Washington, D.C. 20549

Joseph V. Amato

Arthur C. Delibert, Esq.

1601 K Street, N.W.

Washington, D.C. 20006-1600

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940as amended (“Act”) (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Report to Shareholders.

Following are copies of the annual reports transmitted to shareholders pursuant to Rule 30e-1 under the Act.

Neuberger Berman

Alternative and Multi-Asset Class Funds

Institutional Class Shares

Class A Shares

Class C Shares

Class R6 Shares

Commodity Strategy Fund

Global Allocation Fund

Hedged Option Premium Strategy Fund

Long Short Fund

Long Short Credit Fund

Multi-Asset Income Fund

Multi-Style Premia Fund

U.S. Equity Index PutWrite Strategy Fund

Annual Report

October 31, 2018

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund's annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund's website www.nb.com/fundliterature, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 800.877.9700 or by sending an e-mail request to fundinfo@nb.com.

Beginning on January 1, 2019, you may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call 800.877.9700 or send an email request to fundinfo@nb.com to inform the Fund that you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the fund complex if you invest directly with the Fund.

Contents

THE FUNDS | |

President's Letter | | | 1 | | |

PORTFOLIO COMMENTARY | |

Commodity Strategy Fund | | | 2 | | |

Global Allocation Fund | | | 5 | | |

Hedged Option Premium Strategy Fund | | | 8 | | |

Long Short Fund | | | 11 | | |

Long Short Credit Fund | | | 14 | | |

Multi-Asset Income Fund | | | 18 | | |

Multi-Style Premia Fund | | | 22 | | |

U.S. Equity Index PutWrite Strategy Fund | | | 25 | | |

FUND EXPENSE INFORMATION | | | 33 | | |

SCHEDULE OF INVESTMENTS | |

Commodity Strategy Fund | | | 35 | | |

Global Allocation Fund | | | 42 | | |

Positions by Industry | | | 49 | | |

Hedged Option Premium Strategy Fund | | | 62 | | |

Long Short Fund | | | 67 | | |

Long Short Credit Fund | | | 86 | | |

Multi-Asset Income Fund | | | 94 | | |

Multi-Style Premia Fund | | | 116 | | |

Positions by Industry | | | 118 | | |

U.S. Equity Index PutWrite Strategy Fund | | | 165 | | |

FINANCIAL STATEMENTS | | | 168 | | |

FINANCIAL HIGHLIGHTS (ALL CLASSES)/

PER SHARE DATA | |

Commodity Strategy Fund | | | 220 | | |

Global Allocation Fund | | | 222 | | |

Hedged Option Premium Strategy Fund | | | 222 | | |

Long Short Fund | | | 224 | | |

Long Short Credit Fund | | | 226 | | |

Multi-Asset Income Fund | | | 228 | | |

Multi-Style Premia Fund | | | 230 | | |

U.S. Equity Index PutWrite Strategy Fund | | | 232 | | |

Report of Independent Registered Public Accounting Firms | | | 236 | | |

Directory | | | 239 | | |

Trustees and Officers | | | 240 | | |

Proxy Voting Policies and Procedures | | | 250 | | |

Quarterly Portfolio Schedule | | | 250 | | |

Board Consideration of the Management Agreement | | | 251 | | |

Notice to Shareholders | | | 260 | | |

The "Neuberger Berman" name and logo and "Neuberger Berman Investment Advisers LLC" name are registered service marks of Neuberger Berman Group LLC. The individual Fund names in this piece are either service marks or registered service marks of Neuberger Berman Investment Advisers LLC, an affiliate of Neuberger Berman BD LLC, distributor, member FINRA. ©2018 Neuberger Berman BD LLC, distributor. All rights reserved.

Dear Shareholder,

I am pleased to present this annual shareholder report for Neuberger Berman Alternative and Multi-Asset Class Funds.

The global financial market generated mixed results over the 12 months ended October 31, 2018. Despite periods of volatility and a weak finish, U.S. equities posted a solid return during the reporting period. Robust corporate profits and the boost from the December 2017 tax reform bill led to overall positive investor demand. These positive factors more than offset continued U.S. Federal Reserve Board (Fed) monetary policy tightening and concerns over a global trade war. In contrast, equities outside the U.S. generated poor results amid signs of decelerating growth, trade war fears and a number of geopolitical uncertainties.

Meanwhile, the U.S. fixed income market generated weak results over the reporting period. Both short- and long-term Treasury yields moved higher as the economy continued to grow and inflation ticked higher. In addition, the Fed indicated that it would remain on its path to tightening monetary policy in 2019 (although more recent statements by some Fed officials have suggested a less aggressive approach). Elsewhere, central banks in developed countries outside the U.S. largely maintained their accommodative monetary policies. However, the Bank of England raised rates twice over the period and the European Central Bank announced that it would end its bond buying program by the end of the year.

All told, the U.S. equity market, as measured by the S&P 500® Index, gained 7.35% over the reporting period. International developed and emerging market equities, as measured by the MSCI EAFE® and MSCI Emerging Market Indices, returned –6.85% and –12.52%, respectively, over the 12 months ended October 31, 2018. Meanwhile, the overall U.S. bond market, as measured by the Bloomberg Barclays U.S. Aggregate Bond Index, returned –2.05% during the period. Finally, inflation moved higher but was generally well contained over the period.

Looking ahead, if the economy gets through the remainder of 2018 without being derailed by geopolitical issues, Brexit, a trade war, rising U.S. inflation, or a failure of China to stimulate or of Europe and Japan to regain their growth impetus, we think that would bode well for a continuation of the business cycle through 2019 and 2020. That reads like a long list of risks, but many are interconnected and we regard all of them as containable. When the picture does clear, if things look positive, the rebound in sentiment could be sharp. That being said, some of the fog from the potential issues listed above could persist into the new year.

Thank you for your continued support and trust. We look forward to continue serving your investment needs in the years to come.

Sincerely,

JOSEPH V. AMATO

PRESIDENT AND CEO

NEUBERGER BERMAN MUTUAL FUNDS

1

Commodity Strategy Fund* Commentary (Unaudited)

Neuberger Berman Commodity Strategy Fund1 (formally Neuberger Berman Risk Balanced Commodity Strategy Fund) Institutional Class generated a total return of 1.19% for the 12 months ended October 31, 2018 and outperformed its benchmark, the Bloomberg Commodity Index (the Index), which posted a –1.73% return for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

The overall commodity market generated mixed results over the reporting period. On one hand, energy-related commodities were highly resilient and generated positive results. However, this did not spill over to other commodities; non-energy commodities largely generated negative returns, as they were dragged down by periods of investor risk aversion, global trade war concerns and tightening monetary policy by the U.S. Federal Reserve Board. The weakest performers over the period included soybeans and soybean oil, zinc, lead, coffee and sugar.

Looking at the commodity sectors in which the Fund invests, energy was the largest contributor to performance relative to the benchmark. In particular, an out-of-benchmark allocation to gas oil and overweights to both gasoline and heating oil were additive for returns. Within the agriculture sector, the Fund's underweights to soybeans and soybean oil were beneficial for returns. Their prices fell sharply amid growing trade tensions between the U.S. and China, the latter of which is the world's largest soybean importer. Elsewhere, an overweight to cotton was additive for results, as were underweights to sugar and coffee. On the downside, out-of-benchmark allocations to lead and platinum detracted from returns as they performed poorly over the period.

The Fund seeks to gain exposure to the commodity markets by investing, directly or indirectly, in futures contracts on individual commodities and other commodity-linked derivative instruments. The Fund's tactical positioning in commodity futures detracted from performance during the reporting period.

Despite recent challenges, we continue to believe that fundamentals are generally healthy for much of the commodities complex. We are optimistic, but cautious, as we believe that trade war and China slowdown fears may prove overblown. We believe that higher inflation expectations and geopolitical hedging will provide support for precious metals. We remain cautious on agricultural and soft commodities based on what we view as the low chance of supply reduction in the near term.

On top of this, if assets in the equity markets continue to stretch their already expensive valuations, we anticipate marginal investment dollars will start to search for cheaper diversifying sources of returns. As always, in this complex market environment, we advocate for an actively managed, risk-aware approach to commodities investing, in order to dynamically adjust to the uncertainty that lies ahead.

Sincerely,

HAKAN KAYA, THOMAS SONTAG AND DAVID YI WAN

PORTFOLIO MANAGERS

* As previously announced, effective November 8, 2018, the name of Neuberger Berman Risk Balanced Commodity Strategy Fund changed to Neuberger Berman Commodity Strategy Fund.

1 Much of the Fund's investment exposure is accomplished through the use of derivatives which may not require the Fund to deposit the full notional amount of the investment with its counterparties, such as a futures commission merchant. The Fund's resulting cash balances are invested in a variety of conservative fixed income securities.

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

2

Commodity Strategy Fund (Unaudited)

TICKER SYMBOLS

Institutional Class | | NRBIX | |

Class A | | NRBAX | |

Class C | | NRBCX | |

PORTFOLIO BY TYPE OF SECURITY

(as a % of Total Net Assets) | |

Asset-Backed Securities | | | 22.0 | % | |

Corporate Bonds | | | 65.6 | | |

Short-Term Investments | | | 8.0 | | |

Other Assets Less Liabilities | | | 4.4 | * | |

Total | | | 100.0 | % | |

* Includes the impact of the Fund's open positions in derivatives (other than Options Purchased), if any.

(as a % of Total Notional Value) | |

Commodity Futures: | |

Agriculture | | | 21.2 | % | |

Energy | | | 34.0 | | |

Industrial Metals | | | 15.6 | | |

Livestock | | | 6.4 | | |

Precious Metals | | | 17.7 | | |

Softs | | | 5.1 | | |

Total | | | 100.0 | % | |

PERFORMANCE HIGHLIGHTS3

| | Inception | | Average Annual Total Return

Ended 10/31/2018 | |

| | Date | | 1 Year | | 5 Years | | Life of Fund | |

At NAV | |

Institutional Class | | 08/27/2012 | | | 1.19 | % | | | –6.51 | % | | | –6.88 | % | |

Class A | | 08/27/2012 | | | 0.81 | % | | | –6.85 | % | | | –7.22 | % | |

Class C | | 08/27/2012 | | | 0.15 | % | | | –7.67 | % | | | –8.03 | % | |

With Sales Charge | |

Class A | | | | | –4.98 | % | | | –7.95 | % | | | –8.11 | % | |

Class C | | | | | –0.83 | % | | | –7.67 | % | | | –8.03 | % | |

Index | |

| Bloomberg Commodity Index1,2 | | | | | –1.73 | % | | | –7.31 | % | | | –8.18 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("Management") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2017 were 1.18%,1.56% and 3.20% for Institutional Class, Class A and Class C shares, respectively (before expense reimbursements and/or fee waivers, if any). The total annual operating expense ratios were 0.73%, 1.09% and 1.84% for Institutional Class, Class A and Class C shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for the annual period ended October 31, 2018 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

3

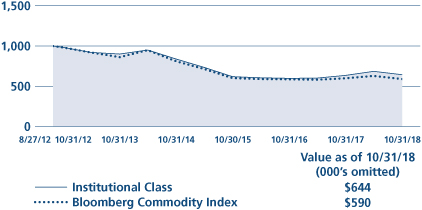

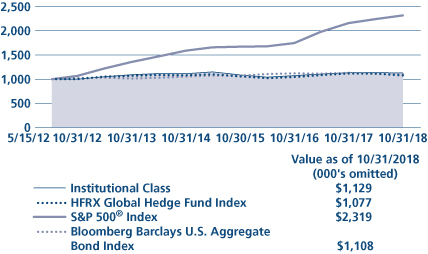

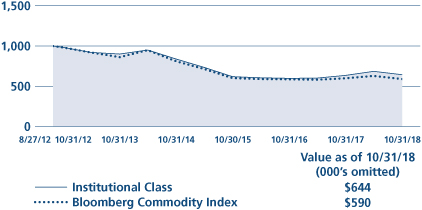

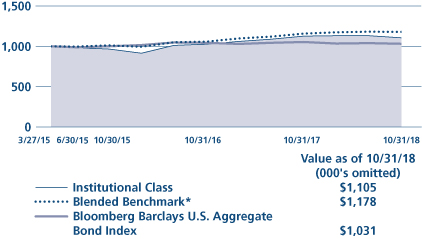

Commodity Strategy Fund (Unaudited)

COMPARISON OF A $1,000,000 INVESTMENT

(000's omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

4

Global Allocation Fund Commentary (Unaudited)

Neuberger Berman Global Allocation Fund Institutional Class generated a –3.14% total return for the 12 month reporting period ended October 31, 2018, underperforming its benchmark, a custom blend consisting of 60% MSCI All Country World Index (Net) and 40% Bloomberg Barclays Global Aggregate Index (together, the Index), which provided a –1.01% return for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

Global equities posted mixed results over the 12 month period. The 2017 calendar year ended with steady gains that continued into the new year. However, despite an improving global macroeconomic backdrop, the threat of rising inflation and the possibility of faster rate hikes by the U.S. Federal Reserve Board spooked global markets, which triggered a sharp sell-off in the first half of February. Although a v-shaped recovery in global markets ensued, rising interest rates and inflation expectations led to higher volatility, and a more challenging environment for markets. The rise of anti-globalization rhetoric by the U.S. presidential administration through proposed tariffs, and the resulting threats of retaliation sparked a wave of uncertainty across global trade relations. During the third quarter of 2018, global equity markets found some steady footing as the U.S. economy continued to demonstrate healthy economic fundamentals combined with strong corporate earnings. However, toward the end of the 12 month period, the U.S. equity market posted steep losses in October as global slowdown fears overshadowed fundamentals, bringing down the global equity markets.

The fixed income markets struggled as Treasury yields moved higher over the year and spread widening negatively impacted credit sector performance. Inflation failed to trend meaningfully higher resulting in Treasury Inflation-Protected Securities (TIPS) lagging. Additionally, emerging market (EM) debt exposure faced headwinds stemming from global trade concerns and country-specific events; namely, in Turkey and Argentina.

Over the period, the Fund struggled across asset classes. Gains from U.S. equity exposure were not enough to offset losses from non-U.S. developed and EM equities. Within fixed income, credit, TIPS and EM debt were detractors. The Fund also posted losses from its opportunistic investments, including its allocation to commodities and a systematic tactical asset allocation strategy.

The Fund's aggregate use of futures, forward foreign currency, swap and option contracts detracted from performance during the reporting period.

Looking back over the 12 month period, markets have experienced unprecedented divergence across regions and styles and within asset class (two examples: the S&P 500® Index has outperformed the MSCI EM Index by almost 20% and the Russell 1000® Growth Index has outperformed the Russell 1000® Value Index by over 7%). Looking forward, we believe it's crucial for investors to consider whether these relationships will continue to diverge, or will re-converge to a historically more "normal" state. The portfolio management team believes that global markets will re-converge, and as such, continues to be positioned with overweights to EM equity and debt, which we think stand to be notable beneficiaries if markets do indeed re-converge. The Fund's exposure to non-U.S. developed equity has also increased based on the reconvergence theme. We have increased exposure to interest rate duration given the recent rise in yields, but remain shorter than benchmark in anticipation of higher risk premiums given central bank plans toward policy normalization. Also, corporate spreads have recently widened, which we think presents an opportunity if, as we anticipate, fundamentals remain healthy and the economic business cycle extends.

We continue to believe that a flexible, multi-dimensional approach to a diversified portfolio is prudent. Our multi-asset class solution offers a "global go-anywhere" strategy, complemented with historically uncorrelated sources of return and a risk framework at both the security and portfolio level, in addition to independent firm oversight.

Sincerely,

ERIK KNUTZEN, BRADLEY TANK AND AJAY JAIN

PORTFOLIO MANAGERS

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

5

Global Allocation Fund (Unaudited)

TICKER SYMBOLS

Institutional Class | | NGLIX | |

Class A | | NGLAX | |

Class C | | NGLCX | |

PERFORMANCE HIGHLIGHTS3

| | Inception | | Average Annual Total Return

Ended 10/31/2018 | |

| | Date | | 1 Year | | 5 Year | | Life of Fund | |

At NAV | |

Institutional Class | | 12/29/2010 | | | –3.14 | % | | | 2.63 | % | | | 5.05 | % | |

Class A | | 12/29/2010 | | | –3.49 | % | | | 2.26 | % | | | 4.68 | % | |

Class C | | 12/29/2010 | | | –4.25 | % | | | 1.50 | % | | | 3.90 | % | |

With Sales Charge | |

Class A | | | | | –9.00 | % | | | 1.05 | % | | | 3.89 | % | |

Class C | | | | | –5.16 | % | | | 1.50 | % | | | 3.90 | % | |

Index | |

| Blended Benchmark*1,2 | | | | | –1.01 | % | | | 3.91 | % | | | 5.09 | % | |

| MSCI All Country World Index (Net)1,2 | | | | | –0.52 | % | | | 6.15 | % | | | 7.29 | % | |

* Blended Benchmark is composed of 60% MSCI All Country World Index (Net) and 40% Bloomberg Barclays Global Aggregate Index.

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("Management") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2017 were 4.03%, 4.53% and 5.27% for Institutional Class, Class A and Class C shares, respectively (before expense reimbursements and/or fee waivers, if any). The total annual operating expense ratios were 0.93%, 1.32% and 2.06% for Institutional Class, Class A and Class C shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for the annual period ended October 31, 2018 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

6

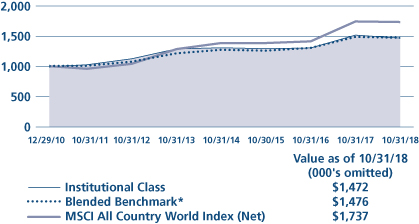

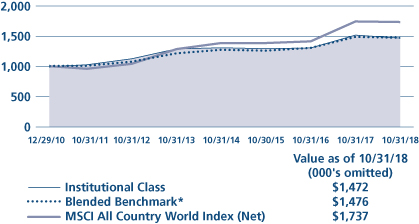

Global Allocation Fund (Unaudited)

COMPARISON OF A $1,000,000 INVESTMENT

(000's omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

* Blended Benchmark is composed of 60% MSCI All Country World Index (Net) and 40% Bloomberg Barclays Global Aggregate Index.

7

Hedged Option Premium Strategy Fund Commentary (Unaudited)

Neuberger Berman Hedged Option Premium Strategy Fund Institutional Class generated a total return of –4.74% for the 12 month reporting period ending October 31, 2018, underperforming its primary benchmark, the CBOE S&P 500® Iron Condor Index (the Index), which generated a total return of –3.66% for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

The Fund pursues an absolute return objective and is intended to experience limited correlation to broader equity markets. The Fund seeks to achieve its goal primarily through a strategy of selling (writing) put and call option spreads on U.S. indices, including the S&P 500® Index and the Russell 2000® Index, on exchange traded funds (ETFs) or on equity securities, and through investments in fixed income instruments. The Fund attempts to generate returns through the receipt of premiums from selling put and call option spreads, as well as through investments in fixed income instruments. Collectively, these strategies are intended to reduce volatility relative to what it would be if the Fund held the underlying reference asset (e.g., the underlying index, ETF or security) on which the options are written. In an effort to diversify exposures and limit volatility, the Fund sells put and call option spreads at varying strike prices and with varying expiration dates on various reference assets.

The significant price reversals in the S&P 500 and Russell 2000 Indices in the first and third quarters of 2018 resulted in losses for the Fund. In particular, the rapid increase in the S&P 500 in the first four weeks of the calendar year (+7.6%) resulted in losses from the Fund's short call spread strategy. Subsequently, the Fund suffered additional losses from its put spread strategy during the –10% drawdown in the S&P 500 from January 26 to February 8. Option exposures to the S&P 500 Index outperformed comparable exposures to the Russell 2000 Index for the period despite higher levels of implied volatility for the Russell 2000 as the S&P 500 remained within narrower limits for the year.

The Fund's fixed income collateral holdings of short-term U.S. Treasuries contributed marginally to returns as short-term U.S. Treasury bond yields increased over the period with the 2-Year U.S. Treasury yield increasing by roughly 130 basis points to 2.87%. We continue to roll maturing bond collateral into new two to three year U.S. Treasury notes at yield levels that are markedly higher than a year ago. Despite the significant rise in short term rates, our fixed income collateral holdings have avoided any meaningful losses. Over time we anticipate the strategy to benefit from higher levels of short-term interest rates as the shorter duration exposures of the Fund's fixed income portfolio allow the Fund to capture what we anticipate will be higher yields without experiencing significant duration risk.

As we reflect on our strategy results in 2018, we feel compelled to drop 'cautious' from the 'cautious optimism' we had coming into the year. We are pleased to have avoided a significant erosion of capital suffered by many volatility and risk-premia strategies in 2018, and believe that if we have increased market uncertainty without a full recessionary economic environment, it bodes well for our ability to earn equity index option premiums and short-term bond income relative to a continued dependence on capital appreciation.

Further, we anticipate equity market return dispersion to continue to increase across various regions, sectors and industries—due to a combination of diverse interest rate politics, increased global competition and geopolitics (e.g., U.S. tax reform and Brexit). As a result, we think equity index returns are likely to be at or below longer-term averages which has the potential to lead to higher relative returns for the Fund versus the Fund's benchmark and related U.S. equity market indexes such as the S&P 500 and Russell 2000 Indices.

Sincerely,

DEREK DEVENS

PORTFOLIO MANAGER

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio manager. The opinions are as of the date of this report and are subject to change without notice.

8

Hedged Option Premium Strategy Fund (Unaudited)

TICKER SYMBOLS

Institutional Class | | NHOIX | |

Class A | | NHOAX | |

Class C | | NHOCX | |

Class R6 | | NHORX | |

PORTFOLIO BY TYPE OF SECURITY

(as a % of Total Net Assets) | |

U.S. Treasury Obligations | | | 101.6 | % | |

Options Purchased | | | 0.2 | | |

Options Written | | | (2.3 | ) | |

Short-Term Investments | | | 0.7 | | |

Liabilities Less Other Assets | | | (0.2 | ) | |

Total | | | 100.0 | % | |

PERFORMANCE HIGHLIGHTS

| | | | Average Annual Total Return

Ended 10/31/2018 | |

| | Inception

Date | | 1 Year | | Life of

Fund | |

At NAV | |

Institutional Class | | 04/12/2017 | | | –4.74 | % | | | –1.88 | % | |

Class A | | 04/12/2017 | | | –5.12 | % | | | –2.24 | % | |

Class C | | 04/12/2017 | | | –5.84 | % | | | –2.98 | % | |

Class R6 | | 04/12/2017 | | | –4.71 | % | | | –1.84 | % | |

With Sales Charge | |

Class A | | | | | –10.57 | % | | | –5.90 | % | |

Class C | | | | | –6.77 | % | | | –2.98 | % | |

Index | |

| CBOE S&P 500 Iron Condor Index1,2 | | | | | –3.66 | % | | | –1.94 | % | |

| S&P 500® Index1,2 | | | | | 7.35 | % | | | 11.63 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("Management") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for the fiscal period ended 2017 are 5.26%, 5.89%, 6.60% and 5.19% for Institutional Class, Class A, Class C and Class R6 shares, respectively (before expense reimbursements and/or fee waivers, if any). The expense ratios for the fiscal period ended 2017 are 0.68%, 1.04%, 1.79% and 0.61% for Institutional Class, Class A, Class C and Class R6 shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for the fiscal period ended 2017 have been restated to reflect actual expenses excluding organization expenses incurred during that period. The expense ratios for the annual period ended October 31, 2018 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

9

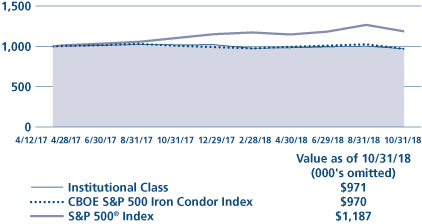

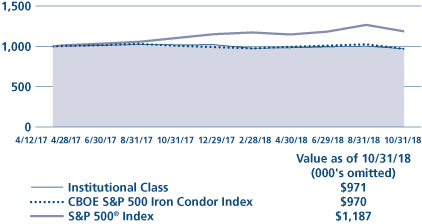

Hedged Option Premium Strategy Fund (Unaudited)

COMPARISON OF A $1,000,000 INVESTMENT

(000's omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

10

Long Short Fund Commentary (Unaudited)

Neuberger Berman Long Short Fund Institutional Class generated a 2.32% total return for the 12-month reporting period ended October 31, 2018, outperforming its primary benchmark, the HFRX Equity Hedge Index (the Index), which returned –2.99% for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

Despite several setbacks, the U.S. stock market generated a positive return during the reporting period. The market was initially supported by generally solid corporate profits. However, the market fell sharply in February and March 2018, partially due to fears that the U.S. Federal Reserve Board (Fed) would take a more aggressive approach in terms of future interest rate hikes. The market then rallied over the next six months as generally positive economic data and robust corporate profits overshadowed concerns over a global trade war. The market ended the reporting period on a weak note amid renewed worries over Fed monetary policy tightening, fears of moderating economic growth and ongoing trade war rhetoric. All told, the S&P 500® Index gained 7.35% over the 12 months ended October 31, 2018.

The Fund remained constructively positioned, albeit increasingly selective, during the period for an ongoing economic recovery in the U.S. Against this backdrop, the Fund's largest sector weights were in Industrials and Consumer Discretionary.

We categorize our long investment exposure into three groups: Capital Growth, Total Return and Opportunistic. Capital Growth continues to represent our largest allocation followed by Total Return and Opportunistic. We continued to identify compelling opportunities in Capital Growth relative to Total Return, as higher interest rates could negatively impact longer duration assets and cash flows. The portfolio's short exposure includes both single name "Fundamental" shorts and "Market" shorts. During the period, equity long exposure increased against the backdrop of heightened market volatility and greater sector dispersion as fundamentals came back into focus while overall total shorts decreased. Market shorts that consist primarily of sector and market cap-specific indices to help manage broader portfolio exposures decreased slightly during the period.

Equity long exposure added to Fund performance, while Fundamental shorts and the Fund's aggregate use of index futures, options and swaps related to hedging activity detracted from performance during the period given the overall positive move in markets.

Despite recent market gyrations, we believe the economic backdrop in the U.S. remains strong and continues to look positive. Looking ahead, the state of U.S. and global growth will likely be the determining factor of how equities perform. Close attention will be paid on whether rising interest rates and recently enacted tariffs will choke off economic activity. However, we anticipate that the path and timing of these policies will continue to be announced in an erratic manner and, therefore, drive near-term market volatility. Against this backdrop, we believe this will create more dispersion and potential opportunities both long and short. Nevertheless, we are very mindful of the complex world in which we live and invest. The risks of the long-term inflationary effects of continued government intervention, coupled with a myriad of ongoing geopolitical issues around the world, remain top of mind.

Sincerely,

CHARLES KANTOR AND MARC REGENBAUM

PORTFOLIO MANAGERS

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

11

Long Short Fund (Unaudited)

TICKER SYMBOLS

Institutional Class | | NLSIX | |

Class A | | NLSAX | |

Class C | | NLSCX | |

PORTFOLIO BY TYPE OF SECURITY

(as a % of Total Net Assets)

| | Long | | Short | |

Common Stocks | | | 79.4 | % | | | (12.4 | )% | |

Convertible Bonds | | | 0.2 | | | | — | | |

Corporate Bonds | | | 5.3 | | | | (1.1 | ) | |

Exchange Traded Funds | | | — | | | | (0.6 | ) | |

Master Limited Partnerships | | | 1.4 | | | | (0.3 | ) | |

Options Purchased | | | 0.2 | | | | — | | |

Preferred Stocks | | | 0.9 | | | | — | | |

Short-Term Investments | | | 10.5 | | | | — | | |

Other Assets Less Liabilities | | | 16.5 | * | | | — | | |

Total | | | 114.4 | % | | | (14.4 | )% | |

* Includes the impact of the Fund's open positions in derivatives (other than Options Purchased), if any.

PERFORMANCE HIGHLIGHTS

| | Inception | | Average Annual Total Return

Ended 10/31/2018 | |

| | Date | | 1 Year | | 5 Year | | Life of Fund | |

At NAV | |

Institutional Class | | 12/29/2011 | | | 2.32 | % | | | 3.32 | % | | | 5.91 | % | |

Class A | | 12/29/2011 | | | 2.01 | % | | | 2.95 | % | | | 5.54 | % | |

Class C | | 12/29/2011 | | | 1.27 | % | | | 2.18 | % | | | 4.75 | % | |

With Sales Charge | |

Class A | | | | | –3.85 | % | | | 1.73 | % | | | 4.63 | % | |

Class C | | | | | 0.27 | % | | | 2.18 | % | | | 4.75 | % | |

Index | |

| HFRX Equity Hedge Index1,2 | | | | | –2.99 | % | | | 1.19 | % | | | 2.85 | % | |

| S&P 500® Index1,2 | | | | | 7.35 | % | | | 11.34 | % | | | 14.34 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("Management") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2017 were 1.81%, 2.17% and 2.92% for Institutional Class, Class A and Class C shares, respectively (before expense reimbursements and/or fee waivers, if any). The expense ratios for the annual period ended October 31, 2018 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

12

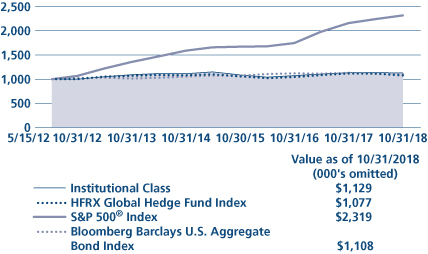

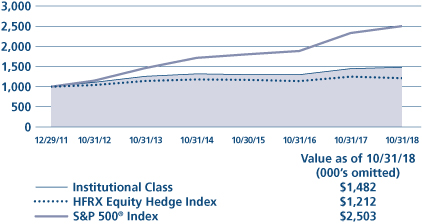

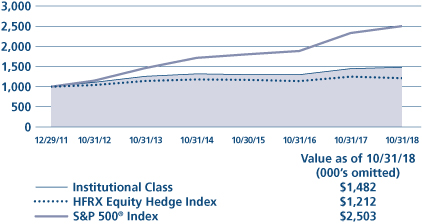

Long Short Fund (Unaudited)

COMPARISON OF A $1,000,000 INVESTMENT

(000's omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

13

Long Short Credit Fund Commentary (Unaudited)

Neuberger Berman Long Short Credit Fund Institutional Class returned –1.00% for the 12-month reporting period ended October 31 2018, underperforming its primary benchmark, the HRFX Fixed Income-Credit Index (the Index), which returned –0.19%% for the same period. The Fund outperformed the Bloomberg Barclays U.S. Aggregate Bond Index, which returned –2.05% for the period. (Performance for all share classes is provided in the table immediately following this letter.)

Credit markets had a difficult time over the reporting period. Concerns over rising rates, the continuation of tightening monetary policy by the U.S. Federal Reserve Board (Fed), uncertainty on global growth, trade tensions between the U.S. and China and a volatile equity backdrop all contributed to investor nervousness and poor performance. Investors appeared to be concerned about the onset of a global slowdown. In addition, continued concerns about the length of the cycle for both credit markets and the overall U.S. business expansion also had investors concerned. Another influencing factor was the pickup in overall market volatility, both in equity and fixed income markets. We believe investors have become accustomed to low volatility trending markets in both credit and equity. For now it appears as if the concerns highlighted above as well as the increase in U.S. interest rates may be breaking that calming influence on investors' risk appetites.

The increase in U.S. Treasuries during the period has, in our view, played a significant role in credit returns. The 10-year U.S. Treasury yield started the period at 2.38% and ended at 3.15%. This move was driven by a number of factors, primarily strong U.S. GDP growth as well as the communication by the Fed of continued interest rate hikes. The total number of interest rate hikes in the reporting period was four and the market has been pricing in approximately a 90% probability of a further hike in December 2018. The upward move in interest rates does not appear to have been absorbed as well as the interest rate hikes of 2017. There appears to be a concern that the number of hikes may begin to choke off the business cycle and that the tightening of financial conditions may accelerate the onset of a recession.

We believe the Fed policy and the move in interest rates will be a dominant feature in driving credit returns over the next 12 months. In addition, the European Central Bank has signaled that they may begin removing some of their extraordinary monetary accommodation. We are somewhat skeptical that the Fed will raise rates at the same pace over the next 12 months as over the past 12 months. When we look at the U.S. economy, we still believe that the economy is healthy and that while we anticipate growth may slow, it should still be robust, albeit not at the same level as the economy is currently operating at. In addition, from a fundamental perspective, credit appears to us to be fairly priced for the default environment. The issue in our minds is the degree to which one is being paid to take both interest rate and credit risk. We continue to believe in the attractiveness of credit, from the standpoint of fundamentals. We do however worry about the valuation levels and question whether investors are being paid appropriately for the interest rate risks.

Over the period, our gains mainly came from our positioning in the communications, financial and basic materials sectors, while our losses stemmed principally from our short positioning in the consumer non-cyclical and healthcare spaces.

The Fund's aggregate use of futures, forward foreign currency, swap, swaption and option contracts detracted from performance during the reporting period.

We intend to remain invested in credit, without taking too much interest rate risk. We believe the market does offer pockets of value, but we intend to remain invested conservatively. We believe that we are entering an interesting time in credit. Much of the adrenalin from central banks, delivered over the last nine years, may be coming to an end. If global growth resurfaces and inflation measures pick up, we expect that the markets will adjust. We do not believe that the transition will be as smooth as is currently predicted. It is our expectation that volatility in credit will increase and we are hoping to benefit from that. We have constructed a portfolio of single name long and short positions based on fundamental analysis. We hope to be able to capture the idiosyncratic opportunities that we believe are mispriced. This continues to be expressed through relative value trades, capital structure arbitrage trades and directional long and short positions.

14

We do not believe that investors need to be exposed to the full credit market; rather, we think that a balanced book of longs and shorts may perhaps be a better solution for the upcoming changes we are anticipating. The Fund seeks to deliver a stable series of returns that are not correlated to either the volatility or general return of the broad credit markets. We believe that a portfolio of fundamental long and short positions in credit, with little interest rate risk, should be able to help accomplish this in the upcoming year.

Sincerely,

RICK DOWDLE* AND NORMAN MILNER

PORTFOLIO MANAGERS

* As previously disclosed in a supplement to the Fund's prospectus, Rick Dowdle will cease his portfolio management responsibilities on or about December 31, 2018. Norman Milner will continue to manage the Fund.

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

15

Long Short Credit Fund (Unaudited)

TICKER SYMBOLS

Institutional Class | | NLNIX | |

Class A | | NLNAX | |

Class C | | NLNCX | |

Class R6 | | NRLNX | |

PORTFOLIO BY TYPE OF SECURITY

(as a % of Total Net Assets) | |

Common Stocks | | | 0.1 | % | |

Corporate Bonds | | | 45.9 | | |

Foreign Government Securities | | | 0.3 | | |

Short Term Investments | | | 27.3 | | |

Other Assets Less Liabilities | | | 26.4 | * | |

Total | | | 100.0 | % | |

* Includes the impact of the Fund's open positions in derivatives (other than Options Purchased), if any.

PERFORMANCE HIGHLIGHTS

| | | | Average Annual Total Return

Ended 10/31/2018 | |

| | Inception

Date | | 1 Year | | Life of

Fund | |

At NAV | |

Institutional Class | | 06/29/2015 | | | –1.00 | % | | | 0.56 | % | |

Class A | | 06/29/2015 | | | –1.43 | % | | | 0.20 | % | |

Class C | | 06/29/2015 | | | –2.14 | % | | | –0.50 | % | |

Class R6 | | 06/29/2015 | | | –0.93 | % | | | 0.63 | % | |

With Sales Charge | |

Class A | | | | | –5.64 | % | | | –1.08 | % | |

Class C | | | | | –3.09 | % | | | –0.50 | % | |

Index | |

| HFRX Fixed Income - Credit Index1,2 | | | | | –0.19 | % | | | 0.55 | % | |

Bloomberg Barclays U.S.

Aggregate Bond Index1,2 | | | | | –2.05% | | | | 1.50% | | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("Management") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2017 were 1.99%, 2.43%, 3.15% and 1.96% for Institutional Class, Class A, Class C and Class R6 shares, respectively (before expense reimbursements and/or fee waivers, if any). The total annual operating expense ratios were 0.80%, 1.18%, 1.93% and 0.74% for Institutional Class, Class A, Class C and Class R6 shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for the annual period ended October 31, 2018 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 4.25% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

16

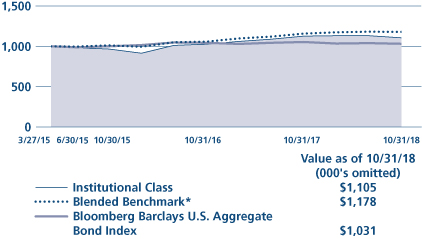

Long Short Credit Fund (Unaudited)

COMPARISON OF A $1,000,000 INVESTMENT

(000's omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

17

Multi-Asset Income Fund Commentary (Unaudited)

Neuberger Berman Multi-Asset Income Fund Institutional Class generated a –1.92% total return for the 12-month reporting period ended October 31, 2018, underperforming its benchmark, a custom blend consisting of 60% Bloomberg Barclays U.S. Aggregate Bond Index and 40% S&P 500® Index (together, the Index), which provided a 1.77% return for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

Global equities posted mixed results over the 12-month period. The 2017 calendar year ended with steady gains that continued into the new year. However, despite an improving global macroeconomic backdrop, the threat of rising inflation and the possibility of faster rate hikes by the U.S. Federal Reserve Board spooked global markets, which triggered a sharp sell-off in the first half of February. Although a v-shaped recovery in global markets ensued, rising interest rates and inflation expectations led to higher volatility, and a more challenging environment for markets. The rise of anti-globalization rhetoric by the U.S. presidential administration through proposed tariffs, and the resulting threats of retaliation sparked a wave of uncertainty across global trade relations. During the third quarter of 2018, global equity markets found some steady footing as the U.S. economy continued to demonstrate healthy economic fundamentals combined with strong corporate earnings. However, toward the end of the 12-month period, the U.S. equity market posted steep losses in October as global slowdown fears overshadowed fundamentals, bringing down the global equity markets.

The fixed income markets struggled as Treasury yields moved higher over the year and spread widening negatively impacted credit sector performance. Inflation failed to trend meaningfully higher resulting in Treasury Inflation-Protected Securities (TIPS) lagging. Additionally, emerging market (EM) debt exposure faced headwinds stemming from global trade concerns and country-specific events, namely in Turkey and Argentina.

Over the 12-month period ending October 31, 2018 the Fund posted positive contributions to total returns from U.S. equities and real estate investment trusts (REITs) but losses in non-U.S. equities and master limited partnerships (MLPs). Furthermore, our tactical decision to be overweight EM equities weighed on performance. Within fixed income, gains from high yield and bank loans were additive, but unable to stem losses from other asset classes, particularly EM debt and TIPS. In general, our fixed income positioning added value relative to the Barclays U.S. Aggregate Bond Index. With regard to the Fund's opportunistic strategies, the Diversified Currency strategy contributed positively, but allocations to systematic Global Tactical Asset Allocation (GTAA) and the Iron Condor options strategy detracted from performance.

The Fund's aggregate use of futures, forward foreign currency, swap and option contracts detracted from performance during the reporting period.

Looking back over the 12-month period, markets have experienced unprecedented divergence across regions and styles and within asset class (for example: the S&P 500® Index has outperformed the MSCI EM Index by almost 20% and the Russell 1000® Growth Index has outperformed the Russell 1000® Value Index by over 7%). Looking forward, we believe it's crucial for investors to consider whether these relationships will continue to diverge, or will re-converge to a historically more "normal" state. The portfolio management team believes that global markets will re-converge, and as such continues to be positioned with overweights to EM equity and debt, which we think stand to be notable beneficiaries if markets do indeed re-converge. The Fund's exposure to non-U.S. developed equity has also increased based on the reconvergence theme. We have increased exposure to interest rate duration given the recent rise in yields, but remain shorter than benchmark in anticipation of higher risk premiums given central bank plans toward policy normalization. Also, corporate spreads have recently widened, which we think presents an opportunity if, as we expect, fundamentals remain healthy and the economic business cycle extends.

18

We continue to believe that a multi-dimensional approach to yield is prudent. Our multi-asset class approach offers diversified income sources, complemented with historically uncorrelated sources of return and a risk framework that seeks to mitigate volatility and deliver an attractive return and income profile.

Sincerely,

ERIK KNUTZEN, BRADLEY TANK AND AJAY JAIN

PORTFOLIO MANAGERS

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

19

Multi-Asset Income Fund (Unaudited)

TICKER SYMBOLS

Institutional Class | | NANIX | |

Class A | | NANAX | |

Class C | | NANCX | |

Class R6 | | NRANX | |

PORTFOLIO BY TYPE OF SECURITY

(as a % of Total Net Assets) | |

Asset-Backed Securities | | | 1.8 | % | |

Common Stocks | | | 35.6 | | |

Convertible Bonds | | | 1.2 | | |

Corporate Bonds | | | 9.9 | | |

Exchange Traded Funds | | | 3.0 | | |

Investment Companies | | | 20.8 | | |

Mortgage-Backed Securities | | | 15.5 | | |

Master Limited Partnerships | | | 3.4 | | |

Options Purchased | | | 0.0 | | |

Preferred Stocks | | | 2.1 | | |

U.S. Government Agency Securities | | | 0.5 | | |

U.S. Treasury Obligations | | | 13.2 | | |

Short-Term Investments | | | 4.5 | | |

Liabilities Less Other Assets | | | (11.5 | )* | |

Total | | | 100.0 | % | |

* Includes the impact of the Fund's open positions in derivatives (other than Options Purchased), if any.

PERFORMANCE HIGHLIGHTS

| | | | Average Annual Total Return

Ended 10/31/2018 | |

| | Inception

Date | | 1 Year | | Life of

Fund | |

At NAV | |

Institutional Class | | 03/27/2015 | | | –1.92 | % | | | 2.80 | % | |

Class A | | 03/27/2015 | | | –2.28 | % | | | 2.42 | % | |

Class C | | 03/27/2015 | | | –3.02 | % | | | 1.66 | % | |

Class R6 | | 03/27/2015 | | | –1.86 | % | | | 2.87 | % | |

With Sales Charge | |

Class A | | | | | –6.42 | % | | | 1.21 | % | |

Class C | | | | | –3.96 | % | | | 1.66 | % | |

Index | |

| Blended Benchmark*1,2 | | | | | 1.77 | % | | | 4.65 | % | |

Bloomberg Barclays U.S.

Aggregate Bond Index1,2 | | | | | –2.05% | | | | 0.86% | | |

* Blended Benchmark is composed of 60% Bloomberg Barclays U.S. Aggregate Bond Index and 40% S&P 500® Index.

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("Management") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

For the period ended October 31, 2018, the 30-day SEC yields were 3.75%, 3.37%, 2.61% and 3.82% for Institutional Class, Class A, Class C and Class R6 shares, respectively. Absent expense reimbursements and/or fee waivers, the 30-day SEC yields would have been 1.96%, 1.52%, 0.82% and 2.03% for Institutional Class, Class A, Class C and Class R6 shares, respectively.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2017 were 3.28%, 3.72%, 4.42% and 3.23% for Institutional Class, Class A, Class C and Class R6 shares, respectively (before expense reimbursements and/or fee waivers, if any). The total annual operating expense ratios were 0.75%, 1.12%, 1.87% and 0.68% for Institutional Class, Class A, Class C and Class R6 shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for the annual period ended October 31, 2018 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 4.25% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

20

Multi-Asset Income Fund (Unaudited)

COMPARISON OF A $1,000,000 INVESTMENT

(000's omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

* Blended Benchmark is composed of 60% Bloomberg Barclays U.S. Aggregate Bond Index and 40% S&P 500® Index.

21

Multi-Style Premia Fund Commentary (Unaudited)

Neuberger Berman Multi-Style Premia Fund Institutional Class generated a –1.16% total return for the period from its inception on May 18, 2018 to October 31, 2018 (the reporting period). In contrast, its benchmark, the ICE BofAML 3-Month U.S. Treasury Bill Index (the Index), provided a 0.91% return during the same period. (Performance for all share classes is provided in the table immediately following this letter.)

The Fund seeks absolute returns with low correlation to traditional asset classes. The Fund invests both long and short in a variety of instruments across multiple asset classes (i.e. equities, fixed income, currencies, commodities and interest rates), as it seeks to generate returns in both up and down markets with low sensitivity to directional market movements.

We experienced a mixed macroeconomic environment during the reporting period. While corporate profits were robust overall, equities experienced a setback late in the period as investor risk aversion increased. This was driven by a number of factors, including escalating trade war rhetoric, continued monetary policy tightening by the U.S. Federal Reserve Board, uncertainties surrounding the U.S. midterm elections and several geopolitical events. Towards the latter part of the period, we began to see a more pronounced rotation in the market from momentum factors to more defensive themes.

The largest detractor from the Fund's performance during the reporting period was its currency positioning. The Fund's long positions in higher yielding emerging market currencies and short positions in lower yielding developed market currencies was a headwind for performance as investor risk aversion increased due to escalating trade concerns. The Fund's commodity exposure was mixed but ended slightly down during the period. In particular, the Fund's long energy positions added value in September as oil prices rallied, but detracted during the October sell-off. The largest contributor to performance was the Fund's equity exposure. While global equity markets struggled in October, the Fund's equity book benefited from short positions in low quality/high risk stocks across the Information Technology, Energy and Communication Services sectors, which fell sharply over the month. Elsewhere, the Fund's volatility strategy, which includes managed futures trend following and equity index put selling, was slightly down overall during the period. The Fund's interest rates strategy ended the reporting period slightly positive.

The Fund's aggregate use of futures, forward foreign currency, swap and option contracts contributed positively to performance during the reporting period.

A number of derivative instruments are used to more efficiently manage the portfolio. The Fund utilizes commodity futures, currency forwards, and equity index derivatives, among others. We believe equity valuations are inflated and that, together with forecasted monetary policy tightening, if it occurs, should set the stage for diversified alternative strategies going forward. We saw hints of this late in the reporting period and, should these trends continue to develop, we believe that we could see a further resurrection of those risk premiums that have delivered healthy risk-adjusted performance to investors for many decades. As the current market cycle continues to move forward, the potential upside of highly market correlated strategies appears to be decreasing. In our view, market dislocations are already creating opportunities to systematically harvest returns from differentiated sources.

Sincerely,

RAY CARROLL, SIMON GRIFFITHS AND FRANK MAEBA

PORTFOLIO MANAGERS

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

22

Multi-Style Premia Fund (Unaudited)

TICKER SYMBOLS

Institutional Class | | NMLIX | |

Class A | | NMLAX | |

Class C | | NMLCX | |

Class R6 | | NMLRX | |

PERFORMANCE HIGHLIGHTS

| | | | Cumulative Total Return

Ended 10/31/2018 | |

| | Inception

Date | | Life of

Fund | |

At NAV | | | | | |

Institutional Class | | 05/18/2018 | | | –1.16 | % | |

Class A | | 05/18/2018 | | | –1.32 | % | |

Class C | | 05/18/2018 | | | –1.64 | % | |

Class R6 | | 05/18/2018 | | | –1.12 | % | |

With Sales Charge | | | | | |

Class A | | | | | –7.01 | % | |

Class C | | | | | –2.62 | % | |

Index | | | | | |

| ICE BofAML 3-Month U.S. Treasury Bill Index1,2 | | | | | 0.91 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("Management") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the estimated total annual operating expense ratios for fiscal year 2018 are 2.25%, 2.61%, 3.36% and 2.18% for Institutional Class, Class A, Class C and Class R6 shares, respectively (before expense reimbursements and/or fee waivers, if any). The estimated total annual operating expense ratios for fiscal year 2018 are 0.99%, 1.35%, 2.10% and 0.92% for Institutional Class, Class A, Class C and Class R6 shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for the annual period ended October 31, 2018 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

23

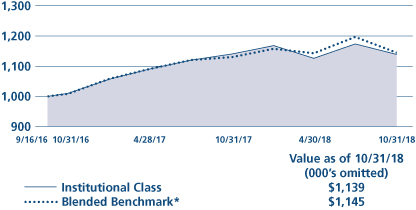

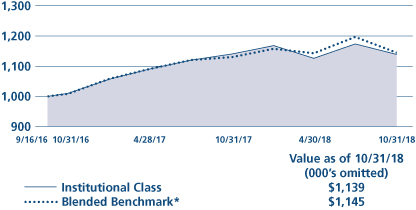

Multi-Style Premia Fund (Unaudited)

COMPARISON OF A $1,000,000 INVESTMENT

(000's omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

24

U.S. Equity Index PutWrite Strategy Fund Commentary (Unaudited)

Neuberger Berman U.S. Equity Index PutWrite Strategy Fund Institutional Class generated a total return of –0.16% for the 12-month reporting period ended October 31, 2018, underperforming its primary benchmark, a blend of 85% CBOE S&P 500 PutWrite Index (PUT) and 15% CBOE Russell 2000 PutWrite Index (PUTR) (together, the Index), which posted a total return of 1.29% for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

Relative performance challenges continue to be residuals of the benchmark price reversals experienced during the first quarter of 2018, rather than a structural change in market conditions. To the contrary, material increases in both equity index option implied volatility levels and short-term U.S. Treasury rates have created a healthy market environment for index put writing strategies.

As we see it, equity markets appear to have transitioned to a more favorable environment for our strategies through a series of small, abruptly painful events rather than a major dislocation. The favorable environment includes a resetting of equity market implied volatility to levels that are materially higher than 2017 averages, the exiting of a number of speculative volatility strategies from the markets, and interest rates that have increased significantly. After the U.S. equity market 'perfection' in 2017, 2018 is a year in which avoiding capital impairment is going to be a reasonable outcome in our view after already suffering two major dislocations. We have been waiting a long time for a less robust equity environment with higher volatility and higher rates, yet we always presumed the transition to that environment would require a more dramatic event. Now that we are here, we believe there is a solid value proposition of allocating to equity strategies with lower market correlation, such as ours.

The Fund posted gains during the second and third quarters, but performance lagged the S&P 500® and Russell 2000® Indices and the Index due to the benchmark's higher market exposure ("beta")1 at the beginning of the quarter. Within the Fund, our S&P 500 and Russell 2000 put writing strategies continued to recover from the 1st quarter and during the most recent drawdown (October 2018), the tides turned. For the month of October, the Fund (–5.00%) outperformed both the PUT (–5.59%) and PUTR (–8.98%), as our diversified risk management benefited from the more orderly/systemic drawdown where volatility remained elevated and the duration of the drawdown was longer as compared to the first quarter dislocation.

The S&P 500 put writing strategy was a positive contributor to the Fund. Despite losses resulting from the first quarter price reversals of the S&P 500 Index, the cumulative premium collection has offset those losses. Net of the short spells of price volatility during the first and third quarters, the S&P 500 Index returned 7.35% over the past 12 months which is a market environment in which we would expect the strategy to underperform.

The Fund's Russell 2000 put writing strategy was a slight detractor to the Fund on an absolute basis. While the Fund's Russell 2000 put writing strategy outperformed PUTR, it underperformed relative to the Russell 2000 Index which had strong second and third quarters, returning 1.85% for the last 12 months.

We continue to roll maturing bond collateral into new two to three year U.S. Treasury notes at yield levels that are markedly higher than a year ago. Despite the significant rise in short term rates, our fixed income collateral holdings have avoided any meaningful losses.

As we reflect on our strategy results in 2018, we feel compelled to drop 'cautious' from the 'cautious optimism' we had coming into the year. We are pleased to have avoided a significant erosion of capital suffered by many volatility and risk-premia strategies year-to-date, and believe that if we have increased market uncertainty without a full recessionary

25

economic environment it bodes well for our ability to earn equity index option premiums and short-term bond income relative to a continued dependence on capital appreciation.