Washington, D.C. 20549

Arthur C. Delibert, Esq.

1601 K Street, N.W.

Washington, D.C. 20006-1600

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Shareholders.

Neuberger Berman

Alternative Funds

Institutional Class Shares

Class A Shares

Class C Shares

Risk Balanced Commodity Strategy Fund

Annual Report

October 31, 2012

| Contents | | | | | |

| | | | | | |

| PRESIDENT'S LETTER | | | 1 | | |

PORTFOLIO COMMENTARY | | | 2 | | |

FUND EXPENSE INFORMATION | | | 8 | | |

CONSOLIDATED SCHEDULE OF INVESTMENTS | | | 10 | | |

CONSOLIDATED FINANCIAL STATEMENTS | | | 13 | | |

CONSOLIDATED FINANCIAL HIGHLIGHTS/ PER SHARE DATA | | | 27 | | |

Report of Independent Registered Public Accounting Firm | | | 30 | | |

| Directory | | | 31 | | |

| Trustees and Officers | | | 32 | | |

| Proxy Voting Policies and Procedures | | | 40 | | |

| Quarterly Portfolio Schedule | | | 40 | | |

Board Consideration of the Management and Sub-Advisory Agreements | | | 41 | | |

��

The "Neuberger Berman" name and logo are registered service marks of Neuberger Berman Group LLC. "Neuberger Berman Management LLC" and the individual Fund name in this piece are either service marks or registered service marks of Neuberger Berman Management LLC. ©2012 Neuberger Berman Management LLC. All rights reserved.

President's Letter

Dear Shareholder,

I am pleased to present to you the first annual shareholder report for Neuberger Berman Risk Balanced Commodity Strategy Fund, which was launched on August 27, 2012. The Fund seeks to generate returns that are not highly correlated with other major asset classes and that may improve the overall risk-reward profile of an investment portfolio. As discussed in the commentary that follows, the Fund uses a systematic, risk-based investment process to determine strategic exposures among a number of major commodities. The management team also employs an active strategy to develop short- to medium-term tactical allocations or tilts within the various commodity sectors. We believe the Fund demonstrates our continued interest in providing relevant strategies to our clients to help them achieve their long-term financial objectives.

Overall, commodity markets were volatile during the short period from the Fund's inception on August 27, 2012 through October 31, 2012. Commodities generally moved higher in September, buoyed by the U.S. Federal Reserve's and the European Central Bank's aggressive actions to stimulate economic growth. The market then experienced a setback in October, as investor sentiment weakened given continued signs of moderating global growth.

Looking ahead, we have a generally positive long-term outlook for the commodity markets. This view is driven by current accommodative monetary policy and our expectations for future inflationary pressures, both of which could be supportive of higher commodity prices. In addition, we are encouraged by the fundamental backdrop in the commodities markets. That being said, there could be periods of increased volatility in the financial markets given a number of unresolved macro issues, including the fast approaching fiscal cliff and its potential impact on the economy.

Thank you for your continued support and trust. We look forward to continue serving your investment needs in the years to come.

Sincerely,

ROBERT CONTI

PRESIDENT AND CEO

NEUBERGER BERMAN MUTUAL FUNDS

Risk Balanced Commodity Strategy Fund Commentary (Unaudited)

We are pleased to provide the first annual report for Neuberger Berman Risk Balanced Commodity Strategy Fund, which was launched on August 27, 2012. The Fund seeks to provide investors with returns that are not highly correlated with other major asset classes and that may improve the overall risk-reward profile of an investment portfolio through a diversified commodities portfolio that employs both a core strategy and active strategy. The core strategy uses a systematic, risk-based investment process to determine strategic exposures among six major commodity sectors: agriculture, industrial metals, energy, softs (e.g., coffee, cotton, sugar), precious metals and livestock. The Fund uses exchange-traded futures contracts, a type of derivative, to gain exposure to commodities. Our active strategy seeks to enhance the Fund's performance return by developing views on macroeconomics, supply/demand, the pricing relationships among commodities and the shape of the futures curve. In aggregate, these views allow us to develop short- to medium-term tactical tilts for the portfolio.

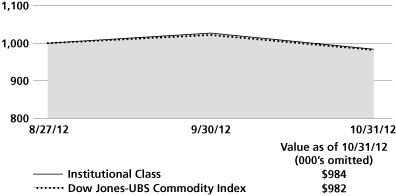

Neuberger Berman Risk Balanced Commodity Strategy Fund Institutional Class generated a –1.60% total return from its inception on August 27, 2012 through October 31, 2012, and outperformed its benchmark, the Dow Jones-UBS Commodity Index, which posted a –1.78% return for the period. (Performance for all share classes is provided in the table immediately following this letter.)

Overall, the commodity markets generated mixed results during the reporting period, rising in September and then declining in October. Industrial and precious metals led the commodity market's gains in September, as investor optimism for a building and manufacturing rebound grew amid central bank stimulus announcements. While agricultural commodities weakened in October, other commodities were relatively flat during the month. September's gains were erased during a sell-off in October, which was primarily driven by signs of slowing global growth, in our view. Against this backdrop, the industrial metals sector posted the weakest results. Energy and precious metals also performed poorly during October.

The Fund's core strategy largely drove its performance during the reporting period, whereas the Active strategy was relatively flat. The core strategy enhanced the Fund's results in September, with the industrial metals and precious metals sectors being the largest contributors to performance. These gains, however, were partially offset by modest declines in the other commodity sectors. In October, the core strategy detracted from performance, with the industrial metals and energy sectors producing the weakest results. Overall during the reporting period, the energy sector was the largest detractor from the Fund's absolute performance, followed by the softs and agricultural sectors. In contrast, the Fund's exposures to the precious metals, industrial metals and livestock sectors modestly contributed to performance.

Overall, our active strategy was slightly negative in September, given our positioning within the energy, softs and precious metals sectors. During October, within the energy our overweight positions in gasoline and crude oil sector detracted from results, whereas our underweight positions in aluminum and zinc within the industrial metals sector added the most value. At the end of the reporting period, the Fund's largest sector weights were in energy, industrial metals and precious metals. The Fund had smaller allocations in the agricultural, livestock and softs sectors.1

Looking ahead, we are cautiously optimistic for the commodity markets. In particular, we feel that current accommodative macroeconomic policies will be supportive of commodities in general. In addition, given rising global deficits, we believe it is a matter of time before we experience inflationary pressures, which could benefit hard assets such as commodities. Fundamentals also appear to us to be supportive for commodity prices, in part due to positive supply/demand characteristics. Risks to this outlook include the U.S. fiscal cliff and its potential impact on the economy in 2013. Should growth moderate or the U.S. fall back into a recession, it would be a headwind for commodities. Nevertheless, this risk is known and acknowledged by fiscal and monetary authorities and we feel a resolution will ultimately be ironed out. If this uncertainty diminishes, we will potentially see market sentiment improve, which could help commodities continue their trend of growth.

Sincerely,

WAI LEE, HAKAN KAYA AND THOMAS SONTAG

PORTFOLIO CO-MANAGERS

Information about the principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change.

| 1 | Much of the Fund's investment exposure is accomplished through the use of derivatives which may not require the Fund to deposit the full notional amount of the investment with its counterparties, such as a futures commission merchant. The Fund's resulting cash balances are invested in money market mutual funds. |

Risk Balanced Commodity Strategy Fund (Unaudited)

| TICKER SYMBOLS |

| Institutional Class | | NRBIX |

| Class A | | NRBAX |

| Class C | | NRBCX |

| PORTFOLIO BY TYPE OF SECURITY |

| (as a % of Total Investments) | |

Mortgage-Backed Securities | | | 28.3 | % | |

| Short-Term Investments | | | 71.7 | | |

| Total | | | 100.0 | % | |

| PORTFOLIO BY INVESTMENT EXPOSURE TO COMMODITY DERIVATIVES |

| (as a % of Total Notional Value) | |

| Commodity Futures: | | | |

| Agriculture | | | 15.7 | % | |

| Energy | | | 30.2 | | |

| Industrial Metals | | | 20.4 | | |

| Livestock | | | 9.0 | | |

| Precious Metals | | | 19.5 | | |

| Softs | | | 5.2 | | |

| Total | | | 100.0 | % | |

| PERFORMANCE HIGHLIGHTS2 |

| | | Inception Date | | Cumulative Total Return Ended 10/31/2012 Life of Fund |

| At NAV | |

| Institutional Class | | 08/27/2012 | | | –1.60 | % | |

| Class A | | 08/27/2012 | | | –1.60 | % | |

| Class C | | 08/27/2012 | | | –1.70 | % | |

| With Sales Charge | |

| Class A | | | | | | | –7.26 | % | |

| Class C | | | | | | | –2.68 | % | |

| Index | |

Dow Jones-UBS Commodity Index1,3 | | | | | | | –1.78 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For more current performance data, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Management LLC ("Management") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the applicable contingent deferred sales charges (CDSC) for Class C shares. The maximum CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

Risk Balanced Commodity Strategy Fund (Unaudited)

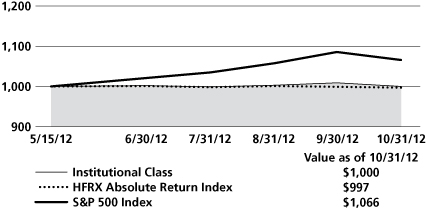

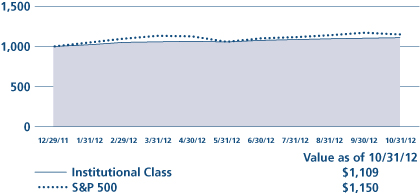

| COMPARISON OF A $1,000,000 INVESTMENT |

(000's omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

Endnotes (Unaudited)

| 1 | Please see "Glossary of Index" on page 7 for a description of indices. Please note that indices do not take into account any fees, expenses or tax consequences of investing in the individual securities that they track, and that individuals cannot invest directly in any index. Data about the performance of an index is prepared or obtained by Neuberger Berman Management LLC ("Management") and reflects the reinvestment of income dividends and other distributions, if any. The Fund may invest in securities not included in the described index and/or may not invest in all securities included in the described index. |

| 2 | The Fund was relatively small during the period shown. The same techniques used to produce returns in a small fund may not work to produce similar returns in a larger fund. |

| 3 | The date used to calculate Life of Fund performance for the index is the inception date of the oldest share class. |

For more complete information on any of the Neuberger Berman Alternative Funds, call Management at (800) 877-9700, or visit our website at www.nb.com.

Glossary of Index (Unaudited)

| Dow Jones-UBS Commodity Index: | | This is a rolling index composed of futures contracts on 19 physical commodities traded on U.S. exchanges, with the exception of aluminum, nickel and zinc, which are traded on the London Metal Exchange (LME). Weighting is based on liquidity, or the relative amount of trading activity of a particular commodity; dollar-adjusted production data are secondary. All data used are averaged over a five-year period. The DJ-UBSCI is calculated on an excess return basis, reflecting only the return of its underlying commodity price movements. A total return index reflects the return on a fully collateralized investment of the index. | |

Information About Your Fund's Expenses (Unaudited)

As a Fund shareholder, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds (if applicable); and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees (if applicable); and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in a Fund and compare these costs with the ongoing costs of investing in other mutual funds.

This table is designed to provide information regarding costs related to your investments. The following examples are based on an investment of $1,000 made at the beginning of the period ended October 31, 2012 (as indicated) and held for the entire period. The table illustrates the Fund's costs in two ways:

| Actual Expenses and Performance: | | The first section of the table provides information about actual account values and actual expenses in dollars, based on the Fund's actual performance during the period. You may use the information in this line, together with the amount you invested, to estimate the expenses you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section of the table under the heading entitled "Expenses Paid During the Period" to estimate the expenses you paid over the period. | |

| Hypothetical Example for Comparison Purposes: | | The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return at 5% per year before expenses. This return is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in this Fund versus other funds. To do so, compare the expenses shown in this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. | |

Please note that the expenses in the table are meant to highlight your ongoing costs only and do not include any transaction costs, such as sales charges (loads) (if applicable). Therefore, the information under the heading "Hypothetical (5% annual return before expenses)" is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

Expense Information as of 10/31/12 (Unaudited)

| Neuberger Berman Alternative Funds | |

| | | ACTUAL | | HYPOTHETICAL (5% ANNUAL RETURN BEFORE EXPENSES)(2) | |

| | | Beginning Account Value 8/27/12 | | Ending Account Value 10/31/12 | | Expenses Paid During the Period(1) 8/27/12 - 10/31/12 | | Expense Ratio | | Beginning Account Value 5/1/12 | | Ending Account Value 10/31/12 | | Expenses Paid During the Period(3) 5/1/12 - 10/31/12 | | Expense Ratio | |

Neuberger Risk Balanced Commodity Strategy Fund | |

| Institutional Class | | $ | 1,000.00 | | | $ | 984.00 | | | $ | 1.97 | | | | 1.10 | % | | $ | 1,000.00 | | | $ | 1,019.61 | | | $ | 5.58 | | | | 1.10 | % | |

| Class A | | $ | 1,000.00 | | | $ | 984.00 | | | $ | 2.61 | | | | 1.46 | % | | $ | 1,000.00 | | | $ | 1,017.80 | | | $ | 7.41 | | | | 1.46 | % | |

| Class C | | $ | 1,000.00 | | | $ | 982.00 | | | $ | 4.02 | | | | 2.21 | % | | $ | 1,000.00 | | | $ | 1,014.03 | | | $ | 11.19 | | | | 2.21 | % | |

(1) | For each class, expenses are equal to the annualized expense ratio for the class, including expenses of the Fund's subsidiary (See Note A-1 of Notes to Consolidated Financial Statements) multiplied by the average account value over the period, multiplied by 66/366 (to reflect the period shown of August 27, 2012 (Commencement of Operations) to October 31, 2012). |

| (2) | Hypothetical 5% annual return before expenses is calculated by multiplying the number of days in the most recent period divided by 366. |

| (3) | For each class, expenses are equal to the annualized expense ratio for the class, including expenses of the Fund's subsidiary (See Note A-1 of Notes to Consolidated Financial Statements) multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period shown), unless otherwise indicated |

Consolidated Schedule of Investments Risk Balanced Commodity Strategy Fund

| PRINCIPAL AMOUNT | | VALUE† | |

| | |

| Mortgage-Backed Securities (26.1%) | |

| | |

| Fannie Mae (10.6%) | |

| $ | 250,000 | | | Fannie Mae, Notes, 3.63%, due 2/12/13 | | $ | 252,414 | | |

| | 300,000 | | | Fannie Mae, Notes, 0.75%, due 2/26/13 | | | 300,565 | | |

| | | | 552,979 | | |

| Freddie Mac (15.5%) | |

| | 250,000 | | | Federal Home Loan Banks, Bonds, 0.38%, due 1/29/13 | | | 250,131 | | |

| | 300,000 | | | Federal Home Loan Banks, Bonds, 3.38%, due 2/27/13 | | | 303,105 | | |

| | 250,000 | | | Freddie Mac, Notes, 4.13%, due 12/21/12 | | | 251,365 | | |

| | | | 804,601 | | |

| | | Total Mortgage-Backed Securities (Cost $1,357,552) | | | 1,357,580 | | |

| | |

| Short-Term Investments (66.0%) | |

| | |

U.S. Treasury Securities-Backed by the Full Faith and Credit of the U.S. Government(a) (51.9%) | |

| | 425,000 | | | U.S. Treasury Bills, Disc. Notes, 0.02%, due 11/23/12 | | | 424,979 | | |

| | 500,000 | | | U.S. Treasury Bills, Disc. Notes, 0.03%, due 11/29/12 | | | 499,967 | | |

| | 425,000 | | | U.S. Treasury Bills, Disc. Notes, 0.03%, due 12/6/12 | | | 424,961 | | |

| | 425,000 | | | U.S. Treasury Bills, Disc. Notes, 0.08%, due 2/7/13 | | | 424,870 | | |

| | 500,000 | | | U.S. Treasury Bills, Disc. Notes, 0.08%, due 2/14/13 | | | 499,832 | | |

| | 425,000 | | | U.S. Treasury Bills, Disc. Notes, 0.08%, due 2/21/13 | | | 424,845 | | |

| | | | | | | | |

| | | Total U.S. Treasury Securities-Backed by the Full Faith and Credit of the U.S. Government (Cost $2,699,397) | | | 2,699,454 | | |

| | | | |

| NUMBER OF SHARES | | | |

| | |

| Money Market Fund (14.1%) | |

| | 734,460 | | | State Street Institutional Government Money Market Fund Institutional Class (Cost $734,460) | | | 734,460 | Ø؆† | |

| | | Total Short-Term Investments (Cost $3,433,857) | | 3,433,914 | | |

| | | Total Investments (92.1%) (Cost $4,791,409) | | | 4,791,494 | ## | |

| | | Cash, receivables and other assets, less liabilities (7.9%) | | | 410,236 | ± | |

| | | Total Net Assets (100.0%) | | $ | 5,201,730 | | |

| See Notes to Schedule of Investments | 10 |

Notes to Consolidated Schedule of Investments

| † | In accordance with Accounting Standards Codification ("ASC") 820 "Fair Value Measurements and Disclosures" ("ASC 820"), all investments held by Neuberger Berman Risk Balanced Commodity Strategy Fund (the "Fund") are carried at the value that Neuberger Berman Management LLC ("Management") believes the Fund would receive upon selling an investment in an orderly transaction to an independent buyer in the principal or most advantageous market for the investment under current market conditions. Various inputs, including the volume and level of activity for the asset or liability in the market, are considered in valuing the Fund's investments, some of which are discussed below. Significant management judgment may be necessary to value investments in accordance with ASC 820. |

| | ASC 820 established a three-tier hierarchy of inputs to create a classification of value measurements for disclosure purposes. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below. |

| | | ● | Level 1 – quoted prices in active markets for identical investments |

| | | | Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, amortized cost, etc.) |

| | | | Level 3 – significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments) |

| | The inputs or methodology used for valuing an investment are not necessarily an indication of the risk associated with investing in those securities. |

| | The value of the Fund's investments in debt securities is determined by Management primarily by obtaining valuations from independent pricing services based on readily available bid quotations, or if quotations are not available, by methods which include various considerations based on security type (generally Level 2 inputs). In addition to the consideration of yields or prices of securities of comparable quality, coupon, maturity and type; indications as to values from dealers; and general market conditions, the following is a description of other Level 2 inputs and related valuation techniques used by an independent pricing service to value certain types of debt securities of the Fund: |

| | | U.S. Treasury Securities. Inputs used to value U.S. Treasury securities generally include quotes from several inter-dealer brokers and other market information which may include benchmark yields, reported trades, broker-dealer quotes, issuer spreads, benchmark securities, bids, offers, and reference data, such as market research publications, when available ("Other Market Information"). |

| | | Mortgage-Backed Securities. Inputs used to value mortgage-backed securities generally include models that consider a number of factors, which may include the following: prepayment speeds, cash flows, spread adjustments and Other Market Information. |

| | The value of commodity futures contracts is determined by obtaining valuations from independent pricing services at the settlement price at the market close (Level 1 inputs). |

| | Management has developed a process to periodically review information provided by independent pricing services for all types of securities. |

| | Investments in State Street Institutional Government Money Market Fund Institutional Class are valued using the fund's daily calculated net asset value per share (Level 2 inputs). |

| | If a valuation is not available from an independent pricing service, or if Management has reason to believe that the valuation received does not represent the amount the Fund might reasonably expect to receive on a current sale in an orderly transaction, the Fund seeks to obtain quotations from principal market makers (generally considered Level 3 inputs). If such quotations are not readily available, the security is valued using methods the Neuberger Berman Alternative Funds' Board of Trustees (the "Board") has approved on the belief that they reflect fair value. |

| See Notes to Financial Statements | 11 |

Notes to Consolidated Schedule of Investments (cont'd)

| | Numerous factors may be considered when determining the fair value of a security based on Level 2 or 3 inputs, including available analyst, media or other reports, trading in futures or ADRs and whether the issuer of the security being fair valued has other securities outstanding. Fair value prices are necessarily estimates, and there is no assurance that such a price will be at or close to the price at which the security is next quoted or next trades. The following is a summary, categorized by Level, of inputs used to value the Fund's investments as of October 31, 2012: |

| Asset Valuation Inputs | |

| | | Level 1 | | Level 2 | | Level 3 | | Total | |

| Investments: | |

Mortgage-Backed Securities^ | | $ | — | | | $ | 1,357,580 | | | $ | — | | | $ | 1,357,580 | | |

Short-Term Investments^ | | | — | | | | 3,433,914 | | | | — | | | | 3,433,914 | | |

Total Investments | | $ | — | | | $ | 4,791,494 | | | $ | — | | | $ | 4,791,494 | | |

| ^ | The Consolidated Schedule of Investments provides information on the industry categorization for the portfolio. |

| | The following is a summary, categorized by Level, of inputs used to value the Fund's derivatives as of October 31, 2012: |

| Liability Valuation Inputs | |

| | | Level 1 | | Level 2 | | Level 3 | | Total | |

| Futures Contracts | | $ | (35,576 | ) | | $ | — | | | $ | — | | | $ | (35,576 | ) | |

| ## | At October 31, 2012, the cost of investments for U.S. federal income tax purposes was $4,791,409. Gross unrealized appreciation of investments was $109,170 and gross unrealized depreciation of investments was $109,085, resulting in net unrealized appreciation of $85 based on cost for U.S. federal income tax purposes |

| ØØ | All or a portion of this security is segregated in connection with obligations for commodity futures contracts. |

| †† | A portion of this security is held by Neuberger Berman Cayman Commodity Fund I Ltd., (the "Subsidiary") a wholly-owned subsidiary of the Fund. See Note A-1 of the Notes to Consolidated Financial Statements. |

| ± | See Note A-12 in the Notes to Consolidated Financial Statements for the Fund's or Subsidiary's open positions in derivatives at October 31, 2012. |

| (a) | Interest rate represents discount rate at time of purchase, not a coupon rate. |

| See Notes to Financial Statements | 12 |

Consolidated Statement of Asset and Liabilities*

| Neuberger Berman Alternative Funds | |

| | | RISK BALANCED COMMODITY STRATEGY FUND | |

| | | October 31, 2012 | |

| Assets | |

| Investments in securities, at value** (Note A)—see Schedule of Investments: | |

| Unaffiliated issuers | | $ | 4,791,494 | | |

| Cash | | | 100,000 | | |

| Deposits with brokers for futures contracts (Note A-12) | | | 298,141 | | |

| Dividends and interest receivable | | | 8,214 | | |

| Receivable for Fund shares sold | | | 57,521 | | |

| Receivable for variation margin (Note A-12) | | | 21,859 | | |

| Receivable from Management—net (Note B) | | | 97,578 | | |

| Prepaid expenses and other assets | | | 48,776 | | |

Total Assets | | | 5,423,583 | | |

Liabilities | |

| Payable to investment manager (Note B) | | | 3,111 | | |

| Payable for organization costs | | | 83,813 | | |

| Accrued expenses and other payables | | | 134,929 | | |

Total Liabilities | | | 221,853 | | |

Net Assets | | $ | 5,201,730 | | |

Net Assets consist of: | |

| Paid-in capital | | $ | 5,237,996 | | |

| Undistributed net investment income (loss) | | | (775 | ) | |

| Net unrealized appreciation (depreciation) in value of investments | | | (35,491 | ) | |

Net Assets | | $ | 5,201,730 | | |

Net Assets | |

| Institutional Class | | $ | 4,976,556 | | |

| Class A | | | 126,924 | | |

| Class C | | | 98,250 | | |

| See Notes to Financial Statements | 13 |

Consolidated Statement of Asset and Liabilities* (cont'd)

| Neuberger Berman Alternative Funds (cont'd) | |

| | | RISK BALANCED COMMODITY STRATEGY FUND | |

| | | October 31, 2012 | |

| Shares Outstanding ($.001 par value; unlimited shares authorized) | |

| Institutional Class | | | 505,509 | | |

| Class A | | | 12,901 | | |

| Class C | | | 10,000 | | |

Net Asset Value, offering and redemption price per share | |

| Institutional Class | | | | | |

Net Asset Value and redemption price per share | |

| Class A | | | | | |

Offering Price per share | |

| Class A‡ | | | | | |

Net Asset Value and offering price per share | |

| Class C^ | | | | | |

**Cost of Investments | | | | | |

| ‡ | On single retail sales of less than $50,000. On sales of $50,000 or more or in certain other circumstances described in the Fund's prospectus, offering price is reduced. |

| ^ | Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. |

| * | See Notes A-1 and A-2 of the Notes to Consolidated Financial Statements. |

| See Notes to Financial Statements | 14 |

Consolidated Statement of Operations*

| Neuberger Berman Alternative Funds | |

| | | RISK BALANCED COMMODITY STRATEGY FUND | |

| | | Period from August 27, 2012 (Commencement of Operations) to October 31, 2012 | |

| Investment Income: | |

| Income (Note A): | |

| Interest income—unaffiliated issuers | | | | | |

Expenses: | |

| Investment management fees (Note B) | | | 6,322 | | |

| Administration fees (Note B) | | | 542 | | |

| Administration fees (Note B): | |

| Institutional Class | | | 778 | | |

| Class A | | | 41 | | |

| Class C | | | 37 | | |

| Distribution fees (Note B): | |

| Class A | | | 51 | | |

| Class C | | | 183 | | |

| Shareholder servicing agent fees: | |

| Institutional Class | | | 1,627 | | |

| Class A | | | 1,539 | | |

| Class C | | | 1,534 | | |

| Organization expense (Note A-9) | | | 391,555 | | |

| Subsidiary administration fees (Note B) | | | 8,333 | | |

| Audit fees | | | 83,500 | | |

| Custodian fees (Note A) | | | 5,905 | | |

| Legal fees | | | 18,333 | | |

| Registration and filing fees | | | 6,094 | | |

| Shareholder reports | | | 25,500 | | |

| Trustees' fees and expenses | | | 2,586 | | |

| Miscellaneous | | | 1,011 | | |

Total expenses | | | 555,471 | | |

| Expenses reimbursed by Management (Note B) | | | (545,259 | ) | |

| Expenses reduced by custodian fee expense offset arrangement (Note A-14) | | | (1 | ) | |

Total net expenses | | | 10,211 | | |

Net investment income (loss) | | | | ) | |

Realized and Unrealized Gain (Loss) on Investments (Note A): | |

Net realized gain (loss) on: | |

| Commodity futures contracts | | | (52,003 | ) | |

Change in net unrealized appreciation (depreciation) in value of: | |

| Unaffiliated investment securities | | | 85 | | |

| Commodity futures contracts | | | (35,576 | ) | |

Net gain (loss) on investments | | | (87,494 | ) | |

Net increase (decrease) in net assets resulting from operations | | | | ) | |

* See Notes A-1 and A-2 of the Notes to Consolidated Financial Statements.

| See Notes to Financial Statements | 15 |

Consolidated Statement of Changes in Net Assets*

| Neuberger Berman Alternative Funds | |

| | | RISK BALANCED COMMODITY STRATEGY FUND | |

| | | Period from August 27, 2012 (Commencement of Operations) to October 31, 2012 | |

| Increase (Decrease) in Net Assets: | |

From Operations (Note A): | |

| Net investment income (loss) | | $ | (9,258 | ) | |

| Net realized gain (loss) on investments | | | (52,003 | ) | |

| Change in net unrealized appreciation (depreciation) of investments | | | (35,491 | ) | |

Net increase (decrease) in net assets resulting from operations | | | (96,752 | ) | |

From Fund Share Transactions (Note D): | |

| Proceeds from shares sold: | |

| Institutional Class | | | 5,069,219 | | |

| Class A | | | 129,263 | | |

| Class C | | | 100,000 | | |

Net increase (decrease) from Fund share transactions | | | 5,298,482 | | |

Net Increase (Decrease) in Net Assets | | | 5,201,730 | | |

Net Assets: | |

| Beginning of period | | | — | | |

| End of period | | $ | 5,201,730 | | |

| Undistributed net investment income (loss) at end of period | | $ | (775 | ) | |

* See Notes A-1 and A-2 of the Notes to Consolidated Financial Statements.

| See Notes to Financial Statements | 16 |

Notes to Consolidated Financial Statements Risk Balanced Commodity Strategy Fund

Note A—Summary of Significant Accounting Policies:

| 1 | General: Neuberger Berman Alternative Funds (the "Trust") is a Delaware statutory trust organized pursuant to an Amended and Restated Trust Instrument dated October 14, 2010. The Trust is registered as an open-end management investment company under the Investment Company Act of 1940, as amended (the "1940 Act"), and its shares are registered under the 1933 Act. The Fund is a separate operating series of the Trust and is non-diversified. The Fund had no operations until August 27, 2012, other than matters relating to its organization and registration of shares under the 1933 Act. The Fund offers Institutional Class shares, Class A shares and Class C shares. The Board may establish additional series or classes of shares without the approval of shareholders. |

| | The assets of the Fund belong only to the Fund, and the liabilities of the Fund are borne solely by the Fund and no other. |

| | The Fund invests in commodity-related instruments through the Subsidiary, which is organized under the laws of the Cayman Islands. Subscription agreements were entered into between the Fund and the Subsidiary with the intent that the Fund will remain the sole shareholder and primary beneficiary of the Subsidiary. The Subsidiary is governed by its own Board of Directors. |

| | As of October 31, 2012, the value of the Fund's investment in the Subsidiary was as follows: |

Commencement Date of Subsidiary | | Investment in Subsidiary | | Percentage of Net Assets | |

August 27, 2012 | | $ | 770,439 | | | | 14.8 | % | |

| | The preparation of financial statements in accordance with U.S. generally accepted accounting principles ("GAAP") requires Management to make estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. |

| 2 | Consolidation: The accompanying financial statements of the Fund present the consolidated accounts of the Fund and the Subsidiary. All intercompany accounts and transactions have been eliminated in consolidation. |

| 3 | Portfolio valuation: Investment securities are valued as indicated in the notes following the Schedule of Investments. |

| 4 | Foreign currency translation: The accounting records of the Fund and Subsidiary are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars using the exchange rate as of 4:00 p.m., Eastern time, to determine the value of investments, other assets and liabilities. Purchase and sale prices of securities, and income and expenses, are translated into U.S. dollars at the prevailing rate of exchange on the respective dates of such transactions. Net unrealized foreign currency gain (loss), if any, arises from changes in the value of assets and liabilities, other than investments in securities, as a result of changes in exchange rates and is stated separately in the Consolidated Statement of Operations. |

| 5 | Securities transactions and investment income: Securities transactions are recorded on trade date for financial reporting purposes. Dividend income is recorded on the ex-dividend date or, for certain foreign dividends, as soon as the Fund becomes aware of the dividends. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Interest income, including accretion of discount (adjusted for original issue discount, where applicable) and amortization of premium, where applicable, is recorded on the accrual basis. Realized gains and losses from securities transactions and foreign currency transactions, if any, are recorded on the basis of identified cost and stated separately in the Consolidated Statement of Operations. |

| 6 | Income tax information: It is the intention of the Fund to qualify for treatment as a regulated investment company by complying with the requirements of the U.S. Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its net investment income and net realized capital gains to its shareholders. To the extent the Fund distributes substantially all of its net investment income and net realized capital gains to shareholders, no federal income or excise tax provision is required. |

| | The Fund has adopted the provisions of ASC 740 "Income Taxes" ("ASC 740"). ASC 740 sets forth a minimum threshold for financial statement recognition of a tax position taken, or expected to be taken, in a tax return. The Fund recognizes interest and penalties, if any, related to unrecognized tax positions as an income tax expense in the Consolidated Statement of Operations. As of October 31, 2012, the Fund did not have any unrecognized tax positions. |

| | The Subsidiary is a controlled foreign corporation under the U.S. Internal Revenue Code. As a U.S. shareholder of a controlled foreign corporation, the Fund will include in its gross income its share of the Subsidiary's current earnings and profits (including net realized gains). Any deficit generated by the Subsidiary will be disregarded for purposes of computing the Fund's gross income in the current period and also disregarded for all future periods. |

| | Income distributions and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP. These differences are primarily due to differing treatments of income and gains on various investment securities held by the Fund, timing differences and differing characterization of distributions made by the Fund. The Fund may also utilize earnings and profits distributed to shareholders on redemption of shares as a part of the dividends-paid deduction for income tax purposes. |

| | As determined on October 31, 2012, permanent differences resulting primarily from different book and tax accounting were reclassified at period end. Such differences may be attributed to one or more of the following: non-deductible Rule 12b-1 fees, and Subsidiary income, gain (loss) and expense adjustments. These reclassifications had no effect on net income, net asset value ("NAV") or NAV per share of the Fund. For the period ended October 31, 2012, the Fund recorded the following permanent reclassifications: |

| Paid-in Capital | | Undistributed Net Investment Income (Loss) | | Accumulated Net Realized Gains (Losses) on Investments | |

| | | | | | | | | | | |

| | For tax purposes, distributions of short-term gains are taxable to shareholders as ordinary income. |

| | As of October 31, 2012, the components of distributable earnings (accumulated losses) on a U.S. federal income tax basis were as follows: |

Undistributed Ordinary Income | | Unrealized Appreciation (Depreciation) | | Loss Carryforwards and Deferrals | | Other Temporary Differences | | Total | |

| | | | | | | | | | | | | | ) | | | | ) | |

| | The difference between book basis and tax basis distributable earnings is primarily due to organizational expenses. |

| | To the extent the Fund's net realized capital gains, if any, can be offset by capital loss carryforwards, it is the policy of the Fund not to distribute such gains. |

| 7 | Distributions to shareholders: The Fund may earn income, net of expenses, daily on its investments. Distributions from net investment income and net realized capital gains, if any, generally are distributed once a year (usually in December) and are recorded on the ex-date. |

| 8 | Foreign taxes: Foreign taxes withheld represent amounts withheld by foreign tax authorities, net of refunds recoverable. |

| 9 | Organization expenses: Costs incurred by the Fund in connection with its organization, which amounted to $391,555, have been expensed as incurred. |

| 10 | Expense allocation: Certain expenses are applicable to multiple funds. Expenses directly attributable to the Fund are charged to the Fund. Expenses of the Trust that are not directly attributable to a particular series of the Trust (e.g., the Fund) are allocated among the series of the Trust, on the basis of relative net assets, except where a more appropriate allocation of expenses to each of the series can otherwise be made fairly. Expenses borne by the complex of related investment companies, which includes open-end and closed-end investment companies for which Management serves as investment manager, that are not directly attributable to a particular investment company in the complex (e.g., the Trust) or series thereof are allocated among the investment companies in the complex or series thereof, on the basis of relative net assets, except where a more appropriate allocation of expenses to each of the investment companies in the complex or series thereof can otherwise be made fairly. The Fund's expenses (other than those specific to each class) are allocated proportionally each day among the classes based upon the relative net assets of each class. |

| 11 | Investments in foreign securities: Investing in foreign securities may involve certain sovereign and other risks, in addition to the credit and market risks normally associated with domestic securities. These additional risks include the possibility of adverse political and economic developments (including political instability, nationalization, expropriation, or confiscatory taxation) and the potentially adverse effects of unavailability of public information regarding issuers, less governmental supervision and regulation of financial markets, reduced liquidity of certain financial markets, and the lack of uniform accounting, auditing, and financial reporting standards or the application of standards that are different or less stringent than those applied in the United States. Foreign securities also may experience greater price volatility, higher rates of inflation, and delays in settlement. |

| 12 | Derivative instruments: During the period ended October 31, 2012, the Fund's use of derivatives was limited to commodity futures contracts. The Fund has adopted the provisions of ASC 815 "Derivatives and Hedging" ("ASC 815"). The disclosure requirements of ASC 815 distinguish between derivatives that qualify for hedge accounting and those that do not. Because investment companies value their derivatives at fair value and recognize changes in fair value through the Consolidated Statement of Operations, they do not qualify for hedge accounting. Accordingly, even though the Fund's investments in derivatives may represent economic hedges, they are considered non-hedge transactions for purposes of this disclosure. |

| | Commodity futures contracts: During the period ended October 31, 2012, the Fund entered into commodity futures contracts (through investments in the Subsidiary) to provide investment exposure to individual commodities, as well as to manage and/or adjust the risk profile of the Fund. |

| | At the time the Fund or Subsidiary enters into a commodity futures contract, it is required to deposit with the futures commission merchant a specified amount of cash or liquid securities, known as "initial margin," which is a percentage of the value of the commodity futures contract being traded that is set by the exchange upon which the futures contract is traded. Each day, the futures contract is valued at the official settlement price of the board of trade or U.S. commodity exchange on which such futures contract is traded. Subsequent payments, known as "variation margin," to and from the broker are made on a daily basis as the market price of the commodity futures contract fluctuates. Daily variation margin adjustments, arising from this "mark to market," are recorded by the Fund or Subsidiary as unrealized gains or losses. |

| | Although some commodity futures contracts by their terms call for actual delivery or acquisition of the underlying securities or currency, in most cases the contracts are closed out prior to delivery by offsetting purchases or sales of matching commodity futures contracts. When the contracts are closed, the Fund or Subsidiary recognizes a gain or loss. Risks of entering into futures contracts include the possibility there may be an illiquid market, possibly at a time of rapidly declining prices, and/or a change in the value of the contract may not correlate with changes in the value of the underlying securities. Futures executed on regulated futures exchanges have minimal counterparty risk to a fund because the exchange's clearinghouse assumes the position of the counterpary in each transaction. Thus, |

the Fund is exposed to risk only in connection with the clearinghouse and not in connection with the original counterpary to the transaction.

For U.S. federal income tax purposes, the futures transactions undertaken by the Fund or Subsidiary may cause the Fund or Subsidiary to recognize gains or losses from marking contracts to market even though its positions have not been sold or terminated, may affect the character of the gains or losses recognized as long-term or short-term, and may affect the timing of some capital gains and losses realized by the Fund or Subsidiary. Also, the Fund's or Subsidiary's losses on transactions involving futures contracts may be deferred rather than being taken into account currently in calculating the Fund's or Subsidiary's taxable income.

At October 31, 2012, open positions in commodity futures contracts(1) were:

| Expiration | | | Open Contracts | | Position | | Unrealized Appreciation (Depreciation) | |

| December 2012 | | | 4 Aluminum High Grade | | Long | | $ | (2,137 | ) | |

| December 2012 | | | 4 Lead | | Long | | | 8,913 | | |

| December 2012 | | | 1 Nickel | | Long | | | (1,212 | ) | |

| December 2012 | | | 4 Zinc | | Long | | | (1,825 | ) | |

| January 2013 | | | 2 Platinum | | Long | | | (2,960 | ) | |

| January 2013 | | | 2 Cattle Feeder | | Long | | | (1,533 | ) | |

| January 2013 | | | 4 Aluminum High Grade | | Long | | | (20,600 | ) | |

| January 2013 | | | 3 Lead | | Long | | | (15,300 | ) | |

| January 2013 | | | 2 Nickel | | Long | | | (25,116 | ) | |

| January 2013 | | | 4 Zinc | | Long | | | (22,700 | ) | |

| February 2013 | | | 3 Natural Gas | | Long | | | (5,030 | ) | |

| February 2013 | | | 4 Aluminum High Grade | | Long | | | (3,494 | ) | |

| February 2013 | | | 4 Lead | | Long | | | 4,550 | | |

| February 2013 | | | 2 Nickel | | Long | | | (2,124 | ) | |

| February 2013 | | | 3 Light Sweet Crude Oil | | Long | | | (1,790 | ) | |

| February 2013 | | | 4 Zinc | | Long | | | 1,225 | | |

| February 2013 | | | 2 Gasoline RBOB | | Long | | | (727 | ) | |

| February 2013 | | | 4 Gas Oil | | Long | | | 2,175 | | |

| February 2013 | | | 3 Gold 100 oz. | | Long | | | (14,490 | ) | |

| February 2013 | | | 3 Lean Hogs | | Long | | | 5,340 | | |

| February 2013 | | | 2 Heating Oil | | Long | | | 1,953 | | |

| February 2013 | | | 4 Live Cattle | | Long | | | 570 | | |

| March 2013 | | | 2 Soybean Meal | | Long | | | 1,940 | | |

| March 2013 | | | 3 Soybean | | Long | | | 400 | | |

| March 2013 | | | 3 Brent Crude Oil | | Long | | | (1,680 | ) | |

| March 2013 | | | 3 Copper High Grade | | Long | | | (16,050 | ) | |

| March 2013 | | | 4 Sugar 11 | | Long | | | (3,192 | ) | |

| March 2013 | | | 6 Corn | | Long | | | 7,600 | | |

| March 2013 | | | 2 Cotton No. 2 | | Long | | | (195 | ) | |

| March 2013 | | | 3 Wheat | | Long | | | (1,362 | ) | |

| March 2013 | | | 1 Coffee | | Long | | | (6,094 | ) | |

| March 2013 | | | 1 Soybean Oil | | Long | | | (726 | ) | |

| March 2013 | | | 2 Cocoa | | Long | | | (1,767 | ) | |

| Expiration | | Open Contracts | | Position | | Unrealized Appreciation (Depreciation) | |

| March 2013 | | 2 Wheat | | Long | | $ | 1,558 | | |

| March 2013 | | 2 Silver | | Long | | | (8,200 | ) | |

| December 2012 | | 4 Aluminum High Grade | | Short | | | 20,900 | | |

| December 2012 | | 4 Lead | | Short | | | 20,850 | | |

| December 2012 | | 1 Nickel | | Short | | | 12,522 | | |

| December 2012 | | 4 Zinc | | Short | | | 23,200 | | |

| January 2013 | | 4 Aluminum High Grade | | Short | | | 7,725 | | |

| January 2013 | | 3 Lead | | Short | | | (3,938 | ) | |

| January 2013 | | 2 Nickel | | Short | | | 1,932 | | |

| January 2013 | | 4 Zinc | | Short | | | 5,313 | | |

| Total | | | | | | $ | (35,576 | ) | |

(1) Commodity futures are held by the Subsidiary. See Note A-1 of the Notes to Financial Statements.

During the period ended October 31, 2012, the average notional value of commodity futures contracts was $5,760,695 for long positions and $(721,238) for short positions.

The notional value of commodity futures contracts at October 31, 2012 was $6,516,921 for long positions and $(1,403,683) for short positions.

At October 31, 2012, the Fund had deposited $298,141 in a segregated account to cover margin requirements on open futures contracts.

At October 31, 2012, the Fund had the following derivatives (which did not qualify as hedging instruments under ASC 815), grouped by primary risk exposure:

Liability Derivatives

| | | Commodity Risk | | Consolidated Statement of Assets and Liabilities Location | |

| Futures Contracts | | $ | (35,576 | ) | | Receivable/Payable for | |

| Total Value | | $ | (35,576 | ) | | variation margin(1) | |

(1) "Futures Contracts" reflects the cumulative appreciation (depreciation) of futures contracts as of October 31, 2012, which is reflected in the Consolidated Statement of Assets and Liabilities under the caption "Net unrealized appreciation (depreciation) in value of investments." The outstanding variation margin as of October 31, 2012, if any, is reflected in the Consolidated Statement of Assets and Liabilities under the caption "Receivable/Payable for variation margin."

The impact of the use of these derivative instruments on the Consolidated Statement of Operations during the period ended October 31, 2012, was as follows:

Realized Gain (Loss)

| | | Commodity Risk | | Consolidated Statement of Operations Location | |

| Futures Contracts | | $ | (52,003 | ) | | Net realized gain (loss) on: commodity | |

| Total Realized Gain (Loss) | | $ | (52,003 | ) | | futures contracts | |

Change in Appreciation (Depreciation)

| | | Commodity Risk | | | |

| Futures Contracts | | $ | (35,576 | ) | | Change in net unrealized appreciation (depreciation) in value of: | |

| Total Change in Appreciation (Depreciation) | $ | (35,576 | ) | | commodity futures contracts | |

13 Indemnifications: Like many other companies, the Trust's organizational documents provide that its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust. In addition, both in some of its principal service contracts and in the normal course of its business, the Trust enters into contracts that provide indemnifications to other parties for certain types of losses or liabilities. The Trust's maximum exposure under these arrangements is unknown as this could involve future claims against the Trust.

14 Expense offset arrangement: The Fund has an expense offset arrangement in connection with its custodian contract. For the period ended October 31, 2012, the impact of this arrangement was a reduction of expenses of $1.

15 Other: All net investment income and realized and unrealized capital gains and losses of the Fund are allocated, on the basis of relative net assets, pro rata among its respective classes.

Note B—Management Fees, Administration Fees, Distribution Arrangements, and Other Transactions with Affiliates:

The Fund retains Management as its investment manager under a Management Agreement. For such investment management services, the Fund pays Management a fee at the annual rate of 0.70% of the first $250 million of the Fund's average daily net assets, 0.675% of the next $250 million, 0.65% of the next $250 million, 0.625% of the next $250 million, 0.60% of the next $500 million, 0.575% of the next $2.5 billion and 0.55% of average daily net assets in excess of $4 billion, less the net asset value of the Subsidiary. Accordingly, for the period ended October 31, 2012, the management fee pursuant to the Management Agreement was equivalent to an annual effective rate of 0.70% of the Fund's average daily net assets.

Management also serves as investment adviser to the Subsidiary. For such investment management services, the Subsidiary pays Management a fee at the annual rate of 0.70% of the first $250 million of the Subsidiary's average daily net assets, 0.675% of the next $250 million, 0.65% of the next $250 million, 0.625% of the next $250 million, 0.60% of the next $500 million, 0.575% of the next $2.5 billion and 0.55% of average daily net assets in excess of $4 billion. Accordingly, for the period ended October 31, 2012, the management fee pursuant to the Management Agreement was equivalent to an annual effective rate of 0.70% of the Subsidiary's average daily net assets.

The Fund retains Management as its administrator under an Administration Agreement. The Fund pays Management an administration fee at the annual rate of 0.06% of its average daily net assets under this agreement. In addition, the Fund's Institutional Class pays Management an administration fee at the annual rate of 0.09% of its average daily net assets under this agreement and the Fund's Class A and Class C pays Management an administration fee at the annual rate of 0.20% of its average daily net assets under this agreement. Additionally, Management retains State Street Bank and Trust Company ("State Street") as its sub-administrator under a

Sub-Administration Agreement. Management pays State Street a fee for all services received under this agreement. The Subsidiary also retains Management as its administrator, and State Street as its sub-administrator.

Management has contractually agreed to waive current payment of fees and/or reimburse certain expenses of the Institutional Class, Class A and Class C of the Fund so that the total annual operating expenses of those classes do not exceed the expense limitations as detailed in the following table. These undertakings apply to the Fund's direct expenses and exclude interest, taxes, brokerage commissions, acquired fund fees and expenses, extraordinary expenses, and dividend expense relating to short sales, if any; consequently, net expenses may exceed the contractual expense limitations. The Fund has agreed that each of its respective classes will repay Management for fees and expenses waived or reimbursed for that class provided that repayment does not cause that class' annual operating expenses to exceed its contractual expense limitation at the time the fees and expenses were waived or reimbursed. Any such repayment must be made within three years after the year in which Management incurred the expense. The expenses of the Subsidiary are included in the total expenses used to calculate the reimbursement, which the Fund has agreed to share with the Subsidiary. For the period ended October 31, 2012, these Subsidiary expenses amounted to $111,128.

During the period ended October 31, 2012, there was no reimbursement to Management under this agreement.

At October 31, 2012, contingent liabilities to Management under the contractual expense limitation were as follows:

| | | | | | | Expenses Reimbursed In Fiscal Period Ending, October 31, 2012 | |

| | | | | | | Subject to Repayment until October 31, | |

| | | Contractual Expense Limitation(1) | | Expiration | | 2015 | |

| Institutional Class | | | 1.10 | % | | 10/31/14 | | | 518,969 | (2) | |

Class A | | | 1.46 | % | | 10/31/14 | | | 13,769 | (2) | |

Class C | | | 2.21 | % | | 10/31/14 | | | 12,521 | (2) | |

(1) Expense limitation per annum of the respective class' average daily net assets.

(2) Period from August 27, 2012 (Commencement of Operations) to October 31, 2012.

Neuberger Berman Fixed Income LLC ("NBFI"), as the sub-adviser to the Fund and the Subsidiary, is retained by Management to provide day-to-day investment management services and receives a monthly fee paid by Management. As investment manager, Management is responsible for overseeing the investment activities of NBFI. Several individuals who are officers and/or Trustees of the Trust are also employees of NBFI, Neuberger Berman LLC ("Neuberger") and/or Management.

Management, NBFI and Neuberger are indirect subsidiaries of Neuberger Berman Group LLC (("NBG") and together with its consolidated subsidiaries ("NB Group")). NBSH Acquisition, LLC ("NBSH"), which is owned by portfolio managers, members of the NB Group management team and certain of NB Group's key employees and senior professionals, owns, as of September 30, 2012, approximately 57% of NBG's common units, and Lehman Brothers Holdings Inc. ("LBHI") and certain of its subsidiaries (collectively the "LBHI Parties") own the remaining 43% of such common units. Pursuant to agreements among NBG, NBSH and the LBHI Parties, NBG is entitled to acquire the remaining Class A common units through a process that is expected to end in 2017. In April 2012, NBG exercised its option (the "Redemption Agreement Option") to redeem during 2012 certain of its Class A common units held by the LBHI Parties equal to 10% of NBG's aggregate common units issued and outstanding as of March 16, 2012. The final payment for such Class A common units is due within thirty (30) days of December 31, 2012.

The Fund also has a distribution agreement with Management with respect to each class of shares. Management acts as agent in arranging for the sale of class shares without sales commission or other compensation, except as described below for Class A and Class C shares, and bears advertising and promotion expenses.

However, Management receives fees from Class A and Class C under their distribution plans (each a "Plan", collectively the "Plans") pursuant to Rule 12b-1 under the 1940 Act. The Plans provide that, as compensation for administrative and other services provided to these classes, Management's activities and expenses related to the sale and distribution of these classes of shares, and ongoing services provided to investors in these classes, Management receives from each of these classes a fee at the annual rate of 0.25% of Class A's and 1.00% of Class C's average daily net assets. Management receives this amount to provide distribution and shareholder servicing for these classes and pays a portion of it to institutions that provide such services. Those institutions may use the payments for, among other purposes, compensating employees engaged in sales and/or shareholder servicing. The amount of fees paid by each class during any year may be more or less than the cost of distribution and other services provided to that class. FINRA rules limit the amount of annual distribution fees that may be paid by a mutual fund and impose a ceiling on the cumulative distribution fees paid. The Trust's Plans comply with those rules.

Class A shares are generally sold with an initial sales charge of up to 5.75% and no contingent deferred sales charge ("CDSC"), except that a CDSC of 1.00% applies to certain redemptions made within 18 months following purchases of $1 million or more without an initial sales charge. Class C shares are sold with no initial sales charge and a 1.00% CDSC if shares are sold within one year after purchase.

For the period ended October 31, 2012, Management, acting as underwriter and broker-dealer, received net initial sales charges from the purchase of Class A shares and CDSCs from the redemption of Class A and Class C shares as follows:

| | | Underwriter | | Broker-Dealer | |

| | | Net Initial Sales Charges | | CDSC | | Net Initial Sales Charges | | CDSC | |

| Class A | | $ | — | | | $ | — | | | $ | — | | | $ | — | | |

| Class C | | | — | | | | — | | | | — | | | | — | | |

Note C—Securities Transactions:

For the period ended October 31, 2012, all securities transactions were short-term.

Note D—Fund Share Transactions:

Share activity for the period ended October 31, 2012 was as follows:

| | | Shares Sold | | Total | |

Institutional Class(1) | | | 505,509 | | | | 505,509 | | |

Class A(1) | | | 12,901 | | | | 12,901 | | |

Class C(1) | | | 10,000 | | | | 10,000 | | |

(1) Period from August 27, 2012 (Commencement of Operations) to October 31, 2012.

Note E—Line of Credit:

At October 31, 2012, the Fund was a participant in a single committed, unsecured $200,000,000 line of credit with State Street, to be used only for temporary or emergency purposes. Other investment companies managed by Management also participate in this line of credit on the same terms. Interest is charged on borrowings under this line of credit at the higher of (a) the Federal Funds Rate plus 1.25% per annum or (b) the Overnight LIBOR Rate

plus 1.25% per annum. A commitment fee of 0.10% per annum of the available line of credit is charged, of which each participating Fund has agreed to pay its pro rata share, based on the ratio of its individual net assets to the net assets of all participants at the time the fee is due and payable. The fee is paid quarterly in arrears. Because several mutual funds participate, there is no assurance that an individual Fund will have access to all or any part of the $200,000,000 at any particular time. There were no loans outstanding pursuant to this line of credit at October 31, 2012. During the period ended October 31, 2012, the Fund did not utilize this line of credit.

Note F—Recent Accounting Pronouncement:

In December 2011, the Financial Accounting Standards Board issued Accounting Standards Update 2011-11 Disclosures about Offsetting Assets and Liabilities ("ASU 2011-11"). Effective for annual reporting periods beginning on or after January 1, 2013 and interim periods within those annual periods, ASU 2011-11 is intended to enhance disclosure requirements on the offsetting of financial assets and liabilities. At this time, Management is evaluating the implications of ASU 2011-11 and its impact on the financial statements.

This page has been left blank intentionally

Consolidated Financial Highlights

The following tables include selected data for a share outstanding throughout the period and other performance information derived from the Financial Statements. Per share amounts that round to less than $0.01 or $(0.01) per share are presented as $0.00 or $(0.00) respectively. Net Asset amounts with a zero balance may reflect actual amounts rounding to less than $0.1 million.

| | | Net Asset Value, Beginning of Period | | Net Investment Income (Loss)@ | | Net Gains or Losses on Securities (both realized and unrealized) | | Total From Investment Operations | | Dividends from Net Investment Income | | Distributions from Net Realized Capital Gains | | Total Distributions | |

Risk Balanced Commodity Strategy Fund | |

| Institutional Class | |

Period from 8/27/2012^ to 10/31/2012 | | $ | 10.00 | | | $ | (0.02 | ) | | $ | (0.14 | ) | | $ | (0.16 | ) | | $ | — | | | $ | — | | | $ | — | | |

Class A | |

Period from 8/27/2012^ to 10/31/2012 | | $ | 10.00 | | | $ | (0.03 | ) | | $ | (0.13 | ) | | $ | (0.16 | ) | | $ | — | | | $ | — | | | $ | — | | |

Class C | |

Period from 8/27/2012^ to 10/31/2012 | | $ | 10.00 | | | $ | (0.04 | ) | | $ | (0.13 | ) | | $ | (0.17 | ) | | $ | — | | | $ | — | | | $ | — | | |

| See Notes to Financial Highlights | 27 |

| | | Net Asset Value, End of Period | | Total Return†† | | Net Assets, End of Period (in millions) | | Ratio of Gross Expenses to Average Net Assets# | | Ratio of Net Expenses to Average Net Assets | | Ratio of Net Investment Income/ (Loss) to Average Net Assets | | Portfolio Turnover Rate | |

Risk Balanced Commodity Strategy Fund | |

| Institutional Class | |

Period from 8/27/2012^ to 10/31/2012 | | $ | 9.84 | | | | (1.60 | %)** | | $ | 5.0 | | | | 25.60 | %*‡ | | | 1.10 | %*‡ | | | (.99 | %)*‡ | | | 0 | %** | |

| Class A | |

Period from 8/27/2012^ to 10/31/2012 | | $ | 9.84 | | | | (1.60 | %)** | | $ | 0.1 | | | | 33.04 | %*‡ | | | 1.46 | %*‡ | | | (1.36 | %)*‡ | | | 0 | %** | |

| Class C | |

Period from 8/27/2012^ to 10/31/2012 | | $ | 9.83 | | | | (1.70 | %)** | | $ | 0.1 | | | | 35.12 | %*‡ | | | 2.21 | %*‡ | | | (2.11 | %)*‡ | | | 0 | %** | |

Notes to Financial Highlights

| †† | Total return based on per share NAV reflects the effects of changes in NAV on the performance of the Fund during the fiscal period and assumes income dividends and other distributions, if any, were reinvested, but does not reflect the effect of sales charges. Results represent past performance and do not indicate future results. Current returns may be lower or higher than the performance data quoted. Investment returns and principal may fluctuate and shares when redeemed may be worth more or less than original cost. Total return would have been lower if Management had not reimbursed and/or waived certain expenses. |

| # | Represents the annualized ratios of net expenses to average daily net assets if Management had not reimbursed certain expenses and/or waived a portion of the investment management fee. |

| @ | Calculated based on the average number of shares outstanding during the fiscal period. |

| ^ | The date investment operations commenced. |

| ‡ | Organization expense, which is a non-recurring expense, is included in these ratios on a non-annualized basis. |

| * | Annualized. |

| ** | Not annualized. |

To the Board of Trustees of Neuberger Berman Alternative Funds

and Shareholders of Neuberger Berman Risk Balanced Commodity Strategy Fund

We have audited the accompanying consolidated statement of assets and liabilities of the Neuberger Berman Risk Balanced Commodity Strategy Fund, one of the series constituting the Neuberger Berman Alternative Funds (the "Fund"), including the consolidated schedule of investments, as of October 31, 2012, the related consolidated statements of operations, changes in net assets, and the financial highlights for the period from August 27, 2012 (commencement of operations) through October 31, 2012. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Fund's internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of October 31, 2012 by correspondence with the custodian and others or by other appropriate auditing procedures where replies from others were not received. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the consolidated financial position of Neuberger Berman Risk Balanced Commodity Strategy Fund, a series of Neuberger Berman Alternative Funds, as of October 31, 2012, and the consolidated results of its operations, the changes in its net assets, and the financial highlights for the period from August 27, 2012 (commencement of operations) through October 31, 2012, in conformity with U.S. generally accepted accounting principles.

Boston, Massachusetts

December 19, 2012

Directory

Investment Manager, Administrator and Distributor Neuberger Berman Management LLC 605 Third Avenue, 2nd Floor New York, NY 10158-0180 800.877.9700 or 212.476.8800 Intermediary Support Services 800.366.6264 Sub-Adviser Neuberger Berman Fixed Income LLC 190 South LaSalle Street Chicago, IL 60603 Custodian and Shareholder Servicing Agent State Street Bank and Trust Company 2 Avenue de Lafayette Boston, MA 02111 | For Institutional Class Shareholders Address correspondence to: Neuberger Berman Management LLC 605 Third Avenue, Mail Drop 2-7 New York, NY 10158-0180 Attn: Intermediary Support Services 800.366.6264 For Class A and Class C Shareholders: Please contact your investment provider Legal Counsel K&L Gates LLP 1601 K Street, NW Washington, DC 20006 Independent Registered Public Accounting Firms Ernst & Young LLP 200 Clarendon Street Boston, MA 02116 |

Trustees and Officers

The following tables set forth information concerning the trustees ("Trustees") and officers ("Officers") of the Fund. All persons named as Trustees and Officers also serve in similar capacities for other funds administered or managed by Management and NBFI. The Fund's Statement of Additional Information includes additional information about the Trustees as of the time of the Fund's most recent public offering and is available upon request, without charge, by calling (800) 877-9700.

Information about the Board of Trustees

Name, (Year of Birth), and Address(1) | | Position(s) and Length of Time Served(2) | | Principal Occupation(s)(3) | | Number of Funds in Fund ComplexOverseen by Fund Trustee | | Other Directorships Held Outside Fund Complex by Fund Trustee(3) | |

Independent Fund Trustees | |

| Faith Colish (1935) | | Trustee since inception | | Counsel, Carter Ledyard & Milburn LLP (law firm) since October 2002; formerly, Attorney-at-Law and President, Faith Colish, A Professional Corporation, 1980 to 2002. | | | 50 | | | Formerly, Director, 1997 to 2003, and Advisory Director, 2003 to 2006, ABA Retirement Funds (formerly, American Bar Retirement Association) (not-for-profit membership corporation). | |

| Martha C. Goss (1949) | | Trustee since 2007 | | President, Woodhill Enterprises Inc./Chase Hollow Associates LLC (personal investment vehicle), since 2006; Chief Operating and Financial Officer, Hopewell Holdings LLC/ Amwell Holdings, LLC (a holding company for investments in the healthcare sector), since 2003; formerly, Consultant, Resources Connection (temporary staffing), 2002 to 2006. | | | 50 | | | Director, American Water (water utility), since 2003; Director, Channel Reinsurance (financial guaranty reinsurance), 2006 to 2010; Director, Allianz Life of New York (insurance), since 2005; Director, Financial Women's Association of New York (not-for-profit association), since 2003; Trustee Emerita, Brown University, since 1998; formerly, Director, Ocwen Financial Corporation (mortgage servicing), 2005 to 2010; formerly, Advisory Board Member, Attensity (software developer), 2005 to 2007; formerly, Director, Bank Leumi (commercial bank), 2005 to 2007; formerly, Director, Claire's Stores, Inc. (retailer), 2005 to 2007. | |

Name, (Year of Birth), and Address(1) | | Position(s) and Length of Time Served(2) | | Principal Occupation(s)(3) | | Number of Funds in Fund Complex | | Other Directorships Held Outside Fund Complex by Fund Trustee(3) Overseen by Fund Trustee | |

| | | | | | | | | | | | |

| Michael M. Knetter (1960) | | Trustee since 2007 | | President and Chief Executive Officer, University of Wisconsin Foundation, since October 2010; formerly, Dean, School of Business, University of Wisconsin—Madison; formerly, Professor of International Economics and Associate Dean, Amos Tuck School of Business—Dartmouth College, 1998 to 2002. | | | 50 | | | Director, American Family Insurance (a mutual company, not publicly traded), since March 2009; formerly, Trustee, Northwestern Mutual Series Fund, Inc., 2007 to 2010; formerly, Director, Wausau Paper, 2005 to 2011; formerly, Director, Great Wolf Resorts, 2004 to 2009. | |

| Howard A. Mileaf (1937) | | Trustee since inception | | Retired; formerly, Vice President and General Counsel, WHX Corporation (holding company), 1993 to 2001. | | | 50 | | | Formerly, Director, Webfinancial Corporation (holding company), 2002 to 2008; formerly, Director, WHX Corporation (holding company), 2002 to 2005; formerly, Director, State Theatre of New Jersey (not-for-profit theatre), 2000 to 2005. | |

| George W. Morriss (1947) | | Trustee since 2007 | | Adjunct Faculty Member, Columbia University School of International Policy and Administration, since October 2012; formerly, Executive Vice President and Chief Financial Officer, People's Bank, Connecticut (a financial services company), 1991 to 2001. | | | 50 | | | Formerly, Manager, Larch Lane Multi-Strategy Fund complex (which consisted of three funds), 2006 to 2011; formerly, Member, NASDAQ Issuers' Affairs Committee, 1995 to 2003. | |

Name, (Year of Birth), and Address(1) | | Position(s) and Length of Time Served(2) | | Principal Occupation(s)(3) | | Number of Funds in Fund Complex | | Other Directorships Held Outside Fund Complex by Fund Trustee(3) Overseen by Fund Trustee | |

| | | | | | | | | | | | |

| Jack L. Rivkin (1940) | | Trustee since inception; President from inception to 2008 | | Formerly, Executive Vice President and Chief Investment Officer, Neuberger Berman Holdings LLC (holding company), 2002 to August 2008 and 2003 to August 2008, respectively; formerly, Managing Director and Chief Investment Officer, Neuberger, December 2005 to August 2008 and 2003 to August 2008, respectively; formerly, Executive Vice President, Neuberger, December 2002 to 2005; formerly, Director and Chairman, Management, December 2002 to August 2008; formerly, Executive Vice President, Citigroup Investments, Inc., September 1995 to February 2002; formerly, Executive Vice President, Citigroup Inc., September 1995 to February 2002. | | | 50 | | | Director, Idealab (private company), since 2009; Director, Distributed World Power (private company), since 2009; Director, Dale Carnegie and Associates, Inc. (private company), since 1999; Director, Solbright, Inc. (private company), since 1998; Director, SA Agricultural Fund, since 2009; Chairman and Director, Essential Brands (consumer products) since 2008; formerly, Director, New York Society of Security Analysts, 2006 to 2008. | |