Washington, D.C. 20549

Arthur C. Delibert, Esq.

1601 K Street, N.W.

Washington, D.C. 20006-1600

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Report to Shareholders.

Neuberger Berman

Alternative and Multi-Asset Class Funds

Institutional Class Shares

Class A Shares

Class C Shares

Class R6 Shares

Absolute Return Multi-Manager Fund

Long Short Multi-Manager Fund

Annual Report

October 31, 2014

Contents

THE FUNDS | |

President's Letter | | | 1 | | |

PORTFOLIO COMMENTARY | |

Absolute Return Multi-Manager Fund | | | 2 | | |

Long Short Multi-Manager Fund | | | 5 | | |

FUND EXPENSE INFORMATION | | | 10 | | |

SCHEDULE OF INVESTMENTS/TOP TEN EQUITY HOLDINGS | |

Absolute Return Multi-Manager Fund | | | 12 | | |

Long Short Multi-Manager Fund | | | 36 | | |

FINANCIAL STATEMENTS | | | 52 | | |

FINANCIAL HIGHLIGHTS (ALL CLASSES)/

PER SHARE DATA | | | 81 | | |

Report of Independent Registered Public Accounting Firm | | | 86 | | |

Directory | | | 87 | | |

Trustees and Officers | | | 88 | | |

Proxy Voting Policies and Procedures | | | 95 | | |

Quarterly Portfolio Schedule | | | 95 | | |

Notice to Shareholders | | | 95 | | |

Board Consideration of the Management and

Sub-Advisory Agreements | | | 96 | | |

The "Neuberger Berman" name and logo are registered service marks of Neuberger Berman Group LLC. "Neuberger Berman Management LLC" and the individual Fund names in this piece are either service marks or registered service marks of Neuberger Berman Management LLC. ©2014 Neuberger Berman Management LLC. All rights reserved.

Dear Shareholder,

I am pleased to present this annual shareholder report for Neuberger Berman Absolute Return Multi-Manager Fund and Neuberger Berman Long Short Multi-Manager Fund.

The global financial markets faced a number of challenges during the reporting period, but generally produced positive results. After a lengthy period of relatively low volatility, the markets experienced sharp fluctuations at times over the 12 months ended October 31, 2014. This was triggered by a number of factors, including signs of moderating global growth, uncertainness regarding future central bank monetary policy and several geopolitical issues. While U.S. equities largely overcame these challenges and posted strong returns, emerging market equities produced only a modest gain and international developed market equities were largely flat. After a difficult start, the fixed income market rallied and generated a positive return for the period. Among the best performers were emerging market debt, high yield and investment grade corporate bonds.

Looking ahead, while growth in many developed countries—including those in the eurozone and Japan—are facing stiff challenges, the U.S. economy appears to be on relatively solid footing. Against this backdrop, the U.S. Federal Reserve concluded its third round of quantitative easing in October 2014 and all eyes are on when the central bank will begin raising interest rates. In contrast, the European Central Bank and Bank of Japan are expected to remain highly accommodative. Elsewhere, growth in China has moderated, which could impact growth in many developing countries. While the markets could remain volatile in the coming year, we believe this could lead to attractive opportunities for long-term investors.

Thank you for your continued support and trust. We look forward to continue serving your investment needs in the years to come.

Sincerely,

ROBERT CONTI

PRESIDENT AND CEO

NEUBERGER BERMAN MUTUAL FUNDS

Absolute Return Multi-Manager Fund Commentary (Unaudited)

Neuberger Berman Absolute Return Multi-Manager Fund Institutional Class generated a 1.96% total return for the 12 months ended October 31, 2014. During the period, the Fund underperformed its primary benchmark, the HFRX Absolute Return Index, which posted a 2.19% return. (Performance for all share classes is provided in the table following this letter.)

Despite periods of heightened volatility, the global financial markets largely generated positive results during the reporting period. Investor sentiment was challenged at times given concerns over global growth, uncertainties regarding future monetary policy and a host of geopolitical issues. Regardless of these headwinds, U.S. equities rallied sharply during the reporting period, whereas international developed equities were largely flat and emerging market equities posted a modest gain. Within the fixed income market, most non-Treasury securities produced positive returns and outperformed equal-duration Treasuries.

All of the portfolio's strategies generated positive absolute returns for the period. Long/short equity was the largest positive contributor, as gains from long positions offset losses from short positions. But short positions were profitable for several months in 2014 due to decreasing correlations between stocks. As a result, the general tilt toward being long mid- and small-cap equities versus short large-cap equities was a detractor from performance.

Event-driven strategies were the next most material positive contributors for the period. Gains for the strategy were driven by positive developments for several ongoing situations in the cable TV, pharmaceutical and food industries. The strategy did, however, face several headwinds. For example, the broad selloff in growth sectors in March and April led to losses for many event-driven managers that had exposure to growth sectors where there was a large amount of corporate activity. Additionally, the negative press about tax inversion mergers beginning in July and culminating in the Shire/AbbVie agreement being terminated in October led to a broad selloff in event-driven trades.

The Fund's credit strategies also generated positive performance. Although the corporate credit long/short allocation was positioned to benefit from rising interest rates during the period when rates actually declined, our subadvisers generated modest gains as they profited from company-specific developments and broad spread tightening (the difference in interest rates between Treasury securities and non-Treasury securities that have a different quality rating). The asset-backed securities allocation was a positive contributor, with gains spread across sectors and led by commercial mortgage-backed securities.

Looking ahead, we believe the dynamics for equity long/short strategies have continued to improve, with decreasing correlations between stocks and the approach of rising interest rates, which could help expose companies that have been able to offset poor operating numbers with cheap financing over the past several years. We continue to see what we believe are the underlying dynamics for a healthy opportunity set for event-driven managers, namely, a continued low growth environment, large amounts of cash on corporate balance sheets and the potential onset of rising interest rates. We are, therefore, positive on the strategy heading into 2015. After reaching one year lows in mid-October 2014, due to the recent flight to quality, Treasury yields have since begun to rise. We anticipate this trend will continue now that quantitative easing has ended and economic data have recently been better than expected. While our credit long/short subadvisers' positioning to benefit from a rising interest rate environment has been a headwind thus far in 2014, we anticipate it to be a tailwind heading into 2015.

Sincerely,

DAVID KUPPERMAN, JEFF MAJIT, FRED INGHAM, IAN HAAS AND ERIC WEINSTEIN

PORTFOLIO CO-MANAGERS

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

Absolute Return Multi-Manager Fund (Unaudited)

TICKER SYMBOLS

Institutional Class | | NABIX | |

Class A | | NABAX | |

Class C | | NABCX | |

Class R6 | | NRABX | |

PORTFOLIO BY TYPE OF SECURITY

(as a % of Total Net Assets)

| | | Long | | Short | |

Asset-Backed Securities | | | 2.6 | % | | | — | % | |

Bank Loan Obligations | | | 10.3 | | | | — | | |

Common Stocks | | | 58.8 | | | | (11.0 | ) | |

Corporate Debt Securities | | | 4.0 | | | | (0.4 | ) | |

Exchange Traded Funds | | | 0.7 | | | | (10.8 | ) | |

Mortgage-Backed Securities | | | 4.8 | | | | — | | |

Municipal Notes | | | 1.0 | | | | — | | |

Preferred Stocks | | | 0.4 | | | | — | | |

Purchased Options | | | 0.4 | | | | — | | |

Rights | | | 0.0 | | | | — | | |

Warrants | | | 0.0 | | | | — | | |

Short-Term Investments | | | 17.7 | | | | — | | |

Cash, receivables and other

assets, less liabilities | | | 21.5 | | | | — | | |

Total | | | 122.2 | % | | | (22.2 | )% | |

PERFORMANCE HIGHLIGHTS3

| | | Inception | | Average Annual Total Return

Ended 10/31/2014 | |

| | | Date | | 1 Year | | Life of Fund | |

At NAV | |

Institutional Class | | 05/15/2012 | | | 1.96 | % | | | 4.45 | % | |

Class A | | 05/15/2012 | | | 1.60 | % | | | 4.07 | % | |

Class C | | 05/15/2012 | | | 0.77 | % | | | 3.29 | % | |

| Class R64 | | 12/31/2013 | | | 2.05 | % | | | 4.49 | % | |

With Sales Charge | | | | | | | | | | | | | |

Class A | | | | | –4.25 | % | | | 1.60 | % | |

Class C | | | | | –0.23 | % | | | 3.29 | % | |

Index | | | | | | | | | | | | | |

| HFRX Absolute Return Index1,2 | | | | | | | 2.19 | % | | | 2.36 | % | |

| S&P 500® Index1,2 | | | | | | | 17.27 | % | | | 20.67 | % | |

| Barclays U.S. Aggregate Bond Index1,2 | | | | | | | 4.14 | % | | | 2.14 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Management LLC (Management) had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2013 (estimated for 2014 for Class R6) were 2.89%, 3.29%, 4.03% and 2.71% for Institutional Class, Class A, Class C and Class R6 shares, respectively (before expense reimbursements and/or fee waivers, if any). The expense ratios were 2.30%, 2.65%, 3.41% and 2.23% for Institutional Class, Class A, Class C and Class R6 shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for fiscal year 2014 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

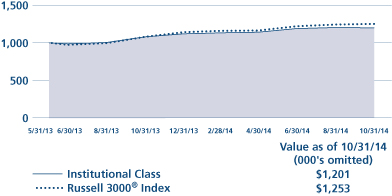

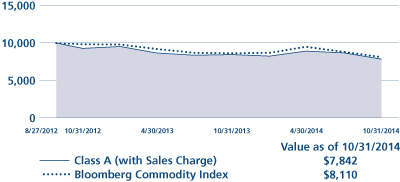

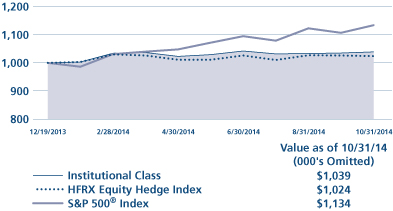

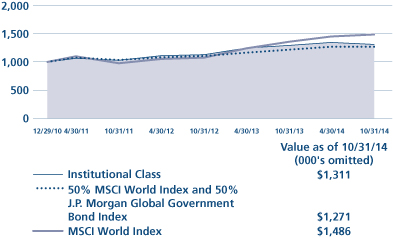

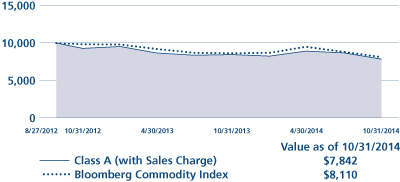

Absolute Return Multi-Manager Fund (Unaudited)

COMPARISON OF A $1,000,000 INVESTMENT

(000's omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

Long Short Multi-Manager Fund Commentary (Unaudited)

Neuberger Berman Long Short Multi-Manager Fund Institutional Class generated a 3.90% total return from its inception on December 19, 2013 through October 31, 2014. During this same time period, its benchmarks, the HFRX Equity Hedge Index and the S&P 500® Index returned 2.41% and 13.38%, respectively. (Performance for all share classes is provided in the table immediately following this letter.)

Despite periods of heightened volatility, the global financial markets largely generated positive results during the reporting period. Investor sentiment was challenged at times given concerns over global growth, uncertainties regarding future monetary policy and a host of geopolitical issues. Regardless of these headwinds, U.S. equities rallied sharply during the reporting period, whereas international developed equities were largely flat and emerging market equities posted a modest gain.

During the period, gains from our subadvisers' long positions outweighed losses from their short positions. From a sector perspective, most areas of the portfolio were profitable. In particular, Health Care, Information Technology (IT) and Consumer Discretionary were the largest contributing sectors to performance. The only notable sector detractor was Financials.

Within Health Care, the portfolio experienced several sources of gains. The largest of these gains came from a long position in a provider of development solutions and delivery technologies for drugs, biologics and consumer health products. The Fund participated in the company's initial public offering (IPO) in late July and its shares rallied after reporting solid results for its first quarter as a public company. In the IT sector, a long position in a company that develops software and hardware for the security, surveillance and business intelligence markets was materially additive to performance. The growth in big data has been a tailwind for the company and its earnings have accelerated as a result of its new focus on security software for government agencies and corporations. Within Consumer Discretionary, a long position in a major fast food company was beneficial to returns as it made a surprise announcement to take over another firm. The subadviser who held the position captured the gain and exited the position. The Fund also benefitted from a short position in a media and entertainment company that is facing higher programming costs and getting squeezed on retransmission fees. Within Financials, the Fund had modest losses from both long and short positions. The top detractor on the short side was an asset manager whose shares rallied sharply on the announcement that a chief investment officer from a competitor would be joining the company. On the long side, the Fund lost money in the preferred securities of a government-sponsored enterprise as a result of adverse litigation.

During the reporting period, the subadvisers' aggregate use of forwards, options and swap contracts contributed to the Fund's performance.

The dynamics for equity long/short strategies have continued to improve with decreasing correlations between stocks and the potential approach of rising interest rates, which we believe should help expose companies that have been able to offset poor operating numbers with cheap financing over the past several years. We therefore maintain our positive view on the strategy.

Sincerely,

DAVID KUPPERMAN, JEFF MAJIT, IAN HAAS, FRED INGHAM AND ERIC WEINSTEIN

PORTFOLIO CO-MANAGERS

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

Long Short Multi-Manager Fund (Unaudited)

TICKER SYMBOLS

Institutional Class | | NLMIX | |

Class A | | NLMAX | |

Class C | | NLMCX | |

PORTFOLIO BY TYPE OF SECURITY

(as a % of Total Net Assets)

| | | Long | | Short | |

Common Stocks | | | 68.3 | % | | | (22.4 | )% | |

Exchange Traded Funds | | | 1.7 | | | | (6.8 | ) | |

Preferred Stocks | | | 0.9 | | | | — | | |

Short-Term Investments | | | 27.8 | | | | — | | |

Cash, receivables and other

assets, less liabilities | | | 30.5 | | | | — | | |

Total | | | 129.2 | % | | | (29.2 | )% | |

PERFORMANCE HIGHLIGHTS

| | | Inception

Date | | Cumulative Total Return

Ended 10/31/2014

Life of Fund | |

At NAV | |

Institutional Class | | 12/19/2013 | | | 3.90 | % | |

Class A | | 12/19/2013 | | | 3.60 | % | |

Class C | | 12/19/2013 | | | 2.90 | % | |

With Sales Charge | |

Class A | | | | | | | –2.36 | % | |

Class C | | | | | | | 1.90 | % | |

Index | |

| HFRX Equity Hedge Index1,2 | | | | | | | 2.41 | % | |

| S&P 500® Index1,2 | | | | | | | 13.38 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Management LLC (Management) had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the estimated total annual operating expense ratios for fiscal year 2014 were 3.26%, 3.62% and 4.37% for Institutional Class, Class A and Class C shares, respectively (before expense reimbursements and/or fee waivers, if any). The expense ratios were 2.51%, 2.87% and 3.62% for Institutional Class, Class A and Class C shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for fiscal year 2014 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

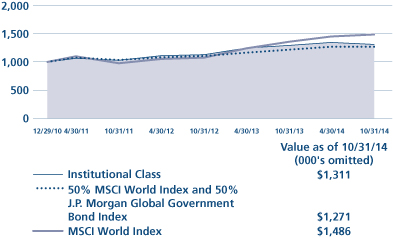

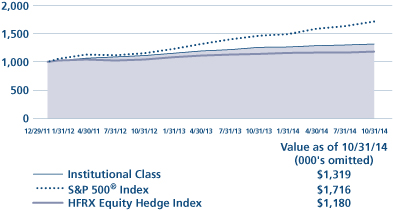

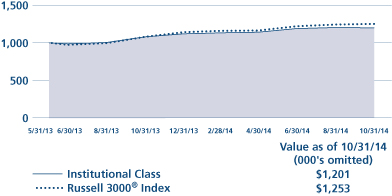

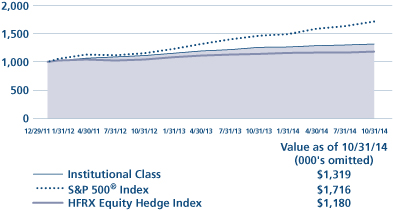

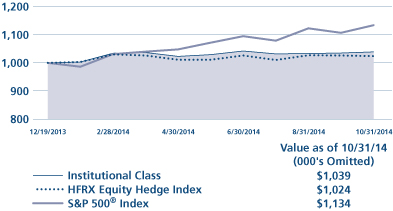

Long Short Multi-Manager Fund (Unaudited)

COMPARISON OF A $1,000,000 INVESTMENT

(000's omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

1 Please see "Glossary of Indices" on page 9 for a description of indices. Please note that individuals cannot invest directly in any index. The S&P 500® and the Barclays U.S. Aggregate Bond indices do not take into account any fees, expenses or tax consequences of investing in the individual securities that they track. The HFRX Absolute Return and HFRX Equity Hedge indices do take into account fees and expenses of investing since they are based on the underlying hedge funds' net returns. Data about the performance of an index are prepared or obtained by Neuberger Berman Management LLC ("Management") and reflect the reinvestment of income dividends and other distributions, if any. The Fund may invest in securities not included in a described index and generally does not invest in all securities included in a described index.

2 The date used to calculate Life of Fund performance for the index is the inception date of the oldest share class.

3 The investments for the Fund are managed by the same portfolio manager(s) who manage(s) one or more other registered funds that have names, investment objectives and investment styles that are similar to those of the Fund. You should be aware that the Fund is likely to differ from the other mutual fund(s) in size, cash flow pattern and tax matters. Accordingly, the holdings and performance of the Fund can be expected to vary from those of the other mutual fund(s).

4 The performance information for Class R6 prior to the class' inception date is that of the Institutional Class of Neuberger Berman Absolute Return Multi-Manager Fund. The Institutional Class has higher expenses and typically lower returns than Class R6.

For more complete information on any of the Neuberger Berman Alternative and Multi-Asset Class Funds, call Management at (800) 877-9700, or visit our website at www.nb.com.

HFRX Absolute Return Index: | | The index is designed to be representative of the overall composition of the hedge fund universe. The index comprises all eligible hedge fund strategies including, but not limited to, convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The index employs a constituent weighting methodology that selects constituent funds which characteristically exhibit lower volatilities and lower correlations to standard directional benchmarks of equity market and hedge fund industry performance. Constituent funds are selected from an eligible pool of the more than 7,500 funds worldwide that report to the Hedge Fund Research (HFR) Database. Constituent funds must meet all of the following criteria: report monthly; report performance net of all fees; be U.S. dollar-denominated; be active and accepting new investments; have a minimum 24 months track record; and the fund's manager must have at least $50 million in assets under management. The index is rebalanced quarterly. | |

HFRX Equity Hedge Index: | | The index comprises equity hedge strategies. Equity hedge strategies maintain positions both long and short in primarily equity and equity derivative securities. A wide variety of investment processes can be employed to arrive at an investment decision, including both quantitative and fundamental techniques; strategies can be broadly diversified or narrowly focused on specific sectors and can range broadly in terms of levels of net exposure, leverage employed, holding period, concentrations of market capitalizations and valuation ranges of typical portfolios. Equity hedge managers would typically maintain at least 50%, and may in some cases be substantially entirely invested, in equities, both long and short. Constituent funds are selected from an eligible pool of the more than 7,500 funds worldwide that report to the Hedge Fund Research (HFR) Database. Constituent funds must meet all of the following criteria: report monthly; report performance net of all fees; be U.S. dollar-denominated; be active and accepting new investments; have a minimum 24 months track record; and the fund's manager must have at least $50 million in assets under management. The index is rebalanced quarterly. | |

| S&P 500® Index: | | The index is a float-adjusted market capitalization-weighted index that focuses on the large-cap segment of the U.S. equity market, and includes a significant portion of the total value of the market. | |

Barclays U.S. Aggregate Bond Index: | | The index measures the investment grade, U.S. dollar-denominated, fixed-rate, taxable bond market and includes Treasuries, government-related and corporate securities, mortgage-backed securities (MBS) (agency fixed-rate and hybrid adjustable rate mortgage (ARM) pass-throughs), asset-backed securities (ABS), and commercial mortgage-backed securities (CMBS) (agency and non-agency). | |

Information About Your Fund's Expenses (Unaudited)

As a Fund shareholder, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds (if applicable); and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees (if applicable), and other Fund expenses. This example is intended to help you understand your ongoing costs (in U.S. dollars) of investing in a Fund and compare these costs with the ongoing costs of investing in other mutual funds.

This table is designed to provide information regarding costs related to your investments. The following examples are based on an investment of $1,000 made at the beginning of the six month period ended October 31, 2014 and held for the entire period. The table illustrates each Fund's costs in two ways:

Actual Expenses and Performance: | | The first section of the table provides information about actual account values and actual expenses in dollars, based on the Fund's actual performance during the period indicated. You may use the information in this line, together with the amount you invested, to estimate the expenses you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section of the table under the heading entitled "Expenses Paid During the Period" to estimate the expenses you paid over the period. | |

Hypothetical Example for

Comparison Purposes: | | The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return at 5% per year before expenses. This return is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund versus other funds. To do so, compare the expenses shown in this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. | |

Please note that the expenses in the table are meant to highlight your ongoing costs only and do not include any transaction costs, such as sales charges (loads) (if applicable). Therefore, the information under the heading "Hypothetical (5% annual return before expenses)" is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

Expense Information as of 10/31/14 (Unaudited)

Neuberger Berman Alternative Funds | |

| | | ACTUAL | | HYPOTHETICAL (5% ANNUAL RETURN BEFORE EXPENSES)(2) | |

| | | Beginning

Account

Value

5/1/14 | | Ending

Account

Value

10/31/14 | | Expenses Paid

During the

Period(1)

5/1/14 - 10/31/14 | | Expense

Ratio | | Beginning

Account

Value

5/1/14 | | Ending

Account

Value

10/31/14 | | Expenses Paid

During the

Period(1)

5/1/14 - 10/31/14 | | Expense

Ratio | |

Absolute Return Multi-Manager Fund | |

Institutional Class | | $ | 1,000.00 | | | $ | 997.30 | | | $ | 13.04 | | | | 2.59 | % | | $ | 1,000.00 | | | $ | 1,012.15 | | | $ | 13.14 | | | | 2.59 | % | |

Class A | | $ | 1,000.00 | | | $ | 995.40 | | | $ | 14.89 | | | | 2.96 | % | | $ | 1,000.00 | | | $ | 1,010.28 | | | $ | 15.00 | | | | 2.96 | % | |

Class C | | $ | 1,000.00 | | | $ | 991.70 | | | $ | 18.57 | | | | 3.70 | % | | $ | 1,000.00 | | | $ | 1,006.55 | | | $ | 18.71 | | | | 3.70 | % | |

Class R6 | | $ | 1,000.00 | | | $ | 997.30 | | | $ | 12.49 | | | | 2.48 | % | | $ | 1,000.00 | | | $ | 1,012.70 | | | $ | 12.58 | | | | 2.48 | % | |

Long Short Multi-Manager Fund | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,015.60 | | | $ | 13.56 | | | | 2.67 | % | | $ | 1,000.00 | | | $ | 1,011.75 | | | $ | 13.54 | | | | 2.67 | % | |

Class A | | $ | 1,000.00 | | | $ | 1,013.70 | | | $ | 15.28 | | | | 3.01 | % | | $ | 1,000.00 | | | $ | 1,010.03 | | | $ | 15.25 | | | | 3.01 | % | |

Class C | | $ | 1,000.00 | | | $ | 1,009.80 | | | $ | 19.15 | | | | 3.78 | % | | $ | 1,000.00 | | | $ | 1,006.15 | | | $ | 19.11 | | | | 3.78 | % | |

(1) For each class, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown).

(2) Hypothetical 5% annual return before expenses is calculated by multiplying the number of days in the most recent period divided by 365.

Schedule of Investments Neuberger Berman Absolute Return Multi-Manager Fund

TOP TEN EQUITY HOLDINGS LONG POSITIONS (as a % of Net Assets)

| | | | | Country | | Industry | | | |

| | 1 | | | DIRECTV | | United States | | Media | | | 2.7 | % | |

| | 2 | | | TRW Automotive Holdings Corp. | | United States | | Auto Components | | | 2.0 | % | |

| | 3 | | | Allergan, Inc. | | United States | | Pharmaceuticals | | | 1.9 | % | |

| | 4 | | | Time Warner Cable, Inc. | | United States | | Media | | | 1.2 | % | |

| | 5 | | | Rockwood Holdings, Inc. | | United States | | Chemicals | | | 1.0 | % | |

| | 6 | | | CareFusion Corp. | | United States | | Health Care Equipment & Supplies | | | 0.9 | % | |

| | 7 | | | Ashland, Inc. | | United States | | Chemicals | | | 0.7 | % | |

| | 8 | | | Verint Systems, Inc. | | United States | | Software | | | 0.7 | % | |

| | 9 | | | Nomad Holdings Ltd. | | United States | | Diversified Financial Services | | | 0.7 | % | |

| | 10 | | | CBS Corp. Class B | | United States | | Media | | | 0.7 | % | |

TOP TEN EQUITY HOLDINGS SHORT POSITIONS (as a % of Net Assets)

| | | | | Country | | Industry | | | |

| | 1 | | | Level 3 Communications, Inc. | | United States | | Diversified Telecommunication Services | | | (0.5 | )% | |

| | 2 | | | Lennar Corp. Class A | | United States | | Household Durables | | | (0.4 | )% | |

| | 3 | | | Comcast Corp. Class A | | United States | | Media | | | (0.3 | )% | |

| | 4 | | | Chico's FAS, Inc. | | United States | | Specialty Retail | | | (0.3 | )% | |

| | 5 | | | Deere & Co. | | United States | | Machinery | | | (0.2 | )% | |

| | 6 | | | Telecom Italia SpA | | Italy | | Diversified Telecommunication Services | | | (0.2 | )% | |

| | 7 | | | Praxair, Inc. | | United States | | Chemicals | | | (0.2 | )% | |

| | 8 | | | The Dow Chemical Co. | | United States | | Chemicals | | | (0.2 | )% | |

| | 9 | | | AT&T, Inc. | | United States | | Diversifed Telecommunications Services | | | (0.2 | )% | |

| | 10 | | | Kinder Morgan, Inc. | | United States | | Oil, Gas & Consumable Fuels | | | (0.2 | )% | |

| | | Number

of Shares | | Value† | |

Long Positions (100.7%) | |

Common Stocks (58.8%) | |

Aerospace & Defense (0.7%) | |

B/E

Aerospace,

Inc. | | | 69,696 | | | $ | 5,188,867 | *£Ø | |

Exelis, Inc. | | | 294,030 | | | | 5,248,436 | Ø | |

MacDonald

Dettwiler &

Associates Ltd. | | | 15,680 | | | | 1,195,634 | Ø | |

| | | 11,632,937 | | |

Airlines (0.1%) | |

American

Airlines

Group, Inc. | | | 12,700 | | | | 525,145 | ±Ø | |

AMR Corp. | | | 14,383 | | | | 35,814 | *fNØ | |

JetBlue

Airways Corp. | | | 24,856 | | | | 286,838 | *£Ø | |

Republic

Airways

Holdings, Inc. | | | 8,295 | | | | 103,853 | * | |

| | | 951,650 | | |

Auto Components (2.8%) | |

Continental AG | | | 3,283 | | | | 644,472 | Ø | |

Cooper

Tire &

Rubber Co. | | | 102,800 | | | | 3,311,188 | Ø | |

TRW

Automotive

Holdings

Corp. | | | 319,211 | | | | 32,352,035 | *Ø | |

| | | Number

of Shares | | Value† | |

Visteon Corp. | | | 110,481 | | | $ | 10,374,166 | *£Ø | |

| | | 46,681,861 | | |

Automobiles (0.4%) | |

Fiat Chrysler

Automobiles

NV | | | 299,053 | | | | 3,427,147 | *Ø | |

General

Motors Co. | | | 10,200 | | | | 320,280 | ± | |

Honda

Motor Co.

Ltd. | | | 56,200 | | | | 1,740,661 | Ø | |

Kia Motors

Corp. | | | 16,705 | | | | 814,360 | Ø | |

Motors

Liquidation

Co. GUC Trust | | | 34,607 | | | | 799,422 | *Ø | |

| | | | 7,101,870 | | |

Banks (2.8%) | |

1st United

Bancorp, Inc. | | | 175,332 | | | | 1,551,688 | Ø | |

Aozora Bank

Ltd. | | | 308,291 | | | | 1,073,152 | Ø | |

Bank of

America

Corp. | | | 301,525 | | | | 5,174,169 | Ø | |

BOC

Hong Kong

Holdings Ltd. | | | 375,000 | | | | 1,247,558 | Ø | |

Cascade

Bancorp | | | 52,519 | | | | 268,372 | *£ | |

| | | Number

of Shares | | Value† | |

China

Construction

Bank Corp.

Class H | | | 1,480,000 | | | $ | 1,103,060 | Ø | |

Chongqing

Rural

Commercial

Bank

Class H | | | 2,198,000 | | | | 1,057,174 | Ø | |

CIT

Group, Inc. | | | 27,018 | | | | 1,321,991 | Ø | |

City National

Corp. | | | 54,150 | | | | 4,262,146 | Ø | |

Dah Sing

Banking

Group Ltd. | | | 168,795 | | | | 306,459 | Ø | |

Dah Sing

Financial

Holdings Ltd. | | | 55,323 | | | | 344,558 | Ø | |

Erste Group

Bank AG | | | 66,962 | | | | 1,704,282 | Ø | |

Intervest

Bancshares

Corp. | | | 62,789 | | | | 612,193 | Ø | |

Mitsubishi

UFJ Financial

Group, Inc. | | | 402,100 | | | | 2,263,144 | Ø | |

Mizuho

Financial

Group,

Inc. | | | 2,321,100 | | | | 4,132,829 | Ø | |

OmniAmerican

Bancorp, Inc. | | | 139,868 | | | | 3,782,031 | Ø | |

See Notes to Schedule of Investments

12

| | | Number

of Shares | | Value† | |

Piraeus

Bank SA | | | 894,349 | | | $ | 1,300,074 | *Ø | |

Regions

Financial

Corp. | | | 638,600 | | | | 6,341,298 | Ø | |

Sberbank

of Russia

ADR | | | 145,187 | | | | 1,101,969 | | |

Sumitomo

Mitsui

Financial

Group, Inc. | | | 51,700 | | | | 2,024,965 | Ø | |

Sumitomo

Mitsui

Trust

Holdings,

Inc. | | | 501,000 | | | | 1,980,360 | Ø | |

The Bank

of Kentucky

Financial

Corp. | | | 50,784 | | | | 2,382,277 | Ø | |

| | | 45,335,749 | | |

Beverages (0.8%) | |

AMBEV SA | | | 533,700 | | | | 3,532,297 | Ø | |

Cott Corp. | | | 678,587 | | | | 4,119,023 | £ | |

PepsiCo, Inc. | | | 51,986 | | | | 4,999,494 | Ø | |

| | | | 12,650,814 | | |

Biotechnology (0.2%) | |

Ambit

Biosciences

Corp. | | | 70,000 | | | | 1,093,400 | *Ø | |

ARIAD

Pharmaceuticals,

Inc. | | | 16,600 | | | | 98,936 | *£ | |

Chelsea

Therapeutics

International

Ltd. | | | 3,500 | | | | 385 | *fNØ | |

Durata

Therapeutics,

Inc. | | | 36,904 | | | | 886,803 | *Ø | |

QLT, Inc. | | | 176,117 | | | | 700,946 | *£Ø | |

Trius

Therapeutics

Inc. | | | 24,000 | | | | 3,120 | *fNØ | |

United

Therapeutics

Corp. | | | 8,204 | | | | 1,074,478 | *Ø | |

| | | | 3,858,068 | | |

Building Products (0.1%) | |

LIXIL

Group

Corp. | | | 40,600 | | | | 867,483 | Ø | |

Sanitec

Corp. | | | 4,000 | | | | 51,326 | * | |

| | | | 918,809 | | |

| | | Number

of Shares | | Value† | |

Capital Markets (0.5%) | |

BGC

Partners,

Inc. Class A | | | 7,374 | | | $ | 62,531 | £ | |

DAB

Bank AG | | | 42,677 | | | | 255,638 | Ø | |

GFI Group,

Inc. | | | 19,175 | | | | 105,462 | | |

Jafco Co.

Ltd. | | | 46,800 | | | | 1,760,338 | Ø | |

Nomura

Holdings,

Inc. | | | 325,600 | | | | 1,956,354 | Ø | |

NorthStar

Asset

Management

Group, Inc. | | | 65,440 | | | | 1,185,773 | *£ | |

RCS Capital

Corp.

Class A | | | 138,739 | | | | 2,276,707 | Ø | |

SWS Group,

Inc. | | | 31,484 | | | | 232,667 | *£ | |

| | | | 7,835,470 | | |

Chemicals (3.9%) | |

Air Products &

Chemicals,

Inc. | | | 72,500 | | | | 9,762,850 | Ø | |

Asahi Kasei

Corp. | | | 93,000 | | | | 746,732 | Ø | |

Ashland,

Inc. | | | 110,640 | | | | 11,956,865 | £Ø | |

Auriga

Industries

A/S Class B | | | 10,000 | | | | 516,037 | *Ø | |

FMC Corp. | | | 73,538 | | | | 4,217,404 | Ø | |

Huntsman

Corp. | | | 69,000 | | | | 1,683,600 | Ø | |

Monsanto

Co. | | | 14,490 | | | | 1,666,929 | Ø | |

Nissan

Chemical

Industries

Ltd. | | | 91,900 | | | | 1,663,322 | Ø | |

Nitto

Denko

Corp. | | | 28,400 | | | | 1,505,143 | Ø | |

Penford Corp. | | | 300 | | | | 5,655 | * | |

Rockwood

Holdings,

Inc. | | | 208,968 | | | | 16,071,729 | Ø | |

Shin-Etsu

Chemical

Co. Ltd. | | | 31,500 | | | | 1,975,393 | Ø | |

Sigma-Aldrich

Corp. | | | 44,082 | | | | 5,991,185 | Ø | |

Taminco

Corp. | | | 26,638 | | | | 689,658 | *Ø | |

Tronox

Ltd.

Class A | | | 35,522 | | | | 858,922 | Ø | |

| | | Number

of Shares | | Value† | |

Ube

Industries

Ltd. | | | 453,000 | | | $ | 685,600 | Ø | |

WR Grace &

Co. | | | 49,258 | | | | 4,659,807 | *Ø | |

| | | 64,656,831 | | |

Commercial Services & Supplies (0.3%) | |

RR Donnelley &

Sons Co. | | | 8,900 | | | | 155,305 | ±Ø | |

The Brink's

Co. | | | 14,573 | | | | 306,033 | ±£ | |

Tyco

International

Ltd. | | | 91,975 | | | | 3,948,487 | Ø | |

| | | 4,409,825 | | |

Communications Equipment (0.2%) | |

Juniper

Networks,

Inc. | | | 31,800 | | | | 670,026 | | |

Motorola

Solutions,

Inc. | | | 32,500 | | | | 2,096,250 | | |

Nokia OYJ

ADR | | | 44,260 | | | | 366,030 | Ø | |

ParkerVision,

Inc. | | | 110,421 | | | | 144,651 | *Ø | |

Riverbed

Technology,

Inc. | | | 29,794 | | | | 565,788 | *Ø | |

ShoreTel, Inc. | | | 13,729 | | | | 111,068 | *£ | |

| | | 3,953,813 | | |

Construction & Engineering (0.3%) | |

Balfour

Beatty PLC | | | 500 | | | | 1,229 | | |

Foster

Wheeler AG | | | 46,265 | | | | 1,435,603 | Ø | |

Pike Corp. | | | 130,500 | | | | 1,558,170 | *Ø | |

Taisei Corp. | | | 313,000 | | | | 1,713,733 | Ø | |

| | | 4,708,735 | | |

Consumer Finance (0.1%) | |

Ally Financial,

Inc. | | | 27,931 | | | | 634,034 | *±£ | |

Carfinco

Financial

Group, Inc. | | | 71,153 | | | | 700,134 | Ø | |

| | | | 1,334,168 | | |

Containers & Packaging (0.4%) | |

Nampak Ltd. | | | 441,793 | | | | 1,801,259 | Ø | |

Orora Ltd. | | | 2,343,712 | | | | 3,578,379 | Ø | |

Pact Group

Holdings

Ltd. | | | 346,768 | | | | 1,165,695 | Ø | |

| | | | 6,545,333 | | |

See Notes to Schedule of Investments

13

| | | Number

of Shares | | Value† | |

Diversified Consumer Services (0.5%) | |

Cengage

Learning

Holdings II LP | | | 1,481 | | | $ | 41,468 | *Ø | |

Regis Corp. | | | 202,600 | | | | 3,440,148 | Ø | |

Sotheby's | | | 96,754 | | | | 3,837,264 | Ø | |

| | | 7,318,880 | | |

Diversified Financial Services (0.9%) | |

Capmark

Financial

Group, Inc. | | | 26,469 | | | | 132,345 | £ | |

EME

Reorganization

Trust | | | 7,488,000 | | | | 973,440 | Ø | |

Nomad

Holdings

Ltd. | | | 1,025,652 | | | | 11,820,639 | *Ø | |

ORIX Corp. | | | 159,600 | | | | 2,143,393 | Ø | |

Rescap

Liquidating

Trust | | | 17,071 | | | | 271,429 | *Ø | |

| | | | 15,341,246 | | |

Diversified Telecommunication

Services (1.6%) | |

BCE, Inc. | | | 15,437 | | | | 685,526 | | |

Consolidated

Communications

Holdings,

Inc. | | | 25,385 | | | | 657,476 | £ | |

Fairpoint

Communications,

Inc. | | | 49,501 | | | | 821,717 | *Ø | |

Globalstar,

Inc. | | | 708,435 | | | | 1,678,991 | *±Ø | |

Intelsat SA | | | 45,903 | | | | 893,272 | *Ø | |

Jazztel PLC | | | 119,098 | | | | 1,901,415 | *Ø | |

Koninklijke

KPN NV | | | 35,000 | | | | 114,782 | Ø | |

Telecom

Italia SpA | | | 3,684,395 | | | | 3,291,992 | Ø | |

tw telecom,

inc. | | | 244,570 | | | | 10,462,705 | *Ø | |

Vivendi SA | | | 156,133 | | | | 3,810,441 | *Ø | |

Ziggo NV | | | 26,335 | | | | 1,286,571 | *Ø | |

| | | 25,604,888 | | |

Electric Utilities (0.2%) | |

Cleco Corp. | | | 52,889 | | | | 2,843,313 | Ø | |

Pepco

Holdings,

Inc. | | | 40,000 | | | | 1,093,600 | Ø | |

| | | | 3,936,913 | | |

Electrical Equipment (0.2%) | |

Nidec Corp. | | | 22,300 | | | | 1,433,791 | Ø | |

Vacon OYJ | | | 26,000 | | | | 1,100,943 | Ø | |

| | | | 2,534,734 | | |

| | | Number

of Shares | | Value† | |

Electronic Equipment, Instruments & Components (0.2%) | |

Hitachi Ltd. | | | 97,000 | | | $ | 741,889 | Ø | |

Keyence Corp. | | | 2,100 | | | | 981,153 | Ø | |

Nichicon Corp. | | | 73,503 | | | | 484,894 | Ø | |

RealD, Inc. | | | 59,707 | | | | 675,883 | *±£ | |

Viasystems

Group, Inc. | | | 4,682 | | | | 74,304 | * | |

| | | | 2,958,123 | | |

Energy Equipment & Services (0.9%) | |

Calfrac Well

Services Ltd. | | | 88,600 | | | | 1,061,266 | Ø | |

Dresser-Rand

Group, Inc. | | | 123,114 | | | | 10,058,414 | *±Ø | |

Noble

Corp. PLC | | | 101,993 | | | | 2,133,694 | Ø | |

Paragon

Offshore

PLC | | | 282,519 | | | | 1,375,867 | *Ø | |

| | | | 14,629,241 | | |

Food & Staples Retailing (0.7%) | |

Rite Aid Corp. | | | 81,169 | | | | 426,137 | * | |

Safeway, Inc. | | | 85,041 | | | | 2,964,529 | Ø | |

Sysco Corp. | | | 65,400 | | | | 2,520,516 | Ø | |

Walgreen Co. | | | 91,475 | | | | 5,874,525 | Ø | |

| | | 11,785,707 | | |

Food Products (0.6%) | |

Boulder

Brands, Inc. | | | 9,777 | | | | 86,820 | *± | |

Cermaq ASA | | | 79,200 | | | | 1,124,308 | Ø | |

Chiquita

Brands

International,

Inc. | | | 139,979 | | | | 2,019,897 | *Ø | |

GrainCorp.

Ltd. Class A | | | 18,000 | | | | 138,758 | Ø | |

Kellogg Co. | | | 35,210 | | | | 2,252,032 | Ø | |

Maple

Leaf Foods,

Inc. | | | 29,036 | | | | 502,375 | Ø | |

Mead

Johnson

Nutrition

Co. | | | 8,415 | | | | 835,694 | ±Ø | |

Nutreco NV | | | 2,000 | | | | 100,139 | | |

Oceana

Group Ltd. | | | 115,067 | | | | 790,777 | Ø | |

Unilever

NV CVA | | | 46,783 | | | | 1,814,185 | Ø | |

Warrnamboo

Cheese &

Butter

Factory Co.

Holding Ltd. | | | 10,000 | | | | 70,928 | *Ø | |

| | | 9,735,913 | | |

Health Care Equipment & Supplies (1.9%) | |

Alere, Inc. | | | 98,620 | | | | 3,941,841 | *Ø | |

| | | Number

of Shares | | Value† | |

ArthroCare

Corp. | | | 46,000 | | | $ | 16,100 | *fN | |

Baxter

International,

Inc. | | | 7,132 | | | | 500,239 | £ | |

CareFusion

Corp. | | | 271,208 | | | | 15,559,203 | *Ø | |

Covidien PLC | | | 46,225 | | | | 4,273,039 | ±Ø | |

Nobel

Biocare

Holding AG | | | 100,000 | | | | 1,766,876 | *Ø | |

Smith &

Nephew

PLC ADR | | | 62,056 | | | | 2,113,007 | ±£Ø | |

Symmetry

Medical, Inc. | | | 38,288 | | | | 379,051 | *£ | |

The Cooper

Cos., Inc. | | | 15,300 | | | | 2,507,670 | £Ø | |

Tornier NV | | | 25 | | | | 699 | *£ | |

Wright

Medical

Group, Inc. | | | 21,148 | | | | 668,700 | *£Ø | |

| | | 31,726,425 | | |

Health Care Providers & Services (1.1%) | |

Accretive

Health, Inc. | | | 522,873 | | | | 3,764,686 | *£Ø | |

Brookdale

Senior Living,

Inc. | | | 108,702 | | | | 3,664,344 | *£Ø | |

Extendicare,

Inc. | | | 346,257 | | | | 2,506,949 | Ø | |

Fresenius

SE & Co.

KGaA | | | 36,030 | | | | 1,853,448 | Ø | |

Gentiva

Health

Services,

Inc. | | | 141,025 | | | | 2,778,193 | *£Ø | |

Kindred

Healthcare,

Inc. | | | 68,979 | | | | 1,500,293 | £ | |

Mediclinic

International

Ltd. | | | 208,891 | | | | 1,865,479 | Ø | |

| | | 17,933,392 | | |

Hotels, Restaurants & Leisure (2.9%) | |

Accor SA | | | 149,084 | | | | 6,260,493 | Ø | |

Bally

Technologies,

Inc. | | | 57,746 | | | | 4,642,778 | *Ø | |

Belmond

Ltd. Class A | | | 3,000 | | | | 34,380 | *Ø | |

Bob Evans

Farms, Inc. | | | 165,323 | | | | 8,076,029 | £Ø | |

Einstein Noah

Restaurant

Group, Inc. | | | 94,453 | | | | 1,912,673 | Ø | |

GTECH SpA | | | 23,242 | | | | 540,864 | Ø | |

See Notes to Schedule of Investments

14

| | | Number

of Shares | | Value† | |

International

Game

Technology | | | 227,112 | | | $ | 3,722,366 | ±£Ø | |

Isle of Capri

Casinos, Inc. | | | 199,741 | | | | 1,484,076 | *Ø | |

McDonald's

Corp. | | | 13,151 | | | | 1,232,643 | Ø | |

Morgans

Hotel Group

Co. | | | 116,316 | | | | 929,365 | *£ | |

Multimedia

Games

Holding Co.,

Inc. | | | 40,839 | | | | 1,425,281 | *Ø | |

Starbucks

Coffee

Japan Ltd. | | | 55,000 | | | | 714,890 | Ø | |

Tim Hortons,

Inc. | | | 196,624 | | | | 15,930,830 | Ø | |

Vail Resorts,

Inc. | | | 2,781 | | | | 240,167 | £ | |

| | | 47,146,835 | | |

Household Durables (0.6%) | |

Blyth, Inc. | | | 4,000 | | | | 33,560 | Ø | |

Brookfield

Residential

Properties,

Inc. | | | 4,015 | | | | 93,349 | * | |

Indesit Co.

SpA | | | 50,000 | | | | 687,353 | *Ø | |

Lennar Corp.

Class B | | | 160,345 | | | | 5,629,713 | Ø | |

Rinnai Corp. | | | 22,600 | | | | 1,973,790 | Ø | |

Sony Corp. | | | 101,030 | | | | 1,863,647 | Ø | |

| | | 10,281,412 | | |

Independent Power & Renewable Electricity Producers (0.0%) | |

Primary

Energy

Recycling

Corp. | | | 29,606 | | | | 153,063 | * | |

Industrial Conglomerates (0.2%) | |

Alliance

Global

Group, Inc. | | | 3,984,500 | | | | 2,246,415 | Ø | |

Toshiba

Corp. | | | 408,000 | | | | 1,756,588 | Ø | |

| | | | 4,003,003 | | |

Insurance (2.1%) | |

Ambac

Financial

Group, Inc. | | | 28,958 | | | | 662,559 | *Ø | |

Aspen

Insurance

Holdings

Ltd. | | | 1,600 | | | | 69,808 | Ø | |

Assured

Guaranty

Ltd. | | | 282,233 | | | | 6,513,938 | Ø | |

| | | Number

of Shares | | Value† | |

FNFV Group | | | 37,066 | | | $ | 498,167 | *£ | |

Hartford

Financial

Services

Group, Inc. | | | 263,661 | | | | 10,435,702 | Ø | |

Insurance

Australia

Group Ltd. | | | 316,970 | | | | 1,818,647 | Ø | |

Meadowbrook

Insurance

Group, Inc. | | | 137,992 | | | | 879,009 | Ø | |

National

Interstate

Corp. | | | 176,689 | | | | 5,025,035 | NØ | |

Protective

Life Corp. | | | 119,118 | | | | 8,300,142 | Ø | |

Schweizerische

National-

Versicherungs-

Gesellschaft

AG | | | 500 | | | | 41,600 | Ø | |

Syncora

Holdings

Ltd. | | | 22,879 | | | | 45,758 | *Ø | |

| | | 34,290,365 | | |

Internet & Catalog Retail (0.2%) | |

Groupon, Inc. | | | 54,976 | | | | 401,875 | *± | |

Overstock.com,

Inc. | | | 6,292 | | | | 145,471 | * | |

Shutterfly,

Inc. | | | 82,785 | | | | 3,462,896 | *±£ | |

| | | | 4,010,242 | | |

Internet Software & Services (1.8%) | |

AOL, Inc. | | | 83,650 | | | | 3,641,285 | *Ø | |

Conversant,

Inc. | | | 101,389 | | | | 3,573,962 | *±£Ø | |

Digital

River, Inc. | | | 13,000 | | | | 332,410 | * | |

eBay, Inc. | | | 104,765 | | | | 5,500,162 | *±£Ø | |

Equinix, Inc. | | | 14,350 | | | | 2,997,715 | Ø | |

Google,

Inc. Class A | | | 11,340 | | | | 6,439,646 | *Ø | |

Move, Inc. | | | 253,497 | | | | 5,310,762 | *Ø | |

Rackspace

Hosting,

Inc. | | | 3,214 | | | | 123,289 | *Ø | |

Travelport

LLC | | | 90,896 | | | | 1,251,638 | *fNØ | |

Zillow,

Inc. Class A | | | 4,689 | | | | 509,835 | *Ø | |

| | | 29,680,704 | | |

IT Services (0.0%) | |

Blackhawk

Network

Holdings, Inc.

Class B | | | 5,000 | | | | 167,000 | * | |

Bull | | | 500 | | | | 3,070 | * | |

| | | | 170,070 | | |

| | | Number

of Shares | | Value† | |

Leisure Products (0.2%) | |

Hasbro, Inc. | | | 57,800 | | | $ | 3,325,234 | Ø | |

Smith &

Wesson

Holding

Corp. | | | 18,610 | | | | 189,078 | * | |

| | | | 3,514,312 | | |

Life Sciences Tools & Services (0.1%) | |

Affymetrix,

Inc. | | | 147,392 | | | | 1,328,002 | *£ | |

Machinery (0.7%) | |

Amada Co.

Ltd. | | | 176,100 | | | | 1,494,087 | Ø | |

Crane Co. | | | 73,648 | | | | 4,591,953 | Ø | |

Komatsu

Ltd. | | | 40,600 | | | | 943,207 | Ø | |

Makita

Corp. | | | 29,300 | | | | 1,614,663 | Ø | |

Parker

Hannifin

Corp. | | | 20,800 | | | | 2,642,224 | Ø | |

Xerium

Technologies,

Inc. | | | 33,956 | | | | 506,623 | *Ø | |

| | | 11,792,757 | | |

Marine (0.0%) | |

Nippon

Yusen KK | | | 262,000 | | | | 667,100 | Ø | |

Media (8.0%) | |

AMC

Networks,

Inc. Class A | | | 11,100 | | | | 673,215 | *±Ø | |

Cablevision

Systems

Corp.

Class A | | | 28,532 | | | | 531,266 | Ø | |

CBS Corp.

Class B | | | 208,425 | | | | 11,300,803 | Ø | |

Cineplex,

Inc. | | | 33,800 | | | | 1,273,367 | Ø | |

DIRECTV | | | 519,629 | | | | 45,098,601 | *Ø | |

DISH

Network

Corp.

Class A | | | 149,448 | | | | 9,512,365 | *±£Ø | |

Gannett

Co., Inc. | | | 139,548 | | | | 4,395,762 | Ø | |

Gray

Television,

Inc. | | | 207,667 | | | | 1,918,843 | *Ø | |

Journal

Communications,

Inc. Class A | | | 131,800 | | | | 1,292,958 | *£Ø | |

Lamar

Advertising

Co. Class A | | | 153,089 | | | | 7,907,047 | Ø | |

Liberty

Global PLC

Class A | | | 224 | | | | 10,185 | *Ø | |

See Notes to Schedule of Investments

15

| | | Number

of Shares | | Value† | |

Liberty

Global

PLC

Series C | | | 114,691 | | | $ | 5,100,309 | *Ø | |

Liberty

Media

Corp.

Class A | | | 4,125 | | | | 198,082 | *Ø | |

Liberty

Media

Corp.

Class C | | | 4,203 | | | | 201,450 | *Ø | |

LIN Media

LLC

Class A | | | 111,332 | | | | 2,664,175 | *Ø | |

Loral Space &

Communications,

Inc. | | | 64,039 | | | | 4,898,983 | *Ø | |

Mediaset

SpA | | | 239,709 | | | | 800,242 | *Ø | |

Nexstar

Broadcasting

Group, Inc.

Class A | | | 9,386 | | | | 423,496 | Ø | |

PubliGroupe

AG | | | 500 | | | | 108,871 | Ø | |

Sinclair

Broadcast

Group, Inc.

Class A | | | 13,293 | | | | 386,162 | Ø | |

Sirius XM

Holdings,

Inc. | | | 410,974 | | | | 1,409,641 | *Ø | |

Sky

Deutschland

AG | | | 201,547 | | | | 1,700,568 | *Ø | |

Starz

Class A | | | 22,200 | | | | 685,980 | *£ | |

Time

Warner

Cable, Inc. | | | 135,352 | | | | 19,925,168 | Ø | |

Time Warner,

Inc. | | | 54,450 | | | | 4,327,141 | Ø | |

Tribune Co.

Class 1C

Litigation | | | 300,000 | | | | 750 | *Ø | |

Tribune

Media Co.

Class A | | | 72,862 | | | | 4,881,754 | *Ø | |

| | | 131,627,184 | | |

Metals & Mining (0.9%) | |

B2Gold Corp. | | | 331 | | | | 551 | * | |

Barrick

Gold Corp. | | | 21,790 | | | | 258,647 | £Ø | |

Gold Fields

Ltd. ADR | | | 639,614 | | | | 2,040,369 | Ø | |

Newmont

Mining

Corp. | | | 24,417 | | | | 458,063 | Ø | |

Nippon

Steel &

Sumitomo

Metal Corp. | | | 376,000 | | | | 970,754 | Ø | |

| | | Number

of Shares | | Value† | |

Nyrstar NV | | | 43,387 | | | $ | 146,256 | *Ø | |

SunCoke

Energy, Inc. | | | 421,850 | | | | 10,082,215 | *Ø | |

| | | 13,956,855 | | |

Multiline Retail (1.3%) | |

Dollar

General

Corp. | | | 43,240 | | | | 2,709,851 | *Ø | |

Dollar Tree,

Inc. | | | 74,850 | | | | 4,533,664 | *Ø | |

Family Dollar

Stores, Inc. | | | 139,818 | | | | 10,946,351 | Ø | |

Macy's, Inc. | | | 43,800 | | | | 2,532,516 | Ø | |

Takashimaya

Co. Ltd. | | | 130,000 | | | | 1,082,128 | Ø | |

| | | 21,804,510 | | |

Multi-Utilities (0.1%) | |

Integrys

Energy

Group, Inc. | | | 16,200 | | | | 1,177,416 | Ø | |

Oil, Gas & Consumable Fuels (2.4%) | |

Alvopetro

Energy Ltd. | | | 50,000 | | | | 21,295 | * | |

Anadarko

Petroleum

Corp. | | | 67,459 | | | | 6,191,387 | £Ø | |

Apco Oil

and Gas

International,

Inc. | | | 22,240 | | | | 318,699 | *£ | |

Athlon

Energy, Inc. | | | 59,857 | | | | 3,489,663 | *Ø | |

| BP PLC ADR | | | 5,830 | | | | 253,372 | | |

Cameco

Corp. | | | 187,220 | | | | 3,253,884 | Ø | |

Cheniere

Energy, Inc. | | | 65,607 | | | | 4,920,525 | *£ | |

CONSOL

Energy, Inc. | | | 85,528 | | | | 3,147,430 | Ø | |

Eni SpA | | | 97,655 | | | | 2,080,398 | Ø | |

Hess Corp. | | | 49,046 | | | | 4,159,591 | £Ø | |

JX Holdings,

Inc. | | | 109,200 | | | | 461,979 | Ø | |

Kinder

Morgan

Management

LLC | | | 26,891 | | | | 2,558,413 | | |

Kodiak

Oil & Gas

Corp. | | | 118,905 | | | | 1,282,985 | *Ø | |

Occidental

Petroleum

Corp. | | | 65,962 | | | | 5,866,001 | £Ø | |

Talisman

Energy, Inc. | | | 170,376 | | | | 1,086,999 | Ø | |

| | | 39,092,621 | | |

Paper & Forest Products (0.0%) | |

Ainsworth

Lumber

Co. Ltd. | | | 110,000 | | | | 253,760 | *Ø | |

| | | Number

of Shares | | Value† | |

Pharmaceuticals (4.5%) | |

AbbVie, Inc. | | | 21,600 | | | $ | 1,370,736 | Ø | |

Actavis PLC | | | 46,107 | | | | 11,192,013 | *£Ø | |

Allergan,

Inc. | | | 165,870 | | | | 31,525,252 | ±Ø | |

AstraZeneca

PLC ADR | | | 6,800 | | | | 495,992 | ±Ø | |

Auxilium

Pharmaceuticals,

Inc. | | | 15,927 | | | | 512,372 | * | |

Bayer AG | | | 17,130 | | | | 2,435,370 | Ø | |

Catalent,

Inc. | | | 98,500 | | | | 2,563,955 | *Ø | |

Endo

International

PLC | | | 5,691 | | | | 380,841 | * | |

Furiex

Pharmaceuticals,

Inc. | | | 1,500 | | | | 14,655 | *fNØ | |

Johnson &

Johnson | | | 33,350 | | | | 3,594,463 | Ø | |

Omthera

Pharmaceuticals,

Inc. | | | 100 | | | | — | *fN | |

Pfizer, Inc. | | | 138,704 | | | | 4,154,185 | ±Ø | |

Revance

Therapeutics,

Inc. | | | 31,043 | | | | 625,827 | *£ | |

Salix

Pharmaceuticals

Ltd. | | | 10,850 | | | | 1,560,772 | *±Ø | |

Shire PLC

ADR | | | 43,374 | | | | 8,666,125 | £Ø | |

Teva

Pharmaceutical

Industries

Ltd. ADR | | | 44,400 | | | | 2,507,269 | Ø | |

Theravance,

Inc. | | | 105,983 | | | | 1,697,848 | Ø | |

Zoetis, Inc. | | | 39,336 | | | | 1,461,726 | Ø | |

| | | 74,759,401 | | |

Real Estate Investment Trusts (2.5%) | |

American

Realty

Capital

Healthcare

Trust, Inc. | | | 382,278 | | | | 4,319,741 | Ø | |

American

Realty

Capital

Properties,

Inc. | | | 314,455 | | | | 2,789,216 | £Ø | |

Aviv REIT, Inc. | | | 12,791 | | | | 431,440 | | |

Gaming and

Leisure

Properties,

Inc. | | | 97,406 | | | | 3,043,937 | Ø | |

Glimcher

Realty Trust | | | 170,369 | | | | 2,339,166 | Ø | |

HealthLease

Properties

Real Estate

Investment

Trust | | | 3,000 | | | | 37,585 | Ø | |

See Notes to Schedule of Investments

16

| | | Number

of Shares | | Value† | |

Iron

Mountain,

Inc. | | | 109,714 | | | $ | 3,957,384 | Ø | |

Japan

Retail

Fund

Investment

Corp. | | | 855 | | | | 1,702,769 | Ø | |

New Senior

Investment

Group, Inc. | | | 39,037 | | | | 745,607 | *Ø | |

Newcastle

Investment

Corp. | | | 484,158 | | | | 11,319,343 | *Ø | |

NorthStar

Realty

Finance

Corp. | | | 550,363 | | | | 10,225,745 | £Ø | |

| | | 40,911,933 | | |

Real Estate Management &

Development (0.5%) | |

Daiwa

House

Industry

Co. Ltd. | | | 213,900 | | | | 3,967,600 | Ø | |

Mitsubishi

Estate Co.

Ltd. | | | 76,000 | | | | 1,891,458 | Ø | |

Tokyo

Tatemono

Co. Ltd. | | | 183,000 | | | | 1,539,595 | Ø | |

Tokyu

Fudosan

Holdings

Corp. | | | 187,700 | | | | 1,295,059 | Ø | |

| | | | 8,693,712 | | |

Road & Rail (0.4%) | |

Contrans

Group, Inc.

Class A | | | 25,000 | | | | 331,174 | Ø | |

Hertz Global

Holdings,

Inc. | | | 154,327 | | | | 3,382,848 | *£Ø | |

Union

Pacific

Corp. | | | 28,750 | | | | 3,347,938 | Ø | |

| | | | 7,061,960 | | |

Semiconductors & Semiconductor Equipment (1.1%) | |

Broadcom

Corp.

Class A | | | 55,700 | | | | 2,332,717 | Ø | |

Cree, Inc. | | | 16,686 | | | | 525,275 | *Ø | |

International

Rectifier

Corp. | | | 88,165 | | | | 3,506,322 | *Ø | |

Marvell

Technology

Group Ltd. | | | 34,930 | | | | 469,459 | | |

| | | Number

of Shares | | Value† | |

Micron

Technology,

Inc. | | | 109,549 | | | $ | 3,624,976 | *Ø | |

Montage

Technology

Group Ltd. | | | 4,649 | | | | 102,743 | * | |

NVIDIA Corp. | | | 38,933 | | | | 760,751 | Ø | |

NXP

Semiconductor

NV | | | 17,100 | | | | 1,174,086 | *Ø | |

OmniVision

Technologies,

Inc. | | | 1,000 | | | | 26,780 | * | |

Peregrine

Semiconductor

Corp. | | | 85,000 | | | | 1,056,550 | *Ø | |

RF Micro

Devices,

Inc. | | | 61,955 | | | | 806,035 | *Ø | |

SCREEN

Holdings

Co. Ltd. | | | 272,000 | | | | 1,438,398 | Ø | |

SunEdison,

Inc. | | | 69,055 | | | | 1,347,263 | *Ø | |

TriQuint

Semiconductor,

Inc. | | | 5,630 | | | | 121,777 | *Ø | |

| | | 17,293,132 | | |

Software (2.6%) | |

Compuware

Corp. | | | 285,756 | | | | 2,900,423 | ±Ø | |

Comverse,

Inc. | | | 61,938 | | | | 1,350,248 | *Ø | |

Concur

Technologies,

Inc. | | | 54,485 | | | | 6,991,515 | *Ø | |

Covisint

Corp. | | | 57,544 | | | | 166,303 | * | |

Ebix, Inc. | | | 2,000 | | | | 29,500 | Ø | |

Exact

Holding

NV | | | 3,023 | | | | 118,781 | | |

Nintendo

Co. Ltd. | | | 4,700 | | | | 498,349 | Ø | |

Nuance

Communications,

Inc. | | | 273,018 | | | | 4,212,668 | *Ø | |

PTC, Inc. | | | 144,550 | | | | 5,514,583 | *Ø | |

Shanda

Games

Ltd. ADR | | | 14,368 | | | | 92,889 | *Ø | |

TIBCO

Software,

Inc. | | | 395,294 | | | | 9,238,021 | *Ø | |

Verint

Systems,

Inc. | | | 207,704 | | | | 11,940,903 | *£Ø | |

| | | 43,054,183 | | |

| | | Number

of Shares | | Value† | |

Specialty Retail (1.1%) | |

ANN, Inc. | | | 125,100 | | | $ | 4,802,589 | *Ø | |

Dick's

Sporting

Goods, Inc. | | | 24,000 | | | | 1,088,880 | Ø | |

Express, Inc. | | | 11,965 | | | | 179,116 | *Ø | |

GNC

Holdings,

Inc. Class A | | | 50,797 | | | | 2,111,631 | Ø | |

New York &

Co., Inc. | | | 9,309 | | | | 30,441 | * | |

Office

Depot,

Inc. | | | 109,500 | | | | 571,590 | *Ø | |

Sanrio

Co. Ltd. | | | 29,000 | | | | 830,047 | Ø | |

Tiffany & Co. | | | 39,639 | | | | 3,810,101 | £Ø | |

United

Arrows Ltd. | | | 62,100 | | | | 2,288,840 | Ø | |

Vitamin

Shoppe,

Inc. | | | 44,568 | | | | 2,091,576 | *£ | |

| | | 17,804,811 | | |

Technology Hardware, Storage & Peripherals (0.6%) | |

Apple, Inc. | | | 24,285 | | | | 2,622,780 | Ø | |

BlackBerry

Ltd. | | | 42,974 | | | | 451,227 | *£Ø | |

EMC Corp. | | | 14,194 | | | | 407,794 | | |

Quantum

Corp. | | | 21,144 | | | | 27,064 | *Ø | |

Ricoh

Co. Ltd. | | | 68,500 | | | | 700,094 | Ø | |

Western

Digital

Corp. | | | 48,336 | | | | 4,754,812 | Ø | |

| | | | 8,963,771 | | |

Textiles, Apparel & Luxury Goods (0.5%) | |

PVH Corp. | | | 27,875 | | | | 3,187,506 | Ø | |

Vera

Bradley, Inc. | | | 206,425 | | | | 4,706,490 | *£ | |

| | | 7,893,996 | | |

Thrifts & Mortgage Finance (0.2%) | |

Dime

Community

Bancshares,

Inc. | | | 17,656 | | | | 278,082 | £ | |

Federal

Home

Loan

Mortgage

Corp. | | | 42,631 | | | | 87,820 | *£ | |

Federal

National

Mortgage

Association | | | 204,222 | | | | 441,119 | * | |

Franklin

Financial

Corp. | | | 21,128 | | | | 438,617 | *Ø | |

See Notes to Schedule of Investments

17

| | | Number

of Shares | | Value† | |

Hudson

City

Bancorp,

Inc. | | | 220,620 | | | $ | 2,128,983 | Ø | |

| | | 3,374,621 | | |

Tobacco (0.1%) | |

Lorillard, Inc. | | | 25,202 | | | | 1,549,923 | Ø | |

Trading Companies & Distributors (0.0%) | |

Mitsubishi

Corp. | | | 34,000 | | | | 654,876 | Ø | |

Transportation Infrastructure (0.3%) | |

Macquarie

Infrastructure

Co. LLC | | | 67,128 | | | | 4,809,050 | Ø | |

Water Utilities (0.1%) | |

Cia de

Saneamento

Basico do

Estado de

Sao Paulo | | | 175,000 | | | | 1,369,406 | Ø | |

Wireless Telecommunication

Services (0.4%) | |

Leap Wireless

International,

Inc. | | | 60,000 | | | | 151,200 | *fNØ | |

SoftBank

Corp. | | | 43,500 | | | | 3,074,529 | Ø | |

Sprint Corp. | | | 18,933 | | | | 112,273 | *£ | |

T-Mobile

US, Inc. | | | 121,375 | | | | 3,542,936 | *±£Ø | |

| | | 6,880,938 | | |

Total Common Stocks

(Cost $957,161,225) | | | | | 966,107,319 | | |

Preferred Stocks (0.4%) | |

Automobiles (0.1%) | |

Volkswagen

AG, 4.06% | | | 4,597 | | | | 979,612 | Ø | |

Banks (0.2%) | |

National

Bank of

Greece SA,

Ser. A,

9.00% | | | 222,541 | | | | 3,932,299 | *Ø | |

Consumer Finance (0.1%) | |

Ally Financial,

Inc., Ser. G,

7.00% | | | 625 | | | | 625,937 | ñ | |

Real Estate Investment Trusts (0.0%) | |

Strategic

Hotels &

Resorts,

Inc., Ser. B,

8.25% | | | 5,145 | | | | 131,197 | £ | |

| | | Number

of Shares | | Value† | |

Thrifts & Mortgage Finance (0.0%) | |

Federal

Home

Loan

Mortgage

Corp.,

Ser. V,

5.57% | | | 11,077 | | | $ | 35,003 | *£ | |

Federal

Home

Loan

Mortgage

Corp.,

Ser. W,

5.66% | | | 5,370 | | | | 16,969 | *£ | |

Federal

Home

Loan

Mortgage

Corp., Ser. Z,

8.38% | | | 70,341 | | | | 298,949 | *ص | |

| | | | 350,921 | | |

Total Preferred Stocks

(Cost $6,341,650) | | | | | 6,019,966 | | |

Exchange Traded Funds (0.7%) | |

iShares

20+ Year

Treasury

Bond ETF | | | 43,800 | | | | 5,223,150 | | |

PowerShares

DB U.S. Dollar

Index Bullish

Fund | | | 252,900 | | | | 5,839,461 | *Ø | |

Total Exchange

Traded Funds

(Cost $10,503,868) | | | | | 11,062,611 | | |

| | | Number

of Rights | | | |

Rights (0.0%) | |

Biotechnology (0.0%) | |

Cubist

Pharmaceuticals,

Inc., due

12/31/49 | | | 5,000 | | | | 377 | * | |

Health Care Providers & Services (0.0%) | |

Community

Health

Systems,

Inc., due

1/4/16 | | | 19,880 | | | | 594 | *£ | |

Total Rights

(Cost $438) | | | | | 971 | | |

| | | Number

of Warrants | | Value† | |

Warrants (0.0%) | |

Diversified Financial Services (0.0%) | |

Nomad

Holdings

Ltd., due

4/10/17 | | | 1,025,486 | | | $ | 548,635 | *Ø | |

Media (0.0%) | |

Tribune

Media Co.,

due 12/31/32 | | | 1,877 | | | | 125,759 | *f | |

Metals & Mining (0.0%) | |

HudBay

Minerals,

Inc., due

7/20/18 | | | 1,360 | | | | 953 | * | |

Total Warrants

(Cost $157,365) | | | | | 675,347 | | |

| | | Principal

Amount | | | |

Mortgage-Backed Securities (4.8%) | |

Collateralized Mortgage

Obligations (1.2%) | |

Alternative Loan Trust,

Ser. 2005-J2,

Class 1A5,

0.65%, due

4/25/35 | | $ | 3,185,301 | | | | 2,860,320 | µ | |

Banc of America

Alternative

Loan Trust,

Ser. 2005-6,

Class 2CB2,

6.00%,

due 7/25/35 | | | 806,430 | | | | 755,954 | | |

Bear Stearns

Asset Backed

Securities Trust,

Ser. 2004-AC4,

Class A1, 5.83%,

due 8/25/34 | | | 403,878 | | | | 414,663 | a | |

CHL Mortgage

Pass-Through

Trust,

Ser. 2005-19,

Class 1A1,

5.50%, due

8/25/35 | | | 427,278 | | | | 420,580 | | |

See Notes to Schedule of Investments

18

| | | Principal

Amount | | Value† | |

Citicorp

Mortgage

Securities

REMIC

Pass-Through

Certificates

Trust,

Ser. 2005-7,

Class 1A4,

5.50%, due

10/25/35 | | $ | 331,919 | | | $ | 334,062 | | |

Citicorp

Mortgage

Securities,

Inc.,

Ser. 2006-3,

Class 1A10,

6.25%, due

6/25/36 | | | 3,389,201 | | | | 3,546,494 | | |

Citicorp

Mortgage

Securities,

Inc.,

Ser. 2006-3,

Class 1A9,

5.75%, due

6/25/36 | | | 691,674 | | | | 711,652 | | |

Citicorp

Mortgage

Securities,

Inc.,

Ser. 2006-4,

Class 1A2,

6.00%, due

8/25/36 | | | 933,330 | | | | 954,627 | | |

Citicorp

Mortgage

Securities,

Inc.,

Ser. 2007-8,

Class 1A4,

6.00%, due

9/25/37 | | | 194,640 | | | | 194,612 | | |

GSR

Mortgage

Loan Trust,

Ser. 2005-AR6,

Class 3A2,

2.64%, due

9/25/35 | | | 569,351 | | | | 537,894 | µ | |

JP Morgan

Alternative

Loan Trust,

Ser. 2006-S4,

Class A3A,

5.78%, due

12/25/36 | | | 802,425 | | | | 738,012 | a | |

JP Morgan

Alternative

Loan Trust,

Ser. 2006-S4,

Class A6,

5.71%, due

12/25/36 | | | 815,309 | | | | 765,368 | a | |

| | | Principal

Amount | | Value† | |

JP Morgan

Mortgage

Trust,

Ser. 2007-A1,

Class 4A1,

2.49%, due

7/25/35 | | $ | 298,724 | | | $ | 301,319 | µ | |

JP Morgan

Mortgage

Trust,

Ser. 2007-A1,

Class 5A6,

2.59%, due

7/25/35 | | | 356,856 | | | | 325,486 | µ | |

MASTR

Alternative

Loans Trust,

Ser. 2004-10,

Class 4A1,

6.00%, due

9/25/19 | | | 140,474 | | | | 145,129 | | |

PHH

Mortgage

Trust,

Ser. 2008-CIM1,

Class 21A2,

6.00%, due

5/25/38 | | | 217,718 | | | | 223,723 | | |

RFMSI

Trust,

Ser. 2005-SA3,

Class 1A,

2.72%, due

8/25/35 | | | 399,028 | | | | 320,055 | µ | |

Structured Asset

Securities

Corp. Trust,

Ser. 2005-6,

Class 2A1,

5.50%, due

5/25/35 | | | 276,433 | | | | 284,892 | | |

WaMu

Mortgage

Pass-Through

Certificates,

Ser. 2004-S1,

Class 1A11,

5.50%, due

3/25/34 | | | 209,133 | | | | 220,329 | | |

Wells Fargo

Mortgage

Backed

Securities Trust,

Ser. 2005-9,

Class 1A12,

5.50%, due

10/25/35 | | | 1,318,712 | | | | 1,324,930 | | |

| | | Principal

Amount | | Value† | |

Wells Fargo

Mortgage

Backed

Securities Trust,

Ser. 2005-AR9,

Class 3A2,

2.61%, due

6/25/34 | | $ | 375,542 | | | $ | 363,272 | µ | |

Wells Fargo

Mortgage

Backed

Securities Trust,

Ser. 2006-13,

Class A5,

6.00%, due

10/25/36 | | | 356,073 | | | | 367,727 | | |

Wells Fargo

Mortgage

Backed

Securities Trust,

Ser. 2007-10,

Class 2A5,

6.25%, due

7/25/37 | | | 1,247,009 | | | | 1,257,035 | | |

Wells Fargo

Mortgage

Backed

Securities Trust,

Ser. 2007-12,

Class A6,

5.50%, due

9/25/37 | | | 912,478 | | | | 929,762 | | |

Wells Fargo

Mortgage

Backed

Securities Trust,

Ser. 2007-14,

Class 1A1,

6.00%, due

10/25/37 | | | 999,945 | | | | 1,013,472 | | |

Wells Fargo

Mortgage

Backed

Securities Trust,

Ser. 2007-16,

Class 1A7,

6.00%, due

12/28/37 | | | 307,875 | | | | 317,711 | | |

| | | | 19,629,080 | | |

Commercial Mortgage-Backed (3.6%) | |

BAMLL

Commercial

Mortgage

Securities Trust,

Ser. 2013-DSNY,

Class F, 3.65%,

due

9/15/26 | | | 4,200,000 | | | | 4,218,686 | ñص | |

See Notes to Schedule of Investments

19

| | | Principal

Amount | | Value† | |

BAMLL

Commercial

Mortgage

Securities Trust,

Ser. 2014-ICTS,

Class E, 3.10%,

due

6/15/28 | | $ | 3,450,000 | | | $ | 3,432,829 | ñµ | |

Boca Hotel

Portfolio Trust,

Ser. 2013-BOCA,

Class E,

3.90%, due

8/15/26 | | | 700,000 | | | | 700,874 | ñص | |

COMM

Mortgage

Trust,

Ser. 2014-PAT,

Class E,

3.30%, due

8/13/27 | | | 1,700,000 | | | | 1,683,372 | ñµ | |

Commercial

Mortgage Trust,

Ser. 2007-GG11,

Class AJ,

6.05%, due

12/10/49 | | | 5,940,000 | | | | 6,209,670 | ص | |

Credit

Suisse

Commercial

Mortgage Trust,

Ser. 2006-C4,

Class AJ,

5.54%, due

9/15/39 | | | 3,500,000 | | | | 3,531,861 | µ | |

Credit

Suisse

First Boston

Commercial

Mortgage Trust,

Ser. 2003-C3,

Class H,

5.16%, due

5/15/38 | | | 382,254 | | | | 382,269 | ñµ | |

GE Capital

Commercial

Mortgage Corp.,

Ser. 2005-C3,

Class G,

5.16%, due

7/10/45 | | | 3,000,000 | | | | 3,021,720 | ñµ | |

JP Morgan

Chase

Commercial

Mortgage

Securities Trust,

Ser. 2006-CB15,

Class AM,

5.86%, due

6/12/43 | | | 4,800,000 | | | | 4,909,973 | ص | |

| | | Principal

Amount | | Value† | |

JP Morgan

Chase

Commercial

Mortgage

Securities Trust,

Ser. 2006-LDP8,

Class C,

5.55%, due

5/15/45 | | $ | 1,200,000 | | | $ | 1,204,918 | ص | |

JP Morgan

Chase

Commercial

Mortgage

Securities Trust,

Ser. 2013-JWRZ,

Class E,

3.89%, due

4/15/30 | | | 4,330,000 | | | | 4,338,734 | ñµ | |

JP Morgan

Chase

Commercial

Mortgage

Securities Trust,

Ser. 2014-FL5,

Class D,

3.65%, due

7/15/31 | | | 1,150,000 | | | | 1,154,730 | ñµ | |

LB-UBS

Commercial

Mortgage Trust,

Ser. 2007-C1,

Class AJ,

5.48%, due

2/15/40 | | | 2,500,000 | | | | 2,602,200 | Ø | |

LB-UBS

Commercial

Mortgage Trust,

Ser. 2007-C7,

Class AJ,

6.25%, due

9/15/45 | | | 4,000,000 | | | | 4,230,816 | ص | |

Morgan

Stanley

Capital I Trust,

Ser. 2007-T25,

Class AJ,

5.57%, due

11/12/49 | | | 7,725,000 | | | | 7,924,475 | ص | |

NorthStar,

Ser. 2013-1A,

Class B,

5.15%, due

8/25/29 | | | 500,000 | | | | 512,500 | ñص | |

PFP III Ltd.,

Ser. 2014-1,

Class D,

4.25%, due

6/14/31 | | | 3,300,000 | | | | 3,306,036 | ñص | |

Wachovia

Bank

Commercial

Mortgage Trust,

Ser. 2007-C31,

Class AJ,

5.66%, due

4/15/47 | | | 4,450,000 | | | | 4,621,881 | ص | |

| | | Principal

Amount | | Value† | |

Wells

Fargo

Commercial

Mortgage Trust,

Ser. 2014-TISH,

Class WTS2,

3.40%, due

2/15/27 | | $ | 1,700,000 | | | $ | 1,698,256 | ñص | |

| | | | 59,685,800 | | |

Total Mortgage-Backed

Securities

(Cost $79,235,019) | | | | | 79,314,880 | | |

Asset-Backed Securities (2.6%) | |

AmeriCredit

Automobile

Receivables

Trust, Ser. 2012-4,

Class E,

3.82%, due

2/10/20 | | | 400,000 | | | | 412,708 | ñ | |

Ameri-

Credit

Automobile

Receivables

Trust, Ser. 2014-1,

Class E,

3.58%, due

8/9/21 | | | 3,500,000 | | | | 3,509,058 | | |

AmeriCredit

Automobile

Receivables

Trust, Ser. 2014-2,

Class E,

3.37%, due

11/8/21 | | | 3,500,000 | | | | 3,491,611 | | |

Atlas Senior

Loan Fund II Ltd.,

Ser. 2012-2A,

Class D,

4.48%, due

1/30/24 | | | 2,200,000 | | | | 2,152,275 | ñµ | |

Babson

CLO Ltd.,

Ser. 2006-2A,

Class D,