Neuberger Berman

Alternative and Multi-Asset Class Funds

Institutional Class Shares

Class A Shares

Class C Shares

Class R6 Shares

Flexible Select Fund

Global Allocation Fund

Inflation Managed Fund

(Formerly Inflation Navigator Fund)

Long Short Fund

Long Short Credit Fund

Multi-Asset Income Fund

Annual Report

October 31, 2015

Contents

THE FUNDS | |

President's Letter | | | 1 | | |

PORTFOLIO COMMENTARY | |

Flexible Select Fund | | | 2 | | |

Global Allocation Fund | | | 6 | | |

Inflation Managed Fund (Formerly Inflation Navigator Fund) | | | 9 | | |

Long Short Fund | | | 12 | | |

Long Short Credit Fund | | | 15 | | |

Multi-Asset Income Fund | | | 18 | | |

FUND EXPENSE INFORMATION | | | 24 | | |

SCHEDULE OF INVESTMENTS | |

Flexible Select Fund | | | 26 | | |

Global Allocation Fund | | | 28 | | |

Positions by Industry | | | 39 | | |

Inflation Managed Fund (Formerly Inflation Navigator Fund) | | | 42 | | |

Long Short Fund | | | 46 | | |

Long Short Credit Fund | | | 50 | | |

Multi-Asset Income Fund | | | 52 | | |

FINANCIAL STATEMENTS | | | 68 | | |

FINANCIAL HIGHLIGHTS (ALL CLASSES)/

PER SHARE DATA | |

Flexible Select Fund | | | 124 | | |

Global Allocation Fund | | | 124 | | |

Inflation Managed Fund (Formerly Inflation Navigator Fund) | | | 126 | | |

Long Short Fund | | | 128 | | |

Long Short Credit Fund | | | 130 | | |

Multi-Asset Income Fund | | | 130 | | |

Reports of Independent Registered Public Accounting Firms | | | 133 | | |

Directory | | | 135 | | |

Trustees and Officers | | | 136 | | |

Proxy Voting Policies and Procedures | | | 145 | | |

Quarterly Portfolio Schedule | | | 145 | | |

Board Consideration of the Management and

Sub-Advisory Agreements | | | 146 | | |

Notice to Shareholders | | | 150 | | |

The "Neuberger Berman" name and logo are registered service marks of Neuberger Berman Group LLC. "Neuberger Berman Management LLC" and the individual Fund names in this piece are either service marks or registered service marks of Neuberger Berman Management LLC. ©2015 Neuberger Berman Management LLC. All rights reserved.

Dear Shareholder,

I am pleased to present this annual shareholder report for Neuberger Berman Flexible Select Fund, Neuberger Berman Global Allocation Fund, Neuberger Berman Inflation Managed Fund, Neuberger Berman Long Short Fund and Neuberger Berman Multi-Asset Income Fund. This report also includes the new Neuberger Berman Long Short Credit Fund, which was launched on June 29, 2015.

The global financial markets were volatile at times and generated mixed results during the 12 months ended October 31, 2015. Investor risk appetite fluctuated given incoming global economic data, uncertainties regarding central bank monetary policy, falling commodity prices and numerous geopolitical issues. Despite experiencing its first correction (a decline of at least 10%) since 2011, the U.S. equity market, as measured by the S&P 500® Index, gained 5.20% over the 12-month period. In contrast, international developed market equities were largely flat, while emerging markets equities fell sharply. Within fixed income, longer-term U.S. Treasury yields declined and the overall bond market, as measured by the Barclays U.S. Aggregate Bond Index, gained 1.96% during the period. Finally, inflation remained tepid, partially a reflection of moderating growth in many countries and lower commodity prices.

Looking ahead, we believe the U.S. economy will continue to expand. However, growth could remain relatively muted, while inflation could edge somewhat higher as the year progresses. Against this backdrop, we expect the U.S. Federal Reserve (Fed) to move toward policy normalization. In our view, the Fed will be very gradual in its tightening cycle and we anticipate two to three rate hikes over the next 12 months, with a fed funds rate of 0.75%—1.0% by the end of 2016. From an investment perspective, the last few months have been challenging, but we maintain high conviction in our portfolio managers and believe they are well positioned for the current and coming environment.

Thank you for your continued support and trust. We look forward to continue serving your investment needs in the years to come.

Sincerely,

ROBERT CONTI

PRESIDENT AND CEO

NEUBERGER BERMAN MUTUAL FUNDS

Flexible Select Fund Commentary (Unaudited)

Neuberger Berman Flexible Select Fund Institutional Class generated a 0.13% total return for the 12 months ended October 31, 2015 but underperformed its benchmark, the Russell 3000® Index, which provided a 4.49% return. (Performance for all share classes is provided in the table immediately following this letter.)

Effective October 1, 2015, the Flexible Select Fund underwent a number of structural changes and enhancements. The Fund is now being co-managed by Joseph V. Amato, who has been managing the Fund since its inception in 2013, and Erik Knutzen, CFA, CAIA, Neuberger Berman's Multi-Asset Class Chief Investment Officer. The portfolio managers determine the Fund's asset allocation using a variety of fundamental and quantitative analyses, and may use Neuberger Berman's fundamental research capabilities, as well as the views of Neuberger Berman's Asset Allocation Committee.

The method for determining the equity sleeve of the Flexible Select Fund has been redesigned to result in a more concentrated, highest-conviction portfolio, consisting of approximately 45–65 names. In selecting the underlying equity securities, the Fund now employs a methodology to systematically extract security selection insights from a select group of underlying managers with a track record of security selection skill. These insights are packaged and delivered in a portfolio that we seek to optimize for risk/reward subject to target levels of risk, as well as limits on sector, market capitalization and individual security weight deviations from the Russell 3000 Index.

The range of eligible strategies for implementing the fixed income allocation of the Fund has been broadened to include a larger group of Neuberger Berman bond funds across different types and maturities of fixed income instruments. In addition to the Neuberger Berman Core Bond Fund, eligible strategies include the Neuberger Berman High Income Bond Fund, Neuberger Berman Short Duration Bond Fund, Neuberger Berman Short Duration High Income Fund, Neuberger Berman Floating Rate Income Fund, Neuberger Berman Emerging Markets Debt Fund and Neuberger Berman Unconstrained Bond Fund.

As of October 31, 2015, the allocation was approximately 85.0% equity, 11.8% fixed income and 3.2% cash and cash equivalents.

A wave of policy-related developments in the U.S. were instrumental in stabilizing investor sentiment and supporting risk assets during October after a pronounced sell-off in August and September. Positive resolutions were reached with respect to the debt ceiling (suspended through March 2017) and budget (agreement for fiscal years 2016 and 2017) and Paul Ryan assumed the position of Speaker of the House of Representatives. The U.S. continues to be among the strongest developed economies as domestic growth remains positive.

Since the Fund's repositioning on October 1, 2015 through the end of the reporting period, industry sector allocations in the equity portion of the portfolio delivered positive contributions to relative performance led by an underweight to Utilities and an overweight to Energy. Security selection had a negative contribution to relative performance, driven by holdings in the Health Care and Industrials sectors. Our fixed income holdings contributed positively to absolute performance during the month.

Over the 12-month reporting period, industry sector allocation in the equity portion of the portfolio had a positive contribution to relative performance, led by underweights to Utilities and Telecommunication Services. Security selection had a negative contribution to relative performance, driven by holdings in the Consumer Discretionary and Energy sectors. The portfolio's fixed income holdings contributed positively to absolute performance during the 12-month period.

Recent economic data have reflected a more resilient growth backdrop. In the U.S., October's employment report was strong on nearly every metric—the headline payroll figure increased by 271,000, the prior two months were revised higher by 12,000 and the unemployment rate edged down to 5.0%. Perhaps most encouraging was the gain in average hourly earnings, which were up 0.4% month-over-month and 2.5% year-over-year. Overall, we anticipate a stable growth backdrop. We remain constructive on risk assets, with a bias towards equities and to credit over government securities.

Sincerely,

JOSEPH V. AMATO AND ERIK KNUTZEN*

PORTFOLIO MANAGERS

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

* Erik Knutzen became a Portfolio Manager of Neuberger Berman Flexible Select Fund effective October 1, 2015.

TICKER SYMBOLS

Institutional Class | | NFLIX | |

Class A | | NFLAX | |

Class C | | NFLCX | |

SECTOR ALLOCATION

(as a % of Total Investments*) | |

Consumer Discretionary | | | 10.2 | % | |

Consumer Staples | | | 6.2 | | |

Energy | | | 7.1 | | |

Financials | | | 16.8 | | |

Health Care | | | 14.2 | | |

Industrials | | | 11.1 | | |

Information Technology | | | 17.3 | | |

Materials | | | 1.5 | | |

Utilities | | | 0.5 | | |

Mutual Funds | | | 11.8 | | |

Short-Term Investments | | | 3.3 | | |

Total | | | 100.0 | % | |

* Derivatives, if any, are excluded from this chart.

PERFORMANCE HIGHLIGHTS

| | | | | Average Annual Total

Return Ended 10/31/2015 | |

| | | Inception

Date | | 1 Year | | Life of

Fund | |

At NAV | |

Institutional Class | | 05/31/2013 | | | 0.13 | % | | | 7.90 | % | |

Class A | | 05/31/2013 | | | –0.23 | % | | | 7.51 | % | |

Class C | | 05/31/2013 | | | –0.95 | % | | | 6.70 | % | |

With Sales Charge | |

Class A | | | | | | | –5.99 | % | | | 4.91 | % | |

Class C | | | | | | | –1.92 | % | | | 6.70 | % | |

Index | |

| Russell 3000® Index1,2 | | | | | | | 4.49 | % | | | 11.77 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Management LLC (Management) had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2014 were 1.22%, 1.70% and 2.44% for Institutional Class, Class A and Class C shares, respectively (before expense reimbursements and/or fee waivers, if any). The expense ratios were 0.89%, 1.25% and 2.00% for Institutional Class, Class A and Class C shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for the annual period ending October 31, 2015 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

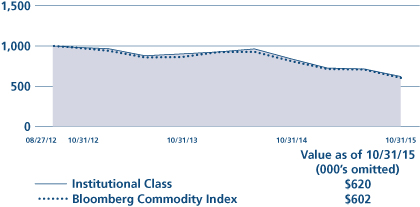

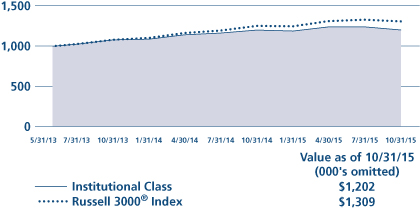

COMPARISON OF A $1,000,000 INVESTMENT

(000's omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

Global Allocation Fund Commentary (Unaudited)

Neuberger Berman Global Allocation Fund Institutional Class generated a –1.12% total return for the 12 months ended October 31, 2015 and underperformed its custom benchmark, a 60/40 combination of the MSCI All Country World Index and the Barclays Global Aggregate Index, which provided a –0.73% return for the period. (Performance for all share classes is provided in the table immediately following this letter.) The benchmark changed during the reporting period; the prior custom benchmark was a 50/50 combination of the MSCI World Index and the J.P. Morgan Global Government Bond Index.

In January of 2015, the Fund was enhanced to include broader access to the firm's entire investment platform and two new portfolio managers were added to the portfolio. The Fund employs a diversified, flexible approach to accessing opportunities across the global marketplace and incorporates both strategic and tactical asset allocation decision making and active management. As part of the change, the benchmark was modified as noted above.

The global equity markets generated mixed returns during the reporting period. U.S. stocks outperformed other regions; non-U.S. developed stocks performed positively, while emerging markets stocks were challenged. In the fixed income markets, returns for non-U.S. and emerging markets were negative, while U.S. fixed income generated positive returns. The U.S. continues to be among the strongest developed economies as domestic growth remains positive. The eurozone is benefiting from the European Central Bank's monetary policies as business conditions have improved amidst lower oil prices and a weaker euro, contributing to increased GDP growth. Japan is aided by stimulus from the Bank of Japan and a weaker yen, but the economy faces threats from slowing growth in China, stagnating business and consumer confidence, and low wage inflation.

In the period since the Fund's enhancement mentioned above, equities have been the largest positive contributors to the Fund's performance. The overweight to the asset class as a whole added to performance, particularly security selection within non-U.S. developed equities. Security selection within U.S. equity markets was a drag on returns.

During the period, the Fund was underweighted to fixed income relative to its benchmark, a decision that added to performance as equity markets broadly outperformed fixed income markets. Security selection within fixed income detracted from returns primarily due to allocations within non-U.S. developed bonds and to emerging markets debt. The Fund's aggregate use of derivatives (futures contracts, forward contracts and swaps) detracted from performance.

Looking ahead, we are optimistic on the global economy, although financial markets remain dynamic and risks, of course, remain. Recent economic data have reflected a more resilient growth backdrop. In the U.S., October's employment report was strong on nearly every metric. Data outside of the U.S. is also showing signs of improvement as the purchasing manager indices for China, the eurozone and Japan all rose in October. Overall, we anticipate a more stable growth backdrop in the U.S. and abroad as the positive effects of additional monetary stimulus, low interest rates and low commodity prices work their way through the global economy. We remain constructive on risk assets, with a bias towards equities, particularly in the U.S. and Europe. In fixed income, we currently favor credit over developed market government securities. We are cautious on both emerging markets equities and debt.

Sincerely,

ERIK KNUTZEN, BRADLEY TANK, WAI LEE AND AJAY JAIN

PORTFOLIO MANAGERS

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

TICKER SYMBOLS

Institutional Class | | NGLIX | |

Class A | | NGLAX | |

Class C | | NGLCX | |

PERFORMANCE HIGHLIGHTS3

| | | | | Average Annual Total

Return Ended 10/31/2015 | |

| | | Inception

Date | | 1 Year | | Life of

Fund | |

At NAV | |

Institutional Class | | 12/29/2010 | | | –1.12 | % | | | 5.50 | % | |

Class A | | 12/29/2010 | | | –1.52 | % | | | 5.13 | % | |

Class C | | 12/29/2010 | | | –2.29 | % | | | 4.34 | % | |

With Sales Charge | |

Class A | | | | | | | –7.22 | % | | | 3.85 | % | |

Class C | | | | | | | –3.25 | % | | | 4.34 | % | |

Index | |

60% MSCI All Country World Index and

40% Barclays Global Aggregate Index1,2 | | | | | | | –0.73 | % | | | 5.28 | % | |

| MSCI All Country World Index1,2 | | | | | 0.50 | % | | | 7.58 | % | |

50% MSCI World Index and

50% J.P. Morgan

Global Government Bond Index1,2 | | | | | | | 0.20 | % | | | 5.12 | % | |

| MSCI World Index1,2 | | | | | | | 2.33 | % | | | 9.04 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Management LLC (Management) had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2014 were 3.13%, 3.51% and 4.26% for Institutional Class, Class A and Class C shares, respectively (before expense reimbursements and/or fee waivers, if any). The expense ratios were 1.53%, 1.89% and 2.64% for Institutional Class, Class A and Class C shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for the annual period ending October 31, 2015 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

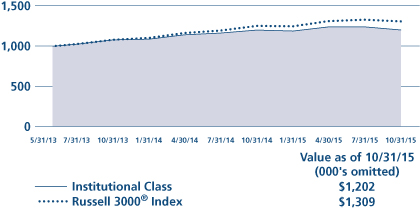

COMPARISON OF A $1,000,000 INVESTMENT

(000's omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

Inflation Managed Fund Commentary* (Unaudited)

Neuberger Berman Inflation Managed Fund Institutional Class generated a –9.98% total return for the 12 months ended October 31, 2015. During this same time period, the Barclays U.S. 1-10 Year Treasury Inflation-Protected Securities (TIPS) Index provided a –1.24% return while the U.S. Consumer Price Index was up 0.2%.1 (Performance for all share classes is provided in the table immediately following this letter.)

Despite periods of volatility, the overall fixed income market posted a positive return over the 12-month period. Short-term Treasury yields rose in anticipation of the first U.S. Federal Reserve (Fed) interest rate hike in nearly a decade. In contrast, longer-term rates declined given several flights to quality, triggered by signs of moderating global growth and numerous geopolitical issues. The yield on the 10-year Treasury began the period at 2.35% and fell to as low as 1.68% in late January 2015, before ending the period at 2.16%. Most non-Treasury securities produced modest gains but generated mixed results versus equal-duration Treasuries during the period. Inflation expectations remained muted during the period.

The Fund's underperformance during the reporting period was largely driven by its allocations to commodities, master limited partnerships (MLPs) and energy- and materials-related equities. The Fund's emerging markets equity exposure was also a headwind for performance. On the upside, the Fund's exposures to real estate investment trusts (REITs) and senior floating rate loans contributed the most to its performance. Elsewhere, the Fund's dynamic overlay (flexible use of strategies in an attempt to capitalize on short-term changes in inflation expectations) did not meaningfully impact performance during the period.

The Fund's use of financial futures contracts had a positive impact on its performance.

Looking ahead, we anticipate that growth in the U.S. will continue to be driven by solid consumer spending, supported by stronger corporate balance sheets, lower energy costs and subdued inflation. In our view, the U.S. economy could expand by 2.5% (+/– 0.5%) in 2016. The sharp decline in energy prices has kept inflation muted, but the base effects of this downward spiral are set to dissipate, which should put upward pressure on the Consumer Price Index. All told, we believe inflation could move up to 2.0% (+/– 0.3) in 2016. In terms of the Fed, we have long felt that the timing of its initial rate hike was not as important as the pace and magnitude of future rate hikes. While we believe a decision on rate hikes will be data dependent, we see this as being a very slow and moderate process, likely taking several years before normalization ultimately occurs.

Sincerely,

THANOS BARDAS, ANDREW JOHNSON AND THOMAS J. MARTHALER

PORTFOLIO MANAGERS

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

1 Consumer Price Index (CPI) is a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food and medical care. The CPI is one of the most frequently used statistics for identifying periods of inflation or deflation. The CPI is available monthly, so the value shown is from October 31, 2014 to October 31, 2015, and is not seasonally adjusted.

* Effective February 28, 2015, Neuberger Berman Inflation Navigator Fund changed its name to Neuberger Berman Inflation Managed Fund.

TICKER SYMBOLS

Institutional Class | | NDRIX | |

Class A | | NDRAX | |

Class C | | NDRCX | |

PORTFOLIO BY TYPE OF

INVESTMENT STRATEGY

(as a % of Total Investment Strategies)

Commodities | | | 9.1 | % | |

Emerging Markets | | | 5.3 | | |

Global Treasury Inflation Protected Securities | | | 28.2 | | |

High Yield Securities | | | 10.2 | | |

Loans | | | 3.7 | | |

Master Limited Partnerships | | | 13.1 | | |

Real Estate Investment Trusts | | | 9.3 | | |

S&P Energy | | | 10.8 | | |

S&P Materials | | | 10.3 | | |

Total | | | 100.0 | % | |

PORTFOLIO BY TYPE OF SECURITY

(as a % of Total Net Assets)

Common Stocks | | | 43.4 | % | |

Government Securities | | | 12.9 | | |

U.S. Treasury Securities | | | 13.7 | | |

Mutual Funds | | | 28.3 | | |

Short-Term Investments | | | 1.0 | | |

Cash, receivables and other assets,

less liabilities | | | 0.7 | * | |

Total | | | 100.0 | % | |

* Percentage includes appreciation/depreciation from derivatives, if any.

PERFORMANCE HIGHLIGHTS4

| | | | | Average Annual Total

Return Ended 10/31/2015 | |

| | | Inception

Date | | 1 Year | | Life of

Fund | |

At NAV | |

Institutional Class | | 12/19/2012 | | | –9.98 | % | | | –0.42 | % | |

Class A | | 12/19/2012 | | | –10.21 | % | | | –0.72 | % | |

Class C | | 12/19/2012 | | | –10.92 | % | | | –1.49 | % | |

| Class R65 | | 05/11/2015 | | | –9.88 | % | | | –0.39 | % | |

With Sales Charge | |

Class A | | | | | | | –15.35 | % | | | –2.75 | % | |

Class C | | | | | | | –11.80 | % | | | –1.49 | % | |

Index | |

Barclays U.S. 1-10 Year

Treasury TIPS Index1,2 | | | | | | | –1.24 | % | | | –1.56 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Management LLC (Management) had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2014 were 3.53%, 3.95% and 4.74% for Institutional Class, Class A and Class C shares, respectively (before expense reimbursements and/or fee waivers, if any). The expense ratios were 1.00%, 1.36% and 2.11% for Institutional Class, Class A and Class C shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for the annual period ending October 31, 2015 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

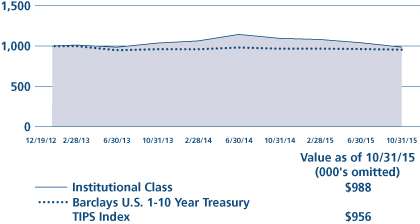

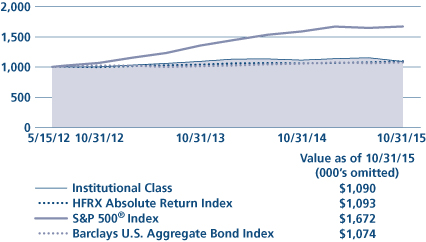

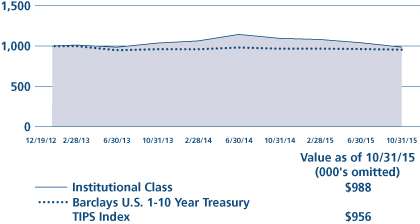

COMPARISON OF A $1,000,000 INVESTMENT

(000's omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

Long Short Fund Commentary (Unaudited)

Neuberger Berman Long Short Fund Institutional Class generated a –1.45% total return for the 12 months ended October 31, 2015 and underperformed its primary benchmark, the HFRX Equity Hedge Index, which returned –0.96% for the period. The Fund also underperformed the S&P 500® Index, which provided a 5.20% return for the period. (Performance for all share classes is provided in the table immediately following this letter.)

The global financial markets generally posted modest gains during the reporting period. The markets experienced periods of elevated volatility due to mixed economic data, uncertainties surrounding monetary policy, falling commodity prices and a host of geopolitical issues. Economic growth in the U.S. was uneven but remained in expansionary mode while inflation remained benign. During the period, expectations increased that the U.S. Federal Reserve (Fed) was getting closer to raising rates for the first time in nearly a decade. Elsewhere, growth was generally muted in Europe and Japan, whereas China's growth expansion moderated during the period.

We maintained our positive outlook on risk assets such as equities and high yield bonds during the reporting period. This was reflected in the Fund's net notional long exposure, which began the period at approximately 55% net long, then moved to a low of about 50%, before closing the period at roughly 52%. Given our outlook for an ongoing economic expansion in the U.S., we continued to favor more cyclical industries, including those within the Consumer Discretionary and Industrials sectors.

We categorize our long investment exposure into three groups: Capital Growth, Total Return and Opportunistic. During the period we reduced our allocation to Total Return in favor of Capital Growth. We found what seemed to us to be more compelling opportunities in Capital Growth relative to Total Return, as higher interest rates could negatively impact longer duration assets and cash flows. The portfolio's short exposure includes "Fundamental" shorts and "Market" shorts. During the period, our Market shorts consisted primarily of sector-based exchange traded funds, coupled with short futures positions on broad-based U.S. equity indices and U.S. Treasuries. During the period, we found more shorting opportunities based on underlying company fundamentals.

The Fund's aggregate use of derivatives (futures contracts, option contracts and swap contracts) detracted from performance during the period.

Looking ahead, we maintain our view that a mix of higher risk assets such as U.S. equities and high yield bonds can present attractive risk-adjusted returns for those market participants that can afford to take on longer-term time horizons, or who believe in the gradual normalization of future growth. We believe the U.S. economy will continue to grow steadily, while a still highly accommodative Fed may create a longer-than-expected (albeit certainly slower than expected) U.S. business cycle. Should more robust growth eventually appear, we believe markets are much more prepared today for an eventual interest rate hike, especially for monetary tightening related to higher inflation. For now, however, it seems to us that the market worry leans toward too little growth (stagnation) as opposed to too much growth (potential for more inflation).

Sincerely,

CHARLES KANTOR

PORTFOLIO MANAGER

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio manager. The opinions are as of the date of this report and are subject to change without notice.

TICKER SYMBOLS

Institutional Class | | NLSIX | |

Class A | | NLSAX | |

Class C | | NLSCX | |

PORTFOLIO BY TYPE OF SECURITY

(as a % of Total Net Assets)

| | | Long | | Short | |

Common Stocks | | | 72.1 | % | | | (8.0 | )% | |

Corporate Debt Securities | | | 4.0 | | | | — | | |

Exchange Traded Funds | | | — | | | | (3.9 | ) | |

Purchased Options | | | 0.0 | | | | — | | |

Short-Term Investments | | | 22.1 | | | | — | | |

Cash, receivables and other

assets, less liabilities | | | 13.7 | * | | | — | | |

Total | | | 111.9 | % | | | (11.9 | )% | |

* Percentage includes appreciation/depreciation from derivatives, if any.

PERFORMANCE HIGHLIGHTS

| | | | | Average Annual Total

Return Ended 10/31/2015 | |

| �� | | Inception

Date | | 1 Year | | Life of

Fund | |

At NAV | |

Institutional Class | | 12/29/2011 | | | –1.45 | % | | | 7.07 | % | |

Class A | | 12/29/2011 | | | –1.89 | % | | | 6.67 | % | |

Class C | | 12/29/2011 | | | –2.56 | % | | | 5.90 | % | |

With Sales Charge | |

Class A | | | | | | | –7.55 | % | | | 5.04 | % | |

Class C | | | | | | | –3.53 | % | | | 5.90 | % | |

Index | |

| HFRX Equity Hedge Index1,2 | | | | | | | –0.96 | % | | | 4.15 | % | |

| S&P 500® Index1,2 | | | | | | | 5.20 | % | | | 16.60 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Management LLC (Management) had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2014 were 1.73%, 2.11% and 2.85% for Institutional Class, Class A and Class C shares, respectively (before expense reimbursements and/or fee waivers, if any). The expense ratios for the annual period ending October 31, 2015 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

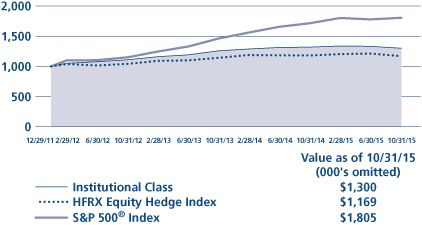

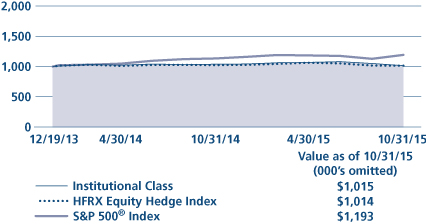

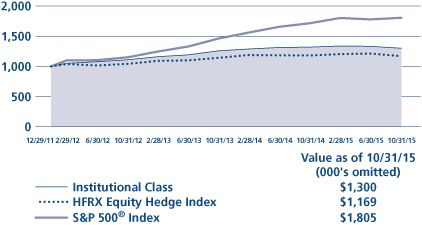

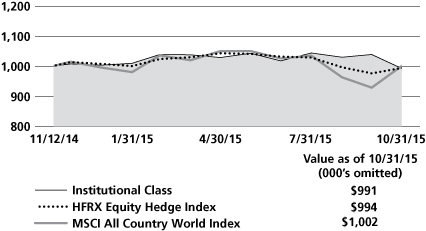

COMPARISON OF A $1,000,000 INVESTMENT

(000's omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

Long Short Credit Fund Commentary (Unaudited)

We are pleased to provide the first annual report for Neuberger Berman Long Short Credit Fund, which was launched on June 29, 2015. The Fund seeks total return, including current income, consistent with managing volatility and preservation of capital.

For the period since its inception through October 31, 2015, the Fund's Institutional Class generated a –2.06% total return, resulting in mixed performance versus its benchmarks. During the period, the Fund outperformed the HFRX Fixed Income-Credit Index, which provided a –2.68% return, and the BofA Merrill Lynch U.S. High Yield Master II Index, which provided a –2.69% return. The Fund underperformed the Barclays U.S. Aggregate Bond Index, which provided a 1.88% return. (Performance for all share classes is provided in the table immediately following this letter.)

The credit markets have been quite volatile since June. From June through September, the Merrill Lynch High Yield Index posted four consecutive months of negative returns, only the second time ever that this has occurred, the last time being 1994. U.S. Federal Reserve (Fed) induced macro gyrations, continued concerns over commodity prices, deteriorating growth trajectories in China and a sense of dread on earnings estimates for the third quarter of 2015 all contributed to the volatility. In October, we saw the high yield bond market, together with other risk assets, post a solid rally. Following months of weakness, we believed that risk assets were in a technically oversold position and investor sentiment was as bearish as we can remember. One spark that helped ignite the rally was the weak September payroll numbers, which helped allay concerns of a Fed rate hike. Together with the stabilization in Chinese growth data, we believed that this produced the foundation for the rally. As earnings season in the U.S. progressed and companies began to beat lowered expectations, we saw growth fears further allayed and the rally became a feeding frenzy, culminating in the historic rally.

The Fund's performance during the period was driven by the Energy, Mining and Materials sectors where there was overall downward pressure, as well as the Industrials sector, where we saw some adverse idiosyncratic events.

The Fund's aggregate use of derivatives (such as option contracts, swaptions, futures contracts, swap contracts and forward contracts) as overlay hedges to the portfolio had a negative impact to the Fund's performance.

Looking forward, we will continue to build a portfolio that we believe can capture significant idiosyncratic opportunities. As risk premiums and volatility in credit have increased, we see increased return possibilities. This has far reaching implications. While we can rationalize market behavior, it is not our intent to sell you a series of returns you can buy through the market. Our portfolio is meant to benefit from both long and short fundamental idiosyncratic positioning. We are encouraged by what we believe we can achieve in the current environment and are of the view that the portfolio has the potential to be handsomely rewarded from both our long and short positioning.

Sincerely,

RICK DOWDLE AND NORMAN MILNER

PORTFOLIO MANAGERS

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

TICKER SYMBOLS

Institutional Class | | NLNIX | |

Class A | | NLNAX | |

Class C | | NLNCX | |

Class R6 | | NRLNX | |

PORTFOLIO BY TYPE OF SECURITY

(as a % of Total Net Assets)

| | | Long | | Short | |

Common Stocks | | | 0.6 | % | | | — | % | |

Corporate Debt Securities | | | 26.9 | | | | (2.5 | ) | |

Government Securities | | | — | | | | (0.7 | ) | |

Cash, receivables and other

assets, less liabilities | | | 75.7 | * | | | — | | |

Total | | | 103.2 | % | | | (3.2 | )% | |

* Percentage includes appreciation/depreciation from derivatives, if any.

PERFORMANCE HIGHLIGHTS

| | | Inception

Date | | Cumulative Total Return

Ended 10/31/2015

Life of Fund | |

At NAV | | | | | |

Institutional Class | | 06/29/2015 | | | –2.06 | % | |

Class A | | 06/29/2015 | | | –2.17 | % | |

Class C | | 06/29/2015 | | | –2.41 | % | |

Class R6 | | 06/29/2015 | | | –2.03 | % | |

With Sales Charge | |

Class A | | | | | | | –6.30 | % | |

Class C | | | | | | | –3.39 | % | |

Index | |

| HFRX Fixed Income-Credit Index1,2 | | | | | | | –2.68 | % | |

| Barclays U.S. Aggregate Bond Index1,2 | | | | | | | 1.88 | % | |

BofA Merrill Lynch U.S. High Yield

Master II Index1,2 | | | | | | | –2.69 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Management LLC (Management) had not reimbursed certain expenses and/or waived a portion of the investment management fees during the period shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

For the period ended October 31, 2015, the 30-day SEC yields were 1.93%, 1.48%, 0.82% and 2.00% for Institutional Class, Class A, Class C and Class R6 shares, respectively. Absent expense reimbursements and/or fee waivers, the 30-day SEC yields would have been 1.47%, 0.82% and 2.32% for Class A, Class C and Class R6 shares, respectively. Absent repayment, the 30-day SEC yield would have been 2.63% for Institutional Class shares.

As stated in the Fund's most recent prospectus, the estimated total annual operating expense ratios for fiscal year 2015 were 1.52%, 1.89%, 2.64% and 1.45% for Institutional Class, Class A, Class C and Class R6 shares, respectively (before expense reimbursements and/or fee waivers, if any). The estimated total annual operating expense ratios are 1.20%, 1.57%, 2.32% and 1.13% for Institutional Class, Class A, Class C and Class R6 shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for the period from June 29, 2015 through October 31, 2015 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 4.25% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

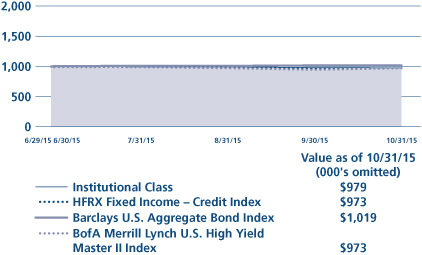

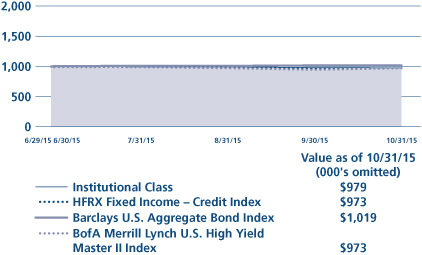

COMPARISON OF A $1,000,000 INVESTMENT

(000's omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

Multi-Asset Income Fund Commentary (Unaudited)

Since its inception on March 27, 2015 through October 31, 2015, the Neuberger Berman Multi-Asset Income Fund Institutional Class generated a –3.43% total return and underperformed its custom benchmark, a 60/40 combination of the Barclays U.S. Aggregate Bond Index and the S&P 500® Index, which provided a 1.07% return for the period. (Performance for all share classes is provided in the table immediately following this letter.)

Global equity markets generated mixed returns since the Fund's inception. U.S. stocks outperformed other regions, as non-U.S. developed and emerging markets stocks were challenged. In fixed income markets, non-U.S. developed fixed income was negative and U.S. fixed income was flat. The U.S. continues to be among the strongest developed economies as domestic growth remains positive. The eurozone appears to be benefiting from the European Central Bank's monetary policy actions as business conditions improve amidst lower oil prices and a weaker euro, contributing to increased GDP growth. Japan was aided by stimulus from the Bank of Japan and a weaker yen, but the economy faces threats from slowing growth in China, stagnating business and consumer confidence, and low wage inflation.

Since the Fund's launch, its overweight position to equities contributed positively to performance, as equities outperformed fixed income. Allocations to Master Limited Partnerships and non-U.S. developed equities, however, detracted from performance. Within equities, the Fund's holdings emphasized securities that, in our view, offered the potential for higher yields than the benchmark index. The Fund's underweight position to fixed income contributed positively to performance, but allocations to credit sectors hurt. Within fixed income, the Fund's holdings were focused less on government securities than was the benchmark index. The Fund's aggregate use of derivatives (futures contracts, forward contracts and option contracts), had a positive impact on performance.

Looking ahead, we are optimistic on the global economy, although financial markets remain dynamic and risks, of course, remain. Recent economic data have reflected a more resilient growth backdrop. In the U.S., October's employment report was strong on nearly every metric. Data outside of the U.S. is also showing signs of improvement as purchasing manager indices for China, the eurozone and Japan all rose in October. Overall, we anticipate a more stable growth backdrop in the U.S. and abroad as the positive effects of additional monetary stimulus, low interest rates and low commodity prices work their way through the global economy. We remain constructive on risk asset classes (e.g., high yield bonds, equities, currencies), with a bias towards equities, particularly in the U.S. and Europe, and currently favor credit over developed market government securities. We are cautious on both emerging markets equities and debt.

Sincerely,

ERIK KNUTZEN, BRADLEY TANK, WAI LEE AND AJAY JAIN

PORTFOLIO MANAGERS

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

TICKER SYMBOLS

Institutional Class | | NANIX | |

Class A | | NANAX | |

Class C | | NANCX | |

Class R6 | | NRANX | |

PORTFOLIO BY TYPE OF SECURITY

(as a % of Total Net Assets)

Common Stocks | | | 40.9 | % | |

Convertible Bonds | | | 0.3 | | |

Exchange Traded Funds | | | 5.7 | | |

Mutual Funds | | | 43.3 | | |

Preferred Stocks | | | 2.0 | | |

U.S. Government Agency Securities | | | 0.8 | | |

U.S. Treasury Securities | | | 6.3 | | |

Short-Term Investments | | | 1.0 | | |

Liabilities, less cash, receivables and

other assets | | | (0.3 | )* | |

Total | | | 100.0 | % | |

* Percentage includes appreciation/depreciation from derivatives, if any.

PERFORMANCE HIGHLIGHTS2

| | | Inception

Date | | Cumulative Total Return

Ended 10/31/2015

Life of Fund | |

At NAV | |

Institutional Class | | 03/27/2015 | | | –3.43 | % | |

Class A | | 03/27/2015 | | | –3.64 | % | |

Class C | | 03/27/2015 | | | –4.07 | % | |

Class R6 | | 03/27/2015 | | | –3.39 | % | |

With Sales Charge | |

Class A | | | | | | | –7.70 | % | |

Class C | | | | | | | –5.01 | % | |

Index | |

60% Barclays U.S. Aggregate Bond Index

and 40% S&P 500 Index1,2 | | | | | | | 1.07 | % | |

| Barclays U.S. Aggregate Bond Index1,2 | | | | | | | –0.02 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Management LLC (Management) had not reimbursed certain expenses and/or waived a portion of the investment management fees during the period shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

For the period ended October 31, 2015, the 30-day SEC yields were 3.84%, 3.33%, 2.73% and 3.92% for Institutional Class, Class A, Class C and Class R6 shares, respectively. Absent expense reimbursements and/or fee waivers, the 30-day SEC yields would have been 0.07%, –0.30%, –0.97% and 0.43% for Institutional Class, Class A, Class C and Class R6 shares, respectively.

As stated in the Fund's most recent prospectus, the estimated total annual operating expense ratios for fiscal year 2015 were 1.36%, 1.73%, 2.48% and 1.29% for Institutional Class, Class A, Class C and Class R6 shares, respectively (before expense reimbursements and/or fee waivers, if any). The estimated total annual operating expense ratios are 0.78%, 1.15%, 1.90% and 0.71% for Institutional Class, Class A, Class C and Class R6 shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for the period from March 27, 2015 through October 31, 2015 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 4.25% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

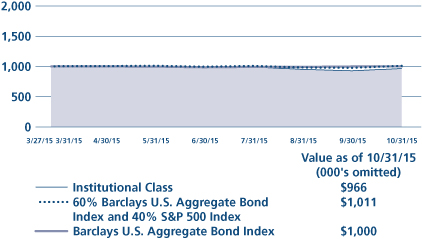

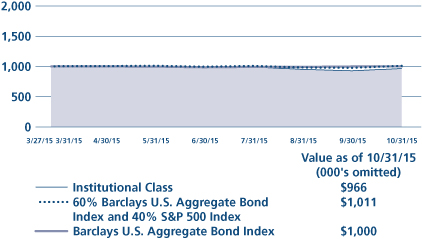

COMPARISON OF A $1,000,000 INVESTMENT

(000's omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

1 Please see "Glossary of Indices" on page 22 for a description of indices. Please note that individuals cannot invest directly in any index. The HFRX Equity Hedge Index takes into account fees and expenses of investing since it is based on the underlying hedge funds' net returns. The other indices described in this report do not take into account any fees, expenses or tax consequences of investing in the individual securities that they track. Data about the performance of an index are prepared or obtained by Neuberger Berman Management LLC* and reflect the reinvestment of income dividends and other distributions, if any. The Fund may invest in securities not included in a described index and generally does not invest in all securities included in a described index.

2 The date used to calculate Life of Fund performance for the index is the inception date of the oldest share class.

3 During the period from December 29, 2010 through April 30, 2011, Neuberger Berman Global Allocation Fund had only one shareholder and the Fund was relatively small, which could have impacted Fund performance. The same techniques used to produce returns in a small fund may not work to produce similar returns in a larger fund.

4 Effective February 28, 2015, Neuberger Berman Inflation Navigator Fund changed its name to Neuberger Berman Inflation Managed Fund.

5 The performance information for Class R6 prior to the class' inception date is that of the Institutional Class of Neuberger Berman Inflation Managed Fund. The performance information for the Institutional Class has not been adjusted to take into account differences in class specific operating expenses. The Institutional Class has higher expenses and typically lower returns than Class R6.

* On or about January 1, 2016, it is anticipated that Neuberger Berman Management LLC (NBM) and Neuberger Berman LLC (NB LLC) will transfer to Neuberger Berman Fixed Income LLC (NBFI) their rights and obligations pertaining to all services they provide to any Fund under any investment management, investment sub-advisory, and/or administration agreement, as applicable (the "Agreements"). Following such transfer, NBFI will be renamed Neuberger Berman Investment Advisers LLC (NBIA). In addition, on the date of the transfer, the services previously provided by NB Alternative Investment Management LLC (NBAIM) will be provided by NBIA.

NBM currently serves as each Fund's investment manager and administrator and each of NB LLC, NBFI and NBAIM currently serve as certain Funds' adviser or sub-adviser. Following the consolidation, the investment professionals of NBM, NB LLC, NBFI and NBAIM who currently provide services to the Funds under the Agreements will continue to provide the same services, except that they will provide those services in their new capacities as investment professionals of NBIA. Further, the consolidation will not result in any change in the investment processes currently employed by any Fund, the nature or level of services provided to any Fund, or the fees any Fund pays under its Agreements.

For more complete information on any of the Neuberger Berman Alternative and Multi-Asset Class Funds, call Neuberger Berman Management LLC at (800) 877-9700, or visit our website at www.nb.com.

Barclays Global Aggregate Index: | | The index measures global investment grade debt from twenty-four different local currency markets and includes fixed-rate treasury, government-related, corporate and securitized bonds from both developed and emerging markets issuers. The index is largely comprised of three major regional aggregate components: the Barclays U.S. Aggregate Bond Index, the Barclays Pan-European Aggregate Bond Index, and the Barclays Asian-Pacific Aggregate Index. In addition to securities from these three indices, the Barclays Global Aggregate Index also includes investment grade Eurodollar, Euro-Yen, Canadian, and 144A Index-eligible securities not already in these three indices. | |

Barclays U.S. Aggregate Bond Index: | | The index measures the investment grade, U.S. dollar-denominated, fixed-rate, taxable bond market and includes Treasuries, government-related and corporate securities, mortgage-backed securities (MBS) (agency fixed-rate and hybrid adjustable rate mortgage (ARM) pass-throughs), asset-backed securities (ABS), and commercial mortgage-backed securities (CMBS) (agency and nonagency). | |

60% Barclays U.S. Aggregate Bond Index and 40% S&P 500® Index: | | The blended index is composed of 60% Barclays U.S. Aggregate Bond Index (described above) and 40% S&P 500® Index (described on following page), and is rebalanced monthly. | |

Barclays U.S. 1-10 Year Treasury Inflation-Protected Securities (TIPS) Index: | | The index is the 1-10 year component of the Barclays U.S. TIPS Index (Series-L). The Barclays U.S. TIPS Index (Series-L) tracks the performance of inflation-protection securities issued by the U.S. Treasury. | |

BofA Merrill Lynch U.S. High Yield Index: | | The index is an unmanaged market value-weighted index of all domestic and Yankee high-yield bonds, including deferred interest bonds and payment-in-kind securities. Qualifying bonds must have at least one year remaining to maturity, a fixed coupon schedule and a minimum amount outstanding of $100 million. Qualifying bonds are capitalization weighted, provided the total allocation to an individual issuer does not exceed 2%. | |

HFRX Fixed Income-Credit Index: | | The index tracks the performance of hedge fund strategies with exposure to credit across a broad continuum of credit sub-strategies, including Corporate, Sovereign, Distressed, Convertible, Asset Backed, Capital Structure Arbitrage, Multi-Strategy and other Relative Value and Event Driven sub-strategies. The investment thesis across all strategies is predicated on realization of a valuation discrepancy between the related credit instruments. Strategies may also include and utilize equity securities, credit derivatives, government fixed income, commodities, currencies or other hybrid securities. Constituent funds are selected from an eligible pool of the more than 7,500 funds worldwide that report to the Hedge Fund Research (HFR) Database. Constituent funds must meet all of the following criteria: report monthly; report performance net of all fees; be U.S. dollar-denominated; be active and accepting new investments; have a minimum 24 months track record; and the fund's manager must have at least $50 million in assets under management. Constituents are weighted by a representative optimization methodology. The index is rebalanced quarterly. | |

Glossary of Indices (cont'd)

HFRX Equity Hedge Index: | | The index comprises equity hedge strategies. Equity hedge strategies maintain positions both long and short in primarily equity and equity derivative securities. A wide variety of investment processes can be employed to arrive at an investment decision, including both quantitative and fundamental techniques; strategies can be broadly diversified or narrowly focused on specific sectors and can range broadly in terms of levels of net exposure, leverage employed, holding period, concentrations of market capitalizations and valuation ranges of typical portfolios. Equity hedge managers would typically maintain at least 50%, and may in some cases be substantially entirely invested, in equities, both long and short. Constituent funds are selected from an eligible pool of the more than 7,500 funds worldwide that report to the Hedge Fund Research (HFR) Database. Constituent funds must meet all of the following criteria: report monthly; report performance net of all fees; be U.S. dollar-denominated; be active and accepting new investments; have a minimum 24 months track record; and the fund's manager must have at least $50 million in assets under management. The index is rebalanced quarterly. | |

MSCI All Country World Index: | | The index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The index consists of 46 country indices comprising 23 developed and 23 emerging market country indices. The developed market country indices included are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States. The emerging market country indices included are: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, the Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey, and the UAE. | |

60% MSCI All Country World Index and 40% Barclays Global Aggregate Index: | | The blended index is composed of 60% MSCI All Country World Index (described above) and 40% Barclays Global Aggregate Index (described above), and is rebalanced monthly. | |

MSCI World Index: | | The index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed markets. The index consists of the following 23 developed market country indices: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States. | |

50% MSCI World Index and 50% J.P. Morgan Global Government Bond Index: | | The blended index is composed of 50% MSCI World Index (described above) and 50% J.P. Morgan Global Government Bond Index, and is rebalanced monthly. The J.P. Morgan Global Government Bond Index tracks the performance of local currency denominated bonds issued by developed market governments. The index consists of issues from the following 13 developed international bond markets: Australia, Belgium, Canada, Denmark, France, Germany, Italy, Japan, Netherlands, Spain, Sweden, United Kingdom and United States. | |

| Russell 3000® Index: | | The index is a float-adjusted market capitalization-weighted index that measures the performance of the 3,000 largest U.S. public companies based on total market capitalization. The index is rebalanced annually in June. | |

| S&P 500® Index: | | The index is a float-adjusted market capitalization-weighted index that focuses on the large-cap segment of the U.S. equity market, and includes a significant portion of the total value of the market. | |

Information About Your Fund's Expenses (Unaudited)

As a Fund shareholder, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds (if applicable); and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees (if applicable), and other Fund expenses. This example is intended to help you understand your ongoing costs (in U.S. dollars) of investing in a Fund and compare these costs with the ongoing costs of investing in other mutual funds.

This table is designed to provide information regarding costs related to your investments. The following examples are based on an investment of $1,000 made at the beginning of the six month period ended October 31, 2015 and held for the entire period. The table illustrates each Fund's costs in two ways:

Actual Expenses and Performance: | | The first section of the table provides information about actual account values and actual expenses in dollars, based on the Fund's actual performance during the period indicated. You may use the information in this line, together with the amount you invested, to estimate the expenses you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section of the table under the heading entitled "Expenses Paid During the Period" to estimate the expenses you paid over the period. | |

Hypothetical Example for Comparison Purposes: | | The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return at 5% per year before expenses. This return is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund versus other funds. To do so, compare the expenses shown in this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. | |

Please note that the expenses in the table are meant to highlight your ongoing costs only and do not include any transaction costs, such as sales charges (loads) (if applicable). Therefore, the information under the heading "Hypothetical (5% annual return before expenses)" is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

Expense Information as of 10/31/15 (Unaudited)

Neuberger Berman Alternative Funds | |

| | | ACTUAL | | HYPOTHETICAL (5% ANNUAL RETURN BEFORE EXPENSES)(5) | |

| | | Beginning

Account

Value

5/1/15 | | Ending

Account

Value

10/31/15 | | Expenses Paid

During the

Period(1)

5/1/15 - 10/31/15 | | Expense

Ratio | | Beginning

Account

Value

5/1/15 | | Ending

Account

Value

10/31/15 | | Expenses Paid

During the

Period(1)

5/1/15 - 10/31/15 | | Expense

Ratio | |

Flexible Select Fund | |

Institutional Class | | $ | 1,000.00 | | | $ | 969.20 | | | $ | 4.12 | | | | 0.83 | % | | $ | 1,000.00 | | | $ | 1,021.02 | | | $ | 4.03 | | | | 0.83 | % | |

Class A | | $ | 1,000.00 | | | $ | 967.40 | | | $ | 5.95 | | | | 1.20 | % | | $ | 1,000.00 | | | $ | 1,019.16 | | | $ | 6.11 | | | | 1.20 | % | |

Class C | | $ | 1,000.00 | | | $ | 963.00 | | | $ | 9.60 | | | | 1.94 | % | | $ | 1,000.00 | | | $ | 1,015.43 | | | $ | 9.86 | | | | 1.94 | % | |

Global Allocation Fund | |

Institutional Class | | $ | 1,000.00 | | | $ | 943.80 | | | $ | 4.80 | | | | 0.98 | % | | $ | 1,000.00 | | | $ | 1,020.27 | | | $ | 4.99 | | | | 0.98 | % | |

Class A | | $ | 1,000.00 | | | $ | 941.80 | | | $ | 6.56 | | | | 1.34 | % | | $ | 1,000.00 | | | $ | 1,018.45 | | | $ | 6.82 | | | | 1.34 | % | |

Class C | | $ | 1,000.00 | | | $ | 938.20 | | | $ | 10.21 | | | | 2.09 | % | | $ | 1,000.00 | | | $ | 1,014.67 | | | $ | 10.61 | | | | 2.09 | % | |

| Inflation Managed Fund(2) | |

Institutional Class | | $ | 1,000.00 | | | $ | 903.80 | | | $ | 3.41 | | | | 0.71 | % | | $ | 1,000.00 | | | $ | 1,021.63 | | | $ | 3.62 | | | | 0.71 | % | |

Class A | | $ | 1,000.00 | | | $ | 903.40 | | | $ | 5.13 | | | | 1.07 | % | | $ | 1,000.00 | | | $ | 1,019.81 | | | $ | 5.45 | | | | 1.07 | % | |

Class C | | $ | 1,000.00 | | | $ | 899.60 | | | $ | 8.71 | | | | 1.82 | % | | $ | 1,000.00 | | | $ | 1,016.03 | | | $ | 9.25 | | | | 1.82 | % | |

Class R6 | | $ | 1,000.00 | | | $ | 907.30 | | | $ | 2.96 | (3) | | | 0.65 | % | | $ | 1,000.00 | | | $ | 1,021.93 | | | $ | 3.31 | | | | 0.65 | % | |

Long Short Fund | |

Institutional Class | | $ | 1,000.00 | | | $ | 967.40 | | | $ | 8.18 | | | | 1.65 | % | | $ | 1,000.00 | | | $ | 1,016.89 | | | $ | 8.39 | | | | 1.65 | % | |

Class A | | $ | 1,000.00 | | | $ | 965.60 | | | $ | 10.01 | | | | 2.02 | % | | $ | 1,000.00 | | | $ | 1,015.02 | | | $ | 10.26 | | | | 2.02 | % | |

Class C | | $ | 1,000.00 | | | $ | 962.40 | | | $ | 13.65 | | | | 2.76 | % | | $ | 1,000.00 | | | $ | 1,011.29 | | | $ | 13.99 | | | | 2.76 | % | |

Long Short Credit Fund | |

Institutional Class | | $ | 1,000.00 | | | $ | 979.40 | | | $ | 3.90 | (4) | | | 1.15 | % | | $ | 1,000.00 | | | $ | 1,019.41 | | | $ | 5.85 | | | | 1.15 | % | |

Class A | | $ | 1,000.00 | | | $ | 978.30 | | | $ | 5.08 | (4) | | | 1.50 | % | | $ | 1,000.00 | | | $ | 1,017.64 | | | $ | 7.63 | | | | 1.50 | % | |

Class C | | $ | 1,000.00 | | | $ | 975.90 | | | $ | 7.44 | (4) | | | 2.20 | % | | $ | 1,000.00 | | | $ | 1,014.12 | | | $ | 11.17 | | | | 2.20 | % | |

Class R6 | | $ | 1,000.00 | | | $ | 979.70 | | | $ | 3.66 | (4) | | | 1.08 | % | | $ | 1,000.00 | | | $ | 1,019.76 | | | $ | 5.50 | | | | 1.08 | % | |

Multi-Asset Income Fund | |

Institutional Class | | $ | 1,000.00 | | | $ | 954.00 | | | $ | 2.12 | | | | 0.43 | % | | $ | 1,000.00 | | | $ | 1,023.04 | | | $ | 2.19 | | | | 0.43 | % | |

Class A | | $ | 1,000.00 | | | $ | 952.30 | | | $ | 3.94 | | | | 0.80 | % | | $ | 1,000.00 | | | $ | 1,021.17 | | | $ | 4.08 | | | | 0.80 | % | |

Class C | | $ | 1,000.00 | | | $ | 948.60 | | | $ | 7.61 | | | | 1.55 | % | | $ | 1,000.00 | | | $ | 1,017.39 | | | $ | 7.88 | | | | 1.55 | % | |

Class R6 | | $ | 1,000.00 | | | $ | 954.40 | | | $ | 1.77 | | | | 0.36 | % | | $ | 1,000.00 | | | $ | 1,023.39 | | | $ | 1.84 | | | | 0.36 | % | |

(1) For each class, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown), unless otherwise indicated.

(2) Effective February 28, 2015. Formerly, Inflation Navigator Fund through February 27, 2015.

(3) For each class, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 174/365 (to reflect the period May 11, 2015 (Commecement of Operations) to October 31, 2015).

(4) For each class, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 125/365 (to reflect the period June 29, 2015 (Commecement of Operations) to October 31, 2015).

(5) Hypothetical expenses are equal to the annualized expense ratios for each class, multiplied by the average account value over the period (assuming a 5% annual return), multiplied by 184/365 (to reflect the one-half year period shown).

Schedule of Investments Flexible Select Fund 10/31/15

| | |

Number

of Shares | |

Value† | |

Road & Rail (1.5%) | |

Avis

Budget Group,

Inc. | | | 29,916 | | | $ | 1,494,005 | * | |

Semiconductors & Semiconductor Equipment (2.4%) | |

ASML

Holding NV | | | 13,778 | | | | 1,278,461 | | |

NXP

Semiconductors

NV | | | 13,247 | | | | 1,037,902 | * | |

| | | | 2,316,363 | | |

Software (8.8%) | |

Activision

Blizzard, Inc. | | | 90,940 | | | | 3,161,074 | | |

Adobe

Systems, Inc. | | | 18,023 | | | | 1,597,919 | * | |

Check Point

Software

Technologies Ltd. | | | 8,388 | | | | 712,477 | * | |

Intuit, Inc. | | | 26,436 | | | | 2,575,660 | | |

Mobileye NV | | | 12,948 | | | | 589,393 | * | |

| | | | 8,636,523 | | |

Specialty Retail (2.1%) | |

Express, Inc. | | | 36,495 | | | | 704,354 | * | |

Lithia

Motors, Inc.

Class A | | | 11,493 | | | | 1,349,163 | | |

| | | | 2,053,517 | | |

Technology Hardware, Storage & Peripherals (4.9%) | |

Apple, Inc. | | | 24,062 | | | | 2,875,409 | | |

SanDisk Corp. | | | 25,619 | | | | 1,972,663 | | |

| | | | 4,848,072 | | |

Textiles, Apparel & Luxury Goods (2.3%) | |

Deckers

Outdoor Corp. | | | 22,131 | | | | 1,231,811 | * | |

Luxottica

Group SpA ADR | | | 8,451 | | | | 592,922 | | |

Under

Armour, Inc.

Class A | | | 4,161 | | | | 395,628 | * | |

| | | | 2,220,361 | | |

Trading Companies &

Distributors (1.3%) | |

AerCap

Holdings NV | | | 29,921 | | | | 1,241,721 | * | |

Total Common Stocks

(Cost $77,571,601) | | | | | 83,799,706 | | |

Mutual Funds (11.8%) | |

Neuberger

Berman Core

Bond Fund

Institutional

Class | | | 840,510 | | | | 8,730,925 | §§ | |

See Notes to Schedule of Investments

Schedule of Investments Flexible Select Fund (cont'd)

| | |

Number

of Shares | |

Value† | |

Neuberger

Berman

Unconstrained

Bond Fund

Institutional

Class | | | 313,065 | | | $ | 2,934,884 | §§ | |

Total Mutual Funds

(Cost $11,632,509) | | | | | 11,665,809 | | |

Short-Term Investments (3.3%) | |

State Street

Institutional

Treasury Money

Market Fund

Premier

Class, 0.00%

(Cost $3,211,986) | | | 3,211,986 | | | | 3,211,986 | d | |

Total Investments (100.1%)

(Cost $92,416,096) | | | | | 98,677,501 | ## | |

Liabilities, less

cash, receivables

and other

assets [(0.1%)] | | | | | (71,343) | | |

Total Net Assets (100.0%) | | | | | | $ | 98,606,158 | | |

See Notes to Schedule of Investments

Schedule of Investments Global Allocation Fund 10/31/15

| | |

Number

of Shares | |

Value† | |

Long Positions (109.7%) | |

Common Stocks (54.6%) | |

Australia (0.9%) | |

BHP Billiton

Ltd. ADR | | | 906 | | | $ | 29,798 | È | |

Dexus

Property

Group | | | 3,183 | | | | 17,473 | | |

Echo

Entertainment

Group Ltd. | | | 4,811 | | | | 17,388 | | |

Fortescue

Metals Group

Ltd. | | | 9,152 | | | | 13,523 | ØØ | |

Goodman

Group | | | 4,383 | | | | 18,805 | | |

GPT

Group | | | 3,587 | | | | 12,148 | | |

Harvey

Norman

Holdings Ltd. | | | 1,830 | | | | 5,141 | | |

Qantas

Airways Ltd. | | | 19,156 | | | | 53,958 | * | |

Scentre

Group | | | 15,512 | | | | 45,499 | | |