UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-21744

Name of Fund: FDP Series, Inc.

Franklin Templeton Total Return FDP Fund

Invesco Value FDP Fund

Marsico Growth FDP Fund

MFS Research International FDP Fund

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, FDP Series, Inc., 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 05/31/2013

Date of reporting period: 05/31/2013

Item 1 – Report to Stockholders

MAY 31, 2013

| ANNUAL REPORT | |  |

FDP Series, Inc.

> | | MFS Research International FDP Fund |

> | | Marsico Growth FDP Fund |

> | | Franklin Templeton Total Return FDP Fund |

Not FDIC Insured • May Lose Value • No Bank Guarantee |

Table of Contents

| | | | | Page | |

Dear Shareholder | | | | | 3 | |

Annual Report:

| | | | | | |

Fund Summaries | | | | | 4 | |

About Fund Performance | | | | | 12 | |

Disclosure of Expenses | | | | | 13 | |

Derivative Financial Instruments | | | | | 13 | |

Portfolio Information | | | | | 14 | |

Financial Statements:

| | | | | | |

Schedules of Investments | | | | | 16 | |

Statements of Assets and Liabilities | | | | | 38 | |

Statements of Operations | | | | | 40 | |

Statements of Changes in Net Assets | | | | | 41 | |

Financial Highlights | | | | | 43 | |

Notes to Financial Statements | | | | | 51 | |

Report of Independent Registered Public Accounting Firm | | | | | 65 | |

Important Tax Information | | | | | 65 | |

Disclosure of Investment Advisory Agreement and Sub-Advisory Agreements | | | | | 66 | |

Officers and Directors | | | | | 70 | |

Additional Information | | | | | 73 | |

A World-Class Mutual Fund Family | | | | | 75 | |

| FDP Series, Inc. is part of the Funds Diversified PortfoliosSM (FDP) Service. You may receive separate shareholder reports for other funds available through the Service. |

| 2 | FDP SERIES, INC. | MAY 31, 2013

|

About this time one year ago, risk assets (such as equities) began to rebound from a spring selloff as weakening global economic data spurred increasing optimism that the world’s largest central banks would intervene to stimulate growth. This theme, along with the European Central Bank’s (“ECB’s”) firm commitment to preserve the euro currency bloc, drove most asset classes higher through the summer of 2012. In early September, the ECB announced its sovereign bond-buying program designed to support the region’s debt-laden countries. Days later, the US Federal Reserve announced its own much-anticipated stimulus package.

Although financial markets worldwide were buoyed by these aggressive policy actions, risk assets weakened in the fall of 2012. Global trade slowed as many European countries fell into recession and growth continued to decelerate in China. In the United States, stocks slid on lackluster corporate earnings and volatility rose in advance of the US Presidential election. In the post-election environment, investors became more concerned about the “fiscal cliff” of tax increases and spending cuts that had been scheduled to take effect at the beginning of 2013. High levels of global market volatility persisted through year-end due to fears that bipartisan gridlock would preclude a timely resolution, putting the US economy at high risk for recession. As 2013 began, the worst of the fiscal cliff was averted with a last-minute tax deal, although decisions relating to spending cuts and the debt ceiling were postponed, leaving lingering uncertainty.

Investors shook off the nerve-wracking finale to 2012 and the New Year started with a powerful relief rally. Money that had been pulled to the sidelines amid year-end tax-rate uncertainty poured back into the markets in January. Key indicators signaling modest but broad-based improvements in the world’s major economies underpinned the rally. Underlying this aura of comfort was the absence of negative headlines out of Europe. As a result, global equities surged early in the year while rising US Treasury yields pressured high quality fixed income assets. (Bond prices move inversely with yields.)

However, February brought a slowdown in global economic momentum and investors toned down their risk appetite. In the months that followed, US equities outperformed international markets, as the US recovery showed greater stability versus most other regions. But the market’s ascent was uneven, with positive economic reports pushing US stock indices to all-time highs in March and disappointing data causing weakness in April. Also driving volatility was speculation and anxiety about how long the US Federal Reserve would continue its stimulus programs. On the whole, US stocks have performed quite well thus far in 2013 as the US economy demonstrated enough resilience to allay fears of recession, while growth has remained slow enough to dissuade the US Federal Reserve from changing its stance.

Volatility has been higher in financial markets outside the United States in 2013. International equities weakened in the middle of the first quarter when political instability in Italy and a severe banking crisis in Cyprus reminded investors that the eurozone was still vulnerable to a number of macro risks. More recently, non-US markets have been pressured by a poor outlook for European economies that are mired in recession, while China’s growth rate continued to disappoint. Emerging markets lagged the rest of the world as growth in these economies was particularly lackluster.

Despite continued headwinds for global growth, risk assets charged ahead for the reporting period, driven largely by investors seeking meaningful yields in the ongoing low-interest-rate environment. For the 12-month period ended May 31, 2013, global equity markets and high yield bonds posted strong gains. US Treasury yields remained low from a historical perspective, but were highly volatile, with a sharp rise in the final month of the period driven by concerns about central bank policy tightening. In fixed income markets, 10-year US Treasury bonds posted negative returns and investment-grade bonds generated only a slight gain. Tax-exempt municipal bonds, however, benefited from favorable supply-and-demand dynamics. Near-zero short term interest rates continued to keep yields on money market securities near their all-time lows.

Market conditions have improved over the past couple of years, but investors still remain highly uncertain and are continuing to seek out new strategies and new ways of investing. At BlackRock, we believe investors need to think globally and extend their scope across a broader array of asset classes within a portfolio that moves freely as market conditions change over time. We would encourage you to talk with your financial advisor and to visit www.blackrock.com for further insight about investing in today’s world.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

| | “Despite continued headwinds for global growth, risk assets charged ahead for the reporting period, driven largely by investors seeking meaningful yields in the ongoing low-interest-rate environment.” |

Rob Kapito

President, BlackRock Advisors, LLC

Total Returns as of May 31, 2013 | | | | 6-month | | 12-month |

US large cap equities

(S&P 500® Index) | | | | | 16.43 | % | | | 27.28 | % |

US small cap equities

(Russell 2000® Index) | | | | | 20.60 | | | | 31.07 | |

International equities

(MSCI Europe, Australasia,

Far East Index) | | | | | 11.39 | | | | 31.62 | |

Emerging market equities (MSCI Emerging

Markets Index) | | | | | 1.30 | | | | 14.10 | |

3-month Treasury bill

(BofA Merrill Lynch

3-Month US Treasury

Bill Index) | | | | | 0.05 | | | | 0.12 | |

US Treasury securities

(BofA Merrill Lynch

10-Year US Treasury Index) | | | | | (3.37 | ) | | | (2.22 | ) |

US investment grade

bonds (Barclays US

Aggregate Bond Index) | | | | | (1.05 | ) | | | 0.91 | |

Tax-exempt municipal

bonds (S&P Municipal

Bond Index) | | | | | (0.86 | ) | | | 3.62 | |

US high yield bonds

(Barclays US Corporate

High Yield 2% Issuer

Capped Index) | | | | | 5.79 | | | | 14.82 | |

Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

| | THIS PAGE NOT PART OF YOUR FUND REPORT | 3 |

| |

| Fund Summary as of May 31, 2013 | MFS Research International FDP Fund

|

Investment Objective

MFS Research International FDP Fund’s (the “Fund”) investment objective is to seek to provide shareholders with capital appreciation.

Portfolio Management Commentary

How did the Fund perform?

| • | For the 12-month period ended May 31, 2013, the Fund generated strong positive returns, although it underperformed its primary benchmark, the Morgan Stanley Capital International Europe, Australasia and Far East (“MSCI EAFE”) Index. For the same period, the Fund’s Institutional and Investor A Shares outperformed the secondary benchmark, the MSCI All Country World (excluding US) Index, while the Investor B and Investor C Shares underperformed the secondary benchmark. The following discussion of relative performance pertains to the MSCI EAFE Index. |

What factors influenced performance?

| • | The Fund underperformed the MSCI EAFE Index due to stock selection in financials and consumer discretionary, where an overweight position in export trading company Li & Fung Ltd. (Hong Kong) weakened relative performance. Across the industries, notable individual detractors included mining company Iluka Resources Ltd. (Australia), oil and gas exploration company Inpex Corp. (Japan), printers and computer peripherals manufacturer Canon, Inc. (Japan), mining operator Rio Tinto Plc (United Kingdom), mining equipment manufacturer Joy Global, Inc. (United States), medical diagnostics company Diagnosticos da America SA (Brazil) and food and beverage producer Danone SA (France). Not owning shares of the strong-performing pharmaceutical company Sanofi (France) also hindered results. Additionally, the Fund’s relative currency exposure, resulting primarily from differences between the benchmark index constituents and the Fund’s holdings of securities denominated in foreign currencies, detracted from performance for the period. Lastly, as the MSCI EAFE Index rose during the period, holding cash caused a drag on the Fund’s performance as compared to the benchmark index, which has no cash position. |

| • | Conversely, the Fund benefited from stock selection in the health care sector, where strong performance came from positions in health care products maker Bayer AG (Germany) and pharmaceutical and diagnostic company Roche Holding AG (Switzerland). Additionally, the timing of the Fund’s investment in pharmaceutical firm GlaxoSmithKline Plc (United Kingdom) benefited relative results as the Fund refrained from purchasing shares until the second half of the reporting period at which point the stock outpaced the benchmark index. Elsewhere in the Fund, notable individual contributors included several firms in the financials sector — Barclays Plc (United Kingdom), Erste Group Bank AG (Austria), ING Groep NV CVA (Netherlands) and global banking group BNP Paribas SA (France). Dutch brewing company Heineken NV and casino resorts operator Sands China Ltd. (Hong Kong) also boosted returns. The avoidance of poor-performing mining giant BHP Billiton (Australia) had a positive impact on relative results as well. |

Describe recent portfolio activity.

| • | In consumer discretionary, the Fund maintained an underweight to cyclical names in Europe, including the United Kingdom, given concerns about the macro environment across the region. Conversely, the Fund favored cyclical consumer stocks in Japan, where equities rallied in the first quarter of 2013. More recently, the Fund began trimming consumer discretionary positions in some of the better-performing Japanese stocks, while taking advantage of price weakness to add to positions in emerging markets. |

| • | In consumer staples, the Fund sought to benefit from growth in emerging markets via European stocks offering exposure to the faster-growing emerging markets at reasonable valuations. |

| • | In health care, the Fund increased exposure to the European pharmaceutical space with the addition of GlaxoSmithKline Plc, which offers a compelling product pipeline and a favorable capital allocation strategy for shareholders. The Fund continued to trim some of its Japanese health care holdings on the back of their strong performance. |

Describe portfolio positioning at period end.

| • | The Fund is a sector-neutral portfolio that emphasizes bottom-up fundamental analysis and therefore, regional and industry allocations are strictly a by-product of where Fund management finds the most attractive opportunities. Relative to the MSCI EAFE Index, the Fund ended the period underweight in the Asia-Pacific region, Europe and the United Kingdom, while overweight the emerging markets and Japan. |

The views expressed reflect the opinions of the Fund’s sub-advisor as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| 4 | FDP SERIES, INC. | MAY 31, 2013

|

| |

| | MFS Research International FDP Fund

|

Total Return Based on a $10,000 Investment

| 1 | | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have a sales charge. |

| 2 | | The Fund invests, under normal market conditions, at least 65% of its assets in equity securities of foreign companies, including emerging market issuers. |

| 3 | | This unmanaged broad-based index measures the total returns of developed foreign stock markets in Europe, Australasia and the Far East. |

| 4 | | This market capitalization index is designed to measure equity market performance in the developed and emerging markets, excluding the US. |

| 5 | | Commencement of operations. |

Performance Summary for the Period Ended May 31, 2013

| | | | Average Annual Total Returns6

|

| | | | 1 Year

| | 5 Years

| | Since Inception7

|

|

| 6-Month

Total Returns

|

| w/o sales

charge

|

| w/sales

charge

|

| w/o sales

charge

|

| w/sales

charge

|

| w/o sales

charge

|

| w/sales

charge

|

Institutional | | 9.49% | | | 26.81 | % | | | N/A | | | | (1.64 | )% | | | N/A | | | | 4.74 | % | | | N/A | |

Investor A | | 9.24 | | | 26.34 | | | | 19.71 | % | | | (1.90 | ) | | | (2.95 | )% | | | 4.47 | | | | 3.76 | % |

Investor B | | 8.85 | | | 25.44 | | | | 20.94 | | | | (2.67 | ) | | | (3.05 | ) | | | 3.66 | | | | 3.66 | |

Investor C | | 8.95 | | | 25.46 | | | | 24.46 | | | | (2.63 | ) | | | (2.63 | ) | | | 3.69 | | | | 3.69 | |

MSCI EAFE Index | | 11.39 | | | 31.62 | | | | N/A | | | | (1.60 | ) | | | N/A | | | | 4.54 | | | | N/A | |

MSCI All Country World (ex US) Index | | 8.11 | | | 25.79 | | | | N/A | | | | (1.62 | ) | | | N/A | | | | 5.45 | | | | N/A | |

| 6 | | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees. |

| 7 | | The Fund commenced operations on July 27, 2005. |

| | N/A — Not applicable as share class and index do not have a sales charge. |

| | Past performance is not indicative of future results. |

Expense Example

| | | | Actual

| | Hypothetical9

|

|

| | | | Beginning

Account Value

December 1, 2012 | | Ending

Account Value

May 31, 2013 | | Expenses Paid

During the Period8 | | Beginning

Account Value

December 1, 2012 | | Ending

Account Value

May 31, 2013 | | Expenses Paid

During the Period8 | | Annualized

Expense

Ratio |

|

Institutional | | | | $ | 1,000.00 | | | $ | 1,094.90 | | | $ | 6.58 | | | $ | 1,000.00 | | | $ | 1,018.65 | | | $ | 6.34 | | | | 1.26 | %�� |

Investor A | | | | $ | 1,000.00 | | | $ | 1,092.40 | | | $ | 7.88 | | | $ | 1,000.00 | | | $ | 1,018.65 | | | $ | 7.60 | | | | 1.51 | % |

Investor B | | | | $ | 1,000.00 | | | $ | 1,088.50 | | | $ | 11.66 | | | $ | 1,000.00 | | | $ | 1,013.73 | | | $ | 11.25 | | | | 2.24 | % |

Investor C | | | | $ | 1,000.00 | | | $ | 1,089.50 | | | $ | 11.67 | | | $ | 1,000.00 | | | $ | 1,013.73 | | | $ | 11.25 | | | | 2.24 | % |

| 8 | | For each class of the Fund, expenses are equal to the annualized net expense ratio for the class, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). |

| 9 | | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365. |

| | See “Disclosure of Expenses” on page 13 for further information on how expenses were calculated. |

| FDP SERIES, INC. | MAY 31, 2013 | 5

|

| |

| Fund Summary as of May 31, 2013 | Marsico Growth FDP Fund

|

Investment Objective

Marsico Growth FDP Fund’s (the “Fund”) investment objective is to seek to provide shareholders with long-term growth of capital.

Portfolio Management Commentary

How did the Fund perform?

| • | For the 12-month period ended May 31, 2013, the Fund generated strong positive returns, but underperformed its benchmark, the Standard & Poor’s (“S&P”) 500® Index. |

What factors influenced performance?

| • | The Fund underperformed its benchmark index due to stock selection in the consumer discretionary, financials and energy sectors. Within consumer discretionary, positions in leather goods retailer Coach, Inc., sportswear retailer NIKE, Inc., coffee purveyor Starbucks Corp. and discount store operator Dollar General Corp. negatively impacted results. The Fund sold its positions in Coach, Inc. and Dollar General Corp. during the period. In addition to stock selection, an underweight position in financials, the strongest-performing sector in the benchmark index during the period, hurt results. Notable positions that generated strong returns, but lagged the sector return in the benchmark index included bank names Wells Fargo & Co. and U.S. Bancorp (the latter of which was sold during the period) and wireless and broadcast communications infrastructure real estate investment trust American Tower Corp. In the energy sector, underperformance came from positions in oilfield services companies Halliburton Co. and National Oilwell Varco, Inc., which were sold before period end. On an individual security basis, the largest detractor from performance was infant formula manufacturer Mead Johnson Nutrition Co. (consumer staples), which was sold during the period. |

| • | The Fund’s cash balances temporarily exceeded 5% of net assets at various points during the fiscal year as the Fund was repositioned. The proceeds of sale activity were not immediately redeployed into other investments. For example, in the summer of 2012, cyclical positions were pared and cash was redeployed into defensive growth names as concerns mounted over the European sovereign debt crisis. Later in the year, cash positions were elevated as uncertainty over the renewal of the debt ceiling and the sequester impacted markets. Cash was opportunistically redeployed, which led to temporarily higher cash balances. As the S&P 500® Index rose during the period, holding cash detracted from the Fund’s performance as compared to the benchmark index, which has no cash position. |

| • | Conversely, the Fund benefited from stock selection in the health care sector, specifically within the pharmaceuticals, biotechnology & life sciences industry group. In particular, holdings in Biogen Idec, Inc., Gilead Sciences, Inc. and Bristol-Myers Squibb Co. delivered strong performance. Elsewhere in the Fund, the avoidance of utilities stocks proved beneficial as this sector generated the weakest performance for the period. Significant individual contributors included the Fund’s positions in credit card processor Visa, Inc. (information technology), home improvement retailer The Home Depot, Inc. (consumer discretionary) and agricultural materials company Monsanto Co. (materials). |

Describe recent portfolio activity.

| • | During the earlier part of the 12-month period, economic data pointed to a slowdown in global growth, while heightened uncertainty stemmed from the European sovereign debt crisis, the US presidential election and federal deficit issues. In this environment, the Fund reduced exposure to cyclical companies and added a defensive component via exposure to growth companies deemed to be self-funding and to have durable franchises, and to have exhibited consistent revenue streams. This resulted in a significant increase in the Fund’s health care holdings. Later in the period, as the global economy showed signs of improvement and policy uncertainty diminished, the Fund took positions in sectors expected to benefit from a slowly improving US economy, which resulted in increased exposure to financials. |

Describe portfolio positioning at period end.

| • | On an absolute basis, the Fund’s largest sector allocations at period end were consumer discretionary, information technology, industrials, health care and financials. Relative to the S&P 500® Index, the Fund was overweight in consumer discretionary and industrials and underweight in energy, consumer staples, financials and information technology. The Fund had no exposure to telecommunication services and utilities. |

The views expressed reflect the opinions of the Fund’s sub-advisor as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| 6 | FDP SERIES, INC. | MAY 31, 2013

|

Total Return Based on a $10,000 Investment

| 1 | | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have a sales charge. |

| 2 | | The Fund invests primarily in equity securities of large cap companies that are selected for their growth potential. |

| 3 | | This unmanaged broad-based index is comprised of 500 industrial, utility, transportation and financial companies of the US markets (mostly New York Stock Exchange (“NYSE”) issues), representing about 75% of NYSE capitalization and 30% of NYSE issues. |

| 4 | | Commencement of operations. |

Performance Summary for the Period Ended May 31, 2013

| | | | | Average Annual Total Returns5

|

| | | | | 1 Year

| | 5 Years

| | Since Inception6

|

|

| 6-Month

Total Returns

|

| w/o sales

charge

|

| w/sales

charge

|

| w/o sales

charge

|

| w/sales

charge

|

| w/o sales

charge

|

| w/sales

charge

|

Institutional | | 16.79% | | | 20.59 | % | | | N/A | | | | 4.40 | % | | | N/A | | | | 5.51 | % | | | N/A | |

Investor A | | 16.63 | | | 20.19 | | | | 13.88 | % | | | 4.14 | | | | 3.02 | % | | | 5.25 | | | | 4.53 | % |

Investor B | | 16.21 | | | 19.37 | | | | 14.87 | | | | 3.31 | | | | 2.95 | | | | 4.43 | | | | 4.43 | |

Investor C | | 16.27 | | | 19.42 | | | | 18.42 | | | | 3.35 | | | | 3.35 | | | | 4.46 | | | | 4.46 | |

S&P 500® Index | | 16.43 | | | 27.28 | | | | N/A | | | | 5.43 | | | | N/A | | | | 5.81 | | | | N/A | |

| 5 | | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees. |

| 6 | | The Fund commenced operations on July 27, 2005. |

| | N/A — Not applicable as share class and index do not have a sales charge. |

| | Past performance is not indicative of future results. |

Expense Example

| | | | Actual

| | Hypothetical8

|

|

| | | | Beginning

Account Value

December 1, 2012 | | Ending

Account Value

May 31, 2013 | | Expenses Paid

During the Period7 | | Beginning

Account Value

December 1, 2012 | | Ending

Account Value

May 31, 2013 | | Expenses Paid

During the Period7 | | Annualized

Expense

Ratio |

|

Institutional | | | | $ | 1,000.00 | | | $ | 1,167.90 | | | $ | 5.78 | | | $ | 1,000.00 | | | $ | 1,019.60 | | | $ | 5.39 | | | | 1.07 | % |

Investor A | | | | $ | 1,000.00 | | | $ | 1,167.10 | | | $ | 7.13 | | | $ | 1,000.00 | | | $ | 1,018.35 | | | $ | 6.64 | | | | 1.32 | % |

Investor B | | | | $ | 1,000.00 | | | $ | 1,162.10 | | | $ | 11.10 | | | $ | 1,000.00 | | | $ | 1,014.66 | | | $ | 10.35 | | | | 2.06 | % |

Investor C | | | | $ | 1,000.00 | | | $ | 1,162.70 | | | $ | 11.11 | | | $ | 1,000.00 | | | $ | 1,014.66 | | | $ | 10.35 | | | | 2.06 | % |

| 7 | | For each class of the Fund, expenses are equal to the annualized net expense ratio for the class, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). |

| 8 | | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365. |

| | See “Disclosure of Expenses” on page 13 for further information on how expenses were calculated. |

| FDP SERIES, INC. | MAY 31, 2013 | 7

|

| |

| Fund Summary as of May 31, 2013 | Invesco Value FDP Fund

|

Investment Objective

Invesco Value FDP Fund’s (the “Fund”) investment objective is to seek to provide shareholders with capital growth and income.

Portfolio Management Commentary

How did the Fund perform?

| • | For the 12-month period ended May 31, 2013, the Fund outperformed its benchmark, the Russell 1000® Value Index. |

What factors influenced performance?

| • | Stock selection within financials was the largest contributor to relative performance, with a notable gain on the Fund’s position in Citigroup, Inc. Stock selection within consumer discretionary also enhanced results, with stand-out performance from holdings in News Corp. and Comcast Corp. With utilities being the worst-performing sector in the Russell 1000® Value Index for the period, the Fund’s material underweight position in this space proved beneficial. In materials, both stock selection and an underweight position to the sector had a positive impact on relative returns. International Paper Co. was the strongest individual contributor within materials. During the period, stock selection and an underweight position to consumer staples also contributed to the Fund’s performance, as did selection and underweight positions in telecommunication services (“telecom”) and energy. |

| • | Although the Fund remained fully invested during the period with minimal cash reserves, any allocation to cash detracts from performance relative to the benchmark index during a strong equity market. Weak stock selection within health care also had a negative impact on relative results, with UnitedHealth Group, Inc. being a notable individual detractor. Stock selection within information technology (“IT”) hindered performance as the Fund held a position in Microsoft Corp., which underperformed the IT sector and the benchmark index for the period. |

Describe recent portfolio activity.

| • | During the 12-month period, the Fund trimmed select holdings in IT services, insurance (financials), media (consumer discretionary) and consumer staples based on valuations. Toward the end of the reporting period, the Fund took advantage of price weakness to add to select holdings in IT equipment and energy. The Fund also initiated positions in food products and beverages (consumer staples), oil & gas exploration & production (energy) and consumer durables (consumer discretionary). |

Describe portfolio positioning at period end.

| • | Relative to the Russell 1000® Value Index, the Fund ended the period with an underweight position in financials, utilities, materials, consumer staples, telecom, energy and industrials. The Fund was overweight in consumer discretionary, IT and health care. It is important to note that the Fund’s sector allocations are the result of individual stock selection, and are not influenced by macro views. |

The views expressed reflect the opinions of the Fund’s sub-advisor as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| 8 | FDP SERIES, INC. | MAY 31, 2013

|

Total Return Based on a $10,000 Investment

| 1 | | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have a sales charge. |

| 2 | | The Fund invests, under normal market conditions, at least 80% of its net assets (plus any borrowings for investment purposes) in common stocks at the time of investment. The Fund invests primarily in a portfolio of equity securities, consisting principally of common stocks. |

| 3 | | This unmanaged broad-based index is a subset of the Russell 1000® Index consisting of those Russell 1000® securities with lower price/book ratios and lower forecasted growth values. |

| 4 | | Commencement of operations. |

Performance Summary for the Period Ended May 31, 2013

| | | | | Average Annual Total Returns5

|

| | | | | 1 Year

| | 5 Years

| | Since Inception6

|

|

| 6-Month

Total Returns

|

| w/o sales

charge

|

| w/sales

charge

|

| w/o sales

charge

|

| w/sales

charge

|

| w/o sales

charge

|

| w/sales

charge

|

Institutional | | 21.35% | | | 35.68 | % | | | N/A | | | | 6.72 | % | | | N/A | | | | 5.46 | % | | | N/A | |

Investor A | | 21.27 | | | 35.47 | | | | 28.35 | % | | | 6.46 | | | | 5.31 | % | | | 5.22 | | | | 4.50 | % |

Investor B | | 20.79 | | | 34.34 | | | | 29.84 | | | | 5.62 | | | | 5.30 | | | | 4.39 | | | | 4.39 | |

Investor C | | 20.72 | | | 34.30 | | | | 33.30 | | | | 5.65 | | | | 5.65 | | | | 4.41 | | | | 4.41 | |

Russell 1000® Value Index | | 19.35 | | | 32.71 | | | | N/A | | | | 4.73 | | | | N/A | | | | 5.31 | | | | N/A | |

| 5 | | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees. |

| 6 | | The Fund commenced operations on July 27, 2005. |

| | N/A — Not applicable as share class and index do not have a sales charge. |

| | Past performance is not indicative of future results. |

Expense Example

| | | | Actual

| | Hypothetical8

|

|

|

|

|

| Beginning

Account Value

December 1, 2012

|

| Ending

Account Value

May 31, 2013

|

| Expenses Paid

During the Period7

|

| Beginning

Account Value

December 1, 2012

|

| Ending

Account Value

May 31, 2013

|

| Expenses Paid

During the Period7

|

| Annualized

Expense

Ratio

|

Institutional | | | | $ | 1,000.00 | | | $ | 1,213.50 | | | $ | 5.90 | | | $ | 1,000.00 | | | $ | 1,019.60 | | | $ | 5.39 | | | | 1.07 | % |

Investor A | | | | $ | 1,000.00 | | | $ | 1,212.70 | | | $ | 7.28 | | | $ | 1,000.00 | | | $ | 1,018.35 | | | $ | 6.64 | | | | 1.32 | % |

Investor B | | | | $ | 1,000.00 | | | $ | 1,207.90 | | | $ | 11.34 | | | $ | 1,000.00 | | | $ | 1,014.66 | | | $ | 10.35 | | | | 2.06 | % |

Investor C | | | | $ | 1,000.00 | | | $ | 1,207.20 | | | $ | 11.34 | | | $ | 1,000.00 | | | $ | 1,014.66 | | | $ | 10.35 | | | | 2.06 | % |

| 7 | | For each class of the Fund, expenses are equal to the annualized net expense ratio for the class, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). |

| 8 | | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365. |

| | See “Disclosure of Expenses” on page 13 for further information on how expenses were calculated. |

| FDP SERIES, INC. | MAY 31, 2013 | 9

|

| |

| Fund Summary as of May 31, 2013 | Franklin Templeton Total Return FDP Fund

|

Investment Objective

Franklin Templeton Total Return FDP Fund’s (the “Fund”) investment objective is to seek to provide shareholders with high current income, consistent with preservation of capital. The Fund’s secondary objective is capital appreciation over the long term.

Portfolio Management Commentary

How did the Fund perform?

| • | For the 12-month period ended May 31, 2013, the Fund outperformed its benchmark, the Barclays US Aggregate Bond Index. |

What factors influenced performance?

| • | Economic data reported during the period supported the idea of sustainable, albeit slow, US growth. Volatility measures and US Treasury rates were generally low and declining during most of the period, but reversed course in the last month of the period due to speculation about the pace of future monetary policy action from the US Federal Reserve and, more specifically, the possible tapering of its asset purchase program. Risk assets continued to perform well despite May’s higher volatility and rising US Treasury rates. The Fund’s corporate bond positions contributed positively to performance. In particular, exposure to the below-investment grade credit sector and security selection in investment grade corporate securities drove returns. Many of the Fund’s non-US dollar-denominated bonds across the yield curve benefited from interest rate movements in non-US markets during the period. Foreign currency exposure had a positive impact as well. The Fund benefited from security selection in commercial mortgage-backed securities and positioning in non-agency residential mortgage-backed securities (“MBS”), which both performed well during the period. Security selection within agency fixed-rate MBS also had a positive impact. The Fund’s defensive duration posture (lower sensitivity to interest rate movements) enhanced results. |

| • | Relative to the benchmark index, the Fund’s exposure to taxable municipal securities detracted from returns as did an underweight position in agency debentures. |

Describe recent portfolio activity.

| • | During the 12-month period, the Fund slightly reduced exposure to the corporate loan sector, while slightly increasing exposure to investment grade and high yield corporate bonds. In the securitized space, the Fund decreased its allocations to asset-backed securities and US Treasury Inflation Protected Securities, and added to its non-agency residential MBS allocation given attractive valuations in that space. Additionally, the Fund selectively pared its global bond holdings over the period to improve overall portfolio risk diversification. |

| • | The Fund transacts in mortgage dollar rolls, which require future mortgage settlements. To meet forward liabilities, the Fund holds cash or invests in high-quality, liquid assets. The Fund’s allocation to cash and cash equivalents did not materially impact performance during the period. |

Describe portfolio positioning at period end.

| • | As of period end, the Fund sought opportunities in global fixed income markets, primarily local government debt and currencies, which continued to present attractive valuations. Within US fixed income markets, the Fund continued to hold exposure to corporate credit sectors, which are not part of the benchmark index, while management remains mindful that recent valuation levels warrant a cautious stance in individual security selection. Relative to the Barclays US Aggregate Bond Index, the Fund was overweight in investment grade corporate bonds and underweight in US Treasuries and agency MBS. The Fund also remained active in non-agency securitized markets, seeking to take advantage of individual securities with attractive risk/reward characteristics. |

The views expressed reflect the opinions of the Fund’s sub-advisor as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| 10 | FDP SERIES, INC. | MAY 31, 2013

|

| |

| | Franklin Templeton Total Return FDP Fund

|

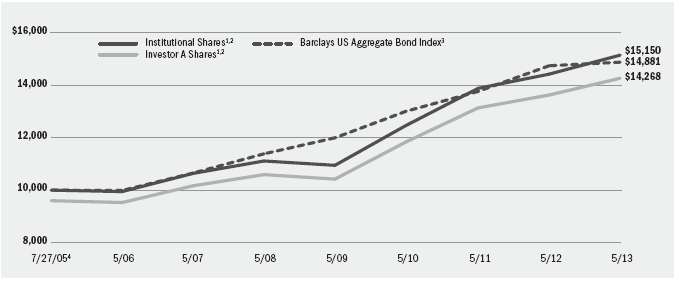

Total Return Based on a $10,000 Investment

| 1 | | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have a sales charge. |

| 2 | | The Fund invests, under normal market conditions, at least 80% of its assets in investment grade debt securities and investments, including government and corporate debt securities, mortgage- and asset-backed securities, investment grade corporate loans and futures with reference securities that are investment grade. |

| 3 | | This unmanaged market-weighted index is comprised of investment grade corporate bonds (rated BBB or better), mortgages and US Treasury and government agency issues with at least one year to maturity. |

| 4 | | Commencement of operations. |

Performance Summary for the Period Ended May 31, 2013

| | | | | | | | Average Annual Total Returns5

|

|

| | | | | | | | 1 Year

| | 5 Years

| | Since

Inception6

|

|

|

|

|

| Standardized

30-Day Yields

|

| 6-Month

Total Returns

|

| w/o sales

charge

|

| w/sales

charge

|

| w/o sales

charge

|

| w/sales

charge

|

| w/o sales

charge

|

| w/sales

charge

|

Institutional | | | | | 1.93 | % | | �� | (0.26 | )% | | | 5.03 | % | | | N/A | | | | 6.40 | % | | | N/A | | | | 5.44 | % | | | N/A | |

Investor A | | | | | 1.59 | | | | (0.38 | ) | | | 4.67 | | | | 0.49 | % | | | 6.14 | | | | 5.27 | % | | | 5.18 | | | | 4.64 | % |

Investor B | | | | | 1.24 | | | | (0.62 | ) | | | 4.14 | | | | 0.14 | | | | 5.57 | | | | 5.25 | | | | 4.63 | | | | 4.63 | |

Investor C | | | | | 1.14 | | | | (0.65 | ) | | | 4.10 | | | | 3.10 | | | | 5.55 | | | | 5.55 | | | | 4.59 | | | | 4.59 | |

Barclays US Aggregate Bond Index | | | | | — | | | | (1.05 | ) | | | 0.91 | | | | N/A | | | | 5.50 | | | | N/A | | | | 5.20 | | | | N/A | |

| 5 | | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees. |

| 6 | | The Fund commenced operations on July 27, 2005. |

| | N/A — Not applicable as share class and index do not have a sales charge. |

| | Past performance is not indicative of future results. |

Expense Example

| | | | Actual

| | Hypothetical8

|

|

|

|

|

| Beginning

Account Value

December 1, 2012

|

| Ending

Account Value

May 31, 2013

|

| Expenses Paid

During the Period7

|

| Beginning

Account Value

December 1, 2012

|

| Ending

Account Value

May 31, 2013

|

| Expenses Paid

During the Period7

|

| Annualized

Expense

Ratio

|

Institutional | | | | $ | 1,000.00 | | | $ | 997.40 | | | $ | 3.49 | | | $ | 1,000.00 | | | $ | 1,021.44 | | | $ | 3.53 | | | | 0.70 | % |

Investor A | | | | $ | 1,000.00 | | | $ | 996.20 | | | $ | 4.73 | | | $ | 1,000.00 | | | $ | 1,020.19 | | | $ | 4.78 | | | | 0.95 | % |

Investor B | | | | $ | 1,000.00 | | | $ | 993.80 | | | $ | 7.11 | | | $ | 1,000.00 | | | $ | 1,017.80 | | | $ | 7.19 | | | | 1.43 | % |

Investor C | | | | $ | 1,000.00 | | | $ | 993.50 | | | $ | 7.41 | | | $ | 1,000.00 | | | $ | 1,017.50 | | | $ | 7.49 | | | | 1.49 | % |

| 7 | | For each class of the Fund, expenses are equal to the annualized net expense ratio for the class, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). |

| 8 | | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365. |

| | See “Disclosure of Expenses” on page 13 for further information on how expenses were calculated. |

| FDP SERIES, INC. | MAY 31, 2013 | 11

|

Shares are only available for purchase through the FDP Service.

| • | Institutional Shares are not subject to any sales charge. These shares bear no ongoing distribution or service fees and are available only to eligible investors. |

| • | Investor A Shares (for all Funds except Franklin Templeton Total Return FDP Fund) are subject to a maximum initial sales charge (front-end load) of 5.25% and a service fee of 0.25% per year (but no distribution fee). Investor A Shares for Franklin Templeton Total Return FDP Fund incur a maximum initial sales charge (front-end load) of 4.00% and a service fee of 0.25% per year (but no distribution fee). |

| • | Investor B Shares (for all Funds except Franklin Templeton Total Return FDP Fund) are subject to a maximum contingent deferred sales charge (“CDSC”) of 4.50% declining to 0% after six years. In addition, these shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. Investor B Shares for Franklin Templeton Total Return FDP Fund are subject to a maximum CDSC of 4.00% declining to 0% after six years. In addition, its Investor B Shares are subject to a distribution fee of 0.50% per year and a service fee of 0.25% per year. Investor B Shares of the Funds are only available through exchanges and dividend reinvestments by existing shareholders and for purchase by certain employer-sponsored retirement plans. Effective on or about the close of business on June 10, 2013, all issued and outstanding Investor B Shares of MFS Research International FDP Fund, Marsico Growth FDP Fund, Invesco Value FDP Fund and Franklin Templeton Total Return FDP Fund will be converted into Investor A Shares. (There is no initial sales charge for automatic share conversions.) |

| • | Investor C Shares (for all Funds except Franklin Templeton Total Return FDP Fund) are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. Investor C Shares for Franklin Templeton Total Return FDP Fund are subject to a distribution fee of 0.55% per year and a service fee of 0.25% per year. In addition, these shares for all Funds are subject to a 1.00% CDSC if redeemed within one year of purchase. |

Performance information reflects past performance and does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Refer to www.blackrock.com/funds to obtain performance data current to the most recent month end. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Figures shown in the performance tables on the previous pages assume reinvestment of all dividends and capital gain distributions, if any, at net asset value (“NAV”) on the ex-dividend date. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Dividends paid to each class of shares will vary because of the different levels of service, distribution and transfer agency fees applicable to each class, which are deducted from the income available to be paid to shareholders. In certain periods, the Funds’ investment advisor waived a portion of its fees. Without such waiver, the Funds’ performance would have been lower.

| 12 | FDP SERIES, INC. | MAY 31, 2013

|

Shareholders of these Funds may incur the following charges: (a) transactional expenses, such as sales charges; and (b) operating expenses, including investment advisory fees, service and distribution fees, including 12b-1 fees, and other Fund expenses. The expense examples on the previous pages (which are based on a hypothetical investment of $1,000 invested on December 1, 2012 and held through May 31, 2013) are intended to assist shareholders both in calculating expenses based on an investment in each Fund and in comparing these expenses with similar costs of investing in other mutual funds.

The expense examples provide information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their Fund and share class under the heading entitled “Expenses Paid During the Period.”

The expense examples also provide information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in these Funds and other funds, compare the 5% hypothetical examples with the 5% hypothetical examples that appear in other funds’ shareholder reports.

The expenses shown in the expense examples are intended to highlight shareholders’ ongoing costs only and do not reflect any transactional expenses, such as sales charges, if any. Therefore, the hypothetical examples are useful in comparing ongoing expenses only, and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

| |

| Derivative Financial Instruments |

|

The Funds may invest in various derivative financial instruments, including financial futures contracts, foreign currency exchange contracts, options and swaps, as specified in Note 2 of the Notes to Financial Statements, which may constitute forms of economic leverage. Such derivative financial instruments are used to obtain exposure to a security, index and/or market without owning or taking physical custody of securities or to hedge market, equity, credit, interest rate and/or foreign currency exchange rate risks. Derivative financial instruments involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the derivative financial instrument. The Funds’ ability to use a derivative financial instrument successfully depends on the investment advisor’s and/or sub-advisor’s ability to predict pertinent market movements accurately, which cannot be assured. The use of derivative financial instruments may result in losses greater than if they had not been used, may require a Fund to sell or purchase portfolio investments at inopportune times or for distressed values, may limit the amount of appreciation a Fund can realize on an investment, may result in lower dividends paid to shareholders or may cause a Fund to hold an investment that it might otherwise sell. The Funds’ investments in these instruments are discussed in detail in the Notes to Financial Statements.

| FDP SERIES, INC. | MAY 31, 2013 | 13

|

| |

| Portfolio Information as of May 31, 2013 |

|

MFS Research International FDP Fund

Ten Largest Holdings | Percent of

Long-Term Investments |

|

Royal Dutch Shell Plc, Class A | | | | | 3 | % |

Nestlé SA, Registered Shares | | | | | 3 | |

Novartis AG, Registered Shares | | | | | 2 | |

Roche Holding AG | | | | | 2 | |

GlaxoSmithKline Plc | | | | | 2 | |

Rio Tinto Plc | | | | | 2 | |

Honda Motor Co. Ltd. | | | | | 2 | |

Westpac Banking Corp. | | | | | 2 | |

Danone SA | | | | | 2 | |

BP Plc | | | | | 2 | |

|

|

Geographic Allocation | Percent of

Long-Term Investments |

|

Japan | | | | | 22 | % |

United Kingdom | | | | | 18 | |

Switzerland | | | | | 11 | |

France | | | | | 11 | |

Germany | | | | | 6 | |

Hong Kong | | | | | 5 | |

Netherlands | | | | | 4 | |

Sweden | | | | | 3 | |

Australia | | | | | 3 | |

Brazil | | | | | 2 | |

United States | | | | | 2 | |

India | | | | | 2 | |

Other1 | | | | | 11 | |

| 1 | | Other includes a 1% holding or less in each of the following countries: Argentina, Austria, Belgium, Bermuda, Canada, China, Denmark, Indonesia, Ireland, Israel, Italy, Papua New Guinea, Russia, Singapore, Spain, Taiwan, and Thailand. |

Marsico Growth FDP Fund

Ten Largest Holdings | Percent of

Long-Term Investments |

|

Gilead Sciences, Inc. | | | | | 5 | % |

Biogen Idec, Inc. | | | | | 5 | |

Google, Inc., Class A | | | | | 4 | |

Citigroup, Inc. | | | | | 4 | |

Monsanto Co. | | | | | 3 | |

eBay, Inc. | | | | | 3 | |

American International Group, Inc. | | | | | 3 | |

Visa, Inc., Class A | | | | | 3 | |

Anheuser-Busch InBev NV — ADR | | | | | 3 | |

Pentair Ltd., Registered Shares | | | | | 3 | |

|

|

Sector Allocation | Percent of

Long-Term Investments |

|

Consumer Discretionary | | | | | 27 | % |

Information Technology | | | | | 16 | |

Industrials | | | | | 15 | |

Health Care | | | | | 14 | |

Financials | | | | | 14 | |

Consumer Staples | | | | | 5 | |

Materials | | | | | 5 | |

Energy | | | | | 4 | |

| | For Fund compliance purposes, each Fund’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by Fund management. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease. |

| 14 | FDP SERIES, INC. | MAY 31, 2013

|

| |

| Portfolio Information as of May 31, 2013 (concluded) |

|

Invesco Value FDP Fund

Ten Largest Holdings | Percent of

Long-Term Investments |

|

Citigroup, Inc. | | | | | 5 | % |

Microsoft Corp. | | | | | 3 | |

JPMorgan Chase & Co. | | | | | 3 | |

Viacom, Inc., Class B | | | | | 3 | |

Weatherford International Ltd. | | | | | 2 | |

Wells Fargo & Co. | | | | | 2 | |

The Bank of New York Mellon Corp. | | | | | 2 | |

Hewlett-Packard Co. | | | | | 2 | |

Merck & Co., Inc. | | | | | 2 | |

General Motors Co. | | | | | 2 | |

|

|

Sector Allocation | Percent of

Long-Term Investments |

|

Financials | | | | | 24 | % |

Consumer Discretionary | | | | | 16 | |

Health Care | | | | | 16 | |

Energy | | | | | 14 | |

Information Technology | | | | | 11 | |

Industrials | | | | | 7 | |

Consumer Staples | | | | | 6 | |

Materials | | | | | 2 | |

Telecommunication Services | | | | | 2 | |

Utilities | | | | | 2 | |

| | For Fund compliance purposes, the Fund’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by Fund management. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease. |

Franklin Templeton Total Return FDP Fund

Portfolio Composition | Percent of

Long-Term Investments |

|

US Government Sponsored Agency Securities | | | | | 31 | % |

Corporate Bonds | | | | | 27 | |

US Treasury Obligations | | | | | 21 | |

Foreign Agency Obligations | | | | | 8 | |

Floating Rate Loan Interests | | | | | 5 | |

Non-Agency Mortgage-Backed Securities | | | | | 4 | |

Preferred Securities | | | | | 2 | |

Asset-Backed Securities | | | | | 2 | |

|

|

Credit Quality Allocation1 | Percent of

Long-Term Investments |

|

AAA/Aaa2 | | | | | 66 | % |

AA/Aa | | | | | 2 | |

A | | | | | 9 | |

BBB/Baa | | | | | 16 | |

BB/Ba | | | | | 3 | |

B | | | | | 4 | |

| 1 | | Using the higher of Standard & Poor’s (“S&P’s”) or Moody’s Investors Services (“Moody’s”) ratings. |

| 2 | | Includes US Government Sponsored Agency Securities and US Treasury Obligations, which were deemed AAA/Aaa by the investment advisor. |

| FDP SERIES, INC. | MAY 31, 2013 | 15

|

| |

| Schedule of Investments May 31, 2013 | MFS Research International FDP Fund

(Percentages shown are based on Net Assets)

|

Common Stocks

|

|

|

|

Shares

|

| Value

|

Argentina — 1.0%

|

Arcos Dorados Holdings, Inc., Class A | | | | | 96,190 | | | $ | 1,325,498 | |

Australia — 3.1%

|

Iluka Resources Ltd. | | | | | 138,717 | | | | 1,460,823 | |

Newcrest Mining Ltd. | | | | | 22,084 | | | | 301,710 | |

Westpac Banking Corp. | | | | | 95,970 | | | | 2,586,478 | |

| | | | | | | | | 4,349,011 | |

Austria — 1.0%

|

Erste Group Bank AG | | | | | 42,214 | | | | 1,355,840 | |

Belgium — 0.7%

|

KBC Groep NV | | | | | 25,855 | | | | 1,024,904 | |

Bermuda — 0.4%

|

Hiscox Ltd. | | | | | 69,990 | | | | 588,625 | |

Brazil — 2.3%

|

Diagnosticos da America SA | | | | | 72,000 | | | | 373,144 | |

EDP — Energias do Brasil SA | | | | | 168,200 | | | | 993,431 | |

Itau Unibanco Holdings SA, Preference

Shares — ADR | | | | | 27,599 | | | | 415,089 | |

M Dias Branco SA | | | | | 19,000 | | | | 833,967 | |

Tim Participacoes SA — ADR | | | | | 32,451 | | | | 621,761 | |

| | | | | | | | | 3,237,392 | |

Canada — 0.5%

|

Cenovus Energy, Inc. | | | | | 22,520 | | | | 674,242 | |

China — 0.8%

|

China Unicom Hong Kong Ltd. | | | | | 594,000 | | | | 807,027 | |

Wumart Stores, Inc., Class H | | | | | 165,000 | | | | 336,177 | |

| | | | | | | | | 1,143,204 | |

Denmark — 0.5%

|

TDC A/S | | | | | 83,042 | | | | 649,306 | |

France — 10.5%

|

BNP Paribas SA | | | | | 38,990 | | | | 2,281,678 | |

Danone SA | | | | | 34,788 | | | | 2,568,583 | |

Dassault Systemes SA | | | | | 7,502 | | | | 940,326 | |

GDF Suez | | | | | 48,758 | | | | 994,380 | |

Legrand SA | | | | | 9,926 | | | | 486,461 | |

LVMH Moet Hennessy Louis Vuitton SA | | | | | 7,983 | | | | 1,410,147 | |

Pernod Ricard SA | | | | | 13,742 | | | | 1,650,453 | |

Publicis Groupe SA | | | | | 20,130 | | | | 1,440,308 | |

Schneider Electric SA | | | | | 28,566 | | | | 2,260,465 | |

Suez Environnement Co. | | | | | 44,010 | | | | 566,700 | |

| | | | | | | | | 14,599,501 | |

Germany — 6.1%

|

Bayer AG, Registered Shares | | | | | 17,903 | | | | 1,913,246 | |

GSW Immobilien AG | | | | | 12,249 | | | | 477,802 | |

Infineon Technologies AG | | | | | 86,601 | | | | 736,872 | |

Linde AG | | | | | 12,639 | | | | 2,420,921 | |

Siemens AG, Registered Shares | | | | | 21,175 | | | | 2,232,107 | |

Symrise AG | | | | | 15,524 | | | | 632,656 | |

| | | | | | | | | 8,413,604 | |

Common Stocks

|

|

|

|

Shares

|

| Value

|

Hong Kong — 4.9%

|

AIA Group Ltd. | | | | | 536,000 | | | $ | 2,369,653 | |

China Resources Gas Group Ltd. | | | | | 162,000 | | | | 422,523 | |

Hutchison Whampoa Ltd. | | | | | 108,000 | | | | 1,143,334 | |

Li & Fung Ltd. | | | | | 1,040,000 | | | | 1,443,333 | |

Sands China Ltd. | | | | | 271,600 | | | | 1,432,973 | |

Sinotruk Hong Kong Ltd. | | | | | 13,500 | | | | 7,563 | |

| | | | | | | | | 6,819,379 | |

India — 1.5%

|

HDFC Bank Ltd. — ADR | | | | | 21,280 | | | | 856,307 | |

ICICI Bank Ltd. | | | | | 22,839 | | | | 465,193 | |

Reliance Industries Ltd. | | | | | 52,795 | | | | 751,022 | |

| | | | | | | | | 2,072,522 | |

Indonesia — 0.4%

|

Bank Rakyat Indonesia Persero Tbk PT | | | | | 601,000 | | | | 543,444 | |

Ireland — 0.1%

|

Experian Plc | | | | | 11,068 | | | | 203,557 | |

Israel — 0.1%

|

Bezeq The Israeli Telecommunication Corp. Ltd. | | | | | 154,150 | | | | 199,411 | |

Italy — 0.9%

|

Telecom Italia SpA, Non-Convertible Savings Shares | | | | | 751,095 | | | | 464,365 | |

UniCredit SpA | | | | | 138,173 | | | | 775,452 | |

| | | | | | | | | 1,239,817 | |

Japan — 21.9%

|

Aeon Credit Service Co. Ltd. | | | | | 25,700 | | | | 685,118 | |

Canon, Inc. | | | | | 35,400 | | | | 1,209,565 | |

Chugoku Marine Paints Ltd. | | | | | 45,000 | | | | 203,071 | |

Denso Corp. | | | | | 51,700 | | | | 2,136,055 | |

GLORY Ltd. | | | | | 41,800 | | | | 1,056,071 | |

Honda Motor Co. Ltd. | | | | | 70,900 | | | | 2,632,145 | |

Inpex Corp. | | | | | 189 | | | | 804,572 | |

Japan Tobacco, Inc. | | | | | 71,000 | | | | 2,416,343 | |

JGC Corp. | | | | | 55,000 | | | | 1,824,786 | |

KDDI Corp. | | | | | 49,600 | | | | 2,237,651 | |

Kobayashi Pharmaceutical Co. Ltd. | | | | | 6,700 | | | | 319,003 | |

Lawson, Inc. | | | | | 10,000 | | | | 727,461 | |

Miraca Holdings, Inc. | | | | | 9,500 | | | | 409,957 | |

Mitsubishi Corp. | | | | | 44,600 | | | | 770,791 | |

Mitsubishi Estate Co. Ltd. | | | | | 65,000 | | | | 1,601,403 | |

Mitsubishi UFJ Financial Group, Inc. | | | | | 251,000 | | | | 1,456,681 | |

Nippon Television Network Corp. | | | | | 51,400 | | | | 782,198 | |

Nomura Research Institute Ltd. | | | | | 32,500 | | | | 939,204 | |

Santen Pharmaceutical Co. Ltd. | | | | | 34,800 | | | | 1,393,619 | |

Sony Financial Holdings, Inc. | | | | | 34,400 | | | | 504,285 | |

Sumitomo Mitsui Financial Group, Inc. | | | | | 60,200 | | | | 2,376,682 | |

Tokyo Gas Co. Ltd. | | | | | 228,000 | | | | 1,225,933 | |

Yahoo! Japan Corp. | | | | | 2,129 | | | | 964,563 | |

Yamato Holdings Co. Ltd. | | | | | 91,800 | | | | 1,685,557 | |

| | | | | | | | | 30,362,714 | |

Portfolio Abbreviations

To simplify the listings of portfolio holdings | | | | ADR | | American Depositary | | GBP | | British Pound | | NVDR | | Non-Voting |

in the Schedules of Investments, the names | | | | | | Receipts | | GO | | General Obligation | | | | Depository Receipts |

and descriptions of many of the securities | | | | AUD | | Australian Dollar | | | | Bonds | | PEN | | Peruvian Nuevo Sol |

| have been abbreviated according to the | | | | BRL | | Brazilian Real | | HKD | | Hong Kong Dollar | | PHP | | Philippine Peso |

| following list: | | | | CAD | | Canadian Dollar | | HUF | | Hungarian Forint | | PLN | | Polish Zloty |

| | | | CHG | | Swiss Franc | | ILS | | Israeli New Shekel | | RB | | Revenue Bonds |

| | | | CLP | | Chilean Peso | | INR | | Indian Rupee | | SEK | | Swedish Krona |

| | | | DKK | | Danish Krone | | JPY | | Japanese Yen | | SGD | | Singapore Dollar |

| | | | EUR | | Euro | | KRW | | South Korean Won | | TBA | | To Be Announced |

| | | | FKA | | Formerly Known As | | MXN | | Mexican New Peso | | USD | | US Dollar |

| | | | | | | | MYR | | Malaysian Ringgit | | | | |

See Notes to Financial Statements.

| 16 | FDP SERIES, INC. | MAY 31, 2013

|

| |

| Schedule of Investments (continued) | MFS Research International FDP Fund

(Percentages shown are based on Net Assets)

|

Common Stocks

|

|

|

|

Shares

|

| Value

|

Netherlands — 3.9%

|

Akzo Nobel NV | | | | | 33,870 | | | $ | 2,166,647 | |

Delta Lloyd NV | | | | | 27,530 | | | | 538,322 | |

Heineken NV | | | | | 15,050 | | | | 1,047,009 | |

ING Groep NV — CVA (a) | | | | | 177,936 | | | | 1,659,198 | |

| | | | | | | | | 5,411,176 | |

Papua New Guinea — 0.4%

|

Oil Search Ltd. | | | | | 62,870 | | | | 491,549 | |

Russia — 0.6%

|

Sberbank — ADR | | | | | 68,721 | | | | 841,145 | |

Singapore — 0.8%

|

DBS Group Holdings Ltd. | | | | | 82,000 | | | | 1,110,230 | |

Spain — 1.2%

|

Amadeus IT Holding SA, Class A Shares | | | | | 30,543 | | | | 932,183 | |

Banco Santander SA | | | | | 106,715 | | | | 763,250 | |

| | | | | | | | | 1,695,433 | |

Sweden — 3.3%

|

Atlas Copco AB, Class A | | | | | 65,928 | | | | 1,739,943 | |

Hennes & Mauritz AB, Class B | | | | | 26,300 | | | | 899,772 | |

Tele2 AB, Class B | | | | | 46,569 | | | | 580,212 | |

Telefonaktiebolaget LM Ericsson, Class B | | | | | 115,535 | | | | 1,357,173 | |

| | | | | | | | | 4,577,100 | |

Switzerland — 10.5%

|

Kuehne & Nagel International AG, Registered Shares | | | | | 8,770 | | | | 979,790 | |

Nestle SA, Registered Shares | | | | | 54,202 | | | | 3,590,589 | |

Novartis AG, Registered Shares | | | | | 44,950 | | | | 3,219,858 | |

Roche Holding AG | | | | | 12,465 | | | | 3,090,527 | |

Schindler Holding AG, Participation Certificates | | | | | 11,290 | | | | 1,641,238 | |

Sonova Holding AG, Registered Shares (a) | | | | | 7,155 | | | | 785,641 | |

UBS AG, Registered Shares (a) | | | | | 75,063 | | | | 1,317,055 | |

| | | | | | | | | 14,624,698 | |

Taiwan — 0.6%

|

Taiwan Semiconductor Manufacturing Co. Ltd. | | | | | 238,439 | | | | 866,994 | |

Thailand — 0.9%

|

Kasikornbank PCL- NVDR | | | | | 80,600 | | | | 517,706 | |

Siam Commercial Bank PCL | | | | | 115,800 | | | | 663,627 | |

| | | | | | | | | 1,181,333 | |

United Kingdom — 18.0%

|

Barclays Plc | | | | | 476,657 | | | | 2,283,248 | |

BG Group Plc | | | | | 84,470 | | | | 1,541,578 | |

BP Plc | | | | | 356,696 | | | | 2,549,379 | |

BT Group Plc | | | | | 168,860 | | | | 768,406 | |

Cairn Energy Plc (a) | | | | | 72,833 | | | | 300,071 | |

Compass Group Plc | | | | | 54,930 | | | | 720,349 | |

GlaxoSmithKline Plc | | | | | 113,819 | | | | 2,944,858 | |

HSBC Holdings Plc | | | | | 223,513 | | | | 2,452,167 | |

Reckitt Benckiser Group Plc | | | | | 18,925 | | | | 1,353,298 | |

Rio Tinto Plc | | | | | 63,260 | | | | 2,701,881 | |

Royal Dutch Shell Plc, Class A | | | | | 112,168 | | | | 3,733,048 | |

Standard Chartered Plc | | | | | 68,479 | | | | 1,585,590 | |

Vodafone Group Plc | | | | | 329,079 | | | | 953,707 | |

Whitbread Plc | | | | | 27,118 | | | | 1,180,589 | |

| | | | | | | | | 25,068,169 | |

Common Stocks

|

|

|

|

|

|

Shares

|

| Value

|

United States — 2.1%

| |

Autoliv, Inc. | | | | | | | | | 14,980 | | | $ | 1,175,331 | |

Cognizant Technology Solutions Corp.,

Class A (a) | | | | | | | | | 9,240 | | | | 597,366 | |

Joy Global, Inc. | | | | | | | | | 21,020 | | | | 1,136,761 | |

| | | | | | | | | | | | | 2,909,458 | |

Total Long-Term Investments |

(Cost — $113,471,588) — 99.0% | | | | | | | | | | | | | 137,579,256 | |

|

Short-Term Securities

| | | | | | | | | Par

(000 | ) | |

|

Time Deposits — 1.3%

|

Europe — 0.1% | |

Citigroup, Inc., 0.00%, 6/03/13 | | | | | EUR | | | | 50 | | | | 64,983 | |

Hong Kong — 0.0% | |

Brown Brothers Harriman & Co., 0.01%, 6/03/13 | | | | | HKD | | | | 129 | | | | 16,615 | |

Japan — 0.0% | |

Brown Brothers Harriman & Co., 0.01%, 6/03/13 | | | | | JPY | | | | 563 | | | | 5,605 | |

Switzerland — 0.1% | |

Brown Brothers Harriman & Co., 0.00%, 6/03/13 | | | | | CHF | | | | 122 | | | | 127,352 | |

United Kingdom — 0.0% | |

Brown Brothers Harriman & Co., 0.08%, 6/03/13 | | | | | GBP | | | | 22 | | | | 32,685 | |

United States — 1.1% | |

Brown Brothers Harriman & Co., 0.04%, 6/03/13 | | | | | USD | | | | 1,592 | | | | 1,591,563 | |

Total Short-Term Securities

(Cost — $1,838,803) — 1.3% | | | | | | | | | | | | | 1,838,803 | |

Total Investments (Cost — $115,310,391) — 100.3% | | | | | | 139,418,059 | |

Liabilities in Excess of Other Assets — (0.3)% | | | | | | (438,102 | ) |

Net Assets — 100.0% | | | | | $ | 138,979,957 | |

See Notes to Financial Statements.

| FDP SERIES, INC. | MAY 31, 2013 | 17

|

| |

| Schedule of Investments (continued) | MFS Research International FDP Fund

|

Notes to Schedule of Investments

| (a) | | | | Non-income producing security. |

| • | | | | Foreign currency exchange contracts as of May 31, 2013 were as follows: |

| Currency Purchased | | Currency Sold | | Counterparty | | Settlement

Date | | Unrealized

Appreciation

(Depreciation) |

GBP | 215,711 | | USD | 326,169 | | Deutsche Bank AG | | 6/03/13 | | $ | 1,581 | |

GBP | 95,969 | | USD | 145,236 | | Goldman Sachs Group, Inc. | | 6/03/13 | | | 579 | |

JPY | 34,496,727 | | USD | 340,543 | | UBS AG | | 6/03/13 | | | 2,861 | |

SEK | 949,940 | | USD | 142,568 | | Citigroup, Inc. | | 6/03/13 | | | 855 | |

USD | 31,715 | | EUR | 24,316 | | Brown Brothers Harriman & Co. | | 6/03/13 | | | 111 | |

USD | 21,993 | | GBP | 14,545 | | Brown Brothers Harriman & Co. | | 6/03/13 | | | (108 | ) |

USD | 16,522 | | HKD | 128,284 | | Brown Brothers Harriman & Co. | | 6/03/13 | | | (4 | ) |

USD | 12,789 | | ILS | 47,114 | | Citigroup, Inc. | | 6/03/13 | | | 12 | |

USD | 135,332 | | SGD | 171,535 | | Deutsche Bank AG | | 6/03/13 | | | (382 | ) |

GBP | 50,913 | | USD | 77,448 | | Citigroup, Inc. | | 6/04/13 | | | (92 | ) |

JPY | 14,009,705 | | USD | 138,417 | | Deutsche Bank AG | | 6/04/13 | | | 1,045 | |

USD | 32,602 | | EUR | 25,125 | | Brown Brothers Harriman & Co. | | 6/04/13 | | | (54 | ) |

USD | 9,571 | | GBP | 6,288 | | Brown Brothers Harriman & Co. | | 6/04/13 | | | 18 | |

USD | 563 | | HKD | 4,372 | | Credit Suisse Group AG | | 6/04/13 | | | — | |

USD | 5,579 | | JPY | 562,968 | | Brown Brothers Harriman & Co. | | 6/04/13 | | | (25 | ) |

GBP | 14,997 | | USD | 22,763 | | Barclays PLC | | 6/05/13 | | | 24 | |

USD | 21,995 | | EUR | 16,964 | | Deutsche Bank AG | | 6/05/13 | | | (53 | ) |

| Total | | | | | | | | | | $ | 6,368 | |

| • | | | | Fair Value Measurements — Various inputs are used in determining the fair value of investments and derivative financial instruments. These inputs to valuation techniques are categorized into a disclosure hierarchy consisting of three broad levels for financial statement purposes as follows: |

| | • | | Level 1 — unadjusted price quotations in active markets/exchanges for identical assets or liabilities that the Fund has the ability to access |

| | | • | | Level 2 — other observable inputs (including, but not limited to, quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market-corroborated inputs) |

| | • | | Level 3 — unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are not available (including the Fund’s own assumptions used in determining the fair value of investments and derivative financial instruments) |

| | | | | The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the fair value hierarchy classification is determined based on the lowest level input that is significant to the fair value measurement in its entirety. |

| | | | | Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy. In accordance with the Fund’s policy, transfers between different levels of the fair value disclosure hierarchy are deemed to have occurred as of the beginning of the reporting period. The categorization of a value determined for investments and derivative financial instruments is based on the pricing transparency of the investment and derivative financial instrument and is not necessarily an indication of the risks associated with investing in those securities. For information about the Fund’s policy regarding valuation of investments and derivative financial instruments, please refer to Note 1 of the Notes to Financial Statements. |

See Notes to Financial Statements.

| 18 | FDP SERIES, INC. | MAY 31, 2013

|

| |

| Schedule of Investments (concluded) | MFS Research International FDP Fund

|

The following tables summarize the Fund’s investments and derivative financial instruments categorized in the disclosure hierarchy as of May 31, 2013: |

|

|

|

| Level 1

|

| Level 2

|

| Level 3

|

| Total

|

Assets:

|

Investments:

| | | | | | | | | | | | | | | | | | |

Long-Term Investments:

| | | | | | | | | | | | | | | | | | |

Common Stocks:

| | | | | | | | | | | | | | | | | | |

Argentina | | | | $ | 1,325,498 | | | | — | | | | — | | | $ | 1,325,498 | |

Australia | | | | | — | | | $ | 4,349,011 | | | | — | | | | 4,349,011 | |

Austria | | | | | — | | | | 1,355,840 | | | | — | | | | 1,355,840 | |

Belgium | | | | | — | | | | 1,024,904 | | | | — | | | | 1,024,904 | |

Bermuda | | | | | — | | | | 588,625 | | | | — | | | | 588,625 | |

Brazil | | | | | 3,237,392 | | | | — | | | | — | | | | 3,237,392 | |

Canada | | | | | 674,242 | | | | — | | | | — | | | | 674,242 | |

China | | | | | — | | | | 1,143,204 | | | | — | | | | 1,143,204 | |

Denmark | | | | | — | | | | 649,306 | | | | — | | | | 649,306 | |

France | | | | | — | | | | 14,599,501 | | | | — | | | | 14,599,501 | |

Germany | | | | | — | | | | 8,413,604 | | | | — | | | | 8,413,604 | |

Hong Kong | | | | | — | | | | 6,819,379 | | | | — | | | | 6,819,379 | |

India | | | | | 856,307 | | | | 1,216,215 | | | | — | | | | 2,072,522 | |

Indonesia | | | | | — | | | | 543,444 | | | | — | | | | 543,444 | |

Ireland | | | | | — | | | | 203,557 | | | | — | | | | 203,557 | |

Israel | | | | | — | | | | 199,411 | | | | — | | | | 199,411 | |

Italy | | | | | — | | | | 1,239,817 | | | | — | | | | 1,239,817 | |

Japan | | | | | — | | | | 30,362,714 | | | | — | | | | 30,362,714 | |

Netherlands | | | | | — | | | | 5,411,176 | | | | — | | | | 5,411,176 | |

Papua New Guinea | | | | | — | | | | 491,549 | | | | — | | | | 491,549 | |

Russia | | | | | 841,145 | | | | — | | | | — | | | | 841,145 | |

Singapore | | | | | — | | | | 1,110,230 | | | | — | | | | 1,110,230 | |

Spain | | | | | — | | | | 1,695,433 | | | | — | | | | 1,695,433 | |

Sweden | | | | | — | | | | 4,577,100 | | | | — | | | | 4,577,100 | |

Switzerland | | | | | — | | | | 14,624,698 | | | | — | | | | 14,624,698 | |

Taiwan | | | | | — | | | | 866,994 | | | | — | | | | 866,994 | |

Thailand | | | | | 663,627 | | | | 517,706 | | | | — | | | | 1,181,333 | |

United Kingdom | | | | | — | | | | 25,068,169 | | | | — | | | | 25,068,169 | |

United States | | | | | 2,909,458 | | | | — | | | | — | | | | 2,909,458 | |

Short-Term Securities:

| | | | | | | | | | | | | | | | | | |

Time Deposits | | | | | — | | | | 1,838,803 | | | | — | | | | 1,838,803 | |

Total | | | | $ | 10,507,669 | | | $ | 128,910,390 | | | | — | | | $ | 139,418,059 | |

| | | | | | | | | | | | | | | | | | | |

|

|

|

| Level 1

|

| Level 2

|

| Level 3

|

| Total

|

Derivative Financial Instruments1

| | | | | | | | | | | | | | | | | | |

Assets:

|

Foreign currency exchange contracts | | | | | — | | | $ | 7,086 | | | | — | | | $ | 7,086 | |

Liabilities:

|

Foreign currency exchange contracts | | | | | — | | | | (718 | ) | | | — | | | | (718 | ) |

Total

| | | | | — | | | $ | 6,368 | | | | — | | | $ | 6,368 | |

| 1 | | Derivative financial instruments are foreign currency exchange contracts, which are valued at the unrealized appreciation/depreciation on the instrument. |

Certain of the Fund’s assets are held at carrying amount, which approximates fair value for financial statement purposes. As of May 31, 2013, foreign currency at value of $527 is categorized as Level 1 within the disclosure hierarchy. |

There were no transfers between levels during the year ended May 31, 2013. |

See Notes to Financial Statements.

| FDP SERIES, INC. | MAY 31, 2013 | 19

|

| |

| Schedule of Investments May 31, 2013 | Marsico Growth FDP Fund

(Percentages shown are based on Net Assets)

|

Common Stocks

|

|

|

|

Shares

|

| Value

|

Aerospace & Defense — 3.8% | | | | | | | | | | |

Precision Castparts Corp. | | | | | 13,603 | | | $ | 2,909,954 | |

Rolls-Royce Holdings Plc, Preference C

Shares (a) | | | | | 8,955,226 | | | | 13,606 | |

Rolls-Royce Holdings Plc (a) | | | | | 103,763 | | | | 1,882,172 | |

| | | | | | | | | 4,805,732 | |

Beverages — 2.6% | | | | | | | | | | |

Anheuser-Busch InBev NV — ADR | | | | | 36,004 | | | | 3,309,488 | |

Biotechnology — 10.1% | | | | | | | | | | |

Biogen Idec, Inc. (a) | | | | | 26,551 | | | | 6,305,597 | |

Gilead Sciences, Inc. (a) | | | | | 118,457 | | | | 6,453,537 | |

| | | | | | | | | 12,759,134 | |

Chemicals — 4.6% | | | | | | | | | | |

Monsanto Co. | | | | | 39,381 | | | | 3,963,304 | |

The Sherwin-Williams Co. | | | | | 9,805 | | | | 1,848,537 | |

| | | | | | | | | 5,811,841 | |

Commercial Banks — 2.1% | | | | | | | | | | |

Wells Fargo & Co. | | | | | 64,791 | | | | 2,627,275 | |

Consumer Finance — 1.3% | | | | | | | | | | |

American Express Co. | | | | | 21,755 | | | | 1,647,071 | |

Diversified Financial Services — 5.0% | | | | | | | | | | |

Citigroup, Inc. | | | | | 85,374 | | | | 4,438,594 | |

Moody’s Corp. | | | | | 28,475 | | | | 1,891,879 | |

| | | | | | | | | 6,330,473 | |

Energy Equipment & Services — 2.3% | | | | | | | | | | |

Schlumberger Ltd. | | | | | 39,655 | | | | 2,896,005 | |

Food Products — 1.8% | | | | | | | | | | |

Green Mountain Coffee Roasters, Inc. (a) | | | | | 10,642 | | | | 778,249 | |

Mondelez International, Inc., Class A | | | | | 51,354 | | | | 1,512,889 | |

| | | | | | | | | 2,291,138 | |

Hotels, Restaurants & Leisure — 7.0% | | | | | | | | | | |

Chipotle Mexican Grill, Inc. (a) | | | | | 3,130 | | | | 1,129,930 | |

Starbucks Corp. | | | | | 41,011 | | | | 2,586,564 | |

Starwood Hotels & Resorts Worldwide, Inc. | | | | | 34,122 | | | | 2,330,533 | |

Wynn Resorts Ltd. | | | | | 20,290 | | | | 2,757,208 | |

| | | | | | | | | 8,804,235 | |

Insurance — 3.0% | | | | | | | | | | |

American International Group, Inc. (a) | | | | | 85,167 | | | | 3,786,525 | |

Internet & Catalog Retail — 3.1% | | | | | | | | | | |

Amazon.com, Inc. (a) | | | | | 4,798 | | | | 1,290,806 | |

priceline.com, Inc. (a) | | | | | 3,210 | | | | 2,580,615 | |

| | | | | | | | | 3,871,421 | |

Internet Software & Services — 8.3% | | | | | | | | | | |

eBay, Inc. (a) | | | | | 70,013 | | | | 3,787,703 | |

Equinix, Inc. (a) | | | | | 6,226 | | | | 1,261,637 | |

Google, Inc., Class A (a) | | | | | 5,113 | | | | 4,450,407 | |

Yahoo! Inc. (a) | | | | | 35,281 | | | | 927,890 | |

| | | | | | | | | 10,427,637 | |

IT Services — 5.5% | | | | | | | | | | |

Accenture Plc, Class A | | | | | 31,385 | | | | 2,577,022 | |

FleetCor Technologies, Inc. (a) | | | | | 7,453 | | | | 649,007 | |

Visa, Inc., Class A | | | | | 21,183 | | | | 3,773,540 | |

| | | | | | | | | 6,999,569 | |

Machinery — 2.6% | | | | | | | | | | |