Washington, D.C. 20549

Arthur C. Delibert, Esq.

1601 K Street, N.W.

Washington, D.C. 20006-1600

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940as amended (“Act”) (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Report to Shareholders.

Following are copies of the annual reports transmitted to shareholders pursuant to Rule 30e-1 under the Act.

Neuberger Berman

Alternative and Multi-Asset Class Funds

Institutional Class Shares

Class A Shares

Class C Shares

Class R6 Shares

Global Allocation Fund

Hedged Option Premium Strategy Fund

Long Short Fund

Long Short Credit Fund

Multi-Asset Income Fund

Risk Balanced Commodity Strategy Fund

U.S. Equity Index PutWrite Strategy Fund

Annual Report

October 31, 2017

Contents

THE FUNDS | |

President's Letter | | | | 1 | |

PORTFOLIO COMMENTARY | |

Global Allocation Fund | | | | 2 | |

Hedged Option Premium Strategy Fund | | | | 5 | |

Long Short Fund | | | | 8 | |

Long Short Credit Fund | | | | 11 | |

Multi-Asset Income Fund | | | | 14 | |

Risk Balanced Commodity Strategy Fund | | | | 17 | |

U.S. Equity Index PutWrite Strategy Fund | | | | 20 | |

FUND EXPENSE INFORMATION | | | | 27 | |

SCHEDULE OF INVESTMENTS | |

Global Allocation Fund | | | | 29 | |

Positions by Industry | | | | 37 | |

Hedged Option Premium Strategy Fund | | | | 48 | |

Long Short Fund | | | | 52 | |

Long Short Credit Fund | | | | 64 | |

Multi-Asset Income Fund | | | | 75 | |

Risk Balanced Commodity Strategy Fund | | | | 93 | |

U.S. Equity Index PutWrite Strategy Fund | | | | 100 | |

FINANCIAL STATEMENTS | | | | 104 | |

FINANCIAL HIGHLIGHTS (ALL CLASSES)/

PER SHARE DATA | |

Global Allocation Fund | | | | 154 | |

Hedged Option Premium Strategy Fund | | | | 156 | |

Long Short Fund | | | | 156 | |

Long Short Credit Fund | | | | 158 | |

Multi-Asset Income Fund | | | | 160 | |

Risk Balanced Commodity Strategy Fund | | | | 162 | |

U.S. Equity Index PutWrite Strategy Fund | | | | 164 | |

Reports of Independent Registered Public Accounting Firms | | | | 168 | |

Directory | | | | 170 | |

Trustees and Officers | | | | 171 | |

Proxy Voting Policies and Procedures | | | | 181 | |

Quarterly Portfolio Schedule | | | | 181 | |

Board of Consideration of the Management Agreement | | | | 182 | |

Notice to Shareholders | | | | 188 | |

The "Neuberger Berman" name and logo and "Neuberger Berman Investment Advisers LLC" name are registered service marks of Neuberger Berman Group LLC. The individual Fund names in this piece are either service marks or registered service marks of Neuberger Berman Investment Advisers LLC, an affiliate of Neuberger Berman BD LLC, distributor, member FINRA. @2017 Neuberger Berman BD LLC, distributor. All rights reserved.

Dear Shareholder,

I am pleased to present this annual shareholder report for Neuberger Berman Alternative and Multi-Asset Class Funds.

The global financial market generated varying results over the 12-months ended October 31, 2017. Global equities generated strong results, supported by corporate profits that often exceeded expectations, strengthening global growth and overall robust demand. Meanwhile, the global fixed income markets posted a modest gain. In the U.S., yields moved higher as the U.S. Federal Reserve (Fed) raised interest rates on three occasions during the period, with another interest rate hike in December 2017. Additionally, in a well telegraphed move, the Fed began reducing its balance sheet in October 2017.

All told, the U.S. equity market, as measured by the S&P 500® Index, gained 23.63% over the reporting period. International developed and emerging market equities also posted strong results. Meanwhile, the overall U.S. bond market, as measured by the Bloomberg Barclays U.S. Aggregate Bond Index, gained 0.90% during the period. Finally, inflation was generally well contained over the period.

Looking ahead, against a background of synchronous global growth, low and falling unemployment and U.S. corporate margins at record highs, we believe the current softness in inflation could be a lagged effect of weak growth and low energy prices during 2015-16. As such, in a scenario of a return to a moderate rise in inflation, we believe the Fed's forecast for interest rate hikes in 2018 would be closer to reality than the market currently anticipates. From an investment perspective, we continue to have high conviction with our portfolio managers and believe their portfolios are well positioned for the current and coming environment.

Thank you for your continued support and trust. We look forward to continue serving your investment needs in the years to come.

Sincerely,

ROBERT CONTI

PRESIDENT AND CEO

NEUBERGER BERMAN MUTUAL FUNDS

1

Global Allocation Fund Commentary (Unaudited)

Neuberger Berman Global Allocation Fund Institutional Class generated a 16.24% total return for the 12 months ended October 31, 2017, and outperformed its custom benchmark, a custom blend consisting of 60% MSCI All Country World Index (Net) and 40% Bloomberg Barclays Global Aggregate Index, which provided a 13.94% return for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

Global equity markets, as measured by the MSCI All Country World Index (Net), generated positive returns during this reporting period as momentum continued to build across the global economy. European stocks in particular benefitted from the rebound in economic growth and rising corporate earnings. U.S. stocks performed well fueled by elevated consumer confidence, strong earnings growth, and renewed talks of tax reform, despite natural disasters and rising geopolitical tensions. In fixed income markets, U.S. and non-U.S. developed regions were broadly positive. Treasury yields were boosted following the November 2016 U.S. election but suffered a setback in the first quarter when the healthcare bill was pulled. Despite a stronger Euro, the European Central Bank announced that it plans to reduce its quantitative easing program while the Bank of Japan maintained its accommodative monetary policy stance. Commodities were strengthened by a weaker U.S. dollar and more balanced supply/demand dynamics. Energy markets performed well over the reporting period given hurricane-driven supply disruptions in the third quarter of 2017 and supply reductions from OPEC countries. The industrial metals sector was supported by robust demand from China, which particularly boosted copper, zinc and aluminum prices.

During the reporting period, equities, fixed income and opportunistic allocations all added value. The largest positive contributors to the Fund's performance were equities, in particular non-US equities. Within fixed income, allocations to high yield and investment grade corporate bonds contributed to results amid solid investor risk appetite and supportive fundamentals. Opportunistic investments provided uncorrelated returns and diversification benefits to the Fund. The allocation to Global TIPS modestly detracted from Fund performance.

The Fund's aggregate use of futures, forward foreign currency, swap and option contracts contributed positively to performance during the reporting period.

The global economy has continued to improve as both hard and soft data have trended higher and consequently, has reignited investor optimism. In particular, corporate earnings growth across key regions such as Europe, Japan, and the U.S. provided further tailwinds. As a whole, we see global markets currently in the midst of an environment characterized by moderate growth, muted inflation, and a still-accommodative monetary policy, but within a more fragile overall economic regime. We believe this favors equity and credit over government bonds although valuations suggest subdued forward-looking returns for most markets.

Sincerely,

ERIK KNUTZEN, BRADLEY TANK, WAI LEE* AND AJAY JAIN

PORTFOLIO MANAGERS

* Wai Lee, a portfolio manager of the Fund during the reporting period, ceased his portfolio management responsibilities on or about December 1, 2017.

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

2

Global Allocation Fund (Unaudited)

TICKER SYMBOLS

Institutional Class | | NGLIX | |

Class A | | NGLAX | |

Class C | | NGLCX | |

PERFORMANCE HIGHLIGHTS3

| | | Inception | | Average Annual Total Return

Ended 10/31/2017 | |

| | | Date | | 1 Year | | 5 Year | | Life of Fund | |

At NAV | | | | | | | | | |

Institutional Class | | 12/29/2010 | | | 16.24 | % | | | 6.13 | % | | | 6.31 | % | |

Class A | | 12/29/2010 | | | 15.77 | % | | | 5.75 | % | | | 5.93 | % | |

Class C | | 12/29/2010 | | | 14.99 | % | | | 4.97 | % | | | 5.14 | % | |

With Sales Charge | | | | | | | | | |

Class A | | | | | 9.16 | % | | | 4.49 | % | | | 5.02 | % | |

Class C | | | | | 13.99 | % | | | 4.97 | % | | | 5.14 | % | |

Index | | | | | | | | | |

60% MSCI All Country World Index (Net)

and 40% Bloomberg Barclays

Global Aggregate Index1,2 | | | | | 13.94 | % | | | 6.66 | % | | | 6.01 | % | |

MSCI All Country World

Index (Net)1,2 | | | | | 23.20 | % | | | 10.80 | % | | | 8.48 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("Management") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2016 were 4.39%, 4.78% and 5.53% for Institutional Class, Class A and Class C shares, respectively (before expense reimbursements and/or fee waivers, if any). The total annual operating expense ratios were 0.90%, 1.26% and 2.01% for Institutional Class, Class A and Class C shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for the annual period ended October 31, 2017 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

3

Global Allocation Fund (Unaudited)

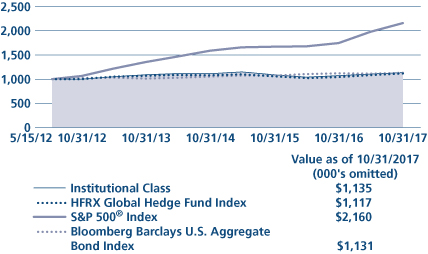

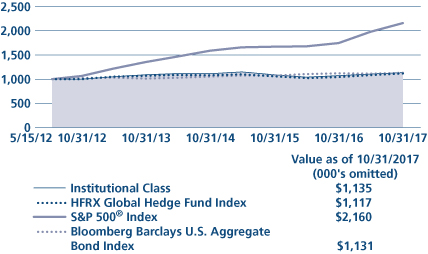

COMPARISON OF A $1,000,000 INVESTMENT

(000's omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

4

Hedged Option Premium Strategy Fund Commentary (Unaudited)

Since inception on April 12, 2017, the Neuberger Berman Hedged Option Premium Fund Institutional Class generated a total return of 1.92% for the period ended October 31, 2017, outperforming its primary benchmark, the CBOE S&P 500 Iron Condor Index, which generated a total return of 0.68% for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

The Fund's fixed income collateral holdings of short-term U.S. Treasuries contributed marginally to returns as short-term U.S. Treasury bond yields increased over the period with the 2-Year U.S. Treasury yield increasing roughly 36 basis points to 1.60%. Over time, we anticipate short-term interest rates to rise, and believe the strategy will benefit from that as the shorter duration exposures of the Fund's collateral portfolio allow the Fund to capture higher yields without experiencing significant duration risk. The CBOE S&P 500 Volatility Index ("VIX") and CBOE Russell 2000 Volatility Index ("RVX"), two popular measures of index option implied volatility levels, remained near historically low levels, averaging 10.9 and 15.3, respectively, over the reporting period.

The Fund pursues an absolute return objective and is intended to experience limited correlation to broader equity markets. The Fund seeks to achieve its goal primarily through a strategy of selling (writing) put and call option spreads on U.S. indices, including the S&P 500® Index and the Russell 2000® Index, exchange traded funds ("ETFs") and equity securities, and through investments in fixed income instruments. The Fund attempts to generate returns through the receipt of premiums from selling put and call option spreads, as well as through investments in fixed income instruments, which collectively are intended to reduce volatility relative to what it would be if the Fund held the underlying reference asset (e.g., the underlying index, ETF or security) on which the options are written. In an effort to diversify exposures and limit volatility, the Fund will sell put and call option spreads at varying strike prices and with varying expiration dates on various reference assets.

As we look towards 2018, we anticipate equity market return dispersion to continue to increase across various regions, sectors and industries due to a combination of diverse interest rate politics, increased global competition, geopolitics (e.g., U.S. tax reform and Brexit). As a result, index returns are likely to be at or below longer-term averages, which may lead to higher relative returns versus the Fund's benchmark and related U.S. equity market indices such as the S&P 500 Index and Russell 2000 Index.

Sincerely,

DEREK DEVENS

PORTFOLIO MANAGER

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio manager. The opinions are as of the date of this report and are subject to change without notice.

5

Hedged Option Premium Strategy Fund (Unaudited)

TICKER SYMBOLS

Institutional Class | | NHOIX | |

Class A | | NHOAX | |

Class C | | NHOCX | |

Class R6 | | NHORX | |

PORTFOLIO BY TYPE OF SECURITY

(as a % of Total Net Assets) | |

U.S. Treasury Obligations | | | 88.6 | % | |

Options Purchased | | | 0.0 | | |

Options Written | | | (0.3 | ) | |

Short-Term Investment | | | 29.4 | | |

Liabilities Less Other Assets | | | (17.7 | ) | |

Total | | | 100.0 | % | |

PERFORMANCE HIGHLIGHTS4

| | | Inception

Date | | Cumulative Total Return

Ended 10/31/2017

Life of Fund | |

At NAV | | | | | |

Institutional Class | | 04/12/2017 | | | 1.92 | % | |

Class A | | 04/12/2017 | | | 1.74 | % | |

Class C | | 04/12/2017 | | | 1.32 | % | |

Class R6 | | 04/12/2017 | | | 1.95 | % | |

With Sales Charge | | | | | |

Class A | | | | | –4.13 | % | |

Class C | | | | | 0.32 | % | |

Index | | | | | |

| CBOE S&P 500 Iron Condor Index1,2 | | | | | 0.68 | % | |

| S&P 500® Index1,2 | | | | | 10.55 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("Management") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the estimated total annual operating expense ratios for fiscal year 2017 are 1.42%, 1.78%, 2.53% and 1.35% for Institutional Class, Class A, Class C and Class R6 shares, respectively (before expense reimbursements and/or fee waivers, if any). The estimated total annual operating expense ratios for the current fiscal year are 0.65%, 1.01%, 1.76% and 0.58% for Institutional Class, Class A, Class C and Class R6 shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for the annual period ended October 31, 2017 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

6

Hedged Option Premium Strategy Fund (Unaudited)

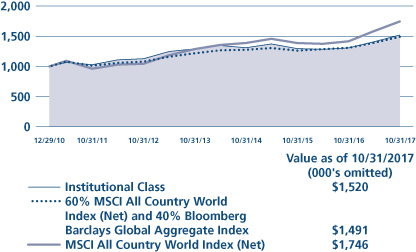

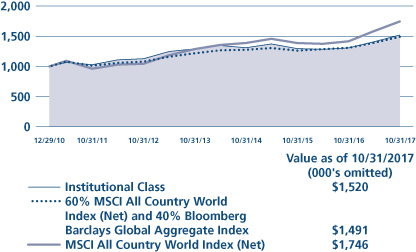

COMPARISON OF A $1,000,000 INVESTMENT

(000's omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

7

Long Short Fund Commentary (Unaudited)

Neuberger Berman Long Short Fund Institutional Class generated an 11.54% total return for the 12 months ended October 31, 2017, outperforming its primary benchmark, the HFRX Equity Hedge Index, which returned 9.69% for the same period. The Fund, however, underperformed the S&P 500® Index which provided a 23.63% return for the period. (Performance for all share classes is provided in the table immediately following this letter.)

The U.S. stock market generated very strong results during the reporting period. Supporting the market were corporate profits that generally exceeded expectations, strengthening global growth and overall robust demand. These factors more than offset the potential headwinds from the U.S. Federal Reserve tightening monetary policy, stalled fiscal policy initiatives and several geopolitical issues. The overall U.S. stock market, as measured by the S&P 500 Index, reached numerous all-time record highs.

We maintained our constructive, albeit highly selective outlook during the reporting period. This was reflected in the Fund's net long exposure during the period. The Fund remained constructively positioned during the period for an ongoing economic recovery in the U.S. Against this backdrop, the Fund's largest sector weights were in Information Technology and Industrials.

We categorize our long investment exposure into three groups: Capital Growth, Total Return and Opportunistic. Capital Growth continues to represent our largest allocation followed by Total Return and Opportunistic. We continued to identify more compelling opportunities in Capital Growth relative to Total Return, as higher interest rates could negatively impact longer duration assets and cash flows. The portfolio's short exposure includes both single name "Fundamental" shorts and "Market" shorts. During the period, Fundamental shorts exposure increased against the backdrop of heightened market volatility and greater sector dispersion. As fundamentals came back into focus, Market shorts consisted primarily of sector and market cap-specific indices to help manage broader portfolio exposures, which also increased during the period.

Equity and credit long exposure added to Fund performance, while Fundamental shorts and the Fund's aggregate use of futures, option and swap contracts related to hedging activity detracted from performance during the period given the overall positive move in markets.

We continue to hold a fairly constructive, albeit highly selective, outlook driven by solid recent economic data and the emergence of a seemingly more pro-business environment in the U.S. Looking ahead, we believe the critical market dynamic will be the ongoing shift from monetary policy to fiscal policy and its effects on growth, earnings, interest rates, confidence and the federal deficit. We believe there could be periods of heightened volatility going forward, particularly if fiscal action differs from expectations in both magnitude and timing. We are very mindful of the complex world in which we live and invest. The risks of the long-term inflationary effects of continued government intervention, coupled with a myriad of ongoing geopolitical issues, remain top of our mind. As always, we remain dedicated to thinking deeply and creatively and strive to deliver attractive risk-adjusted returns. Given the vicissitudes of an increasingly global economy, we will also remain flexible in our decisions and open-minded to new ideas across different sectors, asset classes and geographies.

Sincerely,

CHARLES KANTOR AND MARC REGENBAUM

PORTFOLIO MANAGERS

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio manager. The opinions are as of the date of this report and are subject to change without notice.

8

Long Short Fund (Unaudited)

TICKER SYMBOLS

Institutional Class | | NLSIX | |

Class A | | NLSAX | |

Class C | | NLSCX | |

PORTFOLIO BY TYPE OF SECURITY

(as a % of Total Net Assets)

| | | Long | | Short | |

Common Stocks | | | 74.7 | % | | | (12.6 | )% | |

Convertible Bonds | | | 0.4 | | | | — | | |

Corporate Bonds | | | 5.6 | | | | (1.6 | ) | |

Exchange Traded Funds | | | — | | | | (2.1 | ) | |

Master Limited Partnerships | | | — | | | | (0.3 | ) | |

Options Purchased | | | 0.1 | | | | — | | |

Preferred Stock | | | 0.4 | | | | — | | |

Short-Term Investment | | | 17.6 | | | | — | | |

Other Assets Less Liabilities | | | 17.8 | * | | | — | | |

Total | | | 116.6 | % | | | (16.6 | )% | |

* Includes the impact of the Fund's open positions in derivatives (other than Options Purchased), if any.

PERFORMANCE HIGHLIGHTS

| | | Inception | | Average Annual Total Return

Ended 10/31/2017 | |

| | | Date | | 1 Year | | 5 Year | | Life of Fund | |

At NAV | | | | | | | | | |

Institutional Class | | 12/29/2011 | | | 11.54 | % | | | 5.48 | % | | | 6.54 | % | |

Class A | | 12/29/2011 | | | 11.15 | % | | | 5.09 | % | | | 6.15 | % | |

Class C | | 12/29/2011 | | | 10.31 | % | | | 4.31 | % | | | 5.36 | % | |

With Sales Charge | | | | | | | | | |

Class A | | | | | 4.73 | % | | | 3.87 | % | | | 5.08 | % | |

Class C | | | | | 9.31 | % | | | 4.31 | % | | | 5.36 | % | |

Index | | | | | | | | | |

| HFRX Equity Hedge Index1,2 | | | | | 9.69 | % | | | 3.72 | % | | | 3.88 | % | |

| S&P 500® Index1,2 | | | | | 23.63 | % | | | 15.18 | % | | | 15.58 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("Management") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2016 were 1.94%, 2.30% and 3.04% for Institutional Class, Class A and Class C shares, respectively (before expense reimbursements and/or fee waivers, if any). The expense ratios for the annual period ended October 31, 2017 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

9

Long Short Fund (Unaudited)

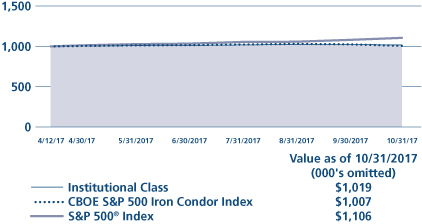

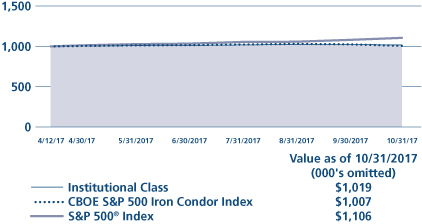

COMPARISON OF A $1,000,000 INVESTMENT

(000's omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

10

Long Short Credit Fund Commentary (Unaudited)

Neuberger Berman Long Short Credit Fund Institutional Class returned 5.36% for the 12 months ended October 31, 2017, and outperformed its primary benchmark, the HRFX Fixed Income—Credit Index, which returned 4.79% for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

Credit markets globally performed well for the period, supported mainly by dovish global central bank policies and synchronous global growth. This period has witnessed a historically low volatility regime, which has also supported investor risk appetites and encouraged investors to continue to invest in credit. The search for yield in a low rate environment clearly persisted during the period.

The modest upward move in U.S. Treasury yields played a significant role in credit market performance. The 10 year U.S. Treasury started the period at 1.84% and ended at 2.38%. This move was driven by a number of factors, the most significant of which were: the election of a new U.S. President; strengthening global growth; a resurgence of reflation; and finally U.S. Federal Reserve (Fed) interest rate hikes. The total number of Fed interest hikes during the period was three with a further hike in December 2017. The upward move in interest rates appears to have been absorbed by the credit markets.

We anticipate many of these drivers to continue to be the dominant themes in the upcoming year. While the Fed has been hiking interest rates and curtailing asset purchases, both the Bank of Japan and the European Central Bank appear committed to their dovish path and asset purchase programs. We believe that is the good news for credit markets. The increase in global growth and the resurgence of some inflation measures that have started to appear may begin to weigh on the interest rates markets. These opposing forces should drive most of the price action in the rates market with their unavoidable spillover to credit. We continue to believe in the attractiveness of credit, from the standpoint of fundamentals. We do, however, worry about the valuation levels and question whether investors are being paid appropriately for the risks. Our perspective should be viewed more so, as to risk vs. reward, as opposed to absolute, outright directional reward.

We have run what we believe is a conservative portfolio. The portfolio has comprised a mix of long positions and short positions both outright and on a relative value basis. We have not excessively levered up the portfolio, nor have we grossed up the exposures. Over the period, the largest contributors to performance were our positions in the communications, financial and basic materials sectors, while our losses stemmed principally from our short positioning in the consumer non-cyclical and healthcare sectors.

The Fund's aggregate use of futures, forward foreign currency, swap and option contracts contributed positively to performance during the reporting period.

In our view, the market does offer pockets of value, but we intend to remain invested conservatively. We believe that we are entering an interesting time in credit. Much of the adrenalin from central banks, delivered over the last nine years, may be coming to an end. As global growth resurfaces and inflation measures pick up, we believe the markets will have to adjust. We do not believe that the transition will be as smooth as is currently predicted; rather, we think volatility in credit will increase. We have constructed a portfolio of single name long and short positions based on fundamental analysis. We hope to be able to capture the idiosyncratic opportunities that we believe are mispriced. This continues to be expressed through relative value trades, capital structure arbitrage trades and directional long and short positions.

We do not believe that investors need to be exposed to the full credit market; but rather, that a balanced book of longs and shorts may perhaps be a better solution for the upcoming changes we are anticipating. Our intention is to deliver a stable series of returns that are not correlated to either the volatility or general return of the broad credit markets. We believe that a portfolio of fundamental long and short positions in credit, with less interest rate risk, should be able to help accomplish this in the upcoming year.

Sincerely,

RICK DOWDLE AND NORMAN MILNER

PORTFOLIO MANAGERS

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

11

Long Short Credit Fund (Unaudited)

TICKER SYMBOLS

Institutional Class | | NLNIX | |

Class A | | NLNAX | |

Class C | | NLNCX | |

Class R6 | | NRLNX | |

PORTFOLIO BY TYPE OF SECURITY

(as a % of Total Net Assets) | |

Common Stocks | | | 1.1 | % | |

Convertible Bonds | | | 1.0 | | |

Corporate Bonds | | | 84.4 | | |

Foreign Government Security | | | 0.6 | | |

Loan Assignments | | | 13.9 | | |

Preferred Stock | | | 3.1 | | |

Short Term Investment | | | 0.0 | | |

Liabilities Less Other Assets | | | (4.1 | )* | |

Total | | | 100.0 | % | |

* Includes the impact of the Fund's open positions in derivatives (other than Options Purchased), if any.

PERFORMANCE HIGHLIGHTS

| | | | | Average Annual Total

Return Ended 10/31/2017 | |

| | | Inception

Date | | 1 Year | | Life of

Fund | |

At NAV | |

Institutional Class | | 06/29/2015 | | | 5.36 | % | | | 1.23 | % | |

Class A | | 06/29/2015 | | | 4.98 | % | | | 0.90 | % | |

Class C | | 06/29/2015 | | | 4.10 | % | | | 0.20 | % | |

Class R6 | | 06/29/2015 | | | 5.33 | % | | | 1.30 | % | |

With Sales Charge | |

Class A | | | | | 0.55 | % | | | –0.93 | % | |

Class C | | | | | 3.10 | % | | | 0.20 | % | |

Index | |

| HFRX Fixed Income - Credit Index1,2 | | | | | 4.79 | % | | | 0.87 | % | |

| Bloomberg Barclays U.S. Aggregate Bond Index1,2 | | | | | 0.90 | % | | | 3.05 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("Management") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2016 were 3.23%, 3.73%, 4.31% and 3.06% for Institutional Class, Class A, Class C and Class R6 shares, respectively (before expense reimbursements and/or fee waivers, if any). The total annual operating expense ratios were 2.08%, 2.48%, 3.16% and 1.93% for Institutional Class, Class A, Class C and Class R6 shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for the annual period ended October 31, 2017 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 4.25% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

12

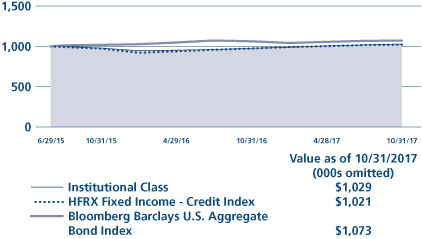

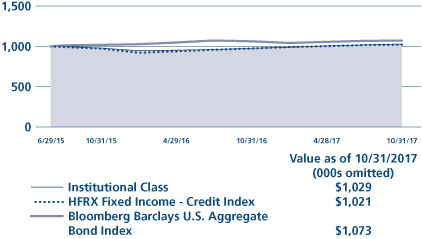

Long Short Credit Fund (Unaudited)

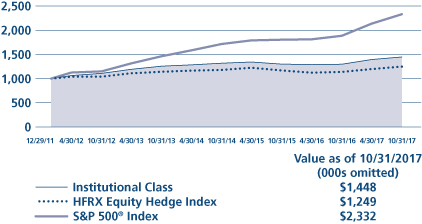

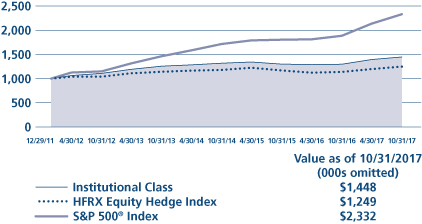

COMPARISON OF A $1,000,000 INVESTMENT

(000's omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

13

Multi-Asset Income Fund Commentary (Unaudited)

Neuberger Berman Multi-Asset Income Fund Institutional Class generated a 9.93% total return for the 12 month period ended October 31, 2017, and outperformed its custom benchmark, a custom blend consisting of 60% Bloomberg Barclays U.S. Aggregate Bond Index and 40% S&P 500® Index (the benchmark), which provided a 9.53% return for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

Global equity markets, as measured by the MSCI All Country World Index (Net), generated positive returns during this reporting period, as momentum continued to build across the global economy. European stocks in particular benefitted from the rebound in economic growth and rising corporate earnings. U.S. stocks performed well fueled by elevated consumer confidence, strong earnings growth, and renewed talks of tax reform, despite natural disasters and rising geopolitical tensions. Over the period, "growth" stocks generally outperformed "value" stocks, pushing the equity market to new highs. Emerging market (EM) equities posted strong positive performance over the period. An uptick in EM earnings expectations and positive gross domestic product revisions provided investor confidence despite losses immediately following the U.S. election.

Fixed income securities were broadly positive, particularly EM debt and high yield securities. Treasury yields were boosted following the 2016 U.S. election but suffered a setback in the first quarter of 2017 when the healthcare bill was pulled. The Federal Reserve's interest rate hikes over the period also impacted fixed income markets. Despite a stronger Euro, the European Central Bank announced that it plans to reduce its quantitative easing program while the Bank of Japan maintained its accommodative monetary policy stance.

During the reporting period, equities, fixed income and opportunistic allocations all added value. The largest positive contributors to the Fund's total returns were high dividend yielding equities. Exposure to MLPs and REITS also added value. Relative to the benchmark's equity exposure however, the equity allocation slightly underperformed. The Fund's fixed income allocations added value, particularly security selection within investment grade bonds, as well as asset-backed securities and high yield securities. The Fund's opportunistic investments provided uncorrelated returns and diversification benefits to the Fund.

The Fund's aggregate use of futures, forward foreign currency, swap and option contracts contributed positively to performance during the reporting period.

The global economy has continued to improve as both hard and soft data have trended higher and consequently, has reignited investor optimism. In particular, corporate earnings growth across key regions such as Europe, Japan, and the U.S. provided further tailwinds. As a whole, we see global markets currently in the midst of an environment characterized by moderate growth, muted inflation, and a still-accommodative monetary policy, but within a more fragile overall economic regime. We believe this favors equity and credit over government bonds although valuations suggest subdued forward-looking returns for most markets.

Sincerely,

ERIK KNUTZEN, BRADLEY TANK, WAI LEE* AND AJAY JAIN

PORTFOLIO MANAGERS

* Wai Lee, a portfolio manager of the Fund during the reporting period, ceased his portfolio management responsibilities on or about December 1, 2017.

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

14

Multi-Asset Income Fund (Unaudited)

TICKER SYMBOLS

Institutional Class | | NANIX | |

Class A | | NANAX | |

Class C | | NANCX | |

Class R6 | | NRANX | |

PORTFOLIO BY TYPE OF SECURITY

(as a % of Total Net Assets) | |

Asset-Backed Securities | | | 3.2 | % | |

Common Stocks | | | 33.8 | | |

Convertible Bonds | | | 0.7 | | |

Convertible Preferred Stocks | | | 0.2 | | |

Corporate Bonds | | | 10.8 | | |

Exchange Traded Funds | | | 3.5 | | |

Foreign Government Security | | | 0.6 | | |

Investment Companies | | | 20.8 | | |

Mortgage-Backed Securities | | | 13.0 | | |

Master Limited Partnerships | | | 3.1 | | |

Preferred Stocks | | | 1.2 | | |

Rights | | | 0.0 | | |

U.S. Government Agency Securities | | | 0.9 | | |

U.S. Treasury Obligations | | | 12.6 | | |

Short-Term Investment | | | 4.3 | | |

Liabilities Less Other Assets | | | (8.7 | )* | |

Total | | | 100.0 | % | |

* Includes the impact of the Fund's open positions in derivatives (other than Options Purchased), if any.

PERFORMANCE HIGHLIGHTS

| | | | | Average Annual Total

Return Ended 10/31/2017 | |

| | | Inception

Date | | 1 Year | | Life of

Fund | |

At NAV | |

Institutional Class | | 03/27/2015 | | | 9.93 | % | | | 4.67 | % | |

Class A | | 03/27/2015 | | | 9.53 | % | | | 4.29 | % | |

Class C | | 03/27/2015 | | | 8.71 | % | | | 3.52 | % | |

Class R6 | | 03/27/2015 | | | 10.01 | % | | | 4.74 | % | |

With Sales Charge | |

Class A | | | | | 4.83 | % | | | 2.58 | % | |

Class C | | | | | 7.71 | % | | | 3.52 | % | |

Index | |

60% Bloomberg Barclays U.S.

Aggregrate Bond Index and 40% S&P 500® Index1,2 | | | | | 9.53 | % | | | 5.77 | % | |

| Bloomberg Barclays U.S. Aggregate Bond Index1,2 | | | | | 0.90 | % | | | 2.00 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("Management") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

For the period ended October 31, 2017, the 30-day SEC yields were 3.12%, 2.75%, 2.00% and 3.19% for Institutional Class, Class A, Class C and Class R6 shares, respectively. Absent expense reimbursements and/or fee waivers, the 30-day SEC yields would have been 1.45%, 1.05%, 0.34% and 1.53% for Institutional Class, Class A, Class C and Class R6 shares, respectively.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2016 were 4.20%, 4.61%, 5.33% and 4.12% for Institutional Class, Class A, Class C and Class R6 shares, respectively (before expense reimbursements and/or fee waivers, if any). The total annual operating expense ratios were 0.78%, 1.15%, 1.90% and 0.71% for Institutional Class, Class A, Class C and Class R6 shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for the annual period ended October 31, 2017 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 4.25% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

15

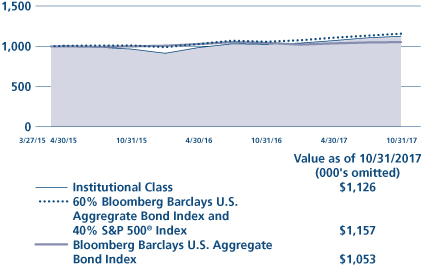

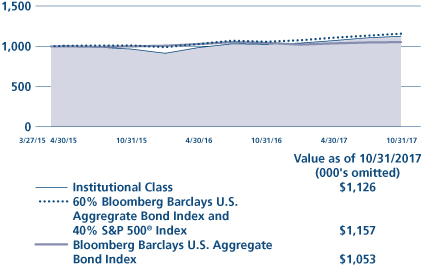

Multi-Asset Income Fund (Unaudited)

COMPARISON OF A $1,000,000 INVESTMENT

(000's omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

16

Risk Balanced Commodity Strategy Fund Commentary (Unaudited)

Neuberger Berman Risk Balanced Commodity Strategy Fund1 Institutional Class generated a total return of 6.18% for the 12 months ended October 31, 2017 and outperformed its benchmark, the Bloomberg Commodity Index (the benchmark), which posted a 2.35% return for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

The overall commodity market generated a positive return during the reporting period. In particular, the energy, industrial metals and livestock sectors produced the strongest returns. Energy performed well given hurricane-driven supply disruptions in the third quarter of 2017 and supply reductions from OPEC countries. The industrial metals sector was supported by robust demand from China which particularly boosted copper, zinc and aluminum prices. The livestock sector performed well, driven by supply issues in the first quarter of 2017 and solid seasonal demand. In contrast, the agriculture, softs and precious metals sectors posted the weakest results over the reporting period. Agriculture performed poorly due to strong global supply and the lack of weather-related events. Weakness in the softs sector was driven by sharply falling sugar prices amid lower consumer demand. Poor performance in the precious metals was largely due to falling prices in the immediate aftermath of the November 2016 U.S. elections.

Looking at the commodity sectors in which the Fund invests, energy was the largest contributor to outperformance relative to the benchmark. This was in part driven by an out-of-benchmark allocation to oil and natural gas. An underweight to sugar, one of the worst performing commodities during the period, was also beneficial. Elsewhere, an out-of-benchmark allocation to feeder cattle was additive to performance. Several of the Fund's tactical adjustments also contributed to results. In particular, an overweight to nickel, which appeared attractively valued relative to other metals, was rewarded. Within the industrial metals sector, the Fund's relative underweight to aluminum was additive to performance while an underweight to copper was a headwind for performance. An out-of-benchmark allocation to cocoa in the softs sector and lead in the industrial metals sector also detracted from results as they generated weak results over the period.

The Fund seeks to gain exposure to the commodity markets by investing, directly or indirectly, in futures contracts on individual commodities and other commodity-linked derivative instruments. The Fund's tactical positioning contributed positively to performance during the reporting period.

Heading into the end of the year, we are optimistic on the overall global economy, despite ongoing geopolitical tensions. We believe the tide is turning towards monetary policy tightening, not just in the U.S., but notably in Europe as well. With improving labor markets, we believe household spending should continue to drive the recovery and, in turn, push up inflation which thus far has been largely subdued. We anticipate commodities to be supported by the U.S. dollar which has been trending lower. In addition, while China's economy is slowing, we believe it will do so gradually and broad emerging market demand for raw materials should support growth oriented commodities. We continue to believe that an actively managed approach that dynamically navigates the risks of the asset class is an attractive way to gain exposure to commodities.

Sincerely,

WAI LEE*, HAKAN KAYA, THOMAS SONTAG AND DAVID YI WAN

PORTFOLIO MANAGERS

* Wai Lee, a portfolio manager of the Fund during the reporting period, ceased his portfolio management responsibilities on or about December 1, 2017.

1 Much of the Fund's investment exposure is accomplished through the use of derivatives which may not require the Fund to deposit the full notional amount of the investment with its counterparties, such as a futures commission merchant. The Fund's resulting cash balances are invested in a variety of conservative fixed income securities.

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers. The opinions are as of the date of this report and are subject to change without notice.

17

Risk Balanced Commodity Strategy Fund (Unaudited)

TICKER SYMBOLS

Institutional Class | | NRBIX | |

Class A | | NRBAX | |

Class C | | NRBCX | |

PORTFOLIO BY TYPE OF SECURITY

(as a % of Total Net Assets) | |

Asset-Backed Securities | | | 17.4 | % | |

Corporate Bonds | | | 54.5 | | |

U.S. Treasury Obligation | | | 7.6 | | |

Short-Term Investments | | | 14.5 | | |

Other Assets Less Liabilities | | | 6.0 | * | |

Total | | | 100.0 | % | |

* Includes the impact of the Fund's open positions in derivatives (other than Options Purchased), if any.

(as a % of Total Notional Value) | |

Commodity Futures: | |

Agriculture | | | 21.9 | % | |

Energy | | | 30.1 | | |

Industrial Metals | | | 17.0 | | |

Livestock | | | 7.1 | | |

Precious Metals | | | 17.3 | | |

Softs | | | 6.6 | | |

Total | | | 100.0 | % | |

PERFORMANCE HIGHLIGHTS3

| | | Inception | | Average Annual Total

Return Ended 10/31/2017 | |

| | | Date | | 1 Year | | 5 Years | | Life of Fund | |

At NAV | |

Institutional Class | | 08/27/2012 | | | 6.18 | % | | | –8.36 | % | | | –8.36 | % | |

Class A | | 08/27/2012 | | | 5.76 | % | | | –8.70 | % | | | –8.69 | % | |

Class C | | 08/27/2012 | | | 4.20 | % | | | –9.53 | % | | | –9.53 | % | |

With Sales Charge | |

Class A | | | | | –0.32 | % | | | –9.78 | % | | | –9.73 | % | |

Class C | | | | | 3.20 | % | | | –9.53 | % | | | –9.53 | % | |

Index | |

| Bloomberg Commodity Index1,2 | | | | | 2.35 | % | | | –9.37 | % | | | –9.37 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("Management") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2016 were 1.45%,1.85% and 2.86% for Institutional Class, Class A and Class C shares, respectively (before expense reimbursements and/or fee waivers, if any). The total annual operating expense ratios were 0.74%, 1.10% and 1.85% for Institutional Class, Class A and Class C shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for the annual period ended October 31, 2017 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

18

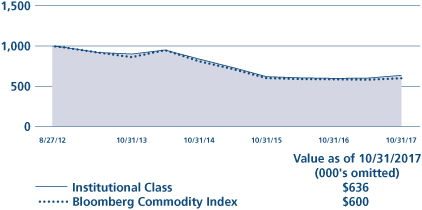

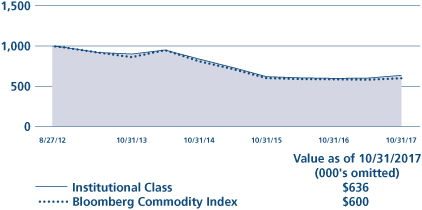

Risk Balanced Commodity Strategy Fund (Unaudited)

COMPARISON OF A $1,000,000 INVESTMENT

(000's omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

19

U.S. Equity Index PutWrite Strategy Fund Commentary (Unaudited)

Neuberger Berman U.S. Equity Index PutWrite Fund Institutional Class generated a total return of 13.05% for the 12-month period ending October 31, 2017, outperforming its primary benchmark, a custom blend consisting of 85% CBOE S&P 500 PutWrite Index and 15% CBOE Russell 2000 PutWrite Index (the benchmark), which posted a 12.09% return for the same period. (Performance for all share classes is provided in the table immediately following this letter.)

As intended, the Fund captured a meaningful portion of the gains in the U.S. equity markets as the S&P 500® Index and the Russell 2000® Index returned 23.63% and 27.85%, respectively. The Fund's fixed income collateral holdings of short-term U.S. Treasuries contributed marginally to returns as short-term U.S. Treasury bond yields increased over the period with the 2-Year U.S. Treasury yield nearly doubling to 1.60%. While this increase limited the performance contribution from the collateral portfolio, we anticipate short-term interest rates to rise, and believe that over time, the strategy will benefit as the shorter duration exposures of the Fund's collateral portfolio allow the Fund to capture higher yields without experiencing significant duration risk. The CBOE S&P 500 Volatility Index ("VIX") and CBOE Russell 2000 Volatility Index ("RVX"), two popular measures of index option implied volatility levels, remained near historically low levels for most of the year, averaging 11.7 and 16.5, respectively, over the period. Despite this continuation of low implied volatility levels for the VIX and RVX, the Fund was able to generate a relatively high risk-adjusted rate of return of over 3.0, which was the result of a low annual daily return volatility of 4.0% for the Fund. The Fund's results over the period continue to illustrate the ability of a collateralized put write strategy to earn an attractive rate of return during periods of lower volatility levels. Shareholders should keep in mind that the Fund's upside can be limited in a strong bull market.

The Fund's investment strategy seeks to collect index put option premiums and holds a fixed income portfolio typically consisting of cash and limited duration U.S. Treasury bonds that "collateralize" the short index put option positions. The market value of the fixed income portfolio is generally equal to the short index put option portfolio's aggregate notional value. Index put option premiums tend to increase during times of greater market uncertainty, which may afford the Fund a level of protection during periods of equity market stress as well as an opportunity to improve its total return potential. The setting of option premiums is a continuous process that assimilates investor sentiments and market risk factors into explicit estimates of prospective index price distributions for specific time horizons, i.e., option implied volatilities.

As we look towards 2018, we anticipate equity market return dispersion to continue to increase across various regions, sectors and industries due to a combination of diverse interest rate politics, increased global competition, geopolitics (e.g., U.S. tax reform and Brexit). As a result, we believe index returns are likely to be at or below longer-term averages, which may lead to higher relative returns versus the Fund's benchmark and related U.S. equity market indexes such as the S&P 500 Index and Russell 2000 Index.

Sincerely,

DEREK DEVENS

PORTFOLIO MANAGER

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio manager. The opinions are as of the date of this report and are subject to change without notice.

20

U.S. Equity Index PutWrite Strategy Fund (Unaudited)

TICKER SYMBOLS

Institutional Class | | NUPIX | |

Class A | | NUPAX | |

Class C | | NUPCX | |

Class R6 | | NUPRX | |

PORTFOLIO BY TYPE OF SECURITY

(as a % of Total Net Assets) | |

U.S. Treasury Obligations | | | 97.8 | % | |

Put Options Written | | | (0.5 | ) | |

Short-Term Investment | | | 3.3 | | |

Liabilities Less Other Assets | | | (0.6 | ) | |

Total | | | 100.0 | % | |

PERFORMANCE HIGHLIGHTS5

| | | | | Average Annual Total

Return Ended 10/31/2017 | |

| | | Inception

Date | | 1 Year | | Life of

Fund | |

At NAV | |

Institutional Class | | 09/16/2016 | | | 13.05 | % | | | 12.40 | % | |

Class A | | 09/16/2016 | | | 12.70 | % | | | 12.09 | % | |

Class C | | 09/16/2016 | | | 11.81 | % | | | 11.21 | % | |

Class R6 | | 09/16/2016 | | | 13.08 | % | | | 12.53 | % | |

With Sales Charge | |

Class A | | | | | 6.18 | % | | | 6.35 | % | |

Class C | | | | | 10.81 | % | | | 11.21 | % | |

Index | |

85% CBOE S&P 500 PutWrite Index and

15% CBOE Russell 2000 PutWrite Index1,2 | | | | | 12.09 | % | | | 11.48 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("Management") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by Management) will decrease the class's returns. Please see Note B in the Notes to Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the estimated total annual operating expense ratios for fiscal year 2017 are 1.49%, 1.85%, 2.60% and 1.42% for Institutional Class, Class A, Class C and Class R6 shares, respectively (before expense reimbursements and/or fee waivers, if any). The estimated total annual operating expense ratios for the current fiscal year are 0.65%, 1.01%, 1.76% and 0.58% for Institutional Class, Class A, Class C and Class R6 shares, respectively, after expense reimbursements and/or fee waivers. The expense ratios for the annual period ended October 31, 2017 can be found in the Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

21

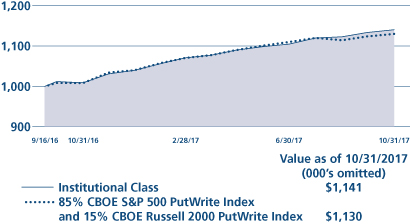

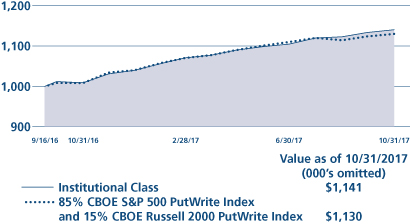

U.S. Equity Index PutWrite Strategy Fund (Unaudited)

COMPARISON OF A $1,000,000 INVESTMENT

(000's omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

22

1 Please see "Glossary of Indices" on page 24 for a description of indices. Please note that individuals cannot invest directly in any index. The HFRX Equity Hedge Index and HFRX Fixed Income-Credit Index do take into account fees and expenses, but not the tax consequences, of investing since they are based on the underlying hedge funds' net returns. The other indices described in this report do not take into account any fees, expenses or tax consequences of investing in the individual securities that they track. Data about the performance of an index are prepared or obtained by Neuberger Berman Investment Advisers LLC* and reflect the reinvestment of income dividends and other distributions, if any. The Fund may invest in securities not included in a described index and generally does not invest in all securities included in a described index.

2 The date used to calculate Life of Fund performance for the index is the inception date of the oldest share class.

3 During the period from December 2010 through April 2011, Neuberger Berman Global Allocation Fund had only one shareholder and the Fund was relatively small, which could have impacted Fund performance. During the period from August 2012 through January 2013, Neuberger Berman Risk Balanced Commodity Strategy Fund was relatively small, which could have impacted Fund performance. The same techniques used to produce returns in a small fund may not work to produce similar returns in a larger fund.

4 Neuberger Berman Hedged Option Premium Strategy Fund is relatively small which could have impacted Fund performance. The same techniques used to produce returns in a small fund may not work to produce similar returns in a larger fund.

5 The investments for the Fund are managed by the same portfolio manager(s) who manage(s) one or more other registered funds that have names, investment objectives and investment styles that are similar to those of the Fund. You should be aware that the Fund is likely to differ from those other mutual fund(s) in size, cash flow pattern and tax matters. Accordingly, the holdings and performance of the Fund can be expected to vary from those of the other mutual fund(s).

* On January 1, 2016, Neuberger Berman Management LLC ("NBM") and Neuberger Berman LLC ("Neuberger Berman") transferred to Neuberger Berman Fixed Income LLC ("NBFI") their rights and obligations pertaining to all services they provided to any Fund under any investment management, investment sub-advisory, and/or administration agreement, as applicable (the "Agreements"). Following such transfer, NBFI was renamed Neuberger Berman Investment Advisers LLC ("NBIA" or "Management"). In addition, since the date of the transfer, the services previously provided by NB Alternative Investment Management LLC ("NBAIM") have been provided by NBIA. Following the consolidation, the investment professionals of NBM and NBAIM who provided services to any Fund under the Agreements continue to provide the same services, except that they provide those services in their new capacities as investment professionals of NBIA. Further, the consolidation did not result in any change in the investment processes employed by any Fund, the nature or level of services provided to any Fund, or the fees any Fund pays under its Agreements.

On July 1, 2016, NBM was reorganized into Neuberger Berman (the "Reorganization"). Upon the completion of the Reorganization, Neuberger Berman assumed all rights and obligations pertaining to all services NBM provided to any Fund under any distribution agreement or distribution and services agreement (the "Agreements") or plan adopted pursuant to Rule 12b-1 under the Investment Company Act of 1940, as amended, (the "Plans"). Accordingly, after the Reorganization, Neuberger Berman became each Fund's distributor and the services previously provided by NBM under the Agreements and Plans are provided by Neuberger Berman. Following the Reorganization, the employees of NBM provide the same services to each Fund under the Agreements and Plans, except that they provide those services in their capacities as employees of Neuberger Berman. Further, the Reorganization did not result in any change in the nature or level of services provided to each Fund, or the fees, if any, each Fund pays under the Agreements or the Plans.

On January 1, 2017, the Funds' distributor, Neuberger Berman, changed its name to Neuberger Berman BD LLC.

For more complete information on any of the Neuberger Berman Alternative and Multi-Asset Class Funds, see the Fund's prospectus, which can be obtained by calling us at (800) 877-9700, or visiting our website at www.nb.com.

23

Bloomberg Barclays Global Aggregate Index: | | The index measures global investment grade debt from twenty-four different local currency markets and includes fixed-rate treasury, government-related, corporate and securitized bonds from both developed and emerging markets issuers. The index is largely comprised of three major regional aggregate components: the Bloomberg Barclays U.S. Aggregate Bond Index, the Bloomberg Barclays Pan-European Aggregate Bond Index, and the Bloomberg Barclays Asian-Pacific Aggregate Index. In addition to securities from these three indices, the Bloomberg Barclays Global Aggregate Index also includes investment grade Eurodollar, Euro-Yen, Canadian, and 144A Index-eligible securities not already in these three indices. | |

Bloomberg Barclays U.S. Aggregate Bond Index: | | The index measures the investment grade, U.S. dollar-denominated, fixed-rate, taxable bond market and includes Treasuries, government-related and corporate securities, mortgage-backed securities (MBS) (agency fixed-rate and hybrid adjustable rate mortgage (ARM) pass-throughs), asset-backed securities (ABS), and commercial mortgage-backed securities (CMBS) (agency and nonagency). | |

60% Bloomberg Barclays U.S. Aggregate Bond Index and 40% S&P 500® Index: | | The blended index is composed of 60% Bloomberg Barclays U.S. Aggregate Bond Index (described above) and 40% S&P 500® Index (described below), and is rebalanced monthly. | |

Bloomberg Commodity Index: | | The index is a rolling index composed of exchange-traded futures contracts on physical commodities. The index relies primarily on liquidity data of futures contracts, along with U.S. dollar-adjusted production data, in determining the relative quantities of included commodities. The index is designed to be a highly liquid and diversified benchmark for commodities investments. The version of the index that is calculated on a total return basis reflects the returns on a fully collateralized investment in the underlying commodity futures contracts, combined with the returns on cash collateral invested in Treasury Bills. | |

CBOE Russell 2000® PutWrite Index: | | The index tracks the value of a passive investment strategy which consists of overlaying Russell 2000 (RUT) short put options over a money market account invested in one-month Treasury bills. The RUT puts are struck at-the-money and are sold on a monthly basis. | |

CBOE S&P 500® Iron Condor Index: | | The index is designed to track the performance of a hypothetical option selling strategy that sells monthly call and put spreads and holds a money market account invested in one-month Treasury bills. The call spread consists of a short position in an out-of-the-money S&P 500 Index call option with a delta of approximately 0.20 and a long position in a further out-of-the-money S&P 500 Index call option with a delta of approximately 0.05. The put spread consists of a short position in an out-of-the-money S&P 500 Index put option with a delta of approximately –0.20 and a long position in a further out-of-the-money S&P 500 Index put option with a delta of approximately –0.05. Call and put spread positions are sized such that their notional strike differences represent 5% of the market value of the money market account. The money market account is rebalanced on option roll days and is designed to limit the downside return of the index. The delta of an option measures its price sensitivity to the price of the underlying asset. For example, if a call option has a delta of 0.20 and the price of the underlying asset increases by $1, the value of the option will increase by $0.20. | |

CBOE S&P 500® PutWrite Index: | | The index tracks the value of a passive investment strategy which consists of overlaying S&P 500 (SPX) short put options over a money market account invested in one- and three-months Treasury bills. The SPX puts are struck at-the-money and are sold on a monthly basis. | |

24

Glossary of Indices (cont'd)

85% CBOE S&P 500® PutWrite Index and 15% CBOE Russell 2000® PutWrite Index: | | The blended index is composed of 85% CBOE S&P 500 PutWrite Index (described above) and 15% CBOE Russell 2000 PutWrite Index (described above), and is rebalanced monthly. | |

HFRX Fixed Income-Credit

Index: | | The index tracks the performance of hedge fund strategies with exposure to credit across a broad continuum of credit sub-strategies, including Corporate, Sovereign, Distressed, Convertible, Asset Backed, Capital Structure Arbitrage, Multi-Strategy and other Relative Value and Event Driven sub-strategies. The investment thesis across all strategies is predicated on realization of a valuation discrepancy between the related credit instruments. Strategies may also include and utilize equity securities, credit derivatives, government fixed income, commodities, currencies or other hybrid securities. Constituent funds are selected from an eligible pool of the more than 7,500 funds worldwide that report to the Hedge Fund Research (HFR) Database. Constituent funds must meet all of the following criteria: report monthly; report performance net of all fees; be U.S. dollar-denominated; be active and accepting new investments; have a minimum 24 months track record; and the fund's manager must have at least $50 million in assets under management. Constituents are weighted by a representative optimization methodology. The index is rebalanced quarterly. | |