Washington, D.C. 20549

M3Sixty Administration, LLC.

The Semi-Annual report to Shareholders of the Snow Family of Funds, a series of funds that are part of the 360 Funds, for the period ended August 31, 2016 pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “1940 Act”), as amended (17 CFR 270.30e-1) is filed herewith.

Snow Capital Focused Value Fund

Class A Shares (Ticker Symbol: SFOAX)

Class I Shares (Ticker Symbol: SFOIX)

Snow Capital Hedged Equity Fund

Class A Shares (Ticker Symbol: SHEAX)

Class I Shares (Ticker Symbol: SHEIX)

Snow Capital Inflation Advantaged Equities Fund

Class A Shares (Ticker Symbol: SIAAX)

Class I Shares (Ticker Symbol: SIAIX)

Snow Capital Dividend Plus Fund

Class A Shares (Ticker Symbol: SDPAX)

Class I Shares (Ticker Symbol: SDPIX)

Snow Capital Mid Cap Value Fund

Class A Shares (Ticker Symbol: SNMAX)

Class I Shares (Ticker Symbol: SNMIX)

each a series of the

360 Funds

SEMI-ANNUAL REPORT

August 31, 2016

(Unaudited)

Investment Adviser

Snow Capital Management L.P.

2000 Georgetowne Drive, Suite 200

Sewickley, Pennsylvania 15143

TABLE OF CONTENTS

| INVESTMENT HIGHLIGHTS | 1 |

| SCHEDULES OF INVESTMENTS | 4 |

| STATEMENTS OF ASSETS AND LIABILITIES | 17 |

| STATEMENTS OF OPERATIONS | 19 |

| STATEMENTS OF CHANGES IN NET ASSETS | 21 |

| FINANCIAL HIGHLIGHTS | 26 |

| NOTES TO FINANCIAL STATEMENTS | 36 |

| ADDITIONAL INFORMATION | 46 |

| EXPENSE EXAMPLES | 48 |

| Snow Family of Funds | SEMI-ANNUAL REPORT |

Investment HighlightsAugust 31, 2016 (Unaudited)

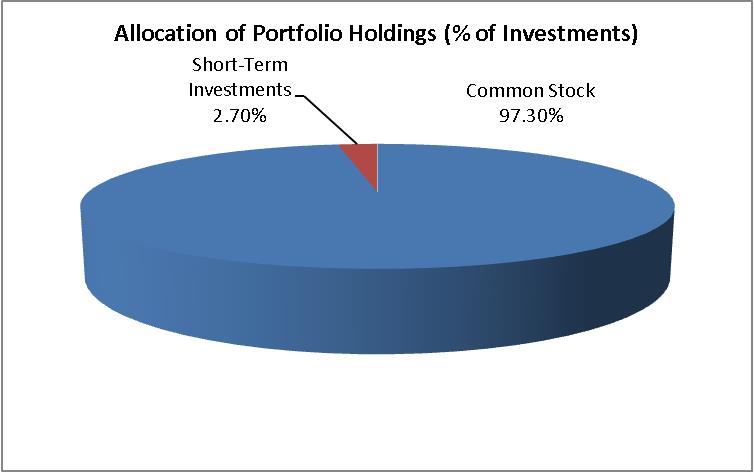

Snow Capital Focused Value Fund

The investment objective of the Fund is long-term growth of capital. The Fund’s principal investment strategy is to invest primarily in equity securities, including common and preferred stocks, convertible securities and shares of other investment companies and exchange-traded funds (“ETFs”) that invest in equity securities, fixed income securities, or other similar investments. Under normal market conditions the Fund will invest at least 80% of its net assets in equity securities of companies with market capitalizations greater than $1 billion.

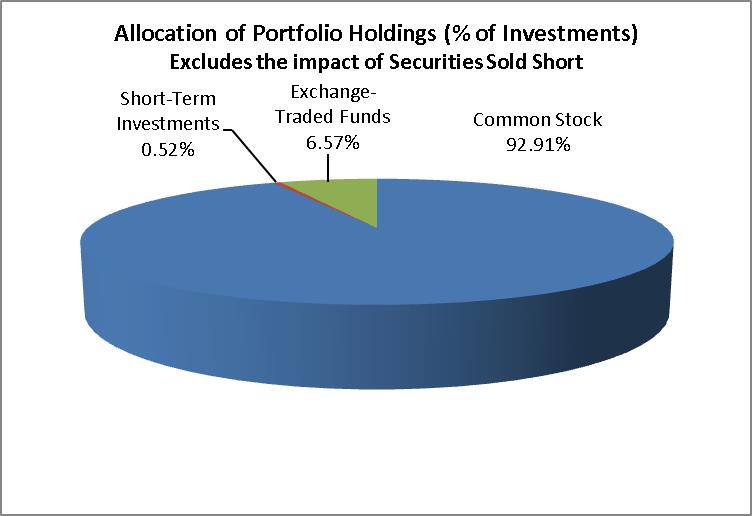

Snow Capital Hedged Equity Fund

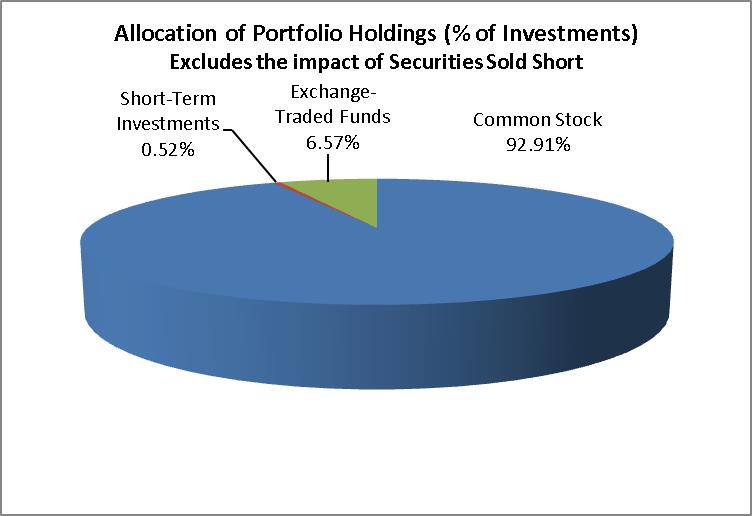

The investment objective of the Fund is long-term growth of capital and protection of investment principal with lower volatility than the U.S. equity market. The Fund’s principal investment strategy is to invest at least 80% of long net assets in equity securities, including common and preferred stocks, convertible securities and shares of other investment companies and exchange-traded funds (“ETFs”) that invest in equity securities. The Adviser will utilize short equity positions in individual equity securities and ETFs to reduce the portfolio’s overall market exposure. The Fund may borrow money from banks or other financial institutions to purchase securities, commonly known as “leveraging,” in an amount not to exceed one-third of its total assets, as permitted by the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund may invest in equity and/or fixed income securities of companies of any size. In addition to domestic securities, the Fund may also directly or indirectly invest in foreign equity, including investments in emerging markets.

The percentages in the above graphs are based on the portfolio holdings of the Funds as of August 31, 2016 and are subject to change.

For a detailed break-out of holdings by industry and exchange-traded funds by investment type, please refer to the Schedules of Investments.

| Snow Family of Funds | SEMI-ANNUAL REPORT |

Investment HighlightsAugust 31, 2016 (Unaudited)

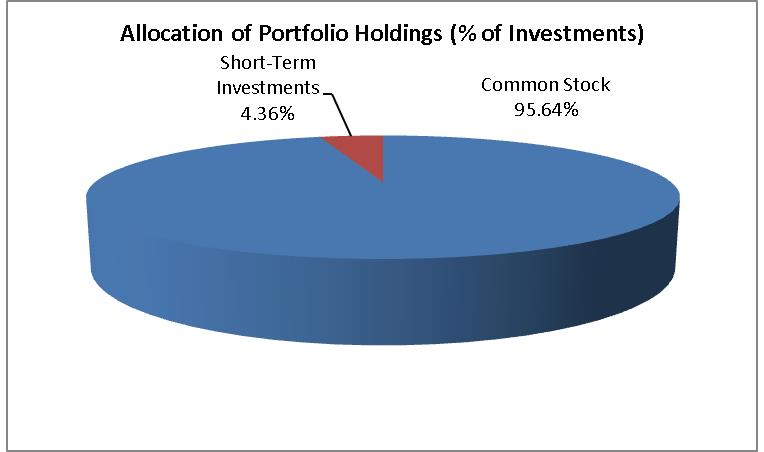

Snow Capital Inflation Advantaged Equities Fund

The investment objective of the Fund is long-term growth of capital and protection of investment principal. The Fund’s principal investment strategy is to invest primarily in equity securities, including common and preferred stocks, convertible securities and shares of other investment companies and ETFs that invest in equity securities.

Snow Capital Dividend Plus Fund

The investment objective of the Fund is long-term growth of capital and income. The Fund’s principal investment strategy is to invest in a diversified portfolio of equities, bonds, preferred stock, and options. Under normal market conditions, the Fund will invest at least 80% of its net assets in equity securities that pay a dividend and are within the market capitalization range of the Russell 1000 Value Index. With respect to its remaining assets, the Fund may invest in corporate bonds, sovereign bonds, convertible bonds, preferred stocks, or other securities or instruments whose prices are linked to the value of the underlying common stock of the issuer of the securities. The Fund may have up to 25% of its net assets invested directly or indirectly in foreign equity securities, including investments in emerging markets.

The percentages in the above graphs are based on the portfolio holdings of the Funds as of August 31, 2016 and are subject to change.

For a detailed break-out of holdings by industry and exchange-traded funds by investment type, please refer to the Schedules of Investments.

| Snow Family of Funds | SEMI-ANNUAL REPORT |

Investment HighlightsAugust 31, 2016 (Unaudited)

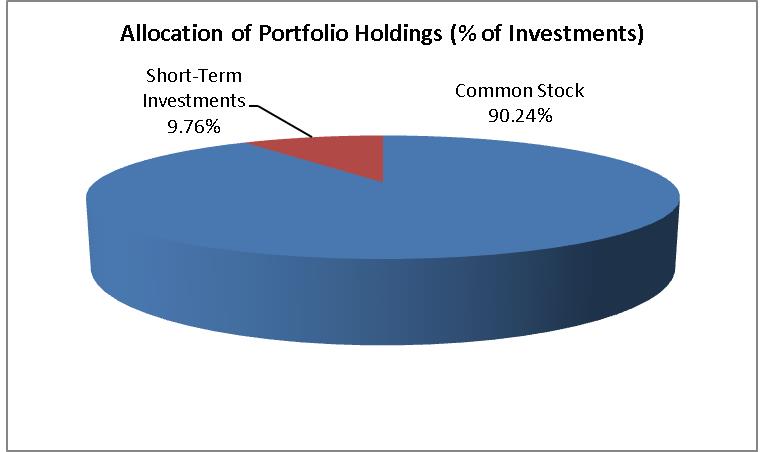

Snow Capital Mid Cap Value Fund

The investment objective of the Fund is long-term growth of capital. The Fund’s principal investment strategy is to invest at least 80% of its net assets in equity securities of companies within the market capitalizations range of the Russell Mid Cap Value Index (“mid-cap securities”). The Fund’s investments in equity securities may include common and preferred stocks, convertible securities and shares of other investment companies and ETFs that invest in equity securities of mid-cap companies. In addition to equity securities, the Fund may also invest up to 15% of its net assets in U.S. Government or U.S. agency obligations. The Fund may have up to 20% of its net assets invested directly or indirectly in foreign equity securities, including investments in emerging markets.

The percentages in the above graph are based on the portfolio holdings of the Fund as of August 31, 2016 and are subject to change.

For a detailed break-out of holdings by industry and exchange-traded funds by investment type, please refer to the Schedules of Investments.

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

Snow Capital Focused Value Fund

SCHEDULE OF INVESTMENTS

August 31, 2016 (Unaudited)

| COMMON STOCK - 96.11% | | Shares | | | Fair Value | |

| | | | | | | |

| Aerospace & Defense - 3.28% | | | | | | |

| Triumph Group, Inc. | | | 605 | | | $ | 19,275 | |

| | | | | | | | | |

| Banks - 12.23% | | | | | | | | |

| JPMorgan Chase & Co. | | | 535 | | | | 36,113 | |

| Bank of America Corp. | | | 2,210 | | | | 35,669 | |

| | | | | | | | 71,782 | |

| Biotechnology - 4.63% | | | | | | | | |

Biogen, Inc. (a) | | | 89 | | | | 27,201 | |

| | | | | | | | | |

| Building Materials - 3.68% | | | | | | | | |

Cemex SAB de CV - ADR (a) | | | 2,607 | | | | 21,612 | |

| | | | | | | | | |

| Chemicals - 4.05% | | | | | | | | |

| Mosaic Co. | | | 790 | | | | 23,755 | |

| | | | | | | | | |

| Computers - 5.09% | | | | | | | | |

| Hewlett-Packard Co. | | | 1,390 | | | | 29,857 | |

| | | | | | | | | |

| Electric - 2.84% | | | | | | | | |

| Exelon Corp. | | | 490 | | | | 16,660 | |

| | | | | | | | | |

| Electronics - 3.24% | | | | | | | | |

Keysight Technologies, Inc. (a) | | | 625 | | | | 19,019 | |

| | | | | | | | | |

| Forest Products & Paper - 4.67% | | | | | | | | |

| International Paper Co. | | | 565 | | | | 27,397 | |

| | | | | | | | | |

| Healthcare - Products - 4.09% | | | | | | | | |

| Zimmer Biomet Holdings, Inc. | | | 185 | | | | 23,978 | |

| | | | | | | | | |

| Home Builders - 2.89% | | | | | | | | |

| PulteGroup, Inc. | | | 795 | | | | 16,989 | |

| | | | | | | | | |

| Insurance - 10.08% | | | | | | | | |

| MetLife, Inc. | | | 780 | | | | 33,852 | |

| Voya Financial, Inc. | | | 865 | | | | 25,293 | |

| | | | | | | | 59,145 | |

| Media - 2.82% | | | | | | | | |

| Viacom, Inc. - Class B | | | 410 | | | | 16,539 | |

| | | | | | | | | |

| Oil & Gas - 8.33% | | | | | | | | |

| BP PLC -ADR | | | 466 | | | | 15,779 | |

| PBF Energy, Inc. - Class A | | | 795 | | | | 17,411 | |

Southwestern Energy Co. (a) | | | 1129 | | | | 15,704 | |

| | | | | | | | 48,894 | |

| Pharmaceuticals - 7.81% | | | | | | | | |

| Teva Pharmaceutical Industries Ltd. - ADR | | | 505 | | | | 25,448 | |

| Merck & Co., Inc. | | | 325 | | | | 20,407 | |

| | | | | | | | 45,855 | |

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

Snow Capital Focused Value Fund

SCHEDULE OF INVESTMENTS

August 31, 2016 (Unaudited)

| COMMON STOCK - 96.11% (continued) | | Shares | | | Fair Value | |

| | | | | | | |

| Pipelines - 4.11% | | | | | | |

| Kinder Morgan, Inc. | | | 1,105 | | | $ | 24,144 | |

| | | | | | | | | |

| Retail - 3.69% | | | | | | | | |

| Dick's Sporting Goods, Inc. | | | 370 | | | | 21,682 | |

| | | | | | | | | |

| Seminconductors - 8.58% | | | | | | | | |

| QUALCOMM, Inc. | | | 520 | | | | 32,796 | |

| Skyworks Solutions, Inc. | | | 235 | | | | 17,592 | |

| | | | | | | | 50,388 | |

| | | | | | | | | |

| TOTAL COMMON STOCK (Cost $543,081) | | | | | | | 564,172 | |

| | | | | | | | | |

| SHORT TERM INVESTMENTS - 2.66% | | | | | | | | |

Fidelity Institutional Money Market Funds - Government Portfolio, 0.26%(b) (Cost $15,651) | | | 15,651 | | | $ | 15,651 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (Cost $558,732) - 98.77% | | | | | | $ | 579,823 | |

| OTHER LIABILITIES IN EXCESS OF ASSETS, NET - 1.23% | | | | | | | 7,196 | |

| NET ASSETS - 100% | | | | | | $ | 587,019 | |

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | Rate shown represents the rate at August 31, 2016, is subject to change and resets daily. |

ADR - American Depositary Receipt.

The accompanying notes are an integral part of these financial statements.

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

Snow Capital Hedged Equity Fund

SCHEDULE OF INVESTMENTS

August 31, 2016 (Unaudited)

| COMMON STOCK - 92.21% | | Shares | | | Fair Value | |

| | | | | | | |

| Aerospace & Defense - 4.05% | | | | | | |

| Triumph Group, Inc. | | | 750 | | | $ | 23,895 | |

| | | | | | | | | |

| Banks - 9.48% | | | | | | | | |

| JPMorgan Chase & Co. | | | 420 | | | | 28,350 | |

| Bank of America Corp. | | | 1,710 | | | | 27,599 | |

| | | | | | | | 55,949 | |

| Biotechnology - 3.11% | | | | | | | | |

Biogen, Inc. (a) | | | 60 | | | | 18,338 | |

| | | | | | | | | |

| Building Materials - 1.90% | | | | | | | | |

Cemex SAB de CV - ADR (a) | | | 1,350 | | | | 11,192 | |

| | | | | | | | | |

| Chemicals - 3.21% | | | | | | | | |

| Mosaic Co. | | | 630 | | | | 18,944 | |

| | | | | | | | | |

| Computers - 5.76% | | | | | | | | |

| Hewlett-Packard Co. | | | 1,585 | | | | 34,046 | |

| | | | | | | | | |

| Electric - 1.61% | | | | | | | | |

| Exelon Corp. | | | 280 | | | | 9,519 | |

| | | | | | | | | |

| Electronics - 4.49% | | | | | | | | |

Keysight Technologies, Inc. (a) | | | 870 | | | | 26,474 | |

| | | | | | | | | |

| Forest Products & Paper - 3.45% | | | | | | | | |

| International Paper Co. | | | 420 | | | | 20,366 | |

| | | | | | | | | |

| Healthcare - Products - 4.39% | | | | | | | | |

| Zimmer Biomet Holdings, Inc. | | | 200 | | | | 25,922 | |

| | | | | | | | | |

| Home Builders - 3.80% | | | | | | | | |

| PulteGroup, Inc. | | | 1,050 | | | | 22,439 | |

| | | | | | | | | |

| Insurance - 7.74% | | | | | | | | |

| MetLife, Inc. | | | 635 | | | | 27,559 | |

| Voya Financial, Inc. | | | 620 | | | | 18,129 | |

| | | | | | | | 45,688 | |

| Media - 4.24% | | | | | | | | |

| Viacom, Inc. - Class B | | | 620 | | | | 25,011 | |

| | | | | | | | | |

| Oil & Gas - 6.29% | | | | | | | | |

| BP PLC -ADR | | | 240 | | | | 8,126 | |

| PBF Energy, Inc. - Class A | | | 990 | | | | 21,681 | |

Southwestern Energy Co. (a) | | | 525 | | | | 7,303 | |

| | | | | | | | 37,110 | |

| Pharmaceuticals - 8.66% | | | | | | | | |

| Merck & Company, Inc. | | | 510 | | | | 25,699 | |

| Teva Pharmaceutical Industries Ltd. - ADR | | | 405 | | | | 25,430 | |

| | | | | | | | 51,129 | |

| Pipelines - 4.63% | | | | | | | | |

| Kinder Morgan, Inc. | | | 1,250 | | | | 27,313 | |

| | | | | | | | | |

| Retail - 4.52% | | | | | | | | |

| Dick's Sporting Goods, Inc. | | | 455 | | | | 26,663 | |

| | | | | | | | | |

| Semiconductors - 10.88% | | | | | | | | |

| QUALCOMM, Inc. | | | 615 | | | | 38,788 | |

| Skyworks Solutions, Inc. | | | 340 | | | | 25,452 | |

| | | | | | | | 64,240 | |

| | | | | | | | | |

| TOTAL COMMON STOCK (Cost $528,952) | | | | | | | 544,238 | |

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

Snow Capital Hedged Equity Fund

SCHEDULE OF INVESTMENTS

August 31, 2016 (Unaudited)

| EXCHANGE-TRADED FUNDS - 6.52% | | Shares | | | Fair Value | |

| | | | | | | |

| Equity Funds - 6.52% | | | | | | |

| Consumer Staples Select Sector SPDR Fund | | | 400 | | | $ | 21,768 | |

| Utilities Select Sector SPDR Fund | | | 340 | | | | 16,738 | |

| TOTAL EXCHANGE-TRADED FUNDS (Cost $33,165) | | | | | | | 38,506 | |

| | | | | | | | | |

| SHORT TERM INVESTMENTS - 0.51% | | | | | | | | |

Fidelity Institutional Money Market Funds - Government Portfolio, 0.26%(b) (Cost $3,016) | | | 3,016 | | | | 3,016 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (Cost $565,133) - 99.24% | | | | | | $ | 585,760 | |

| SECURITIES SOLD SHORT (Proceeds, $157,055) - (27.36%) | | | | | | | (161,493 | ) |

| OTHER ASSETS IN EXCESS OF LIABILITIES, NET - 28.12% | | | | | | | 165,953 | |

| NET ASSETS - 100% | | | | | | $ | 590,220 | |

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | Rate shown represents the rate at May 31, 2016, is subject to change and resets daily. |

ADR - American Depositary Receipt.

The accompanying notes are an integral part of these financial statements.

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

Snow Capital Hedged Equity Fund

SCHEDULE OF INVESTMENTS

August 31, 2016 (Unaudited)

| SECURITIES SOLD SHORT - (27.36)% | | | | | | |

| | | | | | | |

| COMMON STOCK - (27.36)% | | Shares | | | Fair Value | |

| | | | | | | |

| Aerospace & Defense - (0.77)% | | | | | | |

| General Dynamics, Corp. | | | (30 | ) | | $ | (4,567 | ) |

| | | | | | | | | |

| Apparel- (0.73)% | | | | | | | | |

| VF Corp. | | | (70 | ) | | | (4,343 | ) |

| | | | | | | | | |

| Beverages - (1.22)% | | | | | | | | |

| Brown-Forman Corp. - Class B | | | (50 | ) | | | (2,427 | ) |

| Coca-Cola Co. | | | (110 | ) | | | (4,777 | ) |

| | | | | | | | (7,204 | ) |

| Chemicals - (0.71)% | | | | | | | | |

| EI du Pont de Nemours & Co. | | | (60 | ) | | | (4,176 | ) |

| | | | | | | | | |

| Commerical Services - (2.33)% | | | | | | | | |

| Ecolab, Inc. | | | (40 | ) | | | (4,922 | ) |

| Automatic Data Processing, Inc. | | | (50 | ) | | | (4,491 | ) |

| Moody's Corp. | | | (40 | ) | | | (4,348 | ) |

| | | | | | | | (13,761 | ) |

| Computers - (0.78)% | | | | | | | | |

| Accenture PLC - Class A | | | (40 | ) | | | (4,600 | ) |

| | | | | | | | | |

| Cosmetics & Personal Care - (0.76)% | | | | | | | | |

| Colgate-Palmolive Co. | | | (60 | ) | | | (4,460 | ) |

| | | | | | | | | |

| Distribution & Wholesale - (1.66)% | | | | | | | | |

| Fastenal Co. | | | (110 | ) | | | (4,742 | ) |

LKQ Corp. (a) | | | (140 | ) | | | (5,053 | ) |

| | | | | | | | (9,795 | ) |

| Diversified Financial Services - (1.53)% | | | | | | | | |

| CME Group, Inc. | | | (40 | ) | | | (4,334 | ) |

| Invesco, Ltd. | | | (150 | ) | | | (4,679 | ) |

| | | | | | | | (9,013 | ) |

| Electric - (1.53)% | | | | | | | | |

| Duke Energy Corp. | | | (60 | ) | | | (4,780 | ) |

| SCANA Corp. | | | (60 | ) | | | (4,239 | ) |

| | | | | | | | (9,019 | ) |

| Food - (1.72)% | | | | | | | | |

| Ingredion, Inc. | | | (40 | ) | | | (5,478 | ) |

| Sysco Corp. | | | (90 | ) | | | (4,667 | ) |

| | | | | | | | (10,145 | ) |

| Healthcare - Products - (2.40)% | | | | | | | | |

| DENTSPLY SIRONA, Inc. | | | (80 | ) | | | (4,917 | ) |

Edwards Lifesciences Corp. (a) | | | (40 | ) | | | (4,606 | ) |

| Stryker Corp. | | | (40 | ) | | | (4,626 | ) |

| | | | | | | | (14,149 | ) |

| Miscellaneous Manufacturing - (1.62)% | | | | | | | | |

| AO Smith Corp. | | | (50 | ) | | | (4,824 | ) |

| Illinois Tool Works, Inc. | | | (40 | ) | | | (4,754 | ) |

| | | | | | | | (9,578 | ) |

| Oil & Gas - (2.59)% | | | | | | | | |

| EQT Corp. | | | (70 | ) | | | (5,005 | ) |

| PBF Energy, Inc. - Class A | | | (30 | ) | | | (5,371 | ) |

| Hess Corp. | | | (90 | ) | | | (4,887 | ) |

| | | | | | | | (15,263 | ) |

| Oil & Gas Services - (0.73)% | | | | | | | | |

| Halliburton Co. | | | (100 | ) | | | (4,301 | ) |

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

Snow Capital Hedged Equity Fund

SCHEDULE OF INVESTMENTS

August 31, 2016 (Unaudited)

| SECURITIES SOLD SHORT - (27.36)% (continued) | | | | | | |

| | | | | | | |

| COMMON STOCK - (27.36)% (continued) | | Shares | | | Fair Value | |

| | | | | | | |

| Pharmaceuticals - (0.78)% | | | | | | |

| Zoetis, Inc. | | | (90 | ) | | $ | (4,599 | ) |

| | | | | | | | | |

| Retail - (1.53)% | | | | | | | | |

| Domino's Pizza, Inc. | | | (30 | ) | | | (4,487 | ) |

| L Brands, Inc. | | | (60 | ) | | | (4,573 | ) |

| | | | | | | | (9,060 | ) |

| Software - (2.45)% | | | | | | | | |

Adobe Systems, Inc. (a) | | | (50 | ) | | | (5,116 | ) |

Electronic Arts, Inc. (a) | | | (60 | ) | | | (4,874 | ) |

| MSCI, Inc. | | | (50 | ) | | | (4,506 | ) |

| | | | | | | | (14,496 | ) |

| Telecommunications - (1.52)% | | | | | | | | |

| AT&T, Inc. | | | (110 | ) | | | (4,497 | ) |

Level 3 Communications, Inc. (a) | | | (90 | ) | | | (4,467 | ) |

| | | | | | | | (8,964 | ) |

| | | | | | | | | |

| TOTAL COMMON STOCK SOLD SHORT (Proceeds $160,709) | | | | | | $ | (161,493 | ) |

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | Rate shown represents the rate at August 31, 2016, is subject to change and resets daily. |

ADR - American Depositary Receipt.

The accompanying notes are an integral part of these financial statements.

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

Snow Capital Inflation Advantaged Equities Fund

SCHEDULE OF INVESTMENTS

August 31, 2016 (Unaudited)

| COMMON STOCK - 93.92% | | Shares | | | Fair Value | |

| | | | | | | |

| Aerospace & Defense - 2.70% | | | | | | |

| Triumph Group, Inc. | | | 235 | | | $ | 7,487 | |

| | | | | | | | | |

| Banks - 4.36% | | | | | | | | |

| Bank of America Corp. | | | 750 | | | | 12,105 | |

| | | | | | | | | |

| Biotechnology - 2.75% | | | | | | | | |

Biogen, Inc. (a) | | | 25 | | | | 7,641 | |

| | | | | | | | | |

| Building Materials - 2.99% | | | | | | | | |

Cemex SAB de CV - ADR (a) | | | 1,000 | | | | 8,290 | |

| | | | | | | | | |

| Chemicals - 2.71% | | | | | | | | |

| Mosaic Co. | | | 250 | | | | 7,518 | |

| | | | | | | | | |

| Commercial Services - 2.72% | | | | | | | | |

On Assignment, Inc. (a) | | | 200 | | | | 7,542 | |

| | | | | | | | | |

| Electric - 2.82% | | | | | | | | |

| Exelon Corp. | | | 230 | | | | 7,820 | |

| | | | | | | | | |

| Engineering & Construction - 2.15% | | | | | | | | |

| Chicago Bridge & Iron Co. | | | 200 | | | | 5,956 | |

| | | | | | | | | |

| Forest Products & Paper - 3.32% | | | | | | | | |

| International Paper Co. | | | 190 | | | | 9,213 | |

| | | | | | | | | |

| Healthcare - Products - 2.80% | | | | | | | | |

| Zimmer Biomet Holdings, Inc. | | | 60 | | | | 7,777 | |

| | | | | | | | | |

| Home Builders - 3.74% | | | | | | | | |

| PulteGroup, Inc. | | | 485 | | | | 10,364 | |

| | | | | | | | | |

| Insurance - 8.19% | | | | | | | | |

| MetLife, Inc. | | | 185 | | | | 8,029 | |

| Hartford Financial Services Group, Inc. | | | 130 | | | | 5,339 | |

| Voya Financial, Inc. | | | 320 | | | | 9,357 | |

| | | | | | | | 22,725 | |

| Media - 2.54% | | | | | | | | |

| Viacom, Inc. - Class B | | | 175 | | | | 7,060 | |

| | | | | | | | | |

| Mining - 3.45% | | | | | | | | |

| Newmont Mining Corp. | | | 250 | | | | 9,560 | |

| | | | | | | | | |

| Miscellaneous Manufacturing - 6.35% | | | | | | | | |

| Crane Co. | | | 155 | | | | 9,970 | |

| Eaton Corp. PLC | | | 115 | | | | 7,652 | |

| | | | | | | | 17,622 | |

| Oil & Gas - 8.83% | | | | | | | | |

| BP PLC - ADR | | | 280 | | | | 9,481 | |

| PBF Energy, Inc. -A | | | 285 | | | | 6,242 | |

Southwestern Energy Co. (a) | | | 630 | | | | 8,763 | |

| | | | | | | | 24,486 | |

| Packaging & Containers - 3.43% | | | | | | | | |

Owens-Illinois, Inc. (a) | | | 530 | | | | 9,502 | |

| | | | | | | | | |

| Pharmaceuticals - 8.34% | | | | | | | | |

| Teva Pharmaceutical Industries, Ltd. - ADR | | | 120 | | | | 6,047 | |

Lannett Co., Inc. (a) | | | 270 | | | | 9,142 | |

Omega Protein Corp. (a) | | | 315 | | | | 7,941 | |

| | | | | | | | 23,130 | |

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

Snow Capital Inflation Advantaged Equities Fund

SCHEDULE OF INVESTMENTS

August 31, 2016 (Unaudited)

| COMMON STOCK - 93.92% (continued) | | Shares | | | Fair Value | |

| | | | | | | |

| Pipelines - 2.95% | | | | | | |

| Kinder Morgan, Inc. | | | 375 | | | $ | 8,194 | |

| | | | | | | | | |

| Retail - 9.50% | | | | | | | | |

| Dick's Sporting Goods, Inc. | | | 170 | | | | 9,962 | |

| Macy's Inc. | | | 220 | | | | 7,960 | |

| Target Corp. | | | 120 | | | | 8,423 | |

| | | | | | | | 26,345 | |

| Semiconductors - 2.73% | | | | | | | | |

| QUALCOMM, Inc. | | | 120 | | | | 7,567 | |

| | | | | | | | | |

| Software - 2.38% | | | | | | | | |

| Microsoft Corp. | | | 115 | | | | 6,608 | |

| | | | | | | | | |

| Telecommunications - 2.17% | | | | | | | | |

| Verizon Communications, Inc. | | | 115 | | | | 6,018 | |

| | | | | | | | | |

| | | | | | | | | |

| TOTAL COMMON STOCK (Cost $250,558) | | | | | | | 260,530 | |

| | | | | | | | | |

| SHORT TERM INVESTMENTS - 4.27% | | | | | | | | |

Fidelity Institutional Money Market Funds - Government Portfolio, 0.26%(b) (Cost $11,864) | | | 11,864 | | | | 11,864 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (Cost $262,422) - 98.19% | | | | | | $ | 272,394 | |

| OTHER LIABILITIES IN EXCESS OF ASSETS, NET - 1.81% | | | | | | | 5,011 | |

| NET ASSETS - 100% | | | | | | $ | 277,405 | |

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | Rate shown represents the rate at May 31, 2016, is subject to change and resets daily. |

ADR - American Depositary Receipt.

The accompanying notes are an integral part of these financial statements.

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

Snow Capital Dividend Plus Fund

SCHEDULE OF INVESTMENTS

August 31, 2016 (Unaudited)

| COMMON STOCK - 82.41% | | Shares | | | Fair Value | |

| | | | | | | |

| Auto Manufacturers - 2.33% | | | | | | |

| General Motors Co. | | | 245 | | | $ | 7,820 | |

| | | | | | | | | |

| Banks - 7.81% | | | | | | | | |

| KeyCorp | | | 835 | | | | 10,488 | |

| FNB Corp. | | | 230 | | | | 2,873 | |

| JPMorgan Chase & Co. | | | 150 | | | | 10,125 | |

| Wells Fargo & Co. | | | 55 | | | | 2,794 | |

| | | | | | | | 26,280 | |

| Chemicals - 3.48% | | | | | | | | |

| A Schulman, Inc. - Class A | | | 230 | | | | 5,865 | |

| Mosaic Co. | | | 195 | | | | 5,864 | |

| | | | | | | | 11,729 | |

| Commerical Services - 1.74% | | | | | | | | |

| H&R Block, Inc. | | | 270 | | | | 5,848 | |

| | | | | | | | | |

| Computers - 6.40% | | | | | | | | |

| NetApp, Inc. | | | 315 | | | | 10,896 | |

| Hewlett Packard Enterprise Co. | | | 495 | | | | 10,633 | |

| | | | | | | | 21,529 | |

| Electric - 2.17% | | | | | | | | |

| Exelon Corp. | | | 215 | | | | 7,310 | |

| | | | | | | | | |

| Food - 2.15% | | | | | | | | |

| Flowers Foods, Inc. | | | 485 | | | | 7,231 | |

| | | | | | | | | |

| Forest Products & Paper - 2.59% | | | | | | | | |

| International Paper Co. | | | 180 | | | | 8,728 | |

| | | | | | | | | |

| Hand & Machine Tools - 2.66% | | | | | | | | |

| Kennametal, Inc. | | | 320 | | | | 8,947 | |

| | | | | | | | | |

| Healthcare - Products - 2.50% | | | | | | | | |

| Zimmer Biomet Holdings, Inc. | | | 65 | | | | 8,425 | |

| | | | | | | | | |

| Healthcare - Services - 1.62% | | | | | | | | |

| Kindred Healthcare, Inc. | | | 495 | | | | 5,465 | |

| | | | | | | | | |

| Home Builders - 3.05% | | | | | | | | |

| PulteGroup, Inc. | | | 480 | | | | 10,258 | |

| | | | | | | | | |

| Home Furnishings - 1.89% | | | | | | | | |

| Harman International Industries, Inc. | | | 75 | | | | 6,352 | |

| | | | | | | | | |

| Insurance - 7.37% | | | | | | | | |

| American International Group, Inc. | | | 160 | | | | 9,573 | |

| Hartford Financial Services Group, Inc. | | | 190 | | | | 8,246 | |

| MetLife, Inc. | | | 170 | | | | 6,982 | |

| | | | | | | | 24,801 | |

| Media - 1.86% | | | | | | | | |

| Viacom, Inc. - Class B | | | 155 | | | | 6,253 | |

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

Snow Capital Dividend Plus Fund

SCHEDULE OF INVESTMENTS

August 31, 2016 (Unaudited)

| COMMON STOCK - 82.41% (continued) | | Shares | | | Fair Value | |

| | | | | | | |

| Miscellaneous Manufacturing - 3.70% | | | | | | |

| Crane Co. | | | 90 | | | $ | 5,789 | |

| Eaton Corp. PLC | | | 100 | | | | 6,653 | |

| | | | | | | | 12,442 | |

| Oil & Gas- 9.85% | | | | | | | | |

| Chevron Corp. | | | 105 | | | | 10,561 | |

| BP PLC - ADR | | | 280 | | | | 9,481 | |

| PBF Energy, Inc. - Class A | | | 270 | | | | 5,913 | |

| Royal Dutch Shell PLC - ADR | | | 147 | | | | 7,188 | |

| | | | | | | | 33,143 | |

| Pharmaceuticals - 2.25% | | | | | | | | |

| Teva Pharmaceutical Industries, Ltd. - ADR | | | 150 | | | | 7,558 | |

| | | | | | | | | |

| Pipelines - 3.93% | | | | | | | | |

| Kinder Morgan, Inc. | | | 605 | | | | 13,219 | |

| | | | | | | | | |

| Real Estate Investment Trusts - 2.54% | | | | | | | | |

| Chimera Investment Corp. | | | 518 | | | | 8,541 | |

| | | | | | | | | |

| Semiconductors - 4.95% | | | | | | | | |

| Cypress Semiconductor Corp. | | | 710 | | | | 8,470 | |

| QUALCOMM, Inc. | | | 130 | | | | 8,199 | |

| | | | | | | | 16,669 | |

| Telecommunications - 2.71% | | | | | | | | |

| Telefonaktiebolaget LM Ericsson - ADR | | | 840 | | | | 5,981 | |

| Verizon Communications, Inc. | | | 60 | | | | 3,140 | |

| | | | | | | | 9,121 | |

| Transportation - 2.86% | | | | | | | | |

| CSX Corp. | | | 340 | | | | 9,615 | |

| | | | | | | | | |

| TOTAL COMMON STOCK (Cost $266,516) | | | | | | | 277,284 | |

| | | | | | | | | |

| PREFERRED STOCK - 9.20% | | | | | | | | |

| | | | | | | | | |

| Banks - 3.32% | | | | | | | | |

| Bank of America Corp., 7.25%, Series L | | | 9 | | | | 11,169 | |

| | | | | | | | | |

| Diversified Financial Services - 2.85% | | | | | | | | |

| Ally Financial, Inc., 6.602%, Series 2 | | | 380 | | | | 9,599 | |

| | | | | | | | | |

| Real Estate Investment Trusts - 3.03% | | | | | | | | |

| Annaly Capital Management, Inc., 7.625%, Series C | | | 400 | | | | 10,180 | |

| | | | | | | | | |

| TOTAL PREFERRED STOCK (Cost $30,631) | | | | | | | 30,948 | |

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

Snow Capital Dividend Plus Fund

SCHEDULE OF INVESTMENTS

August 31, 2016 (Unaudited)

| PARTNERSHIPS - 6.24% | | Shares | | | Fair Value | |

| | | | | | | |

| Diversified Financial Services - 1.76% | | | | | | |

| AllianceBernstein Holding LP | | | 270 | | | $ | 5,910 | |

| | | | | | | | | |

| Oil & Gas - 2.07% | | | | | | | | |

| Suburban Propane Partners LP | | | 210 | | | | 6,962 | |

| | | | | | | | | |

| Pipelines - 2.41% | | | | | | | | |

| Boardwalk Pipeline Partners LP | | | 500 | | | | 8,115 | |

| | | | | | | | | |

| TOTAL PARTNERSHIPS (Cost $18,343) | | | | | | | 20,987 | |

| | | | | | | | | |

| SHORT TERM INVESTMENTS - 0.07% | | | | | | | | |

Fidelity Institutional Money Market Funds - Government Portfolio, 0.26%(b) (Cost $223) | | | 223 | | | | 223 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (Cost $315,713) - 97.92% | | | | | | $ | 329,442 | |

| OTHER LIABIITIES IN EXCESS OF ASSETS, NET - 2.08% | | | | | | | 7,015 | |

| NET ASSETS - 100% | | | | | | $ | 336,457 | |

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | Rate shown represents the rate at August 31, 2016, is subject to change and resets daily. |

ADR - American Depositary Receipt.

The accompanying notes are an integral part of these financial statements.

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

Snow Capital Mid Cap Value Fund

SCHEDULE OF INVESTMENTS

August 31, 2016 (Unaudited)

| COMMON STOCK - 88.86% | | Shares | | | Fair Value | |

| | | | | | | |

| Aerospace & Defense - 1.87% | | | | | | |

| Triumph Group, Inc. | | | 190 | | | $ | 6,053 | |

| | | | | | | | | |

| Banks - 5.35% | | | | | | | | |

| KeyCorp | | | 890 | | | | 11,178 | |

| Zions Bancorporation | | | 200 | | | | 6,118 | |

| | | | | | | | 17,296 | |

| Chemicals - 4.24% | | | | | | | | |

| Mosaic Co. | | | 300 | | | | 9,021 | |

| FMC Corp. | | | 100 | | | | 4,694 | |

| | | | | | | | 13,715 | |

| Computers - 7.85% | | | | | | | | |

| NetApp, Inc. | | | 240 | | | | 8,302 | |

| Hewlett Packard Enterprise Co. | | | 400 | | | | 8,592 | |

NCR Corp. (a) | | | 250 | | | | 8,463 | |

| | | | | | | | 25,357 | |

| Diversified Financial Services - 3.72% | | | | | | | | |

| Ally Financial, Inc. | | | 600 | | | | 12,024 | |

| | | | | | | | | |

| Electric - 2.11% | | | | | | | | |

| Exelon Corp. | | | 200 | | | | 6,800 | |

| | | | | | | | | |

| Electronics - 5.40% | | | | | | | | |

| Avnet, Inc. | | | 200 | | | | 8,336 | |

Keysight Technologies, Inc. (a) | | | 300 | | | | 9,129 | |

| | | | | | | | 17,465 | |

| Engineering & Construction - 1.38% | | | | | | | | |

| Chicago Bridge & Iron Co. | | | 150 | | | | 4,467 | |

| | | | | | | | | |

| Forest Products & Paper - 3.98% | | | | | | | | |

| International Paper Co. | | | 265 | | | | 12,850 | |

| | | | | | | | | |

| Healthcare - Products - 2.81% | | | | | | | | |

| Zimmer Biomet Holdings, Inc. | | | 70 | | | | 9,073 | |

| | | | | | | | | |

| Healthcare - Services - 1.29% | | | | | | | | |

Community Health Systems, Inc. (a) | | | 390 | | | | 4,165 | |

| | | | | | | | | |

| Home Builders - Services - 1.32% | | | | | | | | |

| PulteGroup, Inc. | | | 200 | | | | 4,274 | |

| | | | | | | | | |

| Home Furnishings - Services - 2.10% | | | | | | | | |

| Harman International Industries, Inc. | | | 80 | | | | 6,775 | |

| | | | | | | | | |

| Insurance - 7.09% | | | | | | | | |

| Hartford Financial Services Group, Inc. | | | 230 | | | | 9,446 | |

| Voya Financial, Inc. | | | 460 | | | | 13,450 | |

| | | | | | | | 22,896 | |

| Internet - 3.06% | | | | | | | | |

| Symantec Corp. | | | 410 | | | | 9,893 | |

| | | | | | | | | |

| Machinery - Construction & Mining - 0.75% | | | | | | | | |

| Terex Corp. | | | 100 | | | | 2,428 | |

| | | | | | | | | |

| Machinery - Diversified - 1.08% | | | | | | | | |

Zebra Technologies Corp. (a) | | | 50 | | | | 3,498 | |

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

Snow Capital Mid Cap Value Fund

SCHEDULE OF INVESTMENTS

August 31, 2016 (Unaudited)

| COMMON STOCK - 88.86% (continued) | | Shares | | | Fair Value | |

| | | | | | | |

| Media - 3.12% | | | | | | |

| Viacom, Inc. - Class B | | | 250 | | | $ | 10,085 | |

| | | | | | | | | |

| Miscellaneous Manufacturing - 7.89% | | | | | | | | |

| Crane Co. | | | 150 | | | | 9,648 | |

| Eaton Corp. PLC | | | 100 | | | | 6,654 | |

| Textron, Inc. | | | 225 | | | | 9,191 | |

| | | | | | | | 25,493 | |

| Oil & Gas - 3.21% | | | | | | | | |

| Devon Energy Corp. | | | 355 | | | | 7,775 | |

| PBF Energy, Inc. - Class A | | | 60 | | | | 2,600 | |

| | | | | | | | 10,375 | |

| Packaging & Containers - 2.77% | | | | | | | | |

Owens-Illinois, Inc. (a) | | | 500 | | | | 8,965 | |

| | | | | | | | | |

| Real Estate Investments Trusts - 2.87% | | | | | | | | |

| Highwoods Properties, Inc. | | | 175 | | | | 9,282 | |

| | | | | | | | | |

| Retail - 7.89% | | | | | | | | |

| Dick's Sporting Goods, Inc. | | | 150 | | | | 8,790 | |

| Abercrombie & Fitch Co. | | | 200 | | | | 3,548 | |

| Big Lots, Inc. | | | 75 | | | | 3,699 | |

| Kohl's Corp. | | | 50 | | | | 2,219 | |

| Macy's, Inc. | | | 200 | | | | 7,236 | |

| | | | | | | | 25,492 | |

| Semiconductors - 3.77% | | | | | | | | |

| Cypress Semiconductor Corp. | | | 500 | | | | 5,965 | |

| Skyworks Solutions, Inc. | | | 50 | | | | 3,743 | |

Micron Technology, Inc. (a) | | | 150 | | | | 2,474 | |

| | | | | | | | 12,182 | |

| Software - 1.94% | | | | | | | | |

| Open Text Corp. | | | 100 | | | | 6,282 | |

| | | | | | | | | |

| TOTAL COMMON STOCK (Cost $280,863) | | | | | | | 287,185 | |

| | | | | | | | | |

| SHORT TERM INVESTMENTS - 9.61% | | | | | | | | |

Fidelity Institutional Money Market Funds - Government Portfolio, 0.26%(b) (Cost $31,065) | | | 31,065 | | | | 31,065 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (Cost $311,928) - 98.47% | | | | | | $ | 318,250 | |

| OTHER LIABILITES IN EXCESS OF ASSETS, NET - 1.53% | | | | | | | 4,947 | |

| NET ASSETS - 100% | | | | | | $ | 323,197 | |

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | Rate shown represents the rate at August 31, 2016, is subject to change and resets daily. |

The accompanying notes are an integral part of these financial statements.

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

STATEMENTS OF ASSETS AND LIABILITIESAugust 31, 2016 (Unaudited)

| | | Snow Capital | | | | Snow Capital | | |

| | | Focused Value Fund | | | | Hedged Equity Fund | | |

| Assets: | | | | | | | | |

| Investments, at value | | $ | 579,823 | | | | $ | 585,760 | | |

| Deposits at broker | | | - | | | | | 163,033 | | |

| Due from advisor | | | 10,887 | | | | | 11,585 | | |

| Receivables: | | | | | | | | | | |

| Interest | | | 4 | | | | | 4 | | |

| Dividends | | | 1,506 | | | | | 1,343 | | |

| Investment securities sold | | | 6,426 | | | | | 50,027 | | |

| Prepaid expenses | | | 1,106 | | | | | 1,106 | | |

| Total assets | | | 599,752 | | | | | 812,858 | | |

| | | | | | | | | | | |

| Liabilities: | | | | | | | | | | |

| Securities sold short, at value | | $ | - | | | | $ | 161,493 | | |

| Payables: | | | | | | | | | | |

| Investment securities purchased | | | 4,877 | | | | | 52,116 | | |

| Accrued distribution (12b-1) fees | | | 111 | | | | | 101 | | |

| Due to administrator | | | 2,909 | | | | | 2,911 | | |

| Due to trustees | | | - | | | | | - | | |

| Accrued expenses | | | 4,836 | | | | | 6,017 | | |

| Total liabilities | | | 12,733 | | | | | 222,638 | | |

| Net Assets | | $ | 587,019 | | | | $ | 590,220 | | |

| | | | | | | | | | | |

| Sources of Net Assets: | | | | | | | | | | |

| Paid-in capital | | $ | 587,248 | | | | $ | 831,103 | | |

| Accumulated net realized loss on investments | | | (24,803 | ) | | | | (264,668 | ) | |

| Undistributed net investment income | | | 3,483 | | | | | 3,943 | | |

| Net unrealized appreciation on investments | | | 21,091 | | | | | 20,626 | | |

| Net unrealized depreciation on securities sold short | | | - | | | | | (784 | ) | |

| Total Net Assets (Unlimited shares of beneficial interest authorized) | | $ | 587,019 | | | | $ | 590,220 | | |

| | | | | | | | | | | |

| Total Investments, at cost | | $ | 558,732 | | | | $ | 565,133 | | |

| Proceeds from securities sold short | | $ | - | | | | $ | 160,709 | | |

| | | | | | | | | | | |

| Class A Shares: | | | | | | | | | | |

| Net assets | | $ | 12,860 | | | | $ | 11,714 | | |

| Shares Outstanding (Unlimited shares of beneficial interest authorized) | | | 656 | | | | | 718 | | |

| Net Asset Value Per Share | | $ | 19.61 | | (d) | | $ | 16.32 | | (d) |

| | | | | | | | | | | |

Maximum Offering Price Per Share (a) | | $ | 20.70 | | | | $ | 17.22 | | |

| | | | | | | | | | | |

Minimum Redemption Price Per Share (b)(c) | | $ | 19.41 | | | | $ | 16.16 | | |

| | | | | | | | | | | |

| Class I Shares: | | | | | | | | | | |

| Net assets | | $ | 574,159 | | | | $ | 579,289 | | |

| Shares Outstanding (Unlimited shares of beneficial interest authorized) | | | 29,228 | | | | | 35,318 | | |

| Net Asset Value and Offering Price Per Share | | $ | 19.64 | | | | $ | 16.40 | | |

| | | | | | | | | | | |

Minimum Redemption Price Per Share (c) | | $ | 19.54 | | | | $ | 16.32 | | |

| (a) | A maximum sales charge of 5.25% is imposed on Class A shares. |

| (b) | Investments in Class A shares made at or above the $1 million breakpoint are not subject to an initial sales charge and may be subject to a 0.50% contingent deferred sales charge ("CDSC") on shares redeemed within one year from the date of purchase. |

| (c) | A redemption fee of 0.50% will be assessed on shares of the Fund that are held for 30 days or less. |

| (d) | NAV does not compute due to rounding. |

The accompanying notes are an integral part of these financial statements.

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

STATEMENTS OF ASSETS AND LIABILITIESAugust 31, 2016 (Unaudited)

| | | Snow Capital | | | | | | | | |

| | | Inflation Advantaged Equities Fund | | | Snow Capital Dividend Plus Fund | | | Snow Capital Mid Cap Value Fund | | |

| Assets: | | | | | | | | | | | | | |

| Investments, at value | | $ | 272,394 | | | $ | 329,442 | | | $ | 318,250 | | |

| Due from advisor | | | 11,461 | | | | 11,678 | | | | 11,636 | | |

| Receivables: | | | | | | | | | | | | | |

| Interest | | | 2 | | | | 1 | | | | 7 | | |

| Dividends | | | 751 | | | | 1,288 | | | | 537 | | |

| Investment securities sold | | | - | | | | 1,266 | | | | - | | |

| Prepaid expenses | | | 1,106 | | | | 1,106 | | | | 1,106 | | |

| Total assets | | | 285,714 | | | | 344,781 | | | | 331,536 | | |

| | | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | | |

| Payables: | | | | | | | | | | | | | |

| Accrued distribution (12b-1) fees | | $ | 99 | | | $ | 104 | | | $ | 108 | | |

| Due to administrator | | | 2,872 | | | | 2,879 | | | | 2,878 | | |

| Due to trustees | | | - | | | | - | | | | - | | |

| Accrued expenses | | | 5,338 | | | | 5,341 | | | | 5,353 | | |

| Total liabilities | | | 8,309 | | | | 8,324 | | | | 8,339 | | |

| Net Assets | | $ | 277,405 | | | $ | 336,457 | | | $ | 323,197 | | |

| | | | | | | | | | | | | | |

| Sources of Net Assets: | | | | | | | | | | | | | |

| Paid-in capital | | $ | 300,410 | | | $ | 329,785 | | | $ | 336,048 | | |

| Accumulated net realized loss on investments | | | (35,500 | ) | | | (13,125 | ) | | | (22,552 | ) | |

| Undistributed net investment income | | | 2,523 | | | | 6,068 | | | | 3,379 | | |

| Net unrealized appreciation on investments | | | 9,972 | | | | 13,729 | | | | 6,322 | | |

| Total Net Assets (Unlimited shares of beneficial interest authorized) | | $ | 277,405 | | | $ | 336,457 | | | $ | 323,197 | | |

| | | | | | | | | | | | | | |

| Total Investments, at cost | | $ | 262,422 | | | $ | 315,713 | | | $ | 311,928 | | |

| | | | | | | | | | | | | | |

| Class A Shares: | | | | | | | | | | | | | |

| Net assets | | $ | 11,004 | | | $ | 13,348 | | | $ | 12,820 | | |

| Shares Outstanding (Unlimited shares of beneficial interest authorized) | | | 589 | | | | 646 | | | | 649 | | |

| Net Asset Value Per Share | | $ | 18.68 | | | $ | 20.66 | | | $ | 19.76 | | (d) |

| | | | | | | | | | | | | | |

| Maximum Offering Price Per Share (a) | | $ | 19.72 | | | $ | 21.80 | | | $ | 20.85 | | |

| | | | | | | | | | | | | | |

| Minimum Redemption Price Per Share (b)(c) | | $ | 18.49 | | | $ | 20.45 | | | $ | 19.56 | | |

| | | | | | | | | | | | | | |

| Class I Shares: | | | | | | | | | | | | | |

| Net assets | | $ | 266,401 | | | $ | 323,109 | | | $ | 310,377 | | |

| Shares Outstanding (Unlimited shares of beneficial interest authorized) | | | 14,235 | | | | 15,611 | | | | 15,682 | | |

| Net Asset Value and Offering Price Per Share | | $ | 18.71 | | | $ | 20.70 | | | $ | 19.79 | | |

| | | | | | | | | | | | | | |

| Minimum Redemption Price Per Share (c) | | $ | 18.62 | | | $ | 20.60 | | | $ | 19.69 | | |

| (a) | A maximum sales charge of 5.25% is imposed on Class A shares. |

| (b) | Investments in Class A shares made at or above the $1 million breakpoint are not subject to an initial sales charge and may be subject to a 0.50% contingent deferred sales charge ("CDSC") on shares redeemed within one year from the date of purchase. |

| (c) | A redemption fee of 0.50% will be assessed on shares of the Fund that are held for 30 days or less. |

| (d) | NAV does not compute due to rounding. |

The accompanying notes are an integral part of these financial statements.

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

STATEMENTS OF OPERATIONSAugust 31, 2016 (Unaudited)

| | | Snow Capital | | | Snow Capital | |

| | | Focused Value Fund | | | Hedged Equity Fund | |

| | | | | | | |

| | | For the | | | For the | |

| | | Six Month Period Ended | | | Six Month Period Ended | |

| | | August 31, 2016 | | | August 31, 2016 | |

| | | (Unaudited) | | | (Unaudited) | |

| Investment income: | | | | | | |

Dividends (a) | | $ | 5,463 | | | $ | 7,463 | |

| Interest | | | 20 | | | | 40 | |

| Total investment income | | | 5,483 | | | | 7,503 | |

| | | | | | | | | |

| Expenses: | | | | | | | | |

| Management fees | | | 1,972 | | | | 2,808 | |

| Distribution (12b-1) fees - Class A | | | 15 | | | | 14 | |

| Administration, Accounting and transfer agent fees and expenses | | | 12,315 | | | | 12,407 | |

| Shareholder reporting and filing | | | 2,168 | | | | 2,168 | |

| Audit fees | | | 2,672 | | | | 2,672 | |

| Legal fees | | | 2,935 | | | | 2,935 | |

| Custodian fees | | | 1,260 | | | | 1,915 | |

| Pricing fees | | | 1,310 | | | | 3,277 | |

| Trustee fees and expenses | | | 7,307 | | | | 7,307 | |

| Registration and filing fees | | | 287 | | | | 287 | |

| Insurance | | | 598 | | | | 598 | |

| Dividends on securities sold short | | | - | | | | 325 | |

| Interest expense | | | - | | | | 42 | |

| Total expenses | | | 32,839 | | | | 36,755 | |

| Less: fees waived and expenses absorbed | | | (30,304 | ) | | | (32,864 | ) |

| Net expenses | | | 2,535 | | | | 3,891 | |

| | | | | | | | | |

| Net investment income | | | 2,948 | | | | 3,612 | |

| | | | | | | | | |

| Realized and unrealized gain (loss): | | | | | | | | |

| Net realized loss on: | | | | | | | | |

| Investments | | | (4,434 | ) | | | (6,717 | ) |

| Securities sold short | | | - | | | | (21,604 | ) |

| Net realized loss on investments | | | (4,434 | ) | | | (28,321 | ) |

| | | | | | | | | |

| Net change in unrealized appreciation on: | | | | | | | | |

| Investments | | | 81,290 | | | | 96,926 | |

| Securities sold short | | | - | | | | 1,642 | |

| Net change in unrealized appreciation | | | 81,290 | | | | 98,568 | |

| | | | | | | | | |

| Net gain on investments | | | 76,856 | | | | 70,247 | |

| | | | | | | | | |

| Net increase in net assets resulting from operations | | $ | 79,804 | | | $ | 73,859 | |

| (a) | Includes foreign taxes withheld of $40 and $39, respectively. |

The accompanying notes are an integral part of these financial statements.

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

STATEMENTS OF OPERATIONSAugust 31, 2016 (Unaudited)

| | | Snow Capital | | | | | | | |

| | | Inflation Advantaged Equities Fund | | | Plus Fund | | | Value Fund | |

| | | | | | | | | | |

| | | For the | | | For the | | | For the | |

| | | Six Month Period Ended | | | Six Month Period Ended | | | Six Month Period Ended | |

| | | August 31, 2016 | | | August 31, 2016 | | | August 31, 2016 | |

| | | (Unaudited) | | | (Unaudited) | | | (Unaudited) | |

| Investment income: | | | | | | | | | |

Dividends (a) | | $ | 3,357 | | | $ | 6,111 | | | $ | 4,642 | |

| Interest | | | 14 | | | | 13 | | | | 52 | |

| Total investment income | | | 3,371 | | | | 6,124 | | | | 4,694 | |

| | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | |

| Management fees | | | 1,323 | | | | 1,182 | | | | 1,149 | |

| Distribution (12b-1) fees - Class A | | | 13 | | | | 15 | | | | 15 | |

| Administration, Accounting and transfer agent fees and expenses | | | 12,185 | | | | 12,222 | | | | 12,216 | |

| Shareholder reporting and filing | | | 2,168 | | | | 2,168 | | | | 2,169 | |

| Audit fees | | | 2,672 | | | | 2,672 | | | | 2,672 | |

| Legal fees | | | 2,935 | | | | 2,935 | | | | 2,935 | |

| Custodian fees | | | 1,512 | | | | 1,463 | | | | 1,361 | |

| Pricing fees | | | 1,663 | | | | 2,269 | | | | 2,167 | |

| Trustee fees and expenses | | | 7,307 | | | | 7,307 | | | | 7,307 | |

| Registration and filing fees | | | 287 | | | | 287 | | | | 288 | |

| Insurance | | | 598 | | | | 598 | | | | 597 | |

| Total expenses | | | 32,663 | | | | 33,118 | | | | 32,876 | |

| Less: fees waived and expenses absorbed | | | (30,996 | ) | | | (31,527 | ) | | | (31,329 | ) |

| Net expenses | | | 1,667 | | | | 1,591 | | | | 1,547 | |

| | | | | | | | | | | | | |

| Net investment income | | | 1,704 | | | | 4,533 | | | | 3,147 | |

| | | | | | | | | | | | | |

| Realized and unrealized gain (loss): | | | | | | | | | | | | |

| Net realized gain (loss) on: | | | | | | | | | | | | |

| Investments | | | 6,654 | | | | 5,172 | | | | (1,928 | ) |

| Net realized gain (loss) on investments | | | 6,654 | | | | 5,172 | | | | (1,928 | ) |

| | | | | | | | | | | | | |

| Net change in unrealized appreciation on: | | | | | | | | | | | | |

| Investments | | | 33,410 | | | | 56,348 | | | | 46,012 | |

| Net change in unrealized appreciation | | | 33,410 | | | | 56,348 | | | | 46,012 | |

| | | | | | | | | | | | | |

| Net gain on investments | | | 40,064 | | | | 61,520 | | | | 44,084 | |

| | | | | | | | | | | | | |

| Net increase in net assets resulting from operations | | $ | 41,768 | | | $ | 66,053 | | | $ | 47,231 | |

| (a) | Includes foreign taxes withheld of $13, $38, and $13, respectively. |

The accompanying notes are an integral part of these financial statements.

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

STATEMENTS OF CHANGES IN NET ASSETSAugust 31, 2016

| | | Snow Capital | |

| | | Focused Value Fund | |

| | | | | | | |

| | | For the | | | | |

| | | Six Month Period Ended | | | | |

| | | August 31, 2016 | | | February 29, 2016 | |

| | | (Unaudited) | | | | |

| Increase (decrease) in net assets from: | | | | | | |

| Operations: | | | | | | |

| Net investment income | | $ | 2,948 | | | $ | 3,555 | |

| Net realized loss on investments | | | (4,434 | ) | | | (19,819 | ) |

| Net unrealized appreciation (depreciation) on investments | | | 81,290 | | | | (88,083 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 79,804 | | | | (104,347 | ) |

| | | | | | | | | |

| Distributions to shareholders from: | | | | | | | | |

| Net investment income - Class A | | | - | | | | (93 | ) |

| Net investment income - Class I | | | - | | | | (2,928 | ) |

| Net realized capital gains - Class A | | | - | | | | (22 | ) |

| Net realized capital gains - Class I | | | - | | | | (529 | ) |

| Total distributions | | | - | | | | (3,572 | ) |

| | | | | | | | | |

| Capital share transactions (Note 2): | | | | | | | | |

| Increase in net assets from capital share transactions | | | 243,657 | | | | 3,571 | |

| | | | | | | | | |

| Increase (decrease) in net assets | | | 323,461 | | | | (104,348 | ) |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of period | | | 263,558 | | | | 367,906 | |

| | | | | | | | | |

| End of period | | $ | 587,019 | | | $ | 263,558 | |

| Undistributed net investment income | | $ | 3,483 | | | $ | 535 | |

The accompanying notes are an integral part of these financial statements.

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

STATEMENTS OF CHANGES IN NET ASSETSAugust 31, 2016

| | | Snow Capital | |

| | | Hedged Equity Fund | |

| | | | | | | |

| | | For the | | | | |

| | | Six Month Period Ended | | | | |

| | | August 31, 2016 | | | February 29, 2016 | |

| | | (Unaudited) | | | | |

| Increase (decrease) in net assets from: | | | | | | |

| Operations: | | | | | | |

| Net investment income | | $ | 3,612 | | | $ | 4,606 | |

| Net realized loss on investments | | | (28,321 | ) | | | (67,225 | ) |

| Net unrealized appreciation (depreciation) on investments | | | 98,568 | | | | (72,932 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 73,859 | | | | (135,551 | ) |

| | | | | | | | | |

| Distributions to shareholders from: | | | | | | | | |

| Net investment income - Class A | | | - | | | | (59 | ) |

| Net investment income - Class I | | | - | | | | (4,183 | ) |

| Total distributions | | | - | | | | (4,242 | ) |

| | | | | | | | | |

| Capital share transactions (Note 2): | | | | | | | | |

| Increase in net assets from capital share transactions | | | - | | | | 4,242 | |

| | | | | | | | | |

| Increase (decrease) in net assets | | | 73,859 | | | | (135,551 | ) |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of period | | | 516,361 | | | | 651,912 | |

| | | | | | | | | |

| End of period | | $ | 590,220 | | | $ | 516,361 | |

| Undistributed net investment income | | $ | 3,943 | | | $ | 331 | |

The accompanying notes are an integral part of these financial statements.

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

STATEMENTS OF CHANGES IN NET ASSETSAugust 31, 2016

| | | Snow Capital | |

| | | Inflation Advantaged Equities Fund | |

| | | | | | | |

| | | For the | | | | |

| | | Six Month Period Ended | | | | |

| | | August 31, 2016 | | | February 29, 2016 | |

| | | (Unaudited) | | | | |

| Increase (decrease) in net assets from: | | | | | | |

| Operations: | | | | | | |

| Net investment income | | $ | 1,704 | | | $ | 3,725 | |

| Net realized gain (loss) on investments | | | 6,654 | | | | (36,217 | ) |

| Net unrealized appreciation (depreciation) on investments | | | 33,410 | | | | (57,390 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 41,768 | | | | (89,882 | ) |

| | | | | | | | | |

| Distributions to shareholders from: | | | | | | | | |

| Net investment income - Class A | | | - | | | | (92 | ) |

| Net investment income - Class I | | | - | | | | (2,822 | ) |

| Net realized capital gains - Class A | | | - | | | | (191 | ) |

| Net realized capital gains - Class I | | | - | | | | (4,599 | ) |

| Total distributions | | | - | | | | (7,704 | ) |

| | | | | | | | | |

| Capital share transactions (Note 2): | | | | | | | | |

| Increase in net assets from capital share transactions | | | - | | | | 7,704 | |

| | | | | | | | | |

| Increase (decrease) in net assets | | | 41,768 | | | | (89,882 | ) |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of period | | | 235,637 | | | | 325,519 | |

| | | | | | | | | |

| End of period | | $ | 277,405 | | | $ | 235,637 | |

| Undistributed net investment income | | $ | 2,523 | | | $ | 819 | |

The accompanying notes are an integral part of these financial statements.

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

STATEMENTS OF CHANGES IN NET ASSETSAugust 31, 2016

| | | Snow Capital | |

| | | Dividend Plus Fund | |

| | | | | | | |

| | | For the | | | | |

| | | Six Month Period Ended | | | | |

| | | August 31, 2016 | | | February 29, 2016 | |

| | | (Unaudited) | | | | |

| Increase (decrease) in net assets from: | | | | | | |

| Operations: | | | | | | |

| Net investment income | | $ | 4,533 | | | $ | 8,792 | |

| Net realized gain (loss) on investments | | | 5,172 | | | | (16,812 | ) |

| Net unrealized appreciation (depreciation) on investments | | | 56,348 | | | | (62,417 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 66,053 | | | | (70,437 | ) |

| | | | | | | | | |

| Distributions to shareholders from: | | | | | | | | |

| Net investment income - Class A | | | - | | | | (283 | ) |

| Net investment income - Class I | | | - | | | | (7,449 | ) |

| Total distributions | | | - | | | | (7,732 | ) |

| | | | | | | | | |

| Capital share transactions (Note 2): | | | | | | | | |

| Increase in net assets from capital share transactions | | | - | | | | 7,732 | |

| | | | | | | | | |

| Increase (decrease) in net assets | | | 66,053 | | | | (70,437 | ) |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of period | | | 270,404 | | | | 340,841 | |

| | | | | | | | | |

| End of period | | $ | 336,457 | | | $ | 270,404 | |

| Undistributed net investment income | | $ | 6,068 | | | $ | 1,535 | |

The accompanying notes are an integral part of these financial statements.

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

STATEMENTS OF CHANGES IN NET ASSETSAugust 31, 2016

| | | Snow Capital | | | Snow Capital | |

| | | Mid Cap Value Fund | | | Mid Cap Value Fund | |

| | | | | | | |

| | | For the | | | | |

| | | Six Month Period Ended | | | | |

| | | August 31, 2016 | | | February 29, 2016 | |

| | | (Unaudited) | | | | |

| Increase (decrease) in net assets from: | | | | | | |

| Operations: | | | | | | |

| Net investment income | | $ | 3,147 | | | $ | 1,968 | |

| Net realized loss on investments | | | (1,928 | ) | | | (9,659 | ) |

| Net unrealized appreciation (depreciation) on investments | | | 46,012 | | | | (73,003 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 47,231 | | | | (80,694 | ) |

| | | | | | | | | |

| Distributions to shareholders from: | | | | | | | | |

| Net investment income - Class A | | | - | | | | (44 | ) |

| Net investment income - Class I | | | - | | | | (1,731 | ) |

| Net realized capital gains - Class A | | | - | | | | (436 | ) |

| Net realized capital gains - Class I | | | - | | | | (10,515 | ) |

| Total distributions | | | - | | | | (12,726 | ) |

| | | | | | | | | |

| Capital share transactions (Note 2): | | | | | | | | |

| Increase in net assets from capital share transactions | | | - | | | | 12,726 | |

| | | | | | | | | |

| Increase (decrease) in net assets | | | 47,231 | | | | (80,694 | ) |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of period | | | 275,966 | | | | 356,660 | |

| | | | | | | | | |

| End of period | | $ | 323,197 | | | $ | 275,966 | |

| Undistributed net investment income | | $ | 3,379 | | | $ | 232 | |

The accompanying notes are an integral part of these financial statements.

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

FINANCIAL HIGHLIGHTSAugust 31, 2016

The following tables set forth the per share operating performance data for a share of capital stock outstanding, total return ratios to average net assets and other supplemental data for the period indicated.

| | | Snow Capital Focused Value Fund | | |

| | | | | | | | | | | | | | | |

| | | Class A | | |

| | | For the | | | | For the | | | For the | | | For the | | |

| | | Six Month Period Ended | | | | Year Ended | | | Year Ended | | | Period Ended | | |

| | | August 31, 2016 | | | | February 29, 2016 | | | February 28, 2015 | | | February 28, 2014 (a) | | |

| | | (Unaudited) | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | | $ | 15.96 | | | | $ | 22.54 | | | $ | 24.02 | | | $ | 20.00 | | |

| | | | | | | | | | | | | | | | | | | |

| Investment Operations: | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.10 | | (b) | | | 0.17 | | | | 0.10 | | | | 0.11 | | |

| Net realized and unrealized gain (loss) on investments | | | 3.55 | | | | | (6.58 | ) | | | 2.11 | | | | 6.73 | | |

| Total from investment operations | | | 3.65 | | | | | (6.41 | ) | | | 2.21 | | | | 6.84 | | |

| | | | | | | | | | | | | | | | | | | |

| Distributions: | | | | | | | | | | | | | | | | | | |

| From net investment income | | | - | | | | | (0.14 | ) | | | (0.10 | ) | | | (0.11 | ) | |

| From net realized capital gains | | | - | | | | | (0.03 | ) | | | (3.59 | ) | | | (2.71 | ) | |

| Total distributions | | | - | | | | | (0.17 | ) | | | (3.69 | ) | | | (2.82 | ) | |

| | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Period | | $ | 19.61 | | | | $ | 15.96 | | | $ | 22.54 | | | $ | 24.02 | | |

| | | | | | | | | | | | | | | | | | | |

Total Return (c) | | | 22.87 | % | (d) | | | (28.52 | )% | | | 8.91 | % | | | 34.48 | % | (d) |

| | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000's) | | $ | 13 | | | | $ | 10 | | | $ | 15 | | | $ | 13 | | |

| | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | |

| Before fees waived and expenses absorbed | | | 15.23 | % | (e) | | | 18.63 | % | | | 15.37 | % | | | 17.16 | % | (e) |

| After fees waived and expenses absorbed | | | 1.40 | % | (e) | | | 1.40 | % | | | 1.40 | % | | | 1.40 | % | (e) |

| | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income (loss): | | | | | | | | | | | | | | | | | | |

| Before fees waived and expenses absorbed | | | (12.73 | )% | (e) | | | (16.40 | )% | | | (13.57 | )% | | | (15.23 | )% | (e) |

| After fees waived and expenses absorbed | | | 1.10 | % | (e) | | | 0.82 | % | | | 0.40 | % | | | 0.52 | % | (e) |

| | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 43.24 | % | (d) | | | 71.87 | % | | | 84.34 | % | | | 87.78 | % | (d) |

| (a) | The Fund commenced operations on March 28, 2013. |

| (b) | Net investment income per share is based on average shares outstanding for the six month period ended August 31, 2016. |

| (c) | Total Return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

The accompanying notes are an integral part of these financial statements.

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

FINANCIAL HIGHLIGHTSAugust 31, 2016

The following tables set forth the per share operating performance data for a share of capital stock outstanding, total return ratios to average net assets and other supplemental data for the period indicated.

| | | Snow Capital Focused Value Fund | | |

| | | | | | | | | | | | | | | |

| | | Class I | | |

| | | For the | | | | For the | | | For the | | | For the | | |

| | | Six Month Period Ended | | | | Year Ended | | | Year Ended | | | Period Ended | | |

| | | August 31, 2016 | | | | February 29, 2016 | | | February 28, 2015 | | | February 28, 2014 (a) | | |

| | | (Unaudited) | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | | $ | 15.97 | | | | $ | 22.56 | | | $ | 24.03 | | | $ | 20.00 | | |

| | | | | | | | | | | | | | | | | | | |

| Investment Operations: | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.11 | | (b) | | | 0.22 | | | | 0.16 | | | | 0.16 | | |

| Net realized and unrealized gain (loss) on investments | | | 3.56 | | | | | (6.59 | ) | | | 2.12 | | | | 6.74 | | |

| Total from investment operations | | | 3.67 | | | | | (6.37 | ) | | | 2.28 | | | | 6.90 | | |

| | | | | | | | | | | | | | | | | | | |

| Distributions: | | | | | | | | | | | | | | | | | | |

| From net investment income | | | - | | | | | (0.19 | ) | | | (0.16 | ) | | | (0.16 | ) | |

| From net realized capital gains | | | - | | | | | (0.03 | ) | | | (3.59 | ) | | | (2.71 | ) | |

| Total distributions | | | - | | | | | (0.22 | ) | | | (3.75 | ) | | | (2.87 | ) | |

| | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Period | | $ | 19.64 | | | | $ | 15.97 | | | $ | 22.56 | | | $ | 24.03 | | |

| | | | | | | | | | | | | | | | | | | |

Total Return (c) | | | 22.98 | % | (d) | | | (28.37 | )% | | | 9.21 | % | | | 34.80 | % | (d) |

| | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000's) | | $ | 574 | | | | $ | 253 | | | $ | 353 | | | $ | 323 | | |

| | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | |

| Before fees waived and expenses absorbed | | | 14.98 | % | (e) | | | 18.38 | % | | | 15.12 | % | | | 16.91 | % | (e) |

| After fees waived and expenses absorbed | | | 1.15 | % | (e) | | | 1.15 | % | | | 1.15 | % | | | 1.15 | % | (e) |

| | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income (loss): | | | | | | | | | | | | | | | | | | |

| Before fees waived and expenses absorbed | | | (12.48 | )% | (e) | | | (16.15 | )% | | | (13.32 | )% | | | (14.98 | )% | (e) |

| After fees waived and expenses absorbed | | | 1.35 | % | (e) | | | 1.07 | % | | | 0.65 | % | | | 0.77 | % | (e) |

| | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 43.24 | % | (d) | | | 71.87 | % | | | 84.34 | % | | | 87.78 | % | (d) |

| (a) | The Fund commenced operations on March 28, 2013. |

| (b) | Net investment income per share is based on average shares outstanding for the six month period ended August 31, 2016. |

| (c) | Total Return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

The accompanying notes are an integral part of these financial statements.

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

FINANCIAL HIGHLIGHTSAugust 31, 2016

The following tables set forth the per share operating performance data for a share of capital stock outstanding, total return ratios to average net assets and other supplemental data for the period indicated.

| | | Snow Capital Hedged Equity Fund | | |

| | | | | | | | | | | | | | | | | |

| | | Class A | | |

| | | For the | | | | For the | | | | For the | | | | For the | | |

| | | Six Month Period Ended | | | | Year Ended | | | | Year Ended | | | | Period Ended | | |

| | | August 31, 2016 | | | | February 29, 2016 | | | | February 28, 2015 | | | | February 28, 2014 (a) | | |

| | | (Unaudited) | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | | $ | 14.28 | | | | $ | 18.17 | | | | $ | 21.86 | | | | $ | 20.00 | | |

| | | | | | | | | | | | | | | | | | | | | |

| Investment Operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.08 | | | | | 0.12 | | | | | 0.05 | | | | | (0.02 | ) | |

| Net realized and unrealized gain (loss) on investments | | | 1.96 | | | | | (3.93 | ) | | | | 1.73 | | | | | 4.16 | | |

| Total from investment operations | | | 2.04 | | | | | (3.81 | ) | | | | 1.78 | | | | | 4.14 | | |

| | | | | | | | | | | | | | | | | | | | | |

| Distributions: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | - | | | | | (0.08 | ) | | | | (0.21 | ) | | | | (0.01 | ) | |

| From net realized capital gains | | | - | | | | | - | | | | | (5.26 | ) | | | | (2.27 | ) | |

| Total distributions | | | - | | | | | (0.08 | ) | | | | (5.47 | ) | | | | (2.28 | ) | |

| | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Period | | $ | 16.32 | | | | $ | 14.28 | | | | $ | 18.17 | | | | $ | 21.86 | | |

| | | | | | | | | | | | | | | | | | | | | |

Total Return (b) | | | 14.15 | % | (c) | | | (21.00 | )% | | | | 7.31 | % | | | | 20.87 | % | (c) |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000's) | | $ | 12 | | | | $ | 10 | | | | $ | 13 | | | | $ | 12 | | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before fees waived and expenses absorbed | | | 13.34 | % | (d)(e) | | | 11.80 | % | (e) | | | 4.38 | % | (e) | | | 10.90 | % | (d)(e) |

| After fees waived and expenses absorbed | | | 1.63 | % | (d)(e) | | | 1.73 | % | (e) | | | 1.84 | % | (e) | | | 1.93 | % | (d)(e) |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income (loss): | | | | | | | | | | | | | | | | | | | | |

| Before fees waived and expenses absorbed | | | (10.66 | )% | (d)(e) | | | (9.56 | )% | (e) | | | (2.45 | )% | (e) | | | (9.09 | )% | (d)(e) |

| After fees waived and expenses absorbed | | | 1.04 | % | (d)(e) | | | 0.51 | % | (e) | | | 0.09 | % | (e) | | | (0.11 | )% | (d)(e) |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 58.98 | % | (c) | | | 171.16 | % | | | | 518.32 | % | | | | 226.74 | % | (c) |

| (a) | The Fund commenced operations on March 28, 2013. |

| (b) | Total Return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

| (e) | The ratios include 0.13% during the six month period ended August 31, 2016, 0.23% during the fiscal year ended February 29, 2016, 0.34% during the fiscal year ended February 28, 2015 and 0.43% during the period ended February 28, 2014 for dividends on securities sold short and interest expense. |

The accompanying notes are an integral part of these financial statements.

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

FINANCIAL HIGHLIGHTSAugust 31, 2016

The following tables set forth the per share operating performance data for a share of capital stock outstanding, total return ratios to average net assets and other supplemental data for the period indicated.

| | | Snow Capital Hedged Equity Fund | | |

| | | | | | | | | | | | | | | | | |

| | | Class I | | |

| | | For the | | | | For the | | | | For the | | | | For the | | |

| | | Six Month Period Ended | | | | Year Ended | | | | Year Ended | | | | Period Ended | | |

| | | August 31, 2016 | | | | February 29, 2016 | | | | February 28, 2015 | | | | February 28, 2014 (a) | | |

| | | (Unaudited) | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | | $ | 14.33 | | | | $ | 18.23 | | | | $ | 21.90 | | | | $ | 20.00 | | |

| | | | | | | | | | | | | | | | | | | | | |

| Investment Operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.10 | | | | | 0.17 | | | | | 0.26 | | | | | 0.03 | | |

| Net realized and unrealized gain (loss) on investments | | | 1.97 | | | | | (3.95 | ) | | | | 1.59 | | | | | 4.17 | | |

| Total from investment operations | | | 2.07 | | | | | (3.78 | ) | | | | 1.85 | | | | | 4.20 | | |

| | | | | | | | | | | | | | | | | | | | | |

| Distributions: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | - | | | | | (0.12 | ) | | | | (0.26 | ) | | | | (0.03 | ) | |

| From net realized capital gains | | | - | | | | | - | | | | | (5.26 | ) | | | | (2.27 | ) | |

| Total distributions | | | - | | | | | (0.12 | ) | | | | (5.52 | ) | | | | (2.30 | ) | |

| | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Period | | $ | 16.40 | | | | $ | 14.33 | | | | $ | 18.23 | | | | $ | 21.90 | | |

| | | | | | | | | | | | | | | | | | | | | |

Total Return (b) | | | 14.31 | % | (c) | | | (20.80 | )% | | | | 7.62 | % | | | | 21.18 | % | (c) |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000's) | | $ | 579 | | | | $ | 506 | | | | $ | 639 | | | | $ | 594 | | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before fees waived and expenses absorbed | | | 13.09 | % | (d)(e) | | | 11.55 | % | (e) | | | 4.13 | % | (e) | | | 10.66 | % | (d)(e) |

| After fees waived and expenses absorbed | | | 1.38 | % | (d)(e) | | | 1.48 | % | (e) | | | 1.59 | % | (e) | | | 1.68 | % | (d)(e) |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income (loss): | | | | | | | | | | | | | | | | | | | | |

| Before fees waived and expenses absorbed | | | (10.41 | )% | (d)(e) | | | (9.30 | )% | (e) | | | (2.20 | )% | (e) | | | (8.84 | )% | (d)(e) |

| After fees waived and expenses absorbed | | | 1.29 | % | (d)(e) | | | 0.76 | % | (e) | | | 0.34 | % | (e) | | | 0.14 | % | (d)(e) |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 58.98 | % | (c) | | | 171.16 | % | | | | 518.32 | % | | | | 226.74 | % | (c) |

| (a) | The Fund commenced operations on March 28, 2013. |

| (b) | Total Return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

| (e) | The ratios include 0.13% during the six month period ended August 31, 2016, 0.23% during the fiscal year ended February 29, 2016, 0.34% during the fiscal year ended February 28, 2015 and 0.43% during the period ended February 28, 2014 for dividends on securities sold short and interest expense. |

The accompanying notes are an integral part of these financial statements.

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

FINANCIAL HIGHLIGHTSAugust 31, 2016

The following tables set forth the per share operating performance data for a share of capital stock outstanding, total return ratios to average net assets and other supplemental data for the period indicated.

| | | Snow Capital Inflation Advantaged Equities Fund | | |

| | | | | | | | | | | | | | | |

| | | Class A | | |

| | | For the | | | | For the | | | For the | | | For the | | |

| | | Six Month Period Ended | | | | Year Ended | | | Year Ended | | | Period Ended | | |

| | | August 31, 2016 | | | | February 29, 2016 | | | February 28, 2015 | | | February 28, 2014 (a) | | |

| | | (Unaudited) | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | | $ | 15.89 | | | | $ | 22.61 | | | $ | 22.92 | | | $ | 20.00 | | |

| | | | | | | | | | | | | | | | | | | |

| Investment Operations: | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.09 | | | | | 0.20 | | | | 0.16 | | | | 0.12 | | |

| Net realized and unrealized gain (loss) on investments | | | 2.70 | | | | | (6.43 | ) | | | 1.89 | | | | 3.64 | | |

| Total from investment operations | | | 2.79 | | | | | (6.23 | ) | | | 2.05 | | | | 3.76 | | |

| | | | | | | | | | | | | | | | | | | |

| Distributions: | | | | | | | | | | | | | | | | | | |

| From net investment income | | | - | | | | | (0.16 | ) | | | (0.16 | ) | | | (0.12 | ) | |

| From net realized capital gains | | | - | | | | | (0.33 | ) | | | (2.20 | ) | | | (0.72 | ) | |

| Total distributions | | | - | | | | | (0.49 | ) | | | (2.36 | ) | | | (0.84 | ) | |

| | | | | | | | | | | | | | | | | | | |

| Net Asset Value, End of Period | | $ | 18.68 | | | | $ | 15.89 | | | $ | 22.61 | | | $ | 22.92 | | |

| | | | | | | | | | | | | | | | | | | |

Total Return (b) | | | 17.56 | % | (c) | | | (27.78 | )% | | | 9.05 | % | | | 18.85 | % | (c) |

| | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000's) | | $ | 11 | | | | $ | 9 | | | $ | 13 | | | $ | 12 | | |

| | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | |

| Before fees waived and expenses absorbed | | | 24.94 | % | (d) | | | 21.67 | % | | | 17.76 | % | | | 18.71 | % | (d) |

| After fees waived and expenses absorbed | | | 1.50 | % | (d) | | | 1.50 | % | | | 1.50 | % | | | 1.50 | % | (d) |

| | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income (loss): | | | | | | | | | | | | | | | | | | |

| Before fees waived and expenses absorbed | | | (22.39 | )% | (d) | | | (19.13 | )% | | | (15.57 | )% | | | (16.61 | )% | (d) |

| After fees waived and expenses absorbed | | | 1.05 | % | (d) | | | 1.05 | % | | | 0.68 | % | | | 0.59 | % | (d) |

| | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 43.68 | % | (c) | | | 57.21 | % | | | 66.57 | % | | | 33.69 | % | (c) |

| (a) | The Fund commenced operations on March 28, 2013. |

| (b) | Total Return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

The accompanying notes are an integral part of these financial statements.

| SNOW FAMILY OF FUNDS | SEMI-ANNUAL REPORT |

FINANCIAL HIGHLIGHTSAugust 31, 2016

The following tables set forth the per share operating performance data for a share of capital stock outstanding, total return ratios to average net assets and other supplemental data for the period indicated.

| | | Snow Capital Inflation Advantaged Equities Fund | | |

| | | | | | | | | | | | | | |

| | | Class I | | |

| | | For the | | | For the | | | For the | | | For the | | |

| | | Six Month Period Ended | | | Year Ended | | | Year Ended | | | Period Ended | | |

| | | August 31, 2016 | | | February 29, 2016 | | | February 28, 2015 | | | February 28, 2014 (a) | | |

| | | (Unaudited) | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | | $ | 15.90 | | | $ | 22.62 | | | $ | 22.92 | | | $ | 20.00 | | |

| | | | | | | | | | | | | | | | | | |

| Investment Operations: | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.12 | | | | 0.25 | | | | 0.22 | | | | 0.17 | | |