UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-21726

360 Funds

(Exact name of registrant as specified in charter)

| 4520 Main Street, Suite 1425 Kansas City, MO | 64111 |

| (Address of principal executive offices) | (Zip code) |

M3Sixty Administration, LLC.

4520 Main Street

Suite 1425

Kansas City, MO 64111

(Name and address of agent for service)

Registrant's telephone number, including area code: 877-244-6235

Date of fiscal year end: 12/31/2016

Date of reporting period: 6/30/2016

| ITEM 1. | REPORTS TO SHAREHOLDERS |

The Semi-Annual report to Shareholders of the Foundry Micro Cap Value Fund, a series of the 360 Funds, for the period ended June 30, 2016 pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “1940 Act”), as amended (17 CFR 270.30e-1) is filed herewith.

FOUNDRY PARTNERS, LLC FUNDS

Foundry Micro Cap Value Fund

Class I Shares (Ticker Symbol: FMCIX)

Series of the

360 Funds

SEMI-ANNUAL REPORT

June 30, 2016

Investment Adviser:

Foundry Partners, LLC

510 First Avenue North,

Suite 409

Minneapolis, MN 55403

TABLE OF CONTENTS

| INVESTMENT HIGHLIGHTS | 1 |

| SCHEDULE OF INVESTMENTS | 2 |

| STATEMENT OF ASSETS AND LIABILITIES | 7 |

| STATEMENT OF OPERATIONS | 8 |

| STATEMENTS OF CHANGES IN NET ASSETS | 9 |

| FINANCIAL HIGHLIGHTS | 10 |

| NOTES TO FINANCIAL STATEMENTS | 11 |

| ADDITIONAL INFORMATION | 17 |

| EXPENSE EXAMPLES | 19 |

| Foundry Partners, LLC Funds | SEMI-ANNUAL REPORT |

Foundry Micro Cap Value Fund

INVESTMENT HIGHLIGHTS

June 30, 2016 (Unaudited)

The investment objective of the Foundry Micro Cap Value Fund (the “Micro Cap Fund”) is capital appreciation. To meet the investment objective of this Fund, the Fund will invest at least 80% of its assets in equity securities of micro-cap companies. Micro-cap companies are those companies contained within the Russell Microcap® Value Index, or companies with similar size characteristics. Equity securities consist of common stock and securities convertible into common stock.

As of June 30, 2016, the median market capitalization of companies included in the Russell Microcap® Value Index was approximately $201 million; the average market capitalization for companies contained within the Russell Microcap® Value Index was approximately $248 million; and the largest stock in the index had a market capitalization of $1.17 billion.

The Micro Cap Fund seeks to provide broad exposure to micro-cap domestic equity securities and seeks to outperform the Russell Microcap® Value Index after fees over a long-term investment horizon. The Adviser seeks to invest in companies that it considers to be “statistically cheap” (based on factors which may include, for example, low ratio of price to earnings, price to cash flow, price to book value, and price to sales). The Adviser also looks for companies that it believes are undervalued relative to their earning power and long-term earnings growth prospects, adjusted for risk. The Adviser may filter less attractive companies by analyzing cash flows, evaluating financial strength, performing earnings analysis and reviewing purchase and sale activity in company shares by company executives, and through fundamental analysis, which may include a review of assets, earnings, sales, products, markets, and management, among other indicators. Ideally, after filtering out companies that do not meet the Adviser’s criteria above, the Adviser looks for companies that have a positive catalyst, (e.g., new products, management changes, acquisition, etc.).

The Adviser also utilizes a sell discipline and may consider selling a security when: it becomes fully valued in the Adviser’s opinion or less attractive to the Adviser; one of the Fund’s holdings has performed well and reached or approached the Adviser’s price target; a company fails to pass the Adviser’s investment screens; or there is deterioration in a company’s fundamentals, management or financial reporting.

The Adviser will look to manage risk through several strategies, which typically include: maintaining minimum and maximum sector weightings relative to the Russell Microcap Value Index; monitoring risk statistics relative to the Russell Microcap® Value Index; and, monitoring trade volume.

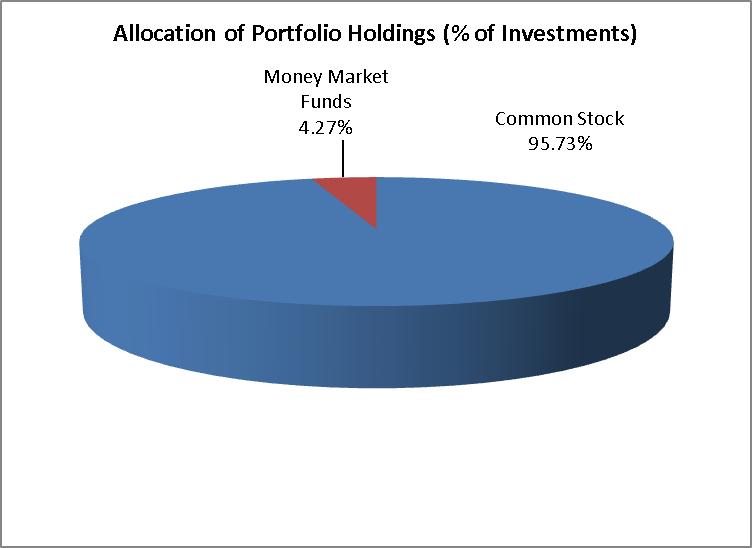

The percentages in the above graph are based on the portfolio holdings of the Fund as of June 30, 2016 and are subject to change. For a detailed break-out of holdings by industry, please refer to the Schedules of Investments.

FOUNDRY PARTNERS, LLC FUNDS FOUNDRY MICRO CAP VALUE FUND SCHEDULE OF INVESTMENTS June 30, 2016 (Unaudited) | SEMI-ANNUAL REPORT |

| COMMON STOCK - 95.94% | | SHARES | | | FAIR VALUE | |

| | | | | | | |

| Aerospace & Defense - 1.71% | | | | | | |

Ducommun, Inc. (a) | | | 3,270 | | | $ | 64,681 | |

| | | | | | | | | |

| Apparel - 1.21% | | | | | | | | |

Perry Ellis International, Inc. (a) | | | 2,265 | | | | 45,572 | |

| | | | | | | | | |

| Auto Parts & Equipment - 1.08% | | | | | | | | |

| Spartan Motors, Inc. | | | 6,525 | | | | 40,846 | |

| | | | | | | | | |

| Banks - 16.60% | | | | | | | | |

| Allegiance Bancshares, Inc. | | | 775 | | | | 19,282 | |

| Bank of Commerce Holdings | | | 2,775 | | | | 18,315 | |

| Bar Harbor Bankshares | | | 460 | | | | 16,146 | |

| Capital City Bank Group, Inc. | | | 2,995 | | | | 41,690 | |

| Financial Institutions, Inc. | | | 1,675 | | | | 43,667 | |

| First Bancorp, Inc. - ME | | | 1,130 | | | | 24,340 | |

| First Financial Corp. - IN | | | 1,495 | | | | 54,747 | |

| First Internet Bancorp | | | 1,420 | | | | 33,824 | |

| Hanmi Financial Corp. | | | 2,005 | | | | 47,097 | |

| Horizon Bancorp - IN | | | 1,765 | | | | 44,372 | |

| Independent Bank Corp. - MI | | | 3,115 | | | | 45,199 | |

| Lakeland Bancorp, Inc. | | | 3,325 | | | | 37,839 | |

| MainSource Financial Group, Inc. | | | 2,445 | | | | 53,912 | |

| Northrim BanCorp, Inc. | | | 655 | | | | 17,220 | |

| Peoples Bancorp, Inc. - OH | | | 2,595 | | | | 56,545 | |

| Sierra Bancorp | | | 1,830 | | | | 30,543 | |

| Washington Trust Bancorp, Inc. | | | 1,100 | | | | 41,712 | |

| | | | | | | | 626,450 | |

| Biotechnology - 0.55% | | | | | | | | |

Harvard Bioscience, Inc. (a) | | | 7,300 | | | | 20,878 | |

| | | | | | | | | |

| Chemicals - 1.15% | | | | | | | | |

Landec Corp. (a) | | | 4,035 | | | | 43,416 | |

| | | | | | | | | |

| Commercial Services - 3.87% | | | | | | | | |

| Barrett Business Services, Inc. | | | 935 | | | | 38,634 | |

CRA International, Inc. (a) | | | 2,425 | | | | 61,158 | |

Cross Country Healthcare, Inc. (a) | | | 3,320 | | | | 46,214 | |

| | | | | | | | 146,006 | |

FOUNDRY PARTNERS, LLC FUNDS FOUNDRY MICRO CAP VALUE FUND SCHEDULE OF INVESTMENTS June 30, 2016 (Unaudited) | SEMI-ANNUAL REPORT |

| COMMON STOCK - 95.94% (Continued) | | SHARES | | | FAIR VALUE | |

| | | | | | | |

| Distribution & Wholesale - 0.62% | | | | | | |

Systemax, Inc. (a) | | | 2,745 | | | $ | 23,415 | |

| | | | | | | | | |

| Diversified Financial Services - 1.06% | | | | | | | | |

| GAIN Capital Holdings, Inc. | | | 6,350 | | | | 40,132 | |

| | | | | | | | | |

| Electronics - 0.95% | | | | | | | | |

Electro Scientific Industries, Inc. (a) | | | 4,325 | | | | 25,258 | |

| LRAD Corp. | | | 5,875 | | | | 10,516 | |

| | | | | | | | 35,774 | |

| Energy - Alternate Sources - 0.76% | | | | | | | | |

Pacific Ethanol, Inc. (a) | | | 5,250 | | | | 28,612 | |

| | | | | | | | | |

| Engineering & Construction - 3.49% | | | | | | | | |

Hill International, Inc. (a) | | | 6,725 | | | | 27,371 | |

Orion Marine Group, Inc. (a) | | | 11,565 | | | | 61,410 | |

Sterling Construction Co., Inc. (a) | | | 8,775 | | | | 43,085 | |

| | | | | | | | 131,866 | |

| Environmental Control - 1.41% | | | | | | | | |

| Ceco Environmental Corp. | | | 6,090 | | | | 53,227 | |

| | | | | | | | | |

| Forest Products & Paper - 0.82% | | | | | | | | |

| PH Glatfelter Co. | | | 1,580 | | | | 30,905 | |

| | | | | | | | | |

| Hand & Machine Tools - 1.05% | | | | | | | | |

| Hardinge, Inc. | | | 3,935 | | | | 39,586 | |

| | | | | | | | | |

| Healthcare - Products - 1.50% | | | | | | | | |

| Digirad Corp. | | | 4,635 | | | | 23,870 | |

Exactech, Inc. (a) | | | 1,225 | | | | 32,756 | |

| | | | | | | | 56,626 | |

| Healthcare - Services - 2.14% | | | | | | | | |

Almost Family, Inc. (a) | | | 1,085 | | | | 46,232 | |

LHC Group, Inc. (a) | | | 800 | | | | 34,624 | |

| | | | | | | | 80,856 | |

| Home Builders - 2.69% | | | | | | | | |

Century Communities, Inc. (a) | | | 3,260 | | | | 56,528 | |

WCI Communities, Inc. (a) | | | 2,660 | | | | 44,954 | |

| | | | | | �� | | 101,482 | |

| Home Furnishings - 0.88% | | | | | | | | |

| Ethan Allen Interiors, Inc. | | | 1,005 | | | | 33,205 | |

| | | | | | | | | |

| Housewares - 0.64% | | | | | | | | |

| Lifetime Brands, Inc. | | | 1,645 | | | | 24,000 | |

FOUNDRY PARTNERS, LLC FUNDS FOUNDRY MICRO CAP VALUE FUND SCHEDULE OF INVESTMENTS June 30, 2016 (Unaudited) | SEMI-ANNUAL REPORT |

| COMMON STOCK - 95.94% (Continued) | | SHARES | | | FAIR VALUE | |

| | | | | | | |

| Insurance - 2.21% | | | | | | |

| HCI Group, Inc. | | | 1,725 | | | $ | 47,058 | |

| United Insurance Holdings Corp. | | | 2,225 | | | | 36,446 | |

| | | | | | | | 83,504 | |

| Internet - 1.17% | | | | | | | | |

1-800-Flowers.com, Inc. - Class A (a) | | | 4,910 | | | | 44,288 | |

| | | | | | | | | |

| Investment Companies - 0.63% | | | | | | | | |

| Saratoga Investment Corp. | | | 1,400 | | | | 23,632 | |

| | | | | | | | | |

| Iron & Steel - 1.15% | | | | | | | | |

Universal Stainless & Alloy Products, Inc. (a) | | | 3,990 | | | | 43,491 | |

| | | | | | | | | |

| Lodging - 0.43% | | | | | | | | |

Century Casinos, Inc. (a) | | | 2,625 | | | | 16,354 | |

| | | | | | | | | |

| Machinery - Diversified - 1.04% | | | | | | | | |

| Columbus McKinnon Corp. - NY | | | 2,775 | | | | 39,266 | |

| | | | | | | | | |

| Metal Fabricate & Hardware - 3.56% | | | | | | | | |

| Haynes International, Inc. | | | 1,290 | | | | 41,383 | |

Northwest Pipe Co. (a) | | | 1,920 | | | | 20,698 | |

| Olympic Steel, Inc. | | | 2,650 | | | | 72,372 | |

| | | | | | | | 134,453 | |

| Oil & Gas - 1.67% | | | | | | | | |

| Evolution Petroleum Corp. | | | 3,175 | | | | 17,367 | |

Ring Energy, Inc. (a) | | | 5,175 | | | | 45,643 | |

| | | | | | | | 63,010 | |

| Oil & Gas Services - 1.62% | | | | | | | | |

| Gulf Island Fabrication, Inc. | | | 2,510 | | | | 17,419 | |

Newpark Resources, Inc. (a) | | | 5,050 | | | | 29,240 | |

| Tesco Corp. | | | 2,145 | | | | 14,350 | |

| | | | | | | | 61,009 | |

| Private Equity - 0.78% | | | | | | | | |

Safeguard Scientifics, Inc. (a) | | | 2,355 | | | | 29,414 | |

| | | | | | | | | |

| Real Estate - 1.46% | | | | | | | | |

| Community Healthcare Trust, Inc. | | | 2,605 | | | | 55,070 | |

| | | | | | | | | |

| Real Estate Investment Trusts - 2.70% | | | | | | | | |

| Independence Realty Trust, Inc. | | | 5,970 | | | | 48,835 | |

| Monmouth Real Estate Investment Corp. | | | 2,745 | | | | 36,399 | |

| Sotherly Hotels, Inc. | | | 2,970 | | | | 16,751 | |

| | | | | | | | 101,985 | |

FOUNDRY PARTNERS, LLC FUNDS FOUNDRY MICRO CAP VALUE FUND SCHEDULE OF INVESTMENTS June 30, 2016 (Unaudited) | SEMI-ANNUAL REPORT |

| COMMON STOCK - 95.94% (Continued) | | SHARES | | | FAIR VALUE | |

| | | | | | | |

| Retail - 8.61% | | | | | | |

Del Frisco's Restaurant Group, Inc. (a) | | | 2,050 | | | $ | 29,356 | |

| Haverty Furniture Cos., Inc. | | | 2,475 | | | | 44,624 | |

| Kirkland's, Inc. | | | 3,295 | | | | 48,371 | |

MarineMax, Inc. (a) | | | 3,440 | | | | 58,377 | |

New York & Co., Inc. (a) | | | 5,500 | | | | 8,195 | |

| Red Robin Gourmet Burgers, Inc. | | | 550 | | | | 26,086 | |

Ruby Tuesday, Inc. (a) | | | 3,800 | | | | 13,718 | |

| Stein Mart, Inc. | | | 5,505 | | | | 42,499 | |

TravelCenters of America LLC (a) | | | 4,575 | | | | 37,332 | |

West Marine, Inc. (a) | | | 1,950 | | | | 16,360 | |

| | | | | | | | 324,918 | |

| Savings & Loans - 11.08% | | | | | | | | |

| Banc of California, Inc. | | | 2,350 | | | | 42,535 | |

| Berkshire Hills Bancorp, Inc. | | | 1,500 | | | | 40,380 | |

| Dime Community Bancshares, Inc. | | | 2,760 | | | | 46,948 | |

| ESSA Bancorp, Inc. | | | 2,335 | | | | 31,289 | |

HomeStreet, Inc. (a) | | | 1,870 | | | | 37,250 | |

HomeTrust Bancshares, Inc. (a) | | | 2,200 | | | | 40,700 | |

| Meta Financial Group, Inc. | | | 1,265 | | | | 64,464 | |

| SI Financial Group, Inc. | | | 1,580 | | | | 20,919 | |

| Territorial Bancorp, Inc. | | | 1,595 | | | | 42,220 | |

| United Community Financial Corp. - OH | | | 8,500 | | | | 51,680 | |

| | | | | | | | 418,385 | |

| Semiconductors - 3.97% | | | | | | | | |

| Exar Corp. | | | 5,180 | | | | 41,699 | |

| IXYS Corp. | | | 3,910 | | | | 40,078 | |

Rudolph Technologies, Inc. (a) | | | 2,135 | | | | 33,157 | |

Xcerra Corp. (a) | | | 6,100 | | | | 35,075 | |

| | | | | | | | 150,009 | |

| Software - 2.34% | | | | | | | | |

| American Software, Inc. - GA - Class A | | | 4,270 | | | | 44,750 | |

| Concurrent Computer Corp. | | | 4,465 | | | | 23,307 | |

| Wayside Technology Group, Inc. | | | 1,125 | | | | 20,318 | |

| | | | | | | | 88,375 | |

| Telecommunications - 2.63% | | | | | | | | |

| Black Box Corp. | | | 2,195 | | | | 28,711 | |

| Silicom Ltd. | | | 1,550 | | | | 46,345 | |

| Spok Holdings, Inc. | | | 1,265 | | | | 24,244 | |

| | | | | | | | 99,300 | |

| Textiles - 0.73% | | | | | | | | |

| Culp, Inc. | | | 1,000 | | | | 27,630 | |

FOUNDRY PARTNERS, LLC FUNDS FOUNDRY MICRO CAP VALUE FUND SCHEDULE OF INVESTMENTS June 30, 2016 (Unaudited) | SEMI-ANNUAL REPORT |

| COMMON STOCK - 95.94% (Continued) | | SHARES | | | FAIR VALUE | |

| | | | | | | |

| Transportation - 3.98% | | | | | | |

| Aegean Marine Petroleum Network, Inc. | | | 4,360 | | | $ | 23,980 | |

| Celadon Group, Inc. | | | 5,480 | | | | 44,772 | |

Covenant Transportation Group, Inc. - Class A (a) | | | 1,870 | | | | 33,791 | |

| Marten Transport Ltd. | | | 2,415 | | | | 47,817 | |

| | | | | | | | 150,360 | |

| Total Common Stocks (Cost $3,608,938) | | | | | | | 3,621,988 | |

| | | | | | | | | |

| MONEY MARKET FUND - 4.27% | | | | | | | | |

First American Prime Obligations Fund - Class Z, 0.27% (b) (Cost $161,362) | | | 161,362 | | | | 161,362 | |

| | | | | | | | | |

| Total Investments at Fair Value - 100.21% (Cost $3,770,300) | | | | | | | 3,783,350 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets, Net - (0.21%) | | | | | | | (8,103 | ) |

| | | | | | | | | |

| Net Assets - 100.00% | | | | | | $ | 3,775,247 | |

| (a) | Non-income producing security. |

| (b) | Rate shown represents the 7-day yield at June 30, 2016, is subject to change and resets daily. |

The accompanying notes are an integral part of these financial statements.

FOUNDRY PARTNERS, LLC FUNDS FOUNDRY MICRO CAP VALUE FUND STATEMENT OF ASSETS AND LIABILITIES June 30, 2016 (Unaudited) | SEMI-ANNUAL REPORT |

| Assets: | | | |

| Investments, at value (identified cost $3,770,300) | | $ | 3,783,350 | |

| Due from advisor | | | 6,750 | |

| Receivables: | | | | |

| Interest | | | 9 | |

| Dividends | | | 4,036 | |

| Prepaid expenses | | | 1,339 | |

| Total assets | | | 3,795,484 | |

| | | | | |

| Liabilities: | | | | |

| Payables: | | | | |

| Fund shares redeemed | | | 9,880 | |

| Due to administrator | | | 143 | |

| Due to trustees | | | 1,609 | |

| Accrued expenses | | | 8,605 | |

| Total liabilities | | | 20,237 | |

| Net Assets | | $ | 3,775,247 | |

| | | | | |

| Sources of Net Assets: | | | | |

| Paid-in capital | | $ | 3,800,838 | |

| Accumulated net realized loss on investments | | | (36,451 | ) |

| Accumulated net investment loss | | | (2,190 | ) |

| Net unrealized appreciation on investments | | | 13,050 | |

| Total Net Assets (Unlimited shares of beneficial interest authorized) | | $ | 3,775,247 | |

| | | | | |

| Institutional Class Shares: | | | | |

| Net assets applicable to 380,697 shares outstanding | | $ | 3,775,247 | |

| Net Asset Value, Offering and Redemption Price Per Share | | $ | 9.92 | |

Minimum Redemption Price Per Share (a) | | $ | 9.72 | |

| (a) | A 2.00% redemption fee is assessed on redemption transactions of shares that are held for 90 days or less. |

The accompanying notes are an integral part of these financial statements.

FOUNDRY PARTNERS, LLC FUNDS FOUNDRY MICRO CAP VALUE FUND STATEMENT OF OPERATIONS June 30, 2016 (Unaudited) | SEMI-ANNUAL REPORT |

| | | For the Six Month Period Ended June 30, 2016 | |

| | | (Unaudited) | |

| Investment income: | | | |

| Dividends | | $ | 29,436 | |

| Interest | | | 190 | |

| Total investment income | | | 29,626 | |

| | | | | |

| Expenses: | | | | |

| Management fees (Note 5) | | | 18,165 | |

| Accounting and transfer agent fees and expenses | | | 18,182 | |

| Audit fees | | | 7,730 | |

| Legal fees | | | 6,732 | |

| Trustee fees and expenses | | | 5,735 | |

| Custodian fees | | | 5,236 | |

| Pricing fees | | | 5,236 | |

| Miscellaneous | | | 3,533 | |

| Insurance | | | 568 | |

| Registration and filing fees | | | 269 | |

| Total expenses | | | 71,386 | |

| Less: fees waived and expenses absorbed | | | (39,570 | ) |

| Net expenses | | | 31,816 | |

| | | | | |

| Net investment loss | | | (2,190 | ) |

| | | | | |

| Realized and unrealized gain (loss): | | | | |

| Net realized loss on: | | | | |

| Investments | | | (56,839 | ) |

| Net realized loss on investments | | | (56,839 | ) |

| | | | | |

| Net change in unrealized appreciation on: | | | | |

| Investments | | | 155,377 | |

| Net change in unrealized appreciation | | | 155,377 | |

| | | | | |

| Net gain on investments | | | 98,538 | |

| | | | | |

| Net increase in net assets resulting from operations | | $ | 96,348 | |

The accompanying notes are an integral part of these financial statements.

FOUNDRY PARTNERS, LLC FUNDS FOUNDRY MICRO CAP VALUE FUND STATEMENT OF CHANGES IN NET ASSETS June 30, 2016 (Unaudited) | SEMI-ANNUAL REPORT |

| | | For the Six Month Period Ended June 30, 2016 | | | For the Year Ended December 31, 2015 | |

| | | (Unaudited) | | | | |

| Increase (decrease) in net assets from: | | | | | | |

| Operations: | | | | | | |

| Net investment income (loss) | | $ | (2,190 | ) | | $ | 1,314 | |

| Net realized gain (loss) on investments | | | (56,839 | ) | | | 94,643 | |

| Net unrealized appreciation (depreciation) on investments | | | 155,377 | | | | (205,748 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 96,348 | | | | (109,791 | ) |

| | | | | | | | | |

| Distributions to shareholders from: | | | | | | | | |

| Net investment income | | | - | | | | (1,559 | ) |

| Net realized capital gains | | | - | | | | (112,640 | ) |

| Decrease in net assets resulting from distributions | | | - | | | | (114,199 | ) |

| | | | | | | | | |

| Capital share transactions (Note 3): | | | | | | | | |

| Increase (decrease) in net assets from capital share transactions | | | (58,822 | ) | | | 2,475,259 | |

| | | | | | | | | |

| Increase in net assets | | | 37,526 | | | | 2,251,269 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of period | | | 3,737,721 | | | | 1,486,452 | |

| | | | | | | | | |

| End of period | | $ | 3,775,247 | | | $ | 3,737,721 | |

| Undistributed (accumulated) net investment income (loss) | | $ | (2,190 | ) | | $ | - | |

The accompanying notes are an integral part of these financial statements.

FOUNDRY PARTNERS, LLC FUNDS FOUNDRY MICRO CAP VALUE FUND FINANCIAL HIGHLIGHTS June 30, 2016 (Unaudited) | SEMI-ANNUAL REPORT |

The following tables set forth the per share operating performance data for a share of capital stock outstanding, total return ratios to average net assets and other supplemental data for the period indicated.

| | | FOUNDRY MICRO CAP VALUE FUND | | |

| | | For the Six Month Period Ended June 30, 2016 | | | | For the Year Ended December 31, 2015 | | | | For the Period Ended December 31, 2014 (a) | | |

| | | (Unaudited) | | | | | | | | | | |

| | | | | | | | | | | | | |

| Net Asset Value, Beginning of Year/Period | | $ | 9.68 | | | | $ | 10.78 | | | | $ | 10.00 | | |

| | | | | | | | | | | | | | | | |

| Investment Operations: | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | (0.01 | ) | | | | - | | (b) | | | (0.02 | ) | |

| Net realized and unrealized gain (loss) on investments | | | 0.25 | | | | | (0.74 | ) | | | | 1.02 | | |

| Total from investment operations | | | 0.24 | | | | | (0.74 | ) | | | | 1.00 | | |

| | | | | | | | | | | | | | | | |

| Distributions: | | | | | | | | | | | | | | | |

| From net investment income | | | - | | | | | - | | (c) | | | - | | |

| From net realized capital gains | | | - | | | | | (0.36 | ) | | | | (0.22 | ) | |

| Total distributions | | | - | | | | | (0.36 | ) | | | | (0.22 | ) | |

| | | | | | | | | | | | | | | | |

| Paid in capital from redemption fees | | | - | | | | | - | | (i) | | | - | | |

| | | | | | | | | | | | | | | | |

| Net Asset Value, End of Year/Period | | $ | 9.92 | | | | $ | 9.68 | | | | $ | 10.78 | | |

| | | | | | | | | | | | | | | | |

Total Return (d) | | | 2.48 | % | (e) | | | (6.78 | )% | | | | 10.03 | % | (e)(f) |

| | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000's) | | $ | 3,775 | | | | $ | 3,738 | | | | $ | 1,486 | | |

| | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | | | | |

| Before fees waived and expenses absorbed | | | 3.93 | % | (h) | | | 6.72 | % | | | | 12.51 | % | (g) (h) |

| After fees waived and expenses absorbed | | | 1.75 | % | (h) | | | 1.75 | % | | | | 1.75 | % | (g) (h) |

| | | | | | | | | | | | | | | | |

| Ratio of net investment income (loss): | | | | | | | | | | | | | | | |

| Before fees waived and expenses absorbed | | | (2.30 | )% | (h) | | | (4.90 | )% | | | | (11.18 | )% | (g) (h) |

| After fees waived and expenses absorbed | | | (0.12 | )% | (h) | | | 0.07 | % | | | | (0.42 | )% | (g) (h) |

| | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 15 | % | (e) | | | 53 | % | | | | 58 | % | (e) |

(a) | The Foundry Micro Cap Value Fund commenced operations on January 30, 2014. |

(b) | Net investment income was less than $0.01 per share for the year ended December 31, 2015. |

(c) | Net investment income distribution was less than $0.01 per share for the year ended December 31, 2015. |

(d) | Total Return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

(f) | Total Return is for the period from January 30, 2014, the date of initial portfolio trades, through December 31, 2014. |

(g) | Ratios are for the period from January 30, 2014, the date of initial expense accruals, through December 31, 2014. |

(i) | Redemption fees resulted in less than $0.005 per share. |

The accompanying notes are an integral part of these financial statements.

| Foundry Partners, LLC Funds | SEMI-ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

June 30, 2016 (Unaudited)

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

The Foundry Micro Cap Value Fund (the “Fund”) is a series of 360 Funds (the “Trust”). The Trust was organized on February 24, 2005 as a Delaware statutory trust. The Trust is registered as an open-end management investment company under the Investment Company Act of 1940 (the “1940 Act”). The investment objective of the Fund is capital appreciation. The Fund is a diversified Fund. The Fund’s investment adviser is Foundry Partners LLC (the “Adviser”). The Fund has one class of shares, Institutional Class Shares. The Institutional Class Shares commenced operations on January 30, 2014.

a) Security Valuation – All investments in securities are recorded at their estimated fair value, as described in note 2.

b) Exchange Traded Funds – The Fund may invest in Exchange Traded Funds (“ETFs”). ETFs are registered investment companies and incur fees and expenses such as operating expenses, licensing fees, registration fees, trustees fees, and marketing expenses, and ETF shareholders, such as a Fund, pay their proportionate share of these expenses. Your cost of investing in a Fund will generally be higher than the cost of investing directly in ETFs. By investing in a Fund, you will indirectly bear fees and expenses charged by the underlying ETFs in which a Fund invests in addition to a Fund's direct fees and expenses.

c) Federal Income Taxes – The Fund has qualified and intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). It is the policy of the Fund to comply with the requirements of the Code applicable to regulated investment companies and to distribute substantially all of its net investment company taxable income and net capital gains. Therefore, no provision for federal income taxes is required.

As of and during the six month period ended June 30, 2016, the Fund did not have a liability for any unrecognized tax expenses. The Fund recognizes interest and penalties, if any, related to unrecognized tax liability as income tax expense in the statement of operations. During the six month period ended June 30, 2016, the Fund did not incur any interest or penalties. The Fund identifies its major tax jurisdictions as U.S. Federal and Delaware state.

d) Distributions to Shareholders – Dividends from net investment income and distributions of net realized capital gains, if any, will be declared and paid at least annually. Income and capital gain distributions, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. Accounting principles generally accepted in the United States of America (“GAAP”) requires that permanent financial reporting differences relating to shareholder distributions be reclassified to paid-in capital or net realized gains. There were no reclassifications made during the six month period ended June 30, 2016.

e) Use of Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

f) Other – Investment and shareholder transactions are recorded on trade date. The Fund determines the gain or loss realized from the investment transactions by comparing the original cost of the security lot sold with the net sales proceeds. Dividend income is recognized on the ex-dividend date or as soon as information is available to the Fund and interest income is recognized on an accrual basis. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

| Foundry Partners, LLC Funds | SEMI-ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

June 30, 2016 (Unaudited)

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued)

g) Investments in Small-Cap Companies and Micro-Cap Companies – A Fund may invest a significant portion of its assets in securities of companies with small market capitalizations or micro market capitalizations. Certain small-cap companies and micro-cap companies may offer greater potential for capital appreciation than larger companies. However, investors should note that this potential for greater capital appreciation is accompanied by a substantial risk of loss and that, by their very nature, investments in small-cap companies and micro-cap companies tend to be very volatile and speculative. Small-cap companies and micro-cap companies may have a small share of the market for their products or services, their businesses may be limited to regional markets, or they may provide goods and services for a limited market. For example, they may be developing or marketing new products or services for markets that are not yet established or may never become established. In addition, small-cap companies and micro-cap companies may have or will develop only a regional market for products or services and thus be affected by local or regional market conditions. In addition, small-cap companies and micro-cap companies may lack depth of management or they may be unable to generate funds necessary for growth or potential development, either internally or through external financing on favorable terms. Such companies may also be insignificant in their industries and be subject to or become subject to intense competition from larger companies. Due to these and other factors, a Fund’s investments in small-cap companies and micro-cap companies may suffer significant losses. Further, there is typically a smaller market for the securities of a small-cap company or micro-cap company than for securities of a large company. Therefore, investments in small-cap companies and micro-cap companies may be less liquid and subject to significant price declines that result in losses for a Fund.

h) Redemption fees - Shareholders that redeem shares within 90 days of purchase will be assessed a redemption fee of 2.00% of the amount redeemed. The redemption fee is paid directly to and retained by the Fund, and is designed to deter excessive short-term trading and to offset brokerage commissions, market impact and other costs that may be associated with short-term money movement in and out of the Fund. Redemption fees of $0 were paid to the Fund during six month period ended June 30, 2016.

2. SECURITIES VALUATIONS

Processes and Structure

The Fund’s Board of Trustees has adopted guidelines for valuing securities and other derivative instruments including in circumstances in which market quotes are not readily available, and has delegated authority to the Adviser to apply those guidelines in determining fair value prices, subject to review by the Board of Trustees.

Hierarchy of Fair Value Inputs

The Trust utilizes various methods to measure the fair value of most of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation techniques used to measure fair value. The three levels of inputs are as follows:

| • | Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities that the company has the ability to access. |

| • | Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates, and similar data. |

| • | Level 3 – Unobservable inputs for the asset or liability to the extent that relevant observable inputs are not available, representing the company's own assumptions about the assumptions that a market participant would use in valuing the asset or liability, and that would be based on the best information available. |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

| Foundry Partners, LLC Funds | SEMI-ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

June 30, 2016 (Unaudited)

2. SECURITIES VALUATIONS (continued)

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Fair Value Measurements

A description of the valuation techniques applied to the company's major categories of assets and liabilities measured at fair value on a recurring basis follows.

Equity securities (common stock and ETFs) – Securities traded on a national securities exchange (or reported on the NASDAQ national market) are stated at the last reported sales price on the day of valuation. To the extent these securities are actively traded, and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy. Certain foreign securities may be fair valued using a pricing service that considers the correlation of the trading patterns of the foreign security to the intraday trading in the U.S. markets for investments such as American Depositary Receipts, financial futures, Exchange Traded Funds, and the movement of the certain indexes of securities based on a statistical analysis of the historical relationship and that are categorized in Level 2. Preferred stock and other equities traded on inactive markets or valued by reference to similar instruments are also categorized in Level 2.

Money market funds – Money market funds are valued at their net asset value of $1.00 per share and are categorized as Level 1.

The following table summarizes the inputs used to value the Fund’s assets and liabilities measured at fair value as of June 30, 2016:

Categories (a) | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Micro Cap Value Fund: | | | | | | | | | | | | |

Common Stock (b) | | $ | 3,621,988 | | | | - | | | | - | | | $ | 3,621,988 | |

| Money market funds | | | 161,362 | | | | - | | | | - | | | | 161,362 | |

| Total Investments in Securities | | $ | 3,783,350 | | | | - | | | | - | | | $ | 3,783,350 | |

| | (a) | As of and during the six month period ended June 30, 2016, the Fund held no securities that were considered to be “Level 3” securities (those valued using significant unobservable inputs). Therefore, a reconciliation of assets in which significant unobservable inputs (Level 3) were used in determining fair value is not applicable. |

| | (b) | All common stock held in the Fund are Level 1 securities. For a detailed break-out of common stock by industry, please refer to the Schedule of Investments. |

The Fund recognizes transfers, if any, between fair value hierarchy levels at the reporting period end. There were no transfers between levels at June 30, 2016, from the valuation input levels used on December 31, 2015.

3. CAPITAL SHARE TRANSACTIONS

Transactions in shares of capital stock for the Fund during the six month period ended June 30, 2016 were as follows:

| MicroCap Value Fund: | | Sold | | | Redeemed | | | Reinvested | | | Net Increase | |

| Institutional Class Shares | | | | | | | | | | | | |

| Shares | | | 10,873 | | | | (16,379 | ) | | | - | | | | (5,506 | ) |

| Value | | $ | 102,439 | | | $ | (161,261 | ) | | $ | - | | | $ | (58,822 | ) |

| Foundry Partners, LLC Funds | SEMI-ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

June 30, 2016 (Unaudited)

3. CAPITAL SHARE TRANSACTIONS (continued)

Transactions in shares of capital stock for the Fund during the year ended December 31, 2015 were as follows:

| MicroCap Value Fund: | | Sold | | | Redeemed | | | Reinvested | | | Net Increase | |

| Institutional Class Shares | | | | | | | | | | | | |

| Shares | | | 249,147 | | | | (12,741 | ) | | | 11,921 | | | | 248,327 | |

| Value | | $ | 2,498,148 | | | $ | (137,088 | )* | | $ | 114,199 | | | $ | 2,475,259 | |

| * | Value of capital stock redeemed is net of redemption fees of $823. |

4. INVESTMENT TRANSACTIONS

For the six month period ended June 30, 2016, aggregate purchases and sales of investment securities (excluding short-term investments) were as follows:

| Fund | | Purchases | | | Sales | |

| Micro Cap Value Fund | | $ | 520,340 | | | $ | 637,554 | |

There were no government securities purchased or sold during the year.

| 5. | ADVISORY FEES AND OTHER RELATED PARTY TRANSACTIONS |

The Fund has entered into an Investment Advisory Agreement (the “Advisory Agreement”) with the Adviser. Pursuant to the Advisory Agreement, the Adviser manages the operations of the Fund and manages the Fund’s investments in accordance with the stated policies of the Fund. As compensation for the investment advisory services provided to the Fund, the Adviser will receive a monthly management fee equal to an annual rate of the Fund’s net assets for Institutional Class shares as follows:

Fund | | Management Fee Rate | | | Accrued | |

| Micro Cap Value Fund: | | 1.00% | | | $ | 18,165 | |

The Adviser and the Fund have entered into an Expense Limitation Agreement (“Expense Agreements”) under which the Adviser has agreed to waive or reduce its fees and to assume other expenses of the Fund, if necessary, in an amount that limits annual operating expenses (exclusive of interest, taxes, brokerage fees and commissions, acquired fund fees and expenses, shareholder servicing fees, extraordinary expenses, dividend and interest expenses in connection with securities sold short and payments, if any, under the Rule 12b-1 Plan) to not more than the following average daily net assets of the Fund through April 30, 2017:

Fund | | Expense Limitation | | | Management Fees Waived | | | Expenses Reimbursed | |

| Micro Cap Value Fund: | | 1.75% | | | $ | 18,165 | | | $ | 21,405 | |

If, at any time, the annualized expenses of Fund were less than the annualized expense ratio, the Fund would reimburse the Adviser for any fees previously waived and/or expenses previously assumed; provided, however, that repayment would be payable only to the extent that it (a) can be made during the three (3) years following the time at which the adviser waived fees or assumed expenses for the Fund, and (b) can be repaid without causing the expenses of the Fund to exceed the annualized expense ratios.

At June 30, 2016, the cumulative unreimbursed amount paid and/or waived by the Adviser on behalf of the Fund that may be recouped no later than the dates stated below:

| Fund | | December 31, 2017 | | | December 31, 2018 | | | December 31, 2019 | | | Totals | |

| Micro Cap Value Fund: | | $ | 89,103 | | | $ | 86,270 | | | $ | 39,570 | | | $ | 214,943 | |

| Foundry Partners, LLC Funds | SEMI-ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

June 30, 2016 (Unaudited)

5. ADVISORY FEES AND OTHER RELATED PARTY TRANSACTIONS (continued)

The Fund has entered into an Investment Company Services Agreement (“Services Agreement”) with M3Sixty Administration, LLC (“M3Sixty”), formerly Matrix 360 Administration, LLC. Under the Services Agreement, M3Sixty is responsible for a wide variety of functions, including but not limited to: (a) Fund accounting services; (b) financial statement preparation; (c) valuation of the Fund’s portfolio securities; (d) pricing the Fund’s shares; (e) assistance in preparing tax returns; (f) preparation and filing of required regulatory reports; (g) communications with shareholders; (h) coordination of Board and shareholder meetings; (i) monitoring the Fund’s legal compliance; (j) maintaining shareholder account records.

For the six month period ended June 30, 2016, the Fund accrued fees pursuant to the Services Agreement as follows:

| Fund | | Service Fees | |

| Micro Cap Value Fund: | | $ | 18,182 | |

Certain officers and a Trustee of the Fund are also employees of M3Sixty.

The Fund has entered into a Distribution Agreement with Matrix Capital Group, Inc. (the “Distributor”). Pursuant to the Distribution Agreement, the Distributor will provide distribution services to the Fund. The Distributor serves as underwriter/distributor of the Fund. Under the Distribution Agreement, for the Fund, the Distributor shall be paid an annual fee of $9,000. The annual fee above includes the first share class of the Fund; the Distributor shall receive $1,500 annually for each additional class. The Distributor shall also receive an annualized amount equal to 1.25 bps (0.000125%) of the average assets of the Fund.

The Distributor is not affiliated with the Adviser. The Distributor is an affiliate of M3Sixty.

6. TAX MATTERS

For U.S. Federal income tax purposes, the cost of securities owned, gross appreciation, gross depreciation, and net unrealized appreciation/(depreciation) of investments at June 30, 2016 were as follows:

Fund | | Tax Cost | | | Gross Unrealized Appreciation | | | Gross Unrealized Depreciation | | | Net Unrealized Depreciation | |

| Micro Cap Value Fund: | | $ | 3,793,942 | | | $ | 306,597 | | | $ | (317,189 | ) | | $ | (10,592 | ) |

The difference between book basis unrealized appreciation and tax-basis unrealized appreciation for the Fund is attributable primarily to the tax deferral of losses on wash sales.

The Fund’s tax basis distributable earnings are determined only at the end of each fiscal year. The tax character of distributable earnings (deficit) at December 31, 2015, the Fund’s most recent fiscal year end, was as follows:

Fund | | Unrealized Appreciation (Depreciation) | | | Undistributed Ordinary Income | | | Undistributed Capital Gains | | | Post-October Losses | | | Total Distributable Earnings | |

| Micro Cap Value Fund: | | $ | (151,781 | ) | | $ | 14,984 | | | $ | 14,858 | | | $ | - | | | $ | (121,939 | ) |

The undistributed ordinary income and capital gains shown above differ from corresponding accumulated net investment income and accumulated net realized gain (loss) figures reported in the statement of assets and liabilities due to differing book/tax treatment of short-term capital gains, and certain temporary book/tax differences due to the tax deferral of losses on wash sales.

| Foundry Partners, LLC Funds | SEMI-ANNUAL REPORT |

NOTES TO THE FINANCIAL STATEMENTS

June 30, 2016 (Unaudited)

6. TAX MATTERS (continued)

Under current tax law, net capital losses realized after October 31st and net ordinary losses incurred after December 31st may be deferred and treated as occurring on the first day of the following fiscal year. The Fund’s carryforward losses, post-October losses and post-December losses are determined only at the end of each fiscal year. As of December 31, 2015, the Fund elected to defer net ordinary losses as indicated in the chart below.

| | | Post-October Losses | | | Post-December Losses | |

| Fund | | Deferred | | | Utilized | | | Deferred | | | Utilized | |

| Micro Cap Value Fund: | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

Under the Regulated Investment Company Modernization Act of 2010 (the Act), net capital losses recognized after December 31, 2010, may be carried forward indefinitely, and their character is retained as short-term and/or long-term. As of December 31, 2015, the Fund had no capital loss carryforwards for federal income tax purposes.

There were no distributions paid during the six month period ended June 30, 2016.

The tax character of distributions paid during the year ended December 31, 2015 by the Fund was as follows.

| Fund | | Long-term Capital Gain | | | Ordinary Income | |

| Micro Cap Value Fund: | | $ | 22,173 | | | $ | 92,026 | |

7. BENEFICIAL OWNERSHIP

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the fund, under Section 2(a)(9) of the Investment Company Act of 1940. As of June 30, 2016, Rhode Island Resource Recovery and Reliance Trust Co. held 41% and 40%, respectively, of the Micro Cap Value Fund’s Institutional Class Shares outstanding.

8. COMMITMENTS AND CONTINGENCIES

In the normal course of business, the Trust may enter into contracts that may contain a variety of representations and warranties and provide general indemnifications. The Trust’s maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated; however, management considers the risk of loss from such claims to be remote.

9. SUBSEQUENT EVENTS

In accordance with GAAP, Management has evaluated the impact of all subsequent events of the Fund through the date the financial statements were issued, and has determined that there were no other subsequent events requiring recognition or disclosure in the financial statements.

| Foundry Partners, LLC Funds | SEMI-ANNUAL REPORT |

ADDITIONAL INFORMATION

June 30, 2016 (Unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the Commission’s website at http://www.sec.gov. The Fund’s Forms N-Q may be reviewed and copied at the Commission��s Public Reference Room in Washington, DC. Information on the operation of the Commission’s Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling 1-877-244-6235; and on the Commission’s website at http://www.sec.gov.

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30th is available without charge, upon request, by calling 1-877-244-6235; and on the Commission’s website at http://www.sec.gov.

For the fiscal year ended December 31, 2016, certain distributions paid by the Fund may be subject to a maximum tax rate of 20%. Complete information will be computed and reported in conjunction with your 2016 Form 1099-DIV.

Shareholders should refer to their Form 1099-DIV or other tax information which will be mailed in 2017 to determine the calendar year amounts to be included on their 2016 tax returns. Shareholders should consult their own tax advisors.

| Foundry Partners, LLC Funds | SEMI-ANNUAL REPORT |

ADDITIONAL INFORMATION

June 30, 2016 (Unaudited)

BOARD OF TRUSTEES, OFFICERS AND PRINCIPAL SHAREHOLDERS - (Unaudited)

The Trustees are responsible for the management and supervision of the Fund. The Trustees approve all significant agreements between the Trust, on behalf of the Fund, and those companies that furnish services to the Fund; review performance of the Fund; and oversee activities of the Fund. This section provides information about the persons who serve as Trustees and Officers to the Trust and Fund, respectively. The Statement of Additional Information of the Trust includes additional information about the Fund’s Trustees and is available upon request, without charge, by calling (877) 244-6235.

Remuneration Paid to Trustees and Officers - Officers of the Trust and Trustees who are “interested persons” of the Trust or the Adviser will receive no salary or fees from the Trust. Officers of the Trust and interested Trustees do receive compensation directly from certain service providers to the Trust. Each Trustee who is not an “interested person” receives a fee of $1,500 each year plus $200 per Board or committee meeting attended. The Trust reimburses each Trustee and officer for his or her travel and other expenses relating to attendance at such meetings.

Name of Trustee1 | Aggregate Compensation From the Fund2 | Pension or Retirement Benefits Accrued As Part of Portfolio Expenses | Estimated Annual Benefits Upon Retirement | Total Compensation From the Fund Paid to Trustees2 |

| Independent Trustees |

| Art Falk | $575 | None | None | $575 |

| Thomas Krausz | $575 | None | None | $575 |

| Tom M. Wirtshafter | $575 | None | None | $575 |

| Gary DiCenzo | $575 | None | None | $575 |

| Interested Trustees |

| Randall K. Linscott | None | None | None | None |

| 1 | Each of the Trustees serves as a Trustee to each Series of the Trust. The Trust currently offers fifteen (15) series of shares. |

| 2 | Figures are for the six month period ended June 30, 2016. |

| Foundry Partners, LLC Funds | SEMI-ANNUAL REPORT |

Information About Your Fund’s Expenses - (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, such as the sales charge (load) imposed on certain subscriptions and the contingent deferred sales charge (“CDSC”) imposed on certain short-term redemptions; and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees; and other Fund expenses. The example below is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses – The first section of the table provides information about actual account values and actual expenses (relating to the example $1,000 investment made at the beginning of the period). You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes – The second section of the table provides information about the hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which are not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund to other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), CDSC fees, or exchange fees. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. For more information on transactional costs, please refer to the Fund’s prospectus.

Expenses and Value of a $1,000 Investment for the six month period from 12/31/15 through 06/30/16

Micro Cap Value Fund: | Beginning Account

Value (12/31/2015) | Annualized Expense

Ratio for the Period | Ending Account

Value (06/30/2016) | Expenses Paid

During Period (a) |

| Actual Fund Return (in parentheses) | | | |

| Institutional Class Shares (+2.48%) | $ 1,000.00 | 1.75% | $ 1,024.79 | $ 8.83 |

| Hypothetical 5% Fund Return | | | |

| Institutional Class Shares | $ 1,000.00 | 1.75% | $ 1,016.20 | $ 8.80 |

| (a) | Expenses are equal to the Fund’s annualized expense ratios, multiplied by the average account value over the period, multiplied by 182/366 to reflect the one-half year period. |

For more information on the Fund’s expenses, please refer to the Fund’s prospectus, which can be obtained from your investment representative or by calling 1-877-244-6235. Please read it carefully before you invest or send money.

| Foundry Partners, LLC Funds | SEMI-ANNUAL REPORT |

Information About Your Fund’s Expenses - (Unaudited)(continued)

Total Fund operating expense ratios as stated in the current Fund prospectus dated April 29, 2016 for the Fund were as follows:

| Foundry Micro Cap Value Fund Institutional Class Shares, gross of fee waivers or expense reimbursements | 6.73% |

| Foundry Micro Cap Value Fund Institutional Class Shares, fee waivers or expense reimbursements | 1.76% |

Foundry Partners, LLC (the “Adviser”) has entered into an Expense Limitation Agreement with the Fund under which it has agreed to waive or reduce its fees and to assume other expenses of the Fund, if necessary, in an amount that limits the Fund’s annual operating expenses (exclusive of interest, taxes, brokerage fees and commissions, acquired funds fees and expenses, extraordinary expenses, dividend and interest expenses related to short investments) to not more than 1.75% for the Foundry Micro Cap Value Fund through at least April 30, 2017. Subject to approval by the Fund’s Board, any waiver under the Expense Limitation Agreement is subject to repayment by the Fund within the three fiscal years following the year in which such waiver occurred, if the Fund is able to make the payment without exceeding the expense limitation. The current contractual agreement cannot be terminated prior to at least one year after the effective date without the Board of Trustees’ approval. Total Gross Operating Expenses (Annualized) during the six month period ended June 30, 2016 were 3.93% for the Foundry Micro Cap Value Fund Institutional Class shares. Please see the Information About Your Fund’s Expenses, the Financial Highlights and Notes to Financial Statements (Note 5) sections of this report for expense related disclosures during the six month period ended June 30, 2016.

360 FUNDS

4520 Main Street

Suite 1425

Kansas City, MO 64111

INVESTMENT ADVISER

Foundry Partners, LLC

510 First Avenue North,

Suite 409

Minneapolis, MN 55403

ADMINISTRATOR & TRANSFER AGENT

M3Sixty Administration, LLC

4520 Main Street

Suite 1425

Kansas City, MO 64111

DISTRIBUTOR

Matrix Capital Group, Inc.

106 West 32nd Street

New York, NY 10001

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Cohen Fund Audit Services, Ltd.

1350 Euclid Ave., Suite 800

Cleveland, OH 44115

LEGAL COUNSEL

Graydon Head & Ritchey LLP

15 West Center Street

Lawrenceburg, IN 47025

CUSTODIAN BANK

U.S. Bank, N.A

425 Walnut Street

Cincinnati, OH 45202

Not applicable at this time.

| ITEM 3. | AUDIT COMMITTEE FINANCIAL EXPERT. |

Not applicable at this time.

| ITEM 4. | PRINCIPAL ACCOUNTANT FEES AND SERVICES. |

Not applicable at this time.

| ITEM 5. | AUDIT COMMITTEE OF LISTED REGISTRANTS. |

Not applicable

| ITEM 6. | SCHEDULE OF INVESTMENT |

Included in semi-annual report to shareholders filed under item 1 of this form.

| ITEM 7. | DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

Not applicable Fund is an open-end management investment company

| ITEM 8. | PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES |

Not applicable Fund is an open-end management investment company

| ITEM 9. | PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS. |

Not applicable Fund is an open-end management investment company

| ITEM 10. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS. |

Not applicable at this time.

| ITEM 11. | CONTROLS AND PROCEDURES. |

| (a) | The registrant's principal executive and principal financial officers, or persons performing similar functions, have concluded that the registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the 1940 Act, are effective, as of a date within 90 days of the filing date of this report, based on the evaluation of these controls and procedures required by Rule 30a-3(b) under the 1940 Act and Rule 15d-15(b) under the Securities Exchange Act of 1934, as amended. |

| (b) | There were no changes in the registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the 1940 Act) that occurred during the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant's internal control over financial reporting. |

| | (1) | Certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 are filed herewith. |

| | (2) | Certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 are filed herewith. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

360 Funds

| /s/ Randy Linscott | |

| By Randy Linscott | |

| Principal Executive Officer, | |

| Date: August 31, 2016 | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following person on behalf of the registrant and in the capacities and on the date indicated.

| /s/ Randy Linscott | |

| By Randy Linscott | |

| Principal Executive Officer | |

| Date: August 31, 2016 | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following person on behalf of the registrant and in the capacities and on the date indicated.

| /s/ Larry E. Beaver, Jr. | |

| By Larry E. Beaver, Jr. | |

| Principal Financial Officer | |

| Date: August 31, 2016 | |