As filed with the Securities and Exchange Commission on January 5, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811- 21715

NEUBERGER BERMAN ALTERNATIVE FUNDS

(Exact Name of Registrant as specified in charter)

c/o Neuberger Berman Investment Advisers LLC

1290 Avenue of the Americas

New York, New York 10104-0002

(Address of Principal Executive Offices – Zip Code)

Joseph V. Amato

Chief Executive Officer and President

Neuberger Berman Alternative Funds

c/o Neuberger Berman Investment Advisers LLC

1290 Avenue of the Americas

New York, New York 10104-0002

Lori L. Schneider, Esq.

K&L Gates LLP

1601 K Street, N.W.

Washington, D.C. 20006-1600

(Names and Addresses of agents for service)

Registrant’s telephone number, including area code: (212) 476-8800

Date of fiscal year end: October 31

Date of reporting period: October 31, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940, as amended (“Act”) (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-1090. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Report to Shareholders.

(a) Following are copies of the annual reports transmitted to shareholders pursuant to Rule 30e-1 under the Act.

Neuberger Berman

Alternative and Multi-Asset Class Funds

Institutional Class Shares

Class A Shares

Class C Shares

Class R6 Shares

Class E Shares

Absolute Return Multi-Manager Fund

Annual Report

October 31, 2022

Contents

PRESIDENT'S LETTER | | | 1 | | |

PORTFOLIO COMMENTARY | | | 2 | | |

FUND EXPENSE INFORMATION | | | 8 | | |

CONSOLIDATED SCHEDULE OF INVESTMENTS | | | 10 | | |

CONSOLIDATED FINANCIAL STATEMENTS | | | 29 | | |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | | | 34 | | |

CONSOLIDATED FINANCIAL HIGHLIGHTS (ALL CLASSES) | | | 51 | | |

Report of Independent Registered Public Accounting Firm | | | 54 | | |

Directory | | | 55 | | |

Trustees and Officers | | | 56 | | |

Proxy Voting Policies and Procedures | | | 66 | | |

Quarterly Portfolio Schedule | | | 66 | | |

Liquidity Risk Management Program | | | 66 | | |

Notice to Shareholders | | | 66 | | |

Report of Votes to Shareholders | | | 67 | | |

Board Consideration of the Management and

Sub-Advisory Agreements | | | 68 | | |

The "Neuberger Berman" name and logo and "Neuberger Berman Investment Advisers LLC" name are registered service marks of Neuberger Berman Group LLC. The individual Fund name in this piece is either a service mark or registered service mark of Neuberger Berman Investment Advisers LLC, an affiliate of Neuberger Berman BD LLC, distributor, member FINRA. ©2022 Neuberger Berman BD LLC, distributor. All rights reserved.

Dear Shareholder,

I am pleased to present this annual shareholder report for Neuberger Berman Absolute Return Multi-Manager Fund covering the 12-month period ended October 31, 2022 (the reporting period).

It was an extremely challenging period in the global financial markets during the reporting period. Sharply rising and persistent inflation was a major factor impacting the market. The U.S. Federal Reserve Board (Fed) initially thought rising prices were transitory and they would come down as COVID-driven supply chain bottlenecks eased. However, these issues continued, consumer demand remained strong, and the impact from the war in Ukraine created a "perfect storm," pushing inflation in the U.S. to a new 40-year high.

This caused the Fed to pivot from its highly accommodative monetary policy that was in place to support the economy during the pandemic, to an aggressively tightening policy in an attempt to rein in inflation. The Fed first raised interest rates in March 2022 from a range between 0.00% to 0.25% to a range between 0.25% to 0.50%. With inflation moving steadily higher, the central bank again raised rates at its next four meetings, and again in early November (after the reporting period ended). With the last increase, the Fed funds rate moved to a range between 3.75% and 4.00%, and the Fed expects to continue raising rates "until the job is done."

Both the global stock and bond markets generated weak results during the reporting period. In addition to high inflation and aggressive Fed tightening, there were concerns that the central bank may drive the economy into a recession and negatively impact corporate profits. All told, the S&P 500® Index returned –14.61% during the reporting period. Meanwhile, international developed and emerging market equities, as measured by the MSCI EAFE® and MSCI Emerging Market (Net) Indices, returned –23.00% and –31.03%, respectively, over the reporting period. Meanwhile, with short- and long-term Treasury yields moving sharply higher bond prices declined (yields and bond prices move in the opposite direction). For the reporting period the broad taxable investment-grade bond market, as measured by the Bloomberg U.S. Aggregate Bond Index, returned –15.68%.

Looking ahead, we believe market volatility will remain elevated, driven by challenging growth and inflation dynamics, as well as uncertainty around monetary and fiscal policy. Investors will closely watch the progression of economic data over the coming months as central bank tightening continues to work its way through the economy. We believe we are moving from the post-Global Financial Crisis/pre-COVID regime to a new environment that will continue to pose headwinds for risk assets in the near-to-medium term. We also anticipate earnings growth to slow meaningfully in the coming months, driven by declining demand, rising costs, inventory build-up, and currency headwinds weighing on margins. Against this backdrop, we believe active portfolio management can be valuable to help navigate the factors impacting the markets, and to seek out attractive opportunities during periods of heightened volatility.

Thank you for your continued support and trust. We look forward to continue serving your investment needs in the years to come.

Sincerely,

JOSEPH V. AMATO

PRESIDENT AND CEO

NEUBERGER BERMAN ALTERNATIVE FUNDS

1

Absolute Return Multi-Manager Fund Commentary (Unaudited)

Neuberger Berman Absolute Return Multi-Manager Fund Institutional Class generated a 4.30% total return for the 12 months ended October 31, 2022 (the reporting period), outperforming its primary benchmark, the HFRX® Global Hedge Fund Index (the Index), which posted a –5.28% total return for the same period. (Performance for all share classes is provided in the table following this letter.)

Global equities sold off during the reporting period after a strong run of performance due to a combination of COVID-19 vaccine dissemination and both monetary and fiscal stimulus. These factors, combined with pent up consumer demand, supply chain issues, and geopolitical conflict, drove inflation to elevated levels, with inflation remaining stubbornly high despite the U.S. Federal Reserve Board (Fed) hiking interest rates at a rapid pace. While the labor market stayed strong, markets became increasingly concerned about the impact of rising rates and inflation on the consumer, capital markets, and corporate earnings. While U.S. Treasury yields moved significantly higher, the yield curve flattened and inverted. Performance for the U.S. dollar was strong versus most major currencies. Energy commodity prices rallied for most of the reporting period, while stabilizing in recent months, and the price of gold declined.

Gains from global macro/managed futures and merger arbitrage/event driven outpaced losses from long/short equity during the reporting period. From a risk management perspective, we were pleased that the Fund's volatility and betas* (risk) relative to the S&P 500® and Bloomberg U.S. Aggregate Bond Indices were all in line with our expectations.

The allocation to global macro/managed futures strategies was the primary driver of returns for the reporting period, with gains split roughly evenly between the managed futures and systematic currency strategies. Positive performance from the managed futures allocation was driven mainly by interest rate positioning, commodities, and currencies, which outpaced small losses from equity exposure. Gains within the systematic currency strategy came primarily from long U.S. dollar positioning versus the euro and, to a lesser extent, versus the Australian dollar and Japanese yen.

The merger arbitrage/event driven allocation contributed positively as a number of deals progressed and closed during the reporting period.

The allocation to long/short equity strategies detracted from performance, as losses from longs outpaced gains from shorts, while the managers in aggregate generated negative returns from both longs and shorts.

The Fund's aggregate use of futures, forward foreign currency, swap contracts and written options contributed positively to performance during the reporting period.

We continue to position the Fund to seek to benefit from elevated volatility, with additional upside if interest rates continue to rise. The Fund's largest allocation is to global macro/managed futures strategies. We believe that increases in market volatility may be beneficial for these strategies, as has been the case historically. In addition, we believe that macroeconomic conditions across regions, as well as differences in fiscal and monetary policies, have the potential to continue driving trends across asset classes. The Fund's second largest strategy allocation is long/short equity. After a period of negative contributions to returns from the strategy, they began to inflect positively in the late third calendar quarter of 2022, and we believe this may continue to play out to the extent fundamentals become a greater driver of price movement. We continue to anticipate a high dispersion of winners and losers over the medium term, driven by a number of factors, including inflation, increasing costs of capital, currency effects, and varying levels of economic sensitivity. The Fund's third largest allocation is to merger arbitrage/event driven strategies. While merger and acquisition activity may decline from the robust levels achieved over the last several quarters, we believe that current deal volumes and spreads offer ample opportunities to put capital to work with what we believe to be fairly attractive expected returns.

Sincerely,

DAVID KUPPERMAN, JEFF MAJIT AND FRED INGHAM

PORTFOLIO MANAGERS

2

* Beta is a measure of the systematic risk of a portfolio. It is the covariance of the portfolio and a market index divided by the variance of the market index. Beta measures the historical sensitivity of a portfolio's returns to movements in the market index. The beta of the market index will always be one. A portfolio with a beta above the market index (i.e., >1) means that the portfolio has greater volatility than the market index. If the beta of the portfolio is 1.2, a market increase in return of 1% implies a 1.2% increase in the portfolio's return. If the beta of the portfolio is 0.8, a market decrease in return of 1% implies a 0.8% decrease in the portfolio's return.

Information about principal risks of investing in the Fund is set forth in the prospectus and statement of additional information.

The portfolio composition, industries and holdings of the Fund are subject to change without notice.

The opinions expressed are those of the Fund's portfolio managers and subadvisers. The opinions are as of the date of this report and are subject to change without notice.

3

Absolute Return Multi-Manager Fund (Unaudited)

TICKER SYMBOLS

Institutional Class | | NABIX | |

Class A | | NABAX | |

Class C | | NABCX | |

Class R6 | | NRABX | |

Class E | | NABEX | |

PORTFOLIO BY INVESTMENT TYPE

(as a % of Total Net Assets)

| | Long | | Short | |

Common Stocks | | | 28.8 | % | | | (6.0 | )% | |

Convertible Preferred Stocks | | | 0.1 | | | | — | | |

Corporate Bonds | | | 0.0 | | | | — | | |

Loan Assignments | | | 0.0 | | | | — | | |

Rights | | | 0.1 | | | | — | | |

Warrants | | | 0.0 | | | | — | | |

Short-Term Investments | | | 69.0 | | | | — | | |

Other Assets Less Liabilities | | | 8.0 | * | | | — | | |

Total | | | 106.0 | % | | | (6.0 | )% | |

* Includes the impact of the Fund's open positions in derivatives (other than options purchased), if any.

PERFORMANCE HIGHLIGHTS

| | | | Average Annual Total Return

Ended 10/31/2022 | |

| | Inception

Date | | 1 Year | | 5 Years | | 10 Years | | Life of

Fund | |

At NAV | |

Institutional Class | | 05/15/2012 | | | 4.30 | % | | | 3.09 | % | | | 2.83 | % | | | 2.70 | % | |

Class A | | 05/15/2012 | | | 3.84 | % | | | 2.71 | % | | | 2.45 | % | | | 2.33 | % | |

Class C | | 05/15/2012 | | | 3.02 | % | | | 1.94 | % | | | 1.69 | % | | | 1.56 | % | |

| Class R63 | | 12/31/2013 | | | 4.40 | % | | | 3.18 | % | | | 2.89 | % | | | 2.76 | % | |

| Class E3 | | 01/11/2022 | | | 5.18 | % | | | 3.27 | % | | | 2.92 | % | | | 2.78 | % | |

With Sales Charge | |

Class A | | | | | –2.11 | % | | | 1.50 | % | | | 1.84 | % | | | 1.75 | % | |

Class C | | | | | 2.02 | % | | | 1.94 | % | | | 1.69 | % | | | 1.56 | % | |

Index | |

HFRX® Global Hedge Fund

Index1,2 | | | | | –5.28 | % | | | 1.55 | % | | | 1.89 | % | | | 1.81 | % | |

| S&P 500® Index1,2 | | | | | –14.61 | % | | | 10.44 | % | | | 12.79 | % | | | 12.86 | % | |

Bloomberg U.S. Aggregate

Bond Index1,2 | | | | | –15.68 | % | | | –0.54 | % | | | 0.74 | % | | | 0.92 | % | |

The performance data quoted represent past performance and do not indicate future results. Current performance may be lower or higher than the performance data quoted. For current performance data, including current to the most recent month-end, please visit www.nb.com/performance.

The results shown in the table reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost.

Returns would have been lower if Neuberger Berman Investment Advisers LLC ("NBIA") had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. Repayment by a class (of expenses previously reimbursed and/or fees previously waived by NBIA) will decrease the class's returns. Please see Note B in the Notes to Consolidated Financial Statements for specific information regarding expense reimbursement and/or fee waiver arrangements.

As stated in the Fund's most recent prospectus, the total annual operating expense ratios for fiscal year 2021 were 2.97%, 3.35%, 4.10% and 2.90% for Institutional Class, Class A, Class C and Class R6 shares, respectively, and the estimated total annual operating expense ratio for fiscal year 2022 is 2.84% for Class E (before expense reimbursements and/or fee waivers, if any). The expense ratios were 2.20%, 2.57%, 3.31% and 2.11% for Institutional Class, Class A, Class C and Class R6 shares, respectively, and the estimated expense ratio for fiscal year 2022 is 1.14% for Class E after expense reimbursements and/or fee waivers. The expense ratios for the annual period ended October 31, 2022, can be found in the Consolidated Financial Highlights section of this report.

Returns shown with a sales charge reflect the deduction of the current maximum initial sales charge of 5.75% for Class A shares and the contingent deferred sales charge (CDSC) for Class C shares. The CDSC for Class C shares is 1.00%, which is reduced to 0% after 1 year. The performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses. Please see the prospectus for more information about sales charge structures, if any, and class expenses for your share class.

4

Absolute Return Multi-Manager Fund (Unaudited)

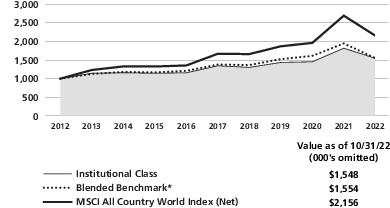

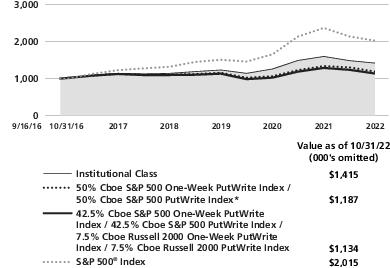

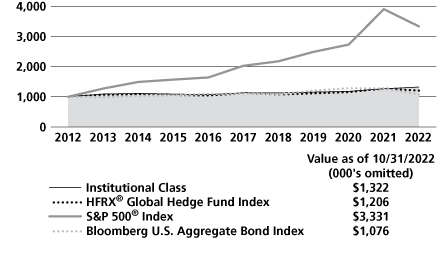

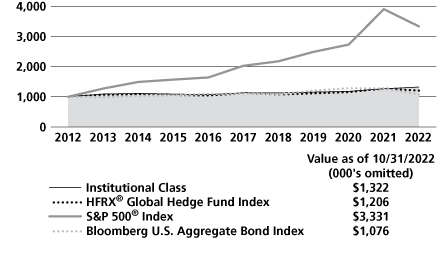

COMPARISON OF A $1,000,000 INVESTMENT

(000's omitted)

This graph shows the change in value of a hypothetical $1,000,000 investment in the Fund over the past 10 fiscal years, or since the Fund's inception if it has not operated for 10 years. The graph is based on the Institutional Class shares only; the performance of the Fund's share classes will differ primarily due to different sales charge structures and class expenses (see Performance Highlights chart on previous page). The result is compared with benchmarks, which include a broad-based market index and may include a more narrowly based index. Market indices have not been reduced to reflect any of the fees and costs of investing. The results shown in the graph reflect the reinvestment of income dividends and other distributions, if any. The results do not reflect the effect of taxes a shareholder would pay on Fund distributions or on the redemption of Fund shares. Results represent past performance and do not indicate future results.

5

1 Please see "Glossary of Indices" on page 7 for a description of indices. Please note that individuals cannot invest directly in any index. The S&P 500® and the Bloomberg U.S. Aggregate Bond Indices do not take into account any fees, expenses or tax consequences of investing in the individual securities that they track. The HFRX® Global Hedge Fund Index does take into account fees and expenses, but not tax consequences, of investing since it is based on the underlying hedge funds' net returns. Data about the performance of an index are prepared or obtained by NBIA and reflect the reinvestment of income dividends and other distributions, if any. The Fund may invest in securities not included in a described index and generally does not invest in all securities included in a described index.

2 The date used to calculate Life of Fund performance for the index is the inception date of the oldest share class.

3 The performance information for Class R6 and Class E prior to the classes' respective inception dates is that of the Institutional Class of Neuberger Berman Absolute Return Multi-Manager Fund. The performance information for the Institutional Class has not been adjusted to take into account differences in class specific operating expenses. The Institutional Class has higher expenses and typically lower returns than Class R6 and Class E.

For more complete information on any of the Neuberger Berman Alternative and Multi-Asset Class Funds, call us at (800) 877-9700, or visit our website at www.nb.com.

6

Glossary of Indices (Unaudited)

Bloomberg U.S. Aggregate

Bond Index: | | The index measures the investment grade, U.S. dollar-denominated, fixed-rate, taxable bond market and includes Treasuries, government-related and corporate securities, mortgage-backed securities (MBS) (agency fixed-rate and hybrid adjustable rate mortgage (ARM) pass-throughs), asset-backed securities (ABS), and commercial mortgage-backed securities (CMBS) (agency and nonagency). Effective August 24, 2021 all Bloomberg Barclays fixed income indices were rebranded as "Bloomberg indices". | |

HFRX® Global Hedge Fund

Index: | | The index is designed to be representative of the overall composition of the hedge fund universe. It is comprised of all eligible hedge fund strategies; including but not limited to convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry. Constituent funds are selected from an eligible pool of the more than 7,500 funds worldwide that report to the Hedge Fund Research (HFR) Database. Constituent funds must meet all of the following criteria: report monthly; report performance net of all fees; be U.S. dollar denominated; be active and accepting new investments; have a minimum 24 month track record; and the fund's manager must have at least $50 million in assets under management. The index is rebalanced quarterly. | |

| S&P 500® Index: | | The index is a float-adjusted market capitalization-weighted index that focuses on the large-cap segment of the U.S. equity market, and includes a significant portion of the total value of the market. | |

7

Information About Your Fund's Expenses (Unaudited)

As a Fund shareholder, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds (if applicable); and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees (if applicable), and other Fund expenses. This example is intended to help you understand your ongoing costs (in U.S. dollars) of investing in the Fund and compare these costs with the ongoing costs of investing in other mutual funds.

This table is designed to provide information regarding costs related to your investments. The following examples are based on an investment of $1,000 made at the beginning of the six month period ended October 31, 2022 and held for the entire period. The table illustrates the Fund's costs in two ways:

Actual Expenses and Performance: | | The first section of the table provides information about actual account values and actual expenses in dollars, based on the Fund's actual performance during the period indicated. You may use the information in this line, together with the amount you invested, to estimate the expenses you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section of the table under the heading entitled "Expenses Paid During the Period" to estimate the expenses you paid over the period. | |

Hypothetical Example for Comparison Purposes: | | The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return at 5% per year before expenses. This return is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund versus other funds. To do so, compare the expenses shown in this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. | |

Please note that the expenses in the table are meant to highlight your ongoing costs only and do not include any transaction costs, such as sales charges (loads) (if applicable). Therefore, the information under the heading "Hypothetical (5% annual return before expenses)" is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

8

Expense Example (Unaudited)

Neuberger Berman Alternative Funds | |

| | ACTUAL | | HYPOTHETICAL (5% ANNUAL RETURN BEFORE EXPENSES) | |

| | Beginning

Account

Value

5/1/2022 | | Ending

Account

Value

10/31/2022 | | Expenses Paid

During the

Period

5/1/2022 -

10/31/2022(1)(3) | | Expense

Ratio | | Beginning

Account

Value

5/1/2022 | | Ending

Account

Value

10/31/2022 | | Expenses Paid

During the

Period

5/1/2022 -

10/31/2022(2)(3) | | Expense

Ratio | |

Absolute Return Multi-Manager Fund | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,025.00 | | | $ | 11.02 | | | | 2.16 | % | | $ | 1,000.00 | | | $ | 1,014.32 | | | $ | 10.97 | | | | 2.16 | % | |

Class A | | $ | 1,000.00 | | | $ | 1,022.00 | | | $ | 12.54 | | | | 2.46 | % | | $ | 1,000.00 | | | $ | 1,012.80 | | | $ | 12.48 | | | | 2.46 | % | |

Class C | | $ | 1,000.00 | | | $ | 1,018.70 | | | $ | 16.43 | | | | 3.23 | % | | $ | 1,000.00 | | | $ | 1,008.92 | | | $ | 16.36 | | | | 3.23 | % | |

Class R6 | | $ | 1,000.00 | | | $ | 1,025.00 | | | $ | 10.36 | | | | 2.03 | % | | $ | 1,000.00 | | | $ | 1,014.97 | | | $ | 10.31 | | | | 2.03 | % | |

Class E | | $ | 1,000.00 | | | $ | 1,030.10 | | | $ | 6.50 | | | | 1.27 | % | | $ | 1,000.00 | | | $ | 1,018.80 | | | $ | 6.46 | | | | 1.27 | % | |

(1) For each class, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown), unless otherwise indicated.

(2) Hypothetical expenses are equal to the annualized expense ratios for each class, multiplied by the average account value over the period (assuming a 5% annual return), multiplied by 184/365 (to reflect the one-half year period shown).

(3) Includes expenses of the Fund's subsidiary (See Note A of the Notes to Consolidated Financial Statements).

9

Consolidated Schedule of Investments Absolute Return Multi-Manager Fund^ October 31, 2022

Investments | | Shares | |

Value | |

Long Positions 98.0% | |

Common Stocks 28.8% | |

Air Freight & Logistics 0.1% | |

Atlas Air

Worldwide

Holdings,

Inc.* | | | 350 | | | $ | 35,399 | | |

GXO Logistics,

Inc.* | | | 4,425 | | | | 161,689 | | |

| | | | 197,088 | | |

Airlines 0.1% | |

American

Airlines

Group, Inc.* | | | 768 | | | | 10,890 | | |

Spirit Airlines,

Inc. | | | 3,800 | | | | 83,600 | | |

| | | | 94,490 | | |

Auto Components 0.1% | |

Tenneco, Inc.,

Class A* | | | 5,901 | | | | 116,250 | | |

Automobiles 0.2% | |

General Motors

Co. | | | 7,189 | | | | 282,168 | | |

Banks 0.8% | |

Bank of America

Corp. | | | 6,582 | | | | 237,215 | | |

First Horizon

Corp. | | | 33,295 | | | | 816,061 | | |

PCSB Financial

Corp. | | | 6,500 | | | | 126,685 | | |

| | | | 1,179,961 | | |

Biotechnology 0.6% | |

Akouos, Inc.* | | | 19,900 | | | | 262,083 | | |

AVEO

Pharmaceuticals,

Inc.* | | | 4,177 | | | | 61,694 | | |

BioMarin

Pharmaceutical,

Inc.* | | | 4,552 | | | | 394,340 | | |

Grifols SA, ADR

(Spain)* | | | 3,800 | | | | 23,978 | | |

Myovant

Sciences Ltd.* | | | 2,000 | | | | 53,480 | | |

| | | | 795,575 | | |

Capital Markets 0.3% | |

BlackRock, Inc. | | | 388 | | | | 250,613 | | |

Cowen, Inc.,

Class A | | | 300 | | | | 11,586 | | |

Pegasus

Acquisition Co.

Europe BV,

Class A

(Netherlands)* | | | 12,042 | | | | 114,840 | | |

Investments | | Shares | |

Value | |

Pershing

Square,

Escrow*(a) | | | 6,100 | | | $ | 610 | | |

| | | | 377,649 | | |

Commercial Services & Supplies 0.2% | |

Rentokil

Initial plc, ADR

(United Kingdom) | | | 9,810 | | | | 303,521 | | |

Communications Equipment 0.6% | |

Cisco Systems,

Inc. | | | 4,607 | | | | 209,296 | | |

Comtech

Telecommunications

Corp. | | | 3,250 | | | | 35,913 | | |

Motorola

Solutions, Inc. | | | 1,455 | | | | 363,328 | | |

Sierra Wireless,

Inc. (Canada)* | | | 10,036 | | | | 297,868 | | |

| | | | 906,405 | | |

Construction & Engineering 0.3% | |

Quanta Services,

Inc. | | | 3,297 | | | | 468,306 | | |

Diversified Financial Services 0.6% | |

Apollo Global

Management,

Inc. | | | 7,152 | | | | 395,935 | | |

Equitable

Holdings, Inc. | | | 16,680 | | | | 510,741 | | |

| | | | 906,676 | | |

| Diversified Telecommunication Services 0.0%(b) | |

Telesat Corp.

(Canada)* | | | 2,585 | | | | 22,515 | | |

Electric Utilities 1.2% | |

Alliant Energy

Corp. | | | 6,207 | | | | 323,819 | | |

NextEra Energy,

Inc. | | | 4,231 | | | | 327,903 | | |

PG&E Corp.* | | | 27,033 | | | | 403,603 | | |

PNM Resources,

Inc. | | | 12,484 | | | | 580,131 | | |

| | | | 1,635,456 | | |

Electronic Equipment, Instruments & Components 0.5% | |

Rogers Corp.* | | | 3,000 | | | | 705,990 | | |

Entertainment 0.9% | |

Activision

Blizzard, Inc. | | | 14,599 | | | | 1,062,807 | | |

Liberty Media

Corp-Liberty

Braves, Class C* | | | 2,304 | | | | 71,793 | | |

Investments | | Shares | |

Value | |

Sciplay Corp.,

Class A* | | | 4,150 | | | $ | 58,058 | | |

| | | | 1,192,658 | | |

Equity Real Estate Investment Trusts (REITs) 0.4% | |

STORE Capital

Corp. | | | 18,105 | | | | 575,729 | | |

Food & Staples Retailing 0.3% | |

Albertsons

Cos., Inc.,

Class A | | | 2,100 | | | | 43,071 | | |

Cia Brasileira

de Distribuicao,

ADR (Brazil)* | | | 1,664 | | | | 7,005 | | |

Fresh Market,

Inc. (The)

Escrow*(a) | | | 46,500 | | | | — | | |

Magnit PJSC

(Russia)(a)(c) | | | 327 | | | | — | | |

Sendas

Distribuidora SA,

ADR (Brazil) | | | 3,520 | | | | 67,056 | | |

Wal-Mart de

Mexico SAB de

CV (Mexico) | | | 39,227 | | | | 151,519 | | |

Walmart, Inc. | | | 958 | | | | 136,352 | | |

X5 Retail

Group NV, GDR

(Russia)(a)(c)(d) | | | 4,390 | | | | — | | |

| | | | 405,003 | | |

Food Products 0.9% | |

Nestle SA

(Registered) | | | 11,391 | | | | 1,240,400 | | |

Gas Utilities 0.3% | |

South Jersey

Industries, Inc. | | | 11,550 | | | | 400,438 | | |

Southwest Gas

Holdings, Inc. | | | 650 | | | | 47,496 | | |

| | | | 447,934 | | |

Health Care Equipment & Supplies 0.1% | |

Meridian

Bioscience, Inc.* | | | 5,106 | | | | 163,239 | | |

Health Care Providers & Services 1.0% | |

1Life

Healthcare,

Inc.* | | | 9,400 | | | | 160,740 | | |

Elevance

Health, Inc. | | | 1,006 | | | | 550,051 | | |

LHC Group,

Inc.* | | | 2,190 | | | | 365,949 | | |

Shanghai

Pharmaceuticals

Holding Co. Ltd.,

Class H (China) | | | 27,684 | | | | 37,519 | | |

See Notes to Consolidated Financial Statements

10

Consolidated Schedule of Investments Absolute Return Multi-Manager Fund^ (cont'd)

Investments | | Shares | |

Value | |

Signify Health,

Inc., Class A*(e) | | | 10,412 | | | $ | 304,343 | | |

Sinopharm

Group Co. Ltd.,

Class H (China) | | | 15,345 | | | | 29,111 | | |

| | | | 1,447,713 | | |

Hotels, Restaurants & Leisure 0.4% | |

Booking

Holdings, Inc.* | | | 151 | | | | 282,292 | | |

Expedia

Group, Inc.* | | | 1,877 | | | | 175,443 | | |

Playtech plc

(United

Kingdom)* | | | 8,600 | | | | 51,186 | | |

Recipe

Unlimited Corp.

(Canada)* | | | 6,500 | | | | 98,859 | | |

| | | | 607,780 | | |

Household Durables 0.2% | |

iRobot Corp.* | | | 1,391 | | | | 78,591 | | |

Lennar Corp.,

Class B | | | 2,800 | | | | 182,616 | | |

| | | | 261,207 | | |

Household Products 0.1% | |

Spectrum

Brands

Holdings, Inc. | | | 2,086 | | | | 96,248 | | |

Insurance 0.8% | |

AIA Group Ltd.

(Hong Kong) | | | 57,852 | | | | 438,217 | | |

Aon plc, Class A | | | 1,030 | | | | 289,935 | | |

Chubb Ltd. | | | 2,097 | | | | 450,624 | | |

| | | | 1,178,776 | | |

Interactive Media & Services 1.1% | |

Alphabet, Inc.,

Class A* | | | 10,904 | | | | 1,030,537 | | |

Baidu, Inc.,

ADR (China)* | | | 636 | | | | 48,699 | | |

Baidu, Inc.,

Class A (China)* | | | 1,560 | | | | 14,956 | | |

Meta

Platforms, Inc.,

Class A* | | | 4,246 | | | | 395,557 | | |

VK Co. Ltd.,

GDR

(Russia)*(a)(c)(d) | | | 1,305 | | | | — | | |

Yandex NV,

Class A

(Russia)*(a)(c) | | | 1,428 | | | | — | | |

| | | | 1,489,749 | | |

Internet & Direct Marketing Retail 2.2% | |

Alibaba Group

Holding Ltd.,

ADR (China)* | | | 6,395 | | | | 406,594 | | |

Investments | | Shares | |

Value | |

Alibaba Group

Holding Ltd.

(China)* | | | 17,250 | | | $ | 134,117 | | |

Altaba, Inc.

Escrow*(a) | | | 63,506 | | | | 241,323 | | |

Amazon.com,

Inc.* | | | 6,058 | | | | 620,582 | | |

ASOS plc

(United

Kingdom)* | | | 1,085 | | | | 7,011 | | |

Deliveroo plc

(United

Kingdom)*(d) | | | 11,689 | | | | 11,684 | | |

eBay, Inc. | | | 4,054 | | | | 161,511 | | |

JD.com, Inc.,

Class A (China) | | | 323 | | | | 5,882 | | |

MercadoLibre,

Inc. (Brazil)* | | | 446 | | | | 402,123 | | |

Overstock.com,

Inc.* | | | 7,031 | | | | 163,471 | | |

Poshmark, Inc.,

Class A* | | | 4,700 | | | | 83,942 | | |

Prosus NV

(China)* | | | 19,289 | | | | 839,506 | | |

| | | | 3,077,746 | | |

IT Services 1.9% | |

Computer

Services, Inc. | | | 4,750 | | | | 274,313 | | |

Evo Payments,

Inc., Class A* | | | 10,061 | | | | 338,955 | | |

MoneyGram

International,

Inc.* | | | 50,400 | | | | 533,736 | | |

PayPal

Holdings, Inc.* | | | 4,054 | | | | 338,833 | | |

Switch, Inc.,

Class A | | | 20,878 | | | | 710,896 | | |

Visa, Inc.,

Class A | | | 2,437 | | | | 504,849 | | |

| | | | 2,701,582 | | |

Life Sciences Tools & Services 1.0% | |

Eurofins

Scientific SE

(Luxembourg) | | | 14,409 | | | | 922,447 | | |

Gerresheimer

AG (Germany) | | | 3,705 | | | | 212,365 | | |

Thermo Fisher

Scientific, Inc. | | | 546 | | | | 280,628 | | |

| | | | 1,415,440 | | |

| Machinery 0.0%(b) | |

Altra Industrial

Motion Corp. | | | 400 | | | | 24,056 | | |

Media 1.4% | |

Aimia, Inc.

(Canada)* | | | 5,650 | | | | 15,345 | | |

Investments | | Shares | |

Value | |

Deluxe

Television

GmbH

(Germany)*(a) | | | 16,063 | | | $ | 1,606 | | |

Shaw

Communications,

Inc., Class B

(Canada) | | | 38,371 | | | | 985,504 | | |

Stroeer SE &

Co. KGaA

(Germany) | | | 6,042 | | | | 246,364 | | |

TEGNA, Inc. | | | 35,374 | | | | 738,609 | | |

WideOpenWest,

Inc.* | | | 2,582 | | | | 35,399 | | |

| | | | 2,022,827 | | |

Metals & Mining 0.2% | |

ArcelorMittal

SA

(Luxembourg) | | | 4,589 | | | | 102,742 | | |

Artemis Gold,

Inc. (Canada)* | | | 605 | | | | 1,661 | | |

Turquoise Hill

Resources Ltd.

(Mongolia)* | | | 1,900 | | | | 53,409 | | |

Turquoise Hill

Resources Ltd.

(Mongolia)* | | | 2,500 | | | | 70,393 | | |

Vale SA,

ADR (Brazil) | | | 7,458 | | | | 96,507 | | |

Yamana Gold,

Inc. (Canada) | | | 1,905 | | | | 8,344 | | |

| | | | 333,056 | | |

Multiline Retail 0.2% | |

Fix Price

Group Ltd.,

GDR

(Russia)*(a)(c)(d) | | | 144 | | | | — | | |

Target Corp. | | | 1,503 | | | | 246,868 | | |

| | | | 246,868 | | |

Oil, Gas & Consumable Fuels 0.9% | |

Archaea

Energy, Inc.* | | | 5,524 | | | | 142,574 | | |

Cheniere

Energy, Inc. | | | 3,006 | | | | 530,288 | | |

Continental

Resources, Inc. | | | 1,400 | | | | 103,558 | | |

DT Midstream,

Inc. | | | 3,245 | | | | 193,727 | | |

Euronav NV

(Belgium) | | | 3,300 | | | | 58,839 | | |

LUKOIL PJSC

(Russia)(a)(c) | | | 661 | | | | — | | |

Petroleo

Brasileiro SA,

ADR (Brazil) | | | 4,258 | | | | 54,588 | | |

Petroleo

Brasileiro SA,

ADR (Brazil) | | | 4,209 | | | | 53,959 | | |

See Notes to Consolidated Financial Statements

11

Consolidated Schedule of Investments Absolute Return Multi-Manager Fund^ (cont'd)

Investments | | Shares | |

Value | |

Williams Cos.,

Inc. (The) | | | 5,831 | | | $ | 190,849 | | |

| | | | 1,328,382 | | |

| Paper & Forest Products 0.0%(b) | |

Resolute Forest

Products, Inc.* | | | 2,250 | | | | 46,822 | | |

Pharmaceuticals 1.6% | |

Aerie

Pharmaceuticals,

Inc.* | | | 10,794 | | | | 164,285 | | |

Aralez

Pharmaceuticals,

Inc. (Canada)*(a) | | | 345 | | | | — | | |

Bristol-Myers

Squibb Co. | | | 4,097 | | | | 317,394 | | |

Dr Reddy's

Laboratories Ltd.,

ADR (India) | | | 2,586 | | | | 140,446 | | |

Eli Lilly & Co. | | | 909 | | | | 329,140 | | |

Hikma

Pharmaceuticals

plc (Jordan) | | | 7,713 | | | | 110,477 | | |

Roche

Holding AG | | | 3,551 | | | | 1,179,293 | | |

Teva

Pharmaceutical

Industries Ltd.,

ADR (Israel)* | | | 722 | | | | 6,440 | | |

| | | | 2,247,475 | | |

Professional Services 0.5% | |

Hill International,

Inc.* | | | 39,273 | | | | 132,350 | | |

Intertrust NV

(Netherlands)*(d) | | | 12,835 | | | | 253,177 | | |

SGS SA

(Registered)

(Switzerland) | | | 145 | | | | 319,873 | | |

| | | | 705,400 | | |

Real Estate Management & Development 0.1% | |

Seritage

Growth

Properties,

Class A, REIT* | | | 12,579 | | | | 134,973 | | |

Semiconductors & Semiconductor Equipment 1.0% | |

ASML Holding

NV (Netherlands) | | | 111 | | | | 52,434 | | |

ASML Holding

NV (Registered),

NYRS

(Netherlands) | | | 302 | | | | 142,671 | | |

CyberOptics

Corp.* | | | 5,130 | | | | 276,866 | | |

Investments | | Shares | |

Value | |

Magnachip

Semiconductor

Corp.

(South Korea)* | | | 6,000 | | | $ | 59,705 | | |

MKS

Instruments, Inc. | | | 101 | | | | 8,297 | | |

NVIDIA Corp. | | | 842 | | | | 113,645 | | |

QUALCOMM,

Inc. | | | 1,794 | | | | 211,082 | | |

Silicon Motion

Technology

Corp., ADR

(Taiwan) | | | 751 | | | | 40,171 | | |

SunEdison,

Inc.*(a)(c) | | | 16,689 | | | | — | | |

Tower

Semiconductor

Ltd. (Israel)* | | | 12,650 | | | | 540,914 | | |

| | | | 1,445,785 | | |

Software 2.5% | |

Black

Knight, Inc.* | | | 1,108 | | | | 67,001 | | |

BTRS

Holdings, Inc.* | | | 13,550 | | | | 127,912 | | |

ChannelAdvisor

Corp.* | | | 5,700 | | | | 131,328 | | |

ForgeRock,

Inc., Class A* | | | 5,752 | | | | 129,765 | | |

KnowBe4, Inc.,

Class A* | | | 3,406 | | | | 83,719 | | |

Microsoft Corp. | | | 1,503 | | | | 348,891 | | |

SAP SE

(Germany) | | | 11,341 | | | | 1,094,660 | | |

UserTesting,

Inc.* | | | 14,500 | | | | 107,300 | | |

VMware, Inc.,

Class A | | | 2,750 | | | | 309,458 | | |

Zendesk, Inc.* | | | 14,288 | | | | 1,095,747 | | |

| | | | 3,495,781 | | |

Specialty Retail 0.4% | |

Sportsman's

Warehouse

Holdings, Inc.* | | | 25,845 | | | | 232,088 | | |

Toys R Us,

Inc.*(a) | | | 1,040 | | | | 5,200 | | |

Ulta Beauty, Inc.* | | | 642 | | | | 269,236 | | |

| | | | 506,524 | | |

Technology Hardware, Storage & Peripherals 1.0% | |

Apple, Inc. | | | 7,151 | | | | 1,096,534 | | |

Samsung

Electronics

Co. Ltd., GDR

(South Korea)(d) | | | 363 | | | | 375,161 | | |

| | | | 1,471,695 | | |

Investments | | Shares | |

Value | |

Textiles, Apparel & Luxury Goods 0.3% | |

Capri Holdings

Ltd.* | | | 3,529 | | | $ | 161,204 | | |

Tapestry, Inc. | | | 5,804 | | | | 183,871 | | |

| | | | 345,075 | | |

Thrifts & Mortgage Finance 0.8% | |

Flagstar

Bancorp, Inc. | | | 27,200 | | | | 1,052,640 | | |

Trading Companies & Distributors 0.3% | |

Brenntag SE

(Germany) | | | 4,377 | | | | 265,763 | | |

IMCD NV

(Netherlands) | | | 1,440 | | | | 186,850 | | |

| | | | 452,613 | | |

| Transportation Infrastructure 0.0%(b) | |

Atlas Corp. (Canada) | | | 650 | | | | 9,614 | | |

Wireless Telecommunication Services 0.4% | |

T-Mobile US, Inc.* | | | 3,467 | | | | 525,459 | | |

Total Common Stocks

(Cost $43,382,360) | |

| | | 40,688,299 | | |

Convertible Preferred Stocks 0.1% | |

Auto Components 0.1% | |

Garrett

Motion, Inc.

(Switzerland),

Series A,

11.00%,

4/30/2027(f)

(Cost $32,686) | | | 6,226 | | | | 49,248 | | |

| | | Principal

Amount | | | |

Corporate Bonds 0.0% | |

Independent Power and Renewable Electricity Producers 0.0% | |

GenOn

Energy,Inc.

Escrow,

9.50%,

10/15/2018(a)(c)(g) | | $ | 354,000 | | | | — | | |

9.88

10/15/2020(a)(c)(g)%, | | | 1,655,000 | | | | — | | |

Total Corporate Bonds

(Cost $—) | | | | | — | | |

See Notes to Consolidated Financial Statements

12

Consolidated Schedule of Investments Absolute Return Multi-Manager Fund^ (cont'd)

Investments | | Principal

Amount | |

Value | |

| Loan Assignments 0.0%(b) | |

| Media 0.0%(b) | |

Deluxe

Entertainment

Services

Group, Inc.,

1st Lien

Term Loan,

(ICE LIBOR

USD 3 Month +

5.00%), 8.67%

Cash/1.50%

PIK, due

3/25/2024(a)(c)(h)(i) | | $ | 14,429 | | | $ | 5,738 | | |

Deluxe

Entertainment

Services

Group, Inc.,

2nd Lien

Term Loan,

(ICE LIBOR

USD 3 Month +

6.00%), 9.67%

Cash/2.50%

PIK, due

9/25/2024(a)(c)(h)(i) | | | 149,698 | | | | — | | |

Total Loan Assignments

(Cost $100,773) | | | | | 5,738 | | |

| | | No. of

Rights | | | |

Rights 0.1% | |

Biotechnology 0.1% | |

Achillion

Pharmaceuticals,

Inc., CVR*(a) | | | 23,300 | | | | 11,650 | | |

Adamas

Pharmaceuticals,

Inc., CVR*(a) | | | 24,600 | | | | 1,230 | | |

Ambit

Biosciences

Corp.,

CVR*(a)(c) | | | 70,000 | | | | 118,300 | | |

Clementia

Pharmaceuticals,

Inc.,

CVR

(France)*(a)(c) | | | 3,200 | | | | — | | |

Tobira

Therapeutics,

Inc., CVR*(a)(c) | | | 6,900 | | | | — | | |

| | | | 131,180 | | |

| IT Services 0.0%(b) | |

Flexion

Therapeutics,

Inc., CVR*(a) | | | 18,500 | | | | 12,025 | | |

Investments | | No. of

Rights | |

Value | |

| Metals & Mining 0.0%(b) | |

Kinross Gold

Corp., CVR

(Canada)*(a)(c) | | | 4,800 | | | $ | 4 | | |

Pan American

Silver Corp.,

CVR, (Canada)* | | | 39,600 | | | | 23,760 | | |

| | | | 23,764 | | |

| Pharmaceuticals 0.0%(b) | |

Dova

Pharmaceuticals,

Inc., CVR

(Sweden)*(a) | | | 8,800 | | | | 1,100 | | |

Zogenix, Inc.,

CVR*(a) | | | 6,450 | | | | 4,837 | | |

| | | | 5,937 | | |

Total Rights

(Cost $29,250) | | | | | 172,906 | | |

| | | No. of

Warrants | | | |

| Warrants 0.0%(b) | |

| Capital Markets 0.0%(b) | |

FinTech

Acquisition

Corp. III,

expiring

12/1/2023*(a)(c) | | | 1,770 | | | | 8 | | |

Pegasus

Acquisition Co.

Europe BV,

expiring

4/27/2026

(Netherlands)* | | | 4,014 | | | | 51 | | |

| | | | 59 | | |

| Leisure Products 0.0%(b) | |

Tonies SE,

expiring

4/30/2026

(Germany)* | | | 4,329 | | | | 1,925 | | |

Total Warrants

(Cost $14) | | | | | 1,984 | | |

| | | Shares | | | |

Short-Term Investments 69.0% | |

Investment Companies 69.0% | |

Morgan

Stanley

Institutional

Liquidity

Funds

Treasury

Securities

Portfolio,

Institutional

Class, 3.03%(j)

(Cost $97,523,849) | | | 97,523,849 | | | | 97,523,849 | | |

Total Long Positions

(Cost $141,068,932) | |

| | | 138,442,024 | | |

Investments | | Shares | |

Value | |

| Short Positions (6.0)%(k) | |

Common Stocks Sold Short (6.0)% | |

Automobiles (0.2)% | |

Tesla, Inc. | | | (1,022 | ) | | $ | (232,546 | ) | |

Banks (0.1)% | |

Brookline

Bancorp, Inc. | | | (4,384 | ) | | | (60,280 | ) | |

Building Products (0.6)% | |

Owens Corning | | | (3,070 | ) | | | (262,823 | ) | |

Trex Co., Inc. | | | (6,847 | ) | | | (329,272 | ) | |

UFP Industries,

Inc. | | | (4,139 | ) | | | (294,821 | ) | |

| | | | (886,916 | ) | |

Capital Markets (0.5)% | |

Evercore, Inc.,

Class A | | | (2,957 | ) | | | (310,781 | ) | |

Intercontinental

Exchange, Inc. | | | (100 | ) | | | (9,557 | ) | |

Moelis & Co.,

Class A | | | (7,957 | ) | | | (337,854 | ) | |

| | | | (658,192 | ) | |

Chemicals (0.2)% | |

International

Flavors &

Fragrances, Inc. | | | (3,011 | ) | | | (293,904 | ) | |

Consumer Finance (0.3)% | |

Credit

Acceptance

Corp. | | | (960 | ) | | | (446,995 | ) | |

Entertainment (0.2)% | |

Netflix, Inc. | | | (1,043 | ) | | | (304,431 | ) | |

Equity Real Estate Investment Trusts (REITs) (0.9)% | |

Digital Realty

Trust, Inc. | | | (4,400 | ) | | | (441,100 | ) | |

Equinix, Inc. | | | (727 | ) | | | (411,802 | ) | |

SL Green Realty

Corp. | | | (5,710 | ) | | | (226,573 | ) | |

Vornado Realty

Trust | | | (9,443 | ) | | | (222,760 | ) | |

| | | | (1,302,235 | ) | |

Household Durables (0.2)% | |

Lennar Corp.,

Class A | | | (2,240 | ) | | | (180,768 | ) | |

Toll Brothers,

Inc. | | | (3,473 | ) | | | (149,617 | ) | |

| | | | (330,385 | ) | |

Household Products (0.2)% | |

Clorox Co. (The) | | | (2,100 | ) | | | (306,684 | ) | |

See Notes to Consolidated Financial Statements

13

Consolidated Schedule of Investments Absolute Return Multi-Manager Fund^ (cont'd)

Investments | | Shares | |

Value | |

Industrial Conglomerates (0.3)% | |

3M Co. | | | (3,700 | ) | | $ | (465,423 | ) | |

Insurance (0.2)% | |

Trupanion, Inc. | | | (5,952 | ) | | | (300,397 | ) | |

Internet & Direct Marketing Retail (0.3)% | |

Wayfair, Inc.,

Class A | | | (9,574 | ) | | | (363,046 | ) | |

IT Services (0.2)% | |

Western

Union Co. (The) | | | (17,311 | ) | | | (233,872 | ) | |

Media (0.2)% | |

Paramount

Global, Class B | | | (15,808 | ) | | | (289,602 | ) | |

Investments | | Shares | |

Value | |

| Oil, Gas & Consumable Fuels (0.0)%(b) | |

Frontline Ltd.

(Norway) | | | (4,214 | ) | | $ | (52,928 | ) | |

Real Estate Management & Development (0.3)% | |

eXp World

Holdings, Inc. | | | (27,062 | ) | | | (357,489 | ) | |

Semiconductors & Semiconductor Equipment (0.1)% | |

Broadcom, Inc. | | | (325 | ) | | | (152,789 | ) | |

MaxLinear, Inc. | | | (292 | ) | | | (9,017 | ) | |

| | | | (161,806 | ) | |

Thrifts & Mortgage Finance (0.8)% | |

New York

Community

Bancorp, Inc. | | | (121,563 | ) | | | (1,131,751 | ) | |

Investments | | Shares | |

Value | |

Trading Companies & Distributors (0.2)% | |

Beacon Roofing

Supply, Inc. | | | (4,512 | ) | | $ | (254,251 | ) | |

Total Common Stocks

Sold Short

(Proceeds $(9,916,109)) | |

| | | (8,433,133 | ) | |

Total Short Positions

(Proceeds $(9,916,109)) | |

| | | (8,433,133 | ) | |

Total Investments 92.0%

(Cost $131,152,823) | | | | | 130,008,891 | | |

Other Assets Less

Liabilities 8.0%(l) | | | | | 11,290,967 | | |

Net Assets 100.0% | | | | $ | 141,299,858 | | |

All bonds are denominated in US dollars, unless noted otherwise.

* Non-income producing security.

(a) Value determined using significant unobservable inputs.

(b) Represents less than 0.05% of net assets of the Fund.

(c) Security fair valued as of October 31, 2022, in accordance with procedures approved by the valuation designee. Total value of all such securities at October 31, 2022, amounted to $124,050, which represents 0.1% of net assets of the Fund.

(d) Security exempt from registration pursuant to Regulation S under the Securities Act of 1933, as amended. Regulation S applies to securities offerings that are made outside of the United States and do not involve directed selling efforts in the United States and as such may have restrictions on resale. At October 31, 2022, these securities amounted to $640,022 of long positions which represents 0.5% of net assets of the Fund.

(e) All or a portion of this security is pledged as collateral for options written.

(f) Perpetual security. Perpetual securities have no stated maturity date, but they may be called/redeemed by the issuer. The date shown reflects the next call date.

(g) Defaulted security.

(h) Payment in-kind security.

(i) Variable or floating rate security. The interest rate shown was the current rate as of October 31, 2022, and changes periodically.

(j) Represents 7-day effective yield as of October 31, 2022.

(k) At October 31, 2022, the Fund had $8,522,265 deposited in one or more accounts to satisfy collateral requirements for borrowing in connection with securities sold short.

(l) Includes the impact of the Fund's open positions in derivatives at October 31, 2022.

See Notes to Consolidated Financial Statements

14

Consolidated Schedule of Investments Absolute Return Multi-Manager Fund^ (cont'd)

Abbreviations

ADR American Depositary Receipt

CVR Contingent Value Rights

GDR Global Depositary Receipt

ICE Intercontinental Exchange

LIBOR London Interbank Offered Rate

PJSC Public Joint Stock Company

SA Société Anonyme

USD United States Dollar

Derivative Instruments

Futures contracts ("futures")

At October 31, 2022, open positions in futures for the Fund were as follows:

Description | | Number of

Contracts | | Expiration

Date | | Notional

Amount | | Value and

Unrealized

Appreciation/

(Depreciation) | |

Long Contracts | |

NY Harbor ULSD | | | 1 | | | 11/2022 | | $ | 154,312 | | | $ | 3,753 | | |

SGX NIFTY 50 Index | | | 1 | | | 11/2022 | | | 36,121 | | | | 258 | | |

Corn | | | 4 | | | 12/2022 | | | 138,300 | | | | 465 | | |

Euro-Bund | | | 3 | | | 12/2022 | | | 410,440 | | | | (12,562 | ) | |

Euro-OAT | | | 1 | | | 12/2022 | | | 131,319 | | | | 459 | | |

Foreign Exchange CAD/USD | | | 49 | | | 12/2022 | | | 3,596,845 | | | | 22,697 | | |

Foreign Exchange MXN/USD | | | 90 | | | 12/2022 | | | 2,251,800 | | | | 36,599 | | |

Foreign Exchange NZD/USD | | | 2 | | | 12/2022 | | | 116,270 | | | | 1,520 | | |

Foreign Exchange USD/NOK | | | 1 | | | 12/2022 | | | 99,750 | | | | 3,032 | | |

Foreign Exchange USD/SEK | | | 1 | | | 12/2022 | | | 99,703 | | | | 3,672 | | |

Foreign Exchange ZAR/USD | | | 9 | | | 12/2022 | | | 243,900 | | | | (6,110 | ) | |

Lean Hogs | | | 3 | | | 12/2022 | | | 101,910 | | | | (2,648 | ) | |

Live Cattle | | | 7 | | | 12/2022 | | | 426,930 | | | | 2,472 | | |

Low Sulphur Gasoil | | | 1 | | | 12/2022 | | | 101,975 | | | | 299 | | |

Milling Wheat | | | 1 | | | 12/2022 | | | 17,406 | | | | 297 | | |

Soybean Meal | | | 2 | | | 12/2022 | | | 85,620 | | | | 915 | | |

Soybean Oil | | | 2 | | | 12/2022 | | | 87,852 | | | | 5,047 | | |

Canola | | | 2 | | | 1/2023 | | | 25,808 | | | | 41 | | |

FCOJ-A | | | 1 | | | 1/2023 | | | 30,165 | | | | 207 | | |

Platinum | | | 1 | | | 1/2023 | | | 46,505 | | | | (1,453 | ) | |

Total Long Contracts | | | | | | $ | 8,202,931 | | | $ | 58,960 | | |

See Notes to Consolidated Financial Statements

15

Consolidated Schedule of Investments Absolute Return Multi-Manager Fund^ (cont'd)

Description | | Number of

Contracts | | Expiration

Date | | Notional

Amount | | Value and

Unrealized

Appreciation/

(Depreciation) | |

Short Contracts | |

Amsterdam Exchange Index | | | (2 | ) | | 11/2022 | | $ | (264,412 | ) | | $ | (10,418 | ) | |

Hang Seng Index | | | (1 | ) | | 11/2022 | | | (93,234 | ) | | | 3,839 | | |

HSCEI | | | (1 | ) | | 11/2022 | | | (31,460 | ) | | | 1,623 | | |

MSCI Singapore Index | | | (13 | ) | | 11/2022 | | | (255,298 | ) | | | (8,741 | ) | |

Natural Gas | | | (2 | ) | | 11/2022 | | | (127,100 | ) | | | (3,074 | ) | |

OMXS30 Index | | | (1 | ) | | 11/2022 | | | (17,779 | ) | | | (309 | ) | |

SGX FTSE China A50 Index | | | (6 | ) | | 11/2022 | | | (66,966 | ) | | | 4,154 | | |

SGX FTSE Taiwan Index | | | (4 | ) | | 11/2022 | | | (183,080 | ) | | | (1,213 | ) | |

| 100 oz Gold | | | (5 | ) | | 12/2022 | | | (820,350 | ) | | | 12,450 | | |

3 Month Canadian Bankers Acceptance | | | (1 | ) | | 12/2022 | | | (174,863 | ) | | | 854 | | |

Australia 10 Year Bond | | | (5 | ) | | 12/2022 | | | (378,934 | ) | | | (5,828 | ) | |

Australia 3 Year Bond | | | (12 | ) | | 12/2022 | | | (825,406 | ) | | | (8,997 | ) | |

Canada 10 Year Bond | | | (5 | ) | | 12/2022 | | | (451,536 | ) | | | (5,031 | ) | |

Canada 10 Year Bond | | | (4 | ) | | 12/2022 | | | (361,229 | ) | | | 2,398 | | |

Cocoa | | | (3 | ) | | 12/2022 | | | (70,050 | ) | | | (168 | ) | |

Coffee 'C' | | | (1 | ) | | 12/2022 | | | (66,638 | ) | | | 1,160 | | |

Copper | | | (1 | ) | | 12/2022 | | | (84,375 | ) | | | 1,673 | | |

Cotton No. 2 | | | (1 | ) | | 12/2022 | | | (36,000 | ) | | | 3,777 | | |

| EURO STOXX 50 Index | | | (1 | ) | | 12/2022 | | | (35,755 | ) | | | (1,502 | ) | |

Euro-Bobl | | | (6 | ) | | 12/2022 | | | (709,583 | ) | | | 5,790 | | |

Euro-BTP | | | (2 | ) | | 12/2022 | | | (226,606 | ) | | | (7,551 | ) | |

Euro-Bund | | | (2 | ) | | 12/2022 | | | (273,627 | ) | | | 1,128 | | |

Euro-Buxl | | | (1 | ) | | 12/2022 | | | (142,525 | ) | | | 1,048 | | |

Euro-OAT | | | (1 | ) | | 12/2022 | | | (131,319 | ) | | | (101 | ) | |

Euro-Schatz | | | (10 | ) | | 12/2022 | | | (1,056,785 | ) | | | 4,419 | | |

Foreign Exchange AUD/USD | | | (101 | ) | | 12/2022 | | | (6,465,010 | ) | | | 55,331 | | |

Foreign Exchange CHF/USD | | | (1 | ) | | 12/2022 | | | (125,506 | ) | | | 1,317 | | |

Foreign Exchange EUR/USD | | | (62 | ) | | 12/2022 | | | (7,690,713 | ) | | | 14,468 | | |

Foreign Exchange GBP/USD | | | (4 | ) | | 12/2022 | | | (287,150 | ) | | | 735 | | |

Foreign Exchange JPY/USD | | | (94 | ) | | 12/2022 | | | (7,950,050 | ) | | | 247,990 | | |

FTSE 100 Index | | | (3 | ) | | 12/2022 | | | (244,526 | ) | | | (4,121 | ) | |

FTSE/JSE Top 40 Index | | | (4 | ) | | 12/2022 | | | (131,669 | ) | | | (2,331 | ) | |

Long Gilt | | | (3 | ) | | 12/2022 | | | (351,368 | ) | | | (16,914 | ) | |

MSCI Emerging Markets E-Mini Index | | | (6 | ) | | 12/2022 | | | (256,080 | ) | | | 7,639 | | |

NASDAQ 100 E-Mini Index | | | (1 | ) | | 12/2022 | | | (228,945 | ) | | | (927 | ) | |

Russell 2000 E-Mini Index | | | (2 | ) | | 12/2022 | | | (185,300 | ) | | | (11,448 | ) | |

S&P 500 E-Mini Index | | | (8 | ) | | 12/2022 | | | (1,553,200 | ) | | | 49,800 | | |

S&P 500 E-Mini Index | | | (1 | ) | | 12/2022 | | | (194,150 | ) | | | (2,352 | ) | |

Short-Term Euro-BTP | | | (3 | ) | | 12/2022 | | | (314,441 | ) | | | (1,112 | ) | |

Silver | | | (1 | ) | | 12/2022 | | | (95,595 | ) | | | 228 | | |

U.S. Treasury 2 Year Note | | | (4 | ) | | 12/2022 | | | (817,531 | ) | | | 5,113 | | |

U.S. Treasury 5 Year Note | | | (7 | ) | | 12/2022 | | | (746,156 | ) | | | 4,812 | | |

U.S. Treasury 10 Year Note | | | (8 | ) | | 12/2022 | | | (884,750 | ) | | | 27,224 | | |

See Notes to Consolidated Financial Statements

16

Consolidated Schedule of Investments Absolute Return Multi-Manager Fund^ (cont'd)

Description | | Number of

Contracts | | Expiration

Date | | Notional

Amount | | Value and

Unrealized

Appreciation/

(Depreciation) | |

U.S. Treasury 10 Year Note | | | (5 | ) | | 12/2022 | | $ | (552,969 | ) | | $ | 5,400 | | |

U.S. Treasury Long Bond | | | (3 | ) | | 12/2022 | | | (361,500 | ) | | | 32,543 | | |

U.S. Treasury Ultra Bond | | | (1 | ) | | 12/2022 | | | (127,656 | ) | | | 11,967 | | |

Robusta Coffee | | | (5 | ) | | 1/2023 | | | (92,650 | ) | | | 3,469 | | |

Sugar No. 11 | | | (1 | ) | | 2/2023 | | | (20,126 | ) | | | (361 | ) | |

3 Month Canadian Bankers Acceptance | | | (11 | ) | | 3/2023 | | | (1,923,294 | ) | | | 14,673 | | |

Cocoa | | | (2 | ) | | 3/2023 | | | (46,860 | ) | | | (855 | ) | |

3 Month Canadian Bankers Acceptance | | | (7 | ) | | 6/2023 | | | (1,225,263 | ) | | | 10,201 | | |

| 3 Month EURIBOR | | | (13 | ) | | 9/2023 | | | (3,113,692 | ) | | | (5,318 | ) | |

| 3 Month SONIA | | | (5 | ) | | 9/2023 | | | (1,364,334 | ) | | | (10,069 | ) | |

| 3 Month SOFR | | | (10 | ) | | 12/2023 | | | (2,381,500 | ) | | | 15,270 | | |

| 3 Month SONIA | | | (5 | ) | | 12/2023 | | | (1,363,259 | ) | | | (6,304 | ) | |

| 3 Month EURIBOR | | | (10 | ) | | 3/2024 | | | (2,396,877 | ) | | | (3,737 | ) | |

| 3 Month SOFR | | | (10 | ) | | 3/2024 | | | (2,386,500 | ) | | | 4,583 | | |

| 3 Month SONIA | | | (2 | ) | | 3/2024 | | | (545,533 | ) | | | 441 | | |

| 3 Month SOFR | | | (10 | ) | | 6/2024 | | | (2,392,625 | ) | | | 14,820 | | |

| 3 Month SONIA | | | (5 | ) | | 6/2024 | | | (1,365,265 | ) | | | (4,468 | ) | |

| 3 Month SOFR | | | (3 | ) | | 9/2024 | | | (719,325 | ) | | | 2,032 | | |

| 3 Month SONIA | | | (1 | ) | | 9/2024 | | | (273,426 | ) | | | (669 | ) | |

| 3 Month SOFR | | | (9 | ) | | 12/2024 | | | (2,161,125 | ) | | | 2,785 | | |

| 3 Month SONIA | | | (4 | ) | | 12/2024 | | | (1,094,965 | ) | | | (5,677 | ) | |

| 3 Month EURIBOR | | | (5 | ) | | 3/2025 | | | (1,199,983 | ) | | | (2,617 | ) | |

| 3 Month SOFR | | | (4 | ) | | 3/2025 | | | (961,700 | ) | | | 18 | | |

| 3 Month SONIA | | | (1 | ) | | 3/2025 | | | (274,028 | ) | | | (3,176 | ) | |

| 3 Month SOFR | | | (10 | ) | | 6/2025 | | | (2,406,625 | ) | | | 883 | | |

| 3 Month SONIA | | | (4 | ) | | 6/2025 | | | (1,096,914 | ) | | | (7,318 | ) | |

| 3 Month SOFR | | | (9 | ) | | 6/2026 | | | (2,168,100 | ) | | | 3,810 | | |

Total Short Contracts | | | | | | $ | (69,423,144 | ) | | $ | 439,158 | | |

Total Futures | | | | | | | | $ | 498,118 | | |

For the year ended October 31, 2022, the average notional value for the months where the Fund had futures outstanding was $8,632,993 for long positions and $(100,184,217) for short positions. At October 31, 2022, the Fund had $1,515,453 deposited in segregated accounts to cover margin requirements on open futures.

Forward foreign currency contracts ("forward contracts")

At October 31, 2022, open forward contracts for the Fund were as follows:

Currency Purchased | | Currency Sold | | Counterparty | | Settlement

Date | | Net

Unrealized

Appreciation/

(Depreciation) | |

GBP | | | | | 5,918 | | | USD | | | | | 6,543 | | | JPM | | 11/18/2022 | | $ | 246 | | |

USD | | | | | 1,975,134 | | | CHF | | | | | 1,959,212 | | | JPM | | 11/18/2022 | | | 15,213 | | |

CHF | | | | | 100,000 | | | USD | | | | | 99,956 | | | JPM | | 12/1/2022 | | | 222 | | |

EUR | | | | | 45,000 | | | USD | | | | | 44,513 | | | JPM | | 12/1/2022 | | | 49 | | |

USD | | | | | 52,257 | | | CAD | | | | | 70,000 | | | JPM | | 12/1/2022 | | | 868 | | |

See Notes to Consolidated Financial Statements

17

Consolidated Schedule of Investments Absolute Return Multi-Manager Fund^ (cont'd)

Currency Purchased | | Currency Sold | | Counterparty | | Settlement

Date | | Net

Unrealized

Appreciation/

(Depreciation) | |

USD | | | 20,491 | | | CHF | | | | | 20,000 | | | JPM | | 12/1/2022 | | $ | 455 | | |

AUD | | | 260,000 | | | JPY | | | | | 24,373,818 | | | JPM | | 12/21/2022 | | | 1,589 | | |

AUD | | | 780,000 | | | JPY | | | | | 73,123,660 | | | SG | | 12/21/2022 | | | 4,763 | | |

AUD | | | 230,000 | | | USD | | | | | 145,176 | | | SG | | 12/21/2022 | | | 2,183 | | |

BRL** | | | 2,160,000 | | | USD | | | | | 408,850 | | | SG | | 12/21/2022 | | | 4,851 | | |

CAD | | | 650,000 | | | USD | | | | | 473,828 | | | SG | | 12/21/2022 | | | 3,571 | | |

CHF | | | 10,000 | | | USD | | | | | 10,036 | | | SG | | 12/21/2022 | | | 13 | | |

CLP** | | | 14,860,000 | | | USD | | | | | 15,328 | | | SG | | 12/21/2022 | | | 287 | | |

CZK | | | 10,790,000 | | | USD | | | | | 429,480 | | | SG | | 12/21/2022 | | | 4,770 | | |

EUR | | | 20,000 | | | TRY | | | | | 383,107 | | | SG | | 12/21/2022 | | | 51 | | |

EUR | | | 30,000 | | | USD | | | | | 29,199 | | | JPM | | 12/21/2022 | | | 574 | | |

EUR | | | 760,000 | | | USD | | | | | 745,645 | | | SG | | 12/21/2022 | | | 8,595 | | |

GBP | | | 700,000 | | | USD | | | | | 771,706 | | | SG | | 12/21/2022 | | | 32,475 | | |

HUF | | | 46,830,000 | | | USD | | | | | 108,759 | | | SG | | 12/21/2022 | | | 2,652 | | |

ILS | | | 80,000 | | | USD | | | | | 22,475 | | | SG | | 12/21/2022 | | | 260 | | |

INR** | | | 8,700,000 | | | USD | | | | | 103,914 | | | SG | | 12/21/2022 | | | 553 | | |

JPY | | | 30,480,131 | | | AUD | | | | | 320,000 | | | SG | | 12/21/2022 | | | 1,300 | | |

JPY | | | 21,220,000 | | | USD | | | | | 142,737 | | | SG | | 12/21/2022 | | | 903 | | |

KRW** | | | 118,590,000 | | | USD | | | | | 82,754 | | | SG | | 12/21/2022 | | | 412 | | |

MXN | | | 10,030,000 | | | USD | | | | | 495,900 | | | JPM | | 12/21/2022 | | | 5,806 | | |

MXN | | | 19,960,000 | | | USD | | | | | 982,739 | | | SG | | 12/21/2022 | | | 15,674 | | |

NOK | | | 300,000 | | | USD | | | | | 28,201 | | | JPM | | 12/21/2022 | | | 706 | | |

NOK | | | 1,900,000 | | | USD | | | | | 178,796 | | | SG | | 12/21/2022 | | | 4,286 | | |

NZD | | | 160,000 | | | USD | | | | | 91,196 | | | JPM | | 12/21/2022 | | | 1,900 | | |

NZD | | | 290,000 | | | USD | | | | | 164,667 | | | SG | | 12/21/2022 | | | 4,071 | | |

PHP** | | | 25,410,000 | | | USD | | | | | 428,019 | | | SG | | 12/21/2022 | | | 7,592 | | |

PLN | | | 6,370,000 | | | EUR | | | | | 1,317,858 | | | SG | | 12/21/2022 | | | 14,342 | | |

PLN | | | 1,500,000 | | | USD | | | | | 302,447 | | | SG | | 12/21/2022 | | | 8,906 | | |

SEK | | | 1,320,000 | | | USD | | | | | 117,392 | | | SG | | 12/21/2022 | | | 2,675 | | |

SGD | | | 1,960,000 | | | USD | | | | | 1,372,185 | | | SG | | 12/21/2022 | | | 12,802 | | |

THB | | | 3,230,000 | | | USD | | | | | 85,109 | | | SG | | 12/21/2022 | | | 142 | | |

TRY | | | 1,762,562 | | | EUR | | | | | 90,000 | | | JPM | | 12/21/2022 | | | 1,763 | | |

TRY | | | 8,228,416 | | | EUR | | | | | 420,000 | | | SG | | 12/21/2022 | | | 8,384 | | |

TRY | | | 960,000 | | | USD | | | | | 48,724 | | | SG | | 12/21/2022 | | | 885 | | |

USD | | | 874,556 | | | AUD | | | | | 1,290,000 | | | SG | | 12/21/2022 | | | 48,055 | | |

USD | | | 1,164,702 | | | CAD | | | | | 1,530,000 | | | SG | | 12/21/2022 | | | 40,978 | | |

USD | | | 1,161,892 | | | CHF | | | | | 1,120,000 | | | SG | | 12/21/2022 | | | 36,471 | | |

USD | | | 96,990 | | | CLP | ** | | | | 89,880,000 | | | SG | | 12/21/2022 | | | 2,542 | | |

USD | | | 299,596 | | | CZK | | | | | 7,340,000 | | | SG | | 12/21/2022 | | | 4,195 | | |

USD | | | 20,104 | | | EUR | | | | | 20,000 | | | JPM | | 12/21/2022 | | | 255 | | |

USD | | | 1,166,814 | | | EUR | | | | | 1,150,000 | | | SG | | 12/21/2022 | | | 25,531 | | |

USD | | | 996,643 | | | GBP | | | | | 850,000 | | | SG | | 12/21/2022 | | | 20,140 | | |

USD | | | 251,196 | | | HUF | | | | | 101,240,000 | | | SG | | 12/21/2022 | | | 10,341 | | |

USD | | | 34,643 | | | ILS | | | | | 120,000 | | | JPM | | 12/21/2022 | | | 541 | | |

See Notes to Consolidated Financial Statements

18

Consolidated Schedule of Investments Absolute Return Multi-Manager Fund^ (cont'd)

Currency Purchased | | Currency Sold | | Counterparty | | Settlement

Date | | Net

Unrealized

Appreciation/

(Depreciation) | |

USD | | | | | 387,627 | | | ILS | | | 1,320,000 | | | SG | | 12/21/2022 | | $ | 12,500 | | |

USD | | | | | 2,202,360 | | | INR** | | | 178,720,000 | | | SG | | 12/21/2022 | | | 56,339 | | |

USD | | | | | 980,448 | | | JPY | | | 139,060,000 | | | SG | | 12/21/2022 | | | 39,129 | | |

USD | | | | | 703,183 | | | KRW** | | | 977,430,000 | | | SG | | 12/21/2022 | | | 17,719 | | |

USD | | | | | 8,705 | | | NOK | | | 90,000 | | | JPM | | 12/21/2022 | | | 32 | | |

USD | | | | | 559,556 | | | NOK | | | 5,550,000 | | | SG | | 12/21/2022 | | | 24,767 | | |

USD | | | | | 659,804 | | | NZD | | | 1,080,000 | | | SG | | 12/21/2022 | | | 31,406 | | |

USD | | | | | 589,865 | | | PHP** | | | 33,980,000 | | | SG | | 12/21/2022 | | | 7,335 | | |

USD | | | | | 339,799 | | | PLN | | | 1,600,000 | | | SG | | 12/21/2022 | | | 7,688 | | |

USD | | | | | 558,904 | | | SEK | | | 5,840,000 | | | SG | | 12/21/2022 | | | 27,700 | | |

USD | | | | | 1,096,483 | | | SGD | | | 1,540,000 | | | SG | | 12/21/2022 | | | 8,276 | | |

USD | | | | | 48,680 | | | THB | | | 1,820,000 | | | JPM | | 12/21/2022 | | | 644 | | |

USD | | | | | 501,832 | | | THB | | | 18,360,000 | | | SG | | 12/21/2022 | | | 17,243 | | |

USD | | | | | 108,912 | | | ZAR | | | 1,960,000 | | | JPM | | 12/21/2022 | | | 2,621 | | |

USD | | | | | 399,443 | | | ZAR | | | 6,930,000 | | | SG | | 12/21/2022 | | | 23,632 | | |

CAD | | | | | 52,750 | | | USD | | | 38,344 | | | JPM | | 12/30/2022 | | | 407 | | |

USD | | | | | 317,535 | | | CAD | | | 429,168 | | | JPM | | 12/30/2022 | | | 2,264 | | |

Total unrealized appreciation | | | | | | | | | | | | $ | 645,540 | | |

Currency Purchased | | Currency Sold | | Counterparty | | Settlement

Date | | Net

Unrealized

Appreciation/

(Depreciation) | |

USD | | | 2,244,832 | | | EUR | | | | | 2,308,047 | | | JPM | | 11/18/2022 | | $ | (38,659 | ) | |

USD | | | 65,185 | | | SEK | | | | | 738,132 | | | JPM | | 11/18/2022 | | | (1,737 | ) | |

CAD | | | 1,415,754 | | | USD | | | | | 1,076,751 | | | JPM | | 12/1/2022 | | | (37,388 | ) | |

CHF | | | 345,000 | | | USD | | | | | 356,975 | | | JPM | | 12/1/2022 | | | (11,361 | ) | |

EUR | | | 292,000 | | | USD | | | | | 294,194 | | | JPM | | 12/1/2022 | | | (5,031 | ) | |

USD | | | 79,996 | | | CAD | | | | | 110,000 | | | JPM | | 12/1/2022 | | | (760 | ) | |

USD | | | 195,997 | | | EUR | | | | | 200,000 | | | JPM | | 12/1/2022 | | | (2,059 | ) | |

AUD | | | 60,000 | | | JPY | | | | | 5,693,096 | | | JPM | | 12/21/2022 | | | (95 | ) | |

AUD | | | 1,320,000 | | | JPY | | | | | 128,240,093 | | | SG | | 12/21/2022 | | | (22,356 | ) | |

AUD | | | 360,000 | | | USD | | | | | 233,926 | | | SG | | 12/21/2022 | | | (3,276 | ) | |

CAD | | | 160,000 | | | USD | | | | | 121,318 | | | SG | | 12/21/2022 | | | (3,805 | ) | |

CHF | | | 520,000 | | | USD | | | | | 531,203 | | | SG | | 12/21/2022 | | | (8,688 | ) | |

CLP** | | | 29,180,000 | | | USD | | | | | 30,931 | | | SG | | 12/21/2022 | | | (267 | ) | |

CZK | | | 4,460,000 | | | USD | | | | | 181,386 | | | SG | | 12/21/2022 | | | (1,890 | ) | |

EUR | | | 30,412 | | | PLN | | | | | 150,000 | | | JPM | | 12/21/2022 | | | (954 | ) | |

EUR | | | 994,141 | | | PLN | | | | | 4,850,000 | | | SG | | 12/21/2022 | | | (20,104 | ) | |

EUR | | | 100,000 | | | TRY | | | | | 1,989,982 | | | JPM | | 12/21/2022 | | | (3,589 | ) | |

EUR | | | 890,000 | | | TRY | | | | | 17,678,266 | | | SG | | 12/21/2022 | | | (30,266 | ) | |

EUR | | | 10,000 | | | USD | | | | | 9,977 | | | JPM | | 12/21/2022 | | | (53 | ) | |

EUR | | | 420,000 | | | USD | | | | | 421,192 | | | SG | | 12/21/2022 | | | (4,376 | ) | |

GBP | | | 90,000 | | | USD | | | | | 104,189 | | | SG | | 12/21/2022 | | | (794 | ) | |

HUF | | | 15,860,000 | | | USD | | | | | 38,162 | | | JPM | | 12/21/2022 | | | (430 | ) | |

See Notes to Consolidated Financial Statements

19

Consolidated Schedule of Investments Absolute Return Multi-Manager Fund^ (cont'd)

Currency Purchased | | Currency Sold | | Counterparty | | Settlement

Date | | Net

Unrealized

Appreciation/

(Depreciation) | |

HUF | | | | | 28,420,000 | | | USD | | | | | 68,478 | | | SG | | 12/21/2022 | | $ | (865 | ) | |

ILS | | | | | 170,000 | | | USD | | | | | 48,510 | | | SG | | 12/21/2022 | | | (198 | ) | |

INR** | | | 71,700,000 | | | USD | | | | | 871,339 | | | SG | | 12/21/2022 | | | (10,385 | ) | |

JPY | | | | | 14,897,438 | | | AUD | | | | | 160,000 | | | JPM | | 12/21/2022 | | | (1,669 | ) | |

JPY | | | | | 91,768,611 | | | AUD | | | | | 990,000 | | | SG | | 12/21/2022 | | | (13,094 | ) | |

JPY | | | | | 48,460,000 | | | USD | | | | | 335,148 | | | SG | | 12/21/2022 | | | (7,115 | ) | |

KRW** | | | 426,630,000 | | | USD | | | | | 301,509 | | | SG | | 12/21/2022 | | | (2,316 | ) | |

NOK | | | | | 780,000 | | | USD | | | | | 77,039 | | | SG | | 12/21/2022 | | | (1,879 | ) | |

NZD | | | | | 170,000 | | | USD | | | | | 102,573 | | | SG | | 12/21/2022 | | | (3,658 | ) | |

PHP** | | | 5,410,000 | | | USD | | | | | 93,244 | | | SG | | 12/21/2022 | | | (499 | ) | |

PLN | | | | | 930,000 | | | EUR | | | | | 195,107 | | | SG | | 12/21/2022 | | | (589 | ) | |

PLN | | | | | 1,020,000 | | | USD | | | | | 213,704 | | | SG | | 12/21/2022 | | | (1,984 | ) | |

SEK | | | | | 890,000 | | | USD | | | | | 81,972 | | | SG | | 12/21/2022 | | | (1,019 | ) | |

SGD | | | | | 280,000 | | | USD | | | | | 199,456 | | | SG | | 12/21/2022 | | | (1,601 | ) | |

THB | | | | | 2,170,000 | | | USD | | | | | 57,721 | | | SG | | 12/21/2022 | | | (446 | ) | |

TRY | | | | | 1,719,895 | | | EUR | | | | | 90,000 | | | SG | | 12/21/2022 | | | (443 | ) | |

USD | | | | | 82,511 | | | AUD | | | | | 130,000 | | | SG | | 12/21/2022 | | | (779 | ) | |

USD | | | | | 400,393 | | | BRL | ** | | | | 2,160,000 | | | SG | | 12/21/2022 | | | (13,306 | ) | |

USD | | | | | 7,287 | | | CAD | | | | | 10,000 | | | JPM | | 12/21/2022 | | | (58 | ) | |

USD | | | | | 422,950 | | | CAD | | | | | 580,000 | | | SG | | 12/21/2022 | | | (3,037 | ) | |

USD | | | | | 170,387 | | | CHF | | | | | 170,000 | | | SG | | 12/21/2022 | | | (435 | ) | |

USD | | | | | 62,359 | | | CLP | ** | | | | 61,290,000 | | | SG | | 12/21/2022 | | | (2,047 | ) | |

USD | | | | | 339,821 | | | CZK | | | | | 8,590,000 | | | SG | | 12/21/2022 | | | (5,889 | ) | |

USD | | | | | 9,763 | | | EUR | | | | | 10,000 | | | JPM | | 12/21/2022 | | | (161 | ) | |

USD | | | | | 638,105 | | | EUR | | | | | 650,000 | | | SG | | 12/21/2022 | | | (6,968 | ) | |

USD | | | | | 487,423 | | | GBP | | | | | 440,000 | | | SG | | 12/21/2022 | | | (18,062 | ) | |

USD | | | | | 20,662 | | | HUF | | | | | 9,110,000 | | | JPM | | 12/21/2022 | | | (1,011 | ) | |

USD | | | | | 65,767 | | | HUF | | | | | 28,590,000 | | | SG | | 12/21/2022 | | | (2,249 | ) | |

USD | | | | | 39,740 | | | ILS | | | | | 140,000 | | | JPM | | 12/21/2022 | | | (46 | ) | |

USD | | | | | 84,736 | | | ILS | | | | | 300,000 | | | SG | | 12/21/2022 | | | (521 | ) | |

USD | | | | | 35,049 | | | INR | ** | | | | 2,920,000 | | | SG | | 12/21/2022 | | | (13 | ) | |

USD | | | | | 189,880 | | | JPY | | | | | 28,130,000 | | | SG | | 12/21/2022 | | | (536 | ) | |

USD | | | | | 226,043 | | | KRW | ** | | | | 323,940,000 | | | SG | | 12/21/2022 | | | (1,135 | ) | |

USD | | | | | 102,758 | | | MXN | | | | | 2,110,000 | | | JPM | | 12/21/2022 | | | (2,786 | ) | |

USD | | | | | 385,607 | | | MXN | | | | | 7,920,000 | | | SG | | 12/21/2022 | | | (10,557 | ) | |

USD | | | | | 36,718 | | | NOK | | | | | 390,000 | | | JPM | | 12/21/2022 | | | (863 | ) | |

USD | | | | | 109,426 | | | NOK | | | | | 1,170,000 | | | SG | | 12/21/2022 | | | (3,312 | ) | |

USD | | | | | 28,382 | | | NZD | | | | | 50,000 | | | JPM | | 12/21/2022 | | | (710 | ) | |

USD | | | | | 148,240 | | | NZD | | | | | 260,000 | | | SG | | 12/21/2022 | | | (3,041 | ) | |

USD | | | | | 210,454 | | | PHP | ** | | | | 12,460,000 | | | SG | | 12/21/2022 | | | (3,151 | ) | |

USD | | | | | 38,467 | | | PLN | | | | | 190,000 | | | JPM | | 12/21/2022 | | | (972 | ) | |

USD | | | | | 206,365 | | | PLN | | | | | 1,030,000 | | | SG | | 12/21/2022 | | | (7,432 | ) | |

USD | | | | | 105,857 | | | SEK | | | | | 1,180,000 | | | SG | | 12/21/2022 | | | (1,475 | ) | |

USD | | | | | 999,428 | | | SGD | | | | | 1,430,000 | | | SG | | 12/21/2022 | | | (11,050 | ) | |

See Notes to Consolidated Financial Statements

20

Consolidated Schedule of Investments Absolute Return Multi-Manager Fund^ (cont'd)

Currency Purchased | | Currency Sold | | Counterparty | | Settlement

Date | | Net

Unrealized

Appreciation/

(Depreciation) | |

USD | | | | | 46,096 | | | TRY | | | | | 930,000 | | | JPM | | 12/21/2022 | | $ | (1,962 | ) | |

USD | | | | | 313,465 | | | TRY | | | | | 6,200,000 | | | SG | | 12/21/2022 | | | (6,919 | ) | |

USD | | | | | 5,954 | | | ZAR | | | | | 110,000 | | | SG | | 12/21/2022 | | | (11 | ) | |

ZAR | | | | | 460,000 | | | USD | | | | | 25,438 | | | JPM | | 12/21/2022 | | | (492 | ) | |

ZAR | | | | | 2,150,000 | | | USD | | | | | 118,494 | | | SG | | 12/21/2022 | | | (1,899 | ) | |

USD | | | | | 940,048 | | | CAD | | | | | 1,280,304 | | | JPM | | 12/30/2022 | | | (476 | ) | |

USD | | | | | 46,503 | | | GBP | | | | | 42,441 | | | JPM | | 12/30/2022 | | | (2,277 | ) | |

Total unrealized depreciation | | | | | | | | | | | | $ | (361,336 | ) | |

Net unrealized appreciation | | | | | | | | | | | | $ | 284,204 | | |

** Non-deliverable forward.

For the year ended October 31, 2022, the average notional value for the months where the Fund had forward contracts outstanding was $9,333,770.

Equity swap contracts ("equity swaps")

At October 31, 2022, the Fund had outstanding equity swaps as follows:

Over the counter equity swaps — Long(a)

| | | Counterparty | | Reference

Entity | | Notional

Amount | | Maturity

Date | | Variable-

Rate(b) | | Spread | | Reference

Rate | | Frequency

of Fund

Receipt/

Payment | | Value

and

Unrealized

Appreciation/

(Depreciation) | |

| | | JPM | | Aareal Bank AG | | EUR | 277,184 | | | 5/24/2023 | | | 1.30 | % | | | 0.65 | % | | | 1 | D ESTR | | T/1M | | $ | 5,007 | | |

| | | MS | | adidas AG | | EUR | 324,061 | | | 12/9/2022 | | | 1.45 | % | | | 0.60 | % | | | 1 | M EURIBOR | | T/1M | | | (252,713 | ) | |

| | JPM | | Alliance Aviation

Services Ltd. | | AUD | 37,145 |

| | 7/14/2023 | |

| 3.21 | % | |

| 0.65 | % | |

| 1 | D RBACR | | T/1M | |

| (2,119 | ) | |

| | | MS | | Amundi SA | | EUR | 718,707 | | | 12/9/2022 | | | 1.45 | % | | | 0.60 | % | | | 1 | M EURIBOR | | T/1M | | | (147,909 | ) | |

| | | MS | | Anima Holding SpA | | EUR | 287,810 | | | 12/9/2022 | | | 1.45 | % | | | 0.60 | % | | | 1 | M EURIBOR | | T/1M | | | (99,401 | ) | |

| | MS | | Aspen Pharmacare

Holdings Ltd. | | USD | 22,283 |

| | 12/15/2022 | |

| 3.98 | % | |

| 0.90 | % | |

| 1 | D FEDEF | | T/1M | |

| (14,851 | ) | |

| | | JPM | | Atlantia SpA | | EUR | 658,884 | | | 4/25/2023 | | | 1.30 | % | | | 0.65 | % | | | 1 | D ESTR | | T/1M | | | (4,519 | ) | |

| | | JPM | | Autogrill SpA | | EUR | 84,385 | | | 9/28/2023 | | | 1.30 | % | | | 0.65 | % | | | 1 | D ESTR | | T/1M | | | (332 | ) | |

| | | JPM

| | Biffa plc

| | GBP | 105,487

|

| | 7/13/2023

| |

| 2.48

2.58% | %- | |

| 0.30

0.40% | %- | |

| 1

| D SONIA | | T/1M

| |

| 1,812

|

| |

| | | MS | | Brenntag SE | | EUR | 252,334 | | | 12/9/2022 | | | 1.45 | % | | | 0.60 | % | | | 1 | M EURIBOR | | T/1M | | | 7,362 | | |

| | | MS | | Bureau Veritas SA | | EUR | 622,463 | | | 12/9/2022 | | | 1.45 | % | | | 0.60 | % | | | 1 | M EURIBOR | | T/1M | | | 77,502 | | |