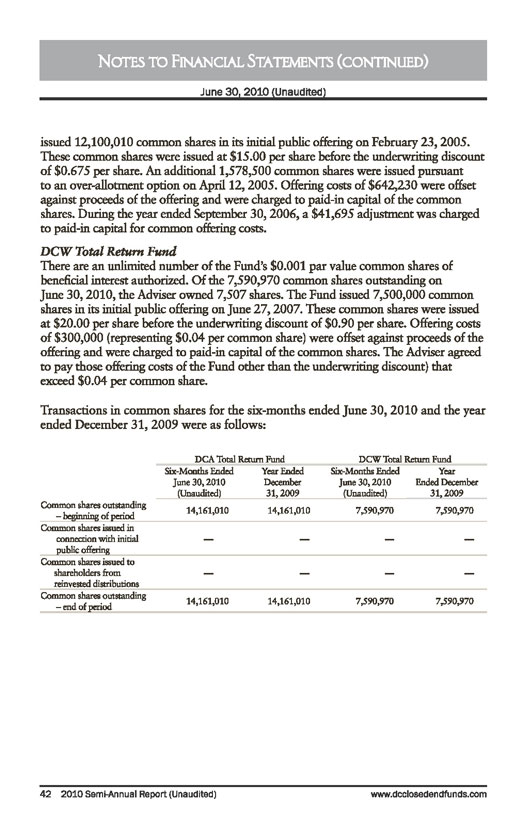

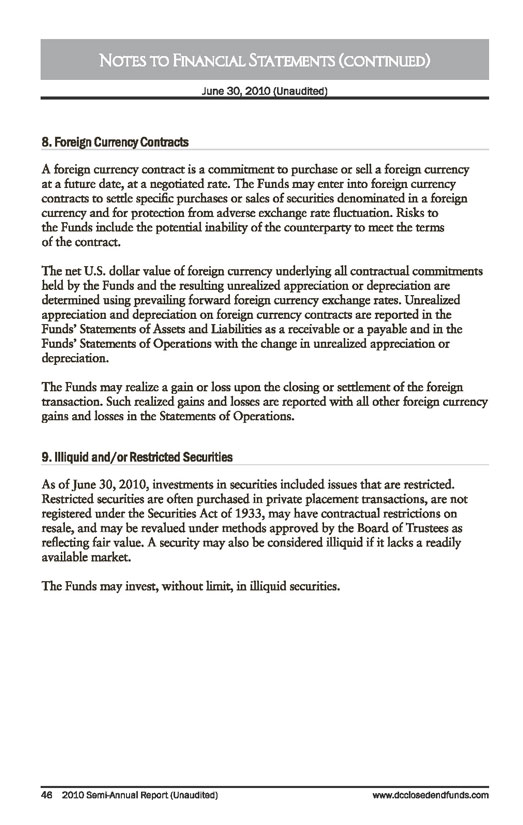

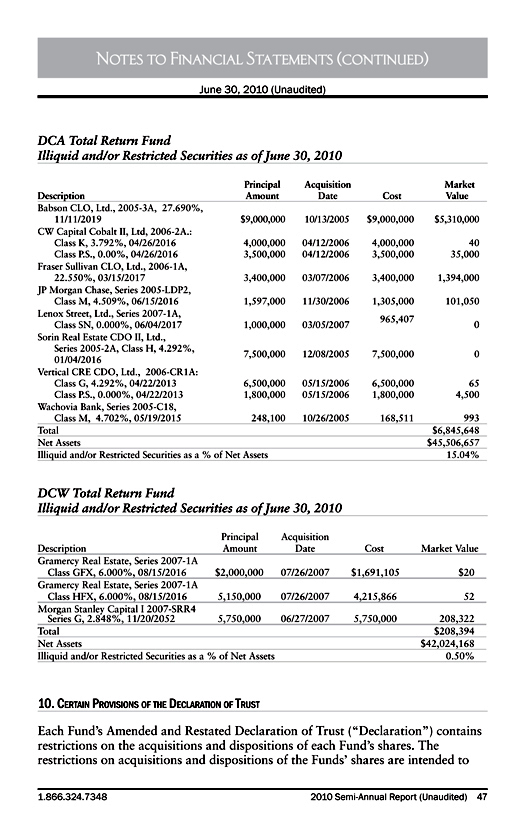

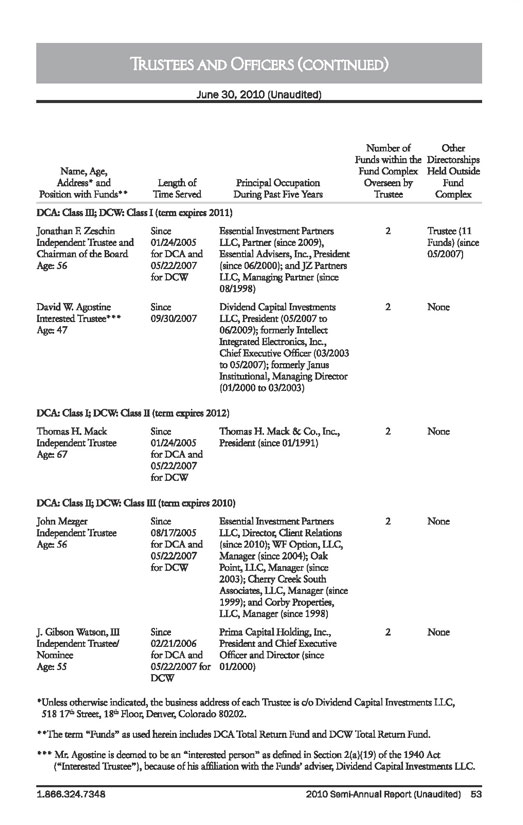

DCA Total Return Fund

Investments in Securities at Value

Level 1 – Quoted Prices

Level 2 –

Other Significant Observable Inputs

Level 3 – Significant Unobservable Inpurs

Total

Common Stock(a)

$27,222,105

$—

$—

$27,222,105

Preferred Stock(a)

13,799,543

—

—

13,799,543

Commercial Real Estate Collateralized Debt Obligations

—

208,322

72

208,394

Money Market Funds

943,198

—

—

943,198

Total

$41,964,846

$208,322

$72

$42,173,240

(a) For detailed descriptions of sectors see the accompanying Statement of Investments.

36 2010 Semi-Annual Report (Unaudited)

www.dcclosedendfunds.com

Notes to Financial Statements (continued)

June 30, 2010 (Unaudited)

Security Valuation (continued)

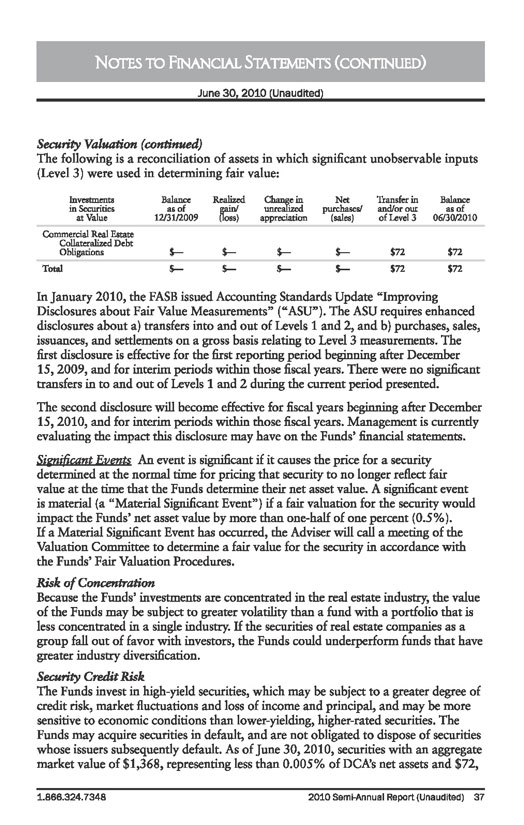

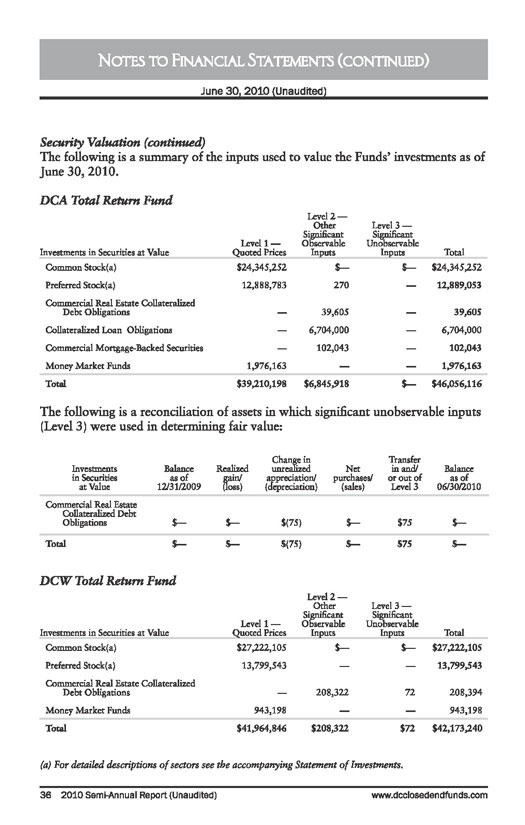

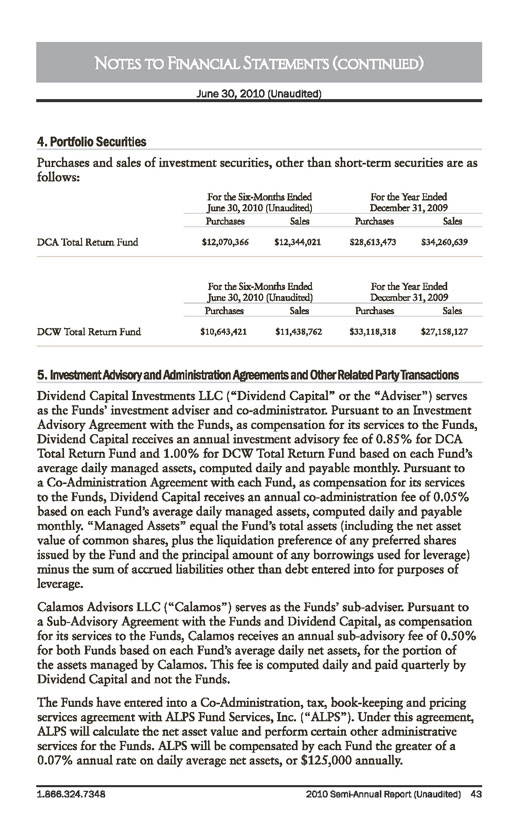

The following is a reconciliation of assets in which significant unobservable inputs (Level 3) were used in determining fair value:

Investments in Securities at Value

Balance as of 12/31/2009

Realized gain/ (loss)

Change in unrealized appreciation

Net purchases/ (sales)

Transfer in and/or out of Level 3

Balance as of 06/30/2010

Commercial Real Estate Collateralized Debt Obligations

$—

$—

$—

$—

$72

$72

Total

$—

$—

$—

$—

$72

$72

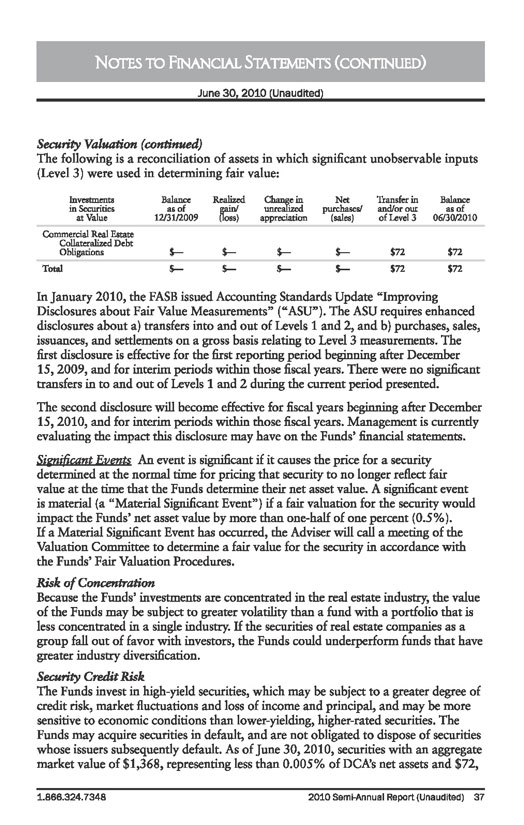

In January 2010, the FASB issued Accounting Standards Update “Improving Disclosures about Fair Value Measurements” (“ASU”). The ASU requires enhanced disclosures about a) transfers into and out of Levels 1 and 2, and b) purchases, sales, issuances, and settlements on a gross basis relating to Level 3 measurements. The first disclosure is effective for the first reporting period beginning after December 15, 2009, and for interim periods within those fiscal years. There were no significant transfers in to and out of Levels 1 and 2 during the current period presented.

The second disclosure will become effective for fiscal years beginning after December 15, 2010, and for interim periods within those fiscal years. Management is currently evaluating the impact this disclosure may have on the Funds’ financial statements.

Significant Events An event is significant if it causes the price for a security determined at the normal time for pricing that security to no longer reflect fair value at the time that the Funds determine their net asset value. A significant event is material (a “Material Significant Event”) if a fair valuation for the security would impact the Funds’ net asset value by more than one-half of one percent (0.5%). If a Material Significant Event has occurred, the Adviser will call a meeting of the Valuation Committee to determine a fair value for the security in accordance with the Funds’ Fair Valuation Procedures.

Risk of Concentration

Because the Funds’ investments are concentrated in the real estate industry, the value of the Funds may be subject to greater volatility than a fund with a portfolio that is less concentrated in a single industry. If the securities of real estate companies as a group fall out of favor with investors, the Funds could underperform funds that have greater industry diversification.

Security Credit Risk

The Funds invest in high-yield securities, which may be subject to a greater degree of credit risk, market fluctuations and loss of income and principal, and may be more sensitive to economic conditions than lower-yielding, higher-rated securities. The Funds may acquire securities in default, and are not obligated to dispose of securities whose issuers subsequently default. As of June 30, 2010, securities with an aggregate market value of $1,368, representing less than 0.005% of DCA’s net assets and $72, representing less than 0.005% of DCW’s net assets, were in default or currently deferring interest payments.

1.866.324.7348

2010 Semi-Annual Report (Unaudited) 37

Notes to Financial Statements (continued)

June 30, 2010 (Unaudited)

Foreign Securities

The Funds may invest without limit in foreign securities. In the event that the Funds execute a foreign security transaction, the Funds will generally enter into forward foreign currency contracts to settle specific purchases or sales of securities denominated in a foreign currency. Foreign securities may carry more risk than U.S. securities, such as political, market and currency risks.

The accounting records of the Funds are maintained in U.S. dollars. Prices of securities denominated in foreign currencies are translated into U.S. dollars at the closing rate of exchange at period end. Amounts related to the purchase and sale of foreign securities and investment income are translated at the rates of exchange prevailing on the respective dates of such transactions.

The effects of changes in foreign currency exchange rates on investments is separately identified from the fluctuations arising from changes in market values of securities held and reported with all other foreign currency gains and losses in the Funds’ Statements of Operations.

Repurchase Agreements

The Funds may invest in repurchase agreements, which are short-term investments in which the Funds acquire ownership of a debt security and the seller agrees to repurchase the security at a future time and specified price. Repurchase agreements are fully collateralized by the underlying debt security. The Funds will make payment for such securities only upon physical delivery or evidence of book entry transfer to the account of the custodian bank. The seller is required to maintain the value of the underlying security at not less than the repurchase proceeds due the Funds.

Distributions to Shareholders

The Funds intend to make dividend distributions each quarter to shareholders. The dividend rate may be modified by the Board of Trustees from time to time. Dividends and distributions to shareholders are recorded by the Funds on the ex-dividend date. Distributions paid by the Funds are subject to recharacterization for tax purposes. A portion of the distributions paid by the Funds may be reclassified to return of capital and long-term capital gains upon the final determination of the Funds’ taxable income for the year. Net realized gains, unless offset by any available capital loss carryforward, are generally distributed to shareholders annually, although net realized gains may be retained by the Funds in certain circumstances.

Securities Transactions and Investment Income

Investment security transactions are accounted for as of trade date. Dividend income is recorded on the ex-dividend date. Interest income, which includes

38 2010 Semi-Annual Report (Unaudited)

www.dcclosedendfunds.com

Notes to Financial Statements (continued)

June 30, 2010 (Unaudited)