As filed with the Securities and Exchange Commission on January 5, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21715

NEUBERGER BERMAN ALTERNATIVE FUNDS

(Exact Name of Registrant as specified in charter)

c/o Neuberger Berman Investment Advisers LLC

1290 Avenue of the Americas

New York, New York 10104-0002

(Address of Principal Executive Offices – Zip Code)

Joseph V. Amato

Chief Executive Officer and President

Neuberger Berman Alternative Funds

c/o Neuberger Berman Investment Advisers LLC

1290 Avenue of the Americas

New York, New York 10104-0002

Lori L. Schneider, Esq.

K&L Gates LLP

1601 K Street, N.W.

Washington, D.C. 20006-1600

(Names and Addresses of agents for service)

Registrant’s telephone number, including area code: (212) 476-8800

Date of fiscal year end: October 31

Date of reporting period: October 31, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940, as amended (“Act”) (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Report to Shareholders.

(a) Following are copies of the annual reports transmitted to shareholders pursuant to Rule 30e-1 under the Act.

Neuberger

Berman

Alternative

Funds

Institutional

Class

Shares

Class

A

Shares

Class

C

Shares

Class

R6

Shares

Class

E

Shares

Absolute

Return

Multi-Manager

Fund

The

“Neuberger

Berman”

name

and

logo

and

“Neuberger

Berman

Investment

Advisers

LLC”

name

are

registered

service

marks

of

Neuberger

Berman

Group

LLC.

The

individual

Fund

name

in

this

piece

is

either

a

service

mark

or

registered

service

mark

of

Neuberger

Berman

Investment

Advisers

LLC,

an

affiliate

of

Neuberger

Berman

BD

LLC,

distributor,

member

FINRA.

©

2023

Neuberger

Berman

BD

LLC,

distributor.

All

rights

reserved.

PRESIDENT’S

LETTER

1

PORTFOLIO

COMMENTARY

2

FUND

EXPENSE

INFORMATION

9

CONSOLIDATED

SCHEDULE

OF

INVESTMENTS

11

CONSOLIDATED

FINANCIAL

STATEMENTS

32

NOTES

TO

CONSOLIDATED

FINANCIAL

STATEMENTS

37

CONSOLIDATED

FINANCIAL

HIGHLIGHTS

(ALL

CLASSES)

51

Report

of

Independent

Registered

Public

Accounting

Firm

55

Directory

56

Trustees

and

Officers

57

Proxy

Voting

Policies

and

Procedures

67

Quarterly

Portfolio

Schedule

67

Liquidity

Risk

Management

Program

67

Notice

to

Shareholders

67

Board

Consideration

of

the

Management

and

Sub-Advisory

Agreements

68

Dear

Shareholder,

I

am

pleased

to

present

this

annual

shareholder

report

for

Neuberger

Berman

Absolute

Return

Multi-Manager

Fund

covering

the

fiscal

year

ended

October

31,

2023

(the

reporting

period).

The

global

financial

markets

experienced

periods

of

heightened

volatility

during

the

reporting

period.

Investor

sentiment

was

impacted

by

a

number

of

factors,

including

continued

high

inflation,

aggressive

monetary

policy

tightening,

a

period

of

unrest

in

the

regional

banking

industry,

wars

in

Ukraine

and

the

Middle

East,

and

several

other

geopolitical

events.

Despite

several

headwinds,

the

U.S.

economy

was

resilient

and

continued

to

expand.

Against

this

backdrop,

equity

and

bond

markets

generated

mixed

results

during

the

reporting

period.

With

inflation

remaining

persistent

and

elevated,

the

U.S.

Federal

Reserve

Board

(Fed)

remained

steadfast

in

its

attempt

to

moderate

economic

growth

and

orchestrate

a

“soft

landing.”

The

Fed

raised

rates

at

11

meetings

from

March

2022

through

July

2023—bringing

the

federal

funds

rate

to

a

range

between

5.25%-5.50%,

the

highest

level

in

22

years.

While

the

central

bank

paused

from

raising

rates

at

its

meetings

in

September

and

November

2023

(after

the

reporting

period),

it

left

on

the

table

the

possibility

of

additional

hikes

in

the

future.

After

rising

over

the

first

nine

months

of

the

reporting

period,

a

portion

of

equity

market

gains

were

given

back

over

the

last

three

months.

This

turnaround

was

partially

triggered

by

investors

reacting

to

the

possibility

of

a

“higher

for

longer”

interest

rate

environment.

All

told,

the

S&P

500

®

Index

returned

10.14%

during

the

reporting

period.

Meanwhile,

international

developed

and

emerging

market

equities,

as

measured

by

the

MSCI

EAFE

®

and

MSCI

Emerging

Market

Indices

(Net),

returned

14.40%

and

10.80%,

respectively.

Meanwhile,

with

short-

and

long-term

Treasury

yields

moving

higher,

the

bond

market

was

challenged

(yields

and

bond

prices

generally

move

in

the

opposite

direction).

For

the

reporting

period

the

broad

taxable

investment-grade

bond

market,

as

measured

by

the

Bloomberg

U.S.

Aggregate

Bond

Index,

returned

0.36%.

Looking

ahead,

until

we

have

more

clarity

on

the

path

of

the

economy

versus

inflation,

we

anticipate

continued

market

volatility.

In

such

an

environment,

we

believe

the

divergence

in

underlying

companies’

operating

performance

will

be

ever

more

apparent

going

forward.

Our

constructive

long-term

view

for

the

market

is

not

without

challenges

as

we

move

through

2023

and

beyond.

As

always,

we

continue

our

efforts

to

best

understand

company

and

portfolio-specific

factors

as

we

believe

this

environment

is

flush

with

a

confluence

of

fiscal

policy

considerations,

monetary

policy

stimulus,

public

health

concerns,

geopolitical

uncertainty,

commodity

price

volatility,

inflation

dynamics

and

sequencing

question

marks.

As

market

dynamics

change,

this

can

cause

company

market

values

to

dislocate

from

their

long-term

potential

values,

creating

a

volatile

environment

with

potential

opportunities.

We

highlight

these

risks

because

the

current

environment,

as

always,

necessitates

a

flexible

approach

in

the

complex

global

world

in

which

we

operate.

Thank

you

for

your

support

and

trust.

We

look

forward

to

continuing

to

serve

your

investment

needs

in

the

years

to

come.

Sincerely,

J

OSEPH

V.

A

MATO

P

RESIDENT

AND

CEO

N

EUBERGER

B

ERMAN

A

LTERNATIVE

F

UNDS

Absolute

Return

Multi-Manager

Fund

Commentary

(Unaudited)

Neuberger

Berman

Absolute

Return

Multi-Manager

Fund

Institutional

Class

generated

a

1.12%

total

return

for

the

fiscal

year

ended

October

31,

2023

(the

reporting

period),

outperforming

its

primary

benchmark,

the

HFRX

®

Global

Hedge

Fund

Index

(the

Index),

which

posted

a

0.64%

total

return

for

the

same

period.

(Performance

for

all

share

classes

is

provided

in

the

table

following

this

letter.)

Global

equities

ended

the

reporting

period

higher,

with

the

bulk

of

gains

earlier

in

the

period,

while

equities

sold

off

in

the

latter

months.

After

selling

off

throughout

most

of

calendar

year

2022

due

to

a

combination

of

geopolitical

conflict,

stubbornly

high

inflation,

and

rising

interest

rates,

equities

recovered

as

inflation

moderated

and

economic

figures

were

resilient

despite

higher

costs

of

capital

permeating

through

the

economy.

However,

weaker

economic

data,

combined

with

rising

bond

yields

and

inflation

in

recent

months,

have

begun

to

concern

investors

once

again,

leading

to

a

recent

market

selloff.

Gains

from

long/short

equity,

insurance

linked,

and

merger

arbitrage/event

driven

strategies

outpaced

losses

from

global

macro/managed

futures

strategies

during

the

reporting

period.

From

a

risk

management

perspective,

we

were

pleased

that

the

Fund’s

volatility

and

betas*

(risk)

to

the

S&P

500

®

and

Bloomberg

U.S.

Aggregate

Bond

Indices

were

all

in

line

with

our

expectations.

The

allocation

to

long/short

equity

strategies

contributed

to

performance,

as

gains

from

longs

outweighed

losses

from

shorts,

with

positive

excess

returns

generated

from

longs

and

negative

excess

returns

generated

from

shorts.

The

small

allocation

to

insurance

linked

was

a

consistent

contributor,

as

catastrophe

bonds

(cat

bonds)

generated

income

and

prices

rallied

with

no

impairment

to

any

bonds.

The

merger

arbitrage/event

driven

allocation

contributed,

as

several

deals

progressed

and

closed

during

the

reporting

period.

The

allocation

to

global

macro/managed

futures

strategies

was

a

small

detractor,

as

losses

from

the

managed

futures

strategy

outweighed

gains

from

the

systematic

currency

strategy.

Within

the

managed

futures

strategy,

gains

from

cash

were

outpaced

by

losses,

driven

by

commodities

and

followed

by

currencies,

equities,

and

interest

rate

positioning.

Within

the

systematic

currency

strategy,

positive

performance

was

driven

by

cash

holdings,

short

U.S.

government

bond

exposure,

and

a

long

in

the

U.S.

dollar

versus

several

currencies.

These

gains

were

partially

offset

by

losses

from

long

positioning

in

the

U.S.

dollar

versus

the

Japanese

yen,

euro,

and

British

pound.

The

Fund’s

aggregate

use

of

futures,

forward

foreign

currency,

swap

contracts

and

purchased

and

written

option

contracts

detracted

from

performance

during

the

reporting

period.

Even

as

central

banks

globally

have

paused

on

hiking

interest

rates,

we

believe

geopolitical

tensions,

as

well

as

declining

economic

growth

and

waning

consumer

confidence,

have

the

potential

to

drive

market

volatility.

We

continue

to

position

the

Fund

defensively

and

seek

to

benefit

from

elevated

volatility,

with

the

potential

for

additional

upside

if

rates

continue

to

rise.

The

Fund’s

largest

allocation

is

to

global

macro/managed

futures

strategies.

We

believe

that

increases

in

market

volatility

may

be

beneficial

for

these

strategies

and

that

macroeconomic

conditions

across

regions,

as

well

as

differences

in

fiscal

and

monetary

policies,

have

the

potential

to

continue

to

drive

trends

across

asset

classes.

The

Fund’s

second

largest

allocation

is

to

merger

arbitrage/event

driven

strategies.

While

M&A

activity

has

slowed,

we

believe

current

deal

volumes

and

relatively

wide

spreads

offer

ample

opportunities

to

put

capital

to

work

with

the

potential

for

attractive

returns.

The

Fund’s

third

largest

allocation

is

long/short

equity.

We

anticipate

a

high

dispersion

of

winners

and

losers

over

the

medium

term,

driven

by

a

number

of

factors,

including

inflation,

increasing

costs

of

capital,

currency

effects,

and

varying

levels

of

economic

sensitivity.

The

opportunistic

allocation

to

cat

bonds

continues

to

benefit

from

the

dislocation

in

the

cat

bond

and

reinsurance

markets

created

by

Hurricane

Ian,

offering

attractive

yields

with

strong

downside

mitigation,

in

our

view.

Sincerely,

D

AVID

K

UPPERMAN,

J

EFF

M

AJIT

AND

F

RED

I

NGHAM

P

ORTFOLIO

M

ANAGERS

*

Beta

is

a

measure

of

the

systematic

risk

of

a

portfolio.

It

is

the

covariance

of

the

portfolio

and

a

market

index

divided

by

the

variance

of

the

market

index.

Beta

measures

the

historical

sensitivity

of

a

portfolio’s

returns

to

movements

in

the

market

index.

The

beta

of

the

market

index

will

always

be

one.

A

portfolio

with

a

beta

above

the

market

index

(i.e.,

>1)

means

that

the

portfolio

has

greater

volatility

than

the

market

index.

If

the

beta

of

the

portfolio

is

1.2,

a

market

increase

in

return

of

1%

implies

a

1.2%

increase

in

the

portfolio’s

return.

If

the

beta

of

the

portfolio

is

0.8,

a

market

decrease

in

return

of

1%

implies

a

0.8%

decrease

in

the

portfolio’s

return.

Information

about

principal

risks

of

investing

in

the

Fund

is

set

forth

in

the

prospectus

and

statement

of

additional

information.

The

portfolio

composition,

industries

and

holdings

of

the

Fund

are

subject

to

change

without

notice.

The

opinions

expressed

are

those

of

the

Fund’s

portfolio

managers

and

subadvisers.

The

opinions

are

as

of

the

date

of

this

report

and

are

subject

to

change

without

notice.

TICKER

SYMBOLS

Institutional

Class

NABIX

Class

A

NABAX

Class

C

NABCX

Class

R6

NRABX

Class

E

NABEX

PORTFOLIO

BY

INVESTMENT

TYPE

(as

a

%

of

Total

Net

Assets)

Long

Short

Common

Stocks

30.9

%

(3.8)

%

Corporate

Bonds

0.0

–

Insurance

Linked

Securities

6.5

–

Loan

Assignments

0.0

–

Preferred

Stocks

0.1

–

Rights

0.1

–

Warrants

0.0

–

Short-Term

Investments

53.6

–

Other

Assets

Less

Liabilities

12.6

*

–

Total

103.8%

(3.8)%

*

Includes

the

impact

of

the

Fund's

open

positions

in

derivatives

(other

than

options

purchased),

if

any.

The

performance

data

quoted

represent

past

performance

and

do

not

indicate

future

results.

Current

performance

may

be

lower

or

higher

than

the

performance

data

quoted.

For

current

performance

data,

including

current

to

the

most

recent

month-end,

please

visit

www.nb.com/performance.

The

results

shown

in

the

table

reflect

the

reinvestment

of

income

dividends

and

other

distributions,

if

any.

The

results

do

not

reflect

the

effect

of

taxes

a

shareholder

would

pay

on

Fund

distributions

or

on

the

redemption

of

Fund

shares.

The

investment

return

and

principal

value

of

an

investment

will

fluctuate

and

shares,

when

redeemed,

may

be

worth

more

or

less

than

their

original

cost.

Returns

would

have

been

lower

if

Neuberger

Berman

Investment

Advisers

LLC

(“NBIA”)

had

not

reimbursed

certain

expenses

and/or

waived

a

portion

of

the

investment

management

fees

during

certain

of

the

periods

shown.

Repayment

by

a

class

(of

expenses

previously

reimbursed

and/or

fees

previously

waived

by

NBIA)

will

decrease

the

class’s

returns.

Please

see

Note

B

in

the

Notes

to

Consolidated

Financial

Statements

for

specific

information

regarding

expense

reimbursement

and/or

fee

waiver

arrangements.

As

stated

in

the

Fund’s

most

recent

prospectus,

the

total

annual

operating

expense

ratios

for

fiscal

year

2022

were

2.98%,

3.33%,

4.13%,

2.90%

and

3.04%

for

Institutional

Class,

Class

A,

Class

C,

Class

R6

and

Class

E

shares,

respectively

(before

expense

reimbursements

and/or

fee

waivers,

if

any).

The

expense

ratios

were

2.29%,

2.62%,

3.39%,

2.18%,

and

1.34%

for

Institutional

Class,

Class

A,

Class

C,

Class

R6

and

Class

E

shares,

respectively,

after

expense

reimbursements

and/or

fee

waivers.

The

expense

ratios

for

the

annual

period

ended

October

31,

2023,

can

be

found

in

the

Consolidated

Financial

Highlights

section

of

this

report.

Returns

shown

with

a

sales

charge

reflect

the

deduction

of

the

current

maximum

initial

sales

charge

of

5.75%

for

Class

A

shares

and

the

contingent

deferred

sales

charge

(CDSC)

for

Class

C

shares.

The

CDSC

for

Class

C

shares

is

1.00%,

which

is

reduced

to

0%

after

1

year.

The

performance

of

the

Fund’s

share

classes

will

differ

primarily

due

to

different

sales

charge

structures

and

class

expenses.

Please

see

the

prospectus

for

more

information

about

sales

charge

structures,

if

any,

and

class

expenses

for

your

share

class.

PERFORMANCE

HIGHLIGHTS

Average

Annual

Total

Return

Ended

10/31/2023

Inception

Date

1

Year

5

Years

10

Years

Life

of

Fund

At

NAV

Institutional

Class

05/15/2012

1.12%

3.44%

2.04%

2.56%

Class

A

05/15/2012

0.79%

3.07%

1.68%

2.19%

Class

C

05/15/2012

0.01%

2.28%

0.90%

1.42%

Class

R6

3

12/31/2013

1.13%

3.53%

2.10%

2.61%

Class

E

3

01/11/2022

2.53%

3.90%

2.27%

2.76%

With

Sales

Charge

Class

A

-5.01%

1.86%

1.08%

1.66%

Class

C

-0.98%

2.28%

0.90%

1.42%

Index

HRFX

®

Global

Hedge

Fund

Index

1,2

0.64%

2.41%

1.27%

1.70%

S&P

500

®

Index

1,2

10.14%

11.01%

11.18%

12.62%

Bloomberg

U.S.

Aggregate

Bond

Index

1,2

0.36%

-0.06%

0.88%

0.87%

Absolute

Return

Multi-Manager

Fund

(Unaudited)

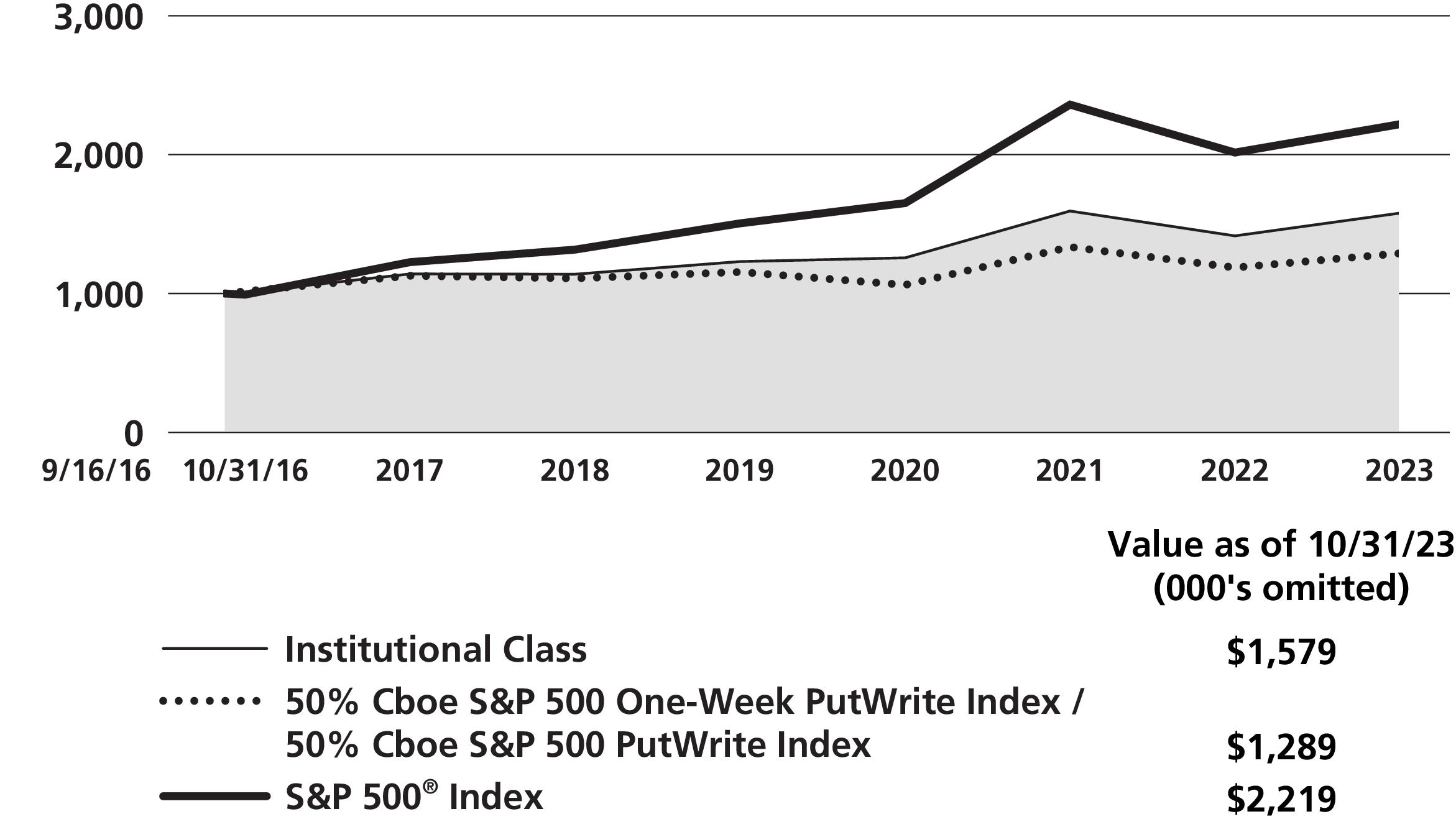

COMPARISON

OF

A

$1,000,000

INVESTMENT

(000’s

omitted)

This

graph

shows

the

change

in

value

of

a

hypothetical

$1,000,000

investment

in

the

Fund

over

the

past

10

fiscal

years,

or

since

the

Fund’s

inception

if

it

has

not

operated

for

10

years.

The

graph

is

based

on

the

Institutional

Class

shares

only;

the

performance

of

the

Fund’s

share

classes

will

differ

primarily

due

to

different

sales

charge

structures

and

class

expenses

(see

Performance

Highlights

chart

on

previous

page).

The

result

is

compared

with

benchmarks,

which

include

a

broad-based

market

index

and

may

include

a

more

narrowly

based

index.

Market

indices

have

not

been

reduced

to

reflect

any

of

the

fees

and

costs

of

investing.

The

results

shown

in

the

graph

reflect

the

reinvestment

of

income

dividends

and

other

distributions,

if

any.

The

results

do

not

reflect

the

effect

of

taxes

a

shareholder

would

pay

on

Fund

distributions

or

on

the

redemption

of

Fund

shares.

Results

represent

past

performance

and

do

not

indicate

future

results.

Absolute

Return

Multi-Manager

Fund

(Unaudited)

1

Please

see

“Glossary

of

Indices”

on

page

7

for

a

description

of

indices.

Please

note

that

individuals

cannot

invest

directly

in

any

index.

The

S&P

500

®

and

the

Bloomberg

U.S.

Aggregate

Bond

Indices

do

not

take

into

account

any

fees,

expenses

or

tax

consequences

of

investing

in

the

individual

securities

that

they

track.

The

HFRX

®

Global

Hedge

Fund

Index

does

take

into

account

fees

and

expenses,

but

not

tax

consequences,

of

investing

since

it

is

based

on

the

underlying

hedge

funds’

net

returns.

Data

about

the

performance

of

an

index

are

prepared

or

obtained

by

NBIA

and

reflect

the

reinvestment

of

income

dividends

and

other

distributions,

if

any.

The

Fund

may

invest

in

securities

not

included

in

a

described

index

and

generally

does

not

invest

in

all

securities

included

in

a

described

index.

2

The

date

used

to

calculate

Life

of

Fund

performance

for

the

index

is

the

inception

date

of

the

oldest

share

class.

3

The

performance

information

for

Class

R6

and

Class

E

prior

to

the

classes’

respective

inception

dates

is

that

of

the

Institutional

Class

of

Neuberger

Berman

Absolute

Return

Multi-Manager

Fund.

The

performance

information

for

the

Institutional

Class

has

not

been

adjusted

to

take

into

account

differences

in

class

specific

operating

expenses.

The

Institutional

Class

has

higher

expenses

and

typically

lower

returns

than

Class

R6

and

Class

E.

For

more

complete

information

on

any

of

the

Neuberger

Berman

Alternative

Funds,

call

us

at

(800)

877-9700,

or

visit

our

website

at

www.nb.com.

Glossary

of

Indices

(Unaudited)

Bloomberg

U.S.

Aggregate

Bond

Index:

The

index

measures

the

investment

grade,

U.S.

dollar-denominated,

fixed-rate,

taxable

bond

market

and

includes

Treasuries,

government-related

and

corporate

securities,

mortgage-backed

securities

(MBS)

(agency

fixed-rate

and

hybrid

adjustable

rate

mortgage

(ARM)

pass-throughs),

asset-backed

securities

(ABS),

and

commercial

mortgage-backed

securities

(CMBS)

(agency

and

nonagency).

Effective

August

24,

2021

all

Bloomberg

Barclays

fixed

income

indices

were

rebranded

as

“Bloomberg

indices”.

HFRX

®

Global

Hedge

Fund

Index:

The

index

is

designed

to

be

representative

of

the

overall

composition

of

the

hedge

fund

universe.

It

is

comprised

of

all

eligible

hedge

fund

strategies;

including

but

not

limited

to

convertible

arbitrage,

distressed

securities,

equity

hedge,

equity

market

neutral,

event

driven,

macro,

merger

arbitrage,

and

relative

value

arbitrage.

The

strategies

are

asset

weighted

based

on

the

distribution

of

assets

in

the

hedge

fund

industry.

Constituent

funds

are

selected

from

an

eligible

pool

of

the

more

than

7,500

funds

worldwide

that

report

to

the

Hedge

Fund

Research

(HFR)

Database.

Constituent

funds

must

meet

all

of

the

following

criteria:

report

monthly;

report

performance

net

of

all

fees;

be

U.S.

dollar

denominated;

be

active

and

accepting

new

investments;

have

a

minimum

24

month

track

record;

and

the

fund’s

manager

must

have

at

least

$50

million

in

assets

under

management.

The

index

is

rebalanced

quarterly.

S&P

500

®

Index:

The

index

is

a

float-adjusted

market

capitalization-weighted

index

that

focuses

on

the

large-cap

segment

of

the

U.S.

equity

market,

and

includes

a

significant

portion

of

the

total

value

of

the

market.

(This

page

intentionally

left

blank)

Information

About

Your

Fund’s

Expenses

(Unaudited)

As

a

Fund

shareholder,

you

incur

two

types

of

costs:

(1)

transaction

costs,

including

sales

charges

(loads)

on

purchase

payments

or

redemption

proceeds

(if

applicable);

and

(2)

ongoing

costs,

including

management

fees,

distribution

and/or

service

(12b-1)

fees

(if

applicable),

and

other

Fund

expenses.

This

example

is

intended

to

help

you

understand

your

ongoing

costs

(in

U.S.

dollars)

of

investing

in

the

Fund

and

compare

these

costs

with

the

ongoing

costs

of

investing

in

other

mutual

funds.

This

table

is

designed

to

provide

information

regarding

costs

related

to

your

investments.

The

following

examples

are

based

on

an

investment

of

$1,000

made

at

the

beginning

of

the

six

month

period

ended

October

31,

2023

and

held

for

the

entire

period.

The

table

illustrates

the

Fund’s

costs

in

two

ways:

Please

note

that

the

expenses

in

the

table

are

meant

to

highlight

your

ongoing

costs

only

and

do

not

include

any

transaction

costs,

such

as

sales

charges

(loads)

(if

applicable).

Therefore,

the

information

under

the

heading

“Hypothetical

(5%

annual

return

before

expenses)”

is

useful

in

comparing

ongoing

costs

only,

and

will

not

help

you

determine

the

relative

total

costs

of

owning

different

funds.

In

addition,

if

these

transaction

costs

were

included,

your

costs

would

have

been

higher.

Actual

Expenses

and

Performance:

The

first

section

of

the

table

provides

information

about

actual

account

values

and

actual

expenses

in

dollars,

based

on

the

Fund’s

actual

performance

during

the

period

indicated.

You

may

use

the

information

in

this

line,

together

with

the

amount

you

invested,

to

estimate

the

expenses

you

paid

over

the

period.

Simply

divide

your

account

value

by

$1,000

(for

example,

an

$8,600

account

value

divided

by

$1,000

=

8.6),

then

multiply

the

result

by

the

number

in

the

first

section

of

the

table

under

the

heading

entitled

“Expenses

Paid

During

the

Period”

to

estimate

the

expenses

you

paid

over

the

period.

Hypothetical

Example

for

Comparison

Purposes:

The

second

section

of

the

table

provides

information

about

hypothetical

account

values

and

hypothetical

expenses

based

on

the

Fund’s

actual

expense

ratio

and

an

assumed

rate

of

return

at

5%

per

year

before

expenses.

This

return

is

not

the

Fund’s

actual

return.

The

hypothetical

account

values

and

expenses

may

not

be

used

to

estimate

the

actual

ending

account

balance

or

expenses

you

paid

for

the

period.

You

may

use

this

information

to

compare

the

ongoing

costs

of

investing

in

the

Fund

versus

other

funds.

To

do

so,

compare

the

expenses

shown

in

this

5%

hypothetical

example

with

the

5%

hypothetical

examples

that

appear

in

the

shareholder

reports

of

other

funds.

Expense

Example

(Unaudited)

Neuberger

Berman

Alternative

Funds

ACTUAL

HYPOTHETICAL

(5%

ANNUAL

RETURN

BEFORE

EXPENSES)

Absolute

Return

Multi-Manager

Fund

Beginning

Account

Value

5/1/2023

Ending

Account

Value

10/31/2023

Expenses

Paid

During

the

Period

5/1/2023

-

10/31/2023

(1)(3)

Expense

Ratio

Beginning

Account

Value

5/1/2023

Ending

Account

Value

10/31/2023

Expenses

Paid

During

the

Period

5/1/2023

-

10/31/2023

(2)(3)

Expense

Ratio

Institutional

Class

$1,000.00

$1,020.10

$9.83

1.93%

$1,000.00

$1,015.48

$9.80

1.93%

Class

A

$1,000.00

$1,016.90

$11.64

2.29%

$1,000.00

$1,013.66

$11.62

2.29%

Class

C

$1,000.00

$1,013.20

$15.43

3.04%

$1,000.00

$1,009.88

$15.40

3.04%

Class

R6

$1,000.00

$1,019.20

$10.59

2.08%

$1,000.00

$1,014.72

$10.56

2.08%

Class

E

$1,000.00

$1,025.20

$3.32

0.65%

$1,000.00

$1,021.93

$3.31

0.65%

(1)

For

each

class,

expenses

are

equal

to

the

annualized

expense

ratio

for

the

class,

multiplied

by

the

average

account

value

over

the

period,

multiplied

by

184/365

(to

reflect

the

one-half

year

period

shown),

unless

otherwise

indicated.

(2)

Hypothetical

expenses

are

equal

to

the

annualized

expense

ratios

for

each

class,

multiplied

by

the

average

account

value

over

the

period

(assuming

a

5%

annual

return),

multiplied

by

184/365

(to

reflect

the

one-half

year

period

shown).

(3)

Includes

expenses

of

the

Fund's

subsidiary

(See

Note

A

of

the

Notes

to

Consolidated

Financial

Statements).

See

Notes

to

Consolidated

Financial

Statements

Consolidated

Schedule

of

Investments

Absolute

Return

Multi-Manager

Fund^

October

31,

2023

Investments

Shares

Value

Long

Positions

91.2%

Common

Stocks

30.9%

Automobile

Components

0.0%

(a)

Garrett

Motion,

Inc.

(Switzerland)

*

5,118

$

36,133

Banks

0.2%

American

National

Bankshares

,

Inc.

3,826

146,000

First

Horizon

Corp.

8,977

96,503

Lakeland

Bancorp,

Inc.

3,164

35,690

278,193

Biotechnology

2.5%

Abcam

plc,

ADR

(United

Kingdom)

*

43,460

996,103

Grifols

SA,

ADR

(Spain)

*

3,800

30,742

Intercept

Pharmaceuticals,

Inc.

*

3,522

66,671

Mirati

Therapeutics,

Inc.

*

10,912

605,943

Orchard

Therapeutics

plc,

ADR

(United

Kingdom)

*

9,738

154,932

Point

Biopharma

Global,

Inc.

*

10,750

136,095

Seagen

,

Inc.

*

5,360

1,140,662

3,131,148

Broadline

Retail

2.9%

Alibaba

Group

Holding

Ltd.,

ADR

(China)

*

8,000

660,320

Alibaba

Group

Holding

Ltd.

(China)

*

21,712

223,527

Amazon.com,

Inc.

*

4,531

603,031

eBay,

Inc.

5,072

198,974

JD.com,

Inc.,

Class

A

(China)

723

9,192

MercadoLibre

,

Inc.

(Brazil)

*

560

694,814

Prosus

NV

(China)

*

41,290

1,154,699

3,544,557

Capital

Markets

0.4%

Avantax

,

Inc.

*

3,500

90,335

Canaccord

Genuity

Group,

Inc.

(Canada)

26,200

135,463

Greenhill

&

Co.,

Inc.

6,308

93,421

Pegasus

Acquisition

Co.

Europe

BV,

Class

A

(Netherlands)

*(b)(c)

12,042

—

Pershing

Square,

Escrow

*(b)

6,100

915

Sculptor

Capital

Management,

Inc.

8,450

106,893

427,027

Chemicals

0.5%

Chase

Corp.

4,534

576,090

Commercial

Services

&

Supplies

0.2%

SP

Plus

Corp.

*

5,400

272,862

Investments

Shares

Value

Communications

Equipment

0.0%

(a)

Comtech

Telecommunications

Corp.

3,250

$

39,650

Consumer

Staples

Distribution

&

Retail

0.9%

Albertsons

Cos.,

Inc.,

Class

A

39,823

864,159

Almacenes

Exito

SA,

ADR

(Colombia)

*

1,925

13,398

Cia

Brasileira

de

Distribuicao

,

ADR

(Brazil)

*

1,071

707

Cia

Brasileira

de

Distribuicao

,

ADR

(Brazil)

*

2,780

1,835

Fix

Price

Group

plc,

GDR

(Russia)

*(b)(c)(d)

144

—

Sendas

Distribuidora

SA,

ADR

(Brazil)

4,023

43,529

Wal-Mart

de

Mexico

SAB

de

CV

(Mexico)

45,582

163,149

X5

Retail

Group

NV,

GDR

(Russia)

*(b)(c)(d)

4,390

—

1,086,777

Containers

&

Packaging

0.1%

Westrock

Co.

3,875

139,229

Diversified

Consumer

Services

0.1%

Arco

Platform

Ltd.,

Class

A

(Brazil)

*

12,434

172,460

Diversified

Telecommunication

Services

0.3%

Altaba

,

Inc.

Escrow

*(b)

128,456

298,660

Telesat

Corp.

(Canada)

*

4,885

49,827

348,487

Electric

Utilities

1.0%

PNM

Resources,

Inc.

28,630

1,209,904

Entertainment

0.2%

Atlanta

Braves

Holdings,

Inc.,

Class

C

*

7,104

247,077

Financial

Services

0.2%

PayPal

Holdings,

Inc.

*

5,072

262,730

Food

Products

1.8%

Hostess

Brands,

Inc.

*

17,913

598,294

Nestle

SA

(Registered)

12,689

1,368,366

Sovos

Brands,

Inc.

*(e)

13,650

296,342

2,263,002

Gas

Utilities

0.1%

Brookfield

Infrastructure

Corp.,

Class

A

(Canada)

1,145

29,495

Southwest

Gas

Holdings,

Inc.

1,200

70,332

99,827

Health

Care

Equipment

&

Supplies

0.1%

Globus

Medical,

Inc.,

Class

A

*

204

9,325

Consolidated

Schedule

of

Investments

Absolute

Return

Multi-Manager

Fund^

(cont’d)

See

Notes

to

Consolidated

Financial

Statements

Investments

Shares

Value

Opsens

,

Inc.

(Canada)

*

39,850

$

81,898

91,223

Health

Care

Providers

&

Services

0.7%

Amedisys,

Inc.

*

8,878

812,248

Shanghai

Pharmaceuticals

Holding

Co.

Ltd.,

Class

H

(China)

30,284

44,057

Sinopharm

Group

Co.

Ltd.,

Class

H

(China)

16,945

40,521

896,826

Health

Care

Technology

0.6%

NextGen

Healthcare,

Inc.

*

22,596

540,496

Tabula

Rasa

HealthCare,

Inc.

*

14,399

150,182

690,678

Hotel

&

Resort

REITs

0.1%

Hersha

Hospitality

Trust,

Class

A,

REIT

15,911

157,837

Hotels,

Restaurants

&

Leisure

1.0%

Booking

Holdings,

Inc.

*

188

524,437

Deliveroo

plc,

Class

A

(United

Kingdom)

*(d)

11,689

18,470

Expedia

Group,

Inc.

*

2,348

223,741

NEOGAMES

SA

(Israel)

*

11,611

299,564

Playtech

plc

(United

Kingdom)

*

21,590

103,024

1,169,236

Household

Durables

0.2%

iRobot

Corp.

*

825

27,167

Lennar

Corp.,

Class

B

2,800

276,108

303,275

Household

Products

0.2%

Spectrum

Brands

Holdings,

Inc.

2,736

206,076

Insurance

0.8%

AIA

Group

Ltd.

(Hong

Kong)

72,499

629,567

American

Equity

Investment

Life

Holding

Co.

2,000

105,920

Argo

Group

International

Holdings

Ltd.

8,014

239,138

974,625

Interactive

Media

&

Services

2.0%

Alphabet,

Inc.,

Class

A

*

9,090

1,127,887

Baidu,

Inc.,

ADR

(China)

*

749

78,645

Baidu,

Inc.,

Class

A

(China)

*

1,931

25,352

Meta

Platforms,

Inc.,

Class

A

*

3,979

1,198,753

VK

Co.

Ltd.,

GDR

(Russia)

*(b)(c)(d)

1,305

—

Yandex

NV,

Class

A

(Russia)

*(b)(c)

1,428

—

2,430,637

Investments

Shares

Value

IT

Services

0.0%

(a)

Chindata

Group

Holdings

Ltd.,

ADR

(China)

*

4,191

$

37,216

Life

Sciences

Tools

&

Services

0.5%

Eurofins

Scientific

SE

(Luxembourg)

11,557

586,354

Gerresheimer

AG

(Germany)

459

42,812

Olink

Holding

AB,

ADR

(Sweden)

*

1,750

43,610

672,776

Machinery

0.0%

(a)

H2O

Innovation,

Inc.

(Canada)

*

2,450

7,456

Velan,

Inc.

(Canada)

5,000

21,020

28,476

Media

1.0%

Aimia

,

Inc.

(Canada)

*

18,800

43,518

Stroeer

SE

&

Co.

KGaA

(Germany)

7,211

330,328

TEGNA,

Inc.

55,120

799,791

WideOpenWest

,

Inc.

*

2,582

18,177

1,191,814

Metals

&

Mining

0.6%

Allkem

Ltd.

(Australia)

*

15,983

97,667

ArcelorMittal

SA

(Luxembourg)

4,832

106,919

Artemis

Gold,

Inc.

(Canada)

*

605

2,221

Newcrest

Mining

Ltd.

(Australia)

(c)

27,089

406,056

United

States

Steel

Corp.

1,850

62,696

Vale

SA,

Class

B,

ADR

(Brazil)

8,667

118,825

794,384

Oil,

Gas

&

Consumable

Fuels

2.7%

Denbury,

Inc.

*

16,733

1,487,396

Earthstone

Energy,

Inc.,

Class

A

*

3,444

72,910

Euronav

NV

(Belgium)

7,821

139,448

Euronav

NV

(Belgium)

2,400

42,961

Hess

Corp.

1,342

193,785

LUKOIL

PJSC,

ADR

(Russia)

*(b)(c)

661

—

Petroleo

Brasileiro

SA,

ADR

(Brazil)

9,839

147,585

Pioneer

Natural

Resources

Co.

5,089

1,216,271

3,300,356

Passenger

Airlines

0.1%

American

Airlines

Group,

Inc.

*

768

8,563

American

Airlines

Group,

Inc.

Escrow

*(b)(c)

14,383

144

Spirit

Airlines,

Inc.

4,996

57,354

66,061

Consolidated

Schedule

of

Investments

Absolute

Return

Multi-Manager

Fund^

(cont’d)

See

Notes

to

Consolidated

Financial

Statements

Investments

Shares

Value

Pharmaceuticals

1.0%

Aralez

Pharmaceuticals,

Inc.

(Canada)

*(b)

345

$

—

Dr

Reddy's

Laboratories

Ltd.,

ADR

(India)

3,006

195,781

Hikma

Pharmaceuticals

plc

(Jordan)

7,575

175,509

Roche

Holding

AG

3,378

870,543

Teva

Pharmaceutical

Industries

Ltd.,

ADR

(Israel)

*

1,671

14,337

1,256,170

Professional

Services

0.2%

SGS

SA

(Registered)

(Switzerland)

3,576

292,054

Real

Estate

Management

&

Development

0.2%

Seritage

Growth

Properties,

Class

A,

REIT

*

33,123

239,811

Retail

REITs

0.0%

(a)

RPT

Realty,

REIT

4,889

52,752

Semiconductors

&

Semiconductor

Equipment

0.6%

ASML

Holding

NV

(Netherlands)

118

70,932

Magnachip

Semiconductor

Corp.

(South

Korea)

*

11,350

83,877

Silicon

Motion

Technology

Corp.,

ADR

(Taiwan)

*

3,262

174,778

SunEdison,

Inc.

*(b)(c)

16,689

—

Tower

Semiconductor

Ltd.

(Israel)

*

15,700

361,414

691,001

Software

3.6%

EngageSmart

,

Inc.

*

2,956

66,953

LiveVox

Holdings,

Inc.

*

21,209

76,565

New

Relic,

Inc.

*

12,263

1,062,834

SAP

SE

(Germany)

10,254

1,375,393

Splunk,

Inc.

*

4,700

691,652

VMware,

Inc.,

Class

A

*(b)(c)

7,577

1,156,250

4,429,647

Specialty

Retail

0.2%

ASOS

plc

(United

Kingdom)

*

1,085

5,242

Chico's

FAS,

Inc.

*

7,250

54,230

GNC

Holdings,

Inc.

Escrow

*(b)(c)

5,700

—

Sportsman's

Warehouse

Holdings,

Inc.

*

36,345

184,996

Toys

R

Us,

Inc.

*(b)

2,810

14,050

258,518

Technology

Hardware,

Storage

&

Peripherals

1.2%

Apple,

Inc.

4,740

809,450

Avid

Technology,

Inc.

*

7,291

197,003

Investments

Shares

Value

Samsung

Electronics

Co.

Ltd.,

GDR

(South

Korea)

(d)

357

$

446,420

Stratasys

Ltd.

*

4,644

47,229

1,500,102

Textiles,

Apparel

&

Luxury

Goods

1.1%

Capri

Holdings

Ltd.

*

23,367

1,195,923

Tapestry,

Inc.

7,262

200,141

1,396,064

Trading

Companies

&

Distributors

0.7%

Brenntag

SE

(Germany)

4,444

330,463

IMCD

NV

(Netherlands)

2,702

325,309

Textainer

Group

Holdings

Ltd.

(China)

5,230

256,897

912,669

Wireless

Telecommunication

Services

0.1%

Millicom

International

Cellular

SA

(Guatemala)

*

4,950

77,764

Total

Common

Stocks

(Cost

$39,855,031

)

38,253,201

Preferred

Stocks

0.1%

Broadline

Retail

0.0%

(a)

Qurate

Retail,

Inc.

8.00%,

3/15/2031

991

23,586

Trading

Companies

&

Distributors

0.1%

Textainer

Group

Holdings

Ltd.,

Series

B,

6.25%,

12/15/2026

(China)

(f)

1,400

33,950

Total

Preferred

Stocks

(Cost

$77,863)

57,536

Principal

Amount

Corporate

Bonds

0.0%

Independent

Power

and

Renewable

Electricity

Producers

0.0%

GenOn

Energy,

Inc.

Escrow

,

9.50%,

10/15/2018

(b)(c)(g)

$

354,000

—

9.88%,

10/15/2020

(b)(c)(g)

1,655,000

—

Total

Corporate

Bonds

(Cost

$—

)

—

Insurance

Linked

Securities

6.5%

2001

Cat

RE

Ltd.

(Bermuda)

Series

A,

(3

Month

Treasury

Bill

Rate

+

12.66%),

18.17%,

1/8/2024

(h)(i)

750,000

747,750

Consolidated

Schedule

of

Investments

Absolute

Return

Multi-Manager

Fund^

(cont’d)

See

Notes

to

Consolidated

Financial

Statements

Investments

Principal

Amount

Value

Atlas

Capital

Reinsurance

2020

DAC

(Ireland)

Series

2020,

(3

Month

Treasury

Bill

Rate

+

8.30%),

13.69%,

6/10/2024

(h)(i)

$

700,000

$

711,620

Gateway

Re

Ltd.

Series

A,

(1

Month

Treasury

Bill

Rate

+

13.00%),

18.48%,

2/24/2026

(h)(i)

250,000

263,925

Herbie

Re

Ltd.

(Bermuda)

Series

B,

(3

Month

Treasury

Bill

Rate

+

9.72%),

15.17%,

1/8/2025

(h)(i)

750,000

746,850

Series

A,

(3

Month

Treasury

Bill

Rate

+

6.73%),

12.18%,

1/8/2025

(h)(i)

250,000

245,250

Hestia

Re

Ltd.

(Bermuda)

Series

A,

(1

Month

Treasury

Bill

Rate

+

9.75%),

15.20%,

4/7/2026

(h)(i)

500,000

518,400

Kendall

Re

Ltd.

(Bermuda)

Series

B,

(3

Month

Treasury

Bill

Rate

+

6.25%),

11.65%,

5/2/2024

(h)(i)

275,000

274,175

Kilimanjaro

III

Re

Ltd.

(Bermuda)

Series

B,

(3

Month

Treasury

Bill

Rate

+

9.91%),

15.42%,

12/19/2024

(h)(i)

250,000

250,750

Lightning

Re

Series

2023-

1,

(3

Month

Treasury

Bill

Rate

+

11.00%),

16.44%,

3/31/2026

(h)(i)

500,000

524,400

Matterhorn

Re

Ltd.

(Bermuda)

(SOFR

+

7.75%),

13.09%,

3/24/2025

(h)(i)

500,000

497,000

Investments

Principal

Amount

Value

Mystic

Re

IV

Ltd.

(Bermuda)

Series

A,

(3

Month

Treasury

Bill

Rate

+

9.75%),

15.26%,

1/8/2024

(h)(i)

$

750,000

$

749,250

Northshore

Re

II

Ltd.

(Bermuda)

Series

A,

(3

Month

Treasury

Bill

Rate

+

5.75%),

11.23%,

1/8/2024

(h)(i)

500,000

499,000

Purple

Re

Ltd.

(Bermuda)

Series

A,

(1

Month

Treasury

Bill

Rate

+

10.00%),

15.47%,

6/5/2026

(h)(i)

250,000

253,175

Tailwind

RE

Ltd.

(Bermuda)

Series

B,

(3

Month

Treasury

Bill

Rate

+

8.75%),

14.19%,

1/8/2025

(h)(i)

750,000

732,375

Titania

RE

Ltd.

(Bermuda)

Series

A,

(1

Month

Treasury

Bill

Rate

+

6.50%),

11.95%,

12/27/2024

(h)(i)

250,000

242,425

Series

A,

(1

Month

Treasury

Bill

Rate

+

12.25%),

17.70%,

2/27/2026

(h)(i)

750,000

802,500

Total

Insurance

Linked

Securities

(Cost

$7,686,220)

8,058,845

Loan

Assignments

0.0%

(a)

Media

0.0%

(a)

Deluxe

Entertainment

Services

Group,

Inc.,

1st

Lien

Term

Loan

,

(ICE

LIBOR

USD

3

Month

+

5.00%),

12.50%

Cash/1.50%

PIK,

due

3/25/2024

(b)(c)(h)(j)

14,162

5,632

Deluxe

Entertainment

Services

Group,

Inc.,

2nd

Lien

Term

Loan

,

Consolidated

Schedule

of

Investments

Absolute

Return

Multi-Manager

Fund^

(cont’d)

See

Notes

to

Consolidated

Financial

Statements

All

bonds

are

denominated

in

US

dollars,

unless

noted

otherwise.

Investments

Principal

Amount

Value

(ICE

LIBOR

USD

3

Month

+

6.00%),

13.50%

Cash/2.50%

PIK,

due

9/25/2024

(b)(c)(h)(j)

$

153,519

$

—

Total

Loan

Assignments

(Cost

$104,127)

5,632

No.

of

Rights

Rights

0.1%

Biotechnology

0.1%

Achillion

Pharmaceuticals,

Inc.,

CVR

*(b)

23,300

11,650

Adamas

Pharmaceuticals,

Inc.,

CVR

*(b)

24,600

1,230

Akouos

,

Inc.,

CVR

*(b)

38,850

29,137

Ambit

Biosciences

Corp.,

CVR

*(b)(c)

70,000

—

Clementia

Pharmaceuticals,

Inc.,

CVR

(France)

*(b)(c)

3,200

—

Tobira

Therapeutics,

Inc.,

CVR

*(b)(c)

6,900

—

42,017

Financial

Services

0.0%

(a)

Resolute

Forest

Products,

Inc.

CVR

*(b)

5,750

11,500

Health

Care

Equipment

&

Supplies

0.0%

(a)

ABIOMED,

Inc.,

CVR

*(b)

3,300

5,775

IT

Services

0.0%

(a)

Flexion

Therapeutics,

Inc.,

CVR

*(b)

18,500

12,025

Metals

&

Mining

0.0%

(a)

Kinross

Gold

Corp.,

CVR

(Canada)

*(b)(c)

4,800

3

Pan

American

Silver

Corp.,

CVR

(Canada)

*

39,600

19,840

19,843

Total

Rights

(Cost

$71,472)

91,160

No.

of

Warrants

Warrants

0.0%

(a)

Leisure

Products

0.0%

(a)

Tonies

SE,

expiring

4/30/2026

(Germany)

*

(Cost

$—)

4,329

229

Investments

Shares

Value

Short-Term

Investments

53.6%

Investment

Companies

53.6%

Fidelity

Treasury

Only

Portfolio,

Institutional

Class,

5.29%

(k)

66,330,745

$

66,330,745

Morgan

Stanley

Institutional

Liquidity

Funds

Treasury

Securities

Portfolio,

Institutional

Class,

5.24%

(k)

1

1

Total

Investment

Companies

(Cost

$66,330,746)

66,330,746

Total

Long

Positions

(Cost

$114,125,459

)

112,797,349

Short

Positions

(3.8)%

(l)

Common

Stocks

Sold

Short

(3.8)%

Banks

(0.2)%

Atlantic

Union

Bankshares

Corp.

(5,169)

(148,919)

Provident

Financial

Services,

Inc.

(2,632)

(36,980)

(185,899)

Chemicals

(0.1)%

Livent

Corp.

(5,282)

(77,064)

Food

Products

(0.0)%

(a)

J

M

Smucker

Co.

(The)

(287)

(32,672)

Household

Durables

(0.2)%

Lennar

Corp.,

Class

A

(2,240)

(238,963)

Metals

&

Mining

(0.3)%

Newmont

Corp.

(10,835)

(405,987)

Oil,

Gas

&

Consumable

Fuels

(2.4)%

Chevron

Corp.

(1,376)

(200,525)

Exxon

Mobil

Corp.

(26,025)

(2,754,746)

Permian

Resources

Corp.

(4,977)

(72,515)

(3,027,786)

Retail

REITs

(0.0)%

(a)

Kimco

Realty

Corp.,

REIT

(2,957)

(53,049)

Semiconductors

&

Semiconductor

Equipment

(0.6)%

Broadcom,

Inc.

(829)

(697,496)

Total

Common

Stocks

Sold

Short

(Proceeds

$(4,653,886))

(4,718,916)

Total

Short

Positions

(Proceeds

$(4,653,886))

(4,718,916)

Total

Investments

87.4%

(Cost

$109,471,573

)

108,078,433

Other

Assets

Less

Liabilities

12.6%

(m)

15,581,268

Net

Assets

100.0%

$123,659,701

Consolidated

Schedule

of

Investments

Absolute

Return

Multi-Manager

Fund^

(cont’d)

See

Notes

to

Consolidated

Financial

Statements

*

Non-income

producing

security.

(a)

Represents

less

than

0.05%

of

net

assets

of

the

Fund.

(b)

Value

determined

using

significant

unobservable

inputs.

(c)

Security

fair

valued

as

of

October

31,

2023,

in

accordance

with

procedures

approved

by

the

valuation

designee.

Total

value

of

all

such

securities

at

October

31,

2023,

amounted

to

$1,568,085,

which

represents

1.3%

of

net

assets

of

the

Fund.

(d)

Security

exempt

from

registration

pursuant

to

Regulation

S

under

the

Securities

Act

of

1933,

as

amended.

Regulation

S

applies

to

securities

offerings

that

are

made

outside

of

the

United

States

and

do

not

involve

directed

selling

efforts

in

the

United

States

and

as

such

may

have

restrictions

on

resale.

At

October

31,

2023,

these

securities

amounted

to

$464,890

of

long

positions

which

represents

0.4%

of

net

assets

of

the

Fund.

(e)

All

or

a

portion

of

this

security

is

pledged

as

collateral

for

options

written.

(f)

Perpetual

security.

Perpetual

securities

have

no

stated

maturity

date,

but

they

may

be

called/redeemed

by

the

issuer.

The

date

shown

reflects

the

next

call

date.

(g)

Defaulted

security.

(h)

Variable

or

floating

rate

security.

The

interest

rate

shown

was

the

current

rate

as

of

October

31,

2023,

and

changes

periodically.

(i)

Securities

were

purchased

or

sold

short

under

Rule

144A

of

the

Securities

Act

of

1933,

as

amended,

or

are

otherwise

restricted

and,

unless

registered

under

the

Securities

Act

of

1933

or

exempted

from

registration,

may

only

be

sold

to

qualified

institutional

investors

or

may

have

other

restrictions

on

resale.

At

October

31,

2023,

these

securities

amounted

to

$8,058,845

of

long

positions,

which

represents

6.5%

of

net

assets

of

the

Fund.

(j)

Payment

in-kind

security.

(k)

Represents

7-day

effective

yield

as

of

October

31,

2023.

(l)

At

October

31,

2023,

the

Fund

had

approximately

$4,569,836

deposited

in

one

or

more

accounts

to

satisfy

collateral

requirements

for

borrowing

in

connection

with

securities

sold

short.

(m)

Includes

the

impact

of

the

Fund’s

open

positions

in

derivatives

at

October

31,

2023.

Abbreviations

ADR

American

Depositary

Receipt

CVR

Contingent

Value

Rights

GDR

Global

Depositary

Receipt

ICE

Intercontinental

Exchange

LIBOR

London

Interbank

Offered

Rate

PJSC

Public

Joint

Stock

Company

SA

Société

Anonyme

USD

United

States

Dollar

Consolidated

Schedule

of

Investments

Absolute

Return

Multi-Manager

Fund^

(cont’d)

See

Notes

to

Consolidated

Financial

Statements

LONG

POSITIONS

BY

COUNTRY

Country

Investments

at

Value

Percentage

of

Net

Assets

United

States

$

26,890,472

21.7%

Bermuda

6,558,900

5.3%

China

2,564,376

2.1%

Germany

2,079,225

1.7%

United

Kingdom

1,277,771

1.0%

Brazil

1,179,755

1.0%

Ireland

711,620

0.6%

Luxembourg

693,273

0.6%

Israel

675,315

0.6%

Hong

Kong

629,567

0.5%

South

Korea

530,297

0.4%

Australia

503,723