Washington, D.C. 20549

M3Sixty Administration, LLC.

The Semi-Annual report to Shareholders of the IMS Family of Funds, series of the 360 Funds, for the period ended December 31, 2015 pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “1940 Act”), as amended (17 CFR 270.30e-1) is filed herewith.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2015 through December 31, 2015).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant only to highlight your ongoing costs and do not reflect any transactional costs, such as short-term redemption fees. Therefore, the second line is only useful in comparing ongoing costs only and will not help you determine the relative costs of owning different funds. In addition, if these transactions costs were included, your costs would have been higher.

| IMS Funds | Beginning Account Value July 1, 2015 | Ending Account Value December 31, 2015 | Expenses Paid During the Period* July 1, 2015 – December 31, 2015 |

| Capital Value Fund |

| Actual (-9.11%) | $1,000.00 | $908.90 | $7.99 |

| Hypothetical** | $1,000.00 | $1,016.80 | $8.44 |

| Strategic Income Fund |

| Actual (-19.70)% | $1,000.00 | $803.00 | $8.95 |

| Hypothetical** | $1,000.00 | $1,015.30 | $10.01 |

| Dividend Growth Fund |

| Actual (-7.52%) | $1,000.00 | $924.80 | $9.46 |

| Hypothetical** | $1,000.00 | $1,015.40 | $9.91 |

| * | Expenses are equal to the Funds’ annualized expense ratios, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the partial year period). The annualized expense ratios for the Capital Value Fund, Strategic Income Fund, and the Dividend Growth Fund were 1.66%, 1.97%, and 1.95%, respectively. |

| ** | Assumes a 5% annual return before expenses. |

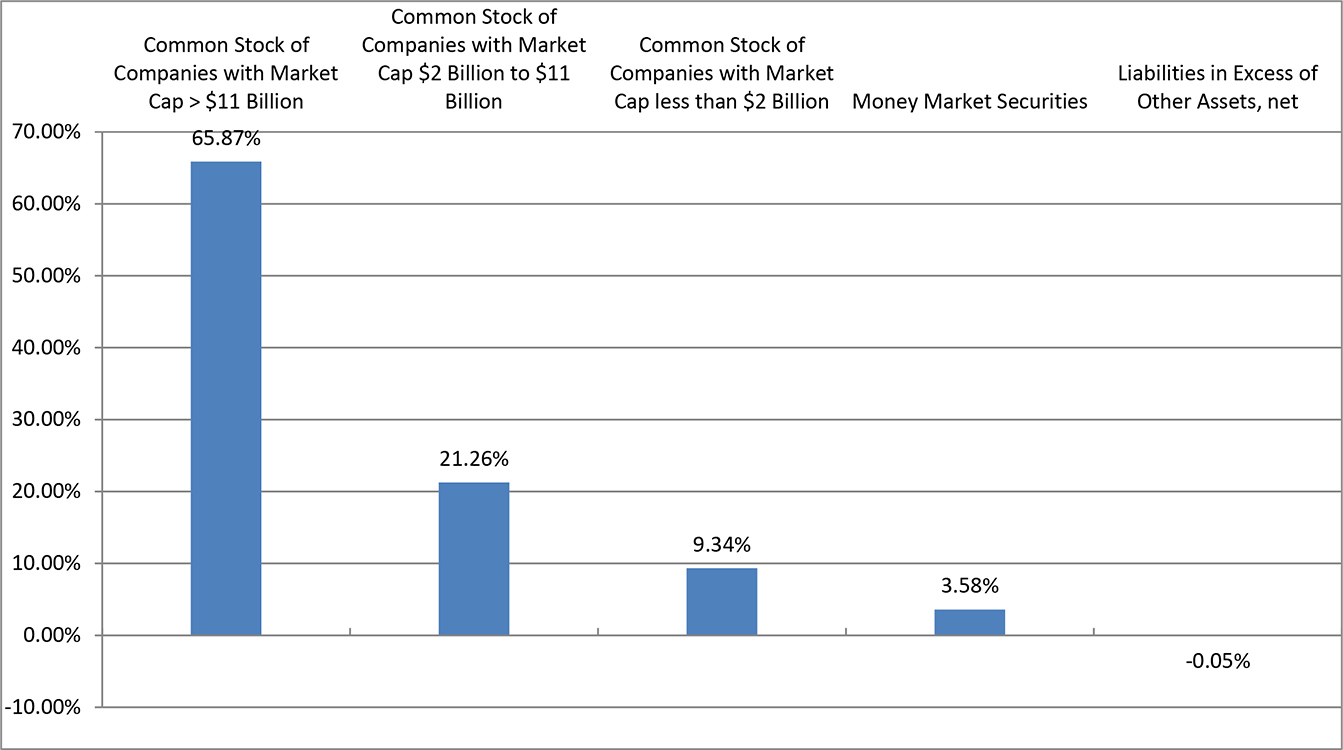

IMS CAPITAL VALUE FUND

SCHEDULE OF INVESTMENTS

December 31, 2015 (Unaudited)

| COMMON STOCK - 96.46% | | Shares | | | Fair Value | |

| | | | | | | |

| Consumer Discretionary - 26.74% | | | | | | |

Amazon.com, Inc. (a) | | | 1,920 | | | $ | 1,297,709 | |

AutoZone, Inc. (a) | | | 1,400 | | | | 1,038,674 | |

Dollar Tree, Inc. (a) | | | 30,000 | | | | 2,316,600 | |

| Domino's Pizza, Inc. | | | 9,600 | | | | 1,068,000 | |

| Home Depot, Inc. | | | 7,000 | | | | 925,750 | |

Noodles & Co. (a) | | | 79,895 | | | | 774,183 | |

| Service Corp. International | | | 30,000 | | | | 780,600 | |

| Starbucks Corp. | | | 13,200 | | | | 792,396 | |

| Yum! Brands, Inc. | | | 22,000 | | | | 1,607,100 | |

| | | | | | | | 10,601,012 | |

| Consumer Staples - 2.56% | | | | | | | | |

| Dr Pepper Snapple Group, Inc. | | | 10,900 | | | | 1,015,880 | |

| | | | | | | | | |

| Energy - 9.11% | | | | | | | | |

| Apache Corp. | | | 15,600 | | | | 693,732 | |

| EOG Resources, Inc. | | | 8,200 | | | | 580,478 | |

| National Oilwell Varco, Inc. | | | 15,700 | | | | 525,793 | |

| Noble Energy, Inc. | | | 15,400 | | | | 507,122 | |

| Occidental Petroleum Corp. | | | 10,200 | | | | 689,622 | |

| Schlumberger Ltd. | | | 8,800 | | | | 613,800 | |

| | | | | | | | 3,610,547 | |

| Financials - 19.01% | | | | | | | | |

| Bank of America Corp. | | | 37,100 | | | | 624,393 | |

| Capital One Financial Corp. | | | 20,000 | | | | 1,443,600 | |

Ezcorp, Inc. - Class A (a) | | | 210,600 | | | | 1,050,894 | |

| Federated Investors, Inc. - Class B | | | 55,700 | | | | 1,595,805 | |

Genworth Financial, Inc. (a) | | | 163,200 | | | | 608,736 | |

| Lincoln National Corp. | | | 14,200 | | | | 713,692 | |

| Umpqua Holdings Corp. | | | 46,000 | | | | 731,400 | |

| Weyerhaeuser Co. | | | 25,600 | | | | 767,488 | |

| | | | | | | | 7,536,008 | |

| Health Care - 17.81% | | | | | | | | |

Edwards Lifesciences Corp. (a) | | | 8,800 | | | | 695,024 | |

| Gilead Sciences, Inc. | | | 7,000 | | | | 708,330 | |

IDEXX Laboratories, Inc. (a) | | | 9,400 | | | | 685,448 | |

InVivo Therapeutics Holdings Corp. (a) | | | 175,933 | | | | 1,266,718 | |

| Merck & Co., Inc. | | | 11,200 | | | | 591,584 | |

OPKO Health, Inc. (a) | | | 51,200 | | | | 514,560 | |

| Patterson Cos., Inc. | | | 11,400 | | | | 515,394 | |

Tenet Healthcare Corp. (a) | | | 26,000 | | | | 787,800 | |

| Zimmer Biomet Holdings, Inc. | | | 6,100 | | | | 625,799 | |

| Zoetis, Inc. | | | 14,000 | | | | 670,880 | |

| | | | | | | | 7,061,537 | |

IMS CAPITAL VALUE FUND

SCHEDULE OF INVESTMENTS

December 31, 2015 (Unaudited)

| COMMON STOCK - 96.46% (continued) | | Shares | | | Fair Value | |

| | | | | | | |

| Industrials - 6.01% | | | | | | |

| FedEx Corp. | | | 5,000 | | | $ | 744,950 | |

| Stanley Black & Decker, Inc. | | | 8,000 | | | | 853,840 | |

| Union Pacific Corp. | | | 10,000 | | | | 782,000 | |

| | | | | | | | 2,380,790 | |

| Information Technology - 12.29% | | | | | | | | |

Alphabet, Inc. - Class C (a) | | | 1,400 | | | | 1,062,432 | |

Micron Technology, Inc. (a) | | | 45,600 | | | | 645,696 | |

| Paychex, Inc. | | | 16,200 | | | | 856,818 | |

PayPal Holdings, Inc. (a) | | | 25,100 | | | | 908,620 | |

Take-Two Interactive Software, Inc. (a) | | | 14,600 | | | | 508,664 | |

Yahoo!, Inc. (a) | | | 26,800 | | | | 891,368 | |

| | | | | | | | 4,873,598 | |

| Telecommunication Services - 2.93% | | | | | | | | |

Sprint Corp. (a) | | | 150,000 | | | | 542,999 | |

| Verizon Communications, Inc. | | | 13,400 | | | | 619,348 | |

| | | | | | | | 1,162,347 | |

| | | | | | | | | |

| TOTAL COMMON STOCK (Cost $36,364,003) | | | | | | | 38,241,719 | |

| | | | | | | | | |

| MONEY MARKET SECURITIES - 3.59% | | | | | | | | |

Federated Prime Obligations Fund - Institutional Shares, 0.24% (b) | | | 1,420,451 | | | | 1,420,451 | |

| | | | | | | | | |

| TOTAL MONEY MARKET SECURITIES (Cost $1,420,451) | | | | | | | 1,420,451 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (Cost $37,784,454) - 100.05% | | | | | | $ | 39,662,170 | |

| LIABILITIES IN EXCESS OF OTHER ASSETS, NET - (0.05%) | | | | | | | (17,937 | ) |

| NET ASSETS - 100.00% | | | | | | $ | 39,644,233 | |

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | Rate shown represents the yield at December 31, 2015, is subject to change and resets daily. |

See accompanying notes which are an integral part of these financial statements.

IMS STRATEGIC INCOME FUND

SCHEDULE OF INVESTMENTS

December 31, 2015 (Unaudited)

| CORPORATE BONDS - 39.51% | | Principal Amount | | | Fair Value | |

| | | | | | | |

Bridgemill Finance LLC, 8.000%, 07/15/2017 (b) (d) | | $ | 919,786 | | | $ | 915,187 | |

| California Resources Corp., 5.000%, 01/15/2020 | | | 725,000 | | | | 258,282 | |

| Clayton Williams Energy, Inc., 7.750%, 04/01/2019 | | | 500,000 | | | | 385,625 | |

| Community Choice Financial, Inc., 10.750%, 05/01/2019 | | | 1,000,000 | | | | 262,500 | |

| Diamond Offshore Drilling, Inc., 5.70%, 10/15/2039 | | | 750,000 | | | | 512,730 | |

| Linn Energy LLC/Linn Energy Finance Corp. , 6.250%, 11/01/2019 | | | 900,000 | | | | 148,500 | |

Performance Drilling Co. LLC, 6.000%, 09/30/2022 (b) (f) (g) | | | 1,420,804 | | | | 539,905 | |

Plaza of Orlando Condominium Finance Co. LLC, 5.500%, 05/15/2031 (b) (d) (f) | | | 361,000 | | | | 306,850 | |

Sabine Oil & Gas Corp., 7.250%, 06/15/2019 (g) (i) | | | 1,375,000 | | | | 85,938 | |

| Sanchez Energy Corp., 7.750%, 06/15/2021 | | | 500,000 | | | | 305,000 | |

Thornton Drilling Co., 5.000%, 06/15/2018 (b) (e) (f) (g) | | | 477,977 | | | | 191,191 | |

Ultra Petroleum Corp., 5.750%, 12/15/2018 (d) | | | 600,000 | | | | 144,000 | |

| Whiting Petroleum Corp., 5.000%, 03/15/2019 | | | 550,000 | | | | 415,250 | |

| | | | | | | | | |

| TOTAL CORPORATE BONDS (Cost $9,153,833) | | | | | | | 4,470,958 | |

| | | | | | | | | |

| FOREIGN BONDS DENOMINATED IN US DOLLARS - 9.78% | | | | | | | | |

| | | | | | | | | |

Cash Store Financial Services, Inc., 11.500%, 01/31/2017 (d) (e) (f) (g) | | | 1,289,000 | | | | 178,174 | |

Newland International Properties Corp., 9.500%, 07/03/2017 (d) (i) | | | 632,850 | | | | 221,498 | |

Newland International Properties Corp., 9.500%, 07/03/2017 (h) (i) | | | 385,990 | | | | 135,096 | |

Oceanografia SA de CV, 11.250%, 07/15/2015 (e) (g) (h) | | | 1,150,000 | | | | 23,000 | |

Panama Canal Railway Co., 7.000%, 11/01/2026 (h) | | | 554,400 | | | | 549,410 | |

| | | | | | | | | |

| TOTAL FOREIGN BONDS DENOMINATED IN US DOLLARS (Cost $3,655,505) | | | | | | | 1,107,178 | |

| | | | | | | | | |

| STRUCTURED NOTES - 43.22% | | | | | | | | |

| | | | | | | | | |

Bank of Nova Scotia Callable Steepener Note Series A, 6.164%, 07/29/2033 (c) | | | 700,000 | | | | 607,250 | |

Barclays Bank PLC Callable Leveraged Steepener Note, 6.480%, 07/31/2034 (c) | | | 750,000 | | | | 645,937 | |

Citigroup, Inc. Callable Barrier Range Accrual Index Linked Note, 8.000%, 01/30/2023 (c) | | | 448,000 | | | | 430,842 | |

JP Morgan Chase & Co. Callable Range Accrual Rate Linked Note, 10.000%, 05/06/2030 (c) | | | 500,000 | | | | 460,000 | |

Morgan Stanley Senior Floating Rate Conversion CMS and Index Linked Note, 9.430%, 03/25/2031 (c) | | | 600,000 | | | | 577,500 | |

Morgan Stanley Fixed to Floating Rate Leveraged CMS and Index Linked Note, 7.660%, 08/30/2028 (c) | | | 350,000 | | | | 310,625 | |

Morgan Stanley Senior Fixed/Floating Rate CMS and Index Linked Note, 9.000%, 06/30/2031 (c) | | | 900,000 | | | | 960,750 | |

Natixis US Medium-Term Note Program LLC Callable Fixed-to Floating Capped Range Accrual Note, 10.000%, 10/31/2034 (c) | | | 500,000 | | | | 423,125 | |

SG Structured Products, Inc. Callable Fixed to Variable Barrier Range Dual Index Linked Note, 10.750%, 11/27/2028 (c) | | | 600,000 | | | | 474,000 | |

| | | | | | | | | |

| TOTAL STRUCTURED NOTES (Cost $5,240,465) | | | | | | | 4,890,029 | |

| | | | | | | | | |

| SECURED SUBORDINATED PROMISSORY NOTES - 6.63% | | | | | | | | |

Aequitas Commercial Finance, LLC Secured Subordinated Promissory Note, 11.000%, 07/28/2019 (d) (f) | | | 750,000 | | | | 750,000 | |

| | | | | | | | | |

| TOTAL SECURED SUBORDINATED PROMISSORY NOTES (Cost $750,000) | | | | | | | 750,000 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (Cost $18,799,803) - 99.14% | | | | | | $ | 11,218,165 | |

| OTHER ASSETS IN EXCESS OF LIABILITIES, NET - 0.86% | | | | | | | 96,869 | |

| NET ASSETS - 100.00% | | | | | | $ | 11,315,034 | |

Percentages are stated as a percent of net assets.

| (a) | Variable rate security. Rate shown represents the yield at December 31, 2015 and resets daily. |

| (b) | This security is currently valued by the Advisor using fair valuation procedures approved by the Board of Trustees under the oversight of the Fair Valuation Committee. |

| (c) | Variable rate security. Rate shown represents the rate in effect at December 31, 2015. |

| (d) | Security exempted from registration under Rule 144A of the Securities Act of 1933. The security may be resold in transactions exempt from registration, normally to qualified institutional investors. |

| (e) | Non-income producing security. |

| (f) | Security is illiquid at December 31, 2015, at which time the aggregate value of illiquid securities is $1,966,120 or 17.38% of net assets. |

| (h) | Security exempted from registration under Regulation S of the Securities Act of 1933. |

| (i) | Partial interest payments made during the period ended December 31, 2015. |

See accompanying notes which are an integral part of these financial statements.

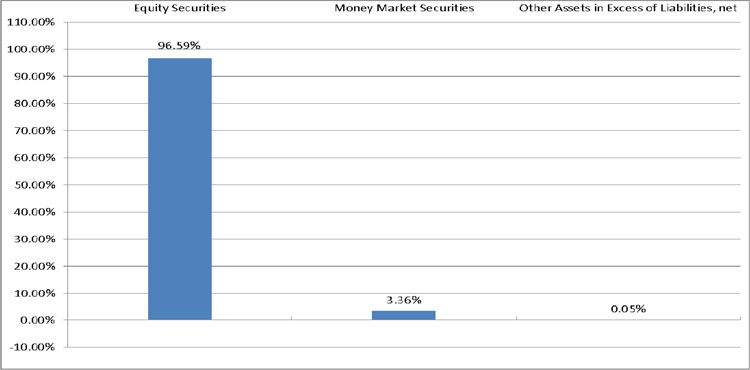

IMS DIVIDEND GROWTH FUND

SCHEDULE OF INVESTMENTS

December 31, 2015 (Unaudited)

| COMMON STOCK - 96.59% | | Shares | | | Fair Value | |

| | | | | | | |

| Consumer Discretionary - 9.65% | | | | | | |

| General Motors Co. | | | 9,000 | | | $ | 306,090 | |

| PetMed Express, Inc. | | | 3,700 | | | | 63,418 | |

| Sturm Ruger & Co., Inc. | | | 3,800 | | | | 226,518 | |

| Twenty-First Century Fox, Inc. - Class B | | | 9,500 | | | | 258,685 | |

| | | | | | | | 854,711 | |

| Consumer Staples - 14.29% | | | | | | | | |

| Altria Group, Inc. | | | 4,100 | | | | 238,661 | |

| Nestle SA - ADR | | | 4,200 | | | | 312,564 | |

| Philip Morris International, Inc. | | | 4,000 | | | | 351,640 | |

| Unilever NV - ADR | | | 6,100 | | | | 264,252 | |

| Unilever PLC - ADR | | | 2,300 | | | | 99,176 | |

| | | | | | | | 1,266,293 | |

| Energy - 8.45% | | | | | | | | |

| Chevron Corp. | | | 2,200 | | | | 197,912 | |

| Halliburton Co. | | | 8,000 | | | | 272,320 | |

| Helmerich & Payne, Inc. | | | 3,000 | | | | 160,650 | |

| SM Energy Co. | | | 6,000 | | | | 117,960 | |

| | | | | | | | 748,842 | |

| Financials - 16.39% | | | | | | | | |

| Axis Capital Holdings Ltd. | | | 5,300 | | | | 297,966 | |

| CME Group, Inc. | | | 4,000 | | | | 362,400 | |

| M&T Bank Corp. | | | 3,000 | | | | 363,540 | |

| Outfront Media, Inc. - Class I | | | 12,000 | | | | 261,960 | |

PRA Group, Inc. (a) | | | 4,800 | | | | 166,512 | |

| | | | | | | | 1,452,378 | |

| Health Care - 14.28% | | | | | | | | |

| Abbott Laboratories | | | 6,500 | | | | 291,915 | |

| AbbVie, Inc. | | | 4,800 | | | | 284,353 | |

| Johnson & Johnson | | | 2,900 | | | | 297,888 | |

| Zoetis, Inc. | | | 8,150 | | | | 390,548 | |

| | | | | | | | 1,264,704 | |

| Industrials - 13.73% | | | | | | | | |

| Copa Holdings SA - Class A | | | 3,000 | | | | 144,780 | |

| Houston Wire & Cable Co. | | | 18,300 | | | | 96,624 | |

| Lockheed Martin Corp. | | | 1,700 | | | | 369,155 | |

| Parker-Hannifin Corp. | | | 1,800 | | | | 174,564 | |

| United Technologies Corp. | | | 2,600 | | | | 249,782 | |

Veritiv Corp. (a) | | | 5,000 | | | | 181,100 | |

| | | | | | | | 1,216,005 | |

IMS DIVIDEND GROWTH FUND

SCHEDULE OF INVESTMENTS

December 31, 2015 (Unaudited)

| COMMON STOCK - 96.59% (continued) | | Shares | | | Fair Value | |

| | | | | | | |

| Information Technology - 17.99% | | | | | | |

| Apple, Inc. | | | 2,900 | | | $ | 305,254 | |

| CDK Global, Inc. | | | 6,900 | | | | 327,543 | |

| Microsoft Corp. | | | 7,100 | | | | 393,908 | |

| QUALCOMM, Inc. | | | 5,350 | | | | 267,420 | |

| Sabre Corp. | | | 10,700 | | | | 299,279 | |

| | | | | | | | 1,593,404 | |

| Materials - 1.81% | | | | | | | | |

| FMC Corp. | | | 4,100 | | | | 160,432 | |

| | | | | | | | | |

| TOTAL COMMON STOCK (Cost $9,372,091) | | | | | | | 8,556,769 | |

| | | | | | | | | |

| MONEY MARKET SECURITIES - 3.36% | | | | | | | | |

Federated Prime Obligations Fund - Institutional Shares, 0.24% (b) | | | 297,146 | | | | 297,146 | |

| | | | | | | | | |

| TOTAL MONEY MARKET SECURITIES (Cost $297,146) | | | | | | | 297,146 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (Cost $9,669,237) - 99.95% | | | | | | $ | 8,853,915 | |

| OTHER ASSETS IN EXCESS OF LIABILITIES, NET - 0.05% | | | | | | | 4,704 | |

| NET ASSETS - 100.00% | | | | | | $ | 8,858,619 | |

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | Rate shown represents the yield at December 31, 2015, is subject to change and resets daily. |

ADR - American Depositary Receipt.

See accompanying notes which are an integral part of these financial statements.

IMS FAMILY OF FUNDS

STATEMENTS OF ASSETS AND LIABILITIES

December 31, 2015 (Unaudited)

| | | IMS Capital Value Fund | | | IMS Strategic Income Fund | | | IMS Dividend Growth Fund | |

| Assets: | | | | | | | | | |

| Investments in securities: | | | | | | | | | |

| At cost | | $ | 37,784,454 | | | $ | 18,799,803 | | | $ | 9,669,237 | |

| At fair value | | $ | 39,662,170 | | | $ | 11,218,165 | | | $ | 8,853,915 | |

| Receivables: | | | | | | | | | | | | |

| Interest | | | 64 | | | | 234,016 | | | | 13 | |

| Dividends | | | 32,386 | | | | 14,304 | | | | 20,528 | |

| Fund shares sold | | | 325 | | | | - | | | | - | |

| Investments sold | | | - | | | | 692,479 | | | | - | |

| Prepaid expenses | | | 15,531 | | | | 18,831 | | | | 6,816 | |

| Total assets | | | 39,710,476 | | | | 12,177,795 | | | | 8,881,272 | |

| | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | |

| Payables: | | | | | | | | | | | | |

| Line of credit borrowings | | | - | | | | 550,000 | | | | - | |

| Due to custodian | | | - | | | | 277,410 | | | | | |

| Fund shares redeemed | | | 2,778 | | | | 1,486 | | | | - | |

| Due to advisor | | | 40,445 | | | | 13,114 | | | | 6,972 | |

| Due to administrator | | | 8,831 | | | | 3,396 | | | | 3,019 | |

| Accrued expenses | | | 14,189 | | | | 17,355 | | | | 12,662 | |

| Total liabilities | | | 66,243 | | | | 862,761 | | | | 22,653 | |

| Net Assets | | $ | 39,644,233 | | | $ | 11,315,034 | | | $ | 8,858,619 | |

| | | | | | | | | | | | | |

| Net Assets consist of: | | | | | | | | | | | | |

| Paid-in capital | | $ | 39,102,374 | | | $ | 68,570,570 | | | $ | 10,233,638 | |

| Accumulated undistributed net investment income (loss) | | | (136,842 | ) | | | 117,968 | | | | 21,970 | |

| Accumulated net realized loss on investments | | | (1,199,015 | ) | | | (49,791,866 | ) | | | (581,667 | ) |

| Net unrealized appreciation (depreciation) on investments | | | 1,877,716 | | | | (7,581,638 | ) | | | (815,322 | ) |

| Total Net Assets | | $ | 39,644,233 | | | $ | 11,315,034 | | | $ | 8,858,619 | |

| | | | | | | | | | | | | |

| Shares outstanding (unlimited number of shares authorized, no par value) | | | 1,882,952 | | | | 3,245,165 | | | | 736,999 | |

| Net asset value and offering price per share | | $ | 21.05 | | | $ | 3.49 | | | $ | 12.02 | |

Minimum redemption price per share (a) | | $ | 20.94 | | | $ | 3.47 | | | $ | 11.96 | |

| (a) | A redemption fee of 0.50% will be assessed on shares of the Fund that are redeemed within 90 days of purchase. |

See accompanying notes which are an integral part of these financial statements.

IMS FAMILY OF FUNDS

STATEMENTS OF OPERATIONS

For the Six Month Period Ended December 31, 2015 (Unaudited)

| | | IMS Capital Value Fund | | | IMS Strategic Income Fund | | | IMS Dividend Growth Fund | |

| | | | | | | | | | |

| Investment income: | | | | | | | | | |

| Dividends (net of foreign withholding taxes of $0, $780 and $0) | | $ | 275,335 | | | $ | 345,613 | | | $ | 135,431 | |

| Interest | | | 699 | | | | 622,101 | | | | 61 | |

| Total investment income | | | 276,034 | | | | 967,714 | | | | 135,492 | |

| | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | |

Investment Advisor fees (a) | | | 240,509 | | | | 105,984 | | | | 60,358 | |

Accounting, administration and transfer agent fees and expenses (a) | | | 53,114 | | | | 24,133 | | | | 18,400 | |

| Registration expenses | | | 7,459 | | | | 5,345 | | | | 3,115 | |

| Miscellaneous expenses | | | 10,512 | | | | 7,498 | | | | 5,468 | |

| Audit expenses | | | 7,741 | | | | 10,446 | | | | 7,903 | |

| Custodian expenses | | | 4,033 | | | | 6,062 | | | | 2,521 | |

| Trustee expenses | | | 4,033 | | | | 4,033 | | | | 4,033 | |

| Pricing expenses | | | 2,521 | | | | 4,789 | | | | 2,269 | |

| Insurance expenses | | | 533 | | | | 533 | | | | 533 | |

| Legal expenses | | | - | | | | - | | | | 2,269 | |

| Printing expenses | | | - | | | | - | | | | 1,512 | |

| Interest expenses | | | 7 | | | | 1,485 | | | | 83 | |

| Total expenses | | | 330,462 | | | | 170,308 | | | | 108,464 | |

Less: Fees waived by Advisor (a) | | | - | | | | (4,347 | ) | | | (14,725 | ) |

| Net expenses | | | 330,462 | | | | 165,961 | | | | 93,739 | |

| | | | | | | | | | | | | |

| Net Investment Income (Loss) | | | (54,428 | ) | | | 801,753 | | | | 41,753 | |

| | | | | | | | | | | | | |

| Realized and unrealized gain (loss): | | | | | | | | | | | | |

| Net realized gain (loss) on investment securities | | | 421,610 | | | | (1,868,517 | ) | | | 35,103 | |

| Change in unrealized appreciation (depreciation) on investment securities and foreign currency | | | (4,112,151 | ) | | | (2,296,378 | ) | | | (824,124 | ) |

| Net realized and unrealized loss on investment securities and foreign currency | | | (3,690,541 | ) | | | (4,164,895 | ) | | | (789,021 | ) |

| | | | | | | | | | | | | |

| Net Decrease in Net Assets Resulting from Operations | | $ | (3,744,969 | ) | | $ | (3,363,142 | ) | | $ | (747,268 | ) |

| (a) | See Note 4 in the Notes to Financial Statements. |

See accompanying notes which are an integral part of these financial statements.

IMS STRATEGIC INCOME FUND

STATEMENT OF CASH FLOWS

For the Six Month Period Ended December 31, 2015 (Unaudited)

| Increase (decrease) in cash: | | | |

| Cash flows from operating activities: | | | |

| Net decrease in net assets from operations | | $ | (3,363,142 | ) |

| Adjustments to reconcile net increase in net assets from operations to net cash provided from operating activities: | | | | |

| Accretion of discount/Amortization of premium, net | | | (79,858 | ) |

| Purchase of investment securities | | | (43,767,256 | ) |

| Proceeds from disposition of investment securities | | | 48,667,743 | |

| Sales of short-term investment securities, net | | | 313,101 | |

| Decrease in dividends and interest receivable | | | 61,991 | |

| Increase in receivables for securities sold | | | (653,602 | ) |

| Decrease in prepaid expenses | | | 2,292 | |

| Decrease in accrued expenses | | | (43,611 | ) |

| Increase in due to custodian | | | 277,410 | |

| Net unrealized depreciation on investment securities and foreign currency | | | 2,296,378 | |

| Net realized loss on investment securities | | | 1,868, 517 | |

| Net cash provided from operating activities | | | 5,302,553 | |

| | | | | |

| Cash flows from financing activities: | | | | |

| Proceeds from loan | | | 5,041,000 | |

| Payments on loan | | | (4,491,000 | ) |

| Proceeds from Fund shares sold | | | 217,276 | |

| Payment on Fund shares redeemed | | | (6,280,624 | ) |

| Cash distributions paid | | | (66,615 | ) |

| Net cash used in financing activities | | | (5,579,963 | ) |

| | | | | |

| Net decrease in cash | | $ | - | |

| | | | | |

| Cash: | | | | |

| Beginning of period | | $ | - | |

| End of period | | $ | - | |

Supplemental disclosure of cash flow information:

Noncash financing activities not included herein consist of reinvestment of distributions of $617,170, receivable for fund shares sold of $0 and payable for Fund shares redeemed of $1,486.

Interest paid by the Fund for outstanding balances on the line of credit amounted to $1,485.

See accompanying notes which are an integral part of these financial statements.

IMS CAPITAL VALUE FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | Six Month | | | | |

| | | Period Ended | | | | |

| | | December 31, 2015 | | | | |

| | | (Unaudited) | | | | |

| Increase (Decrease) in Net Assets due to: | | | | | | |

| Operations: | | | | | | |

| Net investment loss | | $ | (54,428 | ) | | $ | (67,864 | ) |

| Net realized gain on investment securities | | | 421,610 | | | | 1,957,469 | |

| Change in unrealized appreciation (depreciation) on investment securities | | | (4,112,151 | ) | | | 1,733,525 | |

| Net increase (decrease) in net assets resulting from operations | | | (3,744,969 | ) | | | 3,623,130 | |

| | | | | | | | | |

| Capital share transactions: | | | | | | | | |

| Proceeds from shares purchased | | | 4,573,140 | | | | 2,803,048 | |

| Amount paid for shares redeemed | | | (1,900,042 | ) | | | (5,972,903 | ) |

| Proceeds from redemption fees | | | 425 | | | | 40 | |

| Net increase (decrease) in net assets from share transactions | | | 2,673,523 | | | | (3,169,815 | ) |

| | | | | | | | | |

| Total Increase (Decrease) in Net Assets | | | (1,071,446 | ) | | | 453,315 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of year/period | | | 40,715,679 | | | | 40,262,364 | |

| | | | | | | | | |

| End of year/period | | $ | 39,644,233 | | | $ | 40,715,679 | |

| Accumulated net investment loss included in net assets at end of year/period | | $ | (136,842 | ) | | $ | (82,414 | ) |

| | | | | | | | | |

| Capital Share Transactions | | | | | | | | |

| Shares purchased | | | 212,099 | | | | 125,688 | |

| Shares issued in reinvestment of distributions | | | - | | | | - | |

| Shares redeemed | | | (86,997 | ) | | | (276,324 | ) |

| Net increase (decrease) in capital shares | | | 125,102 | | | | (150,636 | ) |

See accompanying notes which are an integral part of these financial statements.

IMS STRATEGIC INCOME FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | Six Month | | | | |

| | | Period Ended | | | | |

| | | December 31, 2015 | | | | |

| | | (Unaudited) | | | | |

| Increase (Decrease) in Net Assets due to: | | | | | | |

| Operations: | | | | | | |

| Net investment income | | $ | 801,753 | | | $ | 2,529,284 | |

| Net realized gain (loss) on investment securities and foreign currency | | | (1,868,517 | ) | | | (5,508,272 | ) |

| Change in unrealized depreciation on investment securities and foreign currency | | | (2,296,378 | ) | | | (2,244,701 | ) |

| Net decrease in net assets resulting from operations | | | (3,363,142 | ) | | | (5,223,689 | ) |

| | | | | | | | | |

| Distributions | | | | | | | | |

| From net investment income | | | (683,785 | ) | | | (2,125,624 | ) |

| Return of capital | | | - | | | | (625,375 | ) |

| Total distributions | | | (683,785 | ) | | | (2,750,999 | ) |

| | | | | | | | | |

| Capital share transactions: | | | | | | | | |

| Proceeds from shares purchased | | | 149,049 | | | | 2,783,020 | |

| Reinvestment of distributions | | | 617,170 | | | | 2,497,602 | |

| Amount paid for shares redeemed | | | (6,269,057 | ) | | | (14,247,967 | ) |

| Proceeds from redemption fees | | | 92 | | | | 2,150 | |

| Net decrease in net assets from share transactions | | | (5,502,746 | ) | | | (8,965,195 | ) |

| | | | | | | | | |

| Total Decrease in Net Assets | | | (9,549,673 | ) | | | (16,939,883 | ) |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of year/period | | | 20,864,707 | | | | 37,804,590 | |

| | | | | | | | | |

| End of year/period | | $ | 11,315,034 | | | $ | 20,864,707 | |

| Accumulated undistributed net investment income included in net assets at end of year/period | | $ | 117,968 | | | $ | - | |

| | | | | | | | | |

| Capital Share Transactions | | | | | | | | |

| Shares purchased | | | 34,792 | | | | 538,510 | |

| Shares issued in reinvestment of distributions | | | 150,290 | | | | 480,708 | |

| Shares redeemed | | | (1,549,788 | ) | | | (2,760,334 | ) |

| Net decrease in capital shares | | | (1,364,706 | ) | | | (1,741,116 | ) |

See accompanying notes which are an integral part of these financial statements.

IMS DIVIDEND GROWTH FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | Six Month | | | | |

| | | Period Ended | | | | |

| | | December 31, 2015 | | | | |

| | | (Unaudited) | | | | |

| Increase (Decrease) in Net Assets due to: | | | | | | |

| Operations: | | | | | | |

| Net investment income | | $ | 41,753 | | | $ | 65,677 | |

| Net realized gain on investment securities | | | 35,103 | | | | 1,091,602 | |

| Change in unrealized depreciation on investment securities | | | (824,124 | ) | | | (704,954 | ) |

| Net increase (decrease) in net assets resulting from operations | | | (747,268 | ) | | | 452,325 | |

| | | | | | | | | |

| Distributions | | | | | | | | |

| From net investment income | | | (22,865 | ) | | | (66,410 | ) |

| Total distributions | | | (22,865 | ) | | | (66,410 | ) |

| | | | | | | | | |

| Capital share transactions: | | | | | | | | |

| Proceeds from shares purchased | | | 496,518 | | | | 2,335,156 | |

| Reinvestment of distributions | | | 22,813 | | | | 66,190 | |

| Amount paid for shares redeemed | | | (1,181,350 | ) | | | (1,167,031 | ) |

| Proceeds from redemption fees | | | 17 | | | | 49 | |

| Net increase (decrease) in net assets from share transactions | | | (662,002 | ) | | | 1,234,364 | |

| | | | | | | | | |

| Total Increase (Decrease) in Net Assets | | | (1,432,135 | ) | | | 1,620,279 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of year/period | | | 10,290,754 | | | | 8,670,475 | |

| | | | | | | | | |

| End of year/period | | $ | 8,858,619 | | | $ | 10,290,754 | |

| Accumulated undistributed net investment income included in net assets at end of year/period | | $ | 21,970 | | | $ | 2,658 | |

| | | | | | | | | |

| Capital Share Transactions | | | | | | | | |

| Shares purchased | | | 40,638 | | | | 176,154 | |

| Shares issued in reinvestment of distributions | | | 1,888 | | | | 5,134 | |

| Shares redeemed | | | (95,480 | ) | | | (88,322 | ) |

| Net increase (decrease) in capital shares | | | (52,954 | ) | | | 92,966 | |

See accompanying notes which are an integral part of these financial statements.

IMS CAPITAL VALUE FUND

FINANCIAL HIGHLIGHTS

For a Fund share outstanding throughout each year

| | | | | | | | | | | | | | | | | | | | | |

| | | (Unaudited) | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Year/Period | | $ | 23.16 | | | | $ | 21.10 | | | $ | 17.62 | | | $ | 14.99 | | | $ | 17.11 | | | | $ | 12.69 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investment Operations: | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | (0.03 | ) | | | | (0.04 | ) | | | (0.10 | ) | | | 0.01 | | | | (0.07 | ) | (a) | | | (0.12 | ) |

| Net realized and unrealized gain (loss) on investments | | | (2.08 | ) | | | | 2.10 | | | | 3.58 | | | | 2.62 | | | | (2.05 | ) | | | | 4.54 | |

| Total from investment operations | | | (2.11 | ) | | | | 2.06 | | | | 3.48 | | | | 2.63 | | | | (2.12 | ) | | | | 4.42 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Paid in capital from redemption fees (b) | | | - | | | | | - | | | | - | | | | - | | | | - | | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Year/Period | | $ | 21.05 | | | | $ | 23.16 | | | $ | 21.10 | | | $ | 17.62 | | | $ | 14.99 | | | | $ | 17.11 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Return (c) | | | (9.11 | )% | (d) | | | 9.76 | % | | | 19.75 | % | | | 17.54 | % | | | (12.39 | )% | | | | 34.83 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year/period (in 000's) | | $ | 39,644 | | | | $ | 40,716 | | | $ | 40,262 | | | $ | 35,031 | | | $ | 40,283 | | | | $ | 59,509 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets: | | | 1.66 | % | (e) | | | 1.74 | % | | | 2.05 | % | | | 2.06 | % | | | 1.87 | % | | | | 1.85 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income (loss) to average net assets: | | | (0.27 | )% | (e) | | | (0.17 | )% | | | (0.50 | )% | | | 0.12 | % | | | (0.46 | )% | | | | (0.71 | )% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 30.66 | % | (d) | | | 62.98 | % | | | 110.42 | % | | | 146.53 | % | | | 98.21 | % | | | | 126.11 | % |

| (a) | Per share net investment income has been calculated using the average shares method. |

| (b) | Redemption fees resulted in less than $0.005 per share. |

| (c) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund assuming reinvestment of dividends. |

See accompanying notes which are an integral part of these financial statements.

IMS STRATEGIC INCOME FUND

FINANCIAL HIGHLIGHTS

For a Fund share outstanding throughout each year

| | | | | | | | | | | | | | | | | | | | | | |

| | | (Unaudited) | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Year/Period | | $ | 4.53 | | | | $ | 5.95 | | | $ | 6.11 | | | | $ | 6.08 | | | | $ | 6.89 | | | $ | 6.50 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investment Operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.27 | | | | | 0.45 | | | | 0.56 | | | | | 0.59 | | | | | 0.62 | | | | 0.62 | |

| Net realized and unrealized gain (loss) on investments and foreign currency | | | (1.08 | ) | | | | (1.37 | ) | | | (0.15 | ) | | | | 0.01 | | (a) | | | (0.82 | ) | | | 0.38 | |

| Total from investment operations | | | (0.81 | ) | | | | (0.92 | ) | | | 0.41 | | | | | 0.60 | | | | | (0.20 | ) | | | 1.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Less Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.23 | ) | | | | (0.39 | ) | | | (0.57 | ) | | | | (0.56 | ) | | | | (0.60 | ) | | | (0.58 | ) |

| Tax return of capital | | | - | | | | | (0.11 | ) | | | - | | | | | (0.01 | ) | | | | (0.01 | ) | | | (0.03 | ) |

| Total distributions | | | (0.23 | ) | | | | (0.50 | ) | | | (0.57 | ) | | | | (0.57 | ) | | | | (0.61 | ) | | | (0.61 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Paid in capital from redemption fees (b) | | | - | | | | | - | | | | - | | | | | - | | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Year/Period | | $ | 3.49 | | | | $ | 4.53 | | | $ | 5.95 | | | | $ | 6.11 | | | | $ | 6.08 | | | $ | 6.89 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Return (c) | | | (19.70 | )% | (g) | | | (16.13 | )% | | | 7.00 | % | | | | 10.02 | % | | | | (2.59 | )% | | | 15.88 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year/period (in 000's) | | $ | 11,315 | | | | $ | 20,865 | | | $ | 37,805 | | | | $ | 38,945 | | | | $ | 34,026 | | | $ | 42,924 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets: | | | 1.97 | % | (h)(i) | | | 1.96 | % | (f) | | 1.94 | % | (e) | | | 1.95 | % | (d) | | | 2.01 | % | | | 1.97 | % |

| Ratio of expenses to average net assets before waiver & reimbursement: | | | 2.02 | % | (h)(i) | | | 1.92 | % | (f) | | 2.12 | % | | | | 2.06 | % | | | | 2.01 | % | | | 1.97 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income to average net assets: | | | 9.51 | % | (h)(i) | | | 8.94 | % | (f) | | 9.27 | % | (e) | | | 9.27 | % | (d) | | | 9.90 | % | | | 9.05 | % |

| Ratio of net investment income to average net assets before waiver & reimbursement: | | | 9.45 | % | (h)(i) | | | 8.90 | % | (f) | | 9.08 | % | | | | 9.16 | % | | | | 9.90 | % | | | 9.05 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 279.85 | % | (g) | | | 562.40 | % | | | 371.35 | % | | | | 389.36 | % | | | | 392.81 | % | | | 400.03 | % |

| (a) | Realized and unrealized gains and losses per share in this caption are balancing amounts necessary to reconcile the changes in net assets value per share for the period, and may not reconcile with the aggregate gains and losses in the statement of operations. |

| (b) | Redemption fees resulted in less than $0.005 per share. |

| (c) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund assuming reinvestment of dividends. |

| (d) | Effective November 1, 2012, the Advisor agreed to waive fees to maintain Fund expenses at 1.89% (excluding brokerage fees and commissions; borrowing costs, such as (a) interest and (b) dividend expenses on securities sold short; taxes; any indirect expenses, such as acquired fund fees and expenses; any 12b-1 fees; and extraordinary litigation expenses). |

| (e) | Effective November 1, 2013, the Advisor agreed to waive fees to maintain Fund expenses at 1.95% (excluding brokerage fees and commissions; borrowing costs, such as (a) interest and (b) dividend expenses on securities sold short; taxes; any indirect expenses, such as acquired fund fees and expenses; any 12b-1 fees; and extraordinary litigation expenses). |

(f) | The ratios include 0.01% of interest expense during the year ended June 30, 2015. |

(i) | The ratios include 0.02% of interest expense during the six month period ended December 31, 2015. |

See accompanying notes which are an integral part of these financial statements.

IMS DIVIDEND GROWTH FUND

FINANCIAL HIGHLIGHTS

For a Fund share outstanding throughout each year

| | | | | | | | | | | | | | | | | | | | | |

| | | (Unaudited) | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Year/Period | | $ | 13.03 | | | | $ | 12.44 | | | $ | 10.96 | | | $ | 9.73 | | | $ | 9.85 | | | | $ | 7.93 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investment Operations: | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.06 | | | | | 0.09 | | | | 0.16 | | | | 0.30 | | | | 0.25 | | | | | 0.15 | |

| Net realized and unrealized gain (loss) on investments | | | (1.04 | ) | | | | 0.59 | | | | 1.46 | | | | 1.44 | | | | (0.17 | ) | | | | 1.90 | |

| Total from investment operations | | | (0.98 | ) | | | | 0.68 | | | | 1.62 | | | | 1.74 | | | | 0.08 | | | | | 2.05 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Less Distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.03 | ) | | | | (0.09 | ) | | | (0.14 | ) | | | (0.38 | ) | | | (0.20 | ) | | | | (0.13 | ) |

| Tax return of capital | | | - | | | | | - | | | | - | | | | (0.13 | ) | | | - | | | | | - | |

| Total distributions | | | (0.03 | ) | | | | (0.09 | ) | | | (0.14 | ) | | | (0.51 | ) | | | (0.20 | ) | | | | (0.13 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Paid in capital from redemption fees (a) | | | - | | | | | - | | | | - | | | | - | | | | - | | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Year/Period | | $ | 12.02 | | | | $ | 13.03 | | | $ | 12.44 | | | $ | 10.96 | | | $ | 9.73 | | | | $ | 9.85 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Return (b) | | | (7.52 | )% | (d) | | | 5.48 | % | | | 14.88 | % | | | 18.10 | % | | | 0.86 | % | | | | 25.91 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | | �� | |

| Net assets, end of year/period (in 000's) | | $ | 8,859 | | | | $ | 10,291 | | | $ | 8,670 | | | $ | 8,000 | | | $ | 7,881 | | | | $ | 8,622 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets: | | | 1.95 | % | (e) | | | 1.95 | % | | | 1.96 | % | | | 1.97 | % | | | 2.09 | % | (c) | | | 2.66 | % |

| Ratio of expenses to average net assets before waiver & reimbursement: | | | 2.26 | % | (e) | | | 2.50 | % | | | 2.50 | % | | | 2.43 | % | | | 2.25 | % | | | | 2.66 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income to average net assets: | | | 0.87 | % | (e) | | | 0.69 | % | | | 1.39 | % | | | 2.85 | % | | | 2.51 | % | (c) | | | 1.48 | % |

| Ratio of net investment income to average net assets before waiver & reimbursement: | | | 0.56 | % | (e) | | | 0.14 | % | | | 0.86 | % | | | 2.39 | % | | | 2.35 | % | | | | 1.48 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 5.45 | % | (d) | | | 86.92 | % | | | 240.61 | % | | | 97.55 | % | | | 47.08 | % | | | | 161.85 | % |

| (a) | Redemption fees resulted in less than $0.005 per share. |

| (b) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund assuming reinvestment of dividends. |

| (c) | Effective September 1, 2011, the Advisor agreed to waive fees to maintain Fund expenses at 1.95% (excluding brokerage fees and commissions; borrowing costs, such as (a) interest and (b) dividend expenses on securities sold short; taxes; any indirect expenses, such as acquired fund fees and expenses; any 12b-1 fees; and extraordinary litigation expenses). Prior to that date, the Fund did not have an expense cap. |

See accompanying notes which are an integral part of these financial statements.

IMS FAMILY OF FUNDS

NOTES TO THE FINANCIAL STATEMENTS

December 31, 2015 (Unaudited)

NOTE 1. ORGANIZATION

The IMS Family of Funds (the “Funds”), comprising the IMS Capital Value Fund (the “Value Fund”), IMS Strategic Income Fund (the “Income Fund”) and IMS Dividend Growth Fund (the “Dividend Growth Fund”), were each organized as a diversified series of 360 Funds (the “Trust”) on June 20, 2014. The Trust was organized on February 24, 2005 as a Delaware statutory trust. The Trust is registered as an open-end management investment company under the Investment Company Act of 1940 (the “1940 Act”). The investment objective of the Value Fund is to provide long-term growth from capital appreciation and secondarily, income from dividends. The investment objective of the Income Fund is to provide current income and secondarily, capital appreciation. The investment objective of the Dividend Growth Fund is to provide long-term growth from capital appreciation and dividends. The investment advisor of each Fund is IMS Capital Management, Inc. (the “Advisor”).

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by each Fund in the preparation of its financial statements.

Securities Valuations – All investments in securities are recorded at their estimated fair value as described in Note 3.

Foreign Currency – Investment securities denominated in foreign currencies are translated into U.S. dollar amounts at the date of valuation. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions. Reported net realized foreign exchange gains or losses arise from currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Funds’ books and the U.S. dollar equivalent of the amounts actually received or paid. The Funds do not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

Reverse Convertible Bonds – The Funds may invest in reverse convertible notes, which are short-term notes (i.e., with maturities of one year or less) that are linked to individual equity securities. These notes make regular interest payments by the issuer, but also have a put option attached, giving the issuer the right to exercise that option only if the price of the related security drops below a stated price.

Structured notes, such as reverse convertible notes, are subject to a number of fixed income risks including general market risk, interest rate risk, as well as the risk that the issuer on the note may fail to make interest and/ or principal payments when due, or may default on its obligations entirely. In addition, as a result of imbedded derivative features in these securities, structured notes generally are subject to more risk than investing in a simple note or bond issued by the same issuer.

IMS FAMILY OF FUNDS

NOTES TO THE FINANCIAL STATEMENTS – (continued)

December 31, 2015 (Unaudited)

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES (continued)

Federal Income Taxes – The Funds make no provision for federal income or excise tax. The Funds intend to qualify each year as regulated investment companies (“RICs”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of their taxable income. The Funds also intend to distribute sufficient net investment income and net capital gains, if any, so that they will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Funds could incur a tax expense.

As of and during the six month period ended December 31, 2015, the Funds did not have a liability for any unrecognized tax benefits. The Funds recognize interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the statement of operations. During the six month period ended December 31, 2015, the Funds did not incur any interest or penalties. The Funds are not subject to examination by U.S. federal tax authorities for tax years prior to 2012.

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or another appropriate basis (as determined by the Board).

Security Transactions and Related Income – Each Fund follows industry practice and records security transactions on the trade date for financial reporting purposes. The first in, first out method is used for determining gains or losses for financial statements and income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Dividend income from real estate investment trusts (REITS) and distributions from limited partnerships are recognized on the ex-date and included in dividend income. The calendar year-end classification of distributions received from REITS during the fiscal year are reported subsequent to year end; accordingly, the Funds estimate the character of REIT distributions based on the most recent information available. Income or loss from limited partnerships is reclassified in the components of net assets upon receipt of K-1’s. Withholding taxes on foreign dividends have been provided for in accordance with each Fund’s understanding of the applicable country’s tax rules and rates. Discounts and premiums on securities purchased are amortized or accreted using the effective interest method. For bonds that miss a scheduled interest payment, after the grace period, all interest accrued on the bond is written off and no additional interest will be accrued. However, for illiquid bonds or those bonds fair valued by the Advisor, if the Advisor’s research indicates a high recovery rate in restructuring, and the Fund expects to hold the bond until the issue is restructured, past due interest may not be written off in its entirety. The ability of issuers of debt securities held by the Funds to meet their obligations may be affected by economic and political developments in a specific country or region.

Purchasing Options – Each Fund may purchase and sell put and call options involving individual securities and market indexes. An option involves either (a) the right or the obligation to buy or sell a specific instrument at a specific price until the expiration date of the option, or (b) the right to receive payments or the obligation to make payments representing the difference between the closing price of a market index and the exercise price of the option expressed in dollars times a specified multiple until the expiration date of the option. Options are sold (written) on securities and market indexes. The purchaser of an option on a security pays the seller (the writer) a premium for the right granted but is not obligated to buy or sell the underlying security. The purchaser of an option on a market index pays the seller a premium for the right granted, and in return the seller of such an option is obligated to make the payment. Options are traded on organized exchanges and in the over-the-counter market.

IMS FAMILY OF FUNDS

NOTES TO THE FINANCIAL STATEMENTS – (continued)

December 31, 2015 (Unaudited)

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES (continued)

The purchase of options involves certain risks. The purchase of options typically will limit a Fund’s potential loss to the amount of the premium paid and can afford the Fund the opportunity to profit from favorable movements in the price of an underlying security to a greater extent than if transactions were effected in the security directly. However, the purchase of an option could result in a Fund losing a greater percentage of its investment than if the transaction were effected directly.

Writing Options – Each Fund may write (sell) covered call options on common stocks in the Fund’s portfolio. A covered call option on a security is an agreement to sell a particular portfolio security if the option is exercised at a specified price, or before a set date. A Fund profits from the sale of the option, but gives up the opportunity to profit from any increase in the price of the stock above the option price, and may incur a loss if the stock price falls. Risks associated with writing covered call options include the possible inability to effect closing transactions at favorable prices and an appreciation limit on the securities set aside for settlement. When a Fund writes a covered call option, it will receive a premium, but it will give up the opportunity to profit from a price increase in the underlying security above the exercise price as long as its obligation as a writer continues, and it will retain the risk of loss should the price of the security decline. The Funds will only engage in exchange-traded options transactions.

The investment objective of the Income Fund and Dividend Growth Fund as it relates to derivative investments is to use such investments in an effort to manage risk and/or generate returns.

Each Fund may write (sell) put options, including “out of the money” put options. When a Fund writes (sells) put options, the Fund receives the option premium, but will lose money if a decrease in the value of the security or index causes the Fund’s costs to cover its obligations upon exercise to increase to a level that is higher than the option premium the Fund received. Each Fund will sell a put option only if the obligation taken on by the sale of the put is “covered,” either 1) by maintaining a cash reserve or an investment in a money market fund equal to the amount necessary to purchase the underlying security if exercised, 2) by owning another put option with the same or a later expiration date and the same or a higher strike price, or 3) by owning another put option with the same or a later expiration date and a lower strike price in addition to cash equal to the difference between the strike price of the sold put and the strike price of the purchased put.

Dividends and Distributions – The Income Fund intends to distribute substantially all of its net investment income as dividends to its shareholders on a monthly basis. The Value Fund and Dividend Growth Fund intend to distribute substantially all of their net investment income as dividends to their shareholders on at least an annual basis. Each Fund intends to distribute its net realized long-term capital gains and its net realized short-term capital gains at least once a year. Dividends to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset values per share of the Funds.

IMS FAMILY OF FUNDS

NOTES TO THE FINANCIAL STATEMENTS – (continued)

December 31, 2015 (Unaudited)

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

Fair value is defined as the price that a Fund would receive upon selling an investment in a orderly transaction to an independent buyer in the principal or most advantageous market of the investment. Accounting principles generally accepted in the United States (“GAAP”) establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (the risk inherent in a particular valuation technique used to measure fair value such as a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

Various inputs are used in determining the value of the Funds’ investments. These inputs are summarized in the three broad levels listed below.

| • | Level 1 – quoted prices in active markets for identical securities |

| • | Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| • | Level 3 – significant unobservable inputs (including each Fund’s own assumptions in determining fair value of investments based on the best information available) |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Equity securities, including common stock, real estate investment trusts, and preferred securities, are generally valued by using market quotations, but may be valued on the basis of prices furnished by a pricing service when the Advisor believes such prices more accurately reflect the fair value of such securities. Securities that are traded on any stock exchange are generally valued by the pricing service at the last quoted sale price. Lacking a last sale price, an exchange traded security is generally valued by the pricing service at its last bid price. Securities traded in the NASDAQ over-the-counter market are generally valued by the pricing service at the NASDAQ Official Closing Price. When using the market quotations or close prices provided by the pricing service and when the market is considered active, the security will be classified as a Level 1 security. Sometimes, an equity security owned by a Fund will be valued by the pricing service with factors other than market quotations or when the market is considered inactive. When this happens, the security will be classified as a Level 2 security.

Investments in mutual funds, including money market mutual funds, are generally priced at the ending net asset value (NAV) provided by the service agent of the funds. These securities will be categorized as Level 1 securities.

IMS FAMILY OF FUNDS

NOTES TO THE FINANCIAL STATEMENTS – (continued)

December 31, 2015 (Unaudited)

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS (continued)

Fixed income securities such as corporate bonds, municipal bonds, reverse convertible bonds, and foreign bonds denominated in U.S. dollars, when valued using market quotations in an active market, will be categorized as Level 1 securities. However, they may be valued on the basis of prices furnished by a pricing service when the Advisor believes such prices more accurately reflect the fair value of such securities. A pricing service utilizes electronic data processing techniques based on yield spreads relating to securities with similar characteristics to determine prices for normal institutional-size trading units of debt securities without regard to sale or bid prices. These securities will generally be categorized as Level 2 securities. If the Advisor decides that a price provided by the pricing service does not accurately reflect the fair value of the securities, when prices are not readily available from a pricing service, or when certain restricted or illiquid securities are being valued, securities are valued at fair value as determined in good faith by the Advisor, in conformity with guidelines adopted by and subject to review of the Board and the Fair Valuation Committee. These securities will be categorized as Level 3 securities. See the chart on page 24 for more information on the inputs used by the Advisor in determining fair value of such level 3 securities. The Advisor has used inputs such as evaluated broker quotes in inactive markets, actual trade prices in inactive markets, present value of expected future cash flows, terms of expected bond restructurings, and yields on similar securities in determining the fair value of such Level 3 securities.

Short-term investments in fixed income securities (those with maturities of less than 60 days when acquired) are valued by using the amortized cost method of valuation, which the Board has determined will represent fair value. These securities will be classified as Level 2 securities.

In accordance with the Trust’s good faith pricing guidelines, the Advisor is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single standard exists for determining fair value, because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of an issue of securities being valued by the Advisor would appear to be the amount which the owner might reasonably expect to receive for them upon their current sale. Methods which are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods. Good faith pricing is permitted if, in the Advisor’s opinion, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event occurs after the close of a market but before a Fund’s NAV calculation that may affect a security’s value, or the Advisor is aware of any other data that calls into question the reliability of market quotations. Good faith pricing may also be used in instances when the bonds the Funds invest in may default or otherwise cease to have market quotations readily available.

The Trustees of the 360 Funds adopted the M3Sixty Consolidated Valuation Procedures on June 24, 2014, which established a Valuation Committee to work with the Advisor and report to the Board on securities being fair valued or manually priced. The Lead Chairman and Trustee for the 360 Funds, along with the Fund Principal Financial Officer and Chief Compliance Officer are members of the Valuation Committee which meets at least monthly or, as required, to review the interim actions and coordination with the Advisor in pricing fair valued securities, and consideration of any unresolved valuation issue or a request to change the methodology for manually pricing a security. In turn, the Lead Chairman provides updates to the Board at the regularly scheduled board meetings as well as interim updates to the board members on substantive changes in a daily valuation or methodology issue.

IMS FAMILY OF FUNDS

NOTES TO THE FINANCIAL STATEMENTS – (continued)

December 31, 2015 (Unaudited)

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS (continued)

The following is a summary of the inputs used to value the Value Fund’s investments as of December 31, 2015:

| | | Valuation Inputs | |

| Investments | | Level 1 – Quoted Prices in Active Markets | | | Level 2 – Other Significant Observable Inputs | | | Level 3 – Significant Unobservable Inputs | | | Total | |

| Common Stocks* | | $ | 38,241,719 | | | $ | – | | | $ | – | | | $ | 38,241,719 | |

| Money Market Securities | | | 1,420,451 | | | | – | | | | – | | | | 1,420,451 | |

| Total | | $ | 39,662,170 | | | $ | – | | | $ | – | | | $ | 39,662,170 | |

| * | Refer to the Schedule of Investments for industry classifications. |

The Value Fund did not hold any investments at any time during the reporting period in which significant unobservable inputs were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period. The Value Fund did not hold any derivative instruments during the reporting period. During the six month period ended December 31, 2015, there were no transfers between levels. The Value Fund recognizes transfers between fair value hierarchy levels at the end of the reporting period.

The following is a summary of the inputs used to value the Income Fund’s investments as of December 31, 2015:

| | | Valuation Inputs | |

| Investments | | Level 1 – Quoted Prices in Active Markets | | | Level 2 – Other Significant Observable Inputs | | | Level 3 – Significant Unobservable Inputs | | | Total | |

| Corporate Bonds | | $ | – | | | $ | 2,517,825 | | | $ | 1,953,133 | | | $ | 4,470,958 | |

| Foreign Bonds | | | – | | | | 1,107,178 | | | | – | | | | 1,107,178 | |

| Structured Notes | | | – | | | | 4,890,029 | | | | – | | | | 4,890,029 | |

| Promissory Notes | | | – | | | | – | | | | 750,000 | | | | 750,000 | |

| Total | | $ | – | | | $ | 8,515,032 | | | $ | 2,703,133 | | | $ | 11,218,165 | |

IMS FAMILY OF FUNDS

NOTES TO THE FINANCIAL STATEMENTS – (continued)

December 31, 2015 (Unaudited)

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS (continued)

Following is a reconciliation of investments in which significant unobservable inputs (Level 3) were used in determining fair value for the Income Fund:

| | Balance as of June 30, 2015 | Realized gain (loss) | Amortization | Change in unrealized appreciation (depreciation) | Purchases | Sales | Transfers in to Level 3 | Transfers out of Level 3 | Balance as of December 31, 2015 |

| Corporate Bonds | $2,501,346 | $– | $1,049 | $(539,648) | $– | $(9,614) | $– | $– | $1,953,133 |

| Promissory Notes | – | – | – | – | 750,000 | – | – | – | 750,000 |

| Total | $2,501,346 | $– | $1,049 | $(539,648) | $750 000 | $(9,614) | $– | $– | $2,703,133 |

The following is a quantitative summary of the techniques and inputs used to fair value the Level 3 securities as of December 31, 2015:

| Quantitative information about Level 3 fair value measurements |

| | Fair value at 12/31/2015 | Valuation technique(s) | Unobservable input | Range (Weighted Average) |

| Corporate bonds | $1,222,037 | Market based | Dealer quote or historical prices | 85-100.67 (95.2) (1) |

| | 731,096 | Asset based | Estimated value of issuers underlying assets (2) | |

| Promissory Notes | 750,000 | Market based | Dealer quote or historical prices | 100 (100) (1) |

| (1) | A significant decrease in the input in isolation would result in a significantly lower fair valuation measurement. (2) A significant increase in this input in isolation would result in a significantly higher fair value measurement. |

The valuation technique for Performance Drilling Co. LLC, 6.000%, 09/30/2022 was changed from a market based technique to an asset based technique. These changes were made pursuant to the fair valuation committee's determination to use asset based techniques due to insufficient market information being available to determine a fair value.

The total change in unrealized appreciation (depreciation) attributable to Level 3 investments still held at December 31, 2015 was $(539,648) as shown below.

| | Total Change in Unrealized Appreciation (Depreciation) |

| Corporate Bonds | $(539,648) |

| Total | $(539,648) |

The Income Fund did not hold any derivative instruments during the six month period ended December 31, 2015. During the six month period ended December 31, 2015, there were no transfers between levels. See reconciliation of investments for Level 3 securities in chart above. The Income Fund recognizes transfers between fair value hierarchy levels at the end of the reporting period.

IMS FAMILY OF FUNDS

NOTES TO THE FINANCIAL STATEMENTS – (continued)

December 31, 2015 (Unaudited)

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS (continued)

The following is a summary of the inputs used to value the Dividend Growth Fund’s investments as of December 31, 2015:

| | | Valuation Inputs | |

| Investments | | Level 1 – Quoted Prices in Active Markets | | | Level 2 – Other Significant Observable Inputs | | | Level 3 – Significant Unobservable Inputs | | | Total | |

| Common Stocks* | | $ | 8,556,769 | | | $ | – | | | $ | – | | | $ | 8,556,769 | |

| Money Market Securities | | | 297,146 | | | | – | | | | – | | | | 297,146 | |

| Total | | $ | 8,853,915 | | | $ | – | | | $ | – | | | $ | 8,853,915 | |

| * | Refer to the Schedule of Investments for industry classifications. |

The Dividend Growth Fund did not hold any investments at any time during the reporting period in which significant unobservable inputs were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period. During the six month period ended December 31, 2015, there were no transfers between levels. The Dividend Growth Fund recognizes transfers between fair value hierarchy levels at the end of the reporting period.

NOTE 4. FEES AND OTHER TRANSACTIONS WITH AFFILIATES

The Advisor serves as investment advisor to the Funds pursuant to an Investment Advisory Agreement (the “Advisory Agreement”) with the Trust. Pursuant to the Advisory Agreement, the Advisor manages the operations of the Funds and manages the Funds’ investments in accordance with the stated policies of the Funds, subject to approval of the Board of Trustees.

In addition, effective June 20, 2014 for the Income Fund and Dividend Growth Fund, and, effective October 31, 2014 for the Value Fund, the Advisor and the Funds have entered into an Expense Limitation Agreement under which the Advisor has agreed to waive or reduce its fees and to assume other expenses of the Funds, if necessary, in an amount that limits annual operating expenses (exclusive of interest, taxes, brokerage fees and commissions, acquired fund fees and expenses, shareholder servicing fees, extraordinary expenses, and, dividend and interest expenses in connection with securities sold short) to not more than 1.95% of the Funds’ average daily net assets through October 31, 2016, subject to the Advisor’s right to recoup payments on a rolling three-year basis, so long as the payments would not exceed the 1.95% expense cap.

IMS FAMILY OF FUNDS

NOTES TO THE FINANCIAL STATEMENTS – (continued)

December 31, 2015 (Unaudited)

NOTE 4. FEES AND OTHER TRANSACTIONS WITH AFFILIATES (continued)

Under the terms of the Advisory Agreement, the Funds are obligated to pay the Advisor a fee computed and accrued daily and paid monthly. Please see the chart below for information regarding the management fee rates, management fees earned, fee waivers and recoupments, and expenses reimbursed during the six month period ended December 31, 2015, as well as amounts due to the Advisor at December 31, 2015.

| | Value Fund | Income Fund | Dividend Growth Fund |

| Management fee under Advisory Agreement (as a percentage of average net assets) | 1.21% | 1.26% | 1.26% |

| Expense limitation (as a percentage of average net assets) | 1.95% | 1.95% | 1.95% |

| Management fees earned | $240,509 | $105,984 | $60,358 |

| Fees recouped (waived) and (expenses reimbursed) | $– | $(4,347) | $(14,725) |

| Payable to Advisor | $40,445 | $13,114 | $6,972 |

Each waiver or reimbursement by the Advisor is subject to repayment by the Funds within the three fiscal years following the fiscal year in which the particular expense was incurred, provided that the Funds are able to make the repayment without exceeding the expense limitations in effect at the time the expenses were waived or currently in effect, whichever is lower as described above.

The amounts subject to repayment by the Income Fund and Dividend Growth Fund, pursuant to the aforementioned conditions, at June are as follows:

| Fund | Amount | Expires June 30, |

| Income Fund | $29,135 | 2016 |

| Income Fund | $73,509 | 2017 |

| Income Fund | $4,347 | 2019 |

| Dividend Growth Fund | $38,289 | 2016 |

| Dividend Growth Fund | $45,290 | 2017 |

| Dividend Growth Fund | $52,469 | 2018 |

| Dividend Growth Fund | $14,725 | 2019 |

There are no amounts subject to repayment by the Capital Value Fund.

The Trust has entered into an Investment Company Services Agreement (the “Services Agreement”) with M3Sixty Administration, LLC (“M3Sixty”). Under the Services Agreement, M3Sixty is responsible for a wide variety of functions, including but not limited to: (a) Fund accounting services; (b) financial statement preparation; (c) valuation of the Funds’ portfolio securities; (d) pricing the Funds’ shares; (e) assistance in preparing tax returns; (f) preparation and filing of required regulatory reports; (g) communications with shareholders; (h) coordination of Board and shareholder meetings; (i) monitoring the Funds’ legal compliance; (j) maintaining shareholder account records.

IMS FAMILY OF FUNDS

NOTES TO THE FINANCIAL STATEMENTS – (continued)

December 31, 2015 (Unaudited)

NOTE 4. FEES AND OTHER TRANSACTIONS WITH AFFILIATES (continued)

For the six month period ended December 31, 2015, the Funds accrued servicing fees, including out of pocket expenses, as follows:

| Fund | | Service Fees | |

| Value Fund | | $ | 53,114 | |

| Income Fund | | | 24,133 | |

| Dividend Growth Fund | | | 18,400 | |

Certain officers and a Trustee of the Trust are also employees of M3Sixty.

Matrix Capital Group, Inc. (the “Distributor”) acts as the principal distributor of the Funds. There were no payments made to the Distributor by the Funds for the six month period ended December 31, 2015.

The Distributor is not affiliated with the Adviser. The Distributor is an affiliate of M3Sixty.

NOTE 5. LINE OF CREDIT

During the six month period ended December 31, 2015, the IMS Funds each respectively entered into an agreement with The Huntington National Bank, the custodian of the Funds’ investments, to open secured lines of credit secured by the Funds’ investments. Borrowings under this agreement bear interest at LIBOR plus 1.500%. Maximum borrowings for each Fund are lesser of $1,500,000 or 10.000% of the Fund’s daily market value. The current agreement expires on June 13, 2016.

| | Value Fund | | | Income Fund | | | Dividend Growth Fund | |

| Total available bank line of credit as of December 31, 2015 | | $ | 1,500,000 | | | $ | 1,121,817 | | | $ | 885,392 | |

| Average borrowings for the period | | $ | 6,859 | | | $ | 109,207 | | | $ | 21,065 | |

| Average interest rate for the period | | | 1.706 | % | | | 1.706 | % | | | 1.706 | % |

| Highest balance drawn during the period | | $ | 162,000 | | | $ | 994,000 | | | $ | 231,000 | |

| Interest rate at December 31, 2015 | | | 1.769 | % | | | 1.769 | % | | | 1.769 | % |

| Line of credit borrowing at December 31, 2015 | | $ | – | | | $ | 550,000 | | | $ | – | |

NOTE 6. INVESTMENTS

For the six month period ended December 31, 2015, purchases and sales of investment securities, other than short-term investments and short-term U.S. government obligations were as follows:

| | | Value Fund | | | Income Fund | | | Dividend Growth Fund | |

| Purchases | | | | | | | | | |

| U.S. Government Obligations | | $ | – | | | $ | – | | | $ | – | |

| Other | | | 16,346,213 | | | | 43,767,256 | | | | 510,764 | |

| Sales | | | | | | | | | | | | |

| U.S. Government Obligations | | $ | – | | | $ | – | | | $ | – | |

| Other | | | 11,686,254 | | | | 48,667,743 | | | | 1,122,773 | |

IMS FAMILY OF FUNDS

NOTES TO THE FINANCIAL STATEMENTS – (continued)

December 31, 2015 (Unaudited)

NOTE 6. INVESTMENTS (continued)

As of December 31, 2015, the net unrealized appreciation (depreciation) of investments for tax purposes was as follows:

| | | Value Fund | | | Income Fund | | | Dividend Growth Fund | |

| Gross Appreciation | | $ | 6,485,039 | | | $ | 112,706 | | | $ | 575,071 | |

| Gross (Depreciation) | | | (4,607,323 | ) | | | (7,694,344 | ) | | | (1,390,393 | ) |

| Net Appreciation (Depreciation) on Investments | | $ | 1,877,716 | | | $ | (7,581,638 | ) | | $ | (815,322 | ) |

| Tax Cost | | $ | 37,784,454 | | | $ | 18,799,803 | | | $ | 9,669,237 | |

NOTE 7. ESTIMATES

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

NOTE 8. BENEFICIAL OWNERSHIP