UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21744

Name of Fund: FDP Series, Inc.

Franklin Templeton Total Return FDP Fund

Invesco Value FDP Fund

Marsico Growth FDP Fund

MFS Research International FDP Fund

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, FDP Series, Inc., 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 05/31/2014

Date of reporting period: 05/31/2014

Item 1 – Report to Stockholders

MAY 31, 2014

| ANNUAL REPORT | |  |

FDP Series, Inc.

| > | | MFS Research International FDP Fund |

> | | Marsico Growth FDP Fund |

> | | Franklin Templeton Total Return FDP Fund |

Not FDIC Insured • May Lose Value • No Bank Guarantee | | | |

Table of Contents

| | | | | Page | |

Shareholder Letter | | | | | 3 | |

Annual Report:

| | | | | | |

Fund Summaries | | | | | 4 | |

About Fund Performance | | | | | 12 | |

Disclosure of Expenses | | | | | 13 | |

Derivative Financial Instruments | | | | | 13 | |

Portfolio Information | | | | | 14 | |

Financial Statements:

| | | | | | |

Schedules of Investments | | | | | 16 | |

Statements of Assets and Liabilities | | | | | 36 | |

Statements of Operations | | | | | 38 | |

Statements of Changes in Net Assets | | | | | 39 | |

Financial Highlights | | | | | 41 | |

Notes to Financial Statements | | | | | 49 | |

Report of Independent Registered Public Accounting Firm | | | | | 63 | |

Important Tax Information | | | | | 63 | |

Disclosure of Investment Advisory Agreement and Sub-Advisory Agreements | | | | | 64 | |

Officers and Directors | | | | | 69 | |

Additional Information | | | | | 72 | |

A World-Class Mutual Fund Family | | | | | 74 | |

FDP Series, Inc. is part of the Funds Diversified PortfoliosSM (FDP) Service. You may receive separate shareholder reports for other funds available through the Service. | | | |

| 2 | FDP SERIES, INC. | MAY 31, 2014

|

Dear Shareholder,

Most asset classes performed well for the 12-month period ended May 31, 2014. The period began with financial markets reacting to a spate of interest rate volatility sparked by the Federal Reserve’s first mention of gradually reducing (or “tapering”) the central bank’s asset purchase programs earlier than originally expected. After a sharp sell-off, markets broadly rebounded in late June as the Fed’s tone turned more dovish. At the same time, improving economic indicators and better corporate earnings helped extend gains through most of the summer. Although the tone of economic and financial news became mixed last autumn, it was a surprisingly positive period for the markets. Early on, the Fed defied investors’ expectations with its decision to delay tapering, but higher volatility returned in late September when the U.S. Treasury Department warned that the national debt would soon breach its statutory maximum. The ensuing political brinksmanship led to a partial government shutdown, roiling global financial markets through the first half of October. Equities and other so-called “risk assets” managed to resume their rally when politicians finally engineered a compromise to reopen the government and extend the debt ceiling.

The remainder of 2013 was a generally positive period for stock markets in the developed world, although investors continued to grapple with uncertainty about when and how much the Fed would scale back on stimulus — a condition that caused fixed income investments to struggle. When the Fed ultimately announced its tapering plans in mid-December, markets reacted positively, as this action signaled the Fed’s perception of real improvement in the economy, and investors were finally released from the anxiety that had gripped them for quite some time.

The start of the new year brought a stark change in sentiment. Heightened volatility in emerging markets — driven by concerns about reduced global liquidity, severe currency weakness, high levels of debt and uneven growth — combined with mixed U.S. economic data caused global equities to weaken in January while bond markets found renewed strength from investors seeking relatively safer assets. Although these headwinds persisted, equities were back on the rise in February as investors were encouraged by a one-year extension of the U.S. debt ceiling and market-friendly comments from new Fed Chair Janet Yellen. While it was clear that U.S. economic data had softened, investors were assuaged by increasing evidence that this was a temporary trend resulting from an unusually harsh winter.

In the months that followed, signs of decelerating growth in China and geopolitical tensions in Russia and Ukraine made for a bumpy ride, but markets were resilient as investors focused on improving U.S. economic data, stronger corporate earnings and a still-dovish central bank. Within developed markets, investors shifted from growth to value stocks as the strong performance of growth stocks in 2013 had pushed valuations higher in many of these sectors. Broadly speaking, the strongest performers of 2013 struggled most in 2014 and vice versa. Emerging markets particularly benefited from this broad rotation into cheaper valuations. For investors in these markets, technical factors heartily outweighed the growing list of geopolitical issues. Emerging market equities ended the period with a strong rally through May even as a military coup was underway in Thailand. May was a strong month for most of the world’s equity and fixed income markets. U.S. large cap stocks touched record highs while volatility trended to unusually low levels. In fixed income, investor appetite for bonds persevered as interest rate volatility remained contained against a strong supply-and-demand backdrop.

On the whole, equity markets in the developed world posted robust gains for the 12-month period ended May 31. Emerging markets generated positive, but less dramatic returns due to increased volatility amid heightened risks for the asset class. In fixed income, higher quality sectors including U.S. Treasury bonds, tax-exempt municipals and investment grade corporate bonds, were challenged by interest rate uncertainty, but produced positive results for the 12-month period as the rate market calmed in 2014. High yield bonds delivered strong performance as they benefited from income-oriented investors’ ongoing search for yield in the overall low-rate environment. Short-term interest rates remained near zero, keeping yields on money market securities close to historic lows.

At BlackRock, we believe investors need to think globally, extend their scope across a broad array of asset classes and be prepared to move freely as market conditions change over time. We encourage you to talk with your financial advisor and visit www.blackrock.com for further insight about investing in today’s world.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Financial markets moved higher over the period despite modest global growth and a shift toward tighter monetary policy in the United States.

Financial markets moved higher over the period despite modest global growth and a shift toward tighter monetary policy in the United States.Rob Kapito

President, BlackRock Advisors, LLC

Total Returns as of May 31, 2014| | 6-month | 12-month |

U.S. large cap equities

(S&P 500® Index) | | 7.63 | % | | 20.45 | % |

U.S. small cap equities

(Russell 2000® Index) | | (0.10 | ) | | 16.79 | |

International equities

(MSCI Europe, Australasia,

Far East Index) | | 5.33 | | | 18.04 | |

Emerging market equities

(MSCI Emerging Markets

Index) | | 1.89 | | | 4.27 | |

3-month Treasury bill

(BofA Merrill Lynch

3-Month U.S. Treasury

Bill Index) | | 0.03 | | | 0.06 | |

U.S. Treasury securities

(BofA Merrill Lynch

10-Year U.S. Treasury Index) | | 4.32 | | | 0.46 | |

U.S. investment grade

bonds (Barclays U.S.

Aggregate Bond Index) | | 3.28 | | | 2.71 | |

Tax-exempt municipal

bonds (S&P Municipal

Bond Index) | | 5.86 | | | 2.97 | |

U.S. high yield bonds

(Barclays U.S. Corporate

High Yield 2% Issuer

Capped Index) | | 5.14 | | | 7.88 | |

Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

| | THIS PAGE NOT PART OF YOUR FUND REPORT | 3 |

| |

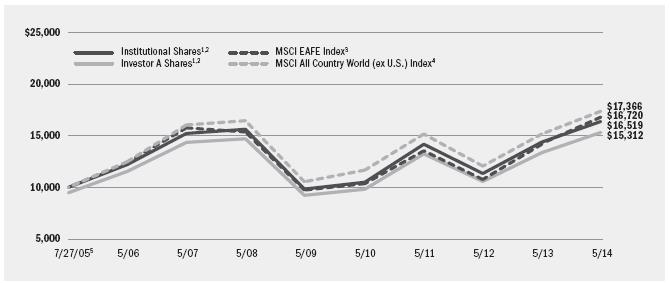

| Fund Summary as of May 31, 2014 | MFS Research International FDP Fund

|

Investment Objective

MFS Research International FDP Fund’s (the “Fund”) investment objective is to seek to provide shareholders with capital appreciation.

Portfolio Management Commentary

How did the Fund perform?

| • | | For the 12-month period ended May 31, 2014, the Fund generated strong, positive returns, although it underperformed its primary benchmark, the MSCI Europe, Australasia and Far East (“EAFE”) Index. For the same period, the Fund’s Institutional and Investor A Share Classes outperformed the secondary benchmark, the MSCI All Country World (excluding U.S.) Index, while the Investor C Shares underperformed the secondary benchmark. The following discussion of relative performance pertains to the MSCI EAFE Index. |

What factors influenced performance?

| • | | Stock selection detracted from the Fund’s performance relative to the benchmark index, with notable detractors within financials including real estate management & development company Mitsubishi Estate Co., Ltd. (Japan) and global banking and financial services firm HSBC Holdings PLC (United Kingdom). Within industrials, the Fund’s holdings in the capital goods industry hurt relative returns including mining company Iluka Resources Ltd. (Australia), Honda Motor Co. Ltd. (Japan) and engineering company JGC Corporation (Japan). In the consumer staples sector, the Fund’s position in Danone SA (France) had a negative impact. In other sectors, individual positions that detracted from relative performance included McDonald’s franchisee Arcos Dorados Holdings, Inc. (Argentina) and electric utility company Energias do Brasil SA (Brazil), while not owning French energy company Total SA proved to be a disadvantage. Additionally, the Fund’s currency exposure detracted from results. |

| • | | Conversely, stock selection in the health care sector had a positive impact on relative results, with strong performance from holdings in Santen Pharmaceutical Co. Ltd. (Japan) and Novartis AG (Switzerland). Stock selection also contributed positively in the information technology (“IT”) sector, where a position in Cognizant Technology Solutions Corp. (United States) boosted returns. Elsewhere in the Fund, notable individual contributors included hotel & restaurant chain operator Whitbread PLC (United Kingdom), banking firm KBC Groep NV (Belgium), diversified financial services company ING Groep NV CVA (Netherlands), casino resorts operator Sands China Ltd. (Hong Kong), telecommunications company KDDI Corporation (Japan) and natural gas distributor GDF Suez (France). The Fund also benefited from not holding Toyota Motor (Japan). |

Describe recent portfolio activity.

| • | | During the 12-month period, the Fund increased exposure in financials with the addition of new positions in Royal Bank of Scotland Group PLC (United Kingdom) and Zurich Insurance Group AG (Switzerland), while increasing an existing position in HSBC Holdings PLC. In other sectors, the Fund added to its holding of telecommunications services company Vodafone Group PLC (United Kingdom) and initiated a position in IT company Mediatek Inc. (Taiwan). The Fund eliminated positions in energy company BP PLC (United Kingdom), financial services firm Barclays PLC (United Kingdom) and two consumer cyclical stocks Publicis Groupe SA (France) and Hennes & Mauritz AB (Sweden). In health care, the Fund trimmed its position in Roche Holding AG (Switzerland). |

Describe portfolio positioning at period end.

| • | | The Fund is a sector-neutral portfolio that emphasizes bottom-up fundamental analysis and therefore, regional and industry allocations are strictly a by-product of where Fund management finds the most attractive opportunities. On an individual security basis, the Fund’s largest overweight positions relative to the MSCI EAFE Index as of period end included Royal Dutch Shell PLC (United Kingdom), Novartis AG, KDDI Corporation, Schneider Electric SA (France) and Rio Tinto PLC (United Kingdom). |

The views expressed reflect the opinions of the Fund’s sub-advisor as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| 4 | FDP SERIES, INC. | MAY 31, 2014

|

| |

| | MFS Research International FDP Fund

|

Total Return Based on a $10,000 Investment

| 1 | | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have a sales charge. |

| 2 | | The Fund invests, under normal market conditions, at least 65% of its assets in equity securities of foreign companies, including emerging market issuers. |

| 3 | | This unmanaged broad-based index measures the total returns of developed foreign stock markets in Europe, Australasia and the Far East. |

| 4 | | This market capitalization index is designed to measure equity market performance in the developed and emerging markets, excluding the US. |

| 5 | | Commencement of operations. |

Performance Summary for the Period Ended May 31, 2014

| | | | | | Average Annual Total Returns6

|

| | | | | | 1 Year

| | 5 Years

| | Since Inception7

|

|

|

|

| 6-Month

Total Returns

|

| w/o sales

charge

|

| w/sales

charge

|

| w/o sales

charge

|

| w/sales

charge

|

| w/o sales

charge

|

| w/sales

charge

|

Institutional | | | | | 3.58 | % | | | 14.88 | % | | | N/A | | | | 10.94 | % | | | N/A | | | | 5.84 | % | | | N/A | |

Investor A | | | | | 3.44 | | | | 14.67 | | | | 8.65 | % | | | 10.67 | | | | 9.48 | % | | | 5.58 | | | | 4.94 | % |

Investor C | | | | | 2.99 | | | | 13.72 | | | | 12.72 | | | | 9.84 | | | | 9.84 | | | | 4.78 | | | | 4.78 | |

MSCI EAFE Index | | | | | 5.33 | | | | 18.04 | | | | N/A | | | | 11.42 | | | | N/A | | | | 5.99 | | | | N/A | |

MSCI All Country World (ex U.S.) Index | | | | | 4.73 | | | | 14.54 | | | | N/A | | | | 10.49 | | | | N/A | | | | 6.44 | | | | N/A | |

| 6 | | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees. |

| 7 | | The Fund commenced operations on July 27, 2005. |

| | N/A — Not applicable as share class and index do not have a sales charge. |

| | Past performance is not indicative of future results. |

Expense Example

| Actual

| | Hypothetical9

|

|

| Beginning

Account Value

December 1, 2013

|

| Ending

Account Value

May 31, 2014

|

| Expenses Paid

During the Period8

|

| Beginning

Account Value

December 1, 2013

|

| Ending

Account Value

May 31, 2014

|

| Expenses Paid

During the Period8

|

| Annualized

Expense

Ratio

|

| Institutional | $ | 1,000.00 | | | $ | 1,035.80 | | | $ | 6.29 | | | $ | 1,000.00 | | | $ | 1,018.75 | | | $ | 6.24 | | | | 1.24 | % |

| Investor A | $ | 1,000.00 | | | $ | 1,034.40 | | | $ | 7.56 | | | $ | 1,000.00 | | | $ | 1,017.50 | | | $ | 7.49 | | | | 1.49 | % |

| Investor C | $ | 1,000.00 | | | $ | 1,029.90 | | | $ | 11.34 | | | $ | 1,000.00 | | | $ | 1,013.76 | | | $ | 11.25 | | | | 2.24 | % |

| 8 | | For each class of the Fund, expenses are equal to the annualized net expense ratio for the class, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). |

| 9 | | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365. |

| | See “Disclosure of Expenses” on page 13 for further information on how expenses were calculated. |

| FDP SERIES, INC. | MAY 31, 2014 | 5

|

| |

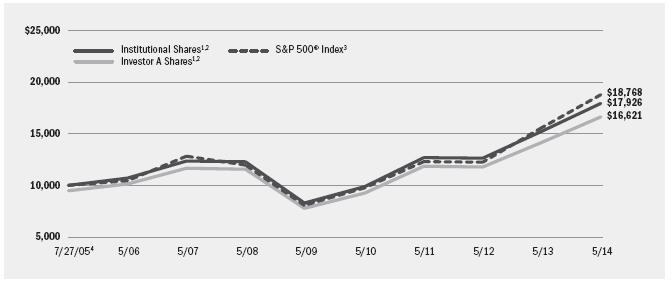

| Fund Summary as of May 31, 2014 | Marsico Growth FDP Fund

|

Investment Objective

Marsico Growth FDP Fund’s (the “Fund”) investment objective is to seek to provide shareholders with long-term growth of capital.

Portfolio Management Commentary

How did the Fund perform?

| • | | For the 12-month period ended May 31, 2014, the Fund generated strong, positive returns, but underperformed its benchmark, the S&P 500® Index. |

What factors influenced performance?

| • | | The main cause of the Fund’s underperformance relative to the benchmark index was stock selection in the information technology (“IT”), financials and industrials sectors. Although the Fund’s IT holdings posted strong returns, they lagged the sector return in the benchmark index, thereby hampering relative performance. Notable laggards included semiconductor equipment manufacturer ASML Holding NV, professional social networking website operator LinkedIn Corp., and cloud-based customer relationship management service provider Salesforce.com Inc. In financials, underperformance came from positions in Citigroup, Inc., Charles Schwab Corp. and Wells Fargo & Co. Within industrials, the Fund’s positions in the capital goods industry hurt returns as Rolls-Royce Holdings PLC and Boeing Co. posted disappointing results. On an individual security basis, the largest detractor from performance was athletic apparel manufacturer Lululemon Athletica, Inc. (consumer discretionary), which lowered its revenue and earnings forecasts after experiencing problems with quality control and supply chain management. The Fund sold its positions in LinkedIn Corp., Citigroup, Inc., Wells Fargo & Co., Rolls-Royce Holdings PLC, Boeing Co. and Lululemon Athletica, Inc. during the period. |

| • | | Contributing positively to the Fund’s performance was stock selection in the health care sector, particularly in the biotechnology industry, with Gilead Sciences, Inc. and Biogen Idec, Inc. producing strong returns. Both companies benefited from the introduction of new drugs in the period. The Fund’s underweight to consumer staples had a positive impact on relative results as the sector was generally weak during the period; however, a select holding in Green Mountain Coffee Roasters, Inc. was a notable contributor to Fund performance as the stock soared after an announcement that Coca-Cola Co. had purchased a stake in the company. In consumer discretionary, stock selection within the consumer services industry boosted results, led by the Fund’s position in Wynn Resorts Ltd., which continued to benefit from strong business results in the Macau market. |

Describe recent portfolio activity.

| • | | During the 12-month period, the Fund decreased exposure to financials given a number of headwinds negatively impacting the banking industry. Within IT, the Fund reduced some of its higher valuation positions in favor of stocks with better earnings visibility, but the overall sector allocation was increased during the period. The Fund increased its allocation to the energy sector while repositioning to gain more exposure to opportunities relating to the energy renaissance in North America, which appears to be gaining traction. The Fund added to existing holdings in the materials sector given increasing potential for price appreciation in these companies. |

| • | | The Fund’s cash position was at times elevated due in part to transitioning to new positions during the period. Holding cash hindered performance relative to the benchmark index given the strong equity market during the period. |

Describe portfolio positioning at period end.

| • | | On an absolute basis, the Fund’s largest sector allocations at period end were consumer discretionary, IT, industrials and health care. Relative to the S&P 500® Index, the Fund was overweight in consumer discretionary, industrials and materials, and underweight in financials, consumer staples and energy. The Fund held no exposure to telecommunication services or utilities. |

The views expressed reflect the opinions of the Fund’s sub-advisor as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| 6 | FDP SERIES, INC. | MAY 31, 2014

|

Total Return Based on a $10,000 Investment

| 1 | | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have a sales charge. |

| 2 | | The Fund invests primarily in equity securities of large cap companies that are selected for their growth potential. |

| 3 | | This unmanaged broad-based index is comprised of 500 industrial, utility, transportation and financial companies of the U.S. markets (mostly New York Stock Exchange (“NYSE”) issues), representing about 75% of NYSE capitalization and 30% of NYSE issues. |

| 4 | | Commencement of operations. |

Performance Summary for the Period Ended May 31, 2014

| | | | | | Average Annual Total Returns5

|

| | | | | | 1 Year

| | 5 Years

| | Since Inception6

|

|

|

|

| 6-Month

Total Returns

|

| w/o sales

charge

|

| w/sales

charge

|

| w/o sales

charge

|

| w/sales

charge

|

| w/o sales

charge

|

| w/sales

charge

|

Institutional | | | | | 4.46 | % | | | 17.70 | % | | | N/A | | | | 16.68 | % | | | N/A | | | | 6.82 | % | | | N/A | |

Investor A | | | | | 4.30 | | | | 17.42 | | | | 11.25 | % | | | 16.40 | | | | 15.15 | % | | | 6.56 | | | | 5.91 | % |

Investor C | | | | | 3.93 | | | | 16.48 | | | | 15.48 | | | | 15.53 | | | | 15.53 | | | | 5.75 | | | | 5.75 | |

S&P 500® Index | | | | | 7.63 | | | | 20.45 | | | | N/A | | | | 18.40 | | | | N/A | | | | 7.38 | | | | N/A | |

| 5 | | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees. |

| 6 | | The Fund commenced operations on July 27, 2005. |

| | N/A — Not applicable as share class and index do not have a sales charge. |

| | Past performance is not indicative of future results. |

Expense Example

| Actual

| | Hypothetical8

|

|

| Beginning

Account Value

December 1, 2013

|

| Ending

Account Value

May 31, 2014

|

| Expenses Paid

During the Period7

|

| Beginning

Account Value

December 1, 2013

|

| Ending

Account Value

May 31, 2014

|

| Expenses Paid

During the Period7

|

| Annualized

Expense

Ratio

|

| Institutional | $ | 1,000.00 | | | $ | 1,044.60 | | | $ | 5.25 | | | $ | 1,000.00 | | | $ | 1,019.80 | | | $ | 5.19 | | | | 1.03 | % |

| Investor A | $ | 1,000.00 | | | $ | 1,043.00 | | | $ | 6.52 | | | $ | 1,000.00 | | | $ | 1,018.55 | | | $ | 6.44 | | | | 1.28 | % |

| Investor C | $ | 1,000.00 | | | $ | 1,039.30 | | | $ | 10.37 | | | $ | 1,000.00 | | | $ | 1,014.76 | | | $ | 10.25 | | | | 2.04 | % |

| 7 | | For each class of the Fund, expenses are equal to the annualized net expense ratio for the class, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). |

| 8 | | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365. |

| | See “Disclosure of Expenses” on page 13 for further information on how expenses were calculated. |

| FDP SERIES, INC. | MAY 31, 2014 | 7

|

| |

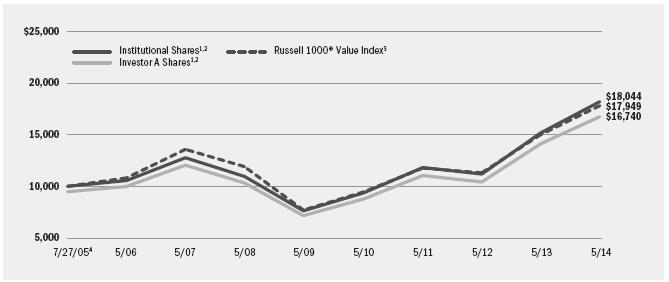

| Fund Summary as of May 31, 2014 | Invesco Value FDP Fund

|

Investment Objective

Invesco Value FDP Fund’s (the “Fund”) investment objective is to seek to provide shareholders with capital growth and income.

Portfolio Management Commentary

How did the Fund perform?

| • | | For the 12-month period ended May 31, 2014, the Fund generated strong, positive returns, but underperformed its benchmark, the Russell 1000® Value Index. |

What factors influenced performance?

| • | | Stock selection in information technology (“IT”) hurt results, mainly from not owning Apple, Inc. and from a non-benchmark holding in eBay, Inc. Stock selection within financials also detracted from performance, mostly due to a material overweight to Citigroup, Inc. Within health care, select pharmaceutical stocks, such as Sanofi negatively impacted performance. The Fund’s underweight in the industrials sector hindered relative returns for the period. The Fund’s small cash position detracted from performance relative to the benchmark index given the strong equity market during the period. |

| • | | Contributing positively to the Fund’s performance was stock selection in the energy sector, mainly within oil and gas service providers. An overweight to consumer discretionary had a positive impact, as did stock selection within the sector, especially in the media industry. Stock selection in the consumer staples sector also helped performance, notably due to a material underweight in Procter & Gamble Co. coupled with an overweight in Tyson Foods, Inc. Stock selection and an underweight in telecommunication services (“telecom”) proved beneficial. Most notably, the Fund’s meaningful underweight in AT&T, Inc. contributed positively to relative results, as did a non-benchmark holding in Vodafone Group PLC. Finally, stock selection in materials and a material underweight to the utilities sector enhanced performance. |

Describe recent portfolio activity.

| • | | During the 12-month period, the Fund maintained a relatively low level of portfolio turnover; however, the Fund added to positions in health care, energy and consumer staples companies. Conversely, the Fund continued to trim select insurance stocks within financials, as well as exiting positions in IT stocks. The majority of the trading activity occurred in the consumer discretionary sector, where the Fund continued to reduce holdings in media and select retail companies that had performed well. |

Describe portfolio positioning at period end.

| • | | Relative to the Russell 1000® Value Index, the Fund ended the period overweight in consumer discretionary, IT, energy and health care, and underweight in financials, utilities, industrials, consumer staples, telecom and materials. |

The views expressed reflect the opinions of the Fund’s sub-advisor as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| 8 | FDP SERIES, INC. | MAY 31, 2014

|

Total Return Based on a $10,000 Investment

| 1 | | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have a sales charge. |

| 2 | | The Fund invests, under normal market conditions, at least 80% of its net assets (plus any borrowings for investment purposes) in common stocks at the time of investment. The Fund invests in equity securities, including common stocks, preferred stocks, and securities convertible into common and preferred stocks (convertible securities). |

| 3 | | This unmanaged broad-based index is a subset of the Russell 1000® Index consisting of those Russell 1000® securities with lower price/book ratios and lower forecasted growth values. |

| 4 | | Commencement of operations. |

Performance Summary for the Period Ended May 31, 2014

| | | | | | Average Annual Total Returns5

|

| | | | | | 1 Year

| | 5 Years

| | Since Inception6

|

|

|

|

| 6-Month

Total Returns

|

| w/o sales

charge

|

| w/sales

charge

|

| w/o sales

charge

|

| w/sales

charge

|

| w/o sales

charge

|

| w/sales

charge

|

Institutional | | | | | 6.48 | % | | | 18.89 | % | | | N/A | | | | 18.78 | % | | | N/A | | | | 6.90 | % | | | N/A | |

Investor A | | | | | 6.33 | | | | 18.56 | | | | 12.34 | % | | | 18.50 | | | | 17.23 | % | | | 6.65 | | | | 6.00 | % |

Investor C | | | | | 5.93 | | | | 17.76 | | | | 16.76 | | | | 17.61 | | | | 17.61 | | | | 5.84 | | | | 5.84 | |

Russell 1000® Value Index | | | | | 8.20 | | | | 19.60 | | | | N/A | | | | 18.44 | | | | N/A | | | | 6.84 | | | | N/A | |

| 5 | | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees. |

| 6 | | The Fund commenced operations on July 27, 2005. |

| | N/A — Not applicable as share class and index do not have a sales charge. |

| | Past performance is not indicative of future results. |

Expense Example

| Actual

| | Hypothetical8

|

|

| Beginning

Account Value

December 1, 2013

|

| Ending

Account Value

May 31, 2014

|

| Expenses Paid

During the Period7

|

| Beginning

Account Value

December 1, 2013

|

| Ending

Account Value

May 31, 2014

|

| Expenses Paid

During the Period7

|

| Annualized

Expense

Ratio

|

| Institutional | $ | 1,000.00 | | | $ | 1,064.80 | | | $ | 5.04 | | | $ | 1,000.00 | | | $ | 1,020.04 | | | $ | 4.94 | | | | 0.98 | % |

| Investor A | $ | 1,000.00 | | | $ | 1,063.30 | | | $ | 6.33 | | | $ | 1,000.00 | | | $ | 1,018.80 | | | $ | 6.19 | | | | 1.23 | % |

| Investor C | $ | 1,000.00 | | | $ | 1,059.30 | | | $ | 10.17 | | | $ | 1,000.00 | | | $ | 1,015.06 | | | $ | 9.95 | | | | 1.98 | % |

| 7 | | For each class of the Fund, expenses are equal to the annualized net expense ratio for the class, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). |

| 8 | | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365. |

| | See “Disclosure of Expenses” on page 13 for further information on how expenses were calculated. |

| FDP SERIES, INC. | MAY 31, 2014 | 9

|

| |

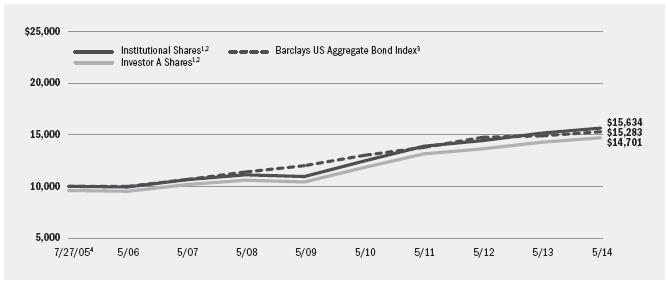

| Fund Summary as of May 31, 2014 | Franklin Templeton Total Return FDP Fund

|

Investment Objective

Franklin Templeton Total Return FDP Fund’s (the “Fund”) investment objective is to seek to provide shareholders with high current income, consistent with preservation of capital. The Fund’s secondary objective is capital appreciation over the long term.

Portfolio Management Commentary

How did the Fund perform?

| • | | For the 12-month period ended May 31, 2014, the Fund’s Institutional and Investor A Share Classes outperformed the benchmark, the Barclays U.S. Aggregate Bond Index, while the Investor C Share Class underperformed the benchmark index. |

What factors influenced performance?

| • | | The Fund’s corporate credit holdings including high yield bonds and investment grade debt contributed positively to performance, resulting mainly from sector allocation. An underweight in agency mortgage-backed securities (“MBS”) had a positive impact on relative results, as did security selection within the sector. The Fund’s positions in commercial mortgage-backed securities (“CMBS”) and non-agency residential MBS added to returns, especially attributable to security selection within CMBS. The Fund’s municipal bond exposure also contributed positively. Many of the Fund’s non-U.S. dollar-denominated bonds as well as yield curve positioning in non-U.S. markets further enhanced results. |

| • | | Conversely, yield curve positioning in the United States detracted from the Fund’s performance during the period. Exposure to non-U.S. currencies also had a negative impact on results. |

Describe recent portfolio activity.

| • | | During the 12-month period, the Fund remained slightly overweight compared to the benchmark in many of the credit sectors, including corporate credit and securitized products, as valuations continued to appear relatively attractive on a longer term basis. The Fund reduced exposure, however, to the high yield and floating rate loan sectors. The Fund increased its allocation to CMBS and municipal bonds as valuations appeared attractive in these sectors. The investment advisor continued to find that many of the best opportunities in global bond markets were outside of the United States and accordingly, maintained the Fund’s strong exposure to international bonds and currencies. |

| • | | The Fund transacts in mortgage dollar rolls, which require future mortgage settlements. To meet forward liabilities, the Fund holds cash or invests in high-quality, liquid assets. The Fund’s allocation to cash and cash equivalents did not materially impact performance during the period. |

Describe portfolio positioning at period end.

| • | | Relative to the Barclays U.S. Aggregate Bond Index, the Fund ended the period slightly overweight in many of the credit sectors, including corporate credit and securitized products such as CMBS and non-agency residential MBS. The Fund also maintained significant exposure to international bonds and foreign currencies. |

The views expressed reflect the opinions of the Fund’s sub-advisor as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| 10 | FDP SERIES, INC. | MAY 31, 2014

|

| |

| | Franklin Templeton Total Return FDP Fund

|

Total Return Based on a $10,000 Investment

| 1 | | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have a sales charge. |

| 2 | | The Fund invests, under normal market conditions, at least 80% of its assets in investment grade debt securities and investments, including government and corporate debt securities, mortgage- and asset-backed securities, investment grade corporate loans and futures with reference securities that are investment grade. |

| 3 | | This unmanaged market-weighted index is comprised of investment grade corporate bonds (rated BBB or better), mortgages and U.S. Treasury and government agency issues with at least one year to maturity. |

| 4 | | Commencement of operations. |

Performance Summary for the Period Ended May 31, 2014

| | | | | | Average Annual Total Returns5

|

| | | | | | 1 Year

| | 5 Years

| | Since Inception6

|

|

| Standardized

30-Day Yields

|

| 6-Month

Total Returns

|

| w/o sales

charge

|

| w/sales

charge

|

| w/o sales

charge

|

| w/sales

charge

|

| w/o sales

charge

|

| w/sales

charge

|

Institutional | | | 2.10 | % | | | 3.58 | % | | | 3.18 | % | | | N/A | | | | 7.39 | % | | | N/A | | | | 5.18 | % | | | N/A | |

Investor A | | | 1.77 | | | | 3.55 | | | | 3.03 | | | | (1.10 | )% | | | 7.12 | | | | 6.25 | % | | | 4.94 | | | | 4.45 | % |

Investor C | | | 1.30 | | | | 3.26 | | | | 2.45 | | | | 1.45 | | | | 6.53 | | | | 6.53 | | | | 4.35 | | | | 4.35 | |

Barclays US Aggregate Bond Index | | | — | | | | 3.28 | | | | 2.71 | | | | N/A | | | | 4.96 | | | | N/A | | | | 4.91 | | | | N/A | |

| 5 | | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees. |

| 6 | | The Fund commenced operations on July 27, 2005. |

| | N/A — Not applicable as share class and index do not have a sales charge. |

| | Past performance is not indicative of future results. |

Expense Example

| Actual

| | Hypothetical8

|

|

| Beginning

Account Value

December 1, 2013

|

| Ending

Account Value

May 31, 2014

|

| Expenses Paid

During the Period7

|

| Beginning

Account Value

December 1, 2013

|

| Ending

Account Value

May 31, 2014

|

| Expenses Paid

During the Period7

|

| Annualized

Expense

Ratio

|

| Institutional | $ | 1,000.00 | | | $ | 1,035.80 | | | $ | 3.45 | | | $ | 1,000.00 | | | $ | 1,021.54 | | | $ | 3.43 | | | | 0.68 | % |

| Investor A | $ | 1,000.00 | | | $ | 1,035.50 | | | $ | 4.77 | | | $ | 1,000.00 | | | $ | 1,020.24 | | | $ | 4.73 | | | | 0.94 | % |

| Investor C | $ | 1,000.00 | | | $ | 1,032.60 | | | $ | 7.55 | | | $ | 1,000.00 | | | $ | 1,017.50 | | | $ | 7.49 | | | | 1.49 | % |

| 7 | | For each class of the Fund, expenses are equal to the annualized net expense ratio for the class, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). |

| 8 | | Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365. |

| | See “Disclosure of Expenses” on page 13 for further information on how expenses were calculated. |

| FDP SERIES, INC. | MAY 31, 2014 | 11

|

Shares are only available for purchase through the FDP Service.

| • | | Institutional Shares are not subject to any sales charge. These shares bear no ongoing distribution or service fees and are available only to eligible investors. |

| • | | Investor A Shares (for all Funds except Franklin Templeton Total Return FDP Fund) are subject to a maximum initial sales charge (front-end load) of 5.25% and a service fee of 0.25% per year (but no distribution fee). Investor A Shares for Franklin Templeton Total Return FDP Fund incur a maximum initial sales charge (front-end load) of 4.00% and a service fee of 0.25% per year (but no distribution fee). Certain redemptions of these shares may be subject to a contingent deferred sales charge (“CDSC”) where no initial sales charge was paid at the time of purchase. On June 10, 2013, all issued and outstanding Investor B Shares of the Funds were converted into Investor A Shares with the same relative aggregate net asset value. |

| • | | Investor C Shares (for all Funds except Franklin Templeton Total Return FDP Fund) are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. Investor C Shares for Franklin Templeton Total Return FDP Fund are subject to a distribution fee of 0.55% per year and a service fee of 0.25% per year. In addition, these shares for all Funds are subject to a 1.00% CDSC if redeemed within one year of purchase. |

| • | | Performance information reflects past performance and does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Refer to www.blackrock.com/funds to obtain performance data current to the most recent month end. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Figures shown in the performance tables on the previous pages assume reinvestment of all dividends and capital gain distributions, if any, at net asset value on the ex-dividend date. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Dividends paid to each class of shares will vary because of the different levels of service, distribution and transfer agency fees applicable to each class, which are deducted from the income available to be paid to shareholders. In certain periods, the Funds’ investment advisor waived a portion of its fees. Without such waiver, the Funds’ performance would have been lower. |

| 12 | FDP SERIES, INC. | MAY 31, 2014

|

Shareholders of these Funds may incur the following charges: (a) transactional expenses, such as sales charges; and (b) operating expenses, including investment advisory fees, service and distribution fees, including 12b-1 fees, and other Fund expenses. The expense examples on the previous pages (which are based on a hypothetical investment of $1,000 invested on December 1, 2013 and held through May 31, 2014) are intended to assist shareholders both in calculating expenses based on an investment in each Fund and in comparing these expenses with similar costs of investing in other mutual funds.

The expense examples provide information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their Fund and share class under the heading entitled “Expenses Paid During the Period.”

The expense examples also provide information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in these Funds and other funds, compare the 5% hypothetical examples with the 5% hypothetical examples that appear in other funds’ shareholder reports.

The expenses shown in the expense examples are intended to highlight shareholders’ ongoing costs only and do not reflect any transactional expenses, such as sales charges, if any. Therefore, the hypothetical examples are useful in comparing ongoing expenses only, and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

| |

| Derivative Financial Instruments |

|

The Funds may invest in various derivative financial instruments, including financial futures contracts, foreign currency exchange contracts, options and swaps, as specified in Note 4 of the Notes to Financial Statements, which may constitute forms of economic leverage. Such derivative financial instruments are used to obtain exposure to a security, index and/or market without owning or taking physical custody of securities or to hedge market, equity, credit, interest rate and/or foreign currency exchange rate risks. Derivative financial instruments involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the derivative financial instrument. The Funds’ ability to use a derivative financial instrument successfully depends on the investment advisor’s and/or sub-advisor’s ability to predict pertinent market movements accurately, which cannot be assured. The use of derivative financial instruments may result in losses greater than if they had not been used, may require a Fund to sell or purchase portfolio investments at inopportune times or for distressed values, may limit the amount of appreciation a Fund can realize on an investment, may result in lower dividends paid to shareholders and/or may cause a Fund to hold an investment that it might otherwise sell. The Funds’ investments in these instruments are discussed in detail in the Notes to Financial Statements.

| FDP SERIES, INC. | MAY 31, 2014 | 13

|

| |

| Portfolio Information as of May 31, 2014 |

|

MFS Research International FDP Fund

Ten Largest Holdings | Percent of

Long-Term Investments |

Novartis AG, Registered Shares | | 4 | % |

Royal Dutch Shell PLC, Class A | | 3 | |

Nestle SA, Registered Shares | | 3 | |

HSBC Holdings PLC | | 3 | |

Rio Tinto PLC | | 2 | |

Schneider Electric SA | | 2 | |

Bayer AG, Registered Shares | | 2 | |

Westpac Banking Corp. | | 2 | |

GlaxoSmithKline PLC | | 2 | |

UBS AG, Registered Shares | | 2 | |

Geographic Allocation | Percent of

Long-Term Investments |

Japan | | 18 | % |

United Kingdom | | 16 | |

Switzerland | | 13 | |

France | | 11 | |

Germany | | 7 | |

Netherlands | | 7 | |

Hong Kong | | 5 | |

Australia | | 4 | |

United States | | 2 | |

Sweden | | 2 | |

Brazil | | 2 | |

Taiwan | | 2 | |

Other1 | | 11 | |

| 1 | | Other includes a 1% holding or less in each of the following countries: Canada, Belgium, Austria, Italy, Singapore, South Korea, India, Turkey, Ireland, Spain, Denmark, Bermuda, Thailand, Russia, Portugal, Israel. |

Marsico Growth FDP Fund

Ten Largest Holdings | Percent of

Long-Term Investments |

Gilead Sciences, Inc. | | 6 | % |

priceline.com, Inc. | | 6 | |

Monsanto Co. | | 5 | |

Biogen Idec, Inc. | | 4 | |

Facebook, Inc., Class A | | 4 | |

Starwood Hotels & Resorts Worldwide, Inc. | | 4 | |

Canadian Pacific Railway Ltd. | | 4 | |

Union Pacific Corp. | | 4 | |

The Sherwin-Williams Co. | | 4 | |

Wynn Resorts Ltd. | | 4 | |

Sector Allocation | Percent of

Long-Term Investments |

Consumer Discretionary | | 29 | % |

Information Technology | | 20 | |

Industrials | | 16 | |

Health Care | | 14 | |

Materials | | 8 | |

Energy | | 7 | |

Consumer Staples | | 4 | |

Financials | | 2 | |

| | For Fund compliance purposes, the Fund’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease. |

| 14 | FDP SERIES, INC. | MAY 31, 2014

|

| |

| Portfolio Information as of May 31, 2014 (concluded) |

|

Invesco Value FDP Fund

Ten Largest Holdings | Percent of

Long-Term Investments |

Citigroup, Inc. | | 4 | % |

Weatherford International Ltd. | | 3 | |

JPMorgan Chase & Co. | | 3 | |

Wells Fargo & Co. | | 2 | |

Merck & Co., Inc. | | 2 | |

Viacom, Inc., Class B | | 2 | |

Royal Dutch Shell PLC — ADR | | 2 | |

Suncor Energy, Inc. | | 2 | |

The Bank of New York Mellon Corp. | | 2 | |

General Electric Co. | | 2 | |

Sector Allocation | Percent of

Long-Term Investments |

Financials | | 23 | % |

Energy | | 18 | |

Health Care | | 15 | |

Consumer Discretionary | | 14 | |

Information Technology | | 11 | |

Industrials | | 7 | |

Consumer Staples | | 5 | |

Utilities | | 3 | |

Materials | | 2 | |

Telecommunication Services | | 2 | |

| | For Fund compliance purposes, the Fund’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease. |

Franklin Templeton Total Return FDP Fund

Portfolio Composition | Percent of

Long-Term Investments |

Corporate Bonds | | 31 | % |

U.S. Treasury Obligations | | 21 | |

U.S. Government Sponsored Agency Securities | | 20 | |

Foreign Agency Obligations | | 9 | |

Non-Agency Mortgage-Backed Securities | | 6 | |

Floating Rate Loan Interests | | 5 | |

Municipal Bonds | | 4 | |

Asset-Backed Securities | | 2 | |

Preferred Securities | | 2 | |

| FDP SERIES, INC. | MAY 31, 2014 | 15

|

| |

| Schedule of Investments May 31, 2014 | MFS Research International FDP Fund

(Percentages shown are based on Net Assets)

|

| Common Stocks | | | | | |

Shares | | Value |

Australia — 3.7% | | | | | | | | | | | | | | |

APA Group | | | | | | | | | 106,098 | | | $ | 691,036 | |

Computershare Ltd. | | | | | | | | | 63,871 | | | | 758,134 | |

Iluka Resources Ltd. | | | | | | | | | 152,462 | | | | 1,237,584 | |

Oil Search Ltd. | | | | | | | | | 59,650 | | | | 524,413 | |

Westpac Banking Corp. | | | | | | | | | 105,470 | | | | 3,380,923 | |

| | | | | | | | | | | | | 6,592,090 | |

Austria — 1.1% | | | | | | | | | | | | | | |

Erste Group Bank AG | | | | | | | | | 56,494 | | | | 1,964,136 | |

Belgium — 1.2% | | | | | | | | | | | | | | |

KBC Groep NV (a) | | | | | | | | | 34,985 | | | | 2,084,119 | |

Bermuda — 0.4% | | | | | | | | | | | | | | |

Hiscox Ltd. | | | | | | | | | 64,810 | | | | 739,257 | |

Brazil — 2.0% | | | | | | | | | | | | | | |

EDP — Energias do Brasil SA | | | | | | | | | 78,797 | | | | 330,270 | |

Gerdau SA — ADR | | | | | | | | | 110,610 | | | | 657,023 | |

M Dias Branco SA | | | | | | | | | 20,900 | | | | 899,233 | |

Odontoprev SA | | | | | | | | | 101,000 | | | | 428,291 | |

Petroleo Brasileiro SA — ADR | | | | | | | | | 56,060 | | | | 790,446 | |

Telefonica Brasil SA — ADR | | | | | | | | | 23,118 | | | | 464,903 | |

| | | | | | | | | | | | | 3,570,166 | |

Canada — 1.3% | | | | | | | | | | | | | | |

Canadian Utilities Ltd., Class A | | | | | | | | | 19,480 | | | | 705,146 | |

Cenovus Energy, Inc. | | | | | | | | | 18,890 | | | | 562,188 | |

Dollarama, Inc. | | | | | | | | | 11,840 | | | | 998,806 | |

| | | | | | | | | | | | | 2,266,140 | |

Denmark — 0.4% | | | | | | | | | | | | | | |

TDC A/S | | | | | | | | | 79,479 | | | | 773,831 | |

France — 10.6% | | | | | | | | | | | | | | |

BNP Paribas SA | | | | | | | | | 31,755 | | | | 2,223,177 | |

Danone SA | | | | | | | | | 38,235 | | | | 2,851,148 | |

Dassault Systemes SA | | | | | | | | | 8,916 | | | | 1,131,583 | |

GDF Suez | | | | | | | | | 61,385 | | | | 1,713,231 | |

L’Oreal SA | | | | | | | | | 8,160 | | | | 1,424,415 | |

Legrand SA | | | | | | | | | 10,135 | | | | 641,813 | |

LVMH Moet Hennessy Louis Vuitton SA | | | | | | | | | 10,820 | | | | 2,152,292 | |

Pernod Ricard SA | | | | | | | | | 19,226 | | | | 2,357,537 | |

Schneider Electric SA | | | | | | | | | 36,257 | | | | 3,415,581 | |

Technip SA | | | | | | | | | 8,420 | | | | 904,959 | |

| | | | | | | | | | | | | 18,815,736 | |

Germany — 7.1% | | | | | | | | | | | | | | |

Bayer AG, Registered Shares | | | | | | | | | 23,519 | | | | 3,404,392 | |

Deutsche Wohnen AG (a) | | | | | | | | | 32,988 | | | | 712,736 | |

Infineon Technologies AG | | | | | | | | | 80,647 | | | | 1,000,504 | |

Linde AG | | | | | | | | | 13,891 | | | | 2,904,102 | |

ProSiebenSat.1 Media AG, Registered Shares | | | | | | | | | 10,120 | | | | 461,183 | |

| Common Stocks | | | | | |

Shares | | Value |

Germany (concluded) | | | | | | | | | | | | | | |

Siemens AG, Registered Shares | | | | | | | | | 23,273 | | | $ | 3,093,100 | |

Symrise AG | | | | | | | | | 17,062 | | | | 924,857 | |

| | | | | | | | | | | | | 12,500,874 | |

Hong Kong — 4.7% | | | | | | | | | | | | | | |

AIA Group Ltd. | | | | | | | | | 496,200 | | | | 2,491,250 | |

China Resources Gas Group Ltd. | | | | | | | | | 244,000 | | | | 748,880 | |

Esprit Holdings Ltd. | | | | | | | | | 255,400 | | | | 377,433 | |

Hutchison Whampoa Ltd. | | | | | | | | | 118,000 | | | | 1,585,813 | |

Li & Fung Ltd. | | | | | | | | | 1,388,000 | | | | 2,020,045 | |

Sands China Ltd. | | | | | | | | | 138,800 | | | | 1,014,259 | |

| | | | | | | | | | | | | 8,237,680 | |

India — 0.7% | | | | | | | | | | | | | | |

HDFC Bank Ltd. — ADR | | | | | | | | | 15,554 | | | | 700,396 | |

Reliance Industries Ltd. | | | | | | | | | 28,732 | | | | 518,052 | |

| | | | | | | | | | | | | 1,218,448 | |

Ireland — 0.6% | | | | | | | | | | | | | | |

Experian PLC | | | | | | | | | 57,092 | | | | 993,038 | |

Israel — 0.2% | | | | | | | | | | | | | | |

Bezeq The Israeli Telecommunication Corp. Ltd. | | | | | | | | | 169,820 | | | | 304,826 | |

Italy — 1.0% | | | | | | | | | | | | | | |

Telecom Italia SpA, Non-Convertible Savings Shares | | | | | | | | | 715,329 | | | | 683,774 | |

UniCredit SpA | | | | | | | | | 132,134 | | | | 1,153,618 | |

| | | | | | | | | | | | | 1,837,392 | |

Japan — 17.6% | | | | | | | | | | | | | | |

AEON Financial Service Co. Ltd. | | | | | | | | | 34,300 | | | | 866,588 | |

Denso Corp. | | | | | | | | | 56,900 | | | | 2,620,892 | |

Honda Motor Co. Ltd. | | | | | | | | | 77,900 | | | | 2,734,680 | |

Inpex Corp. | | | | | | | | | 61,700 | | | | 893,779 | |

Japan Tobacco, Inc. | | | | | | | | | 60,200 | | | | 2,044,900 | |

JGC Corp. | | | | | | | | | 47,000 | | | | 1,356,796 | |

JSR Corp. | | | | | | | | | 80,700 | | | | 1,362,456 | |

KDDI Corp. | | | | | | | | | 54,500 | | | | 3,256,541 | |

Kobayashi Pharmaceutical Co. Ltd. | | | | | | | | | 7,300 | | | | 470,515 | |

Mitsubishi Corp. | | | | | | | | | 49,100 | | | | 973,157 | |

Mitsubishi Estate Co. Ltd. | | | | | | | | | 21,000 | | | | 512,909 | |

Mitsubishi UFJ Financial Group, Inc. | | | | | | | | | 304,600 | | | | 1,719,257 | |

Mitsui Fudosan Co. Ltd. | | | | | | | | | 24,000 | | | | 759,371 | |

Nippon Television Network Corp. | | | | | | | | | 56,500 | | | | 916,923 | |

Nomura Research Institute Ltd. | | | | | | | | | 26,000 | | | | 876,179 | |

Santen Pharmaceutical Co. Ltd. | | | | | | | | | 44,200 | | | | 2,387,995 | |

Sony Financial Holdings, Inc. | | | | | | | | | 37,800 | | | | 626,116 | |

Sumitomo Mitsui Financial Group, Inc. | | | | | | | | | 57,600 | | | | 2,337,307 | |

Sundrug Co. Ltd. | | | | | | | | | 20,600 | | | | 926,705 | |

Tokyo Gas Co. Ltd. | | | | | | | | | 240,000 | | | | 1,362,272 | |

Yamato Holdings Co. Ltd. | | | | | | | | | 100,900 | | | | 2,155,820 | |

| | | | | | | | | | | | | 31,161,158 | |

Portfolio Abbreviations

ABS

ADR

AGM

BRL

CAB

CAD

CHF

CLP

DKK

EDA | Asset-Backed Security

American Depositary Receipts

Assured Guaranty Municipal Corp.

Brazilian Real

Capital Appreciation Bonds

Canadian Dollar

Swiss Franc

Chilean Peso

Danish Krone

Economic Development Authority | | EUR

GBP

GO

HKD

HUF

KRW

MXN

MYR

NVDR

OTC | | Euro

British Pound

General Obligation Bonds

Hong Kong Dollar

Hungarian Forint

South Korean Won

Mexican Peso

Malaysian Ringgit

Non-voting Depository Receipts

Over-the-Counter | | PEN

PHP

PLN

PSF-GTD

RB

REIT

SEK

SGD

USD | | Peruvian Nuevo Sol

Philippine Peso

Polish Zloty

Permanent School Fund Guaranteed

Revenue Bonds

Real Estate Investment Trust

Swedish Krona

Singapore Dollar

U.S. Dollar |

See Notes to Financial Statements.

| 16 | FDP SERIES, INC. | MAY 31, 2014

|

| |

| Schedule of Investments (continued) | MFS Research International FDP Fund

(Percentages shown are based on Net Assets)

|

| Common Stocks | | | | | |

Shares | | Value |

Netherlands — 7.0% | | | | | | | | | | | | | | |

Akzo Nobel NV | | | | | | | | | 35,931 | | | $ | 2,693,132 | |

Delta Lloyd NV | | | | | | | | | 20,599 | | | | 500,448 | |

ING Groep NV — CVA (a) | | | | | | | | | 137,964 | | | | 1,934,929 | |

Reed Elsevier NV | | | | | | | | | 58,215 | | | | 1,302,155 | |

Royal Dutch Shell PLC, Class A | | | | | | | | | 150,183 | | | | 5,905,660 | |

| | | | | | | | | | | | | 12,336,324 | |

Portugal — 0.2% | | | | | | | | | | | | | | |

Galp Energia SGPS SA | | | | | | | | | 23,879 | | | | 423,198 | |

Russia — 0.3% | | | | | | | | | | | | | | |

Mobile Telesystems OJSC | | | | | | | | | 3,859 | | | | 31,697 | |

Sberbank of Russia — ADR (a) | | | | | | | | | 39,430 | | | | 399,426 | |

| | | | | | | | | | | | | 431,123 | |

Singapore — 1.0% | | | | | | | | | | | | | | |

DBS Group Holdings Ltd. | | | | | | | | | 134,000 | | | | 1,806,641 | |

South Korea — 0.7% | | | | | | | | | | | | | | |

Kia Motors Corp. | | | | | | | | | 21,700 | | | | 1,253,204 | |

Spain — 0.4% | | | | | | | | | | | | | | |

Inditex SA | | | | | | | | | 5,330 | | | | 774,042 | |

Sweden — 2.4% | | | | | | | | | | | | | | |

Atlas Copco AB, Class A | | | | | | | | | 86,700 | | | | 2,545,445 | |

Telefonaktiebolaget LM Ericsson, Class B | | | | | | | | | 139,868 | | | | 1,743,422 | |

| | | | | | | | | | | | | 4,288,867 | |

Switzerland — 12.3% | | | | | | | | | | | | | | |

Julius Baer Group Ltd. (a) | | | | | | | | | 27,777 | | | | 1,203,544 | |

Nestle SA, Registered Shares | | | | | | | | | 58,694 | | | | 4,608,186 | |

Novartis AG, Registered Shares | | | | | | | | | 68,590 | | | | 6,171,324 | |

Roche Holding AG | | | | | | | | | 5,471 | | | | 1,612,589 | |

Schindler Holding AG, Participation Certificates | | | | | | | | | 12,409 | | | | 1,917,854 | |

Sonova Holding AG, Registered Shares (a) | | | | | | | | | 7,242 | | | | 1,105,766 | |

UBS AG, Registered Shares (a) | | | | | | | | | 162,686 | | | | 3,270,889 | |

Zurich Insurance Group AG (a) | | | | | | | | | 6,411 | | | | 1,925,734 | |

| | | | | | | | | | | | | 21,815,886 | |

Taiwan — 1.9% | | | | | | | | | | | | | | |

MediaTek, Inc. | | | | | | | | | 122,000 | | | | 1,984,224 | |

Taiwan Semiconductor Manufacturing Co. Ltd. | | | | | | | | | 333,439 | | | | 1,336,422 | |

| | | | | | | | | | | | | 3,320,646 | |

Thailand — 0.4% | | | | | | | | | | | | | | |

Kasikornbank PCL — NVDR | | | | | | | | | 122,900 | | | | 703,448 | |

Turkey — 0.6% | | | | | | | | | | | | | | |

Turkcell Iletisim Hizmetleri AS (a) | | | | | | | | | 164,510 | | | | 1,027,958 | |

United Kingdom — 16.0% | | | | | | | | | | | | | | |

BG Group PLC | | | | | | | | | 89,191 | | | | 1,828,895 | |

BT Group PLC | | | | | | | | | 119,760 | | | | 797,622 | |

Cairn Energy PLC (a) | | | | | | | | | 80,093 | | | | 265,183 | |

Capital Shopping Centres Group PLC | | | | | | | | | 58,300 | | | | 308,027 | |

| Common Stocks | | | | | |

Shares | | Value |

United Kingdom (concluded) | | | | | | | | | | | | | | |

Centrica PLC | | | | | | | | | 192,162 | | | $ | 1,082,474 | |

Compass Group PLC | | | | | | | | | 77,490 | | | | 1,294,810 | |

GlaxoSmithKline PLC | | | | | | | | | 125,097 | | | | 3,357,159 | |

HSBC Holdings PLC | | | | | | | | | 428,226 | | | | 4,517,091 | |

Prudential PLC | | | | | | | | | 22,541 | | | | 524,346 | |

Reckitt Benckiser Group PLC | | | | | | | | | 20,800 | | | | 1,780,535 | |

Rio Tinto PLC | | | | | | | | | 69,540 | | | | 3,566,327 | |

Royal Bank of Scotland Group PLC (a) | | | | | | | | | 365,603 | | | | 2,126,503 | |

Standard Chartered PLC | | | | | | | | | 76,298 | | | | 1,717,851 | |

Vodafone Group PLC | | | | | | | | | 509,488 | | | | 1,786,288 | |

Whitbread PLC | | | | | | | | | 28,525 | | | | 2,002,741 | |

WPP PLC | | | | | | | | | 62,729 | | | | 1,356,584 | |

| | | | | | | | | | | | | 28,312,436 | |

United States — 2.4% | | | | | | | | | | | | | | |

Autoliv, Inc. | | | | | | | | | 16,460 | | | | 1,744,760 | |

Cognizant Technology Solutions Corp., Class A (a) | | | | | | | | | 25,490 | | | | 1,239,069 | |

Joy Global, Inc. | | | | | | | | | 23,110 | | | | 1,320,736 | |

| | | | | | | | | | | | | 4,304,565 | |

Total Long-Term Investments

(Cost — $135,649,533) — 98.2% | | | | | | | | | | | | | 173,857,229 | |

|

Short-Term Securities | | | | | | | | Par

(000) | | | | |

Time Deposits — 1.4% |

Europe — 0.0% | | | | | | | | | | | | | | |

Wells Fargo Co., 0.04%, 06/02/14 | | | | | EUR | | | | 15 | | | | 20,661 | |

Hong Kong — 0.0% | | | | | | | | | | | | | | |

Brown Brothers Harriman & Co., 0.01%, 6/03/14 | | | | | HKD | | | | 613 | | | | 79,035 | |

Switzerland — 0.1% | | | | | | | | | | | | | | |

Brown Brothers Harriman & Co., 0.00%, 6/02/14 | | | | | CHF | | | | 134 | | | | 149,587 | |

United Kingdom — 0.0% | | | | | | | | | | | | | | |

Wells Fargo Co., 0.08%, 6/02/14 | | | | | GBP | | | | 24 | | | | 39,803 | |

United States — 1.3% | | | | | | | | | | | | | | |

Brown Brothers Harriman & Co., 0.01%, 06/02/14 | | | | | USD | | | | 2,254 | | | | 2,253,877 | |

Total Short-Term Securities

(Cost — $2,542,963) — 1.4% | | | | | | | | | | | | | 2,542,963 | |

Total Investments (Cost — $138,192,496) — 99.6% | | | | | | 176,400,192 | |

Other Assets Less Liabilities — 0.4% | | | | | | | | | | | | | 623,219 | |

Net Assets — 100.0% | | | | | | | | | | | | $ | 177,023,411 | |

See Notes to Financial Statements.

| FDP SERIES, INC. | MAY 31, 2014 | 17

|

| |

| Schedule of Investments (concluded) | MFS Research International FDP Fund

|

Notes to Schedule of Investments

| (a) | | | | Non-income producing security. |

| | | | | |

| • | | | | Fair Value Measurements — Various inputs are used in determining the fair value of investments. These inputs to valuation techniques are categorized into a disclosure hierarchy consisting of three broad levels for financial statement purposes as follows: |

| • | | | | Level 1 — unadjusted price quotations in active markets/exchanges for identical assets or liabilities that the Fund has the ability to access |

| | | | | |

| • | | | | Level 2 — other observable inputs (including, but not limited to, quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market-corroborated inputs) |

| | | | | |

| • | | | | Level 3 — unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are not available (including the Fund’s own assumptions used in determining the fair value of investments) |

| | | | | The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the fair value hierarchy classification is determined based on the lowest level input that is significant to the fair value measurement in its entirety. |

| | | | | |

| | | | | Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy. In accordance with the Fund’s policy, transfers between different levels of the fair value disclosure hierarchy are deemed to have occurred as of the beginning of the reporting period. The categorization of a value determined for investments is based on the pricing transparency of the investment and is not necessarily an indication of the risks associated with investing in those securities. For information about the Fund’s policy regarding valuation of investments, please refer to Note 2 of the Notes to Financial Statements. |

| | | | | |

| | | | | The following table summarizes the Fund’s investments categorized in the disclosure hierarchy as of May 31, 2014: |

| | | | | Level 1 | | Level 2 | | Level 3 | | Total |

Assets:

| | | | | | | | | | | | | | | | | | |

Investments:

| | | | | | | | | | | | | | | | | | |

Long-Term Investments:

| | | | | | | | | | | | | | | | | | |

Common Stocks:

| | | | | | | | | | | | | | | | | | |

Australia | | | | | — | | | $ | 6,592,090 | | | | — | | | $ | 6,592,090 | |

Austria | | | | | — | | | | 1,964,136 | | | | — | | | | 1,964,136 | |

Belgium | | | | | — | | | | 2,084,119 | | | | — | | | | 2,084,119 | |

Bermuda | | | | $ | 739,257 | | | | — | | | | — | | | | 739,257 | |

Brazil | | | | | 3,570,166 | | | | — | | | | — | | | | 3,570,166 | |

Canada | | | | | 2,266,140 | | | | — | | | | — | | | | 2,266,140 | |

Denmark | | | | | — | | | | 773,831 | | | | — | | | | 773,831 | |

France | | | | | — | | | | 18,815,736 | | | | — | | | | 18,815,736 | |

Germany | | | | | 1,637,594 | | | | 10,863,280 | | | | — | | | | 12,500,874 | |

Hong Kong | | | | | — | | | | 8,237,680 | | | | — | | | | 8,237,680 | |

India | | | | | 700,396 | | | | 518,052 | | | | — | | | | 1,218,448 | |

Ireland | | | | | — | | | | 993,038 | | | | — | | | | 993,038 | |

Israel | | | | | — | | | | 304,826 | | | | — | | | | 304,826 | |

Italy | | | | | — | | | | 1,837,392 | | | | — | | | | 1,837,392 | |

Japan | | | | | 759,371 | | | | 30,401,787 | | | | — | | | | 31,161,158 | |

Netherlands | | | | | — | | | | 12,336,324 | | | | — | | | | 12,336,324 | |

Portugal | | | | | — | | | | 423,198 | | | | — | | | | 423,198 | |

Russia | | | | | 399,426 | | | | 31,697 | | | | — | | | | 431,123 | |

Singapore | | | | | — | | | | 1,806,641 | | | | — | | | | 1,806,641 | |

South Korea | | | | | — | | | | 1,253,204 | | | | — | | | | 1,253,204 | |

Spain | | | | | — | | | | 774,042 | | | | — | | | | 774,042 | |

Sweden | | | | | — | | | | 4,288,867 | | | | — | | | | 4,288,867 | |

Switzerland | | | | | — | | | | 21,815,886 | | | | — | | | | 21,815,886 | |

Taiwan | | | | | — | | | | 3,320,646 | | | | — | | | | 3,320,646 | |

Thailand | | | | | — | | | | 703,448 | | | | — | | | | 703,448 | |

Turkey | | | | | — | | | | 1,027,958 | | | | — | | | | 1,027,958 | |

United Kingdom | | | | | — | | | | 28,312,436 | | | | — | | | | 28,312,436 | |

United States | | | | | 4,304,565 | | | | — | | | | — | | | | 4,304,565 | |

Short-Term Securities:

| | | | | | | | | | | | | | | | | | |

Time Deposits | | | | | — | | | | 2,542,963 | | | | — | | | | 2,542,963 | |

Total

| | | | $ | 14,376,915 | | | $ | 162,023,277 | | | | — | | | $ | 176,400,192 | |

| | | | | The Fund may hold assets in which the fair value approximates the carrying amount for financial statement purposes. As of May 31, 2014, foreign currency at value of $6 is categorized as Level 1 within the disclosure hierarchy. |

| | | | | |

| | | | | There were no transfers between levels during the year ended May 31, 2014. |

See Notes to Financial Statements.

| 18 | FDP SERIES, INC. | MAY 31, 2014

|

| |

| Schedule of Investments May 31, 2014 | Marsico Growth FDP Fund

(Percentages shown are based on Net Assets)

|

| Common Stocks | | | |

Shares | | Value |

Aerospace & Defense — 4.0% | | | | | | | | | | |

General Dynamics Corp. | | | | | 40,083 | | | $ | 4,734,604 | |

Safran SA | | | | | 21,110 | | | | 1,433,209 | |

| | | | | | | | | 6,167,813 | |

Auto Components — 1.2% | | | | | | | | | | |

Delphi Automotive PLC | | | | | 26,351 | | | | 1,819,800 | |

Beverages — 2.3% | | | | | | | | | | |

Keurig Green Mountain, Inc. | | | | | 31,414 | | | | 3,542,871 | |

Biotechnology — 13.1% | | | | | | | | | | |

Biogen Idec, Inc. (a) | | | | | 19,769 | | | | 6,313,626 | |

Celgene Corp. (a) | | | | | 29,809 | | | | 4,561,671 | |

Gilead Sciences, Inc. (a) | | | | | 115,056 | | | | 9,343,698 | |

| | | | | | | | | 20,218,995 | |

Chemicals — 7.8% | | | | | | | | | | |

Monsanto Co. | | | | | 54,406 | | | | 6,629,371 | |

The Sherwin-Williams Co. | | | | | 25,899 | | | | 5,299,194 | |

| | | | | | | | | 11,928,565 | |

Diversified Financial Services — 1.6% | | | | | | | | | | |

The Charles Schwab Corp. | | | | | 95,884 | | | | 2,417,236 | |

Energy Equipment & Services — 3.7% | | | | | | | | | | |

Halliburton Co. | | | | | 22,629 | | | | 1,462,739 | |

Schlumberger Ltd. | | | | | 41,026 | | | | 4,268,345 | |

| | | | | | | | | 5,731,084 | |

Food & Staples Retailing — 1.4% | | | | | | | | | | |

CVS Caremark Corp. | | | | | 27,034 | | | | 2,117,303 | |

Hotels, Restaurants & Leisure — 8.9% | | | | | | | | | | |

Starbucks Corp. | | | | | 36,086 | | | | 2,642,939 | |

Starwood Hotels & Resorts Worldwide, Inc. | | | | | 73,172 | | | | 5,842,784 | |

Wynn Resorts Ltd. | | | | | 24,547 | | | | 5,276,868 | |

| | | | | | | | | 13,762,591 | |

Industrial Conglomerates — 3.0% | | | | | | | | | | |

Tyco International Ltd. | | | | | 106,380 | | | | 4,642,423 | |

Internet & Catalog Retail — 5.5% | | | | | | | | | | |

priceline.com, Inc. (a) | | | | | 6,663 | | | | 8,519,512 | |

Internet Software & Services — 8.0% | | | | | | | | | | |

Facebook, Inc., Class A (a) | | | | | 96,248 | | | | 6,092,499 | |

Google, Inc., Class A (a) | | | | | 6,196 | | | | 3,541,943 | |

Google, Inc., Class C (a) | | | | | 4,748 | | | | 2,663,533 | |

| | | | | | | | | 12,297,975 | |

IT Services — 3.7% | | | | | | | | | | |

FleetCor Technologies, Inc. (a) | | | | | 5,321 | | | | 672,628 | |

Visa, Inc., Class A | | | | | 23,135 | | | | 4,970,092 | |

| | | | | | | | | 5,642,720 | |

| Common Stocks | | | |

Shares | | Value |

Media — 8.4% | | | | | | | | | | |

CBS Corp., Class B | | | | | 87,250 | | | $ | 5,200,972 | |

Comcast Corp., Class A | | | | | 57,800 | | | | 3,017,160 | |

The Walt Disney Co. | | | | | 55,690 | | | | 4,678,517 | |

| | | | | | | | | 12,896,649 | |

Oil, Gas & Consumable Fuels — 2.8% | | | | | | | | | | |

Antero Resources Corp. (a) | | | | | 42,433 | | | | 2,609,630 | |

Continental Resources, Inc. (a) | | | | | 12,015 | | | | 1,686,425 | |

| | | | | | | | | 4,296,055 | |

Road & Rail — 7.3% | | | | | | | | | | |

Canadian Pacific Railway Ltd. | | | | | 34,766 | | | | 5,824,000 | |

Union Pacific Corp. | | | | | 27,465 | | | | 5,472,951 | |

| | | | | | | | | 11,296,951 | |

Semiconductors & Semiconductor Equipment — 5.1% |

ASML Holding NV — NY Shares | | | | | 53,356 | | | | 4,582,213 | |

Texas Instruments, Inc. | | | | | 67,862 | | | | 3,188,157 | |

| | | | | | | | | 7,770,370 | |

Software — 2.1% | | | | | | | | | | |

Salesforce.com, Inc. (a) | | | | | 60,280 | | | | 3,172,536 | |

Specialty Retail — 3.6% | | | | | | | | | | |

The Home Depot, Inc. | | | | | 34,163 | | | | 2,740,898 | |

TJX Cos., Inc. | | | | | 52,167 | | | | 2,840,493 | |

| | | | | | | | | 5,581,391 | |

Trading Companies & Distributors — 1.4% | | | | | | | | | | |

W.W. Grainger, Inc. | | | | | 8,370 | | | | 2,162,557 | |

Total Long-Term Investments

(Cost — $108,168,824) — 94.9% | | | | | | | | | 145,985,397 | |

|

Short-Term Securities | | | | | Par

(000 | ) | | | | |

Time Deposits — 5.2% |

United States — 5.2% | | | | | | | | | | |

Brown Brothers Harriman & Co., 0.01%, 6/02/14 | | | | $ | 7,919 | | | | 7,919,439 | |

Total Short-Term Securities

(Cost — $7,919,439) — 5.2% | | | | | | | | | 7,919,439 | |

Total Investments (Cost — $116,088,263) — 100.1% | | 153,904,836 | |

Liabilities in Excess of Other Assets — (0.1)% | | | | | | | | | (80,939 | ) |

Net Assets — 100.0% | | | | | | | | $ | 153,823,897 | |

See Notes to Financial Statements.

| FDP SERIES, INC. | MAY 31, 2014 | 19

|

| |

| Schedule of Investments (concluded) | Marsico Growth FDP Fund

|

Notes to Schedule of Investments

| (a) | | | | Non-income producing security. |

| • | | | | For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease. |

| • | | | | Fair Value Measurements — Various inputs are used in determining the fair value of investments. These inputs to valuation techniques are categorized into a disclosure hierarchy consisting of three broad levels for financial statement purposes as follows: |

| • | | | | Level 1 — unadjusted price quotations in active markets/exchanges for identical assets or liabilities that the Fund has the ability to access |

| • | | | | Level 2 — other observable inputs (including, but not limited to, quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market-corroborated inputs) |

| • | | | | Level 3 — unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are not available (including the Fund’s own assumptions used in determining the fair value of investments) |

| | | | | The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the fair value hierarchy classification is determined based on the lowest level input that is significant to the fair value measurement in its entirety. |

| | | | | Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy. In accordance with the Fund’s policy, transfers between different levels of the fair value disclosure hierarchy are deemed to have occurred as of the beginning of the reporting period. The categorization of a value determined for investments is based on the pricing transparency of the investment and is not necessarily an indication of the risks associated with investing in those securities. For information about the Fund’s policy regarding valuation of investments, please refer to Note 2 of the Notes to Financial Statements. |

| | | | | The following table summarizes the Fund’s investments categorized in the disclosure hierarchy as of May 31, 2014: |

| | | | | Level 1 | | Level 2 | | Level 3 | | Total |

Assets:

| | | | | | | | | | | | | | | | | | |

Investments:

| | | | | | | | | | | | | | | | | | |

Long-Term Investments1 | | | | $ | 144,552,188 | | | $ | 1,433,209 | | | | — | | | $ | 145,985,397 | |

Short-Term Securities | | | | | — | | | | 7,919,439 | | | | — | | | | 7,919,439 | |

Total

| | | | $ | 144,552,188 | | | $ | 9,352,648 | | | | — | | | $ | 153,904,836 | |

| 1 | See above Schedule of Investments for values in each industry, excluding Level 2, which includes a portion of Aerospace & Defense within the table. |

| | | | | There were no transfers between levels during the year ended May 31, 2014. |

See Notes to Financial Statements.

| 20 | FDP SERIES, INC. | MAY 31, 2014

|

| |

| Schedule of Investments May 31, 2014 | Invesco Value FDP Fund

(Percentages shown are based on Net Assets)

|

| Common Stocks | | | |

Shares | | Value |

Aerospace & Defense — 2.0% |

Honeywell International, Inc. | | | | | 12,797 | | | $ | 1,192,040 | |

Textron, Inc. | | | | | 46,704 | | | | 1,831,731 | |

| | | | | | | | | 3,023,771 | |

Auto Components — 1.3% |

Johnson Controls, Inc. | | | | | 39,387 | | | | 1,904,755 | |

Automobiles — 1.9% |

General Motors Co. | | | | | 82,155 | | | | 2,840,920 | |

Capital Markets — 5.7% |