UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-21726

360 Funds

(Exact name of registrant as specified in charter)

| 4300 Shawnee Mission Parkway, Suite 100, Fairway, KS | 66205 |

| (Address of principal executive offices) | (Zip code) |

The Corporation Trust Company

Corporation Trust Center

1209 Orange St.

Wilmington, DE 19801

(Name and address of agent for service)

With Copies To:

Bo J. Howell

Strauss Troy Co., LPA

Federal Reserve Building

150 E. 4th Street, 4th Floor

Cincinnati, OH 45202-4018

Registrant’s telephone number, including area code: 877-244-6235

Date of fiscal year end: 02/28/2021

Date of reporting period: 02/28/2021

| ITEM 1. | REPORTS TO SHAREHOLDERS |

The Annual report to Shareholders of the Stringer Growth Fund, a series of the 360 Funds (the "registrant"), for the fiscal year ended February 28, 2021 pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the "1940 Act") (17 CFR 270.30e-1) is filed herewith.

Stringer Growth Fund Class A Shares (Ticker Symbol: SRGAX) Class C Shares (Ticker Symbol: SRGCX) Institutional Class Shares (Ticker Symbol: SRGIX) A series of the 360 Funds |

ANNUAL REPORT

February 28, 2021

Investment Adviser

Stringer Asset Management, LLC

5050 Poplar Avenue, Suite 1103

Memphis, TN 38157

IMPORTANT NOTE: Effective January 1, 2021, as permitted by regulations adopted by the SEC, paper copies of the Stringer Growth Fund’s (the “Fund”) shareholder reports are no longer sent by mail unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports are made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive all future reports in paper free of charge. You can inform the Fund or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by calling or sending an e-mail request.

TABLE OF CONTENTS

Dear Shareholders:

In last year’s Letter we said that our indicators suggested that the economy was likely heading for a brief yet deep recession, followed by a strong economic rebound. Pent up demand often results in a swift acceleration in the pace of economic activity.

The Stringer Growth Fund (the “Fund” or “Growth Fund”) was positioned conservatively early last year because of the inverted yield curve we saw in 2019. An inverted yield curve, where short-term interest rates are higher than long-term interest rates, is a bad omen for the economy and markets, in our view. As our other sensitive leading economic indicators were turning down, we began to reduce equity exposure and hold more cash in early March. As the markets experienced a liquidity shock in mid-March, our Cash Indicator signaled for the first time since inception of the Fund. As a result, we increased cash further to about 25% of Fund assets. During that period, the Fund performed near the top of its peer group and held up better than the global equity market.

By early April, our most sensitive leading indicators were turning in a positive direction and we began to reinvest the cash holdings and reallocate existing equity holdings. Investments in convertible bonds, information technology, home builders, and transportation companies worked out very well, as did our long-term positions in momentum ETFs. Overall, our process, supported by our Three Layers of Risk Management (strategic, tactical, and the Cash Indicator) resulted in the Fund both protecting during the depths of the equity market decline as well as participating in the recovery. By May and June, we were estimating and positioning for a V-shaped recovery and what we think will be deemed a steep but short recession, the shortest since records began in 1854.

During the fiscal year ended February 28, 2021, the Fund had a return of 26.98%(a) versus 30.25% for the MCSI AC World Net Total Return Index(b). Given the level of risk in the Growth Fund, these results are in-line with expectations. Unlike most funds that can raise cash to play defense, the Growth Fund was fully invested early in the market recovery. This early reinvestment helped the Growth Fund participate in the market rebound.

The Fund experienced an above average capital gain distribution due to the amount of trading based on economic and market volatility, yet was fairly tax efficient as we realized losses throughout the year.

Our current outlook is optimistic for the U.S. economy overall. At this phase of the economic recovery, the Growth Fund is overweight cyclical value sectors including financial and energy while also being overweight the health care sector.

Thank you for your continued trust and support. Please let us know if there is anything we can do to help you.

Respectfully,

Gary Stringer, CFA

President of Stringer Asset Management, LLC

March 22, 2021

Stringer Asset Management, LLC | 5050 Poplar Avenue, Suite 1103 | Memphis, TN 38157 | 901-800-2956 | info@stringeram.com

(a) The performance information shown is for the Fund’s Institutional Class shares. Please see the Total Return Table on the following pages for performance information on the Fund’s Class A and Class C shares. The performance information quoted assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235. Investors should consider the investment objectives, risks, charges and expenses carefully before investing or sending money. This and other important information about the Fund can be found in the Fund’s prospectus. Please read it carefully before investing.

(b) MSCI AC World Net Total Return Index is a free-float weighted equity index that includes both emerging and developed world markets. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track and individuals cannot invest directly in any index.

Stringer Asset Management, LLC | 5050 Poplar Avenue, Suite 1103 | Memphis, TN 38157 | 901-800-2956 | info@stringeram.com

| Stringer Growth Fund | ANNUAL REPORT |

INVESTMENT HIGHLIGHTS

February 28, 2021 (Unaudited)

The investment objective of the Stringer Growth Fund (the “Fund”) is long-term growth of capital. To meet its investment objective, the Fund will invest primarily in unaffiliated exchange-traded funds (“ETFs”). The underlying ETFs will invest in various securities including, but not limited to, domestic equity securities (including large-, mid-and small-cap stocks), stocks offered in international markets, including emerging markets, domestic fixed income securities, foreign debt securities, and cash or cash equivalents. The Fund may also invest in alternative sector ETFs, such as commodity and real estate ETFs, as well as exchange-traded notes (“ETNs”). ETNs are unsecured debt obligations of investment banks which are traded on exchanges and the returns of which are linked to the performance of market indices. The Fund will generally invest in ETNs which are linked to commodities indices; however, investing in ETNs is not equivalent to investing directly in index components or the relevant index itself. The Fund may also invest directly in domestic equity securities (including large-, small-and mid-cap stocks), stocks offered in international markets, including emerging markets, and unaffiliated open-end investment companies.

The Fund is designed to meet investor needs for a diversified portfolio solution with a defined risk objective of long-term growth through a fully managed investment policy utilizing primarily ETFs as well as United States and foreign equity securities, debt and money market securities, the combination of which will be varied from time to time both with respect to types of securities and markets in response to changing market and economic trends. The portfolio is built around a strategic allocation which allocates the portfolio’s investments to large cap stocks, small-and mid-cap stocks, international securities (including emerging markets), and other investments, primarily through investments in ETFs.

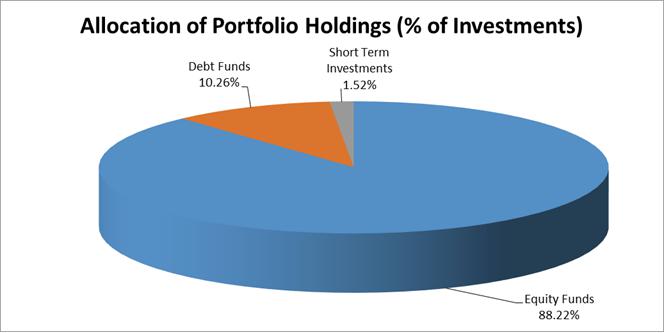

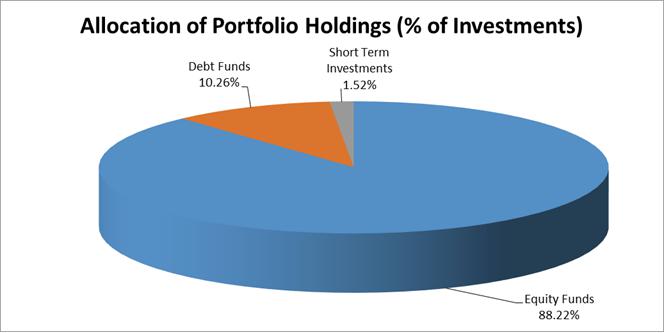

The percentages in the above graph are based on the portfolio holdings of the Fund as of February 28, 2021 and are subject to change.

| Stringer Growth Fund | ANNUAL REPORT |

INVESTMENT HIGHLIGHTS

February 28, 2021 (Unaudited)

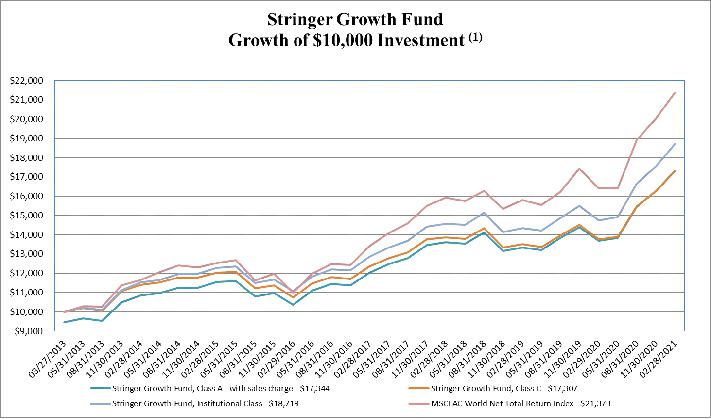

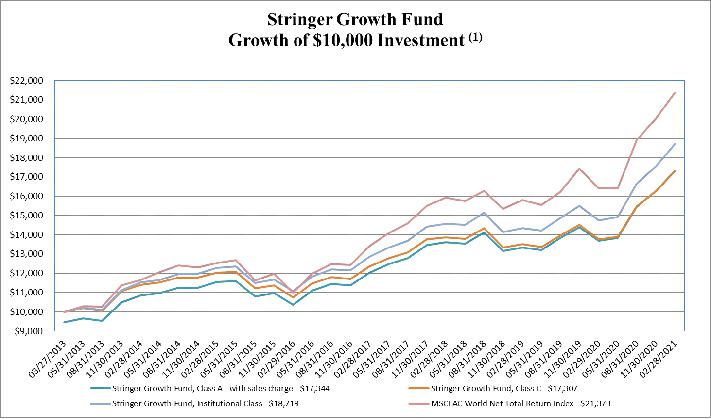

(1) The minimum initial investment for the Institutional Class shares is $1,000,000.

Returns as of February 28, 2021 | | One Year Ended February 28, 2021 | | Five Years Ended February 28, 2021 | | Since Inception of

March 27, 2013

through February 28, 2021 |

| Stringer Growth Fund Class A without sales charge | | 26.60% | | 10.82% | | 7.96% |

| Stringer Growth Fund Class A with sales charge | | 19.64% | | 9.58% | | 7.19% |

| Stringer Growth Fund Class C without CDSC | | 25.69% | | 10.02% | | 7.16% |

| Stringer Growth Fund Institutional Class | | 26.98% | | 11.09% | | 8.23% |

| MSCI AC World Net Total Return Index | | 30.25% | | 14.25% | | 10.06% |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-244-6235.

The above graph depicts the performance of the Stringer Growth Fund versus the MSCI AC World Net Total Return Index. The MSCI AC World Net Total Return Index is a free-float weighted equity index that includes both emerging and developed world markets. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the MSCI AC World Net Total Return Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the index; so too with the Stringer Growth Fund, which will generally not invest in all the securities comprising this index.

| STRINGER GROWTH FUND | ANNUAL REPORT |

| SCHEDULE OF INVESTMENTS | | | | | | |

| February 28, 2021 | | | | | | |

| | | | | | | |

| | | Shares | | | Value | |

| EXCHANGE-TRADED FUNDS - 98.58% | | | | | | | | |

| | | | | | | | | |

| DEBT FUNDS - 10.27% | | | | | | | | |

| First Trust Preferred Securities and Income ETF | | | 58,961 | | | $ | 1,183,937 | |

| iShares Convertible Bond ETF | | | 18,520 | | | | 1,923,858 | |

| | | | | | | | 3,107,795 | |

| EQUITY FUNDS - 88.31% | | | | | | | | |

| Energy Select Sector SPDR Fund | | | 29,615 | | | | 1,425,962 | |

| Financial Select Sector SPDR Fund | | | 45,599 | | | | 1,473,304 | |

| FlexShares Quality Dividend Index Fund | | | 29,429 | | | | 1,479,690 | |

| Health Care Select Sector SPDR Fund | | | 10,495 | | | | 1,181,842 | |

| Invesco Russell 1000 Dynamic Multifactor ETF | | | 43,157 | | | | 1,826,836 | |

| iShares MSCI Emerging Markets Asia ETF | | | 19,833 | | | | 1,833,957 | |

| iShares MSCI Global Min Vol Factor ETF | | | 15,130 | | | | 1,424,036 | |

| iShares MSCI International Momentum Factor ETF | | | 38,590 | | | | 1,443,621 | |

| iShares MSCI International Quality Factor ETF | | | 35,616 | | | | 1,263,656 | |

| iShares MSCI USA Min Vol Factor ETF | | | 18,265 | | | | 1,201,472 | |

| iShares MSCI USA Momentum Factor ETF | | | 14,723 | | | | 2,398,377 | |

| iShares MSCI USA Value Factor ETF | | | 28,621 | | | | 2,747,043 | |

| iShares Russell 1000 Value ETF | | | 6,438 | | | | 924,239 | |

| Overlay Shares Large Cap Equity ETF | | | 32,691 | | | | 1,067,763 | |

| Simplify US Equity PLUS Downside Convexity ETF | | | 48,876 | | | | 1,332,848 | |

| SPDR MSCI EAFE StrategicFactors ETF | | | 33,657 | | | | 2,355,653 | |

| SPDR S&P Bank ETF | | | 27,131 | | | | 1,349,225 | |

| | | | | | | | 26,729,524 | |

| | | | | | | | | |

| TOTAL EXCHANGE-TRADED FUNDS (Cost $24,880,134) | | | | | | | 29,837,319 | |

| | | | | | | | | |

| SHORT TERM INVESTMENTS - 1.52% | | | | | | | | |

| Federated Hermes Government Obligations Fund - Institutional Shares, 0.01% (a) (Cost $461,460) | | | 461,460 | | | | 461,460 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (Cost $25,341,594) - 100.10% | | | | | | $ | 30,298,779 | |

| | | | | | | | | |

| LIABILITIES IN EXCESS OF OTHER ASSETS, NET - (0.10)% | | | | | | | (30,426 | ) |

| | | | | | | | | |

| NET ASSETS - 100% | | | | | | $ | 30,268,353 | |

| Percentages are stated as a percent of net assets. |

| |

| (a) Rate shown represents the 7-day yield at February 28, 2021, is subject to change and resets daily. |

| |

| ETF - Exchange-Traded Fund |

| |

| The accompanying notes are an integral part of these financial statements. |

| STRINGER GROWTH FUND | |

| STATEMENT OF ASSETS AND LIABILITIES | |

| February 28, 2021 | | ANNUAL REPORT | |

| Assets: | | | |

| Investments, at cost | | $ | 25,341,594 | |

| Investments, at value | | $ | 30,298,779 | |

| Receivables: | | | | |

| Interest | | | 5 | |

| Fund shares sold | | | 498 | |

| Prepaid expenses | | | 26,200 | |

| Total assets | | | 30,325,482 | |

| | | | | |

| Liabilities: | | | | |

| Payables: | | | | |

| Fund shares redeemed | | | 1,780 | |

| Due to Adviser | | | 6,882 | |

| Accrued distribution (12b-1) fees | | | 9,887 | |

| Due to administrator | | | 12,890 | |

| Accrued expenses | | | 25,690 | |

| Total liabilities | | | 57,129 | |

| Net Assets | | $ | 30,268,353 | |

| | | | | |

| Sources of Net Assets: | | | | |

| Paid-in beneficial interest | | $ | 23,368,026 | |

| Total distributable earnings | | | 6,900,327 | |

| Total Net Assets (Unlimited $0 par value shares of beneficial interest authorized) | | $ | 30,268,353 | |

| | | | | |

| | | | | |

| Class A Shares: | | | | |

| Net assets | | $ | 4,027,933 | |

| Shares Outstanding (Unlimited $0 par value shares of beneficial interest authorized) | | | 295,410 | |

| Net Asset Value Per Share | | $ | 13.64 | |

| | | | | |

| Maximum Offering Price Per Share (a) | | $ | 14.43 | |

| | | | | |

| Minimum Redemption Price Per Share (b) | | $ | 13.50 | |

| | | | | |

| Class C Shares: | | | | |

| Net assets | | $ | 9,923,983 | |

| Shares Outstanding (Unlimited $0 par value shares of beneficial interest authorized) | | | 734,614 | |

| Net Asset Value and Offering Price Per Share | | $ | 13.51 | |

| | | | | |

| Minimum Redemption Price Per Share (c) | | $ | 13.37 | |

| | | | | |

| Institutional Class Shares: | | | | |

| Net assets | | $ | 16,316,437 | |

| Shares Outstanding (Unlimited $0 par value shares of beneficial interest authorized) | | | 1,195,455 | |

| Net Asset Value, Offering and Redemption Price Per Share | | $ | 13.65 | |

| (a) A maximum sales charge of 5.50% is imposed on Class A shares. |

| (b) Investments in Class A shares made at or above the $1 million breakpoint are not subject to an initial sales charge and may be subject to a 1.00% contingent deferred sales charge ("CDSC") on shares redeemed within one year from the date of purchase. |

| (c) A contingent deferred sales charge ("CDSC") of 1.00% is imposed in the event of certain Class C redemption transactions made within one year from the date of purchase. |

| | | | | | | |

| The accompanying notes are an integral part of these financial statements. |

| STRINGER GROWTH FUND | | | | |

| STATEMENT OF OPERATIONS | | | | |

| | | | | |

| | | | | ANNUAL REPORT |

| | | For the | |

| | | Year Ended | |

| | | February 28, 2021 | |

| Investment income: | | | | |

| Dividends | | $ | 515,924 | |

| Interest | | | 1,804 | |

| Total investment income | | | 517,728 | |

| | | | | |

| Expenses: | | | | |

| Advisory fees (Note 5) | | | 260,479 | |

| Distribution (12b-1) fees - Class A (Note 5) | | | 9,481 | |

| Distribution (12b-1) fees - Class C (Note 5) | | | 87,924 | |

| Accounting and transfer agent fees and expenses (Note 5) | | | 114,563 | |

| Registration and filing fees | | | 33,968 | |

| Trustee fees and expenses | | | 16,979 | |

| Liquidity Rule fees | | | 26,754 | |

| Miscellaneous | | | 15,945 | |

| Audit fees | | | 13,000 | |

| Custodian fees | | | 9,334 | |

| Legal fees | | | 8,267 | |

| Reports to shareholders | | | 19,556 | |

| Insurance | | | 2,603 | |

| Pricing fees | | | 2,616 | |

| Non-12b-1 shareholder servicing expense | | | 393 | |

| Total expenses | | | 621,862 | |

| | | | | |

| Less: fees waived (Note 5) | | | (236,559 | ) |

| Net expenses | | | 385,303 | |

| | | | | |

| Net investment income | | | 132,425 | |

| | | | | |

| Realized and unrealized gain: | | | | |

| Net realized gain on: | | | | |

| Investments (a) | | | 2,689,048 | |

| Net realized gain on investments | | | 2,689,048 | |

| | | | | |

| Net change in unrealized appreciation on: | | | | |

| Investments | | | 3,771,877 | |

| Net change in unrealized appreciation | | | 3,771,877 | |

| | | | | |

| Net realized and unrealized gain on investments | | | 6,460,925 | |

| | | | | |

| Net increase in net assets resulting from operations | | $ | 6,593,350 | |

| (a) Includes capital gains distributions from underlying investments of $52,198. |

| | | | | |

| The accompanying notes are an integral part of these financial statements. |

| STRINGER GROWTH FUND | |

| STATEMENTS OF CHANGES IN NET ASSETS | |

| | |

| | ANNUAL REPORT |

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | February 28, 2021 | | | February 29, 2020 | |

| Increase (decrease) in net assets from: | | | | | | | | |

| Operations: | | | | | | | | |

| Net investment income | | $ | 132,425 | | | $ | 195,803 | |

| Net realized gain on investments | | | 2,689,048 | | | | 1,410,369 | |

| Net change in unrealized appreciation (depreciation) on investments | | | 3,771,877 | | | | (639,801 | ) |

| Net increase in net assets resulting from operations | | | 6,593,350 | | | | 966,371 | |

| | | | | | | | | |

| Distributions to shareholders from: | | | | | | | | |

| Distributable earnings - Class A | | | (231,664 | ) | | | (60,164 | ) |

| Distributable earnings - Class C | �� | | (504,934 | ) | | | (57,991 | ) |

| Distributable earnings - Institutional Class | | | (935,306 | ) | | | (251,010 | ) |

| Total distributions | | | (1,671,904 | ) | | | (369,165 | ) |

| | | | | | | | | |

| Beneficial interest transactions (Note 3): | | | | | | | | |

| Decrease in net assets from beneficial interest transactions | | | (338,352 | ) | | | (5,846,061 | ) |

| | | | | | | | | |

| Increase (decrease) in net assets | | | 4,583,094 | | | | (5,248,855 | ) |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of year | | | 25,685,259 | | | | 30,934,114 | |

| | | | | | | | | |

| End of year | | $ | 30,268,353 | | | $ | 25,685,259 | |

The accompanying notes are an integral part of these financial statements.

| STRINGER GROWTH FUND | |

| FINANCIAL HIGHLIGHTS | |

| | |

| | ANNUAL REPORT |

The following tables set forth the per share operating performance data for a share of beneficial interest outstanding, total return, ratios to average net assets and other supplemental data for the years indicated.

| | | Class A | |

| | | For the | | | For the | | | For the | | | For the | | | For the | |

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | February 28, 2021 | | | February 29, 2020 | | | February 28, 2019 | | | February 28, 2018 | | | February 28, 2017 | |

| Net Asset Value, Beginning of Year | | $ | 11.42 | | | $ | 11.28 | | | $ | 12.65 | | | $ | 12.01 | | | $ | 10.45 | |

| | | | | | | | | | | | | | | | | | | | | |

| Investment Operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.07 | (d) | | | 0.09 | (d) | | | 0.12 | | | | 0.11 | | | | 0.11 | |

| Net realized and unrealized gain (loss) on investments | | | 2.94 | | | | 0.23 | | | | (0.47 | ) | | | 1.46 | | | | 1.56 | |

| Total from investment operations | | | 3.01 | | | | 0.32 | | | | (0.35 | ) | | | 1.57 | | | | 1.67 | |

| | | | | | | | | | | | | | | | | | | | | |

| Distributions: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.07 | ) | | | (0.10 | ) | | | (0.09 | ) | | | (0.11 | ) | | | (0.11 | ) |

| From net realized capital gains | | | (0.72 | ) | | | (0.08 | ) | | | (0.93 | ) | | | (0.82 | ) | | | — | |

| Total distributions | | | (0.79 | ) | | | (0.18 | ) | | | (1.02 | ) | | | (0.93 | ) | | | (0.11 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Year | | $ | 13.64 | | | $ | 11.42 | | | $ | 11.28 | | | $ | 12.65 | | | $ | 12.01 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Return(a) | | | 26.60 | % | | | 2.70 | % | | | (1.97 | )% | | | 13.09 | % | | | 15.98 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in 000's) | | $ | 4,028 | | | $ | 3,730 | | | $ | 4,355 | | | $ | 10,083 | | | $ | 13,524 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before fees waived and expenses absorbed (b) | | | 2.16 | % | | | 1.86 | % | | | 1.70 | % | | | 1.63 | % | | | 1.57 | % |

| After fees waived and expenses absorbed (b) | | | 1.30 | % | | | 1.30 | % | | | 1.30 | % | | | 1.37 | % | | | 1.57 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income (loss): | | | | | | | | | | | | | | | | | | | | |

| Before fees waived and expenses absorbed (b) (c) | | | (0.27 | )% | | | 0.19 | % | | | 0.39 | % | | | 0.60 | % | | | 0.99 | % |

| After fees waived and expenses absorbed (b) (c) | | | 0.60 | % | | | 0.75 | % | | | 0.79 | % | | | 0.86 | % | | | 1.00 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 212 | % | | | 68 | % | | | 68 | % | | | 126 | % | | | 79 | % |

| (a) | Total Return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. Had the Adviser not waived fees/reimbursed expenses, total returns would have been lower. The returns shown exclude the impact of any sales loads and contingent deferred sales charges. |

| (b) | These ratios exclude the impact of the expenses of the underlying investment companies in which the Fund invests. |

| (c) | Recognition of net investment income (loss) by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. |

| (d) | Net investment income per share is based on average shares outstanding for the years ended February 28, 2021 and February 29, 2020. |

The accompanying notes are an integral part of these financial statements.

| STRINGER GROWTH FUND | |

| FINANCIAL HIGHLIGHTS | |

| | | |

| | | ANNUAL REPORT |

The following tables set forth the per share operating performance data for a share of beneficial interest outstanding, total return, ratios to average net assets and other supplemental data for the years indicated.

| | | Class C | |

| | | For the | | | For the | | | For the | | | For the | | | For the | |

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | February 28, 2021 | | | February 29, 2020 | | | February 28, 2019 | | | February 28, 2018 | | | February 28, 2017 | |

| Net Asset Value, Beginning of Year | | $ | 11.34 | | | $ | 11.19 | | | $ | 12.55 | | | $ | 11.92 | | | $ | 10.36 | |

| | | | | | | | | | | | | | | | | | | | | |

| Investment Operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | (0.02 | )(f) | | | 0.00 | (a)(f) | | | 0.00 | (a) | | | 0.01 | | | | 0.01 | |

| Net realized and unrealized gain (loss) on investments | | | 2.91 | | | | 0.23 | | | | (0.43 | ) | | | 1.46 | | | | 1.55 | |

| Total from investment operations | | | 2.89 | | | | 0.23 | | | | (0.43 | ) | | | 1.47 | | | | 1.56 | |

| | | | | | | | | | | | | | | | | | | | | |

| Distributions: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | — | | | | — | | | | — | | | | (0.02 | ) | | | (0.00 | ) |

| From net realized capital gains | | | (0.72 | ) | | | (0.08 | ) | | | (0.93 | ) | | | (0.82 | ) | | | — | |

| Total distributions | | | (0.72 | ) | | | (0.08 | ) | | | (0.93 | ) | | | (0.84 | ) | | | (0.00 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Year | | $ | 13.51 | | | $ | 11.34 | | | $ | 11.19 | | | $ | 12.55 | | | $ | 11.92 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Return (c) | | | 25.69 | % | | | 1.99 | % | | | (2.68 | )% | | | 12.27 | % | | | 15.08 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in 000's) | | $ | 9,924 | | | $ | 8,380 | | | $ | 11,094 | | | $ | 14,648 | | | $ | 15,582 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before fees waived and expenses absorbed (d) | | | 2.91 | % | | | 2.61 | % | | | 2.45 | % | | | 2.38 | % | | | 2.32 | % |

| After fees waived and expenses absorbed (d) | | | 2.05 | % | | | 2.05 | % | | | 2.05 | % | | | 2.12 | % | | | 2.32 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income (loss): | | | | | | | | | | | | | | | | | | | | |

| Before fees waived and expenses absorbed (d)(e) | | | (1.02 | )% | | | (0.53 | )% | | | (0.33 | )% | | | (0.15 | )% | | | 0.24 | % |

| After fees waived and expenses absorbed (d)(e) | | | (0.16 | )% | | | 0.03 | % | | | 0.07 | % | | | 0.11 | % | | | 0.25 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 212 | % | | | 68 | % | | | 68 | % | | | 126 | % | | | 79 | % |

| (a) | Net investment income (loss) per share was less than $0.01 per share for the years ended February 29, 2020 and February 28, 2019. |

| (b) | Net investment income distribution was less than $0.01 per share for the year ended February 28, 2017. |

| (c) | Total Return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. Had the Adviser not waived fees/reimbursed expenses, total returns would have been lower. The returns shown exclude the impact of any contingent deferred sales charges. |

| (d) | These ratios exclude the impact of the expenses of the underlying investment companies in which the Fund invests. |

| (e) | Recognition of net investment income (loss) by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. |

| (f) | The ratio is net investment income (loss) per share and based on average outstanding shares for the years ended February 28, 2021 and February 29, 2020. |

The accompanying notes are an integral part of these financial statements.

| STRINGER GROWTH FUND | |

| FINANCIAL HIGHLIGHTS | |

| | | |

| | | ANNUAL REPORT |

The following tables set forth the per share operating performance data for a share of beneficial interest outstanding, total return, ratios to average net assets and other supplemental data for the years indicated.

| | | Institutional Class | |

| | | For the | | | For the | | | For the | | | For the | | | For the | |

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | February 28, 2021 | | | February 29, 2020 | | | February 28, 2019 | | | February 28, 2018 | | | February 28, 2017 | |

| | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Year | | $ | 11.42 | | | $ | 11.29 | | | $ | 12.68 | | | $ | 12.04 | | | $ | 10.48 | |

| | | | | | | | | | | | | | | | | | | | | |

| Investment Operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.10 | (d) | | | 0.12 | (d) | | | 0.14 | | | | 0.15 | | | | 0.14 | |

| Net realized and unrealized gain (loss) on investments | | | 2.95 | | | | 0.22 | | | | (0.46 | ) | | | 1.46 | | | | 1.56 | |

| Total from investment operations | | | 3.05 | | | | 0.34 | | | | (0.32 | ) | | | 1.61 | | | | 1.70 | |

| | | | | | | | | | | | | | | | | | | | | |

| Distributions: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.10 | ) | | | (0.13 | ) | | | (0.14 | ) | | | (0.15 | ) | | | (0.14 | ) |

| From net realized capital gains | | | (0.72 | ) | | | (0.08 | ) | | | (0.93 | ) | | | (0.82 | ) | | | — | |

| Total distributions | | | (0.82 | ) | | | (0.21 | ) | | | (1.07 | ) | | | (0.97 | ) | | | (0.14 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Year | | $ | 13.65 | | | $ | 11.42 | | | $ | 11.29 | | | $ | 12.68 | | | $ | 12.04 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Return(a) | | | 26.98 | % | | | 2.86 | % | | | (1.69 | )% | | | 13.35 | % | | | 16.25 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in 000's) | | $ | 16,316 | | | $ | 13,575 | | | $ | 15,485 | | | $ | 16,664 | | | $ | 15,348 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before fees waived and expenses absorbed (b) | | | 1.91 | % | | | 1.61 | % | | | 1.45 | % | | | 1.38 | % | | | 1.32 | % |

| After fees waived and expenses absorbed (b) | | | 1.05 | % | | | 1.05 | % | | | 1.05 | % | | | 1.12 | % | | | 1.32 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income (loss): | | | | | | | | | | | | | | | | | | | | |

| Before fees waived and expenses absorbed (b)(c) | | | (0.03 | )% | | | 0.46 | % | | | 0.79 | % | | | 0.85 | % | | | 1.24 | % |

| After fees waived and expenses absorbed (b)(c) | | | 0.83 | % | | | 1.02 | % | | | 1.19 | % | | | 1.11 | % | | | 1.25 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 212 | % | | | 68 | % | | | 68 | % | | | 126 | % | | | 79 | % |

| (a) | Total Return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. Had the Adviser not waived fees/reimbursed expenses, total returns would have been lower. |

| (b) | These ratios exclude the impact of the expenses of the underlying investment companies in which the Fund invests. |

| (c) | Recognition of net investment income (loss) by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. |

| (d) | Net investment income per share is based on average shares outstanding for the years ended February 28, 2021 and February 29, 2020. |

The accompanying notes are an integral part of these financial statements.

| |

| Stringer Growth Fund | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

February 28, 2021

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES |

The Stringer Growth Fund (the “Fund”) is a series of 360 Funds (the “Trust”). The Trust was organized on February 24, 2005 as a Delaware statutory trust. The Trust is registered as an open-end management investment company under the Investment Company Act of 1940 (the “1940 Act”). The Fund is a diversified fund. The Fund’s investment objective is long-term growth of capital. The Fund’s investment adviser is Stringer Asset Management, LLC (the “Adviser”). The Fund offers three classes of shares, Class A, Class C and Institutional Class shares. Each class of shares commenced operations on March 27, 2013. Each class differs as to sales and redemption charges and ongoing fees. Income and realized/unrealized gains or losses are allocated to each class based on relative share balances.

The following is a summary of the significant accounting policies followed by the Fund in the preparation of its financial statements. The Fund is an investment company that follows the accounting and reporting guidance of Accounting Standards Codification Topic 946 applicable to investment companies.

a) Security Valuation – All investments in securities are recorded at their estimated fair value, as described in Note 2.

b) Exchange-Traded Funds – The Fund may invest in Exchange-Traded Funds (“ETFs”). ETFs are registered investment companies and incur fees and expenses such as operating expenses, licensing fees, registration fees, trustees fees, and marketing expenses, and ETF shareholders, such as the Fund, pay their proportionate share of these expenses. Your cost of investing in the Fund will generally be higher than the cost of investing directly in ETFs. By investing in the Fund, you will indirectly bear fees and expenses charged by the underlying ETFs in which the Fund invests in addition to the Fund’s direct fees and expenses.

c) Federal Income Taxes – The Fund has qualified and intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). It is the policy of the Fund to comply with the requirements of the Code applicable to regulated investment companies and to distribute substantially all of its net investment company taxable income and net capital gains. Therefore, no provision for federal income taxes is required.

As of and during the year ended February 28, 2021, the Fund did not have a liability for any unrecognized tax expenses. The Fund recognizes interest and penalties, if any, related to unrecognized tax liability as income tax expense in the Statement of Operations. During the year ended February 28, 2021, the Fund did not incur any interest or penalties. The Fund identifies its major tax jurisdictions as U.S. Federal and Delaware State. As required by accounting principles generally accepted in the United States of America (“GAAP”), ASC 740, management has analyzed the Fund’s tax positions taken on Federal income tax returns for all open tax years (tax years ended 2018, 2019 and 2020) and for the year ended February 28, 2021 and has concluded that no provision for income tax is required in these financial statements.

d) Distributions to Shareholders – Dividends from net investment income and distributions of net realized capital gains, if any, will be declared and paid at least annually. Income and capital gain distributions, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. GAAP requires that permanent financial reporting differences relating to shareholder distributions be reclassified to paid-in beneficial interest. There were no reclassifications necessary for the year ended February 28, 2021.

e) Use of Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

f) Other – Investment and shareholder transactions are recorded on trade date. The Fund determines the gain or loss realized from the investment transactions by comparing the original cost of the security lot sold with the net sales proceeds. Dividend income is recognized on the ex-dividend date or as soon as information is available to the Fund and interest income is recognized on an accrual basis. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

| |

| Stringer Growth Fund | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

February 28, 2021

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

g) Contingent Deferred Sales Charges – For initial purchases of Class A shares of the Fund of $1 million or more, a broker-dealer’s commission (equal to 1.00% of such purchases over $1 million) may be paid by the Adviser to participating unaffiliated broker- dealers through whom such purchases are effected. A contingent deferred sales charge (“CDSC”) may be imposed upon certain redemptions of Class A shares purchased at net asset value in amounts totaling $1 million or more if the dealer’s commission described above was paid by the Adviser and the shares are redeemed within one year from the date of purchase. The Adviser may advance a commission to a dealer that sells such Class A shares and any CDSC will be reimbursed to the Adviser and will be equal to 1.00% of the lesser of (1) the net asset value at the time of purchase of the Class A shares being redeemed; or (2) the net asset value of such shares at the time of redemption. There were no CDSC fees from Class A redemptions reimbursed to the Adviser during the year ended February 28, 2021.

For initial purchases of Class C shares of the Fund, a broker-dealer's commission (equal to 1.00% of such purchases) may be paid by the Adviser to participating unaffiliated broker-dealers through whom such purchases are effected. A CDSC of 1.00% may be imposed on certain redemptions of Class C shares that are redeemed within one year from the date of purchase. The Adviser may advance a commission to a dealer that sells Class C shares and any CDSC will be reimbursed to the Adviser and will be a percentage of the dollar amount of shares redeemed and will be assessed on an amount equal to the net asset value at the time of purchase of the Class C shares being redeemed. During the year ended February 28, 2021, CDSC Fees paid from Class C redemptions of $178 were reimbursed to the Adviser by the Fund.

Processes and Structure

The Fund’s Board of Trustees has adopted guidelines for valuing securities and other derivative instruments including in circumstances in which market quotes are not readily available, and has delegated authority to the Adviser to apply those guidelines in determining fair value prices, subject to review by the Board of Trustees.

Hierarchy of Fair Value Inputs

The Fund utilizes various methods to measure the fair value of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation techniques used to measure fair value. The three levels of inputs are as follows:

| • | Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. |

| • | Level 2 – Observable inputs other than quoted prices included in level 1 that are observable for the asset or liability either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates, and similar data. |

| • | Level 3 – Unobservable inputs for the asset or liability to the extent that relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions that a market participant would use in valuing the asset or liability, and that would be based on the best information available. |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

| |

| Stringer Growth Fund | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

February 28, 2021

| 2. | SECURITIES VALUATIONS (continued) |

Fair Value Measurements

A description of the valuation techniques applied to the Fund’s major categories of assets and liabilities measured at fair value on a recurring basis follows.

Equity securities (common stock and ETFs) – Securities traded on a national securities exchange (or reported on the NASDAQ national market) are stated at the last reported sales price on the day of valuation. To the extent these securities are actively traded, and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy. Certain foreign securities may be fair valued using a pricing service that considers the correlation of the trading patterns of the foreign security to the intraday trading in the U.S. markets for investments such as American Depositary Receipts, financial futures, ETFs, and the movement of the certain indexes of securities based on a statistical analysis of the historical relationship and that are categorized in Level 2. Preferred stock and other equities traded on inactive markets or valued by reference to similar instruments are also categorized in Level 2.

Money market funds – Money market funds are valued at their net asset value of $1.00 per share and are categorized as Level 1.

The following table summarizes the inputs used to value the Fund’s assets and liabilities measured at fair value as of February 28, 2021.

| Financial Instruments – Assets | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Security Classification(1) | | | Level 1 | | | | Level 2 | | | | Level 3 | | | | Totals | |

| Exchange-Traded Funds(2) | | $ | 29,837,319 | | | $ | — | | | $ | — | | | $ | 29,837,319 | |

| Short Term Investments | | | 461,460 | | | | — | | | | — | | | | 461,460 | |

| Total Assets | | $ | 30,298,779 | | | $ | — | | | $ | — | | | $ | 30,298,779 | |

(1) As of and during the year ended February 28, 2021, the Fund held no securities that were considered to be “Level 3” securities (those valued using significant unobservable inputs). Therefore, a reconciliation of assets in which significant unobservable inputs (Level 3) were used in determining fair value is not applicable.

(2) All ETFs held in the Fund are Level 1 securities. For a detailed break-out of ETFs by investment type, please refer to the Schedule of Investments.

During the year ended February 28, 2021, no securities were valued using alternative procedures approved by the Board of Trustees.

| 3. | BENEFICIAL INTEREST TRANSACTIONS |

Transactions in shares of beneficial interest for the Fund for the year ended February 28, 2021 were as follows:

| | | Sold | | | Redeemed | | | Reinvested | | | Net Increase (Decrease) | |

| Class A | | | | | | | | | | | | | | | | |

| Shares | | | 15,686 | | | | (63,084 | ) | | | 16,041 | | | | (31,357 | ) |

| Value | | $ | 186,045 | | | $ | (772,429 | ) | | $ | 211,259 | | | $ | (375,125 | ) |

| Class C | | | | | | | | | | | | | | | | |

| Shares | | | 70,493 | | | | (110,793 | ) | | | 36,038 | | | | (4,262 | ) |

| Value | | $ | 874,874 | | | $ | (1,337,542 | ) | | $ | 471,020 | | | $ | 8,352 | |

| Institutional Class | | | | | | | | | | | | | | | | |

| Shares | | | 262,990 | | | | (321,607 | ) | | | 65,719 | | | | 7,102 | |

| Value | | $ | 3,155,437 | | | $ | (3,993,196 | ) | | $ | 866,180 | | | $ | 28,421 | |

| |

| Stringer Growth Fund | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

February 28, 2021

| 3. | BENEFICIAL INTEREST TRANSACTIONS (continued) |

Transactions in shares of beneficial interest for the Fund for the year ended February 29, 2020 were as follows:

| | | Sold | | | Redeemed | | | Reinvested | | | Net Decrease | |

| Class A | | | | | | | | | | | | | | | | |

| Shares | | | 124,762 | | | | (188,353 | ) | | | 4,368 | | | | (59,223 | ) |

| Value | | $ | 1,349,584 | | | $ | (2,182,882 | ) | | $ | 53,814 | | | $ | (779,484 | ) |

| Class C | | | | | | | | | | | | | | | | |

| Shares | | | 35,466 | | | | (292,355 | ) | | | 4,377 | | | | (252,512 | ) |

| Value | | $ | 421,155 | | | $ | (3,309,992 | ) | | $ | 53,663 | | | $ | (2,835,174 | ) |

| Institutional Class | | | | | | | | | | | | | | | | |

| Shares | | | 283,038 | | | | (484,707 | ) | | | 17,922 | | | | (183,747 | ) |

| Value | | $ | 3,296,540 | | | $ | (5,748,919 | ) | | $ | 220,976 | | | $ | (2,231,403 | ) |

| 4. | INVESTMENT TRANSACTIONS |

For the year ended February 28, 2021, aggregate purchases and sales of investment securities (excluding short-term investments) for the Fund were as follows:

| Purchases | | | Sales | |

| $ | 55,560,167 | | | $ | 57,841,124 | |

There were no government securities purchased or sold during the year.

| 5. | ADVISORY FEES AND OTHER RELATED PARTY TRANSACTIONS |

The Fund has entered into an Investment Advisory Agreement (the “Advisory Agreement”) with the Adviser. Pursuant to the Advisory Agreement, the Adviser manages the operations of the Fund and manages the Fund’s investments in accordance with the stated policies of the Fund. As compensation for the investment advisory services provided to the Fund, the Adviser will receive a monthly management fee equal to an annual rate of 0.95% of the Fund’s net assets.

The Adviser has entered into an Expense Limitation Agreement with the Fund under which it has agreed to waive or reduce its fees and to assume other expenses of the Fund, if necessary, in an amount that limits the Fund’s annual operating expenses (exclusive of interest, taxes, brokerage fees and commissions, other expenditures that are capitalized in accordance with GAAP, acquired funds fees and expenses, other extraordinary expenses not incurred in the ordinary course of the Fund’s business, interest and dividend expense on securities sold short, and amounts, if any, payable pursuant to a plan adopted in accordance with Rule 12b-1 of the 1940 Act, to not more than 1.05% until and through at least June 30, 2021. The current contractual agreement cannot be terminated prior to at least one year after the effective date without the Board of Trustees’ approval. Please see the table below for information regarding the management fees earned, fee waivers and expenses reimbursed during the year ended February 28, 2021, as well as amounts due to (from) the Adviser at February 28, 2021.

| Advisory fees earned | | $ | 260,479 | |

| Fees waived | | | 236,559 | |

| Payable to (Due from) Adviser | | | 6,882 | |

| Stringer Growth Fund | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

February 28, 2021

| 5. | ADVISORY FEES AND OTHER RELATED PARTY TRANSACTIONS (continued) |

If, at any time, the annualized expenses of the Fund are less than the annualized expense limitation ratio, the Fund would reimburse the Adviser for any fees previously waived and/or expenses previously assumed; provided, however, that repayment would be payable only to the extent that it (a) can be made during the three (3) years following the time at which the Adviser waived fees or assumed expenses for the Fund, and (b) can be repaid without causing the expenses of the Fund to exceed the annualized expense limitation ratio. The amounts subject to repayment by the Fund, pursuant to the aforementioned conditions, are as follows:

| February 28, 2022 | | | February 28, 2023 | | | February 29, 2024 | | | Totals | |

| $ | 146,343 | | | $ | 166,586 | | | $ | 236,559 | | | $ | 549,488 | |

The Fund has entered into an Investment Company Services Agreement (“ICSA”) with M3Sixty Administration, LLC (“M3Sixty”). Pursuant to the ICSA, M3Sixty will provide day-to-day operational services to the Fund including, but not limited to: (a) Fund accounting services; (b) financial statement preparation; (c) valuation of the Fund’s portfolio securities; (d) pricing the Fund’s shares; (e) assistance in preparing tax returns; (f) preparation and filing of required regulatory reports; (g) communications with shareholders; (h) coordination of Board and shareholder meetings; (i) monitoring the Fund’s legal compliance; and (j) maintaining shareholder account records.

For the year ended February 28, 2021, the Fund accrued servicing fees, including out of pocket expenses, and have amounts payable to M3Sixty as follows.

| Service fees accrued | | $ | 114,563 | |

| Service fees payable | | | 12,890 | |

Certain officers and a Trustee of the Fund are also employees of M3Sixty.

The Fund has entered into a Distribution Agreement with Matrix 360 Distributors, LLC (“M3SixtyD”). Pursuant to the Distribution Agreement, M3SixtyD provides distribution services to the Fund. M3SixtyD serves as underwriter/distributor of the Fund.

M3SixtyD is an affiliate of M3Sixty.

The Fund has adopted a Distribution Plan (“Plan”) pursuant to Rule 12b-1 under the Investment Company Act of 1940 for each class of shares. The Fund may expend up to 1.00% for Class C shares and up to 0.25% for Class A shares of the Fund’s average daily net assets annually to pay for any activity primarily intended to result in the sale of shares of the Fund and the servicing of shareholder accounts, provided that the Trustees have approved the category of expenses for which payment is being made.

The distribution plans for the Class A and Class C shares of the Fund took effect March 27, 2013. For the year ended February 28, 2021, the Fund accrued 12b-1 expenses attributable to Class A shares and Class C shares as follows.

| Class A | | | Class C | |

| $ | 9,481 | | | $ | 87,924 | |

For U.S. Federal income tax purposes, the cost of securities owned, gross appreciation, gross depreciation, and net unrealized appreciation of the Fund’s investments at February 28, 2021 were as follows:

| Cost | | | Gross Appreciation | | | Gross Depreciation | | | Net Appreciation | |

| $ | 25,375,560 | | | $ | 4,955,745 | | | $ | (32,526 | ) | | $ | 4,923,219 | |

The difference between book basis unrealized appreciation and tax-basis unrealized appreciation for the Fund is attributable primarily to the tax deferral of losses on wash sales.

| Stringer Growth Fund | ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

February 28, 2021

| 6. | TAX MATTERS (continued) |

The tax character of distributions paid by the Fund during the fiscal year ended February 28, 2021 were as follows:

| Long-Term Capital Gains | | | Ordinary Income | |

| $ | 757,889 | | | $ | 914,015 | |

The tax character of distributions paid by the Fund during the fiscal year ended February 29, 2020 were as follows:

| Long-Term Capital Gains | | | Ordinary Income | |

| $ | 178,775 | | | $ | 190,390 | |

As of February 28, 2021, the components of distributable earnings presented on an income tax basis were as follows:

Undistributed

Ordinary

Income | | | Undistributed

Long-Term

Capital Gains | | | Post-October

Capital Losses &

Post-December

Ordinary Loss | | | Net

Unrealized

Appreciation | | | Total Distributable

Earnings | |

| $ | 1,235,272 | | | $ | 801,351 | | | $ | (59,515 | ) | | $ | 4,923,219 | | | $ | 6,900,327 | |

| | | | | | | | | | | | | | | | | | | |

Under current tax law, net capital losses realized after October 31st and net ordinary losses incurred after December 31st may be deferred and treated as occurring on the first day of the following fiscal year. The Fund’s carryforward losses, post-October losses and post-December losses are determined only at the end of each fiscal year. As of February 28, 2021, the Fund elected to defer net capital losses and net ordinary losses as indicated in the chart below:

| | Post-October Losses | | | | | | | | Post-December Losses | | | | | |

| | Deferred | | | | Utilized | | | | Deferred | | | | Utilized | |

| $ | — | | | $ | — | | | $ | 59,515 | | | $ | 53,811 | |

| 7. | COMMITMENTS AND CONTINGENCIES |

In the normal course of business, the Trust may enter into contracts that may contain a variety of representations and warranties and provide general indemnifications. The Trust’s maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated; however, management considers the risk of loss from such claims to be remote.

In accordance with GAAP, Management has evaluated the impact of all subsequent events of the Fund through the date the financial statements were issued, and has determined that there were no subsequent events requiring recognition or disclosure in the financial statements.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Trustees of 360 Funds

and the Shareholders of Stringer Growth Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Stringer Growth Fund, a series of shares of beneficial interest in 360 Funds (the “Fund”), including the schedule of investments, as of February 28, 2021, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended and the financial highlights for each of the years in the three-year period then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of February 28, 2021, and the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended and its financial highlights for each of the years in the three-year period then ended, in conformity with accounting principles generally accepted in the United States of America. The financial highlights for the each of the years in the two-year period ended February 28, 2018 were audited by other auditors, whose report dated April 26, 2018, expressed an unqualified opinion on such financial highlights.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities law and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risk of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of February 28, 2021 by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

BBD, LLP

We have served as the auditor of one or more of the Funds in the 360 Funds since 2018.

Philadelphia, Pennsylvania

April 28, 2021

| Stringer Growth Fund | ANNUAL REPORT |

ADDITIONAL INFORMATION

February 28, 2021 (Unaudited)

The Fund files its complete schedules of portfolio holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-PORT. The Fund’s Forms N-PORT are available on the Commission’s website at http://www.sec.gov. The Fund’s Forms N-PORT may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Commission’s Public Reference Room may be obtained by calling 1-800-SEC-0330.

Prior to March 31, 2020, the Fund filed its complete schedules of portfolio holdings with the Commission for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Forms N-Q are available on the Commission’s website at http://www.sec.gov.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling 1-877-244-6235; and on the Commission’s website at http://www.sec.gov.

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30th is available without charge, upon request, by calling 1-877-244-6235; and on the Commission’s website at http://www.sec.gov.

Shareholder Tax Information - For the year ended February 28, 2021, the Fund distributed $914,015 as ordinary income and $757,889 as long-term capital gains. Tax information is reported from the Fund’s fiscal year and not calendar year, therefore, shareholders should refer to their Form 1099-DIV or other tax information which will be mailed in 2021 to determine the calendar year amounts to be included on their 2020 tax returns. Shareholders should consult their own tax advisors.

| Stringer Growth Fund | ANNUAL REPORT |

ADDITIONAL INFORMATION

February 28, 2021

BOARD OF TRUSTEES, OFFICERS AND PRINCIPAL SHAREHOLDERS - (Unaudited)

The Trustees are responsible for the management and supervision of the Fund. The Trustees approve all significant agreements between the Trust, on behalf of the Fund, and those companies that furnish services to the Fund; review performance of the Fund; and oversee activities of the Fund. This section provides information about the persons who serve as Trustees and Officers to the Trust and Fund, respectively, as well as the entities that provide services to the Fund. The Statement of Additional Information of the Trust includes additional information about the Fund's Trustees and is available upon request, without charge, by calling (877) 244-6235.

Trustees and Officers. Following are the Trustees and Officers of the Trust, their age and address, their present position with the Trust or the Fund, and their principal occupation during the past five years. Each of the Trustees of the Trust will generally hold office indefinitely. The Officers of the Trust will hold office indefinitely, except that: (1) any Officer may resign or retire and (2) any Officer may be removed any time by written instrument signed by at least two-thirds of the number of Trustees prior to such removal. In case a vacancy or an anticipated vacancy on the Board of Trustees shall for any reason exist, the vacancy shall be filled by the affirmative vote of a majority of the remaining Trustees, subject to certain restrictions under the 1940 Act. Those Trustees who are “interested persons” (as defined in the 1940 Act) by virtue of their affiliation with either the Trust or the Adviser, are indicated in the table. The address of each trustee and officer is 4300 Shawnee Mission Parkway, Suite 100, Fairway, KS 66205.

| Name, Address and Year of Birth (“YOB”) | Position(s)

Held with

Trust | Length of

Service | Principal Occupation(s) During Past 5 Years | | Number of Series Overseen | Other Directorships

During Past 5 Years |

| Independent Trustees |

Arthur Q. Falk YOB: 1937 | Trustee | Since 2011 | Retired. | | Six | | None |

Tom M. Wirtshafter YOB: 1954 | Trustee | Since 2011 | Senior Vice President, American Portfolios Financial Services, (broker-dealer), American Portfolios Advisors (investment Advisor) (2009-Present). | | Six | | None |

Gary W. DiCenzo YOB: 1962 | Trustee and Independent Chairman | Since 2014 Since 2019 | Partner, Cognios Capital (investment management firm) (2015-2020) Chief Executive officer (2015-2019). | Six | None |

Steven D. Poppen YOB: 1968 | Trustee | Since 2018 | Executive Vice President and Chief Financial Officer, Minnesota Vikings (professional sports organization) (1999-present). | Six | M3Sixty Funds Trust (1 portfolio) (2015 – present) |

Thomas J. Schmidt YOB: 1963 | Trustee | Since 2018 | Principal, Tom Schmidt & Associates Consulting, LLC (2015-Present) | Six | None |

| Interested Trustee* | | | | | |

Randall K. Linscott YOB: 1971 | President | Since 2013 | Chief Executive Officer, M3Sixty Administration, LLC (2013 – present) | Six | M3Sixty Funds Trust (1 portfolio) (2015 – present) |

* The Interested Trustee is an Interested Trustee because he is Chief Executive Officer and principal owner of M3Sixty Administration, LLC, the Fund's administrator and transfer agent.

| Stringer Growth Fund | ANNUAL REPORT |

ADDITIONAL INFORMATION

February 28, 2021

BOARD OF TRUSTEES, OFFICERS AND PRINCIPAL SHAREHOLDERS - (Unaudited)(continued)

Name, Address and Year

of Birth (“YOB”) | Position(s) Held

with

Trust | Length of

Service | Principal Occupation(s) During Past 5 Years | Number of

Series

Overseen | Other Directorships

During Past 5 Years |

Officers | | | | | |

Andras P. Teleki YOB: 1971 | Chief Compliance Officer and Secretary | Since 2015 | Chief Legal Officer, M3Sixty Administration, LLC, M3Sixty Holdings, LLC, Matrix 360 Distributors, LLC and M3Sixty Advisors, LLC (2015-present); Chief Compliance Officer and Secretary, M3Sixty Funds Trust (2016-present); Chief Compliance Officer and Secretary, WP Trust (2016-present); Secretary and Assistant Treasurer, Capital Management Investment Trust (2015); Partner, K&L Gates (2009-2015). | N/A | N/A |

Brandon J. Byrd YOB: 1981 | Assistant Secretary and Anti-Money Laundering Officer Vice President | Since 2013

Since 2018

| Chief Operating Officer, M3Sixty Administration, LLC (2013-present); Anti-Money Laundering Compliance Officer, Monteagle Funds (2015-2016). | N/A | N/A |

Larry E. Beaver, Jr.** YOB: 1969 | Assistant Treasurer | Since 2017 | Fund Accounting, Administration and Tax Officer, M3Sixty Administration, LLC (2017-Present); Director of Fund Accounting & Administration, M3Sixty Administration, LLC (2005-2017); Chief Accounting Officer, Amidex Funds, Inc. (2003-2020); Assistant Treasurer, Capital Management Investment Trust (July 2017-July 2018); Assistant Treasurer, M3Sixty Funds Trust (July 2017-Present; Assistant Treasurer, WP Trust (July 2017-Present); Treasurer and Assistant Secretary, Capital Management Investment Trust (2008-July 2017); Treasurer, 360 Funds Trust (2007-2017); Treasurer, M3Sixty Funds Trust (2015-July 2017); Treasurer, WP Trust (2015-July 2017); Treasurer and Chief Financial Officer, Monteagle Funds (2008-2016). | N/A | N/A |

Bo J. Howell YOB: 1981 | Assistant Secretary | Since 2020 | Shareholder, Strauss Troy Co., LPA (2020 - present); CEO, Joot (2018 - present); Partner, Practus LLP (2018 - 2020); Director of Fund Administration, Ultimus Fund Services, LLC (2014-2018). | N/A | N/A |

Ted L. Akins YOB: 1974 | Assistant Secretary | Since 2018 | Vice President of Operations, M3Sixty Administration, LLC (2012-present). | N/A | N/A |

| ** | Effective December 28, 2018, Larry E. Beaver, Jr. was assigned as Interim Treasurer until a new Treasurer is appointed by the Board. |

| Stringer Growth Fund | ANNUAL REPORT |

ADDITIONAL INFORMATION

February 28, 2021

BOARD OF TRUSTEES, OFFICERS AND PRINCIPAL SHAREHOLDERS - (Unaudited) (continued)

Remuneration Paid to Trustees and Officers - Officers of the Trust and Trustees who are “interested persons” of the Trust or the Adviser will receive no salary or fees from the Trust. Officers of the Trust and interested Trustees do receive compensation directly from certain service providers to the Trust, including Matrix 360 Distributors, LLC and M3Sixty Administration, LLC. Each Trustee who is not an “interested person” (an “Independent Trustee”) receives a $5,000 annual retainer (paid quarterly). In addition, each Independent Trustee receives, on a per fund basis: (i) a fee of $1,500 per fund each year (paid quarterly); (ii) a fee of $200 per Board meeting attended; and (iii) a fee of $200 per committee meeting attended. The Trust will also reimburse each Trustee for travel and other expenses incurred in connection with, and/or related to, the performance of their obligations as a Trustee. Officers of the Trust will also be reimbursed for travel and other expenses relating to their attendance at Board meetings.

| Name of Trustee1 | | Aggregate

Compensation From the Fund2 | | | Pension or Retirement

Benefits Accrued As Part

of Portfolio Expenses | | Estimated

Annual Benefits

Upon

Retirement | | Total Compensation From the Fund Paid to Trustees2 | |

| Independent Trustees |

| Arthur Q. Falk | | $ | 3,182 | | | None | | None | | $ | 3,182 | |

| Tom M. Wirtshafter | | $ | 3,182 | | | None | | None | | $ | 3,182 | |

| Gary W. DiCenzo | | $ | 3,182 | | | None | | None | | $ | 3,182 | |

| Steven D. Poppen | | $ | 3,182 | | | None | | None | | $ | 3,182 | |

| Thomas J. Schmidt | | $ | 3,182 | | | None | | None | | $ | 3,182 | |

| Interested Trustees |

| Randall K. Linscott | | | None | | | Not Applicable | | Not Applicable | | | None | |

| | | | | | | | | | | | | |

| 1 | Each of the Trustees serves as a Trustee to the six series of the Trust. |

| 2 | Figures are for the year ended February 28, 2021. |

| Stringer Growth Fund | ANNUAL REPORT |

February 28, 2021

Information About Your Fund’s Expenses - (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, such as the sales charge (load) imposed on certain subscriptions and the contingent deferred sales charge (“CDSC”) imposed on certain short-term redemptions; and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees; and other Fund expenses. The example below is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses – The first section of the table provides information about actual account values and actual expenses (relating to the example $1,000 investment made at the beginning of the period). You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes – The second section of the table provides information about the hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund to other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), CDSC fees, or exchange fees. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. For more information on transactional costs, please refer to the Fund’s prospectus.

| Expenses and Value of a $1,000 Investment for the period from 09/01/20 through 02/28/21 |

| |

| | | Beginning Account

Value (09/01/2020) | | | Annualized Expense

Ratio for the Period | | | Ending Account

Value (02/28/2021) | | | Expenses Paid

During Period(a) | |

| Actual Fund Return (in parentheses) | | | | | | | | | |

| Class A (12.25%) | | $ | 1,000.00 | | | | 1.30 | % | | $ | 1,122,50 | | | $ | 6.84 | |

| Class C (11.79%) | | $ | 1,000.00 | | | | 2.05 | % | | $ | 1,117.90 | | | $ | 10.77 | |

| Institutional Class (12.33%) | | $ | 1,000.00 | | | | 1.05 | % | | $ | 1,123.30 | | | $ | 5.53 | |

| Hypothetical 5% Fund Return | | | | | | | | | | | | | | | | |

| Class A | | $ | 1,000.00 | | | | 1.30 | % | | $ | 1,018.30 | | | $ | 6.51 | |

| Class C | | $ | 1,000.00 | | | | 2.05 | % | | $ | 1,014.60 | | | $ | 10.24 | |

| Institutional Class | | $ | 1,000.00 | | | | 1.05 | % | | $ | 1,019.60 | | | $ | 5.26 | |

| | | | | | | | | | | | | | | | | |

| (a) | Expenses are equal to the Fund’s annualized expense ratios, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period. |

| Stringer Growth Fund | ANNUAL REPORT |

February 28, 2021

Information About Your Fund’s Expenses - (Unaudited)(continued)

For more information on Fund expenses, please refer to the Fund’s prospectus, which can be obtained from your investment representative or by calling 1-877-244-6235. Please read it carefully before you invest or send money.

Total Fund operating expense ratios as stated in the current Fund prospectus dated June 28, 2020 were as follows: |

| Stringer Growth Fund Class A, gross of fee waivers or expense reimbursements | 2.12% |

| Stringer Growth Fund Class A, after waiver and reimbursement* | 1.56% |

| Stringer Growth Fund Class C, gross of fee waivers or expense reimbursements | 2.87% |

| Stringer Growth Fund Class C, after waiver and reimbursement* | 2.31% |

| Stringer Growth Fund Institutional Class, gross of fee waivers or expense reimbursements | 1.87% |

| Stringer Growth Fund Institutional Class, after waiver and reimbursement* | 1.31% |

| | |

* Stringer Asset Management, LLC (the “Adviser”) has entered into an Expense Limitation Agreement with the Fund under which it has agreed to waive or reduce its fees and to assume other expenses of the Fund, if necessary, in an amount that limits the Fund’s annual operating expenses (exclusive of interest, taxes, brokerage fees and commissions, other expenditures that are capitalized in accordance with generally accepted accounting principles, acquired funds fees and expenses, other extraordinary expenses not incurred in the ordinary course of the Fund’s business, interest and dividend expense on securities sold short, and amounts, if any, payable pursuant to a plan adopted in accordance with Rule 12b-1 of the Investment Company Act of 1940, as amended (the “1940 Act”)) to not more than 1.05% until and through at least June 30, 2021. Subject to approval by the Fund’s Board, any waiver under the Expense Limitation Agreement is subject to repayment by the Fund within the three fiscal years following the year in which such waiver occurred, if the Fund is able to make the payment without exceeding the 1.05% expense limitation. The current contractual agreement cannot be terminated prior to at least one year after the effective date without the Board of Trustees’ approval. Total Gross Operating Expenses (Annualized) during the year ended February 28, 2021 were 2.16%, 2.91% and 1.91% for the Class A, Class C and Institutional Class shares, respectively. Please see the Information About Your Fund’s Expenses, the Financial Highlights and Notes to Financial Statements (Note 5) sections of this report for gross and net expense related disclosures during the year ended February 28, 2021. |

Approval of the Investment Advisory Agreement Renewal for the Stringer Growth Fund (Unaudited)

At a meeting held on January 27, 2021, the Board of Trustees (the “Board”) considered the approval of the renewal of the Investment Advisory Agreement (the “Advisory Agreement”) between the Trust and Stringer Asset Management, LLC (the “Adviser”) in regard to the Stringer Growth Fund (the “Stringer Fund”).

Legal counsel to the Independent Trustees (“Trustee Counsel”) reviewed with the Board a memorandum from Trustee Counsel and addressed to the Trustees that summarized, among other things, the fiduciary duties and responsibilities of the Board in reviewing and approving the renewal of the Investment Advisory Agreement (the “Advisory Agreement”) between the Trust and Stringer (the “Adviser,” solely for this portion of the minutes) concerning the Stringer Fund. A copy of this memorandum was circulated to the Trustees in advance of the Meeting. Trustee Counsel discussed with the Trustees the types of information and factors that should be considered by the Board to make an informed decision regarding the approval of the continuation of the Advisory Agreement, including the following material factors: (i) the nature, extent, and quality of the services provided by the Adviser; (ii) the investment performance of the Stringer Fund; (iii) the costs of the services provided and profits realized by the Adviser from the relationship with the Stringer Fund; (iv) the extent to which economies of scale would be realized if the Stringer Fund grows and whether advisory fee levels reflect those economies of scale for the benefit of the Stringer Fund’ investors; and (v) the Adviser’s practices regarding possible conflicts of interest.